South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

DATE AND SIGNATURES PAGE

The effective date of this Technical Report is February 23, 2022. The issue date of this Technical Report is March 14, 2022.

| (Signed) “Matthew Sletten” | | March 14, 2022 |

| Matthew Sletten, PE | | Date |

| | | |

| (Signed) “Benjamin Bermudez” | | March 14, 2022 |

| Benjamin Bermudez, PE | | Date |

| | | |

| (Signed) “Art S Ibrado” | | March 14, 2022 |

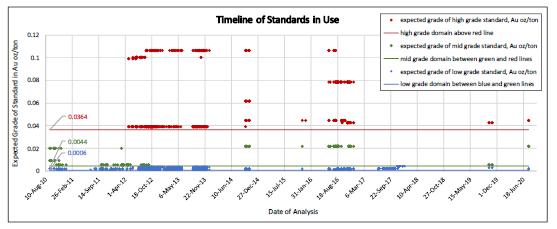

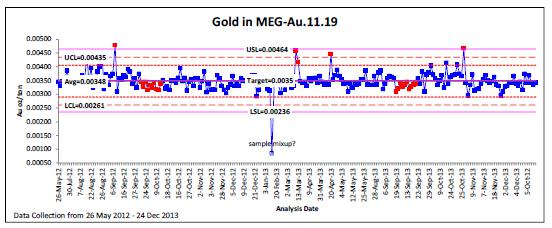

| Art S. Ibrado, PE | | Date |

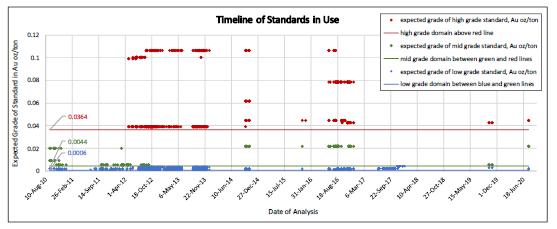

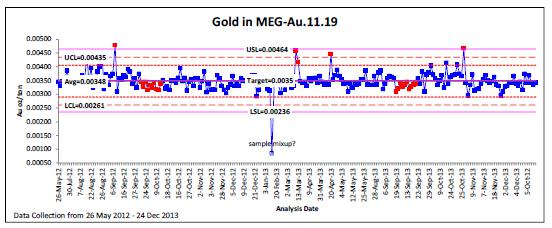

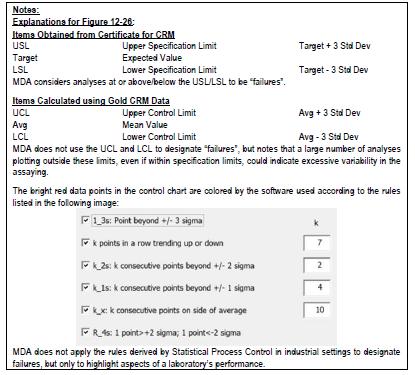

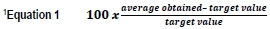

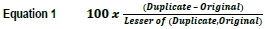

| | | |

| (Signed) “Michael S. Lindholm” | | March 14, 2022 |

| Michael S. Lindholm, CPG | | Date |

| | | |

| (Signed) “Thomas L. Dyer” | | March 14, 2022 |

| Thomas L. Dyer, PE | | Date |

| | | |

| (Signed) “Jordan M. Anderson” | | March 14, 2022 |

| Jordan M. Anderson, QP RM-SME | | Date |

| | | |

| (Signed) “Gary L. Simmons” | | March 14, 2022 |

| Gary L. Simmons, QP-MMSA | | Date |

| | | |

| (Signed) “Richard DeLong” | | March 14, 2022 |

| Richard DeLong, QP MMSA, RG, PG | | Date |

| | | |

| (Signed) “Kevin Lutes” | | March 14, 2022 |

| Kevin Lutes, PE | | Date |

| M3-PN185074

14 March 2022

Revision 1 | i |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

SOUTH RAILROAD PROJECT

FORM 43-101F1 TECHNICAL REPORT

TABLE OF CONTENTS

| SECTION | PAGE |

| DATE AND SIGNATURES PAGE | i |

| | |

| TABLE OF CONTENTS | ii |

| | |

| LIST OF APPENDICES | iv |

| 1 | EXECUTIVE SUMMARY | 1-1 |

| | | |

| 2 | INTRODUCTION | 2-1 |

| | | |

| 3 | RELIANCE ON OTHER EXPERTS | 3-1 |

| | | |

| 4 | PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| | | |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 5-1 |

| | | |

| 6 | HISTORY | 6-1 |

| | | |

| 7 | GEOLOGICAL SETTING AND MINERALIZATION | 7-1 |

| | | |

| 8 | DEPOSIT TYPES | 8-1 |

| | | |

| 9 | EXPLORATION | 9-1 |

| | | |

| 10 | DRILLING | 10-1 |

| | | |

| 11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 11-1 |

| | | |

| 12 | DATA VERIFICATION | 12-1 |

| | | |

| 13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 13-1 |

| | | |

| 14 | MINERAL RESOURCE ESTIMATES | 14-1 |

| | | |

| 15 | MINERAL RESERVE ESTIMATES | 15-1 |

| | | |

| 16 | MINING METHODS | 16-1 |

| | | |

| 17 | RECOVERY METHODS | 17-1 |

| | | |

| 18 | PROJECT INFRASTRUCTURE | 18-1 |

| | | |

| 19 | MARKET STUDIES AND CONTRACTS | 19-1 |

| | | |

| 20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 20-1 |

| M3-PN185074

14 March 2022

Revision 1 | ii |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| 21 | CAPITAL AND OPERATING COSTS | 21-1 |

| | | |

| 22 | ECONOMIC ANALYSIS | 22-1 |

| | | |

| 23 | ADJACENT PROPERTIES | 23-1 |

| | | |

| 24 | OTHER RELEVANT DATA AND INFORMATION | 24-1 |

| | | |

| 25 | INTERPRETATION AND CONCLUSIONS | 25-1 |

| | | |

| 26 | RECOMMENDATIONS | 26-1 |

| | | |

| 27 | REFERENCES | 27-1 |

| M3-PN185074

14 March 2022

Revision 1 | iii |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

LIST OF APPENDICES

| APPENDIX | DESCRIPTION | PAGE |

| | | |

| A | FEASIBILITY STUDY CONTRIBUTORS AND PROFESSIONAL QUALIFICATIONS – CERTIFICATES OF QUALIFIED PERSONS | A-1 |

| | | |

| B | CLAIMS LIST | B-1 |

| | | |

| C | BREAKDOWN OF MINERAL RESOURCES BY AREA AND OXIDATION STATE | C-1 |

| M3-PN185074

14 March 2022

Revision 1 | iv |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

SECTION 1 TABLE OF CONTENTS

| SECTION | PAGE |

| 1 | SUMMARY | 1-1 |

| | 1.1 | PRINCIPAL FINDINGS | 1-1 |

| | 1.2 | PROPERTY DESCRIPTION AND OWNERSHIP | 1-2 |

| | 1.3 | EXPLORATION AND MINING HISTORY | 1-3 |

| | 1.4 | GEOLOGY AND MINERALIZATION | 1-3 |

| | 1.5 | DATA VERIFICATION | 1-4 |

| | 1.6 | PROCESSING AND METALLURGICAL TESTING | 1-5 |

| | 1.7 | RECOVERY METHODS | 1-6 |

| | 1.8 | MINERAL RESOURCE ESTIMATE AND MINERAL RESERVE ESTIMATE | 1-6 |

| | | 1.8.1 | Mineral Resource Estimate | 1-6 |

| | | 1.8.2 | Mineral Reserve Estimate | 1-8 |

| | 1.9 | MINING METHODS | 1-9 |

| | 1.10 | INFRASTRUCTURE | 1-9 |

| | 1.11 | ENVIRONMENT AND PERMITTING | 1-9 |

| | 1.12 | WATER MANAGEMENT | 1-10 |

| | 1.13 | CAPITAL COST SUMMARY | 1-11 |

| | 1.14 | OPERATING COST SUMMARY | 1-11 |

| | 1.15 | CONCLUSIONS AND RECOMMENDATIONS | 1-12 |

SECTION 1 LIST OF TABLES

| TABLE | DESCRIPTION | PAGE |

| Table 1-1: | Key Project Data | 1-1 |

| Table 1-2: | Summary of Leach Tests Performed | 1-5 |

| Table 1-3: | Dark Star, Pinion, Jasperoid Wash and North Bullion Estimated Mineral Resources | 1-7 |

| Table 1-4: | Proven and Probable Mineral Reserves | 1-8 |

| Table 1-5: | Capital Expenditure Schedule | 1-11 |

| Table 1-6: | LOM Operating Costs | 1-11 |

| Table 1-7: | Economic Analysis Summary | 1-12 |

| M3-PN185074

14 March 2022

Revision 1 | 1-i |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

This Technical Report (“Technical Report”) has been prepared by M3 Engineering and Technology Corporation (“M3”) with Gold Standard Ventures Corp. (“Gold Standard” or “GSV”) in accordance with the National Instrument 43-101F1 Standards of Disclosures for Mineral Projects (“NI 43-101”). The Technical Report presents the results of the South Railroad feasibility study (“FS”), incorporating new design-work, scheduling, and projected costs, in support of mineral resource and mineral reserve estimates in the Dark Star and Pinion gold deposits.

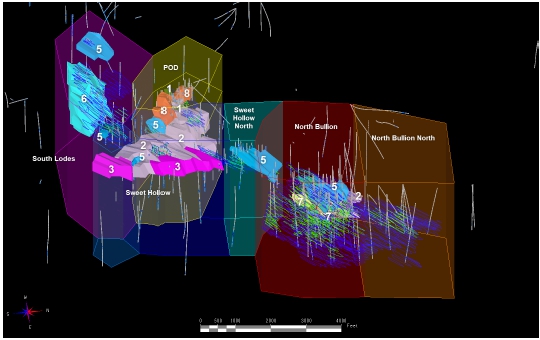

Gold Standard’s Railroad Pinion property is located in the Bullion mining district of the southern Carlin trend in Nevada. The property has two adjacent parts, the North Railroad portion (“North Railroad”), which includes POD, Sweet Hollow, South Lodes and North Bullion (collectively called the North Bullion deposits, or the North Bullion area), and the South Railroad portion (“South Railroad”), which includes Dark Star, Pinion, and Jasperoid Wash.

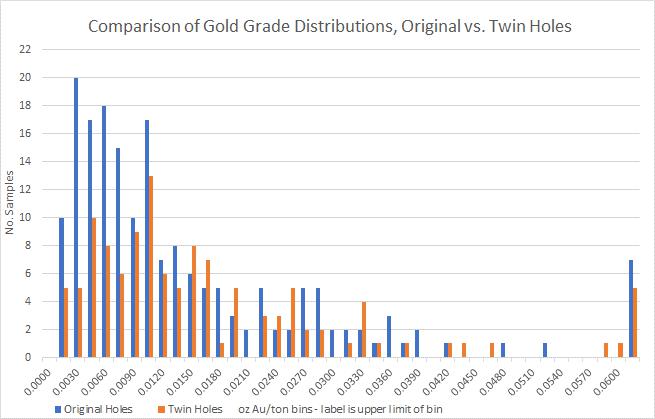

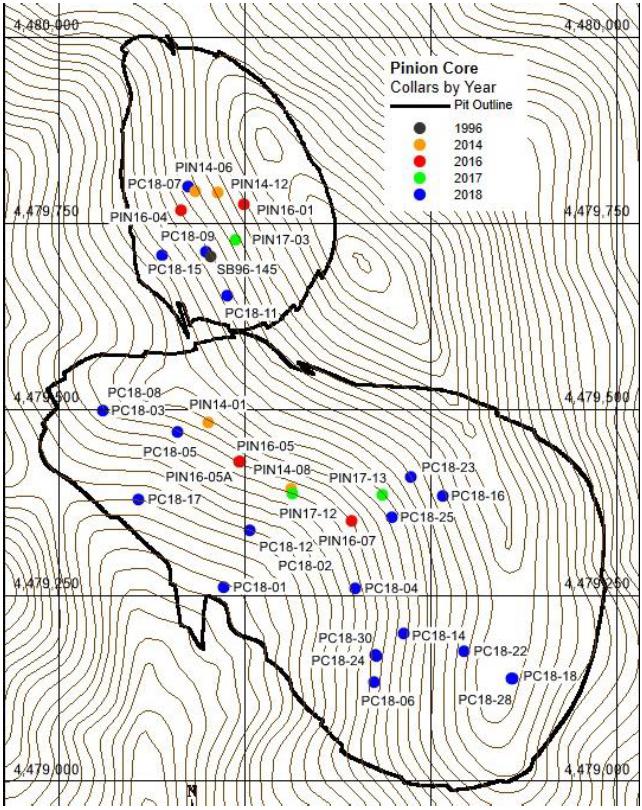

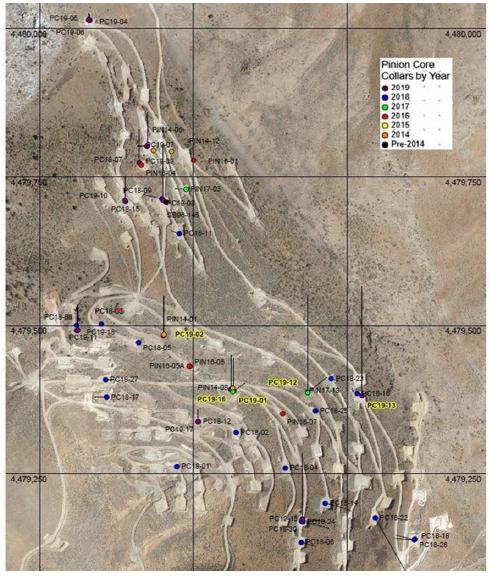

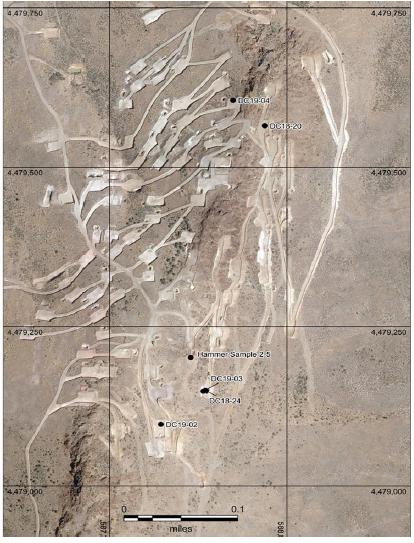

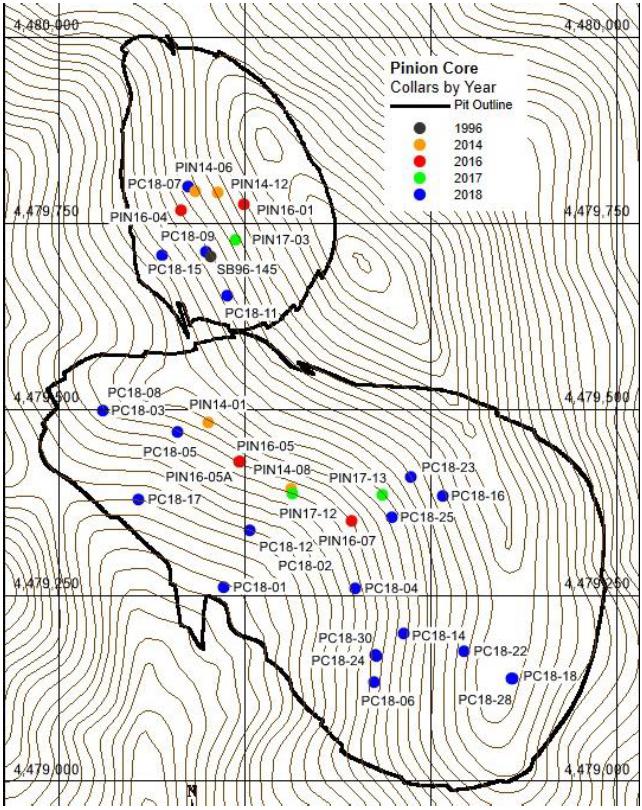

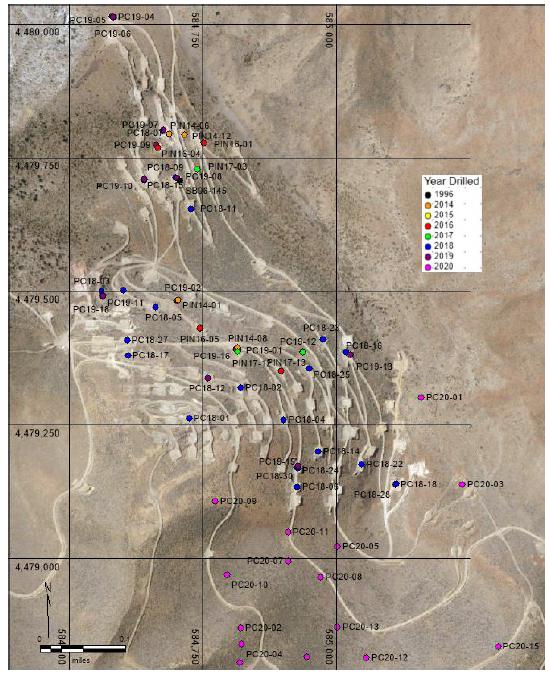

Gold Standard has drilled, or received assays, for 127 new holes since the effective dates of the databases for the respective deposits on the Railroad-Pinion property. In many cases, assay results were delayed significantly past the effective dates due to the COVID-19 pandemic. That drilling was primarily focused on obtaining metallurgy samples, generating geotechnical data, construction of water and monitor wells, infilling within modeled areas, or for exploration of secondary targets. The new drilling in the Dark Star, Pinion, North Bullion and Jasperoid Wash areas were evaluated with respect to the resource models and it was determined there would be minimal to no impact on estimated volumes and grades as reported within optimized pits in this Technical Report.

Extensive metallurgical testing has been completed for the Dark Star and Pinion deposits. On the other hand, the North Railroad portion of the property has not been tested comprehensively for metallurgical response.

Gold Standard reports mineral reserves for Dark Star and Pinion deposits in this Technical Report. The FS, which includes the mine schedule, process-plant design, and financial analysis, covers only these two deposits.

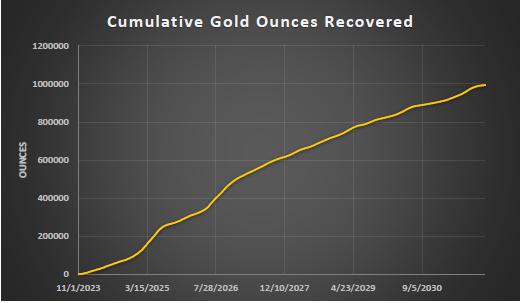

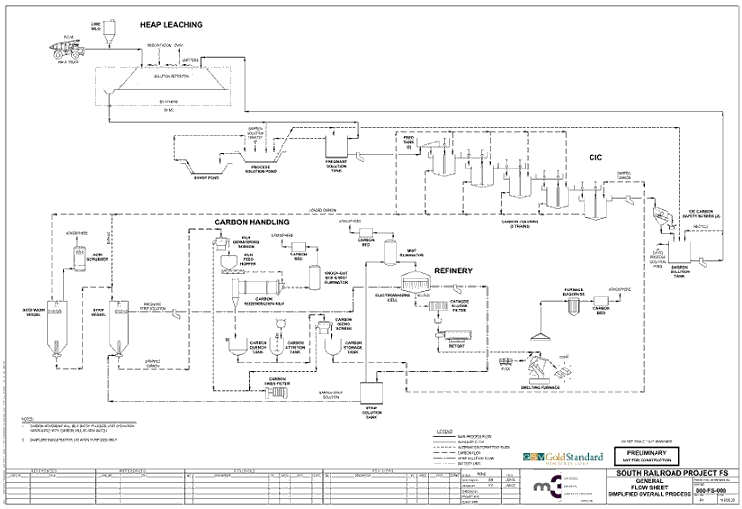

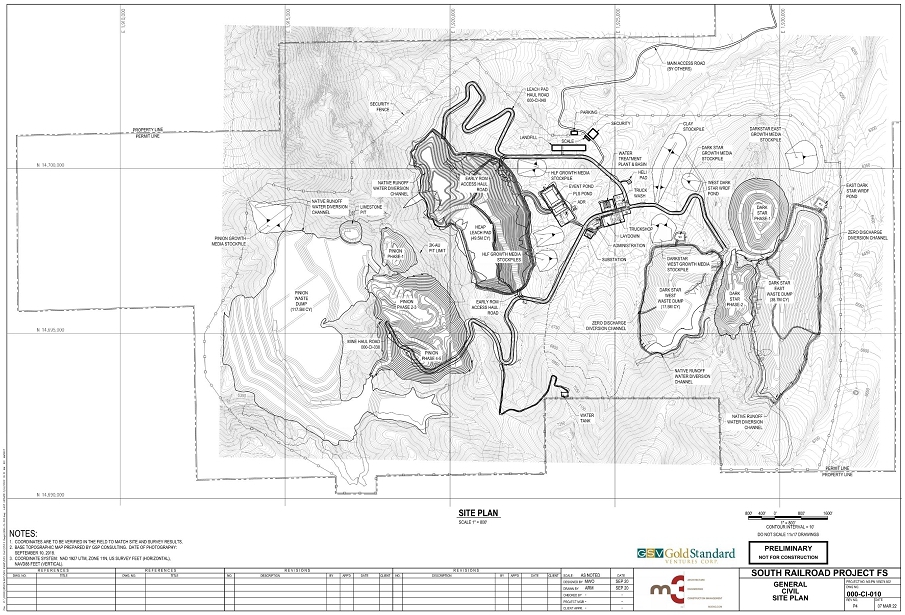

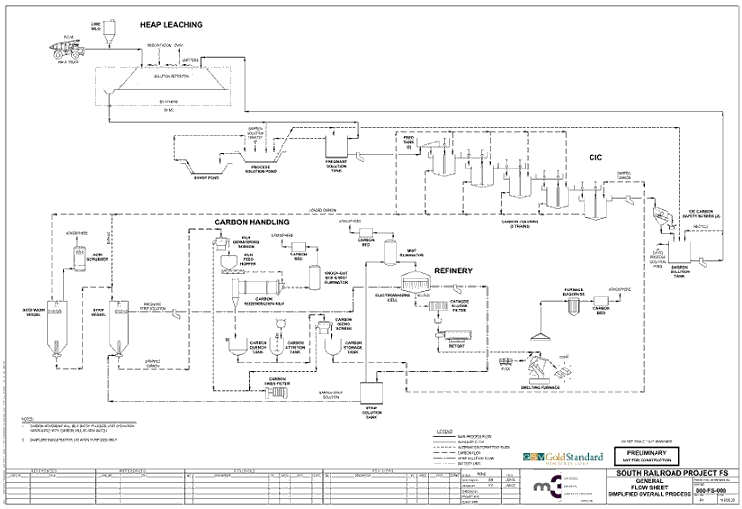

The proposed project is an open-pit gold mine operation that will deliver ore to a 71.9 million-ton heap leach facility over 8 years of mine life. The heap leach facility will treat Run-of-Mine (ROM) ore via leaching on a dedicated leach pad with cyanide-bearing solution.

Gold Standard selected M3 and other third-party consultants to prepare mineral resource/reserve estimates, mine plans, process plant design, and to complete environmental studies and cost estimates used for this Technical Report. All consultants have the capability to support the project, as required and within the confines of their expertise, from feasibility study to full operation.

The key project parameters and findings are presented in Table 1-1, including a summary of the project size, productions, capital and operating costs, metal prices, and financial indicators.

Table 1-1: Key Project Data

| Mine Life | 8 Years + pre-strip (6 months) |

| Mine Type | Open Pit |

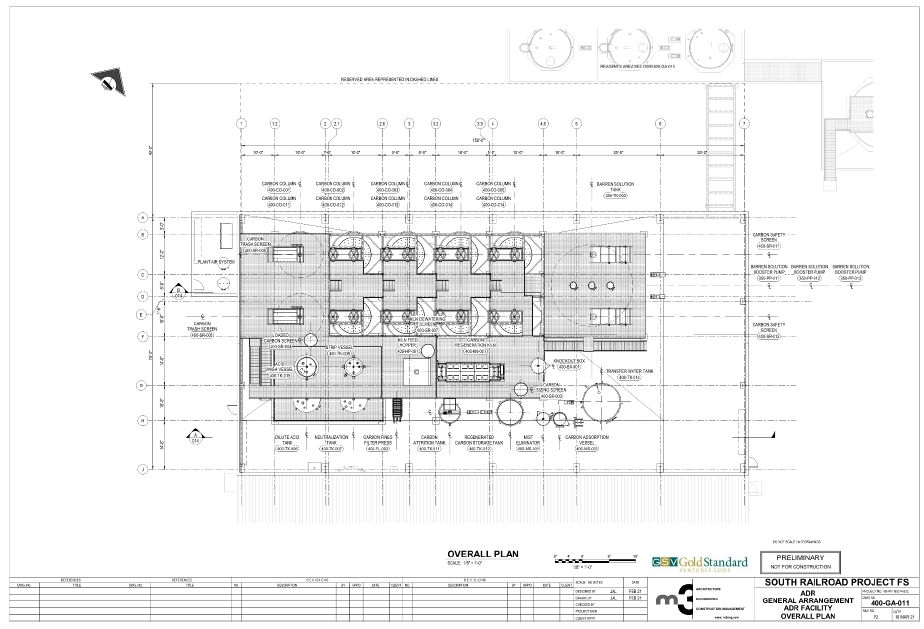

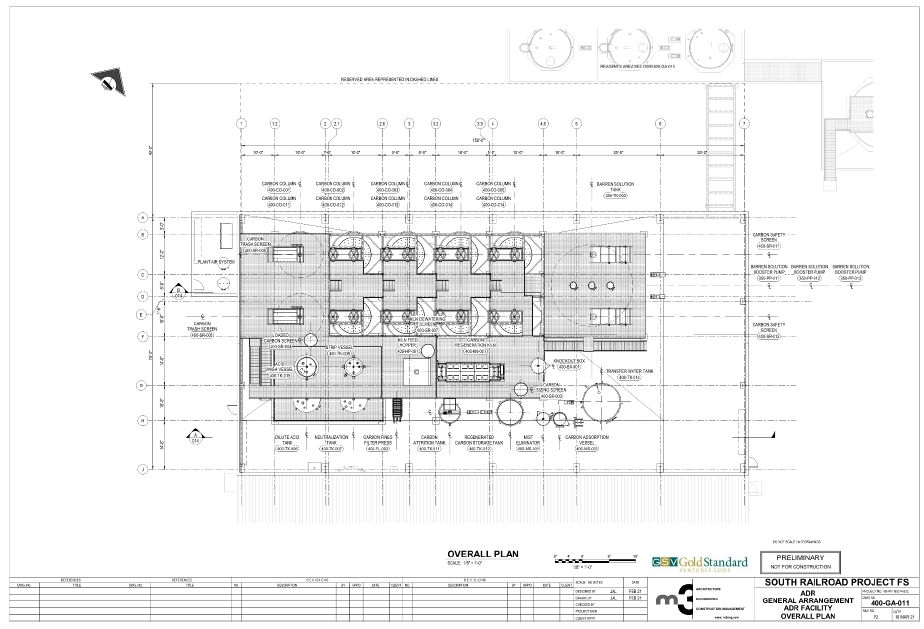

| Process Description | ROM heap leach Gold/silver recovery by ADR plant & Refinery, dual carbon column trains |

| Total Mineral Reserve Estimate | 71.9 M Tons |

| Average Grade | 0.022 oz Au/ton; 0.154 oz Ag/ton (Pinion – Representing 39.7 M tons of ore) |

| Contained Gold / Silver Ounces | 1.604 M oz Au; 6.137 M oz Ag (Pinion) |

| Average Recovery | ROM: 64.5% Au, 10.8% Ag |

| Average Annual Tons Moved | 44 Million Tons |

| Annual Mineral Reserve Estimate | 8.8 Million Tons |

| M3-PN185074

14 March 2022

Revision 1 | 1-1 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| Strip Ratio | 4.10:1 |

| Process (ROM) Throughput (tons/day) | 32,700 (Design); 24,700 (Average) |

| Initial Capital Expenditures | $190.2 M |

| Sustaining Capital Expenditures | $186.7 M |

| | |

| Payable Metals | |

| Gold, oz | 1,030,000 |

| Silver, oz | 651,000 |

| | |

| Unit Operating Costs | |

| Average Life of Mine (“LOM”) Mining Costs | $1.68 / ton mined |

| Average LOM Processing Costs | $2.05 / ore ton |

| G & A | $0.53 / ore ton |

| Refining | $0.07 / ore ton |

| Cash Costs | $794 / oz Au |

| Cash Costs After By-Product Credit | $792 / oz Au |

| All in Sustaining Costs (“AISC”) | $1,021 / oz Au |

| Financial Indicators | Spot Price (Au)

(Feb 22, 2022) | Base +150 | Base Case | Base -150 | Base -250 |

| Gold Price (per troy oz) | $1,899 | $1,800 | $1,650 | $1,500 | $1,400 |

| Silver Price (per troy oz) | $21.50 | $21.50 | $21.50 | $21.50 | $21.50 |

| Pre-tax Cash Flow, $M | $753.9 | $651.9 | $497.3 | $342.8 | $239.8 |

| Pre-tax NPV (5%) in $M | $603.0 | $517.9 | $388.9 | $259.9 | $173.9 |

| Pre-tax Internal Rate of Return (IRR) | 68.2% | 60.8% | 49.2% | 36.5% | 27.2% |

| Pre-tax Payback (Years) | 1.6 | 1.7 | 1.9 | 2.1 | 2.4 |

| After-tax Cash Flow, $M | $606.3 | $526.1 | $403.2 | $280.9 | $199.0 |

| After-tax NPV (5%) in $M | $486.4 | $418.7 | $314.8 | $211.2 | $141.6 |

| After-tax IRR | 62.1% | 55.3% | 44.3% | 32.6% | 24.0% |

| After-tax Payback (Years) | 1.6 | 1.7 | 1.9 | 2.2 | 2.4 |

The effective date of this FS is February 23, 2022, and the issue date of the Technical Report is March 14, 2022. The effective dates of the Pinion and Dark Star databases on which the mineral resources described in this Technical Report are estimated on, are June 2, 2021 and June 15, 2021, respectively. The effective date of the Jasperoid Wash database is October 6, 2018, and the effective date of the North Bullion deposits database is August 21, 2020. New optimized pits and underground shells were generated using current mining costs in 2022, so the effective dates of the reported mineral resource estimates for all deposits is January 31, 2022.

| 1.2 | Property Description and Ownership |

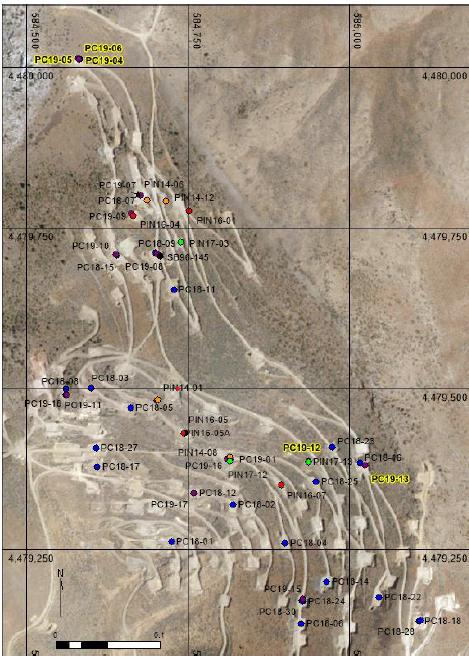

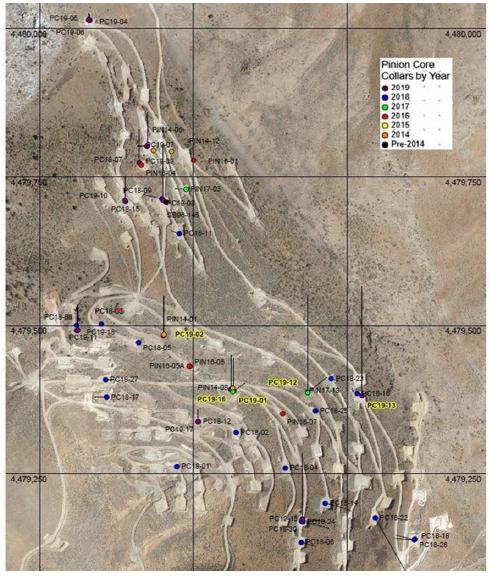

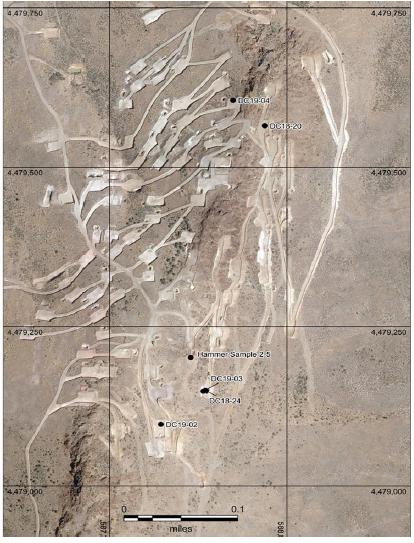

The primary site access for South Railroad will be from Elko, NV using a 41.7-mile access route. This 41.7-mile route begins from its intersection with 12th Street in Elko, NV and continues approximately 5.5 miles along the existing paved State Route (SR) 227 (i.e., Lamoille Highway) to the intersection with SR 228 (i.e., Jiggs Highway). The route continues south along paved SR 228 for another 5.5 miles to the paved Elko County Road 715 (i.e., South Fork Road). The route follows southward along County Road 715 approximately 5.7 miles to the intersection with County Road 715B (i.e., Lucky Nugget Road/Grant Avenue). From this intersection, the route follows County Road 715B approximately 3.1 miles along the west shore of South Fork Reservoir through a semi-rural residential area to the intersection with BLM Road 1119, which continues southwest approximately 6 miles to its intersection with Elko County Road 720 (i.e., Bullion Road). The route follows the Bullion Road southwest approximately 10 miles to the intersection with the un-improved BLM Road 1053, then continues southward following the approximate alignment of BLM Road 1053 along the eastern flank of the Pinion Range approximately 6 miles to the South Railroad Project). The property is centered approximately at UTM NAD27 Zone 11 coordinates of 585,000E and 4,480,000N.

| M3-PN185074

14 March 2022

Revision 1 | 1-2 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

Gold Standard’s contiguous North and South Railroad portions of the Railroad-Pinion property constitute a combined land position totaling 53,570 acres in Elko County, Nevada, centered approximately at UTM NAD27 Zone 11 with coordinates of 585,000E and 4,480,000N. This includes 1,454 claims owned by Gold Standard and 207 claims held under lease, a total of 30 claims are patented. There is also a total of 23,630 gross acres of private lands of which Gold Standard’s ownership of the subsurface mineral rights varies from 49.2% to 100%.

| 1.3 | Exploration and Mining History |

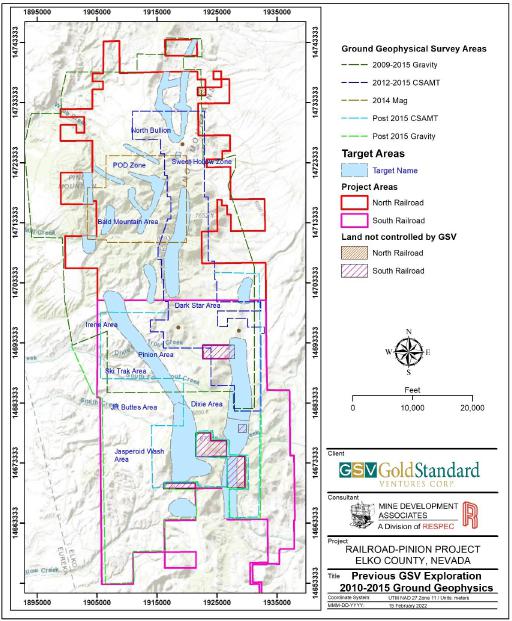

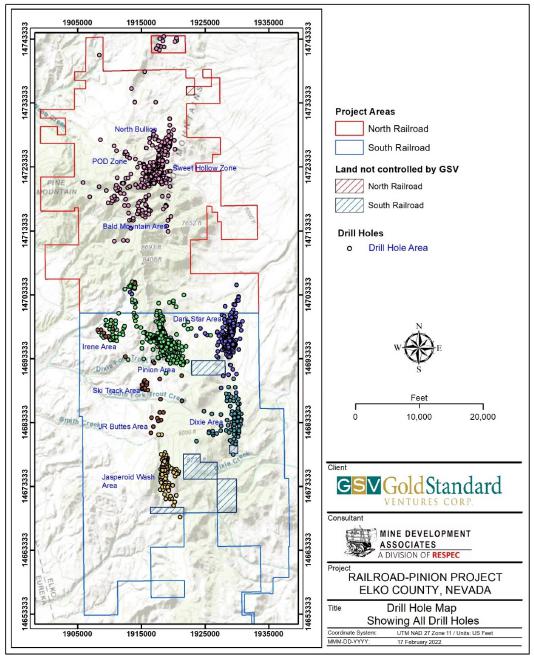

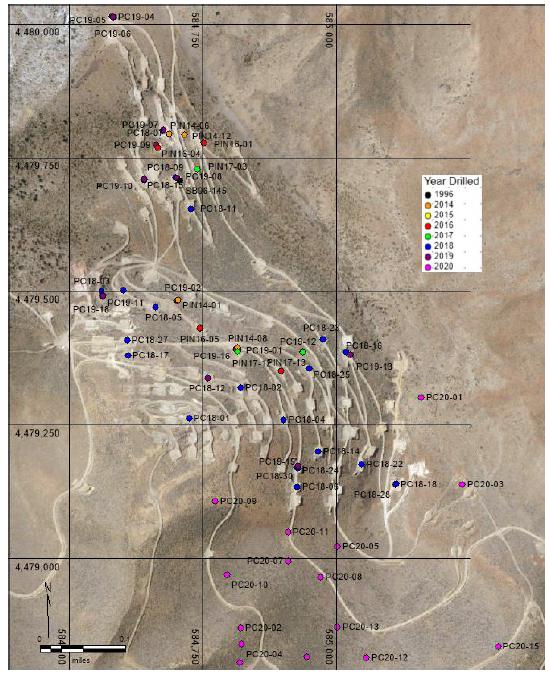

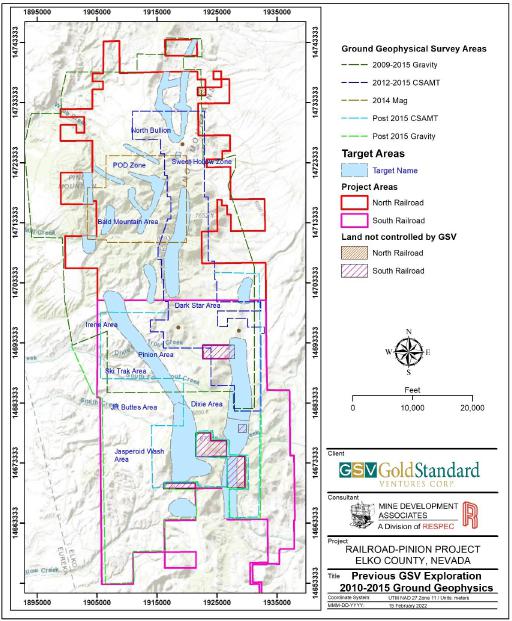

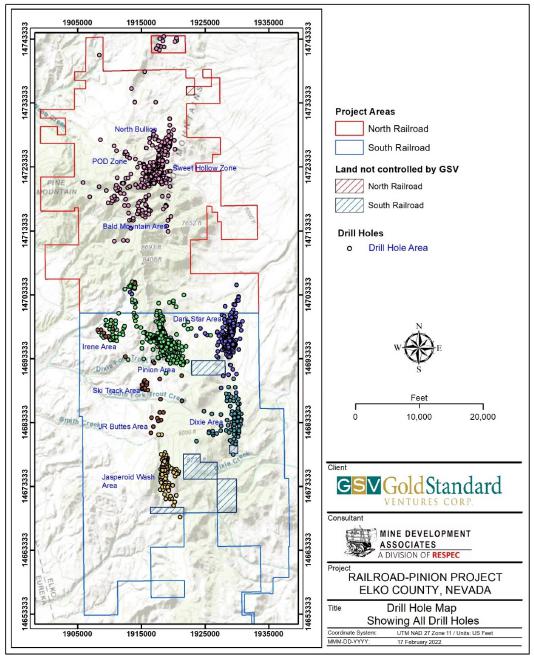

The Railroad–Pinion property is being explored on an ongoing basis by Gold Standard using geological mapping, geochemical and geophysical surveying, and drilling. Exploration work by Gold Standard commenced in 2010 and has resulted in the identification of 17 prospect areas or zones of mineralization within the property.

