Exhibit 99.1

DRIVE

FOR PROFITABLE

GROWTH

Deutsche Bank

2014 Global Auto Industry Conference

January 2014

CooperStandard

PASSION FOR PERFORMANCE

Forward-Looking Statements

This presentation includes “forward-looking statements” within the meaning of U.S. federal securities laws, and we intend that such forward-looking statements be subject to the safe harbor created thereby. We make forward-looking statements in this presentation and may make such statements in future filings with the SEC. We may also make forward-looking statements in our press releases or other public or stockholder communications. These forward-looking statements include statements concerning our plans, objectives, goals, strategies, future events, future revenue or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, business trends, and other information that is not historical information. When used in this presentation, the words “estimates,” “expects,” “anticipates,” “projects,” “plans,” “intends,” “believes,” “forecasts,” or future or conditional verbs, such as “will,” “should,” “could,” or “may,” and variations of such words or similar expressions are intended to identify forward-looking statements. All forward-looking statements, including, without limitation, management’s examination of historical operating trends and data are based upon our current expectations and various assumptions. Our expectations, beliefs, and projections are expressed in good faith and we believe there is a reasonable basis for them. However, no assurances can be made that these expectations, beliefs and projections will be achieved. Forward-looking statements are not guarantees of future performance and are subject to significant risks and uncertainties that may cause actual results or achievements to be materially different from the future results or achievements expressed or implied by the forward-looking statements.

There are a number of risks and uncertainties that could cause our actual results to differ materially from the forward-looking statements contained in this presentation. Important factors that could cause our actual results to differ materially from the forward-looking statements we make herein include, but are not limited to: cyclicality of the automotive industry with the possibility of further material contractions in automotive sales and production effecting the viability of our customers and financial condition of our customers; global economic uncertainty, particularly in Europe; loss of large customers or significant platforms; supply shortages; escalating pricing pressures and decline of volume requirements from our customers; our ability to meet significant increases in demand; availability and increasing volatility in cost of raw materials or manufactured components; our ability to continue to compete successfully in the highly competitive automotive parts industry; risks associated with our non-U.S. operations; foreign currency exchange rate fluctuations; our ability to control the operations of joint ventures for our benefit; the effectiveness of our lean manufacturing and other cost savings plans; product liability and warranty and recall claims that may be brought against us; work stoppages or other labor conditions; natural disasters; our ability to attract and retain key personnel; our ability to meet our customers’ needs for new and improved products in a timely manner or cost-effective basis; the possibility that our acquisition strategy may not be successful; our legal rights to our intellectual property portfolio; environmental and other regulations; legal proceedings or commercial and contractual disputes that we may be involved in; the possible volatility of our annual effective tax rate; our ability to generate sufficient cash to service our indebtedness, and obtain future financing; our underfunded pension plans; significant changes in discount rates and the actual return on pension assets; the possibility of future impairment charges to our goodwill and long-lived assets; and operating and financial restrictions imposed on us by our bond indentures and credit agreement.

There may be other factors that may cause our actual results to differ materially from the forward-looking statements. All forward-looking statements attributable to us or persons acting on our behalf apply only as of the date of this presentation and are expressly qualified in their entirety by the cautionary statements included herein. We undertake no obligation to update or revise forward-looking statements to reflect events or circumstances that arise after the date made or to reflect the occurrence of unanticipated events.

TOP 30 / TOP 5

2

PASSION FOR PERFORMANCE

Jeff Edwards

Chairman and Chief Executive Officer

3

PASSION FOR PERFORMANCE

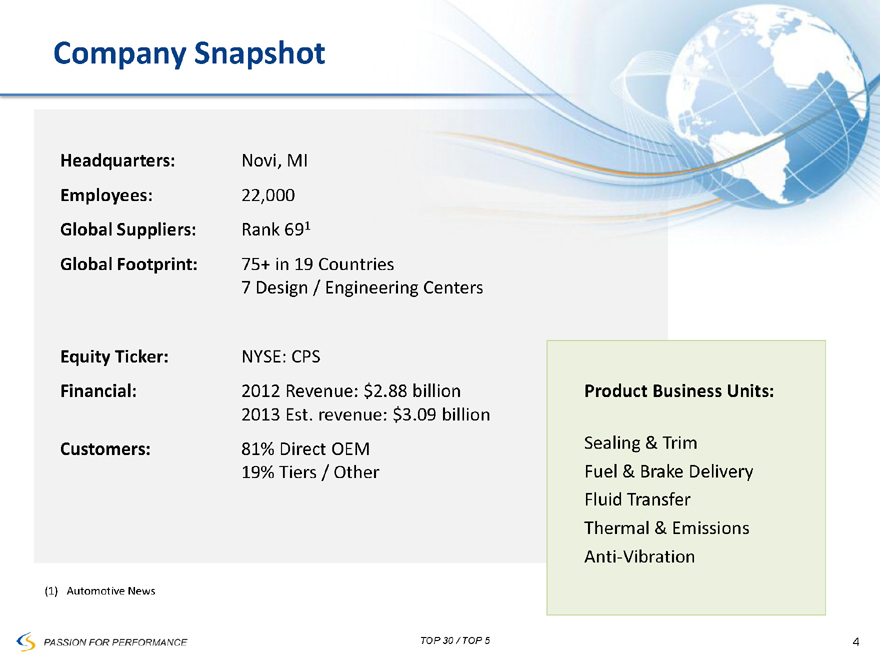

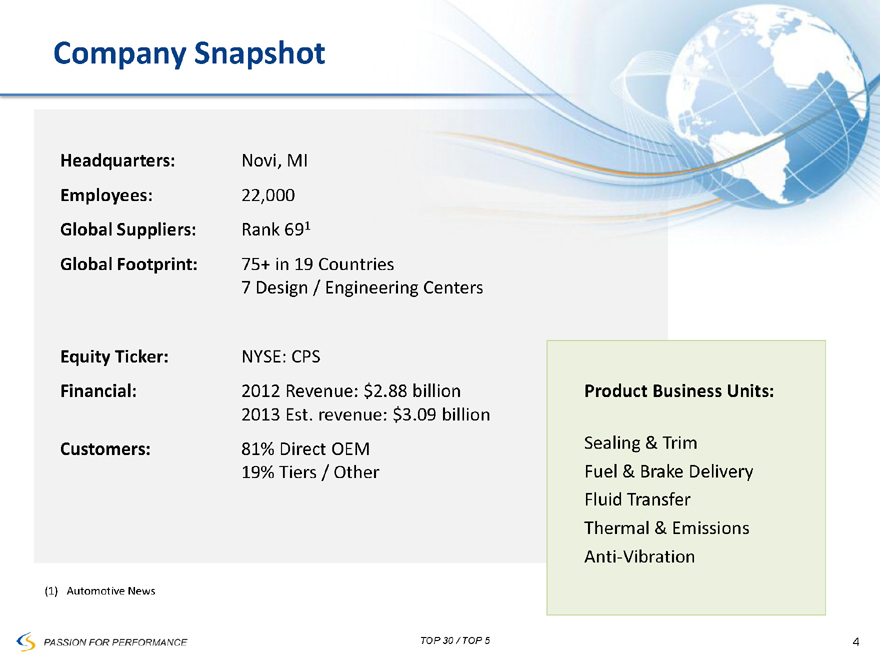

Company Snapshot

Headquarters: Novi, MI

Employees: 22,000

Global Suppliers: Rank 691

Global Footprint: 75+ in 19 Countries

7 Design / Engineering Centers

Equity Ticker: NYSE: CPS

Financial: 2012 Revenue: $2.88 billion

2013 Est. revenue: $3.09 billion

Customers: 81% Direct OEM

19% Tiers / Other

(1) Automotive News

Product Business Units:

