Kraton Corporation Fourth Quarter 2018 Earnings Presentation February 28, 2019

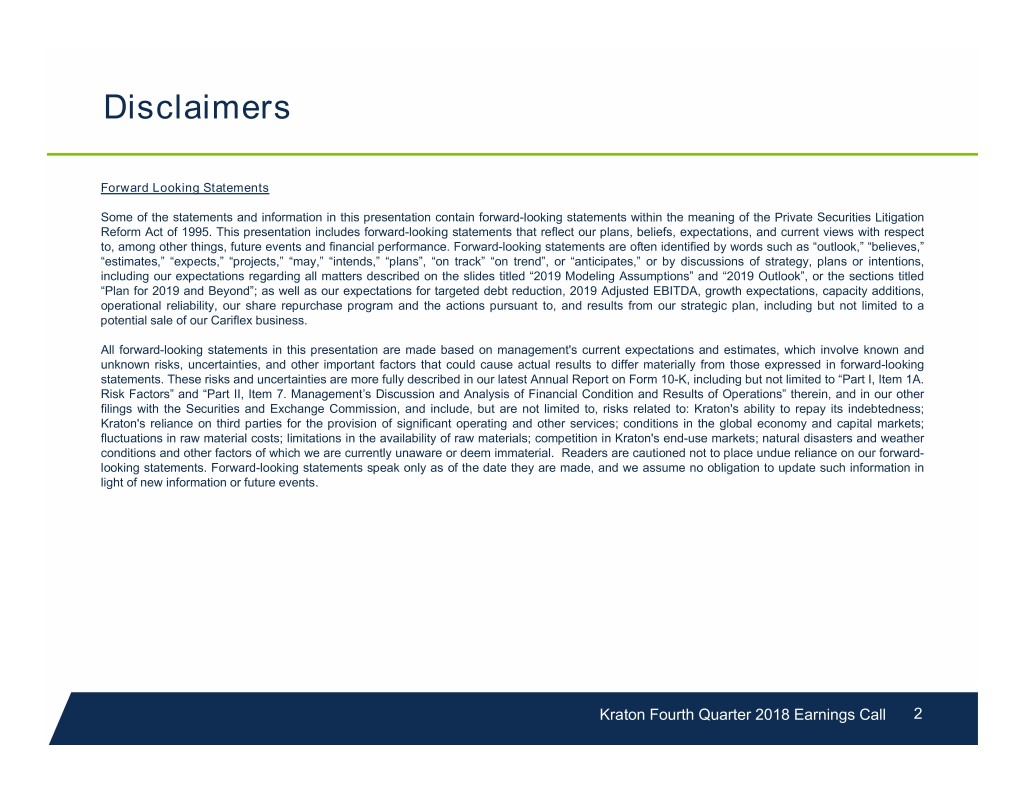

Disclaimers Forward Looking Statements Some of the statements and information in this presentation contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. This presentation includes forward-looking statements that reflect our plans, beliefs, expectations, and current views with respect to, among other things, future events and financial performance. Forward-looking statements are often identified by words such as “outlook,” “believes,” “estimates,” “expects,” “projects,” “may,” “intends,” “plans”, “on track” “on trend”, or “anticipates,” or by discussions of strategy, plans or intentions, including our expectations regarding all matters described on the slides titled “2019 Modeling Assumptions” and “2019 Outlook”, or the sections titled “Plan for 2019 and Beyond”; as well as our expectations for targeted debt reduction, 2019 Adjusted EBITDA, growth expectations, capacity additions, operational reliability, our share repurchase program and the actions pursuant to, and results from our strategic plan, including but not limited to a potential sale of our Cariflex business. All forward-looking statements in this presentation are made based on management's current expectations and estimates, which involve known and unknown risks, uncertainties, and other important factors that could cause actual results to differ materially from those expressed in forward-looking statements. These risks and uncertainties are more fully described in our latest Annual Report on Form 10-K, including but not limited to “Part I, Item 1A. Risk Factors” and “Part II, Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations” therein, and in our other filings with the Securities and Exchange Commission, and include, but are not limited to, risks related to: Kraton's ability to repay its indebtedness; Kraton's reliance on third parties for the provision of significant operating and other services; conditions in the global economy and capital markets; fluctuations in raw material costs; limitations in the availability of raw materials; competition in Kraton's end-use markets; natural disasters and weather conditions and other factors of which we are currently unaware or deem immaterial. Readers are cautioned not to place undue reliance on our forward- looking statements. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update such information in light of new information or future events. Kraton Fourth Quarter 2018 Earnings Call 2

Disclaimers GAAP Disclaimer This presentation includes the use of non-GAAP financial measures, as defined below. Tables included in this presentation reconcile each of these non-GAAP financial measures with the most directly comparable GAAP financial measure. For additional information on the impact of the spread between the FIFO basis of accounting and estimated current replacement cost (“ECRC”), see our Annual Report on Form 10-K for the fiscal year ended December 31, 2018. We consider these non-GAAP financial measures to be important supplemental measures in the evaluation of our absolute and relative performance. However, we caution that these non-GAAP financial measures have limitations as analytical tools and may vary substantially from other measures of our performance. You should not consider them in isolation, or as a substitute for analysis of our results under GAAP in the United States. EBITDA, Adjusted EBITDA, and Adjusted EBITDA Margin: For our consolidated results, EBITDA represents net income (loss) before interest, taxes, depreciation and amortization. For each reporting segment, EBITDA represents operating income before depreciation and amortization, disposition and exit of business activities and earnings of unconsolidated joint ventures. Among other limitations, EBITDA does not: reflect the significant interest expense on our debt or reflect the significant depreciation and amortization expense associated with our long-lived assets; and EBITDA included herein should not be used for purposes of assessing compliance or non-compliance with financial covenants under our debt agreements since it calculation differs in such agreements. Other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure. As an analytical tool, Adjusted EBITDA is subject to all the limitations applicable to EBITDA. We prepare Adjusted EBITDA by eliminating from EBITDA the impact of a number of items we do not consider indicative of our on-going performance but you should be aware that in the future we may incur expenses similar to the adjustments in this presentation. Our presentation of Adjusted EBITDA should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, due to volatility in raw material prices, Adjusted EBITDA may, and often does, vary substantially from EBITDA and other performance measures, including net income calculated in accordance with U.S. GAAP. We define Adjusted EBITDA Margin as Adjusted EBITDA as a percentage of revenue (for each reporting segment or on a consolidated bases, as applicable). Adjusted Gross Profit and Adjusted Gross Profit Per Ton: We define Adjusted Gross Profit Per Ton as Adjusted Gross Profit divided by total sales volume (for each reporting segment or on a consolidated basis, as applicable). We define Adjusted Gross Profit as gross profit excluding certain charges and expenses. Adjusted Gross Profit is limited because it often varies substantially from gross profit calculated in accordance with U.S. GAAP due to volatility in raw material prices. Certain amounts reported in the prior periods have been reclassified to conform to the current reporting presentation. Adjusted Diluted Earnings Per Share: Adjusted Diluted Earnings Per Share is Diluted Earnings (Loss) Per Share excluding the impact of a number of non- recurring items we do not consider indicative of our on-going performance. Net Debt and Consolidated Net Debt: Net debt for Kraton is total debt (excluding debt of KFPC due to its own capital structure) less cash and cash equivalents. Consolidated net debt is Kraton net debt plus debt of Kraton Formosa Polymers (KFPC) joint venture less KFPC’s cash and cash equivalents. Management believes that net debt is useful to investors in determining our leverage since we could choose to use cash and cash equivalents to satisfy our debt obligations. Consolidated Net Debt, as adjusted for foreign exchange impact accounts for the FX effect on the Euro Tranche of our Term Loan. Consolidated Net Debt Leverage Ratio: The consolidated net debt leverage ratio is defined as consolidated net debt as of the balance sheet date dividedby Adjusted EBITDA for the twelve months then ended. Our use of this term may vary from the use of similarly-titled measures by others in our industry due to the potential inconsistencies in the method of calculation and differences due to items subject to interpretation. Kraton Fourth Quarter 2018 Earnings Call 3

