EXPLANATORY NOTE

TreeHouse Foods, Inc. (the "Company") is filing this exhibit to reflect changes to the presentation of the Company’s financial information as set forth in the Company's Annual Report on Form 10-K for the year ended December 31, 2019 (the "2019 Form 10-K"), as filed with the Securities and Exchange Commission (the "SEC") on February 13, 2020, in order to give effect to a change in segment reporting.

As previously disclosed in the Quarterly Report on Form 10-Q for the period ended March 31, 2020 (as filed with the SEC on May 7, 2020), effective January 1, 2020, the Company changed how it manages its business, allocates resources, and goes to market, which resulted in modifications to its organizational and segment structure. As a result, the Company reorganized from a three segment structure previously organized by product category (Baked Goods, Beverages, and Meal Solutions) to a two segment structure organized by market dynamics (Meal Preparation and Snacking & Beverages). In connection with this segment reorganization, the Company also recast expenses related to its commercial sales organization from direct selling, general, and administrative expense previously included within the segments to corporate unallocated selling, general, and administrative expense to align with the revised organizational structure. All prior period information has been recast to reflect this change in reportable segments. This exhibit updates the information in the following items as initially filed in order to reflect the change in segment reporting: Part 1. Item 1 Business; Part 1. Item 2 Properties; Part II. Item 6 Selected Financial Data; Part II. Item 7 Management's Discussion and Analysis of Financial Condition and Results of Operations; and Part II. Item 8 Financial Statements and Supplementary Data.

No items in the 2019 Form 10-K other than those identified above are being updated by this filing. Information in the 2019 Form 10-K is generally stated as of December 31, 2019 and this filing does not reflect any subsequent information or events other than the change in segment reporting noted above. Without limiting the foregoing, this filing does not purport to update Management’s Discussion and Analysis of Financial Condition and Results of Operations contained in the 2019 Form 10-K for any information, uncertainties, transactions, risks, events or trends occurring, or known to management, other than the events described above. More current information is contained in the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2020 (the “Form 10-Q”) and other filings with the SEC. This exhibit should be read in conjunction with the 2019 Form 10-K, the Form 10-Q and any other documents the Company has filed with the SEC subsequent to February 13, 2020 (the “Other Documents”). The Form 10-Q and the Other Documents contain information regarding events, developments and updates to certain expectations of the Company that have occurred since the filing of the 2019 Form 10-K.

TABLE OF CONTENTS

|

| | |

| | Page |

| | | |

| | | |

| Item 1 | | |

| Item 2 | | |

| | | |

| | | |

| Item 6 | | |

| Item 7 | | |

| Item 8 | | |

PART I

References herein to “we”, “us”, “our”, “Company”, and “TreeHouse” refer to TreeHouse Foods, Inc. and its consolidated subsidiaries unless the context specifically states or implies otherwise.

We are a consumer packaged food and beverage manufacturer operating over 40 manufacturing facilities across the United States, Canada, and Italy servicing primarily retail grocery and food away from home customers. We manufacture a variety of shelf stable, refrigerated, fresh, and frozen products. We have a comprehensive offering of packaging formats and flavor profiles, and we also offer organic and preservative-free ingredients in many categories.

The Company was incorporated on January 25, 2005 by Dean Foods Company to accomplish a spin-off of certain specialty businesses to its shareholders, which was completed on June 27, 2005. Since the Company began operating as an independent entity, it has expanded its product offerings through a number of strategic and bolt-on acquisitions. We manufacture and sell the following:

| |

| • | private label products to retailers, such as supermarkets, mass merchandisers, and specialty retailers, for resale under the retailers’ own or controlled labels, |

| |

| • | private label and branded products to the foodservice industry, including foodservice distributors and national restaurant operators, |

| |

| • | branded products under our own proprietary brands, primarily on a regional basis to retailers, |

| |

| • | branded products under co-pack agreements to other major branded companies for their distributions, and |

| |

| • | products to our industrial customer base for repackaging in portion control packages and for use as ingredients by other food manufacturers. |

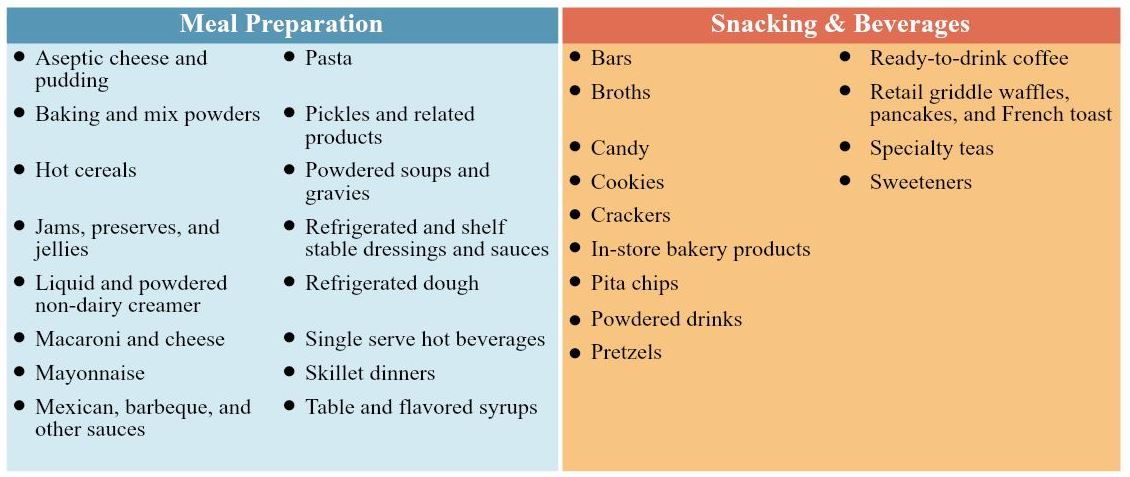

Our reportable segments, and the principal products that comprise each segment, are as follows:

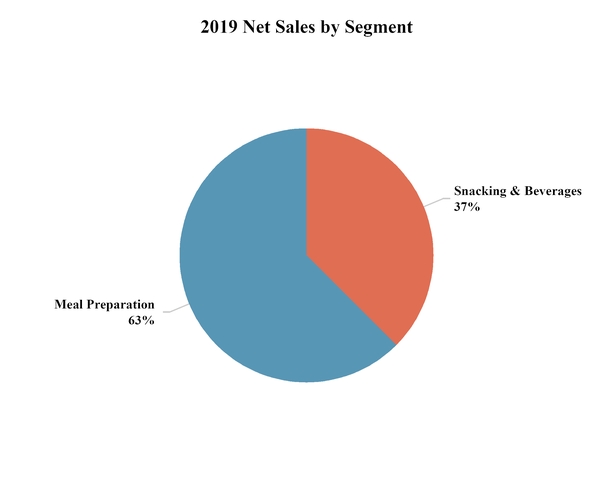

Net sales are distributed across segments in the following manner:

See Item 7 – Management’s Discussion and Analysis of Financial Condition and Results of Operations and Note 22 to the Consolidated Financial Statements for financial information by segment.

We operate our business as Bay Valley Foods, LLC ("Bay Valley"), Sturm Foods, Inc. (includes Cains Foods, Inc. beginning in the fourth quarter of 2019), S.T. Specialty Foods, Inc., Associated Brands, Inc., Protenergy Natural Foods, Inc., TreeHouse Private Brands, Inc., American Italian Pasta Company, Linette Quality Chocolates, Inc., Ralcorp Frozen Bakery Products, Inc., Cottage Bakery, Inc., and The Carriage House Companies, Inc. in the United States, E.D. Smith Foods, Ltd., Associated Brands, Inc., Protenergy Natural Foods Corporation, BFG Canada Ltd., and Western Waffles Corp. in Canada, and Pasta Lensi, S.r.l. in Italy. Bay Valley is a Delaware limited liability company, and a 100% owned subsidiary of TreeHouse. All operating units are directly or indirectly 100% owned subsidiaries of Bay Valley. As of August 1, 2019, Nutcracker Brands, Inc. and Flagstone Foods, Inc. are no longer subsidiaries due to the Snacks division divestiture.

Significant Divestitures and Acquisitions

On August 1, 2019, the Company completed the sale of its Snacks division to Atlas Holdings, LLC. ("Atlas"). Beginning in the third quarter of 2019, the Snacks division (through the date of sale) was excluded from continuing operations and segment results for all periods presented. Refer to Note 8 to our Consolidated Financial Statements for additional information.

Customers and Distribution

We sell our products through various distribution channels, including grocery retailers, foodservice distributors, and industrial and export, which includes food manufacturers and repackagers of foodservice products. We have an internal sales force that manages customer relationships and a broker network for sales to retail, foodservice, and export accounts. Industrial food products are generally sold directly to customers without the use of a broker. Most of our customers purchase products from us either by purchase order or pursuant to contracts that generally are terminable at will.