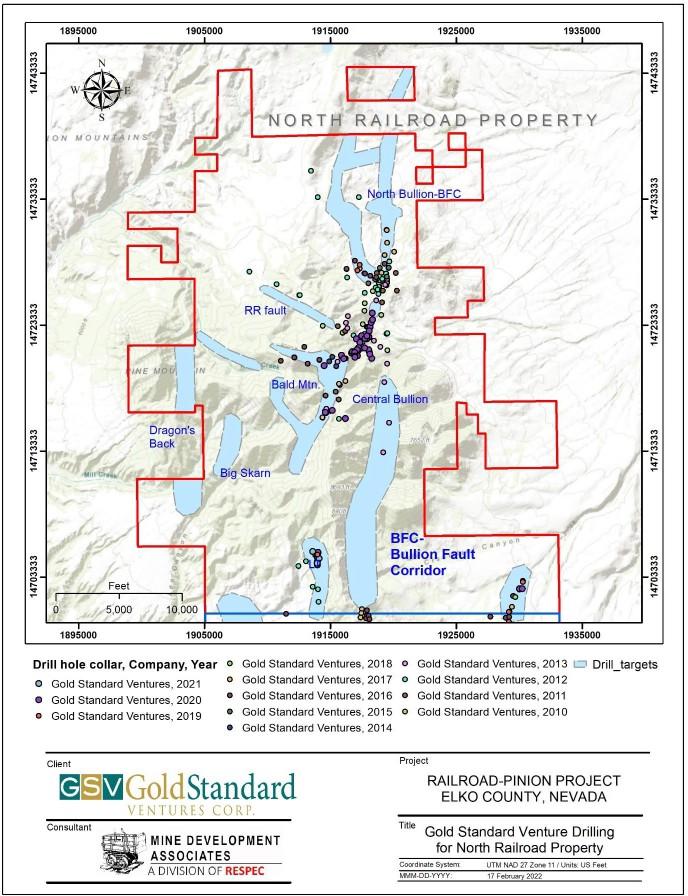

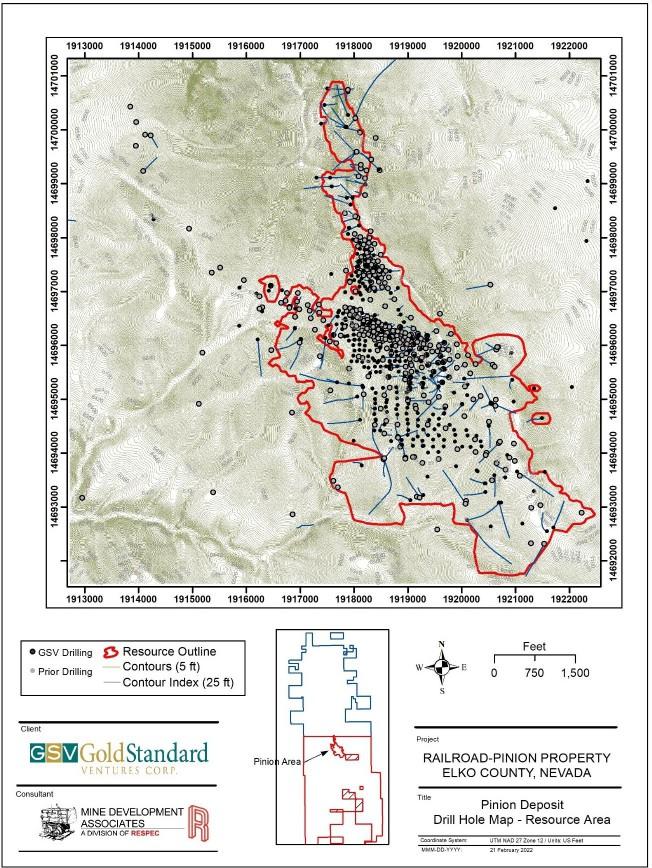

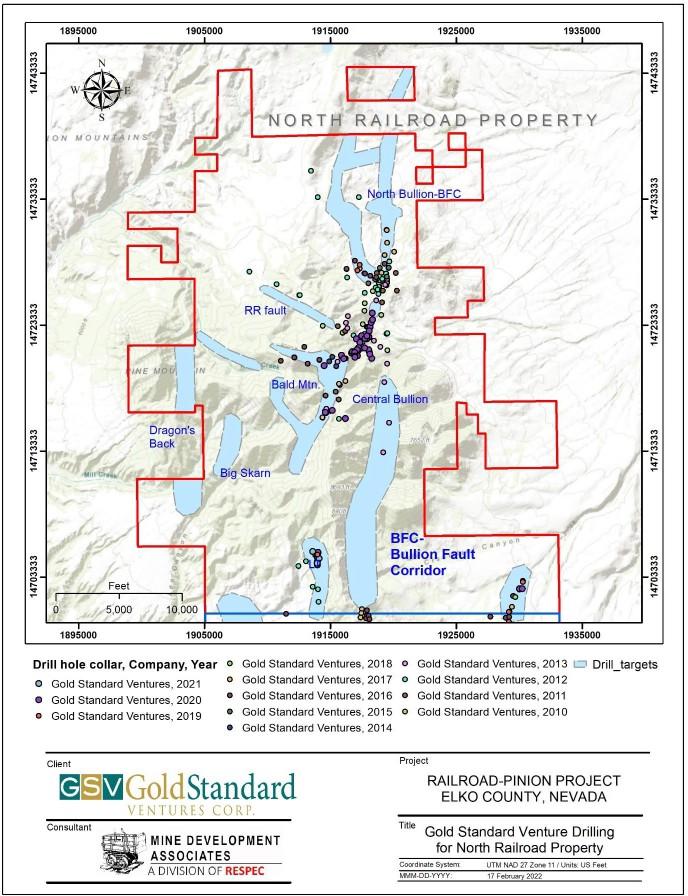

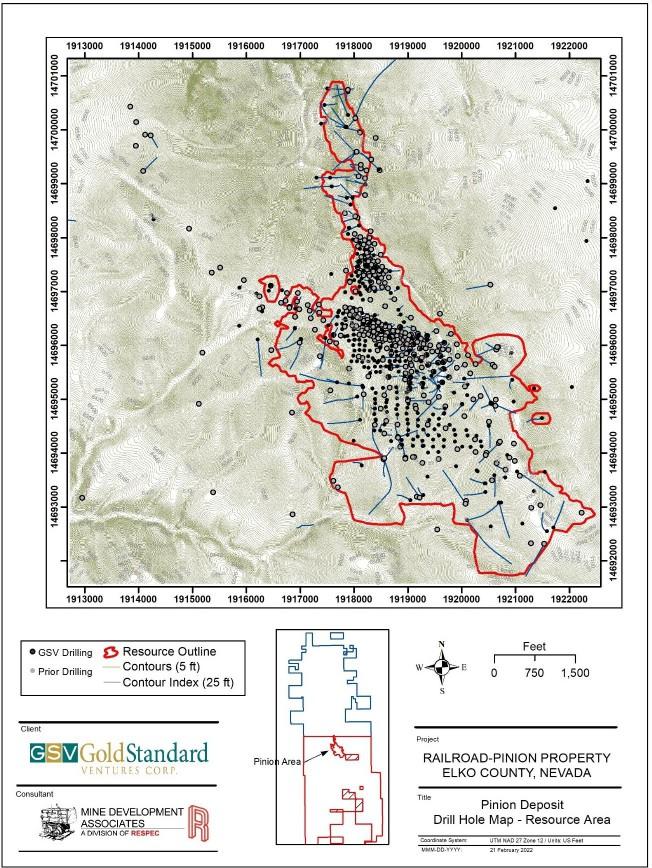

Twenty-one different historical operators are known to have drilled 1,084 holes, for a total of 500,544. 1 ft, from 1969 through 2008. As of the database effective dates, Gold Standard has drilled 1,121 holes for a total of 953,112 ft. At least 80% of all drilling used RC methods. However, the amount of RC drilling may be understated because the hole- types are not known for a substantial number of holes drilled in the late 1980s and 1990s, when RC drilling was common.

| 1.4 | Geology and Mineralization |

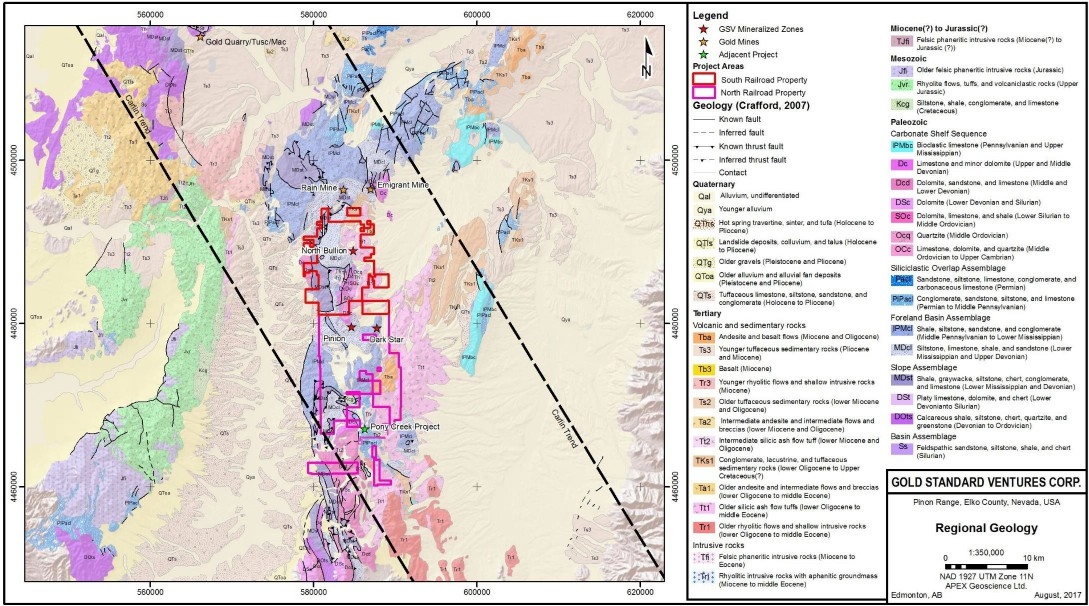

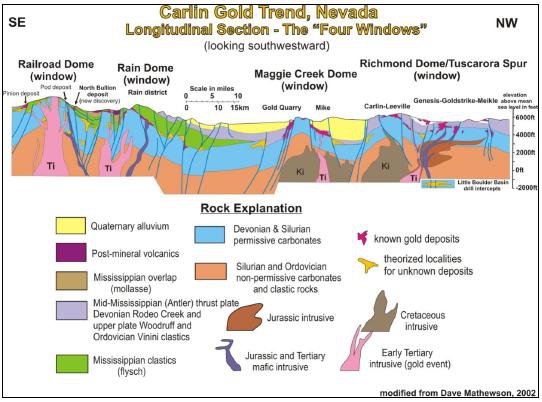

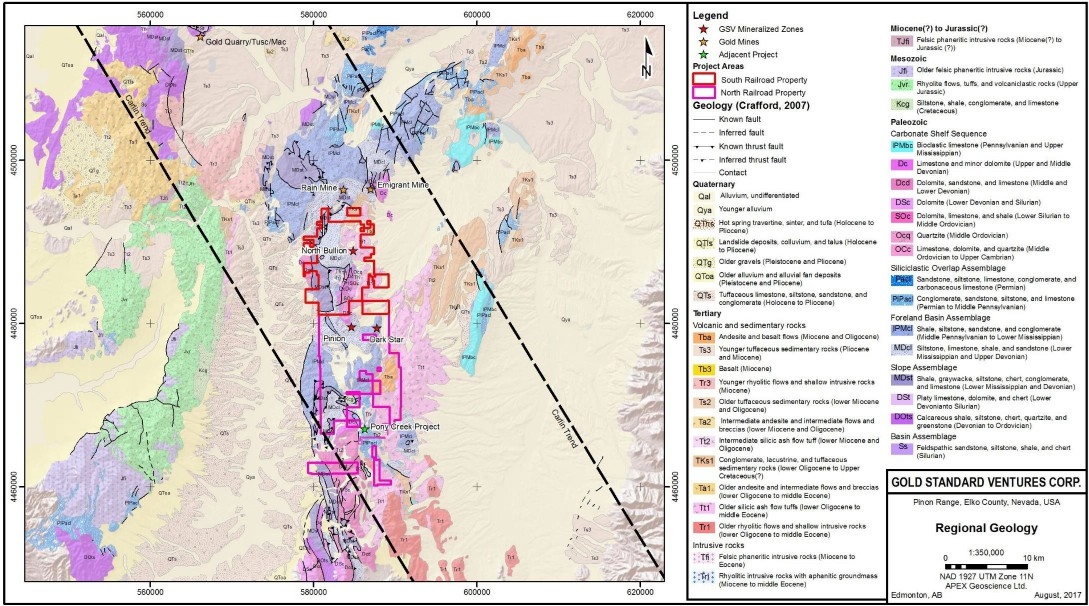

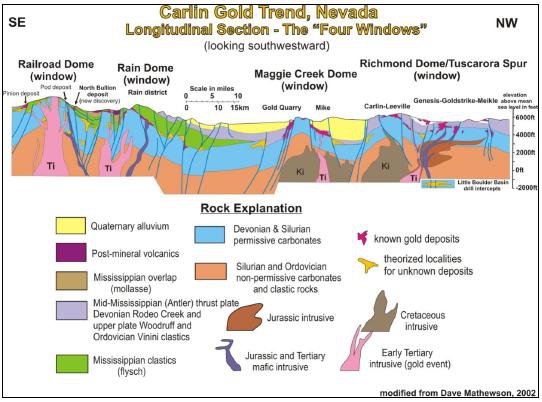

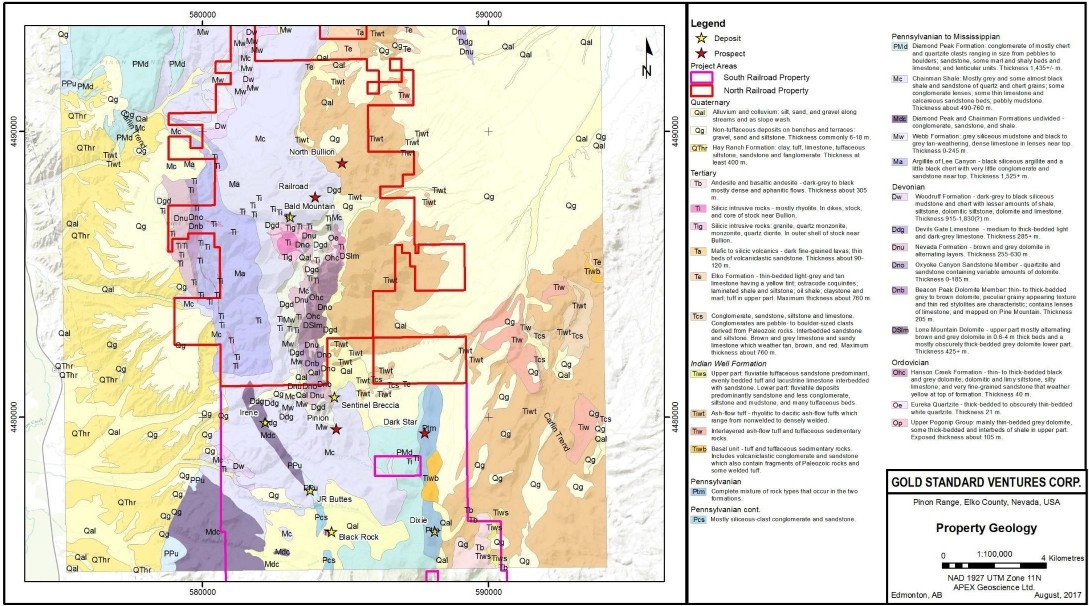

The Railroad-Pinion property is located in the southern portion of the Carlin trend, centered on the Railroad dome in the Piñon Range, which is comprised of Ordovician through Permian marine sedimentary rocks. Eastern assemblage formations throughout the property include the Pogonip, Hanson Creek, Eureka Quartzite, Lone Mountain Dolomite, Oxyoke, Beacon Peak, Sentinel Mountain Dolomite, and Devils Gate Limestone and Tripon Pass formations. Siliceous clastic units include those of the Webb, Chainman, and Tonka formations. The north-south-striking Bullion fault corridor separates Tertiary volcanic rocks to the east from the Paleozoic sedimentary units in the range, which have been intruded by a complex of Eocene igneous rocks centered south of Bald Mountain, in the core and east flank of the range.

The gold-silver deposits within the Railroad-Pinion property that are the focus of this Technical Report are considered to be Carlin-type, sedimentary-rock-hosted deposits. Precious metal mineralization is generally submicroscopic, disseminated, and hosted principally in sedimentary rocks, with some mineralization in felsic dikes and sills as well.

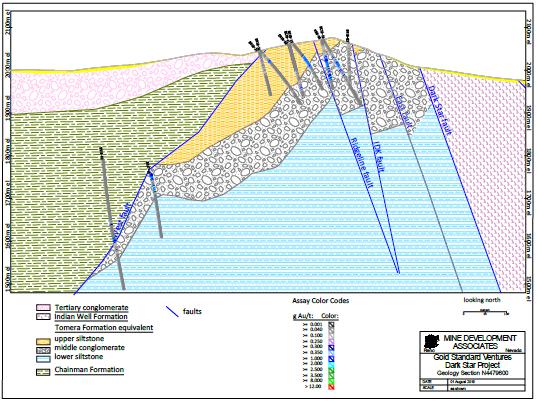

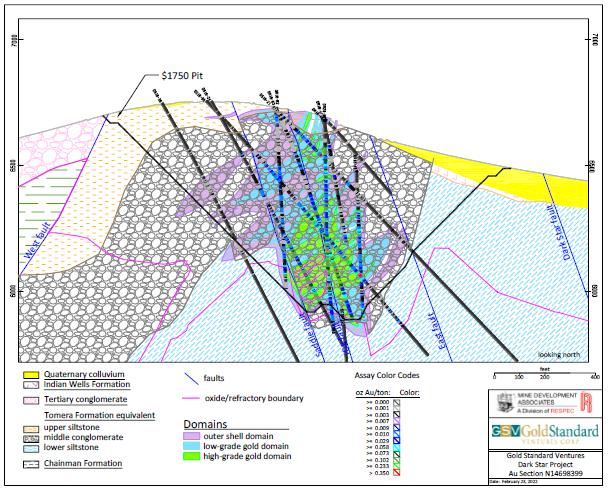

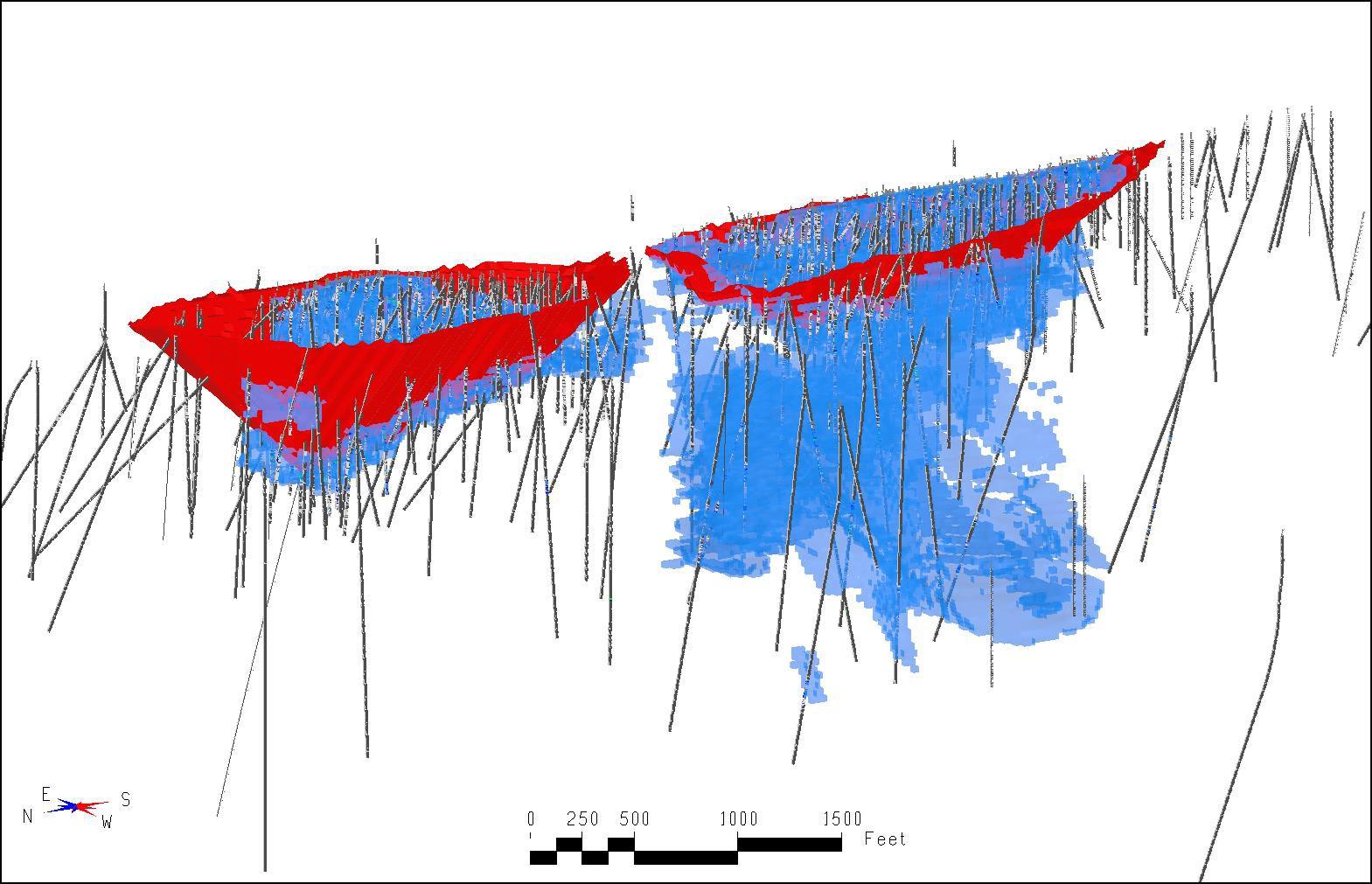

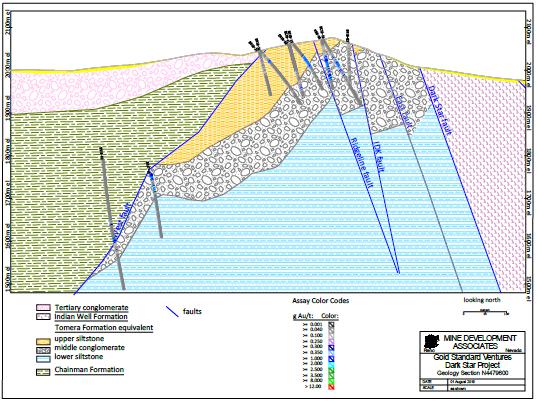

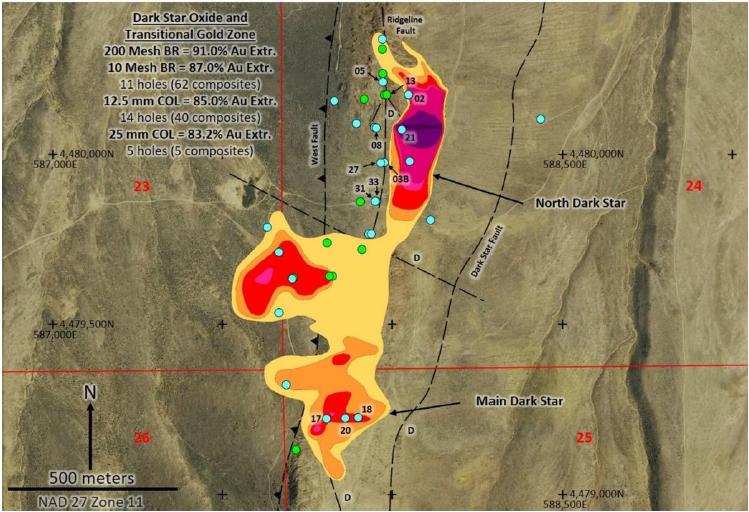

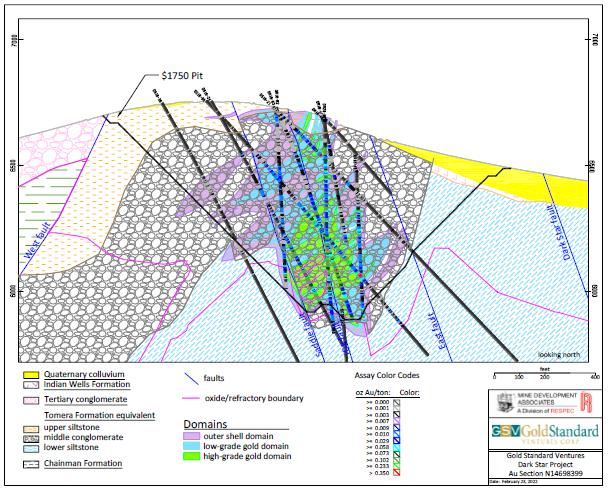

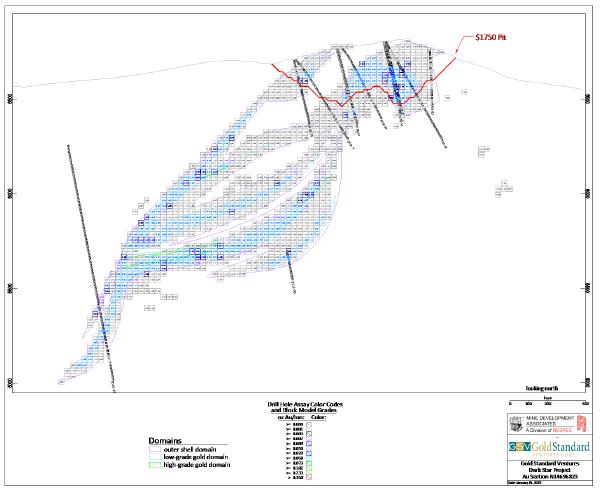

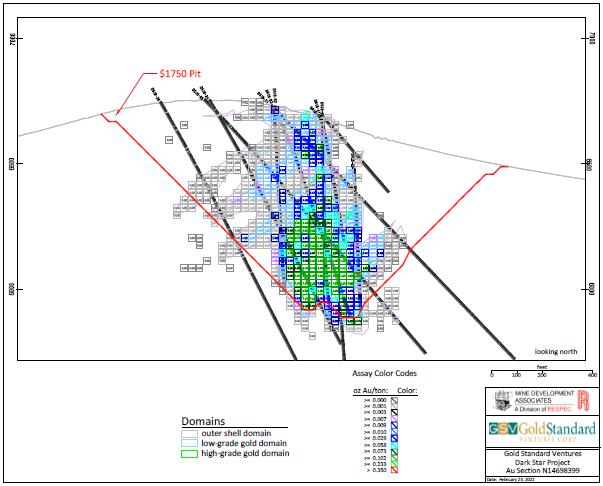

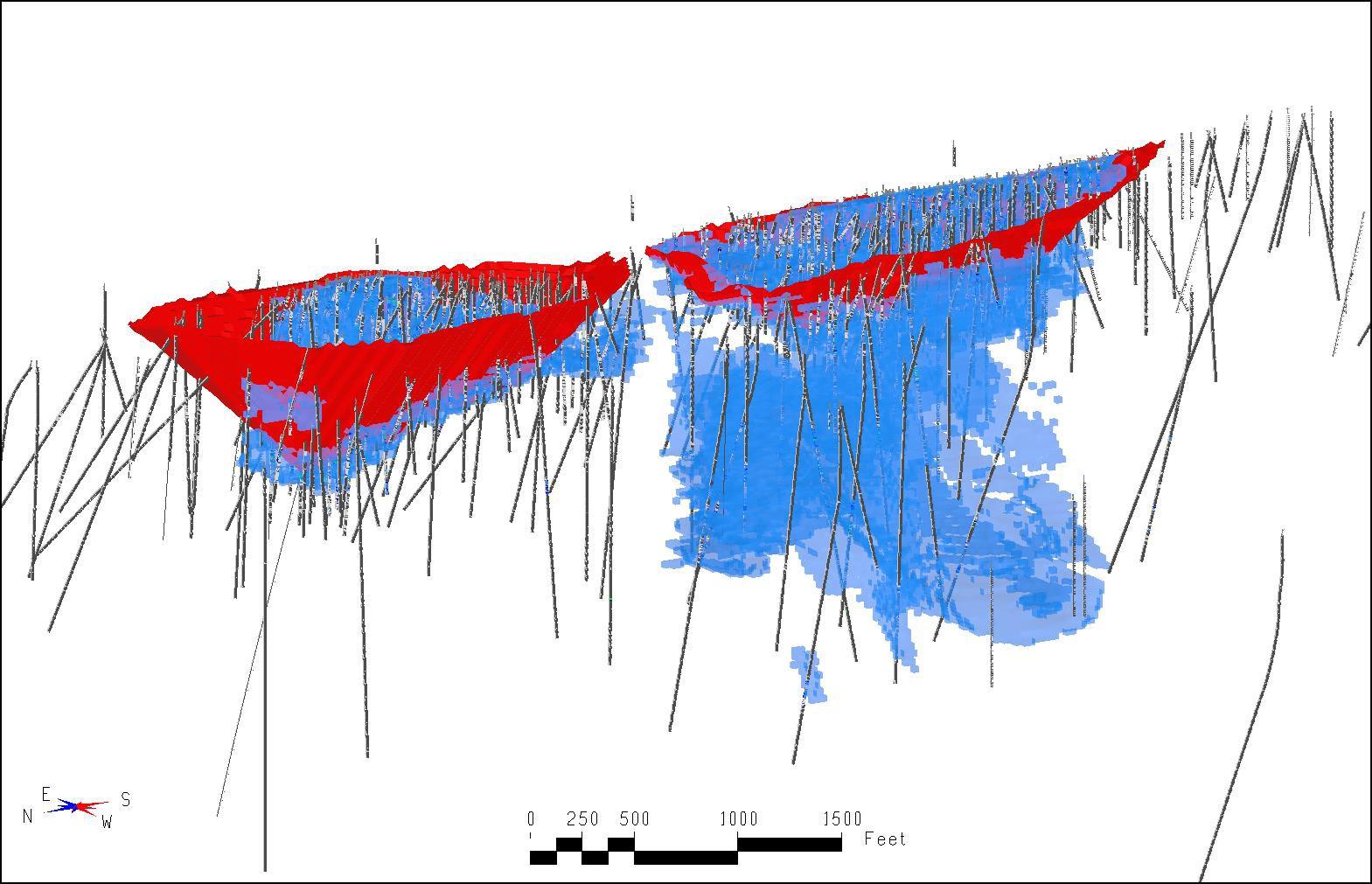

In the South Railroad portion of the property, the Dark Star Main (“Dark Star Main”) and Dark Star North (“Dark Star North”) zones, which comprise the Dark Star deposit are hosted primarily within Pennsylvanian-Permian rocks, with minor amounts of gold mineralization found in the Chainman Formation and Tertiary conglomerates. The deposits are centered along the roughly north-south Dark Star fault corridor, within which is a horst block and associated silicified zone bounded by the West fault and Dark Star fault. Gold mineralization in the horst block is hosted in the middle, coarse-grained conglomeratic and bioclastic limestone-bearing unit of a Pennsylvanian-Permian undifferentiated sequence interpreted to be equivalent to the Tomera Formation. Mineralization dips steeply to the west near the surface at Dark Star Main and Dark Star North, but dips less steeply at depth at Dark Star Main.

