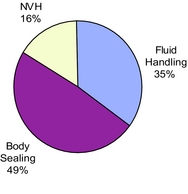

We are a leading North American supplier of systems and components that control and isolate noise and vibration in a vehicle to improve ride and handling. We believe we are the largest provider of NVH control products in North America based on sales. We provide a comprehensive line of powertrain and suspension products and active noise and vibration cancellation systems. We are a leader in engineering, design, testing, and rubber-to-metal bonding technology, and provide superior integrated customer service and problem-solving capabilities. Our products are found on some of the world's top-selling platforms, including the Ford F-Series and General Motors GMT800 (includes Yukon, Tahoe, Sierra, and Silverado) and GMX 380 (Malibu). For the years ended December 31, 2005 and 2004, we generated approximately 16% and 20%, respectively, of total revenue before corporate eliminations from the sale of NVH control products.

NVH control products include various engine and body mounts, dampers, isolators, and other equipment. Engine mounts secure and isolate vehicle powertrain noise, vibration, and harshness from the uni-body or frame. Body and cradle mounts enable isolation of the cabin from the vehicle frame, reducing noise, vibration, and harshness, and are manufactured with a variety of materials, such as natural rubber, butyl, and microcellular urethane. Tuned dampers are designed to reduce specific vibration issues, such as for the steering wheel and column, exhaust system, and internal driveshaft.

We believe we are the market leader in developing breakthrough innovations in NVH control products and continue to make significant investment in our ability to deliver advanced technologies. We developed the popular Truck Tuff hydromounts for light trucks and sport utility vehicles. We believe that the Truck Tuff hydromount design was critical to our winning the engine mounting system on the new Ford F-Series, which Ford claims to be the smoothest, quietest truck on the market. We also recently developed ENVIsys, an advanced electronic system for the active control of noise and vibration for commercial applications. ENVIsys products have a wide variety of potential applications, including aircraft, rail, heavy truck, automotive, and mining equipment.

We believe these engineering and design capabilities, combined with intense focus on quality and customer service, have led to strong customer relationships and a growing customer base. In addition to strengthening our relationships with the Big 3, we target NAMs and Asian expansion opportunities. In North America, we continue to target NAMs and have recently been awarded new business with

Table of ContentsToyota and Hyundai. In China, we are pursuing plans to establish development and manufacturing operations, and in Korea, we are pursuing expansion via joint venture partners.

Supplies and Raw Materials

The principal raw materials for our business include fabricated metal-based components, synthetic rubber, carbon black, and natural rubber. We manage the procurement of our raw materials to assure supply and to obtain favorable pricing. For natural rubber, procurement is managed by buying forward of production requirements and by buying in the spot market. For other materials, procurement arrangements may contain formula-based pricing based on commodity indices. These arrangements provide quantities needed to satisfy normal manufacturing demands. We believe we have adequate sources for the supply of raw materials and components for our products with suppliers located around the world. We often use offshore suppliers for machined components, metal stampings, castings, and other labor-intensive, economically freighted products.

Patents and Trademarks

We hold over 300 patents. Our patents cover both products, such as the ENVIsys active control system, the Daylight Opening Module, and our Engineered Stretched Plastics, and specific manufacturing processes, such as our plastics-to-aluminum overmolding process. We consider each of these patents to be of value and seek to protect our rights throughout the world against infringement. While in the aggregate these patents are important to our business, we do not consider them of such importance that the loss or termination of any one of them would materially affect our company. We continue to seek patent protection for our new products. Our patents will continue to be amortized over the next two to 13 years.

We also have license and technology sharing agreements with Nishikawa Rubber Company for sales, marketing, and engineering services on certain body sealing products we sell. Under those agreements, each party pays for services provided by the other and royalties on certain products for which the other party provides design or development services.

We own or have licensed several trademarks that are registered in many countries, enabling us to protect and market our products worldwide. Through December 23, 2006, we intend to use our current name under an agreement with Cooper Tire.

Seasonality

Sales to automotive customers are lowest during the months prior to model changeovers and during assembly plant shutdowns. These typically result in lower sales volumes during July, August, and December. During these periods of lower sales volumes, profit performance is lower, but working capital improves due to continuing collection of accounts receivable.

Competition

We believe that the principal competitive factors in our industry are price, quality, service, performance, design and engineering capabilities, innovation, and timely delivery. We believe that our capabilities in these core competencies are integral to our position as a market leader in each of our product lines. In body sealing products we compete with GDX Automotive; Metzeler Automotive Profile Systems; Toyoda Gosei; and Hutchinson, a subsidiary of Total SA, among others. In fluid handling products, we compete with TI Automotive, Dana, Mark IV Automotive, Martinrea, and numerous manufacturers of hoses. In NVH control products we compete with Delphi; Trelleborg; Tokai; Vibracoustic, a joint venture between Freudenberg and Phoenix; and Paulstra, a subsidiary of Total SA.

Customers

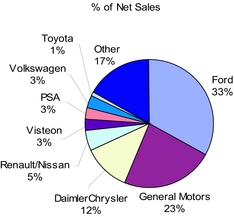

We are a leading supplier to the Big 3 in each of our product categories and are increasing our presence with NAMs and European and Asian OEMs. During the year ended December 31, 2005,

67

Table of Contentsapproximately 33%, 23%, and 12% of our sales were to Ford, General Motors, and DaimlerChrysler, respectively, as compared to 35%, 21%, and 14% for the year ended December 31, 2004, respectively. Sales to Ford include sales to OEMs owned by Ford, such as Volvo, Jaguar, and Land Rover. Our other major customers include Renault/Nissan, PSA Peugeot Citroën, and Visteon. We also sell products to Volkswagen, Toyota, Porsche and, through NISCO, Honda. Our business with any given customer is typically split among several contracts for different platforms. We are actively pursuing relationships to diversify our customer relationships, including expanding sales with NAMs and European and Asian OEMs.

Research and Development

We operate eight design, engineering, and administration facilities throughout the world and employ 437 research and development personnel, some of whom reside at our customers' facilities. We utilize Design for Six Sigma and other methodologies that emphasize manufacturability and quality. We are aggressively expanding our capabilities with new systems for Computer Aided Design, Computer Aided Engineering, vehicle testing, and rapid prototyping. We spend significantly each year to maintain and enhance our technical centers, enabling us to quickly and effectively respond to customer demands. We spent $53.6 million, $63.4 million, and $65.6 million in 2003, 2004, and 2005, respectively, on research and development.

Joint Ventures and Strategic Alliances

Joint ventures represent an important part of our business, both operationally and strategically. We have often used joint ventures to enter into new geographic markets such as China and Korea, to acquire new customers, and to develop new technologies. In entering new geographic markets, teaming with a local partner can reduce capital investment by leveraging pre-existing infrastructure. In addition, local partners in these markets can provide knowledge and insight into local practices and access to local suppliers of raw materials and components. In North America, joint ventures have proven valuable in establishing new relationships with NAMs. For example, we won significant new business with Honda through our NISCO joint venture. In 2005, we acquired a 20% equity interest and expanded our technical alliance with Guyoung, a Korean supplier of metal stampings which is currently building a manufacturing facility in Alabama to service Hyundai.

Geographic Information

In 2005, we generated 68% of net sales in North America, 23% in Europe, 4% in South America and 5% in Asia/Pacific. Approximately 19% of our revenues were generated from our Canadian operations.

In 2004, we generated 70% of net sales in North America, 23% in Europe, 3% in South America and 4% in Asia/Pacific. Approximately 19% of our revenues were generated from our Canadian operations.

Employees

We maintain good relations with both our union and non-union employees and have experienced no work stoppages for more than ten years. We recently negotiated some longer-term agreements, including two five-year agreements with the USWA at two facilities located in the United States. We are currently negotiating two of our Canadian union agreements, which are due to expire this year. As of December 31, 2005, approximately 49.7% of our employees were represented by unions, of which approximately 22% were located in the United States.

As of December 31, 2005, we had 13,429 full-time and temporary employees.

Environmental

We are subject to a broad range of federal, state, and local environmental and occupational safety and health laws and regulations in the United States and other countries, including those governing

68

Table of Contentsemissions to air; discharges to water; noise, and odor emissions; the generation, handling, storage, transportation, treatment, and disposal of waste materials; the cleanup of contaminated properties; and human health and safety. For example, as an owner and operator of real property or a generator of hazardous substances, we may be subject to environmental cleanup liability, regardless of fault, pursuant to the Comprehensive Environmental Response, Compensation and Liability Act or analogous laws, as well as to claims for harm to health or property or for natural resource damages arising out of contamination or exposure to hazardous substances. Several of our properties have been the subject of remediation activities to address historic contamination. In general, we believe we are in substantial compliance with the requirements under such laws and regulations and our continued compliance is not expected to have a material adverse effect on our financial condition or the results of our operations. We expect that additional requirements with respect to environmental matters will be imposed in the future. Our expense and capital expenditures in recent years for environmental matters at our facilities have not been material, it is not expected that expenditures in future years for such uses will be material.

