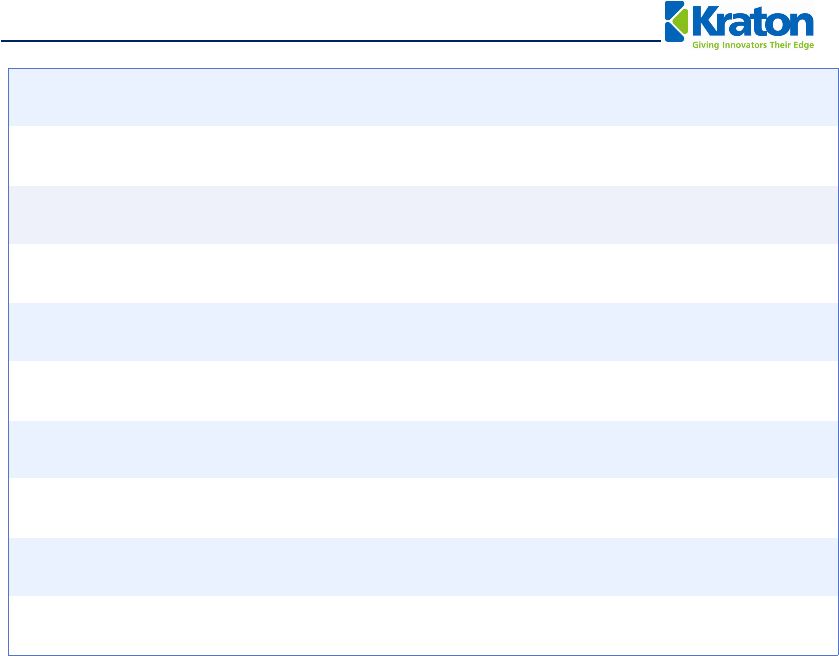

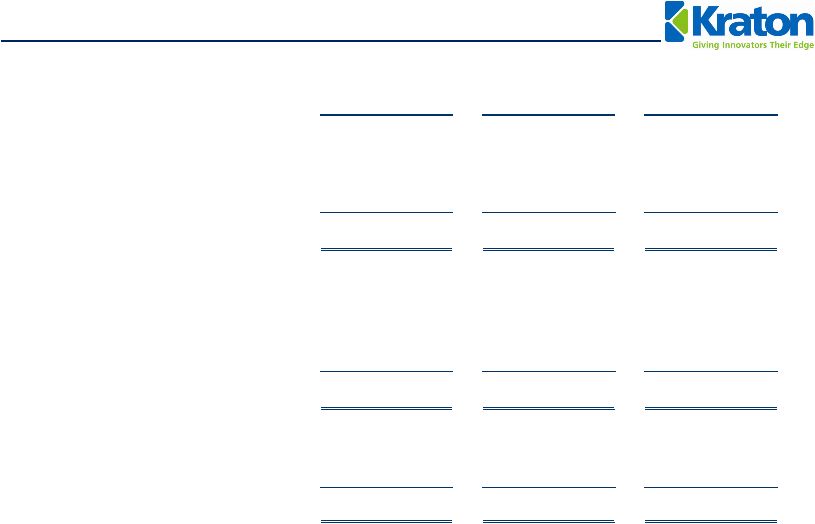

CONFIDENTIAL Q1 2010 Reconciliation of Net Income/(Loss) to EBITDA and Adjusted EBITDA 17 Three months Ended Three months Ended Three months Ended 3/31/2010 12/31/2009 3/31/2009 Net Income (Loss) 19,795 $ (1,516) $ (16,461) $ Add(deduct): Interest expense, net 6,064 9,179 8,908 Income tax expense 4,250 (882) 269 Depreciation and amortization expenses 11,046 25,168 12,564 EBITDA (1) 41,155 $ 31,949 $ 5,280 $ EBITDA (1) 41,155 $ 31,949 $ 5,280 $ Add(deduct): Sponsor fees and expenses - 500 500 Restructuring and related charges 135 2,144 694 Other non-cash expenses 1,332 450 3,301 Gain on extinguishment of debt - - (19,491) Adjusted EBITDA (2) 42,622 $ 35,043 $ (9,716) $ Restructuring and related detail: Cost of goods sold - $ 105 $ 78 $ Selling, general and administrative 135 2,039 616 Total restructuring and related charges 135 $ 2,144 $ 694 $ US $ in Thousands (1) The EBITDA measure is used by management to evaluate operating performance. Management believes that EBITDA is useful to investors because it is frequently used by investors and other interested parties in the evaluation of companies in our industry. EBITDA is not a recognized term under GAAP and does not purport to be an alternative to net income (loss) as an indicator of operating performance or to cash flows from operating activities as a measure of liquidity. Since not all companies use identical calculations, this presentation of EBITDA may not be comparable to other similarly titled measures of other companies. Additionally, EBITDA is not intended to be a measure of free cash flow for management's discretionary use, as it does not consider certain cash requirements such as interest payments, tax payments and debt service requirements. (2) Adjusted EBITDA is EBITDA excluding sponsor fees, restructuring and related charges, non-cash expenses, and the gain on extinguishment of debt. |