QuickLinks -- Click here to rapidly navigate through this document

As filed with the Securities and Exchange Commission on June 8, 2005

Registration Statement No. 333-124104

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549-1004

AMENDMENT NO. 1

TO

FORMS F-4* AND S-4*

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

CASCADES INC.

(Exact Name of Registrant as Specified in Its Charter)

| Québec, Canada (State or Other Jurisdiction of Incorporation or Organization) | 2600 (Primary Standard Industrial Classification Code Number) | 98-0140192 (I.R.S. Employer Identification Number) |

404 Marie-Victorin Blvd.

Kingsey Falls, Québec, Canada J0A 1B0

(819) 363-5100

(Address, including zip code, and telephone number, including area code,

of registrant's principal executive offices)

Robert F. Hall

Vice President, Legal Affairs and Corporate Secretary

404 Marie-Victorin Blvd.

Kingsey Falls, Québec, Canada J0A 1B0

(819) 363-5100

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies To:

Meredith Berkowitz, Esq.

Jones Day

222 East 41st Street

New York, New York 10017

(212) 326-3939

Approximate date of commencement of proposed sale to the public: As soon as practicable after this Registration Statement becomes effective.

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

TABLE OF ADDITIONAL REGISTRANTS

| Exact Name of Registrant as Specified in its Charter | State or Other Jurisdiction of Incorporation or Organization | I.R.S. Employer Identification Number | ||

|---|---|---|---|---|

| Cascades Auburn Fiber Inc. | Delaware | 01-0518538 | ||

| Cascades Boxboard Group Inc. | Canada | Not Applicable | ||

| Cascades Boxboard U.S., Inc. | Delaware | 52-2052689 | ||

| Cascades Canada Inc. | Canada | 98-0454050 | ||

| Cascades Delaware LLC | Delaware | Not Applicable | ||

| Cascades Diamond, Inc. | Massachusetts | 04-3049944 | ||

| Cascades Fine Papers Group (Sales) Inc. | Delaware | 14-1685880 | ||

| Cascades Fine Papers Group (USA) Inc. | New York | 52-1291428 | ||

| Cascades Fine Papers Group Inc. | Canada | Not Applicable | ||

| Cascades Fine Papers Group Thunder Bay Inc. | Canada | Not Applicable | ||

| Cascades Moulded Pulp, Inc. | North Carolina | 56-1522825 | ||

| Cascades Nova Scotia Company | Nova Scotia | Not Applicable | ||

| Cascades Plastics Inc. | Delaware | 43-1888636 | ||

| Cascades Tissue Group—Arizona Inc. | Delaware | 45-0470187 | ||

| Cascades Tissue Group—IFC Disposables Inc. | Tennessee | 62-1454515 | ||

| Cascades Tissue Group—New York Inc. | Delaware | 45-0470185 | ||

| Cascades Tissue Group—North Carolina Inc. | North Carolina | 56-1374538 | ||

| Cascades Tissue Group—Oregon Inc. | Delaware | 82-0543336 | ||

| Cascades Tissue Group—Pennsylvania Inc. | Delaware | 23-3091814 | ||

| Cascades Tissue Group—Pickering Inc. | Canada | Not Applicable | ||

| Cascades Tissue Group—Sales Inc. | Delaware | 11-3726050 | ||

| Cascades Tissue Group—Tennessee Inc. | Delaware | 68-0554988 | ||

| Cascades Tissue Group—Wisconsin Inc. | Delaware | 52-2338207 | ||

| Cascades Transport Inc. | Canada | 98-0417452 | ||

| Cascades USA Inc. | Delaware | 68-0592968 | ||

| Conference Cup Ltd. | Ontario, Canada | Not Applicable | ||

| Dopaco, Inc. | Pennsylvania | 23-2106485 | ||

| Dopaco Canada, Inc. | Canada | Not Applicable | ||

| Dopaco Limited Partnership | Delaware | 23-2925650 | ||

| Dopaco Pacific LLC | Delaware | 23-2914117 | ||

| Garven Incorporated | Ontario, Canada | Not Applicable | ||

| Kingsey Falls Investments Inc. | Canada | Not Applicable | ||

| Rabotage Lemay Inc. | Québec, Canada | Not Applicable | ||

| Scierie Lemay Inc. | Québec, Canada | Not Applicable | ||

| W.H. Smith Paper Corporation | New York | 14-1077370 | ||

| 3815285 Canada Inc. | Canada | Not Applicable | ||

| 3815315 Canada Inc. | Canada | 98-0444929 | ||

| 6265642 Canada Inc. | Canada | Not Applicable |

All of the additional registrants have their principal executive offices c/o Cascades Inc., 404 Marie-Victorin Blvd., Kingsey Falls, Québec, Canada J0A 1B0.

- *

- This registration statement comprises a filing on Form F-4 with respect to the securities of the non-U.S. registrants and a filing on Form S-4 with respect to the securities of the U.S. registrants.

Information contained herein is subject to completion or amendment. A registration statement relating to these securities has been filed with the Securities and Exchange Commission. These securities may not be sold nor may offers to buy be accepted prior to the time the registration statement becomes effective. This prospectus shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of these securities in any State in which such offer solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such State.

PROSPECTUS SUBJECT TO COMPLETION, DATED JUNE 8, 2005

US$125,000,000

Cascades Inc.

Offer to exchange our 71/4% Senior Notes due 2013, which have

been registered under the Securities Act, for our outstanding

restricted 71/4% Senior Notes due 2013 issued in December 2004

On December 2, 2004, we issued US$125.0 million restricted 71/4% Senior Notes due 2013 in a private placement. We refer to these as our outstanding restricted notes. These notes are part of the same class of securities as our US$550.0 million in aggregate principal amount of 71/4% Senior Notes due 2013, which we refer to as our outstanding unrestricted notes, except they are subject to restrictions on transfer, and were issued under the same indenture as the outstanding unrestricted notes.

We are offering to exchange all outstanding restricted notes that are validly tendered and not validly withdrawn for an equal principal amount of exchange notes that will be freely transferable. The exchange notes will be part of the same class of securities as our outstanding unrestricted notes.

You may withdraw tenders of outstanding restricted notes at any time prior to the expiration of the exchange offer.

The exchange offer expires at 5:00 p.m. New York City Time, on , 2005, unless extended. We do not currently intend to extend the expiration date but, if extended, the exchange offer will remain open for a maximum of 45 business days after the date of this prospectus.

We do not intend to list the exchange notes on any securities exchange or to seek approval through any automated quotation system, and no active public market for the exchange notes is anticipated.

Each broker-dealer that receives exchange notes for its own account pursuant to the registered exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for outstanding restricted notes where the outstanding restricted notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, for a period of 90 days after the expiration date, we will make this prospectus available to any broker-dealer for use in connection with these resales. See "Plan of Distribution."

You should consider carefully the risk factors beginning on page 16 of this prospectus before deciding to participate in the exchange offer.

Neither the Securities and Exchange Commission nor any state securities commission or other similar authority has approved these notes or determined that this prospectus is accurate or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2005

| | Page | |

|---|---|---|

| Market and Industry Data and Forecasts | ii | |

| Forward-Looking Statements | ii | |

| Summary | 1 | |

| Risk Factors | 16 | |

| The Exchange Offer | 29 | |

| Use of Proceeds | 38 | |

| Capitalization | 39 | |

| Exchange Rate Data and Exchange Controls | 40 | |

| Selected Historical Consolidated Financial Information | 41 | |

| Management's Discussion and Analysis of Financial Position and Operating Results | 45 | |

| Business | 74 | |

| Management | 94 | |

| Principal Shareholders | 104 | |

| Related Party Transactions and Other Material Contracts | 106 | |

| Description of Other Indebtedness | 109 | |

| Description of Notes | 112 | |

| Registration Rights for Outstanding Restricted Notes | 166 | |

| Notice To Canadian Investors | 168 | |

| Important U.S. and Canadian Tax Considerations | 169 | |

| Plan of Distribution | 173 | |

| Legal Matters | 173 | |

| Experts | 173 | |

| Enforceability of Civil Liabilities | 174 | |

| Where You Can Find More Information | 174 | |

| Index to Financial Statements | F-1 |

You should rely only on the information contained in this prospectus or in the documents to which we have referred you. We have not authorized anyone to provide you with information that is different. This prospectus may only be used where it is legal to make the exchange offer and by a broker-dealer for resales of exchange notes acquired in the exchange offer where it is legal to do so. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

The exchange notes have not been and will not be qualified for public distribution under the securities laws of any province or territory of Canada. The exchange notes are not being offered for sale and may not be offered or sold, directly or indirectly, in Canada or to any resident thereof except in accordance with the securities laws of the provinces and territories of Canada. The outstanding restricted notes have been issued pursuant to exemptions from the prospectus requirements of the applicable Canadian provincial and territorial securities laws and may be sold in Canada only pursuant to an exemption therefrom.

