Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant o |

Filed by a Party other than the Registrant x |

Check the appropriate box:

o | Preliminary Proxy Statement |

o | Confidential, for Use of the Commission Only (as permitted by Rule 14(a)-6(e)(2)) |

o | Definitive Proxy Statement |

x | Definitive Additional Materials |

o | Soliciting Materials Pursuant to §240.14a-12 |

Bradley Pharmaceuticals, Inc.

(Name of Registrant as Specified In Its Charter)

Costa Brava Partnership III L.P.

Roark, Rearden & Hamot, LLC

Roark, Rearden & Hamot Capital Management, LLC

Seth W. Hamot

Douglas E. Linton

John S. Ross

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box): |

| | |

x | No fee required |

| |

o | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| (1) | Title of each class of securities to which transaction applies: N/A |

| | |

| (2) | Aggregate number of securities to which transaction applies: N/A |

| | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): N/A |

| | |

| (4) | Proposed maximum aggregate value of transaction: N/A |

| | |

| (5) | Total fee paid: N/A |

| | |

o | Fee paid previously with preliminary materials: |

| |

o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identifying the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

| 1) | Amount Previously Paid: N/A |

| | |

| 2) | Form, Schedule or Registration Statement No.: N/A |

| | |

| 3) | Filing Party: N/A |

| | |

| 4) | Date Filed: N/A |

On September 29, 2006, Costa Brava Partnership III L.P. (“Costa Brava”), together with the other participants (as defined below), made a definitive filing with the Securities and Exchange Commission of a proxy statement and accompanying BLUE proxy card to be used to solicit votes for the election of its slate of director nominees and certain business proposals at the 2006 annual meeting of stockholders of Bradley Pharmaceuticals, Inc. (the “Company”), scheduled to be held on October 26, 2006.

Filed herewith as Exhibit 1 is a slide presentation released by Costa Brava for meetings with stockholders of the Company.

COSTA BRAVA PARTNERSHIP III L.P., ROARK, REARDEN & HAMOT, LLC, ROARK, REARDEN & HAMOT CAPITAL MANAGEMENT, LLC, SETH W. HAMOT, DOUGLAS E. LINTON AND JOHN S. ROSS (COLLECTIVELY, THE “PARTICIPANTS”) FILED A DEFINITIVE PROXY STATEMENT AND ACCOMPANYING FORM OF PROXY WITH THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION (“SEC”) ON SEPTEMBER 29, 2006, TO BE USED TO SOLICIT VOTES FOR THE ELECTION OF ITS SLATE OF DIRECTOR NOMINEES AND CERTAIN BUSINESS PROPOSALS FOR USE AT THE 2006 ANNUAL MEETING OF SHAREHOLDERS OF BRADLEY PHARMACEUTICALS, INC. INFORMATION RELATING TO THE PARTICIPANTS IS SET FORTH IN THE DEFINITIVE PROXY STATEMENT FILED WITH THE SEC.

STOCKHOLDERS ARE ADVISED TO READ THE DEFINITIVE PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

THE DEFINITIVE PROXY STATEMENT, FORM OF PROXY AND OTHER PROXY MATERIALS ARE AVAILABLE AT NO CHARGE AT THE SECURITIES AND EXCHANGE COMMISSION’S WEBSITE AT HTTP://WWW.SEC.GOV.

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Link to searchable text

Searchable text section

Costa Brava Partnership III L.P.

Presentation

to

Stockholders of Bradley Pharmaceuticals, Inc.

October 2006

Costa Brava Partnership III L.P.

Not your typical small-cap investor

- Costa Brava Partnership III L.P. ("Costa Brava") is an investment fund with approximately $165 million of assets under management.

- Costa Brava often invests in companies that we believe are undervalued because of special situations, including poor corporate governance, poor financial management, inadequate regulatory compliance, and illegal or inappropriate conduct.

- Costa believes that these companies often present attractive investment opportunities and, as underlying problems are remedied, can result in an increase in stockholder value.

- Costa Brava has both the skills and experience necessary to address the underlying problems and bring about change.

Costa Brava Partnership III L.P. (cont.)

Costa Brava's investment strategy produces results, including the following:

- Riscorp - Persuaded majority stockholder to pay full value for company, maximizing value for all stockholders.

- Huntsman Polymer - Persuaded company to repurchase defaulted securities.

- Sports Supply Group - Persuaded majority stockholder to pay more for company, maximizing value for all stockholders.

- Telos Corporation - Uncovered malfeasance that resulted in the resignation of a majority of the company's directors.

Bradley Pharmaceuticals, Inc. (NYSE:BDY)

- Costa Brava made its initial investment in Bradley Pharmaceuticals, Inc. ("Bradley" or the "Company"), a specialty pharmaceutical company, in February 2005.

- Costa Brava has maintained a long position in Bradley since its initial investment.

- Today, Costa Brava is the largest owner of Bradley's publicly traded common stock, owning approximately 9.5% or 1,607,700 of the outstanding shares.

The Two Faces of Bradley

- Bradley is a solvent, growing company that generates substantial cash flow. From modest entrepreneurial beginnings, Bradley has grown to a size that now provides numerous strategic alternatives that can greatly enhance stockholder value over the next few years. This is why Costa Brava is the Company's largest stockholder.

- Those positive attributes, however, are obscured by egregious corporate governance practices, consistent inattention to regulatory compliance, poor financial controls and little financial transparency. While Bradley has grown the top-line of its business, it has focused little on its governance practices or financial controls, and the Company's management and Board continues to run Bradley like the family-owned business that it once was.

The Troubled State of Affairs at Bradley

- Bradley has demonstrated a complete disregard for sound principles of corporate governance. The Company's Board of Directors is plagued by a fundamental lack of independence and has failed to be accountable to the Company's public stockholders.

- Poor corporate governance has not come without a cost to Bradley's public stockholders. In addition to watching Bradley's stock lose approximately 60% of its value from July 2004 to July 2006, Bradley was forced to restate its financial results on two separate occasions, and failed to timely file its periodic reports with the SEC on multiple occasions.

The Troubled State of Affairs at Bradley (cont.)

