QuickLinks -- Click here to rapidly navigate through this document

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-133574

PROSPECTUS

AMC Entertainment Inc.

OFFER TO EXCHANGE

$325,000,000 principal amount of its 11% Series B Senior Subordinated Notes due 2016

which have been registered under the Securities Act, for any and all of its outstanding

11% Series A Senior Subordinated Notes due 2016

We offer to exchange up to $325,000,000 aggregate principal amount of our outstanding 11% Series A Senior Subordinated Notes due February 1, 2016, or the "original notes," for an equal principal amount of our 11% Series B Senior Subordinated Notes due February 1, 2016, or the "exchange notes." We refer to the original notes and the exchange notes collectively in this prospectus as the "notes." The exchange notes are substantially identical to the original notes, except that the exchange notes have been registered under the federal securities laws and will not bear any legend restricting their transfer. The exchange notes will represent the same debt as the original notes, and we will issue the exchange notes under the same indenture.

We may redeem some or all of the notes at any time on or after February 1, 2011 at the redemption prices set forth in this prospectus. In addition, we may redeem up to 35% of the aggregate principal amount of the notes using net proceeds from certain equity offerings completed on or prior to February 1, 2009. There is no sinking fund for the notes.

The exchange notes will be our unsecured senior subordinated obligations and will rank junior to all our existing and future senior indebtedness, including indebtedness under our new senior secured credit facility. Our obligations under the exchange notes will be guaranteed on a senior subordinated basis by all of our existing and future subsidiaries that guarantee our other indebtedness.

Terms of the Exchange Offer

- •

- The exchange offer expires at 5:00 p.m., New York City time, on June 13, 2006, unless extended.

- •

- The exchange offer is subject to certain customary conditions, which we may waive.

- •

- The exchange offer is not conditioned upon any minimum principal balance of the original notes being tendered for exchange.

- •

- You may withdraw tenders of original notes at any time before the exchange offer expires.

- •

- All original notes that are validly tendered and not withdrawn will be exchanged for exchange notes.

- •

- We will not receive any proceeds from, and no underwriter is being used in connection with, the exchange offer.

- •

- There is no existing market for the exchange notes to be issued and we do not intend to apply for their listing on any securities exchange.

- •

- The exchange of original notes for exchange notes pursuant to the exchange offer should not be a taxable event for U.S. federal income tax purposes.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of these exchange notes. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market making activities or other trading activities. We have agreed that, for a period of one year after consummation of the registered exchange offer, we will make this prospectus available to any broker-dealer for use in connection with any resale. See "Plan of Distribution."

See "Risk Factors" beginning on page 26 for a discussion of the factors you should consider in connection with the exchange offer and exchange of original notes for exchange notes.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the original notes or the exchange notes or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 12, 2006.

We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained in this prospectus. You must not rely upon any information or representation not contained in this prospectus as if we had authorized it. This prospectus does not constitute an offer to sell or a solicitation of an offer to buy any securities other than the registered securities to which it relates, nor does this prospectus constitute an offer to sell or a solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

| Market and Industry Information | ii | |

| Where You Can Find More Information About Us | ii | |

| Forward-Looking Statements | ii | |

| Summary | 1 | |

| Risk Factors | 26 | |

| The Exchange Offer | 40 | |

| Use of Proceeds | 47 | |

| Capitalization | 48 | |

| Selected Historical Financial and Operating Data | 49 | |

| Unaudited Pro Forma Condensed Consolidated and Consolidating Financial Information | 56 | |

| AMCE's Management's Discussion and Analysis of Financial Condition and Results of Operations | 68 | |

| Loews' Management's Discussion and Analysis of Financial Condition and Results of Operations | 93 | |

| Business | 103 | |

| Management | 113 | |

| Principal Stockholders | 123 | |

| Certain Relationships and Related Party Transactions | 125 | |

| Description of Other Indebtedness | 129 | |

| Description of Exchange Notes | 133 | |

| Certain U.S. Federal Income Tax Considerations | 165 | |

| Plan of Distribution | 166 | |

| Legal Matters | 167 | |

| Experts | 167 | |

| Index to Consolidated Financial Statements | F-1 |

i

MARKET AND INDUSTRY INFORMATION

Information regarding market share, market position and industry data pertaining to our business contained in this prospectus consists of our estimates based on data and reports compiled by industry professional organizations (including the Motion Picture Association of America ("MPAA"), the National Association of Theatre Owners ("NATO"), Nielsen Media Research, Dodona Research, Rentrak Corporation ("Rentrak") and Screen Digest), industry analysts and our management's knowledge of our business and markets.

Although we believe that the sources are reliable, we have not independently verified market industry data provided by third parties or by industry or general publications, and we take no further responsibility for this data. Similarly, while we believe our internal estimates with respect to our industry are reliable, our estimates have not been verified by any independent sources, and we cannot assure you that they are accurate.

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

AMC Entertainment Inc. files annual, quarterly and special reports and other information with the Securities and Exchange Commission (the "SEC"). You can inspect and copy this registration statement, as well as reports and other information filed by us at the public reference facilities maintained by the SEC at Headquarters Office, 100 F Street, N.E., Washington, D.C. 20549. You can call the SEC at 1-800-SEC-0330 for information regarding the operations of its Headquarters Office. The SEC also maintains a World Wide Web site at http://www.sec.gov that contains reports and information statements and other information regarding registrants (including us) that file electronically.

All statements, other than statements of historical facts, included in this prospectus regarding the prospects of our industry and our prospects, plans, financial position and business strategy may constitute forward-looking statements. In addition, forward-looking statements generally can be identified by the use of forward-looking terminology such as "may," "will," "expect," "intend," "estimate," "anticipate," "plan," "foresee," "believe" or "continue" or the negatives of these terms or variations of them or similar terminology. Although we believe that the expectations reflected in these forward-looking statements are reasonable, we can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those contemplated by the relevant forward-looking statement. Important factors that could cause actual results to differ materially from our expectations include, among others: (i) the cost and availability of films and the performance of films licensed by us; (ii) competition, including the introduction of alternative forms of entertainment; (iii) construction delays; (iv) the ability to open or close theatres and screens as currently planned; (v) the ability to sub-lease vacant retail space; (vi) domestic and international political, social and economic conditions; (vii) demographic changes; (viii) increases in the demand for real estate; (ix) changes in real estate, zoning and tax laws; (x) unforeseen changes in operating requirements; (xi) our ability to identify suitable acquisition candidates and successfully integrate acquisitions into our operations, including the integration of Loews Cineplex Entertainment Corporation and the achievement of estimated cost savings and synergies as a result of the Mergers (as defined below) on a timely basis; (xii) results of significant litigation; and (xiii) our ability to enter into various financing programs. Readers are urged to consider these factors carefully in evaluating the forward-looking statements. For a discussion of these and other risk factors, see "Risk Factors."

All subsequent written and oral forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by these cautionary statements. The forward-looking statements included herein are made only as of the date of this prospectus, and we do not undertake any obligation to release publicly any revisions to such forward-looking statements to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

ii

The following summary highlights some of the information contained in this prospectus and does not contain all of the information that may be important to you. Before deciding to invest in our exchange notes, you should read the entire prospectus carefully, including the section entitled "Risk Factors" and the consolidated financial statements and unaudited pro forma financial data and the related notes contained elsewhere in this prospectus.

On January 26, 2006, Marquee Holdings Inc. ("Holdings"), the parent of AMC Entertainment Inc. ("AMC Entertainment"), merged with LCE Holdings, Inc. ("LCE Holdings"), the parent of Loews Cineplex Entertainment Corporation ("Loews"), with Holdings continuing as the holding company for the merged businesses, and Loews merged with and into AMC Entertainment, with AMC Entertainment continuing after the merger (collectively, the "Mergers").

Unless the context otherwise requires, this prospectus reflects the consummation of the Mergers and refers to the Mergers with the related transactions and financings described under "Summary—The Transactions—The Financing Transactions," as the "Merger Transactions." As used in this prospectus, references to "AMC Entertainment" or "AMCE" refer to AMC Entertainment Inc. and its subsidiaries prior to giving effect to the Mergers and references to "Loews" refer to Loews Cineplex Entertainment Corporation and its subsidiaries prior to giving effect to the Mergers. Except as otherwise indicated or otherwise required by the context, references in this prospectus to "we," "us," "our," the "combined company" or the "company" refer to the combined business of AMC Entertainment, Loews, and their respective subsidiaries after giving effect to the Mergers.

As used in this prospectus, unless the context otherwise requires, the term "pro forma" refers to (i) in the case of pro forma financial information given as of December 29, 2005, such information after giving pro forma effect to the Merger Transactions (which are described on page 9 of this prospectus) as if they had occurred on such date, and (ii) in the case of pro forma financial information for the fifty-two week periods ended March 31, 2005 or December 29, 2005, such information after giving pro forma effect to the Merger Transactions, AMCE's contribution of NCN assets to NCM (which is described on page 8 of this prospectus), the Loews Transactions (which are described on page 7 of this prospectus) and the Marquee Transactions (which are described on page 7 of this prospectus) as if each had occurred on April 2, 2004.

AMC Entertainment's fiscal year ends on the Thursday closest to the last day of March and is either 52 or 53 weeks long, depending on the year. References to a fiscal year of AMC Entertainment or to a pro forma fiscal year are to the 52 or 53 week period ending in that year. For example, AMC Entertainment's fiscal 2005 ended on March 31, 2005. Loews' fiscal year was based on the calendar year, the last one of which ended on December 31, 2005.

Who We Are

We are one of the world's leading theatrical exhibition companies based on total revenues. As of December 29, 2005, on a pro forma basis, we owned, operated or held interests in 425 theatres with a total of 5,739 screens, of which approximately 81% were located in the United States and Canada and the balance were located in attractive international markets. We believe that we have one of the most modern theatre circuits among the world's major theatre exhibitors. Our circuit of high-performing theatres is primarily located in large, urban markets where we have a strong market position which allows us to maximize revenues and manage our costs effectively. For the 52 weeks ended March 31, 2005, on a pro forma basis, we had revenues of $2.5 billion and a loss from continuing operations of $116.0 million. For the 39 weeks ended December 29, 2005, on a pro forma basis, we had revenues of $1.8 billion and a loss from continuing operations of $109.4 million.

In the United States, on a pro forma basis, we operate 324 theatres with 4,498 screens in 29 states and the District of Columbia. We have a significant presence in major urban "Designated Market

1

Areas," or "DMAs" (television market areas as defined by Nielsen Media Research) and for the 52 weeks ended December 29, 2005, on a pro forma basis, we had the number one or two market share in 22 of the top 25 DMAs, including the number one market share in New York City, Chicago, Dallas and Boston. As of December 29, 2005, on a pro forma basis, we had an average of 14.1 screens per theatre, which we believe to be the highest among the major U.S. and Canadian theatre exhibitors. Our U.S. and Canadian theatre circuit represented 90% of our pro forma revenues for the 52 weeks ended March 31, 2005.

The following table provides detail with respect to the geographic location of our pro forma U.S. and Canadian theatre circuit as of December 29, 2005:

| United States and Canada | Theatres(1) | Screens(1) | |||

|---|---|---|---|---|---|

| California | 36 | 556 | |||

| Texas | 27 | 489 | |||

| Florida | 29 | 440 | |||

| New York | 30 | 292 | |||

| Illinois | 22 | 291 | |||

| New Jersey | 24 | 287 | |||

| Michigan | 13 | 214 | |||

| Georgia | 11 | 177 | |||

| Arizona | 9 | 169 | |||

| Maryland | 16 | 167 | |||

| Pennsylvania | 14 | 158 | |||

| Massachusetts | 12 | 151 | |||

| Washington | 15 | 149 | |||

| Ohio | 10 | 139 | |||

| Virginia | 9 | 131 | |||

| Missouri | 7 | 103 | |||

| Minnesota | 6 | 75 | |||

| Colorado | 4 | 72 | |||

| Louisiana | 5 | 68 | |||

| North Carolina | 3 | 60 | |||

| Kansas | 3 | 55 | |||

| Indiana | 4 | 49 | |||

| Oklahoma | 2 | 44 | |||

| Connecticut | 2 | 36 | |||

| South Carolina | 3 | 28 | |||

| District of Columbia | 4 | 27 | |||

| Nebraska | 1 | 24 | |||

| Kentucky | 1 | 20 | |||

| Wisconsin | 1 | 18 | |||

| Utah | 1 | 9 | |||

| Total United States | 324 | 4,498 | |||

| Canada | 7 | 160 | |||

| Total United States and Canada | 331 | 4,658 | |||

- (1)

- Included in the above table are six theatres and 64 screens that the combined company manages or in which it has a partial interest.

2

Our international circuit principally includes theatres in Mexico, South America and Spain. In Mexico, we own and operate theatres primarily located in the Mexico City Metropolitan Area, or MCMA, through Grupo Cinemex, S.A. de C.V., or Cinemex. We believe that we have the number one market share in the MCMA with an estimated 48% of MCMA box office revenues in 2005. We participate in 50% joint ventures in South America (Hoyts General Cinema South America, or HGCSA) and Spain (Yelmo Cineplex, S.L. or Yelmo). In addition, we have eight wholly-owned theatres in Europe. Our wholly-owned international circuit represented 10% of our pro forma revenues for the 52 weeks ended March 31, 2005.

Revenues from our international circuit historically have been sufficient to fund its ongoing operating costs, and the debt of our international subsidiaries and joint ventures is non-recourse to our domestic business. Although we do not consolidate our joint ventures, these ventures can be a source of cash for us. For example, in July 2005, Loews received a distribution from its South Korea circuit, Megabox Cineplex, Inc., or Megabox, of approximately $11.9 million (12.3 billion South Korean won), net of local withholding taxes. In addition, in December 2005, Loews sold its 50% stake in Megabox, which sale generated approximately $78.4 million (79.5 billion South Korean won) in proceeds, net of local withholding taxes. We hold the proceeds of the sale in cash on our balance sheet and may use it to reduce outstanding debt in the future.

The following table provides detail with respect to the geographic location of our pro forma international theatre circuit as of December 29, 2005:

| International | Theatres(1) | Screens(1) | |||

|---|---|---|---|---|---|

| Mexico | 40 | 443 | |||

| Argentina(2) | 10 | 95 | |||

| Brazil(2) | 1 | 15 | |||

| Chile(2) | 6 | 50 | |||

| Uruguay(2) | 1 | 8 | |||

| China (Hong Kong) | 1 | 11 | |||

| France | 1 | 14 | |||

| Portugal | 1 | 20 | |||

| Spain(3) | 31 | 397 | |||

| United Kingdom | 2 | 28 | |||

| Total International | 94 | 1,081 | |||

- (1)

- Included in the above table are 45 theatres and 479 screens that the combined company manages or in which it has a partial interest.

- (2)

- Operated through HGCSA.

- (3)

- Includes 27 theatres with 311 screens operated through Yelmo.

Our Competitive Strengths

Key characteristics of our business that we believe make us a particularly effective competitor against other theatrical exhibition companies and position us well for future growth include:

- •

- our leading market position;

- •

- our modern theatre circuit;

- •

- our highly productive theatres;

- •

- our broad major market coverage with prime theatre locations;

3

- •

- our leading position in attractive international markets;

- •

- our strong free cash flow generation; and

- •

- our proven management team.

Market Leader. The Mergers combined two leading theatrical exhibition companies, each with a long history of operating in the industry. We are now one of the world's leading theatrical exhibition companies based on total revenues, enjoying geographic market diversification and leadership in major markets worldwide. As of December 29, 2005, on a pro forma basis, we owned, operated or held interests in a geographically diverse theatre circuit consisting of 425 theatres and 5,739 screens. We believe the scale of our operations provides a competitive advantage and allows us to achieve economies of scale.

Modern Theatre Circuit. We are an industry leader in the development and operation of megaplex theatres, typically defined as a theatre having 14 or more screens and offering amenities to enhance the movie-going experience, such as stadium seating providing unobstructed viewing, digital sound and enhanced seat design. We believe that the megaplex format provides the operator with enhanced revenue opportunities and better asset utilization while creating convenience for patrons by increasing film choice and the number of film starting times. We believe that our introduction of the megaplex in 1995 has led to the current industry replacement cycle, which has accelerated the obsolescence of older, smaller theatres by setting new standards for moviegoers. We continually upgrade the quality of our theatre circuit by adding new screens through new builds (including expansions) and acquisitions and by disposing of older screens through closures and sales. From April 1995 through December 29, 2005, on a combined basis, AMCE and Loews built 188 theatres with 3,437 new screens, acquired 431 theatres with 3,007 screens and disposed of 649 theatres with 3,826 screens. As of December 29, 2005, 3,154 or approximately 68% of our pro forma screens in the United States and Canada were located in megaplex theatres. The average number of screens per theatre of AMCE and Loews, on a combined basis, in the United States and Canada increased from 11.2 at the end of 2001 to 14.1 as of December 29, 2005, which was well above the NATO average of 6.5 and indicative of the extent to which we have upgraded our theatre circuit.

Highly Productive Theatres. Our theatres are generally among the most productive in the markets in which they operate. As measured by Rentrak, we operated 26 of the top 50 theatres in the United States and Canada in terms of box office revenues for the 52 weeks ended December 29, 2005 on a pro forma basis. Our next closest competitor operated six of the top 50. In addition, for the 52 weeks ended December 29, 2005, on a pro forma basis, our theatre circuit in the United States and Canada produced box office revenues per screen at rates approximately 38% higher than the industry average, as measured by Rentrak.

Broad Major Market Coverage in the United States with Prime Theatre Locations. Our theatres are generally located in large, urban markets, giving us a breadth of market coverage that places us in most major markets in the United States. As of December 29, 2005, on a pro forma basis, we operate in 92% of the Top 25 DMAs. Our theatres are usually located near or within developments that include retail stores, restaurants and other activities that complement the movie-going experience.

Leading Positions in Attractive International Markets. We have a significant presence in our principal international markets. Cinemex has the number one market share in the MCMA with an estimated 48% of box office revenues in 2005. Our HGCSA joint venture is one of the leading exhibitors in Argentina and Chile, with leading market shares in Buenos Aires (Argentina) and Santiago (Chile). Our joint venture in Spain operates one of Spain's largest film exhibitors based on attendance, with theatres located in large urban markets, including Madrid and Barcelona. Our international circuit is comprised of modern theatres with an average of 11.5 screens per theatre. Our international markets tend to have a significantly higher population per screen and lower attendance

4

frequency than the U.S. markets, and we believe that we are well-positioned to benefit from the potential growth in these markets.

Strong Free Cash Flow Generation. In future years, after anticipated cash obligations for interest, taxes and capital expenditures, we expect to generate enough free cash flow to repay debt and to invest in our business.

Proven Management Team. Our highly experienced senior management team has an average of 24 years of experience in the theatrical exhibition industry. Management has successfully integrated a number of acquisitions and has demonstrated the ability to successfully manage our business through all industry and economic cycles, including the years from 1999 to 2001 when all but one of our peer competitors declared bankruptcy.

Our Strategy

Our strategic plan has three principal elements:

- •

- maximizing operating efficiencies by focusing on the fundamentals of our business;

- •

- optimizing our theatre portfolio through selective new builds, acquisitions and the disposition of underperforming theatres; and

- •

- enhancing and extending our business and brands and in doing so, growing our ancillary revenues.

Maximizing Operating Efficiencies. We believe the fundamentals of our business include maximizing revenues, managing our costs and improving our margins. For example, since fiscal 2001, AMCE has implemented key initiatives in each of these areas, which have resulted in the following:

- •

- theatre revenues per patron for AMCE have increased by a 5.2% compound annual growth rate, or CAGR, over the last five years, which resulted in a per patron increase of greater than $2.00 over this period; and

- •

- general and administrative expenses: other for AMCE declined from 5.1% of revenues in fiscal 1999 to 2.8% in fiscal 2005.

Optimizing Our Theatre Portfolio. Asset quality is a function of our selective new build, acquisition and theatre disposition strategies.

As a recognized leader in the development and operation of megaplex theatres and based upon our financial resources, we believe that we will continue to have attractive new build opportunities presented to us by real estate developers and others. We intend to selectively pursue new build opportunities where the characteristics of the location and the overall market meet our strategic and financial return criteria. As of December 29, 2005, on a pro forma basis, AMCE and Loews combined had 3 theatres with 38 screens under construction and scheduled to open in fiscal 2006 in the United States and Mexico.

There are approximately 590 theatrical exhibitors in the United States and Canada, and the top five exhibitors account for approximately 52% of the industry's screens. This statistic is up from 34% in 1999 and is evidence that the theatrical exhibition business in the United States and Canada has been consolidating. AMCE and Loews each played a key role in this consolidation process from 2002 through 2004, with AMCE acquiring three domestic theatre operators with a total of 737 screens and Loews acquiring two domestic theatre operators with a total of 185 screens. We intend to continue to assess strategic acquisition opportunities as they present themselves.

We believe that a major factor that further differentiates us from our competitors and has contributed to our overall theatre portfolio quality has been our proactive effort to close or dispose of

5

older, underperforming theatres. Since fiscal 1995, our last fiscal year before the first megaplex theatre opened, we have closed or disposed of 3,826 screens on a combined basis, 1,368 of which were owned by AMCE at the time of disposal, 2,338 of which were owned by Loews and 120 of which will be disposed of to comply with the U.S. Department of Justice requirements for approval of the Mergers. We have identified 35 multiplex theatres with 278 screens that we may close over the next one to three years due to the expiration of leases or early lease terminations. In order to maintain a modern, high quality theatre circuit, we will continue to evaluate our theatre portfolio and, where appropriate, dispose of theatres through closures, lease terminations, lease buyouts, sales or subleases.

The following table sets forth historical and pro forma information of AMCE and Loews, on a combined basis, concerning new builds (including expansions), acquisitions and dispositions (including disposals to comply with the U.S. Department of Justice requirements for approval of the Mergers) and end of period theatres and screens owned or operated through December 29, 2005:

| | New Builds | Acquisitions | Closures/Dispositions | Total Theatres(1) | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | Number of Theatres | Number of Screens | Number of Theatres | Number of Screens | Number of Theatres | Number of Screens | Number of Theatres | Number of Screens | ||||||||

| 1996 | 9 | 177 | — | — | 42 | 180 | 371 | 2,575 | ||||||||

| 1997 | 20 | 368 | — | — | 30 | 133 | 361 | 2,810 | ||||||||

| 1998 | 28 | 674 | — | — | 33 | 151 | 356 | 3,333 | ||||||||

| 1999 | 33 | 547 | 314 | 1,736 | 73 | 278 | 630 | 5,338 | ||||||||

| 2000 | 33 | 650 | — | — | 96 | 490 | 567 | 5,498 | ||||||||

| 2001 | 16 | 262 | — | — | 144 | 837 | 439 | 4,923 | ||||||||

| 2002 | 15 | 255 | 5 | 68 | 54 | 338 | 405 | 4,908 | ||||||||

| 2003 | 7 | 123 | 109 | 1,155 | 106 | 829 | 415 | 5,357 | ||||||||

| 2004 | 9 | 133 | 3 | 48 | 27 | 190 | 400 | 5,348 | ||||||||

| 2005 | 7 | 89 | — | — | 16 | 102 | 391 | 5,335 | ||||||||

| 2006(2) | 11 | 159 | — | — | 28 | 298 | 374 | 5,196 | ||||||||

| 188 | 3,437 | 431 | 3,007 | 649 | 3,826 | |||||||||||

- (1)

- Excludes 51 theatres and 543 screens that the combined company manages or in which it has a partial interest.

- (2)

- Through December 29, 2005.

Enhancing and Extending Our Business and Brands. We believe there are opportunities to increase our core and ancillary revenues and build brand equity through enhancements of our business, new product offerings and strategic marketing initiatives. We have also explored numerous ways to grow our ancillary revenues, which are traditionally high growth, high margin prospects. For example:

- •

- AMC Entertainment was a founding member and currently owns approximately 29% of National CineMedia, LLC, a cinema screen advertising venture representing approximately 13,500 U.S. and Canadian theatre screens (of which 11,000 will be equipped with digital projection capabilities by the end of fiscal 2006) and reaching more than 560 million movie guests annually;

- •

- AMC Entertainment was a founding partner and currently owns approximately 27% of MovieTickets.com, an Internet ticketing venture representing over 9,300 screens; Loews is a shareholder of Fandango, an on-line movie ticketing company that Loews founded with several other exhibitors and which represents approximately 12,500 screens;

- •

- AMC Entertainment's MovieWatcher frequent moviegoer loyalty program has been the largest program in the industry with approximately 1.8 million active members; and

6

- •

- AMC Entertainment introduced the AMC Entertainment Card in October 2002, the first stored valued gift card sold circuit wide in the industry. AMC Entertainment sells the card through several marketing alliances at approximately 38,000 retail outlets throughout the United States and Canada.

The Industry

Motion picture theatres are the primary distribution channel for new motion picture releases and we believe that the theatrical success of a motion picture is often the most important factor in establishing its value in the other parts of the product life cycle (DVD/videocassette, cable television and other ancillary markets).

Theatrical exhibition has demonstrated long-term steady growth. U.S. and Canada box office revenues increased by a 4.5% CAGR over the last 20 years, driven by increases in both ticket prices and attendance. Ticket prices have grown steadily over the past 20 years, growing at a 3% CAGR. Historically, the industry has experienced swings in attendance from time to time. Since 1970, the industry in the United States and Canada has experienced seven distinct attendance cycles, with attendance downturns ranging from one to two years at an average decline of 8%. Most recently, attendance peaked at 1.639 billion in 2002, marking a 45-year high. However, attendance has since declined in 2003, 2004 and 2005. Ultimately, however, attendance has trended upward from 1970 to present, growing at a 1.2% CAGR. In 2005, box office revenues declined approximately 5.7% as compared to the prior year, which in our view is principally the result of the popularity of film product.

We believe the movie-going experience continues to provide an attractive value for consumers because it is a convenient and affordable option when compared to other forms of out-of-home entertainment. The average ticket price in the United States and Canada was $6.41 in 2005, which is considerably less than other forms of out-of-home entertainment such as concerts and sporting events.

Since 1995, when megaplex theatres were introduced, U.S. and Canada screen count has grown from 27,000 to approximately 37,000 at the end of 2005. According to NATO and the Motion Picture Association 2004 MPAA Market Statistics, average screens per theatre have increased from 3.8 in 1995 to 6.5 in 2005, which we believe is indicative of the industry's development of megaplex theatres.

Recent Developments

In July 2004, LCE Holdings, a company formed by investment funds affiliated with Bain Capital Partners, LLC, or Bain Capital Partners, The Carlyle Group, and Spectrum Equity Investors acquired 100% of the capital stock of Loews and, indirectly, Cinemex, for an aggregate purchase price of approximately $1.5 billion. The purchase of Loews and Cinemex was financed with borrowings by Loews under its senior secured credit facility, the issuance of the Tendered Loews Notes (as defined below) and cash equity investments by Bain Capital Partners, The Carlyle Group and Spectrum Equity Investors. Prior to the closing of the acquisition, Loews sold all of its Canadian and German film exhibition operations to its former investors, who indemnified Loews for certain potential liabilities in connection with those sales. In this prospectus, we refer to the transactions described in this paragraph and the payment of fees and expenses related thereto, along with the South Korea Transaction (as defined and described below), as the "Loews Transactions."

In December 2004, AMC Entertainment completed a merger in which it was acquired by Holdings, a newly created investment vehicle owned by J.P. Morgan Partners (BHCA) L.P. and certain other affiliated funds managed by J.P. Morgan Partners, LLC (collectively, "JPMP") and Apollo Investment Fund V, L.P. and certain related investment funds (collectively, "Apollo") and certain other co-investors. Marquee Inc. ("Marquee"), a wholly-owned subsidiary of Holdings, merged with and into AMC Entertainment, with AMC Entertainment as the surviving entity. Pursuant to the terms of the merger, each issued and outstanding share of AMC Entertainment's common stock and Class B stock was

7

converted into the right to receive $19.50 in cash and each issued and outstanding share of AMC Entertainment's preferred stock was converted into the right to receive $2,727.27 in cash. The total value of the merger and related transactions was approximately $2.0 billion (approximately $1.67 billion in equity and the assumption of $750 million in debt less $397 million in cash and equivalents). Following consummation of the merger, AMC Entertainment became a privately held company, wholly-owned by Holdings. Holdings was owned by JPMP, Apollo, other co-investors and by certain members of management at that time. The consideration paid in the merger was funded with the proceeds from the issuance of AMC Entertainment's 85/8% senior fixed rate notes due 2012 and senior floating rate notes due 2010, the proceeds from the issuance of Holdings' 12% senior discount notes due 2014, equity contributions by JPMP, Apollo and the other co-investors and cash on hand. Concurrently with the consummation of the merger, AMC Entertainment entered into an amendment to its existing $175.0 million revolving credit facility. In this prospectus, we refer to the transactions described in this paragraph and the payment of fees and expenses related thereto as the "Marquee Transactions."

In March 2005, AMC Entertainment contributed certain assets consisting of fixed assets and exhibitor agreements of National Cinema Network, Inc. ("NCN") to a new joint venture with Regal Entertainment Group called National CineMedia, LLC ("NCM"). The new company engages in the marketing and sale of cinema screen advertising and promotions products, business communications and training services, and the distribution of digital alternative content. AMC Entertainment paid termination benefits related to the displacement of certain NCN associates. In consideration of the NCN contributions described above, NCM issued a 37% interest in its Class A units to NCN. Since that date, AMC Entertainment's interest in NCM has declined to 29% due to the entry of new investors.

In March 2005, AMC Entertainment commenced an organizational restructuring related to functions at its home office in Kansas City, Missouri and its film office in Los Angeles, California. AMC Entertainment's new organizational system flattened management structure and aligned systems, resources and areas of expertise to promote faster communication. The primary goal of the restructuring was to create a simplified organizational structure to enable AMC Entertainment to position itself in a manner it believes will best serve its existing guests while setting the stage to handle growth with improved infrastructure.

AMC Entertainment recorded $4.9 million and $3.9 million of expenses related to one-time termination benefits and other costs related to the displacement of approximately 200 associates as part of the organizational restructuring and the contribution of assets by NCN to NCM during fiscal 2005 and fiscal 2006, respectively.

In June 2005, AMC Entertainment sold four of its five theatres in Japan for a sales price of approximately $44.8 million and, on September 1, 2005, sold its remaining Japanese theatre for a sales price of approximately $8.6 million. These operations met the criteria for reporting as discontinued operations. Under GAAP, AMC Entertainment was required to reclassify previously reported prior period financial statements to reflect the discontinued operations. On October 7, 2005, AMC Entertainment filed a Current Report on Form 8-K that provided certain financial information that would have been required to be included in its Annual Report on Form 10-K for fiscal 2006. The historical financial information included in this prospectus, as well as the historical financial data of AMC Entertainment included in this prospectus, has been revised and updated from its original presentation to incorporate the following:

- •

- The reclassification of the results of operations for certain assets that AMC Entertainment sold on June 30, 2005 and September 1, 2005 that meet the criteria for discontinued operations to be presented as such in accordance with Statement of Financial Accounting Standards No. 144,Accounting for the Impairment or Disposal of Long-Lived Assets, and the addition to Note 3 to the notes to AMC Entertainment's consolidated financial statements;

8

- •

- Reclassifications and footnote disclosure updates to conform to the presentation in AMC Entertainment's Quarterly Report on Form 10-Q for the period ended June 30, 2005; and

- •

- Reclassifications in "Management's Discussion and Analysis of Financial Condition and Results of Operations" to conform to the presentation in AMC Entertainment's Quarterly Report on Form 10-Q for the period ended June 30, 2005.

In December 2005, Loews sold its 50% interest in Megabox (the "South Korea Transaction"), Loews' joint venture in South Korea, which sale generated approximately $78.4 million (79.5 billion South Korean won) in proceeds, net of local withholding taxes. In this prospectus, we refer to the South Korea Transaction as part of the Loews Transactions. We hold the proceeds of the sale in cash on our balance sheet and may use it to reduce outstanding debt in the future.

In January, 2006 AMC Entertainment agreed to sell its interests in AMC Entertainment España S.A., which owns and operates 4 theatres with 86 screens in Spain, and Actividades Multi-Cinemas E Espectáculos, LDA, which owns and operates 1 theatre with 20 screens in Portugal. Sales of the two entities are part of one pending transaction, which is expected to close in the first fiscal quarter of 2007 and is subject to customary closing conditions for transactions of this type, including approval from relevant anti-trust authorities.

The Mergers

On January 26, 2006, Holdings merged with LCE Holdings, the parent of Loews, with Holdings continuing as the holding company for the merged businesses, and Loews merged with and into AMC Entertainment, with AMC Entertainment continuing after the merger. The previous stockholders of Holdings, including affiliates of J.P. Morgan Partners, LLC and Apollo Management, L.P., currently hold approximately 60% of its outstanding capital stock, and the previous stockholders of LCE Holdings, including affiliates of Bain Capital Partners, The Carlyle Group and Spectrum Equity Investors (collectively with J.P. Morgan Partners, LLC and Apollo Management, L.P., the "Sponsors"), currently hold approximately 40% of the outstanding capital stock. We financed the Mergers and the refinancing of AMC Entertainment's and Loews' existing indebtedness as described below.

The Mergers were subject to antitrust approvals that have resulted in agreements with the Department of Justice and Attorney Generals of California, Washington and the District of Columbia to divest ten theatres and 120 screens in seven U.S. markets. For the 52 weeks ended March 31, 2005, on a pro forma basis, these theatres in the aggregate comprised $82.1 million of total revenues.

After completion of the Mergers, we have continued to be one of the world's leading theatrical exhibition companies based on total revenues. We expect to achieve corporate overhead savings as a result of actions that we expect to take during the first six months following completion of the Mergers, including the elimination of duplicative facilities and services, enhancing operating efficiencies in areas such as advertising and field support and theatre-level staffing, and realizing economies of scale in several areas, most notably in purchasing and contracting for services and supplies.

The Financing Transactions

Concurrently with the closing of the Mergers, we entered into the following financing transactions:

- •

- our new senior secured credit facility, consisting of a $650.0 million term loan facility and a $200.0 million revolving credit facility;

- •

- our offering of $325.0 million in aggregate principal amount of 11% Senior Subordinated Notes due 2016, which we refer to in this prospectus as the "original notes";

9

- •

- the termination of AMC Entertainment's existing senior secured credit facility, under which no amounts were outstanding, and the repayment of all outstanding amounts under Loews' existing senior secured credit facility and the termination of all commitments thereunder; and

- •

- the completion of the tender offer and consent solicitation, which we refer to in this prospectus as the "Tender Offer," for all $315.0 million aggregate principal amount of Loews' 9.0% senior subordinated notes due 2014, or the Tendered Loews Notes.

We refer collectively to the Mergers, the Tender Offer, the issuance of the original notes, the repayment of all outstanding amounts under AMC Entertainment's existing senior secured credit facility and Loews' existing senior secured credit facility, the consummation of the other financing transactions described above, and the divestitures described above throughout this prospectus as the "Merger Transactions."

Risk Factors

You should consider carefully all the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under "Risk Factors" for risks involved with an investment in the notes.

Additional Information

Our principal executive offices are located at 920 Main Street, Kansas City, Missouri 64105-1977. Our telephone number is (816) 221-4000 and our website address iswww.amctheatres.com. The information contained on our website is not a part of this prospectus.

10

On January 26, 2006, we completed the private offering of $325,000,000 aggregate principal amount of 11% Series A Senior Subordinated Notes due 2016. As part of that offering, we entered into a registration rights agreement with the initial purchasers of the original notes in which we agreed, among other things, to deliver this prospectus to you and to complete an exchange offer for the original notes. Below is a summary of the exchange offer.

| Securities Offered | Up to $325,000,000 aggregate principal amount of new 11% Series B Senior Subordinated Notes due 2016, which have been registered under the Securities Act. | |||

The form and terms of these exchange notes are identical in all material respects to those of the original notes except that: | ||||

• | the exchange notes have been registered under the federal securities laws and will not bear any legend restricting their transfer; | |||

• | the exchange notes bear a series B designation and a different CUSIP number than the original notes; and | |||

• | the holders of exchange notes will not have the benefit of certain rights under the registration rights agreement. | |||

The Exchange Offer | We are offering to exchange $1,000 principal amount of our new 11% Series B Senior Subordinated Notes due 2016 for each $1,000 principal amount of our outstanding 11% Series A Senior Subordinated Notes due 2016. | |||

We will accept any and all original notes validly tendered and not withdrawn prior to 5:00 p.m., New York City time, on June 13, 2006. Holders may tender some or all of their original notes pursuant to the exchange offer. However, original notes may be tendered only in integral multiples of $1,000 in principal amount. | ||||

In order to be exchanged, an original note must be properly tendered and accepted. All original notes that are validly tendered and not withdrawn will be exchanged. As of the date of this prospectus, there are $325,000,000 principal amount of original notes. We will issue exchange notes promptly after the expiration of the exchange offer. | ||||

Transferability of Exchange Notes | Based on interpretations by the staff of the SEC, as detailed in a series of no-action letters issued to third parties, we believe that the exchange notes issued in the exchange offer may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act as long as: | |||

• | You are acquiring the exchange notes in the ordinary course of your business; | |||

11

• | You are not participating, do not intend to participate and have no arrangement or understanding with any person to participate, in a distribution of the exchange notes; and | |||

• | You are not an affiliate of ours. | |||

If you are an affiliate of ours, are engaged in or intend to engage in or have any arrangement or understanding with any person to participate in the distribution of the exchange notes: | ||||

• | you cannot rely on the applicable interpretations of the staff of the SEC; | |||

• | you will not be entitled to participate in the exchange offer; and | |||

• | you may be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction. | |||

Each broker or dealer that receives exchange notes for its own account in exchange for original notes that were acquired as a result of market-making or other trading activities must acknowledge that it will comply with the registration and prospectus delivery requirements of the Securities Act in connection with any offer to resell or other transfer of the exchange notes issued in the exchange offer, including the delivery of a prospectus that contains information with respect to any selling holder required by the Securities Act in connection with any resale of the exchange notes. | ||||

Furthermore, any broker-dealer that acquired any of its original notes directly from us: | ||||

• | may not rely on the applicable interpretation of the staff of the SEC's position contained in Exxon Capital Holdings Corp., SEC no-action letter (April 13, 1988), Morgan, Stanley & Co. Inc., SEC no-action letter (June 5, 1991) and Shearman & Sterling, SEC no-action letter (July 2, 1993); and | |||

• | must also be named as a selling noteholder in connection with the registration and prospectus delivery requirements of the Securities Act relating to any resale transaction. | |||

Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on June 13, 2006, unless we extend the expiration date. | |||

Conditions to the Exchange Offer | The exchange offer is subject to customary conditions. We may assert or waive these conditions in our reasonable discretion. If we materially change the terms of the exchange offer, we will resolicit tenders of the original notes. See "The Exchange Offer—Conditions to the Exchange Offer" for more information regarding conditions to the exchange offer. | |||

12

Procedures for Tendering Original Notes | Except as described in the section titled "The Exchange Offer—Procedures for Tendering," a tendering holder must, on or prior to the expiration date, transmit an agent's message to the exchange agent at the address listed in this prospectus. | |||

Consequences of Exchanging or Failing to Exchange Original Notes | Any original notes that are not tendered, or that are tendered but not accepted, will remain subject to the restrictions on transfer. Since the original notes have not been registered under the federal securities laws, they bear a legend restricting their transfer absent registration or the availability of a specific exemption from registration. Upon the completion of the exchange offer, we will have no further obligations, except under limited circumstances, to provide for registration of the original notes under the federal securities laws. See "The Exchange Offer—Consequences of Exchanging or Failing to Exchange Original Notes." | |||

Withdrawal Rights | Tenders may be withdrawn at any time before 5:00 p.m., New York City time, on the expiration date. | |||

Interest on Exchange Notes and the Original Notes | The exchange notes will bear interest from the most recent interest payment date to which interest has been paid on the original notes or, if no interest has been paid, from January 26, 2006. Interest on the original notes accepted for exchange will cease to accrue upon the issuance of the exchange notes. Accrued but unpaid interest on the original notes will be cancelled. | |||

Acceptance of Original Notes and Delivery of Exchange Notes | Subject to the conditions stated in the section "The Exchange Offer—Conditions to the Exchange Offer" of this prospectus, we will accept for exchange any and all original notes which are properly tendered in the exchange offer before 5:00 p.m., New York City time, on the expiration date. The exchange notes will be delivered promptly after the expiration date. See "The Exchange Offer—Terms of the Exchange Offer." | |||

U.S. Federal Income Tax Considerations | The exchange by a holder of original notes for exchange notes to be issued in the exchange offer will not result in a taxable transaction for U.S. federal income tax purposes. See "Certain U.S. Federal Income Tax Considerations." | |||

Exchange Agent | HSBC Bank USA, National Association is serving as exchange agent in connection with the exchange offer. The address and telephone number of the exchange agent are listed under the heading "The Exchange Offer—Exchange Agent." | |||

Use of Proceeds | We will not receive any proceeds from the issuance of exchange notes in the exchange offer. We will pay all expenses incident to the exchange offer. See "Use of Proceeds." | |||

13

Summary of the Terms of the Exchange Notes

The form and terms of the exchange notes and the original notes are identical in all material respects, except that the transfer restrictions and most registration rights applicable to the original notes do not apply to the exchange notes. The exchange notes will evidence the same debt as the original notes and will be governed by the same indentures.

| Issuer | AMC Entertainment Inc. | |||

Notes Offered | $325,000,000 in aggregate principal amount of 11% Series B Senior Subordinated Notes due 2016. | |||

Maturity Date | February 1, 2016. | |||

Interest Payment Dates | February 1 and August 1 of each year, commencing August 1, 2006. | |||

Guarantees | The exchange notes will be fully and unconditionally guaranteed on a joint and several senior subordinated basis by all of our existing and future domestic restricted subsidiaries that guarantee our other indebtedness. See "Description of Exchange Notes—Subsidiary Guarantees." | |||

Optional Redemption | We may redeem some or all of the exchange notes at any time on or after February 1, 2011 at the redemption prices listed under "Description of Exchange Notes—Optional Redemption." In addition, we may redeem up to 35% of the aggregate principal amount of the notes using net proceeds from certain equity offerings completed on or prior to February 1, 2009. See "Description of Exchange Notes—Optional Redemption." | |||

Change of Control | If we experience a change of control (as defined in the indenture governing the notes), we will be required to make an offer to repurchase the notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest, if any, to the date of purchase. See "Description of Exchange Notes—Change of Control." | |||

Ranking | The exchange notes and the guarantees will be our and our guarantors' unsecured senior subordinated obligations. The exchange notes will rank: | |||

• | junior to all of our and our guarantors' existing and future senior indebtedness, including borrowings under our new senior secured credit facility and AMCE's existing 85/8% Senior Notes due 2012 and Senior Floating Rate Notes due 2010 (collectively, the "Existing AMCE Senior Notes"); | |||

• | equally in right of payment with all of our and our guarantors' existing and future unsecured senior subordinated indebtedness, including AMCE's existing 91/2% Senior Subordinated Notes due 2011, 97/8% Senior Subordinated Notes due 2012 and 8% Senior Subordinated Notes due 2014 (collectively, the "Existing AMCE Subordinated Notes"); | |||

14

• | senior in right of payment to any of our or our guarantors' future indebtedness that is expressly subordinated in right of payment to the notes; and | |||

• | effectively junior to all of the existing and future indebtedness, including trade payables, of our subsidiaries that do not guarantee the notes. | |||

As of December 29, 2005, on a pro forma basis, the notes and the guarantees would have ranked junior to approximately $1,169.7 million of our senior indebtedness, consisting of the Existing AMCE Senior Notes, borrowings under our new senior secured credit facility, capital lease obligations and 10% mortgage payable due 2007. The notes would also have been structurally subordinated to $106.5 million of indebtedness of Cinemex, a non-guarantor subsidiary, pursuant to its senior secured credit facility. | ||||

On a pro forma basis, our subsidiaries that are not guarantors (including Cinemex) would have accounted for approximately $223.7 million, or 8.8%, of our total revenues for the 52 weeks ended March 31, 2005 and approximately $418.9 million, or 9.4%, of our total assets and approximately $245.8 million, or 7.6%, of our total liabilities (including the Cinemex indebtedness referred to above) as of December 29, 2005. | ||||

Certain Covenants | The indenture governing the exchange notes contains covenants that, among other things, will restrict our ability and the ability of our subsidiaries (other than unrestricted subsidiaries) to: | |||

• | incur additional indebtedness; | |||

• | pay dividends or make distributions to our stockholders; | |||

• | purchase or redeem capital stock; | |||

• | enter into transactions with affiliates; or | |||

• | merge or consolidate with other companies or transfer all or substantially all of our assets. | |||

All of these restrictive covenants are subject to a number of important exceptions and qualifications. In particular, there are no restrictions on our ability or the ability of our subsidiaries to prepay subordinated debt or to make advances to, or invest in, other entities (including unaffiliated entities) or to incur liens. See "Risk Factors—The indenture governing the notes contains covenants that may limit our ability to take advantage of certain business opportunities advantageous to us that may arise" and "Description of Exchange Notes—Certain Covenants" and "—Merger and Sale of Substantially All Assets." | ||||

Risk Factors | You should consider carefully all the information set forth in this prospectus and, in particular, you should evaluate the specific factors set forth under "Risk Factors" for risks involved with investments in the notes. | |||

15

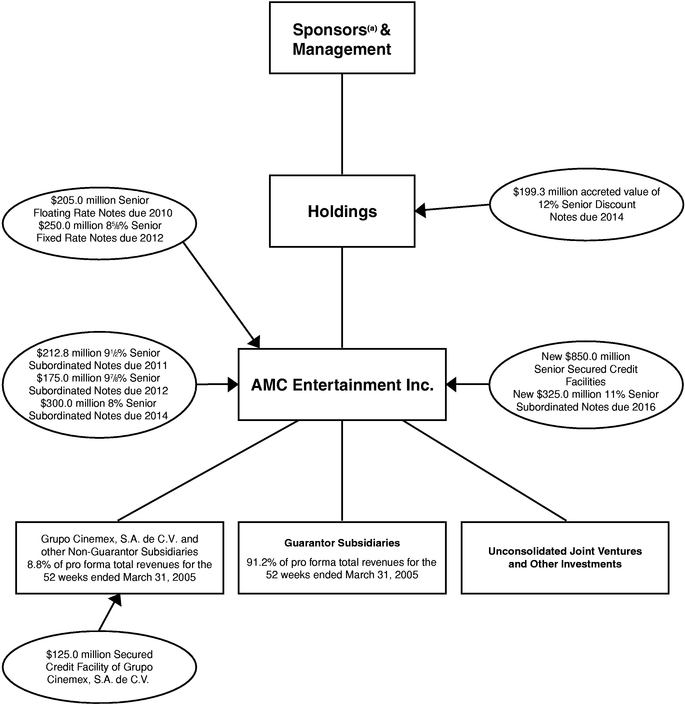

The following chart sets forth the organization of AMCE and its subsidiaries:

| (a) | Sponsors: | Apollo Management, L.P. J.P. Morgan Partners, LLC Bain Capital Partners, LLC The Carlyle Group Spectrum Equity Investors Certain additional co-investors |

16

Summary Unaudited Pro Forma Combined Financial and Operating Data

The following summary unaudited pro forma financial data sets forth our unaudited pro forma combined balance sheet as of December 29, 2005 and unaudited pro forma combined statement of operations for the 39 weeks ended December 29, 2005 and the 52 weeks ended March 31, 2005. The pro forma financial data has been derived from our unaudited pro forma condensed consolidated financial information and the notes thereto included elsewhere in this prospectus and has been prepared based on AMC Entertainment's audited and unaudited consolidated financial statements and Loews' audited and unaudited combined consolidated financial statements, each included in this prospectus. The unaudited pro forma combined balance sheet data gives pro forma effect to the Merger Transactions as if they had occurred on December 29, 2005. The unaudited pro forma combined statement of operations data gives pro forma effect to (i) the Merger Transactions, (ii) AMCE's contribution of NCN assets to NCM, (iii) the Loews Transactions and (iv) the Marquee Transactions as if each had occurred at April 2, 2004. The summary unaudited pro forma financial and operating data is based on certain assumptions and adjustments and does not purport to present what our actual results of operations would have been had the Merger Transactions (or other transactions given pro forma effect in the case of the pro forma combined statement of operations data) and events reflected by them in fact occurred on the dates specified, nor is it necessarily indicative of the results of operations that may be achieved in the future. The summary unaudited pro forma combined financial data should be read in conjunction with "Unaudited Pro Forma Condensed Consolidated Financial Information," the unaudited pro forma condensed consolidated financial statements, the historical consolidated financial statements, including the notes thereto, "Loews' Management's Discussion and Analysis of Financial Condition and Results of Operations," "AMCE's Management's Discussion and Analysis of Financial Condition and Results of Operations" and other financial data of AMC Entertainment and Loews presented elsewhere in this prospectus.

17

| | Pro Forma | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| | 39 Weeks Ended December 29, 2005 | 52 Weeks Ended March 31, 2005 | |||||||

| | (thousands of dollars, except operating data) | ||||||||

| Statement of Operations Data: | |||||||||

| Total revenues | $ | 1,835,680 | $ | 2,531,990 | |||||

| Cost of operations | 1,173,597 | 1,606,952 | |||||||

| Rent | 322,420 | 421,873 | |||||||

| General and administrative expense: | |||||||||

| Merger and acquisition costs | 7,923 | 8,098 | |||||||

| Management fee | 4,497 | 4,540 | |||||||

| Other | 61,915 | 89,935 | |||||||

| Preopening expense | 8,714 | 2,553 | |||||||

| Theatre and other closure expense | 1,390 | 12,025 | |||||||

| Restructuring charge | 3,935 | 5,053 | |||||||

| Depreciation and amortization | 212,283 | 294,645 | |||||||

| Disposition of assets and other (gains)/losses | (233 | ) | (5,274 | ) | |||||

| Total costs and expenses | 1,796,441 | 2,440,400 | |||||||

| Other income | (11,966 | ) | (6,778 | ) | |||||

| Interest expense | 152,333 | 208,760 | |||||||

| Investment expense (income) | 3,077 | (5,880 | ) | ||||||

| Total other expense | 143,444 | 196,102 | |||||||

| Loss from continuing operations before income taxes | (104,205 | ) | (104,512 | ) | |||||

| Income tax provision | 5,196 | 11,461 | |||||||

| Loss from continuing operations | $ | (109,401 | ) | $ | (115,973 | ) | |||

| Balance Sheet Data (at period end): | |||||||||

| Cash and equivalents | $ | 247,915 | |||||||

| Corporate borrowings | 2,244,047 | ||||||||

| Other long-term liabilities | 410,007 | ||||||||

| Capital and financing lease obligations | 62,451 | ||||||||

| Stockholders' equity (deficit) | 1,221,645 | ||||||||

| Total assets | 4,461,383 | ||||||||

| Operating Data (at period end): | |||||||||

| Average screens—continuing operations(2) | 5,145 | 5,134 | |||||||

| Number of screens operated | 425 | ||||||||

| Number of theatres operated | 5,739 | ||||||||

| Screens per theatre | 13.5 | ||||||||

| Attendance (in thousands)—continuing operations(1) | 186,696 | 273,947 | |||||||

18

Summary Historical Financial and Operating Data

AMC Entertainment Inc.

The following tables set forth certain of AMC Entertainment's historical financial and operating data. The summary historical financial data for the interim periods ended December 30, 2004 and December 29, 2005 and for the three fiscal years ended March 31, 2005 have been derived from AMC Entertainment's audited and unaudited consolidated financial statements and related notes for such periods included elsewhere in this prospectus. The historical financial data set forth below is qualified in its entirety by reference to AMC Entertainment's consolidated financial statements and the notes thereto included elsewhere in this prospectus.

On December 23, 2004, AMC Entertainment completed the Marquee Transactions in which Holdings acquired AMC Entertainment through a merger of AMC Entertainment and Marquee. Marquee was formed on July 16, 2004. On December 23, 2004, pursuant to a merger agreement, Marquee merged with and into AMC Entertainment (the "Predecessor") with AMC Entertainment as the surviving entity (the "Successor"). The merger was treated as a purchase with Marquee being the "accounting acquiror" in accordance with Statement of Financial Accounting Standards No. 141Business Combinations. As a result, the Successor applied the purchase method of accounting to the separable assets, including goodwill, and liabilities of the accounting acquiree, AMC Entertainment, as of December 23, 2004, the closing date of the merger. The consolidated summary historical financial statements presented below are those of the accounting acquiror from its inception on July 16, 2004 through December 29, 2005, and those of its Predecessor, AMC Entertainment, for all prior periods through the closing date of the merger.

The summary historical financial and operating data presented below should be read in conjunction with "AMCE's Management's Discussion and Analysis of Financial Condition and Result of Operations," the historical consolidated financial statements, including the notes thereto, and the unaudited interim financial statements, including the notes thereto, of AMC Entertainment, each included in this prospectus.

19

| | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Thirty-Nine Week Periods | Fiscal Years Ended(1)(3)(5) | ||||||||||||||||||||||

| | April 1, 2005 through December 29, 2005 (Successor) | From Inception July 16, 2004 through December 30, 2004 (Successor) | April 2, 2004 through December 23, 2004(6) (Predecessor) | From Inception July 16, 2004 through March 31, 2005(6) (Successor) | April 2, 2004 through December 23, 2004(6) (Predecessor) | 52 Weeks Ended April 1, 2004 (Predecessor) | 53 Weeks Ended April 3, 2003 (Predecessor) | |||||||||||||||||

| | (thousands of dollars) | (thousands of dollars) | (thousands of dollars) | |||||||||||||||||||||

| Statement of Operations Data: | ||||||||||||||||||||||||

| Total revenues | $ | 1,222,539 | $ | 59,873 | $ | 1,293,968 | $ | 452,900 | $ | 1,293,968 | $ | 1,722,439 | $ | 1,733,599 | ||||||||||

| Film exhibition costs | 440,075 | 21,815 | 465,086 | 157,339 | 465,086 | 621,848 | 637,606 | |||||||||||||||||

| Concession costs | 35,867 | 1,903 | 39,725 | 13,348 | 39,725 | 49,212 | 51,976 | |||||||||||||||||

| Operating expense | 320,326 | 9,454 | 333,279 | 119,070 | 333,279 | 454,190 | 480,749 | |||||||||||||||||

| Rent | 237,504 | 6,049 | 232,208 | 83,904 | 232,208 | 298,945 | 286,107 | |||||||||||||||||

| General and administrative expense: | ||||||||||||||||||||||||

| Merger and acquisition costs | 2,909 | 20,000 | 42,732 | 22,268 | 42,732 | 5,508 | 1,128 | |||||||||||||||||

| Management fee | 1,500 | — | — | 500 | — | — | — | |||||||||||||||||

| Other(7) | 28,237 | 1,365 | 33,908 | 14,716 | 33,908 | 56,500 | 66,215 | |||||||||||||||||

| Preopening expense | 4,251 | 66 | 1,292 | 39 | 1,292 | 3,858 | 3,227 | |||||||||||||||||

| Theatre and other closure expense | 1,390 | 132 | 10,758 | 1,267 | 10,758 | 4,068 | 5,416 | |||||||||||||||||

| Restructuring charge | 3,935 | — | — | 4,926 | — | — | — | |||||||||||||||||

| Depreciation and amortization | 112,122 | 3,158 | 90,259 | 45,263 | 90,259 | 120,867 | 123,808 | |||||||||||||||||

| Impairment of long-lived assets | — | — | — | — | — | 16,272 | 14,564 | |||||||||||||||||

| Disposition of assets and other gains | (1,067 | ) | — | (2,715 | ) | (302 | ) | (2,715 | ) | (2,590 | ) | (1,385 | ) | |||||||||||

| Total costs and expenses | 1,187,049 | 63,942 | 1,246,532 | 462,338 | 1,246,532 | 1,628,678 | 1,669,411 | |||||||||||||||||

| Other expense (income)(4) | (11,966 | ) | — | — | (6,778 | ) | — | 13,947 | — | |||||||||||||||

| Interest expense: | ||||||||||||||||||||||||

| Corporate borrowings | 73,938 | 14,686 | 66,851 | 39,668 | 66,851 | 66,963 | 65,585 | |||||||||||||||||

| Capital and financing lease obligations | 4,379 | 90 | 7,408 | 2,047 | 7,408 | 10,754 | 12,215 | |||||||||||||||||

| Investment (income) expense | 2,251 | (2,247 | ) | (6,476 | ) | (2,511 | ) | (6,476 | ) | (2,861 | ) | (3,502 | ) | |||||||||||

| Earnings (loss) from continuing operations before income taxes | (33,112 | ) | (16,598 | ) | (20,347 | ) | (41,864 | ) | (20,347 | ) | 4,958 | (10,110 | ) | |||||||||||

| Income tax provision (benefit) | (12,800 | ) | 1,500 | 15,000 | (6,800 | ) | 15,000 | 11,000 | 10,000 | |||||||||||||||

| Loss from continuing operations | (20,312 | ) | (18,098 | ) | (35,347 | ) | (35,064 | ) | (35,347 | ) | (6,042 | ) | (20,110 | ) | ||||||||||

| Earnings (loss) from discontinued operations, net of income tax benefit(2) | (22,437 | ) | 195 | (531 | ) | 301 | (531 | ) | (4,672 | ) | (9,436 | ) | ||||||||||||

| Net loss | $ | (42,749 | ) | $ | (17,903 | ) | $ | (35,878 | ) | $ | (34,763 | ) | $ | (35,878 | ) | $ | (10,714 | ) | $ | (29,546 | ) | |||

| Preferred dividends | — | — | 104,300 | — | 104,300 | 40,277 | 27,165 | |||||||||||||||||

| Net loss for shares of common stock | $ | (42,749 | ) | $ | (17,903 | ) | $ | (140,178 | ) | $ | (34,763 | ) | $ | (140,178 | ) | $ | (50,991 | ) | $ | (56,711 | ) | |||

20

| | ||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Thirty-Nine Week Periods | Fiscal Years Ended(1)(3)(5) | ||||||||||||||||||||

| | April 1, 2005 through December 29, 2005 (Successor) | From Inception July 16, 2004 through December 30, 2004 (Successor) | April 2, 2004 through December 23, 2004 (Predecessor) | From Inception July 16, 2004 through March 31, 2005(4)(7) (Successor) | April 2, 2004 through December 23, 2004(4)(7) (Predecessor) | 52 Weeks Ended April 1, 2004(4) (Predecessor) | 53 Weeks Ended April 3, 2003 (Predecessor) | |||||||||||||||

| | (thousands of dollars, except operating data) | (thousands of dollars, except operating data) | (thousands of dollars, except operating data) | |||||||||||||||||||

| Balance Sheet Data (at period end): | ||||||||||||||||||||||

| Cash and equivalents | $ | 134,522 | $ | 70,949 | $ | $ | 333,248 | $ | 244,412 | |||||||||||||

| Corporate borrowings | 1,160,208 | 1,161,970 | 686,431 | 668,661 | ||||||||||||||||||

| Other long-term liabilities | 293,905 | 350,490 | 182,467 | 177,555 | ||||||||||||||||||

| Capital and financing lease obligations | 36,352 | 65,470 | 61,281 | 59,101 | ||||||||||||||||||

| Stockholders' equity | 857,396 | 900,966 | 280,604 | 279,719 | ||||||||||||||||||

| Total assets | 2,701,659 | 2,789,948 | 1,506,534 | 1,480,698 | ||||||||||||||||||

| Cash Flow Data: | ||||||||||||||||||||||

| Net cash provided by (used in) operating activities | $ | 115,988 | $ | 8,327 | $ | 141,654 | $ | (58,560 | ) | $ | 141,654 | $ | 183,278 | $ | 128,747 | |||||||

| Net cash used in investing activities | (27,447 | ) | (1,269,873 | ) | (692,395 | ) | (1,259,794 | ) | (692,395 | ) | (69,378 | ) | (137,201 | ) | ||||||||

| Net cash provided by (used in) financing activities | (25,569 | ) | 1,401,155 | 614,744 | 1,387,456 | 614,744 | (24,613 | ) | 33,437 | |||||||||||||

| Other Data: | ||||||||||||||||||||||

| Capital expenditures | (77,336 | ) | (1,490 | ) | (66,155 | ) | (18,622 | ) | (66,155 | ) | (95,011 | ) | (100,932 | ) | ||||||||

| Proceeds from sale/leasebacks | 6,661 | — | — | 50,910 | — | 63,911 | 43,665 | |||||||||||||||

| Ratio of earnings to fixed charges(6)(8) | — | — | 1.0x | — | ||||||||||||||||||

| Operating Data (at period end): | ||||||||||||||||||||||

| Screen additions | 92 | — | 44 | — | 44 | 114 | 95 | |||||||||||||||

| Screen acquisitions | — | — | 28 | 3,728 | — | 48 | 809 | |||||||||||||||

| Screen dispositions | 116 | — | 14 | 28 | 142 | 111 | ||||||||||||||||

| Average screens—continuing operations(9) | 3,456 | 3,456 | 3,456 | 3,461 | 3,456 | 3,415 | 3,419 | |||||||||||||||

| Number of screens operated | 3,690 | 3,728 | 3,728 | 3,714 | 3,728 | 3,712 | 3,692 | |||||||||||||||

| Number of theatres operated | 244 | 249 | 249 | 247 | 249 | 250 | 257 | |||||||||||||||

| Screens per theatre | 15.1 | 15.0 | 15.0 | 15.0 | 15.0 | 14.8 | 14.4 | |||||||||||||||

| Attendance—continuing operations (in thousands)(9) | 119,858 | 6,114 | 131,026 | 45,953 | 131,026 | 182,467 | 193,194 | |||||||||||||||

- (1)

- There were no cash dividends declared on common stock during the last three fiscal years.

- (2)

- Fiscal 2004 and 2003 include losses from discontinued operations related to a theatre in Sweden that was sold during fiscal 2004. Fiscal 2005, 2004 and 2003 include losses from discontinued operations related to five theatres in Japan that were sold during fiscal 2006. During the 39 weeks ended December 29, 2005, the Successor includes a loss from discontinued operations of $22,437 (net of income tax provision of $20,100) and during the 39 weeks ended December 23, 2004, the Predecessor includes earnings from discontinued operations of $531 (net of income tax provision of $0). During fiscal 2005 the Successor includes earnings from discontinued operations of $301 (net of income tax benefit of $0) and the Predecessor includes a loss from discontinued operations of $531 (net of income tax benefit of $0). Fiscal 2004 includes a $4,672 loss from discontinued operations (net of income tax benefit of $2,600) and fiscal 2003 includes a $9,436 loss from discontinued operations including a charge for impairment of long-lived assets of $4,999 (net of income tax benefit of $700).

- (3)

- Fiscal 2003 includes 53 weeks. All other years have 52 weeks.

- (4)

- During the 39 weeks ended December 29, 2005, other expense (income) is composed of $7,312 of income related to the de-recognition of stored value card liabilities where management believes future redemption to be remote, insurance recoveries of $3,032 for property losses related to Hurricane Katrina, net of disposition losses of $346 and $1,968 of business interruption insurance recoveries related to Hurricane Katrina. During fiscal 2005, other expense (income) is composed of $6,745 of income related to the derecognition of stored value card liabilities where management believes future redemption to be remote and $33 of gain recognized on the redemption of $1,663 of AMC Entertainment's 91/2% Senior Subordinated

21

Notes due 2011. During fiscal 2004, other expense (income) is composed of losses recognized on the redemption of $200,000 of AMC Entertainment's 91/2% Senior Subordinated Notes due 2009 and $83,400 of its 91/2% Senior Subordinated Notes due 2011.

- (5)

- As a result of the Marquee Transactions, the Successor applied the purchase method of accounting to the separable assets, including goodwill, and liabilities of the accounting acquiree, AMC Entertainment, as of December 23, 2004. Because of the application of purchase accounting, Successor and Predecessor periods are not prepared on comparable bases of accounting.

- (6)

- In connection with the Marquee Transactions, Marquee was formed on July 16, 2004, and issued debt and held the related proceeds from issuance of debt in escrow until the consummation of the Marquee Transactions. The Predecessor consolidated this merger entity in accordance with FIN 46(R). As a result, both the Predecessor and the Successor have recorded interest expense of $12,811, interest income of $2,225 and income tax benefit of $4,500 during the 38 weeks ended December 23, 2004 and both the Predecessor and Successor have recorded interest expense of $12,811, interest income of $2,225 and income tax benefit of $4,500 during fiscal 2005 related to Marquee.

- (7)

- Includes stock-based compensation of $1,392, $0 and $0 for the 39 week periods ended December 29, 2005, (Successor), December 30, 2004 (Successor) and December 23, 2004 (Predecessor) respectively. Includes stock-based compensation of $1,201, $0, $8,727 and $2,011 during fiscal 2005 (Successor), fiscal 2005 (Predecessor), fiscal 2004 and fiscal 2003, respectively.

- (8)

- AMCE had a deficiency of earnings to fixed charges for the 39 weeks ended December 29, 2005 (Successor) and from inception on July 16, 2004 through December 30, 2004 of $31.0 million and $16.7 million, respectively. AMCE had a deficiency of earnings to fixed charges for the Successor period from inception on July 16, 2004 through March 31, 2005 of $41.9 million. AMCE had a deficiency of earnings to fixed charges for the Predecessor Period from April 2, 2004 through December 23, 2004 of $20.0 million. AMCE had a deficiency of earnings to fixed charges for fiscal 2003 of $13.0 million. Earnings consist of earnings (loss) from continuing operations before income taxes, plus fixed charges (excluding capitalized interest), amortization of capitalized interest, and undistributed equity in losses of joint ventures. Fixed charges consist of interest expense, interest capitalized and one-third of rent expense on operating leases treated as representative of the interest factor attributable to rent expense. AMC Entertainment's pro forma unaudited deficiency of earnings to fixed charges for the 52 weeks ended March 31, 2005 was $104.2 million. AMC Entertainment's pro forma unaudited deficiency of earnings to fixed charges for the 39 weeks ended December 29, 2005 was $101.2 million.

- (9)

- Includes consolidated theatres only.

22

Loews Cineplex Entertainment Corporation

The following tables set forth certain of Loews' historical financial and operating data. The summary historical financial data for the year ended December 31, 2003, the seven months ended July 31, 2004, the five months ended December 31, 2004 and the year ended December 31, 2005 are derived from Loews' audited combined consolidated financial statements and related notes for such periods included in this prospectus. Loews' financial statements include the assets, liabilities and results of operations of Cinemex on a combined basis for the period June 19, 2002 (the date Cinemex became an entity under common control) through July 31, 2004 and on a fully consolidated basis beginning August 1, 2004. Loews has reflected the financial position and results of operations of its former Canadian operations as discontinued operations for all periods from April 1, 2002 to July 31, 2004, as those operations were sold to affiliates of its former investors.