Exhibit 99.1

Confidential

Excerpts from Confidential Information Memorandum December 2015

Kraton Performance Polymers, Inc.

Confidential 1

H. Forward-looking statement disclaimer

This presentation includes forward-looking statements that reflect Kraton Performance Polymers, Inc.’s (“our” or “Kraton”) plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often characterized by the use of words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions.

All forward-looking statements in this presentation are made based on management’s current expectations and estimates, which involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in such forward-looking statements. The statements in this presentation that are not historical statements, including statements regarding the benefits, synergies and cost rationalizations of the proposed acquisition of Arizona Chemical Holdings Corporation (the “Acquisition”), the expected method of financing the Acquisition, the expected timing and amount of operating cash flow we expect to generate after the closing of the Acquisition, future opportunities for the combined company and products, beliefs regarding strengthening relationships with customers, statements regarding market share or positioning, the expected timetable for completing the proposed Acquisition, the expected timing and amount of the repayment of indebtedness, future financial performance and any other statements regarding Kraton’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts, are forward-looking statements within the meaning of the federal securities laws. Our expectations and assumptions regarding cost rationalizations, variable cost optimizations and reductions in overhead may not materialize, or our costs to achieve synergies may exceed our estimates, any of which would adversely affect our ability to achieve projected synergies. Our expectations and assumptions regarding the financial performance of the combined company may not materialize, which would adversely affect our ability to achieve expected accretion. Our performance or that of Arizona Chemical Holdings Corporation could be adversely affected by other risks and uncertainties, which would adversely affect the ability of the combined company to achieve expected results and benefits. Additional information concerning factors that could cause actual results to differ materially from those expressed in forward-looking statements is contained in Kraton’s filings with the U.S. Securities and Exchange Commission, including but not limited to Kraton’s most recent annual report on Form 10-K and subsequent quarterly reports on Form 10-Q and include, but are not limited to, risks related to the closing and benefits of the Acquisition; conditions in the global economy and capital markets; declines in raw material costs; limitations in the availability of raw materials we need to produce our products in the amounts or at the prices necessary for us to effectively and profitably operate our business; competition in our end-use markets from other producers of SBCs and from producers of products that can be substituted for our products; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update such information in light of new information or future events.

Confidential

2

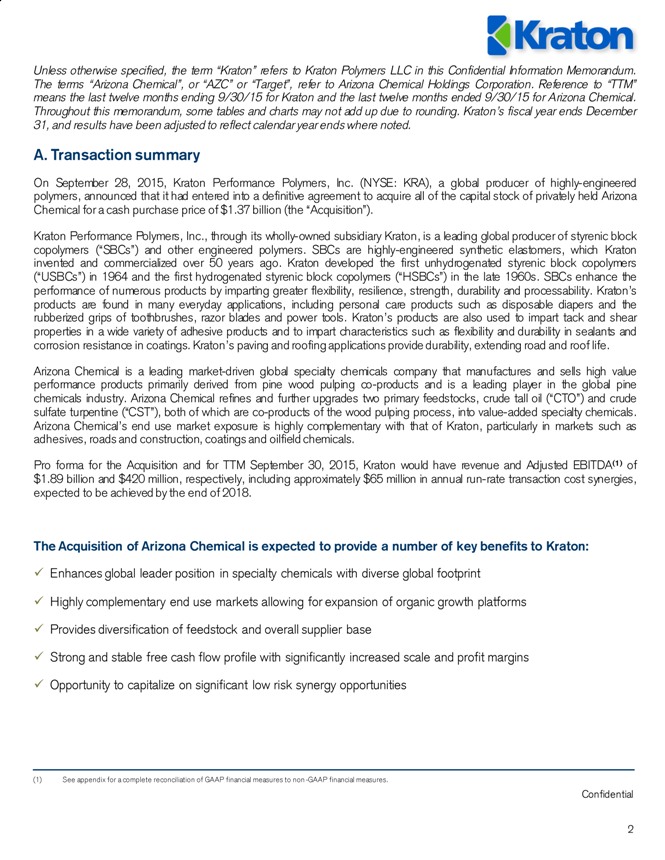

Unless otherwise specified, the term “Kraton” refers to Kraton Polymers LLC in this Confidential Information Memorandum. The terms “Arizona Chemical”, or “AZC” or “Target”, refer to Arizona Chemical Holdings Corporation. Reference to “TTM” means the last twelve months ending 9/30/15 for Kraton and the last twelve months ended 9/30/15 for Arizona Chemical. Throughout this memorandum, some tables and charts may not add up due to rounding. Kraton’s fiscal year ends December 31, and results have been adjusted to reflect calendar year ends where noted.

A. Transaction summary

On September 28, 2015, Kraton Performance Polymers, Inc. (NYSE: KRA), a global producer of highly-engineered polymers, announced that it had entered into a definitive agreement to acquire all of the capital stock of privately held Arizona Chemical for a cash purchase price of $1.37 billion (the “Acquisition”).

Kraton Performance Polymers, Inc., through its wholly-owned subsidiary Kraton, is a leading global producer of styrenic block copolymers (“SBCs”) and other engineered polymers. SBCs are highly-engineered synthetic elastomers, which Kraton invented and commercialized over 50 years ago. Kraton developed the first unhydrogenated styrenic block copolymers (“USBCs”) in 1964 and the first hydrogenated styrenic block copolymers (“HSBCs”) in the late 1960s. SBCs enhance the performance of numerous products by imparting greater flexibility, resilience, strength, durability and processability. Kraton’s products are found in many everyday applications, including personal care products such as disposable diapers and the rubberized grips of toothbrushes, razor blades and power tools. Kraton’s products are also used to impart tack and shear properties in a wide variety of adhesive products and to impart characteristics such as flexibility and durability in sealants and corrosion resistance in coatings. Kraton’s paving and roofing applications provide durability, extending road and roof life.

Arizona Chemical is a leading market-driven global specialty chemicals company that manufactures and sells high value performance products primarily derived from pine wood pulping co-products and is a leading player in the global pine chemicals industry. Arizona Chemical refines and further upgrades two primary feedstocks, crude tall oil (“CTO”) and crude sulfate turpentine (“CST”), both of which are co-products of the wood pulping process, into value-added specialty chemicals. Arizona Chemical’s end use market exposure is highly complementary with that of Kraton, particularly in markets such as adhesives, roads and construction, coatings and oilfield chemicals.

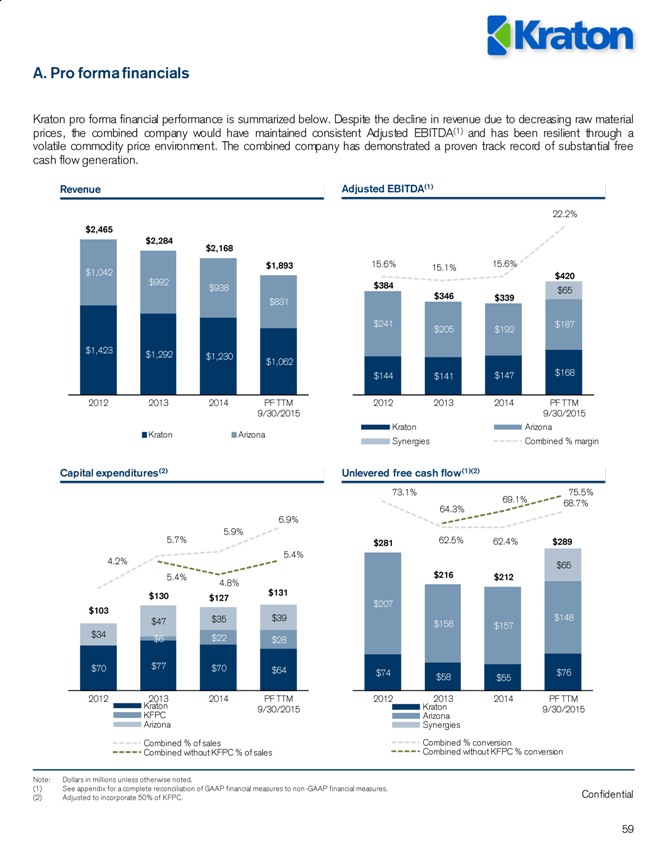

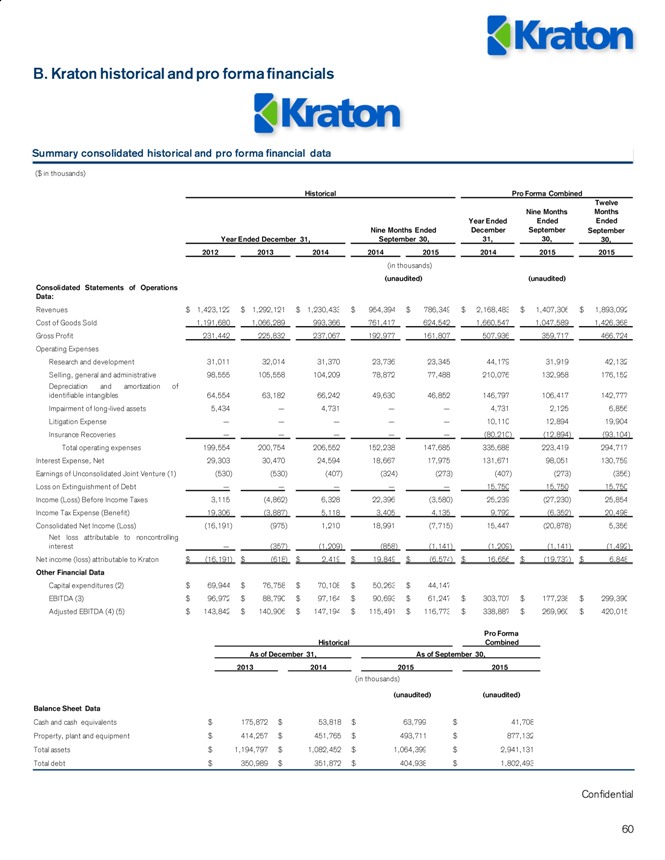

Pro forma for the Acquisition and for TTM September 30, 2015, Kraton would have revenue and Adjusted EBITDA(1) of $1.89 billion and $420 million, respectively, including approximately $65 million in annual run-rate transaction cost synergies, expected to be achieved by the end of 2018.

The Acquisition of Arizona Chemical is expected to provide a number of key benefits to Kraton:

ü Enhances global leader position in specialty chemicals with diverse global footprint

ü Highly complementary end use markets allowing for expansion of organic growth platforms

ü Provides diversification of feedstock and overall supplier base

ü Strong and stable free cash flow profile with significantly increased scale and profit margins

ü Opportunity to capitalize on significant low risk synergy opportunities

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures.

Confidential 3

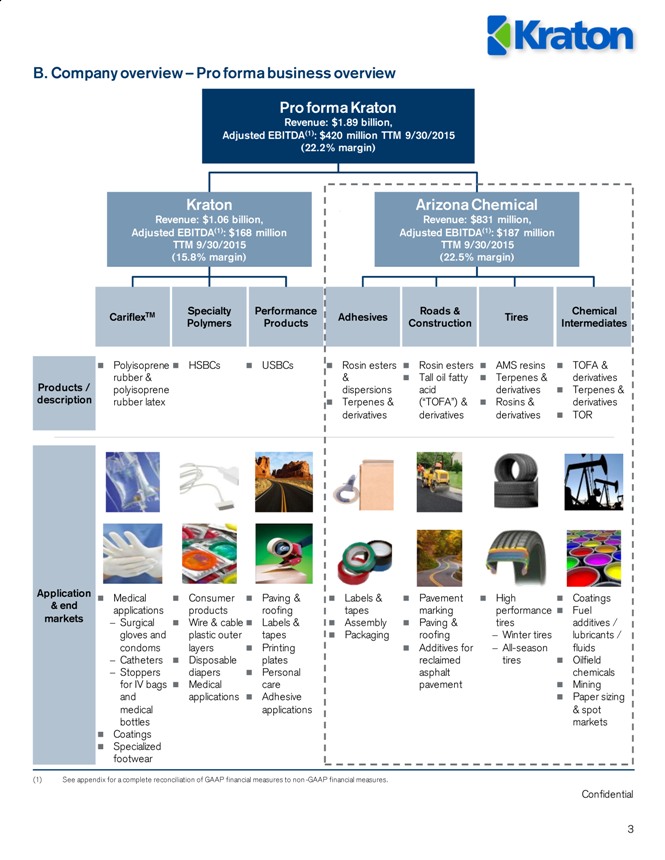

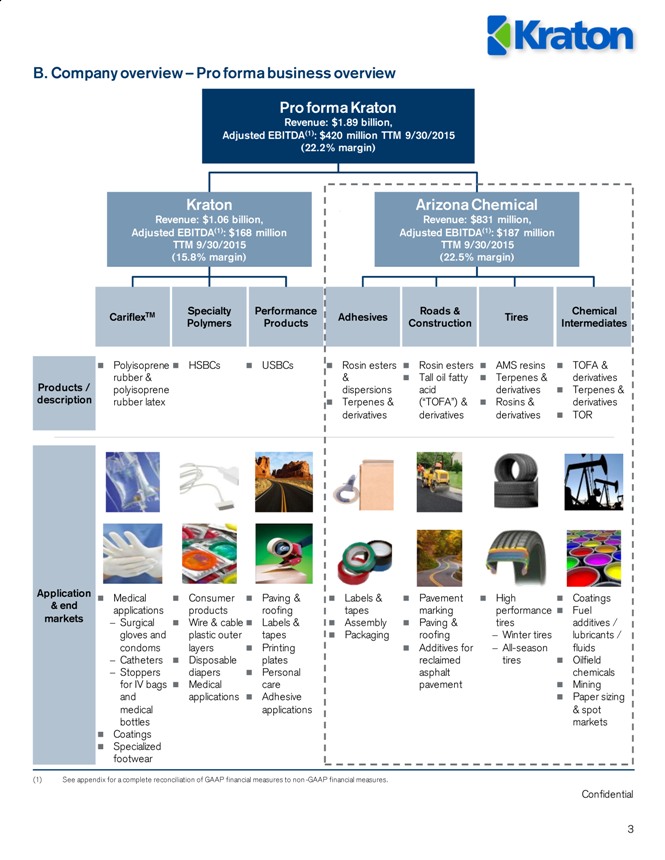

B. Company overview – Pro forma business overview

Pro forma Kraton

Revenue: $1.89 billion,

Adjusted EBITDA(1): $420 million TTM 9/30/2015 (22.2% margin)

Arizona Chemical

Revenue: $831 million,

Adjusted EBITDA(1): $187 million

TTM 9/30/2015

(22.5% margin) Kraton Revenue: $1.06 billion, Adjusted EBITDA(1): $168 million TTM 9/30/2015 (15.8% margin)

Specialty Polymers

CariflexTM Performance Products Adhesives

Roads & Construction

Tires

Chemical Intermediates

Products / description

Application & end markets

HSBCs

Polyisoprene rubber & polyisoprene rubber latex

USBCs

Rosin esters & dispersions

Terpenes & derivatives

Rosin esters

Tall oil fatty acid (“TOFA”) & derivatives

AMS resins

Terpenes & derivatives

Rosins & derivatives

TOFA & derivatives

Terpenes & derivatives

TOR

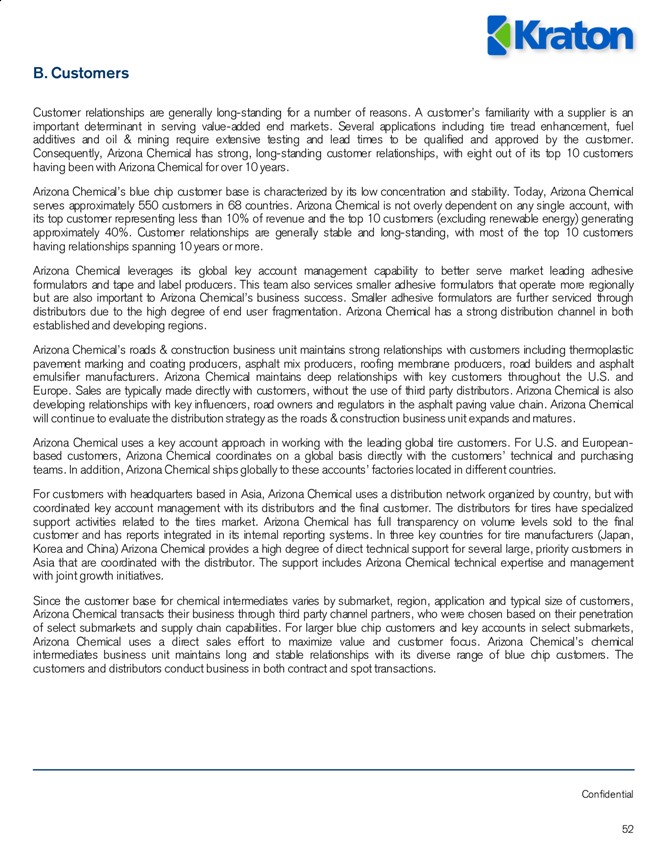

Consumer products

Wire & cable plastic outer layers

Disposable diapers

Medical applications

Medical applications

? Surgical gloves and condoms

? Catheters

? Stoppers for IV bags and medical bottles

Coatings

Specialized footwear

Paving & roofing

Labels & tapes

Printing plates

Personal care

Adhesive applications

Labels & tapes

Assembly

Packaging

Pavement marking

Paving & roofing

Additives for reclaimed asphalt pavement

High performance tires

? Winter tires

? All-season tires

Coatings

Fuel additives / lubricants / fluids

Oilfield chemicals

Mining

Paper sizing & spot markets

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures.

Confidential 4

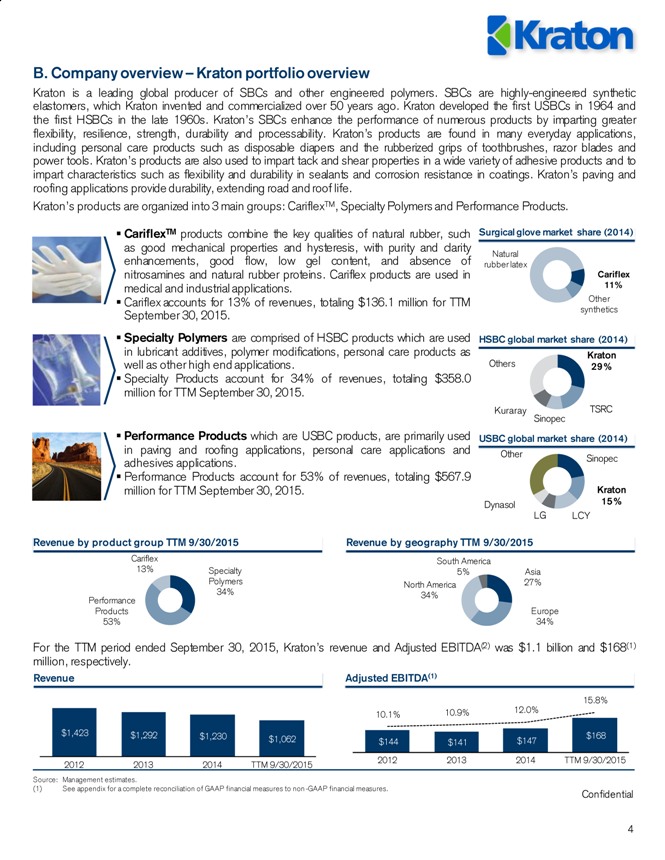

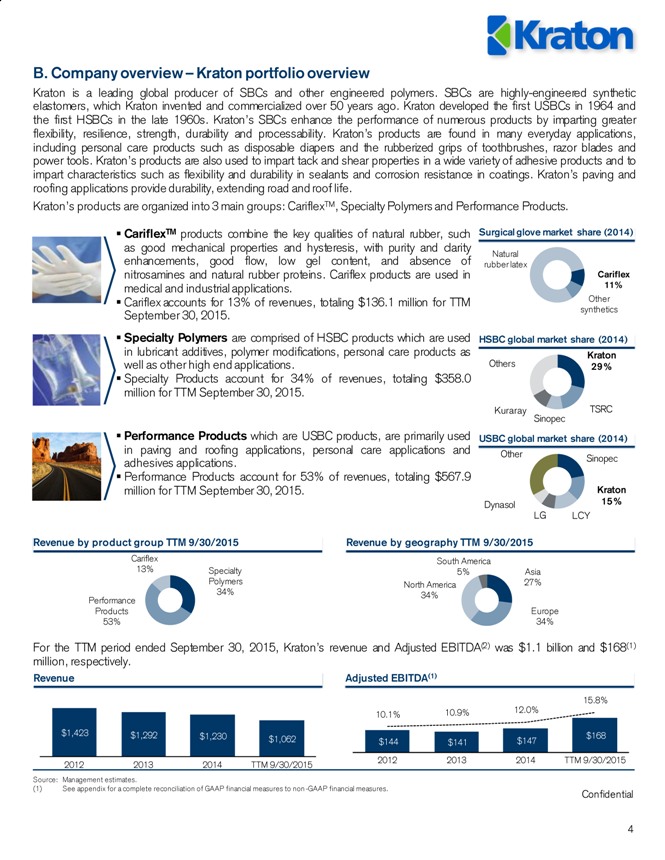

B. Company overview – Kraton portfolio overview

Kraton is a leading global producer of SBCs and other engineered polymers. SBCs are highly-engineered synthetic elastomers, which Kraton invented and commercialized over 50 years ago. Kraton developed the first USBCs in 1964 and the first HSBCs in the late 1960s. Kraton’s SBCs enhance the performance of numerous products by imparting greater flexibility, resilience, strength, durability and processability. Kraton’s products are found in many everyday applications, including personal care products such as disposable diapers and the rubberized grips of toothbrushes, razor blades and power tools. Kraton’s products are also used to impart tack and shear properties in a wide variety of adhesive products and to impart characteristics such as flexibility and durability in sealants and corrosion resistance in coatings. Kraton’s paving and roofing applications provide durability, extending road and roof life.

Kraton’s products are organized into 3 main groups: CariflexTM, Specialty Polymers and Performance Products.

Revenue by geography TTM 9/30/2015

Revenue by product group TTM 9/30/2015 Asia 27% Europe 34% North America 34% South America 5% 39%

Specialty Polymers 34%

Performance Products 53%

Cariflex 13%

For the TTM period ended September 30, 2015, Kraton’s revenue and Adjusted EBITDA(2) was $1.1 billion and $168(1) million, respectively.

n Performance Products which are USBC products, are primarily used in paving and roofing applications, personal care applications and adhesives applications.

n Performance Products account for 53% of revenues, totaling $567.9 million for TTM September 30, 2015.

n Specialty Polymers are comprised of HSBC products which are used in lubricant additives, polymer modifications, personal care products as well as other high end applications.

n Specialty Products account for 34% of revenues, totaling $358.0 million for TTM September 30, 2015.

n CariflexTM products combine the key qualities of natural rubber, such as good mechanical properties and hysteresis, with purity and clarity enhancements, good flow, low gel content, and absence of nitrosamines and natural rubber proteins. Cariflex products are used in medical and industrial applications.

n Cariflex accounts for 13% of revenues, totaling $136.1 million for TTM September 30, 2015.

Revenue

Adjusted EBITDA(1)

Sinopec

Kraton 15% LCY LG Dynasol Other

USBC global market share (2014)

Kraton 29%

TSRC

Sinopec

Kuraray Others Cariflex 11% Other synthetics

Natural rubber latex

HSBC global market share (2014)

Surgical glove market share (2014)

Source: Management estimates.

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures. $1,423 $1,292 $1,230 $1,062

2012 2013 2014 TTM 9/30/2015

$144

$141

$147

$168 10.1% 10.9% 12.0% 15.8%

2012 2013 2014 TTM 9/30/2015

Confidential

5

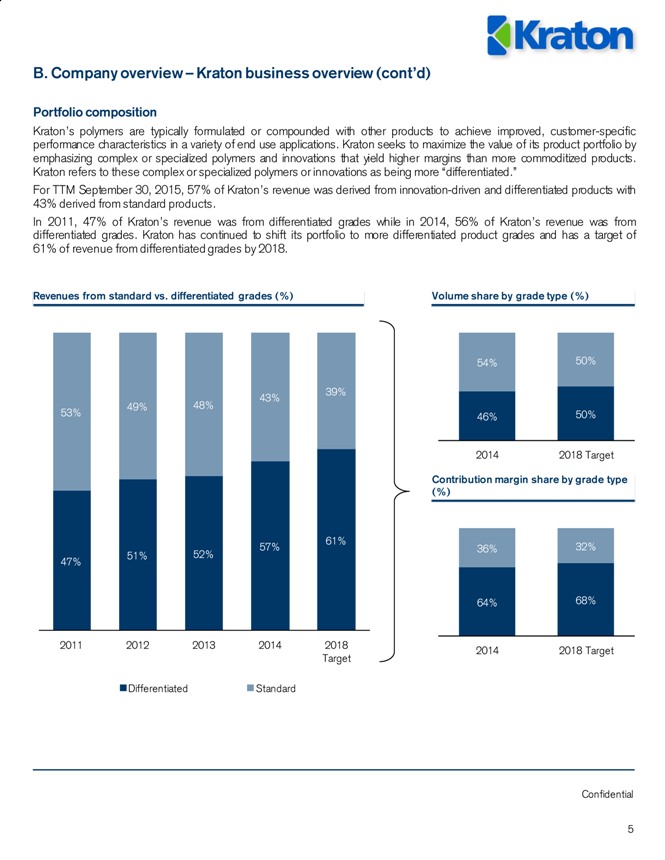

B. Company overview – Kraton business overview (cont’d)

Portfolio composition

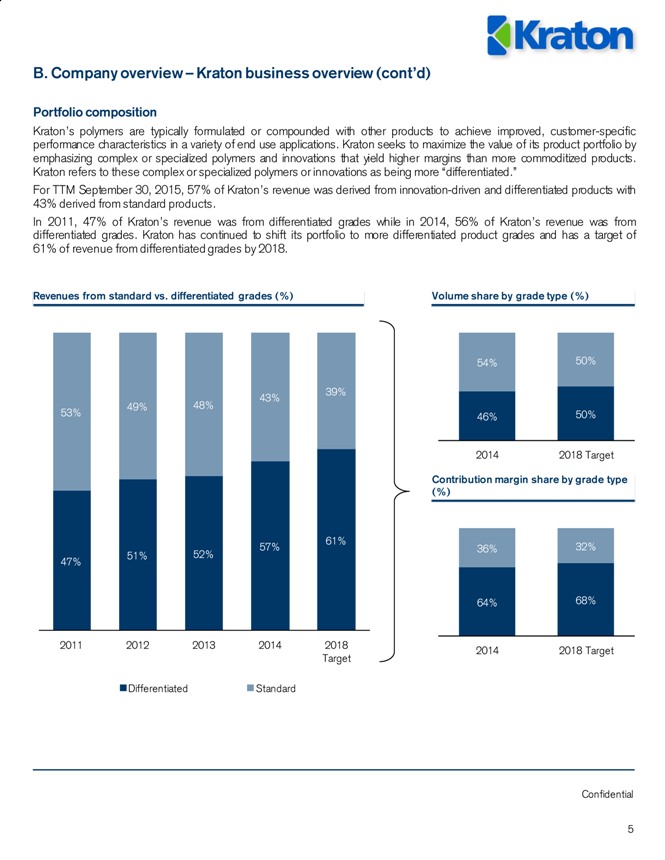

Kraton’s polymers are typically formulated or compounded with other products to achieve improved, customer-specific performance characteristics in a variety of end use applications. Kraton seeks to maximize the value of its product portfolio by emphasizing complex or specialized polymers and innovations that yield higher margins than more commoditized products. Kraton refers to these complex or specialized polymers or innovations as being more “differentiated.”

For TTM September 30, 2015, 57% of Kraton’s revenue was derived from innovation-driven and differentiated products with 43% derived from standard products.