- Bradley's history is marked by a failure to act until being forced to do so. On numerous occasions, the Company has disregarded stockholders' rights until legal action was instituted to enforce those rights. Similarly, only after Costa Brava instituted a proxy contest did Bradley announce a vague commitment to improved corporate governance and maximizing stockholder value.

- Costa Brava believes that the only way to institute change at Bradley is to provide public stockholders with a truly independent voice on the Board of Directors. That is why we have nominated the highly qualified slate of Douglas E. Linton, John S. Ross and Seth W. Hamot for election to the Board of Directors of the Company.

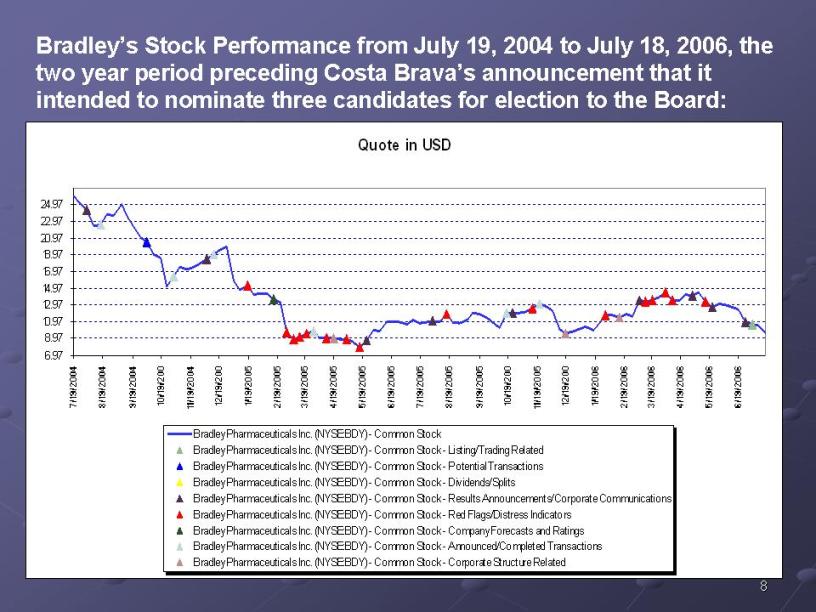

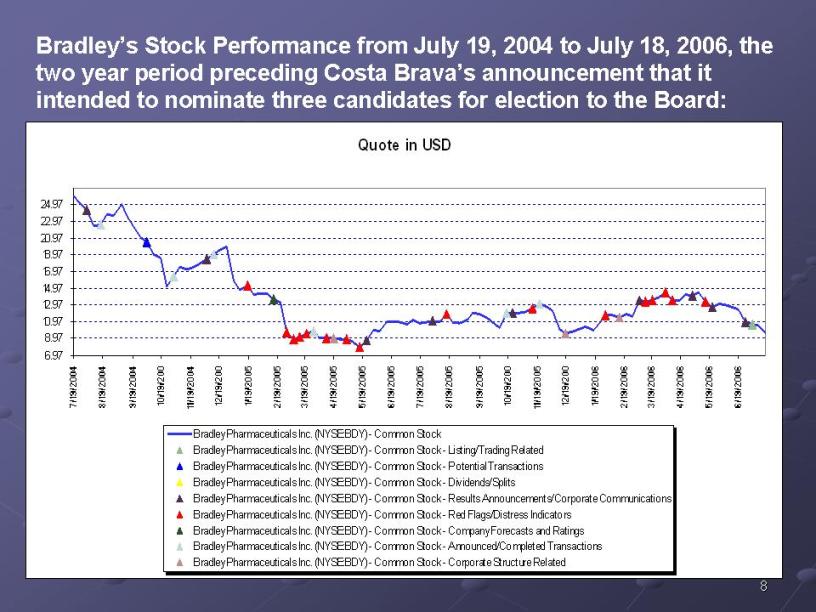

Bradley's Stock Performance from July 19, 2004 to July 18, 2006, the two year period preceding Costa Brava's announcement that it intended to nominate three candidates for election to the Board:

See graphic chart on slide 8

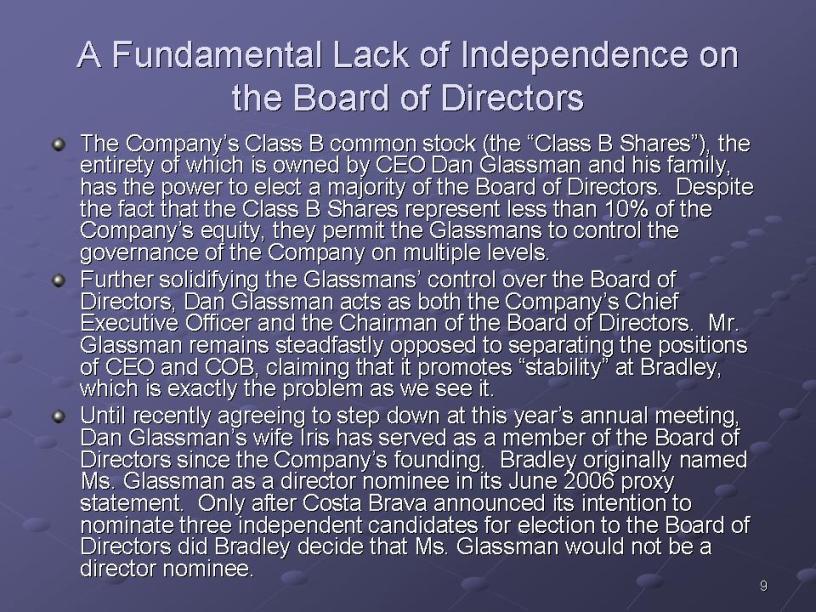

A Fundamental Lack of Independence on

the Board of Directors

- The Company's Class B common stock (the "Class B Shares"), the entirety of which is owned by CEO Dan Glassman and his family, has the power to elect a majority of the Board of Directors. Despite the fact that the Class B Shares represent less than 10% of the Company's equity, they permit the Glassmans to control the governance of the Company on multiple levels.

- Further solidifying the Glassmans' control over the Board of Directors, Dan Glassman acts as both the Company's Chief Executive Officer and the Chairman of the Board of Directors. Mr. Glassman remains steadfastly opposed to separating the positions of CEO and COB, claiming that it promotes "stability" at Bradley, which is exactly the problem as we see it.

