UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-21729

| Name of Fund: | | BlackRock Enhanced Global Dividend Trust (BOE) |

| Fund Address: | | 100 Bellevue Parkway, Wilmington, DE 19809 |

Name and address of agent for service: John M. Perlowski, Chief Executive Officer, BlackRock Enhanced Global Dividend Trust, 50 Hudson Yards, New York, NY 10001

Registrant’s telephone number, including area code: (800) 882-0052, Option 4

Date of fiscal year end: 12/31/2023

Date of reporting period: 12/31/2023

Item 1 – Report to Stockholders

(a) The Report to Shareholders is attached herewith.

| | |

| | DECEMBER 31, 2023 |

BlackRock Energy and Resources Trust (BGR)

BlackRock Enhanced Capital and Income Fund, Inc. (CII)

BlackRock Enhanced Equity Dividend Trust (BDJ)

BlackRock Enhanced Global Dividend Trust (BOE)

BlackRock Enhanced International Dividend Trust (BGY)

BlackRock Health Sciences Term Trust (BMEZ)

BlackRock Health Sciences Trust (BME)

BlackRock Innovation and Growth Term Trust (BIGZ)

BlackRock Resources & Commodities Strategy Trust (BCX)

BlackRock Science and Technology Term Trust (BSTZ)

BlackRock Science and Technology Trust (BST)

BlackRock Utilities, Infrastructure & Power Opportunities Trust (BUI)

|

Not FDIC Insured • May Lose Value • No Bank Guarantee |

|

| | |

Supplemental Information (unaudited) | | |

Section 19(a) Notices

BlackRock Energy and Resources Trust’s (BGR), BlackRock Enhanced Capital and Income Fund, Inc.’s (CII), BlackRock Enhanced Equity Dividend Trust’s (BDJ), BlackRock Enhanced Global Dividend Trust’s (BOE), BlackRock Enhanced International Dividend Trust’s (BGY), BlackRock Health Sciences Term Trust’s (BMEZ), BlackRock Health Sciences Trust’s (BME), BlackRock Innovation and Growth Term Trust’s (BIGZ), BlackRock Resources & Commodities Strategy Trust’s (BCX), BlackRock Science and Technology Term Trust’s (BSTZ), BlackRock Science and Technology Trust’s (BST) and BlackRock Utilities, Infrastructure & Power Opportunities Trust’s (BUI) (collectively, the “Trusts” or individually, a “Trust”) amounts and sources of distributions reported are estimates and are being provided pursuant to regulatory requirements and are not being provided for tax reporting purposes. The actual amounts and sources for tax reporting purposes will depend upon each Trust’s investment experience during its fiscal year and may be subject to changes based on tax regulations. Each Trust will provide a Form 1099-DIV each calendar year that will tell you how to report these distributions for U.S. federal income tax purposes.

December 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| | | Total Cumulative Distributions

for the Fiscal Period | | | % Breakdown of the Total Cumulative

Distributions for the Fiscal Period | |

| Trust Name | |

| Net

Income |

| |

| Net Realized

Capital Gains

Short-Term |

| |

| Net Realized

Capital Gains

Long-Term |

| |

| Return of

Capital |

(a) | |

| Total Per

Common

Share |

| |

| Net

Income |

| |

| Net Realized

Capital Gains

Short-Term |

| |

| Net Realized

Capital Gains

Long-Term |

| |

| Return of

Capital |

| |

| Total Per

Common

Share |

|

| |

BGR | | $ | 0.386340 | | | $ | — | | | $ | — | | | $ | 0.387660 | | | $ | 0.774000 | | | | 50 | % | | | — | % | | | — | % | | | 50 | % | | | 100% | |

CII | | | 0.084620 | | | | — | | | | 1.109380 | | | | — | | | | 1.194000 | | | | 7 | | | | — | | | | 93 | | | | — | | | | 100 | |

BDJ | | | 0.273080 | | | | 0.049100 | | | | 0.407220 | | | | — | | | | 0.729400 | | | | 37 | | | | 7 | | | | 56 | | | | — | | | | 100 | |

BOE | | | 0.222930 | | | | — | | | | — | | | | 0.533070 | | | | 0.756000 | | | | 29 | | | | — | | | | — | | | | 71 | | | | 100 | |

BGY | | | 0.088760 | | | | — | | | | 0.154160 | | | | 0.162680 | | | | 0.405600 | | | | 22 | | | | — | | | | 38 | | | | 40 | | | | 100 | |

BMEZ | | | — | | | | — | | | | — | | | | 1.582470 | | | | 1.582470 | | | | — | | | | — | | | | — | | | | 100 | | | | 100 | |

BME | | | 0.146200 | | | | — | | | | 1.586760 | | | | 0.823040 | | | | 2.556000 | | | | 6 | | | | — | | | | 62 | | | | 32 | | | | 100 | |

BIGZ | | | — | | | | — | | | | — | | | | 0.765770 | | | | 0.765770 | | | | — | | | | — | | | | — | | | | 100 | | | | 100 | |

BCX | | | 0.293280 | | | | — | | | | — | | | | 0.328320 | | | | 0.621600 | | | | 47 | | | | — | | | | — | | | | 53 | | | | 100 | |

BSTZ | | | — | | | | — | | | | 0.167000 | | | | 1.654710 | | | | 1.821710 | | | | — | | | | — | | | | 9 | | | | 91 | | | | 100 | |

BST | | | — | | | | — | | | | — | | | | 3.000000 | | | | 3.000000 | | | | — | | | | — | | | | — | | | | 100 | | | | 100 | |

BUI | | | 0.360190 | | | | 0.209850 | | | | 0.606660 | | | | 0.275300 | | | | 1.452000 | | | | 25 | | | | 14 | | | | 42 | | | | 19 | | | | 100 | |

| |

| (a) | Each Trust estimates that it has distributed more than its net income and net realized capital gains; therefore, a portion of the distribution may be a return of capital. A return of capital may occur, for example, when some or all of the shareholder’s investment in a Trust is returned to the shareholder. A return of capital does not necessarily reflect a Trust’s investment performance and should not be confused with “yield” or “income.” When distributions exceed total return performance, the difference will reduce a Trust’s net asset value per share. |

Section 19(a) notices for the Trusts, as applicable, are available on the BlackRock website at blackrock.com.

Section 19(b) Disclosure

The Trusts, acting pursuant to a U.S. Securities and Exchange Commission (“SEC”) exemptive order and with the approval of each Trust’s Board of Trustees (the “Board”), each has adopted a managed distribution plan, consistent with its investment objectives and policies, to support a level distribution of income, capital gains and/or return of capital (the “Plan”). In accordance with the Plans, the Trusts currently distribute the following fixed amounts per share on a monthly basis:

| | | | |

| Trust Name | | Amount Per

Common Share | |

BGR | | $ | 0.065700 | |

CII | | | 0.099500 | |

BDJ | | | 0.056200 | |

BOE | | | 0.063000 | |

BGY | | | 0.033800 | |

BMEZ | | | 0.091600 | |

BME | | | 0.213000 | |

BIGZ | | | 0.044870 | |

BCX | | | 0.051800 | |

BSTZ | | | 0.102540 | |

BST | | | 0.250000 | |

BUI | | | 0.121000 | |

The fixed amounts distributed per share are subject to change at the discretion of each Trust’s Board. Under its Plan, each Trust will distribute all available net income to its shareholders as required by the Internal Revenue Code of 1986, as amended (the “Code”). If sufficient income (inclusive of net income and short-term capital gains) is not earned on a monthly basis, the Trusts will distribute long-term capital gains and/or return of capital to shareholders in order to maintain a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board; however, each Trust may make additional distributions from time to time, including additional capital gain distributions at the end of the taxable year, if required to meet requirements imposed by the Code and/or the Investment Company Act of 1940, as amended (the “1940 Act”).