In 2011, 47% of Kraton’s revenue was from differentiated grades while in 2014, 56% of Kraton’s revenue was from differentiated grades. Kraton has continued to shift its portfolio to more differentiated product grades and has a target of 61% of revenue from differentiated grades by 2018.

Volume share by grade type (%)

Contribution margin share by grade type (%) 47%

51%

52%

57%

61%

53%

49%

48%

43%

39%

2011 2012

2013 2014 2018 Target Differentiated Standard

Revenues from standard vs. differentiated grades (%)

46%

50%

54%

50%

2014

2018 Target

64% 68% 36% 32% 2014

2018 Target

Confidential

6

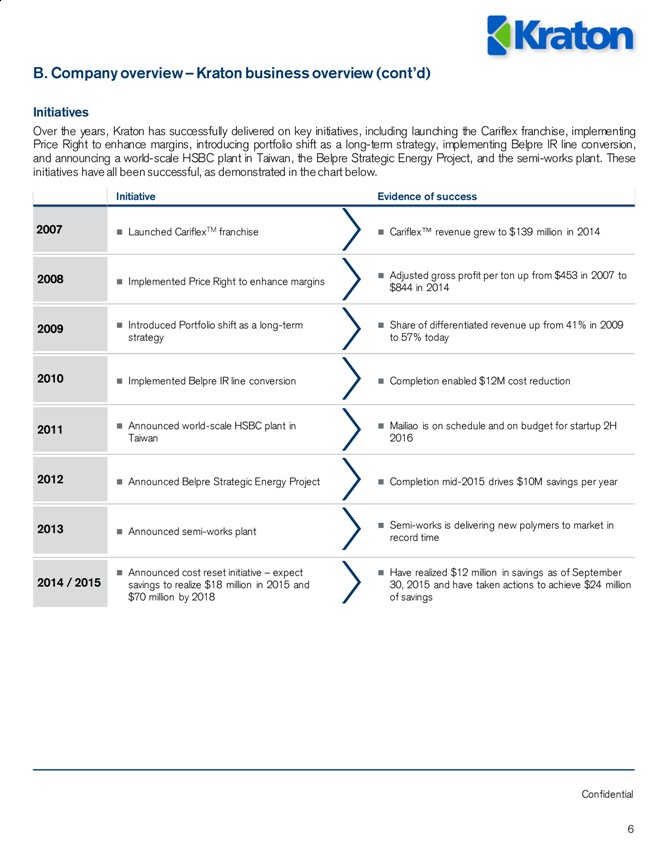

B. Company overview – Kraton business overview (cont’d)

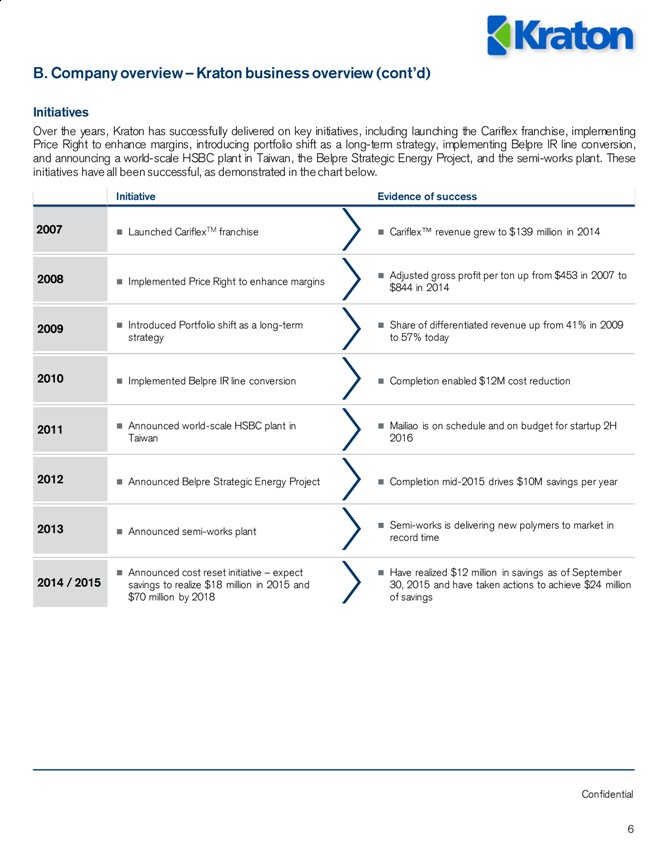

Initiatives

Over the years, Kraton has successfully delivered on key initiatives, including launching the Cariflex franchise, implementing Price Right to enhance margins, introducing portfolio shift as a long-term strategy, implementing Belpre IR line conversion, and announcing a world-scale HSBC plant in Taiwan, the Belpre Strategic Energy Project, and the semi-works plant. These initiatives have all been successful, as demonstrated in the chart below.

2007

Initiative

Evidence of success

Launched CariflexTM franchise

Cariflex™ revenue grew to $139 million in 2014

2008

Implemented Price Right to enhance margins

Adjusted gross profit per ton up from $453 in 2007 to $844 in 2014

2009

Introduced Portfolio shift as a long-term strategy

Share of differentiated revenue up from 41% in 2009 to 57% today

2010

Implemented Belpre IR line conversion

Completion enabled $12M cost reduction

2011

Announced world-scale HSBC plant in Taiwan

Mailiao is on schedule and on budget for startup 2H 2016

2012

Announced Belpre Strategic Energy Project

Completion mid-2015 drives $10M savings per year

2013

Announced semi-works plant

Semi-works is delivering new polymers to market in record time

2014 / 2015

Announced cost reset initiative – expect savings to realize $18 million in 2015 and $70 million by 2018

Have realized $12 million in savings as of September 30, 2015 and have taken actions to achieve $24 million of savings

Confidential Adhesives 29%

Roads & Construction 7% Tires 5% Fuel Additives 6%

Oilfield Chemicals 4% Mining 1% Coatings 7% Metalworking Fluids & Lubricants 4% Inks 8% Flavors & Fragrances 4% Other Chemical Intermediates 14% Renewable Energy 11% Chemical Intermediates 57%

Adhesives 32%

Roads & Construction 6%

Tires 5% 7

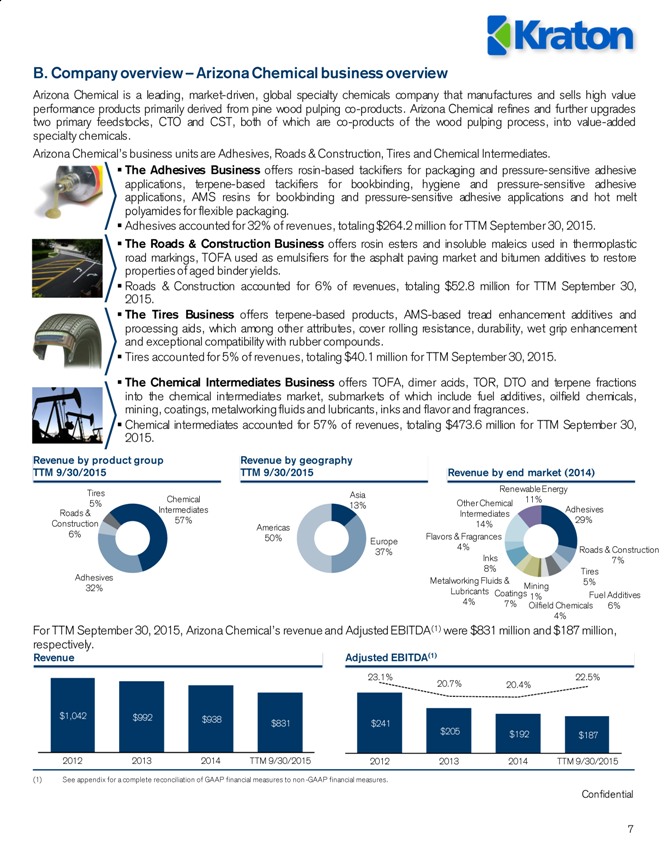

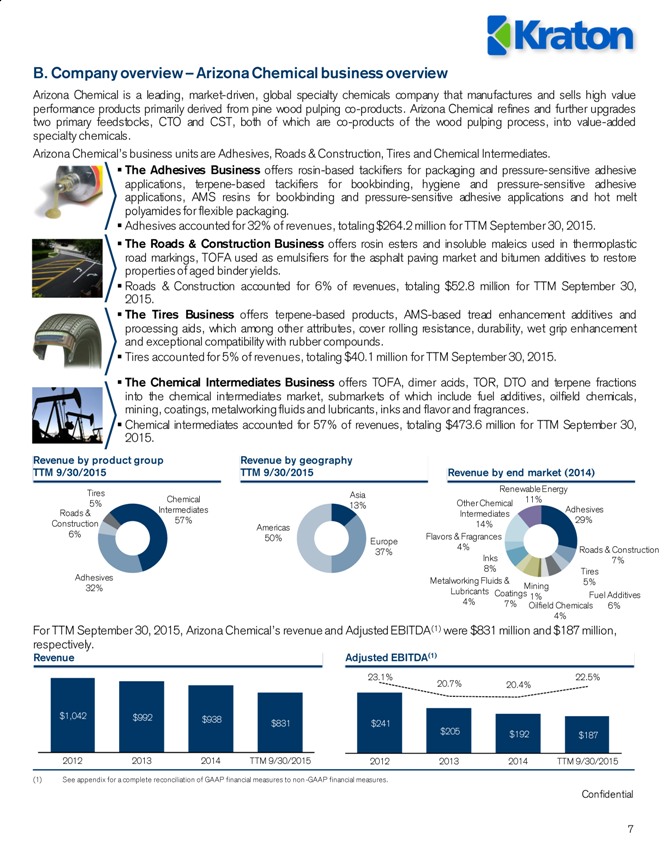

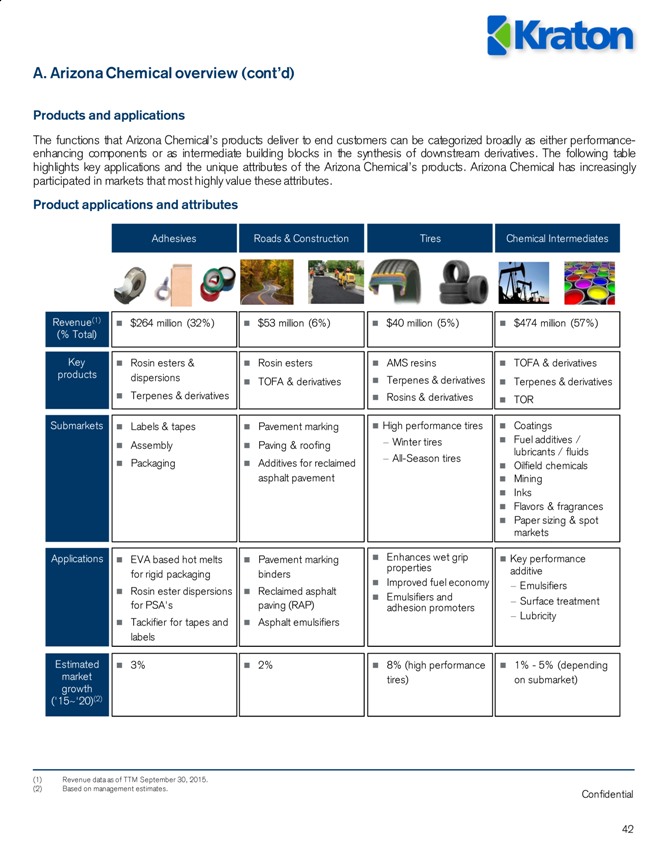

B. Company overview – Arizona Chemical business overview

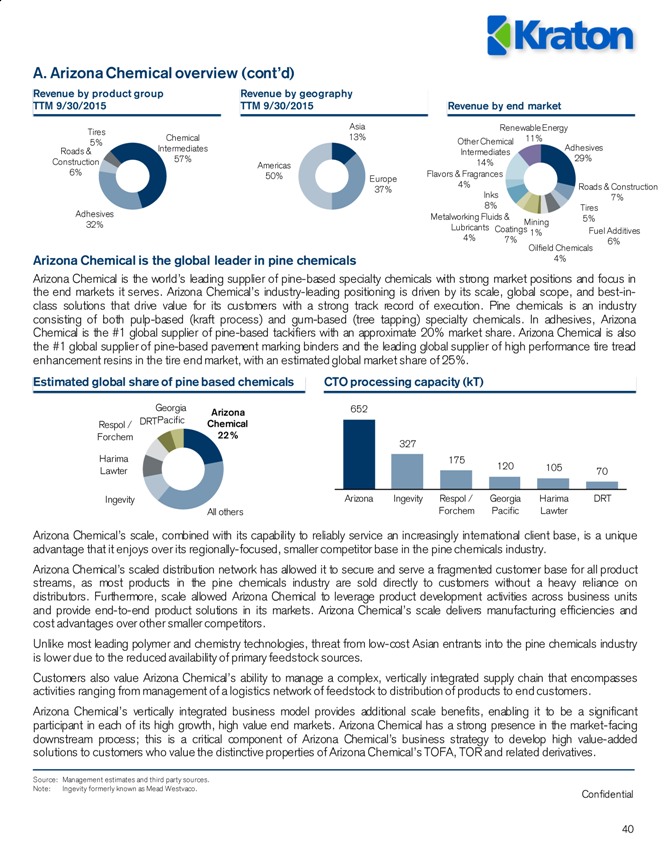

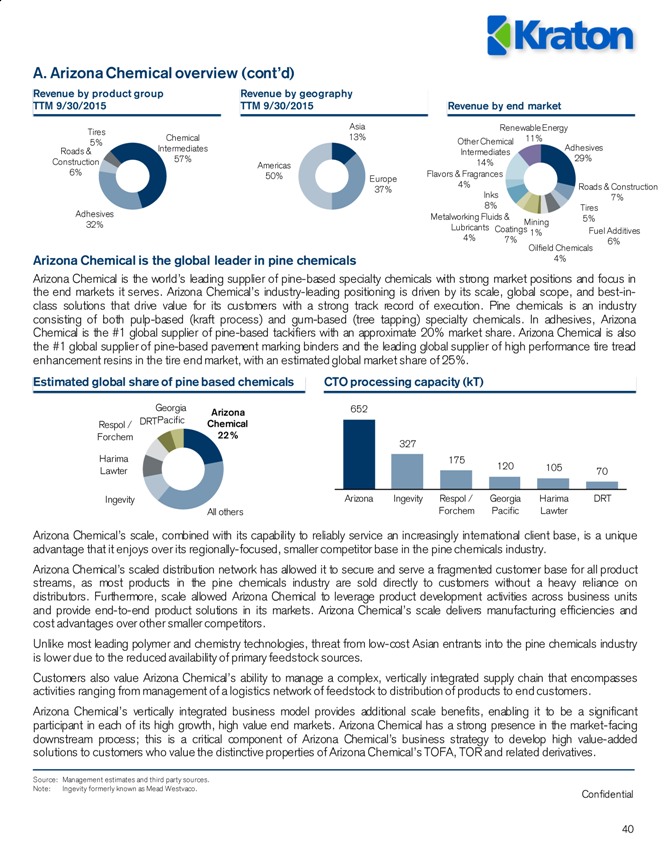

Revenue by end market (2014) Asia 13% Europe 37% Americas 50% 39%

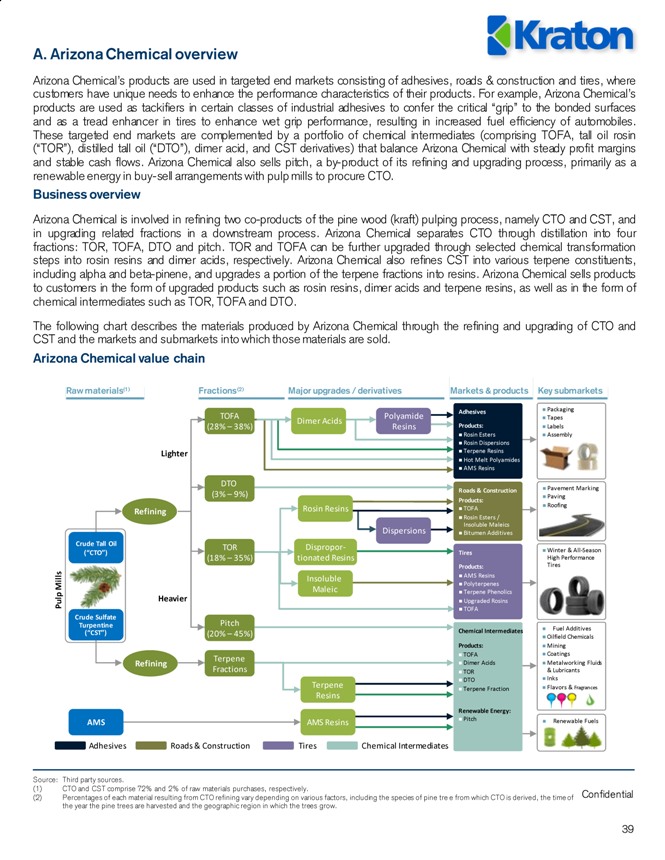

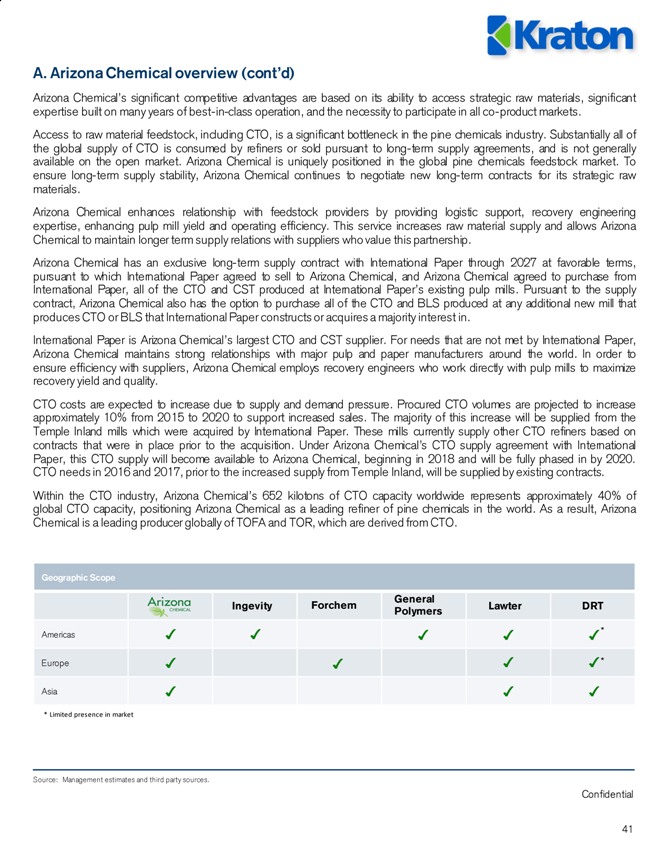

Arizona Chemical is a leading, market-driven, global specialty chemicals company that manufactures and sells high value performance products primarily derived from pine wood pulping co-products. Arizona Chemical refines and further upgrades two primary feedstocks, CTO and CST, both of which are co-products of the wood pulping process, into value-added specialty chemicals.

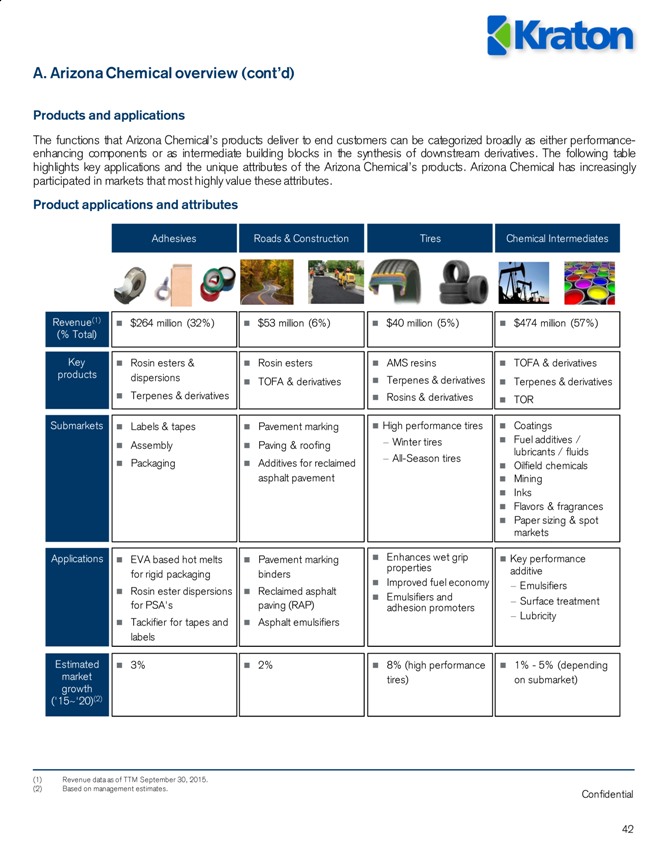

Arizona Chemical’s business units are Adhesives, Roads & Construction, Tires and Chemical Intermediates.

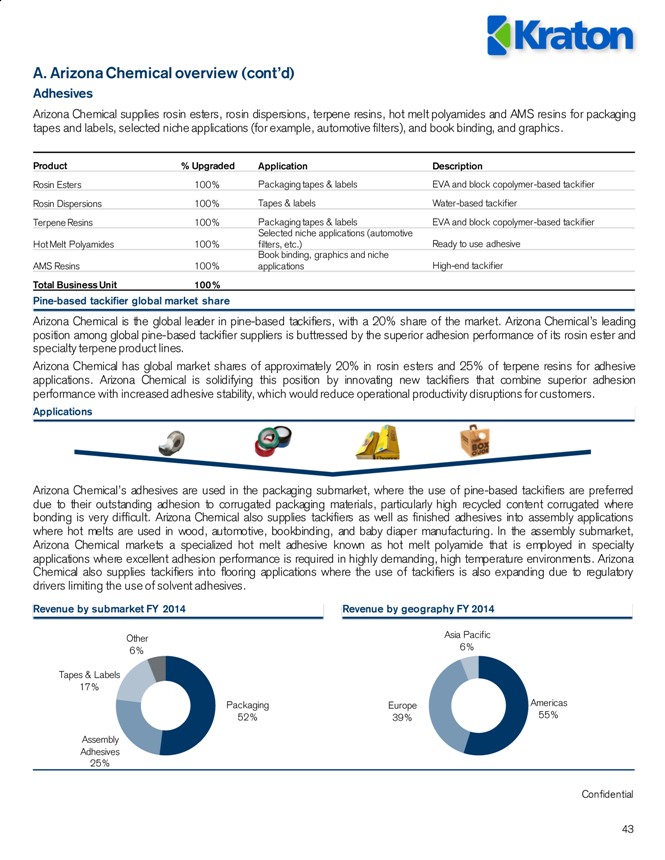

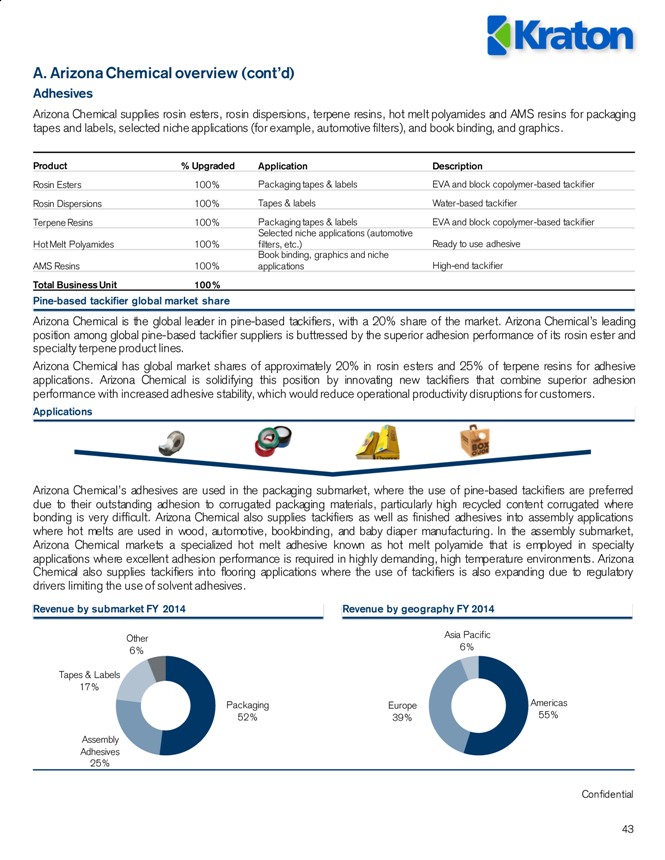

n The Adhesives Business offers rosin-based tackifiers for packaging and pressure-sensitive adhesive applications, terpene-based tackifiers for bookbinding, hygiene and pressure-sensitive adhesive applications, AMS resins for bookbinding and pressure-sensitive adhesive applications and hot melt polyamides for flexible packaging.

n Adhesives accounted for 32% of revenues, totaling $264.2 million for TTM September 30, 2015.

n The Roads & Construction Business offers rosin esters and insoluble maleics used in thermoplastic road markings, TOFA used as emulsifiers for the asphalt paving market and bitumen additives to restore properties of aged binder yields.

n Roads & Construction accounted for 6% of revenues, totaling $52.8 million for TTM September 30, 2015.

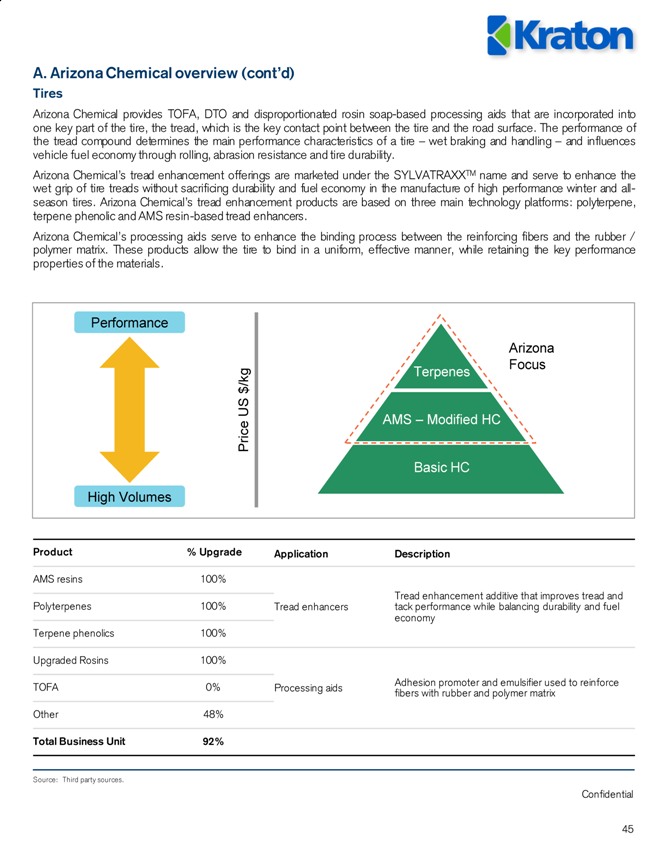

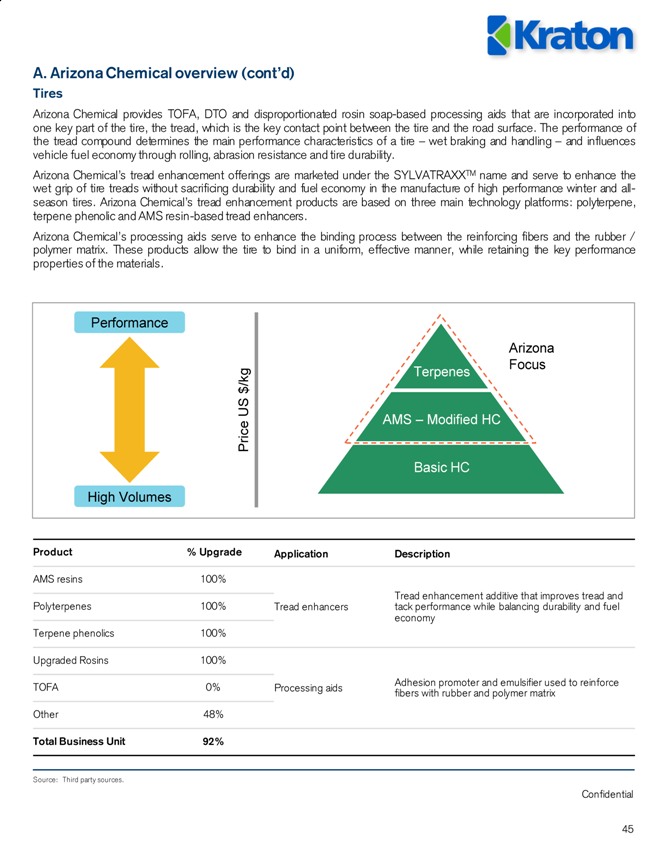

n The Tires Business offers terpene-based products, AMS-based tread enhancement additives and processing aids, which among other attributes, cover rolling resistance, durability, wet grip enhancement and exceptional compatibility with rubber compounds.

n Tires accounted for 5% of revenues, totaling $40.1 million for TTM September 30, 2015.

