UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

DIAMOND FOODS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | Title of each class of securities to which transaction applies: |

| | (2) | Aggregate number of securities to which transaction applies: |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | Proposed maximum aggregate value of transaction: |

| x | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number or the Form or Schedule and the date of its filing. |

| | (1) | Amount previously paid: |

| | (2) | Form, Schedule or Registration Statement No.: |

EXPLANATORY NOTE

This proxy statement relates to the special meeting of stockholders of Diamond Foods, Inc. (“Diamond”) to approve the issuance of shares of Diamond common stock in the merger (“Merger”) of The Wimble Company (the “Pringles Company”), a Delaware corporation and presently a direct wholly-owned subsidiary of The Procter & Gamble Company (“P&G”), with and into Wimbledon Acquisition LLC (“Merger Sub”), a Delaware limited liability company and a direct wholly-owned subsidiary of Diamond, with Merger Sub continuing as the surviving company and a wholly-owned subsidiary of Diamond. The Pringles Company currently is a wholly-owned subsidiary of P&G and P&G intends to distribute its shares of the Pringles Company common stock to P&G shareholders in an exchange offer (“Exchange Offer”) immediately prior to the Merger (as described in the next paragraph). Diamond has filed a registration statement on Form S-4 (Reg. No. 333-175025) to register the issuance of its shares of common stock, par value $0.001 per share, which will be issued to the stockholders of the Pringles Company in the Merger. In addition, the Pringles Company has filed a registration statement on a combined Form S-4/S-1 (Reg. No. 333-175029) to register the issuance of its shares of common stock, par value $0.01 per share, which will be distributed to P&G shareholders in an Exchange Offer or a spin-off, which shares of Pringles Company common stock will automatically convert into the right to receive Diamond common stock in the Merger.

In the Exchange Offer, P&G shareholders would have the option to exchange their shares of P&G common stock for shares of Pringles Company common stock, which will automatically convert into the right to receive Diamond common stock in the Merger, resulting in a reduction in P&G’s outstanding shares. If the Exchange Offer is completed but is not fully subscribed, P&G will distribute all of its remaining shares of Pringles Company common stock (“Remaining Shares”) as a pro rata dividend to all P&G shareholders. In this case, P&G will irrevocably deliver all of its right and title to the Remaining Shares to a distribution agent on the closing date of the Transactions, which closing shall occur immediately after the completion of the Exchange Offer. The distribution agent will hold the Remaining Shares for the benefit of P&G shareholders as of such date (after giving effect to the completion of the Exchange Offer). The distribution agent will distribute the shares of Diamond common stock, into which the Remaining Shares will be converted in the Merger, to P&G shareholders on a pro rata basis as promptly as practicable thereafter.

References in this document to “P&G shareholders participating in the Exchange Offer” are deemed to include any P&G shareholders who receive any of the Remaining Shares in the pro rata dividend described above. When the Merger is described in this document as occurring “immediately after the completion of the Distribution,” it is meant that the Merger will take place immediately after the completion of the Exchange Offer and, if applicable, the irrevocable delivery by P&G of its right and title to the Remaining Shares to a distribution agent for distribution to P&G shareholders in a pro rata dividend.

September 26, 2011

MERGER PROPOSED—YOUR VOTE IS IMPORTANT

You are cordially invited to attend the Special Meeting of Stockholders of Diamond Foods, Inc. at 10:00 a.m. Pacific Time, on Thursday, October 27, 2011, at 333 Battery Street, San Francisco, CA 94111. A notice of the special meeting and the proxy statement follow.

At the special meeting, you will be asked to approve a proposal to issue shares of Diamond common stock in connection with a merger of the Pringles business of The Procter & Gamble Company (“P&G”) with The Wimble Company (“Pringles Company”), a wholly-owned subsidiary of Diamond (“Merger”). You will also be asked to approve a proposal to adopt the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock, a proposal to approve adjournments or postponements of the special meeting, if necessary, to permit further solicitation of proxies and a proposal to approve the adoption of the 2011 International Stock Purchase Plan. Immediately after the completion of the Merger and related transactions, the Pringles business of P&G will be owned by Wimbledon Acquisition LLC, which will be a wholly-owned subsidiary of Diamond. As more fully described in the accompanying proxy statement, P&G will make an offer to P&G shareholders to exchange shares of P&G common stock for shares of Pringles Company common stock (“Exchange Offer”), based upon the market prices of shares of P&G common stock and Diamond common stock calculated during a specified period pursuant to the terms of the Exchange Offer, at a discount to be set by P&G when the Exchange Offer is commenced. If the Exchange Offer is completed but not fully subscribed, any shares of Pringles Company common stock not exchanged for shares of P&G common stock in the Exchange Offer will be distributed pro rata to P&G shareholders (after giving effect to the completion of the Exchange Offer). Pursuant to the Merger, Pringles Company common stock will convert into the right to receive shares of Diamond common stock on a one-for-one basis (“Exchange Ratio”), which Exchange Ratio takes into account the acquisition of the Pringles business, including the assumption of the Pringles debt. Diamond expects to issue 29,143,190 shares of Diamond common stock in connection with the Merger. We expect that the shares of Diamond common stock outstanding immediately prior to the Merger will represent approximately 43% of the Diamond common stock that will be outstanding immediately after the Merger, and that Diamond common stock issued in connection with the conversion of Pringles Company common stock in the Merger will represent approximately 57% of the Diamond common stock that will be outstanding immediately after the Merger. All Diamond common stock issued in connection with the Merger will be listed on The NASDAQ Global Select Market under our current symbol “DMND.”

Your Board of Directors believes that the Merger and the addition of the Pringles business of P&G should enhance stockholder value by providing a platform for growth, growing revenue and earnings, improving product mix, enhancing our global reach and geographic diversity, and diversifying our customer base.Your Board of Directors unanimously recommends that you vote FOR the proposal to issue Diamond common stock in connection with the Merger, FOR the proposal to adopt the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock, FOR the proposal to approve adjournments or postponements of the special meeting for the purpose of soliciting additional proxies, if necessary, and FOR the proposal to adopt the 2011 International Stock Purchase Plan.

Your vote is very important.Please vote by completing, signing and dating the enclosed proxy card(s) for the special meeting and mailing the proxy card(s) to us, whether or not you plan to attend the special meeting. If you sign, date and mail your proxy card without indicating how you want to vote, your proxy will be counted as a voteFOR each of the proposals presented at the special meeting. In addition, you may vote by proxy by calling the toll-free telephone number or by using the Internet as described in the instructions included with the enclosed proxy card(s). If you do not return your card, vote by telephone or by using the Internet, or if you do not specifically instruct your broker how to vote any shares held for you in “street name,” your shares will not be voted at the special meeting.

This document is a proxy statement by Diamond for its use in soliciting proxies for the special meeting. This document answers questions about the proposed Merger and related transactions and the special meeting and includes a summary description of the Merger and related transactions. We urge you to review this entire document carefully.In particular, you should also consider the matters discussed under “Risk Factors” beginning on page 25.

We thank you for your consideration and continued support.

|

| Sincerely, |

|

Michael J. Mendes |

| Chairman, President and |

| Chief Executive Officer |

This document is first being mailed to Diamond stockholders on or about September 26, 2011.

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

DIAMOND FOODS, INC.

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

A special meeting of stockholders of Diamond Foods, Inc. will be held at 10:00 a.m., Pacific Time, on Thursday, October 27, 2011 at 333 Battery Street, San Francisco, CA 94111. The special meeting will be held for the following purposes:

1. A proposal to approve the issuance of Diamond common stock in connection with a Merger of the Pringles business of P&G with a wholly-owned subsidiary of Diamond.

2. Subject to the approval of the first proposal, a proposal to approve the adoption of the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock.

3. A proposal to approve adjournments or postponements of the special meeting, if necessary, to permit further solicitation of proxies if there are not sufficient votes at the time of the special meeting to approve the issuance of Diamond common stock in connection with the Merger.

4. Subject to the approval of the first proposal, a proposal to approve the adoption of the 2011 International Stock Purchase Plan.

