Exhibit 99.1

COASTAL CONTACTS INC.

Notice of Annual and Special Meeting of Shareholders

and

Management Information Circular

For Meeting to be held on February 28, 2013

Suite 2200, 885 West Georgia Street

Vancouver, British Columbia

V6C 3E8

January 28, 2013

NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON February 28, 2013

NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of the shareholders of Coastal Contacts Inc. (the “Corporation”) will be held at Suite 2200, 885 West Georgia Street, Vancouver, British Columbia, on Thursday, February 28, 2013, at 11:00 a.m. (Vancouver time), for the following purposes:

1. to receive the consolidated financial statements of the Corporation for the financial year ended October 31, 2012, together with the report of the auditor thereon;

2. to elect the directors of the Corporation for the ensuing year;

3. to appoint KPMG LLP, Chartered Accountants, as auditor of the Corporation for the ensuing year;

4. to consider and, if deemed appropriate, pass, with or without variation, a resolution to re-approve the Corporation’s Stock Option Plan, as more fully described in the accompanying Management Information Circular;

5. to consider and, if deemed appropriate, pass, with or without variation, a resolution to approve certain amendments to the Corporation’s Stock Option Plan, as more fully described in the accompanying Management Information Circular;

6. to consider and, if deemed appropriate, approve, on an advisory basis (and not to diminish the role and responsibilities of the Board of Directors), the Corporation’s approach to executive compensation; and

7. to transact such other business as may properly come before the Meeting or any adjournments thereof.

Accompanying this notice of meeting is the Management Information Circular and a form of proxy.

Only shareholders of record at the close of business on January 28, 2013 will be entitled to receive notice of, and to vote at, the Meeting or any adjournment thereof. Registered shareholders who are unable to, or who do not wish to, attend the Meeting in person are requested to date and sign the enclosed form of proxy promptly and return it in the self-addressed envelope enclosed for that purpose, or by any of the other methods indicated on the form of proxy. To be used at the Meeting, Proxies must be received by Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M51 2Y1 by 11:00 a.m. (Vancouver time) on February 26, 2013 or, if the Meeting is adjourned, by 48 hours prior to the time at which the Meeting is reconvened, or may be accepted by the Chairman of the Meeting prior to the commencement of the Meeting, or any adjournment thereof. If a registered shareholder receives more than one proxy because such shareholder owns shares registered in different names or addresses, each proxy should be completed and returned.

DATED at Vancouver, British Columbia, this 28th day of January, 2013.

| BY ORDER OF THE BOARD OF DIRECTORS |

| |

| |

| | “Roger V. Hardy” |

| | Roger V. Hardy |

| | Chairman and Chief Executive Officer |

If you are a non-registered shareholder of the Corporation and receive these materials through your broker or through another intermediary, please complete and return the materials in accordance with the instructions provided to you by your broker or by the other intermediary. Failure to do so may result in your shares not being eligible to be voted by proxy at the Meeting.

COASTAL CONTACTS INC.

ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS

MANAGEMENT INFORMATION CIRCULAR

GENERAL INFORMATION

This Management Information Circular is furnished to the holders (“shareholders”) of common shares (“Common Shares”) of Coastal Contacts Inc. (the “Corporation”) by management of the Corporation in connection with the solicitation of proxies to be voted at the annual and special meeting (the “Meeting”) of the shareholders to be held on Thursday, February 28, 2013 and at any adjournment thereof, for the purposes set forth in the accompanying Notice of Meeting.

On August 30, 2012, the Corporation filed Articles of Amendment to give effect to a share consolidation on the basis of two pre-consolidation Common Shares for each one post-consolidation Common Share (the “Consolidation”). The Corporation’s issued and outstanding stock options were adjusted to give effect to the Consolidation. All data relating to numbers of Common Shares, prices of Common Shares, numbers of stock options and exercise prices of stock options set forth in this Management Information Circular have been adjusted to give retroactive effect to the Consolidation. For the purpose of giving retroactive effect to the Consolidation, we have rounded fractional shares to the nearest whole share and rounded fractional price information to the nearest cent, with fractions of 0.5 or greater rounded up and fractions of less than 0.5 rounded down. As a result of such rounding, actual amounts may differ.

PROXIES

Solicitation of Proxies

The enclosed form of proxy is solicited by and on behalf of management of the Corporation. The persons named in the enclosed form of proxy are management-designated proxyholders. A registered shareholder desiring to appoint some other person (who need not be a shareholder) to represent the shareholder at the Meeting may do so either by inserting such other person’s name in the blank space provided on the form of proxy or by completing another form of proxy. To be used at the Meeting, Proxies must be received by Computershare Investor Services Inc., Proxy Department, 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1 by 11:00 a.m. (Vancouver time) on February 26, 2013 or, if the Meeting is adjourned, by 48 hours prior to the time at which the Meeting is reconvened, or may be accepted by the Chairman of the Meeting prior to the commencement of the Meeting, or any adjournment thereof. Solicitation will be primarily by mail, but some proxies may be solicited personally or by telephone by regular employees or directors of the Corporation at a nominal cost. The cost of solicitation by management of the Corporation will be borne by the Corporation.

Non-Registered Holders

Only registered holders of Common Shares or the persons they appoint as their proxyholders are permitted to vote at the Meeting. In many cases, however, Common Shares beneficially owned by a holder (a “Non-Registered Holder”) are registered either:

(a) in the name of an Intermediary (an “Intermediary”) that the Non-Registered Holder deals with in respect of the Common Shares. Intermediaries include banks, trust companies, securities dealers or brokers, and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans; or

(b) in the name of a clearing agency (such as The Canadian Depository for Securities Limited (“CDS”)) of which the Intermediary is a participant.

Pursuant to the Canadian Securities Administrators’ National Instrument 54-101 — Communication with Beneficial Owner of Securities of a Reporting Issuer, the Corporation has distributed copies of proxy-related materials in connection with this Meeting (including this Management Information Circular) to Intermediaries and clearing agencies for onward distribution to Non-Registered Holders.

Intermediaries are required to forward the proxy-related materials to Non-Registered Holders unless a Non-Registered Holder has waived the right to receive them. Intermediaries often use service companies to forward the proxy-related materials to Non-Registered Holders. Generally, Non-Registered Holders who have not waived the right to receive proxy-related materials will be sent a voting instruction form which must be completed, signed and returned by the Non-Registered Holder in accordance with the Intermediary’s directions on the voting instruction form. In some cases, such Non-Registered Holders will instead be given a proxy which has already been signed by the Intermediary (typically by a facsimile, stamped signature) which is restricted as to the number of Common Shares beneficially owned by the Non-Registered Holder but which is otherwise not completed. This form of proxy does not need to be signed by the Non-Registered Holder, but, to be used at the Meeting, needs to be properly completed and deposited with Computershare Investor Services Inc. as described under “Solicitation of Proxies”.

The purpose of these procedures is to permit Non-Registered Holders to direct the voting of the Common Shares that they beneficially own. Should a Non-Registered Holder wish to attend and vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Holder), the Non-Registered Holder should insert the Non-Registered Holder’s (or such other person’s) name in the blank space provided or, in the case of a voting instruction form, follow the corresponding instructions on the form.

Non-Registered Holders should carefully follow the instructions of their Intermediaries and their service companies, including instructions regarding when and where the voting instruction form or proxy is to be delivered.

Revocability of Proxies

A registered shareholder who has given a proxy may revoke it:

(a) by depositing an instrument in writing executed by the shareholder or by the shareholder’s attorney authorized in writing

(i) at the registered office of the Corporation at any time up to and including the last business day preceding the day of the Meeting, or any adjournment thereof, at which the proxy is to be used, or

(ii) with the chairman of the Meeting on the day of the Meeting or any adjournment thereof; or

(b) in any other manner permitted by law.

Non-Registered Holders who wish to revoke a voting instruction form or a waiver of the right to receive proxy-related materials should contact their Intermediaries for instructions.

Voting of Proxies

Common Shares represented by a shareholder’s proxy will be voted or withheld from voting in accordance with the shareholder’s instructions on any ballot that may be called for at the Meeting and, if the shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of any instructions, the management-designated proxyholder named on the form of proxy will cast the shareholder’s votes in favour of the passage of the resolutions set forth herein and in the Notice of Meeting.