Shareholders should not draw any conclusions about a Trust’s investment performance from the amount of these distributions or from the terms of the Plan. Each Trust’s total return performance is presented in its financial highlights table.

| | |

| 2 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Supplemental Information (unaudited) (continued) | | |

The Board may amend, suspend or terminate a Trust’s Plan at any time without prior notice to the Trust’s shareholders if it deems such actions to be in the best interests of the Trust or its shareholders. The suspension or termination of the Plan could have the effect of creating a trading discount (if the Trust’s stock is trading at or above net asset value) or widening an existing trading discount. The Trusts are subject to risks that could have an adverse impact on their ability to maintain level distributions. Examples of potential risks include, but are not limited to, economic downturns impacting the markets, changes in interest rates, decreased market volatility, companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to BDJ, BME, BST and BUI’s prospectuses for a more complete description of each Trust’s risks.

| | |

SUPPLEMENTAL INFORMATION | | 3 |

The Markets in Review

Dear Shareholder,

The combination of continued economic growth and cooling inflation provided a supportive backdrop for investors during the 12-month reporting period ended December 31, 2023. Significantly tighter monetary policy helped to rein in inflation, and the Consumer Price Index decelerated substantially in the first half of the year before stalling between 3% and 4% in the second half. A moderating labor market helped ease inflationary pressure, although wages continued to grow. Wage and job growth powered robust consumer spending, backstopping the economy. On October 7, 2023, Hamas launched a horrific attack on Israel. The ensuing war will have a significant humanitarian impact and could lead to heightened economic and market volatility. We see geopolitics as a structural market risk going forward. See our geopolitical risk dashboard at blackrock.com for more details.

Equity returns were robust during the period, as interest rates stabilized and the economy proved to be more resilient than many investors expected. The U.S. economy continued to show strength, and growth further accelerated in the third quarter of 2023. Large-capitalization U.S. stocks posted particularly substantial gains, supported by the performance of a few notable technology companies and small-capitalization U.S. stocks also advanced. Meanwhile, international developed market equities and emerging market stocks posted solid gains.

The 10-year U.S. Treasury yield ended 2023 where it began despite an eventful year that saw significant moves in bond markets. Overall, U.S. Treasuries gained as investors began to anticipate looser financial conditions. The corporate bond market benefited from improving economic sentiment, although high-yield corporate bond prices fared significantly better than investment-grade bonds as demand from yield-seeking investors remained strong.

The U.S. Federal Reserve (the “Fed”), attempting to manage persistent inflation, raised interest rates four times during the 12-month period, but paused its tightening in the second half of the period. The Fed also wound down its bond-buying programs and incrementally reduced its balance sheet by not replacing securities that reach maturity.

Supply constraints appear to have become an embedded feature of the new macroeconomic environment, making it difficult for developed economies to increase production without sparking higher inflation. Geopolitical fragmentation and an aging population risk further exacerbating these constraints, keeping the labor market tight and wage growth high. Although the Fed has stopped tightening for now, we believe that the new economic regime means that the Fed will need to maintain high rates for an extended period despite the market’s hopes for interest rate cuts, as reflected in the recent rally. In this new regime, we anticipate greater volatility and dispersion of returns, creating more opportunities for selective portfolio management.

We believe developed market equities have priced in an optimistic scenario for rate cuts, which we view as premature, so we prefer an underweight stance in the near term. Nevertheless, we are overweight on Japanese stocks as shareholder-friendly policies generate increased investor interest. We also believe that stocks with an AI tilt should benefit from an investment cycle that is set to support revenues and margins. In credit, there are selective opportunities in the near term despite tighter credit and financial conditions. For fixed income investing with a six- to twelve-month horizon, we see the most attractive investments in short-term U.S. Treasuries, U.S. mortgage-backed securities, and hard-currency emerging market bonds.

Overall, our view is that investors need to think globally, position themselves to be prepared for a decarbonizing economy, and be nimble as market conditions change. We encourage you to talk with your financial advisor and visit blackrock.com for further insight about investing in today’s markets.

Sincerely,

Rob Kapito

President, BlackRock Advisors, LLC

Rob Kapito

President, BlackRock Advisors, LLC

| | | | |

Total Returns as of December 31, 2023 |

| | | 6-Month | | 12-Month |

U.S. large cap equities (S&P 500® Index) | | 8.04% | | 26.29% |

U.S. small cap equities (Russell 2000® Index) | | 8.18 | | 16.93 |

International equities (MSCI Europe, Australasia, Far East Index) | | 5.88 | | 18.24 |

Emerging market equities (MSCI Emerging Markets Index) | | 4.71 | | 9.83 |

3-month Treasury bills (ICE BofA 3-Month U.S. Treasury Bill Index) | | 2.70 | | 5.02 |

U.S. Treasury securities (ICE BofA 10-Year U.S. Treasury Index) | | 1.11 | | 2.83 |

U.S. investment grade bonds (Bloomberg U.S. Aggregate Bond Index) | | 3.37 | | 5.53 |

Tax-exempt municipal bonds (Bloomberg Municipal Bond Index) | | 3.63 | | 6.40 |

U.S. high yield bonds (Bloomberg U.S. Corporate High Yield 2% Issuer Capped Index) | | 7.65 | | 13.44 |

|

Past performance is not an indication of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index. |

| | |

| 4 | | THIS PAGE IS NOT PART OF YOUR FUND REPORT |

Table of Contents

Option Over-Writing Strategy

Overview

In general, the goal of each of the Trusts is to provide total return through a combination of current income and realized and unrealized gains (capital appreciation). The Trusts seek to pursue these goals primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options in an effort to generate current gains from option premiums and to enhance each Trust’s risk-adjusted return. Each Trust’s objectives cannot be achieved in all market conditions.

Each Trust primarily writes single stock covered call options and may also from time to time write single stock put options. When writing (selling) a covered call option, a Trust holds an underlying equity security and enters into an option transaction which allows the counterparty to purchase the equity security at an agreed-upon price (“strike price”) within an agreed-upon time period. The Trust receives cash premiums from the counterparties upon writing (selling) the option, which along with net investment income and net realized gains, if any, are generally available to support current or future distributions paid by the Trust. During the option term, the counterparty may elect to exercise the option if the market value of the equity security rises above the strike price, and the Trust is obligated to sell the equity security to the counterparty at the strike price, realizing a gain or loss. Premiums received increase gains or reduce losses realized on the sale of the equity security. If the option remains unexercised upon its expiration, the Trust realizes gains equal to the premiums received. Alternatively, an option may be closed out by an offsetting purchase or sale of an option prior to expiration. The Trust realizes a capital gain from a closing purchase or sale transaction if the premium paid is less than the premium received from writing the option. The Trust realizes a capital loss from a closing purchase or sale transaction if the premium received is less than the premium paid to purchase the option.

Writing covered call options entails certain risks, which include, but are not limited to, the following: an increase in the value of the underlying equity security above the strike price can result in the exercise of a written option (sale by a Trust to the counterparty) when the Trust might not otherwise have sold the security; exercise of the option by the counterparty may result in a sale below the current market value and a gain or loss being realized by the Trust; and limiting the potential appreciation that could be realized on the underlying equity security to the extent of the strike price of the option. The premium that a Trust receives from writing a covered call option may not be sufficient to offset the potential appreciation on the underlying equity security above the strike price of the option that could have otherwise been realized by the Trust. As such, an option over-writing strategy may outperform the general equity market in flat or falling markets but underperform in rising markets.

Option Over-Writing Strategy Illustration

To illustrate these concepts, assume the following: (1) a common stock purchased at and currently trading at $37.15 per share; (2) a three-month call option is written by a Trust with a strike price of $40 (i.e., 7.7% higher than the current market price); and (3) the Trust receives $2.45, or 6.6% of the common stock’s value, as a premium. If the stock price remains unchanged, the option expires and there would be a 6.6% return for the three-month period. If the stock were to decline in price by 6.6% (i.e., decline to $34.70 per share), the option strategy would “break-even” from an economic perspective resulting in neither a gain nor a loss. If the stock were to climb to a price of $40 or above, the option would be exercised and the stock would return 7.7% coupled with the option premium received of 6.6% for a total return of 14.3%. Under this scenario, the Trust loses the benefit of any appreciation of the stock above $40, and thus is limited to a 14.3% total return. The premium from writing the call option serves to offset some of the unrealized loss on the stock in the event that the price of the stock declines, but if the stock were to decline more than 6.6% under this scenario, the Trust’s downside protection is eliminated and the stock could eventually become worthless.

Each Trust intends to write covered call and other options to varying degrees depending upon market conditions. Please refer to each Trust’s Schedule of Investments and the Notes to Financial Statements for details of written options.