- Until recently agreeing to step down at this year's annual meeting, Dan Glassman's wife Iris has served as a member of the Board of Directors since the Company's founding. Bradley originally named Ms. Glassman as a director nominee in its June 2006 proxy statement. Only after Costa Brava announced its intention to nominate three independent candidates for election to the Board of Directors did Bradley decide that Ms. Glassman would not be a director nominee.

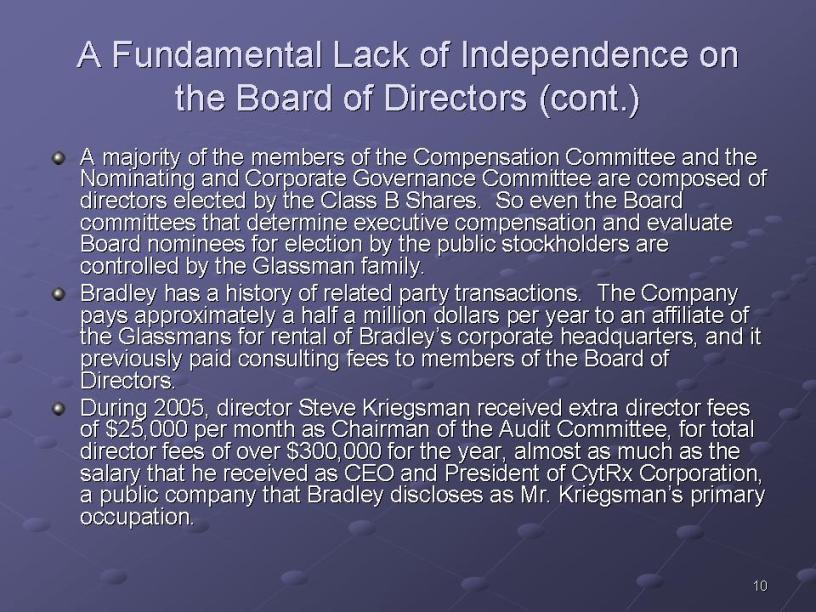

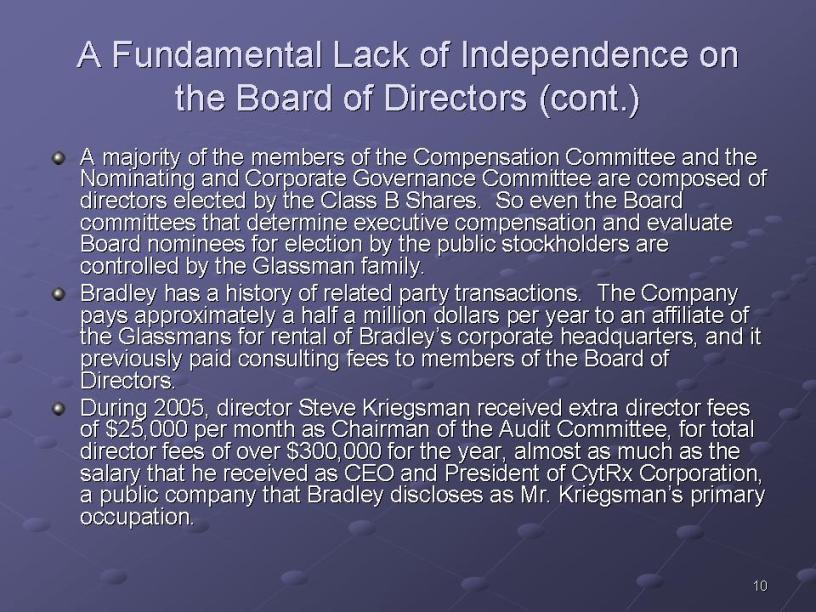

A Fundamental Lack of Independence

on the Board of Directors (cont.)

- A majority of the members of the Compensation Committee and the Nominating and Corporate Governance Committee are composed of directors elected by the Class B Shares. So even the Board committees that determine executive compensation and evaluate Board nominees for election by the public stockholders are controlled by the Glassman family.

- Bradley has a history of related party transactions. The Company pays approximately a half a million dollars per year to an affiliate of the Glassmans for rental of Bradley's corporate headquarters, and it previously paid consulting fees to members of the Board of Directors.

- During 2005, director Steve Kriegsman received extra director fees of $25,000 per month as Chairman of the Audit Committee, for total director fees of over $300,000 for the year, almost as much as the salary that he received as CEO and President of CytRx Corporation, a public company that Bradley discloses as Mr. Kriegsman's primary occupation.