2

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to (a) amendments or variations to matters identified in the Notice of Meeting and (b) other matters which may properly come before the Meeting or any adjournment thereof. At the time of printing of this Management Information Circular, management of the Corporation knows of no such amendments, variations or other matters to come before the Meeting other than the matters referred to in the accompanying Notice of Meeting.

VOTING SHARES AND PRINCIPAL HOLDERS THEREOF

Only Common Shares carry voting rights at the Meeting with each Common Share carrying the right to one vote. The Board of Directors of the Corporation (the “Board”) has fixed January 28, 2013 as the record date for the determination of shareholders of the Corporation entitled to receive notice of and to vote at the Meeting and at any adjournment thereof, and only shareholders of record at the close of business on that date are entitled to such notice and to vote at the Meeting. As at January 28, 2013, 28,620,753 Common Shares were issued and outstanding. A complete list of the shareholders entitled to vote at the Meeting will be open to examination by any shareholder for any purpose germane to the Meeting, during ordinary business hours for a period of 10 days prior to the Meeting, at the offices of Computershare Investor Services Inc., at 510 Burrard Street, Vancouver, British Columbia V6C 3B9.

To the knowledge of the directors or executive officers of the Corporation, as at January 28, 2013, no person beneficially owned, directly or indirectly, or exercised control or direction over, shares carrying 10% or more of the voting rights attached to the issued and outstanding Common Shares, except for the following:

Name | | Number of Common Shares | | Percentage of Outstanding

Common Shares | |

Roger V. Hardy | | 3,327,387 | (1) | 11.6 | % |

(1) These Common Shares are held of record and beneficially by Mr. Hardy or his registered retirement savings plan. Mr. Hardy also owns stock options entitling him to purchase an additional 882,500 Common Shares. This represents approximately 14.3% of the issued and outstanding Common Shares on a partially-diluted basis, assuming the exercise of all stock options held by Mr. Hardy.

VOTES NECESSARY TO PASS RESOLUTIONS AT THE MEETING

Under the Corporation’s by-laws, the quorum for the transaction of business at the Meeting will be one or more individuals present in person, each being a shareholder entitled to vote at the Meeting or a duly appointed proxyholder or representative for an absent shareholder so entitled, and holding, or representing by proxy, not less than 10% of the outstanding Common Shares. A simple majority of the votes cast at the Meeting (in person or by proxy) is required in order to pass each of the resolutions referred to in the accompanying Notice of Meeting.

INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

No: (a) director or executive officer of the Corporation who has held such position at any time since November 1, 2011; (b) proposed nominee for election as a director of the Corporation; or (c) associate or affiliate of a person referenced in (a) or (b) has any material interest, direct or indirect, by way of beneficial ownership of securities or otherwise, in any matter to be acted upon at the Meeting, other than directors and executive officers of the Corporation having an interest in the resolutions regarding the re-approval of, and amendments to, the Corporation’s stock option plan as such persons are eligible to participate in such plan.

3

CORPORATE GOVERNANCE DISCLOSURE

The Canadian Securities Administrators’ National Instrument 58-101 - Disclosure of Corporate Governance Practices (“NI 58-101”) requires issuers to disclose on an annual basis their corporate governance practices in accordance with NI 58-101. Corporate governance disclosure of the Corporation is set out in Appendix A to this Management Information Circular.

COMPENSATION OF EXECUTIVE OFFICERS AND DIRECTORS

Executive Compensation

Set out below are particulars of compensation paid to the following persons (the “Named Executive Officers”, or “NEOs”):

(a) the Corporation’s Chief Executive Officer (“CEO”);

(b) the Corporation’s current and former Chief Financial Officer (“CFO”); and

(c) each of the three most highly compensated executive officers of the Corporation, other than the CEO and the CFO, at the end of the Corporation’s most recently completed financial year whose total compensation was, individually, more than $150,000 for that financial year.

During the Corporation’s financial year ended October 31, 2012, the Named Executive Officers were: Roger V. Hardy (Chairman and CEO), Nicholas S. Bozikis (CFO), Gordon Howie (former CFO), Terry Vanderkruyk (Vice President, Corporate Development), Aaron Magness (Vice President, Marketing — USA) and Peter Lee (Vice President of Information Technology).

Compensation Discussion and Analysis

The Compensation and Corporate Governance Committee (the “Compensation Committee”) has the responsibility to, among other things, review and approve corporate goals and objectives relevant to the CEO’s compensation, evaluate the CEO’s performance in light of those goals and objectives and set the CEO’s compensation level based on this evaluation. The Compensation Committee also reviews and approves, for recommendation to the Board, the applicable components of compensation for the CEO and reviews the compensation of other executive officers, including salary, bonus and incentive compensation levels, deferred compensation, executive perquisites, equity compensation, severance arrangements and change of control benefits.

John Currie is the Chairman of the Compensation Committee. The other members of the Compensation Committee are Jeffrey Mason and Jeff Booth.

The Corporation’s compensation policy with respect to executive officers is designed to provide both short-term and long-term rewards that are consistent with individual and corporate performance and its goal is to provide sufficient compensation opportunities for executive officers in order to attract, retain and motivate the best possible management team. Compensation for executive officers consists of:

(i) a base salary;

(ii) annual and special bonus incentives; and

(iii) options granted on a discretionary basis under the Corporation’s Option Plan (as defined under “Option-based Awards”).

The Compensation Committee reviews base salary with reference to relevant industry norms, experience, performance and level of responsibility. The Compensation Committee reviews salary levels annually and may make adjustments, if warranted, as a result of salary trends in the marketplace, competitive positioning and a

4

modification in the level of responsibilities of the executive. Cash bonus incentives assessed annually, or at a more frequent period as determined, are based upon the Corporation’s ability to meet certain financial and operational metrics and each executive’s individual performance. The Compensation Committee reviews and assesses executive performance and accomplishments at a minimum on an annual basis.

The Compensation Committee also considers stock options to be an important component of executive compensation. The objective of making grants under the Option Plan is to encourage executive officers to acquire an ownership interest in the Corporation over a period of time, thus better aligning the interests of executive officers with the interests of shareholders. When reviewing and recommending option grants to directors of the Corporation, the Compensation Committee considers the executive’s overall contribution to the success of the Corporation, past option grants and industry peer groups.

Each of the elements of the executive compensation packages are considered during the Compensation Committee’s benchmarking process which reviews the executive compensation packages of similar companies to ensure that the Corporation provides compensation that is effective in rewarding executives for meeting goals and objectives and ensures that the Corporation can attract and retain the right individuals. The Board considers the Compensation Committee’s benchmarking process in its analysis and decision-making process.

The Compensation Committee’s benchmarking process took into account pertinent elements of the Corporation’s compensation package and included the following 18 comparative companies selected as the Corporation’s peer group:

Corporation | | Market | | Symbol |

1-800-Flowers.com Inc. | | NASDAQ | | FLWS |

Absolute Software Corp. | | TSX | | ABT |

Blue Nile Inc. | | NASDAQ | | NILE |

Bluefly, Inc. | | NASDAQ | | BFLY |

Enghouse Systems Ltd. | | TSX | | ESL |

Indigo Books & Music Inc. | | TSX | | IDG |

Mediagrif Interactive Technologies Inc. | | TSX | | MDF |

Orbitz Worldwide, Inc. | | NYSE | | OWW |

Overstock.com Inc. | | NASDAQ | | OSTK |

PC Mall, Inc. | | NASDAQ | | MALL |

Peer 1 Network Enterprises, Inc. | | TSX | | PIX |

PetMed Express, Inc. | | NASDAQ | | PETS |

Points International Ltd. | | TSX | | PTS |

Spark Networks Inc. | | NYSE MKT | | LOV |

Stamps.com Inc. | | NYSE | | STMP |

U.S. Auto Parts Network Inc. | | NASDAQ | | PRTS |

United Online Inc. | | NASDAQ | | UNTD |

Vitacost.com, Inc. | | NASDAQ | | VITC |

The benchmarking process took into account all available elements of compensation for the peer group companies, on a normalized basis, whether or not the Corporation included these elements as part of their executive compensation packages. For example, the value of certain long-term incentive plans that are awarded to peer group executives, but absent from the Corporation’s executive compensation package, would be considered in setting the remaining elements of the compensation package. The Compensation Committee considers the Black-Scholes model of valuation, among other information, in its recommendations to the Board.

The Compensation Committee focussed primarily on reviewing the CEO’s performance and determining his compensation. It then provided input to the CEO and other relevant management as part of its review of the compensation for the other executive officers. The Compensation Committee also monitored the performance of

5

the other executive officers as part of understanding the management composition, evaluating potential promotion from within, and succession planning.