Until 90 days after the expiration date, all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer's obligation to deliver a prospectus when acting as an underwriter and with respect to their unsold allotments and subscriptions and pursuant to the commitment to deliver a prospectus in connection with resales of exchange notes.

i

MARKET AND INDUSTRY DATA AND FORECASTS

Market and industry data and other statistical information and forecasts used throughout this prospectus are based on independent industry publications, government publications and reports by market research firms or other published independent sources. Some data are also based on our good faith estimates, which are derived from our review of internal surveys, as well as independent sources. Forecasts are particularly likely to be inaccurate, especially over long periods of time.

This prospectus contains forward-looking statements. You should not place undue reliance on these statements. Forward-looking statements include information concerning possible or assumed future results of operations, capital expenditures, the outcome of pending legal proceedings and claims, goals and objectives for future operations, including descriptions of our business strategies and purchase commitments from customers, among other things. These statements are typically identified by words such as "believe," "anticipate," "expect," "plan," "intend," "estimate" and similar expressions. We base these statements on particular assumptions that we have made in light of our industry experience, as well as our perception of historical trends, current conditions, expected future developments and other factors that we believe are appropriate under the circumstances. As you read and consider the information in this prospectus, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties and assumptions, the most important of which are described in "Risk Factors."

Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual financial results or results of operations and could cause actual results to differ materially from those expressed in the forward-looking statements. In light of these risks and uncertainties, there can be no assurance that the results and events contemplated by the forward-looking statements contained in this prospectus will in fact transpire.

ii

This summary highlights key information contained elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether or not to participate in the exchange offer. You should read this entire prospectus before making any decision.

Unless otherwise indicated, all financial information provided in this prospectus is presented in Canadian dollars and is derived from financial statements prepared in accordance with generally accepted accounting principles in Canada, or Canadian GAAP. References to "$" are to Canadian dollars and references to "US$" are to U.S. dollars. We have also included some convenience translations of Canadian dollars to U.S. dollars or U.S. dollars to Canadian dollars. These translations are solely for informational purposes and, unless otherwise stated, are based on the noon buying rate of the Bank of Canada on March 31, 2005, of $1.2096 to US$1.00.

Unless otherwise indicated or required by the context, as used in this prospectus, the terms "we," "our" and "us" refer to Cascades Inc. and all of our subsidiaries and joint ventures that are consolidated under Canadian GAAP. Under Canadian GAAP, joint ventures are proportionately consolidated. On August 24, 2004, we acquired the remaining 50% interest that we did not already own of Dopaco, Inc. Prior to this acquisition, Dopaco's fiscal year ended on March 31 of each year. When we refer to Dopaco's fiscal year, we are referring to the fiscal year ended on March 31 of that year. When we refer to the "restricted group" in this prospectus, we are referring to Cascades Inc. and only those of our subsidiaries that are restricted subsidiaries under the indenture governing the outstanding unrestricted notes, the outstanding restricted notes and the exchange notes, whether or not those subsidiaries have guaranteed the outstanding unrestricted notes or the outstanding restricted notes, or will guarantee the exchange notes, including our subsidiaries incorporated outside of Canada and the United States, but excluding our joint ventures and minority investments.

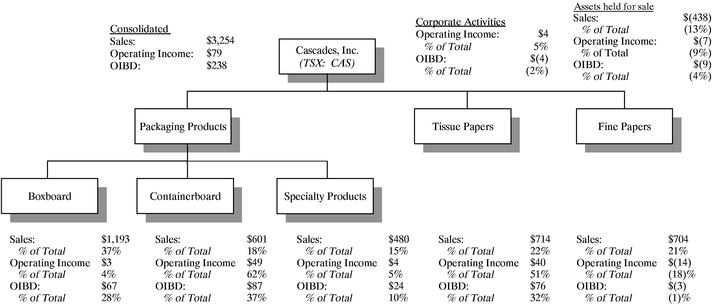

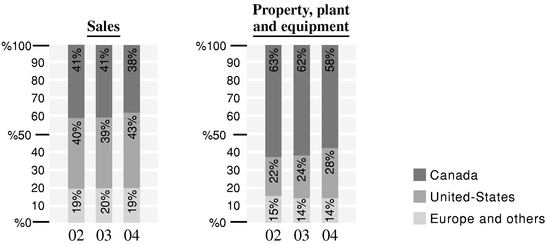

Our Business

We are a diversified producer of packaging products, tissue paper and fine papers with operations in Canada, the United States, Europe, Asia and Australia. We believe that we have leading market positions for many of our products in North America and are a leading producer of coated boxboard in Europe. We believe that our product and geographic diversification, the relative demand stability of a number of the end-markets we serve and our high utilization of recycled fiber have allowed us to maintain relatively stable operating margins through industry cycles. From 1994 to 2004, our net sales and operating income increased at compound annual growth rates of 8% and 4%, respectively. We have achieved this growth primarily by making acquisitions of what we believe to be attractive assets that fit within our core business lines, while maintaining disciplined financial management. In 2004, we had consolidated sales of $3.2 billion, operating income of $79 million and Operating Income before Depreciation and Amortization of $238 million. The restricted group had sales of $2.4 billion, operating income of $13 million and Adjusted Operating Income before Depreciation and Amortization of $131 million. In 2004, approximately 38% of our consolidated sales were in Canada, 43% in the United States and 19% in other countries, primarily in Europe.

We use the terms Operating Income before Depreciation and Amortization and Adjusted Operating Income before Depreciation and Amortization in this prospectus, which are non-GAAP financial measures within the meaning of the recent rules and regulations issued by the Securities and Exchange Commission on the use of non-GAAP financial measures. Adjusted Operating Income before Depreciation and Amortization is defined as operating income before depreciation and amortization plus cash dividends paid to us by joint ventures and companies in which we hold a minority interest. For a reconciliation of Operating Income before Depreciation and Amortization to net cash provided by (used in) operating activities and net earnings, which we believe to be the closest Canadian GAAP liquidity measures and performance to Operating Income before Depreciation and Amortization, and

1

of Adjusted Operating Income before Depreciation and Amortization to Operating Income before Depreciation and Amortization, and for an explanation of why we present Operating Income before Depreciation and Amortization and Adjusted Operating Income before Depreciation and Amortization information, see footnotes (c) and (e) to our summary historical consolidated financial information on pages 13 and 14.

Our operations are organized in three segments: packaging products, tissue paper and fine papers. Our packaging products segment includes boxboard and folding cartons, containerboard and corrugated packaging and specialty packaging products. All of our containerboard and corrugated packaging products are manufactured by Norampac Inc., a 50%-owned joint venture with Domtar Inc. We have added to our packaging products group through, among other things, the acquisition of the 50% interest that we did not already own in Dopaco, one of the largest North American suppliers of folding cartons for the quick service restaurant industry. Our tissue paper segment includes retail products for use by consumers at home, as well as commercial and industrial, or away-from-home, products. During 2004, we expanded our tissue paper operations by acquiring the assets of a tissue mill located in Memphis, Tennessee. Our fine papers segment includes both the manufacture of coated and uncoated papers and the distribution of fine papers and graphic arts products. During the fourth quarter of 2004, we initiated a divestiture plan for our distribution assets in the Fine Papers and Tissue Papers segments. We are also reviewing other strategic alternatives regarding our fine papers manufacturing assets.