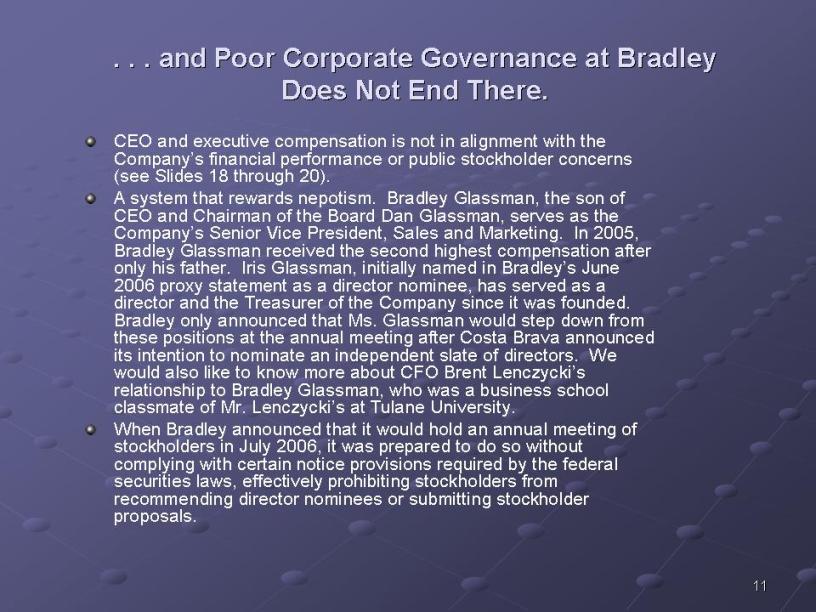

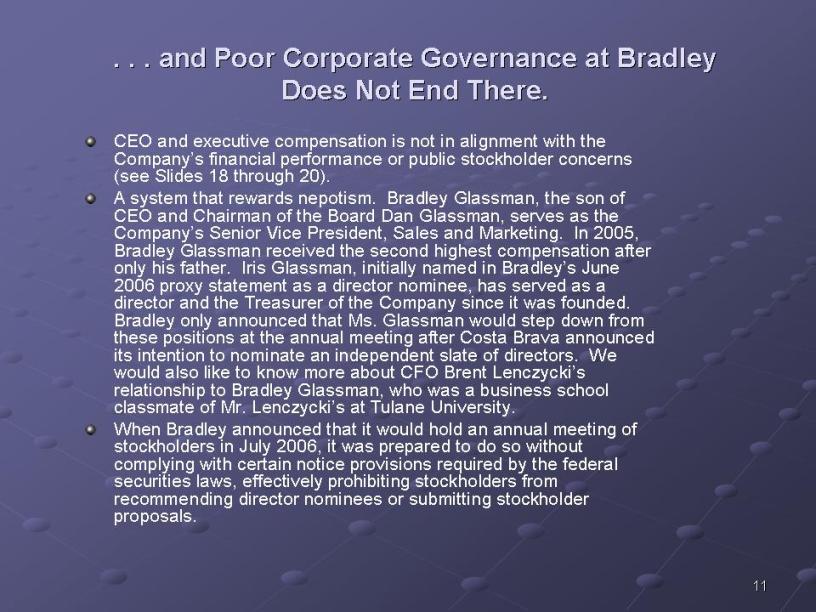

. . . and Poor Corporate Governance at Bradley Does Not End There.

- CEO and executive compensation is not in alignment with the Company's financial performance or public stockholder concerns (see Slides 18 through 20).

- A system that rewards nepotism. Bradley Glassman, the son of CEO and Chairman of the Board Dan Glassman, serves as the Company's Senior Vice President, Sales and Marketing. In 2005, Bradley Glassman received the second highest compensation after only his father. Iris Glassman, initially named in Bradley's June 2006 proxy statement as a director nominee, has served as a director and the Treasurer of the Company since it was founded. Bradley only announced that Ms. Glassman would step down from these positions at the annual meeting after Costa Brava announced its intention to nominate an independent slate of directors. We would also like to know more about CFO Brent Lenczycki's relationship to Bradley Glassman, who was a business school classmate of Mr. Lenczycki's at Tulane University.

- When Bradley announced that it would hold an annual meeting of stockholders in July 2006, it was prepared to do so without complying with certain notice provisions required by the federal securities laws, effectively prohibiting stockholders from recommending director nominees or submitting stockholder proposals.

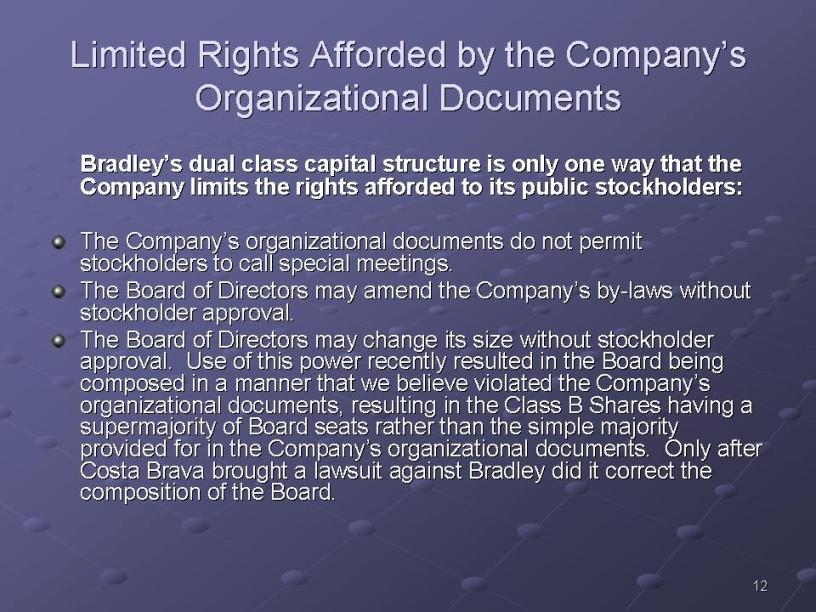

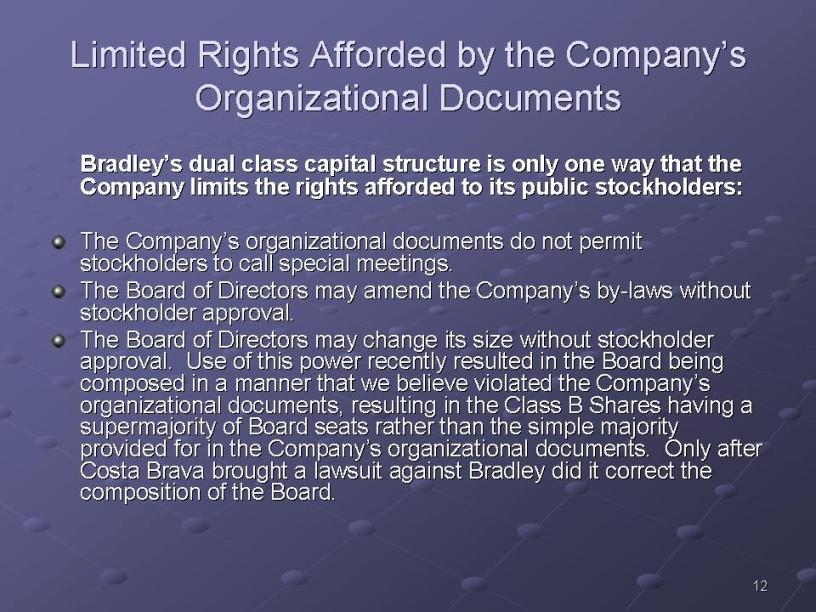

Limited Rights Afforded by the Company's

Organizational Documents

Bradley's dual class capital structure is only one way that the Company limits the rights afforded to its public stockholders:

- The Company's organizational documents do not permit stockholders to call special meetings.

- The Board of Directors may amend the Company's by-laws without stockholder approval.

