VIA EDGAR AND FACSIMILE

Mr. Mark Webb

Branch Chief

Division of Corporation Finance

Securities and Exchange Commission

450 Fifth Street, N.W.

Washington, D.C. 20549

| Re: | Lazard Ltd and Lazard Group Finance LLC |

| | Registration Statement on Form S-1, filed March 21, 2005 |

Dear Mr. Webb,

On behalf of Lazard Ltd (“Lazard” or the “Company”) and Lazard Group Finance LLC (“Lazard Group Finance,” and, together with the Company, the “Registrants”), set forth below are the responses of the Registrants to the comments of the staff of the Division of Corporation Finance (the “Staff”), regarding the above-referenced Registration Statement, which you delivered in a letter dated April 12, 2005.

We are providing under separate cover five copies of Amendment No. 1 to the above-referenced Registration Statement (“Amendment No. 1”), which reflects the Registrants’ responses and additional and revised disclosure. Two copies of Amendment No. 1 are marked to show changes from the initial filing of the Registration Statement on Form S-1 on March 21,

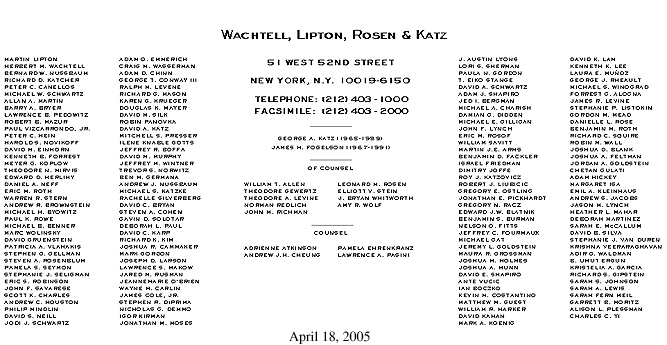

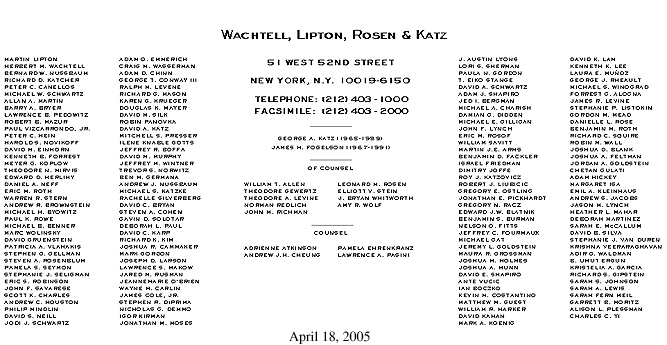

WACHTELL, LIPTON, ROSEN & KATZ

Division of Corporate Finance

April 18, 2005

Page 2 of 7

2005. We are providing courtesy copies of Amendment No. 1, including a version marked for changes, to Angela Jackson, Staff Accountant, Joyce Sweeney, Senior Accountant, and Christian Windsor, Special Counsel.

For your convenience, the text of the Staff’s comments is set forth in bold text followed by the responses of the Registrants. All page references in the responses set forth below refer to pages of the revised Registration Statement.

General comments on this filing

| 1. | Revise this registration statement to comply with relevant comments directed towards registration statement 333-121407. |

Response: The Registration Statement has been revised to reflect the comments of the Staff as included herein, as well as to reflect the comments of the Staff to the Company’s Registration Statement on Form S-1 (File No. 333-121307) relating to shares of the Company’s Class A common stock as applicable.

| 2. | Please use no type size smaller than the size that prevails in the document. Currently, footnotes, information used in connection with diagrams, and some financial information is in a smaller size. |

Response: The Registration Statement has been revised in response to the Staff’s comment.

| 3. | Either include Lazard Group as a co-issuer, or supplementally why it is not a co-issuer. |

Response: The Company supplementally advises the Staff that Lazard Group was not included as a co-issuer with respect to the equity security unit offering under the Registration Statement because no Lazard Group securities are being offered or sold in the offering and Lazard Group is not providing a guarantee or other financial support that could be deemed to be a security. In addition, because Lazard Group Finance will control all of the outstanding voting interests of Lazard Group and will act as its managing member, the “chief part” of Lazard Group Finance’s business will not consist of the purchase of the securities of “one issuer . . . and the sale of its own securities.” Accordingly, Rule 140 of the Securities Act of 1933 is inapplicable to the offering of the equity security units by Lazard Ltd (or the Lazard Group Finance senior notes that are a component thereof) and Lazard Group would not be deemed to be a co-issuer thereunder.