Sealing & Trim

Fuel & Brake Delivery

Fluid Transfer

Thermal & Emissions

Anti-Vibration

TOP 30 / TOP 5

4

PASSION FOR PERFORMANCE

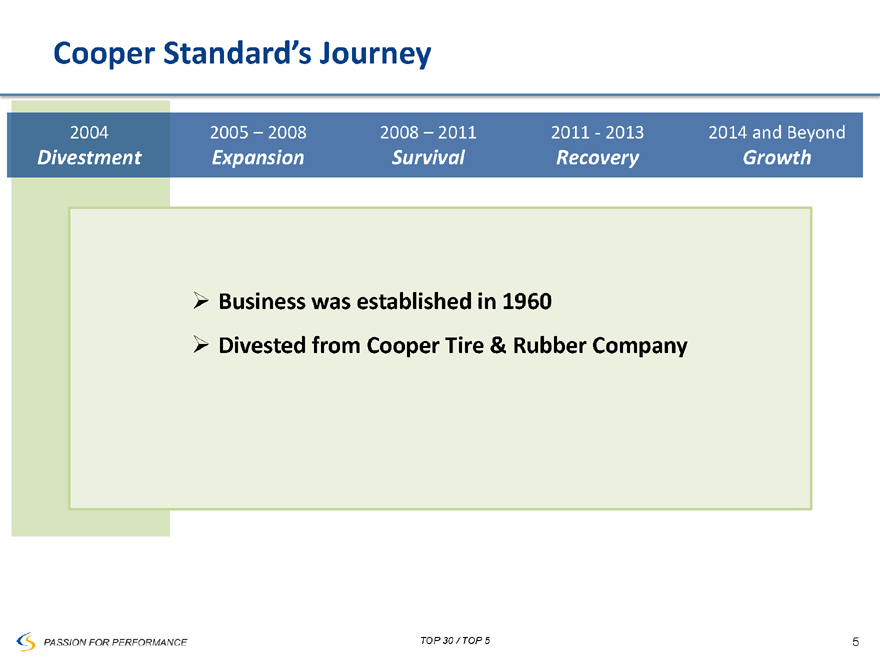

Cooper Standard’s Journey

2004 2005 – 2008 2008 – 2011 2011 - 2013 2014 and Beyond

Divestment Expansion Survival Recovery Growth

Business was established in 1960

Divested from Cooper Tire & Rubber Company

TOP 30 / TOP 5

5

PASSION FOR PERFORMANCE

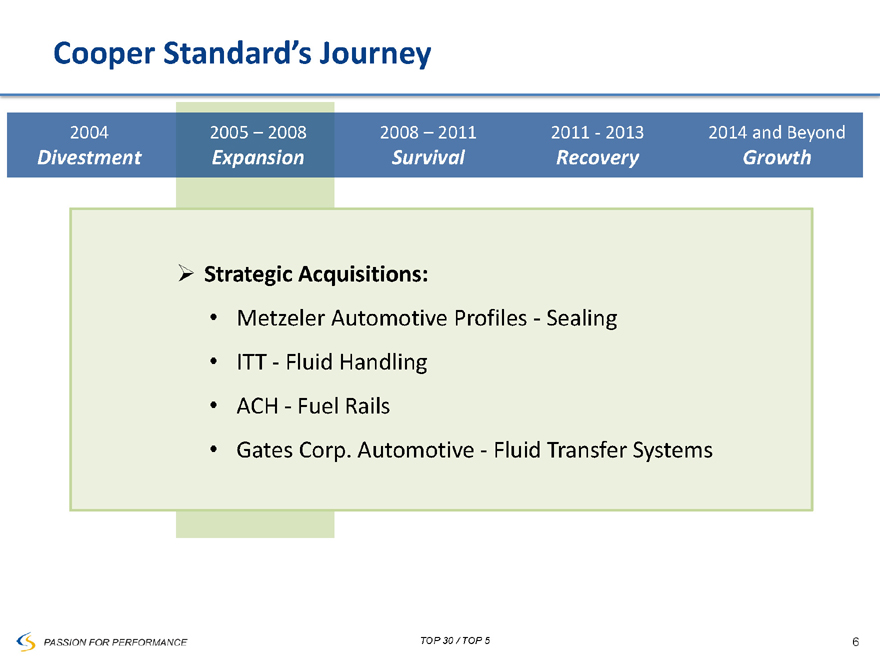

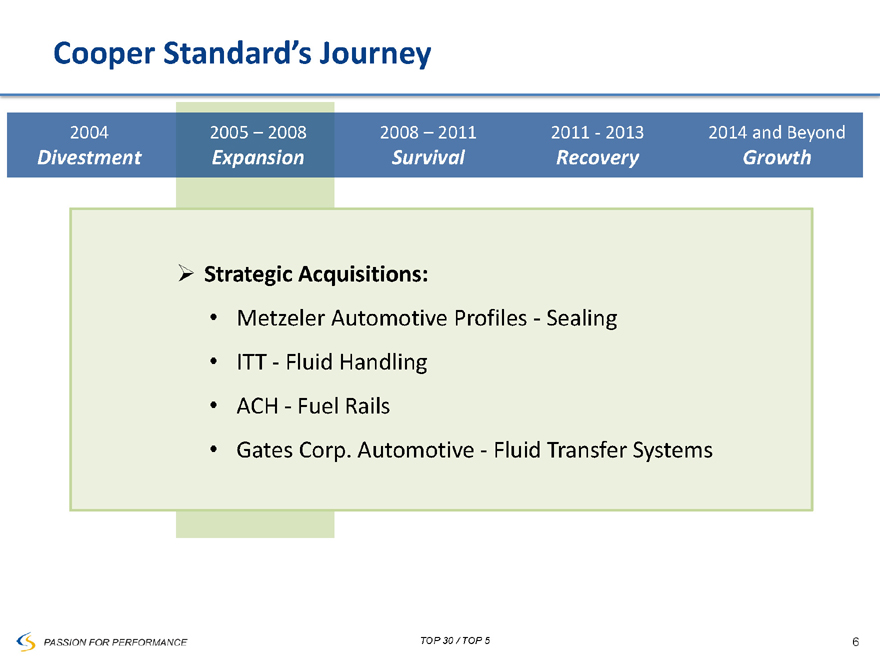

Cooper Standard’s Journey

2004 2005 – 2008 2008 – 2011 2011 - 2013 2014 and Beyond

Divestment Expansion Survival Recovery Growth

Strategic Acquisitions:

Metzeler Automotive Profiles - Sealing

ITT - Fluid Handling

ACH - Fuel Rails

Gates Corp. Automotive - Fluid Transfer Systems

TOP 30 / TOP 5

6

PASSION FOR PERFORMANCE

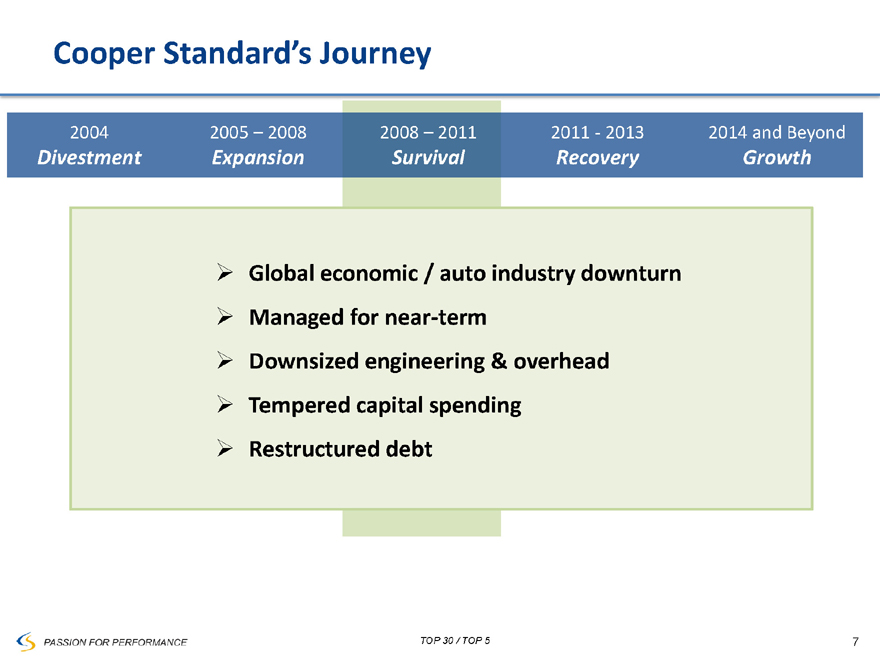

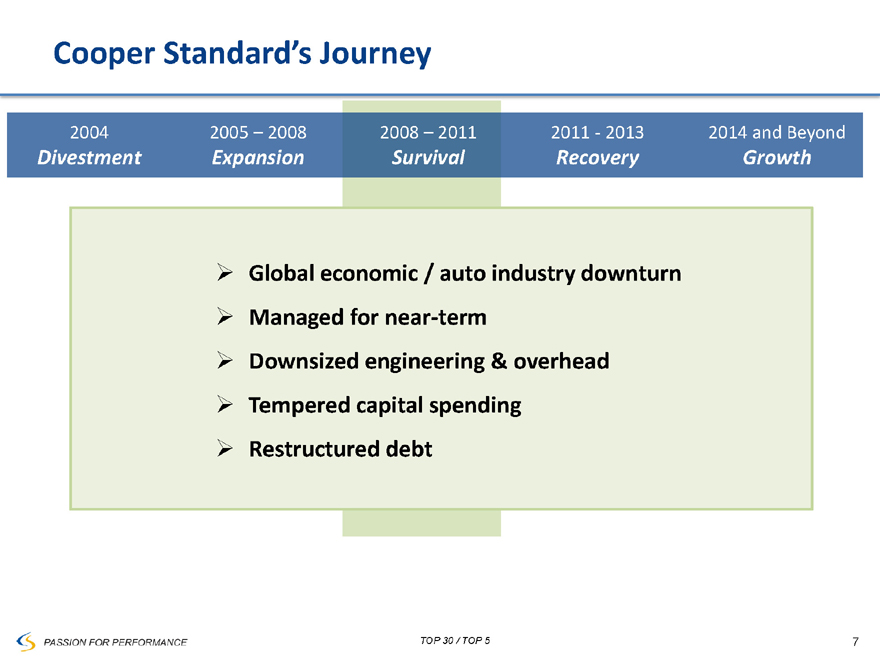

Cooper Standard’s Journey

2004 2005 – 2008 2008 – 2011 2011 - 2013 2014 and Beyond

Divestment Expansion Survival Recovery Growth

Global economic / auto industry downturn Managed for near-term Downsized engineering & overhead Tempered capital spending Restructured debt

TOP 30 / TOP 5

7

PASSION FOR PERFORMANCE

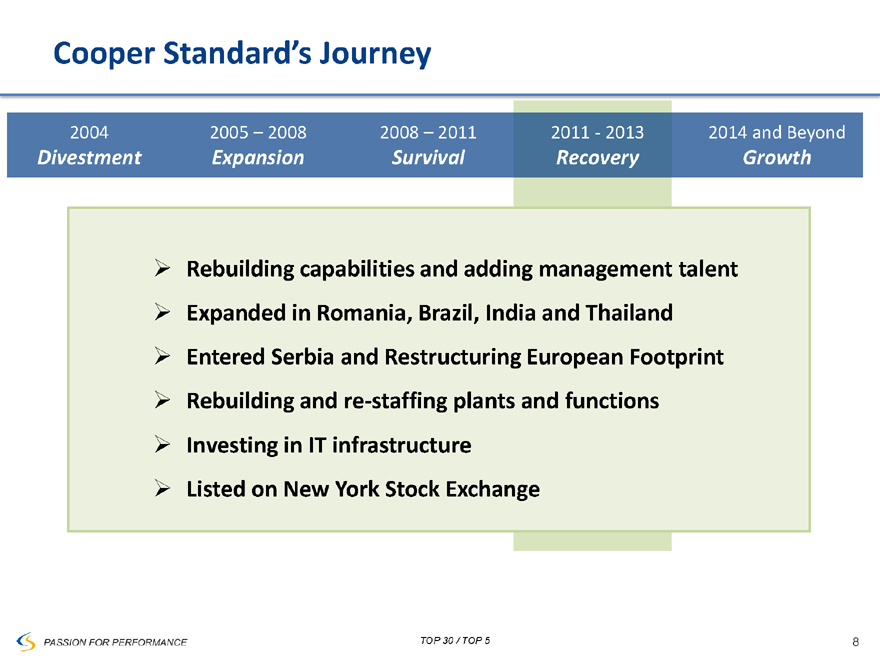

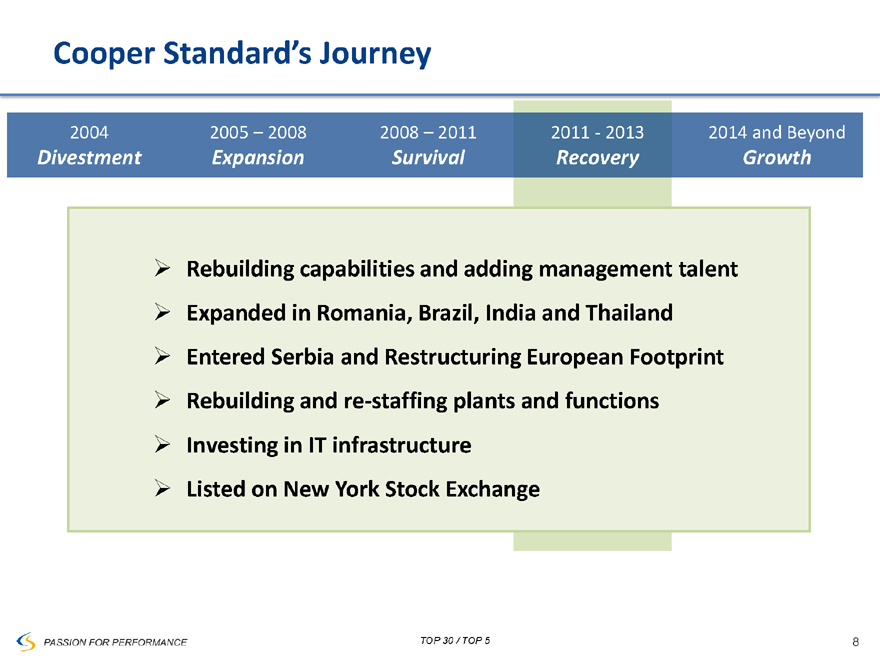

Cooper Standard’s Journey

2004 2005 – 2008 2008 – 2011 2011 - 2013 2014 and Beyond

Divestment Expansion Survival Recovery Growth

Rebuilding capabilities and adding management talent

Expanded in Romania, Brazil, India and Thailand

Entered Serbia and Restructuring European Footprint

Rebuilding and re-staffing plants and functions

Investing in IT infrastructure

Listed on New York Stock Exchange

TOP 30 / TOP 5

8

PASSION FOR PERFORMANCE

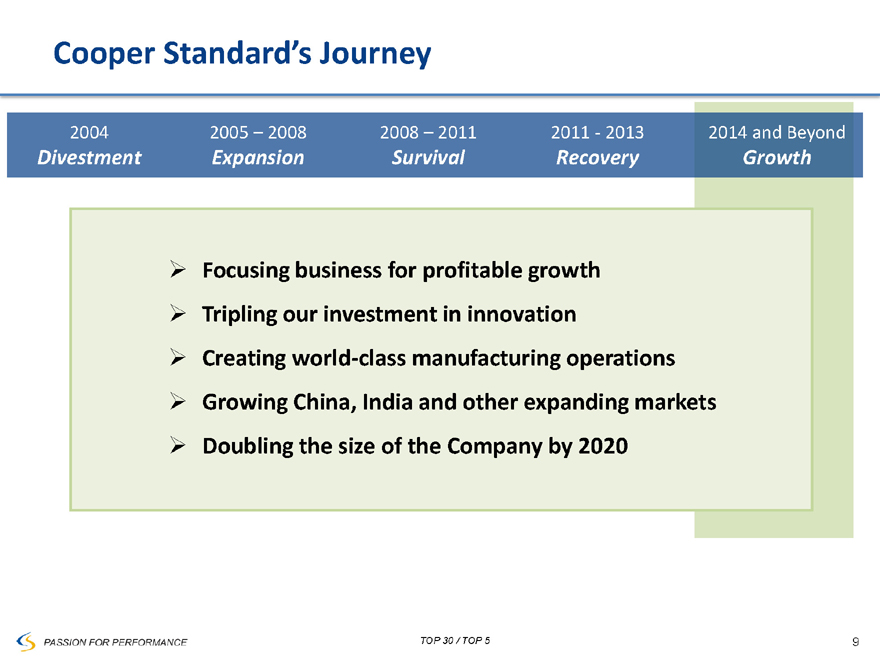

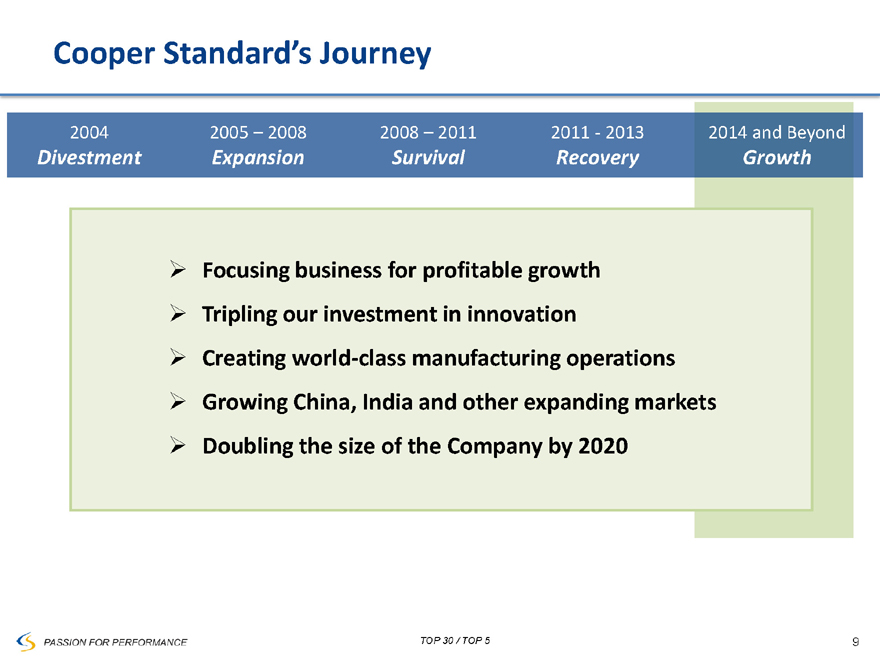

Cooper Standard’s Journey

2004 2005 – 2008 2008 – 2011 2011 - 2013 2014 and Beyond

Divestment Expansion Survival Recovery Growth

Focusing business for profitable growth

Tripling our investment in innovation

Creating world-class manufacturing operations

Growing China, India and other expanding markets

Doubling the size of the Company by 2020

TOP 30 / TOP 5

9

PASSION FOR PERFORMANCE

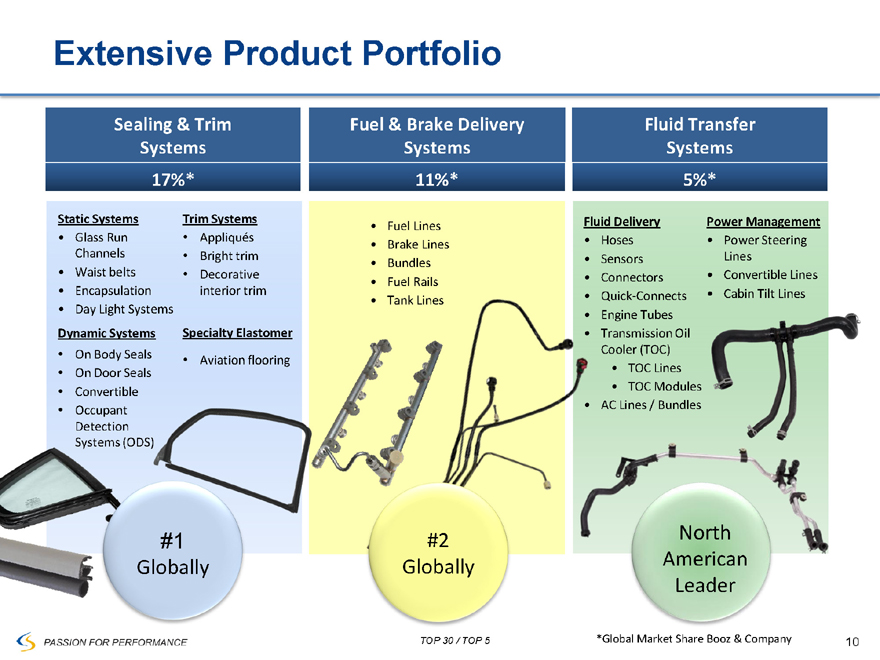

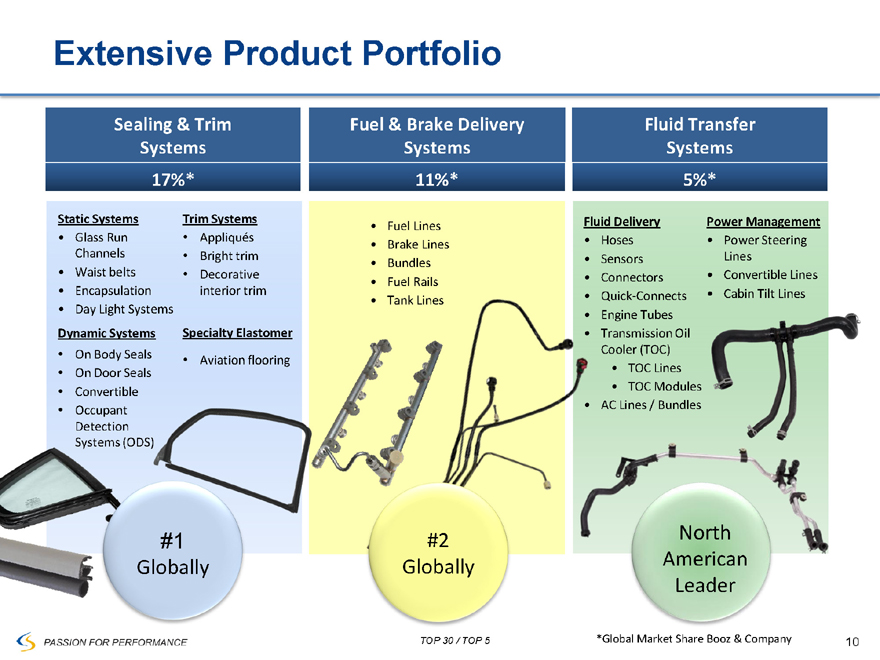

Extensive Product Portfolio

Sealing & Trim Systems 17%*

Static Systems

Glass Run Channels

Waist belts

Encapsulation

Day Light Systems

Trim Systems

Appliqués

Bright trim

Decorative interior trim

Dynamic Systems

On Body Seals

On Door Seals

Convertible

Occupant Detection

Systems (ODS)

Specialty Elastomer

Aviation flooring

Fuel & Brake Delivery Systems 11%*

Fuel Lines

Brake Lines

Bundles

Fuel Rails

Tank Lines

Fluid Transfer Systems 5%*

Fluid Delivery

Hoses

Sensors

Connectors

Quick-Connects

Engine Tubes

Transmission Oil

Cooler (TOC)

TOC Lines

TOC Modules

AC Lines / Bundles

Power Management

Power Steering Lines

Convertible Lines

Cabin Tilt Lines

#1

Globally

#2 Globally

North American Leader

TOP 30 / TOP 5

*Global Market Share Booz & Company

10

PASSION FOR PERFORMANCE

VISION

Drive for Profitable Growth

TOP 30 * TOP 5

* Top 30 automotive suppliers for sales, Top 5% ROIC

CooperStandard

PASSION FOR PERFORMANCE

VISION

Drive for Profitable Growth

Relentless Focus on the Customer

Superior Products and Innovation

Advantaged Global Footprint & World-Class Operations

High Performing Engaged Workforce

* Top 30 automotive suppliers for sales, Top 5% ROIC

TOP 30 * TOP 5

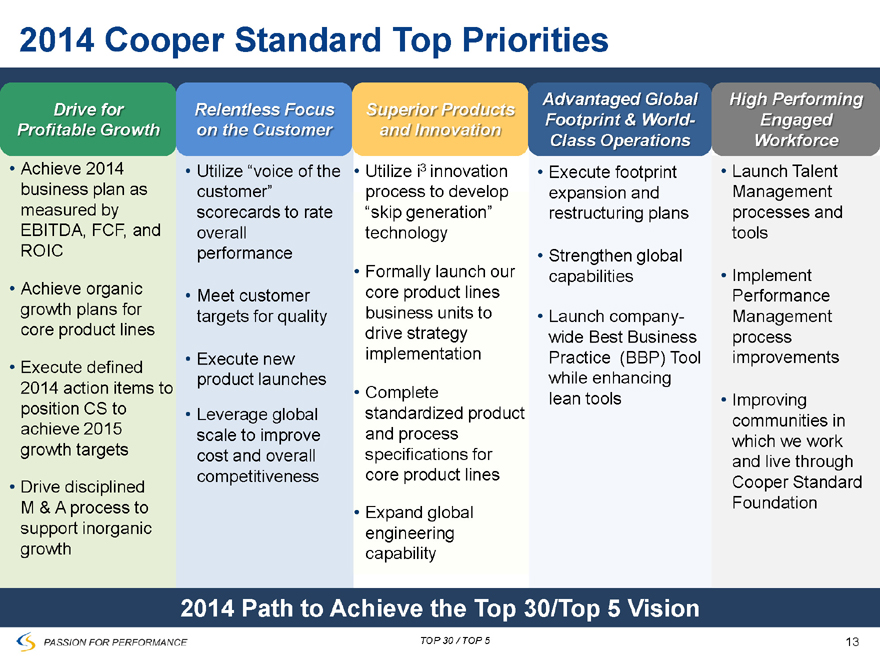

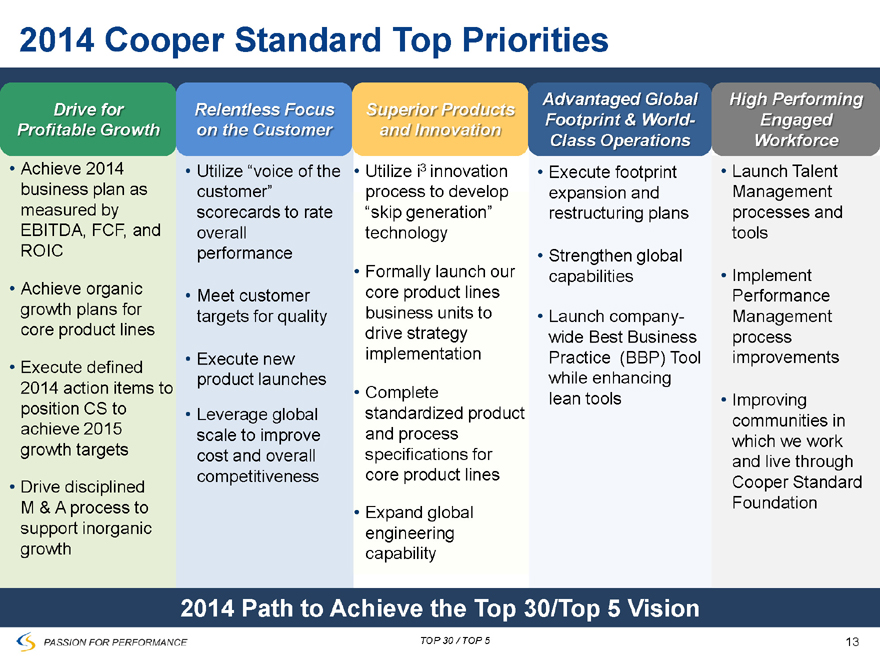

2014 Cooper Standard Top Priorities

Drive for Profitable Growth

Achieve 2014 business plan as measured by EBITDA, FCF, and ROIC

Achieve organic growth plans for core product lines

Execute defined 2014 action items to position CS to achieve 2015 growth targets

Drive disciplined M & A process to support inorganic growth Relentless Focus on the Customer

Utilize “voice of the customer” scorecards to rate overall performance

Meet customer targets for quality

Execute new product launches

Leverage global scale to improve cost and overall competitiveness Superior Products and Innovation

Utilize i3 innovation process to develop “skip generation” technology

Formally launch our core product lines business units to drive strategy implementation

Complete standardized product and process specifications for core product lines

Expand global engineering capability Advantaged Global Footprint & World-Class Operations

Execute footprint expansion and restructuring plans

Strengthen global capabilities

Launch company-wide Best Business Practice (BBP) Tool while enhancing lean tools

High Performing Engaged Workforce

Launch Talent Management processes and tools

Implement Performance Management process improvements

Improving communities in which we work and live through Cooper Standard Foundation

2014 Path to Achieve the Top 30/Top 5 Vision

TOP 30 / TOP 5

13

PASSION FOR PERFORMANCE

Cooper Standard is Aligned with and

Well-Positioned to Capitalize on Industry Trends

Avenues for Profitable Growth

1. Capture China Growth

2. Long-term Growth in Emerging Markets

3. North America and Europe Market Recovery

4. Trend Toward Global Platforms

5. Innovation

6. Capture Strategic M&A Opportunities

TOP 30 / TOP 5

14

PASSION FOR PERFORMANCE

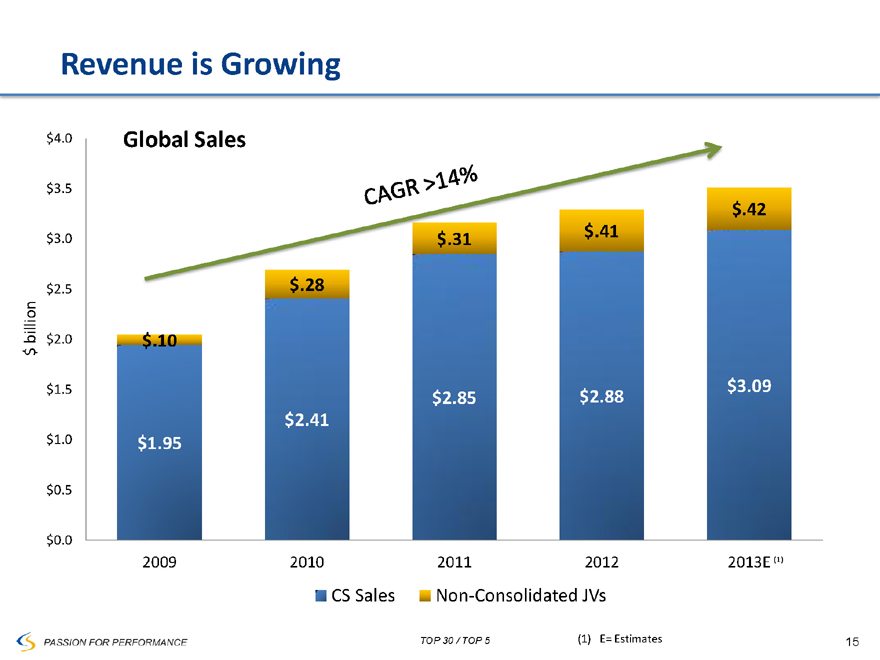

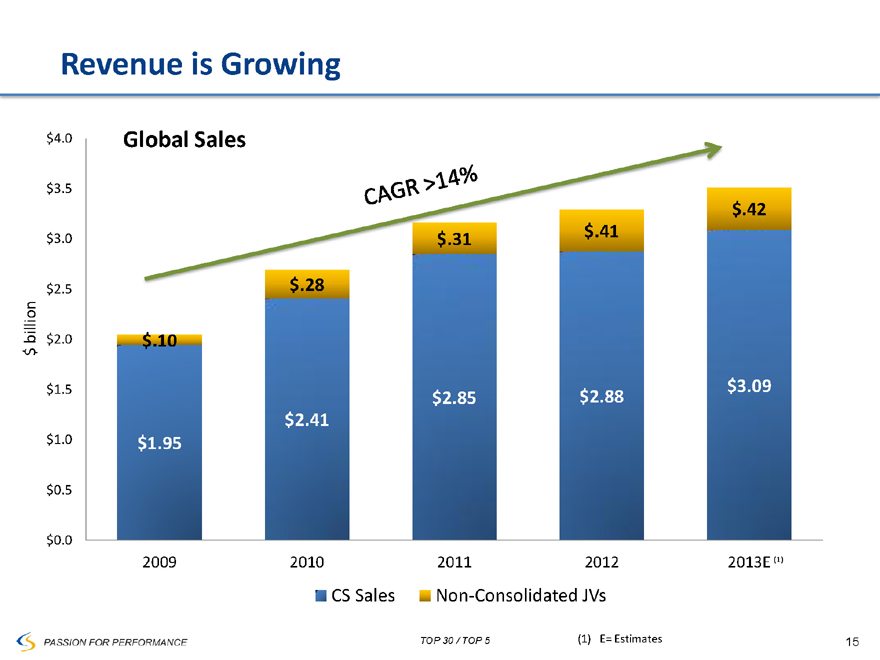

Revenue is Growing

Global Sales

CAGR >14%

$ billion

$4.0

$3.5

$3.0

$2.5

$2.0

$1.5

$1.0

$0.5

$0.0

$.10

$1.95

$.28

$2.41

$.31

$2.85

$.41

$.42

$2.88

$3.09

2009

2010

2011

2012

2013E (1)