Diamond’s Board of Directors has unanimously approved the Merger and related transactions, the Transaction Agreement, the Separation Agreement and the other agreements relating to the Merger and related transactions, and determined that the Merger and the issuance of Diamond common stock in connection with the Merger, are advisable, fair to and in the best interests of Diamond and its stockholders. Diamond’s Board of Directors unanimously recommends that stockholders vote FOR the proposal to issue Diamond common stock in connection with the Merger, FOR the proposal to adopt the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock, FOR the proposal to approve adjournments or postponements of the special meeting for the purpose of soliciting additional proxies, if necessary and FOR the proposal to adopt the 2011 International Stock Purchase Plan.

All Diamond stockholders are cordially invited to attend the special meeting, although only those stockholders of record at the close of business on September 22, 2011 are entitled to notice of the special meeting and to vote at the special meeting and any adjournments or postponements of the special meeting.

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING IN PERSON, PLEASE COMPLETE, DATE, SIGN AND RETURN THE ENCLOSED PROXY CARD(S) IN THE ENCLOSED POSTAGE-PAID ENVELOPE OR VOTE YOUR SHARES OF COMMON STOCK BY CALLING THE TOLL-FREE TELEPHONE NUMBER OR BY USING THE INTERNET AS DESCRIBED IN THE INSTRUCTIONS INCLUDED WITH YOUR PROXY CARD(S) AT YOUR EARLIEST CONVENIENCE.

|

By order of the Board of Directors, |

|

Stephen E. Kim |

Secretary |

Please vote your shares promptly. You can find instructions for voting on the enclosed proxy card(s).

If you have questions, contact

Georgeson Inc.

Call Toll-Free: 1 (888) 607-9252

or

1 (212) 440-9800 (call collect)

San Francisco, California

September 26, 2011

Your vote is important. Please complete, date, sign and return your

proxy card(s) or vote your shares of common stock by calling the toll-free

telephone number or by using the Internet as described in the

instructions included with your proxy card(s) at your earliest convenience.

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

PROXY STATEMENT

September 26, 2011

The accompanying proxy is solicited on behalf of Diamond’s Board of Directors (“Diamond Board”) for use at a special meeting of stockholders to be held at 333 Battery Street, San Francisco, CA 94111 on Thursday, October 27, 2011 at 10:00 a.m., Pacific Time. This proxy statement and the accompanying form of proxy card were first mailed to stockholders on or about September 26, 2011.

Record Date; Quorum

Only holders of record of Diamond common stock as of the close of business on September 22, 2011, the record date, will be entitled to vote at the special meeting. At the close of business on the record date, we had 22,008,605 shares of common stock outstanding and entitled to vote. A majority of the shares outstanding on the record date, present in person or represented by proxy, will constitute a quorum for the transaction of business at the special meeting.

Purpose of the special meeting

You will be voting on the following matters at the special meeting:

1. A proposal to approve the issuance of Diamond common stock in connection with a merger of the Pringles business of P&G with a wholly-owned subsidiary of Diamond.

2. Subject to the approval of the first proposal, a proposal to approve the adoption of the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock.

3. A proposal to approve adjournments or postponements of the special meeting, if necessary, to permit further solicitation of proxies if there are not sufficient votes at the time of the special meeting to approve the issuance of Diamond common stock in connection with the Merger.

4. Subject to the approval of the first proposal, a proposal to approve the adoption of the 2011 International Stock Purchase Plan.

Recommendation of the Diamond Board

The Diamond Board recommends that you vote:

1. “FOR” the proposal to approve the issuance of Diamond common stock in connection with a merger of the Pringles business of P&G with a wholly-owned subsidiary of Diamond.

2. “FOR” the proposal to approve the adoption of the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock.

3. “FOR” the proposal to approve adjournments or postponements of the special meeting, if necessary, to permit further solicitation of proxies if there are not sufficient votes at the time of the special meeting to approve the issuance of Diamond common stock in connection with the Merger.

4. “FOR” the proposal to approve the adoption of the 2011 International Stock Purchase Plan.

Voting Rights; Required Vote

Stockholders are entitled to one vote for each share of common stock held as of the record date. Diamond common stock beneficially held by Diamond or its subsidiaries will not be voted. The affirmative vote of the holders of a majority of the shares represented and voting at the special meeting, either in person or by proxy is

required to approve the issuance of Diamond common stock in connection with the Merger, the adjournments or postponements of the special meeting and the adoption of the 2011 International Stock Purchase Plan. The affirmative vote of the majority of the shares of common stock issued and outstanding is required to approve the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock. The inspector of elections appointed for the special meeting will separately tabulate the relevant affirmative and negative votes, abstentions and broker non-votes for each proposal. The presence in person or by proxy at the special meeting of holders of Diamond common stock entitled to exercise as of the record date at least a majority of the outstanding voting power of Diamond common stock is necessary for a quorum.

Effect of Abstentions and Broker Discretionary Voting

Shares held by a stockholder who indicates on the proxy card that he or she wishes to abstain from voting will be considered present and entitled to vote at the special meeting and will count toward determining whether or not a quorum is present. A broker is not entitled to vote shares held for a beneficial holder on any of the proposals in this proxy statement.Abstentions and broker non-votes relating to shares of Diamond common stock will not be taken into account in determining the outcome of the proposal to issue Diamond common stock in connection with the Merger, the proposal to approve adjournments or postponements of the special meeting, if necessary, and the proposal to adopt the 2011 International Stock Purchase Plan but will have the same effect as a vote AGAINST the proposal relating to adoption of the certificate of amendment to Diamond’s certificate of incorporation.

Voting of Proxies

Most stockholders have three options for submitting their votes: by Internet, telephone or mail. If you have Internet access, you may submit your proxy by following the “Vote by Internet” instructions on the proxy card. If you live in the United States or Canada, you may submit your proxy by following the “Vote by Telephone” instructions on the proxy card. If you complete and properly sign the proxy card you receive and return it to Diamond in the prepaid envelope, your shares will be voted in accordance with the specifications made on the proxy card. If no specification is made on a signed and returned proxy card, the shares represented by the proxy will be voted “FOR” each of the proposals presented. Diamond encourages stockholders with Internet access to record their votes on the Internet or, alternatively, to vote by telephone. Internet and telephone voting is convenient, saves on postage and mailing costs and is recorded immediately, minimizing risk that postal delays may cause votes to arrive late and therefore not be counted. Stockholders who attend the special meeting may vote in person, and any previously submitted votes will be superseded by the vote cast at the special meeting.

Adjournment of the Special Meeting

Any adjournment may be made from time to time by approval of the stockholders holding a majority of the voting power present in person or by proxy at the special meeting, whether or not a quorum exists, without further notice other than by an announcement made at the special meeting.

Additional Copy of the Proxy Materials

To receive a additional copies of the proxy materials, stockholders should contact:

Georgeson Inc.

199 Water Street, 26th Floor

Call Toll Free: 1 (888) 607-9252

or

1 (212) 440-9800 (Call Collect)

or

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, CA 94111

Attention: Investor Relations

Telephone: (415) 445-7444

Revocability of Proxies

If you are a record holder of Diamond common stock, you can change your vote at any time before it is voted by:

| | • | | delivering a written notice to Georgeson Inc., that the proxy is revoked; |

| | • | | signing and dating a new proxy card(s), and submitting your proxy so that it is received prior to the special meeting or voting by telephone or by using the Internet prior to the special meeting in accordance with the instructions included with the proxy card(s); or |

| | • | | attending the special meeting and voting in person. |

If your shares are held in street name by your broker, you will need to contact your broker to revoke your proxy, and if in the alternative you wish to vote in person at the special meeting, you must bring to the special meeting a letter from the broker confirming your beneficial ownership of the shares and that the broker is not voting the shares at the special meeting. Note that your mere presence at the special meeting will not revoke the appointment if you had previously appointed a proxy. In the event of multiple online or telephone votes by a stockholder, each vote will supersede the previous vote and the last vote cast will be deemed to be the final vote of the stockholder unless such vote is revoked in person at the special meeting.

TABLE OF CONTENTS

i

TABLE OF CONTENTS

(continued)

ii

TABLE OF CONTENTS

(continued)

iii

INFORMATION REGARDING CONTENT OF THIS DOCUMENT

Securities and Exchange Commission Filings

This document incorporates important business and financial information about Diamond from documents that Diamond has filed with the Securities and Exchange Commission but that have not been included in or delivered with this document. For a list of documents incorporated by reference into this document, see “Where You Can Find More Information; Incorporation by Reference” beginning on page 152.

