As filed with the Securities and Exchange Commission on April 25, 2016

Securities Act File No. 333-

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-14

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

| Pre-Effective Amendment | |

| No. __ | ¨ |

| Post-Effective Amendment | |

| No. __ | ¨ |

(Check appropriate box or boxes)

Mercer Funds

(Exact Name of Registrant as Specified in Charter)

99 High Street Boston, Massachusetts 02110 (Address of Principal Executive Offices) Registrant’s Telephone Number: (617) 747-9500 Scott M. Zoltowski, Esq. Mercer Investment Management, Inc. 99 High Street Boston, Massachusetts 02110 (Name and Address of Agent for Service) |

Copy to: Patrick W. D. Turley, Esq. Dechert LLP 1900 K Street, NW Washington, DC 20006 (202) 261-3300 |

Approximate Date of Proposed Public Offering: As soon as practicable after this Registration Statement becomes effective.

It is proposed that this Registration Statement will become effective on May 25, 2016 pursuant to Rule 488.

No filing fee is due because an indefinite number of shares of beneficial interest have been deemed to be registered in reliance on Section 24(f) under the Investment Company Act of 1940, as amended.

mercer FUNDS

Mercer US Large Cap Value Equity Fund

99 High Street

Boston, Massachusetts 02110

May [ ], 2016

Dear Shareholder:

The Board of Trustees (the “Board”) of the Mercer Funds (the “Trust”) has recently approved an Agreement and Plan of Reorganization relating to your fund, the Mercer US Large Cap Value Equity Fund, a series of the Trust (the “Acquired Fund”). Under the Agreement and Plan of Reorganization, the Acquired Fund would be combined with the Mercer US Large Cap Growth Equity Fund (the “Acquiring Fund”), another series of the Trust, in a tax-free reorganization (the “Reorganization”).

In addition, the Board also approved a repositioning of the Acquiring Fund (as described further below), which is designed to combine certain aspects of the strategies and investment management activities of the Acquired Fund and the Acquiring Fund (the “Acquiring Fund Repositioning”), which will be implemented immediately upon the closing of the Reorganization.

The Board unanimously approved the Reorganization of the Acquired Fund with and into the Acquiring Fund after considering the recommendation of Mercer Investment Management, Inc. (the “Advisor”), the investment advisor to both Funds, and concluding that the Reorganization would be in the best interests of the Acquired Fund and its shareholders. The Reorganization is expected to occur on or about June 30, 2016. Upon completion of the Reorganization, you will become a shareholder of the Acquiring Fund, and you will receive Class Y-3 shares of the Acquiring Fund equal in value to your Class Y-3 shares of the Acquired Fund on the closing date of the transaction. The Reorganization is expected to be tax-free to you for Federal income tax purposes, and no commission, redemption fee or other transactional fee will be charged as a result of the Reorganization.

The Reorganization is intended to correspond with the planned Acquiring Fund Repositioning, which is expected to occur on or about July 1, 2016, and which involves, among other things: (i) the implementation of new principal investment strategies for the Repositioned Acquiring Fund in order to reflect a “core equity” investment approach in replacement of its current “growth equity” investment approach; (ii) changing the Acquiring Fund’s name from Mercer US Large Cap Growth Equity Fund to Mercer US Large Cap Equity Fund (the “Repositioned Acquiring Fund”); (iii) the termination of the current subadvisory agreement between the Advisor, on behalf of the Acquiring Fund, and Sands Capital Management, LLC, an existing subadvisor to the Acquiring Fund; and (iv) the retention of Brandywine Global Investment Management, LLC and O’Shaughnessy Asset Management, LLC, two of the existing subadvisors to the Acquired Fund, and the appointment of AJO, LP as new Subadvisors to the Repositioned Acquiring Fund, all of which is described in greater detail in the accompanying Information Statement/Prospectus.

Neither the Reorganization nor the Acquiring Fund Repositioning require shareholder approval, and you are not being asked to vote on their approval. We do, however, ask that you carefully review the enclosed Information Statement/Prospectus, which contains important information about the Funds, the Reorganization and the Acquiring Fund Repositioning.

If you have any questions, please call us toll-free at 1-888-887-0619 between 8:30 a.m. and 7:00 p.m., Eastern time, Monday through Friday.

Sincerely,

Richard L. Nuzum, CFA

Trustee, President and Chief Executive Officer

Mercer Funds

THE INFORMATION IN THIS INFORMATION STATEMENT/PROSPECTUS IS NOT COMPLETE AND MAY BE CHANGED. WE MAY NOT SELL THESE SECURITIES UNTIL THE REGISTRATION STATEMENT FILED WITH THE SECURITIES AND EXCHANGE COMMISSION IS EFFECTIVE. THIS INFORMATION STATEMENT/PROSPECTUS IS NOT AN OFFER TO SELL THESE SECURITIES AND IS NOT SOLICITING AN OFFER TO BUY THESE SECURITIES IN ANY STATE WHERE THE OFFER OR SALE IS NOT PERMITTED

Subject to Completion

Dated: April 25, 2016

INFORMATION STATEMENT/PROSPECTUS

May [ ], 2016

INFORMATION STATEMENT FOR:

Mercer US Large Cap Value Equity Fund

99 High Street

Boston, Massachusetts 02110

(888) 887-0619

PROSPECTUS FOR:

Mercer US Large Cap Growth Equity Fund

(to be renamed Mercer US Large Cap Equity Fund)

99 High Street

Boston, Massachusetts 02110

(888) 887-0619

INTRODUCTION

This combined Information Statement and Prospectus (“Information Statement/Prospectus”) is being furnished in connection with: (i) the upcoming reorganization (the “Reorganization”) of the Mercer US Large Cap Value Equity Fund (the “Acquired Fund”), a series of the Mercer Funds, a Delaware statutory trust (the “Trust”), with and into the Mercer US Large Cap Growth Equity Fund, another series of the Trust (the “Acquiring Fund” and together with the Acquired Fund, the “Funds”); and (ii) the planned repositioning of the Acquiring Fund (the “Acquiring Fund Repositioning”), which involves certain subadvisor appointments and terminations with respect to each of the Funds, consisting of: (i) the implementation of new principal investment strategies for the Acquiring Fund which reflect a “core equity” investment approach, and (ii) changing the Acquiring Fund’s name from Mercer US Large Cap Growth Equity Fund to Mercer US Large Cap Equity Fund (the “Repositioned Acquiring Fund”).

This Information Statement/Prospectus is being provided to shareholders of the Acquired Fund to inform you of the pending Reorganization and to provide you with information concerning the Acquiring Fund, as well as information concerning the Repositioned Acquiring Fund. Because shareholders of the Acquired Fund will ultimately hold shares of the Repositioned Acquiring Fund which they will receive

immediately following the closing of the Reorganization, this Information Statement/Prospectus also serves as a Prospectus for the Repositioned Acquiring Fund.

This Information Statement/Prospectus is for informational purposes only and you do not need to do anything in response to receiving it. We are not asking you for a proxy or written consent, and you are requested not to send us a proxy or written consent.

This Information Statement/Prospectus, which should be read and retained for future reference, sets forth concisely the information about the Acquiring Fund that a shareholder should know before investing. A Statement of Additional Information (the “SAI”) relating to this Information Statement/Prospectus dated May [ ], 2016, containing additional information about the Reorganization and the Funds, has been filed with the U.S. Securities and Exchange Commission (the “SEC”) and is incorporated herein by reference. You may receive a copy of the SAI without charge by contacting the Funds at 99 High Street, Boston, Massachusetts, or calling toll free 1-888-887-0619.

For more information regarding the Acquiring Fund, see the Prospectus and SAI for the Acquiring Fund dated July 31, 2015, which have been filed with the SEC and which are incorporated herein by reference. The annual report of each of the Funds for the fiscal year ended March 31, 2015, and the semi-annual report of each of the Funds for the six-month period ended September 30, 2015, which highlight certain important information such as investment results and financial information for the Funds, and which have been filed with the SEC, are incorporated herein by reference. You may receive copies of each of the Prospectuses, SAIs and shareholder reports mentioned above without charge by contacting the Funds directly at 1-888-887-0619 or visiting the Trust’s Web site, www.mercer.us/mutual-funds-on-offer.

You also can copy and review information about the Funds (including the SAI) at the SEC’s Public Reference Room in Washington, D.C. You may obtain information on the operation of the Public Reference Room by calling the SEC at 202-551-8090 or 1-800-SEC-0330. Reports and other information about the Funds are available on the EDGAR Database on the SEC’s Internet site at http://www.sec.gov. You may obtain copies of this information, after paying a duplicating fee, by electronic request at the following e-mail address: publicinfo@sec.gov, or by writing the SEC’s Public Reference Section, 100 F Street N.E., Washington, D.C. 20549-0102.

THE U.S. SECURITIES AND EXCHANGE COMMISSION HAS NOT APPROVED OR DISAPPROVED THESE SECURITIES, OR DETERMINED THAT THIS INFORMATION STATEMENT/PROSPECTUS IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

TABLE OF CONTENTS

SUMMARY

This Summary is qualified in its entirety by reference to the additional information contained elsewhere in this Information Statement/Prospectus and in the Agreement and Plan of Reorganization, a form of which is attached to this Information Statement/Prospectus as Exhibit A. Shareholders should read this entire Information Statement/Prospectus carefully. For more complete information, please read each Fund’s Prospectus and the Prospectus for the Repositioned Acquiring Fund.

The Reorganization

The Board of Trustees of Mercer Funds (the “Trust”) has approved the Agreement and Plan of Reorganization, which provides for the following:

| · | the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange for shares of beneficial interest of the Acquiring Fund; |

| · | the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund; |

| · | the distribution of Acquiring Fund shares of beneficial interest to the shareholders of the Acquired Fund; and |

| · | the complete termination and liquidation of the Acquired Fund. |

The Agreement and Plan of Reorganization is not subject to approval by shareholders of the Acquired Fund. The Reorganization is scheduled to be effective upon the close of business on June 30, 2016, or on a later date as the parties may agree (the “Closing Date”). As a result of the Reorganization, each shareholder of the Acquired Fund will become the owner of the number of full and fractional Class Y-3 shares of the Acquiring Fund having an aggregate net asset value (“NAV”) equal to the aggregate NAV of the shareholder’s Class Y-3 shares of the Acquired Fund as of the close of business on the Closing Date. See “INFORMATION ABOUT THE REORGANIZATION,” below. It is expected that the Reorganization will be a tax-free reorganization. See “INFORMATION ABOUT THE REORGANIZATION – Tax Considerations,” below.

Board Consideration of the Reorganization

For the reasons set forth below under “Reasons for the Reorganization and Board Considerations,” the Board of Trustees, including all of the Trustees who are not “interested persons” of the Trust, as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), (the “Independent Trustees”), has concluded that the Reorganization is in the best interests of the Acquired Fund and its shareholders, and that the interests of the Acquired Fund’s existing shareholders would not be diluted as a result of the Reorganization. The Board of Trustees has also approved the Reorganization on behalf of the Acquiring Fund and has concluded that the Reorganization is in the best interests of the Acquiring Fund and its shareholders, and that the interests of the Acquiring Fund’s existing shareholders would not be diluted as a result of the Reorganization.

The Repositioning

The Board of Trustees of the Trust has also approved the Repositioning, which involves, among other things:

| · | the implementation of new principal investment strategies for the Repositioned Acquiring Fund which reflect a “core equity” investment approach. |

| · | changing the Acquiring Fund’s name from Mercer US Large Cap Growth Equity Fund to Mercer US Large Cap Equity Fund; |

| | | |

| · | the termination of the subadvisory agreement between Mercer Investment Management, Inc., on behalf of the Acquiring Fund, and Sands Capital Management, LLC, an existing subadvisor to the Acquiring Fund; and |

| · | the retention of Brandywine Global Investment Management, LLC and O’Shaughnessy Asset Management, LLC, two of the existing subadvisors to the Acquired Fund, and the appointment of a new firm, AJO, LP as new Subadvisors to the Acquiring Fund. |

The Repositioning is scheduled to be effective upon the opening of business on July 1, 2016, which is the first business day immediately following the closing of the Reorganization, and, as a result, shareholders of the Acquired Fund will be subject solely to the investment strategies of the Repositioned Acquiring Fund and not of the Acquiring Fund. See “INFORMATION ABOUT THE REPOSITIONING,” below.

The Trust

Both Funds are series of the Trust, an open-end management investment company organized as a Delaware statutory trust. The Trust offers redeemable shares in different classes and series. Both the Acquiring Fund and the Acquired Fund commenced investment operations on August 15, 2005. Both Funds have registered and are authorized to offer interests in four classes of shares: Class S, Class Y-1, Class Y-2 and Class Y-3. The principal difference between the classes of shares is the level of shareholder service, marketing and administrative fees borne by the classes. As of the date of this Information Statement/Prospectus, only the Class Y-3 shares of the Funds had commenced operations.

COMPARISON OF INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES

This section will help you compare the investment objectives and principal investment strategies of the Acquired Fund and the Repositioned Acquiring Fund.

Investment Objectives and Principal Investment Strategies

Both the Acquired Fund and the Repositioned Acquiring Fund have the same investment objective: to provide long-term total return, which includes capital appreciation and income.

While the principal investment strategies of the Acquired Fund and the principal investment strategies proposed for use by the Repositioned Acquiring Fund are similar, there are certain differences, as discussed below. Each Fund invests primarily in equity securities issued by large capitalization U.S. companies.

Set forth below is a side-by-side comparison of the investment objectives and principal investment strategies of each of the Funds.

| | | The Acquired Fund | | The Repositioned Acquiring Fund |

| Investment Objective | | The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. | | The investment objective of the Fund is to provide long-term total return, which includes capital appreciation and income. |

| | | | | |

Principal Investment

Strategies | | The Fund invests principally in equity securities (such as common stock) issued by large capitalization U.S. companies. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes, if any) in the equity securities of large capitalization U.S. companies. For purposes of the 80% test, equity securities include securities such as common stock, preferred stock, and other securities that are not debt securities, cash or cash equivalents. For purposes of this investment policy, the Fund considers “large capitalization U.S. companies” to be U.S. companies, at the time of investment, whose market capitalizations exceed the market capitalization of the smallest company included in the Russell 1000® Value Index, as measured at the end of the preceding month (as of June 30, 2015, $78.6 million). Generally, the Fund invests in stocks that appear to be undervalued based on the stocks’ intrinsic values relative to their current market prices. The Fund may invest in derivative instruments, such as exchange-listed equity futures contracts, to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs. | | The Fund invests principally in equity securities (such as common stock) issued by large capitalization U.S. companies. Under normal circumstances, the Fund will invest at least 80% of its net assets (plus borrowings for investment purposes, if any) in the equity securities of large capitalization U.S. companies. For purposes of the 80% test, equity securities include securities such as common stock, preferred stock, and other securities that are not debt securities, cash or cash equivalents. For purposes of this investment policy, the Fund considers “large capitalization U.S. companies” to be U.S. companies, at the time of investment, whose market capitalizations exceed the market capitalization of the smallest company included in the Russell 1000® Index, as measured at the end of the preceding month (as of June 30, 2015, $36.8 million). The Fund may invest in derivative instruments, such as exchange-listed equity futures contracts, to gain market exposure on cash balances or to reduce market exposure in anticipation of liquidity needs. |

| | | | | |

| Investment Adviser | | Mercer Investment Management, Inc. | | Mercer Investment Management, Inc. |

| | | | | |

| Sub-Advisers | | Brandywine Global Investment Management, LLC O’Shaughnessy Asset Management, LLC Parametric Portfolio Associates LLC Robeco Investment Management, Inc., d/b/a Boston Partners The Boston Company Asset Management, LLC | | Brandywine Global Investment Management, LLC O’Shaughnessy Asset Management, LLC Parametric Portfolio Associates LLC Columbia Management Investment Advisers, LLC HS Management Partners, LLC AJO, LP |

COMPARISON OF FEES AND EXPENSES

The following discussion describes and compares the fees and expenses of the Funds. The Annual Fund Operating Expenses and Example tables shown below are based on actual expenses incurred for the fiscal year ended March 31, 2015 for both Funds. Pro forma numbers are as of September 30, 2015 and are estimated in good faith.