The following chart shows how we are organized operationally by segment and, within packaging products, our core business lines:

Notes: Sales, operating income and Operating Income before Depreciation and Amortization (OIBD) figures shown are for 2004 and are expressed in millions of Canadian dollars. Our containerboard business consists solely of our 50% joint venture interest in Norampac.

Since our inception, we have owned or had interests in recycling operations and recycled paper has been our principal fiber source. We are currently Canada's largest consumer of recycled paper, consuming approximately 2.1 million short tons annually of which approximately 0.4 million short tons, or 19%, come from our own recovery network. We own or have interests in more than 20 recycled paper recovery centers in Canada and the United States. In July, 2004, we completed the acquisition of the 50% interest we did not already own in a de-inked pulp mill located in France, which allowed us to increase our recycling operations in Europe. Our experience as both a seller and a consumer of recycled paper gives us market knowledge that allows us to better anticipate industry trends, enabling

2

us to better manage our inventory levels and fiber costs. In addition, the technical knowledge that we have developed allows us to efficiently use a wide variety of recycled paper grades to produce our products.

We also produce virgin pulp, substantially all of which is consumed by our mill operations. On a net basis, in 2004, we purchased approximately 140,000 metric tonnes of various virgin and recycled pulp grades in the open market.

Competitive Strengths

We believe that we have a number of competitive strengths, which are described in more detail in "Business—Competitive Strengths," including:

- •

- a diversified portfolio of products and customers that operate in a broad range of industries;

- •

- a significant degree of converting integration, which in addition to increasing our proximity to our customers, leads to better overall operating margins;

- •

- a high utilization of recycled fiber, which we believe allows us to maintain relatively stable operating margins through industry cycles compared to competitors that rely more heavily on internally produced virgin fiber; and

- •

- a strong management team and corporate culture, which creates individual accountability at every level of our business.

Business Strategy

We intend to continue to capitalize on our leading market positions and core competencies to drive profitable growth by emphasizing the following key strategies:

- •

- improve efficiency and reduce costs;

- •

- enhance customer service;

- •

- focus on higher margin products and higher growth markets;

- •

- maintain disciplined financial management;

- •

- increase converting integration and access to recycled fiber; and

- •

- pursue strategic acquisitions.

Recent Developments

On March 31, 2005, our subsidiary Cascades Tissue Group—Pickering Inc., formerly known as Wood Wyant Inc., sold the distribution activities of its tissue paper segment for net consideration after the retention of liabilities of $16 million.

Our principal executive offices are located at 404 Marie-Victorin Boulevard, Kingsey Falls, Québec, Canada J0A 1B0, and our telephone number is (819) 363-5100. We also maintain a website atwww.cascades.com. However, the information on our website is not a part of this prospectus and you should rely only on the information contained in this prospectus when deciding whether or not to participate in the exchange offer.

3

| The Exchange Offer | We are offering to exchange up to US$125,000,000 aggregate principal amount of our registered 71/4% Senior Notes due 2013 for an equal principal amount of our outstanding restricted 71/4% Senior Notes due 2013 that were issued in a private placement in December 2004. The terms of the exchange notes are identical in all material respects to those of the outstanding restricted notes, except for transfer restrictions and registration rights relating to the outstanding restricted notes. The exchange notes will be of the same class as our outstanding unrestricted notes. | |

Purpose of the Exchange Offer | The exchange notes are being offered to satisfy our obligations under a registration rights agreement entered into at the time we issued and sold the outstanding restricted notes. | |

Expiration Date; Withdrawal of Tender | The exchange offer will expire at 5:00 p.m., New York City time, on , 2005, or on a later date and time to which we extend it, but if extended, the exchange offer will remain open for a maximum or 45 business days after the date of this prospectus. The tender of outstanding restricted notes in the exchange offer may be withdrawn at any time prior to the expiration date. The exchange date will be the second business day following the expiration date. Any outstanding restricted notes that are not accepted for exchange for any reason will be returned without expense to the tendering holder promptly after the expiration or termination of the exchange offer. | |

Procedures for Tendering Outstanding Restricted Notes | Each holder of outstanding restricted notes wishing to accept the exchange offer must complete, sign and date the letter of transmittal, or its facsimile, in accordance with its instructions, and mail or otherwise deliver it, or its facsimile, together with the outstanding restricted notes and any other required documentation to the exchange agent at the address in the letter of transmittal. Outstanding restricted notes may be physically delivered, but physical delivery is not required if a confirmation of a book-entry transfer of the outstanding restricted notes to the exchange agent's account at DTC is delivered in a timely fashion. See "The Exchange Offer — Procedures for Tendering Outstanding Restricted Notes." | |

4

Conditions to the Exchange Offer | The exchange offer is not conditioned upon any minimum aggregate principal amount of outstanding restricted notes being tendered for exchange. The exchange offer is subject to customary conditions, which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See "The Exchange Offer—Conditions to the Exchange Offer." | |

Exchange Agent | The Bank of New York | |

U.S. Federal Income Tax Considerations | Your exchange of an outstanding restricted note for an exchange note will not constitute a taxable exchange. The exchange will not result in taxable income, gain or loss being recognized by you or by us. Immediately after the exchange, you will have the same adjusted basis and holding period in each exchange note received as you had immediately prior to the exchange in the corresponding outstanding restricted note surrendered. See "Important U.S. and Canadian Tax Considerations." |

5

The terms of the exchange notes are identical in all material aspects to those of the outstanding restricted notes, except for the transfer restrictions and registration rights relating to the outstanding restricted notes that do not apply to the exchange notes.

| Issuer | Cascades Inc. | |||

Notes Offered | US$125,000,000 aggregate principal amount of 71/4% Senior Notes due 2013. The notes offered hereby will be the same class as our outstanding unrestricted notes and will bear the same CUSIP number. | |||

Maturity Date | February 15, 2013. | |||

Interest Payment Dates | February 15 and August 15 of each year, commencing on August 15, 2005. | |||

Guarantees | The exchange notes will be guaranteed by each of our existing and future Canadian and U.S. restricted subsidiaries. The exchange notes will not be guaranteed by our subsidiaries outside Canada and the United States or by any of our joint ventures, including Norampac. | |||

Ranking | The exchange notes will be our unsecured senior obligations and will rank equally with all of our other unsecured senior debt. The exchange notes will be senior in right of payment to all of our subordinated debt. As of March 31, 2005, we had approximately $1,157 million of debt outstanding, approximately $268 million of which was secured. This debt includes obligations under capital leases and mandatorily redeemable preferred shares but excludes our proportionate share of debt of our joint ventures, which is included in our consolidated financial statements under Canadian GAAP, and also excludes undrawn commitments under our revolving credit facility. | |||

The guarantees of the exchange notes will be unsecured senior obligations of each subsidiary guarantor and will rank equally with all other unsecured senior debt of the subsidiary guarantor. The guarantees will be senior in right of payment to all of the subordinated debt of each subsidiary guarantor. As of March 31, 2005, the subsidiary guarantors had approximately $101 million of debt outstanding, not including the guarantees of the notes or our subsidiaries' obligations under our revolving credit facility, approximately $44 million of which was secured, and not including intercompany debt. This debt includes obligations under capital leases and mandatorily redeemable preferred shares. | ||||

6

Because the exchange notes will not be guaranteed by all of our subsidiaries or by any of our joint ventures, the notes will be effectively subordinated to all liabilities, including trade debt and preferred share claims, of our non-guarantor subsidiaries and joint ventures. As of March 31, 2005, our non-guarantor subsidiaries had outstanding approximately $228 million, and our joint ventures had outstanding approximately $604 million, of debt, accounts payable and other accrued liabilities, including preferred share claims, but excluding any intercompany debt owing to us or our subsidiaries. | ||||

Optional Redemption | Prior to February 15, 2008, we may redeem all or part of the exchange notes by paying a "make-whole" premium based on U.S. Treasury rates as specified in this prospectus under "Description of Notes—Optional Redemption." At any time on or after February 15, 2008, we may redeem all or part of the notes at our option at the redemption prices described under "Description of Notes—Optional Redemption." Prior to February 15, 2006, we may also redeem, at any time at our option, up to 35% of the aggregate principal amount of the notes and outstanding restricted notes with the net cash proceeds of qualified equity offerings. | |||

Additional Amounts | We generally will pay such additional amounts as may be necessary so that the amount received by noteholders after tax-related withholdings or deductions in relation to the notes will not be less than the amount that noteholders would have received in the absence of the withholding or deduction. | |||

Tax Redemption | If we are required to pay additional amounts as a result of changes in the laws applicable to tax-related withholdings or deductions, we will have the option to redeem the exchange notes, in whole but not in part, at a redemption price equal to 100% of the principal amount of the exchange notes, plus any accrued and unpaid interest to the date of redemption and any additional amounts that may be then payable. | |||

Certain Covenants | We will issue the exchange notes under the same indenture under which our outstanding unrestricted notes were issued. The indenture limits, among other things, our ability and the ability of our restricted subsidiaries, to: | |||

• | borrow money; | |||

• | pay dividends on stock, redeem stock or redeem subordinated debt; | |||

• | make investments; | |||

• | sell capital stock of subsidiaries; | |||

7

• | guarantee other indebtedness; | |||

• | enter into agreements that restrict dividends or other distributions from restricted subsidiaries; | |||

• | enter into transactions with affiliates; | |||

• | create or assume liens; | |||

• | enter into sale and leaseback transactions; | |||

• | engage in mergers or consolidations; and | |||

• | enter into a sale of all or substantially all of our assets. | |||

Each of these restrictions has a number of important qualifications and exceptions. Please refer to the section in this prospectus entitled "Description of Exchange Notes." | ||||

If at any time the credit rating on the exchange notes, as determined by Standard & Poor's Rating Services, a division of the McGraw-Hill Companies, Inc., and Moody's Investors Service, Inc., equals or exceeds both BBB— and Baa3, respectively, or any equivalent replacement ratings, then these restrictions, other than the limitations on our ability to create or assume liens, engage in certain sale and leaseback transactions and engage in mergers, consolidations or a sale of all or substantially all of our assets, will cease to apply. Any covenants that cease to apply to us as a result of achieving these ratings will not be restored, even if the credit rating on the exchange notes later falls below one or both of these ratings. | ||||

Change of Control | Upon a change of control, we will be required to offer to purchase the exchange notes at a price equal to 101% of their principal amount plus accrued and unpaid interest, if any, to the date of purchase. | |||

Use of Proceeds | We will not receive any cash proceeds from the issuance of the exchange notes. | |||

You should carefully consider the information in the section entitled "Risk Factors" beginning on page 16.

8

SUMMARY HISTORICAL CONSOLIDATED FINANCIAL INFORMATION

The following table presents summary historical consolidated financial information about us. The summary historical consolidated financial information as of December 31, 2003 and 2004 and for each of the fiscal years ended December 31, 2002, 2003 and 2004 has been derived from, and should be read together with, our audited consolidated financial statements and the accompanying notes, which are included elsewhere in this prospectus. The summary historical consolidated balance sheet data as of December 31, 2002 has been derived from our audited consolidated financial statements, which have not been included in this prospectus. The summary historical financial information as of March 31, 2005 and for the three months ended March 31, 2004 and 2005 has been derived from, and should be read together with, our unaudited consolidated financial statements and the accompanying notes, included elsewhere in this prospectus. The summary historical balance sheet information as of March 31, 2004 has been derived from our unaudited consolidated financial statements, which are not included in this prospectus. In the opinion of management, all adjustments considered necessary for a fair presentation of our interim results and financial position have been included in those results and financial position. Interim results and financial position are not necessarily indicative of the results and financial position that can be expected for a full year. All of the following historical consolidated financial information should also be read in conjunction with "Management's Discussion and Analysis of Financial Condition and Results of Operations" included in this prospectus. Information presented for the "restricted group" has been derived from the information used in preparing our audited consolidated financial statements as of and for the years ended December 31, 2002, 2003 and 2004 and our unaudited consolidated financial statements as of and for the three months ended March 31, 2004 and 2005.

Our audited consolidated financial statements have been prepared in accordance with Canadian GAAP. In certain respects, Canadian GAAP differs from U.S. GAAP. See note 24 to our audited consolidated financial statements, included elsewhere in this prospectus, for a description of material differences between U.S. GAAP and Canadian GAAP as they relate to our audited consolidated financial statements.

Due to proportionate consolidation under Canadian GAAP, the financial results for the year ended December 31, 2004, include the impact of only four months of our ownership of 100% of Dopaco, while the first eight months include 50% of Dopaco's results.

9

| | Year Ended December 31, | Three Months Ended March 31, | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2004 | 2005 | |||||||||||||

| | (restated)(a)(i) | | | | ||||||||||||||

| | (in millions of Canadian dollars, except share and per share data, ratios and shipment data) | |||||||||||||||||

| Consolidated Statement of Earnings Data: | ||||||||||||||||||

| Sales(a) | $ | 3,118 | $ | 2,995 | $ | 3,254 | 763 | 843 | ||||||||||

| Cost of sales (exclusive of depreciation shown below)(a) | 2,414 | 2,463 | 2,691 | 640 | 702 | |||||||||||||

| Selling and administrative expenses | 289 | 294 | 313 | 75 | 82 | |||||||||||||

| Impairment loss on property, plant and equipment | — | — | 18 | — | — | |||||||||||||

| Loss (gain) on derivative financial commodity instruments | — | 1 | (2 | ) | (6 | ) | 1 | |||||||||||

| Unusual losses (gains) | 4 | — | (4 | ) | — | (3 | ) | |||||||||||

| Depreciation and amortization | 137 | 143 | 159 | 39 | 44 | |||||||||||||

| Operating income from continuing operations | 274 | 94 | 79 | 15 | 17 | |||||||||||||

| Interest expense(b) | 69 | 80 | 76 | 20 | 20 | |||||||||||||

| Unrealized loss on derivative financial instruments | — | — | — | — | 1 | |||||||||||||

| Foreign exchange loss (gain) on long-term debt | — | (72 | ) | (18 | ) | 6 | 2 | |||||||||||

| Loss on long-term debt refinancing | — | 22 | 1 | — | — | |||||||||||||

| Provision (recovery) for income taxes | 60 | 10 | 2 | (3 | ) | (2 | ) | |||||||||||

| Share of loss (earnings) of significantly influenced companies | (22 | ) | 3 | (2 | ) | (1 | ) | (1 | ) | |||||||||

| Share of earnings attributable to non-controlling interests | 1 | — | — | — | — | |||||||||||||

| Net earnings (loss) from continuing operation | 166 | 51 | 20 | (7 | ) | (3 | ) | |||||||||||

| Net earnings from assets held for sale | 3 | 4 | 3 | 1 | 3 | |||||||||||||

| Net earnings (loss) | $ | 169 | $ | 55 | $ | 23 | (6 | ) | — | |||||||||

| Basic net earnings (loss) from continuing operations per common shares | $ | 2.04 | $ | 0.61 | $ | 0.25 | $ | (0.09 | ) | $ | (0.03 | ) | ||||||

| Net earnings (loss) per common share: | ||||||||||||||||||

| Basic | $ | 2.07 | $ | 0.66 | $ | 0.28 | $ | (0.08 | ) | — | ||||||||

| Diluted | $ | 2.05 | $ | 0.66 | $ | 0.28 | $ | (0.08 | ) | — | ||||||||

| Weighted average number of common shares outstanding during the year | 81,482,507 | 81,720,379 | 81,678,884 | 81,734,786 | 81,350,647 | |||||||||||||

Other Consolidated Financial Data: | ||||||||||||||||||

| Operating Income before Depreciation and Amortization(c) | $ | 411 | $ | 237 | $ | 238 | 54 | 61 | ||||||||||

| Cash flows provided by (used in) operating activities | 330 | 126 | 156 | 4 | (59 | ) | ||||||||||||

| Cash flows used in investing activities | (272 | ) | (165 | ) | (244 | ) | (35 | ) | (30 | ) | ||||||||

| Cash flows provided by (used in) financing activities | (54 | ) | 31 | 93 | 33 | 67 | ||||||||||||

| Capital expenditures | 128 | 121 | 129 | 19 | 25 | |||||||||||||

| Ratios of earnings to fixed charges(h) | 3.6x | 1.7x | 1.2x | — | — | |||||||||||||

10

Consolidated Balance Sheet Data (at end of period): | ||||||||||||||||||

| Cash and cash equivalents | $ | 38 | $ | 27 | $ | 30 | 29 | 23 | ||||||||||

| Working capital | 386 | 508 | 502 | 541 | 569 | |||||||||||||

| Property, plant and equipment | 1,604 | 1,636 | 1,700 | 1,640 | 1,675 | |||||||||||||

| Total assets | 2,959 | 2,927 | 3,144 | 2,970 | 3,181 | |||||||||||||

| Total debt(b) | 1,195 | 1,153 | 1,273 | 1,212 | 1,356 | |||||||||||||

| Non-controlling interests | 2 | 3 | — | 3 | — | |||||||||||||

| Net assets | 1,065 | 1,056 | 1,059 | 1,045 | 1,047 | |||||||||||||

| Capital stock | 268 | 264 | 265 | 264 | 265 | |||||||||||||

| Restricted Group Financial Data(d): | ||||||||||||||||||

| Sales(a) | $ | 2,407 | $ | 2,240 | $ | 2,388 | 536 | 660 | ||||||||||

| Operating income (loss) | 189 | 34 | 13 | (3 | ) | (3 | ) | |||||||||||

| Interest expense(b) | 51 | 63 | 63 | 16 | 18 | |||||||||||||

| Net earnings (loss) from continuing operations | 166 | 51 | 20 | (7 | ) | (3 | ) | |||||||||||

| Net earnings from assets held for sale | 3 | 4 | 3 | 1 | 3 | |||||||||||||

| Net earnings (loss) | 169 | 55 | 23 | (6 | ) | — | ||||||||||||

| Cash and cash equivalents | 24 | 15 | 22 | 19 | 15 | |||||||||||||

| Total assets | 2,582 | 2,478 | 2,765 | 2,501 | 2,796 | |||||||||||||

| Total debt(b) | 977 | 927 | 1,076 | 979 | 1,157 | |||||||||||||

| Shareholders' equity | 1,065 | 1,056 | 1,059 | 1,045 | 1,047 | |||||||||||||

| Capital expenditures | 97 | 86 | 89 | 14 | 21 | |||||||||||||

| Operating Income before Depreciation and Amortization(c) | 298 | 142 | 131 | 25 | 32 | |||||||||||||

| Adjusted Operating Income before Depreciation and Amortization(e) | 314 | 158 | 150 | 40 | 47 | |||||||||||||

| Cash flows provided by (used in) operating activities | 268 | 84 | 101 | 7 | (58 | ) | ||||||||||||

| Cash flows used in investing activities | (214 | ) | (121 | ) | (176 | ) | (29 | ) | (30 | ) | ||||||||

| Cash flows provided by (used in) financing activities | (57 | ) | 29 | 83 | 26 | 66 | ||||||||||||

11

U.S. GAAP Consolidated Financial and Other Data: | ||||||||||||||||||

| Sales | $ | 3,118 | $ | 2,995 | $ | 3,254 | ||||||||||||

| Net earnings | 173 | 60 | 16 | |||||||||||||||

| Cash and cash equivalents | 38 | 27 | 30 | |||||||||||||||

| Total assets | 3,014 | 3,003 | 3,213 | |||||||||||||||

| Total debt | 1,139 | 1,153 | 1,273 | |||||||||||||||

Mandatorily redeemable preferred shares | 56 | 4 | 2 | |||||||||||||||

| Convertible preferred shares(f) | 6 | — | — | |||||||||||||||

| Shareholders' equity | 1,090 | 1,103 | 1,101 | |||||||||||||||

| Operating Income before Depreciation and Amortization(c) | 418 | 249 | 250 | |||||||||||||||

| Cash flows provided by operating activities | 334 | 127 | 156 | |||||||||||||||

| Cash flow used in investing activities | (272 | ) | (163 | ) | (244 | ) | ||||||||||||

| Cash flow provided by (used in) financing activities | (54 | ) | 31 | 93 | �� | |||||||||||||

| Basic and diluted earnings from Continuing operations per Common Share | $ | 2.08 | $ | 0.68 | $ | 0.17 | ||||||||||||

Net earnings per common share: | ||||||||||||||||||

| Basic | $ | 2.11 | $ | 0.73 | $ | 0.20 | ||||||||||||

| Diluted | $ | 2.09 | $ | 0.73 | $ | 0.20 | ||||||||||||

| Cash dividends | ||||||||||||||||||

| Common shares | (10 | ) | (13 | ) | (13 | ) | ||||||||||||

| Preferred shares | (1 | ) | (1 | ) | — | |||||||||||||

| Ratios of earnings to fixed charges(h) | 3.9 | x | 1.9 | x | 1.2 | x | ||||||||||||

Shipment Data (in thousands): | ||||||||||||||||||

| Packaging Products | ||||||||||||||||||

| Boxboard (short tons) | ||||||||||||||||||

| North America | 356 | 363 | 336 | 86 | 78 | |||||||||||||

| Europe | 530 | 493 | 521 | 130 | 135 | |||||||||||||

| Containerboard(g) | ||||||||||||||||||

| Manufacturing (short tons) | 724 | 721 | 718 | 179 | 179 | |||||||||||||

| Converting (square feet) | 6,378 | 6,699 | 6,802 | 1,630 | 1,630 | |||||||||||||

| Specialty products (paper only-short tons) | 184 | 190 | 195 | 47 | 47 | |||||||||||||

| Tissue Paper (short tons) | 338 | 368 | 399 | 96 | 99 | |||||||||||||

| Fine Paper (short tons) | ||||||||||||||||||

| Uncoated paper | 152 | 140 | 138 | 33 | 28 | |||||||||||||

| Coated paper | 161 | 139 | 151 | 32 | 40 | |||||||||||||

- (a)

- On January 1, 2004, we adopted the new Canadian Institute of Chartered Accountants (CICA) section 1100 and 1400 and reclassified cost of delivery, which previously had been subtracted from sales, as cost of sales. As a result, the prior-year results were restated.

- (b)

- Under Canadian GAAP, the mandatorily redeemable preferred shares issued by our subsidiaries, Cascades Boxboard Group Inc. and Cascades Tissue Group—Pickering Inc., formerly known as

12

Wood Wyant Inc., are classified as debt in our financial statements and dividends on those shares are included in interest expense. During 2003, we repurchased all of the outstanding preferred shares issued by Cascades Boxboard Group Inc. Capital lease obligations are also classified as debt.

- (c)

- Operating Income before Depreciation and Amortization is not a measure of performance under Canadian GAAP or U.S. GAAP. We include Operating Income before Depreciation and Amortization because it is the measure used by our management to assess the operating and financial performance of our operating segments. In addition, we believe that Operating Income before Depreciation and Amortization provides an additional measure often used by investors to assess a company's operating performance, leverage and liquidity, and its ability to meet debt service requirements. However, Operating Income before Depreciation and Amortization does not represent, and should not be used as a substitute for, operating income, net earnings or cash flows from operations as determined in accordance with Canadian GAAP or U.S. GAAP, and Operating Income before Depreciation and Amortization is not necessarily an indication of whether cash flow will be sufficient to fund our cash requirements. In addition, our definition of Operating Income before Depreciation and Amortization may differ from that of other companies. Set forth below is a reconciliation of consolidated Operating Income before Depreciation and Amortization to net cash provided by (used in) operating activities and net earnings, which we believe to be the closest Canadian GAAP performance and liquidity measures to Operating Income before Depreciation and Amortization:

| | Year Ended December 31, | Three Months Ended March 31, | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2004 | 2005 | |||||||||

| | (restated)(a)(i) | | | | ||||||||||

| | (in millions of Canadian dollars) | |||||||||||||

| Net cash provided by (used in) operating activities | $ | 330 | $ | 126 | $ | 156 | 4 | (59 | ) | |||||

| Changes in non-cash working capital components | (23 | ) | 32 | 2 | 27 | 90 | ||||||||

| Depreciation and amortization | (137 | ) | (143 | ) | (159 | ) | (39 | ) | (44 | ) | ||||

| Current income taxes | 47 | 11 | 22 | 1 | 9 | |||||||||

| Interest expense (includes interest on long-term debt, other interest less interest income and capitalized interest) | 69 | 80 | 76 | 20 | 20 | |||||||||

| Impairment loss of property, plant and equipment | — | — | (18 | ) | — | — | ||||||||

| Unrealized gain (loss) on derivative financial commodity instruments | — | — | 2 | 5 | (1 | ) | ||||||||

| Unusual gain (loss) | (4 | ) | — | 4 | — | 3 | ||||||||

| Other non-cash adjustments | (8 | ) | (12 | ) | (6 | ) | (3 | ) | (1 | ) | ||||

| Operating income | 274 | 94 | 79 | 15 | 17 | |||||||||

| Depreciation and amortization | 137 | 143 | 159 | 39 | 44 | |||||||||

| Operating Income before Depreciation and Amortization | 411 | 237 | 238 | 54 | 61 | |||||||||

| Net earnings (loss) | $ | 169 | $ | 55 | $ | 23 | (6 | ) | — | |||||

| Net earnings from assets held for sale | (3 | ) | (4 | ) | (3 | ) | (1 | ) | (3 | ) | ||||

| Share of earnings attributable to non-controlling interests | 1 | — | — | — | — | |||||||||

| Share of earnings of significantly influenced companies | (22 | ) | 3 | (2 | ) | (1 | ) | (1 | ) | |||||

| Provision (recovery) for income taxes | 60 | 10 | 2 | (3 | ) | (2 | ) | |||||||

| Loss on long-term debt refinancing | — | 22 | 1 | — | — | |||||||||

| Foreign exchange loss (gain) on long-term debt | — | (72 | ) | (18 | ) | 6 | 2 | |||||||

| Unrealized loss on financial derivative instruments | — | — | — | — | 1 | |||||||||

| Interest expense | 69 | 80 | 76 | 20 | 20 | |||||||||

| Operating income | 274 | 94 | 79 | 15 | 17 | |||||||||

| Depreciation and amortization | 137 | 143 | 159 | 39 | 44 | |||||||||

| Operating Income before Depreciation and Amortization | 411 | 237 | 238 | 54 | 61 | |||||||||

13

- In our fiscal 2002, Dopaco did not contribute to our Operating Income before Depreciation and Amortization. In our fiscal years 2003 and 2004, Dopaco contributed $6 million, and $33 million, respectively. Dopaco had Operating Income before Depreciation and Amortization for its fiscal years ended March 31, 2002, 2003, and 2004, of $31 million, $34 million and $43 million, respectively.

- (d)

- Restricted group financial data represents financial results, calculated in accordance with Canadian GAAP except for Operating Income before Depreciation and Amortization and the ratios, for Cascades Inc. and those subsidiaries that will be "restricted" under the indenture governing the notes. The restricted group financial data includes data of subsidiaries that will not guarantee the notes but that will be part of the restricted group for purposes of the indenture. We have included the restricted group financial information because we believe it provides investors with helpful information with respect to the financial results, including cash flows, of the business and operations that will be subject to the restrictive covenants under the indenture. For further information on guarantor and non-guarantor subsidiaries, see note 25 to our audited consolidated financial statements, included elsewhere in this prospectus.

- (e)

- Adjusted Operating Income before Depreciation and Amortization is not a recognized measure under Canadian GAAP or U.S. GAAP and is defined as Operating Income before Depreciation and Amortization plus cash dividends paid to us during the relevant period by joint ventures and companies in which we hold a minority interest. These dividends amounted to approximately $16 million in 2002, $16 million in 2003, and $19 million in 2004. The cash dividends made by our joint ventures and companies in which we hold a minority interest represent cash available to us to fund our operations and those of the restricted group and to service debt even though the entities from whom we receive the dividends are not part of the restricted group. As such, we have included Adjusted Operating Income before Depreciation and Amortization because it is a measure used by management and our investors to assess our ability to fund operations and service debt. Dopaco contributed $3 million of these dividends for the year ended December 31, 2004.

- (f)

- Represents Class B preferred shares issued by our subsidiary, Cascades Boxboard Group Inc., that were repurchased on May 23, 2003.

- (g)

- Our production of containerboard consists solely of our 50% proportionate interest in the production of Norampac, our joint venture with Domtar, which is not part of the restricted group.

- (h)

- For the purposes of calculating the ratio of earnings to fixed charges, "earnings" represents earnings from continuing operations before income taxes plus fixed charges. "Fixed charges" consist of interest expense and capitalized interest, amortization of debt issuance costs and that portion of rental expense considered to be a reasonable approximation of interest, as well as dividends on the preferred shares issued by two of our subsidiaries, Cascades Boxboard Group Inc. and Cascades Tissue Group—Pickering Inc. For the three months ended March 31, 2004 and 2005, earnings were insufficient to cover fixed charges by $11 million and $6 million, respectively.

14

- (i)

- During the fourth quarter of 2004, we initiated a divestiture plan for our distribution assets in the Fine Papers and Tissue Papers segments. Consequently, the assets, liabilities, earnings and cash flows of the distribution activities have been reclassified as assets held for sale for each of the years presented above, with our results for 2002 and 2003 having been restated. Financial information relating to these assets held for sale is as follow:

| | Year Ended December 31, | Three Months Ended March 31, | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | 2002 | 2003 | 2004 | 2004(1) | 2005 | |||||||||||

| | (in millions of dollars, except amounts per share) | |||||||||||||||

| Condensed balance sheet | ||||||||||||||||

| Current assets | $ | 109 | $ | 126 | $ | 126 | $ | 126 | 116 | |||||||

| Long-term assets | 7 | 12 | 9 | 9 | 5 | |||||||||||

| Current liabilities | 21 | 31 | 29 | 29 | 23 | |||||||||||

Condensed statement of earnings | ||||||||||||||||

| Sales | $ | 473 | $ | 454 | $ | 438 | 107 | 113 | ||||||||

| Depreciation and amortization | 2 | 2 | 2 | 1 | — | |||||||||||

| Operating income, including gain on disposal | 7 | 11 | 7 | 2 | 5 | |||||||||||

| Interest expense | 3 | 3 | 3 | — | 1 | |||||||||||

| Provision for income taxes | 1 | 4 | 1 | 1 | 1 | |||||||||||

| Net earnings, including gain on disposal, from assets held for sale | 3 | 4 | 3 | 1 | 3 | |||||||||||

| Net earnings per share, including gain on disposal, from assets held for sale | $ | 0.03 | $ | 0.05 | $ | 0.03 | $ | 0.01 | $ | 0.03 | ||||||

Condensed statement of cash flows | ||||||||||||||||

| Cash flow from operating activities | $ | (5 | ) | $ | 14 | $ | 1 | (7 | ) | (4 | ) | |||||

| Cash flow from investing activities | (5 | ) | (1 | ) | (1 | ) | — | 14 | ||||||||

| Cash flow from financing activities | 10 | (13 | ) | — | 7 | 4 | ||||||||||

- (1)

- As at December 31, 2004 for the condensed balance sheet items.

15

An investment in the exchange notes represents a high degree of risk. The material risk factors known to us and discussed below may adversely affect our ability to make payments on the exchange notes. However, additional risks that we do not know about or that we currently view as immaterial may also impair our business or adversely affect our ability to make payments on, or adversely affect the trading price of, the exchange notes. You should carefully consider the risks described below, together with the other information in this prospectus, before making a decision to participate in the exchange offer.

Risks Relating to Our Business

The markets for some of our products tend to be cyclical in nature and prices for some of our products, as well as raw material and energy costs, may fluctuate significantly, which can adversely affect our operating results, profitability and financial position.

The markets for some of our products, particularly containerboard and fine papers, are highly cyclical. As a result, prices for these types of products and for our two principal raw materials, recycled paper and virgin fiber, have fluctuated significantly in the past and will likely continue to fluctuate significantly in the future, principally due to market imbalances between supply and demand. Demand is heavily influenced by the strength of the global economy and the countries or regions in which we do business, particularly in Canada and the United States, our two primary markets. Demand is also influenced by fluctuations in inventory levels held by customers and consumer preferences. Supply depends primarily on industry capacity and capacity utilization rates. In periods of economic weakness, reduced spending by consumers and businesses results in decreased demand, potentially causing downward price pressure. Industry participants may also, at times, add new capacity or increase capacity utilization rates, potentially causing supply to exceed demand and exerting downward price pressure.

In the second half of 2000, economic growth in North America began to slow. As a result, between the second half of 2000 and the end of 2001, demand for some of our products, particularly in containerboard, boxboard and fine papers, slowed and selling prices declined. To adjust our production to demand, we took market-related downtime for some of our products. Market conditions gradually improved during 2002, and we were able to implement increases in the selling prices for some of these products. However, in 2003, increased energy and fiber costs combined with lower demand for some of our products led to more difficult market conditions. The strengthening of the Canadian dollar against the U.S. dollar also contributed to reduced profitability as it reduced the proceeds of export sales from Canada and Europe. In 2004, sales increased, however operating income was lower than 2003 due in large part to the strengthening of the Canadian dollar against the U.S. dollar, when compared with 2003, which adversely affects our revenues since a large part of our products, from our Canadian operations, are priced with reference to the U.S. dollar while most of our costs are incurred in Canadian dollars. In the first quarter of 2005, sales and operating income increased compared to the same period in 2004 despite the further strengthening of the Canadian dollar against the U.S. dollar, when compared with the same period in 2004. Depending on market conditions and related demand, we may have to take further market-related downtime. In addition, we may not be able to maintain current prices or implement additional price increases in the future. If we are not able to do so, our revenues, profitability and cash flows could be adversely affected. In addition, other participants may introduce new capacity or increase capacity utilization rates, which also could adversely affect our business, operating results and financial position.

Prices for recycled and virgin fiber have also fluctuated considerably since 1999. The costs of these materials present a potential risk to our profit margins to the extent that we are unable to pass along price increases to our customers on a timely basis. For example, for the fiscal year of 2004, the list price of recycled paper increased approximately 14.5%. The price of recycled paper increased in the first quarter of 2005 compared to the first quarter of 2004. Although changes in the price of recycled

16

fiber generally correlate with changes in the price of products made from recycled paper, this may not always be the case. To the extent we are not able to implement increases in the selling prices for our products to compensate for increases in the price of recycled or virgin fiber, our profitability and cash flows would be adversely affected.

In addition, we use energy, mainly natural gas and fuel oil, to generate steam, which we use in the production process and to operate machinery. Energy prices, particularly for natural gas and fuel oil, have continued to increase since 2000, with a corresponding effect on our production costs. Energy prices increased approximately 21% in 2003 from 2002. In 2004, prices for energy declined slightly by 3% in Canada but increased by 13% in the United States compared to 2003. In the first quarter of 2005, prices for energy increased slightly by 4% in Canada and by 10% in the United States compared to the same period in 2004. We continue to evaluate our energy costs and consider ways to factor energy costs into our pricing. However, if energy prices were to increase, our production costs, competitive position and results of operations would be adversely affected. In addition, uncertainty in the Middle East could lead to an increase in the cost of energy. A substantial increase in energy costs would adversely affect our operating results and could have broader market implications that could further adversely affect our business or financial results.

We face significant competition and some of our competitors may have greater cost advantages, be able to achieve greater economies of scale or be able to better withstand periods of declining prices and adverse operating conditions, which could negatively affect our market share and profitability.

The markets for our products are highly competitive. In some of the markets in which we compete, particularly in boxboard, tissue and specialty products, we compete with a small number of other producers. Other markets, such as for containerboard, are extremely fragmented. In some businesses, such as in the containerboard and fine papers industries, competition tends to be global. In others, such as the tissue industry, competition tends to be regional. In our packaging products segment, we also face competition from alternative packaging materials, such as vinyl, plastic and styrofoam, which can lead to excess capacity, decreased demand and pricing pressures.

Competition in our markets is primarily based upon the quality, breadth and performance characteristics of our products, customer service and price. Our ability to compete successfully depends upon a variety of factors, including:

- •

- our ability to maintain high plant efficiencies and operating rates and lower manufacturing costs;

- •

- the availability, quality and cost of raw materials, particularly recycled and virgin fiber, and labor; and

- •

- the cost of energy.

Some of our competitors may, at times, have lower fiber, energy and labor costs and less restrictive environmental and governmental regulations to comply with than we do. For example, fully integrated manufacturers, which are those manufacturers whose requirements for pulp or other fiber are met fully from their internal sources, may have some competitive advantages over manufacturers that are not fully integrated, such as us, in periods of relatively high prices for raw materials, in that the former are able to ensure a steady source of these raw materials at costs that may be lower than prices in the prevailing market. In contrast, competitors that are less integrated than we are may have cost advantages in periods of relatively low pulp or fiber prices because they may be able to purchase pulp or fiber at prices lower than the costs we incur in the production process. Other competitors may be larger in size or scope than we are, which may allow them to achieve greater economies of scale on a global basis or allow them to better withstand periods of declining prices and adverse operating conditions.

In addition, there has been an increasing trend among our customers towards consolidation. With fewer customers in the market for our products, the strength of our negotiating position with these

17

customers could be weakened, which could have an adverse effect on our pricing, margins and profitability.

Because of our international operations, we face political, social and exchange rate risks which can negatively affect our business, operating results, profitability and financial condition.

We have customers and operations located outside Canada and the United States. In 2004, sales outside Canada and the United States represented approximately 19% of our consolidated net sales. Our international operations present us with a number of risks and challenges, including:

- •

- the effective marketing of our products in other countries;

- •

- tariffs and other trade barriers; and

- •

- different regulatory schemes and political environments applicable to our operations in areas such as environmental and health and safety compliance.

In addition, our financial statements are reported in Canadian dollars while a portion of our sales is made in other currencies, primarily the U.S. dollar and the euro. A substantial portion of our debt is also denominated in currencies other than the Canadian dollar. Although fluctuations in exchange rates between the Canadian dollar and foreign currencies have not had a significant impact on net earnings in the past, the recent appreciation of the Canadian dollar against the U.S. dollar has adversely affected our reported operating results and financial condition. Although the recent appreciation of the Canadian dollar against the U.S. dollar has had a direct impact on export prices, it has also contributed to reducing Canadian dollar prices in Canada because several of our product lines are priced in U.S. dollars. Moreover, in some cases, the currency of our sales does not match the currency in which we incur costs, which can negatively affect our profitability. Fluctuations in exchange rates can also affect the relative competitive position of a particular facility where the facility faces competition from non-local producers, as well as our ability to successfully market our products in export markets. As a result, the continuing appreciation of the Canadian dollar can affect the profitability of our facilities, which could lead us to shut down facilities either temporarily or permanently, all of which could adversely affect our business or financial results.

Our operations are subject to comprehensive environmental regulation and involve expenditures which may be material in relation to our operating cash flow.

Our operations are subject to extensive environmental, health and safety laws and regulations promulgated by federal, provincial, state and local governments in the various jurisdictions in which we have operations. These environmental laws and regulations impose stringent standards on us regarding, among other things:

- •

- air emissions;

- •

- water discharges;

- •

- use and handling of hazardous materials;

- •

- use, handling and disposal of waste; and

- •

- remediation of environmental contamination.

Our failure to comply with applicable environmental laws, regulations or permit requirements may result in civil or criminal fines or penalties or enforcement actions. These may include regulatory or judicial orders enjoining or curtailing operations or requiring corrective measures, installing pollution control equipment or remedial actions, any of which could entail significant expenditures. It is difficult to predict the future development of such laws and regulations or their impact on future earnings and operations, but these laws and regulations may require capital expenditures to ensure compliance. In addition, amendments to, or more stringent implementation of, current laws and regulations governing our operations could have a material adverse effect on our business, results of operations or financial position. For example, the U.S. Environmental Protection Agency has proposed additional requirements

18

for the pulp and paper industry which, if and when adopted, may require additional material expenditures. The ratification of the Kyoto Protocol by Canada and the European Union will result in the imposition of limits to the discharge of carbon dioxide and other greenhouse gases. The specific limitations in respect of our Canadian and European operations, or the operations of others providing energy or other products or services to us, are unknown and uncertain and may require additional material expenditures. In addition, although we generally try to plan for capital expenditures relating to environmental and health and safety compliance on an annual basis, actual capital expenditures may exceed those estimates. In such an event, we may be forced to curtail other capital expenditures or other activities.

In addition, enforcement of existing environmental laws and regulations has become increasingly strict. We may discover currently unknown environmental problems or conditions in relation to our past or present operations, or we may face unforeseen environmental liabilities in the future. These conditions and liabilities may:

- •

- require site remediation or other costs to maintain compliance or correct violations of environmental laws and regulations; or

- •

- result in governmental or private claims for damage to person, property or the environment, either of which could have a material adverse effect on our financial condition and results of operations.

We may be subject to strict liability and, under specific circumstances, joint and several liability for the investigation and remediation of the contamination of soil, surface and ground water, including contamination caused by other parties, at properties that we own or operate and at properties where we or our predecessors have arranged for the disposal of regulated materials. As a result, we are involved from time to time in administrative and judicial proceedings and inquiries relating to environmental matters. We may become involved in additional proceedings in the future, the total amount of future costs and other environmental liabilities of which could be material.

We may be subject to losses that might not be covered in whole or in part by our insurance coverage.

We carry comprehensive liability, fire and extended coverage insurance on most of our facilities, with policy specifications and insured limits customarily carried in our industry for similar properties. The cost of our insurance policies has increased recently. In addition, some types of losses, such as losses resulting from wars, acts of terrorism, or natural disasters, generally are not insured because they are either uninsurable or not economically practical. Moreover, insurers recently have become more reluctant to insure against these types of events. Should an uninsured loss or a loss in excess of insured limits occur, we could lose capital invested in that property, as well as the anticipated future revenues derived from the manufacturing activities conducted at that property, while remaining obligated for any mortgage indebtedness or other financial obligations related to the property. Any such loss could adversely affect our business, results of operations or financial condition.

Labor disputes could have a material adverse effect on our cost structure and ability to run our mills and plants.

As of December 31, 2004, we had approximately 15,800 employees, of whom approximately 14,200 were employees of our Canadian and United States operations. Approximately 63% of our Canadian and U.S. employees are represented by unions under 46 separate collective bargaining agreements. In addition, in Europe, some of our operations are subject to national collective bargaining agreements that are renewed on an annual basis. Our inability to negotiate acceptable contracts with these unions upon expiration of an existing contract could result in strikes or work stoppages by the affected workers and increased operating costs as a result of higher wages or benefits paid to union members. If the unionized workers were to engage in a strike or other work stoppage, or other employees were to become unionized, we could experience a significant disruption in operations or higher labor costs, which could have a material adverse effect on our business, financial condition, results of operations

19

and cash flow. We had one work stoppage ongoing as of December 31, 2004: a lock-out of unionized employees in our Fjordcell Kraft pulp mill located in Jonquière, Québec. The Fjordcell Kraft pulp mill had sales of $49 million in 2004. This work stoppage was resolved on May 6, 2005. Of our 46 collective bargaining agreements, six have expired. Another five will expire within this year and five more will expire in 2006. We generally begin the negotiation process several months before agreements are due to expire and are currently in the process of negotiating with the unions where the agreements have expired. However, we may not be successful in negotiating new agreements on satisfactory terms, if at all.

We may make investments in entities that we do not control and may not receive dividends or returns from those investments in a timely fashion or at all.

We have established joint ventures and made minority interest investments to increase our vertical integration, enhance customer service and increase efficiencies in our marketing and distribution in the United States and other markets. Our principal joint ventures and minority investments include:

- •

- Norampac, a 50%-owned joint venture with Domtar through which all of our containerboard and corrugated packaging products are manufactured;

- •

- three 50%-owned joint ventures with Sonoco Products Company, one in Canada, one in the United States and one in Europe, which produce specialty paper packaging products such as headers, rolls and wrappers;

- •

- a 50%-owned joint venture interest in Metro Waste Paper Recovery Inc., a Canadian operator of waste paper recovery and recycling operations, part of which we own through Norampac; and

- •

- a 43% interest in Boralex, a public Canadian corporation and an independent producer of electric and thermal power with operations in the Province of Québec and the northeastern United States.

We do not control these entities and they will not be restricted under the indenture governing the notes. The indenture governing the notes will limit, but not prohibit, our ability to continue making these types of investments, and we anticipate continuing to enter into joint ventures and make minority investments.

Our inability to control entities in which we invest may affect our ability to receive distributions from those entities or to fully implement our business plan. The incurrence of debt or entering into other agreements by an entity not under our control may result in restrictions or prohibitions on that entity's ability to pay distributions to us. For example, our joint venture Norampac has a credit agreement and indenture that contain covenants that restrict its ability to pay dividends to us. Even where these entities are not restricted by contract or by law from paying dividends or making distributions to us, we may not be able to influence the making or timing of these dividends or distributions. In addition, if any of the other investors in a non-controlled entity fail to observe their commitments, that entity may not be able to operate according to its business plan or we may be required to increase our level of commitment. If any of these events were to transpire, our business, results of operations, financial condition and ability to make payments on the notes could be adversely affected.

In addition, we have entered into various shareholder agreements relating to our joint ventures and equity investments. Some of these agreements contain "shotgun" provisions, which provide that if one shareholder offers to buy all the shares owned by the other parties to the agreement, the other parties must either accept the offer or purchase all the shares owned by the offering shareholder at the same price and conditions. In addition, some of the agreements provide that in the event a shareholder is subject to bankruptcy proceedings or other default on any indebtedness, the non-defaulting parties to that agreement are entitled to invoke the shotgun provision or sell their shares to a third party. Our ability to purchase the other shareholders' interests in these joint ventures if they were to exercise these shotgun provisions could be limited by the covenants in our revolving credit facility and the indenture.

20

In addition, we may not have sufficient funds to accept the offer or the ability to raise adequate financing should the need arise, which could result in our having to sell our interests in these entities or otherwise alter our business plan.

Acquisitions have been and are expected to continue to be a substantial part of our growth strategy, which could expose us to difficulties in integrating the acquired operation, diversion of management time and resources and unforeseen liabilities, among other business risks.

Acquisitions have been a significant part of our growth strategy. We expect to continue to selectively seek strategic acquisitions in the future. Our ability to consummate and to integrate effectively any future acquisitions on terms that are favorable to us may be limited by the number of attractive acquisition targets, internal demands on our resources and, to the extent necessary, our ability to obtain financing on satisfactory terms, if at all. Acquisitions may expose us to additional risks, including:

- •

- difficulties in integrating and managing newly acquired operations and improving their operating efficiency;

- •

- difficulties in maintaining uniform standards, controls, procedures and policies across all of our businesses;

- •

- entry into markets in which we have little or no direct prior experience;

- •

- our ability to retain key employees of the acquired company;

- •

- disruptions to our ongoing business; and

- •

- diversion of management time and resources.

In addition, future acquisitions could result in the incurrence of additional debt, which we may incur to finance, or may assume as part of, an acquisition, as well as costs, contingent liabilities and amortization expenses. We may also incur costs and divert management attention for potential acquisitions which are never consummated. For acquisitions we do consummate, expected synergies may not materialize. Our failure to effectively address any of these issues could adversely affect our results of operations, financial condition and ability to service debt, including the notes.