- The Board of Directors may change its size without stockholder approval. Use of this power recently resulted in the Board being composed in a manner that we believe violated the Company's organizational documents, resulting in the Class B Shares having a supermajority of Board seats rather than the simple majority provided for in the Company's organizational documents. Only after Costa Brava brought a lawsuit against Bradley did it correct the composition of the Board.

Poor Corporate Governance Has Not Come

Without a Cost to Bradley's

Public Stockholders

- In December 2004, the SEC announced that it was conducting an inquiry into Bradley's potential violation of federal securities laws, including the Company's revenue recognition practices.

- For a period of over one year, Bradley failed to timely file its periodic reports with the SEC (See Slide 14).

- Bradley has not held an annual meeting of stockholders since June 2004.

- Not even six months after restating its financial results for the third quarter of 2004, Bradley announced on July 19, 2006 that it would be restating its financial results for the first quarter of 2006.

- During the two year period preceding Costa Brava's announcement of its intention to nominate three truly independent nominees for election to the Board of Directors, Bradley's stock lost approximately 60% of its value.

- Bradley is a party to numerous federal and state lawsuits instituted by its stockholders.

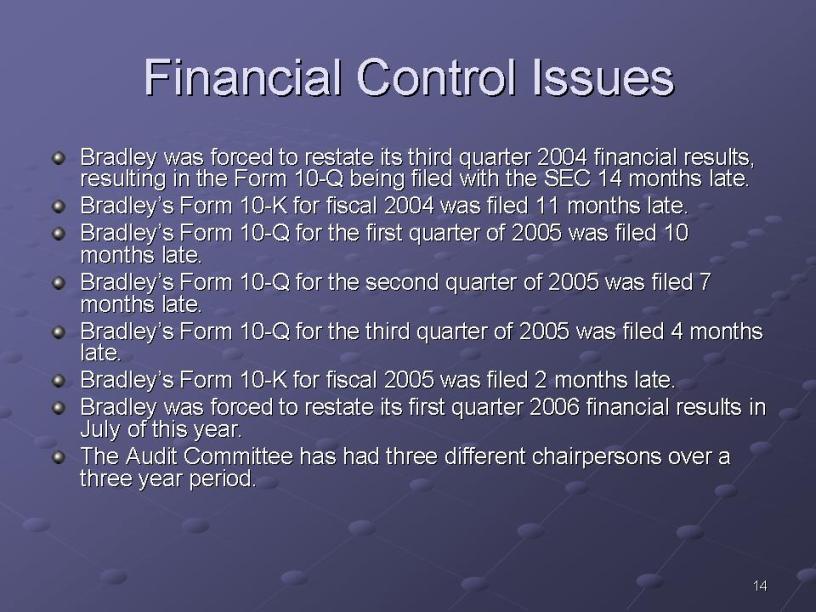

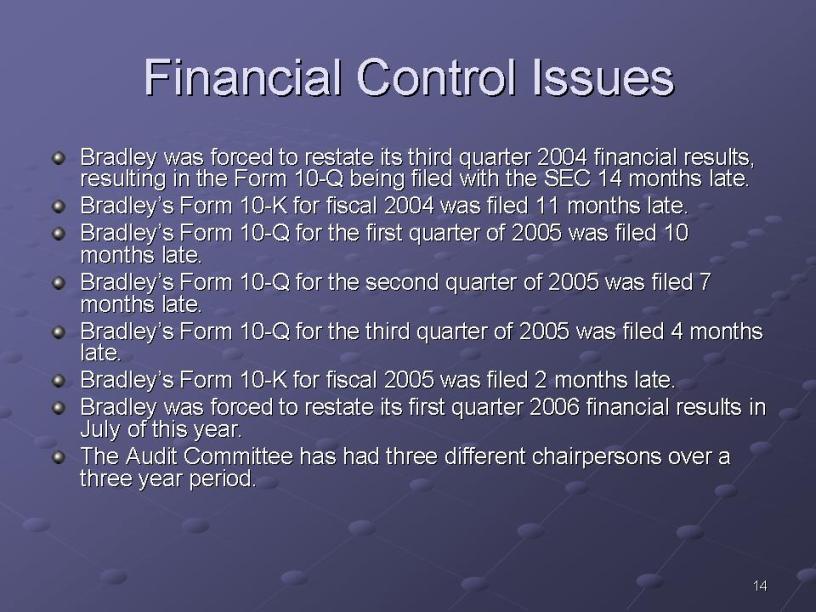

Financial Control Issues

- Bradley was forced to restate its third quarter 2004 financial results, resulting in the Form 10-Q being filed with the SEC 14 months late.

- Bradley's Form 10-K for fiscal 2004 was filed 11 months late.

- Bradley's Form 10-Q for the first quarter of 2005 was filed 10 months late.

- Bradley's Form 10-Q for the second quarter of 2005 was filed 7 months late.

- Bradley's Form 10-Q for the third quarter of 2005 was filed 4 months late.

- Bradley's Form 10-K for fiscal 2005 was filed 2 months late.

- Bradley was forced to restate its first quarter 2006 financial results in July of this year.

- The Audit Committee has had three different chairpersons over a three year period.

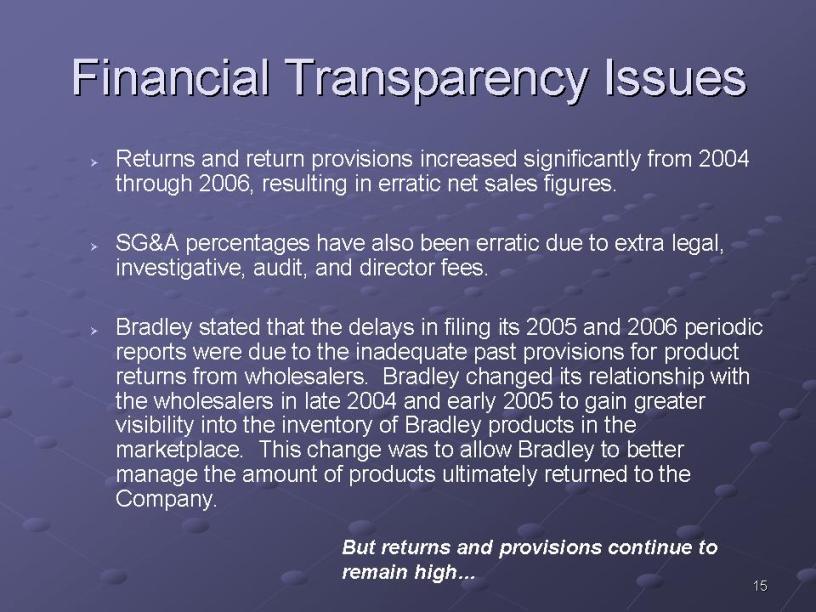

Financial Transparency Issues

- Returns and return provisions increased significantly from 2004 through 2006, resulting in erratic net sales figures.

