United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 20-F

(Mark One)

| | ¨ REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

| | þ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the fiscal year ended December 31, 2014 |

| | ¨ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES |

| | ¨ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Date of event requiring this shell company report ______________________ For the transition period from ____ to ____ |

Commission file number: 0-51236

Gold Standard Ventures Corp.

(Exact name of Registrant as specified in its charter)

N/A (Translation of Registrant’s name into English) | British Columbia, Canada (Jurisdiction of incorporation or organization) |

Suite 610 – 815 West Hastings Street, Vancouver, B.C. V6C 1B4

(Address of principal executive offices)

Jonathan T. Awde, President & CEO, (604) 669-5702, jonathan@goldstandardv.com, Suite 610 – 815 West Hastings Street, Vancouver, B.C. V6C 1B4

(Name, Telephone, E-mail and/or Facsimile number and address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

Title of each class Common Stock | Name of each exchange on which registered NYSE - MKT |

Securities registered or to be registered pursuant to Section 12(g) of the Act.

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act.

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report: 123,739,878

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act

¨Yes þNo

If this report is an annual or transition report, indicate by check mark, if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 ¨Yes þNo

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

þYes ¨No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for shorter period that the registrant was required to submit and post such files).

¨Yes þNo (not required)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer.

Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer þ |

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ¨ | International Financial Reporting Standards as issued by the International Accounting Standards Board þ | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨Item 17 ¨Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act) ¨Yes þNo

TABLE OF CONTENTS

Page

| GENERAL INFORMATION | iv |

| | | |

| CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS | |

| | | |

| CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESOURCE ESTIMATES | vi |

| | | | |

| GLOSSARY | vii |

| | | | |

| PART I | 1 |

| Item 1. Identity of Directors, Senior Management and Advisers | 1 |

| | | | |

| Item 2. Offer Statistics and Expected Timetable | 1 |

| | | | |

| Item 3. Key Information | 1 |

| | A. | Selected financial data | 1 |

| | B. | Capitalization and indebtedness | 3 |

| | C. | Reasons for the offer and use of proceeds | 3 |

| | D. | Risk Factors | 3 |

| | | | |

| Item 4. Information on the Company | 17 |

| | A. | History and development of the company | 17 |

| | B. | Business overview | 18 |

| | C. | Organizational structure | 21 |

| | D. | Property, plants and equipment | 21 |

| | | | |

| Item 4A. Unresolved Staff Comments | 45 |

| | | | |

| Item 5. Operating and Financial Review and Prospects | 45 |

| | A. | Operating results | 45 |

| | B. | Liquidity and Capital Resources | 49 |

| | C. | Research and development, patents and licenses, etc. | 51 |

| | D. | Trend information | 51 |

| | E. | Off-balance sheet arrangements | 51 |

| | F. | Tabular disclosure of contractual obligations | 51 |

| | G. | Safe harbor | 52 |

| | | | |

| Item 6. Directors, Senior Management and Employees | 52 |

| | A. | Directors and senior management | 52 |

| | B. | Compensation | 54 |

| | C. | Board practices | 57 |

| | D. | Employees | 58 |

| | E. | Share ownership | 58 |

| | | | |

| Item 7. Major Shareholders and Related Party Transactions | 59 |

| | A. | Major shareholders | 59 |

| | B. | Related party transactions | 60 |

| | C. | Interests of experts and counsel | 60 |

| | | | |

| Item 8. Financial Information | 60 |

| | A. | Consolidated statements and other financial information | 60 |

| | B. | Significant changes | 60 |

| | | | |

| Item 9. The Offer and Listing | 61 |

| | A. | Offer and listing details | 61 |

| | B. | Plan of distribution | 63 |

| | C. | Markets | 63 |

| | D. | Selling shareholders | 63 |

| | E. | Dilution | 63 |

| | F. | Expenses of the issue | 63 |

| | | | |

| Item 10. Additional Information | 63 |

| | A. | Share capital | 63 |

| | B. | Memorandum and articles of association | 63 |

| | C. | Material contracts | 63 |

| | D. | Exchange controls | 64 |

| | E. | Taxation | 65 |

| | F. | Dividends and paying agents | 71 |

| | G. | Statement by experts | 71 |

| | H. | Documents on display | 71 |

| | I. | Subsidiary information | 72 |

| | | | |

| Item 11. Quantitative and Qualitative Disclosures About Market Risk | 72 |

| Item 12. Description of Securities Other than Equity Securities | 72 |

| | A. | Debt securities | 72 |

| | B. | Warrants and rights | 72 |

| | C. | Other securities | 72 |

| | D. | American depositary shares | 72 |

| | | | |

| PART II | |

| Item 13. Defaults, Dividends Arrearages and Delinquencies | 73 |

| | | | |

| Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds | 73 |

| | | | |

| Item 15. Controls and Procedures | 73 |

| | | | |

| Item 16A. Audit Committee Financial Expert | 74 |

| Item 16B. Code of Ethics | 74 |

| Item 16C. Principal Accountant Fees and Services | 75 |

| Item 16D. Exemptions from the Listing Standards for Audit Committees | 75 |

| Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers | 75 |

| Item 16F. Change in Registrant’s Certifying Accountant | 75 |

| Item 16G. Corporate Governance | 75 |

| Item 16H. Mine Safety Disclosure | 76 |

| | |

| PART III | |

| Item 17. Financial Statements | 77 |

| | |

| Item 18. Financial Statements | 77 |

| | |

| Item 19. Exhibits | 77 |

| | |

| Signatures | 79 |

| | |

| Financial Statements | F-1 |

GENERAL INFORMATION:

Gold Standard Ventures Corp. is a British Columbia corporation. In this Annual Report, Gold Standard Ventures Corp. is referred to as the “Company,” the “Registrant,” “we” or “us,” and includes our subsidiaries unless the context other requires.

All references to “$” or “dollars” herein are to lawful currency of Canada unless otherwise expressly stated. References to “U.S.$” are to United States dollars.

Imperial and Metric Conversions

The following table sets forth certain standard conversions between Standard Imperial Units and the International System of Units (or metric units).

| To Convert From | To | Multiply By |

| | | |

| Feet | Metres | 0.305 |

| Metres | Feet | 3.281 |

| Miles (“mi”) | Kilometers (“km”) | 1.609 |

| Kilometers | Miles | 0.621 |

| Acres | Hectares | 0.405 |

| Hectares | Acres | 2.471 |

CAUTIONARY STATEMENT REGARDING FORWARD LOOKING STATEMENTS

This Annual Report contains “forward looking statements,” as defined in Section 27A of the U.S. Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on our current expectations, assumptions, estimates, beliefs and projections about our Company. These forward-looking statements are subject to various known and unknown risks and uncertainties. Generally, the forward-looking statements can be identified by the use of terminology followed by or that include words such as “seeks”, “plans”, “expects”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or “believes”, or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “should”, “would”, “might” or “will be taken”, “occur” or “be achieved”, or the negative forms of any of these words and other similar expressions.

