UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

[X] QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended July 31, 2008; or

[ ] TRANSITION REPORT UNDER SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______________to ______________

Commission File Number000-51922

TAO MINERALS LTD.

(Exact Name of Small Business Issuer in Its Charter)

| Nevada | 20-1682702 |

| (State or Other Jurisdiction of | (I.R.S. Employer |

| Incorporation or Organization) | Identification Number) |

Officina 624, Empresarial Mall Ventura, Cra.32#1B

Sur 51, Medellin, Columbia

(305) 726-0602

(Address and telephone number of principal executive offices

and principal place of business)

Check whether the issuer (1) filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the past 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes [X] No [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer”. “accelerated filer” and smaller reporting company” in Rule12b-2 of the Exchange Act.

| Large accelerated filer [ ] | Accelerated filer [ ] |

| Non-accelerated filer [ ] (Do not check if smaller reporting company) | Smaller reporting company [X] |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes [ ] No [X]

APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PRECEDING FIVE YEARS

Check whether the registrant filed all documents and reports required to be filed by section 12,13 or 15 of the Exchange Act after distribution of securities under a plan confirmed by a court [ ]

APPLICABLE ONLY TO CORPORATE ISSUERS

As of July 31, 2008, there were111,401,538shares of the issuer’s common stock and outstanding, par value $0.001.

Transitional Small Business Disclosure Format (Check one): Yes [ ] No [X]

INDEX

PART 1.FINANCIAL INFORMATION

| | Item 1. | Financial Statements |

| | | |

| | | Consolidated Balance Sheets as of July 31, 2008 |

| | | |

| | Consolidated Statements of Operations for the three and six months ended July 31, 2008 and 2007, and for the period from September 23, 2004 (Date of inception) to July 31, 2008 |

| | | |

| | Consolidated Statements of Cash Flows for the three and six months ended July 31, 2008 and 2007, and for the period September 23, 2004 (Date of inception) to July 31, 2008 |

| | | |

| | | Notes to Consolidated Financial Statements |

| | | |

| | Item 2 | Management Discussion and Analysis |

| | | |

| | Item 3 | Controls and Procedures |

PART II. OTHER INFORMATION

| | Item 1 | Legal Proceedings |

| | | |

| | Item 2 | Changes in Securities |

| | | |

| | Item 3 | Defaults Upon Senior Securities |

| | | |

| | Item 4 | Submission of Matters to a Vote of Security Holders |

| | | |

| | Item 5 | Other Information |

| | | |

| | Item 6 | Exhibits and Reports on Form 8K |

| | | |

| | SIGNATURES | |

TAO MINERALS LTD.

(An Exploration Stage Company)

Unaudited Financial Statements

| TAO MINERALS LTD. |

| (An Exploration Stage Company) |

| Consolidated Balance Sheets |

| (Unaudited) |

| | | July 31, 2008 | | | January 31, 2008 | |

| | | | | | | |

| ASSETS | | | | | | |

| Current | | | | | | |

| Cash | $ | 91,756 | | $ | 1,563 | |

| Prepaid and other assets | | 14,933 | | | 9,500 | |

| Total current assets | | 106,689 | | | 11,063 | |

| Other Assets | | | | | | |

| Mineral Rights, net | | 409,010 | | | 350,000 | |

| Intangible | | 105,819 | | | - | |

| Total Other Assets | | 514,829 | | | 350,000 | |

| | | | | | | |

| | | | | | | |

| Total assets | $ | 621,518 | | $ | 361,063 | |

| | | | | | | |

| LIABILITIES | | | | | | |

| Current | | | | | | |

| Accounts payable and accrued expenses | $ | 246,705 | | $ | 178,145 | |

| Note Payable | | 250,000 | | | - | |

| Convertible Note | | 273,500 | | | 620,000 | |

| Stock issuance liability | | 92,100 | | | 92,100 | |

| Derivative liability | | 787,127 | | | - | |

| Other accrued liabilities | | 106,559 | | | 100,000 | |

| Due to a related party | | 6,744 | | | - | |

| Total current liabilities | | 1,762,735 | | | 990,245 | |

| Note payable long term | | 2,337 | | | | |

| Total Liabilities | | 1,765,072 | | | 990,245 | |

| | | | | | | |

| Minority interest | | (8,451 | ) | | - | |

| | | | | | | |

| STOCKHOLDERS’ DEFICIT | | | | | | |

| Share capital | | | | | | |

| Authorized: | | | | | | |

| Preferred stock $0.001 par value 1,000,000 shares authorized | | | | | | |

| None issued, allotted and outstanding: | | - | | | - | |

| Common stock $0.001 par value, 552,000,000 shares authorized | | | | | | |

| Issued, and outstanding: | | | | | | |

| 111,401,538 and 57,106 , 909 shares of common stock at July 31, | | 111,402 | | | 57,106 | |

| 2008 and January 31, 2008, respectively | | | | | | |

| Additional paid-in capital | | 1,843,762 | | | 655,441 | |

| Deficit accumulated during exploration stage | | (3,089,253 | ) | | (1,341,729 | ) |

| Accumulated Comprehensive loss | | (1,014 | ) | | - | |

| Total stockholders’ deficit | | (1,135,103 | ) | | (629,182 | ) |

| Total liabilities and stockholders’ equity | $ | 621,518 | | $ | 361,063 | |

The accompanying notes are an integral part of these financial statements.

F-1

| TAO MINERALS LTD. And SUBSIDIARY |

| (An Exploration Stage Company) |

| Consolidated Statements of Operations |

| (Unaudited) |

| | | From Inception | | | | | | | | | | | | | |

| | | Date of | | | | | | | | | | | | | |

| | | September 23, | | | | | | | | | | | | | |

| | | 2004 to Period | | | For the three | | | For the three | | | For the six | | | For the six | |

| | | Ended July 31, | | | Months ended | | | Months ended | | | Months ended | | | Months ended | |

| | | 2008 | | | July 31, 2008 | | | July 31, 2007 | | | July 31, 2008 | | | July 31, 2007 | |

| OPERATING EXPENSES | | | | | | | | | | | | | | | |

| Exploration expenses | $ | 122,650 | | $ | - | | $ | - | | $ | - | | $ | - | |

| Professional fees | | 228,128 | | | 24,030 | | | 48,523 | | | 24,420 | | | 55,698 | |

| Directors Fees | | 120,000 | | | - | | | - | | | - | | | - | |

| Consulting fees | | 703,850 | | | 48,000 | | | 39,000 | | | 96,000 | | | 78,000 | |

| Legal | | 266,301 | | | 21,039 | | | - | | | 87,854 | | | - | |

| General and administrative | | 82,584 | | | 24,361 | | | 129 | | | 26,057 | | | 679 | |