- SG&A percentages have also been erratic due to extra legal, investigative, audit, and director fees.

- Bradley stated that the delays in filing its 2005 and 2006 periodic reports were due to the inadequate past provisions for product returns from wholesalers. Bradley changed its relationship with the wholesalers in late 2004 and early 2005 to gain greater visibility into the inventory of Bradley products in the marketplace. This change was to allow Bradley to better manage the amount of products ultimately returned to the Company.

But returns and provisions continue to

remain high...

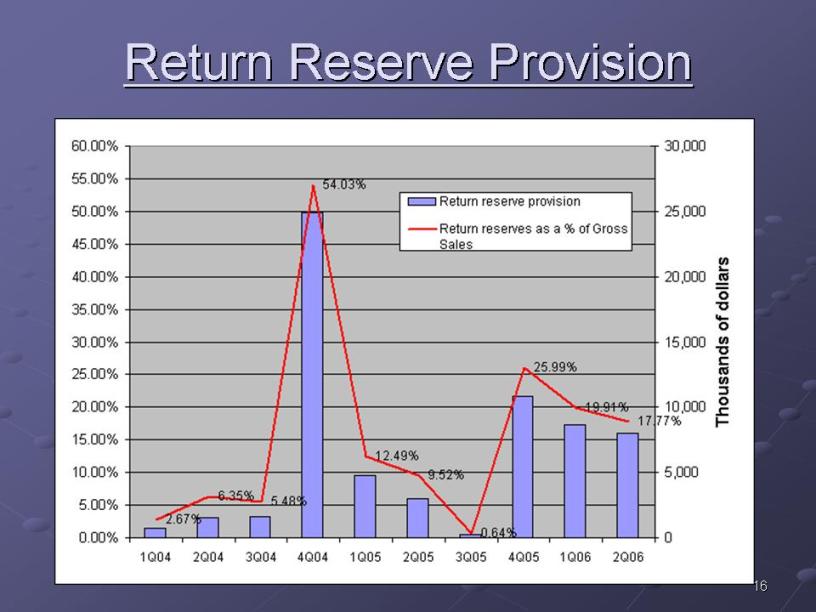

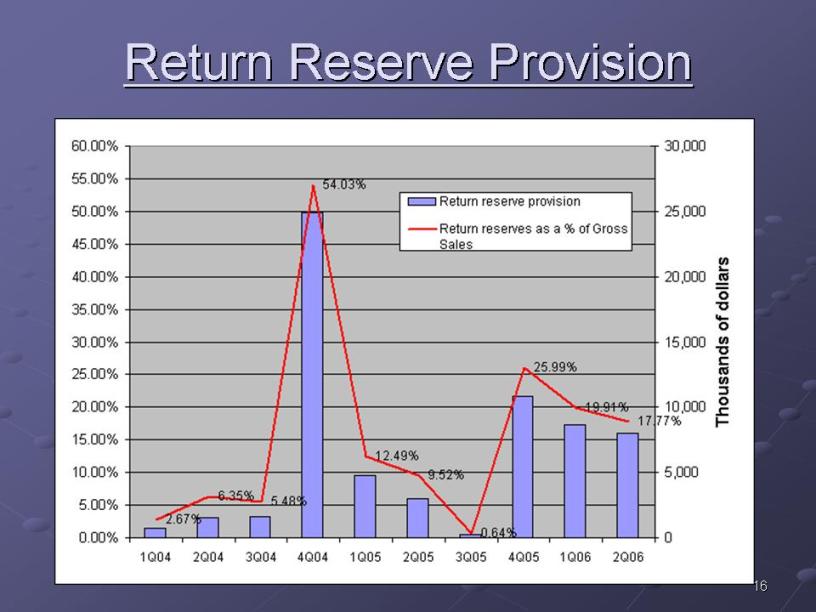

Return Reserve Provision

See graphic chart on slide 16

"Gross Sales" are trending up consistently over the past two years...

See graphic chart on slide 17

...while net sales are more erratic...

We want the lines to be parallel. We want transparency.

