Filed pursuant to Rule 424(b)(3)

File Number 333-150500

COOPER-STANDARD AUTOMOTIVE INC.

Supplement No. 3 to market-making prospectus dated April 9, 2009

The date of this supplement is May 22, 2009

On May 22, 2009, Cooper-Standard Holdings Inc. filed the attached Quarterly Report on Form 8-K

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 19, 2009

COOPER-STANDARD HOLDINGS INC.

(Exact name of Registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| 333-123708 | 20-1945088 | |

| (Commission File Number) | (I.R.S. Employer Identification No.) |

39550 Orchard Hill Place Drive

Novi, Michigan 48375

(Address of principal executive offices)

Registrant’s telephone number, including area code: (248) 596-5900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.02 Results of Operations and Financial Condition.

Cooper-Standard Holdings Inc. is furnishing the following information:

On May 19, 2009, we issued a press release (the “Press Release”) and posted a presentation to our website (the “Presentation”) that disclose information regarding our results of operations for our fiscal quarter ended March 31, 2009. Copies of the Press Release and Presentation are being furnished and included herewith as Exhibit 99.1 and Exhibit 99.2, respectively.

The Press Release and Presentation contain non-GAAP financial measures (as that term is defined in Item 10(e) of the Commission’s Regulation S-K). Statements providing a reconciliation from these non-GAAP financial measures to the most directly comparable financial measure calculated in accordance with generally accepted accounting principles are also included in the Press Release and Presentation. Management included the non-GAAP financial measures in the Press Release and Presentation because it believes such measures provide investors with a better understanding of the measures used by management to evaluate our performance.

Item 9.01 Financial Statements and Exhibits

(c) Exhibits.

The following exhibits are furnished pursuant to Item 9.01 of Form 8-K:

99.1 Press release of Cooper-Standard Holdings Inc. dated May 19, 2009.

99.2 Earnings Presentation of Cooper-Standard Holdings Inc. dated May 19, 2009.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| Cooper-Standard Holdings Inc. |

/s/ Timothy W. Hefferon |

| Name: Timothy W. Hefferon |

| Title: Vice President, General Counsel and Secretary |

Date: May 22, 2009

Exhibit 99.1

COOPER-STANDARD AUTOMOTIVE POSTS

2009 FIRST QUARTER RESULTS

| • | First quarter sales of $401.8 million on lower global auto production |

| • | Reorganized to geographic operating structure |

| • | Net new business of $95.6 million in first quarter 2009 |

Novi, Mich., May 19, 2009 - Cooper-Standard Holdings Inc., the parent company of Cooper-Standard Automotive Inc., today announced sales and earnings for the first quarter of 2009.

Net sales for the first quarter were $401.8 million, down from $756.0 million for the same quarter of 2008. This decrease resulted primarily from significantly lower vehicle production volume in North America, Europe and Brazil, unfavorable changes in vehicle mix and the strengthening of the U.S. dollar.

The company reported a $55.0 million net loss for the first quarter, compared to net income of $15.7 million for the same period of 2008, due to significantly lower sales volume, increased restructuring and reorganization costs, and unfavorable foreign exchange. Net interest expense for the quarter totaled $21.1 million, a $3.1 million improvement over the prior year first quarter, due to lower interest rates and reduced term loan balances.

“Severe economic conditions have kept demand for new vehicles at historically low levels and brought transformational changes to the global automotive industry,” said Cooper-Standard Automotive Chairman and Chief Executive Officer James S. McElya. “The numerous cost-containment actions taken by our management team, including a reorganization of our operating structure, have enabled us to partially offset lower industry volumes and position the company for success as the industry consolidates, while fully serving our global customers.”

To better manage its operating costs and resources in severe industry conditions, on March 26, Cooper-Standard Automotive announced the implementation of a comprehensive reorganization plan that changed the company’s operating structure and reporting segments. The new operating structure allows Cooper-Standard Automotive to maintain its full portfolio of global products and provide unified customer contact points. In addition, the reorganization will enable the company to realize substantial savings when fully implemented.

1

Net New Business Wins

During the first quarter of 2009, the company received $95.6 million in net new business awards, up $26.4 million versus prior year first quarter. This business is across the company’s global customer portfolio with particular emphasis in Europe.