Properties

As of December 31, 2005, our operations were conducted through 48 facilities in 14 countries, of which 40 are manufacturing facilities and 8 are used for multiple purposes. Our headquarters are located in Novi, Michigan. Our manufacturing facilities are located in North America, Asia, Europe, South America, and Australia. We believe that substantially all of our properties are in good condition and that we have sufficient capacity to meet our current and projected manufacturing and design needs. The following table summarizes our property holdings.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Region |  | Division |  | Total Facilities |  | Owned Facilities |

| North America |  | Sealing |  | | 12 | |  | | 12 | |

| |  | Fluid |  | | 7 | |  | | 6 | |

| |  | NVH |  | | 3 | |  | | 3 | |

| |  | Other |  | | 5 | |  | | 1 | |

| Asia |  | Sealing |  | | 3 | |  | | 2 | |

| |  | Fluid |  | | 2 | |  | | 0 | |

| |  | NVH |  | | 1 | |  | | 0 | |

| Europe |  | Sealing |  | | 5 | |  | | 4 | |

| |  | Fluid |  | | 4 | |  | | 3 | |

| |  | Other |  | | 3 | |  | | 1 | |

| South America |  | Sealing |  | | 1 | |  | | 1 | |

| |  | Fluid |  | | 1 | |  | | 0 | |

| Australia |  | Fluid |  | | 1 | |  | | 1 | |

| Total |  | Sealing |  | | 21 | |  | | 19 | |

| |  | Fluid |  | | 15 | |  | | 10 | |

| |  | NVH |  | | 4 | |  | | 3 | |

| |  | Other |  | | 8 | |  | | 2 | |

|

We acquired an additional 15 facilities through the acquisition of FHS, of which 10 are located in North America, four in Europe and one in Asia.

69

Table of ContentsLegal Proceedings

We are a defendant in various judicial proceedings arising in the ordinary course of business. After reviewing all of these proceedings, and taking into account all relevant factors concerning them, we do not believe that any liabilities resulting from these proceedings are reasonably likely to have a material adverse effect on its liquidity, financial condition or results of operations.

70

Table of ContentsMANAGEMENT

Directors and Executive Officers

The following table sets forth information about our current directors, executive officers and other named officers.

|  |  |  |  |  |  |  |  |  |  |

| Name |  | Age |  | Position |

| James S. McElya |  | | 58 | |  | Chief Executive Officer and Director |

| Allen J. Campbell |  | | 48 | |  | Chief Financial Officer |

| Larry J. Beard |  | | 58 | |  | President, Global Fluid Systems |

| Edward A. Hasler |  | | 56 | |  | President, Global Sealing Systems |

| James W. Pifer |  | | 58 | |  | Executive Vice President, Sales & Marketing; President, Global NVH Control Systems |

| S.A. (Tony) Johnson |  | | 65 | |  | Non-Executive Chairman and Director |

| Gerald J. Cardinale |  | | 38 | |  | Director |

| Jack Daly |  | | 39 | |  | Director |

| Michael F. Finley |  | | 44 | |  | Director |

| John C. Kennedy |  | | 47 | |  | Director |

| Leo F. Mullin |  | | 63 | |  | Director |

| Kenneth L. Way |  | | 66 | |  | Director |

|

James S. McElya is our Chief Executive Officer, a position he has held since the Acquisition in December 2004. He has been a director of the Company since the Acquisition. He was the President of Cooper-Standard and a Corporate Vice President of Cooper Tire from June 2000 until the Acquisition. Mr. McElya has over 31 years of automotive experience and was previously President of Siebe Automotive Worldwide, a division of Invensys, PLC. Mr. McElya spent 22 years with Handy & Harman in various executive management positions, including President, Handy & Harman Automotive, and Corporate Vice President and Officer of the parent company. Mr. McElya is a board member of OESA (Original Equipment Supplier Association), MEMA (Motor & Equipment Manufacturers Association), and NAAG (National Alliance for Accessible Golf).

Allen J. Campbell is our Chief Financial Officer, a position he has held since the Acquisition in December 2004. He was Vice President, Finance from 1999 to 2003 and Vice President, Asian Operations of Cooper-Standard Automotive Group from 2003 until the Acquisition. Mr. Campbell has seven years of automotive experience and has held various executive positions in the industry. Prior to this position, Mr. Campbell was with The Dow Chemical Company for 18 years and held executive finance positions for both US and Canadian operations. Mr. Campbell is a Certified Public Accountant and received his MBA in Finance from Xavier University.

Larry J. Beard is our President, Global Fluid Systems, a position he has held since the Acquisition in December 2004. He was President of the Global Fluid Systems Division and a Corporate Vice President of Cooper Tire from 1998 until the Acquisition. Mr. Beard has over 37 years of automotive experience and has held various executive management positions, including Executive Vice President, Tire Operations; President, Fluid Systems Division North America; Vice President, Operations; and was a Senior Vice President and General Manager at P.L. Porter, a leading supplier of automotive and aerospace components. Mr. Beard is a journeyman Tool and Die maker, and has a BSME from Wayne State University and an MBA from Northeastern University.

Edward A. Hasler is our President, Global Sealing Systems, a position he has held since the Acquisition in December 2004. He was the President of the Global Sealing Systems Division and a Corporate Vice President of Cooper Tire from 2003 until the Acquisition. Mr. Hasler was employed from 2000 to 2001 in Germany as Managing Director, Europe for GDX Corporation (which includes Draftex and GenCorp), a major player in the automotive weathersealing business. Prior to joining GenCorp, Mr. Hasler had been with Cooper Tire for nearly 15 years. At Cooper Tire, Mr. Hasler held several senior posts including Vice President, Operations; and Vice President, Controller. He has both an MBA and a BS in Business Administration.

71

Table of ContentsJames W. Pifer is our Executive Vice President, Sales & Marketing, a position he has held since the Acquisition in December 2004 and President, Global NVH Control Systems, a position he has held since September 2005. He was the Executive Vice President, Sales & Marketing, Cooper-Standard Automotive Group and a Corporate Vice President, Cooper Tire from 1999 until the Acquisition. In over 36 years of automotive experience, Mr. Pifer has held various executive positions, including President, Global Fluid Systems Division; President, Sealing Systems Division North America; Vice President, Sales, Marketing & Engineering, Sealing Systems Division; Vice President, Sales, Marketing & Engineering, Cooper Engineered Products Division; and various positions with Cooper Tire.

S.A. (Tony) Johnson is our Non-Executive Chairman and a director of our company, a position he has held since the Acquisition in December 2004. Mr. Johnson is the founder of Hidden Creek Industries. Prior to forming Hidden Creek, Mr. Johnson served from 1986 to 1989 as President and Chief Operating Officer of Pentair, Inc. From 1981 to 1985, Mr. Johnson was President and Chief Executive Officer of Onan Corp. Mr. Johnson also currently serves as Chairman and a director of Tower Automotive Inc., J. L. French, Commercial Vehicles Group Inc., and Saleen Inc. Mr. Johnson served as a director of Dura Automotive Systems, Inc., a manufacturer of mechanical assemblies and integrated systems for the automotive industry, from 1990 to 2004, serving as its Chairman from 1990 to 2002.

Gerald J. Cardinale has been a director of the Company since the Acquisition in December 2004. Mr. Cardinale is a Managing Director and Partner in the Principal Investment Area at Goldman Sachs. He joined Goldman Sachs in 1992, became a Managing Director in 2002 and was made a Partner in 2004. He serves on the Boards of Directors of the Yankees Entertainment and Sports (‘‘YES’’) Network, Sensus Metering Systems Inc., Cebridge Connections, and Fiberlink Communications Corporation. Mr. Cardinale received an Honors B.A. from Harvard University and an M.Phil in Politics from Oxford University where he was a Rhodes Scholar.

Jack Daly has been a director of the Company since the Acquisition in December 2004. Mr. Daly is a Vice President in the Principal Investment Area of Goldman Sachs, where he has worked since 2000. From 1998 to 2000, he was a member of the Investment Banking Division of Goldman Sachs. From 1991 to 1997, Mr. Daly was a Senior Instructor of Mechanical & Aerospace Engineering at Case Western Reserve University. Mr. Daly currently serves as a director of IPC Information Systems, Inc., Euramax Corporation, and Autocam, Inc. He earned a B.S. and M.S. in Engineering from Case Western Reserve University and an M.B.A. from the Wharton School of Business.