| Total Operating Expenses | | 1,523,513 | | | 117,430 | | | 87,652 | | | 234,331 | | | 134,377 | |

| LOSS FROM OPERATIONS | | (1,523,513 | ) | | (117,430 | ) | | (87,652 | ) | | (234,331 | ) | | (134,377 | ) |

| OTHER EXPENSES | | | | | | | | | | | | | | | |

| Interest expense | | (9,701 | ) | | (9,244 | ) | | - | | | 9,701 | | | - | |

| Derivative charge | | (687,127 | ) | | (673,355 | ) | | - | | | 687,127 | | | - | |

| Loss on settlement of debt | | (816,367 | ) | | (816,367 | ) | | | | | 816,367 | | | | |

| Foreign currency translation | | 1,531 | | | - | | | - | | | - | | | - | |

| gain | | | | | | | | | | | | | | | |

| Total Other Expenses | | (1,511,664 | ) | | (1,498,966 | ) | | (87,652 | ) | | (1,513,195 | ) | | (134,377 | ) |

| Minority interest | | 515 | | | 515 | | | - | | | 515 | | | - | |

| Net Loss for the Period | | (3,034,662 | ) | $ | (1,615,881 | ) | $ | (87,652 | ) | $ | (1,747,011 | ) | $ | (134,377 | ) |

LOSS PER SHARE – BASIC AND FULLY

DILUTED | |

| | $ | (.02 | )

| $ | 0.00 |

| $ | (.03 | )

| $ | 0.0 |

|

| | | | | | | | | | | | | | | | |

| WEIGHTED AVERAGE NUMBER OF | | | | | | | | | | | | | |

| ISSUED SHARES BASIC and FULLY | | | 68,620,271 | | | 51,816,000 | | | 67,979,387 | | | 51,816,000 | |

| DILUTED | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these financial statements.

F-2

| TAO MINERALS LTD. And SUBSIDIARY |

| (An Exploration Stage Company) |

| Consolidated Statements of Cash Flows |

| (Unaudited) |

| | | From Inception Date | | | | | | | |

| | | of September 23, 2004 | | | For the Six Months | | | For the Six Months | |

| | | to July 31, 2008 | | | ended July 31, 2008 | | | ended July 31, 2007 | |

| Cash Provided by (Used for) Operating | | | | | | | | | |

| Activities | | | | | | | | | |

| Net loss for the period | $ | (3,035,077 | ) | $ | (1,747,524 | ) | $ | (134,377 | ) |

| Issuance of common stock for services | | 682,386 | | | 79,750 | | | - | |

| Loss on settlement of debt | | 816,367 | | | 816,367 | | | - | |

| Minority interest in loss | | 515 | | | 515 | | | - | |

| Changes in non-cash working capital items | | | | | | | | - | |

| Accounts payable and accrued liabilities | | 343,567 | | | 72,897 | | | 85,768 | |

| Prepaid expenses | | (14,933 | ) | | (5,433 | ) | | 8,000 | |

| Derivative liability | | 787,,127 | | | 787,127 | | | - | |

| Deferred Charges | | (97,663 | ) | | (97,663 | ) | | - | |

| Cash used by operations | | (517,711 | ) | | (93,964 | ) | | (40,609 | ) |

| Investing Activities | | | | | | | | | |

| Purchase of mineral rights | | (414,829 | ) | | (164,829 | ) | | - | |

| Cash used by investing activities | | (414,829 | ) | | (164,829 | ) | | - | |

| Financing Activities | | | | | | | | | |

| Issuance of debt | | 970,000 | | | 350000 | | | - | |

| Issuance of common stock for cash | | 55,310 | | | | | | - | |

| Cash provided by financing activities | | 1,025,310 | | | 350,000 | | | - | |

| Cash Increase (Decrease) During the | | 92,770 | | | 91,207 | | | (40,609 | ) |

| Period | | | | | | | | | |

| Foreign Currency Translation Adjustment | | (1,014 | ) | | (1,014 | ) | | - | |

| | | | | | | | | | |

| Cash, Beginning of Period | | - | | | 1,563 | | | 43,444 | |

| Cash and Equivalent, End of Period | $ | 91,756 | | $ | 91,756 | | $ | 2,835 | |

During the periods ended July 31, 2008 and 2007 the Company did not pay any cash for interest or taxes.

The accompanying notes are an integral part of these financial statements.

F-3

| TAO MINERALS LTD |

| (An Exploration Stage Company) |

| Notes to Consolidated Financial Statements |

| For the period ended July 31, 2008 and 2007 |

| |

| 1. | Organization and Summary of Significant Accounting Policies |

Nature of Operations and Going Concern

Tao Minerals, Ltd. (an exploration stage company) (the “Company”) was incorporated under the laws of the State of Nevada on September 23, 2004. The Company is a natural resource exploration company with an objective of acquiring, exploring and if warranted and feasible, developing natural resource properties. On July 16, 2008, the Company acquired 611,000 shares of common stock of Minera Tao, SA a Colombian company representing a 93.14 % ownership interest. The Company paid $1,000 and assumed $105,819 of liabilities to acquire Minera TAO< SA.

As reflected in the accompanying financial statements, the Company is in the exploration stage and has a cumulative negative cash flows from operations of ($517,811) and losses of ($3,034,662) since inception. This raises substantial doubt about its ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent on the Company’s ability to raise additional capital and implement its business plan. The financial statements do not include any adjustments that might be necessary if the Company is unable to continue as a going concern.

Management believes that actions presently being taken to obtain additional funding and implement its strategic plans provide the opportunity for the Company to continue as a going concern.

The financial statements for the three and six months ended July 31, 2008 and 2007, and for the period from September 23, 2004 (inception) to July 31, 2008, together with the balance sheet as of July 31, 2008 included herein have not been audited by the Company’s independent public accountants. In the opinion of management, all adjustments necessary to present fairly the financial position at July 31, 2008 and the results of operations and cash flows for the periods presented herein have been made.

The financial statements included herein have been prepared pursuant to the rules and regulations of the Securities and Exchange Commission. Certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States of America have been omitted pursuant to such regulations. These financial statements should be read in conjunction with the financial statements and notes thereto included in the Company’s Annual Report on Form 10-KSB for the year ended January 31, 2008.

The financial statements of the Company have been prepared in accordance with accounting principles generally accepted in the United States of America. Because a precise determination of many assets and liabilities is dependent upon future events, the preparation of financial statements for a period necessarily involves the use of estimates which have been made using careful judgment. Actual results may vary from these estimates. Prior periods have been adjusted to conform with the presentation of the financial statements ended July 31, 2008.