Key Launches

During the first quarter of 2009, the company successfully launched production with all three product lines on new customer vehicles, as well as next-generation models for existing platforms, including:

| • | Daimler (Mercedes E-Class) |

| • | Ford (Lincoln MKS) |

| • | General Motors (Chevrolet Camaro) |

| • | Toyota (Lexus RS) |

Adjusted EBITDA

Adjusted EBITDA, a measure of operating performance which excludes certain non-cash and non-recurring items, was $15.5 million in the first quarter of 2009, compared to $83.1 million in the first quarter of 2008. A table reconciling Adjusted EBITDA, a measure not recognized under Generally Accepted Accounting Principles (GAAP), can be found in this news release.

2

Adjusted EBITDA reconciliation for the first quarter of 2009 is presented in the table below.

| Three Months Ended March 31, | ||||||||

| 2008 | 2009 | |||||||

Net income (loss) | $ | 15.7 | $ | (55.0 | ) | |||

Provision (benefit) for income tax expense | 7.2 | (3.8 | ) | |||||

Interest expense, net of interest income | 24.2 | 21.1 | ||||||

Depreciation and amortization | 35.8 | 30.1 | ||||||

EBITDA | $ | 82.9 | $ | (7.6 | ) | |||

Restructuring(1) | 2.4 | 22.6 | ||||||

Gain on bond repurchase | (1.7 | ) | — | |||||

Canadian voluntary retirement | — | 1.0 | ||||||

Foreign exchange gain(2) | (0.5 | ) | (0.5 | ) | ||||

Adjusted EBITDA | $ | 83.1 | $ | 15.5 | ||||

| (1) | Product line discontinuation and plant shutdown costs. |

| (2) | Unrealized foreign exchange (gain) loss on acquisition-related indebtedness. |

Management uses Adjusted EBITDA as a measure of the company’s performance. Adjusted EBITDA varies from the amount used in calculating covenant compliance under the company’s credit facilities due to the classification of joint venture equity earnings and certain pro forma adjustments. EBITDA and Adjusted EBITDA are not calculated according to GAAP and should not be construed as income from operations or net income, as determined by GAAP. Other companies may report EBITDA differently and therefore Cooper-Standard Automotive’s results may not be comparable to other similarly titled measures of other companies.

Conference Call Details

Cooper-Standard Automotive will hold a conference call and webcast with investors on Tuesday, May 19, 2009 at 1 p.m. EDT to discuss its 2009 first quarter results, provide a general business update and respond to investor questions.

An interactive webcast will also be available via

http://www.cooperstandard.com/investor_home.php or

http://investor.shareholder.com/cooperstandard/eventdetail.cfm?eventid=68074.

3

To participate in a live question-and-answer session, North American callers should dial toll-free 800-949-4315 (international callers dial 001-678-825-8315) and provide conference ID 98856831 or ask to be connected to the Cooper-Standard Automotive first quarter teleconference. Callers should dial in at least five minutes prior to the start of the call. Financial and automotive analysts are invited to ask questions after the presentations are made.

Individuals unable to participate during the live teleconference or webcast may visit the Investor Relations portion of the Cooper-Standard Automotive Web site (http://www.cooperstandard.com/investor_home.php) for a webcast replay of the presentation.

About Cooper-Standard Automotive

Cooper-Standard Automotive Inc., headquartered in Novi, Mich., is a leading global automotive supplier specializing in the manufacture and marketing of systems and components for the automotive industry. Products include body sealing systems, fluid handling systems and NVH control systems, which are represented within the company’s two operating divisions: North America and International. Cooper-Standard Automotive employs approximately 17,000 people globally with more than 70 facilities throughout the world. For more information, visit the company’s Web site at:www.cooperstandard.com.

Cooper-Standard is a privately-held portfolio company of The Cypress Group and Goldman Sachs Capital Partners Funds.

The Cypress Group is a New York-based private equity investment firm founded in 1994. Since its formation, Cypress has invested more than $3.5 billion of capital within its two funds. Cypress has an extensive track record of making growth-oriented investments in targeted industry sectors and building equity value alongside proven management teams.

The Goldman Sachs Group, Inc. is a leading global financial services firm providing investment banking, securities and investment management services to a substantial and diversified client base that includes corporations, financial institutions, governments and high-net-worth individuals. Founded in 1869, the firm is headquartered in New York and maintains offices in London, Frankfurt, Tokyo, Hong Kong and other major financial centers around the world.