Michael F. Finley has been a director of the Company since the Acquisition in December 2004. Mr. Finley has been a Managing Director of Cypress since 1998 and has been a member of Cypress since its formation in April 1994. Prior to joining Cypress, he was a Vice President in the Merchant Banking Group at Lehman Brothers Inc. Mr. Finley received a B.A. from St. Thomas University and an M.B.A. from the University of Chicago's Graduate School of Business. Mr. Finley currently serves on the Boards of Directors of Affinia Group Inc., CPI International, Inc., and Williams Scotsman International, Inc.

John C. Kennedy has been a director of the Company since May 2005. Mr. Kennedy is the President and CEO of Autocam Corporation, a manufacturer of precision machined components for the automotive and medical industries. Mr. Kennedy purchased Autocam Corporation in 1988 and has led the company since that time. Mr. Kennedy is also a director of Fifth Third Bank’s Michigan affiliate, Lacks Enterprises, Sligh Furniture, and numerous civic and charitable organizations.

Leo F. Mullin has been a director of the Company since May 2005. Since September 2004, he has been a Senior Advisor on a part-time basis to Goldman Sachs Capital Partners. Mr. Mullin served as President and Chief Executive Officer of Delta Air Lines from 1997 to 1999, as Chairman and Chief Executive Officer from 1999 to December 31, 2003 and as Chairman until his retirement on May 1, 2004. Previously, he served as Vice Chairman of Unicom Corporation and its principal subsidiary, Commonwealth Edison Company, from 1995 to 1997. He was an executive at First Chicago

72

Table of ContentsCorporation from 1981 to 1995, serving as that company’s President and Chief Operating Officer from 1993 to 1995. Mr. Mullin is a director of BellSouth Corporation, Johnson & Johnson, and Euramax Corporation.

Kenneth L. Way has been a director of the Company since the Acquisition in December 2004. Mr. Way is the former Chairman and CEO of Lear Corporation, the world's largest automotive interior systems supplier. Mr. Way had been affiliated with Lear Corporation and its predecessor companies for 37 years in various engineering, manufacturing and general management capacities. Mr. Way is also a Director of WESCO International, Inc., Comerica, Inc., CMS Energy Corporation, and United Way, and is on the boards of trustees for Henry Ford Health Systems and the Barbara Ann Karmanos Cancer Institute.

Director Compensation

None of our directors who are officers or nominees of our sponsors receive any compensation for serving as a director or as a member or chair of a committee of the Board of Directors. Members of the Board of Directors that are not our employees or officers, nominees, or employees of our sponsors are compensated with a retainer in the amount of $40,000 per year, plus $1,500 per meeting of the Board of Directors that such member attends. Our Chairman, Mr. Johnson, receives an additional $75,000 per year for his service as Chairman of the Board, and Mr. Way receives $10,000 per year for his service as the Chairman of the Audit Committee. Our directors who are not our employees or officers, nominees, or employees of our sponsors are eligible to receive grants of non-qualified and incentive stock options, stock appreciation rights, restricted stock, and other stock-based awards under the 2004 Cooper-Standard Holdings Inc. Stock Incentive Plan. In 2005, each of Messrs. Johnson, Way, and Kennedy were granted options to purchase 1,000 shares of the common stock of the Company for an exercise price of $100 per share. These options have a ten-year life and vest 20% per year over five years.

Committees of the Board of Directors

Our Board of Directors currently has an executive committee and an audit committee.

Executive Committee

Our executive committee currently consists of four members, which include Mr. Johnson, Mr. McElya, any director who is a nominee of The Cypress Group L.L.C. (currently Mr. Finley) and any director who is a nominee of GS Capital Partners 2000, L.P. (currently either Mr. Cardinale, Mr. Daly, or Mr. Mullin). Mr. Johnson serves as the chairman of the Executive Committee. The Executive Committee has the authority to discharge all functions of the Board of Directors in the management of our business during the interim between meetings of the Board of Directors.

Audit Committee

Our audit committee currently consists of Messrs. Way, Daly, and Finley. Mr. Way serves as the chairman of the audit committee. The Board of Directors has determined that the Company has at least one ‘‘audit committee financial expert’’ (as defined in Item 401(h) of Regulation S-K), Mr. Way, serving on the Audit Committee. Mr. Way is ‘‘independent’’ within the meaning of Item 401(h) of Regulation S-K. The audit committee is responsible for (i) reviewing and discussing with management and our independent auditors our annual audited financial statements and quarterly financial statements and any audit issues and management's response; (ii) reviewing and discussing with management and our independent auditors our financial reporting and accounting standards and principles and significant changes in such standards and principles or their application; (iii) reviewing and discussing with management and our independent auditors our internal system of financial controls and disclosure controls and our risk assessment and management policies and activities; (iv) reviewing and evaluating the independence, qualifications, and performance of our independent

73

Table of Contentsauditors; (v) reviewing our legal compliance and ethics programs and investigating matters relating to management's integrity, including adherence to standards of business conduct established in our policies; and (vi) taking such actions as may be required or permitted under applicable law to be taken by an audit committee on behalf of us and our Board of Directors.

Other Matters Concerning Directors

Leo F. Mullin served as the Chief Executive Officer of Delta air Lines, Inc. from 1997 through December 2003 and as its Chairman of the Board from 1999 through May 2004. Delta Air Lines filed for protection under Chapter 11 of the United States Bankruptcy code in September 2005.

Code of Business Conduct and Ethics

We have adopted a Code of Business Conduct and Ethics Policy that applies to all directors, officers, and employees of the Company and its subsidiaries, including our chief executive officer, our chief financial officer and our controller. The Code of Business Conduct and Ethics Policy is available on our website at www.cooperstandard.com. We will also post on our website any amendment to, or waiver from, a provision of our policies that relates to any of the following elements of these policies: honest and ethical conduct; disclosure in reports or documents filed by the Company with the SEC and in other public communications; compliance with applicable laws, rules and regulations; prompt internal reporting of code violations; and accountability for adherence to the policies.

Executive Compensation

As an independent company, we have established executive compensation plans that link compensation with the performance of our company. We will continually review our executive compensation programs to ensure that they are competitive.

The following table shows all compensation awarded to, earned by, or paid to our Chief Executive Officer and four other most highly compensated executive officers based on salary, whom we refer to as the ‘‘named executive officers.’’

Summary Compensation Table

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | Annual Compensation |  | Long-Term Compensation |  | All Other

Compensation(6) |

| Name and Principal Positions (1) |  | Year |  | Salary |  | Bonus (2) |  | Other Annual

Compensation (3) |  | Number of

Shares

Underlying

Stock Option

Awards (4) |  | LTIP Payout (5) |

James S. McElya

Chief Executive Officer |  | 2005 |  | $ | 695,442 | |  | $ | 420,801 | |  | $ | 38,784 | |  | | 0 | |  | $ | 396,342 | |  | $ | 15,311 | (7) |

| | 2004 | |  | | 463,000 | |  | | 408,597 | |  | | 40,289 | |  | | 44,723 | |  | | 76,356 | |  | | 3,246,342 | |

Allen J. Campbell

Vice President and Chief Financial Officer |  | | 2005 | |  | | 327,653 | |  | | 111,587 | |  | | 15,784 | |  | | 0 | |  | | 146,884 | |  | | 14,712 | (8) |

| | 2004 | |  | | 230,000 | |  | | 92,869 | |  | | 2,755 | |  | | 22,362 | |  | | 25,452 | |  | | 0 | |

Larry J. Beard

President, Global Fluid Systems |  | | 2005 | |  | | 314,807 | |  | | 70,875 | |  | | 3,426 | |  | | 0 | |  | | 131,463 | |  | | 13,766 | (9) |

| | 2004 | |  | | 234,615 | |  | | 124,959 | |  | | 3,987 | |  | | 24,598 | |  | | 55,958 | |  | | 167,322 | |

Edward A. Hasler (12)

President, Global Sealing Systems |  | | 2005 | |  | | 319,615 | |  | | 136,294 | |  | | 2,897 | |  | | 0 | |  | | 14,353 | |  | | 16,810 | (10) |

| | 2004 | |  | | 300,000 | |  | | 189,405 | |  | | 646 | |  | | 24,598 | |  | | 0 | |  | | 215,441 | |

| James W. Pifer |  | | 2005 | |  | | 304,808 | |  | | 103,134 | |  | | 780 | |  | | 0 | |  | | 103,444 | |  | | 13,668 | (11) |

Executive Vice-President,

Sales & Marketing;