The consolidated financial statements include the accounts of the Company and it’s majority owned subsidiary Minera TAO, SA a Colombian entity. All intercompany accounts have been eliminated.

On April 4, 2008 the Company entered into a Securities Purchase Agreement for the sale of 10% convertible notes for an aggregate principal amount of $1,000,000 On April 9 $125,000 was advanced and

| TAO MINERALS LTD |

| (An Exploration Stage Company) |

| Notes to Consolidated Financial Statements |

| For the period ended July 31, 2008 and 2007 |

| |

the second instalment of $875,000 will be advanced 5 days of the effective date of a registration statement with the SEC (see 8-k filed on 4/4/08). The notes are convertible at a price of 50% of the weighted average price of the stock for the preceding 5 days prior to conversion. The Company is obligated to file a registration statement within 45 days following the closing. As of July 31, 2008, the Company has not complied with the 45 day registration and has not received notice of default from the note holder.

On April 4, 2008 the $620,000 note payable was transferred to a new party which the Company entered into an agreement enabling the new creditor to convert the principal outstanding amount of the note at a price equal to 30% of the lowest closing bid price for the five previous dates prior to conversion. As of July 31, 2008, $346,500 of the note has been converted to 52,844,624 shares of common stock.

In May 2008 the Company entered into a note payable with an investor for $500,000 with an 8% interest rate due on demand. Such note was to be funded as of July 31, 2008. As of July 31, 2008 the Company had received $250,000 of such amounts.

On April 21 the Company issued 1,450,000 shares of common stock at $.055 for a value of $79,750 for legal costs. From May 1 to July 31, 2008 the holder of the $620,000 note converted $346,500 into 52,844,624 shares of common stock. Such conversions resulted in a $816,367 loss on settlement of debt for the six months ended July 31, 2008.

On April 4, 2008 the Company executed a convertible note agreement for a principal amount of $125,000 Net proceeds of $100,000 (net of fees of $25,000) were received. The Note bears interest at 10%, and matures two years from the date of issuance, and was convertible into common stock, at the holders’ option, at a conversion price, equal to 50% of the weighted average of the lowest trading prices for the Company’s common stock during the five trading days before, but not including, the conversion date.

On April 4, 2008 the Company transferred a $620,000 demand note to a third party and modified the terms so that the holder could convert such note into common stock at a 70% discount. At July 31, 2008, the Company determined that this was a derivate and utilized Black Scoles to record the liability.

In May 2008 the Company entered into a note payable with an investor for $500,000 with an 8% interest rate due on demand. Such note was to be funded as of July 31, 2008. As of July 31, 2008 the Company had received $250,000 of such amounts. At July 31, 2008, the Company determined that this was a derivate and utilized Black Scoles to record the liability. The note is convertible into common stock, at the holders’ option, at a conversion price, equal to 50% of the weighted average of the lowest trading prices for the Company’s common stock during the five trading days before, but not including, the conversion date.

The Company uses the Black-Scholes option pricing model to evaluate the fair value of the embedded derivative in the Note. At issuance of the Note, the value of the embedded derivative exceeded the proceeds received. The Company allocated the excess of the embedded derivative over note proceeds, to derivatives expense in the aggregate amount of approximately $13,772, and after such bifurcation, recorded the principal amount at zero. The principal amount was then accreted over the term of the note, using the yield-to-maturity method. The embedded derivative was then recorded at fair market value at each period end date, and the change recorded to derivatives income (expense). For the six ,months ended July 31, 2008 the company recorded a derivative expense of $687,127 and a liability of $787,127 as a result of marking such instruments to market.

On August 2008 the Company received $150,000 from the $500,000 demand note. The Company is waiting to receive the final $100,000 from this financing

| Item 2. | Management’s Discussion and Analysis and Plan of Operation. |

FORWARD-LOOKING STATEMENTS

This quarterly report contains forward-looking statements as that term is defined in the Private Securities Litigation Reform Act of 1995. These statements relate to future events or our future financial performance. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors, including the risks in the section entitled “Risk Factors”, that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

Our financial statements are stated in United States dollars and are prepared in accordance with United States generally accepted accounting principles. The following discussion should be read in conjunction with our financial statements and the related notes that appear elsewhere in this quarterly report.

In this quarterly report, unless otherwise specified, all references to “common shares” refer to the common shares in our capital stock and the terms “we”, “us” and “our” mean Tao Mining Ltd.

Overview

We are in the mineral resource business. This business generally consists of three stages: exploration, development and production. Mineral resource companies that are in the exploration stage have not yet found mineral resources in commercially exploitable quantities, and are engaged in exploring land in an effort to discover them. Mineral resource companies that have located a mineral resource in commercially exploitable quantities and are preparing to extract that resource are in the development stage, while those engaged in the extraction of a known mineral resource are in the production stage. Our company is in the exploration stage.

Mineral resource exploration can consist of several stages. The earliest stage usually consists of the identification of a potential prospect through either the discovery of a mineralized showing on that property or as the result of a property being in proximity to another property on which exploitable resources have been identified, whether or not they are or have in the past been extracted.

After the identification of a property as a potential prospect, the next stage would usually be the acquisition of a right to explore the area for mineral resources. This can consist of the outright acquisition of the land or the acquisition of specific, but limited, rights to the land (e.g., a license, lease or concession). After acquisition, exploration would probably begin with a surface examination by a prospector or professional geologist with the aim of identifying areas of potential mineralization, followed by detailed geological sampling and mapping of this showing with possible geophysical and geochemical grid surveys to establish whether a known trend of mineralization continues through un-exposed portions of the property (i.e., underground), possibly trenching in these covered areas to allow sampling of the underlying rock. Exploration also commonly includes systematic regularly spaced drilling in order to determine the extent and grade of the mineralized system at depth and over a given area, as well as gaining underground access by ramping or shafting in order to obtain bulk samples that would allow one to determine the ability to recover various commodities from the rock. Exploration might culminate in a feasibility study to ascertain if the mining of the minerals would be economic. A feasibility study is a study that reaches a conclusion with respect to the economics of bringing a mineral resource to the production stage.

Our mineral resource properties consist of exploration claims located in Columbia (“Risaldo La Golondrina D14-082 mineral property located in Narino, Colombia”). There is no assurance that a commercially viable mineral deposit exists on any of our properties, and further exploration is required before we can evaluate whether any exist and, if so, whether it would be economically and legally feasible to develop or exploit those resources. Even if we complete our current exploration program and we are successful in identifying a mineral deposit, we would be required to spend substantial funds on further drilling and engineering studies before we could know whether that mineral deposit will constitute a reserve (a reserve is a commercially viable mineral deposit). Please refer to the section entitled ‘Risk Factors’, of this quarterly report on Form 10-Q, for additional information about the risks of mineral exploration.

