Leveraging Opportunity to Deliver Growth and Enhanced Profitability Kraton Performance Polymers 2015 Investor Day June 16, 2015

Forward- Looking Statement Disclaimer This presentation includes forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often characterized by the use of words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans” or “anticipates,” or by discussions of strategy, plans or intentions, including the matters described under the captions “A broad complexity reduction program will help us meet customer needs more efficiently”; “We believe there is strong growth potential for CariflexTM in condoms”; ”Specialty Polymers: Low Molecular Weight Polymers”; “Specialty Polymers: Medical Applications in Asia”; “Specialty Polymers: Optical Cable Gels”; “Performance Products: Paving in emerging markets”; “Performance Products: Flexographic printing plates”; “Going forward we will rebalance our investment allocation to better serve customer needs and maximize returns”; “Through the execution of our strategic plan, revenues are projected to reach $1.4B in 2018”; “Organic growth, continued protfolio shift and benefits of the cost reset are expected to drive margin expansion”; “This is expected to yield Adjusted Ebitda improvement of $100M and an 800 basis point increase in ROCE”; “…and is expected to generate $740 million of cumulative cash flow from 2015 through 2018”; “Cost reset initiative expected to generate $70 million in run-rate savings by 2018”; “We will leverage these advantages to further drive organic growth and portfolio shift”; “We believe this strategy will transform our business”; “Cost Competitiveness: We intend to aggressively improve our cost position through multiple initiatives”; “We intend to continue to grow our Cariflex business in current market applications and through new market development”; “Growth in Specialty Polymers will be supported by new grades manufactured at Mailiao”; “Our Performance Products business will benefit from a cost reset initiatives underway”; and “We expect innovation to continue to improve our portfolio mix through 2018.” For the purpose of projecting financial results contained in this presentation we assumed raw material prices similar to Q4 2014, a EUR:USD exchange rate of 1.2 in 2018, and a wage inflation rate of 3.5%. Projections for annual savings resulting from the cost competitiveness initiatives are based on our current projections for the performance of our business through 2018. Actual results will differ if our projections are not realized. All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and unknown risks, uncertainties and other important factors that could cause actual results to differ materially from those expressed in suchforward-looking statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: conditions in the global economy and capital markets; declines in raw material costs; our reliance on LyondellBasell Industries for the provision of significant operating and other services; the failure of our raw materials suppliers to perform their obligations under long-term supply agreements, or our inability to replace or renew these agreements when they expire; limitations in the availability of raw materials we need to produce our products in the amounts or at the prices necessary for us to effectively and profitably operate our business; competition from other producers of SBCs and from producers of products that can be substituted for our products; our ability to produce and commercialize technological innovations; our ability to protect our intellectual property, on which our business is substantially dependent; hazards inherent to the chemical manufacturing business; other risks, factors and uncertainties described in this presentation and our other reports and documents; and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on our forward-looking statements. Forward-looking statements speak only as of the date they are made, and we undertake no obligation to update such information in light of new information or future events. Kraton Performance Polymers – 2015 Investor Day 2

GAAP Disclaimer This presentation includes the use of both GAAP and non-GAAP financial measures. The non-GAAP financial measures are EBITDA, Adjusted EBITDA, Adjusted Gross Profit and Adjusted Net Income attributable to Kraton (or earnings per share). Tables included in this presentation reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see Management’s Discussion and Analysis of Financial Condition and Results of Operations in our Annual Report on Form 10-K for the fiscal year ended December 31, 2014. We consider these non-GAAP financial measures to be important supplemental measures of our performance and believe they are frequently used by investors, securities analysts and other interested parties in the evaluation of our performance including period-to-period comparisons and/or that of other companies in our industry. Further, management uses these measures to evaluate operating performance, and our incentive compensation plan bases incentive compensation payments on our Adjusted EBITDA performance, along with other factors. These non-GAAP financial measures have limitations as analytical tools and in some cases can vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States. For EBITDA, these limitations include: EBITDA does not reflect the significant interest expense on our debt; EBITDA does not reflect the significant depreciation and amortization expense associated with our long-lived assets; EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements. The calculation of EBITDA in our debt agreements includes adjustments, such as extraordinary, non-recurring or one- time charges, proforma cost savings, certain non-cash items, turnaround costs, and other items included in our definition of EBITDA in our debt agreements; and other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC, but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP; and Adjusted EBITDA may, and often will, vary significantly from EBITDA calculations under the terms of our debt agreements and should not be used for assessing compliance or non-compliance with financial covenants under our debt agreements. Because of these and other limitations, EBITDA and Adjusted EBITDA should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. As a measure of our performance, Adjusted Gross Profit is limited because it often will vary substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Finally, we prepare Adjusted Net Income attributable to Kraton by eliminating from net income the impact of a number of items we do not consider indicative of our on-going performance, including the spread between FIFO and ECRC. Our presentation of non-GAAP financial measures and the adjustments made therein should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items, and in the future we may incur expenses or charges similar to the adjustments made in the presentation of our non-GAAP financial measures. Kraton Performance Polymers – 2015 Investor Day 3

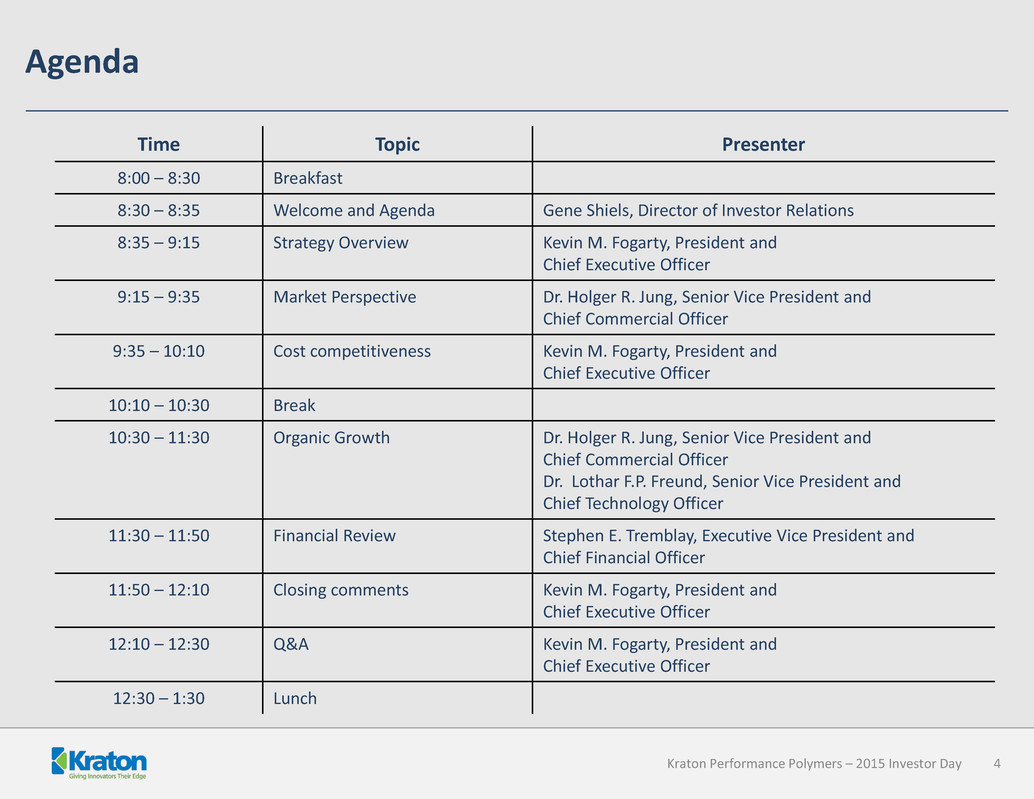

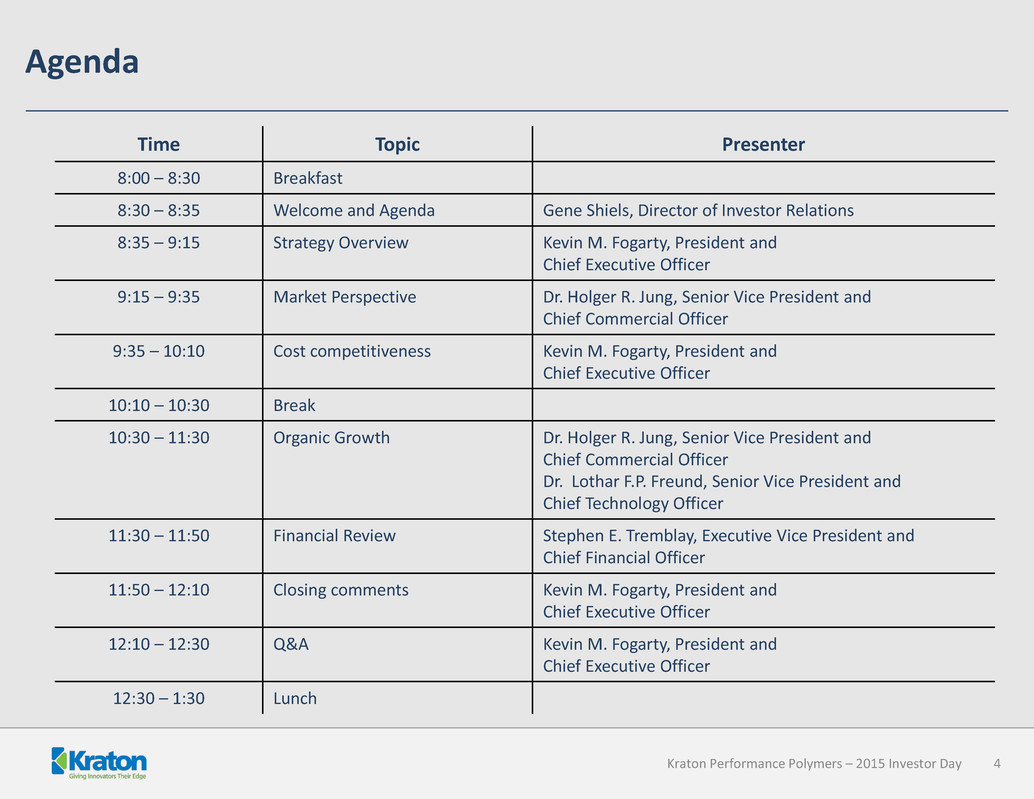

Agenda Time Topic Presenter 8:00 – 8:30 Breakfast 8:30 – 8:35 Welcome and Agenda Gene Shiels, Director of Investor Relations 8:35 – 9:15 Strategy Overview Kevin M. Fogarty, President and Chief Executive Officer 9:15 – 9:35 Market Perspective Dr. Holger R. Jung, Senior Vice President and Chief Commercial Officer 9:35 – 10:10 Cost competitiveness Kevin M. Fogarty, President and Chief Executive Officer 10:10 – 10:30 Break 10:30 – 11:30 Organic Growth Dr. Holger R. Jung, Senior Vice President and Chief Commercial Officer Dr. Lothar F.P. Freund, Senior Vice President and Chief Technology Officer 11:30 – 11:50 Financial Review Stephen E. Tremblay, Executive Vice President and Chief Financial Officer 11:50 – 12:10 Closing comments Kevin M. Fogarty, President and Chief Executive Officer 12:10 – 12:30 Q&A Kevin M. Fogarty, President and Chief Executive Officer 12:30 – 1:30 Lunch Kraton Performance Polymers – 2015 Investor Day 4

Strategy Overview Kevin M. Fogarty President and Chief Executive Officer Kraton Performance Polymers – 2015 Investor Day 5

Kraton continues to define leadership in the styrenic block copolymer industry Kraton holds a position of strength in the SBC industry – we are a market leader in revenues, innovation, and product portfolio Despite feedstock volatility and the emergence of low-cost competitors, Kraton’s resilient business model has maintained profitability and market leadership We are executing a balanced three-part strategy going forward: 1. A cost reset to improve overall competitive position 2. A rebalanced innovation approach to revitalize organic growth 3. The pursuit of strategic acquisitions in the specialty materials space Kraton Performance Polymers – 2015 Investor Day 6

We provide highly-engineered polymer solutions to enhance a wide variety of end use products SBCs provide valuable performance enhancement for polymers… … in a host of everyday applications Kraton Performance Polymers – 2015 Investor Day 7

We also market CariflexTM in both solid and latex forms for a wide variety of applications Polyisoprene rubber latex Solid Polyisoprene rubber Food & medical packaging Dental Dams Catheters Surgical gloves Stoppers/Needle Shields Condoms Marine coatings Transparent soles Resealable insulin plugs Pure Elastic Transparent Strong Soft Kraton Performance Polymers – 2015 Investor Day 8

Broadest manufacturing footprint and production capabilities in the industry Sales network covering >60 countries, five R&D centers and global technical support We have a truly global manufacturing, R&D, and technical support presence Innovation center Production facility Kraton Performance Polymers – 2015 Investor Day 9

We bring the industry’s broadest portfolio to numerous end markets… Hydrogenated SBCs Key markets: Oil gels, medical, lubricant additives, personal care, automotive Exceptional breadth: The broadest product portfolio in the industry High end focus: 57% of sales are differentiated, with premium margins Excellent IP Protection: 1,440 patents granted or pending underpin our global differentiated market position Specialty Polymers (34% of revenues) Unhydrogenated SBCs Key markets: Paving and roofing, labels, tapes, printing plates, personal care Performance Products (55% of revenues) Polyisoprene rubber & Polyisoprene rubber latex Key markets: Surgical gloves, condoms, medical components CariflexTM (11% of revenues) Data for 2014 FY Kraton Performance Polymers – 2015 Investor Day 10

By driving innovation across all of our businesses PVC Alternatives Natural Rubber Replacement Asphalt Modification The Challenge: Medical industry sought to reduce risks associated with natural rubber allergies in latex surgical gloves The Challenge: Concerns about using PVC in medical applications led to a search for a substitute The Challenge: Demand for SBS with broader compatibility characteristics for asphalt blending The Solution: Kraton 1192 allowed customers to leverage lower quality asphalts The Results: Increased barriers to entry for low cost competitors – eventually led to HiMA breakthrough The Solution: Kraton’s ERS polymers enabled a cost-effective solution with excellent clarity, strength and flexibility The Results: ERS polymers are now the preferred alternative to PVC in medical applications (e.g. IV bags, tubing) The Solution: Kraton developed a synthetic with superior haptics and exceptional purity standards The Results: Developed a market leading position in polyisoprene rubber and latex Kraton Performance Polymers – 2015 Investor Day 11 Specialty Polymers Performance Products CariflexTM

As a result, we continue to hold leadership positions in SBC markets… Source: Kraton 2014 estimates Kraton continues to hold leadership positions in both HSBC and USBC We are known for the breadth of our product portfolio, superior quality, and excellent service HSBC global market share (volume kT) USBC global market share (volume kT) Kraton Performance Polymers – 2015 Investor Day 12

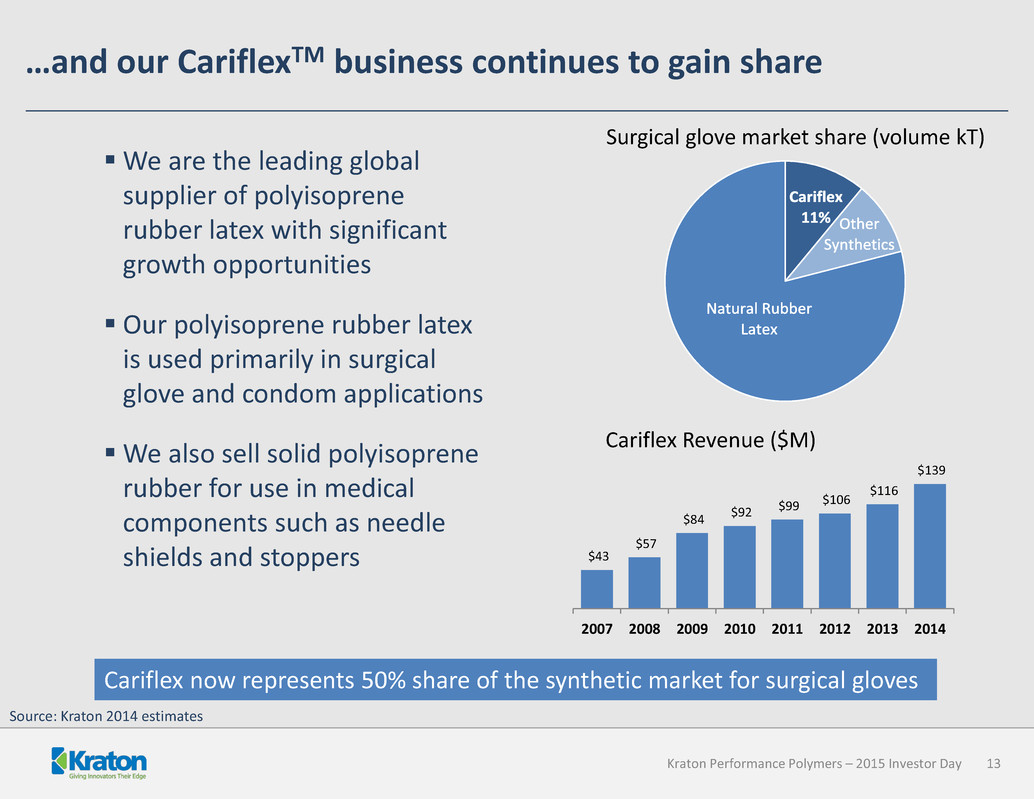

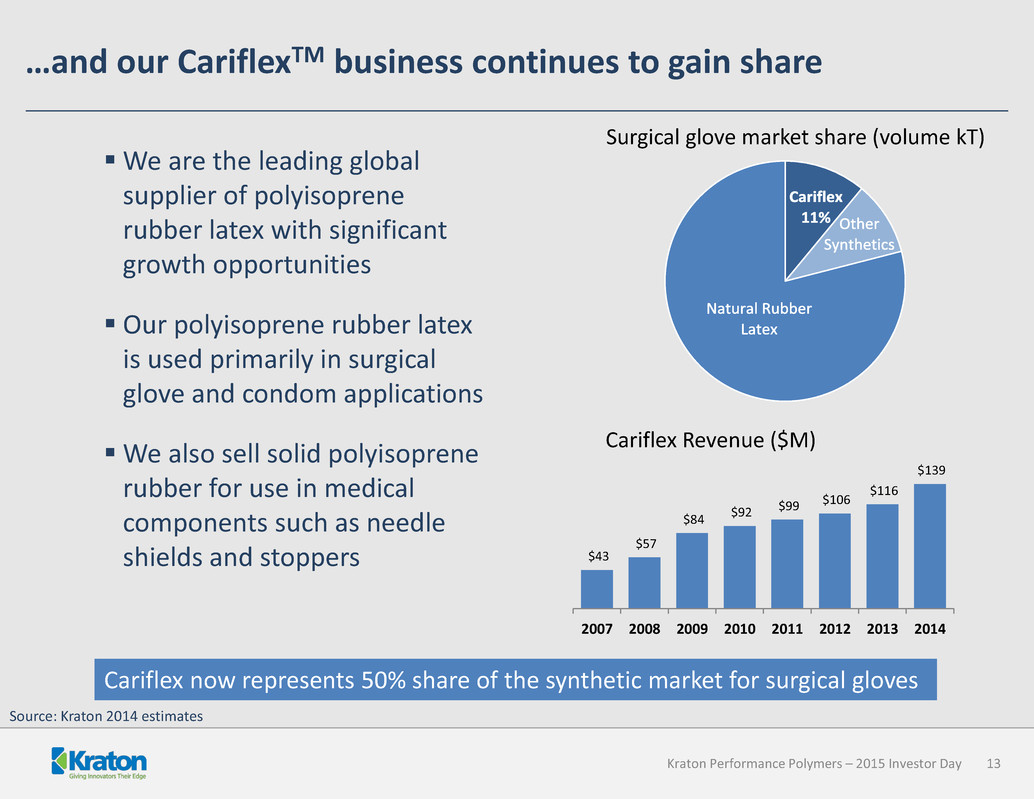

…and our CariflexTM business continues to gain share We are the leading global supplier of polyisoprene rubber latex with significant growth opportunities Our polyisoprene rubber latex is used primarily in surgical glove and condom applications We also sell solid polyisoprene rubber for use in medical components such as needle shields and stoppers Surgical glove market share (volume kT) Source: Kraton 2014 estimates Kraton Performance Polymers – 2015 Investor Day 13 Cariflex now represents 50% share of the synthetic market for surgical gloves $43 $57 $84 $92 $99 $106 $116 $139 2007 2008 2009 2010 2011 2012 2013 2014 Cariflex Revenue ($M)

Moreover, despite significant capacity additions and raw material volatility… Kraton Performance Polymers – 2015 Investor Day 14 Relative Butadiene Volatility 0 50 100 150 200 Cents/lb FOB North America Gulf Coast Butadiene FOB US Gulf Coast Ethylene FOB United States Propylene Source: IHS Chemical, Kraton estimates Global USBC Capacity (kT) Global HSBC Capacity (kT) Asia RoW

… we have continued to upgrade our portfolio to more differentiated product grades… Kraton Performance Polymers – 2015 Investor Day 15 2014 share of volume, revenue and contribution margin by type of grade (%) Historical share of revenue by type of grade (%) Standard Differentiated 46% 54% 64% 36% 57% 43% 47% 53% 51% 49% 52% 48% 57% 43%

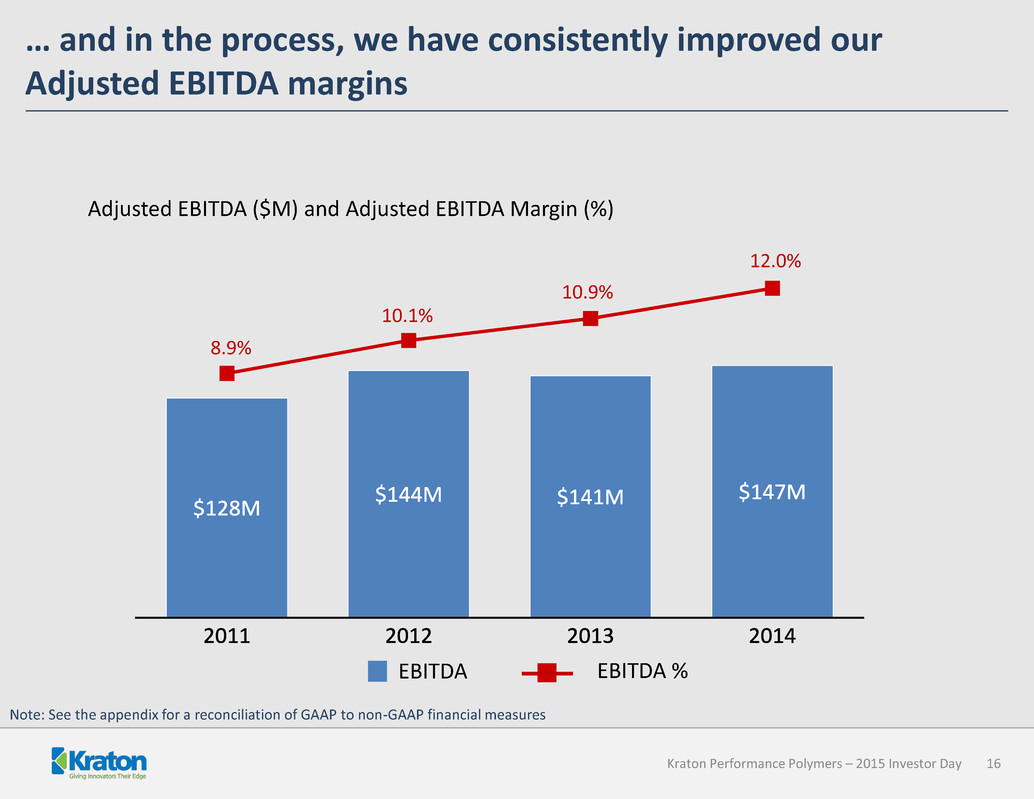

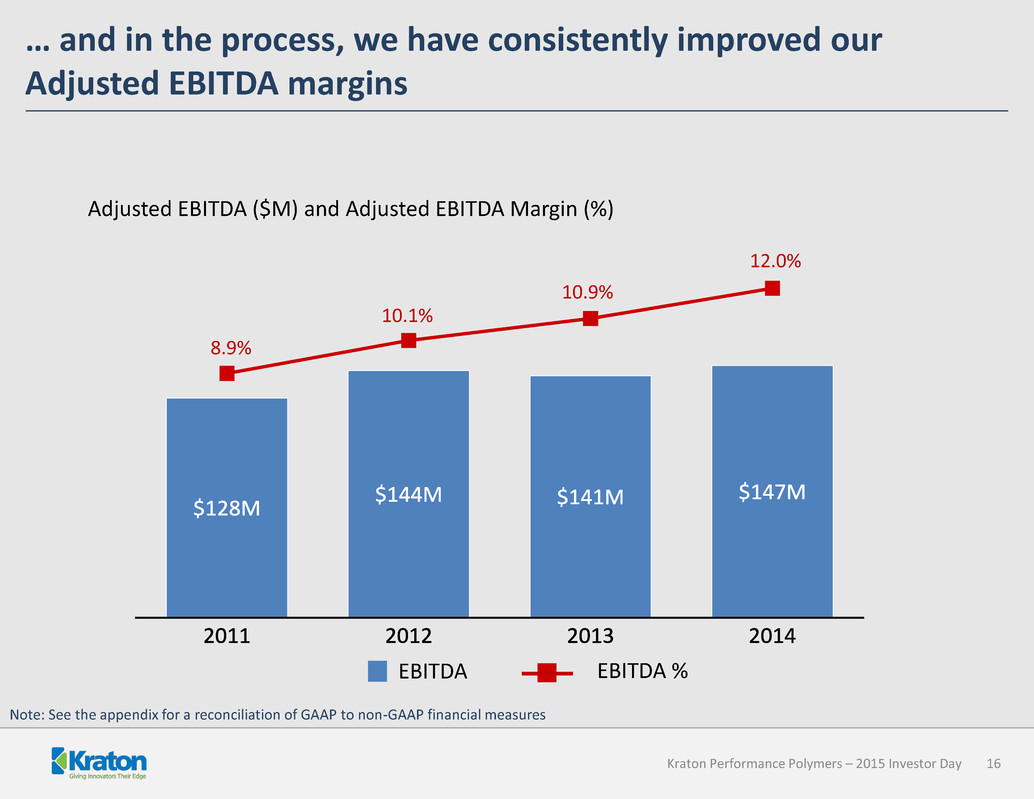

… and in the process, we have consistently improved our Adjusted EBITDA margins Note: See the appendix for a reconciliation of GAAP to non-GAAP financial measures Kraton Performance Polymers – 2015 Investor Day 16 Adjusted EBITDA ($M) and Adjusted EBITDA Margin (%) 8.9% 10.1% 10.9% 12.0% EBITDA % EBITDA

Over the years we have successfully delivered on key initiatives… Initiative … 1.7M shares repurchased through March 31, 2015 at a cost of $32M Announced $50M share repurchase plan 2014 Semi-works is delivering new polymers to market in record time Announced semi-works plant 2013 Mailiao is on schedule and on budget for startup 1’H 2016 Announced world-scale HSBC plant in Taiwan 2011 Adjusted gross profit per ton up from $453 in 2007 to $844 in 2014 Implemented Price Right to enhance margins 2008 Evidence of Success Initiative Share of differentiated revenue up from 41% in 2009 to 57% today Introduced Portfolio shift as a long-term strategy 2009 CariflexTM revenue grew to $139M in 2014 Launched CariflexTM franchise 2007 Completion mid 2015 drives $10M savings per year Announced Belpre Strategic Energy Project 2012 Completion enabled $12M cost reduction Implemented Belpre IR line conversion 2010 Kraton Performance Polymers – 2015 Investor Day 17

Revised approach to the market Rebalanced R&D strategy and portfolio Compelling and strategic acquisitions to improve cost position and access new markets Manufacturing optimization and investments in asset productivity Broad complexity reduction and overhead efficiency effort … providing the foundation to deliver growth and improved profitability through our new three-part strategy Kraton Performance Polymers – 2015 Investor Day 18

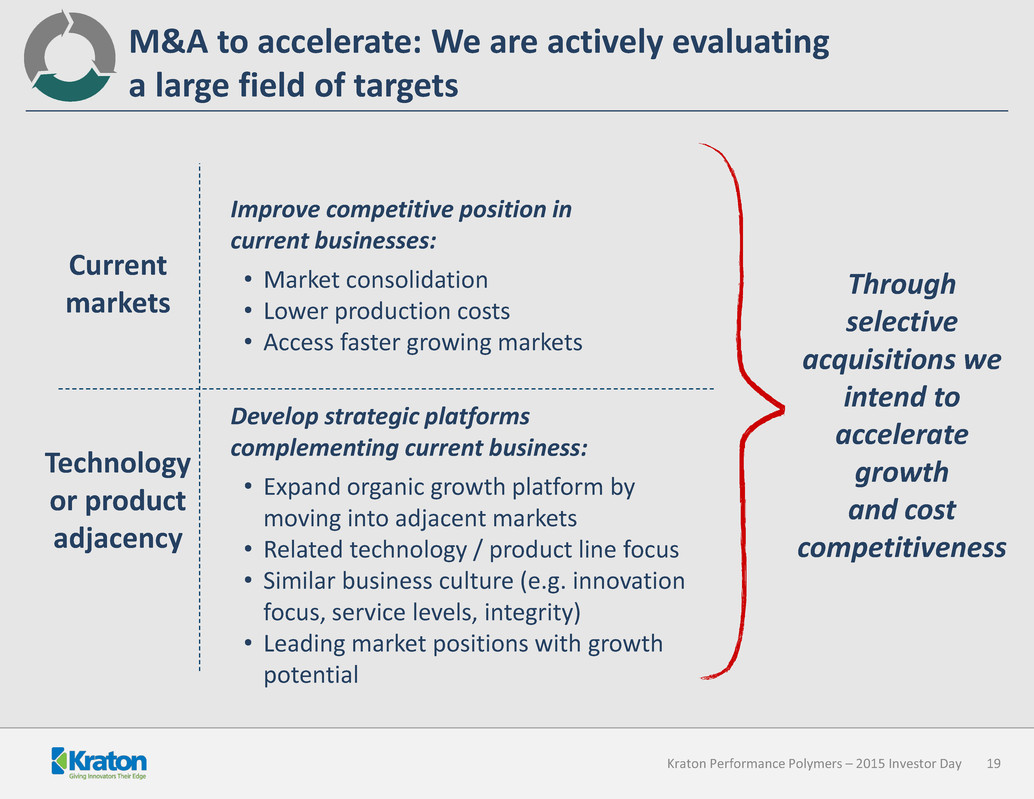

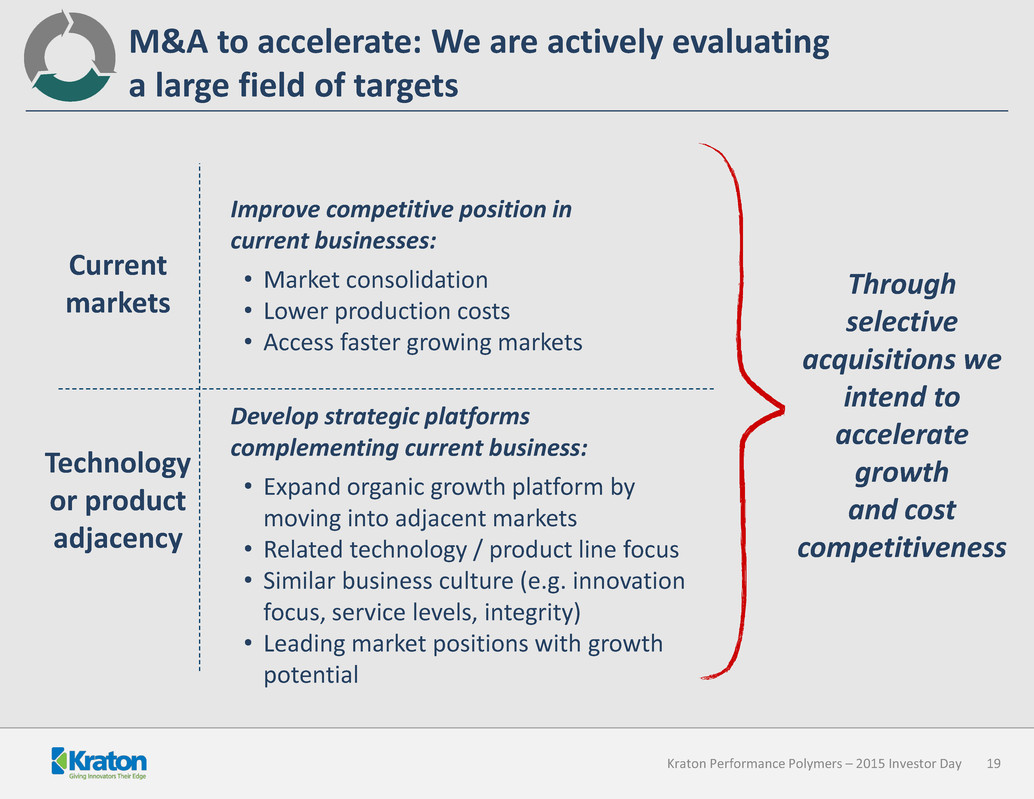

M&A to accelerate: We are actively evaluating a large field of targets Current markets Technology or product adjacency Improve competitive position in current businesses: • Market consolidation • Lower production costs • Access faster growing markets Develop strategic platforms complementing current business: • Expand organic growth platform by moving into adjacent markets • Related technology / product line focus • Similar business culture (e.g. innovation focus, service levels, integrity) • Leading market positions with growth potential Through selective acquisitions we intend to accelerate growth and cost competitiveness Kraton Performance Polymers – 2015 Investor Day 19

