UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No.__ )

| | | | | | | | | | | |

| ☒ | Filed by the Registrant | ☐ | Filed by a Party other than the Registrant |

| | | | | | | | |

| CHECK THE APPROPRIATE BOX: |

| ☒ | | Preliminary Proxy Statement |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | | Definitive Proxy Statement |

| ☐ | | Definitive Additional Materials |

| ☐ | | Soliciting Material Under §240.14a-12 |

TREEHOUSE FOODS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

| | | | | | | | | | | |

| PAYMENT OF FILING FEE (CHECK ALL BOXES THAT APPLY): |

| ☒ | | No fee required |

| ☐ | | Fee paid previously with preliminary materials |

| ☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| | | | | | | | |

| | |

| | |

| Notice of Annual Meeting

of Stockholders | |

| | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Meeting Details | | | To the Stockholders of TreeHouse Foods, Inc.: |

| | | | | | | | |

DATE AND TIME Thursday, April 24, 2025 9:00 a.m. CT | | | You are cordially invited to the Annual Meeting of Stockholders (“Annual Meeting”) of TreeHouse Foods, Inc. ("TreeHouse Foods," “TreeHouse,” “Company,” "we," "us," or "our," as the context requires) to be held on Thursday, April 24, 2025, at 9:00 a.m. Central Time. Your vote is very important to us. Whether or not you plan to attend the 2025 Annual Meeting online, we encourage you to vote promptly. You can vote via the internet, by telephone, by mail or by attending and voting online during the Annual Meeting. We hope that you vote your shares, which in turn helps us ensure that our corporate governance practices, decisions and strategy all remain aligned with the priorities of our stockholders and other stakeholders. Regular, transparent interaction with our stockholders is a cornerstone of our corporate governance practices. The following matters will be considered at the Annual Meeting: |

| | |

LOCATION Via live webcast at www.virtualshareholdermeeting.com/THS2025 | | |

| | | | | | | |

| | | | | | | |

| | Proposals | | Board Vote

Recommendation | | For Further

Details |

| | | |

| | | | | | | |

| | | 1 | Election of Directors. | | FOR each director nominee | | |

WHO CAN VOTE Stockholders of record as of February 25, 2025 | | | | |

| | 2 | Advisory vote to approve the Company’s executive compensation. | | FOR | | |

| | 3 | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2025. | | FOR | | |

| | | 4 | Approval of an amendment to the Company's Restated Certificate of Incorporation to limit the liability of certain officers as permitted by law. | | FOR | | |

| | | 5 | Stockholder proposal to implement a simple majority vote requirement in our governance documents. | | FOR | | |

| | | Stockholders may also act on any other business properly presented to the meeting. | | |

Similar to last year, we will conduct our 2025 Annual Meeting in a virtual format with no physical in-person meeting. Stockholders attending the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. Stockholders can attend the 2025 Annual Meeting by visiting www.virtualshareholdermeeting.com/THS2025 where you will be able to listen to the meeting live, submit questions and vote.

This Notice of the 2025 Annual Meeting and Proxy Statement contain details of the business to be conducted at the upcoming Annual Meeting. For more information about registering to attend the Annual Meeting, please refer to the Summary of the Annual Meeting section in the accompanying proxy statement. On or about March 14, 2025, we will distribute our 2025 Proxy Statement (“Proxy Statement”), our 2024 Annual Report (“Annual Report”), and a proxy card to our stockholders.

On behalf of our Board, we thank you for your continued support and investment in TreeHouse Foods, Inc.

Kristy N. Waterman

EVP, Chief Human Resources Officer, General Counsel & Corporate Secretary

February 27, 2025

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON APRIL 24, 2025

Our proxy materials include this Proxy Statement, a proxy card and our Annual Report and are available free of charge at www.proxyvote.com.

This summary highlights information contained elsewhere in this Proxy Statement. This summary does not contain all of the information that you should consider, and you should read the entire Proxy Statement carefully before voting. Page references are supplied to help you find further information in this Proxy Statement.

Meeting Details

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

DATE Thursday, April 24, 2025 | | TIME 9:00 a.m. Central Time | | LOCATION Via live webcast at www.virtualshareholdermeeting.com/THS2025 | | WHO CAN VOTE Stockholders of record as of February 25, 2025 |

How to Vote

| | | | | |

| BY INTERNET Go to www.proxyvote.com to use the internet to transmit your voting instructions and for electronic delivery of information up until 11:59 p.m. Eastern Time on Wednesday, April 23, 2025. Have your proxy card in hand when you access the website and follow the instructions to obtain your records and to create an electronic voting instruction form. |

| BY TELEPHONE Call 1-800-690-6903 and use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m. Eastern Time on Wednesday, April 23, 2025. Have your proxy card in hand when you call and then follow the instructions. |

| BY MAIL Mark, sign, and date your proxy card and return it in the postage-paid envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. |

| DURING THE ANNUAL MEETING Go to www.virtualshareholdermeeting.com/THS2025. You may attend the meeting via the internet and vote during the meeting. You will need the control number provided on your proxy card that accompanied your proxy materials in order to vote during the virtual Annual Meeting. |

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 1 |

Voting Matters

| | | | | | | | | | | | | | | | | |

| | | | | |

| Proposals | | Board Vote

Recommendation | | For Further

Details |

| | | | | |

| 1 | Election of Directors. | | FOR each director nominee | | |

| 2 | Advisory vote to approve the Company’s executive compensation. | | FOR | | |

| 3 | Ratification of the selection of Deloitte & Touche LLP as our independent registered public accounting firm for fiscal year 2025. | | FOR | | |

| 4 | Approval of an amendment to the Company's Restated Certificate of Incorporation to limit the liability of certain officers as permitted by law. | | FOR | | |

| 5 | Stockholder proposal to implement a simple majority vote requirement in our governance documents. | | FOR | | |

| Stockholders may also act on other business properly presented to the meeting. | | | | |

This Proxy Statement contains forward-looking statements within the meaning of the federal securities laws. The forward-looking statements are based on current expectations, estimates, forecasts, and projections about the industry in which we operate and management’s beliefs and assumptions. Forward-looking statements may be identified by the use of words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “outlook,” “projects,” “forecasts,” and similar expressions. Forward-looking statements are not guarantees of future performance, rely on a number of assumptions, and involve certain known and unknown risks and uncertainties that are difficult to predict, many of which are beyond our control. For more information on these risks, uncertainties and other factors, refer to our Annual Report on Form 10-K for the year ended December 31, 2024, under the heading “Risk Factors” in Item 1A, as updated in Part II of our subsequent Quarterly Reports on Form 10-Q, and other filings with the Securities and Exchange Commission. The forward-looking statements contained in this Proxy Statement speak only as of the date of this Proxy Statement. We undertake no obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. For more complete information regarding the Company’s 2024 performance, please review the Company’s Form 10-K for the year ended December 31, 2024.

Standards of measurement and performance made in reference to our environmental, social, governance, and other sustainability plans and goals may be based on protocols, processes and assumptions that continue to evolve and are subject to change in the future, including due to the impact of future rulemaking. Website references throughout this document are provided for convenience only, and the content on the referenced websites is not incorporated by reference into, and does not constitute a part of, this Proxy Statement.

Company Overview

TreeHouse Foods is a leading private brands snacking and beverage manufacturer in North America. Our purpose is to Engage and Delight - One Customer at a Time. We serve a wide range of customers across North America. Our products are available to consumers every day through the retail grocery, warehouse & club store and e-commerce channels. Our products are also sold to restaurants and institutions through foodservice distributors. Many of our products serve industrial, ingredient, export and co-pack customers as well. Through our customer focus and category experience, we strive to deliver excellent service, build capabilities and provide insights to drive mutually profitable growth for both TreeHouse and our customers. Our purpose is supported by investments in depth, capabilities and operational efficiencies which are aimed to capitalize on the long-term growth prospects within the categories where we operate.

We operate a network of approximately 25 production facilities across the United States and Canada. Our uncompromising standards of food safety and quality are underpinned by manufacturing best practices, a process-driven culture and continuous improvement principles.

| | | | | | | | | | | |

| 2 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

We believe we are well positioned at the intersection of snacking & beverage and private brands trends, across attractive growth categories. Our portfolio includes snacking, beverages & drink mix, as well as other grocery offerings. We also offer our customer partners a range of value and nutritional solutions, including natural, organic, kosher, and gluten free offerings, and offerings which contain ingredients which are third-party certified as responsibly sourced, providing each customer with the capability to meet the unique needs of all consumers.

Performance Highlights

We continued progress on our journey in 2024 strengthening our leadership position at the intersection of private brands and snacking across food & beverage categories. With that said, as the year progressed, the overall economic backdrop remained challenging for consumers, with most categories experiencing softer trends in the second half of the calendar year. Grocery retailers maintained higher shelf prices due to continued broad-based inflationary pressure. These higher shelf prices, along with nominal consumer savings rates and other macro factors put pressure on consumers, driving changes to their purchasing behavior. Ultimately, overall food and beverage unit consumption was weaker than the prior year. Private brands consistently outperformed national brands over the same time-frame, which is a positive sign for the industry. Retailers continue to invest in private brands, and consumers are still migrating to the strong value proposition that private brands offer. In fact, as we closed 2024, private brands unit share reached an all-time high in our categories of just over 24%.

We are strategically positioned to compete within private brands across the majority of our categories. We continue to make strategic investments to strengthen our portfolio depth and capabilities, including recent investments in:

•Tea – in January 2025 we completed the purchase of Harris Tea, which strengthens our competitive positioning in the fast-growing private label tea category and adds unique blending and sourcing capabilities that customers desire. The acquisition includes Harris Tea's manufacturing facilities in Moorestown, NJ, and Marietta, GA, and provides vertical integration across the Company's existing tea business.

•Pickles – purchased Bick’s® pickles and other branded assets in January 2024 to enhance our depth of offerings, expand our presence in Canada, and increase our margin structure in the Pickles category.

•Coffee – we continue to integrate the manufacturing facility in Northlake, TX to enhance vertical integration within our coffee business. This asset has added roasting, grinding, flavoring and blending capabilities, which expand our depth with end-to-end private brand coffee offerings in our portfolio.

Our net sales declined by 2% year-over-year, driven by pricing, primarily due to the impact of deflationary pass-through contracts, temporary product availability disruptions due to product recalls as a result of our commitment to quality and safety, and slightly negative volume/mix driven by a tougher macro environment.

We continued to execute our supply chain initiatives across our network, which generated savings, and maintained profit margins. Our supply chain savings were primarily driven by the work of our distribution and procurement teams, with the latter proving a particular standout, as we were able to better leverage our purchasing scale, building stronger strategic relationships with our suppliers. This work drove significant gross cost savings in the second half of 2024, and we enter 2025 from a position of strength given the momentum in this area.