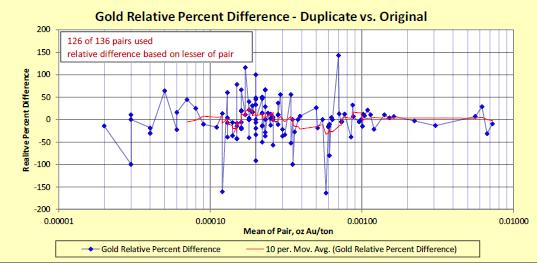

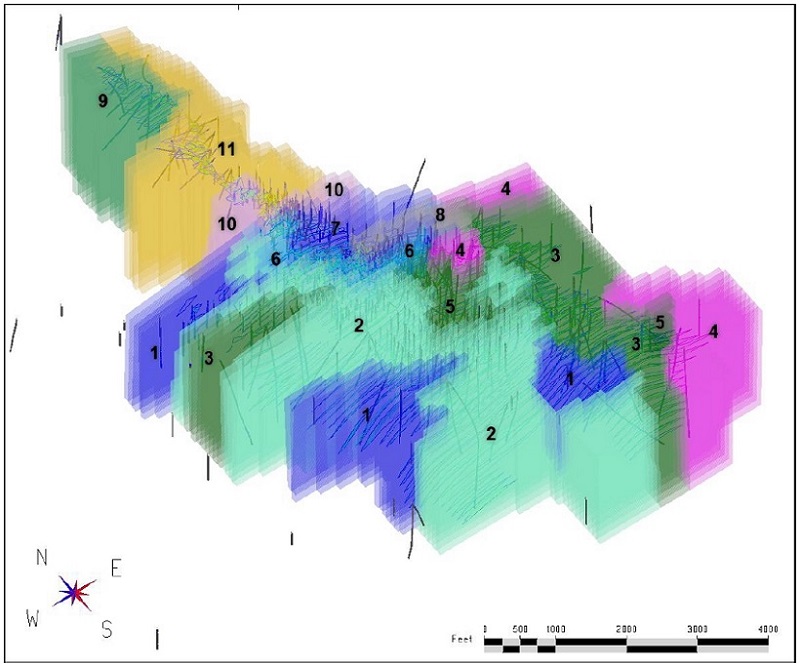

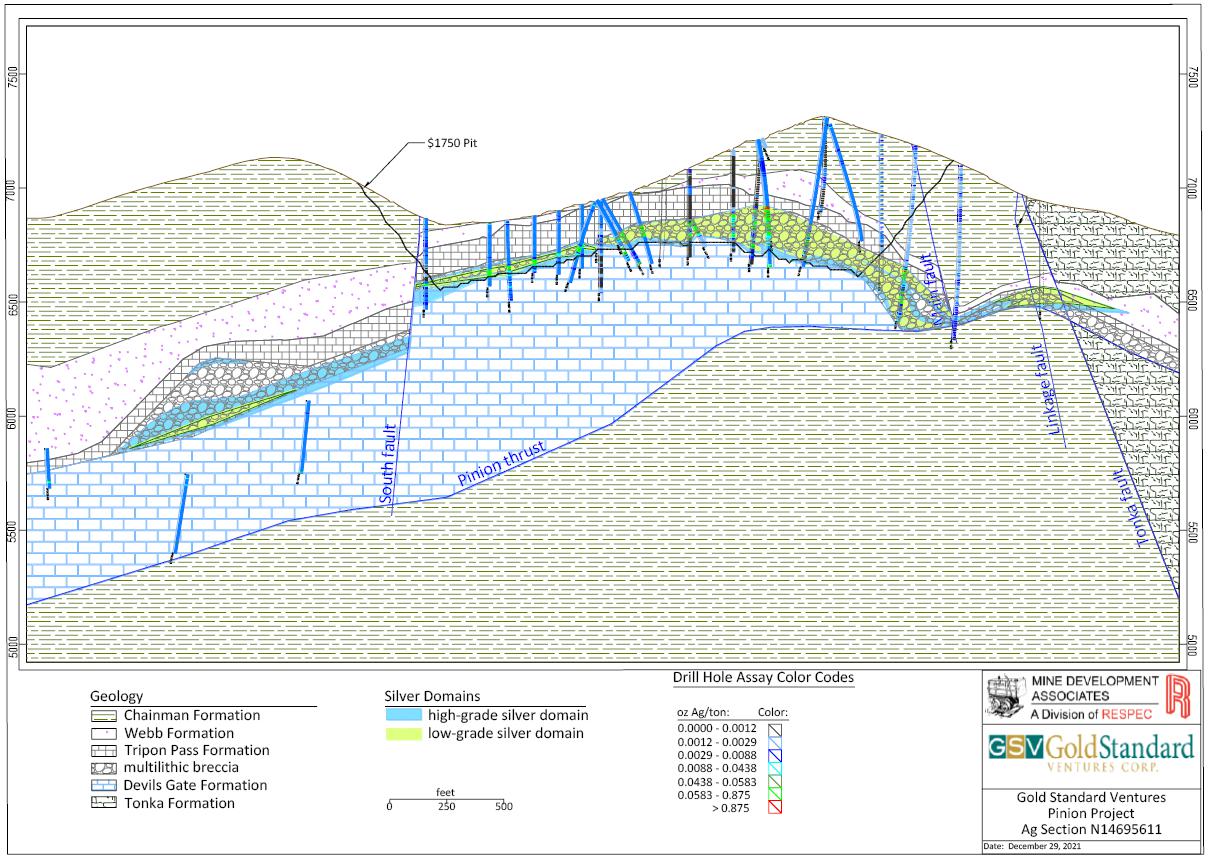

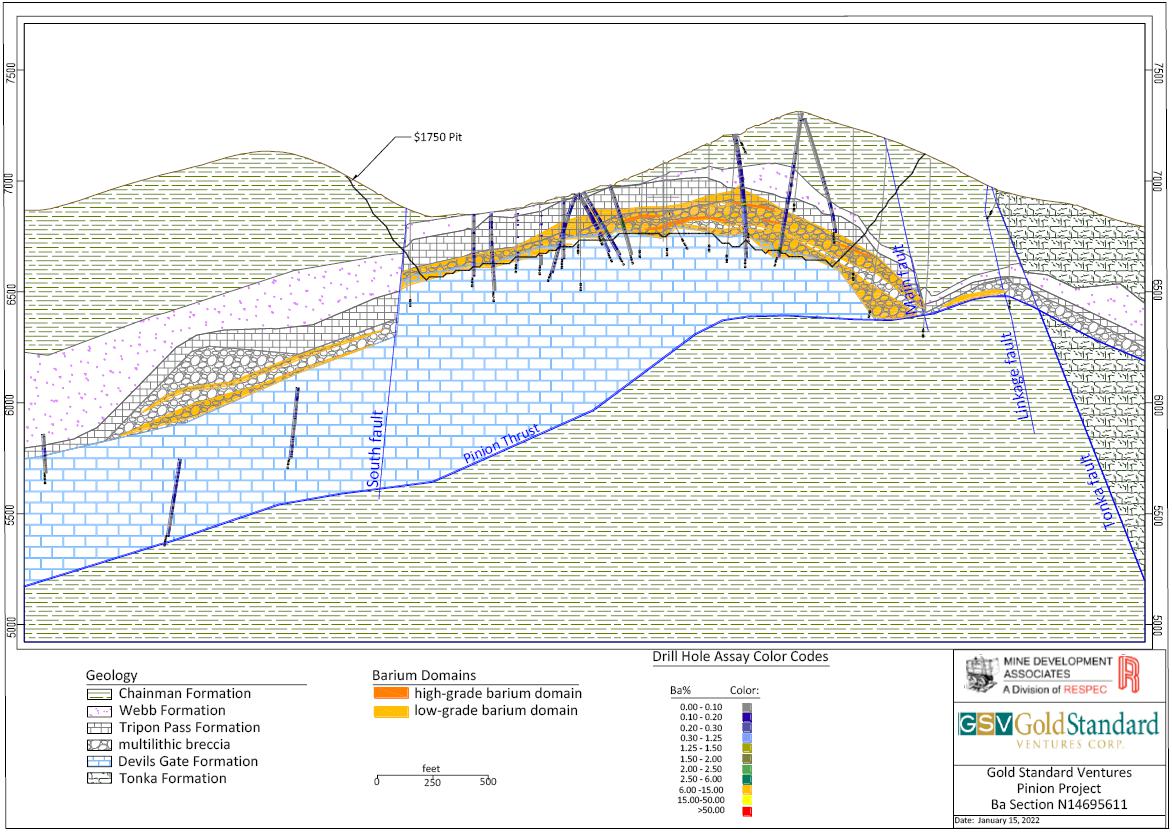

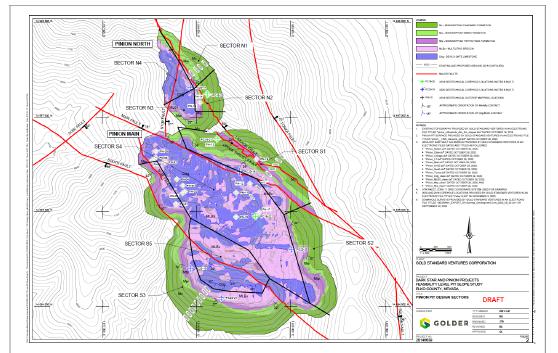

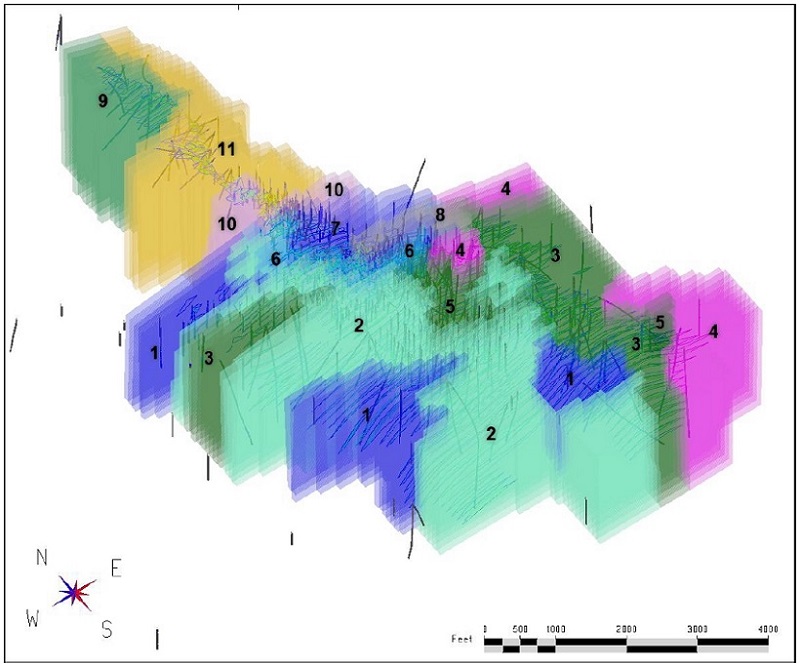

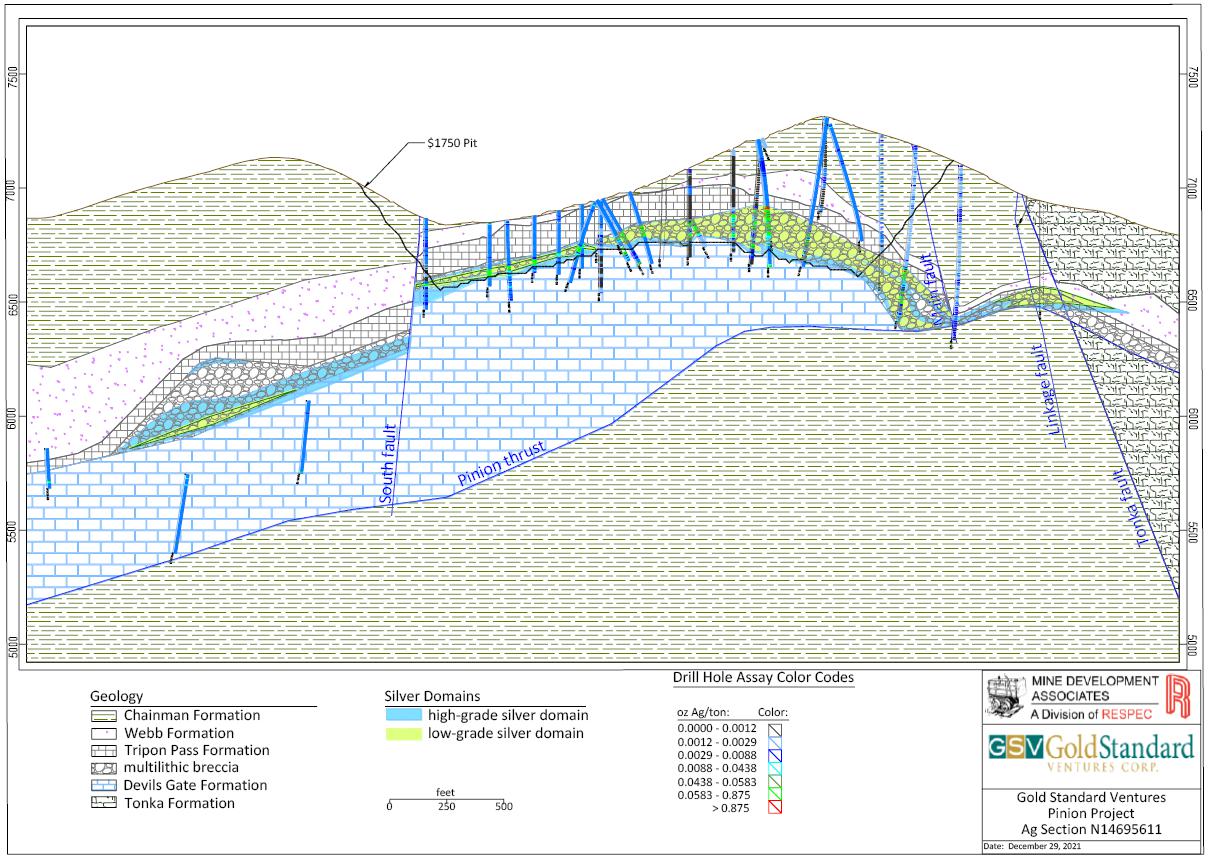

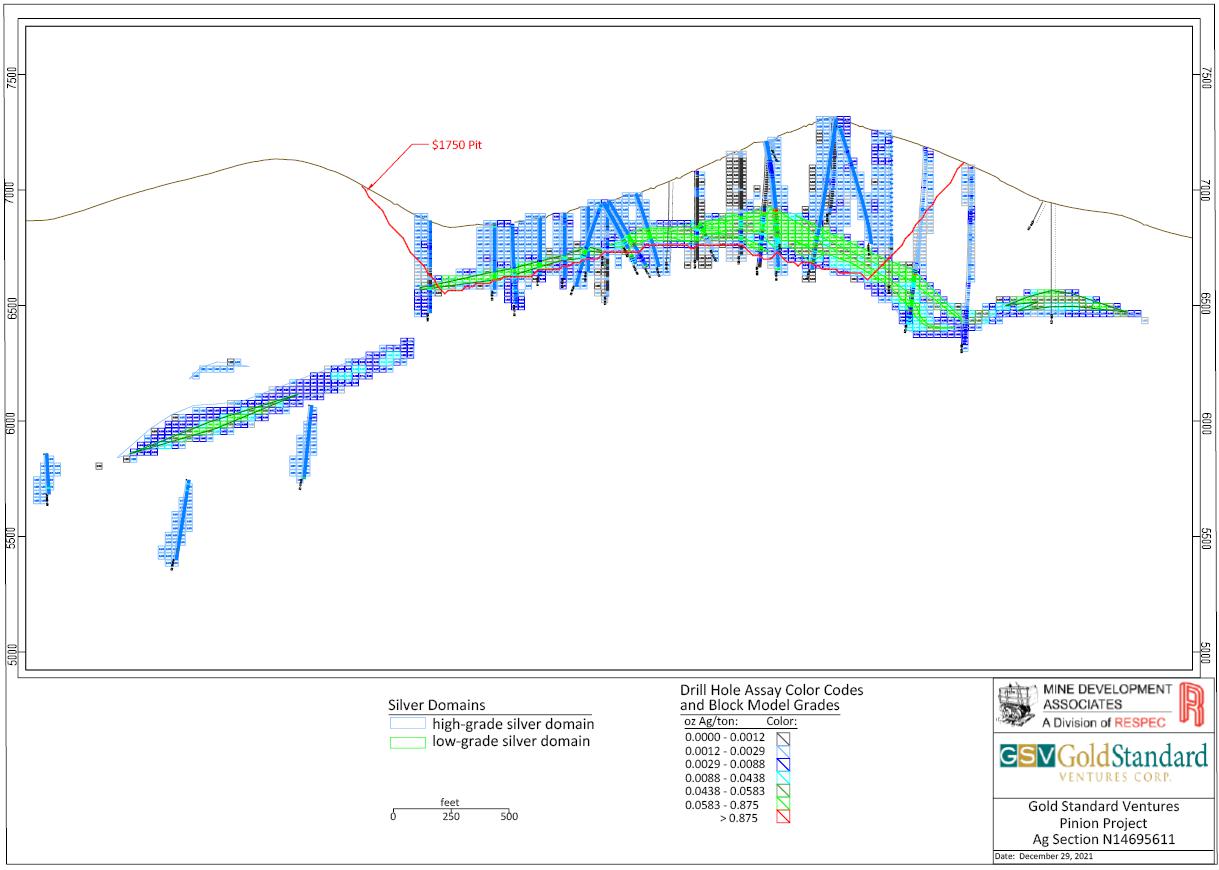

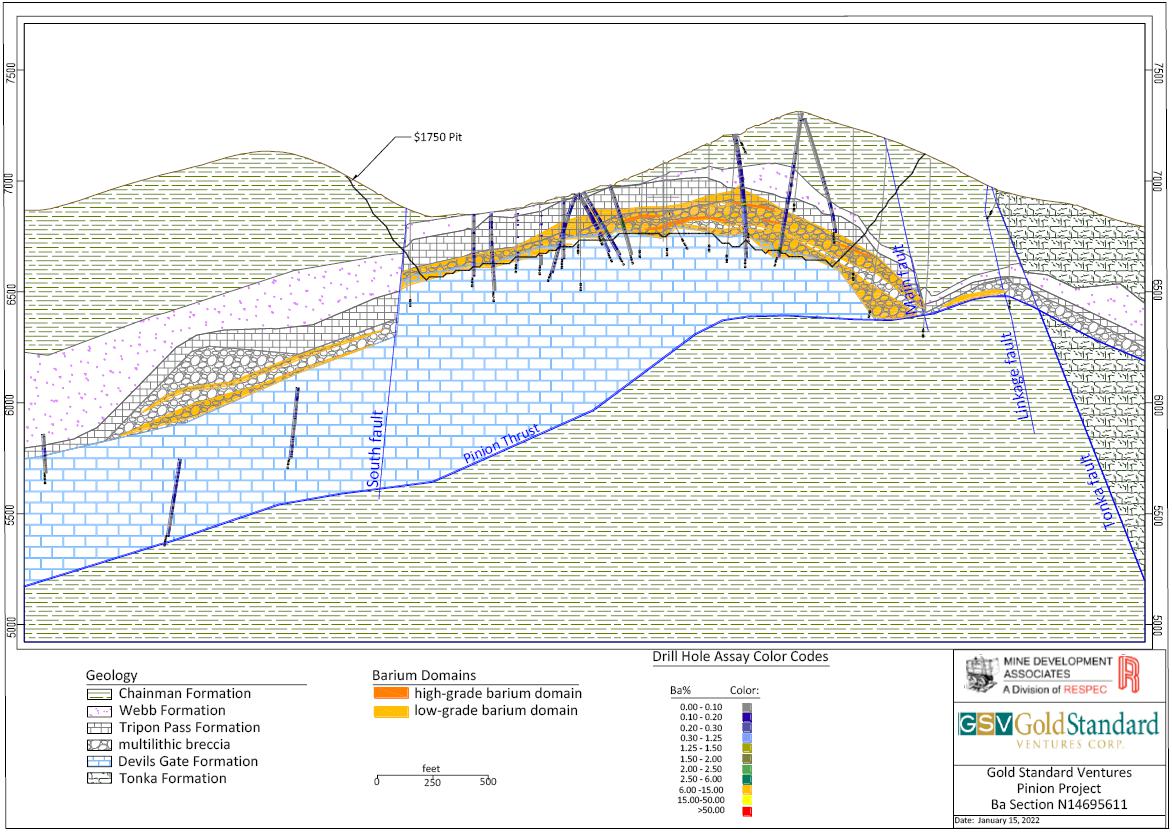

Also, in the South Railroad portion of the property, the Pinion deposit is situated in a sequence of Paleozoic sedimentary rocks exposed within large horst blocks in which the sedimentary rocks have been broadly folded into a south- to southeastward-plunging, asymmetric anticline. The axis of this Pinion anticline trends approximately N50ºW to N60ºW and can be traced for approximately 2.0 mi (3.2 km). The limbs of the anticline dip shallowly at 10° to 25° to the west, and more steeply at 35° to 50° to the east. Disseminated gold and silver mineralization at the Pinion deposit is strongly controlled by a 10 ft to 400 ft-thick (3 m to 120 m-thick) dissolution-collapse breccia at the contact between calcarenite of the Devils Gate Limestone and the overlying silty micrite of the Tripon Pass Formation. Gold deposition was contemporaneous with breccia development, quartz veins formation, silica ± barite replacement and infill of open spaces.

| M3-PN185074

14 March 2022

Revision 1 | 1-3 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

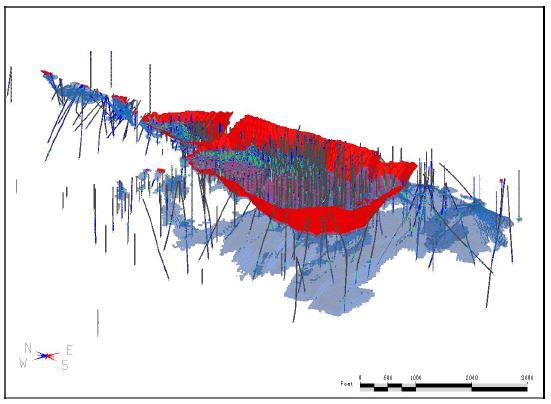

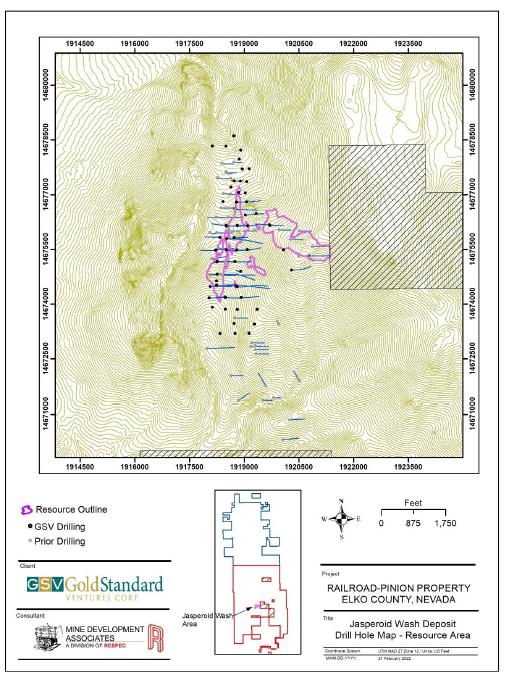

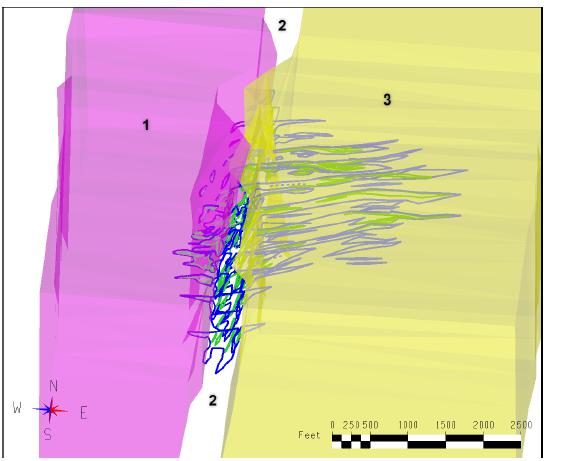

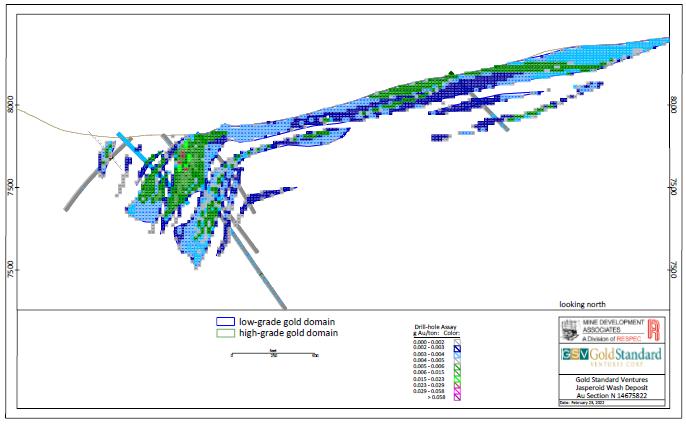

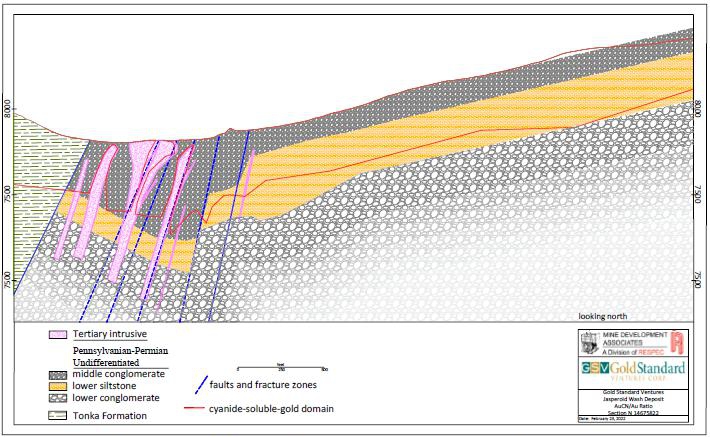

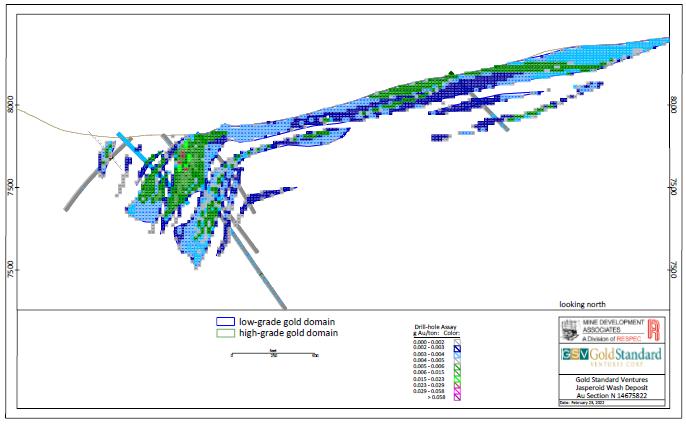

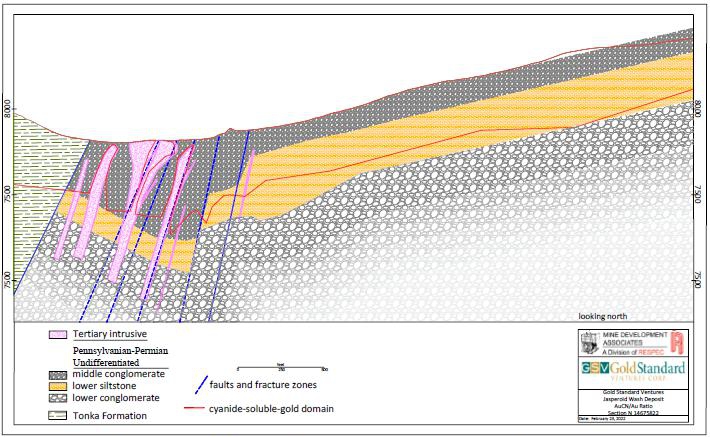

The Jasperoid Wash disseminated gold deposit, also located in the South Railroad portion of the property, is hosted by altered Tertiary feldspar porphyry dikes and their host Pennsylvanian-Permian conglomeratic rocks of a Tomera Formation equivalent. The deposit has approximate extents of 4,600 ft (1,400 m) to the north and a width of about 3,600 ft (1,100 m), and is partially contained within an elongate, north to south, steeply dipping structural corridor. Drilling shows the deposit dips steeply to the west nearby and within Tertiary dikes; east of the dikes, the deposit dips gently to the west. The gold is Inferred to be submicroscopic in grain size, however, petrographic studies have yet to be performed.

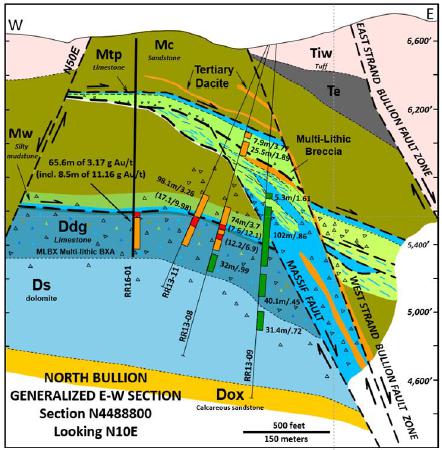

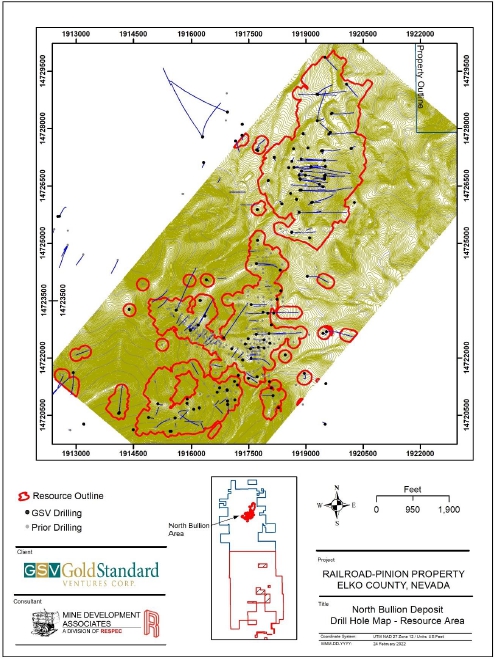

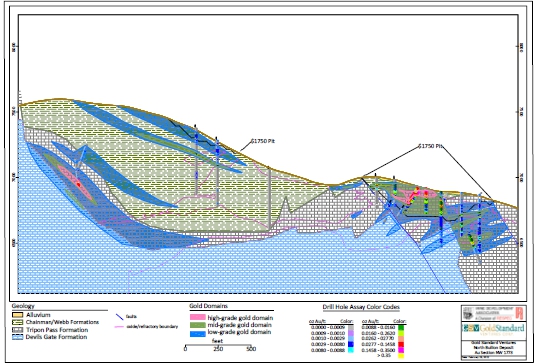

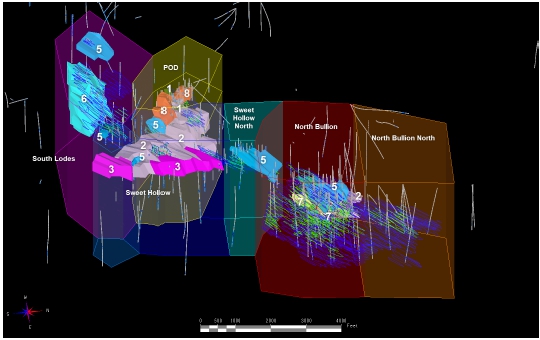

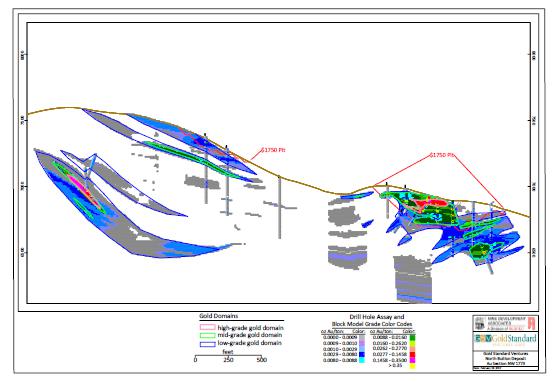

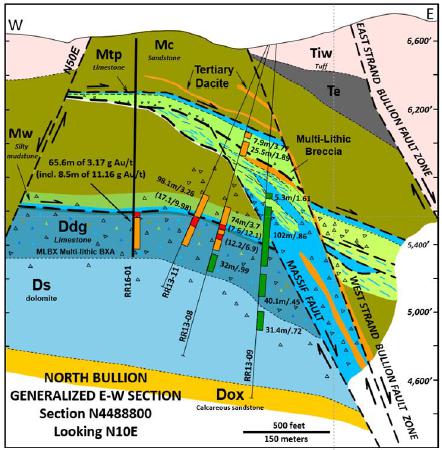

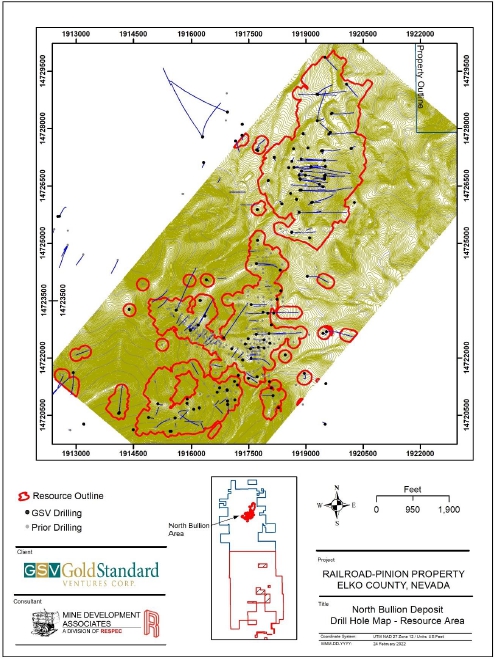

In the North Railroad portion of the property, disseminated gold mineralization has been defined by drilling in the North Bullion, POD, and Sweet Hollow zones. The mineralization is focused in the footwall of the Bullion fault zone. Faults appear to be important controls on mineralization. In general, gold-silver mineralization is localized in gently to moderately dipping, strongly sheared rocks of the Webb and Tripon Pass formations, in dissolution-collapse breccia developed above and within silty micrite of the Tripon Pass Formation, and calcarenite of the Devils Gate Limestone. The top of gold mineralization varies from 350 ft to 1,300 ft (105 m to 400 m) below the surface and varies in dip from 10° to 45° to the east. Gold is associated with “sooty” sulfide minerals, silica, carbon, clay, barite, realgar, and orpiment.

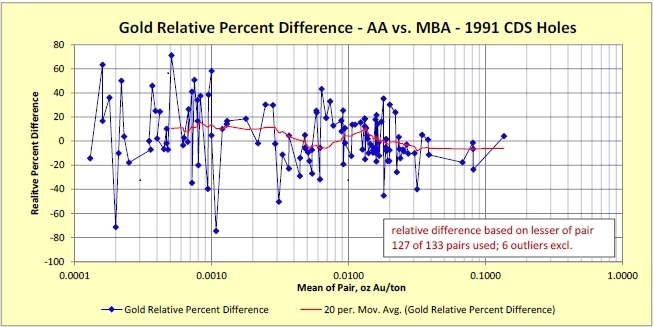

Mr. Lindholm is satisfied that the Pinion, Dark Star, Jasperoid Wash and North Bullion drilling databases are in good condition. Various audits and checks were performed by Mine Development Associates Inc., a division of RESPEC, LLC (“MDA”) to verify collar coordinates, down-hole deviation surveys, geology and assay data in the drill-hole database. All Gold Standard gold assay data was verified using digital laboratory certificates. However, about one third of the Pinion assays and one quarter of the Dark Star assays from historical drill campaigns were unsupported with original assay certificates. The same is true at North Bullion, where Gold Standard drilling makes up only 28% of the database, almost all of which is in the North Bullion deposit. The drill-hole data at the POD, Sweet Hollow and South Lodes deposits is almost entirely historical. Drill-hole data lacking adequate supporting documentation, as well as data from holes observed during sectional modeling to be inconsistent with surrounding holes, were treated as lower confidence, or excluded from use in modeling and estimation.

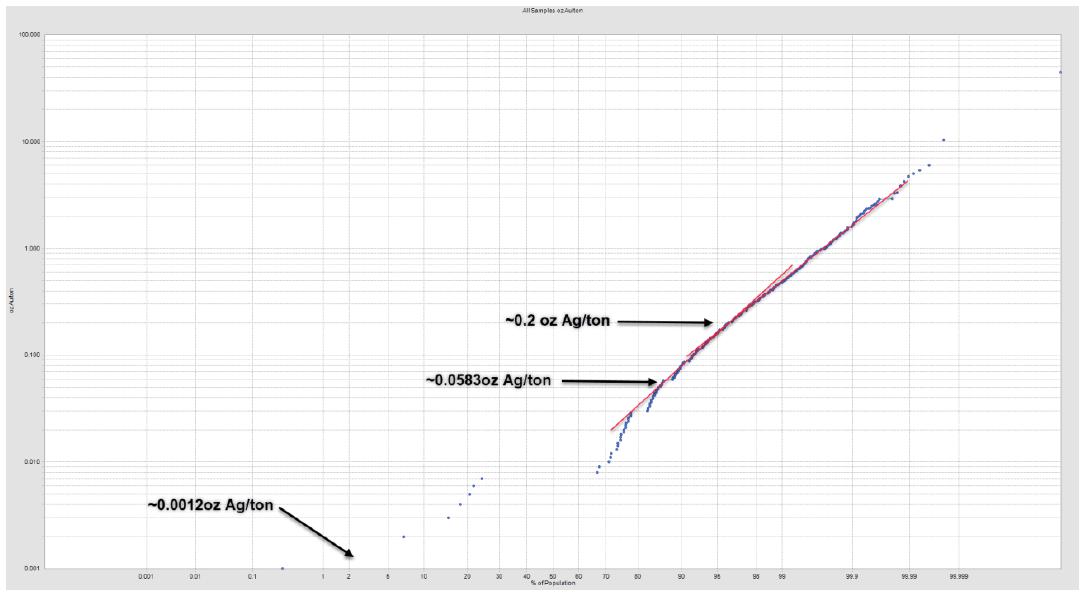

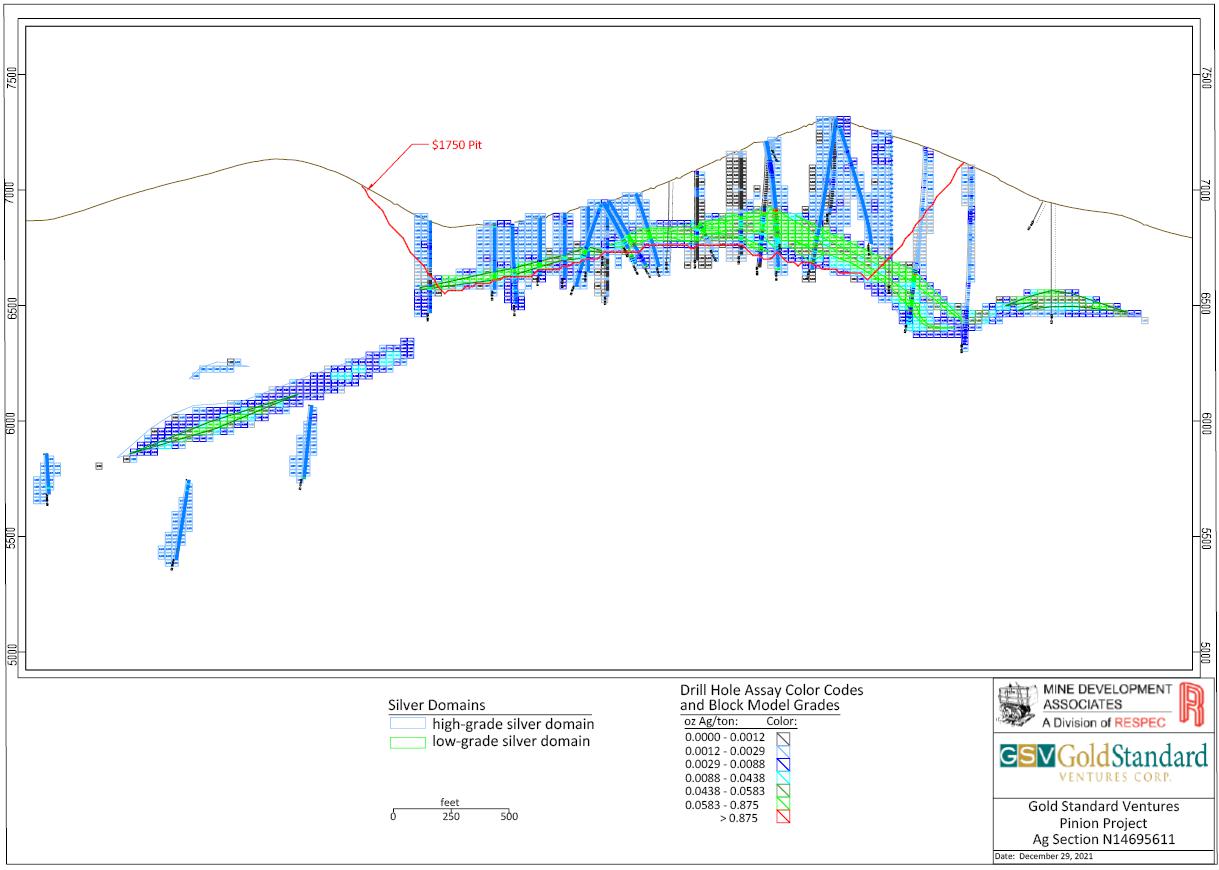

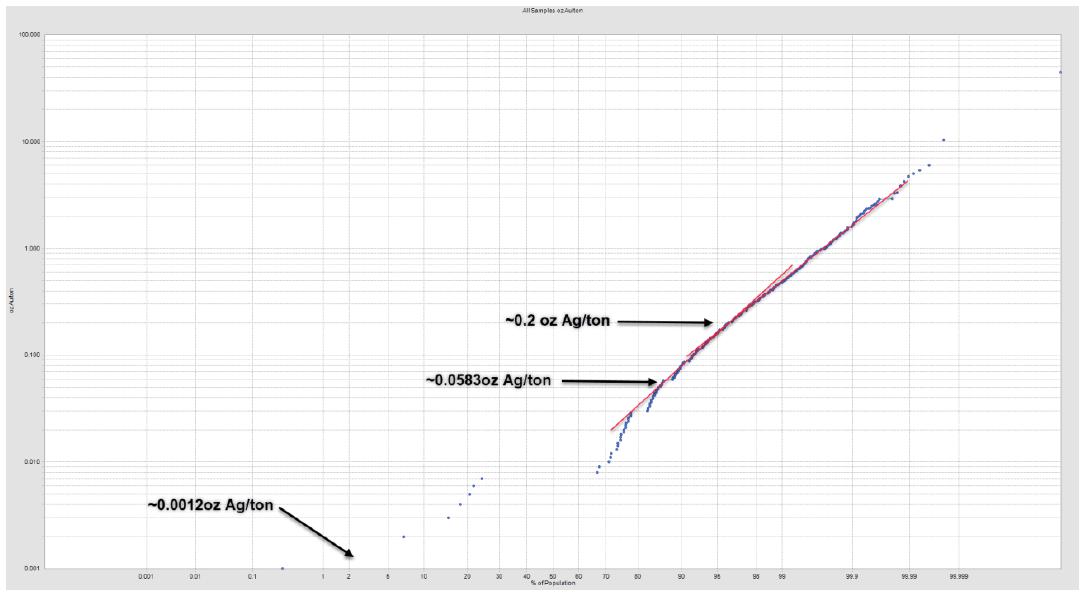

In 2019, Gold Standard supplemented their Pinion silver database with re-assayed individual samples for which composites of multiple intervals had previously been analyzed. Over 50% of the original certificates were available for all silver data and were used for verification. Quality assurance/quality control (“QA/QC”) data was also evaluated, and the silver data was deemed acceptable for use in estimation of classified mineral resources.

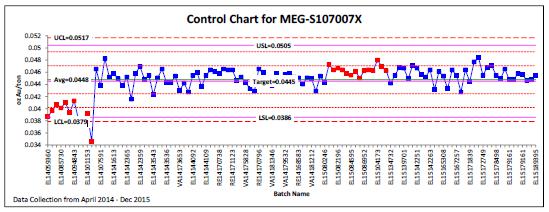

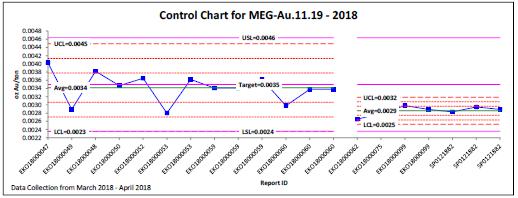

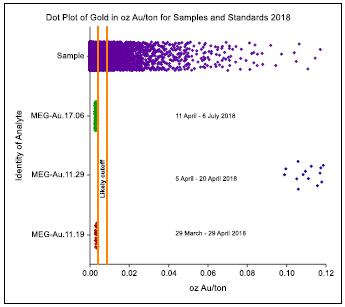

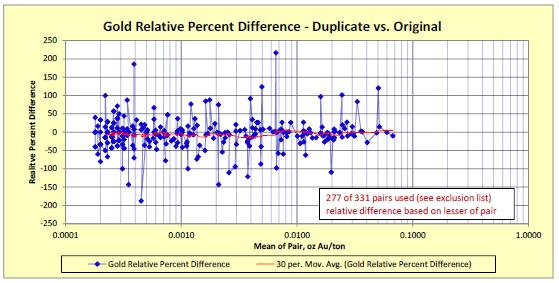

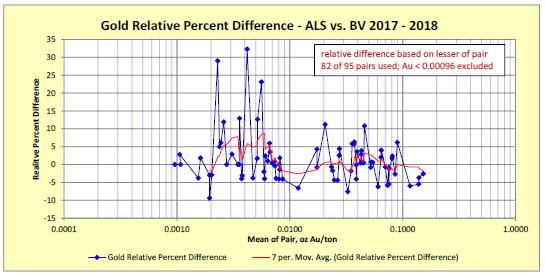

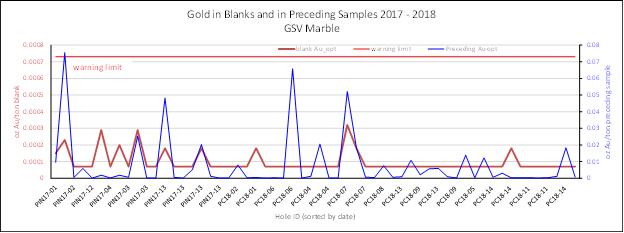

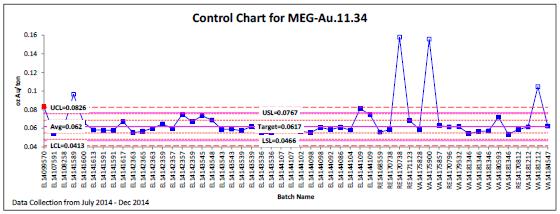

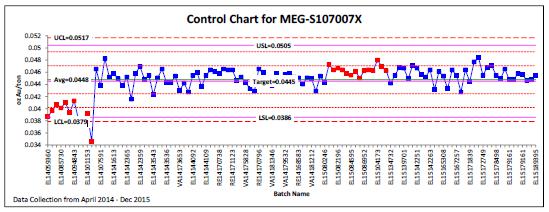

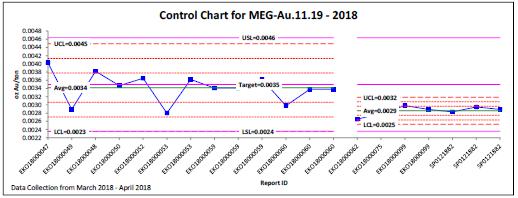

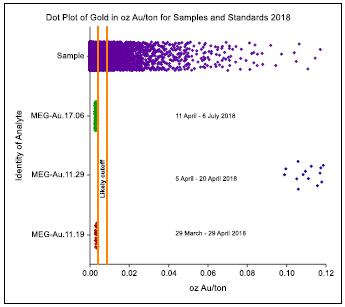

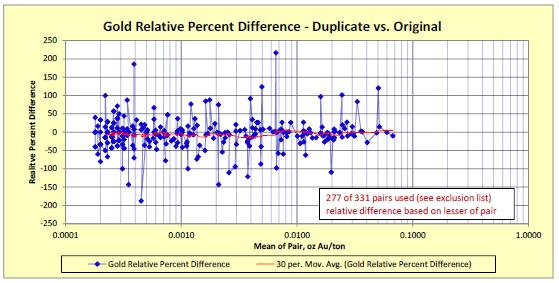

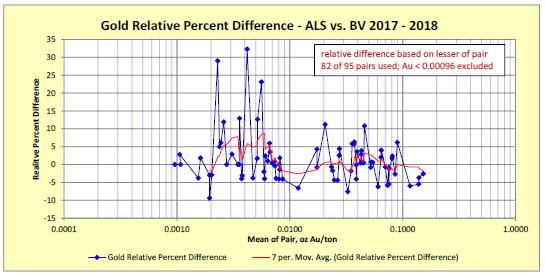

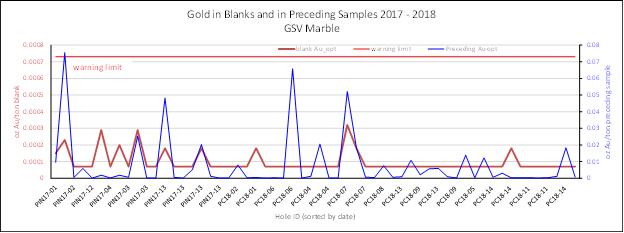

There is no evidence of significant historical QA/QC programs for drilling prior to 2014. For Gold Standard programs at Dark Star, Pinion and Jasperoid Wash, the QA/QC program was minimal in 2014 through 2016 but was more comprehensive in 2017 to 2020. Similarly at North Bullion, over the full-time span of the Gold Standard drilling from 2010 to 2012 there is a reasonable implementation of QA/QC protocols, but during some periods of time it is less substantial. The results and amount of QA/QC data, as well as non-remedied QA/QC “failures,” were considered in mineral resource classification for the Dark Star, Pinion, Jasperoid Wash and North Bullion deposits. Mr. Lindholm concludes that the Dark Star, Pinion, and Jasperoid Wash analytical data are adequate for the purposes used in this Technical Report, subject to issues described in Section 12.

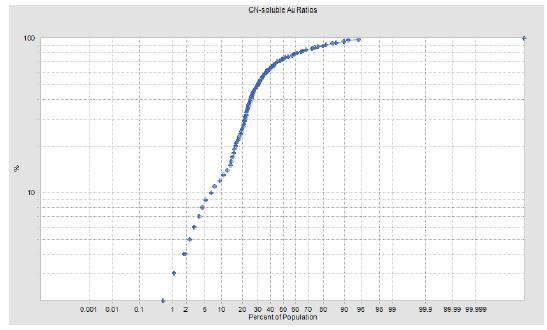

Cyanide-soluble gold assays at Dark Star and Pinion were verified, but no QA/QC data was available for evaluation. Carbon and sulfur species data were audited and determined to be adequate for use in their respective estimates done for waste handling and metallurgical characterization. No QA/QC data was associated with the carbon and sulfur analyses.

| M3-PN185074

14 March 2022

Revision 1 | 1-4 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

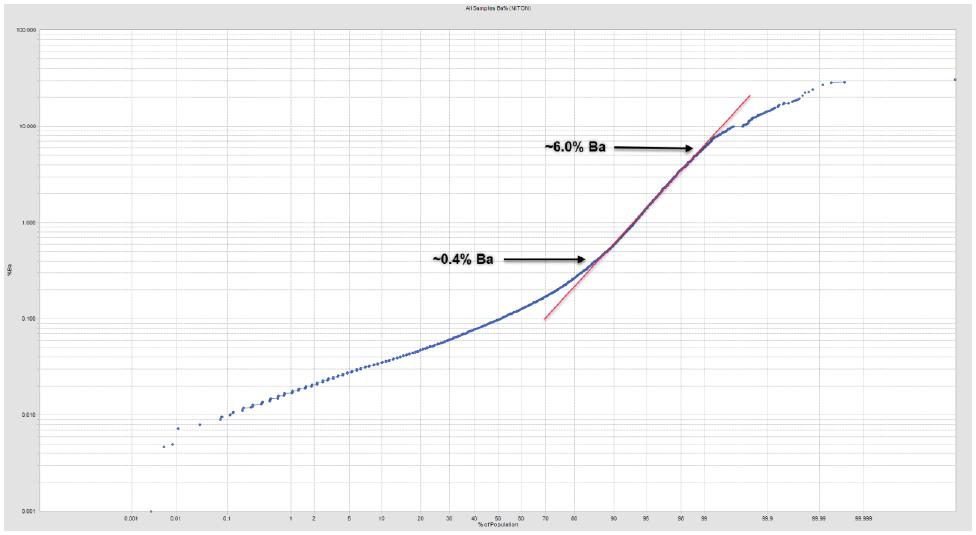

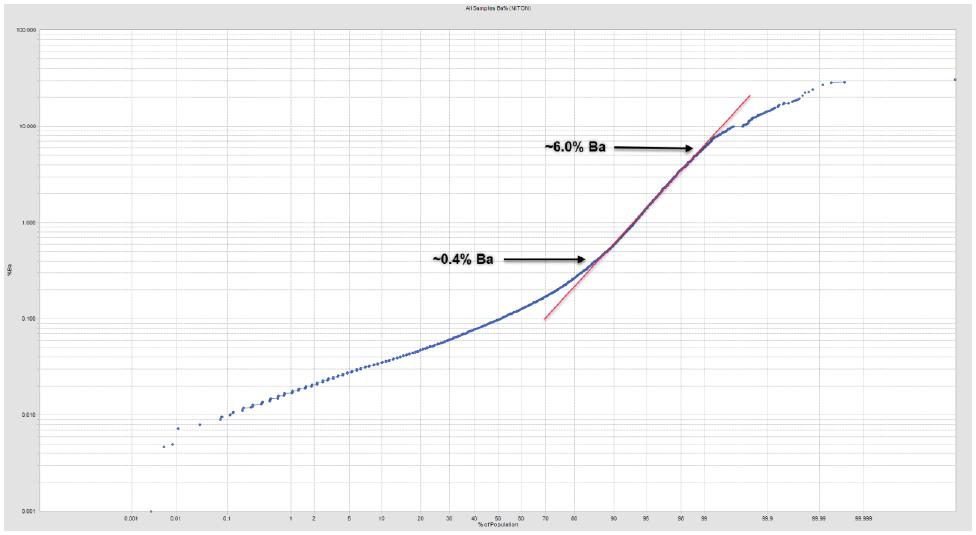

Barium was estimated in the Pinion deposit block model for metallurgical characterization. Barium analyses were done using pressed-powder energy-dispersive x-ray fluorescence (“XRF-ED”) and loose-powder NITON XRF analytical methods. These methods were evaluated by running additional analyses on duplicate pulp samples by various methods. After evaluating the reliability and relationship of barium assays produced by the two methods, and verification of the data, the data was used to model and estimate NITON XRF-derived barium grades.

| 1.6 | Processing and Metallurgical Testing |

The current study of the South Railroad portion of the Railroad-Pinion project focuses on two main sources of ore, for which mineral reserves are declared: The Pinion and Dark Star deposits. These deposits have different geo- metallurgical characteristics, which are briefly summarized as follows:

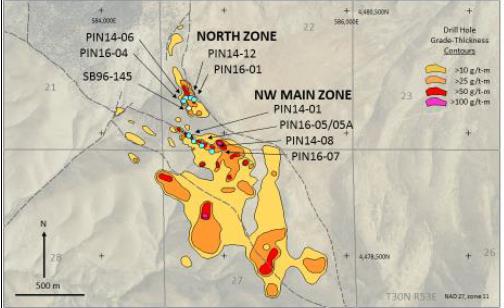

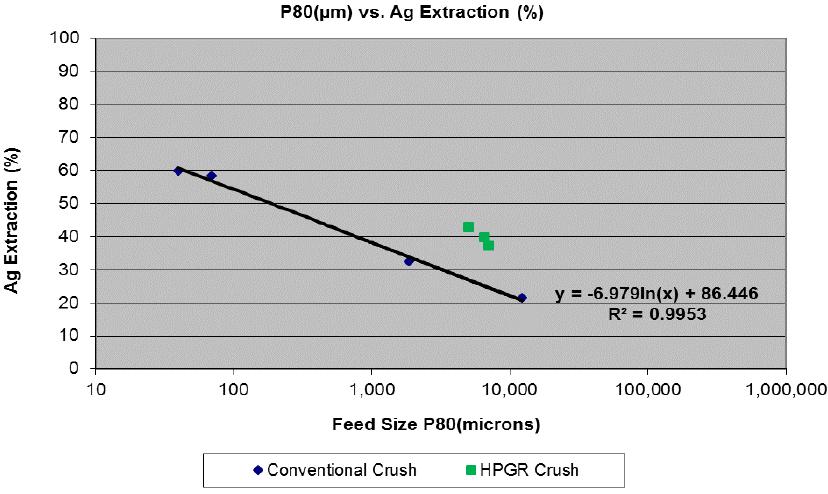

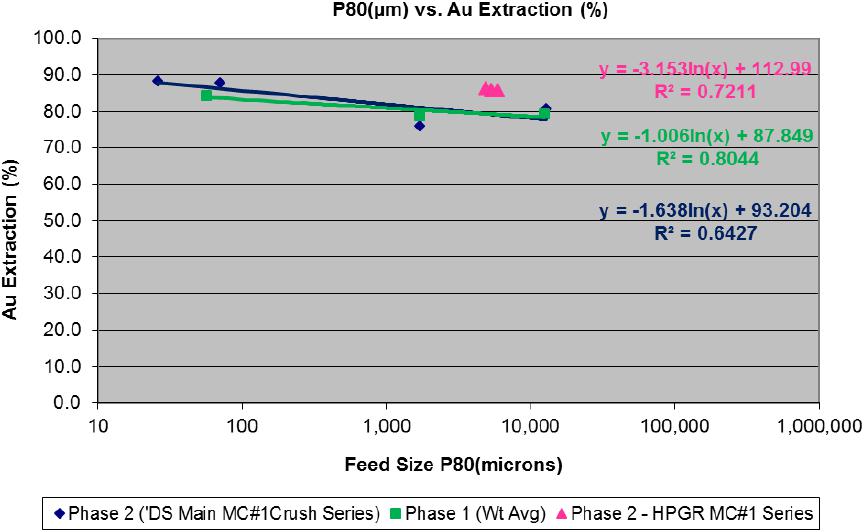

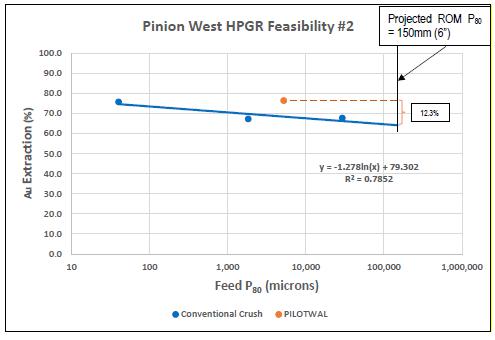

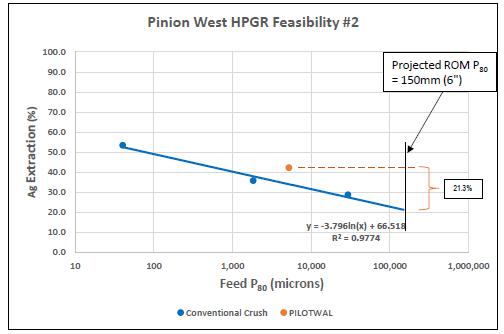

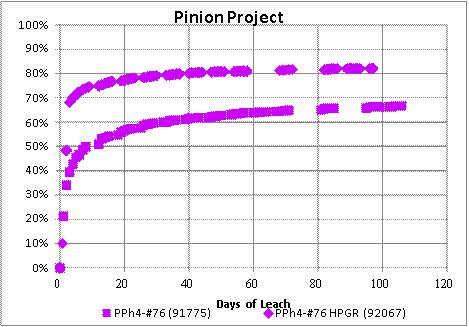

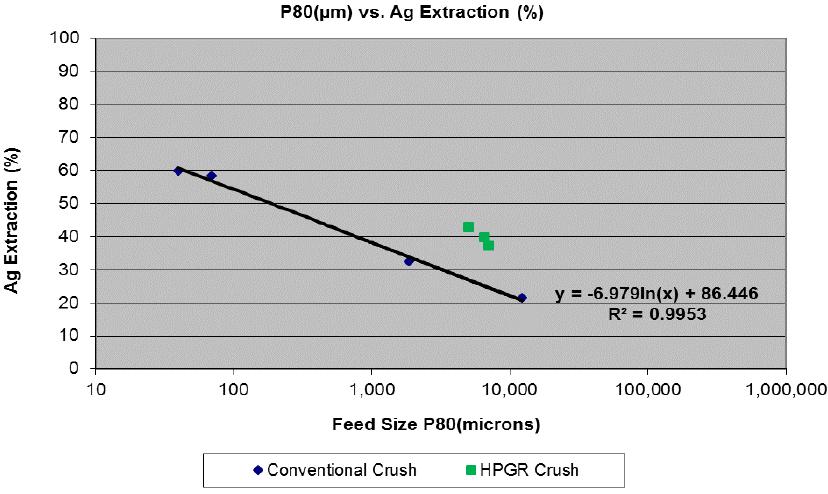

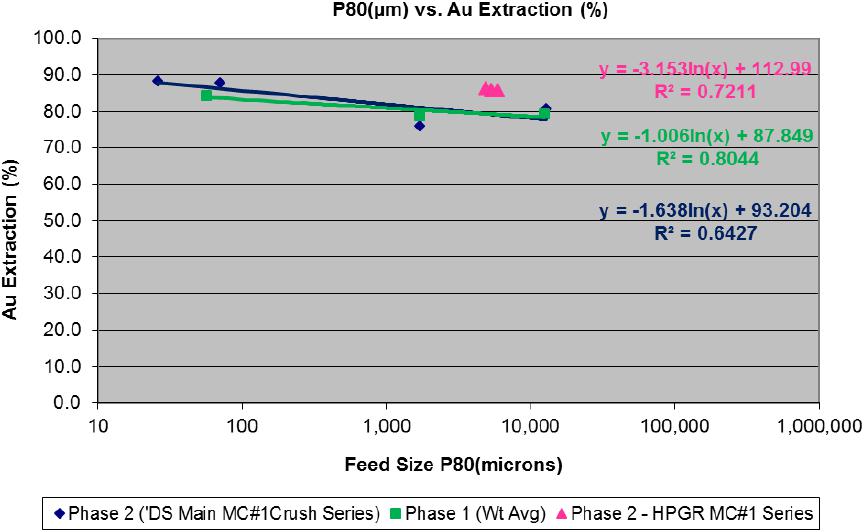

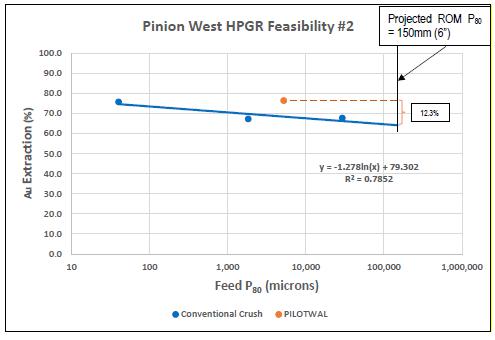

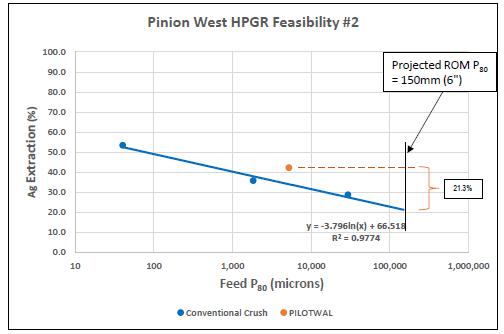

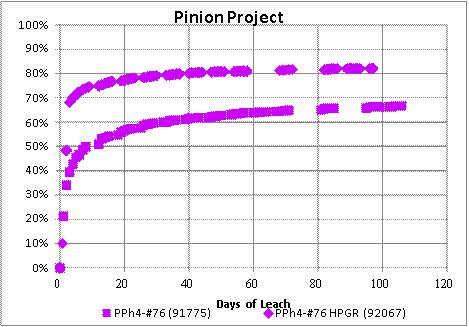

The Pinion deposit can be characterized as hard and abrasive material, with a steep feed P80 vs. gold recovery response. Much of the gold is contained in the rock ground mass and requires fine crushing (-1/4” inch) to liberate gold for the most efficient cyanide-leach extraction. Gold recovery has proven to be sensitive to high barite/silica content in the mulilithic breccia (mlbx) ore type. Gold recovery from the high-barite/silica materials benefits the most from fine crushing. This deposit can be heap leached without crushing, at low gold recovery, conventionally crushed and leached at modestly higher gold recovery, or HPGR-crushed at higher gold recovery.

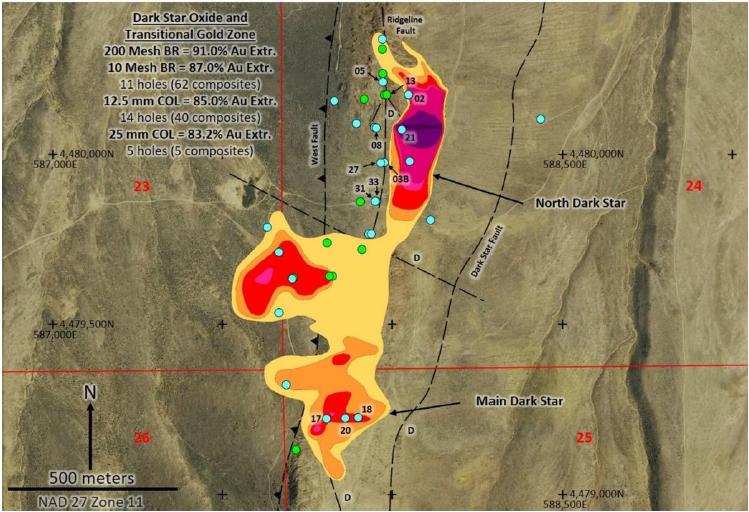

The Dark Star deposit can be characterized as hard and moderately abrasive material, with a flat feed P80 vs. gold recovery response. Most of the gold is contained in fractures that have been oxidized and accessible to cyanide solutions that easily pass through the rock matrix. Consequently, high gold extractions are achieved at coarse particle size, requiring no crushing prior to heap leaching.

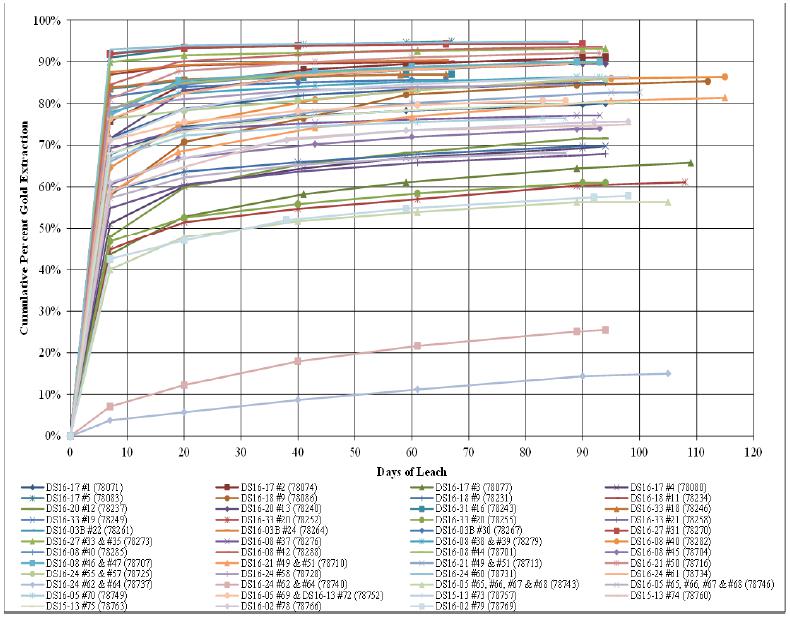

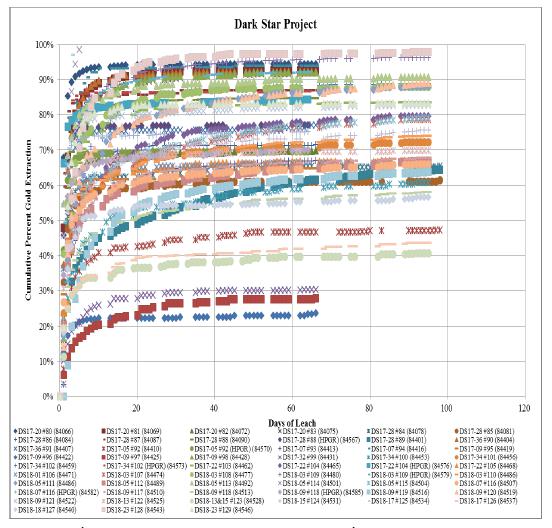

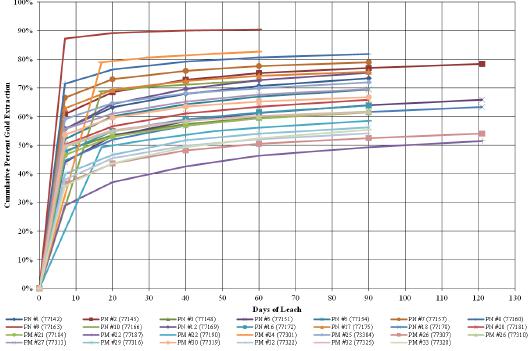

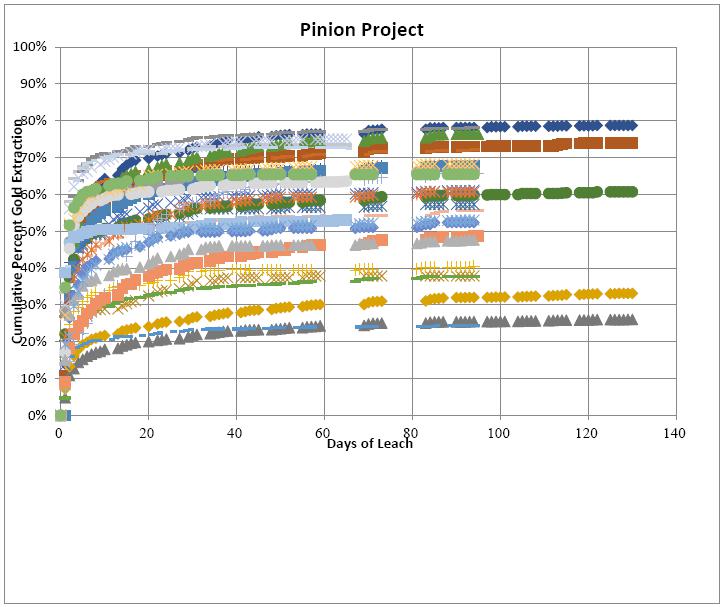

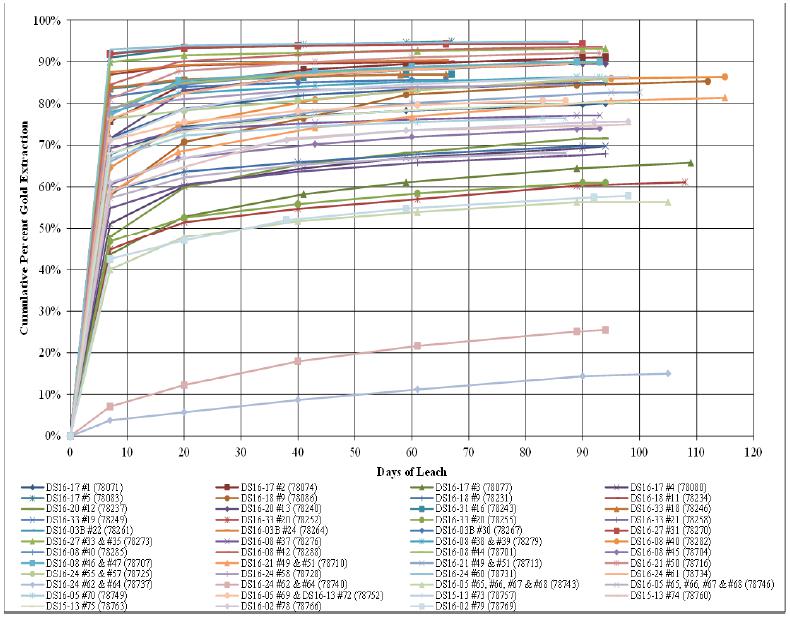

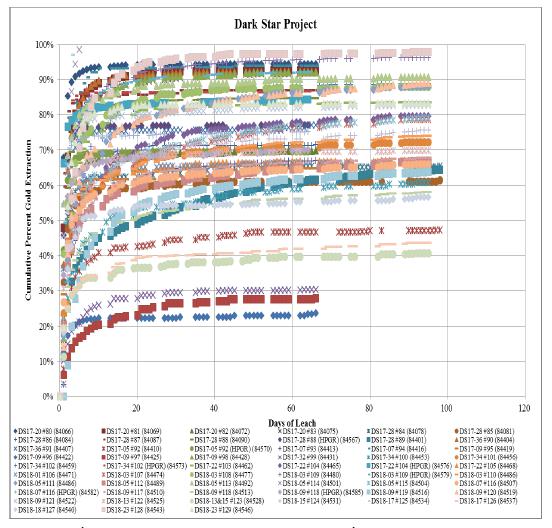

A large number of variability and master composites (mostly from PQ core) were selected by Gold Standard Ventures for feasibility level testing on the Dark Star and Pinion Deposits. Standard metallurgical testing protocols consisted of bottle roll leach testing at 80 percent passing (P80) size targets of 75 microns (200 mesh) and 1,700 microns (10 mesh), and column leaching testing at various P80 sizes ranging from 0.375 inch to 1.0 inch (9.5 mm to 25 mm). Additional composites were crushed using High Pressure Grinding Rolls (HPGR), at medium press force, and subjected to column leaching. The total number of metallurgical tests, by deposit, is presented in Table 1-2 below.