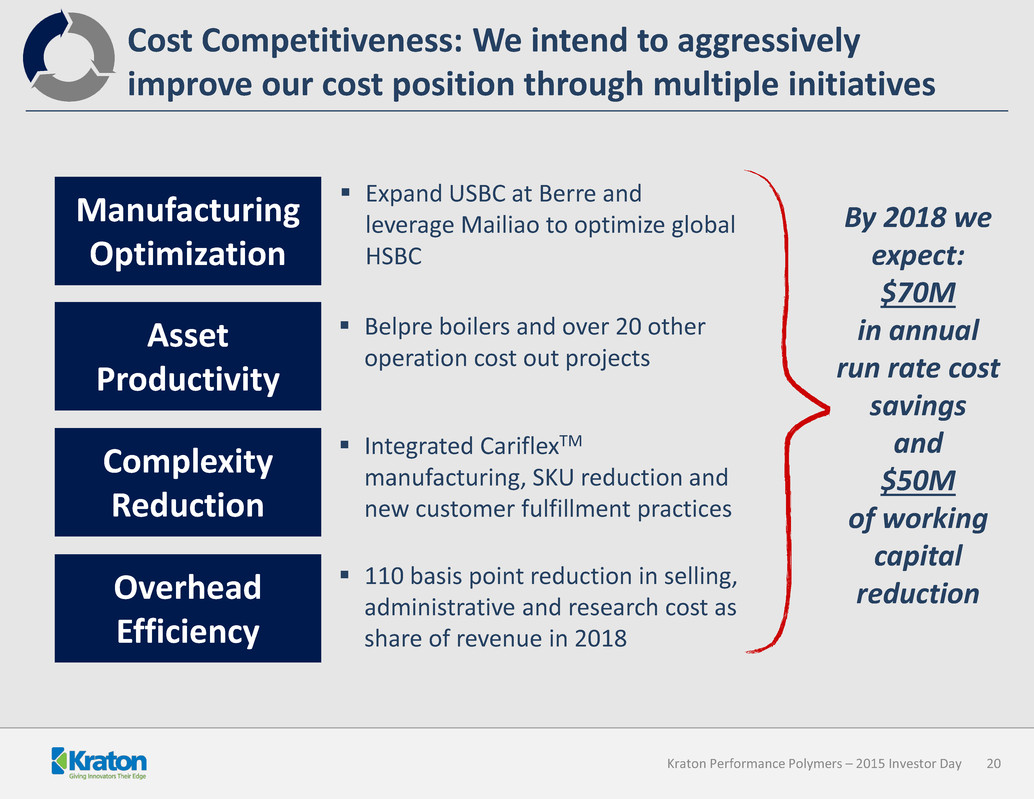

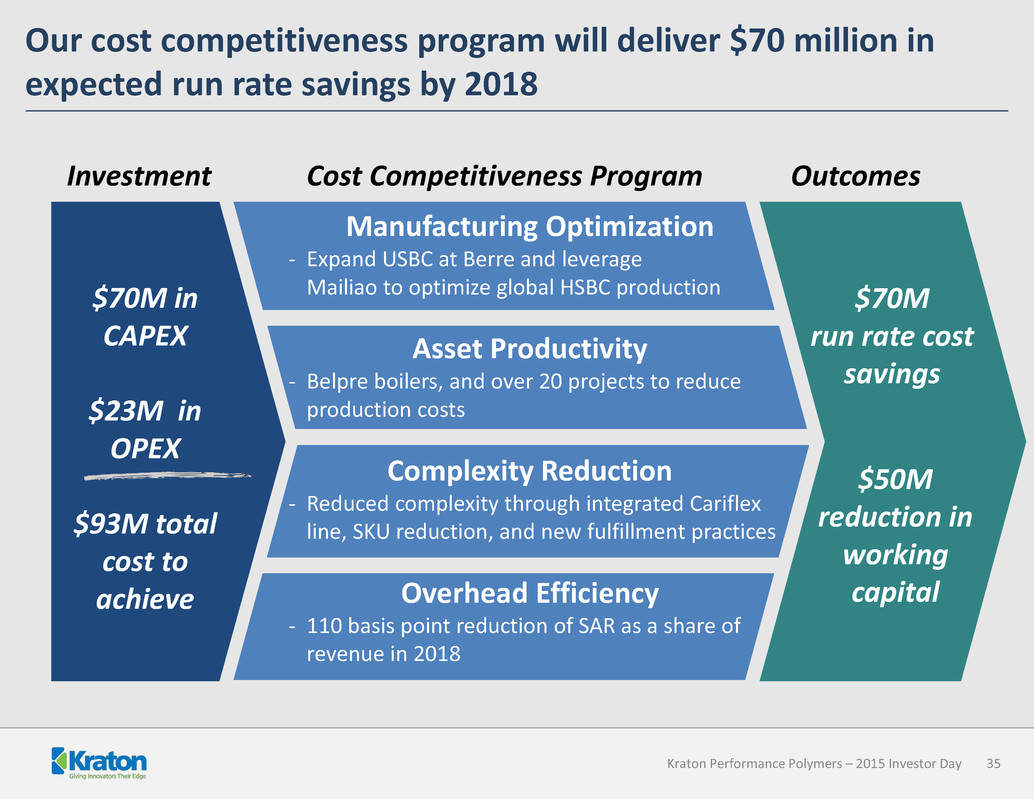

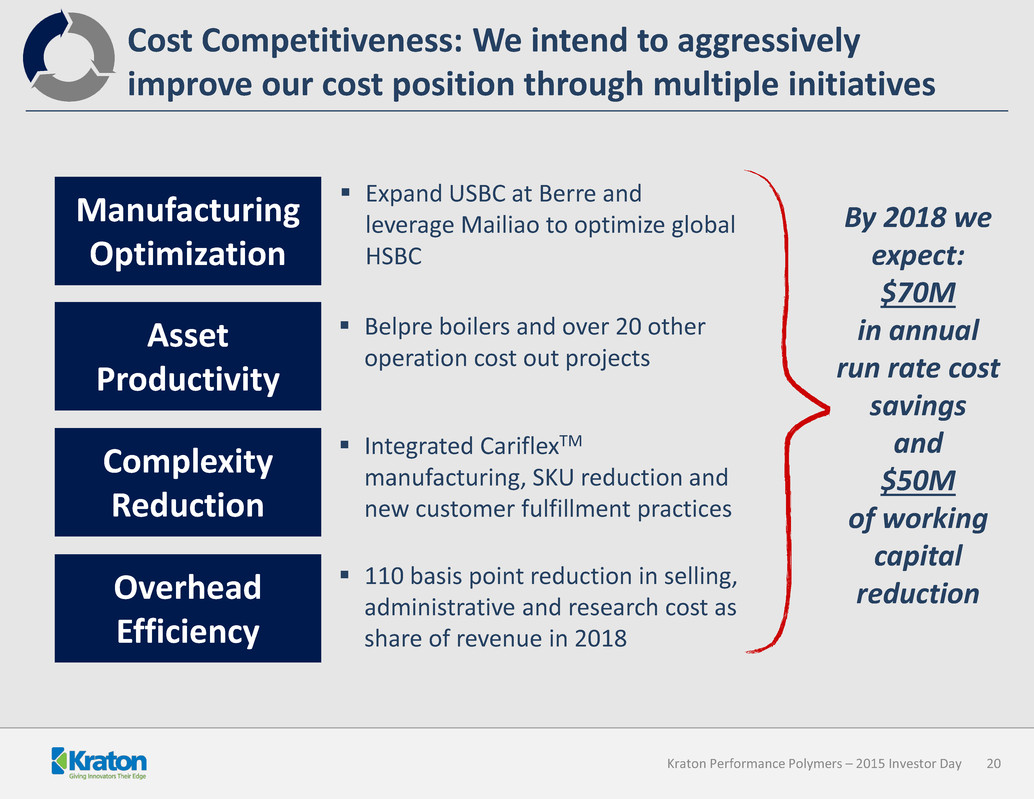

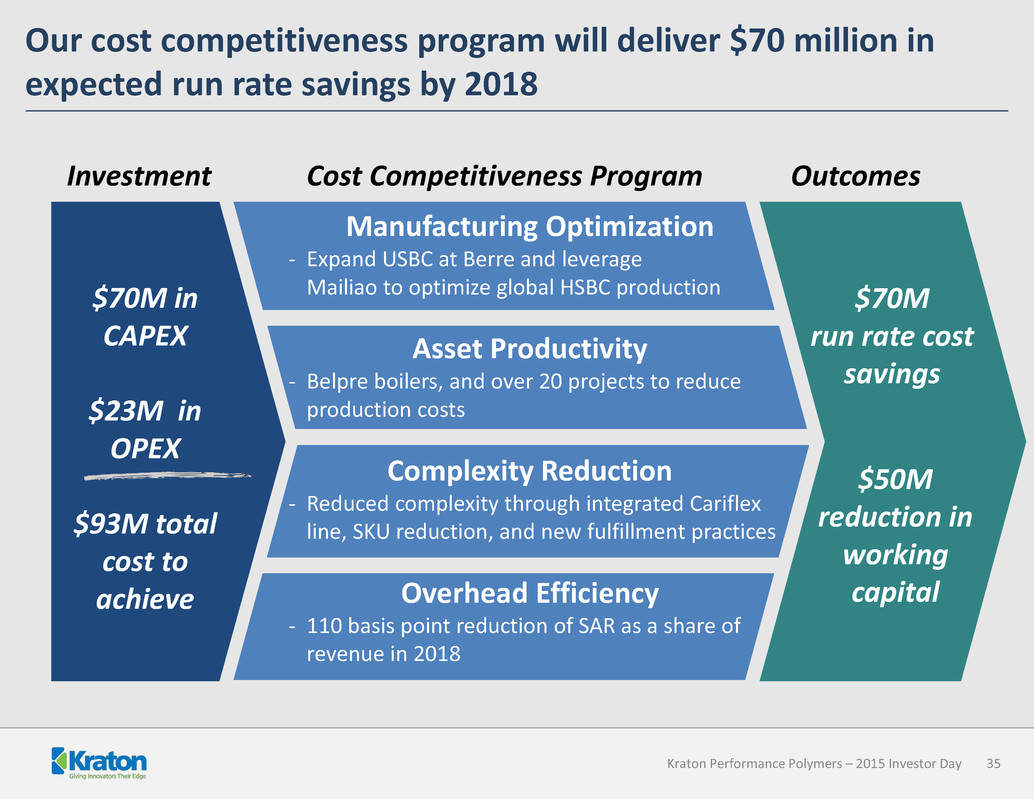

Cost Competitiveness: We intend to aggressively improve our cost position through multiple initiatives By 2018 we expect: $70M in annual run rate cost savings and $50M of working capital reduction Manufacturing Optimization Asset Productivity Overhead Efficiency Expand USBC at Berre and leverage Mailiao to optimize global HSBC Belpre boilers and over 20 other operation cost out projects 110 basis point reduction in selling, administrative and research cost as share of revenue in 2018 Complexity Reduction Integrated CariflexTM manufacturing, SKU reduction and new customer fulfillment practices Kraton Performance Polymers – 2015 Investor Day 20

Revised market approach Rebalanced Innovation Strategy Organic growth: A new approach to the market and a rebalanced R&D strategy to revitalize organic growth We expect this work to drive our organic growth through further portfolio shift and deeper customer relationships Kraton Performance Polymers – 2015 Investor Day 21

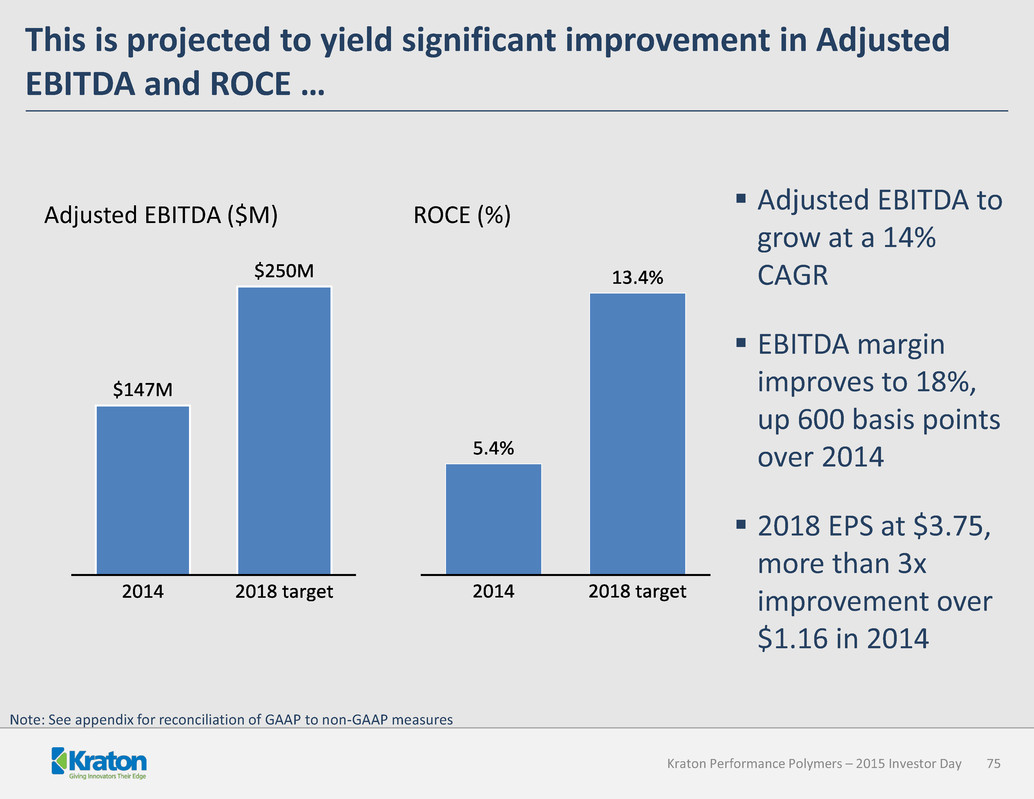

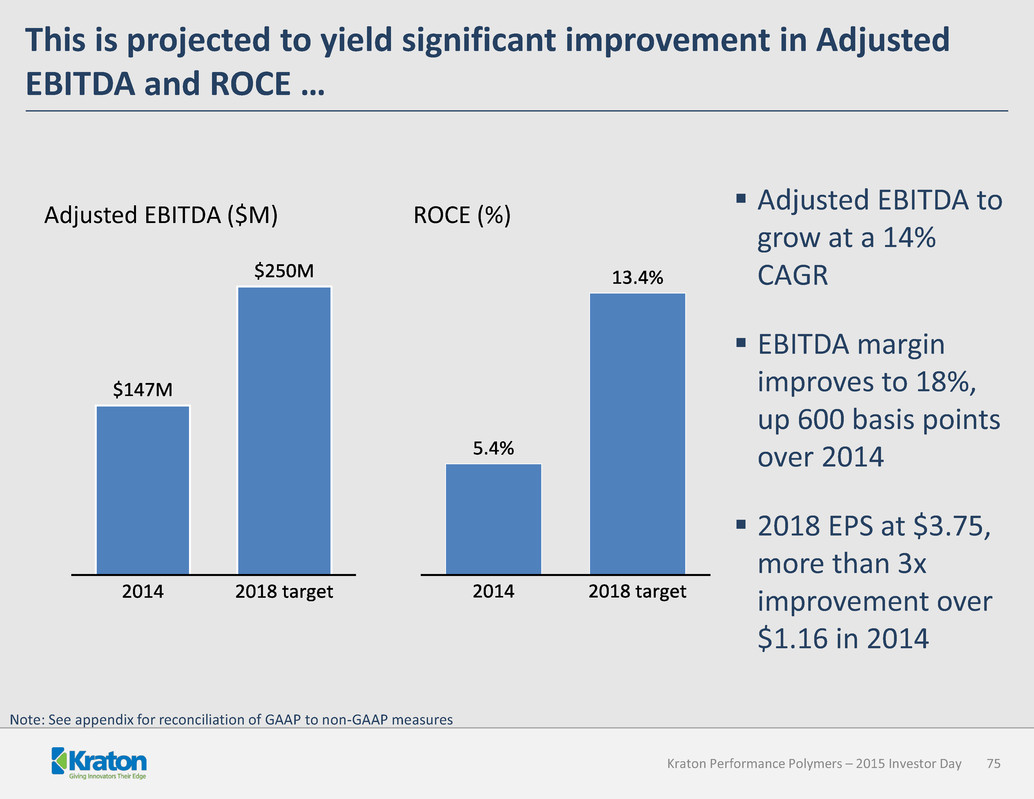

We believe this strategy will transform our business Continued portfolio shift… … combines with cost reset for greater profitability… … resulting in compelling financial outcomes Share of revenue from differentiated grades expected to increase from 57% to 61% Adjusted gross profit/ton expected to increase from $844 to $1,025 and adjusted EBITDA up from $147M to $250M EPS projected to increase from $1.16 to $3.75 and ROCE increases from 5.4% to 13.4% Note: For comparability purposes 2014 EPS is adjusted while 2018 is on a GAAP basis. See appendix for reconciliation of GAAP to non-GAAP measures. Kraton Performance Polymers – 2015 Investor Day 22

Market Perspective Dr. Holger R. Jung Senior Vice President, Chief Commercial Officer Kraton Performance Polymers – 2015 Investor Day 23

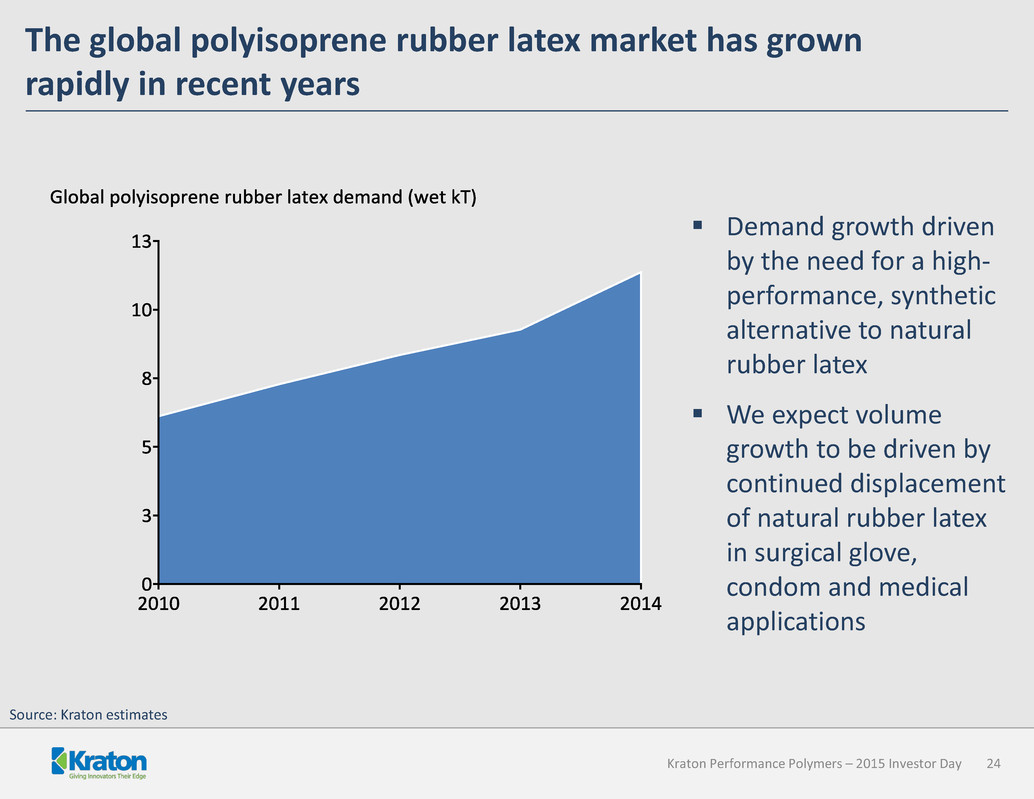

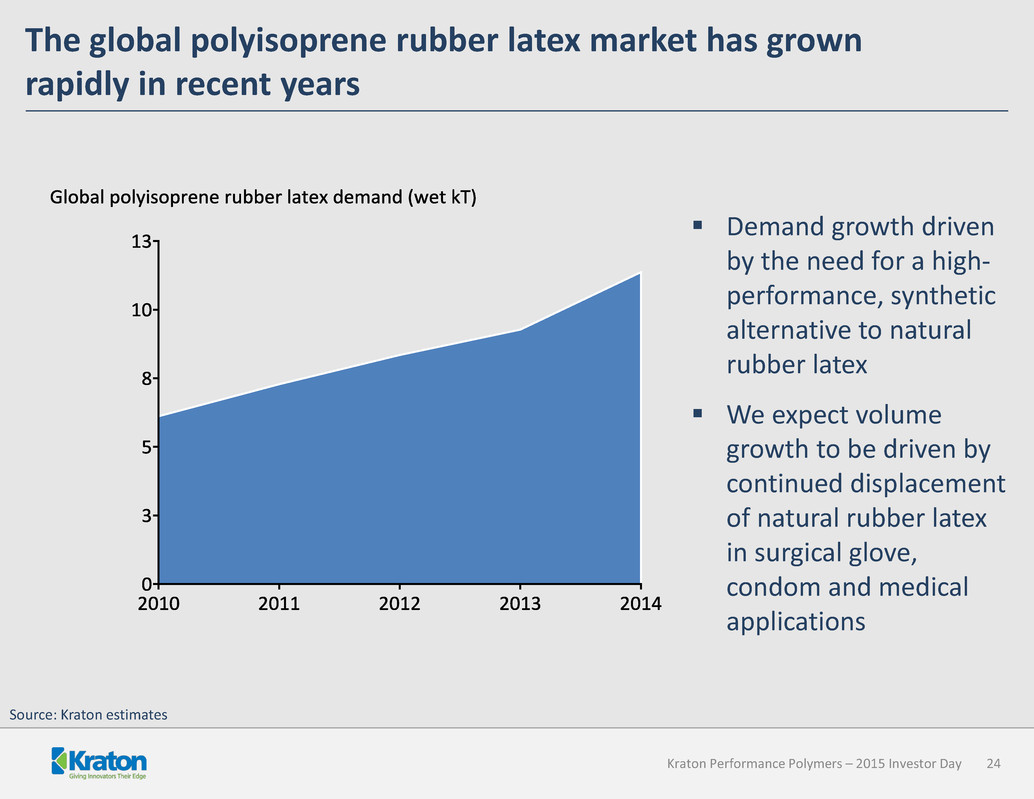

The global polyisoprene rubber latex market has grown rapidly in recent years Source: Kraton estimates Demand growth driven by the need for a high- performance, synthetic alternative to natural rubber latex We expect volume growth to be driven by continued displacement of natural rubber latex in surgical glove, condom and medical applications Kraton Performance Polymers – 2015 Investor Day 24

To date CariflexTM has only taken a small share of target markets – we believe there is significant growth opportunity Solid Rubber – Medical Applications Total market estimated at 120kT (dry tons); Kraton is a niche, high quality player End uses are primarily medical stoppers and other rubber parts produced from solid polyisoprene rubber Cariflex offers purity, superior resealability and reduced coring vs. incumbent materials Rubber Latex - Surgical Gloves Market Addressable market is approximately 65 kT rubber latex (wet tons) Cariflex provides superior haptics with exceptional purity standards – natural rubber allergy concerns are the main growth driver Source: Kraton estimates Note: Total addressable market estimates represent magnitude of market targeted, not expected future sales Global surgical gloves volume share Global medical applications volume share Kraton Performance Polymers – 2015 Investor Day 25

CariflexTM has steadily grown share in the US surgical glove market Total unit volume demand for surgical gloves in the U.S. (all materials) has increased slightly However, Cariflex is displacing traditional materials (market share up over 20 percentage points since 2008) Additionally, Kraton has made strong in-roads overseas. We believe >25% of sales of surgical gloves based upon Cariflex are international today Other Synthetics Cariflex Natural Rubber Source: Kraton estimates Kraton Performance Polymers – 2015 Investor Day 26

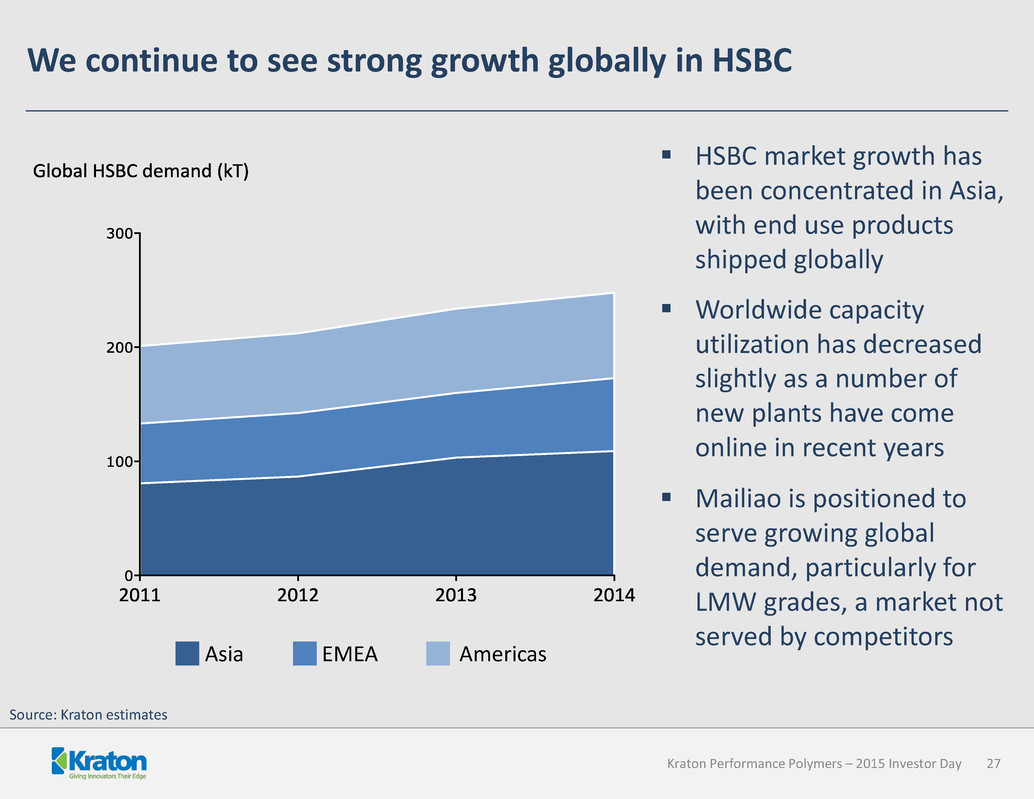

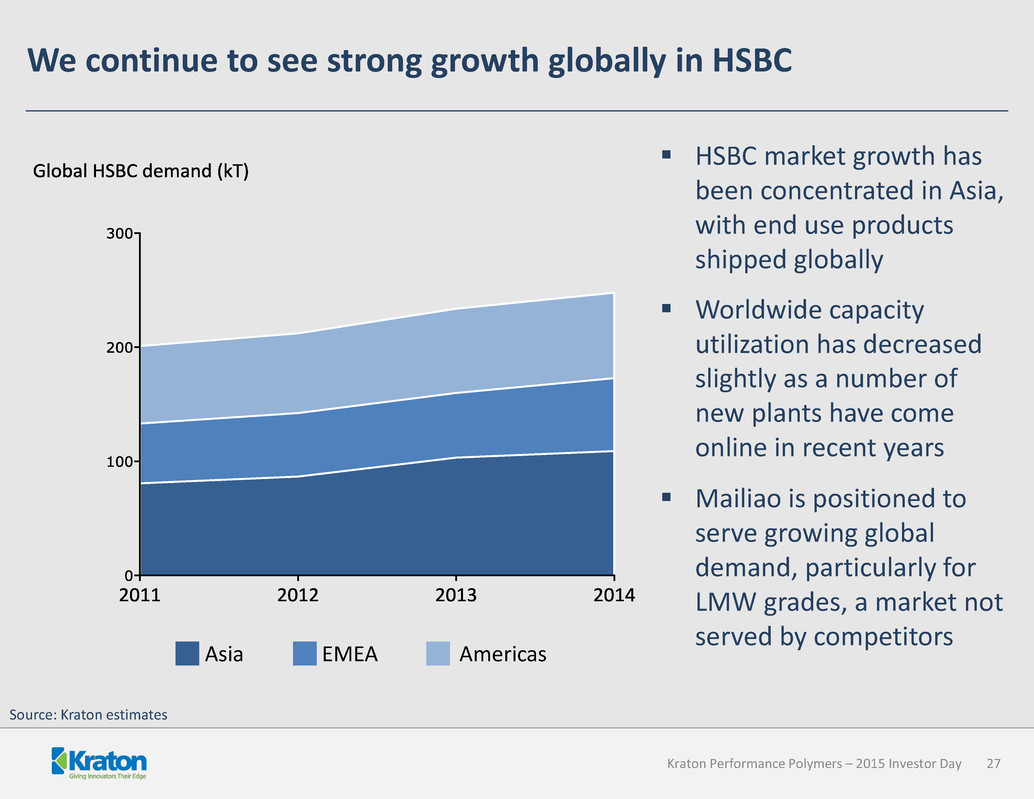

We continue to see strong growth globally in HSBC HSBC market growth has been concentrated in Asia, with end use products shipped globally Worldwide capacity utilization has decreased slightly as a number of new plants have come online in recent years Mailiao is positioned to serve growing global demand, particularly for LMW grades, a market not served by competitors Source: Kraton estimates Americas EMEA Asia Kraton Performance Polymers – 2015 Investor Day 27

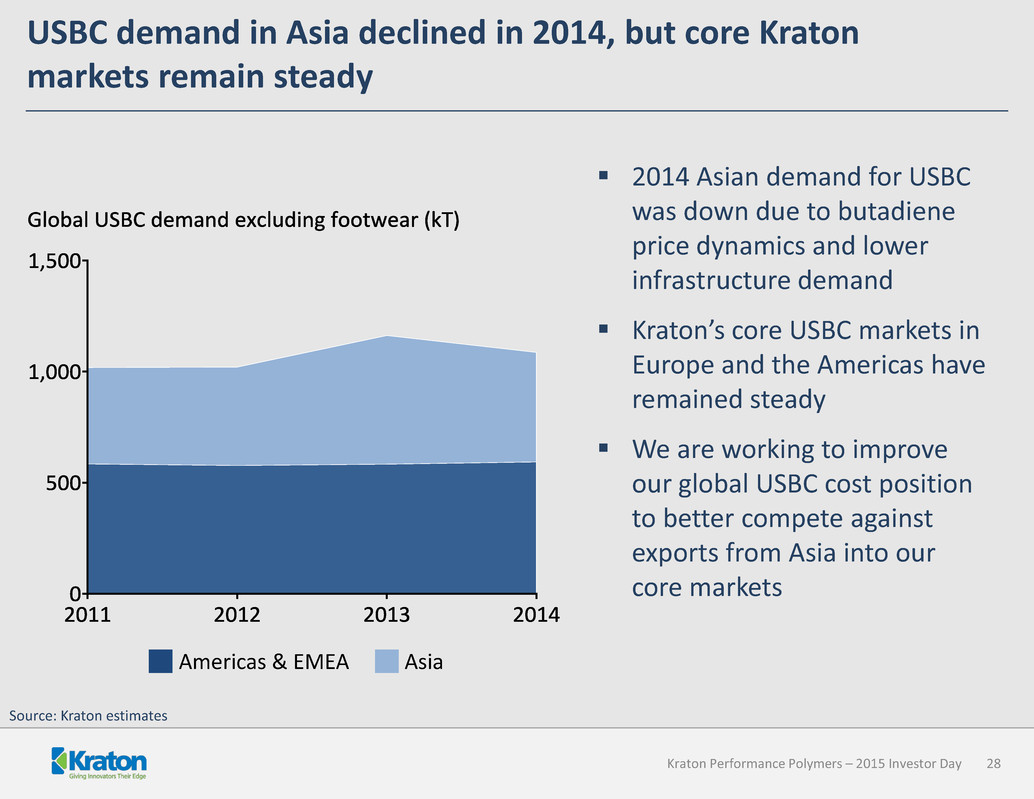

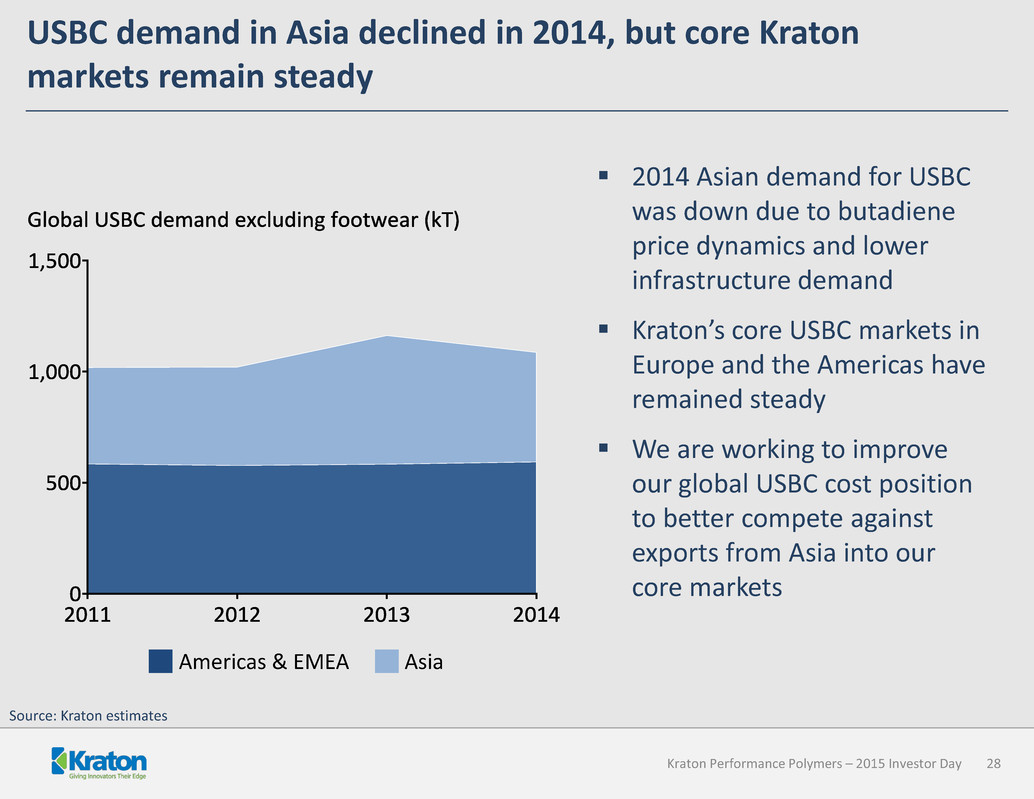

Asia Americas & EMEA Source: Kraton estimates 2014 Asian demand for USBC was down due to butadiene price dynamics and lower infrastructure demand Kraton’s core USBC markets in Europe and the Americas have remained steady We are working to improve our global USBC cost position to better compete against exports from Asia into our core markets USBC demand in Asia declined in 2014, but core Kraton markets remain steady Kraton Performance Polymers – 2015 Investor Day 28

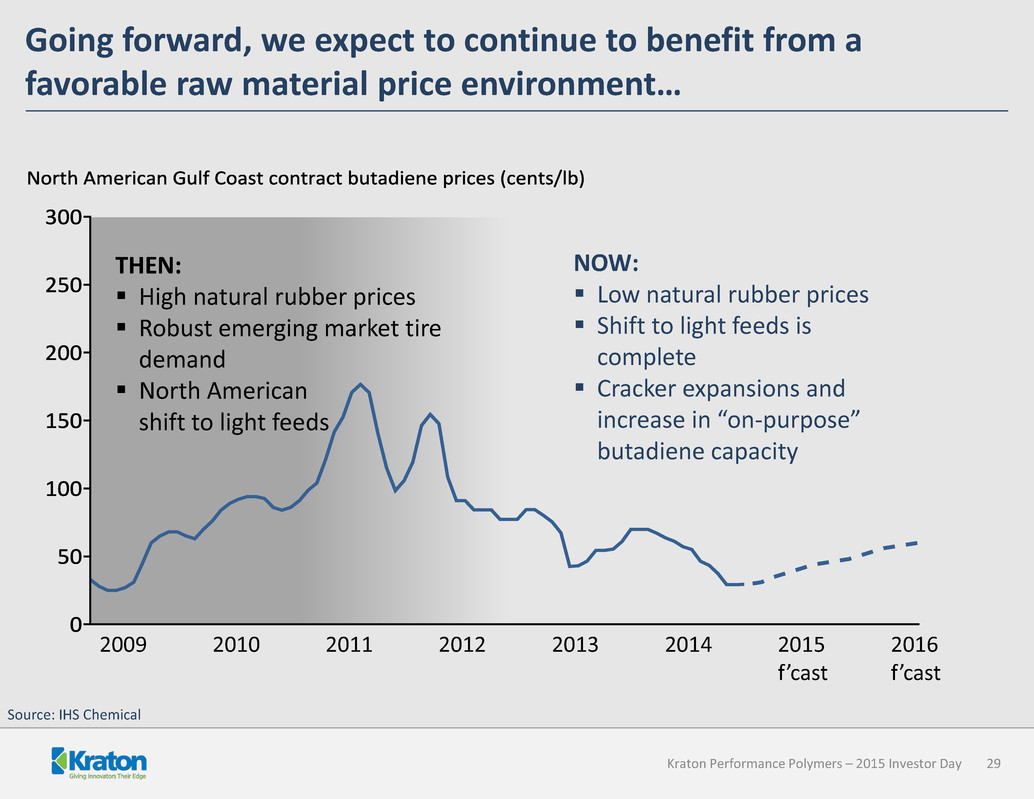

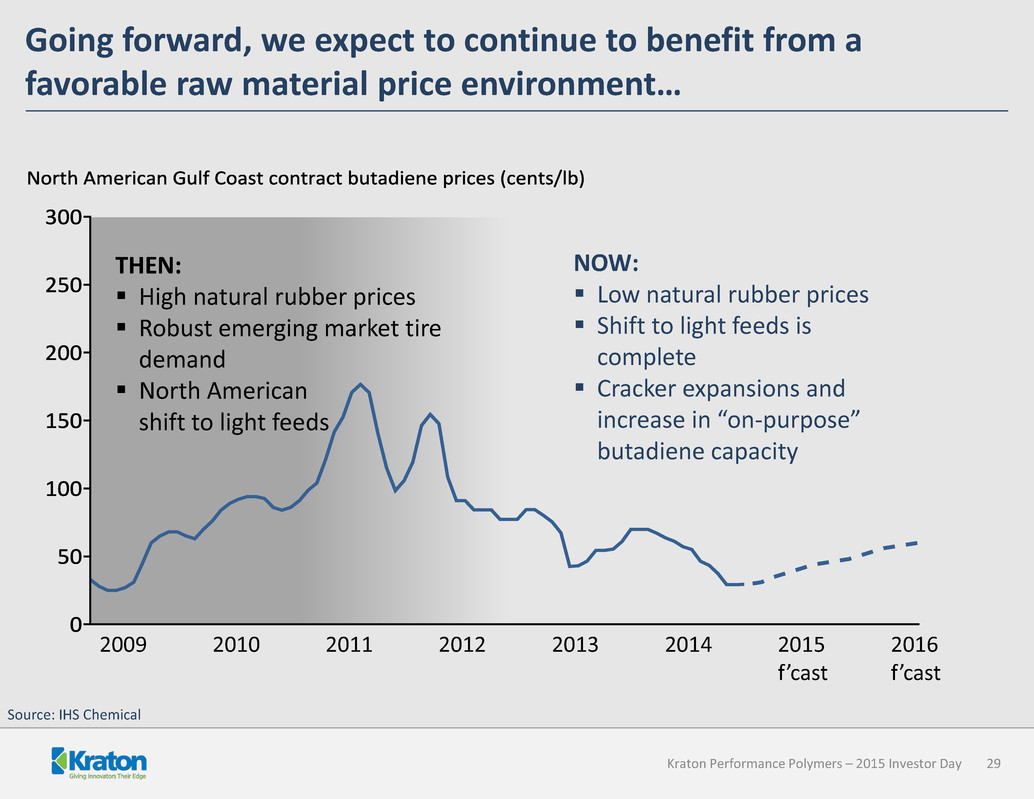

Going forward, we expect to continue to benefit from a favorable raw material price environment… THEN: High natural rubber prices Robust emerging market tire demand North American shift to light feeds NOW: Low natural rubber prices Shift to light feeds is complete Cracker expansions and increase in “on-purpose” butadiene capacity 2009 2011 2012 2013 2014 2015 f’cast 2016 f’cast 2010 Source: IHS Chemical Kraton Performance Polymers – 2015 Investor Day 29

A number of global long-term trends are expected to drive future demand for SBCs Emerging economies expected to invest in infrastructure to support economic growth Aging North American infrastructure will require investment Continued growth of disposable income in emerging markets will drive demand for consumer goods, personal hygiene products, and residential construction Infrastructure Investment Emerging Middle Class Aging Populations Aging populations in Europe, East Asia, and North America Supports baseline demand growth in personal hygiene and medical applications Kraton Performance Polymers – 2015 Investor Day 30

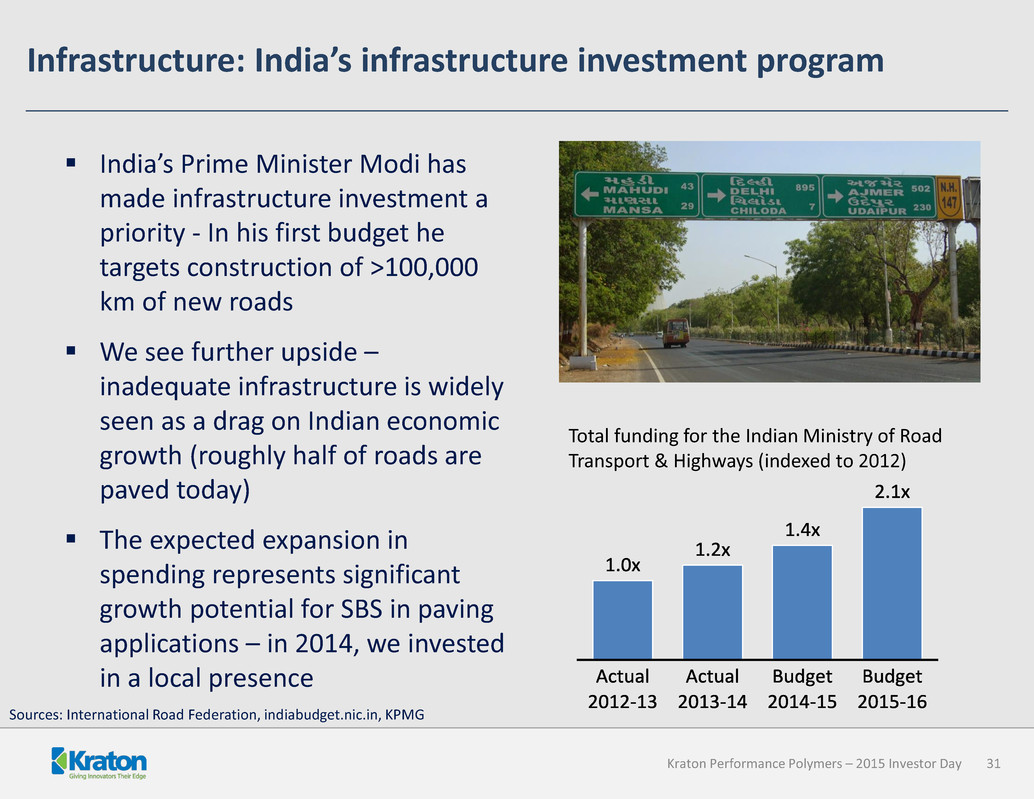

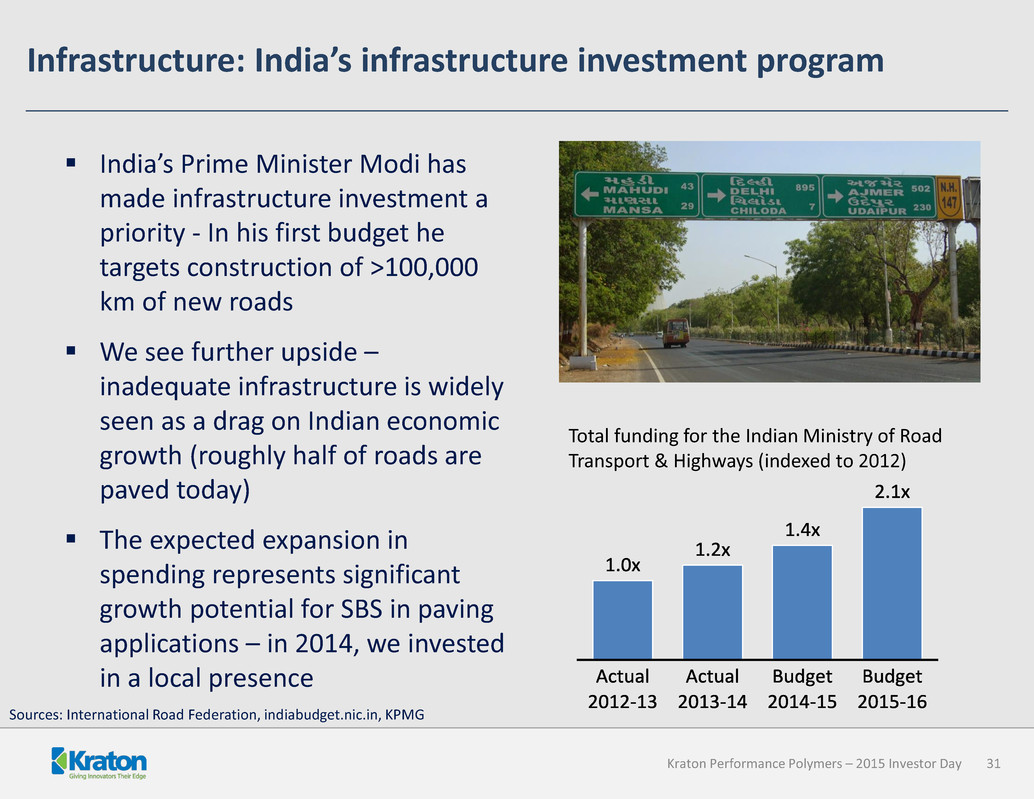

Infrastructure: India’s infrastructure investment program India’s Prime Minister Modi has made infrastructure investment a priority - In his first budget he targets construction of >100,000 km of new roads We see further upside – inadequate infrastructure is widely seen as a drag on Indian economic growth (roughly half of roads are paved today) The expected expansion in spending represents significant growth potential for SBS in paving applications – in 2014, we invested in a local presence Sources: International Road Federation, indiabudget.nic.in, KPMG Total funding for the Indian Ministry of Road Transport & Highways (indexed to 2012) Kraton Performance Polymers – 2015 Investor Day 31

Emerging middle class: Adhesives for e-commerce Sources: eMarketer.com Retail e-commerce sales worldwide ($T) E-commerce has fundamentally altered the retail sector in developed markets, and is increasing in developing markets Continued e-commerce growth is supported by middle class expansion in emerging markets (internet access, credit cards) We expect the increase in shipping volumes to present opportunities in tape and label applications Kraton Performance Polymers – 2015 Investor Day 32

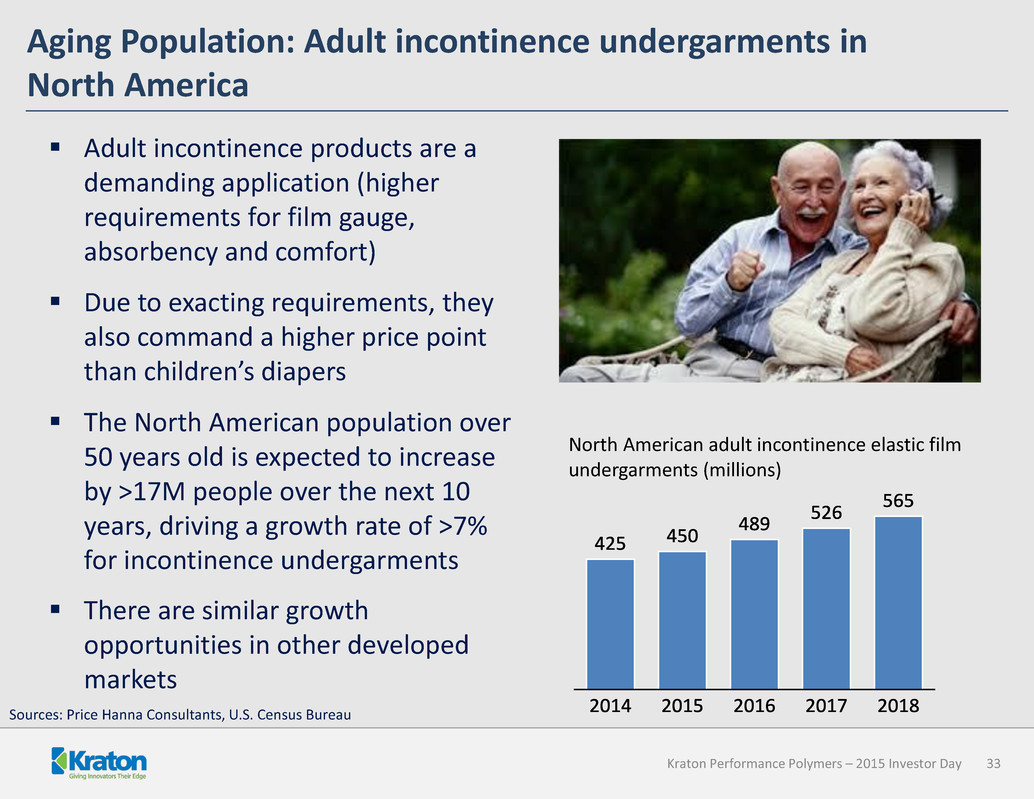

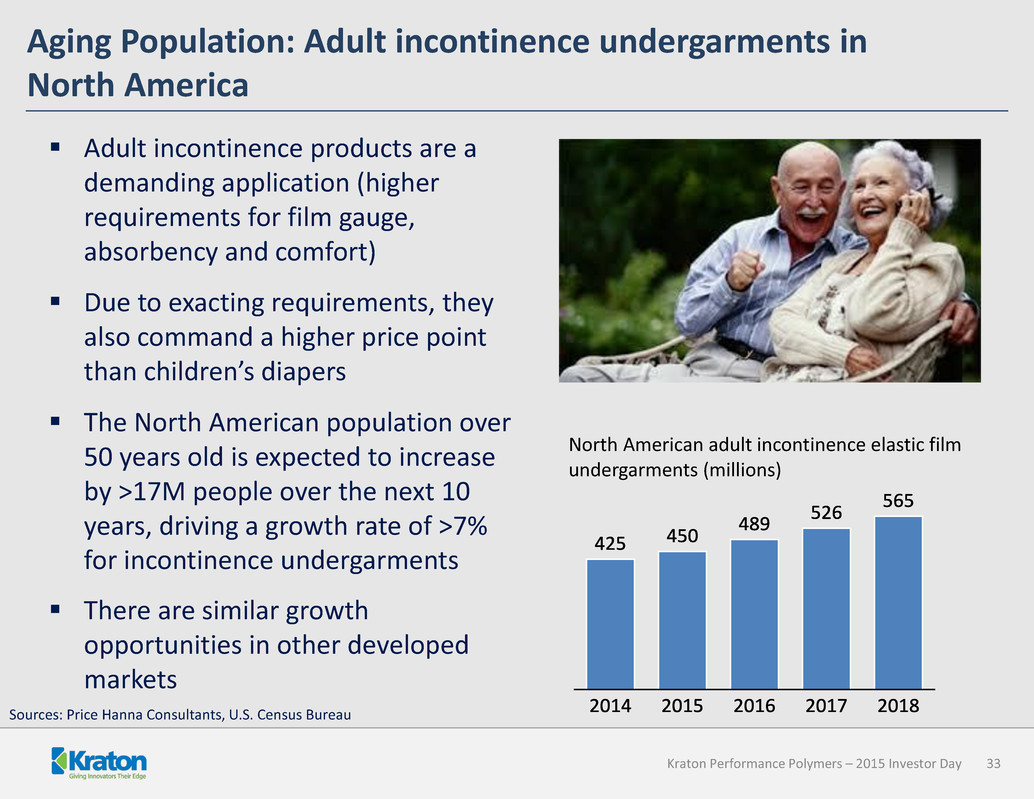

Aging Population: Adult incontinence undergarments in North America Adult incontinence products are a demanding application (higher requirements for film gauge, absorbency and comfort) Due to exacting requirements, they also command a higher price point than children’s diapers The North American population over 50 years old is expected to increase by >17M people over the next 10 years, driving a growth rate of >7% for incontinence undergarments There are similar growth opportunities in other developed markets North American adult incontinence elastic film undergarments (millions) Sources: Price Hanna Consultants, U.S. Census Bureau Kraton Performance Polymers – 2015 Investor Day 33

Cost Competitiveness Kevin M. Fogarty President and Chief Executive Officer Kraton Performance Polymers – 2015 Investor Day 34

Our cost competitiveness program will deliver $70 million in expected run rate savings by 2018 + + Manufacturing Optimization - Expand USBC at Berre and leverage Mailiao to optimize global HSBC production Asset Productivity - Belpre boilers, and over 20 projects to reduce production costs Complexity Reduction - Reduced complexity through integrated Cariflex line, SKU reduction, and new fulfillment practices Overhead Efficiency - 110 basis point reduction of SAR as a share of revenue in 2018 Cost Competitiveness Program $70M in CAPEX $23M in OPEX $93M total cost to achieve Investment $70M run rate cost savings Outcomes Kraton Performance Polymers – 2015 Investor Day $50M reduction in working capital 35

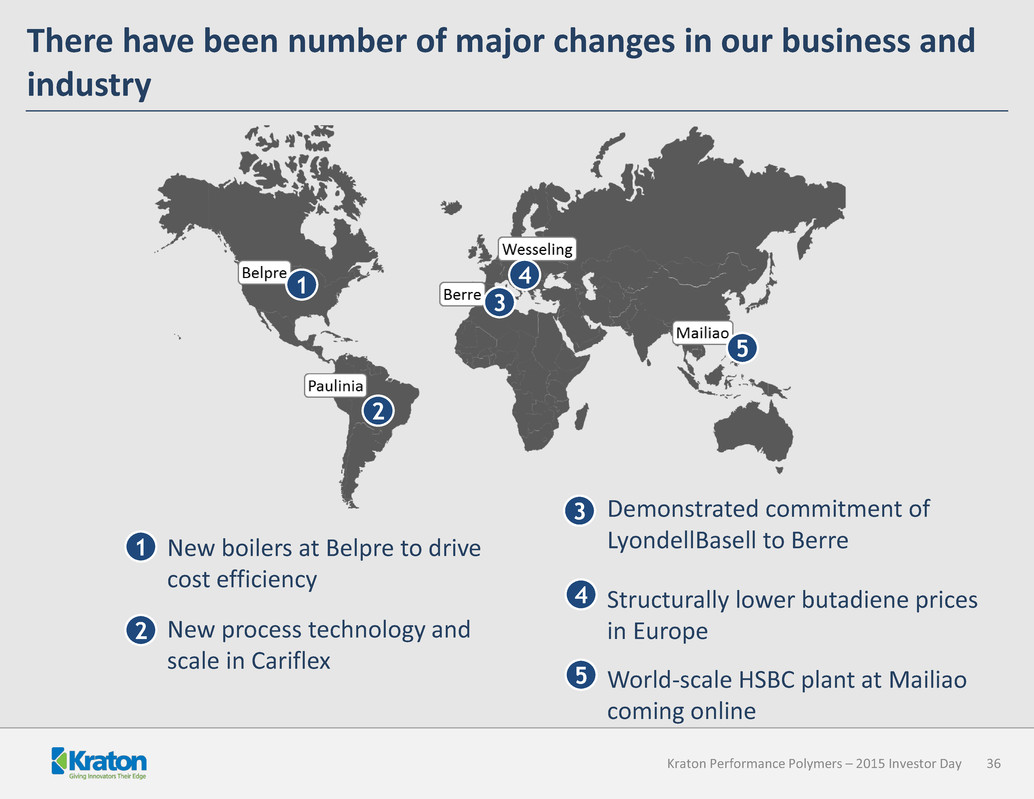

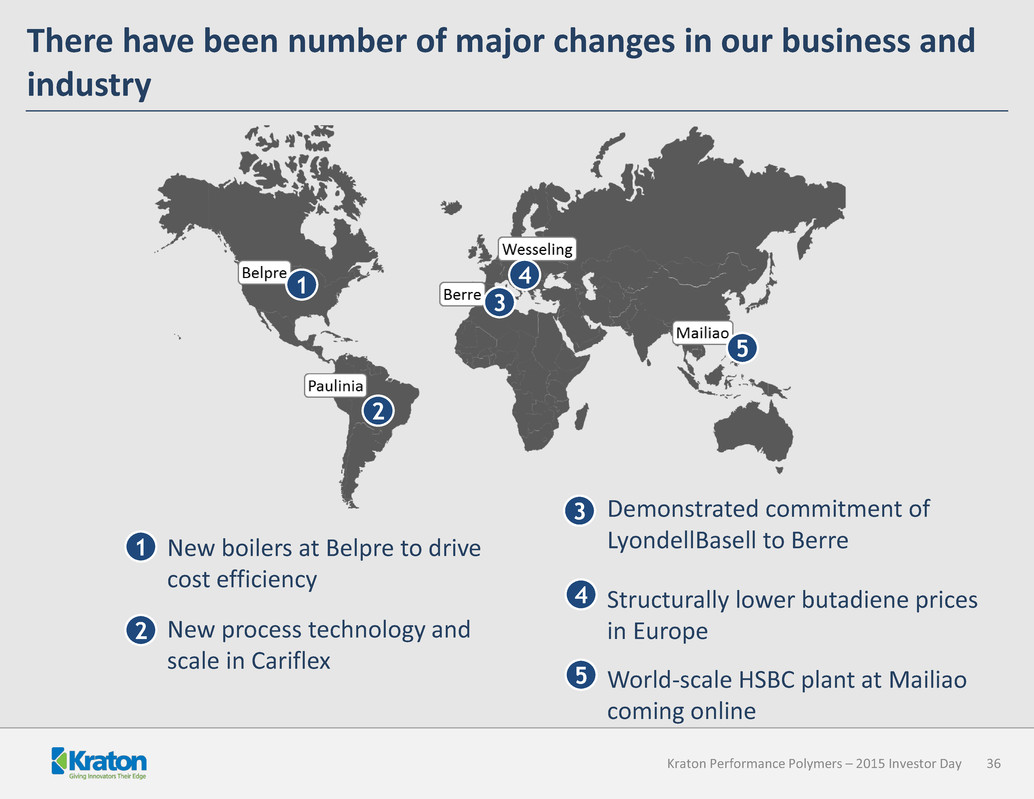

Demonstrated commitment of LyondellBasell to Berre Structurally lower butadiene prices in Europe World-scale HSBC plant at Mailiao coming online There have been number of major changes in our business and industry New boilers at Belpre to drive cost efficiency New process technology and scale in Cariflex 1 2 3 Kraton Performance Polymers – 2015 Investor Day 36 4 5 1 2 3 4 5

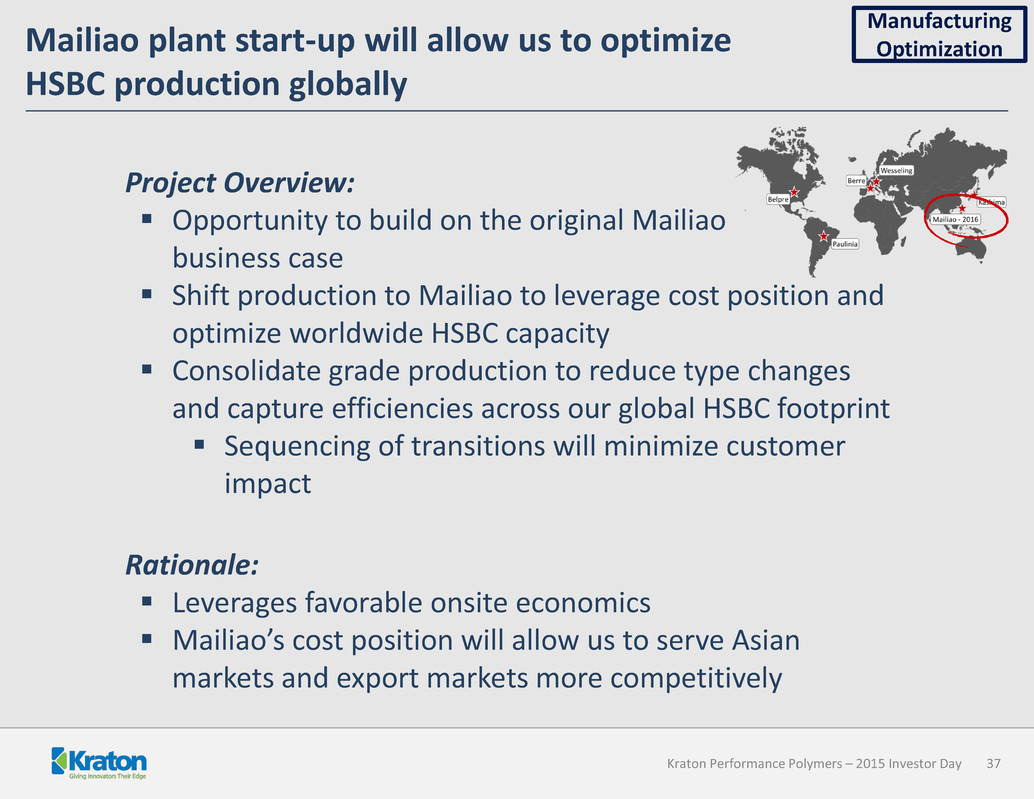

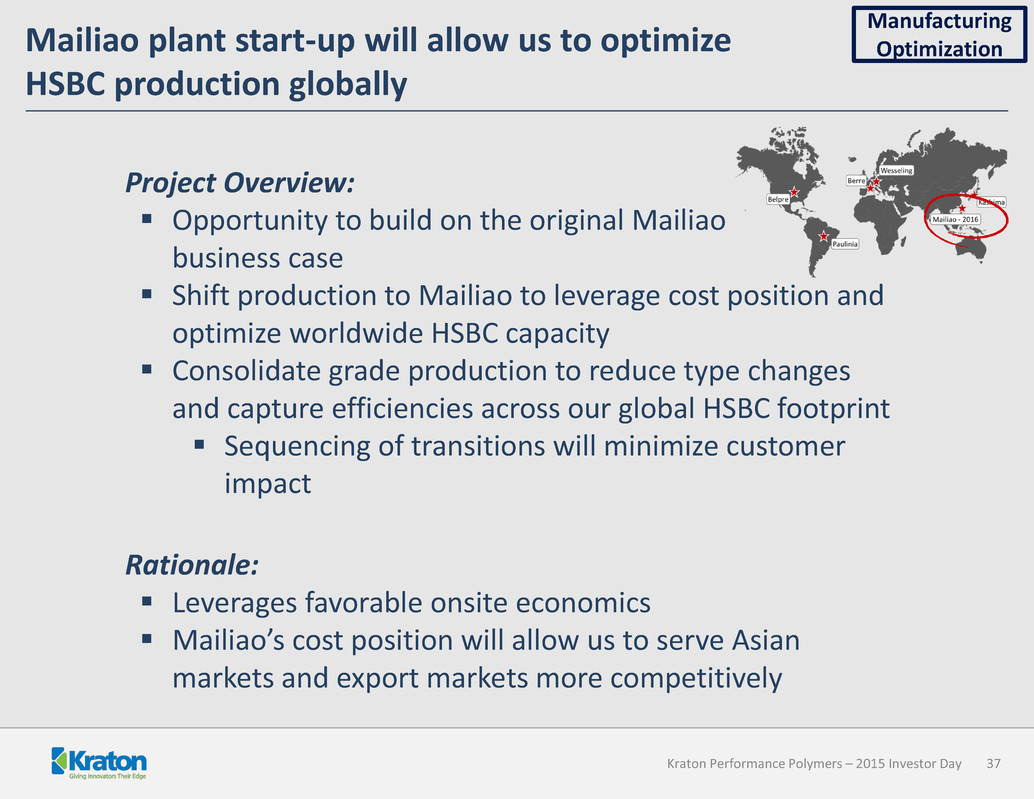

Mailiao plant start-up will allow us to optimize HSBC production globally Kraton Performance Polymers – 2015 Investor Day 37 Project Overview: Opportunity to build on the original Mailiao business case Shift production to Mailiao to leverage cost position and optimize worldwide HSBC capacity Consolidate grade production to reduce type changes and capture efficiencies across our global HSBC footprint Sequencing of transitions will minimize customer impact Rationale: Leverages favorable onsite economics Mailiao’s cost position will allow us to serve Asian markets and export markets more competitively Manufacturing Optimization

Once expanded, Berre will improve our competitiveness in Europe and North America Project Overview: Expansion of USBC capacity to: Improve scale and economics at Berre Displace higher cost production at other sites Rationale: LyondellBasell has demonstrated its ongoing commitment to Berre This change in outlook creates an opportunity for further investments in Berre to improve its cost position A Berre expansion is the most capital effective way to improve our worldwide USBC cost position Leverages on site, structurally low-cost butadiene Kraton Performance Polymers – 2015 Investor Day 38 Manufacturing Optimization

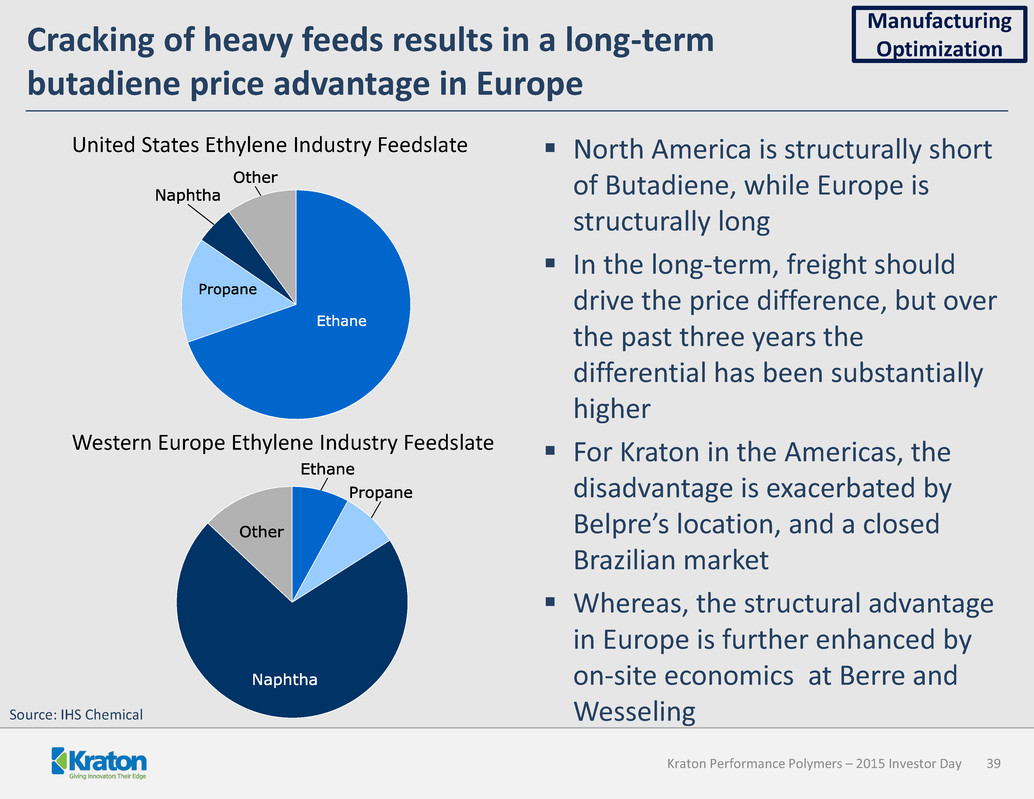

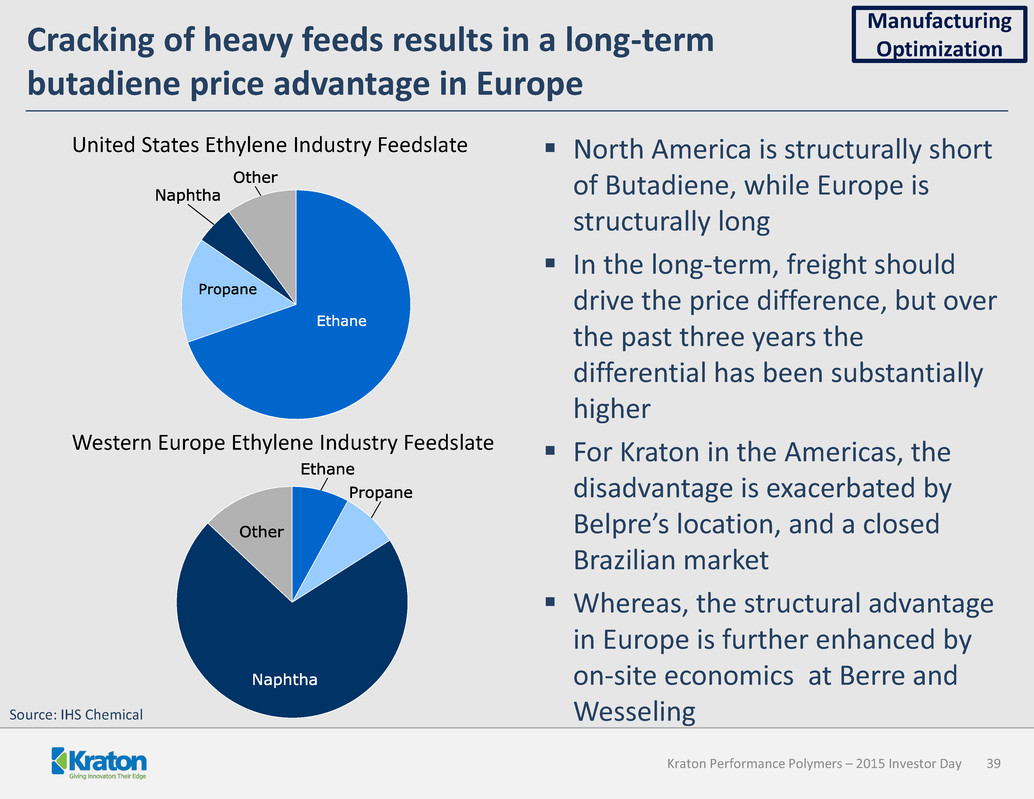

Cracking of heavy feeds results in a long-term butadiene price advantage in Europe United States Ethylene Industry Feedslate Western Europe Ethylene Industry Feedslate Source: IHS Chemical Manufacturing Optimization Kraton Performance Polymers – 2015 Investor Day 39 North America is structurally short of Butadiene, while Europe is structurally long In the long-term, freight should drive the price difference, but over the past three years the differential has been substantially higher For Kraton in the Americas, the disadvantage is exacerbated by Belpre’s location, and a closed Brazilian market Whereas, the structural advantage in Europe is further enhanced by on-site economics at Berre and Wesseling

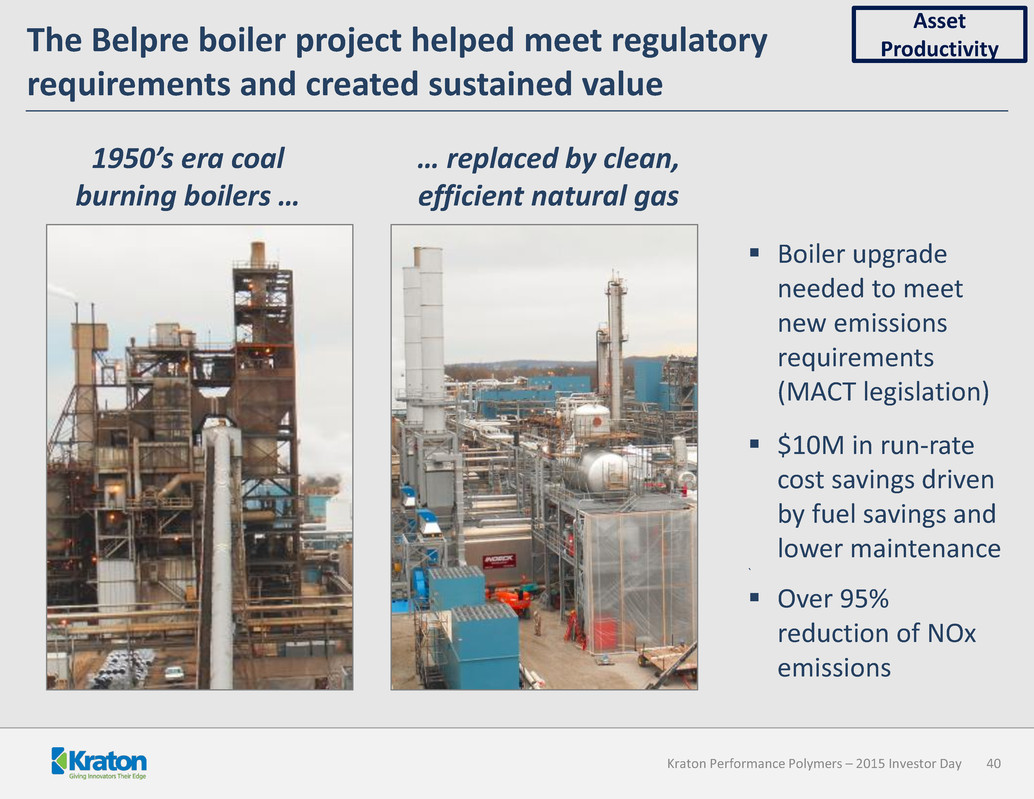

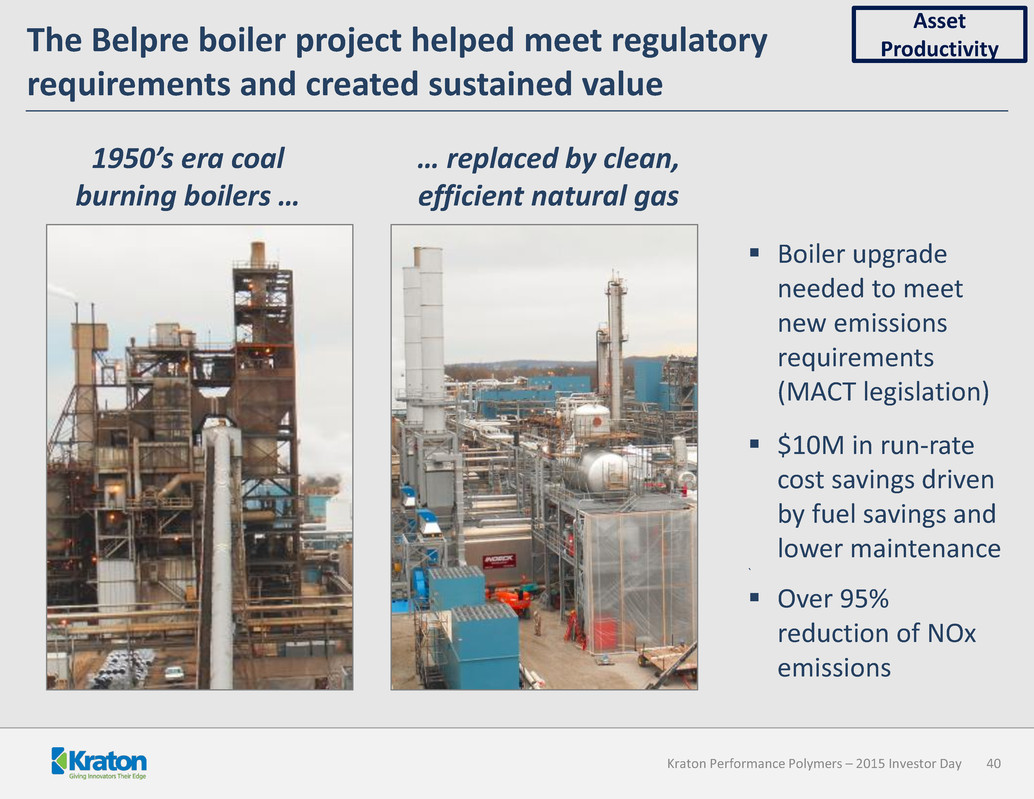

The Belpre boiler project helped meet regulatory requirements and created sustained value Boiler upgrade needed to meet new emissions requirements (MACT legislation) $10M in run-rate cost savings driven by fuel savings and lower maintenance ` Over 95% reduction of NOx emissions 1950’s era coal burning boilers … … replaced by clean, efficient natural gas Kraton Performance Polymers – 2015 Investor Day 40 Asset Productivity

A broad complexity reduction program will help us meet customer needs more efficiently Complexity reduction program expected to reduce working capital by $50M, in addition to operating cost reductions SKU elimination Make to order vs. make to stock 30% reduction of SKUs through numerous initiatives (e.g. grade consolidation, reduced packaging options) Reduces inventory and type changes; simplifies product handling Moving some grades to a make-to-order fulfillment system to further reduce inventory Kraton Performance Polymers – 2015 Investor Day 41 Complexity Reduction

We expect new proprietary integrated CariflexTM process at Paulinia to meet growth needs at reduced costs Project Overview: Implement new proprietary process technology to simplify supply chain and provide for cost effective future expansions Extensive piloting of new technology completed Expected completion in 2017 Rationale: Most capital efficient option to meet future growth needs Considerable efficiency gains captured through simplified manufacturing process and improved logistics Kraton Performance Polymers – 2015 Investor Day 42 Complexity Reduction

The integrated plant at Paulinia will simplify our supply chain and operations IR Polymerization IR Polymer Recovery IR Drying & Finishing Transport to Paulinia IR re-dissolved IR latex emulsification IR latex finishing & packaging Belpre (Solid IR) Paulinia (IR Latex) Paulinia (IR Latex) IR Polymerization IR latex emulsification IR latex finishing & packaging 1 2 3 4 5 6 7 1 2 3 Multiple process steps eliminated Potential for new product development Current CariflexTM supply chain Streamlined supply chain Kraton Performance Polymers – 2015 Investor Day 43 Complexity Reduction

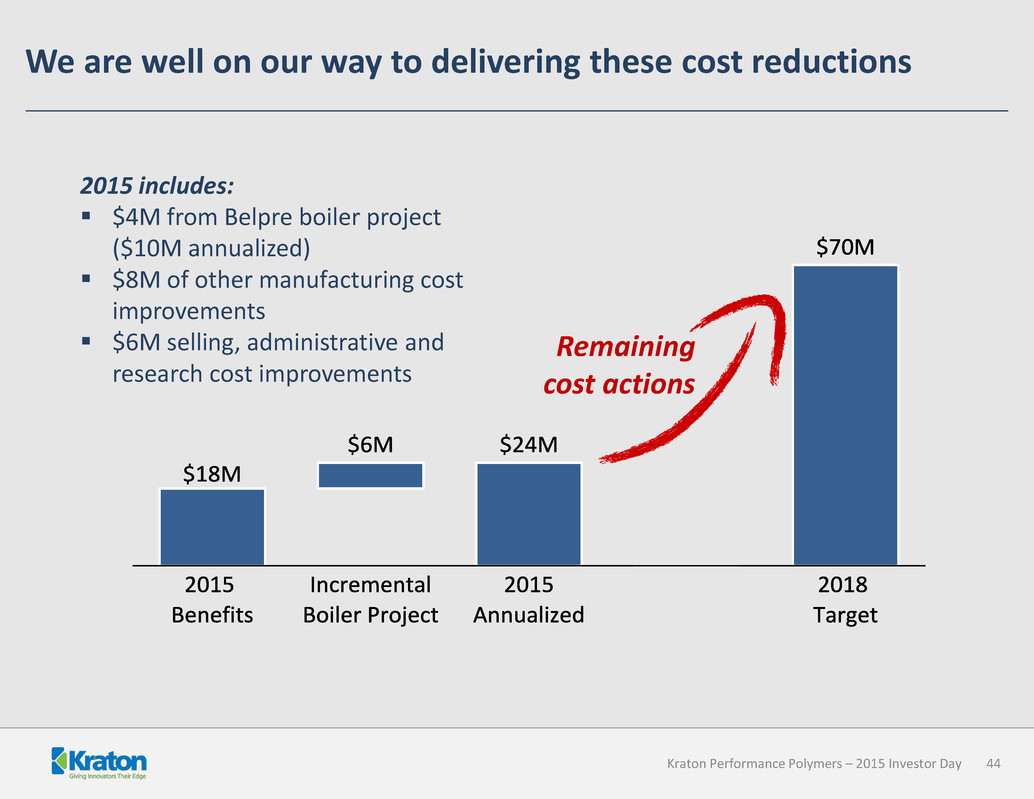

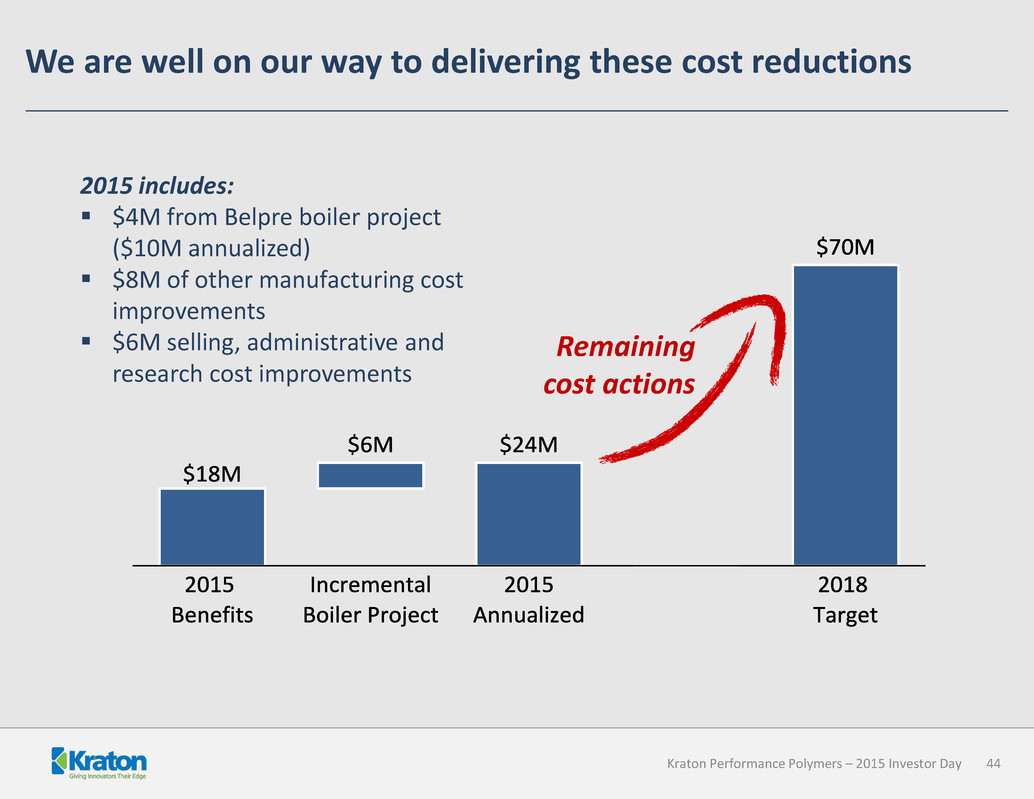

We are well on our way to delivering these cost reductions Remaining cost actions Kraton Performance Polymers – 2015 Investor Day 44 2015 includes: $4M from Belpre boiler project ($10M annualized) $8M of other manufacturing cost improvements $6M selling, administrative and research cost improvements

Organic Growth Dr. Holger R. Jung, Senior Vice President & Chief Commercial Officer Dr. Lothar F.P. Freund, Senior Vice President & Chief Technology Officer Kraton Performance Polymers – 2015 Investor Day 45

New approaches by our commercial and R&D organizations are expected to drive future organic growth Organic Growth Revised Market Approach: Realigned organization expected to drive growth by better meeting customer needs Rebalanced Innovation Strategy: Rebalanced innovation portfolio expected to deliver robust returns Kraton Performance Polymers – 2015 Investor Day 46

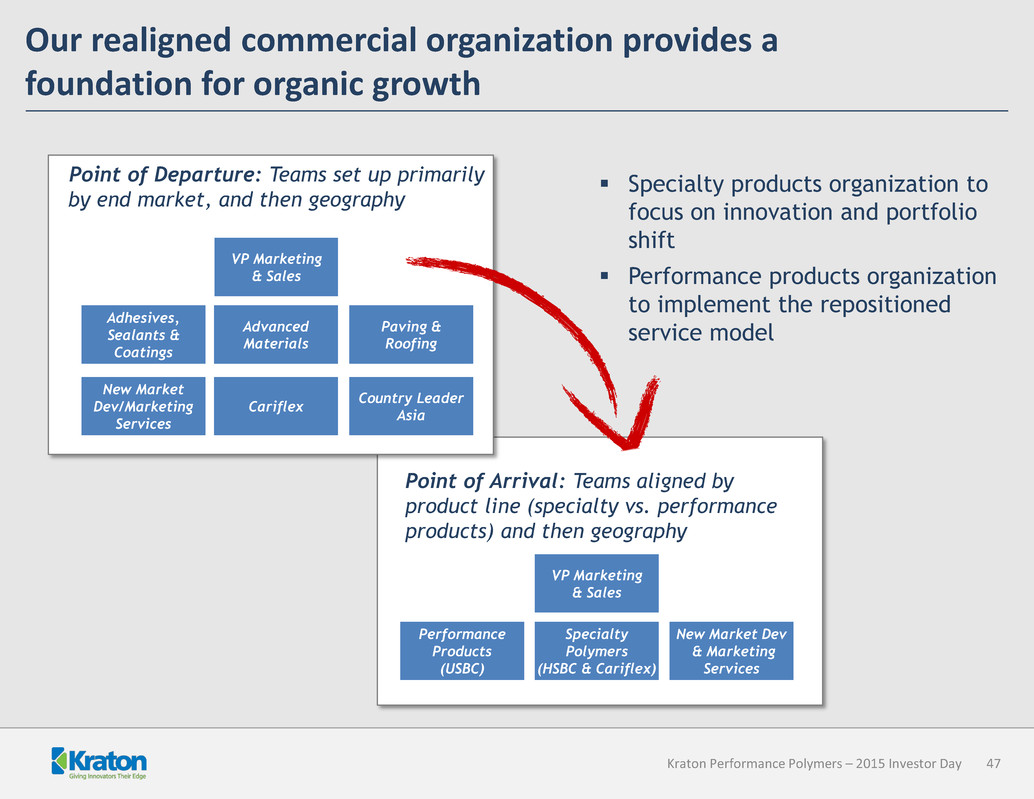

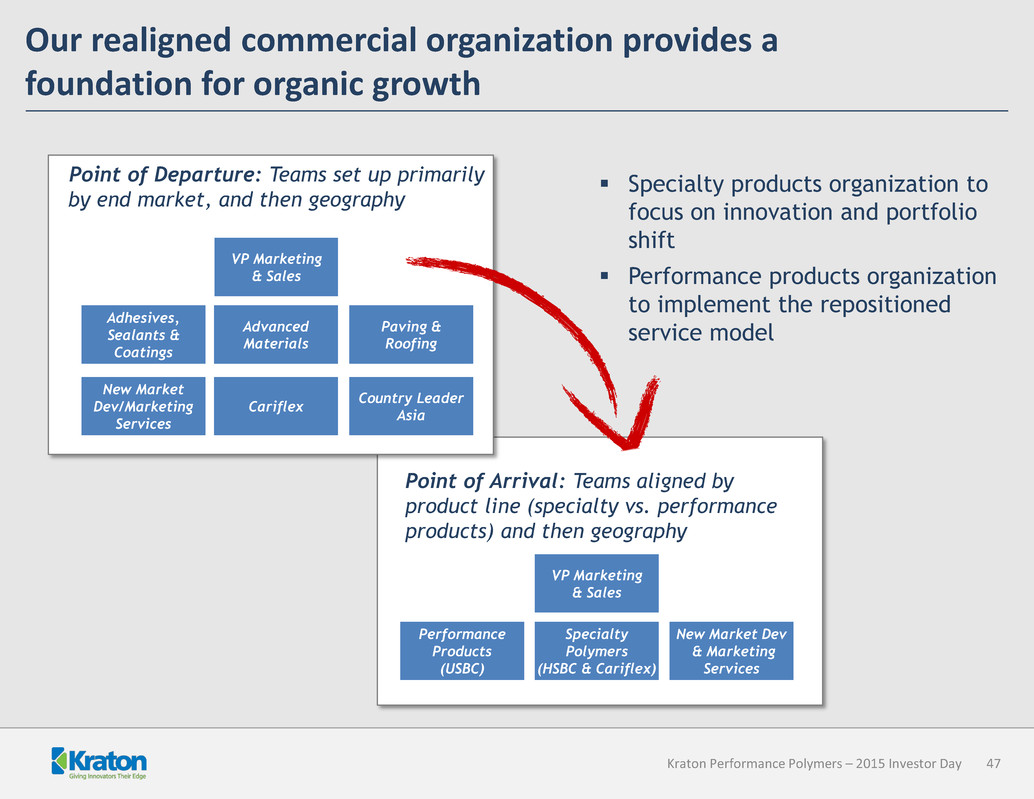

Our realigned commercial organization provides a foundation for organic growth Adhesives, Sealants & Coatings Advanced Materials Paving & Roofing VP Marketing & Sales Cariflex Country Leader Asia Performance Products (USBC) Specialty Polymers (HSBC & Cariflex) New Market Dev & Marketing Services VP Marketing & Sales New Market Dev/Marketing Services Point of Arrival: Teams aligned by product line (specialty vs. performance products) and then geography Point of Departure: Teams set up primarily by end market, and then geography Specialty products organization to focus on innovation and portfolio shift Performance products organization to implement the repositioned service model Kraton Performance Polymers – 2015 Investor Day 47

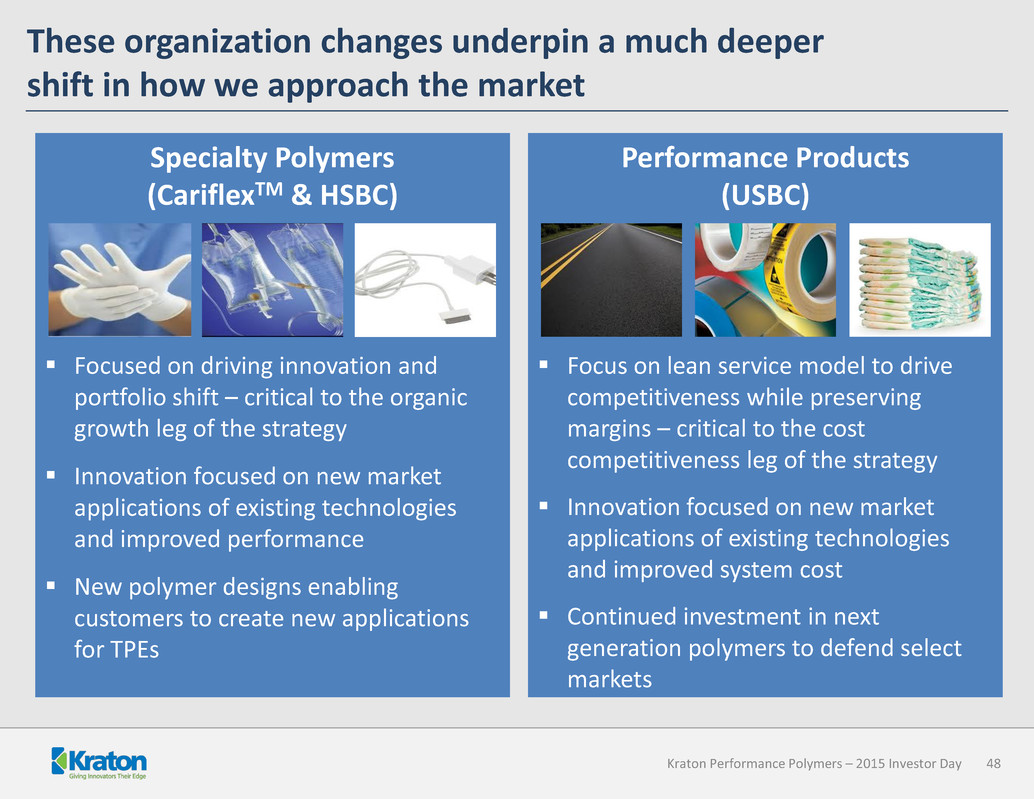

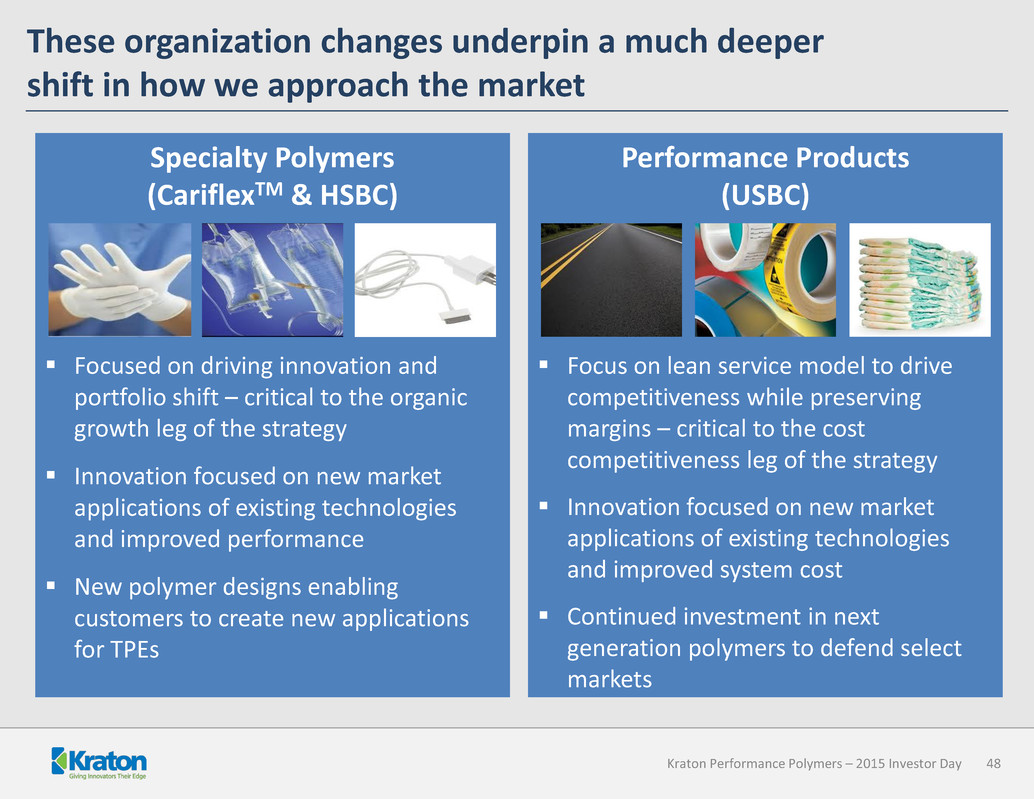

These organization changes underpin a much deeper shift in how we approach the market Specialty Polymers (CariflexTM & HSBC) Performance Products (USBC) Focus on lean service model to drive competitiveness while preserving margins – critical to the cost competitiveness leg of the strategy Innovation focused on new market applications of existing technologies and improved system cost Continued investment in next generation polymers to defend select markets Focused on driving innovation and portfolio shift – critical to the organic growth leg of the strategy Innovation focused on new market applications of existing technologies and improved performance New polymer designs enabling customers to create new applications for TPEs Kraton Performance Polymers – 2015 Investor Day 48

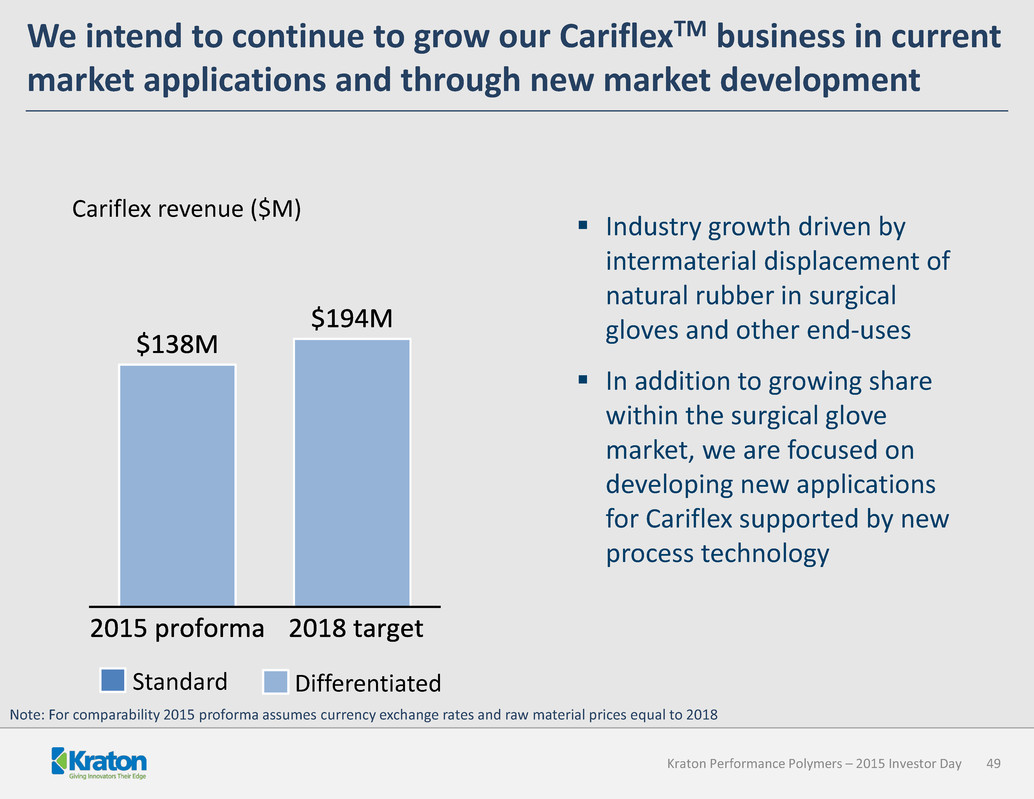

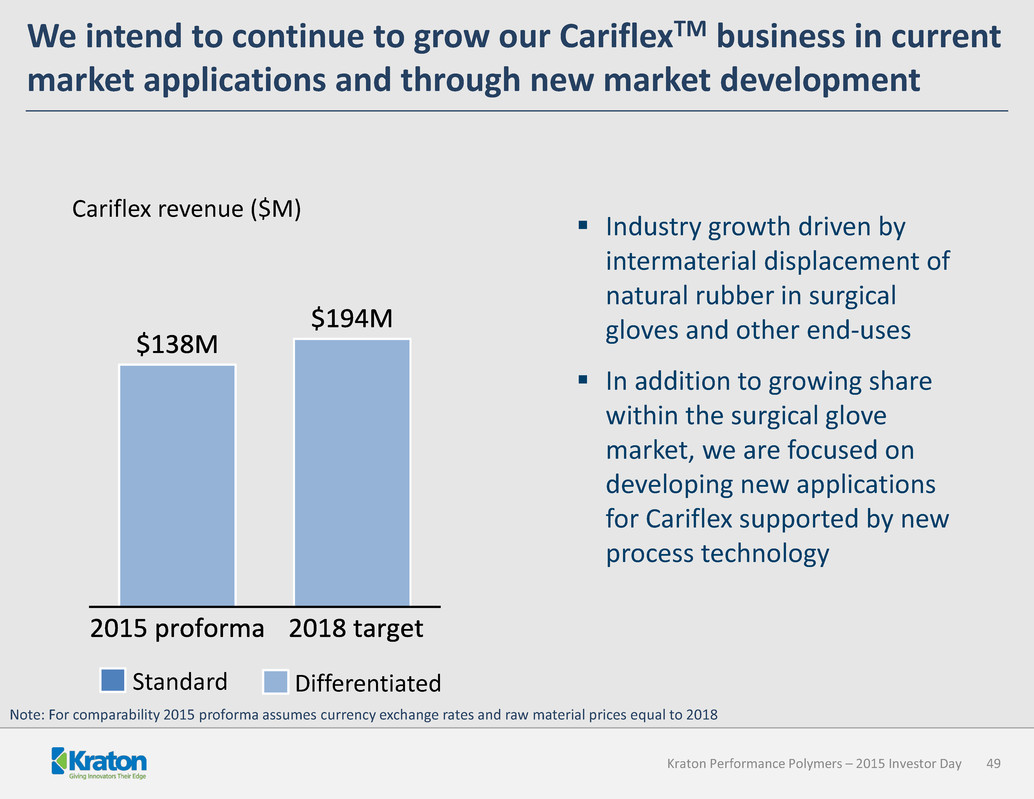

We intend to continue to grow our CariflexTM business in current market applications and through new market development Industry growth driven by intermaterial displacement of natural rubber in surgical gloves and other end-uses In addition to growing share within the surgical glove market, we are focused on developing new applications for Cariflex supported by new process technology Cariflex revenue ($M) Standard Differentiated Note: For comparability 2015 proforma assumes currency exchange rates and raw material prices equal to 2018 Kraton Performance Polymers – 2015 Investor Day 49

We are targeting growth in CariflexTM in a number of applications Exam Gloves High-end Footwear Potential for selected niches in a large, lower cost market Longer-term opportunity Niche application for transparent rubber compounds Commercial today 2 kT global addressable market Niche, high- margin specialty equipment Commercialization underway Electrical Insulation Gloves Condoms Roughly 20kT addressable market Only the high end is attractive Commercial today Note: Total addressable market estimates represent magnitude of market targeted, not expected future sales Source: Kraton estimates Kraton Performance Polymers – 2015 Investor Day 50

We believe there is strong growth potential for CariflexTM in condoms Market Characteristics Total addressable market is roughly 20kT, growing at 5-7% Polyisoprene is gaining share vs. natural rubber Addressable market limited to branded/retail condoms – government health programs are not likely to purchase premium products Large growth opportunity - polyisoprene rubber still below 10% of addressable market today The Cariflex Advantage Polyisoprene rubber latex provides superior comfort-in-use Global Cariflex condom sales (volume, indexed) Source: Kraton estimates Kraton Performance Polymers – 2015 Investor Day 51

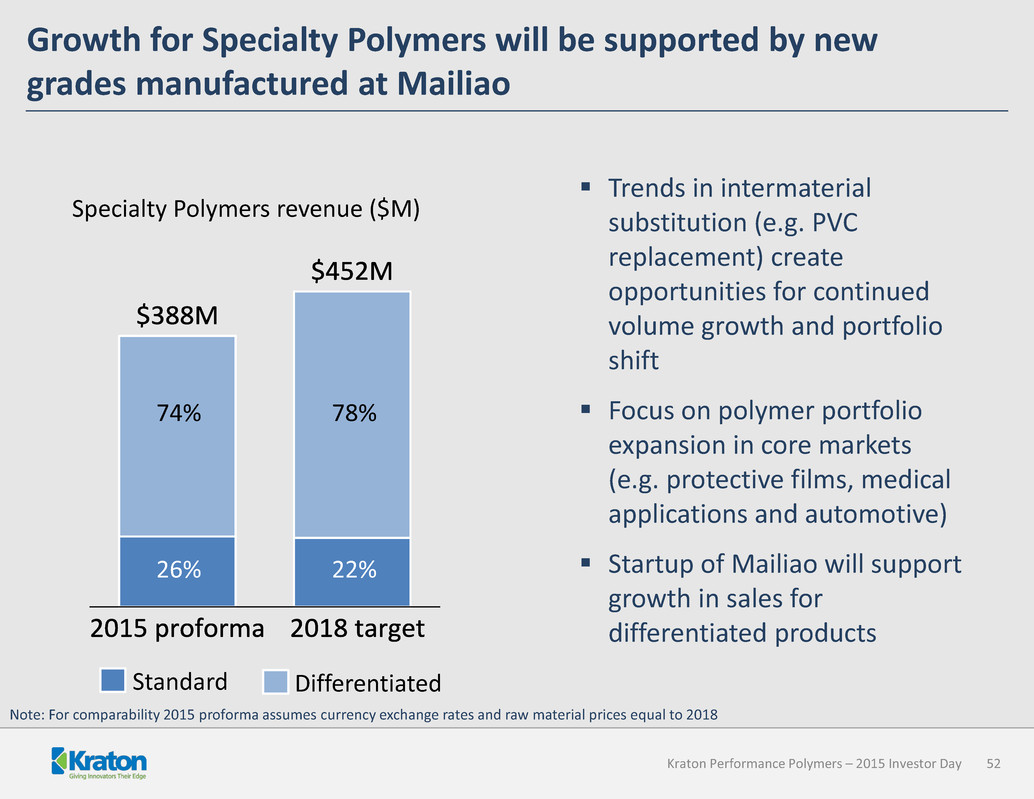

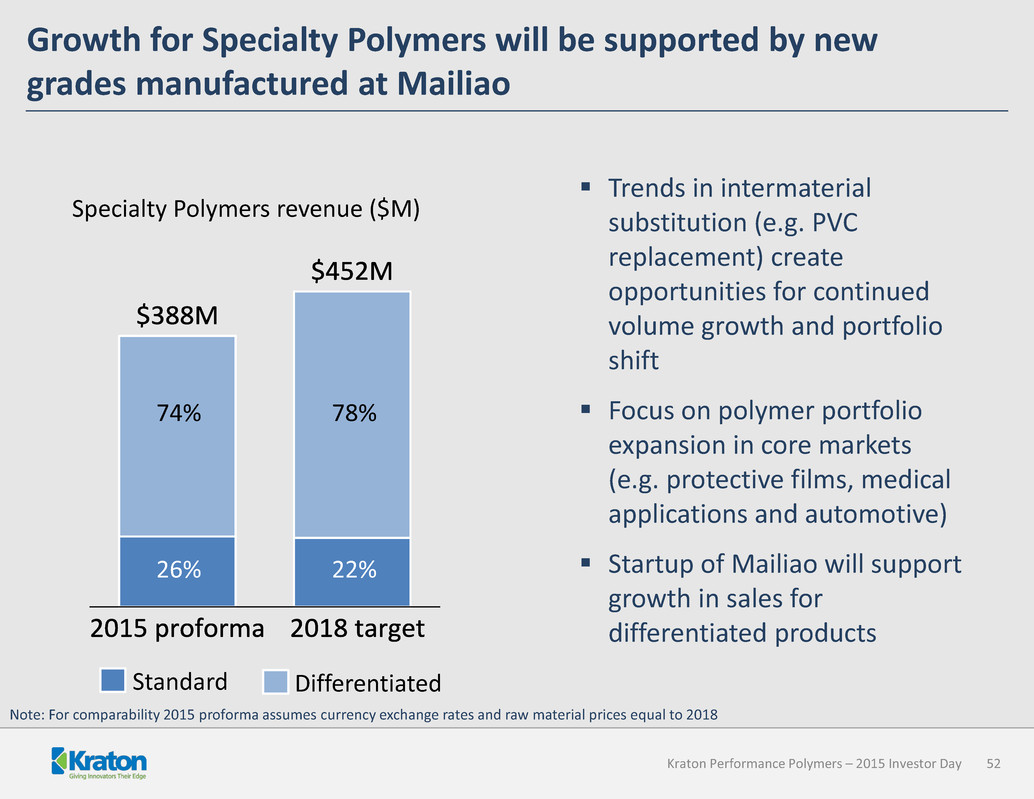

Growth for Specialty Polymers will be supported by new grades manufactured at Mailiao Trends in intermaterial substitution (e.g. PVC replacement) create opportunities for continued volume growth and portfolio shift Focus on polymer portfolio expansion in core markets (e.g. protective films, medical applications and automotive) Startup of Mailiao will support growth in sales for differentiated products Specialty Polymers revenue ($M) Standard Differentiated 74% 78% 26% 22% Note: For comparability 2015 proforma assumes currency exchange rates and raw material prices equal to 2018 Kraton Performance Polymers – 2015 Investor Day 52

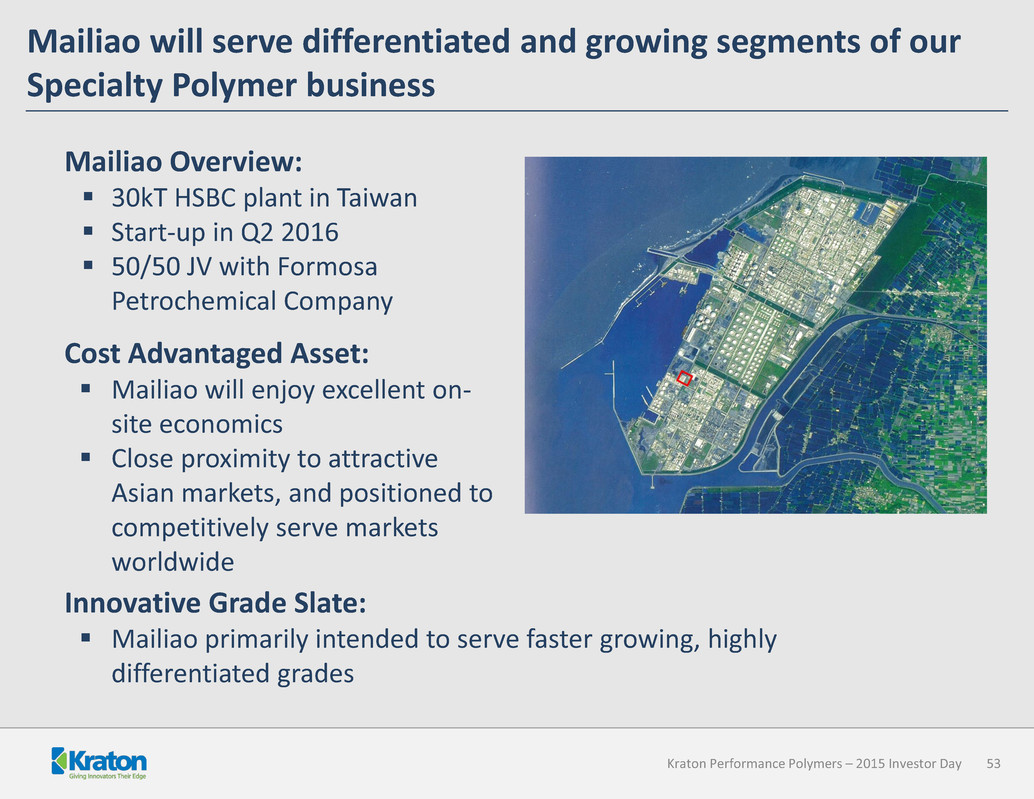

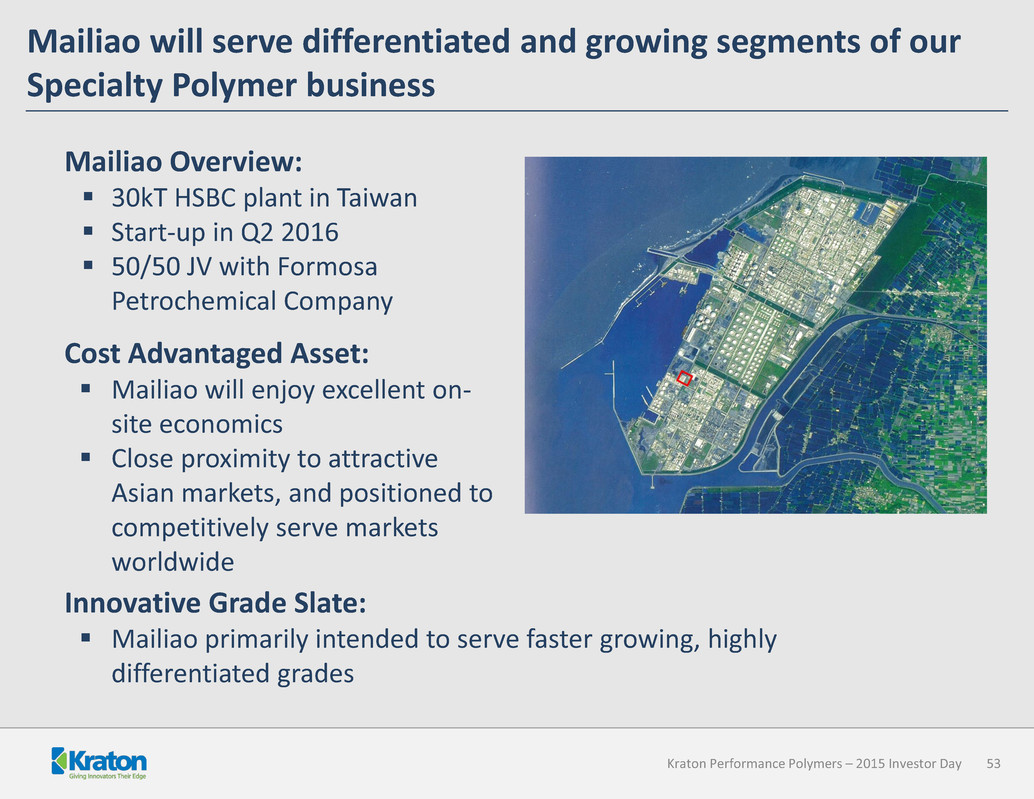

Mailiao will serve differentiated and growing segments of our Specialty Polymer business Mailiao Overview: 30kT HSBC plant in Taiwan Start-up in Q2 2016 50/50 JV with Formosa Petrochemical Company Cost Advantaged Asset: Mailiao will enjoy excellent on- site economics Close proximity to attractive Asian markets, and positioned to competitively serve markets worldwide Innovative Grade Slate: Mailiao primarily intended to serve faster growing, highly differentiated grades Kraton Performance Polymers – 2015 Investor Day 53

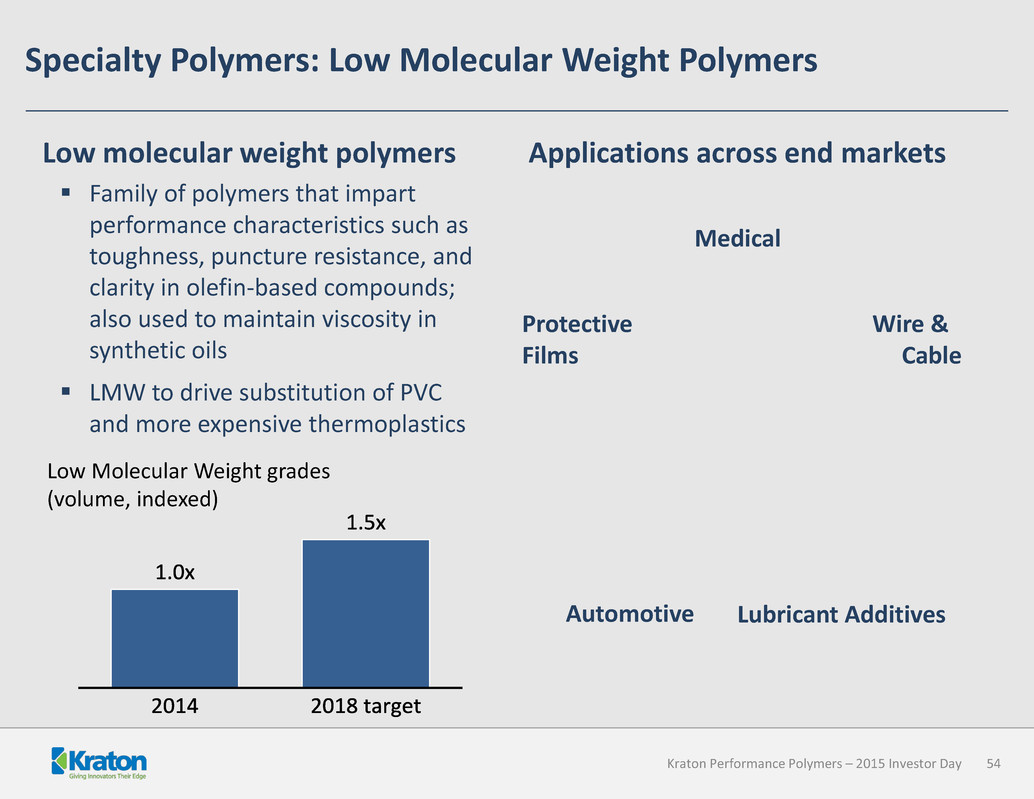

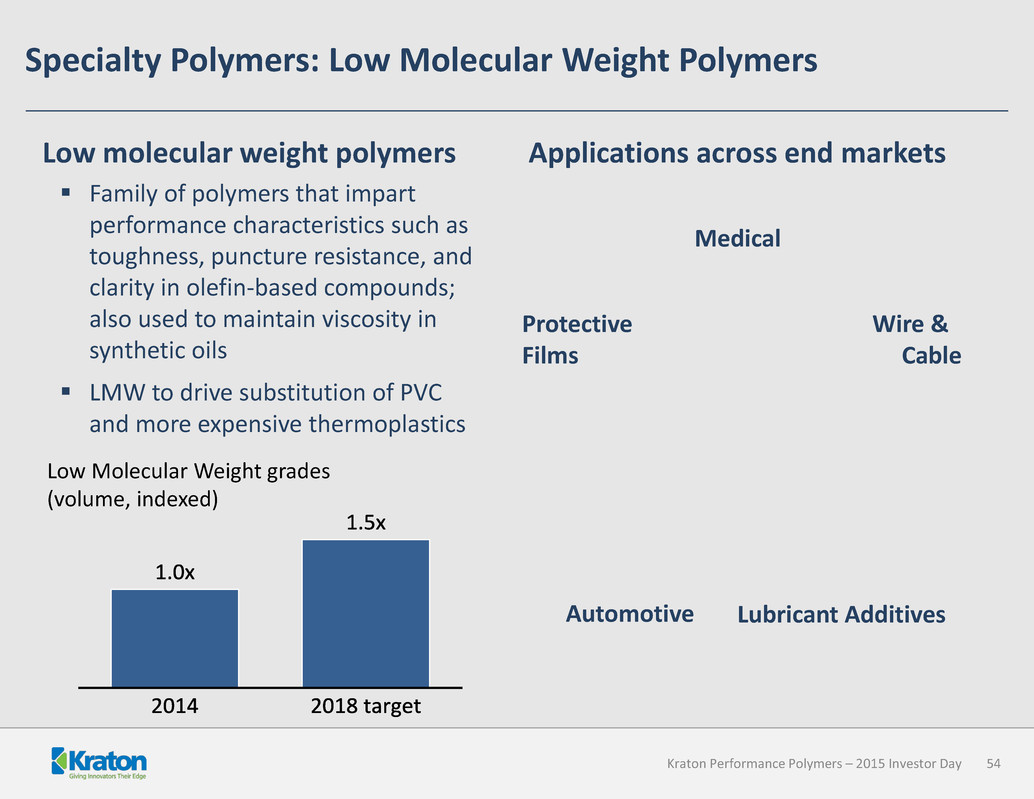

Specialty Polymers: Low Molecular Weight Polymers Low Molecular Weight grades (volume, indexed) Low molecular weight polymers Family of polymers that impart performance characteristics such as toughness, puncture resistance, and clarity in olefin-based compounds; also used to maintain viscosity in synthetic oils LMW to drive substitution of PVC and more expensive thermoplastics Applications across end markets Kraton Performance Polymers – 2015 Investor Day 54 Medical Wire & Cable Lubricant Additives Automotive Protective Films

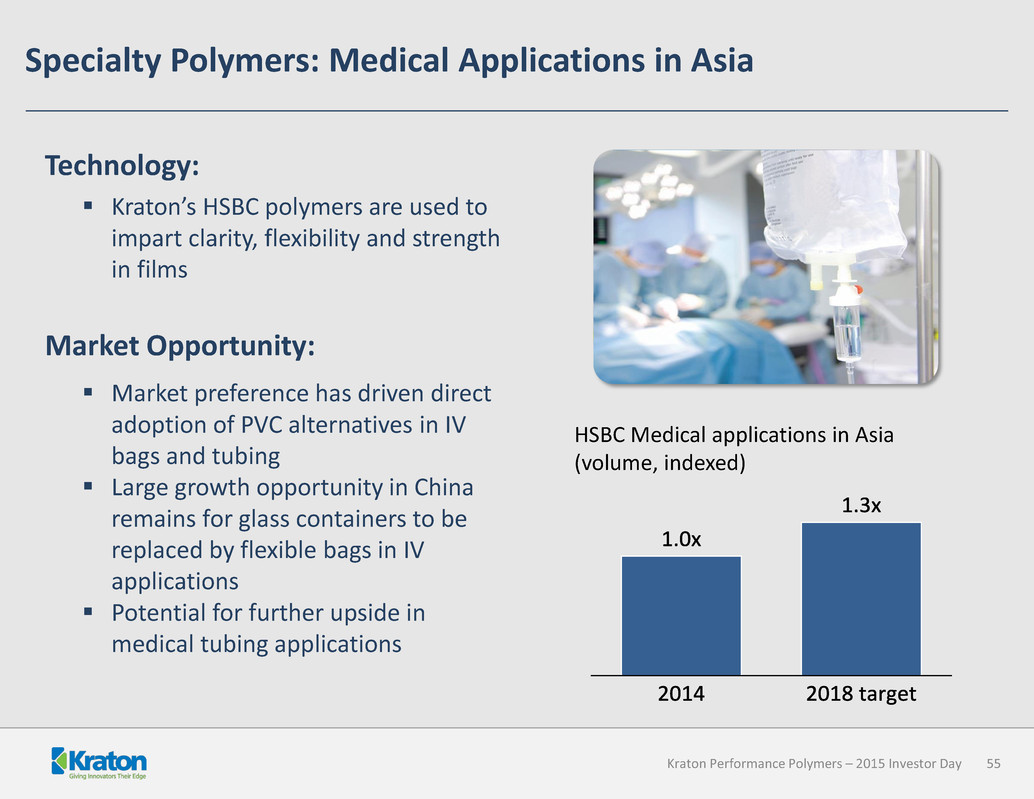

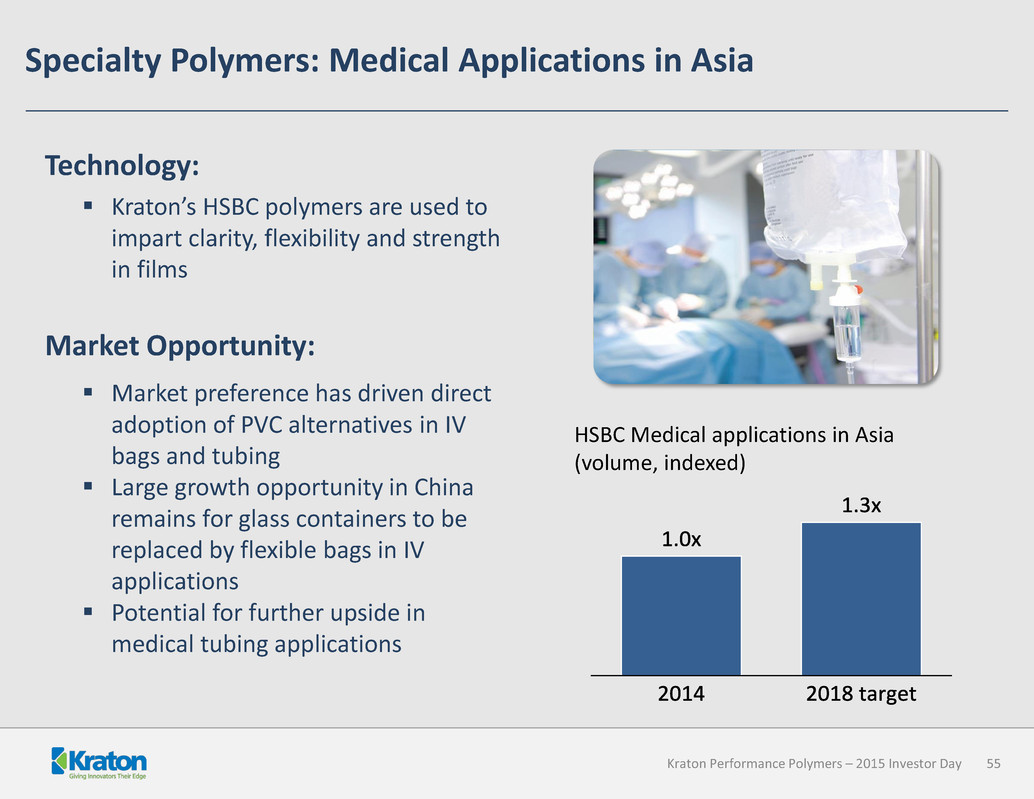

Specialty Polymers: Medical Applications in Asia Market Opportunity: Market preference has driven direct adoption of PVC alternatives in IV bags and tubing Large growth opportunity in China remains for glass containers to be replaced by flexible bags in IV applications Potential for further upside in medical tubing applications Technology: Kraton’s HSBC polymers are used to impart clarity, flexibility and strength in films HSBC Medical applications in Asia (volume, indexed) Kraton Performance Polymers – 2015 Investor Day 55

Specialty Polymers : Optical Cable Gels Market Opportunity: Major infrastructure investments in China, India, and other emerging markets provide strong growth opportunities We believe our incumbent status will help us capture a large share of this growth due to the high qualification requirements for new entrants Technology: Kraton polymers are used to modify cable gels in fiber optic cables Oil gel protection solutions are the industry standard Optical Cable Gels (volume, indexed) Kraton Performance Polymers – 2015 Investor Day 56

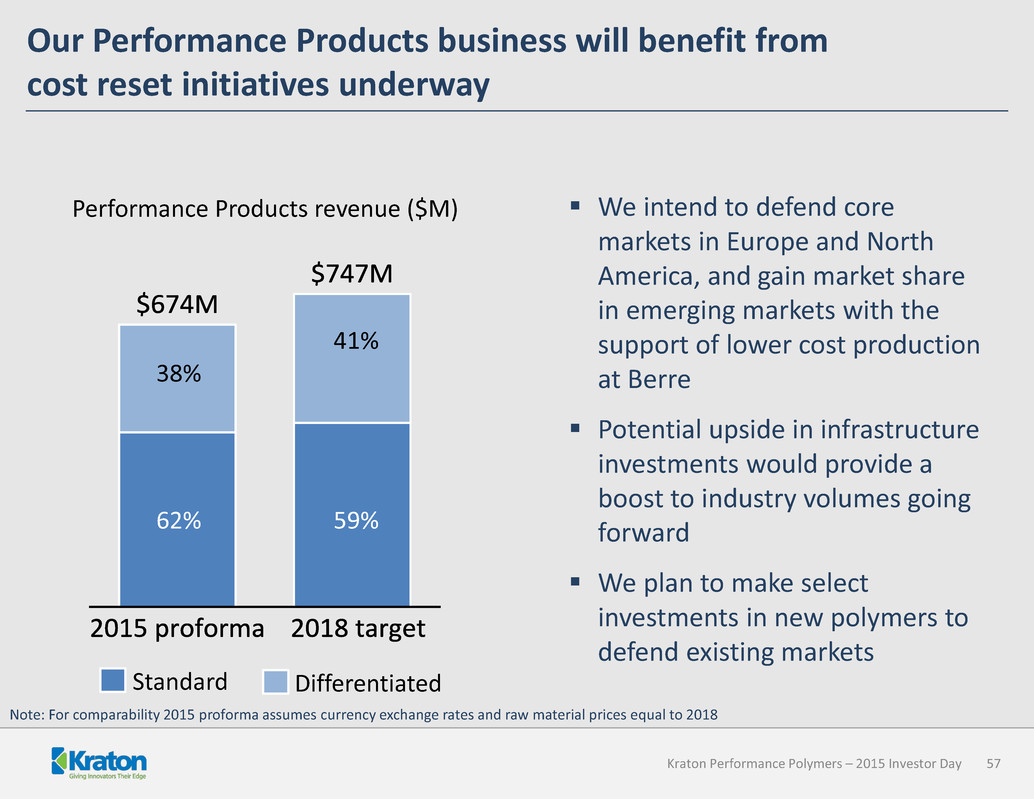

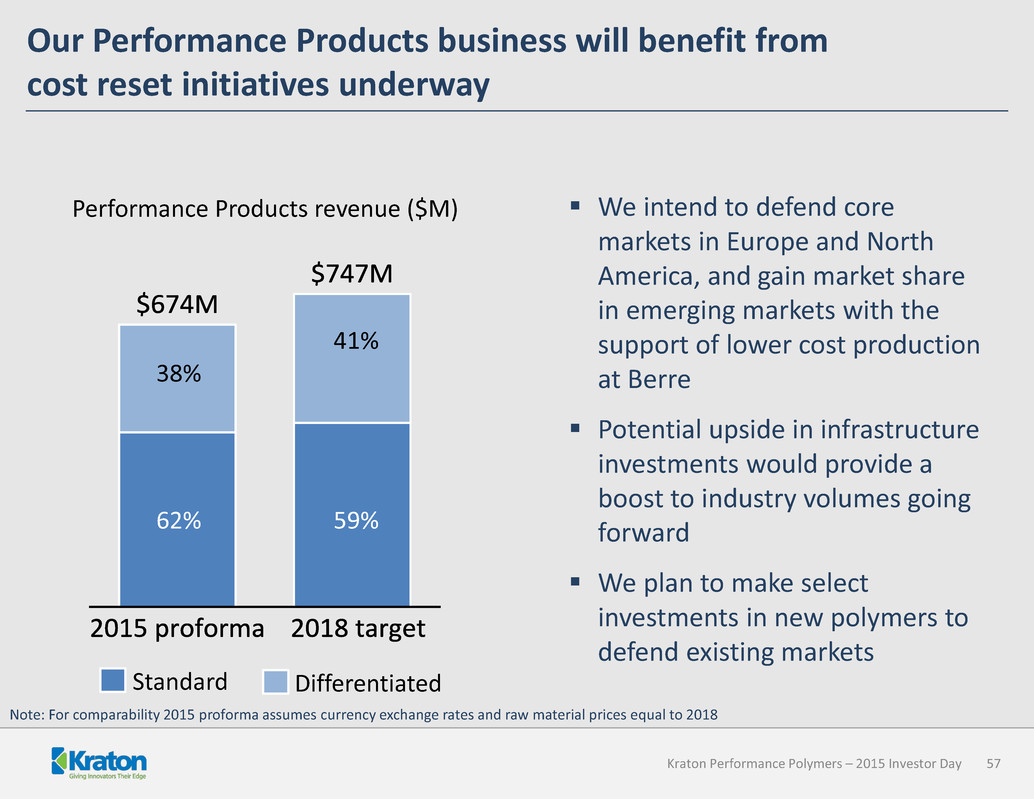

Our Performance Products business will benefit from cost reset initiatives underway We intend to defend core markets in Europe and North America, and gain market share in emerging markets with the support of lower cost production at Berre Potential upside in infrastructure investments would provide a boost to industry volumes going forward We plan to make select investments in new polymers to defend existing markets Performance Products revenue ($M) Standard Differentiated 64% 62% 38% 41% 62% 59% 38% 41% Note: For comparability 2015 proforma assumes currency exchange rates and raw material prices equal to 2018 Kraton Performance Polymers – 2015 Investor Day 57

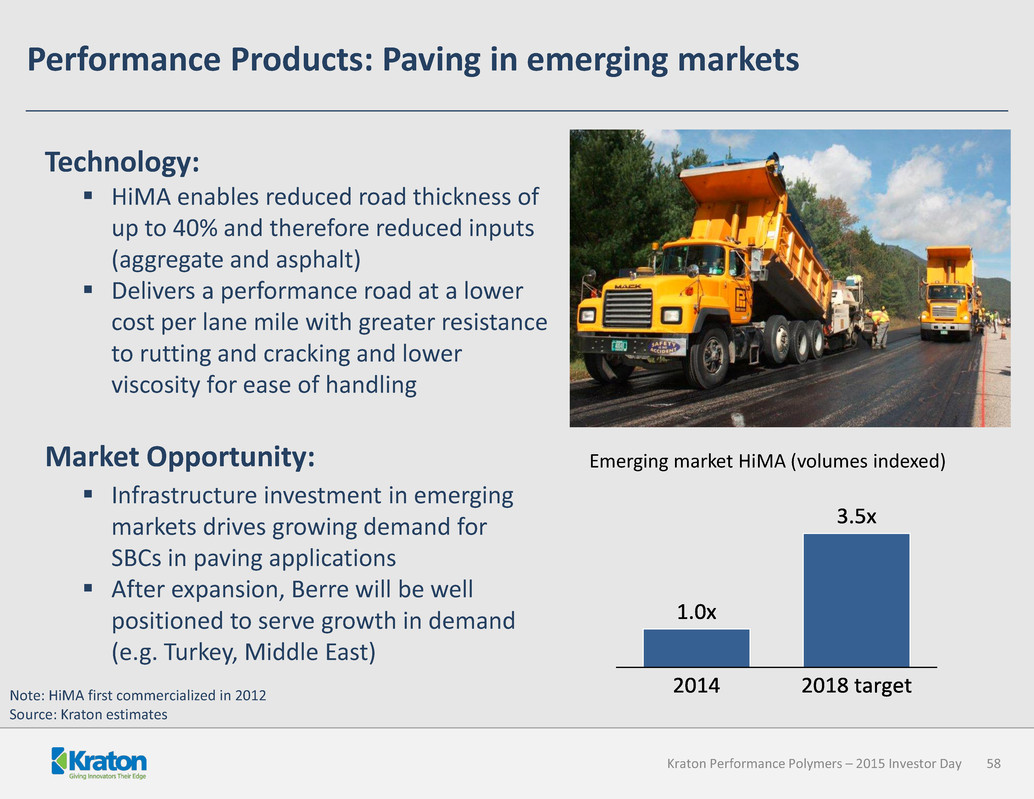

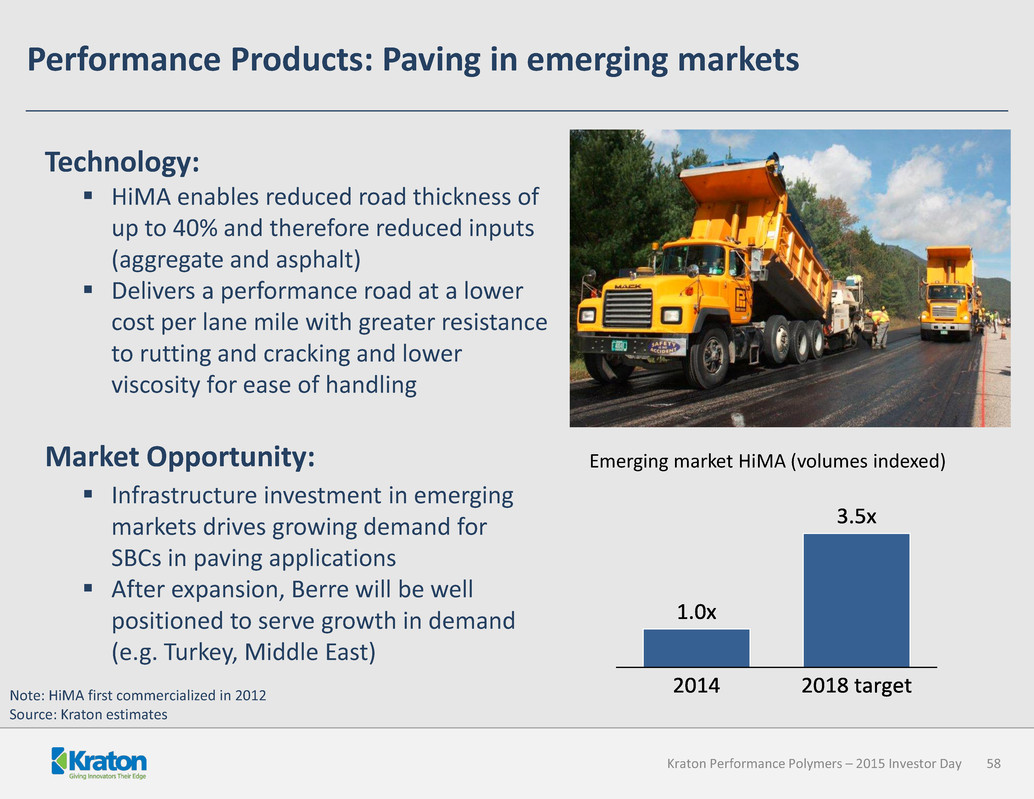

Performance Products: Paving in emerging markets Note: HiMA first commercialized in 2012 Source: Kraton estimates Emerging market HiMA (volumes indexed) Market Opportunity: Infrastructure investment in emerging markets drives growing demand for SBCs in paving applications After expansion, Berre will be well positioned to serve growth in demand (e.g. Turkey, Middle East) Technology: HiMA enables reduced road thickness of up to 40% and therefore reduced inputs (aggregate and asphalt) Delivers a performance road at a lower cost per lane mile with greater resistance to rutting and cracking and lower viscosity for ease of handling Kraton Performance Polymers – 2015 Investor Day 58

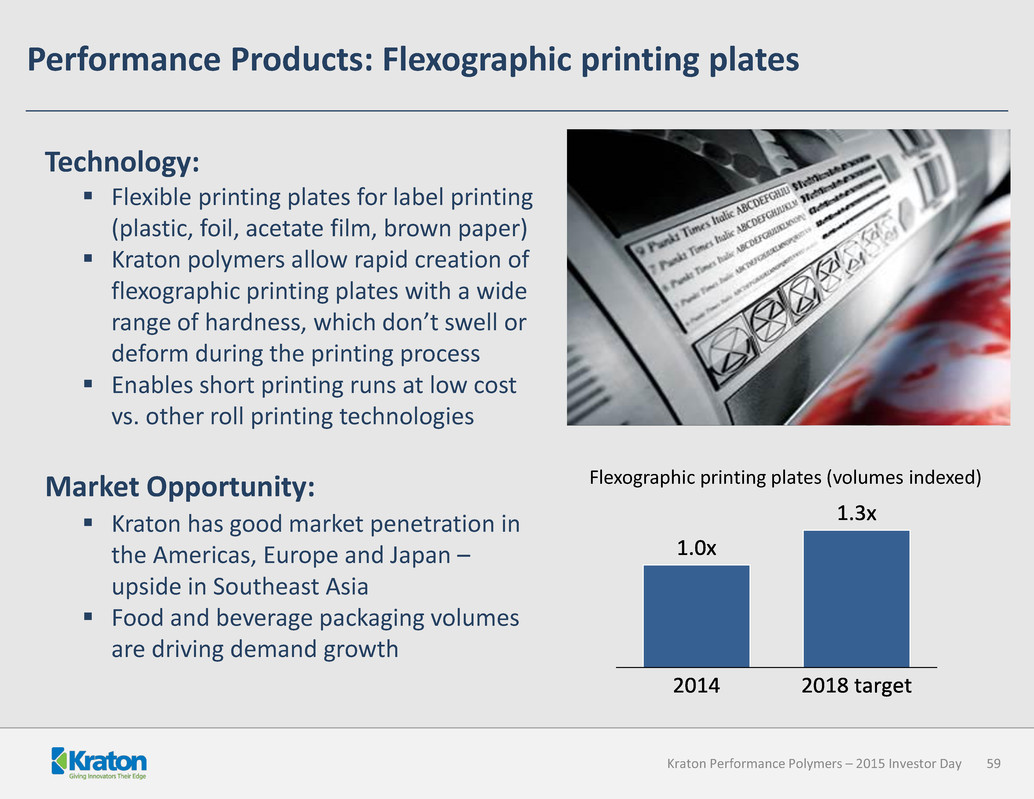

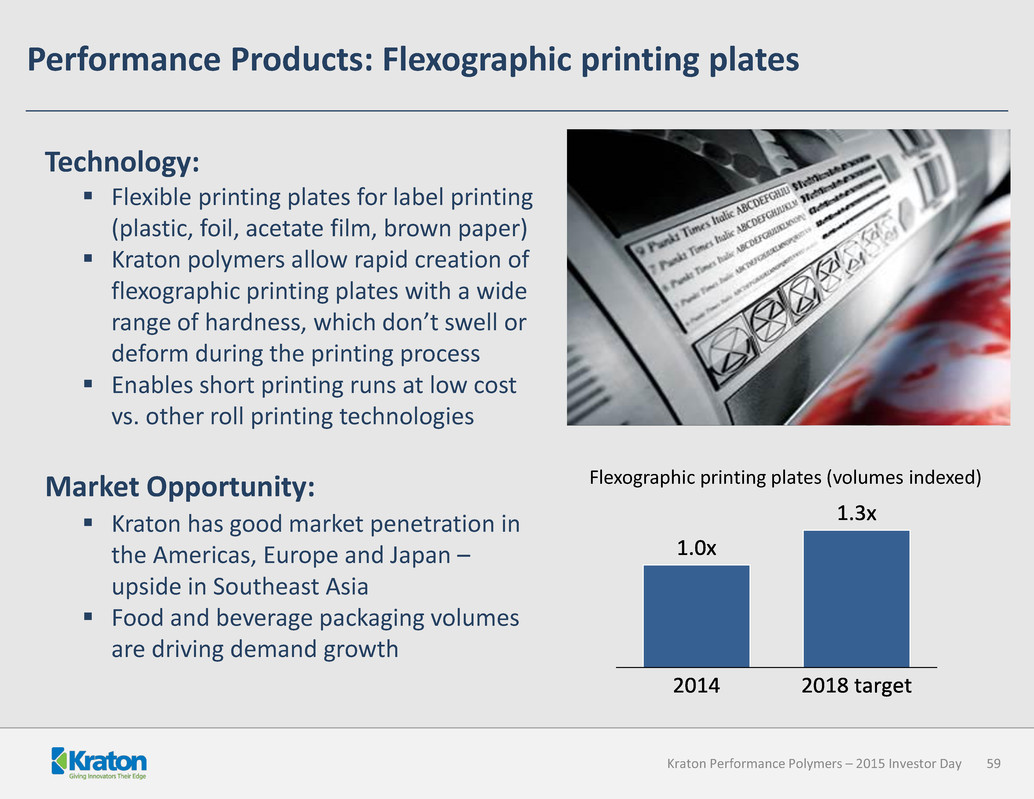

Flexographic printing plates (volumes indexed) Performance Products: Flexographic printing plates Market Opportunity: Kraton has good market penetration in the Americas, Europe and Japan – upside in Southeast Asia Food and beverage packaging volumes are driving demand growth Technology: Flexible printing plates for label printing (plastic, foil, acetate film, brown paper) Kraton polymers allow rapid creation of flexographic printing plates with a wide range of hardness, which don’t swell or deform during the printing process Enables short printing runs at low cost vs. other roll printing technologies Kraton Performance Polymers – 2015 Investor Day 59

New approaches by R&D and commercial will drive future organic growth Revised Market Approach: Realigned organization expected to drive growth by better meeting customer needs Organic Growth Kraton Performance Polymers – 2015 Investor Day 60 Rebalanced Innovation Strategy: Rebalanced innovation portfolio expected to deliver robust returns

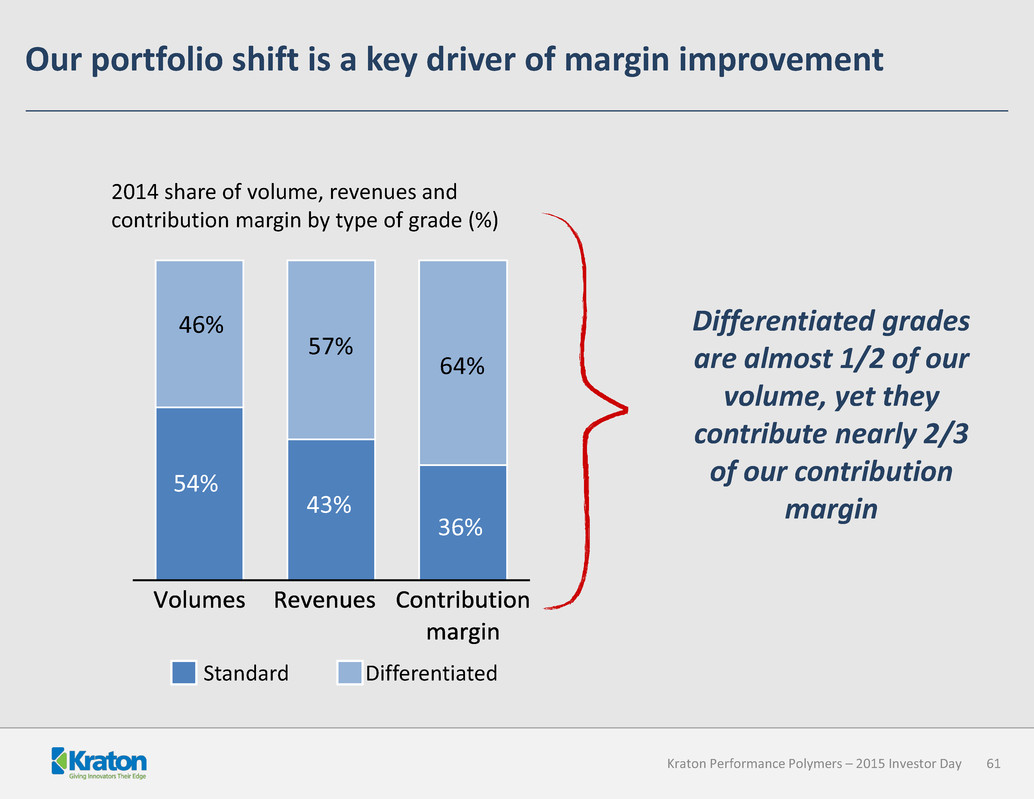

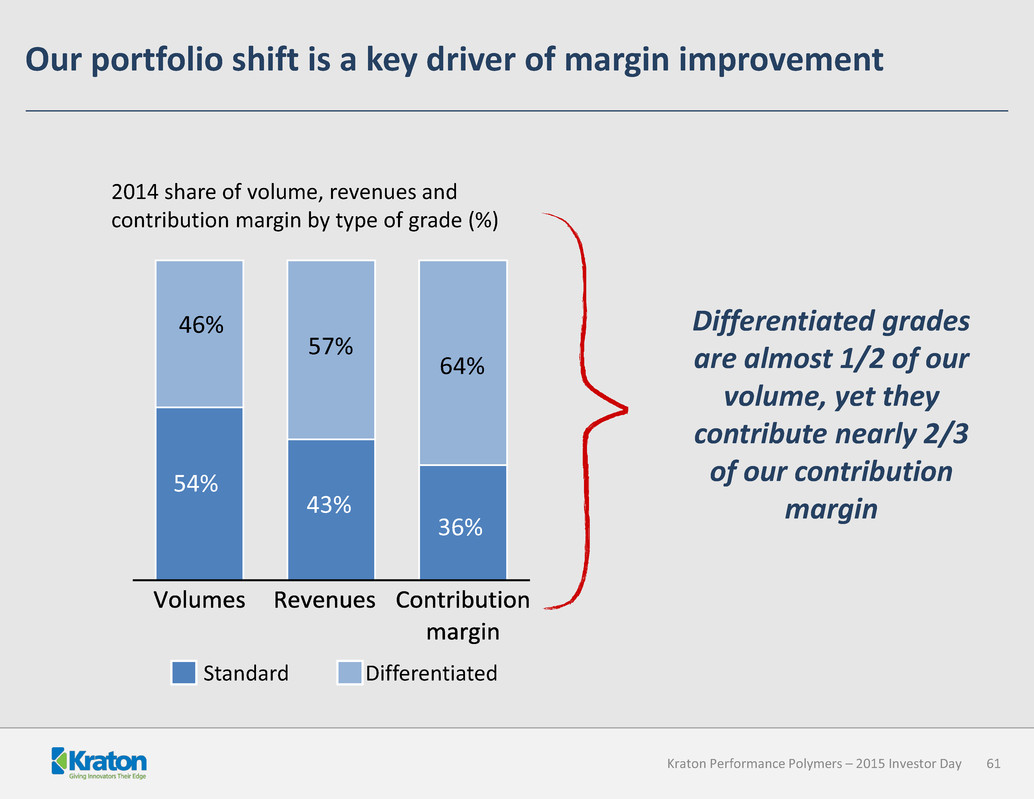

Our portfolio shift is a key driver of margin improvement 46% 54% 64% 36% 2014 share of volume, revenues and contribution margin by type of grade (%) Standard Differentiated Differentiated grades are almost 1/2 of our volume, yet they contribute nearly 2/3 of our contribution margin 57% 43% Kraton Performance Polymers – 2015 Investor Day 61

We are maintaining our commitment to growth through innovation Advance growth in core markets via new polymers Leverage existing technology for new applications Giving Innovators Their Edge Increasing profitability through portfolio shift Explore new markets & technology concepts Kraton Performance Polymers – 2015 Investor Day 62

We believe a balanced approach to R&D investment is critical to drive steady progress on innovation Custom Polymers New polymers to grow core markets Breakthrough New polymer chemistry & process technology to ensure long-term sustainability Incremental Innovation Process and polymer optimization to defend core markets Application Development Translate technology to grow number of accounts Existing New New Technolog ie s Customers/Markets >30 projects typically active >30 projects typically active 2-5 projects typically active 5-10 projects typically active Kraton Performance Polymers – 2015 Investor Day 63

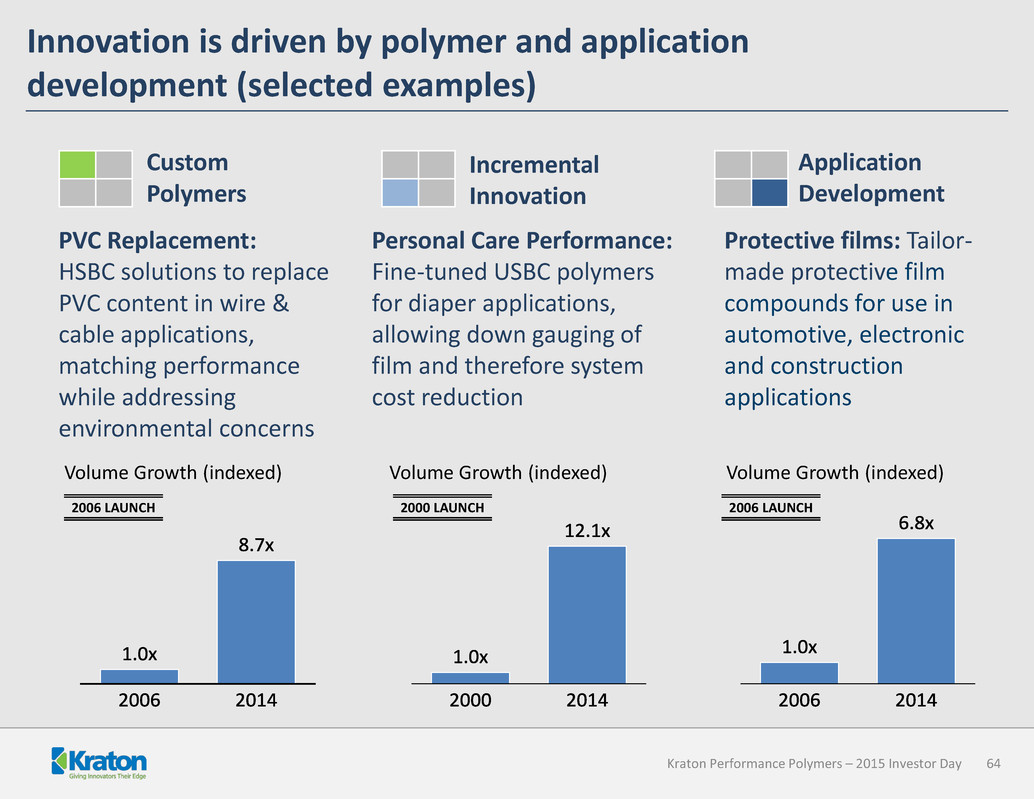

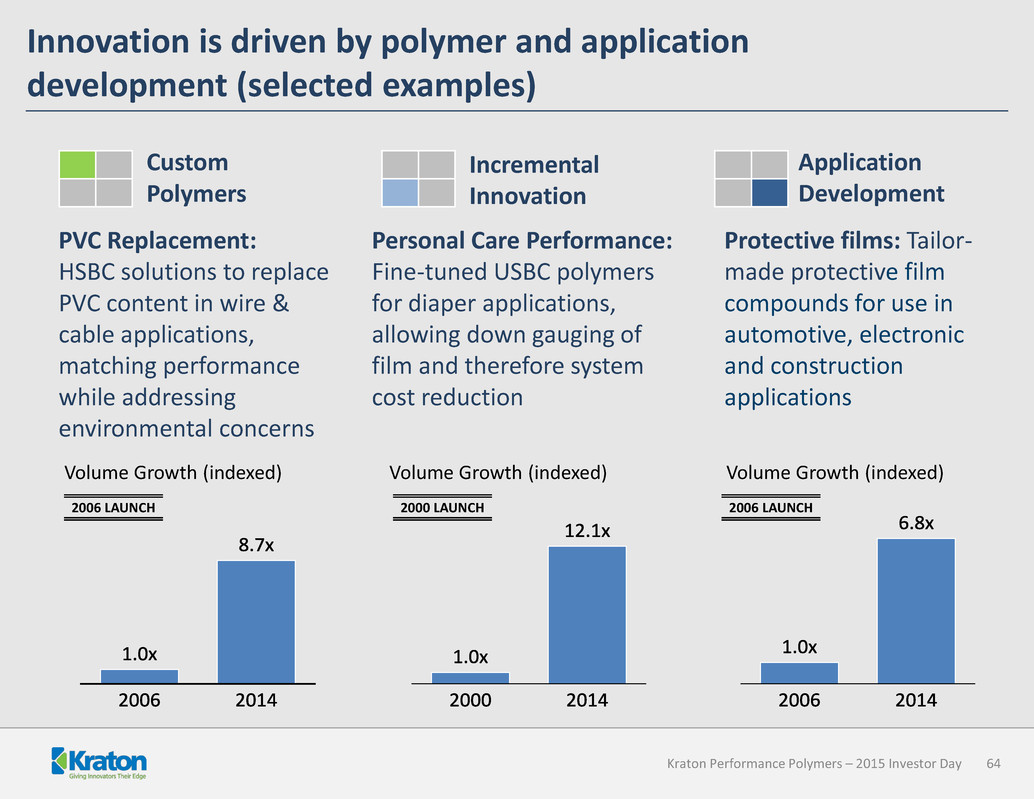

Innovation is driven by polymer and application development (selected examples) Incremental Innovation Application Development Personal Care Performance: Fine-tuned USBC polymers for diaper applications, allowing down gauging of film and therefore system cost reduction Protective films: Tailor- made protective film compounds for use in automotive, electronic and construction applications Custom Polymers PVC Replacement: HSBC solutions to replace PVC content in wire & cable applications, matching performance while addressing environmental concerns Volume Growth (indexed) Volume Growth (indexed) Volume Growth (indexed) 2000 LAUNCH 2006 LAUNCH2006 LAUNCH Kraton Performance Polymers – 2015 Investor Day 64

Key technology projects have contributed >$200M to the top line in 2014 We announced a portfolio of projects in 2012 – many have delivered on expectations Many applications are early in the adoption curve – we expect these investments to drive further growth Kraton Performance Polymers – 2015 Investor Day 65

Going forward we will rebalance our investment allocation to better serve customer needs and maximize returns R&D investment allocation (%) 25% 35% 30% 10% 19% 31% 22% 28% Incremental Innovation Application Development Custom polymers Breakthrough Expanded application of existing technology to drive improved returns Selective investments in breakthrough technologies Kraton Performance Polymers – 2015 Investor Day 66 Semiworks allows greater productivity at lower costs

We expect continued returns from our investments in existing technology Robust growth, reliable returns Driven by close collaboration and deep customer relationships Higher success rates, growing impact on business over time Sample Projects: Performance Products - Roofing Wind and hail resistant shingles Specialty Polymers - Strippable coatings Improved toughness and adhesive retention Specialty Polymers - Structural interior fiber reinforced elements Improved toughness and stiffness Kraton Performance Polymers – 2015 Investor Day 67

The new Semi-works at Belpre is further accelerating our ability to bring new polymers to market The Semi-Works Advantage Shorter time to market and reduced investment risk Small batch capabilities; can produce HSBC, USBC, and CariflexTM Shorter product development cycle Semi-works plant at Belpre New Polymer Profile: Process: Multiple product runs on the Semi-works were critical to fine tuning the molecular structure to meet customer specs. Commercialization time less than 12 months Results: Leading oilfield services company has adopted the polymer for well casing insulation for permafrost conditions. The polymer has been qualified by two of the super majors Project: MD8703 used to modify drilling and completion fluids in oil field applications, providing superior viscosity stability at high temperatures up to 150 C° Kraton Performance Polymers – 2015 Investor Day 68

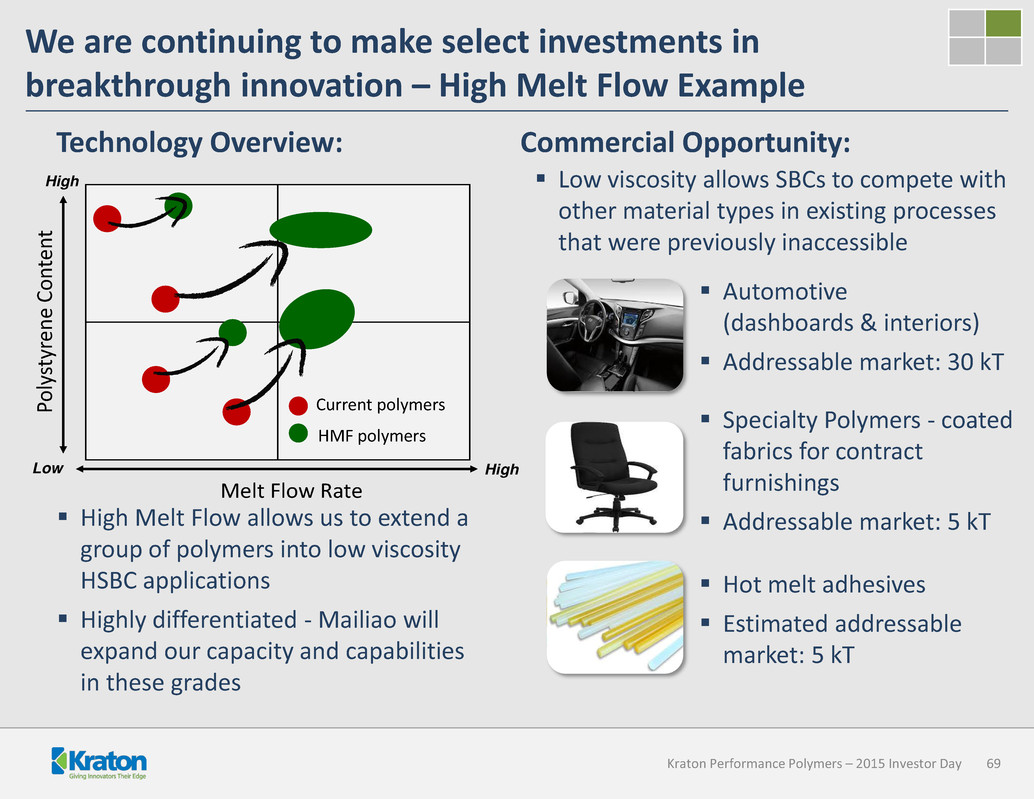

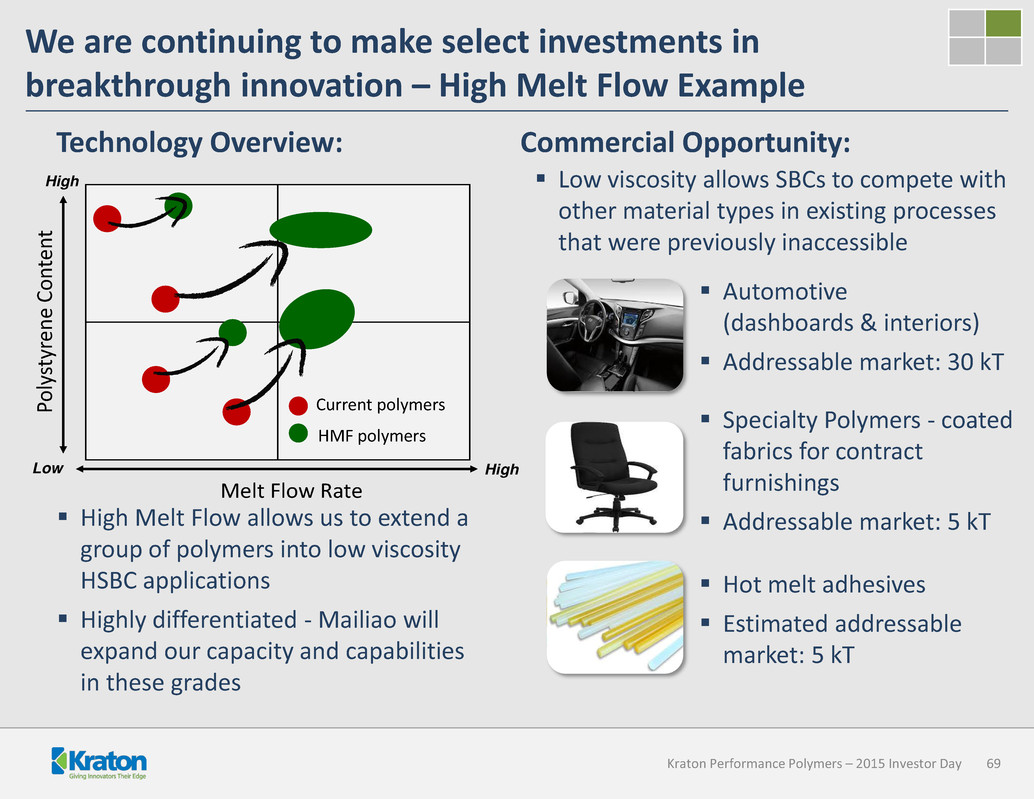

Low High High Po lys ty rene Co nt en t Melt Flow Rate We are continuing to make select investments in breakthrough innovation – High Melt Flow Example High Melt Flow allows us to extend a group of polymers into low viscosity HSBC applications Highly differentiated - Mailiao will expand our capacity and capabilities in these grades Technology Overview: Commercial Opportunity: Low viscosity allows SBCs to compete with other material types in existing processes that were previously inaccessible Automotive (dashboards & interiors) Addressable market: 30 kT Specialty Polymers - coated fabrics for contract furnishings Addressable market: 5 kT Hot melt adhesives Estimated addressable market: 5 kT HMF polymers Current polymers Kraton Performance Polymers – 2015 Investor Day 69

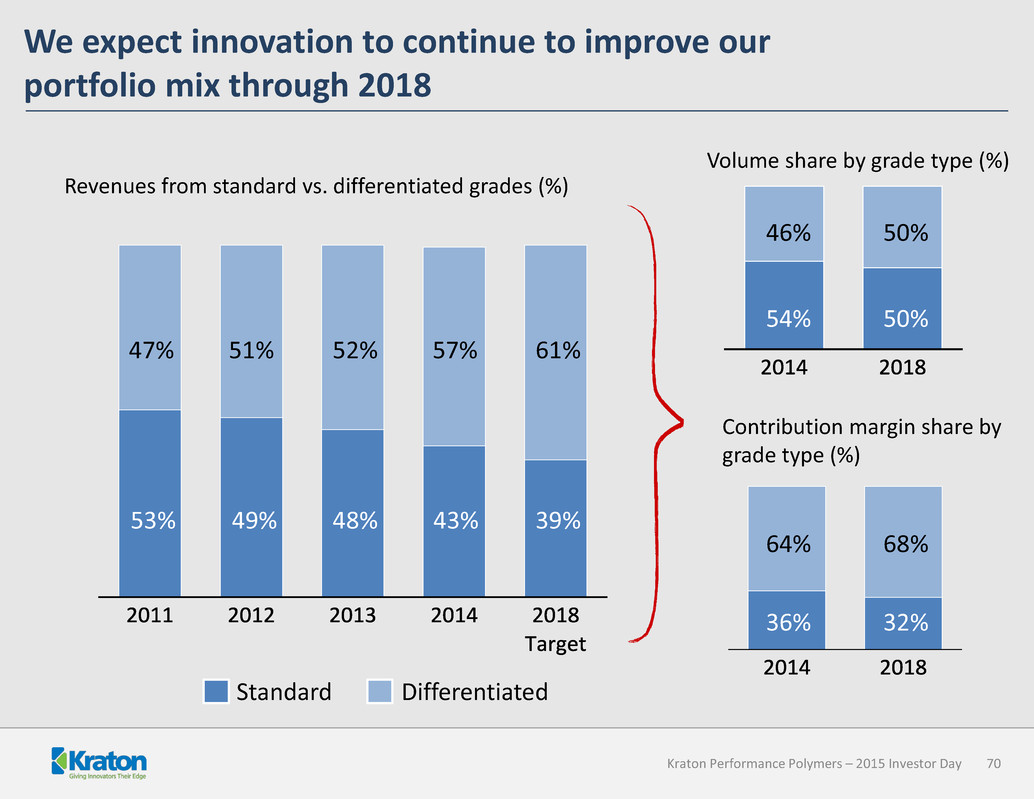

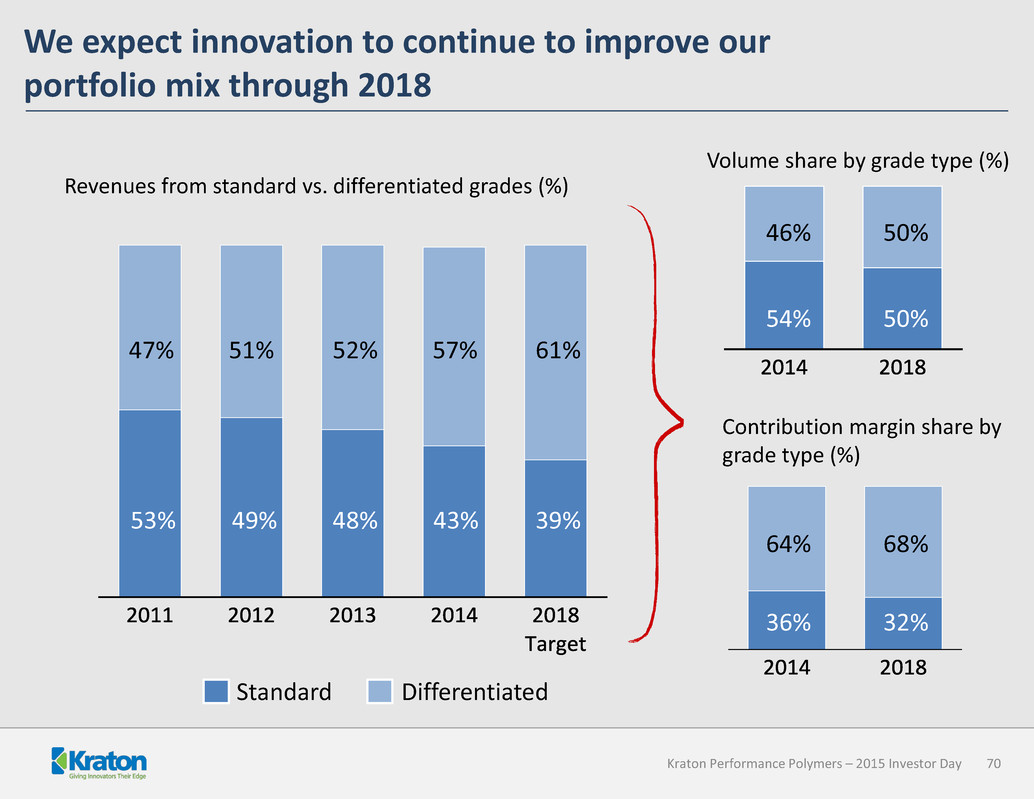

We expect innovation to continue to improve our portfolio mix through 2018 Revenues from standard vs. differentiated grades (%) Standard Differentiated 47% 53% 51% 49% 52% 48% 57% 43% 61% 39% Kraton Performance Polymers – 2015 Investor Day 70 46% 54% 50% 50% 64% 36% 68% 32% Volume share by grade type (%) Contribution margin share by grade type (%)

Financial Targets Stephen E. Tremblay, Executive Vice President and Chief Financial Officer Kraton Performance Polymers – 2015 Investor Day 71

We have four overarching financial imperatives Continue to shift the portfolio to a richer mix of revenue derived from differentiated product grades Expand earnings through portfolio shift and the implementation of cost competitiveness initiatives Drive growth in cash flow, further strengthening the balance sheet and enhancing financial flexibility Focus on working capital reductions and lowering capex to expand return on capital employed 1 2 3 4 Kraton Performance Polymers – 2015 Investor Day 72

Through the execution of our strategic plan revenues are projected to reach $1.4B in 2018 Americas Asia EMEA Standard Differentiated Revenue ($B) 57% 61% 43% 39% 36% 31% 25% 28% 39% 41% Kraton Performance Polymers – 2015 Investor Day 73 Note: 2018 Target Includes $90M negative effect from currency and raw materials

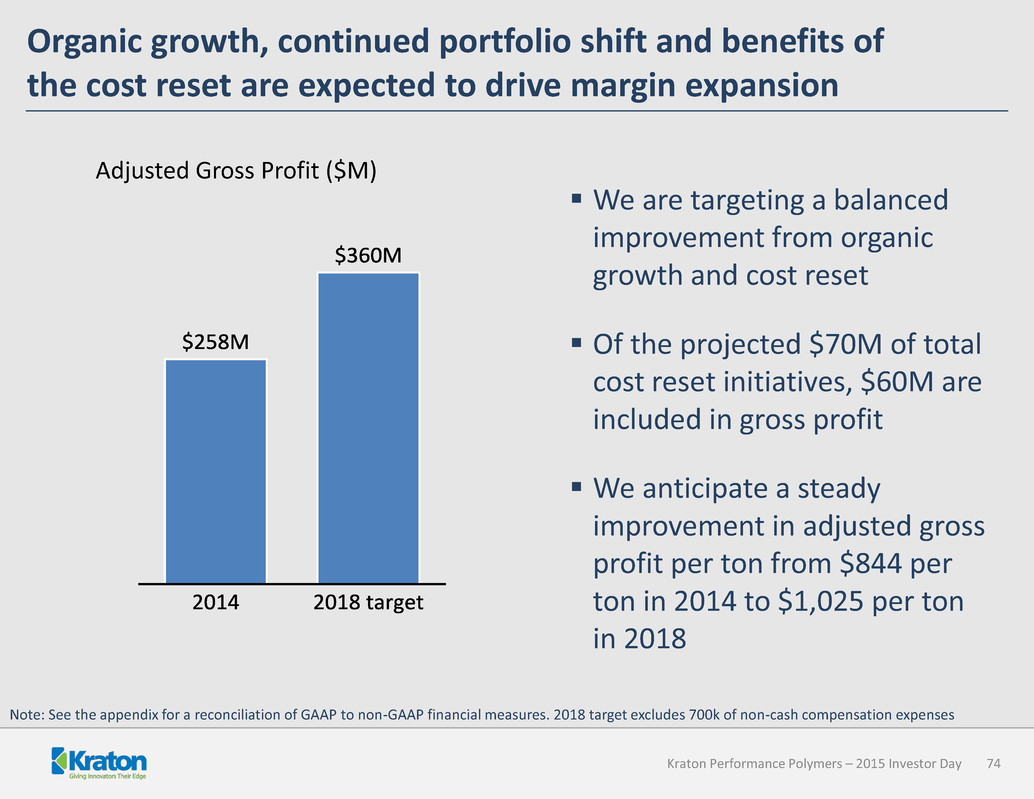

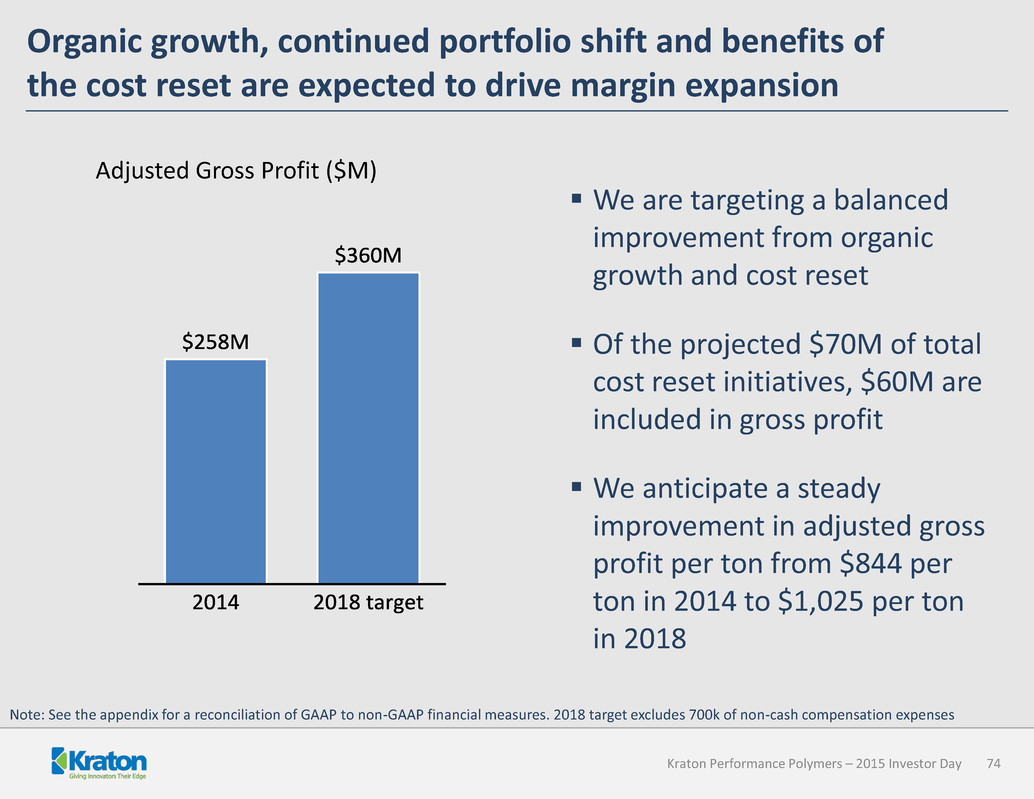

Note: See the appendix for a reconciliation of GAAP to non-GAAP financial measures. 2018 target excludes 700k of non-cash compensation expenses Organic growth, continued portfolio shift and benefits of the cost reset are expected to drive margin expansion We are targeting a balanced improvement from organic growth and cost reset Of the projected $70M of total cost reset initiatives, $60M are included in gross profit We anticipate a steady improvement in adjusted gross profit per ton from $844 per ton in 2014 to $1,025 per ton in 2018 Adjusted Gross Profit ($M) Kraton Performance Polymers – 2015 Investor Day 74

This is projected to yield significant improvement in Adjusted EBITDA and ROCE … Adjusted EBITDA ($M) Note: See appendix for reconciliation of GAAP to non-GAAP measures Kraton Performance Polymers – 2015 Investor Day 75 Adjusted EBITDA to grow at a 14% CAGR EBITDA margin improves to 18%, up 600 basis points over 2014 2018 EPS at $3.75, more than 3x improvement over $1.16 in 2014 ROCE (%)

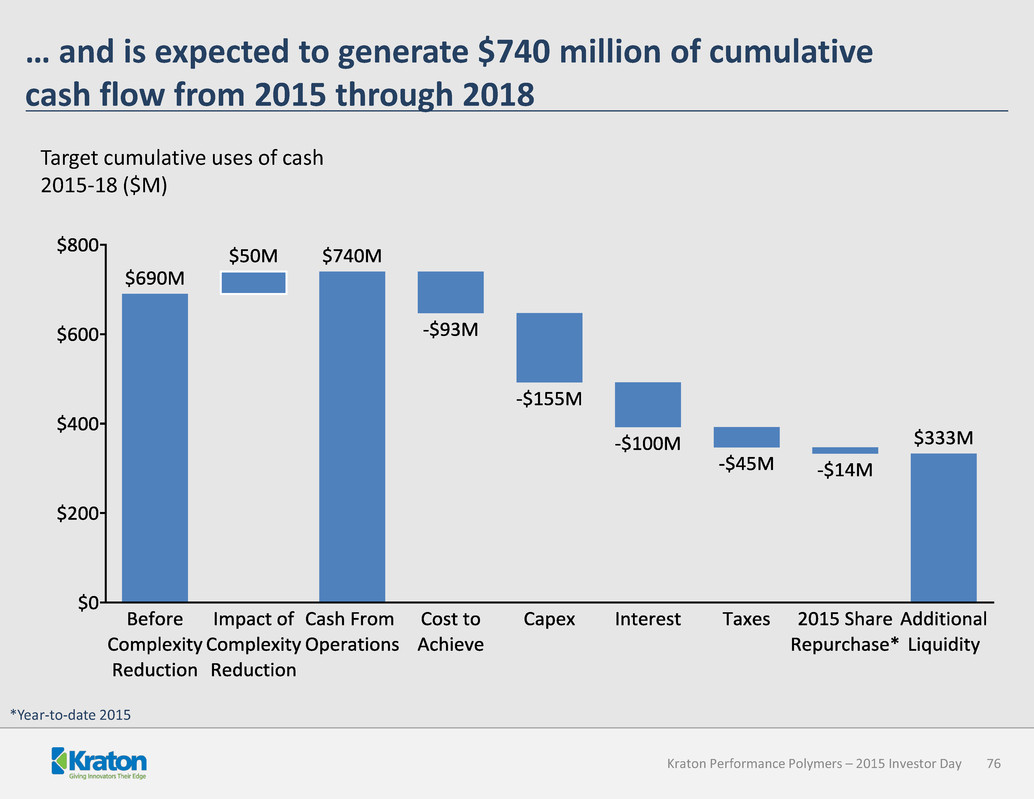

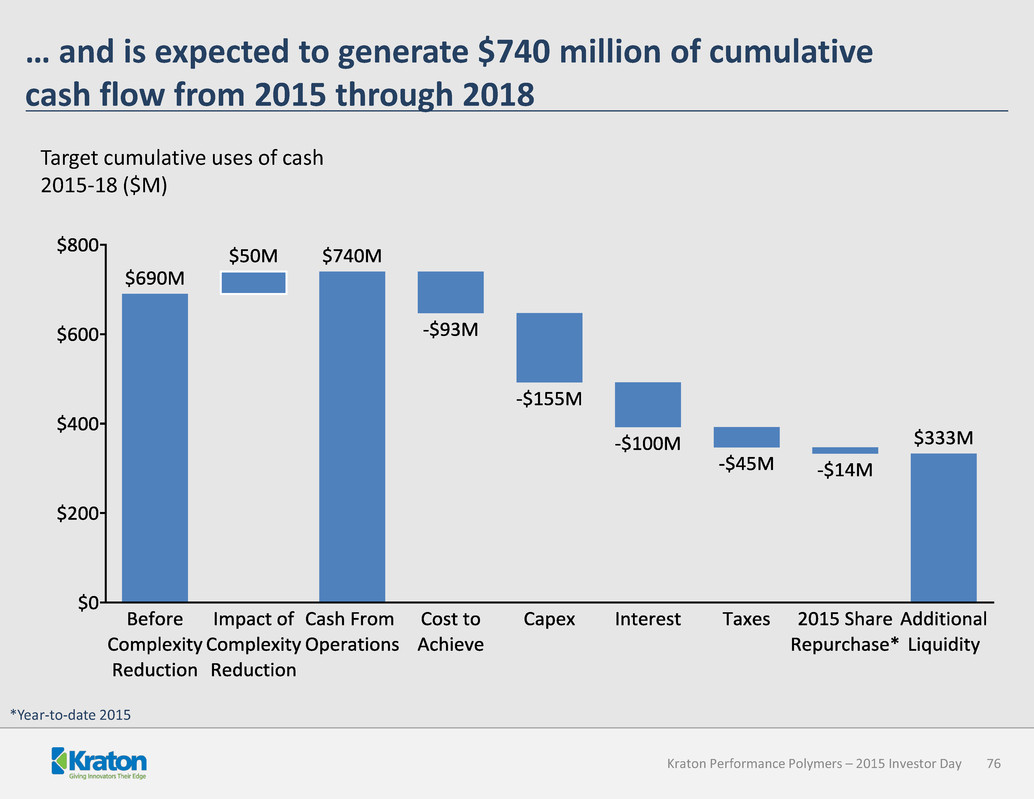

… and is expected to generate $740 million of cumulative cash flow from 2015 through 2018 Target cumulative uses of cash 2015-18 ($M) *Year-to-date 2015 Kraton Performance Polymers – 2015 Investor Day 76

Uses for additional liquidity Maintain ratings and financial strength Investments to drive organic growth Strategic M&A Return to shareholders Kraton Performance Polymers – 2015 Investor Day 77

Closing Comments Kevin M. Fogarty President and Chief Executive Officer Kraton Performance Polymers – 2015 Investor Day 78

Compelling and strategic acquisitions to improve cost position and access new markets Manufacturing optimization and investments in asset productivity Broad complexity reduction and overhead efficiency effort We expect our three part strategy to deliver growth and improved profitability Kraton Performance Polymers – 2015 Investor Day 79 Refreshed approach to the market Rebalanced R&D strategy and portfolio

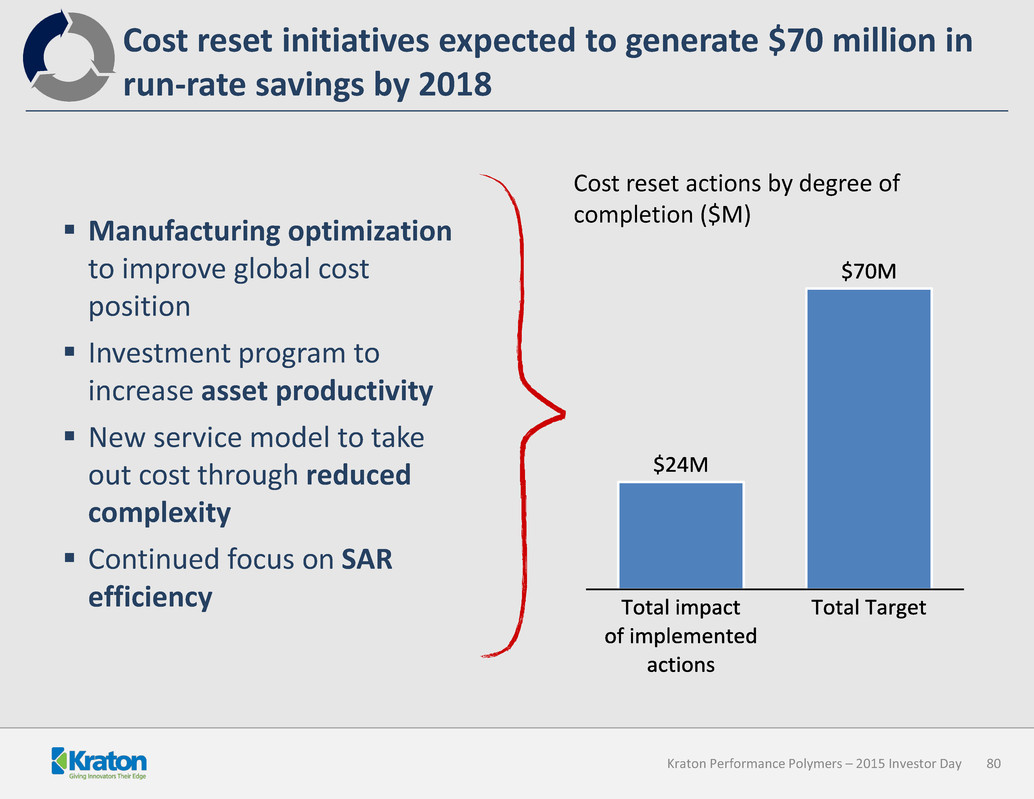

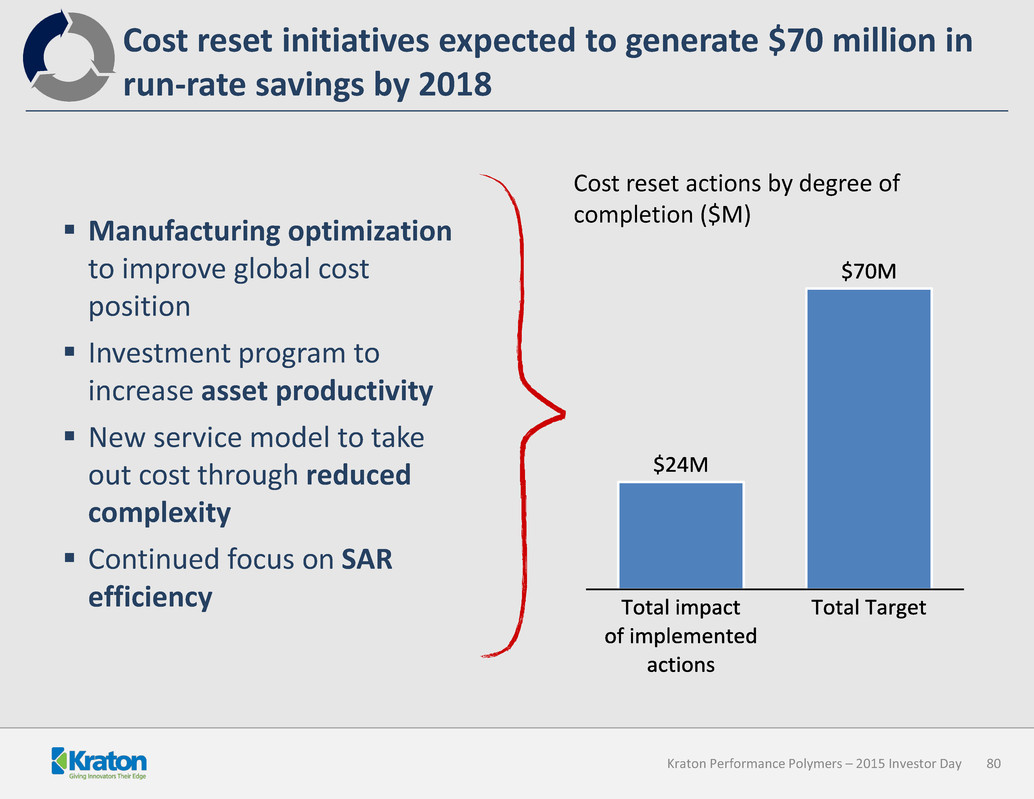

Cost reset initiatives expected to generate $70 million in run-rate savings by 2018 Manufacturing optimization to improve global cost position Investment program to increase asset productivity New service model to take out cost through reduced complexity Continued focus on SAR efficiency Cost reset actions by degree of completion ($M) Kraton Performance Polymers – 2015 Investor Day 80

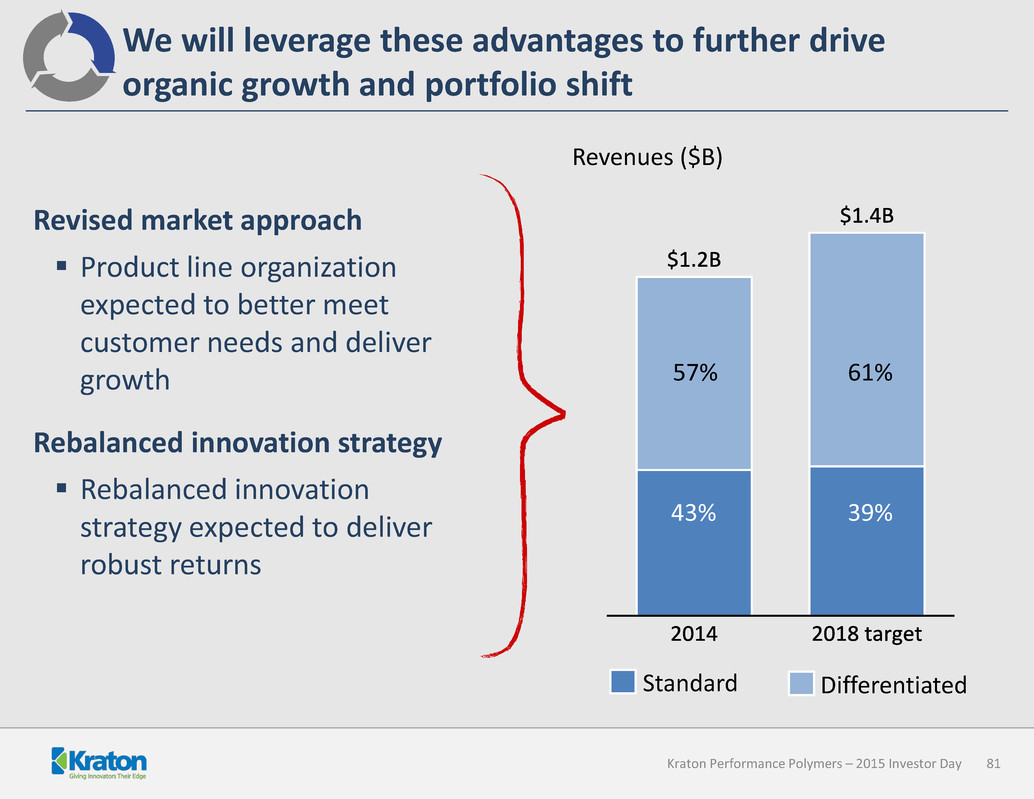

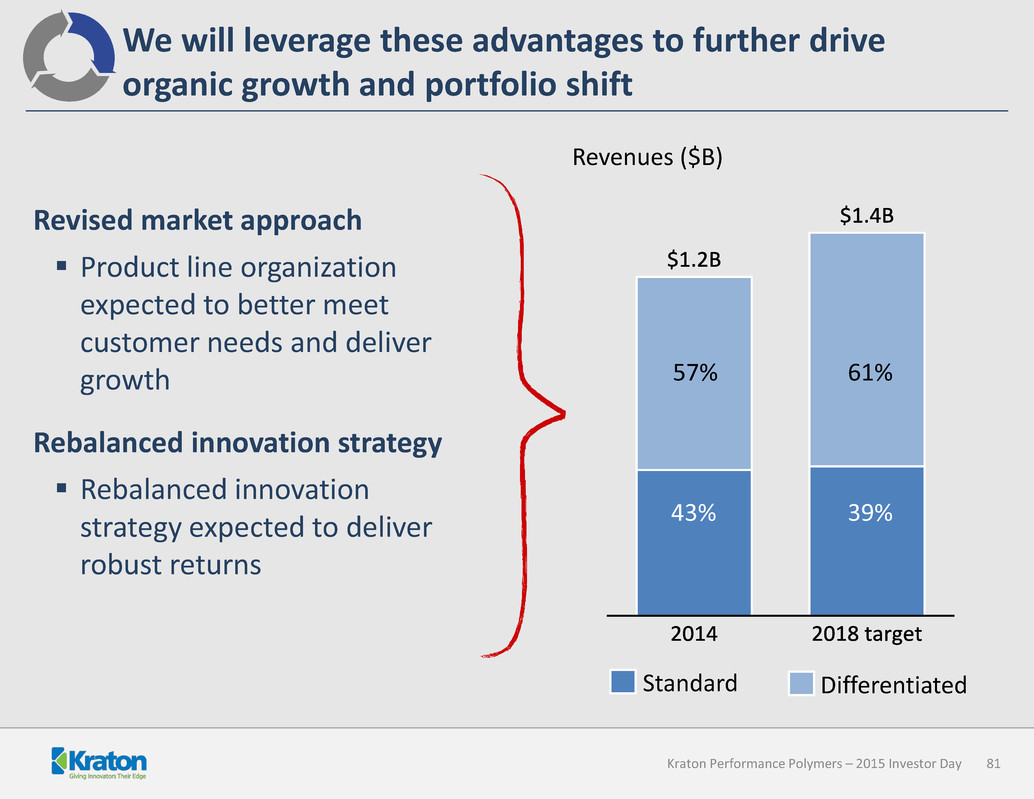

We will leverage these advantages to further drive organic growth and portfolio shift Revised market approach Product line organization expected to better meet customer needs and deliver growth Rebalanced innovation strategy Rebalanced innovation strategy expected to deliver robust returns Standard Differentiated 57% 43% 61% 39% Kraton Performance Polymers ��� 2015 Investor Day 81 Revenues ($B)

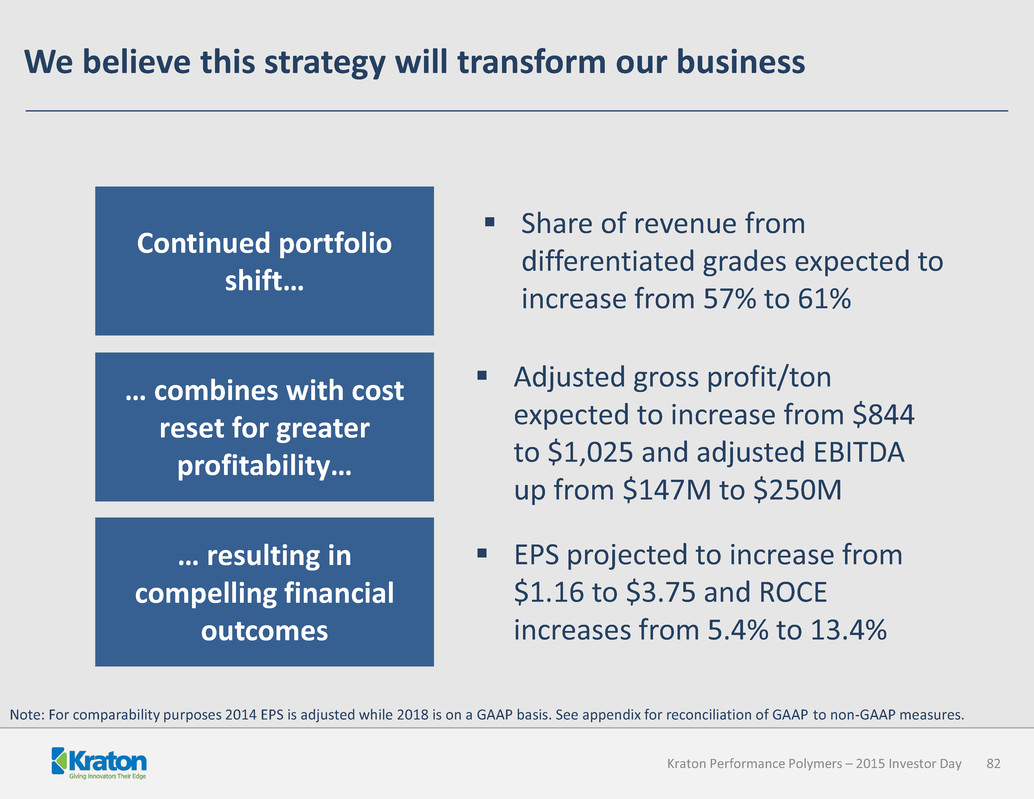

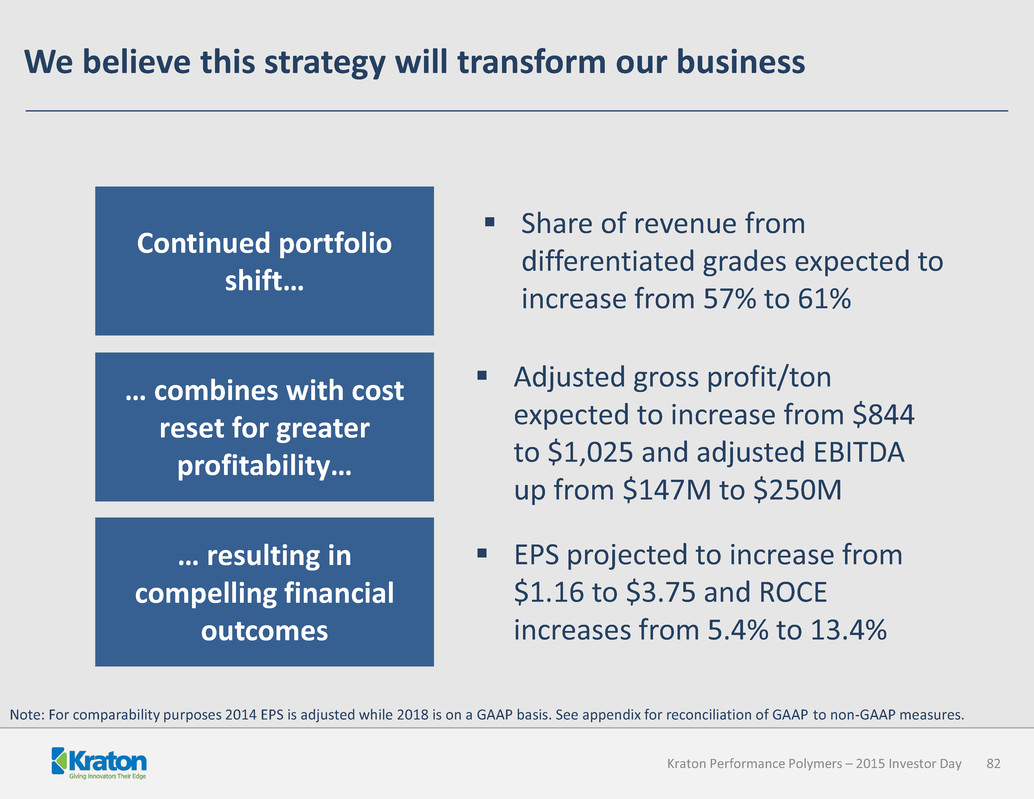

We believe this strategy will transform our business Continued portfolio shift… … combines with cost reset for greater profitability… … resulting in compelling financial outcomes Share of revenue from differentiated grades expected to increase from 57% to 61% Adjusted gross profit/ton expected to increase from $844 to $1,025 and adjusted EBITDA up from $147M to $250M EPS projected to increase from $1.16 to $3.75 and ROCE increases from 5.4% to 13.4% Note: For comparability purposes 2014 EPS is adjusted while 2018 is on a GAAP basis. See appendix for reconciliation of GAAP to non-GAAP measures. Kraton Performance Polymers – 2015 Investor Day 82

Appendices Kraton Performance Polymers – 2015 Investor Day 83

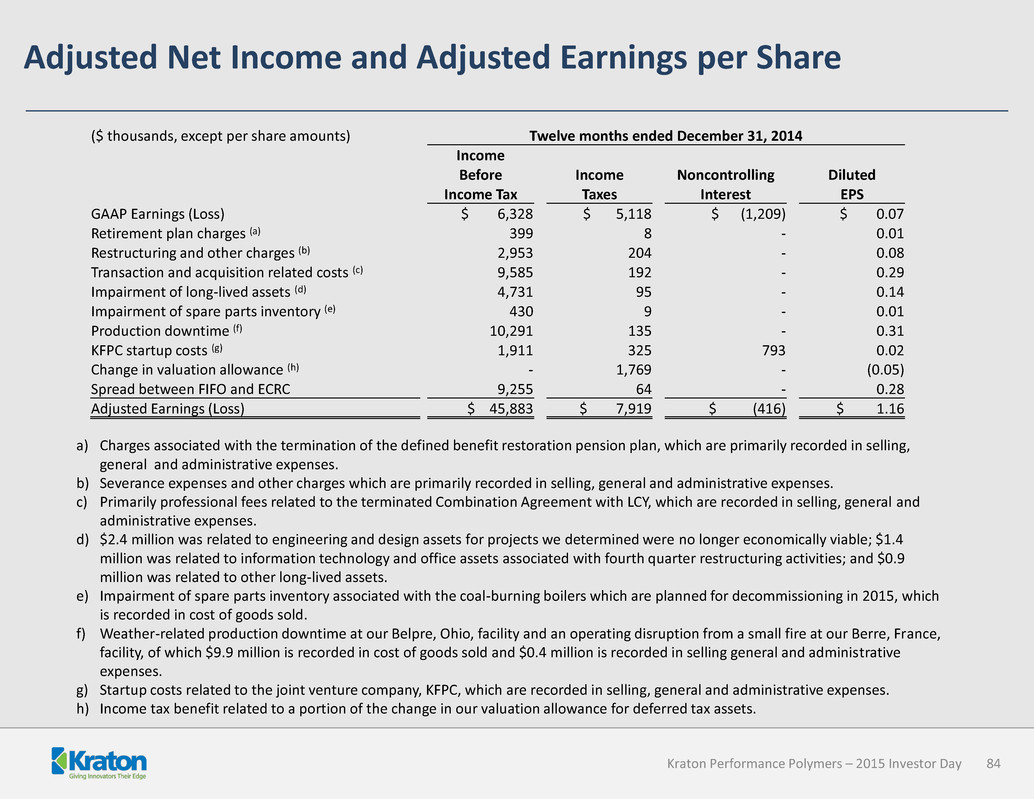

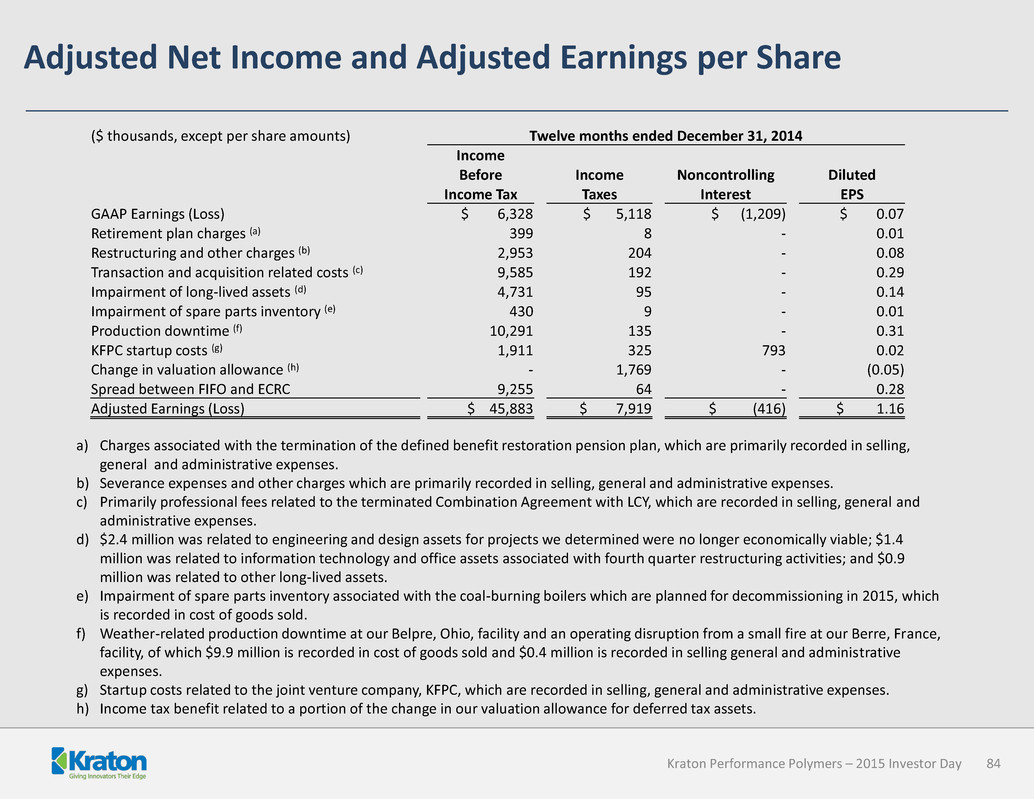

Adjusted Net Income and Adjusted Earnings per Share ($ thousands, except per share amounts) Twelve months ended December 31, 2014 Income Before Income Noncontrolling Diluted Income Tax Taxes Interest EPS GAAP Earnings (Loss) $ 6,328 $ 5,118 $ (1,209) $ 0.07 Retirement plan charges (a) 399 8 - 0.01 Restructuring and other charges (b) 2,953 204 - 0.08 Transaction and acquisition related costs (c) 9,585 192 - 0.29 Impairment of long-lived assets (d) 4,731 95 - 0.14 Impairment of spare parts inventory (e) 430 9 - 0.01 Production downtime (f) 10,291 135 - 0.31 KFPC startup costs (g) 1,911 325 793 0.02 Change in valuation allowance (h) - 1,769 - (0.05) Spread between FIFO and ECRC 9,255 64 - 0.28 Adjusted Earnings (Loss) $ 45,883 $ 7,919 $ (416) $ 1.16 a) Charges associated with the termination of the defined benefit restoration pension plan, which are primarily recorded in selling, general and administrative expenses. b) Severance expenses and other charges which are primarily recorded in selling, general and administrative expenses. c) Primarily professional fees related to the terminated Combination Agreement with LCY, which are recorded in selling, general and administrative expenses. d) $2.4 million was related to engineering and design assets for projects we determined were no longer economically viable; $1.4 million was related to information technology and office assets associated with fourth quarter restructuring activities; and $0.9 million was related to other long-lived assets. e) Impairment of spare parts inventory associated with the coal-burning boilers which are planned for decommissioning in 2015, which is recorded in cost of goods sold. f) Weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility, of which $9.9 million is recorded in cost of goods sold and $0.4 million is recorded in selling general and administrative expenses. g) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses. h) Income tax benefit related to a portion of the change in our valuation allowance for deferred tax assets. Kraton Performance Polymers – 2015 Investor Day 84

Reconciliation of Consolidated Net Income (Loss) to EBITDA and Adjusted EBITDA a) Receipt from LyondellBasell in settlement of disputed charges, which is recorded in cost of goods sold. b) Charge associated with resolution of a property tax dispute in France, of which $5.6 million is recorded in cost of goods sold and $0.6 million is recorded in selling, general and administrative expenses. c) In 2014, charges associated with the termination of the defined benefit restoration pension plan, which are primarily recorded in selling, general and administrative expenses. In 2012, retirement plan settlement charge associated with a disbursement from a benefit plan upon the retirement of an employee, which is recorded in selling, general and administrative expenses. d) Restructuring and other charges which are primarily recorded in selling, general and administrative expenses in 2014, 2013, and 2011 and primarily in cost of goods sold in 2012. e) Primarily professional fees related to the terminated Combination Agreement with LCY, which are recorded in selling, general and administrative expenses. f) In 2014, $2.4 million related to engineering and design assets for projects we determined were no longer economically viable; $1.4 million related to information technology and office assets associated with fourth quarter restructuring activities; and $0.9 million related to other long-lived assets. In 2012, $3.4 million related to the Asia HSBC facility and $2.0 million related to other long-lived assets. g) Impairment of spare parts inventory associated with the coal-burning boilers which are planned for decommissioning in 2015 which is recorded in cost of goods sold. h) In 2014, weather-related production downtime at our Belpre, Ohio, facility and an operating disruption from a small fire at our Berre, France, facility, of which $9.9 million is recorded in cost of goods sold and $0.4 million is recorded in selling general and administrative expenses. In 2013, production downtime at our Belpre, Ohio facility, in preparation for the installation of natural gas boilers to replace the coal-burning boilers required by the MACT legislation, which is recorded in cost of goods sold. In 2012, storm related charges at our Belpre, Ohio, facility, which are recorded in cost of goods sold. i) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses. j) We had historically recorded these costs in selling, general and administrative expenses; however, beginning in the second quarter of 2013, a portion of these costs were recorded in cost of goods sold and research and development expenses. In 2014, $9.0 million, $0.9 million, and $0.6 million and in 2013, $7.1 million, $0.5 million and $0.3 million is recorded in selling, general and administrative, research and development expenses and cost of goods sold, respectively. k) Loss on extinguishment of debt associated with the 2011 debt refinancing ($ in Thousands) Twelve months ended Twelve months ended Twelve months ended Twelve months ended Twelve months ended 12/31/2011 12/31/2012 12/31/2013 12/31/2014 12/31/2018 (FORECAST) Consolidated net income (loss) 90,925 (16,191) (975) 1,210 126,669 Add: Interest expense, net 29,884 29,303 30,470 24,594 23,488 Income tax expense (benefit) 584 19,306 (3,887) 5,118 8,937 Depreciation and amortization expenses 62,735 64,554 63,182 66,242 79,906 EBITDA 184,128 96,972 88,790 97,164 239,000 Add (deduct): Settlement gain (a) - (6,819) - - - Property tax dispute (b) - 6,211 - - - Retirement plan charges (c) - 1,100 - 399 - Restructuring and other charges (d) 1,755 1,359 815 2,953 - Transaction and acquisition related costs (e) - - 9,164 9,585 - Impairment of long-lived assets (f) - 5,434 - 4,731 - Impairment of spare parts inventory (g) - - - 430 - Production downtime (h) - 2,481 3,506 10,291 - KFPC startup costs (i) - - - 1,911 - Non-cash compensation expense (j) 5,459 6,571 7,894 10,475 11,000 Loss on extinguishment of debt (k) 2,985 - - - - Spread between FIFO and ECRC (66,332) 30,533 30,737 9,255 - Adjusted EBITDA $ 127,995 $ 143,842 $ 140,906 $ 147,194 $ 250,000 Kraton Performance Polymers – 2015 Investor Day 85

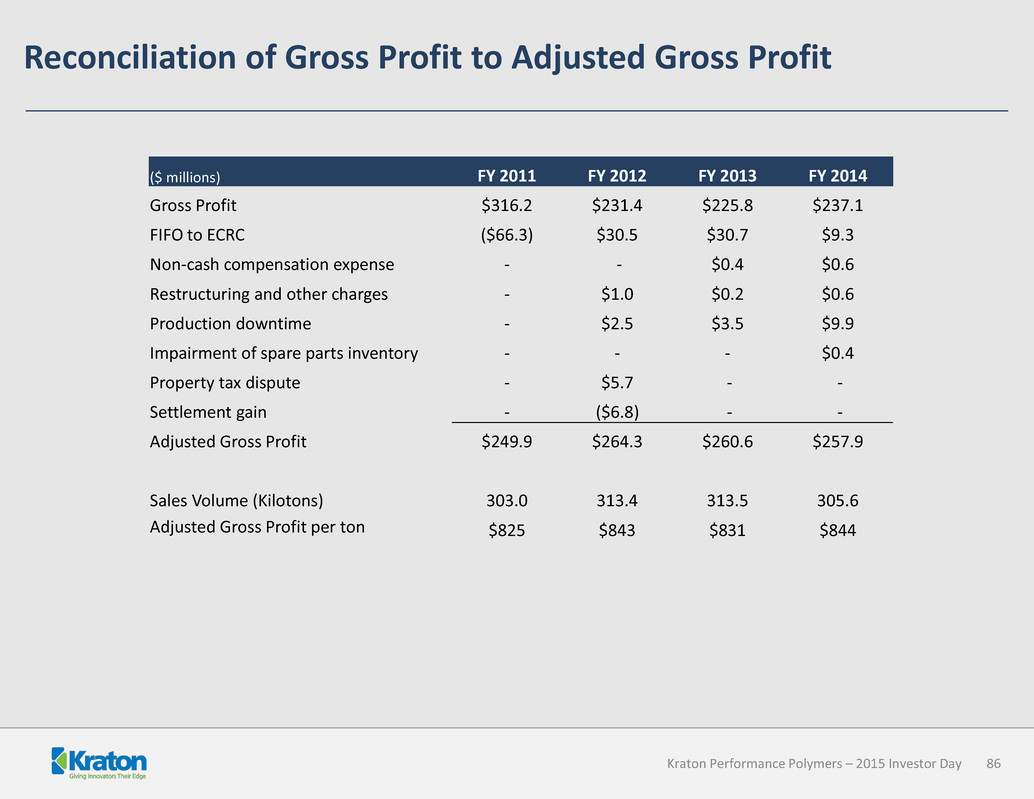

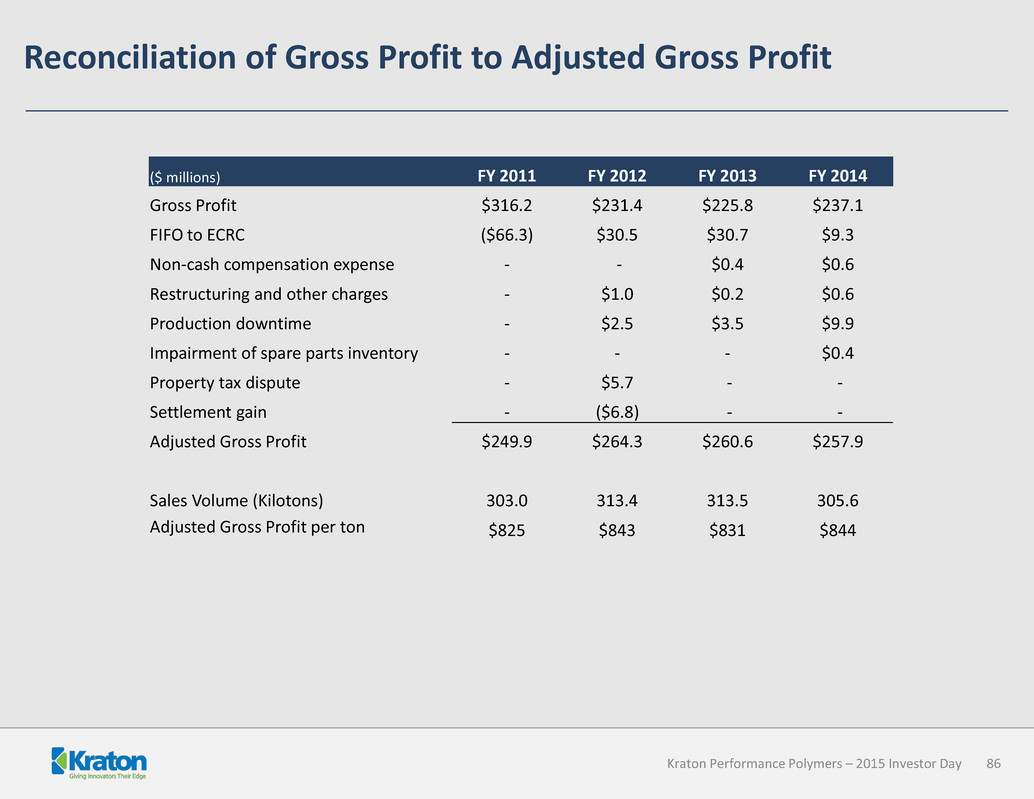

Reconciliation of Gross Profit to Adjusted Gross Profit ($ millions) FY 2011 FY 2012 FY 2013 FY 2014 Gross Profit $316.2 $231.4 $225.8 $237.1 FIFO to ECRC ($66.3) $30.5 $30.7 $9.3 Non-cash compensation expense - - $0.4 $0.6 Restructuring and other charges - $1.0 $0.2 $0.6 Production downtime - $2.5 $3.5 $9.9 Impairment of spare parts inventory - - - $0.4 Property tax dispute - $5.7 - - Settlement gain - ($6.8) - - Adjusted Gross Profit $249.9 $264.3 $260.6 $257.9 Sales Volume (Kilotons) 303.0 313.4 313.5 305.6 Adjusted Gross Profit per ton $825 $843 $831 $844 Kraton Performance Polymers – 2015 Investor Day 86

Legal Disclaimer Kraton Performance Polymers, Inc. believes the information set forth herein with respect to its products to be true and accurate, but any recommendations, presentations, statements or suggestions that may be made with respect to Kraton’s products are without any warranty or guarantee whatsoever, and shall establish no legal duty on the part of any Kraton Polymers affiliated entity. The legal responsibilities of any Kraton Polymers affiliate with respect to the products described herein are limited to those set forth in Kraton’s conditions of sale or any effective sales contract. Kraton does not warrant that the products described herein are suitable for any particular uses, including, without limitation, cosmetics and/or medical uses. Persons using the products must rely on their own independent technical and legal judgment, and must conduct their own studies, registrations, and other related activities, to establish the safety and efficacy of their end products incorporating any Kraton products for any application. Nothing set forth herein shall be construed as a recommendation to use any Kraton product in any specific application or in conflict with any existing patent rights. Kraton reserves the right to withdraw any product from commercial availability and to make any changes to any existing commercial or developmental polymer. Kraton expressly disclaims, on behalf of all Kraton affiliates, any and all liability for any damages or injuries arising out of any activities relating to the use of any information set forth in this publication with respect to Kraton products, or the use of any Kraton products. Kraton maintains a Cosmetics, Drugs and Medical Device Policy that restricts the use of Kraton’s products in certain end use applications without Kraton’s prior written consent. Accordingly, Kraton does not guarantee that Kraton’s products will be available for use in all potential end use applications. Kraton’s Cosmetics, Drugs and Medical Device Policy is available on Kraton’s website at www.kraton.com. Kraton, the Kraton logo and design, the Cariflex logo, Cariflex, Nexar and the Giving Innovators Their Edge tagline and, in some cases, their expression in other languages, are trademarks of Kraton Performance Polymers, Inc. and are registered in many countries throughout the world. Kraton Performance Polymers – 2015 Investor Day 87