Management's Discussion and Analysis of

Results of Operations and Financial Condition

For the three and six months ended

June 30, 2024

August 12, 2024

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated August 12, 2024 is intended to supplement Hudbay Minerals Inc.'s unaudited condensed consolidated interim financial statements and related notes for the three and six months ended June 30, 2024 and 2023 (the "consolidated interim financial statements"). The consolidated interim financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS"), including International Accounting Standard 34, Interim Financial Reporting, as issued by the International Accounting Standards Board ("IASB").

References to "Hudbay", the "Company", "we", "us", "our" or similar terms refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at June 30, 2024.

Readers should be aware that:

- This MD&A contains certain "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") that are subject to risk factors set out in a cautionary note contained in our MD&A.

- This MD&A includes information with respect to Hudbay's acquisition of Copper Mountain, which was completed on June 20, 2023, including the results of the Copper Mountain mine's operations during the 10-day stub period from June 20 to June 30, 2023 (the "10-day stub period").

- This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers.

- We use a number of non-IFRS financial performance measures in our MD&A, which do not have standardized meaning under IFRS. For further information and detailed reconciliations of such measures, please see the discussion under the "Non-IFRS Financial Performance Measures" section herein.

- The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates. Please see the discussion under the "Qualified Person and NI 43-101" section herein.

Readers are also urged to review the "Notes to Reader" section beginning on page 62 of this MD&A.

Additional information regarding Hudbay, including the risks related to our business and those that are reasonably likely to affect our consolidated interim financial statements in the future, is contained in our continuous disclosure materials, including our most recent AIF, consolidated interim financial statements and Management Information Circular available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

All amounts are in US dollars unless otherwise noted.

OUR BUSINESS

We are a diversified mining company with long-life assets in North and South America. Our Constancia operations in Cusco (Peru) produce copper with gold, silver and molybdenum by-products. Our Snow Lake operations in Manitoba (Canada) produce gold with copper, zinc and silver by-products. Our Copper Mountain operations in British Columbia (Canada) produce copper with gold and silver by-products. We have a copper-focused project development pipeline that includes the Copper World project in Arizona (United States) and the Mason project in Nevada (United States), and our growth strategy is focused on the exploration, development, operation, and optimization of properties we already control, as well as other mineral assets we may acquire that fit our strategic criteria. We are governed by the Canada Business Corporations Act and our shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima.

OUR PURPOSE

We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities.

We transform lives: We invest in our employees, their families and local communities through long-term employment, local procurement and economic development to improve their quality of life and ensure the communities benefit from our presence.

We operate responsibly: From exploration to closure, we operate safely and responsibly, we welcome innovation and we strive to minimize our environmental footprint while following leading operating practices in all facets of mining.

We provide critical metals: We produce copper and other metals needed for everyday products and essential for applications to support the energy transition toward a more sustainable future.

SUMMARY

Delivered In-line Second Quarter Operating and Financial Results; Production Guidance Reaffirmed and Cash Cost Guidance Improved

- Achieved consolidated copper production of 28,578 tonnes and gold production of 58,614 ounces in the second quarter of 2024, in line with quarterly production cadence expectations for 2024.

- Enhanced operating platform delivered a 32% increase in copper production and a 20% increase in gold production over the second quarter of 20232, reflecting the benefits of a larger diversified operating platform with the addition of Copper Mountain and the continued execution of operational efficiencies across the business.

- Strong cost control with consolidated cash cost1 and sustaining cash cost1 per pound of copper produced, net of by-product credits1, in the second quarter of 2024 of $1.14 and $2.65, respectively, in alignment with the cadence of costs expected in 2024.

- Reaffirmed full year 2024 consolidated production guidance for all metals including 137,000 to 176,000 tonnes of copper and 263,000 to 319,000 ounces of gold as we expect stronger production in the second half of 2024 in accordance with our mine production profile.

- Improved 2024 annual operating cost guidance with decreased consolidated cash cost1 guidance range of $0.90 to $1.10 per pound, a result of meaningful exposure to gold by-product credits and continued strong cost control.

- Peru operations continued to benefit from strong mill throughput, averaging approximately 85,000 tonnes per day in the second quarter despite a planned semi-annual mill maintenance shutdown. The Pampacancha stripping program to advance to higher grades later this year is well underway. The reduced mining from Pampacancha resulted in 19,217 tonnes of copper and 10,672 ounces of gold produced in the second quarter of 2024, in line with quarterly cadence expectations. Peru cash cost per pound of copper produced, net of by-product credits1, in the second quarter was $1.78, an expected increase from the first quarter given lower planned production levels and a 17% decrease compared to the second quarter of 2023.

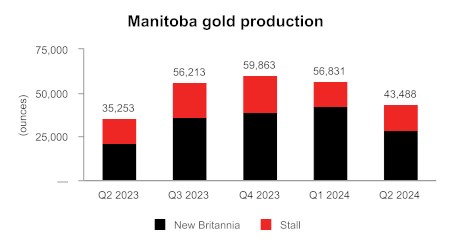

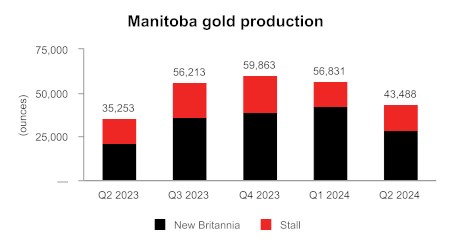

- Manitoba operations produced 43,488 ounces of gold in the second quarter of 2024 as New Britannia continues to operate well above nameplate capacity and budgeted throughput levels. Manitoba cash cost per ounce of gold produced, net of by-product credits1, was $771 during the second quarter of 2024, similar to the first quarter, and a decrease of 30% compared to the same quarter last year.

- British Columbia operations produced 6,719 tonnes of copper at a cash cost per pound of copper produced, net of by-product credits1, of $2.67 in the second quarter. Cash cost improved by 23% over the first quarter, reflecting ongoing operational stabilization efforts as mine stripping activities are accelerated and mill improvement initiatives are underway at Copper Mountain.

- Achieved revenue of $425.5 million and operating cash flow before change in non-cash working capital of $122.0 million in the second quarter of 2024.

- Second quarter net loss attributable to owners and loss per share attributable to owners were $16.6 million and $0.05, respectively. After adjusting for items on a pre-tax basis such as a non-cash gain of $2.7 million related to a quarterly revaluation of our closed site environmental reclamation provision, a $10.7 million revaluation loss related to the gold prepayment liability, unrealized strategic gold and copper hedges and investments and a $2.1 million write-down of PP&E, among other items, second quarter adjusted earnings1 per share attributable to owners was nil.

- Net loss attributable to owners of $16.6 million in the second quarter was meaningfully impacted by tax expense of $20.8 million despite having earnings before tax of only $0.4 million. The elevated tax expense was due to mining taxes that are calculated based on taxable mining profits in each operating jurisdiction, the limited deductibility of certain expenses and foreign exchange fluctuations on deferred tax balances.

- Adjusted EBITDA1 was $145.0 million during the second quarter of 2024.

- Cash and cash equivalents and short-term investments increased by $274.0 million to $523.8 million during the first half of 2024 due to a successful equity offering and strong operating cash flows bolstered by higher copper and gold prices enabling a $405.9 million reduction in net debt1 during the first half of 2024.

Accelerated Deleveraging and Transformed Balance Sheet

- Hudbay's unique copper and gold diversification in Peru and North America provides exposure to higher copper and gold prices and attractive free cash flow generation.

- Achieved trailing 12 month adjusted EBITDA1 of $824.3 million, a substantial increase from $407.1 million for the 12 months ending June 30, 2023.

- Completed successful equity offering on May 24, 2024 for gross proceeds of $402.5 million and net proceeds of $386.2 million, net of transaction costs, to accelerate growth and deleveraging.

- Significantly accelerated deleveraging efforts. Repaid all $90.0 million of advances outstanding on the senior secured credit facilities during the second quarter of 2024 and made open market purchases of approximately $34.1 million of our senior unsecured notes in June 2024, at a discount to par. Long-term debt reduced to $1,155.6 million at June 30, 2024 from $1,278.6 million at March 31, 2024.

- Reduced net debt1 to $631.8 million in the second quarter of 2024, reflecting a reduction of $405.9 million over the first half of 2024.

- The increase in cash and reduction in long-term debt significantly reduced our net debt to adjusted EBITDA1 to 0.8x at June 30, 2024 compared to 1.6x at the end of 2023. Achieved the targeted 1.2x net debt to adjusted EBITDA ratio outlined in our three prerequisites plan (the "3-P plan") for advancing Copper World well ahead of schedule.

- Deleveraging efforts continued into the third quarter of 2024 with an additional $48.5 million of open market purchases of our senior unsecured notes in July and August.

- Scheduled to complete the final payment under the gold prepay liability in August 2024, which was the financing instrument used to fund the refurbishment of the New Britannia gold mill. The elimination of the gold prepay will further increase the Company's exposure to higher gold production in Snow Lake.

- Total liquidity substantially increased by 65% to $948.5 million at June 30, 2024 from $573.7 million at the end of 2023.

Continued Execution of Growth Initiatives to Further Enhance Copper and Gold Exposure

- Successfully ratified multi-year agreements with the unions representing members of our workforce in Peru and Manitoba, with no disruption to operations, demonstrating our focus on working closely with our employees and community stakeholders to ensure aligned economic and social benefits.

- Stripping program for the next mining phase at Pampacancha is underway and is expected to lead to significantly higher copper and gold grades in the fourth quarter of 2024, which together with maintaining strong operating performance at Constancia is expected to continue to generate meaningful free cash flow in Peru.

- The New Britannia mill continued to exceed expectations, driving higher gold production in Manitoba. The mill achieved record throughput levels of nearly 2,100 tonnes per day in June and averaged 1,850 tonnes per day in the second quarter, exceeding its original design capacity of 1,500 tonnes per day and its 2024 budgeted capacity of 1,800 tonnes per day due to the successful implementation of process improvement initiatives and effective preventative maintenance measures.

- Post-acquisition plans to stabilize the Copper Mountain operations remain in progress with a focus on mining fleet ramp-up activities, accelerated stripping and increasing mill reliability. Higher mill availability of 94% and better-than-planned copper recoveries of 82% were achieved in the second quarter of 2024.

- The development of an access drift to the 1901 deposit in Snow Lake remains on track to reach mineralization in early 2025 and is intended to enable confirmation of the optimal mining method for the deposit and underground drilling to further evaluate the orebody and upgrade inferred gold resources to reserves.

- Continued to progress the 3-P plan for sanctioning Copper World, with transformed balance sheet nearing targeted levels and remaining key state permits progressing on track and expected in 2024.

- Drill permitting for highly prospective Maria Reyna and Caballito properties near Constancia continues to advance through the multi-step regulatory process with the environmental impact assessment application approved for Maria Reyna in June and the Caballito application progressing through the review stage.

- Results from the winter 2024 exploration program in Snow Lake confirm two mineralized zones located 400 metres northwest of Lalor with an intersection of 9 metres grading 2.88% copper and 6.27 grams per tonne gold. Also identified follow-up targets for a summer 2024 drill program to test new geophysical anomalies, complete follow-up drilling at Lalor Northwest and complete regional drilling at the Snow Lake satellite properties.

- Continuing to advance Flin Flon tailings reprocessing opportunities through metallurgical test work and early economic evaluation to assess the possibility of producing critical minerals and precious metals while reducing the environmental footprint.

- Published 2023 annual sustainability report in June 2024, demonstrating meaningful progress towards achieving our long-term sustainability goals and commitments with many 2023 activities focused on "our people, our communities and our planet".

Summary of Second Quarter Results

Cash generated from operating activities was $138.5 million during the second quarter of 2024, an increase of $113.9 million compared to the same period in 2023. Operating cash flow before change in non-cash working capital was $122.0 million during the second quarter of 2024, reflecting an increase of $66.1 million compared to the second quarter of 2023. The increase in operating cash flows before change in non-cash working capital was primarily the result of higher copper and gold sales volumes partially from incremental contributions from the Copper Mountain mine and higher gold production in Manitoba, strong operational cost performance across the business and higher realized metal prices. This was partially offset by a significant increase in cash taxes paid of $12.9 million mainly at our Peru operations, compared to the same period in 2023. It was also partially offset by lower copper sales volumes in Peru and lower zinc sales volumes in Manitoba due to timing of shipments.

Consolidated copper, gold and silver production in the second quarter of 2024 increased by 32%, 20% and 21%, respectively, compared to the same period in 2023 primarily due to meaningfully higher recoveries in Peru and Manitoba, higher throughput at all sites and incremental production from the Copper Mountain mine. Consolidated zinc production in the second quarter of 2024 decreased by 8% compared to the same period in 2023 primarily due to lower planned zinc grades.

Net loss attributable to owners and loss per share attributable to owners in the second quarter of 2024 were $16.6 million and $0.05, respectively, compared to $14.9 million and $0.05, respectively, in the second quarter of 2023. The 2024 results were meaningfully impacted by tax expense of $20.8 million despite having earnings before tax of only $0.4 million in the quarter. The elevated tax expense was due to mining taxes that are calculated based on taxable mining profits in each operating jurisdiction, the limited deductibility of certain expenses and foreign exchange fluctuations on deferred tax balances. The 2024 results were also impacted by various non-cash charges for unrealized losses on strategic copper and gold hedges, revaluation of share-based compensation due to a higher share price and the revaluation of our gold prepayment liability to higher gold prices.

Adjusted net earnings attributable to owners1 and adjusted net earnings per share attributable to owners1 in the second quarter of 2024 were $0.1 million and nil per share, respectively, after adjusting for a $10.7 million revaluation loss related to the gold prepayment liability and revaluation of our strategic gold and copper hedges and investments, an $8.8 million revaluation of our share-based compensation due to a higher share price and a $2.1 million write-down of PP&E, among other items. This compares to adjusted net loss attributable to owners1 and net loss per share attributable to owners1 of $18.3 million, and $0.07 in the same period of 2023.

Second quarter adjusted EBITDA1 was $145.0 million, compared to $81.2 million in the same period in 2023. The increase of 79% is the result of higher copper and gold sales volumes, higher realized metal prices and continued cost control leading to lower cash costs per unit both before and after by-product credits, in addition to the incremental contributions from the Copper Mountain mine.

In the second quarter of 2024, consolidated cash cost per pound of copper produced, net of by-product credits1, was $1.14, compared to $1.60 in the same period in 2023. This decrease was mainly the result of higher copper production and significantly higher by-product credits, partially offset by higher mining, milling and G&A costs from incorporating Copper Mountain. Consolidated sustaining cash cost per pound of copper produced, net of by-product credits1, was $2.65 in the second quarter of 2024 compared to $2.73 in the same period in 2023. This decrease was primarily due to the same reasons outlined above partially offset by higher cash sustaining capital expenditures.

Consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, was $3.07 in the second quarter of 2024, and is marginally higher than $2.98 in the same period in 2023 due to higher corporate selling and administrative expenses mainly from revaluation of share-based compensation with a higher share price and higher amortization of non-operational community agreement costs.

As at June 30, 2024, total liquidity was $948.5 million, including $483.8 million in cash and cash equivalents, $40.0 million in short-term investments as well as undrawn availability of $424.7 million under our revolving credit facilities. Net debt1 declined substantially by $362.4 million during the second quarter of 2024 to $631.8 million as part of our efforts to deleverage the balance sheet. This was driven by the free cash flow generation from the operations and our equity offering which contributed cash of $386.2 million, net of transaction and issuance costs. Some of these funds were utilized to repay all $90.0 million of debt outstanding on the senior secured credit facilities as at March 31, 2024 and to repurchase and retire approximately $34.1 million of our senior unsecured notes. As a result, we have made significant progress towards achieving our deleveraging targets outlined in our 3-P plan for sanctioning Copper World. We expect that our current liquidity together with cash flows from operations will be sufficient to meet our liquidity needs for the next year.

*British Columbia production in Q2 2023 represents a 10-day stub period of production following the June 20, 2023 transaction closing date.

**Copper equivalent production is calculated using the quarter average LME prices for each metal.

*British Columbia production in Q2 2023 represents a 10-day stub period of production following the June 20, 2023 transaction closing date.

1 Adjusted net earnings (loss) - attributable to owners and adjusted net earnings (loss) per share - attributable to owners, adjusted EBITDA, cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, combined unit cost, net debt and net debt to adjusted EBITDA ratio are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

2 Second quarter 2023 results only include a 10-day stub period of production from British Columbia following the June 20, 2023 transaction closing date.

KEY FINANCIAL RESULTS

| Financial Condition | | | | | | |

| (in $ thousands, except net debt to adjusted EBITDA ratio) | | Jun. 30, 2024 | | | Dec. 31 2023 | |

| Cash and cash equivalents and short-term investments | $ | 523,767 | | $ | 249,794 | |

| Total long-term debt | | 1,155,575 | | | 1,287,536 | |

| Net debt1 | | 631,808 | | | 1,037,742 | |

| Working capital2 | | 423,793 | | | 135,913 | |

| Total assets | | 5,442,422 | | | 5,312,634 | |

| Equity attributable to owners of the Company | | 2,482,545 | | | 2,096,811 | |

| Net debt to adjusted EBITDA 1 | | 0.8 | | | 1.6 | |

1 Net debt and net debt to adjusted EBITDA are a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

2 Working capital is determined as total current assets less total current liabilities as defined under IFRS and disclosed on the consolidated interim financial statements.

| Financial Performance | | Three months ended | | | Six months ended | |

| (in $ thousands, except per share amounts or as noted below) | | Jun. 30, 2024 | | | Jun. 30, 20233 | | | Jun. 30, 2024 | | | Jun. 30, 20233 | |

| Revenue | $ | 425,520 | | $ | 312,166 | | $ | 950,509 | | $ | 607,385 | |

| Cost of sales | | 347,893 | | | 289,273 | | | 720,928 | | | 517,979 | |

| Earnings (loss) before tax | | 441 | | | (30,731 | ) | | 68,191 | | | (13,301 | ) |

| Net loss | | (20,377 | ) | | (14,932 | ) | | (1,842 | ) | | (9,475 | ) |

| Net (loss) earnings attributable to owners | | (16,583 | ) | | (14,932 | ) | | 5,775 | | | (9,475 | ) |

| Basic and diluted (loss) earnings per share - attributable | | (0.05 | ) | | (0.05 | ) | | 0.02 | | | (0.04 | ) |

| Adjusted earnings (loss) per share - attributable1 | | 0.00 | | | (0.07 | ) | | 0.17 | | | (0.07 | ) |

| Operating cash flow before change in non-cash working capital2 | | 122.0 | | | 55.9 | | | 269.6 | | | 141.5 | |

| Adjusted EBITDA1,2 | | 145.0 | | | 81.2 | | | 359.2 | | | 183.1 | |

1 Adjusted earnings (loss) per share - attributable to owners and adjusted EBITDA are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

2 In $ millions.

3 Following completion of the Copper Mountain acquisition on June 20, 2023, the Company's financial performance was not materially affected by Copper Mountain's operations for the applicable period noted, with no revenues or corresponding cost of sales recorded during the 10-day stub period from the date of acquisition to the end of the second quarter of 2023.

KEY PRODUCTION RESULTS

| | | Three months ended | | | Three months ended | |

| | Jun. 30, 2024 | | | Jun. 30, 2023 | |

| | Peru | | | Manitoba | | | British

Columbia3 | | | Total | | | Peru | | | Manitoba | | | British

Columbia3 | | | Total | |

| Contained metal in concentrate and doré produced1 | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 19,217 | | | 2,642 | | | 6,719 | | | 28,578 | | | 17,682 | | | 2,794 | | | 1,239 | | | 21,715 | |

| Gold | oz | | 10,672 | | | 43,488 | | | 4,454 | | | 58,614 | | | 12,998 | | | 35,253 | | | 745 | | | 48,996 | |

| Silver | oz | | 450,833 | | | 210,647 | | | 77,227 | | | 738,707 | | | 419,642 | | | 180,750 | | | 11,918 | | | 612,310 | |

| Zinc | tonnes | | - | | | 8,087 | | | - | | | 8,087 | | | - | | | 8,758 | | | - | | | 8,758 | |

| Molybdenum | tonnes | | 369 | | | - | | | - | | | 369 | | | 414 | | | - | | | - | | | 414 | |

| Payable metal sold | | | | | | | | | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 16,806 | | | 2,429 | | | 6,564 | | | 25,799 | | | 21,207 | | | 1,871 | | | - | | | 23,078 | |

| Gold2 | oz | | 13,433 | | | 42,763 | | | 5,099 | | | 61,295 | | | 14,524 | | | 33,009 | | | - | | | 47,533 | |

| Silver2 | oz | | 400,302 | | | 197,486 | | | 69,248 | | | 667,036 | | | 671,532 | | | 133,916 | | | - | | | 805,448 | |

| Zinc | tonnes | | - | | | 5,133 | | | - | | | 5,133 | | | - | | | 8,641 | | | - | | | 8,641 | |

| Molybdenum | tonnes | | 347 | | | - | | | - | | | 347 | | | 314 | | | - | | | - | | | 314 | |

| | | Six months ended | | | Six months ended | |

| | Jun. 30, 2024 | | | Jun. 30, 2023 | |

| | Peru | | | Manitoba | | | British

Columbia3 | | | Total | | | Peru | | | Manitoba | | | British

Columbia 3 | | | Total | |

| Contained metal in concentrate and doré produced1 | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 43,793 | | | 5,791 | | | 13,743 | | | 63,327 | | | 38,200 | | | 4,839 | | | 1,239 | | | 44,278 | |

| Gold | oz | | 39,816 | | | 100,319 | | | 8,871 | | | 149,006 | | | 24,204 | | | 71,287 | | | 745 | | | 96,236 | |

| Silver | oz | | 1,090,551 | | | 430,470 | | | 165,603 | | | 1,686,624 | | | 971,809 | | | 331,392 | | | 11,918 | | | 1,315,119 | |

| Zinc | tonnes | | - | | | 16,885 | | | - | | | 16,885 | | | - | | | 18,604 | | | - | | | 18,604 | |

| Molybdenum | tonnes | | 766 | | | - | | | - | | | 766 | | | 703 | | | - | | | - | | | 703 | |

| Payable metal sold | | | | | | | | | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 40,560 | | | 5,350 | | | 13,497 | | | 59,407 | | | 37,523 | | | 4,096 | | | - | | | 41,619 | |

| Gold2 | oz | | 56,110 | | | 104,766 | | | 8,500 | | | 169,376 | | | 26,305 | | | 70,949 | | | - | | | 97,254 | |

| Silver2 | oz | | 1,154,009 | | | 429,327 | | | 152,548 | | | 1,735,884 | | | 1,063,739 | | | 283,595 | | | - | | | 1,347,334 | |

| Zinc | tonnes | | - | | | 11,252 | | | - | | | 11,252 | | | - | | | 14,269 | | | - | | | 14,269 | |

| Molybdenum | tonnes | | 762 | | | - | | | - | | | 762 | | | 568 | | | - | | | - | | | 568 | |

1 Metal reported in concentrate is prior to deductions associated with smelter contract terms.

2 Includes total payable gold and silver in concentrate and in doré sold.

3 Includes 100% of Copper Mountain mine production. Hudbay owns 75% of Copper Mountain mine. As Copper Mountain was acquired on June 20, 2023, the production for the three and six months ended June 30, 2023 represent the 10-day stub period following the acquisition through to the end of the second quarter of 2023.

KEY COST RESULTS

| | | | Three months ended | | | Six months ended | | | Guidance | |

| | | | Jun. 30,

2024 | | | Jun. 30,

2023 | | | Jun. 30,

2024 | | | Jun. 30,

2023 | | | Annual

20243 | |

| Peru cash cost per pound of copper produced | | | | | | | | | | |

| Cash cost1 | $/lb | | 1.78 | | | 2.14 | | | 1.02 | | | 1.72 | | | 1.25 - 1.60 | |

| Sustaining cash cost1 | $/lb | | 2.61 | | | 3.06 | | | 1.74 | | | 2.56 | | | | |

| Manitoba cash cost per ounce of gold produced | | | | | | | | | | |

| Cash cost1 | $/oz | | 771 | | | 1,097 | | | 751 | | | 1,017 | | | 700 - 900 | |

| Sustaining cash cost1 | $/oz | | 1,163 | | | 1,521 | | | 1,042 | | | 1,427 | | | | |

| British Columbia cash cost per pound of copper produced2 | | | | | | | | | | |

| Cash cost1 | $/lb | | 2.67 | | | - | | | 3.09 | | | - | | | 2.00 - 2.50 | |

| Sustaining cash cost1 | $/lb | | 5.56 | | | - | | | 5.20 | | | - | | | | |

| Consolidated cash cost per pound of copper produced | | | | | | | | | | |

| Cash cost1 | $/lb | | 1.14 | | | 1.60 | | | 0.60 | | | 1.21 | | | 0.90 - 1.10 | |

| Sustaining cash cost1 | $/lb | | 2.65 | | | 2.73 | | | 1.76 | | | 2.25 | | | 2.00 - 2.45 | |

| All-in sustaining cash cost1 | $/lb | | 3.07 | | | 2.98 | | | 2.11 | | | 2.50 | | | | |

1 Cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, gold cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, and unit operating cost are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

2 Cash cost, sustaining cash cost per pound of copper produced for British Columbia does not have any comparative information for the three and six months ended June 30, 2023 as Copper Mountain was acquired by Hudbay on June 20, 2023. Copper Mountain's operations had no revenues or corresponding cost of sales recorded during the 10-day stub period from the date of acquisition to the end of the second quarter of 2023.

3 We have improved our 2024 annual consolidated cash cost guidance range to $0.90 to $1.10 per pound from the original guidance range of $1.05 to $1.25 per pound.

RECENT DEVELOPMENTS

Production Guidance Reaffirmed and Cash Cost Guidance Improved

We have reaffirmed our full year 2024 consolidated production guidance for all metals, including 137,000 to 176,000 tonnes of copper and 263,000 to 319,000 ounces of gold as we expect stronger production in the second half of 2024 in accordance with our mine production profile. We expect 2024 consolidated copper production to be below the midpoint of the guidance range, while 2024 consolidated gold production is expected to be above the midpoint of the guidance range. This is a result of a combination of lower than expected grades and timing impacts from heavy rains in Peru, as well as the ongoing ramp-up of stabilization efforts at Copper Mountain, offset by the continued strong operational performance in Manitoba driven by New Britannia performance and grades exceeding our expectations.

We have improved our 2024 annual consolidated cash cost guidance range to $0.90 to $1.10 per pound from the original guidance range of $1.05 to $1.25 per pound, as a result of meaningful exposure to gold by-product credits and continued strong cost control. We have reaffirmed all other 2024 guidance metrics.

Enhanced Balance Sheet through Successful Equity Offering and Accelerated Debt Reduction

We took several prudent measures in the second quarter of 2024 to further improve balance sheet position, including more than $150 million of combined debt repayments and gold prepayment liability reductions:

• Completed successful $402.5 million equity offering - On May 24, 2024, we closed a public offering of common shares for gross proceeds of $402.5 million, resulting in net proceeds of $386.2 million after transaction costs.

• Fully repaid $90.0 million outstanding under the revolving credit facilities - We fully repaid $90 million of debt outstanding under our revolving credit facilities during the quarter with no remaining amounts drawn (other than letters of credit).

• Repurchased and retired $34.1 million of senior unsecured notes - We made open market purchases of $11.6 million of the 2026 senior unsecured notes and $22.5 million of the 2029 senior unsecured notes during the quarter.

• Delivered $24.0 million under gold forward sale and prepay agreement - We completed three additional months of gold deliveries during the quarter and are scheduled to fully repay the gold prepay facility by the end of August 2024, which was used to fund the refurbishment of the New Britannia gold mill.

As a result of these deleveraging efforts and continued cash flow generation, we have substantially reduced net debt1 to $631.8 million at June 30, 2024, from $1,037.7 million at the end of 2023. The net debt reduction, together with higher levels of adjusted EBITDA1 over the last twelve months, has significantly improved our net debt to adjusted EBITDA ratio1 to 0.8x compared to 1.6x at the end of 2023.

Subsequent to the quarter, deleveraging efforts continued in July and August with an additional $48.5 million of open market purchases of the senior unsecured notes, at a discount.

The improved balance sheet flexibility and accelerated debt reduction significantly advances the company's progress as part of its 3-P plan for sanctioning Copper World, and results in the successful achievement of the targeted 1.2x net debt to adjusted EBITDA ratio well ahead of schedule.

Disciplined Capital Allocation Driving Increased Copper and Gold Exposure

We continued to deliver positive free cash flow generation this quarter with strong gold production in Manitoba and strong cost control across the operations, while advancing planned stripping activities in Peru and British Columbia to drive higher copper and gold production levels in the second half of 2024. We also continue to evaluate areas to further improve mill performance across the business as part of our continuous improvement efforts.

____________________________________________

1 Adjusted EBITDA and net debt to adjusted EBITDA ratio are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

In addition to enhancing balance sheet flexibility through debt repayments as mentioned above, the net proceeds of the equity offering are intended to fund near-term growth initiatives, including acceleration of mine pre-stripping activities and mill optimization initiatives at Copper Mountain, and to evaluate mill throughput enhancement opportunities at Constancia and New Britannia.

Copper Mountain Stabilization Efforts to Drive Higher Copper Production

The key elements of Hudbay's stabilization plans for Copper Mountain include executing a campaign of accelerated stripping to access higher grades and implementing several plant improvement initiatives to increase mill throughput and recoveries.

Earlier this year, we commenced a three-year accelerated stripping program to mitigate the substantially reduced stripping that occurred over the four years prior to Hudbay's acquisition. We have successfully remobilized all 28 haul trucks and added five additional haul trucks this year to execute the accelerated stripping campaign at a lower cost and avoid contractor mining costs. The accelerated stripping program is expected to improve operating efficiencies and lower unit operating costs.

Hudbay's mine plan as disclosed in the December 2023 technical report for Copper Mountain assumes a mill ramp up to its nominal capacity of 45,000 tonnes per day in 2025 and an expansion to the permitted capacity of 50,000 tonnes per day in 2027. Mill initiatives are progressing as planned for 2024, including reprogramming the mill expert system, installing advanced grinding control instrumentation, flotation operational strategy improvements and improved maintenance practices. In the second half of 2024, we are also accelerating various engineering studies to increase mill throughput to 50,000 tonnes per day earlier than was originally contemplated in the technical report.

We have exceeded the targeted $10 million in annualized corporate synergies and we are on track to realize our three-year annual operating efficiencies target.

New Britannia Mill Performance Exceeding Expectations to Drive Higher Gold Production

We completed the brownfield investment in New Britannia in 2021 and refurbished the mill to a nominal capacity of 1,500 tonnes per day. This provided additional processing capacity to our Snow Lake operations and allowed us to achieve higher gold recoveries of approximately 90% as Lalor transitioned to the higher gold and copper areas of the mine plan. The New Britannia mill has been consistently exceeding performance expectations, achieving 1,650 tonnes per day in 2023, more than 1,850 tonnes per day in the first half of 2024, and a new monthly record of nearly 2,100 tonnes per day in June 2024.

The final payment for the New Britannia gold prepay financing in August 2024 further enhances our exposure to higher gold production in Snow Lake. With approximately two million ounces of contained gold in current mineral reserve estimates and another 1.4 million ounces of contained gold in inferred mineral resources, the New Britannia investment has unlocked significant value in Snow Lake. This could be further enhanced by regional exploration upside and the current strong gold price environment.

In the first quarter of 2024, we received a permit approval to increase the production rate at New Britannia to 2,500 tonnes per day, which will provide the opportunity to process more Lalor ore at the New Britannia mill and create additional processing capacity for potential new regional discoveries in Snow Lake.

Peru Investment Programs to Drive Higher Copper and Gold Production

We are well-advanced in executing a stripping program for the next mining phase at the Pampacancha pit. This stripping program is expected to continue until September and is intended to unlock higher copper and gold grades at the Peru operations in the fourth quarter of 2024.

During the second quarter of 2024, the Peruvian government approved regulatory changes to allow mining companies to increase their annual mill throughput levels up to 10% above permitted levels. We are evaluating the potential to increase planned production levels at Constancia, as early as 2026, which could partially offset the grade declines after the completion of mining at Pampacancha in late 2025.

Advancing Permitting at Copper World

The first key state permit required for Copper World, the Mined Land Reclamation Plan, was initially approved by the Arizona State Mine Inspector in October 2021 and was subsequently amended and approved to reflect a larger private land project footprint. This approval was challenged in state court, but the challenge was dismissed in May 2023. In late 2022, Hudbay submitted the applications for an Aquifer Protection Permit and an Air Quality Permit to the Arizona Department of Environmental Quality. The public comment period for the Aquifer Protection Permit was completed in the second quarter while the public comment period for the Air Quality Permit commenced in July. Hudbay continues to expect to receive these two outstanding state permits in the second half of 2024.

Copper World is one of the highest-grade open pit copper projects in the Americas2 with proven and probable mineral reserves of 385 million tonnes at 0.54% copper. Copper World Phase I contemplates average annual copper production of 85,000 tonnes over a 20-year mine life, at average cash costs and sustaining cash costs of $1.47 and $1.81 per pound of copper, respectively. In addition, there remains approximately 60% of the total copper contained in measured and indicated mineral resources (exclusive of mineral reserves), providing significant potential for a Phase II expansion and mine life extension. The inferred mineral resource estimates are at a comparable copper grade and also provide significant upside potential. Copper World is expected to provide meaningful copper to support the U.S. domestic supply chain.

Manitoba Exploration Update

Lalor Northwest Follow-up Drilling Confirms Two Mineralized Zones

Hudbay's 2024 winter drill program included follow-up drilling of a geophysical anomaly located northwest of Lalor, which was initially drilled in 2023. Recent positive assay results at Lalor Northwest confirm the discovery of two mineralized zones located within 400 metres of the existing Lalor underground infrastructure.

In 2023, hole CH2302 intersected two mineralized zones, including 4.8 metres at 2.97% copper, 2.92 grams per tonne gold and 80.3 grams per tonne of silver. Earlier in 2024, hole CH2406 intersected the same two mineralized zones, including 9.0 metres of 2.88% copper, 6.27 grams per tonne of gold and 88.9 grams per tonne of silver. See "Qualified Person and NI 43-101".

These promising results justified additional follow-up drilling in the summer of 2024 with two drill rigs currently turning at Lalor Northwest. Drilling results are expected to be received by the end of the year and will be used to determine the potential size of Lalor Northwest and the potential for future underground drift development from Lalor for further definition drilling. Lalor Northwest has the potential to add near-term production growth at Lalor, extend mine life and create additional value from our Snow Lake operations.

Snow Lake 2024 Regional Geophysics Program Identifies Prospective Targets; Summer Drill Program Initiated

During the first half of 2024, Hudbay conducted the company's largest geophysics program in its history in Snow Lake. This program resulted in the identification of a number of anomalies and prospective targets across the Snow Lake tenements which are currently being tested near the former Reed and Anderson mines and in the vicinity of the Bur and Rail deposits that were acquired as part of the Rockcliff transaction. Hudbay intends to continue similar size geophysical programs and mapping of our consolidated land package in the region in 2025.

The 2024 geophysical program included surface electromagnetic (EM) surveys covering a 25 square kilometre area including the recently acquired Cook Lake claims that had been previously untested by modern deep geophysics, which was the discovery method for the Lalor deposit. This surface EM survey used cutting-edge techniques that enabled the team to detect deep targets at depths of over 1,000 metres below surface. The new EM methodology is unique to Hudbay and will lead to advanced understanding of the mineralization at depths previously undetectable.

____________________________________________

2 Sourced from S&P Global, August 2023.

In addition, one very strong deep anomaly located at Cook Lake North, approximately six kilometres from Lalor, was identified through borehole EM surveys. 2024 drilling intersected multiple horizons of non-economic mineralization but a deeper and stronger conductor will be tested in the coming weeks by extending the drill hole at depth as part of our summer-fall 2024 exploration program.

Hudbay continues to execute its 2024 drilling program with the goal of extending known mineralization near the Lalor deposit to further extend mine life as well as to find a new anchor deposit within trucking distance of the Snow Lake processing infrastructure. The 2024 summer drill program is well underway, and we currently have six drill rigs turning in Snow Lake, including two drills at Lalor Northwest as mentioned above. We expect to ramp up to eight drill rigs by the end of August to test new geophysical targets and complete follow-up drilling at potential regional satellite deposits. Results from the summer drill program are expected in late 2024.

Advancing Access to the 1901 Deposit

In the first quarter of 2024, we commenced the development of a smaller profile drift from the existing Lalor ramp towards the 1901 deposit. The 1901 development drift is expected to reach the mineralization in early 2025, following which we plan to conduct definition drilling intended to confirm the optimal mining method, evaluate the orebody geometry and continuity, and convert inferred mineral resources in the gold lenses to mineral reserves. Pending positive results from the drilling programs, the plan is to initiate a haulage drift and other related mining infrastructure in 2025 and 2026 in anticipation of full production from the 1901 deposit in 2027.

Continuing to Advance Studies for Flin Flon Tailings Reprocessing

Hudbay continues to advance studies to evaluate the opportunity to reprocess Flin Flon tailings where more than 100 million tonnes of tailings have been deposited for over 90 years from the mill and the zinc plant. The studies are evaluating the potential to re-purpose the existing Flin Flon concentrator, which is currently on care and maintenance, with flow sheet modifications to reprocess tailings to recover critical minerals and precious metals while creating environmental and social benefits for the region.

We continue to advance metallurgical test work, and during the second quarter of 2024, we received results from the initial confirmatory drill program in the section of the tailings facility that was utilized by the zinc plant. The results confirmed the grades of precious metals and critical minerals previously estimated from historical zinc plant records. An early economic study to evaluate the opportunity to reprocess initially the portion where the zinc plant tailings were deposited has shown promising results that warrant further engineering work in the second half of 2024. A similar study is planned in respect of the mill tailings.

Peru Exploration Update

Hudbay controls a large, contiguous block of mineral rights with the potential to host mineral deposits in close proximity to the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. The company commenced early exploration activities at Maria Reyna and Caballito after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. As part of the drill permitting process, environmental impact assessment applications were submitted for the Maria Reyna property in November 2023 and for the Caballito property in April 2024. The environmental impact assessment (EIA) for Maria Reyna was approved by the government in June 2024 and the Caballito application continues to make progress through the permitting process. This represents one of several steps in the drill permitting process, which is expected to take approximately 12 months to complete after the EIAs are approved.

New Concentrate Contracts with Attractive Terms

In light of the extremely tight copper concentrate market that currently exists, Hudbay has strategically taken steps to preserve uncommitted copper concentrate units. This has allowed us to enter into several new contracts covering approximately 20% to 25% of our estimated Constancia concentrate sales over the next four years with favourable treatment and refining charges ("TC/RC"), including contracts with fixed TC/RCs that are negative in certain years and other contracts that have TC/RC priced at significant discounts of 45% to 65% to market benchmark terms.

Collective Bargaining Agreements Ratified in Manitoba and Peru

In June, new three-and-a-half year collective bargaining agreements were ratified by the members of all five unions at our Manitoba operations, effective July 1, 2024. In July, a new three-year agreement was signed with the union at our Peru operations, effective November 10, 2023. The ratification of these agreements is a significant achievement and demonstrates Hudbay's focus on working closely with our employees and community stakeholders to ensure aligned economic and social benefits.

Dividend Declared

A semi-annual dividend of C$0.01 per share was declared on August 12, 2024. The dividend will be paid out on September 20, 2024 to shareholders of record as of close of business on September 3, 2024.

SUSTAINABILITY

Hudbay published its 2023 annual sustainability report in June, providing transparency and progress on key business accomplishments and sustainability initiatives in 2023, along with goals for the upcoming year and longer term. Hudbay's purpose statement serves as the cornerstone for our commitment to sustainability: "We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities."

Highlights from our 2023 annual sustainability report include:

Our Planet

• In 2023, we made meaningful progress on our roadmap towards the overall goal of a 50% reduction in Scope 1 and Scope 2 greenhouse gas ("GHG") emissions by 20303 . The roadmap helps identify initiatives across the organization, categorize their potential impacts and plan their annual progression.

• In 2023, direct energy consumption decreased 11% and indirect energy consumption increased 21% from the prior year primarily as a result of the addition of the Copper Mountain mine in 2023. Total GHG intensity per tonne of copper equivalent production decreased 8% compared to 2022.

• Approximately 55% of total energy consumption came from renewables, with nearly 100% of electricity at our Manitoba and British Columbia operations sourced from renewable hydropower.

• In 2023, we reduced the total amount of water withdrawn by 6% and water discharged by approximately 37% compared to 2022. Approximately 77% of total water use was recycled or reused.

• Hudbay commits to implementing the Mining Association of Canada's Towards Sustainable Mining (TSM) program. All business units achieved a level A or higher TSM rating across all TSM Climate Change Protocol indicators, and Manitoba and Peru received level AA ratings for the facility climate change management indicator. Hudbay also achieved a level A rating for the corporate-focus indicator related to setting meaningful targets for emissions reduction and focusing on climate adaptation.

• Constancia signed a 10-year power purchase agreement with ENGIE Energía Perú, providing access to a 100% renewable energy supply for Constancia beginning in 2026.

• Copper Mountain ranks among the lowest quartile for GHG emissions among copper mines and has the only electric trolley-assist system in North America, with seven trolley-capable haul trucks in operation that use hydroelectricity and reduce diesel consumption. In October 2023, we commissioned the world's largest electric hydraulic excavator, adding to the two other electric excavators in the British Columbia's operation electric fleet.

• In Manitoba, we conducted metallurgical research with technology partners to explore the potential for reprocessing Flin Flon tailings to produce non-acid-generating residual tailings. This has the potential to reduce the on-site waste that contributes to ongoing water treatment requirements, create a new mineral resource and extend the life of the Flin Flon operations.

____________________________________________

3 Hudbay's climate change targets were established in 2022 and are based on a 2021 baseline for Scope 1 and Scope 2 GHG emissions from existing operations. The targets exclude the British Columbia operations which were acquired in 2023, and the company is evaluating the impact of the British Columbia operations on Hudbay's GHG reduction roadmap.

• In September 2023, we released the pre-feasibility study (PFS) for Phase I of our Copper World development project in Arizona. The PFS includes the addition of a concentrate leach facility in the fifth year of operations to produce copper cathode, which is estimated to lower energy consumption by more than 10% and decrease GHG and sulfur dioxide emissions by eliminating overseas shipping, smelting and refining activities associated with copper concentrate.

Our People

• In Peru, Constancia received the "Healthy Company Management" certificate from SGS Peru, one of the world's leading testing, inspection and certification companies, in recognition of its management practices, processes and systems related to health and well-being.

• In Manitoba, the business unit leader spearheaded the launch of the "Home Safe Everyday Initiative." This program revolves around a roadmap comprising three key work streams - Safety Governance, Supervisory Leadership, and High Potential Prevention and Mitigation - to prevent incidents by thoroughly assessing risks and implementing controls to reduce their frequency.

• In British Columbia, following Hudbay's acquisition of Copper Mountain, the human resources team adapted to the changing business needs focusing on recruiting for critical positions, such as mill operators, and building a positive organizational culture, which will continue into 2024.

• Launched the "ONETeam" leadership training program in 2023 to focus on coaching and conflict resolution skills in a six-day leadership development program for supervisors and upper-level management. In Manitoba, supervisors completed the program in February 2024, while the British Columbia business unit plans to roll it out in the fall of 2024.

• In Arizona, Hudbay is establishing a strong workplace safety culture with the hiring of a dedicated health and safety manager, who initiated safety programs including a critical risk management program, an all-volunteer emergency response team, and a monthly employee-led safety meeting where a team member selects and presents a relevant and timely safety topic.

• Nine of the ten directors on our Board are independent, non-executive directors. Hudbay's President and CEO, Peter Kukielski, is the only executive director.

• Among the directors, 40% are women and a further 20% are from other designated groups. The Board remains committed to a company target of having at least 30% women directors on the Board as part of its overall commitment to diversity and inclusion.

Our Communities

• Hudbay navigated through a period of nationwide social unrest in early 2023 and was able to keep the Constancia mill operating due in large measure to the efforts of community members near Constancia.

• In 2023, we signed new sustainable development agreements with six communities in the area near Constancia and engaged in nearly 7,700 interactions involving more than 3,000 local stakeholders.

• Our Manitoba business unit expanded its Indigenous Circle for Everyone (ICE) program in 2023 offering employees a comprehensive exploration of the cultural aspects of the neighbouring First Nations communities.

• In British Columbia, we held regular meetings with representatives from the Towns of Princeton and Keremeos, RDOS, outfitters, ranchers and trappers. We also began the process of amending the existing participation agreements with local First Nations to provide a more meaningful and aligned relationship.

• In Arizona, we continued to meet with leadership and council members of local Native American tribes at the Copper World site to discuss the project and create opportunities for them to express concerns and provide feedback. We are also responding to public comments received on the draft permits for Copper World, which were issued by the Arizona Department of Environmental Quality in 2024.

We are pleased with the steps taken in 2023 towards our long-term sustainability goals. Details of our sustainability results can be found on our website.

PERU OPERATIONS REVIEW

| | | Three months ended | | | Six months ended | |

| | Jun. 30, 2024 | | | Jun. 30, 2023 | | | Jun. 30, 2024 | | | Jun. 30, 2023 | |

| Constancia ore mined1 | tonnes | | 5,277,654 | | | 3,647,399 | | | 7,837,201 | | | 7,050,580 | |

| Copper | % | | 0.29 | | | 0.31 | | | 0.30 | | | 0.33 | |

| Gold | g/tonne | | 0.03 | | | 0.04 | | | 0.03 | | | 0.04 | |

| Silver | g/tonne | | 2.50 | | | 2.49 | | | 2.60 | | | 2.50 | |

| Molybdenum | % | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | |

| Pampacancha ore mined1 | tonnes | | 1,288,789 | | | 2,408,495 | | | 3,503,143 | | | 3,305,790 | |

| Copper | % | | 0.41 | | | 0.36 | | | 0.51 | | | 0.39 | |

| Gold | g/tonne | | 0.20 | | | 0.34 | | | 0.28 | | | 0.39 | |

| Silver | g/tonne | | 3.83 | | | 2.81 | | | 4.34 | | | 3.44 | |

| Molybdenum | % | | 0.02 | | | 0.02 | | | 0.02 | | | 0.01 | |

| Total ore mined | tonnes | | 6,566,443 | | | 6,055,894 | | | 11,340,344 | | | 10,356,370 | |

| Strip ratio2 | | | 1.74 | | | 1.74 | | | 1.83 | | | 1.78 | |

| Ore milled | tonnes | | 7,718,962 | | | 7,223,048 | | | 15,796,923 | | | 14,886,776 | |

| Copper | % | | 0.30 | | | 0.31 | | | 0.33 | | | 0.32 | |

| Gold | g/tonne | | 0.07 | | | 0.09 | | | 0.11 | | | 0.09 | |

| Silver | g/tonne | | 2.85 | | | 2.78 | | | 3.17 | | | 3.25 | |

| Molybdenum | % | | 0.01 | | | 0.01 | | | 0.01 | | | 0.01 | |

| Copper concentrate | tonnes | | 89,629 | | | 82,796 | | | 203,728 | | | 178,244 | |

| Concentrate grade | % Cu | | 21.44 | | | 21.36 | | | 21.50 | | | 21.43 | |

| Copper recovery | % | | 83.1 | | | 80.0 | | | 84.1 | | | 80.9 | |

| Gold recovery | % | | 61.4 | | | 61.1 | | | 69.7 | | | 59.0 | |

| Silver recovery | % | | 63.9 | | | 65.1 | | | 67.7 | | | 62.5 | |

| Molybdenum recovery | % | | 46.3 | | | 40.5 | | | 44.6 | | | 40.5 | |

| Combined unit operating costs3,4 | $/tonne | | 12.68 | | | 14.07 | | | 11.78 | | | 12.73 | |

1 Reported tonnes and grade for ore mined are estimates based on mine plan assumptions and may not reconcile fully to ore milled.

2 Strip ratio is calculated as waste mined divided by ore mined.

3 Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs.

4 Combined unit costs is a non-IFRS financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

| | | | Three months ended | | | Six months ended | |

| | | | Jun. 30, 2024 | | | Jun. 30, 2023 | | | Jun. 30, 2024 | | | Jun. 30, 2023 | |

| Contained metal in concentrate produced | | | | | | | | | | | | |

| Copper | tonnes | | 19,217 | | | 17,682 | | | 43,793 | | | 38,200 | |

| Gold | oz | | 10,672 | | | 12,998 | | | 39,816 | | | 24,204 | |

| Silver | oz | | 450,833 | | | 419,642 | | | 1,090,551 | | | 971,809 | |

| Molybdenum | tonnes | | 369 | | | 414 | | | 766 | | | 703 | |

| Payable metal sold | | | | | | | | | | | | | |

| Copper | tonnes | | 16,806 | | | 21,207 | | | 40,560 | | | 37,523 | |

| Gold | oz | | 13,433 | | | 14,524 | | | 56,110 | | | 26,305 | |

| Silver | oz | | 400,302 | | | 671,532 | | | 1,154,009 | | | 1,063,739 | |

| Molybdenum | tonnes | | 347 | | | 314 | | | 762 | | | 568 | |

| Cost per pound of copper produced | | | | | | | | | | | | | |

| Cash cost1 | $/lb | | 1.78 | | | 2.14 | | | 1.02 | | | 1.72 | |

| Sustaining cash cost1 | $/lb | | 2.61 | | | 3.06 | | | 1.74 | | | 2.56 | |

1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-IFRS financial performance measures, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

Overview

Peru operations continued to benefit from strong mill throughput, averaging approximately 87,000 tonnes processed per day year-to-date, as well as higher realized prices of all metals. Cost performance was also strong, achieving lower unit operating costs, cash cost and sustaining cash cost compared to the comparative 2023 periods. Cash cost also benefited from higher by-product sales revenues of gold, silver and molybdenum throughout 2024.

Mining efforts at Pampacancha are focused on continuing the stripping program to advance to the next mining phase and we are on track to resume mining in higher copper and gold grade areas later in the year.

During the quarter, the Peruvian Ministry of Energy and Mines approved a regulatory change, Supreme Decree 011-2024-EM, to allow mining companies in Peru to increase throughput by up to 10% above permitted levels. Previously, the regulation only allowed for an increase of up to 5%. As such, we are evaluating the potential to increase future production at Constancia.

Mining Activities

Total ore mined in the second quarter of 2024 increased by 8% compared to the same period in 2023 in line with our mine plan. Ore mined from Pampacancha during the second quarter decreased to 1.3 million tonnes compared with 2.4 million tonnes in the same period in 2023 as a result of higher capitalized stripping activities.

Year-to-date ore mined was 10% higher than the same period in 2023 due to the same factors as the quarterly variance as well as the comparative 2023 period having reduced mining activity in order to ration fuel during regional protests and social unrest in Peru.

Milling Activities

Ore milled during the second quarter of 2024 was 7% higher than the comparative 2023 period mainly due to the treatment of softer ore from stockpiles. Ore milled included supplemental ore feed from stockpiles during the quarter as the team advances pit stripping activities. Milled copper and gold grades decreased by 3% and 22%, respectively, in the second quarter of 2024 compared to the same period in 2023 due to lower amounts of high grade copper and gold from Pampacancha as the stripping campaign is underway, in addition to lower grades from the processing of stockpiled ore.

Ore milled during the first half of 2024 was 6% higher than the comparative 2023 period due to the same factors as the quarterly variance. Milled copper grade increased by 3% in the first half of 2024 compared to the same period in 2023 due to an increase in the mining of higher grade copper ore from Pampacancha during the period. Gold grades increased by 22% compared to the same period in 2023 due to additional tonnes of ore milled from Pampacancha in the first quarter of 2024.

Recoveries of copper and gold during the second quarter of 2024 were 83%, and 61%, respectively, representing an increase of 4%, and 1%, respectively, compared with the same period in 2023 and were in line with our metallurgical models.

Recoveries of copper, gold and silver during the first half of 2024 were 84%, 70% and 68%, representing an increase of 4%, 18%, and 8%, respectively, compared with the 2023 period. This is also in line with our metallurgical models and is the result of ongoing recovery improvement initiatives.

Production and Sales Performance

Second quarter 2024 production of copper and silver was 19,217 tonnes and 450,833 ounces, respectively, representing an increase of 9% and 7%, respectively, compared with the same period in 2023 due to higher copper recoveries and higher throughput. Production of gold and molybdenum in the second quarter of 2024 was 10,672 ounces and 369 tonnes respectively, representing a decrease of 18% and 11% from the comparative 2023 period primarily due to lower grades.

Year-to-date production of copper, gold and silver was 43,793 tonnes, 39,816 ounces and 1,090,551 ounces, respectively, representing an increase of 15%, 65%, and 12%, respectively, from the comparative 2023 period due to higher copper and silver grades from Pampacancha, higher gold grade due to additional tonnes of ore milled from Pampacancha, higher recoveries and higher throughput. Production of molybdenum in the first half of 2024 was 766 tonnes.

Quantities of payable copper, gold and silver sold during the second quarter of 2024 were 21%, 8% and 40%, respectively, lower than the corresponding period in 2023 primarily due to higher volume of copper concentrate sold in the second quarter of 2023 from the rapid reduction in the buildup of inventories after the social unrest during the first quarter of 2023.

Year-to-date copper, gold and silver metal sold was 8%, 113% and 8%, respectively, higher than the comparable period primarily as a result of higher production levels and a precious metal stream sale that was recognized in revenue shortly after the year end cutoff date in the first quarter of 2024.

Payable copper metal sold was also lower than the first quarter of 2024 due to lower copper production and 10,000 wet metric tonne copper concentrate shipment that remained unsold at the end of the second quarter and was recognized as revenue early in the third quarter of 2024.

Cost Performance

Combined mine, mill and G&A unit operating costs in the second quarter were $12.68 per tonne, 10% lower than the same period in 2023 primarily due to higher ore throughput.

Cash cost per pound of copper produced, net of by-product credits, in the second quarter of 2024 was $1.78, a decrease of 17% compared to the same period in 2023 due to higher copper production, higher by-product credits and lower treatment and refining charges. This was partially offset by higher profit sharing. On a year-to-date basis, cash costs pound of copper produced, net of by-product credits, in the first half of 2024 was $1.02, compared with $1.72, a significant decrease for the same reasons as stated for the quarterly decrease.

Sustaining cash cost per pound of copper produced, net of by-product credits, was $2.61 and $1.74 for the second quarter and first half of 2024, or 15% and 32%, respectively lower than the comparative 2023 periods primarily due to the same factors affecting cash cost.

Peru Guidance Outlook

| | | | Three months ended | | | Six months ended | | | Guidance | |

| | | | Jun. 30, 2024 | | | Jun. 30, 2023 | | | Jun. 30, 2024 | | | Jun. 30, 2023 | | | Annual 2024 | |

| Contained metal in concentrate produced | | | | | | | | | | | | | | | | |

| Copper | tonnes | | 19,217 | | | 17,682 | | | 43,793 | | | 38,200 | | | 98,000 - 120,000 | |

| Gold | oz | | 10,672 | | | 12,998 | | | 39,816 | | | 24,204 | | | 76,000 - 93,000 | |

| Silver | oz | | 450,833 | | | 419,642 | | | 1,090,551 | | | 971,809 | | | 2,500,000 - 3,000,000 | |

| Molybdenum | tonnes | | 369 | | | 414 | | | 766 | | | 703 | | | 1,250 - 1,500 | |

| Cost per pound of copper produced | | | | | | | | | | | | | | | | |

| Cash cost1 | $/lb | | 1.78 | | | 2.14 | | | 1.02 | | | 1.72 | | | 1.25 - 1.60 | |

1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-IFRS financial performance measures, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

We expect to achieve our 2024 production guidance for all metals in Peru. Year-to-date cash cost is below the low-end of our 2024 guidance range primarily due to high gold by-product credits from higher sales volumes in the first quarter; however, the full year cash cost is expected to be within the 2024 guidance range.

MANITOBA OPERATIONS REVIEW

| | | Three months ended | | | Six months ended | |

| | Jun. 30, 2024 | | | Jun. 30, 2023 | | | Jun. 30, 2024 | | | Jun. 30, 2023 | |

| Lalor ore mined | tonnes | | 385,478 | | | 413,255 | | | 793,186 | | | 786,854 | |

| Gold | g/tonne | | 3.75 | | | 4.07 | | | 4.31 | | | 4.02 | |

| Copper | % | | 0.69 | | | 0.81 | | | 0.77 | | | 0.69 | |

| Zinc | % | | 2.76 | | | 3.14 | | | 2.84 | | | 3.23 | |

| Silver | g/tonne | | 22.29 | | | 23.27 | | | 22.88 | | | 20.88 | |

| New Britannia ore milled | tonnes | | 167,899 | | | 141,905 | | | 338,308 | | | 284,947 | |

| Gold | g/tonne | | 5.31 | | | 5.82 | | | 6.18 | | | 5.94 | |

| Copper | % | | 0.94 | | | 0.77 | | | 1.04 | | | 0.69 | |

| Zinc | % | | 0.92 | | | 0.85 | | | 0.87 | | | 0.80 | |

| Silver | g/tonne | | 24.42 | | | 25.79 | | | 23.00 | | | 24.08 | |

| Copper concentrate | tonnes | | 9,350 | | | 6,128 | | | 20,997 | | | 11,684 | |

| Concentrate grade | % Cu | | 15.96 | | | 16.20 | | | 15.97 | | | 15.29 | |

| Gold recovery1 | % | | 90.0 | | | 88.6 | | | 89.2 | | | 88.2 | |

| Copper recovery | % | | 94.4 | | | 91.2 | | | 95.4 | | | 91.4 | |

| Silver recovery1 | % | | 83.1 | | | 79.6 | | | 82.6 | | | 80.2 | |

| Contained metal in concentrate produced | | | | | | | | | | | | |

| Gold | oz | | 18,050 | | | 14,614 | | | 43,645 | | | 31,849 | |

| Copper | tonnes | | 1,492 | | | 992 | | | 3,353 | | | 1,786 | |

| Silver | oz | | 85,759 | | | 67,134 | | | 162,975 | | | 130,903 | |

| Metal in doré produced2 | | | | | | | | | | | | | |

| Gold | oz | | 10,843 | | | 6,305 | | | 27,338 | | | 11,692 | |

| Silver | oz | | 37,675 | | | 11,231 | | | 76,733 | | | 22,809 | |

| Stall ore milled | tonnes | | 229,527 | | | 238,633 | | | 448,885 | | | 481,252 | |

| Gold | g/tonne | | 3.02 | | | 3.12 | | | 3.05 | | | 2.95 | |

| Copper | % | | 0.59 | | | 0.85 | | | 0.61 | | | 0.72 | |

| Zinc | % | | 4.05 | | | 4.47 | | | 4.29 | | | 4.64 | |

| Silver | g/tonne | | 21.74 | | | 22.15 | | | 23.07 | | | 19.62 | |

| Copper concentrate | tonnes | | 6,202 | | | 8,281 | | | 13,369 | | | 14,926 | |

| Concentrate grade | % Cu | | 18.54 | | | 21.76 | | | 18.23 | | | 20.46 | |

| Zinc concentrate | tonnes | | 15,280 | | | 16,417 | | | 33,118 | | | 35,615 | |

| Concentrate grade | % Zn | | 52.92 | | | 53.35 | | | 50.98 | | | 52.24 | |

| Gold recovery | % | | 65.5 | | | 59.9 | | | 66.7 | | | 60.9 | |

| Copper recovery | % | | 85.4 | | | 88.5 | | | 88.6 | | | 87.9 | |

| Zinc recovery | % | | 87.1 | | | 82.2 | | | 87.7 | | | 83.3 | |

| Silver recovery | % | | 54.2 | | | 60.3 | | | 57.1 | | | 58.5 | |

| Contained metal in concentrate produced | | | | | | | | | | | | |

| Gold | oz | | 14,595 | | | 14,334 | | | 29,336 | | | 27,746 | |

| Copper | tonnes | | 1,150 | | | 1,802 | | | 2,438 | | | 3,053 | |

| Zinc | tonnes | | 8,087 | | | 8,758 | | | 16,885 | | | 18,604 | |

| Silver | oz | | 87,213 | | | 102,385 | | | 190,762 | | | 177,680 | |

1 Gold and silver recovery includes total recovery from concentrate and doré.

2 Doré includes sludge, slag and carbon fines.

| | | Three months ended | | | Six months ended | |

| | Jun. 30, 2024 | | | Jun. 30, 2023 | | | Jun. 30, 2024 | | | Jun. 30, 2023 | |

| Total contained metal in concentrate and doré produced1 | | | | | | | | | | | | |

| Gold | oz | | 43,488 | | | 35,253 | | | 100,319 | | | 71,287 | |

| Copper | tonnes | | 2,642 | | | 2,794 | | | 5,791 | | | 4,839 | |

| Zinc | tonnes | | 8,087 | | | 8,758 | | | 16,885 | | | 18,604 | |

| Silver | oz | | 210,647 | | | 180,750 | | | 430,470 | | | 331,392 | |

| Payable metal sold in concentrate and doré | | | | | | | | | | | | |

| Gold | oz | | 42,763 | | | 33,009 | | | 104,766 | | | 70,949 | |

| Copper | tonnes | | 2,429 | | | 1,871 | | | 5,350 | | | 4,096 | |

| Zinc | tonnes | | 5,133 | | | 8,641 | | | 11,252 | | | 14,269 | |

| Silver | oz | | 197,486 | | | 133,916 | | | 429,327 | | | 283,595 | |

| Unit Operating Costs2 | | | | | | | | | | | | | |

| Lalor | C$/tonne | | 150.06 | | | 135.45 | | | 148.36 | | | 135.99 | |

| New Britannia | C$/tonne | | 71.49 | | | 84.18 | | | 74.78 | | | 83.08 | |

| Stall | C$/tonne | | 38.45 | | | 35.44 | | | 39.54 | | | 34.88 | |

| Combined mine/mill unit operating costs3,4 | C$/tonne | | 225 | | | 220 | | | 230 | | | 218 | |

| Cost per ounce of gold produced | | | | | | | | | | | | |

| Cash cost4 | $/oz | | 771 | | | 1,097 | | | 751 | | | 1,017 | |

| Sustaining cash cost4 | $/oz | | 1,163 | | | 1,521 | | | 1,042 | | | 1,427 | |

1 Metal reported in concentrate is prior to deductions associated with smelter terms.

2 Reflects costs per tonne of ore mined/milled.

3 Reflects combined mine, mill and G&A costs per tonne of milled ore.

4 Combined unit costs, cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits, are non-IFRS financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-IFRS Financial Performance Measures" section of this MD&A.

Overview

Our Snow Lake operations in Manitoba maintained steady production results despite overcoming challenges in the second quarter of 2024, including forest fires and temporary production interruptions at the Lalor mine, partially offset by stronger than budgeted throughput at New Britannia. Our team's resilience and dedication ensured that we continued to operate effectively and efficiently while achieving our quarterly production targets.

A significant forest fire in the Flin Flon area in May 2024 temporarily impacted operations, causing workforce shortages due to road closures south of Flin Flon, which limited the ability for many employees to travel to Snow Lake and a number of employees were evacuated from their homes. We express our heartfelt gratitude to the brave individuals who battled the fire and those who supported essential community functions during this crisis.

At the Lalor mine, we encountered issues with the production hoist gearbox and electrical faults on the hoist drives, causing a ten-day stoppage in hoisting ore. Our maintenance teams collaborated closely with original equipment manufacturers to resolve these issues quickly. During the hoisting outage, the operations team focused on value-added activities, including underground ore buildup close to the shaft, waste filling, increased maintenance, building longhole inventory, and trucking ore to surface. Additionally, we implemented stope design modifications that yielded positive results by improving mucking efficiency throughout the lifecycle of our stopes.

The New Britannia mill consistently operated above nameplate capacity, achieving a new monthly record of nearly 2,100 tonnes per day in June. Ongoing efforts to increase throughput are aligned with our long-term objectives to maximize gold production by directing more gold ore from Lalor to the New Britannia mill for higher gold recoveries.

At the Anderson tailings facility, we achieved high deposition efficiency by utilizing new equipment and updated procedures allowing for the deferral of, dam construction capital to future years. We also received permit approval from Manitoba Environment and Climate Change to proceed with the sub-aerial tailings deposition trial, which is currently underway.

An extensive diamond drill grouting program was implemented at the 1901 exploration drift to establish a grout curtain and reduce water inflows and pressures to manageable levels. The drift is expected to reach mineralization by early 2025. This will be followed by definition drilling to further confirm the optimal mining method, evaluate orebody geometry and continuity, and convert inferred mineral resources in the gold lenses to mineral reserves.

Our Manitoba operation also progressed its sustainability initiatives by reducing propane and diesel consumption in the first half of 2024 compared to the same period in 2023. In addition, at Lalor, an initiative to capture and recycle natural groundwater and use it as process water to reduce the freshwater intake into the mine has proven to be effective.

Mining Activities

Total ore mined in Manitoba in the second quarter of 2024 was 7% lower than the comparable quarter in 2023. Gold, copper, silver and zinc grades mined at Lalor during the second quarter were 8%, 15%, 4% and 12% lower, respectively, compared with the same period in 2023. These changes reflect the temporary Lalor mine production disruptions noted above and the completion of a planned lower grade mining sequence in the quarter.

Total ore mined at our Manitoba operations during the first half of 2024 was 1% higher than the same period in 2023. Gold, copper and silver grades mined at Lalor during the first half of 2024 were 7%, 12% and 10% higher, respectively, compared with the same period in 2023, consistent with the mine plan. Zinc grades mined at Lalor during the first half of 2024 were 12% lower than the same period in 2023.

Milling Activities

Consistent with our strategy of allocating more Lalor ore feed to New Britannia, the New Britannia mill throughput averaged approximately 1,850 tonnes per day in the second quarter of 2024, approximately 18% above average daily throughput levels in the comparative 2023 period. Recoveries of gold, copper and silver in the second quarter of 2024 were 90%, 94% and 83%, respectively, representing an increase of 2%, 4%, and 4%, respectively, compared to the same period in 2023. Year-to-date total ore milled at New Britannia was 19% higher than the prior period. Despite the higher throughput gold recoveries were maintained, while copper and silver increased by 4% and 3%, respectively.

During the three and six months ended June 30, 2024, the Stall mill processed 4% and 7%, respectively, less ore than the comparative 2023 period, which is aligned with our strategy of allocating more Lalor ore feed to New Britannia, as noted above.

Production and Sales Performance

Manitoba operations produced 43,488 ounces of gold, 2,642 tonnes of copper, 8,087 tonnes of zinc and 210,647 ounces of silver during the second quarter of 2024. Compared to the second quarter of 2023, production of gold and silver in the second quarter of 2024 increased by 23% and 17%, respectively, while production of copper and zinc declined by 5% and 8%, respectively. The increased gold and silver production in the quarter is mainly due to our strategy of mining and allocating more Lalor gold ore feed to New Britannia to achieve higher recoveries, which resulted in planned lower production of copper and zinc.