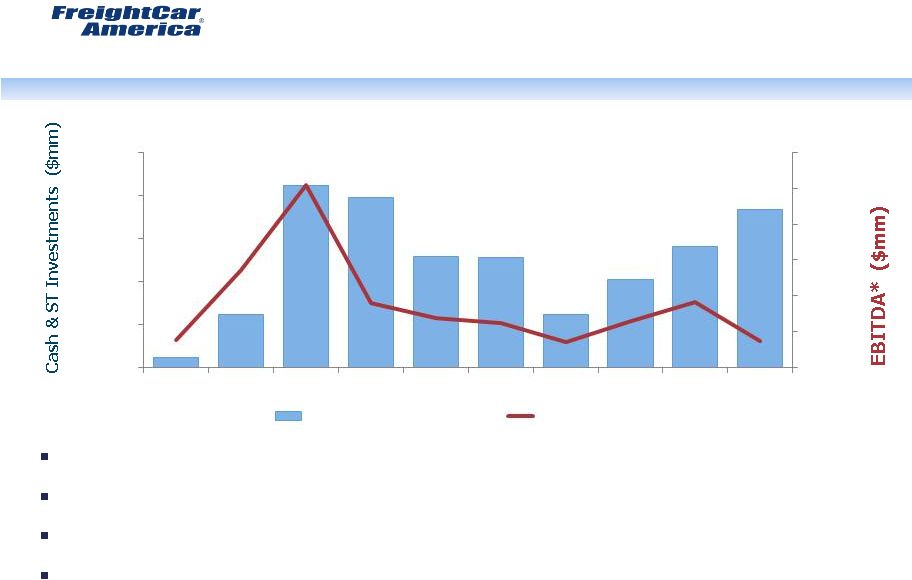

Non-GAAP Reconciliation EBITDA 27 ($ in thousands) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2013 2014 Net income (loss) ($24,860) $45,693 $128,733 $27,459 $11,420 $4,784 ($12,862) $4,939 $19,095 ($19,295) ($7,008) $1,098 Interest income (282) (1,225) (5,860) (8,349) (3,827) (124) (89) (6) (11) (64) (59) (48) Interest expense and deferred financing costs 14,315 11,858 658 652 677 793 965 226 384 809 481 854 Income tax provision (benefit) (7,962) 21,762 75,530 15,389 6,769 248 (9,511) 354 13,771 (5,537) 633 252 Depreciation and amortization 7,350 7,810 5,442 3,910 4,380 5,658 7,015 8,821 8,398 10,077 7,289 7,481 EBITDA ($11,439) $85,898 $204,503 $39,061 $19,419 $11,359 ($14,482) $14,334 $41,637 ($14,010) $1,336 $9,637 Nine months ended September 30, EBITDA is defined as net income (loss) before interest income, interest expense and deferred financing costs, income tax provision (benefit) and depreciation and amortization. We believe that EBITDA is useful to investors in evaluating our operating performance compared to that of other companies in our industry. In addition, our management uses EBITDA to evaluate our operating performance. The calculation of EBITDA eliminates the effects of financing, income taxes and the accounting effects of capital spending. These items may vary for different companies for reasons unrelated to the overall operating performance of a company’s business. EBITDA is not a financial measure presented in accordance with GAAP. Accordingly, when analyzing our operating performance, investors should not consider EBITDA in isolation or as a substitute for net income (loss), cash flows from operating activities or other statements of operations or cash flow data prepared in accordance with GAAP. Our calculation of EBITDA is not necessarily comparable to that of other similarly titled measures provided by other companies. We recognize that the usefulness of EBITDA has certain limitations. EBITDA does not include the provision for income taxes and, because the payment of income taxes is a necessary element of our costs, any measure that excludes income tax expense may have material limitations. EBITDA does not include depreciation and amortization and, because we use capital assets, depreciation and amortization expense is a necessary element of our costs and ability to generate profits and any measure that excludes depreciation and amortization expense may have material limitations. EBITDA does not reflect cash expenditures or future requirements for capital expenditures or contractual commitments and does not reflect changes in, or cash requirements for, working capital needs. We compensate for the foregoing limitations by using EBITDA as a comparative tool, together with GAAP measures, to assist in the evaluation of our operating performance. |