- HBM Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

-

Insider

- Institutional

- Shorts

-

6-K Filing

Hudbay Minerals (HBM) 6-KConsolidated Financial Statements

Filed: 20 Feb 25, 11:19am

Management's Discussion and Analysis of

Results of Operations and Financial Condition

For the year ended

December 31, 2024

February 18, 2025

INTRODUCTION

This Management's Discussion and Analysis ("MD&A") dated February 18, 2025 is intended to supplement Hudbay Minerals Inc.'s audited consolidated financial statements and related notes for the year ended December 31, 2024 and 2023 (the "consolidated financial statements"). The consolidated financial statements have been prepared in accordance with IFRS® Accounting Standards ("IFRS" or "GAAP") as issued by the International Accounting Standards Board ("IASB").

References to "Hudbay", the "Company", "we", "us", "our" or similar terms refer to Hudbay Minerals Inc. and its direct and indirect subsidiaries as at December 31, 2024.

Readers should be aware that:

- This MD&A contains certain "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") that are subject to risk factors set out in a cautionary note contained in our MD&A.

- This MD&A includes information with respect to Hudbay's acquisition of Copper Mountain, which was completed on June 20, 2023, including the results of the Copper Mountain mine's operations from the date of acquisition, June 20, 2023.

- This MD&A has been prepared in accordance with the requirements of the securities laws in effect in Canada, which may differ materially from the requirements of United States securities laws applicable to US issuers.

- We use a number of non-GAAP financial performance measures in our MD&A, which do not have standardized meaning under IFRS. For further information and detailed reconciliations of such measures, please see the discussion under the "Non-GAAP Financial Performance Measures" section herein.

- The technical and scientific information in this MD&A has been approved by qualified persons based on a variety of assumptions and estimates. Please see the discussion under the "Qualified Person and NI 43-101" section herein.

Readers are also urged to review the "Notes to Reader" section beginning on page 75 of this MD&A.

Additional information regarding Hudbay, including the risks related to our business and those that are reasonably likely to affect our consolidated financial statements in the future, is contained in our continuous disclosure materials, including our most recent AIF, consolidated financial statements and Management Information Circular available on SEDAR+ at www.sedarplus.ca and on EDGAR at www.sec.gov.

All amounts are in US dollars unless otherwise noted.

OUR BUSINESS

We are a copper-focused critical minerals company with three long-life operations and a world-class pipeline of copper growth projects in tier-one mining jurisdictions of Canada, Peru and the United States. Hudbay's operating portfolio includes the Constancia mine in Cusco (Peru), the Snow Lake operations in Manitoba (Canada) and the Copper Mountain mine in British Columbia (Canada). Copper is the primary metal produced by the company, which is complemented by meaningful gold production and by-product zinc, silver and molybdenum. Hudbay's growth pipeline includes the Copper World project in Arizona (United States), the Mason project in Nevada (United States), the Llaguen project in La Libertad (Peru) and several expansion and exploration opportunities near its existing operations. We are governed by the Canada Business Corporations Act and our shares are listed under the symbol "HBM" on the Toronto Stock Exchange, New York Stock Exchange and Bolsa de Valores de Lima.

OUR PURPOSE

We care about our people, our communities and our planet. Hudbay provides the metals the world needs. We work sustainably, transform lives and create better futures for communities.

We transform lives: We invest in our employees, their families and local communities through long-term employment, local procurement and economic development to improve their quality of life and ensure the communities benefit from our presence.

We operate responsibly: From exploration to closure, we operate safely and responsibly, we welcome innovation and we strive to minimize our environmental footprint while following leading operating practices in all facets of mining.

We provide critical metals: We produce copper and other metals needed for everyday products and essential for applications to support the energy transition toward a more sustainable future.

OUR STRATEGY

Our mission is to create sustainable value and strong returns by leveraging our core strengths in community relations, focused exploration, mine development and efficient operations.

We believe that copper is the commodity with the best long-term supply/demand fundamentals and offers shareholders the greatest opportunity for sustained risk-adjusted returns. Copper is essential for achieving energy transition and AI technology needs - it is one of the most heavily utilized metals in renewable energy systems and is a key component for power networks, circuit boards and cooling systems in data processing centres. Through the discovery and successful development of economic mineral deposits, and through highly efficient low-cost operations to extract the metals, we believe sustainable value will be created for all stakeholders.

Hudbay's successful development, ramp-up and operation of the Constancia open-pit mine in Peru, our long history of underground mining and full life-cycle experience in northern Manitoba, our track record of reserve expansion through effective exploration, and our organic pipeline of copper development projects including Copper World and Mason provide us with a competitive advantage to deliver sustainable value relative to other mining companies of similar scale.

Over the past decade, we have built a world-class asset portfolio by executing a consistent long-term growth strategy focused on copper. We continuously work to generate strong free cash flow and optimize the value of our producing assets through exploration, brownfield expansion projects and efficient and safe operations. Furthermore, we intend to sustainably grow Hudbay through the exploration and development of our robust project pipeline, as well as through the acquisition of other properties that fit our stringent strategic criteria.

To ensure that any investment in our existing assets or acquisition of other mineral assets is consistent with our purpose and mission, we have established a number of criteria for evaluating these opportunities. The criteria include the following:

- Sustainability: We are focused on jurisdictions that support responsible mining activity. Our current geographic focus is on select investment grade countries in the Americas, with strong rule of law and respect for human rights consistent with our long-standing focus on environmental, social and governance ("ESG") principles;

- Copper Focus: We believe copper is the commodity with the best long-term supply/demand fundamentals. Global copper mine supply is challenged due to declining industry grades, limited exploration success and an insufficient pipeline of development-ready projects while demand will continue to increase through global decarbonization initiatives and the rapid growth in AI data processing centres. We believe this long-term supply/demand gap will create opportunities for increased risk-adjusted returns. While our primary focus is on copper, we recognize and value the polymetallic nature of copper deposits and, in particular, the counter-cyclical nature of gold in our portfolio;

- Quality: We are focused on investing in long-life, low-cost, expandable, high-quality assets that can capture peak pricing of multiple commodity price cycles and can generate free cash flow through the troughs of price cycles;

- Potential: We consider the full spectrum of acquisition and investment opportunities, from early-stage exploration to producing assets, that offer significant incremental potential for exploration, development, expansion and optimization beyond the stated resources and mine plan;

- Process: We develop a clear understanding of how an investment or acquisition can create value through our robust due diligence and capital allocation process that applies our technical, social, operational and project execution expertise;

- Operatorship: We believe value is created through leveraging Hudbay's competitive advantages in safe and efficient operations and effective exploration and project development and community relations. While operatorship is a key criterion, we are open to joint ventures and partnerships that de-risk our portfolio and increase risk-adjusted returns; and

- Capital Allocation: We pursue investments and acquisitions that are accretive to Hudbay on a per share basis. Given that our strategic focus includes allocating capital to assets at various stages of development, when evaluating accretion, we will consider measures such as internal rate of return ("IRR"), return on invested capital ("ROIC"), net asset value per share and the contained value of reserves and resources per share.

Our key objectives for 2025 are to:

- Deliver strong copper and gold production levels from diversified operating platform;

- Maintain strong operating cost performance, achieving industry-leading margins;

- Generate strong cash flow to further enhance Hudbay's financial position to reinvest in high-return brownfield projects and unlock industry-leading copper growth pipeline;

- Maintain focus on financial discipline with stringent capital allocation criteria to guide discretionary spending and generate strong returns on invested capital;

- Maintain record performance at our New Britannia mill and continuous improvement initiatives throughout our Snow Lake operations;

- Implement mill optimization projects at Copper Mountain to drive improved operating performance;

- Evaluate the potential to increase mill throughput at Constancia with the installation of a pebble crusher;

- Advance the Copper World project through definitive feasibility studies and the remaining elements of the three pre-requisites plan required for sanctioning, including a potential joint venture partnership;

- Drill the 1901 deposit from the new underground access drift to test for gold and copper extensions and upgrade resources;

- Advance plans to drill the prospective Maria Reyna and Caballito properties near Constancia;

- Execute extensive exploration program on the large land package in Snow Lake to target new discoveries to utilize excess capacity at the Stall mill and further enhance production;

- Advance economic studies for the reprocessing of Flin Flon tailings;

- Explore for new discoveries within trucking distance of the Flin Flon processing facilities as part of the exploration partnership with Marubeni;

- Continue to identify and evaluate opportunities to further reduce greenhouse gas emissions and update corporate targets based on further studies and the Copper Mountain acquisition;

- Assess growth opportunities that meet our stringent strategic criteria and allocate capital to pursue those opportunities that create sustainable value for the company and our stakeholders; and

- As always, continue to operate safely and sustainably, aligned with our company purpose to ensure that our activities have a positive impact on our people, our communities and our planet.

SUMMARY

Delivered Record Annual Results, Led by Record Gold Production from Manitoba Operations and Record Revenues; 2024 Consolidated Production and Cost Guidance Achieved

- Achieved record annual revenue of $2,021.2 million and record annual adjusted EBITDA1 of $822.5 million.

- Enhanced operating platform achieved 2024 consolidated production guidance for all metals with record gold production exceeding the top end of the 2024 guidance range. Full-year consolidated copper production of 137,943 tonnes, gold production of 332,240 ounces and silver production of 3,983,851 ounces increased by 5%, 7% and 11% respectively, compared to full year 2023.

- Significantly outperformed our twice-improved 2024 consolidated cash cost guidance. Strong cost control and meaningful exposure to gold by-product credits resulted in better-than-expected consolidated 2024 cash cost1 and sustaining cash cost1 per pound of copper produced, net of by-product credits, of $0.46 and $1.62, respectively, an improvement of 43% and 6%, respectively, compared to 2023.

- Peru full year copper production was within the 2024 guidance range while gold production exceeded the top end of guidance as additional gold benches were prioritized in the fourth quarter. Peru full year cash costs of $1.18 per pound outperformed the 2024 annual guidance range.

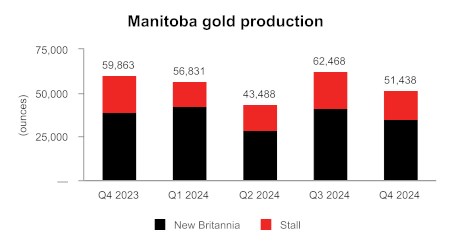

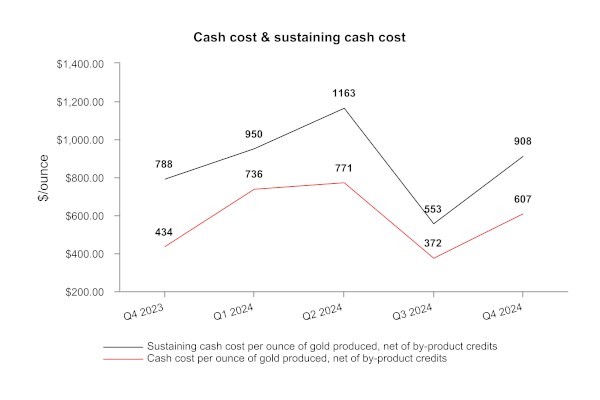

- Manitoba full year gold production of 214,225 ounces exceeded the top end of the 2024 guidance range of 170,000 to 200,000 ounces. Manitoba full year cash costs of $606 per ounce outperformed the lower end of 2024 annual guidance range of $700 to $900 per ounce.

- British Columbia full year copper production was below the low end of the 2024 guidance range, as expected, while full year gold production was in line with the 2024 annual guidance range. Copper production was lower than the guidance range as a result of lower grades in stockpiled ore and lower mill throughput during the ramp-up of stabilization and optimization efforts throughout the year. British Columbia continues to advance mill optimization initiatives with the goal to achieve higher mill throughput in 2025.

- Cash and cash equivalents and short-term investments increased by $332.0 million to $581.8 million during 2024 due to a successful equity offering and strong operating cash flows bolstered by higher copper and gold prices, which enabled a $512.0 million reduction in net debt1 during 2024.

Delivered Strong Fourth Quarter Operating and Financial Results

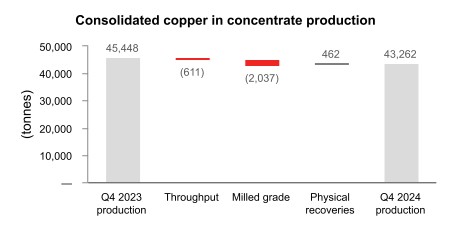

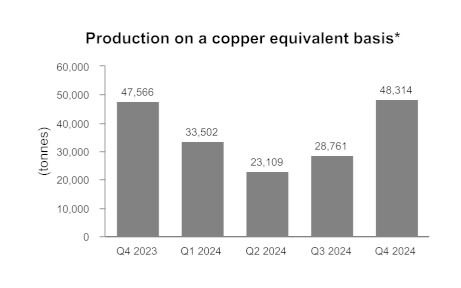

- Fourth quarter consolidated copper production of 43,262 tonnes was in line with quarterly production cadence expectations and increased 38% from the third quarter of 2024. Consolidated gold production of 94,161 ounces significantly exceeded expectations and represented an increase of 6% from the strong levels achieved in the third quarter of 2024.

- Strong operating cost performance with consolidated cash cost1 and sustaining cash cost1 per pound of copper produced, net of by-product credits1, in the fourth quarter of 2024 of $0.45 and $1.37, respectively, representing another quarter of industry-leading cost performance.

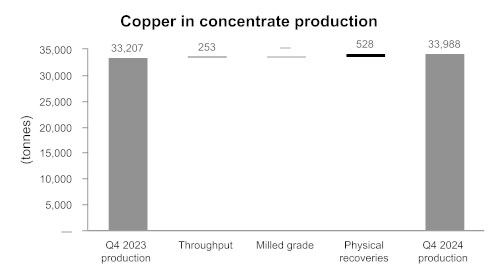

- Peru operations continued to benefit from strong and consistent mill throughput, achieving averages of approximately 87,000 tonnes per day in the fourth quarter, despite a planned semi-annual mill maintenance shutdown. The on-time completion of the Pampacancha stripping program contributed to higher grade ore during the fourth quarter. Peru operations produced 33,988 tonnes of copper and 38,079 ounces of gold in the fourth quarter of 2024, in line with quarterly cadence expectations. Peru cash cost per pound of copper produced, net of by-product credits1, was $1.00 in the fourth quarter, demonstrating continued strong cost performance.

- Manitoba operations produced 51,438 ounces of gold in the fourth quarter of 2024, significantly exceeding management's expectations in both production and efficiency. Manitoba cash cost per ounce of gold produced, net of by-product credits1, was $607 during the fourth quarter, reflecting better-than-expected operating performance and continued strong operating cost margins.

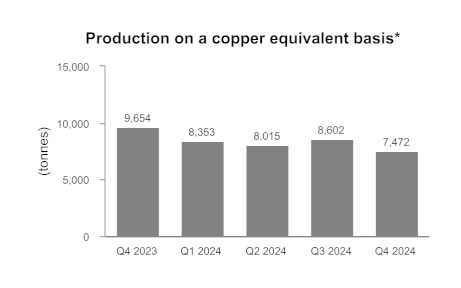

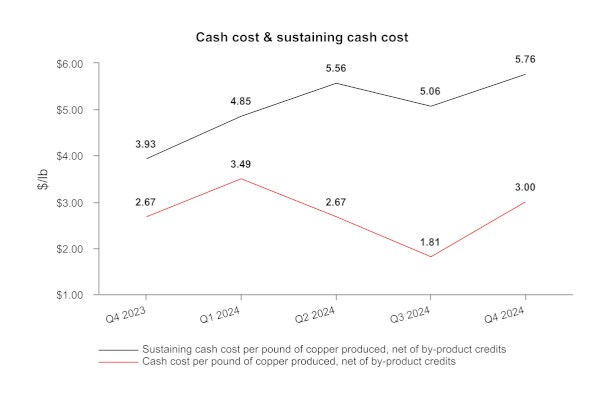

- British Columbia operations produced 5,927 tonnes of copper at a cash cost per pound of copper produced, net of by-product credits1, of $3.00 in the fourth quarter of 2024, reflecting reduced mill throughput versus the third quarter of 2024 as a result of ramp-up periods following mill maintenance shutdowns during the quarter.

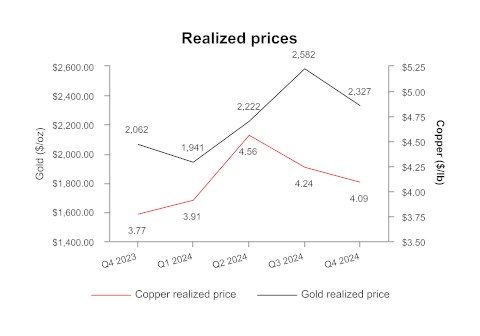

- Achieved revenue of $584.9 million and operating cash flow before change in non-cash working capital of $231.5 million in the fourth quarter of 2024, a 20% and 24% increase, respectively, from the third quarter of 2024. Strong financial results were driven by higher realized gold prices as well as strong copper production in Peru, while delivering on higher grades, throughput and cost control initiatives across all business units.

- Fourth quarter net earnings attributable to owners and earnings per share attributable to owners were $21.2 million and $0.05, respectively. After adjusting for items on a pre-tax basis such as a non-cash $17.4 million foreign exchange loss, a $14.1 million write-down of PP&E, a $10.3 million mark-to-market revaluation gain on various instruments such as unrealized strategic copper hedges, investments and share-based compensation, and a non-cash loss of $2.5 million related to a quarterly revaluation of our closed site environmental reclamation provision, among other items, fourth quarter adjusted earnings1 per share attributable to owners was $0.18.

- Adjusted EBITDA1 was $257.3 million during the fourth quarter of 2024, a 25% increase compared to the third quarter of 2024.

- Financial results in the fourth quarter would have been even higher if excess copper inventory in Peru at the end of December 2024 was sold. A total of approximately 30,000 wet metric tonnes of copper concentrate was unsold at the end of December, compared to normal levels of 15,000 wet metric tonnes. The excess copper concentrate inventory in Peru is expected to be sold in the first quarter of 2025.

Achieved Significant Debt Reduction and Transformed Balance Sheet

- Hudbay's unique copper and gold diversification in Peru and Canada provides exposure to higher copper and gold prices and attractive free cash flow generation.

- While the majority of revenues continue to be derived from copper production, gold represented an increasing portion of total revenues at 35% in 2024 compared to 29% in 2023, which was driven by high gold prices and record gold production in Manitoba.

- Impressive operating cash flow and free cash flow generation in 2024 reflects continued strong copper and gold production in Peru and higher gold production from Manitoba following the full repayment of our gold prepayment liability in August 2024, as well as operating cash flow contributions from British Columbia.

- Strong operating cash flow generation and the net proceeds from the equity offering in May 2024 allowed the Company to significantly deleverage and transform the balance sheet with $245 million of combined debt repayments and gold prepayment liability reductions in 2024.

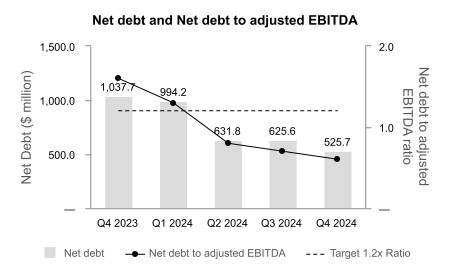

- Further reduced net debt1 to $525.7 million in the fourth quarter of 2024, representing the fourth consecutive quarter of lower net debt as a result of deleveraging efforts and capitalizing on strong operating cash flow generation.

- Record annual adjusted EBITDA1 of $822.5 million in 2024 was a substantial increase from $647.8 million in 2023.

- The increase in cash and reduction in long-term debt significantly reduced our net debt to adjusted EBITDA ratio1 to 0.6x at the end of 2024 compared to 1.6x at the end of 2023, well within the targeted 1.2x net debt to adjusted EBITDA ratio outlined in our three prerequisites plan (the "3-P plan") for advancing Copper World, and transforming Hudbay from one of the highest leverage positions to the lowest leverage position among industry peers .

- In November 2024, further improved long-term balance sheet resilience with a proactive three-year extension of the Company's senior secured revolving credit facilities from October 2025 to November 2028. The extended credit facilities provide increased financial flexibility to accretively maintain the 4.50% coupon 2026 senior unsecured notes outstanding to maturity and advance Copper World towards a sanctioning decision in accordance with the 3-P plan. The $450 million revolving credit facilities include an improved pricing grid reflecting the enhanced financial position of Hudbay and feature an opportunity to increase the facility by an additional $150 million at Hudbay's discretion during the four-year tenor, providing additional financial flexibility.

- Total liquidity substantially increased by 76% to $1,007.8 million at the end of 2024 from $573.7 million at the end of 2023.

Advancing Growth Initiatives to Further Enhance Copper and Gold Exposure

- Received all major permits required for the development and operation of Copper World with the receipt of the Air Quality Permit in January 2025 and the Aquifer Protection Permit in August 2024. Copper World is now the highest grade and lowest capital intensity fully permitted copper project in the Americas.

- Continuing to progress the 3-P plan for Copper World in 2025 with definitive feasibility study activities and minority joint venture partner process underway.

- The successful completion of the planned stripping program at Pampacancha in September unlocked significantly higher copper and gold grades in the fourth quarter of 2024, which together with maintaining strong operating performance at Constancia has generated meaningful free cash flow in Peru.

- The New Britannia mill continued to exceed throughput expectations, driving continued strong gold production and free cash flow generation in Manitoba. The New Britannia mill achieved throughput levels of approximately 2,020 tonnes per day in the fourth quarter, exceeding its original design capacity of 1,500 tonnes per day and its 2024 budgeted capacity of 1,800 tonnes per day due to the successful implementation of process improvement initiatives and effective preventative maintenance measures. After three years of operations, a post-project review of the New Britannia refurbishment investment has increased the unlevered IRR to 36% from 19% at project sanction in 2020.

- We have successfully implemented post-acquisition plans to stabilize the Copper Mountain operations through mining fleet ramp-up activities and increased mill reliability and performance. Efforts are now focused on optimizing the operations in 2025 through execution of the planned accelerated stripping program and mill throughput improvement projects.

- Drill permitting for highly prospective Maria Reyna and Caballito properties near Constancia continues to advance through the multi-step regulatory process with the conclusion of the process expected in 2025.

- The development of an access drift to the 1901 deposit in Snow Lake is progressing well and first ore mining is expected in the second quarter of 2025 to enable confirmation of the optimal mining method for the deposit. Underground step-out drilling to-date has intersected copper-gold mineralization and additional drilling is planned for 2025. The development of an adjacent haulage drift has been initiated to de-risk planned full production in 2027.

- Large 2024 exploration program in Snow Lake continued testing targets near Lalor and regional satellite properties throughout the winter months with encouraging results. 2025 exploration plans include a large geophysics program and follow-up drilling at Lalor Northwest located 400 metres from Lalor's underground infrastructure, along with the testing of a deep geophysical target at the Cook Lake North property.

- Continuing to advance Flin Flon tailings reprocessing opportunities through metallurgical test work and early economic evaluation to assess the possibility of producing critical minerals and precious metals while reducing the environmental footprint.

2025 Guidance Reflects Stable Copper and Gold Production at Industry-leading Margins

- Consolidated copper production of 133,000 tonnes, based on the midpoint of the 2025 guidance range, is expected to remain stable with 2024 levels, reflecting higher expected production in British Columbia as mill throughput optimization plans are implemented, offset by a lower portion of ore feed from the high-grade Pampacancha satellite deposit in Peru.

- Consolidated gold production of 277,750 ounces, based on the midpoint of the 2025 guidance range, is expected to be lower than 2024 production, reflecting a lower portion of ore feed from Pampacancha in 2025 and the accelerated mining of high-grade gold benches in late 2024, partially offset by continued strong gold production in Manitoba.

- Consolidated cash cost, net of by-product credits, in 2025 is expected to be within $0.80 to $1.00 per pound as we continue to focus on maintaining strong cost control across the business, driving industry-leading margins.

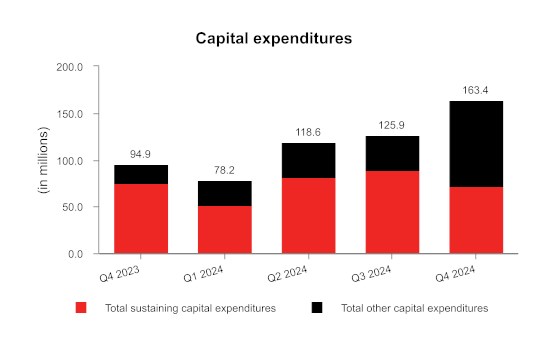

- Total sustaining capital expenditures are expected to be $365 million in 2025, reflecting some deferrals from 2024 and higher sustaining spending at the operations.

- Total growth capital expenditures are expected to be $205 million in 2025 as we reinvest in several high-return growth projects in 2025 to deliver increased copper exposure. This includes $55 million for mill throughput improvement projects in British Columbia, $25 million for mill throughput improvement projects in Peru, and $65 million for Copper World de-risking activities and feasibility studies.

- Exploration expenditures are expected to total $40 million in 2025 as we continue to execute our large multi-year exploration program in the Snow Lake region, which continues to be partially funded by critical minerals premium flow-through financing that was completed in the fourth quarter.

Summary of Fourth Quarter Results

Cash generated from operating activities of $238.1 million increased by $92.1 million in the fourth quarter of 2024 compared to the third quarter of 2024, and was higher by $9.1 million compared to the fourth quarter of 2023. Operating cash flow before change in non-cash working capital was $231.5 million during the fourth quarter of 2024, reflecting an increase of $45.4 million from the third quarter of 2024 and a decrease of $15.0 million compared to the fourth quarter of 2023. The increase compared to the third quarter of 2024 reflects higher copper and gold sales volumes driven by higher grades in Peru and continued strong gold production in Manitoba. The decrease compared to the fourth quarter of 2023 was primarily the result of lower copper sales volumes in Peru due to higher unsold copper concentrate inventory levels at year end 2024 as a result of a strong ramp-up of production of higher grade ore during the quarter. In addition, operating cash flow was impacted by lower copper production from Copper Mountain due to planned and unplanned maintenance activities at the mill. This was partially offset by strong operational cost performance across the business and higher realized metal prices.

Consolidated copper production of 43,262 tonnes in the fourth quarter of 2024 was in line with quarterly production cadence and represented a significant increase of 38% from the third quarter of 2024. Consolidated gold production of 94,161 ounces significantly exceeded expectations and represented an increase of 6% from the third quarter of 2024. Consolidated copper and gold production in the fourth quarter of 2024 decreased by 5% and 17%, respectively, compared to the same period in 2023 primarily due to lower gold production and lower planned ore grades in Peru and Manitoba as well as lower copper production at Copper Mountain due to mill maintenance. Consolidated silver and zinc production in the fourth quarter of 2024 increased by 10% and 46%, respectively compared to the same period in 2023 primarily due to higher grades and higher throughput in Peru, as we completed planned stripping activities.

Net earnings attributable to owners in the fourth quarter of 2024 was $21.2 million, or $0.05 per share, compared to $30.7 million, or $0.10 per share, in the fourth quarter of 2023. The fourth quarter of 2024 was impacted by various non-cash charges for foreign exchange losses, write-offs of previously capitalized PP&E and revaluation of share-based compensation due to a higher share price.

Adjusted net earnings attributable to owners1 and adjusted net earnings per share attributable to owners1 in the fourth quarter of 2024 were $70.3 million and $0.18 per share, respectively, after adjusting for items on a pre-tax basis such as a non-cash $17.4 million foreign exchange loss, a $14.1 million write-down of PP&E, a $10.3 million mark-to-market revaluation gain on various instruments such as unrealized strategic copper hedges, investments and stock based compensation, and a non-cash loss of $2.5 million related to a quarterly revaluation of our closed site environmental reclamation provision, among other items. This compares to adjusted net earnings attributable to owners1 and net earnings per share attributable to owners1 of $68.9 million and $0.20 per share in the same period of 2023.

Fourth quarter adjusted EBITDA1 was $257.3 million, a 25% increase compared to $206.2 million in the third quarter of 2024 as higher copper and gold grades led to increased sales volumes. Fourth quarter adjusted EBITDA declined by 6% compared to $274.4 million in the fourth quarter of 2023 as a result of the aforementioned lower copper and gold sales volumes. In addition, in Peru copper concentrate inventory levels totaled approximately 30,000 wet metric tonnes at the end of the quarter, higher than normal levels of 15,000 wet metric tonnes were unsold at the end of the quarter because of the strong production ramp-up late in the year. The excess copper concentrate in Peru is expected to be sold in the first quarter of 2025.

In the fourth quarter of 2024, consolidated cash cost per pound of copper produced, net of by-product credits1, was $0.45 compared to $0.18 in the third quarter of 2024, as higher production more than offset higher mining, milling and G&A costs in the fourth quarter, but by-product credits were lower on a per pound basis. Fourth quarter consolidated cash cost per pound of copper, net of by-product credits1 increased compared to $0.16 in the same period in 2023. This increase was mainly the result of higher mining, milling and G&A costs as well as lower copper production.

Consolidated sustaining cash cost per pound of copper produced, net of by-product credits1, was $1.37 in the fourth quarter of 2024 compared to $1.71 in the third quarter of 2024, with the decrease is driven by strong cost control and lower sustaining capital expenditures in the fourth quarter. Fourth quarter consolidated sustaining cash cost per pound of copper produced, net of by-product credit1, was higher compared to $1.09 in the same period in 2023. This increase was primarily due to the same reasons outlined above, partially offset by lower sustaining capital expenditures.

Consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, was $1.53 in the fourth quarter of 2024, lower than $1.95 in the third quarter of 2024 mainly due to the same reason outlined above as well as lower corporate G&A and regional costs in the fourth quarter. Fourth quarter consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, was higher than $1.31 in the same period in 2023 due to the same reasons outlined above.

As at December 31, 2024, total liquidity was $1,007.8 million, including $541.8 million in cash and cash equivalents, $40.0 million in short-term investments as well as undrawn availability of $426.0 million under our revolving credit facilities. Net debt1 declined to $525.7 million at the end of 2024 compared to $1,037.7 million at the end of 2023. We expect that our current liquidity together with cash flows from operations will be sufficient to meet our liquidity needs for the next year.

Summary of Full Year Results

We achieved our 2024 consolidated production guidance for all metals and significantly exceeded our 2024 production guidance for gold. On a business unit stand-alone basis, Peru exceeded the top end of the gold production guidance and achieved the guidance ranges for all other metals. Manitoba exceeded the top end of the gold and copper guidance ranges and achieved the guidance ranges for all other metals. In British Columbia production of gold was within the guidance range, whereas copper production was below the low end of guidance range as a result of lower grades in stockpiled ore and reduced throughput during the mill stabilization period.

Consolidated copper, gold and silver production for the full year 2024 increased by 5%, 7% and 11%, respectively, compared to the same period in 2023 primarily due to the incremental production from Copper Mountain and higher throughput and operating performance in Manitoba.

Cash generated from operating activities increased to $666.2 million in 2024 from $476.9 million in 2023. Operating cash flow before change in non-cash working capital increased to a record $691.1 million in 2024 from $570.0 million in 2023. The increase in operating cash flow before changes in working capital was primarily the result of higher metal prices and gold sales volumes, as well as the incremental contribution margin from the Copper Mountain mine. This was partially offset by a significant increase in cash taxes paid of $132.5 million, compared to $54.8 million in 2023 mainly at our Peru operations.

Net earnings attributable to owners for 2024 was $76.7 million, or $0.20 per share, compared to $66.4 million, or $0.22 per share, in 2023. Full year 2024 net earnings were positively impacted by increases in sales volumes and higher realized prices for all metals, partially offset by various non-cash charges related to foreign exchange losses, write-offs of previously capitalized PP&E, mark-to-market revaluation losses on various instruments such as unrealized strategic copper hedges, investments and share-based compensation and higher mining and income tax expenses.

Adjusted net earnings attributable to owners1 and adjusted net earnings per share attributable to owners1 for 2024 were $181.4 million and $0.48 per share, respectively, after adjusting for items on a pre-tax basis such as a $27.4 million write-down of PP&E, a $27.1 million mark-to-market revaluation loss on various instruments such as the gold prepayment liability, unrealized strategic copper and gold hedges, investments and stock based compensation, a non-cash $21.0 million foreign exchange loss and a non-cash gain of $3.5 million related to the revaluation of our closed site environmental reclamation provision, among other items. This compares to adjusted net earnings attributable to owners1 and net earnings per share attributable to owners1 of $69.0 million and $0.23 per share in the same period of 2023.

Adjusted EBITDA1 was $822.5 million in 2024, a 27% increase compared to $647.8 million in 2023. The increase is the result of higher realized metal prices and higher sales volumes during the year.

Consolidated cash cost per pound of copper produced, net of by-product credits1, was $0.46, compared to $0.80 in 2023 which outperformed our twice-improved 2024 annual cost guidance. The improvement was mainly the result of higher copper production and higher gold by-product credits, partially offset by higher mining, milling and G&A costs. Consolidated sustaining cash cost per pound of copper produced, net of by-product credits1, of $1.62 in 2024 decreased from $1.72 in 2023 due to the same reasons outlined above partially offset by higher cash sustaining capital expenditures.

Consolidated all-in sustaining cash cost per pound of copper produced, net of by-product credits1, was $1.88 in 2024, slightly lower than $1.92 in 2023 as a result of the same reasons outlined above partially offset by higher corporate selling and administrative costs primarily due to a revaluation of share-based compensation associated with a higher share price.

*Copper equivalent production is calculated using the quarter average LME prices for each metal.

|

1 Adjusted net earnings (loss) - attributable to owners and adjusted net earnings (loss) per share - attributable to owners, adjusted EBITDA, cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, combined unit cost, net debt and net debt to adjusted EBITDA ratio are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

KEY FINANCIAL RESULTS

| Financial Condition | ||||||

| (in $ millions, except net debt to adjusted EBITDA ratio) | Dec. 31, 2024 | Dec. 31, 2023 | ||||

| Cash and cash equivalents and short-term investments | $ | 581.8 | $ | 249.8 | ||

| Total long-term debt | 1,107.5 | 1,287.5 | ||||

| Net debt1 | 525.7 | 1,037.7 | ||||

| Working capital2 | 511.3 | 135.8 | ||||

| Total assets | 5,487.6 | 5,312.6 | ||||

| Equity attributable to owners of the Company | 2,553.2 | 2,096.8 | ||||

| Net debt to adjusted EBITDA 1 | 0.6 | 1.6 |

1 Net debt and net debt to adjusted EBITDA are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

2 Working capital is determined as total current assets less total current liabilities as defined under IFRS and disclosed on the consolidated financial statements.

| Financial Performance | Three months ended | Year ended | ||||||||||

| (in $ millions, except per share amounts or as noted below) | Dec. 31, 2024 | Dec. 31, 2023 | Dec. 31, 2024 | Dec. 31, 2023 | ||||||||

| Revenue | $ | 584.9 | $ | 602.2 | $ | 2,021.2 | $ | 1,690.0 | ||||

| Cost of sales | 400.5 | 405.4 | 1,467.4 | 1,297.5 | ||||||||

| Earnings before tax | 103.7 | 81.0 | 251.6 | 151.8 | ||||||||

| Net earnings | 19.3 | 33.5 | 67.8 | 69.5 | ||||||||

| Net earnings attributable to owners | 21.2 | 30.7 | 76.7 | 66.4 | ||||||||

| Basic and diluted earnings per share - attributable | 0.05 | 0.10 | 0.20 | 0.22 | ||||||||

| Adjusted earnings per share - attributable1 | 0.18 | 0.20 | 0.48 | 0.23 | ||||||||

| Operating cash flow before change in non-cash working capital | 231.5 | 246.5 | 691.1 | 570.0 | ||||||||

| Adjusted EBITDA1 | 257.3 | 274.4 | 822.5 | 647.8 | ||||||||

1 Adjusted earnings per share - attributable to owners and adjusted EBITDA are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

KEY PRODUCTION RESULTS

| Three months ended | Three months ended | ||||||||||||||||||||||||

| Dec. 31, 2024 | Dec. 31, 2023 | ||||||||||||||||||||||||

| Peru | Manitoba | British Columbia3 | Total | Peru | Manitoba | British Columbia3 | Total | ||||||||||||||||||

| Contained metal in concentrate and doré produced1 | |||||||||||||||||||||||||

| Copper | tonnes | 33,988 | 3,347 | 5,927 | 43,262 | 33,207 | 3,735 | 8,508 | 45,450 | ||||||||||||||||

| Gold | oz | 38,079 | 51,438 | 4,644 | 94,161 | 49,418 | 59,863 | 3,495 | 112,776 | ||||||||||||||||

| Silver | oz | 969,502 | 283,223 | 58,933 | 1,311,658 | 836,208 | 255,579 | 105,295 | 1,197,082 | ||||||||||||||||

| Zinc | tonnes | - | 8,385 | - | 8,385 | - | 5,747 | - | 5,747 | ||||||||||||||||

| Molybdenum | tonnes | 195 | - | - | 195 | 397 | - | - | 397 | ||||||||||||||||

| Payable metal sold | |||||||||||||||||||||||||

| Copper | tonnes | 28,775 | 3,321 | 5,831 | 37,927 | 31,200 | 3,687 | 9,119 | 44,006 | ||||||||||||||||

| Gold2 | oz | 37,459 | 50,239 | 5,036 | 92,734 | 38,114 | 63,635 | 3,091 | 104,840 | ||||||||||||||||

| Silver2 | oz | 824,613 | 282,158 | 43,747 | 1,150,518 | 703,679 | 246,757 | 98,441 | 1,048,877 | ||||||||||||||||

| Zinc | tonnes | - | 5,261 | - | 5,261 | - | 7,385 | - | 7,385 | ||||||||||||||||

| Molybdenum | tonnes | 182 | - | - | 182 | 468 | - | - | 468 | ||||||||||||||||

| Year ended | Year ended | ||||||||||||||||||||||||

| Dec. 31, 2024 | Dec. 31, 2023 | ||||||||||||||||||||||||

| Peru | Manitoba | British Columbia3 | Total | Peru | Manitoba | British Columbia 3 | Total | ||||||||||||||||||

| Contained metal in concentrate and doré produced1 | |||||||||||||||||||||||||

| Copper | tonnes | 99,001 | 12,536 | 26,406 | 137,943 | 100,487 | 12,154 | 19,050 | 131,691 | ||||||||||||||||

| Gold | oz | 98,226 | 214,225 | 19,789 | 332,240 | 114,218 | 187,363 | 8,848 | 310,429 | ||||||||||||||||

| Silver | oz | 2,708,262 | 995,090 | 280,499 | 3,983,851 | 2,505,229 | 851,723 | 218,282 | 3,575,234 | ||||||||||||||||

| Zinc | tonnes | - | 33,339 | - | 33,339 | - | 34,642 | - | 34,642 | ||||||||||||||||

| Molybdenum | tonnes | 1,323 | - | - | 1,323 | 1,566 | - | - | 1,566 | ||||||||||||||||

| Payable metal sold | |||||||||||||||||||||||||

| Copper | tonnes | 88,138 | 11,602 | 25,354 | 125,094 | 96,213 | 10,708 | 18,075 | 124,996 | ||||||||||||||||

| Gold2 | oz | 103,364 | 212,243 | 19,735 | 335,342 | 97,176 | 171,297 | 8,420 | 276,893 | ||||||||||||||||

| Silver2 | oz | 2,343,820 | 956,460 | 249,536 | 3,549,816 | 2,227,419 | 728,304 | 189,443 | 3,145,166 | ||||||||||||||||

| Zinc | tonnes | - | 25,120 | - | 25,120 | - | 28,779 | - | 28,779 | ||||||||||||||||

| Molybdenum | tonnes | 1,287 | - | - | 1,287 | 1,462 | - | - | 1,462 | ||||||||||||||||

1 Metal reported in concentrate is prior to deductions associated with smelter contract terms.

2 Includes total payable gold and silver in concentrate and in doré sold.

3 Includes 100% of Copper Mountain mine production. Hudbay owns 75% of Copper Mountain mine. As Copper Mountain was acquired on June 20, 2023, the production for the year ended December 31, 2023 represents the period from acquisition date, June 20, 2023, through to year end December 31, 2023.

KEY COST RESULTS

| Three months ended | Year ended | Guidance | ||||||||||||||

| Dec. 31, 2024 | Dec. 31, 2023 | Dec. 31, 2024 | Dec. 31, 2023 | Annual 20242 | ||||||||||||

| Peru cash cost per pound of copper produced | ||||||||||||||||

| Cash cost1 | $/lb | 1.00 | 0.54 | 1.18 | 1.07 | 1.25 - 1.60 | ||||||||||

| Sustaining cash cost1 | $/lb | 1.48 | 1.21 | 1.86 | 1.81 | |||||||||||

| Manitoba cash cost per ounce of gold produced | ||||||||||||||||

| Cash cost1 | $/oz | 607 | 434 | 606 | 727 | 700 - 900 | ||||||||||

| Sustaining cash cost1 | $/oz | 908 | 788 | 868 | 1,077 | |||||||||||

| British Columbia cash cost per pound of copper produced3 | ||||||||||||||||

| Cash cost1 | $/lb | 3.00 | 2.67 | 2.74 | 2.49 | 2.00 - 2.50 | ||||||||||

| Sustaining cash cost1 | $/lb | 5.76 | 3.93 | 5.29 | 3.41 | |||||||||||

| Consolidated cash cost per pound of copper produced | ||||||||||||||||

| Cash cost1 | $/lb | 0.45 | 0.16 | 0.46 | 0.80 | 0.65 - 0.85 | ||||||||||

| Sustaining cash cost1 | $/lb | 1.37 | 1.09 | 1.62 | 1.72 | 1.75 - 2.20 | ||||||||||

| All-in sustaining cash cost1 | $/lb | 1.53 | 1.31 | 1.88 | 1.92 | |||||||||||

1 Cash cost, sustaining cash cost, all-in sustaining cash cost per pound of copper produced, net of by-product credits, gold cash cost, sustaining cash cost per ounce of gold produced, net of by-product credits, and unit operating cost are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

2 We previously improved our 2024 annual consolidated cash cost guidance range to $0.65 to $0.85 per pound from the original guidance range of $1.05 to $1.25 per pound. We also previously improved our 2024 annual consolidated sustaining cash cost guidance range to $1.75 to $2.20 per pound from the original guidance range of $2.00 to $2.45 per pound.

3As Copper Mountain was acquired on June 20, 2023, the results for the year ended December 31, 2023 represents the period from the acquisition date, June 20, 2023, through to the year ended 2023.

RECENT DEVELOPMENTS

Significant Debt Reduction and Transformed Balance Sheet

We took several prudent measures in 2024 to significantly improve the strength of our balance sheet and improve financial flexibility, including a total of $245 million of combined debt repayments and gold prepayment liability reductions:

• In May 2024, we completed a successful equity offering issuing common shares for gross proceeds of $402.5 million, resulting in net proceeds of $386.2 million after transaction costs.

• Repurchased and retired a total of $82.6 million of senior unsecured notes during the year.

• Repaid $100 million of prior drawdowns under our revolving credit facilities during the year.

• Fully repaid the gold prepay facility, with $62.3 million in gold deliveries in 2024 and the final payment completed in August.

• In November, we proactively extended our senior secured revolving credit facilities by three years from October 2025 to November 2028 and negotiated the flexibility to leave our 4.50% 2026 senior unsecured notes outstanding to maturity as Copper World advances towards a sanctioning decision in accordance with the 3-P plan. The newly extended $450 million revolving credit facilities include an improved pricing grid reflecting the enhanced financial position of Hudbay and feature an opportunity to increase the facility by an additional $150 million at our discretion during the four-year tenor, providing additional financial flexibility.

We have delivered six consecutive quarters of meaningful free cash flow generation as a result of recent brownfield investments, continuous operational improvement efforts and steady cost control across the business. As a result of the continued cash flow generation and our deleveraging efforts, we have substantially reduced our net debt[1] to $525.7 million as of December 31, 2024, as compared to $1,037.7 million at the end of 2023. The net debt reduction, together with higher levels of adjusted EBITDA1 over the last twelve months, has significantly improved our net debt to adjusted EBITDA ratio1 to 0.6x compared to 1.6x at the end of 2023.

Copper World Permitting Completed

On January 2, 2025, Hudbay received the Air Quality Permit for the Copper World project from the Arizona Department of Environmental Quality ("ADEQ"). The issuance of this permit is a significant milestone in the advancement of the project as it is the final major permit required for the development and operation of Copper World. Copper World is expected to produce 85,000 tonnes of copper per year over an initial 20-year mine life.

Hudbay has now received all three key state permits required for Copper World development and operation:

• Mined Land Reclamation Plan - Completed - the Mined Land Reclamation Plan was initially approved by the Arizona State Mine Inspector in October 2021 and was subsequently amended and approved to reflect a larger private land project footprint. This approval was challenged in state court, but the challenge was dismissed in May 2023.

• Aquifer Protection Permit - Completed - the Aquifer Protection Permit was received on August 29, 2024 from the ADEQ following a robust process that included detailed analysis by the agency and Hudbay, along with a public comment period that was completed in the second quarter of 2024.

• Air Quality Permit - Completed - the Air Quality Permit was received on January 2, 2025 from the ADEQ following a similarly robust process, including a public comment period that concluded in the third quarter of 2024. An administrative appeal was filed by certain opponents in late January, as expected and the Company is confident the permit will be upheld, similar to the project's other state-level permits .

Hudbay received the Aquifer Protection Permit and Air Quality Permit on schedule after a thorough public consultation process, and the Company is pleased with the level of local support it has received. Hudbay looks forward to providing significant benefits for the community and local economy in Arizona. Once in production, Copper World is expected to be a meaningful copper producer in the U.S. domestic copper supply chain, which will be required to help secure growing U.S. metal demand related to increased manufacturing capacity, infrastructure development, increased energy independence, domestic battery supply chain and strengthening the nation's security.

Now that the major permits for Copper World have been received, Hudbay commenced a minority joint venture partner process early in 2025. It is anticipated that any minority joint venture partner would participate in the funding of definitive feasibility study activities in 2025 as well as in the final project design and construction for Copper World.

The sanctioning of Copper World is not expected until 2026 based on current estimated timelines.

____________________________________________

1 Adjusted EBITDA and net debt to adjusted EBITDA ratio are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A

Bolstering Technical Capabilities

As we advance the many brownfield and greenfield growth opportunities within our portfolio, we have enhanced the senior management team with additional technical expertise and expanded the U.S. team to build bench strength and establish key leadership positions.

Hudbay's Senior Vice President of the U.S. Business Unit, Javier Del Rio, has been focusing his time solely on leading the Copper World project, leveraging his project development and operational expertise as the former head of Hudbay's South America Business Unit where he oversaw the development and operation of the Company's flagship Constancia mine in Peru. In addition, Warren Flannery, Hudbay's Vice President of Business Planning and Reclamation, relocated to Arizona in September 2024 to take on the role of Vice President of Copper World. In his new role, Mr. Flannery is leading the operational readiness of Copper World as the company advances through definitive feasibility study activities in 2025.

Adding to the U.S. expertise, in August 2024, Hudbay hired Robert Comer as Executive Director, External Affairs & Legal in Arizona. As an experienced attorney, Mr. Comer brings more than 30 years of U.S. permitting and mining law expertise. During his career, Mr. Comer has held senior leadership positions with businesses and the federal government and has successfully advanced numerous resource projects, including through environmental and land use compliance, defending permits through litigation, NEPA permitting and government relations. He is a significant asset to Copper World as Hudbay continues to advance towards a sanctioning decision in 2026.

After receiving all key permits and with feasibility study activities underway, in February 2025, we added to our U.S. team's project development expertise with the appointment of Kim Hackney as Project Director of Copper World. Mr. Hackney is a project professional with over 40 years of extensive experience in the mining industry having held several roles in project and construction management, including managing owners teams, EPCM projects and self-perform projects. He is recognized in the industry for bringing projects online within budget and on schedule, and his in-depth expertise includes global base and precious metals projects located in North, Central and South America, Canada, Africa, Australia, Indonesia, and Uzbekistan.

Hudbay also appointed John O'Shaughnessy as Vice President, Business Development in February 2025 to provide expert oversight and strategic leadership of the global mine planning process. Mr. O'Shaughnessy has 25 years of mining expertise, including numerous progressive engineering, operational and leadership roles at Vale's mining operations in Ontario and Newfoundland and Labrador. He was most recently the North Atlantic Lead for Vale's Base Metals division where he led and deployed strategic initiatives for the North Atlantic region. His broad technical expertise further augments Hudbay's technical bench strength.

New Britannia Demonstrates Successful Capital Allocation to Maximize Risk-adjusted Returns

Hudbay has a proven track record of prudently allocating capital to generate the highest risk-adjusted returns as we execute our growth strategy and advance our world-class asset portfolio. As an example of this success, we have completed a post-project review of the brownfield investment in the New Britannia mill refurbishment project in 2020 and 2021.

Hudbay acquired the New Britannia mill in 2015 for $12 million as a potential gold processing solution for the high-grade Lalor gold and copper-gold ores by providing additional processing capacity at the Snow Lake operations and allowing us to achieve higher gold recoveries of approximately 90%, compared to 55% at the existing mill. After completing several economic studies, the refurbishment project construction commenced in early 2020 with an initial capital cost of $115 million and an estimated unlevered IRR of 19%. The initial capital investment was funded by a $115 million low-cost gold prepay facility entered into in May 2020. Project construction was completed on time with mill ramp-up and commissioning achieved in the fourth quarter of 2021. The mill was refurbished with a nameplate design capacity of 1,500 tonnes per day, and has been consistently exceeding performance expectations, achieving throughput levels of 1,650 tonnes per day in 2023 and reaching record throughput levels of over 2,000 tonnes per day in 2024. The project payback was achieved after 2.5 years, and in August 2024, the gold prepay facility was fully repaid, which has increased exposure to the current high gold price environment and further improved cash flows. After three years of operations, the unlevered IRR for the New Britannia gold mill refurbishment project has now increased to 36% after adjusting for the higher production rates, stronger gold prices and current capital and operating costs.

Hudbay Celebrates Major Milestone with Millionth Ounce of Gold Recovered from Lalor Mine

At the end of 2024, we surpassed a total of one million ounces of gold produced at our Lalor mine in Snow Lake, Manitoba. This milestone reinforces the significant value Hudbay has unlocked by combining its exploration expertise, processing infrastructure and operating efficiency to maximize gold production at our Snow Lake operations. In 2024, the Snow Lake operations achieved record annual gold production exceeding the top end of the gold production guidance range with 214,225 ounces produced.

With approximately two million ounces of contained gold in current mineral reserve estimates and another 1.4 million ounces of contained gold in inferred mineral resources, Hudbay expects to continue to unlock significant value in Snow Lake and looks forward to further growing the mineral resource base through regional exploration as we continue to execute one of the largest exploration programs in Snow Lake operating history.

Exploration Update

Large Exploration Drill Program Continues in Snow Lake

In 2024, Hudbay completed the largest exploration program in the Company's history with the goal of extending known mineralization near the Lalor deposit to further extend mine life as well as to find a new anchor deposit within trucking distance of the Snow Lake processing infrastructure. The 2024 program included the largest geophysical program in Hudbay's history in Snow Lake, with surface electromagnetic surveys detecting targets at more than 1,000 metres below surface and covering a 25 square-kilometre area including the Cook Lake claims that had been previously untested by modern deep geophysics.

At Lalor Northwest, follow-up drilling in the second half of 2024 confirmed the potential for a new gold-copper discovery located approximately 400 metres from the existing Lalor underground infrastructure. Several new intersections have helped establish the geometry of this new discovery, and we plan to continue to drill Lalor Northwest in 2025.

At the regional Rail property, which was acquired through the Rockcliff acquisition in 2023, the 2024 drill program yielded new intersections of high-grade copper-gold mineralization. These results will be combined with historical drilling results on the property to update the geological model and assess its economic potential.

2024 drilling at the 1901 deposit from the exploration drift targeted down plunge extensions of the ore body. Five step-out holes were drilled beyond the known extent of the mineralization and all five holes have intersected visible copper-gold mineralization. Additional planned drilling at 1901 in 2025 is expected to confirm and potentially extend the orebody geometry and to convert inferred mineral resources in the gold lenses to mineral reserves.

We continue to test a very strong deep geophysical anomaly located at Cook Lake North, approximately six kilometres from Lalor with drilling activities continuing throughout the winter season.

Signed Exploration Agreement with First Nations in Manitoba

In February 2025, Hudbay signed its first-ever exploration agreement with the Kiciwapa Cree Nation, reflecting the Company's commitment to meaningful collaboration as we explore for new mineral resources in the Snow Lake and Flin Flon regions.

Advancing Engineering Work for Flin Flon Tailings Reprocessing

Zinc Plant Tailings - Metallurgical test work continues following positive results from the initial confirmatory drill program completed in 2024 in the section of the tailings facility that was utilized by the zinc plant for 25 years. The results confirmed the grades of precious metals and critical minerals previously estimated from historical zinc plant records. An early economic study to evaluate the opportunity to reprocess the zinc plant tailings has confirmed the potential for a technically viable reprocessing alternative, and further engineering work is underway.

Mill Tailings - We continue to advance metallurgical test work on the opportunity to reprocess Flin Flon mill tailings where 100 million tonnes of tailings were deposited over 90 years. An early economic study on the mill tailings is planned.

Maria Reyna and Caballito Drill Permits Expected in 2025

Hudbay controls a large, contiguous block of mineral rights with the potential to host mineral deposits in close proximity to the Constancia processing facility, including the past producing Caballito property and the highly prospective Maria Reyna property. The Company commenced early exploration activities at Maria Reyna and Caballito after completing a surface rights exploration agreement with the community of Uchucarcco in August 2022. As part of the drill permitting process, environmental impact assessment applications were submitted for the Maria Reyna property in November 2023 and for the Caballito property in April 2024. The environmental impact assessment (EIA) for Maria Reyna was approved by the government in June 2024 and the Caballito EIA was approved in September 2024. This represents one of several steps in the drill permitting process, which is expected to be completed in 2025.

Board Chair Transition

Effective January 1, 2025, Stephen A. Lang stepped down as Chair of Hudbay's Board of Directors due to health reasons. David S. Smith, current independent director, has been appointed Chair of the Board. Mr. Lang, who was appointed Chair in October 2019, will remain on the Board as an independent director. Mr. Smith joined the Board as an independent director in May 2019, bringing nearly 40 years of financial and executive leadership experience in the mining sector. Mr. Smith is a corporate director who has had a career on both the finance and the supply sides of the mining business, with extensive international experience in the acquisition, sale, development, financing and operations of base and precious metal operations.

Dividend Declared

A semi-annual dividend of C$0.01 per share was declared on February 18, 2025. The dividend will be paid out on March 21, 2025 to shareholders of record as of close of business on March 4, 2025.

PERU OPERATIONS REVIEW

| Three months ended | Year ended | |||

Dec. 31, 2024 | Dec. 31, 2023 | Dec. 31, 2024 | Dec. 31, 2023 | ||

Constancia ore mined1 | tonnes | 4,186,058 | 973,176 | 15,046,190 | 9,265,954 |

Copper | % | 0.40 | 0.30 | 0.34 | 0.32 |

Gold | g/tonne | 0.04 | 0.04 | 0.04 | 0.04 |

Silver | g/tonne | 3.88 | 2.26 | 3.08 | 2.53 |

Molybdenum | % | 0.02 | 0.01 | 0.01 | 0.01 |

Pampacancha ore mined1 | tonnes | 4,037,264 | 5,556,613 | 9,317,499 | 14,756,416 |

Copper | % | 0.63 | 0.56 | 0.55 | 0.51 |

Gold | g/tonne | 0.38 | 0.32 | 0.32 | 0.33 |

Silver | g/tonne | 6.43 | 4.84 | 5.61 | 4.28 |

Molybdenum | % | 0.00 | 0.01 | 0.01 | 0.01 |

Total ore mined | tonnes | 8,223,322 | 6,529,789 | 24,363,689 | 24,022,370 |

Strip ratio2 |

| 1.22 | 1.26 | 1.78 | 1.51 |

Ore milled | tonnes | 7,999,453 | 7,939,044 | 31,933,624 | 30,720,929 |

Copper | % | 0.48 | 0.48 | 0.36 | 0.39 |

Gold | g/tonne | 0.20 | 0.25 | 0.14 | 0.16 |

Silver | g/tonne | 5.28 | 4.20 | 3.84 | 3.62 |

Molybdenum | % | 0.01 | 0.01 | 0.01 | 0.01 |

Copper concentrate | tonnes | 148,283 | 146,065 | 452,473 | 457,137 |

Concentrate grade | % Cu | 22.92 | 22.73 | 21.88 | 21.98 |

Copper recovery | % | 87.8 | 87.4 | 85.0 | 84.2 |

Gold recovery | % | 73.3 | 77.6 | 70.7 | 71.8 |

Silver recovery | % | 71.4 | 78.0 | 68.8 | 70.0 |

Molybdenum recovery | % | 37.1 | 33.6 | 41.7 | 35.8 |

Combined unit operating costs3,4 | $/tonne | 15.25 | 12.24 | 12.91 | 12.47 |

1 Reported tonnes and grade for ore mined are estimates based on mine plan assumptions and may not reconcile fully to ore milled.

2 Strip ratio is calculated as waste mined divided by ore mined.

3 Reflects combined mine, mill and general and administrative ("G&A") costs per tonne of ore milled. Reflects the deduction of expected capitalized stripping costs.

4 Combined unit costs is a non-GAAP financial performance measure with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

|

| Three months ended | Year ended | ||

|

| Dec. 31, 2024 | Dec. 31, 2023 | Dec. 31, 2024 | Dec. 31, 2023 |

Contained metal in concentrate produced |

|

|

|

|

|

Copper | tonnes | 33,988 | 33,207 | 99,001 | 100,487 |

Gold | oz | 38,079 | 49,418 | 98,226 | 114,218 |

Silver | oz | 969,502 | 836,208 | 2,708,262 | 2,505,229 |

Molybdenum | tonnes | 195 | 397 | 1,323 | 1,566 |

Payable metal sold |

|

|

|

|

|

Copper | tonnes | 28,775 | 31,200 | 88,138 | 96,213 |

Gold | oz | 37,459 | 38,114 | 103,364 | 97,176 |

Silver | oz | 824,613 | 703,679 | 2,343,820 | 2,227,419 |

Molybdenum | tonnes | 182 | 468 | 1,287 | 1,462 |

Cost per pound of copper produced |

|

|

|

|

|

Cash cost1 | $/lb | 1.00 | 0.54 | 1.18 | 1.07 |

Sustaining cash cost1 | $/lb | 1.48 | 1.21 | 1.86 | 1.81 |

1 Cash cost and sustaining cash costs per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-GAAP financial performance measures, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

Overview

Peru operations delivered higher grades in fourth quarter, as planned, and continued to benefit from strong and consistent mill throughput in 2024, averaging approximately 87,000 tonnes processed per day in the fourth quarter and full year of 2024. Cost performance in 2024 was better than expected as the operations achieved steady operating unit cost performance while benefiting from higher gold by-product sales revenues. The fourth quarter also benefited from a larger portion of ore mill feed coming from Pampacancha.

Approximately 30,000 wet metric tonnes of copper concentrate in Peru were unsold as of December 31, 2024, which is approximately 15,000 wet metric tonnes above normal levels and resulted from the strong production ramp-up that occurred late in the quarter. The excess copper concentrate is expected to be sold in the first quarter of 2025.

The Company continues to evaluate opportunities to further increase mill throughput after the Peruvian Ministry of Energy and Mines approved a regulatory change in June 2024 to allow mining companies in Peru to increase throughput by up to 10% above permitted levels.

Mining Activities

Total ore mined in the fourth quarter of 2024 increased by 26% compared to the same period in 2023, in line with our mine plan as we completed the planned stripping program at Pampacancha in late September. The planned stripping phase at Pampacancha allowed us to mine higher copper and gold grade ore in the fourth quarter, as expected. Ore mined from Pampacancha during the fourth quarter decreased to 4.0 million tonnes compared with 5.6 million tonnes in the fourth quarter of 2023 when we were in an unusually high period of ore mined from Pampacancha as per the 2023 mine plan cadence. However, total ore mined in the fourth quarter of 2024 was higher than the same period in 2023 with the inclusion of ore mined in the Constancia pit.

Full year ore mined in 2024 was slightly higher than 2023 despite periods of intensive stripping in 2024, primarily as a result of the effective use of mobile equipment and higher fleet availability.

Milling Activities

Ore milled during the fourth quarter of 2024 was 1% higher than the comparative 2023 period mainly due to the treatment of softer ore from Constancia. Milled copper grades were consistent with the same period last year. Milled gold grades decreased by 20% in the fourth quarter of 2024 compared to the same period in 2023 but were better than expected as we mined additional gold benches in the Pampacancha pit during the fourth quarter of 2024. The Constancia mill achieved record copper recoveries of 88% in the fourth quarter of 2024, higher than the previous record of 87% achieved in the comparative period. Recoveries of gold and silver during the fourth quarter of 2024 were 73% and 71%, respectively, representing a decrease of 6% and 8% respectively, compared to the same period in 2023, but remained in line with our metallurgical models for the ore types that were being processed.

Ore milled during the year ended 2024 was 4% higher than the comparative 2023 period due to the same factors as the quarterly variance. For the full year, milled copper and gold grades decreased by 8% and 13%, respectively, compared to the same period in 2023, as a result of less ore being fed from Pampacancha, as per plan. Recoveries of copper during the year ended 2024 were 85%, representing an increase of 1%, compared with the 2023 period, despite being impacted by supplemental ore feed from stockpiles during pit stripping activities early in the year. Gold and silver recoveries during the year ended 2024 were 71% and 69%, representing a decrease of 2% and 2%, respectively. This is in line with our metallurgical models.

Production and Sales Performance

Production of copper and silver in the fourth quarter of 2024 was 33,988 tonnes and 969,502 ounces, respectively, representing an increase of 2% and 16%, respectively, compared to the same period in 2023 primarily due to higher throughput. Production of gold and molybdenum in the fourth quarter of 2024 was 38,079 ounces and 195 tonnes, respectively, representing a decrease of 23% and 51%, respectively, compared to the same period in 2023 as a larger portion of lower grade Constancia ore was processed in the current quarter compared to the same period last year.

Full year production of copper, gold and molybdenum in 2024 was 99,001 tonnes, 98,226 ounces, and 1,323 tonnes, respectively, representing a decrease of 1%, 14% and 16%, respectively, from the comparative 2023 period primarily due to lower grades since more material was mined from Constancia and reclaimed from the stockpile during 2024 compared with the prior year, partially offset by higher throughput. Production of silver was 2,708,262 ounces, representing an increase of 8% from the comparative 2023 period due to higher silver grades from Pampacancha.

Quantities of sold copper and gold during the fourth quarter of 2024 were lower by 8%, and 2%, respectively, than the corresponding period in 2023 primarily due to unsold copper concentrate inventory levels at quarter end. Approximately 30,000 wet metric tonnes of copper concentrate in Peru were unsold as of December 31, 2024, which is approximately 15,000 wet metric tonnes above normal levels and resulted from the strong production ramp-up that occurred late in the quarter. Copper concentrate inventory levels are expected to normalize in the first quarter of 2025. Quantity of molybdenum sold during the fourth quarter of 2024 was lower by 61% due to lower production during the quarter. Quantity of silver sold during the fourth quarter of 2024 was higher by 17% than the corresponding period in 2023 due to the aforementioned higher grades.

Full year copper metal sold was 8% lower than the comparable period due to higher ending inventory levels. Gold metal sold was 6% higher than the comparable period primarily due to timing of precious metal sales at the beginning of the year.

*Copper equivalent production is calculated using the quarter average LME prices for each metal excluding molybdenum.

Cost Performance

Combined mine, mill and G&A unit operating cost in the fourth quarter of 2024 was $15.25 per tonne, 25% higher than the same period in 2023 primarily due to lower capitalized stripping, higher milling costs with a planned semi-annual mill maintenance shutdown in the quarter, and higher G&A costs including profit sharing. This increase was partially offset by higher ore milled. Combined mine, mill and G&A unit operating costs for the full year 2024 were $12.91 per tonne, a 4% increase compared to the same period in 2023 as higher mining and G&A costs were partially offset by higher throughput and slightly lower milling costs.

Cash cost per pound of copper produced, net of by-product credits, in the fourth quarter of 2024 was $1.00, an increase compared to $0.54 in the same period in 2023 due to lower capitalized stripping, higher mining, milling and G&A costs including profit sharing. In addition, lower by-product credits were realized from gold and molybdenum mostly as a result of lower grades compared to the same period last year.

Full year 2024 cash cost per pound of copper produced, net of by-product credits2 was $1.18, an increase compared to $1.07 in 2023 due to lower capitalized stripping, higher mining and G&A costs, including higher profit sharing and slightly lower copper production.

Sustaining cash cost per pound of copper produced, net of by-product credits2, was $1.48 in the fourth quarter, an increase compared with $1.21 in the same period of 2023. The increase was due to the same factors as described for the cash cost variance above, partially offset by lower sustaining capital due to lower capitalized stripping. On a full year basis, sustaining cash cost per pound of copper produced, net of by-products credits2, was $1.86, only marginally higher than the $1.81 for the comparable period in 2023, due to the same reasons described for the cash cost variance over the full year period.

Peru Guidance Outlook

|

| Three months ended | Year ended | Guidance | |||

|

| Dec. 31, | Dec. 31, | Dec. 31, | Dec. 31, | Annual 2024 | Annual 2025 |

Contained metal in concentrate produced |

|

|

|

|

|

|

|

Copper | tonnes | 33,988 | 33,207 | 99,001 | 100,487 | 98,000 - 120,000 | 80,000 - 97,000 |

Gold | oz | 38,079 | 49,418 | 98,226 | 114,218 | 76,000 - 93,000 | 49,000 - 60,000 |

Silver | oz | 969,502 | 836,208 | 2,708,262 | 2,505,229 | 2,500,000 - 3,000,000 | 2,475,000 - 3,025,000 |

Molybdenum | tonnes | 195 | 397 | 1,323 | 1,566 | 1,250 - 1,500 | 1,300 - 1,500 |

Cost per pound of copper produced |

|

|

|

|

|

|

|

Cash cost1 | $/lb | 1.00 | 0.54 | 1.18 | 1.07 | 1.25 - 1.60 | 1.35 - 1.65 |

1 Cash cost per pound of copper produced, net of by-product credits, are not recognized under IFRS. For more detail on these non-GAAP financial performance measures, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

Full year 2024 copper, silver and molybdenum production achieved our annual guidance ranges, and gold production exceeded the upper end of our guidance range by 6%.

Cash cost per pound of copper produced2 of $1.18 was better than expected and outperformed the low end of the cost guidance range by 6%.

MANITOBA OPERATIONS REVIEW

| Three months ended | Year ended | |||

Dec. 31, 2024 | Dec. 31, 2023 | Dec. 31, 2024 | Dec. 31, 2023 | ||

Lalor ore mined | tonnes | 422,454 | 372,384 | 1,626,935 | 1,526,729 |

Gold | g/tonne | 4.61 | 5.92 | 4.68 | 4.74 |

Copper | % | 0.95 | 1.04 | 0.85 | 0.86 |

Zinc | % | 2.95 | 2.20 | 2.84 | 3.00 |

Silver | g/tonne | 31.91 | 28.92 | 27.14 | 24.51 |

New Britannia ore milled | tonnes | 185,592 | 165,038 | 715,198 | 596,912 |

Gold | g/tonne | 5.99 | 8.03 | 6.29 | 6.76 |

Copper | % | 1.17 | 1.46 | 1.04 | 1.03 |

Zinc | % | 1.08 | 0.85 | 0.99 | 0.84 |

Silver | g/tonne | 33.97 | 27.97 | 27.78 | 25.11 |

Copper concentrate | tonnes | 12,345 | 15,179 | 44,198 | 37,176 |

Concentrate grade | % Cu | 16.00 | 14.55 | 15.78 | 15.44 |

Gold recovery1 | % | 90.2 | 89.0 | 89.7 | 88.6 |

Copper recovery | % | 91.3 | 91.6 | 93.6 | 93.3 |

Silver recovery1 | % | 79.6 | 83.2 | 80.9 | 81.5 |

Contained metal in concentrate produced |

|

|

|

| |

Gold | oz | 22,011 | 24,760 | 90,011 | 77,798 |

Copper | tonnes | 1,975 | 2,208 | 6,976 | 5,739 |

Silver | oz | 119,201 | 90,501 | 396,333 | 292,694 |

Metal in doré produced2 |

|

|

|

|

|

Gold | oz | 12,747 | 14,144 | 56,853 | 40,239 |

Silver | oz | 46,431 | 34,895 | 165,408 | 97,630 |

Stall ore milled | tonnes | 222,004 | 228,799 | 893,510 | 965,567 |

Gold | g/tonne | 3.36 | 4.22 | 3.42 | 3.45 |

Copper | % | 0.73 | 0.73 | 0.71 | 0.74 |

Zinc | % | 4.62 | 3.20 | 4.33 | 4.36 |

Silver | g/tonne | 29.90 | 28.63 | 26.54 | 24.19 |

Copper concentrate | tonnes | 7,222 | 7,938 | 29,029 | 31,900 |

Concentrate grade | % Cu | 19.01 | 19.23 | 19.16 | 20.11 |

Zinc concentrate | tonnes | 16,187 | 11,778 | 64,643 | 66,824 |

Concentrate grade | % Zn | 51.80 | 48.79 | 51.58 | 51.84 |

Gold recovery | % | 69.6 | 67.5 | 68.6 | 64.8 |

Copper recovery | % | 84.4 | 92.0 | 87.4 | 90.4 |

Zinc recovery | % | 81.7 | 78.5 | 86.2 | 82.2 |

Silver recovery | % | 55.1 | 61.8 | 56.8 | 61.4 |

Contained metal in concentrate produced |

|

|

|

| |

Gold | oz | 16,680 | 20,959 | 67,361 | 69,326 |

Copper | tonnes | 1,372 | 1,527 | 5,560 | 6,415 |

Zinc | tonnes | 8,385 | 5,747 | 33,339 | 34,642 |

Silver | oz | 117,591 | 130,183 | 433,349 | 461,399 |

1 Gold and silver recovery includes total recovery from concentrate and doré.

2 Doré includes sludge, slag and carbon fines.

| Three months ended | Year ended | |||

Dec. 31, 2024 | Dec. 31, 2023 | Dec. 31, 2024 | Dec. 31, 2023 | ||

Total contained metal in concentrate and doré produced1 | |||||

Gold | oz | 51,438 | 59,863 | 214,225 | 187,363 |

Copper | tonnes | 3,347 | 3,735 | 12,536 | 12,154 |

Zinc | tonnes | 8,385 | 5,747 | 33,339 | 34,642 |

Silver | oz | 283,223 | 255,579 | 995,090 | 851,723 |

Payable metal sold in concentrate and doré |

|

|

|

| |

Gold | oz | 50,239 | 63,635 | 212,243 | 171,297 |

Copper | tonnes | 3,321 | 3,687 | 11,602 | 10,708 |

Zinc | tonnes | 5,261 | 7,385 | 25,120 | 28,779 |

Silver | oz | 282,158 | 246,757 | 956,460 | 728,304 |

Unit Operating Costs2 |

|

|

|

|

|

Lalor | C$/tonne | 141.13 | 147.10 | 142.59 | 142.35 |

New Britannia | C$/tonne | 69.09 | 75.36 | 70.99 | 82.91 |

Stall | C$/tonne | 46.34 | 36.97 | 43.02 | 35.82 |

Combined unit operating costs3,4 | C$/tonne | 233 | 216 | 226 | 217 |

Cost per ounce of gold produced |

|

|

|

|

|

Cash cost4 | $/oz | 607 | 434 | 606 | 727 |

Sustaining cash cost4 | $/oz | 908 | 788 | 868 | 1,077 |

1 Metal reported in concentrate is prior to deductions associated with smelter terms.

2 Reflects costs per tonne of ore mined/milled.

3 Reflects combined mine, mill and G&A costs per tonne of milled ore.

4 Combined unit costs, cash cost and sustaining cash cost per ounce of gold produced, net of by-product credits, are non-GAAP financial performance measures with no standardized definition under IFRS. For further information and a detailed reconciliation, please see the discussion under the "Non-GAAP Financial Performance Measures" section of this MD&A.

Overview