UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

(Mark One)

|

| |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Fiscal Year Ended December 31, 2019

Or

|

| |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the Transition Period from to

Commission File Number 001-32504

TreeHouse Foods, Inc.

(Exact name of the registrant as specified in its charter)

|

| | |

| Delaware | | 20-2311383 |

| (State or other jurisdiction of incorporation or organization) | | (I.R.S. employer identification no.) |

|

| | | |

| | | |

| 2021 Spring Road, Suite 600 | Oak Brook, | IL | 60523 |

| (Address of principal executive offices) | | | (Zip Code) |

Registrant’s telephone number, including area code (708) 483-1300

Securities registered pursuant to Section 12(b) of the Act:

|

| | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, $.01 par value | THS | New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes þ No ¨

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer”, “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. |

| | | |

| Large accelerated filer | þ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | ☐ |

| Emerging growth company | ☐ | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new of revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No þ

The aggregate market value of the registrant’s common stock held by non-affiliates as of June 28, 2019, based on the $54.10 per share closing price on the New York Stock Exchange on such date, was approximately $3,021.3 million. Shares of common stock held by executive officers and directors of the registrant have been excluded from this calculation because such persons may be deemed to be affiliates.

The number of shares of the registrant’s common stock outstanding as of January 31, 2020 was 56,219,349.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s definitive Proxy Statement for its Annual Meeting of Stockholders to be held on April 30, 2020 are incorporated by reference into Part III of this Form 10-K.

TABLE OF CONTENTS

|

| | |

| | Page |

| | | |

| |

| | | |

| | | |

| Item 1 | | |

| Item 1A | | |

| Item 1B | | |

| Item 2 | | |

| Item 3 | | |

| Item 4 | | |

| | | |

| | | |

| Item 5 | | |

| Item 6 | | |

| Item 7 | | |

| Item 7A | | |

| Item 8 | | |

| Item 9 | | |

| Item 9A | | |

| Item 9B | | |

| | | |

| | | |

| Item 10 | | |

| Item 11 | | |

| Item 12 | | |

| Item 13 | | |

| Item 14 | | |

| | | |

| | | |

| Item 15 | | |

| Item 16 | | |

| | |

| | |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

Certain statements and information in this Form 10-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “1933 Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). The words “believe,” “estimate”, “project”, “expect,” “anticipate,” “plan,” “intend,” “foresee,” “should,” “would,” “could” or other similar expressions are intended to identify forward-looking statements, which are generally not historical in nature. These forward-looking statements are based on our current expectations and beliefs concerning future developments and their potential effect on us. These forward-looking statements and other information are based on our beliefs as well as assumptions made by us using information currently available. Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected or intended. We are making investors aware that such forward-looking statements, because they relate to future events, are by their very nature subject to many important factors that could cause actual results to differ materially from those contemplated. Such factors include, but are not limited to: our level of indebtedness and related obligations; disruptions in the financial markets; interest rates; changes in foreign currency exchange rates; customer consolidation; raw material and commodity costs; competition, and our ability to continue to make acquisitions in accordance with our business strategy or effectively manage the growth from acquisitions; changes and developments affecting our industry, including customer preferences; the outcome of litigation and regulatory proceedings to which we may be a party; product recalls; changes in laws and regulations applicable to us; disruptions in or failures of our information technology systems; and labor strikes or work stoppages and other risks that are described Part I, Item 1A – Risk Factors and our other reports filed from time to time with the Securities and Exchange Commission (the “SEC”).

Readers are cautioned not to place undue reliance on forward-looking statements, which speak only as of the date that such statements are made. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise.

PART I

References herein to “we”, “us”, “our”, “Company”, and “TreeHouse” refer to TreeHouse Foods, Inc. and its consolidated subsidiaries unless the context specifically states or implies otherwise.

We are a consumer packaged food and beverage manufacturer operating over 40 manufacturing facilities across the United States, Canada, and Italy servicing primarily retail grocery and food away from home customers. We manufacture a variety of shelf stable, refrigerated, fresh, and frozen products. We have a comprehensive offering of packaging formats and flavor profiles, and we also offer organic and preservative-free ingredients in many categories.

The Company was incorporated on January 25, 2005 by Dean Foods Company to accomplish a spin-off of certain specialty businesses to its shareholders, which was completed on June 27, 2005. Since the Company began operating as an independent entity, it has expanded its product offerings through a number of strategic and bolt-on acquisitions. We manufacture and sell the following:

| |

| • | private label products to retailers, such as supermarkets, mass merchandisers, and specialty retailers, for resale under the retailers’ own or controlled labels, |

| |

| • | private label and branded products to the foodservice industry, including foodservice distributors and national restaurant operators, |

| |

| • | branded products under our own proprietary brands, primarily on a regional basis to retailers, |

| |

| • | branded products under co-pack agreements to other major branded companies for their distributions, and |

| |

| • | products to our industrial customer base for repackaging in portion control packages and for use as ingredients by other food manufacturers. |

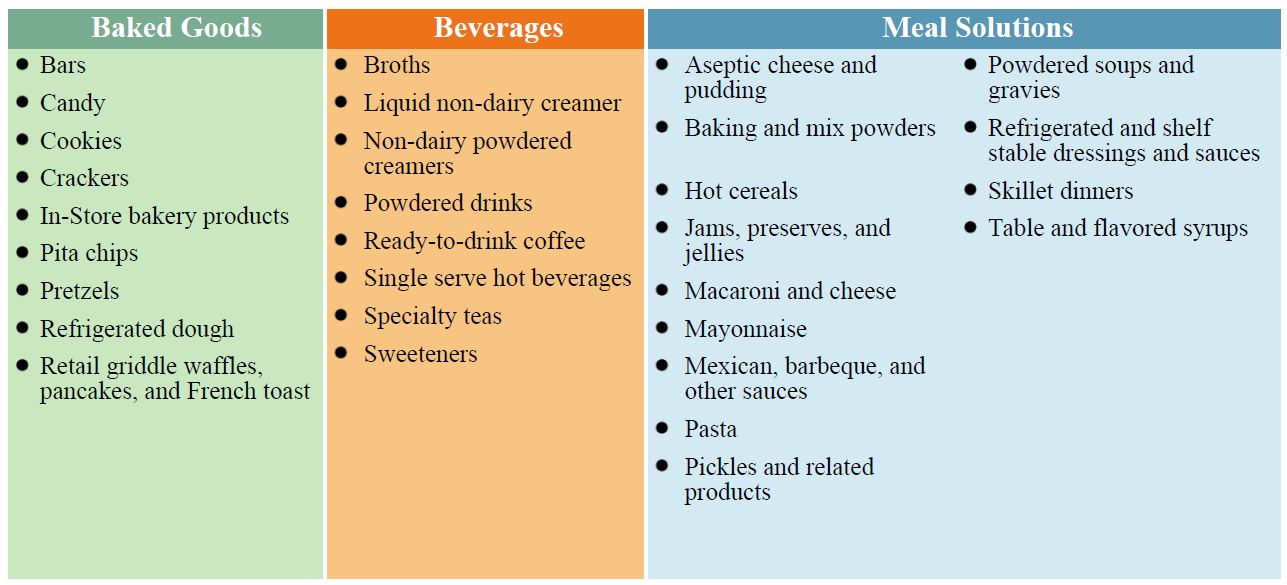

Our reportable segments, and the principal products that comprise each segment, are as follows:

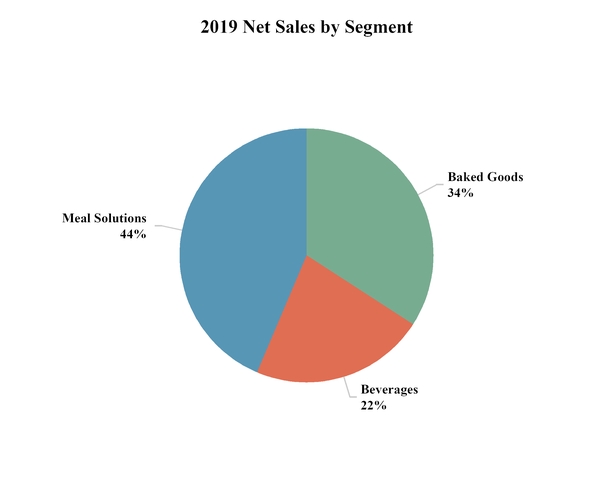

Net sales are relatively evenly distributed across segments:

See Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 22 to the Consolidated Financial Statements for financial information by segment.