In establishing the base salary of $495,000 and $510,000 for the Corporation’s CEO for fiscal 2012 and 2013, respectively, the Compensation Committee assessed the performance of the Corporation and the CEO in fiscal 2011 and 2012, respectively, and evaluated the CEO’s contribution to the overall success of the Corporation along with a review of benchmark information.

With respect to stock options for the Corporation’s CEO, the Compensation Committee considered the CEO’s performance, historic stock option amounts, a survey of 18 peer group companies, as well as the limited availability of Common Shares for new option grants under the Option Plan, which became the determining factor. After consideration of the Compensation Committee’s recommendation, the Board approved, on January 11, 2013, the grant of an option to the CEO to purchase 50,000 Common Shares (with an effective grant date of January 18, 2013) at a price of $5.28 per share with an expiry date of January 18, 2018, vesting over three years, pro-rated equally as to one-sixth every six months.

In October 2012, the Compensation Committee engaged Lane Caputo Compensation Inc. (the “Compensation Consultant”) to act as its compensation consultant to review the compensation of the Corporation’s executive officers and independent directors on a go-forward basis. During the financial year ended October 31, 2012, the Compensation Consultant billed the Corporation $10,000 for such services.

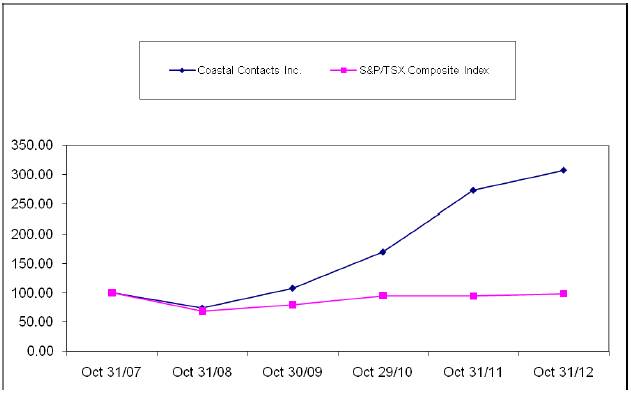

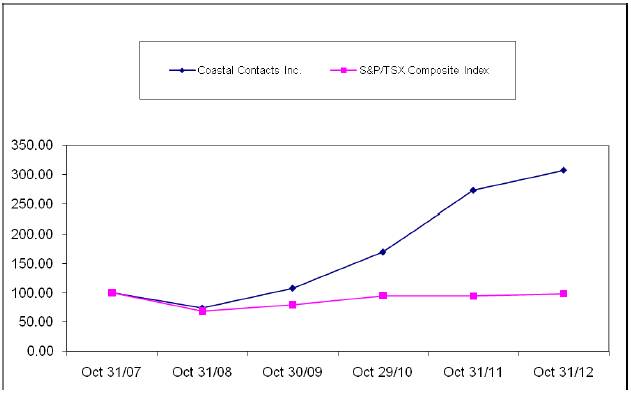

Performance Graph

The following graph compares the yearly percentage change in the Corporation’s cumulative total shareholder return on the Common Shares with the cumulative total return on the S&P/TSX Composite Index for the period from October 31, 2007 to October 31, 2012. The graph illustrates the cumulative return on a $100 investment in the Common Shares made on October 31, 2007 as compared with the cumulative return on a $100 investment in the S&P/TSX Composite Index (assuming the reinvestment of dividends). The performance of the Common Shares as set out in the graph below does not necessarily indicate future performance. Executive compensation has generally followed the trend in shareholder returns.

6

| | Oct 31/07 | | Oct 31/08 | | Oct 30/09 | | Oct 29/10 | | Oct 31/11 | | Oct 31/12 | |

Coastal Contacts Inc. | | 100.00 | | 73.68 | | 107.89 | | 169.39 | | 272.81 | | 614.03 | |

S&P/TSX Composite Index | | 100.00 | | 68.65 | | 79.45 | | 94.91 | | 94.12 | | 98.33 | |

Risk Management

The Compensation Committee is responsible for ensuring that the application of the compensation policy is appropriately aligned to support its stated objectives and encourage appropriate management behaviours, while avoiding excessive risk-taking by executive officers. Given the current stage of development and the limited elements of executive compensation, at this time the Board has not formally assessed the implications of the risks associated with the Corporation’s compensation policies and practices.

Option-based Awards

The Amended and Restated Stock Option Plan of the Corporation (the “Option Plan”) is administered by the Board and the Compensation Committee. The Option Plan is designed to advance the interests of the Corporation by encouraging directors, employees and consultants of the Corporation and its subsidiaries or affiliates, if any, by providing them with the opportunity, through options, to acquire Common Shares, thereby increasing their proprietary interest in the Corporation, encouraging them to remain associated with the Corporation and furnishing them with additional incentive in their efforts on behalf of the Corporation in the conduct of its affairs.

The Compensation Committee considers stock option grants when reviewing executive officer compensation packages as a whole. See “Compensation Discussion and Analysis”.

The original version of the Option Plan was approved by the shareholders of the Corporation effective February 27, 2007 and the Option Plan (including amendments to the original version) was last confirmed by the shareholders of the Corporation on March 26, 2010. No amendments were made to the plan during the last financial year

7

ended October 31, 2012. See “Particulars of Other Matters to be Acted Upon — Amendments to the Stock Option Plan” for a discussion of proposed amendments to the Option Plan which shareholders will be asked to consider and approve at the Meeting.

The Option Plan currently includes the following provisions:

· Directors, consultants and employees of the Corporation or any of its subsidiaries and employees of a person or company which provides management services to the Corporation or any of its subsidiaries shall be eligible for selection to participate in the Option Plan. Options are granted at the discretion of the Board or a special committee of the Board appointed from time to time by the Board (presently the Compensation Committee).

· The aggregate number of Common Shares issuable upon the exercise of all options granted under the Option Plan and any other “security-based compensation arrangements” (as defined in the Company Manual of the TSX) of the Corporation shall not exceed 10% of the issued and outstanding Common Shares from time to time.

· No single optionee may be granted options to purchase a number of Common Shares equalling more than 5% of the issued Common Shares in any 12-month period unless the Corporation has obtained disinterested shareholder approval in respect of such grant and meets applicable TSX requirements.

· Options shall not be granted if the exercise thereof would result in the issuance of more than 2% of the issued Common Shares in any 12-month period to any one consultant of the Corporation (or any of its subsidiaries).

· Options shall not be granted if the exercise thereof would result in the issuance of more than 2% of the issued Common Shares in any 12-month period to employees of the Corporation (or any of its subsidiaries) conducting investor relations activities. Options granted to persons performing investor relations activities will contain vesting provisions such that vesting occurs over at least 12 months with no more than ¼ of the options vesting in any three-month period.

· The number of Common Shares issuable to insiders of the Corporation, at any time, under all security-based compensation arrangements of the Corporation, cannot exceed 10% of the issued and outstanding Common Shares.

· The number of Common Shares issued to insiders of the Corporation, within any one-year period, under all security-based compensation arrangements of the Corporation, cannot exceed 10% of the issued and outstanding Common Shares.

· The exercise price of options shall not be lower than the market price (as such term is defined in section 601 of the TSX Company Manual) of the Common Shares at the time the option is granted or any other exercise price permitted by the TSX. The exercise price of an option held by an insider of the Corporation may be reduced only if disinterested shareholder approval is obtained.

· Each option shall have a term set out in the option agreement, provided that in no circumstances shall the term of an option exceed the maximum term permitted by the TSX (the TSX does not currently specify any maximum term for stock options—the Corporation has generally been granting options under the Option Plan with a five-year term).

· Options granted may have a vesting period as required by the Board on a case-by-case basis. Options granted to officers and employees generally vest as to one-sixth of the options each six-month period during the initial three-year period of the option term. Options granted to outside directors generally vest as to 1,000 options immediately upon grant with remaining options vesting as to one-sixth of the options each six-month period during the initial three-year period of the option term. In the event of a reorganization, merger or consolidation of the Corporation with one or more corporations where the Corporation is not the surviving corporation or upon the sale of substantially all of the property or more than 80% of the then outstanding Common Shares to another corporation (each a “change of control” event for the purposes of the Option Plan), all options granted which have not yet vested shall immediately vest, subject to any applicable TSX policies.