President, Global NVH Control Systems |  | | 2004 | |  | | 295,000 | |  | | 234,200 | |  | | 0 | |  | | 17,889 | |  | | 0 | |  | | 116,229 | |

|

|  |

| (1) | We have provided compensation information only as to 2004 and 2005 for the named executive officers because prior to 2004, we were not subject to applicable filing requirements under the Exchange Act. |

74

Table of Contents |  |

| (2) | For 2004, includes payments made under Cooper Tire's Return on Assets Managed bonus program. For 2005, includes payments made under the Company’s Return on Assets Managed bonus program. |

|  |

| (3) | Includes perquisites including company car and, in the case of Mr. McElya and Mr. Campbell, benefits including expenses related to housing and commuting airfare. For Mr. McElya, expenses related to housing and commuting airfare were $38,225 in 2005 and $39,997 in 2004. For Mr. Campbell, expenses related to housing were $11,300 in 2005. |

|  |

| (4) | In 2004, options were awarded to members of senior management in connection with the Acquisition. Half of each officer's stock options are Time Options and half are Performance Options, as described more fully below. |

|  |

| (5) | For 2005, includes (i) amounts attributable to the Cooper Tire & Rubber Company long term incentive plan paid in connection with the Acquisition pursuant to the Cooper Tire & Rubber Company Change in Control Severance Pay Plan which totaled, for Mr. McElya, $345,704; for Mr. Campbell, $115,235; for Mr. Beard, $99,814; for Mr. Hasler, $111,884 and for Mr. Pifer, $76,015; and (ii) amounts paid pursuant to the Company’s Performance Cash Plan for 2005 which totaled for Mr. McElya, $50,638; for Mr. Campbell, $31,649; for Mr. Beard, $31,649; for Mr. Hasler, $31,649 and for Mr. Pifer, $27,429. |

|  |

| (6) | For 2004, includes flexible spending allowance, allocations to the Cooper Tire Nonqualified Supplementary Benefit Plan and amounts attributable to the repurchase by Cooper Tire of qualified and nonqualified options to purchase Cooper Tire Stock. Mr McElya's other compensation for 2004 also includes a $2 million retention bonus paid in connection with the Acquisition part of which was paid in cash and part of which was paid in the form of Cooper-Standard Holdings Inc. common stock. |

|  |

| (7) | Includes matching contributions under the Company’s investment savings plan of $4,200 and flexible spending allowance of $11,111. Does not include amounts attributable to, in connection with the Acquisition, the repurchase by Cooper Tire of qualified and nonqualified options to purchase Cooper Tire stock of $398,375; the repurchase by Cooper Tire of Cooper Tire restricted stock of $231,403; a retention bonus paid by Cooper Tire for remaining employed through the closing of the Acquisition of $231,500 or a special bonus paid by Cooper Tire as a result of the completion of the Acquisition of $2,286,012. |

|  |

| (8) | Includes matching contributions under the Company’s Investment Savings Plan of $4,200 and flexible spending allowance of $10,512. Does not include amounts attributable to, in connection with the Acquisition, the repurchase by Cooper Tire of qualified and nonqualified options to purchase Cooper Tire stock of $112,783; the repurchase by Cooper Tire of Cooper Tire restricted stock of $46,011; a retention bonus paid by Cooper Tire for remaining employed through the closing of the Acquisition of $115,000 or a special bonus paid by Cooper Tire as a result of the completion of the Acquisition of $400,052. |

|  |

| (9) | Includes matching contributions under the Company’s Investment Savings Plan of $4,200 and flexible spending allowance of $9,566. Does not include amounts attributable to, in connection with the Acquisition, the repurchase by Cooper Tire of qualified and nonqualified options to purchase Cooper Tire stock of $436,625; the repurchase by Cooper Tire of Cooper Tire restricted stock of $125,828; a retention bonus paid by Cooper Tire for remaining employed through the closing of the Acquisition of $152,500 or a special bonus paid by Cooper Tire as a result of the completion of the Acquisition of $571,503. |

|  |

| (10) | Includes matching contributions under the Company’s Investment Savings Plan of $4,200 and flexible spending allowance of $12,610. Does not include amounts attributable to, in connection with the Acquisition, the repurchase by Cooper Tire of qualified and nonqualified options to purchase Cooper Tire stock of $210,938; the repurchase by Cooper Tire of Cooper Tire restricted stock of $132,107; a retention bonus paid by Cooper Tire for remaining employed through the |

75

Table of Contents |  |

| closing of the Acquisition of $150,000 or a special bonus paid by Cooper Tire as a result of the completion of the Acquisition of $571,503. |

|  |

| (11) | Includes matching contributions under the Company’s Investment Savings Plan of $4,200 and flexible spending allowance of $9,468. Does not include amounts attributable to, in connection with the Acquisition, the repurchase by Cooper Tire of qualified and nonqualified options to purchase Cooper Tire stock of $217,952; the repurchase by Cooper Tire of Cooper Tire restricted stock of $185,945; a retention bonus paid by Cooper Tire for remaining employed through the closing of the Acquisition of $147,500 or a special bonus paid by Cooper Tire as a result of the completion of the Acquisition of $457,202. |

|  |

| (12) | Mr. Hasler’s reported compensation for 2004 does not include a negative adjustment of $10,148 related to expatriate status. |

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year End Option Values

Shown below is information with respect to the exercise of stock options during the last fiscal year and the year-end value of unexercised options to purchase common stock of the Company granted to the named executive officers and held by them as of December 31, 2005.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | |  | |  | Number of Securities Underlying

Unexercised Options at Fiscal

Year-End |  | Value of Unexercised

In-the-Money Options at Fiscal

Year End (1) |

| Name |  | Shares Acquired

on Exercise (#) |  | Value

Realized ($) |  | Exercisable |  | Unexercisable |  | Exercisable |  | Unexercisable |

| James S. McElya |  | | 0 | |  | | 0 | |  | | 8,945 | |  | | 35,778 | |  | | — | |  | | — | |

| Allen J. Campbell |  | | 0 | |  | | 0 | |  | | 4,472 | |  | | 17,890 | |  | | — | |  | | — | |

| Larry J. Beard |  | | 0 | |  | | 0 | |  | | 4,920 | |  | | 19,678 | |  | | — | |  | | — | |

| Edward A. Hasler |  | | 0 | |  | | 0 | |  | | 4,920 | |  | | 19,678 | |  | | — | |  | | — | |

| James W. Pifer |  | | 0 | |  | | 0 | |  | | 3,578 | |  | | 14,311 | |  | | — | |  | | — | |

|

|  |

| (1) | The exercise price with respect to all options is $100 per share. Due to the absence of a trading market, the shares underlying the options have been valued at their original issue and exercise price of $100. |

Long-Term Incentive Plans — Awards in Last Fiscal Year

Shown below is information regarding awards made to the named executive officers in 2005 under the Company’s Performance Cash Plan.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| |  | |  | |  | Estimated Future Payouts

Under Non-Stock Price-Based

Plans |  | |

| Name |  | Number Of

Shares, Units

Or Other Rights (1) |  | Performance or Other

Period Until Maturation

or Payout |  | Threshold $ (2) |  | Target $ |  | Maximum $ (3) |

| James S. McElya |  | | — | |  | 1/1/2005 – 12/31/2007 |  | | 60,000 – 114,000 | |  | | 120,000 | |  | | — | |

| Allen J. Campbell |  | | — | |  | 1/1/2005 – 12/31/2007 |  | | 37,500 – 71,250 | |  | | 75,000 | |  | | — | |

| Larry J. Beard |  | | — | |  | 1/1/2005 – 12/31/2007 |  | | 37,500 – 71,250 | |  | | 75,000 | |  | | — | |

| Edward A. Hasler |  | | — | |  | 1/1/2005 – 12/31/2007 |  | | 37,500 – 71,250 | |  | | 75,000 | |  | | — | |

| James W. Pifer |  | | — | |  | 1/1/2005 – 12/31/2007 |  | | 32,500 – 58,500 | |  | | 65,000 | |  | | — | |

|

|  |

| (1) | The Performance Cash Plan provides for cash payments to participants based upon the Company’s achievement over a three-year period of operating cash generation targets established by the Board of Directors. Payments are made on a rolling basis over three years following the achievement of such objectives. |

|  |

| (2) | Participants may earn between 50% to 95% of their target payment upon achievement by the Company of 90% or more of the established cash generation targets. |

|  |

| (3) | Participants may earn amounts in excess of their target payment upon achievement by the Company of cash generation results exceeding the established targets on an uncapped, percentage basis. |

76

Table of ContentsDefined Benefit Plan Pensions

The Company maintains the Cooper-Standard Automotive Inc. Salary Retirement Plan (the "Defined Benefit Plan") and the Cooper-Standard Automotive Inc. Nonqualified Supplementary Benefit Plan (the "Supplementary Plan") (collectively the "Pension Plans"). The Defined Benefit Plan generally provides benefits stated in the form of a hypothetical account balance which is credited with hypothetical principal and interest each year (the "cash balance benefit formula"). For certain participants, including one named executive officer, the Defined Benefit Plan provides benefits generally stated as 1.5% times average compensation (the five highest consecutive of the last ten years) times years of service (the "final pay formula"). The Supplementary Benefit Plan provides benefits based on the Defined Benefit Plan formula applicable to a specified participant in excess of the Internal Revenue Code Section 415 benefits and 401(a)(17) compensation limits, and for one named executive officer (James S. McElya), provides benefits stated in the Defined Benefit Plan final pay formula although the cash balance benefit formula in fact applies to Mr. McElya (in all cases, minus benefits provided under the Defined Benefit Plan).