Forward-looking statements may relate to future financial conditions, results of operations, plans, objectives, performance or business developments. Forward-looking statements contained or incorporated by reference in this Annual Report relating to the Company may pertain to the following, among others: exploration and work programs, drilling plans and timing of drilling, plans for development and facilities construction and timing, method of funding and completion thereof, performance characteristics of our mineral properties, drilling, results of our various projects, the existence of mineral resources or reserves and the timing of development thereof, projections of market prices and costs, supply and demand for gold and other precious metals, expectations regarding the ability to raise capital and to acquire reserves through acquisitions and/or development, treatment under governmental regulatory regimes and tax laws, and capital expenditure programs and the timing and method of financing thereof. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable by us as of the date of such statements, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Our estimates and assumptions contained or incorporated by reference in this Annual Report, which may prove to be incorrect, include, but are not limited to, the various assumptions set forth herein, or as otherwise expressly incorporated herein by reference as well as:

| | · | our limited operating history |

| | · | our history of losses and expectation of future losses |

| | · | uncertainty as to our ability to continue as a going concern |

| | · | the existence known mineral resources on our mineral properties |

| | · | our ability to obtain adequate financing for exploration and development |

| | · | our ability to attract and retain qualified personnel |

| | · | foreign currency fluctuations |

| | · | uncertainty as to our ability to maintain effective internal controls |

| | · | the involvement by some of our directors and officers with other natural resource companies |

| | · | the uncertain nature of estimating mineral resources and reserves |

| | · | uncertainty surrounding our ability to successfully develop our mineral properties |

| | · | exploration, development and mining risks, including risks related to infrastructure, accidents and equipment breakdowns |

| | · | title defects to our mineral properties |

| | · | our ability to obtain all necessary permits and other approvals |

| | · | risks related to equipment shortages, access restrictions and inadequate infrastructure |

| | · | increased costs and restrictions on operations due to compliance with environmental legislation and potential lawsuits |

| | · | fluctuations in the market price of gold and other metals |

| | · | intense competition in the mining industry |

| | · | our ability to comply with applicable regulatory requirements. |

In making the forward-looking statements included in this Annual Report and the documents incorporated by reference herein, we have made various material assumptions, including, but not limited to:

| | · | the results of our proposed exploration programs on the Railroad-Pinion Project will be consistent with current expectations |

| | · | our assessment and interpretation of potential geological structures and mineralization at the Railroad-Pinion Project are accurate in all material respects |

| | · | the sufficiency of our current cash on hand to begin Phase 1 of the work program on the Railroad-Pinion Project recommended in the Railroad-Pinion Report |

| | · | the price for gold and other precious metals will not fall significantly below current levels |

| | · | we will be able to secure additional financing to continue our exploration and, if warranted, development activities on the Railroad-Pinion Project and meet future obligations |

| | · | we will be able to obtain regulatory approvals and permits in a timely manner and on terms consistent with current expectations |

| | · | we will be able to procure drilling and other mining equipment, energy and supplies in a timely and cost efficient manner to meet our needs from time to time |

| | · | our capital and operating costs will not increase significantly from current levels |

| | · | key personnel will continue their employment with us and we will be able to obtain and retain additional qualified personnel, as needed, in a timely and cost efficient manner |

| | · | there will be no significant adverse changes in the Canada/U.S. currency exchange rate |

| | · | there will be no significant changes in our ability to comply with environmental, safety and other regulatory requirements |

| | · | the absence of any material adverse effects arising as a result of political instability, terrorism, sabotage, natural disasters, equipment failures or adverse changes in government legislation or the socio-economic conditions in Nevada and the surrounding area with respect to our properties and operations. |

There can be no assurance that forward-looking statements may prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements are provided for the purpose of providing information about management’s expectations and plans relating to the future. All of the forward-looking statements made or incorporated by reference in this Annual Report are qualified by these cautionary statements. We disclaim any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, or to explain any material difference between subsequent actual events and such forward-looking statements, except to the extent required by applicable law. Readers should carefully review the information in this Annual Report, especially “Risk Factors” in Item 3D “Business Overview” in Item 4B and “Operating and Financial Review and Prospects” in Item 5, and in other filings we may make in the future with the SEC.

Forward-looking statements speak only as of the date the statements are made. We assume no obligation to update publicly or otherwise revise any forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable securities laws. If we do update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

CAUTIONARY NOTE TO U.S. INVESTORS CONCERNING MINERAL RESOURCE ESTIMATES

The disclosures in this Annual Report and the documents incorporated by reference herein regarding mineral reserve and resource estimates have been prepared in accordance with the requirements of Canadian securities laws, which differ from the requirements of United States securities laws. Disclosure, including scientific or technical information, has been made in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”). NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Canadian standards under NI 43-101 differ significantly from the standards in the SEC Industry Guide 7 under Regulation S-K of the Securities Act.

In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “reserve”. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Among other things, all necessary permits would be required to be in hand or imminently issued in order to classify mineralized material as reserves under SEC standards. In addition, the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in and required to be disclosed by NI 43-101; however, these terms are not defined under SEC Industry Guide 7, and these terms or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by United States standards are normally not permitted to be used in reports and registration statements filed with the SEC. United States investors should also understand that “measured mineral resources”, “indicated mineral resources” and “inferred mineral resources” have a great amount of uncertainty as to their existence and as to their economic and legal feasibility. Investors are cautioned not to assume that any part, or all, of the mineral deposits in these categories will ever be converted into mineral reserves. In accordance with Canadian rules, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable, or that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. In addition, the definitions of “proven” and “probable mineral reserves” used in NI 43-101 differ from the definitions in the SEC Industry Guide 7. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute reserves as in place tonnage and grade without reference to unit measures.

Accordingly, information contained in this Annual Report and any documents incorporated by reference herein containing descriptions of our mineral properties may not be comparable to similar information made public by U.S. companies subject to the reporting and disclosure requirements under the United States federal securities laws and the rules and regulations thereunder.

GLOSSARY

Glossary of Terms

“2015 Railroad-Pinion Report” means the technical report dated March 31, 2015 on the Railroad-Pinion Project entitled “Technical Report on the Railroad and Pinion Projects Elko County, Nevada USA” prepared in compliance with NI 43-101 by Andrew Turner, B.Sc., P. Geol. and Michael B. Dufresne, M.Sc., P. Geol., of APEX and Steven R. Koehler, B.Sc., QP, CPG#10216, our Manager of Projects.

“APEX” means APEX Geoscience Ltd., of Edmonton, Alberta.

“Arrangement” means our acquisition on July 13, 2010 of all of the issued and outstanding securities of JKR in exchange for like securities (including Common Shares) on a one for one basis.

“Arrangement Agreement” means the arrangement agreement, dated May 26, 2010, between us and JKR pursuant to which the Arrangement was effected.

“BCBCA” means the Business Corporations Act (British Columbia), as amended from time to time.

“BLM” means the United States, Department of Interior, Bureau of Land Management.

“Board” means our board of directors.

“Common Shares” means Common Shares without par value of our capital stock.

“Company” means Gold Standard Ventures Corp., and includes our subsidiaries unless the context otherwise requires.

“Computershare” means Computershare Investor Services Inc., our registrar and transfer agent.

“Dark Star Deposit” means the gold deposit located at the southern end of the Railroad-Pinion Project approximately two miles (three km) east of the Pinion Deposit and the subject of a recent April 17, 2015 report entitled "Technical Report Maiden Resource Estimate Dark Star Deposit, Elko County, Nevada USA", prepared in compliance with NI 43-101 under the direction of Michael Dufresne, M.Sc., P.Geol., P.Geo., Steven Nicholls, BA.Sc., M AIG and Andrew Turner, B.Sc., P.Geol. of APEX Geoscience Ltd. of Edmonton, Canada.

