Exhibit 5.2

Lazard Ltd

Clarendon House

2 Church Street

Hamilton HM 11, Bermuda

Lazard Group Finance LLC

c/o Lazard Group LLC

30 Rockefeller Plaza

New York, New York 10020

Ladies and Gentlemen:

We have acted as special counsel in connection with the registration by Lazard Ltd, a Bermuda exempted company (“Lazard”), and Lazard Group Finance LLC, a Delaware limited liability company (“Lazard Group Finance”), under the Securities Act of 1933 (the “Act”) of Equity Security Units (the “Units”), each of which will initially consist of (i) a purchase contract under which the holder agrees to purchase in 2008, for $25, shares of Class A common stock of Lazard (the “Purchase Contracts”) and (ii) a 1/40, or 2.5%, ownership interest in a senior note of Lazard Finance, each with a principal amount of $1000 (the “Senior Notes,” together with the Units and the Purchase Contracts, the “Securities”). The Purchase Contracts will be evidenced by unit certificates (the “Unit Certificates”).

In rendering this opinion, we have examined such corporate records and other documents, including without limitation (i) the form of the Certificate of Incorporation and Memorandum of Association of Lazard and the Certificate of Incorporation in Change of Name of Lazard, filed as

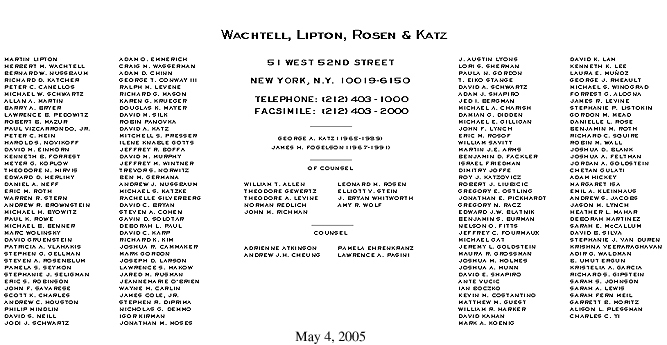

WACHTELL, LIPTON, ROSEN & KATZ

May 4, 2005

Page 2

Exhibits 3.1 and 3.2 to the Registration Statement, respectively; (ii) the form of Indenture of Lazard Group Finance LLC, filed as Exhibit 4.2 of the Registration Statement; (iii) the Registration Statement; (iv) the Prospectus contained within the Registration Statement; (v) the form of the Underwriting Agreement relating to the equity public offering of Lazard, filed as Exhibit 1.1 to the Registration Statement; (vi) the form of the Underwriting Agreement relating to the equity security units offering of Lazard and Lazard Group Finance, filed as Exhibit 1.2 to the Registration Statement; (vii) the Pledge Agreement relating to Lazard Group Finance senior notes, which are components of the Lazard equity security units, filed as Exhibit 4.6 to the Registration Statement; and (viii) such corporate and company records, agreements, documents and other instruments, and such certificates or comparable documents of public officials and of officers and representatives of Lazard and Lazard Group Finance, we have made such inquiries of such officers and representatives, as we have deemed relevant and necessary as a basis for the opinion hereinafter set forth, and we have reviewed such matters of law, in each case as we have deemed necessary or appropriate in connection with giving the opinions set forth herein.

In rendering the opinions set forth herein, we have, with your consent, relied upon representations of officers of Lazard and Lazard Group Finance and certificates of public officials with respect to the accuracy of the factual matters addressed in such representations and certificates. In addition, in rendering the opinions set forth herein we have, with your consent, assumed the genuineness of all signatures or instruments relied upon by us, and the conformity of certified copies submitted to us with the original documents to which such certified copies relate.

Members of our firm are admitted to the Bar in the State of New York, and the opinions expressed in this letter are limited to the effects of the federal laws of the United States of America normally applicable, in our experience to transactions of the type contemplated by the Registration Statement with respect to the Senior Notes, the internal laws of the State of New York (excluding any political subdivision), and the General Corporation Law of the State of Delaware, and are based upon such law (as such law is presently interpreted by regulations or published judicial opinions) and the state of facts that exist as of the date of this letter. With respect to matters of Bermuda law, we rely on the opinion of Conyers Dill & Pearman.

Based on and subject to the foregoing, we are of the opinion that:

(1) When the Registration Statement relating to the Securities (the “Registration Statement”) has become effective under the Act, an indenture (the “Indenture”) among Lazard Group Finance and The Bank of New York (the “Trustee”), substantially in the form filed as an exhibit to the Registration Statement, has been duly authorized, executed and delivered by each of the parties thereto, the terms of the Senior Notes and of their issuance and sale have been duly established in conformity with the Indenture, and the Senior Notes have been duly executed and authenticated in accordance with the Indenture and issued and sold as contemplated in the Registration Statement, the Senior Notes will constitute valid and legally binding obligations of Lazard Group Finance, subject to (a) the effects of bankruptcy, insolvency, fraudulent

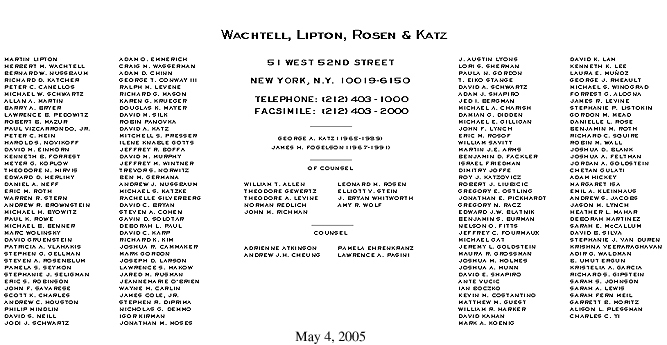

WACHTELL, LIPTON, ROSEN & KATZ

May 4, 2005

Page 3

conveyance, reorganization, moratorium and similar laws of general applicability relating to or affecting creditors’ rights generally, from time to time in effect, and (b) application of general equity principles (whether considered in a proceeding in equity or at law, and including without limitation, concepts of materiality, reasonableness, good faith and fair dealing) and, except with respect to the rights of indemnification and contribution thereunder, which enforcement thereof may be limited by federal or state securities laws or the policies underlying such laws.

(2) The Purchase Contracts, which are evidenced by the Unit Certificates, when duly authorized, executed and delivered as described in the Registration Statement and when payment therefor is received, will constitute valid and binding obligations of Lazard in accordance with the terms thereof.

We hereby consent to the filing of this opinion with the Securities and Exchange Commission as an exhibit to the Registration Statement, and to the references therein to us. In giving such consent, we do not thereby admit that we are in the category of persons whose consent is required under Section 7 of the Securities Act of 1933, as amended.

Very truly yours,

/s/ Wachtell, Lipton, Rosen & Katz