We operate our business as Bay Valley Foods, LLC ("Bay Valley"), Sturm Foods, Inc. (includes Cains Foods, Inc. beginning in the fourth quarter of 2019), S.T. Specialty Foods, Inc., Associated Brands, Inc., Protenergy Natural Foods, Inc., TreeHouse Private Brands, Inc., American Italian Pasta Company, Linette Quality Chocolates, Inc., Ralcorp Frozen Bakery Products, Inc., Cottage Bakery, Inc., and The Carriage House Companies, Inc. in the United States, E.D. Smith Foods, Ltd., Associated Brands, Inc., Protenergy Natural Foods Corporation, BFG Canada Ltd., and Western Waffles Corp. in Canada, and Pasta Lensi, S.r.l. in Italy. Bay Valley is a Delaware limited liability company, and a 100% owned subsidiary of TreeHouse. All operating units are directly or indirectly 100% owned subsidiaries of Bay Valley. As of August 1, 2019, Nutcracker Brands, Inc. and Flagstone Foods, Inc. are no longer subsidiaries due to the Snacks division divestiture.

Significant Divestitures and Acquisitions

On August 1, 2019, the Company completed the sale of its Snacks division to Atlas Holdings, LLC. ("Atlas"). Beginning in the third quarter of 2019, the Snacks division (through the date of sale) was excluded from continuing operations and segment results for all periods presented. Refer to Note 8 to our Consolidated Financial Statements for additional information.

Customers and Distribution

We sell our products through various distribution channels, including grocery retailers, foodservice distributors, and industrial and export, which includes food manufacturers and repackagers of foodservice products. We have an internal sales force that manages customer relationships and a broker network for sales to retail, foodservice, and export accounts. Industrial food products are generally sold directly to customers without the use of a broker. Most of our customers purchase products from us either by purchase order or pursuant to contracts that generally are terminable at will.

Products are shipped from our production facilities directly to customers, or from warehouse distribution centers where products are consolidated for shipment to customers if an order includes products manufactured in more than one production facility or product category. We believe this consolidation of products enables us to improve customer service by offering our customers a single order, invoice, and shipment. Some customers also pick up their orders at our production facilities or distribution centers.

We sell our products to a diverse customer base, including the leading grocery retailers and foodservice operators in the United States and Canada. Also, a variety of our customers purchase bulk products for industrial food applications. We currently supply more than 800 total customers in North America, including over 47 of the 75 largest non-convenience food retailers.

A relatively limited number of customers account for a large percentage of our consolidated net sales. For the year ended December 31, 2019, our ten largest customers accounted for approximately 57.6% of our consolidated net sales. For the years ended December 31, 2019, 2018 and 2017, our largest customer, Walmart Inc. and its affiliates, accounted for approximately 24.4%, 23.6%, and 23.1%, respectively, of our consolidated net sales. No other customer accounted for 10% or more of the Company’s consolidated net sales. The Company had revenues from customers outside of the United States of approximately 7.3%, 10.3%, and 10.5% of total consolidated net sales in 2019, 2018, and 2017, respectively, with 5.8%, 8.7%, and 8.8% from Canada in 2019, 2018, and 2017, respectively. Sales are determined based on the customer destination where the products are shipped.

Competition

Our business faces intense competition from large branded manufacturers and highly competitive private label and foodservice manufacturers. In some instances, large branded companies manufacture private label products. The industries in which we compete are expected to remain highly competitive for the foreseeable future. Our customers do not typically commit to buy predetermined amounts of products, and many retailers utilize bidding procedures to select vendors.

We have several competitors in each of our channels. For sales of private label products to retailers, the principal competitive factors are product quality, quality of service, and price. For sales of products to foodservice, industrial, and export customers, the principal competitive factors are price, product quality, specifications, and reliability of service.

Competition to obtain shelf space for our branded products with retailers generally is based on the expected or historical performance of our product sales relative to our competitors. The principal competitive factors for sales of our branded products to consumers are brand recognition and loyalty, product quality, promotion, and price. Some of our branded competitors have significantly greater resources and brand recognition than we do.

Recent trends impacting competition include an increase in snacking and awareness of healthier and “better for you” foods. These trends, together with a surge of specialty retailers who cater to consumers looking for either the highest quality ingredients, unique packaging, products to satisfy particular dietary needs, or value offerings where consumers are looking to maximize their food purchasing power, create pressure on manufacturers to provide a full array of products to meet customer and consumer demand.

We believe our strategies for competing in each of our business segments, which include providing superior product quality, effective cost control, an efficient supply chain, successful innovation programs, and competitive pricing, allow us to compete effectively.

Trademarks

We own a number of registered trademarks. While we consider our trademarks to be valuable assets, we do not consider any trademark to be of such material importance that its absence would cause a material disruption of our business. No trademark is material to any one segment.

Seasonality

In the aggregate, our sales are generally weighted slightly toward the second half of the year, particularly the fourth quarter, with a more pronounced impact on profitability. As our product portfolio has grown, we have shifted to a higher percentage of cold weather products. Products that show a higher level of seasonality include non-dairy powdered creamer, coffee, specialty teas, cappuccinos, hot cereal, saltine and entertainment crackers, in-store bakery items, refrigerated dough products, and certain pasta products, all of which generally have higher sales in the first and fourth quarters. Additionally, sales of broth are generally higher in the fourth quarter. Warmer weather products such as dressings, pickles, and condiments typically have higher sales in the second quarter, while drink mixes generally show higher sales in the second and third quarters.

Raw Materials and Supplies

Our raw materials consist of ingredients and packaging materials. Principal ingredients used in our operations include casein, cheese, cocoa, coconut oil, coffee, corn and corn syrup, cucumbers, eggs, fruit, non-fat dry milk, almonds, oats, palm oil, peppers, rice, soybean oil, sugar, tea, tomatoes, and wheat (including durum wheat). These ingredients are generally purchased under supply contracts. We believe these ingredients generally are available from a number of suppliers. The cost of raw materials used in our products may fluctuate due to weather conditions, regulations, fuel prices, energy costs, labor disputes, transportation delays, political unrest, industry, general U.S. and global economic conditions, or other unforeseen circumstances. The most important packaging materials and supplies used in our operations are cartons, composite cans, corrugated containers, glass, metal cans, metal closures, and plastic. Most packaging materials are purchased under long-term supply contracts. We believe these packaging materials are generally available from a number of suppliers. Volatility in the cost of our raw materials and packaging supplies can adversely affect our performance, as price changes often lag behind changes in costs, and we are not always able to adjust our pricing to reflect changes in raw material and supply costs.

For additional discussion of the risks associated with the raw materials used in our operations, see Part 1, Item 1A – Risk Factors and Item 7 - Known Trends and Uncertainties.

Working Capital

Our short-term financing needs are primarily for financing working capital and are generally highest in the first and third quarters as inventory levels increase relative to other quarters, due to the seasonal nature of our business. As a result of our product portfolio and the related seasonality, our financing needs are generally highest in the first and third quarters, while cash flow is highest in the second and fourth quarters following the seasonality of our sales.

Employees

As of December 31, 2019, our work force consisted of approximately 10,800 full-time employees, with 8,850 in the United States, 1,850 in Canada, and 100 in Italy.

Regulatory Environment and Environmental Compliance

The conduct of our businesses, and the production, distribution, sale, labeling, safety, transportation, and use of our products, are subject to various laws and regulations administered by federal, state, and local governmental agencies in the United States, as well as to foreign laws and regulations administered by government entities and agencies in markets where we operate. It is our policy to abide by the laws and regulations that apply to our businesses.

