Management's Discussion and Analysis of

Results of Operations and Financial Condition

For the year ended

December 31, 2022

February 23, 2023

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated February 23, 2023 is intended to supplement Hudbay Minerals Inc.'s audited consolidated financial statements and related notes for the year ended December 31, 2022 and 2021 (the "consolidated financial statements"). The consolidated financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), as issued by the International Accounting Standards Board ("IASB").

References to "Hudbay", the "Company", "we", "us", "our" or similar terms refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at December 31, 2022.

Readers should be aware that:

- This MD&A contains certain "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") that are subject to risk factors set out in a cautionary note contained in this MD&A.

- This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers.

- We use a number of non-IFRS financial performance measures in this MD&A. Please see the discussion under the "Non-IFRS Financial Performance Measures" section herein.

- The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates.

For a discussion of each of the above matters, readers are urged to review the "Notes to Reader" discussion beginning on page 69 of this MD&A.

Additional information regarding Hudbay, including the risks related to our business and those that are reasonably likely to affect our consolidated financial statements in the future, is contained in our continuous disclosure materials, including our most recent Annual Information Form ("AIF"), consolidated financial statements and Management Information Circular available on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

All amounts are in US dollars unless otherwise noted.

OUR BUSINESS

We are a diversified mining company with long-life assets in North and South America. Our Constancia operations in Cusco (Peru) produce copper with gold, silver and molybdenum by-products. Our Snow Lake operations in Manitoba (Canada) produce gold with copper, zinc and silver by-products. We have an organic pipeline that includes the Copper World project in Arizona and the Mason project in Nevada (United States), and our growth strategy is focused on the exploration, development, operation, and optimization of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. We are governed by the Canada Business Corporations Act and our shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima.

STRATEGY

Our mission is to create sustainable value through the acquisition, development and operation of high quality, long life deposits with exploration potential in jurisdictions that support responsible mining, and to see the regions and communities in which we operate benefit from our presence.

We believe that copper is the commodity with the best long-term supply/demand fundamentals and offers shareholders the greatest opportunity for sustained risk-adjusted returns. Through the discovery and successful development of economic mineral deposits, and through highly efficient low-cost operations to extract the metals, we believe sustainable value will be created for all stakeholders.

Hudbay's successful development, ramp-up and operation of the Constancia open-pit mine in Peru, our long history of underground mining and full life-cycle experience in northern Manitoba, and our track record of reserve expansion through effective exploration, and our organic pipeline of copper development projects including Copper World, Mason and Llaguen, provide us with a competitive advantage relative to other mining companies of similar scale.

Over the past decade, we have built a world-class asset portfolio by executing a consistent long-term growth strategy focused on copper. We continuously work to generate strong free cash flow and optimize the value of our producing assets through exploration, brownfield expansion projects and efficient and safe operations. Furthermore, we intend to sustainably grow Hudbay through the exploration and development of our robust project pipeline, as well as through the acquisition of other properties that fit our stringent strategic criteria.

To ensure that any investment in our existing assets or acquisition of other mineral assets is consistent with our mission and creates sustainable value for stakeholders, we have established a number of criteria for evaluating these opportunities. The criteria include the following:

- Sustainability: We are focused on jurisdictions that support responsible mining activity. Our current geographic focus is on select investment grade countries in the Americas, with strong rule of law and respect for human rights consistent with our long-standing focus on environmental, social and governance ("ESG") principles;

- Copper Focus: We believe copper is the commodity with the best long-term supply/demand fundamentals. Global copper mine supply is challenged due to declining industry grades, limited exploration success and an insufficient pipeline of development-ready projects while demand will continue to increase through global decarbonization initiatives. We believe this long-term supply/demand gap will create opportunities for increased risk-adjusted returns. While our primary focus is on copper, we recognize the polymetallic nature of copper deposits and, in particular, the counter-cyclical nature of gold in our portfolio;

- Quality: We are focused on investing in long-life, low-cost, expandable, high-quality assets that can capture peak pricing of multiple commodity price cycles and can generate free cash flow through the trough of price cycles;

- Potential: We consider the full spectrum of acquisition and investment opportunities, from early-stage exploration to producing assets, that offer significant incremental potential for exploration, development, expansion and optimization beyond the stated resources and mine plan;

- Process: We develop a clear understanding of how an investment or acquisition can create value through our robust due diligence and capital allocation process that applies our technical, social, operational and project execution expertise;

- Operatorship: We believe value is created through leveraging Hudbay's competitive advantages in safe and efficient operations and effective exploration and project development and community relations. While operatorship is a key criterion, we are open to joint venture and partnerships that de-risk our portfolio and increase risk-adjusted returns; and

- Capital Allocation: We pursue investments and acquisitions that are accretive to Hudbay on a per share basis. Given that our strategic focus includes allocating capital to assets at various stages of development, when evaluating accretion, we will consider measures such as internal rate of return ("IRR"), return on invested capital ("ROIC"), net asset value per share and the contained value of reserves and resources per share.

Our key objectives for 2023 are to:

- Deliver copper and gold production growth with low cash costs driven by efficient operations;

- Position Hudbay to unlock its copper development pipeline through generating cash flow, managing discretionary spending, deleveraging and achieving strong returns on invested capital;

- De-risk the Copper World project through the completion of pre-feasibility studies, state permitting activities, evaluating a bulk sampling program and a potential joint venture partnership;

- Progress Constancia's leading efficiency metrics by applying smart technologies to continuously improve operating performance, including sensor-based ore sorting and the mill recovery improvement project;

- Advance plans to drill the prospective Maria Reyna and Caballito properties near Constancia;

- Continue to navigate the complex environment in Peru while maintaining aligned and supportive relationships with local communities;

- Execute expansion opportunities in Snow Lake with the completion of the Stall mill recovery improvement program and the ramp up beyond 4,650 tonnes per day at Lalor;

- Test the down-dip extensions at Lalor where the gold and copper zones remain open at depth and have the potential to expand Snow Lake gold mineralization beyond the current 2.4 million ounces of reserves and 1.7 million ounces of resources;

- Investigate opportunities to utilize the operating infrastructure in Snow Lake for potential future tailings reprocessing;

- Assess opportunities to reduce greenhouse gas emissions in alignment with our climate change commitments and global decarbonization goals;

- Prudently advance the three pre-requisites plan required for Copper World sanctioning; and

- Evaluate and execute growth opportunities that meet our stringent strategic criteria and allocate capital to pursue those opportunities that create sustainable value for the company and our stakeholders.

SUMMARY

Fourth Quarter and Full Year Operating and Financial Results

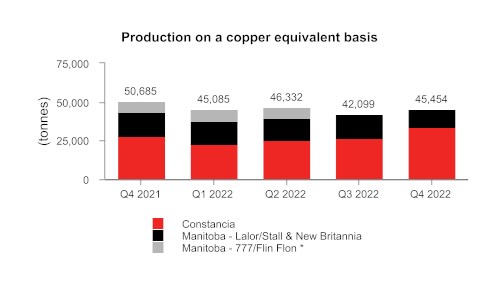

- Achieved 2022 consolidated production guidance for all metals and consolidated cash cost and sustaining cash cost guidance.

- Full year consolidated copper production of 104,173 tonnes, consolidated gold production of 219,700 ounces and consolidated silver production of 3,161,294 increased by 5%, 13% and 4%, respectively, in 2022 compared to 2021.

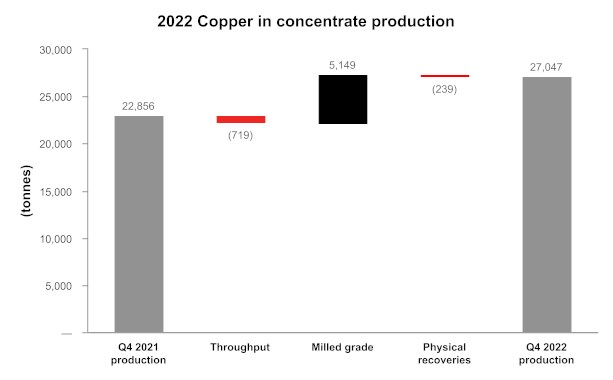

- The Peru operations delivered strong performance in the fourth quarter with a 21% increase in copper production and a 64% increase in gold production, compared to the third quarter of 2022, as grades and recoveries improved. The fourth quarter of 2022 was a record quarter for gold production in Peru. Peru's cash cost per pound of copper produced, net of by-product credits1, improved to $1.34 in the fourth quarter, representing a 20% decline compared to the third quarter of 2022.

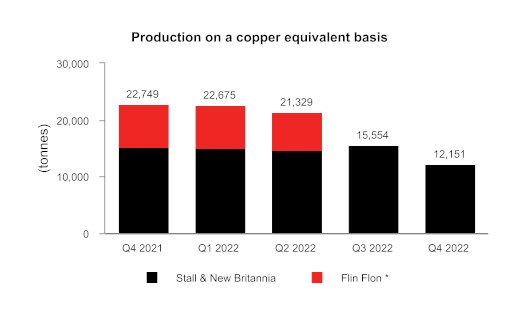

- The Manitoba operations saw a 6% increase in Lalor's ore production in the fourth quarter compared to the third quarter of 2022, and the Lalor mine continues to ramp up following the transition of Flin Flon employees to Snow Lake. Manitoba's full year gold cash cost per ounce of gold produced, net of by-product credits1, was 1% below the low end of the annual guidance range.

- Full year consolidated cash cost and sustaining cash cost per pound of copper produced, net of by-product credits1, were $0.86 and $2.07, respectively, and similar to 2021 levels, despite inflationary cost pressures which were offset by higher copper production and higher by-product credits.

- Fourth quarter net loss and loss per share were $17.4 million and $0.07, respectively. After adjusting for a non-cash loss of $13.5 million related to a quarterly revaluation of the Flin Flon environmental reclamation provision due to changes in real, long-term risk-free discount rates, and an $8.0 million revaluation loss related to the gold prepayment liability, among other items, fourth quarter adjusted earnings1 per share were $0.01.

- Operating cash flow before change in non-cash working capital was $109.1 million and adjusted EBITDA1 was $124.7 million in the fourth quarter, an increase of 34% and 26%, respectively, over the third quarter of 2022, benefiting from higher copper sales volumes and higher molybdenum prices and sales volumes, but negatively impacted by a temporary buildup of unsold inventory in Peru.

- Constancia continued to operate throughout nation-wide road blockades in Peru in December and while the company was successful in completing two port shipments in December, inventory of approximately 25,000 wet metric tonnes of copper concentrate in Peru was unsold at the end of the quarter.

Executing on Growth Initiatives and Disciplined Capital Allocation

- Successful completion of recent brownfield investment program in 2022 with the Pampacancha satellite deposit contributing higher grade feed to Constancia and the New Britannia mill operating at targeted capacity.

- Invested approximately $80 million in 2022 to successfully execute a new strategy at Copper World focused on project de-risking. The pre-feasibility study for Phase I of Copper World is well-advanced with the main facility engineering completed and metallurgical test work being analyzed as part of the concentrate leaching trade off evaluations.

- Reached a community exploration agreement in 2022 to access the Maria Reyna and Caballito satellite properties located north of Constancia in Peru. Completed the surface investigation work needed to support drill permit applications.

- Initiated deep drilling at Lalor in January 2023 to test the down-dip gold and copper extensions and potentially unlock further value in Snow Lake.

- The Stall recovery improvement program is well-advanced and remains on track for completion in early 2023 with higher gold and copper recoveries expected to commence in the second quarter of 2023.

- Reinvigorated focus on free cash flow and delivered on discretionary spending reduction targets by reducing 2022 growth capital and exploration spending by approximately $30 million in Arizona, Manitoba and Peru.

- Reduced 2023 discretionary spending by more than $50 million primarily related to the deferral of the Copper World definitive feasibility study and the pebble crusher in Peru.

- Repaid approximately 50% of the original gold prepayment liability in 2022 and we remain focused on reducing net debt throughout 2023.

- Prudent approach to capital allocation demonstrated with the introduction of three prerequisites for sanctioning Copper World, including a prudent financing strategy with multi-faceted financial targets focused on a minimum cash balance, a stated maximum leverage, limited non-recourse project level debt and committed financial partners.

2023 Annual Guidance and Outlook

- Consolidated copper production is forecast to increase by approximately 10%2 to 114,0002 tonnes in 2023, compared to 2022, with higher grades from the Pampacancha deposit in Peru.

- Consolidated gold production is forecast to increase by 30%2 to 285,5002 ounces, compared to 2022, due to significantly higher gold production in Peru and Manitoba.

- Consolidated copper and gold production is expected to further increase in 2024, similar to the previously issued guidance, and 2025 copper and gold production is expected to benefit from an extension of mining activities at Pampacancha into the first half of 2025.

- Consolidated cash cost, net of by-product credits1, in 2023 is expected to decline by 30%2 and be within a range of $0.40 and $0.80 per pound of copper as a result of higher copper production and gold by-product credits.

- Approximately $65 million reduction in growth capital expenditures and exploration spending is expected in 2023 compared to 2022.

- Total capital expenditures are expected to decline by approximately 13% year-over-year to $300 million in 2023.

- Exploration expenditures are expected to decline by approximately 61% in 2023 as activities are focused on areas with high potential for new discovery and mineral reserve and resource expansion.

Summary of Fourth Quarter Results

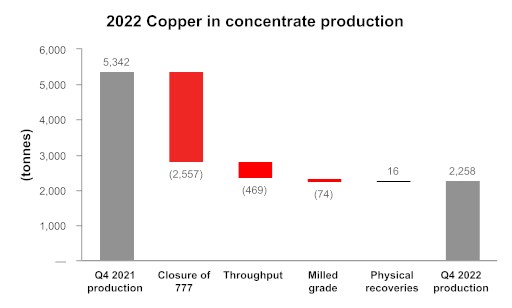

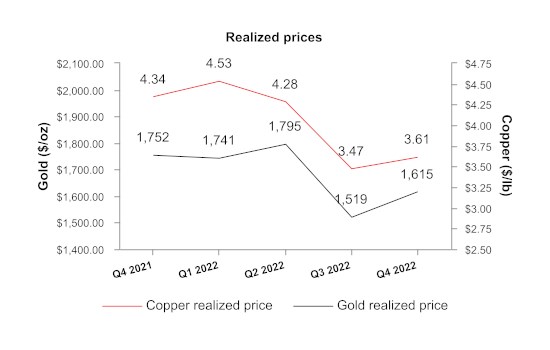

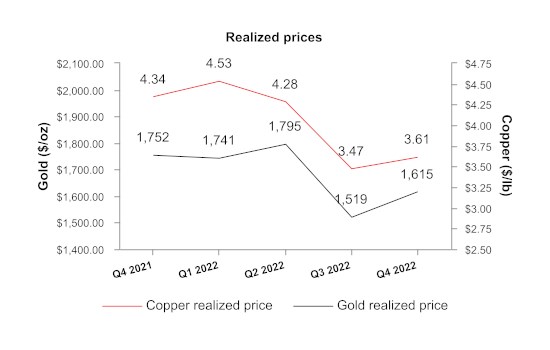

Cash generated from operating activities in the fourth quarter of 2022 decreased to $86.4 million compared to $97.1 million in the same quarter of 2021. Peru operations were impacted by increasing tensions, protests, and social unrest following a change in political leadership in December 2022. Constancia has continued to operate throughout these disruptions but our ability to steadily receive critical supplies, such as fuel, and to transport concentrates has been impacted. Operating cash flow before change in non-cash working capital was $109.1 million during the fourth quarter of 2022, reflecting a decrease of $47.8 million compared to the same period of 2021. The decrease was primarily the result of lower copper prices, lower zinc and gold sales volumes, inflationary cost pressures on mine operating costs and higher treatment and refining charges, partially offset by higher molybdenum prices and sales volumes and higher copper sales volumes. Zinc and gold sales volumes were lower than the prior year primarily due to the planned closure of the Company's 777 mine in June 2022.

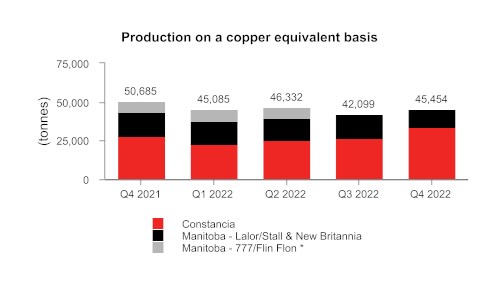

Production in the fourth quarter of 2022 did not include any production from the 777 mine, which closed, as planned, in June 2022. The comparison in this paragraph excludes the production from the 777 mine in the fourth quarter of 2021 to illustrate the comparative performance of our current operations. Consolidated copper production in the fourth quarter of 2022 increased by 14% compared to the same period in 2021 primarily due to higher copper grades in Peru. Consolidated gold production in the fourth quarter of 2022 decreased by 2% compared to the fourth quarter of 2021, due to lower throughput in Manitoba and Peru resulting from planned maintenance programs, partially offset by higher recoveries in Peru, higher Lalor gold grades and higher recoveries at Stall. Consolidated zinc production in the fourth quarter decreased by 55%, versus the comparative 2021 quarter due to the transition of mining toward the gold lenses at Lalor and a corresponding decrease of production from the base metal zones. Consolidated silver production in the fourth quarter decreased by 1% compared to the same period in 2021, due to lower Manitoba and Peru throughput and silver grades at Lalor, partially offset by higher recoveries. For a comprehensive comparison to the prior period (which includes production from the 777 mine), please refer to "Manitoba Operations Review" section.

Net loss and loss per share in the fourth quarter of 2022 were $17.4 million and $0.07, respectively, compared to a net loss and loss per share of $10.5 million and $0.04, respectively, in the fourth quarter of 2021. The 2022 fourth quarter results were negatively impacted by a non-cash loss of $13.5 million related to the quarterly revaluation of our Flin Flon environmental reclamation provision due to changes in real, long-term discount rates, an $8.0 million revaluation loss related to the gold prepayment liability and a $5.8 million loss on changes to other provisions. These costs were offset by a $2.4 million Manitoba post-employment plan curtailment gain.

Adjusted net earnings1 and adjusted net earnings per share1 in the fourth quarter of 2022 were $2.6 million and $0.01 per share, respectively, after adjusting for the non-cash revaluation loss of the environmental reclamation provision and the revaluation loss on the gold prepayment liability, among other items. This compares to adjusted net earnings and adjusted net earnings per share of $32.7 million, and $0.13 in the same period of 2021. Fourth quarter adjusted EBITDA1 was $124.7 million, compared to $180.8 million in the same period of 2021.

In the fourth quarter of 2022, consolidated cash cost per pound of copper produced, net of by-product credits1, was $1.08, compared to $0.51 in the same period in 2021. This increase was a result of lower precious metal by-product credits, inflationary cost pressures on operating costs and higher freight, treatment and refining charges, partially offset by slightly higher copper production. Consolidated sustaining cash cost per pound of copper produced, net of by-product credits1, was $2.21 in the fourth quarter of 2022 compared to $1.95 in the same period in 2021. This increase was primarily due to the same reasons outlined above, slightly offset by lower cash sustaining capital expenditures in Peru.

Consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, was $2.41 in the fourth quarter of 2022, higher than $2.20 in the same period in 2021, due to the same reasons outlined above partially offset by lower corporate selling and administrative expenses.

As at December 31, 2022, our liquidity includes $225.7 million in cash as well as undrawn availability of $354.3 million under our revolving credit facilities. We expect that our current liquidity combined with cash flow from operations, will be sufficient to meet our liquidity needs for the foreseeable future.

Summary of Full Year Results

We achieved our 2022 consolidated production guidance for all metals. However, production of copper and gold was at the lower end of the guidance range primarily due to lower-than-planned grades in the fourth quarter in Peru caused by short-term mine plan changes that were implemented to mitigate the risks associated with logistical and supply chain disruptions in Peru.

Cash generated from operating activities increased to $487.8 million in 2022 from $385.1 million in 2021. A portion of the increase is due to changes in non-cash working capital caused primarily by timing and changes in provisionally priced receivables and changes to other financial assets, liabilities and inventories. Operating cash flow before changes in non-cash working capital decreased to $391.7 million from $483.9 million in 2021. The decrease is the result of lower copper prices, lower zinc sales volumes and inflationary cost pressures on mine operating costs, partially offset by higher zinc prices and higher gold sales volumes. Zinc sales volumes were lower than the prior year due to the planned closure of the 777 mine in June 2022.

Excluding production from 777, consolidated copper, gold and silver production in the full year 2022 increased by 14%, 36% and 13%, respectively, compared to the same period in 2021 primarily due to higher throughput in Peru and Manitoba as well as higher overall copper and gold grades.

Net earnings and earnings per share for 2022 were $70.4 million and $0.27, respectively, compared to a net loss and loss per share of $244.4 million and $0.93, respectively, in 2021. The prior period results were negatively impacted by a $193.5 million revaluation of our Flin Flon environmental reclamation provision resulting in an impairment charge of the same amount as well as a $66.7 million in mark-to-market loss mostly from $49.8 million of write-offs for a non-cash embedded derivative on the early redemption option associated with our extinguished senior unsecured notes. Full year 2022 net earnings benefited from a non-cash gain of $133.5 million related to the revaluation of our Flin Flon environmental reclamation provision. The full year 2022 financial results were negatively impacted by a $95.0 million pre-tax impairment loss related to certain specific capitalized costs and assets associated with the previous stand-alone development plan for the Rosemont deposit, which were determined to no longer be recoverable.

Consolidated cash costs per pound of copper produced, net of by-product credits, in 2022 was $0.86 compared to $0.74 in 2021 and consolidated sustaining cash cost per pound of copper produced, net of by-product credits, in 2022 remained unchanged from 2021 at $2.07. Both measures remained in line with our 2022 guidance ranges.

* Mining activities at 777 were completed in June 2022

1 Adjusted net earnings (loss) and adjusted net earnings (loss) per share, adjusted EBITDA, cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, combined unit cost and net debt are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

2 Calculated using the mid-point of the guidance range.

KEY FINANCIAL RESULTS

| Financial Condition | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| (in $ thousands) | | | | | | |

| Cash | $ | 225,665 | | $ | 270,989 | |

| Total long-term debt | | 1,184,162 | | | 1,180,274 | |

| Net debt1 | | 958,497 | | | 909,285 | |

| Working capital2 | | 76,534 | | | 147,512 | |

| Total assets | | 4,325,943 | | | 4,616,231 | |

| Equity | | 1,571,809 | | | 1,476,828 | |

| 1 Net debt is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

| 2 Working capital is determined as total current assets less total current liabilities as defined under IFRS and disclosed on the consolidated financial statements. |

| Financial Performance | | Three months ended | | | Year ended | |

(in $ thousands, except per share amounts or

as noted below) | | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Revenue | $ | 321,196 | | $ | 425,170 | | $ | 1,461,440 | | $ | 1,501,998 | |

| Cost of sales | | 251,520 | | | 343,426 | | | 1,184,552 | | | 1,370,979 | |

| (Loss) earnings before tax | | (14,287 | ) | | (149 | ) | | 95,815 | | | (202,751 | ) |

| Net (loss) earnings | | (17,441 | ) | | (10,453 | ) | | 70,382 | | | (244,358 | ) |

| Basic and diluted (loss) earnings per share | | (0.07 | ) | | (0.04 | ) | | 0.27 | | | (0.93 | ) |

| Adjusted earnings per share1 | | 0.01 | | | 0.13 | | | 0.10 | | | 0.09 | |

| Operating cash flow before changes in non-cash working capital2 | | 109.1 | | | 156.9 | | | 391.7 | | | 483.9 | |

| Adjusted EBITDA1,2 | | 124.7 | | | 180.8 | | | 475.9 | | | 547.8 | |

| 1 Adjusted earnings per share and adjusted EBITDA are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

| 2 In $ millions. |

KEY PRODUCTION RESULTS

| | | Three months ended | | | Three months ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| | Peru | | | Manitoba | | | Total | | | Peru | | | Manitoba | | | Total | |

| Contained metal in concentrate and doré produced 1 | | | | | | | | | | | | | |

| Copper | tonnes | | 27,047 | | | 2,258 | | | 29,305 | | | 22,856 | | | 5,342 | | | 28,198 | |

| Gold | oz | | 20,860 | | | 33,060 | | | 53,920 | | | 17,917 | | | 46,242 | | | 64,159 | |

| Silver | oz | | 655,257 | | | 139,758 | | | 795,015 | | | 578,140 | | | 321,573 | | | 899,713 | |

| Zinc | tonnes | | - | | | 6,326 | | | 6,326 | | | - | | | 23,207 | | | 23,207 | |

| Molybdenum | tonnes | | 344 | | | - | | | 344 | | | 275 | | | - | | | 275 | |

| Payable metal sold | | | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 23,789 | | | 1,626 | | | 25,415 | | | 20,551 | | | 4,408 | | | 24,959 | |

| Gold2 | oz | | 15,116 | | | 32,140 | | | 47,256 | | | 16,304 | | | 40,623 | | | 56,927 | |

| Silver2 | oz | | 411,129 | | | 148,177 | | | 559,306 | | | 380,712 | | | 257,928 | | | 638,640 | |

| Zinc3 | tonnes | | - | | | 8,230 | | | 8,230 | | | - | | | 21,112 | | | 21,112 | |

| Molybdenum | tonnes | | 421 | | | - | | | 421 | | | 245 | | | - | | | 245 | |

| 1 Metal reported in concentrate is prior to deductions associated with smelter contract terms. |

| 2 Includes total payable gold and silver in concentrate and in doré sold. |

| 3 Includes refined zinc metal and payable zinc in concentrate sold. |

| | | Year ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| | Peru | | | Manitoba | | | Total | | | Peru | | | Manitoba | | | Total | |

| Contained metal in concentrate produced 1 | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 89,395 | | | 14,778 | | | 104,173 | | | 77,813 | | | 21,657 | | | 99,470 | |

| Gold | oz | | 58,229 | | | 161,471 | | | 219,700 | | | 50,306 | | | 143,477 | | | 193,783 | |

| Silver | oz | | 2,309,352 | | | 851,942 | | | 3,161,294 | | | 1,972,949 | | | 1,072,532 | | | 3,045,481 | |

| Zinc | tonnes | | - | | | 55,381 | | | 55,381 | | | - | | | 93,529 | | | 93,529 | |

| Molybdenum | tonnes | | 1,377 | | | - | | | 1,377 | | | 1,146 | | | - | | | 1,146 | |

| Payable metal sold | | | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 79,805 | | | 14,668 | | | 94,473 | | | 71,398 | | | 20,802 | | | 92,200 | |

| Gold2 | oz | | 49,968 | | | 163,447 | | | 213,415 | | | 41,807 | | | 126,551 | | | 168,358 | |

| Silver2 | oz | | 2,045,678 | | | 932,807 | | | 2,978,485 | | | 1,490,651 | | | 936,857 | | | 2,427,508 | |

| Zinc3 | tonnes | | - | | | 59,043 | | | 59,043 | | | - | | | 96,435 | | | 96,435 | |

| Molybdenum | tonnes | | 1,352 | | | - | | | 1,352 | | | 1,098 | | | - | | | 1,098 | |

| 1 Metal reported in concentrate is prior to deductions associated with smelter contract terms. |

| 2 Includes total payable gold and silver in concentrate and in doré sold. |

| 3 Includes refined zinc metal and payable zinc in concentrate sold. |

KEY COST RESULTS

| | | | Three months ended | | | Year ended | | | Guidance | |

| | | | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Annual

2022 | |

| Peru cash cost per pound of copper produced | | | | | | | | | | |

| Cash cost 1 | $/lb | | 1.34 | | | 1.28 | | | 1.58 | | | 1.54 | | | 1.10 - 1.40 | |

| Sustaining cash cost 1 | $/lb | | 2.09 | | | 2.46 | | | 2.35 | | | 2.46 | | | | |

| Manitoba cash cost per ounce of gold produced | | | | | | | | | | |

| Cash cost 1,2 | $/oz | | 922 | | | - | | | 297 | | | - | | | 300 - 550 | |

| Sustaining cash cost 1,2 | $/oz | | 1,795 | | | - | | | 1,091 | | | - | | | | |

| Consolidated cash cost per pound of copper produced | | | | | | | | | | |

| Cash cost 1 | $/lb | | 1.08 | | | 0.51 | | | 0.86 | | | 0.74 | | | 0.60 - 1.05 | |

| Sustaining cash cost 1 | $/lb | | 2.21 | | | 1.95 | | | 2.07 | | | 2.07 | | | 1.60 - 2.25 | |

| All-in sustaining cash cost1 | $/lb | | 2.41 | | | 2.20 | | | 2.26 | | | 2.30 | | | | |

| 1 Cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, gold cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, and unit operating cost are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

| 2 Cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits were introduced in 2022 and do not have a published comparative. |

RECENT DEVELOPMENTS

Commitment to Climate Change Initiatives

On December 12, 2022, we announced our commitment to achieve net zero greenhouse gas ("GHG") emissions by 2050 and the adoption of interim 2030 GHG reduction targets to support this commitment. We have initiated a roadmap to further identify and manage risks associated with climate change, and opportunities to reduce GHG emissions in alignment with global decarbonization goals.

While our operations are well-positioned in the lower half of the global GHG emissions curve for copper operations, we recognize our role in mitigating climate change. Hudbay's GHG emissions reduction plan includes the following initiatives:

• Pursuing a 50% reduction in absolute Scope 1 and Scope 2 emissions from existing operations by 2030 (compared to 2021)

• Achieving net zero total emissions by 2050

• Reporting on material Scope 3 emissions in the near-term

• Assessing acquisitions and new projects against corporate emissions targets

• Continuing to be transparent with GHG performance data disclosure, including reporting total GHG emissions and GHG intensity

Hudbay's efforts have been focused on improving operating efficiencies to reduce the GHG emissions intensity at our mines through initiatives such as ore sorting and recovery improvement programs. We have identified multiple opportunities to achieve further reductions in emissions, including grid decarbonization in Peru, fleet and heating electrification and fuel switching in mobile equipment. We will continue to monitor and evaluate existing and new technologies as they become financially viable to implement at our operations. We will also consider emissions reduction opportunities in the design of our brownfield and greenfield growth projects. All initiatives will balance emissions and economic targets as part of our disciplined capital allocation strategy.

Advancing Activities to Prudently De-risk Copper World

In 2022, we invested approximately $80 million at Copper World to successfully execute a new strategy focused on a two-phase mine plan with the first phase located on private land claims. This strategy involved significant drilling campaigns to delineate seven newly discovered deposits adjacent to the known East deposit, the expansion of our private land package to over 4,500 acres, and the completion of a robust preliminary economic assessment for Copper World demonstrating a 16-year mine plan for Phase I, requiring only state level permits, and an expansion to a 44 year operation in Phase II with the utilization of federal lands.

Hudbay continues to advance pre-feasibility activities for Phase I of the Copper World project, which is expected to support the conversion of mineral resources to mineral reserves and optimize the layout and sequencing of the mineral processing facilities, in addition to evaluating other upside opportunities. Pre-feasibility level engineering of the main processing facility was completed by year-end together with geotechnical and hydrogeological site investigation activities. Metallurgical test work activities continued into 2023 and the results are being analyzed as part of concentrate leaching trade off evaluations. A pre-feasibility study for Phase I of the Copper World project is expected to be released in the second quarter of 2023.

In late 2022, Hudbay submitted the applications for an Aquifer Protection Permit and an Air Quality Permit to the Arizona Department of Environmental Quality ("ADEQ"). Hudbay continues to expect to receive these two remaining state permits in 2023. The other key state permit, the Mined Land Reclamation Plan, was received in 2022.In January 2023, Hudbay received an approved right-of-way from the State Land Department that will allow for infrastructure, such as roads, pipelines and powerlines, to connect between the properties in our private land package at Copper World.

Upon receipt of the state level permits, the company expects to conduct a bulk sampling program at Copper World to continue to de-risk the project by testing grade continuity, variable cut-off effectiveness and metallurgical strategies. Hudbay also intends to initiate a minority joint venture partner process following receipt of permits, which will allow the potential joint venture partner to participate in and help fund the definitive feasibility study activities in 2024.

Continued Focus on Cost Reductions and Capital Discipline

With a focus on generating positive cash flow, we delivered on our discretionary spending reduction targets by reducing 2022 growth capital and exploration spending by approximately $30 million in Arizona, Manitoba and Peru. We also reduced planned 2023 discretionary spending by more than $50 million primarily related to the deferral of the Copper World definitive feasibility study and the pebble crusher in Peru. Furthermore, planned 2023 growth and exploration expenditures are expected to be approximately $65 million lower than 2022 levels.

As an additional prudent measure intended to ensure positive cash flow generation and continued financial discipline, Hudbay expects to extend its existing quotational period hedging program, to cover approximately 13,000 tonnes of contained copper in the unsold concentrate inventory in Peru to lock in current copper prices.

We expect spending on our Copper World project in 2023 will be limited to de-risking activities, including the completion of the pre-feasibility study and state level permitting. The opportunity to sanction Copper World is not expected until 2025 based on current estimated timelines. This, together with our 2023 discretionary spending reductions, reflects a conservative approach to capital spending at Copper World over the next two years. As part of our disciplined financial planning approach to Copper World, we identified three specific prerequisites that would need to be achieved prior to making an investment decision in the project:

1. Permits - receipt of all state level permits required for Phase I;

2. Plan - completion of a definitive feasibility study with an internal rate of return of greater than 15%; and,

3. Prudent Financing Strategy - multi-faceted financial targets focused on a minimum cash balance, a stated maximum leverage, limited non-recourse project level debt and committed financial partners.

Exploration Update

Peru Regional Exploration

Hudbay controls a large, contiguous block of mineral rights with the potential to host mineral deposits within trucking distance of the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. Following the execution of a surface rights exploration agreement with the community of Uchucarcco in August 2022, the company has commenced early exploration activities at the Maria Reyna and Caballito properties. Surface investigation activities together with baseline environmental and archaeological activities necessary to support drill permit applications for the Maria Reyna and Caballito prospects have been completed. Ground geophysical surveys commenced in the fourth quarter of 2022 and will continue once the Peruvian social situation improves. Field evidence confirms that both Caballito and Maria Reyna host sulfide and oxide rich copper mineralization in skarns, hydrothermal breccias and large porphyry intrusive bodies.

Recent activities at the Llaguen copper-molybdenum porphyry deposit in the Otuzco province in northern Peru have been focused on initiating metallurgical test work.

Manitoba Regional Exploration

Hudbay commenced a winter drill program in January 2023 with four drill rigs testing the down-dip gold and copper extensions of the Lalor deposit, which is the first time we have completed step-out drilling in the deeper zones at Lalor since the initial discovery of the gold and copper-gold zones in 2009 and 2010. One additional drill rig is testing a target located to the north of Lalor.

Arizona Regional Exploration

Recent drilling activities at Copper World have focused on close spaced infill drilling to support potential future bulk sampling programs. This drilling is now completed, and no additional drilling is planned for 2023.

Nevada Regional Exploration

A conductivity-resistivity IP ground survey commenced in the fourth quarter of 2022 on Hudbay's private land claims near the Mason project. This work, in combination with a re-interpretation of geological data from past operating mines and previous exploration data, will be used to finalize a future drill plan to test high grade skarn targets.

Dividend Declared

A semi-annual dividend of C$0.01 per share was declared on February 23, 2023. The dividend will be paid out on March 24, 2023 to shareholders of record as of March 7, 2023.

PERU OPERATIONS REVIEW

| | | Three months ended | | | Year ended | | | Guidance | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Annual | |

| | 2022 | |

| Constancia ore mined 1 | tonnes | | 5,614,918 | | | 7,742,469 | | | 25,840,435 | | | 29,714,327 | | | | |

| Copper | % | | 0.40 | | | 0.33 | | | 0.35 | | | 0.31 | | | | |

| Gold | g/tonne | | 0.04 | | | 0.04 | | | 0.04 | | | 0.04 | | | | |

| Silver | g/tonne | | 3.48 | | | 2.81 | | | 3.40 | | | 2.88 | | | | |

| Molybdenum | % | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | | | | |

| Pampacancha ore mined 1 | tonnes | | 3,771,629 | | | 2,107,196 | | | 8,319,250 | | | 5,141,001 | | | | |

| Copper | % | | 0.37 | | | 0.27 | | | 0.33 | | | 0.27 | | | | |

| Gold | g/tonne | | 0.29 | | | 0.34 | | | 0.29 | | | 0.30 | | | | |

| Silver | g/tonne | | 3.84 | | | 4.26 | | | 4.06 | | | 4.02 | | | | |

| Molybdenum | % | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | | | | |

| Total ore mined | tonnes | | 9,386,547 | | | 9,849,665 | | | 34,159,685 | | | 34,855,328 | | | | |

| Strip ratio 2 | | | 0.97 | | | 0.95 | | | 1.13 | | | 1.02 | | | | |

| Ore milled | tonnes | | 7,795,735 | | | 8,048,925 | | | 30,522,294 | | | 28,809,755 | | | | |

| Copper | % | | 0.41 | | | 0.33 | | | 0.34 | | | 0.32 | | | | |

| Gold | g/tonne | | 0.12 | | | 0.11 | | | 0.09 | | | 0.08 | | | | |

| Silver | g/tonne | | 3.93 | | | 3.67 | | | 3.58 | | | 3.35 | | | | |

| Molybdenum | % | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | | | | |

| Copper concentrate | tonnes | | 117,980 | | | 96,123 | | | 393,255 | | | 335,490 | | | | |

| Concentrate grade | % Cu | | 22.93 | | | 23.78 | | | 22.73 | | | 23.19 | | | | |

| Copper recovery | % | | 85.1 | | | 86.0 | | | 85.0 | | | 84.6 | | | | |

| Gold recovery | % | | 69.6 | | | 63.6 | | | 63.6 | | | 64.6 | | | | |

| Silver recovery | % | | 66.5 | | | 60.8 | | | 65.7 | | | 63.7 | | | | |

| Molybdenum recovery | % | | 37.7 | | | 26.7 | | | 34.8 | | | 31.5 | | | | |

| Combined unit operating costs 3,4,5 | $/tonne | | 13.64 | | | 9.96 | | | 12.78 | | | 10.70 | | | 10.10 - 12.90 6 | |

| 1 Reported tonnes and grade for ore mined are estimates based on mine plan assumptions and may not reconcile fully to ore milled. |

| 2 Strip ratio is calculated as waste mined divided by ore mined. |

| 3 Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs. |

| 4 Combined unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

| 5 Excludes approximately $0.7 million, or $0.09 per tonne and $5.2 million, or $0.17 per tonne, of COVID-19 related costs during the three and twelve months ended December 31, 2022 respectively and $4.1 million, or $0.51 per tonne and $19.8 million or $0.69 per tonne, of COVID-19 related costs during the three and twelve months ended December 31, 2021. |

| 6 Combined unit cost guidance for 2022 excludes COVID-19 related costs. |

Total ore mined in the fourth quarter of 2022 decreased by 5% compared to the same period in 2021 due, in part, to a short-term change in mine plan where the company prioritized the processing of lower grade stockpiles and shorter haulage distance ore from the Constancia pit in order to ration fuel during a period of nation-wide social unrest and road blockades following a change in Peru's political leadership in early December 2022. This short-term change in mine plan ensured the plant continued to operate uninterrupted.

Ore milled during the fourth quarter of 2022 was 3% lower than the same period in 2021 due to a previously announced plant maintenance program in November 2022. Milled copper grades increased by 24% in the fourth quarter of 2022 compared to the same period in 2021 due to higher head grades from both Pampacancha and Constancia.

Full year 2022 ore mined was 2% lower than the same period in 2021. Full year 2022 copper and gold grades milled were 6% and 13% higher, respectively, than the comparative 2021 period due to higher head grades from both Pampacancha and Constancia.

Copper recoveries in the fourth quarter of 2022 were in line with the comparative 2021 period. Gold and silver recoveries in the fourth quarter were both 9% higher than the comparative 2021 period due to higher milled gold and silver grades. Peru achieved a record quarterly gold recovery of 70% in the fourth quarter of 2022.

Full year 2022 recoveries for copper, gold and silver were relatively consistent with the comparable period of 2021.

Combined mine, mill and G&A unit operating costs in the fourth quarter of 2022 were 37% higher than the same period in 2021 primarily due to incremental costs associated with the fourth quarter planned mill maintenance, higher mining costs associated with mining more ore from Pampacancha, as well as inflationary pressures on fuel, consumables and energy costs. Full year combined mine, mill and G&A unit operating costs for 2022 were 19% higher than the same period in 2021 due to the same factors as the quarterly variance partially offset by higher ore milled.

Contained metal in

concentrate

produced | | Three months ended | | | Year ended | | | Guidance | |

| | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Annual | |

| | 2022 | | | 2023 | |

| Copper | tonnes | | 27,047 | | | 22,856 | | | 89,395 | | | 77,813 | | | 89,000 - 115,000 | | | 91,000 - 116,000 | |

| Gold | oz | | 20,860 | | | 17,917 | | | 58,229 | | | 50,306 | | | 70,000 - 90,000 | | | 83,000 - 108,000 | |

| Silver | oz | | 655,257 | | | 578,140 | | | 2,309,352 | | | 1,972,949 | | | 1,620,000 - 2,100,000 | | | 2,210,000 - 2,650,000 | |

| Molybdenum | tonnes | | 344 | | | 275 | | | 1,377 | | | 1,146 | | | 1,100 - 1,400 | | | 1,300 - 1,600 | |

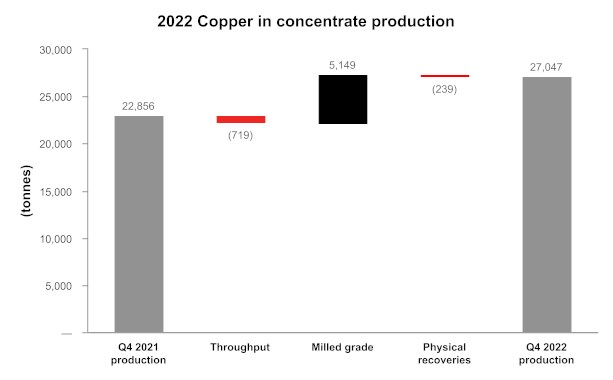

Fourth quarter 2022 production of molybdenum, copper, gold and silver was 25%, 18%, 16% and 13% higher, respectively, than the comparative period in 2021 due to higher copper and precious metal grades and higher precious metal and molybdenum recoveries. The fourth quarter of 2022 was a record quarter for gold production in Peru. Full year 2022 production of copper, gold, silver and molybdenum was 15%, 16%, 17% and 20% higher, respectively, than the comparative period in 2021 due to higher throughput, higher copper and precious metal grades and higher copper, silver and molybdenum recoveries.

Full year 2022 production of copper increased by 15% year-over-year to 89,395 tonnes, within the guidance range. Similarly, full year 2022 production of gold, silver and molybdenum increased by 16%, 17% and 20%, respectively, compared to 2021 due to higher throughput, higher copper and precious metal grades and higher copper, silver and molybdenum recoveries. Molybdenum production was in line with our annual guidance range, whereas silver production exceeded the top end of our annual guidance range by 10%. Gold production fell short of the annual guidance range primarily due to lower-than-planned grades from the Pampacancha pit in the fourth quarter of 2022 as a result of short-term changes in the mine plan.

Peru Cash Cost and Sustaining Cash Cost

| | | Three months ended | | | Year ended | | | Guidance | |

| | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Annual

2022 | | | Annual

2023 | |

| Cash cost per pound of copper produced, net of by-product credits1 | $/lb | | 1.34 | | | 1.28 | | | 1.58 | | | 1.54 | | | 1.10 - 1.40 | | | 1.05 - 1.30 | |

| Sustaining cash cost per pound of copper produced, net of by-product credits1 | $/lb | | 2.09 | | | 2.46 | | | 2.35 | | | 2.46 | | | | | | | |

| 1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-IFRS financial performance measures, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

Cash cost per pound of copper produced, net of by-product credits, in the fourth quarter of 2022 was $1.34, an increase of 5% compared to the same period in 2021 due to inflationary pressures on fuel, consumables and energy costs driving higher mining and milling costs, partially offset by lower general and administrative costs, higher molybdenum by-product credits and higher copper production. However, cash cost per pound of copper produced, net of by-product credits, in the fourth quarter of 2022 was below the run rate for the first nine months of the year primarily due to higher copper, gold and silver grades in the fourth quarter. Full year cash cost per pound of copper produced, net of by-product credits, was $1.58, a slight increase of 3% compared to the same period of 2021. This exceeded the upper end of our 2022 guidance range primarily due to higher mining and milling costs from input cost inflation and lower than expected by-product credits due to lower-than-expected gold grades from Pampacancha in the fourth quarter of 2022, as described above.

Sustaining cash cost per pound of copper produced, net of by-product credits, for the fourth quarter and full year 2022 were 15% and 4% lower, respectively, than the comparative 2021 periods due to lower sustaining capital expenditures and higher copper and gold production, offset, in part, by higher mining and milling costs from input cost inflation.

Metal Sold

| | | Three months ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Payable metal in concentrate | | | | | | | | | | | | | |

| Copper | tonnes | | 23,789 | | | 20,551 | | | 79,805 | | | 71,398 | |

| Gold | oz | | 15,116 | | | 16,304 | | | 49,968 | | | 41,807 | |

| Silver | oz | | 411,129 | | | 380,712 | | | 2,045,678 | | | 1,490,651 | |

| Molybdenum | tonnes | | 421 | | | 245 | | | 1,352 | | | 1,098 | |

While we were able to complete two copper concentrate shipments from the Matarani port during December, Peru's copper, gold and silver sales in the fourth quarter of 2022 were impacted by higher-than-normal unsold copper concentrate inventory levels of approximately 25,000 wet metric tonnes as at December 31, 2022, due to the nation-wide road blockades in early December. We have been able to steadily operate the Constancia mill throughout the recent road blockades, and despite completing three copper concentrate shipments from the port in January 2023, Peru's unsold copper concentrate inventory levels reached a peak of approximately 47,000 wet metric tonnes in mid-February when transportation of concentrate resumed with the assistance of the community-based concentrate trucking companies.We expect concentrate inventory levels to normalize over the next several months.

MANITOBA OPERATIONS REVIEW

Mines

| | | Three months ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Lalor | | | | | | | | | | | | | |

| Ore | tonnes | | 369,453 | | | 422,208 | | | 1,516,203 | | | 1,593,141 | |

| Copper | % | | 0.73 | | | 0.78 | | | 0.73 | | | 0.71 | |

| Zinc | % | | 2.17 | | | 4.19 | | | 3.14 | | | 4.23 | |

| Gold | g/tonne | | 4.00 | | | 3.92 | | | 4.00 | | | 3.41 | |

| Silver | g/tonne | | 19.37 | | | 30.35 | | | 21.96 | | | 24.66 | |

| 777 | | | | | | | | | | | | | |

| Ore | tonnes | | - | | | 266,744 | | | 484,355 | | | 1,053,710 | |

| Copper | % | | - | | | 1.13 | | | 1.12 | | | 1.28 | |

| Zinc | % | | - | | | 4.16 | | | 3.83 | | | 3.91 | |

| Gold | g/tonne | | - | | | 1.80 | | | 1.66 | | | 2.03 | |

| Silver | g/tonne | | - | | | 25.02 | | | 20.85 | | | 25.25 | |

| Total Mines | | | | | | | | | | | | | |

| Ore | tonnes | | 369,453 | | | 688,952 | | | 2,000,558 | | | 2,646,851 | |

| Copper | % | | 0.73 | | | 0.91 | | | 0.83 | | | 0.94 | |

| Zinc | % | | 2.17 | | | 4.18 | | | 3.31 | | | 4.10 | |

| Gold | g/tonne | | 4.00 | | | 3.10 | | | 3.43 | | | 2.86 | |

| Silver | g/tonne | | 19.37 | | | 28.29 | | | 21.69 | | | 24.90 | |

| | | | | | | | | | | | | | |

| Unit Operating Costs 1 | | Three months ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Mines | | | | | | | | | | | | | |

| Lalor | C$/tonne | | 140.10 | | | 112.34 | | | 136.71 | | | 114.95 | |

| 777 | C$/tonne | | - | | | 100.34 | | | 87.50 | | | 91.12 | |

| Total Mines | C$/tonne | | 140.10 | | | 107.69 | | | 124.80 | | | 105.46 | |

| 1 Reflects costs per tonne of ore mined. | |

During the fourth quarter of 2022, the Manitoba team continued to focus on integrating our Flin Flon employees and equipment into the Snow Lake operations in order to significantly reduce our reliance on higher cost contractors. Lalor's ore production during the quarter was impacted by a planned maintenance program to replace surface ore chutes as well as various other pre-winter maintenance activities including the muck circuit, hoist drive and electrical maintenance. We continue to advance several key initiatives to support higher production levels at Lalor, including building longhole inventory, improving stope muck fragmentation, optimizing the development drift size and focusing on shaft availability improvements to enable more ore to be hoisted to surface while reducing inefficient trucking of ore via the ramp.

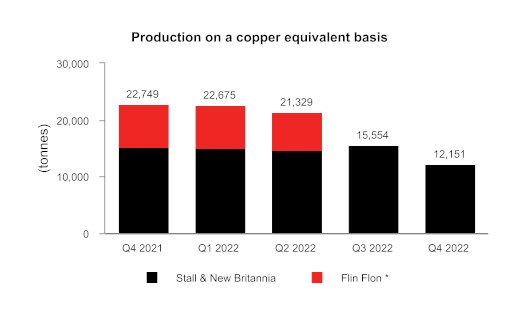

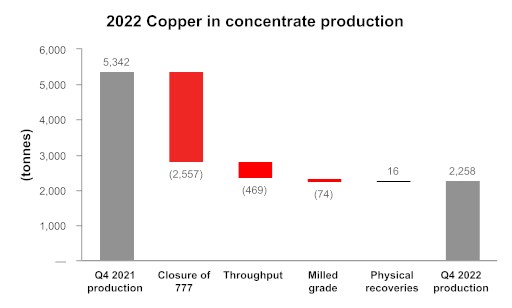

Ore mined at our Manitoba operations during the fourth quarter of 2022 was 46% lower than the same period in 2021 mainly due to the planned closure of 777 in June 2022 which resulted in a significant decline in ore mined in the fourth quarter compared to the prior year period which benefited from the full contribution of 777 mine production. Excluding 777 production, Lalor mined ore in the fourth quarter was 12% lower than the same period in 2021 due to the above noted transition and the planned maintenance program impacting operations. Gold grades mined during the fourth quarter of 2022 were 2% higher than the same period in 2021. Copper, zinc and silver grades mined at Lalor during the fourth quarter of 2022 were 6%, 48% and 36% lower, respectively, compared to the same period in 2021.

Ore mined at our Manitoba operations for the full year 2022 was 24% lower than 2021 mainly due to the closure of 777 in June 2022 as mentioned above. Ore mined at Lalor for the full year 2022 was 5% lower than 2021 while copper and gold grades mined at Lalor during 2022 were 3% and 17% higher, respectively. The zinc and silver grades at Lalor were 26% and 11% lower, respectively, compared to the same period in 2021, mainly due to an increased focus on mining of gold and copper-gold stopes and a corresponding decrease of production from the base metal zones.

Total mine unit operating costs during the fourth quarter of 2022 increased by 30%, reflecting the standalone cost structure of Lalor compared to the same period in 2021 which included operating costs for both Lalor and the lower cost 777 mine. Operating costs were also impacted by inflationary cost pressures for bulk commodities, fuel, and contractor costs compared to the same period in 2021, in addition to lower ore production volumes as mentioned above.

Total mine unit operating costs during the full year 2022 increased by 18% compared to the same period in 2021 due to the factors mentioned above and higher propane usage early in the year caused by a colder winter.

Processing Facilities

| | | Three months ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Stall & New Britannia Concentrator Combined | | | | | | | | | | | | |

| Ore | tonnes | | 345,492 | | | 419,727 | | | 1,510,907 | | | 1,506,756 | |

| Copper | % | | 0.73 | | | 0.75 | | | 0.75 | | | 0.72 | |

| Zinc | % | | 2.31 | | | 4.12 | | | 3.30 | | | 4.30 | |

| Gold | g/tonne | | 3.98 | | | 3.90 | | | 4.08 | | | 3.42 | |

| Silver | g/tonne | | 20.40 | | | 30.07 | | | 22.15 | | | 24.95 | |

| Copper concentrate | tonnes | | 14,201 | | | 17,494 | | | 58,276 | | | 57,291 | |

| Concentrate grade | % Cu | | 15.90 | | | 15.92 | | | 17.12 | | | 16.43 | |

| Zinc concentrate | tonnes | | 12,706 | | | 27,672 | | | 77,806 | | | 111,370 | |

| Concentrate grade | % Zn | | 49.79 | | | 51.02 | | | 50.63 | | | 50.56 | |

| Copper recovery - concentrate | % | | 89.2 | | | 88.7 | | | 88.6 | | | 86.8 | |

| Zinc recovery - concentrate (Stall) | % | | 90.1 | | | 87.4 | | | 86.6 | | | 88.9 | |

| Gold recovery - concentrate | % | | 58.8 | | | 54.6 | | | 59.2 | | | 54.9 | |

| Silver recovery - concentrate | % | | 56.1 | | | 53.9 | | | 58.1 | | | 54.4 | |

| Contained metal in concentrate produced | | | | | | | | | | |

| Copper | tonnes | | 2,258 | | | 2,785 | | | 9,977 | | | 9,415 | |

| Zinc | tonnes | | 6,326 | | | 14,119 | | | 39,395 | | | 56,310 | |

| Gold | oz | | 25,961 | | | 28,720 | | | 117,526 | | | 90,911 | |

| Silver | oz | | 127,099 | | | 218,679 | | | 625,145 | | | 656,847 | |

| Metal in doré produced | | | | | | | | | | |

| Gold | oz | | 7,099 | | | 8,598 | | | 28,707 | | | 9,002 | |

| Silver | oz | | 12,659 | | | 6,519 | | | 52,834 | | | 6,529 | |

| Flin Flon Concentrator | | | | | | | | | | | | | |

| Ore | tonnes | | - | | | 262,565 | | | 497,344 | | | 1,133,516 | |

| Copper | % | | - | | | 1.12 | | | 1.11 | | | 1.23 | |

| Zinc | % | | - | | | 4.16 | | | 3.87 | | | 3.95 | |

| Gold | g/tonne | | - | | | 1.78 | | | 1.67 | | | 2.04 | |

| Silver | g/tonne | | - | | | 25.04 | | | 21.00 | | | 24.90 | |

| Copper concentrate | tonnes | | - | | | 12,554 | | | 22,602 | | | 56,646 | |

| Concentrate grade | % Cu | | - | | | 20.37 | | | 21.24 | | | 21.61 | |

| Zinc concentrate | tonnes | | - | | | 18,353 | | | 31,602 | | | 73,974 | |

| Concentrate grade | % Zn | | - | | | 49.51 | | | 50.59 | | | 50.31 | |

| Copper recovery | % | | - | | | 86.7 | | | 86.7 | | | 87.7 | |

| Zinc recovery | % | | - | | | 83.1 | | | 83.0 | | | 83.0 | |

| Gold recovery | % | | - | | | 59.2 | | | 57.1 | | | 58.5 | |

| Silver recovery | % | | - | | | 45.6 | | | 51.8 | | | 45.1 | |

| Contained metal in concentrate produced | | | | | | | | | | |

| Copper | tonnes | | - | | | 2,557 | | | 4,801 | | | 12,242 | |

| Zinc | tonnes | | - | | | 9,088 | | | 15,986 | | | 37,219 | |

| Gold | oz | | - | | | 8,924 | | | 15,238 | | | 43,564 | |

| Silver | oz | | - | | | 96,375 | | | 173,963 | | | 409,156 | |

| Unit Operating Costs 1 | | Three months ended | | | Year ended | | | Guidance | |

| | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Annual | |

| | 2022 | |

| Concentrators | | | | | | | | | | | | | | | | |

| Stall & New Britannia | C$/tonne | | 58.49 | | | 47.67 | | | 54.16 | | | 31.17 | | | | |

| Flin Flon | C$/tonne | | - | | | 30.33 | | | 28.14 | | | 28.27 | | | | |

| Combined mine/mill unit operating costs 2,3 | | | | | | | | | | |

| Manitoba | C$/tonne | | 241 | | | 168 | | | 195 | | | 154 | | | 170 - 185 | |

| 1 Reflects costs per tonne of milled ore. |

| 2 Reflects combined mine, mill and G&A costs per tonne of milled ore. |

| 3 Combined unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

The combined Stall and New Britannia mills processed 18% less ore in the fourth quarter of 2022 compared to the same period in 2021, mainly due to the above noted transition and planned maintenance program impacting Lalor and the milling operations. Stall recoveries were consistent with the metallurgical model for the head grades delivered. Compared to the same period in 2021, unit operating costs at the Stall and New Britannia mills were higher in the fourth quarter of 2022 as a result of higher costs at New Britannia and inflationary cost pressures.

Ore processed at the combined Stall and New Britannia mills during the full year 2022 was in line with the same period in 2021. Stall recoveries were consistent with the metallurgical model for the head grades delivered. Compared to the same period in 2021, unit operating costs at the Stall and New Britannia mills were higher in 2022 for the same reasons outlined in the fourth quarter variance as well as scheduled mill maintenance at New Britannia early in the year and baseline effects as New Britannia was not yet fully operational in the comparative period.

The New Britannia mill continued to achieve consistent production in the fourth quarter, averaging approximately 1,530 tonnes per day. Metal recoveries have now stabilized near our targeted levels for the mill. Additional improvement initiatives will continue to be advanced in the upcoming quarters with a focus on reducing reagent and grinding media consumption that has contributed to higher operating costs than planned. These initiatives require minimal capital expenditures and will further improve overall metal recoveries and copper concentrate grades.

Combined mine, mill and G&A unit operating costs in the fourth quarter of 2022 and full year 2022 increased by 43% and 27%, respectively, compared to the same periods in 2021 reflecting inflationary cost pressures for bulk commodities, fuel, and contractor costs and the standalone cost structure of Lalor compared to the same period in 2021, which included operating costs for both Lalor and the lower cost 777 mine.

| | | | Three months ended | | | Year ended | | | Guidance | |

Contained

metal in

concentrate

produced 1 | | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Annual | |

| | 2022 | | | 2023 | |

| Copper | tonnes | | 2,258 | | | 5,342 | | | 14,778 | | | 21,657 | | | 12,000 - 16,000 | | | 9,000 - 12,000 | |

| Gold 2 | oz | | 25,961 | | | 37,644 | | | 132,764 | | | 134,475 | | | - | | | - | |

| Silver 3 | oz | | 127,099 | | | 315,054 | | | 799,108 | | | 1,066,003 | | | - | | | - | |

| Zinc | tonnes | | 6,326 | | | 23,207 | | | 55,381 | | | 93,529 | | | 50,000 - 70,000 | | | 28,000 - 36,000 | |

| Metal in doré produced 1 | | | | | | | | | | |

| Gold 2 | oz | | 7,099 | | | 8,598 | | | 28,707 | | | 9,002 | | | - | | | - | |

| Silver 3 | oz | | 12,659 | | | 6,519 | | | 52,834 | | | 6,529 | | | - | | | - | |

| Contained metal in concentrate and doré produced | | | | | | | |

| Gold 2 | oz | | 33,060 | | | 46,242 | | | 161,471 | | | 143,477 | | | 150,000 - 185,000 | | | 175,000 - 205,000 | |

| Silver 3 | oz | | 139,758 | | | 321,573 | | | 851,942 | | | 1,072,532 | | | 800,000 - 1,100,000 | | | 750,000 - 1,000,000 | |

| 1 Metal reported in concentrate is prior to deductions associated with smelter terms. |

| 2 Gold production guidance includes gold contained in concentrate produced and gold in doré. |

| 3 Silver production guidance includes silver contained in concentrate produced and silver in doré. |

Manitoba's production of copper, gold, silver and zinc in the fourth quarter of 2022 was lower by 58%, 29%, 57% and 73%, respectively, than the comparative 2021 period following the planned closure of the 777 mine in June 2022, partially offset by higher metal recoveries. Full year 2022 metal production was similarly impacted by the planned closure of 777, resulting in a decrease in copper, zinc and silver production, while 2022 gold production increased by 13% as New Britannia ramped up to full production.

Full year production of all metals in Manitoba achieved our 2022 annual guidance ranges.

* Mining activities at 777 were completed in June 2022

Zinc Plant

| Zinc Production | | Three months ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Zinc Concentrate Treated | | | | | | | | | | |

| Domestic | tonnes | | - | | | 45,143 | | | 76,223 | | | 191,283 | |

| Refined Metal Produced | | | | | | | | | | |

| Domestic | tonnes | | - | | | 20,783 | | | 37,894 | | | 89,568 | |

| Unit Operating Costs | | Three months ended | | | Year ended | |

| | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Dec. 31,

2022 | | | Dec. 31,

2021 | |

| Zinc Plant 1,2 | C$/lb | | - | | | 0.63 | | | 0.60 | | | 0.55 | |

1 Zinc unit operating costs include G&A costs.

2 Zinc unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

The zinc plant ceased operations on June 30, 2022 and, as such, had no production during the second half of 2022. Closure activities commenced in the third quarter of 2022 and progressed safely during the fourth quarter of 2022.

Manitoba Cash Cost and Sustaining Cash Cost

| | | Three months ended | | | Year ended | | | Guidance | |

| | | | | | | | | | | | | | Annual | |

| | Dec. 31,

2022 | | | Dec. 31,

2021 | | | Dec. 31,

2022 | | | Dec. 31,

2021 | | | 2022 | | | 2023 | |

| Cost per pound of gold produced | | | | | | | | | | | | | | | | | | |

| Cash cost per ounce of gold produced, net of by-product credits 1, 2 | $/oz | | 922 | | | - | | | 297 | | | - | | | 300 - 550 | | | 500 - 800 | |

| Sustaining cash cost per ounce of gold produced, net of by-product credits 1, 2 | $/oz | | 1,795 | | | - | | | 1,091 | | | - | | | | | | | |

| 1 Cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits, are not recognized under IFRS. For more detail on this non-IFRS financial performance measure, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A. |

| 2Cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits were introduced in 2022 and do not have a published comparative. |

Cash cost per ounce of gold produced, net of by-product credits, in the fourth quarter was $922, higher than the third quarter of 2022, primarily due to lower by-product credits and lower gold production. This was partially offset by lower mining, milling and general and administrative costs as well as lower treatment, refining and freight costs. However, full year 2022 cash cost per ounce of gold produced, net of by-product credits, was $297, 1% below the low end of our 2022 guidance range.

Sustaining cash cost per ounce of gold produced, net of by-product credits, in the fourth quarter was $1,795, higher than the third quarter of 2022, primarily due to the same factors affecting cash cost, partially offset by lower sustaining capital expenditures.

Metal Sold

| | | Three months ended | | | Year ended | |

| | Dec. 31, 2022 | | | Dec. 31, 2021 | | | Dec. 31, 2022 | | | Dec. 31, 2021 | |

| Payable metal in concentrate and doré | | | | | | | | | | | | | |

| Copper | tonnes | | 1,626 | | | 4,408 | | | 14,668 | | | 20,802 | |

| Gold | oz | | 32,140 | | | 40,623 | | | 163,447 | | | 126,551 | |

| Silver | oz | | 148,177 | | | 257,928 | | | 932,807 | | | 936,857 | |

| Zinc 1 | tonnes | | 8,230 | | | 21,112 | | | 59,043 | | | 96,435 | |

| 1 Includes refined zinc metal and payable zinc in concentrate sold. | |

Sales of copper and zinc during the three and twelve months ended December 31, 2022 were lower than the comparable periods in 2021 due to the same factors affecting production noted above. Gold sales during 2022 were 29% higher than 2021 as New Britannia only reached commercial production in September 2021.

OUTLOOK

This outlook includes forward-looking information about our operations and financial expectations based on our expectations and outlook as of February 23, 2023.

This outlook, including expected results and targets, is subject to various risks, uncertainties and assumptions, which may impact future performance and our achievement of the results and targets discussed in this section. For additional information on forward-looking information, refer to the "Forward-Looking Information" section of this MD&A. We may update our outlook depending on changes in metals prices and other factors, as per our "Commodity Markets" and "Sensitivity Analysis" discussions below. In addition to this section, refer to the "Operations Review", "Financial Review" and "Liquidity and Capital Resources" sections for additional details on our outlook for 2023.

Material Assumptions

Our annual production and operating cost guidance, along with our annual capital and exploration expenditure forecasts are discussed in detail below.

Production Guidance

Contained Metal in

Concentrate and Doré1 | 2023 Guidance | Year ended Dec. 31, 2022 | 2022 Guidance |

Peru | | | | |

Copper | tonnes | 91,000 - 116,000 | 89,395 | 89,000 - 115,000 |

Gold | oz | 83,000 - 108,000 | 58,229 | 70,000 - 90,000 |

Silver | oz | 2,210,000 - 2,650,000 | 2,309,352 | 1,620,000 - 2,100,000 |

Molybdenum | tonnes | 1,300 - 1,600 | 1,377 | 1,100 - 1,400 |

| | | | |

Manitoba | | | | |

Gold | oz | 175,000 - 205,000 | 161,471 | 150,000 - 185,000 |

Zinc | tonnes | 28,000 - 36,000 | 55,381 | 50,000 - 70,000 |

Copper | tonnes | 9,000 - 12,000 | 14,778 | 12,000 - 16,000 |

Silver | oz | 750,000 - 1,000,000 | 851,942 | 800,000 - 1,100,000 |

| | | | |

Total | | | | |

Copper | tonnes | 100,000 - 128,000 | 104,173 | 101,000 - 131,000 |

Gold | oz | 258,000 - 313,000 | 219,700 | 220,000 - 275,000 |

Zinc | tonnes | 28,000 - 36,000 | 55,381 | 50,000 - 70,000 |

Silver | oz | 2,960,000 - 3,650,000 | 3,161,294 | 2,420,000 - 3,200,000 |

Molybdenum | tonnes | 1,300 - 1,600 | 1,377 | 1,100 - 1,400 |

1 Metal reported in concentrate and doré is prior to refining losses or deductions associated with smelter terms. |

On a consolidated basis, we met 2022 production guidance for all metals. Consolidated copper and gold production was on the lower end of the guidance range primarily due to lower-than-planned grades in the fourth quarter of 2022 in Peru due to short-term mine plan changes that were implemented to mitigate the risks associated with logistical and supply chain disruptions in Peru.

In 2023, consolidated copper production is forecast to increase to 114,0001 tonnes, an increase of approximately 10%1 compared to 2022 levels, primarily as a result of higher expected copper production in Peru, with higher planned copper grades from the Pampacancha pit more than offsetting lower copper production in Manitoba. Consolidated gold production in 2023 is expected to increase by 30%1 to 285,5001 ounces year-over-year, due to significantly higher gold production in both Peru and Manitoba.

In early 2023, the mine plan for Peru was adjusted to prioritize the processing of lower grade stockpiles and shorter haulage distance ore to manage through the regional logistical challenges and ensure steady operation of the plant. This is expected to result in more ore being mined from the Constancia pit and less from the Pampacancha pit in the early part of the year, as well as lower recoveries due to the varying ore types present in the stockpiles. Despite these mine plan changes, 2023 copper and gold production in Peru is expected to be 103,5001 tonnes and 95,5001 ounces, representing year-over-year increases of 16%1 and 64%1, respectively. The revised mine plan for 2023 reflects a period of higher stripping activities in the Pampacancha pit from March to June with significantly higher copper and gold grades expected to be mined in the second half of 2023. Peru's production guidance also reflects regularly scheduled semi-annual mill maintenance shutdowns at Constancia during the second and fourth quarters of 2023.

In Manitoba, 2023 gold production is expected to increase by 18%1 to 190,0001 ounces compared to 2022 due to higher gold grades and a 10% increase in ore throughput at the Lalor mine. The 2023 mine plan at Lalor reflects higher production from the gold and copper-gold zones as those zones are expected to be prioritized over the base metal zones. The production guidance reflects a 10% increase in New Britannia mill throughput in 2023 given the mill has been consistently operating above its 1,500 tonnes per day nameplate capacity. The 2023 mine plan achieves gold production levels consistent with the most recent mine plan for Snow Lake but without the full ramp up to 5,300 tonnes per day as it maximizes value per tonne of ore at Lalor by prioritizing the mining of the gold-rich zones over the zinc-rich base metal zones and reflects higher throughput at the New Britannia mill. Year-over-year zinc production is expected to decline by 42%1 primarily as a result of the closure of the 777 mine in June 2022 and prioritizing the mining of the gold-rich zones over the zinc-rich base metal zones at Lalor. Manitoba's production guidance reflects regularly scheduled maintenance programs at the Lalor mine during the second and fourth quarters of 2023.

Given the short-term mine plan changes implemented at Constancia in early 2023 and the Lalor ramp-up strategy, as mentioned above, the company is examining the potential impact of these changes to 2024 and 2025 production. We expect our 2024 production guidance to be similar to the previously issued guidance on February 23, 2022, reflecting a further increase in copper production in Peru and gold production in Manitoba from 2023 levels. As a result of the 2023 mine plan changes in Peru, we now expect mining activities at the Pampacancha deposit to continue into the first half of 2025, which is expected to result in higher copper and gold production from Peru in 2025 beyond the levels shown in the most recent technical report for Constancia, dated March 29, 2021. We expect to release our new three-year production outlook together with our annual mineral reserve and resource update at the end of March 2023.

Capital Expenditure Guidance

Capital Expenditures1

(in $ millions) | 2023 Guidance3,4 | Year ended

Dec. 31, 2022 | 2022 Guidance |

| Sustaining capital | | | |

| Peru2 | 160.0 | 101.4 | 105.0 |

| Manitoba | 75.0 | 125.1 | 115.0 |

| Total sustaining capital | 235.0 | 226.5 | 220.0 |

| Growth capital | | | |

| Peru | 10.0 | 4.3 | 10.0 |

| Manitoba | 15.0 | 33.4 | 50.0 |

| Arizona5 | 30.0 | 36.2 | 40.0 |

| Total growth capital | 55.0 | 73.9 | 100.0 |

| Capitalized exploration | 10.0 | 42.3 | 40.0 |

| Total | 300.0 | 342.7 | 360.0 |

| 1 Excludes capitalized costs not considered to be sustaining or growth capital expenditures. |

| 2 Includes capitalized stripping costs. |

| 3 2023 capital expenditure guidance excludes right-of-use lease additions. |

| 4 2023 capital expenditure guidance is converted into U.S. dollars using an exchange rate of 1.35 C$/US$. |

| 5 2022 guidance reflects revised Arizona spending guidance issued on June 8, 2022, which includes $5 million in additional growth expenditures and $15 million in additional capitalized exploration related to Copper World. |

2022 total capital expenditures were 5% below guidance expectations as a result of the discretionary capital reductions across the business, partially offset by higher sustaining capital expenditures in Manitoba primarily due inflationary cost pressures and lease additions that were not originally contemplated in guidance.

We expect to continue to reduce discretionary spending with an approximately 13% year-over-year decline in total capital expenditures to $300 million in 2023, primarily due to lower discretionary growth spending and capitalized exploration in 2023.

Peru's sustaining capital expenditures in 2023 are expected to increase from 2022 levels primarily due to higher costs associated with heavy civil works for the completion of a tailings dam raise in 2023 and higher capitalized stripping costs as a result of the mine plan resequencing in 2023. Peru's growth capital spending of $10 million in 2023 includes costs associated with mill recovery improvement initiatives targeted to increase copper and molybdenum recoveries.

Manitoba's sustaining capital expenditures in 2023 are expected to be lower than 2022 primarily due to lower equipment spending at Lalor and in the mills after the Snow Lake transition and ramp up period in 2022. Manitoba's growth capital spending of $15 million in 2023 relates to the costs for the completion of the Stall mill recovery improvement project, which is expected to involve several flow sheet enhancements to increase gold and copper recoveries starting in the second quarter of 2023. These low-capital brownfield growth projects are expected to generate attractive returns and are part of our continuous improvement efforts.

The Manitoba spending guidance excludes approximately $20 million of annual care and maintenance costs related to the Flin Flon facilities in 2023, which are expected to be recorded as other operating expenses.

Arizona's growth capital spending of $30 million includes approximately $20 million in annual carrying and permitting costs for the Copper World and Mason projects and approximately $10 million for economic studies and site works in 2023.

Exploration Guidance

(in $ millions) | | Year ended | |

2023 Guidance1 | Dec. 31, 2022 | 2022 Guidance |

Peru | 15.0 | 25.1 | 25.0 |

Manitoba | 15.0 | 14.2 | 15.0 |

Arizona and other 2 | - | 37.5 | 40.0 |

Total exploration expenditures | 30.0 | 76.8 | 80.0 |

Capitalized spending | (10.0) | (42.3) | (40.0) |

Total exploration expense | 20.0 | 34.5 | 40.0 |

1 2023 exploration guidance excludes $5 million of non-cash amortization of community agreements for exploration properties. |