The following Pension Plan Table applies to the two named executive officers (James S. McElya and Edward A. Hasler) who will receive benefits under the Defined Benefit Plan or the Supplementary Benefit Plan, or both, utilizing the final pay formula.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Pension Plan Table |

| Remuneration |  | Years of Service |

| |  | 15 |  | 20 |  | 25 |  | 30 |  | 35 |

| |  | $ |  | $ |  | $ |  | $ |  | $ |

125,000 to 400,000

Not Applicable |  | | | |  | | | |  | | | |  | | | |  | | | |

| 450,000 |  | | 101,250 | |  | | 135,000 | |  | | 168,750 | |  | | 202,500 | |  | | 236,250 | |

| 500,000 |  | | 112,500 | |  | | 150,000 | |  | | 187,500 | |  | | 225,000 | |  | | 262,500 | |

| 600,000 |  | | 135,000 | |  | | 180,000 | |  | | 225,000 | |  | | 270,000 | |  | | 315,000 | |

| 800,000 |  | | 180,000 | |  | | 240,000 | |  | | 300,000 | |  | | 360,000 | |  | | 420,000 | |

| 1,000,000 |  | | 225,000 | |  | | 300,000 | |  | | 375,000 | |  | | 450,000 | |  | | 525,000 | |

| 1,250,000 |  | | 281,250 | |  | | 375,000 | |  | | 468,750 | |  | | 562,500 | |  | | 656,250 | |

| 1,500,000 |  | | 337,500 | |  | | 450,000 | |  | | 562,500 | |  | | 675,000 | |  | | 787,500 | |

| 1,750,000 |  | | 393,750 | |  | | 525,000 | |  | | 656,250 | |  | | 787,500 | |  | | 918,750 | |

| 2,000,000 |  | | 450,000 | |  | | 600,000 | |  | | 750,000 | |  | | 900,000 | |  | | 1,050,000 | |

|

The compensation covered by the Pension Plans includes all compensation reported as wages for federal income tax withholding purposes excluding employer contributions to a plan of deferred compensation, income attributable to stock options (including income attributable to any disqualifying dispositions thereof), director fees, sales awards, relocation bonuses, signing bonuses, lump-sum severance payments, suggestion system awards, tuition reimbursement, payments upon the exercise of stock appreciation rights or in lieu of the exercise of stock options, imputed income (such as, but not limited to, group term life insurance coverage that is reportable as taxable income), benefits accruing or payable under nonqualified retirement plans, expatriate income, and other amounts that either are excludable or deductible from income in whole or in part for federal income tax purposes, or that represent payments pursuant to program of benefits or deferred compensation, whether or not such program is qualified under the Code.

Compensation covered by the Pension Plans is equal to amounts shown on the "Salary", "Bonuses", "Other Annual Compensation" and the "LTIP Payout Columns" of the Summary Compensation Table, plus the flexible spending account shown in the footnotes to the "All Other Compensation" column in the Summary Compensation Table above.

The estimated credited years of service for the two named executives covered by the final pay formula in one or both of the Pension Plans are: James S. McElya, 9.9 years, Edward S. Hassler, 19.0 years. Benefits shown in the Pension Plan Table are payable as a straight-life annuity. Benefits under the final pay formula are not subject to any deduction for social security or other offset. Benefits

77

Table of Contentsunder the final pay formula are subject to a maximum which takes social security benefits into account, but that maximum is not expected to apply.

The remaining three named executive officers (Allen J. Campbell, Larry J. Beard and James W. Pifer) are only eligible for the Pension Plans' cash balance formula. Benefits under the cash balance formula are equal to the opening account balance (the present value of the participant's December 31, 2001 benefit under the applicable prior plan final pay formula), plus interest credits for each year at the rate paid on 30-year Treasury securities in the previous October, plus pay credits based on the sum of the participant's age plus years of service as follows:

|  |  |  |  |  |  |

Sum of Age and

Accrual Service |  | Percentage

Factor |

| up to 35 |  | 3.0% |

| 36-50 |  | 4.0% |

| 51-65 |  | 5.5% |

| 66-80 |  | 7.5% |

| over 80 |  | 10.0% |

|

Footnotes 6 through 10 to the above Summary Compensation Table show the amounts allocated to the cash balance accounts in both Pension Plans for all five named executive officers during 2005.

The estimated annual retirement benefits at retirement age (the later of age 65 or the completion of 5 years of participation) under both Pension Plans, payable as a straight life annuity, for these remaining three named executive officers are:

Estimated Retirement Benefit

|  |

| Allen J. Campbell | $25,008 |

|  |

| Larry J. Beard | $ 7,360 |

|  |

| James W. Pifer | $57,618 |

Following the Acquisition, ten of our executives received nonqualified stock options to acquire up to 6.2%, in the aggregate, of the outstanding shares of common stock of Cooper-Standard Holdings Inc. as of December 31, 2005. The allocation of such options was made by the Board of Directors of Cooper-Standard Holdings Inc., based on the recommendation of Mr. McElya, our Chief Executive Officer (all such options, collectively, the ‘‘Options’’). The Options were granted pursuant to the 2004 Cooper-Standard Holdings Inc. Stock Incentive Plan, which is an omnibus plan permitting the grant of stock options and other stock-based awards. Fifty percent of the Options granted to each executive (the ‘‘Time Options’’) vest and become exercisable with respect to 20% of the shares subject to Time Options on December 23 of each of the first five anniversaries of closing date of the Acquisition. The remaining 50% of the Options granted to each executive (the ‘‘Performance Options’’) will vest and become exercisable on the eighth anniversary of the date of grant, subject to partial accelerated vesting of up to 20% per year based upon achievement of annual EBITDA targets. Notwithstanding the foregoing, the option agreements provide that the eighth anniversary vesting date will no longer be of any effect if the elimination of such vesting date will not cause the Performance Options to be subject to variable accounting treatment.

The Options have a term of 10 years and the vested portion of the Options will expire (i) 90 days following termination of employment for any reason other than those discussed in (ii) and (iii), below, (ii) immediately upon termination for Cause and (iii) one year following termination of employment due to death, disability, retirement at normal retirement age under Cooper-Standard Holdings Inc.’s or its affiliates’ qualified retirement plan or Cooper-Standard Holdings Inc.’s sale of the business or division in which such executive was principally employed.

Any unvested Options will be forfeited upon a termination of the executive’s employment for any reason; provided that in the event of a termination without cause or for good reason (as those terms are defined in the option agreement), or in the event of a termination due to death or disability, the executive shall be deemed vested in any Time Options that would otherwise have vested in the calendar year of termination.

78

Table of ContentsUpon a change of control (i) all unvested Time Options will vest and (ii) 20% to 100% of the unvested Performance Options that relate to the tranche (i.e., 20%) applicable to the calendar year in which such change of control occurs (and which relate to any future calendar years) shall vest to the extent that cumulative performance from calendar year 2004 through the most recent fiscal year-end meets or exceeds 85% of the applicable cumulative annual EBITDA targets. Upon an initial public offering of Cooper-Standard Holdings Inc. of at least 25% of the outstanding shares or that results in gross proceeds to Cooper-Standard Holdings Inc. greater than or equal to 50% of Sponsors’ initial investment, 20% to 100% of the unvested Performance Options that relate to the tranche (i.e., 20%) applicable to the calendar year in which such offering occurs (and which relate to any future calendar years) shall vest to the extent that cumulative performance through the most recent fiscal year-end meets or exceeds 85% of the applicable cumulative annual EBITDA targets.

All shares acquired upon the exercise of an Option shall be held subject to the terms and conditions of a management shareholders’ agreement more fully described elsewhere in this Form S-1 under the caption ‘‘Certain Relationships and Related Party Transactions.’’

