Exhibit 99

THERE FOR YOU THEN, HERE FOR YOU NOW.

CAUTIONARY STATEMENT This presentation contains forward-looking statements about future financial performance, business plans and strategies of Heritage Financial Group. Because forward-looking statements involve risks and uncertainties, actual results may differ materially from those expressed or implied. Investors are cautioned not to place undue reliance on these forward-looking statements and are advised to carefully review the discussion of forward-looking statements and risk factors in documents that the Company files with the Securities and Exchange Commission, including the Company’s most recent Annual Report on Form 10-K and Quarterly Report on Form 10-Q.

HISTORICAL HIGHLIGHTS Began operations in 1955 as AGE Federal Credit Union Converted to a savings bank in 2001 Took a different route to expansion into commercial banking by hiring seasoned bankers who have an average of 28 years experience Completed First-Step common stock offering in June 2005, selling 30% to the public

ABOUT THE COMPANY A lending leader in its home market of Albany, Georgia, with a strong commercial focus Significant internal funding through core deposits Expanded to Florida in mid-2006 with a de novo branch in Ocala; subsequently opened a second office there Invested $1 million in North Georgia de novoStrong capital base with 17% total risk-based capital

HBOS IS NOT THE TYPICAL MHC Most MHCs’ lending portfolios are heavily weighted toward single family real estateMany have had unsuccessful, even disastrous forays into commercial lending HeritageBank of the South has greater lending balance, with almost 57% of its loan portfolio invested in commercial-related loans HeritageBank of the South has a significant retail presence, providing ample funding for loan growth HeritageBank of the South has a substantial and growing source of non-interest income with its in-house brokerage business, which has more than $126 million in assets under management HeritageBank of the South is a state-chartered savings bank, which provides greater flexibility; HBOS is OTS-regulated

ACQUISITION UPDATE In December 2009, acquired branch office in Lake City, FloridaOpened a second market in FloridaHelped in-fill the footprint between Albany and OcalaAdded $10 million in loans and $41 million in deposits

ACQUISITION UPDATE In December 2009, acquired branch office in Lake City, Florida Also in December, completed FDIC-assisted acquisition of Reidsville, Georgia-based Tattnall Bank $60 million full-service bank chartered in 1900Second location in Collins, Georgia Added $39 million in loans/other real estate and $54 million in deposits Did not involve a loss-share agreement, but was subject to a $15 million purchase discount by the FDIC Purchase discount applied to write-down loan portfolio ($8 million), write-down OREO and repossessed assets ($5 million) and reserve for expense to carry problem assets

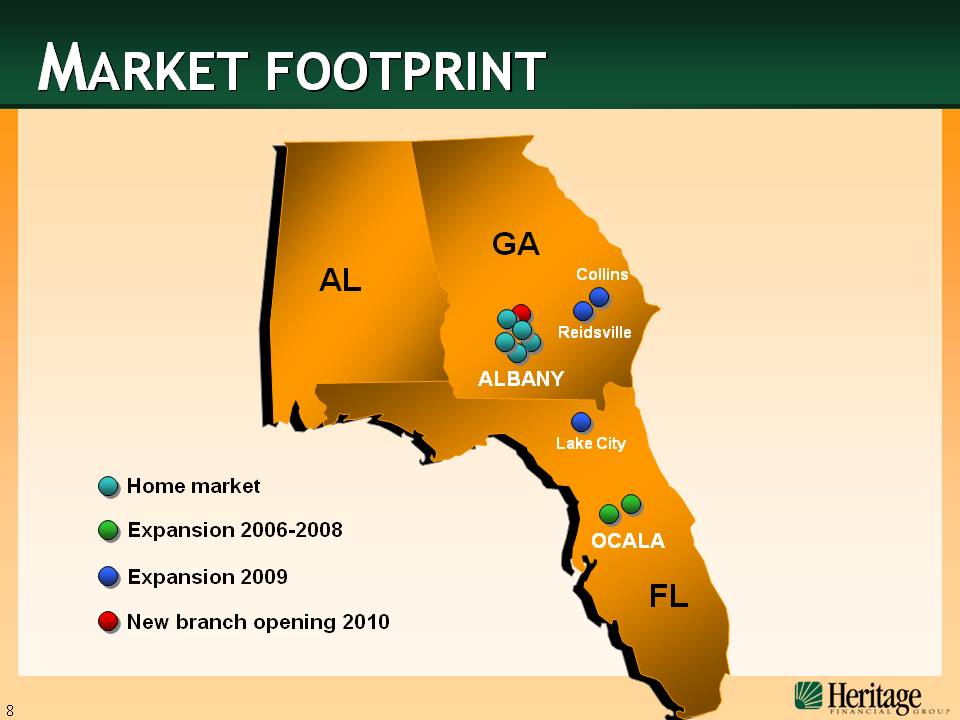

MARKET FOOTPRINT AL GA FL ALBANY OCALA Reidsville Collins Lake City Home market Expansion 2006-2008 Expansion 2009 New branch opening 2010

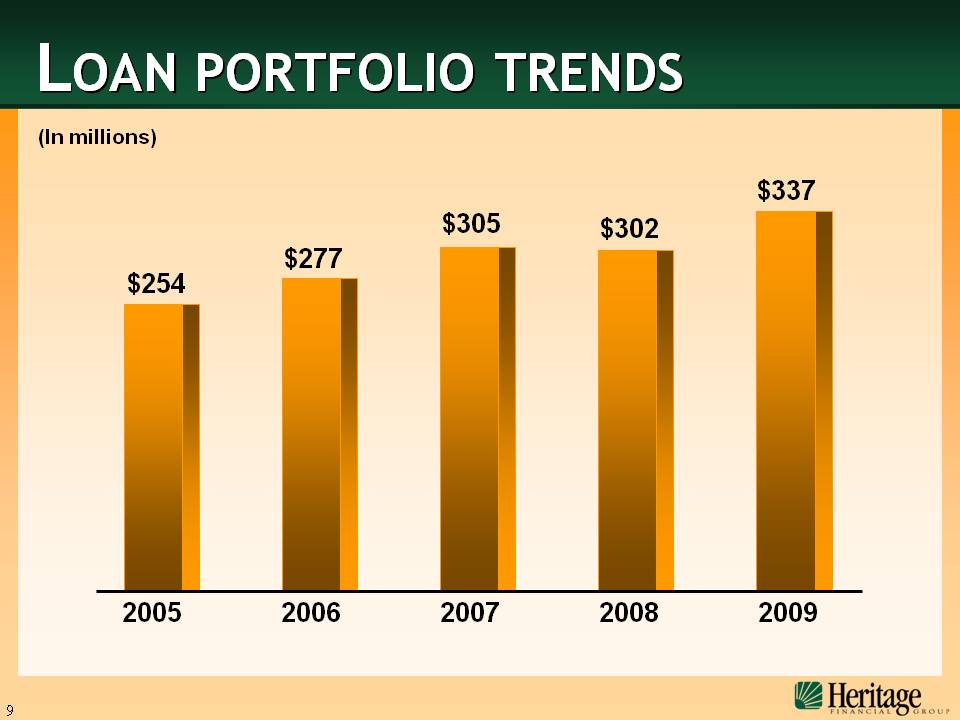

2007 2008 2009 2006 2005 $305 $302 $337 $254 $277 LOAN PORTFOLIO TRENDS (In millions)