Derivative Financial Instruments

The Trusts may invest in various derivative financial instruments. These instruments are used to obtain exposure to a security, commodity, index, market, and/or other assets without owning or taking physical custody of securities, commodities and/or other referenced assets or to manage market, equity, credit, interest rate, foreign currency exchange rate, commodity and/or other risks. Derivative financial instruments may give rise to a form of economic leverage and involve risks, including the imperfect correlation between the value of a derivative financial instrument and the underlying asset, possible default of the counterparty to the transaction or illiquidity of the instrument. Pursuant to Rule 18f-4 under the 1940 Act, among other things, the Trusts must either use derivative financial instruments with embedded leverage in a limited manner or comply with an outer limit on fund leverage risk based on value-at-risk. The Trusts’ successful use of a derivative financial instrument depends on the investment adviser’s ability to predict pertinent market movements accurately, which cannot be assured. The use of these instruments may result in losses greater than if they had not been used, may limit the amount of appreciation a Trust can realize on an investment and/or may result in lower distributions paid to shareholders. The Trusts’ investments in these instruments, if any, are discussed in detail in the Notes to Financial Statements.

| | |

| 6 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 | | BlackRock Energy and Resources Trust (BGR) |

Investment Objective

BlackRock Energy and Resources Trust’s (BGR) (the “Trust”) investment objective is to provide total return through a combination of current income and long-term capital appreciation. The Trust seeks to achieve its investment objective by investing, under normal market conditions, at least 80% of its total assets in equity securities of energy and natural resources companies and equity derivatives with exposure to the energy and natural resources industry. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust seeks to pursue this goal primarily by investing in a portfolio of equity securities and also by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange | | BGR |

Initial Offering Date | | December 29, 2004 |

Current Distribution Rate on Closing Market Price as of December 31, 2023 ($12.45)(a) | | 6.33% |

Current Monthly Distribution per Common Share(b) | | $0.065700 |

Current Annualized Distribution per Common Share(b) | | $0.788400 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/23 | | | 12/31/22 | | | Change | | | High | | | Low | |

Closing Market Price | | $ | 12.45 | | | $ | 12.53 | | | | (0.64 | )% | | $ | 13.36 | | | $ | 11.23 | |

Net Asset Value | | | 14.13 | | | | 14.21 | | | | (0.56 | ) | | | 15.09 | | | | 12.71 | |

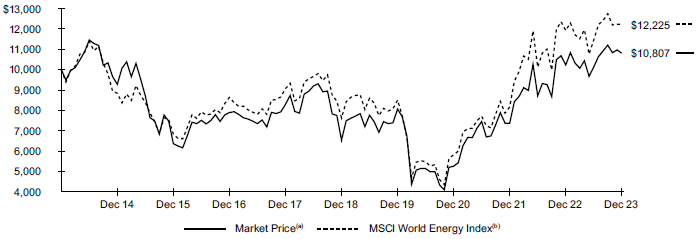

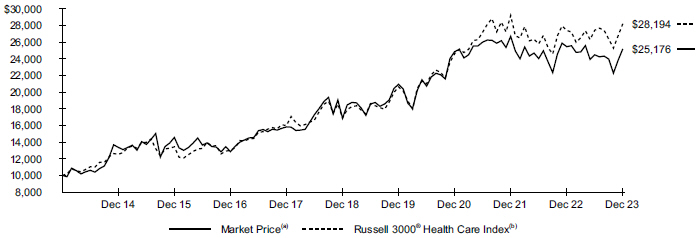

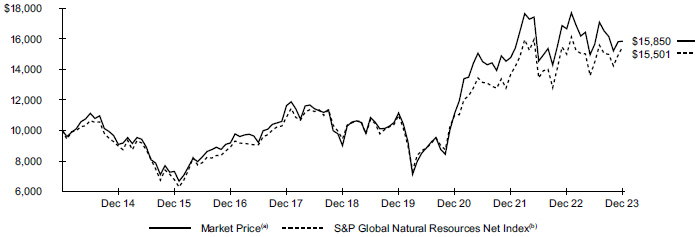

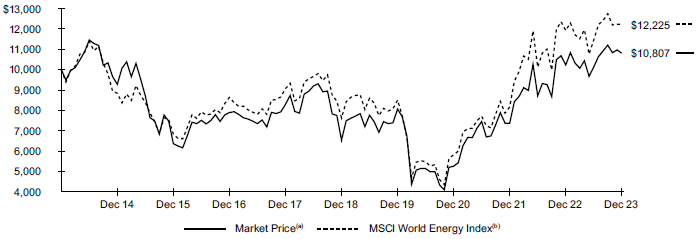

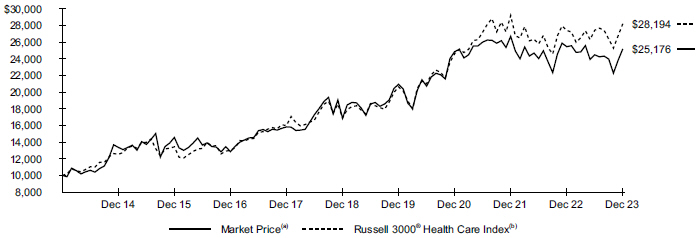

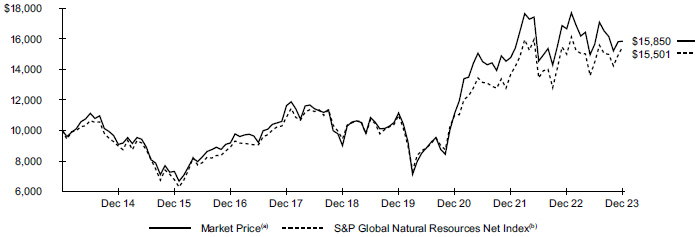

GROWTH OF $10,000 INVESTMENT

| | (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | An index that is designed to capture the large- and mid-cap segments across developed markets countries. All securities in the index are classified in the energy sector as per the Global Industry Classification Standard. | |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Energy and Resources Trust (BGR) |

Performance

Returns for the period ended December 31, 2023 were as follows:

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Trust at NAV(a)(b) | | | 5.75 | % | | | 10.34 | % | | | 0.98 | % |

Trust at Market Price(a)(b) | | | 5.66 | | | | 10.57 | | | | 0.78 | |

| | | |

MSCI World Energy Call Overwrite Index(c) | | | 5.18 | | | | 7.71 | | | | N/A | |

MSCI World Energy Index | | | 2.54 | | | | 9.88 | | | | 2.03 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | An index that incorporates an option overlay component on the MSCI World Energy Index with a 33% overwrite level. The benchmark commenced on December 31, 2018 and therefore the benchmark does not have 10-year returns. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s relative performance based on NAV:

What factors influenced performance?

Natural resources stocks posted gains as a group in 2023, but they lagged the broader equity market due largely to weakness in commodity prices.

The Trust’s overweight positions in Canadian Natural Resources Ltd. and Diamondback Energy, Inc., which rose on the strength of robust production and positive earnings results, contributed to performance. Zero weightings in Devon Energy Corp. and Occidental Petroleum Corp. also contributed. Devon reported weaker-than-expected profits, and Occidental’s share price fell following the announcement of a debt-trusted acquisition. The U.S. liquified natural gas exporter Cheniere Energy, Inc., which reported strong results and upgraded its earnings guidance throughout the year, was another noteworthy contributor.

On the negative side, an underweight in the oilfield services sub-sector detracted from performance. At the stock level, an overweight position in Patterson-UTI Energy Inc. detracted in the first half of the year. A zero weighting in Baker Hughes, Inc. hurt performance, as well. Elsewhere in the portfolio, zero weightings in Cameco Inc., Neste oyj, and Phillips 66 pressured results. A position in BP PLC also detracted. Although the company reported robust earnings, investors reacted negatively to the company’s decision to reduce its pace of share buybacks.

The Trust used an options overlay strategy in which calls were written on a portion of the portfolio’s holdings. This strategy contributed to results in the annual period.

The Trust’s practice of maintaining a specified level of monthly distributions to shareholders did not have a material impact on the Trust’s investment strategy. The distribution policy resulted in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

The investment adviser added to the Trust’s weighting in the oilfield services subsector, and it modestly reduced the allocation to integrated oil companies. The investment adviser also reduced the Trust’s position in U.S. shale exploration and production companies, and it rotated its holdings in the integrated subsector in an effort to capitalize on differences in relative performance.

Describe portfolio positioning at period end.

The investment adviser actively manages the Trust’s positioning to focus on areas where it sees compelling return opportunities and attractive valuations. It believed valuations were favorable at the end of the reporting period given energy companies’ ability to generate profits and deliver high free cash flows. The Trust was overweight in European integrated producers, where the investment advisor saw the most compelling valuations. The Trust maintained selective exposure within the U.S. shale space.