Employment and Severance Agreements

James S. McElya. In connection with the Acquisition, we assumed and continued Mr. McElya’s existing employment agreement with the Cooper Tire with certain modifications. The agreement provides for a term from the closing of the Acquisition through December 31, 2007, with automatic one-year extensions commencing on January 1, 2008 and each January 1 thereafter (until Mr. McElya’s 63rd birthday), unless either party gives notice no later than September 30 of the preceding year. During the term of the agreement, Mr. McElya is serving as our President and Chief Executive Officer, and receives a base salary equal to $700,000; has an annual bonus opportunity equal to 80% of base salary, based upon and subject to the achievement of annual performance targets; participates in our long-term incentive compensation programs; participates in our Change of Control Severance Pay Plan (described below); and participates in employee benefit plans, including health, life, disability, retirement, and fringe benefits that are substantially comparable in the aggregate to the level of such benefits that were provided by Cooper Tire immediately prior to the closing of the Acquisition, subject to reduction that applies to other of our senior executives.

Upon termination without cause or for good reason (as those terms are defined in the agreement) on or prior to December 31, 2007, subject to execution of an effective release of claims, Mr. McElya will be entitled to: (i) a lump sum payment equal to his base salary and pro rata incentive compensation accrued through termination, (ii) a lump sum payment equal to the greater of (a) Mr. McElya’s average annual compensation, including base salary and any annual and long-term incentive compensation earned during the five calendar years prior to termination, during the remainder of the employment term and (b) three times the sum of Mr. McElya’s base salary plus target annual incentive compensation for the year prior to the Acquisition; (iii) a lump sum payment equal to the actuarial equivalent of three additional years of service credit under Mr. McElya’s retirement plans plus the retirement pension accrued under the applicable nonqualified supplemental retirement plan; (iv) three years of continued life, accident, and health insurance, reduced by comparable benefits received by Mr. McElya during such period; (v) lifetime retiree medical and life insurance coverage; and (vi) outplacement services up to 15% of Mr. McElya’s base salary. After the closing of the Acquisition, Cooper Tire provided Mr. McElya with full vesting and payment of Cooper Tire restricted stock units (not equity securities of Cooper-Standard Holdings Inc.) and full vesting and cash-out of Cooper Tire stock options (not equity securities of Cooper-Standard Holdings Inc.). The requirement under the agreement that upon a change in control (as defined in the agreement) a ‘‘rabbi trust’’ must be funded applies only to the change in control that resulted from the Acquisition, and such requirement was satisfied by Cooper Tire, and not Cooper-Standard Holdings Inc. or us. Any claims for severance or termination benefits described in (i) through (vi), above, will be made against the rabbi trust first and exclusively, except to the extent there are not sufficient assets in the trust in which event the remaining balance due will be payable by us. Upon termination without cause or for good reason (as those terms are defined in the agreement) following December 31, 2007, during the term of the agreement and prior to a change of control (as defined in our Change of Control

79

Table of ContentsSeverance Pay Plan (described below)), subject to execution of an effective release of claims, Mr. McElya will be entitled to: (i) a lump sum payment equal to Mr. McElya’s average annual compensation, including base salary and any annual and long term incentive compensation earned during the five calendar years prior to termination, during the remainder of the employment term; (ii) a lump sum payment equal to the actuarial equivalent of two additional years of service credit under Mr. McElya’s retirement plans; and (iii) lifetime life, accident, and health insurance benefits substantially similar to those to which Mr. McElya and his family were entitled immediately prior to termination, reduced by comparable benefits received.

The agreement provides for a gross-up payment for excise tax imposed by Section 4999 of the Code related to excess parachute payments, and we will pay for any legal fees incurred by Mr. McElya associated with the interpretation, enforcement, or defense of his rights under the agreement. Pursuant to the agreement, Mr. McElya is subject to a non-disclosure covenant at all times and a non-competition and non-solicitation covenant during employment and for two years following termination.

Certain Executives (excluding Mr. McElya). Seven of our executives (excluding Mr. McElya) each entered into an employment agreement with us for a term from December 23, 2004 through December 31, 2007, with automatic one-year extensions commencing on December 31, 2007 and each December 31 thereafter, unless either party gives 60 days prior written notice. During the term of the agreement, each executive receives a base salary and an annual bonus award based on achievement of annual performance targets; participates in our long-term incentive compensation programs as are generally provided to other senior executives; participates in our Change of Control Severance Pay Plan (described below); and participates in employee benefit plans, including health, life, disability, retirement, and fringe benefits that are substantially comparable in the aggregate to the level of such benefits provided by Cooper Tire immediately prior to the closing of the Acquisition, subject to reduction that applies to other of our senior executives.

With respect to any termination without cause or resignation for good reason (as defined in the agreements) during the term of the agreement on or prior to December 23, 2006, the executive will be entitled to his or her accrued rights through termination; provided that each executive will be entitled to payments and benefits under the Cooper Tire & Rubber Company Change in Control Severance Pay Plan with certain modifications. The requirement under the Cooper Tire & Rubber Company Change in Control Severance Pay Plan that upon a change in control (as defined therein) a ‘‘rabbi trust’’ be funded was satisfied by Cooper Tire, and not Cooper-Standard Holdings Inc. or us. Any claims for severance or termination benefits will be made against the rabbi trust first and exclusively, except to the extent there are not sufficient assets in the trust in which event the remaining balance due will be payable by us. With respect to any termination without cause or resignation for good reason (as defined in the agreements) during the term of the agreement prior to a change of control (as defined therein) and following December 23, 2006, subject to execution of an effective release of claims, the agreements may provide that the executive will be entitled to: (i) accrued base salary and pro rata accrued incentive compensation through termination; (ii) a lump sum payment of two (for members of Operations Committee one for others) times the sum of (x) base salary and (y) target annual incentive compensation for the year of termination; and (iii) a lump sum payment of value of two (for members of Operations Committee one for others) years additional service credit under our tax qualified retirement plan; and (iv) two years continued life, accident, and health insurance coverage on the same basis applicable to our active employees.

Another of our executives entered into an agreement with us with a term from January 1, 2006 through December 31, 2007 with substantially the same provisions as the above with the exception that the provisions relating to the Cooper Tire & Rubber Company Change in Control Severance Pay Plan were omitted. Pursuant to the above agreement, each executive is subject to a non-disclosure covenant at all times, an intellectual property covenant, and a non-competition and non-solicitation covenant during employment and for two years following termination.

80

Table of ContentsChange of Control Severance Pay Plan

Our top nine executives are entitled to participate in our Change of Control Severance Pay Plan (the ‘‘Plan’’). The Plan has a term from December 23, 2004 until the later of December 31, 2006 or the second anniversary of a change of control (as defined in the Plan); provided that on each December 31, commencing with 2004, the termination date will automatically be extended for an additional year unless, not later than 120 calendar days prior to such date, we shall have given written notice to the executives. If an executive’s employment is terminated following a change of control without cause or for the reasons enumerated in the Plan, the Plan provides that he or she shall be entitled to receive, subject to execution of an effective release of claims: (i) a lump sum payment equal to his or her base salary; (ii) a pro rata portion of any annual bonus or long-term cash incentive compensation, if any, the executive would have received in respect of such year based upon the percentage of the year that shall have elapsed through the date of termination, payable when it would otherwise have been payable had executive’s employment continued; (iii) a lump sum payment equal to three (for the Chief Executive Officer), two (for Operations Committee members), one (for Management Group members), or the multiple set forth in a committee action times the sum of (a) base salary, plus (b) target annual incentive cash compensation for the year prior to the change of control; (iv) a lump sum payment equal to the actuarial equivalent of three (for the Chief Executive Officer), two (for Operations Committee members), one (for Management Group members) additional years of service credit (or the period set forth in a committee action) under the executive’s retirement plans plus the retirement pension the executive has accrued under the applicable nonqualified supplemental retirement plan; (v) three years (for the Chief Executive Officer) and two years (for other executives) of continued life, accident, and health insurance, reduced by comparable benefits received during such period; (v) lifetime retiree medical and life insurance coverage; and (vi) outplacement services up to 15% of base salary.

The Plan provides for a gross-up payment for excise tax imposed by Section 4999 of the Code related to excess parachute payments. Upon a change of control or within five business days of Cooper-Standard Holdings Inc.’s Board of Directors’ declaration that a change of control is imminent, the Plan requires funding of severance and gross-up amounts into a rabbi trust for the benefit of the affected executives. We will pay for any legal fees incurred by an executive associated with the interpretation, enforcement, or defense of his or her rights under the Plan. Pursuant to the Plan, each executive is subject to a non-disclosure covenant at all times and a non-competition and non-solicitation covenant during employment and for two years following termination.

81

Table of ContentsSECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

Cooper-Standard Holdings Inc. owns 100% of the issued and outstanding common stock of Cooper-Standard Automotive Inc., which in turn wholly owns, directly or indirectly, all of the subsidiary guarantor registrants. The following table and accompanying footnotes show information regarding the beneficial ownership of the issued and outstanding common stock of Cooper-Standard Holdings Inc. as of March 21, 2006 by (i) each person known by us to beneficially own more than 5% of the issued and outstanding common stock of Cooper-Standard Holdings Inc., (ii) each of our directors, (iii) each named executive officer and (iv) all directors and executive officers as a group.

|  |  |  |  |  |  |  |  |  |  |  |  |  |  |

| Name and beneficial owner |  | Number |  | Percent |  | |

| The Cypress Group L.L.C. (1) |  | | 1,590,000 | |  | | 49.1 | % |  | | | |

| The Goldman Sachs Group, Inc. (2) |  | | 1,590,000 | |  | | 49.1 | |  | | | |

| James S. McElya |  | | 20,000 | |  | * |  | | | |

| S.A. (Tony) Johnson |  | | 5,000 | |  | * |  | | | |

| Kenneth L. Way |  | | 2,500 | |  | * |  | | | |

| John C. Kennedy |  | | 1,000 | |  | * |  | | | |

| Michael F. Finley (3) |  | | — | |  | | — | |  | | | |

| Gerald J. Cardinale (4) |  | | — | |  | | — | |  | | | |

| Jack Daly (4) |  | | — | |  | | — | |  | | | |

| Leo F. Mullin (4) |  | | 1,000 | |  | * |  | | | |

| Larry J. Beard |  | | 5,000 | |  | * |  | | | |

| Edward A. Hasler |  | | 2,700 | |  | * |  | | | |

| James W. Pifer |  | | 4,500 | |  | * |  | | | |

| Allen J. Campbell |  | | 3,150 | |  | * |  | | | |

| All directors and executive officers as a group (12 persons) |  | | 44,850 | |  | | 1.4 | % |  | | | |

|

|  |

| * | less than 1%. |

|  |

| (1) | Includes 64,114 shares of common stock owned by Cypress Merchant Banking II C.V., 1,508,152 shares of common stock owned by Cypress Merchant Banking Partners II L.P., 14,554 shares of common stock owned by 55th Street Partners II L.P. (collectively, the ‘‘Cypress Funds’’) and 3,180 shares owned by Cypress Side-by-Side L.L.C. Cypress Associates II L.L.C. is the managing general partner of Cypress Merchant Banking II C.V. and the general partner of Cypress Merchant Banking Partners II L.P. and 55th Street Partners II L.P., and has voting and investment power over the shares held or controlled by each of these funds. Certain executives of The Cypress Group L.L.C., including Messrs. Jeffrey Hughes and James Stern, may be deemed to share beneficial ownership of the shares shown as beneficially owned by the Cypress Funds. Each of such individuals disclaims beneficial ownership of such shares. Cypress Side-By-Side L.L.C. is a sole member-L.L.C. of which Mr. James A. Stern is the sole member. The business address of these entities is c/o The Cypress Group L.L.C., 65 East 55th Street, New York, New York 10022. |

|  |

| (2) | The Goldman Sachs Group, Inc. (‘‘GS Group’’) and certain affiliates, may be deemed to own beneficially and indirectly in the aggregate 1,590,000 shares of common stock which are owned directly or indirectly by investment partnerships, of which affiliates of the GS Group are the general partner or managing general partner. The GS Group and their respective beneficial ownership of shares of our common stock are: (a) GS Capital Partners 2000, L.P. 899,797 shares, (b) GS Capital Partners 2000 Offshore, L.P. 326,952 shares, (c) GS Capital Partners 2000 GmbH & Co. Beteiligungs KG 37,609 shares, (d) GS Capital Partners 2000 Employee Fund, L.P. 285,892 shares and (e) Goldman Sachs Direct Investment Fund 2000, L.P. 39,750 shares. The GS Group disclaims beneficial ownership of the shares owned directly or indirectly by its affiliates, except to the extent of their pecuniary interest therein, if any. The business address of these entities is c/o GS Capital Partners 2000, 85 Broad St., New York, New York 10004. |

82

Table of Contents |  |

| (3) | Mr. Finley is a Managing Director of The Cypress Group L.L.C. Mr. Finley disclaims beneficial ownership of any shares held or controlled by the Cypress Funds or their affiliates. |

|  |

| (4) | Mr. Cardinale is a Managing Director and Partner in Goldman, Sachs & Co.'s Principal Investment Area. Mr. Daly is a Vice President in Goldman, Sachs & Co.'s Principal Investment Area. Mr. Mullin is a Senior Advisor to GS Capital Partners. Each of Messrs. Cardinale, Daly, and Mullin disclaim beneficial ownership of any shares held or controlled by these entities or their affiliates. |

83

Table of ContentsCERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS

Stockholders Agreement

In connection with the Acquisition, Cooper-Standard Holdings Inc. entered into a stockholders agreement with entities affiliated with Cypress, entities affiliated with GS Capital Partners (each a ‘‘Sponsor Entity’’ and together the ‘‘Sponsor Entities’’) and certain members of senior management that provides for, among other things,

|  |  |

| • | a right of the Sponsor Entities to designate a certain number of directors to Cooper-Standard Holdings Inc.'s Board of Directors for so long as they hold a certain amount of Cooper-Standard Holdings Inc.'s common stock. Cypress and GS Capital Partners each have the right to designate three members of our Board of Directors, the chief executive officer is designated as a member, and up to four outside directors are designated to the Board; |

|  |  |

| • | certain limitations on transfers of Cooper-Standard Holdings Inc.'s common stock held by the Sponsor Entities for a period of five years after the completion of the Acquisition, after which, if Cooper-Standard Holdings Inc. has not completed an initial public offering, any Sponsor Entity wishing to sell any of its Cooper-Standard Holdings Inc.'s common stock must first offer to sell such stock to Cooper-Standard Holdings Inc. and the Sponsor Entities, provided that, if Cooper-Standard Holdings Inc. completes an initial public offering, any Sponsor Entity may sell pursuant to its registration rights as described below; |

|  |  |

| • | certain limitations on transfers of Cooper-Standard Holdings Inc.'s common stock held by management stockholders for a period of seven years after the completion of the Acquisition, after which, if Cooper-Standard Holdings Inc. has not undergone a ‘‘change of control’’ or completed a ‘‘qualified initial public offering’’ resulting in either the sale of at least 25% of the then outstanding shares of Common Stock of Cooper-Standard Holdings Inc. or in gross proceeds of at least 50% of Sponsor Entities' equity investment in Cooper-Standard Holdings Inc., any sale of Cooper-Standard Holdings Inc.'s common stock by a management stockholder is subject to a right of first refusal in favor of Cooper-Standard Holdings Inc.; provided that, if Cooper-Standard Holdings Inc. completes an initial public offering, any management stockholder may sell pursuant to ‘‘piggyback’’ registration rights as described below; |

|  |  |

| • | a consent right for the Sponsor Entities with respect to certain corporate actions; |

|  |  |

| • | the ability of the Sponsor Entities and management stockholders to ‘‘tag-along’’ their shares of Cooper-Standard Holdings Inc.'s common stock to sales by the Sponsor Entities, and the ability of the Sponsor Entities to ‘‘drag-along’’ Cooper-Standard Holdings Inc.'s common stock held by the other Sponsor Entities and management stockholders under certain circumstances; |

|  |  |

| • | the right of the Sponsor Entities and management stockholders to purchase a pro rata portion of all or any part of any new securities offered by Cooper-Standard Holdings Inc.; and |

|  |  |

| • | the right of Cooper-Standard Holdings Inc. and the Sponsor Entities to purchase the shares held by a management stockholder if a management stockholder's employment is terminated. |

Registration Rights Agreement

In connection with the Acquisition, Cooper-Standard Holdings Inc. entered into a registration rights agreement with the Sponsor Entities and management stockholders pursuant to which the Sponsor Entities are entitled to certain demand and piggyback rights and the management stockholders are entitled to certain piggyback rights with respect to the registration and sale of Cooper-Standard Holdings Inc.'s common stock held by them.

Transaction Fee Agreement

In connection with the Acquisition and related financing transactions, affiliates of the Sponsors entered into transaction fee agreements with us relating to certain structuring and advisory services

84

Table of Contentsthat affiliates of the Sponsors provided to us for aggregate transaction and advisory fees of $12 million that were paid upon closing of the Acquisition. We agreed to indemnify the Sponsors and their respective affiliates, directors, officers, and representatives for losses relating to the services contemplated by the transaction fee agreements and the engagement of affiliates of the Sponsors pursuant to, and the performance by them of the services contemplated by, the transaction fee agreements.

85

Table of ContentsDESCRIPTION OF OTHER INDEBTEDNESS

Senior Credit Facilities

The senior credit facilities are provided by a syndicate of banks and other financial institutions led by Deutsche Bank Trust Company Americas, as administrative agent, Deutsche Bank Securities Inc., as joint lead arranger and joint bookrunner, Lehman Commercial Paper Inc., as syndication agent, Lehman Brothers Inc., as joint lead arranger and joint bookrunner, and Goldman Sachs Credit Partners L.P., UBS Securities LLC, and The Bank of Nova Scotia, each as a co-documentation agent.

The senior credit facilities provide senior secured financing consisting of:

|  |

| • | Term Loan A facility to our Canadian subsidiary, Cooper-Standard Automotive Canada Limited (the "Canadian Borrower") in Canadian dollars with a maturity in 2010 and a loan balance of approximately U.S. $47.5 as of December 31, 2005; |

|  |

| • | Term Loan B facility to the Canadian Borrower in U.S. dollars with a maturity in 2011 and a loan balance of $113.9 as of December 31, 2005; |

|  |

| • | Term Loan C facility to us in U.S. dollars with a maturity in 2011 and a loan balance of $183.2 as of December 31, 2005; |

|  |

| • | Term Loan D facility to us structured in two tranches with a maturity in 2011, with $190 million borrowed in U.S. dollars and €20.7 borrowed in Euros; and |

|  |

| • | $125 million of revolving credit facilities with a maturity in 2010, $25 million of which is available to the Canadian Borrower in U.S. or Canadian dollars; |

In addition, upon the occurrence of certain events, we or the Canadian Borrower may request additional term loan facilities and/or an increase to the existing term loan facilities in an amount not to exceed $150 million in the aggregate, subject to receipt of commitments by existing term loan lenders or other financing institutions and certain other conditions.

The Term Loan A, Term Loan B and Term Loan C facilities were entered into on December 23, 2004 in connection with the Acquisition. Cooper-Standard Automotive Inc. is the borrower under the Term Loan C facility and the U.S. dollar denominated revolving credit facility. The Canadian Borrower is borrower under the Term Loan A facility, the Term Loan B facility, and the multicurrency revolving credit facility. The Term Loan A facility and a portion of the multicurrency revolving facility are obligations of the Canadian Borrower in Canadian dollars. The multicurrency revolving credit facility includes $5 million available for letters of credit and the U.S. dollar denominated revolving credit facility includes $40 million available for letters of credit. The U.S. dollar denominated revolving credit facility also provides for $20 million available for borrowings on same-day notice, referred to as the swingline loans. Undrawn amounts under the multicurrency revolving credit facility and the U.S. dollar denominated revolving credit facility are available on a revolving credit basis for general corporate purposes of the applicable borrower and its subsidiaries.

On February 6, 2006, in conjunction with the closing of the FHS acquisition, we entered into an amendment to the senior credit facilities which established a Term Loan D facility, with a notional amount of $215 million. The Term Loan D facility was structured in two tranches, with $190 million borrowed in US dollars and €20.7 million borrowed in Euros.

Interest Rate and Fees

Borrowings under the senior credit facilities denominated in U.S. dollars bear interest at a rate equal to an applicable margin plus, at our or the Canadian Borrower's option, as applicable, either (a) a base rate determined by reference to the higher of (1) the prime rate of Deutsche Bank Trust Company Americas (or another bank of recognized standing reasonably selected by the administrative agent) and (2) the federal funds rate plus 0.5% or (b) LIBOR rate determined by reference to the costs of funds for deposits in U.S. dollars for the interest period relevant to such borrowing adjusted for certain additional costs. Borrowings under the senior credit facilities denominated in Canadian

86

Table of Contentsdollars bear interest at a rate equal to an applicable margin plus, at the Canadian Borrower's option, either (a) an adjusted Canadian prime rate determined by reference to the higher of (1) the prime rate of Deutsche Bank AG, Canada Branch for commercial loans made in Canada in Canadian dollars and (2) the average rate per annum for Canadian dollar bankers' acceptances having a term of 30 days that appears on Reuters Screen CDOR Page plus 0.75% or (b) bankers' acceptances rate determined by reference to the average discount rate on bankers' acceptances as quoted on Reuters Screen CDOR Page or as quoted by certain Canadian reference lenders.

In addition to paying interest on outstanding principal under the senior credit facilities, we are required to pay a commitment fee to the lenders under the revolving credit facilities in respect of the unutilized commitments thereunder at a rate equal to 0.50% per annum. We also pay customary letter of credit fees.

Prepayments

The senior credit facilities require us to prepay outstanding term loans, subject to certain exceptions, with:

|  |

| • | 50% (which percentage will be reduced to 25% if our leverage ratio is less than 3.25 to 1.00 and to 0% if our leverage ratio is less than 2.50 to 1.00) of our excess cash flow for each fiscal year beginning with the fiscal year ending December 31, 2005; |

|  |

| • | 100% of the net cash proceeds of asset sales and casualty and condemnation events, in each case if we do not reinvest those proceeds in assets to be used in our business within 360 days following the date of receipt of the net cash proceeds subject to certain limitations; and |

|  |

| • | 100% of the net proceeds of any incurrence of debt other than debt permitted under the senior credit facilities, subject to certain exceptions. |

We may voluntarily repay outstanding loans under the senior credit facilities, other than advances maintained as bankers' acceptances, at any time without premium or penalty, other than customary "breakage" costs with respect to certain eurocurrency or LIBOR loans.

Amortization

The Term Loan A facility amortizes in equal quarterly installments of C$1.538 million for the fiscal quarters in 2005 and 2006, C$2.308 million for the fiscal quarters in 2007 and 2008 and C$3.846 million for the fiscal quarters in 2009 and 2010.

The Term Loan B facility amortizes each year in an amount equal to 1% per annum in equal quarterly installments for the first six years and nine months, with the remaining amount payable on December 23, 2011.

The Term Loan C facility amortizes each year in an amount equal to 1% per annum in equal quarterly installments for the first six years and nine months, with the remaining amount payable on December 23, 2011.

Both tranches of the Term Loan D facility amortize each year in an amount equal to 1% per annum in equal quarterly installments for the first four years and eleven months, with the remaining amount payable on December 23, 2011.

Principal amounts outstanding under the revolving credit facilities will be due and payable in full at maturity, six years from the date of the closing of the senior credit facilities.

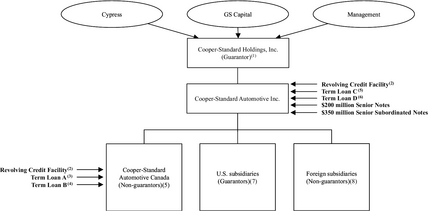

Guarantee and security

All obligations under the senior credit facilities are unconditionally guaranteed by Cooper-Standard Holdings Inc. and, subject to certain exceptions, each of our existing and future direct and indirect wholly-owned domestic subsidiaries, referred to collectively as U.S. Guarantors. In addition, all obligations of the Canadian Borrower under the senior credit facilities are unconditionally guaranteed by each existing and future direct and indirect wholly-owned Canadian subsidiary of Cooper-Standard Holdings Inc., referred to collectively, as Canadian Guarantors.

87

Table of ContentsAll obligations under the senior credit facilities, and the guarantees of those obligations, are secured by substantially all the assets of Cooper-Standard Holdings Inc., us and each U.S. Guarantor, including, but not limited to, the following, and subject to certain exceptions:

|  |

| • | a pledge of 100% of our capital stock, 100% of the equity interests of each U.S. Guarantor and 65% (or 100% in the case of equity interests securing obligations of the Canadian Borrower under the senior credit facilities) of the equity interests of each of our foreign subsidiaries that are directly owned by us or any one or more of the U.S. Guarantors; and |

|  |

| • | a security interest in substantially all tangible and intangible assets of Cooper-Standard Holdings Inc., us and each U.S. Guarantor. |

In addition, the obligations of the Canadian Borrower under the senior credit facilities and Canadian guarantees of such obligations are, subject to certain exceptions, secured by the following:

|  |

| • | a pledge of the equity interests of each direct and indirect subsidiary of the Canadian Borrower and each Canadian Guarantor; and |

|  |

| • | a security interest in substantially all tangible and intangible assets of the Canadian Borrower and each Canadian Guarantor. |

Certain covenants and events of default