4

This news release includes forward-looking statements, reflecting current analysis and expectations, based on what are believed to be reasonable assumptions. Forward-looking statements may involve known and unknown risks, uncertainties and other factors, which may cause the actual results to differ materially from those projected, stated or implied, depending on many factors, including, without limitation: the company’s substantial leverage; limitations on flexibility in operating business contained in the company’s debt agreements; the company’s dependence on the automotive industry; availability and cost of raw materials; the company’s dependence on certain major customers; competition in the industry; sovereign and other risks related to the company conducting operations outside the United States; the uncertainty of the company’s ability to achieve expected cost reduction savings; the company’s exposure to product liability and warranty claims; labor conditions; the company’s vulnerability to rising interest rates; the company’s ability to meet customers’ needs for new and improved products in a timely manner; the company’s ability to attract and retain key personnel; potential conflicts of interests between owners and the company; the company’s recent status as a stand-alone company; the company’s legal rights to its intellectual property portfolio; the company’s underfunded pension plans; environmental and other regulations; and the possibility that the company’s acquisition strategy will not be successful. There may be other factors that may cause the company’s actual results to differ materially from the forward-looking statement. Accordingly, there can be no assurance that Cooper-Standard Automotive will meet future results, performance or achievements expressed or implied by such forward-looking statements. This paragraph is included to provide safe harbor for forward-looking statements, which are not generally required to be publicly revised as circumstances change, and which Cooper-Standard Automotive does not intend to update.

# # #

Contact for Analysts:

Allen Campbell, chief financial officer, Cooper-Standard Automotive (248) 596-6031,ajcampbell@cooperstandard.com

Contact for Media:

Sharon Wenzl, vice president, Corporate Communications, Cooper-Standard Automotive, (248) 596-6211,sswenzl@cooperstandard.com

5

Q1 2009 Earnings Conference Call May 19, 2009 EXHIBIT 99.2 |

2 Introduction & Agenda I. Introduction – Sharon Wenzl Vice President Corporate Communications II. Business Environment – Jim McElya Chairman and Chief Executive Officer III. Operational Overview – Ed Hasler Vice Chairman and President North America IV. Financial Overview – Allen Campbell Chief Financial Officer V. Questions & Answers |

3 Safe Harbor Some of the statements included herein may include forward-looking statements which reflect our current views with respect to future events and financial performance. Statements which include the words “expect,” “intend,” “plan,” “believe,” “project,” “anticipate” and similar statements of a future or forward-looking nature identify forward-looking statements for the purposes of the federal securities laws or otherwise. All forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important risk factors that could cause actual results to differ materially from those indicated in these statements. For complete disclosure please reference our 10K important risk factors that are available on our website under the Investor Relations link. We do not intend to update any of these forward-looking statements. |

Business Environment Q1 2009 Jim McElya Chairman & CEO |

5 Business Environment Weakness in global vehicle demand continues Inventories remain high Customers financially challenged Chrysler bankruptcy – many unknowns GM - continuing uncertainties Additional extended plant down time across many OEMs Planning and forecasting challenges |

Cooper-Standard Automotive Results & Actions First quarter results reflect global vehicle production downturn Reorganization of operations yielding results New business and conquest wins up versus prior year Future positives with Fiat – Chrysler merger 6 |

Operational Update Q1 2009 Ed Hasler Vice Chairman & President, North American |

8 CSA Q1 – 2009 Actions Reorganized operating structure Benefiting from efficiencies Smooth transition with customers Continued consolidations of Headquarter facilities North America International (Europe, Asia South America) Divisions Countries Belgium Brazil Canada China Czech Republic France Germany India Italy Japan Korea Mexico Netherlands Poland Spain United Kingdom United States |

9 Chrysler Bankruptcy GM Shutdown Inclusion in Automotive Supplier Support Program (ASSP) Member of Chrysler supplier council Fiat merger positive for Cooper-Standard Adjusting capacity to align with customer shut-down periods Proactively adjusting capacity |

10 Commercial Highlights Supplier consolidation Conquest business wins Cooper-Standard is well-positioned to absorb conquest business Awards: Kunshan, China facility received Ford Q1 Award Myslenice, Poland facility received Toyota Peugeot Citroen Automobile Supplier Performance Award Total Net New Business: Q1- 2009 $95.6 m Q1-2008 $69.2 m Includes Nisco JV sales |

11 Q1-2009 Launches Launches: Daimler (Mercedes E-Class) Ford (Lincoln MKS) General Motors (Chevrolet Camaro) Toyota (Lexus RS) Cooper-Standard delivers advanced launch capabilities |