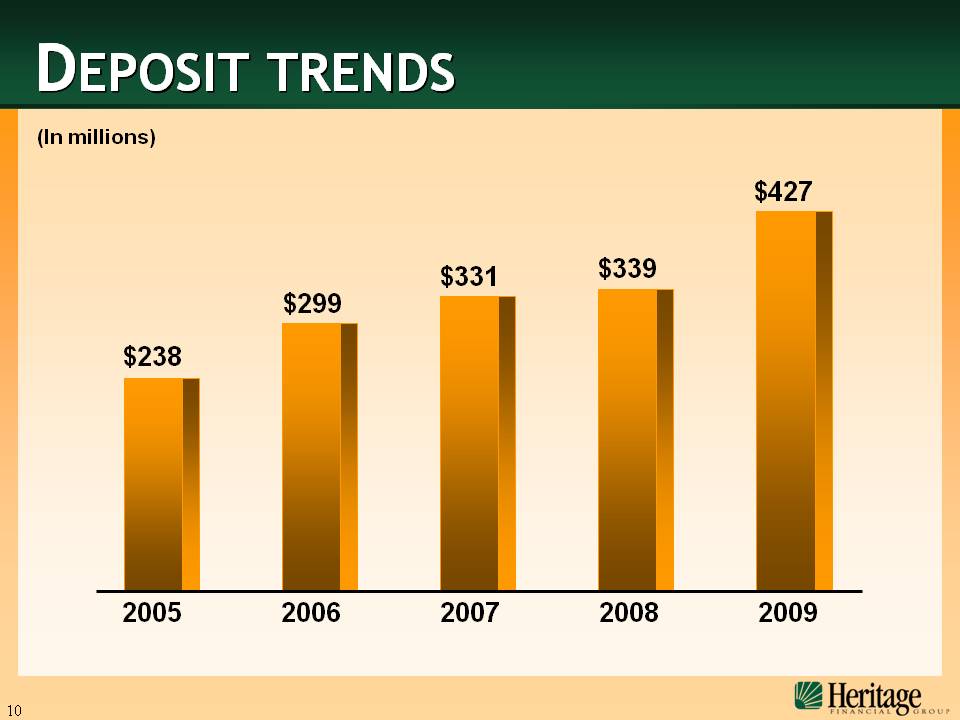

$427 $238 $299 $331 $339 DEPOSIT TRENDS (In millions) � 0;2007 2008 2009 2006 2005

LOAN MIX 2008 2009 FDIC-Assisted Acquisition Portfolio 93%$313 million 7% $24 mil lion 100% $302 Million (As of December 31,) Core Portfolio Core Portfolio

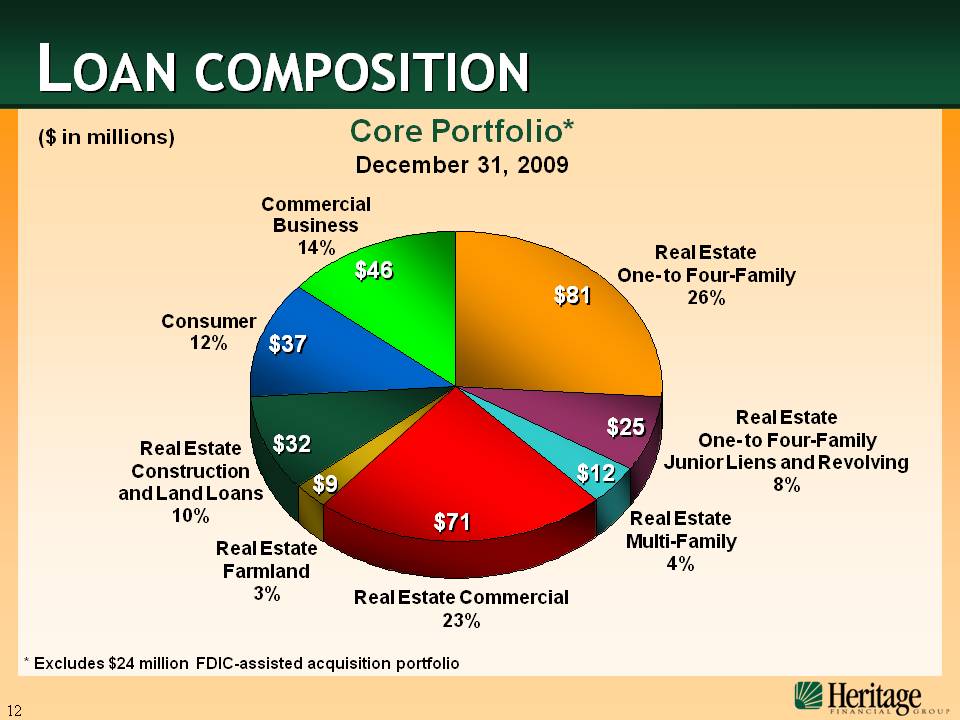

LOAN COMPOSITION Commercial Business 14% Consumer 12% Real Estate One- to Four-Family 26% Real Estate Commercial 23% Real Estate Multi-Family 4% Real Estate Farmland 3% Real Estate Construction and Land Loans 10% $81 $12 $71 $9 $32 $37 $46 ($ in millions) Real Estate One- to Four-Family Junior Liens and Revolving8% $25 * Excludes $24 million FDIC-assisted acquisition portfolio Core Portfolio* December 31, 2009

KEY GROWTH STRATEGIES Maintain strong presence in our Albany marketExpand and grow in our Ocala market

Source: US Census Bureau. Population Change 2000-2009 MARKET GROWTH STRATEGY U.S. 25,584,644 9.1% Five Fastest-Growing States (in population) Texas 3,930,482 18.8% California 3,090,016 9.1% Florida 2,555,591 16.0% Georgia 1,642,758 20.1% Arizona 1,465,146 28.6% Albany MSA 7,086 4.5% Ocala MSA 70,712 27.3%

KEY GROWTH STRATEGIES Maintain strong presence in our Albany market Expand and grow in our Ocala marketSeize new expansion opportunities Branch acquisitions Rigorous due-diligence process Take only high-quality, performing loansPost-closing put back period FDIC-assisted acquisitions

KEY GROWTH STRATEGIES Maintain strong presence in our Albany market Expand and grow in our Ocala market Seize new expansion opportunities Leverage our capabilities in commercial lending Commercial business loan portfolio has grown at CGR of 17% over last five years

KEY GROWTH STRATEGIES Maintain strong presence in our Albany market Expand and grow in our Ocala market Seize new expansion opportunities Leverage our capabilities in commercial and consumer lending Focus on controlling overhead and increasing operational efficiencies

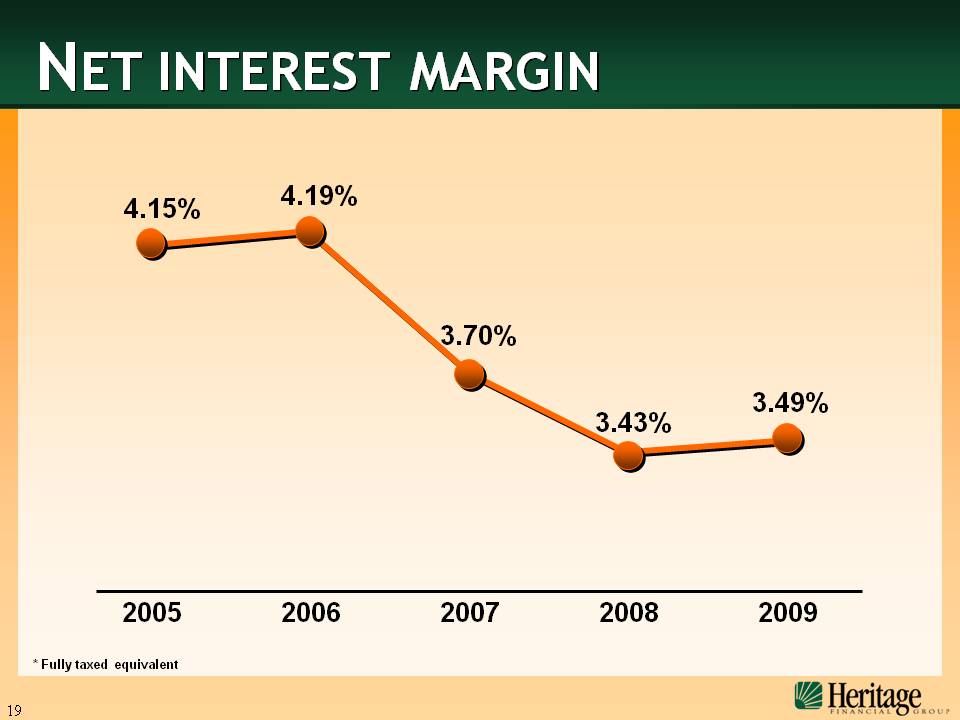

NET INTEREST MARGIN 3.43% 3.49% 4.15% 4.19% 3.70% * Fully taxed equivalent 2007 2008 2009 2006 2005