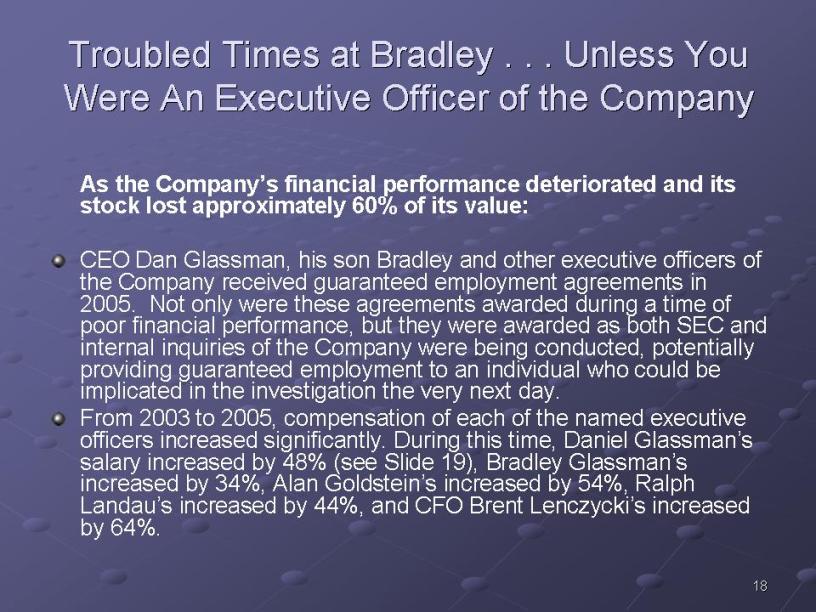

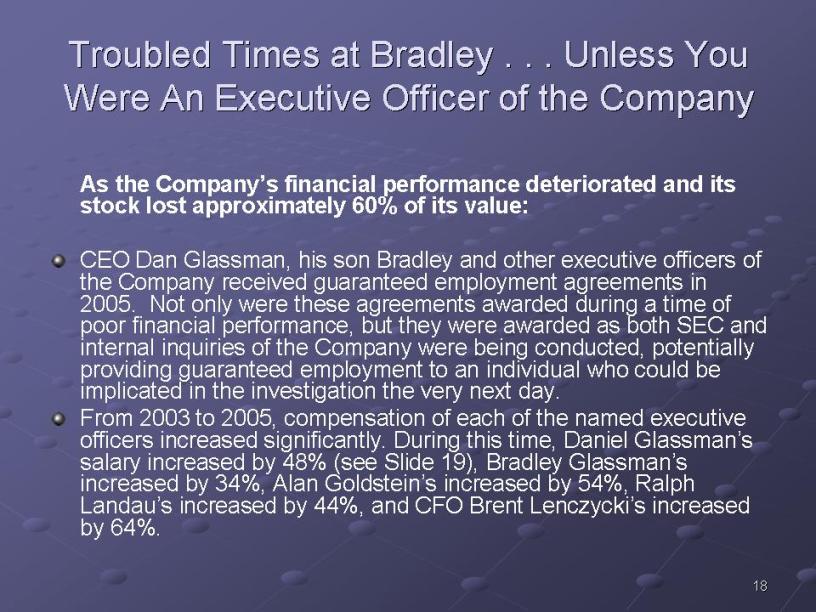

Troubled Times at Bradley . . . Unless You

Were An Executive Officer of the Company

As the Company's financial performance deteriorated and its stock lost approximately 60% of its value

- CEO Dan Glassman, his son Bradley and other executive officers of the Company received guaranteed employment agreements in 2005. Not only were these agreements awarded during a time of poor financial performance, but they were awarded as both SEC and internal inquiries of the Company were being conducted, potentially providing guaranteed employment to an individual who could be implicated in the investigation the very next day.

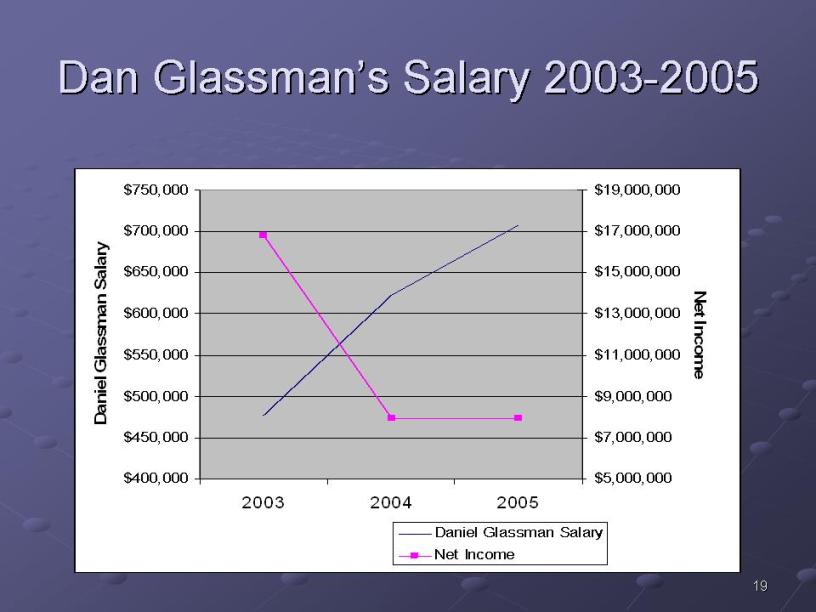

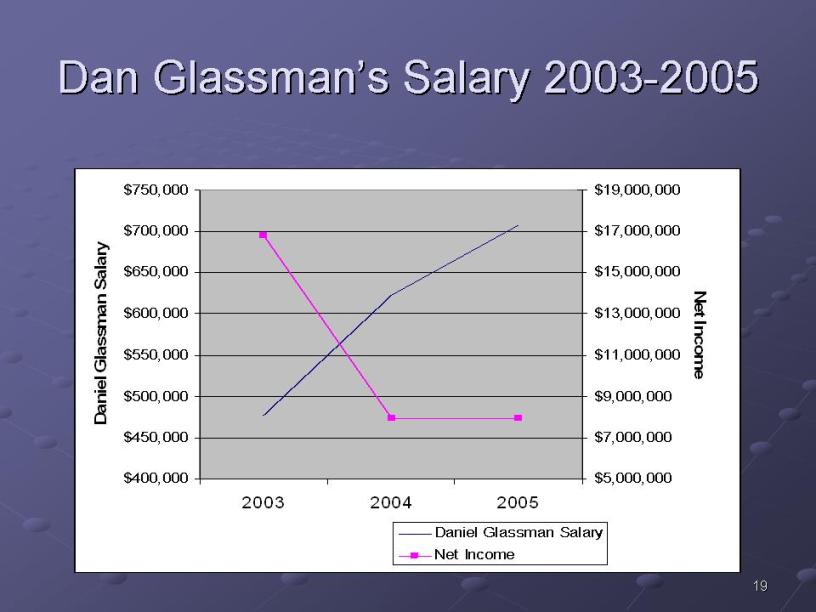

- From 2003 to 2005, compensation of each of the named executive officers increased significantly. During this time, Daniel Glassman's salary increased by 48% (see Slide 19), Bradley Glassman's increased by 34%, Alan Goldstein's increased by 54%, Ralph Landau's increased by 44%, and CFO Brent Lenczycki's increased by 64%.

Dan Glassman's Salary 2003-2005

See graphic chart on slide 19

. . . and Excessive Compensation Did Not End There.

As current financial statements remained unavailable to the Company's public stockholders throughout 2005:

- The Company rewarded Dan Glassman with a "non-accountable expense allowance" of $25,000 per year.

- The Company rewarded its named executive officers with lucrative option grants.