Table 1-2: Summary of Leach Tests Performed

| Test Procedure | Number of Tests |

| Dark Star | Pinion |

| Bottle Roll P80 Target = 75 microns (200 mesh) | 121 | 195 |

| Bottle Roll P80 Target = 1,700 microns (10 mesh) | 121 | 207 |

| Conv. Crush Columns P80 Target = 0.375-1.0 inch (9.5-25 mm) | 99 | 90 |

| HPGR Crush Columns P80 Target = 0.20-0.24 inch (5-6 mm) | 11 | 23 |

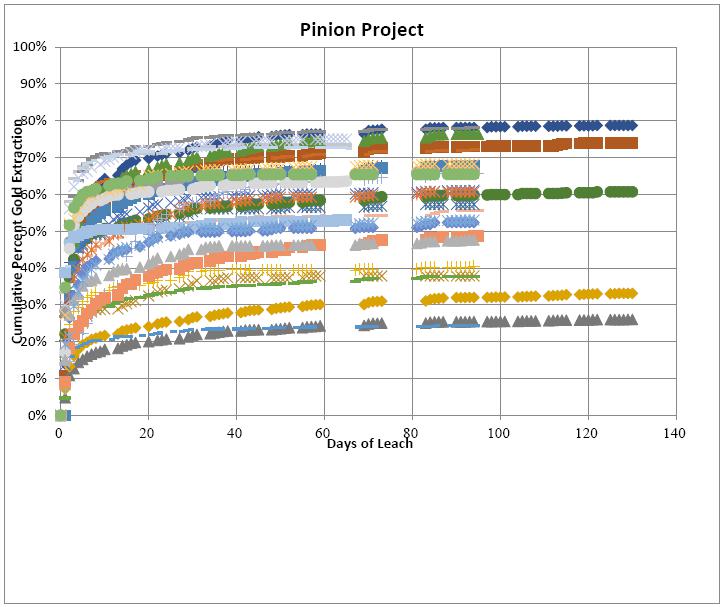

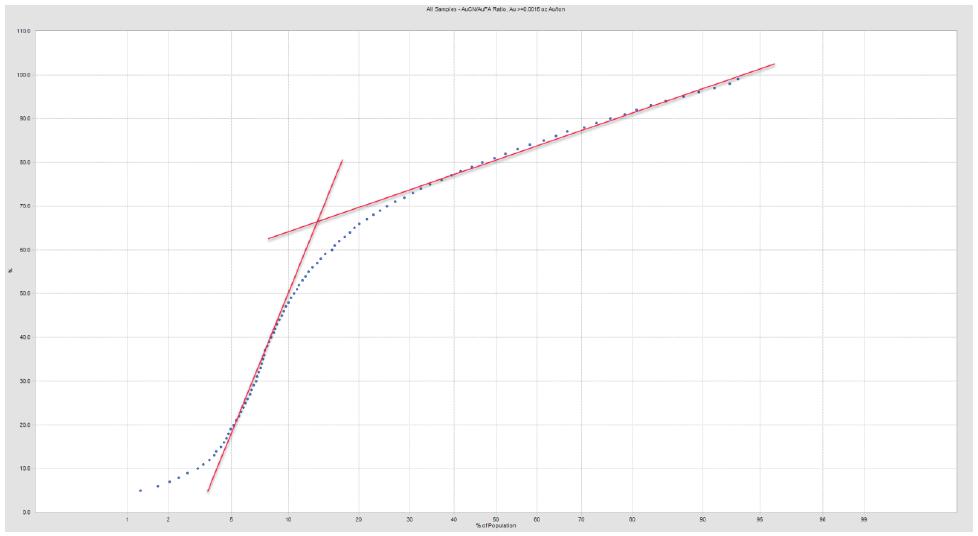

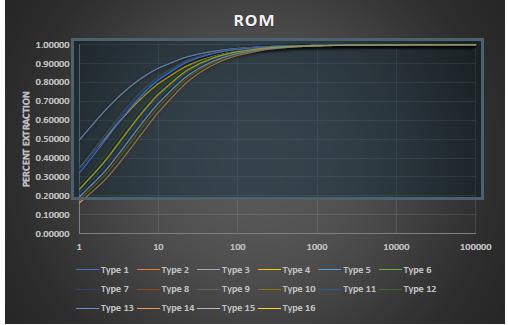

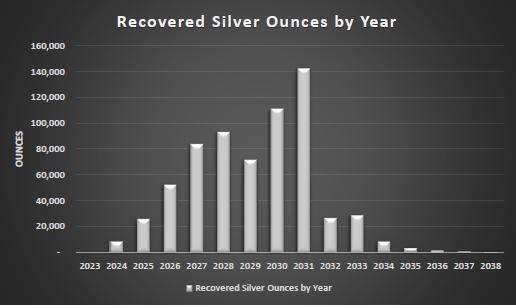

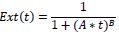

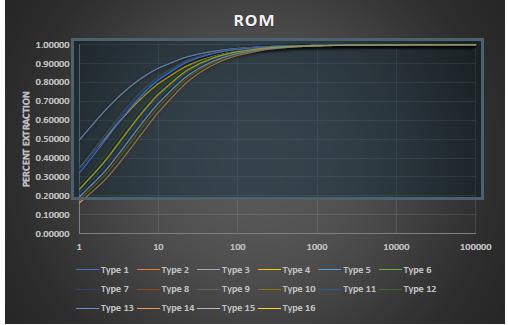

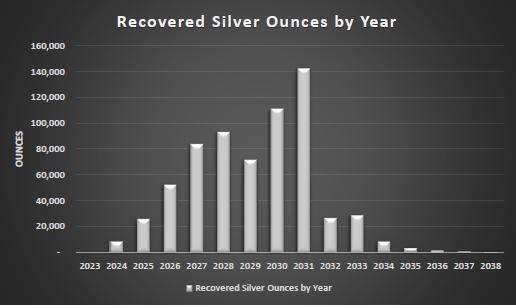

ROM heap leach head grade vs. gold recovery models were developed for Dark Star and Pinion and silver recovery models were developed for Pinion. Silver recovery was not modelled for Dark Star as silver grades are too low to be of economic significance.

Due to the multiple material types, and the dependence of gold recoveries on head grades and crush size, 71 gold and silver recovery vs head grade equations were developed, along with recovery vs solution-to-ore ratio equations. Of the recovery equations, 28 are for Pinion oxide and transition ROM ores and 16 are for Dark Star oxide and transition ROM ores. The recovery equations can be found in Section 13 of this Technical Report.

| M3-PN185074

14 March 2022

Revision 1 | 1-5 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

The gold and silver recovery equations for each ore type were delivered to the mine modelers for incorporation into the block calculations.

The overall life-of-mine ROM average gold recovery for the Dark Star deposit is estimated at 71.9 percent and the Pinion deposit is estimated at 56.3 percent.

The major reagent consumptions for heap leaching of Pinion and Dark Star ore have been taken from available metallurgical test results from column leach tests on crushed material. No test data exists at the ROM particle size, so the selected reagent consumptions have been estimated based on test results on the coarsest samples tests 1.5 inch (37 mm). Cyanide consumptions have been estimated at 0.44 lb/ton (0.22 kg/tonne) for Pinion and 0.46 lb/ton (0.23 kg/tonne) for Dark Star. Lime consumption is estimated at 2.0 lb/ton (1.0 kg/tonne) for both Pinion and Dark Star ores.

The process selected for recovery of gold and silver from the Pinion and Dark Star ore is a conventional ROM heap leach. Oxide and transition ore types will be mined by standard open pit mining methods from two separate pits. The ore will be truck-stacked on the heap as ROM ore directly, without crushing, in 30-foot lifts. Lime will be added directly to the haul trucks for pH control.

The stacking rate will be in accordance with the mine plan. The ROM ore placement is equivalent to a LOM average of 24,700 tons per day, with the peak in Year 5 of an average of 32,700 tons per day.

Gold and silver in the stacked ore will be leached with a dilute cyanide solution using a drip irrigation system at application rates in the range of 4,800-6,100 gallons per minute. The leached gold and silver will be recovered from solution using a carbon adsorption circuit. The gold and silver will be stripped from carbon using a desorption process, followed by electrowinning to produce a precipitate sludge. The precipitate sludge will be processed using a retort oven for drying and mercury recovery, and then refined in a melting furnace to produce gold and silver doré bars.

| 1.8 | Mineral Resource Estimate and Mineral Reserve Estimate |

| 1.8.1 | Mineral Resource Estimate |

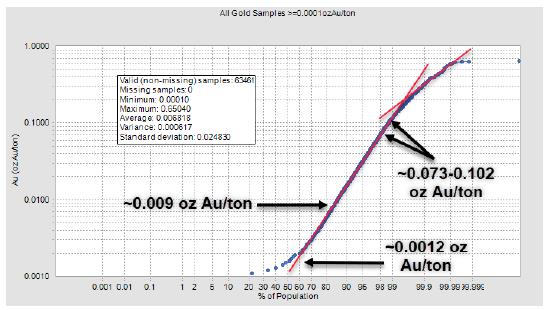

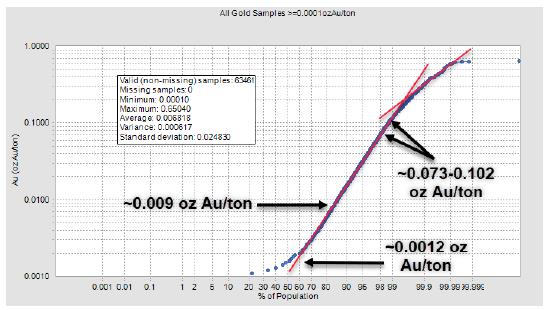

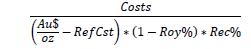

The estimated mineral resources presented in this Technical Report were classified in order of increasing geological and quantitative confidence into Inferred, Indicated, and Measured categories to be in accordance with the “CIM Definition Standards - For Mineral Resources and Mineral Reserves” (2014) and therefore Canadian National Instrument 43-101. Mineral resources are reported at cutoffs that are reasonable for deposits of this nature given anticipated mining methods and plant processing costs, while also considering economic conditions, because of the regulatory requirements that a mineral resource exists “in such form and quantity and of such a grade or quality that it has reasonable prospects for eventual economic extraction.”

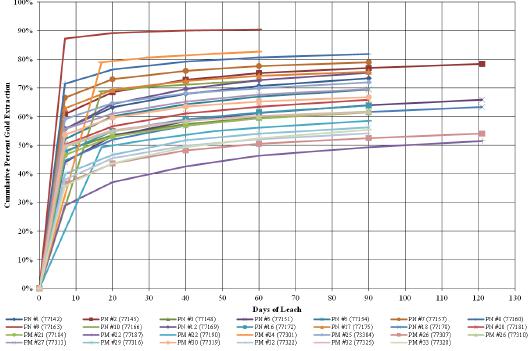

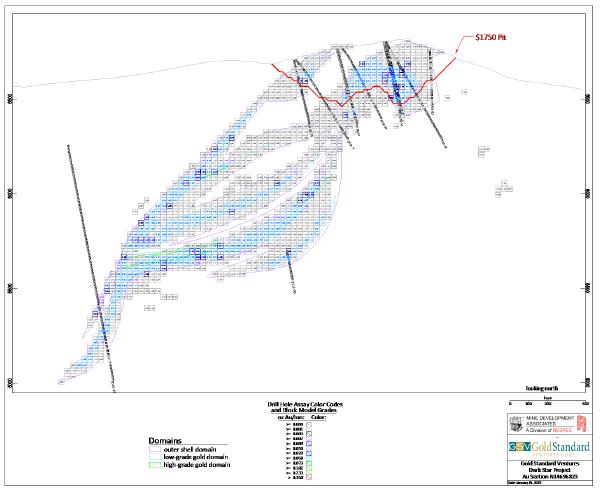

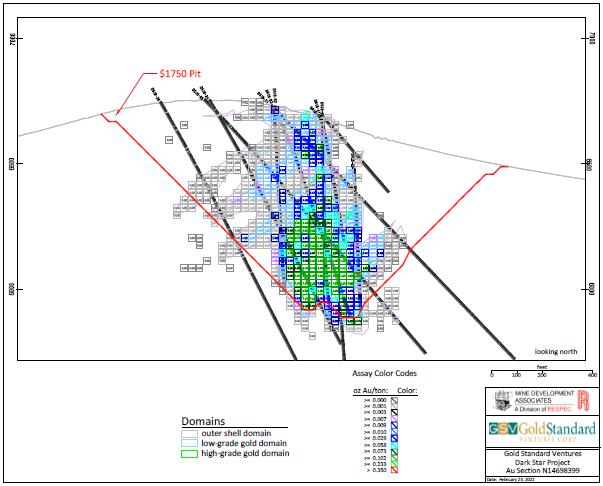

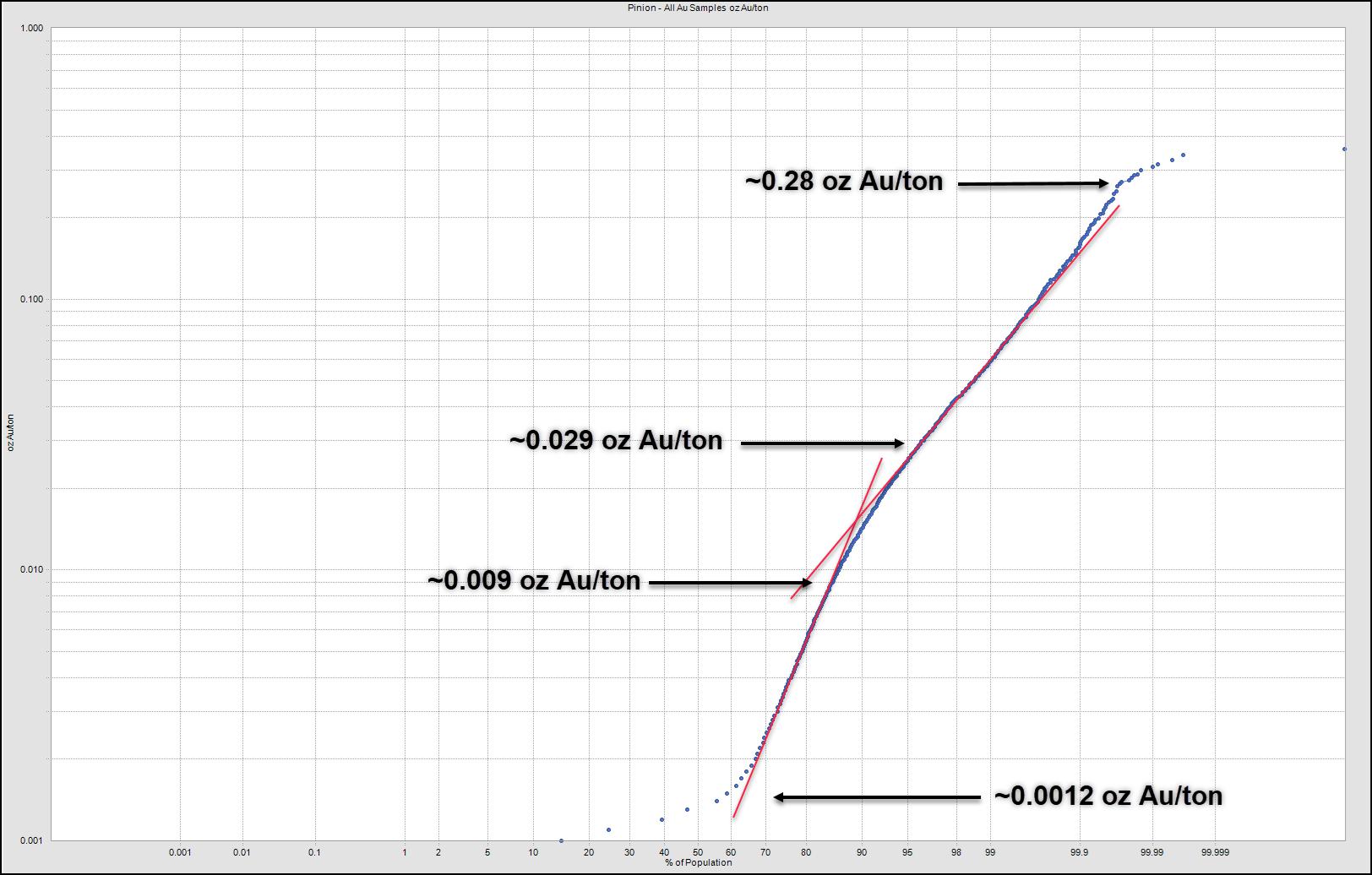

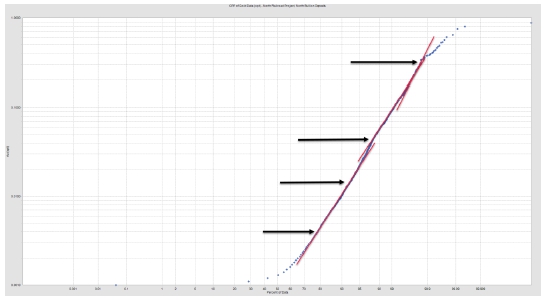

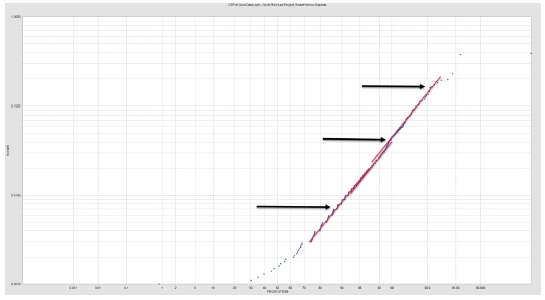

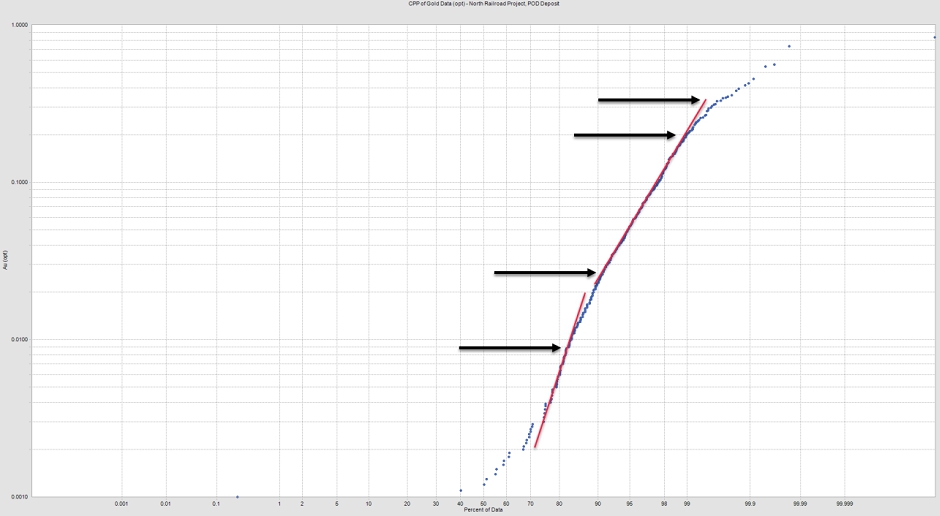

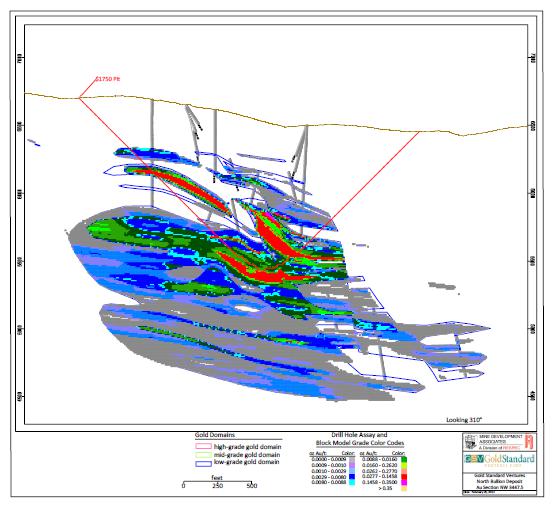

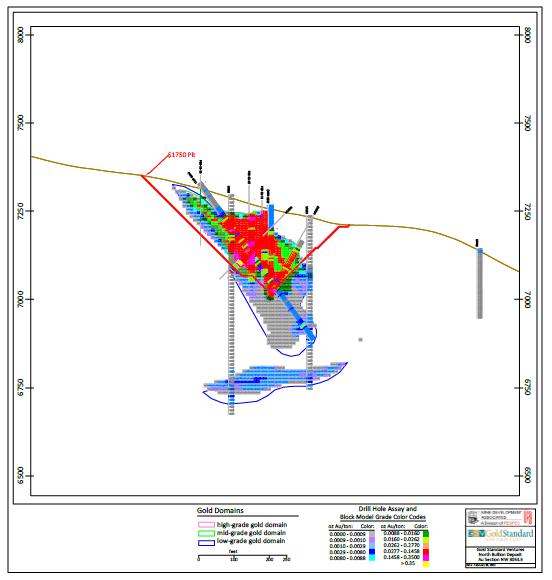

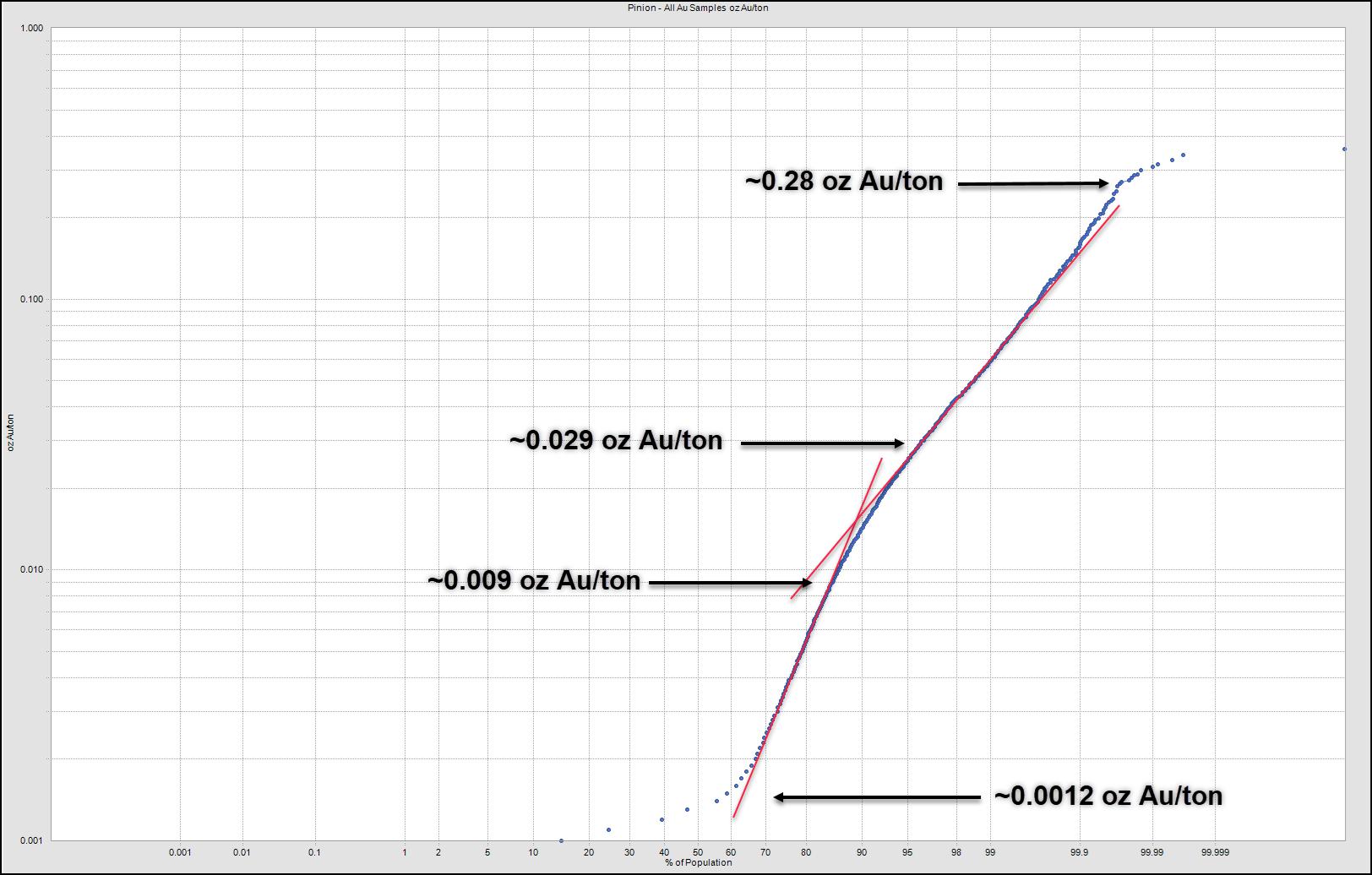

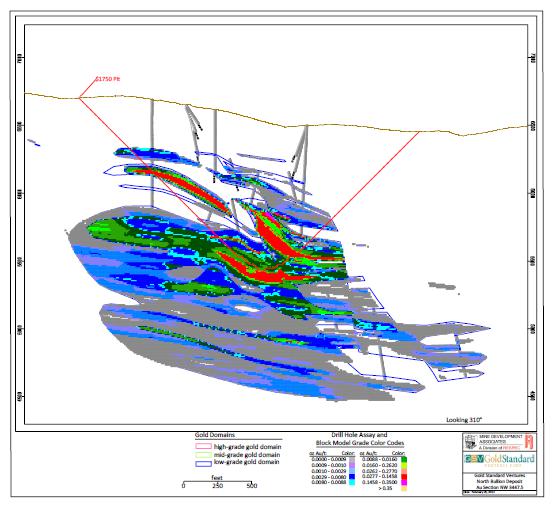

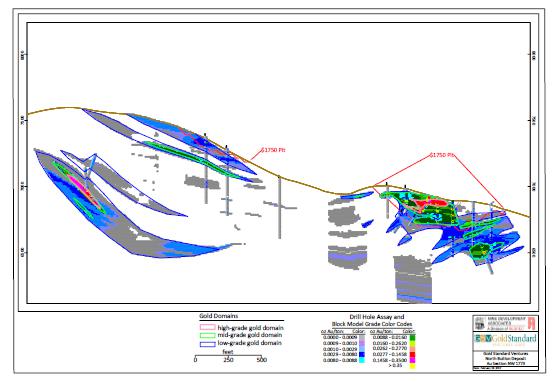

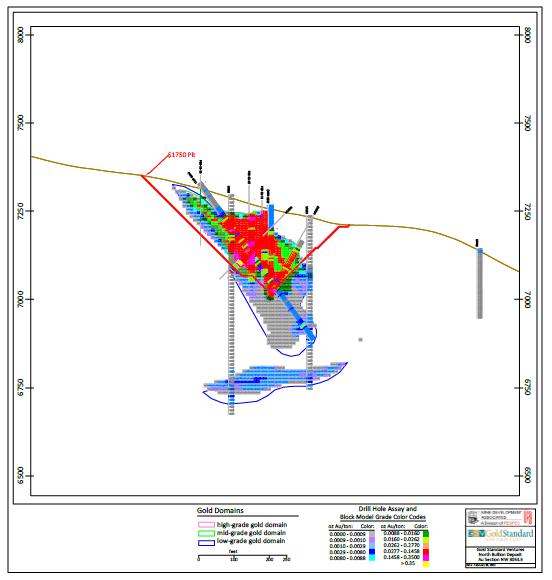

MDA modeled geology and metal domains for the Dark Star, Pinion, and Jasperoid Wash deposits, then estimated and classified gold mineral resources. A silver estimate was also produced for the Pinion deposit. Gold Standard provided the geologic modeling for the various deposits and were intimately involved with metal domain modeling. Block sizes were 30 ft x 30 ft x 30 ft for Dark Star and Pinion, and 20 ft x 20 ft x 20 ft for Jasperoid Wash. The block size for modeling and estimation at the North Bullion deposits model was 10 ft x 10 ft x 10 ft for evaluation of underground potential, but reblocked to 30 ft x 30 ft x 30 ft to optimize open pits. Estimation was done using inverse-distance methods with powers ranging from two to four. Multiple models were estimated in order to optimize the estimation parameters.

The estimate of mineral resources for the Railroad-Pinion property is the block-diluted inverse-distance estimate and is reported at variable cutoffs for open-pit and underground mining. The cutoff for oxidized and transitional redox material in an open pit is 0.005 oz Au/ton, whereas the cutoff for sulfide material is 0.045 oz Au/ton. Potential sulfide

| M3-PN185074

14 March 2022

Revision 1 | 1-6 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

underground resources, present only at the North Bullion deposit, are reported at a cutoff of 0.100 oz Au/ton. Mineral resources were classified as Measured, Indicated or Inferred for each deposit separately. Factors considered for classification include results of data verification and QA/QC results, the level of geologic understanding of each deposit, and performance of past mineral resource block models with new drilling. Table 1-3 presents the optimized pit- and underground grade shell-constrained estimated mineral resources for the Dark Star, Pinion, Jasperoid Wash and North Bullion deposits based on a $1,750/oz gold price. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

Table 1-3: Dark Star, Pinion, Jasperoid Wash and North Bullion Estimated Mineral Resources

| Dark Star Mineral Resources |

| | Cutoff | | | |

| | oz Au/ton | Tons | oz Au/ton | oz Au |

| Measured* | 0.005 | 7,964,000 | 0.036 | 288,000 |

| Indicated* | variable** | 27,081,000 | 0.023 | 625,000 |

| Measured & Indicated* | variable** | 35,045,000 | 0.026 | 913,000 |

| Inferred | variable** | 1,296,000 | 0.015 | 19,000 |

| *Mineral resources are inclusive of mineral reserves |

| **Cutoff for oxide and transitional resources is 0.005 oz Au/ton, and for sulfide resources at 0.045 oz Au/ton |

| Pinion Mineral Resources |

| | Cutoff | | | | | |

| | oz Au/ton | Tons | oz Au/ton | oz Au | oz Ag/ton | oz Ag |

| Measured* | 0.005 | 2,575,000 | 0.021 | 55,000 | 0.19 | 488,000 |

| Indicated* | 0.005 | 45,408,000 | 0.018 | 816,000 | 0.15 | 6,617,000 |

| Measured & Indicated* | 0.005 | 47,983,000 | 0.018 | 871,000 | 0.15 | 7,105,000 |

| Inferred | 0.005 | 1,299,000 | 0.012 | 15,000 | 0.07 | 92,000 |

| *mineral resources are inclusive of mineral reserves |

| Jasperoid Wash Mineral Resources |

| | Cutoff | | | |

| | oz Au/ton | Tons | oz Au/ton | oz Au |

| Inferred | 0.005 | 13,160,000 | 0.01 | 130,000 |

| | | | | |

| North Bullion Inferred Mineral Resources |

| | Cutoff | | | |

| | oz Au/ton | Tons | oz Au/ton | oz Au |

| North Bullion Open Pit | variable* | 3,214,000 | 0.107 | 345,000 |

| North Bullion Underground | 0.100 | 504,000 | 0.131 | 66,000 |

| Sweet Hollow | variable* | 2,884,000 | 0.016 | 45,000 |

| POD | variable* | 1,459,000 | 0.06 | 87,000 |

| South Lodes | 0.005 | 800,000 | 0.016 | 13,000 |

| **Cutoff for open pit oxide and transitional resources is 0.005 oz Au/ton, and for sulfide resources at 0.045 oz Au/ton |

| M3-PN185074

14 March 2022

Revision 1 | 1-7 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

Barium was estimated into the Pinion deposit block model for use in metallurgical characterization of the Pinion mineralized material. The average barium grade is ~2.25% for the gold mineralization grading at least 0.005 oz Au/ton. Factoring between barium analytical results were required, which added some uncertainty to the model.

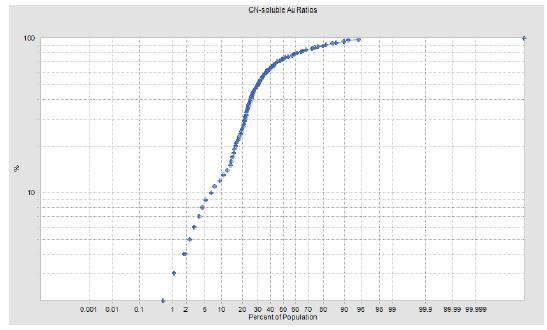

Cyanide-soluble gold block models were produced for the Pinion and Dark Star deposits. These estimates appear reasonable in areas with Gold Standard drilling, however, there is less confidence in some areas where cyanide-soluble gold data is lacking, such as where historical drilling is predominant.

An acid-base accounting (“ABA”) model was generated for Pinion and Dark Star to characterize waste material for mine planning and handling. An organic carbon model was also produced to evaluate effects on metallurgy at Pinion. Because of limited data, these estimates can only be considered as guides for environmental planning and metallurgy.

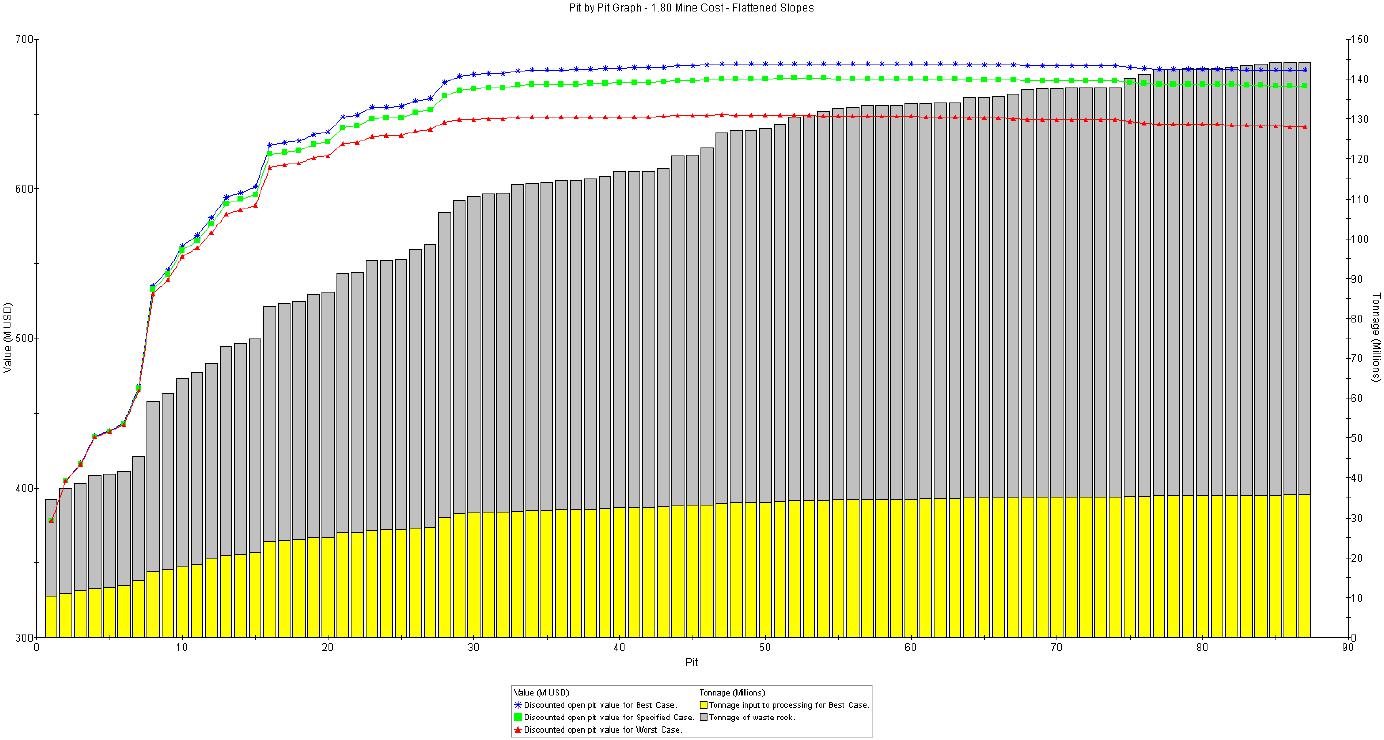

| 1.8.2 | Mineral Reserve Estimate |

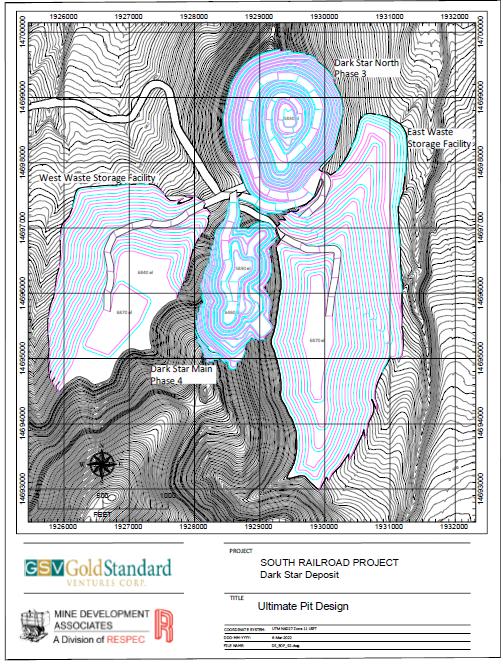

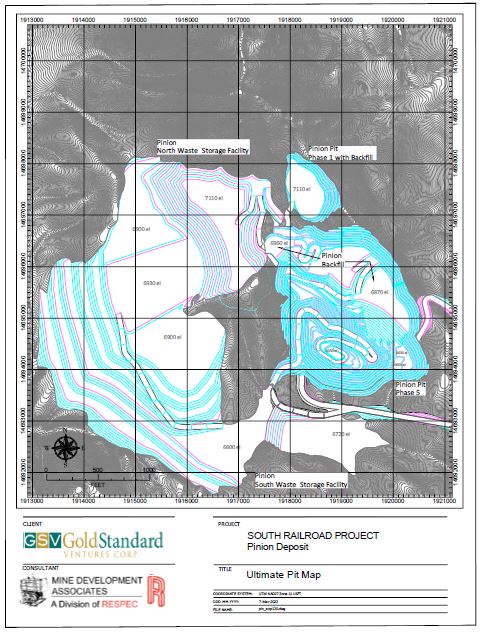

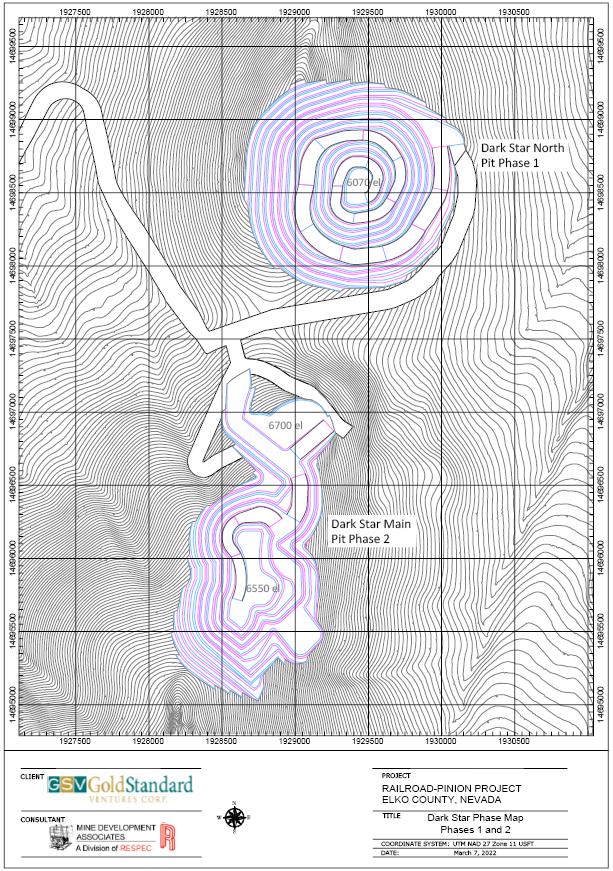

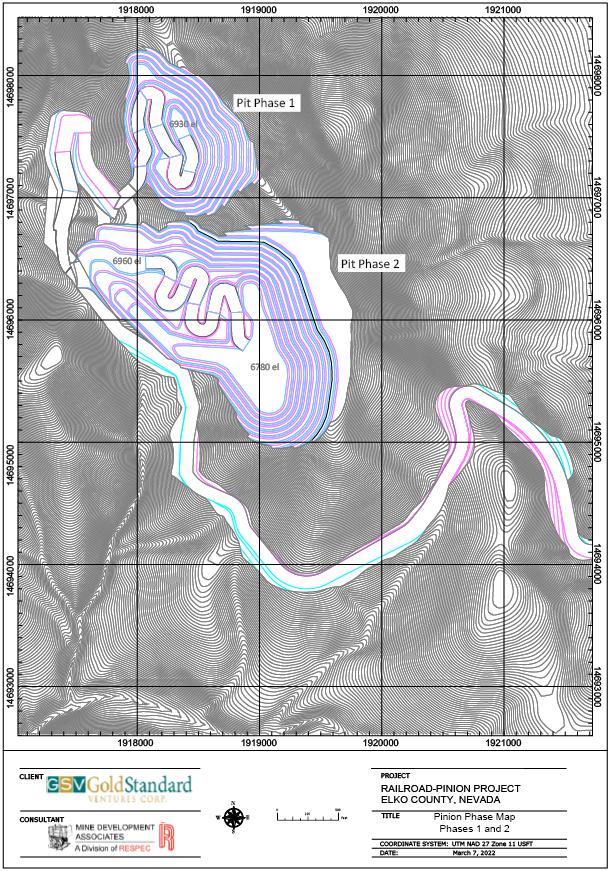

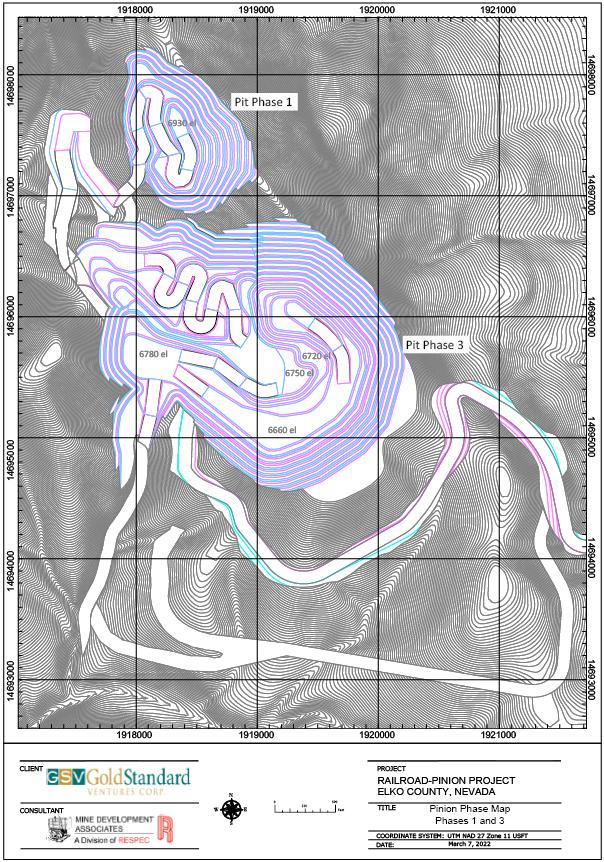

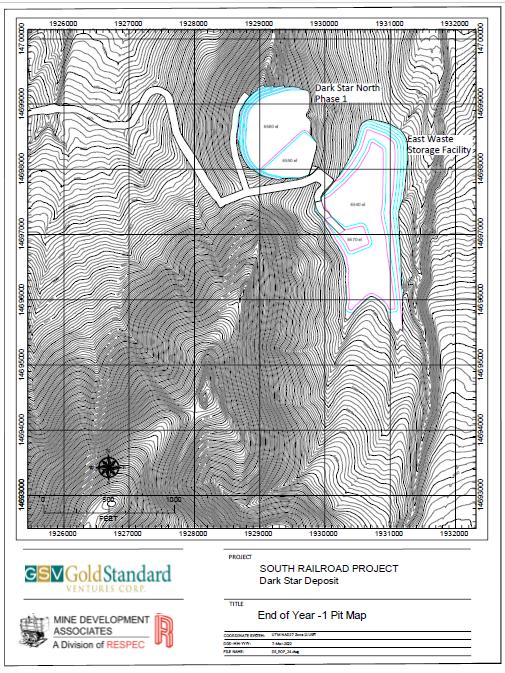

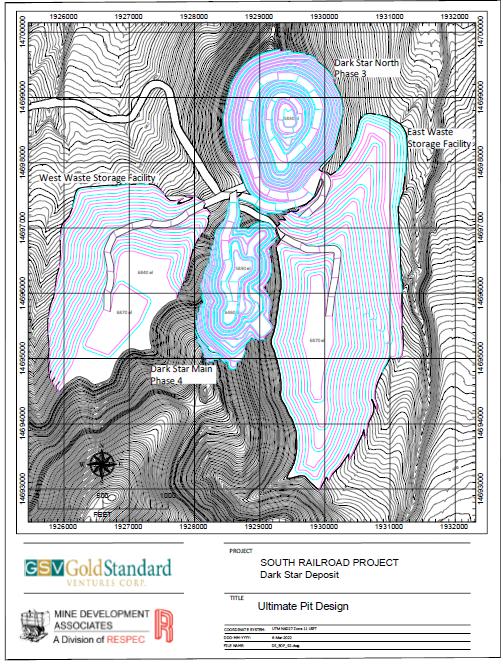

Measured and Indicated mineral resources were used as the basis to define mineral reserves for both the Dark Star and Pinion deposits. Mineral reserve definition was done by first identifying ultimate pit limits using economic parameters and applying pit optimization techniques. The resulting optimized pit shells were then used for guidance in pit design to allow access for equipment and personnel. Modifying factors including mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, social, and governmental factors have been applied in the estimate of mineral reserves.

RESPEC provided the final production schedule to M3 who developed the final cash-flow model which demonstrates that the Pinion and Dark Star deposits make a positive cash flow and are reasonable with respect to statement of mineral reserves for these deposits.

The total Proven and Probable mineral reserves reported for the FS are shown in Table 1-4. Within the designed pits there are a total of 294.5 million tons of waste associated with the in-pit mineral reserves. This results in an overall project strip ratio of 4.1 tons of waste for each ton of material processed.

Table 1-4 Proven and Probable Mineral Reserves

| Dark Star | K Tons | oz Au/ton | K Ozs Au |

Proven Probable | 7,618 24,524 | 0.037 0.023 | 282 557 |

| P&P | 32,142 | 0.026 | 840 |

| Pinion | K Tons | oz Au/ton | K Ozs Au | oz Ag/ton | K Ozs Ag |

Proven Probable | 2,258 37,469 | 0.022 0.019 | 50 714 | 0.194 0.152 | 437 5,700 |

| P&P | 39,728 | 0.019 | 764 | 0.154 | 6,137 |

| Consolidated Gold Reserves | | |

| Dark Star & Pinion | K Tons | oz Au/ton | K Ozs Au |

| Proven | 9,877 | 0.034 | 333 |

| Probable | 61,993 | 0.021 | 1,271 |

| P&P | 71,870 | 0.022 | 1,604 |

Note: Cutoff grades are applied by material type as described in Section 15.2.3; Proven and Probable mineral reserves for Pinion include silver as reported above; and Due to lack of silver at Dark Star, consolidated gold reserves are reported without silver to avoid reporting erroneous average silver grade.

| M3-PN185074

14 March 2022

Revision 1 | 1-8 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

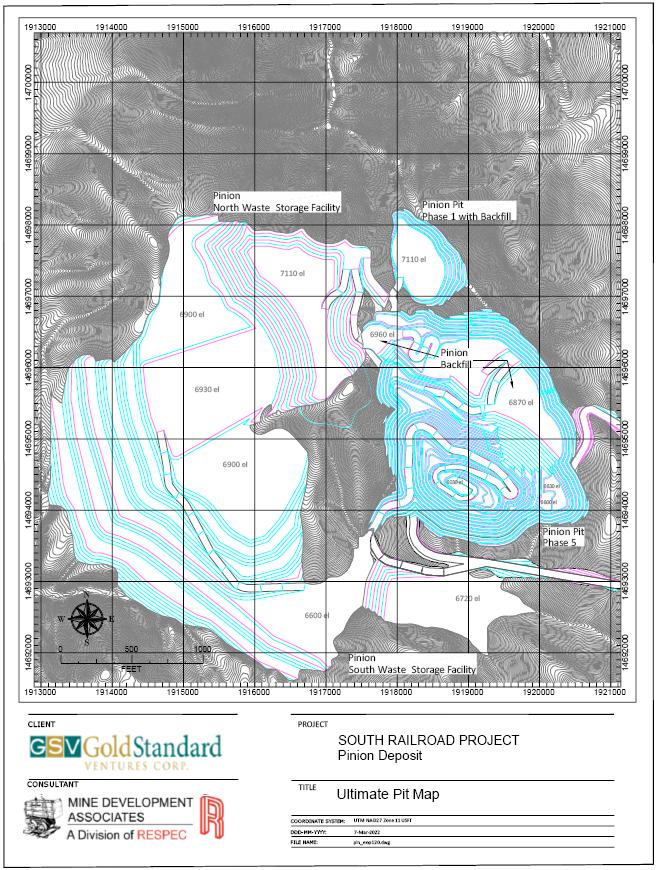

The FS includes mining at both the Dark Star and Pinion deposits; both are planned as open-pit, truck and shovel operations. The truck and shovel method provides reasonable costs and selectivity for these deposits.

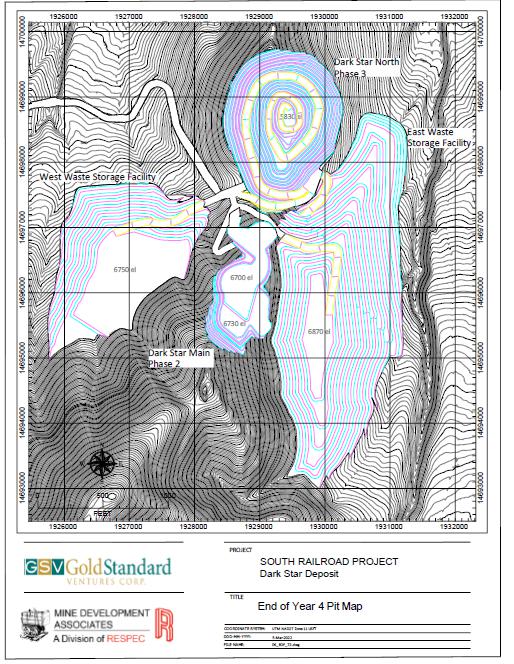

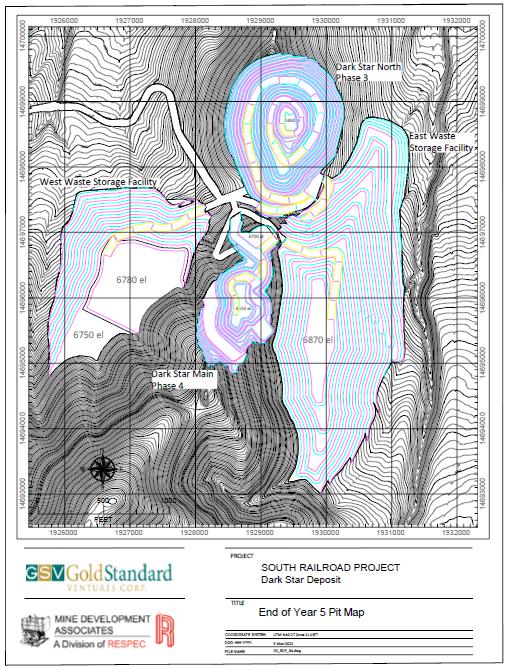

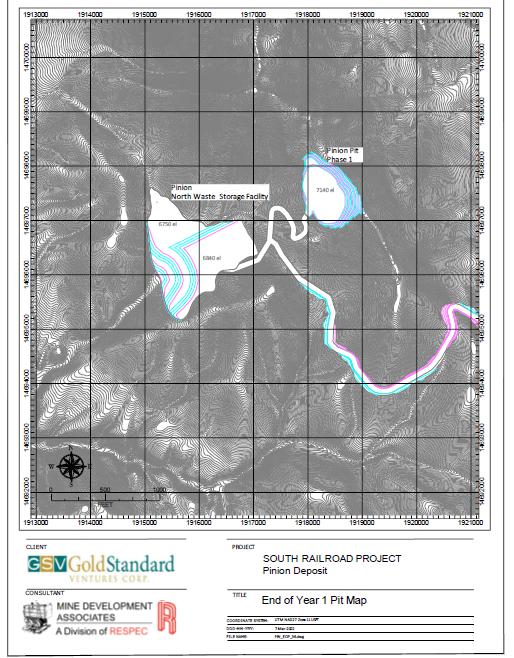

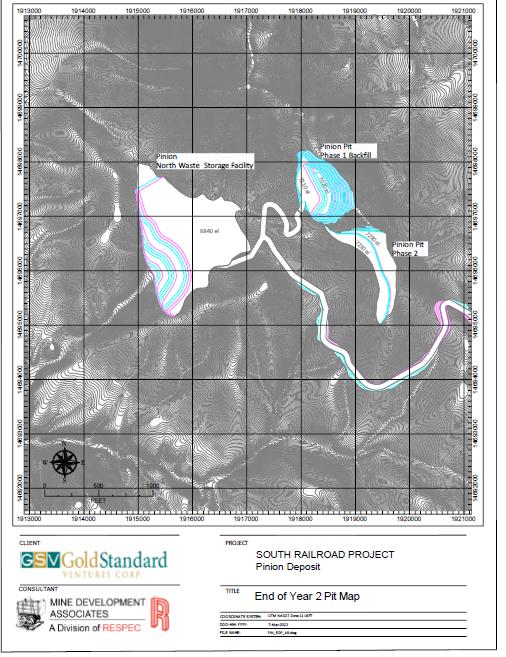

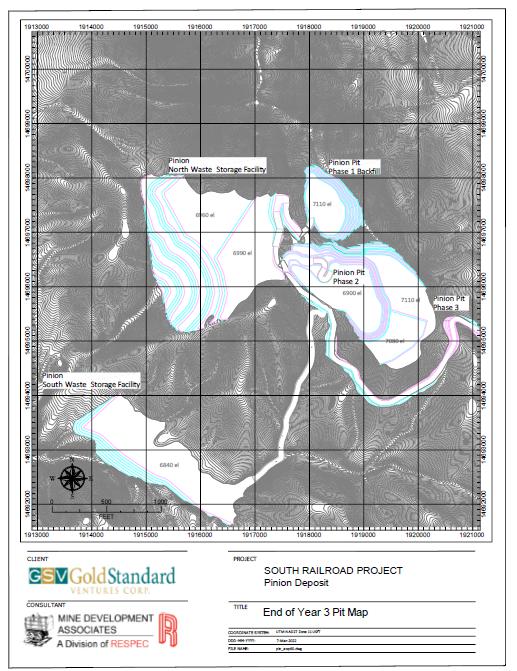

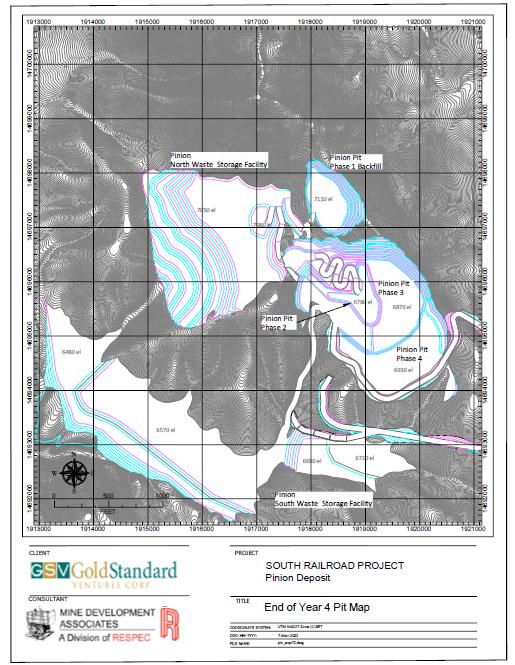

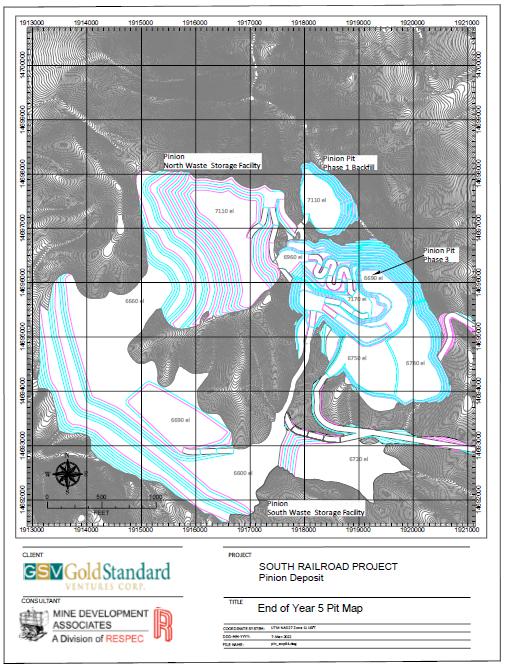

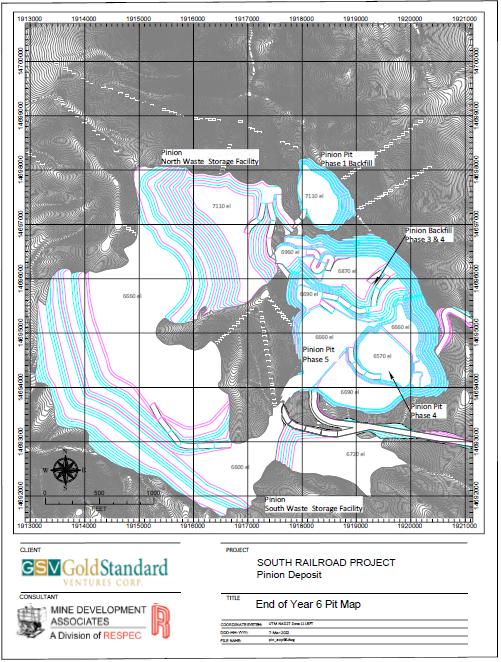

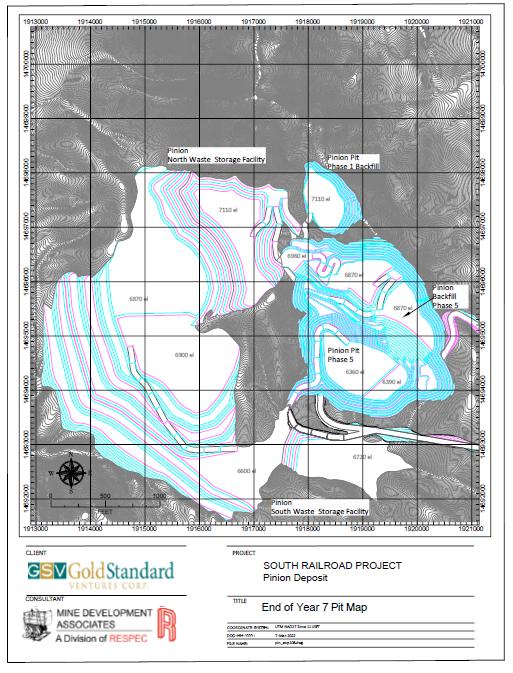

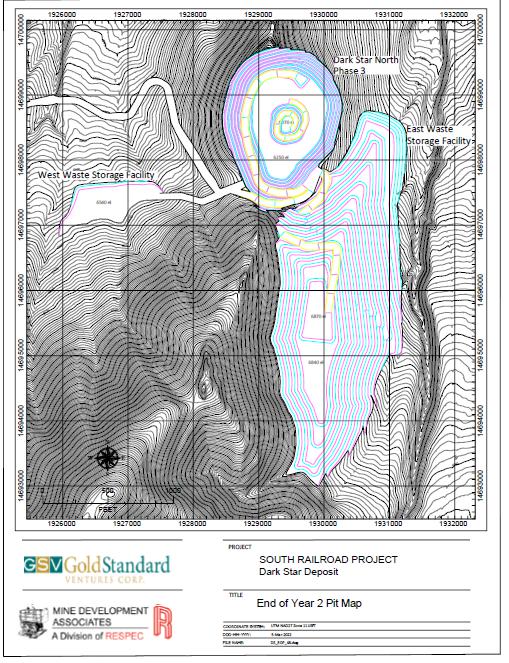

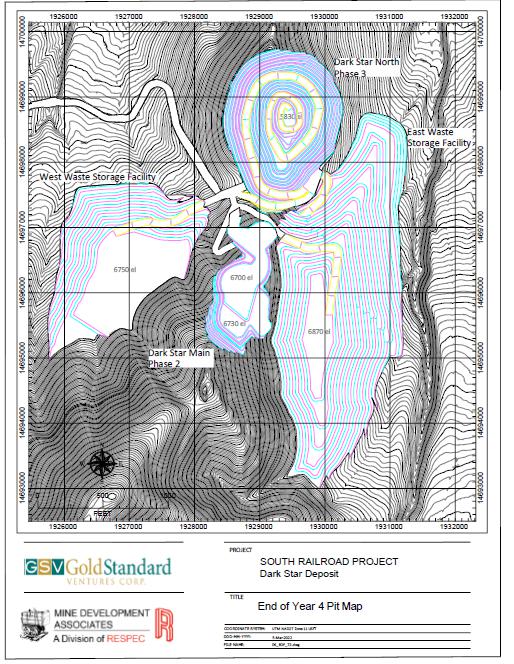

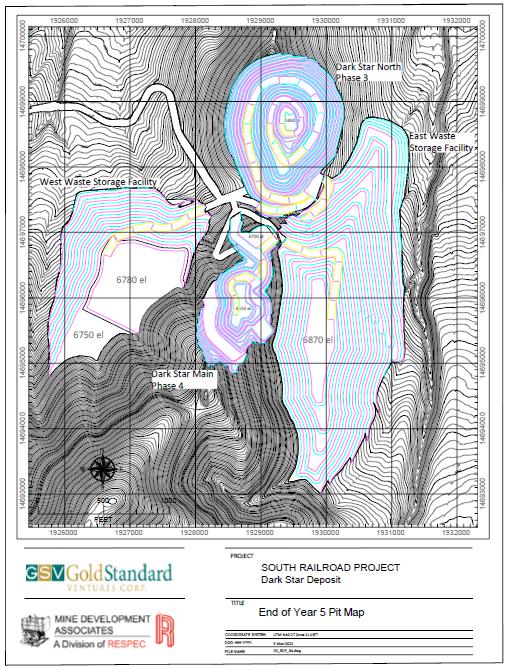

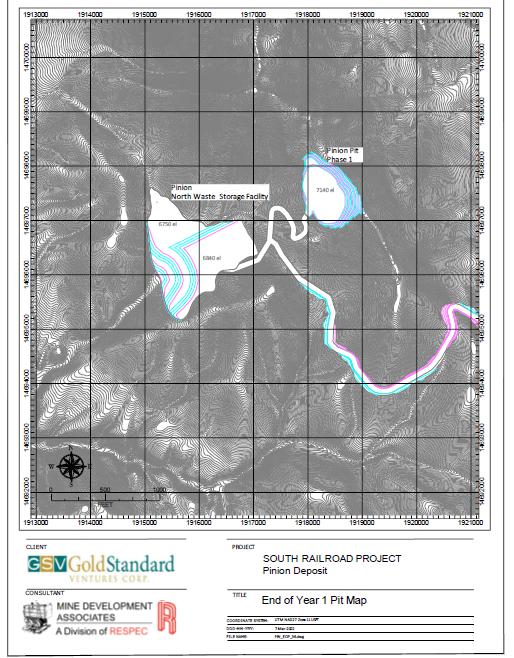

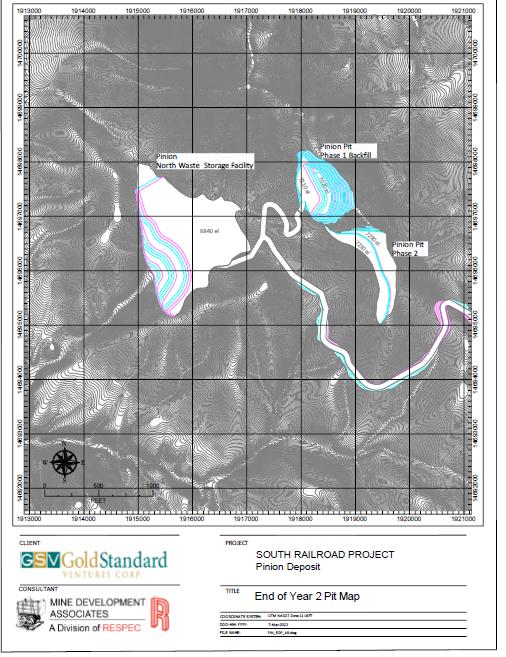

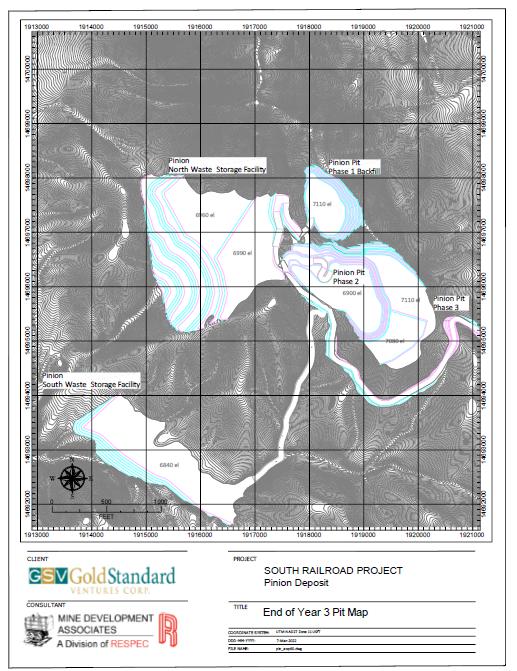

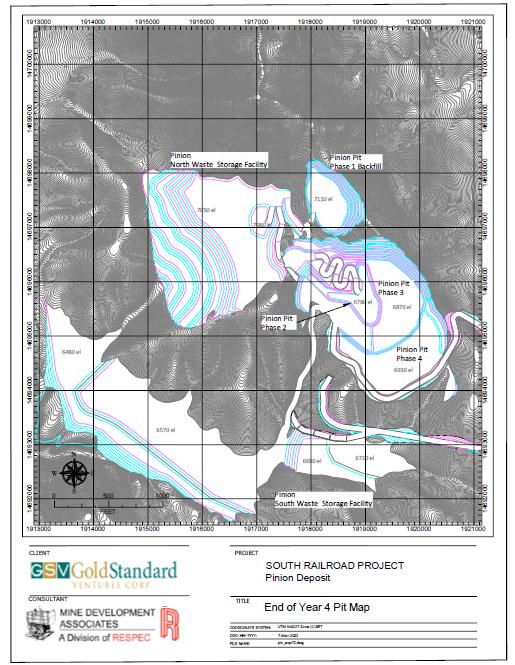

The production schedule considers the processing of material by ROM. All ROM material will be dumped in place directly on the ROM leach pad. Monthly periods were used to create the production schedule with pre-stripping starting in Dark Star at month -6. Start of ROM processing is assumed to be month 2.

The total Dark Star mining rate would ramp up from 20,000 tons per day to about 80,000 tons per day over a period of 6 months. A maximum of 109,000 tons per day is used in the production schedule during the peak mining of deeper Dark Star material. Pre-production mining is planned to start in Dark Star North and then progress to Pinion in Year 1. The maximum mining rate required in Pinion is 126,000 tons per day.

The FS has assumed owner mining to keep the cost lower than it would be with contract mining. The production schedule was used along with additional efficiency factors, cycle times, and productivity rates to develop the first principle hours required for primary mining equipment to achieve the production schedule. Primary mining equipment includes drills, loaders, hydraulic shovels, and 200-ton capacity haul trucks.

Waste storage facility designs were created for the FS to contain the material that is not processed. A 1.3 swell factor was assumed which provides for both swell when mined and re-compaction when placed into the facility.

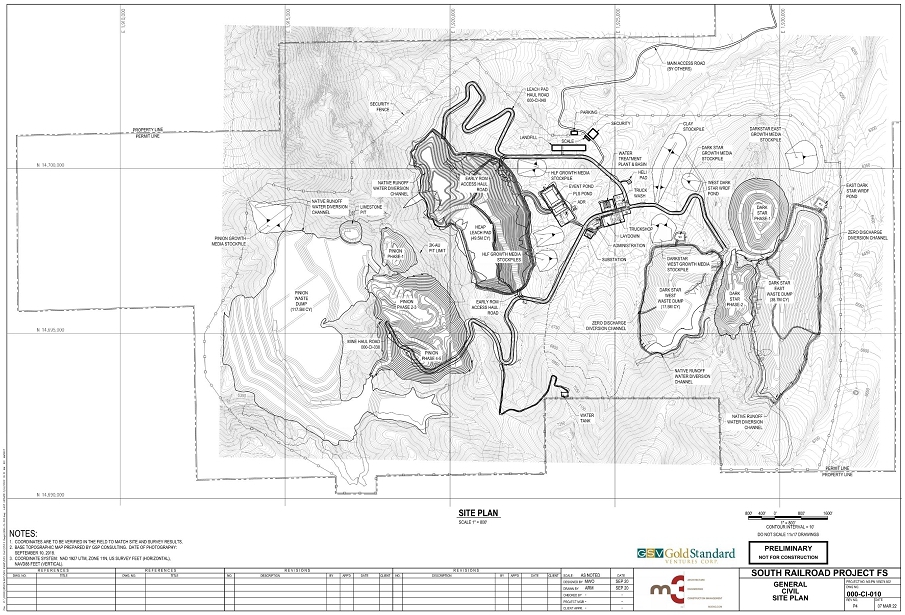

Project infrastructure for South Railroad has been developed to support the mining and heap leaching operations. Electrical power will be generated onsite by generators powered by liquified natural gas (LNG). Project buildings located at the site will include Security and Emergency services, Administration, Change House, Crushing, Truck Shop, ADR/Refinery Plant, and Laboratory buildings. These will mainly be located between Pinion and Dark Star pits for ease of access and be connected by local roads and haul routes.

| 1.11 | Environment and Permitting |

Gold Standard has been conducting environmental baseline studies over the past several years as part of their ongoing permitting efforts and in preparation for the submittal of permit applications for conduct mining operations. The main portion for the project area has been surveyed for surface water resources, including Waters of the United States (“WOTUS”), biological resources, and cultural resources. The project access road, and the water management area remain to be surveyed. In 2018, Gold Standard commenced material characterization testing of the mineralized material and waste rock to determine the metal leaching and acid generation potential. Additionally, an evaluation of the groundwater resources was commenced to determine groundwater supply potential, as well as the potential impacts from groundwater pumping and pit lake development. Gold Standard has had several meetings with the United States Bureau of Land Management (“BLM”) since January 2019 to determine any additional baseline data collection needs for the permitting process.