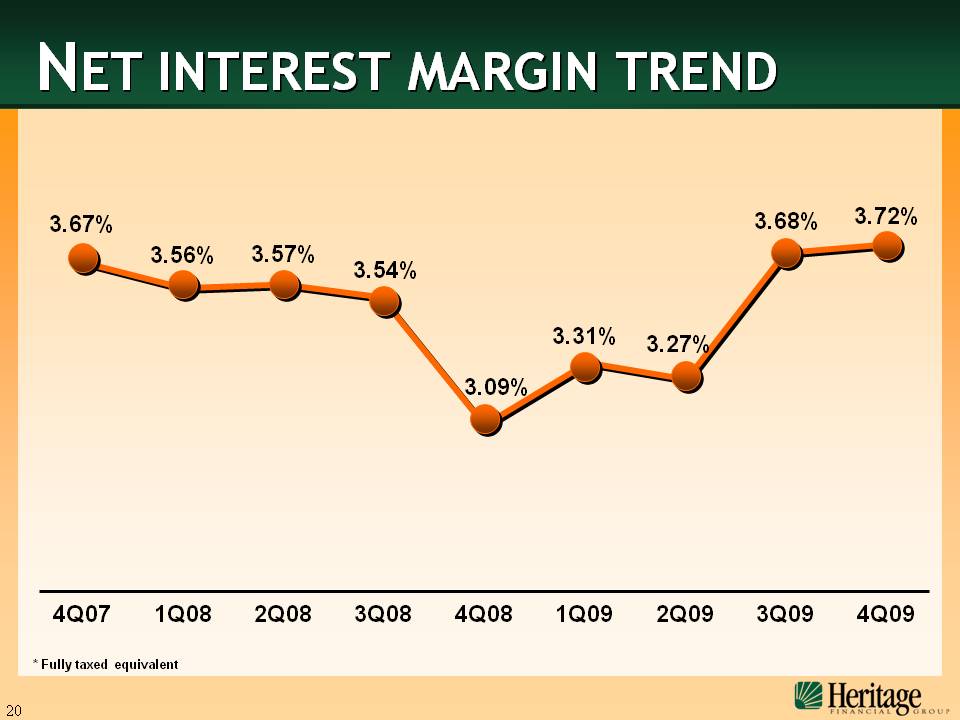

NET INTEREST MARGIN TREND 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 3.54% 3.09% 3.31% 3.27% 3.68% 3.72% 3.67% 3.56% 3.57% * Fully taxed equivalent

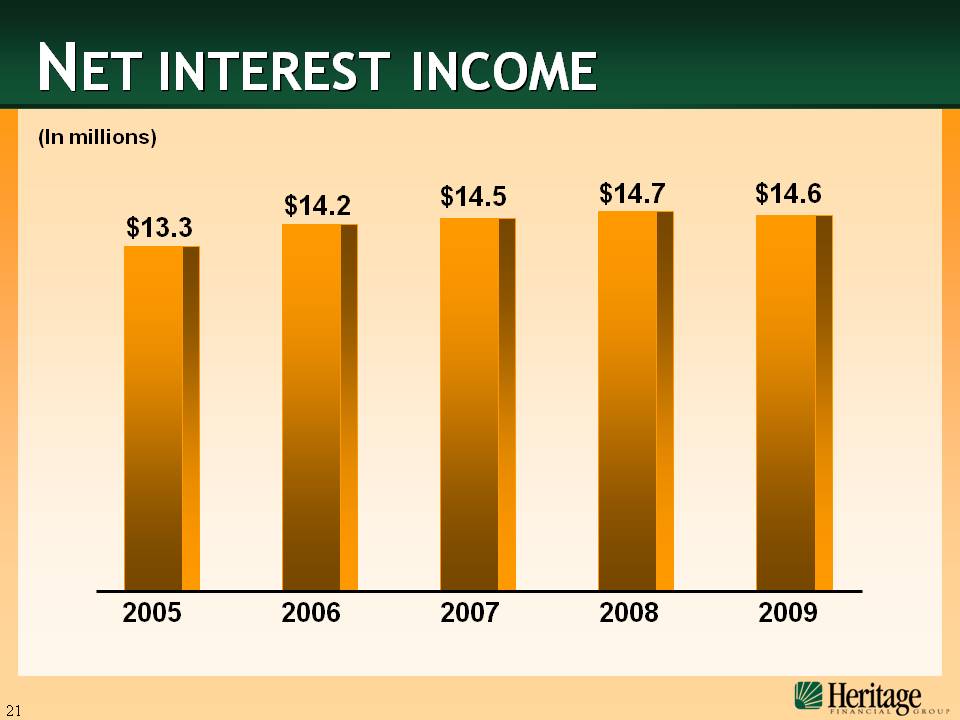

NET INTEREST INCOME $14.7 $14.6 $13.3 $14.2 $14.5 (In millions) 2007 2008 2009 2006 2005

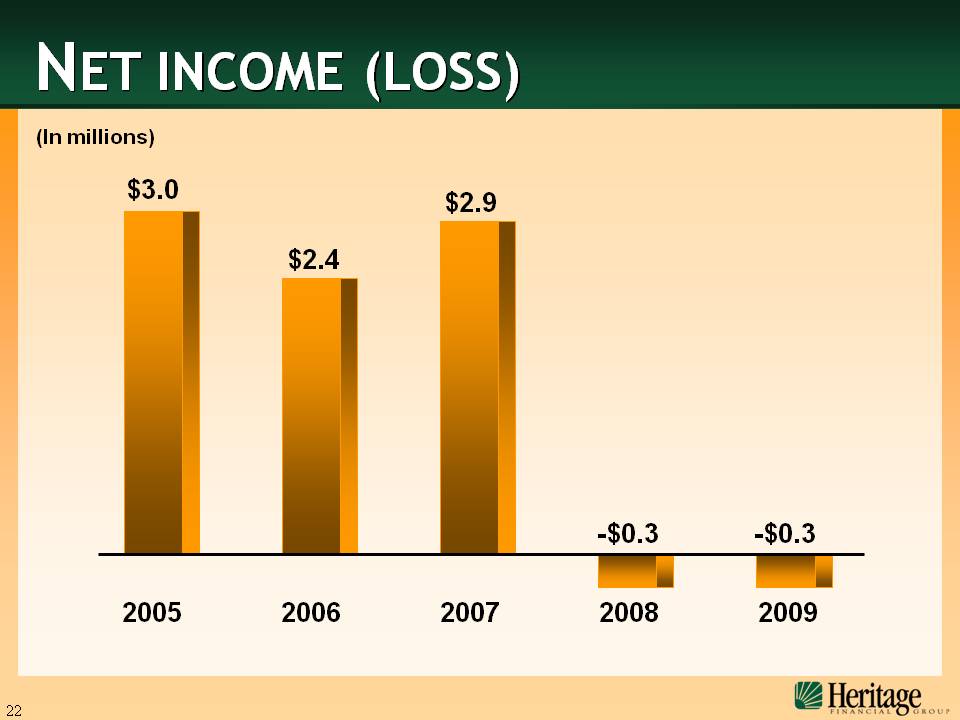

NET INCOME (LOSS) -$0.3 -$0.3 $3.0 $2.4 $2.9 (In millions) 2007 2008 2009 2006 2005

DILUTED EARNINGS (LOSS) PER SHARE 2007 2008 2009 2006 2005 -$0.03 -$0.03 $0.31 $0.22 $0.28

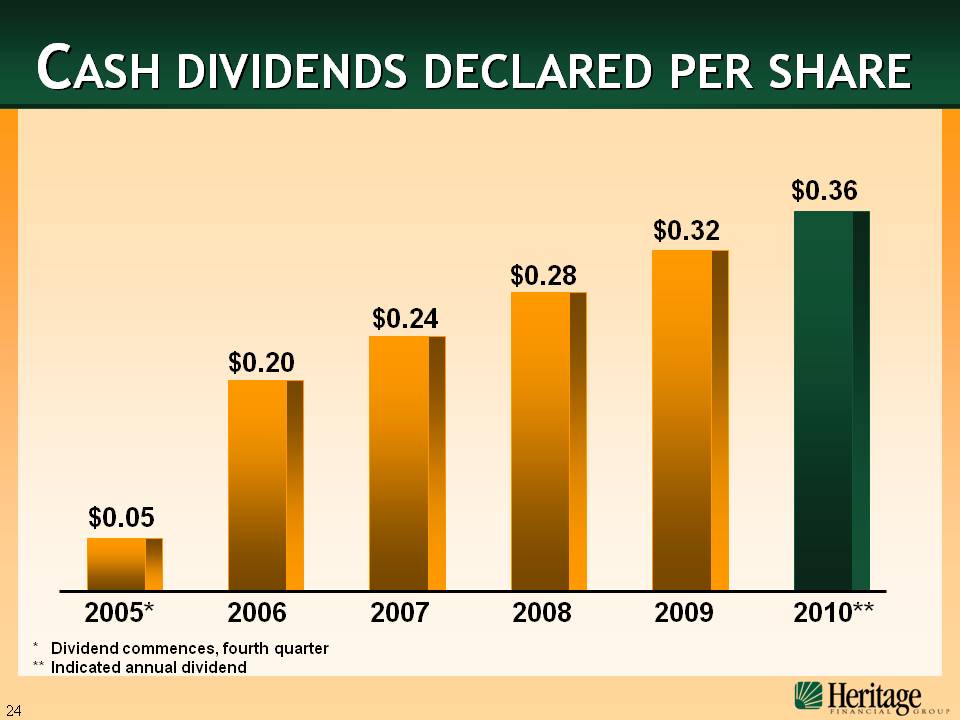

2007 2008 2009 2006 2005* 2010** CASH DIVIDENDS DECLARED PER SHARE $0.28 $0.32 $0.05 $0.20 $0.24 $0.36 * Dividend commences, fourth quarter ** Indicated annual dividend