We are subject to national and local environmental laws in the United States and in foreign countries in which we do business including laws relating to water consumption and treatment, air quality, waste handling and disposal, and other regulations intended to protect public health and the environment. We are committed to meeting all applicable environmental compliance requirements.

The cost of compliance with national and international laws does not have, and is not expected to have, a material financial impact on our capital expenditures, earnings, or competitive position.

Supplemental Disclosure of Information about our Executive Officers

|

| | | | |

| Executive Officer | | Age | | Title |

| Steven Oakland | | 58 | | Chief Executive Officer and President since March 2018. |

| William J. Kelley Jr. | | 55 | | Executive Vice President and Chief Financial Officer since February 2020. |

| Thomas E. O'Neill | | 64 | | Executive Vice President since July 2011. General Counsel, Chief Administrative Officer and Corporate Secretary since January 2005. |

| C. Shay Braun | | 52 | | Senior Vice President, Chief Operations Officer since January 2019. |

| Lori G. Roberts | | 59 | | Senior Vice President, Human Resources since January 2015. Senior Vice President, Chief Human Resources Officer since January 2019. |

| Amit R. Philip | | 42 | | Senior Vice President, Chief Strategy Officer since September 2019. |

| Dean T. General | | 53 | | Senior Vice President, Chief Commercial Officer since February 2019. |

| Maurice "Moe" Alkemade | | 52 | | Senior Vice President, Division President, Beverages since January 2019. |

| Mark A. Fleming | | 49 | | Senior Vice President, Division President, Baked Goods since January 2019. |

| Triona C. Schmelter | | 50 | | Senior Vice President, Division President, Meal Solutions since January 2019. |

Available Information

We make available, free of charge, through the “Investors” link then "Financials" then "SEC Filings" on our Internet website at www.treehousefoods.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We use our Internet website, through the “Investors” link, as a channel for routine distribution of important information, including news releases, analyst presentations, and financial information. We are not, however, including the information contained on our website, or information that may be accessed through links to our website, as part of, or incorporating such information by reference into, this Form 10-K. Copies of any materials the Company files with the SEC can be obtained free of charge through the SEC’s website at http://www.sec.gov.

In addition to the factors discussed elsewhere in this Report, the following risks and uncertainties could materially and adversely affect the Company’s business, financial condition, results of operations, and cash flows. Additional risks and uncertainties not presently known to the Company also may impair the Company’s business operations and financial condition.

We operate in the highly competitive and rapidly changing food industry.

The food industry is highly competitive, and faces increased competition as a result of consolidation, channel proliferation and the growth of online food retailers and new market participants. We face competition across our product lines from other companies that have varying abilities to withstand changes in market conditions. Some of our competitors have substantial financial, marketing, and other resources, and competition with them in our various business segments and product lines could cause us to reduce prices, increase capital, marketing or other expenditures, or lose sales, which could have a material adverse effect on our business and financial results. Category sales and growth could also be adversely impacted if we are not successful in introducing new products.

Some customer buying decisions are based on a periodic bidding process in which the successful bidder is reasonably assured the selling of its selected product to the food retailer, super center, mass merchandiser, or foodservice distributors, until the next bidding process. Our sales volume may decrease significantly if our offer is too high and we lose the ability to sell products through these channels, even temporarily. Alternatively, we risk reducing our margins if our offer is successful but below our desired price point. Either of these outcomes may adversely affect our results of operations. Additionally, competition can impact our ability to pass on increased costs or otherwise increase prices.

As new and evolving distribution channels acquire greater attention with consumers, we will need to evaluate whether our business methods and processes can be utilized or adopted in a manner that permits us to successfully serve these distribution channels. Our inability to offer competitive products to these customer segments could have an adverse impact on our results of operations.

As we are dependent upon a limited number of customers, the loss of a significant customer, or consolidation of our customer base, could adversely affect our operating results.

A limited number of customers represent a large percentage of our consolidated net sales. Our operating results are contingent on our ability to maintain our sales to these customers. The competition to supply products to these high volume customers is very strong. We expect that a significant portion of our net sales will continue to arise from a small number of customers, consisting primarily of traditional grocery retailers, mass merchandisers, and foodservice operators. For the year ended December 31, 2019, our ten largest customers accounted for approximately 57.6% of our consolidated net sales. For the year ended December 31, 2019, our largest customer, Walmart Inc. and its affiliates, accounted for approximately 24.4% of our consolidated net sales. No other customer accounted for 10% or more of the Company’s consolidated net sales. These customers typically do not enter into written contracts with fixed purchase commitments, and the contracts that they do enter into generally are terminable at will. Our customers make purchase decisions based on a combination of price, product quality, and customer service performance. If our product sales to one or more of these customers decline, this reduction may have a material adverse effect on our business, results of operations, and financial condition.

Further, over the past several years, the retail grocery and foodservice industries have experienced a consolidation trend, which has resulted in mass merchandisers and non-traditional grocers, such as ecommerce grocers with direct-to-consumer channels, gaining market share. As our customer base continues to consolidate, we expect competition to intensify as we compete for the business of fewer large customers. As this trend continues and such customers grow larger, they may seek to use their position to improve their profitability through improved efficiency, lower pricing, or increased promotional programs. If we are unable to use our scale, product innovation, and category leadership positions to respond to these demands, our profitability or volume growth could be negatively impacted. Additionally, if the surviving entity of a consolidation or similar transaction is not a current customer of the Company, we may lose significant business once held with the acquired retailer.

Consolidation also increases the risk that adverse changes in our customers' business operations or financial performance will have a corresponding material adverse effect on us. For example, if our customers cannot access sufficient funds or financing, then they may delay, decrease, or cancel purchases of our products, or delay or fail to pay us for previous purchases.

If we are unable to attract, hire or retain key employees or a highly skilled and diverse global workforce, it could have an adverse impact on our business, financial condition and results of operations.

The competitive environment requires us to attract, hire, retain and develop key employees, including our executive officers and senior management team, and maintain a highly skilled and diverse global workforce. We compete to attract and hire highly skilled employees and our own employees are highly sought after by our competitors and other companies. Competition could cause us to lose talented employees, and unplanned turnover could deplete our institutional knowledge and result in increased costs due to increased competition for employees.

Disruption of our supply chain or distribution capabilities could have an adverse effect on our business, financial condition, and results of operations.

Our ability to manufacture, move, and sell products is critical to our success. We are subject to damage or disruption to raw material supplies or our manufacturing or distribution capabilities (in particular, to the extent that our raw materials are sourced globally) due to weather, including any potential effects of climate change, natural disaster, fire, terrorism, adverse changes in political conditions or political unrest, pandemic, strikes, import restrictions, or other factors that could impair our ability to manufacture or sell our products. Failure to take adequate steps to mitigate the likelihood or potential impact of such events, or to effectively manage such events if they occur, could adversely affect our business, financial condition, and results of operations, as well as require additional resources to restore our supply chain.

Our business operations could be disrupted if our information technology systems fail to perform adequately or are breached.

The efficient operation of our business depends on our information technology systems. We rely on our information technology systems, including the internet, to effectively manage our business data, communications, supply chain, order entry and fulfillment, and other business processes. These information technology systems, some of which are dependent on services provided by third parties, may be susceptible to damage, invasions, disruptions, or shutdowns due to hardware failures, computer viruses, hacker attacks, and other cybersecurity risks, telecommunication failures, user errors, employee error or malfeasance, catastrophic events, natural disasters, fire or other factors. If we are unable to prevent or adequately respond to and resolve these breaches, disruptions or failures, our business may be disrupted, and we may suffer other adverse consequences such as data loss, financial or reputational damage or penalties, legal claims or proceedings, remediation costs, or the loss of sales or customers.

Increases in input costs, such as ingredients, packaging materials, and fuel costs, could adversely affect earnings.