PLAN OF OPERATIONS AND CASH REQUIREMENTS

We are an exploration stage company that has not yet generated or realized any revenues from our business operations. We have concentrated our recent exploration efforts on the La Golondrina Property in Columbia and we intend to focus primarily on this property over the nine month period ending January 31, 2009.

There is no assurance that a commercially viable mineral deposit exists on any of our properties, including the La Golondrina Property, or that we will be able to identify any mineral resource on any of these properties that can be developed profitably. Even if we do discover commercially exploitable levels of mineral resources on any of our properties there can be no assurance that we will be able to enter into commercial production of our mineral properties:

Golondria Gold-Silver Project

Acquisition, Location and Access

On February 1, 2006 we executed a letter agreement with Primecap Resources and Nueva California S.A., concerning the acquisition of an interest in the Risaraldo La Golondrina D14-082 property located in Narino, Colombia.

On March 5, 2006, we entered into an Assignment Agreement dated effective February 28, 2006 (the “Definitive Agreement”), with Primecap Resources Inc., of Las Vegas, Nevada, (Primecap), concerning the acquisition of Primecap’s option (the “Option”), to acquire a 100% interest in the Risaldo La Golondrina D14-082 mineral property located in Narino, Colombia (the “Property”). Primecap had been granted the Option by Nueva California S.A., of Medellin, Colombia, pursuant to the terms and conditions of a Heads of Agreement dated August 23, 2004 (the “HOA”).

The Definitive Agreement provides for the assignment of the Option for the following consideration:

| 1. | Payment of US$150,000, payable on or before March 15, 2006 and upon execution of the Definitive Agreement; and |

| 2. | The issuance of 2,500,000 common shares in the capital stock of the company, subject to applicable trading restrictions, to Nueva California which will be issued either contemporaneous with the payment of US$150,000 or within 14 days of the execution of a Definitive Agreement, whichever is the earlier. |

| 3. | The issuance of 600,000 shares of common stock as follows: |

| 300,000 as of August 23,2006 and 300,000 shares as of August 23, 2007. |

In addition, we will assume Primecap’s financial obligations under the HOA.

On March 15, 2006, we entered into an amending agreement (the “Amending Agreement”) which agreement amended certain terms of the Definitive Agreement. The Amending Agreement provides for an extension to the payment terms such that the $150,000 payment time of March 15, 2006 was extended to April 15, 2006. The payment was made on April 10, 2006. On April 21, 2006 we issued 2,500,000 common shares to Nueva California SA pursuant to the terms of the Definitive Agreement.

On May 9, 2008 we entered into a second amending agreement which agreement amended certain terms of the Definitive Agreement. The second agreement modifies payments of $280,000 which would have to been

made from August 23, 2005 through August 23, 2009 to two payments of $100,000 each on or before July 1, 2006 and on or before August 1, 2008. The first payment of $100,000 has been made. As of May 9, 2008 the company has not issued the 600,000 shares of common stock and has not received any notice of default from non issuance.

The property is located within a mixture of small-scale mining and small-scale agricultural lands. Limited accommodations and supplies are available in Sotomayor, while Pasto acts as the main supply centre. The property is accessible from Sotomayor by a one-lane gravel road for the first four kilometres and then by a 1 kilometre ATV trail. Access to Sotomayor is from Pasto by a secondary gravel road, with travel time estimated to be 4 hrs. Transportation to Sotomayor is available in Pasto. The gravel roads are suitable for movement of heavy equipment.

ESTIMATED BUDGET, PHASE 1 PROGRAM

Chronological Schedule

| | | Weeks |

Item

| Labour

| 1

| 2

| 3

| 4

| 5

| 6

| 7

| 8

| 9

| 1

0 |

| 1 | Historical data | X | | | | | | | | | |

2

| Environmental

Review |

| X

|

| X

|

| X

|

|

|

|

|

3

| Regional Geological

Mapping |

|

| X

|

|

|

|

|

|

|

|

4

| Stream Sediment

Geochemistry |

|

|

| X

|

|

|

|

|

|

|

5

| Detailed Geological

Mapping |

|

|

|

| X

| X

| X

|

|

|

|

6

| Underground

Sampling |

|

|

|

|

| X

| X

|

|

|

|

| 7 | Soil Geochemistry | | | | X | | | | | | |

| 8 | Trench Sampling | | | | | | | | X | | |

9

| Rock Sampling

(Prospecting) |

|

| X

|

|

|

|

|

|

|

|

10

| Sample

Preparation/Analysis |

|

|

| X

|

|

| X

| X

| X

|

|

| 11 | Report | | | | | | | | | | X |

Expense Schedule

ITEM

|

| #

| Cost/wk

| # Wks

| $US/day

| Total

$US | Comments

|

| 1 | Senior Geologist | 1 | $1400 | 6 | $200 | $8400 | |

| 2 | Junior Geologist | 2 | $875 | 6 | $125 | $10500 | |

| 3 | Labourers | 6 | $140 | 6 | $7 | $5040 | |

4

| Stream sample

Analysis | 5

0 |

|

| $20/sample

| $1000

| ICP+AuFA

|

5

| Soil sample analysis

| 5

0 |

|

| $20/sample

| $1000

| ICP+AuFA

|

6

| Underground sample

analysis

| 2

0

0 |

|

| $20/sample

| $4000

| ICP+AuFA

|

7

| Trenching/backhoe

| 1

| $1500

| 1

| $45/hr

| $1500

| RetroCAT10

0 |

| 8 | Food | 9 | $180 | 6 | $20 | $9720 | |

9

| Transportation

| 1

| $400

| 6

|

| $2400

| Campero

4X4 |

1

0 | Accommodation

| 9

| $35

| 6

| $5

| $1890

|

|

1

1 | OfficeManagement-local

| 1

| $1000

| 3

|

| $1000

|

|

1

2 | Administration-Medellin

| 1

| $1000

| 12

| $4000/mo

| $6000

|

|

| | TOTAL | | | | | $52,450 | |

The proposed program is exploratory in nature as there are no proven reserves currently.