As of December 31, 2023, the Trust had in place an option overwriting program whereby 29.8% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 3.9% out of the money) and for maturities averaging 48 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 8 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Energy and Resources Trust (BGR) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security(a) | | Percent of

Total Investments | |

Exxon Mobil Corp. | | | 16.3 | % |

Shell PLC | | | 10.8 | |

Chevron Corp. | | | 8.8 | |

TotalEnergies SE | | | 8.2 | |

ConocoPhillips | | | 6.2 | |

BP PLC | | | 4.7 | |

Canadian Natural Resources Ltd. | | | 4.2 | |

EOG Resources, Inc. | | | 4.0 | |

Williams Cos., Inc. | | | 3.7 | |

Cheniere Energy, Inc. | | | 3.7 | |

INDUSTRY ALLOCATION

| | | | |

| | |

| Industry(a)(b) | | Percentage of

Total Investments | |

Oil, Gas & Consumable Fuels | | | 93.6 | % |

Energy Equipment & Services | | | 6.4 | |

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s industry classifications refer to one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such industry sub-classifications for reporting ease. |

| | |

Trust Summary as of December 31, 2023 | | BlackRock Enhanced Capital and Income Fund, Inc. (CII) |

Investment Objective

BlackRock Enhanced Capital and Income Fund, Inc.’s (CII) (the “Trust”) investment objective is to provide current income and capital appreciation. The Trust seeks to achieve its investment objective by investing in a portfolio of equity securities of U.S. and foreign issuers. The Trust may invest directly in such securities or synthetically through the use of derivatives. The Trust also seeks to achieve its investment objective by employing a strategy of writing (selling) call and put options.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange | | CII |

Initial Offering Date | | April 30, 2004 |

Current Distribution Rate on Closing Market Price as of December 31, 2023 ($19.00)(a) | | 6.28% |

Current Monthly Distribution per Common Share(b) | | $0.099500 |

Current Annualized Distribution per Common Share(b) | | $1.194000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/23 | | | 12/31/22 | | | Change | | | High | | | Low | |

Closing Market Price | | $ | 19.00 | | | $ | 17.12 | | | | 10.98 | % | | $ | 19.32 | | | $ | 16.82 | |

Net Asset Value | | | 19.81 | | | | 17.55 | | | | 12.88 | | | | 19.84 | | | | 17.42 | |

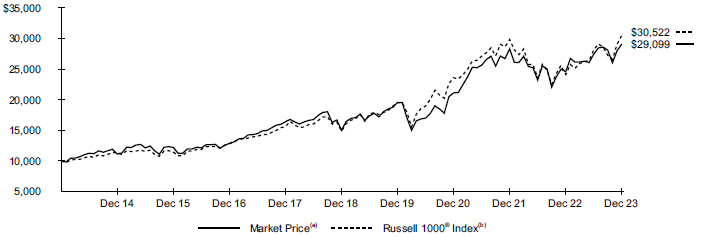

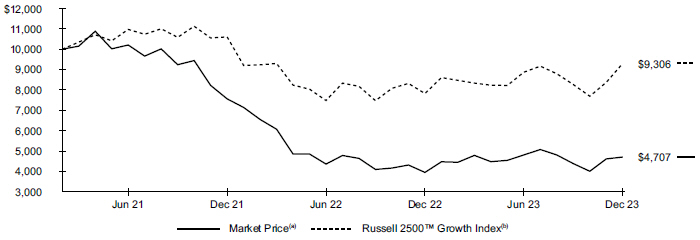

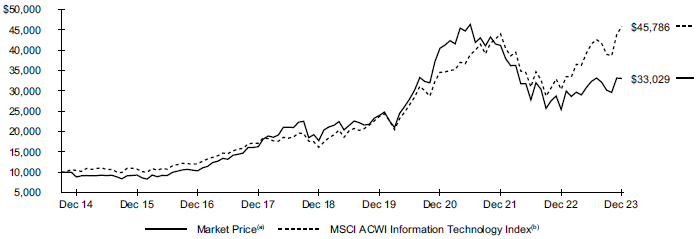

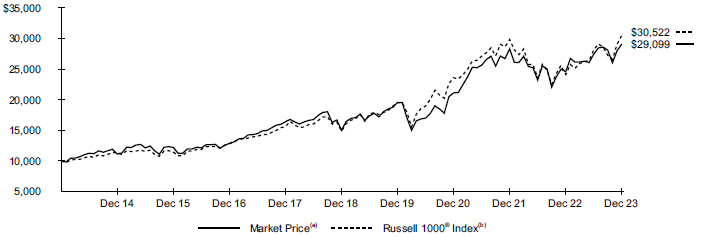

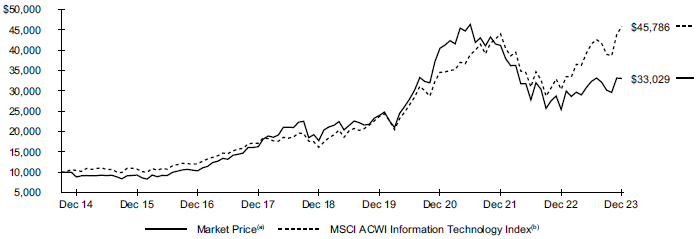

GROWTH OF $10,000 INVESTMENT

| | (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | An index that measures the performance of the large-cap segment of the U.S. equity universe. It is a subset of the Russell 3000® Index and includes approximately 1,000 of the largest securities based on a combination of their market capitalization and current index membership. The Russell 1000® Index represents approximately 93% of the U.S. market. | |

| | |

| 10 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced Capital and Income Fund, Inc. (CII) |

Performance

Returns for the period ended December 31, 2023 were as follows:

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Trust at NAV(a)(b) | | | 20.45 | % | | | 13.27 | % | | | 10.25 | % |

Trust at Market Price(a)(b) | | | 18.43 | | | | 14.18 | | | | 11.27 | |

| | | |

MSCI USA Call Overwrite Index(c) | | | 22.00 | | | | 11.57 | | | | N/A | |

Russell 1000® Index | | | 26.53 | | | | 15.52 | | | | 11.80 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | An index that incorporates an option overlay component on the MSCI USA Index with a 55% overwrite level. The benchmark commenced on December 31, 2018 and therefore the benchmark does not have 10-year returns. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s relative performance based on NAV:

What factors influenced performance?

Stock selection within the healthcare sector was a leading contributor to relative performance, most notably within the pharmaceuticals industry. Investment decisions within communication services also proved additive, most notably an overweight allocation to the sector along with stock selection in interactive media and services. Finally, positioning within the energy sector and a lack of exposure to utilities was beneficial as well.

An underweight allocation to the information technology sector was the largest detractor during the period. Stock selection in materials also detracted, most notably an overweight allocation to and poor selection within the containers and packaging industry. Stock selection within consumer discretionary and industrials detracted as well.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy detracted from relative performance for the 12-month period.

The Trust’s practice of maintaining a specified level of monthly distributions did not have a material impact on the Trust’s investment strategy. The distribution policy did not result in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

During the reporting period, a combination of portfolio trading activity and market price changes resulted in the Trust adding exposure to the information technology and communication services sectors, while the Trust saw reduced exposure to industrials and materials.

Describe portfolio positioning at period end.

As of December 31, 2023, the Trust had an options overwriting program in place whereby 51% of the underlying equities were overwritten with call options. These call options were typically written at levels above prevailing market prices (estimated to be 6.0% out of the money) with an average time until expiration of 53 days.