· If an optionee ceases any position with the Corporation as a result of having been dismissed from any

8

such position for cause, all unexercised option rights of that optionee under the Option Plan shall immediately terminate. If an optionee ceases any position with the Corporation other than for cause or due to the optionee’s death, the option shall continue to be exercisable, to the extent it was entitled to be exercised at the date of cessation, until the earlier of 90 days thereafter (30 days in the case of an optionee engaged to provide investor relations activities) and the normal expiry date of the option.

· In the event of the death of an optionee, unexercised options held by such optionee may be exercised by the optionee’s legal representatives until the earlier of one year from the date of death and the normal expiry date of the option to the extent that the options were exercisable on the date of death.

· All benefits, rights and options accruing to any optionee in accordance with the terms and conditions of the Option Plan shall not be transferable or assignable unless specifically provided in the Option Plan or to the extent, if any, permitted by the TSX. During the lifetime of an optionee, any benefits, rights and options may only be exercised by the optionee.

· Subject to applicable approval of the TSX, the Board may, at any time, suspend or terminate the Option Plan. Subject to applicable approval of the TSX, the Board may also at any time amend or revise the terms of the Option Plan; provided that no such amendment or revision shall alter the terms of any options theretofore granted under the Option Plan, unless shareholder approval, or disinterested shareholder approval, as the case may be, is obtained for such amendment or revision. Despite the previous two sentences, no shareholder approval, or disinterested shareholder approval, as the case may be, is required for amendments or revisions of the following types:

(a) amendments of a “housekeeping” nature;

(b) a change to the vesting provisions of the Option Plan;

(c) a change to the termination provisions of the Option Plan which does not entail an extension beyond the original expiry date; and

(d) the addition of a cashless exercise feature, payable in cash or securities, which provides for a full deduction of the number of underlying securities from the Option Plan reserve (where applicable);

notwithstanding that such amendment or revision shall alter the terms of any options theretofore granted under the Plan.

The Option Plan does not provide any ability for the Corporation to transform an option into a stock appreciation right involving an issuance of securities from treasury.

The Corporation does not provide any financial assistance to optionees in order to facilitate the purchase of Common Shares issuable pursuant to the exercise of options granted under the Option Plan.

The Option Plan is subject to the rules and policies of the TSX, including the requirement for shareholder approval every three years following institution. Shareholders are being asked to approve the Option Plan at the Meeting, it having been last approved in 2010. See “Particulars of Other Matters to be Acted Upon — Approval of Unallocated Options under the Stock Option Plan”.

As at January 28, 2013, the total number of Common Shares issuable under outstanding options granted under the Option Plan is 2,843,084, representing approximately 9.9% of the issued and outstanding Common Shares. Approximately 0.1% of the issued and outstanding Common Shares are available for future options to be granted under the Option Plan. As discussed under, “Particulars of Other Matters to be Acted Upon — Amendments to the Stock Option Plan”, the Board proposes to increase the total number of Common Shares available to be granted under the Option Plan from 10% to 12.5% of the issued and outstanding Common Shares from time to time.

9

Summary Compensation Table

The following table provides a summary of compensation earned by the Named Executive Officers during the Corporation’s last three financial years ended October 31, 2012.

| | | | | | Share- | | Option- | | Non-equity incentive plan compensation

($) | | | | | | | |

Name and

principal position | | Year | | Salary

($) | | based

awards

($) | | based

awards (1)

($) | | Annual

incentive

plans (2) | | Long-term

incentive

plans | | Pension

value

($) | | All other

compensation (3)

($) | | Total

compensation

($) | |

ROGER V. HARDY (4) | | 2012 | | 495,000 | | Nil | | 105,137 | | Nil | | Nil | | Nil | | 7,500 | | 607,637 | |

CEO | | 2011 | | 495,000 | | Nil | | 267,558 | | 150,000 | | Nil | | Nil | | 7,500 | | 920,058 | |

| | 2010 | | 482,000 | | Nil | | 382,655 | | 90,000 | | Nil | | Nil | | 7,500 | | 962,155 | |

| | | | | | | | | | | | | | | | | | | |

NICHOLAS S. BOZIKIS (5) | | 2012 | | 169,539 | | Nil | | 18,774 | | 60,000 | | Nil | | Nil | | 7,488 | | 255,801 | |

CFO | | 2011 | | 140,000 | | Nil | | 99,667 | | 37,500 | | Nil | | Nil | | 7,500 | | 284,667 | |

| | 2010 | | 130,000 | | Nil | | Nil | | 35,000 | | Nil | | Nil | | 7,500 | | 172,500 | |

| | | | | | | | | | | | | | | | | | | |

GORDON HOWIE (6) | | 2012 | | 212,308 | | Nil | | Nil | | 12,000 | | Nil | | Nil | | 2,959 | | 227,267 | |

Former CFO | | 2011 | | 61,923 | | Nil | | 167,392 | | 12,000 | | Nil | | Nil | | 3,199 | | 244,514 | |

| | 2010 | | N/A | | Nil | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

| | | | | | | | | | | | | | | | | | | |

TERRY VANDERKRUYK | | 2012 | | 150,000 | | Nil | | 18,774 | | 153,237 | | Nil | | Nil | | 7,500 | | 329,511 | |

Vice President, Corporate Development | | 2011 | | 150,000 | | Nil | | Nil | | 25,000 | | Nil | | Nil | | 7,500 | | 182,500 | |

| | 2010 | | 150,000 | | Nil | | Nil | | 15,000 | | Nil | | Nil | | 7,488 | | 172,488 | |

| | | | | | | | | | | | | | | | | | | |

AARON MAGNESS | | 2012 | | 179,769 | | Nil | | 41,304 | | 44,015 | | Nil | | Nil | | 5,833 | | 270,921 | |

Vice President, Marketing – USA | | 2011 | | 10,096 | | Nil | | 200,870 | | 13,000 | | Nil | | Nil | | Nil | | 223,966 | |

| | 2010 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

| | | | | | | | | | | | | | | | | | | |

PETER LEE | | 2012 | | 200,000 | | Nil | | Nil | | 34,375 | | Nil | | Nil | | Nil | | 234,375 | |

Vice President of Information Technology | | 2011 | | 81,731 | | Nil | | 122,890 | | 20,800 | | Nil | | Nil | | Nil | | 225,421 | |

| | 2010 | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | | N/A | |

(1) The grant date fair value of each option granted during the financial years ended October 31, 2010, 2011 and 2012 is estimated on the date of grant using the Black-Scholes option pricing model, with the following assumptions: expected volatility of 53.9% (in 2010), 49.4% (in 2011) and 45.1% (in 2012); risk free interest rate of 2.22% (in 2010), 2.12% (in 2011) and 1.28% (in 2012); expected option life of five years; and expected dividend rate of nil. The Black-Scholes pricing methodology was used in this estimate of fair value as it is an established calculation widely used by the financial industry for securities valuations and is supported as an appropriate methodology by Section 3870 of the CICA Handbook.

(2) Comprised of performance bonuses earned in respect of the indicated financial year, but paid subsequent to each related financial year end.

(3) The amount indicated represents the Corporation’s matching contribution towards the price of Common Shares purchased by the NEO under the Corporation’s Employee Share Ownership Plan in which all regular employees of the Corporation are eligible to participate. Perquisites (including property or other personal benefits provided to an NEO that are not generally available to all employees) did not exceed either $50,000 or 10% of the NEO’s total salary for the financial year.

(4) No compensation amounts received by Mr. Hardy related to his role as a director of the Corporation.

(5) Mr. Bozikis was appointed as CFO of the Corporation effective April 4, 2012.

(6) Mr. Howie served as CFO of the Corporation from July 2011 until March 2012.