We maintained the strength of our balance sheet, which provided us the opportunity to deploy capital in a disciplined manner throughout the year. We focused on these investments in our business, including capital expenditures for growth and supply chain initiatives as well as infrastructure and maintenance at our manufacturing plants, and returning capital to stockholders. During 2024, we opportunistically repurchased approximately $150 million of company stock. Going forward, we will continue to take a disciplined approach to our capital allocation and maximizing returns.

As we look ahead to 2025, we recognize that consistent execution across our network remains paramount and believe we are making the right investments to drive improvements in this area. Our company will focus on profitability and cash flow in the near-term as we navigate a tougher consumer environment, by managing what we can control as an organization, primarily our supply chain. The foundation we've built with our various supply chain initiatives remains strong and we have visibility to delivering our longer-term commitment of $250 million of gross supply chain savings through 2027.

We believe we have positioned TreeHouse Foods in the proper categories, and will capitalize on opportunities to further invest in those categories to improve our competitive positioning, depth, capabilities, and execution.

We continue to build a cross functional margin management function, which will allow us to enhance our profitability by allocating our capacity to the most attractive mix of business that best drives healthy cash flow, and profitability for both TreeHouse Foods and for our customers.

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 3 |

Key Financial Highlights Include:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| Net Sales | | | | Net Income from Continuing Operations | | | | Adjusted EBITDA from Continuing Operations* | |

| $3,354.0M | | | | $26.9M | | | | $337.4M | |

| | | | | | | | | | |

| | | | | | | | | | |

| Net sales from continuing operations of $3,354.0 million in 2024, compares to $3,431.6 million in 2023, a decrease of 2.3% driven by pricing from deflationary pass-through contracts, temporary product availability disruptions due to product recalls as a result of our commitment to quality and safety, and slightly weaker volume/mix | | | | GAAP net income from continuing operations decreased $32.1 million in 2024 to $26.9 million, representing 0.8% margin, primarily driven by cost pressures due to the re-start of one of our broth facilities in the first half of the year as well as a temporary disruption from a product recall at our griddle facility in the 4th quarter. This compares to net income from continuing operations of $59.0 million, representing 1.7% margin, in 2023. Adjusted net income from continuing operations* for the year ended December 31, 2024 totaled $100.5 million compared to $139.2 million for the year ended December 31, 2023, a decrease of $38.7 million, or 27.8% | | | | Adjusted earnings before interest, taxes, depreciation and amortization (adjusted "EBITDA") from continuing operations decreased 7.8% to $337.4 million, or margin of 10.0%. This compares to adjusted EBITDA from continuing operations of $365.9 million, or margin of 10.7%, in 2023 | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash Provided by Operating Activities from Continuing Operations | | | | Free Cash Flow from Continuing Operations* | | | | Cash Returned to Stockholders | |

| $265.8M | | | | $126.1M | | | | $149.7M | |

| | | | | | | | | | |

| | | | | | | | | | |

| Cash provided by operating activities from continuing operations of $265.8 million in 2024 compared to $157.3 million in 2023 | | | | Free cash flow from continuing operations was $126.1 million in 2024 compared to $16.5 million in 2023 | | | | TreeHouse Foods repurchased approximately $149.7 million in company shares during 2024 | |

| | | | | | | | | | |

* Refer to Appendix A for a reconciliation of GAAP to Non-GAAP measures.

| | | | | | | | | | | |

| 4 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

Stockholder Engagement

Our relationships with our stockholders are an important component of our success, and we highly value the insights and perspectives that our stockholders offer. We maintain a robust practice and regular cadence of Board and executive leadership team engagement with our stockholders by listening proactively, considering each of their opinions and working collaboratively to understand different points of view. We are committed to delivering long-term stockholder value, clearly communicating our financial goals, and holding our management team accountable for Company results.

During 2024 and 2025, the Company engaged with prospective and current stockholders representing approximately 85% of our common stock outstanding through email, virtual and in-person communications on key topics including the following:

•Our financial performance and path to delivering stockholder value;

•Our governance practices and an overview of the Board of Directors composition and committees;

•Our approach to ESG and our 2030 ESG goals; and

•Our executive compensation philosophy and proposed 2025 design.

Below is an overview of the Company's 2024 approach to stockholder engagement:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | OUTREACH | | | | | LISTEN | | |

| | STOCKHOLDER MEETINGS Our Investor Relations team, executive management, and the Board maintains consistent engagement with stockholders year-round through company-hosted events, annual communications to stockholders, annual stockholder meeting, industry presentations and conferences, and more. Formal engagement generally occurs in the Spring and the Fall.

| | | | FEEDBACK SOLICITATION Through our conversations, we gain an understanding of what matters to our stockholders and any concerns or recommendations they may have and proactively provide key updates to our stockholders. Our teams regularly keep executive management, our Investor Relations team, and the Board up-to-date on the priorities and concerns of our stockholders. We value these opportunities to have constructive dialogue, gain feedback, and further strengthen our engagement. | | |

| | | | | |

| | | | | | | |

| | | | | | | | | |

| | RESPOND | | | PLAN | |

| | |

| | RESPONSE | COMPANY ACTION We execute on our plans to respond. Our Investor Relations team, management and the Board then re-engage in stockholder meetings to continue the conversation. | | | | COMPENSATION DELIBERATION We solicited stockholder feedback, along with other stakeholder input, about our compensation programs. This feedback helps the Committee plan for executive compensation design changes. We evaluate how to address concerns and discuss potential new disclosures or strategies within the broader landscape of the Company’s short and long-term business goals and priorities. | | |

| | | | | | | | |

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 5 |

We have a demonstrable history of being responsive to stockholder feedback. Beginning in the Fall of 2024, we contacted over 20 stockholders, representing approximately 85% of our common stock outstanding, and offered to meet with each of them to discuss the Company’s strategy, performance, executive compensation, and environmental, social, and governance ("ESG") topics. Leading up to our Annual Meeting, we have held meetings with multiple stockholders, representing approximately 50% of our common stock outstanding, as well as a proxy advisory firm. Our Chairman of the Board, Executive Vice President, Chief Human Resources Officer, General Counsel, and Corporate Secretary, and Vice President of Investor Relations participated in all of our meetings. Our Independent Directors also participated in the meetings when requested.