Revenue

Adjusted EBITDA(1)

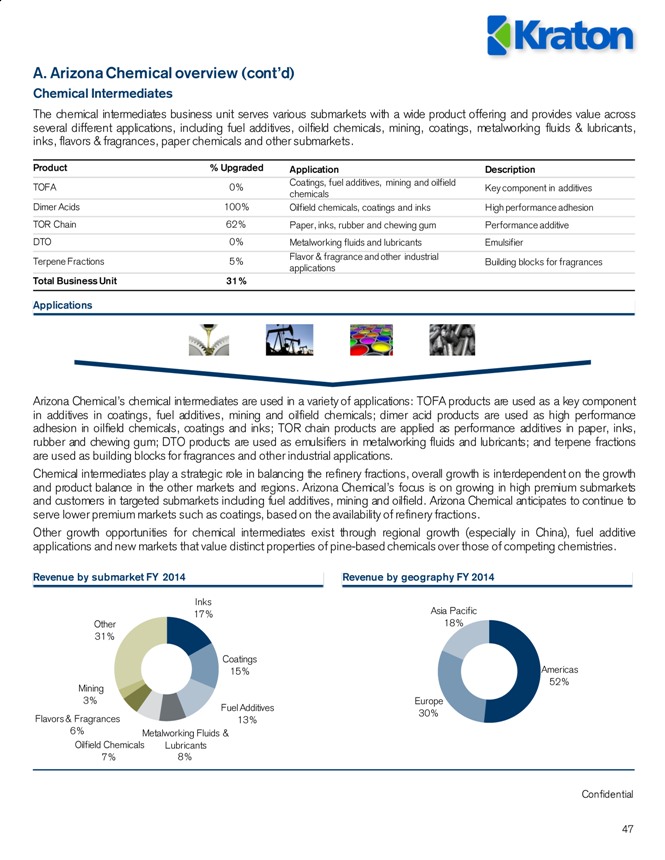

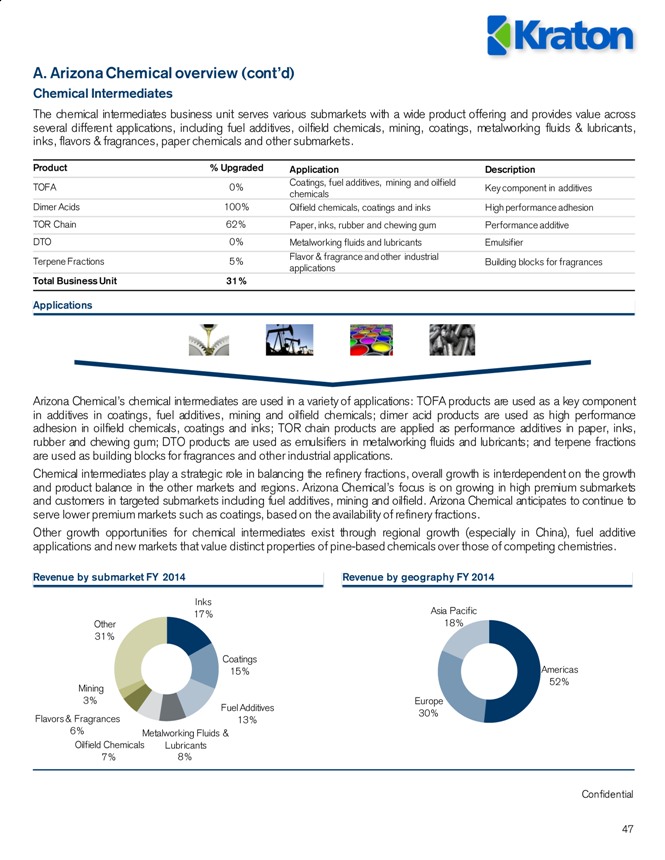

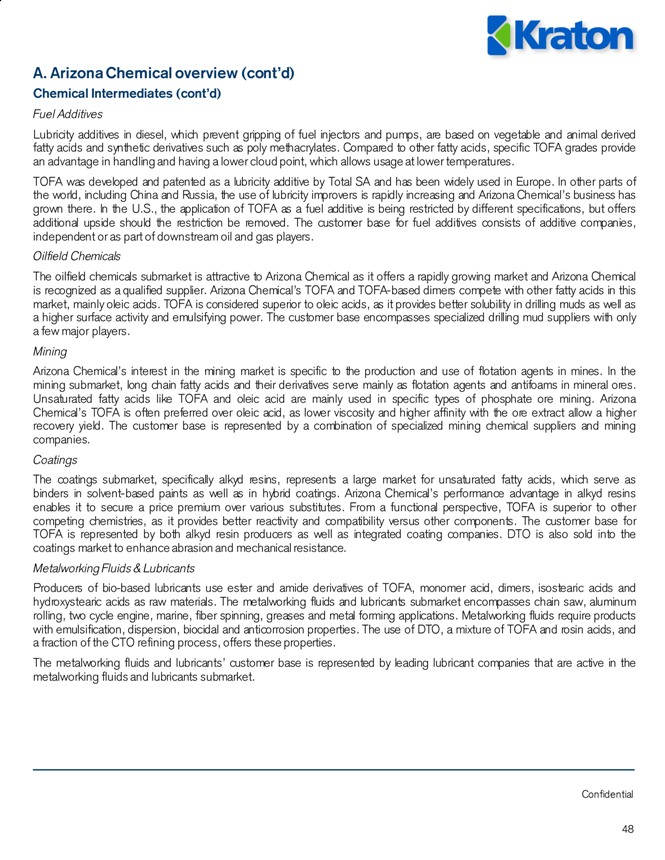

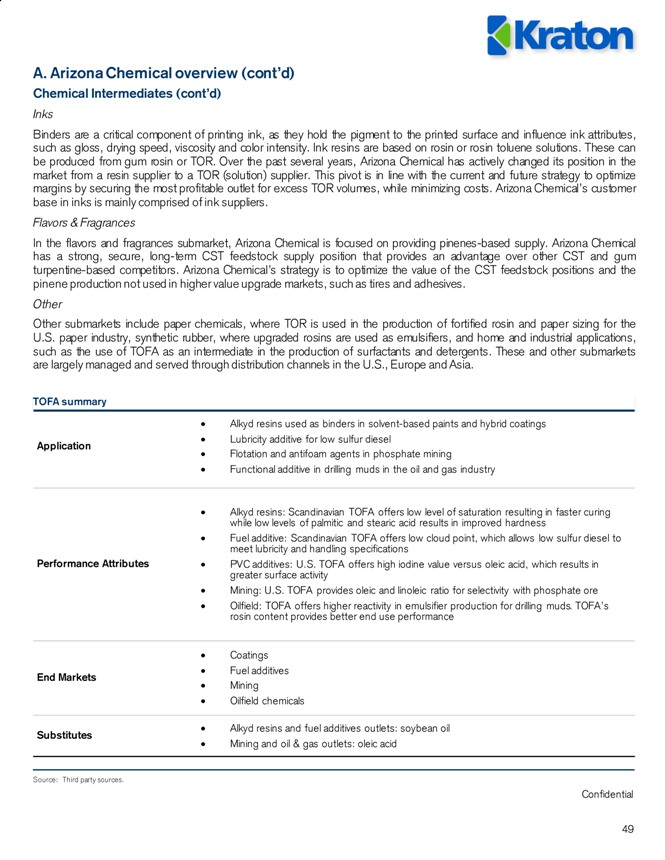

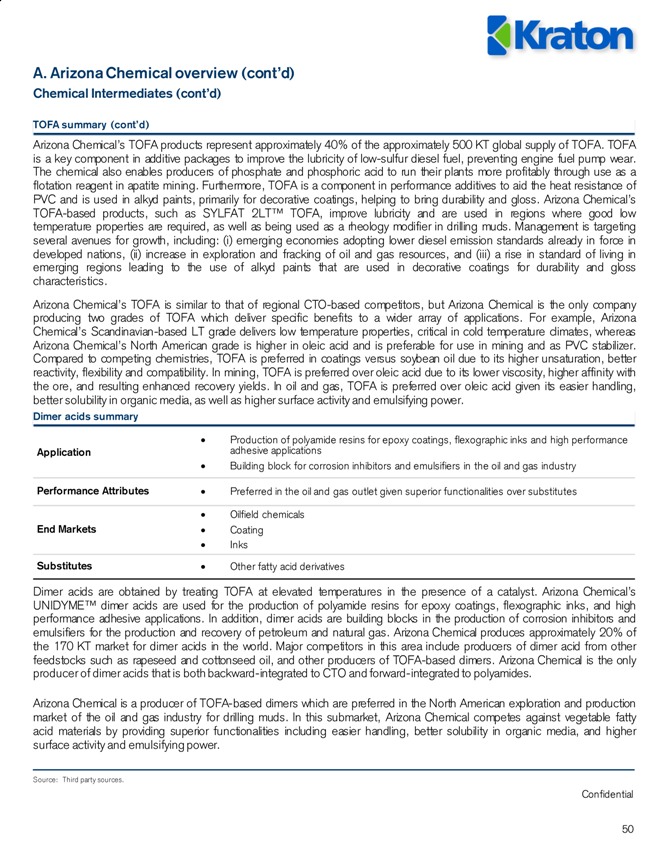

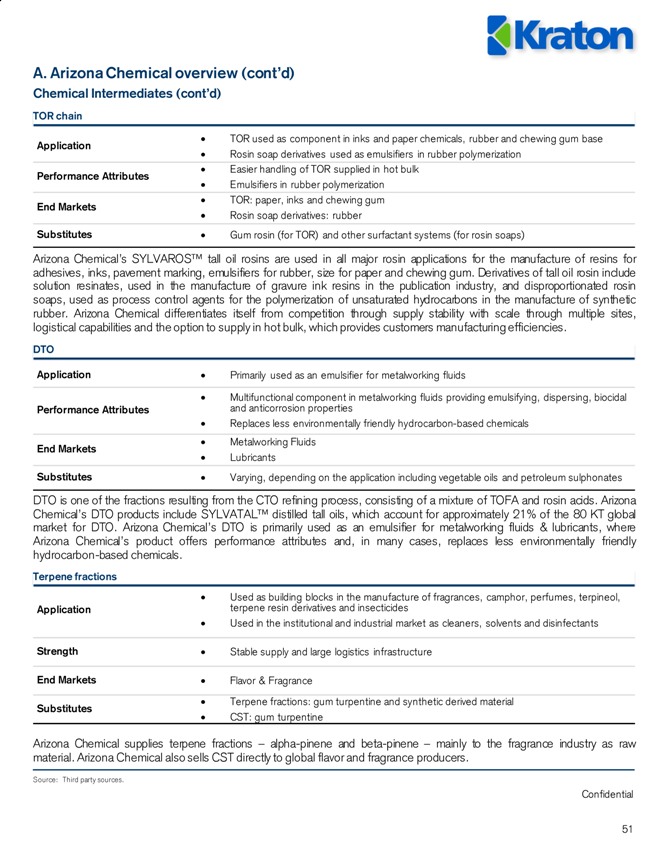

n The Chemical Intermediates Business offers TOFA, dimer acids, TOR, DTO and terpene fractions into the chemical intermediates market, submarkets of which include fuel additives, oilfield chemicals, mining, coatings, metalworking fluids and lubricants, inks and flavor and fragrances.

n Chemical intermediates accounted for 57% of revenues, totaling $473.6 million for TTM September 30, 2015.

Revenue by geography

TTM 9/30/2015

Revenue by product group

TTM 9/30/2015

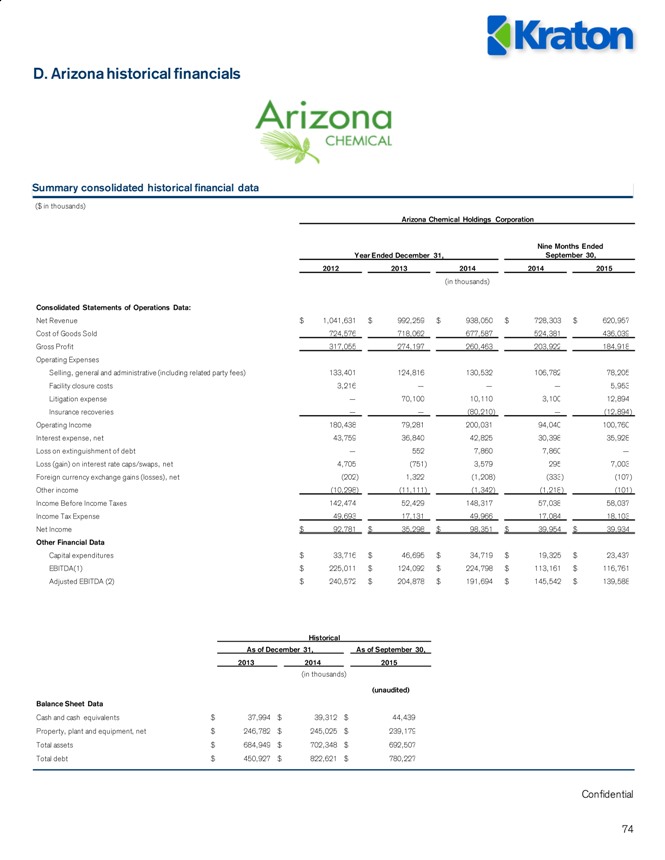

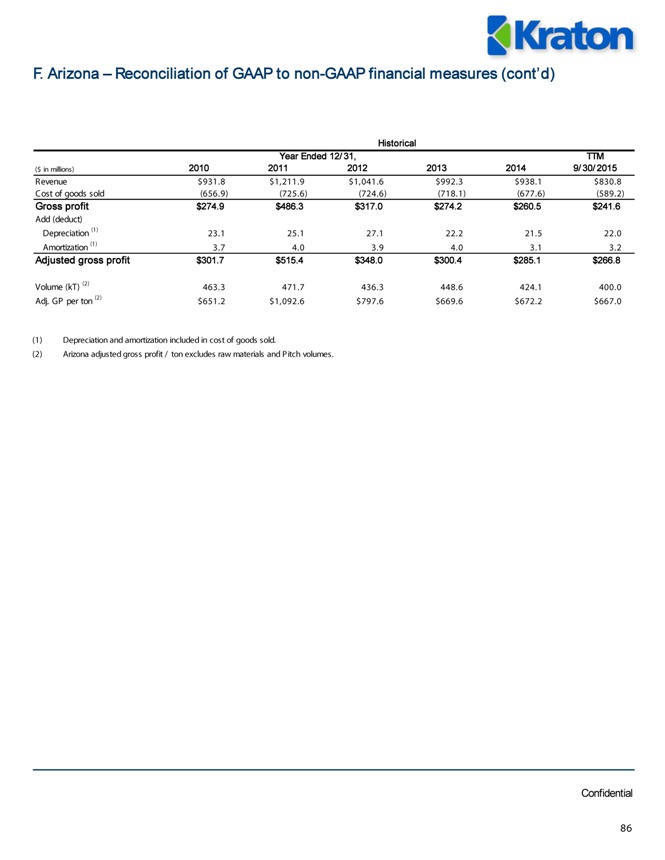

For TTM September 30, 2015, Arizona Chemical’s revenue and Adjusted EBITDA(1) were $831 million and $187 million, respectively. $1,042 $992

$938 $831 2012 2013

2014

TTM 9/30/2015

$241

$205 $192 $187 23.1% 20.7%

20.4% 22.5% 2012 2013

2014

TTM 9/30/2015

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures.

Kraton

Confidential 8

III. Strategic rationale & key credit highlights

Confidential

9

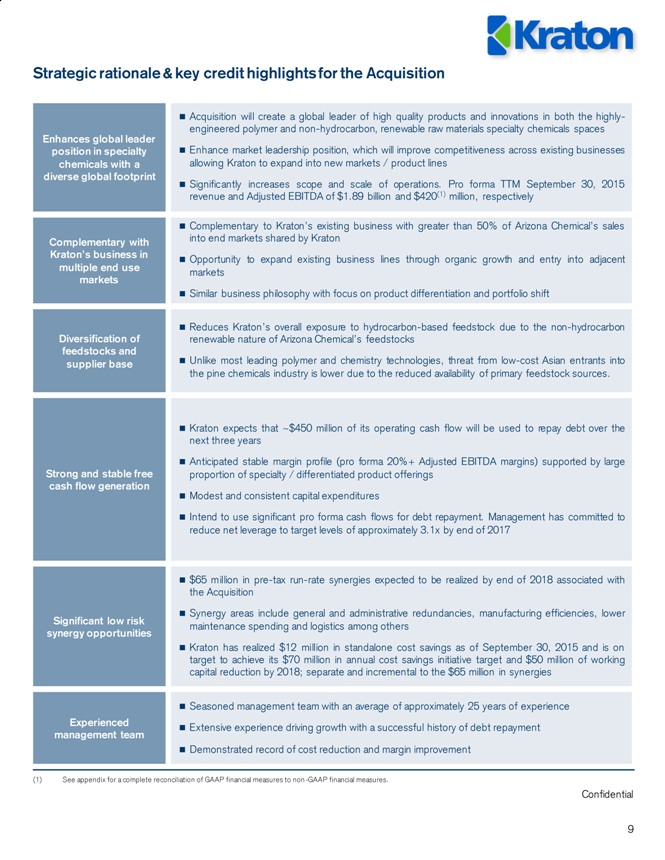

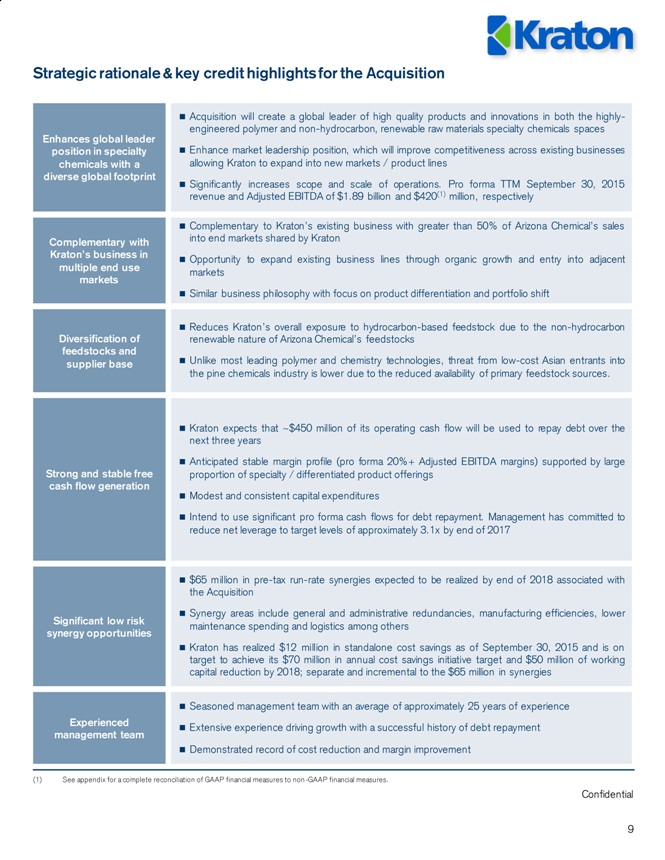

Strategic rationale & key credit highlights for the Acquisition

Enhances global leader position in specialty chemicals with a diverse global footprint

Acquisition will create a global leader of high quality products and innovations in both the highly-engineered polymer and non-hydrocarbon, renewable raw materials specialty chemicals spaces

Enhance market leadership position, which will improve competitiveness across existing businesses allowing Kraton to expand into new markets / product lines

Significantly increases scope and scale of operations. Pro forma TTM September 30, 2015 revenue and Adjusted EBITDA of $1.89 billion and $420(1) million, respectively

Complementary with Kraton’s business in multiple end use markets

Complementary to Kraton’s existing business with greater than 50% of Arizona Chemical’s sales into end markets shared by Kraton

Opportunity to expand existing business lines through organic growth and entry into adjacent markets

Similar business philosophy with focus on product differentiation and portfolio shift

Diversification of feedstocks and supplier base

Reduces Kraton’s overall exposure to hydrocarbon-based feedstock due to the non-hydrocarbon renewable nature of Arizona Chemical’s feedstocks

Unlike most leading polymer and chemistry technologies, threat from low-cost Asian entrants into the pine chemicals industry is lower due to the reduced availability of primary feedstock sources.

Strong and stable free cash flow generation

Kraton expects that ~$450 million of its operating cash flow will be used to repay debt over the next three years

Anticipated stable margin profile (pro forma 20%+ Adjusted EBITDA margins) supported by large proportion of specialty / differentiated product offerings

Modest and consistent capital expenditures

Intend to use significant pro forma cash flows for debt repayment. Management has committed to reduce net leverage to target levels of approximately 3.1x by end of 2017

Significant low risk synergy opportunities

$65 million in pre-tax run-rate synergies expected to be realized by end of 2018 associated with the Acquisition

Synergy areas include general and administrative redundancies, manufacturing efficiencies, lower maintenance spending and logistics among others

Kraton has realized $12 million in standalone cost savings as of September 30, 2015 and is on target to achieve its $70 million in annual cost savings initiative target and $50 million of working capital reduction by 2018; separate and incremental to the $65 million in synergies

Experienced management team

Seasoned management team with an average of approximately 25 years of experience

Extensive experience driving growth with a successful history of debt repayment

Demonstrated record of cost reduction and margin improvement

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures.

Confidential 10

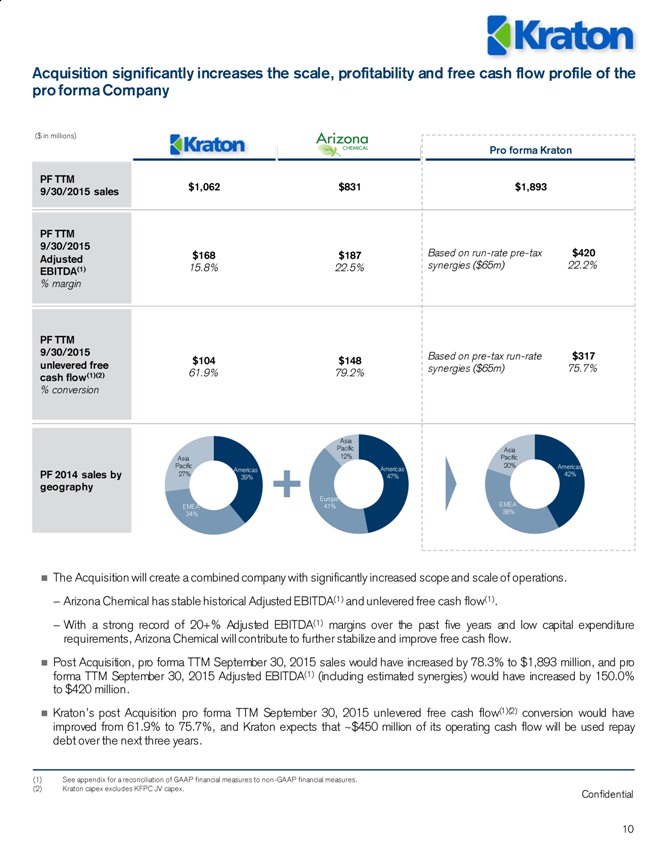

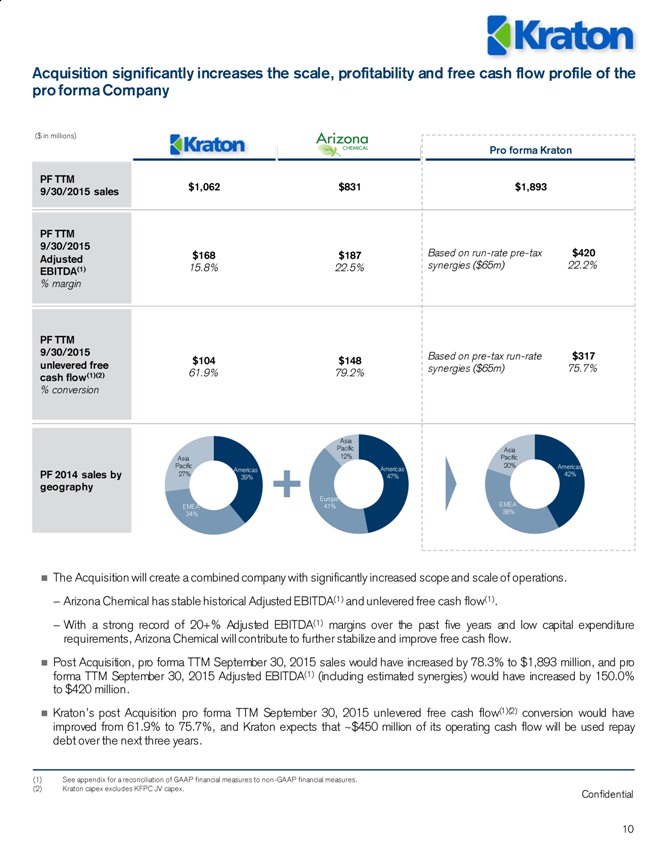

Acquisition significantly increases the scale, profitability and free cash flow profile of the pro forma Company PF TTM 9/30/2015 unlevered free cash flow(1)(2) % conversion PF TTM 9/30/2015 sales

$1,062 PF TTM 9/30/2015 Adjusted EBITDA(1) % margin

Kraton

Arizona Chemical

Pro forma Kraton

$831

$1,893

Based on run-rate pre-tax synergies ($65m)

$420 22.2%

$168

15.8%

$187

22.5%

Based on pre-tax run-rate synergies ($65m)

$317 75.7%

$104

61.9%

$148

79.2% ($ in millions)

PF 2014 sales by geography Americas 39%

EMEA 34%

Asia Pacific 27%

Americas 47%

Europe 41%

Asia Pacific 12%

Americas 42%

EMEA 38%

Asia Pacific 20%

(1) See appendix for a reconciliation of GAAP financial measures to non -GAAP financial measures.

(2) Kraton capex excludes KFPC JV capex.

The Acquisition will create a combined company with significantly increased scope and scale of operations.

Arizona Chemical has stable historical Adjusted EBITDA(1) and unlevered free cash flow(1).

With a strong record of 20+% Adjusted EBITDA(1) margins over the past five years and low capital expenditure requirements, Arizona Chemical will contribute to further stabilize and improve free cash flow.