Fees and Expenses

Shareholder Transaction Fees

(fees paid directly from your investment) | | Acquired

Fund –

Class Y-3

Shares(1) | | Acquiring

Fund –

Class Y-3

Shares(2) | | Repositioned

Acquiring

Fund –

Class Y-3

Shares

Pro Forma |

| Redemption Fee on shares owned less than 30 days (as a % of total redemption proceeds) | | 2.00% | | 2.00% | | 2.00% |

| | | | | | | |

Annual Fund Operating Expenses

(expenses that you pay each year as a

percentage of the value of your investment) | | | | | | |

| Management Fees | | 0.53% | | 0.55% | | 0.53%(1) |

| Distribution and/or service (12b-1) Fees | | None | | None | | None |

| Other Expenses(2) | | 0.09% | | 0.08% | | 0.07% |

| Acquired Fund Fees and Expenses | | None | | None | | None |

| Total Annual Fund Operating Expenses | | 0.62% | | 0.63% | | 0.60% |

| 1 | In connection with the Reorganization, effective as of the closing date of the Reorganization, Mercer Investment Management, Inc. has reduced the Management Fees applicable to the Repositioned Acquiring Fund from (i) 0.55% on the first $750 million of Fund assets and 0.53% on all assets in excess of $750 million; to (ii) 0.53% on the first $750 million of Fund assets and 0.51% on all assets in excess of $750 million. |

| 2 | “Other Expenses” include custodial, legal, audit, transfer agent and Trustees’ fees and expenses. |

The following examples are intended to help you compare the costs of investing in each Fund and the combined Fund. The examples assume that you invest $10,000 in each Fund and in the combined Fund after the Reorganization and the Repositioning for the time periods indicated and reflects what you would pay if you close your account at the end of each of the time periods shown. The examples also assume that your investment has a 5% return each year, that all distributions are reinvested and that each Fund’s operating expenses remain the same. Your actual costs may be higher or lower than those presented.

| Fund | | 1 year | | | 3 years | | | 5 years | | | 10 years | |

| Acquired Fund | | | | | | | | | | | | | | | | |

| Class Y-3 Shares | | $ | 63 | | | $ | 199 | | | $ | 346 | | | $ | 774 | |

| | | | | | | | | | | | | | | | | |

| Acquiring Fund | | | | | | | | | | | | | | | | |

| Class Y-3 Shares | | $ | 64 | | | $ | 202 | | | $ | 351 | | | $ | 786 | |

| | | | | | | | | | | | | | | | | |

| Pro Forma Combined (Repositioned Acquiring Fund) | | | | | | | | | | | | | | | | |

| Class Y-3 Shares | | $ | 61 | | | $ | 192 | | | $ | 335 | | | $ | 750 | |

| | | | | | | | | | | | | | | | | |

COMPARISON OF SALES LOAD, DISTRIBUTION AND SHAREHOLDER SERVICING ARRANGEMENTS

As of the date of this Information Statement/Prospectus, only the Class Y-3 shares of the Funds had commenced operations. Class Y-3 shares have the same class-specific features with respect to each Fund. Class Y-3 shares are sold at NAV without any sales charge being imposed.

COMPARISON OF PURCHASE, REDEMPTION AND EXCHANGE POLICIES AND PROCEDURES

The Funds have the same policies with respect to purchases, redemptions and exchanges by shareholders. More complete information regarding the Funds may be found in Exhibit B to this Information Statement/Prospectus.

COMPARISON OF PRINCIPAL RISKS OF INVESTING IN THE FUNDS

The following summarizes and compares the principal risks of investing in the Funds. The fact that a risk is not listed as a principal risk does not necessarily mean that shareholders of that Fund are not subject to that risk. You may lose money on your investment in any Fund. The value of each Fund’s shares may go up or down, sometimes rapidly and unpredictably. Market conditions, financial conditions of issuers represented in a Fund, investment strategies, portfolio management, and other factors affect the volatility of each Fund’s shares.

Similar Risks of the Funds

The Acquired Fund and the Repositioned Acquiring Fund share the same fundamental investment restrictions. Because of the similarities between the investment objectives, strategies and limitations of the Acquired Fund and the investment objective, limitations and strategies of the Repositioned Acquiring Fund, the risks of investing in the Acquired Fund are similar to the risks of investing in the Repositioned Acquiring Fund. Risks that the Acquired Fund and the Repositioned Acquiring Fund share include the following:

Custody Risk. There are risks involved in dealing with the custodians or brokers who settle Fund trades. Securities and other assets deposited with custodians or brokers may not be clearly or constantly identified as being assets of the Fund, and hence the Fund may be exposed to a credit risk with regard to such parties. In some jurisdictions, the Fund may only be an unsecured creditor of its broker in the event of bankruptcy or administration of such broker. Further, there may be practical or time problems associated with enforcing the Fund’s rights to its assets in the case of an insolvency of any such party.

Derivatives Risk. Each Fund may invest in derivative instruments such as exchange-listed equity futures contracts. Derivatives are financial instruments, the values of which depend upon, or are derived from, the value of something else, such as one or more underlying investments, pools of investments, indices, or currencies. A subadvisor may use exchange-listed equity futures contracts to equitize cash held in the portfolio. Derivatives involve special risks and may result in losses. The successful use of derivatives depends on the ability of a subadvisor to manage these sophisticated instruments. The prices of derivatives may move in unexpected ways due to the use of leverage or other factors, especially in unusual market conditions, and may result in increased volatility. The possible lack of a liquid secondary market for derivatives and the resulting inability of a Fund to sell or otherwise close a derivatives position could expose the Fund to losses and could make derivatives more difficult for a Fund to value accurately. Derivatives are also subject to the risk that the other party in the transaction will not fulfill its contractual obligations. Certain derivatives are subject to mandatory central clearing. Central clearing is intended to

reduce counterparty credit risk and increase liquidity, but central clearing does not make derivatives transactions risk-free.

Equity Securities Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. U.S. and global stock markets have experienced periods of substantial price volatility in the past and may do so in the future.

Issuer Risk. The issuer of a security may perform poorly and the value of its stocks or bonds may decline as a result. An issuer of securities held by a Fund could become bankrupt or could default on its issued debt or have its credit rating downgraded.

Large Capitalization Stock Risk. Large-capitalization stocks as a group could fall out of favor with the market, causing a Fund to underperform investments that focus on small- or medium-capitalization stocks. Larger, more established companies may be slow to respond to challenges and may grow more slowly than smaller companies.

Management Techniques Risk. The investment strategies, techniques, and risk analyses employed by the subadvisors, while designed to enhance potential returns, may not produce the desired results or expected returns, which may cause a Fund to not meet its investments objective, or underperform its benchmark index or funds with similar investment objectives and strategies. The subadvisors may be incorrect in their assessments of the values of securities or their assessments of market trends, which can result in losses to a Fund.

Market Risk. The value of the securities in which a Fund invests may be adversely affected by fluctuations in the financial markets, regardless of how well the companies in which a Fund invests perform. The market as a whole may not favor the types of investments a Fund makes. Also, there is the risk that the price(s) of one or more of the securities or other instruments in a Fund’s portfolio will fall, or will fail to rise. Many factors can adversely affect a security’s performance, including both general financial market conditions and factors related to a specific company, government, industry, country, or geographic region.

Portfolio Turnover Risk. Depending on market and other conditions, a Fund may experience high portfolio turnover, which may result in higher brokerage commissions and transaction costs and capital gains (which could increase taxes and, consequently, reduce returns).

Value Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Value stocks represent companies that tend to have lower than average price to earnings ratios and are therefore cheaper than average relative to the companies’ earnings. These companies may have relatively weak balance sheets and, during economic downturns, these companies may have insufficient cash flow to pay their debt obligations and difficulty finding additional financing needed for their operations. A particular value stock may not increase in price, as anticipated by a subadvisor, if other investors fail to recognize the stock’s value or the catalyst that the subadvisor believes will increase the price of the stock does not affect the price of the stock in the manner or to the degree that the subadvisor anticipates. Also, cyclical stocks tend to increase in value more quickly during economic upturns than non-cyclical stocks, but also tend to lose value more quickly in economic downturns.

Distinct Risk of the Repositioned Acquiring Fund

Risk that the Repositioned Acquiring Fund is subject to that the Acquired Fund is not subject to is the following:

Growth Stock Risk. The value of a company’s equity securities is subject to changes in the company’s financial condition, and overall market and economic conditions. Companies with strong growth potential (both domestic and foreign) tend to have higher than average price-to-earnings ratios, meaning that these stocks are more expensive than average relative to the companies’ earnings. The market prices of equity securities of growth companies are often quite volatile, since the prices may be particularly sensitive to economic, market, or company developments and may present a greater degree of risk of loss.

COMPARISON OF PERFORMANCE

Set forth below is performance information for each of the Acquired Fund and the Acquiring Fund. The following performance information provides some indication of the risks of investing in each of the Funds. The bar charts below illustrate how each Fund’s total returns have varied from year to year. The tables below illustrate how each Fund’s average annual total return for the one-year, five-year and ten-year periods compares with a broad-based securities index. Each Fund’s past performance, before and after taxes, is not necessarily an indication of how such Fund will perform in the future. Updated performance is available on the Funds’ website at http://www.mercer.us/ services/investments/investment-opportunities/delegated-solutions/mutual-funds-on-offer.html.