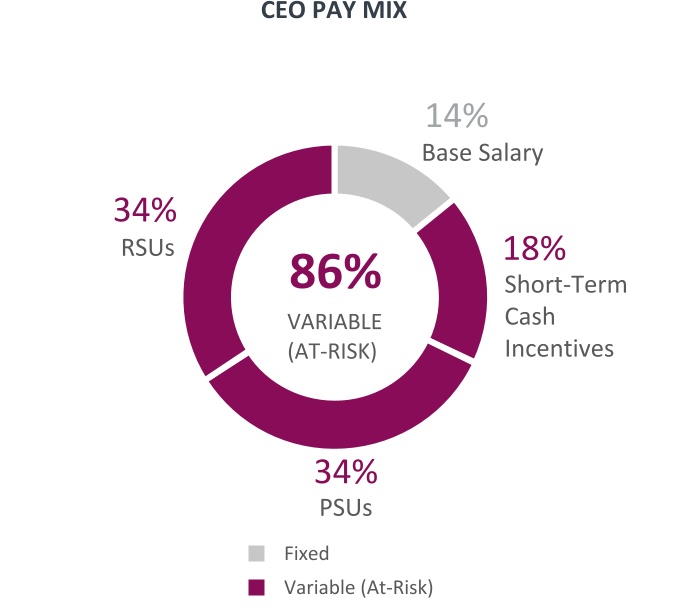

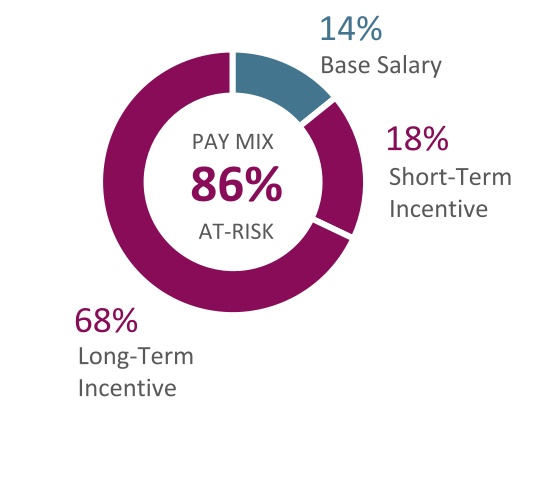

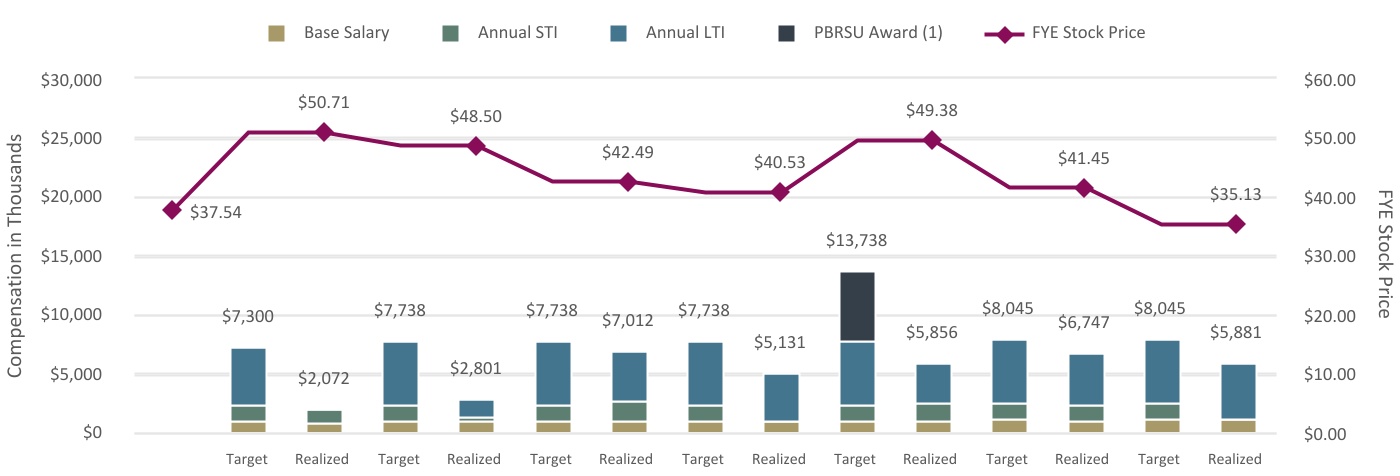

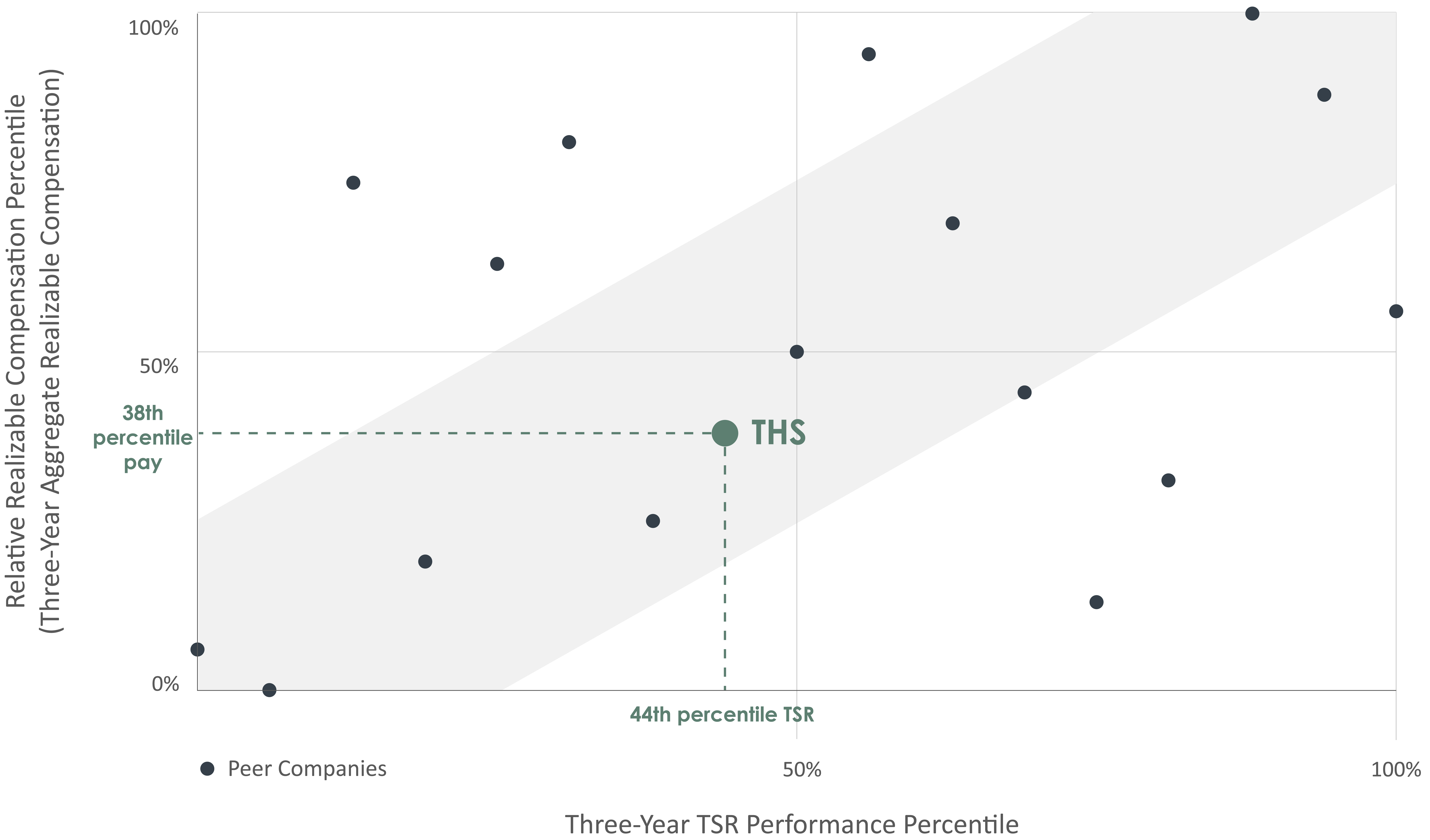

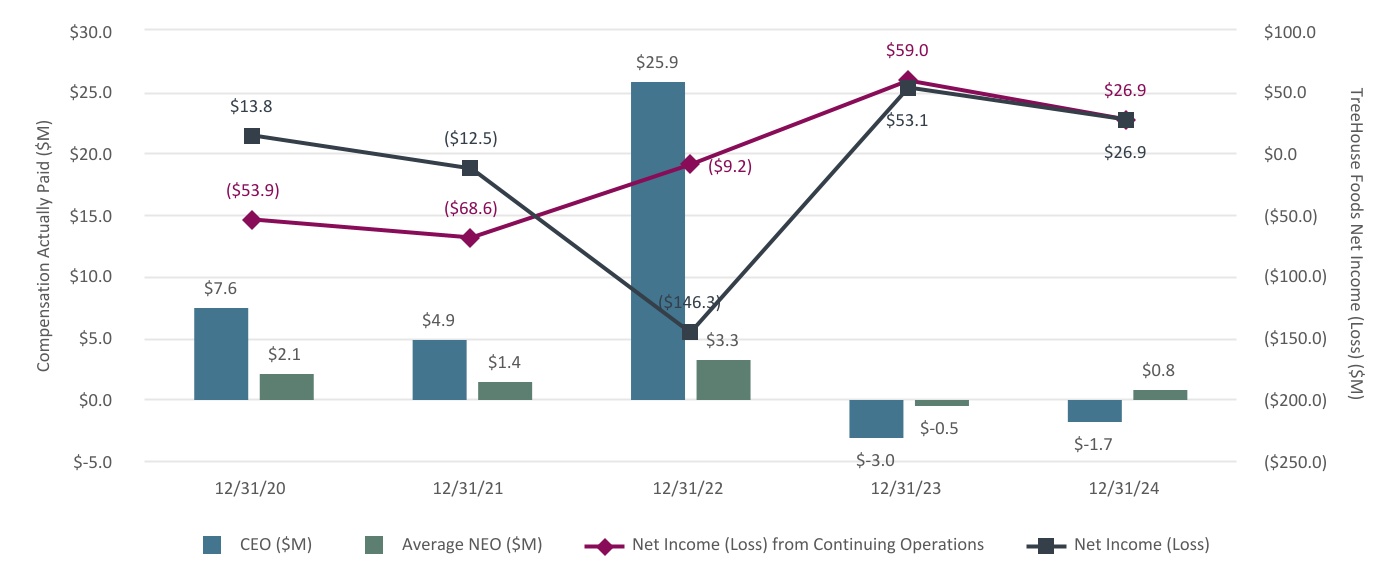

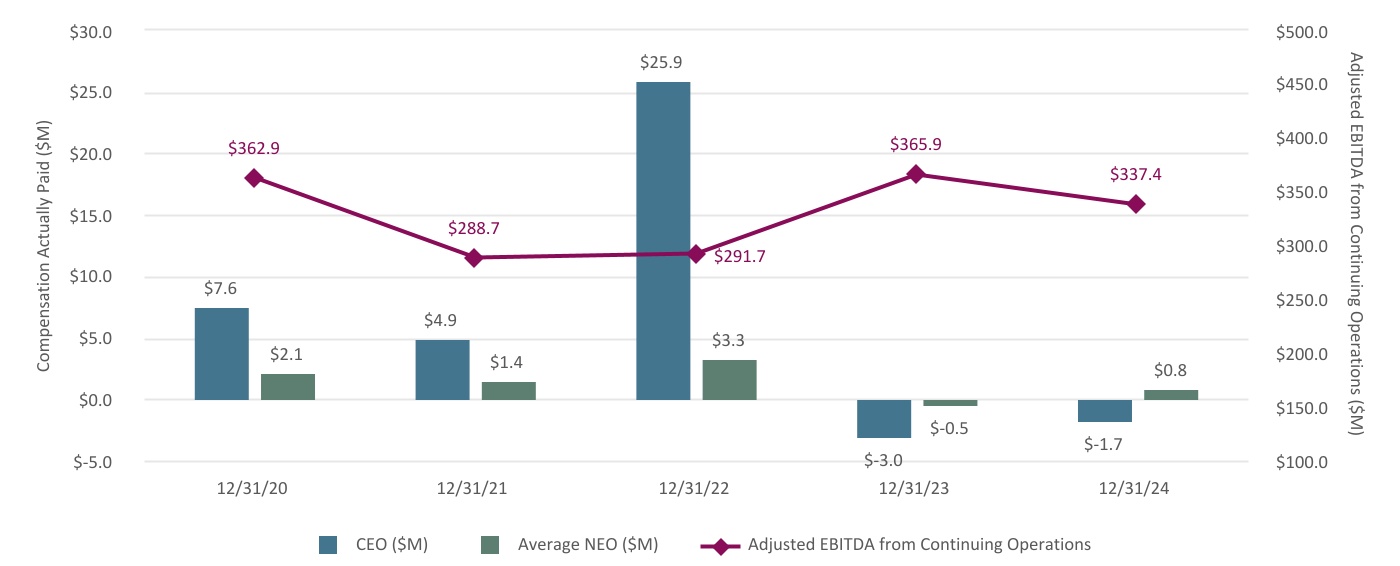

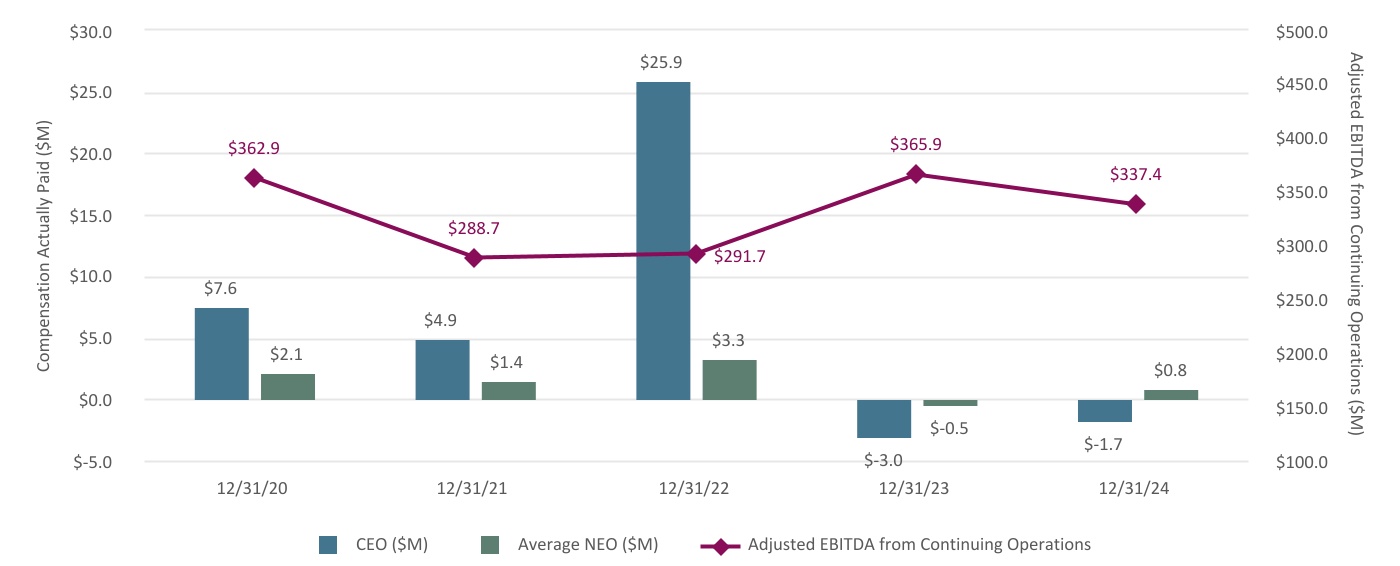

Pay for Performance Alignment

Our compensation philosophy is designed to attract, retain and motivate top-tier talent, appropriately pay for performance and align the interests of our stockholders with those of our NEOs. Our compensation approach is based on sound design principles that allow us to responsibly reward our executives in a labor climate where we need to attract and retain talent capable of leading our more focused portfolio and achieving our financial and strategic objectives. Our Compensation Committee has structured our compensation programs so that actual compensation received by our executives is aligned to the business results of the Company and the ultimate value realized by our stockholders. This is achieved by maintaining a high level of "at-risk" incentive pay, the majority of which is linked to the achievement of long-term business results and delivered in equity - further aligning interests to those of our stockholders. Our performance goals require significant effort to attain target payouts and we hold our executives accountable to those stretch objectives.