$469 $502 $573 $364 $413 TOTAL ASSETS (In millions) 2007 2008 2009 2006 2005

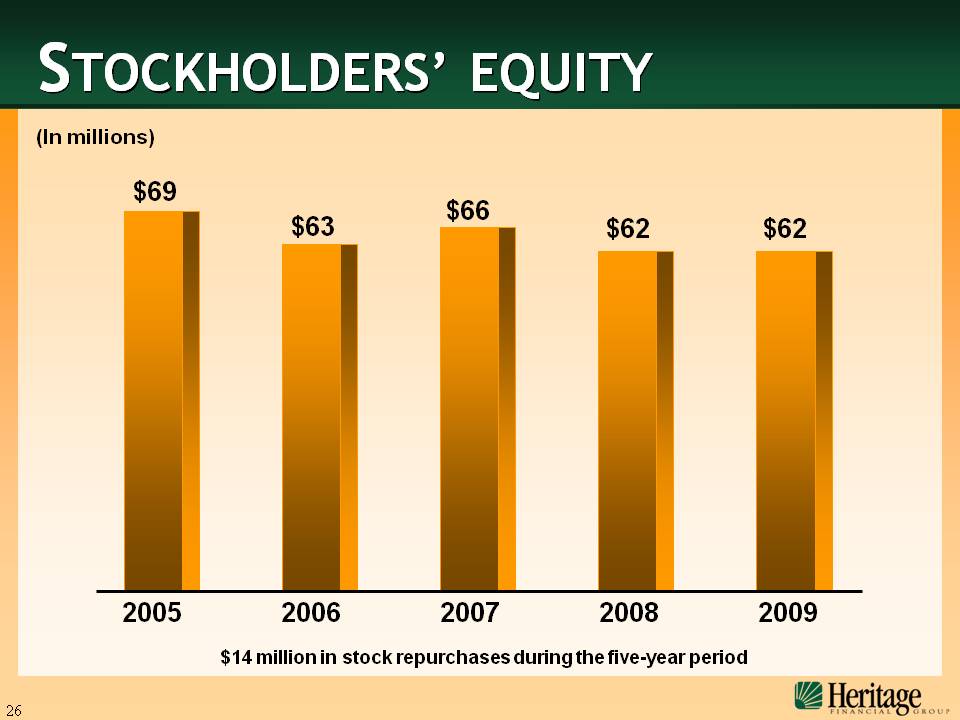

$66 $62 $62 $69 $63 STOCKHOLDERS’ EQUITY (In millions) 2007 2008 2009 2006 2005 $14 million in stock repurchases during the five-year period

KEY INVESTMENT POINTS Record of solid financial performance Strong commercial lending focus coupled with a significant retail presence Good growth opportunities in new and legacy markets Increasing focus on strategic relationships Ancillary financial services add balance to revenue stream

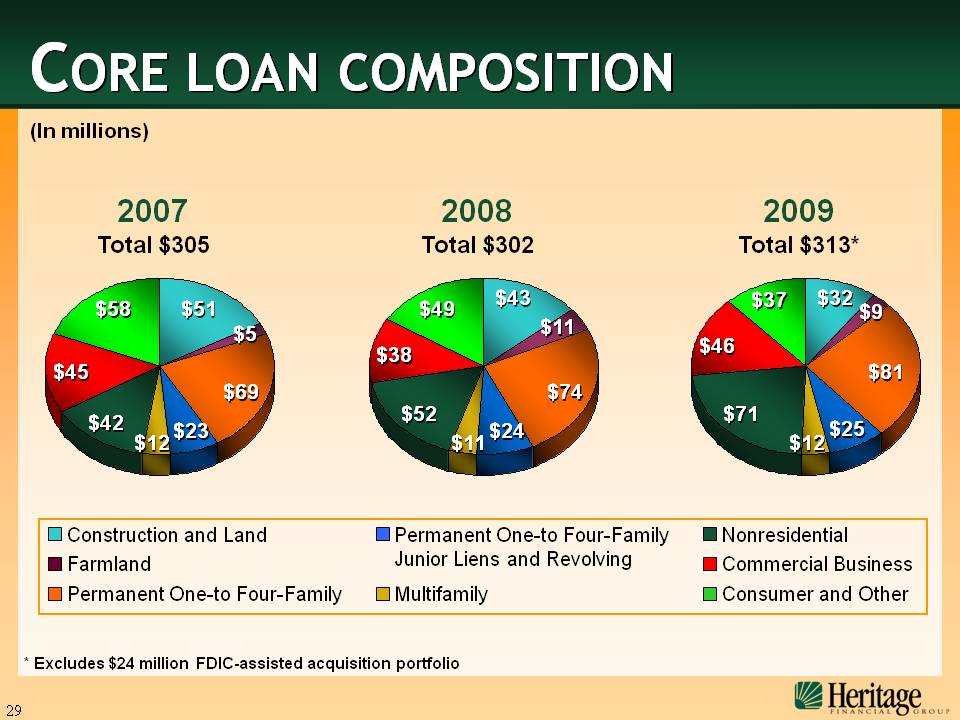

CORE LOAN COMPOSITION $81 $12 $71 $9 $32 $37 $46 (In millions) $25 * Excludes $24 million FDIC-assisted acquisition portfolio 2009 Total $313* Construction and Land Farmland Permanent One-to Four-Family Permanent One-to Four-Family Junior Liens and Revolving Multifamily Nonresidential Commercial Business Consumer and Other $74 $11 $52 $11 $43 $49 $38 $24 2008 Total $302 $69 $12 $42 $5 $51 $58 $45 $23 2007 Total $305

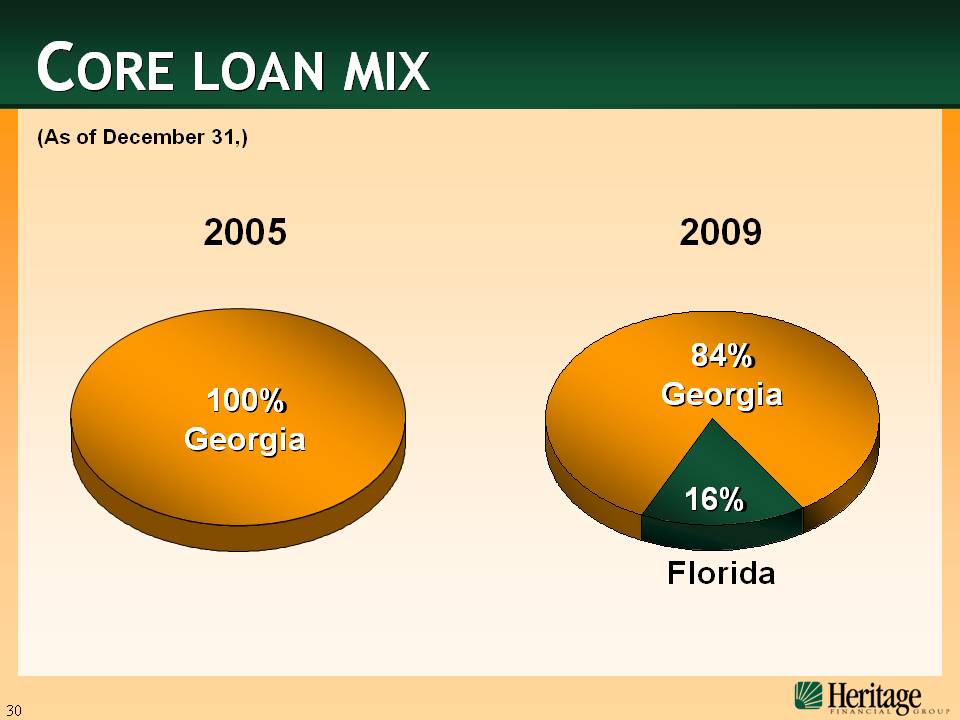

CORE LOAN MIX 2005 2009 Florida 84% Georgia 16% 100% Georgia (As of December 31,)