At period end, the Trust’s largest absolute allocations were in IT, healthcare and financials. Relative to the benchmark, the Trust’s most significant overweight exposures were in communication services, health care and consumer discretionary. The Trust maintained its most significant relative underweight sector exposures to IT, real estate and utilities.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced Capital and Income Fund, Inc. (CII) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security(a) | | Percent of

Total Investments | |

Microsoft Corp. | | | 8.7 | % |

Amazon.com, Inc. | | | 5.5 | |

Alphabet, Inc. | | | 5.4 | |

Apple, Inc. | | | 4.4 | |

Meta Platforms, Inc. | | | 3.1 | |

Berkshire Hathaway, Inc. | | | 2.6 | |

Advanced Micro Devices, Inc. | | | 2.3 | |

Comcast Corp. | | | 2.3 | |

Fortive Corp. | | | 2.3 | |

Sanofi SA | | | 2.2 | |

SECTOR ALLOCATION

| | | | |

| | |

| Sector(a)(b) | | Percent of

Total Investments | |

Information Technology | | | 25.2 | % |

Health Care | | | 16.2 | |

Financials | | | 13.1 | |

Communication Services | | | 13.1 | |

Consumer Discretionary | | | 12.8 | |

Industrials | | | 6.9 | |

Consumer Staples | | | 5.5 | |

Energy | | | 4.2 | |

Materials | | | 3.0 | |

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| | |

| 12 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 | | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Investment Objective

BlackRock Enhanced Equity Dividend Trust’s (BDJ) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing in common stocks that pay dividends and have the potential for capital appreciation and by utilizing an option writing strategy to enhance distributions to its shareholders. The Trust invests, under normal market conditions, at least 80% of its total assets in dividend paying equities and may invest up to 20% of its total assets in equity securities of issuers that do not pay dividends. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange | | BDJ |

Initial Offering Date | | August 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2023 ($7.69)(a) | | 8.77% |

Current Monthly Distribution per Common Share(b) | | $0.056200 |

Current Annualized Distribution per Common Share(b) | | $0.674400 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/23 | | | 12/31/22 | | | Change | | | High | | | Low | |

Closing Market Price | | $ | 7.69 | | | $ | 9.01 | | | | (14.65 | )% | | $ | 9.36 | | | $ | 6.92 | |

Net Asset Value | | | 8.82 | | | | 8.74 | | | | 0.92 | | | | 9.15 | | | | 8.05 | |

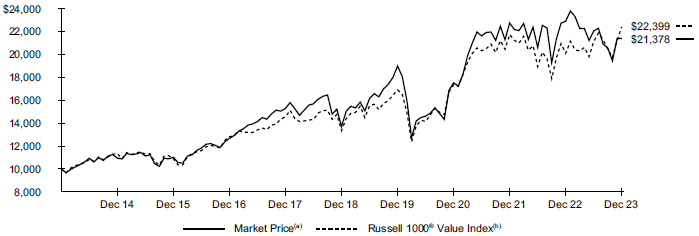

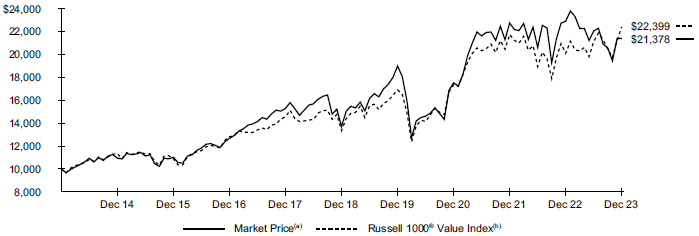

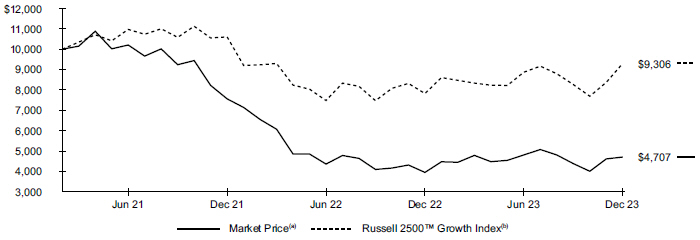

GROWTH OF $10,000 INVESTMENT

| | (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | An index that measures the performance of the large-cap value segment of the U.S. equity universe. It includes those Russell 1000 companies with lower price-to-book ratios and lower expected growth values. | |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Performance

Returns for the period ended December 31, 2023 were as follows:

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Trust at NAV(a)(b) | | | 10.37 | % | | | 9.76 | % | | | 7.88 | % |

Trust at Market Price(a)(b) | | | (6.65 | ) | | | 9.31 | | | | 7.89 | |

| | | |

MSCI USA Value Call Overwrite Index(c) | | | 5.33 | | | | 7.12 | | | | N/A | |

Russell 1000® Value Index | | | 11.46 | | | | 10.91 | | | | 8.40 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust moved from a premium to NAV to a discount during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | An index that incorporates an option overlay component on the MSCI USA Value Index with a 55% overwrite level. The benchmark commenced on December 31, 2018 and therefore the benchmark does not have 10-year returns. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s relative performance based on NAV:

What factors influenced performance?

The global equity markets produced robust returns in 2023 thanks to stronger-than-expected economic growth and a more favorable outlook for central bank policy. Dividend-paying stocks, while posting gains, lagged the broader market at a time in which investors displayed a preference for faster-growing companies.

Stock selection in the financial sector made the largest contribution to the Fund’s relative performance. Selection in health care also boosted results, mainly due to positioning in pharmaceuticals. Stock selection in energy was an additional contributor, led by the oil, gas, and consumable fuels industry group. Positioning in utilities contributed as well.

On the other hand, an underweight in the information technology sector detracted from performance. Stock selection in materials further weighed on results, with the weakest showing in the containers and packaging industry. Positioning in the consumer discretionary and consumer staples sectors also detracted.

The Trust used an options overlay strategy in which calls were written on a portion of the portfolio’s holdings. The options overlay strategy detracted from relative performance.

The Trust’s practice of maintaining a specified level of monthly distributions to shareholders did not have a material impact on the Trust’s investment strategy. The distribution policy did not result in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

The Trust’s allocations to the financials and industrials sectors increased due to a combination of portfolio trading activity and market price changes. The Trust’s weightings in information technology and healthcare sectors decreased.

Describe portfolio positioning at period end.

As of December 31, 2023, the Trust had in place an option overwriting program whereby 50.8% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 5.0% out of the money) and for maturities averaging 55 days.

At period end, the Trust’s largest absolute allocations were in financials, healthcare, and industrials. Relative to the benchmark, the Trust’s most significant overweight exposures were in financials, communication services and health care. The Trust maintained its most significant relative underweight sector exposures to IT, real estate and materials.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

| 14 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced Equity Dividend Trust (BDJ) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security(a) | | Percent of

Total Investments | |

Wells Fargo & Co. | | | 3.2 | % |

Citigroup, Inc. | | | 3.0 | |

American International Group, Inc. | | | 2.9 | |

Shell PLC | | | 2.6 | |

Kraft Heinz Co. | | | 2.4 | |

Leidos Holdings, Inc. | | | 2.3 | |

L3Harris Technologies, Inc. | | | 2.3 | |

General Motors Co. | | | 2.2 | |

SS&C Technologies Holdings, Inc. | | | 2.1 | |

BP PLC | | | 2.1 | |

SECTOR ALLOCATION

| | | | |

| | |

| Sector(a)(b) | | Percent of

Total Investments | |

Financials | | | 26.9 | % |

Health Care | | | 18.2 | |

Industrials | | | 11.5 | |

Consumer Staples | | | 8.8 | |

Energy | | | 8.5 | |

Information Technology | | | 7.3 | |

Consumer Discretionary | | | 6.3 | |

Communication Services | | | 5.5 | |

Utilities | | | 4.1 | |

Materials | | | 2.1 | |

Real Estate | | | 0.8 | |

| (a) | Excludes short-term securities. |

| (b) | For Trust compliance purposes, the Trust’s sector classifications refer to one or more of the sector sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or as defined by the investment adviser. These definitions may not apply for purposes of this report, which may combine such sector sub-classifications for reporting ease. |

| | |

Trust Summary as of December 31, 2023 | | BlackRock Enhanced Global Dividend Trust (BOE) |

Investment Objective

BlackRock Enhanced Global Dividend Trust’s (BOE) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary investment objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies located in countries throughout the world and by employing a strategy of writing (selling) call and put options. Under normal circumstances, the Trust invests at least 80% of its net assets in dividend-paying equity securities and at least 40% of its assets outside of the U.S. (unless market conditions are not deemed favorable by Trust management, in which case the Trust would invest at least 30% of its assets outside of the U.S.). The Trust may invest in securities of companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange | | BOE |

Initial Offering Date | | May 31, 2005 |

Current Distribution Rate on Closing Market Price as of December 31, 2023 ($ 9.92)(a) | | 7.62% |

Current Monthly Distribution per Common Share(b) | | $0.063000 |

Current Annualized Distribution per Common Share(b) | | $0.756000 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/23 | | | 12/31/22 | | | Change | | | High | | | Low | |

Closing Market Price | | $ | 9.92 | | | $ | 9.56 | | | | 3.77 | % | | $ | 10.59 | | | $ | 8.87 | |

Net Asset Value | | | 11.81 | | | | 10.97 | | | | 7.66 | | | | 11.81 | | | | 10.56 | |

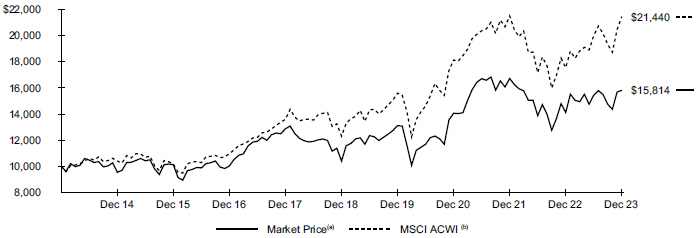

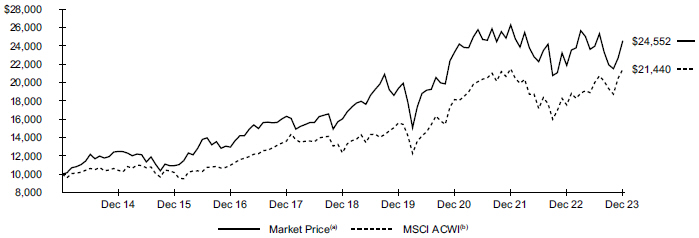

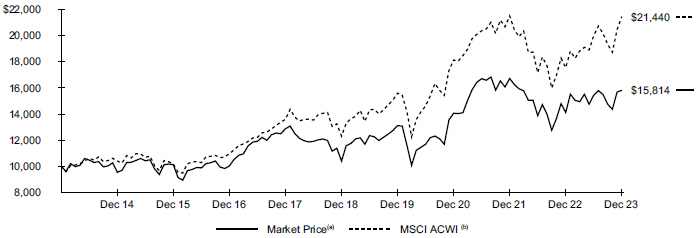

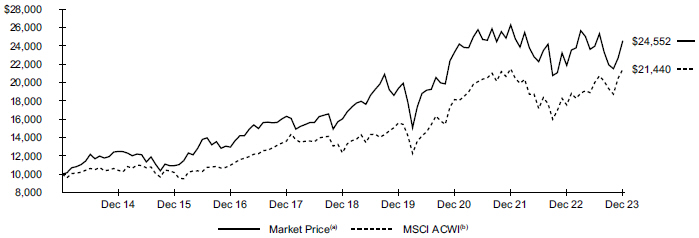

GROWTH OF $10,000 INVESTMENT

| | (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | An index that captures large- and mid-cap representation across certain developed and emerging markets. | |

| | |

| 16 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced Global Dividend Trust (BOE) |

Performance

Returns for the period ended December 31, 2023 were as follows:

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Trust at NAV(a)(b) | | | 16.16 | % | | | 8.89 | % | | | 5.14 | % |

Trust at Market Price(a)(b) | | | 11.95 | | | | 8.72 | | | | 4.69 | |

| | | |

MSCI ACWI Call Overwrite Index(c) | | | 18.00 | | | | 8.97 | | | | N/A | |

MSCI ACWI | | | 22.20 | | | | 11.72 | | | | 7.93 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | An index that incorporates an option overlay component on the MSCI ACWI Index with a 45% overwrite level. The benchmark commenced on December 31, 2018 and therefore the benchmark does not have 10-year returns. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s relative performance based on NAV:

What factors influenced performance?

At the individual stock level, a lack of exposure to Nvidia Corp. and Meta Platforms, Inc., along with an underweight position in Apple, Inc. were among the top detractors given the outsized gains posted by these stocks over the year. The Trust’s focus on investing in high quality companies with sustainable growing cash flows that pay a dividend limits its ability to invest in much of the universe of technology-related companies given that these companies typically pay very low dividends or have no dividend policies. The Trust’s position in International Flavors & Fragrances, Inc. also detracted from performance. The company missed earnings estimates and guided lower on full year 2023 growth given an uncertain market environment that led to weaker volumes and industry-wide consumer destocking in the United States. The Fund exited the position in the third quarter of 2023.

In terms of individual holdings, positive contributions were led by MediaTek, Inc. (“MediaTek”), a Taiwanese semiconductor company that supplies chips for smartphones in China. MediaTek shares benefited as expectations for central bank rate cuts supported growth-oriented areas of the market. In addition, the company continued to beat earnings estimates and saw significant improvements in inventory levels and expectations for the recovery in China’s smartphone market where the investment adviser believed it was positioned to continue to gain market share. Holdings of U.K. home construction company Taylor Wimpey PLC also contributed to performance. The shares were supported by expectations for lower U.K. mortgage rates and a more robust U.K. housing market in 2024. The company’s strong balance sheet and attractive land bank along with the structural imbalance between supply and demand in the U.K. housing market continued to make it an attractive holding in the view of the investment adviser. Finally, Spanish clothing retailer Industria de Diseno Textil SA, curator of brands such as Zara, reported strong profits over the year thanks to robust in-store and online sales. The company has been able to maintain pricing strength in markets outside the Eurozone, which has boosted profitability.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy contributed positively to relative performance.

The Trust’s practice of maintaining a specified level of monthly distributions to shareholders did not have a material impact on the Trust’s investment strategy. The distribution policy resulted in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

During the reporting period, the Trust added exposure to the industrials, information technology and energy sectors. The Trust reduced exposure to the consumer discretionary sector, particularly in relation to the luxury segment, as well as to healthcare and utilities.

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector overweights were in industrials, healthcare and consumer staples, while consumer discretionary was the largest underweight. Regionally, the Trust was overweight Europe and underweight the United States.

As of December 31, 2023, the Trust had an options overwriting program in place whereby 44% of the underlying equities were overwritten with call options. These call options were typically written at levels above prevailing market prices (estimated to be 2.3% out of the money) with an average time until expiration of 57 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced Global Dividend Trust (BOE) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security(a) | | Percent of

Total Investments | |

Microsoft Corp. | | | 4.8 | % |

Apple, Inc. | | | 3.4 | |

Nestle SA | | | 3.0 | |

Mondelez International, Inc. | | | 2.9 | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 2.8 | |

AstraZeneca PLC | | | 2.8 | |

Union Pacific Corp. | | | 2.7 | |

AbbVie, Inc. | | | 2.7 | |

Accenture PLC | | | 2.7 | |

RELX PLC | | | 2.6 | |

GEOGRAPHIC ALLOCATION

| | | | |

| | |

| Country/Geographic Region | | Percentage of

Total Investments | |

United States | | | 50.9 | % |

United Kingdom | | | 11.1 | |

France | | | 9.4 | |

Switzerland | | | 6.7 | |

Taiwan | | | 4.9 | |

Netherlands | | | 4.1 | |

Ireland | | | 4.1 | |

Denmark | | | 2.2 | |

Mexico | | | 2.1 | |

Canada | | | 2.0 | |

Singapore | | | 1.4 | |

Indonesia | | | 1.1 | |

India | | | — | (b) |

| (a) | Excludes short-term securities. |

| (b) | Rounds to less than 0.1%. |

| | |

| 18 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 | | BlackRock Enhanced International Dividend Trust (BGY) |

Investment Objective

BlackRock Enhanced International Dividend Trust’s (BGY) (the “Trust”) primary investment objective is to provide current income and current gains, with a secondary objective of long-term capital appreciation. The Trust seeks to achieve its investment objectives by investing primarily in equity securities issued by companies of any market capitalization located in countries throughout the world and by employing a strategy of writing (selling) call and put options. The Trust invests, under normal circumstances, at least 80% of its net assets in dividend-paying equity securities issued by non-U.S. companies of any market capitalization, but intends to invest primarily in securities of large capitalization companies. The Trust may invest directly in such securities or synthetically through the use of derivatives.

No assurance can be given that the Trust’s investment objectives will be achieved.

Trust Information

| | |

Symbol on New York Stock Exchange | | BGY |

Initial Offering Date | | May 30, 2007 |

Current Distribution Rate on Closing Market Price as of December 31, 2023 ($ 5.27)(a) | | 7.70% |

Current Monthly Distribution per Common Share(b) | | $0.033800 |

Current Annualized Distribution per Common Share(b) | | $0.405600 |

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. | |

| | (b) | The distribution rate is not constant and is subject to change. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/23 | | | 12/31/22 | | | Change | | | High | | | Low | |

Closing Market Price | | $ | 5.27 | | | $ | 5.02 | | | | 4.98 | % | | $ | 5.64 | | | $ | 4.68 | |

Net Asset Value | | | 6.21 | | | | 5.78 | | | | 7.44 | | | | 6.40 | | | | 5.54 | |

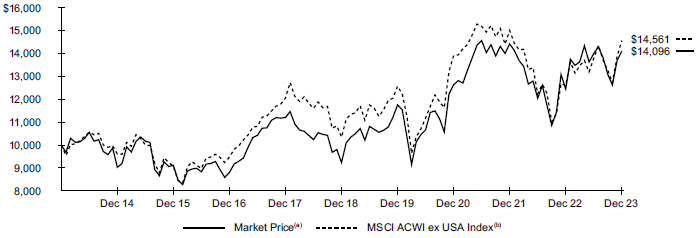

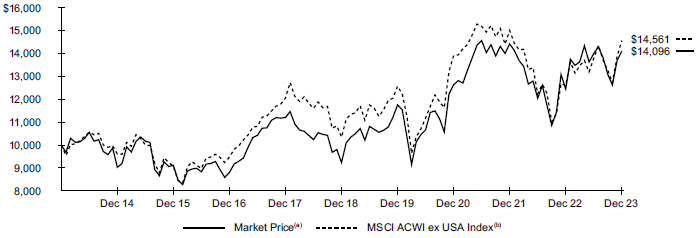

GROWTH OF $10,000 INVESTMENT

| | (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | An index that captures large- and mid-cap representation across certain developed markets countries (excluding the U.S.) and certain emerging markets countries. | |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced International Dividend Trust (BGY) |

Performance

Returns for the period ended December 31, 2023 were as follows:

| | | | | | | | | | | | |

| | | Average Annual Total Returns | |

| | | |

| | | 1 Year | | | 5 Years | | | 10 Years | |

| | | |

Trust at NAV(a)(b) | | | 15.94 | % | | | 9.12 | % | | | 3.93 | % |

Trust at Market Price(a)(b) | | | 13.29 | | | | 8.82 | | | | 3.49 | |

| | | |

MSCI ACWI ex USA Call Overwrite Index(c) | | | 11.24 | | | | 4.61 | | | | N/A | |

MSCI ACWI ex USA Index | | | 15.62 | | | | 7.08 | | | | 3.83 | |

| | (a) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. | |

| | (c) | An index that incorporates an option overlay component on the MSCI ACWI ex USA Index with a 45% overwrite level. The benchmark commenced on December 31, 2018 and therefore the benchmark does not have 10-year returns. | |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s relative performance based on NAV:

What factors influenced performance?

Stock selection within and an overweight to industrials led positive contributions to the Trust’s relative performance during the reporting period. Stock selection within and underweights to materials and consumer discretionary also contributed.

In terms of individual holdings, positive contributions were led by MediaTek Inc.(“MediaTek”), a Taiwanese semiconductor company that supplies chips for smartphones in China. MediaTek shares benefited as expectations for central bank rate cuts supported growth-oriented areas of the market. In addition, the company continued to beat earnings estimates and is seeing significant improvements in inventory levels and expectations for the recovery in China’s smartphone market where it is positioned to continue to gain market share. Spanish clothing retailer Industria de Diseno Textil SA, curator of brands such as Zara, reported strong profits during the period thanks to robust sales both in-store and online. The company has been able to maintain pricing strength in markets outside the eurozone, aiding profitability. Novo Nordisk A/S, the Danish multinational pharmaceutical company, also contributed to returns. The stock reacted positively as Novo Nordisk A/S reported that its latest trial resulted in a 20% decrease in cardiovascular events in obese patients using Wegovy, – the GLP-1 weight-loss drug manufactured by the company. This result was expected to help unlock reimbursement of the product in commercial plans and potentially lead to Medicare reimbursement, while differentiating Wegovy from competing products.

Stock selection in financials was the main detractor from relative performance during the period. Stock selection within and an overweight to consumer staples and stock selection within communication services also detracted.

Lonza Group AG, the Swiss pharmaceutical and biotech company and largest biologics contract manufacturer in the world, was the top detractor from relative performance over the period. Following the unexpected departure of the CEO in September 2023, the company held its Capital Markets Day in October 2023 and downgraded 2024 guidance. The reduced guidance was centered on Lonza Group AG’s Biologics business that management had previously indicated was “sold out for the foreseeable future”. The Trust subsequently exited the position. Prudential PLC, the U.K.-based multinational insurance company and leading provider of insurance products and services in Asia, also detracted during the period as the shares came under pressure due to weaker sentiment in China. The company posted strong new business profits for the first half of 2023 and the new CEO announced plans for a $1 billion organic investment program through 2025 to drive an increase in new business premiums growth. Finally, brewer Budweiser Brewing Co. APAC Ltd. had significant exposure to the on-premise and nightlife channels in China and saw its shares come under pressure due to increasing concerns over the strength of China’s post-pandemic reopening.

The Trust utilized an options overlay strategy in which calls are written on a portion of the portfolio’s holdings. The Trust’s options overlay strategy contributed to relative performance for the reporting period.

The Trust’s practice of maintaining a specified level of monthly distributions did not have a material impact on the Trust’s investment strategy. The distribution policy resulted in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

During the reporting period, the Trust reduced its exposure to the materials, energy and information technology sectors, while adding to consumer staples, consumer discretionary and industrials.

Describe portfolio positioning at period end.

At period end, the Trust’s largest sector overweights were in industrials, healthcare and information technology. Regionally, the majority of portfolio assets comprised securities listed in Europe, with particularly significant exposure in Europe excluding the United Kingdom.

| | |

| 20 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Enhanced International Dividend Trust (BGY) |

As of December 31, 2023, the Trust had an options overwriting program in place whereby 43% of the underlying equities were overwritten with call options. These call options were typically written at levels above prevailing market prices (estimated to be 2.3% out of the money) with an average time until expiration of 60 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security(a) | | Percent of

Total Investments | |

Taiwan Semiconductor Manufacturing Co. Ltd. | | | 4.5 | % |

Novo Nordisk A/S | | | 3.7 | |

RELX PLC | | | 3.6 | |

Baker Hughes Co. | | | 3.4 | |

Keyence Corp. | | | 3.3 | |

ASML Holding NV | | | 3.1 | |

Atlas Copco AB | | | 3.1 | |

Air Liquide SA | | | 3.0 | |

FinecoBank Banca Fineco SpA | | | 3.0 | |

Shell PLC | | | 3.0 | |

GEOGRAPHIC ALLOCATION

| | | | |

| | |

| Country/Geographic Region | | Percentage of

Total Investments | |

United Kingdom | | | 13.4 | % |

Netherlands | | | 11.9 | |

France | | | 10.5 | |

United States | | | 10.3 | |

Japan | | | 7.6 | |

Taiwan | | | 7.1 | |

Sweden | | | 5.7 | |

Switzerland | | | 4.5 | |

Canada | | | 4.4 | |

Germany | | | 4.3 | |

Singapore | | | 4.1 | |

Denmark | | | 3.7 | |

Italy | | | 3.0 | |

Mexico | | | 2.9 | |

India | | | 2.6 | |

Indonesia | | | 1.5 | |

Brazil | | | 1.4 | |

China | | | 1.1 | |

| (a) | Excludes short-term securities. |

| | |

Trust Summary as of December 31, 2023 | | BlackRock Health Sciences Term Trust (BMEZ) |

Investment Objective

BlackRock Health Sciences Term Trust’s (BMEZ) (the “Trust”) (formerly known as BlackRock Health Sciences Trust II) investment objective is to provide total return and income through a combination of current income, current gains and long-term capital appreciation. Under normal market conditions, the Trust will invest at least 80% of its total assets in equity securities of companies principally engaged in the health sciences group of industries and equity derivatives with exposure to the health sciences group of industries. Equity derivatives in which the Trust invests include purchased and sold (written) call and put options on equity securities of companies in the health sciences group of industries.

On March 31, 2023 the Board approved a proposal to change the name of BlackRock Health Sciences Trust II, effective as of April 5, 2023, to BlackRock Health Sciences Term Trust. There were no changes to the Trust’s investment policies or strategies in conjunction with the name change.

No assurance can be given that the Trust’s investment objective will be achieved.