This information is available to you without charge upon your written or oral request. You can obtain the documents incorporated by reference into this document by accessing the Securities and Exchange Commission’s website maintained at www.sec.gov.

In addition, Diamond’s Securities and Exchange Commission filings are available to the public on Diamond’s website, www.diamondfoods.com. Information contained on Diamond’s website is not incorporated by reference into this document, and you should not consider information contained on that website as a part of this document.

Diamond will provide you with copies of this information, without charge, if you request them in writing or by telephone from:

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

Attention: Investor Relations

Telephone: (415) 445-7444

If you would like to request documents from Diamond, please do so by October 20, 2011 in order to receive them before the special meeting.

Sources of Information

All information contained in this document with respect to P&G, the Pringles Company (up to the closing date of the Transactions) and their subsidiaries has been provided by P&G. All other information contained or incorporated by reference in this document, including information with respect to Diamond and its subsidiaries, has been provided by Diamond.

Trademarks and Market and Industry Data

This proxy statement contains references to trademarks, trade names and service marks, including Pringles®, Eagle®, Torengos®, Mr. Moustache® and Once You Pop You Can’t Stop®, that are owned by the Pringles Business.

Unless otherwise specified in this proxy statement, all industry and market share data relating to the Pringles Business and the snacks industry included in this proxy statement are based on P&G’s market research and internally developed, proprietary analytical modeling system as well as statistical data obtained or derived from independent market research firms. Some of these third-party firms, such as Euromonitor International Limited (“Euromonitor”) and ACNielsen, categorize data differently from how the Pringles Business categorizes data. Information in this proxy statement on the snack industry is from independent market research carried out by Euromonitor but should not be relied upon in making, or refraining from making, an investment decision. Market share data is used by P&G to standardize market share information across different products and retail channels and is regularly used by P&G in the analysis of the Pringles Business. While P&G has no reason to believe any third-party information is not reliable, P&G has not independently verified this information.

1

Diamond of California®, Emerald®, Pop Secret® and Kettle Brand® are registered trademarks of Diamond in the United States. All other trademarks or service marks appearing in this proxy statement are trademarks or service marks of others.

Some of the market and industry data and forecasts relating to Diamond included in this proxy statement are based on independent industry sources. Although Diamond believes that these independent sources are reliable, Diamond has not independently verified the accuracy and completeness of this information, nor has Diamond independently verified the underlying economic assumptions relied upon in preparing any data or forecasts.

Statements in this proxy statement about the Pringles Business that Diamond proposes to acquire are made primarily on the basis of information furnished by the owners and management of the Pringles Business. Statements in this proxy statement about Diamond are made primarily on the basis of information furnished by the owners and management of Diamond.

HELPFUL INFORMATION

In this proxy statement:

| | • | | “Code” means the Internal Revenue Code of 1986, as amended. |

| | • | | “Diamond” means Diamond Foods, Inc., a Delaware corporation and, unless the context otherwise requires, its consolidated subsidiaries. |

| | • | | “Diamond common stock” means the Common Stock, par value $0.001 per share, of Diamond, including the preferred share purchase right issuable pursuant to the Rights Agreement, dated as of April 29, 2005, between Diamond and EquiServe Trust Company, N.A. entitling the holder under certain circumstances to purchase 1/100th of a share of Diamond’s Series A Junior Participating Preferred Stock for no additional consideration. |

| | • | | “Diamond Group” means Diamond and each of its consolidated subsidiaries including, after the completion of the Merger, the Pringles Company. |

| | • | | “Distribution” means the distribution by P&G of its shares of Pringles Company common stock to P&G shareholders by way of an exchange offer and, if the exchange offer is completed but is not fully subscribed, the distribution of the Remaining Shares as a pro rata dividend to P&G shareholders as described herein. |

| | • | | “GAAP” means accounting principles generally accepted in the United States. |

| | • | | “immediately after the completion of the Distribution” means immediately after notice of acceptance of the shares of P&G common stock tendered for exchange is given by P&G to the exchange agent appointed by P&G and irrevocable delivery by P&G of its right and title to all shares of Pringles Company common stock to the exchange agent for distribution to eligible P&G shareholders in the exchange offer and pursuant to a pro rata dividend, if any. |

| | • | | “market disruption event” with respect to either shares of P&G common stock or shares of Diamond common stock means a suspension, absence or material limitation of trading of shares of P&G common stock on the NYSE or shares of Diamond common stock on NASDAQ for more than two hours of trading or a breakdown or failure in the price and trade reporting systems of the NYSE or NASDAQ as a result of which the reported trading prices for shares of P&G common stock on the NYSE or shares of Diamond common stock on NASDAQ, respectively, during any half-hour trading period during the principal trading session of the NYSE or NASDAQ are materially inaccurate, as determined by P&G, on the day with respect to which such determination is being made. For purposes of such determination: (1) a limitation on the hours or number of days of trading will not constitute a market disruption event if it results from an announced change in the regular business hours of the |

2

| | NYSE or NASDAQ and (2) limitations pursuant to any applicable rule or regulation enacted or promulgated by the NYSE, NASDAQ, any other self-regulatory organization or the SEC of similar scope as determined by P&G shall constitute a suspension, absence or material limitation of trading. |

| | • | | “Merger” means the merger of the Pringles Company with and into Merger Sub, with Merger Sub continuing as the surviving company, as contemplated by the Transaction Agreement. |

| | • | | “Merger Sub” means Wimbledon Acquisition LLC, a Delaware limited liability company and direct wholly owned subsidiary of Diamond. |

| | • | | “NASDAQ” means the NASDAQ Global Select Market. |

| | • | | “NYSE” means the New York Stock Exchange. |

| | • | | “P&G” means The Procter & Gamble Company, an Ohio corporation, and, unless the context otherwise requires, its consolidated subsidiaries. |

| | • | | “P&G shareholders” means the holders of shares of P&G common stock. |

| | • | | “Pringles” or “Pringles Business” means the business of P&G and its subsidiaries relating to the sourcing, producing, marketing, selling, distributing and development of (1) potato snack-related products and services, including potato crisps and various flavors and product line extensions that feature different compositions and flavors, and (2) cracker stick-related products and services that will be transferred by P&G and its subsidiaries to the Pringles Company as part of the Separation, including the Pringles® brand. |

| | • | | “Pringles Company” means The Wimble Company, a Delaware corporation and direct wholly owned subsidiary of P&G, and, where the context requires, its consolidated subsidiaries. |

| | • | | “Pringles Debt” means the new senior secured bank debt in an amount between $700 million and $1.05 billion to be (1) incurred by the Pringles Company prior to the Distribution and guaranteed by all existing and future direct and indirect subsidiaries of the Pringles Company, other than certain foreign subsidiaries, (2) assumed by Merger Sub by operation of law upon consummation of the Merger and (3) guaranteed after the consummation of the Merger by (a) all existing and future direct and indirect subsidiaries of Merger Sub, other than certain foreign subsidiaries, and (b) Diamond and all subsidiaries of Diamond that guarantee the indebtedness under Diamond’s credit facilities. |

| | • | | “Remaining Shares” means any remaining shares of Pringles Company common stock held by P&G after completion of the exchange offer. |

| | • | | “Separation” means the transfer by P&G of certain of the assets and liabilities related to the Pringles Business, including certain subsidiaries of P&G, to the Pringles Company. |

| | • | | “Separation Agreement” means the Separation Agreement, dated as of April 5, 2011, by and among P&G, the Pringles Company and Diamond. |

| | • | | “Transaction Agreement” means the Transaction Agreement, dated as of April 5, 2011, by and among P&G, the Pringles Company, Diamond and Merger Sub. |

| | • | | “Transactions” means the transactions contemplated by the Transaction Agreement and the Separation Agreement, which provide, among other things, for the Separation, the Pringles Debt, the Distribution and the Merger, as described in the section “The Transactions.” |

| | • | | “VWAP” means the volume-weighted average price. |

3

QUESTIONS AND ANSWERS ABOUT THE TRANSACTIONS AND THE SPECIAL MEETING

The following are some of the questions that Diamond stockholders may have, and answers to those questions. These questions and answers, as well as the following summary, are not meant to be a substitute for the information contained in the remainder of this document, and this information is qualified in its entirety by the more detailed descriptions and explanations contained elsewhere in this document. Diamond urges its stockholders to read this document in its entirety prior to making any decision.

The Transactions

| Q: | Why am I receiving this document? |

| A: | Diamond and P&G have entered into a Transaction Agreement under which Diamond will acquire the Pringles Company, a subsidiary of P&G that will own the Pringles Business, through the Merger of the Pringles Company with and into a subsidiary of Diamond. Diamond is holding a special meeting of its stockholders in order to obtain their approval of the issuance of Diamond common stock in connection with the Merger, and, subject to approval of the issuance of Diamond common stock in connection with the Merger, the approval of the adoption of the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock and the approval of the adoption of the 2011 International Stock Purchase Plan. Diamond cannot complete the Merger unless the issuance of Diamond common stock in connection with the Merger is approved by the affirmative vote of the holders of a majority of the shares represented and voting at the special meeting, either in person or by proxy. |

This document includes important information about the Merger and the Transactions and the special meeting of the stockholders of Diamond. Diamond stockholders should read this information carefully and in its entirety. A copy of the Transaction Agreement is attached as Annex A to this document. The enclosed voting materials allow Diamond stockholders to vote their shares without attending the special meeting.The vote of Diamond stockholders is very important and Diamond encourages its stockholders to vote their proxy as soon as possible. Please follow the instructions set forth on the enclosed proxy card(s) or on the voting instruction form provided by the record holder if the shares of Diamond stockholders are held in the name of their broker or other nominee.

| Q: | What is Diamond proposing? |

| A: | Diamond is proposing a business combination with the Pringles Company through a series of transactions that are described in more detail below and elsewhere in this document. At the conclusion of the Transactions: |

| | • | | the Pringles Business will be owned by Merger Sub, which is and will continue to be a wholly-owned subsidiary of Diamond; |

| | • | | the Pringles Company is expected to incur debt equal to the Recapitalization Amount. The Recapitalization Amount means $850.0 million; provided, however, that: |

| | • | | if the simple arithmetic average of the daily VWAPs of shares of Diamond common stock on NASDAQ for the five trading days ending the trading day which is two clear trading days prior to the commencement date of the exchange offer (the “Diamond Collar Stock Price”) is greater than $51.47 per share, then the Recapitalization Amount will be $850.0 million reduced by an amount equal to the lesser of (1) $150.0 million and (2)(a) the Diamond Collar Stock Price minus $51.47 times (b) 29,143,190; and |

| | • | | if the Diamond Collar Stock Price is less than $51.47, then the Recapitalization Amount will be $850.0 million increased by an amount equal to the lesser of (1) $200.0 million and (2)(a) $51.47 minus the Diamond Collar Stock Price times (b) 29,143,190. |

4

Thus, if the Diamond Collar Stock Price is greater than $56.62, the Recapitalization Amount will be $700.0 million, and if the Diamond Collar Stock Price is less than $44.61, the Recapitalization Amount will be $1.05 billion.

The Pringles Company, in connection with the Separation, will use the borrowed proceeds and any cash contributed by P&G to the Pringles Company to purchase certain Pringles Business assets from P&G affiliates;

| | • | | upon consummation of the Merger, Merger Sub will assume the Pringles Company’s obligations under the Pringles Debt by operation of law, and the Pringles Debt will be guaranteed by (1) all existing and future direct and indirect subsidiaries of Merger Sub, other than certain foreign subsidiaries, and (2) Diamond and all subsidiaries of Diamond that guarantee the indebtedness under Diamond’s credit facilities; and |

| | • | | the Diamond common stock outstanding immediately prior to the Merger will represent approximately 43% of the Diamond common stock that will be outstanding immediately after the Merger, and the Diamond common stock issued in connection with the conversion of shares of Pringles Company common stock in the Merger will represent approximately 57% of the Diamond common stock that will be outstanding immediately after the Merger. |

| Q: | What will happen in the Transactions? |

| A: | Below is a summary of the key steps of the Transactions. A step-by-step description of material events relating to the Transactions is set forth under “The Transactions.” |

| | • | | P&G will transfer to the Pringles Company, a newly formed, direct wholly owned subsidiary of P&G, certain assets relating to the Pringles Business, including certain subsidiaries of P&G. The Pringles Company will also assume certain liabilities associated with the Pringles Business. |

| | • | | Prior to the Distribution, and in partial consideration for the assets of the Pringles Business transferred from P&G to the Pringles Company, the Pringles Company will be recapitalized in the following manner: |

| | • | | the Pringles Company will issue and deliver to P&G a number of additional shares of Pringles Company common stock such that the total number of shares of Pringles Company common stock held by P&G at the time of the Distribution will equal 29,143,190, all of which shares of Pringles Company common stock P&G will dispose of in the Distribution; and |

| | • | | the Pringles Company will enter into senior secured term credit facilities to borrow an amount between $700 million and $1.05 billion and will use the borrowed proceeds, along with any cash contributed by P&G to the Pringles Company, to purchase certain Pringles Business assets from P&G affiliates. |

| | • | | P&G will offer to P&G shareholders the right to exchange all or a portion of their shares of P&G common stock for shares of Pringles Company common stock in this exchange offer. |

If the exchange offer is completed but is not fully subscribed, P&G will distribute the Remaining Shares as a pro rata dividend to P&G shareholders whose shares of P&G common stock remain outstanding after consummation of the exchange offer. If there is a pro rata dividend to be distributed, the exchange agent will calculate the exact number of shares of Pringles Company common stock not exchanged in the exchange offer and to be distributed in a pro rata dividend and that number of shares of Diamond common stock, into which the Remaining Shares will be converted in the Merger, will be transferred to P&G shareholders (after giving effect to the consummation of the exchange offer) on a pro rata basis as promptly as practicable thereafter.

The exchange agent will hold, for the account of the relevant P&G shareholders, the global certificate(s) representing all of the outstanding shares of Pringles Company common stock, pending the completion of the Merger. Shares of Pringles Company common stock will not be traded during this period.

5

| | • | | Immediately after the completion of the Distribution, on the closing date of the Transactions, the Pringles Company will merge with and into Merger Sub, with Merger Sub continuing as the surviving company. |

| | • | | Each share of Pringles Company common stock will be automatically converted into the right to receive one fully paid and nonassessable share of Diamond common stock. |

| | • | | Upon consummation of the Merger, Merger Sub will assume Pringles’ obligations under the Pringles Debt by operation of law, and the Pringles Debt will be guaranteed by (1) all existing and future direct and indirect subsidiaries of Merger Sub, other than certain foreign subsidiaries, and (2) Diamond and all subsidiaries of Diamond that guarantee the indebtedness under Diamond’s credit facilities. |

| | • | | The shares of Diamond common stock outstanding immediately prior to the Merger will represent approximately 43% of the shares of Diamond common stock that will be outstanding immediately after the Merger, and the shares of Diamond common stock issued in connection with the conversion of shares of Pringles Company common stock in the Merger will represent approximately 57% of the shares of Diamond common stock that will be outstanding immediately after the Merger. |

In connection with the Transactions, P&G and Diamond have entered into various agreements, and will enter into additional agreements, establishing the terms of the Separation. These agreements include a transition services agreement in which P&G will agree to provide certain services to Merger Sub and Diamond for a limited period of time following the Transactions. See “Additional Agreements.”

| Q: | What will Diamond stockholders receive in the Merger? |

| A: | Diamond stockholders will not directly receive any consideration in the Merger. All shares of Diamond common stock issued and outstanding immediately before the Merger will remain issued and outstanding after consummation of the Merger. Immediately after the Merger, Diamond stockholders will continue to own shares in Diamond, which will include (1) the Pringles Business, which will be owned and operated though Merger Sub, Diamond’s wholly owned subsidiary and (2) the Pringles Debt in an amount between $700 million and $1.05 billion, which upon consummation of the Merger will be assumed by Merger Sub by operation of law and guaranteed by (a) all existing and future direct and indirect subsidiaries of Merger Sub, other than certain foreign subsidiaries and (b) Diamond and all subsidiaries of Diamond that guarantee the indebtedness under Diamond’s credit facilities. |

| Q: | What are the material U.S. federal income tax consequences to Diamond and Diamond stockholders resulting from the Transactions? |

| A: | The Merger will not be a taxable event to Diamond, its stockholders, Merger Sub or the Pringles Company. |

| Q: | What are the principal adverse consequences of the Transactions to Diamond stockholders? |

| A: | Following the consummation of the Transactions, pre-Merger Diamond stockholders will be stockholders in a company that owns the Pringles Business, but their interests in Diamond will have been diluted. Diamond stockholders who owned 100% of Diamond common stock before the Merger will own approximately 43% of the Diamond common stock that will be outstanding after the Transactions. |

The Pringles Company is expected to incur between $700 million and $1.05 billion of debt. The Pringles Debt will remain a debt obligation of the Pringles Company that Diamond will guarantee following completion of the Transactions.

P&G shareholders that participate in the Exchange Offer will be exchanging their shares of P&G common stock for shares of Pringles Company common stock at a discount to the per-share value of shares of Diamond common stock. The discount, along with the issuance of Diamond common stock pursuant to the Merger, may negatively affect the market price of Diamond common stock. Please see “Information on the Distribution” to obtain additional information regarding the discount. Further, Diamond anticipates that it will incur one-time charges of approximately $150 million through fiscal 2013 as a result of transaction and

6

integration costs associated with the Transactions, the amount and timing of which could adversely affect the period to period operating results of Diamond and result in a reduction in the market price of Diamond common stock.

Please see “Risk Factors—Risks Relating to the Transactions” for a further discussion of the material risks associated with the Transactions.

| Q: | What will P&G and P&G shareholders receive in the Transactions? |

| A: | P&G is offering to P&G shareholders the right to exchange all or a portion of their shares of P&G common stock for shares of Pringles Company common stock. Shares of Pringles Company common stock will be offered to P&G shareholders in the Exchange Offer based upon market prices of shares of P&G common stock and Diamond common stock calculated during a specified period pursuant to the terms of the Exchange Offer, at a discount which will be set by P&G at the time of commencement of the Exchange Offer. Promptly after the specific terms of the Exchange Offer are set, Diamond will publish a press release describing them. The press release will be filed with the SEC and available to stockholders on Diamond’s web page (www.diamondfoods.com). If the Exchange Offer is completed but not fully subscribed, any shares of Pringles Company common stock that are not subscribed for in the Exchange Offer will be distributed as a pro rata dividend to P&G shareholders (after giving effect to the completion of the Exchange Offer). In the Merger, each share of Pringles Company common stock will automatically convert into the right to receive one fully paid and nonassessable share of Diamond common stock. Diamond common stock will continue to be listed on the NASDAQ Stock Market under the symbol “DMND.” |

The Pringles Company is expected to incur between $700 million and $1.05 billion of debt based on a collar mechanism based upon Diamond’s stock price during a trading period prior to the commencement of the Exchange Offer and will use the borrowed proceeds, along with any cash contributed by P&G to the Pringles Company, to purchase certain Pringles Business assets from P&G affiliates.

Upon consummation of the Merger, Merger Sub will assume the Pringles Company’s obligations under the Pringles Debt by operation of law, and the Pringles Debt will be guaranteed by (1) all existing and future direct and indirect subsidiaries of Merger Sub, other than certain foreign subsidiaries, and (2) Diamond and all subsidiaries of Diamond that guarantee the indebtedness under Diamond’s credit facilities.

| Q: | Are there any conditions to the completion of the Transactions? |

| A: | Yes. The completion of the Merger is subject to a number of conditions, including: |

| | • | | the completion of the Separation and Distribution; |

| | • | | the valid tender in the Exchange Offer of a number of shares of Pringles Company common stock exceeding a specified threshold (the “Minimum Condition”), which is subject to adjustment pursuant to the terms of the Transaction Agreement; |

| | • | | the approval by Diamond’s stockholders of the issuance of shares of Diamond common stock in connection with the Merger; |

| | • | | the receipt of written tax opinions from special tax counsel to P&G and tax counsel to Diamond; and |

| | • | | other customary conditions. |

In the event that either Diamond or P&G waive the satisfaction of a material condition to the consummation of the Transactions, Diamond will resolicit stockholder approval of the issuance of Diamond common stock in connection with the Merger if required by law to do so.

This proxy statement describes these conditions in more detail under “The Transaction Agreement—Conditions to the Merger.”

7

| Q: | When will the Transactions be completed? |

| A: | The Transactions are expected to be completed as soon as practicable after consummation of the exchange offer. However, it is possible that factors outside Diamond’s and P&G’s control could require the parties to complete the Transactions at a later time or not complete them at all. For a discussion of the conditions to the Transactions, see “The Transaction Agreement—Conditions to the Merger.” |

| Q: | Are there risks associated with the Transactions? |

| A: | Yes. You should consider all of the information included or incorporated by reference in this proxy statement, including the factors described under the heading “Risk Factors.” You are strongly encouraged to read this entire proxy statement very carefully. The risks include, among others, the possibility that Diamond may fail to realize the anticipated benefits of the acquisition, the uncertainty that Diamond will be able to integrate the Pringles Business successfully and the possibility that Diamond may be unable to provide benefits and services or access to equivalent financial strength and resources to the Pringles Business that historically have been provided by P&G. |

| Q: | Will there be any change to the Diamond Board or the executive officers of Diamond after the Transactions? |

| A: | No. The directors and executive officers of Diamond immediately following the closing of the Transactions are expected to be the directors and executive officers of Diamond immediately prior to the closing of the Transactions. |

| Q: | What approvals of Diamond stockholders are needed in connection with the Transactions? |

| A: | Diamond cannot complete the Merger unless the proposal relating to the issuance of Diamond common stock in connection with the Merger is approved by the affirmative vote of the holders of a majority of the shares represented and voting at the special meeting, either in person or by proxy. Approval of the proposal to adopt the certificate of amendment to Diamond’s certificate of incorporation in connection with the Merger and the proposal to adopt the 2011 International Stock Purchase Plan is not required to complete the Merger. |

| Q: | How does the Diamond Board recommend stockholders vote? |

| A: | The Diamond Board has unanimously recommended that stockholders vote FOR the proposal to issue Diamond common stock in connection with the Merger, FOR the proposal to adopt the certificate of amendment to Diamond’s certificate of incorporation to increase the authorized number of shares of Diamond common stock, FOR the proposal to approve adjournments or postponements of the special meeting for the purpose of soliciting additional proxies, if necessary, and FOR the proposal to approve the adoption of the 2011 International Stock Purchase Plan. |

| Q: | Do P&G shareholders have to vote to approve the Transactions? |

| A: | No. No vote of P&G shareholders is required or being sought in connection with the Transactions. |

The Special Meeting

| A: | You should read this document carefully and return your completed, signed and dated proxy card(s) by mail in the enclosed postage-paid envelope as soon as possible so that your shares will be represented and voted at the special meeting. You may vote your shares by signing, dating and mailing the enclosed proxy card(s), by calling the toll-free telephone number or by using the Internet as described in the instructions included with the proxy card(s). We encourage stockholders with Internet access to record their votes on the Internet or, alternatively, to vote by telephone. Internet and telephone voting is convenient, saves on postage and mailing costs and is recorded immediately, minimizing risk that postal delays may cause votes to arrive late and therefore not be counted. A number of banks and brokerage firms participate in a program that also |

8

| | permits stockholders whose shares are held in “street name” to direct their vote by using the Internet or telephone. This option, if available, will be reflected in the voting instructions from the bank or brokerage firm that accompany this document and will allow you to direct the vote of these shares by the Internet or telephone by following the voting instructions enclosed with the proxy form from the bank or brokerage firm. See “Voting By Proxy—Voting Your Proxy.” Stockholders who attend the special meeting may vote in person, and any previously submitted votes will be superseded by the vote cast at the special meeting. |

| Q: | If I am not going to attend the special meeting, should I return my proxy card(s)? |

| A: | Yes. Returning your signed and dated proxy card(s) ensures that your shares will be represented and voted at the special meeting, even if you are unable to or do not attend. Instead of returning your proxy card(s), you may vote by proxy by calling the toll-free telephone number or by using the Internet as described in the instructions included with the proxy card(s). See “Voting By Proxy—How to Vote.” |

| Q: | How will my proxy be voted? |

| A: | If you complete, sign and date your proxy card(s), or vote by telephone or by using the Internet, your proxy will be voted in accordance with your instructions. If you sign and date your proxy card(s) but do not indicate how you want to vote, your shares will be voted FOR the proposals at the special meeting. If you fail to submit a proxy or vote in person at the special meeting, or abstain, or you do not provide your bank, brokerage firm or other nominee with voting instructions, as applicable, your shares of Diamond common stock will not be taken into account in determining the outcome of the proposals relating to the issuance of Diamond common stock in connection with the Merger, the adjournments or postponements of the Diamond special meeting or the adoption of the 2011 International Stock Purchase Plan, but will have the same effect as a vote AGAINST the proposal relating to adoption of the certificate of amendment to Diamond’s certificate of incorporation. |

| Q: | Can I change my vote after I mail my proxy card(s)? |

| A: | Yes. If you are a record holder of Diamond common stock, you can change your vote at any time before it is voted by: |

| | • | | delivering a written notice or revocation to the corporate secretary of Diamond that is received prior to the special meeting and states that you revoke your proxy; |

| | • | | signing and dating a new proxy card(s) and submitting your proxy so that it is received prior to the special meeting or voting by telephone or by using the Internet prior to the special meeting in accordance with the instructions included with the proxy card(s); or |

| | • | | attending the special meeting and voting in person. |

In the event of multiple online or telephone votes by a stockholder, each vote will supersede the previous vote and the last vote cast will be deemed to be the final vote of the stockholder unless such vote is revoked in person at the special meeting.

If your shares are held in street name by your broker, you will need to contact your broker to revoke your proxy, and if in the alternative you wish to vote in person at the special meeting, you must bring to the special meeting a letter from the broker confirming your beneficial ownership of the shares and that the broker is not voting the shares at the special meeting. Note that your mere presence at the special meeting will not revoke the appointment if you had previously appointed a proxy. In the event of multiple online or telephone votes by a stockholder, each vote will supersede the previous vote and the last vote cast will be deemed to be the final vote of the stockholder unless such vote is revoked in person at the special meeting. See “Voting By Proxy—Revoking Your Proxy.”

| Q: | What if my shares are held in “street name” by my broker? |

| A: | Your broker will vote your shares with respect to the proposals at the special meeting only if you instruct your broker how to vote. You should instruct your broker using the written instruction form and envelope |

9

| | provided by your broker. If you do not provide your broker with instructions, under the rules of The NASDAQ Stock Market, your broker will not be authorized to vote with respect to any of the proposals in this proxy statement. If you hold your shares in your broker’s name and wish to vote in person at the special meeting, you must contact your broker and request a document called a “legal proxy.” You must bring this legal proxy to the special meeting in order to vote in person. See “Voting By Proxy—How to Vote.” |

| Q: | What if Diamond stockholders abstain from voting or do not instruct their brokers to vote their shares? |

| A: | Shares held by a Diamond stockholder who indicates on the proxy card that he or she wishes to abstain from voting will not be taken into account in determining the outcome of the proposals relating to the issuance of Diamond common stock or adjournments or postponements of the Diamond special meeting. However, those shares are considered present and entitled to vote at the special meeting and will count toward determining whether or not a quorum is present. A broker is not entitled to vote shares held for a beneficial holder on any of the proposals in this proxy statement.Abstentions and broker non-votes relating to shares of Diamond common stock will not be taken into account in determining the outcome of the proposal to issue Diamond common stock in connection with the Merger, the proposal to approve adjournments or postponements of the special meeting, if necessary, and the proposal to approve the adoption of the 2011 International Stock Purchase Plan, but will have the same effect as a vote AGAINST the proposal relating to adoption of the certificate of amendment to Diamond’s certificate of incorporation.See “The Special Meeting—Vote Necessary at the Special Meeting to Approve the Proposals.” |

| Q: | What does it mean if I receive multiple proxy cards? |

| A: | Your shares may be registered in more than one account, such as brokerage accounts and 401(k) accounts. It is important that you complete, sign, date and return each proxy card you receive, or vote using the telephone or by using the Internet as described in the instructions included with your proxy card(s). See “Voting By Proxy—Voting Your Proxy.” |

| Q: | Who can answer my questions? |

| A: | If you have any questions about the Transactions or the special meeting, need assistance in voting your shares, or need additional copies of this document or the enclosed proxy card(s) or voting instructions, you should contact: |

Georgeson Inc.

199 Water Street, 26th Floor

Call Toll Free: 1 (888) 607-9252

or

1 (212) 440-9800 (Call Collect)

or

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

Attention: Investor Relations

Telephone: (415) 445-7444

| Q: | Where can I find more information about Diamond and Pringles? |

| A: | Diamond stockholders can find more information about Diamond and Pringles in the sections entitled “Information on Diamond” and “Information on Pringles” and, in the case of Diamond, from the various sources described under “Where You Can Find More Information; Incorporation by Reference.” |

10

SUMMARY

Unless otherwise stated in this proxy statement or the context otherwise provides, the description of the Pringles Company and the Pringles Business contained in this proxy statement is based on the assumption that the transferred assets and liabilities of the Pringles Business had been held by the Pringles Company for all of the periods discussed. The following summary contains certain information from this document. It does not contain all the details concerning the Transactions, including information that may be important to you. To better understand the Transactions, you should carefully review this entire document and the documents it refers to. See “Where You Can Find More Information; Incorporation by Reference.”

Diamond’s fiscal year begins on August 1 and ends on the following July 31. The Pringles Company’s fiscal year begins on July 1 and ends on the following June 30. For example, Diamond’s “fiscal 2011” began on August 1, 2010 and ended on July 31, 2011 and the Pringles Company’s “fiscal 2011” began on July 1, 2010, and ended on June 30, 2011.

The Companies

Diamond Foods, Inc.

Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

Telephone: (415) 445-7444

Diamond Foods, Inc., a Delaware corporation referred to in this proxy statement as Diamond, is an innovative packaged food company focused on building, acquiring and energizing brands. Diamond was founded in 1912 and has a proven track record of growth, which is reflected in the growth of Diamond’s revenues from approximately $201 million in fiscal 2000 to approximately $966 million in fiscal year 2011. Diamond specializes in processing, marketing and distributing snack products and culinary, in-shell and ingredient nuts. In 2004, Diamond complemented its strong heritage in the culinary nut market under the Diamond of California® brand by launching a full line of snack nuts under the Emerald® brand. In September 2008, Diamond acquired the Pop Secret® brand of microwave popcorn products, which provided Diamond with increased scale in the snack market, significant supply chain economies of scale and cross-promotional opportunities with Diamond’s existing brands. In March 2010, Diamond acquired Kettle Foods, a leading premium potato chip company in the two largest potato chip markets in the world, the United States and United Kingdom. Diamond sells its products to global, national, regional and independent grocery, drug and convenience store chains, as well as to mass merchandisers, club stores and other retail channels.

For the fiscal years ended July 31, 2011 and 2010, Diamond had $965.9 million and $680.2 million of net sales, respectively, and generated net income of $50.2 million and $26.2 million, respectively.

Wimbledon Acquisition LLC

Wimbledon Acquisition LLC

c/o Diamond Foods, Inc.

600 Montgomery Street, 13th Floor

San Francisco, California 94111

Telephone: (415) 445-7444

Wimbledon Acquisition LLC, a Delaware limited liability company referred to in this proxy statement as Merger Sub, is a newly formed, direct wholly owned subsidiary of Diamond that was organized specifically for

11

the purpose of completing the Merger. Merger Sub has engaged in no business activities to date and it has no material assets or liabilities of any kind, other than those incident to its formation and in connection with the Transactions.

The Procter & Gamble Company

The Procter & Gamble Company

One Procter & Gamble Plaza

Cincinnati, Ohio 45202

Telephone: (513) 983-1100

The Procter & Gamble Company, an Ohio corporation referred to in this proxy statement as P&G, was incorporated in Ohio in 1905, having been built from a business founded in 1837 by William Procter and James Gamble. Today, P&G manufactures and markets a broad range of consumer products in many countries throughout the world. P&G has one of the strongest portfolios of trusted, quality, leadership brands, including Pampers®, Tide®, Ariel®, Always®, Whisper®, Pantene®, Mach3®, Bounty®, Dawn®, Gain®, Pringles®, Charmin®, Downy®, Lenor®, Iams®, Crest®, Oral-B®, Actonel®, Duracell®, Olay®, Head & Shoulders®, Wella®, Gillette®, Braun® and Febreze®. As of June 30, 2011, P&G owned and operated 36 manufacturing facilities in the United States located in 22 different states or territories. In addition, as of June 30, 2011, P&G owned and operated 102 manufacturing facilities in 41 other countries. Many of the domestic and international facilities produce products for multiple P&G business units.

The Wimble Company

The Wimble Company

c/o The Procter & Gamble Company

One Procter & Gamble Plaza

Cincinnati, Ohio 45202

Telephone: (513) 983-1100

The Wimble Company, a Delaware corporation referred to in this proxy statement as the Pringles Company, is a direct wholly owned subsidiary of P&G organized on April 1, 2011 for the purpose of effecting the Separation of the Pringles Business from P&G. It has no material assets or liabilities of any kind other than those incident to its formation and those acquired or incurred in connection with the Transactions.

Pringles is a combination of wholly owned subsidiaries of P&G and assets and liabilities of the Pringles Business. Pringles manufactures, markets and distributes snack foods, primarily under the Pringles® brand, and sells snacks products in over 140 countries around the world across North America, Europe, Asia and Latin America. Pringles sells its products principally to leading mass merchandisers, grocery retailers, club stores and convenience outlets globally, through the P&G sales force and third-party distributors.

For the fiscal years ended June 30, 2011 and 2010, P&G’s Pringles Business generated combined net sales of $1,445.7 million and $1,367.4 million, respectively, and operating income of $197.4 million and $166.9 million, respectively.

The Transactions

On April 5, 2011, Diamond and P&G announced that they had entered into a Transaction Agreement and a Separation Agreement, which provide for a business combination involving Diamond, P&G and Pringles. In the Transactions, P&G will contribute certain of the assets and liabilities of the Pringles Business to the Pringles Company, a newly formed wholly owned subsidiary of P&G. Prior to the Distribution, the Pringles Company is expected to be recapitalized by (1) issuing and delivering to P&G a number of additional shares of Pringles Company common stock such that the total number of shares of Pringles Company common stock held by P&G

12

at the time of the Distribution will equal 29,143,190, all of which shares of Pringles Company common stock P&G will dispose of in the Distribution, (2) incurring new indebtedness in the form of the Pringles Debt and receiving net cash proceeds in an amount between $700 million and $1.05 billion, and (3) using such cash proceeds from the Pringles Debt, along with any cash contributed by P&G to the Pringles Company, to purchase certain Pringles Business assets from P&G affiliates.

On the closing date of the Transactions, P&G will distribute shares of Pringles Company common stock to its participating shareholders in an exchange offer. If the exchange offer is completed but is not fully subscribed, P&G will distribute all of the Remaining Shares as a pro rata dividend to P&G shareholders (after giving effect to the consummation of the exchange offer). On or prior to the consummation of the exchange offer, P&G will irrevocably deliver to the exchange agent all of the shares of Pringles Company common stock outstanding, with irrevocable instructions to hold the shares of Pringles Company common stock for the benefit of P&G shareholders whose shares of P&G common stock are being accepted for exchange in the exchange offer and, in the case of a pro rata dividend P&G shareholders whose shares of P&G common stock are outstanding after consummation of the exchange offer. If there is a pro rata dividend to be distributed, the exchange agent will calculate the exact number of shares of Pringles Company common stock not exchanged in the exchange offer and to be distributed in a pro rata dividend and that number of shares of Diamond common stock, into which such Remaining Shares will be converted in the Merger, will be transferred to P&G shareholders (after giving effect to the consummation of the exchange offer) on a pro rata basis as promptly as practicable thereafter. Immediately after the completion of the Distribution, the Pringles Company will merge with and into Merger Sub, a wholly owned subsidiary of Diamond, with Merger Sub continuing as the surviving company. In connection with the Merger, the shares of Pringles Company common stock distributed in connection with the Distribution will automatically convert into the right to receive shares of Diamond common stock on a one-for-one basis. See the sections of this proxy statement entitled “The Transactions,” “The Transaction Agreement” and “The Separation Agreement.”

Diamond expects to issue 29,143,190 shares of Diamond common stock in the Merger. Based upon the reported closing sales price of $90.37 per share for Diamond common stock on NASDAQ on September 23, 2011, the last NASDAQ trading day prior to the date of this proxy statement, the total value of the consideration to be paid by Diamond in the Transactions, including the Pringles Debt in an amount between $700 million and $1.05 billion to be assumed by Merger Sub after the consummation of the Transactions, would have been an amount between $3.33 billion and $3.68 billion. The value of the consideration to be paid by Diamond will depend on the market price of shares of Diamond common stock at the time of determination.

After the Merger, Diamond, through Merger Sub, its wholly owned subsidiary, will own and operate the Pringles Business under its current brand names and will also continue its current businesses. Diamond will continue to use the name “Diamond Foods, Inc.” after the Merger. All shares of Diamond common stock issued in the Merger will be listed on NASDAQ under Diamond’s current trading symbol “DMND.”

Below is a step-by-step description of the sequence of material events relating to the Transactions.

| | |

| Step 1 | | Separation |

| |

| | P&G will transfer to the Pringles Company, a newly formed, direct wholly owned subsidiary of P&G, certain assets relating to the Pringles Business, including certain subsidiaries of P&G. The Pringles Company will also assume certain liabilities associated with the Pringles Business. |

13

| | |

| |

| Step 2 | | Pringles Company Recapitalization |

| |

| | Prior to the Distribution, and in partial consideration for the assets of the Pringles Business transferred from P&G to the Pringles Company, the Pringles Company will be recapitalized in the following manner: • the Pringles Company will issue and deliver to P&G a number of additional shares of Pringles Company common stock such that the total number of shares of Pringles Company common stock held by P&G at the time of the Distribution will equal 29,143,190, all of which shares of Pringles Company common stock P&G will dispose of in the Distribution; and • the Pringles Company will enter into senior secured term credit facilities to borrow an amount between $700 million and $1.05 billion and will use the borrowed proceeds, along with any cash contributed by P&G to the Pringles Company, to purchase certain Pringles Business assets from P&G affiliates. |

| |

| Step 3 | | Distribution—Exchange Offer |

| |

| | P&G will offer to P&G shareholders the right to exchange all or a portion of their shares of P&G common stock for shares of Pringles Company common stock in this exchange offer. If the exchange offer is completed but is not fully subscribed, P&G will distribute the Remaining Shares as a pro rata dividend to P&G shareholders whose shares of P&G common stock remain outstanding after consummation of the exchange offer. If there is a pro rata dividend to be distributed, the exchange agent will calculate the exact number of shares of Pringles Company common stock not exchanged in the exchange offer and to be distributed in a pro rata dividend and that number of shares of Diamond common stock, into which the Remaining Shares will be converted in the Merger, will be transferred to P&G shareholders (after giving effect to the consummation of the exchange offer) on a pro rata basis as promptly as practicable thereafter. The exchange agent will hold, for the account of the relevant P&G shareholders, the global certificate(s) representing all of the outstanding shares of Pringles Company common stock, pending the completion of the Merger. Shares of Pringles Company common stock will not be traded during this period. |

| |

| Step 4 | | Merger |

| |

| | Immediately after the completion of the Distribution, on the closing date of the Transactions, the Pringles Company will merge with and into Merger Sub, with Merger Sub continuing as the surviving company. Each share of Pringles Company common stock will be automatically converted into the right to receive one fully paid and nonassessable share of Diamond common stock. |

14

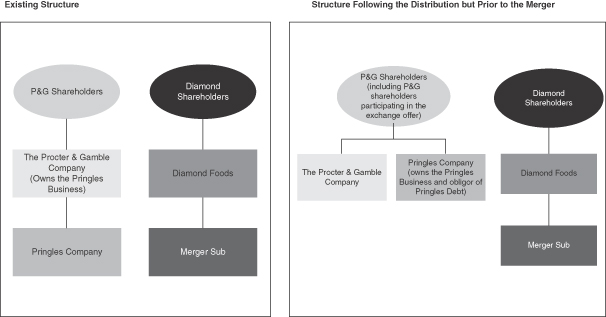

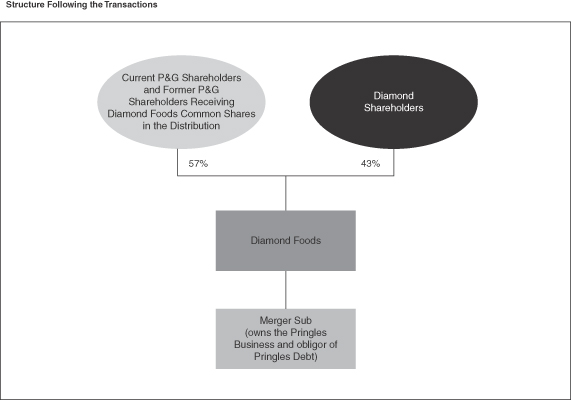

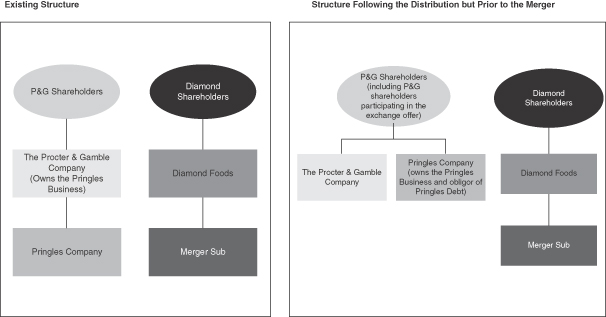

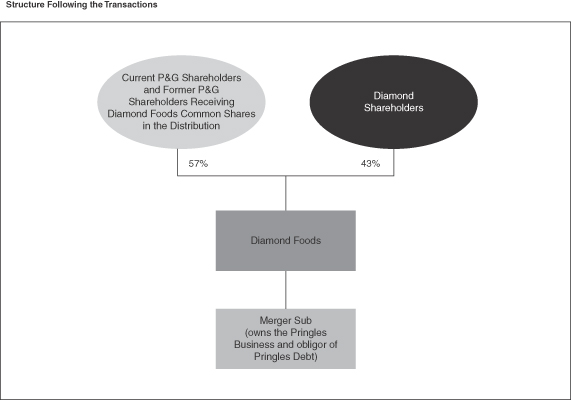

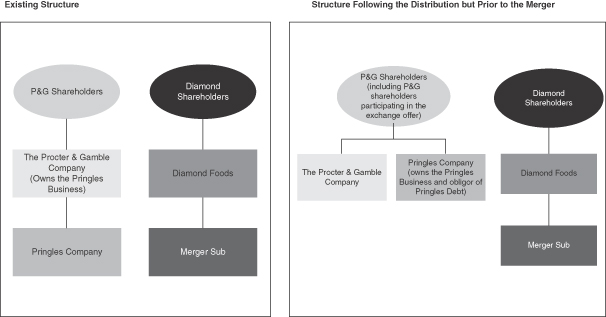

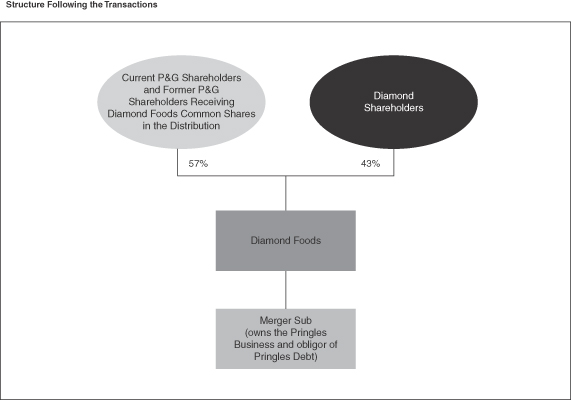

Set forth below are diagrams that graphically illustrate, in simplified form, the existing corporate structure, the corporate structure immediately following the Distribution but prior to the Merger, and the corporate structure immediately following the consummation of the Transactions.

15

After completion of the steps mentioned above, the shares of Diamond common stock outstanding immediately prior to the Merger will represent approximately 43% of the shares of Diamond common stock that will be outstanding immediately after the Merger, and the shares of Diamond common stock issued in connection with the conversion of shares of Pringles Company common stock in the Merger will represent approximately 57% of the shares of Diamond common stock that will be outstanding immediately after the Merger.

After completion of all of the Merger and the other steps mentioned above, the Pringles Business will be owned and operated by Diamond through Merger Sub, its direct wholly owned subsidiary; Merger Sub will be the obligor on the Pringles Debt in an amount between $700 million and $1.05 billion; the Pringles Debt will be guaranteed by all existing and future direct and indirect subsidiaries of Merger Sub, other than certain foreign subsidiaries, and Diamond and all subsidiaries of Diamond that guarantee the indebtedness under Diamond’s credit facilities; and P&G’s affiliates will have received proceeds from the sale of certain Pringles Business assets to the Pringles Company funded from the net proceeds of the Pringles Debt and from any cash contributed by P&G to the Pringles Company, in each case, consummated prior to the Distribution. See “The Transactions—Number of Shares of Pringles Company Common Stock to be Distributed to P&G Shareholders.”

Various factors were considered by Diamond and P&G in negotiating the terms of the Transactions, including the equity ownership levels of Diamond stockholders and current and former P&G shareholders receiving shares of Diamond common stock in the Distribution. The principal factors considered by the parties negotiating the allocation of equity ownership following the Transactions were the relative actual results of operations of Diamond and the Pringles Business, the opportunities expected to be obtained from combining Diamond and the Pringles Business and the enhancements to Diamond’s strategic global growth objectives as a result of acquiring the Pringles Business. Diamond also considered, among other things, the expected impacts of the integration of the Pringles Business with Diamond and the other factors identified under “The Transactions—Background of the Transactions—Diamond’s Reasons for the Transactions.” P&G also considered, among other things, the relative sales, earnings and cash flow growth rates of the Pringles Business, the value to P&G shareholders that could be realized in the Transactions and the other factors identified under “The Transactions—Background of the Transactions—P&G’s Reasons for the Transactions.”

Business Strategies After the Transactions

Diamond is an innovative packaged foods company focused on building, acquiring and energizing brands. Diamond focuses on organic growth in its product lines, and will consider acquiring brands to improve its overall portfolio and competitive position. Diamond specializes in processing, marketing and distributing snack products and culinary, in-shell and ingredient nuts.

Diamond has demonstrated that it can grow both organically and through acquisitions. Between fiscal 2003 and fiscal 2011, Diamond’s retail sales grew at a 23% compounded annual growth rate. In the past five fiscal years, Diamond’s gross margin improved from 15% to 26%, operating margin grew from 3% to 11% and earnings per share have grown four-fold. Diamond’s profitable growth has been driven by its ability to expand distribution, and to contribute to category growth with high quality and innovative new products. Diamond competes based on product quality, innovation and differentiation as well as support of its brands among consumers and retailers.

Diamond expects the addition of Pringles, an iconic, global snack brand, to increase its scale in the snack aisle and provide opportunities to expand distribution and cross-promotional activities for Diamond’s entire snack portfolio. As with its previous acquisitions, Diamond plans to invest in the Pringles® brand to grow and leverage its increased scale to benefit its entire snack portfolio. In markets where Diamond currently sells snack products, Pringles would extend distribution reach into channels such as mass merchandisers, discount and

16

convenience stores. These are channels where Diamond’s existing portfolio is more limited. Diamond is strongest in the grocery channel where Pringles is under-represented, which may provide the brand an opportunity for growth.

The acquisition of Pringles is attractive to Diamond because of its distribution strength in both developed and emerging markets. Pringles products are sold in 140 countries around the world, including developed countries and emerging markets across Asia, Latin America, Central Europe, the Middle East and Africa. These markets often experience higher growth rates than more developed markets, and Diamond plans to focus on and invest in the Pringles® brand, to grow the brand and to create new growth opportunities for other Diamond products as well.

Additional Agreements