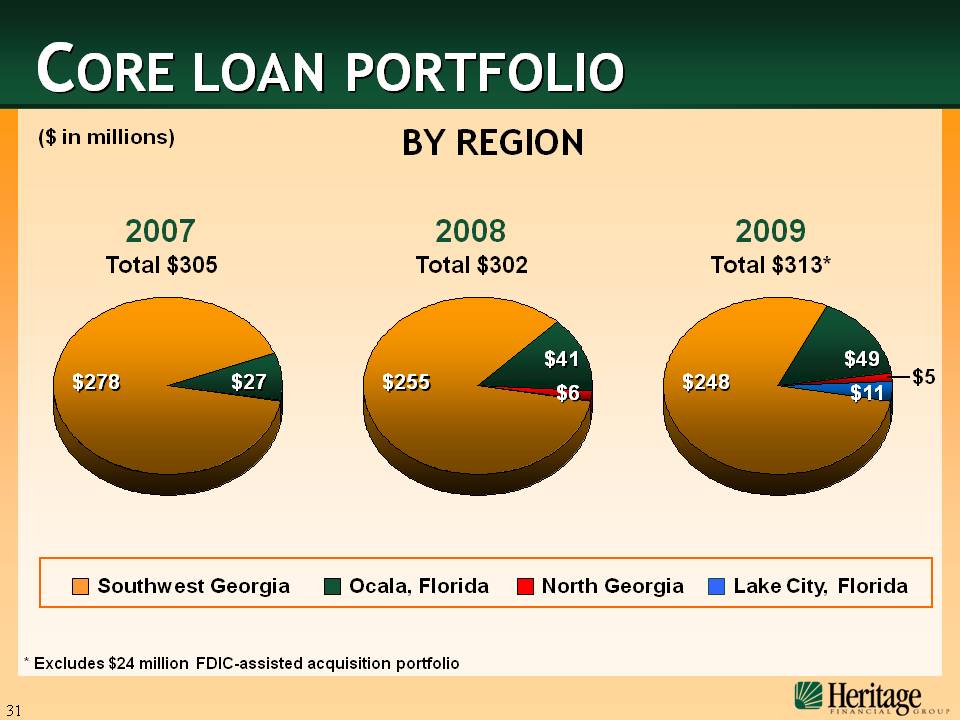

CORE LOAN PORTFOLIO ($ in millions) BY REGION Southwest Georgia Ocala, Florida North Georgia Lake City, Florida $27 $278 2007 Total $305 $41 $255 2008 Total $302 $6 $49 $255 2008 Total $313* $11 $5 * Excludes $24 million FDIC-assisted acquisition portfolio

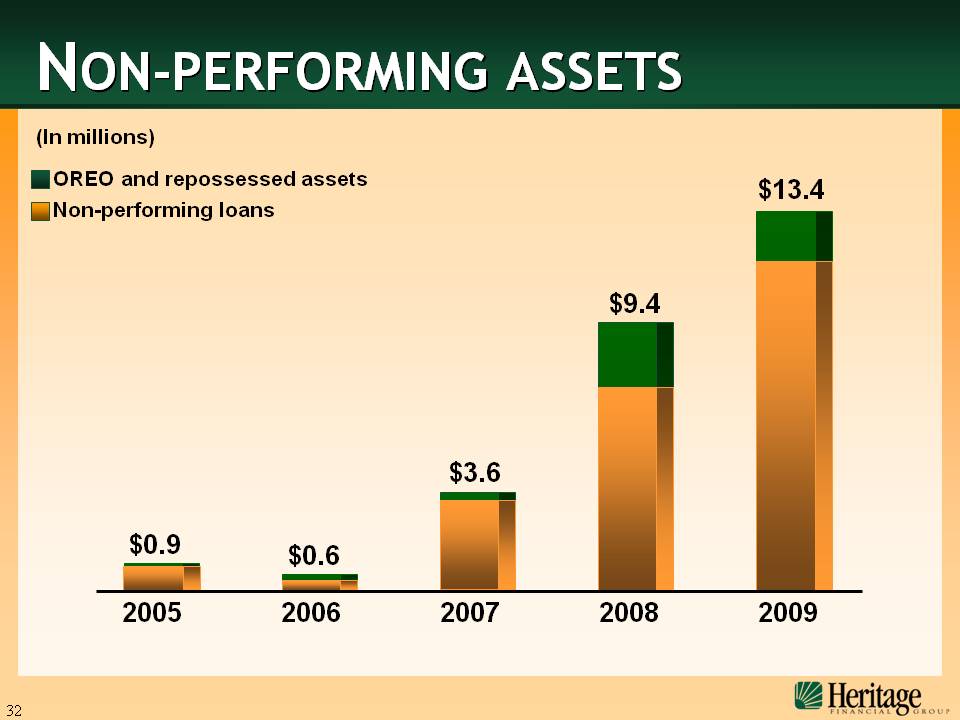

NON-PERFORMING ASSETS $3.6 $9.4 $13.4 $0.9 $0.6 2007 2008 2009 2006 2005 (In millions) (Gp:) OREO and repossessed assetsNon-performing loans

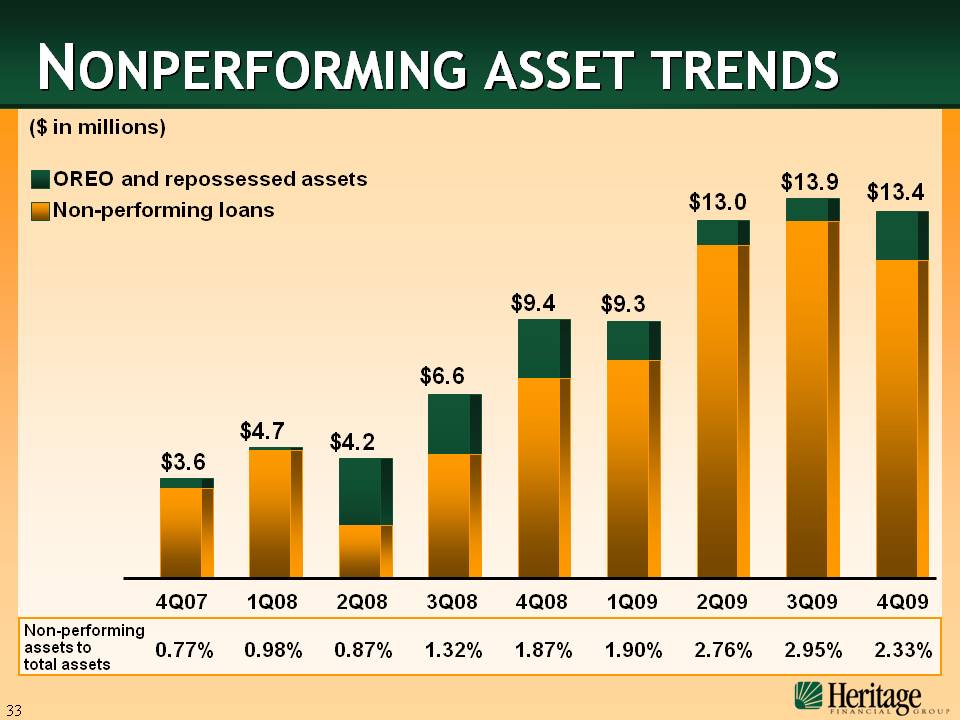

NONPERFORMING ASSET TRENDS ($ in millions) $9.4 $9.3 $13.0 $13.9 $13.4 1.87% 1.90% 2.76% 2.95% 2.33% 0.77% 0.98% 0.87% 1.32% $3.6 $4.7 $4.2 $6.6 Non-performing assets to total assets (Gp:) OREO and repossessed assetsNon-performing loans 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09

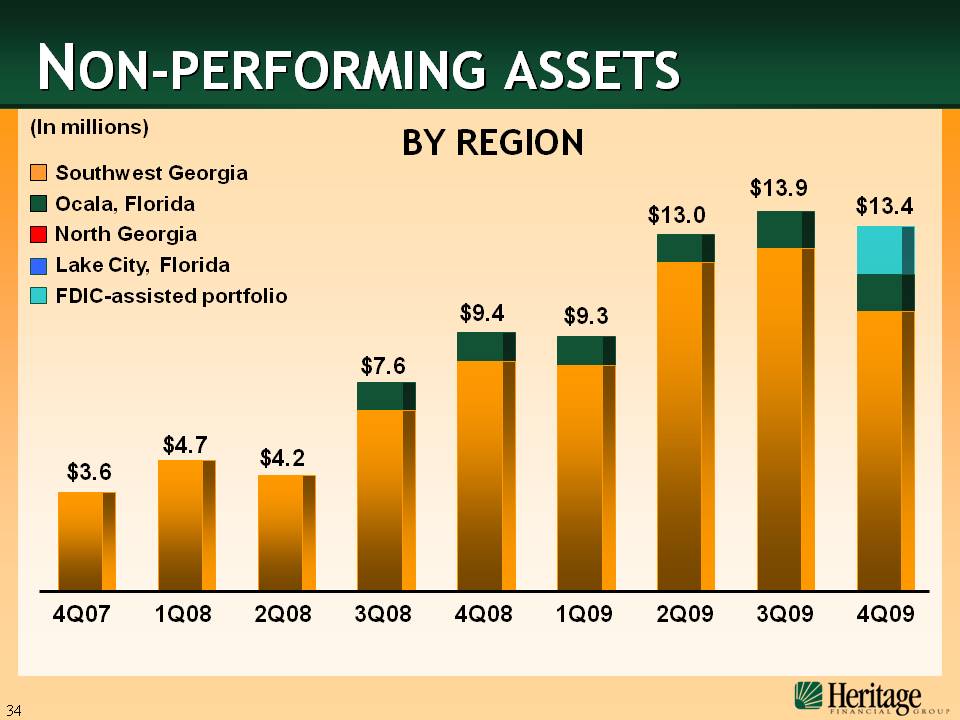

NON-PERFORMING ASSETS (In millions) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 $3.6 $4.7 $4.2 $7.6 $9.4 $9.3 $13.0 $13.9 Southwest Georgia Ocala, Florida North Georgia Lake City, Florida BY REGION $13.4 FDIC-assisted portfolio

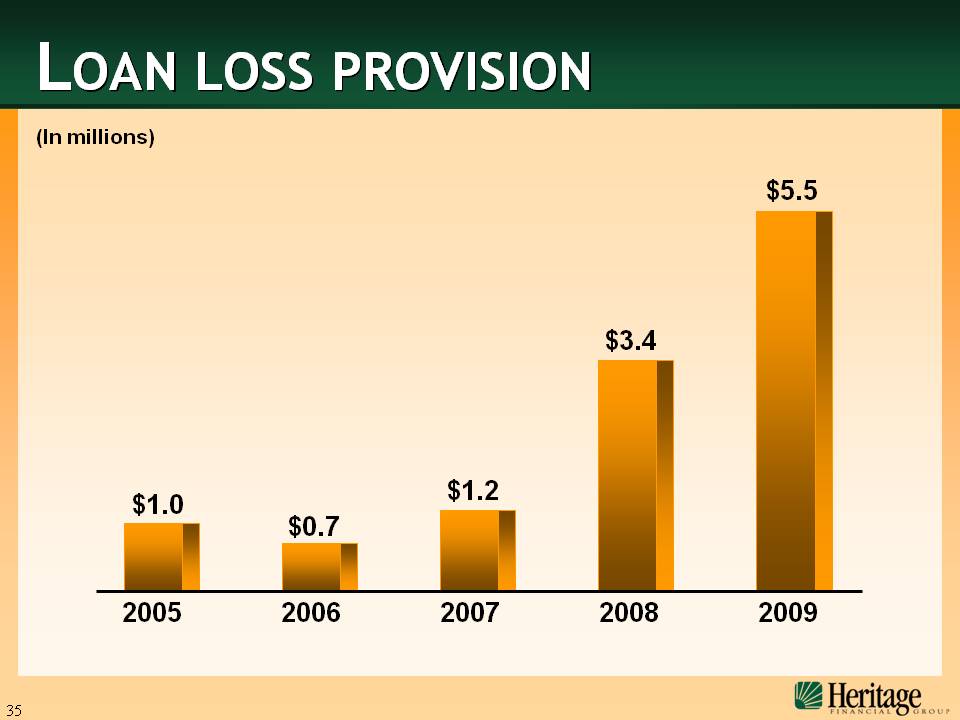

LOAN LOSS PROVISION (In millions) $1.2 $3.4 $5.5 $1.0 $0.7 2007 2008 2009 2006 2005

LOAN LOSS PROVISION TREND (In millions) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 $0.6 $0.4 $0.8 $1.2 $1.0 $0.8 $0.5 $2.5 $1.7

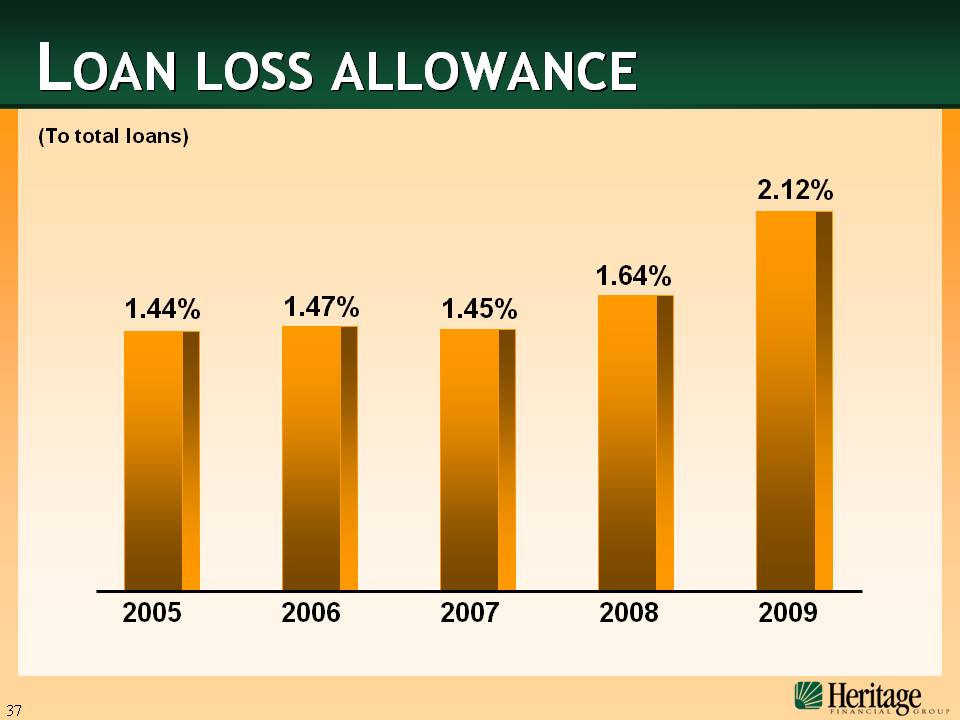

LOAN LOSS ALLOWANCE (To total loans) 1.45% 1.64% 2.12% 1.44% 1.47% 2007 2008 2009 2006 2005

LOAN LOSS ALLOWANCE TREND 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1.66% 1.64% 1.82% 1.94% 2.68% 2.12% (To total loans) 1.45% 1.51% 1.31