CS Sales

Non-Consolidated JVs

TOP 30 / TOP 5

(1) E= Estimates

15

PASSION FOR PERFORMANCE

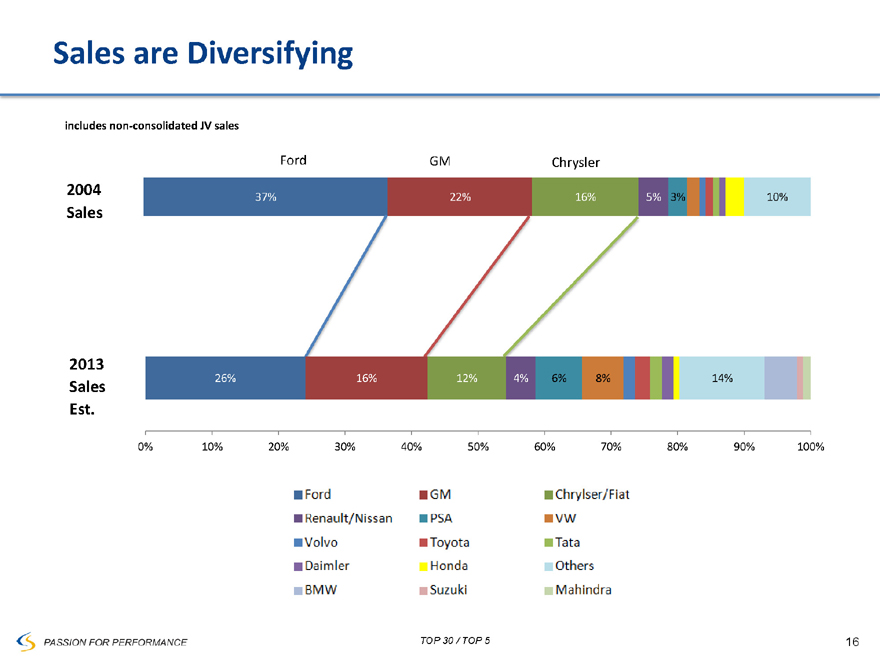

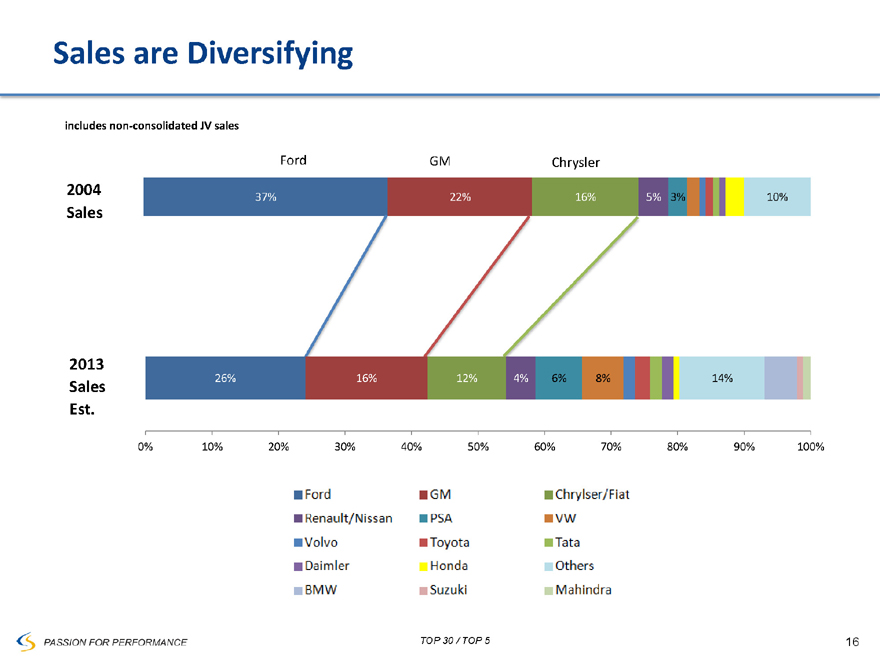

Sales are Diversifying

includes non-consolidated JV sales

2004 Sales

Ford GM Chrysler

37% 22% 16% 5% 3% 10%

2013 Sales Est.

26% 16% 12% 4% 6% 8% 14%

0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100%

Ford

Renault/Nissan

Volvo

Daimler

BMW

GM

PSA

Toyota

Honda

Suzuki

Chrysler/Fiat

VW

Tata

Others

Mahindra

TOP 30 / TOP 5

16

PASSION FOR PERFORMANCE

Cooper Standard Products Well Represented on Global Platforms 2013

Denotes Global Platform

#1 Ford F-150

#2 Ford Explorer

#3 Ford Fiesta / Fusion

#4 Ford Focus/Escape

#5 GM LaCrosse / Malibu

#6 GM Silverado/Sierra

#7 GM Tahoe/Yukon/ Escalade

#8 Chrysler 200 Mid - Size CUV

#9 PSA Picasso/C3

#10 Chrysler Ram

#11 PSA 408 / C4

#12 GM Cruze/Volt/Astra

#13 Volvo* S60/V70

#14 Fiat Giulietta / Dart

#15 Ford F-Series Super Duty

#16 Chrysler Dodge Challenger/Charger

#17 VW Jetta

#18 Chrysler Town &Country/ Dodge Caravan

#19 Ford Fusion/Mondeo/MKZ

#20 Chrysler Jeep Wrangler

Cooper Standard Products are Consistently on the Top Selling Global Platforms

TOP 30 / TOP 5

*This particular Volvo model is not global but the platform was designed as part of Ford’s global platform

17

PASSION FOR PERFORMANCE

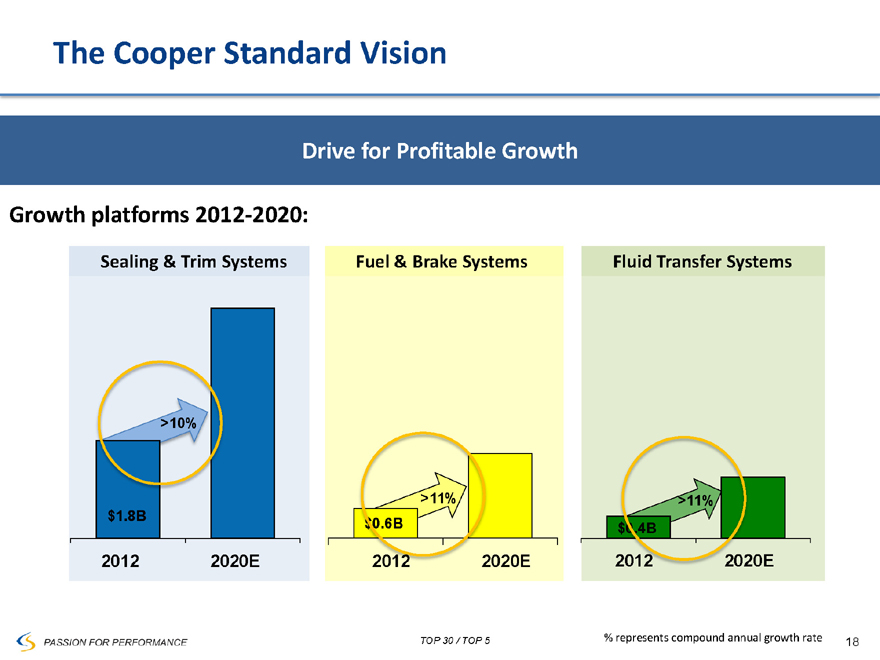

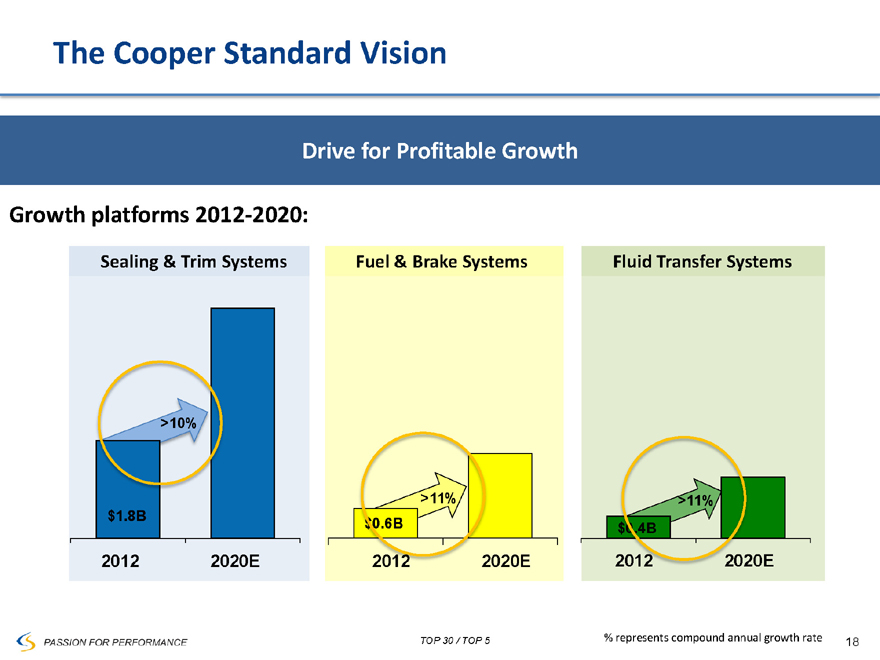

The Cooper Standard Vision

Drive for Profitable Growth

Growth platforms 2012-2020:

Sealing & Trim Systems

$1.8B

>10%

2012

2020E

Fuel & Brake Systems

$0.6B >11%

2012

2020E

Fluid Transfer Systems

$6.4B >11%

2012

2020E

TOP 30 / TOP 5

% represents compound annual growth rate

18

PASSION FOR PERFORMANCE

Drive for Profitable Growth

Strategic plan focuses on core product segments

– Sealing & Trim Systems

– Fluid Transfer Systems

– Fuel & Brake Delivery

Investing in breakthrough technologies

Building company-wide capabilities to support growth, optimize returns and deliver higher ROIC (BBP, program management, product engineering, innovation management, purchasing and IT systems)

Divesting non-core product segments when lack capability to achieve leading market position

TOP 30 / TOP 5

19

PASSION FOR PERFORMANCE

Breakthrough Technologies

Sealing & Trim Systems

– Plastic replacing rubber (TPV)

– Trim fully integrated with vehicle sealing systems

Fluid Transfer Systems

– New innovations for high performance hose applications

– Revolutionary materials and constructions (nano technologies)

Fuel & Brake Delivery

– Non-traditional materials provide ultra-low mass, high strength, long life

TOP 30 / TOP 5

20

PASSION FOR PERFORMANCE

Summary

All employees aligned and engaged with the strategic plan

Stabilize our European business and focus on North and South

America financial performance

Continue to make necessary infrastructure / capacity investments and fund our Asia growth strategy

Continue to evaluate partnerships and acquisition opportunities to augment the strategic plan

Laser focus on successfully launching new business and achieving double digit adjusted EBITDA margins and Top 30 / Top 5 Vision