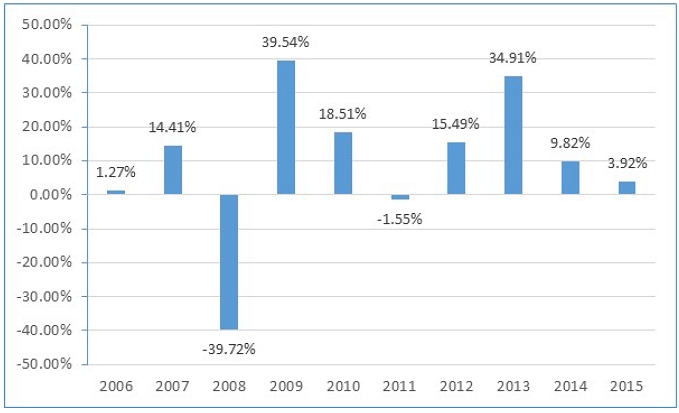

Acquired Fund – Class Y-3 Shares

Calendar Year Total Returns

The Fund’s highest return for a quarter during the periods shown above was 16.39%, for the quarter ended September 30, 2009.

The Fund’s lowest return for a quarter during the periods shown above was -22.05%, for the quarter ended December 31, 2008.

Average Annual Total Returns

For the Periods Ended December 31, 2015 | | | | | | | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years |

| Mercer US Large Cap Value Equity Fund – Class Y-3 Shares | | | | | | | | | | | | |

| Return Before Taxes | | | -5.83 | % | | | 12.07 | % | | | 4.57 | % |

| Return After Taxes on Distributions | | | -9.33 | % | | | 10.12 | % | | | 3.37 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | | -0.55 | % | | | 9.62 | % | | | 3.61 | % |

| Russell 1000® Value Index(1) (reflects no deduction for fees, expenses, or taxes) | | | -3.83 | % | | | 11.27 | % | | | 6.16 | % |

| | | | | | | | | | | | | |

| (1) | The Russell 1000® Value Index measures the performance of those Russell 1000® companies with lower price-to-book ratios and lower forecasted growth values. The index is unmanaged and cannot be invested in directly. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates in effect and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

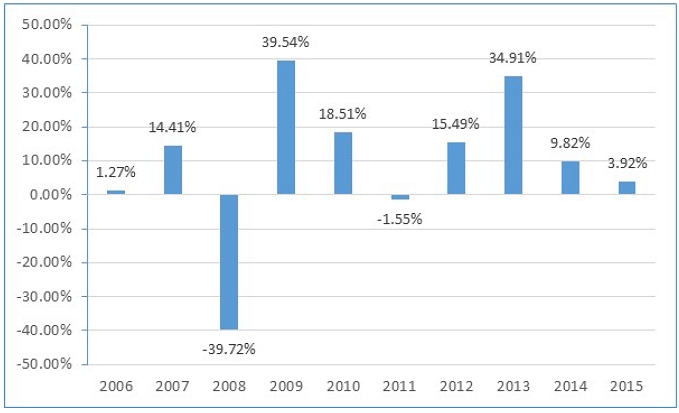

Acquiring Fund – Class Y-3 Shares

Calendar Year Total Returns

The Fund’s highest return for a quarter during the periods shown above was 18.17%, for the quarter ended March 31, 2012.

The Fund’s lowest return for a quarter during the periods shown above was -23.66%, for the quarter ended December 31, 2008.

Average Annual Total Returns

For the Periods Ended December 31, 2015 | | | | | | | | | |

| | | 1 Year | | 5 Years | | 10 Years |

| Mercer US Large Cap Growth Equity Fund – Class Y-3 Shares | | | | | | | | | | | | |

| Return Before Taxes | | | 3.92 | % | | | 11.85 | % | | | 7.29 | % |

| Return After Taxes on Distributions | | | 0.27 | % | | | 8.16 | % | | | 5.40 | % |

| Return After Taxes on Distributions and Sale of Fund Shares | | | 4.15 | % | | | 8.96 | % | | | 5.65 | % |

| Russell 1000® Growth Index(1) (reflects no deduction for fees, expenses, or taxes) | | | 5.67 | % | | | 13.53 | % | | | 8.53 | % |

| (1) | The Russell 1000® Growth Index measures the performance of those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The index is unmanaged and cannot be invested in directly. |

After-tax returns are calculated using the historical highest individual federal marginal income tax rates in effect and do not reflect the impact of state and local taxes. Actual after-tax returns depend on an investor’s situation and may differ from those shown. In addition, the after-tax returns shown are not relevant to investors who hold Fund shares through tax-deferred arrangements, such as 401(k) plans or individual retirement accounts.

INFORMATION ABOUT THE REORGANIZATION

The Agreement and Plan of Reorganization

The terms and conditions under which the proposed Reorganization may be consummated are set forth in the Agreement and Plan of Reorganization. Significant provisions of the Agreement and Plan of Reorganization are summarized below, however, this summary is qualified in its entirety by reference to the form of the Agreement and Plan of Reorganization attached to this Information Statement/Prospectus as Exhibit A.

The Agreement and Plan of Reorganization provides for: (i) the transfer, as of the Closing Date, of all of the assets of the Acquired Fund in exchange for shares of beneficial interest of the Acquiring Fund and the assumption by the Acquiring Fund of all of the Acquired Fund’s liabilities; and (ii) the distribution of shares of the Acquiring Fund to shareholders of the Acquired Fund, as provided for in the Agreement and Plan of Reorganization. The Acquired Fund will then be terminated and liquidated.

After the Reorganization, each shareholder of the Acquired Fund will own Class Y-3 shares of the Acquiring Fund having an aggregate value equal to the aggregate value of the Class Y-3 shares in the Acquired Fund held by that shareholder as of the Closing Date.

The Acquiring Fund and the Acquired Fund have adopted the same valuation policies and procedures and therefore there are no differences between their respective valuation policies and procedures for purposes of valuing assets in each respective Fund.

Until the Closing Date, shareholders of the Acquired Fund will continue to be able to redeem or exchange their shares.

The obligations of the Funds under the Agreement and Plan of Reorganization are subject to various conditions, including receipt of an opinion from legal counsel that the Reorganization will qualify as a tax-free reorganization for Federal income tax purposes. The Agreement and Plan of Reorganization may be terminated by mutual agreement of the parties or on certain other grounds. Please refer to Exhibit A to review the terms and conditions of the Agreement and Plan of Reorganization.

Reasons for the Reorganization and Board Considerations

The proposed Reorganization was presented to the Board of Trustees of the Trust for consideration at meetings held on December 7-8, 2015 and March 17-18, 2016. At each of these meetings, representatives of the Advisor provided, and the Board reviewed, information about the proposed Reorganization. For the reasons discussed below, the Trustees, including all of the Independent Trustees, determined that the Reorganization is in the best interests of both Funds and their shareholders and that the interests of the Funds and their shareholders would not be diluted as a result of the Reorganization. The Board took note of the fact that the Reorganization is being conducted in accordance

with applicable rules under the 1940 Act that permit affiliated mutual funds to be reorganized without obtaining the vote of shareholders if certain conditions are met, and the Board considered that the relevant conditions were satisfied in connection with the Reorganization and that shareholders of the Acquired Fund would receive prior notice of the Reorganization.

Representatives of the Advisor had informed the Board of Trustees that they had determined that the Reorganization would be advisable and in the best interests of the Acquired Fund, the Acquiring Fund, and their shareholders because the primary purpose of the Reorganization is to combine two funds with similar investment strategies into a single fund.

The Board of Trustees of the Trust, in determining to approve the proposed Reorganization, considered a number of factors in connection with this decision. Among the factors considered by the Board were: (1) the terms of the proposed Reorganization, including the anticipated tax-free nature of the transaction for the Funds and their shareholders; (2) that the investment objectives and principal investment strategies of the Funds are similar, although the Repositioned Acquiring Fund will maintain a “core equity” investment approach; (3) the operating expense ratios of the Funds and the potential for lower operating expenses for the Funds as a result of the Reorganization; and (4) that neither the Funds nor their shareholders will bear any costs of the Reorganization because the Advisor has agreed to bear all of the costs of the transaction.

Tax Considerations

The Reorganization is intended to qualify for Federal income tax purposes as a tax-free reorganization under Section 368(a) of the Internal Revenue Code of 1986, as amended. Accordingly, pursuant to this treatment, neither the Acquired Fund nor its shareholders, nor the Acquiring Fund nor its shareholders are expected to recognize any gain or loss for federal income tax purposes from the transactions contemplated by the Agreement and Plan of Reorganization. As a non-waivable condition to the Closing of the Reorganization, the Funds will receive an opinion from the law firm of Dechert LLP, counsel to the Trust, to the effect that the Reorganization will qualify as a tax-free reorganization for Federal income tax purposes. That opinion will be based in part upon certain assumptions and upon certain representations made by the Funds.

Immediately prior to the Reorganization, the Acquired Fund may pay a dividend or dividends which, together with all previous dividends, will have the effect of distributing to its shareholders all of the Acquired Fund’s investment company taxable income for taxable years ending on or prior to the Reorganization (computed without regard to any deduction for dividends paid) and all of its net capital gain, if any, realized in taxable years ending on or prior to the Reorganization (after reduction for any available capital loss carry forward). Such dividends will be included in the taxable income of the Acquired Fund shareholders.

In connection with the Reorganization, it is anticipated that the Acquired Fund will sell certain of its portfolio securities which are not intended to be retained by the Repositioned Acquiring Fund. The sales of these portfolio securities could, under certain circumstances, cause potentially adverse tax results for certain taxable investors because such sales could potentially result in the recognition of capital gains by the Acquired Fund, depending upon the specific circumstances of the portfolio security, which are then passed through to shareholders. If such securities had been sold on September 30, 2015, the sale of these portfolio securities by the Acquired Fund would have totaled approximately $182,191,342 (excluding brokerage costs), but would not have resulted in any capital gains for the Acquired Fund because the transactions would have resulted in net losses for the Acquired Fund. The brokerage costs estimated to be incurred with respect to the sale of these portfolio securities is approximately $60,579 (or approximately $0.0018 per share).

At present, neither the Acquired Fund nor the Acquiring Fund have available any capital loss carryforwards.

You should consult your tax advisor regarding the effect, if any, of the Reorganization in light of your individual circumstances. Since the foregoing discussion only relates to the Federal income tax consequences of the Reorganization, you should also consult your tax advisor as to state and other local tax consequences, if any, of the Reorganization.

Expenses of the Reorganization

Mercer Investment Management is responsible for the expenses related to the Reorganization, other than brokerage costs incurred, and neither of the Funds will bear any of the costs or expenses incurred in connection with carrying out the Reorganization.

INFORMATION ABOUT THE ACQUIRING FUND REPOSITIONING

The Planned Fund Repositioning

At meetings held on December 7-8, 2015 and March 17-18, 2016, the Board considered various matters regarding the proposed Repositioning. Following their consideration of each of the matters presented, the Board, including a majority of the Independent Trustees, at the Advisor’s recommendation, approved the planned Repositioning of the Acquiring Fund, which will involve, among other things: (i) the implementation of new principal investment strategies for the Repositioned Acquiring Fund which reflect a “core equity” investment approach in replacement of its current “growth equity” investment approach; (ii) changing the Acquiring Fund’s name from Mercer US Large Cap Growth Equity Fund to Mercer US Large Cap Equity Fund; (iii) the termination of the subadvisory agreement between the Advisor, on behalf of the Acquiring Fund, and Sands Capital Management, LLC, an existing subadvisor to the Acquiring Fund; and (iv) the retention of Brandywine Global Investment Management, LLC and O’Shaughnessy Asset Management, LLC, two of the existing subadvisors to the Acquired Fund, and the appointment of AJO, LP as new Subadvisors to the Repositioned Acquiring Fund.

It is anticipated that the Repositioning will be effectuated on or about July 1, 2016, at which time the Advisor will transition the Acquiring Fund’s investment activities to a “core equity” investment strategy that will seek to meet the Fund’s investment objective by investing in a range of large cap equity securities, including both growth- and value-oriented equity securities. In addition to the proposed changes to the Acquiring Fund’s principal investment strategies, there would be certain changes to the Fund’s risk profile, among other changes to the Fund.

Set forth below is information about each of the Subadvisors to the Repositioned Acquiring Fund.

Information About the Subadvisors and the Portfolio Managers

The following individuals would be primarily responsible for the day-to-day management of the Repositioned Acquiring Fund. As noted, certain of these individuals have also provided investment management services to the Acquired Fund, as well.

AJO, LP (“AJO”), located at 230 South Broad Street, 20th Floor, Philadelphia, Pennsylvania 19102, is a limited partnership that is wholly owned by its 17 active principals, one of whom, Theodore R. Aronson, is the principal owner.

| · | Theodore R. Aronson, CFA, CIC, Managing Principal, joined AJO as a founder of the firm in 1984. Mr. Aronson will begin managing AJO’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Stefani Cranston, CFA, CPA, Principal, joined AJO in 1991. Ms. Cranston will begin managing AJO’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Gina Marie N. Moore, CFA, Principal, joined AJO in 1998. Ms. Moore will begin managing AJO’s allocated portion of the Repositioned Acquiring Fund on July, 2016. |

| · | Gregory R. Rogers, CFA, Principal, joined AJO in 1993. Mr. Rogers will begin managing AJO’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Christopher J.W. Whitehead, CFA, Principal, joined AJO in 2000. Mr. Whitehead will begin managing AJO’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

Brandywine Global Investment Management, LLC (“Brandywine”), located at 2929 Arch Street, Suite 800, Philadelphia, Pennsylvania 19104, is a wholly owned subsidiary of Legg Mason, Inc.

| · | Patrick Kaser, Portfolio Manager and lead of the Large Cap Value Equity Team, joined Brandywine in 1998. Mr. Kaser began managing Brandywine’s allocated portion of the Acquired Fund’s portfolio in 2011 and will begin managing Brandywine’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | James Clarke, Portfolio Manager and back-up portfolio manager of the Large Cap Value Equity Team, rejoined the Firm in 2008. Mr. Clarke began managing Brandywine’s allocated portion of the Acquired Fund’s portfolio in 2011 and will begin managing Brandywine’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

Columbia Management Investment Advisers, LLC (“Columbia”), located at 225 Franklin Street, Boston, Massachusetts 02110, is a wholly-owned subsidiary of Ameriprise Financial, Inc.

| · | Thomas Galvin, CFA, Senior Portfolio Manager and Head of Focused Large Cap Growth, joined Columbia in May 2010. Mr. Galvin began managing Columbia’s allocated portion of the Acquiring Fund’s portfolio in April 2014 and will begin managing Columbia’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Richard Carter, Senior Portfolio Manager, joined Columbia in May 2010. Mr. Carter began managing Columbia’s allocated portion of the Acquiring Fund’s portfolio in April 2014 and will begin managing Columbia’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Todd Herget, Senior Portfolio Manager, joined Columbia in May 2010. Mr. Herget began managing Columbia’s allocated portion of the Acquiring Fund’s portfolio in April 2014 and will begin managing Columbia’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

HS Management Partners, LLC (“HSMP”), located at 598 Madison Avenue, New York, New York 10022, is a Delaware limited liability company that is privately owned by 100% by its partners.

| · | Harry W. Segalas, Managing Partner & Chief Investment Officer, founded HS Management Partners in 2007. Mr. Segalas began managing HSMP’s allocated portion of the Acquiring Fund’s portfolio in April 2014 and will begin managing HSMP’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

O’Shaughnessy Asset Management, LLC (“O’Shaughnessy”), located at 6 Suburban Avenue, Stamford, Connecticut 06901, is 90% employee-owned, and The Royal Bank of Canada is a minority stakeholder in the firm, owning a passive member interest.

| · | James O’Shaughnessy, Chief Executive Officer, Chief Investment Officer, and Chairman of O’Shaughnessy since 2007. Mr. O’Shaughnessy began managing O’Shaughnessy’s allocated |

| | portion of the Acquired Fund’s portfolio in 2010 and will begin managing O’Shaughnessy’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Christopher Meredith, Senior Portfolio Manager and Director of Portfolio Management and Research of O’Shaughnessy since 2007. Mr. Meredith began managing O’Shaughnessy’s allocated portion of the Acquired Fund’s portfolio in 2010 and will begin managing O’Shaughnessy’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

Parametric Portfolio Associates LLC (“Parametric”), headquartered at 1918 Eighth Avenue, Suite 3100, Seattle, Washington 98101, is majority-owned by Eaton Vance Corp., a publicly traded company.

| · | Justin Henne, CFA, Managing Director, Customized Exposure Management, joined The Clifton Group in 2004, which was acquired by Parametric in 2012. Mr. Henne began managing Parametric’s allocated portion of each Fund’s portfolio in February 2015 and will begin managing Parametric’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Ricky Fong, CFA, Portfolio Manager, joined The Clifton Group in 2010, which was acquired by Parametric in 2012. Mr. Fong began managing Parametric’s allocated portion of each Fund’s portfolio in February 2015 and will begin managing Parametric’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

| · | Matt Liebl, CFA, Portfolio Manager, joined the Clifton Group in 2007, which was acquired by Parametric in 2012. Mr. Liebl began managing Parametric’s allocated portion of each Fund’s portfolio in February 2015 and will begin managing Parametric’s allocated portion of the Repositioned Acquiring Fund on July 1, 2016. |

ADDITIONAL INFORMATION ABOUT THE FUNDS AND THE REPOSITIONED ACQUIRING FUND

Investment Adviser

Mercer Investment Management, Inc., a Delaware corporation located at 99 High Street, Boston, Massachusetts 02110, serves as the investment advisor to the Funds. The Advisor is an indirect, wholly-owned subsidiary of Marsh & McLennan Companies, Inc. The Advisor is registered as an investment advisor with the SEC. The Advisor is an affiliate of Mercer Investment Consulting LLC (“Mercer IC”), an investment consultant that among other things, reviews, rates and recommends investment managers for its clients, including Subadvisors recommended by the Advisor and utilized by the Trust.

The Advisor has overall supervisory responsibility for the general management and investment of each Fund’s securities portfolio, and, subject to review and approval by the Board of Trustees: (i) sets the Funds’ overall investment strategies; (ii) evaluates, selects, and recommends subadvisors to manage all or part of the Funds’ assets; (iii) when appropriate, allocates and reallocates the Funds’ assets among subadvisors; (iv) monitors and evaluates the performance of subadvisors, including the subadvisors’ compliance with the investment objectives, policies, and restrictions of the Funds; and (v) implements procedures to ensure that the subadvisors comply with the Funds’ investment objectives, policies, and restrictions.

When identifying possible subadvisors, the Advisor typically begins with a universe of investment managers rated highly by the Manager Research Group of Mercer IC (the “Mercer Research Group”). The Mercer Research Group evaluates each investment manager based upon both quantitative and qualitative factors, including: an assessment of the strength of the overall investment management organization; the people involved in the investment process; the appropriateness of the investment product and its composites; and an analysis of the investment manager’s investment philosophy and process, risk-adjusted performance, consistency of performance, and the style purity of the product. The Advisor’s team of investment professionals reviews each manager that is highly rated by the Mercer Research Group, and creates a short list for further analysis. Short-list candidates are scrutinized to

evaluate performance and risk characteristics, performance in up and down markets, investment styles, and characteristics of the securities held in the portfolio. The Advisor’s team of investment professionals then conducts due diligence meetings with the subadvisors’ portfolio management teams. The list of candidates is further narrowed, and each potential subadvisor, in combination with the existing subadvisor(s) of the portfolio, is analyzed using proprietary methods. The most compatible subadvisor candidates are then put through an on-site compliance review conducted by the Advisor’s compliance staff. Results are shared with the Advisor’s investment team, after which the final selection of the subadvisor is made and a recommendation to appoint the manager is made to the Board.

The Advisor also considers the Mercer Research Group’s ratings of investment managers when contemplating the termination of a subadvisor. Although the recommendations of the Mercer Research Group are given substantial weight in the decision-making process, the Advisor’s investment team performs its own analysis of potential and existing subadvisors and is ultimately responsible for selecting or terminating a subadvisor. Therefore, there is a possibility that the Advisor’s decision with respect to a particular subadvisor may differ from recommendations made by the Mercer Research Group.

The Advisor manages the Funds based on the philosophy and belief that portfolios which are appropriately constructed with combinations of quality, asset-class specialist investment managers can generally be expected to provide consistent, above-average performance over time. Stan Mavromates, Larry Vasquez, CFA, Manny Weiss, CFA, and John Johnson are responsible for establishing the Funds’ overall investment strategies and evaluating and monitoring the subadvisors managing the Funds. Mr. Mavromates has served as Vice President and Chief Investment Officer of the Advisor since 2012. From 2005 to 2012, Mr. Mavromates was the Chief Investment Officer of the Massachusetts Pension Reserves Investment Board. Mr. Vasquez has served as Vice President of the Advisor since 2012. From 2009 to 2012, Mr. Vasquez was a portfolio manager at UBS Global Asset Management, Inc. Prior to 2009, he was a portfolio manager at SEI Investments. Mr. Weiss has served as Vice President of the Advisor since January 2009. Mr. Johnson has served as Vice President of the Advisor since 2015. Prior to joining the Advisor, Mr. Johnson was a Fixed Income Portfolio Manager and Trader for Aberdeen Asset Management.

The Repositioned Acquiring Fund will pay the Advisor fees for managing the Repositioned Acquiring Fund’s investments at an annual rate of 0.53% of the average daily net assets on the first $750 million of Fund assets and 0.51% on all assets in excess of $750 million.

The Advisor has entered into subadvisory agreements (the “Subadvisory Agreements”) with the subadvisors pursuant to which the subadvisors are compensated out of the investment advisory fees that the Advisor receives from the Funds.

The Repositioned Acquiring Fund’s SAI provides additional information about the Portfolio Managers’ compensation, other accounts managed and the Portfolio Managers’ ownership of shares in the Repositioned Acquiring Fund.

A discussion regarding the basis for the Board’s approval of the investment management agreement with the Advisor and of the Subadvisory Agreements with each of Columbia and HSMP with respect to the Acquiring Fund is available in the Funds’ semi-annual report to shareholders for the period ended September 30, 2015. A discussion regarding the Board’s approval of the Subadvisory Agreement with Parametric with respect to the Acquiring Fund is available in the Funds’ annual report to shareholders for the period ended March 31, 2015. A discussion regarding the Board’s approval of the Subadvisory Agreements with each of AJO, Brandywine and O’Shaughnessy with respect to the Repositioned Acquiring Fund will be available in the Funds’ annual report to shareholders for the period ending March 31, 2016.

The Trust and the Advisor have obtained an exemptive order (the “Exemptive Order”) from the SEC that permits the Trust and the Advisor, subject to certain conditions and approval by the Board, to hire and retain subadvisors and modify subadvisory arrangements without shareholder approval. Under the Exemptive Order, the Advisor may act as a manager of managers for all or some of the Funds in the Trust, and the Advisor supervises the provision of portfolio management services to those Funds by the subadvisors. The Exemptive Order allows the Advisor: (i) to continue the employment of an existing subadvisor after events that would otherwise cause an automatic termination of a subadvisory agreement with the subadvisor; and (ii) to reallocate assets among existing or new subadvisors. Within 90 days of retaining new subadvisors, the affected Fund(s) will notify shareholders of the changes. The Advisor has ultimate responsibility (subject to oversight by the Board) to oversee the subadvisors and recommend their hiring, termination, and replacement. The Exemptive Order also relieves the Funds from disclosing certain fees paid to non-affiliated subadvisors in documents filed with the SEC and provided to shareholders.

Administrative Services

State Street Bank and Trust Company (the “Administrator”), located at 1 Heritage Drive, North Quincy, Massachusetts 02171, is the administrator of the Funds. The Funds pay the Administrator at an annual rate of the Funds’ average daily net assets for external administrative services. These external administrative services include fund accounting, daily and ongoing maintenance of certain Fund records, calculation of the Funds’ NAVs, and preparation of shareholder reports.

Other Service Providers

State Street Bank and Trust Company, located at 1 Heritage Drive, North Quincy, Massachusetts 02171, serves as the Trust’s transfer agent (the “Transfer Agent”).

MGI Funds Distributors, LLC (the “Distributor”), a Delaware limited liability company that is a wholly-owned subsidiary of Foreside Distributors, LLC, located at 899 Cassatt Road, 400 Berwyn Park, Suite 110, Berwyn, Pennsylvania 19312, acts as the principal underwriter of each class of shares of the Funds pursuant to an Underwriting Agreement with the Trust.

State Street Bank and Trust Company (the “Custodian”), located 1 Heritage Drive, North Quincy, Massachusetts 02171, provides custody services for the securities and cash of the Funds.

Form of Organization

The Funds are series of the Trust, which is an open-end management investment company organized as a Delaware statutory trust. The Trust is governed by a Board of Trustees consisting of four members, three of whom are Independent Trustees.

Capitalization

The following table shows the capitalization of each of the Funds as of September 30, 2015, and on a pro forma basis as of September 30, 2015 giving effect to the Reorganization as if it had occurred on that date:

| | | Acquiring

Fund | | | Acquired

Fund | | | Adjustments | | | Pro Forma

Combined | |

| Net Assets | | | | | | | | | | | | | | | | |

| Class Y-3 Shares | | $ | 360,387,328 | | | $ | 350,426,100 | | | $ | — | | | $ | 710,813,428 | |

| | | | | | | | | | | | | | | | | |

| Shares Outstanding | | | | | | | | | | | | | | | | |

| Class Y-3 Shares | | | 34,251,157 | | | | 33,604,780 | | | | -294,314 | | | | 67,561,623 | |

| | | | | | | | | | | | | | | | | |

| Net Asset Value Per Share | | | | | | | | | | | | | | | | |

| Class Y-3 Shares | | $ | 10.52 | | | $ | 10.43 | | | $ | -10.43 | | | $ | 10.52 | |

| | | | | | | | | | | | | | | | | |

Security Ownership of Certain Beneficial Owners

As of March 31, 2016, the following persons owned beneficially or of record 5% or more of the outstanding Class Y-3 Shares of the Acquiring Fund:

| Principal Holders of Securities | | Number of Shares

Held | | | Percentage of

the Outstanding

Shares of the

Class Y-3

Shares | |

| | | | | | | | | |

| Mercer Collective Trust: Mercer US Large Cap Growth Equity Portfolio | | | 27,688,078.890 | | | | 85.9% | |

| | | | | | | | | |

| Mercer Global Investments FBO Mercer Canada US Large Cap Growth Fund | | | 4,246,872.880 | | | | 13.2% | |

As of March 31, 2016, the following persons owned beneficially or of record 5% or more of the outstanding Investor Shares of the Acquired Fund:

| Principal Holders of Securities | | Number of Shares

Held | | | Percentage of

the Outstanding

Shares of the

Class Y-3

Shares | |

| | | | | | | | | |

| Mercer Collective Trust: Mercer US Large Cap Value Equity Portfolio | | | 29,180,171.241 | | | | 86.4% | |

| | | | | | | | | |

| Mercer Global Investments FBO Mercer Canada US Large Cap Value Fund | | | 4,287,567.660 | | | | 12.7% | |

Financial Highlights of the Acquiring Fund The Financial Highlights table is meant to help you understand the financial performance of the Acquiring Fund over the period of the Fund’s operations. Certain information reflects financial results for a single Fund share. Financial highlights for the Class Y-3 shares of the Acquiring Fund, which are the only shares currently offered for sale, are shown. The total returns in the table represent the rate that you would have earned (or lost) on an investment in the Acquiring Fund, assuming reinvestment of all dividends and distributions. The information for each period through the fiscal year ended March 31, 2015, has been audited by Deloitte & Touche LLP, an Independent Registered Public Accounting Firm, whose report, along with the Acquiring Fund’s financial statements, are included in the Trust’s annual report, which is available upon request and which are incorporated by reference herein. The information for the period ended September 30, 2015 is unaudited and is incorporated by reference herein. |

| Financial Highlights |

| | | | | | | | | | | | | | | | | | | |

| | | Period

Ended

09/30/15

(Unaudited) | | | Year

Ended

03/31/15 | | | Year

Ended

03/31/14 | | | Year

Ended

03/31/13 | | | Year

Ended

03/31/12 | | | Year

Ended

03/31/11 | |

| For a Class Y-3 Share Outstanding Throughout Each Period: | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at beginning of period | | $ | 11.11 | | | $ | 13.16 | | | $ | 13.56 | | | $ | 13.27 | | | $ | 12.19 | | | $ | 10.08 | |

| Net investment income† | | | 0.02 | | | | 0.05 | | | | 0.07 | | | | 0.08 | | | | 0.04 | | | | 0.03 | |

| Net realized and unrealized gain (loss) on investments | | | (0.61 | ) | | | 1.63 | | | | 3.11 | | | | 0.68 | | | | 1.06 | | | | 2.12 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total from investment operations | | | (0.59 | ) | | | 1.68 | | | | 3.18 | | | | 0.76 | | | | 1.10 | | | | 2.15 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Less dividends and distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

| From net investment income | | | — | | | | (0.04 | ) | | | (0.09 | ) | | | (0.08 | ) | | | (0.02 | ) | | | (0.04 | ) |

| From net realized gain on investments | | | — | | | | (3.69 | ) | | | (3.49 | ) | | | (0.39 | ) | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Total dividends and distributions | | | — | | | | (3.73 | ) | | | (3.58 | ) | | | (0.47 | ) | | | (0.02 | ) | | | (0.04 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Net asset value at end of period | | $ | 10.52 | | | $ | 11.11 | | | $ | 13.16 | | | $ | 13.56 | | | $ | 13.27 | | | $ | 12.19 | |

| Total investment return | | | (5.31 | )%** | | | 13.63 | %(a) | | | 23.99 | %(a) | | | 6.03 | %(a) | | | 9.08 | %(a) | | | 21.38 | %(a) |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Ratios/Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

| Net investment income to average net assets | | | 0.28 | %* | | | 0.37 | % | | | 0.48 | % | | | 0.61 | % | | | 0.33 | % | | | 0.27 | % |

| Net expenses to average daily net assets | | | 0.63 | %*(b) | | | 0.60 | %(b) | | | 0.57 | % | | | 0.57 | % | | | 0.57 | % | | | 0.57 | % |

| Total expenses (before reductions and reimbursements) to average daily net assets | | | 0.63 | %*(b) | | | 0.63 | %(b) | | | 0.63 | % | | | 0.63 | % | | | 0.63 | % | | | 0.64 | % |

| Portfolio turnover rate | | | 36 | %** | | | 118 | % | | | 50 | % | | | 65 | % | | | 64 | % | | | 106 | %(c) |

| Net assets at end of period (in 000s) | | $ | 360,387 | | | $ | 362,698 | | | $ | 358,862 | | | $ | 465,787 | | | $ | 465,641 | | | $ | 427,840 | |

| (a) | The total return would have been lower had certain expenses not been reduced or reimbursed during the periods shown. |

| (b) | Includes interest expense that amounts to less than 0.01%. |

| (c) | Portfolio turnover calculation does not include $23,568,413 of securities transferred into the Fund as part of in-kind contributions. |

| † | Computed using average shares outstanding throughout the period. |

| * | Annualized |

| ** | Not annualized |

EXHIBIT A

AGREEMENT AND PLAN OF REORGANIZATION

THIS AGREEMENT AND PLAN OF REORGANIZATION (the “Agreement”), is made as of the ____ day of __________, 2016, by Mercer Funds, a Delaware statutory trust with its principal place of business at 99 High Street, Boston, Massachusetts 02110, on behalf of each of its two separate investment series, the Mercer US Large Cap Growth Equity Fund (the “Acquiring Fund”) and the Mercer US Large Cap Value Equity Fund (the “Acquired Fund”), with respect to the reorganization transaction described herein.

This Agreement is intended to be and is adopted as a plan of reorganization and liquidation within the meaning of Section 368(a)(1) of the United States Internal Revenue Code of 1986, as amended (the “Code”). The reorganization (the “Reorganization”) will consist of the transfer of all of the assets of the Acquired Fund to the Acquiring Fund in exchange solely for Class Y-3 Shares of the Acquiring Fund (the “Acquiring Fund Shares”), the assumption by the Acquiring Fund of all of the liabilities of the Acquired Fund described in paragraph 1.3, and the distribution of the Acquiring Fund Shares to the shareholders of the Acquired Fund in complete liquidation of the Acquired Fund as provided herein, all upon the terms and conditions hereinafter set forth in this Agreement.

WHEREAS, the Acquired Fund and Acquiring Fund are each separate investment series of an open-end, registered investment company of the management type and the Acquired Fund owns securities that generally are assets of the character in which the Acquiring Fund is permitted to invest; and

WHEREAS, the Board of Trustees of the Trust has determined, with respect to the Acquiring Fund, that the exchange of all of the assets of the Acquired Fund for the Acquiring Fund Shares and the assumption of all of the liabilities of the Acquired Fund by the Acquiring Fund, as described in paragraph 1.3 herein, is in the best interests of the Acquiring Fund and its shareholders and that the interests of the existing shareholders of the Acquiring Fund would not be diluted as a result of this transaction; and

WHEREAS, the Board of Trustees of the Trust has also determined, with respect to the Acquired Fund, that the exchange of all of the assets of the Acquired Fund for the Acquiring Fund Shares and the assumption of the liabilities of the Acquired Fund by the Acquiring Fund, as described in paragraph 1.3 herein, is in the best interests of the Acquired Fund and its shareholders and that the interests of the existing shareholders of the Acquired Fund would not be diluted as a result of this transaction;

NOW, THEREFORE, in consideration of the premises and of the covenants and agreements hereinafter set forth, the Trust, on behalf of each of the Acquiring Fund and the Acquired Fund, respectively, hereby covenants and agrees as follows:

| 1. | TRANSFER OF ASSETS OF THE ACQUIRED FUND TO THE ACQUIRING FUND IN EXCHANGE FOR ACQUIRING FUND SHARES, THE ASSUMPTION OF THE LIABILITIES OF THE ACQUIRED FUND AND THE LIQUIDATION OF THE ACQUIRED FUND |

1.1. Subject to the requisite approvals and the other terms and conditions herein set forth and on the basis of the representations and warranties contained herein, the Acquired Fund agrees to transfer all of its respective assets, as set forth in paragraph 1.2, to the Acquiring Fund, and the Acquiring Fund agrees in exchange therefor: (i) to deliver to the Acquired Fund the number of full and fractional Acquiring Fund Shares as of the time and date set forth in paragraph 2.1 and (ii) to assume the liabilities

of the Acquired Fund, as set forth in paragraph 1.3. Such transactions shall take place at the closing provided for in paragraph 3.1 (the “Closing”).

1.2. The assets of the Acquired Fund to be acquired by the Acquiring Fund shall consist of all assets and property, including, without limitation, all cash, securities, commodities and futures interests, claims (whether absolute or contingent, known or unknown, accrued or unaccrued) and dividends or interest receivable that are owned by the Acquired Fund and any deferred or prepaid expenses shown as an asset on the books of the Acquired Fund on the closing date provided for in paragraph 3.1 (the “Closing Date”) (collectively, “Assets”).

1.3. The Acquiring Fund shall assume all of the liabilities of the Acquired Fund. The Acquired Fund shall deliver to the Acquiring Fund the Acquired Fund’s Statement of Assets and Liabilities as of the Closing Date pursuant to paragraph 8.2 hereof.

1.4. On or as soon as practicable prior to the Closing Date, the Acquired Fund will declare and pay to its shareholders of record one or more dividends and/or other distributions so that it will have distributed all of its investment company taxable income (computed without regard to any deduction for dividends paid) and realized net capital gain, if any, for the current taxable year through the Closing Date.

1.5. Immediately after the transfer of assets provided for in paragraph 1.1, the Acquired Fund will: (i) distribute to the Acquired Fund’s shareholders of record with respect to its Class Y-3 Shares, determined as of immediately after the close of business on the Closing Date, on a pro rata basis, the Class Y-3 Shares of the Acquiring Fund received by the Acquired Fund pursuant to paragraph 1.1 and (ii) completely liquidate. Such distribution and liquidation will be accomplished, with respect to the Acquired Fund’s shares, by the transfer of the Acquiring Fund Shares then credited to the account of the Acquired Fund on the books of the Acquiring Fund to open accounts on the share records of the Acquiring Fund in the names of the shareholders of record of the Acquired Fund’s shares, determined as of immediately after the close of business on the Closing Date (the “Acquired Fund Shareholders”). The aggregate net asset value of such Acquiring Fund Shares to be so credited to such Acquired Fund Shareholders shall be equal to the aggregate net asset value of the Investor Shares of the Acquired Fund owned by such shareholders on the Closing Date. All issued and outstanding Class Y-3 Shares of the Acquired Fund will simultaneously be canceled on the books of the Acquired Fund. The Acquiring Fund shall not issue certificates representing such Acquiring Fund Shares in connection with such exchange.

1.6. Ownership of Acquiring Fund Shares of the Acquiring Fund will be shown on its books. Acquiring Fund Shares will be issued in the manner described in the Acquiring Fund’s current prospectus.

1.7. Any reporting responsibility of the Acquired Fund including, but not limited to, the responsibility for filing of regulatory reports, tax returns, or other documents with the U.S. Securities and Exchange Commission (the “Commission”), any state securities commission, and any federal, state or local tax authorities or any other relevant regulatory authority, is and shall remain the responsibility of the Acquired Fund.

1.8. As soon as reasonably practicable after the Closing Date, the Acquired Fund shall make all filings and take all steps as shall be necessary and proper to effect its complete dissolution.

2.1. The value of the Assets shall be the value computed as of immediately after the close of business of the New York Stock Exchange (and after the declaration of any dividends) (such time and

date being hereinafter called the “Valuation Date”), using the valuation procedures set forth in the Trust’s Amended and Restated Agreement and Declaration of Trust and then-current prospectus and statement of additional information with respect to the Acquiring Fund, and valuation procedures established by the Trust’s Board.

2.2. All computations of value shall be made by the Trust’s accounting agent and shall be subject to review by the Trust’s independent registered public accounting firm.

| 3. | CLOSING AND CLOSING DATE |

3.1. The Closing Date shall be June 30, 2016, or such other date as the parties may agree to in writing. All acts taking place at the Closing shall be deemed to take place simultaneously as of immediately after the close of business on the Closing Date unless otherwise agreed to by the parties. The close of business on the Closing Date shall be as of 4:00 p.m., Eastern Time. The Closing shall be held at the offices of the Trust or at such other time and/or place as the parties may agree.

3.2. The Trust shall direct State Street Bank and Trust Company, as custodian for the Acquired Fund (the “Custodian”), to deliver at the Closing a certificate of an authorized officer stating that: (i) the Assets shall have been delivered in proper form to the Acquiring Fund within two business days prior to or on the Closing Date; and (ii) all necessary taxes in connection with the delivery of the Assets, including all applicable federal and state stock transfer stamps, if any, have been paid or provision for payment has been made. The Acquired Fund’s portfolio securities represented by a certificate or other written instrument shall be presented by the Custodian to those persons at the Custodian who have primary responsibility for the safekeeping of the Assets of the Acquiring Fund for examination no later than five business days preceding the Closing Date, and shall be transferred and delivered by the Acquired Fund as of the Closing Date for the account of the Acquiring Fund duly endorsed in proper form for transfer in such condition as to constitute good delivery thereof. The Trust on behalf of the Acquired Fund, shall direct the Custodian to deliver as of the Closing Date by book entry, in accordance with the customary practices of the Custodian and any securities depository (as defined in Rule 17f-4 under the Investment Company Act of 1940, as amended (the “1940 Act”)) in which the Assets are deposited, the Acquired Fund’s portfolio securities and instruments deposited with such depositories. The cash to be transferred by the Acquired Fund shall be delivered by wire transfer of federal funds on the Closing Date.

3.3. The Trust shall direct State Street Bank and Trust Company, as transfer agent for the Acquired Fund (the “Transfer Agent”), to deliver at the Closing a certificate of an authorized officer stating that: (i) its records contain the names and addresses of the Acquired Fund Shareholders, and (ii) the number and percentage ownership of outstanding shares owned by each such shareholder immediately prior to the Closing. The Acquiring Fund shall issue and deliver a confirmation evidencing the Acquiring Fund Shares to be credited on the Closing Date to the Secretary of the Acquired Fund, or provide evidence satisfactory to the Acquired Fund that such Acquiring Fund Shares have been credited to the Acquired Fund’s account on the books of the Acquiring Fund. At the Closing, each party shall deliver to the other such bills of sale, checks, assignments, share certificates, if any, receipts or other documents as such other party or its counsel may reasonably request.

3.4. In the event that on the Valuation Date: (a) the New York Stock Exchange or another primary trading market for portfolio securities of the Acquired Fund shall be closed to trading or trading thereupon shall be restricted, or (b) trading or the reporting of trading on such Exchange or elsewhere shall be disrupted so that, in the judgment of the Board of the Trust, accurate appraisal of the value of the net assets of the Acquired Fund is impracticable, the Closing Date shall be postponed until the first business day after the day when trading shall have been fully resumed and reporting shall have been restored.

| 4. | REPRESENTATIONS AND WARRANTIES |

4.1. The Trust, on behalf of the Acquired Fund, represents and warrants to the Acquiring Fund as follows:

(a) The Acquired Fund is duly organized as a series of the Trust, which is a statutory trust duly organized, validly existing and in good standing under the laws of the State of Delaware, with power under the Trust’s Amended and Restated Agreement and Declaration of Trust and its Amended and Restated By-Laws, to own all of its properties and assets and to carry on its business as it is presently being conducted;

(b) The Trust is a registered investment company classified as a management company of the open-end type, and its registration with the Commission as an investment company under the 1940 Act, and the registration of shares of the Acquired Fund under the Securities Act of 1933, as amended (“1933 Act”), is in full force and effect;

(c) No consent, approval, authorization, or order of any court or governmental authority is required for the consummation by the Acquired Fund of the transactions contemplated herein, except such as have been obtained under the 1933 Act, the Securities Exchange Act of 1934, as amended (the “1934 Act”) and the 1940 Act and such as may be required by state securities or blue sky laws;