Exhibit 99.1

District Scale Undeveloped Land

Package on the Carlin Trend

NYSE MKT: GSV | TSX.V: GSV

CORPORATE PRESENTATION

AUGUST 7, 2014

A final base shelf prospectus containing important information relating to the securities described in this document has been filed with the securities regulatory authorities in each of the Canadian provinces of British Columbia, Alberta and Ontario. A copy of the final base shelf prospectus dated June 23, 2014, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

The Company has filed a registration statement on Form F-3 and a preliminary prospectus supplement with the United States Securities and Exchange Commission (the "SEC") for the Offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and other documents the Company has filed with the SEC for more complete information about the Company and this Offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the Offering will arrange to send you the prospectus or you may request it from Macquarie Capital Markets Canada Ltd., Attention: Scott Speed, Senior Vice-President, 550 Burrard Street, Bentall 5, Suite 2400, Vancouver, B.C. V6K 1W4, fax: (604) 605-1634, email: Scott.Speed@macquarie.com or Attention: Jenny Makula, 181 Bay Street, Suite 3100 – Brookfield Place, Toronto, ON M5J 2T3, phone: +1 416 848 3667, email: jenny.makula@macquarie.com.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Certain statements contained in this Presentation constitute "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements include statements

concerning the Company's current expectations, estimates, projections, assumptions and beliefs, and, in certain cases, can be identified by the use of words such as “seeks”,“plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates”, or“believes”, or variations of such words and phrases or statements that certain actions, events or results

“may”, “could”, “should”, “would”, “might”or“will be taken”, “occur”or“be achieved”, or the negative forms of any of these wordsand other similar expressions. Forward-looking statements

reflect the Company's current expectations and assumptions, and are subject to a number of known and unknown risks, uncertainties and other factors that may cause the Company's actual results,

performance or achievements to be materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements, including without

limitation, the Company's limited operating history; the Company's history of losses and expectation of future losses; uncertainty as to the Company's ability to continue as a going concern; the lack of

known mineral resources and reserves on the Company's mineral properties; the Company's ability to obtain adequate financing for exploration and development; the Company's ability to attract and retain

qualified personnel; foreign currency fluctuations; uncertainty as to the Company's ability to maintain effective internal controls; the involvement by some of the Company's directors and officers with

other natural resource companies; the uncertain nature of estimating mineral resources and reserves; uncertainty surrounding the Company's ability to successfully develop its mineral properties;

exploration, development and mining risks, including risks related to infrastructure, accidents and equipment breakdowns; title defects to the Company's mineral properties; the Company's ability to

obtain all necessary permits and other approvals; risks related to equipment shortages, access restrictions and inadequate infrastructure; increased costs and restrictions on operations due to compliance

with environmental legislation and potential lawsuits; fluctuations in the market price of gold and other metals; intense competition in the mining industry; and the Company's ability to comply with

applicable regulatory requirements.

In making the forward-looking statements included in this Presentation, the Company has made various material assumptions, including, but not limited to, the results of the proposed exploration programs

on the Railroad-Pinion Project will be consistent with current expectations; the Company's assessment and interpretation of potential geological structures and mineralization at the Railroad-Pinion Project

are accurate in all material respects; the sufficiency of the Company's current working capital to commence Phase 1 of the work program on the Railroad-Pinion Project and the Company's ability to raise

additional financing on reasonably commercial terms to complete Phase 1 on a timely basis; the price for gold and other preci ous metals will not fall significantly below current levels; the Company will be

able to secure additional financing to continue exploration and, if warranted, development activities on the Railroad-Pinion Project and meet future obligations as required from time to time; the

Company will be able to obtain regulatory approvals and permits in a timely manner and on terms consistent with current expectations; the Company will be able to procure drilling and other mining

equipment, energy and supplies in a timely and cost efficient manner to meet the Company's needs from time to time; the Company's capital and operating costs will not increase significantly from current

levels; key personnel will continue their employment with the Company and the Company will be able to obtain and retain additional qualified personnel, as needed, in a timely and cost efficient manner;

there will be no significant adverse changes in the Canada/U.S. currency exchange rate; there will be no significant changes in the ability of the Company to comply with environmental, safety and other

regulatory requirements; and the absence of any material adverse effects arising as a result of political instability, terrorism, sabotage, natural disasters, equipment failures or adverse changes in

government legislation or the socio-economic conditions in Nevada and the surrounding area with respect to the Company's properties and operations.

Investors are cautioned not to place undue reliance on the forward-looking statements or the assumptions on which the Company's forward-looking statements are based and investing in securities of the

Company should be considered highly speculative. Investors are advised to carefully review and consider the risk factors identified in this Presentation and in the accompanying final base shelf prospectus

and shelf prospectus supplement and the documents incorporated by reference therein for a discussion of the factors that could cause the Company's actual results, performance and achievements to be

materially different from any anticipated future results, performance or achievements expressed or implied by the forward-looking statements. Investors are further cautioned that the foregoing list of

risks and assumptions is not exhaustive and prospective investors should consult the more complete discussion of the Company's business, financial condition and prospects that is included in the

accompanying final base shelf prospectus and shelf prospectus supplement and the documents incorporated by reference therein. The forward-looking statements contained in this Presentation are

expressly qualified in their entirety by the foregoing cautionary statements.

Forward-looking statements speak only as of the date the statements are made. The Company assumes no obligation to update publicly or otherwise revise any forward-looking statements to

reflect actual results, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable securities laws.

Certain technical data in this Presentation was taken from the technical report entitled “Technical Report on the Railroad and Pinion Projects, Elko County, Nevada USA" dated March 31, 2014 (the

“Railroad-Pinion Report”) and is subject to all of the assumptions, qualifications and procedures described therein. Steven R. Koehler, the Company's Manager of Projects, BSc, Geology, and CPG 10216, a

qualified person as defined by National Instrument 43-101Standards of Disclosure for Mineral Projects has approved the scientific and technical information in this Presentation. The following is a general

description of the Company's sampling methodology, chain of custody, quality control and quality assurance procedures applicable to its drill results contained in this Presentation, save and except for

historical results. All sampling is conducted under the supervision of the Company's project geologists and the chain of custody from the drill to the sample preparation facility is continuously monitored.

Core is cut at the Company's facility in Elko, Nevada and one half is sent to the lab for analysis and the other half retained in the original core box. A blank, quarter core duplicate or certified reference

material is inserted approximately every 10 to 15 samples. The samples are delivered to ALS Minerals' preparation facility in Elko. The samples are then crushed and pulverized and sample pulps are

shipped to ALS Minerals' certified laboratory in Reno, Nevada or Vancouver, B.C. Pulps are digested and analyzed for gold using fire assay fusion and an atomic absorption spectroscopy (AAS) finish on a 30

gram split. All other elements are determined by ICP analysis. Data verification of the analytical results includes a statistical analysis of the duplicates, standards and blanks that must pass certain

parameters for acceptance to insure accurate and verifiable results.

1

District Scale Discovery in Nevada

Gold Standard Ventures

District scale, largely contiguous land position in the Carlin Trend, Nevada

Expanded land package with the recent acquisition of the near surface,

oxide-gold Pinion deposit

Advancing the Pinion deposit to initial NI 43-101 Compliant Resource, Q3

2014

Significant gold discovery: North Bullion deposit continues to expand

Exploring its new oxide gold discovery at Bald Mountain

Target-rich project which remains predominantly untested

2

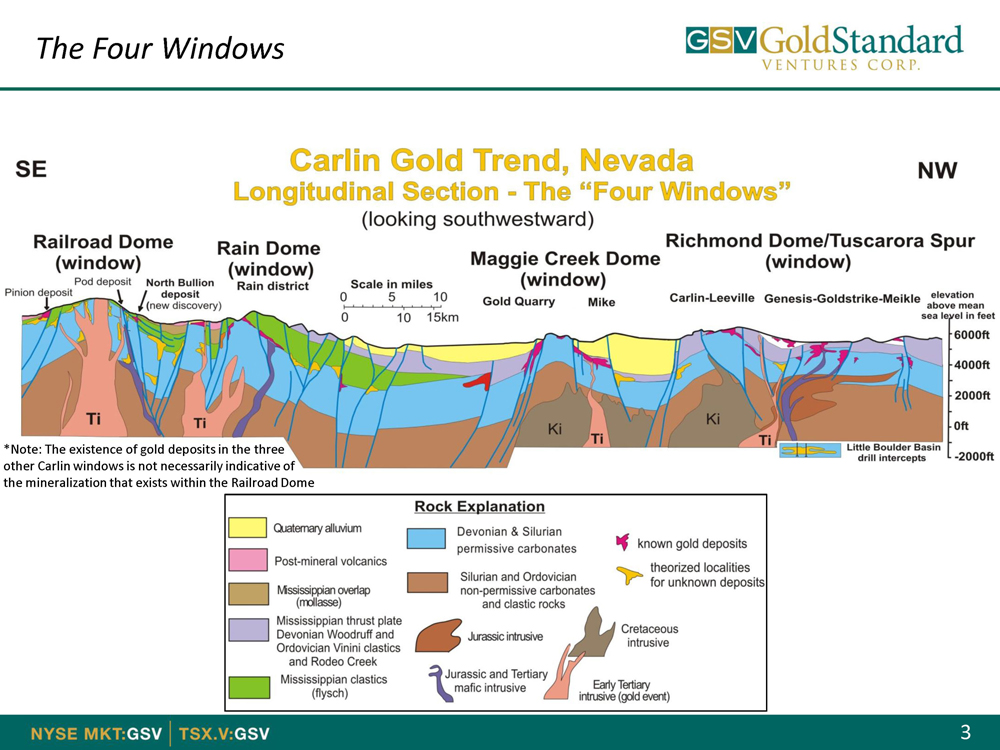

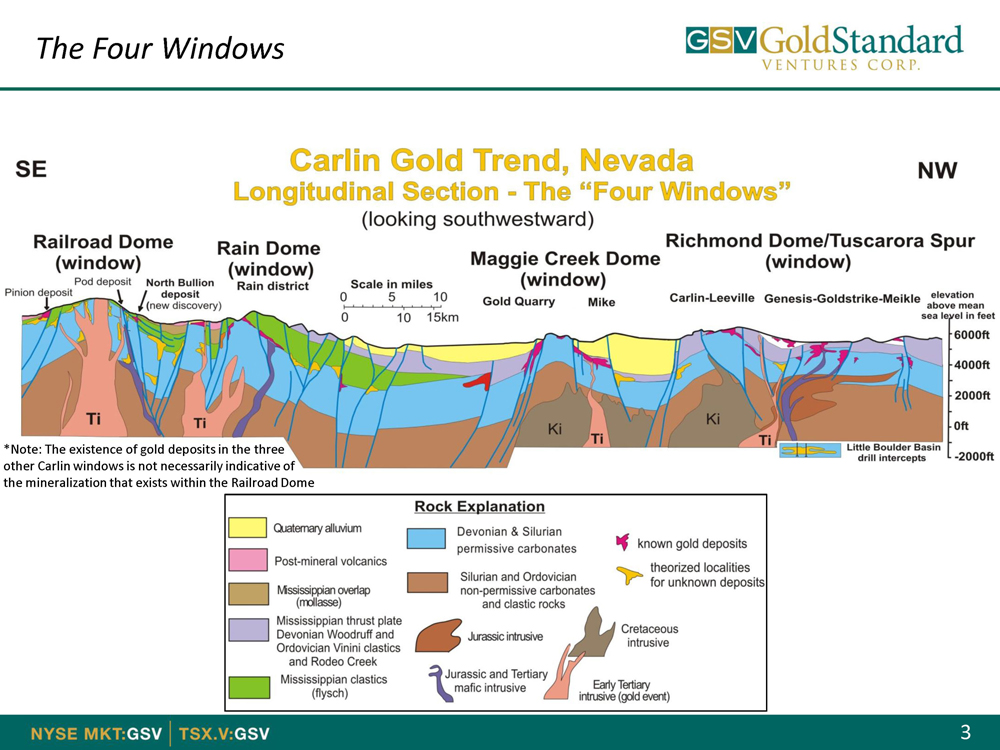

The Four Windows

*Note: The existence of gold deposits in the three

other Carlin windows is not necessarily indicative of

the mineralization that exists within the Railroad Dome

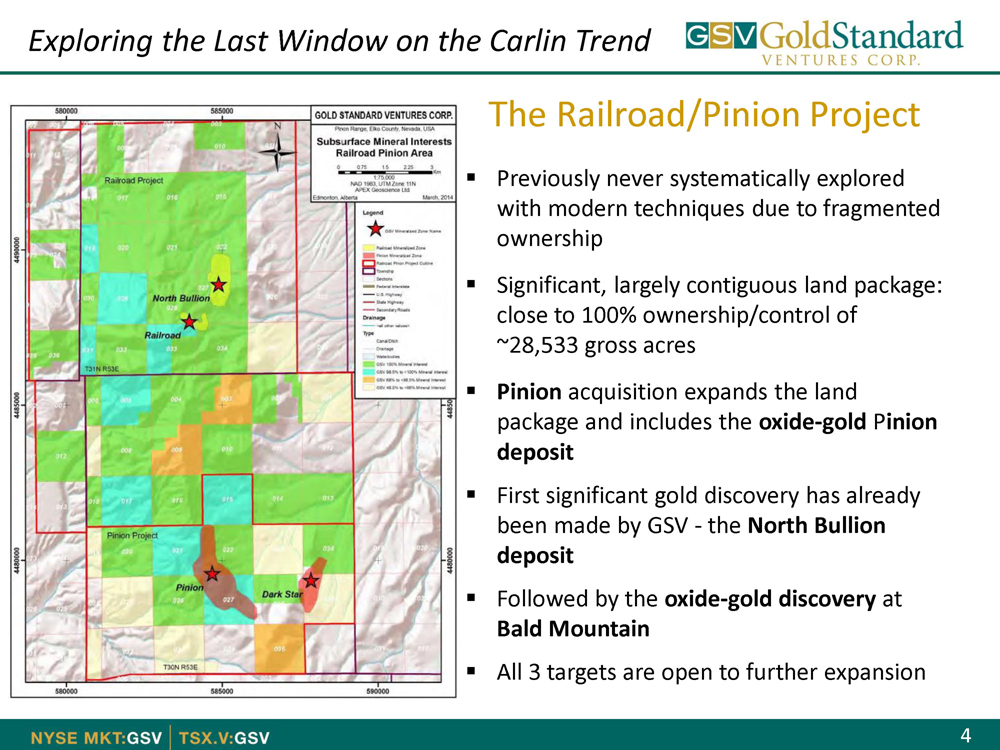

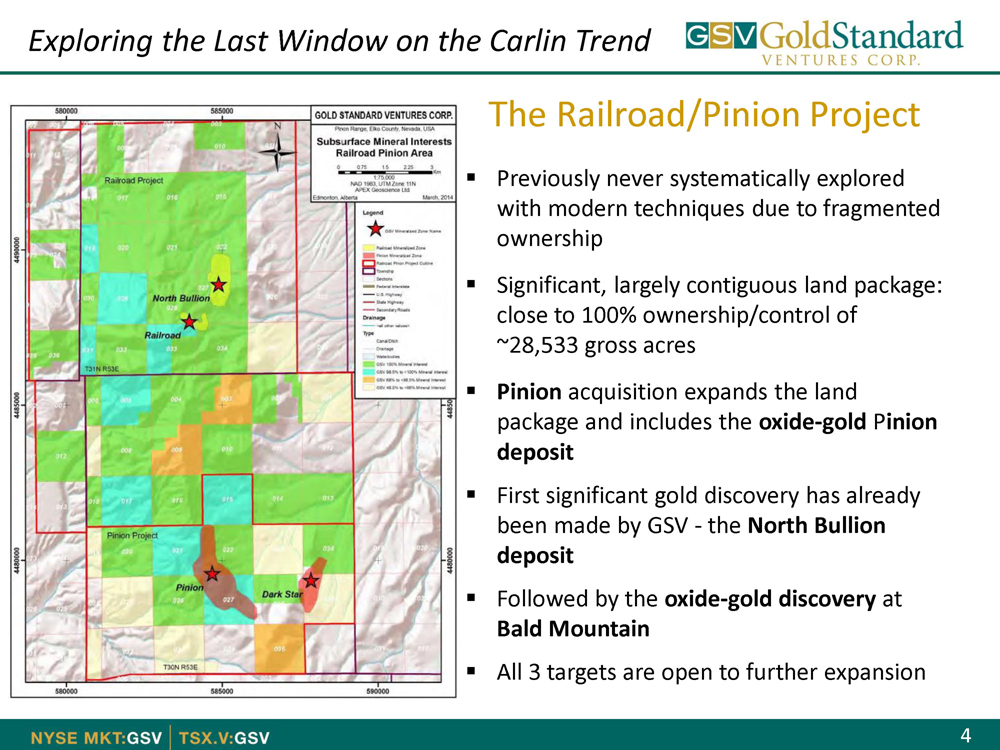

Exploring the Last Window on the Carlin Trend

The Railroad/Pinion Project

Previously never systematically explored

with modern techniques due to fragmented

ownership

Significant, largely contiguous land package:

close to 100% ownership/control of

28,533 gross acres

Pinion acquisition expands the land

package and includes theoxide-goldPinion

deposit

First significant gold discovery has already

been made by GSV - theNorth Bullion

deposit

Followed by theoxide-gold discoveryat

Bald Mountain

All 3 targets are open to further expansion

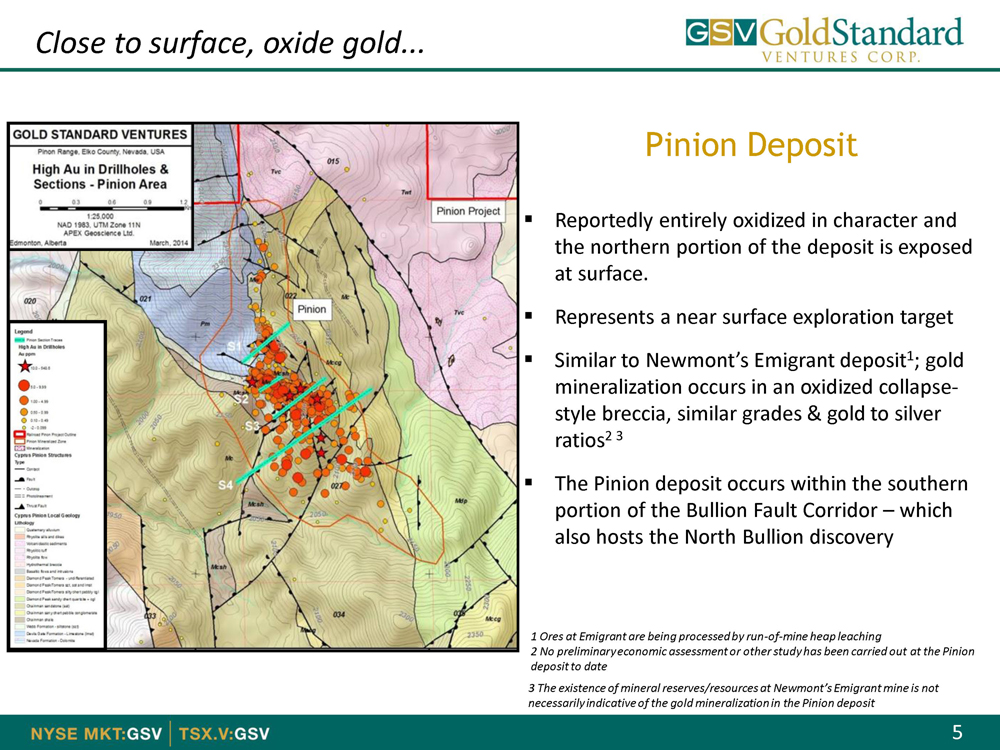

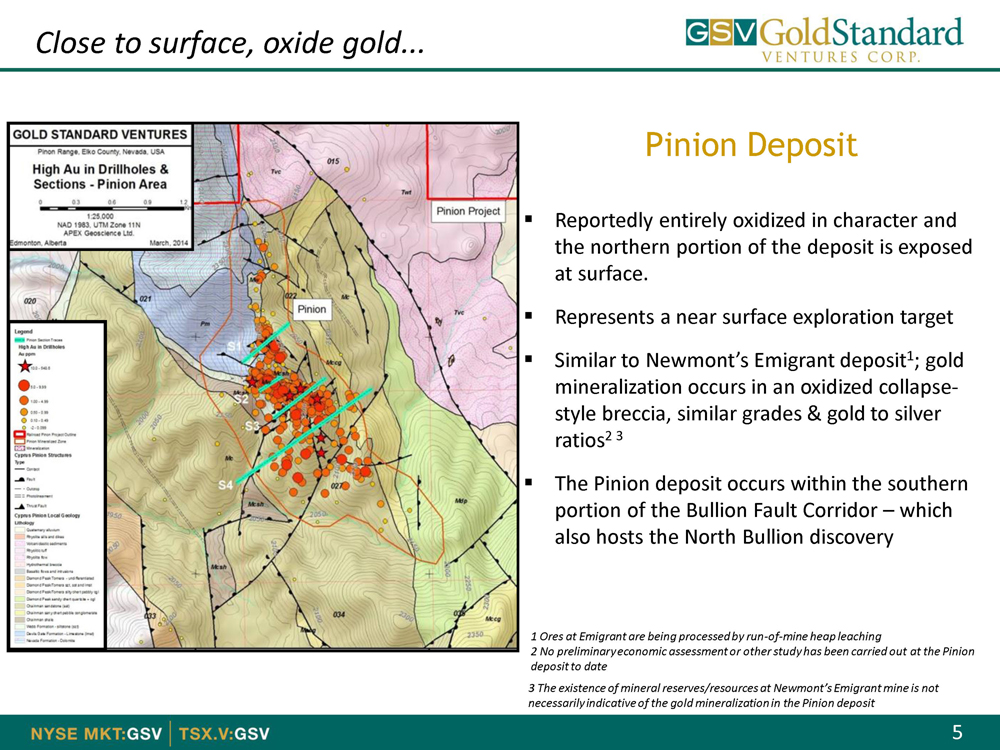

Close to surface, oxide gold...

Pinion Deposit

Reportedly entirely oxidized in character and

the northern portion of the deposit is exposed

at surface.

Represents a near surface exploration target

Similar to Newmont’s Emigrant deposit1; gold

mineralization occurs in an oxidized collapse-

style breccia, similar grades & gold to silver

ratios2 3

The Pinion deposit occurs within the southern

portion of the Bullion Fault Corridor which

also hosts the North Bullion discovery

1 Ores at Emigrant are being processed by run-of-mine heap leaching

2 No preliminary economic assessment or other study has been carried out at the Pinion

deposit to date

3 The existence of mineral reserves/resources at Newmont’s Emigrant mine is not

necessarily indicative of the gold mineralization in the Pinion deposit

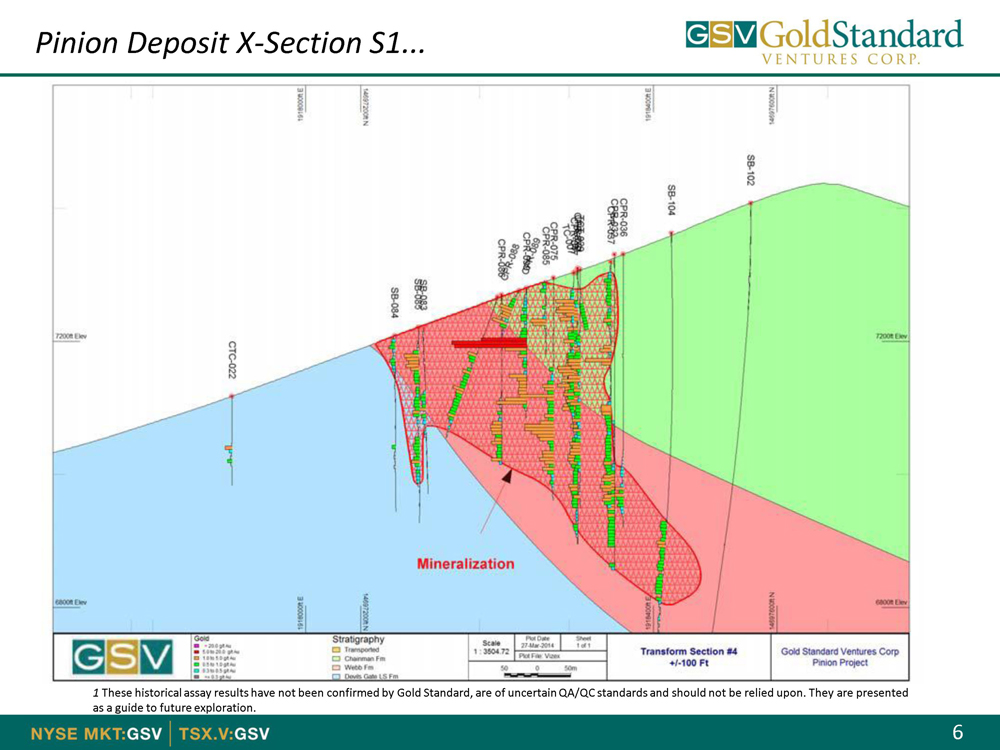

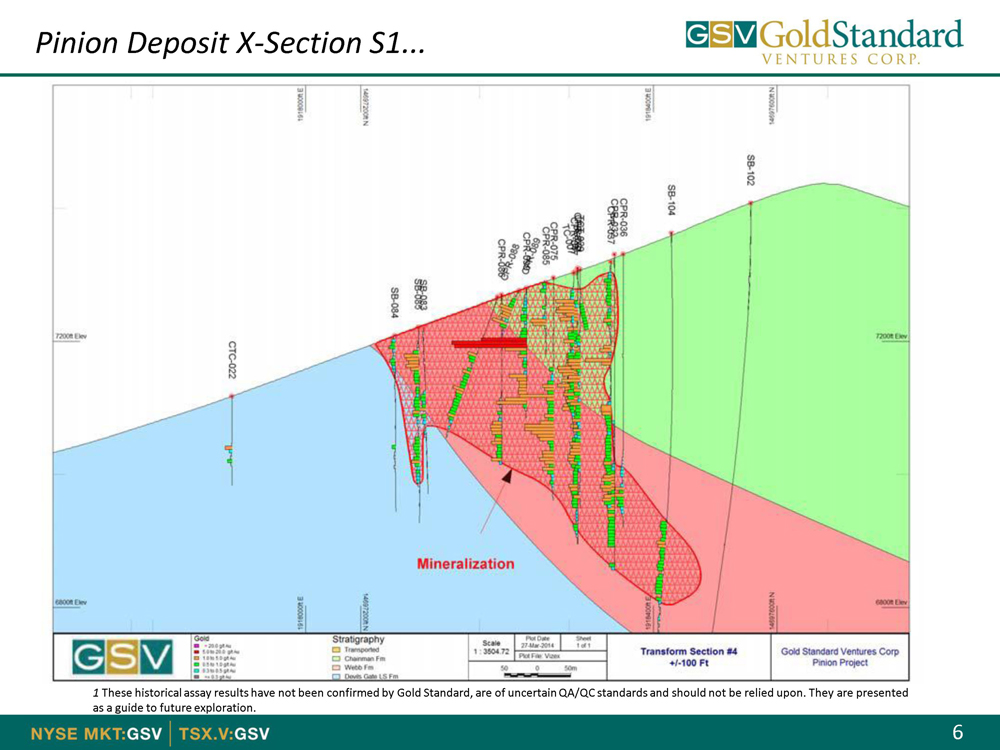

Pinion Deposit X-Section S1...

1 These historical assay results have not been confirmed by Gold Standard, are of uncertain QA/QC standards and should not be relied upon. They are presented

as a guide to future exploration.

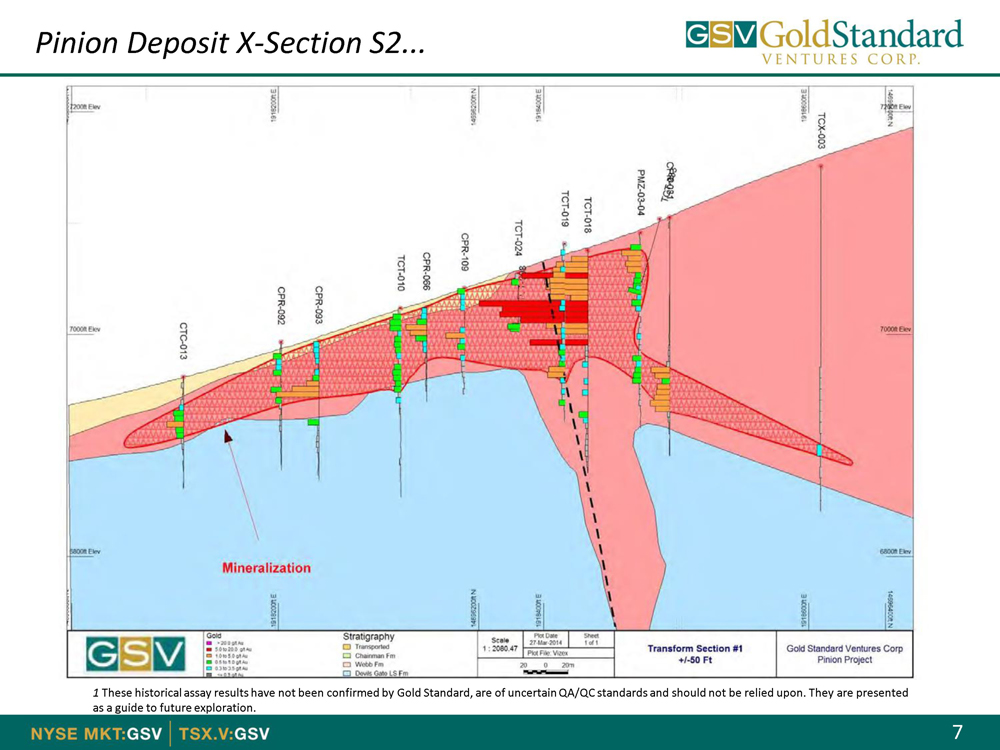

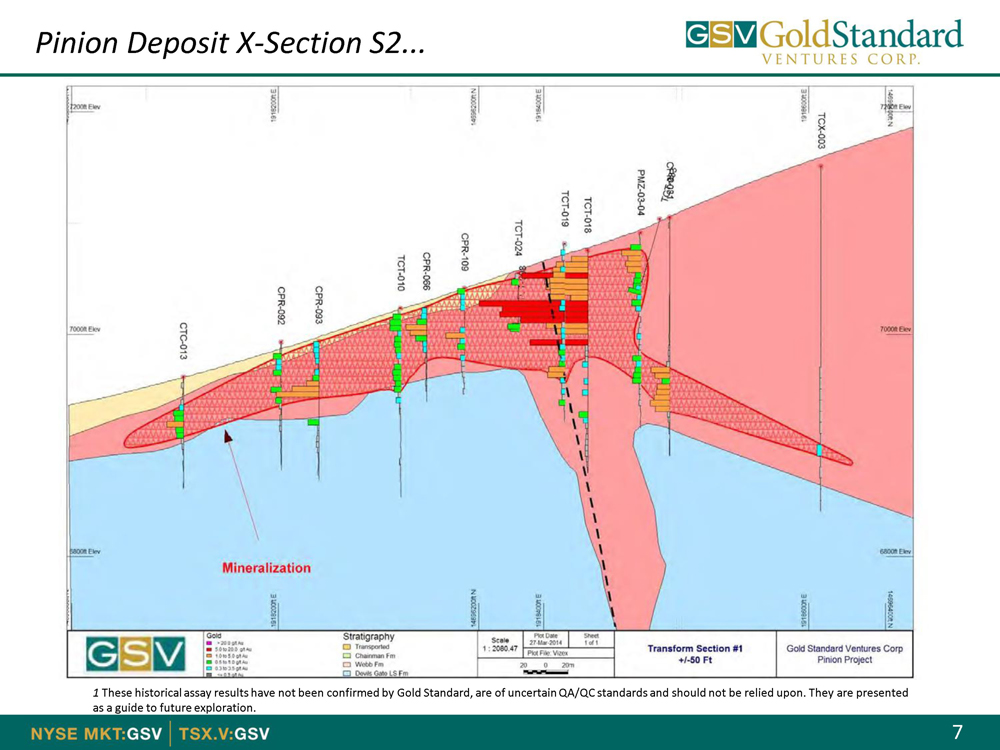

Pinion Deposit X-Section S2...

1 These historical assay results have not been confirmed by Gold Standard, are of uncertain QA/QC standards and should not be relied upon. They are presented

as a guide to future exploration.

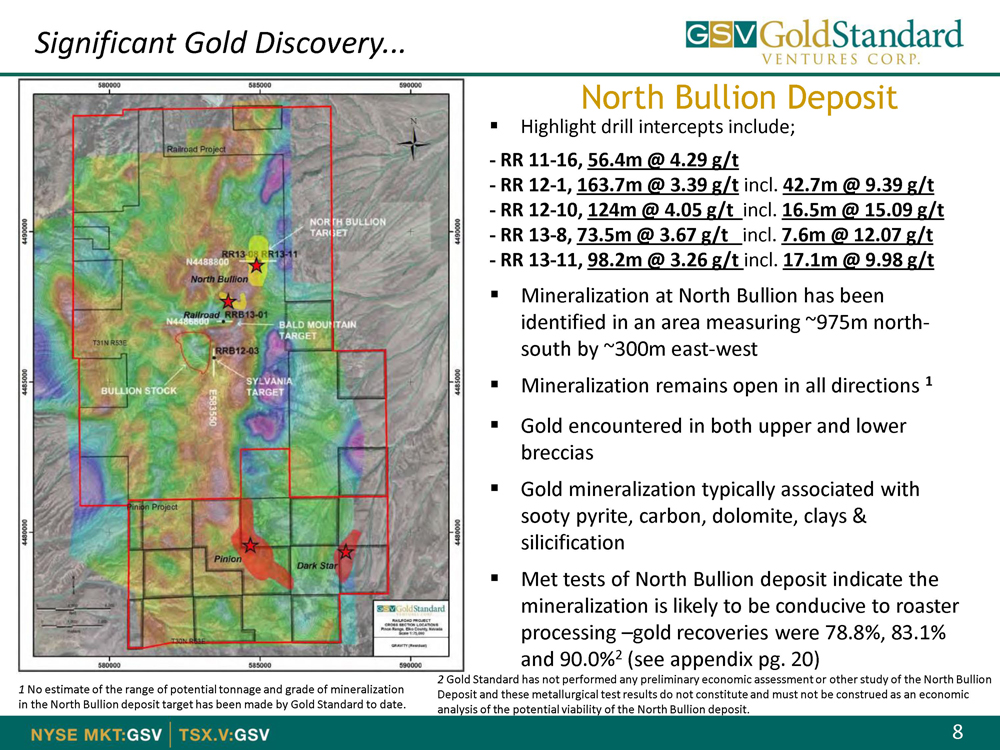

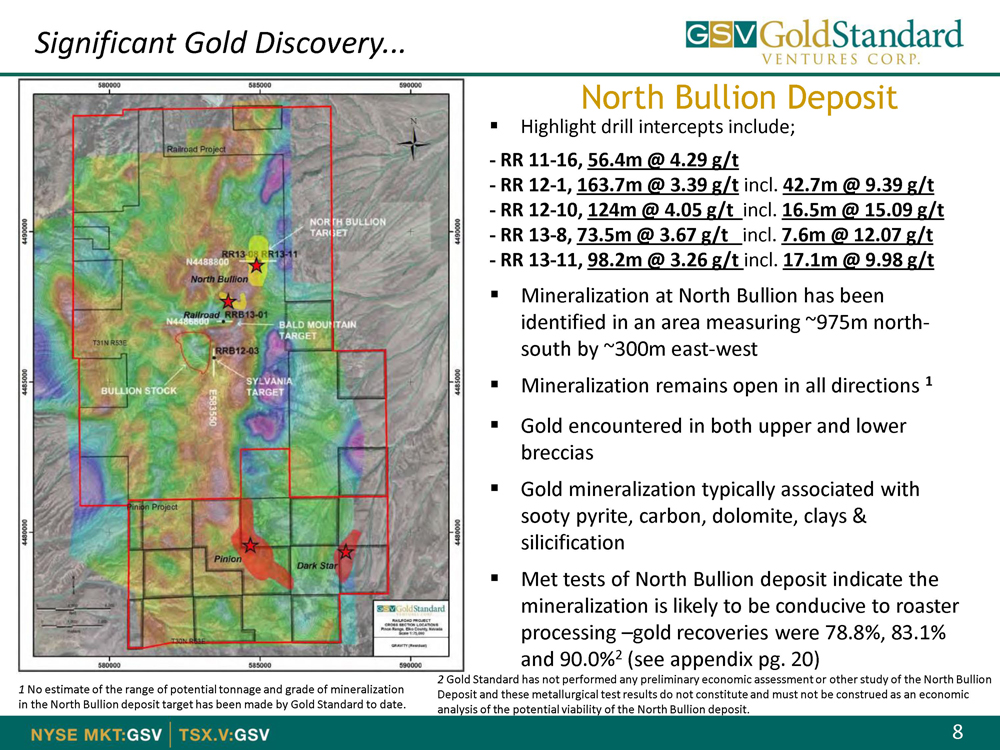

Significant Gold Discovery...

Highlight drill intercepts include;

- RR 11-16, 56.4m @ 4.29 g/t

- RR 12-1, 163.7m @ 3.39 g/tincl.42.7m @ 9.39 g/t

- RR 12-10, 124m @ 4.05 g/tincl.16.5m @ 15.09 g/t

- RR 13-8, 73.5m @ 3.67 g/tincl.7.6m @ 12.07 g/t

- RR 13-11, 98.2m @ 3.26 g/tincl. 17.1m @ 9.98 g/t

Mineralization at North Bullion has been

identified in an area measuring ~975m north-

south by ~300m east-west

Mineralization remains open in all directions1

Gold encountered in both upper and lower

breccias

Gold mineralization typically associated with

sooty pyrite, carbon, dolomite, clays &

silicification

Met tests of North Bullion deposit indicate the

mineralization is likely to be conducive to roaster

processing gold recoveries were 78.8%, 83.1%

and 90.0%2(see appendix pg. 20)

1No estimate of the range of potential tonnage and grade of mineralization in the North Bullion deposit target has been made by Gold Standard to date.

2Gold Standard has not performed any preliminary economic assessment or other study of the North Bullion Deposit and these metallurgical test results do not constitute and must not be construed as an economic analysis of the potential viability of the North Bullion deposit.

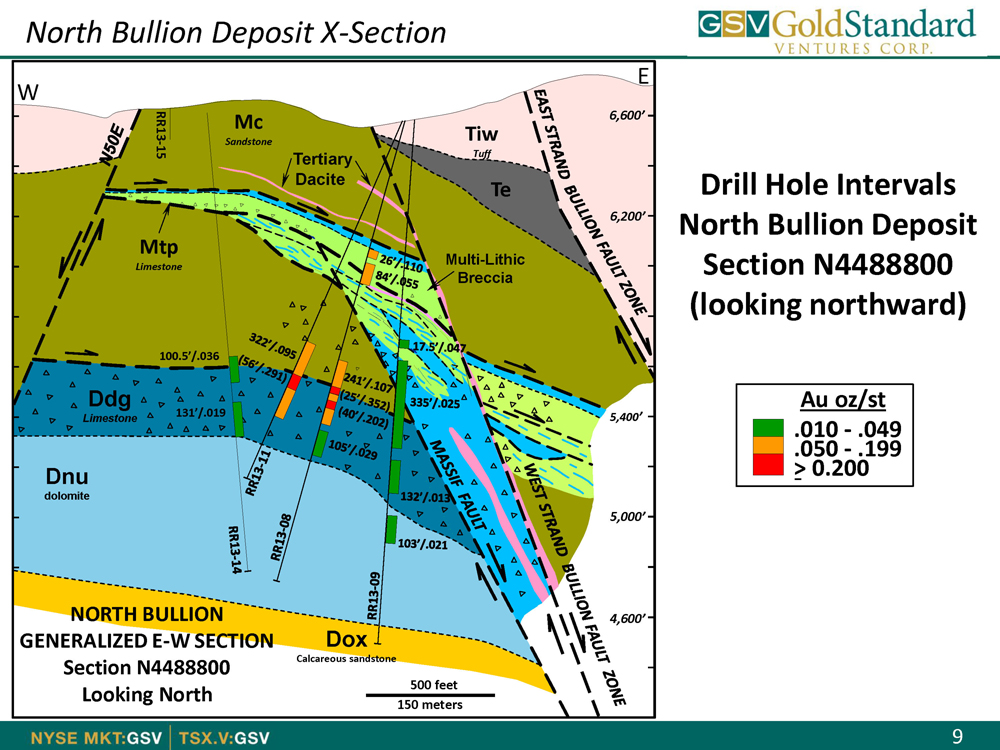

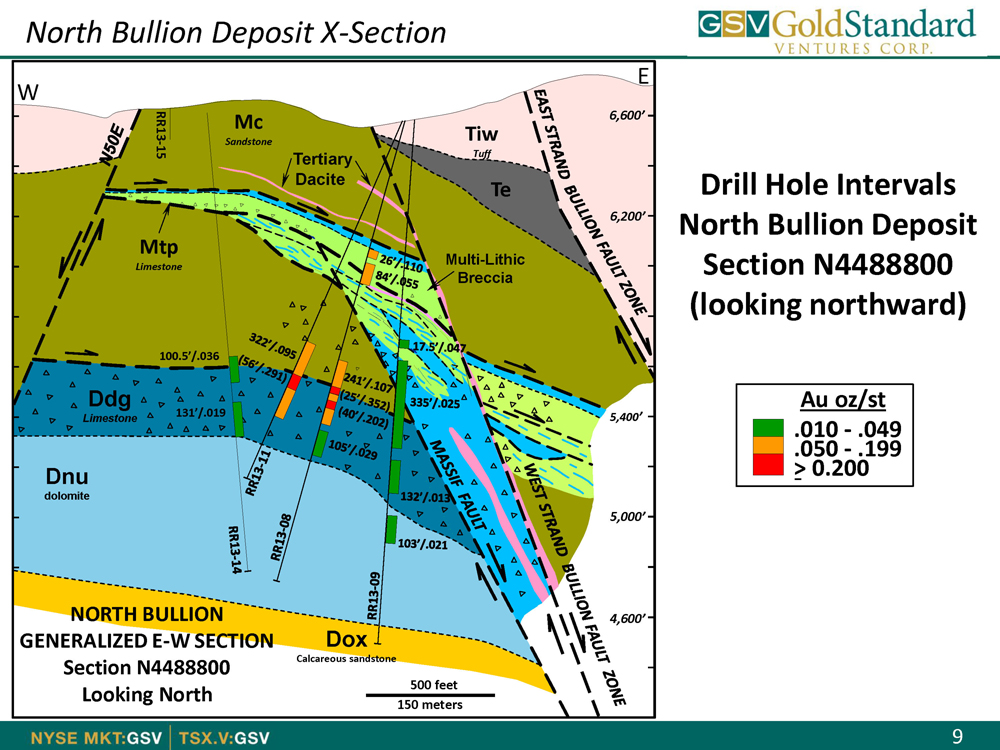

North Bullion Deposit X-Section

Drill Hole Intervals

North Bullion Deposit

Section N4488800

(looking northward)

Au oz/st

010 - .049

050 - .199

-> 0.200

W

Mc6,600’

Tiw

Sandstone

RR13-15 TertiaryTuff

Dacite

Te

6,200’

Mtp

Multi-Lithic

Limestone

Breccia

100.5’/.036

Ddg

131’/.0195,400’

Limestone

Dnu

dolomite

5,000’

NORTH BULLION4,600’

GENERALIZED E-W SECTION Dox

Section N4488800 Calcareous sandstone

500 feet

Looking North

150 meters

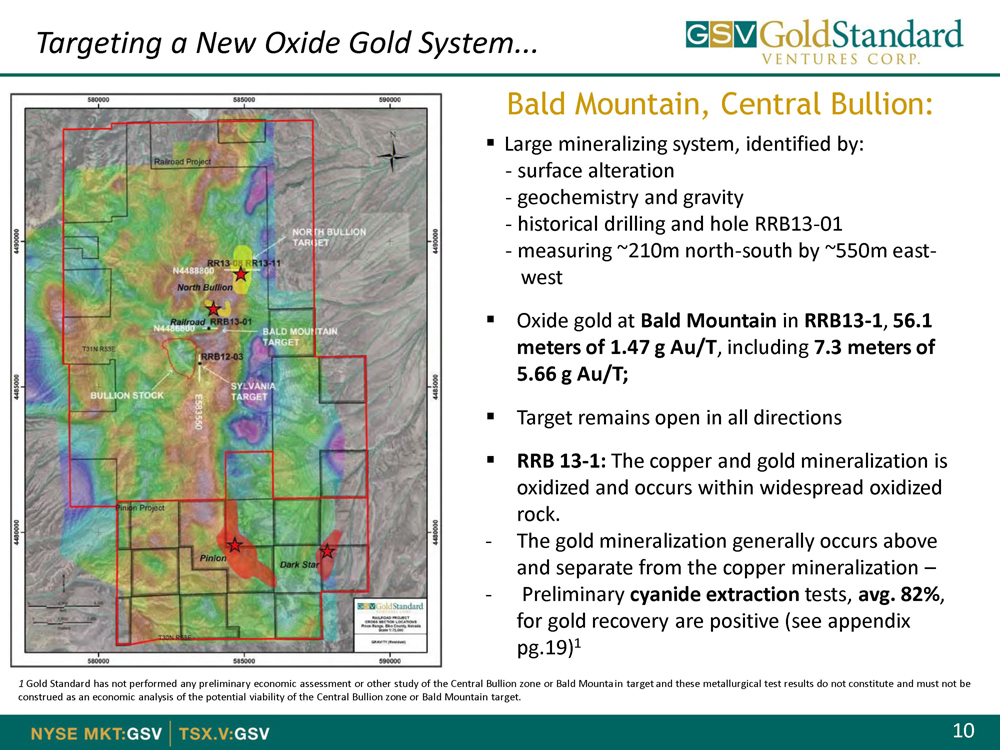

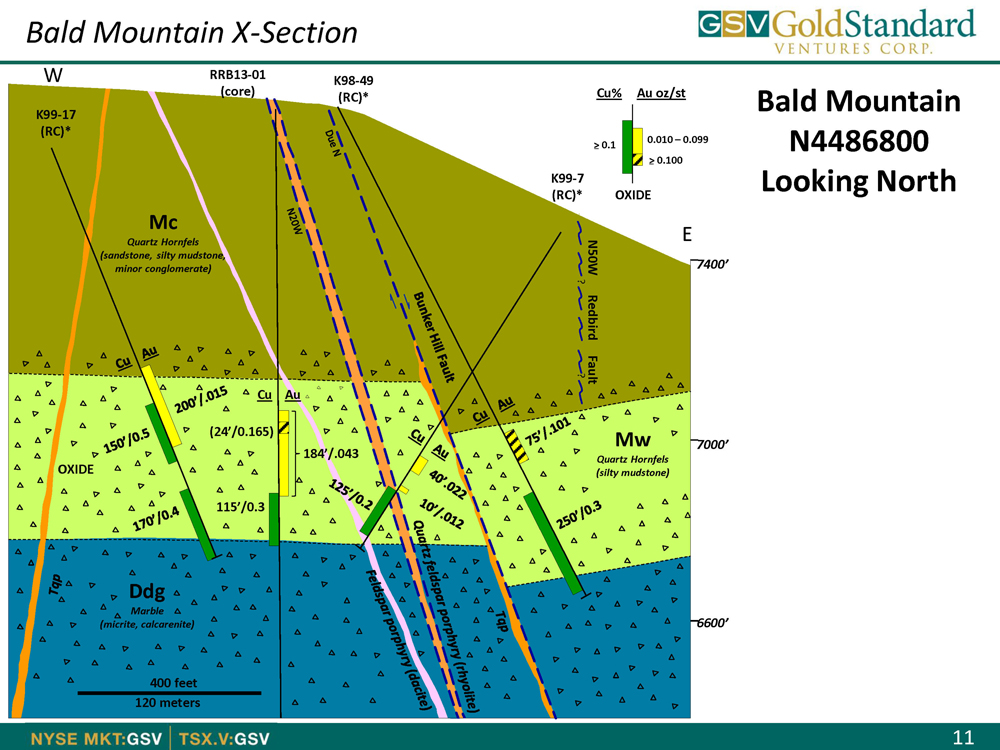

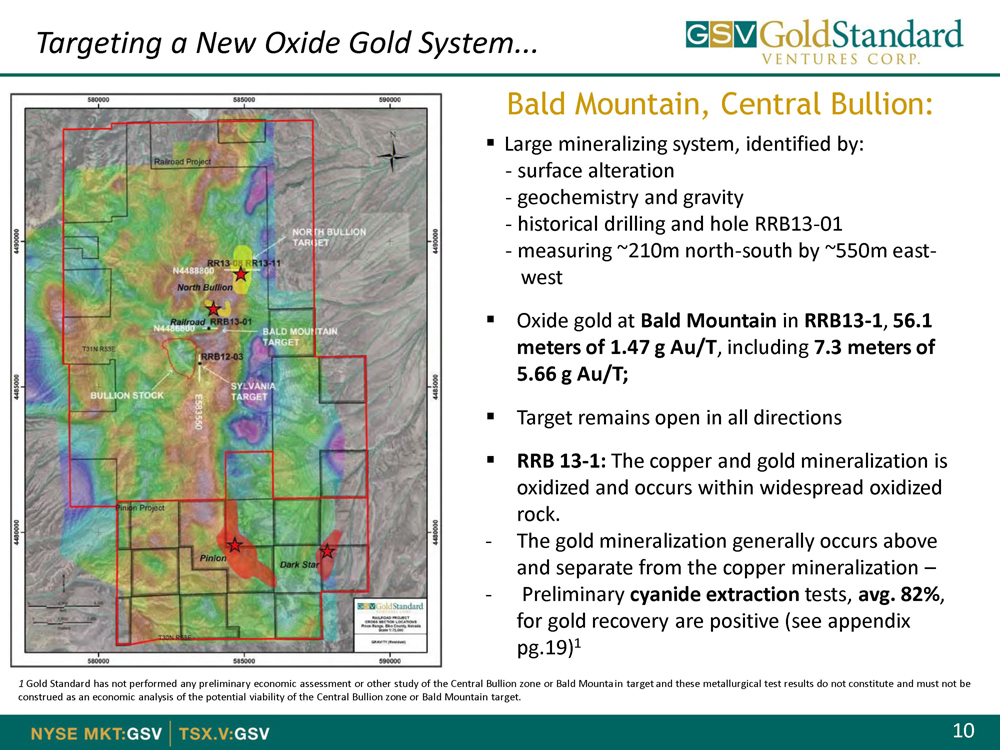

Targeting a New Oxide Gold System...

Bald Mountain, Central Bullion:

Large mineralizing system, identified by:

- surface alteration

- geochemistry and gravity

- historical drilling and hole RRB13-01

- measuring ~210m north-south by ~550m east-

west

Oxide gold atBald MountaininRRB13-1,56.1

meters of 1.47 g Au/T, including7.3 meters of

5.66 g Au/T;

Target remains open in all directions

RRB 13-1:The copper and gold mineralization is

oxidized and occurs within widespread oxidized

rock.

- The gold mineralization generally occurs above

and separate from the copper mineralization

- Preliminarycyanide extractiontests,avg. 82%,

for gold recovery are positive (see appendix

pg.19)1

1Gold Standard has not performed any preliminary economic assessment or other study of the Central Bullion zone or Bald Mountain target and these metallurgical test results do not constitute and must not be

construed as an economic analysis of the potential viability of the Central Bullion zone or Bald Mountain target.

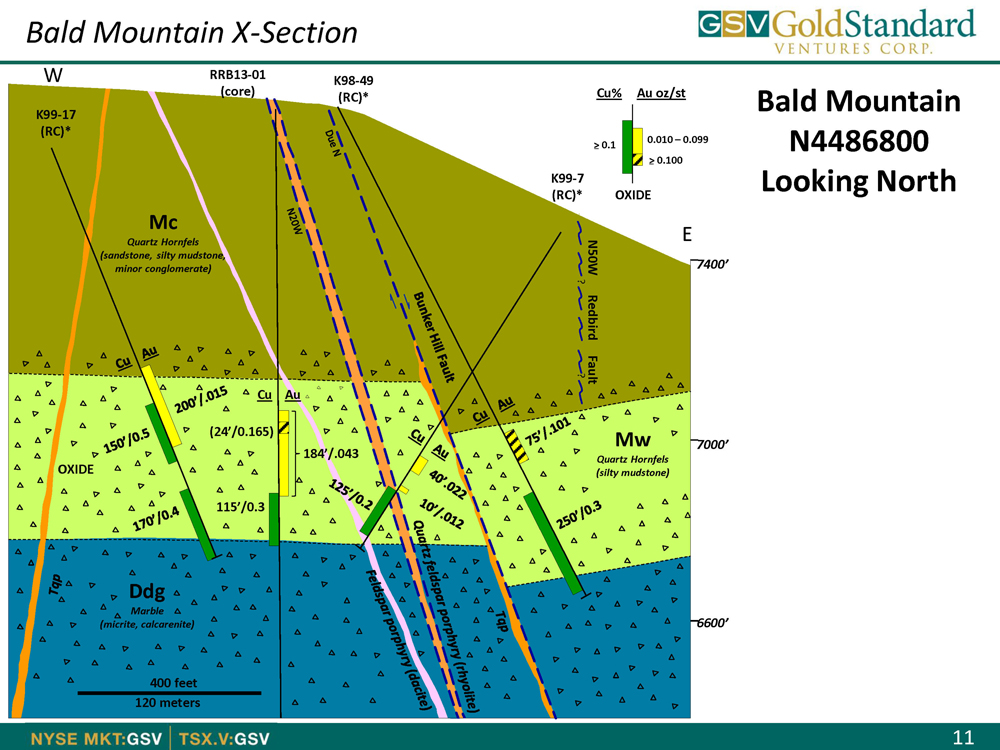

Bald Mountain X-Section

WRRB13-01

K98-49

(core) Cu% Au oz/st

(RC)*

K99-17

(RC)*

0.010 0.099

> 0.1 _

> 0.100_

K99-7

(RC)* OXIDE

Mc

Quartz HornfelsE

(sandstone, silty mudstone,

minor conglomerate)N50W7400’

?

Redbird

?Fault

Cu Au

(24’/0.165) Mw

7000’

184’/.043

Quartz Hornfels

OXIDE(silty mudstone)

115’/0.3

Ddg

Marble

(micrite, calcarenite) 6600’

400 feet

120 meters

Bald Mountain

N4486800

Looking North

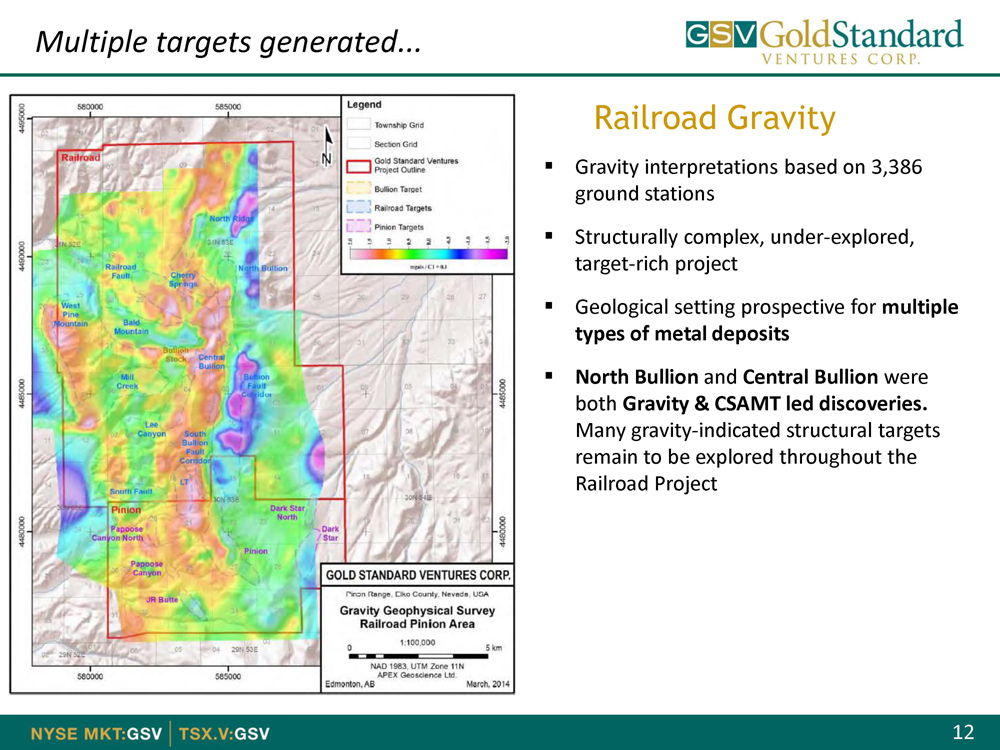

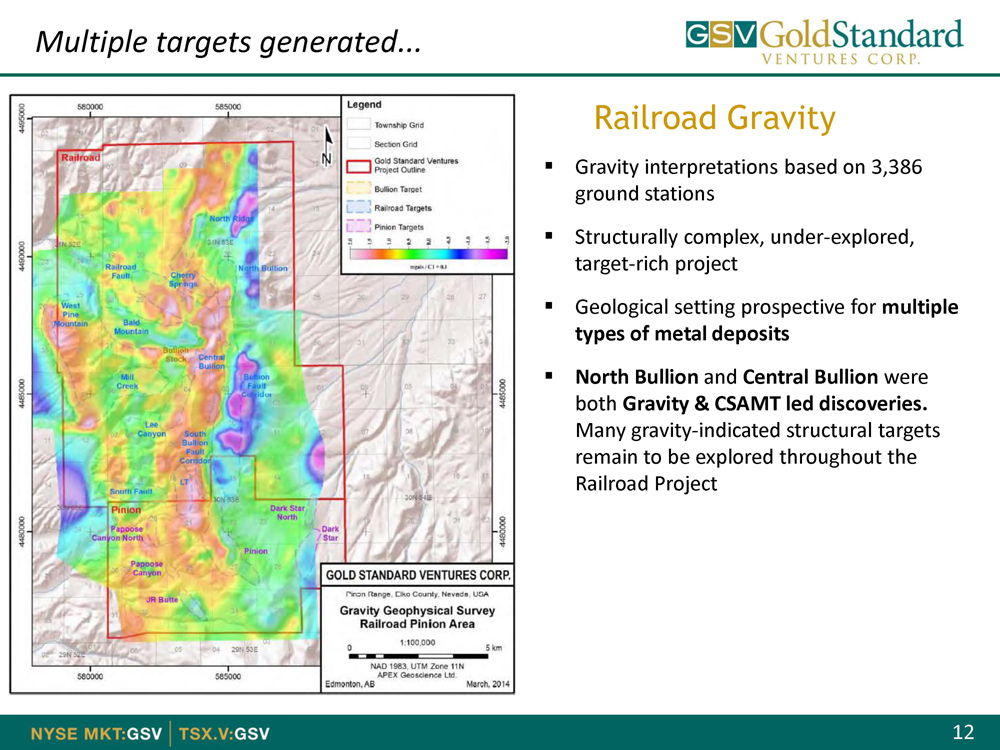

Multiple targets generated...

Railroad Gravity

Gravity interpretations based on 3,386

ground stations

Structurally complex, under-explored,

target-rich project

Geological setting prospective formultiple

types of metal deposits

North BullionandCentral Bullionwere

bothGravity & CSAMT led discoveries.

Many gravity-indicated structural targets

remain to be explored throughout the

Railroad Project

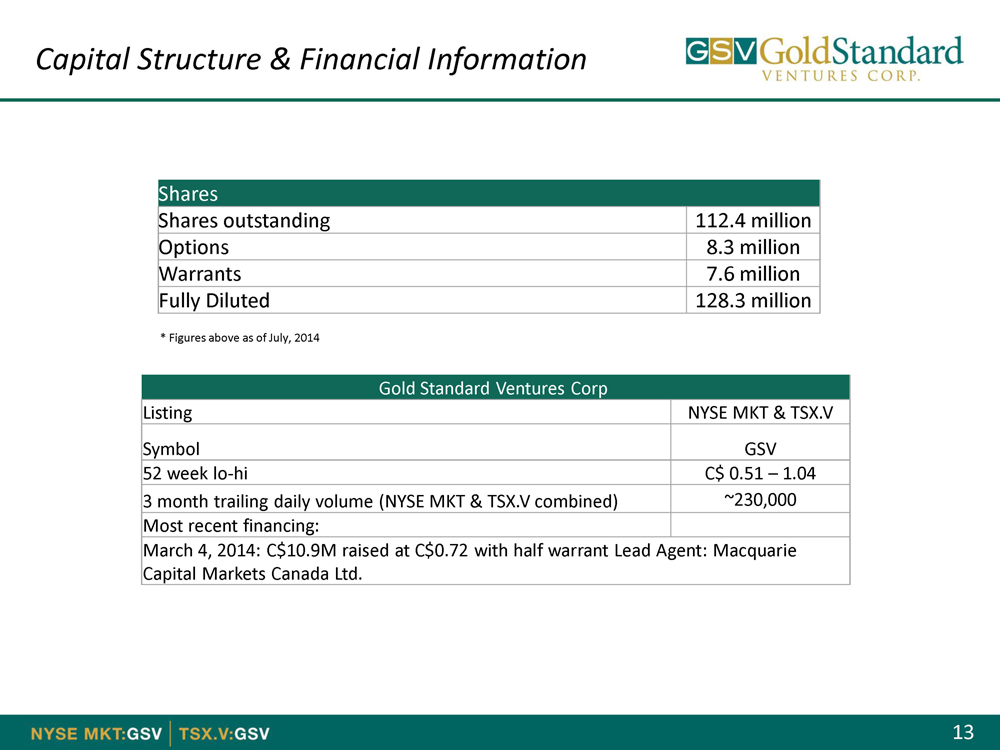

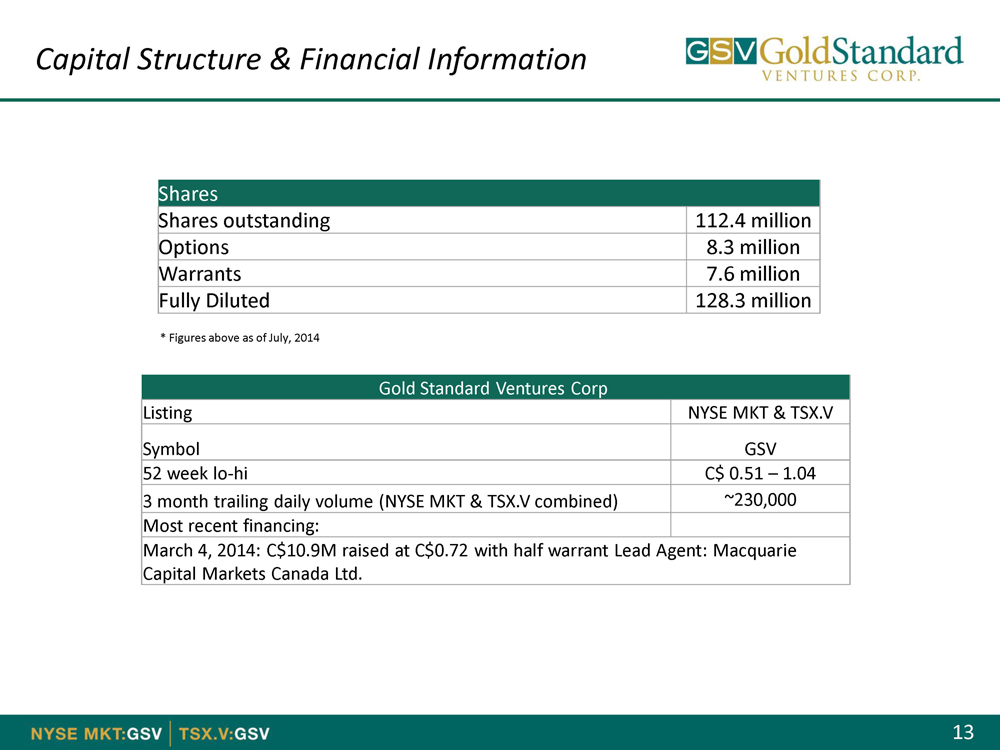

Capital Structure & Financial Information

Shares

Shares outstanding 112.4 million

Options 8.3 million

Warrants 7.6 million

Fully Diluted 128.3 million

* Figures above as of July, 2014

Gold Standard Ventures Corp

Listing NYSE MKT & TSX.VRetail

Symbol InstitutionalGSV Insider

52 week lo-hi C$ 0.51 1.04&

3 month trailing daily volume (NYSE MKT & TSX.V combined) ~230,000

Most recent financing:

March 4, 2014: C$10.9M raised at C$0.72 with half warrant Lead Agent: Macquarie

Capital Markets Canada Ltd.

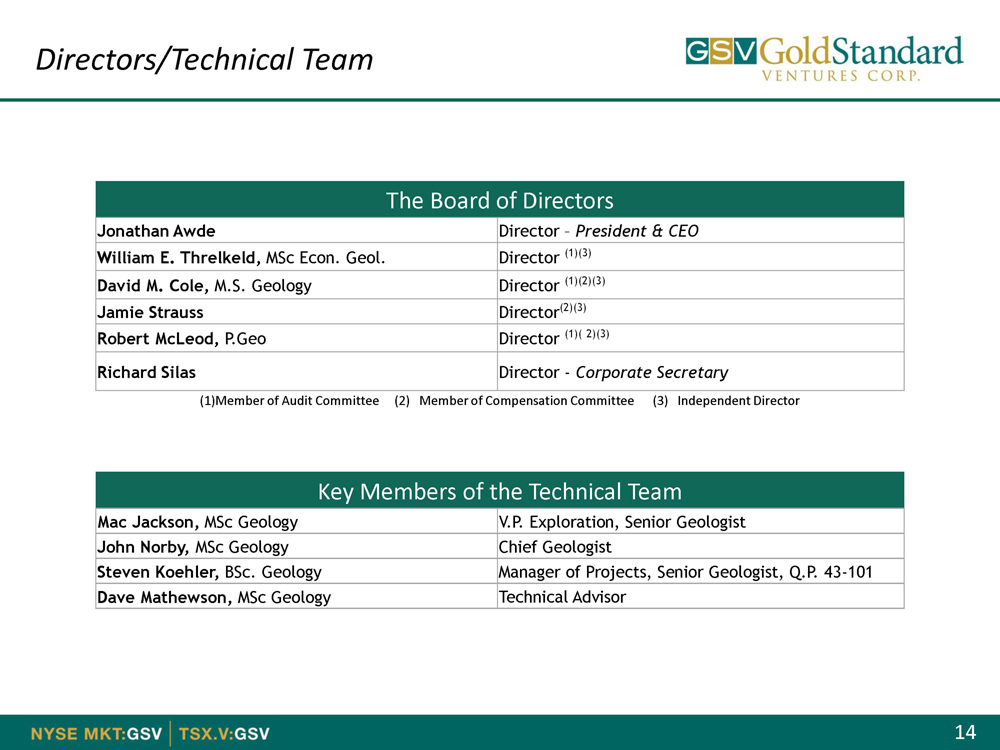

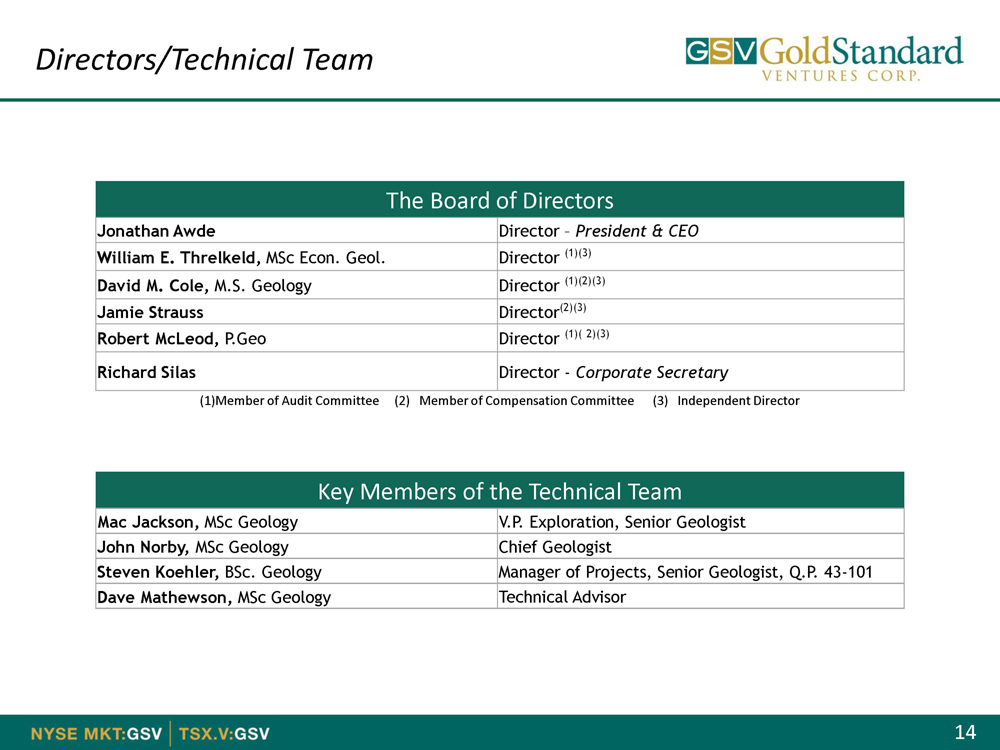

Directors/Technical Team

The Board of Directors

Jonathan AwdeDirectorPresident & CEO

William E. Threlkeld,MSc Econ. Geol.Director(1)(3)

David M. Cole,M.S. Geology Director(1)(2)(3)

Jamie StraussDirector(2)(3)

Robert McLeod,P.Geo Director(1)( 2)(3)

Richard SilasDirector -Corporate Secretary

(1)Member of Audit Committee (2) Member of Compensation Committee (3) Independent Director

Key Members of the Technical Team

Mac Jackson,MSc Geology V.P. Exploration, Senior Geologist

John Norby,MSc Geology Chief Geologist

Steven Koehler,BSc. Geology Manager of Projects, Senior Geologist, Q.P. 43-101

Dave Mathewson,MSc Geology Technical Advisor

Why Gold Standard?

The Opportunity

One of only four “windows” in the Carlin Trend

Railroad/Pinion District has never been systematically explored with modern techniques

Gold Standardhas madetwo high grade discoverieson its Railroad project

Pinion&North Bulliondeposits, along with theBald Mountaindiscovery, are all open to

expansion

Ongoing exploration in a target rich environment

Appendix: X-Sections/Stratigraphy/Met Tests

& CSAMT

North Bullion core drilling

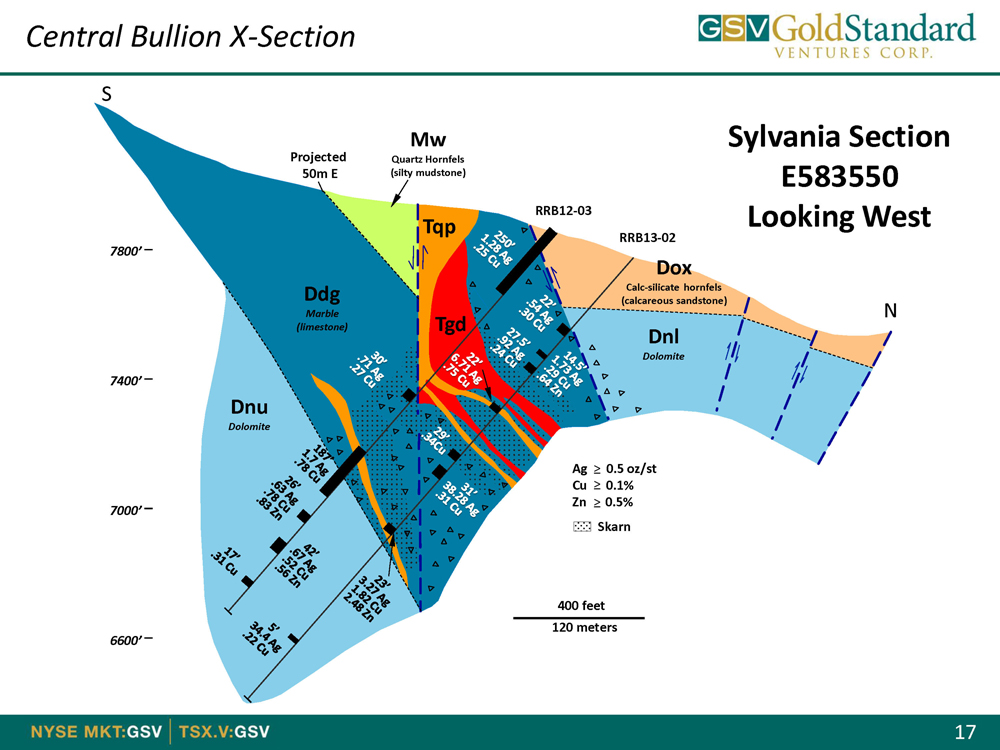

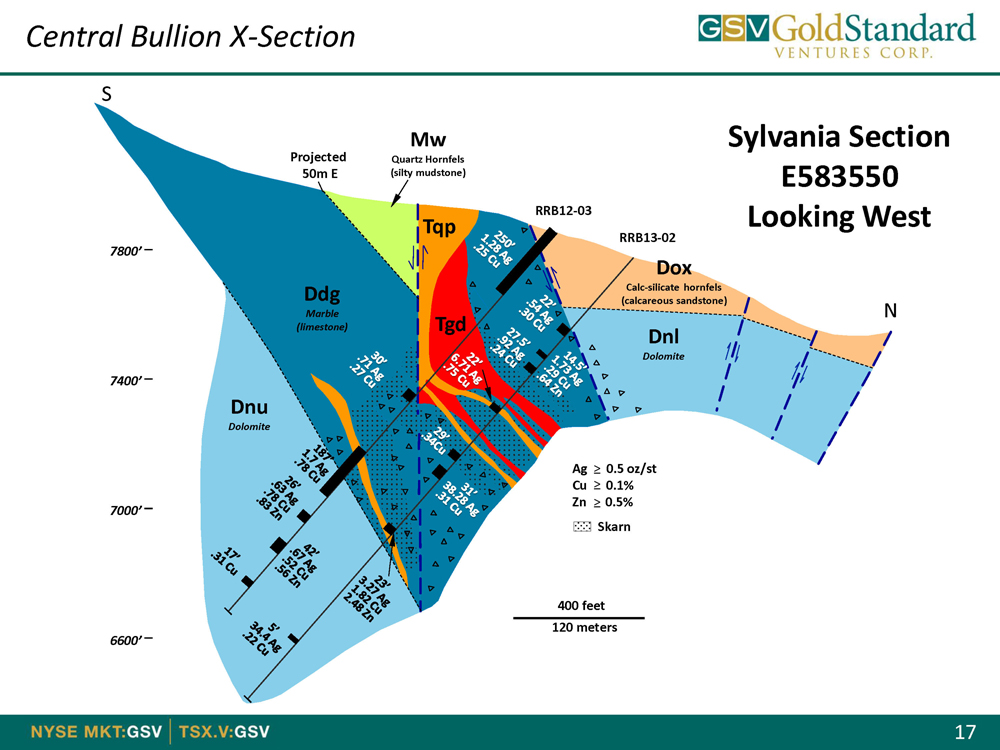

Central Bullion X-Section

S

Mw Sylvania Section

Projected Quartz Hornfels

50m E (silty mudstone) E583550

RRB12-03 Looking West

Tqp

RRB13-02

7800’

Dox

Ddg Calc-silicate hornfels

(calcareous sandstone)

MarbleN

(limestone)Tgd

Dnl

Dolomite

7400’

Dnu

Dolomite

Ag> _0.5 oz/st

Cu> _0.1%

Zn> _0.5%

7000’

Skarn

400 feet

120 meters

6600’

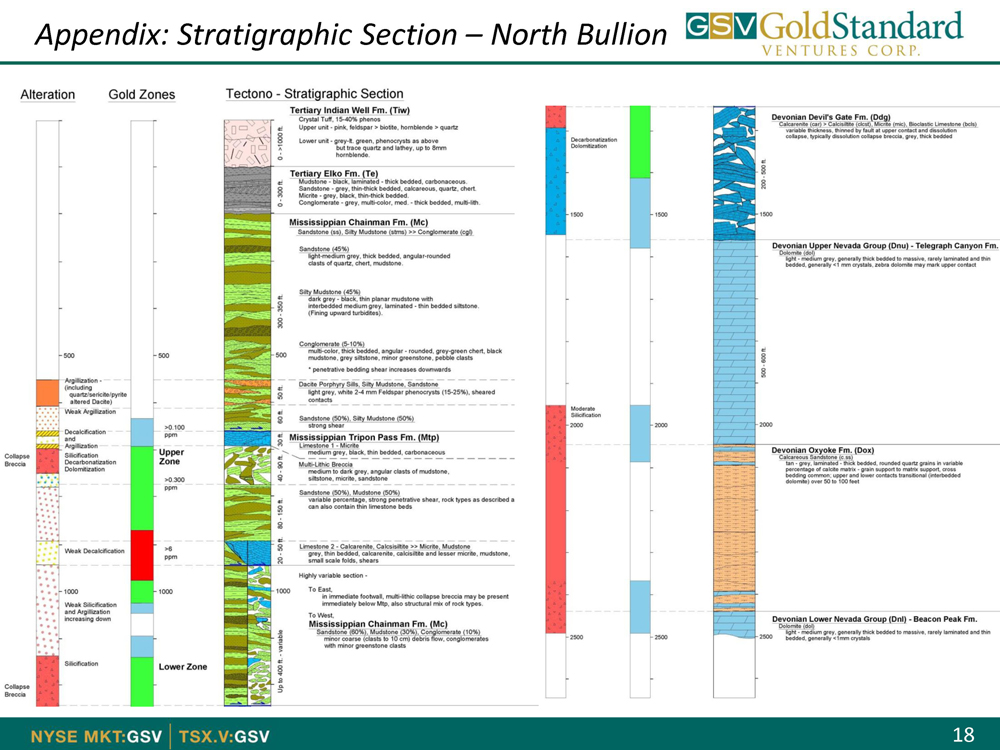

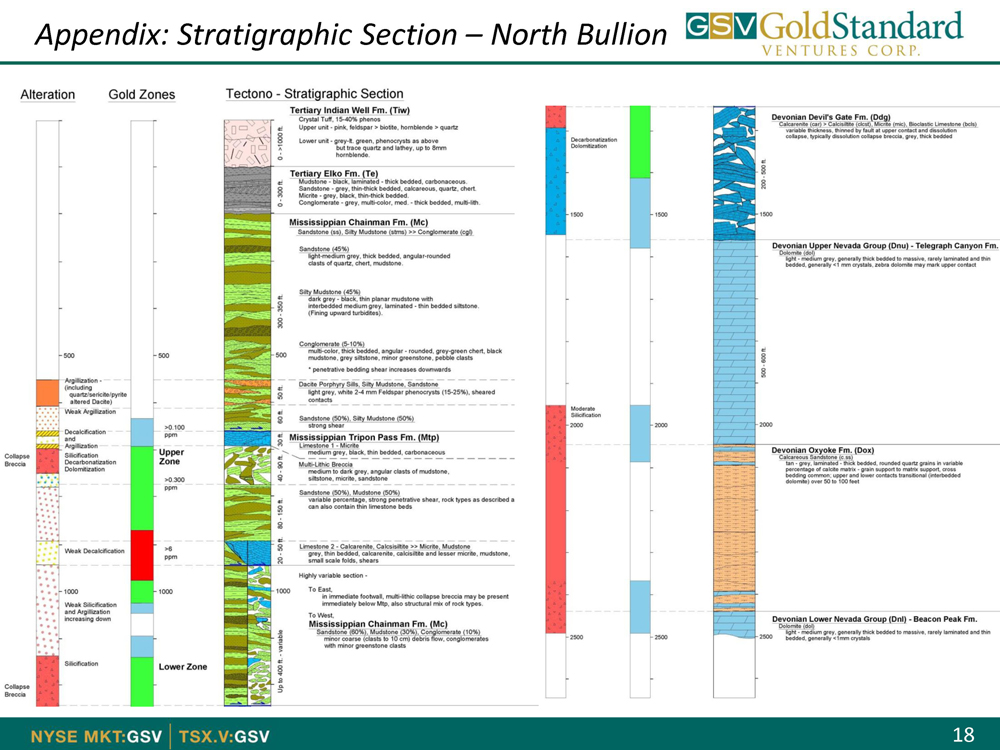

Appendix: Stratigraphic Section North Bullion

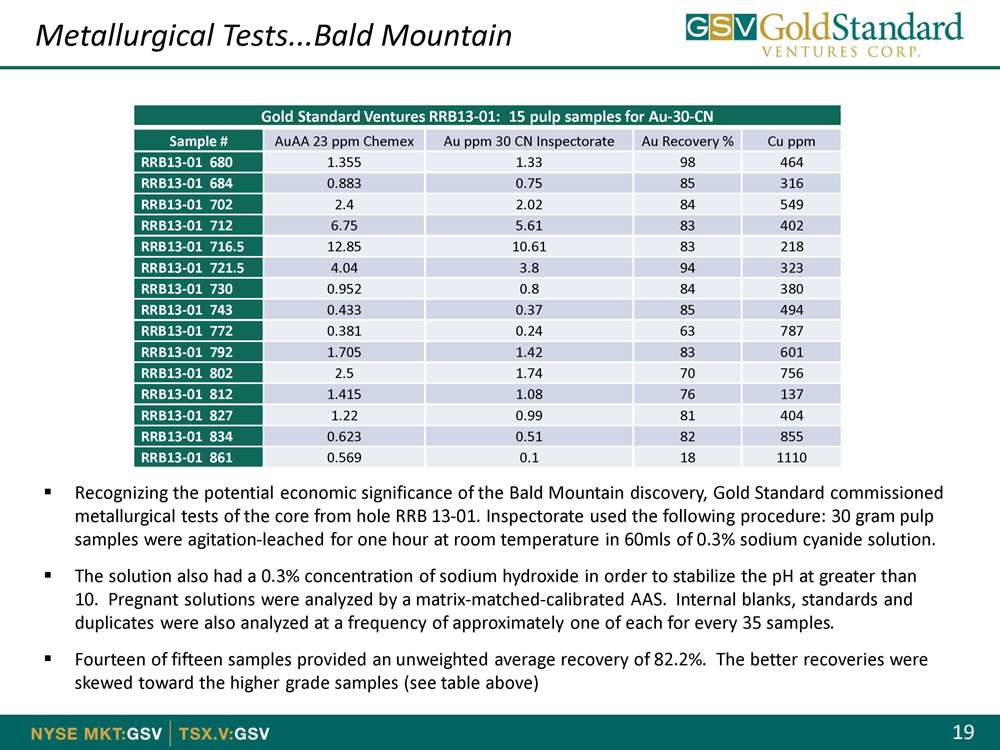

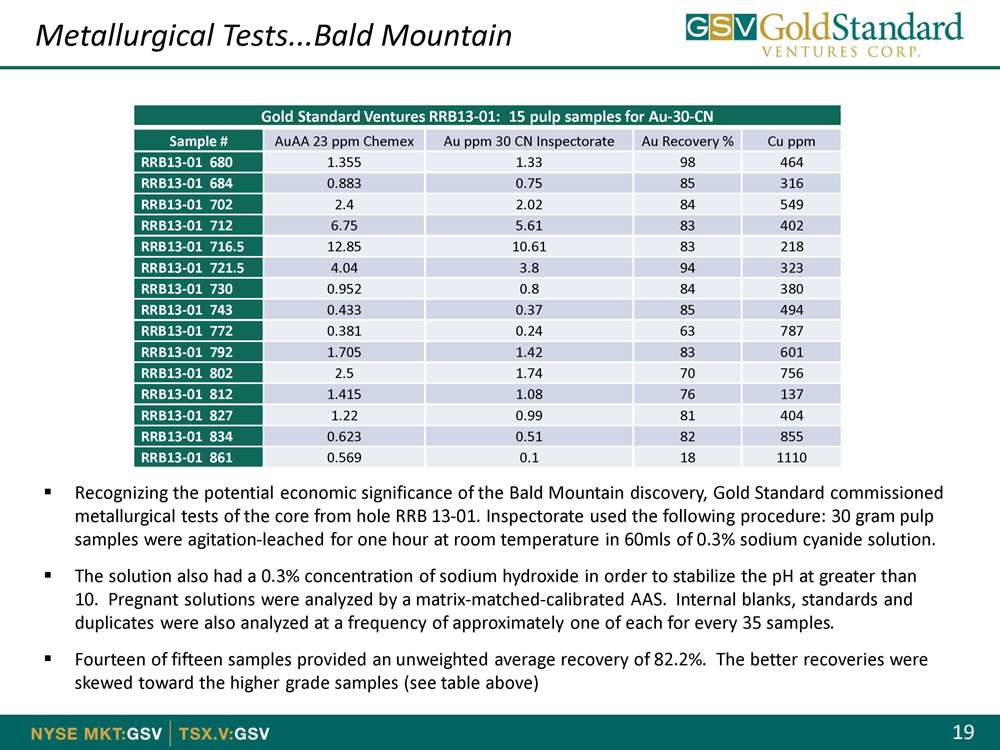

Metallurgical Tests...Bald Mountain

Gold Standard Ventures RRB13-01: 15 pulp samples for Au-30-CN

Sample # AuAA 23 ppm Chemex Au ppm 30 CN Inspectorate Au Recovery % Cu ppm

RRB13-01 680 1.355 1.33 98 464

RRB13-01 684 0.883 0.75 85 316

RRB13-01 702 2.4 2.02 84 549

RRB13-01 712 6.75 5.61 83 402

RRB13-01 716.5 12.85 10.61 83 218

RRB13-01 721.5 4.04 3.8 94 323

RRB13-01 730 0.952 0.8 84 380

RRB13-01 743 0.433 0.37 85 494

RRB13-01 772 0.381 0.24 63 787

RRB13-01 792 1.705 1.42 83 601

RRB13-01 802 2.5 1.74 70 756

RRB13-01 812 1.415 1.08 76 137

RRB13-01 827 1.22 0.99 81 404

RRB13-01 834 0.623 0.51 82 855

RRB13-01 861 0.569 0.1 18 1110

Recognizing the potential economic significance of the Bald Mountain discovery, Gold Standard commissioned

metallurgical tests of the core from hole RRB 13-01. Inspectorate used the following procedure: 30 gram pulp

samples were agitation-leached for one hour at room temperature in 60mls of 0.3% sodium cyanide solution.

he solution also had a 0.3% concentration of sodium hydroxide in order to stabilize the pH at greater than

10. Pregnant solutions were analyzed by a matrix-matched-calibrated AAS. Internal blanks, standards and

duplicates were also analyzed at a frequency of approximately one of each for every 35 samples.

Fourteen of fifteen samples provided an unweighted average recovery of 82.2%. The better recoveries were

skewed toward the higher grade samples (see table above)

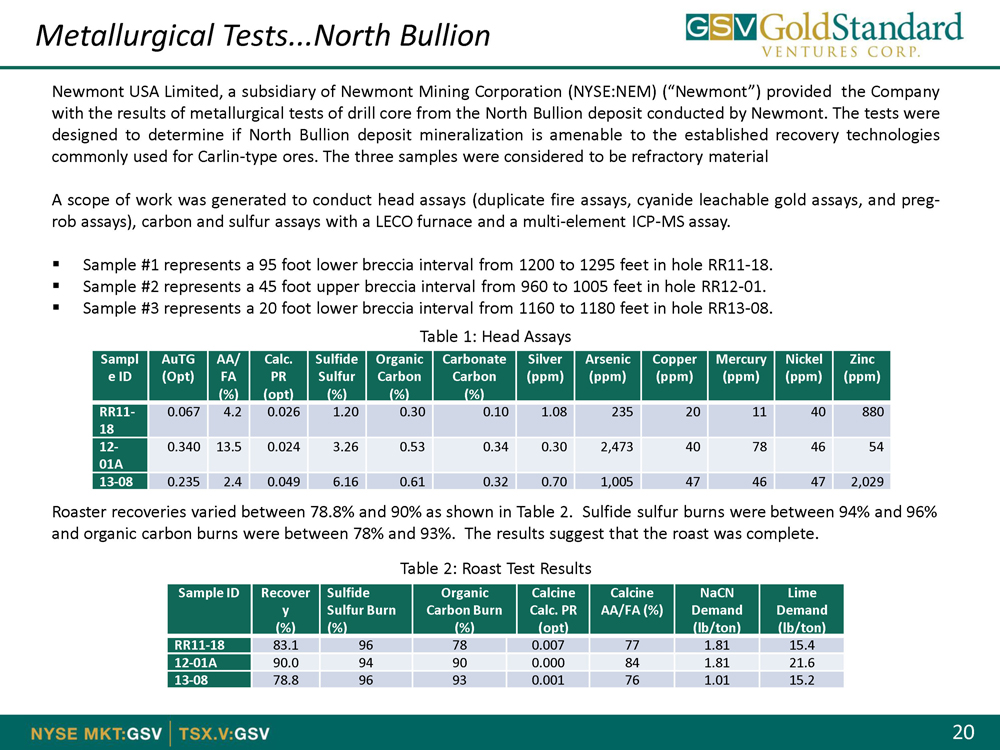

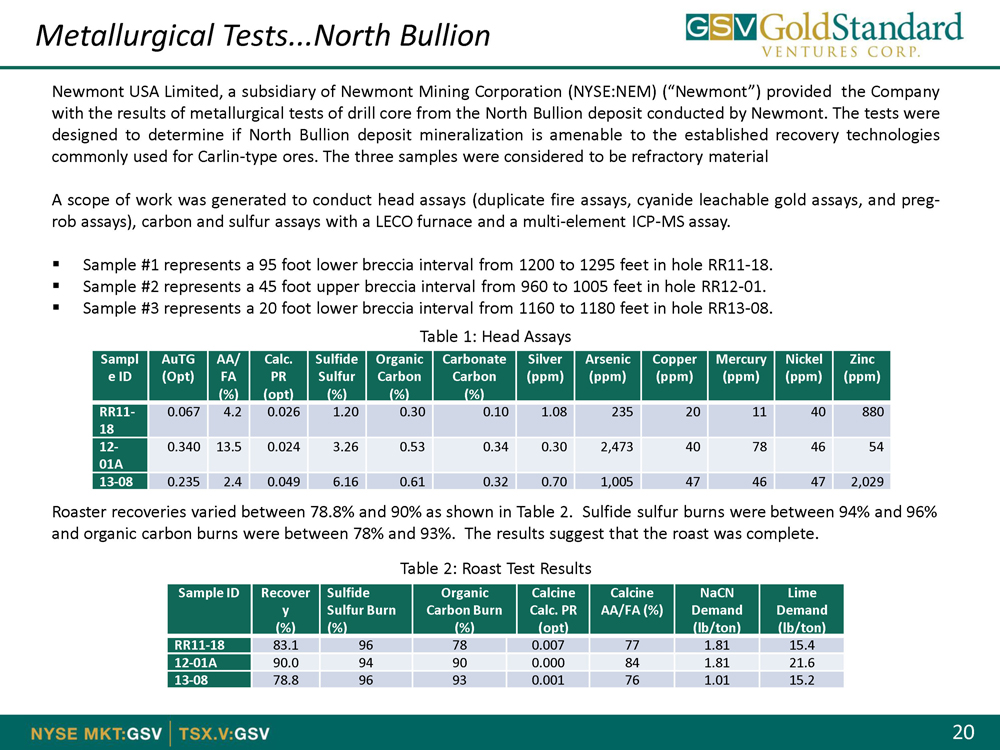

Metallurgical Tests...North Bullion

Newmont USA Limited, a subsidiary of Newmont Mining Corporation (NYSE:NEM) (“Newmont”) provided the Company

with the results of metallurgical tests of drill core from the North Bullion deposit conducted by Newmont. The tests were

designed to determine if North Bullion deposit mineralization is amenable to the established recovery technologies

commonly used for Carlin-type ores. The three samples were considered to be refractory material

A scope of work was generated to conduct head assays (duplicate fire assays, cyanide leachable gold assays, and preg-

rob assays), carbon and sulfur assays with a LECO furnace and a multi-element ICP-MS assay.

Sample #1 represents a 95 foot lower breccia interval from 1200 to 1295 feet in hole RR11-18.

Sample #2 represents a 45 foot upper breccia interval from 960 to 1005 feet in hole RR12-01.

Sample #3 represents a 20 foot lower breccia interval from 1160 to 1180 feet in hole RR13-08.

Table 1: Head Assays

Sampl AuTG AA/ Calc. Sulfide Organic Carbonate Silver Arsenic Copper Mercury Nickel Zinc

e ID (Opt) FA PR Sulfur Carbon Carbon (ppm) (ppm) (ppm) (ppm) (ppm) (ppm)

(%) (opt) (%) (%) (%)

RR11- 0.067 4.2 0.026 1.20 0.30 0.10 1.08 235 20 11 40 880

18 12 - 0.340 13.5 0.024 3.26 0.53 0.34 0.30 2,473 40 78 46 54

01A

13-08 0.235 2.4 0.049 6.16 0.61 0.32 0.70 1,005 47 46 47 2,029

Roaster recoveries varied between 78.8% and 90% as shown in Table 2. Sulfide sulfur burns were between 94% and 96%

and organic carbon burns were between 78% and 93%. The results suggest that the roast was complete.

Table 2: Roast Test Results

Sample ID Recover Sulfide Organic Calcine Calcine NaCN Lime

y Sulfur Burn Carbon Burn Calc. PR AA/FA (%) Demand Demand

(%) (%) (%) (opt) (lb/ton) (lb/ton)

RR11-18 83.1 96 78 0.007 77 1.81 15.4

12-01A 90.0 94 90 0.000 84 1.81 21.6

13-08 78.8 96 93 0.001 76 1.01 15.2

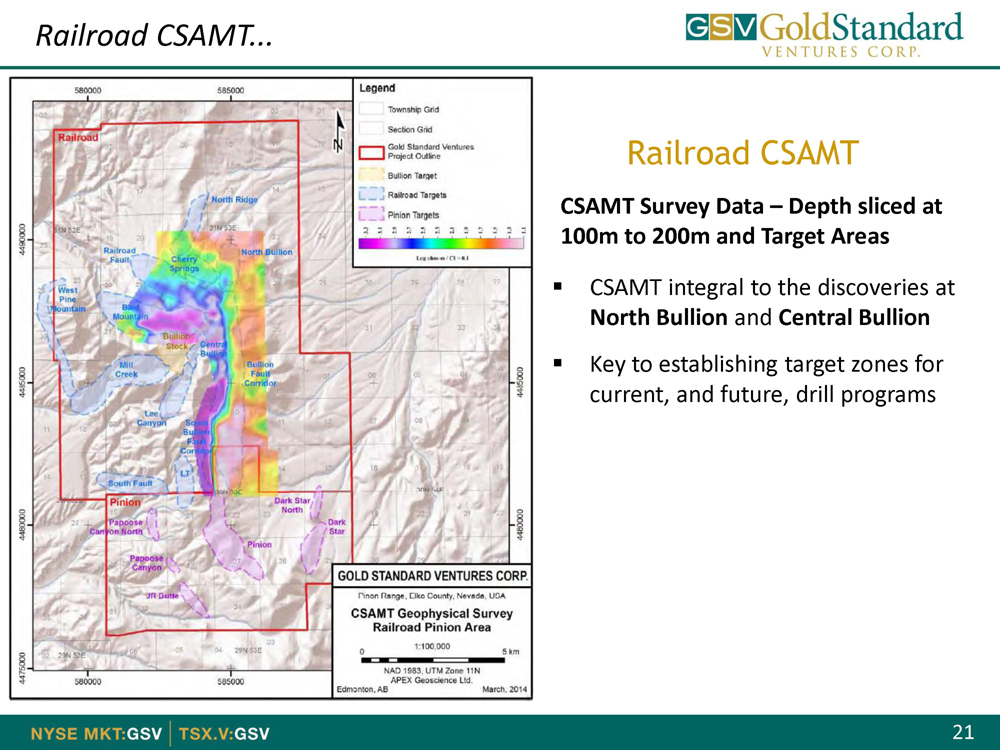

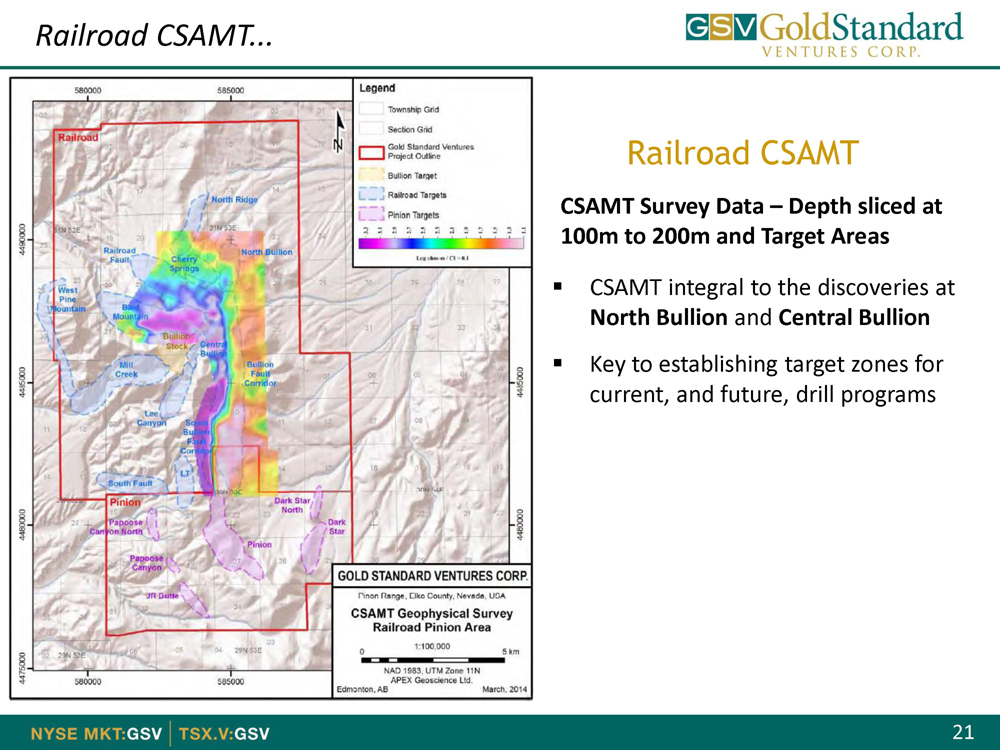

Railroad CSAMT...

Railroad CSAMT

CSAMT Survey Data Depth sliced at

100m to 200m and Target Areas

CSAMT integral to the discoveries at

North Bullion and Central Bullion

Key to establishing target zones for

current, and future, drill programs

Gold standard Ventures Corp.

Suite 610 – 815 West Hastings Street

Vancouver, BC, Canada. V6C 1B4

T: 604-669-5702

F: 604-687-3567

info@goldstandardv.com

www.goldstandardv.com