The costs of raw materials, packaging materials, and fuel have varied widely in recent years and future changes in such costs may cause our results of operations and our operating margins to fluctuate significantly. We are also subject to delays caused by interruptions in production of raw materials based on conditions not within our control. Such conditions include job actions or strikes by employees of suppliers, weather, crop conditions, transportation shortages and interruptions, natural disasters, sustainability issues or other catastrophic events. While individual input cost changes varied throughout the year, with certain costs increasing and others decreasing, input costs were in the aggregate unfavorable in 2019 compared to 2018. We expect the volatile nature of these costs to continue with an overall long-term upward trend.

We manage the impact of increases in the costs of raw materials, wherever possible, by locking in prices on quantities required to meet our production requirements. The price of oil has been particularly volatile recently and there can be no assurance that our hedging activities will result in the optimal price. In addition, we attempt to offset the effect of such increases by raising prices to our customers. However, changes in the prices of our products may lag behind changes in the costs of our materials. Competitive pressures may also limit our ability to quickly raise prices in response to increased raw materials, packaging, and fuel costs. Accordingly, if we are unable to increase our prices to offset increasing raw material, packaging, and fuel costs, our operating profits and margins could be materially affected. In addition, in instances of declining input costs, customers may look for price reductions in situations where we have locked into purchases at higher costs.

Potential liabilities and costs from litigation could adversely affect our business.

There is no guarantee that we will be successful in defending ourself in civil, criminal, or regulatory actions, including under general, commercial, employment, environmental, data privacy or security, intellectual property, food quality and safety, anti-trust and trade, advertising and claims, and environmental laws and regulations, or in asserting our rights under various laws. For example, our claims could face allegations of false or deceptive advertising or other criticisms which could end up in litigation and result in potential liabilities or costs. In addition, we could incur substantial costs and fees in defending our self or in asserting our rights in these actions or meeting new legal requirements. The costs and other effects of potential and pending litigation and administrative actions against us, and new legal requirements, cannot be determined with certainty and may differ from expectations.

Our private label and regionally branded products may not be able to compete successfully with nationally branded products.

For sales of private label products to retailers, the principal competitive factors are price, product quality, and quality of service. For sales of private label products to consumers, the principal competitive factors are price and product quality. In many cases, competitors with nationally branded products have a competitive advantage over private label products due to name recognition. In addition, when branded competitors focus on price and promotion, the environment for private label producers becomes more challenging because the price differential between private label products and branded products may become less significant.

Competition to obtain shelf space for our branded products with retailers is primarily based on the expected or historical performance of our product sales relative to our competitors. The principal competitive factors for sales of our branded products to consumers are brand recognition and loyalty, product quality, promotion, and price. Some of our branded competitors have significantly greater resources and brand recognition than we do.

Competitive pressures or other factors could cause us to lose sales, which may require us to lower prices, increase the use of discounting or promotional programs, or increase marketing expenditures, each of which would adversely affect our margins and could result in a decrease in our operating results and profitability.

Our operations are subject to the general risks associated with acquisitions and divestitures.

We have made several acquisitions and divestitures in recent years that align with our strategic initiative of delivering long-term value to shareholders. The Company regularly reviews strategic opportunities to grow through acquisitions and to divest non-strategic assets. Potential risks associated with these transactions include the inability to consummate a transaction on favorable terms, the diversion of management’s attention from other business concerns, the potential loss of key employees and customers of current or acquired companies, the inability to integrate or divest operations successfully, the possible assumptions of unknown liabilities, potential disputes with buyers or sellers, potential impairment charges if purchase assumptions are not achieved, and the inherent risks in entering markets or lines of business in which the Company has limited or no prior experience. Any or all of these risks could impact the Company’s financial results and business reputation. In addition, acquisitions outside the United States may present unique challenges and increase the Company’s exposure to the risks associated with foreign operations.

We may not realize some or all of the anticipated benefits of our restructuring plans in the anticipated time frame or at all.

We depend on our ability to evolve and grow, and as changes in our business environments occur, we may adjust our business plans by introducing new restructuring programs, from time to time, to meet these changes, such as TreeHouse 2020, a long-term growth and margin improvement strategy involving plants and distribution locations, and Structure to Win, a sales, general, and administrative expenses improvement and alignment program. During 2019, the Company incurred approximately $105.4 million in restructuring program costs. See Note 3 of the Consolidated Financial Statements for additional information. Restructuring programs often require a substantial amount of management and operational resources, which may divert the Company’s attention from existing core businesses, potentially disrupting our operations and adversely affecting our relationships with suppliers and customers. In addition, events and circumstances, such as financial or strategic difficulties, delays and unexpected costs may occur that could result in our not realizing all or any of the anticipated benefits on our expected timetable or at all, and there can be no assurance that any benefits we realize from these restructuring efforts will be sufficient to offset the restructuring charges and other costs that we expect to incur.

The recognition of impairment charges on goodwill or long-lived assets could adversely impact our future financial reporting and results of operations.

We have $2,662.0 million of total intangible assets at December 31, 2019, consisting of $2,107.3 million of goodwill and $554.7 million of other intangible assets. Additionally, we have $1,045.2 million of property, plant, and equipment at December 31, 2019.

We perform an annual impairment assessment for goodwill and our indefinite-lived intangible assets, and as necessary, for other long-lived assets. If the results of such assessments were to show that the fair value of these assets were less than the carrying values, we could be required to recognize a charge for impairment of goodwill or long-lived assets, and the amount of the impairment charge could be material. Factors which could result in an impairment include, but are not limited to, (i) reduced demand for our products; (ii) higher commodity prices; (iii) lower prices for our products or increased marketing as a result of increased competition; and (iv) significant disruptions to our operations as a result of both internal and external events.

In 2019, on a continuing operations basis, we incurred a total of $129.1 million of impairment charges, comprised of $88.0 million of non-cash impairment charges related to the Cookies and Dry Dinners asset groups and $41.1 million related to the expected disposal loss on the In-Store Bakery facilities. In 2019, on a discontinued operations basis, we incurred a total of $141.0 million of non-cash impairment charges, comprised of $66.5 million related to long-lived asset impairment in the Snacks segment and the expected disposal loss on the RTE Cereal transaction of $74.5 million. These impairments and any future impairments on goodwill or long-lived assets could adversely impact our future financial position and results of operations.

We may be unable to anticipate changes in consumer preferences, which may result in decreased demand for our products.

Our success depends in part on our ability to anticipate the tastes, quality demands, eating habits, and overall purchasing trends of consumers and to offer products that appeal to their preferences. Consumer preferences change from time to time, and our failure to anticipate, identify, or react to these changes could result in reduced demand for our products, which would adversely affect our operating results and profitability.

New laws or regulations or changes in existing laws or regulations could adversely affect our business.

The food industry is subject to a variety of federal, state, local, and foreign laws and regulations, including those related to food safety, food labeling (including the Nutrition Labeling and Education Act (NLEA) and Bioengineered (BE) Labeling Declaration), and environmental matters. Governmental regulations also affect taxes and levies, healthcare costs, energy usage, international trade, immigration, and other labor issues, all of which may have a direct or indirect effect on our business or those of our customers or suppliers. Changes in these laws or regulations, or the introduction of new laws or regulations, could increase the costs of doing business for the Company, our customers, or suppliers, or restrict our actions, causing our results of operations to be adversely affected.

Our indebtedness and our ability to service our debt could adversely affect our business and financial condition.

As of December 31, 2019, we had $2,122.7 million of outstanding indebtedness, including a $458.4 million term loan (“Term Loan A”) maturing on January 31, 2025, a $681.6 million term loan (“Term Loan A-1” and, together with Term Loan A, the “Term Loans”) maturing on February 1, 2023, $375.9 million of 4.875% notes due March 15, 2022 (the “2022 Notes”), $602.9 million of 6.0% notes due February 15, 2024 (the “2024 Notes”), and $3.9 million of finance lease obligations and other debt. The Revolving Credit Facility (as defined in Note 13) and the Term Loans are known collectively as the “Credit Agreement.” The degree to which we are leveraged could have adverse consequences to us, limiting management's choices in responding to business, economic, regulatory and other competitive conditions. In addition, our ability to make scheduled payments on or refinance our debt obligations depends on our financial condition and operating performance, which are subject to prevailing economic and competitive conditions and to certain financial, business, legislative, regulatory and other factors beyond our control. We may be unable to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness. If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investments and capital expenditures, dispose of material assets or operations, seek additional debt or equity capital, or restructure or refinance our indebtedness. We may not be able to effect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, those alternative actions may not allow us to meet our scheduled debt service obligations. In addition, we and our subsidiaries may be able to incur significant additional indebtedness in the future. Although the agreements governing our indebtedness contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of qualifications and exceptions, and the additional indebtedness incurred in compliance with these

restrictions could be substantial. These restrictions also will not prevent us from incurring obligations that do not constitute indebtedness. If new debt is added to our current debt levels, the risks described herein would increase.

The terms of the agreements governing our indebtedness may restrict our current and future operations.

The agreements governing our indebtedness contain a number of restrictive covenants that impose significant operating and financial restrictions on us and may limit our ability to engage in acts that may be in our long-term best interest, including restrictions on our ability to: incur additional indebtedness and guarantee indebtedness; pay dividends or make other distributions or repurchase or redeem our capital stock; prepay, redeem, or repurchase certain subordinated debt; issue certain preferred stock or similar equity securities; make loans and investments; sell assets; incur liens; enter into transactions with affiliates; enter into agreements restricting our subsidiaries’ ability to pay dividends; and consolidate, merge, sell, or otherwise dispose of all or substantially all of our assets.

In addition, our Credit Agreement requires us to maintain a certain consolidated net leverage ratio tested on a quarterly basis. Our ability to meet these financial covenants can be affected by events beyond our control, and we may be unable to meet the required ratio.

A breach of the covenants or restrictions under the agreements governing our indebtedness could result in an event of default under the applicable indebtedness. Such default may allow the creditors to accelerate the related debt and may result in the acceleration of any other debt to which a cross acceleration or cross default provision applies. In addition, an event of default under the Credit Agreement may permit our lenders to terminate all commitments to extend further credit under those facilities. In the event our lenders or noteholders accelerate the repayment of our borrowings, we and our subsidiaries may not have sufficient assets to repay that indebtedness. As a result of these restrictions, we may be:

| |

| • | limited in how we conduct our business; |

| |

| • | unable to raise additional debt or equity financing to operate during general economic or business downturns; or |

| |

| • | unable to compete effectively or to take advantage of new business opportunities. |

These restrictions may affect our ability to grow in accordance with our strategy. In addition, our financial results, substantial indebtedness and credit ratings could materially adversely affect the availability and terms of our financing.

Disruptions in the financial markets could impair our ability to fund our operations or limit our ability to expand our business.

United States capital credit markets have experienced volatility, dislocations, and liquidity disruptions that caused tightened access to capital markets and other sources of funding. Capital and credit markets and the U.S. and global economies could be affected by additional volatility or economic downturns in the future. Events affecting the credit markets could have an adverse effect on other financial markets in the United States, which may make it more difficult or costly for us to raise capital through the issuance of common stock or other equity securities. There can be no assurance that future volatility or disruption in the capital and credit markets will not impair our liquidity or increase our costs of borrowing. Our business could also be negatively impacted if our suppliers or customers experience disruptions resulting from tighter capital and credit markets, or a slowdown in the general economy. Any of these risks could impair our ability to fund our operations or limit our ability to expand our business and could possibly increase our interest expense, which could have a material adverse effect on our financial results.

Multiemployer pension plans could adversely affect our business.

We participate in various multiemployer pension plans administered by labor unions representing some of our employees. We make periodic contributions to these plans to allow them to meet their pension benefit obligations to their participants. Our required contributions to these funds could increase because of a shrinking contribution base as a result of the insolvency or withdrawal of other companies that currently contribute to these funds, inability or failure of withdrawing companies to pay their withdrawal liability, lower than expected returns on pension fund assets or other funding deficiencies. In the event that we withdraw from participation in one of these plans, then applicable law could require us to make an additional lump-sum contribution (“withdrawal liability”) to the plan, and we would have to reflect that as an expense in our results of operations. Our withdrawal liability for any multiemployer plan would depend on the extent of the plan’s funding of vested benefits. In the ordinary course of our renegotiation of collective bargaining agreements with labor unions that maintain these plans, we may decide to discontinue participation in a plan, and in that event, we could face a withdrawal liability.

Increases in interest rates may negatively affect earnings.

As of December 31, 2019, the aggregate principal amount of our debt instruments with exposure to interest rate risk was approximately $1,140.0 million, based on the outstanding debt balance of our Credit Agreement. As a result, higher interest rates will increase the cost of servicing our financial instruments with exposure to interest rate risk, and could materially reduce our profitability and cash flows. Certain of our variable rate debt currently uses LIBOR as a benchmark for establishing the interest rate. LIBOR is the subject of recent proposals for reform. These reforms and other pressures may cause LIBOR to disappear entirely or to perform differently than in the past. The consequences of these developments with respect to LIBOR cannot be entirely predicted but could result in a change in the cost of our variable rate debt. In June 2016, we entered into $500.0 million of long-term interest rate swap agreements to lock into a fixed LIBOR rate base, beginning on January 31, 2017 and ending on February 28, 2020. In February 2018, we entered into an additional $1,625.0 million of staggered long-term interest rate swap agreements to lock into a fixed LIBOR base rate. As of December 31, 2019, each one percentage point change in LIBOR rates would result in an approximate $2.7 million change in the annual cash interest expense, before any principal payment, on our financial instruments with exposure to interest rate risk, including the impact of the $875 million in interest rate swap agreements that were effective in 2019.

As mentioned, the interest rates on some of our debt is tied to LIBOR. In July 2017, the head of the United Kingdom’s Financial Conduct Authority announced its intention to phase out the use of LIBOR by the end of 2021. The uncertainty regarding the future of LIBOR, as well as the transition from LIBOR to another benchmark rate or rates could have adverse impacts on our outstanding debt that currently use LIBOR as a benchmark rate, and ultimately, adversely affect our financial condition and results of operations.

Fluctuations in foreign currencies may adversely affect earnings.

The Company is exposed to fluctuations in foreign currency exchange rates. The Company’s foreign subsidiaries purchase various inputs that are based in U.S. dollars; accordingly, the profitability of the foreign subsidiaries are subject to foreign currency transaction gains and losses that affect earnings. We manage the impact of foreign currency fluctuations related to raw material purchases using foreign currency contracts. We are also exposed to fluctuations in the value of our foreign currency investment in our Canadian subsidiaries, which includes Canadian dollar denominated intercompany notes. We translate the Canadian and Italian assets, liabilities, revenues and expenses into U.S. dollars at applicable exchange rates. Accordingly, we are exposed to volatility in the translation of foreign currency denominated earnings due to fluctuations in the values of the Canadian dollar and Euro, which may negatively impact the Company’s results of operations and financial position.

Changes in weather conditions, natural disasters, and other events beyond our control could adversely affect our results of operations.

Changes in weather conditions, climate changes, and natural disasters such as floods, droughts, frosts, earthquakes, hurricanes, fires, or pestilence, may affect the cost and supply of commodities and raw materials. Additionally, these events could result in reduced supplies of raw materials. Our competitors may be affected differently by weather conditions and natural disasters depending on the location of their suppliers and operations. Further, changes in weather could impact consumer demand and our earnings may be affected by seasonal factors including the seasonality of our supplies and such changes in consumer demand. Damage or disruption to our production or distribution capabilities due to weather, natural disaster, fire, terrorism, pandemic, strikes, or other reasons could impair our ability to manufacture or sell our products. Failure to take adequate steps to reduce the likelihood or mitigate the potential impact of such events, or to effectively manage such events if they occur, particularly when a product is sourced from a single location, could adversely affect our business and results of operations, as well as require additional resources to restore our supply chain.

Our business could be harmed by strikes or work stoppages by our employees.

Currently, collective bargaining agreements cover a significant number of our full-time distribution, production, and maintenance employees. A dispute with a union or employees represented by a union could result in production interruptions caused by work stoppages. If a strike or work stoppage were to occur, our results of operations could be adversely affected.

| |

| Item 1B. | Unresolved Staff Comments |

None.

We operate the following production facilities, the majority of which we own, as shown below. We lease our principal executive offices in Oak Brook, Illinois and other office space in Green Bay, Wisconsin; Omaha, Nebraska (1); and Winona, Ontario, Canada. We also maintain a network of owned and leased distribution facilities. We believe our owned and leased facilities are suitable for our operations and provide sufficient capacity to meet our requirements for the foreseeable future. See Note 3 to the Consolidated Financial Statements for information regarding restructuring programs including facility closures. The following chart lists the location and principal products produced (by segment) at our production facilities at December 31, 2019:

|

| | | | | | |

| Baked Goods: | | | | | | |

Lodi, California (2) (In-store bakery) | | Brantford, Ontario, Canada (Frozen griddle) | | Georgetown, Ontario, Canada (Crackers) | | Kitchener, Ontario, Canada (Crackers) |

| Forest Park, Georgia (Refrigerated dough) | | South Beloit, Illinois

(Cookies) | | Princeton, Kentucky

(Crackers) | | Fridley, Minnesota (2)

(In-store bakery) |

Lakeville, Minnesota (Bars) | | Tonawanda, New York (Cookies) | | Hanover, Pennsylvania

(Pretzels) | | Lancaster, Pennsylvania (Pretzels) |

| Womelsdorf, Pennsylvania (Candy) | | Carrollton, Texas

(Refrigerated dough) | | Milwaukee, Wisconsin

(Pita chips) | | Ogden, Utah*

(In-store bakery and frozen griddle) |

| | | | | | | |

| Beverages: | | | | | | |

Delta, British Columbia, Canada* (Specialty tea) | | Richmond Hill, Ontario, Canada* (Broths and gravies) | | Pecatonica, Illinois (Non-dairy powdered creamer) | | New Hampton, Iowa (Non-dairy powdered creamer) |

Cambridge, Maryland* (Broth, gravies, and ready-to-drink coffee) | | Wayland, Michigan (Non-dairy powdered creamer) | | Manawa, Wisconsin (3) (Beverages) | | Medina, New York (3) (Beverages and beverage enhancers) |

| | | | | | | |

| Meal Solutions: | | | | | | |

Tolleson, Arizona (Dry pasta) | | Atlanta, Georgia

(Dressings, sauces, and dips) | | Chicago, Illinois

(Refrigerated foodservice pickles) | | Dixon, Illinois

(Aseptic cheese sauces, puddings, and gravies) |

Cedar Rapids, Iowa (Hot cereal) | | Fara Gera d'Adda, Bergamo, Italy* (Dry pasta) | | Verolanuova, Brescia, Italy (Dry pasta) | | Buckner, Kentucky

(Syrups, mayonnaise, preserves, jams, barbeque, and other sauces) |

Excelsior Springs, Missouri

(Dry pasta) | | Medina, New York (3)

(Dry dinners and dry soup) | | Faison, North Carolina

(Pickles, peppers, relish, and sauces) | | Winona, Ontario, Canada (Jams, pie fillings, and specialty sauces) |

North East, Pennsylvania

(Salad dressings and mayonnaise) | | Columbia, South Carolina

(Dry pasta) | | San Antonio, Texas

(Mexican sauces) | | Green Bay, Wisconsin

(Pickles, peppers, relish, and sauces) |

Kenosha, Wisconsin

(Macaroni and cheese and skillet dinners) | | Manawa, Wisconsin (3)

(Hot cereal) | | | | |

| | | | | | | |

| *The Company leases these facilities. |

| |

| (1) | On July 18, 2018, the Company announced the planned closure of this administrative office. Refer to Note 3 to the Consolidated Financial Statements for more information. |

| |

| (2) | On January 10, 2020, the Company entered into a definitive agreement to sell these facilities. Refer to Note 8 to the Consolidated Financial Statements for more information. |

| |

| (3) | Production facility crosses multiple segments; principal products produced for each segment included within the above table. |

As of December 31, 2019, the Company also owns facilities in Sparks, Nevada and Lancaster, Ohio related to its Ready-to-eat Cereal business. These facilities were classified as discontinued operations; therefore, they are excluded from the table above.

Information regarding legal proceedings is available in Note 20 to the Consolidated Financial Statements in this report.

| |

| Item 4. | Mine Safety Disclosures |

Not applicable.

PART II

| |

| Item 5. | Market for Registrant’s Common Equity, Related Stockholder Matters, and Issuer Purchases of Equity Securities |

The Company’s common stock is traded on the New York Stock Exchange (“NYSE”) under the symbol “THS.”

On January 31, 2020, there were 2,084 shareholders of record of our common stock.

We have not paid any cash dividends on the common stock and currently anticipate that, for the foreseeable future, we will retain any earnings for the development of our business. Accordingly, no dividends are expected to be declared or paid on the common stock. The declaration of dividends is at the discretion of our board of directors (“Board of Directors”).

Purchases of Equity Securities by the Issuer and Affiliated Purchasers

On November 2, 2017, the Company announced that the Board of Directors adopted a stock repurchase program. The stock repurchase program authorizes the Company to repurchase up to $400 million of the Company’s common stock at any time, or from time to time. Any repurchases under the program may be made by means of open market transactions, negotiated block transactions, or otherwise, including pursuant to a repurchase plan administered in accordance with Rules 10b5-1 and 10b-18 under the Exchange Act. The size and timing of any repurchases will depend on price, market and business conditions, and other factors. The Company was authorized to enter into an administrative repurchase plan for $50 million of the $400 million in fiscal 2018. The administrative repurchase plan expired as of December 31, 2018. The Company continues to have the ability to make discretionary repurchases up to an annual cap of $150 million under the $400 million total authorization. Any shares repurchased will be held as treasury stock. There were no amounts repurchased during the year ending December 31, 2019.

Performance Graph

The price information reflected for our common stock in the following performance graph and accompanying table represents the closing sales prices of the common stock for the period from December 31, 2014 through December 31, 2019. The graph and accompanying table compare the cumulative total stockholders’ return on our common stock with the cumulative total return of the S&P MidCap 400 Index and the Peer Group Index. Our Current Peer Group includes the following companies based on the similar nature of their business to ours: General Mills, Inc.; Kellogg Co.; Conagra Brands, Inc.; Post Holdings, Inc.; Snyder's-Lance Inc. (included through March 26, 2018 when it was acquired by the Campbell Soup Co); Campbell Soup Co.; McCormick & Co., Inc.; Pinnacle Foods, Inc. (included through October 25, 2018 when it was acquired by Conagra Brands, Inc.); JM Smucker Co.; Cott Corp.; Lancaster Colony Corp.; Flowers Foods, Inc.; The Hain Celestial Group, Inc.; J&J Snack Foods Corp.; B&G Foods, Inc.; Farmer Bros. Co.; and Dean Foods. The graph assumes an investment of $100 on December 31, 2014 in each of TreeHouse Foods’ common stock, the stocks comprising the S&P MidCap 400 Index, and the Peer Group Index.

Comparison of Cumulative Total Return of $100 among TreeHouse Foods, Inc., S&P MidCap 400 Index, and the Peer Group Index

|

| | | | | | | | | | | | | | | | | | | | | | |

| | | Base Period | | INDEXED RETURNS Years Ending |

| Company Name/Index | | 12/31/2014 | | 12/31/2015 | | 12/31/2016 | | 12/31/2017 | | 12/31/2018 | | 12/31/2019 |

| TreeHouse Foods, Inc. | | 100 | | $ | 91.73 |

| | $ | 84.40 |

| | $ | 57.83 |

| | $ | 59.29 |

| | $ | 56.71 |

|

| S&P MidCap 400 Index | | 100 | | 97.82 |

| | 118.11 |

| | 137.30 |

| | 122.08 |

| | 154.07 |

|

| Peer Group | | 100 | | 115.27 |

| | 129.74 |

| | 127.79 |

| | 108.05 |

| | 141.44 |

|

The performance graph and related table above is furnished and not filed for purposes of Section 18 of the Exchange Act and will not be incorporated by reference into any registration statement filed under the 1933 Act unless specifically identified therein as being incorporated therein by reference. The performance graph is not soliciting material subject to Regulation 14A.

| |

| Item 6. | Selected Financial Data |

The following table provides selected financial data as of and for each of the five years in the period ended December 31, 2019. The selected financial data should be read in conjunction with Item 7, and our Consolidated Financial Statements and related Notes.

On April 1, 2019, the Company changed its method of valuing its Pickle inventory in its Meal Solutions segment from the last-in, first-out (LIFO) method to the first-in, first-out (FIFO) method. After adopting the change, all of the Company's inventory is now valued using the FIFO method. The FIFO method has been applied retrospectively and is reflected in the Consolidated Statements of Operations for the years ended December 31, 2019, 2018, and 2017 and Consolidated Balance Sheets for the years ended December 31, 2019 and 2018. Additional periods in the table below were not recast for the change in inventory method because such information is not available without unreasonable effort or expense. Refer to Note 7 to the Consolidated Financial Statements for additional information regarding the inventory valuation change.

Beginning in the third quarter of 2019, the Company determined that both its Snacks division (through the date of sale) and its Ready-to-eat ("RTE") Cereal business met the discontinued operations criteria in Accounting Standards Codification 205-20-45 and were classified as discontinued operations. The results of these businesses have been reflected as discontinued operations in the Consolidated Statements of Operations and Consolidated Statements of Cash Flows for the years ended December 31, 2019, 2018, and 2017. The assets and liabilities of these businesses have been reflected in assets and liabilities of discontinued operations in the Consolidated Balance Sheets as of December 31, 2019 and 2018. Additional periods in the table below were not recast for discontinued operations because such information is not available without unreasonable effort or expense. Refer to Note 8 to the Consolidated Financial Statements for additional information regarding discontinued operations.

|

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 | | 2016 (1) | | 2015 |

| | (in millions, except per share data) |

| Operating data: | | | | | | | | | |

| Net sales | $ | 4,288.9 |

| | $ | 4,587.8 |

| | $ | 4,852.6 |

| | $ | 6,175.1 |

| | $ | 3,206.4 |

|

| Operating (loss) income | (16.1 | ) | | 83.4 |

| | 79.2 |

| | (95.5 | ) | | 241.3 |

|

| Net (loss) income from continuing operations | (110.3 | ) | | (46.2 | ) | | 111.3 |

| | — |

| | — |

|

| Net loss from discontinued operations | (250.7 | ) | | (18.2 | ) | | (390.8 | ) | | — |

| | — |

|

| Net (loss) income | (361.0 | ) | | (64.4 | ) | | (279.5 | ) | | (228.6 | ) | | 114.9 |

|

| Net (loss) earnings per basic share from continuing operations | $ | (1.96 | ) | | $ | (0.83 | ) | | $ | 1.95 |

| | $ | — |

| | $ | — |

|

| Net (loss) earnings per basic share | $ | (6.42 | ) | | $ | (1.15 | ) | | $ | (4.89 | ) | | $ | (4.10 | ) | | $ | 2.67 |

|

| Net (loss) earnings per diluted share from continuing operations | $ | (1.96 | ) | | $ | (0.83 | ) | | $ | 1.93 |

| | $ | — |

| | $ | — |

|

| Net (loss) earnings per diluted share | $ | (6.42 | ) | | $ | (1.15 | ) | | $ | (4.85 | ) | | $ | (4.10 | ) | | $ | 2.63 |

|

| Weighted average shares -- basic | 56.2 |

| | 56.0 |

| | 57.1 |

| | 55.7 |

| | 43.1 |

|

| Weighted average shares -- diluted | 56.2 |

| | 56.0 |

| | 57.6 |

| | 55.7 |

| | 43.7 |

|

| Other data: | | | | | | | | | |

| Balance sheet data (at end of period): | | | | | | | | | |

| Total assets | $ | 5,139.4 |

| | $ | 5,629.3 |

| | $ | 5,779.3 |

| | $ | 6,545.8 |

| | $ | 3,702.8 |

|

| Long-term debt, excluding current portion | 2,091.7 |

| | 2,297.4 |

| | 2,535.7 |

| | 2,724.8 |

| | 1,221.7 |

|

| Other long-term liabilities | 143.4 |

| | 168.2 |

| | 202.1 |

| | 202.3 |

| | 71.6 |

|

| Total stockholders’ equity | 1,830.9 |

| | 2,160.0 |

| | 2,263.3 |

| | 2,503.3 |

| | 1,854.9 |

|

| Cash flow data: | | | | | | | | | |

| Net cash provided by operating activities | $ | 307.7 |

| | $ | 505.8 |

| | $ | 506.0 |

| | $ | 478.6 |

| | $ | 290.6 |

|

| Capital expenditures | 146.8 |

| | 177.4 |

| | 161.6 |

| | 187.0 |

| | 86.1 |

|

| |

| (1) | The Company acquired the Private Brands Business in 2016. |

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Executive Overview

We make high quality food and beverages affordable to all. Our vision is to be the undisputed solutions leader for custom brands. Our mission is to create value as our customers’ preferred manufacturing and distribution partner, providing thought leadership, superior innovation and a relentless focus on execution. To achieve our mission we have developed a four point, customer centric enterprise strategy, as depicted graphically and explained further below:

| |

| • | Commercial Excellence. An unrelenting focus on the customer must be at the heart of everything we do. As private label continues to grow and evolve, our strategy is to be the solutions provider for our customers. To be a solutions provider, we must: understand our customers' needs and challenges; execute flawlessly; ensure products meet quality and safety standards and are competitively priced; and continue to innovate. During 2019, we designed, built, launched, and supported a new Commercial Excellence organization that is focused on the customer, eliminating the multiple touch points that existed with our previous division structure. |

| |

| • | Operational Excellence. We strive to be the supplier of choice and a world-class partner to our customers, a great investment to our shareholders, and a great place to work for our employees. We are working to build a high performance culture, as we communicate and engage our people with common metrics and build a continuous improvement mindset whereby the status quo is challenged. As we engage, educate and enable our employees, we are building a winning mindset rooted in the new TreeHouse mission, vision and purpose. In conjunction with this tenet of our strategy, we continue to progress in our rollout of a standardized management operating system across our manufacturing facilities ("TMOS"). Through December 31, 2019, we completed full implementations of TMOS in 30 plants and launched Lean Manufacturing in 18 locations. As of December 31, 2019, our service levels have improved over 300 basis points over the past two years, which represents our unrelenting focus on operational excellence. |

| |

| • | Optimized Portfolio. We will periodically review our portfolio in an attempt to identify areas of optimization. As part of this review, we may identify specific businesses (typically lower growth and lower margin) which may be better served by a fundamental change in tactics, strategy, or ownership. Optimizing the portfolio will allow us to focus our resources on fewer business in order to drive improved results and future cash generation. During 2019, we have simplified our organization through these portfolio optimization efforts, specifically related to the Snacks business. |

| |

| • | People & Talent. We are working to build a performance-based culture. We will be disciplined in our approach to building this culture, by communicating clear goals and fostering decision ownership. We have established a set of TreeHouse values that have been embraced by the organization and our goal is to align and incentivize our people and celebrate our successes together. |

The following discussion and analysis presents the factors that had a material effect on our financial condition, changes in financial condition, and results of operations for the years ended December 31, 2019, 2018, and 2017. This should be read in conjunction with the Consolidated Financial Statements and the Notes to those Consolidated Financial Statements included elsewhere in this report.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements. See Cautionary Statement Regarding Forward-Looking Information for a discussion of the uncertainties, risks, and assumptions associated with these statements.

Recent Developments

In-Store Bakery Facilities Divestiture

During the fourth quarter of 2019, the Company reached the decision to sell two of its In-Store Bakery facilities located in Fridley, Minnesota and Lodi, California, which manufacture breads, rolls, and cakes for in-store retail bakeries and foodservice customers. These two facilities are included within the Baked Goods reporting segment. The Company determined the associated assets met the held for sale accounting criteria as of December 31, 2019 and were classified accordingly in the Consolidated Balance Sheets. These two facilities did not meet the criteria to be presented as a discontinued operation.

The disposal group was measured at fair value, and the Company recognized the expected disposal loss as an impairment charge of $41.1 million during the year ended December 31, 2019, as the fair value was determined to be less than the carrying value of the associated assets, including the related goodwill. The impairment is recognized within Asset impairment in the Consolidated Statements of Operations.

Discontinued Operations

Beginning in the third quarter of 2019, the Company determined that both its Snacks division and its RTE Cereal business met the discontinued operations criteria in Accounting Standards Codification ("ASC") 205-20-45 and were classified as discontinued operations. As such, both businesses have been excluded from continuing operations and segment results for all periods presented. Refer to Note 8 to our Consolidated Financial Statements for additional information.

Long-Lived Asset Impairments

We evaluate property, plant, and equipment and finite lived intangible assets for impairment when circumstances indicate that their carrying values may not be recoverable. Indicators of impairment include deteriorations in operating cash flows, the anticipated sale or disposal of an asset group, and other significant changes in business conditions.

During 2019, our assessment indicated an impairment in our Cookies and Dry Dinners asset groups driven by the historical and forecasted performance of these businesses. As a result, we recognized a total of $88.0 million of long-lived asset impairment losses. The impairment charges are included in Asset impairment in the Consolidated Statements of Operations. Refer to Note 9 to our Consolidated Financial Statements for additional information.

Impairment charges are measured by comparing the carrying values of the asset groups to their estimated fair values. The fair value of these assets were based on expected future cash flows using Level 3 inputs under ASC 820. We can provide no assurance regarding the prospect of additional impairment charges in future periods.

Change in Inventory Valuation Method

Effective April 1, 2019, the Company changed its method of valuing its Pickle inventory in its Meal Solutions segment from the last-in, first out (LIFO) method to the first-in, first out (FIFO) method. Prior period information included in this Form 10-K has been adjusted to apply the FIFO method retrospectively. Refer to Note 7 to our Consolidated Financial Statements for additional information.

Change in Segments

On January 1, 2019, the Company changed how it manages its business, allocates resources, and goes to market, which resulted in modifications to its organizational and segment structure. As a result, the Company consolidated its Condiments and Meals segments into one segment called Meal Solutions. Additionally, the Bars and Ready-to-eat cereal categories moved from the

Company's Snacks and Meals segments, respectively, into the Baked Goods segment. All prior period information has been recast to reflect this change in reportable segments.

Results of Operations

The following table presents certain information concerning our financial results, including information presented as a percentage of consolidated net sales:

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| | Dollars | | Percent | | Dollars | | Percent | | Dollars | | Percent |

| | (Dollars in millions) |

| Net sales | $ | 4,288.9 |

| | 100.0 | % | | $ | 4,587.8 |

| | 100.0 | % | | $ | 4,852.6 |

| | 100.0 | % |

| Cost of sales | 3,492.1 |

| | 81.4 |

| | 3,695.6 |

| | 80.6 |

| | 3,874.5 |

| | 79.8 |

|

| Gross profit | 796.8 |

| | 18.6 |

| | 892.2 |

| | 19.4 |

| | 978.1 |

| | 20.2 |

|

| Operating expenses: | |

| | |

| | |

| | |

| | |

| | |

|

| Selling and distribution | 256.9 |

| | 6.0 |

| | 328.5 |

| | 7.2 |

| | 345.5 |

| | 7.1 |

|

| General and administrative | 253.2 |

| | 5.9 |

| | 264.4 |

| | 5.7 |

| | 283.7 |

| | 5.8 |

|

| Amortization expense | 74.1 |

| | 1.8 |

| | 80.2 |

| | 1.7 |

| | 85.5 |

| | 1.8 |

|

| Asset impairment | 129.1 |

| | 3.0 |

| | — |

| | — |

| | 59.0 |

| | 1.2 |

|

| Other operating expense, net | 99.6 |

| | 2.3 |

| | 135.7 |

| | 3.0 |

| | 125.2 |

| | 2.6 |

|

| Total operating expenses | 812.9 |

| | 19.0 |

| | 808.8 |

| | 17.6 |

| | 898.9 |

| | 18.5 |

|

| Operating (loss) income | (16.1 | ) | | (0.4 | ) | | 83.4 |

| | 1.8 |

| | 79.2 |

| | 1.7 |

|

| Other expense (income): | |

| | |

| | |

| | |

| | |

| | |

|

| Interest expense | 102.4 |

| | 2.4 |

| | 107.8 |

| | 2.4 |

| | 122.4 |

| | 2.5 |

|

| (Gain) loss on foreign currency exchange | (3.5 | ) | | (0.1 | ) | | 8.6 |

| | 0.2 |

| | (5.0 | ) | | (0.1 | ) |

| Other expense (income), net | 40.8 |

| | 1.0 |

| | 24.6 |

| | 0.5 |

| | (9.7 | ) | | (0.2 | ) |

| Total other expense | 139.7 |

| | 3.3 |

| | 141.0 |

| | 3.1 |

| | 107.7 |

| | 2.2 |

|

| Loss before income taxes | (155.8 | ) | | (3.7 | ) | | (57.6 | ) | | (1.3 | ) | | (28.5 | ) | | (0.5 | ) |

| Income tax benefit | (45.5 | ) | | (1.1 | ) | | (11.4 | ) | | (0.3 | ) | | (139.8 | ) | | (2.9 | ) |

| Net (loss) income from continuing operations | (110.3 | ) | | (2.6 | ) | | (46.2 | ) | | (1.0 | ) | | 111.3 |

| | 2.4 |

|

| Net loss from discontinued operations | (250.7 | ) | | (5.8 | ) | | (18.2 | ) | | (0.4 | ) | | (390.8 | ) | | (8.1 | ) |

| Net loss | $ | (361.0 | ) | | (8.4 | )% | | $ | (64.4 | ) | | (1.4 | )% | | $ | (279.5 | ) | | (5.7 | )% |

Year Ended December 31, 2019 Compared to Year Ended December 31, 2018

Continuing Operations

Net Sales – Consolidated net sales decreased 6.5% to $4,288.9 million for the year ended December 31, 2019, compared to $4,587.8 million for the year ended December 31, 2018. The change in net sales from 2018 to 2019 was due to the following:

|

| | | | | | | | | | |

| | | Dollars | | Percent | | Percentage Change in Pounds |

| | | (In millions) | | | | |

| 2018 Net sales | | $ | 4,587.8 |

| | | | |

| Volume/mix excluding SKU rationalization | | (256.5 | ) | | (5.6 | )% | | (7.2 | )% |

| Pricing | | 27.5 |

| | 0.6 |

| | — |

|

| 2019 Organic Net Sales | | $ | 4,358.8 |

| | (5.0 | )% | | (7.2 | )% |

| SKU rationalization | | (60.2 | ) | | (1.3 | ) | | (1.3 | ) |

| Divestiture | | (4.5 | ) | | (0.1 | ) | | (0.1 | ) |

| Foreign currency | | (5.2 | ) | | (0.1 | ) | | — |

|

| 2019 Net sales | | $ | 4,288.9 |

| | (6.5 | )% | | (8.6 | )% |

Organic net sales decreased 5.0% for the year ended December 31, 2019 driven by:

| |

| • | Volume/mix was unfavorable 5.6% year-over-year across all segments with the largest decreases in the Meal Solutions and Baked Goods segments primarily due to distribution lost as a result of pricing actions taken in 2018. Shipped volume in pounds excluding the impact of SKU rationalization and the divestiture of the McCann's business declined 7.2%. |

| |