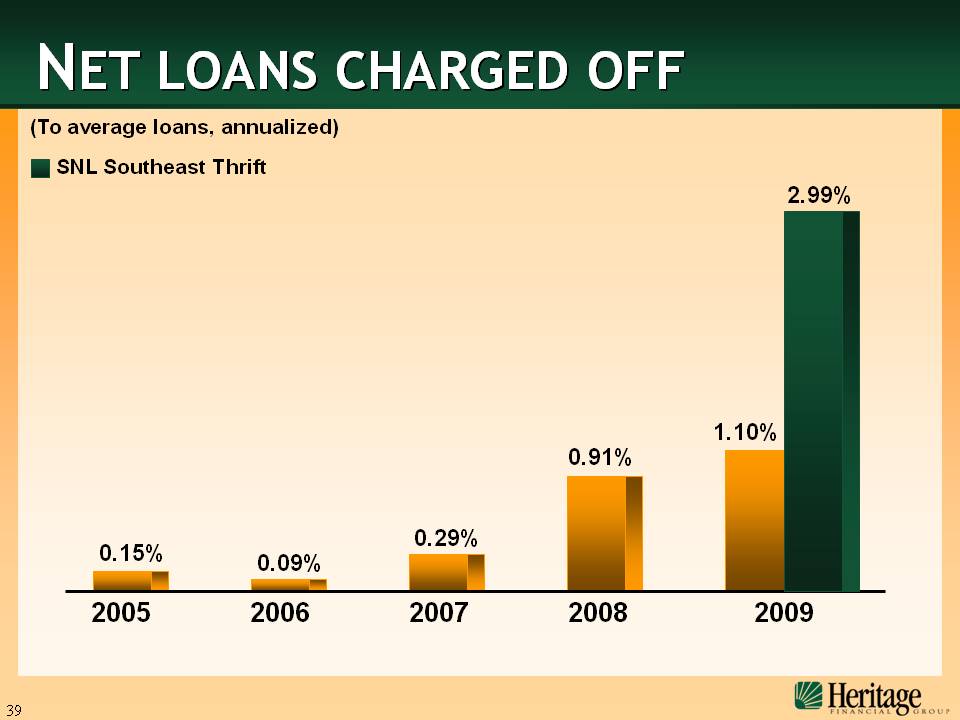

NET LOANS CHARGED OFF (To average loans, annualized) SNL Southeast Thrift 2007 2008 2009 2006 2005 0.91% 1.10% 0.09% 0.29% 0.15% 2.99%

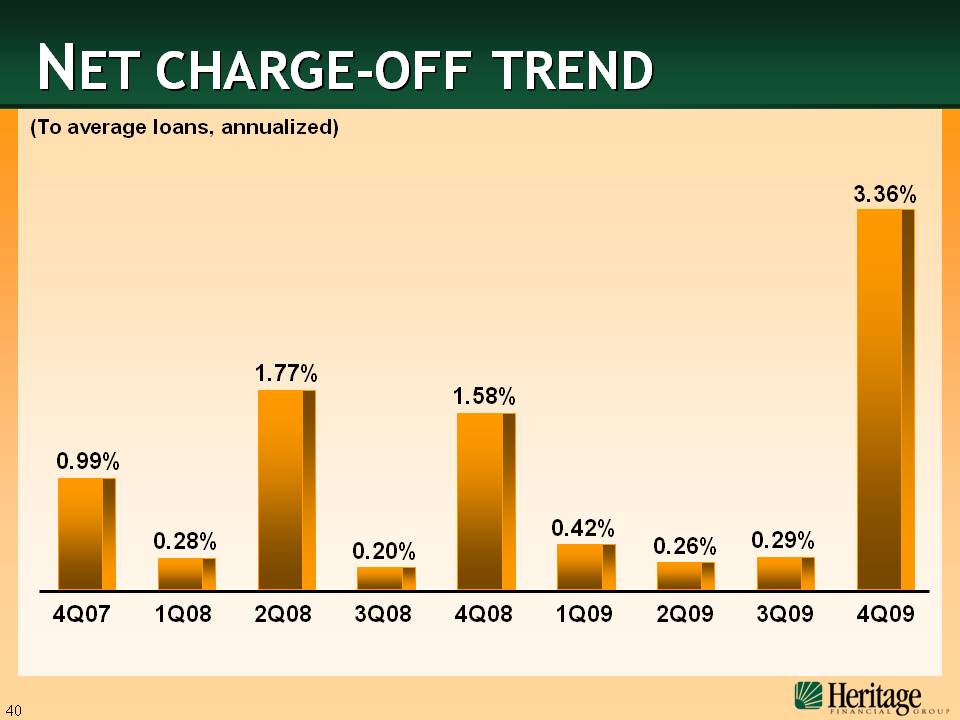

NET CHARGE-OFF TREND (To average loans, annualized) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 0.99% 0.28% 1.77% 0.20% 1.58% 0.42% 0.26% 0.29% 3.36%

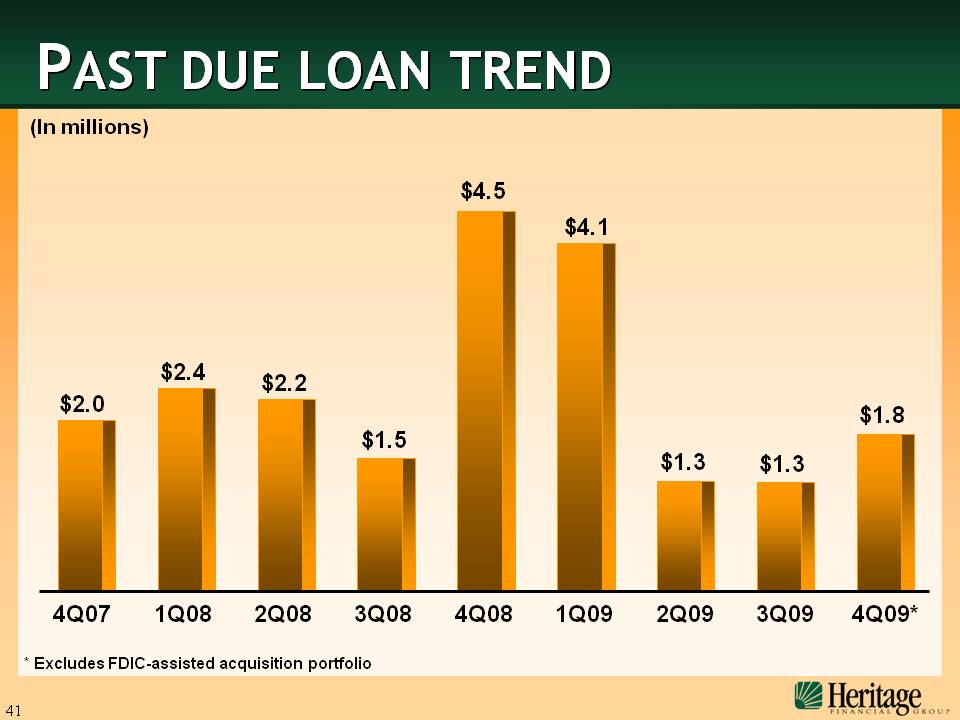

PAST DUE LOAN TREND (In millions) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09* $2.0 $2.4 $2.2 $1.5 $4.5 $4.1 $1.3 $1.3 $1.8 * Excludes FDIC-assisted acquisition portfolio

PAST DUE LOANS (In millions) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09* $2.0 $2.4 $2.2 $1.5 $4.5 $4.1 $1.3 $1.3 $1.8 Southwest Georgia Ocala, Florida North Georgia Lake City, Florida BY REGION * Excludes FDIC-assisted acquisition portfolio

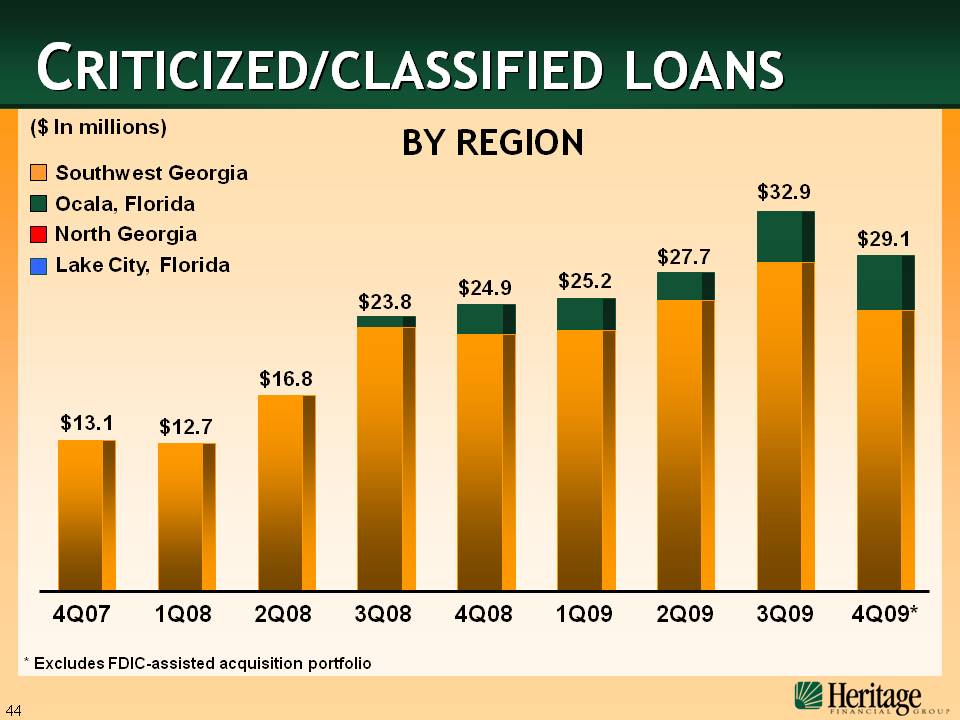

CRITICIZED/CLASSIFIED LOAN TREND (In millions) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09* $13.1 $12.7 $16.8 $23.8 $24.9 $25.2 $27.7 $32.9 $29.1 * Excludes FDIC-assisted acquisition portfolio