TOP 30 / TOP 5

21

PASSION FOR PERFORMANCE

Allen Campbell

Executive Vice President and

Chief Financial Officer

22

PASSION FOR PERFORMANCE

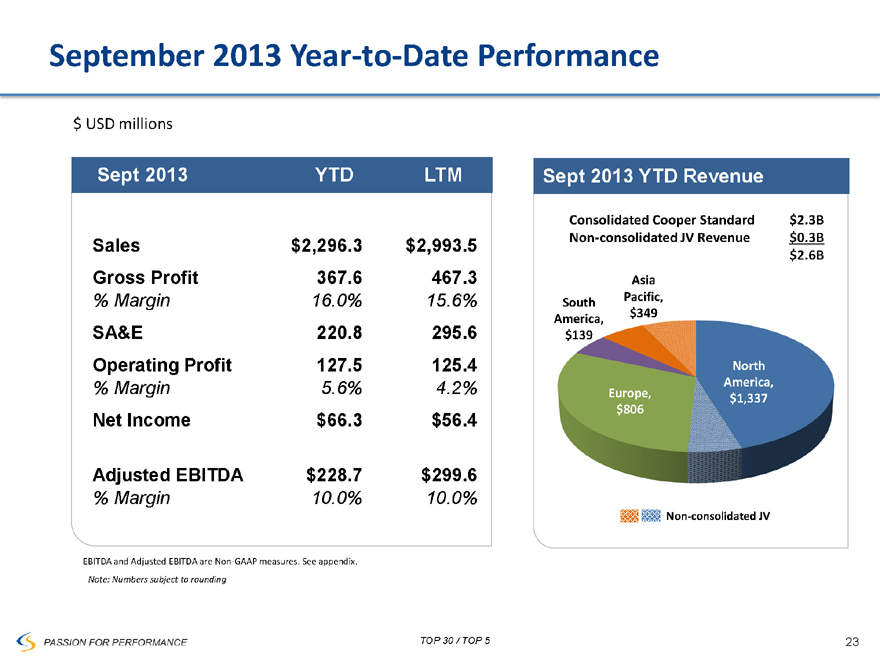

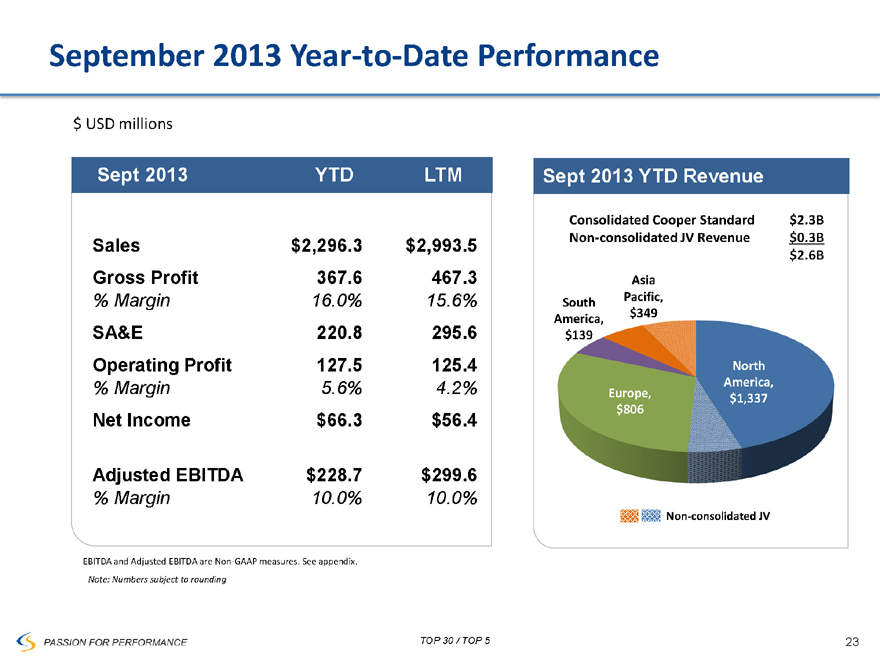

September 2013 Year-to-Date Performance

$ USD millions

Sept 2013 YTD LTM

Sales $2,296.3 $2,993.5

Gross Profit 367.6 467.3

% Margin 16.0% 15.6%

SA&E 220.8 295.6

Operating Profit 127.5 125.4

% Margin 5.6% 4.2%

Net Income $66.3 $56.4

Adjusted EBITDA $228.7 $299.6

% Margin 10.0% 10.0%

EBITDA and Adjusted EBITDA are Non-GAAP measures. See appendix.

Note: Numbers subject to rounding

Sept 2013 YTD Revenue

Consolidated Cooper Standard $ 2.3B

Non-consolidated JV Revenue $ 0.3B

$ 2.6B

South America, $139

Asia Pacific, $349

Europe, $806

North America, $1,337

Non-consolidated JV

TOP 30 / TOP 5

23

PASSION FOR PERFORMANCE

Period of Transition

North America recovery

Investing in regional management talent

Capacity and footprint optimization

Investments in technologies to improve competitiveness

Short-term challenges associated with product complexities

TOP 30 / TOP 5

24

PASSION FOR PERFORMANCE

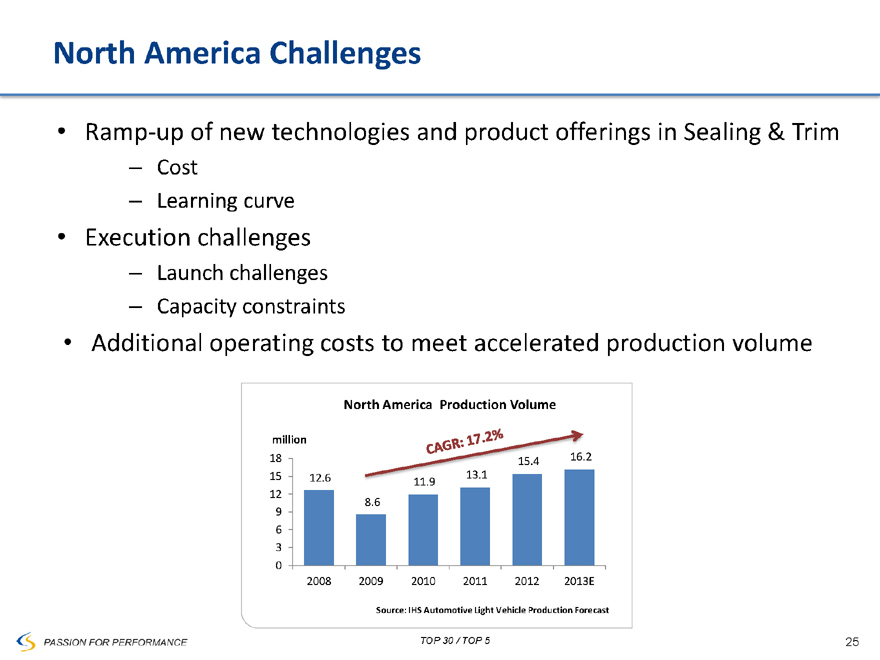

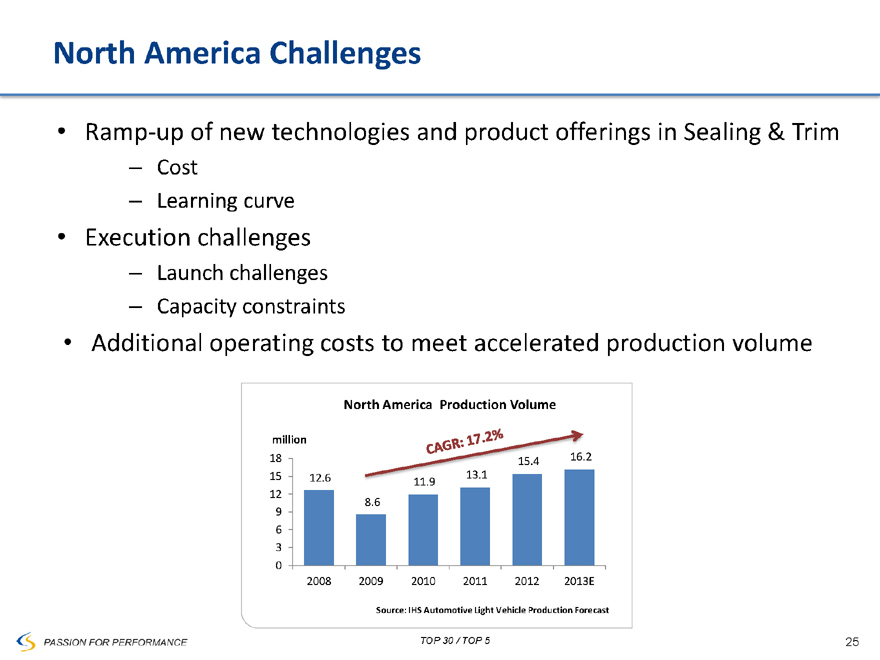

North America Challenges

Ramp-up of new technologies and product offerings in Sealing & Trim

– Cost

– Learning curve

Execution challenges

– Launch challenges

– Capacity constraints

Additional operating costs to meet accelerated production volume

North America Production Volume

million

18 15 12 9 6 3 0

12.6

8.6

11.9

13.1

15.4

16.2

CAGR: 17.2%

2008

2009

2010

2011

2012

2013E

Source: IHS Automotive Light Vehicle Production Forecast

TOP 30 / TOP 5

25+

PASSION FOR PERFORMANCE

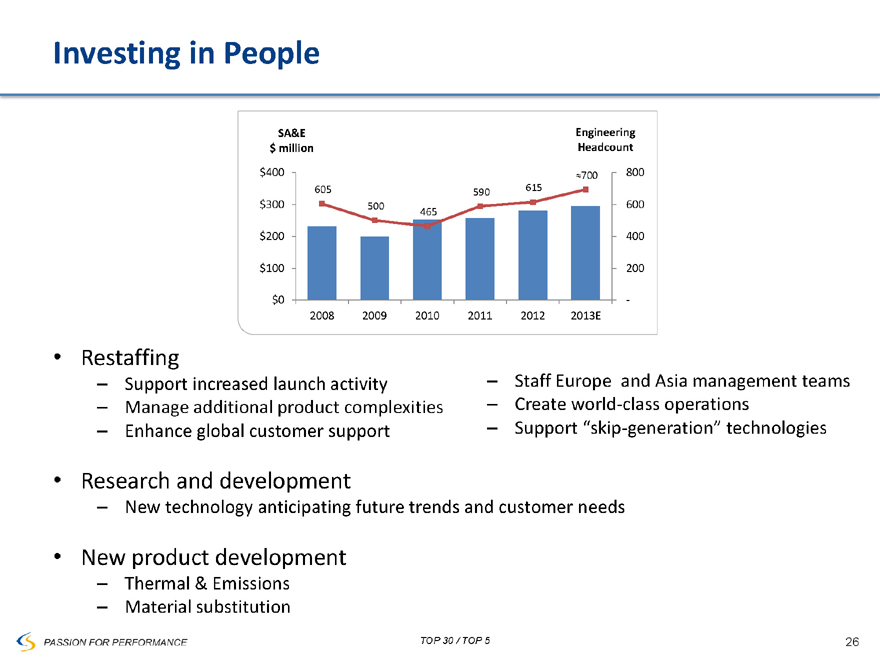

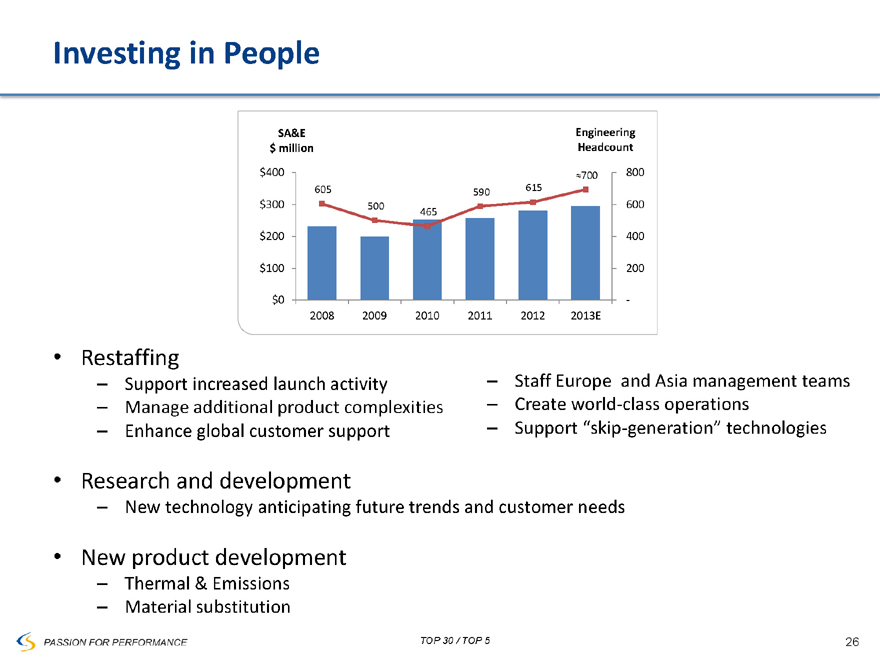

Investing in People

SA&E $ million

Engineering Headcount

$400

$300

$200

$100

$0

2008

2009

2010

2011

2012

2013E

605

500

465

590

615

»700

800 600 400 200 -

Restaffing

– Support increased launch activity

– Manage additional product complexities

– Enhance global customer support

– Staff Europe and Asia management teams

– Create world-class operations

– Support “skip-generation” technologies

Research and development

– New technology anticipating future trends and customer needs

New product development

– Thermal & Emissions

– Material substitution

TOP 30 / TOP 5

26

PASSION FOR PERFORMANCE

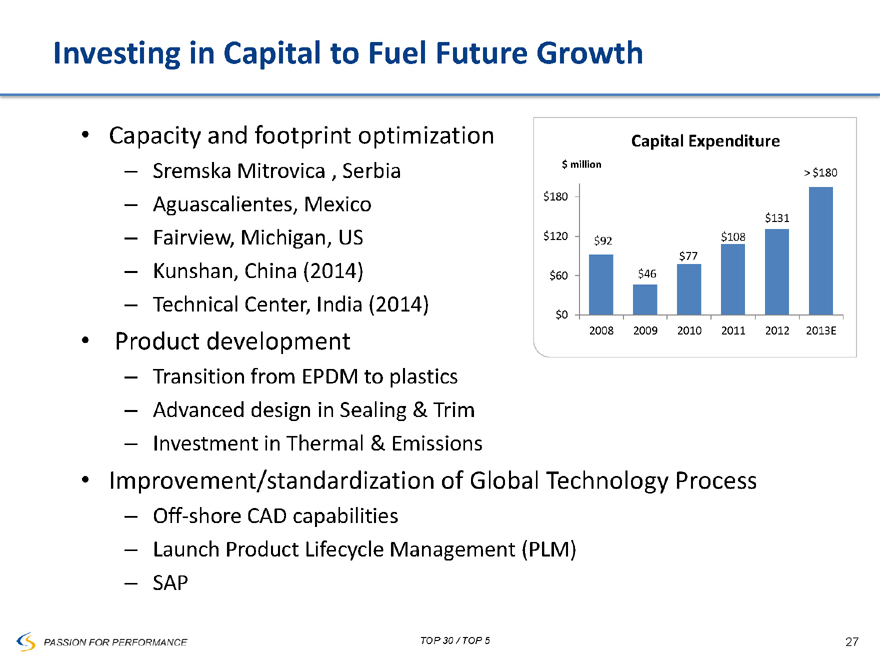

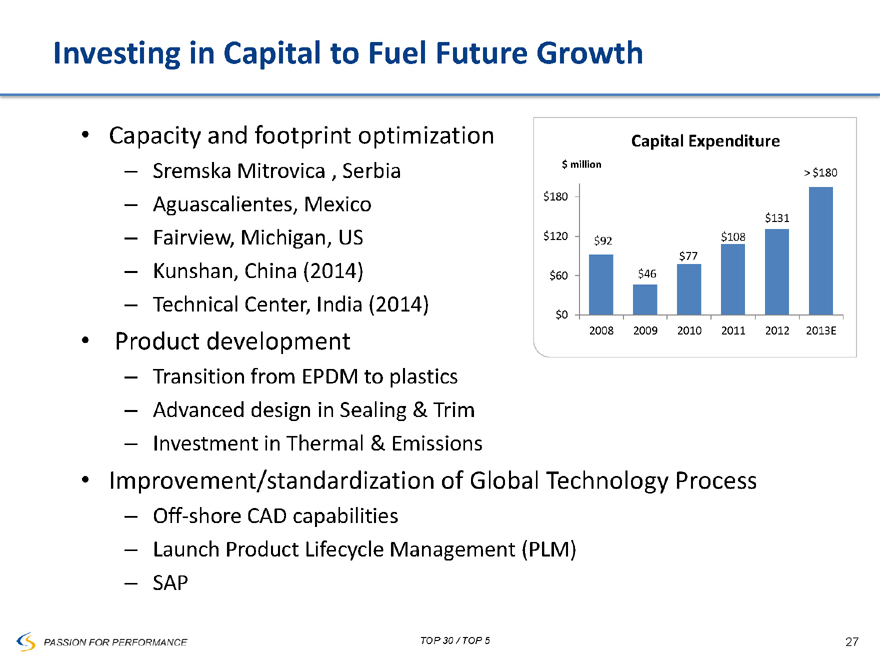

Investing in Capital to Fuel Future Growth

Capacity and footprint optimization

– Sremska Mitrovica , Serbia

– Aguascalientes, Mexico

– Fairview, Michigan, US

– Kunshan, China (2014)

– Technical Center, India (2014)

Product development

– Transition from EPDM to plastics

– Advanced design in Sealing & Trim

– Investment in Thermal & Emissions

Improvement/standardization of Global Technology Process

– Off-shore CAD capabilities

– Launch Product Lifecycle Management (PLM)

– SAP

TOP 30 / TOP 5

Capital Expenditure

$ million

$180 $120 $60 $0

2008 2009 2010 2011 2012 2013E

$92

$46

$77

$108

$131

> $180

27

PASSION FOR PERFORMANCE

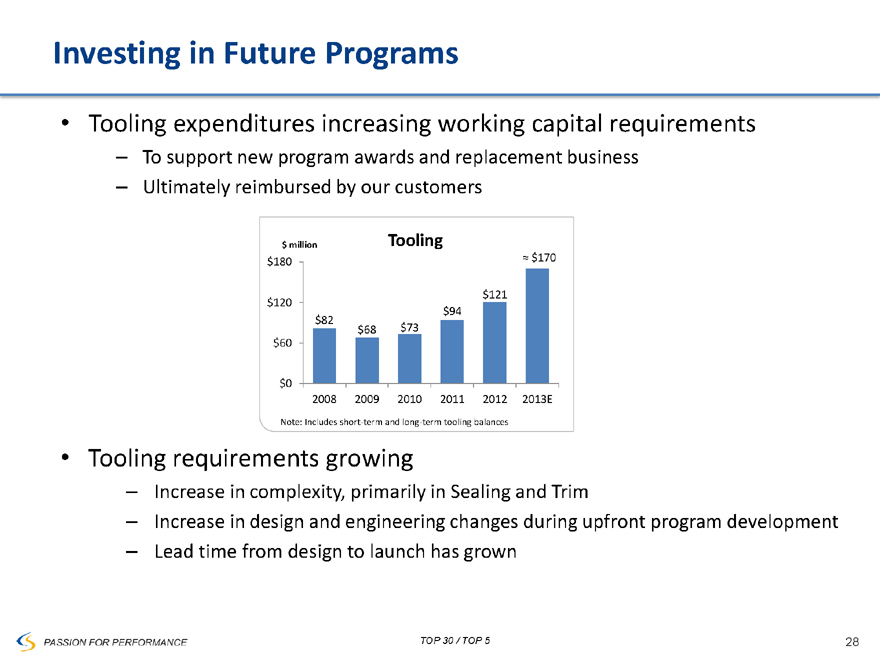

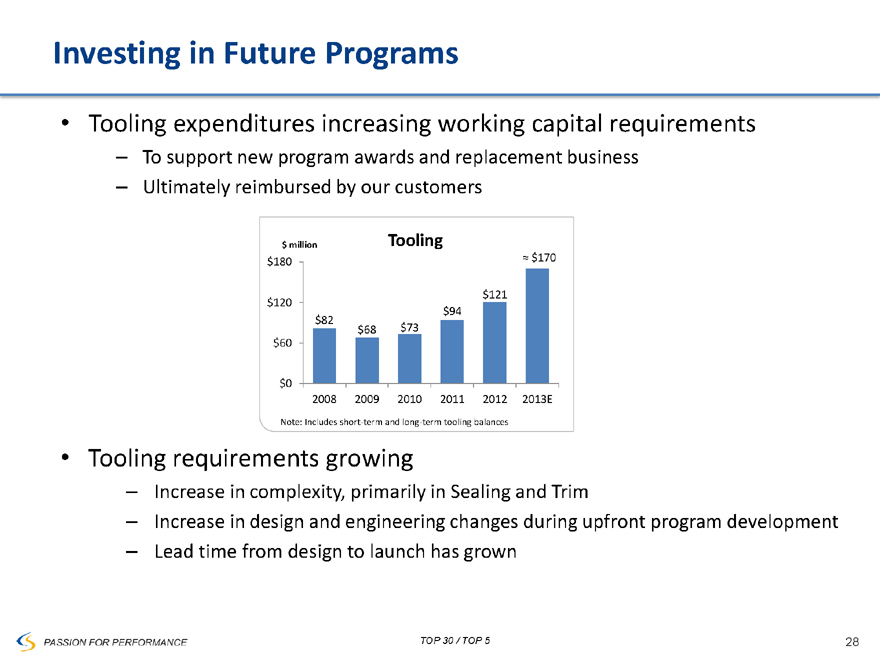

Investing in Future Programs

Tooling expenditures increasing working capital requirements

– To support new program awards and replacement business

– Ultimately reimbursed by our customers

Tooling

$ million

$180

$120

$60

$0

2008 2009 2010 2011 2012 2013E

$82

$68

$73

$94

$121

» $170

Note: Includes short-term and long-term tooling balances

Tooling requirements growing

– Increase in complexity, primarily in Sealing and Trim

– Increase in design and engineering changes during upfront program development

– Lead time from design to launch has grown

TOP 30 / TOP 5

28

PASSION FOR PERFORMANCE

2014 Guidance

Sales of $3.25 - $3.35 billion

Improvement over LTM EBITDA margin

Key Assumptions:

- North American production 16.8 million

- Europe (including Russia) production 19.6 million

- Average full year exchange rate $1.28/Euro

Further guidance during Q4 2013 Earning call

TOP 30 / TOP 5

29

PASSION FOR PERFORMANCE

Appendix

30

PASSION FOR PERFORMANCE

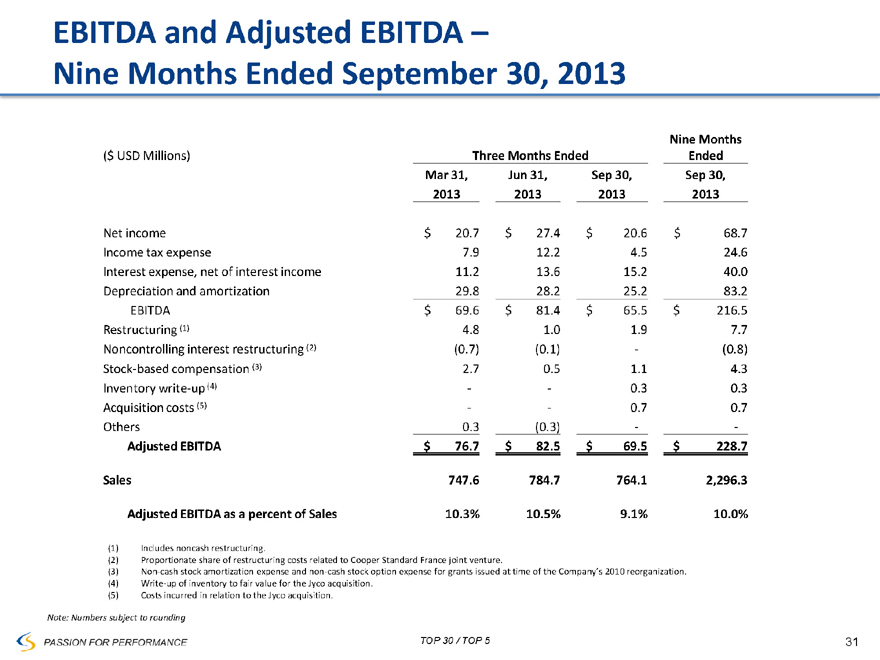

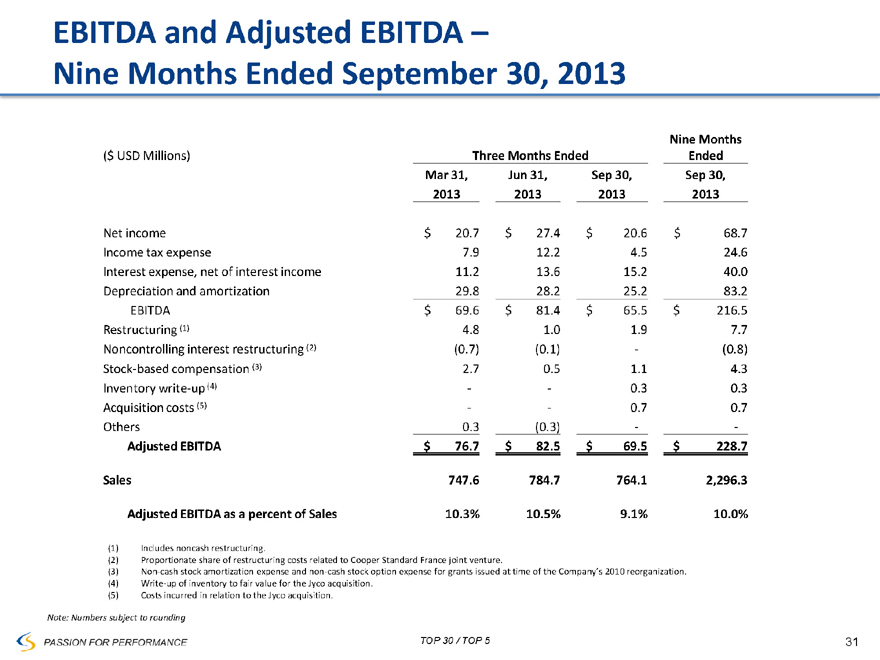

EBITDA and Adjusted EBITDA –

Nine Months Ended September 30, 2013

Nine Months

($ USD Millions) Three Months Ended Ended

Mar 31, Jun 31, Sep 30, Sep 30,

2013 2013 2013 2013

Net income $ 20.7 $ 27.4 $ 20.6 $ 68.7

Income tax expense 7.9 12.2 4.5 24.6

Interest expense, net of interest income 11.2 13.6 15.2 40.0

Depreciation and amortization 29.8 28.2 25.2 83.2

EBITDA $ 69.6 $ 81.4 $ 65.5 $ 216.5

Restructuring (1) 4.8 1.0 1.9 7.7

Noncontrolling interest restructuring (2) (0.7) (0.1) - (0.8)

Stock-based compensation (3) 2.7 0.5 1.1 4.3

Inventory write-up (4) - - 0.3 0.3

Acquisition costs (5) - - 0.7 0.7

Others 0.3 (0.3) - -

Adjusted EBITDA $ 76.7 $ 82.5 $ 69.5 $ 228.7

Sales 747.6 784.7 764.1 2,296.3

Adjusted EBITDA as a percent of Sales 10.3% 10.5% 9.1% 10.0%

(1) Includes noncash restructuring.

(2) Proportionate share of restructuring costs related to Cooper Standard France joint venture.

(3) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization.

(4) Write-up of inventory to fair value for the Jyco acquisition. (5) Costs incurred in relation to the Jyco acquisition.

Note: Numbers subject to rounding

TOP 30 / TOP 5

31

PASSION FOR PERFORMANCE

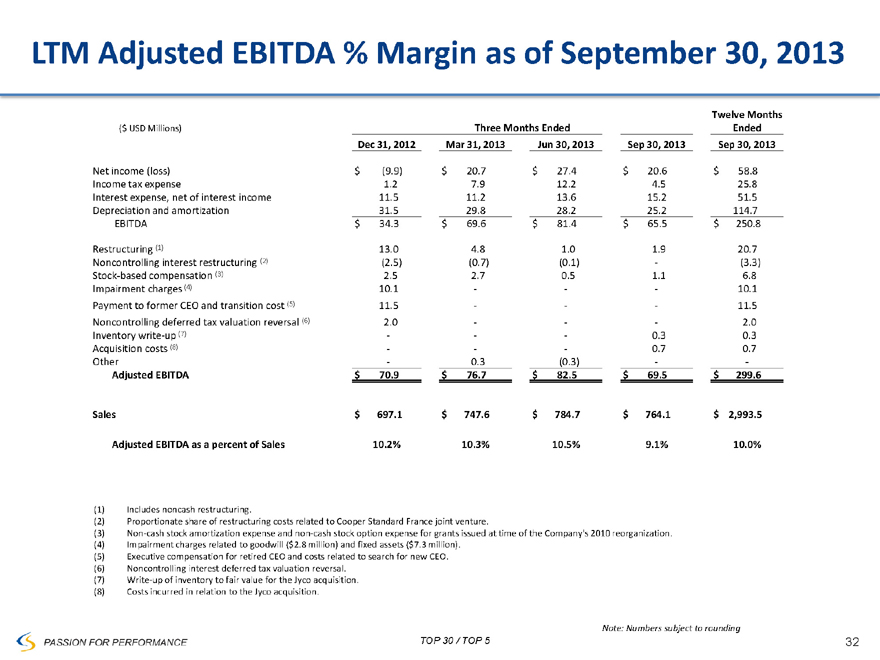

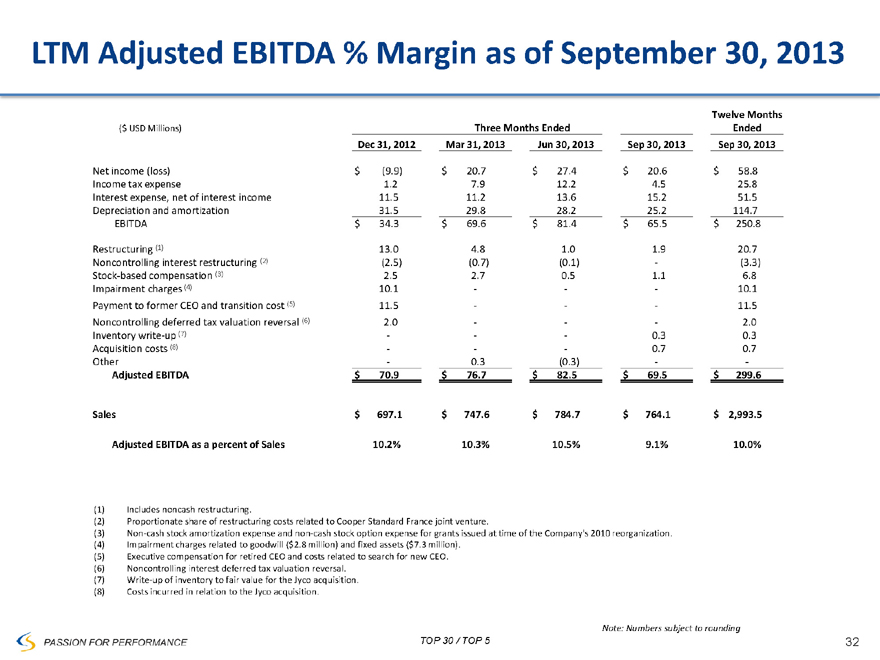

LTM Adjusted EBITDA % Margin as of September 30, 2013

Twelve Months

($ USD Millions) Three Months Ended Ended

Dec 31, 2012 Mar 31, 2013 Jun 30, 2013 Sep 30, 2013 Sep 30, 2013

Net income (loss) $ (9.9) $ 20.7 $ 27.4 $ 20.6 $ 58.8

Income tax expense 1.2 7.9 12.2 4.5 25.8

Interest expense, net of interest income 11.5 11.2 13.6 15.2 51.5

Depreciation and amortization 31.5 29.8 28.2 25.2 114.7

EBITDA $ 34.3 $ 69.6 $ 81.4 $ 65.5 $ 250.8

Restructuring (1) 13.0 4.8 1.0 1.9 20.7

Noncontrolling interest restructuring (2) (2.5) (0.7) (0.1) - (3.3)

Stock-based compensation (3) 2.5 2.7 0.5 1.1 6.8

Impairment charges (4) 10.1 - - - 10.1

Payment to former CEO and transition cost (5) 11.5 - - - 11.5

Noncontrolling deferred tax valuation reversal (6) 2.0 - - - 2.0

Inventory write-up (7) - - - 0.3 0.3

Acquisition costs (8) - - - 0.7 0.7

Other - 0.3 (0.3) - -

Adjusted EBITDA $ 70.9 $ 76.7 $ 82.5 $ 69.5 $ 299.6

Sales $ 697.1 $ 747.6 $ 784.7 $ 764.1 $ 2,993.5

Adjusted EBITDA as a percent of Sales 10.2% 10.3% 10.5% 9.1% 10.0%

(1) Includes noncash restructuring.

(2) Proportionate share of restructuring costs related to Cooper Standard France joint venture.

(3) Non-cash stock amortization expense and non-cash stock option expense for grants issued at time of the Company’s 2010 reorganization. (4) Impairment charges related to goodwill ($2.8 million) and fixed assets ($7.3 million).

(5) Executive compensation for retired CEO and costs related to search for new CEO. (6) Noncontrolling interest deferred tax valuation reversal.

(7) Write-up of inventory to fair value for the Jyco acquisition. (8) Costs incurred in relation to the Jyco acquisition.

TOP 30 / TOP 5

Note: Numbers subject to rounding

32

PASSION FOR PERFORMANCE

Non-GAAP Financial Measures

EBITDA and adjusted EBITDA are measures not recognized under Generally Accepted Accounting Principles (GAAP) which exclude certain non-cash and non-recurring items.

When analyzing the company’s operating performance, investors should use EBITDA and adjusted EBITDA in addition to, and not as alternatives for, net income (loss), operating income, or any other performance measure derived in accordance with GAAP, or as an alternative to cash flow from operating activities as a measure of the company’s performance. EBITDA and adjusted EBITDA have limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the company’s results of operations as reported under GAAP. Other companies may report EBITDA and adjusted

EBITDA differently and therefore Cooper Standard’s results may not be comparable to other similarly titled measures of other companies.

TOP 30 / TOP 5

33

PASSION FOR PERFORMANCE