Financial Overview Q1 2009 Allen Campbell CFO |

13 $ Millions Q-1 2008 Q-1 2009 Net Sales $756.0 $401.8 SGA & E $ 67.4 $ 45.2 Q1 2009 Key Income Statement Items Gross Profit $119.1 $ 37.8 Amortization of Intangibles $ 7.8 $ 7.2 Net Interest Expense $ 24.2 $ 21.1 Net Income (Loss) $ 15.7 $ (55.0) Restructuring / Severance $ 2.4 $22.6 |

st 14 Consolidated EBITDA Reconciliation Net Income (Loss) $ 15.7 $ (55.0) Provision (benefit ) for income tax expense 7.2 EBITDA $ 82.9 $ (7.6) Restructuring 2.4 2.6 (3.8) Three Months Ended March 31 Net interest expense 24.2 21.1 Capital Expenditures $ 8.3 $ 25.7 Depreciation and amortization 35.8 30.1 (2.2) Other (1) 0.5 (1) Unrealized foreign exchange (gain) loss on acquisition-related indebtedness, Canadian voluntary retirement program and gain on bond repurchase. (2) The Company’s share of EBITDA in its joint ventures, net of equity earnings. (3) Severance costs associated with the discontinuance of the Company’s global product line operating divisions and the establishment of a new operating structure organized on the basis of geographic regions. (4) Pro forma adjustments to the Company’s EBITDA for the Company’s discontinuance of its global product line operating divisions and the establishment of a new operating structure organized on the basis of geographic regions. EBITDA adjustment related to other joint ventures (2) 1.5 2.4 Severance (3) 20.0 -- Pro forma adjustments related to product line organization discontinuance (4) 11.8 -- Consolidated EBITDA $ 85.5 $ 28.8 $ USD Millions Q1 2008 Q1 2009 |

Liquidity & Covenant Metrics 15 03/31/2009 Senior Secured to EBITDA 2.54x Covenant Ratio 3.00x Committed Liquidity ($115M Facility) $5.9M Cash $88.3M Total Availability $94.2M Total Debt to EBITDA 5.0x |

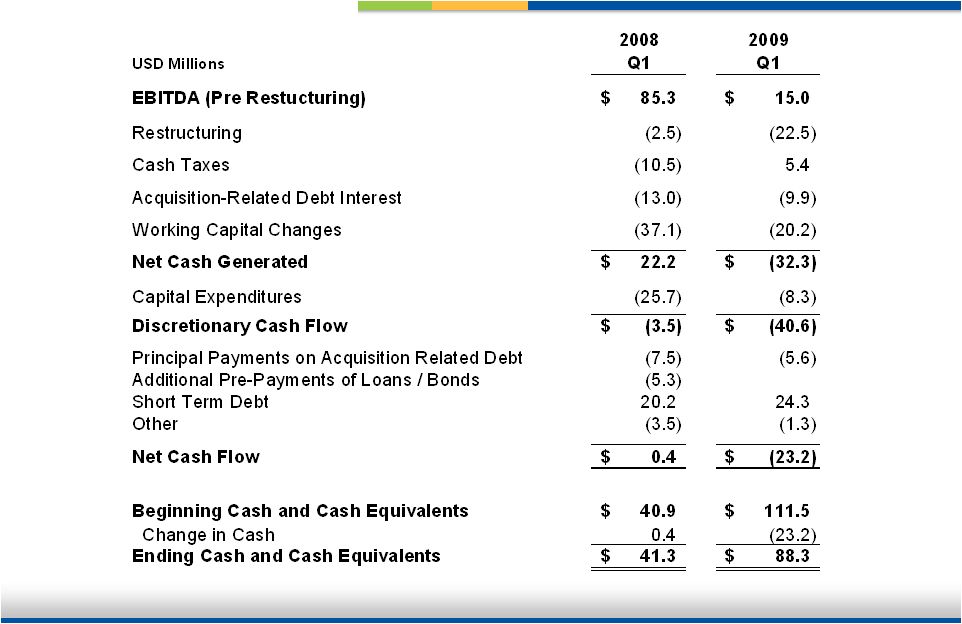

Cash Flow 2009 Year to Date 16 |

Questions & Answers |

18 Closing Remarks Economic conditions remain difficult Uncertain customer production schedules Taking all actions necessary Cost reductions taken to improve cost structure Supplier consolidation opportunities |