- Director Steve Kriegsman received $300,000 in additional director fees for serving as Chairman of the Audit Committee.

What Costa Brava is not attempting to do...

- We are not trying to "take over" Bradley.

- We are not recommending that Bradley be sold.

- We are not recommending that Bradley use its substantial cash balance for share repurchases.

- We are not recommending that Bradley incur significantly more debt, and pay stockholders a large dividend.

- We are not trying to exclude Dan Glassman from the management of Bradley.

- We are not recommending the termination of any employees.

- We are not attempting to embarrass any individual.

What Costa Brava and its nominees will work to accomplish . . .

- Obtaining an independent voice for the Company's public stockholders, one that is not controlled by or affiliated with the Glassmans.

- Improving corporate governance, financial transparency and financial controls at Bradley.

- Working constructively with other Board members and the Company's management to address current challenges facing the Company, including provisions for returns and the review of strategic initiatives.

Douglas Linton has the specific skill set to address the

issue of excessive return reserve provisions

- Doug was one of the top five officers at Cardinal Health (formerly known as Cardinal Distribution) at the time that it became a public company. Cardinal Health is now one of the top three drug wholesalers in the country, and is Bradley's top wholesale customer.

- While at Cardinal, Doug developed the sophisticated purchasing programs to improve margins that Cardinal relied upon to fuel its growth through acquiring less profitable wholesalers.

- After similar jobs at two regional drug wholesalers, Doug returned as a consultant to Cardinal, then a much larger company, and created the successful Fee-for-Service program for smaller manufacturers. Instead of Cardinal buying drugs - "taking a position in product" - the Fee-for-Service business had Cardinal being paid for the provision of logistics services to companies like Bradley.

- This is similar to the program that Bradley signed up for with Cardinal and McKesson in late 2004 and early 2005 to better manage inventory controls and returns!

- Doug now works with ValueCentric, LLC, where he provides consulting services to branded pharmaceutical firms similar to Bradley on the use of Fee-for-Service strategies and the use of wholesaler sales and inventory data.

We selected Doug as our nominee because of his ability to address the specific return issues plaguing Bradley's business right now. We believe that Doug is uniquely qualified to bring Bradley's returns in line with industry norms.

John Ross has the specific skill set to evaluate Bradley's

growth initiatives and oversee their successful

implementation

- John was a co-founder, investor and board member of MetaWorks Inc.

- MetaWorks' statistical analyses are employed to support pharmaceutical product claims with respect to both regulatory approval and pharmacoeconomic benefits.

- John also worked at Cellcor Therapies, Inc., an autologous, living cell biotech company focused on an autologous cell therapy for renal cell cancer.

- Bradley is licensing Phase III drugs for sale in the United States and has indicated that it will continue to pursue this strategy in the future. John's experience at MetaWorks and Cellcor will help the Board ask the right questions as it reviews licensing initiatives.

- John would aid the Board in Costa Brava's planned implementation of a Strategic Review Board (SRB) at Bradley. The SRB, consisting of three non-executive Board members, would review management's growth initiatives versus the strategic strengths and weaknesses of the Company. Through this process, all costs of a new product introduction can be addressed and evaluated prior to the project proceeding.

We selected John as our nominee because of his ability to evaluate and oversee the implementation of growth initiatives. We believe that John is uniquely qualified to address issues concerning Bradley's strategic alternatives.

Seth Hamot has the experience necessary to remedy and

improve corporate governance practices at Bradley

- Seth has a proven track record of implementing improved corporate governance practices at the companies that he invests in.

- Seth has experience protecting the rights of security holders as a purchaser of defaulted debt since the late 1980s.

- Seth has prior experience serving as a member of a public company's board of directors, successfully managing a recapitalization, and has been on the creditors' committee of public companies in bankruptcy.

A vote for the Costa Brava nominees is a vote for:

- Director nominees that are truly independent in every sense of the word. Costa Brava's nominees were not elected by the Glassman family and were not nominated by a Board committee controlled by Glassman-elected directors.

- Director nominees who will act as a voice for ALL stockholders, committed to maximizing stockholder value.

- Director nominees that are uniquely qualified to address the current challenges facing the Company, including poor corporate governance, return reserve provisions, and future growth initiatives.

- Director nominees whose interests are aligned with the public stockholders. As the largest holder of the Company's publicly traded common stock, Costa Brava has the same fundamental interest as its fellow stockholders - maximizing the value of our Company, and Costa Brava's nominees are committed to that goal

Our Commitment to Improved

Corporate Governance

If elected to the Board of Directors of Bradley, our nominees will work to institute the following improvements to corporate governance:

- Split the roles of Chief Executive Officer and Chairman of the Board of Directors. There is an inherent lack of oversight in the current arrangement, and splitting the roles will reduce unnecessary rigidity in the management of the Company.

- Establish performance-based compensation for senior management.

- Comply at all times with the Company's organizational documents and honor the rights afforded to stockholders in those documents.

What is Bradley offering the public stockholders?

- A vague commitment to increase stockholder value. Are conference calls and attendance at analyst meetings the answer to a fundamental lack of independence on the Board Of Directors?

- Director nominees that lack independence from the Glassmans, including nominee Whitehead who was recommended by Dan Glassman himself.

- Executive compensation that is not tied to the Company's financial performance.

- A Board of Directors on which only two of the eight members own Bradley stock.

Bradley has made empty promises to its stockholders on previous occasions, and this time is no different.

Bradley's Future Is Bleak Without the Costa Brava Nominees

History has demonstrated that Bradley cannot be expected to act on its own, and will only act when pressured or required to do so. Without an independent voice on the Board of Directors, Bradley will continue to operate with the same conflicts of interest, nepotism and poor corporate governance practices that the public stockholders have to deal with today.

Bradley's public stockholders deserve better than that!

Our nominees are committed to moving

Bradley forward in the right direction:

- Bradley's public stockholders require a truly independent voice on the Board of Directors, one that is not controlled by or affiliated with the Glassmans.

- Douglas E. Linton, John S. Ross and Seth W. Hamot are uniquely qualified and ready to serve fellow stockholders as independent directors.

- Messrs. Linton, Ross and Hamot are committed to working with fellow Board members and management to improve the Company's corporate governance practices and effectively address the challenges that Bradley faces.