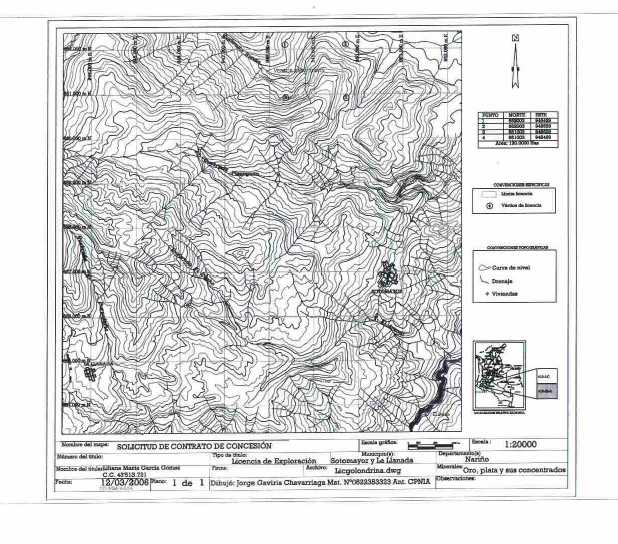

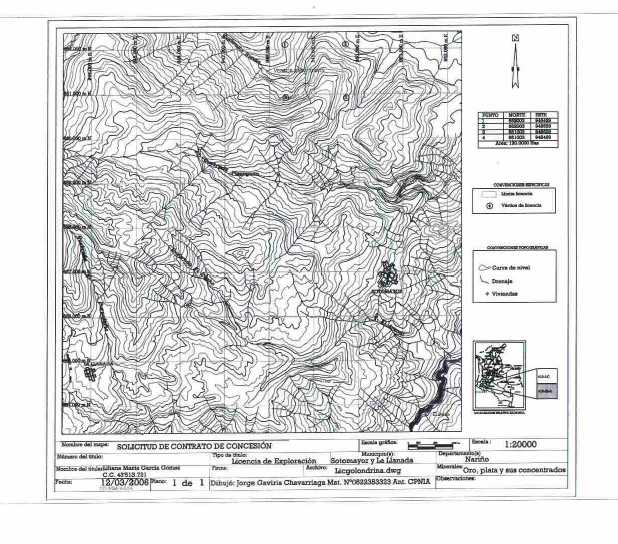

| Point | North | East |

| P.A. | 662.810 | 949.700 |

| 1 | 662.003 | 949.629.4 |

| 2 | 662.003 | 949.629.4 |

| 3 | 661.003 | 948.429.4 |

| 4 | 662.003 | 948.429.4 |

The above represents the longitude and latitude of the property representing 120 hectares. We have obtained a 30 year concession from under concession number 6927 from the department of Agrominas De Colombia LTDA. Our property is located in the municipality of Los Andes Sotomayor. We currently are in the process of exploration and do not have any production facilities.

History

Historically gold has been mined in the country since pre-Columbian times. Exploration of the Sierra Nevada de Santa Marta area, along the north coast of the country, was conducted by Alonso de Ojeda, one of the companions of Columbus. His work revealed the large amounts of precious metals held by the local Indians and led to the rapid Spanish colonization of the west coast and interior of South America. Much of Colombia was thus conquered and a number of towns established by 1539. Pasto was founded in 1537. From that time the population has spread out along the major river valleys, searching for land to cultivate and precious metals to mine, eventually reaching the valleys of tributaries of the Rio Pacual, where the town of Sotomayor was established. There are no government records of historical mining activity in the area of the Golondrina property

The Golondrina property was acquired by Colombian mining company Barro Blanco S.A Barro Blanco S.A. also acquired the Nueva Esparta property which lies approximately 4 kilometres to the east. Several other properties exist in the area of these two properties. Latingold optioned several properties from Barro Blanco S.A. and carried out exploration on those properties. This work included surface and underground mapping and sampling, as well as a Lithium-Bismuth surface geochemical survey. In 1998 Latingold abandoned its option.

Property Geology

The Golondrina Gold-Silver property is underlain by Dagua Group fine-grained layered quartzites (siliceous clastic sediments) of Cretaceous age. These contain minor basalt flows and diabase dikes of the same age. Intruded into these sediments is a small (2 km X 0.5 km) biotite-hornblende tonalite body of Tertiary age. It is associated with the larger Vergel STock, which is found 7 kilometers to the northwest. The intrusion has a 100 meter wide hornfelsed contact aureole against the sediments.

Mineralization on the Golondrina Project is confined to milky white quartz veins which contain disseminated sulphides. These sulphides include pyrite, chalcopyrite (copper) and galena (lead). Vein widths range between 5 and 50 centimeters.

We have not found any other mineral properties either for staking or purchasing but will seek other mineral properties during the next year so to diversify our holdings. Any staking and/or purchasing of mineral properties may involve the issuance of substantial blocks of our shares. We have no intentions of purchasing for cash or other considerations any mineral properties from our officers and/or directors.

Financial Condition, Liquidity and Capital Resources

Our principal capital resources have been through the issuance of common stock, although we may use shareholder loans, advances from related parties, or borrowing in the future.

At July 31, 2008, we had negative working capital of ($1,656,046), compared to a working capital deficit of ($885,771) as at July 31, 2007.

At July 31, 2008, our total current assets were $106,689 which consisted of cash and prepaid expenses, compared to total current assets of $12,355 as at July 31, 2007.

At July 31, 2008, our total current liabilities were $1,762,735 compared to total current liabilities of $898,106 as at July 31, 2007.

For the six and three month period ended July 31, 2008, we posted losses of $1,747,011and $1,615,881 compared to $134,377 and 87,652 for the six and three months ended July 31, 2007, respectably. The main reason for the change was due to the derivative expense and the loss on settlement of debt.

At July 31, 2008, we had cash on hand of $91,756 compared to $2,835 as at April 30, 2007.

Cash Requirements

We will require additional funds to implement our growth strategy in exploration operations. These funds may be raised through equity financing, debt financing, or other sources, which may result in further dilution in the equity ownership of our shares. There is still no assurance that we will be able to maintain operations at a level sufficient for an investor to obtain a return on his investment in our common stock. Further, we may continue to be unprofitable.

On April 4, 2008, the Company amended it’s $620,000 note to provide the holder with a conversion privilege. The amendment calls for conversion of the note at the average of the lowest closing bid price of the Company’s stock for the previous five days prior to conversion at a 30% conversion price.

Going Concern

Due to our being an exploration stage company and not having generated revenues, in their Notes to our financial statements for the year ended January 31, 2008, our independent auditors included an explanatory paragraph regarding concerns about our ability to continue as a going concern.

We have historically incurred losses, and through July 31, 2008 have incurred losses of $3,035,077 from our inception. Because of these historical losses, we will require additional working capital to develop our business operations. We intend to raise additional working capital through private placements, public offerings, bank financing and/or advances from related parties or shareholder loans.

The continuation of our business is dependent upon obtaining further financing and achieving a break even or profitable level of operations. The issuance of additional equity securities by us could result in a significant dilution in the equity interests of our current or future stockholders. Obtaining commercial loans, assuming those loans would be available, will increase our liabilities and future cash commitments.

There are no assurances that we will be able to either (1) achieve a level of revenues adequate to generate sufficient cash flow from operations; or (2) obtain additional financing through either private placements, public offerings and/or bank financing necessary to support our working capital requirements. To the extent that funds generated from operations and any private placements, public offerings and/or bank financing are insufficient, we will have to raise additional working capital. No assurance can be given that additional financing will be available, or if available, will be on terms acceptable to us. If adequate working capital is not available we may not increase our operations.

These conditions raise substantial doubt about our ability to continue as a going concern. The financial statements do not include any adjustments relating to the recoverability and classification of asset carrying amounts or the amount and classification of liabilities that might be necessary should we be unable to continue as a going concern.

Risks Associated With Our Business

We have a limited operating history and as a result there is no assurance we can operate on a profitable basis.

We have a limited operating history and must be considered in the exploration stage. Our company's operations will be subject to all the risks inherent in the establishment of an exploration stage enterprise and the uncertainties arising from the absence of a significant operating history. Potential investors should be aware of the difficulties normally

encountered by mineral exploration companies and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties, complications and delays encountered in connection with the exploration of the mineral properties that we plan to undertake. These potential problems include, but are not limited to, unanticipated problems relating to exploration, and additional costs and expenses that may exceed current estimates. The expenditures to be made by us in the exploration of the mineral claims may not result in the discovery of mineral deposits. Problems such as unusual or unexpected formations of rock or land and other conditions are involved in mineral exploration and often result in unsuccessful exploration efforts. If the results of our exploration do not reveal viable commercial mineralization, we may decide to abandon our claims and acquire new claims for new exploration or cease operations. The acquisition of additional claims will be dependent upon us possessing capital resources at the time in order to purchase such claims. If no funding is available, we may be forced to abandon our operations. No assurance can be given that we may be able to operate on a profitable basis.

If we do not obtain additional financing, our business will fail and our investors could lose their investment.

We had cash in the amount of $91,756 and working capital deficit of $1,656,046 as of the period ended July 31, 2008. We currently do not generate revenues from our operations. Our business plan calls for substantial investment and cost in connection with the acquisition and exploration of our mineral properties currently under lease and option. Any direct acquisition of the claim under lease or option is subject to our ability to obtain the financing necessary for us to fund and carry out exploration programs on the properties. The requirements are substantial. We do not currently have any arrangements for additional financing and we can provide no assurance to investors that we will be able to find such financing if required. Obtaining additional financing would be subject to a number of factors, including market prices for minerals, investor acceptance of our properties, and investor sentiment. These factors may make the timing, amount, terms or conditions of additional financing unavailable to us. The most likely source of future funds presently available to us is through the sale of equity capital and loans. Any sale of share capital will result in dilution to existing shareholders.

Because there is no assurance that we will generate revenues, we face a high risk of business failure.

We have not earned any revenues as of the date of this annual report and have never been profitable. We do not have an interest in any revenue generating properties. We were incorporated in September 2004 and to date have been involved primarily in organizational activities and limited exploration activities. Prior to our being able to generate revenues, we will incur substantial operating and exploration expenditures without realizing any revenues. We therefore expect to incur significant losses into the foreseeable future. We have limited operating history upon which an evaluation of our future success or failure can be made. Our net loss from inception to our year ended January 31, 2008 was $1,287,553. We have incurred additional losses for the three month period ended April 30, 2008 of $131,230. We recognize that if we are unable to generate significant revenues from our activities, we will not be able to earn profits or continue operations. Based upon current plans, we also expect to incur significant operating losses in the future. We cannot guarantee that we will be successful in raising capital to fund these operating losses or generate revenues in the future. We can provide investors with no assurance that we will generate any operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely fail and our investors could lose their investment.

Because of the speculative nature of the exploration of natural resource properties, there is substantial risk that this business will fail.

There is no assurance that any of the claims we explore or acquire will contain commercially exploitable reserves of minerals. Exploration for natural resources is a speculative venture involving substantial risk. Hazards such as unusual or unexpected geological formations and other conditions often result in unsuccessful exploration efforts. We may also become subject to significant liability for pollution, cave-ins or hazards, which we cannot insure or which we may elect not to insure.

Our foremost project is located in Colombia where mineral exploration activities may be affected in varying degrees by political and government regulations which could have a negative impact on our ability to continue our operations.

Certain projects in which we have interests are located in Colombia. Mineral exploration activities in Colombia may be affected in varying degrees by political instabilities and government regulations relating to the mining industry. Any changes in regulations or shifts in political conditions are beyond our control and may adversely affect our

business. Operations may be affected in varying degrees by government regulations with respect to restrictions on production, price controls, export controls, income taxes, expropriations of property, environmental legislation and mine safety. The status of Colombia as a developing country may make it more difficult for us to obtain any required financing for our projects. The effect of all these factors cannot be accurately predicted. Notwithstanding the progress achieved in restructuring Colombia political institutions and revitalizing its economy, the present administration, or any successor government, may not be able to sustain the progress achieved. While the Colombian economy has experienced growth in recent years, such growth may not continue in the future at similar rates or at all. If the economy of Colombia fails to continue its growth or suffers a recession, we may not be able to continue our operations in that country. We do not carry political risk insurance.

If we cannot compete successfully for financing and for qualified managerial and technical employees, our exploration program may suffer.

Our competition in the mining industry includes large established mining companies with substantial capabilities and with greater financial and technical resources than we have. As a result of this competition, we may be unable to acquire additional financing on terms we consider acceptable. We also compete with other mining companies in the recruitment and retention of qualified managerial and technical employees. If we are unable to successfully compete for financing or for qualified employees, our exploration program may be slowed down or suspended.

There are no known reserves of minerals on our mineral claims and we cannot guarantee that we will find any commercial quantities of minerals.

We have not found mineral reserves on our claims and there can be no assurance that any of the mineral claims we are exploring contain commercial quantities of any minerals. Even if we identify commercial quantities of minerals in any of our claims, there can be no assurance that we will be able to exploit the reserves or, if we are able to exploit them, that we will do so on a profitable basis.

If we are unable to hire and retain key personnel, we may not be able to implement our business plan.

Our success is also largely dependent on our ability to hire highly qualified personnel. This is particularly true in highly technical businesses such as mineral exploration. These individuals are in high demand and we may not be able to attract the personnel we need. In addition, we may not be able to afford the high salaries and fees demanded by qualified personnel, or may lose such employees after they are hired. Failure to hire key personnel when needed, or on acceptable terms, would have a significant negative effect on our business.

Inability of our officers and directors to devote sufficient time to the operation of the business may limit our company's success.

Presently some of our officers and directors allocate only a portion of their time to the operation of our business. If the business requires more time for operations than anticipated or the business develops faster than anticipated, the officers and directors may not be able to devote sufficient time to the operation of the business to ensure that it continues as a going concern. Even if this lack of sufficient time of our management is not fatal to our existence, it may result in limited growth and success of the business.

Because of the inherent dangers involved in mineral exploration, there is a risk that we may incur liability or damages as we conduct our business.

The exploration of valuable minerals involves numerous hazards. As a result, we may become subject to liability for such hazards, including pollution, cave-ins and other hazards against which we cannot insure or against which we may elect not to insure. The payment of such liabilities may have a material adverse effect on our financial position.

Our independent certified public accounting firm, in their Notes to the audited financial statements for the year ended January 31, 2006 states that there is a substantial doubt that we will be able to continue as a going concern.

Our independent certified public accounting firm state in their Notes to the audited financial statements for the year ended January 31, 2008, that we have experienced significant losses since inception. Failure to arrange adequate financing on acceptable terms and to achieve profitability would have an adverse effect on our financial position, results of operations, cash flows and prospects, there is a substantial doubt that we will be able to continue as a going

concern.

We are subject to various government regulations and environmental concerns.

We are subject to various government and environmental regulations. Permits from a variety of regulatory authorities are required for many aspects of exploration, mining operations and reclamation. We cannot predict the extent to which future legislation and regulation could cause additional expense, capital expenditures, restrictions, and delays in the development of our U.S. or Colombian properties, including those with respect to unpatented mining claims.

Our activities are not only subject to extensive federal, state and local regulations controlling the exploration and mining of mineral properties, but also the possible effects of such activities upon the environment. Future legislation and regulations could cause additional expense, capital expenditures, restrictions and delays in the development of our properties, the extent of which cannot be predicted. Also, as discussed above, permits from a variety of regulatory authorities are required for many aspects of mine operation and reclamation. In the context of environmental permitting, including the approval of reclamation plans, we must comply with known standards, existing laws and regulations that may entail greater or lesser costs and delays, depending on the nature of the activity to be permitted and how stringently the regulations are implemented by the permitting authority. We are not presently aware of any specific material environmental constraint affecting our properties that would preclude the economic development or operation of any specific property.

If we become more active on our properties, it is reasonable to expect that compliance with environmental regulations will increase our costs. Such compliance may include feasibility studies on the surface impact of the our proposed operations; costs associated with minimizing surface impact, water treatment and protection, reclamation activities, including rehabilitation of various sites, on-going efforts at alleviating the mining impact on wildlife, and permits or bonds as may be required to ensure our compliance with applicable regulations. It is possible that the costs and delays associated with such compliance could become so prohibitive that we may decide to not proceed with exploration, development, or mining operations on any of our mineral properties.

Risks Associated with Our Common Stock

Trading on the OTC Bulletin Board may be volatile and sporadic, which could depress the market price of our common stock and make it difficult for our stockholders to resell their shares.

Our common stock is quoted on the OTC Bulletin Board service of the National Association of Securities Dealers. Trading in stock quoted on the OTC Bulletin Board is often thin and characterized by wide fluctuations in trading prices, due to many factors that may have little to do with our operations or business prospects. This volatility could depress the market price of our common stock for reasons unrelated to operating performance. Moreover, the OTC Bulletin Board is not a stock exchange, and trading of securities on the OTC Bulletin Board is often more sporadic than the trading of securities listed on a quotation system like Nasdaq or a stock exchange like Amex. Accordingly, shareholders may have difficulty reselling any of the shares.

Our stock is a penny stock. Trading of our stock may be restricted by the SEC’s penny stock regulations and the NADSD’s sales practice requirements, which may limit a stockholder’s ability to buy and sell our stock.

Our stock is a penny stock. The Securities and Exchange Commission has adopted Rule 15g-9 which generally defines “penny stock” to be any equity security that has a market price (as defined) less than $5.00 per share or an exercise price of less than $5.00 per share, subject to certain exceptions. Our securities are covered by the penny stock rules, which impose additional sales practice requirements on broker-dealers who sell to persons other than established customers and “accredited investors”. The term “accredited investor” refers generally to institutions with assets in excess of $5,000,000 or individuals with a net worth in excess of $1,000,000 or annual income exceeding $200,000 or $300,000 jointly with their spouse. The penny stock rules require a broker-dealer, prior to a transaction in a penny stock not otherwise exempt from the rules, to deliver a standardized risk disclosure document in a form prepared by the SEC which provides information about penny stocks and the nature and level of risks in the penny stock market. The broker-dealer also must provide the customer with current bid and offer quotations for the penny stock, the compensation of the broker-dealer and its salesperson in the transaction and monthly account statements showing the market value of each penny stock held in the customer’s account. The bid and offer quotations, and the broker-dealer and salesperson compensation information, must be given to the customer orally or in writing prior to

effecting the transaction and must be given to the customer in writing before or with the customer’s confirmation. In addition, the penny stock rules require that prior to a transaction in a penny stock not otherwise exempt from these rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser’s written agreement to the transaction. These disclosure requirements may have the effect of reducing the level of trading activity in the secondary market for the stock that is subject to these penny stock rules. Consequently, these penny stock rules may affect the ability of broker-dealers to trade our securities. We believe that the penny stock rules discourage investor interest in and limit the marketability of our common stock.

In addition to the “penny stock” rules promulgated by the Securities and Exchange Commission, the NASD has adopted rules that require that in recommending an investment to a customer, a broker-dealer must have reasonable grounds for believing that the investment is suitable for that customer. Prior to recommending speculative low priced securities to their non-institutional customers, broker-dealers must make reasonable efforts to obtain information about the customer’s financial status, tax status, investment objectives and other information. Under interpretations of these rules, the NASD believes that there is a high probability that speculative low priced securities will not be suitable for at least some customers. The NASD requirements make it more difficult for broker-dealers to recommend that their customers buy our common stock, which may limit your ability to buy and sell our stock.

Other Risks

Because some of our officers and directors are located in non-U.S. jurisdictions, you may have no effective recourse against the non U.S. officers and directors for misconduct and may not be able to enforce judgment and civil liabilities against our officers, directors, experts and agents.

Some of our directors and officers are nationals and/or residents of countries other than the United States, specifically Canada and Colombia, and all or a substantial portion of such persons’ assets are located outside the United States. As a result, it may be difficult for investors to enforce within the United States any judgments obtained against our officers or directors, including judgments predicated upon the civil liability provisions of the securities laws of the United States or any state thereof.