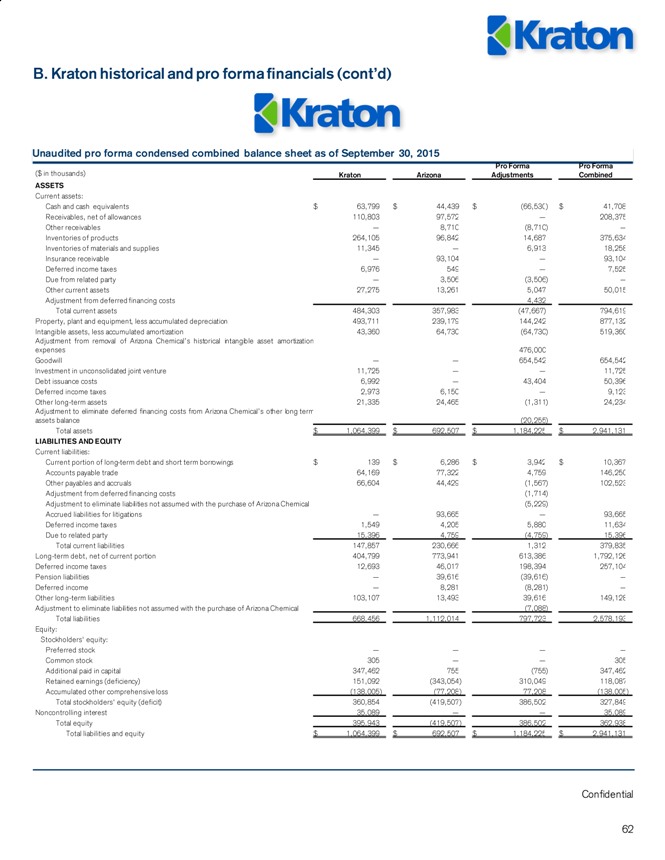

Post Acquisition, pro forma TTM September 30, 2015 sales would have increased by 78.3% to $1,893 million, and pro forma TTM September 30, 2015 Adjusted EBITDA(1) (including estimated synergies) would have increased by 150.0% to $420 million.

Kraton’s post Acquisition pro forma TTM September 30, 2015 unlevered free cash flow(1)(2) conversion would have improved from 61.9% to 75.7%, and Kraton expects that ~$450 million of its operating cash flow will be used repay debt over the next three years.

Confidential

11

The combination of Kraton and Arizona Chemical creates a combined company with an expanded global footprint

Kraton’s acquisition of Arizona Chemical will create a global leader of high quality products and innovations in both the highly-engineered polymer and non-hydrocarbon, renewable raw materials specialty chemicals space. The combination will significantly increase the scope and scale of operations. Kraton expects that the Acquisition will enhance its market leadership position, which will improve competitiveness across existing businesses allowing Kraton to expand into new markets and product lines as the incumbent market leader, with a combination of technical capabilities and global footprint that is unparalleled in the SBC and pine chemicals industry. Wesseling, Germany Manufacturing Facility Berre, France Manufacturing Facility Belpre, OH Manufacturing Facility Paulinia, Brazil Manufacturing Facility Mailiao, Taiwan HSBC Plant under construction through KFPC JV Kashima, Japan JV Manufacturing Facility Dover, OH Manufacturing Facility Savannah, GA Manufacturing Facility “BLS” acidulation capabilities Pensacola, FL Manufacturing Facility Panama City, FL Manufacturing Facility “BLS” acidulation capabilities Niort, France Manufacturing Facility Sandarne, Sweden Manufacturing Facility Oulu, Finland Manufacturing Facility Gersthofen, Germany Manufacturing Facility Arizona Kraton Kraton Corporate HQ Location Arizona refineries located in close proximity to some of the world’s largest kraft pulp supplies

The combined company will have a broad manufacturing footprint and production capabilities. At the closing of the Acquisition, the combined company will operate 14 manufacturing plants with refineries that are strategically located in proximity of raw material sources. Additionally, at the closing of the Acquisition, there will be 10 innovation R&D and technical support centers and 13 sales offices to facilitate product development and capitalize on sales opportunities.

The manufacturing and production footprint will allow revenue diversity, both geographically and by end use market. This global manufacturing footprint will be complemented by a broad network of sales offices in North America, Latin America, Europe and Asia, enabling the combined company to seamlessly serve its customers worldwide.

Note: BLS defined as Black Liquor Soap.

Confidential

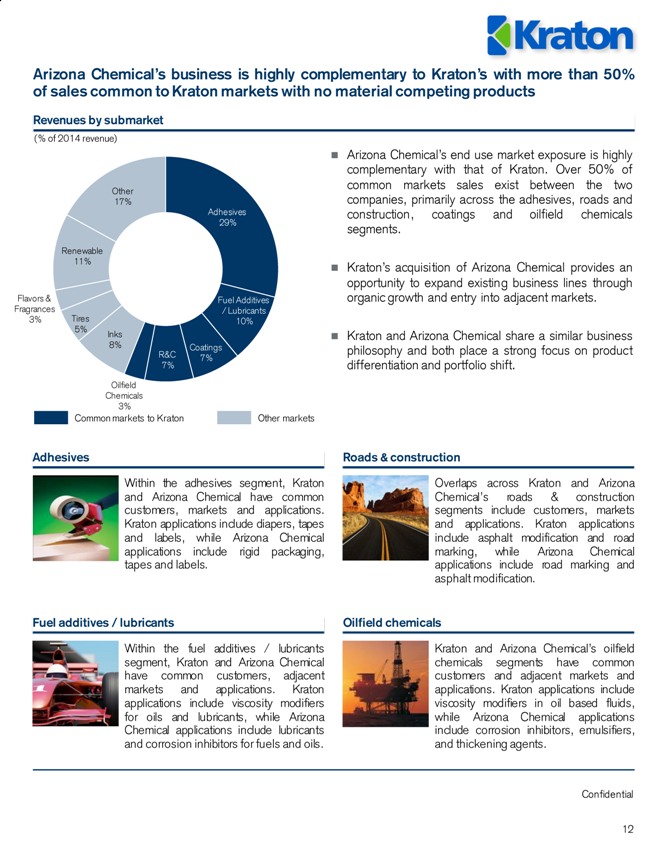

12 Adhesives 29%

Fuel Additives / Lubricants 10%

Coatings 7%

R&C 7%

Oilfield Chemicals 3%

Inks 8%

Tires 5%

Flavors & Fragrances 3%

Renewable 11%

Other 17%

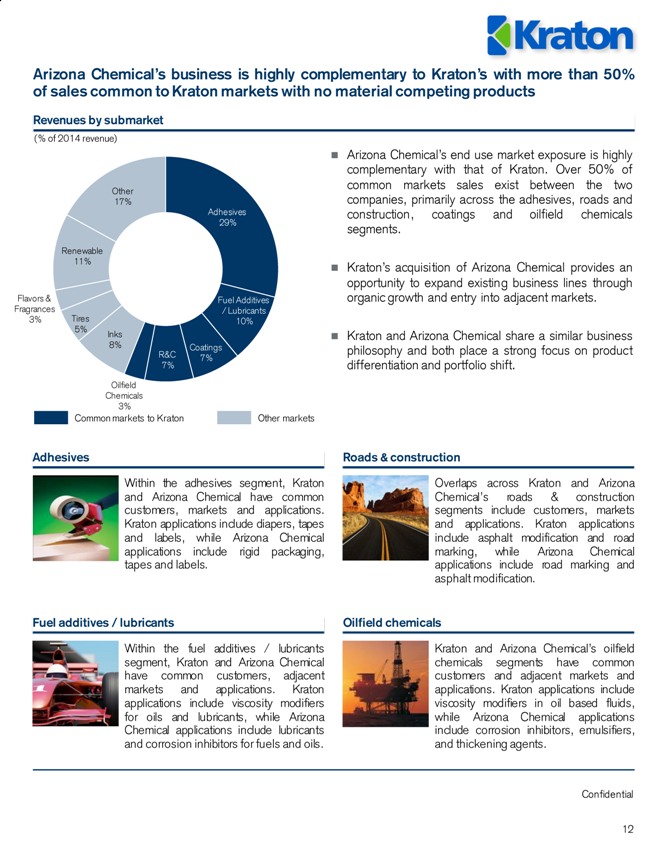

Arizona Chemical’s business is highly complementary to Kraton’s with more than 50% of sales common to Kraton markets with no material competing products

Adhesives

Revenues by submarket

(% of 2014 revenue)

Within the adhesives segment, Kraton and Arizona Chemical have common customers, markets and applications. Kraton applications include diapers, tapes and labels, while Arizona Chemical applications include rigid packaging, tapes and labels.

Common markets to Kraton

Other markets

Arizona Chemical’s end use market exposure is highly complementary with that of Kraton. Over 50% of common markets sales exist between the two companies, primarily across the adhesives, roads and construction, coatings and oilfield chemicals segments.

Kraton’s acquisition of Arizona Chemical provides an opportunity to expand existing business lines through organic growth and entry into adjacent markets.

Kraton and Arizona Chemical share a similar business philosophy and both place a strong focus on product differentiation and portfolio shift.

Roads & construction

Overlaps across Kraton and Arizona Chemical’s roads & construction segments include customers, markets and applications. Kraton applications include asphalt modification and road marking, while Arizona Chemical applications include road marking and asphalt modification.

Fuel additives / lubricants

Oilfield chemicals

Within the fuel additives / lubricants segment, Kraton and Arizona Chemical have common customers, adjacent markets and applications. Kraton applications include viscosity modifiers for oils and lubricants, while Arizona Chemical applications include lubricants and corrosion inhibitors for fuels and oils.

Kraton and Arizona Chemical’s oilfield chemicals segments have common customers and adjacent markets and applications. Kraton applications include viscosity modifiers in oil based fluids, while Arizona Chemical applications include corrosion inhibitors, emulsifiers, and thickening agents.

Confidential

13

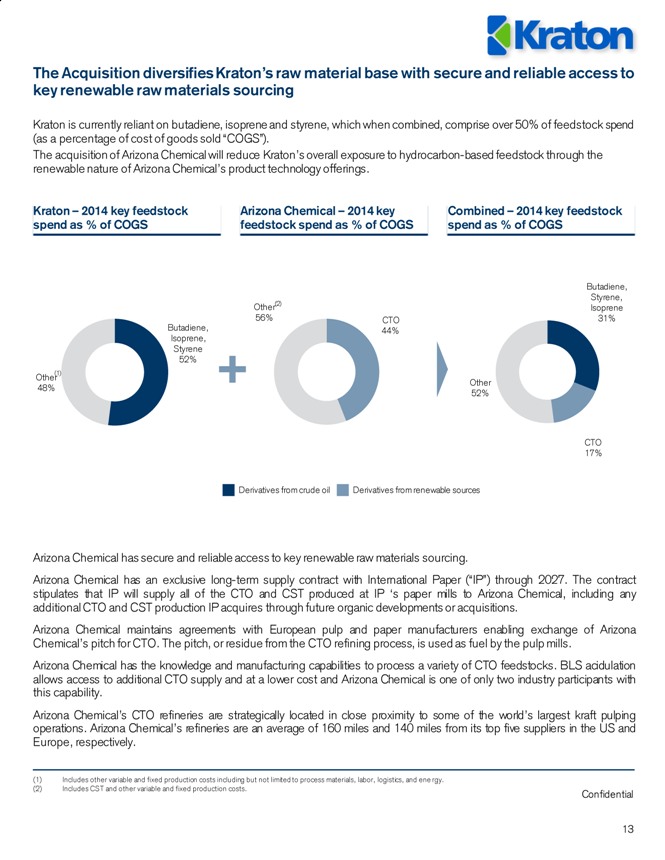

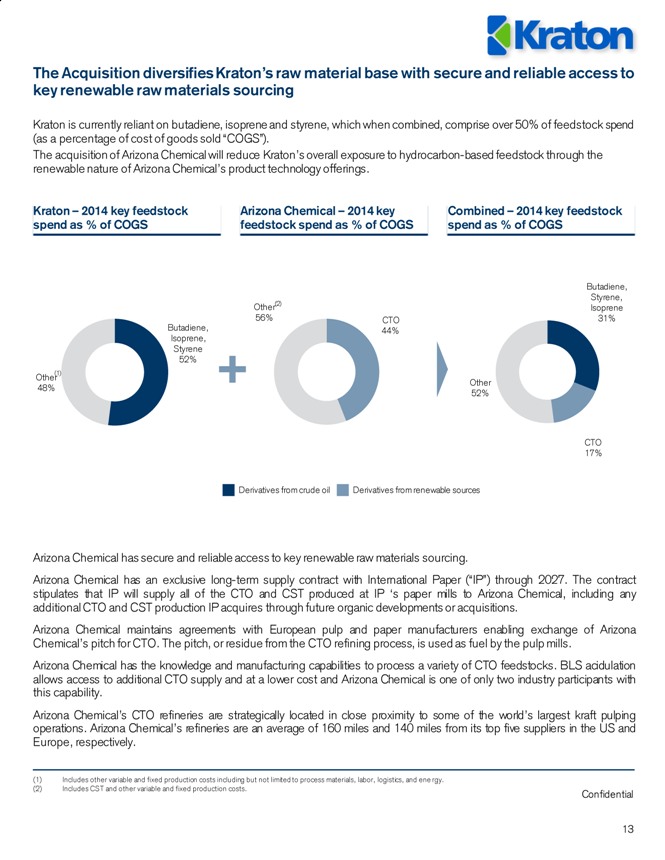

Combined – 2014 key feedstock spend as % of COGS

Arizona Chemical – 2014 key feedstock spend as % of COGS

Kraton – 2014 key feedstock spend as % of COGS

Butadiene, Isoprene, Styrene 52%

Other 48%

(1)

CTO 44%

Other 56%

(2)

Butadiene, Styrene, Isoprene 31%

CTO 17%

Other 52%

Derivatives from crude oil

Derivatives from renewable sources

The Acquisition diversifies Kraton’s raw material base with secure and reliable access to key renewable raw materials sourcing

Kraton is currently reliant on butadiene, isoprene and styrene, which when combined, comprise over 50% of feedstock spend (as a percentage of cost of goods sold “COGS”).

The acquisition of Arizona Chemical will reduce Kraton’s overall exposure to hydrocarbon-based feedstock through the renewable nature of Arizona Chemical’s product technology offerings.

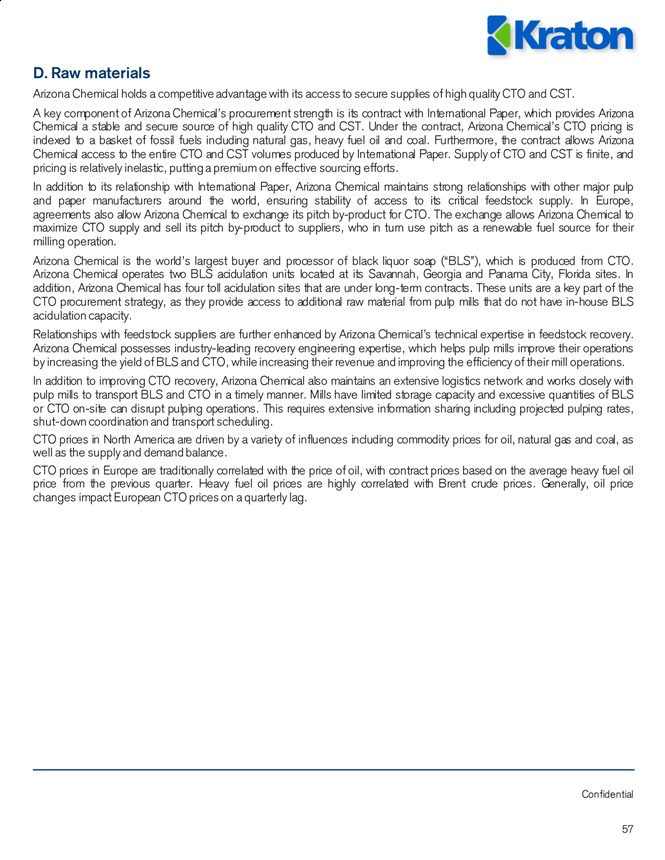

Arizona Chemical has secure and reliable access to key renewable raw materials sourcing.

Arizona Chemical has an exclusive long-term supply contract with International Paper (“IP”) through 2027. The contract stipulates that IP will supply all of the CTO and CST produced at IP ‘s paper mills to Arizona Chemical, including any additional CTO and CST production IP acquires through future organic developments or acquisitions.

Arizona Chemical maintains agreements with European pulp and paper manufacturers enabling exchange of Arizona Chemical’s pitch for CTO. The pitch, or residue from the CTO refining process, is used as fuel by the pulp mills.

Arizona Chemical has the knowledge and manufacturing capabilities to process a variety of CTO feedstocks. BLS acidulation allows access to additional CTO supply and at a lower cost and Arizona Chemical is one of only two industry participants with this capability.

Arizona Chemical’s CTO refineries are strategically located in close proximity to some of the world’s largest kraft pulping operations. Arizona Chemical’s refineries are an average of 160 miles and 140 miles from its top five suppliers in the US and Europe, respectively.

(1) Includes other variable and fixed production costs including but not limited to process materials, labor, logistics, and ene rgy.

(2) Includes CST and other variable and fixed production costs.

Confidential

14

(1) See appendix for a reconciliation of GAAP financial measures to non -GAAP financial measures.

(2) Kraton adjusted to incorporate 50% of KFPC capex.

Stable returns independent of commodity price volatility

While Kraton and Arizona Chemical are exposed to commodity price volatility, each company has maintained stable returns in recent years despite volatility in raw material pricing.

Kraton has demonstrated the ability to improve unit margins during periods of raw material volatility by employing its “Price Right” strategy, which includes passing through changes in raw material costs and shifting the portfolio to more differentiated products.

Despite a lower commodity price environment, including a long TOFA market stemming from a record soybean harvest and a drop in the price of oil and natural gas, in addition to the stronger dollar, Arizona Chemical has maintained Adjusted EBITDA(1) margins in excess of 20% over the recent years.

As a result, both Kraton and Arizona Chemical have generated stable Adjusted EBITDA(1), margins and returns, independent of commodity prices.

$183

$128

$144

$141

$147

$168

$0.00

$0.20

$0.40

$0.60

$0.80

$1.00

$1.20

$1.40

$0

$50

$100

$150

$200

$250

2010

2011

2012

2013

2014

TTM 9/30/2015

Average butadiene price (cents/lb)

Adjusted EBITDA ($mm)

Adjusted EBITDA

Average butadiene price ($/lb)

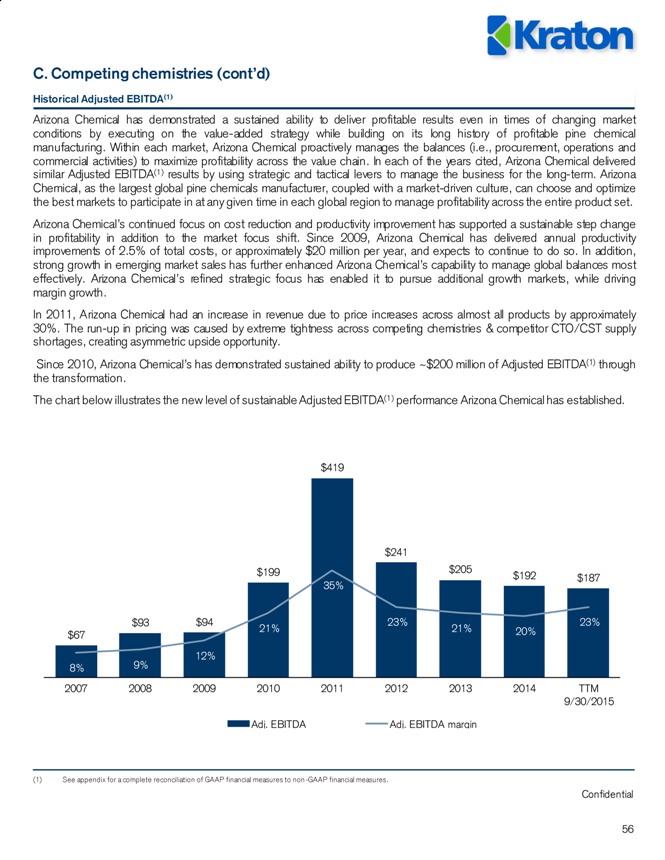

$199

$419

$241

$205

$192

$187

$0

$20

$40

$60

$80

$100

$120

$0

$100

$200

$300

$400

$500

$600

2010

2011

2012

2013

2014

TTM 9/30/2015

Average brent price ($/bbl)

Adjusted EBITDA ($mm)

Adjusted EBITDA

Average oil price (Brent $/bbl) 2010 2011 2012 2013 2014 TTM 9/30/15

Gross profit / ton(1) $651 $1093 $798 $670 $672 $667

Adjusted EBITDA margin 21% 35% 23% 21% 20% 22%

Unlevered FCF(1)(2) $164 $389 $207 $158 $157 $146

Confidential

15

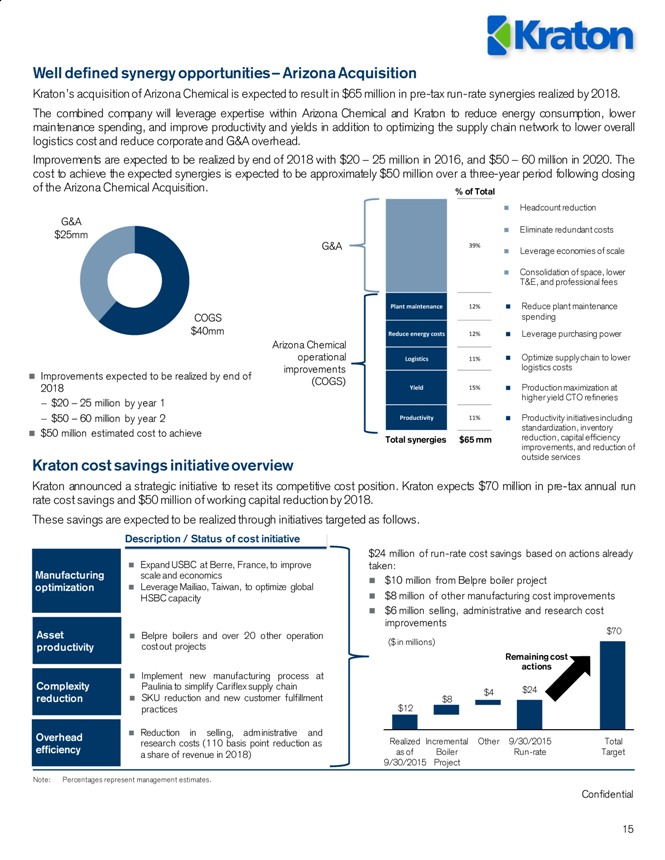

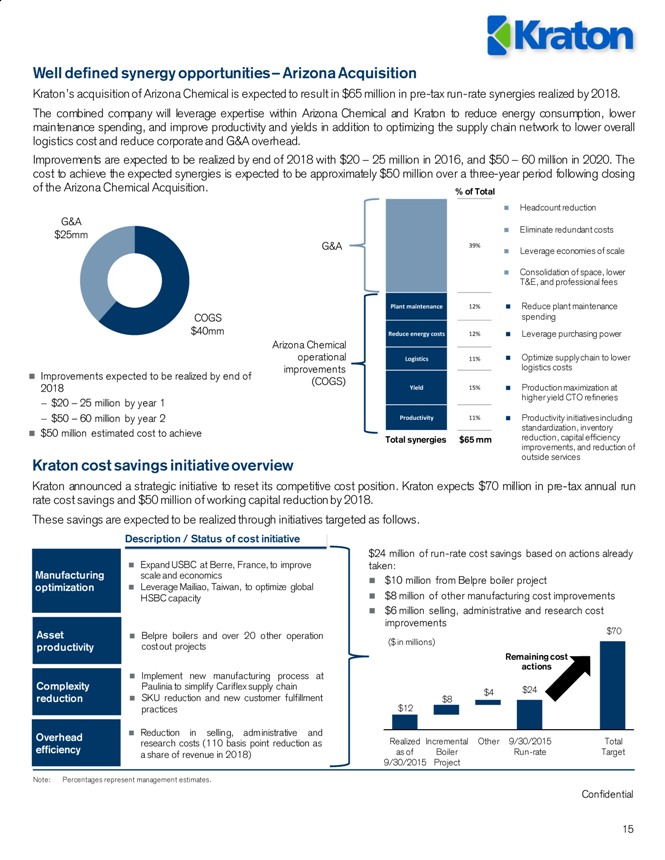

Well defined synergy opportunities – Arizona Acquisition

Kraton’s acquisition of Arizona Chemical is expected to result in $65 million in pre-tax run-rate synergies realized by 2018.

The combined company will leverage expertise within Arizona Chemical and Kraton to reduce energy consumption, lower maintenance spending, and improve productivity and yields in addition to optimizing the supply chain network to lower overall logistics cost and reduce corporate and G&A overhead.

Improvements are expected to be realized by end of 2018 with $20 – 25 million in 2016, and $50 – 60 million in 2020. The cost to achieve the expected synergies is expected to be approximately $50 million over a three-year period following closing of the Arizona Chemical Acquisition.

COGS $40mm

G&A $25mm

Reduce plant maintenance spending

Leverage purchasing power

Optimize supply chain to lower logistics costs

Production maximization at higher yield CTO refineries

Productivity initiatives including standardization, inventory reduction, capital efficiency improvements, and reduction of outside services

Arizona Chemical operational improvements

(COGS)

G&A

Headcount reduction

Eliminate redundant costs

Leverage economies of scale

Consolidation of space, lower T&E, and professional fees

Kraton cost savings initiative overview

Kraton announced a strategic initiative to reset its competitive cost position. Kraton expects $70 million in pre-tax annual run rate cost savings and $50 million of working capital reduction by 2018.

These savings are expected to be realized through initiatives targeted as follows.

Manufacturing optimization

Asset productivity

Complexity reduction

Overhead efficiency

Expand USBC at Berre, France, to improve scale and economics

Leverage Mailiao, Taiwan, to optimize global HSBC capacity

Belpre boilers and over 20 other operation cost out projects

Implement new manufacturing process at Paulinia to simplify Cariflex supply chain

SKU reduction and new customer fulfillment practices

Reduction in selling, administrative and research costs (110 basis point reduction as a share of revenue in 2018)

Description / Status of cost initiative $24 million of run-rate cost savings based on actions already taken:

$10 million from Belpre boiler project

$8 million of other manufacturing cost improvements

$6 million selling, administrative and research cost improvements

$12

$8

$4 $24 $70 Realized as of 9/30/2015 Incremental Boiler Project

Other 9/30/2015 Run-rate

Total Target

Remaining cost actions

($ in millions)

Improvements expected to be realized by end of 2018

$20 – 25 million by year 1

$50 – 60 million by year 2

$50 million estimated cost to achieve

Plant maintenance 12% Reduce energy costs 12% Logistics 11% Yield 15% Productivity 11% 39%

Total synergies

$65 mm

Note: Percentages represent management estimates.

% of Total

Confidential

16

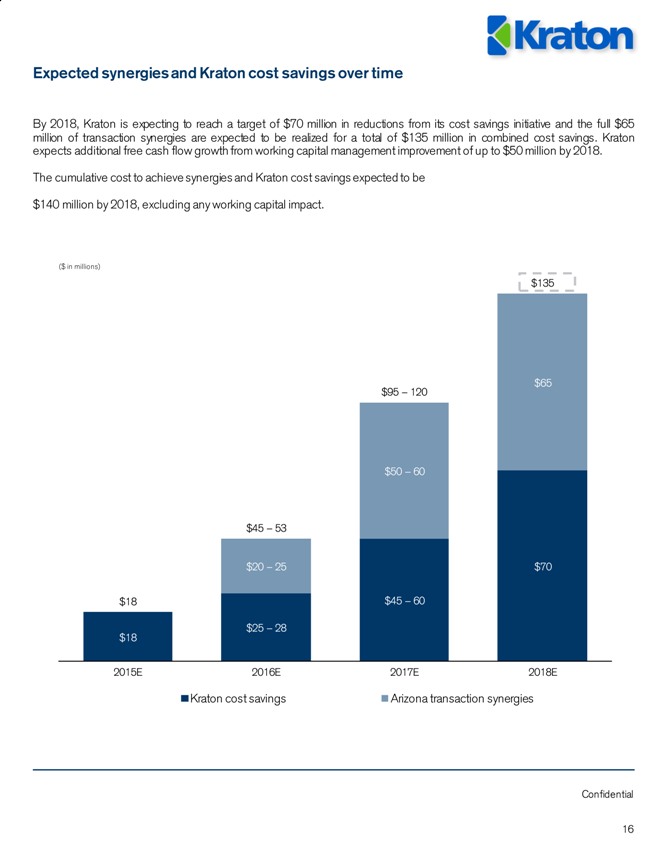

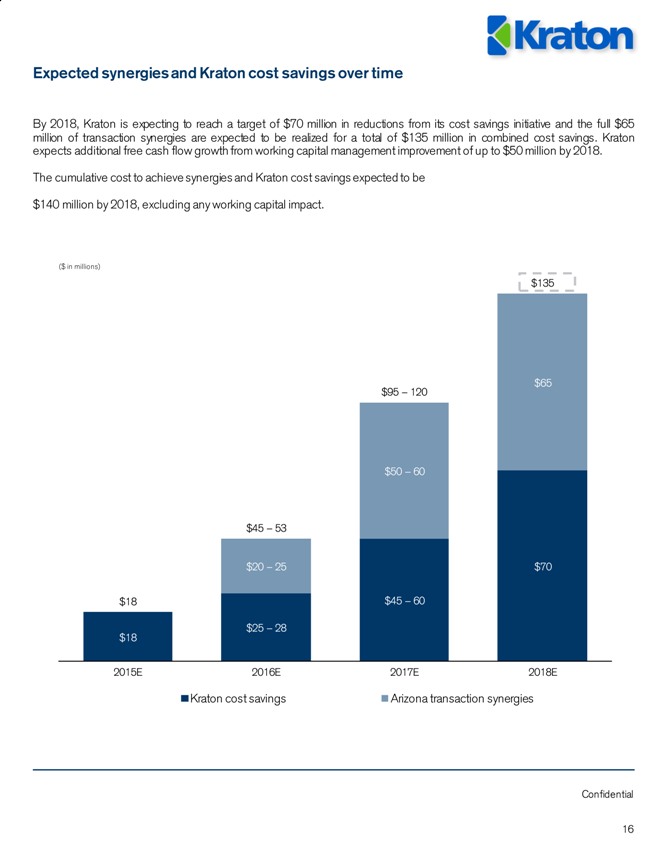

Expected synergies and Kraton cost savings over time

$18

$25 – 28

$45 – 60 $70

$20 – 25

$50 – 60 $65

$18

$45 – 53

$95 – 120 $135

2015E 2016E 2017E

2018E

Kraton cost savings

Arizona transaction synergies

($ in millions)

By 2018, Kraton is expecting to reach a target of $70 million in reductions from its cost savings initiative and the full $65 million of transaction synergies are expected to be realized for a total of $135 million in combined cost savings. Kraton expects additional free cash flow growth from working capital management improvement of up to $50 million by 2018.

The cumulative cost to achieve synergies and Kraton cost savings expected to be

$140 million by 2018, excluding any working capital impact.

Confidential

17

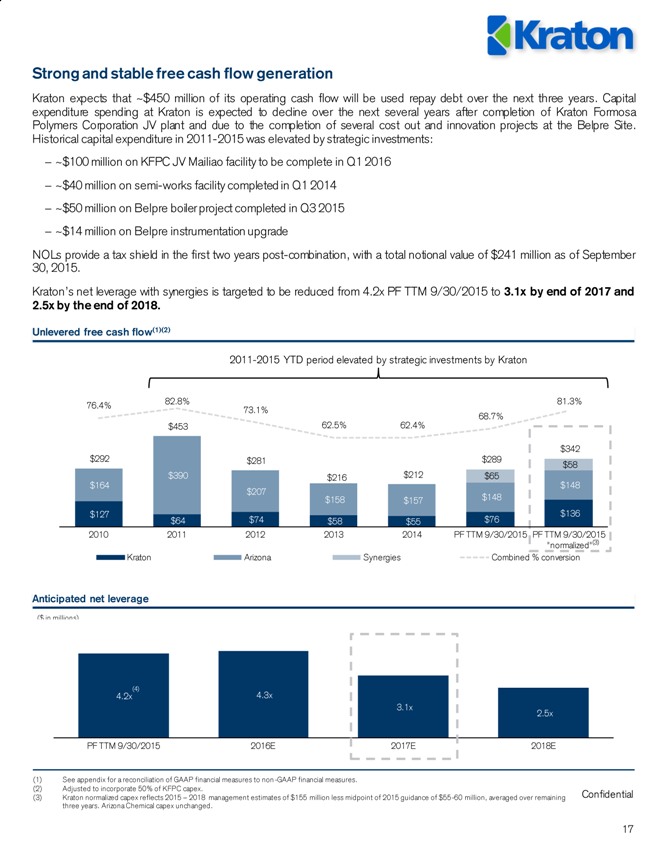

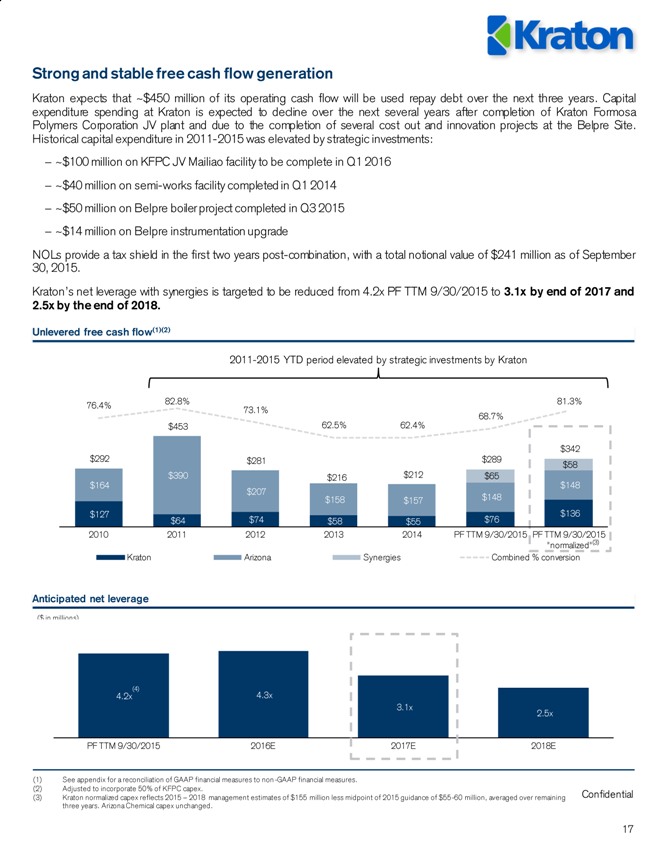

Strong and stable free cash flow generation

Kraton expects that ~$450 million of its operating cash flow will be used repay debt over the next three years. Capital expenditure spending at Kraton is expected to decline over the next several years after completion of Kraton Formosa Polymers Corporation JV plant and due to the completion of several cost out and innovation projects at the Belpre Site. Historical capital expenditure in 2011-2015 was elevated by strategic investments:

? ~$100 million on KFPC JV Mailiao facility to be complete in Q1 2016

? ~$40 million on semi-works facility completed in Q1 2014

? ~$50 million on Belpre boiler project completed in Q3 2015

? ~$14 million on Belpre instrumentation upgrade

NOLs provide a tax shield in the first two years post-combination, with a total notional value of $241 million as of September 30, 2015.

Kraton’s net leverage with synergies is targeted to be reduced from 4.2x PF TTM 9/30/2015 to 3.1x by end of 2017 and 2.5x by the end of 2018.

Unlevered free cash flow(1)(2)

Anticipated net leverage

4.2x

4.3x

3.1x 2.5x

PF TTM 9/30/2015

2016E

2017E

2018E

($ in millions)

(1) See appendix for a reconciliation of GAAP financial measures to non -GAAP financial measures.

(2) Adjusted to incorporate 50% of KFPC capex.

(3) Kraton normalized capex reflects 2015 – 2018 management estimates of $155 million less midpoint of 2015 guidance of $55-60 million, averaged over remaining three years. Arizona Chemical capex unchanged.

2011-2015 YTD period elevated by strategic investments by Kraton

(3)

(4)

$127

$64

$74

$58

$55

$76 $136

$164

$390

$207

$158

$157

$148

$148

$65

$58

$292

$453

$281

$216

$212

$289 $342

76.4%

82.8%

73.1%

62.5%

62.4%

68.7%

81.3%

2010

2011

2012

2013

2014

PF TTM 9/30/2015

PF TTM 9/30/2015 “normalized”

Kraton Arizona

Synergies

Combined % conversion

Confidential 18

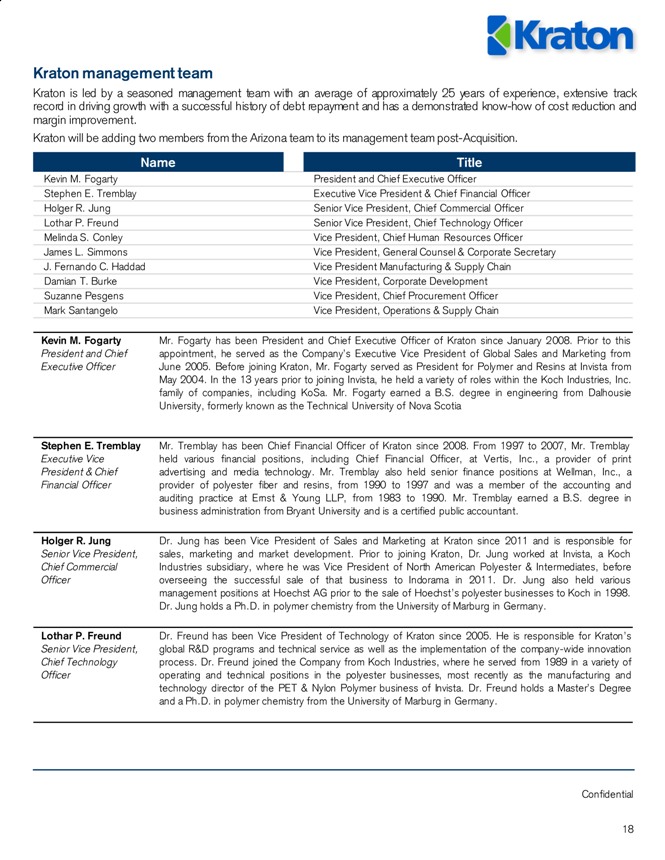

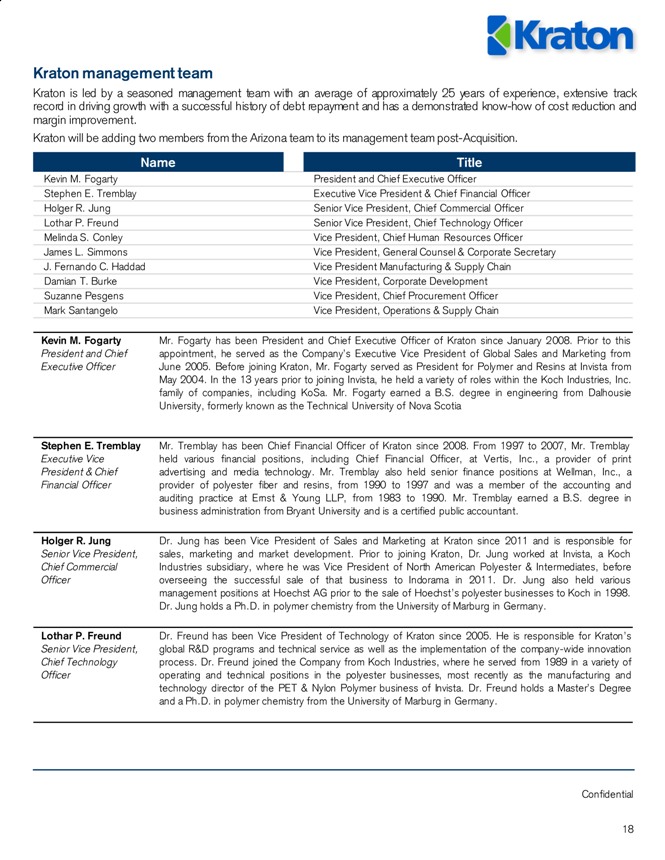

Kraton management team

Kraton is led by a seasoned management team with an average of approximately 25 years of experience, extensive track record in driving growth with a successful history of debt repayment and has a demonstrated know-how of cost reduction and margin improvement.

Kraton will be adding two members from the Arizona team to its management team post-Acquisition. Kevin M. Fogarty President and Chief Executive Officer

Stephen E. Tremblay Executive Vice President & Chief Financial Officer

Holger R. Jung Senior Vice President, Chief Commercial Officer

Lothar P. Freund Senior Vice President, Chief Technology Officer

Melinda S. Conley Vice President, Chief Human Resources Officer

James L. Simmons Vice President, General Counsel & Corporate Secretary

J. Fernando C. Haddad Vice President Manufacturing & Supply Chain

Damian T. Burke Vice President, Corporate Development

Suzanne Pesgens Vice President, Chief Procurement Officer

Mark Santangelo Vice President, Operations & Supply Chain

Confidential

19

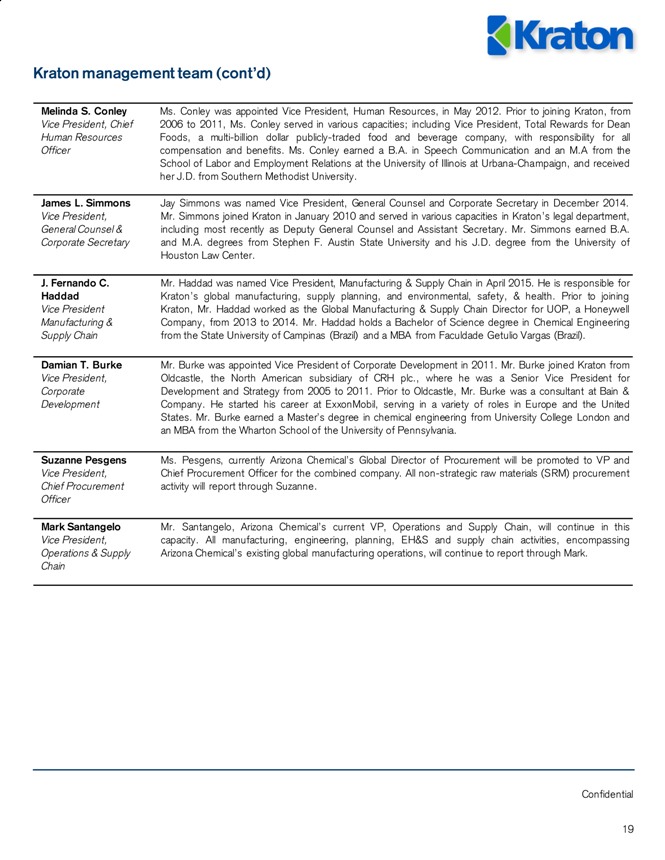

Kraton management team (cont’d) Melinda S. Conley

Vice President, Chief Human Resources Officer Ms. Conley was appointed Vice President, Human Resources, in May 2012. Prior to joining Kraton, from 2006 to 2011, Ms. Conley served in various capacities; including Vice President, Total Rewards for Dean Foods, a multi-billion dollar publicly-traded food and beverage company, with responsibility for all compensation and benefits. Ms. Conley earned a B.A. in Speech Communication and an M.A from the School of Labor and Employment Relations at the University of Illinois at Urbana-Champaign, and received her J.D. from Southern Methodist University.

James L. Simmons

Vice President, General Counsel & Corporate Secretary Jay Simmons was named Vice President, General Counsel and Corporate Secretary in December 2014. Mr. Simmons joined Kraton in January 2010 and served in various capacities in Kraton’s legal department, including most recently as Deputy General Counsel and Assistant Secretary. Mr. Simmons earned B.A. and M.A. degrees from Stephen F. Austin State University and his J.D. degree from the University of Houston Law Center.

J. Fernando C. Haddad

Vice President Manufacturing & Supply Chain Mr. Haddad was named Vice President, Manufacturing & Supply Chain in April 2015. He is responsible for Kraton’s global manufacturing, supply planning, and environmental, safety, & health. Prior to joining Kraton, Mr. Haddad worked as the Global Manufacturing & Supply Chain Director for UOP, a Honeywell Company, from 2013 to 2014. Mr. Haddad holds a Bachelor of Science degree in Chemical Engineering from the State University of Campinas (Brazil) and a MBA from Faculdade Getulio Vargas (Brazil).

Damian T. Burke

Vice President, Corporate Development Mr. Burke was appointed Vice President of Corporate Development in 2011. Mr. Burke joined Kraton from Oldcastle, the North American subsidiary of CRH plc., where he was a Senior Vice President for Development and Strategy from 2005 to 2011. Prior to Oldcastle, Mr. Burke was a consultant at Bain & Company. He started his career at ExxonMobil, serving in a variety of roles in Europe and the United States. Mr. Burke earned a Master’s degree in chemical engineering from University College London and an MBA from the Wharton School of the University of Pennsylvania.

Suzanne Pesgens

Vice President,

Chief Procurement Officer Ms. Pesgens, currently Arizona Chemical’s Global Director of Procurement will be promoted to VP and Chief Procurement Officer for the combined company. All non-strategic raw materials (SRM) procurement activity will report through Suzanne.

Mark Santangelo

Vice President,

Operations & Supply Chain Mr. Santangelo, Arizona Chemical’s current VP, Operations and Supply Chain, will continue in this capacity. All manufacturing, engineering, planning, EH&S and supply chain activities, encompassing Arizona Chemical’s existing global manufacturing operations, will continue to report through Mark.

Kraton

Confidential 20

IV. Company overview

Kraton

Confidential 21

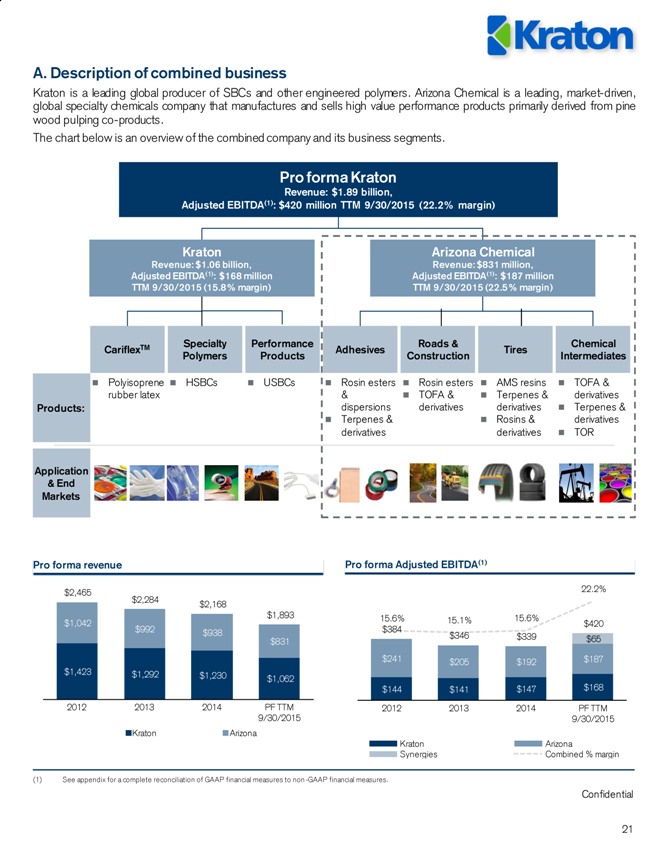

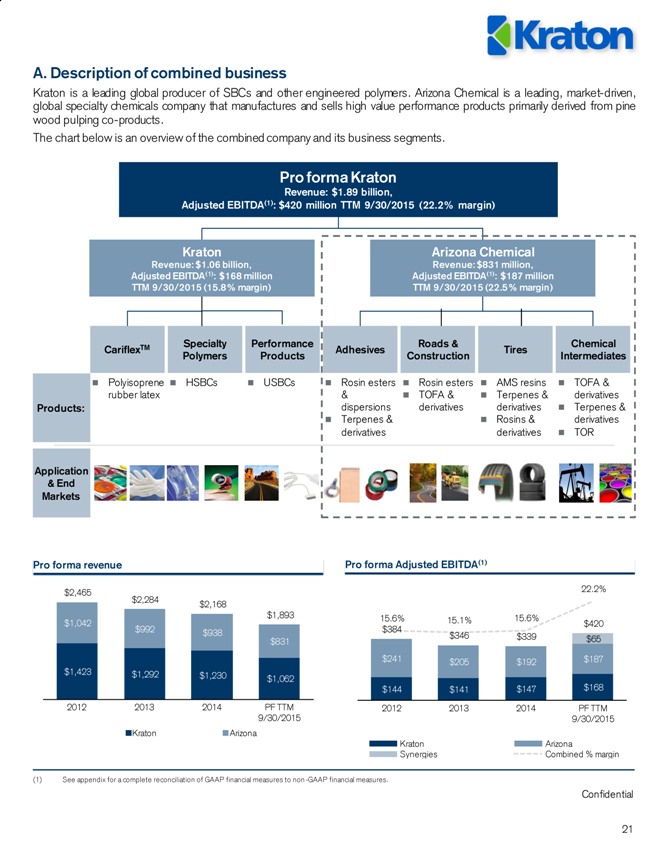

A. Description of combined business

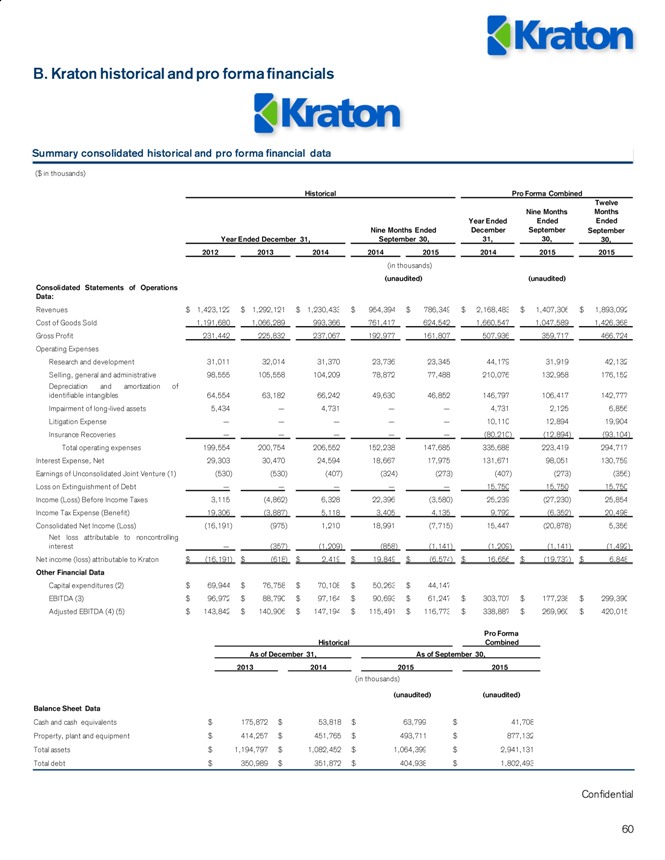

Kraton is a leading global producer of SBCs and other engineered polymers. Arizona Chemical is a leading, market-driven, global specialty chemicals company that manufactures and sells high value performance products primarily derived from pine wood pulping co-products.

The chart below is an overview of the combined company and its business segments.

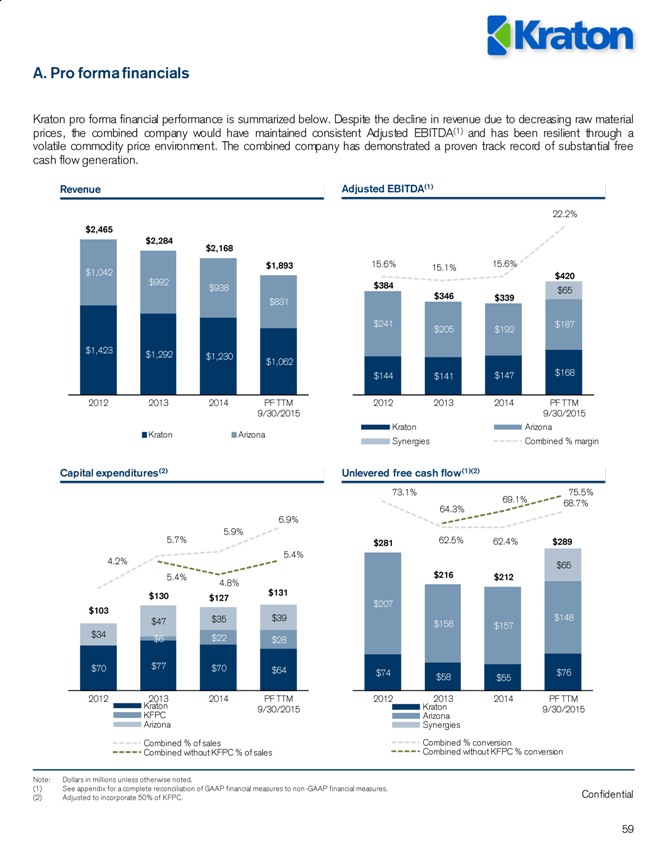

Pro forma revenue

Pro forma Adjusted EBITDA(1) Pro forma Kraton Revenue: $1.89 billion, Adjusted EBITDA(1): $420 million TTM 9/30/2015 (22.2% margin)

Arizona Chemical

Revenue: $831 million,

Adjusted EBITDA(1): $187 million

TTM 9/30/2015 (22.5% margin)

Specialty Polymers

CariflexTM

Performance Products

Adhesives

Roads & Construction Tires Chemical Intermediates Products: Application & End Markets

HSBCs

Polyisoprene rubber latex

USBCs

Rosin esters & dispersions

Terpenes & derivatives

Rosin esters

TOFA & derivatives

AMS resins

Terpenes & derivatives

Rosins & derivatives

TOFA & derivatives

Terpenes & derivatives

TOR

Kraton

Revenue: $1.06 billion,

Adjusted EBITDA(1): $168 million

TTM 9/30/2015 (15.8% margin) $1,423 $1,292 $1,230

$1,062

$1,042

$992 $938 $831 $2,465 $2,284

$2,168

$1,893 2012 2013 2014 PF TTM 9/30/2015 Kraton Arizona

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures.

$144

$141 $147 $168 $241 $205

$192

$187 $65 $384 $346 $339 $420 15.6%

15.1% 15.6%

22.2%

2012 2013 2014 PF TTM 9/30/2015 Kraton

Arizona

Synergies Combined % margin

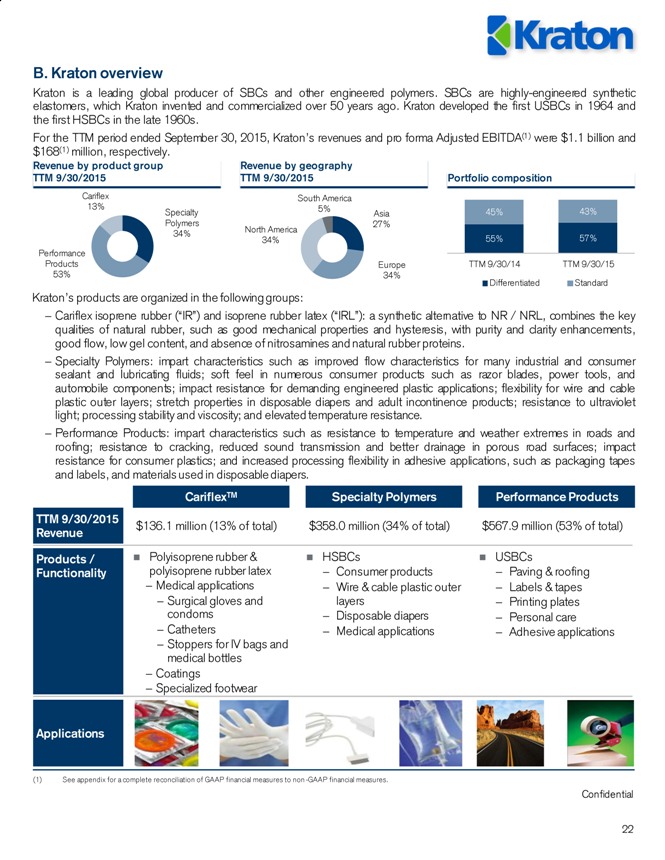

Confidential 22 CariflexTM Specialty Polymers Performance Products

TTM 9/30/2015 Revenue Products / Functionality Applications

$136.1 million (13% of total)

$358.0 million (34% of total)

$567.9 million (53% of total)

Polyisoprene rubber & polyisoprene rubber latex

Medical applications

Surgical gloves and condoms

Catheters

Stoppers for IV bags and medical bottles

Coatings

Specialized footwear

HSBCs

Consumer products

Wire & cable plastic outer layers

Disposable diapers

Medical applications

USBCs

Paving & roofing

Labels & tapes

Printing plates

Personal care

Adhesive applications

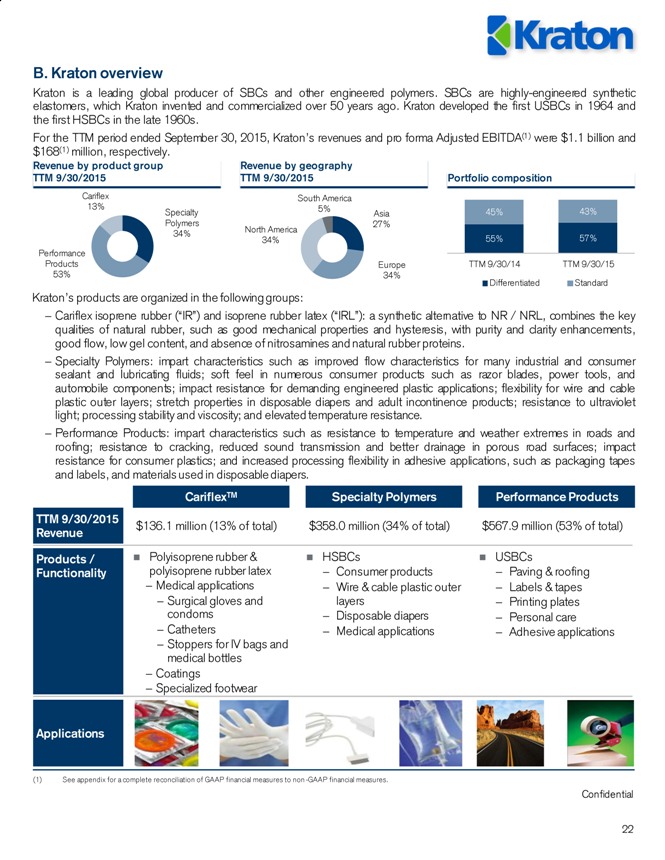

B. Kraton overview

Kraton is a leading global producer of SBCs and other engineered polymers. SBCs are highly-engineered synthetic elastomers, which Kraton invented and commercialized over 50 years ago. Kraton developed the first USBCs in 1964 and the first HSBCs in the late 1960s.

For the TTM period ended September 30, 2015, Kraton’s revenues and pro forma Adjusted EBITDA(1) were $1.1 billion and $168(1) million, respectively.

Kraton’s products are organized in the following groups:

Cariflex isoprene rubber (“IR”) and isoprene rubber latex (“IRL”): a synthetic alternative to NR / NRL, combines the key qualities of natural rubber, such as good mechanical properties and hysteresis, with purity and clarity enhancements, good flow, low gel content, and absence of nitrosamines and natural rubber proteins.

Specialty Polymers: impart characteristics such as improved flow characteristics for many industrial and consumer sealant and lubricating fluids; soft feel in numerous consumer products such as razor blades, power tools, and automobile components; impact resistance for demanding engineered plastic applications; flexibility for wire and cable plastic outer layers; stretch properties in disposable diapers and adult incontinence products; resistance to ultraviolet light; processing stability and viscosity; and elevated temperature resistance.

Performance Products: impart characteristics such as resistance to temperature and weather extremes in roads and roofing; resistance to cracking, reduced sound transmission and better drainage in porous road surfaces; impact resistance for consumer plastics; and increased processing flexibility in adhesive applications, such as packaging tapes and labels, and materials used in disposable diapers.

Portfolio composition

55%

57%

45% 43% TTM 9/30/14 TTM 9/30/15

Differentiated Standard

Revenue by geography

TTM 9/30/2015

Revenue by product group

TTM 9/30/2015

Asia 27% Europe 34% North America 34%

South America 5% 39% Specialty Polymers 34%

Performance Products 53%

Cariflex 13%

(1) See appendix for a complete reconciliation of GAAP financial measures to non -GAAP financial measures.

Kraton

Confidential 23

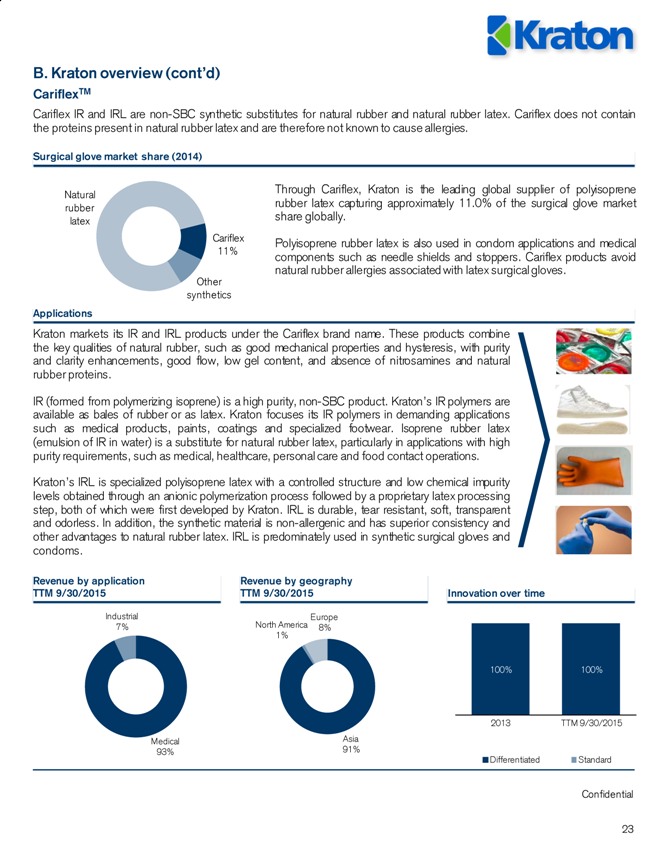

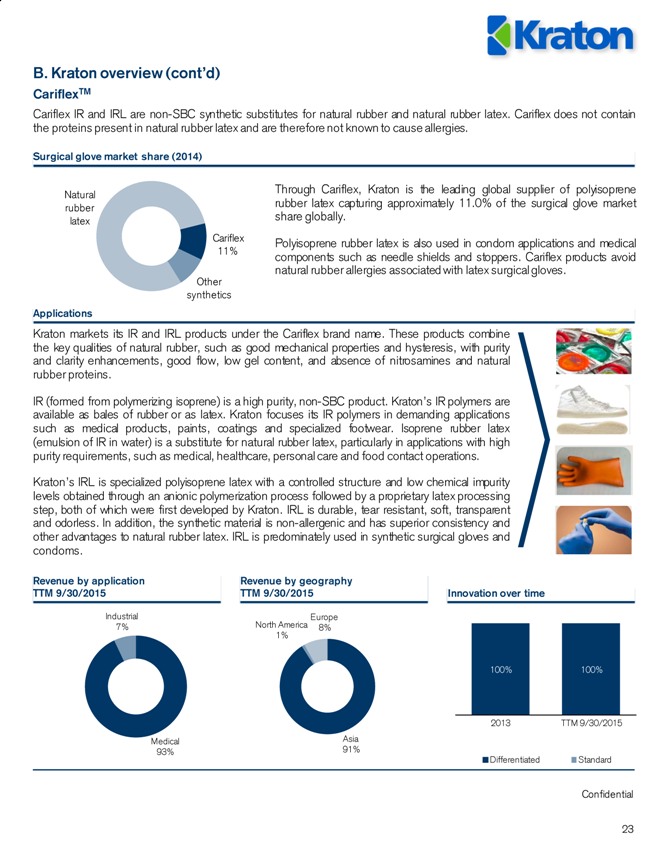

B. Kraton overview (cont’d)

CariflexTM

Cariflex IR and IRL are non-SBC synthetic substitutes for natural rubber and natural rubber latex. Cariflex does not contain the proteins present in natural rubber latex and are therefore not known to cause allergies.

Revenue by application

TTM 9/30/2015

Revenue by geography

TTM 9/30/2015

Surgical glove market share (2014)

Through Cariflex, Kraton is the leading global supplier of polyisoprene rubber latex capturing approximately 11.0% of the surgical glove market share globally.

Polyisoprene rubber latex is also used in condom applications and medical components such as needle shields and stoppers. Cariflex products avoid natural rubber allergies associated with latex surgical gloves.

Applications

Innovation over time

Cariflex 11%

Other synthetics

Natural rubber latex

Kraton markets its IR and IRL products under the Cariflex brand name. These products combine the key qualities of natural rubber, such as good mechanical properties and hysteresis, with purity and clarity enhancements, good flow, low gel content, and absence of nitrosamines and natural rubber proteins.

IR (formed from polymerizing isoprene) is a high purity, non-SBC product. Kraton’s IR polymers are available as bales of rubber or as latex. Kraton focuses its IR polymers in demanding applications such as medical products, paints, coatings and specialized footwear. Isoprene rubber latex (emulsion of IR in water) is a substitute for natural rubber latex, particularly in applications with high purity requirements, such as medical, healthcare, personal care and food contact operations.

Kraton’s IRL is specialized polyisoprene latex with a controlled structure and low chemical impurity levels obtained through an anionic polymerization process followed by a proprietary latex processing step, both of which were first developed by Kraton. IRL is durable, tear resistant, soft, transparent and odorless. In addition, the synthetic material is non-allergenic and has superior consistency and other advantages to natural rubber latex. IRL is predominately used in synthetic surgical gloves and condoms. Medical 93% Industrial 7%

Asia 91%

North America 1%

Europe 8%

100%

100%

2013

TTM 9/30/2015 Differentiated

Standard

Kraton

Confidential

24

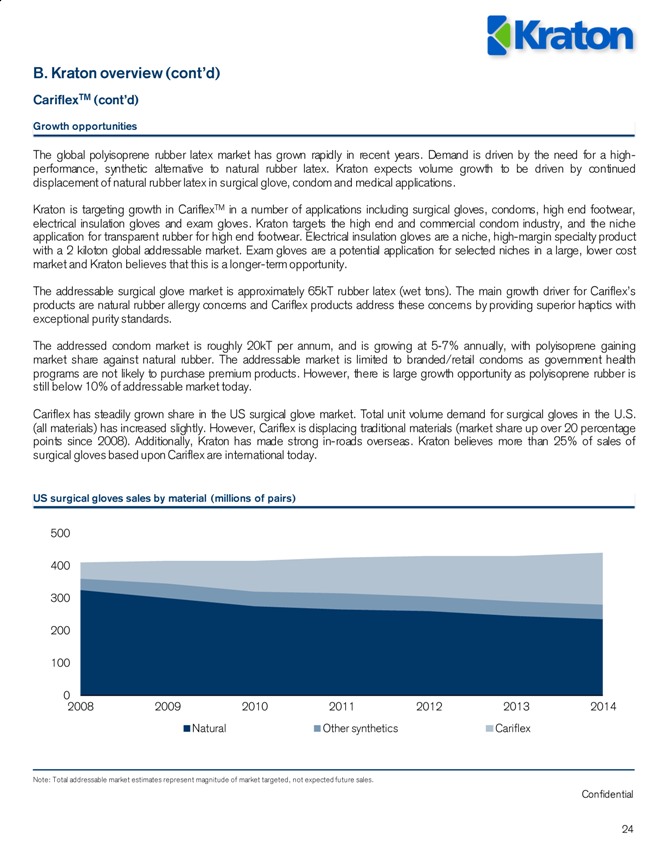

B. Kraton overview (cont’d)

CariflexTM (cont’d)

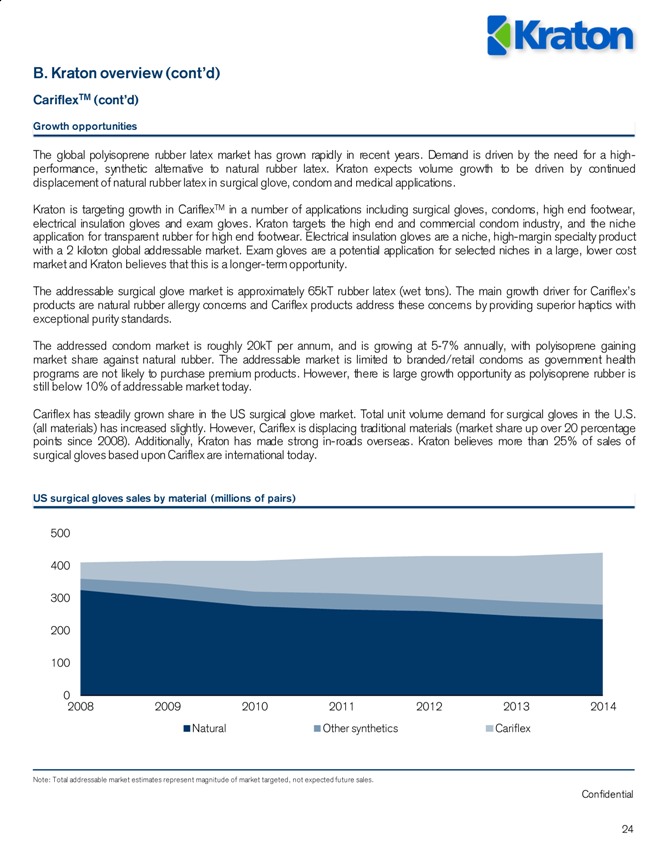

The global polyisoprene rubber latex market has grown rapidly in recent years. Demand is driven by the need for a high-performance, synthetic alternative to natural rubber latex. Kraton expects volume growth to be driven by continued displacement of natural rubber latex in surgical glove, condom and medical applications.

Kraton is targeting growth in CariflexTM in a number of applications including surgical gloves, condoms, high end footwear, electrical insulation gloves and exam gloves. Kraton targets the high end and commercial condom industry, and the niche application for transparent rubber for high end footwear. Electrical insulation gloves are a niche, high-margin specialty product with a 2 kiloton global addressable market. Exam gloves are a potential application for selected niches in a large, lower cost market and Kraton believes that this is a longer-term opportunity.

The addressable surgical glove market is approximately 65kT rubber latex (wet tons). The main growth driver for Cariflex’s products are natural rubber allergy concerns and Cariflex products address these concerns by providing superior haptics with exceptional purity standards.

The addressed condom market is roughly 20kT per annum, and is growing at 5?7% annually, with polyisoprene gaining market share against natural rubber. The addressable market is limited to branded/retail condoms as government health programs are not likely to purchase premium products. However, there is large growth opportunity as polyisoprene rubber is still below 10% of addressable market today.

Cariflex has steadily grown share in the US surgical glove market. Total unit volume demand for surgical gloves in the U.S. (all materials) has increased slightly. However, Cariflex is displacing traditional materials (market share up over 20 percentage points since 2008). Additionally, Kraton has made strong in-roads overseas. Kraton believes more than 25% of sales of surgical gloves based upon Cariflex are international today.

Note: Total addressable market estimates represent magnitude of market targeted, not expected future sales.

Growth opportunities

0

100

200

300

400

500

2008

2009

2010

2011 2012

2013

2014 Natural

Other synthetics

Cariflex

US surgical gloves sales by material (millions of pairs)

Kraton

Confidential

25

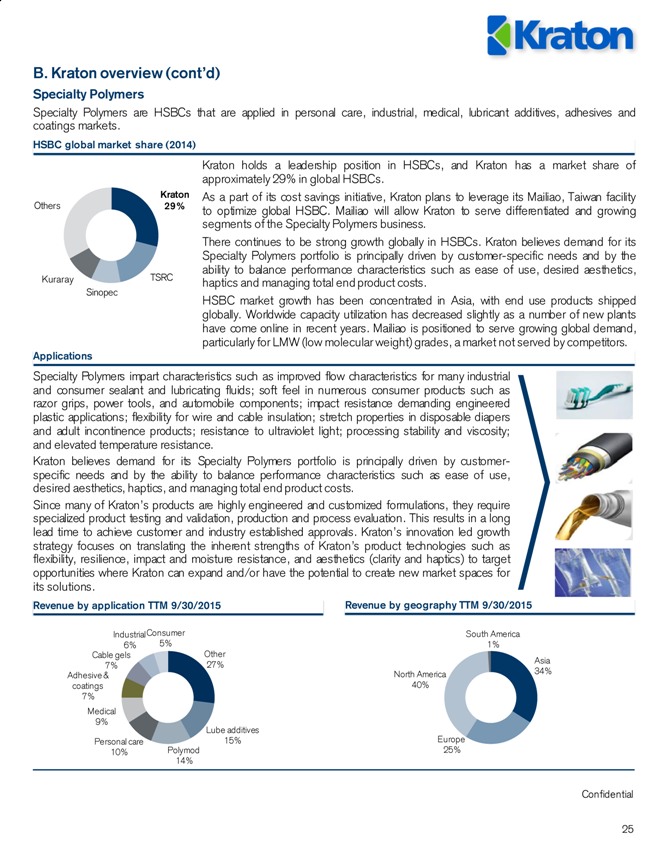

B. Kraton overview (cont’d)

Specialty Polymers

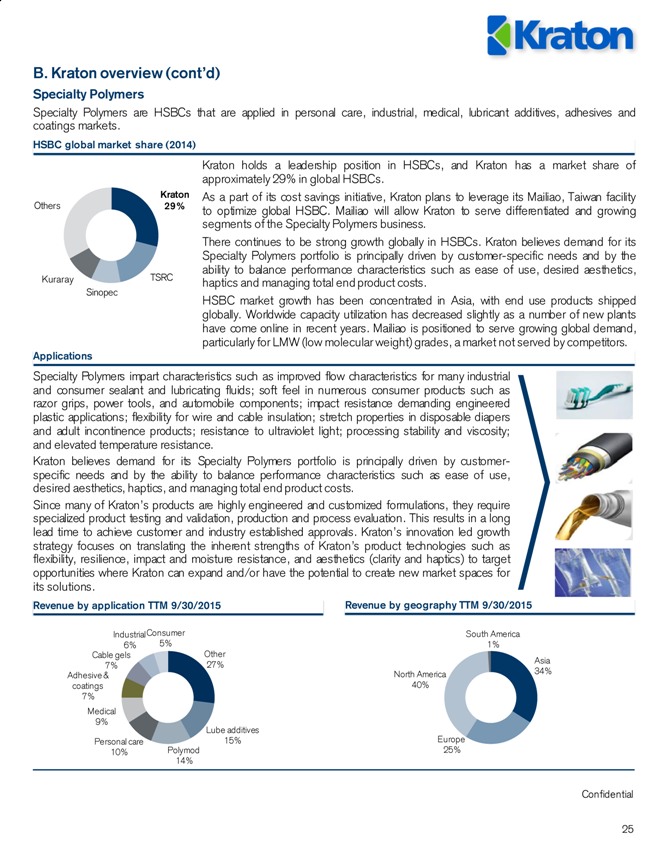

Specialty Polymers are HSBCs that are applied in personal care, industrial, medical, lubricant additives, adhesives and coatings markets.

HSBC global market share (2014)

Kraton holds a leadership position in HSBCs, and Kraton has a market share of approximately 29% in global HSBCs.

As a part of its cost savings initiative, Kraton plans to leverage its Mailiao, Taiwan facility to optimize global HSBC. Mailiao will allow Kraton to serve differentiated and growing segments of the Specialty Polymers business.

There continues to be strong growth globally in HSBCs. Kraton believes demand for its Specialty Polymers portfolio is principally driven by customer-specific needs and by the ability to balance performance characteristics such as ease of use, desired aesthetics, haptics and managing total end product costs.

HSBC market growth has been concentrated in Asia, with end use products shipped globally. Worldwide capacity utilization has decreased slightly as a number of new plants have come online in recent years. Mailiao is positioned to serve growing global demand, particularly for LMW (low molecular weight) grades, a market not served by competitors.

Applications

Kraton 29%

TSRC

Sinopec

Kuraray

Others

Specialty Polymers impart characteristics such as improved flow characteristics for many industrial and consumer sealant and lubricating fluids; soft feel in numerous consumer products such as razor grips, power tools, and automobile components; impact resistance demanding engineered plastic applications; flexibility for wire and cable insulation; stretch properties in disposable diapers and adult incontinence products; resistance to ultraviolet light; processing stability and viscosity; and elevated temperature resistance.

Kraton believes demand for its Specialty Polymers portfolio is principally driven by customer-specific needs and by the ability to balance performance characteristics such as ease of use, desired aesthetics, haptics, and managing total end product costs.

Since many of Kraton’s products are highly engineered and customized formulations, they require specialized product testing and validation, production and process evaluation. This results in a long lead time to achieve customer and industry established approvals. Kraton’s innovation led growth strategy focuses on translating the inherent strengths of Kraton’s product technologies such as flexibility, resilience, impact and moisture resistance, and aesthetics (clarity and haptics) to target opportunities where Kraton can expand and/or have the potential to create new market spaces for its solutions.

Other 27%

Lube additives 15%

Polymod 14%

Personal care 10%

Medical 9%

Adhesive & coatings 7%

Cable gels 7%

Industrial 6%

Consumer 5%

Asia 34%

Europe 25%

North America 40%

South America 1%

Revenue by application TTM 9/30/2015

Revenue by geography TTM 9/30/2015

Kraton

Confidential

26

B. Kraton overview (cont’d)

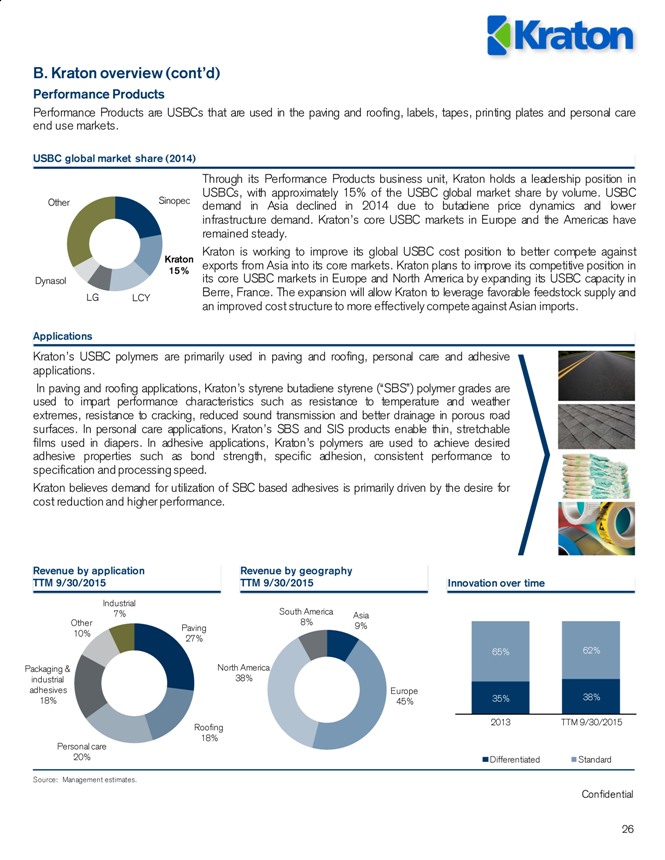

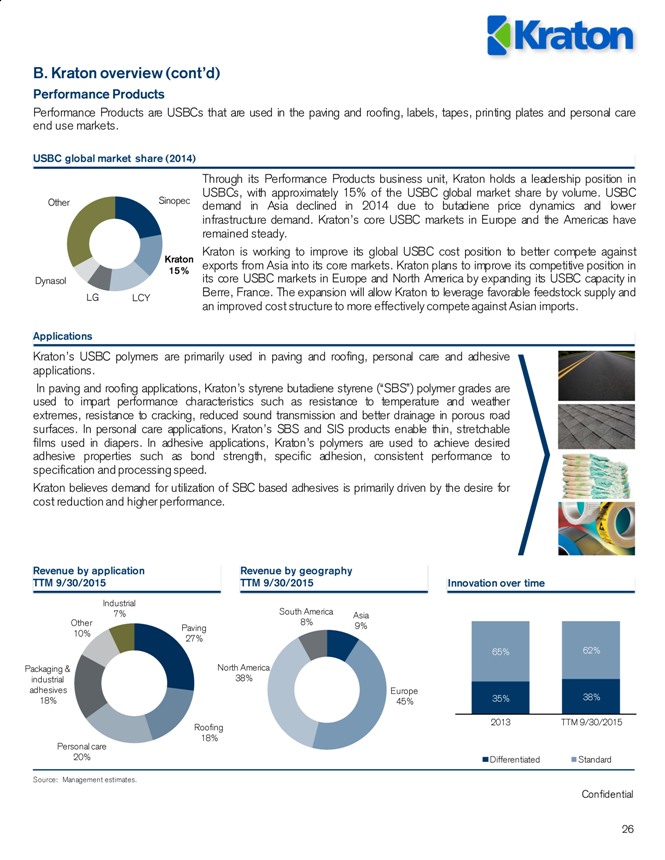

Performance Products

Performance Products are USBCs that are used in the paving and roofing, labels, tapes, printing plates and personal care end use markets.

Sinopec

Kraton 15%

LCY

LG

Dynasol

Other

Revenue by application

TTM 9/30/2015

Revenue by geography

TTM 9/30/2015

USBC global market share (2014)

Applications

Kraton’s USBC polymers are primarily used in paving and roofing, personal care and adhesive applications.

In paving and roofing applications, Kraton’s styrene butadiene styrene (“SBS”) polymer grades are used to impart performance characteristics such as resistance to temperature and weather extremes, resistance to cracking, reduced sound transmission and better drainage in porous road surfaces. In personal care applications, Kraton’s SBS and SIS products enable thin, stretchable films used in diapers. In adhesive applications, Kraton’s polymers are used to achieve desired adhesive properties such as bond strength, specific adhesion, consistent performance to specification and processing speed.

Kraton believes demand for utilization of SBC based adhesives is primarily driven by the desire for cost reduction and higher performance.

Innovation over time

Paving 27%

Roofing 18%

Personal care 20%

Packaging & industrial adhesives 18%

Other 10%

Industrial 7%

Asia 9%

Europe 45%

North America 38%

South America 8%

35%

38%

65%

62%

2013

TTM 9/30/2015

Differentiated

Standard

Through its Performance Products business unit, Kraton holds a leadership position in USBCs, with approximately 15% of the USBC global market share by volume. USBC demand in Asia declined in 2014 due to butadiene price dynamics and lower infrastructure demand. Kraton’s core USBC markets in Europe and the Americas have remained steady.

Kraton is working to improve its global USBC cost position to better compete against exports from Asia into its core markets. Kraton plans to improve its competitive position in its core USBC markets in Europe and North America by expanding its USBC capacity in Berre, France. The expansion will allow Kraton to leverage favorable feedstock supply and an improved cost structure to more effectively compete against Asian imports.

Source: Management estimates.

Kraton

Confidential

27

C. Joint venture

Mailiao, Taiwan

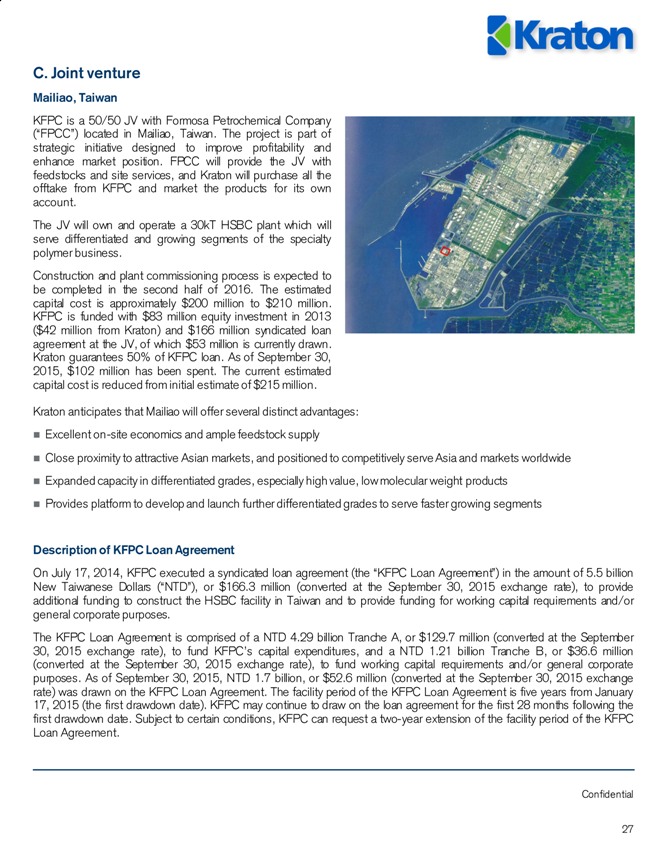

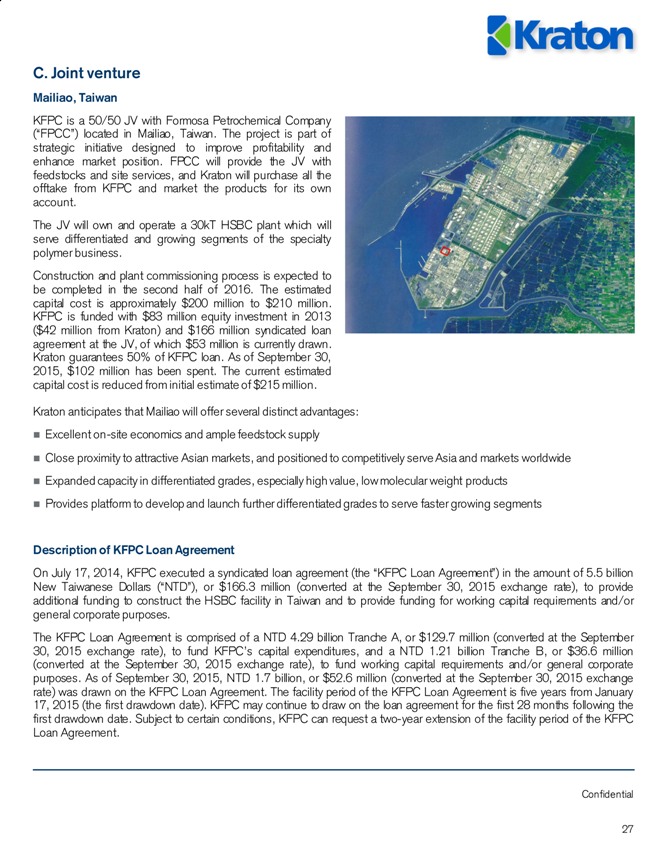

KFPC is a 50/50 JV with Formosa Petrochemical Company (“FPCC”) located in Mailiao, Taiwan. The project is part of strategic initiative designed to improve profitability and enhance market position. FPCC will provide the JV with feedstocks and site services, and Kraton will purchase all the offtake from KFPC and market the products for its own account.

The JV will own and operate a 30kT HSBC plant which will serve differentiated and growing segments of the specialty polymer business.

Construction and plant commissioning process is expected to be completed in the second half of 2016. The estimated capital cost is approximately $200 million to $210 million. KFPC is funded with $83 million equity investment in 2013 ($42 million from Kraton) and $166 million syndicated loan agreement at the JV, of which $53 million is currently drawn. Kraton guarantees 50% of KFPC loan. As of September 30, 2015, $102 million has been spent. The current estimated capital cost is reduced from initial estimate of $215 million.

Kraton anticipates that Mailiao will offer several distinct advantages:

Excellent on-site economics and ample feedstock supply

Close proximity to attractive Asian markets, and positioned to competitively serve Asia and markets worldwide

Expanded capacity in differentiated grades, especially high value, low molecular weight products

Provides platform to develop and launch further differentiated grades to serve faster growing segments

Description of KFPC Loan Agreement

On July 17, 2014, KFPC executed a syndicated loan agreement (the “KFPC Loan Agreement”) in the amount of 5.5 billion New Taiwanese Dollars (“NTD”), or $166.3 million (converted at the September 30, 2015 exchange rate), to provide additional funding to construct the HSBC facility in Taiwan and to provide funding for working capital requirements and/or general corporate purposes.

The KFPC Loan Agreement is comprised of a NTD 4.29 billion Tranche A, or $129.7 million (converted at the September 30, 2015 exchange rate), to fund KFPC’s capital expenditures, and a NTD 1.21 billion Tranche B, or $36.6 million (converted at the September 30, 2015 exchange rate), to fund working capital requirements and/or general corporate purposes. As of September 30, 2015, NTD 1.7 billion, or $52.6 million (converted at the September 30, 2015 exchange rate) was drawn on the KFPC Loan Agreement. The facility period of the KFPC Loan Agreement is five years from January 17, 2015 (the first drawdown date). KFPC may continue to draw on the loan agreement for the first 28 months following the first drawdown date. Subject to certain conditions, KFPC can request a two-year extension of the facility period of the KFPC Loan Agreement.

Kraton

Confidential

28

C. Joint venture (cont’d)

Mailiao, Taiwan (cont’d)

Description of KFPC Loan Agreement (cont’d)

The total outstanding principal amount is payable in six semi-annual installments with the first payment due on July 17, 2017 and each subsequent payment due every six months thereafter. The first five installments shall be in an amount equal to 10% of the outstanding principal amount and the final installment shall be in an amount equal to the remaining 50% of the outstanding principal amount. In the event the extension period is granted, the final 50% of the outstanding principal amount shall be repaid in five equal semi-annual installments with the first installment due on the original final maturity date.

The KFPC Loan Agreement is subject to a variable interest rate composed of a fixed 0.8% margin plus the three-month or six-month fixing rate of the Taipei Interbank Offered Rate (depending on the interest period as selected by KFPC in the drawdown request or the interest period notice), subject to a floor of 1.7%. Interest is payable on a monthly basis.

The KFPC Loan Agreement contains certain financial covenants which change during the term of the KFPC Loan Agreement. The financial covenants include a maximum debt to equity ratio of 3.0 to 1.0 through 2016, which will decrease to 2.0 to 1.0 in 2017 and 1.2 to 1.0 in 2018; a minimum tangible net worth requirement of $50.0 million through 2018, which will increase to $100.0 million in 2019; and a minimum interest coverage ratio of 2.5 to 1.0 commencing in 2016, which will increase to 5.0 to 1.0 in 2017. In each case, these covenants are calculated and tested on an annual basis. Formosa Petrochemical Corporation and Kraton Polymers LLC are the guarantors of the KFPC Loan Agreement with each guarantor guaranteeing 50% of the indebtedness on an unsecured basis. At September 30, 2015, KFPC was in compliance with the covenants under the KFPC Loan Agreement.

Kashima, Japan

Kraton’s Kashima manufacturing facility is owned and operated by Kraton JSR Elastomers K.K., (“KJE”), a joint venture between Kraton and JSR Corporation.

The Kashima facility is located northeast of Tokyo on the main island of Honshu at a JSR site that includes several synthetic rubber facilities and butadiene and isoprene extraction units. This facility is serviced by rail, barge and truck connections. Production capacity is approximately 31 kilotons of USBCs, and Kraton is generally entitled to 50% of this production pursuant to its joint venture agreement.

JSR markets its portion of the production under its own trademarks, and Kraton markets its portion of the production under the Kraton® brand name although this amount may vary from time to time based on the economic interest of the joint venture. Kraton and JSR each have a right of first refusal on the transfer of the joint venture interests of the other.

D. Customers

Kraton’s customers are diversified by industry and geography with more than 800 customers in over 60 countries.

Kraton has had a long-standing relationship with many of its customers and works closely with them to design products that meet application-specific performance and quality requirements. Kraton have a diverse customer base, with no single customer accounting for more than 10.0% of its revenue in 2014, and its top 10 customers together represent approximately 31.7% of its revenues in 2014. Because of the technical expertise and investment required to develop many of Kraton’s product formulations and the lead times required to replace them, Kraton believes many of its customers would likely incur additional costs by changing to an alternative vendor.

Kraton

Confidential

29

E. Competition

Kraton also competes against a broad range of alternative, non-SBC products within each of its product groups.

Kraton’s most significant competitors in the SBC industry are: Asahi Chemical, Chi Mei, Dynasol Elastomers, Kuraray Company, Korea Kumho P.C., LCY, LG Chemical, Sinopec, Taiwan Synthetic Rubber Corporation, Versalis, Voronezh and Zeon Corporation. Generally, however, Kraton believes, no individual competitor competes across all of its product applications.

Kraton competes with other SBC producers and against producers of non-SBC competing materials, primarily on the basis of price, breadth of product availability, product quality and speed of service from order to delivery. Kraton believes its customers also base their supply decisions on the supplier’s ability to design and produce custom products and on the availability of technical support.

CariflexTM

Kraton’s products primarily compete with natural rubber, conventional Ziegler Natta sourced solid IR, halo butyl rubber and several synthetic latex alternatives, notably neoprene, nitrile and polychloroprene latex rubber, as well as polyurethane.

Specialty Polymers

Kraton’s Specialty Polymers products primarily compete against a variety of chemical and non-chemical alternatives including, but not limited to, thermoplastic vulcanizate, thermoplastic polyurethane, PVC, thermoplastic polyolefin, polyethylene terephthalate, polycarbonate, polyamide and ethylene-propylene-diene-monomer based products. Kraton believes demand for its Specialty Polymers portfolio is principally driven by customer-specific needs and by the ability to balance performance characteristics such as ease of use, desired aesthetics, haptics, and managing total end product costs.

Since many of Kraton’s products are highly engineered and customized formulations, they require specialized product testing and validation, production and process evaluation. This results in a long lead time to achieve customer and industry established approvals. Kraton’s innovation led growth strategy focuses on translating the inherent strengths of its product technologies such as flexibility, resilience, impact and moisture resistance, and aesthetics (clarity and haptics) to target opportunities where it can expand and/or have the potential to create new market spaces for its solutions.

Performance Products

In paving and roofing applications, the Performance Products segment primarily compete with chemicals such as styrene-butadiene rubber latex, acetates, polyphosphoric acids and thermoplastic materials like ethylene-propylene-diene-monomer, polyethylene, atactic polypropylene and unmodified asphalts. Kraton believes that customer choice for these markets is driven principally by total end-product cost, temperature performance, bitumen source and application. Styrene-butadiene-styrene (“SBS”)-modified asphalt in roofing applications produces stronger and more durable felts and shingles, thus reducing the possibility of damage from weather, ice and water build-up and therefore extending service life. SBS modified asphalt pavements enhance the strength and elasticity of asphalt-based paving compositions over an extended temperature range, thus increasing resistance to wear, rutting and cracking and again extending service life. For example, Kraton’s HiMA technology polymers provide better rut and cracking resistance than other elastic binders, while achieving 25-40% reduction in road thickness without any major sacrifice of viscosity or temperature performance. Kraton believes this innovation will extend road life by allowing pavements to withstand heavy traffic loads and varying climate conditions.

In personal care applications, Kraton’s products primarily compete against low priced alternatives such as metallocenes. Kraton believes that customer choice for these markets is driven principally by total end-product cost and performance.

In adhesives applications, Performance Products primarily compete with acrylics, silicones and solvent-based rubber systems. The choice between these materials is influenced by bond strength, specific adhesion, consistent performance to specification, processing speed, hot-melt application, resistance to water and total end-product cost. Kraton’s SBCs are compatible with many other formulating ingredients. For example, Kraton has expanded its offering of formulated compounds for adhesives for protective films that provide improved adhesive performance with no residue or haze after removal. Kraton believe demand for utilization of SBC based adhesives is primarily driven by cost reduction and higher performance.

Kraton

Confidential

F. Raw materials procurement

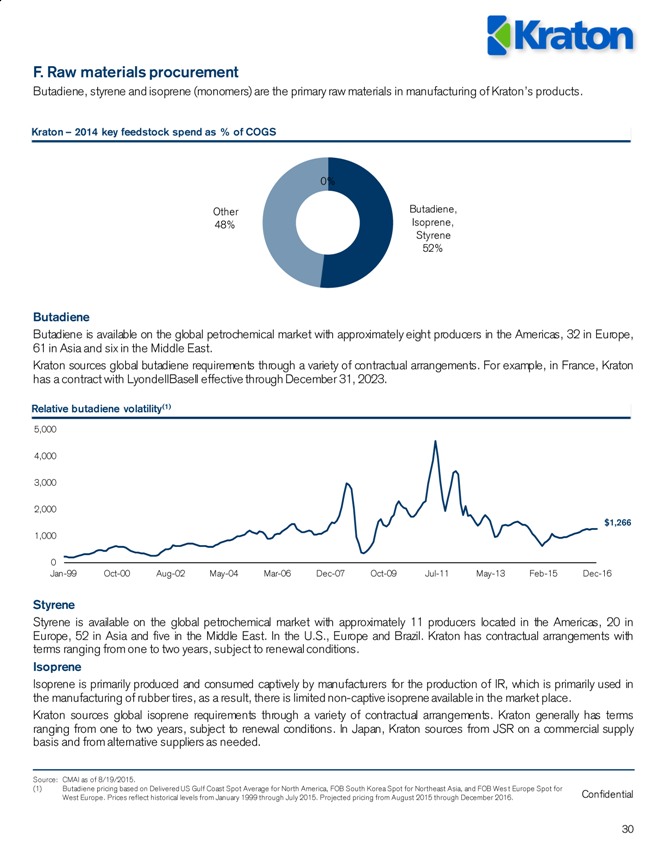

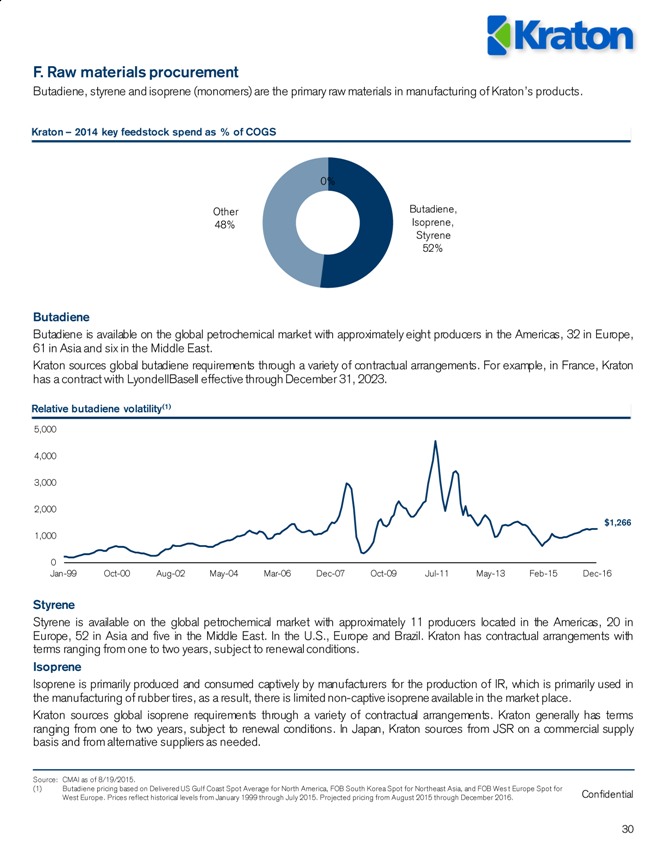

Butadiene, styrene and isoprene (monomers) are the primary raw materials in manufacturing of Kraton’s products.

Butadiene

Butadiene is available on the global petrochemical market with approximately eight producers in the Americas, 32 in Europe, 61 in Asia and six in the Middle East.

Kraton sources global butadiene requirements through a variety of contractual arrangements. For example, in France, Kraton has a contract with LyondellBasell effective through December 31, 2023.

Styrene

Styrene is available on the global petrochemical market with approximately 11 producers located in the Americas, 20 in Europe, 52 in Asia and five in the Middle East. In the U.S., Europe and Brazil. Kraton has contractual arrangements with terms ranging from one to two years, subject to renewal conditions.

Isoprene

Isoprene is primarily produced and consumed captively by manufacturers for the production of IR, which is primarily used in the manufacturing of rubber tires, as a result, there is limited non-captive isoprene available in the market place.

Kraton sources global isoprene requirements through a variety of contractual arrangements. Kraton generally has terms ranging from one to two years, subject to renewal conditions. In Japan, Kraton sources from JSR on a commercial supply basis and from alternative suppliers as needed.

30

Source: CMAI as of 8/19/2015.

(1) Butadiene pricing based on Delivered US Gulf Coast Spot Average for North America, FOB South Korea Spot for Northeast Asia, and FOB Wes t Europe Spot for West Europe. Prices reflect historical levels from January 1999 through July 2015. Projected pricing from August 2015 through December 2016.

Relative butadiene volatility(1)

0

1,000

2,000

3,000

4,000

5,000

Jan-99

Oct-00

Aug-02

May-04

Mar-06

Dec-07

Oct-09

Jul-11

May-13

Feb-15

Dec-16

$1,266

Butadiene, Isoprene, Styrene 52%

Other 48%

0%

Kraton – 2014 key feedstock spend as % of COGS

Kraton

Confidential

31

G. Research and development

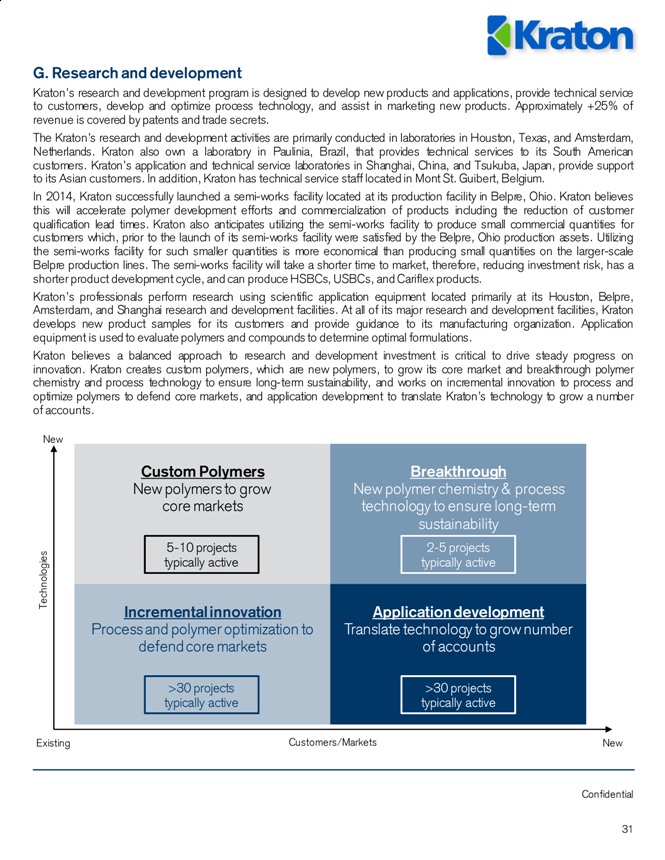

Kraton’s research and development program is designed to develop new products and applications, provide technical service to customers, develop and optimize process technology, and assist in marketing new products. Approximately +25% of revenue is covered by patents and trade secrets.

The Kraton’s research and development activities are primarily conducted in laboratories in Houston, Texas, and Amsterdam, Netherlands. Kraton also own a laboratory in Paulinia, Brazil, that provides technical services to its South American customers. Kraton’s application and technical service laboratories in Shanghai, China, and Tsukuba, Japan, provide support to its Asian customers. In addition, Kraton has technical service staff located in Mont St. Guibert, Belgium.

In 2014, Kraton successfully launched a semi-works facility located at its production facility in Belpre, Ohio. Kraton believes this will accelerate polymer development efforts and commercialization of products including the reduction of customer qualification lead times. Kraton also anticipates utilizing the semi-works facility to produce small commercial quantities for customers which, prior to the launch of its semi-works facility were satisfied by the Belpre, Ohio production assets. Utilizing the semi-works facility for such smaller quantities is more economical than producing small quantities on the larger-scale Belpre production lines. The semi-works facility will take a shorter time to market, therefore, reducing investment risk, has a shorter product development cycle, and can produce HSBCs, USBCs, and Cariflex products.

Kraton’s professionals perform research using scientific application equipment located primarily at its Houston, Belpre, Amsterdam, and Shanghai research and development facilities. At all of its major research and development facilities, Kraton develops new product samples for its customers and provide guidance to its manufacturing organization. Application equipment is used to evaluate polymers and compounds to determine optimal formulations.

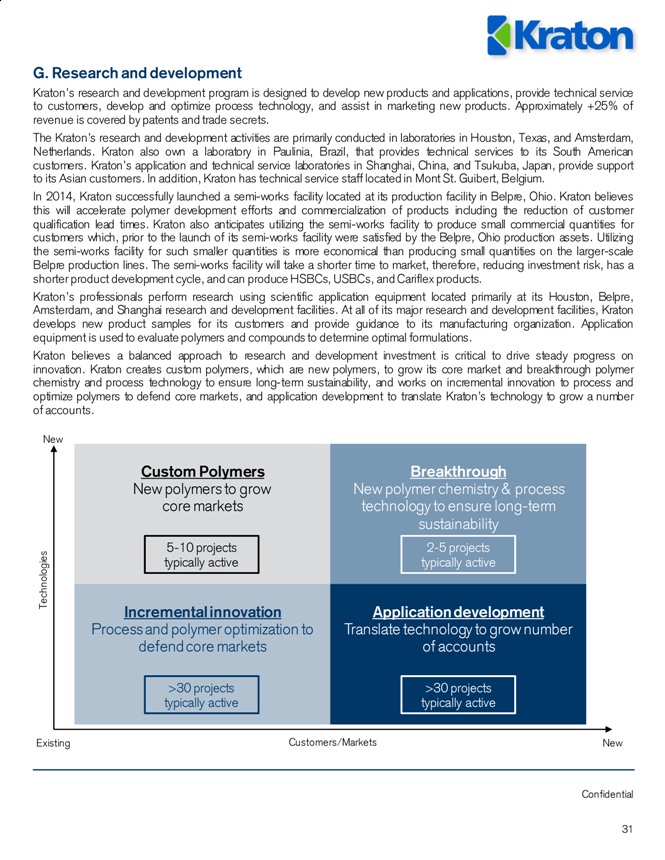

Kraton believes a balanced approach to research and development investment is critical to drive steady progress on innovation. Kraton creates custom polymers, which are new polymers, to grow its core market and breakthrough polymer chemistry and process technology to ensure long-term sustainability, and works on incremental innovation to process and optimize polymers to defend core markets, and application development to translate Kraton’s technology to grow a number of accounts.

New

Existing

New

Technologies

Customers/Markets

Custom Polymers

New polymers to grow core markets

Breakthrough

New polymer chemistry & process technology to ensure long-term sustainability

5-10 projects typically active

2-5 projects typically active

Incremental innovation

Process and polymer optimization to defend core markets

Application development

Translate technology to grow number of accounts

>30 projects typically active

>30 projects typically active

Kraton

Confidential

32

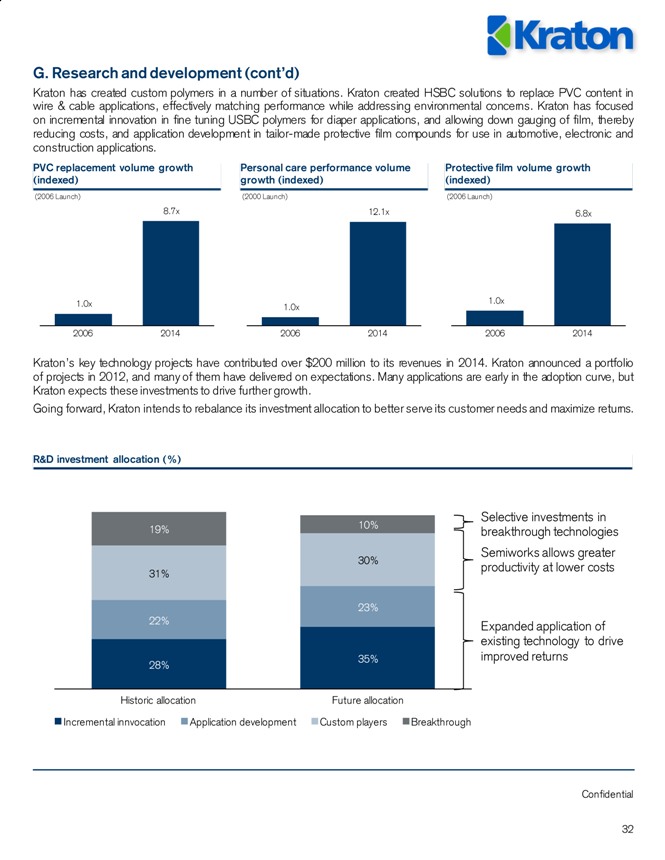

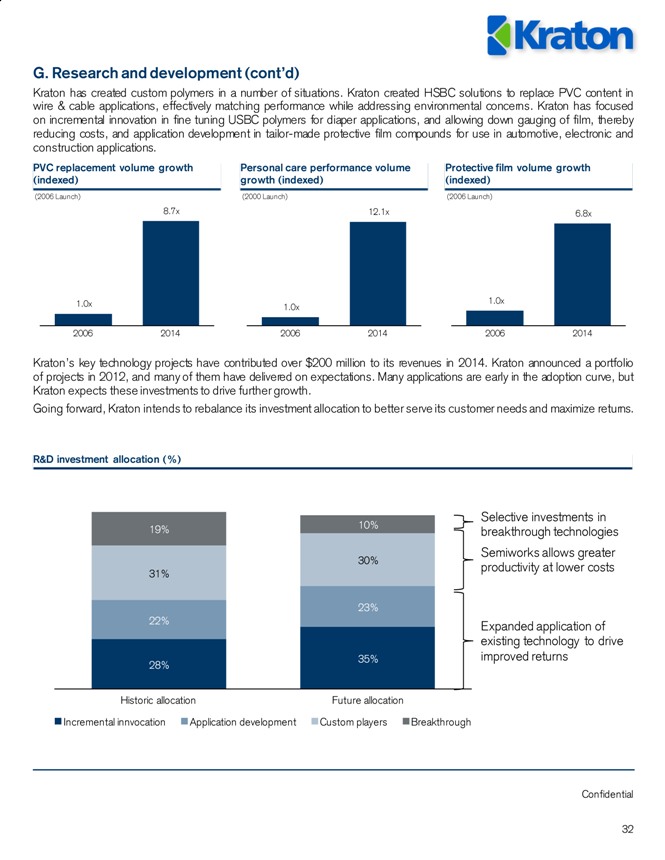

G. Research and development (cont’d)

Kraton has created custom polymers in a number of situations. Kraton created HSBC solutions to replace PVC content in wire & cable applications, effectively matching performance while addressing environmental concerns. Kraton has focused on incremental innovation in fine tuning USBC polymers for diaper applications, and allowing down gauging of film, thereby reducing costs, and application development in tailor-made protective film compounds for use in automotive, electronic and construction applications.

Kraton’s key technology projects have contributed over $200 million to its revenues in 2014. Kraton announced a portfolio of projects in 2012, and many of them have delivered on expectations. Many applications are early in the adoption curve, but Kraton expects these investments to drive further growth.

Going forward, Kraton intends to rebalance its investment allocation to better serve its customer needs and maximize returns.

PVC replacement volume growth (indexed)

Personal care performance volume growth (indexed)

Protective film volume growth (indexed)

1.0x

8.7x

2006

2014

(2006 Launch)

1.0x

12.1x

2006

2014

(2000 Launch)

1.0x

6.8x

2006

2014

(2006 Launch)

R&D investment allocation (%)

Selective investments in breakthrough technologies

Semiworks allows greater productivity at lower costs

Expanded application of existing technology to drive improved returns

28%

35%

22%

23%

31%

30%

19%

10%

Historic allocation

Future allocation

Incremental innvocation

Application development

Custom players

Breakthrough

Confidential

33

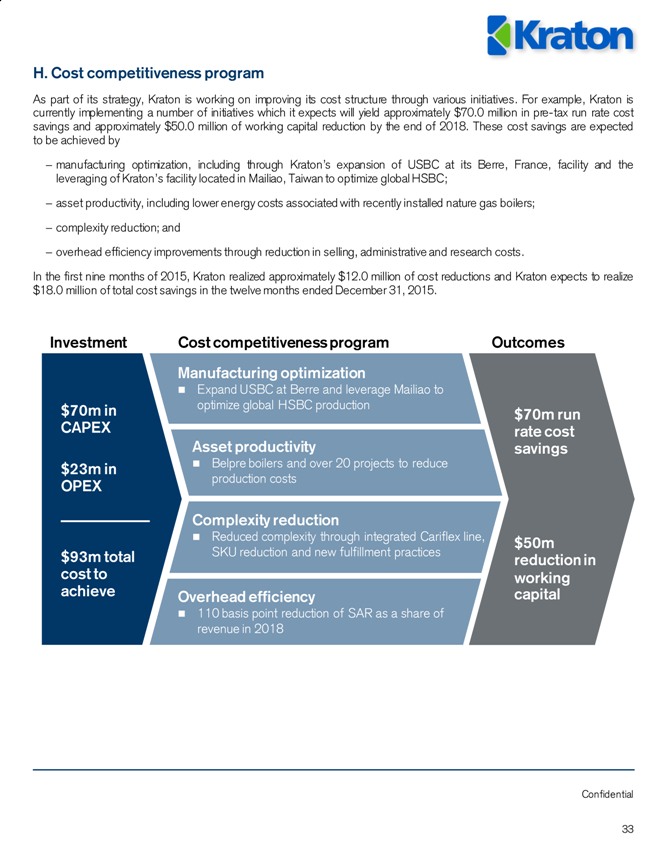

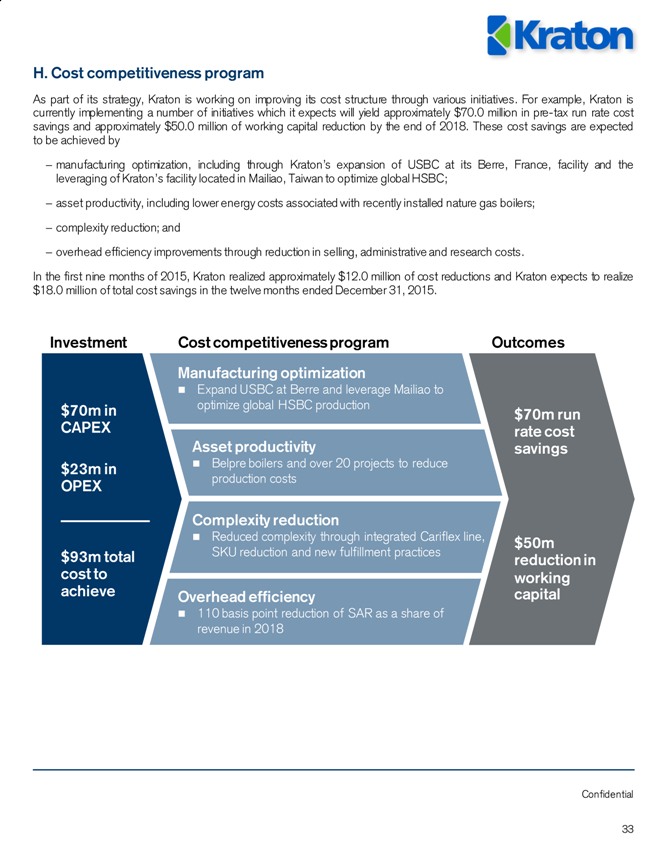

H. Cost competitiveness program

As part of its strategy, Kraton is working on improving its cost structure through various initiatives. For example, Kraton is currently implementing a number of initiatives which it expects will yield approximately $70.0 million in pre-tax run rate cost savings and approximately $50.0 million of working capital reduction by the end of 2018. These cost savings are expected to be achieved by

manufacturing optimization, including through Kraton’s expansion of USBC at its Berre, France, facility and the leveraging of Kraton’s facility located in Mailiao, Taiwan to optimize global HSBC;

asset productivity, including lower energy costs associated with recently installed nature gas boilers;

complexity reduction; and

overhead efficiency improvements through reduction in selling, administrative and research costs.

In the first nine months of 2015, Kraton realized approximately $12.0 million of cost reductions and Kraton expects to realize $18.0 million of total cost savings in the twelve months ended December 31, 2015. Manufacturing optimization

Expand USBC at Berre and leverage Mailiao to optimize global HSBC production

Asset productivity

Belpre boilers and over 20 projects to reduce production costs

Complexity reduction

Reduced complexity through integrated Cariflex line, SKU reduction and new fulfillment practices

Overhead efficiency

110 basis point reduction of SAR as a share of revenue in 2018

$70m in CAPEX

$23m in OPEX

$93m total cost to achieve

$70m run rate cost savings

$50m reduction in working capital

Investment

Cost competitiveness program

Outcomes

Kraton

Confidential 34

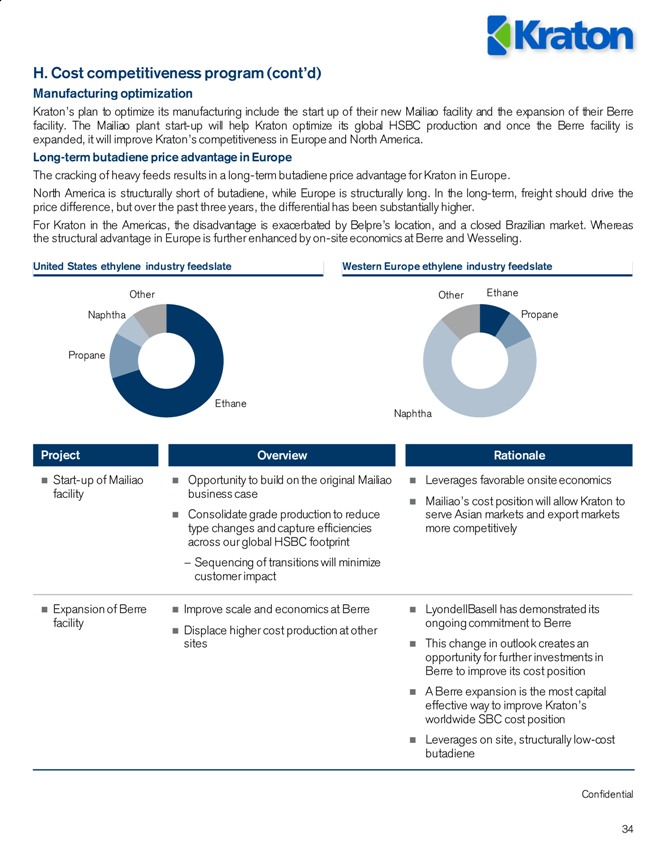

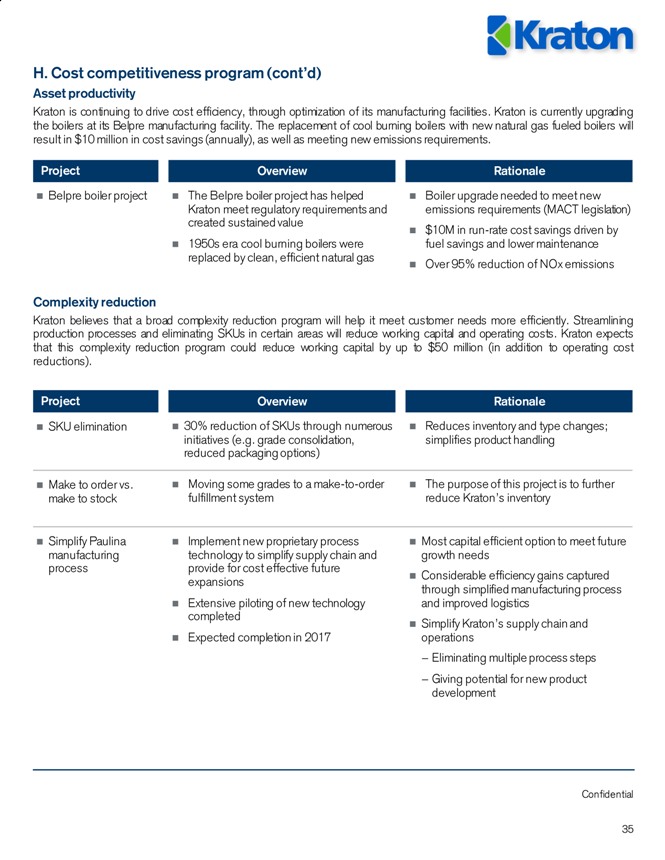

H. Cost competitiveness program (cont’d)

Manufacturing optimization

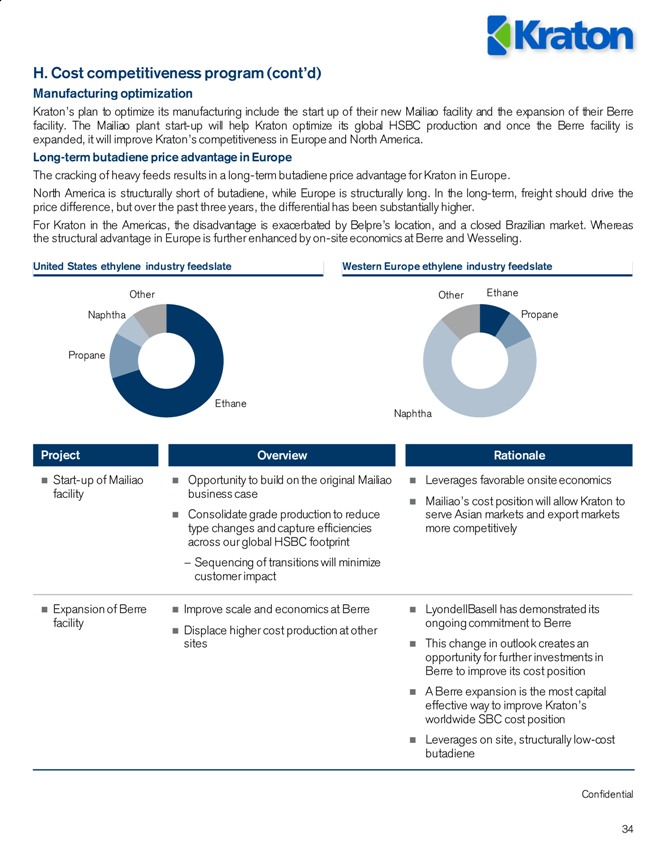

Kraton’s plan to optimize its manufacturing include the start up of their new Mailiao facility and the expansion of their Berre facility. The Mailiao plant start-up will help Kraton optimize its global HSBC production and once the Berre facility is expanded, it will improve Kraton’s competitiveness in Europe and North America.

Long-term butadiene price advantage in Europe

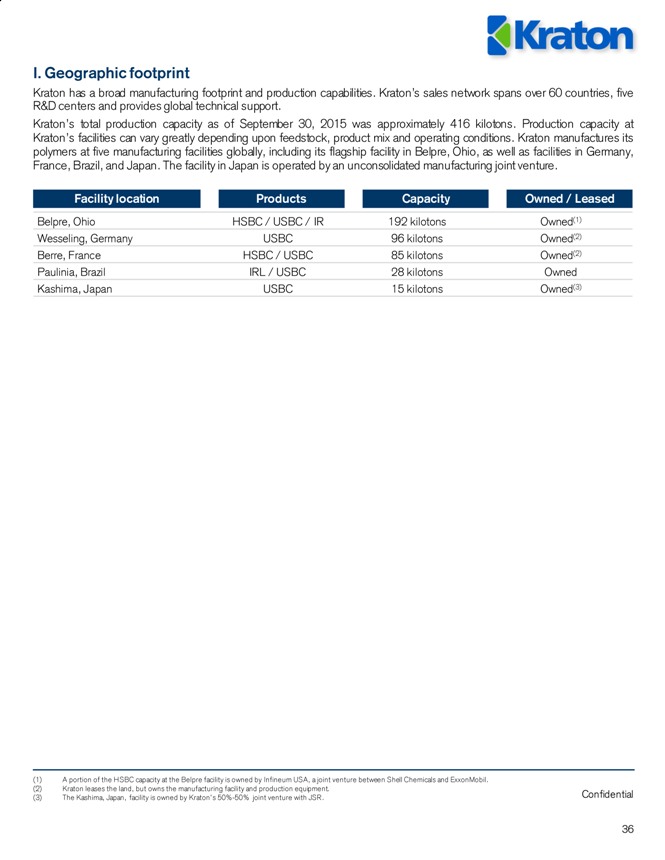

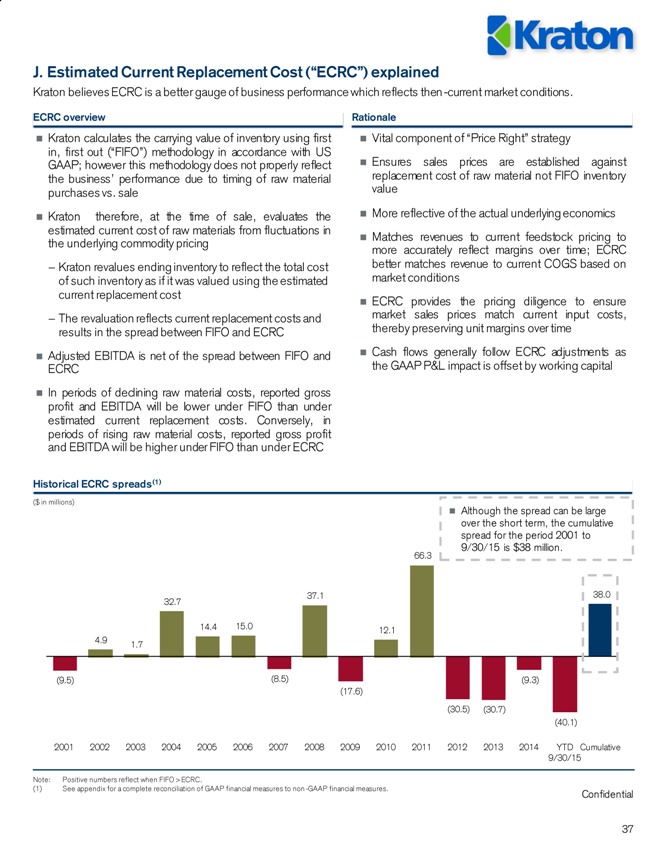

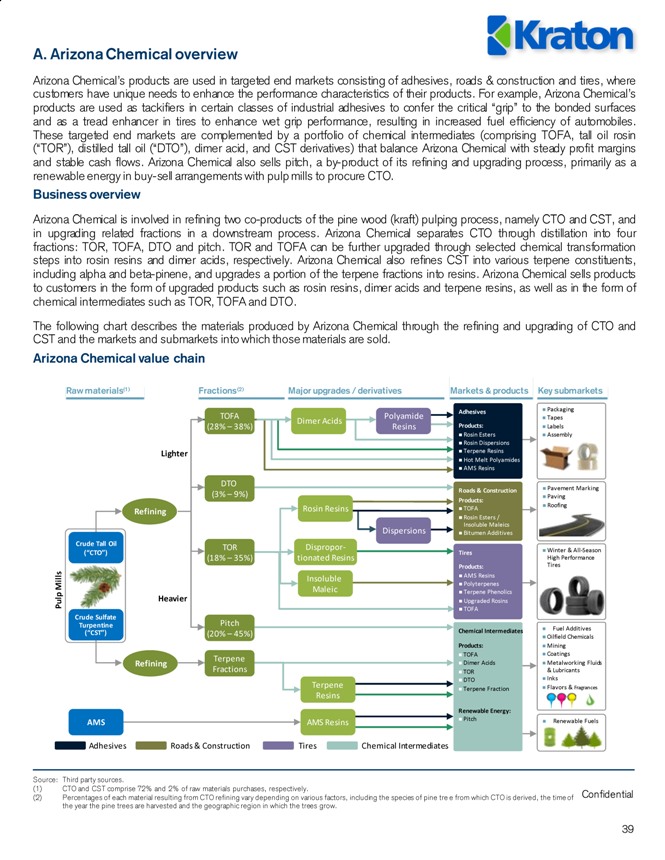

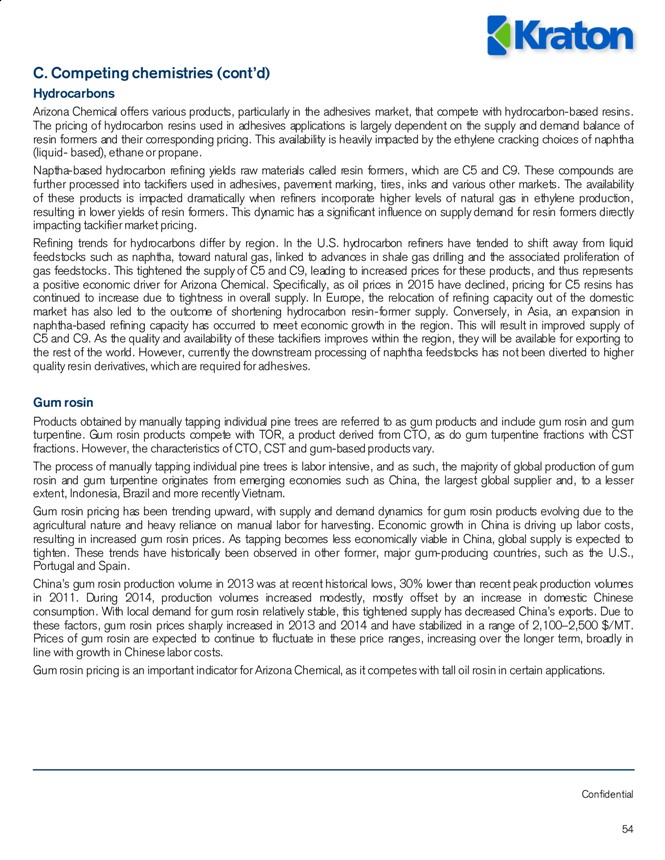

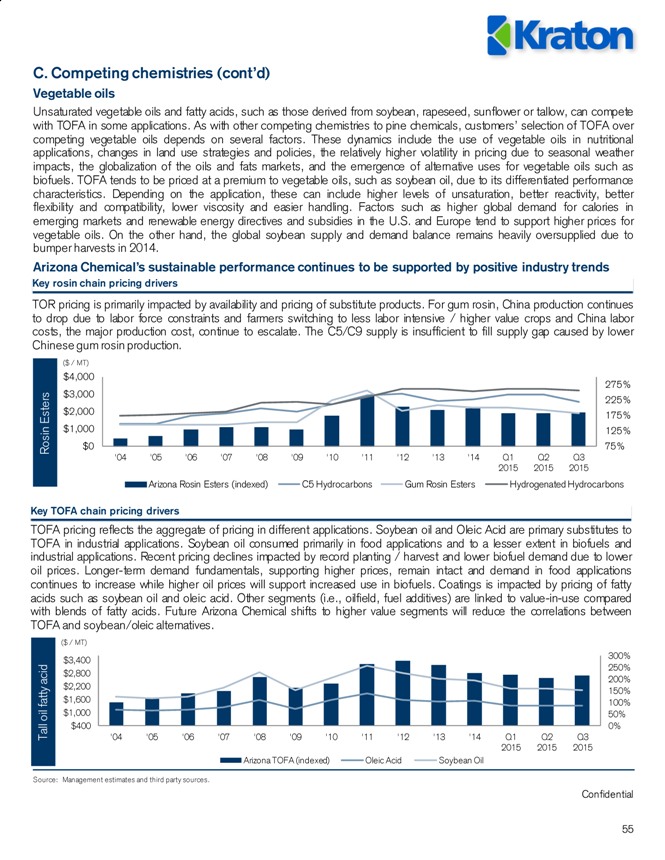

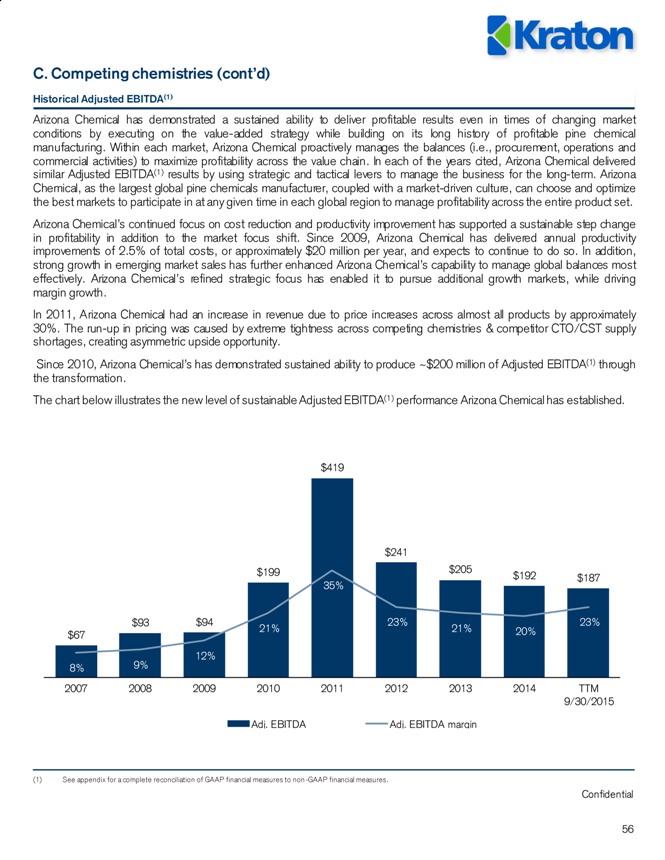

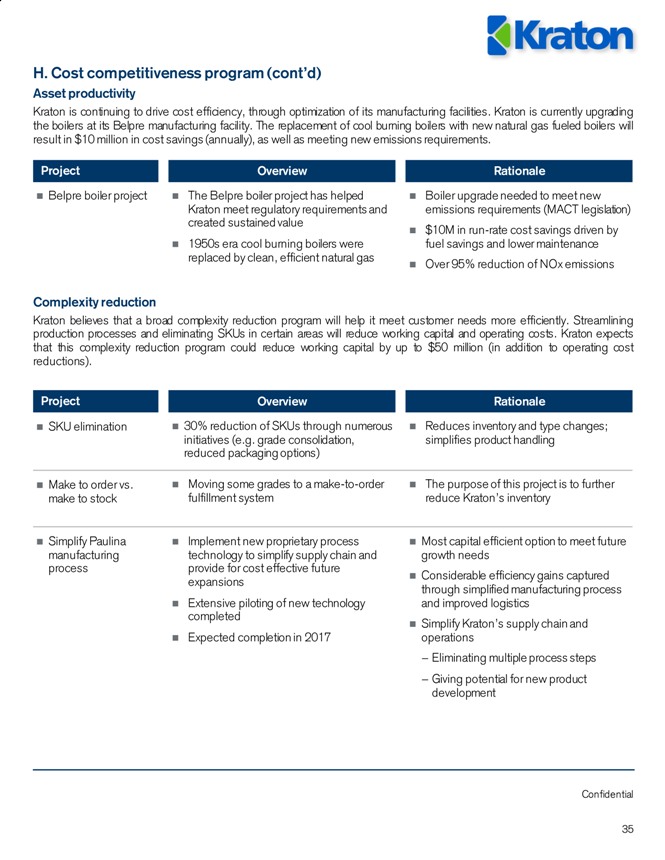

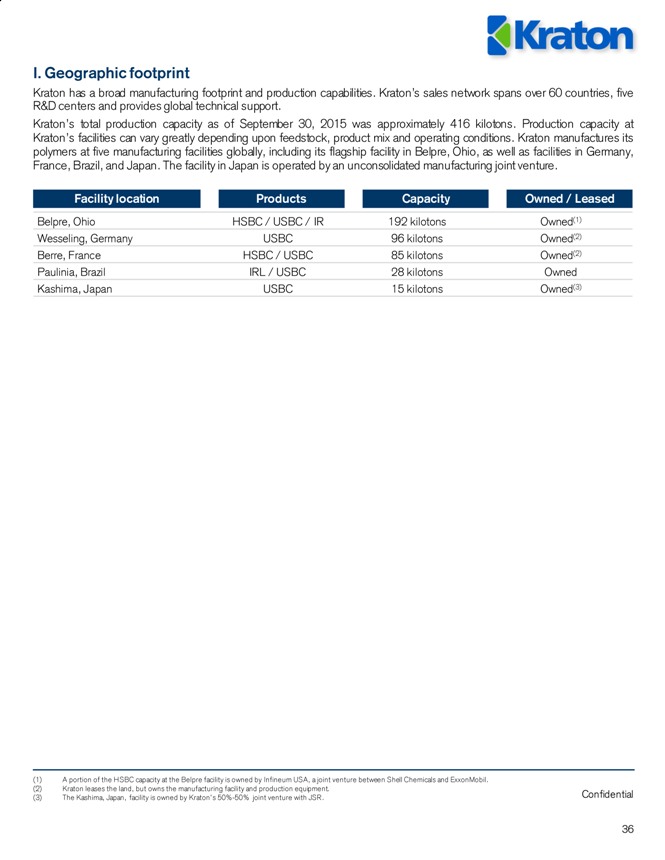

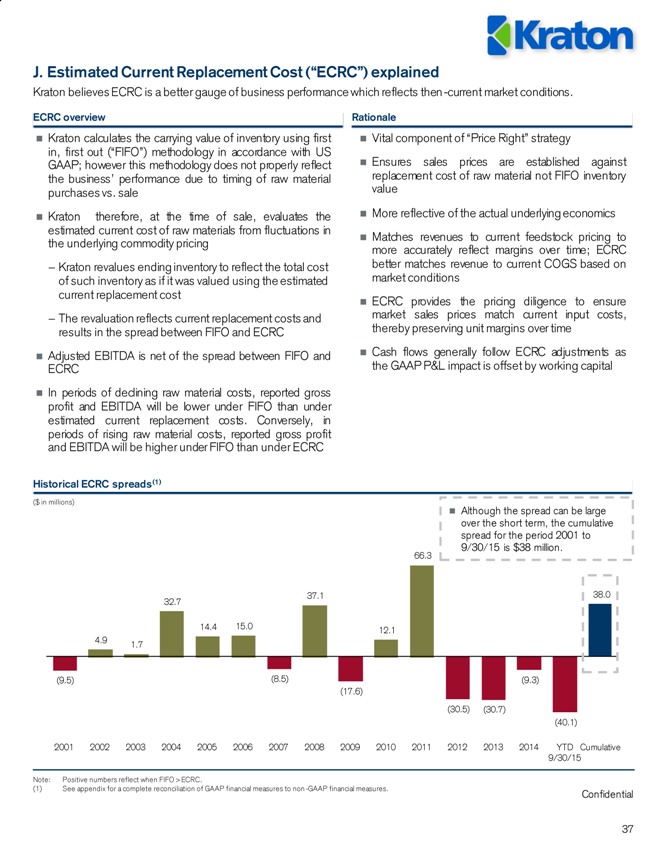

The cracking of heavy feeds results in a long-term butadiene price advantage for Kraton in Europe.