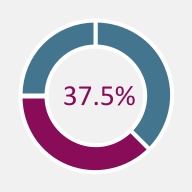

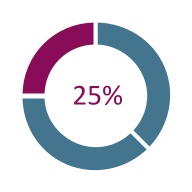

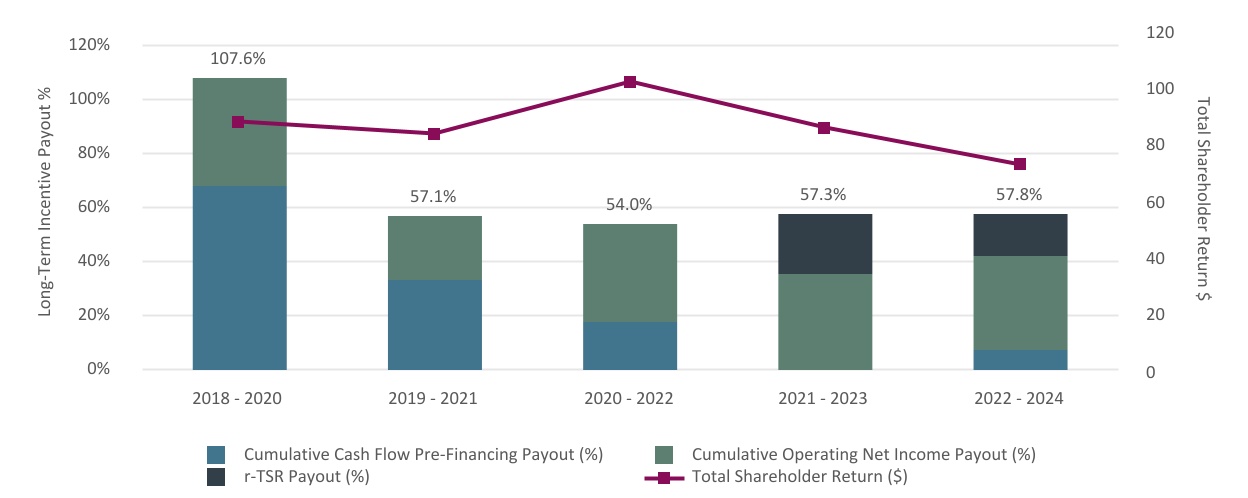

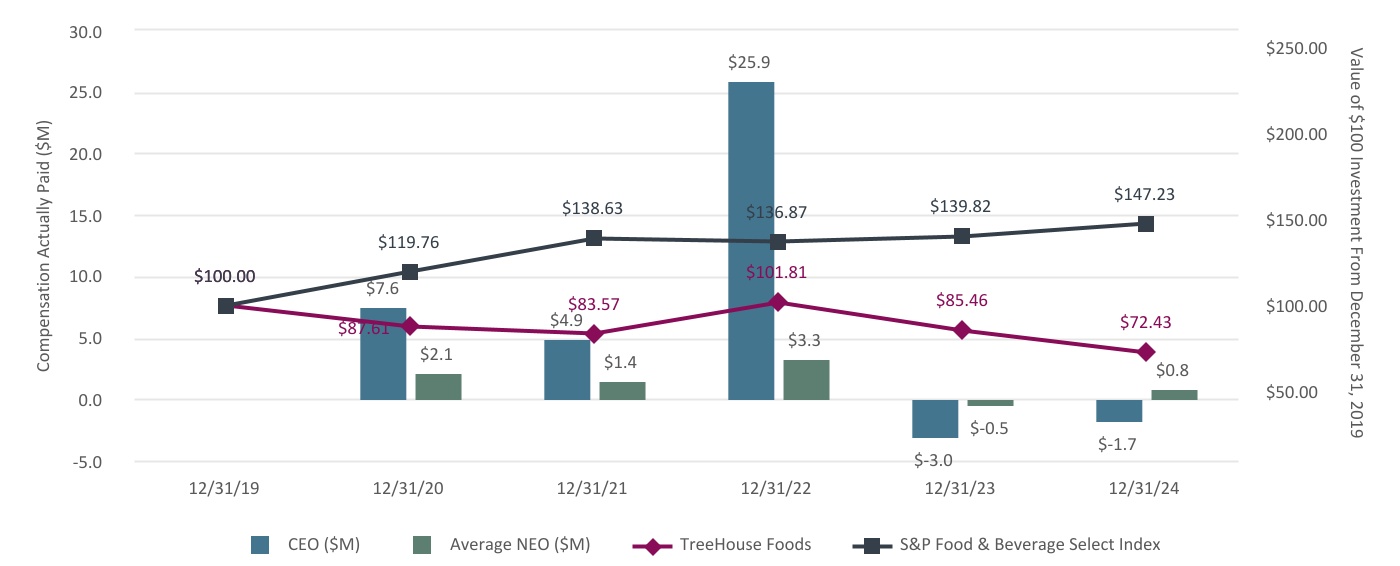

Over the past five years, our short-term incentive payouts as a percent of target have varied widely from year-to-year based on our operating performance. In 2024, the overall payout for each NEO's short-term incentive, excluding Mr. Lewis, was 0%. The Company's short-term incentive payout for 2024 reflects our pay for performance philosophy, as the payout is directly linked to our operating performance during the performance period. Additionally, 50% of our annual long-term incentives have been delivered as PSUs or performance cash awards. Similar to our short-term incentives, payouts have varied over the past five years consistent with our operating net income and cash flow performance.

| | | | | | | | | | | |

| 6 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

Director Nominees and Continuing Directors

The following provides summary information about each director nominee and our continuing directors.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | Director

Since | | Committee Membership for 2024-2025 Board Year |

| | Age | Independent | AC | CC | NCGC |

| | | | | | | |

| | | | | | | |

| Director Nominees | | | | | | |

| | | | | | | |

| | | | | | | |

| Term Expires in 2025 | | | | | | |

| | | | | | | |

| Steven Oakland

Chairman, CEO & President, TreeHouse Foods, Inc. | 64 | 2018 | | | | |

| Linda K. Massman Lead Independent Director Former President & Chief Executive Officer,

Clearwater Paper Corporation | 58 | 2016 | | g | | g |

| Adam J. DeWitt Chief Executive Officer, Curbside SOS Inc. | 52 | 2023 | | g g | g | |

| Jill A. Rahman Chief Operating Officer, Greater Chicago Food Depository | 64 | 2020 | | g | | g |

| Joseph E. Scalzo Partner, Centerview Capital Consumer | 66 | 2022 | | g | g | |

| Jason J. Tyler President of the Wealth Management Business, Northern Trust Corporation | 53 | 2019 | | | g | g g |

| | | | | | | |

| Continuing Directors | | | | | | |

| | | | | | | |

| | | | | | | |

| Term Expires in 2026 | | | | | | |

| | | | | | | |

| Scott D. Ostfeld Managing Partner and Portfolio Manager of JANA Partners | 48 | 2022 | | | g | |

| Jean E. Spence Former Executive Vice President of Research, Development, & Quality at Mondelēz International, Inc. | 67 | 2018 | | | g g | g |