Trends, Risks and Uncertainties

We have sought to identify what we believe to be the most significant risks to our business, but we cannot predict whether, or to what extent, any of such risks may be realized nor can we guarantee that we have identified all possible risks that might arise. Investors should carefully consider all of such risk factors before making an investment decision with respect to our common stock.

| Item 3. | Disclosure Controls and Procedures |

As required by Rule 13a-15 under the Exchange Act, we have carried out an evaluation of the effectiveness of the design and operation of our company’s disclosure controls and procedures as of the end of the period covered by this quarterly report, July 31, 2008. This evaluation was carried out under the supervision and with the participation of our company’s management, including our company’s president and chief executive officer. Based upon that evaluation, our company’s president and chief executive officer concluded that our company’s disclosure controls and procedures are effective as at the end of the prior fiscal quarter. There have been no significant changes in our company’s internal controls or in other factors, which could significantly affect internal controls subsequent to the date we carried out our evaluation.

Disclosure controls and procedures are controls and other procedures that are designed to ensure that information required to be disclosed in our company’s reports filed or submitted under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Securities and Exchange Commission’s rules and forms. Disclosure controls and procedures include, without limitation, controls and procedures designed to ensure that information required to be disclosed in our company’s reports filed under the Exchange Act is accumulated and communicated to management, including our company’s president and chief executive officer as appropriate, to allow timely decisions regarding required disclosure

PART II - OTHER INFORMATION

| Item 1. | Legal Proceedings. |

We know of no material, active or pending legal proceedings against our company, nor are we involved as a plaintiff in any material proceeding or pending litigation. There are no proceedings in which any of our directors, officers or affiliates, or any registered or beneficial shareholder, is an adverse party or has a material interest adverse to our interest.

| Item 2. | Unregistered Sales of Equity Securities and Use of Proceeds. |

On February 1, 2006 we entered into an agreement with Primecap Resources Inc. and Nueva California S.A. concerning the acquisition of an interest in the Risaraldo La Golondrina D14-082 property located in Narino, Colombia. On March 5, 2006, we entered into an Assignment Agreement dated effective February 28, 2006 (the “Definitive Agreement”), with Primecap Resources Inc., of Las Vegas, Nevada, (Primecap), concerning the acquisition of Primecap’s option (the “Option”), to acquire a 100% interest in the Risaldo La Golondrina D14-082 mineral property located in Narino, Colombia (the “Property”). Primecap had been granted the Option by Nueva California S.A., of Medellin, Colombia, pursuant to the terms and conditions of a Heads of Agreement dated August 23, 2004 (the “HOA”).

Pursuant to the terms of the Definitive Agreement, we issued 2,500,000 shares of our capital stock to Nueva California. In issuing the shares, we relied on the exemption from registration requirements of the United States Securities Act of 1933, as amended, provided by Regulation S promulgated thereunder.

On March 13, 2006, our board of directors approved an eight (8) for one (1) forward stock split of our authorized, issued and outstanding common stock. The forward stock split became effective with the Secretary of State of Nevada on March 24, 2006. As a result, our authorized capital increased from 69,000,000 shares of common stock with a par value of $0.001 and 1,000,000 Preferred “A” stock with a par value of $0.001 to 552,000,000 shares of common stock with a par value of $0.001 and 1,000,000 Preferred “A” stock with a par value of $0.001. Our issued and outstanding share capital increased from 7,739,500 shares of common stock to 51,816,000 shares of common stock.

| Item 3. | Defaults Upon Senior Securities. |

None.

| Item 4. | Submission of Matters to a Vote of Security Holders. |

None.

| Item 5. | Other Information. |

None

Exhibits required by Item 601 of Regulation S-B

| Exhibit Number | Description |

| | |

| (3) | (i) Articles of Incorporation; and (ii) Bylaws |

| | |

| 3.1 | Articles of Incorporation (incorporated by reference from our Form SB-2 Registration Statement, filed on March 24, 2005). |

| | |

| 3.2 | Bylaws (incorporated by reference from our Form SB-2 Registration Statement, filed on March 24, 2005). |

| | |

| 3.3 | Certificate of Change (incorporated by reference from our Current Report on Form 8-K, filed on March 24, 2006). |

| | |

| (10) | Material Contracts |

| | |

| 10.1 | Purchase and Sale Agreement dated October 22, 2004 (incorporated by reference from our Amendment No. 1 on Form SB-2/A Registration Statement, filed on April 28, 2005). |

| | |

| 10.2 | Letter Agreement dated February 1, 2006 between our company and Nueva California S.A. and Primecap Resources Inc. (incorporated by reference from our Current Report on Form 8-K, filed on February 6, 2006). |

| | |

| 10.3 | Assignment Agreement dated February 28, 2006 between our company and Primecap Resources Inc. (incorporated by reference from our Current Report on Form 8-K, filed on March 10, 2006). |

| | |

| 10.4 | Amending Agreement dated March 15, 2006 between our company and Primecap Resources Inc. (incorporated by reference from our Current Report on Form 8-K, filed on March 20, 2006). |

| | |

| 10.5 | Consulting Agreement dated April 1, 2006 between our company and James Sikora (incorporated by reference from our Current Report on Form 8-K, filed on April 20, 2006) |

| | |

| 10.6 | Consulting Agreement dated April 1, 2006 between our company and Gordon Samson (incorporated by reference from our Current Report on Form 8-K, filed on April 20, 2006) |

| | |

| 10.7 | Amending Agreement Dated June 30, 2006 between our Company and Primecap Resources Inc. (incorporated by reference from our Current Report on Form 8-K, filed on July 14, 2006). |

| | |

| 10.8 | Consulting Agreement dated September 1, 2006 between our company and Julio De Leon |

| | |

| (31) | 302 Certification |

| | |

| 31.1* | Section 302 Certification under Sarbanes-Oxley Act of 2002 of James Sikora. |

| | |

| 31.2* | Section 302 Certification under Sarbanes-Oxley Act of 2002 of Julio De Leon. |

| | |

| (32) | 906 Certification |

| | |

| 32.1* | Section 906 Certification under Sarbanes-Oxley Act of 2002 of James Sikora. |

| | |

| 32.2* | Section 906 Certification under Sarbanes-Oxley Act of 2002 of Julio De Leon. |

*Filed herewith

SIGNATURES

In accordance with Section 13 or 15(d) of the Exchange Act, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TAO MINERALS INC.

By:/s/ James Sikora

President and Director

Principal Executive Officer

Date: 9/22/08

By:/s/ Julio De Leon

Chief Financial Officer and Director

Principal Financial Officer

Date: 9/22/08

Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By:/s/ James Sikora

President and Director

Principal Executive Officer

Date: 9/22/08

By:/s/ Julio De Leon

Chief Financial Officer and Director

Principal Accounting Officer

Date: 9/22/08