Products are shipped from our production facilities directly to customers, or from warehouse distribution centers where products are consolidated for shipment to customers if an order includes products manufactured in more than one production facility or product category. We believe this consolidation of products enables us to improve customer service by offering our customers a single order, invoice, and shipment. Some customers also pick up their orders at our production facilities or distribution centers.

We sell our products to a diverse customer base, including the leading grocery retailers and foodservice operators in the United States and Canada. Also, a variety of our customers purchase bulk products for industrial food applications. We currently supply more than 800 total customers in North America, including over 47 of the 75 largest non-convenience food retailers.

A relatively limited number of customers account for a large percentage of our consolidated net sales. For the year ended December 31, 2019, our ten largest customers accounted for approximately 57.6% of our consolidated net sales. For the years ended December 31, 2019, 2018 and 2017, our largest customer, Walmart Inc. and its affiliates, accounted for approximately 24.4%, 23.6%, and 23.1%, respectively, of our consolidated net sales. No other customer accounted for 10% or more of the Company’s consolidated net sales. The Company had revenues from customers outside of the United States of approximately 7.3%, 10.3%, and 10.5% of total consolidated net sales in 2019, 2018, and 2017, respectively, with 5.8%, 8.7%, and 8.8% from Canada in 2019, 2018, and 2017, respectively. Sales are determined based on the customer destination where the products are shipped.

Competition

Our business faces intense competition from large branded manufacturers and highly competitive private label and foodservice manufacturers. In some instances, large branded companies manufacture private label products. The industries in which we compete are expected to remain highly competitive for the foreseeable future. Our customers do not typically commit to buy predetermined amounts of products, and many retailers utilize bidding procedures to select vendors.

We have several competitors in each of our channels. For sales of private label products to retailers, the principal competitive factors are product quality, quality of service, and price. For sales of products to foodservice, industrial, and export customers, the principal competitive factors are price, product quality, specifications, and reliability of service.

Competition to obtain shelf space for our branded products with retailers generally is based on the expected or historical performance of our product sales relative to our competitors. The principal competitive factors for sales of our branded products to consumers are brand recognition and loyalty, product quality, promotion, and price. Some of our branded competitors have significantly greater resources and brand recognition than we do.

Recent trends impacting competition include an increase in snacking and awareness of healthier and “better for you” foods. These trends, together with a surge of specialty retailers who cater to consumers looking for either the highest quality ingredients, unique packaging, products to satisfy particular dietary needs, or value offerings where consumers are looking to maximize their food purchasing power, create pressure on manufacturers to provide a full array of products to meet customer and consumer demand.

We believe our strategies for competing in each of our business segments, which include providing superior product quality, effective cost control, an efficient supply chain, successful innovation programs, and competitive pricing, allow us to compete effectively.

Trademarks

We own a number of registered trademarks. While we consider our trademarks to be valuable assets, we do not consider any trademark to be of such material importance that its absence would cause a material disruption of our business. No trademark is material to any one segment.

Seasonality

In the aggregate, our sales are generally weighted slightly toward the second half of the year, particularly the fourth quarter, with a more pronounced impact on profitability. As our product portfolio has grown, we have shifted to a higher percentage of cold weather products. Products that show a higher level of seasonality include non-dairy powdered creamer, coffee, specialty teas, cappuccinos, hot cereal, saltine and entertainment crackers, in-store bakery items, refrigerated dough products, and certain pasta products, all of which generally have higher sales in the first and fourth quarters. Additionally, sales of broth are generally higher in the fourth quarter. Warmer weather products such as dressings, pickles, and condiments typically have higher sales in the second quarter, while drink mixes generally show higher sales in the second and third quarters.

Raw Materials and Supplies

Our raw materials consist of ingredients and packaging materials. Principal ingredients used in our operations include casein, cheese, cocoa, coconut oil, coffee, corn and corn syrup, cucumbers, eggs, fruit, non-fat dry milk, almonds, oats, palm oil, peppers, rice, soybean oil, sugar, tea, tomatoes, and wheat (including durum wheat). These ingredients are generally purchased under supply contracts. We believe these ingredients generally are available from a number of suppliers. The cost of raw materials used in our products may fluctuate due to weather conditions, regulations, fuel prices, energy costs, labor disputes, transportation delays, political unrest, industry, general U.S. and global economic conditions, or other unforeseen circumstances. The most important packaging materials and supplies used in our operations are cartons, composite cans, corrugated containers, glass, metal cans, metal closures, and plastic. Most packaging materials are purchased under long-term supply contracts. We believe these packaging materials are generally available from a number of suppliers. Volatility in the cost of our raw materials and packaging supplies can adversely affect our performance, as price changes often lag behind changes in costs, and we are not always able to adjust our pricing to reflect changes in raw material and supply costs.

For additional discussion of the risks associated with the raw materials used in our operations, see Part 1, Item 1A – Risk Factors and Item 7 - Known Trends and Uncertainties.

Working Capital

Our short-term financing needs are primarily for financing working capital and are generally highest in the first and third quarters as inventory levels increase relative to other quarters, due to the seasonal nature of our business. As a result of our product portfolio and the related seasonality, our financing needs are generally highest in the first and third quarters, while cash flow is highest in the second and fourth quarters following the seasonality of our sales.

Employees

As of December 31, 2019, our work force consisted of approximately 10,800 full-time employees, with 8,850 in the United States, 1,850 in Canada, and 100 in Italy.

Regulatory Environment and Environmental Compliance

The conduct of our businesses, and the production, distribution, sale, labeling, safety, transportation, and use of our products, are subject to various laws and regulations administered by federal, state, and local governmental agencies in the United States, as well as to foreign laws and regulations administered by government entities and agencies in markets where we operate. It is our policy to abide by the laws and regulations that apply to our businesses.

We are subject to national and local environmental laws in the United States and in foreign countries in which we do business including laws relating to water consumption and treatment, air quality, waste handling and disposal, and other regulations intended to protect public health and the environment. We are committed to meeting all applicable environmental compliance requirements.

The cost of compliance with national and international laws does not have, and is not expected to have, a material financial impact on our capital expenditures, earnings, or competitive position.

Supplemental Disclosure of Information about our Executive Officers

|

| | | | |

| Executive Officer | | Age | | Title |

| Steven Oakland | | 58 | | Chief Executive Officer and President since March 2018. |

| William J. Kelley Jr. | | 55 | | Executive Vice President and Chief Financial Officer since February 2020. |

| Thomas E. O'Neill | | 64 | | Executive Vice President since July 2011. General Counsel, Chief Administrative Officer and Corporate Secretary since January 2005. |

| C. Shay Braun | | 52 | | Senior Vice President, Chief Operations Officer since January 2019. |

| Lori G. Roberts | | 59 | | Senior Vice President, Human Resources since January 2015. Senior Vice President, Chief Human Resources Officer since January 2019. |

| Amit R. Philip | | 42 | | Senior Vice President, Chief Strategy Officer since September 2019. |

| Dean T. General | | 53 | | Senior Vice President, Chief Commercial Officer since February 2019. |

| Maurice "Moe" Alkemade | | 52 | | Senior Vice President, Division President, Beverages since January 2019. |

| Mark A. Fleming | | 49 | | Senior Vice President, Division President, Meal Preparation since February 2020. Division President, Baked Goods since January 2019. |

| Triona C. Schmelter | | 50 | | Senior Vice President, Chief Transformation Officer since February 2020. Division President, Meal Solutions since January 2019. |

| Kevin G. Jackson | | 53 | | Senior Vice President, Division President, Snacking & Beverages since February 2020. |

Available Information

We make available, free of charge, through the “Investors” link then "Financials" then "SEC Filings" on our Internet website at www.treehousefoods.com, our annual report on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, and amendments to those reports filed or furnished pursuant to Section 13(a) or 15(d) of the Exchange Act, as soon as reasonably practicable after such material is electronically filed with or furnished to the SEC. We use our Internet website, through the “Investors” link, as a channel for routine distribution of important information, including news releases, analyst presentations, and financial information. We are not, however, including the information contained on our website, or information that may be accessed through links to our website, as part of, or incorporating such information by reference into, this Form 10-K. Copies of any materials the Company files with the SEC can be obtained free of charge through the SEC’s website at http://www.sec.gov.