CRITICIZED/CLASSIFIED LOANS ($ In millions) 4Q07 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09* $13.1 $12.7 $16.8 $23.8 $24.9 $25.2 $27.7 $32.9 $29.1 Southwest Georgia Ocala, Florida North Georgia Lake City, Florida BY REGION * Excludes FDIC-assisted acquisition portfolio

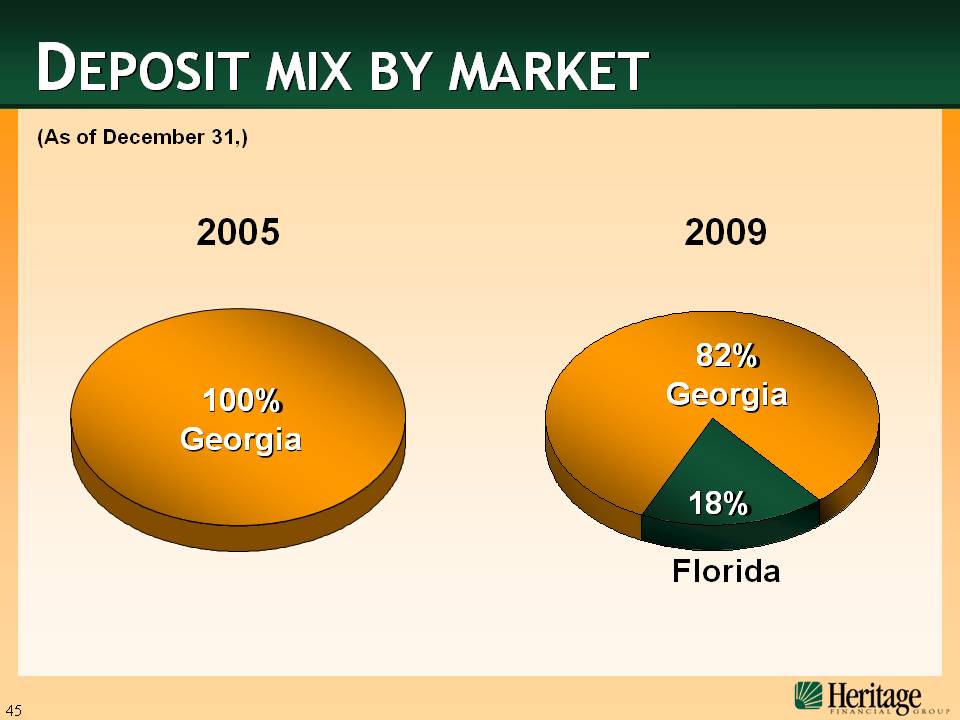

100% Georgia 2005 2009 DEPOSIT MIX BY MARKET Florida 82% Georgia 18% (As of December 31,)

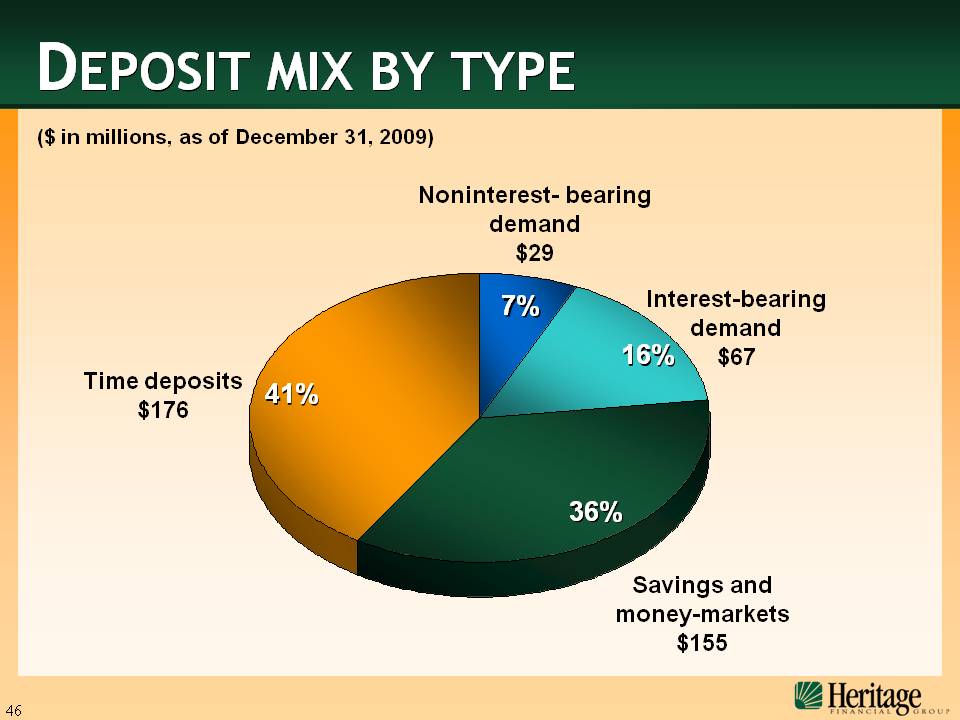

DEPOSIT MIX BY TYPE Noninterest- bearing demand $29 Interest-bearing demand $67 Savings and money-markets $155 7% 16% 36% Time deposits$176 41% ($ in millions, as of December 31, 2009)

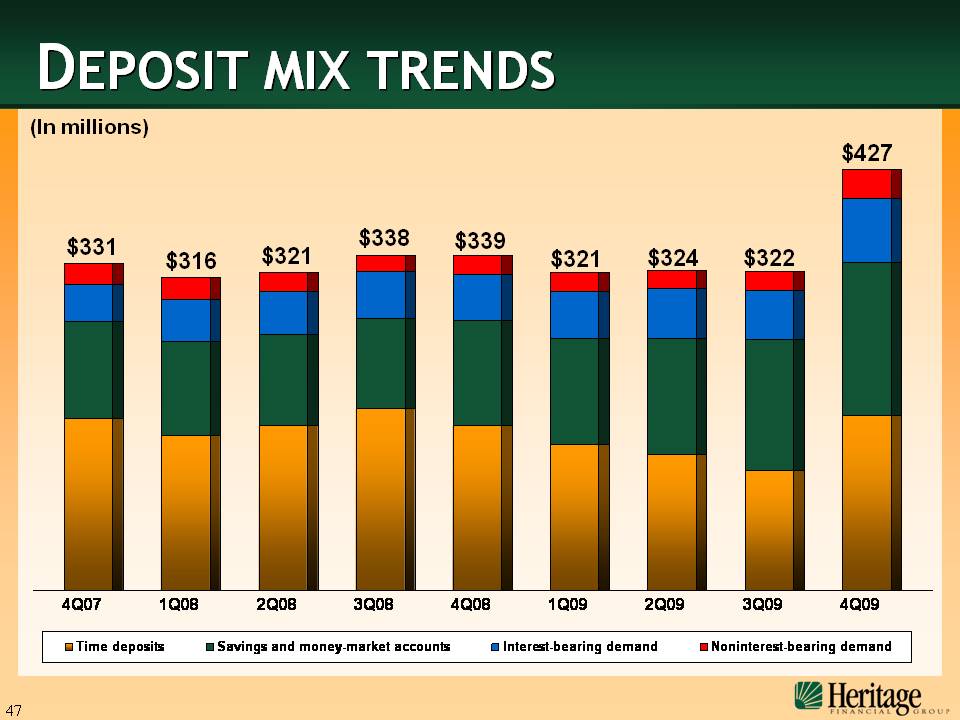

DEPOSIT MIX TRENDS (In millions) $331 $316 $321 $338 $339 $321 $324 $322 $427