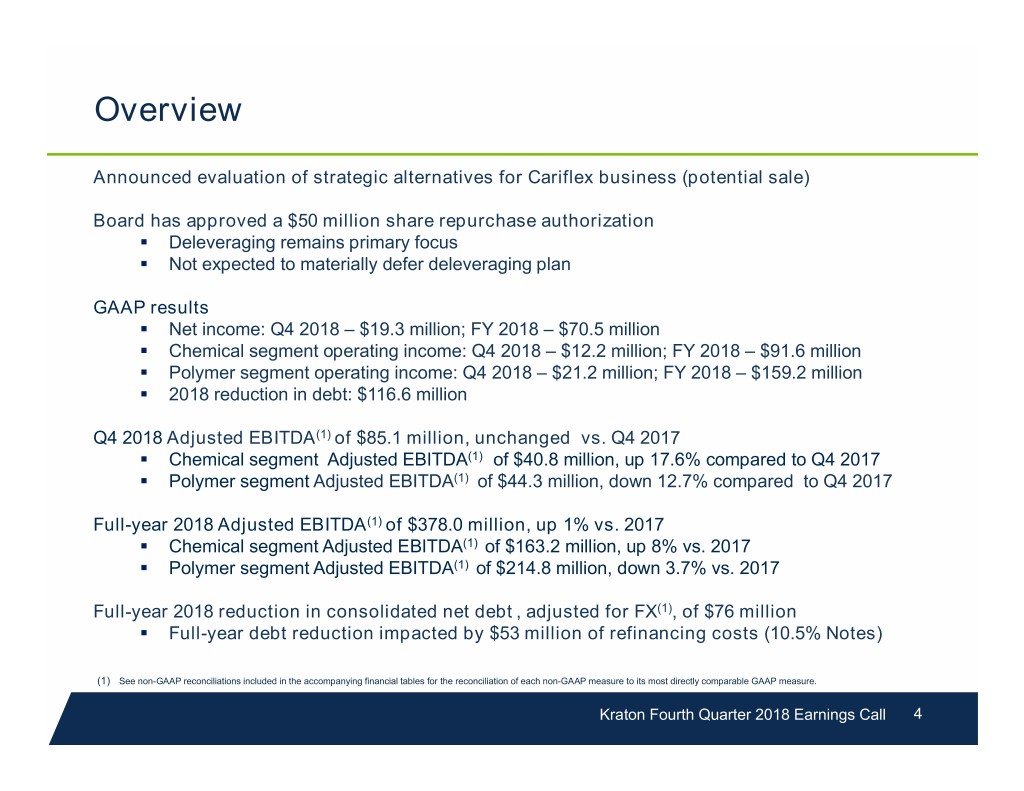

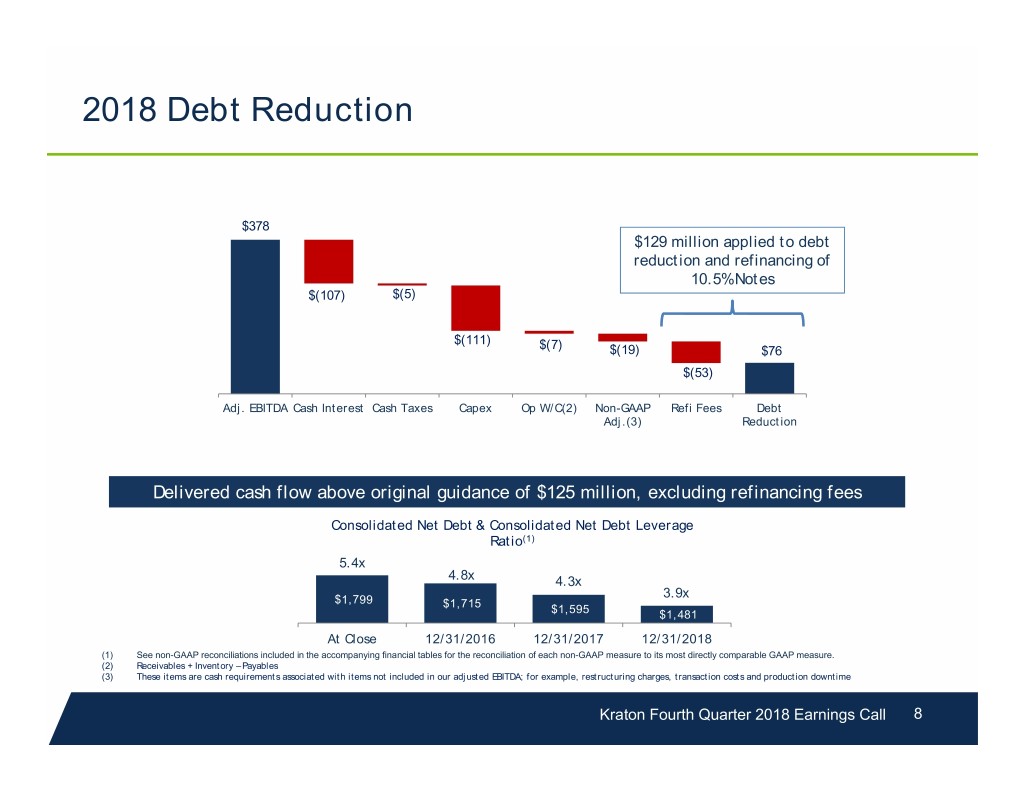

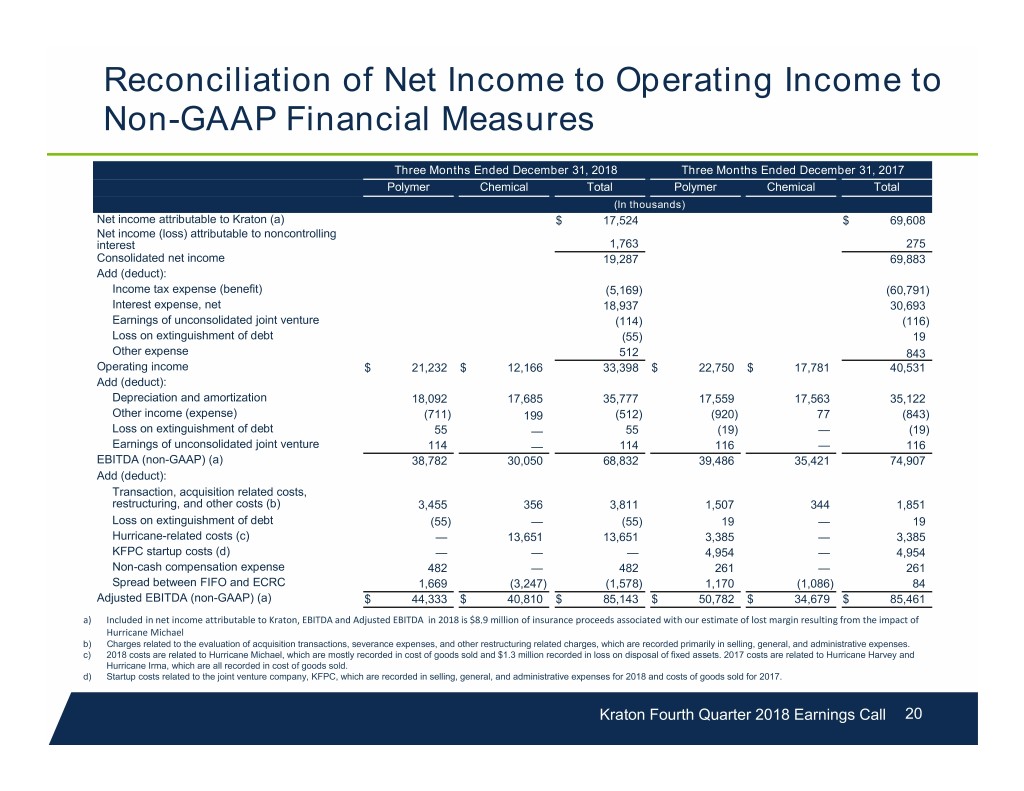

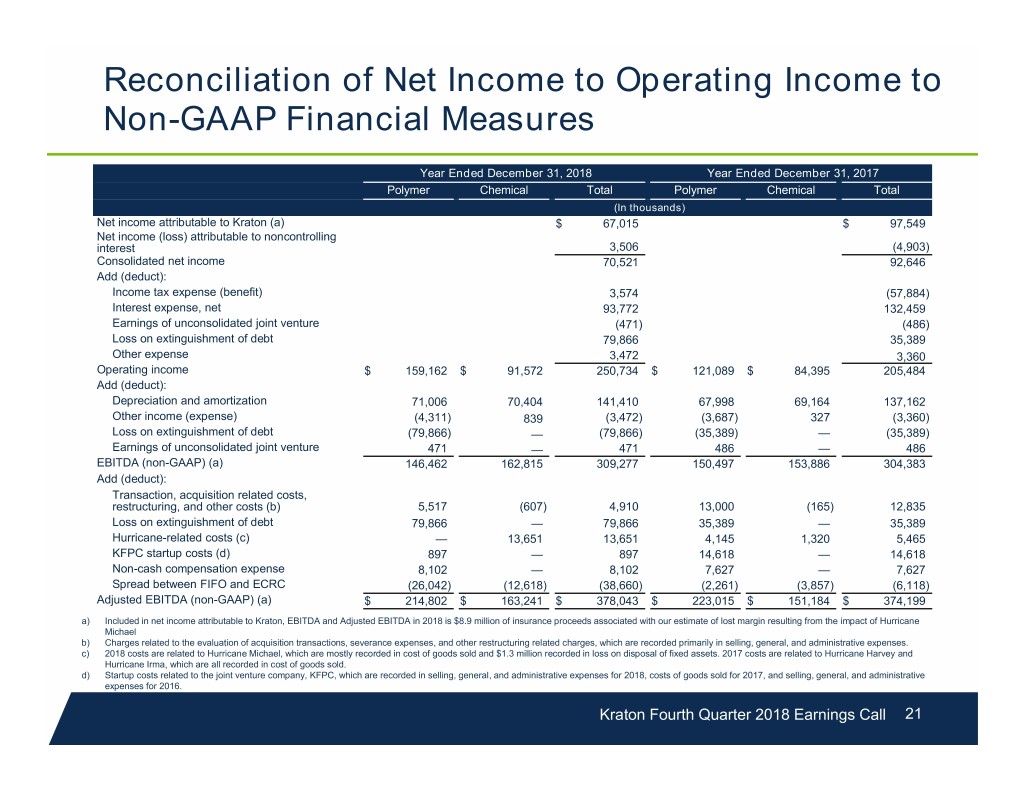

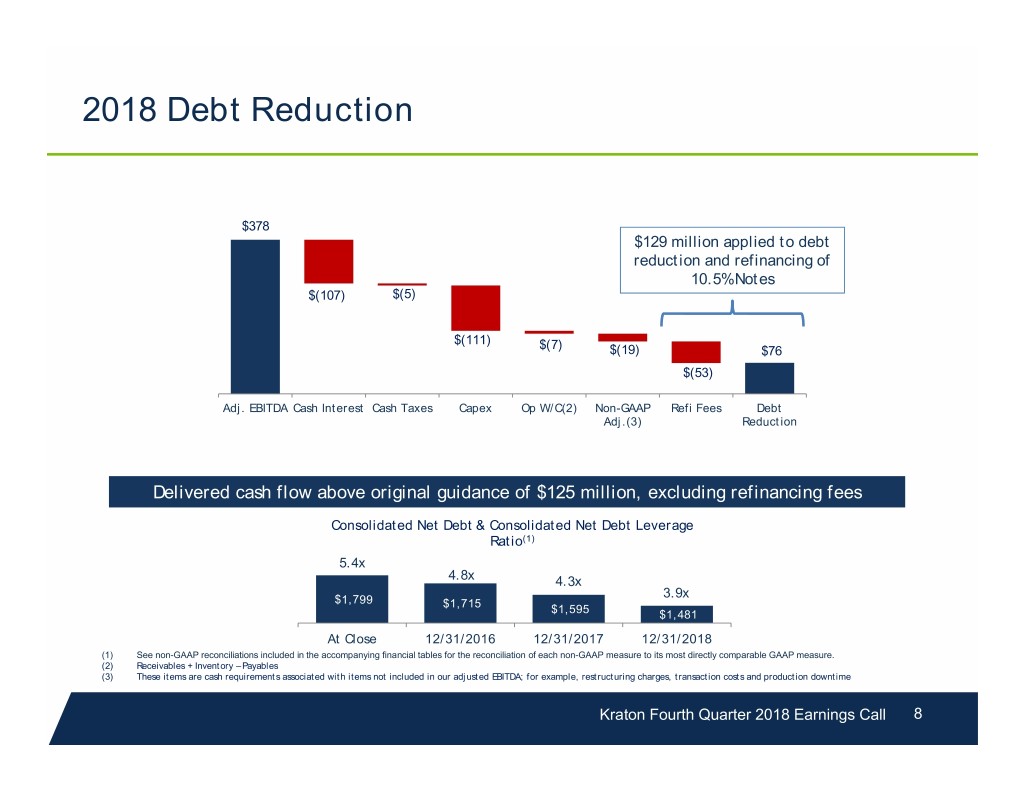

Overview Announced evaluation of strategic alternatives for Cariflex business (potential sale) Board has approved a $50 million share repurchase authorization . Deleveraging remains primary focus . Not expected to materially defer deleveraging plan GAAP results . Net income: Q4 2018 – $19.3 million; FY 2018 – $70.5 million . Chemical segment operating income: Q4 2018 – $12.2 million; FY 2018 – $91.6 million . Polymer segment operating income: Q4 2018 – $21.2 million; FY 2018 – $159.2 million . 2018 reduction in debt: $116.6 million Q4 2018 Adjusted EBITDA(1) of $85.1 million, unchanged vs. Q4 2017 . Chemical segment Adjusted EBITDA(1) of $40.8 million, up 17.6% compared to Q4 2017 . Polymer segment Adjusted EBITDA(1) of $44.3 million, down 12.7% compared to Q4 2017 Full-year 2018 Adjusted EBITDA(1) of $378.0 million, up 1% vs. 2017 . Chemical segment Adjusted EBITDA(1) of $163.2 million, up 8% vs. 2017 . Polymer segment Adjusted EBITDA(1) of $214.8 million, down 3.7% vs. 2017 Full-year 2018 reduction in consolidated net debt , adjusted for FX(1), of $76 million . Full-year debt reduction impacted by $53 million of refinancing costs (10.5% Notes) (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. Kraton Fourth Quarter 2018 Earnings Call 4