As described in the Registration Statement, Lazard Group will be part of the family of companies under Lazard Ltd, the public parent company of the Lazard businesses. Lazard Ltd is the issuer of the equity security units (and the purchase contracts that are a component thereof). Lazard Group Finance is a co-issuer of the equity security units

WACHTELL, LIPTON, ROSEN & KATZ

Division of Corporate Finance

April 18, 2005

Page 3 of 7

because it is the issuer of the senior notes that are a component of the equity security units. The Company selected Lazard Group Finance to be the issuer of the senior notes because its “placement” within the Lazard family, among other considerations, allows the Company to maximize the tax deductibility of interest expense associated with the senior notes (relative to other potential subsidiaries of Lazard Ltd). As mentioned above, however, Lazard Group Finance also serves an important role as the intermediate holding company within the Lazard family -- it is the entity through which Lazard Ltd exercises control of Lazard Group. Lazard Ltd and Lazard Group Finance will control and manage an active, on-going financial advisory and asset management business conducted through their controlled subsidiaries. As described in the Registration Statement, Lazard Ltd will consolidate the results of Lazard Group and the other Lazard subsidiaries into its financial statements.

Lazard Group itself also is merely a holding company for other Lazard subsidiaries and does not conduct any material operations directly. The net proceeds that Lazard Ltd and Lazard Group Finance receive in connection with the equity security unit offering, prior to be used in connection with the recapitalization, will first be contributed to Lazard Group in return for an intercompany note. The contribution or “on-lending” of proceeds of an offering to a subsidiary is quite common. The contribution and on-lending of proceeds is, in fact, what Lazard Ltd will be doing with the net proceeds of the common stock offering - Lazard Ltd will take the proceeds of the common stock offering and, through its subsidiaries, purchase a number of units of Lazard Group equal to the number of shares of Lazard Ltd common stock sold in the common equity offering. The Company does not believe the contribution or “on-lending” of proceeds to a subsidiary, absent other facts customarily present in offerings where Rule 140 is implicated (such as in a “trust preferred” environment where the “trust” is nothing more than a special purpose conduit and clearly has no control over the “parent”), requires the application of Rule 140.

In addition, the Company understands that Rule 140 was adopted to address abuses in the underwriting of securities by persons whose primary business is the purchase and sale of securities. Rule 140 reflects the determination that underwriters should not be able to sell the securities of one entity by issuing their own securities and using the proceeds of the sale of those securities to purchase the securities of another issuer, without full disclosure to the purchasers of the underwriter’s securities of information with respect to that other issuer. Although Rule 140 was adopted in connection with Section 2(11) of the Act, which defines “underwriter”, the Commission has in the past taken the position in interpreting Rule 140 that the issuer of an unregistered security that is being purchased with the proceeds from the sale of a registered security is a “co-issuer” of the registered security, requiring the issuer of the unregistered security to sign the registration statement. This interpretation is intended to prevent the issuer of the underlying security from circumventing the registration process. Such a concern is not applicable to the equity security unit offering. Lazard Ltd, the public parent company for the Lazard

WACHTELL, LIPTON, ROSEN & KATZ

Division of Corporate Finance

April 18, 2005

Page 4 of 7

business, is the primary issuer of the equity security units and, as a result, the public parent company is already fully liable for the contents of the Registration Statement. The directors and officers of Lazard Ltd, who will oversee and manage all of the public Lazard businesses, will execute the Registration Statement. Accordingly, the persons of substance in the Lazard business going forward will have the liabilities prescribed by Section 11 of the Securities Act for this offering, and the assets of Lazard Ltd and its subsidiaries will be available to support such liability. Moreover, the Company notes that Rule 3-16 of Regulation S-X provides for financial disclosure in the “holding company” circumstance, and the Registration Statement fully complies with the requirements of Rule 3-16. The Registration Statement contains at least the same disclosure that would have been required had Lazard Group sold notes directly to the public in this offering, including full financial and business information concerning Lazard Group. As a result, investors in this offering will have all material information relevant to an investment decision regarding the equity security units.

The Company does not believe that Rule 140 requires a significant subsidiary of a holding company (particularly a significant subsidiary that is itself a holding company) to become a co-issuer merely as a result of the contribution of the proceeds of the holding company’s offering in exchange for securities of such subsidiary with similar terms. Instead, Rule 140 is designed to prevent abuses whereby the “real issuer” is not responsible for the contents of the Registration Statement and the Registration Statement contains inadequate disclosure regarding such “real issuer.” The Company believes that significant subsidiaries of public companies should not be required to become “co-registrants”, and thus increase the number of reporting companies within a business group, unless such subsidiaries do, in fact, issue a security (or a guarantee thereof) to the public. To the Company’s knowledge, neither Rule 140 or the co-issuer position has been applied so broadly in this context, and the Company respectfully submits that it is not appropriate in this instance.

Summary

The ESU Offering — page 15

| 4. | Please cross reference the fixed settlement option with the discussion of the option and the pricing formula on page 187. |

Response: The Company has revised the Registration Statement to remove the fixed settlement option from the terms of the equity security units.

Material U.S. Federal Income Tax and Bermuda Tax Considerations — page 227

| 5. | Revise this section to note, if true, that the discussion of the tax consequences represent the opinion of counsel. Also, revise the discussion to eliminate the term “summary” as the discussion represents the opinion of counsel. |

WACHTELL, LIPTON, ROSEN & KATZ

Division of Corporate Finance

April 18, 2005

Page 5 of 7

Response: The Company has revised the “Material U.S. Federal Income Tax and Bermuda Tax Considerations” section of the Registration Statement in response to the Staff’s comment.

| 6. | In this section on page 228 and in the Summary and Risk Factors sections, you reference a single IRS revenue ruling on similar securities. However, you do not state the effect of the fact that there is a dearth of authority on the tax treatment of these securities. Please clarify the impact that the fact that only a single revenue ruling on the particular securities had ruling upon the opinion provided by counsel. Also, revise this section to clarify the substance of that revenue ruling. |

Response: The Company has revised the Registration Statement on pages 23, 65 and 235 in response to the Staff’s comment.

| 7. | In “Risk of Recharacterization,” counsel assumes a particular tax treatment. Please note the reasons for counsel’s assumption, and also discuss what other possible tax treatment and consequences are possible. |

Response: The Company has revised the Registration Statement on page 235 in response to the Staff’s comment.

| 8. | Revise this section describe the tax consequences in the event that the IRS were to reach a conclusion different from the one assumed by your counsel. |

Response: The Company has revised the Registration Statement on page 235 in response to the Staff’s comment.

| 9. | Please clarify what “should” means in the second to last sentence of the first paragraph of page 229. |

Response: The Company has revised the Registration Statement on page 236 in response to the Staff’s comment.

| 10. | Since you are offering common stock, you also need to include a discussion similar to that required in the concurrent S-1. Please revise. |

Response: The Company has revised the disclosure on page 238 in the section entitled “Ownership of Our Common Stock—Tax Status of Lazard and its Subsidiaries—Partnership Status of Lazard for U.S. Federal Income Tax Purposes” to conform to changes made in the amended Form S-1 of the Company with respect to its common stock.

Exhibit 8.1

WACHTELL, LIPTON, ROSEN & KATZ

Division of Corporate Finance

April 18, 2005

Page 6 of 7

| 11. | Please file this exhibit as soon as possible to facilitate the review by the staff. |

Response: The tax opinions of Wachtell, Lipton, Rosen & Katz have been filed in response to the Staff’s comment.

* * *

WACHTELL, LIPTON, ROSEN & KATZ

Division of Corporate Finance

April 18, 2005

Page 7 of 7

Should you require further clarification of the matters discussed in this letter or in the revised Registration Statement, please contact Craig M. Wasserman, Esq., Benjamin D. Fackler, Esq. or the undersigned at (212) 403-1000 (facsimile: (212) 403-2000).

Sincerely,

/s/ Gavin D. Solotar

Gavin D. Solotar, Esq.

| cc: | Scott D. Hoffman, Esq. |

| | Managing Director and General Counsel, Lazard LLC |

| | Cravath, Swaine & Moore LLP |