Trust Information

| | |

|

Symbol on New York Stock Exchange | | BMEZ |

Initial Offering Date | | January 30, 2020 |

Current Distribution Rate on Closing Market Price as of December 31, 2023 ($14.65)(a) | | 7.50% |

Current Monthly Distribution per Common Share(b) | | $0.091600 |

Current Annualized Distribution per Common Share(b) | | $1.099200 |

|

| | (a) | Current distribution rate on closing market price is calculated by dividing the current annualized distribution per share by the closing market price. The current distribution rate may consist of income, net realized gains and/or a return of capital. Past performance is not an indication of future results. | |

| | (b) | The monthly distribution per Common Share, declared on February 1, 2024, was decreased to $0.090440 per share. The current distribution rate on closing market price, current monthly distribution per Common Share, and current annualized distribution per Common Share do not reflect the new distribution rate. The new distribution rate is not constant and is subject to change in the future. A portion of the distribution may be deemed a return of capital or net realized gain. | |

Market Price and Net Asset Value Per Share Summary

| | | | | | | | | | | | | | | | | | | | |

| | | 12/31/23 | | | 12/31/22 | | | Change | | | High | | | Low | |

Closing Market Price | | $ | 14.65 | | | $ | 15.43 | | | | (5.06 | )% | | $ | 16.99 | | | $ | 13.02 | |

Net Asset Value | | | 17.91 | | | | 18.76 | | | | (4.53 | ) | | | 19.72 | | | | 15.62 | |

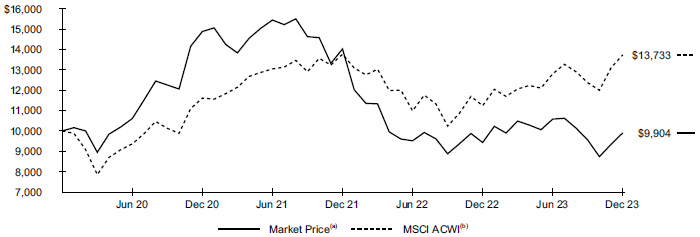

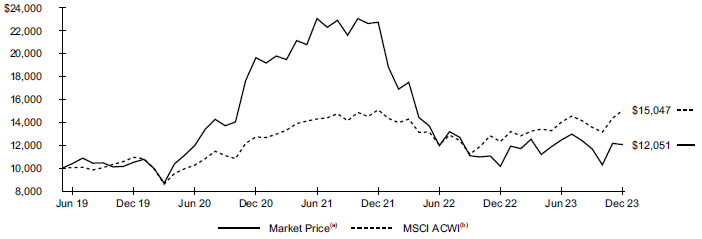

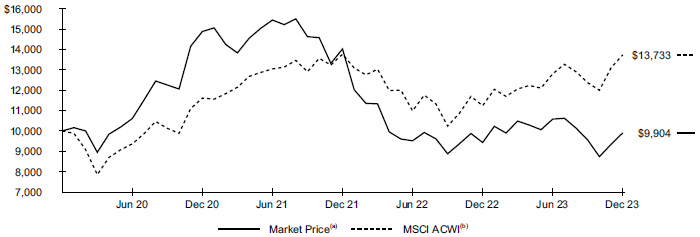

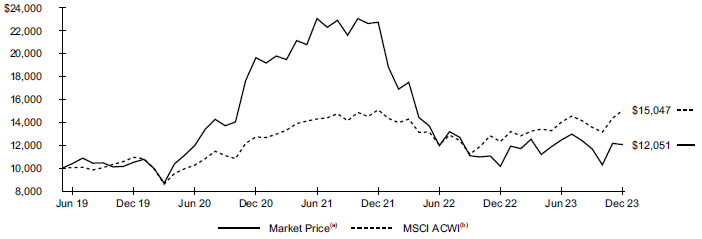

GROWTH OF $10,000 INVESTMENT

BMEZ commenced operations on January 30, 2020.

| | (a) | Represents the Trust’s closing market price on the NYSE and reflects the reinvestment of dividends and/or distributions at actual reinvestment prices. | |

| | (b) | An index that captures large- and mid-cap representation across certain developed and emerging markets. | |

| | |

| 22 | | 2 0 2 3 BLACK ROCK ANNUAL REPORT TO SHAREHOLDERS |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Health Sciences Term Trust (BMEZ) |

Performance

Returns for the period ended December 31, 2023 were as follows:

| | | | | | | | |

| | | Average Annual Total Returns | |

| | | 1 Year | | | Since Inception(a) | |

Trust at NAV(b)(c) | | | 5.60 | % | | | 5.00% | |

Trust at Market Price(b)(c) | | | 5.02 | | | | (0.24) | |

MSCI Custom ACWI SMID Growth HC Call Overwrite Index(d) | | | 4.08 | | | | (6.87) | |

MSCI ACWI | | | 22.20 | | | | 8.44 | |

| | (a) | BMEZ commenced operations on January 30, 2020. |

| | (b) | All returns reflect reinvestment of dividends and/or distributions at actual reinvestment prices. |

| | (c) | The Trust’s discount to NAV widened during the period, which accounts for the difference between performance based on market price and performance based on NAV. |

| | (d) | An index representing the Health Care sector stocks within the MSCI ACWI SMID Cap Growth Index and incorporating an option overlay component with a 25% overwrite level. The MSCI ACWI SMID Cap Growth Index captures mid- and small-cap securities exhibiting overall growth style characteristics across certain developed and emerging markets countries. The index commenced on March 31, 2022 and therefore the since inception return presented is for the period March 31, 2022 through the current reporting period. |

Performance results may include adjustments made for financial reporting purposes in accordance with U.S. generally accepted accounting principles. Past performance is not an indication of future results.

The Trust is presenting the performance of one or more indices for informational purposes only. The Trust is actively managed and does not seek to track or replicate the performance of any index. The index performance shown is not intended to be indicative of the Trust’s investment strategies, portfolio components or past or future performance.

More information about the Trust’s historical performance can be found in the “Closed End Funds” section of blackrock.com.

The following discussion relates to the Trust’s relative performance based on NAV:

What factors influenced performance?

Selection in the biotechnology and pharmaceuticals sub-sectors contributed to the Fund’s relative performance in 2023.

At the individual security level, an out-of-benchmark position in Vertex Pharmaceuticals, Inc. was the largest contributor. The biotechnology company reported consistently strong earnings during the reporting period and released promising trial results for its non-opioid pain medicine. An overweight position in Reata Pharmaceuticals, Inc. (“Reata”) was another top contributor. The biotechnology giant Biogen, Inc. announced it would acquire the company for $7.3 billion to obtain Reata’s pipeline of rare disease treatments. An overweight in Blueprint Medicines also contributed positively. The precision therapy company reported increased sales of its hematological disorder treatment, Avyakit. Performance was further bolstered by a year-end rally in small- and mid-cap stocks after the Fed signaled it was likely to begin easing interest rates in 2024.

Security selection in the healthcare providers and services and medical devices and supplies sub-sectors detracted from relative performance.

An overweight in the oncology company Novocure, Ltd., which reported disappointing trial results for its ovarian cancer therapy, was the largest individual detractor from performance. Additionally, a separate trial caused market participants to question the commercial viability of the company’s experimental lung cancer treatment. An underweight in Align Technology, Inc. detracted, as well. The dental device company missed earnings expectations and provided negative future guidance, citing decreased orthodontic case starts and longer sales cycles for capital equipment purchases. An out-of-benchmark position in the Chinese medical devices company Adicon Holdings, Ltd., which declined due to the broader weakness in the nation’s stock market, also detracted.

The Trust used an options overlay strategy in which calls were written on a portion of the portfolio’s holdings. This strategy contributed to relative performance.

The Trust’s practice of maintaining a specified level of monthly distributions to shareholders did not have a material impact on the Trust’s investment strategy. The distribution policy resulted in return of capital for the period. Refer to the financial highlights and income tax information sections in this report for further information about the distributions.

Describe recent portfolio activity.

The Trust increased its allocations to the biotechnology, healthcare providers and services, and pharmaceuticals sub-sectors, while reducing its weighting in the medical devices and supplies sub-sector.

Describe portfolio positioning at period end.

At the end of the period, the Trust held 41% of net asset value in biotechnology, 36% in medical devices and supplies, 11% in healthcare providers and services, and 10% in pharmaceuticals. These industry weightings were the result of bottom-up stock selection.

As of December 31, 2023, the Trust had in place an option overwriting program whereby 25% of the underlying equities were overwritten with call options on individual stocks. These call options were typically written at prices above the prevailing market prices (estimated to be 6.8% out of the money) and for maturities averaging 57 days.

The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

| | |

T R U S T S U M M A R Y | | 23 |

| | |

Trust Summary as of December 31, 2023 (continued) | | BlackRock Health Sciences Term Trust (BMEZ) |

Overview of the Trust’s Total Investments

TEN LARGEST HOLDINGS

| | | | |

| | |

| Security(a) | | Percent of

Total Investments | |

BioMarin Pharmaceutical, Inc. | | | 2.1 | % |

Cencora, Inc. | | | 2.1 | |