Within and adjacent to the project area there are Greater Sage Grouse and Golden Eagles. These species will have an effect on how the project is permitted and what mitigation in required or proposed. Gold Standard is working with the BLM on the management of these species.

| M3-PN185074

14 March 2022

Revision 1 | 1-9 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

The review and approval process for the Plan Application by the BLM constitutes a federal action under the National Environmental Policy Act (“NEPA”) and BLM regulations. Thus, for the BLM to process the Plan Application the BLM is required to comply with the NEPA and prepare either an Environmental Assessment (“EA”), or an Environmental Impact Statement (“EIS”). The BLM has determined that this process requires an EIS, due to the mine dewatering and potential pit lake. Gold Standard will also need an Individual Section 404 Permit from the United States Army Corps of Engineers, and this agency will be a cooperating agency on the NEPA documents.

There are a number of environmental permits issued by the Nevada Department of Environmental Protection (“NDEP”) that are necessary to develop the project and which Gold Standard needs to permit the project. The NDEP issues permits that address water and air pollution, as well as land reclamation. The Nevada Division of Water Resources (“NDWR”) issues water rights for the use and management of water.

The SRMP (as defined below) is a previously explored minerals property with exploration related disturbance. However, there have been very long periods of non-operation. There are no known ongoing environmental issues with any of the regulatory agencies. Gold Standard has been conducting baseline data collection for a couple of years for environmental studies required to support the Plan Application and permitting process. The waste and mineralized material characterization and the hydrogeologic evaluation are currently in their latter stages of development. Material characterization indicates the need to manage a significant portion of the waste rock as potentially acid generating in engineered facilities. Additional results to date indicate limited cultural issues, air quality impacts appear to be within State of Nevada standards, traffic and noise issues are present but at low levels, and socioeconomic impacts are positive.

Social and community impacts have been and are being considered and evaluated for the Plan Amendment and Plan Application performed for the project in accordance with the NEPA and other federal laws. Potentially affected Native American tribes, tribal organizations and/or individuals are consulted during the preparation of all plan amendments to advise on the proposed projects that may have an effect on cultural sites, resources, and traditional activities.

Potential community impacts to existing population and demographics, income, employment, economy, public finance, housing, community facilities and community services are evaluated for potential impacts as part of the NEPA process. There are no known social or community issues that would have a material impact on the project’s ability to extract mineral resources. Identified socioeconomic issues (employment, payroll, services and supply purchases, and state and local tax payments) are anticipated to be positive.

A Tentative Plan for Permanent Closure (“TPPC”) for the project would be submitted to the NEDP with the Water Pollution Control Permit (“WPCP”) application. In the TPPC, the proposed heap leach closure approach would consist of fluid management through evaporation, covering the heap leach pad and waste rock facilities with growth media, and then revegetating. The design of the process components is not sufficiently advanced to determine the closure costs. Any residual heap leach or waste rock facilities drainage will be managed with evaporation cells.

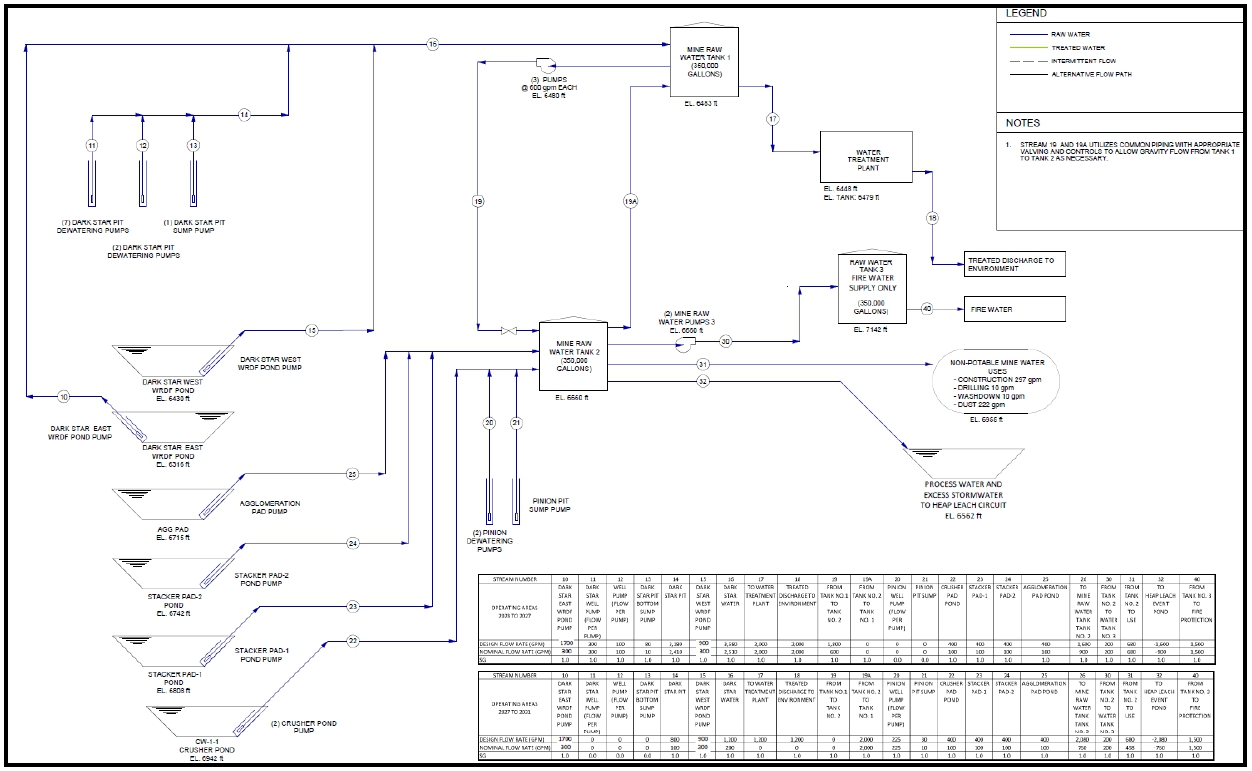

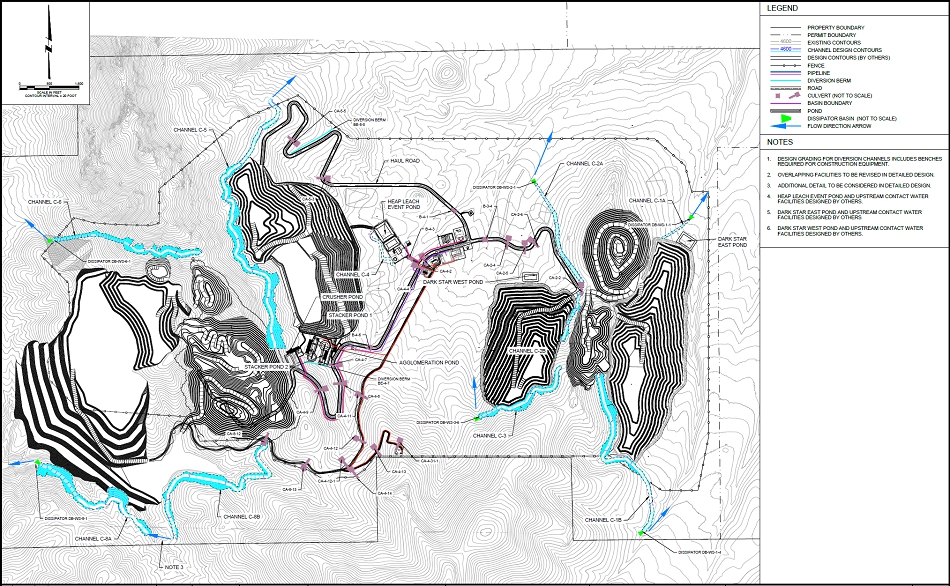

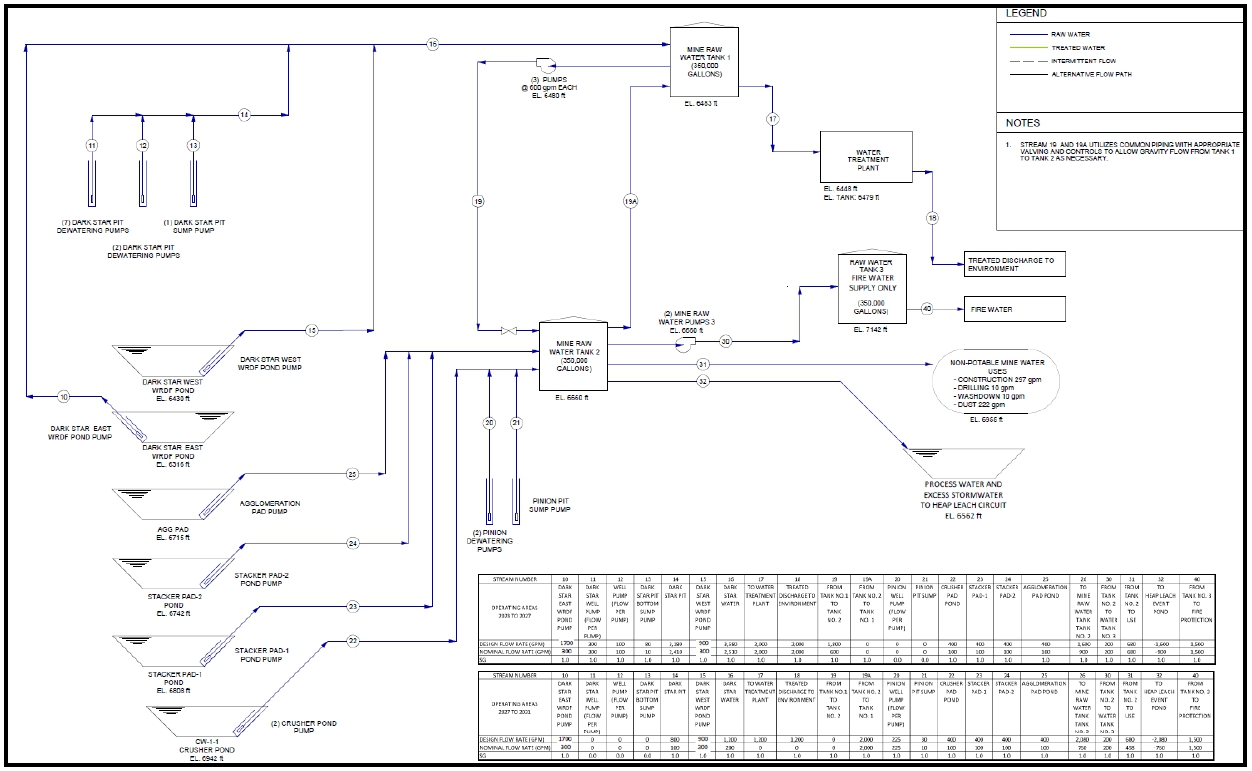

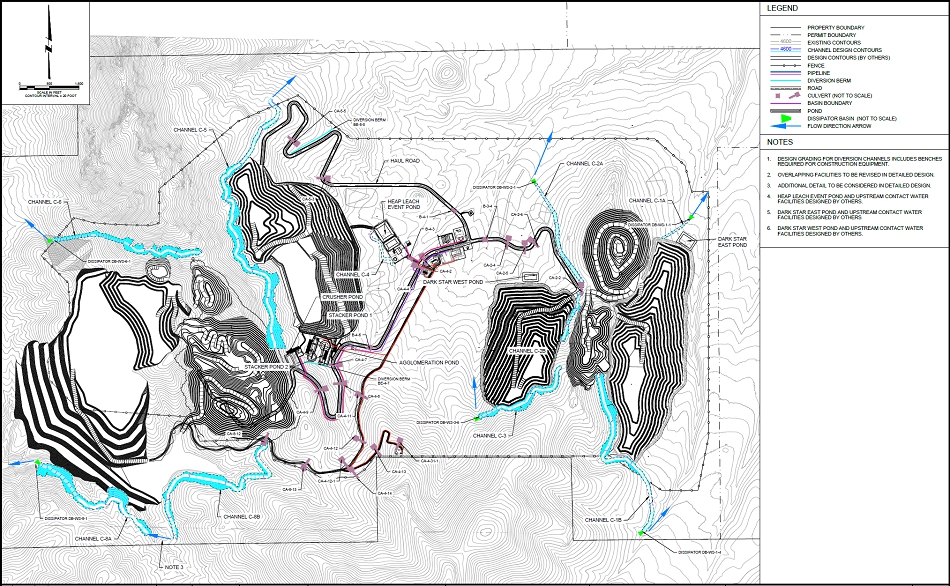

Gold Standard developed a Water Management Plan for South Railroad in support of the FS. The Water Management Plan formed the basis for evaluating the infrastructure and associated cost to manage water through the life cycle of the mine. The purpose of the Water Management Plan is to present the water management strategies that focus on water as an asset and allow Gold Standard to proactively plan and manage water from development to post-closure such that operational and stakeholder water needs are met, and that human health and the environment are protected.

| M3-PN185074

14 March 2022

Revision 1 | 1-10 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

To support the development of water management strategies for the project, the following pre-design studies/activities were completed:

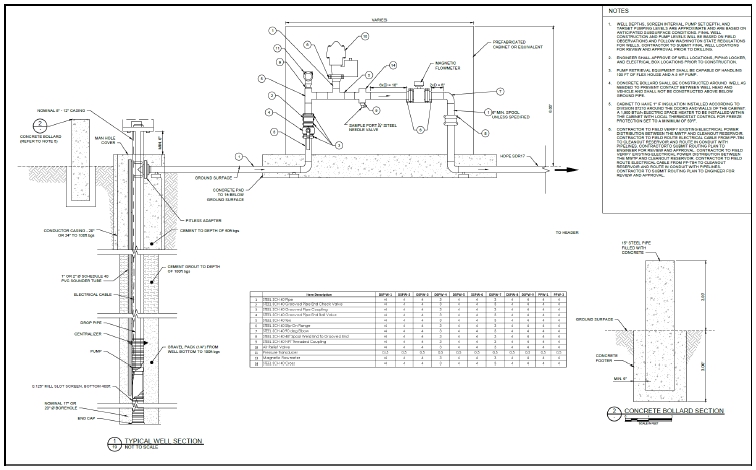

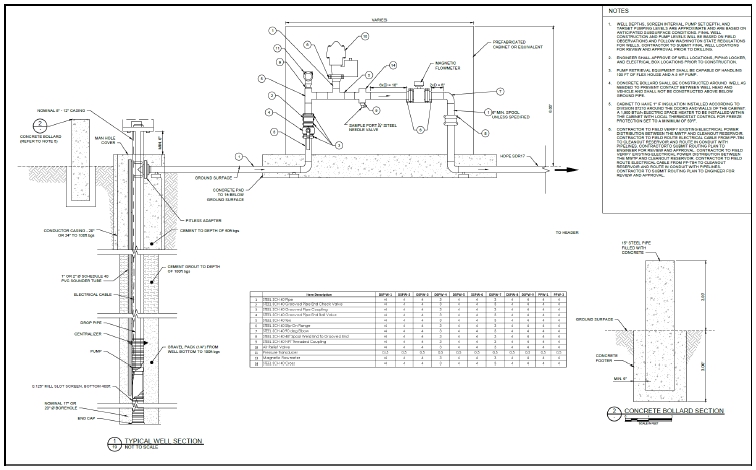

| · | Analytical and numerical groundwater model to estimate pit dewatering requirements and potential impacts for the Dark Star North pit and the Pinion Phase 4/5 expansion; |

| · | Evaluation and modeling of long-term climate records and 24-hour design storms used as input for event- based stormwater modeling, continuous water balance modeling, and infiltration modeling; |

| · | Stormwater modeling and calculations for locating and sizing stormwater management infrastructure; |

| · | Infiltration modeling to predict the amount of seepage from the Water Rock Disposal Facility (“WRDF”s) that will require management during operation, closure, and post-closure periods; |

| · | Water balance modeling to evaluate the supplies of and demands of site water over the LOM; and |

| · | Closure and 404 mitigation cost evaluation. |

The water management strategy and technical investigations to support the Water Management Plan resulted in the following FS level infrastructure:

| · | Stormwater management and seepage collection facilities, such as channels, ponds, culverts, attenuation structures, down drains, and other related open-channel stormwater controls; |

| · | A groundwater dewatering system needed to mine ore below the groundwater table in the Dark Star pits and the Pinion Phase 4/5 expansion; and |

| · | A site-wide water conveyance system. |

The capital expenditure schedule for the LOM is shown in Table 1-5 below.

Table 1-5: Capital Expenditure Schedule

Capital Expenditure

($000) | Initial | Sustaining | Total |

| Year -1 | Year 1 | Year 2 | Year 3 | Year 4 | Year 5 | Year 6 | Year 7 | Year 8 | Year 9 | Year 10 |

| Mine Pre-Prod. | $22,640 | - | - | - | - | - | - | - | - | - | - | $22,640 |

| Mine Capital | $13,943 | $10,703 | $16,798 | $16,306 | $16,914 | $16,284 | $10,884 | $9,147 | $5,588 | - | - | $116,568 |

| Process | $152,458 | $27,169 | $8,953 | $15,149 | $6,798 | $13,850 | $5,375 | $2,563 | $1,329 | $1,223 | $1,644 | $236,511 |

| Owner’s Cost | $1,157 | - | - | - | - | - | - | - | - | - | - | $1,157 |

| Total | $190,197 | $37,872 | $25,751 | $31,455 | $23,712 | $30,133 | $16,259 | $11,710 | $6,918 | $1,223 | $1,644 | $376,873 |

| 1.14 | Operating Cost Summary |

The total production cost includes mine operations, process plant operations, general and administration, reclamation and closure, and government fees. Table 1-6 below shows the operating costs over the LOM by area.

Table 1-6: LOM Operating Costs

| LOM Operating Cost ($000) |

| Mining | $616,504 |

| Process Plant | $147,424 |

| G&A | $37,750 |

| $5,153Refining | $5,153 |

| Total Operating Cost | $806,832 |

| Royalty | $10,911 |

| Salvage Value | -$12,410 |

| Reclamation/Closure | $22,569 |

| Total Production Cost | $827,901 |

| M3-PN185074

14 March 2022

Revision 1 | 1-11 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| 1.15 | Conclusions and Recommendations |

The results of this study indicate that South Railroad is both technically and economically feasible and demonstrates robust returns, even at the moderate metal prices. The authors recommend that the South Railroad project be advanced to basic engineering, with a list of specific recommendations to achieve that goal (see Section 26).

Presently there are 1.60 million proven and probable ounces of gold and 6.1 million ounces of silver in the Dark Star and Pinion deposits estimated mineral reserves combined, 1.78 million Measured and Indicated ounces of gold in the Dark Star and Pinion deposits estimated mineral resources combined, inclusive of mineral reserves in the Dark Star and Pinion deposits, and there are 0.72 million Inferred ounces of gold in the Dark Star, Pinion, Jasperoid Wash and North Bullion deposits estimated mineral resources combined. There are also 7.1 million Measured and Indicated and

0.9 million Inferred ounces of silver in the Pinion resource. Mineral resources that are not mineral reserves do not have demonstrated economic viability.

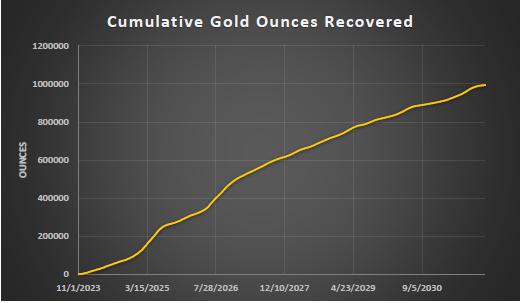

The FS indicates an average gold production over the estimated 8-year LOM of about 124,000 ounces per year, with peak production in Year 2 of 197,000 ounces of gold. Cash costs are estimated to be $792 per ounce of gold after by- product credit, and AISC are estimated to be $1,021 per ounce of gold. The resulting after-tax cash flow is $403.2 million, for an after-tax NPV (5%) of $314.8 million and an estimated payback period of 1.9 years. A summary of the pre-tax and after-tax FS economic indicators is shown in Table 1-7.

Table 1-7: Economic Analysis Summary

| Indicators | Before-Tax | After-Tax |

| LOM Cash Flow ($000) | $497,330 | $403,162 |

| NPV @ 5% ($000) | $388,866 | $314,791 |

| NPV @ 10% ($000) | $307,248 | $247,592 |

| IRR | 49.2% | 44.3% |

| Payback (years) | 1.9 | 1.93 |

| M3-PN185074

14 March 2022

Revision 1 | 1-12 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

SECTION 2 TABLE OF CONTENTS

| SECTION | | PAGE |

| 2 | INTRODUCTION AND TERMS OF REFERENCE | 2-1 |

| | 2.1 | PURPOSE OF REPORT | 2-1 |

| | 2.2 | SOURCES OF INFORMATION | 2-1 |

| | 2.3 | PROJECT SCOPE AND TERMS OF REFERENCE | 2-2 |

| | 2.4 | FREQUENTLY USED ACRONYMS, ABBREVIATIONS, DEFINITIONS, AND UNITS OF MEASURE | 2-3 |

SECTION 2 LIST OF TABLES

| TABLE | DESCRIPTION | PAGE |

| Table 2-1: | List of Qualified Persons | 2-2 |

| Table 2-2: | Acronyms and Abbreviations | 2-4 |

| M3-PN185074

14 March 2022

Revision 1 | 2-i |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| 2 | INTRODUCTION AND TERMS OF REFERENCE |

This NI 43-101 Technical Report was prepared by M3 for Gold Standard of Vancouver, British Columbia, a corporation that is listed in TSX Venture Exchange (TSX.V: GSV) and the New York Stock Exchange (NYSE: GSV).

Gold Standard owns the Railroad-Pinion project in the southern Carlin trend, in Elko County, Nevada, USA.

This Technical Report for the Railroad-Pinion project describes the feasibility of extracting and processing the oxide mineral reserve at the South Railroad property, which includes the Dark Star and Pinion gold deposits. This study incorporates new design-work, scheduling, and projected costs.

This update is based on the resource estimates and pit optimizations as of January 31, 2022. This includes the updated 2022 mineral resource and mineral reserve estimates for the Dark Star and Pinion gold deposits, and updated mineral resource estimates for the North Bullion deposit.

Gold Standard has drilled or received assays for 127 new holes since the effective dates of the databases for the respective deposits on the Railroad-Pinion property. In many cases, assay results were delayed significantly past the effective dates due to the COVID-19 pandemic. That drilling was primarily focused on obtaining metallurgy samples, generating geotechnical data, construction of water and monitor wells, infilling within modeled areas, or for exploration of secondary targets. The new drilling in the Dark Star, Pinion, North Bullion and Jasperoid Wash areas were evaluated with respect to the resource models and it was determined there would be minimal to no impact on estimated volumes and grades as reported within optimized pits in this report. Further discussion is given in Section 14.

The North Railroad portion of Gold Standard’s property includes the POD (formerly Railroad deposit), Sweet Hollow, South Lodes, and North Bullion cluster of gold deposits. Together these four deposits are referred to as the North Bullion deposits or North Bullion area. The first-time estimates of POD, Sweet Hollow, and North Bullion gold mineral resources were originally reported by Dufresne and Nicholls (2017b). The POD, Sweet Hollow, South Lodes, and North Bullion deposits were remodeled by MDA, a Division of RESPEC, LLC. (“MDA”), and new mineral resources, are presented herein.

Other targets mentioned in this Technical Report include Bald Mountain, in the North Railroad portion of the Railroad- Pinion property, and JR Buttes, Dixie, Irene, Sentinel, Ski Track, and East Jasperoid in the South Railroad portion of the Railroad-Pinion project.

References to Tomera Formation equivalent stratigraphy have been noted historically. However, recent work suggests these units in the Railroad-Pinion area may not be of equivalent age, so all usage of Tomera Formation equivalent in this Technical Report refer to units that are Pennsylvanian-Permian undifferentiated.

This Technical Report has been prepared in accordance with the disclosure and reporting requirements set forth in NI 43-101 Companion Policy 43-101CP, and Form 43-101F1, as well as with the Canadian Institute of Mining, Metallurgy and Petroleum’s “CIM Definition Standards - For Mineral Resources and Reserves, Definitions and Guidelines” (“CIM Standards”) adopted by the CIM Council on May 10, 2014.

| 2.2 | Sources of Information |

In compiling the background information for this Technical Report, the authors fully relied on information provided by Gold Standard and on other references as cited in Section 3, including technical reports by APEX (Dufresne and Turner, 2014; Dufresne et al., 2014; Dufresne et al., 2015; Dufresne and Nicholls, 2016; Dufresne et al., 2017; and Dufresne and Nicholls, 2017a, 2017b, 2018).

| M3-PN185074

14 March 2022

Revision 1 | 2-1 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

The Pinion, Dark Star, Jasperoid Wash and North Bullion deposits mineral resource estimates presented in this Technical Report were estimated and classified under the supervision of Mr. Michael S. Lindholm, C.P.G. and Senior Geologist for MDA, Mr. Thomas L. Dyer, P.E., Senior Engineer for MDA, prepared the mining and economic studies for the FS.

Table 2-1 is a list of qualified persons who contributed to this Technical Report.

Table 2-1: List of Qualified Persons

| QP Name | Company | Qualification | Site Visit Date | Area of Responsibility |

| Matthew Sletten | M3 Engineering & Technology Corporation, Chandler, AZ | PE | No site visit | Sections 1.1, 1.10, 1.13, 1.14, 1.15, 4, 5, 18.1, 18.2, 18.3, 18.4, 18.5, 18.8, 19, 21 except (21.1 and 21.4), 22, 23, 24, 25, and 26 |

| Benjamin Bermudez | M3 Engineering & Technology Corporation, Chandler, AZ | PE | No site visit | Section 1.7 and 17 |

| Art Ibrado | Fort Lowell Consulting PLLC, Tucson, AZ | PE | September 25, 2019 | Sections 2, 3, and 27 |

| Michael S. Lindholm | Mine Development Associates (a division of RESPEC), Reno, NV | CPG | July 16, 2020 | Sections 1.3, 1.4, 1.5, 1.8.1, 6, 7, 8, 9, 10, 11, 12, and 14 |

| Thomas Dyer | Mine Development Associates (a division of RESPEC), Reno, NV | PE | November 18, 2016 | Sections 1.8, 1.9, 15, 16, 21.1, and 21.4 |

| Jordan Anderson | Mine Development Associates (a division of RESPEC), Reno, NV | QP RM-SME | February 23, 2022 | Sections 1.8, 1.9, 15, 16, 21.1, and 21.4 |

| Gary L. Simmons | GL Simmons Consulting, LLC | QP-MMSA | October 9, 2020 | Section 1.6 and 13 |

| Richard DeLong | EM Strategies, Inc., Reno, NV | QP-MMSA,

RG, PG | No site visit | Sections 1.2, 1.11, 1.12 and 20 |

| Kevin Lutes | NewFields | PE | February of 2021 | Section 18.6 and 18.7 |

| 2.3 | Project Scope and Terms of Reference |

Gold Standard has been actively exploring the North Railroad portion of the property since 2010 and the South Railroad portion of the property since 2014 (Koehler et al., 2014; Turner et al., 2015).

The scope of this study includes a review of pertinent technical reports and data provided to MDA by Gold Standard relative to the general setting, geology, project history, exploration activities and results, methodology, quality assurance, interpretations, drilling programs, metallurgy, and estimated mineral resources.

The authors have relied almost entirely on data and information derived from work done by Gold Standard and its predecessor operators of the amalgamated South Railroad and North Railroad portions of the Railroad-Pinion property. The authors have reviewed much of the available data and made site visits and have made judgments about the general reliability of the underlying data. Where deemed either inadequate or unreliable, the data were either eliminated from use or procedures were modified to account for lack of confidence in that specific information. The authors have made such independent investigations as deemed necessary in their professional judgment to be able to reasonably present the conclusions discussed herein.

| M3-PN185074

14 March 2022

Revision 1 | 2-2 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

The effective date of this FS is February 23, 2022, and the issue date of the Technical Report is March 14, 2022. The effective dates of the Pinion and Dark Star databases on which the mineral resources described in this Technical Report are estimated on are June 2, 2021, and June 15, 2021, respectively. The effective dates of the Jasperoid Wash database is October 6, 2018, and the effective date of the North Bullion deposits database is August 21, 2020. New optimized pits and underground shells were generated using current mining costs in 2022, so the effective dates of the reported mineral resource estimates for all deposits is January 31, 2022.

| 2.4 | Frequently Used Acronyms, Abbreviations, Definitions, and Units of Measure |

In this Technical Report, measurements are generally reported in metric units. Where information was originally reported in imperial units, MDA has made the conversions as shown below. In the case of metallurgical test data and historical mineral resource estimates the units are as originally reported in order to preserve historical accuracy and avoid errors that can result from rounding converted data.

Currency, units of measure, and conversion factors used in this Technical Report include:

Linear Measure 1 inch | = 2.54 centimeter | |

1 foot 1 mile | = 0.3048 meter = 1.6093 kilometer | = 0.3333 yard |

Area Measure 1 acre | = 0.40469 hectares | = 0.001562 square mile |

Capacity Measure (liquid) 1 gallon | = 3.7846 liters | |

Weight 1 ton | = 1 imperial short ton | = 2,000 pounds |

1 tonne 1 kilogram | = 1.1023 short tons = 2.205 pounds | = 2,205 pounds or = 1,000 kilograms |

Regarding currency, unless otherwise indicated, all references to dollars ($) in this Technical Report refer to currency of the United States.

Frequently used acronyms and abbreviations are as shown in Table 2-2.

| M3-PN185074

14 March 2022

Revision 1 | 2-3 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

Table 2-2: Acronyms and Abbreviations

| Abbreviation | Description |

| 2SD | two times the standard deviation |

| 3SD | three times the standard deviation |

| AA | atomic absorption spectrometry |

| ABA | acid-base accounting |

| Ag | silver |

| AgCN | cyanide-soluble silver |

| AgFA | silver analysis by fire assay, total silver content |

| Au | gold |

| AuCN | cyanide-soluble gold |

| AuFA | gold analysis by fire assay, total gold content |

| Calc, calc | calculated |

| CINO | inorganic carbon |

| cm | centimeters |

| core | diamond core-drilling method |

| °C | degrees Celsius |

| Ext | extracted |

| °F | degrees Fahrenheit |

| FA | fire assay |

| ft | foot or feet |

| ft2, sf | square feet |

| gal | gallon(s) |

| g | gram |

| gpl | grams per liter |

| GPM, gpm | gallons per minute |

| g/t | grams per metric tonne |

| Ha | hectares |

| hd | head |

| HP | horsepower |

| Hr., hr., hrs | hour, hours |

| ICP | inductively-coupled plasma-emission spectrometric method |

| ICP-MS | inductively-coupled plasma-emission and mass spectrometry |

| in | inch or inches |

| kg | kilograms |

| km | kilometers |

| kW | kilowatts |

| kWh/m3 | kilowatt-hours per cubic meter |

| kWh/yr | kilowatt-hours per year |

| l | liter (L in metallurgical use) |

| lb or lbs. | Pounds |

| m | Meters |

| Ma | million years |

| mi | mile or miles |

| mm | millimeters |

| µm | micron or 10-6 meters |

| NAG | non-acid generating, (neutralizing potential) |

| NSR | net smelter return |

| Opt, oz/ton | troy ounce per short ton |

| org | Organic |

| oz | troy ounce |

| P80 | the theoretical square screen-opening, through which 80 weight percent of the particles will pass. |

| M3-PN185074

14 March 2022

Revision 1 | 2-4 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| Abbreviation | Description |

| PAG | potential acid generating |

| ppm | parts per million |

| ppb | parts per billion |

| QA/QC | quality assurance and quality control |

| RC | reverse-circulation drilling method |

| RQD | rock-quality designation |

| SO4 | Sulfate |

| st | Imperial short ton (2,000 pounds) |

| SSUL | sulfide sulfur |

| t | metric tonne or tonnes |

| tot | total |

| M3-PN185074

14 March 2022

Revision 1 | 2-5 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

SECTION 3 TABLE OF CONTENTS

| 3 | RELIANCE ON OTHER EXPERTS | 3-1 |

| M3-PN185074

14 March 2022

Revision 1 | 3-i |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| 3 | RELIANCE ON OTHER EXPERTS |

Mr. Ekins, who is an independent registered professional landman (RPL#32306) and president of GIS Land Services in Reno, Nevada, assisted with the preparation of the summary land description and property maps discussed below. Mr. Ekins and Gold Standard have relied upon title opinions prepared by Mr. Jeff N. Faillers of Erwin Thompson Faillers, of Reno, Nevada, Mr. Richard Thompson of Harris & Thompson, of Reno, Nevada, and Ms. Tracy Guinand, an independent registered professional landman of Tracy Guinand Land LLC, of Reno, Nevada. The most recent of these title opinions are dated September 5, 2018. The opinions provided on surface ownership and subsurface mineral ownership, along with royalty information, are current as of the effective date of this Technical Report. Additional details with respect to the surface and subsurface ownership are provided in Gold Standard’s most recent Annual Information Form (“AIF”), which can be found on the SEDAR website at www.sedar.com.

The sample collection, security, transportation, preparation, and analytical procedures are judged by the authors to be acceptable and to have produced data suitable for use in the estimation of the mineral resources reported in Section 11, subject to those exclusions or modifications discussed in Section 14. The authors consider the procedures utilized by Gold Standard and the assay laboratories to be appropriate for use as described.