We operate the following production facilities, the majority of which we own, as shown below. We lease our principal executive offices in Oak Brook, Illinois and other office space in Green Bay, Wisconsin; Omaha, Nebraska (1); and Winona, Ontario, Canada. We also maintain a network of owned and leased distribution facilities. We believe our owned and leased facilities are suitable for our operations and provide sufficient capacity to meet our requirements for the foreseeable future. See Note 3 to the Consolidated Financial Statements for information regarding restructuring programs including facility closures. The following chart lists the location and principal products produced (by segment) at our production facilities at December 31, 2019:

|

| | | | | | |

| Meal Preparation: | | | | | | |

Tolleson, Arizona (Dry pasta) | | Atlanta, Georgia

(Dressings, sauces, and dips) | | Forest Park, Georgia (Refrigerated dough) | | Chicago, Illinois

(Refrigerated foodservice pickles) |

Dixon, Illinois

(Aseptic cheese sauces, puddings, and gravies) | | Pecatonica, Illinois

(Non-dairy powdered creamer) | | Cedar Rapids, Iowa

(Hot cereal) | | New Hampton, Iowa

(Non-dairy powdered creamer) |

Fara Gera d'Adda, Bergamo, Italy*

(Dry pasta) | | Verolanuova, Brescia, Italy

(Dry pasta) | | Buckner, Kentucky

(Syrups, mayonnaise, preserves, jams, barbeque, and other sauces) | | Wayland, Michigan

(Non-dairy powdered creamer) |

Excelsior Springs, Missouri

(Dry pasta) | | Medina, New York (3)

(Dry dinners and dry soup) | | Faison, North Carolina

(Pickles, peppers, relish, and sauces) | | Winona, Ontario, Canada

(Jams, pie fillings, and specialty sauces) |

North East, Pennsylvania

(Salad dressings and mayonnaise) | | Columbia, South Carolina

(Dry pasta) | | Carrollton, Texas

(Refrigerated dough) | | San Antonio, Texas

(Mexican sauces) |

Green Bay, Wisconsin

(Pickles, peppers, relish, and sauces) | | Kenosha, Wisconsin

(Macaroni and cheese and skillet dinners) | | Manawa, Wisconsin (3)

(Single serve hot beverages and hot cereals) | | |

| | | | | | | |

| Snacking & Beverages: | | | | | | |

Lodi, California (2) (In-store bakery) | | Delta, British Columbia, Canada*

(Specialty tea) | | Brantford, Ontario, Canada (Frozen griddle) | | Georgetown, Ontario, Canada (Crackers) |

| Kitchener, Ontario, Canada (Crackers) | | Richmond Hill, Ontario, Canada*

(Broths and gravies) | | South Beloit, Illinois

(Cookies) | | Princeton, Kentucky

(Crackers) |

Cambridge, Maryland*

(Broth, gravies, and ready-to-drink coffee) | | Fridley, Minnesota (2)

(In-store bakery) | | Lakeville, Minnesota (Bars) | | Medina, New York (3)

(Beverages and beverage enhancers) |

| Tonawanda, New York (Cookies) | | Hanover, Pennsylvania

(Pretzels) | | Lancaster, Pennsylvania (Pretzels) | | Womelsdorf, Pennsylvania (Candy) |

Ogden, Utah*

(In-store bakery and frozen griddle) | | Manawa, Wisconsin (3)

(Powdered drinks) | | Milwaukee, Wisconsin

(Pita chips)

| | |

| | | | | | | |

| | | | | | | |

| *The Company leases these facilities. |

| |

| (1) | On July 18, 2018, the Company announced the planned closure of this administrative office. Refer to Note 3 to the Consolidated Financial Statements for more information. |

| |

| (2) | On January 10, 2020, the Company entered into a definitive agreement to sell these facilities. Refer to Note 8 to the Consolidated Financial Statements for more information. |

| |

| (3) | Production facility crosses multiple segments; principal products produced for each segment included within the above table. |

As of December 31, 2019, the Company also owns facilities in Sparks, Nevada and Lancaster, Ohio related to its Ready-to-eat Cereal business. These facilities were classified as discontinued operations; therefore, they are excluded from the table above.

PART II

| |

| Item 6. | Selected Financial Data |

The following table provides selected financial data as of and for each of the five years in the period ended December 31, 2019. The selected financial data should be read in conjunction with Item 7, and our Consolidated Financial Statements and related Notes.

On April 1, 2019, the Company changed its method of valuing its Pickle inventory in its Meal Preparation segment from the last-in, first-out (LIFO) method to the first-in, first-out (FIFO) method. After adopting the change, all of the Company's inventory is now valued using the FIFO method. The FIFO method has been applied retrospectively and is reflected in the Consolidated Statements of Operations for the years ended December 31, 2019, 2018, and 2017 and Consolidated Balance Sheets for the years ended December 31, 2019 and 2018. Additional periods in the table below were not recast for the change in inventory method because such information is not available without unreasonable effort or expense. Refer to Note 7 to the Consolidated Financial Statements for additional information regarding the inventory valuation change.

Beginning in the third quarter of 2019, the Company determined that both its Snacks division (through the date of sale) and its Ready-to-eat ("RTE") Cereal business met the discontinued operations criteria in Accounting Standards Codification 205-20-45 and were classified as discontinued operations. The results of these businesses have been reflected as discontinued operations in the Consolidated Statements of Operations and Consolidated Statements of Cash Flows for the years ended December 31, 2019, 2018, and 2017. The assets and liabilities of these businesses have been reflected in assets and liabilities of discontinued operations in the Consolidated Balance Sheets as of December 31, 2019 and 2018. Additional periods in the table below were not recast for discontinued operations because such information is not available without unreasonable effort or expense. Refer to Note 8 to the Consolidated Financial Statements for additional information regarding discontinued operations.

|

| | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 | | 2016 (1) | | 2015 |

| | (in millions, except per share data) |

| Operating data: | | | | | | | | | |

| Net sales | $ | 4,288.9 |

| | $ | 4,587.8 |

| | $ | 4,852.6 |

| | $ | 6,175.1 |

| | $ | 3,206.4 |

|

| Operating (loss) income | (16.1 | ) | | 83.4 |

| | 79.2 |

| | (95.5 | ) | | 241.3 |

|

| Net (loss) income from continuing operations | (110.3 | ) | | (46.2 | ) | | 111.3 |

| | — |

| | — |

|

| Net loss from discontinued operations | (250.7 | ) | | (18.2 | ) | | (390.8 | ) | | — |

| | — |

|

| Net (loss) income | (361.0 | ) | | (64.4 | ) | | (279.5 | ) | | (228.6 | ) | | 114.9 |

|

| Net (loss) earnings per basic share from continuing operations | $ | (1.96 | ) | | $ | (0.83 | ) | | $ | 1.95 |

| | $ | — |

| | $ | — |

|

| Net (loss) earnings per basic share | $ | (6.42 | ) | | $ | (1.15 | ) | | $ | (4.89 | ) | | $ | (4.10 | ) | | $ | 2.67 |

|

| Net (loss) earnings per diluted share from continuing operations | $ | (1.96 | ) | | $ | (0.83 | ) | | $ | 1.93 |

| | $ | — |

| | $ | — |

|

| Net (loss) earnings per diluted share | $ | (6.42 | ) | | $ | (1.15 | ) | | $ | (4.85 | ) | | $ | (4.10 | ) | | $ | 2.63 |

|

| Weighted average shares -- basic | 56.2 |

| | 56.0 |

| | 57.1 |

| | 55.7 |

| | 43.1 |

|

| Weighted average shares -- diluted | 56.2 |

| | 56.0 |

| | 57.6 |

| | 55.7 |

| | 43.7 |

|

| Other data: | | | | | | | | | |

| Balance sheet data (at end of period): | | | | | | | | | |

| Total assets | $ | 5,139.4 |

| | $ | 5,629.3 |

| | $ | 5,779.3 |

| | $ | 6,545.8 |

| | $ | 3,702.8 |

|

| Long-term debt, excluding current portion | 2,091.7 |

| | 2,297.4 |

| | 2,535.7 |

| | 2,724.8 |

| | 1,221.7 |

|

| Other long-term liabilities | 143.4 |

| | 168.2 |

| | 202.1 |

| | 202.3 |

| | 71.6 |

|

| Total stockholders’ equity | 1,830.9 |

| | 2,160.0 |

| | 2,263.3 |

| | 2,503.3 |

| | 1,854.9 |

|

| Cash flow data: | | | | | | | | | |

| Net cash provided by operating activities | $ | 307.7 |

| | $ | 505.8 |

| | $ | 506.0 |

| | $ | 478.6 |

| | $ | 290.6 |

|

| Capital expenditures | 146.8 |

| | 177.4 |

| | 161.6 |

| | 187.0 |

| | 86.1 |

|

| |

| (1) | The Company acquired the Private Brands Business in 2016. |

| |

| Item 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Executive Overview

We make high quality food and beverages affordable to all. Our vision is to be the undisputed solutions leader for custom brands. Our mission is to create value as our customers’ preferred manufacturing and distribution partner, providing thought leadership, superior innovation and a relentless focus on execution. To achieve our mission we have developed a four point, customer centric enterprise strategy, as depicted graphically and explained further below:

| |

| • | Commercial Excellence. An unrelenting focus on the customer must be at the heart of everything we do. As private label continues to grow and evolve, our strategy is to be the solutions provider for our customers. To be a solutions provider, we must: understand our customers' needs and challenges; execute flawlessly; ensure products meet quality and safety standards and are competitively priced; and continue to innovate. During 2019, we designed, built, launched, and supported a new Commercial Excellence organization that is focused on the customer, eliminating the multiple touch points that existed with our previous division structure. |

| |

| • | Operational Excellence. We strive to be the supplier of choice and a world-class partner to our customers, a great investment to our shareholders, and a great place to work for our employees. We are working to build a high performance culture, as we communicate and engage our people with common metrics and build a continuous improvement mindset whereby the status quo is challenged. As we engage, educate and enable our employees, we are building a winning mindset rooted in the new TreeHouse mission, vision and purpose. In conjunction with this tenet of our strategy, we continue to progress in our rollout of a standardized management operating system across our manufacturing facilities ("TMOS"). Through December 31, 2019, we completed full implementations of TMOS in 30 plants and launched Lean Manufacturing in 18 locations. As of December 31, 2019, our service levels have improved over 300 basis points over the past two years, which represents our unrelenting focus on operational excellence. |

| |

| • | Optimized Portfolio. We will periodically review our portfolio in an attempt to identify areas of optimization. As part of this review, we may identify specific businesses (typically lower growth and lower margin) which may be better served by a fundamental change in tactics, strategy, or ownership. Optimizing the portfolio will allow us to focus our resources on fewer business in order to drive improved results and future cash generation. During 2019, we have simplified our organization through these portfolio optimization efforts, specifically related to the Snacks division. |

| |

| • | People & Talent. We are working to build a performance-based culture. We will be disciplined in our approach to building this culture, by communicating clear goals and fostering decision ownership. We have established a set of TreeHouse values that have been embraced by the organization and our goal is to align and incentivize our people and celebrate our successes together. |

The following discussion and analysis presents the factors that had a material effect on our financial condition, changes in financial condition, and results of operations for the years ended December 31, 2019, 2018, and 2017. This should be read in conjunction with the Consolidated Financial Statements and the Notes to those Consolidated Financial Statements included elsewhere in this report.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations contains forward-looking statements. See Cautionary Statement Regarding Forward-Looking Information for a discussion of the uncertainties, risks, and assumptions associated with these statements.

Recent Developments

In-Store Bakery Facilities Divestiture

During the fourth quarter of 2019, the Company reached the decision to sell two of its In-Store Bakery facilities located in Fridley, Minnesota and Lodi, California, which manufacture breads, rolls, and cakes for in-store retail bakeries and foodservice customers. These two facilities are included within the Snacking & Beverages reporting segment. The Company determined the associated assets met the held for sale accounting criteria as of December 31, 2019 and were classified accordingly in the Consolidated Balance Sheets. These two facilities did not meet the criteria to be presented as a discontinued operation.

The disposal group was measured at fair value, and the Company recognized the expected disposal loss as an impairment charge of $41.1 million during the year ended December 31, 2019, as the fair value was determined to be less than the carrying value of the associated assets, including the related goodwill. The impairment is recognized within Asset impairment in the Consolidated Statements of Operations.

Discontinued Operations

Beginning in the third quarter of 2019, the Company determined that both its Snacks division and its RTE Cereal business met the discontinued operations criteria in Accounting Standards Codification ("ASC") 205-20-45 and were classified as discontinued operations. As such, both businesses have been excluded from continuing operations and segment results for all periods presented. Refer to Note 8 to our Consolidated Financial Statements for additional information.

Long-Lived Asset Impairments

We evaluate property, plant, and equipment and finite lived intangible assets for impairment when circumstances indicate that their carrying values may not be recoverable. Indicators of impairment include deteriorations in operating cash flows, the anticipated sale or disposal of an asset group, and other significant changes in business conditions.

During 2019, our assessment indicated an impairment in our Cookies and Dry Dinners asset groups driven by the historical and forecasted performance of these businesses. As a result, we recognized a total of $88.0 million of long-lived asset impairment losses. The impairment charges are included in Asset impairment in the Consolidated Statements of Operations. Refer to Note 9 to our Consolidated Financial Statements for additional information.

Impairment charges are measured by comparing the carrying values of the asset groups to their estimated fair values. The fair value of these assets were based on expected future cash flows using Level 3 inputs under ASC 820. We can provide no assurance regarding the prospect of additional impairment charges in future periods.

Change in Inventory Valuation Method

Effective April 1, 2019, the Company changed its method of valuing its Pickle inventory in its Meal Preparation segment from the last-in, first out (LIFO) method to the first-in, first out (FIFO) method. Prior period information included in this Form 10-K has been adjusted to apply the FIFO method retrospectively. Refer to Note 7 to our Consolidated Financial Statements for additional information.

Change in Segments

On January 1, 2019, the Company changed how it manages its business, allocates resources, and goes to market, which resulted in modifications to its organizational and segment structure (the “2019 Segment Change”). As a result, the Company consolidated its Condiments and Meals segments into one segment called Meal Solutions. Additionally, the Bars and Ready-to-eat cereal categories moved from the Company's Snacks and Meals segments, respectively, into the Baked Goods segment.

On January 1, 2020, the Company changed how it manages its business, allocates resources, and goes to market, which resulted in modifications to its organizational and segment structure (the "2020 Segment Change"). As a result, the Company reorganized from a three segment structure previously organized by product category (Baked Goods, Beverages, and Meal Solutions) to a two segment structure organized by market dynamics (Snacking & Beverages and Meal Preparation).

During 2019, all prior period information was originally recast to reflect the 2019 Segment Change. Upon the 2020 Segment Change, all prior period information was recast to reflect this change in reportable segments and as such, the information herein no longer presents the 2019 Segment Change. Refer to Note 22 for additional information.

Results of Operations

The following table presents certain information concerning our financial results, including information presented as a percentage of consolidated net sales:

|

| | | | | | | | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| | Dollars | | Percent | | Dollars | | Percent | | Dollars | | Percent |

| | (Dollars in millions) |

| Net sales | $ | 4,288.9 |

| | 100.0 | % | | $ | 4,587.8 |

| | 100.0 | % | | $ | 4,852.6 |

| | 100.0 | % |

| Cost of sales | 3,492.1 |

| | 81.4 |

| | 3,695.6 |

| | 80.6 |

| | 3,874.5 |

| | 79.8 |

|

| Gross profit | 796.8 |

| | 18.6 |

| | 892.2 |

| | 19.4 |

| | 978.1 |

| | 20.2 |

|

| Operating expenses: | |

| | |

| | |

| | |

| | |

| | |

|

| Selling and distribution | 256.9 |

| | 6.0 |

| | 328.5 |

| | 7.2 |

| | 345.5 |

| | 7.1 |

|

| General and administrative | 253.2 |

| | 5.9 |

| | 264.4 |

| | 5.7 |

| | 283.7 |

| | 5.8 |

|

| Amortization expense | 74.1 |

| | 1.8 |

| | 80.2 |

| | 1.7 |

| | 85.5 |

| | 1.8 |

|

| Asset impairment | 129.1 |

| | 3.0 |

| | — |

| | — |

| | 59.0 |

| | 1.2 |

|

| Other operating expense, net | 99.6 |

| | 2.3 |

| | 135.7 |

| | 3.0 |

| | 125.2 |

| | 2.6 |

|

| Total operating expenses | 812.9 |

| | 19.0 |

| | 808.8 |

| | 17.6 |

| | 898.9 |

| | 18.5 |

|

| Operating (loss) income | (16.1 | ) | | (0.4 | ) | | 83.4 |

| | 1.8 |

| | 79.2 |

| | 1.7 |

|

| Other expense (income): | |

| | |

| | |

| | |

| | |

| | |

|

| Interest expense | 102.4 |

| | 2.4 |

| | 107.8 |

| | 2.4 |

| | 122.4 |

| | 2.5 |

|

| (Gain) loss on foreign currency exchange | (3.5 | ) | | (0.1 | ) | | 8.6 |

| | 0.2 |

| | (5.0 | ) | | (0.1 | ) |

| Other expense (income), net | 40.8 |

| | 1.0 |

| | 24.6 |

| | 0.5 |

| | (9.7 | ) | | (0.2 | ) |

| Total other expense | 139.7 |

| | 3.3 |

| | 141.0 |

| | 3.1 |

| | 107.7 |

| | 2.2 |

|

| Loss before income taxes | (155.8 | ) | | (3.7 | ) | | (57.6 | ) | | (1.3 | ) | | (28.5 | ) | | (0.5 | ) |

| Income tax benefit | (45.5 | ) | | (1.1 | ) | | (11.4 | ) | | (0.3 | ) | | (139.8 | ) | | (2.9 | ) |

| Net (loss) income from continuing operations | (110.3 | ) | | (2.6 | ) | | (46.2 | ) | | (1.0 | ) | | 111.3 |

| | 2.4 |

|

| Net loss from discontinued operations | (250.7 | ) | | (5.8 | ) | | (18.2 | ) | | (0.4 | ) | | (390.8 | ) | | (8.1 | ) |

| Net loss | $ | (361.0 | ) | | (8.4 | )% | | $ | (64.4 | ) | | (1.4 | )% | | $ | (279.5 | ) | | (5.7 | )% |

Year Ended December 31, 2019 Compared to Year Ended December 31, 2018

Continuing Operations

Net Sales – Consolidated net sales decreased 6.5% to $4,288.9 million for the year ended December 31, 2019, compared to $4,587.8 million for the year ended December 31, 2018. The change in net sales from 2018 to 2019 was due to the following:

|

| | | | | | | | | | |

| | | Dollars | | Percent | | Percentage Change in Pounds |

| | | (In millions) | | | | |

| 2018 Net sales | | $ | 4,587.8 |

| | | | |

| Volume/mix excluding SKU rationalization | | (256.5 | ) | | (5.6 | )% | | (7.2 | )% |

| Pricing | | 27.5 |

| | 0.6 |

| | — |

|

| 2019 Organic Net Sales | | $ | 4,358.8 |

| | (5.0 | )% | | (7.2 | )% |

| SKU rationalization | | (60.2 | ) | | (1.3 | ) | | (1.3 | ) |

| Divestiture | | (4.5 | ) | | (0.1 | ) | | (0.1 | ) |

| Foreign currency | | (5.2 | ) | | (0.1 | ) | | — |

|

| 2019 Net sales | | $ | 4,288.9 |

| | (6.5 | )% | | (8.6 | )% |

Organic net sales decreased 5.0% for the year ended December 31, 2019 driven by:

| |

| • | Volume/mix was unfavorable 5.6% year-over-year across both segments primarily due to distribution lost as a result of pricing actions taken in 2018. Shipped volume in pounds excluding the impact of SKU rationalization and the divestiture of the McCann's business declined 7.2%. |

| |

| • | Pricing was favorable 0.6% during 2019 compared to 2018 driven by pricing actions executed in 2019 to cover commodity, freight, and packaging inflation, partially offset by competitive pressure in Single Serve Beverages. |

Our efforts to simplify and rationalize low margin SKUs from our product portfolio contributed 1.3% to the overall year-over-year decline in net sales, primarily within our Snacking & Beverages segment. The divestiture of the McCann's business in July 2018 and unfavorable foreign currency exchange each contributed 0.1% to the year-over-year decline in net sales.

Gross Profit — Gross profit as a percentage of net sales was 18.6% for the year ended December 31, 2019 compared to 19.4% for the year ended December 31, 2018, a decrease of 0.8 percentage points. The decrease is primarily due to lower volumes and the related cost impacts, $11.4 million of expenses related to regulatory compliance with upcoming nutrition label requirements and $4.3 million related to the multiemployer pension plan withdrawal recognized in 2019. This is partially offset by lower expenses associated with our restructuring programs of $4.4 million in 2019 compared to $13.3 million in 2018.

Total Operating Expenses — Total operating expenses as a percentage of net sales was 19.0% for the year ended December 31, 2019 compared to 17.6% for the year ended December 31, 2018, an increase of 1.4 percentage points. The increase is primarily due to non-cash impairment charges of $129.1 million related to the Cookies and Dry Dinners asset groups, within the Snacking & Beverages and Meal Preparation segments, respectively, and two In-Store Bakery facilities in 2019, and $13.4 million of acquisition, integration, divestiture and related gains mostly related to the divestiture of the McCann's business in 2018 compared to $0.6 million expense in 2019. This is partially offset by lower restructuring expenses of $99.3 million in 2019, compared to $149.1 million in 2018, lower freight costs due to increased market capacity and reduced spot market usage, and lower variable incentive compensation.

Total Other Expense — Total other expense decreased by $1.3 million to $139.7 million in 2019 compared to $141.0 million in 2018. The decrease was primarily due to favorable fluctuations in the currency exchange rates between the U.S. and Canadian dollar during the respective periods and lower interest expense. The lower interest expense reflects lower net debt compared to the prior year, partially offset by the year-over-year increase in the LIBOR interest rate. This decrease in total other expense is partially offset by unrealized losses of $47.0 million related to mark-to-market derivative contracts in 2019, compared to unrealized losses of $22.5 million in 2018.

Income Taxes - Income tax benefit was recorded at an effective rate of 29.2% in 2019 compared to 19.8% in 2018. The change in the Company’s effective tax rate year-over-year is primarily due to a one-time tax benefit in 2019 associated with the repatriation of the U.S. customer based intangibles formerly held by our Canadian subsidiaries, a change in the valuation

allowance recorded against certain deferred tax assets, and a change in the amount of executive compensation that is non-deductible for tax purposes.

Our effective tax rate may change from period to period based on recurring and non-recurring factors including the jurisdictional mix of earnings, enacted tax legislation, state income taxes, settlement of tax audits, and the expiration of the statute of limitations in relation to unrecognized tax benefits.

Discontinued Operations

Net loss from discontinued operations increased $232.5 million in the year ended December 31, 2019 compared to 2018. The increase is primarily the result of the non-cash pre-tax loss on the divestiture of the Snacks division of $98.4 million and expected disposal loss on the RTE Cereal business recognized as an impairment charge of $74.5 million during the twelve months ended December 31, 2019.

Year Ended December 31, 2019 Compared to Year Ended December 31, 2018 — Results by Segment

|

| | | | | | | | | | | | | |

| | Year Ended December 31, 2019 |

| | Meal Preparation | | Snacking & Beverages |

| | Dollars | | Percent | | Dollars | | Percent |

| | |

| Net sales | $ | 2,680.7 |

| | 100.0 | % | | $ | 1,608.2 |

| | 100.0 | % |

| Cost of sales | 2,162.4 |

| | 80.7 |

| | 1,313.2 |

| | 81.7 |

|

| Gross profit | 518.3 |

| | 19.3 |

| | 295.0 |

| | 18.3 |

|

| Freight out and commissions | 102.6 |

| | 3.8 |

| | 79.5 |

| | 4.9 |

|

| Direct selling, general, and administrative | 34.4 |

| | 1.3 |

| | 22.7 |

| | 1.4 |

|

| Direct operating income | $ | 381.3 |

| | 14.2 | % | | $ | 192.8 |

| | 12.0 | % |

|

| | | | | | | | | | | | | |

| | Year Ended December 31, 2018 |

| | Meal Preparation | | Snacking & Beverages |

| | Dollars | | Percent | | Dollars | | Percent |

| | |

| Net sales | $ | 2,871.6 |

| | 100.0 | % | | $ | 1,716.2 |

| | 100.0 | % |

| Cost of sales | 2,287.6 |

| | 79.7 |

| | 1,396.9 |

| | 81.4 |

|

| Gross profit | 584.0 |

| | 20.3 |

| | 319.3 |

| | 18.6 |

|

| Freight out and commissions | 127.0 |

| | 4.4 |

| | 113.3 |

| | 6.6 |

|

| Direct selling, general, and administrative | 38.1 |

| | 1.3 |

| | 25.8 |

| | 1.5 |

|

| Direct operating income | $ | 418.9 |

| | 14.6 | % | | $ | 180.2 |

| | 10.5 | % |

The change in net sales from the year ended December 31, 2018 to year ended December 31, 2019 was due to the following:

|

| | | | | | | | | | | | | | |

| | Year Ended December 31, |

| | Meal Preparation | | Snacking & Beverages |

| | Dollars | | Percent | | Dollars | | Percent |

| | |

| 2018 Net Sales | $ | 2,871.6 |

| | | | $ | 1,716.2 |

| | |

| SKU rationalization | (15.3 | ) | | (0.5 | )% | | (44.9 | ) | | (2.6 | )% |

| Volume/mix excluding SKU rationalization | (174.6 | ) | | (6.1 | ) | | (81.9 | ) | | (4.8 | ) |

| Pricing | 7.3 |

| | 0.3 |

| | 20.2 |

| | 1.2 |

|

| Divestiture | (4.5 | ) | | (0.2 | ) | | — |

| — |

| — |

|

| Foreign currency | (3.8 | ) | | (0.1 | ) | | (1.4 | ) | | (0.1 | ) |

| 2019 Net sales | $ | 2,680.7 |

| | (6.6 | )% | | $ | 1,608.2 |

| | (6.3 | )% |

Meal Preparation

Net sales in the Meal Preparation segment decreased $190.9 million or 6.6% in the year ended December 31, 2019 compared to the year ended December 31, 2018 due to unfavorable volume/mix primarily from lost distribution mostly in Pasta, Pickles, Powdered Creamers, and Single Serve Beverages, the continued impact of lower pricing on Single Serve Beverages due to competitive pressure, ongoing efforts to simplify and rationalize low margin SKUs, the divestiture of the McCann's business, and unfavorable foreign currency. These declines were partially offset by pricing actions taken to recover commodity, freight, and packaging inflation.

Direct operating income as a percentage of net sales decreased 0.4 percentage points in the year ended December 31, 2019 compared to the year ended December 31, 2018. The decrease is primarily due to lost distribution, the continued impact of lower pricing on Single Serve Beverages due to competitive pressure, and higher operating costs. These declines were partially offset by pricing actions taken in response to commodity, freight, and packaging inflation and lower freight costs due to increased market capacity and reduced spot market usage.

Snacking & Beverages

Net sales in the Snacking & Beverages segment decreased $108.0 million or 6.3% in the year ended December 31, 2019 compared to year ended December 31, 2018 due to unfavorable volume/mix primarily from lost distribution mostly in Broth, In-Store Bakery, Crackers and Bars, ongoing efforts to simplify and rationalize low margin SKUs, and unfavorable foreign currency. These declines were partially offset by pricing actions taken to recover commodity, freight, and packaging inflation.

Direct operating income as a percentage of net sales increased 1.5 percentage points in the year ended December 31, 2019 compared to the year ended December 31, 2018. The increase is primarily due to lower freight costs as a result of increased market capacity and reduced spot market usage, cost savings due to TreeHouse 2020 and Structure to Win initiatives, pricing actions taken to recover commodity, freight, and packaging inflation, and favorable mix due to the rationalization of low margin business. This was partially offset by lower volume.

Year Ended December 31, 2018 Compared to Year Ended December 31, 2017

Continuing Operations

Net Sales – Consolidated net sales decreased 5.5% to $4,587.8 million for the year ended December 31, 2018, compared to $4,852.6 million for the year ended December 31, 2017. The change in net sales from 2017 to 2018 was due to the following:

|

| | | | | | | | | | |

| | | Dollars | | Percent | | Percentage Change in Pounds |

| | | (In millions) | | | | |

| 2017 Net sales | | $ | 4,852.6 |

| | | | |

| Volume/mix excluding SKU rationalization | | (119.0 | ) | | (2.5 | )% | | (5.4 | )% |

| Pricing | | 71.2 |

| | 1.5 |

| | — |

|

| Product recalls | | (2.3 | ) | | — |

| | — |

|

| 2018 Organic Net Sales | | $ | 4,802.5 |

| | (1.0 | )% | | (5.4 | )% |

| SKU rationalization | | (149.2 | ) | | (3.1 | ) | | (2.8 | ) |

| Divestitures | | (65.9 | ) | | (1.4 | ) | | — |

|

| Foreign currency | | 0.4 |

| | — |

| | — |

|

| 2018 Net sales | | $ | 4,587.8 |

| | (5.5 | )% | | (8.2 | )% |

Organic net sales decreased 1.0% for the year ended December 31, 2018 driven by:

| |

| • | Volume/mix was unfavorable 2.5% year-over-year due to declines in the Meal Preparation segment. Shipped volume in pounds excluding the impact of SKU rationalization declined 5.4%. |

| |

| • | Pricing was favorable 1.5% during 2018 compared to 2017 driven by pricing actions to cover commodity, freight, and packaging inflation. |

Our efforts to simplify and rationalize low margin SKUs from our product portfolio contributed 3.1% to the overall year-over-year decline in net sales, across both segments. The divestiture of the McCann's business in July 2018 and the soup and infant feeding business ("SIF") in May 2017 contributed 1.4% to the year-over-year decline in net sales.

Gross Profit — Gross profit as a percentage of net sales was 19.4% for the year ended December 31, 2018 compared to 20.2% for the year ended December 31, 2017, a decrease of 0.8 percentage points. The decrease is primarily due to lower volumes across both segments and higher production costs, including costs associated with a labor dispute in the Meal Preparation segment, as well as higher freight, commodity and variable incentive compensation costs. This was partially offset by pricing actions to recover commodity, freight, and packaging inflation, and lower expenses for restructuring programs of $13.3 million for 2018 compared to $35.5 million for restructuring programs in 2017.

Total Operating Expenses - Total operating expenses decreased to $808.8 million in 2018 compared to $898.9 million in 2017. The decrease of $90.1 million in 2018 is primarily attributable to a goodwill and other intangible asset impairment of $59.0 million related to Bars asset group in the Snacking & Beverages segment in 2017, and savings from the Structure to Win initiative and other cost saving measures, partially offset by an increase in other operating expenses and higher freight costs. Included in other operating expenses in 2018 were costs associated with restructuring programs with respect to the Company's TreeHouse 2020 margin improvement program and other plant closures, and acquisition, integration, divestiture and related costs, partially offset by the gain on the divestiture of the McCann's business of $14.3 million in the third quarter of 2018. Other operating expenses in 2017 reflects a loss on the divestiture of the SIF business of $86.0 million in the second quarter of 2017, costs associated with restructuring programs with respect to the Company's TreeHouse 2020 margin improvement activities and other plant closures, and acquisition, integration, divestiture and related costs. Refer to Note 3 to our Consolidated Financial Statements for additional information regarding restructuring activity.

Total Other Expense - Total other expense increased by $33.3 million to $141.0 million in 2018 compared to $107.7 million for 2017. The increase was primarily related to non-cash mark-to-market expense in 2018 compared to non-cash mark-to-market income in 2017 on derivative instruments, primarily interest rate swaps, unfavorable fluctuations in currency exchange rates between the U.S. and Canadian dollar during the respective periods, and a loss on debt extinguishment related to repurchases of the 2022 Notes and 2024 Notes. This was partially offset by lower interest expense mainly driven by lower net debt and lower credit facility pricing from the December 1, 2017 credit agreement amendment.

Income Taxes - Income tax benefit was recorded at an effective rate of 19.8% in 2018 compared to 490.5% in 2017. The change in the Company’s effective tax rate year-over-year is primarily due to the enactment of the Tax Cuts and Jobs Act, restructuring of the Company’s foreign operations in 2017, the 2017 impairment of goodwill that was not deductible for tax purposes, and compensation of officers that is not deductible for tax purposes.

Our effective tax rate may change from period to period based on recurring and non-recurring factors including the jurisdictional mix of earnings, enacted tax legislation, state income taxes, settlement of tax audits, and the expiration of the statute of limitations in relation to unrecognized tax benefits.

Discontinued Operations

Net loss from discontinued operations decreased to $18.2 million in the year ended December 31, 2018 compared to $390.8 million in the year ended December 31, 2017. The decrease is primarily attributable to the impairment of goodwill and other intangible assets of $490.7 million related to the Snacks division in 2017. There was no impairment recorded in 2018.

Year Ended December 31, 2018 Compared to Year Ended December 31, 2017 — Results by Segment

|

| | | | | | | | | | | | | |

| | Year Ended December 31, 2018 |

| | Meal Preparation | | Snacking & Beverages |

| | Dollars | | Percent | | Dollars | | Percent |

| | |

| Net sales | $ | 2,871.6 |

| | 100.0 | % | | $ | 1,716.2 |

| | 100.0 | % |

| Cost of sales | 2,287.6 |

| | 79.7 |

| | 1,396.9 |

| | 81.4 |

|

| Gross profit | 584.0 |

| | 20.3 |

| | 319.3 |

| | 18.6 |

|

| Freight out and commissions | 127.0 |

| | 4.4 |

| | 113.3 |

| | 6.6 |

|

| Direct selling, general, and administrative | 38.1 |

| | 1.3 |

| | 25.8 |

| | 1.5 |

|

| Direct operating income | $ | 418.9 |

| | 14.6 | % | | $ | 180.2 |

| | 10.5 | % |

|

| | | | | | | | | | | | | |

| | Year Ended December 31, 2017 |

| | Meal Preparation | | Snacking & Beverages |

| | Dollars | | Percent | | Dollars | | Percent |

| | |

| Net sales | $ | 3,095.9 |

| | 100.0 | % | | $ | 1,751.9 |

| | 100.0 | % |

| Cost of sales | 2,452.3 |

| | 79.2 |

| | 1,398.5 |

| | 79.8 |

|

| Gross profit | 643.6 |

| | 20.8 |

| | 353.4 |

| | 20.2 |

|

| Freight out and commissions | 135.0 |

| | 4.4 |

| | 96.7 |

| | 5.5 |

|

| Direct selling, general, and administrative | 46.4 |

| | 1.5 |

| | 31.2 |

| | 1.8 |

|

| Direct operating income | $ | 462.2 |

| | 14.9 | % | | $ | 225.5 |

| | 12.9 | % |

The change in net sales from the year ended December 31, 2017 to year ended December 31, 2018 was due to the following:

|

| | | | | | | | | | | | | |

| | Year Ended December 31, |

| | Meal Preparation | | Snacking & Beverages |

| | Dollars | | Percent | | Dollars | | Percent |

| | |

| 2017 Net Sales | $ | 3,095.9 |

| | | | $ | 1,751.9 |

| | |

| SKU rationalization | (86.3 | ) | | (2.8 | )% | | (62.9 | ) | | (3.6 | )% |

| Volume/mix excluding SKU rationalization | (122.7 | ) | | (3.9 | ) | | 6.2 |

| | 0.4 |

|

| Pricing | 50.5 |

| | 1.6 |

| | 20.7 |

| | 1.2 |

|

| Divestitures | (65.9 | ) | | (2.1 | ) | | — |

| | — |

|

| Foreign currency | 0.1 |

| | — |

| | 0.3 |

| | — |

|

| 2018 Net sales | $ | 2,871.6 |

| | (7.2 | )% | | $ | 1,716.2 |

| | (2.0 | )% |

Meal Preparation

Net sales in the Meal Preparation segment decreased by $224.3 million, or 7.2%, for the year ended December 31, 2018 compared to the year ended December 31, 2017. The change in net sales was due to unfavorable volume/mix primarily related to Powdered Creamers, Refrigerated Dough, Pasta, Dry Dinners, Preserves, Pickles and Dressings, ongoing efforts to simplify and rationalize low margin SKUs, the divestiture of the SIF and McCann's businesses, and the impact of lower pricing on Single Serve Beverages due to competitive pressure. This was partially offset by pricing actions taken to recover commodity and freight inflation.

Direct operating income as a percentage of net sales decreased 0.3 percentage points for the year ended December 31, 2018 compared to the year ended December 31, 2017. This decrease was primarily due to higher production costs (Powdered Creamers) and the impact of lower pricing on Single Serve Beverages due to competitive pressure, partially offset by pricing actions taken to recover commodity and freight inflation, lower expenses due to Structure to Win savings combined with lower expenses due to other cost savings activities, and logistics efficiency.

Snacking & Beverages

Net sales in the Snacking & Beverages segment decreased by $35.7 million, or 2.0%, for the year ended December 31, 2018 compared to the year ended December 31, 2017. The change in net sales was due to ongoing efforts to simplify and rationalize low margin SKUs, partially offset by pricing actions taken to recover commodity and freight inflation, and favorable volume/mix.

Direct operating income as a percentage of net sales decreased 2.4 percentage points for the year ended December 31, 2018 compared to the year ended December 31, 2017. This decrease was primarily due to higher production, commodity, and freight costs, partially offset by pricing actions taken to recover commodity and freight inflation, and lower expenses due to Structure to Win savings combined with lower expenses due to other cost savings activities.

Known Trends and Uncertainties

The costs of raw materials, ingredients, packaging materials, fuel, and energy have been volatile in recent years and future changes in such costs may cause our results of operations and our operating margins to fluctuate significantly. We expect these costs to continue to be volatile with an overall long-term upward trend. We manage the impact of cost increases, wherever possible, on commercially reasonable terms, by locking in prices on the quantities we expect are required to meet our production requirements. In addition, we offset the effect of increased costs by raising prices to our customers. However, for competitive reasons, we may not be able to pass along the full effect of increases in raw materials and other input costs as we incur them. Additionally, the Company expects to incur additional costs related to compliance with the Nutrition Labeling and Education Act and Bioengineered Labeling Declaration.

Freight rates decreased during 2019 compared to 2018. This decrease in rates was primarily due to added capacity lowering freight rates in the trucking market. The Company attempts to secure freight agreements when available and price accordingly to offset the increase in rates.

The Canadian dollar exposure to revenue is greater than the exposure to input costs for Canadian produced products. As such, an unfavorable Canadian dollar leads to an unfavorable impact to the Company’s operating results. The average exchange rate for fiscal year 2019 compared to fiscal year 2018 between the U.S. and Canadian dollar shows the U.S. dollar strengthened approximately 2.4%, while the exchange rate at December 31, 2019 shows that the U.S. dollar weakened approximately 5.3% as compared to the rate at December 31, 2018. The Company enters hedging arrangements to limit the impact of these fluctuations. In addition to higher input costs, the Company is impacted by the re-measurement of the Canadian dollar denominated intercompany loans and the translation of the Canadian dollar financial statements.

Competitive Environment

There has been significant consolidation in the retail grocery and foodservice industries in recent years resulting in mass merchandisers and non-traditional grocers, such as those offering a limited assortment of products, gaining market share. As our customer base continues to consolidate, we expect competition to intensify as we compete for the business of fewer, large customers. Additionally, the introduction of e-commerce grocers brings new opportunities and risks. There can be no assurance that we will be able to keep our existing customers, or gain new customers. As the consolidation of the retail grocery and foodservice industry continues, we could lose sales and profits if any one or more of our existing customers were to be sold or if limited assortment stores reduce the variety of products that we sell.

Both the difficult economic environment and the increased competitive environment in the retail and foodservice channels have caused competition to become increasingly intense in our business. We expect this trend to continue for the foreseeable future.

Liquidity and Capital Resources

Cash Flow

Management assesses the Company’s liquidity in terms of its ability to generate cash to fund its operating, investing, and financing activities. The Company remains in a strong financial position, with resources available for reinvesting in existing businesses, conducting acquisitions, and managing its capital structure on a short and long-term basis. If additional borrowings are needed, approximately $723.6 million was available under the Revolving Credit Facility as of December 31, 2019. See Note 13 to our Consolidated Financial Statements for additional information regarding our Revolving Credit Facility. We are in compliance with the terms of the Revolving Credit Facility and expect to meet foreseeable financial requirements.

The following table is derived from our Consolidated Statement of Cash Flows:

|

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| | (in millions) |

| Net Cash Flows Provided By (Used In): | |

| | |

| | |

|

| Operating activities of continuing operations | $ | 263.9 |

| | $ | 472.1 |

| | $ | 465.7 |

|

| Investing activities of continuing operations | (139.3 | ) | | (142.4 | ) | | (135.6 | ) |

| Financing activities of continuing operations | (206.9 | ) | | (311.0 | ) | | (278.3 | ) |

| Cash flows from discontinued operations | 115.0 |

| | 15.2 |

| | 16.1 |

|

Operating Activities From Continuing Operations

Our cash provided by operating activities of continuing operations was $263.9 million in 2019 compared to $472.1 million in 2018, a decrease of $208.2 million. The decrease is primarily attributable to lower accounts payable and higher incentive compensation payments partially offset by lower receivables due to the higher use of the Receivables Sales Program (refer to Note 6 to the Consolidated Financial statements for additional information). Accounts payable decreased largely due to the settlement of payables retained as part of the divestiture of the Snacks division.

Our cash provided by operating activities of continuing operations was $472.1 million in 2018 compared to $465.7 million in 2017, an increase of $6.4 million. The increase is primarily attributable to improved working capital management partially offset by higher restructuring program expenses in 2018.

The Company's working capital management emphasis continues to be focused on reducing inventory, driving faster collection of receivables, and extending vendor terms.

Investing Activities From Continuing Operations

Cash used in investing activities of continuing operations was $139.3 million in 2019 compared to $142.4 million in 2018, a decrease in cash used of $3.1 million, driven by lower capital expenditures in 2019 compared to 2018, partially offset by the proceeds from the sale of the McCann's business in 2018.

Cash used in investing activities of continuing operations was $142.4 million in 2018 compared to $135.6 million in 2017, an increase in cash used of $6.8 million, driven by higher capital expenditures in 2018 compared to 2017, partially offset by increased proceeds from divestitures.

Financing Activities From Continuing Operations

Net cash used in financing activities from continuing operations was $206.9 million in 2019 compared to $311.0 million in 2018, a decrease in cash used of $104.1 million. The decrease is primarily attributable to repurchases of the 2022 Notes and 2024 Notes (refer to Note 13) and common stock repurchases, which did not recur in 2019, partially offset by early payments of $200.0 million on the Company's term loans during 2019.

Net cash used in financing activities of continuing operations was $311.0 million in 2018 compared to $278.3 million in 2017, an increase in cash used of $32.7 million. The increase is primarily attributable to repurchases of the 2022 Notes and 2024 Notes (refer to Note 13) and common stock repurchases, partially offset by reduced net loan activity under the Revolver during 2018.

Cash Flows From Discontinued Operations

Our cash provided by discontinued operations was $115.0 million in 2019 compared to cash provided of $15.2 million in 2018, an increase in cash provided of $99.8 million. The increase in cash flow during 2019 compared to 2018 is primarily attributable to proceeds received from the sale of the Snacks division and lower inventory.

Our cash provided by discontinued operations was $15.2 million in 2018 compared to $16.1 million in 2017, a decrease in cash provided of $0.9 million. The decrease in cash flow during 2018 compared to 2017 is primarily attributable to lower cash earnings partially offset by lower inventory and lower capital expenditures.

Free Cash Flow From Continuing Operations

In addition to measuring our cash flow generation and usage based upon the operating, investing, and financing classifications included in the Consolidated Statements of Cash Flows, we also measure free cash flow from continuing operations (a Non-GAAP measure) which represents net cash provided by operating activities from continuing operations less capital expenditures. We believe free cash flow is an important measure of operating performance because it provides management and investors a measure of cash generated from operations that is available for mandatory payment obligations and investment opportunities such as funding acquisitions, repaying debt, and repurchasing our common stock.

The following table reconciles cash flow provided by operating activities from continuing operations (a GAAP measure) to our free cash flow from continuing operations (a Non-GAAP measure):

|

| | | | | | | | | | | |

| | Year Ended December 31, |

| | 2019 | | 2018 | | 2017 |

| | (In millions) |

| Cash flow provided by operating activities from continuing operations | $ | 263.9 |

| | $ | 472.1 |

| | $ | 465.7 |

|

| Less: Capital expenditures | (146.8 | ) | | (177.4 | ) | | (161.6 | ) |

| Free cash flow from continuing operations | $ | 117.1 |

| | $ | 294.7 |

| | $ | 304.1 |

|

Debt Obligations

At December 31, 2019, we had $458.4 million outstanding under Term Loan A, $681.6 million outstanding under Term Loan A-1, $375.9 million of the 2022 Notes outstanding, $602.9 million of the 2024 Notes outstanding, and $3.9 million of other obligations. In addition, at December 31, 2019, there were $26.4 million in letters of credit under the Revolving Credit Facility that were issued but undrawn.

Credit Agreement — On December 1, 2017, the Company entered into the Second Amended and Restated Credit Agreement (the “Credit Agreement”) which amends, restates, and replaces the Company’s prior credit agreement, dated as of February 1, 2016 (as amended from time to time prior to February 1, 2016, the “Prior Credit Agreement”). As amended, the senior unsecured credit facility includes a revolving credit facility (the “Revolving Credit Facility” or the “Revolver”) and two term loans. The Credit Agreement (1) extended the maturity dates of the Revolving Credit Facility, Term Loan A, and Term Loan A-1, (2) resized the Revolver from $900 million to $750 million, (3) consolidated three term loans into two, (4) tightened pricing, and (5) modified the fee structure on the Revolving Credit Facility to now calculate based on the unused portion of the commitments under the Revolving Credit Facility rather than the total commitments under the Revolving Credit Facility.

On June 11, 2018, the Company entered into Amendment No. 1 (the “Amendment”) to the Credit Agreement. Under the Amendment, among other things, (i) the leverage covenant threshold has increased through fiscal year 2019, (ii) the Company and the other loan parties secured the obligations with liens on substantially all of their personal property, and (iii) such liens will be released upon the Company’s leverage ratio being less than or equal to 4.00 to 1.00 no earlier than the fiscal quarter ended on December 31, 2019. The material terms and conditions under the Credit Agreement are otherwise substantially consistent with those contained in the Credit Agreement prior to the Amendment. In connection with this Amendment, $0.6 million in lender fees will be amortized ratably through January 31, 2025 and $1.8 million of fees will be amortized ratably through February 1, 2023.

On August 26, 2019, the Company entered into Amendment No. 2 (the “Amendment”) to the Credit Agreement. This Amendment permanently maintains the secured status of the credit facility and the maximum permitted leverage ratio at 4.5x. Absent the Amendment, the Credit Agreement was scheduled to return to unsecured status with a maximum permitted leverage

ratio of 4.0x in the fourth quarter of 2019. The material terms and conditions under the Credit Agreement are otherwise substantially consistent with those contained in the Credit Agreement prior to the Amendment.

The Company’s average interest rate on debt outstanding under its Credit Agreement for the year ended December 31, 2019 was 4.11%. Including the impact of the interest rate swap agreements in effect as of December 31, 2019, the average rate decreased to 3.60%.

Revolving Credit Facility — As of December 31, 2019, $723.6 million of the aggregate commitment of $750.0 million of the Revolving Credit Facility was available. Under the Credit Agreement, the Revolving Credit Facility matures on February 1, 2023. In addition, as of December 31, 2019, there were $26.4 million in letters of credit under the Revolving Credit Facility that were issued but undrawn, which have been included as a reduction to the calculation of available credit.

Interest is payable quarterly or, if earlier, at the end of the applicable interest period in arrears on any outstanding borrowings under the Revolving Credit Facility. The interest rates applicable to the Revolving Credit Facility are based upon the Company’s consolidated net leverage ratio or the Company’s Corporate Credit Rating, whichever results in lower pricing, and are determined by either (i) LIBOR, plus a margin ranging from 1.20% to 1.70%, or (ii) a Base Rate (as defined in the Credit Agreement), plus a margin ranging from 0.20% to 0.70%. The unused fee on the Revolving Credit Facility is also based on the Company’s consolidated net leverage ratio or the Company’s Corporate Credit Rating, whichever results in lower pricing, and accrues at a rate ranging from 0.20% to 0.35%.

The Credit Agreement is fully and unconditionally, as well as jointly and severally, guaranteed by our 100% owned direct and indirect domestic subsidiaries: Bay Valley Foods, LLC; Sturm Foods, Inc. (includes Cains Foods, Inc. beginning in the fourth quarter of 2019); S.T. Specialty Foods, Inc.; Associated Brands, Inc.; Protenergy Holdings, Inc.; Protenergy Natural Foods, Inc.; TreeHouse Private Brands, Inc. (formerly Ralcorp Holdings, Inc.); American Italian Pasta Company.; Linette Quality Chocolates, Inc.; Ralcorp Frozen Bakery Products, Inc.; Cottage Bakery, Inc.; The Carriage House Companies, Inc. and certain other domestic subsidiaries that may become guarantors in the future, which are collectively known as the “Guarantor Subsidiaries.” As of August 1, 2019, Nutcracker Brands, Inc. and Flagstone Foods, Inc. are no longer Guarantor Subsidiaries due to the Snacks division divestiture. During the fourth quarter of 2019, Cains Foods, L.P. was dissolved and Cains GP, LLC was renamed as TreeHouse Foods Services, LLC. The Credit Agreement contains various financial and restrictive covenants and requires that the Company maintain a consolidated net leverage ratio of no greater than 4.50 to 1.0. The Credit Agreement also contains cross-default provisions which could result in the acceleration of payments in the event TreeHouse or the Guarantor Subsidiaries (i) fails to make a payment when due in respect of any indebtedness or guarantee having an aggregate principal amount greater than $75.0 million or (ii) fails to observe or perform any other agreement or condition related to such indebtedness or guarantee as a result of which the holder(s) of such debt are permitted to accelerate the payment of such debt.

Term Loan A — On December 1, 2017, the Company entered into a $500 million term loan which amended and extended the Company’s existing term A loan. The maturity date is January 31, 2025. The interest rates applicable to Term Loan A are based upon the Company’s consolidated net leverage ratio or the Company’s Corporate Credit Rating, whichever results in lower pricing, and are determined by either (i) LIBOR, plus a margin ranging from 1.675% to 2.175%, or (ii) a Base Rate (as defined in the Credit Agreement), plus a margin ranging from 0.675% to 1.175%. Principal amortization payments are due on a quarterly basis and interest is payable quarterly or, if earlier, at the end of the applicable interest period in arrears on any outstanding borrowings under Term Loan A. Term Loan A is subject to substantially the same covenants as the Revolving Credit Facility, and also has the same Guarantor Subsidiaries.

Term Loan A-1 — On December 1, 2017, the Company entered into a $900 million term loan which amended and extended the Company’s existing tranche A-1 and tranche A-2 term loans. The maturity date is February 1, 2023. The interest rates applicable to Term Loan A-1 are the same as those applicable to the Revolving Credit Facility (other than, for the avoidance of doubt, the unused fee). Principal amortization payments are due on a quarterly basis and interest is payable quarterly or, if earlier, at the end of the applicable interest period in arrears on any outstanding borrowing under Term Loan A-1. Term Loan A-1 is subject to substantially the same covenants as the Revolving Credit Facility, and has the same Guarantor Subsidiaries.

Term Loan A-2 — On December 1, 2017, Term Loan A-2 was paid off as part the Credit Agreement utilizing borrowings under Term Loan A and Term Loan A-1.

2022 Notes — On March 11, 2014, the Company completed its underwritten public offering of $400 million in aggregate principal amount of 4.875% notes due March 15, 2022 (the “2022 Notes”). The net proceeds of $394.0 million ($400.0 million less underwriting discount of $6.0 million, providing an effective interest rate of 4.99%) were used to extinguish the Company’s previously issued 7.75% notes due on March 1, 2018 (the “2018 Notes”). Interest is payable on March 15 and September 15 of each year. The 2022 Notes will mature on March 15, 2022.

The Company may redeem all or some of the 2022 Notes upon not less than 30 nor more than 60 days’ notice, at the redemption prices as set forth in the Indenture plus any accrued or unpaid interest to the applicable redemption date. Subject to certain limitations, in the event of a change in control of the Company, the Company will be required to make an offer to purchase the 2022 Notes at a purchase price equal to 101% of the principal amount of the 2022 Notes, plus accrued and unpaid interest up to the purchase date.

2024 Notes — On January 29, 2016, the Company completed an exempt offering under Rule 144A and Regulation S of the Securities Act of $775 million in aggregate principal amount of 6.0% notes due February 15, 2024. The net proceeds from the issuance of the 2024 Notes (approximately $760.7 million after deducting issuance costs, providing an effective interest rate of 6.23%) were used to fund a portion of the purchase price of the Private Brands Business. Interest is payable on February 15 and August 15 of each year. The payments began on August 15, 2016. The 2024 Notes will mature on February 15, 2024.