“East Bailey Project” means the early stage gold exploration prospect comprising 532 unpatented lode mineral claims totaling approximately 10,425 acres in Elko County, as more particularly described under Item 4D “Property, Plants and Equipment” of this Annual Report.

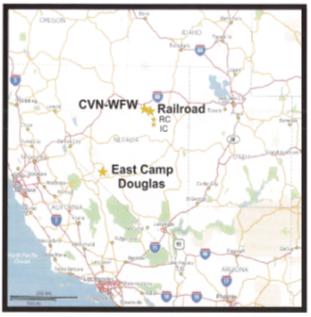

“East Camp Douglas Project” means the early stage gold exploration prospect comprising 281 unpatented mineral claims and several blocks of fee lands totaling approximately 5,403.7 acres in the Walker Lane Trend of Mineral County, Nevada as more particularly described under Item 4D “Property, Plants and Equipment” of this Annual Report.

“EDGAR” means the SEC Electronic Data Gathering and Retrieving as located on the internet at www.edgar.com.

“GSV US” means Gold Standard Ventures (US) Inc., a wholly owned subsidiary of JKR incorporated pursuant to the laws of the state of Nevada and holding all of JKR’s interest in the Railroad-Pinion Project and the Camp Douglas Project.

“IFRS” means International Financial Reporting Standards.

“JKR” means JKR Gold Resources Inc., our wholly owned subsidiary incorporated under the BCBCA.

“JKR US” means JKR Gold Resources USA Inc., a wholly owned subsidiary of JKR incorporated pursuant to the laws of Nevada and holding all of our interest in the Safford-CVN Project and East Bailey Project.

“JMD” means JMD Exploration Corp., a wholly owned subsidiary of JKR incorporated under the BCBCA.

“NI 43-101” means National Instrument 43-101 Standards of Disclosure of Mineral Projects adopted by the Canadian Securities Administrators.

“NSR” means net smelter returns royalty.

“NYSE-MKT” means the NYSE-MKT LLC, a wholly-owned subsidiary of NYSE Euronext.

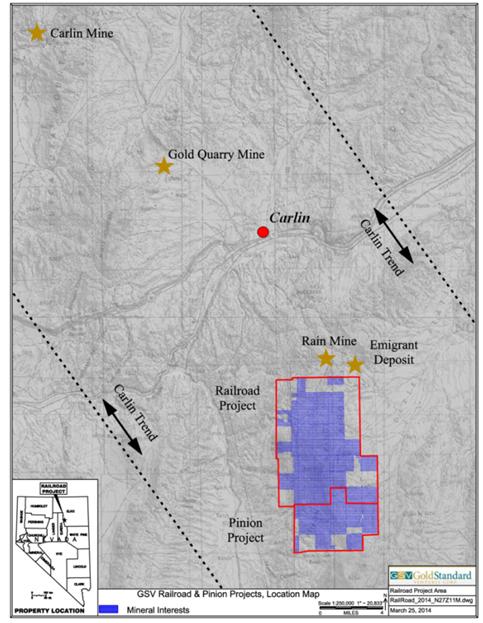

“Pinion Deposit” means the gold deposit located primarily within Section 27 (T30N, R53E) of the Pinion Project and the subject of the maiden resource estimate in the Pinion Resource Report.

“Pinion Project” means that portion of the Railroad-Pinion Project located in Elko County, Nevada adjoining the southern boundary of the Railroad Project as more particularly described under Item 4D “Property, Plants and Equipment” of this Annual Report.

“Pinion Resource Report” means the technical report dated October 24, 2014 establishing the maiden resource estimate for the Pinion Deposit titled “Technical Report Maiden Resource Estimate Pinion Project Elko County, Nevada USA” prepared in accordance with NI 43-101 by Michael B. Dufresne, M.Sc., P. Geol., P. Geo, Steven J. Nicholls, BA.Sc., MAIG, and Andrew J. Turner, BSc., P. Geol, of APEX.

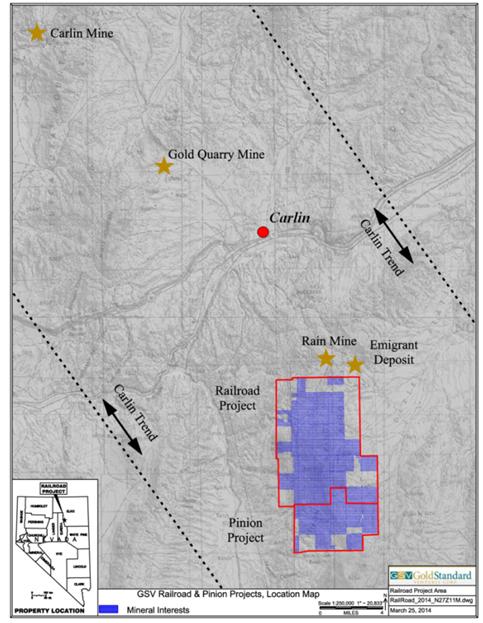

“Railroad Project” means that portion of the Railroad-Pinion Project in Elko County, Nevada situated north of and adjacent to the Pinion Project as more particularly described under Item 4D “Property, Plants and Equipment” of this Annual Report.

“Railroad-Pinion Project” means the significant and largely contiguous land position of about 30,404 gross acres (12,304 hectares) and 28,271 net acres (11,623 net hectares) of patented and unpatented lode claims and private lands situated in the prolific Carlin Trend of north-central Nevada, U.S.A. and our flagship mineral project as more particularly described under Item 4D “Property, Plants and Equipment” of this Annual Report.

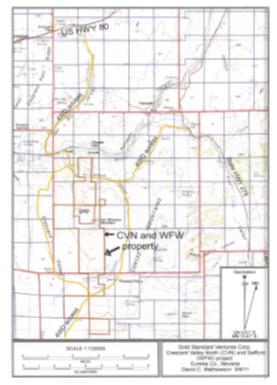

“Safford-CVN Project” means the early stage gold and silver exploration prospect comprising 267 contiguous unpatented lode mining claims covering approximately 5,380.5 acres of land located in Eureka County, Nevada, U.S. as more particularly described under Item 4D “Property, Plants and Equipment” of this Annual Report.

“Scorpio” means Scorpio Gold Corporation, where the context so requires, its wholly-owned U.S. subsidiary, Scorpio Gold (US) Corporation.

“SEC” means the United States Securities and Exchange Commission.

“SEDAR” means the Canadian System for Electronic Document Analysis and Retrieval as located on the Internet at www.sedar.com.

“Tanqueray” means Tanqueray Exploration Ltd.

“Tanqueray LOI” means the binding letter of intent dated May 29, 2014, as amended, that we signed with Tanqueray pursuant to which we have agreed to sell all of our right, title and interest in and to the Safford-CVN Project, the East Bailey Project and the East Camp Douglas Project to Tanqueray in consideration for a combination of cash and shares of Tanqueray.

“TSXV” means the TSX Venture Exchange.

“U.S. Exchange Act” means the Securities Exchange Act of 1934, as amended.

Words importing the masculine shall be interpreted to include the feminine or neuter and the singular to include the plural and vice versa where the context so requires.

Glossary of Technical Terms

The following is a glossary of geological and technical terms used in this Annual Report:

Ag - silver.

anticline - a flexure or fold in a rock formation that takes the form of an arch.

Anomaly - any departure from the norm which may indicate the presence of mineralization in the underlying bedrock.

Assay - in economic geology, to analyze the proportions of metal in a rock or overburden sample; to test an ore or mineral for composition, purity, weight or other properties of commercial interest.

Au - gold.

breccia - a coarse-grained clastic rock, composed of angular broken rock fragments held together by a mineral cement or in a fine-grained matrix; it differs from conglomerate in that the fragments have sharp edges and unworn corners. Breccia may originate as a result of talus accumulation, explosive igneous processes, collapse of rock material, or faulting.

carbonates - a sedimentary rock composed of carbonate minerals, including limestone (CaCO3) and dolomite (CaMg(CO3)2)

clastic - A sedimentary rock (such as shale, siltstone, sandstone or conglomerate) or sediment (such as mud, silt, sand, or pebbles) composed of fragments (clasts) of pre-existing rock or fossils.

conglomerate - rock comprising pieces of other rocks: coarse-grained sedimentary rock containing fragments of other rock larger than 2 mm (0.08 in.) in diameter, held together with another material such as clay.

CSAMT survey – controlled source, audio-frequency, magnetotelluric survey.

Cu - copper.

dip - the angle at which a stratum is inclined from the horizontal.

EM - electromagnetic geophysical survey.

geochemical - pertaining to various chemical aspects (e.g. concentration, associations of elements) of natural media such as rock, soil and water.

geophysical survey - the exploration of an area by exploiting differences in physical properties of different rock types. Geophysical methods include seismic, magnetic, gravity, induced polarization and other techniques.

grade - the amount of valuable metal in each tonne of ore, expressed as grams per tonne (g/t) for precious metals, as percent (%) for copper, lead, zinc and nickel.

Gravity Depth - a measurement of gravity below the surface.

host - a rock or mineral that is older than rocks or minerals introduced into it.

hydrothermal - relative to the circulation of hot water within Earth’s crust.

intrusive - an igneous rock body that crystallized from a magma slowly cooling below the surface of the Earth.

jasperoids - a rare, peculiar type of hydrothermal metasomatic alteration and occurs in two main forms; sulfidic jasperoids and hematitic jasperoids. True jasperoids are different from jaspillite, which is a form of metamorphosed chemical sedimentary rock, and from jasper which is a chemical sediment.

limestone - a sedimentary rock composed mainly of calcite (CaCO3) often deposited as a by-product of biological activity in the ocean.

metamorphic rocks - rocks which have undergone a change in texture or mineral composition as the result of exposure to heat and/or pressure.

metasomatic - the chemical alteration of a rock by hydrothermal and other fluids.

outcrop - an exposure of bedrock at the surface.

plutonic - refers to rocks of igneous origin that have come from depth and cooled slowly below the surface of the earth.

porphyry - any igneous rock in which relatively large crystals, called phenocrysts, are set in a fine-grained groundmass.

ppb - parts per billion.

ppm - parts per million, numerically equivalent to grams per long tonne.

pyrite - a common iron sulfide mineral (FeS2) with a brassy metallic luster.

sedimentary rocks - secondary rocks formed from material derived from other rocks mainly deposited under water. Examples are limestone, shale and sandstone.

silica - a combination of silicon dioxide (SiO2); quartz.

silicification - the introduction of, or replacement by, silica, generally resulting in the formation of fine-grained quartz, chalcedony, or opal, which may fill pores and replace existing minerals.

silts - a fine soil particle with sizes that range between 0.075mm and 0.002mm.

skarn - name for the metamorphic rocks surrounding an igneous intrusive where it comes in contact with a limestone or dolostone formation.

st – short ton.

sulphide - a group of minerals in which one or more metals are found in combination with sulphur.

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

Item 3. Key Information.

A. Selected Financial Data

The following selected financial and operating data of the Company should be read in conjunction with our consolidated financial statements and related notes, and Item 5 “Operating and Financial Review and Prospects” and the other financial information included elsewhere in this Annual Report.

For the 2014, 2013, 2012 and 2011 fiscal years, our financial statements were prepared pursuant to International Financial Reporting Standards (IFRS) issued by the International Accounting Standards Board (“IASB”), and for the 2010 fiscal year were prepared pursuant to Canadian Generally Accepted Accounting Principles.

To date, we have not generated any cash flow from operations to fund on-going operational requirements and cash commitments. Our mineral properties are in the exploration stage and are without a known body of commercial ore. We have financed our operations principally through the sale of our equity securities. We believe that we have sufficient funds to maintain operations at their current level of activity for a period of six (6) months from the date of this Annual Report. We further believe that we will continue to rely on the sale of our equity securities to provide funds for future activities until such time as we begin to generate cash flow from the operation or the sale of properties, although there is no assurance that we will be able to do so.

| Statement of Income Data: | | IFRS Year (Period) Ended December 31, | | | Canadian GAAP Year (Period) Ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | | | | | | | | | | | | | | |

| Revenues | | $ | - | | | $ | - | | | $ | - | | | $ | - | | | $ | - | |

| (Loss) from operations | | | (5,731,071 | ) | | | (4,263,602 | ) | | | (5,271,516 | ) | | | (3,989,654 | ) | | | (3,448,360 | ) |

| Interest income | | | 434 | | | | 38,832 | | | | 78,292 | | | | 93,083 | | | | 574 | |

| Gain (loss) from settlement of debt | | | 10,249 | | | | - | | | | - | | | | (242,309 | ) | | | - | |

| Write down | | | (5,988,249 | ) | | | (133,189 | ) | | | - | | | | - | | | | - | |

| (Loss) before taxes | | | (11,708,637 | ) | | | (4,357,959 | ) | | | (5,193,224 | ) | | | (4,138,880 | ) | | | (3,447,786 | ) |

| Future tax recovery | | | - | | | | - | | | | - | | | | - | | | | 27,000 | |

| (Loss) | | | (11,708,637 | ) | | | (4,357,959 | ) | | | (5,193,224 | ) | | | (4,138,880 | ) | | | (3,420,786 | ) |

| | | | | | | | | | | | | | | | | | | | | |

| Basic and diluted loss per share | | | (0.10 | ) | | | (0.05 | ) | | | (0.07 | ) | | | (0.07 | ) | | | (0.11 | ) |

| Weighted average number of shares outstanding | | | 112,820,397 | | | | 87,125,176 | | | | 75,049,087 | | | | 56,556,912 | | | | 32,467,466 | |

| Balance Sheet Data: | | | | | | |

| | | IFRS December 31, | | | Canadian GAAP Year (Period) Ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| Cash | | $ | 494,878 | | | $ | 1,221,192 | | | $ | 10,785,758 | | | $ | 7,886,869 | | | $ | 4,109,636 | |

| Exploration and evaluation assets | | | 67,312,235 | | | | 53,089,035 | | | | 42,165,595 | | | | 17,126,450 | | | | 8,352,251 | |

| Total assets | | | 68,675,954 | | | | 54,971,286 | | | | 53,482,564 | | | | 25,312,542 | | | | 12,675,603 | |

| Total liabilities | | | 4,736,845 | | | | 1,933,958 | | | | 1,838,851 | | | | 1,212,781 | | | | 1,421,245 | |

| Accumulated deficit | | | (28,841,501 | ) | | | (17,132,864 | ) | | | (12,774,905 | ) | | | (7,581,681 | ) | | | (3,712,471 | ) |

| Total shareholders’ equity | | | 63,939,109 | | | | 53,037,328 | | | | 51,643,713 | | | | 24,009,761 | | | | 11,254,358 | |

Exchange Rate History

The following table sets forth: (i) the rates of exchange for Canadian dollars, expressed in United States dollars, in effect at the end of each of the periods indicated; (ii) the average of exchange rates in effect on the last day of each month during such period; and (iii) the high and low exchange rates during each such period, in each case based on the noon buying rate in the City of New York for cable transfers in Canadian dollars as certified for customer purposes by the Federal Reserve Bank of New York.

| | | Year ended December 31, | |

| | | 2014 | | | 2013 | | | 2012 | | | 2011 | | | 2010 | |

| | | (U.S.$) | |

| Rate at end of period | | | 0.8620 | | | | 0.9401 | | | | 1.0042 | | | | 0.9835 | | | | 0.9991 | |

| Average rate during period | | | 0.9054 | | | | 0.9709 | | | | 1.0000 | | | | 1.0101 | | | | 0.9709 | |

| High | | | 0.9422 | | | | 1.0204 | | | | 1.0310 | | | | 1.0638 | | | | 1.0000 | |

| Low | | | 0.8589 | | | | 0.9345 | | | | 0.9615 | | | | 0.9434 | | | | 0.9259 | |

The following table sets forth the high and low exchange rates for one Canadian dollar expressed in terms of one U.S. dollar for the past six months:

| Month | High | Low |

| April 2015 (through April 27) | 0.8261 | 0.7929 |

| March 2015 | 0.8039 | 0.7811 |

| February 2015 | 0.8063 | 0.7915 |

| January 2015 | 0.8527 | 0.7863 |

| December 2014 | 0.8815 | 0.8589 |

| November 2014 | 0.8900 | 0.8751 |

| October 2014 | 0.8980 | 0.8858 |

On April 27, 2015, the conversion rate of one Canadian dollar into one U.S. dollar was $0.8261 (U.S.$1.00 = CDN$1.2105).

| | B. | Capitalization and Indebtedness |

Not applicable.

| | C. | Reason for the Offer and Use of Proceeds |

Not applicable.

Our operations are highly speculative due to, among other things, the high-risk nature of our business, which includes the acquisition, financing, exploration and, if warranted, development of mineral properties. Accordingly, any investment in our Common Shares involves a high degree of risk and should be considered speculative. While we consider the risks set out below and incorporated by reference herein to be the most significant to potential investors, they are not the only ones we face. Additional risks and uncertainties not currently known to us, or that we currently deem immaterial, may also materially adversely affect our operations, business and financial condition. If any of these risks materialize into actual events or circumstances, our assets, liabilities, financial condition, results of operations (including future results of operations), business and business prospects, are likely to be materially and adversely affected. In such circumstances, the price of our securities could decline and investors may lose all or part of their investment. Accordingly, potential investors should carefully consider the risks set out below and other information contained or incorporated by reference in this Annual Report before purchasing Common Shares.

Risks Relating to the Company

We have a limited operating history.

We have a limited history of operations and all of our properties are in the exploration stage. In May 2014, we entered into a letter of intent to sell our entire portfolio of non-core early stage exploration assets to concentrate our efforts on the Railroad-Pinion Project on Nevada’s Carlin Trend. In the event that sale transaction does not close, we may incur additional losses and expenses in order to maintain our interests in those assets. We have not generated any operating revenues. As such, we are subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel and lack of revenues.

We have a history of losses and negative operating cash flow and expect to incur losses for the foreseeable future.

We have not been profitable since our inception, we had negative cash flow from operational activities and we do not expect to generate revenues in the foreseeable future. For the fiscal year ended December 31, 2014, we had a loss and comprehensive loss of $11,708,637 (2013- $4,357,959). As at December 31 2014, we had an accumulated deficit of $28,841,501 (2013 - $17,132,864). To become profitable, we must first establish commercial quantities of mineral reserves on its properties, and then either develop such properties or locate and enter into agreements with third party operators to bring such properties into production. Mineral exploration and development involves a high degree of risk that even a combination of careful evaluation, experience and knowledge cannot eliminate, and few properties that are explored are ultimately developed into producing mines. In the event we undertake development activity on any of our properties, there is no certainty that we will produce revenues, operate profitably or provide a return on investment in the future. It could be years before we receive any revenues from the production of gold or other precious metals, if ever. We may suffer significant additional losses in the future and may never be profitable.

We may not be able to continue as a going concern.

We have limited financial resources and no operating revenues. To maintain our existing interest in the Railroad-Pinion and other projects, we have contractually agreed to make certain expenditures on our properties. The report of the independent auditors to our consolidated financial statements for the fiscal year ended December 31, 2014 contained a note that indicated the existence of material uncertainties that raised substantial doubt about our ability to continue as a going concern. Our ability to continue as a going concern is dependent upon, among other things, establishing commercial quantities of mineral reserves on our properties and obtaining the necessary financing to develop and profitably produce such minerals or, alternatively, disposing of our interests on a profitable basis. Any unexpected costs, problems or delays could severely impact our ability to continue exploration and development activities. Should we be unable to continue as a going concern, realization of assets and settlement of liabilities in other than the normal course of business may be at amounts materially different than the our estimates. The amounts attributed to our exploration properties in our financial statements represent acquisition and exploration costs and should not be taken to represent realizable value.

The majority of our mineral projects have no mineral resources and no reserves.

We currently have an interest in four mineral projects located in north central Nevada: the Railroad-Pinion Project, the Safford-CVN Project, the East Bailey Project and the East Camp Douglas Project.

The Railroad-Pinion Project is considered an early to intermediate stage exploration project with a favourable structural, geological and stratigraphic setting that is situated at the southeast end of the Carlin Trend. More than 40 separate gold deposits have been delineated along the Carlin Trend with production exceeding 80 million ounces of gold.

Save for the Pinion and Dark Star Deposits, the Railroad-Pinion Project has no known NI 43-101 compliant mineral resources or reserves.

However, historic and current exploration in the Railroad Project area as outlined in the 2015 Railroad-Pinion Report demonstrates that the Railroad Project is a well mineralized area that has the potential to yield future mineral resources with additional exploration.

While the 2015 Railroad-Pinion Report does not contain an estimate for mineral resources or mineral reserves for the Railroad Project, it does make reference to certain historical estimates for gold on portions of the Railroad Project. We do not treat these historical estimates, or any part of them, as current mineral resources or reserves as defined by NI 43-101, as there is insufficient information available to fully assess data quality, complete estimation procedures, and the standards by which the estimates were completed or categorized. In addition, no gold has been produced from the historical estimates. The historical estimates have been included in the 2015 Railroad-Pinion Report simply to demonstrate the mineral potential of certain target areas within the Railroad Project. A thorough review of all historic data performed by a “qualified person” as defined in NI 43-101, along with additional exploration and validation work to confirm results and estimation parameters, would be required in order to produce a current and compliant NI 43-101 mineral resource estimate for the subject targets.

For these reasons, among others, the historical estimates included in the 2015 Railroad-Pinion Report with respect to the Railroad Project should not be relied upon as a guarantee of mineral resources or reserves. Actual mineral resources or reserves, if any, may differ significantly.

The Safford-CVN, East Bailey and East Camp Douglas Projects are in the early exploration stage and, like the Railroad Project, are without known mineral resources or reserves.

Newmont Mining Corporation has retained a back-in right on a portion of the Railroad Project, which, if exercised, could dilute our interest in that portion of the Railroad Project.

We have leased a portion of the property comprising the Railroad-Pinion Project from Newmont Mining Corporation (“Newmont”). The lease relates to 640 acres of fee surface rights and 1,280 acres of fee mineral rights and 1,280 acres of mining claims. However, Newmont has retained a back-in right over the leased property, which allows them to re-acquire up to a 70% interest in this portion of the Railroad Project. If Newmont exercises its back-in right, our interest in that portion of the Railroad Project would decline. See Item 4D “Property, Plants and Equipment”.

We will require additional capital to develop our mineral properties or complete further exploration programs.

Our current operations do not generate any cash flow. Future work on our properties will require additional financing. At December 31, 2014, we had cash and cash equivalents of $494,878 and a working capital deficit of $4,035,579. Subsequent to December 31, 2014, we completed a public offering of 19,032,000 common shares at a price of U.S.$0.47 per share for gross proceeds of U.S.$8,945,040 to pay the balance of the purchase price due to Scorpio, fund additional exploration of the Railroad-Pinion Project and for general corporate and working capital purposes. See Item 4A “ History and Development of the Company - Recent Financings”. While we estimate that the balance of the net proceeds from this public offering will enable us to carry out small portions of the Phase 1 and Phase 2 exploration programs on the Pinion Project recommended in the Pinion Resource Report, we will require additional capital to complete Phases 1 and 2, and, if warranted, carry out additional exploration work. Furthermore, if we are successful in identifying additional resources through additional drilling and analysis, we will require significant amounts of additional capital to construct a mill and other facilities and to develop metallurgical processes to extract those resources at any mine site. There are no assurances that we will be able to obtain additional funding to allow us to fund such costs in whole or in part. Failure to obtain such additional financing could result in the delay or indefinite postponement of further exploration and the possible, partial or total loss of our interest in certain properties. We will also require additional funding to acquire further property interests, maintain or carry out additional exploration work on its other mineral projects and for general and administrative and working capital purposes.

Our ability to arrange financing in the future will depend, in part, upon the prevailing capital market conditions as well as our business performance. There can be no assurance that we will be successful in its efforts to arrange additional financing on satisfactory terms or at all. If we raise additional financing through the issuance of shares from our treasury, control of our company may change and existing shareholders will suffer additional dilution.

Calculations of mineral resources and reserves are only estimates.

The Pinion Deposit contains a NI 43-101 compliant resource of 20.84 million tonnes at 0.63 g/t Au for a total of 423,000 ounces of gold (indicated) and 55.93 million tonnes at 0.57 g/t Au for 1.022 million ounces of gold (inferred). In addition, the Dark Star Deposit contains a NI 43-101 compliant resource of 23.11 million tonnes grading 0.51 g/t Au totaling 375,000 ounces of gold (inferred).

However, the estimating of mineral reserves and resources is a subjective process and the accuracy of such estimates is a function of the quantity and quality of available data and the assumptions used and judgments made in interpreting engineering and geological information. There is significant uncertainty in any mineral resource or reserve estimate, and the actual deposits encountered and the economic viability of mining a deposit may differ materially from our estimates. Estimated mineral resources or reserves may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. These changes could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence estimates of mineral resources and reserves. Any material change in the quantity of mineral resources and reserves, mineralization, grade or stripping ratio may affect the economic viability of our properties. In addition, there can be no assurance that gold recoveries or other metal recoveries in small-scale laboratory tests will be duplicated in larger scale tests under on-site conditions or during production. Save for the Pinion Deposit, as of the date of this Annual Report, there are no known resources or reserves on the Railroad-Pinion Project or any of our other mineral projects.

We may experience difficulty attracting and retaining qualified personnel.

Our success will be largely dependent upon the experience, judgment, discretion, integrity, good faith and performance of our management and key employees, such as Jonathan T. Awde, President and Chief Executive Officer, and Mac R. Jackson, Jr., Vice-President, Exploration. We could be adversely affected if such individuals do not remain with us. We do not maintain life insurance policies in respect of our key personnel. See Item 6 “Directors, Senior Management and Employees.”

Our future success will also be highly dependent on our ability to attract and retain key individuals to act as directors and executives who have the necessary skills and abilities to successfully grow the Company.

Locating mineral deposits depends on a number of factors, not the least of which is the technical skill and expertise of the personnel involved. The competition for qualified personnel in the mineral resource industry is intense and there can be no assurance that we will be able to continue to attract and retain all personnel necessary for the development and operation of our business. Failure to retain existing management and key employees or to attract and retain additional key individuals could have a materially adverse impact upon our success.

We may incur expenses and suffer losses if the Tanqueray LOI is not completed.

We have entered into the Tanqueray LOI to sell the Safford-CVN, East Bailey and East Camp Douglas Projects in north-central Nevada to Tanqueray in exchange for a combination of cash and common shares in the capital stock of Tanqueray. See Item 4B “Business Overview.”

Closing of the Tanqueray LOI is anticipated to take place on or about May 31, 2015 and is subject to a number of conditions including, but not limited to, a consolidation of Tanqueray’s issued shares on a three to one basis, Tanqueray raising a minimum of $1,500,000 prior to or concurrently with the closing in order to, among other things, fund the cash portion of the purchase price for the Non-Core Assets (as defined below) and the acceptance of the TSXV. Due to poor market conditions, closing of the Tanqueray LOI (which was originally contemplated for August 15, 2014) has been delayed. As a result, we have agreed to reimburse Tanqueray for its out-of-pocket costs incurred in obtaining shareholder approval for the Tanqueray LOI totaling approximately $29,000 (paid) and certain additional general and administrative expenses incurred by Tanqueray prior to February 28, 2015 up to an additional $11,432 (paid). In April 2014, we paid additional reimbursement in the amount of $13,500. In addition, in an effort to facilitate raising the minimum financing of $1,500,000 by Tanqueray, we have reduced the purchase price for the Non-Core Assets to $300,000 cash and 4,000,000 post-consolidated common shares of Tanqueray payable upon closing. We have also agreed to be responsible for all ongoing BLM fees, property taxes and lease payments required to maintain the Non-Core Assets in good standing up to closing of the Tanqueray LOI. There is no assurance that Tanqueray will be successful in raising the minimum funds required under the concurrent financing or that all other conditions to closing will be satisfied or waived. In the event the Tanqueray LOI is not completed, we will be required to incur additional expenses to maintain the Non-Core Assets in good standing and may suffer additional losses as a result thereof. For further details, please see Item 5B “Liquidity and Capital Resources - “Tanqueray LOI.”

We are subject to foreign currency fluctuations.

Our financial results are reported in Canadian dollars. Our exploration properties are located in the United States and we incur most of our expenditures in United States dollars. Any appreciation in the currency of the United States against the Canadian dollar will increase our costs of carrying out operations and our ability to continue to finance our operations. Such fluctuations could have a material adverse effect on our financial results. See Item 3A “Selected Financial Data-Exchange Rate History.”

Failure to maintain effective internal control over financial reporting could have a material adverse effect on our operations.

We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of United States Sarbanes-Oxley Act (“SOX”), which requires annual management assessments of the effectiveness of our internal control over financial reporting. During the course of our testing, we may identify material weaknesses. If we fail to achieve and maintain the adequacy of our internal controls, as such standards are modified, supplemented or amended from time to time, we may not be able to conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of SOX. Moreover, effective internal controls are necessary for us to produce reliable financial reports and are important to help prevent financial fraud. If we cannot provide reliable financial reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial information, and the trading price of the Common Shares could drop significantly. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Future acquisitions of companies, if any, may provide us with challenges in implementing the required processes, procedures and controls in our acquired operations. No evaluation can provide complete assurance that our internal control over financial reporting will detect or uncover all failures of persons within the Company to disclose material information otherwise required to be reported. The effectiveness of our processes, procedures and controls could also be limited by simple errors or faulty judgments. There is no certainty that we will be successful in complying with Section 404 of SOX on an ongoing basis.

Conflicts of interest may arise among our board of directors as a result of their involvement with other natural resource companies.

Certain of our directors are also directors or officers of other companies that are similarly engaged in the business of acquiring, developing, and exploiting natural resource properties. Such associations may give rise to conflicts of interest from time to time if we were to enter into negotiations to acquire an interest in a mineral project in which their other companies hold an interest, or we were to enter into negotiations to sell an interest in our mineral properties to, or enter into a joint venture with, any of these companies. Our directors are required to act honestly and in good faith with a view to our best interests and disclose any interest which they may have in any of our projects or opportunities. If a conflict of interest arises at a meeting of the board of directors, any director with a conflict must disclose his interest and abstain from voting on such matter. As a result of these conflicts of interests, we may miss the opportunity to participate in certain transactions, which may have a material adverse effect on our business prospects, operations and financial position.

Our growth, future profitability and ability to obtain financing may be impacted by global financial conditions.

In recent years, global financial markets have been characterized by extreme volatility impacting many industries, including the mining industry. Global financial conditions remain subject to sudden and rapid destabilizations in response to future economic shocks, as government authorities may have limited resources to respond to future crises. A sudden or prolonged slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates and tax rates, may adversely affect our growth and profitability. Future economic shocks may be precipitated by a number of causes, including, but not limited to, material changes in the price of oil and other commodities, the volatility of metal prices, geopolitical instability, war, terrorism, the devaluation and volatility of global stock markets and natural disasters. Any sudden or rapid destabilization of global economic conditions could impact our ability to obtain equity or debt financing in the future on terms we find favorable or at all, which may have a material adverse effect on our business prospects, operations and financial position

Risks Relating to the Mining Industry

Exploration and development of mineral properties involve a high degree of risk and few properties that are explored are ultimately developed into producing properties.

Exploration and development of mineral properties involve a high degree of risk and few properties that are explored are ultimately developed into producing properties. There is no assurance that our exploration activities will result in any discoveries of commercial bodies of ore. There is also no assurance that even if commercial quantities of ore are discovered, a property will be brought into commercial production or that the metallurgical processing will produce economically viable saleable products. The commercial viability of a deposit once discovered and the decision as to whether it should be brought into production will depend upon the results of exploration programs and/or feasibility studies, and the recommendations of qualified engineers and/or geologists, all of which involves significant expense. This decision will also involve consideration and evaluation of several significant factors including, but not limited to:

| | · | costs of bringing a property into production, including exploration and development work, preparation of feasibility studies and construction of production facilities |

| | · | availability and costs of financing |

| | · | ongoing costs of production |

| | · | market prices for the minerals to be produced |

| | · | environmental compliance regulations and restraints (including potential environmental liabilities associated with historical exploration activities) |

| | · | political climate and/or governmental regulation and control. |

Many of these factors are beyond our control.

We are subject to substantial operating hazards and risks beyond our control.

The exploration, development and operation of mineral properties is inherently dangerous and involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome, including, but not limited to:

| | · | difficult surface or underground conditions |

| | · | unexpected or unusual rock conditions or geological operating conditions, including rock bursts, cave-ins, ground fall, slope failures and landslides |

| | · | fires, explosions, flooding, adverse weather conditions and earthquakes |

| | · | unanticipated variations in grade and other geological problems |

| | · | failure of pit walls or dams |

| | · | adverse environmental conditions or hazards |

| | · | mechanical and equipment performance problems |

| | · | power failures and interruptions. |

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury or death, including to our employees, environmental damage, delays in mining, increased production costs, asset write downs, monetary losses and possible legal liability. While we maintain insurance to insure against general commercial liability claims, such insurance will not cover all of the potential risks associated with our operations at economically feasible premiums or at all. Currently, we are not insured against most environmental risks.

Losses from any one or more of these events that are not covered by our insurance policies may cause us to incur significant costs that could materially adversely affect our financial condition and ability to fund activities on our properties. A significant loss could force us to reduce or terminate our operations and even result in bankruptcy.

We may not have clear title to our properties.

Our ability to explore and operate our properties depends on the validity of title to our properties. The mineral claims currently making up our properties consist of both patented and unpatented mining claims.

Unpatented mining claims are unique property interests and are generally considered to be subject to greater risk than other real property interests because the validity of unpatented mining claims is often uncertain. Unpatented mining claims provide only possessory title and their validity is often subject to contest by third parties or the federal government. These uncertainties relate to such things as the sufficiency of mineral discovery, proper posting and marking of boundaries, assessment work, unregistered agreements, undetected defects and possible conflicts with other claims not determinable from descriptions of record. Since a substantial portion of all mineral exploration, development and mining in the United States now occurs on unpatented mining claims, this uncertainty is inherent in the mining industry.

No assurances can be given that title defects to our current properties or any future properties in which we may seek to acquire an interest do not exist. Such defects may impair our development of the underlying property and result in the loss of all or a portion of the property to which the title defect relates.

Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained secure claim to individual mineral properties or mining concessions may be severely constrained. Our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We will also remain at risk that the mining claims may be forfeited either to the United States government or to rival private claimants due to failure to comply with statutory requirements as to location and maintenance of the claims or challenges to whether a discovery of a valuable mineral exists on every claim. Our current mineral properties are also subject to annual compliance with assessment work and/or fee requirements, property taxes, lease payments and other contractual payments and obligations. Any failure to make such payments or comply with such requirements or obligations could result in the loss of all or a portion of our interest in the properties.

Our operations are subject to various governmental and regulatory requirements.

Our current and future operations, including exploration and development activities and, if applicable, commencement of production on our properties, require permits from various federal, state and local governmental authorities, as well as approval of members of surrounding communities. Such operations are also subject to extensive federal, state, and local laws, regulations and policies governing various matters, including:

| | · | environmental protection |

| | · | management and use of toxic substances and explosives |

| | · | management of natural resources |

| | · | exploration and development of mines, production and post-closure reclamation; |

| | · | taxation and mining royalties |

| | · | regulations concerning business dealings with native groups |

| | · | management of tailing and other waste generated by operations |

| | · | labor standards and occupational health and safety, including mine safety |

| | · | historic and cultural preservation. |

Permits and studies may be necessary prior to operation of the exploration properties in which we have an interest and there can be no guarantee that we will be able to obtain or maintain all necessary permits that may be required to commence construction or operation of mining facilities at these properties on terms that enable operations to be conducted at economically justifiable costs. We cannot be certain that all permits and approvals which we may require for our future operations will be obtainable on reasonable terms or that such laws and regulations would not have an adverse effect on any mining project that we might undertake. To the extent such permits and approvals are required and are not obtained, we may be delayed or prohibited from proceeding with planned exploration or development of mineral properties, which would adversely affect our business, prospects and operations.

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may have civil or criminal fines or penalties imposed upon them for violation of applicable laws or regulations. Amendments to current laws and regulations and permits governing operations and activities of mining companies, or more stringent implementation thereof, could have a material adverse impact on us and cause increases in capital expenditures or exploration costs, reduction in levels of exploration or abandonment or delays in the development of mining properties.

We may face equipment shortages, access restrictions and lack of infrastructure.

Natural resource exploration, development and mining activities are dependent on the availability of mining, drilling and related equipment in the particular areas where such activities are conducted. A limited supply of such equipment or access restrictions may affect the availability of such equipment to us and may delay exploration, development or extraction activities. Certain equipment may not be immediately available, or may require long lead time orders. A delay in obtaining necessary equipment for mineral exploration, including drill rigs, could have a material adverse effect on our operations and financial results.

Mining, processing, development and exploration activities also depend, to one degree or another, on the availability of adequate infrastructure. Reliable roads, bridges, power sources, fuel and water supply and the availability of skilled labor and other infrastructure are important determinants, which affect capital and operating costs. The lack of availability on acceptable terms or the delay in the availability of any one or more of these items could prevent or delay development of our projects.

In accordance with the laws of the State of Nevada, we will need to obtain permits to drill water wells in connection with our future exploration and, if applicable, development and production activities at our Nevada properties. However, the amount of water that we will be entitled to use from those wells will not be determined by the appropriate regulatory authorities until a future date. A final determination of these rights will be dependent in part on our ability to demonstrate a beneficial use for the amount of water that we intend to use. Unless we are successful in developing our Nevada properties to a point where we can commence commercial production of gold or other precious metals, we may not be able to demonstrate such beneficial use. Accordingly, there is no assurance that we will have access to the amount of water needed to operate a mine at our Nevada properties.

Our activities are subject to environmental laws and regulations that may increase our costs and restrict our operations.

All phases of our operations will be subject to federal, state and local environmental laws and regulations. These laws and regulations address, among other things, the maintenance of air and water quality standards, land reclamation, the generation, transportation, storage and disposal of solid and hazardous waste, and the protection of natural resources and endangered species. Environmental legislation is evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects, and a heightened degree of responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on our behalf and may cause material changes or delays in our intended activities. Future changes in environmental regulation, if any, may adversely affect our operations, make our operations prohibitively expensive, or prohibit them altogether.

Environmental hazards may exist on our current properties and on properties in which we may hold interests in the future that are unknown to us at the present and that have been caused by us or by previous owners or operators of the properties, or that may have occurred naturally. We may be liable for remediating such damages.

Failure to comply with applicable environmental laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment, or remedial actions.

Future production, if any, at our properties will involve the use of hazardous materials. Should these materials leak or otherwise be discharged from their containment systems, we may become subject to liability. At present, we maintain only limited insurance for environmental risks which may not cover or adequately protect us from all potential liabilities including, but not limited to, pollution or other hazards as a result of the disposal of waste products occurring from exploration or production.

In addition, neighboring landowners and other third parties could file claims based on environmental statutes and common law for personal injury and property damage allegedly caused by the release of hazardous substances or other waste material into the environment on or around our properties. There can be no assurance that our defense of such claims will be successful. A successful claim against us could have a material adverse effect on our business prospects, financial condition and results of operations.

We are subject to the volatility in the market price of gold and other metals, which in the past have fluctuated widely.

The market price of gold and other metals has experienced volatile and significant price movements over short periods of time, and is affected by numerous factors beyond our control, including:

| | · | international economic and political trend |

| | · | expectations of inflation |

| | · | currency exchange fluctuations (specifically, the U.S. dollar relative to other currencies) |

| | · | global or regional consumption patterns |

| | · | purchases and sales of gold by central banks |

| | · | availability and costs of substitutes |

| | · | increased production due to improved mining and production methods. |

The effect of these factors on metal prices cannot be predicted. A decrease in the price of gold or other relevant metal prices at any time during exploration, development or production, if any, of our properties may prevent our properties from being economically mined or may result in the write-off of assets whose value is impaired as a result of lower metal prices. A sustained period of declining gold and other applicable metal prices would adversely affect our financial performance, financial position and results of operations.

Our competition is intense in all phases of our business.

We compete with many companies in the mining industry, including large, established mining companies. There is a limited supply of desirable mineral lands available for claim-staking, lease or acquisition in the United States, particularly Nevada, and other areas where we may conduct exploration activities. We may be at a competitive disadvantage in acquiring mineral properties, since we will be competing with individuals and companies, many of which have greater financial resources, operational experience and technical capabilities. Our competitors may be able to respond more quickly to new laws and regulations or emerging technologies, or devote greater resources to the expansion or efficiency of their operations than we can. In addition, current and potential competitors may make strategic acquisitions or establish cooperative relationships among themselves or with third parties. Our inability to successfully compete with other companies would have a material adverse effect on our results of operation and business.

Legislation has been proposed that would significantly affect the mining industry.

Periodically, members of the U.S. Congress have introduced bills that would supplant or alter the provisions of the General Mining Law of 1872, which governs the unpatented claims that we currently control within our properties. One such amendment has become law and has imposed a moratorium on patenting of mining claims, which reduced the security of title provided by unpatented claims such as those in the Railroad-Pinion, Safford-CVN, East Bailey and East Camp Douglas Projects. If additional legislation is enacted, it could substantially increase the cost of holding unpatented mining claims by requiring payment of royalties, and could significantly impair our ability to develop mineral resources on unpatented mining claims. Such bills have proposed, among other things, to make permanent the patent moratorium, to impose a federal royalty on production from unpatented mining claims and to declare certain lands as unsuitable for mining. Although it is impossible to predict at this time what royalties may be imposed in the future, the imposition of such royalties could adversely affect the potential for development of such mining claims, and the economics of operating mines on federal unpatented mining claims. Passage of such legislation could adversely affect our business.

Our operations are subject to issues relating to security and human rights.

Civil disturbances and criminal activities such as trespass, illegal mining, theft, vandalism and terrorism may cause disruptions at our operations in Nevada. Such incidents may halt or delay exploration, increase operating costs, result in harm to employees or trespassers, decrease operational efficiency, increase community tensions or result in criminal and/or civil liability for us or our employees and/or financial damages or penalties. The manner in which our personnel respond to civil disturbances and criminal activities can give rise to additional risks where those responses are not conducted in accordance with applicable laws. The failure to conduct security operations in accordance with these standards can result in harm to employees or community members, increase community tensions, result in reputational harm to us and our partners or result in criminal and civil liability for us or our employees and financial damages or penalties. It is not possible to determine with certainty the future costs that we may incur in dealing with the issues described above at our operations.

We are dependent on information technology and our systems and infrastructure face certain risks, including cybersecurity risks and data leakage risks.

Any significant breakdown, invasion, destruction or interruption of our systems by employees, others with authorized access to our systems or unauthorized persons could negatively impact operations. There is also a risk that we could experience a business interruption, theft of information, or reputational damage as a result of a cyber-attack, such as an infiltration of a data center, or data leakage of confidential information either internally or at our third-party providers. While we have invested in the protection of our data and informational technology to reduce these risks and periodically test the security of our information systems network, there can be no assurance that our efforts will prevent breakdowns or breaches in our systems that could adversely affect or business. Management is not aware of a cybersecurity incident that has had a material impact on our operations.

Risks Relating to Shares

We have never paid dividends and do not expect to do so in the foreseeable future.

We have not declared or paid any dividends on the Common Shares and do not expect to do so in the foreseeable future. Future earnings, if any, will likely be retained to finance growth. Any return on investment in the Common Shares will come from the appreciation, if any, in the value thereof. The payment of any future dividends will depend upon our earnings, if any, our then-existing financial requirements and other factors, and will be at the discretion of our Board.