Exhibit 99.1

SUMMARY CONSOLIDATED HISTORICAL FINANCIAL DATA—ARIZONA CHEMICAL

The table below sets forth Arizona Chemical’s summary consolidated historical financial data for the periods indicated. The summary consolidated historical financial data presented below for the years ended December 31, 2012, 2013 and 2014 and as of December 31, 2013 and 2014 have been derived from, are qualified in their entirety by, and should be read in conjunction with, Arizona Chemical’s audited consolidated financial statements and notes related thereto (the “Arizona Chemical Audited Financial Statements”) included elsewhere in this offering circular. The summary consolidated historical financial data as of and for the nine months ended September 30, 2014 and 2015 are derived from, are qualified in their entirety by, and should be read in conjunction with, Arizona Chemical’s unaudited condensed consolidated financial statements and notes related thereto (the “Arizona Chemical Interim Financial Statements”) included elsewhere in this offering circular. The Arizona Chemical Interim Financial Statements have been prepared on the same basis as the Arizona Chemical Audited Financial Statements and, in the opinion of Arizona Chemical’s management, include all adjustments, consisting only of normal and recurring adjustments, necessary for a fair presentation of the information set forth herein. Interim financial results are not necessarily indicative of results that may be expected for the full fiscal year or any future reporting period. These historical results are not necessarily indicative of future results and should be read in conjunction with “Selected Historical Consolidated Financial Data—Arizona Chemical,” the Arizona Chemical Audited Financial Statements and the Arizona Chemical Interim Financial Statements appearing elsewhere in this offering circular.

| | | | | | | | | | | | | | | | | | | | |

| | | Arizona Chemical Holdings Corporation | |

| | | Year Ended December 31, | | | Nine Months Ended

September 30, | |

| | | 2012 | | | 2013 | | | 2014 | | | 2014 | | | 2015 | |

| | | (in thousands) | |

Consolidated Statements of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net revenue | | $ | 1,041,631 | | | $ | 992,259 | | | $ | 938,050 | | | $ | 728,303 | | | $ | 620,957 | |

Cost of goods sold | | | 724,576 | | | | 718,062 | | | | 677,587 | | | | 524,381 | | | | 436,039 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 317,055 | | | | 274,197 | | | | 260,463 | | | | 203,922 | | | | 184,918 | |

| | | | | | | | | | | | | | | | | | | | |

Operating expenses | | | | | | | | | | | | | | | | | | | | |

Selling, general and administrative (including related party fees) | | | 133,401 | | | | 124,816 | | | | 130,532 | | | | 106,782 | | | | 78,205 | |

Facility closure costs | | | 3,216 | | | | — | | | | — | | | | — | | | | 5,953 | |

Litigation expense | | | — | | | | 70,100 | | | | 10,110 | | | | 3,100 | | | | 12,894 | |

Insurance recoveries | | | — | | | | — | | | | (80,210 | ) | | | — | | | | (12,894 | ) |

| | | | | | | | | | | | | | | | | | | | |

Operating income | | | 180,438 | | | | 79,281 | | | | 200,031 | | | | 94,040 | | | | 100,760 | |

Interest expense, net | | | 43,759 | | | | 36,840 | | | | 42,825 | | | | 30,398 | | | | 35,928 | |

Loss on extinguishment of debt | | | — | | | | 552 | | | | 7,860 | | | | 7,860 | | | | — | |

Loss (gain) on interest rate caps/swaps, net | | | 4,705 | | | | (751 | ) | | | 3,579 | | | | 295 | | | | 7,003 | |

Foreign currency exchange gains (losses), net | | | (202 | ) | | | 1,322 | | | | (1,208 | ) | | | (333 | ) | | | (107 | ) |

Other income | | | (10,298 | ) | | | (11,111 | ) | | | (1,342 | ) | | | (1,218 | ) | | | (101 | ) |

| | | | | | | | | | | | | | | | | | | | |

Income before income taxes | | | 142,474 | | | | 52,429 | | | | 148,317 | | | | 57,038 | | | | 58,037 | |

Income tax expense | | | 49,693 | | | | 17,131 | | | | 49,966 | | | | 17,084 | | | | 18,103 | |

| | | | | | | | | | | | | | | | | | | | |

Net income | | $ | 92,781 | | | $ | 35,298 | | | $ | 98,351 | | | $ | 39,954 | | | $ | 39,934 | |

| | | | | | | | | | | | | | | | | | | | |

Other Financial Data | | | | | | | | | | | | | | | | | | | | |

Capital expenditures | | $ | 33,716 | | | $ | 46,695 | | | $ | 34,719 | | | $ | 19,325 | | | $ | 23,437 | |

EBITDA(1) | | $ | 225,011 | | | $ | 124,092 | | | $ | 224,798 | | | $ | 113,165 | | | $ | 116,760 | |

Adjusted EBITDA(2) | | $ | 240,572 | | | $ | 204,878 | | | $ | 191,694 | | | $ | 145,542 | | | $ | 139,588 | |

1

| | | | | | | | | | | | |

| | | Historical | |

| | | As of December 31, | | | As of

September 30, | |

| | | 2013 | | | 2014 | | | 2015 | |

| | | (in thousands) | |

Balance Sheet Data | | | | | | | | |

Cash and cash equivalents | | $ | 37,994 | | | $ | 39,312 | | | $ | 44,439 | |

Property, plant and equipment, net | | $ | 246,782 | | | $ | 245,025 | | | $ | 239,179 | |

Total assets | | $ | 684,949 | | | $ | 702,348 | | | $ | 692,507 | |

Total debt | | $ | 450,927 | | | $ | 822,621 | | | $ | 780,227 | |

| (1) | Arizona Chemical defines EBITDA as earnings before interest, taxes, depreciation, and amortization. EBITDA should not be considered an alternative to net income, operating income, cash flows from operating activities, or any other measure of financial performance presented in accordance with GAAP. Arizona Chemical’s EBITDA may not be comparable to EBITDA or similarly titled financial metrics of other entities, as other entities may not calculate EBITDA in the same manner as Arizona Chemical does. Arizona Chemical compensates for the limitations of EBITDA as an analytical tool by reviewing the comparable GAAP measures, understanding the differences between the measures, and incorporating this knowledge into management’s decision-making processes. |

| (2) | Arizona Chemical defines Adjusted EBITDA as EBITDA net of the impact of items that Arizona Chemical does not consider indicative of its ongoing operating performance. We explain how each adjustment is derived and why we believe it is helpful and appropriate in the reconciliation below. You are encouraged to evaluate each adjustment and the reasons we consider it appropriate for supplemental analysis. As an analytical tool, Adjusted EBITDA is subject to the limitations applicable to EBITDA described above. |

Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of discretionary cash available to Arizona Chemical to invest in the growth of its business.

Arizona Chemical’s presentation of non-GAAP financial measures and the adjustments made therein should not be construed as an inference that its future results will be unaffected by unusual or non-recurring items, and in the future Arizona Chemical may incur expenses or charges similar to the adjustments made in the presentation of its non-GAAP financial measures.

2

Arizona Chemical compensates for these limitations by relying primarily on its GAAP results and using EBITDA and Adjusted EBITDA only as supplemental measures.

| | | | | | | | | | | | | | | | | | | | |

| | | Arizona Chemical Holdings Corporation | |

| | | Year Ended December 31, | | | Nine Months Ended

September 30, | |

| | | 2012 | | | 2013 | | | 2014 | | | 2014 | | | 2015 | |

| | | (in thousands) | |

Net Income | | $ | 92,781 | | | $ | 35,298 | | | $ | 98,351 | | | $ | 39,954 | | | $ | 39,934 | |

Add (deduct): | | | | | | | | | | | | | | | | | | | | |

Interest expense, net | | | 43,759 | | | | 36,840 | | | | 42,825 | | | | 30,398 | | | | 35,928 | |

Income tax expense | | | 49,693 | | | | 17,131 | | | | 49,966 | | | | 17,084 | | | | 18,103 | |

Depreciation and amortization | | | 38,778 | | | | 34,823 | | | | 33,656 | | | | 25,729 | | | | 22,795 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | | 225,011 | | | | 124,092 | | | | 224,798 | | | | 113,165 | | | | 116,760 | |

Add (deduct): | | | | | | | | | | | | | | | | | | | | |

Loss (gain) on interest rate caps/swaps, net(a) | | | 4,705 | | | | (751 | ) | | | 3,579 | | | | 295 | | | | 7,003 | |

Loss on extinguishment of debt(b) | | | — | | | | 552 | | | | 7,860 | | | | 7,860 | | | | — | |

Curtailment charges(c) | | | — | | | | — | | | | 162 | | | | 197 | | | | 40 | |

Other retirement charges(c) | | | — | | | | — | | | | 865 | | | | 135 | | | | 475 | |

Restructuring and other charges(d) | | | 1,328 | | | | 2,078 | | | | 4,074 | | | | 3,429 | | | | 1,165 | |

Transaction and acquisition related costs(e) | | | 822 | | | | 75 | | | | 817 | | | | 107 | | | | 2,137 | |

Impairment of long-lived assets and facility closure cost(f) | | | 3,216 | | | | — | | | | — | | | | — | | | | 5,953 | |

Non-cash share-based compensation(g) | | | 12,074 | | | | 5,484 | | | | 1,999 | | | | 2,050 | | | | (173 | ) |

Management incentive-based share-based compensation(h) | | | 2,400 | | | | 291 | | | | 8,193 | | | | 8,193 | | | | — | |

Tax expense on share-based compensation(h) | | | 1,619 | | | | 324 | | | | 2,400 | | | | 2,400 | | | | — | |

Gain on sale of assets(i) | | | (9,964 | ) | | | (9,091 | ) | | | (365 | ) | | | (365 | ) | | | — | |

Financing costs in connection with debt(j) | | | 3,537 | | | | 1,327 | | | | 4,152 | | | | 3,575 | | | | 121 | |

Management fees(k) | | | 2,198 | | | | 2,202 | | | | 2,149 | | | | 1,571 | | | | 1,562 | |

Litigation expense(l) | | | — | | | | 70,100 | | | | (70,100 | ) | | | 3,100 | | | | — | |

CTO spill related costs(m) | | | (5,115 | ) | | | — | | | | — | | | | — | | | | — | |

Other indirect CTO spill related costs(m) | | | — | | | | — | | | | 1,164 | | | | — | | | | — | |

UK manufacturing plant closure(n) | | | — | | | | — | | | | — | | | | — | | | | 3,612 | |

Unrealized foreign currency losses (gains)(o) | | | (1,259 | ) | | | 8,195 | | | | (53 | ) | | | (170 | ) | | | 933 | |

| | | | | | | | | | | | | | | | | | | | |

Adjusted EBITDA | | $ | 240,572 | | | $ | 204,878 | | | $ | 191,694 | | | $ | 145,542 | | | $ | 139,588 | |

| | | | | | | | | | | | | | | | | | | | |

| (a) | Represents loss (gain) on interest rate caps and swaps. |

| (b) | Represents loss incurred on the extinguishment of debt. |

| (c) | Charges associated with the termination of an employee defined benefit pension plan including curtailment costs and cash costs related to the termination of the plan. |

| (d) | Restructuring and other charges primarily related to severance expenses for employees in eliminated positions which were not replaced. |

| (e) | Professional fees and other costs associated with the evaluation of acquisition transactions. In 2015, primarily professional fees and other related costs associated with the pending sale of Arizona Chemical. |

| (f) | In 2012, impairment and closure costs related to the shutdown of the CST plant in Oulu, Finland, and in 2015, impairment and closure costs related to the cessation of operations at the Chester-le-Street plant in the U.K in late 2015. |

| (g) | Represents expense recognized for non-cash share-based compensation. |

3

| (h) | Represents other share-based compensation expense in the form of common profit interests granted to certain employees. These interests are recognized as compensation expense at fair market value when probable of monetization. |

| (i) | In 2013 and 2014, the net gains relate to the sale of Arizona Chemical’s personal care business consisting of intellectual property, customer relationships and inventories, for $12.0 million in cash on May 23, 2013 of which $11.4 million was received in May 2013 and $0.6 million was received in June 2014. The gain of $9.0 million in 2013 is net of restructuring expenses and the gain of $0.3 million in 2014 is net of an expense for a claim from a distributor. In 2012, this amount represents a net gain on the sale of Arizona Chemical’s 10% investment in Arboris and the related land for $15 million in cash and $5 million receivable over the following two-year period. |

| (j) | Professional fees and other costs incurred related to the refinancing of Arizona Chemical’s historical indebtedness and other financing costs related to the historical indebtedness. |

| (k) | Management fees and out of pocket expenses paid to Arizona Chemical’s owners in accordance with the management agreement that will terminate at the closing of the pending Arizona Chemical Acquisition. |

| (l) | In 2013, this represents litigation expenses and damages associated with a claim filed by a former customer for an alleged breach of warranty and breach of contract regarding delivery of resin products during the period 2005 through 2009. In 2014, the credit represents an accrued insurance recovery for the related litigation expenses and damages. |

| (m) | In December 2011, a leak was discovered in CTO tanks owned by Arizona Chemical in Sôderhamn, Sweden. The net reduction in costs in 2012 represents insurance recoveries related to environmental remediation costs and the amount in 2014 represents additional storage costs incurred as a result of the loss of the CTO tanks. |

| (n) | Represents the pro rata portion of the full year operational expenses expected to be eliminated upon the cessation of operations in late 2015 of Arizona Chemical’s U.K. manufacturing facility. |

| (o) | Represents unrealized foreign currency losses (gains). |

4

RISK FACTORS

Your investment in the notes will involve substantial risks. You should carefully consider the following factors described below and all other information contained or incorporated by reference in this offering circular before making an investment decision. See “Where You Can Find More Information” and “Incorporation of Certain Documents by Reference.” Although we describe below and elsewhere in this offering circular the risks we consider to be material, there may be other unknown or unpredictable economic, business, competitive, regulatory or other factors that also could have material adverse effects on our results of operations, financial condition, business or operations in the future. In addition, past financial performance may not be a reliable indicator of future performance and historical trends should not be used to anticipate results or trends in future periods. If any of these risks were to materialize, individually or in combination, our business, prospects, financial condition, results of operations and/or cash flows could be materially adversely affected.

Risks Related to Our Indebtedness

Our substantial indebtedness could adversely affect our financial condition and prevent us from fulfilling our obligations under our indebtedness, including the notes and the New Senior Secured Credit Facilities.

As of September 30, 2015, we had $350.0 million principal amount of indebtedness outstanding in the form of our 6.75% Senior Notes and our Existing Senior Secured Credit Facilities were undrawn, with available borrowing capacity of $169.6 million. On a pro forma basis, after giving effect to the Transactions, our total consolidated indebtedness as of September 30, 2015 would have been $1,351.7 million of senior secured indebtedness and $425.0 million of senior unsecured indebtedness. In addition, KFPC executed the KFPC Loan Agreement to provide additional funding to construct the HSBC facility in Taiwan and to provide funding for working capital requirements and/or general corporate purposes. FPCC and Kraton LLC are the guarantors of the KFPC Loan Agreement with each guarantor guaranteeing fifty percent (50%) of the indebtedness, of which NTD 1.7 billion, or $52.6 million (converted at the September 30, 2015 exchange rate), of indebtedness was outstanding as of September 30, 2015.

Although the credit agreements governing the New Senior Secured Credit Facilities and the indenture governing the notes offered hereby will, and the KFPC Loan Agreement does, contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of important exceptions, and additional indebtedness that we may incur from time to time to finance projects or for other reasons in compliance with these restrictions could be substantial. If we and our restricted subsidiaries incur significant additional indebtedness, the related risks that we face could increase.

Our indebtedness could:

| | • | | make it more difficult for us to satisfy our financial obligations; |

| | • | | increase our vulnerability to adverse economic and industry conditions; |

| | • | | increase the risk that we breach financial covenants and other restrictions in our debt agreements, which can be exacerbated by volatility in the cost of our raw materials and the resulting impact on our earnings; |

| | • | | require us to dedicate a substantial portion of our cash flow from operations to make payments on our indebtedness, thereby reducing the availability of our cash flow to fund working capital, capital expenditures and other general corporate purposes; |

| | • | | limit our flexibility in planning for, or reacting to, changes in the business and industry in which we operate; |

| | • | | restrict us from exploiting business opportunities; |

| | • | | place us at a disadvantage compared to our competitors that have less debt and lease obligations; and |

| | • | | limit our ability to borrow additional funds for working capital, capital expenditures, acquisitions, debt service requirements, execution of our business strategy and other general corporate purposes or to refinance our existing debt. |

5

Our ability to pay principal of and interest on indebtedness, fund working capital and make anticipated capital expenditures depends on our future performance, which is subject to general economic conditions and other factors, some of which are beyond our control. There can be no assurance that our business will generate sufficient cash flow from operations or that future borrowings will be available under the New Senior Secured Credit Facilities to fund liquidity needs, including debt service. Furthermore, if we decide to undertake additional investments in existing or new facilities, this will likely require additional capital, and there can be no assurance that this capital will be available.

Despite current indebtedness levels and restrictive covenants, we and our subsidiaries may incur additional indebtedness or we may pay dividends in the future. This could further exacerbate the risks associated with our substantial financial leverage.

We and our subsidiaries may incur significant additional indebtedness in the future under the agreements governing our indebtedness. Although the credit agreements governing the New Senior Secured Credit Facilities and the indenture governing the notes offered hereby will contain restrictions on the incurrence of additional indebtedness and the payment of distributions to our equity holders, these restrictions are subject to a number of thresholds, qualifications and exceptions, and the additional indebtedness incurred, and distributions paid, in compliance with these restrictions could be substantial. Additionally, these restrictions also will permit us to incur obligations that, although preferential to our common stock in terms of payment, do not constitute indebtedness. As of September 30, 2015, on a pro forma basis after giving effect to the Transactions, we would have had approximately $250.0 million of borrowing capacity under the ABL Facility. In addition, if new debt is added to our and/or our subsidiaries’ debt levels, the related risks that we now face as a result of our leverage would intensify. See “Description of Notes—Certain Covenants” and “Description of Other Indebtedness.”

Our debt instruments, including the indenture governing the notes offered hereby and the New Senior Secured Credit Facilities, may impose significant operating and financial restrictions on us and affect our ability to access liquidity.

The indenture governing the notes offered hereby, the credit agreements governing the New Senior Secured Credit Facilities and any future indebtedness may contain, a number of restrictive covenants that impose significant operating and financial restrictions on us. The credit agreement governing the ABL Facility will subject us to a financial covenant requiring us to maintain a fixed charge coverage ratio of 1.0:1.0 if availability under the facilities is below specified amounts. In addition, our debt instruments may include restrictions on our ability to, in certain circumstances, among other things:

| | • | | place liens on our or our restricted subsidiaries’ assets; |

| | • | | make investments other than permitted investments; |

| | • | | incur additional indebtedness; |

| | • | | merge, consolidate or dissolve; |

| | • | | engage in transactions with affiliates; |

| | • | | change the nature of our business; |

| | • | | change our or our subsidiaries’ fiscal year or organizational documents; and |

| | • | | make restricted payments (including certain equity issuances). |

6

A failure by us or our subsidiaries to comply with the covenants and restrictions contained in the agreements governing our indebtedness could result in an event of default under such indebtedness, which could adversely affect our ability to respond to changes in our business and manage our operations. Upon the occurrence of an event of default under any of the agreements governing our indebtedness, the lenders could elect to declare all amounts outstanding to be due and payable and exercise other remedies as set forth in the agreements. Further, an event of default or acceleration of indebtedness under one instrument may constitute an event of default under another instrument. If any of our indebtedness were to be accelerated, there can be no assurance that our assets would be sufficient to repay this indebtedness in full, which could have a material adverse effect on our ability to continue to operate as a going concern.

To service our indebtedness, we will require a significant amount of cash.

Our ability to generate cash depends on many factors beyond our control, and any failure to meet our debt service obligations could harm our business, financial condition and results of operations. Our ability to make payments on and to refinance our indebtedness, including the notes, and to fund working capital needs and planned capital expenditures will depend on our ability to generate cash in the future. This, to a certain extent, is subject to general economic, financial, competitive, business, legislative, regulatory and other factors that are beyond our control, including, among other things, the costs of raw materials used in the production of our products.

If our business does not generate sufficient cash flow from operations or if future borrowings are not available to us in an amount sufficient to enable us to pay our indebtedness, including the notes, or to fund our other liquidity needs, we may need to refinance all or a portion of our indebtedness, including the notes, on or before the maturity thereof, sell assets, reduce or delay capital investments or seek to raise additional capital, any of which could have a material adverse effect on our operations. We might not generate sufficient cash flow to repay indebtedness as currently anticipated. In addition, we may not be able to effect any of these actions, if necessary, on commercially reasonable terms or at all. Our ability to restructure or refinance our indebtedness, including the notes, will depend on the condition of the capital markets and our financial condition at such time. Any refinancing of our indebtedness could be at higher interest rates and may require us to comply with more onerous covenants, which could further restrict our business operations. The terms of existing or future debt instruments, including the indenture governing the notes, may limit or prevent us from taking any of these actions. In addition, any failure to make scheduled payments of interest and principal on our outstanding indebtedness would likely result in a reduction of our credit rating, which could harm our ability to incur additional indebtedness on commercially reasonable terms or at all. Our inability to generate sufficient cash flow to satisfy our debt service obligations, or to refinance or restructure our obligations on commercially reasonable terms or at all, would have an adverse effect, which could be material, on our business, financial condition and results of operations, as well as on our ability to satisfy our obligations in respect of the notes.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase significantly.

Borrowings under the New Senior Secured Credit Facilities are at variable rates of interest and expose us to interest rate risk. Interest rates are currently at historically low levels. If interest rates increase, our debt service obligations on the variable rate indebtedness will increase even though the amount borrowed remained the same, and our net income and cash flows, including cash available for servicing our indebtedness, will correspondingly decrease. As of September 30, 2015, on a pro forma basis after giving effect to the Transactions, approximately $1,350.0 million of our debt would have been variable rate debt, and, holding other variables constant, an increase or decrease in interest rates by 0.125% on our variable rate debt would increase or decrease our annual interest expense by approximately $1.7 million. In the future, we may enter into interest rate swaps that involve the exchange of floating for fixed rate interest payments in order to reduce interest rate volatility. However, we may not maintain interest rate swaps with respect to any of our variable rate indebtedness, and any swaps we enter into may not fully mitigate our interest rate risk.

7

Risk Factors Related to the Notes and this Offering

The notes will be unsecured and will be effectively subordinated to our and the guarantors’ senior secured indebtedness and indebtedness of non-guarantor subsidiaries.

The issuers’ obligations under the notes and the guarantors’ obligations under the guarantees of the notes will not be secured by any of our or our subsidiaries’ assets. Following the consummation of this offering, the issuers will have $1,350.0 million of senior secured indebtedness outstanding under the Term Loan Facility in addition to availability under the ABL Facility. If the issuers and the guarantors were to become insolvent or otherwise fail to make payments on the notes, holders of our and our guarantors’ secured obligations would be paid first and would receive payments from the assets securing such obligations before the holders of the notes would receive any payments. You may therefore not be fully repaid in the event we become insolvent or otherwise fail to make payments on the notes. On a pro forma basis after giving effect to the Transactions, as of September 30, 2015, our non-guarantor subsidiaries (including the non-guarantor subsidiaries of Arizona Chemical) held approximately $1,025.4 million, or 34.8%, of our total assets and approximately $313.9 million, or 12.2%, of our total liabilities and for the nine months ended September 30, 2015, accounted for approximately $764.1 million, or 54.3%, of our net revenue and approximately $39.0 million, or 17.9%, of our EBITDA at ECRC. For a reconciliation of EBITDA to GAAP measures, see “Summary—Summary Consolidated Historical and Pro Forma Financial Data—Kraton.”

The notes will not be guaranteed by all of our subsidiaries. For example, our immaterial subsidiaries are not required to guarantee the notes. Accordingly, claims of holders of the notes will be structurally subordinate to the claims of creditors of these non-guarantor subsidiaries, including trade creditors. All obligations of our non-guarantor subsidiaries will have to be satisfied before any of the assets of such subsidiaries would be available for distribution, upon a liquidation or otherwise, to us or a guarantor of the notes.

Our failure to comply with the agreements relating to our indebtedness, including as a result of events beyond our control, could result in an event of default that could materially and adversely affect our results of operations and our financial condition.

If there were an event of default under any of the agreements relating to our current or future indebtedness, the holders of the defaulted debt could cause all amounts outstanding with respect to that debt to be due and payable immediately. Upon acceleration of certain of our other indebtedness, holders of the notes could declare all amounts outstanding under the notes immediately due and payable. We cannot assure you that our assets or cash flow would be sufficient to fully repay borrowings under our outstanding debt instruments if accelerated upon an event of default. Further, if we are unable to repay, refinance or restructure our secured indebtedness, the holders of such indebtedness could proceed against the collateral securing that indebtedness. In addition, any event of default or declaration of acceleration under one debt instrument could also result in an event of default under one or more of our other debt instruments. In addition, counterparties to some of our long term customer contracts may have the right to amend or terminate those contracts if we have an event of default or a declaration of acceleration under certain of our indebtedness, which could materially adversely affect our business, financial condition or results of operations.

Under certain circumstances a court could cancel the notes or the related guarantees under fraudulent conveyance laws.

Federal and state fraudulent transfer and conveyance statutes may apply to the issuance of the notes and the incurrence of the guarantees. Under federal bankruptcy law and comparable provisions of state fraudulent transfer or conveyance laws, which may vary from state to state, the notes or guarantees could be voided as a fraudulent transfer or conveyance if (1) we or any of the guarantors, as applicable, issued the notes or incurred the guarantees with the intent of hindering, delaying or defrauding creditors or (2) we or any of the guarantors, as applicable, received less than reasonably equivalent value or fair consideration in return for either issuing the notes or incurring the guarantees and, in the case of (2) only, one of the following is also true at the time thereof:

| | • | | we or any of the guarantors, as applicable, were insolvent or rendered insolvent by reason of the issuance of the notes or the incurrence of the guarantees; |

8

| | • | | the issuance of the notes or the incurrence of the guarantees left us or any of the guarantors, as applicable, with an unreasonably small amount of capital to carry on the business; |

| | • | | we or any of the guarantors intended to, or believed that we or such guarantor would, incur debts beyond our or such guarantor’s ability to pay as they mature; or |

| | • | | we or any of the guarantors was a defendant in an action for money damages, or had a judgment for money damages docketed against us or such guarantor if, in either case, after final judgment, the judgment is unsatisfied. |

If a court were to find that the issuance of the notes or the incurrence of the guarantee was a fraudulent transfer or conveyance, the court could void the payment obligations under the notes or such guarantee or further subordinate the notes or such guarantee to presently existing and future indebtedness of ours or of the related guarantor, or require the holders of the notes to repay any amounts received with respect to such guarantee. In the event of a finding that a fraudulent transfer or conveyance occurred, you may not receive any repayment on the notes. Further, the voidance of the notes or the guarantees could result in an event of default with respect to our and our subsidiaries’ other indebtedness that could result in acceleration of such indebtedness.

As a general matter, value is given for a transfer or an obligation if, in exchange for the transfer or obligation, property is transferred or an antecedent debt is secured or satisfied. A debtor will generally not be considered to have received value in connection with a debt offering if the debtor uses the proceeds of that offering to make a dividend payment or otherwise retire or redeem equity securities issued by the debtor. We cannot be certain as to the standards a court would use to determine whether or not we or the guarantors were solvent at the relevant time or, regardless of the standard that a court uses, that the issuance of the guarantees would not be further subordinated to our or any of our guarantors’ other debt.

You may not be able to sell the notes readily or at all or at or above the price that you paid.

We do not intend to apply for the notes to be listed on any securities exchange or to arrange for quotation on any automated dealer quotation system. The initial purchasers have advised us that they intend to make a market in the notes, but they are not obligated to do so and may discontinue any market making in the notes at any time, in their sole discretion. You may not be able to sell your notes at a particular time or at favorable prices. As a result, we cannot assure you as to the liquidity of any trading market for the notes. Accordingly, you may be required to bear the financial risk of your investment in the notes indefinitely. Future trading prices of the notes may be volatile and will depend on many factors, including:

| | • | | our operating performance and financial condition; |

| | • | | the interest of securities dealers in making a market for them; |

| | • | | prevailing interest rates; and |

| | • | | the market for similar securities. |

In addition, the market for non-investment grade debt historically has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. The market for the notes may be subject to similar disruptions that could adversely affect their value.

You may not be able to determine when a change of control has occurred and may not be able to require us to purchase notes as a result of a change in the composition of the directors on our board.

The definition of change of control includes a phrase relating to the sale, lease or transfer of “all or substantially all” of our assets. See “Description of Notes—Repurchase at the Option of Holders—Change of Control.” There is no precisely established definition of the phrase “substantially all” under applicable law. Accordingly, your ability to require us to repurchase your notes as a result of a sale, lease or transfer of less than all of our assets to another individual, group or entity may be uncertain.

9

In addition, a Delaware Chancery Court decision found that incumbent directors are permitted to approve as a continuing director any person, including one nominated by a dissident stockholder and not recommended by the board, as long as the approval is granted in good faith and in accordance with the board’s fiduciary duties. Accordingly if a court were to similarly rule with respect to our notes, you may not be able to require us to purchase your notes as a result of a change in the composition of the directors on our board unless a court were to find that such approval was not granted in good faith or violated the board’s fiduciary duties. The court also observed that certain provisions in indentures, such as continuing director provisions, could function to entrench an incumbent board of directors and could raise enforcement concerns if adopted in violation of a board’s fiduciary duties. If such a provision were found unenforceable, you would not be able to require us to purchase your notes upon a change of control resulting from a change in the composition of our board.

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture governing the notes.

Upon the occurrence of a “change of control,” as defined in the indenture governing the notes, we must offer to buy back the notes at a price equal to 101% of the principal amount, together with any accrued and unpaid interest, if any, to the date of the repurchase. Our failure to purchase, or give notice of purchase of, the notes would be a default under the indenture governing the notes. See “Description of Notes—Repurchase at the Option of Holders—Change of Control.”

If a change of control occurs, it is possible that we may not have sufficient assets at the time of the change of control to make the required repurchase of notes or to satisfy all obligations under the Term Loan Facility, the ABL Facility and the indenture governing the notes. In order to satisfy our obligations, we could seek to refinance any or all of our outstanding indebtedness or seek to obtain a waiver from the lenders under the Term Loan Facility or the ABL Facility or the holders of the notes. We cannot assure you that we would be able to obtain a waiver or refinance our indebtedness on terms acceptable to us, if at all.

Volatility in the market price and trading volume of our common stock could adversely impact the trading price of the notes.

The stock market in recent years has experienced significant price and volume fluctuations that have often been unrelated to the operating performance of companies. The market price of our common stock could fluctuate significantly for many reasons, including in response to the risks described in this section, elsewhere in this offering circular or the documents we have incorporated by reference in this offering circular or for reasons unrelated to our operations, such as reports by industry analysts, investor perceptions or negative announcements by our customers, competitors or suppliers regarding their own performance, as well as industry conditions and general financial, economic and political instability. A decrease in the market price of our common stock would likely adversely impact the trading price of the notes.

Any adverse rating of the notes may negatively affect the trading price and liquidity of the notes.

A rating agency’s rating of the notes is not a recommendation to purchase, sell or hold any particular security, including the notes. Such ratings are limited in scope, and do not comment as to material risks relating to an investment in the notes. If one or more rating agencies were to lower its rating of the notes below the rating initially assigned to the notes or otherwise announce its intention to put the notes on credit watch, the trading price or liquidity of the notes could decline.

We have not registered, and will not register, the offer or sale of the notes, which will limit your ability to resell them.

The offer and sale of the notes have not been, and will not be, registered under the Securities Act or any state securities laws. Unless the offer and sale of the notes have been registered, they may not be transferred or resold except in a transaction exempt from or not subject to the registration requirements of the Securities Act and applicable state securities laws. We do not intend to file a registration statement for the resale of the notes.

10

Under Rule 144 under the Securities Act (“Rule 144”) as currently in effect, a person who acquired the notes from us or our affiliate and who has beneficially owned the notes for at least one year is entitled to sell such notes without registration, but only if such person is not our affiliate at the time of, or at any time during three months preceding, the sale. Furthermore, under Rule 144, a person who acquired the notes from us or our affiliate and who has beneficially owned the notes for at least six months is entitled to sell such notes without registration, so long as (i) such person is not our affiliate at the time of, or at any time during three months preceding, the sale and (ii) we have filed all required reports under Section 13 or 15(d) of the Exchange Act, as applicable, during the twelve months preceding such sale (other than current reports on Form 8-K). If we are not current in filing our Exchange Act reports, a person who acquires from us or our affiliate notes could be required to hold such notes for up to one year following such acquisition. If we are not current in filing our Exchange Act reports, a person who is our affiliate and who owns notes could be required to hold such notes indefinitely. As a result of the foregoing, your ability to resell in the public market the notes may be limited, which may adversely affect the size of the market for the notes and pricing on resales. See “Transfer Restrictions.”

The notes may be issued with OID for U.S. federal income tax purposes.

The notes will be treated as issued with original issue discount (“OID”) for U.S. federal income tax purposes if the difference between the principal amount of the notes and their issue price is equal to or greater than a specified de minimis amount. If the notes are issued with OID, a U.S. holder (as defined in “Certain U.S. Federal Income Tax Consequences”) will be required to include such OID in gross income (as ordinary income) on a constant yield to maturity basis in advance of the receipt of cash payment thereof, regardless of such holder’s method of accounting for U.S. federal income tax purposes. See “Certain U.S. Federal Income Tax Consequences.”

Additionally, a bankruptcy court may not allow a claim for all or a portion of any unamortized amount of the OID on the notes.

The lenders under the New Senior Secured Credit Facilities will have the discretion to release the guarantors under the New Senior Secured Credit Facilities in a variety of circumstances, which will cause those guarantors to be released from their guarantees of the notes.

While any obligations under the New Senior Secured Credit Facilities remain outstanding, any guarantee of the notes may be released without action by, or consent of, any holder of the notes or the trustee, at the discretion of lenders under the New Senior Secured Credit Facilities, if such guarantor is no longer a guarantor of obligations under the new Senior Secured Credit Facilities or any capital markets indebtedness above a certain threshold. See “Description of Notes—Guarantees.” The lenders under the New Senior Secured Credit Facilities will have the discretion to release the guarantees under the New Senior Secured Credit Facilities in a variety of circumstances. You will not have a claim as a creditor against any subsidiary that is no longer a guarantor of the notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will effectively be senior to claims of noteholders.

Risk Factors Related to the Pending Arizona Chemical Acquisition

Failure to successfully integrate Arizona Chemical in the expected time frame following completion of the pending Arizona Chemical Acquisition may adversely affect the future results of the combined organization, and, consequently, the value of the notes.

The success of the pending Arizona Chemical Acquisition will depend substantially on our ability to realize the anticipated benefits and synergies from combining our business with Arizona Chemical’s business. To realize these anticipated benefits, the businesses must be successfully integrated and combined, and we will incur substantial costs to do so. We currently estimate the cost to achieve expected annual synergies of approximately $65.0 million (expected to be fully realized by 2018) to be approximately $50.5 million over the three-year period following closing of the Arizona Chemical Acquisition and in addition, expect to incur transaction-related

11

costs associated with completing the acquisition and integrating the businesses. The combined organization may not be able to achieve its objectives or expected synergies for a number of reasons, including, but not limited to, the following: (i) we may fail to integrate the Arizona Chemical business with our existing business into a cohesive, efficient enterprise; (ii) our resources, including management resources, are limited and may be strained, and the Arizona Chemical Acquisition may divert our management’s attention from initiating or carrying out programs to save costs or enhance revenues; (iii) our failure to retain key employees and contracts of Arizona Chemical; (iv) we may fail to identify operating problems or liabilities prior to closing of the Arizona Chemical Acquisition; and (v) we may not be able to implement the requirements of Section 404 of the Sarbanes-Oxley Act of 2002 in a timely manner. In addition, costs to achieve anticipated synergies and benefits may exceed our estimates, and the actual integration may result in additional and unforeseen expenses, which could reduce the anticipated benefits of the pending Arizona Chemical Acquisition. These unrealized benefits and difficulties could result in declines in the value of the notes.

We may be unable to realize the anticipated cost synergies or may incur additional and/or unexpected costs in order to realize them.

There can be no assurance that we will be able to realize the anticipated cost synergies from the pending Arizona Chemical Acquisition in the anticipated amounts or within the anticipated timeframes or costs expectations, or at all. We plan to implement a series of cost savings initiatives at the combined company that, as described above under “Summary—Our Pending Acquisition of Arizona Chemical” and “Summary—Summary Consolidated Historical and Pro Forma Financial Data—Kraton,” we expect to result in annual cost synergies. We expect to incur one-time, non-recurring costs to achieve such cost synergies. These or any other costs or synergies that we realize may differ materially from our estimates. We cannot provide assurances that these anticipated cost synergies will be achieved or that our programs and improvements will be completed as anticipated or at all. In addition, any cost synergies that we realize may be offset, in whole or in part, by reductions in revenues or through increases in other expenses.

Neither our independent registered public accounting firm nor any other independent auditors, have examined, compiled or performed any procedures with respect to these cost synergies, nor have they expressed any opinion, or any other form of assurance on such information or their achievability. Assumptions relating to these cost synergies involve subjective decisions and judgments. Although our management believes these estimates and assumptions to be reasonable, any of the assumptions could be inaccurate and, therefore, there can be no assurance that the Adjusted EBITDA metric described herein will prove to be accurate or that the objectives and plans expressed will be achieved. The internal financial projections used to calculate anticipated cost synergies also do not take into account any circumstances or events occurring after the date on which they were prepared. These internal financial projections reflect assumptions as to certain business decisions that are subject to change. As a result, actual results may differ materially from those contained in these internal financial projections.

Accordingly, there can be no assurance that the internal financial projections and the related anticipated cost synergies will be realized or that actual results will not be significantly higher or lower than projected. We undertake no obligation to update or otherwise revise or reconcile these internal financial projections and the related anticipated cost synergies whether as a result of new information, future events or otherwise.

Failure to complete the pending Arizona Chemical Acquisition, or significant delays in completing the Arizona Chemical Acquisition, could negatively affect our future business and financial results.

If the Arizona Chemical Acquisition is not completed, or if there are significant delays in completing the Arizona Chemical Acquisition, our future business and financial results could be negatively affected, and we will be subject to several risks, including the following:

| | • | | the parties may be liable for damages to one another under the terms and conditions of the Acquisition Agreement; |

| | • | | negative reactions from the financial markets; |

12

| | • | | having to pay certain significant costs relating to the Arizona Chemical Acquisition; and |

| | • | | the attention of our management will have been diverted to the Arizona Chemical Acquisition rather than to our current operations and pursuit of other opportunities that could have been beneficial to us. |

The pro forma financial information in this offering circular may not be reflective of our operating results and financial condition following the Transactions.

The pro forma financial information included in this offering circular is derived from the Arizona Chemical Audited Financial Statements, the Arizona Chemical Interim Financial Statements, the Kraton Audited Financial Statements and the Kraton Interim Financial Statements. We prepared the pro forma information based upon available information and assumptions and estimates that we believe are reasonable. This pro forma information may not necessarily reflect what our results of operations and financial position would have been had the Transactions occurred during the periods presented or what our results of operations and financial position will be in the future. For example, the merger, financing, integration, restructuring and transaction costs related to the pending Arizona Chemical Acquisition could be higher or lower than currently estimated. In addition, our customers may not buy products or services from us following completion of the Transactions in the expected amounts or at all, and as a result, our revenue could materially decline or any anticipated increases in our revenue could be lower than expected.

Risk Factors Related to the Combined Business

LyondellBasell Industries provides significant operating and other services under agreements that are important to our business. The failure of LyondellBasell to perform its obligations, or the termination of these agreements, could adversely affect our operations.

We have operating and service agreements with LyondellBasell Industries, or LyondellBasell, that are important to our business. We are a party to:

| | • | | Operating agreements under which LyondellBasell (in Berre, France and Wesseling, Germany) operates and maintains our European manufacturing facilities and employs and provides substantially all of the staff for those facilities; these operating agreements also provide for site services, utilities, materials and facilities, which had previously been under separate agreements; and |

| | • | | Lease agreements under which we lease our European manufacturing sites (a 96 kiloton capacity facility in Wesseling, Germany and a 85 kiloton capacity facility in Berre, France) from LyondellBasell. |

Under the terms of the above agreements, either party is permitted to terminate the applicable agreement in a variety of situations. The operating agreement relating to the Berre facility is terminable by either party upon 18 months’ written notice. As of November 30, 2015, no such notice has been given by either party. Should LyondellBasell fail to provide these services or should any operating agreement be terminated, we would be forced to obtain these services from third parties or provide them ourselves. Similarly, if in connection with or independent from the termination of an operating agreement, LyondellBasell terminates a facility lease, we would be forced to relocate our manufacturing facility. The failure of LyondellBasell to perform its obligations under, or the termination of, any of these agreements could materially adversely affect our operations and, depending on market conditions at the time of any such termination, we may not be able to enter into substitute arrangements in a timely manner, if at all, and if we are able to enter into a substitute arrangement, it may not be on terms as favorable to us.

Conditions in the global economy and capital markets may adversely affect our results of operations, financial condition and cash flows.

Our products are sold in markets that are sensitive to changes in general economic conditions, such as automotive, construction and consumer products. Downturns in general economic conditions can cause

13

fluctuations in demand for our products, product prices, sales volumes and margins. A decline in the demand for our products or a shift to lower-margin products due to deteriorating economic conditions could adversely affect sales of our products and our profitability and could also result in impairments of certain of our assets.

Our business and operating results have been affected by fluctuating commodity prices, volatile exchange rates and other challenges currently affecting the global economy and our customers. Uncertainty regarding global economic conditions poses a continuing risk to our business, as consumers and businesses may postpone spending in response to tighter credit, negative financial news or declines in income or asset values, which may reduce demand for our products. If global economic and market conditions, or economic conditions in key markets, remain uncertain or deteriorate further, our results of operations, financial condition and cash flows could be materially adversely affected.

The failure of our raw materials suppliers to perform their obligations under long-term supply agreements, or our inability to replace or renew these agreements when they expire, could increase our cost for these materials, interrupt production or otherwise adversely affect our results of operations.

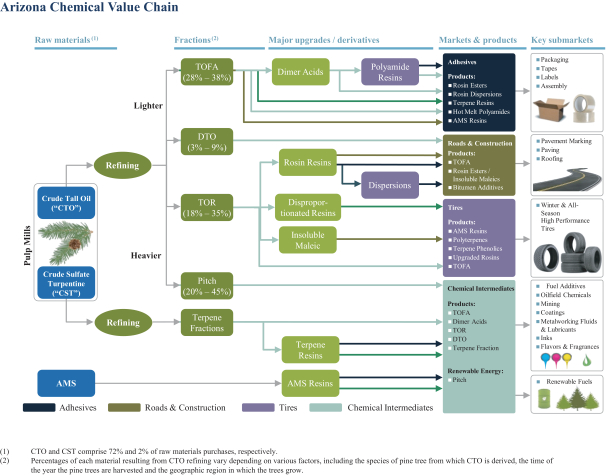

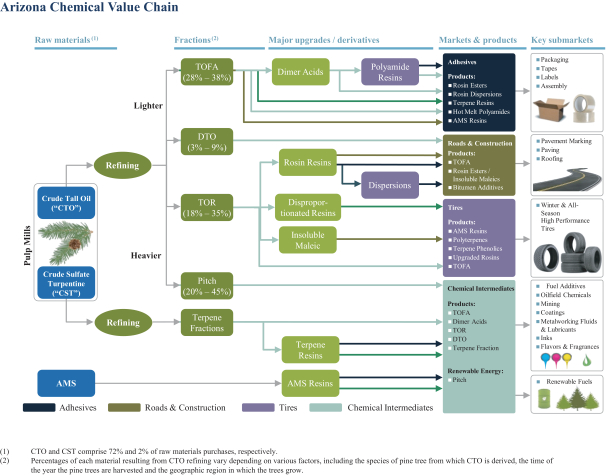

Our manufacturing processes use the following primary raw materials: butadiene, styrene and isoprene, and after the consummation of the pending Arizona Chemical Acquisition, CTO, including black liquor soap which Arizona Chemical refines into CTO. We have entered into long-term supply agreements with Shell Chemicals, LyondellBasell, International Paper (with respect to CTO) and others to supply our raw material needs in the United States and Europe.

In addition, many of our long-term contracts contain provisions that allow our suppliers to limit, or allocate, the amount of raw materials shipped to us below the contracted amount in certain circumstances. If we are required to obtain alternate sources for raw materials because a supplier is unwilling or unable to perform under raw material supply agreements, if a supplier terminates its agreements with us, if we are unable to renew our existing contract, or if we are unable to obtain new long-term supply agreements to meet changing demand, we may not be able to obtain these raw materials in sufficient quantities or in a timely manner, and we may not be able to enter into long-term supply agreements on terms as favorable to us, if at all. A lack of availability of raw materials could have a material adverse effect on our results of operations, financial condition and cash flows.

If the availability of isoprene is limited, we may be unable to produce some of our products in quantities or on economic terms sought by our customers, which could have an adverse effect on our sales of products requiring isoprene.

Isoprene is not widely available, and the few isoprene producers tend to use their production for captive manufacturing purposes or to sell only limited quantities into the world chemicals market. As a result, there is limited non-captive isoprene available for purchase in the markets in which we operate.

Currently, we source our isoprene requirements for the United States and Europe from a portfolio of suppliers. In Japan, we obtain the majority of our isoprene requirements from our joint venture partner, and from alternative suppliers as needed. In Brazil, isoprene is primarily obtained from a local third party supplier. These suppliers may not be able to meet our isoprene requirements, and we may not be able to obtain isoprene in quantities required for our operations on terms favorable to us, or at all. A lack of availability of isoprene in the quantities we require to produce products containing isoprene could have a material adverse effect on our results of operations, financial condition and cash flows.

Because there is limited non-captive isoprene availability, the market for isoprene is thin and prices are particularly volatile. Prices for isoprene are impacted by the supply and prices of natural and synthetic rubber, prevailing energy prices and the existing supply and demand of isoprene in the market. In the past, tight supply in the isoprene market has been exacerbated by operational problems of some key producers and reduced availability of crude C5 inputs for the extraction units. More recently, the trend toward lighter ethylene cracker

14

feed slates has reduced the supply of crude C5 in the United States. This decrease has been replaced by imports of crude C5 and/or isoprene. Significant increases in the cost of isoprene could have a material adverse impact on our results of operations, financial condition and cash flows.

If the availability of butadiene is limited, we may be unable to produce some of our products in quantities or on economic terms sought by our customers, which could have an adverse effect on our sales of products requiring butadiene.

The North American market is structurally short of butadiene and has relied on imports of crude C4 and/or butadiene to balance demand. With the trend toward lighter ethylene cracker feed slates in the United States, there has been a reduction in the supply of crude C4. The North American market has been supplemented by imports of crude C4 and butadiene. Historically, the European market has been better balanced and provided exports to North America. Currently, our butadiene requirements in the United States are satisfied by several suppliers, and LyondellBasell is our major butadiene supplier in Europe. In general, the quantity of butadiene available in any one region is dependent on the cracking inputs of olefins plants, ethylene demand, inter-regional demand for butadiene and demand for other oil derivatives. Suppliers may not be able to meet our butadiene requirements, and we may not be able to obtain substitute supplies of butadiene from alternative suppliers in a timely manner or on favorable terms. A lack of availability of butadiene in the quantities we require to produce products containing butadiene could have a material adverse effect on our results of operations, financial condition and cash flows.

If the availability of styrene is limited, we may be unable to produce some of our products in quantities or on economic terms sought by our customers, which could have an adverse effect on facility utilization and our sales of products requiring styrene.

We satisfy our styrene requirements in the United States and Europe pursuant to purchase agreements with terms of one to two years, subject to renewal conditions. We have more than one supplier in each of these regions and also generally have alternatives for either modifying the contract, supply portfolio or obtaining spot supply. As contracts expire, we cannot give assurances that we will obtain new long-term supply agreements or that the terms of any such agreements will be on terms favorable to us, and consequently our future acquisition costs for styrene may therefore increase which could have a material adverse effect on our results of operations, financial condition and cash flows.

After the consummation of the pending Arizona Chemical Acquisition, if the availability of CTO is limited, Arizona Chemical may be unable to produce some of its products in quantities or on economic terms sought by its customers, which could have an adverse effect on facility utilization and the sales of products requiring CTO.

The availability of CTO is directly linked to the production output of kraft mills using pine as their source of pulp. As a result, there is a finite global supply of CTO, with global demand for kraft board driving the global supply of CTO, rather than demand for CTO itself. Most of the CTO made available for sale by its producers in North America is covered by long-term supply agreements, further constraining availability. Arizona Chemical has a long-term supply contract with International Paper pursuant to which they sell to Arizona Chemical all of the CTO produced at their paper mills. If International Paper, or any of Arizona Chemical’s other suppliers for CTO, fail to meet their respective obligations under Arizona Chemical’s supply agreements or Arizona Chemical is otherwise unable to procure an adequate supply of CTO, Arizona Chemical would be unable to produce the quantity of products that it has historically produced. There are other pressures on the availability of CTO. Some pulp or paper mills may choose to consume their production of CTO to meet their energy needs rather than sell the CTO to third parties. Also, there are regulatory pressures that may incentivize suppliers of CTO to sell CTO into alternative fuel markets rather than to historical end users such as Arizona Chemical. Furthermore, weather conditions have in the past and may in the future affect the availability and quality of pine trees used in the kraft pulping process and therefore the availability of CTO meeting Arizona Chemical’s quality standards. A lack of

15

availability of CTO in the quantities Arizona Chemical requires to produce products containing CTO could have a material adverse effect on our results of operations, financial condition and cash flows following the consummation of the pending Arizona Chemical Acquisition.

The European Union’s Directive 2009/28 on the promotion of the use of energy from renewable resources (“Renewable Energy Directive” or “RED”) and similar legislation in the United States and elsewhere may incentivize the use of CTO as a feedstock for production of alternative fuels.

In December 2008, the European Union adopted RED, which established a 20% EU-wide target for energy consumed from renewable sources relative to the EU’s gross final consumption of energy, as well as a 10% target for energy consumed from renewable sources in the transport section. In order to reach these targets, the RED established mandatory targets for each Member State (as defined in RED) and required each Member State to adopt a national renewable energy action plan setting forth measures to achieve its national targets. RED also established sustainability criteria for biofuels, which must be satisfied in order for the consumption of a fuel to count toward a Member State’s national targets. CTO-based biofuel currently satisfies RED’s biofuel sustainability criteria. In spring 2015, the EU adopted amendments to RED, expressly listing CTO as a residue-type feedstock whose use in biofuel would make that biofuel eligible for double counting towards national targets of the Member States, and at least two Member States additionally have or plan fiscal incentives for the domestic marketing of CTO-based and other qualifying biofuels. In addition to these developments in the European Union, various pieces of legislation regarding the use of alternative fuels have been introduced in the United States. Because the supply of CTO is inherently constrained by the volume of kraft pulp processing, any diversion of CTO for production of alternative fuels would reduce the available supply of CTO as the principal raw material of the pine chemicals industry. A reduced ability to procure an adequate supply of CTO due to competing new uses such as for biofuel production, could have a material adverse effect on our results of operations, financial condition and cash flows following the consummation of the pending Arizona Chemical Acquisition.

Increases in the costs of our raw materials could have an adverse effect on our financial condition and results of operations if those costs cannot be passed on to our customers.

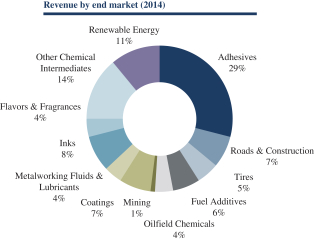

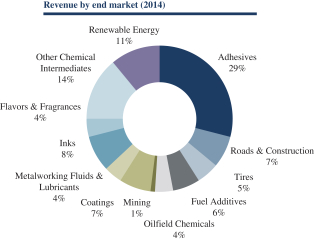

Our results of operations are directly affected by the cost of raw materials. Historically, we have used butadiene, styrene and isoprene as our primary raw materials in manufacturing our products. These monomers together represented approximately $297.7 million, $512.8 million, $609.5 million and $732.9 million or 47.7%, 51.6%, 57.2% and 61.5% of our total cost of goods sold for the nine months ended September 30, 2015 and the years ended December 31, 2014, 2013 and 2012, respectively. After the consummation of the pending Arizona Chemical Acquisition, CTO will become another one of our primary raw materials. CTO purchased was approximately $154.2 million, $286.2 million, $301.0 million and $311.4 million or 35.4%, 42.2%, 41.9%, and 43.0% of Arizona Chemical’s total cost of goods sold for the nine months ended September 30, 2015 and the years ended December 31, 2014, 2013 and 2012, respectively. Since the cost of these primary raw materials comprise a significant amount of the total cost of goods sold, the selling prices for our and Arizona Chemical’s products and therefore total revenue is impacted by movements in raw material costs, as well as the cost of other inputs. In the past we have experienced erratic and significant changes in the costs of these raw materials, the cost of which has generally correlated with changes in energy prices, supply and demand factors, and prices for natural and synthetic rubber. The pricing for butadiene has historically been particularly volatile. Political unrest in the Middle East and market dislocation resulting from U.S. sanctions relating thereto could lead to increases in the price of crude oil, and, as a result, in the price of butadiene, styrene and isoprene. In addition, product mix can have an impact on our overall unit selling prices, since we provide an extensive product offering and therefore experience a wide range of unit selling prices. Because of the significant portion of our cost of goods sold represented by these raw materials, our gross profit margins could be adversely affected by changes in the cost of these raw materials if we are unable to pass the increases on to our customers.

Due to volatile raw material prices, there can be no assurance that we can continue to recover raw material costs or retain customers in the future. As a result of our pricing actions, customers may become more likely to consider competitors’ products, some of which may be available at a lower cost. Significant loss of customers could have a material adverse effect on our results of operations, financial condition and cash flows.

16

Significant fluctuations in raw material costs may result in volatility in our quarterly results of operations, financial condition and cash flows.

In periods of raw material price volatility, reported results under GAAP will differ from what the results would have been if cost of goods sold were based on ECRC. Specifically, in periods of declining raw material costs, reported gross profit will be lower under GAAP than under ECRC, and in periods of rising raw material costs, gross profit will be higher under GAAP than under ECRC. However, because raw material costs are difficult to predict, we cannot accurately anticipate fluctuations in raw material costs with precision, or effectively or economically hedge against the effects of any such change. If raw material costs fluctuate in a quarter, our results of operations, financial condition and cash flows will be affected, the magnitude of which could be significant.

Our industry is highly competitive, and we compete with producers of SBCs, and after the consummation of the pending Arizona Chemical Acquisition, value-added pine based specialty chemicals, or to producers of other products that can be substituted for our products.

Our industry is highly competitive, and we face significant competition from both large international producers and from smaller regional competitors. Our competitors may improve their competitive position in our core markets by successfully introducing new products, improving their manufacturing processes, or expanding their capacity or manufacturing facilities. Further, some of our competitors benefit from advantageous cost positions that could make it increasingly difficult for us to compete in markets for less-differentiated applications. If we are unable to keep pace with our competitors’ product and manufacturing process innovations or cost position, our financial condition, results of operations and cash flows could be materially adversely affected.

In addition, competition in the various product applications in which we compete is intense. Increased competition from existing or newly developed SBCs, value-added specialty chemicals or non-SBC products may reduce demand for our products in the future and our customers may decide on alternate sources to meet their requirements. If we are unable to successfully compete with other producers of SBCs, and following the consummation of the Arizona Chemical Acquisition, refiners of CTO, or if other products can be successfully substituted for our products, our sales may decline. In particular, hydrocarbon and gum-based resins compete with tall oil-based resins in the adhesives and inks markets, and animal and vegetable-based fatty acids compete with TOFA. Arizona Chemical has in certain cases been subject to pricing pressure from Chinese manufacturers of gum rosins, and hydrocarbon competitors have introduced metallocene-based products that compete directly with many of Arizona Chemical’s adhesive tackifiers.

If we are not able to continue the technological innovation and successful commercial introduction of new products, our customers may turn to other producers to meet their requirements which could have a material adverse effect on our financial condition, results of operations and cash flows.

Our industry and the markets into which we sell our products experience periodic technological change and ongoing product improvements. In addition, our customers may introduce new generations of their own products or require new technological and increased performance specifications that would require us to develop customized products. Innovation or other changes in our customers’ product performance requirements may also adversely affect the demand for our products. Our future growth and profitability will depend on our ability to gauge the direction of the commercial and technological progress in all key markets, and upon our ability to successfully develop, manufacture and sell products in such changing markets. In order to maintain our profit margins and our competitive position, we must continue to identify, develop and market innovative products on a timely basis to replace existing products. We may not be successful in developing new products and technology that successfully compete with newly introduced products and materials, and our customers may not accept, or may have lower demand for, any of our new products. Further, an important part of our strategy is the creation of demand for innovations that we develop and introduce to the markets. If we fail to keep pace with evolving

17

technological innovations, fail to modify our products in response to our customers’ needs or fail to develop innovations that generate additional demand, then our business, financial condition and results of operations could be adversely affected as a result of reduced sales of our products or diminished return on investment in innovations.

Our business relies on intellectual property and other proprietary information, and our failure to protect our rights could harm our competitive advantages with respect to the manufacturing of some of our products.

Our success depends, to a significant degree, upon our ability to protect and preserve our intellectual property and other proprietary information relating to our business. However, we may be unable to prevent third parties from using our intellectual property and other proprietary information without our authorization or from independently developing intellectual property and other proprietary information that is similar to ours, particularly in those countries where the laws do not protect our proprietary rights to the same degree as in the United States. The use of our intellectual property and other proprietary information by others could reduce or eliminate any competitive advantage we have developed, potentially causing us to lose sales or otherwise harm our business. If it becomes necessary for us to litigate to protect these rights, any proceedings could be burdensome and costly, and we may not prevail.

In addition, we acquired a significant number of patents from Shell Chemicals. According to the agreements with Shell Chemicals relating to their contribution of these patents to us and our ownership of these patents, Shell Chemicals retained for itself fully-transferable and exclusive licenses to their use outside of the elastomers business, as well as fully-transferable non-exclusive licenses within the field of elastomers for certain limited uses in non-competing activities. Shell Chemicals is permitted to sublicense these rights. Shell Chemicals also retains the right to enforce these patents outside the elastomers field and recover any damages resulting from these actions.

Our patent applications and issued patents may not provide us with any competitive advantage and may be challenged by third parties. Our competitors may also attempt to design around our patents or copy or otherwise obtain and use our intellectual property and other proprietary information. Moreover, our competitors may already hold or have applied for patents in the United States or abroad that, if enforced or issued, could possibly prevail over our patent rights or otherwise limit our ability to manufacture or sell one or more of our products in the United States or abroad. With respect to our pending patent applications, we may not be successful in securing patents for these claims. Our failure to secure these patents may limit our ability to protect inventions that these applications were intended to cover. In addition, the expiration of a patent can result in increased competition with consequent erosion of profit margins.

It is our policy to enter into confidentiality agreements with our employees and third parties to protect our unpatented proprietary manufacturing expertise, continuing technological innovation and other trade secrets, but our confidentiality agreements could be breached or may not provide meaningful protection for our trade secrets or proprietary manufacturing expertise. Adequate remedies may not be available in the event of an unauthorized use or disclosure of our trade secrets and manufacturing expertise. Violations by others of our confidentiality agreements and the loss of employees who have specialized knowledge and expertise could harm our competitive position and cause our sales and operating results to decline as a result of increased competition. In addition, others may obtain knowledge of our trade secrets through independent development or other access by legal means.

The applicable governmental authorities may not approve our pending service mark and trademark applications. A failure to obtain trademark registrations in the United States and in other countries could limit our ability to obtain and retain our trademarks and impede our marketing efforts in those jurisdictions. Moreover, third parties may seek to oppose our applications or otherwise challenge the resulting registrations. In the event that our trademarks are successfully challenged, we could be forced to rebrand our products, which could result in loss of brand recognition and could require us to devote resources to advertising and marketing new brands.

18

The failure of our patents, trademarks or confidentiality agreements to protect our intellectual property and other proprietary information, including our processes, apparatuses, technology, trade secrets, trade names and proprietary manufacturing expertise, methods and compounds, could have a material adverse effect on our competitive advantages over other producers.

Our products may infringe on the intellectual property rights of others, which may cause us to incur unexpected costs or prevent us from selling our products.

Many of our competitors have a substantial amount of intellectual property. We cannot guarantee that our processes and products do not and will not infringe issued patents (whether present or future) or other intellectual property rights belonging to others, including, without limitation, situations in which our products, processes or technologies may be covered by patent applications filed by other parties in the United States or abroad.

From time to time, we oppose patent applications that we consider overbroad or otherwise invalid in order to maintain the necessary freedom to operate fully in our various business lines without the risk of being sued for patent infringement. If, however, patents are subsequently issued on any such applications by other parties, or if patents belonging to others already exist that cover our products, processes or technologies, we could be liable for infringement or have to take other remedial or curative actions to continue our manufacturing and sales activities with respect to one or more products.

We may also be subject to legal proceedings and claims in the ordinary course of our business, including claims of alleged infringement of the patents, trademarks and other intellectual property rights of third parties by us or our licensees in connection with their use of our products. Intellectual property litigation is expensive and time-consuming, regardless of the merits of any claim, and could divert our management’s attention from operating our business.