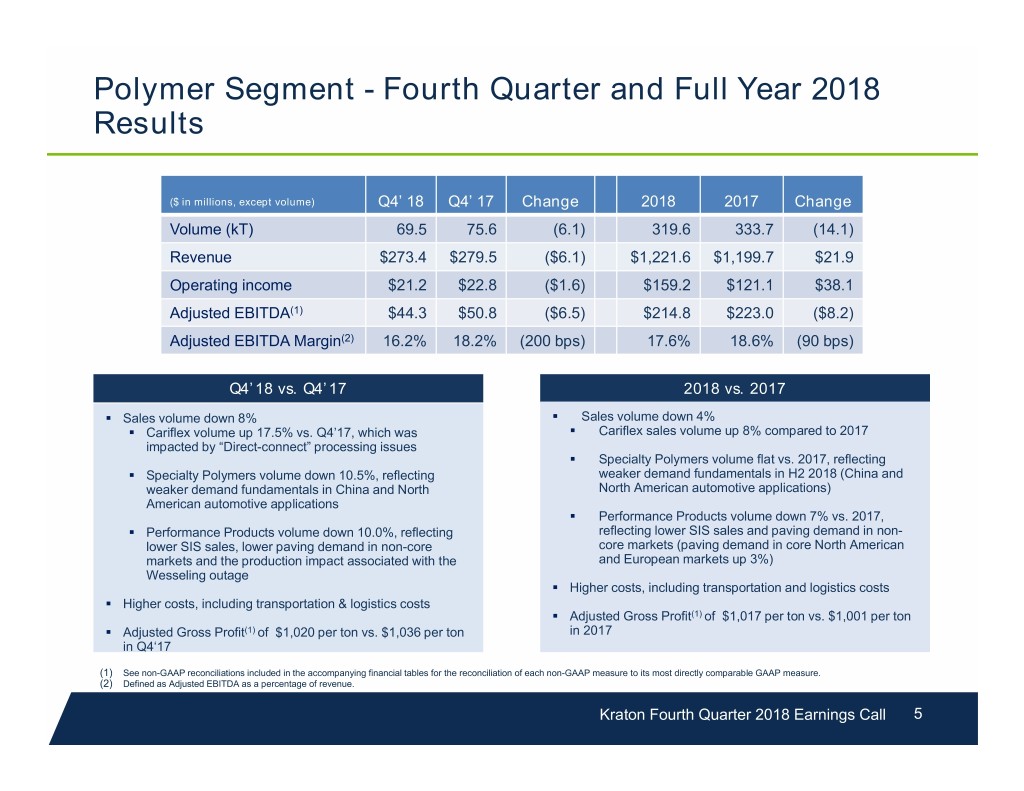

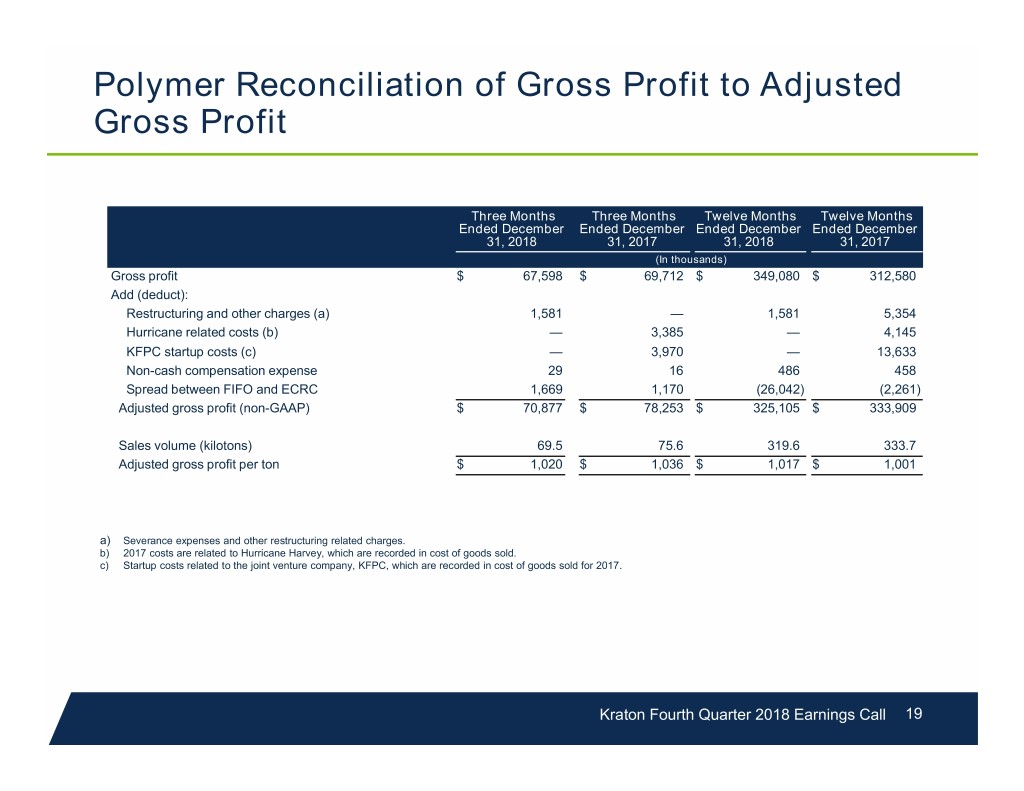

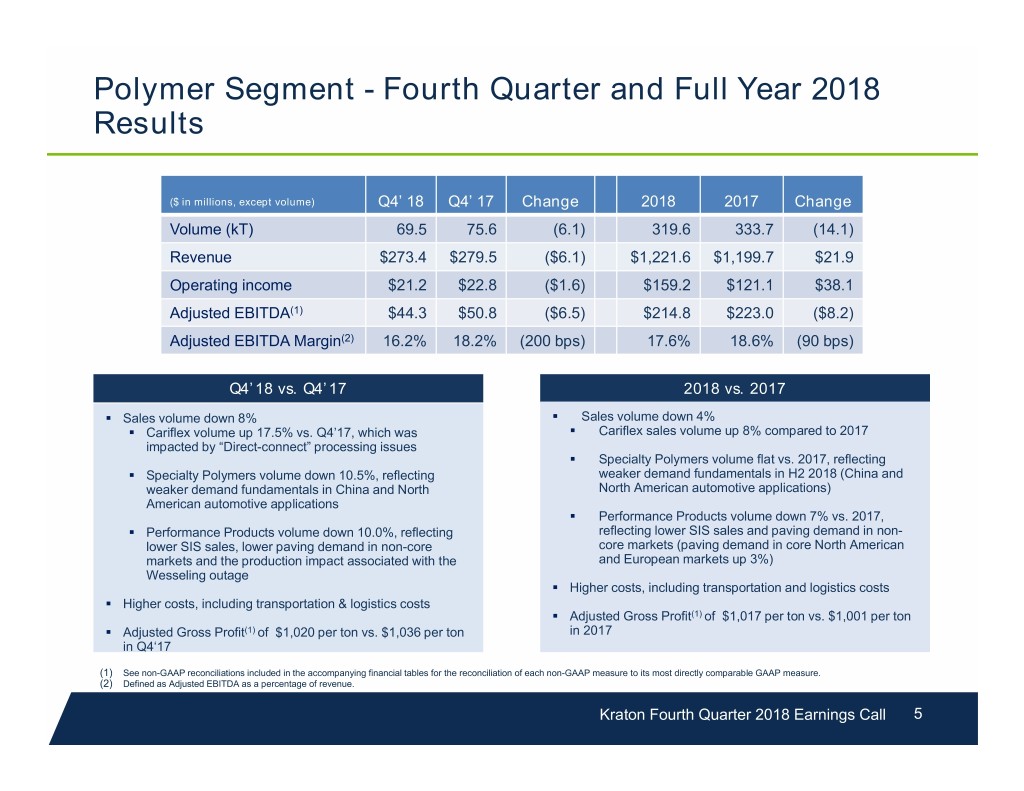

Polymer Segment - Fourth Quarter and Full Year 2018 Results ($ in millions, except volume) Q4’ 18 Q4’ 17 Change 2018 2017 Change Volume (kT) 69.5 75.6 (6.1) 319.6 333.7 (14.1) Revenue $273.4 $279.5 ($6.1) $1,221.6 $1,199.7 $21.9 Operating income $21.2 $22.8 ($1.6) $159.2 $121.1 $38.1 Adjusted EBITDA(1) $44.3 $50.8 ($6.5) $214.8 $223.0 ($8.2) Adjusted EBITDA Margin(2) 16.2% 18.2% (200 bps) 17.6% 18.6% (90 bps) Q4’18 vs. Q4’17 2018 vs. 2017 . Sales volume down 8% . Sales volume down 4% . Cariflex volume up 17.5% vs. Q4’17, which was . Cariflex sales volume up 8% compared to 2017 impacted by “Direct-connect” processing issues . Specialty Polymers volume flat vs. 2017, reflecting . Specialty Polymers volume down 10.5%, reflecting weaker demand fundamentals in H2 2018 (China and weaker demand fundamentals in China and North North American automotive applications) American automotive applications . Performance Products volume down 7% vs. 2017, . Performance Products volume down 10.0%, reflecting reflecting lower SIS sales and paving demand in non- lower SIS sales, lower paving demand in non-core core markets (paving demand in core North American markets and the production impact associated with the and European markets up 3%) Wesseling outage . Higher costs, including transportation and logistics costs . Higher costs, including transportation & logistics costs . Adjusted Gross Profit(1) of $1,017 per ton vs. $1,001 per ton . Adjusted Gross Profit(1) of $1,020 per ton vs. $1,036 per ton in 2017 in Q4‘17 (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. Kraton Fourth Quarter 2018 Earnings Call 5

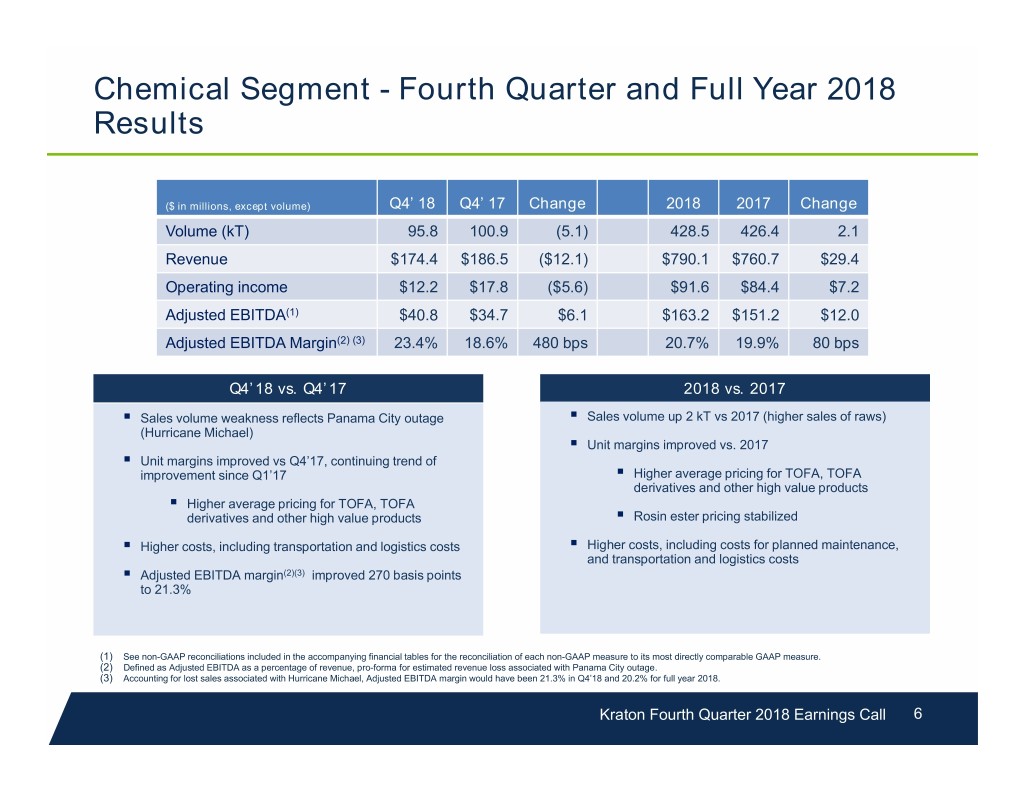

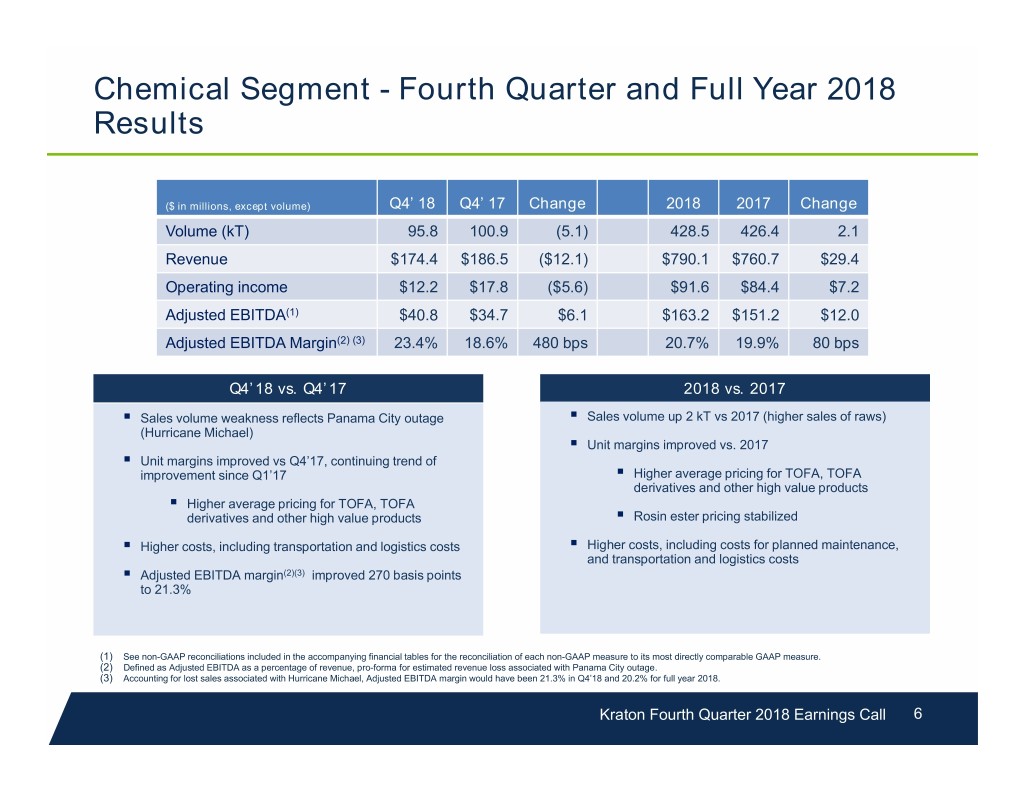

Chemical Segment - Fourth Quarter and Full Year 2018 Results ($ in millions, except volume) Q4’ 18 Q4’ 17 Change 2018 2017 Change Volume (kT) 95.8 100.9 (5.1) 428.5 426.4 2.1 Revenue $174.4 $186.5 ($12.1) $790.1 $760.7 $29.4 Operating income $12.2 $17.8 ($5.6) $91.6 $84.4 $7.2 Adjusted EBITDA(1) $40.8 $34.7 $6.1 $163.2 $151.2 $12.0 Adjusted EBITDA Margin(2) (3) 23.4% 18.6% 480 bps 20.7% 19.9% 80 bps Q4’18 vs. Q4’17 2018 vs. 2017 . Sales volume weakness reflects Panama City outage . Sales volume up 2 kT vs 2017 (higher sales of raws) (Hurricane Michael) . Unit margins improved vs. 2017 . Unit margins improved vs Q4’17, continuing trend of improvement since Q1’17 . Higher average pricing for TOFA, TOFA derivatives and other high value products . Higher average pricing for TOFA, TOFA derivatives and other high value products . Rosin ester pricing stabilized . Higher costs, including transportation and logistics costs . Higher costs, including costs for planned maintenance, and transportation and logistics costs . Adjusted EBITDA margin(2)(3) improved 270 basis points to 21.3% (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue, pro-forma for estimated revenue loss associated with Panama City outage. (3) Accounting for lost sales associated with Hurricane Michael, Adjusted EBITDA margin would have been 21.3% in Q4’18 and 20.2% for full year 2018. Kraton Fourth Quarter 2018 Earnings Call 6

Consolidated Results – Fourth Quarter and Full Year 2018 ($ In millions, except per share amounts) Three Months Ended December 31, Twelve Months Ended December 31, 2018 2017 Change 2018 2017 Change Revenue $ 447.8 $ 466.0 $ (18.2) $ 2,011.7 $ 1,960.4 $ 51.3 Net income attributable to Kraton $ 17.5 $ 69.6 $ (52.1) $ 67.0 $ 97.5 $ (30.5) Diluted earnings per share $ 0.55 $ 2.17 $ (1.62) $ 2.08 $ 3.07 $ (0.99) Operating income $ 33.4 $ 40.5 $ (7.1) $ 250.7 $ 205.5 $ 45.2 Adjusted EBITDA(1) $ 85.1 $ 85.5 $ (0.4) $ 378.0 $ 374.2 $ 3.8 Adjusted EBITDA margin(2)(3) 19.0% 18.3% 70 bps 18.8% 19.1% (30) bps Adjusted diluted earnings per share(1) $ 0.67 $ 0.67 $ - $ 3.16 $ 2.85 $ 0.31 Operating Income Adjusted EBITDA(1) $250.7 $378.0 $374.2 $205.5 $91.6 $84.4 $163.2 $151.2 $159.2 $85.1 $33.4 $40.5 $121.1 $85.5 $214.8 $223.0 40.8 34.7 12.2 17.8 21.2 22.8 44.3 50.8 Q4'18 Q4'17 2018 2017 Q4'18 Q4'17 2018 2017 Polymer Chemical Polymer Chemical (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Defined as Adjusted EBITDA as a percentage of revenue. (3) Accounting for lost sales associated with Hurricane Michael, Adjusted EBITDA margin would have been 18.3% for the three months ended December 31, 2018 and 18.6% for the twelve months ended December 31, 2018. Kraton Fourth Quarter 2018 Earnings Call 7

2018 Debt Reduction $378 $129 million applied to debt reduction and refinancing of 10.5% Notes $(107) $(5) $(111) $(7) $(19) $76 $(53) Adj. EBITDA Cash Interest Cash Taxes Capex Op W/C(2) Non-GAAP Refi Fees Debt Adj.(3) Reduction Delivered cash flow above original guidance of $125 million, excluding refinancing fees Consolidated Net Debt & Consolidated Net Debt Leverage Ratio(1) 5.4x 4.8x 4.3x 3.9x $1,799 $1,715 $1,595 $1,481 At Close 12/31/2016 12/31/2017 12/31/2018 (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. (2) Receivables + Inventory – Payables (3) These items are cash requirements associated with items not included in our adjusted EBITDA; for example, restructuring charges, transaction costs and production downtime Kraton Fourth Quarter 2018 Earnings Call 8

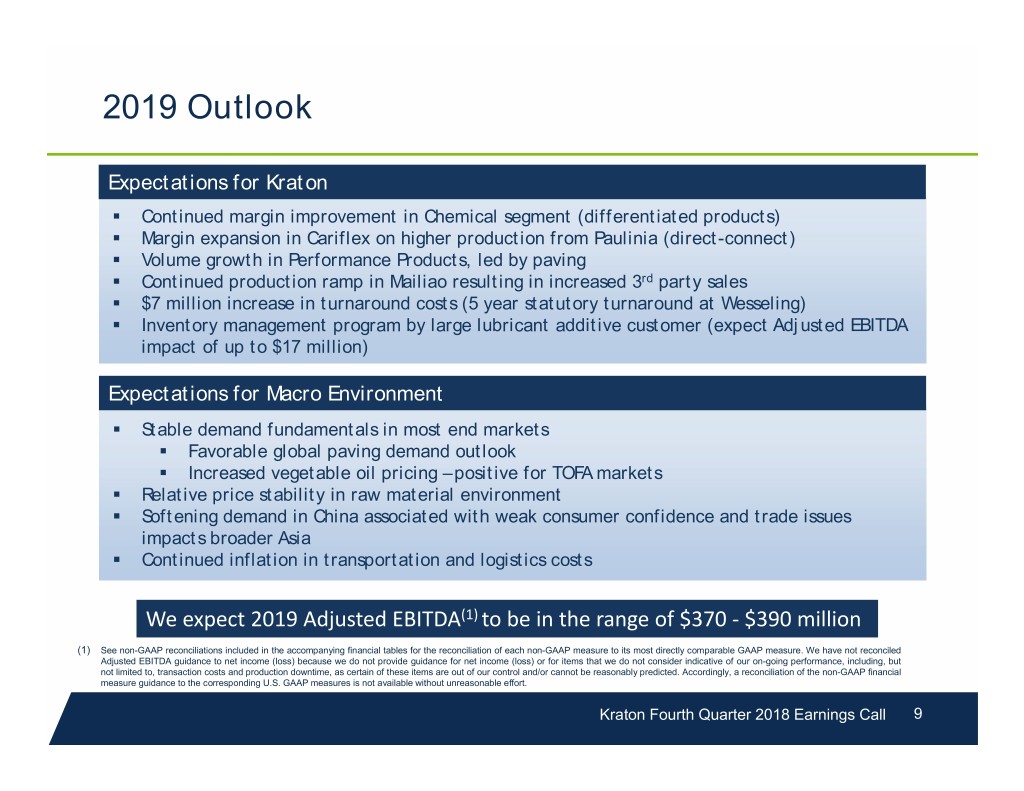

2019 Outlook Expectations for Kraton . Continued margin improvement in Chemical segment (differentiated products) . Margin expansion in Cariflex on higher production from Paulinia (direct-connect) . Volume growth in Performance Products, led by paving . Continued production ramp in Mailiao resulting in increased 3rd party sales . $7 million increase in turnaround costs (5 year statutory turnaround at Wesseling) . Inventory management program by large lubricant additive customer (expect Adjusted EBITDA impact of up to $17 million) Expectations for Macro Environment . Stable demand fundamentals in most end markets . Favorable global paving demand outlook . Increased vegetable oil pricing – positive for TOFA markets . Relative price stability in raw material environment . Softening demand in China associated with weak consumer confidence and trade issues impacts broader Asia . Continued inflation in transportation and logistics costs We expect 2019 Adjusted EBITDA(1) to be in the range of $370 ‐ $390 million (1) See non-GAAP reconciliations included in the accompanying financial tables for the reconciliation of each non-GAAP measure to its most directly comparable GAAP measure. We have not reconciled Adjusted EBITDA guidance to net income (loss) because we do not provide guidance for net income (loss) or for items that we do not consider indicative of our on-going performance, including, but not limited to, transaction costs and production downtime, as certain of these items are out of our control and/or cannot be reasonably predicted. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding U.S. GAAP measures is not available without unreasonable effort. Kraton Fourth Quarter 2018 Earnings Call 9

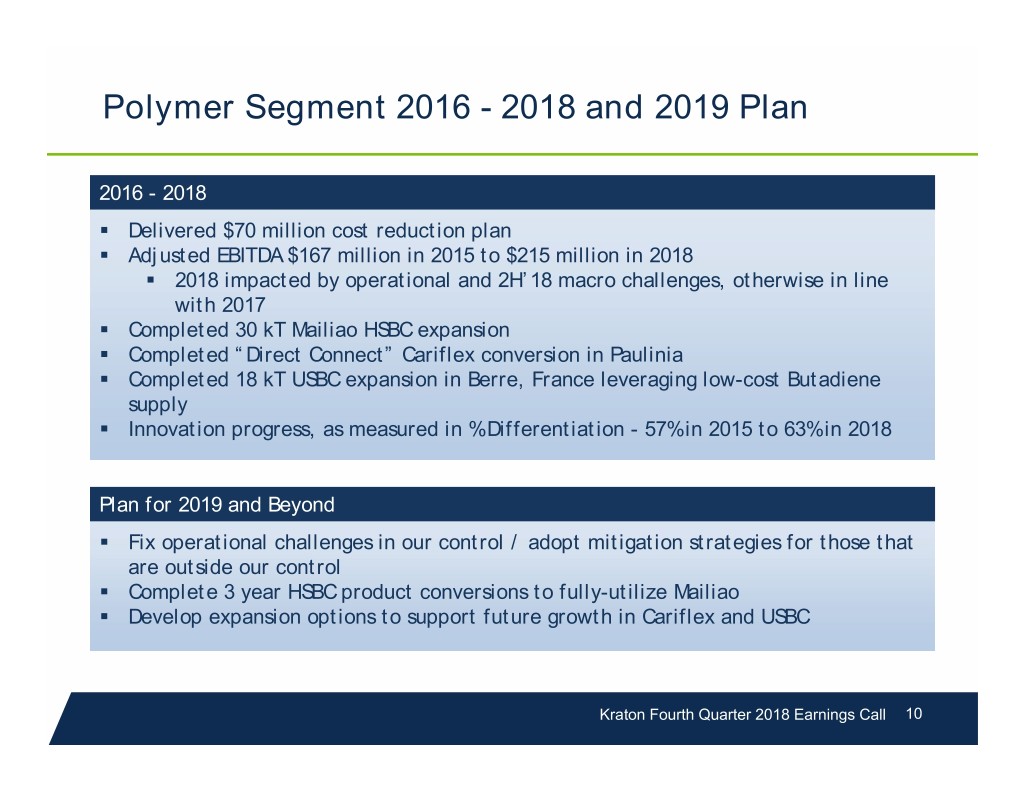

Polymer Segment 2016 - 2018 and 2019 Plan 2016 - 2018 . Delivered $70 million cost reduction plan . Adjusted EBITDA $167 million in 2015 to $215 million in 2018 . 2018 impacted by operational and 2H’18 macro challenges, otherwise in line with 2017 . Completed 30 kT Mailiao HSBC expansion . Completed “Direct Connect” Cariflex conversion in Paulinia . Completed 18 kT USBC expansion in Berre, France leveraging low-cost Butadiene supply . Innovation progress, as measured in % Differentiation - 57% in 2015 to 63% in 2018 Plan for 2019 and Beyond . Fix operational challenges in our control / adopt mitigation strategies for those that are outside our control . Complete 3 year HSBC product conversions to fully-utilize Mailiao . Develop expansion options to support future growth in Cariflex and USBC Kraton Fourth Quarter 2018 Earnings Call 10

Chemical Segment 2016 - 2018 and 2019 Plan 2016 - 2018 . Acquired January 2016 . Delivered $65 million of cost-based synergies, one year ahead of plan . Post-acquisition, market dynamics impacted TOFA and TOR margins . TOFA markets have recovered significantly, benefitting from rebound in oilfield activity . Rosin ester pricing pressured by excess supply of commodity C5 tackifier . Segment margins have continued to improve since Q1’17 Plan for 2019 and Beyond . Emphasis on R&D to continue to drive portfolio differentiation . Reduced color in rosin ester portfolio presents significant opportunity for expansion in adhesive markets . Focus on growth in high-margin tire business . Continue to leverage attractive margins in CST chain Kraton Fourth Quarter 2018 Earnings Call 11

We are focused on organic growth, led by innovation We have refreshed our approach to innovation projects Rebalance resources . Market-based innovation focus . Prioritize and rebalance resources for near-term success and commercialization Capacity expansions will be needed to meet growth expectations Given future growth expectations, planning underway for capacity additions . USBC . Current high utilization of assets provides minimal operational flexibility . Lead times 3+ years . Planning for demand growth in global paving, including India . Cariflex . Anticipate return to attractive growth – volume up 8% in 2018 . Planning for next increment of growth driven by further penetration in Europe/Asia . New process technology in Paulina successfully operating near design rates –tolling capacity available – margins on incremental “direct-connect” capacity compelling Kraton Fourth Quarter 2018 Earnings Call 12

And we are focused on unlocking value for shareholders Strategic evaluation of Cariflex . High-margin, attractive growth specialty business, but not appropriately valued in Kraton portfolio . Strong strategic fit with other market participants . Cariflex platform “stand-alone” – no technology overlap with SBC or chemical portfolio . Cariflex assets largely standalone Kraton’s Board has approved a $50 million share repurchase program . Given current valuation we believe an opportunistic repurchase program is warranted . No significant impact on longer-term deleveraging commitment . Expect to fund through cash and short-term borrowings . Two year authorization – discretion to implement through privately-negotiated transactions or purchases through Rule 10b5-1 Kraton Fourth Quarter 2018 Earnings Call 13

Appendix

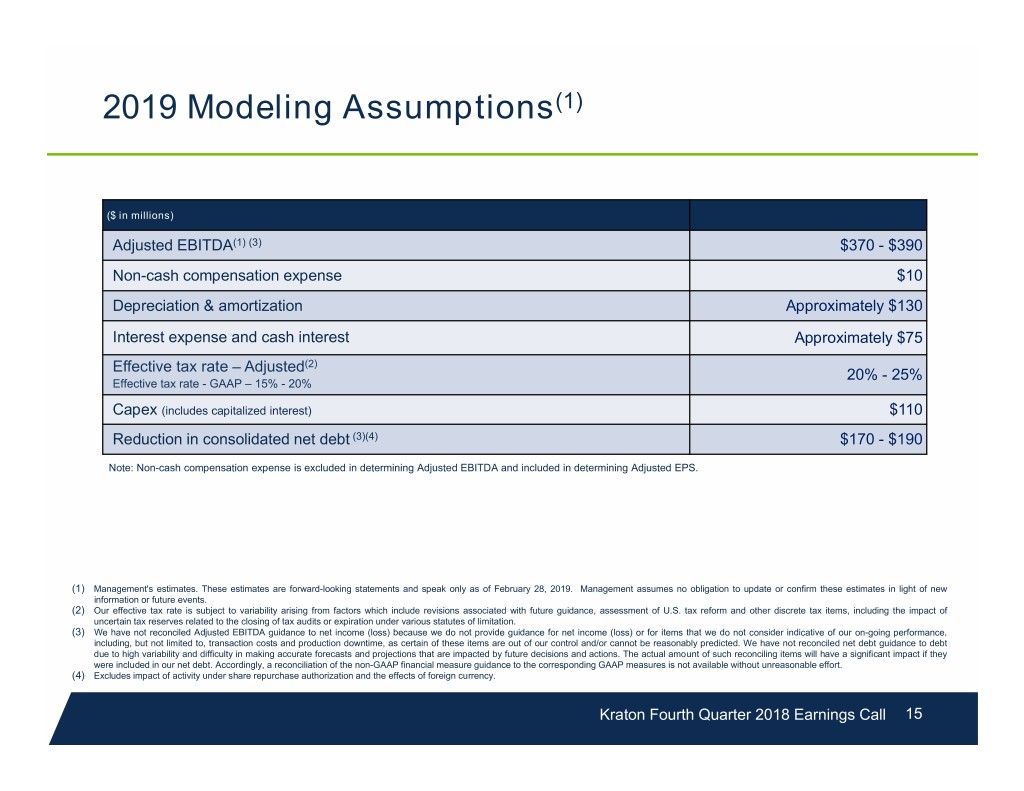

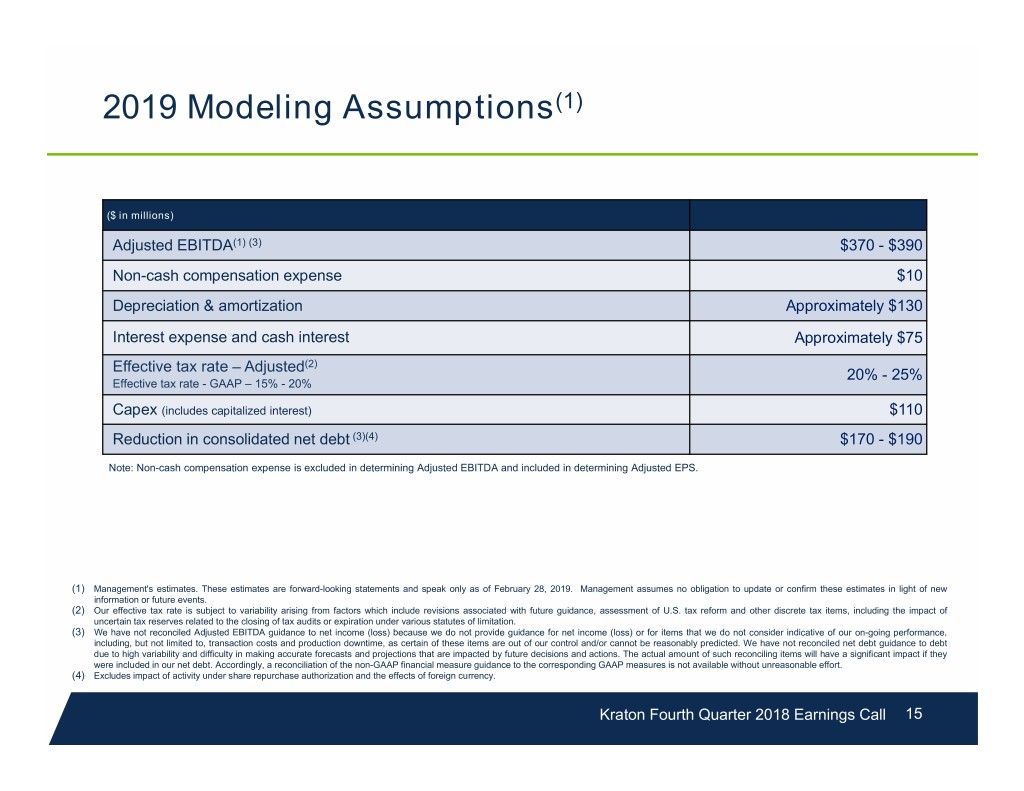

2019 Modeling Assumptions(1) ($ in millions) Adjusted EBITDA(1) (3) $370 - $390 Non-cash compensation expense $10 Depreciation & amortization Approximately $130 Interest expense and cash interest Approximately $75 Effective tax rate – Adjusted(2) 20% - 25% Effective tax rate - GAAP – 15% - 20% Capex (includes capitalized interest) $110 Reduction in consolidated net debt (3)(4) $170 - $190 Note: Non-cash compensation expense is excluded in determining Adjusted EBITDA and included in determining Adjusted EPS. (1) Management's estimates. These estimates are forward-looking statements and speak only as of February 28, 2019. Management assumes no obligation to update or confirm these estimates in light of new information or future events. (2) Our effective tax rate is subject to variability arising from factors which include revisions associated with future guidance, assessment of U.S. tax reform and other discrete tax items, including the impact of uncertain tax reserves related to the closing of tax audits or expiration under various statutes of limitation. (3) We have not reconciled Adjusted EBITDA guidance to net income (loss) because we do not provide guidance for net income (loss) or for items that we do not consider indicative of our on-going performance, including, but not limited to, transaction costs and production downtime, as certain of these items are out of our control and/or cannot be reasonably predicted. We have not reconciled net debt guidance to debt due to high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. The actual amount of such reconciling items will have a significant impact if they were included in our net debt. Accordingly, a reconciliation of the non-GAAP financial measure guidance to the corresponding GAAP measures is not available without unreasonable effort. (4) Excludes impact of activity under share repurchase authorization and the effects of foreign currency. Kraton Fourth Quarter 2018 Earnings Call 15

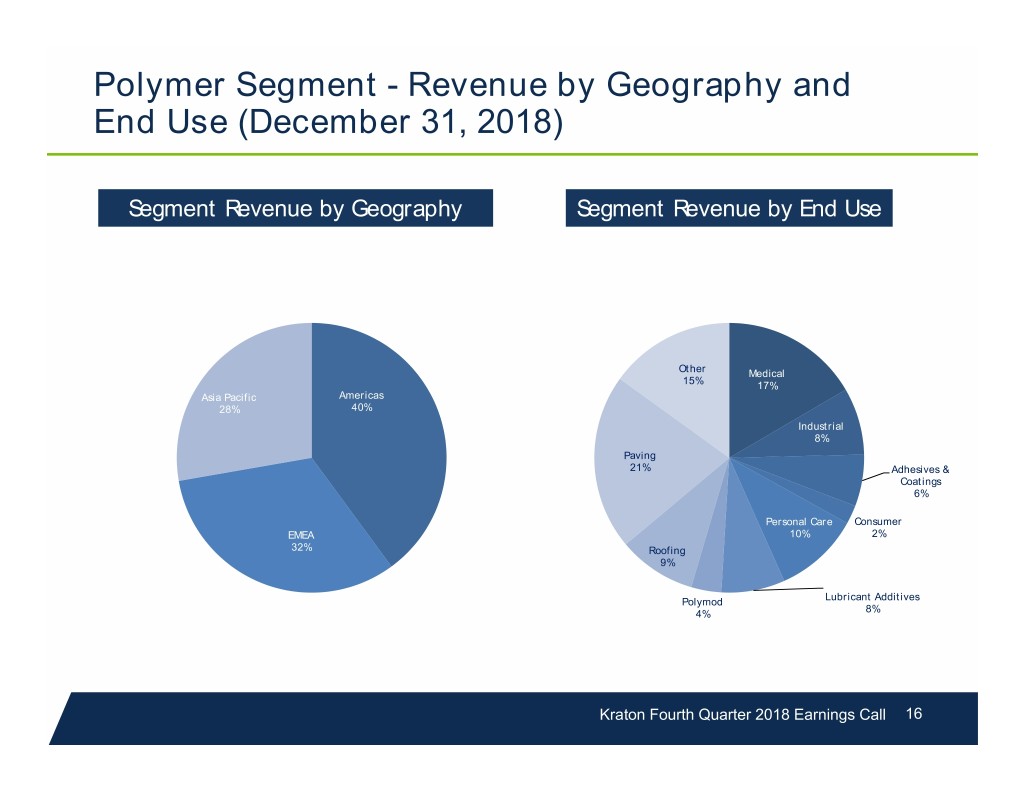

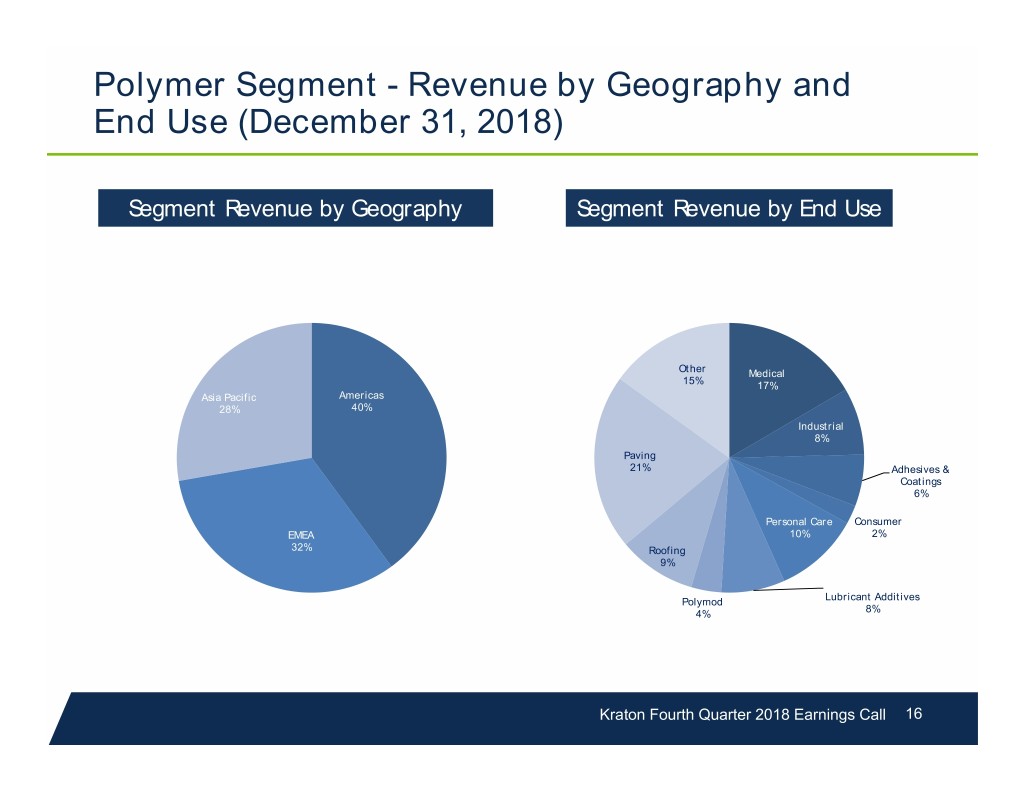

Polymer Segment - Revenue by Geography and End Use (December 31, 2018) Segment Revenue by Geography Segment Revenue by End Use Other Medical 15% 17% Asia Pacific Americas 28% 40% Industrial 8% Paving 21% Adhesives & Coatings 6% Personal Care Consumer EMEA 10% 2% 32% Roofing 9% Polymod Lubricant Additives 4% 8% Kraton Fourth Quarter 2018 Earnings Call 16

Polymer Segment - Revenue by Geography and Product Group (December 31, 2018) CARIFLEX SPECIALTY POLYMERS PERFORMANCE PRODUCTS Americas Asia Pacific 1% 7% EMEA 7% Asia Pacific 31% Americas Americas 47% EMEA 46% 47% Asia Pacific 92% EMEA 22% Revenue by Geography Revenue by Pkg. & Ind. Consumer Industrial Other 7% Adhesive & 2% Adhesives 6% Industrial 1% Coatings 8% 5% Cable Gels Other 5% 10% Other 28% Personal Pkg & Indust. Paving Care Adhsv. 41% 5% 8% Industrial Roofing Medical 6% 90% Lubricant Medical 18% Additives 9% Personal 23% Polymod Care 11% 17% Revenue by Product Group by Revenue Kraton Fourth Quarter 2018 Earnings Call 17

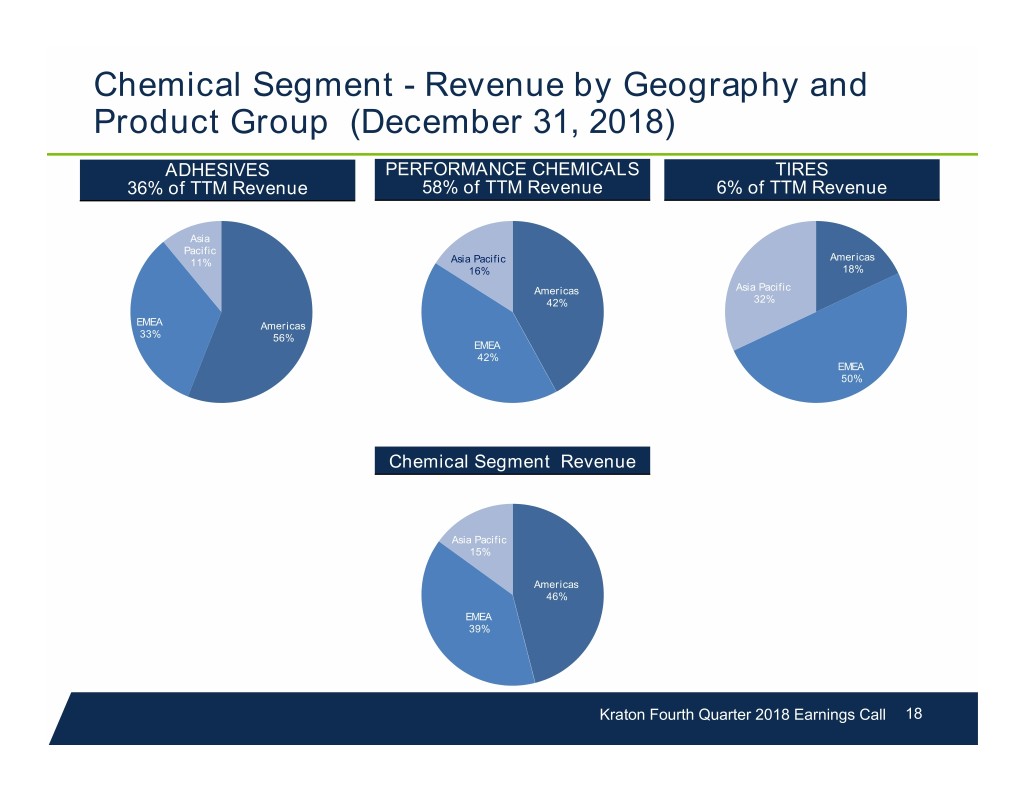

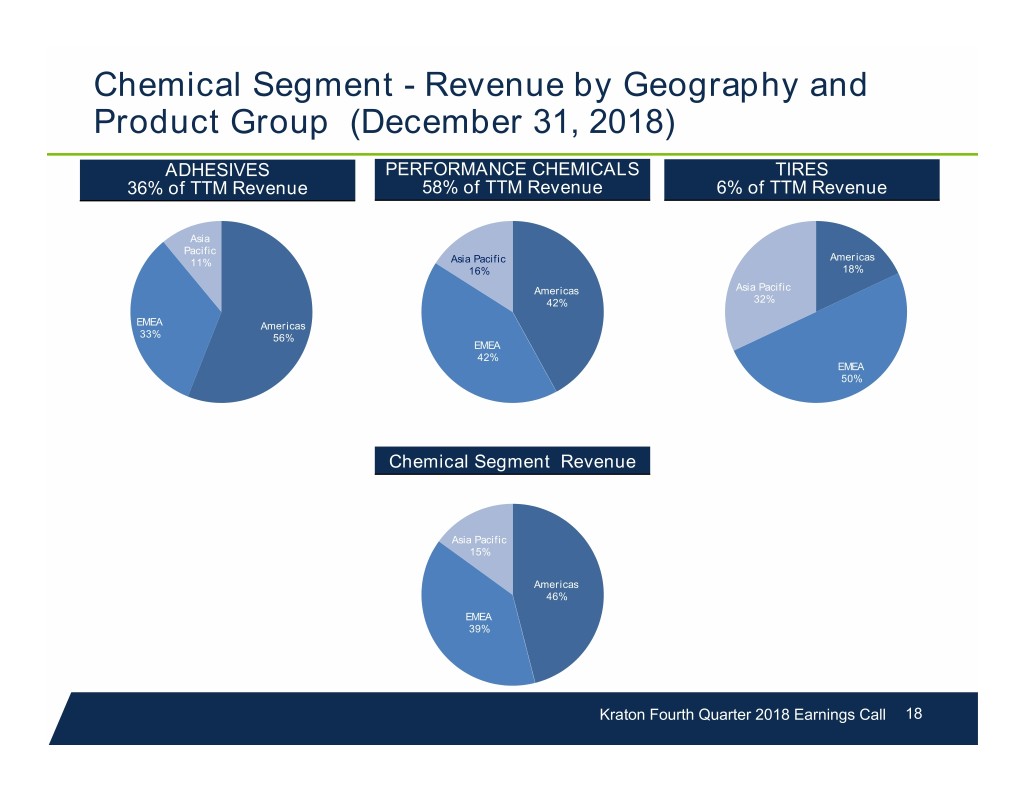

Chemical Segment - Revenue by Geography and Product Group (December 31, 2018) ADHESIVES PERFORMANCE CHEMICALS TIRES 36% of TTM Revenue 58% of TTM Revenue 6% of TTM Revenue Asia Pacific Americas 11% Asia Pacific 16% 18% Americas Asia Pacific 42% 32% EMEA Americas 33% 56% EMEA 42% EMEA 50% Chemical Segment Revenue Asia Pacific 15% Americas 46% EMEA 39% Kraton Fourth Quarter 2018 Earnings Call 18

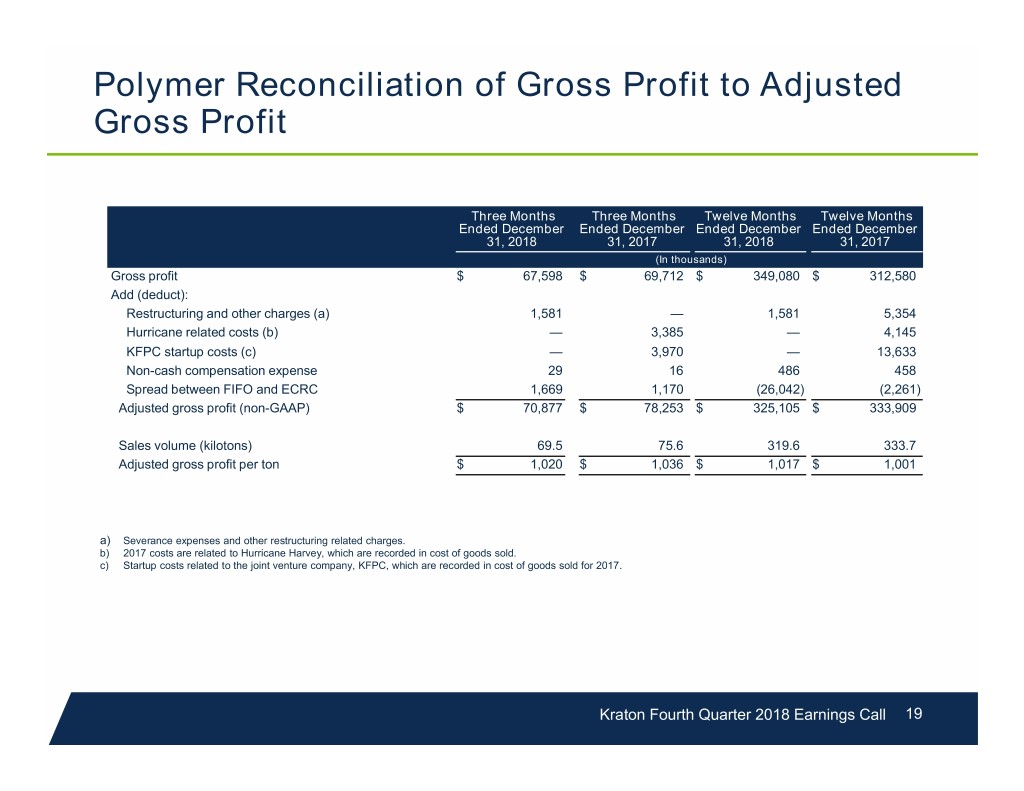

Polymer Reconciliation of Gross Profit to Adjusted Gross Profit Three Months Three Months Twelve Months Twelve Months Ended December Ended December Ended December Ended December 31, 2018 31, 2017 31, 2018 31, 2017 (In thousands) Gross profit $ 67,598 $ 69,712 $ 349,080 $ 312,580 Add (deduct): Restructuring and other charges (a) 1,581 — 1,581 5,354 Hurricane related costs (b) — 3,385 — 4,145 KFPC startup costs (c) — 3,970 — 13,633 Non-cash compensation expense 29 16 486 458 Spread between FIFO and ECRC 1,669 1,170 (26,042) (2,261) Adjusted gross profit (non-GAAP) $ 70,877 $ 78,253 $ 325,105 $ 333,909 Sales volume (kilotons) 69.5 75.6 319.6 333.7 Adjusted gross profit per ton $ 1,020 $ 1,036 $ 1,017 $ 1,001 a) Severance expenses and other restructuring related charges. b) 2017 costs are related to Hurricane Harvey, which are recorded in cost of goods sold. c) Startup costs related to the joint venture company, KFPC, which are recorded in cost of goods sold for 2017. Kraton Fourth Quarter 2018 Earnings Call 19

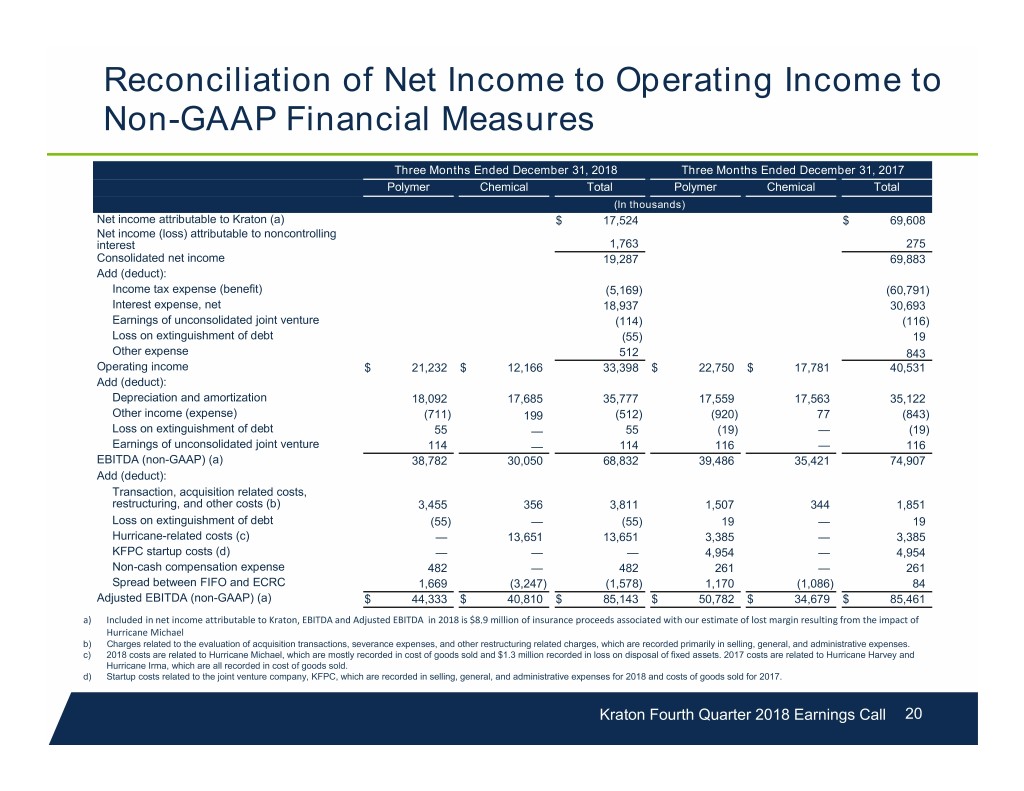

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Three Months Ended December 31, 2018 Three Months Ended December 31, 2017 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income attributable to Kraton (a) $ 17,524 $ 69,608 Net income (loss) attributable to noncontrolling interest 1,763 275 Consolidated net income 19,287 69,883 Add (deduct): Income tax expense (benefit) (5,169) (60,791) Interest expense, net 18,937 30,693 Earnings of unconsolidated joint venture (114) (116) Loss on extinguishment of debt (55) 19 Other expense 512 843 Operating income $ 21,232 $ 12,166 33,398 $ 22,750 $ 17,781 40,531 Add (deduct): Depreciation and amortization 18,092 17,685 35,777 17,559 17,563 35,122 Other income (expense) (711) 199 (512) (920) 77 (843) Loss on extinguishment of debt 55 — 55 (19) — (19) Earnings of unconsolidated joint venture 114 — 114 116 — 116 EBITDA (non-GAAP) (a) 38,782 30,050 68,832 39,486 35,421 74,907 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 3,455 356 3,811 1,507 344 1,851 Loss on extinguishment of debt (55) — (55) 19 — 19 Hurricane-related costs (c) — 13,651 13,651 3,385 — 3,385 KFPC startup costs (d) — — — 4,954 — 4,954 Non-cash compensation expense 482 — 482 261 — 261 Spread between FIFO and ECRC 1,669 (3,247) (1,578) 1,170 (1,086) 84 Adjusted EBITDA (non-GAAP) (a) $ 44,333 $ 40,810 $ 85,143 $ 50,782 $ 34,679 $ 85,461 a) Included in net income attributable to Kraton, EBITDA and Adjusted EBITDA in 2018 is $8.9 million of insurance proceeds associated with our estimate of lost margin resulting from the impact of Hurricane Michael b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are recorded primarily in selling, general, and administrative expenses. c) 2018 costs are related to Hurricane Michael, which are mostly recorded in cost of goods sold and $1.3 million recorded in loss on disposal of fixed assets. 2017 costs are related to Hurricane Harvey and Hurricane Irma, which are all recorded in cost of goods sold. d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general, and administrative expenses for 2018 and costs of goods sold for 2017. Kraton Fourth Quarter 2018 Earnings Call 20

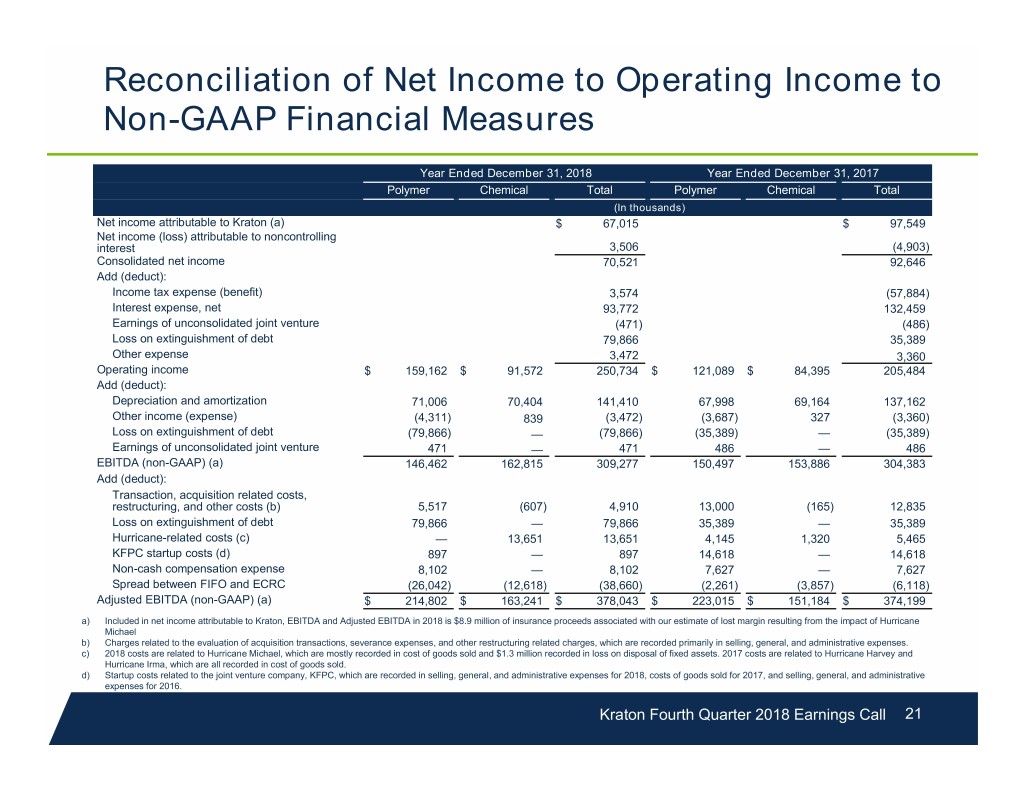

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Year Ended December 31, 2018 Year Ended December 31, 2017 Polymer Chemical Total Polymer Chemical Total (In thousands) Net income attributable to Kraton (a) $ 67,015 $ 97,549 Net income (loss) attributable to noncontrolling interest 3,506 (4,903) Consolidated net income 70,521 92,646 Add (deduct): Income tax expense (benefit) 3,574 (57,884) Interest expense, net 93,772 132,459 Earnings of unconsolidated joint venture (471) (486) Loss on extinguishment of debt 79,866 35,389 Other expense 3,472 3,360 Operating income $ 159,162 $ 91,572 250,734 $ 121,089 $ 84,395 205,484 Add (deduct): Depreciation and amortization 71,006 70,404 141,410 67,998 69,164 137,162 Other income (expense) (4,311) 839 (3,472) (3,687) 327 (3,360) Loss on extinguishment of debt (79,866) — (79,866) (35,389) — (35,389) Earnings of unconsolidated joint venture 471 — 471 486 — 486 EBITDA (non-GAAP) (a) 146,462 162,815 309,277 150,497 153,886 304,383 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (b) 5,517 (607) 4,910 13,000 (165) 12,835 Loss on extinguishment of debt 79,866 — 79,866 35,389 — 35,389 Hurricane-related costs (c) — 13,651 13,651 4,145 1,320 5,465 KFPC startup costs (d) 897 — 897 14,618 — 14,618 Non-cash compensation expense 8,102 — 8,102 7,627 — 7,627 Spread between FIFO and ECRC (26,042) (12,618) (38,660) (2,261) (3,857) (6,118) Adjusted EBITDA (non-GAAP) (a) $ 214,802 $ 163,241 $ 378,043 $ 223,015 $ 151,184 $ 374,199 a) Included in net income attributable to Kraton, EBITDA and Adjusted EBITDA in 2018 is $8.9 million of insurance proceeds associated with our estimate of lost margin resulting from the impact of Hurricane Michael b) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are recorded primarily in selling, general, and administrative expenses. c) 2018 costs are related to Hurricane Michael, which are mostly recorded in cost of goods sold and $1.3 million recorded in loss on disposal of fixed assets. 2017 costs are related to Hurricane Harvey and Hurricane Irma, which are all recorded in cost of goods sold. d) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general, and administrative expenses for 2018, costs of goods sold for 2017, and selling, general, and administrative expenses for 2016. Kraton Fourth Quarter 2018 Earnings Call 21

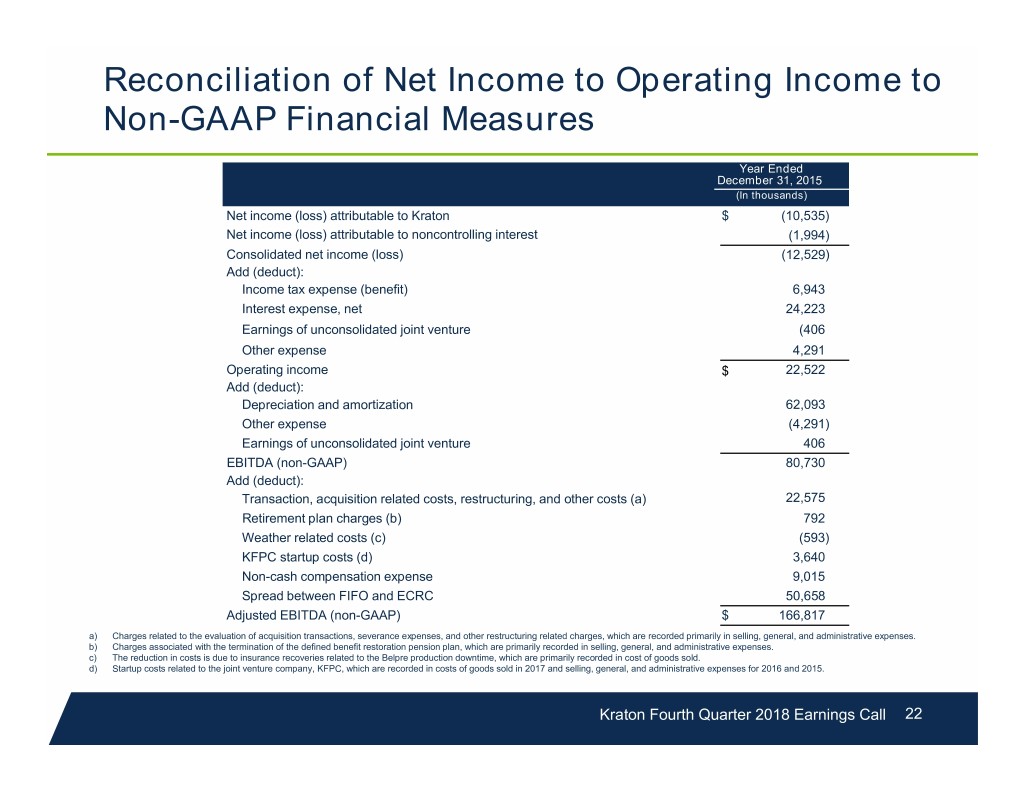

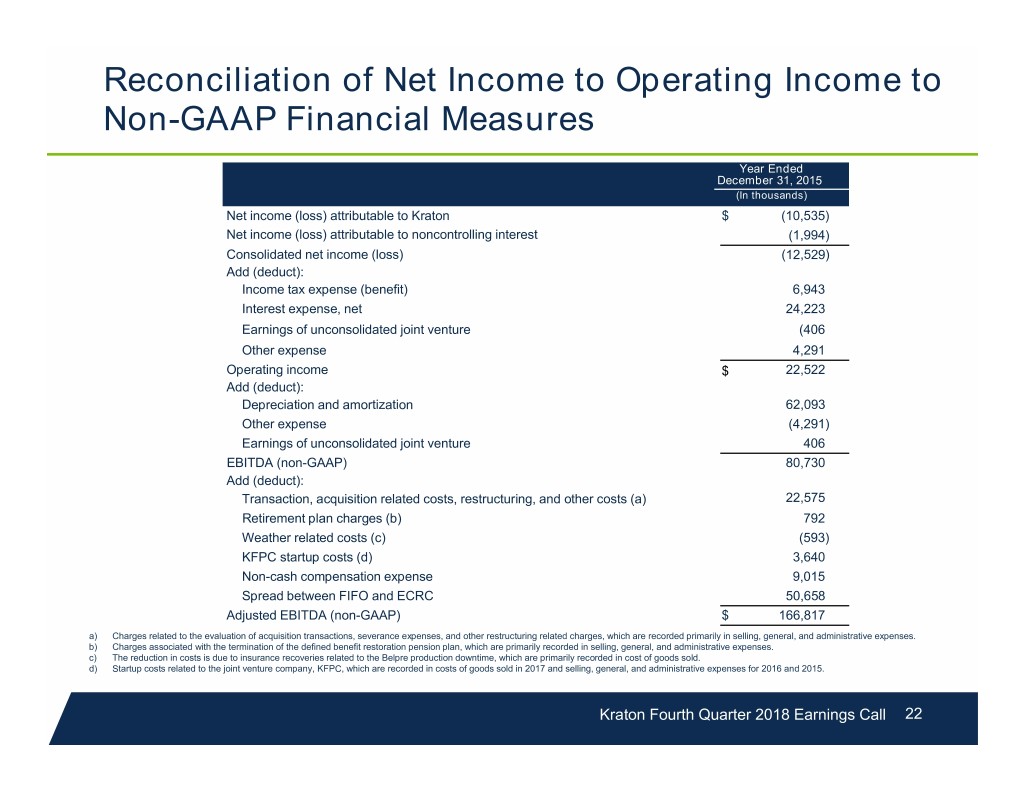

Reconciliation of Net Income to Operating Income to Non-GAAP Financial Measures Year Ended December 31, 2015 (In thousands) Net income (loss) attributable to Kraton $ (10,535) Net income (loss) attributable to noncontrolling interest (1,994) Consolidated net income (loss) (12,529) Add (deduct): Income tax expense (benefit) 6,943 Interest expense, net 24,223 Earnings of unconsolidated joint venture (406 Other expense 4,291 Operating income $ 22,522 Add (deduct): Depreciation and amortization 62,093 Other expense (4,291) Earnings of unconsolidated joint venture 406 EBITDA (non-GAAP) 80,730 Add (deduct): Transaction, acquisition related costs, restructuring, and other costs (a) 22,575 Retirement plan charges (b) 792 Weather related costs (c) (593) KFPC startup costs (d) 3,640 Non-cash compensation expense 9,015 Spread between FIFO and ECRC 50,658 Adjusted EBITDA (non-GAAP) $ 166,817 a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are recorded primarily in selling, general, and administrative expenses. b) Charges associated with the termination of the defined benefit restoration pension plan, which are primarily recorded in selling, general, and administrative expenses. c) The reduction in costs is due to insurance recoveries related to the Belpre production downtime, which are primarily recorded in cost of goods sold. d) Startup costs related to the joint venture company, KFPC, which are recorded in costs of goods sold in 2017 and selling, general, and administrative expenses for 2016 and 2015. Kraton Fourth Quarter 2018 Earnings Call 22

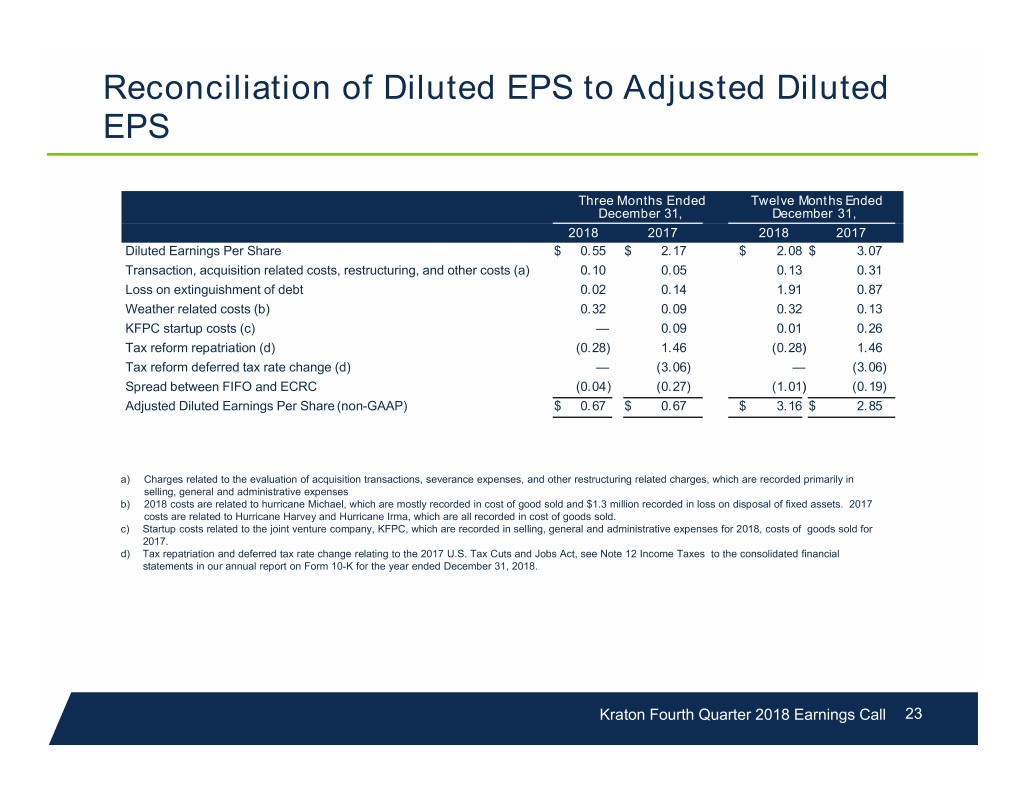

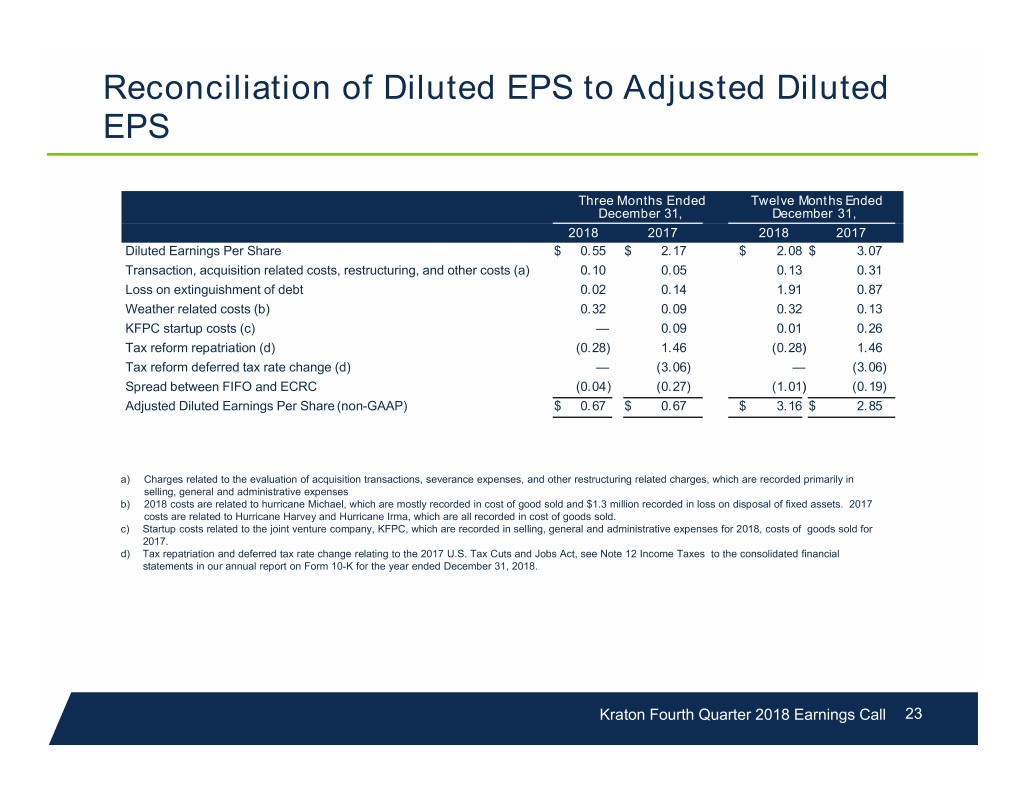

Reconciliation of Diluted EPS to Adjusted Diluted EPS Three Months Ended Twelve Months Ended December 31, December 31, 2018 2017 2018 2017 Diluted Earnings Per Share $ 0.55 $ 2.17 $ 2.08 $ 3.07 Transaction, acquisition related costs, restructuring, and other costs (a) 0.10 0.05 0.13 0.31 Loss on extinguishment of debt 0.02 0.14 1.91 0.87 Weather related costs (b) 0.32 0.09 0.32 0.13 KFPC startup costs (c) — 0.09 0.01 0.26 Tax reform repatriation (d) (0.28) 1.46 (0.28) 1.46 Tax reform deferred tax rate change (d) — (3.06) — (3.06) Spread between FIFO and ECRC (0.04) (0.27) (1.01) (0.19) Adjusted Diluted Earnings Per Share (non-GAAP) $ 0.67 $ 0.67 $ 3.16 $ 2.85 a) Charges related to the evaluation of acquisition transactions, severance expenses, and other restructuring related charges, which are recorded primarily in selling, general and administrative expenses b) 2018 costs are related to hurricane Michael, which are mostly recorded in cost of good sold and $1.3 million recorded in loss on disposal of fixed assets. 2017 costs are related to Hurricane Harvey and Hurricane Irma, which are all recorded in cost of goods sold. c) Startup costs related to the joint venture company, KFPC, which are recorded in selling, general and administrative expenses for 2018, costs of goods sold for 2017. d) Tax repatriation and deferred tax rate change relating to the 2017 U.S. Tax Cuts and Jobs Act, see Note 12 Income Taxes to the consolidated financial statements in our annual report on Form 10-K for the year ended December 31, 2018. Kraton Fourth Quarter 2018 Earnings Call 23

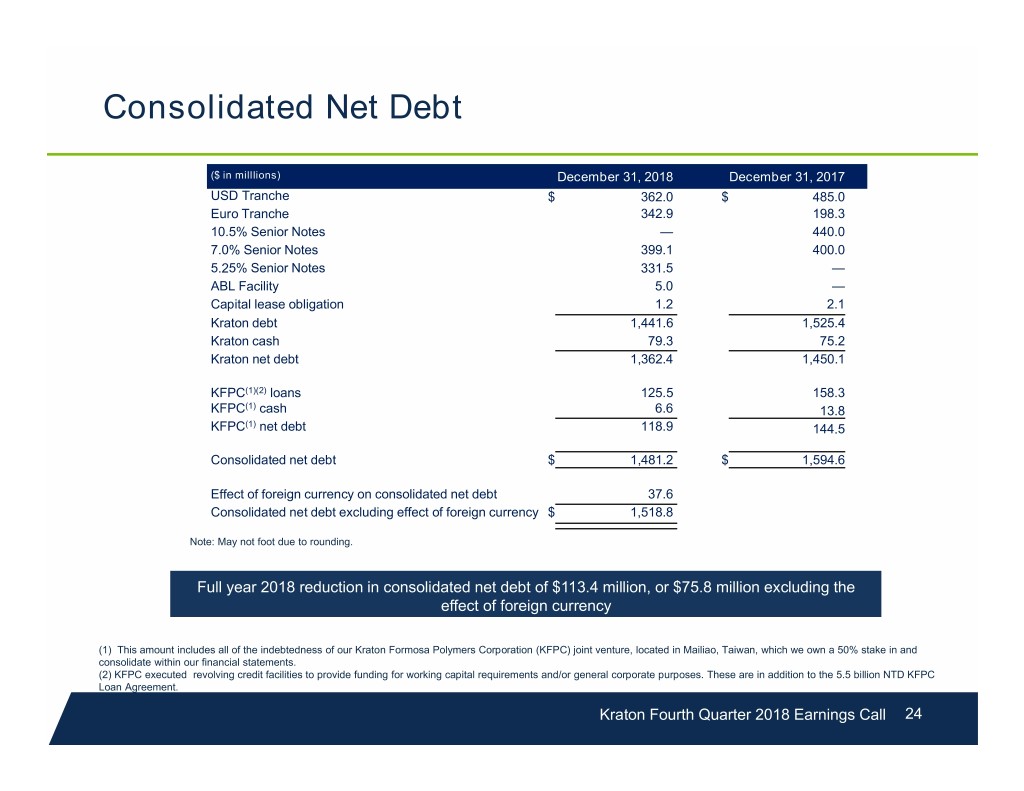

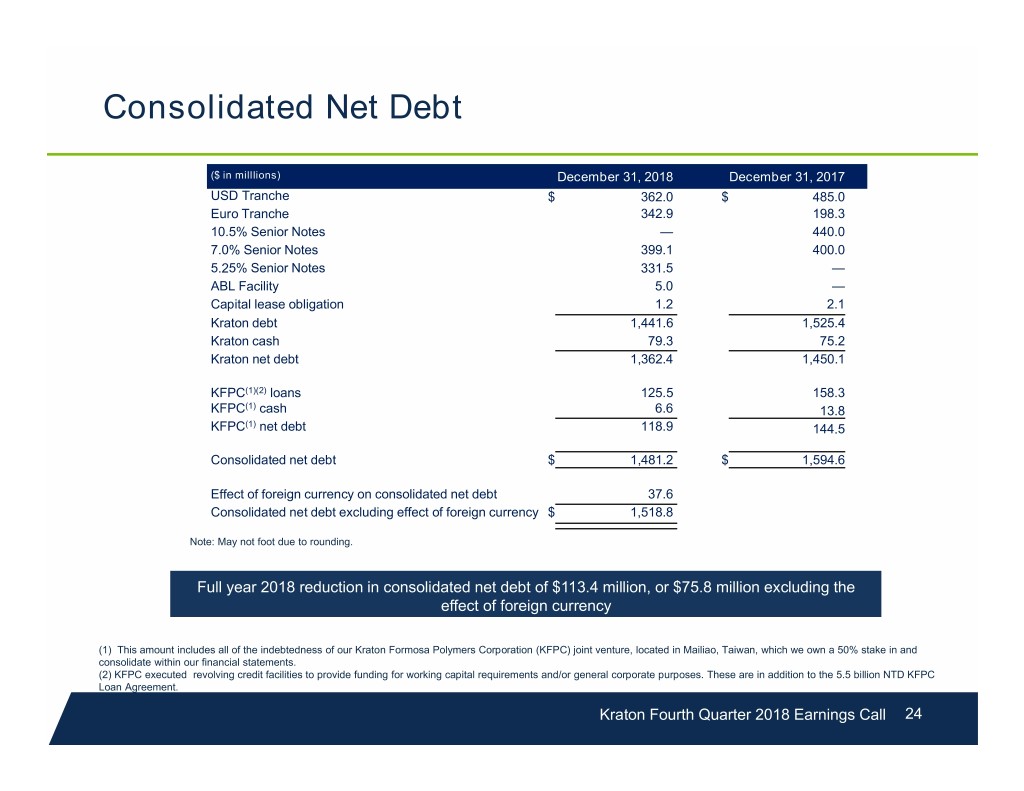

Consolidated Net Debt ($ in milllions) December 31, 2018 December 31, 2017 USD Tranche $ 362.0 $ 485.0 Euro Tranche 342.9 198.3 10.5% Senior Notes — 440.0 7.0% Senior Notes 399.1 400.0 5.25% Senior Notes 331.5 — ABL Facility 5.0 — Capital lease obligation 1.2 2.1 Kraton debt 1,441.6 1,525.4 Kraton cash 79.3 75.2 Kraton net debt 1,362.4 1,450.1 KFPC(1)(2) loans 125.5 158.3 KFPC(1) cash 6.6 13.8 KFPC(1) net debt 118.9 144.5 Consolidated net debt $ 1,481.2 $ 1,594.6 Effect of foreign currency on consolidated net debt 37.6 Consolidated net debt excluding effect of foreign currency $ 1,518.8 Note: May not foot due to rounding. Full year 2018 reduction in consolidated net debt of $113.4 million, or $75.8 million excluding the effect of foreign currency (1) This amount includes all of the indebtedness of our Kraton Formosa Polymers Corporation (KFPC) joint venture, located in Mailiao, Taiwan, which we own a 50% stake in and consolidate within our financial statements. (2) KFPC executed revolving credit facilities to provide funding for working capital requirements and/or general corporate purposes. These are in addition to the 5.5 billion NTD KFPC Loan Agreement. Kraton Fourth Quarter 2018 Earnings Call 24