The QPs of this report relied upon contributions from other consultants as well as Gold Standard Ventures. The QPs have reviewed the work of the other contributors and find that this work has been performed to normal and acceptable industry and professional standards. The authors are not aware of any reason why the information provided by these contributors cannot be relied upon.

| M3-PN185074

14 March 2022

Revision 1 | 3-1 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

SECTION 4 TABLE OF CONTENTS

| 4 | PROPERTY DESCRIPTION AND LOCATION | 4-1 |

| | 4.1 | LOCATION AND LAND AREA | 4-1 |

| | 4.2 | AGREEMENTS AND ENCUMBRANCES | 4-3 |

| | 4.3 | ENVIRONMENTAL PERMITS | 4-5 |

| | | 4.3.1 | Other Permits | 4-5 |

| | | 4.3.2 | Private Land Disturbance | 4-5 |

SECTION 4 LIST OF FIGURES

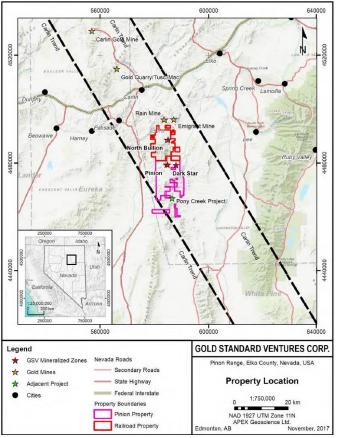

| Figure 4-1: | Location Map for the Railroad-Pinion Property | 4-2 |

| Figure 4-2: | Railroad-Pinion Property with Ownership Percentages, Elko County, Nevada | 4-2 |

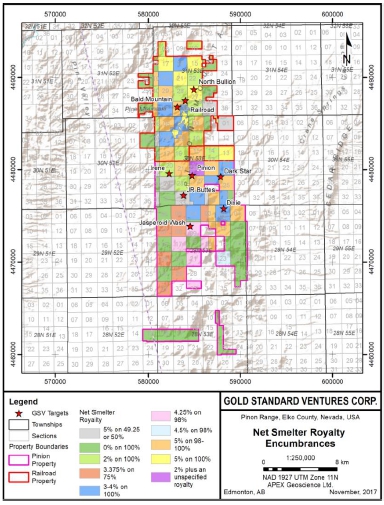

| Figure 4-3: | Railroad-Pinion Property Map with Royalty Encumbrances | 4-4 |

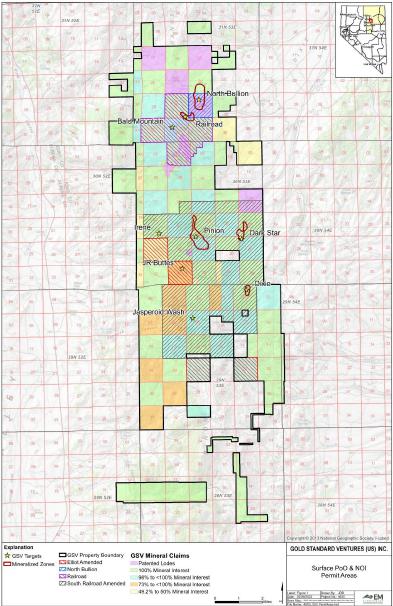

| Figure 4-4: | Property Map with Railroad- Pinion Permit Boundaries | 4-6 |

| M3-PN185074

14 March 2022

Revision 1 | 4-i |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| 4 | PROPERTY DESCRIPTION AND LOCATION |

| 4.1 | Location and Land Area |

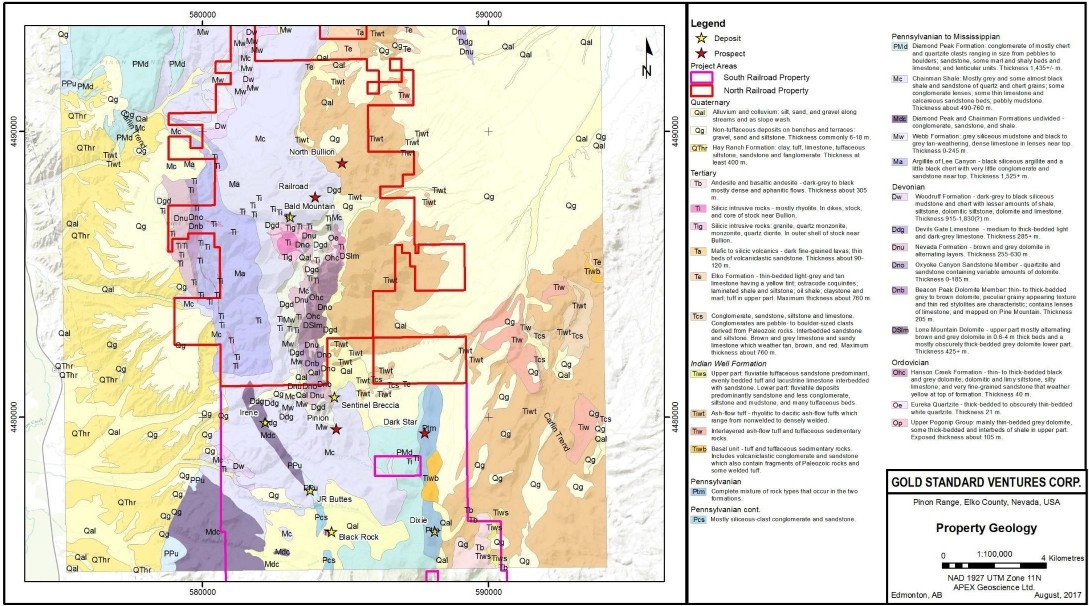

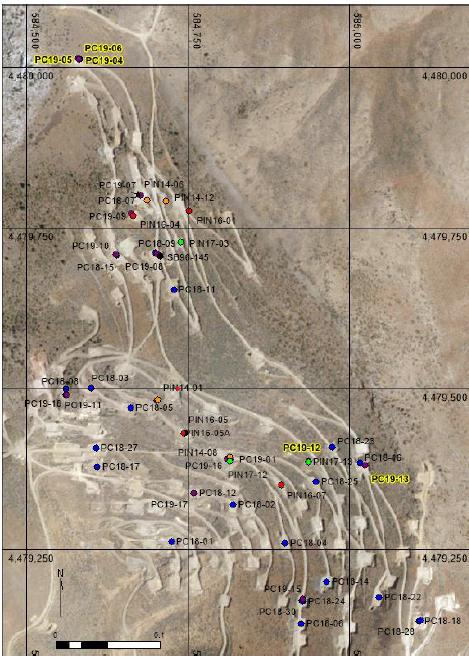

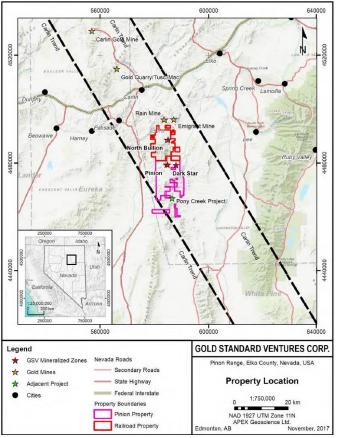

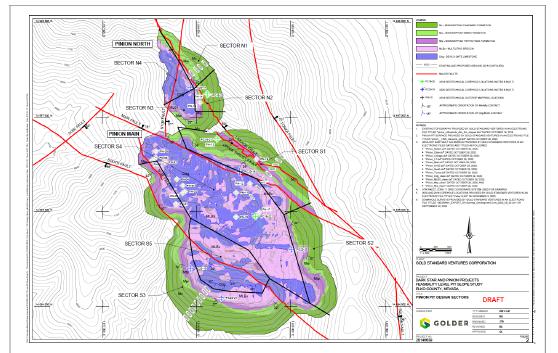

The property that is the subject of this Technical Report comprises two contiguous areas of mineral tenure held by Gold Standard (Figure 4-1) that straddle the Piñon Range in the Railroad mining district at the southeast end of the Carlin trend, a northwest-southeast trending belt of prolific gold endowment in northern Nevada. In previous Technical Reports, the northern portion of the land holdings, now referred to as the North Railroad portion of the property (Figure 4-1), has been referred to as the Railroad project and the Railroad property (Dufresne et al., 2017). The southern portion of the Railroad-Pinion property, now referred to as the South Railroad portion of the property (Figure 4-1), was referred to as the Pinion project and the Pinion property in previous technical reports (Dufresne et al., 2017). In November 2017, Gold Standard published a technical report on the Railroad-Pinion property, which included a mineral resource estimate for the North Bullion, POD, and Sweet Hollow gold deposits (Dufresne and Nicholls, 2017b), located in the North Railroad portion of the Railroad-Pinion property, approximately 6 miles north of the Dark Star and Pinion deposits. Based on available information, North Bullion, POD, and Sweet Hollow would not likely share a common mining infrastructure with Dark Star and Pinion.

The Railroad-Pinion property in the Piñon Range is accessed primarily from the four-lane transcontinental U.S. Interstate 80 (“I-80”), approximately 275 miles west of Salt Lake City, Utah, and 290 miles east of Reno, Nevada (Figure 4-1). The project is located between 8 and 18 miles south of I-80 and can be reached by a series of paved and gravel roads from Elko, Nevada (population 18,300). The property is centered approximately at UTM NAD27 Zone 11 coordinates of 585,000E and 4,480,000N.

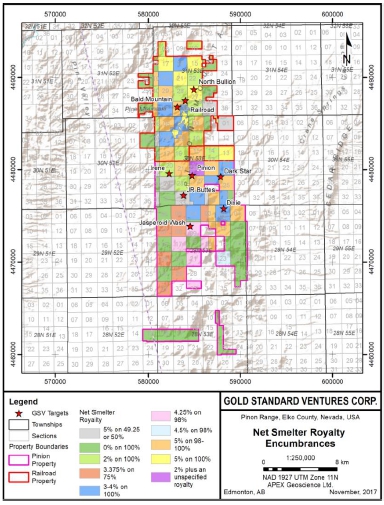

The North and South Railroad properties combined constitute a land position totaling 53,570 acres, and with partial interests taken into consideration, 50,600 acres net acres of land in Elko County, Nevada. The properties are located within Section 13 in Township (“T”) 28N, Range (“R”) 52E; Sections 10, 11, 14, 16, 17, 18, 23, and 24 in T28N, R53E; Sections 1 to 21, 23, 24, 25, 29, 30, 31, 33, 35, and 36 in T29N, R53E; Sections 7, 18, 19, and 30 in T29N, R54E; Section 12 in T30N, R52E; Sections 1 to 10, 13 to 33, and 36 in T30N, R53E; Sections 24 and 36 in T31N, R52E; and Sections 8, 10, 14 to 22 and 26 to 35 in T31N, R53E, as shown in Figure 4-2. Gold Standard owns, or otherwise controls 100% of the subsurface mineral rights on a total of 29,942 acres of land held as patented and unpatented lode claims. This includes 1,455 unpatented claims owned by Gold Standard and 207 unpatented claims held under lease (Appendix B). Gold Standard also owns or leases 30 patented claims (Appendix B).

There is also a total of 23,628 gross acres of private lands of which Gold Standard’s ownership of the subsurface mineral rights varies from 49.2% to 100% (Figure 4-2), for a net position of approximately 20,658 gross acres.

| M3-PN185074

14 March 2022

Revision 1 | 4-1 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| |  |

| | | |

| Figure 4-1: Location Map for the Railroad-Pinion Property | | Figure 4-2: Railroad-Pinion Property with Ownership Percentages, Elko County, Nevada |

| | | |

| (from Dufresne and Nicholls, 2017b) | | (from Dufresne and Nicholls, 2017b) |

| M3-PN185074

14 March 2022

Revision 1 | 4-2 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

Private surface and private mineral property are wholly owned and subject to lease agreement payments (see Section 4.2) and property taxes (paid on an annual basis) as determined by Elko County. Unpatented lode mining claims grant the holder 100% of the locatable mineral rights and access to the surface for exploration activities which cause insignificant surface disturbance. Ownership of the unpatented mining claims is in the name of the holder (locator), subject to the paramount title of the United States of America, under the administration of the BLM. Under the Mining Law of 1872, which governs the location of unpatented mining claims on federal lands, the locator has the right to explore, develop, and mine minerals on unpatented mining claims without payments of production royalties to the U.S. government, subject to the surface management regulation of the BLM. Currently, annual claim-maintenance fees are the only federal payments related to unpatented mining claims. The mineral rights do not expire if the unpatented claims are maintained by paying an annual fee of $165 per claim to the U.S. Department of Interior, BLM prior to the end of the business day on August 31 every year. A notice of intent to hold must also be filed with the Elko County Recorder on or before November 1 annually, along with a filing fee of $12.00 per claim, plus a $4.00 document fee.

Gold Standard has completed its federal claim maintenance fee obligations for the owned and leased unpatented claims for 2021-2022 assessment year. The federal claim maintenance fees for the claims for the 2022-2023 assessment year are due on or before September 1, 2022. Gold Standard’s estimated claim maintenance fee cost for the owned and leased unpatented claims is $294,414 per annum, and the company’s total estimated annual cost to maintain its property package is $1,572,834.

| 4.2 | Agreements and Encumbrances |

Portions of the unpatented and private lands are encumbered with royalties predominantly in the form of standard Net (or Gross) Smelter Return (“NSR” or “GSR”) and Mineral Production (“MP”) royalty agreements, or Net Profit Interest (“NPI”) agreements. The locations and aerial distribution of the currently relevant royalty encumbrances for the Railroad-Pinion property are shown in Figure 4-3. These are summarized as follows:

| ● | 1.0% NSR royalty to Franco-Nevada U.S. Corporation, as successor-in-interest to Royal Standard Minerals, Inc. and Manhattan Mining Co. on the portion of the property acquired by statutory plan of arrangement; |

| ● | 1.5% MP royalty to Kennecott Holdings Corporation on claims noted as the Selco Group; |

| ● | 5.0% NSR royalty to the owners of the undivided private mineral interests; |

| ● | Gold Standard owns an approximate 99.2% mineral interest in Sections 21 and 27 by way of several lease agreements. Pursuant to the terms of the relevant lease agreements, Sections 21 and 27 are subject to a 5.0% NSR royalty to the lessors of the leased property; |

| ● | Section 22 is comprised of the TC 1 through 39, and TC 37R and 38R unpatented lode mining claims owned by Gold Standard. The TC claims are subject to an unknown/unspecified NSR royalty to "GSI, Inc., of Virginia"; |

| ● | 1.0% NSR royalty to Aladdin Sweepstake Consolidated Mining Company on the portion of the property acquired by statutory plan of arrangement, including the PIN#1 to PIN#12 lode mining claims; |

| ● | 4.0% NSR royalty to ANG Pony LLC for mining claims leased by Gold Standard in Sections 34 and 36 in T30N, R53E, and Sections 2 and 4 in T29, R53E; |

| ● | 3.0% NSR royalty to Peter Maciulaitis for certain mining claims in Sections 24 and 26 in T30N, R53E; |

| ● | A 3.0% NSR royalty (relative to mineral interest) to Linda Zunino and Tony Zunino, Trustees of the Delert J. Zunino and Linda Zunino Family Trusts dated October 11, 1994, and a 3.0% NSR royalty (relative to mineral interest) to John C. Carpenter and Roseann Carpenter, husband and wife, on Section 23 in T29N, R53E; |

| M3-PN185074

14 March 2022

Revision 1 | 4-3 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

| ● | 2.0% NSR royalty to Maverix Metals Inc., a successor-in-interest to Amax Gold Inc., on certain patented and unpatented mining claims owned by the company; |

| ● | A 3.0% NSR royalty to Nevada Sunrise LLC on the 14 WMH claims situated in Sections 1, 2, 3, and 11 in T29N, R53E; and |

| ● | A 3.5% NSR royalty (relative to mineral interest) to Dominek Pieretti and the heirs of Tusca Sullivan on Sections 3, 5, 7, 8, 9, 10, 15, 17, 19, 21, 29, 31, and 33 in T29N, R53E, and Section 33 in T30N, R53E. |

(from Dufresne & Nicholls, 20147b)

Figure 4-3: Railroad-Pinion Property Map with Royalty Encumbrances

| M3-PN185074

14 March 2022

Revision 1 | 4-4 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

As of the effective date of this Technical Report, the authors are not aware of any significant factors or risks that may affect access, title, or the right or ability to perform work on the property. Gold Standard controls sufficient ground and has sufficient permitting in place to access the project and continue future exploration programs. Details on permitting are provided below. The following section discusses land use permitting and other regulatory information specific to the South Railroad portion of the property.

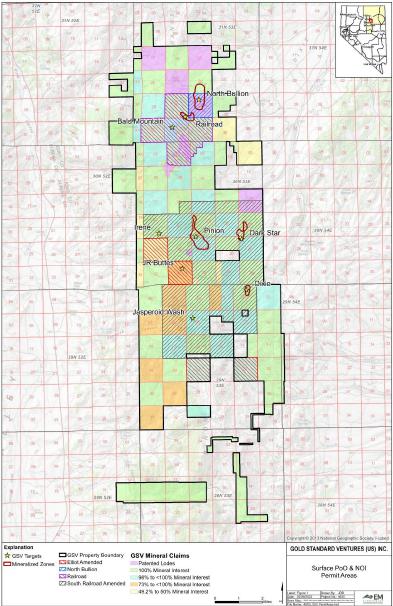

A Plan of Operations for the South Railroad Mining Project was submitted to BLM in November 2020. BLM issued a letter of completeness in December 2020 and determined that due to the scope of the project, an Environmental Impact Statement would need to be prepared under the National Environmental Policy Act prior to approval. Additional State and Federal Permit applications are being prepared concurrently with the EIS preparation and are expected to be submitted in 2022. These include; Air Operating Permits, a Water Pollution Control Permit, Jurisdictional Water (404) permit, Groundwater Discharge (NPDES) permit and several others.

Exploration

Gold Standard currently has a Plan of Operations (PoO) in place with the BLM and a Surface Area Disturbance Permit with the Nevada Division of Environmental Protection (NDEP) for the South Railroad portion of the property (Figure 4-4).

Gold Standard represents that the PoO for the “South Railroad” portion of the Railroad-Pinion project was approved by the BLM in December 2020. The approved PoO covers a total of 8,456 ac with 5,236 ac of public land and 3,072 ac of private land located in Section 2 in T29N, R53E, and Sections 20, 21, 22, 23, 24, 25, 27, 28, 34, 35, and 36, and portions of Sections 14, 16, and 26 in T30N, R53E. Within the area of the PoO exploration-related disturbance and reclamation bonding can be conducted in three phases totaling 500 acres. A reclamation bond in the amount of 1,448,735 has been posted with the BLM. This covers the initial 300 acres of exploration related disturbance in Phases One and Two.

A PoO and SAD permit are also held for the Railroad Exploration Area. Notices of Intent cover other exploration areas including Section 22, LT, Section 14, and Camp Douglas

| 4.3.2 | Private Land Disturbance |

As of the effective date of this Technical Report, Gold Standard has received a Reclamation Permit (“RP”) that includes the Pinion, Dark Star, and Irene reclamation plans. This RP covers both private land and public land disturbances. Previously approved reclamation plans associated with these areas will be closed by the respective permitting agency, either BLM or NDEP. These operated under an Interim Reclamation Permit (“IRP”) issued by the State of Nevada for disturbance greater than five acres on private land. The IRP allowed up to 11 acres of surface disturbance and covered portions of Sections 21 and 27 (not included in the PoO) in T30N, R53E.

| M3-PN185074

14 March 2022

Revision 1 | 4-5 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

(from Gold Standard, 2018)

Figure 4-4: Property Map with Railroad- Pinion Permit Boundaries

| M3-PN185074

14 March 2022

Revision 1 | 4-6 |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

SECTION 5 TABLE OF CONTENTS

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 5-1 |

| | 5.1 | Access to Property | 5-1 |

| | 5.2 | Climate | 5-1 |

| | 5.3 | Physiography | 5-1 |

| | 5.4 | Local Resources and Infrastructure | 5-2 |

| | | | | |

| M3-PN185074

14 March 2022

Revision 1 | 5-i |

South Railroad Project

Form 43-101F1 Technical Report – Feasibility Study |

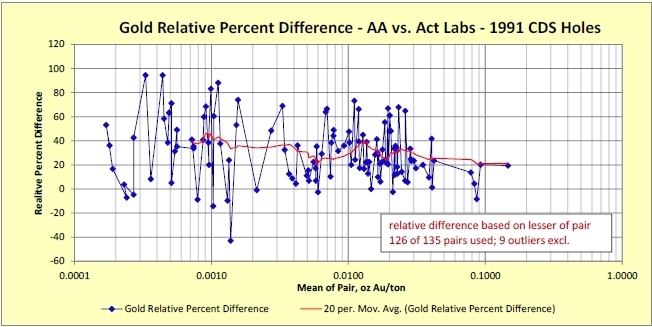

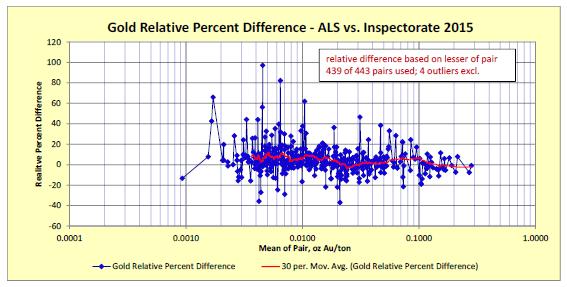

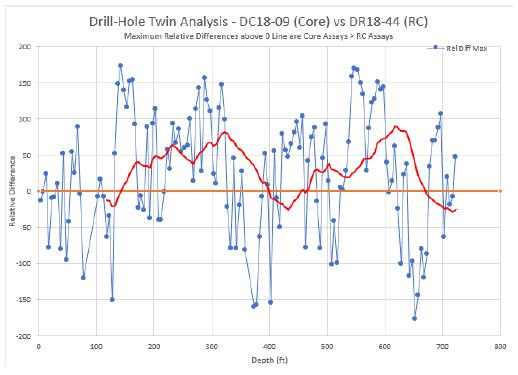

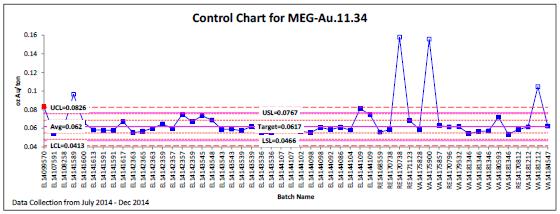

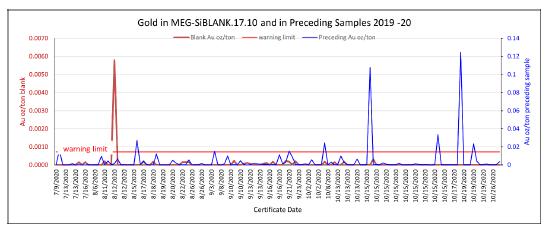

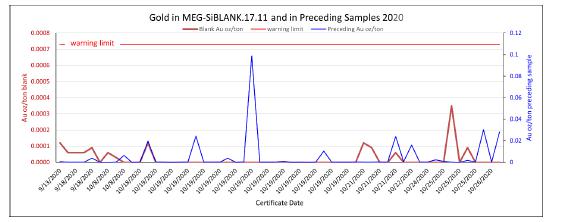

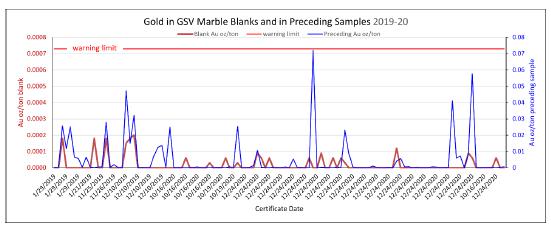

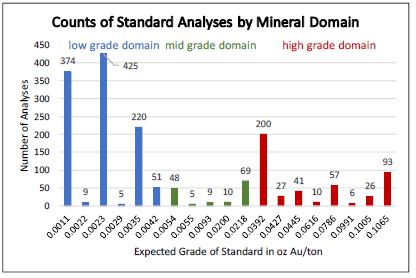

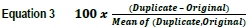

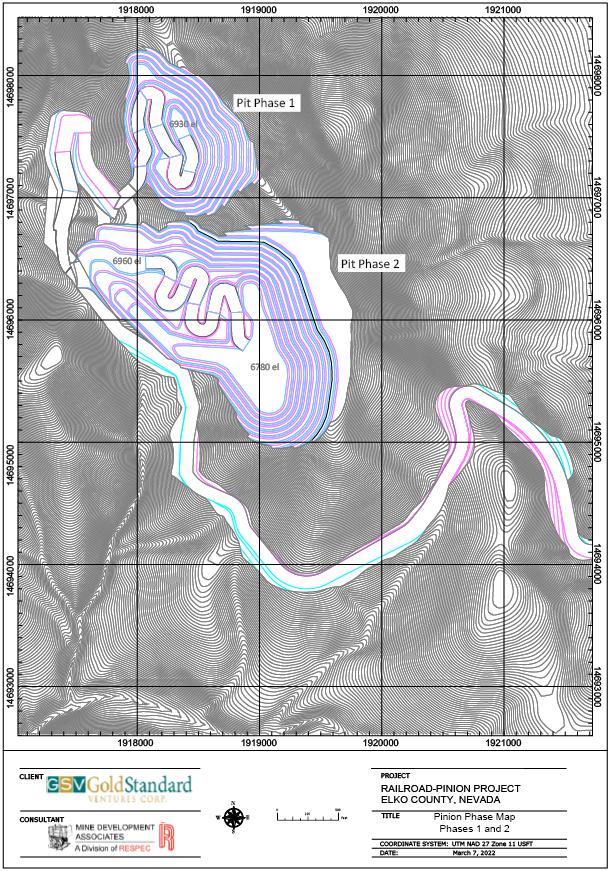

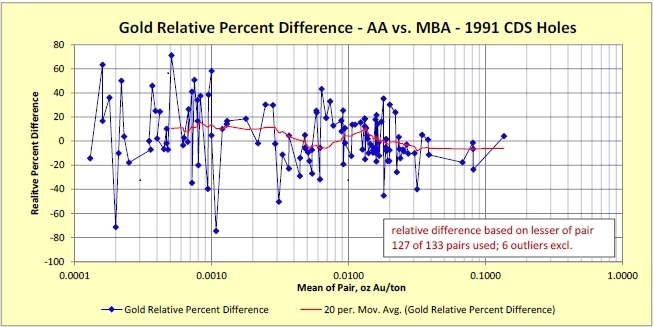

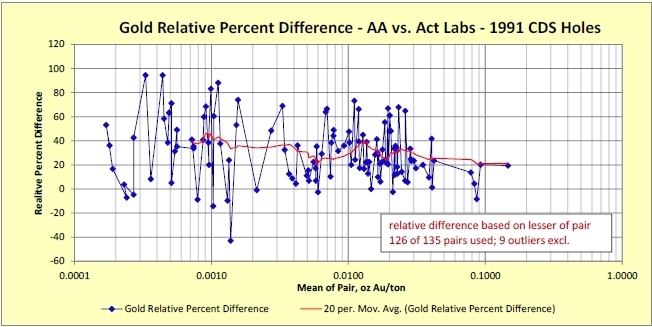

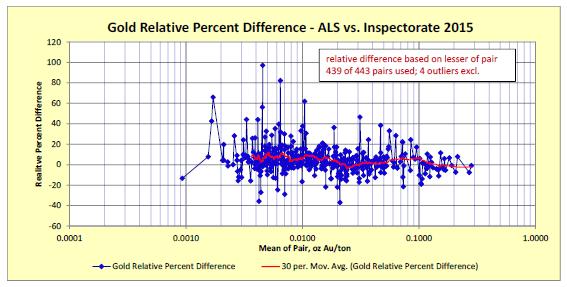

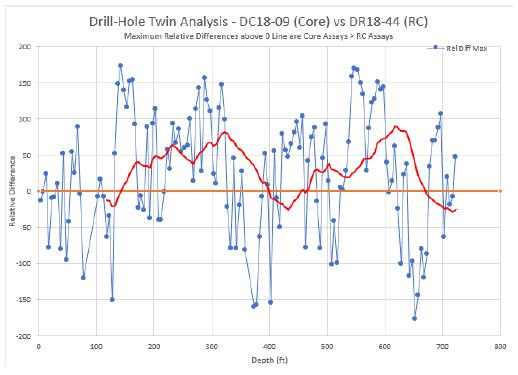

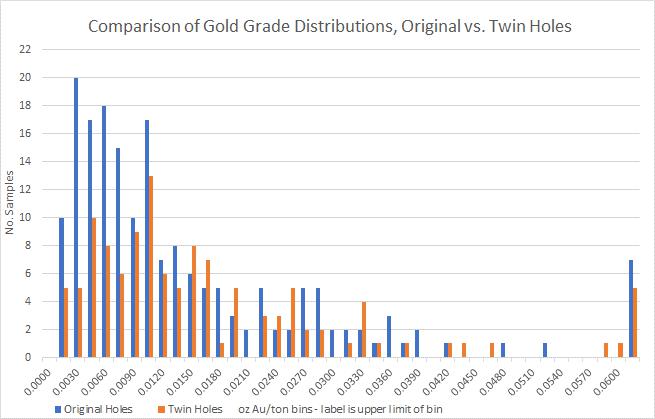

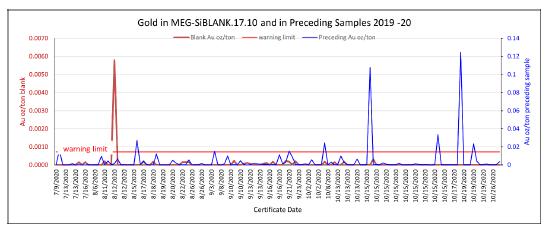

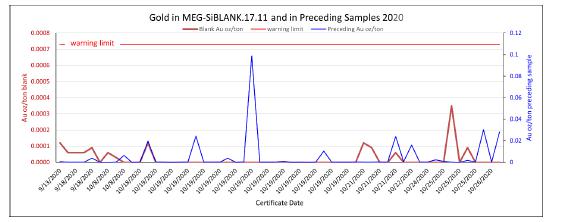

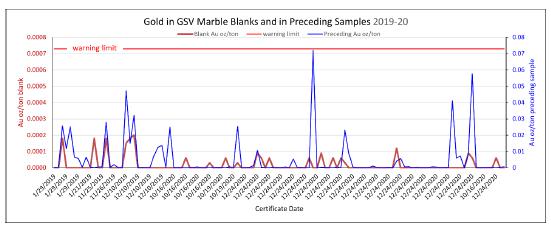

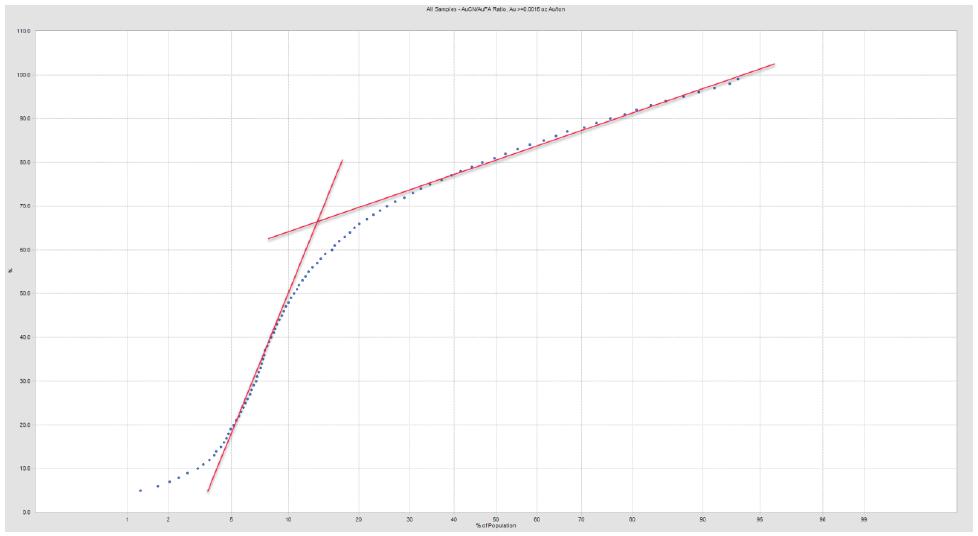

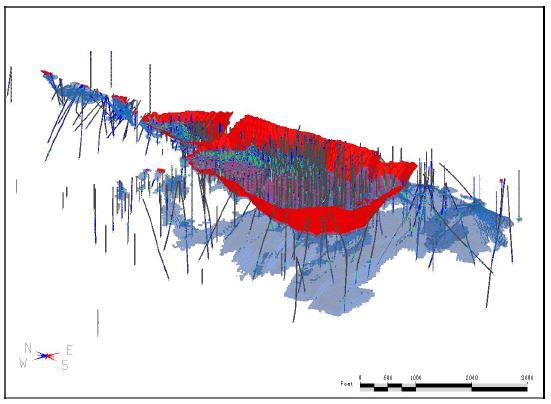

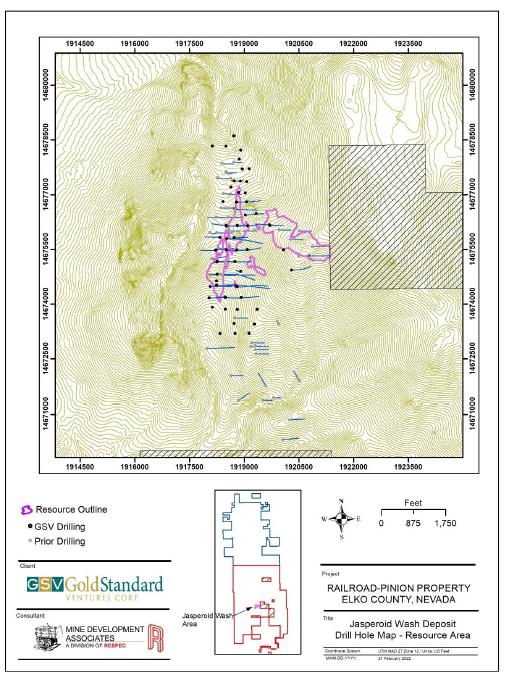

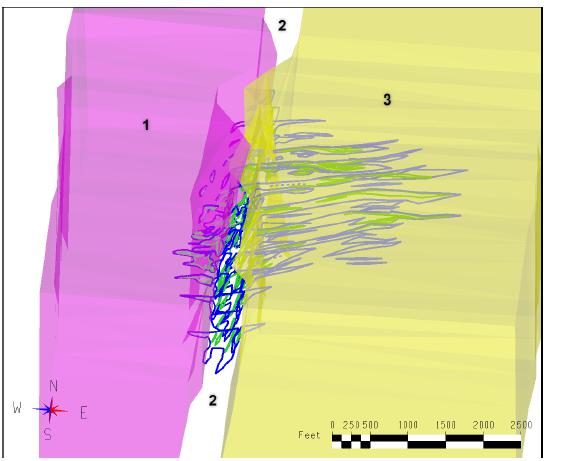

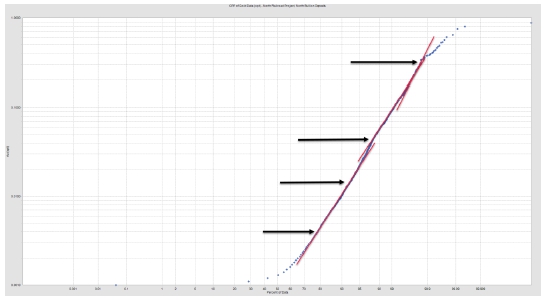

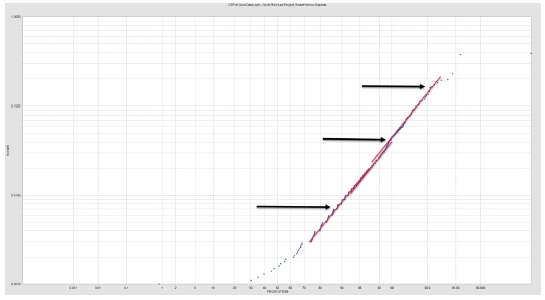

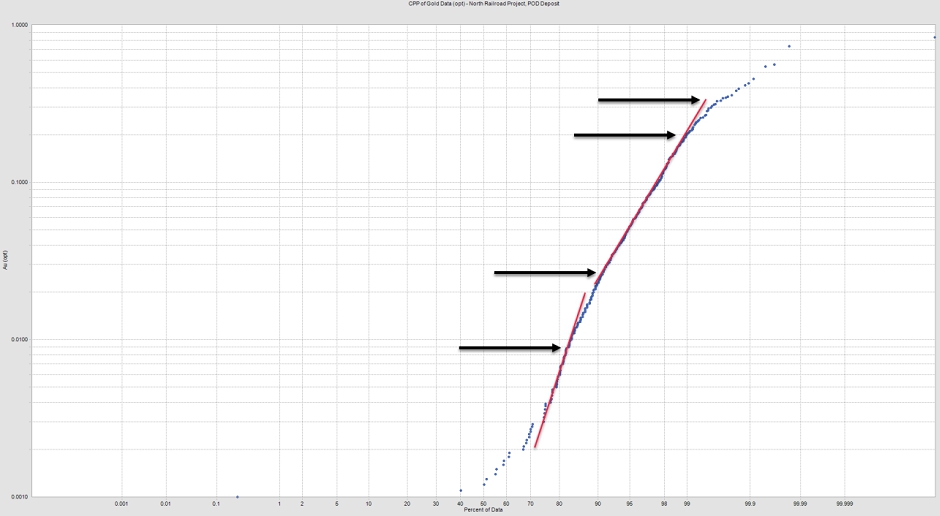

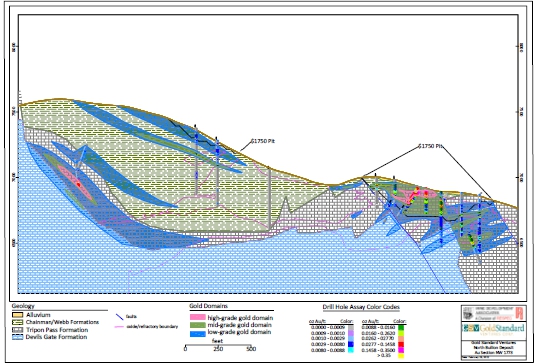

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |