As filed with the Securities and Exchange Commission on May 3, 2006. Registration Statement No. ________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________

FORM F-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

_______________

HIGH PLAINS URANIUM, INC.

(Exact name of registrant as specified in its charter)

New Brunswick, Canada (State or other jurisdiction of incorporation or organization) | 1000 (Primary Standard Industrial Classification Code Number) | None (I.R.S. Employer Identification No.) |

Thomas H. Parker

Chief Executive Officer

1718 Capitol Avenue

Cheyenne, Wyoming 82001

(307) 433-8708

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

________________

Copies to:

Henry I. Rothman Thomas M. Rose Troutman Sanders LLP The Chrysler Building 405 Lexington Avenue New York, New York 10174 Tel: (212) 704-6000 Fax: (212) 704-6288 | Walied Soliman Ali Kermalli Ogilvy Renault LLP 200 Bay Street, Suite 3800 Royal Bank Plaza, South Tower Toronto, Ontario Canada M5J 2Z4 Tel: (416) 216-4000 Fax: (416) 216-3930 |

_______________

Approximate date of proposed sale to the public:

From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. o

________________

CALCULATION OF REGISTRATION FEE | ||||||||

Title of each class of securities to be registered | Amount to be registered | Proposed maximum offering price per share (1) (2) | Proposed maximum aggregate offering price | Amount of registration fee | ||||

| Common Shares | 44,078,557 | $0.88 | $38,789,130.16 | $4,150.44 | ||||

(1) U.S. dollar amounts are calculated on the noon buying rate in New York City for cable transfers payable in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York on April 28, 2006. On such date, the noon buying rate was Cdn$1.00 = $0.8926.

(2) Estimated pursuant to Rule 457(c) solely for purposes of calculating the amount of the registration fee using the Cdn$0.99 average of the high and low sales price for the registrant’s common shares on the Toronto Stock Exchange on April 28, 2006.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission acting pursuant to said Section 8(a), may determine.

(Subject to Completion, Dated May 3, 2006)

The information contained in this prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

High Plains Uranium, Inc.

44,078,557 Common Shares

This prospectus relates to up to 40,948,557 Common Shares and up to 3,130,000 Common Shares that may be issued as the result of the exercise of warrants which may be sold from time to time by selling shareholders of High Plains Uranium, Inc. named herein or their pledgees, donees or successors. The shares are being registered to permit the selling shareholders to sell shares from time to time in the public market. The price at which the selling shareholders may sell the shares will be determined by the prevailing market price for the shares or in negotiated transactions. The selling shareholders will receive all of the net proceeds from the sale of the Common Shares. We will, however, receive the respective exercise price of the warrants which may occur prior to the sale of the underlying Common Shares by a selling shareholder.

Our Common Shares are traded on the Toronto Stock Exchange under the symbol “HPU.” On May 2, 2006, the last trading day prior to the filing of the registration statement, the closing sale price of our Common Shares on the Toronto Stock Exchange was Cdn$0.97. There is currently no public market for our Common Shares in the United States.

________________

Before purchasing any of the Common Shares covered by this prospectus, carefully read and consider the risk factors included in the section entitled “Risk Factors” beginning on page . Investing in our Common Shares is speculative, and you could lose all of your investment.

________________

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of the Common Shares or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

________________

The date of this prospectus is __________, 2006

TABLE OF CONTENTS

Page

| PROSPECTUS SUMMARY | 2 |

| CURRENCY AND EXCHANGE RATES | 5 |

| SUMMARY CONSOLIDATED FINANCIAL DATA | 6 |

| RISK FACTORS | 8 |

| FORWARD-LOOKING STATEMENTS | 17 |

| USE OF PROCEEDS | 18 |

| DIVIDEND POLICY | 18 |

| CAPITALIZATION | 18 |

| RECENT SHARE PRICE HISTORY | 19 |

| SELECTED CONSOLIDATED FINANCIAL DATA | 20 |

| CURRENCY RISK | 29 |

| BUSINESS | 30 |

| SUMMARY COMPENSATION TABLE | 77 |

| RELATED PARTY TRANSACTIONS | 79 |

| SELLING SHAREHOLDERS | 83 |

| PLAN OF DISTRIBUTION | 86 |

| DESCRIPTION OF CAPITAL STOCK | 88 |

| LIMITATION ON ENFORCEMENT OF CIVIL JUDGMENTS | 89 |

| SHARES ELIGIBLE FOR FUTURE SALE | 90 |

| MATERIAL INCOME TAX CONSEQUENCES | 91 |

| LEGAL MATTERS | 97 |

| EXPERTS | 97 |

| TRANSFER AGENT AND REGISTRAR | 98 |

| WHERE YOU CAN FIND MORE INFORMATION | 98 |

| GLOSSARY OF GEOLOGICAL AND MINING TERMS | G-1 |

| SIGNATURES | II-5 |

| POWER OF ATTORNEY | II-5 |

| EXHIBIT INDEX | II-6 |

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement we filed with the Securities and Exchange Commission. If the Securities and Exchange Commission declares the registration statement effective, the selling shareholders named beginning on page may sell up to 44,078,557 Common Shares. We will update this prospectus from time to time to include new information about us, and we will file supplements to the prospectus with the Securities and Exchange Commission. You should carefully read this prospectus, any prospectus supplement, and the information we from time to time file with Securities and Exchange Commission as described under the caption “Where You Can Find Additional Information.” In this prospectus, unless the context otherwise requires, “High Plains,” “we,” “us,” and “our” refer to High Plains Uranium, Inc.; our wholly-owned subsidiary High Plains Uranium, Inc., incorporated in the State of Idaho; and our wholly-owned subsidiary High Plains Uranium, Inc., incorporated in the State of Alaska.

You should rely only on the information provided in this prospectus or included in any prospectus supplement. We have authorized no one to provide you with different information. We are not making an offer of these securities in any state where the offer is not permitted. You should not assume that the information in this prospectus or the prospectus supplement is accurate as of any date other than the date on the front of the document.

1

PROSPECTUS SUMMARY

The following summary is qualified in its entirety by the more detailed information and the financial statements and notes thereto appearing elsewhere in this prospectus. Prospective investors should consider carefully the information discussed under “Risk Factors,” beginning on page . An investment in our securities presents substantial risks, and you could lose all or substantially all of your investment. In this prospectus, references to “U.S. dollars” or “US$” are to the currency of the United States, and references to “Canadian dollars” or “Cdn$” are the currency of Canada.

We are a Canadian mining company currently engaged in the acquisition and exploration of partially evaluated uranium properties, focusing on the States of Wyoming and Texas. Subject to completion of additional drilling, a favorable bankable feasibility study, permitting and raising sufficient capital, we seek to become a uranium producer from one or both of our current projects utilizing the in-situ leach mining technology.

We currently hold interests in approximately 1,172 acres of mineral rights, approximately 5,561 acres of surface rights and approximately 2,469 acres of federal lode claims in two separate property groups known as the Sand Draw property and the Bear Creek property, both located in the Allemand Ross region of Wyoming. These two properties are collectively referred to as High Plains’ Allemand Ross project. Exploration work conducted by Continental Oil Company and Power Reactor and Nuclear Fuel Development Corporation in the early 1970s and 1980s on the Allemand Ross project estimated that the Sand Draw property contained approximately 970,000 pounds of recoverable uranium in the “indicated resource” category (214,000 short tons at 0.32% U3O8 grade) and approximately 3,790,000 pounds of recoverable uranium in the “inferred resource” category (1,400,000 short tons at 0.19% U3O8 grade) and that the Bear Creek property contained approximately 827,700 pounds of recoverable uranium in the “inferred resource” category (361,300 short tons at 0.16% U3O8 grade). See “Business - Allemand Ross Project.”

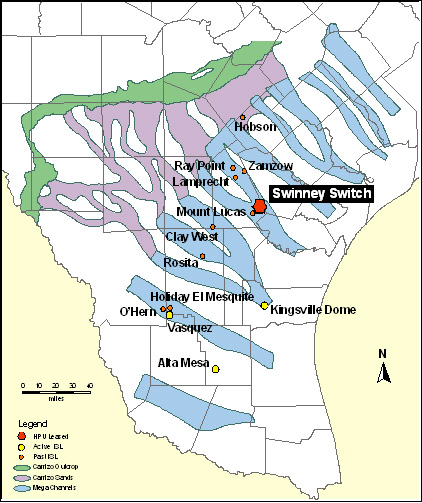

We currently hold interests in approximately 3,251 acres of mineral rights and 4,224 acres of surface rights in three separate property groups known as the Wallace Ranch property, the Johnson property and Seager-Salvo property all located in the Swinney Switch district of Texas. These three properties are collectively referred to as High Plains’ Swinney Switch project. Exploration work conducted by TXO Minerals, an exploration group established by Texas Oil and Gas Company, in the late 1970s on the Swinney Switch Project estimated that the Wallace Ranch property contained approximately 1,200,000 pounds of in-situ uranium. In situ uranium is uranium that has not been moved from its original position. See “Business - Swinney Switch Project.”

All of the estimates provided are historical, and apply definitions recognized and required by Canadian regulations that are not recognized by the United States Securities and Exchange Commission. See “Business - Cautionary Note to United States Investors Concerning Disclosure of Mineral Resources.” No mineral reserve or mineral resource estimates have been prepared by us. The classification categories in these estimates used internal nomenclature that was not based upon the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Standards on Mineral Resources and Reserves Definitions and Guidelines adopted by the CIM Council on August 20, 2000, as the estimates were prepared prior to the implementation of these guidelines. Micon International Limited has reviewed the methodology and data that was used in the preparation of these estimates and considers that the internal classification categories employed generally comply with the CIM guidelines in effect today. Micon considers that these estimates are of sufficient reliability to provide an order-of-magnitude estimate of the amount of uranium recoverable from these mineralized deposits and is of sufficient quality to form the basis for further work. See “Risk Factors - We are an exploration-stage company with a very limited operating history and our estimates of mineralization are only preliminary based primarily on past drilling data which may not reflect the actual deposits or the economic viability of extraction.” As of the date of this prospectus, we are not in possession of any more recent estimates or data on the Bear Creek property or the Sand Draw property in Wyoming or the Wallace Ranch property in Texas. We are currently assembling and acquiring data on the Johnson property and Seager-Salvo property. As of the date of this prospectus, we are not in possession of sufficient data to provide reliable estimates on the poundage and quality of the potential uranium resources which may exist on these two properties. No mineral reserve or mineral resource estimates have been conducted by us on the Johnson property or the Seager-Salvo property.

In addition to the Allemand Ross project and Swinney Switch project, we have acquired additional previously explored uranium interests throughout the western United States and Texas. See “Business - Other Projects.”

2

High Plains Uranium, Inc. was incorporated under the laws of the province of New Brunswick, Canada on February 8, 2005. We were established to be the Canadian holding company of High Plains Uranium, Inc., a corporation incorporated under the laws of the State of Idaho on April 6, 2004, and High Plains Uranium, Inc., a corporation incorporated under the laws of the State of Alaska. Our executive offices are located at 1718 Capitol Avenue, Cheyenne, Wyoming 82001 and our telephone number is (307) 433-8708. Our website address is www.hpur.com. The information contained on, or that can be accessed through, our website is not a part of this prospectus.

On December 16, 2005, we completed an initial public offering in Canada (“IPO”) with a concurrent private placement in the United States of an aggregate of 5,000,000 units at Cdn$1.00 per unit, each unit consisted of one common share and one-half of one common share purchase warrant to purchase one common share at $1.50 until December 16, 2006, for gross proceeds of Cdn$5,000,000.

3

THE OFFERING

Common shares offered by the selling shareholders | Up to 44,078,557 Common Shares | |

Common shares to be outstanding after this offering(1) | 48,973,557 Common Shares | |

Use of proceeds | We will not receive any proceeds from the sale of Common Shares by the selling shareholders. We will, however, receive the respective exercise price upon the exercise of warrants, which may occur prior to the sale of the underlying Common Shares by a selling shareholder. We will use these proceeds for general corporate purposes. See “Use of Proceeds.” | |

TSX Symbol | “HPU” | |

Plan of Distribution | The offering is made by the selling shareholders named in this Prospectus, to the extent they sell shares. Sales may be made in the open market or in privately negotiated transactions, at fixed or negotiated prices. | |

Risk factors | Investing in our Common Shares involves a high degree of risk. You should carefully review and consider the risks set forth under “Risk Factors,” as well as the other information contained in this prospectus before purchasing any of our Common Shares. |

(1) Based on the number of shares issued and outstanding on March 31, 2006. This number assumes the issuance of 3,130,000 Common Shares that may be issued upon exercise of common share purchase warrants held by selling shareholders and excludes, as of March 31, 2006 (a) 2,900,000 Common Shares issuable upon the exercise of options under our Long-Term Incentive Plan at a weighted average price of $0.50 per share, (b) 200,000 Common Shares issuable upon the exercise of other options at a weighted average price of $0.25 per share, (c) 2,434,356 options available for future issuance under our Long-Term Incentive Plan and (d) 6,554,640 Common Shares issuable upon the exercise of warrants not held by the selling shareholders. We cannot assure you that the warrants will be exercised by the selling shareholders.

Price Range of Common Shares

Our common stock is traded on the Toronto Stock Exchange under the symbol HPU. Prices reported represent prices between dealers, do not include markups, markdowns or commissions and do not necessarily represent actual transactions. The market for our shares has been sporadic and at times very limited.

The following table sets forth the high and low bid quotations for the common stock for the period ended March 31, 2006.

High | Low | ||||||

| Period Ended March 31, 2006 | |||||||

Third Quarter | $ | 0.75 | $ | 0.66 | |||

Fourth Quarter | $ | 1.25 | $ | 0.46 | |||

On May 2, 2006, the last sale price reported on the Toronto Stock Exchange for our common stock was Cdn$0.97 per share.

4

CURRENCY AND EXCHANGE RATES

Some of the financial and other information included in this prospectus is presented in Canadian dollars (“Cdn$”). As of April 28, 2006 the noon rate of exchange, as reported by the Federal Reserve Bank of New York for the conversion of United States dollars into Canadian dollars was US$0.8926 (US$1.00 = Cdn$1.1203). Unless otherwise indicated in this prospectus, all references herein are to United States dollars.

Exchange Rate Information

The following tables set forth certain exchange rates based on the noon buying rate in New York City for cable transfers in Canadian dollars as certified for customs purposes by the Federal Reserve Bank of New York. Each of the tables set forth the number of Canadian dollars required under that formula to buy one United States dollar.

The following table sets forth the exchange rate for the past five fiscal years ended March 31, 2006:

Fiscal Year Ended March 31, 2006 | Fiscal Year Ended March 31, 2005 | Fiscal Year Ended March 31, 2004 | Fiscal Year Ended March 31, 2003 | Fiscal Year Ended March 31, 2002 | |||||

Average (1) | 1.1871 | 1.2753 | 1.3622 | 1.5447 | 1.5671 |

(1) The average of the exchange rates for each period are calculated by using the average of the exchange rates on the last day of each month during the period indicated.

The following table sets forth the high and low exchanges rates for each month under the most recently completed six months:

| Month | |||||||||||

| November 2005 | December 2005 | January 2006 | February 2006 | March 2006 | April 2006 | ||||||

| High | 1.1960 | 1.1736 | 1.1726 | 1.1577 | 1.1722 | 1.1718 | |||||

| Low | 1.1656 | 1.1507 | 1.1436 | 1.1379 | 1.1320 | 1.1203 | |||||

5

SUMMARY CONSOLIDATED FINANCIAL DATA

You should read our summary consolidated financial data set forth below in conjunction with our historical consolidated financial statements and the related notes and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, all included elsewhere in this prospectus.

The summary of selected financial information of High Plains prepared in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”) as of and for the periods indicated and should be read in conjunction with the audited consolidated financial statements of High Plains for the period commencing from the date of incorporation on April 6, 2004 to March 31, 2005 and the unaudited interim consolidated financial statements of High Plains for the nine months ended December 31, 2005. Our results for the nine months ended December 31, 2005 are not necessarily indicative of the results to be expected for the year ending March 31, 2006. We prepare our financial statements in accordance with Canadian GAAP, which differs in certain respects from U.S. GAAP. For a discussion of the principal differences between Canadian GAAP and U.S. GAAP as they pertain to us, see note 14 to our audited consolidated financial statements for the period commencing from the date of incorporation on April 6, 2004 to March 31, 2005 and note 10 to our unaudited interim consolidated financial statements for the nine months ended December 31,2005 included elsewhere in this prospectus.

Canadian GAAP:

Nine months ended December 31, 2005 | Period ended March 31, 2005 | ||||||

| (unaudited) | |||||||

| Statement of operations | |||||||

| Expenses: | |||||||

| Consulting | $ | 520,072 | $ | 600,569 | |||

| Payroll and payroll burden | 339,786 | - | |||||

| Stock option compensation | 207,666 | 75,800 | |||||

| General and administration | 492,702 | 145,743 | |||||

| Professional fees | 222,351 | 54,674 | |||||

| Loss on sale of investments | - | 17,347 | |||||

| Interest | 17,042 | 36,074 | |||||

| Write-down of marketable securities | 138,310 | 22,047 | |||||

| Accretion of convertible notes | 9,294 | 15,306 | |||||

| Amortization | 6,619 | 2,454 | |||||

| Loss from operations | (1,953,842 | ) | (970,014 | ) | |||

| Dividend income | 451 | 38 | |||||

| Interest Income | 114,361 | - | |||||

| Loss for the period | $ | (1,839,030 | ) | $ | (969,976 | ) | |

| Loss per share, basic and diluted | $ | (0.08 | ) | $ | (0.13 | ) | |

| December 31, 2005 | March 31, 2005 | ||||||

| (unaudited) | |||||||

| Cash and cash equivalents | $ | 3,668,950 | $ | 510,486 | |||

| Total assets | 11,302,799 | 7,948,541 | |||||

| Total current liabilities | 402,446 | 667,762 | |||||

| Total shareholders’ equity | 10,740,353 | 7,120,779 | |||||

6

United States GAAP:

Nine months ended December 31, 2005 | Period ended March 31, 2005 | ||||||

| (unaudited) | |||||||

| Loss for the period | $ | (2,746,341 | ) | $ | (1,362,661 | ) | |

| Loss per share, basic and diluted | (0.13 | ) | (0.18 | ) | |||

| December 31, 2005 | March 31, 2005 | ||||||

| (unaudited) | |||||||

| Cash and cash equivalents | $ | 3,668,950 | $ | 510,486 | |||

| Total assets | 10,058,601 | 7,579,163 | |||||

| Total current liabilities | 402,446 | 636,315 | |||||

| Total shareholders’ equity | 11,078,810 | 7,458,710 | |||||

7

RISK FACTORS

An investment in our securities should be considered highly speculative due to various factors, including the nature of our business and the present stage of our development. An investment in our securities should only be undertaken by persons who have sufficient financial resources to afford the total loss of their investment. In addition to the usual risks associated with investment in a business, the following is a general description of significant risk factors which should be considered.

RISKS RELATING TO OUR BUSINESS AND INDUSTRY

Uranium exploration is highly speculative in nature and there can be no certainty of our successful development of profitable commercial mining operations.

The exploration for and development of uranium properties involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; drilling and other related costs which appear to be rising; and government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection. The exact effect of these factors cannot be accurately predicted, but the combination of these factors may result in us not receiving an adequate return on invested capital.

Although we do not currently operate a mine on any of our properties, we intend to pursue the development of uranium mines at the Allemand Ross Project and the Swinney Switch Project. There is no certainty that the expenditures made by us towards the search and evaluation of mineral deposits will result in discoveries of commercial quantities of ore.

Mining operations generally involve a high degree of risk.

Such operations are subject to all the hazards and risks normally encountered in the exploration, development and production of uranium and other base or precious metals, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding and other conditions involved in the drilling and removal of material, any of which could result in damage to, or destruction of, mines and other producing facilities, damage to life or property, environmental damage and possible legal liability. Mining operations could also experience periodic interruptions due to bad or hazardous weather conditions and other acts of God. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability.

If any of these risks and hazards adversely affect our mining operations or our exploration activities, they may: (i) increase the cost of exploration, development or production to a point where it is no longer economically feasible to continue operations; (ii) require us to write down the carrying value of one or more mines or a property; (iii) cause delays or a stoppage in the exploration, development or production of copper; (iv) result in damage to or destruction of mineral properties or processing facilities; and (v) result in personal injury or death or legal liability. All of these adverse consequences may have a material adverse effect on our financial condition, results of operation, and our future cash flows.

We are an exploration-stage company with a very limited operating history and our estimates of mineralization are only preliminary based primarily on past drilling data which may not reflect the actual deposits or the economic viability of extraction.

Categories of inferred, indicated and measured mineral resources are recognized in order of increasing geological confidence. However, mineral resources are not equivalent to mineral reserves and do not have demonstrated economic viability. There can be no assurance that mineral resources in a lower category may be converted to a higher category, or that mineral resources may be converted to mineral reserves. Inferred mineral resources cannot be converted into mineral reserves as the ability to assess geological continuity is not sufficient to demonstrate economic viability. Due to the uncertainty which may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to indicated or measured mineral resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration.

8

There is a degree of uncertainty to the estimation of mineral reserves and mineral resources and corresponding grades being mined or dedicated to future production. The estimating of mineralization is a subjective process and the accuracy of estimates is a function of the quantity and quality of available data, the accuracy of statistical computations, and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any mineralization estimate, and the actual deposits encountered and the economic viability of mining a deposit may differ significantly from our estimates. Until mineral reserves or mineral resources are actually mined and processed, the quantity of mineral and reserve grades must be considered as estimates only. In addition, the quantity of mineral reserves and mineral resources may vary depending on, among other things, metal prices. Any material change in quantity of mineral reserves, mineral resources, grade or stripping ratio may affect the economic viability of the properties. In addition, there can be no assurance that recoveries in small scale laboratory tests will be duplicated in a larger scale tests under on-site conditions or during production. Fluctuation in uranium prices, results of drilling, metallurgical testing and production and the evaluation of mine plans subsequent to the date of any estimate may require revision of such estimate. The volume and grade of reserves mined and processed and recovery rates may not be the same as currently anticipated. Estimates may have to be recalculated based on changes in mineral prices or further exploration or development activity. This could materially and aversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence estimates. Any material reductions in estimates of mineral reserves and mineral resources, or of our ability to extract these mineral reserves, could have a material adverse effect on our financial condition, results of operations and future cash flows.

The marketability of uranium is subject to numerous factors beyond our control.

The price of uranium may experience volatile and significant price movements over short periods of time. Factors that impact on the price of uranium include demand for nuclear power, political and economic conditions in uranium-producing and consuming nations, reprocessing of spent fuel and re-enrichment of depleted uranium tails or waste, sales of excess civilian and military inventories (including from dismantling nuclear weapons) by governments and industry participants and products levels and costs of production. These factors could negatively impact the price for uranium and lower uranium prices would negatively impact our future profitability. We do not have a hedging policy to protect us from a decline in uranium pricing and have no intention to establish one while we are in the exploratory phases of our operations. In addition, we may not have the ability to purchase hedging instruments in the future. Hedging instruments may also not protect us adequately from fluctuations in the market price of uranium.

There are a limited number of customers available in our target market.

A small number of electric utilities worldwide buy uranium for nuclear power plants. Because of the limited market for uranium, a reduction in demand by electric utilities for newly-produced uranium would adversely affect our business.

We are dependent upon continued public acceptance of nuclear energy.

Because of unique political, technological and environmental factors that affect the nuclear industry, the industry is subject to public opinion risks which could have an adverse impact on the demand for nuclear power and increase the regulation of the nuclear power industry. An accident at a nuclear reactor anywhere in the world could impact the continuing acceptance of nuclear energy and the future prospects for nuclear generation, which may have a material adverse effect on our business.

We are subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products from our mining activities.

All phases of our operations are subject to environmental regulation in the jurisdictions in which we operate. These regulations mandate, among other things, the maintenance of air and water quality standards and land reclamation. They also set forth limitations on the generation, transportation, storage and disposal of solid and hazardous waste. Environmental legislation is evolving in a manner which will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. There is no assurance that future changes in environmental regulation, if any, will not adversely affect our operations.

9

Environmental hazards may exist on the properties which are unknown to us at present and which have been caused by previous or existing owners or operators of the properties. We are subject to potential risks and liabilities associated with pollution of the environment and disposal of waste products from our mining activities. Reclamation costs are uncertain and planned expenditures estimated by management may differ from the actual expenditures required.

The payment of any liabilities or the costs that we may incur to remedy environmental impacts would reduce funds otherwise available to us for operations. We might be required to suspend operations or enter into interim compliance measures pending completion of the required remedy. The potential financial exposure to us may be significant. We have not purchased insurance for environmental risks (including potential liability for pollution or other hazards as a result of the disposal or waste products occurring from exploration and production) as it is not generally available at what we believe to be a reasonable price.

Our business could be adversely affected if we fail to comply with extensive government regulations or fail to obtain, renew or comply with necessary licenses and permits.

Our mineral exploration and planned development activities are subject to various laws governing prospecting, mining, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use, water use, land claims of local people and other matters. Although we believe our exploration and development activities are currently carried out in accordance with all applicable laws, rules and regulations, no assurance can be given that new laws, rules and regulations will not be enacted or that existing laws, rules and regulations will not be applied in a manner which could limit or curtail production or development.

Amendments to current laws and regulations governing operations or more stringent implementation thereof could have a substantial adverse impact on our business and cause increases in exploration expenses, capital expenditures or production costs or reduction in levels of production at producing properties or require abandonment or delays in development of new mining properties.

Many of our mineral rights and interests are subject to government approvals, licenses and permits. Obtaining necessary permits and licenses can be a complex, time consuming process and we cannot be certain that we will be able to obtain all required permits on acceptable terms, in a timely manner or at all. The costs and delays associated with obtaining necessary permits and complying with these permits and applicable laws and regulations could stop, delay or restrict us from proceeding with the development of an exploration project or the development and operation of a mine. Such approvals, licenses and permits are, as a practical matter, subject to the discretion of applicable governments or governmental officials. No assurance can be given that we will be successful in maintaining any or all of the various approvals, licenses and permits in full force and effect without modification or revocation. To the extent such approvals are required and not obtained, we may be curtailed or prohibited from continuing or proceeding with planned exploration or development of mineral properties.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations or in the exploration or development of mineral properties may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed for violations of applicable laws or regulations.

Public involvement in the permitting process may delay our acquisition of certain licenses, permits and authorization.

The process of obtaining radioactive materials licenses (which we refer to as “RML”) from the US Nuclear Regulatory Commission and the Texas Department of Health and aquifer exemptions (for injection), production area authorizations and other permits from the Wyoming Department of Environmental Quality and the Texas Commission on Environmental Quality and pursuant to the Environmental Protection Act allow for public participation. If a third party chooses to object to the issuance of any RML or permit required by us, significant delays may occur before we are able to secure an RML or permit. Generally, the public objections can be overcome with the passage of time and through the procedures set forth in the applicable permitting legislation. However, the regulatory agencies must also allow and fully consider public comment according to such procedures and there can be no assurance that we will be successful in obtaining any RML or permit.

10

Our future prospects may be affected by political decisions about the uranium market.

There can be no assurance that the United States or other government will not enact legislation restricting to whom we can sell uranium or that the United States or other government will not increase the supply of uranium by decommissioning nuclear weapons.

RISKS RELATING TO OUR COMPANY

We have no history of mineral production or mining operations.

We have never had uranium producing properties. There is no assurance that commercial quantities of uranium will be discovered at the Allemand Ross Project, the Swinney Switch Project or other future properties, nor is there any assurance that our exploration program thereon will yield positive results. Even if commercial quantities of uranium are discovered, there can be no assurance that any of our property will ever be brought to a stage where uranium resources can profitably be produced therefrom. Factors which may limit our ability to produce uranium resources from our properties include, but are not limited to, the spot price of uranium, availability of additional capital and financing and the nature of any mineral deposits.

We do not have a history of mining operations and there is no assurance that we will produce revenue, operate profitably or provide a return on investment in the future.

We have a history of losses and expect to incur losses in the future.

As an exploration company that has no production history, we have incurred losses since our inception. From February, 2005 when our exploration activities began, through December 31, 2005, we had no revenues and incurred losses of $2,809,006. We believe that we will be unable to generate enough revenue to offset our operating costs and, therefore, expect to continue to experience losses until we complete our exploration work on the Allemand Ross Project and the Swinney Switch Project, successfully complete feasibility studies and develop the Allemand Ross Project and the Swinney Switch Project into operating mines. There can be no assurance that we will successfully complete our exploration work, develop an operating mine, or achieve or sustain profitability in the future.

We do not have any uranium sales contracts with customers

Most uranium is sold by producers under medium to long-term contracts with nuclear utilities. We have not entered into agreements for the sale of uranium to any customers. Our ability to place our projects into production will be somewhat dependant on our ability to enter into sales contracts with suitable customers.

We may not own all of the uranium in lands we lease in the Swinney Switch Project

We have uranium or other mineral leases, including lease ratifications, from all of the surface owners covering approximately 3,133 acres in the Wallace Ranch Property of the Swinney Switch Project area. However, we do not have uranium or other mineral leases from all the mineral owners in respect of the property. We believe that our uranium deposits are located more than 200 feet below the surface. The surface and mineral estates in these lands were severed prior to June 8, 1983 in instruments that do not specify who is the owner of the uranium in these lands. Therefore, ownership of uranium must be determined by a factual determination of (i) whether the uranium deposits are near the surface; and (ii) whether any reasonable method of mining and production of uranium would consume, deplete, or destroy the surface. This factual determination will depend upon the following factors:

| · | If the uranium deposits are within 200 feet of the surface, and any reasonable method of mining and production of those uranium deposits would consume, deplete, or destroy the surface, then the uranium deposits are owned by the surface owners. |

| · | If uranium deposits are below 200 feet from the surface, but any reasonable method of mining and production of those uranium deposits would consume, deplete, or destroy the surface, then the uranium deposits are owned by the surface owner. |

| · | If ISL mining of uranium deposits below 200 feet from the surface would not consume, deplete, or destroy the surface, then the mineral owners own the uranium deposits. |

11

It is a factual determination whether in-situ mining of uranium deposits below 200 feet from the surface would consume, deplete, or destroy the surface.

The outcome of the factual determinations described above may affect our ownership of uranium. These factual determinations can only be made in a judicial proceeding in which all potential owners are joined as parties. If an unleased mineral owner brings a judicial proceeding to determine the ownership of uranium on our leased property, it may be determined that we do not own all the uranium and we may be obligated to compensate the unleased mineral owners for that portion of the uranium we have mined, but does not have under lease. An unleased mineral owner could bring such a judicial proceeding to determine the ownership of uranium deposits after we have installed and begun operation of our facilities for mining and production of uranium.

A conclusive answer concerning ownership of uranium on the Wallace Ranch Property can only be given by the finder of facts in a lawsuit involving all necessary parties, in Live Oak County, Texas. However, we believe if such a lawsuit occurred that the surface owner would be found to own the uranium deposits. There is no uncertainty about whether we own the uranium deposits in 1,920 acres out of the 3,133 acres, because our ISL Uranium Lease (the “Lease”) is signed by parties who own 100% of the surface estate and mineral estate in those lands. In addition, our Lease also covers 100% of the surface estate and (i) 50% of the mineral estate under another approximately 199 acres, and (ii) 1/32 of the mineral estate under approximately 1,011 acres. The unleased portion of the mineral estate under the remaining portion of the 3,133 acres is owned of record by five persons and one company, that we have attempted, but have been unable, to locate.

Under Texas law, a lease from one co-owner or co-tenant of the mineral estate in a tract of land permits us to enter on the land and explore for and produce uranium and associated substances without liability for waste or trespass, and requires them only to account to the non-joining co-tenants for their proportionate share of the revenues derived from the uranium produced, less their proportionate share of expenses. We have a Lease from all of the owner(s) of the uranium in a substantial portion of the approximately 3,133 acres. With respect to the remaining acreage, there is a risk that the uranium might be determined to be owned by the holders of the mineral estate, which would mean that (i) the Lease does not cover any portion of the uranium in two small tracts of 5.41 acres and 7.75 acres, and (ii) we would be required to account to any non-joining co-tenants for their share of revenues from the sale of uranium, less their share of the expenses of extracting uranium from the tracts in which the Lease covers some, but not all the mineral estate.

The historical mineral resource estimates for the Allemand Ross Project and the Swinney Switch Project are entirely based on historical drill hole data from past exploration programs

The mineral resource estimates for the Allemand Ross Project are based on historic drill hole data prepared by Conoco and PNC in the 1970s. The mineral resource estimates for the Swinney Switch Project are based on historic drill hole data prepared by TXO in the 1970s. Unknown to us are, among other things: (i) the methods by which drilling was undertaken, (ii) the methods by which sample preparation of the historical drill hole data was analyzed, and (iii) the nature of the assay procedures used. The accuracy of the mineral resource estimates is a function, in part, of the quantity and quality of available data and, given the uncertainties of the resource estimates for the Allemand Ross Project and the Swinney Switch Project, the technical and economic viability of this mineralization has not been demonstrated. There can be no assurance that we will be able to verify the historical drill hole data in the future, nor that we will be able to use the historic drill hole data for calculating future mineral resources. As a result, the unreliability of the historical drill hole data may have an adverse impact on our ability to establish profitable mining operations in the future.

We may not be able to secure good title to the surface or mineral properties which could delay or restrict our exploration and developmental activities.

The acquisition of the right to exploit mineral properties is a very detailed and time consuming process. There can be no guarantee that we have acquired title to any such surface or mineral rights which have been obtained or will be obtained in the future. To the extent they are obtained, titles to our surface or mineral properties may be challenged or impugned and title insurance is generally not available. Our surface or mineral properties may be subject to prior unregistered agreements, transfers or claims and title may be affected by, among other things, undetected defects. Such third party claims could have a material adverse impact on our operations. In addition, we may be unable to operate our properties as permitted or to enforce our rights with respect to our properties. Our management has been advised that the US federal registry for claims cannot currently be accessed and therefore our disclosure as to staked federal lode claims cannot be verified. Our management, together with our local counsel, is continually assessing such risks, which our management believes are normal course risks for a company at our current stage of development.

12

Our ability to maintain or increase our production in the future will depend upon our ability to bring new mines into production or to expand the reserves at our existing mines.

Because mines have limited lives based on proven and probable mineral reserves, we will be required to continually replace and expand our mineral reserves as our mines produce uranium. Our ability to maintain or increase our annual production of uranium in the future will be dependent in significant part on our ability to bring new mines into production and to expand mineral reserves at existing mines.

Our insurance coverage does not cover all potential losses.

Our business is subject to a number of risks and hazards generally, including adverse environmental conditions, industrial accidents, labor disputes, unusual or unexpected geological conditions, ground or slope failures, cave-ins, changes in the regulatory environment and natural phenomena such as inclement weather conditions, floods and earthquakes. Such occurrences could result in damage to mineral properties or production facilities, personal injury or death, environmental damage to our properties or the properties of others, delays in development or mining, monetary losses and possible legal liability.

Although we maintain insurance to protect against certain risks in such amounts as we consider to be reasonable, our insurance will not cover all the potential risks associated with our operations. We may also be unable to maintain insurance to cover these risks at economically feasible premiums. Insurance coverage may not continue to be available or may not be adequate to cover any resulting liability. Moreover, insurance against risks such as environmental pollution or other hazards as a result of exploration and production is not generally available to us or to other companies in the mining industry on acceptable terms. We might also become subject to liability for pollution or other hazards which may not be insured against or which we may elect not to insure against because of premium costs or other reasons. Losses from these events may cause us to incur significant costs that could have a material adverse effect upon our financial performance and results of operations.

It may not be commercially economical for us to recover our carrying value of our properties.

Factors which may affect carrying values include, but are not limited to, uranium prices, capital cost estimates, mining, processing and other operating costs, grade and metallurgical characteristics of ore, mine design and timing of production.

We are a small operator in a highly competitive industry and may not have the adequate resources to compete effectively.

Significant and increasing competition exists for mineral acquisition opportunities throughout the world. As a result of this competition, some of which is with large, better established mining companies with substantial capabilities and greater financial and technical resources, we may be unable to acquire rights to exploit additional attractive mining properties on terms we consider acceptable. Accordingly, there can be no assurance that we will acquire any interest in additional operations that would yield reserves or result in commercial mining operations. If we are not able to acquire such interests, this could have an adverse impact on future cash flows, earnings, results of operations and financial condition.

We currently depend on a limited number of mining properties and negative developments affecting the any of the properties could adversely affect our business.

The Allemand Ross Project and the Swinney Switch Project account for most of our mineralization and the potential for the future generation of revenue. Unless we acquire additional properties or projects, any adverse development affecting the Allemand Ross Project or the Swinney Switch Project such as, but not limited to, obtaining financing on commercially suitable terms, hiring suitable personnel and mining contractors, or securing supply agreements on commercially suitable terms, may have a material adverse effect on our financial performance, result of operations and future cash flows.

13

We will require a significant amount of capital to fund our operations, our ability to obtain additional capital depends on many factors beyond our control and lack of adequate capital could delay or prevent us from achieving profitability.

We will require significant capital in order to fund our operating costs and to carry out plans to develop and bring into production the Allemand Ross Project and the Swinney Switch Project. As well, a portion of our activities may be directed towards the search for, and development of, new uranium deposits which will require significant capital investment to achieve commercial production from any successful exploration efforts. We may require additional financing from external sources, such as through debt financing, equity financing, joint venture relationships, or other means, to meet such requirements. There can be no assurance that such financing will be available to us or, if it is, that it will be offered on acceptable terms. If additional financing is raised through the issuance of our equity or convertible debt securities, the interests of shareholders in our net assets may be diluted. Any failure by us to obtain required financing on acceptable terms could have a material adverse effect on our financial condition, results of operations and liquidity and require us to cancel or postpone planned capital investments. It is reasonable to conclude that we may expend the majority portion of our current cash assets on property acquisitions or on drilling and exploration activities on our current property portfolio, and therefore, it may be reasonably concluded that we may be out of cash within a two year period or less unless we raise further capital.

Certain of our directors and officers serve as directors and officers of other companies in our industry and may have conflicts of interest.

Certain of our directors and officers also serve as directors and/or officers of other companies involved in the exploration and development of uranium properties and consequently there exists the possibility for such directors and officers to be in a position of conflict.

We rely on our management team, outside contractors, experts and other advisors and the loss of any of them, if they cannot be replaced, could have a material adverse effect on our business and financial performance.

The success of our operations and activities is dependent to a significant extent on the efforts and abilities of our small senior management team, as well as outside contractors, experts and other advisors. In making an investment in our securities, you must be willing to rely to a significant extent on management’s discretion and judgment, as well as the expertise and competence of outside contractors, experts and other advisors that we hire to advise us. The loss of one or more member of senior management, key employees or contractors, if not replaced, could materially adversely affect our operations and financial performance.

Currency fluctuations may adversely affect our costs.

Exchange rate fluctuations may affect the costs that we incur in our exploration activities. We do not currently have, and do not intend to enter into, hedging contracts in connection with currencies. Uranium is generally sold in US dollars. Since we principally raise funds in Canadian dollars, but our costs are incurred principally in US dollars, the appreciation of the US dollar against the Canadian dollar can increase the cost of uranium and other mineral exploration and production in Canadian dollar terms.

RISKS RELATING TO OUR COMMON SHARES AND THE TRADING MARKET

Because our shares are deemed "penny stocks," you may have difficulty selling them in the secondary trading market.

The Securities and Exchange Commission has adopted regulations which generally define a "penny stock" to be any equity security that has a market price (as therein defined) less than $5.00 per share or with an exercise price of less than $5.00 per share, subject to certain exceptions. Additionally, if the equity security is not registered or authorized on a national securities exchange that makes certain reports available, the equity security may also constitute a "penny stock." As our common stock falls within the definition of penny stock, these regulations require the delivery by the broker-dealer, prior to any transaction involving our common stock, of a risk disclosure schedule explaining the penny stock market and the risks associated with it. The broker-dealer also must provide the customer with bid and offer quotations for the penny stock, the compensation of the broker-dealer and any salesperson in the transaction, and monthly account statements indicating the market value of each penny stock held in the customer's account. In addition, the penny stock rules require that, prior to a transaction in a penny stock not otherwise exempt from those rules, the broker-dealer must make a special written determination that the penny stock is a suitable investment for the purchaser and receive the purchaser's written agreement to the transaction. These disclosure requirements may have the effect of reducing the trading activity in the secondary market for our common stock. The ability of broker-dealers to sell our common stock and the ability of shareholders to sell our common stock in the secondary market would be limited. As a result, the market liquidity for our common stock would be severely and adversely affected. We can provide no assurance that trading in our common stock will not be subject to these or other regulations in the future, which would negatively affect the market for our common stock.

14

We have not and do not plan to pay any dividends.

No dividends on the Common Shares have been paid by us to date and we do not currently intend to pay dividends in the future. Payment of any future dividends will be at the discretion of our Board of Directors after taking into account many factors, including our operating results, financial condition and current and anticipated cash needs.

We may, in the future, issue additional Common Shares or other securities, which would reduce investors’ percentage ownership and may dilute the value of our shares.

Our Articles of Incorporation authorize the issuance of an unlimited number of Common Shares without par value and an unlimited number of preferred shares without par value. Additional financing needed to continue exploration and development of the Allemand Ross Project and the Swinney Switch Project may require the issuance of additional Common Shares, preferred shares, warrants or other securities which may result in substantial dilution in the percentage of our shares held by our then existing shareholders. We may value any securities issued in the future on an arbitrary basis. The issuance of additional securities for future services or acquisitions or other corporate actions may also have the effect of diluting the value of the shares held by our investors, and might have an adverse effect on the trading market for our Common Shares.

Our Board of Directors may issue, without shareholder approval, preferred shares that have rights and preferences superior to those of Common Shares and that may delay or prevent a change of control. After the offering, there will be no preferred shares outstanding. However, our Board of Directors may set the rights and preferences of any class of preferred shares in its sole discretion without the approval of the holders of Common Shares. The rights and preferences of these preferred shares may be superior to those of the Common Shares. Accordingly, the issuance of preferred shares may adversely affect the rights of holders of Common Shares. The issuance of preferred shares also could have the effect of delaying or preventing a change of control of our company. See “Description of Share Capital.”

You may also experience dilution upon exercise of the common share purchase warrants and vested options.

In the event that all of the outstanding common share purchase warrants and vested options to purchase Common Shares are exercised, there will be an additional 10,605,807 Common Shares available for trading in the public market. The increase in the number of Common Shares in the market will result in the voting power of our existing shareholders and purchasers in the Offering being diluted.

We may be deemed to be a Passive Foreign Investment Company and, as a result, U.S. investors in our company could suffer adverse tax consequences.

A passive foreign investment company, or PFIC, is a non-U.S. corporation that meets an income test and/or an asset test. The income test is met if 75% or more of a corporation’s gross income is “passive income” (generally dividends, interest, rents, royalties, and gains from the disposition of passive assets) in any taxable year. The asset test is met if at least 50% of the average value of a corporation’s assets produce, or are held for the production of, passive income. We have not determined whether or not the IRS would treat us as a PFIC for U.S. federal income tax purposes. If we were treated as a PFIC, a U.S. holder of our Common Shares could be subject to substantially increased tax liability, possibly including an interest charge, upon the sale or other disposition of the U.S. holder’s Common Shares or upon the receipt of “excess distributions” from us. In the alternative, if we were treated as a PFIC, U.S. holders may enter into certain U.S. tax elections that may result in a current Federal tax liability prior to any distribution or disposition of the shares, and without the assurance of any eventual distribution or successful disposition.

15

Since we are a “Foreign Private Issuer” under United States Securities Laws, our shareholders may have less complete and timely data regarding us.

As a “foreign private issuer,” we are exempt from the Section 14 proxy rules and Section 16 of the 1934 Securities Exchange Act, as amended. The submission of proxy and annual meeting of shareholder information (prepared to Canadian standards) on Form 6-K and the exemption from Section 16 rules regarding sales of Common Shares by insiders may result in shareholders having less complete and timely data.

The market price of our Common Shares may fluctuate substantially.

Prior to this offering, there has been a limited public market for our Common Shares. An active public trading market may not develop following completion of this offering or, if an active public market develops, it may not be sustained. A number of factors may affect the market price for the Common Shares following this offering, including the following:

| · | quarterly and annual variations in our or our competitors’ results of operations; |

| · | developments in our industry; |

| · | our ability to timely announce our quarterly or fiscal year-end operating results; and |

| · | general market conditions and other factors, including factors unrelated to our operating performance or the operating performance of our competitors. |

Our results of operations are difficult to predict and may fluctuate from quarter to quarter. If our results of operations in any particular quarter fail to meet the expectations of securities analysts or the market generally, the price of our Common Shares could decline significantly.

Share prices for many companies in our industry have experienced wide fluctuations that have often been unrelated to the operating performance of the companies themselves. The above factors and share price fluctuations, as well as general economic, political and market conditions, may materially adversely affect the market price of our Common Shares.

16

FORWARD-LOOKING STATEMENTS

Certain statements contained in this prospectus constitute forward-looking statements. All statements, other than statements of historical facts, included in this prospectus regarding our strategy, future operations, future financial position, future revenues, projected costs, prospects and plans and objectives of management are forward-looking statements.

These forward-looking statements are not based on historical facts but rather on our expectations regarding future growth, results of operations, performance, future capital and other expenditures (including the amount, nature and sources of funding thereof), competitive advantages, business prospects and opportunities. Statements in this prospectus about our future plans and intentions, results, levels of activity, performance, goals or achievements or other future events constitute forward-looking statements.

Words such as “may”, “will” “should”, “could”, “anticipate”, “believe”, “expect”, “intend”, “plan”, “potential”, “continue”, “estimate” and similar expressions have been used to identify these forward-looking statements. These words and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain these identifying words.

In particular, this prospectus contains forward-looking statements including, but not limited to, statements about:

| · | expectations regarding our ability to put properties into production using in-situ leach mining technology, raise capital, and to acquire and develop uranium opportunities; |

| · | expectations with respect to regulatory requirements such as permitting; |

| · | future supply and demand for uranium; |

| · | our expectations to bring our properties into production; |

| · | projections of uranium prices; and |

| · | expectations regarding the quality and quantity of uranium present in the properties in which we have an interest. |

These forward-looking statements reflect our current beliefs and are based on information currently available to us. Forward-looking statements involve significant risks and uncertainties. A number of factors could cause actual results to differ materially from the results discussed in the forward-looking statements including, but not limited to, changes in general economic and market conditions and other risk factors. Although the forward-looking statements contained herein are based upon what we believe to be reasonable assumptions, we cannot assure that actual results will be consistent with these forward-looking statements. Investors should not place undue reliance on forward-looking statements. These forward-looking statements are made as of the date of this prospectus and we assume no obligation to update or revise them to reflect new events or circumstances. Forward-looking statements and other information contained in this prospectus concerning the uranium industry and the our general expectations concerning the uranium industry are based on estimates prepared by us using data from publicly available industry sources as well as from market research and industry analysis and on assumptions based on data and knowledge of this industry which we believe to be reasonable. However, this data is inherently imprecise, although generally indicative of relative market positions, market shares and performance characteristics. While we are not aware of any misstatements regarding any industry data presented herein, the uranium industry involves risks and uncertainties and industry data is subject to change based on various factors. See “Risk Factors”.

17

USE OF PROCEEDS

We will not receive any proceeds from the sale of securities offered by the selling shareholders, other than amounts representing the warrant exercise price received upon exercise of warrants, which may occur prior to the sale of the underlying Common Shares by a selling shareholder. We will use these proceeds for general corporate purposes.

DIVIDEND POLICY

We have not paid dividends in the past and we do not expect to have the ability to pay dividends in the near future. We currently intend to retain any future earnings to fund the development and growth of our business. Therefore, we do not currently anticipate paying any cash dividends in the foreseeable future.

CAPITALIZATION

The table below describes our capitalization as of February 28, 2006:

As at February 28. 2006 | ||||

(unaudited) | ||||

| Cash, cash equivalents and marketable securities | $ | 6,966,907 | ||

| Total shareholders’ equity | $ | 13,469,103 | ||

| Additional paid-in capital | 24,600 | |||

| Accumulated Deficit | (3,226,715 | ) | ||

| Total capitalization | $ | 10,266,988 | ||

18

Our Common Shares trade on the Toronto Stock Exchange under the symbol “HPU”. The Common Shares commenced trading on December 23, 2005. The tables below present the high and low market prices for our Common Shares in Canadian dollars based on information obtained from the TSX.

Common Shares

December 2005 | January 2006 | February 2006 | March 2006 | April 2006 | ||||||

| High | Cdn$0.75 | Cdn$0.72 | Cdn$0.75 | Cdn$1.25 | Cdn$1.18 | |||||

| Low | Cdn$0.68 | Cdn$0.52 | Cdn$0.46 | Cdn$0.66 | Cdn$0.85 |

On May 2, 2006, the closing price of the Common Shares, as quoted on the TSX, was Cdn$0.97.

The average exchange rate between the Canadian dollar and the U.S. dollar for the twelve months ended March 31, 2006 was 1.1871.

19

SELECTED CONSOLIDATED FINANCIAL DATA

You should read our selected consolidated financial data set forth below in conjunction with our historical consolidated financial statements and the related notes and the section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations”, all included elsewhere in this prospectus.

The summary of selected financial information of High Plains prepared in accordance with accounting principles generally accepted in Canada (“Canadian GAAP”) as of and for the periods indicated and should be read in conjunction with the audited consolidated financial statements of High Plains for the period commencing from the date of incorporation on April 6, 2004 to March 31, 2005 and the unaudited interim consolidated financial statements of High Plains for the nine months ended December 31, 2005. Our results for the nine months ended December 31, 2005 are not necessarily indicative of the results to be expected for the year ending March 31, 2006. We prepare our financial statements in accordance with Canadian GAAP, which differs in certain respects from U.S. GAAP. For a discussion of the principal differences between Canadian GAAP and U.S. GAAP as they pertain to us, see note 14 to our audited consolidated financial statements for the period commencing from the date of incorporation on April 6, 2004 to March 31, 2005 and note 10 to our unaudited interim consolidated financial statements for the nine months ended December 31, 2005 included elsewhere in this prospectus.

Canadian GAAP:

Nine months ended December 31, 2005 | Period ended March 31, 2005 | (1) | |||||||

| (unaudited) | |||||||||

| Total net loss | (1,839,030 | ) | (969,976 | ) | |||||

| Net loss per common share— basic and diluted | (0.08 | ) | (0.13 | ) | |||||

| Total assets | 11,302,799 | 7,948,541 | |||||||

| Cash and cash equivalents | 3,668,950 | 510,486 |

United States GAAP:

Nine months endedDecember 31, 2005 | Period ended March 31, 2005 | (1) | |||||||

| (unaudited) | |||||||||

| Total net loss | (2,746,341 | ) | (1,362,661 | ) | |||||

| Net loss per common share— basic and diluted | (0.13 | ) | (0.18 | ) | |||||

| Total assets | 10,058,601 | 7,579,163 | |||||||

| Cash and cash equivalents | 3,668,950 | 510,486 |

20

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION

AND RESULTS OF OPERATIONS

The following discussion of our financial condition and results of operations should be read in conjunction with our unaudited consolidated interim financial statements for the nine-month period ended December 31, 2005 and the notes thereto and our audited consolidated financial statements for the period beginning on April 6, 2004 and ending March 31, 2005 and the notes thereto both included elsewhere in this prospectus. This prospectus contains forward-looking statements that involve risks and uncertainties. You should not place undue reliance on forward-looking statements, because actual results may differ materially from those indicated in forward-looking statements. See “Forward-Looking Statements.” Some of the factors that could cause or contribute to such differences are discussed below and under the heading “Risk Factors.”

Overview

High Plains was incorporated under the laws of the Province of New Brunswick on February 8, 2005. High Plains was established to be the Canadian holding company of HPU Idaho, a corporation incorporated under the laws of the State of Idaho on April 6, 2004. On March 9, 2005, the holders of all of the HPU Idaho Securities exchanged the HPU Idaho Securities for Common Shares, warrants, options and convertible notes issued by High Plains pursuant to a Securities Exchange (the “Securities Exchange”). Upon completion of the Securities Exchange, HPU Idaho became a wholly-owned subsidiary of High Plains. HPU Idaho is also the sole shareholder of High Plains Uranium, Inc. (Alaska), an entity established under the laws of the State of Alaska to evaluate uranium opportunities in that State. On December 16, 2005, High Plains completed an initial public offering in Canada (“IPO”) with a concurrent private placement in the United States of an aggregate of 5,000,000 units at Cdn$1.00 per unit, each unit consisted of one common share and one-half of one common share purchase warrant to purchase one common share at $1.50 until December 16, 2006, for gross proceeds of Cdn$5,000,000.

We are currently engaged in the acquisition and exploration of partially evaluated uranium properties, focusing on the States of Wyoming and Texas. Our goal is to become a uranium producer at the earliest possible opportunity utilizing ISL mining technology. Since our establishment, we have been assembling a seasoned management team to identify, acquire and cultivate strategic acquisitions. In addition to our head office in Cheyenne, Wyoming, we have also recently established regional offices in Casper, Wyoming, Karnes City, Texas and Hilton Head, South Carolina. Our current material properties are located at the Allemand Ross Project in the State of Wyoming and the Swinney Switch Project in the State of Texas. For further information on these projects as well as a summary of the terms of our agreements in respect of these properties, see “Principal Exploration Projects - Allemand Ross Project” and “Principal Exploration Projects - Swinney Switch Project”.

Property Portfolio

Allemand-Ross Project

The Allemand Ross Project is located in the south central Powder River Basin of Wyoming. A number of roll front deposits were found within the project by former operators Kerr McGee, Conoco, and Power Reactor & Nuclear Fuel Development Corp. in the 1970’s and 1980’s. These roll fronts were identified by drilling programs totaling 692 drill holes of which 116 drill holes encountered significant mineralization.

Two specific areas within the Allemand Ross Project were explored in the past. The Sand Draw property included 512 drill holes and the Bear Creek property included 180 drill holes. These areas are approximately four miles apart. Known uranium mineralization in the Powder River Basin is sandstone-hosted, and generally consists of several C-shaped sub-roll fronts in a frontal system formed at a geochemical interface.

Mineral rights to the Sand Draw property are held under 172 federal lode claims occupying 2,222 acres (899 hectares) and 1,168 acres (473 hectares) of fee mineral leases covered by 2,537 acres (1,027 hectares) of surface rights. The Bear Creek property comprises approximately 1,920 acres (777 hectares) acres of surface rights along with 77 lode claims comprising approximately 1,113 acres (450 hectares).

The Sand Draw property carries a historic resource (considered comparable to the CIM “indicated resource” category) of approximately 970,000 pounds of in-situ uranium in 214,000 short tons averaging 0.32% U3O8 grade. An additional 3,790,000 pounds of in-situ uranium (considered comparable to the CIM “inferred resource” category) is contained within 1,400,000 short tons averaging 0.19% U3O8. The Bear Creek deposit contains 827,700 pounds of in-situ uranium in an historic mineral resource (considered comparable with the CIM “inferred resource” category) of 361,300 short tons averaging 0.17% U3O8.

21

A proposed budget totaling approximately US$6,000,000 will be expended in two phases over a 30-36 month period. The first phase of the recommended work program will involve a delineation drilling and resource verification program at the Allemand Ross Project. The data obtained from this initial drilling program will be used to develop a pre-feasibility Report. This report is presently scheduled for completion at the end of 2006.

Preliminary permitting work has also started on the Allemand Ross Project. This permitting effort will include obtaining permits from the Wyoming Department of Environmental Quality and the Nuclear Regulatory Commission. Both of these permit applications will include extensive environmental baseline data. Initially, data will be collected for vegetation, soils, wildlife, and hydrology. This data collection program is scheduled for 2006 and will include:

| ● | pump tests for aquifer characterization, |

| ● | installation of baseline wells, |

| ● | collection of groundwater baseline, |

| ● | initiation of wildlife field surveys, |

| ● | vegetation sampling and characterization, and |

| ● | identification of climatological conditions |

Additional Exploration Properties

In addition to the Allemand Ross Project described above, we have also acquired interests in other properties in the States of Wyoming and Texas, as outlined below:

(a) Swinney Switch Project, Texas