10

Incentive Plan Awards

Outstanding share-based awards and option-based awards

The following table provides information regarding the incentive plan awards (option-based awards) outstanding for each Named Executive Officer that were outstanding as of October 31, 2012, including awards granted before the most recently completed financial year. There are no incentive plan awards in the form of share-based awards outstanding for the Named Executive Officers.

| | Option-based Awards | | Share-based Awards | |

Name | | Number of securities

underlying

unexercised options (1)

(#) | | Option

exercise

price

($) | | Option expiration date | | Value of

unexercised in-

the-money

options (2)

($) | | Number of shares

or units of shares

that have not

vested

(#) | | Market or payout

value of share-

based awards

that have not

vested

($) | |

ROGER V. HARDY | | 70,000 | | 5.24 | | December 22, 2016 | | 123,200 | | Nil | | N/A | |

| | 175,000 | | 3.24 | | December 23, 2015 | | 658,000 | | Nil | | N/A | |

| | 337,500 | | 2.84 | | July 14, 2015 | | 1,404,000 | | Nil | | N/A | |

| | 125,000 | | 1.60 | | January 8, 2014 | | 675,000 | | Nil | | N/A | |

| | 125,000 | | 2.10 | | March 23, 2013 | | 612,500 | | Nil | | N/A | |

NICHOLAS S. BOZIKIS | | 12,500 | | 5.26 | | December 22, 2016 | | 21,750 | | Nil | | N/A | |

| | 25,000 | | 5.60 | | June 21, 2016 | | 35,000 | | Nil | | N/A | |

| | 25,000 | | 3.24 | | December 23, 2015 | | 94,000 | | Nil | | N/A | |

| | 25,000 | | 1.82 | | July 20, 2013 | | 129,500 | | Nil | | N/A | |

GORDON HOWIE | | Nil | | N/A | | N/A | | N/A | | Nil | | N/A | |

TERRY VANDERKRUYK | | 12,500 | | 5.24 | | December 22, 2016 | | 22,000 | | Nil | | N/A | |

| | 150,000 | | 1.60 | | May 6, 2014 | | 810,000 | | Nil | | N/A | |

| | 25,000 | | 1.60 | | January 8, 2014 | | 135,000 | | Nil | | N/A | |

| | 50,000 | | 1.82 | | July 20, 2013 | | 259,000 | | Nil | | N/A | |

AARON MAGNESS | | 27,500 | | 5.24 | | December 22, 2016 | | 48,400 | | Nil | | N/A | |

| | 90,000 | | 5.34 | | September 18, 2016 | | 149,400 | | Nil | | N/A | |

PETER LEE | | 50,000 | | 5.60 | | June 21, 2016 | | 70,000 | | Nil | | N/A | |

(1) Options were granted with a five-year term and vest as to one-sixth of the options each six-month period during the initial three-year period of the option term.

(2) The value of unexercised in-the-money options is calculated by multiplying the difference between the closing price of the Common Shares on the Toronto Stock Exchange on October 31, 2012, which was $7.00, and the option exercise price, by the number of outstanding options. These stock options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise.

Incentive plan awards—value vested or earned during the year

The following table provides information regarding the value vested or earned in respect of incentive plan awards during the financial year ended October 31, 2012 for each Named Executive Officer. The Corporation did not grant any share-based awards during the financial year ended October 31, 2012 not did any value vest in connection with share-based awards.

Name | | Option-based awards – Value

vested during the year

($) | | Share-based awards – Value

vested during the year

($) | | Non-equity incentive plan

compensation – Value earned

during the year

($) | |

ROGER V. HARDY | | 211,666 | | Nil | | Nil | |

NICHOLAS S. BOZIKIS | | 18,752 | | Nil | | 60,000 | |

GORDON HOWIE | | 12,500 | | Nil | | 12,000 | |

TERRY VANDERKRUYK | | 6,249 | | Nil | | 153,237 | |

AARON MAGNESS | | 34,584 | | Nil | | 44,015 | |

PETER LEE | | 16,667 | | Nil | | 34,375 | |

11

Pension Plan Benefits

The Corporation and its subsidiaries do not have any pension plan arrangements in place.

Termination and Change of Control Benefits

Other than as set out below, there are no contracts, agreements, plans or arrangements that provide for payments to a Named Executive Officer following or in connection with any termination (whether voluntary, involuntary or constructive), resignation, retirement, a change of control of the Company or a change in responsibilities of the Named Executive Officer following a change of control of the Company.

Roger V. Hardy, Chairman and Chief Executive Officer

Mr. Hardy entered into an employment agreement dated March 29, 2004, as amended, with the Corporation (the “Hardy Agreement”). The Hardy Agreement is renewable annually for an indefinite term. If Mr. Hardy’s employment is terminated for any reason prior to the termination of the Hardy Agreement other than for cause or if he resigns without “good reason” (as defined in the Hardy Agreement), he would be entitled to receive his then base salary and perquisite benefits for 24 months following the termination of his employment and an amount equal to two times his pro-rated bonus. If such termination had occurred on October 31, 2012, Mr. Hardy would have been entitled to receive approximately $1,290,000. If, in connection with or within 18 months of a change of control of the Corporation, Mr. Hardy voluntarily terminates his employment for good reason or is involuntarily discharged, he would be entitled to receive instead a severance payment of 2.5 times the sum of his then annual base salary and then current annual bonus. If such change of control of the Corporation had occurred on October 31, 2012, Mr. Hardy would have been entitled to receive approximately $1,612,500. In connection with the termination of Mr. Hardy’s employment under any of the above-described circumstances and in all cases of a change of control of the Corporation in any event, all of his unvested rights in any stock option or other benefit plan will also immediately vest in full. If all of Mr. Hardy’s unvested options as at October 31, 2012 had vested on that date upon any of such events, the value of the newly vested options would have been approximately $933,412.

Nicholas S. Bozikis, Chief Financial Officer

Mr. Bozikis entered into an employment agreement dated May 21, 2008 with the Corporation (the “Bozikis Agreement”). The Bozikis Agreement is effective for so long as Mr. Bozikis is employed by the Corporation, subject to the termination provisions in the agreement. If the Corporation terminates the Bozikis Agreement without cause or if the termination of Mr. Bozikis’ employment occurs in contemplation of, at the time of, or within 18 months after a change of control of the Corporation, Mr. Bozikis would be entitled to receive an amount equal to 25% of his then annual base salary. If any such termination had occurred on October 31, 2012, Mr. Bozikis would have been entitled to receive approximately $47,500. The Bozikis Agreement also provides that, upon Mr. Bozikis ceasing to be an employee of the Corporation, he shall conduct himself in a manner as will not breach any fiduciary duty he owes to the Corporation and will continue to be subject to the confidentiality provisions in the Bozikis Agreement. In addition, upon any termination of the Bozikis Agreement, Mr. Bozikis will not solicit any business from any person or entity which was a customer or client of the Corporation during Mr. Bozikis’ employment, or accept business from any customers or clients of the Corporation for a one-year period. In the event of a change of control of the Corporation for the purposes of the Option Plan, all unvested options then held by Mr. Bozikis will immediately vest. If all of Mr. Bozikis’ unvested options as at October 31, 2012 had vested on that date upon such change of control of the Corporation, the value of the newly vested options would have been approximately $88,661.

Terry Vanderkruyk, Vice President, Corporate Development

Mr. Vanderkruyk entered into an employment agreement dated January 15, 2006 with the Corporation (the “Vanderkruyk Agreement”). The Vanderkruyk Agreement is effective for so long as Mr. Vanderkruyk is employed

12

by the Corporation, subject to the termination provisions in the agreement. If the Corporation terminates the Vanderkruyk Agreement without cause or if the termination of Mr. Vanderkruyk’s employment occurs in contemplation of, at the time of, or within 18 months after a change of control of the Corporation, Mr. Vanderkruyk would be entitled to receive an amount equal to 50% of his then annual base salary. If any such termination had occurred on October 31, 2012, Mr. Vanderkruyk would have been entitled to receive approximately $75,000. The Vanderkruyk Agreement also provides that, upon Mr. Vanderkruyk ceasing to be an employee of the Corporation, he shall conduct himself in a manner as will not breach any fiduciary duty he owes to the Corporation and will continue to be subject to the confidentiality provisions in the Vanderkruyk Agreement. In addition, upon any termination of the Vanderkruyk Agreement, Mr. Vanderkruyk will not solicit any business from any person or entity which was a customer or client of the Corporation during Mr. Vanderkruyk’s employment, or accept business from any customers or clients of the Corporation for a three-year period. In the event of a change of control of the Corporation for the purposes of the Option Plan, all unvested options then held by Mr. Vanderkruyk will immediately vest. If all of Mr. Vanderkruyk’s unvested options as at October 31, 2012 had vested on that date upon such change of control of the Corporation, the value of the newly vested options would have been approximately $18,332.

Director Compensation

Discussion of Directors’ Compensation

Pursuant to the Directors’ Compensation Policy, as amended, inside directors are not paid any compensation. Outside directors are paid an annual retainer of $20,000. In addition, outside directors are paid $1,000 for each Board meeting attended and for each committee meeting attended. In addition, the chairperson of the Audit Committee receives an additional $13,000 per year and the chairperson of each other committee receives an additional $5,000 per year (the only other current standing committee is the Compensation Committee). Outside directors are also entitled to a grant of stock options to purchase 5,000 Common Shares concurrent with each year’s annual meeting with such grant subject to consent by the Board after each annual meeting. All payments made to outside directors pursuant to the Directors’ Compensation Policy are payable in arrears and on a semi-annual basis at the end of June and December each year.

Under the Directors’ Expenses Reimbursement Policy and Procedures, both inside and outside directors are entitled to reimbursement of travel and other expenses incurred in the conduct of the Corporation’s business.

The Corporation has no pension plan or other arrangement for non-cash compensation to the directors, except for stock options. Pursuant to the terms of the Option Plan, the number of options issuable to each non-employee director, at any time, under all security-based compensation arrangements of the Corporation, cannot exceed 1% of the issued and outstanding Common Shares.

13

Director Compensation Table

The following table provides a summary of compensation earned by the directors of the Corporation (other than Roger V. Hardy who is a Named Executive Officer) during the financial year ended October 31, 2012. For Mr. Hardy’s compensation during the financial year ended October 31, 2012, see “Executive Compensation — Summary Compensation Table”.

Name | | Fees

earned

($) | | Share-based

awards

($) | | Option-based

awards (1)

($) | | Non-equity incentive

plan compensation

($) | | Pension

value

($) | | All other

compensation

($) | | Total

($) | |

MURRAY MCBRIDE | | 30,000 | | Nil | | 7,919 | | Nil | | Nil | | Nil | | 37,919 | |

MICHAELA TOKARSKI | | 28,000 | | Nil | | 7,919 | | Nil | | Nil | | Nil | | 35,919 | |

JEFFREY MASON | | 50,750 | | Nil | | 7,919 | | Nil | | Nil | | Nil | | 58,669 | |

JOHN CURRIE | | 16,250 | | Nil | | 7,909 | | Nil | | Nil | | Nil | | 24,159 | |

JEFF BOOTH | | 16,000 | | Nil | | 7,909 | | Nil | | Nil | | Nil | | 23,909 | |

NEEL GROVER (2) | | 5,000 | | Nil | | Nil | | Nil | | Nil | | Nil | | 5,000 | |

STUART BELKIN (3) | | 8,000 | | Nil | | Nil | | Nil | | Nil | | Nil | | 8,000 | |

TUSHAR SHAH (4) | | Nil | | Nil | | NIl | | Nil | | Nil | | Nil | | Nil | |

(1) The grant date fair value of each option granted during the financial year ended October 31, 2012 is estimated on the date of grant using the Black-Scholes option pricing model, with the following assumptions: expected volatility of 45.1%; risk-free interest rate of 1.28%; expected option life of five years; and expected dividend rate of nil. The Black-Scholes pricing methodology was used in this estimate of fair value as it is an established calculation widely used by the financial industry for securities valuations and is supported as an appropriate methodology by Section 3870 of the CICA Handbook.

(2) Mr. Grover was appointed as a director of the Corporation on October 10, 2012.

(3) Mr. Belkin resigned as a director of the Corporation on January 17, 2012.

(4) Mr. Shah resigned as a director of the Corporation on October 9, 2012.

Incentive Plan Awards

Outstanding share-based awards and option-based awards

The following table provides information on share-based and option-based awards to directors of the Corporation (other than Roger V. Hardy who is a Named Executive Officer) that were outstanding as at October 31, 2012. For information regarding Mr. Hardy’s incentive plan awards during financial 2012, see “Executive Compensation—Summary Compensation Table”. There are no incentive plan awards in the form of share-based awards outstanding for the directors.

| | Option-based Awards | | Share-based Awards | |

Name | | Number of securities

underlying

unexercised options (1)

(#) | | Option

exercise

price

($) | | Option expiration date | | Value of

unexercised in-

the-money

options (2)

($) | | Number of shares

or units of shares

that have not

vested

(#) | | Market or payout

value of share-

based awards

that have not

vested

($) | |

MURRAY MCBRIDE | | 5,000 | | 5.24 | | December 22, 2016 | | 8,800 | | Nil | | N/A | |

| | 5,000 | | 3.24 | | December 23, 2015 | | 18,800 | | Nil | | N/A | |

| | 5,000 | | 2.84 | | March 26, 2015 | | 20,800 | | Nil | | N/A | |

| | 5,000 | | 2.16 | | August 25, 2014 | | 24,200 | | Nil | | N/A | |

MICHAELA TOKARSKI | | 5,000 | | 5.24 | | December 22, 2016 | | 8,800 | | Nil | | N/A | |

| | 5,000 | | 3.24 | | December 23, 2015 | | 18,800 | | Nil | | N/A | |

| | 5,000 | | 2.84 | | March 26, 2015 | | 20,800 | | Nil | | N/A | |

| | 5,000 | | 2.16 | | August 25, 2014 | | 24,200 | | Nil | | N/A | |

| | 5,000 | | 2.10 | | March 23, 2013 | | 24,500 | | Nil | | N/A | |

JEFFREY MASON | | 5,000 | | 5.24 | | December 22, 2016 | | 8,800 | | Nil | | N/A | |

| | 5,000 | | 3.24 | | December 23, 2015 | | 18,800 | | Nil | | N/A | |

| | 5,000 | | 2.84 | | March 26, 2015 | | 20,800 | | Nil | | N/A | |

| | 5,000 | | 2.16 | | August 25, 2014 | | 24,200 | | Nil | | N/A | |

| | 5,000 | | 2.10 | | March 23, 2013 | | 24,500 | | Nil | | N/A | |

JOHN CURRIE | | 5,000 | | 5.78 | | June 19, 2017 | | 6,100 | | Nil | | N/A | |

14

| | Option-based Awards | | Share-based Awards | |

Name | | Number of securities

underlying

unexercised options (1)

(#) | | Option

exercise

price

($) | | Option expiration date | | Value of

unexercised in-

the-money

options (2)

($) | | Number of shares

or units of shares

that have not

vested

(#) | | Market or payout

value of share-

based awards

that have not

vested

($) | |

JEFF BOOTH | | 5,000 | | 5.78 | | June 19, 2017 | | 6,100 | | Nil | | N/A | |

NEEL GROVER | | Nil | | N/A | | N/A | | N/A | | Nil | | N/A | |

(1) Options were granted with a five-year term and vest as to 1,000 options immediately upon grant with remaining options vesting as to one-sixth of the options each six-month period during the initial three-year period of the option term.

(2) The value of unexercised in-the-money options is calculated by multiplying the difference between the closing price of the Common Shares on the Toronto Stock Exchange on October 31, 2012, which was $7.00, and the option exercise price, by the number of outstanding options. These stock options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise.

Incentive plan awards—value vested or earned during the year

The following table provides information for directors of the Corporation (other than Roger V. Hardy who is a Named Executive Officer) on value of incentive awards vested or earned during the financial year ended October 31, 2012. For information on the value of incentive awards vested or earned by Mr. Hardy during financial 2012, see “Executive Compensation — Summary Compensation Table”. The Corporation did not grant any share-based awards during the financial year ended October 31, 2012 nor did any value vest in connection with share-based awards.

Name | | Option-based awards - Value

vested during the year

($) | | Share-based awards - Value

vested during the year

($) | | Non-equity incentive plan

compensation - Value earned

during the year

($) | |

MURRAY MCBRIDE | | 5,000 | | Nil | | Nil | |

MICHAELA TOKARSKI | | 5,000 | | Nil | | Nil | |

JEFFREY MASON | | 5,000 | | Nil | | Nil | |

JOHN CURRIE | | 500 | | Nil | | Nil | |

JEFF BOOTH | | 500 | | Nil | | Nil | |

NEEL GROVER | | Nil | | Nil | | Nil | |

TUSHAR SHAH | | Nil | | Nil | | Nil | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS

The following table sets out information on the Corporation’s equity compensation plan under which Common Shares are authorized for issuance as at October 31, 2012. The information shown for “Equity compensation plans approved by securityholders” relates to the Option Plan.

EQUITY COMPENSATION PLAN INFORMATION

Plan Category | | Number of Securities to be

issued upon exercise of

outstanding options, warrants

and rights

(a) | | Weighted average exercise

price of outstanding options,

warrants and rights

(b) | | Number of securities remaining

available for future issuance under

equity compensation plans

(excluding securities reflected in

column (a))

(c) | |

Equity compensation plans approved by securityholders | | 2,307,833 | | $ | 3.45 | | 553,742 | (1) |

Equity compensation plans not approved by securityholders | | N/A | | N/A | | N/A | |

Total | | 2,307,833 | | $ | 3.45 | | 553,742 | |

(1) Currently, the total number of Common Shares that may be reserved and authorized for issuance pursuant to options granted under the Option Plan is 10% of the issued and outstanding Common Shares from time to time (being 2,861,575 Common Shares as at

15

October 31, 2012). As discussed under, “Particulars of Other Matters to be Acted Upon — Amendments to the Stock Option Plan”, management proposes to increase the total number of Common Shares available to be granted under the Option Plan from 10% to 12.5% of the issued and outstanding Common Shares from time to time.

MANAGEMENT CONTRACTS

No management functions of the Corporation are to any substantial degree performed by a person other than the directors or executive officers of the Corporation.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS

Aggregate Indebtedness

As at January 28, 2013, there was no indebtedness outstanding of any current or former director, executive officer or employee of the Corporation or any of its subsidiaries which is owing to the Corporation or any of its subsidiaries or to another entity which is the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation or any of its subsidiaries, entered into in connection with a purchase of securities or otherwise.

Indebtedness of Directors and Executive Officers under Securities Purchase and Other Programs

The following table sets out information for each individual who is, or at any time during the financial year ended October 31, 2012 was, a director or executive officer of the Corporation, each proposed nominee for election as a director of the Corporation, and each associate of any such director, executive officer or proposed nominee, who is, or at any time since November 1, 2011 has been, indebted to the Corporation or any of its subsidiaries, or whose indebtedness to another entity is, or at any time since November 1, 2011 has been, the subject of a guarantee, support agreement, letter of credit or other similar arrangement or understanding provided by the Corporation or any of its subsidiaries.

INDEBTEDNESS OF DIRECTORS AND EXECUTIVE OFFICERS UNDER SECURITIES PURCHASE AND OTHER PROGRAMS

Name and principal

position | | Involvement

of Corporation

or subsidiary | | Largest amount

outstanding

during year ended

October 31, 2012

($) | | Amount

outstanding as

at January 28,

2013

($) | | Financially

assisted securities

purchased during

year ended

October 31, 2011

(#) | | Security for

indebtedness | | Amount

forgiven

during year

ended

October 31,

2012

($) | |

STEVE BOCHEN Chief Operating Officer | | Corporation | | 28,500 | (1) | Nil | | Nil | | Nil | | Nil | |

TERRY VANDERKRUYK Vice President, Corporate Development | | Corporation | | 101,600 | (1) | Nil | | Nil | | Nil | | Nil | |

NANCY MORISON Vice President, Operations | | Corporation | | 18,150 | (1) | Nil | | Nil | | Nil | | Nil | |

(1) These amounts represent loans to the respective executive officers to facilitate the purchase of Common Shares upon exercise of options granted under the Option Plan. The Corporation no longer provides such financial assistance.

16

INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS

Except as otherwise disclosed herein or as previously disclosed in a Management Information Circular of the Corporation, no informed person (i.e. insider) of the Corporation, no proposed director of the Corporation, and no associate or affiliate of any informed person or proposed director has had any material interest, direct or indirect, in any transaction since November 1, 2011 or in any proposed transaction which has materially affected or would materially affect the Corporation or any of its subsidiaries.

PARTICULARS OF MATTERS TO BE ACTED UPON

Election of Directors

Historically, the Corporation has had three classes of directors, resulting in the directors serving staggered terms. Beginning this year, however, each of the Corporation’s directors will be elected annually for a one year term or until the director’s successor is elected or appointed, unless his or her office is earlier vacated in accordance with the articles of the Corporation or under the provisions of the Canada Business Corporations Act (the “CBCA”).

Accordingly, at the Meeting, shareholders of the Corporation will be called upon to elect Roger V. Hardy, Murray McBride, Michaela Tokarski, Jeffrey Mason, John Currie, Jeff Booth and Neel Grover (the “Nominees”) as directors to serve for a term of one year until the next annual meeting of shareholders of the Corporation.

The Corporation has not adopted a ‘majority voting policy’ which requires that a nominee director receive a greater number of “for” votes than “withheld” votes. The Board believes that additional consideration is required before determining whether to further change the manner in which the Corporation’s directors are elected. As part of its ongoing commitment to corporate governance, the Board will continue to consider whether or not to adopt a majority voting policy in the future.

While management does not contemplate that the Nominees will be unable to serve as directors, if prior to the Meeting any vacancy occurs in the slate of such Nominees for any reason, the management representatives designated in the form of proxy solicited in respect of the Meeting shall have discretionary authority to vote for the election of any other person as a director. Proxies received by the directors on which no designation is made will be voted for the management Nominees for election as directors or any substitute nominee(s) thereof as may be determined by management, if necessary.

The following table sets out the name of each of the Nominees; all positions and offices with the Corporation presently held by each Nominee; that person’s principal occupation, business or employment; the period during which that person has served as a director; and the number of Common Shares that the Corporation is advised are beneficially owned by that person, directly or indirectly, or over which control or direction is exercised, as of January 28, 2013.

Name, place of residence and

positions with the Corporation | | Present principal occupation,

business or employment | | Period served as a director | | Common Shares

beneficially owned

or controlled/

directed | |

| | | | | | | |

ROGER V. HARDY British Columbia, Canada Chairman, Chief Executive Officer and Director | | Chairman and Chief Executive Officer of the Corporation | | Since July 1, 2002 | | 3,327,387 | |

| | | | | | | |

MURRAY McBRIDE Ontario, Canada Director | | Business Consultant, Murray McBride Consulting Services Ltd. | | From December 14, 2000 to March 5, 2001 and since December 29, 2003 | | 308,000 | |

17

Name, place of residence and

positions with the Corporation | | Present principal occupation,

business or employment | | Period served as a director | | Common Shares

beneficially owned

or controlled/

directed | |

| | | | | | | |

MICHAELA TOKARSKI Ontario, Canada Director | | Strategic and Marketing Consultant, Creekside Communications Inc. (e-business communications consulting company) | | Since February 12, 2001 | | 845,500 | |

| | | | | | | |

JEFFREY MASON (1)(2) British Columbia, Canada Director | | Chief Financial Officer of Prophecy Platinum Corp. and Prophecy Coal Corp. (mining companies) | | Since October 16, 2006 | | 180,550 | |

| | | | | | | |

JOHN CURRIE (1)(2) British Columbia, Canada Director | | Chief Financial Officer of lululemon athletica inc. (athletic apparel manufacturer/retailer) | | Since April 20, 2012 | | 3,500 | |

| | | | | | | |

JEFF BOOTH (1)(2) British Columbia, Canada Director | | Chief Executive Officer and Co-founder of BuildDirect.com (online retailer of building materials) | | Since April 20, 2012 | | Nil | |

| | | | | | | |

NEEL GROVER California, United States Director | | Operating Partner at Clearlake Capital Group (investment firm); from May 2006 to September 2012, Mr. Grover was the Chief Executive Officer and President of Rakuten.com Shopping (formerly Buy.com) | | October 10, 2012 | | Nil | |

(1) Member of the Audit Committee. Mr. Mason is the Chairman of the Audit Committee.

(2) Member of the Compensation and Corporate Governance Committee. Mr. Currie is the Chairman of the Compensation and Corporate Governance Committee.

Director Biographies

The principal occupations, businesses or employments of each of the Nominees within the past five years are as disclosed in the brief biographies set forth below.

Roger V. Hardy — Chairman, Chief Executive Officer and Director. Since December 2003, Mr. Hardy has been the Corporation’s Chairman. From July 2002 until present, Mr. Hardy has been the Corporation’s Chief Executive Officer and a director of the Corporation. Mr. Hardy was the President of the Corporation from July 2002 until December 2003 and from September 2006 until August 2012. Mr. Hardy also serves on the board of BuildDirect.com, a leading building products retailer; and on the board of Shoeme.com, a leading online seller of shoes in Canada.

Murray McBride — Director. From December 2000 until March 2001 and since December 2003, Mr. McBride has been a director of the Corporation. From February 1982 until present, Mr. McBride has been a business consultant with Murray McBride Consulting Services Ltd. Mr. McBride acquired significant financial experience and exposure to accounting and financial issues while serving in a number of positions, including: Chairman of the Intellivest Group of Companies, President of the Alexander Proudfoot Company of Canada, Member of Parliament of Canada, Chairman of the Canadian Egg Marketing Agency, Vice Chairman and General Manager of the Farm Credit Corporation of Canada, Chief of Staff of the Canadian Ministry of Consumer and Corporate Affairs and Chief of Staff of the Postmaster General of Canada.

Michaela Tokarski — Director. Since February 2001, Ms. Tokarski has been a director of the Corporation. Since September 2007, Ms. Tokarski has been a strategic and marketing consultant with Creekside Communications Inc. (an e-business communications consulting company). From July 2006 until August 2007, she was the Vice

18

President, Marketing at MODASolutions Corporation. From October 2000 until July 2006, Ms. Tokarski was the Director, Sales and Marketing and Vice President, Product Management of Coastal.

Jeffrey Mason — Director. Since October 2006, Mr. Mason has been a director of the Corporation. In addition, Mr. Mason is also a director of Amarc Resources Ltd., Slater Mining Corporation and Red Eagle Mining Corporation. Mr. Mason serves as Chief Financial Officer of both Prophecy Coal Corp., with coal mining and a power generation plant project in Mongolia, and Prophecy Platinum Corp., with nickel PGM and copper minerals in the Yukon, Ontario and Uruguay. Previously, Mr. Mason was Chief Financial Officer and a director of Hunter Dickinson Inc. and has spent the last 19 years as a corporate officer, including Chief Financial Officer, and director to a number of publicly-traded companies (TSX, NYSE MKT and NASDAQ). Mr. Mason is a Chartered Accountant and holds an Institute of Corporate Directors designation.

John Currie — Director. Since April 2012, Mr. Currie has been a director of the Corporation. Mr. Currie currently holds the role of Executive Vice President, Chief Financial Officer of lululemon athletica inc. (athletic apparel manufacturer/retailer listed on NASDAQ and the TSX) since January 2007. Prior thereto, Mr. Currie was Chief Financial Officer of Intrawest Corporation (now Intrawest ULC, a destination resort company listed on the New York Stock Exchange and the TSX). In November 2012, Mr. Currie also became a director for the Vancouver Airport Authority.

Jeff Booth — Director. Since April 2012, Mr. Booth has been a director of the Corporation. Mr. Booth is the Founder and Chief Executive Officer of BuildDirect.com (online retailer of building materials) since 1999. Mr. Booth’s professional background includes seven years of senior management in real estate and construction industries.

Neel Grover — Director. Mr. Grover currently serves as an Operating Partner at Clearlake Capital Group. Prior to that, Mr. Grover served as the Chief Executive Officer and President of Rakuten.com Shopping (formerly Buy.com) from May 2006 until September 2012 after having served as President and Chief Operating Officer from September 2003. Prior to that, Mr. Grover was President of ThinkTank Holdings from 2000 until 2003. Mr. Grover remains a director of Rakuten.com Shopping and Rakuten U.S.A, in addition to the SWI Group.

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

No Nominee is, as at the date of this Management Information Circular, or has been, within the 10 years preceding the date of this Management Information Circular, a director, chief executive officer or chief financial officer of any company (including the Corporation) that:

(a) was subject to a cease trade or similar order or an order that denied the relevant company access to any exemption under securities legislation that was in effect for a period of more than 30 consecutive days (collectively, an “Order”), when such Order was issued while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company; or

(b) was subject to an Order that was issued after such person ceased to be a director, chief executive officer or chief financial officer of the relevant company, and which resulted from an event that occurred while the person was acting in the capacity of a director, chief executive officer or chief financial officer of the relevant company.

No Nominee is, as at the date of this Management Information Circular, or has been, within the 10 years preceding the date of this Management Information Circular, a director or executive officer of any company (including the Corporation) that, while that person was acting in that capacity, or within one year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets.

19

No Nominee has, within the 10 years preceding the date of this Management Information Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of that person.

No Nominee has been subject to (a) any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority, or (b) any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable shareholder in deciding whether to vote for a proposed director.

Appointment of Auditor

The persons named in the enclosed form of proxy intend to vote for the appointment of KPMG LLP, Chartered Accountants, as the auditor of the Corporation to hold office until the next annual meeting of shareholders of the Corporation. KPMG LLP was first appointed as the auditor of the Corporation on January 16, 2008.

Approval of Unallocated Options Under the Stock Option Plan

Pursuant to the policies of the TSX, all unallocated options, rights, or other entitlements under a security-based compensation arrangement which does not have a fixed maximum number of securities issuable must be approved by the listed issuer’s security holders every three years after the institution of the arrangement. In the case of the Option Plan, it was last approved by shareholders in March 2010. A description of the Option Plan is provided under the heading “Compensation of Executive Officers and Directors — Option-based Awards”.

Unallocated options were approved by the shareholders of the Corporation at the Corporation’s annual general meeting on March 26, 2010. As the three-year term prescribed by the TSX expires on March 26, 2013, an ordinary resolution (the “Options Resolution”) will be placed before the shareholders to approve the unallocated options. This approval will be effective for three years from the date of the Meeting. If approval is not obtained at the Meeting, options which have not been allocated as of March 26, 2013 and Common Shares underlying options which are outstanding as at March 26, 2013 and are subsequently cancelled or terminated will not be available for a new grant of options. Previously allocated options will be unaffected by the approval or disapproval of the Options Resolution.

As at the date of this Management Information Circular, options to purchase a total of 2,843,084 Common Shares are outstanding, representing approximately 9.9% of the issued and outstanding Common Shares. As a result, there are 18,991 unallocated options available under the Option Plan, representing approximately 0.1% of the issued and outstanding Common Shares.

The following is the text of the Options Resolution to be considered at the Meeting:

“BE IT RESOLVED THAT:

1. All unallocated stock options under the Option Plan of the Corporation, as amended from time to time, are hereby approved and authorized and the Corporation is authorized to continue granting options under the Option Plan until February 28, 2016, which is the date that is three years from the date where shareholder approval is being sought; and

2. Any one director or officer of the Corporation be and is hereby directed and authorized to take all necessary actions, steps and proceedings and to execute, deliver and file any and all declarations, agreements, documents and other instruments and do all such other acts and things that may be necessary or desirable to give effect to this resolution, including the filing of all necessary documents with regulatory authorities including the

20

TSX.”

The Board of Directors of the Corporation recommends that shareholders vote FOR the approval of the Options Resolution.

The named proxyholders intend to vote the Common Shares represented by such proxy for the approval of the Options Resolution unless a shareholder has directed in the proxy that such Common Shares be voted against it.

Approval of Amendments to the Stock Option Plan

At the Meeting, shareholders will be asked to approve an ordinary resolution amending the terms of the Option Plan to: (i) increase the maximum number of Common Shares which may be issued upon exercise of options granted under the Option Plan from 10% to 12.5% of the issued and outstanding Common Shares from time to time; and (ii) add a provision to allow for the expiry date for an option that expires during a self-imposed blackout period, or within 48 hours following the end of any self-imposed blackout period, to be extended to the date that is 10 calendar days following the end of such blackout period (collectively, the “Option Plan Amendments Resolution”). Other amendments of a “housekeeping” nature will be made to the Option Plan.

As at the date of this Management Information Circular, options to purchase a total of 2,843,084 Common Shares are outstanding, representing approximately 9.9% of the issued and outstanding Common Shares. As a result, there are 18,991 unallocated options available under the Option Plan, representing approximately 0.1% of the issued and outstanding Common Shares. Accordingly, in order to give the Board flexibility to grant additional options in future years when the Board considers it to be in the Corporation’s best interests to do so, the Board is seeking approval to increase the maximum number of Common Shares issuable under the Option Plan from an amount equal to 10% of the issued and outstanding Common Shares (from time to time) to an amount equal to 12.5% of the issued and outstanding Common Shares (from time to time). If this amendment is approved by shareholders and based on the number of Common Shares issued and outstanding as at the date of this Management Information Circular, there will be available under the Option Plan options to purchase an additional 715,518 Common Shares.

Shareholders will be asked to approve the Option Plan Amendments Resolution at the Meeting. The affirmative vote of the holders of the majority of the Common Shares represented and voting at the Meeting will be required to approve the Option Plan Amendments Resolution.

The following is the text of the Option Plan Amendments Resolution to be considered at the Meeting:

“BE IT RESOLVED THAT: