Exhibit 99.1

HUDBAY MINERALS INC.

ANNUAL INFORMATION FORM

FOR THE

YEAR ENDED DECEMBER 31, 2011

March 30, 2012

TABLE OF CONTENTS

FORWARD-LOOKING INFORMATION | 1 |

NOTE TO UNITED STATES INVESTORS | 1 |

CURRENCY AND EXCHANGE RATES | 2 |

OTHER IMPORTANT INFORMATION | 2 |

CORPORATE STRUCTURE | 2 |

Incorporation and Registered Office | 2 |

Intercorporate Relationships | 3 |

DEVELOPMENT OF OUR BUSINESS | 3 |

General | 3 |

Three Year History | 4 |

DESCRIPTION OF OUR BUSINESS | 7 |

General | 7 |

Material Mineral Projects | 8 |

Other Assets | 14 |

Other Information | 19 |

CORPORATE SOCIAL RESPONSIBILITY | 20 |

RISK FACTORS | 21 |

DESCRIPTION OF CAPITAL STRUCTURE | 29 |

Common Shares | 29 |

Preference Shares | 29 |

DIVIDENDS | 29 |

MARKET FOR SECURITIES | 30 |

Price Range and Trading Volume | 30 |

DIRECTORS AND OFFICERS | 30 |

Board of Directors | 30 |

Executive Officers | 32 |

Corporate Cease Trade Orders, Bankruptcies, Penalties and Sanctions | 34 |

Conflicts of Interest | 35 |

AUDIT COMMITTEE DISCLOSURE | 36 |

LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 37 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 39 |

TRANSFER AGENT AND REGISTRAR | 39 |

MATERIAL CONTRACTS | 39 |

QUALIFIED PERSON | 39 |

INTEREST OF EXPERTS | 40 |

ADDITIONAL INFORMATION | 40 |

SCHEDULE A GLOSSARY OF MINING TERMS | 1 |

SCHEDULE B MATERIAL MINERAL PROJECTS | 1 |

SCHEDULE C AUDIT COMMITTEE CHARTER | 1 |

FORWARD-LOOKING INFORMATION

This annual information form (“AIF”) contains “forward-looking information”, within the meaning of applicable Canadian and U.S. securities legislation. Forward looking information includes, but is not limited to, information with respect to our ability to develop our Lalor, Constancia and Reed projects and our other mineral properties, changes to the scope of our Constancia project, project development plan, and the anticipated timing of a project decision by our board of directors, the ability of management to execute on key strategic and operational objectives and meet production forecasts, exploration expenditures and activities and the possible success of such exploration activities, the estimation of mineral reserves and resources, the realization of mineral estimates, the timing and amount of estimated future production, costs of production, capital expenditures, costs and timing of the development of new deposits, mineral pricing, reclamation costs, economic outlook, government regulation of mining operations, mine life projections, the ability to maintain a regular dividend on our common shares, the availability of third party concentrate for processing in our facilities and the availability of third party processing facilities for our concentrate, business and acquisition strategies and the timing and possible outcome of pending litigation. Often, but not always, forward looking information can be identified by the use of forward looking words like “plans”, “expects”, or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “understands”, “anticipates”, or “does not anticipate”, or “believes” or variations of such words and phrases or statements that certain actions, events or results “may”, “could”, “would”, “might”, or “will be taken”, “occur”, or “be achieved”. Forward looking information is based on the opinions and estimates of management as of the date such information is provided and is subject to known and unknown risks, uncertainties and other factors that may cause our actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward looking information, including the ability to develop and operate our Lalor, Constancia and Reed projects on an economic basis and in accordance with applicable timelines, the ability to receive permits required to achieve production at Lalor, Constancia and Reed, geological and technical conditions at our key projects being adequate to permit development, the ability to meet required solvency tests to support a dividend payment, risks associated with the mining industry such as economic factors (including future commodity prices, currency fluctuations and energy prices), failure of plant, equipment, processes and transportation services to operate as anticipated, dependence on key personnel and employee relations, environmental risks, government regulation (including anti-bribery legislation), aboriginal rights and title, actual results of current exploration activities, possible variations in ore grade or recovery rates, permitting timelines, capital expenditures, reclamation activities, land titles, and social and political developments and other risks of the mining industry as well as those risk factors discussed or referred to in this AIF under the heading “Risk Factors”. Although we have attempted to identify important factors that could cause actual results to differ materially from those contained in forward looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward looking information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such information. Accordingly, readers should not place undue reliance on forward looking information. We do not undertake to update or revise any forward looking information whether as a result of new information, future events or otherwise, except as required by applicable securities laws, or to comment on analyses, expectations or statements made by third parties in respect of our financial or operating results or our securities.

NOTE TO UNITED STATES INVESTORS

Information concerning our mineral properties has been prepared in accordance with the requirements of Canadian securities laws, which differ in material respects from the requirements of the U.S. Securities and Exchange Commission (“SEC”) Industry Guide 7. Under SEC Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time of the reserve determination, and the SEC does not recognize the reporting of mineral deposits which do not meet the SEC Industry Guide 7 definition of “Reserve”. In accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators, the terms “mineral reserve”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) Definition Standards for Mineral

Resources and Mineral Reserves adopted by the CIM Council on December 11, 2005. While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are recognized and required by NI 43-101, the SEC does not recognize them. You are cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence and as to whether they can be economically or legally mined. It cannot be assumed that all or any part of an inferred mineral resource will ever be upgraded to a higher category. Therefore, you are cautioned not to assume that all or any part of an inferred mineral resource exists, that it can be economically or legally mined, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of measured or indicated mineral resources will ever be upgraded into mineral reserves. For more information on the technical terms as they are used under NI 43-101, please see Schedule A “Glossary of Mining Terms”.

CURRENCY AND EXCHANGE RATES

This AIF contains references to both United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in Canadian dollars, and United States dollars are referred to as “United States dollars” or “US$”. For Canadian dollars to United States dollars, the average exchange rate for 2011 and the closing exchange rate at December 30, 2011, as reported by the Bank of Canada, were one Canadian dollar per 0.989 and 0.983 United States dollars, respectively. On March 29, 2012 the Bank of Canada noon rate of exchange was C$1.00 = US$1.00.

OTHER IMPORTANT INFORMATION

Certain scientific and technical terms and abbreviations used in this AIF are defined in the “Glossary of Mining Terms” attached as Schedule A.

Unless the context suggests otherwise, references to “we”, “us”, “our” and similar terms, as well as references to “Hudbay” and “Company”, refer to HudBay Minerals Inc. and its direct and indirect subsidiaries.

CORPORATE STRUCTURE

Incorporation and Registered Office

We were formed by the amalgamation of Pan American Resources Inc. and Marvas Developments Ltd. on January 16, 1996, pursuant to the Business Corporations Act (Ontario) and changed our name to Pan American Resources Inc. On March 12, 2002, we acquired ONTZINC Corporation, a private Ontario corporation, through a reverse takeover and changed our name to ONTZINC Corporation. On December 21, 2004, we acquired Hudson Bay Mining and Smelting Co., Limited (“HBMS”) and changed our name to HudBay Minerals Inc. In connection with the acquisition of HBMS, on December 21, 2004, we amended our articles to consolidate our common shares on a 30 to 1 basis. On October 25, 2005, we were continued under the Canada Business Corporations Act (“CBCA”). On August 15, 2011, we completed a vertical short-form amalgamation under the CBCA with our subsidiary, HMI Nickel Inc.

Our registered office is located at 2200-201 Portage Avenue, Winnipeg, Manitoba R3B 3L3 and our principal executive office is located at 25 York Street, Suite 800, Toronto, Ontario M5J 2V5.

Our common shares are listed on the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”) under the symbol “HBM”.

2

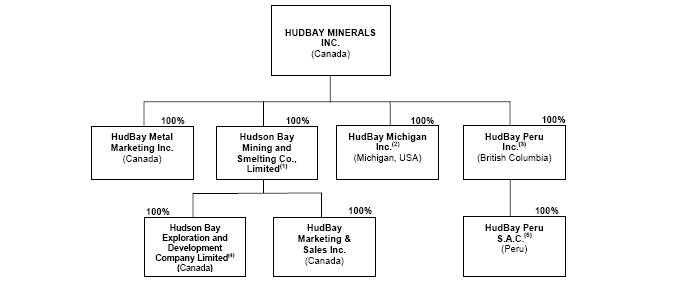

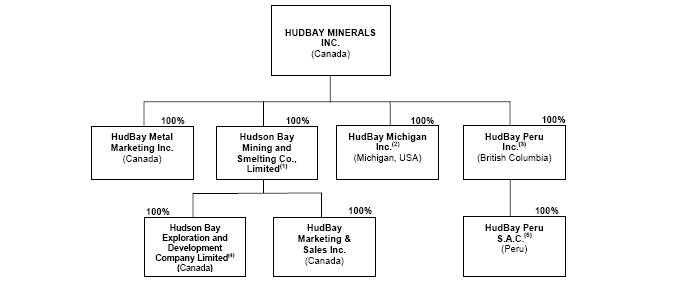

Intercorporate Relationships

The following chart shows our principal subsidiaries, their jurisdiction of incorporation and the percentage of voting securities we beneficially own or over which we have control or direction.

Notes:

(1) HBMS owns our 777, Trout Lake and Chisel North mines, our Lalor project and our 70% owned Reed copper project.

(2) HudBay Michigan Inc. owns a 51% interest in the Back Forty project, a joint venture with Aquila Resources Inc. (“Aquila”).

(3) HudBay Peru Inc. changed its name from Norsemont Mining Inc. on September 26, 2011.

(4) Hudson Bay Exploration and Development Company Limited (“HBED”) holds our key exploration properties in Canada and acts as agent for HBMS.

(5) HudBay Peru S.A.C. owns the Constancia copper project.

DEVELOPMENT OF OUR BUSINESS

General

We are an integrated mining company with assets in North and South America. We produce copper concentrate (containing copper, gold and silver) and zinc metal and are focused on the discovery, production and marketing of base and precious metals. Through our subsidiaries, we own copper/zinc/gold mines, ore concentrators and a zinc production facility in northern Manitoba and Saskatchewan, and a copper project in Peru. Our mission is to create sustainable value through increased commodity exposure on a per share basis, in high quality and growing long life deposits in mining friendly jurisdictions.

The key elements of our strategic plan are as follows: (i) optimize operations and grow our principal operating platform in northern Manitoba, including aggressively pursuing development of our Lalor project and continuing exploration in the Flin Flon Greenstone Belt; and (ii) grow beyond our Manitoba base, including through the development of our Constancia project, and seek acquisitions of volcanogenic massive sulphide (“VMS”) and porphyry deposits with exploration upside in mining friendly jurisdictions in the Americas.

As described below, under the heading “Three Year History”, we have been able to execute on this strategy in recent years by, among other things, acquiring and beginning to develop the Constancia project in Peru, making a full commitment to the development of our 100% owned Lalor project, approving the construction of our 70% owned Reed copper project, disposing of our interest in the Fenix project and other non-core assets and expanding our investment portfolio in junior exploration companies.

3

Three Year History

Reed Copper Project

On December 19, 2011 our board of directors approved a capital investment of $71 million toward the construction of the Reed copper project, which has an indicated mineral resource of 2.55 million tonnes of 4.52% copper and an inferred mineral resource of 170,000 tonnes of 4.26% copper. Pursuant to our agreement with VMS Ventures Inc. (“VMS Ventures”), we have a 70% interest and VMS has a 30% interest in the Reed project. For additional information, refer below to the heading “Description of Our Business — Other Assets — Joint Ventures — Reed Copper Project”.

Dispositions of Fenix Project and Zochem Inc.

On September 9, 2011 we completed the sale of our interest in the Fenix ferro nickel project in Guatemala to the Solway Group. We acquired the Fenix project in August 2008, through our acquisition of all of the issued and outstanding common shares of HMI Nickel Inc. (formerly Skye Resources Inc.). Pursuant to the terms of our agreement with the Solway Group, we received US$140 million in cash at closing and, if Solway successfully develops the project and certain conditions are satisfied, will receive an additional US$30 million upon the occurrence of such events. The sale proceeds have further strengthened our balance sheet as we develop our Lalor and Constancia projects.

On November 1, 2011 we sold our interest in Zochem Inc. to a third party for cash consideration of US$15.1 million. Zochem Inc. owns and operates a zinc oxide production facility in Brampton, Ontario.

Lalor

On August 4, 2010 our board of directors made a full commitment to the development of our 100% owned Lalor project near Snow Lake, Manitoba by authorizing a $560 million investment to put the project into full production. On July 5, 2011 we announced the results of our Lalor optimization study. Following our optimization study, our board of directors approved an incremental capital expenditure investment of $144 million to build a new 4,500 tonne per day concentrator at Lalor instead of refurbishing our existing Snow Lake concentrator. First production from the 985 metre production shaft is anticipated in late 2014 which is scheduled to coincide with the completion of the new concentrator. Including the new concentrator, the total estimated project cost for Lalor is $704 million, of which approximately $206 million had been spent as of December 31, 2011. Full production, use of the new concentrator and an increase to the capacity of the tailings facility are contingent upon receipt of required permits, which we believe to be forthcoming.

Our board of directors had previously approved the development of an access ramp from our Chisel North mine to the deposit, which is expected to facilitate early production of zinc rich ore from the ventilation shaft in the middle of 2012 and provide access to the Lalor gold zone for additional underground exploration. Development of the 3,200 metre ramp commenced in December 2009 and was completed on time and on budget in the fourth quarter of 2011. For additional information, refer below to the heading “Description of Our Business — Material Mineral Projects — Lalor Project”.

Acquisition of Norsemont Mining Inc.

We acquired Norsemont Mining Inc. (“Norsemont”) pursuant to a support agreement dated January 9, 2011 and an offer dated January 24, 2011 (as extended by a notice of extension dated March 1, 2011, the “Offer”). As set forth in the Offer, Norsemont shareholders were entitled to elect to receive, as consideration for each deposited common share of Norsemont (“Norsemont Share”), either: (a) 0.2617 of a Hudbay common share and $0.001 in cash, or (b) cash in an amount that is greater than $0.001, not to exceed $4.50, and, if less than $4.50 in cash was elected, the number of Hudbay common shares equal to the excess of $4.50 over such elected cash amount, divided by $17.19, subject, in each case, to pro-ration and rounding as set out in the Offer.

4

On March 15, 2011, upon expiry of the Offer, we had taken up an aggregate of 112,185,931 Norsemont Shares validly deposited under the Offer which, together with the Norsemont Shares already owned by us, represented approximately 98% of the issued and outstanding Norsemont Shares (on a fully-diluted basis). This constituted a significant acquisition for us pursuant to Part 8 of National Instrument 51-102 and we filed a business acquisition report on April 28, 2011 in respect of the acquisition. On July 6, 2011, we announced that we had acquired all of the remaining Norsemont Shares pursuant to a compulsory acquisition carried out under the provisions of the Business Corporations Act (British Columbia). Pursuant to the Offer and compulsory acquisition, we issued 22,475,704 Hudbay common shares and paid an aggregate of $130 million in cash to former Norsemont shareholders.

Following completion of our acquisition of Norsemont, we changed Norsemont’s name to HudBay Peru Inc. (“Hudbay Peru”). Hudbay Peru’s wholly-owned subsidiary, HudBay Peru S.A.C., owns 100% of the Constancia copper project in southern Peru. The Constancia project has proven and probable mineral reserves containing 372 million tonnes grading 0.39% copper, 105 g/t molybdenum, 0.05 g/t gold and 3.6 g/t silver. In addition, the higher grade Pampacancha deposit, approximately 2.5 kilometres from the proposed Constancia open pit, contains a measured mineral resource of 32.7 million tonnes of 0.48% copper and an indicated mineral resource of 18.5 million tonnes of 0.38% copper.

As a result of general cost escalation, scope enhancements, local currency appreciation and other factors, our capital cost estimate for Constancia is estimated to be US$1.5 billion. This amount represents gross capital costs, with no credits for revenue from production prior to achieving commercial production and includes sunk costs incurred during 2012. Capitalized costs expected to be incurred prior to a formal project decision total US$141 million. To support the continuing pre-construction development of Constancia during the second quarter of 2012, our board of directors has approved an incremental US$34 million in capitalized spending on Constancia, over and above the US$107 million approved for the first quarter of 2012. These expenditures will support ongoing engineering and procurement activity, hydrogeological drilling and camp construction among other activities.

The anticipated project schedule currently remains unchanged, with first production expected in 2015 and full production in 2016. By mid-2012, we expect to present our board of directors with a formal project recommendation, including a financing plan expected to involve project financing for Constancia. For additional information, refer below to the heading “Description of our Business — Material Mineral Projects — Constancia Project”.

New Credit Facility

On November 3, 2010 we announced a new four-year $300 million revolving credit facility with a syndicate of lenders.

New York Stock Exchange Listing

Our common shares commenced trading on the NYSE on October 25, 2010 under the ticker symbol “HBM”, which is the same ticker symbol HBMS was listed under on the NYSE from 1938 until 1983. Our listing on the NYSE is intended to increase the trading liquidity of our common shares and provide greater visibility among U.S.-based investors.

Back Forty Joint Venture

On September 1, 2010 we exercised our option to earn a 51% interest in the Back Forty project in Michigan’s Upper Peninsula. For additional information, refer below to the heading “Description of Our Business — Other Assets — Joint Ventures — Back Forty Project”.

Investment in Augusta Resource Corporation

On August 27, 2010 we acquired 10,905,590 units of Augusta Resource Corporation (“Augusta”) at a subscription price of $2.75 per unit and an aggregate acquisition cost of approximately $30 million. Each unit consisted of one Augusta common share and one half of a common share purchase warrant,

5

which was exercisable for one common share at an exercise price of $3.90 until February 27, 2012. On March 18, 2011, we exercised all of our Augusta warrants after receiving notice from Augusta that, in accordance with Augusta’s rights under the warrants, the expiry time of the warrants had been accelerated to March 21, 2011. Following our exercise of the warrants, we own approximately 14.1% of Augusta’s issued and outstanding common shares. Augusta’s primary asset is the Rosemont copper project in Arizona. The investment in Augusta was consistent with our strategy of investing in junior companies with near-development mineral projects.

777 North Expansion

On August 4, 2010 we announced plans to expand our 777 mine. The 777 North expansion involves driving a 2,500 metre ramp from surface to the 440 metre level below surface to access mineral resources of 550,000 tonnes grading 1.5 g/t gold, 22.5 g/t silver, 1.0% copper and 3.6% zinc. These zones are connected to the underground workings of our 777 mine. Total capital costs for the expansion are estimated at $20 million. Production is expected to begin in mid-2012 at a rate of 200 tonnes per day and full production is planned for 2013 at a rate of 330 tonnes per day, producing approximately 5,500 tonnes of copper metal and 20,000 tonnes of zinc metal over the six year life of the project. For additional information, refer below to the heading “Description of our Business — Material Mineral Projects — 777 Mine”.

CEO Appointment

David Garofalo joined us as our President and Chief Executive Officer (“CEO”) on July 12, 2010, succeeding W. Warren Holmes, who had served as our Interim CEO since January 1, 2010 and our Executive Vice Chairman since November 12, 2009.

Mr. Garofalo was previously Senior Vice President, Finance and Chief Financial Officer and a director at Agnico-Eagle Mines Limited, where he had been employed since 1998. Between 1990 and 1998, Mr. Garofalo served as Treasurer and in various finance roles with another international mining company.

Closure of Copper Smelter and Refinery

On June 11, 2010 we completed the closure of our copper smelter in Flin Flon, which had been in operation for over 80 years. We closed our White Pine copper refinery soon thereafter and sold it in the second quarter of 2011.

Re-Start of Chisel North Mine and Snow Lake Concentrator

On October 30, 2009 we announced the re-start of operations at our Chisel North mine and Snow Lake concentrator, which were placed on care and maintenance in the first quarter of 2009 due to depressed metals prices.

Board and Executive Transition

Our previous board of directors resigned on March 23, 2009 following the resolution of a proxy contest initiated by a shareholder and on that date, the current board of directors (as constituted at the time) was appointed. In connection with the board transition, Colin K. Benner resigned as Interim CEO and Peter R. Jones was appointed CEO. Mr. Benner had replaced Allen J. Palmiere, who resigned as CEO on March 9, 2009.

On November 12, 2009 we announced that Mr. Jones would be retiring, effective December 31, 2009, and our President and Chief Operating Officer, Michael D. Winship, was resigning from the Company. On that date we also announced that W. Warren Holmes had been appointed Executive Vice Chairman and, from January 1, 2010 to July 12, 2010, Mr. Holmes also served as Interim CEO.

6

Arrangement Agreement with Lundin Mining Corporation and Share Subscription

On November 21, 2008 we entered into an arrangement agreement (the “Arrangement Agreement”) with Lundin Mining Corporation (“Lundin”) pursuant to which we would have acquired all of the issued and outstanding common shares of Lundin. Also, on November 21, 2008, we entered into a subscription agreement with Lundin whereby we agreed to acquire 96,997,492 common shares of Lundin at a price of $1.40 per share (the “Share Subscription”), with aggregate gross proceeds to Lundin of $135.8 million. The Share Subscription was completed on December 11, 2008, and on its completion we held 19.9% of the issued and outstanding Lundin common shares.

On January 23, 2009 the Ontario Securities Commission (“OSC”) set aside a decision of the TSX granting conditional approval for the listing of the Hudbay common shares to be issued as consideration pursuant to the Arrangement Agreement. The OSC determined in its decision that Hudbay shareholder approval of the acquisition of Lundin was required as a condition to the listing of the additional common shares.

After the previous board of directors concluded that we were not likely to receive the requisite shareholder approval, we entered into a termination agreement with Lundin (the “Termination Agreement”) on February 23, 2009, which provided for the termination of the Arrangement Agreement.

On May 26, 2009 we sold all of the Lundin shares we acquired in the Share Subscription for gross proceeds of approximately $236 million, representing a gain of approximately $100 million.

DESCRIPTION OF OUR BUSINESS

General

As described in further detail below, we have three material mineral projects, all of which are 100% owned:

1. our 777 underground mine in Flin Flon, Manitoba;

2. our Lalor project, a zinc, gold and copper deposit near Snow Lake, Manitoba; and

3. our Constancia copper project in Peru, which we acquired in the first quarter of 2011 through our acquisition of Norsemont.

In addition, our other assets include: our Trout Lake and Chisel North underground mines in northern Manitoba, both of which are scheduled to close in 2012; our joint ventures, including our 70% interest in the Reed copper project near Snow Lake, Manitoba which our board of directors has approved for construction and our 51% interest in the Back Forty project in Michigan’s Upper Peninsula; our Balmat mine and concentrator in Balmat, New York, which were placed on care and maintenance in August 2008; exploration properties in North and South America; and strategic investments in junior exploration companies.

The following map shows where our material mineral projects and certain of our other assets are located.

7

Material Mineral Projects

777 Mine

Our 100% owned 777 mine is an underground copper, zinc, gold and silver mine located within the Flin Flon Greenstone Belt, immediately adjacent to our principal concentrator and zinc pressure leach plant in Flin Flon, Manitoba. Development of the 777 mine commenced in 1999 and commercial production began in 2004. The anticipated mine life is until 2020.

Ore produced at the 777 mine is transported to our Flin Flon concentrator for processing into copper and zinc concentrate. Copper concentrate is sold to third party purchasers and zinc concentrate is sent to our Flin Flon zinc plant where it is further processed into special high grade zinc before being sold to third party purchasers. For additional information, refer below to the headings “Description of our Business — Other Information — Processing Facilities” and “Description of our Business — Other Information — Products and Marketing”.

For additional details on our 777 mine, refer to Schedule B of this AIF.

8

Production

The following table sets forth our production forecast for the 777 Mine for 2012, and actual production for the years ended December 31, 2011, 2010 and 2009.

| | December 31 | |

| | Units | | 2012E | | 2011 | | 2010 | | 2009 | |

Ore mined | | 000s tonnes | | 1,553.00 | | 1,491.72 | | 1,488.01 | | 1,540.35 | |

Copper grade in ore | | % | | 2.30 | | 3.18 | | 2.89 | | 2.49 | |

Zinc grade in ore | | % | | 4.30 | | 3.71 | | 4.01 | | 4.35 | |

Gold grade in ore | | grams/tonne | | 1.90 | | 2.37 | | 2.09 | | 2.12 | |

Silver grade in ore | | grams/tonne | | 28.00 | | 26.78 | | 25.89 | | 26.39 | |

Strong production is expected again in 2012 from our flagship 777 mine. Copper grades at 777 are expected to be slightly higher than reserve grades mainly due to the areas planned for mining during 2012. Operating costs are expected to be similar to costs experienced in the past several years. Costs in the first and fourth quarters are expected to be higher due to additional heating and other seasonal costs.

Mineral Reserves and Resources

The following tables set forth our estimates of the mineral reserves and resources at the 777 mine.

In-Mine Mineral Reserves — January 1, 2012 (1)(2)(3)

| | Tonnes | | Au (g/t) | | Ag (g/t) | | Cu (%) | | Zn (%) | |

777 Mine | | | | | | | | | | | |

Proven | | 4,827,000 | | 1.98 | | 26.81 | | 2.39 | | 4.15 | |

Probable | | 7,011,000 | | 1.84 | | 28.25 | | 1.67 | | 4.51 | |

777 North | | | | | | | | | | | |

Proven | | 94,000 | | 1.57 | | 25.48 | | 0.74 | | 4.58 | |

Probable | | 453,000 | | 1.47 | | 21.77 | | 1.10 | | 3.37 | |

Total Proven and Probable Reserves | | 12,385,000 | | | | | | | | | |

Notes:

(1) This table shows the estimated reserves at our 777 mine, including the 777 North expansion, in Manitoba. To estimate mineral reserves, measured and indicated mineral resources were first estimated in a 12-step process, which includes determination of the integrity and validation of the data collected, including confirmation of specific gravity, assay results and methods of data recording. The process also includes determining the appropriate geological model, selection of data and the application of statistical models including probability plots and restrictive kriging to establish continuity and model validation. The resultant estimates of measured and indicated mineral resources are then converted to proven and probable mineral reserves by the application of mining dilution and recovery, as well as the determination of economic viability using full cost analysis. Other factors such as depletion from production are applied as appropriate.

(2) The zinc price used for mineral reserve estimation was US$1.00 per pound (includes premium), the copper price was US$2.75 per pound, the gold price was US$1,100 per ounce and the silver price was US$22 per ounce using an exchange of 1.05 C$/US$.

(3) The estimate as at January 1, 2012 was prepared in accordance with NI 43-101 and the CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines.

9

In-Mine Inferred Mineral Resources — January 1, 2012(1)(2)(3)

| | Tonnes | | Au (g/t) | | Ag (g/t) | | Cu (%) | | Zn (%) | |

| | | | | | | | | | | |

777 Mine | | 1,065,000 | | 1.99 | | 39.61 | | 1.48 | | 5.44 | |

777 North | | 118,000 | | 1.66 | | 35.20 | | 0.95 | | 5.70 | |

Total Inferred Resources | | 1,183,000 | | | | | | | | | |

Notes:

(1) This table shows our estimated inferred mineral resources at our 777 mine, including the 777 North expansion, in Manitoba. Estimated inferred mineral resources within our 777 mine were estimated by a 12-step process similar to the one used to estimate measured and indicated resources, as described in Note 1 to the In-mine Mineral Reserves table above.

(2) The zinc price used for mineral reserve estimation was US$1.00 per pound (includes premium), the copper price was US$2.75 per pound, the gold price was US$1,100 per ounce and the silver price was US$22 per ounce using an exchange of 1.05 C$/US$.

(3) The estimate as at January 1, 2012 was prepared in accordance with NI 43-101 and the CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines.

777 North Expansion

The 777 North mine expansion was approved by our board of directors on August 4, 2010 and its development involves driving a ramp from surface to a depth of 440 metres below surface to access mineral resources located in the north and east zones. These zones are situated directly up plunge of the 777 ore body and are connected to underground workings of the 777 mine. Upon its completion, the 777 North mine expansion will provide an additional egress from the 777 mine and supply additional copper and zinc ore feed to the Flin Flon concentrator. It will also provide an underground exploration platform to enable the evaluation of additional exploration opportunities near the 777 mine.

The 777 North mine expansion is located entirely within the associated 777 mine property and is covered by 777’s Saskatchewan Mineral Leases and Manitoba Order in Council leases.

Development of the portal, which is located adjacent to our metallurgical plant area, began in August 2010. The ramp had advanced a total of 1,706 metres (or approximately 60% of the total distance) as of December 31, 2011. Production is expected to begin in mid-2012 at a rate of 200 tonnes per day and full production is planned for 2013 at a rate of 330 tonnes per day.

Lalor Project

Lalor is a 100% owned zinc, gold and copper project currently under construction near Snow Lake, Manitoba. Our board of directors has made a full commitment to the development of the Lalor project by authorizing the expenditures necessary to put the project into full production. We undertook fast-track prefeasibility work in early 2010 and completed an updated prefeasibility study in February 2011 and an optimization study in July 2011. Following our optimization study, our board of directors approved an incremental capital expenditure investment of $144 million to build a new 4,500 tonnes per day concentrator at Lalor instead of refurbishing our existing Snow Lake concentrator. First production from the 985 metre production shaft is anticipated in late 2014 which is scheduled to coincide with the completion of the new concentrator. Including the new concentrator, the total estimated project cost for Lalor is $704 million, of which approximately $206 million had been spent as of December 31, 2011. Full production, use of the new concentrator and an increase to the capacity of the tailings facility are contingent upon receipt of required permits, which we believe to be forthcoming.

A 3,200 metre underground ramp from Hudbay’s Chisel North mine to the Lalor deposit began in December 2009 and was completed on time and on budget in 2011. The ramp is expected to facilitate early production of zinc rich ore from the ventilation shaft and provide access to the gold zones for additional underground exploration. With the ramp now completed, the focus at Lalor has turned to completion of the ventilation shaft to allow first ore production up the temporary hoisting facilities by the middle of 2012. Other major activities contemplated at Lalor include the commencement of production shaft sinking early in 2012, delivery of underground equipment and completion of engineering and procurement for the new concentrator.

10

For additional details on our Lalor project, refer to Schedule B of this AIF.

Production

The following table sets forth our production forecast from the ventilation shaft for 2012. Full production from the 985 metre production shaft is anticipated in late 2014.

| | 2012 Production Forecast | |

| | Units | | 2012 | |

Ore mined | | 000s tonnes | | 86.0 | |

Zinc grade in ore | | % | | 10.1 | |

Copper grade in ore | | % | | 0.4 | |

Gold grade in ore | | grams/tonne | | 1.1 | |

Silver grade in ore | | grams/tonne | | 16.9 | |

Mineral Reserves and Resources

Lalor Probable Mineral Reserves — March 29, 2012(1)(2)(3)

Mineralization

Type | | Tonnes | | Au

(g/t) | | Ag

(g/t) | | Cu

(%) | | Zn

(%) | |

Base Metal | | 12,591,000 | | 1.55 | | 23.81 | | 0.63 | | 7.92 | |

| | | | | | | | | | | |

Gold Zone | | 1,841,000 | | 3.99 | | 21.77 | | 0.38 | | 0.38 | |

| | | | | | | | | | | |

Total | | 14,432,000 | | | | | | | | | |

Notes:

(1) To estimate mineral reserves, measured and indicated mineral resources were first estimated in a 12-step process, which includes determination of the integrity and validation of the data collected, including confirmation of specific gravity, assay results and methods of data recording. The process also includes determining the appropriate geological model, selection of data and the application of statistical models including probability plots and restrictive kriging to establish continuity and model validation. The resultant estimates of measured and indicated mineral resources are then converted to proven and probable mineral reserves by the application of mining dilution and recovery, as well as the determination of economic viability using full cost analysis.

(2) The weighted average (based on planned production tonnage) price from 2012 to 2016 used in the Lalor pre-feasibility study for mineral reserve estimation for zinc was US$1.11 per pound (includes premium), the copper price was US$3.12 per pound, the gold price was US$1,399 per ounce and the silver price was US$27.28 per ounce using an exchange of 1.03 C$/US$. Post 2016 the mineral reserve estimation used a zinc price of US$1.00 per pound (includes premium), a copper price of US$2.75 per pound, a gold price of US$1,100 per ounce and a silver price of US$22 per ounce using an exchange of 1.05 C$/US$.

(3) The estimate as at March 29, 2012 was prepared in accordance with NI 43-101 and the CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines.

11

Lalor Inferred Mineral Resources — September 30, 2011(1)(2)(3)(4)(5)

Mineralization

Type | | Tonnes | | Au

(g/t) | | Ag

(g/t) | | Cu

(%) | | Zn

(%) | |

Base Metal | | 3,817,000 | | 1.2 | | 22.2 | | 0.60 | | 9.09 | |

| | | | | | | | | | | |

Gold Zone | | 7,338,000 | | 4.6 | | 31.3 | | 0.41 | | 0.32 | |

| | | | | | | | | | | |

Copper-Gold Zone | | 1,461,000 | | 6.8 | | 20.3 | | 4.15 | | 0.31 | |

| | | | | | | | | | | |

Total | | 12,616,000 | | | | | | | | | |

Notes:

(1) Estimated inferred mineral resources at Lalor were estimated by a 12-step process similar to the one used to estimate measured and indicated resources, as described in Note 1 to the Lalor Probable Mineral Reserves table above.

(2) Zinc rich base metal mineral resources are estimated at a Zinc Equivalency formula (“ZNEQ”) cut-off of 4% (ZNEQ% equals Zn% + Cu% x 2.895 + Au g/t x 1.220 + Ag g/t x 0.023) and a minimum two metre true width. Long term $US metal prices of $1,100/oz gold, $22.00/oz silver, $2.75/lb copper and $0.95/lb zinc and metal recovery assumptions of 65% gold, 60% silver, 90% copper and 90% zinc were used for the estimation of ZNEQ.

(3) Gold zone mineral resources are estimated at a 1.0 g/t gold cut-off and a minimum two metre true width.

(4) Specific gravity measurements were taken on a large portion of the samples. Where actual measurements were not available stoichiometric values were calculated.

(5) The estimate as at September 30, 2011 was prepared in accordance with NI 43-101 and the CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines.

Constancia Project

We hold a 100% interest in the Constancia copper project in Peru, which we acquired when we completed our acquisition of Norsemont in 2011.

Constancia is located in the districts of Chamaca, Livitaca and Velille, Province of Chumbivilcas in southern Peru, close to roads, major power lines and a port. The mine plan currently contemplates an open pit mine with a production rate of 85,000 tonnes of copper per year over a 15 year mine life, with molybdenum, silver and gold by-products. We have received the key environmental permit for Constancia and believe that additional required permits will be granted in the ordinary course. A portion of the surface rights for the Constancia project belong to the communities of Chilloroya and Uchucarcco. In the first quarter of 2012, we reached life of mine agreements with these communities to secure land required for project construction and operations.

The Constancia property also holds considerable exploration potential, as evidenced by the recently completed resource for the Pampacancha deposit, which contains a measured mineral resource of 32.7 million tonnes of 0.48% copper and an indicated mineral resource of 18.5 million tonnes of 0.38% copper. There are additional targets in the Chilloroya South prospect which we intend to explore starting in the second quarter of 2012.

We are currently completing optimization work on the feasibility study prepared by Norsemont as part of the FEED (front end engineering and design) for the Constancia project. Significant changes to the previous project design include:

· Value engineering and comminution optimization, which has yielded an annual ore production capacity increase from 24.5 million tonnes per year in Norsemont’s Feasibility Study Optimization to 28.2 million tonnes per year, which represents a 15% increase in throughput.

· An expected increase in the in-pit reserve to incorporate additional economic mineralization. This will require an increase in the project’s tailings dam capacity. The increase in reserve along with plans to incorporate the higher grade Pampacancha resource early into the mine plan are expected to be incorporated into a new mine plan by mid-2012.

· Value engineering efforts are underway with optimization efforts focused on areas such as camp accommodations, water management and tailings impoundment.

12

As a result of general cost escalation, the scope enhancements described above, local currency appreciation and other factors, our capital cost estimate for Constancia is estimated to be US$1.5 billion. This amount represents gross capital costs, with no credits for revenue from production prior to achieving commercial production and includes sunk costs incurred during 2012. Capitalized costs expected to be incurred prior to a formal project decision total US$141 million. To support the continuing pre-construction development of Constancia during the second quarter of 2012, our board of directors has approved an incremental US$34 million in capitalized spending on Constancia, over and above the US$107 million approved for the first quarter of 2012. These expenditures will support ongoing engineering and procurement activity, hydrogeological drilling and camp construction among other activities.

The anticipated project schedule currently remains unchanged, with first production expected in 2015 and full production in 2016. By mid-2012, we expect to present our board of directors with a formal project recommendation, including a financing plan expected to involve project financing for Constancia.

For additional details on our Constancia project, refer to Schedule B of this AIF.

Mineral Reserves and Resources

The following table sets forth our estimates of the mineral reserves and resources at the Constancia project as at February 21, 2011.(1)

Category | | Tonnes | | Au (g/t) | | Ag (g/t) | | Cu (%) | | Mo (%) | | Cu Equivalent (%) | |

| | | | | | | | | | | | | |

Proven | | 195,000,000 | | 0.04 | | 3.49 | | 0.42 | | 0.0117 | | 0.54 | |

| | | | | | | | | | | | | |

Probable | | 177,000,000 | | 0.05 | | 3.66 | | 0.37 | | 0.0092 | | 0.49 | |

| | | | | | | | | | | | | |

Total Reserves | | 372,000,000 | | 0.05 | | 3.57 | | 0.39 | | 0.0105 | | 0.51 | |

| | | | | | | | | | | | | |

Inferred Resources | | 20,963,000 | | 0.04 | | 3.69 | | 0.26 | | 0.0067 | | 0.36 | |

Notes:

(1) For additional details relating to the estimates of mineral reserves and resources at the Constancia project, including data verification and quality assurance/quality control processes, refer to the “Constancia Project Technical Report” as filed on SEDAR by Norsemont Mining Inc. on February 21, 2011.

Based on this estimate, the proven and probable reserves at Constancia contain approximately 3.23 billion pounds of copper, 105 million pounds of molybdenum, 42.7 million ounces of silver and 548,000 ounces of gold at a 0.2% copper cut-off.

13

The following table sets forth our estimates of the mineral resources at the Pampacancha deposit as at March 30, 2012.(1)(2)(3)

Category | | Tonnes | | Au (g/t) | | Ag (g/t) | | Cu (%) | | Mo (%) | | Cu Equivalent (%) | |

| | | | | | | | | | | | | |

Measured | | 32,681,000 | | 0.31 | | 4.78 | | 0.48 | | 0.0166 | | 0.79 | |

| | | | | | | | | | | | | |

Indicated | | 18,526,000 | | 0.26 | | 4.59 | | 0.38 | | 0.0145 | | 0.65 | |

| | | | | | | | | | | | | |

Total Resources | | 51,207,000 | | 0.29 | | 4.71 | | 0.44 | | 0.0158 | | 0.74 | |

Notes:

(1) CuEq% is calculated for the in situ value of contained metals using the following $US metal price assumptions, Cu=2.75/lb Mo=13/lb, Ag=22/oz and Au=1100/oz.

(2) Measured and indicated mineral resources were estimated in house. The process includes determination of the integrity and validation of the data collected, including confirmation of specific gravity, assay results and methods of data recording. The process also includes determining the appropriate geological model, selection of data and the application of statistical models including probability plots to establish continuity and model validation.

(3) The estimate as at March 30, 2012 was prepared in accordance with NI 43-101 and the CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines.

Other Assets

Trout Lake and Chisel North Mines

Our Chisel North and Trout Lake mines are mature operations reaching the end of their mine lives and we expect their production to end in mid-2012.

Trout Lake

The Trout Lake mine is an underground zinc and copper mine located approximately six kilometres northeast of Flin Flon.

The main shaft has been sunk to a depth of 1,091 metres. The mine development includes a number of inclined ramps and steeply inclined ventilation shafts and ore passes. The ramp extends to approximately 1,460 metres below surface at an inclination of 15% from the horizontal. A 762 metre long inclined conveyor delivers the ore from the underground crusher to the ore bin adjacent to the shaft.

Mining is conducted by longhole open stoping using trackless equipment. Crushed ore is trucked from the mine site to the Flin Flon concentrator for processing. Commercial production commenced at the Trout Lake mine in 1982 and the mine is scheduled to reach the end of its mine life and be closed in mid-2012.

Chisel North

The Chisel North mine is an underground zinc mine located 15 kilometres west of the Snow Lake concentrator and about six kilometres south of the town of Snow Lake, Manitoba. The mine returned to commercial production in June 2010 after being placed on care and maintenance in January 2009 due to depressed metal prices related to the global downturn.

The Chisel North mineral reserves only consisted of zinc ore until 2011 when copper and gold mineralization, located downplunge to the north and northwest of Lens 1, were separately estimated. The mineral reserves are between 400 metre and 650 metre depths in four stacked zinc rich sulphide lenses.

The mine depth is to the 687 metre level. Mining is by room and pillar, post pillar cut and fill and blast hole stoping using trackless equipment with unconsolidated rock fill as backfill. Ore is hauled by truck to surface for crushing. The zinc ore is trucked to the Snow Lake concentrator while the copper ore is trucked to the Flin Flon concentrator.

14

The Chisel North mine is scheduled to close in September 2012. Mining personnel and equipment will be moved from Chisel North to Lalor on completion of the ventilation shaft at Lalor, which is expected in the middle of 2012.

In-Mine Mineral Reserves — January 1, 2012

| | Tonnes | | Au (g/t) | | Ag (g/t) | | Cu (%) | | Zn (%) | |

Trout Lake Mine | | | | | | | | | | | |

Proven | | 229,000 | | 2.06 | | 1.33 | | 2.07 | | 1.90 | |

Probable | | — | | — | | — | | — | | — | |

Chisel North Mine — Zinc | | | | | | | | | | | |

Proven | | 48,000 | | — | | — | | — | | 7.97 | |

Probable | | 60,000 | | — | | — | | — | | 6.57 | |

Chisel North Mine — Copper | | | | | | | | | | | |

Proven | | — | | — | | — | | — | | — | |

Probable | | 57,000 | | 2.06 | | 20.58 | | 1.49 | | 2.65 | |

Joint Ventures

Part of our strategy is to leverage our exploration expertise through strategic partnerships with junior resource companies. Between 2009 and 2011, we entered into agreements with Aquila, VMS Ventures and Halo Resources Ltd. (“Halo”) which allow us to earn majority interests in promising exploration properties.

Reed Copper Project

On July 5, 2010 we entered into a joint venture agreement with VMS Ventures respecting the Reed copper project, a copper-rich development property near Snow Lake, Manitoba. We have a 70% interest in the Reed copper project and VMS Ventures has a 30% interest. We have agreed to provide full financing for VMS Ventures’ proportionate share of the costs to develop the property, which will be repayable solely from VMS Ventures’ share of cash flow generated by the project. We are also a party to four option agreements with VMS Ventures which allow us to earn a 70% interest in four properties adjacent to the Reed property by meeting certain work expenditure obligations and making cash payments to VMS Ventures. We intend to continue our exploration on these properties in 2012.

On December 19, 2011 our board of directors approved a capital investment of $71 million toward the construction of the Reed copper project based on our preliminary economic assessment of the project. Since December 2011 we have undertaken a pre-feasibility study with the assistance of Stantec Consulting and have upgraded 2,157,000 of indicated mineral resources into probable mineral reserves. Our estimates of mineral reserves and resources for the Reed copper project are set out below:

Reed Copper Project Probable Mineral Reserves — March 30, 2012(1)

Tonnes | | Au

(g/t) | | Ag

(g/t) | | Cu

(%) | | Zn

(%) | |

2,157,000 | | 0.48 | | 6.02 | | 3.83 | | 0.59 | |

Notes:

(1) The copper price used for the mineral reserves estimation was US$2.95 per pound, the gold price was US$1269.09 per ounce and the silver price was US$24.78 per ounce using an exchange rate of 1.034 C$/US$.

15

Reed Copper Project Inferred Mineral Resources — March 15, 2011

Tonnes | | Au

(g/t) | | Ag

(g/t) | | Cu

(%) | | Zn

(%) | |

170,000 | | 0.38 | | 4.55 | | 4.26 | | 0.52 | |

Back Forty Project

Pursuant to a subscription, option and joint venture agreement with Aquila, we have obtained a 51% joint venture interest in the Back Forty project, a zinc and gold rich VMS deposit in Michigan’s Upper Peninsula. We can increase our joint venture interest to 65% by completing a feasibility study and making mine permitting applications. Our interest can be further increased to 75% if we notify Aquila of our intention to put the Back Forty project into production and Aquila elects to have us fund their share of the development costs, which would be repaid out of project cash flows.

On October 15, 2010 we announced the following updated NI 43-101 mineral resource estimate for the Back Forty project.(1)

Classification | | Tonnes

(millions) | | Au (g/t) | | Ag (g/t) | | Cu (%) | | Zn (%) | |

Open Pit | | | | | | | | | | | |

Measured | | 14.1 | | 1.59 | | 16.97 | | 0.15 | | 2.54 | |

Indicated | | 2.1 | | 1.53 | | 32.80 | | 0.41 | | 1.17 | |

Measured and Indicated | | 16.2 | | 1.58 | | 19.00 | | 0.18 | | 2.36 | |

Inferred | | 1.4 | | 1.4 | | 32.89 | | 0.62 | | 1.00 | |

Underground | | | | | | | | | | | |

Measured | | 0.8 | | 1.67 | | 25.83 | | 0.24 | | 3.45 | |

Indicated | | 0.9 | | 1.28 | | 24.72 | | 0.34 | | 3.13 | |

Measured and Indicated | | 1.7 | | 1.46 | | 25.23 | | 0.29 | | 3.13 | |

Inferred | | 2.0 | | 1.22 | | 18.34 | | 0.32 | | 2.64 | |

Combined Open Pit and Underground | | | | | | | | | | | |

Measured and Indicated | | 17.9 | | 1.57 | | 19.60 | | 0.19 | | 2.44 | |

Inferred | | 3.4 | | 1.29 | | 24.33 | | 0.44 | | 1.96 | |

Notes:

(1) The cut-off grades are based on metal price assumptions of US$0.95 per pound zinc, US$2.50 per pound copper, US$0.59 per pound lead, US$900 per troy ounce gold and US$15.00 per troy ounce silver. Metallurgical recoveries were determined and used for each of the metallurgical domains determined for the deposit. For additional detail relating to the Back Forty mineral resource estimate see “Technical Report, Back Forty Deposit, Menominee County, Michigan” as filed on SEDAR by Aquila Resources Inc. on November 29, 2010.

Halo Option Agreements

In December 2009 we entered into an option agreement with Halo, pursuant to which we earned a 51% interest in Halo’s Cold and Lost properties in the Sherridon VMS District in Manitoba, which have an indicated resource of 411,000 tonnes of 6.1% zinc and an inferred resource of 69,000 tonnes of 6.2% zinc. We can increase our interest to 60% by funding and completing a feasibility study and paying $2 million in cash to Halo, in each case, before the fourth anniversary date, and we may further increase our interest to 67.5% by paying Halo an additional $2.5 million prior to commencement of commercial production.

In October 2011, we entered into a second option agreement with Halo which allows us to earn up to a 75% joint venture interest in the western half of Halo’s interest in the 200 square kilometre Sherridon VMS District in Manitoba (exclusive of the Cold and Lost properties), including the past-

16

producing Sherridon East and West mines. We can exercise our option to earn a 51% interest by making aggregate cash payments to Halo of $1.6 million and completing minimum expenditures of $5 million, in each case, over three years. We can increase our 51% interest to 75% by funding and completing a feasibility study for the project and making a cash payment to Halo of $1.75 million before the fifth anniversary date.

Balmat

The Balmat mine is an underground zinc mine located in Balmat, New York owned by our wholly-owned subsidiary, St. Lawrence Zinc Company, LLC (“SLZ”). The mine includes a 3,200 ft. deep shaft, underground development to five ore zones and extensive mining equipment as well as a 5,000 ton per day concentrator. The Balmat mine and concentrator were placed on care and maintenance on August 22, 2008 due to, among other factors, lower prices for zinc metal at that time.

In addition to the Balmat mine and concentrator, SLZ owns approximately 52,000 acres of exploration land in the Balmat district.

Exploration Properties

Our exploration properties are the key to our strategy of pursuing organic growth. Over the past 85 years, we and our predecessors have brought into production 26 ore bodies on our lands. Our exploration efforts were most recently recognized when we won the Prospectors’ and Developers’ Association of Canada’s Bill Dennis Award in 2009 for our discovery of the Lalor deposit. For 2012, our board of directors has approved total exploration expenditures of approximately $54 million.

We hold a land position of approximately 400,000 hectares in Manitoba and Saskatchewan, primarily in the highly prolific Flin Flon Greenstone Belt. Since much of this property is within 100 kilometres of our two ore concentrators in the region, and given that we have available capacity at our processing facilities, we are in a good position to economically exploit mineral deposits that a mining company without such proximate facilities may not be able to develop profitably due to higher costs of transportation and treatment charges. In addition, we believe the exploration methodologies we have developed are suitable for other greenstone belts and other types of mineralization.

As a means of leveraging our exploration capabilities in the Flin Flon Greenstone Belt, we have optioned some of our properties to other exploration companies, which allows us to advance the exploration and development of new mineral deposits without incurring significant costs. These agreements typically allow the optionee to earn up to a 100% interest in the property by completing certain exploration expenditures and making cash payments to us, and we may elect to exercise back-in rights which allow us to earn back a majority interest in the properties, or retain a net smelter return royalty.

The Constancia project includes a considerable amount of land that has not yet been the subject of significant exploration, including the nearby Chilloroya target.

We also hold exploration properties and properties under option to us in the Yukon, Peru, Colombia and Chile. Our 100% owned Tom and Jason properties include an indicated mineral resource of 6.4 million tonnes of 6.33% zinc, 5.05% lead and 56.55 g/t silver and an inferred mineral resource of 24.6 million tonnes of 6.71% zinc, 3.48% lead and 33.85 g/t silver. We conducted a drill program in 2011 intended to enable the upgrading of some inferred resources to indicated and collecting of metallurgical samples. We intend to complete a preliminary economic assessment on the project in the second quarter of 2012.

In addition, through our exploration alliance with Aquila, we have rights to earn majority interests in a number of promising mineral properties in Michigan and elsewhere in the United States. We will continue to seek other exploration opportunities as they arise and we plan to conduct exploration on our other properties in North and South America with the intention of upgrading and expanding our current mineral resources.

17

Processing Facilities

Concentrators

Our primary ore concentrator is located in Flin Flon, Manitoba. The concentrator, which is directly adjacent to our metallurgical zinc plant, produces zinc and copper concentrates from ore mined at our 777 and Trout Lake mines. Its capacity is approximately 2.18 million tonnes of ore per year, and in 2011 approximately 2.04 million tonnes of ore were milled. The concentrator can handle ore from each mine separately, and blending is done at the grinding stage. The Flin Flon concentrator facility includes a paste backfill plant and associated infrastructure such as maintenance shops and laboratories. In 2010 we completed a copper concentrate filtration plant and other facilities to allow for the overseas shipping of the copper concentrate we produce. Tailings from the concentrator are pumped to the Flin Flon tailings impoundment immediately adjacent to the concentrator.

Our concentrator in Snow Lake, Manitoba was re-started in late 2009, reaching full production in the second quarter of 2010, after being placed on care and maintenance in January 2009. The concentrator processes zinc ore from the Chisel North mine and produces zinc concentrate, which is shipped by truck for processing at the zinc plant in Flin Flon. The concentrator, which has crushing, grinding, flotation, thickening, filtering and drying capabilities, has a capacity of approximately 1.2 million tonnes of ore per year. Tailings generated by the Snow Lake concentrator are deposited in our Anderson Lake tailings facility, which we believe mitigates environmental concerns, as the tailings are deposited in a subaqueous manner, minimizing the potential for generation of acid rock drainage. Pending the closure of the Chisel North mine, we intend to put a copper recovery circuit into the Snow Lake concentrator to allow for the processing of the early Lalor ores until the new concentrator is commissioned. For additional information, refer above to the heading “Description of our Business — Material Mineral Projects — Lalor Project”.

We also have a concentrator in Balmat, New York, which processed zinc ore produced from our Balmat mine. The Balmat mine and concentrator were placed on care and maintenance on August 22, 2008.

Zinc Plant

Our zinc plant located in Flin Flon, Manitoba produces special high-grade zinc metal in three cast shapes from zinc concentrate. Our plant is one of three primary zinc producers in North America. We produced 107,704 tonnes of cast zinc in 2011. The capacity of the zinc plant is approximately 115,000 tonnes of cast zinc per year, and an additional approximate 15% expansion is possible at comparatively low capital investment. Included in the zinc plant are an oxygen plant, a concentrate handling, storage and regrinding facility, a zinc pressure leach plant, a solution purification plant, a modern electro-winning cell house, a casting plant and a zinc storage area with the ability to load trucks or rail cars. The zinc plant has a dedicated leach residue disposal facility. The bulk of the waste material is gypsum, iron and elemental sulphur. Wastewater is treated and recycled through the zinc plant.

Both domestic concentrate produced from our mines and concentrate purchased from third parties are processed at the zinc plant. Purchased concentrate accounted for approximately 29.6% of zinc metal produced at our zinc plant in 2011. The zinc plant currently has excess capacity beyond our domestic concentrate production and we intend to utilize this capacity by purchasing concentrate and advancing our development projects, including Lalor, to production.

Strategic Investments

As at December 31, 2011, we held minority equity positions in 16 junior exploration companies, representing investments valued at approximately $100 million, executing our strategy to populate a pipeline of projects ready for development following the construction of Lalor and Constancia. Our early stage opportunity pipeline consists of projects in Canada, the United States, Chile, Peru and Colombia. Among our strategic investments are the following companies: Augusta, VMS Ventures, Aquila, Panoro Minerals Ltd., MacDonald Mines Exploration Ltd. and CuOro Resources Corporation. We are continuing to evaluate new projects and potential investments to add to our portfolio.

18

Cash and Cash Equivalents

Our cash and cash equivalents as of December 31, 2011 were $899.1 million, and are held in low risk liquid investments and deposit accounts pursuant to our investment policy.

Other Information

Products and Marketing

Our principal products are copper concentrate and zinc. In 2011, we produced 107,704 tonnes of cast zinc and 222,932 tonnes of copper concentrate. In 2011 and 2010 combined copper metal and copper concentrate sales represented approximately 54% and 49% and zinc metal sales represented approximately 19% and 23% of our total consolidated revenue, respectively.

In 2011 we sold approximately 19% of our copper concentrate production to third party purchasers in North America and Europe on benchmark terms and in 2012 we expect that number to increase to approximately 75%. We sell the remainder of our copper concentrate production pursuant to shorter-term contracts as opportunities arise. Sales of our copper concentrate (including gold and silver contained in concentrate) were adversely affected in early 2011 by the inability of our rail service provider to supply sufficient railcars to transport our concentrate production. This issue was resolved over the course of the year and the excess inventory that had accumulated was substantially eliminated by December 31, 2011.

We ship cast zinc metal produced at our Flin Flon zinc plant to third party customers in North America by rail and truck. Following the sale of our Zochem Inc. subsidiary in November 2011, we agreed to sell approximately 20% of our zinc production to Zochem Inc. for one year at market terms, with the intent to sell lesser quantities at market terms for an additional two years.

Commodity Markets

Over the course of 2011, metal prices declined primarily as a result of concerns over the European sovereign debt crisis in the second half of the year, although average prices in 2011 were generally higher than average prices in 2010. For additional information refer to our market analysis of copper, zinc, gold and silver prices during this period on pages 10 and 11 of our management’s discussion and analysis for the year ended December 31, 2011, a copy of which has been filed on SEDAR at www.sedar.com.

Specialized Skill and Knowledge

The success of our operations depends in part on our ability to attract and retain geologists, engineers, metallurgists and other personnel in the geographic areas in which we operate with specialized skill and knowledge about the mining industry. For additional information, refer below to the heading “Risk Factors — Human Resources”.

Competitive Conditions

The mining industry is intensely competitive and we compete with many companies in the search for and the acquisition of attractive mineral properties. In addition, we also compete for the technical expertise to find, develop, and operate such properties, the labour to operate the properties, and the capital for the purpose of funding such properties. For additional information, refer below to the heading “Risk Factors — Competition”.

Economic Dependence

We do not have any contracts upon which our business is substantially dependent, as our principal products, copper concentrate and zinc, are widely traded commodities and we may enter into contracts for the sale of such products with a variety of potential purchasers.

19

Environmental Protection

Our activities are subject to environmental laws and regulations, including proposed climate change initiatives aimed at reducing greenhouse gas emissions. Environmental laws and regulations are evolving in a manner that will require stricter standards and enforcement, increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and a heightened degree of responsibility for companies and their officers, directors and employees. For additional information, refer below to the heading “Risk Factors — Governmental and Environmental Regulation”.

In light of this and our goal of continually improving our environmental performance, we have established an environmental management program directed at environmental protection and compliance to achieve our goal of continually improving our environmental performance and address these regulatory changes. The program consists of an environmental policy, codes of practice, regular audits, the integration of environmental procedures with operating procedures, employee training and emergency prevention and response procedures. For additional information, refer below to the heading “Corporate Social Responsibility”.

Employees

As at December 31, 2011, we had approximately 47 employees at our Toronto head office, approximately 31 employees at HudBay Peru S.A.C.’s office in Lima, Peru and approximately 48 employees at the Constancia site. In addition, we had approximately 33 employees elsewhere in North and South America.

Our HBMS subsidiary had approximately 1,286 employees as at December 31, 2011, of whom approximately 986 were unionized. In 1998, we entered into a labour stability agreement in respect of our existing Flin Flon/Snow Lake collective bargaining agreements, whereby we agreed with the unions that any collective agreement expiring prior to July 1, 2012 would be settled by way of binding arbitration in the event that the parties could not otherwise agree to a negotiated contract settlement. This agreement is intended to ensure that there will be no strike or lockout through December 2014. In the first quarter of 2012, we negotiated new collective bargaining agreements with the majority of our unionized employees, thereby avoiding the need to settle such agreements by way of binding arbitration.

HBMS maintains a profit sharing plan pursuant to which 10% of its after-tax profit (excluding provisions or recoveries for deferred income and mining tax) for any given year is distributed among eligible employees in the Flin Flon/Snow Lake operations, with the exception of executive officers and key management personnel.

CORPORATE SOCIAL RESPONSIBILITY

At Hudbay, we apply the same discipline to Corporate Social Responsibility as we do to meeting operating and financial targets. We commit to our stakeholders to work to create benefits and opportunities that contribute to their economic and social sustainability, and to protect our natural environment. As described below, we have adopted a number of voluntary codes and other external instruments that we consider particularly relevant to our business, including ISO 14001, OHSAS 18001 and our Human Rights Policy.

Health and Safety and Environmental Policies

Among our core values are protecting the health and welfare of our employees and contractors and reducing the impact of our operations on the environment. All of our producing operations are certified to Occupational Health and Safety Assessment Series 18001 and Environmental Management System Standard ISO 14001. In addition, the production and supply of Manitoba’s final products are registered to the ISO 9001 quality standard.

We believe that ongoing improvements in the safety of our workforce assists in maintaining healthy labour relations and that our ability to minimize lost-time injuries and environmental regulatory

20

violations is a significant factor in maintaining and realizing opportunities to improve overall operational efficiency. Our safety management systems include the Positive Attitude Safety System (“PASS”), which is in use at our Manitoba operations. The PASS system is based on facilitated discussions at all levels of the organization to increase each person’s involvement in recognizing and managing workplace risks. In 2011, our lost time accident frequency per 200,000 hours worked was 0.3, compared to 1.2 for 2010. We remain committed to continuously improving the safety of our workplace.

We have established an environmental management program directed at environmental protection and compliance. The program consists of an environmental policy, codes of practice, regular audits, the integration of environmental procedures with operating procedures, employee training and emergency prevention and response procedures. We have a dedicated team which is charged with managing our environmental activities and our compliance with all applicable environmental standards and regulations. We did not have any material environmental non-compliances in 2011.

Human Rights Policy

In May 2011, we adopted our first formal Human Rights Policy. The policy is intended to capture and clearly state our commitments to human rights. Key aspects include our commitment to:

· Ethical business practices — further articulated in our Code of Business Conduct and Ethics;

· Labour practices and labour relations — including fair labour practices at our workplaces and to the health and safety of our employees;

· Community participation — including community consultation, contributing to long-term and sustainable opportunities for communities, respecting communities’ legal rights, and participating in a common effort to promote respect for human rights as they relate to our business; and

· Security measures that respect human rights — including our adoption of the Voluntary Principles on Security and Human Rights, and the United Nations Code of Conduct for Law Enforcement Officials.

Sustainability Reporting

We publish an annual corporate social responsibility report that further presents and discusses our environmental, health and safety performance. This report is prepared pursuant to the Global Reporting Initiative G3 guidelines, which is the world’s most widely used sustainability framework. We also subscribe to the Mining Association of Canada’s “Toward Sustainable Mining” initiative, which was designed to help mining companies evaluate the quality, comprehensiveness and robustness of their management systems under key performance elements, including tailings management, energy use and emissions, external outreach and crisis management planning. Our 2010 Corporate Social Responsibility Report is available on our website at www.hudbayminerals.com.

RISK FACTORS

An investment in our securities is speculative and involves significant risks that should be carefully considered by investors and prospective investors. In addition to the risk factors described elsewhere in this AIF, the risk factors that impact us and our business include, but are not limited to, those set out below. Any one or more of these risks could have a material adverse effect on our business, results of operations, financial condition and the value of our securities.

Metals Prices and Foreign Exchange

Our profit or loss and financial condition depend upon the market prices of metals, which are cyclical and which can fluctuate widely with demand for our metals. Demand is affected by numerous factors beyond our control, including the overall state of the economy, general level of industrial production, interest rates, rate of inflation, foreign exchange rates and investment demand for

21

commodities. Such external economic factors are in turn influenced by changes in international investment patterns, monetary systems and political developments.

Future price declines may, depending on hedging practices, materially reduce our profitability and could cause us to reduce output at our operations (including, possibly, closing one or more of our mines or plants), all of which could reduce our cash flow from operations.

In addition, since our core operations are located in Canada, our costs are incurred primarily in Canadian dollars. However, our revenue is tied to market prices for copper, zinc and other metals we produce, which are typically denominated in United States dollars. If the Canadian dollar appreciates in value against the United States dollar, our results of operations and financial condition could be materially adversely affected. Although we may use hedging strategies to limit our exposure to currency fluctuations, there can be no assurance that such hedging strategies will be successful or that they will mitigate the risk of such fluctuations.

Development of Key Projects

Our ability to develop our key mineral projects, including our Lalor and Constancia projects, is subject to many risks and uncertainties, including: our ability to upgrade mineral resources and conceptual estimates of tonnage and grade of a mineral deposit into mineral reserves; completion of feasibility studies; the ability to secure adequate financing to fund such projects; obtaining and maintaining various permits and approvals from governmental authorities; construction risk; securing required surface and other land rights; finding or generating suitable sources of power and water; potential resistance from stakeholders and other interested parties; political and social risk; and confirming the availability and suitability of appropriate local area infrastructure.

We have negotiated life of mine community agreements with two communities near the Constancia project to secure required land rights for the project. Any inability to enforce such agreements or otherwise maintain good relations with the nearby communities and other stakeholders could impair our ability to successfully develop the project. At Lalor, we require permits under Manitoba’s Environmental Act in order to reach full production, expand the tailings facility and operate the concentrator that is planned at the site. While we believe that such permits are forthcoming, it is possible that one or more of such permits may be delayed or not granted, which could prevent us from developing the Lalor project.

In addition, significant amounts of capital will be required to bring each of our Lalor and Constancia projects to production. We are currently attempting to secure financing for the Constancia project but, given current economic circumstances and other factors, there can be no certainty that such financing will be available on acceptable terms, if at all. If such financing is not available, we may not be able to fund the development of one or both of the Constancia and Lalor projects from our existing cash resources and future cash flows.

The capital expenditures and timeline needed to develop a new mine are considerable and the economics of and ability to complete a project can be affected by many factors, including: inability to complete construction and related infrastructure in a timely manner; changes in the legal and regulatory environment; currency fluctuations; industrial disputes; availability of parts, machinery or operators; delays in the delivery of major process plant equipment; inability to obtain, renew or maintain the necessary permits, licences or approvals; unforeseen natural events; and political and other factors. Factors such as changes to technical specifications, failure to enter into agreements with contractors or suppliers in a timely manner, and shortage of capital, may also delay the completion of construction or commencement of production or require the expenditure of additional funds. Many major mining projects constructed in the last several years, or under construction currently, have experienced cost overruns that substantially exceeded the capital cost estimated during the basic engineering phase of those projects, sometimes by as much as 50% or more. There can be no assurance that our development projects will be able to be developed successfully or economically or that they will not be subject to the other risks described in this section.

22

Depletion of Reserves