| | | | | | | | | | | |

| AC | Audit Committee | g g | Committee Chair |

| CC | Compensation Committee | g | Member |

| NCGC | Nominating & Corporate Governance Committee | | |

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 7 |

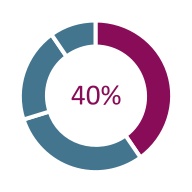

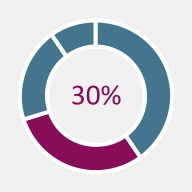

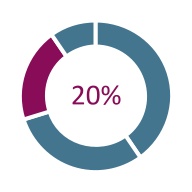

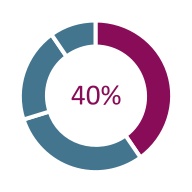

Board of Directors Snapshot

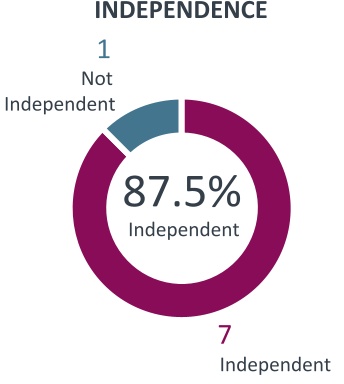

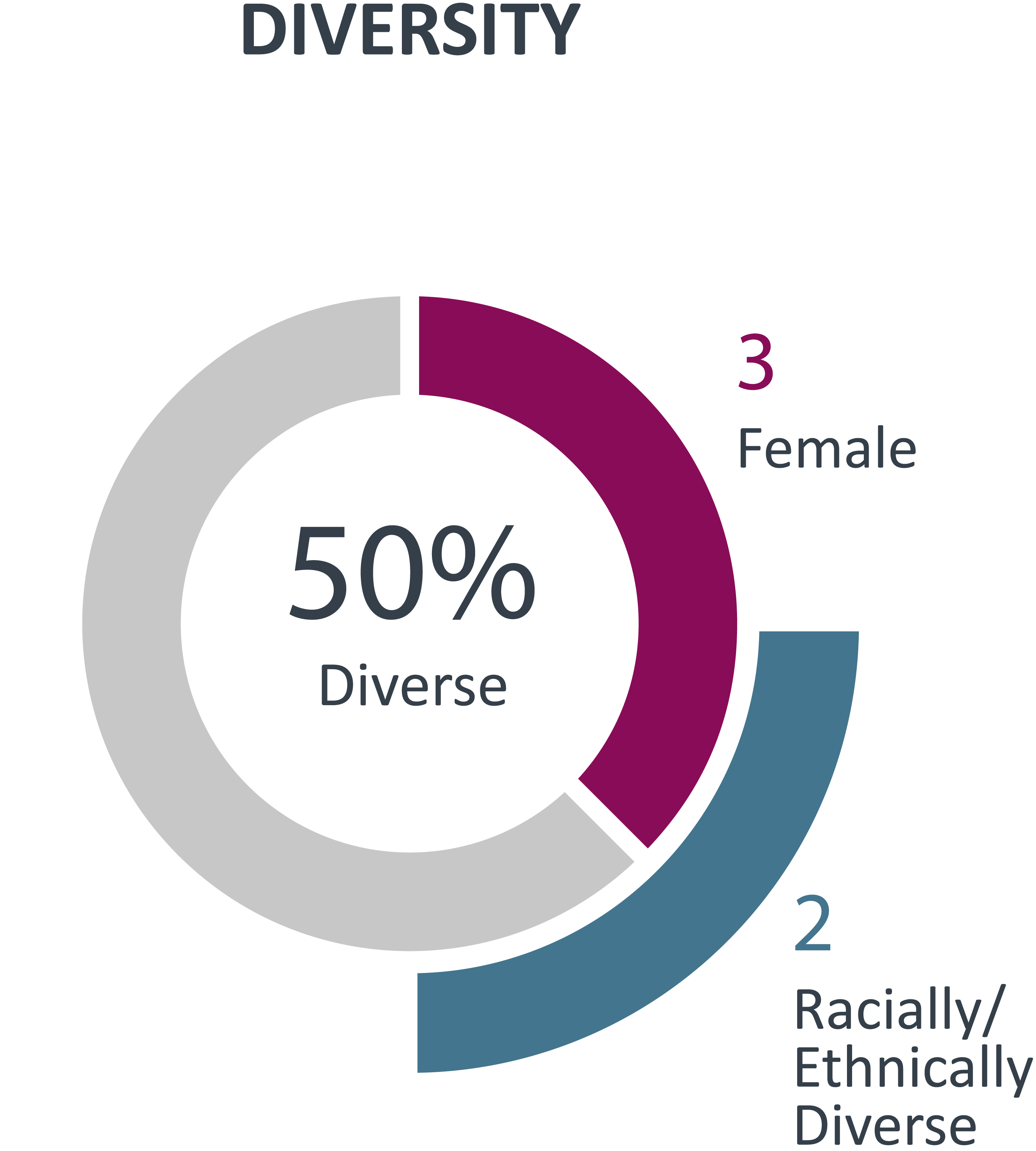

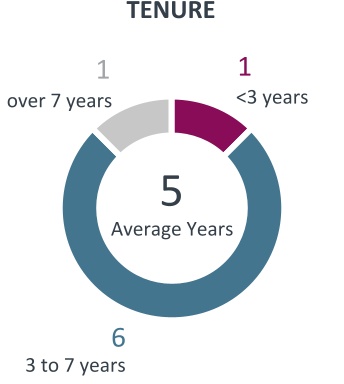

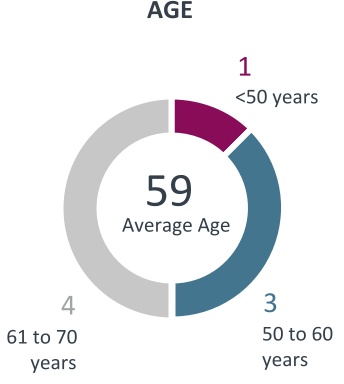

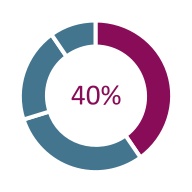

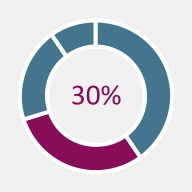

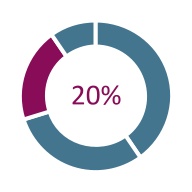

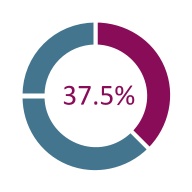

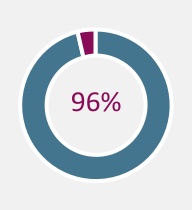

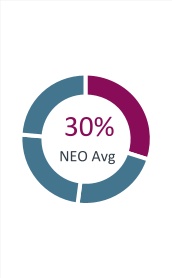

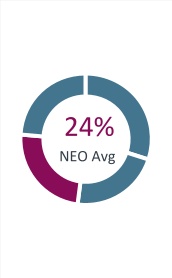

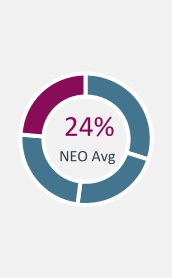

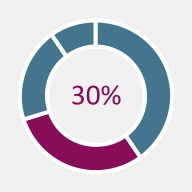

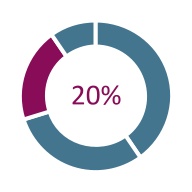

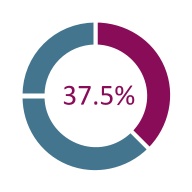

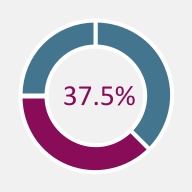

Snapshot above calculated based upon the Board structure as of the 2025 Annual Meeting.

Governance Practices

TreeHouse's executive compensation and governance practices are designed to drive Company performance and stockholder value while mitigating risk. This includes ongoing evaluation of emerging practices, which has led to several changes over the past few years so that TreeHouse does not adopt practices in either the executive compensation program or governance practices that do not align to the interests of stockholders. TreeHouse's compensation program is based on three core principles:

•Align pay and performance, utilizing both absolute and relative goals that measure performance both on an annual and multi-year basis.

•Align stockholder and management interests by emphasizing rigorous goals that balance and measure value creation in both our short-term and long-term compensation programs.

•Pay the majority of compensation in the form of long-term incentives for our Chief Executive Officer.

Governance Snapshot

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| BOARD OVERSIGHT | | | | BOARD PERFORMANCE | | | | STOCKHOLDER RIGHTS | |

| | | | | | | | | | |

| | | | | | | | | | |

| •7 of 8 of our Board members are independent, including all committee members •Board declassification in progress, to be completed by 2026 •Robust Lead Independent Director responsibilities •Regular executive session meetings of independent directors •Annual Board and committee evaluation process •Strategic and Risk Oversight by Board and Committees | | | | •Proactive Board refreshment to bring new and diverse perspectives, with an average tenure of five years •Utilizes a resignation policy with respect to the election of our directors in a "majority withheld" stockholder vote •Board responsiveness to stockholder feedback, resulting in proactive board declassification, executive compensation program updates, and Board refreshment efforts | | | | •No "poison pill" •Majority voting standard in uncontested Director elections •Robust stockholder engagement | |

| | | | | | | | | | |

| | | | | | | | | | | |

| 8 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

| | | | | | | | |

| | |

| | |

| Environmental, Social and Governance | |

| | |

At TreeHouse, we work to bring Environmental, Social, and Governance ("ESG") concepts to life for our customers. We are committed to expanding environmental stewardship, stakeholder value creation and thoughtful governance in everything we do. We believe that our commitment to enterprise wide ESG integration is fundamental in meeting the expectations of our customers, employees, investors, consumers and suppliers.

Our Values

We are dedicated to supporting a performance-based culture where we live our values – both with each other and our customers – to provide for our mutual success and safety. Our values serve as the foundation for our culture, which in turn creates an environment where corporate responsibility is inherent in every decision we make.

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 9 |

| | | | | | | | |

| | Environmental, Social, and Governance (ESG) |

ESG Governance

Our Board of Directors ("Board") oversee our ESG strategy, through its Nominating and Corporate Governance Committee, which regularly reviews the Company’s ESG activities, developments, goals and objectives, including the Company’s ESG programs and disclosures. The Compensation Committee meets with the Company’s ESG Steering Committee to review human capital activities, developments, goals and objectives incorporated into the Company’s ESG initiatives. Our ESG Steering Committee drives our activities in this space, and is composed of our Executive Leadership Team, including our Chairman, CEO & President. This committee is supported by four subcommittees and our ESG team, which reports to our EVP, Chief Human Resources Officer & General Counsel.

Each subcommittee is led by a chair and is made up of a cross-functional team of subject matter experts from the business. The subcommittees are responsible for setting the action plans needed to achieve our ESG goals, providing subject matter guidance to the Company on ESG issues, and assisting with ESG reporting and disclosure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Nominating & Governance

Board Committee | | | | | | | | ESG

Steering

Committee |

| | | | | | |

| | | | | | | | | | |

| ESG Leader | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

Responsible

Sourcing Subcommittee | | Operational

Sustainability Subcommittee | | Transparency & Disclosure Subcommittee | | Culture & Engagement Council |

| | |

Our 2030 Goals

Our 2030 ESG goals were developed with the help of our cross-functional ESG subcommittees in response to the findings from our prioritization assessment in 2023. Achieving these goals in line with our ESG Strategy is guided by the ESG Steering Committee, and responsibility for achieving these goals will sit with each of our ESG subcommittees. These cross functional teams are designed to provide that all of our ESG efforts include the subject matter expertise needed to be successful, and that our efforts are embedded and integrated across the enterprise. We will continue to keep stakeholders updated on progress toward achieving these goals.

Environment & Climate

•Reduce Scope 1 & 2 greenhouse gas ("GHG") emissions by 25% by 2030

•Assess baseline Scope 3 calculations and establish reduction goal by 2025

•Reduce water usage across manufacturing facilities by 20% by 2030

•Reduce food loss & waste by 50% by 2030

•Increase company-wide landfill diversion to 90% by 2030

•By 2030, have 100% of packaging be recyclable, reusable, or compostable

•Eliminate problematic and unnecessary plastics in packaging where feasible by 2025

•Continue to maintain at least 20% post-consumer recycled content average across all packaging

| | | | | | | | | | | |

| 10 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

| | | | | | | | | | | |

| Environmental, Social, and Governance (ESG) | | |

People & Communities

•Reduce Total Recordable Incident Rate ("TRIR") by 20% by 2030 to continue towards the goal of zero incidents

•We strive to have our workforce be representative of the communities in which we operate, and the customers and consumers who purchase our products by:

◦Conducting annual Values training by 2024 for all employees

◦Providing intentional learning and development programming for our employees

◦Expanding recruiting efforts by partnering with community, academic, and professional organizations to attract and hire diverse talent

◦Working to provide transparent internal mobility processes to enable robust career growth

◦Disclosing EEO-1 data by 2030 and annually thereafter

•Donate $50 million in volunteer time, food, and/or cash to organizations focused on alleviating food insecurity in our local communities by 2030

Products & Operations

•Direct source 100% Roundtable on Sustainable Palm Oil ("RSPO") physical certified palm oil by 2030

•Increase offerings of third-party certified responsibly sourced cocoa by 2030

•Update our Responsible Sourcing Policy to include the following:

◦Animal Welfare expectations

◦Supplier Diversity acknowledgement and commitment to increase spend with diverse suppliers

◦Global Food Safety Initiative ("GFSI") expectation for ingredient and food contact suppliers

•Roll out annual ESG supplier survey and scorecard for strategic suppliers

Annual ESG Disclosures Overview

In 2024, we published our latest ESG Report, which included appendices aligned with the Sustainable Accounting Standards Board ("SASB") Processed Food Standard and the Task Force for Climate-related Financial Disclosures ("TCFD") framework. We also completed the annual CDP Survey, including Climate Change, Forests and Water sections. Our latest disclosures can be found at https://www.treehousefoods.com/esg/reports-and-disclosures. The information contained in our ESG reports and disclosures, or otherwise on or connected to our website as may be referenced throughout this Proxy Statement, is not incorporated by reference into this Proxy Statement and should not be considered part of this or any other report filed with the SEC.

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 11 |

| | | | | | | | |

| | Environmental, Social, and Governance (ESG) |

In August of 2024, we shared our annual ESG disclosures, which included an update on our progress to our 2030 ESG goals, and we plan to do the same in 2025. Recent highlights from our ESG programs and efforts include:

| | | | | | | | |

| | |

| | |

| Environment & Climate •Disclosed Scope 1 & 2 emissions in the annual CDP Survey, and expanded our response to include the Forests and Water modules •Set ambitious Scope 1 & 2 greenhouse gas emissions (“GHG”) targets •Reduced Scope 1 & 2 GHG emissions by 4.4% •Evaluated our Scope 3 footprint in preparation for setting a reduction target by end of 2025 •Completed sustainability treasure hunts at six of our plants, finding opportunities for both resource and cost savings •Reduced water withdrawn in manufacturing operations by nearly 17% •Increased use of post-consumer recycled content in packaging by 8% | |

| | |

| | | | | | | | |

| | |

| | |

| People & Communities •Conducted annual employee engagement survey, with an increase in engagement •Established a new Employee Resource Group: Emerging Professionals •Operated under a strategic plan with the objective of creating a diverse, equitable and inclusive workplace •Strong commitment to Board diversity •Rolled out an online learning management system for employees that offers expanded professional development opportunities •Donated approximately $12 million to charitable organizations •Expanded Employee Resource Group membership by 23% | |

| | |

| | | | | | | | |

| | |

| | |

| Products & Operations •Board and committee oversight of human capital management, ESG programs and disclosures •Robust enterprise risk oversight by full Board and its committees •Increased use of Roundtable on Sustainable Palm Oil (“RSPO”)-certified palm oil by 5% •Conducted a prioritization assessment to ensure our strategy is in line with stakeholder priorities and expectations •Published our Responsible Sourcing Policy Grievance Mechanism •Distributed a Responsible Supplier Survey to our strategic suppliers to assess opportunities and weaknesses within our supply chain •Updated our Responsible Sourcing Policy in April 2024 to include a commitment to animal welfare | |

| | |

| | | | | | | | | | | |

| 12 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

| | | | | | | | | | | |

| Environmental, Social, and Governance (ESG) | | |

Culture

We believe creating a values-led, high-performance workforce and becoming a talent leader is key to achieving success in our growth strategy. We are committed to promoting equal opportunity across our organization. In 2024, we introduced a new employee resource group ("ERG"), Emerging Professionals, and maintained our existing groups: Parents & Caregivers Network, TreeHouse’s Black Employee Resource Group, Women at TreeHouse and Free To Be Me (our LGBTQIA+ resource group). We believe that these ERGs play a critical role in attracting diverse talent, providing mentorship and career development opportunities, delivering commercial business insights and connecting people to the Company and the communities where we do business.

We educate our leaders and employees on how best to contribute to an inclusive culture through continuing education and training to foster an employee experience where everyone feels a sense of belonging. In 2024 we also expanded our recruitment strategies focused on strengthening the diversity of candidate slates by attending various career fairs, including the National Black MBA Association Career Expo and Service Academy Career Conference.

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 13 |

We are committed to high standards of business integrity and corporate governance. Accordingly, we have developed a corporate structure and culture that promotes the highest ethical standards and compliance with all applicable laws and regulations. Further, we understand that corporate governance is not static, and as a result, we regularly monitor and evaluate best practices and new developments in corporate governance against our own current practices.

We are managed under the direction of our board of directors, which is currently composed of eight members. The current members of the Board are: Steven Oakland, Linda K. Massman, Adam J. DeWitt, Scott D. Ostfeld, Jill A. Rahman, Joseph E. Scalzo, Jean E. Spence and Jason J. Tyler. Every director on our Board other than Mr. Oakland is independent. We believe that the number of independent, experienced directors that make up our Board benefits our Company and our stockholders.

Our Amended and Restated Certificate of Incorporation currently provides for a board of directors comprised of three classes of directors, with staggered three-year terms. Our Board is currently divided among the two classes as follows:

•Our 2025 Class directors are Steven Oakland, Linda Massman, Adam DeWitt, Jill Rahman, Joseph Scalzo and Jason Tyler and their term will expire at the Annual Meeting. All of our 2025 Class directors are standing for re-election at the Annual Meeting.

•Our 2026 Class directors are Scott Ostfeld and Jean Spence, and their term will expire at the 2026 Annual Meeting.

In 2023 we continued to enhance our corporate governance profile, and our Board and stockholders approved an amendment to our Amended and Restated Certificate of Incorporation to implement a phased declassification of our Board (the "Declassification Amendment"). Beginning with our Annual Meeting to be held in 2026, the declassification of our board of directors will be complete, and all directors will be subject to annual election for one-year terms.

Board Leadership

The Board does not have a fixed policy regarding the separation of the offices of Chair of the Board and CEO and believes that it should maintain the flexibility to select the Chair and its Board leadership structure, from time to time, based on the criteria that it deems to be in the best interests of the Company and our stockholders. In the event that circumstances facing the Company change, a different leadership structure may be in the best interests of the Company and our stockholders. For this reason, our Board evaluates issues that may be relevant to our leadership structure as part of our annual Board self-evaluation process, and the Nominating and Corporate Governance Committee regularly reviews the Board's leadership structure and recommends changes to the Board, as appropriate. In the event the Chair of the Board is not an independent director, the Corporate Governance Guidelines provide that the Board will elect a Lead Independent Director. The Board welcomes and takes under consideration any input received from our stockholders regarding the Board’s leadership structure, and informs stockholders of any change in the Board’s leadership structure on our website and in our annual proxy statements.

| | | | | | | | | | | |

| 14 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

In April 2023 the Board's independent directors appointed Mr. Steven Oakland to the role of Chairman of the Board, in addition to his current positions as CEO & President of the Company. The Board considered several factors, including: the strategic goals of the Company, the status of TreeHouse's progress with respect to our transformation journey, the various capabilities of our directors, the dynamics of our Board, and best practices in the market. While the Company's independent directors bring experience, oversight and expertise from various perspectives outside the Company, Mr. Oakland's in-depth knowledge of our business, as well as his tenure as CEO & President enables him to identify areas of focus for the Board and effectively recommend appropriate agendas. The Board believes that the combined role of Chair and CEO facilitates information flow between our Executive Leadership Team and the Board, provides clear accountability and promotes efficient decision making, all of which are essential to effective governance.

The Board also reflected upon the Company’s independent oversight function exercised by our Board, which consists entirely of independent directors other than Mr. Oakland, as well as the independent leadership to be provided by each of the three standing Board Committees, which consist solely of, and are chaired by independent directors. The Board believes this structure provides the most effective leadership structure for the Company at this time for the reasons noted above. The Board's leadership structure is further enhanced by the appointment of Ms. Linda Massman as our Lead Independent Director in April 2023. As Lead Independent Director, Ms. Massman maintains clearly defined and robust responsibilities, including to:

•Call Board meetings in the event of the unavailability or incapacity of the Chair;

•Conduct and preside at executive sessions of the Board;

•Act as a liaison between the independent members of the Board and the CEO; and

•Participate in meetings with major stockholders, stakeholders and the public.

Director Independence

Except as may otherwise be permitted by the New York Stock Exchange ("NYSE") rules, our Corporate Governance Guidelines provide that a majority of the members of the Board shall be independent directors under applicable law and NYSE listing standards. To be considered independent: (1) a director must be independent as determined under Section 303A.02(b) of the NYSE Listed Company Manual; and (2) in the Board’s judgment (based on a review of all relevant facts and circumstances and taking into consideration all applicable laws, regulations and stock exchange listing requirements), the director must not have a material relationship with the Company (either directly or as a partner, stockholder or officer of an organization that has a relationship with the Company).

Pursuant to the policies listed above, we affirmatively assess whether each director has a relationship that would interfere with the exercise of independent judgment pursuant to these policies and corporate governance best practices. In addition to the Nominating and Corporate Governance Committee’s review, the Board conducts an annual review of director independence, during which the Board also considers each director's background, employment, affiliations, transactions, relationships and arrangements between each director or an immediate family member of the director and each of the Company and our executive officers. The Board has determined that each of the following non-employee directors who served during the last completed fiscal year qualifies as “independent” in accordance with the above listed guidelines, standards and rules: Ms. Massman, Mr. DeWitt, Mr. Ostfeld, Ms. Rahman, Mr. Scalzo, Ms. Spence and Mr. Tyler. As Mr. Oakland is employed by TreeHouse as our CEO & President, Mr. Oakland does not qualify as independent.

All members of our Audit, Compensation, and Nominating and Corporate Governance Committees are independent directors, and our Compensation Committee members meet the enhanced independence requirements for Compensation Committee members under the NYSE’s listing standards. The Board has determined that all of the members of our Audit Committee also satisfy the SEC independence requirement, which provides that they may not accept directly or indirectly any consulting, advisory or other compensatory fee from the Company or any of its subsidiaries other than their directors’ compensation.

Our Board’s standards for director independence are available in our Corporate Governance Guidelines which can be located at https://www.treehousefoods.com/investors/governance/governance-documents.

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 15 |

Standing Committees of the Board

The Board has three standing committees to help oversee various matters of the Company: the Audit Committee, the Compensation Committee, and the Nominating and Corporate Governance Committee. The Board has approved a written charter for each standing committee, which we review annually and revise as appropriate. The charters define each committee’s roles and responsibilities. The charters are available on our website at: https://www.treehousefoods.com/investors/governance/governance-documents. The Board determines the membership of each of these committees from time to time, and each committee is composed entirely of independent directors, in accordance with our Corporate Governance Guidelines, the NYSE listing standards and SEC rules.

Mr. Oakland as Chair of the Board, CEO & President is permitted to attend committee meetings only at the invitation of the respective committee. Accordingly, Mr. Oakland is not permitted to attend committee meetings when the independent directors meet in executive session, such as when independent directors conduct performance evaluations or discuss the compensation of the CEO, or any other portion of any committee meeting that the independent directors deem appropriate to conduct outside of the CEO's presence for any reason.

Audit Committee

| | | | | | | | | | | | | | | | | |

| | | | PRINCIPAL RESPONSIBILITIES •Reviews and approves the scope and cost of all services, both audit and non-audit, provided by the firm selected to conduct the audit. •Provides oversight of the audit process and financial reporting process and reviews the Company's financial and operating controls. •Oversees the Company’s systems of disclosure controls and procedures, internal controls over financial reporting, and compliance with ethical standards adopted by the Company. In addition, the Board has determined that each member of the Audit Committee meets the heightened standards of independence for audit committee members pursuant to the listing standards of the NYSE and the rules and regulations of the SEC, and the Board has determined that each of them has accounting and related financial management expertise as required by the listing standards of the NYSE. Further, Messrs. DeWitt and Scalzo and Mses. Massman and Rahman qualified as audit committee financial experts. | |

| MEMBERS IN 2024 Adam J. DeWitt (Chair) Linda K. Massman Jill A. Rahman Joseph E. Scalzo MEETINGS IN 2024

8 | | | |

| | | | |

| | | | |

Compensation Committee

| | | | | | | | | | | | | | | | | |

| | | | PRINCIPAL RESPONSIBILITIES •Reviews and approves the compensation of the Company’s CEO and executive officers, including the administration of the TreeHouse Foods, Inc. Equity and Incentive Plan. •Approves and evaluates the compensation plans, policies and programs of the Company. •Oversight of human capital management activities, developments, goals and objectives and executive leadership team succession. •Reviews and recommends the director compensation to the Board. The Compensation Committee engaged Pay Governance LLC as its independent executive compensation advisor in 2024. For more information regarding the role of compensation advisors in the Compensation Committee's decision-making process, please see the disclosure under the heading "Executive Compensation Decision Making Process" in the Compensation Discussion and Analysis section of this Proxy Statement. In addition, the Board has determined that each member of the Compensation Committee meets the qualifications for compensation committee members as required by the listing standards of the NYSE and is a "non-employee director" within the meaning of SEC Rule 16b-3. | |

| MEMBERS IN 2024 Jean E. Spence (Chair) Adam J. DeWitt Scott D. Ostfeld Joseph E. Scalzo Jason J. Tyler MEETINGS IN 2024

5 | | | |

| | | | |

| | | | |

| | | | | | | | | | | |

| 16 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

Nominating and Corporate Governance Committee

| | | | | | | | | | | | | | | | | |

| | | | PRINCIPAL RESPONSIBILITIES •Identifies individuals qualified to become members of the Board. •Recommends to the Board the persons to be nominated for election as directors at any meeting of the stockholders. •In the event of a vacancy on or increase in the size of the Board, the committee recommends to the Board the persons to be nominated to fill such vacancy or additional Board seat. •Recommends to the Board the persons to be nominated for each committee of the Board. •Develops and recommends to the Board a set of corporate governance guidelines applicable to the Company, including the Company’s Code of Ethics. •Oversees the evaluation of the Board and CEO. •Oversees the development of a succession plan for the Board and CEO. •Considers nominees who are recommended by stockholders, provided such recommendations are made in accordance with the nominating procedures set forth in the Company’s By-laws. •Regularly reviews the Company’s ESG activities, developments, goals and objectives, including the Company’s ESG programs and disclosures. | |

| MEMBERS IN 2024 Jason J. Tyler (Chair) Linda K. Massman Jill A. Rahman Jean E. Spence MEETINGS IN 2024

4 | | | |

| | | | |

| | | | |

| | | | | |

| Board Practices, Processes and Policies |

|

Meetings of the Board of Directors and its Committees

Members of the Board are expected to attend each Board meeting, as set forth in the Company’s Corporate Governance Guidelines. The Board met seven times in 2024. Each current director of our Board attended at least 75% of the aggregate of the meetings of the Board and the committee(s) on which they served during 2024.

Annual Meeting of Stockholders

Our directors are expected to make every effort to attend the Company’s Annual Meeting, and all of them that served as directors at the time of the meeting did so in 2024. The Company believes that annual meetings provide an opportunity for stockholders to communicate with directors. It is the Board’s policy that all of our directors attend the Annual Meeting, absent exceptional cause.

Executive Sessions

The independent directors meet in executive session at least quarterly to discuss, among other matters, the performance of the Company and its executives. The independent directors will meet in executive session at other times at the request of any independent director. Absent unusual circumstances, these sessions shall be held in conjunction with regular Board meetings. Our Lead Independent Director presides at these sessions.

Annual Board and Committee Evaluations

The Nominating and Corporate Governance Committee oversees the annual evaluation process for the Board and each of its committees. These evaluations are designed to assess whether the Board or the respective committee are functioning effectively and also to provide a mechanism for the Board or the respective committee to identify potential areas for improvement. Once completed, the results of the evaluations and any appropriate recommendations or action plans are discussed among the members of the Board and each of its committees. From time to time, our Board evaluation process includes an external evaluator.

Director Orientation and Continuing Education

The Nominating and Corporate Governance Committee is tasked with developing and overseeing a Company orientation program for new directors and a continuing education program for current directors, periodically reviewing these programs and updating them as necessary. As such, the Board and the Company’s management conduct a mandatory orientation program for new directors. The orientation program

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 17 |

includes presentations by management to familiarize new directors with, among other things, the Company’s principal operational and financial objectives, strategies and plans; results of operations and financial condition of the Company and of significant subsidiaries; the relative standing of the business of the Company and vis-à-vis competitors; risk management processes and findings; compliance programs, relevant policies and procedures; fiduciary duties; and introductions to the Company's principal officers, internal and independent auditors, its General Counsel, and outside advisors.

Further, the Company encourages board education to continually enhance board effectiveness and director expertise in timely governance and oversight matters. Each director is expected to be involved in continuing director education on an ongoing basis to enable him or her to better perform his or her duties and to recognize and deal appropriately with issues that arise. The Company will cover reasonable costs related to continuing director education.

Certain Relationships and Related Person Transactions

We maintain procedures relating to the review, approval or ratification, if pre-approval was not feasible, of transactions in which we are a participant and in which any of our directors, director nominees, named executive officers, major stockholders or their family members have a direct or indirect material interest. We refer to these individuals and entities in this Proxy Statement as related parties. Our Code of Ethics, which is available on our website at https://www.treehousefoods.com/investors/governance/governance-documents, prohibits our employees, including our executive officers and directors, from engaging in certain activities. These activities typically relate to conflict of interest situations where an employee or director may have significant financial or business interests in another company competing with or doing business with us, or who stands to benefit in some way from such a relationship or activity.

We review all relationships and transactions in which the Company and our directors, director nominees, named executive officers, or their immediate family members are participants, to determine whether such persons have a direct or indirect material interest and the dollar value. Our Legal Department has responsibility for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related party transactions and for then determining, based upon the facts and circumstances, whether the Company or a related party has a direct or indirect material interest in the transaction. Each year, we require our directors and executive officers to complete a questionnaire, among other things, to identify such related party relationships and transactions. Further, any director faced with any potential conflict is required to disclose any such potential conflict to the Chair of the Board, Chair of the Nominating and Corporate Governance Committee, and the General Counsel of the Company. As required under SEC rules, transactions involving the Company that exceed $120,000 and that a related party has a direct or indirect material interest in are disclosed in our Proxy Statement. Our Board has responsibility for reviewing and approving or ratifying, if pre-approval was not feasible, related person transactions.

Since January 1, 2024, there were no reportable related person transactions, and there are currently no proposed transactions in excess of $120,000 in which the Company was or is to be a participant and in which any related person had or will have a direct or indirect material interest.

Code of Ethics

The Nominating and Corporate Governance Committee is responsible for developing and recommending to the Board a set of corporate governance guidelines applicable to the Company, including the Code of Ethics (the "Code"). The Board has adopted a Code that applies to all of the Company’s employees, officers and directors, as well as independent contractors working on behalf of the Company. Through our Code, we establish clear ethical and professional guidelines, and work though several mechanisms to hold the Company collectively to the highest professional ethical standards.

Our Code serves as a framework for our ethical business practices and provides us with high-level guidance and direction about difficult choices we might face. The Code defines our collective responsibilities to one another, our customers and consumers, the communities we call home and all our stakeholders. Adherence to the Code is critical for us to achieve our standards. The Code lays out a clear set of expectations for our employees, directors and suppliers and helps fortify our culture of integrity, accountability, and ownership for all who impact, or are impacted by, our business.

Our Code meets the requirements of a “code of ethics” as defined by Item 406 of Regulation S-K, and also meets the requirements of a “code of business conduct and ethics” under NYSE Rules. All employees are required to certify that they have reviewed and are familiar with the Code. The Code can be located in its entirety on the Company’s website at https://www.treehousefoods.com/investors/governance/governance-documents.

| | | | | | | | | | | |

| 18 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| The Board’s Role and Responsibilities | | | | |

| | | | |

The Board’s Role in Risk Oversight

Management undertakes a regular review of a broad set of enterprise risks across the Company's business and operations to identify, assess, prioritize and manage potential issues over the short, intermediate and long-term. Specific emphasis is placed on identifying those risks that could have the highest impact to the Company and its operations, and the highest likelihood of risk occurrence. Management’s risk assessment also takes into account input from the internal audit function, which reports regularly to the Audit Committee, and the Board receives ongoing updates from management on trends in risk management and in new risks facing the business. Management is responsible for day-to-day risk assessment and mitigation activities, and our Board is responsible for risk oversight, focusing on our Company’s overall risk management strategy. While the Board as a whole maintains the ultimate oversight responsibility for risk management, the committees of the Board can be assigned responsibility for risk management oversight of specific areas, as set forth below:

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| FULL BOARD | |

| | | | | | |

| | | | | | |

| Together with the Board’s standing committees, the Board regularly reviews material risks identified by management and the Board. The Board and its committees regularly review the actions, policies and guidelines that management uses to address material risk. | | Develops a corporate governance structure that permits the Board to fulfill its responsibilities. | | Further, the Board establishes a corporate environment that promotes timely and effective disclosure, sufficient controls, procedures and incentives, fiscal accountability, high ethical standards and compliance with all applicable laws and regulations. | |

| | | | | | |

| | | | |

| | | | | | |

AUDIT

COMMITTEE | | COMPENSATION

COMMITTEE | | NOMINATING AND CORPORATE

GOVERNANCE COMMITTEE |

| | | | | | |

| | | | | | |

| As part of its responsibilities as set forth in its charter, the Audit Committee discusses with management the Company’s policies and guidelines to govern the process by which risk assessment and risk management are undertaken by management, including guidelines and policies to identify the Company’s major financial risk exposures, and the steps management has taken to monitor and control such exposures. The Audit Committee also performs an oversight role with respect to financial and compliance risks. | | The Compensation Committee considers risk in connection with its design of compensation programs for our executives and employees so that they do not encourage unnecessary or excessive risk-taking. | | The Nominating and Corporate Governance Committee is responsible for developing and recommending to the Board a set of governance guidelines applicable to the Company, including the Code. This committee also provides oversight of the Company's ESG activities, developments, goals, objectives, programs and disclosures. | |

| | | | | | |

| | | | |

| | | | | | |

| SENIOR MANAGEMENT | |

| | | | | | |

| | | | | | |

| Senior management tracks, evaluates and works to mitigate risks across all aspects of the Company's business operations. | |

| | | | | | |

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 19 |

Cybersecurity

BOARD OF DIRECTORS

Our Board of Directors oversees our Enterprise Risk Management program, and cybersecurity risks are monitored as a part of the broader program. Our Board has delegated the primary responsibility to oversee risks from cybersecurity threats to the Audit Committee.

Our Audit Committee receives quarterly updates from the Chief Information Officer ("CIO") on significant risks, cyber incidents, key performance indicators measuring the effectiveness of our cybersecurity risk program, and other relevant matters, and regularly reviews the measures implemented by the Company to identify, treat, mitigate, and transfer cybersecurity risk. The Audit Committee regularly briefs the Board on these updates, and the Board also receives periodic briefings on cybersecurity risk through our broader Enterprise Risk Management program. These risks, including current and emerging risks, are regularly evaluated by the Audit Committee and the Board. In addition to the regular updates to the Audit Committee, we have protocols by which certain cybersecurity incidents and threats are escalated within the Company and, where appropriate, reported in a timely manner to the Board and Audit Committee.

Stockholder Communication with the Board

Stockholders and other interested parties may contact the Board, the independent directors as a group or any individual director. All communications should be directed to:

TreeHouse Foods, Inc.

Attn: Corporate Secretary

2021 Spring Road, Suite 600

Oak Brook, IL 60523

Any such communication should prominently indicate on the outside of the envelope that it is intended for the Board or a particular director. All appropriate communication intended for the Board or a particular director and received by the Corporate Secretary will be forwarded to the specified party following its clearance through normal security procedures.

| | | | | | | | | | | |

| 20 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

| | | | | | | | | | | | | | | | | |

| Election of Directors | | | | |

| | | | |

| | | | | |

| The Company’s Restated Certificate of Incorporation (the "Charter") and Amended and Restated By-laws (the "By-laws") provide that the Board shall be composed of not less than three nor more than 15 directors. As a result of continued evaluation of our corporate governance practices and consideration of views held by the investor community, in 2023 our Board determined that it was advisable and in the best interests of the Company and our stockholders to propose to our stockholders that we amend our Certificate of Incorporation (the “Certificate”) to declassify our Board of Directors and phase-in the annual election of all directors, as described below (the “Declassification Amendment”). We believe these amendments reflect our commitment to good corporate governance and better align our governance processes with governance practices supported by the investor community. In 2023, our stockholders approved the Declassification Amendment. The Declassification Amendment, which will be phased in over a period of three years, does not shorten the existing terms of our directors. Accordingly, a director who has been elected to a three-year term (including directors elected at the 2023 Annual Meeting) will complete that term. The Declassification Amendment means that, beginning with the 2026 Annual Meeting, the declassification of our Board will be complete and all directors would be subject to annual election for one-year terms. Currently, six directors serve in the 2025 Class (Mr. Oakland, Ms. Massman, Mr. DeWitt, Ms. Rahman, Mr. Scalzo and Mr. Tyler) and two directors serve in the 2026 Class (Mr. Ostfeld and Ms. Spence). Upon the recommendation of the Nominating and Corporate Governance Committee, there are six nominees to be considered for election to our Board of Directors: Mr. Oakland, Ms. Massman, Mr. DeWitt, Ms. Rahman, Mr. Scalzo and Mr. Tyler. If elected, these nominees will serve a one-year term. The nominees’ biographies below describe each candidate’s background and relevant experience in more detail. As such, at the Annual Meeting, you will elect a total of six directors named in this Proxy Statement, subject to the provisions of the Company’s By-laws, to hold office until the 2026 Annual Meeting and until their successors are duly elected and qualified. | | | | |

| | | THE BOARD UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES LISTED BELOW. •STEVEN OAKLAND •LINDA K. MASSMAN •ADAM J. DEWITT •JILL A. RAHMAN •JOSEPH E. SCALZO •JASON J. TYLER Proxies solicited by the Board will be voted for the election of each Director nominee unless stockholders specify a contrary vote. | |

| | | | |

| | | | |

| | | | | |

| | | | | | | | | | | |

| 2025 Proxy Statement | TreeHouse Foods, Inc. | | 21 |

Once our Board is fully declassified, directors elected to fill vacancies and newly created seats on the Board will serve for a term expiring at the next Annual Meeting, and while the declassification of our Board is being phased in, any director elected to a newly created seat on the Board will serve for the same term as the remainder of the class to which the director is elected.

As the Company invests in strengthening the foundation of our business, we are continuously enhancing our corporate governance practices to align with our strategy. We have brought fresh and diverse perspectives to the Board, as five highly qualified directors have been added to our Board since 2019. We believe that the Board possesses the appropriate mix of diversity in terms of age, gender, race, national origin, skills, experience, viewpoints and service on our Board and the boards of other organizations. Each director nominee has agreed to be named in this Proxy Statement, and to serve as a director if elected.

Proxies cannot be voted for a greater number than the number of nominees named. The affirmative vote of a majority of the votes cast is required to elect each director. In other words, the number of votes “for” a director must exceed the number of votes “against” a director in order to elect such director. For information regarding our resignation policy, see the section titled "Summary of the Annual Meeting — Resignation Policy" in this Proxy Statement.

Nomination of Directors

The Nominating and Corporate Governance Committee is responsible for identifying individuals qualified to become Board members, consistent with the Director Criteria (as defined below) and recommending to the Board the nominees for election as directors. The Board is responsible for approving criteria for selecting directors (the “Director Criteria”). The Nominating and Corporate Governance Committee reviews and uses such criteria and the principles set forth in the Company’s Corporate Governance Guidelines to guide its director selection process. On an annual basis, the Nominating and Corporate Governance Committee reviews with the Board the requisite skills and criteria for new Board members as well as the composition of the Board as a whole. In considering potential candidates for election to the Board, including with respect to incumbent directors and stockholder recommended candidates, the Nominating and Corporate Governance Committee shall consider, among other qualifications that it deems appropriate, the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| | Candidates who have a reputation for integrity, honesty, and adherence to high ethical standards | | | Candidates who provide diversity of occupational and personal backgrounds to the Board, including diversity with respect to self-identified diversity characteristics such as gender, ethnicity and national origin, geography, age and sexual orientation | | | Candidates whose background and qualifications provides a significant breadth of experience, knowledge, and abilities that assist the Board in fulfilling its responsibilities | |

| | | | | | | |

| | Candidates with demonstrated business acumen, experience, and an ability to exercise sound judgment in matters that relate to the current and long-term objectives of the Company | | | | | |

| | | | | | |

| | | | | Candidates time commitments, particularly the number of other boards on which the potential candidate may serve | |

| | | | | | |

| | | | Candidates who demonstrate independence and absence of conflicts of interest | | |

| | | | | | |

| | Candidates committed to understand the Company and its industry | | | | |

| | | | | | | | | |

The Nominating and Corporate Governance Committee reviewed, updated and evaluated the Board’s skill and experience matrix and evaluated each of the directors’ qualifications against the Company’s long-term strategic plans. Within this framework, specific items relevant to the Board’s determination for each director are listed in each director’s biographical information beginning on page 24. The directors’ ages are shown as of April 24, 2025. There are no family relationships among our directors or NEOs (which term is the same as and used interchangeably with “Executive Officers”). Identifying New Directors

The Nominating and Corporate Governance Committee receives suggestions for new directors from a number of sources, including current Board members and stockholders (when recommended in accordance with the nomination procedures set forth in our By-laws). It also may, in its discretion, employ a third-party search firm to assist in identifying potential candidates. In considering potential candidates for election to the Board, including with respect to incumbent directors and stockholder recommended candidates, the Nominating and Corporate Governance Committee shall consider, among other qualifications that it deems appropriate, the factors described above. For more information, please review the "Stockholder Proposals for 2026 Annual Meeting" section of this Proxy Statement.

| | | | | | | | | | | |

| 22 | | TreeHouse Foods, Inc. | 2025 Proxy Statement |

Director Qualifications

The Board, acting through the Nominating and Corporate Governance Committee, considers its members, including those directors being nominated for reelection to the Board at the Annual Meeting, to be highly qualified for service on the Board. Generally, the Board seeks individuals with broad-based experience and the background, judgment, independence, and integrity to represent the stockholders in overseeing the Company’s management in their operation of the business. The current members of the Board, including our nominees, hold or have held senior executive positions in large, complex organizations and have operating experience that meets this objective. In these positions, they have gained experience in core management skills, such as strategic and financial planning, public company financial reporting, compliance, risk management, and leadership development. Many of our directors also have experience serving on boards of directors and board committees of other public companies and have an understanding of corporate governance practices and trends. We consider the members of our Board to have a diverse set of business and personal experiences, backgrounds and expertise.

Over the past few years, we have refocused our efforts on Board refreshment. The Board believes the fresh perspectives brought by new directors are critical to a forward-looking and strategic Board while retaining those who have a deep understanding of TreeHouse’s business provided by longer-serving directors.

The Board is committed to having a Board that reflects diverse perspectives, including those based on gender, ethnicity, skills, experience at policy-making levels in areas that are relevant to the Company’s activities, and functional, geographic or cultural background. The Board assesses its effectiveness in this regard as part of the annual Board and committee evaluation process. As part of the search process for each new director, our Nominating and Corporate Governance Committee actively seeks out diverse candidates to include in the pool from which Board nominees are chosen.

The Board does not believe it should establish term limits. Term limits could result in the loss of directors who have been able to develop, over a period of time, increasing insight into the Company and its operations and an institutional memory that benefits the entire membership of the Board as well as management. However, the Board does believe that a mandatory retirement age for directors is appropriate and has adopted the policy that an individual may not stand for election or reelection to the Board if such individual (i) has reached 75 years of age or (ii) would reach 75 years of age during such individual’s term as a director if elected or re-elected; provided, however, from time to time the Board may re-nominate a director for additional terms if the Board determines that due to such director’s unique capabilities and/or special circumstances, such re-nomination is in the best interest of the Company.

Other Directorships

Directors and the Company’s executive officers must receive approval from the Chair of the Board and the Nominating and Corporate Governance Committee in advance of accepting an invitation to serve, or being publicly reflected as a nominee to serve, on the board of another public company. The Nominating and Corporate Governance Committee shall take into account the nature of and time involved in a director’s service on other boards in evaluating the suitability of individual directors and making its recommendations to the Board. Service on boards and/or committees of other organizations shall comply with the Company’s conflict of interest policies. Directors generally will serve on no more than four boards of public companies (including the Company’s Board) or, if the director is serving as an executive officer of a public company, no more than two boards of public companies (including the Company’s Board).

Agreement with JANA Partners