UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-21745 |

|

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund |

(Exact name of registrant as specified in charter) |

|

The Eaton Vance Building, 255 State Street, Boston, Massachusetts | | 02109 |

(Address of principal executive offices) | | (Zip code) |

|

Alan R. Dynner

The Eaton Vance Building, 255 State Street, Boston, Massachusetts 02109 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (617) 482-8260 | |

|

Date of fiscal year end: | December 31 | |

|

Date of reporting period: | June 30, 2006 | |

| | | | | | | | |

Item 1. Reports to Stockholders

Semiannual Report June 30, 2006

EATON VANCE

TAX-MANAGED

GLOBAL

BUY-WRITE

OPPORTUNITIES

FUND

IMPORTANT NOTICES REGARDING PRIVACY,

DELIVERY OF SHAREHOLDER DOCUMENTS,

PORTFOLIO HOLDINGS AND PROXY VOTING

Privacy. The Eaton Vance organization is committed to ensuring your financial privacy. Each of the financial institutions identified below has in effect the following policy ("Privacy Policy") with respect to nonpublic personal information about its customers:

• Only such information received from you, through application forms or otherwise, and information about your Eaton Vance fund transactions will be collected. This may include information such as name, address, social security number, tax status, account balances and transactions.

• None of such information about you (or former customers) will be disclosed to anyone, except as permitted by law (which includes disclosure to employees necessary to service your account). In the normal course of servicing a customer's account, Eaton Vance may share information with unaffiliated third parties that perform various required services such as transfer agents, custodians and broker/dealers.

• Policies and procedures (including physical, electronic and procedural safeguards) are in place that are designed to protect the confidentiality of such information.

• We reserve the right to change our Privacy Policy at any time upon proper notification to you. Customers may want to review our Policy periodically for changes by accessing the link on our homepage: www.eatonvance.com.

Our pledge of privacy applies to the following entities within the Eaton Vance organization: the Eaton Vance Family of Funds, Eaton Vance Management, Eaton Vance Investment Counsel, Boston Management and Research, and Eaton Vance Distributors, Inc.

In addition, our Privacy Policy only applies to those Eaton Vance customers who are individuals and who have a direct relationship with us. If a customer's account (i.e. fund shares) is held in the name of a third-party financial adviser/broker-dealer, it is likely that only such adviser's privacy policies apply to the customer. This notice supersedes all previously issued privacy disclosures.

For more information about Eaton Vance's Privacy Policy, please call 1-800-262-1122.

Delivery of Shareholder Documents. The Securities and Exchange Commission (the "SEC")permits funds to deliver only one copy of shareholder documents, including prospectuses, proxy statements and shareholder reports, to fund investors with multiple accounts at the same residential or post office box address. This practice is often called "householding" and it helps eliminate duplicate mailings to shareholders.

Eaton Vance, or your financial adviser, may household the mailing of your documents indefinitely unless you instruct Eaton Vance, or your financial adviser, otherwise.

If you would prefer that your Eaton Vance documents not be householded, please contact Eaton Vance at 1-800-262-1122, or contact your financial adviser.

Your instructions that householding not apply to delivery of your Eaton Vance documents will be effective within 30 days of receipt by Eaton Vance or your financial adviser.

Portfolio Holdings. Each Eaton Vance Fund and it's underlying Portfolio (if applicable) will file a schedule of its portfolio holdings on Form N-Q with the SEC for the first and third quarters of each fiscal year. The Form N-Q will be available on the Eaton Vance website www.eatonvance.com, by calling Eaton Vance at 1-800-262-1122 or in the EDGAR database on the SEC's website at www.sec.gov. Form N-Q may also be reviewed and copied at the SEC's public reference room in Washington, D.C. (call 1-800-732-0330 for information on the operation of the public reference room).

Proxy Voting. From time to time, funds are required to vote proxies related to the securities held by the funds. The Eaton Vance Funds or their underlying Portfolios (if applicable) vote proxies according to a set of policies and procedures approved by the Funds' and Portfolios' Boards. You may obtain a description of these policies and procedures and information on how the Funds or Portfolios voted proxies relating to Portfolio securities during the most recent 12 month period ended June 30, without charge, upon request, by calling 1-800-262-1122. This description is also available on the SEC's website at www.sec.gov.

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

I N V E S T M E N T U P D A T E

Walter A. Row, CFA | |

Eaton Vance Management | |

David Stein, PhD | |

Parametric Portfolio | |

Associates LLC | |

Thomas Seto | |

Parametric Portfolio | |

Associates LLC | |

Ronald M. Egalka | |

Rampart Investment | |

Management | |

The Fund

• Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (the Fund) is a diversified, closed-end investment company traded on the New York Stock Exchange under the symbol ETW.

• Based on share price, the Fund had a total return of 10.41% for the six months ended June 30, 2006. This return resulted from an increase in share price to $18.10 on June 30, 2006, from $17.20 on December 31, 2005, and the reinvestment of $0.900 in quarterly distributions.

• Based on net asset value (NAV), the Fund had a total return of 5.32% for the six months ended June 30, 2006. That return was the result of an increase in NAV per share to $18.68 on June 30, 2006, from $18.61 on December 31, 2005, and the reinvestment of $0.900 in quarterly distributions.

• For comparison, the CBOE S&P 500 BuyWrite Index – an unmanaged stock-plus-covered-call index created and maintained by the Chicago Board Options Exchange – had a return of 4.88% during the same period.(1) The S&P 500 Index – a broad-based, unmanaged, market index commonly used as a measure of overall U.S. stock market performance – had a total return of 2.71% during the same period.(1) The Nasdaq 100 Index – an unmanaged index that includes 100 of the largest domestic and international non-financial companies listed on the Nasdaq – had a total return of -4.05% during the same period.(1) The Morgan Stanley Capital International Europe, Australasia and Far East Index – a broad-based, unmanaged index of approximately 1,000 companies based in twenty countries – had a total return of 10.16% during the same period.(1)

• The Fund’s Lipper peer group, Lipper Options Arbitrage/Options Strategies Funds Classification, had a return of 4.28% during the same period.(1)

Management Discussion

• The Fund’s primary objective is to provide current income and gains, with a secondary objective of capital appreciation. In pursuing these objectives, the Fund invests in a diversified portfolio of common stocks, including stocks of U.S. issuers (the “U.S. Segment”) and stocks of non-U.S. issuers (the “International Segment”), sells on a continuous basis call options on broad-based domestic stock indices and call options on broad-based foreign country and/or regional stock indices, and employs a number of tax-management strategies.

• The global stock markets demonstrated continuing volatility during the six months ended June 30, 2006. In the U.S., the market started the year slowly, faced with rising interest rates and soaring energy costs. The Federal Reserve continued its campaign of higher short-term rates, hiking its benchmark Federal Funds rate on four occasions during the six-month period. However, resilient consumer spending, surprisingly good corporate earnings and increasing merger activity propelled the market higher in the second quarter, netting modest gains for the six months ended June 30, 2006. The European markets rallied strongly in the first quarter, led by mining, commodity and energy companies. The European markets peaked in late April and early May, although those gains were trimmed significantly in the second quarter. The Japanese market rose sharply to open the year, boosted by strong consumer and business spending. However, the market retraced its gains in the second quarter, as investors pulled back in response to the prospect of higher interest rates and concerns over a high-profile Japanese trading scandal.

• At June 30, 2006, the Fund held a diversified portfolio representing the broad spectrum of the U.S. economy and investments in a wide range of foreign countries. The Fund’s investments in U.S. issuers (the “U.S. Segment”) constituted 52.8% of total investments. The Fund’s investments in non-U.S. issuers (the “International Segment”) represented 47.2% of total investments. The majority of the Fund’s non-

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. The Fund has no current intention to utilize leverage, but may do so in the future through the issuance of preferred shares and/or borrowings, including the issuance of debt securities. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. For performance as of the most recent month end, please refer to www.eatonvance.com.

(1) It is not possible to invest directly in an Index. The Indexes’ total returns do not reflect commissions or expenses that would have been incurred if an investor individually purchased or sold the securities represented in the Indexes.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

1

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

F U N D P E R F O R M A N C E

U.S. investments were divided between European markets (35.1%) and Japan (10.0%).

• The Fund’s chief investment strategy seeks current earnings from option premiums. The level of option premium available from writing call options is dependent, to a large extent, on investors’ expectation of the future volatility of the underlying asset. This volatility expectation, or “implied volatility,” is the primary driving force in determining the level of option premiums. The implied volatility of equity index options rose significantly in the first half of 2006, in step with an increase in perceived investment risk due to economic, interest rate and geopolitical concerns.

The high-premium environment allowed Rampart Investment Management, the Fund’s options manager, to, in some cases, increase the degree to which call options were written “out-of-the-money.” A call option is out-of-the-money when its strike price is greater than the price of the underlying security. The Fund tends to write farther out-of-the-money options after a market decline – a good time to have more upside exposure. Conversely, the Fund tends to write closer-to-the-money options after a period of market strength – a good time to be taking a more conservative position. In effect, this strategy seeks to emulate a “buy low (less hedge)/sell high (more hedge)” investment approach.

• As part of its tax-managed strategy, management continued to employ tax-efficient investment techniques. These included harvesting losses to offset gains, using cash flows to avoid excess turnover, and monitoring holding periods to optimize favorable tax treatment for dividends and capital gains.

Performance

Average Annual Total Returns (by share price, New York Stock Exchange) | | | |

Life of Fund (9/30/05) | | 2.00 | % |

Average Annual Total Returns (at net asset value) | | | |

Life of Fund (9/30/05) | | 5.27 | % |

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value or share price (as applicable) with all distributions reinvested. The Fund’s performance at market share price will differ from its results at NAV. Although share price performance generally reflects investment results over time, during shorter periods, returns at share price can also be affected by factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for the Fund’s shares, or changes in Fund distributions. The Fund has no current intention to utilize leverage, but may do so in the future through the issuance of preferred shares and/or borrowings, including the issuance of debt securities. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance is for the stated time period only; due to market volatility, the Fund’s current performance may be lower or higher than quoted. For performance as of the most recent month end, please refer to www.eatonvance,com.

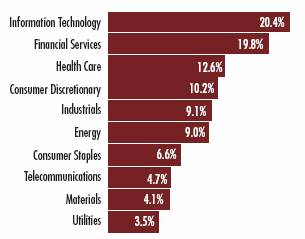

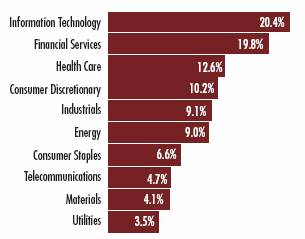

Sector Weightings(1)

By total investments

(1) As a percentage of the Fund’s total investments as of June 30, 2006. Sector Weightings may not be representative of the Fund’s current or future investments and may change due to active management.

Ten Largest Holdings(2)

By total investments

Microsoft Corp. | | 2.2 | % |

BP PLC | | 1.9 | |

HSBC Holdings PLC | | 1.7 | |

Qualcomm, Inc. | | 1.5 | |

Total SA | | 1.4 | |

Apple Computer, Inc. | | 1.3 | |

GlaxoSmithKline PLC | | 1.3 | |

Intel Corp. | | 1.3 | |

Cisco Systems Inc. | | 1.3 | |

Exxon Mobil Corp. | | 1.2 | |

(2) Ten Largest Holdings represented 15.1% of the Fund’s total investments as of June 30, 2006. Fund information may not be representative of the Fund’s current or future investments and may change due to active management.

The views expressed throughout this report are those of the portfolio managers and are current only through the end of the period of the report as stated on the cover. These views are subject to change at any time based upon market or other conditions, and the investment adviser disclaims any responsibility to update such views. These views may not be relied on as investment advice and, because investment decisions for a fund are based on many factors, may not be relied on as an indication of trading intent on behalf of any Eaton Vance fund.

2

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited)

| Common Stocks — 101.4% | |

| Security | | Shares | | Value | |

| Aerospace & Defense — 1.0% | |

| BAE Systems PLC | | | 150,520 | | | $ | 1,028,478 | | |

| General Dynamics Corp. | | | 66,702 | | | | 4,366,313 | | |

| Honeywell International, Inc. | | | 152,231 | | | | 6,134,909 | | |

| Lockheed Martin Corp. | | | 48,765 | | | | 3,498,401 | | |

| Northrop Grumman Corp. | | | 58,863 | | | | 3,770,764 | | |

| | | $ | 18,798,865 | | |

| Air Freight & Logistics — 0.9% | |

| C.H. Robinson Worldwide, Inc. | | | 74,961 | | | $ | 3,995,421 | | |

| Deutsche Post AG | | | 295,340 | | | | 7,911,160 | | |

| FedEx Corp. | | | 28,786 | | | | 3,363,932 | | |

| Yamato Holdings Co., Ltd. | | | 118,000 | | | | 2,096,169 | | |

| | | $ | 17,366,682 | | |

| Airlines — 0.1% | |

| Deutsche Lufthansa AG | | | 69,057 | | | $ | 1,268,984 | | |

| Japan Airlines Corp.(1) | | | 335,000 | | | | 841,196 | | |

| | | $ | 2,110,180 | | |

| Auto Components — 0.3% | |

| Bridgestone Corp. | | | 72,000 | | | $ | 1,390,409 | | |

| Cooper Tire and Rubber Co. | | | 33,444 | | | | 372,566 | | |

| Johnson Controls, Inc. | | | 39,177 | | | | 3,221,133 | | |

| NGK Spark Plug Co., Ltd. | | | 20,000 | | | | 402,749 | | |

| Stanley Electric Co.,Ltd. | | | 17,200 | | | | 355,995 | | |

| Sumitomo Rubber Industries, Inc. | | | 25,000 | | | | 275,640 | | |

| Toyota Industries Corp. | | | 9,000 | | | | 356,176 | | |

| | | $ | 6,374,668 | | |

| Automobiles — 1.3% | |

| DaimlerChrysler AG | | | 241,620 | | | $ | 11,918,650 | | |

| Harley-Davidson, Inc. | | | 24,652 | | | | 1,353,148 | | |

| Honda Motor Co., Ltd. | | | 119,200 | | | | 3,790,426 | | |

| Mitsubishi Motors Corp.(1) | | | 172,000 | | | | 319,043 | | |

| Nissan Motor Co., Ltd. | | | 97,600 | | | | 1,066,926 | | |

| Toyota Motor Corp. | | | 89,500 | | | | 4,682,768 | | |

| Volkswagen AG | | | 24,592 | | | | 1,240,254 | | |

| Volkswagen AG | | | 22,976 | | | | 1,607,730 | | |

| | | $ | 25,978,945 | | |

| Security | | Shares | | Value | |

| Beverages — 0.9% | |

| Brown-Forman Corp., Class B | | | 9,015 | | | $ | 646,285 | | |

| Ito En, Ltd. | | | 16,600 | | | | 607,514 | | |

| Kirin Brewery Company, Ltd. | | | 24,000 | | | | 377,962 | | |

| Molson Coors Brewing Co., Class B | | | 8,253 | | | | 560,214 | | |

| Pepsi Bottling Group, Inc. | | | 19,042 | | | | 612,200 | | |

| PepsiCo, Inc. | | | 140,963 | | | | 8,463,419 | | |

| Pernod-Ricard SA | | | 7,339 | | | | 1,453,109 | | |

| SABMiller PLC | | | 65,976 | | | | 1,187,950 | | |

| Sapporo Holdings, Ltd. | | | 153,000 | | | | 775,204 | | |

| Scottish & Newcastle PLC | | | 151,490 | | | | 1,426,648 | | |

| Takara Holdings, Inc. | | | 137,000 | | | | 801,657 | | |

| | | $ | 16,912,162 | | |

| Biotechnology — 2.6% | |

| Amgen, Inc.(1) | | | 307,743 | | | $ | 20,074,076 | | |

| Biogen Idec, Inc.(1) | | | 204,749 | | | | 9,486,021 | | |

| Celgene Corp.(1) | | | 173,152 | | | | 8,212,599 | | |

| Genzyme Corp.(1) | | | 17,735 | | | | 1,082,722 | | |

| Gilead Sciences, Inc.(1) | | | 174,490 | | | | 10,322,828 | | |

| Regeneron Pharmaceuticals, Inc.(1) | | | 186,398 | | | | 2,389,622 | | |

| | | $ | 51,567,868 | | |

| Building Products — 0.2% | |

| Asahi Glass Co., Ltd. | | | 160,000 | | | $ | 2,032,943 | | |

| JS Group Corp. | | | 25,600 | | | | 538,770 | | |

| Masco Corp. | | | 17,357 | | | | 514,461 | | |

| Sanwa Shutter Corp. | | | 78,000 | | | | 460,040 | | |

| | | $ | 3,546,214 | | |

| Capital Markets — 2.5% | |

| Bank of New York Co., Inc. | | | 134,492 | | | $ | 4,330,642 | | |

| Charles Schwab Corp. | | | 43,252 | | | | 691,167 | | |

| Daiwa Securities Group, Inc. | | | 160,000 | | | | 1,908,611 | | |

| E*Trade Financial Corp.(1) | | | 31,960 | | | | 729,327 | | |

| Federated Investors, Inc. | | | 15,936 | | | | 501,984 | | |

| Franklin Resources, Inc. | | | 66,123 | | | | 5,740,138 | | |

| Goldman Sachs Group, Inc. | | | 7,200 | | | | 1,083,096 | | |

| Man Group PLC | | | 39,111 | | | | 1,841,550 | | |

| Matsui Securities Co., Ltd. | | | 18,300 | | | | 173,802 | | |

| Mediobanca SPA | | | 55,007 | | | | 1,075,705 | | |

| Merrill Lynch & Co., Inc. | | | 85,000 | | | | 5,912,600 | | |

| Morgan Stanley | | | 11,743 | | | | 742,275 | | |

See notes to financial statements

3

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Capital Markets (continued) | |

| Nikko Cordial Corp. | | | 81,000 | | | $ | 1,035,963 | | |

| Nomura Holdings, Inc. | | | 69,300 | | | | 1,302,910 | | |

| T. Rowe Price Group, Inc. | | | 18,174 | | | | 687,159 | | |

| UBS AG | | | 205,567 | | | | 22,457,422 | | |

| | | $ | 50,214,351 | | |

| Chemicals — 1.7% | |

| Air Products and Chemicals, Inc. | | | 9,559 | | | $ | 611,011 | | |

| BASF AG | | | 140,361 | | | | 11,256,894 | | |

| BOC Group PLC | | | 53,805 | | | | 1,573,346 | | |

| Daicel Chemical Industries, Ltd. | | | 62,000 | | | | 508,899 | | |

| Dainippon Ink and Chemicals, Inc. | | | 120,000 | | | | 451,659 | | |

| Dow Chemical Co. | | | 73,566 | | | | 2,871,281 | | |

| E.I. du Pont de Nemours and Co. | | | 19,328 | | | | 804,045 | | |

| Eastman Chemical Co. | | | 11,375 | | | | 614,250 | | |

| Ecolab, Inc. | | | 16,822 | | | | 682,637 | | |

| Mitsubishi Chemical Holdings Corp. | | | 35,000 | | | | 219,062 | | |

| Monsanto Co. | | | 52,707 | | | | 4,437,402 | | |

| Nippon Kayaku Co., Ltd. | | | 184,000 | | | | 1,535,921 | | |

| Nissan Chemical Industries, Ltd. | | | 87,000 | | | | 1,088,313 | | |

| Nitto Denko Corp. | | | 5,600 | | | | 399,406 | | |

| Rohm & Haas Co. | | | 12,829 | | | | 642,989 | | |

| Shin-Etsu Chemical Co., Ltd. | | | 65,000 | | | | 3,539,256 | | |

| Sumitomo Bakelite Co., Ltd. | | | 39,000 | | | | 367,271 | | |

| Taiyo Nippon Sanso Corp. | | | 72,000 | | | | 571,821 | | |

| Teijin, Ltd. | | | 179,000 | | | | 1,138,736 | | |

| Zeon Corp. | | | 19,000 | | | | 226,899 | | |

| | | $ | 33,541,098 | | |

| Commercial Banks — 9.7% | |

| ABN AMRO Holdings NV | | | 422,512 | | | $ | 11,567,254 | | |

| Banca Intesa SPA | | | 295,707 | | | | 1,600,243 | | |

| Banco Popular Espanol SA | | | 81,170 | | | | 1,209,909 | | |

| Banco Santander Central Hispano SA | | | 1,280,098 | | | | 18,699,448 | | |

| Bank of America Corp. | | | 325,118 | | | | 15,638,176 | | |

| Bank of Fukuoka, Ltd. | | | 32,000 | | | | 243,705 | | |

| Bank of Yokohama, Ltd. | | | 113,000 | | | | 874,014 | | |

| Barclays PLC | | | 1,305,495 | | | | 14,802,186 | | |

| BNP Paribas SA | | | 14,125 | | | | 1,350,270 | | |

| Comerica, Inc. | | | 8,894 | | | | 462,399 | | |

| Commerzbank AG | | | 48,772 | | | | 1,768,556 | | |

| Credit Agricole SA | | | 203,148 | | | | 7,707,055 | | |

| Security | | Shares | | Value | |

| Commercial Banks (continued) | |

| Danske Bank A/S | | | 174,280 | | | $ | 6,616,101 | | |

| DNB NOR ASA | | | 105,036 | | | | 1,306,063 | | |

| First Horizon National Corp. | | | 14,106 | | | | 567,061 | | |

| HSBC Holdings PLC | | | 1,878,108 | | | | 33,051,730 | | |

| Huntington Bancshares, Inc. | | | 22,759 | | | | 536,657 | | |

| Joyo Bank, Ltd. | | | 37,000 | | | | 225,212 | | |

| KeyCorp | | | 16,538 | | | | 590,076 | | |

| Lloyds TSB Group PLC | | | 910,946 | | | | 8,925,341 | | |

| Marshall & Ilsley Corp. | | | 36,714 | | | | 1,679,298 | | |

| Mizuho Financial Group, Inc. | | | 25 | | | | 212,253 | | |

| Mizuho Trust & Banking Co., Ltd. | | | 155,000 | | | | 380,370 | | |

| National City Corp. | | | 168,516 | | | | 6,098,594 | | |

| North Fork Bancorp, Inc. | | | 157,976 | | | | 4,766,136 | | |

| Placer Sierra Bancshares | | | 7,177 | | | | 166,435 | | |

| Regions Financial Corp. | | | 16,786 | | | | 555,952 | | |

| Royal Bank of Scotland Group PLC | | | 471,202 | | | | 15,470,063 | | |

| Sanpaolo IMI SPA | | | 389,520 | | | | 6,884,209 | | |

| Skandinaviska Enskilda Banken AB | | | 51,831 | | | | 1,233,395 | | |

| Societe Generale | | | 102,929 | | | | 15,107,947 | | |

| Sterling Bancorp | | | 25,916 | | | | 505,362 | | |

| Sumitomo Mitsui Financial Group, Inc. | | | 105 | | | | 1,113,148 | | |

| Sumitomo Trust and Banking Co., Ltd. | | | 191,000 | | | | 2,093,377 | | |

| Svenska Handelsbanken AB | | | 48,059 | | | | 1,236,918 | | |

| Synovus Financial Corp. | | | 19,321 | | | | 517,416 | | |

| UnicCredito Italiano SPA | | | 195,279 | | | | 1,519,537 | | |

| Wells Fargo & Co. | | | 52,300 | | | | 3,508,284 | | |

| | | $ | 190,790,150 | | |

| Commercial Services & Supplies — 1.1% | |

| Adecco SA | | | 28,437 | | | $ | 1,676,425 | | |

| Avery Dennison Corp. | | | 10,114 | | | | 587,219 | | |

| Cendant Corp. | | | 126,039 | | | | 2,053,175 | | |

| Cintas Corp. | | | 136,477 | | | | 5,426,326 | | |

| Dai Nippon Printing Co., Ltd. | | | 98,000 | | | | 1,516,929 | | |

| Donnelley (R.R.) & Sons Co. | | | 73,912 | | | | 2,361,488 | | |

| Equifax, Inc. | | | 15,217 | | | | 522,552 | | |

| Half (Robert) International, Inc. | | | 15,815 | | | | 664,230 | | |

| Pitney Bowes, Inc. | | | 36,173 | | | | 1,493,945 | | |

| Resources Connection, Inc.(1) | | | 44,239 | | | | 1,106,860 | | |

| SECOM Co., Ltd. | | | 71,000 | | | | 3,359,846 | | |

| SGS SA | | | 1,164 | | | | 1,102,546 | | |

| Waste Management, Inc. | | | 18,690 | | | | 670,597 | | |

| | | $ | 22,542,138 | | |

See notes to financial statements

4

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Communications Equipment — 4.4% | |

| Cisco Systems, Inc.(1) | | | 1,277,165 | | | $ | 24,943,032 | | |

| Corning, Inc.(1) | | | 179,244 | | | | 4,335,912 | | |

| Motorola, Inc. | | | 149,639 | | | | 3,015,226 | | |

| Nokia Oyj | | | 680,083 | | | | 13,782,828 | | |

| QUALCOMM, Inc. | | | 729,121 | | | | 29,215,878 | | |

| Research in Motion, Ltd.(1) | | | 52,753 | | | | 3,680,577 | | |

| Telefonaktiebolaget LM Ericsson | | | 2,407,117 | | | | 7,936,508 | | |

| | | $ | 86,909,961 | | |

| Computer Peripherals — 3.2% | |

| Apple Computer, Inc.(1) | | | 459,775 | | | $ | 26,262,348 | | |

| Dell, Inc.(1) | | | 368,613 | | | | 8,997,843 | | |

| Diebold, Inc. | | | 42,647 | | | | 1,732,321 | | |

| EMC Corp.(1) | | | 279,905 | | | | 3,070,558 | | |

| Fujitsu, Ltd. | | | 200,000 | | | | 1,551,738 | | |

| Hewlett-Packard Co. | | | 207,871 | | | | 6,585,353 | | |

| International Business Machines Corp. | | | 153,614 | | | | 11,800,627 | | |

| McDATA Corp., Class A(1) | | | 101,887 | | | | 415,699 | | |

| Palm, Inc.(1) | | | 54,994 | | | | 885,403 | | |

| Toshiba Corp. | | | 191,000 | | | | 1,248,492 | | |

| | | $ | 62,550,382 | | |

| Construction & Engineering — 0.2% | |

| Chiyoda Corp. | | | 67,000 | | | $ | 1,372,251 | | |

| Fluor Corp. | | | 8,474 | | | | 787,489 | | |

| JGC Corp. | | | 64,000 | | | | 1,103,031 | | |

| Kajima Corp. | | | 151,000 | | | | 693,704 | | |

| Nishimatsu Construction Co., Ltd. | | | 97,000 | | | | 362,188 | | |

| | | $ | 4,318,663 | | |

| Construction Materials — 0.1% | |

| Holcim, Ltd. | | | 14,620 | | | $ | 1,118,534 | | |

| Sumitomo Osaka Cement Co., Ltd. | | | 337,000 | | | | 1,038,853 | | |

| Vulcan Materials Co. | | | 7,353 | | | | 573,534 | | |

| | | $ | 2,730,921 | | |

| Consumer Finance — 0.1% | |

| Credit Saison Co., Ltd. | | | 41,400 | | | $ | 1,963,720 | | |

| UFJ NICOS Co., Ltd. | | | 59,000 | | | | 478,323 | | |

| | | $ | 2,442,043 | | |

| Security | | Shares | | Value | |

| Containers & Packaging — 0.1% | |

| Bemis Co., Inc. | | | 21,337 | | | $ | 653,339 | | |

| Temple-Inland, Inc. | | | 28,051 | | | | 1,202,546 | | |

| Toyo Seikan Kaisha, Ltd. | | | 51,400 | | | | 934,225 | | |

| | | $ | 2,790,110 | | |

| Distributors — 0.0% | |

| Genuine Parts Co. | | | 12,278 | | | $ | 511,501 | | |

| | | $ | 511,501 | | |

| Diversified Consumer Services — 0.2% | |

| H&R Block, Inc. | | | 190,927 | | | $ | 4,555,518 | | |

| | | $ | 4,555,518 | | |

| Diversified Financial Services — 2.7% | |

| CITGroup, Inc. | | | 27,153 | | | $ | 1,419,830 | | |

| Citigroup, Inc. | | | 379,082 | | | | 18,286,916 | | |

| Deutsche Boerse AG | | | 13,303 | | | | 1,809,117 | | |

| Fortis | | | 212,310 | | | | 7,226,245 | | |

| ING Groep NV | | | 421,640 | | | | 16,547,381 | | |

| JPMorgan Chase & Co. | | | 124,797 | | | | 5,241,474 | | |

| Moody's Corp. | | | 59,015 | | | | 3,213,957 | | |

| | | $ | 53,744,920 | | |

| Diversified Telecommunication Services — 2.7% | |

| AT&T Corp. | | | 151,129 | | | $ | 4,214,988 | | |

| Citizens Communications Co. | | | 465,146 | | | | 6,070,155 | | |

| Deutsche Telekom AG | | | 549,716 | | | | 8,826,843 | | |

| Embarq Corp.(1) | | | 13,779 | | | | 564,801 | | |

| France Telecom SA | | | 137,691 | | | | 2,936,998 | | |

| Qwest Communications International, Inc.(1) | | | 313,368 | | | | 2,535,147 | | |

| Telecom Italia SPA | | | 1,864,846 | | | | 4,811,462 | | |

| Telefonica SA | | | 936,051 | | | | 15,554,769 | | |

| Verizon Communications, Inc. | | | 246,478 | | | | 8,254,548 | | |

| | | $ | 53,769,711 | | |

| Electric Utilities — 1.3% | |

| Enel SPA | | | 1,205,625 | | | $ | 10,368,844 | | |

| Fortum Oyj | | | 55,552 | | | | 1,418,796 | | |

| Kyushu Electric Power Co., Inc. | | | 13,400 | | | | 311,939 | | |

| PPL Corp. | | | 44,342 | | | | 1,432,247 | | |

| Progress Energy, Inc. | | | 142,438 | | | | 6,106,317 | | |

See notes to financial statements

5

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Electric Utilities (continued) | |

| Scottish and Southern Energy PLC | | | 78,146 | | | $ | 1,662,294 | | |

| Scottish Power PLC | | | 103,495 | | | | 1,115,066 | | |

| Tokyo Electric Power Co., Inc. | | | 57,300 | | | | 1,584,915 | | |

| Union Fenosa SA | | | 25,318 | | | | 979,979 | | |

| | | $ | 24,980,397 | | |

| Electrical Equipment — 0.9% | |

| ABB Ltd. | | | 109,913 | | | $ | 1,424,258 | | |

| Cooper Industries, Ltd., Class A | | | 41,187 | | | | 3,827,096 | | |

| Emerson Electric Co. | | | 96,516 | | | | 8,089,006 | | |

| Fuji Electric Holdings Co., Ltd. | | | 217,000 | | | | 1,137,689 | | |

| Fujikura, Ltd. | | | 80,000 | | | | 884,083 | | |

| Furukawa Electric Co., Ltd. | | | 87,000 | | | | 563,915 | | |

| Hitachi Cable, Ltd. | | | 41,000 | | | | 190,322 | | |

| Schneider Electric SA | | | 11,952 | | | | 1,243,592 | | |

| Ushio, Inc. | | | 10,900 | | | | 230,707 | | |

| | | $ | 17,590,668 | | |

| Electronic Equipment & Instruments — 0.8% | |

| Agilent Technologies, Inc.(1) | | | 73,937 | | | $ | 2,333,452 | | |

| Alps Electric Co., Ltd. | | | 74,700 | | | | 934,882 | | |

| Anritsu Corp. | | | 33,000 | | | | 175,939 | | |

| Hoya Corp. | | | 11,700 | | | | 416,977 | | |

| Kyocera Corp. | | | 74,600 | | | | 5,792,421 | | |

| Mabuchi Motor Co., Ltd. | | | 7,700 | | | | 460,743 | | |

| Murata Manufacturing Co., Ltd. | | | 6,400 | | | | 416,298 | | |

| Omron Corp. | | | 11,800 | | | | 300,608 | | |

| TDK Corp. | | | 66,700 | | | | 5,062,818 | | |

| | | $ | 15,894,138 | | |

| Energy Equipment & Services — 0.8% | |

| BJ Services Co. | | | 14,856 | | | $ | 553,535 | | |

| Halliburton Co. | | | 87,526 | | | | 6,495,304 | | |

| National-Oilwell Varco, Inc.(1) | | | 7,944 | | | | 503,014 | | |

| Noble Corp. | | | 57,947 | | | | 4,312,416 | | |

| Transocean, Inc.(1) | | | 56,851 | | | | 4,566,272 | | |

| | | $ | 16,430,541 | | |

| Food & Staples Retailing — 1.7% | |

| Circle K Sunkus Co., Ltd. | | | 16,500 | | | $ | 357,087 | | |

| CVS Corp. | | | 208,079 | | | | 6,388,025 | | |

| Familymart Co., Ltd. | | | 10,600 | | | | 305,987 | | |

| Security | | Shares | | Value | |

| Food & Staples Retailing (continued) | |

| Koninklijke Ahold NV(1) | | | 153,410 | | | $ | 1,328,089 | | |

| Lawson, Inc. | | | 10,800 | | | | 394,016 | | |

| Matsumotokiyoshi Co., Ltd. | | | 8,200 | | | | 208,327 | | |

| Metro AG | | | 28,658 | | | | 1,621,106 | | |

| Seven and I Holdings Co., Ltd. | | | 94,200 | | | | 3,109,277 | | |

| SUPERVALU, Inc. | | | 17,345 | | | | 532,492 | | |

| Sysco Corp. | | | 100,301 | | | | 3,065,199 | | |

| UNY Co., Ltd. | | | 21,000 | | | | 310,053 | | |

| Walgreen Co. | | | 92,732 | | | | 4,158,103 | | |

| Wal-Mart Stores, Inc. | | | 257,716 | | | | 12,414,180 | | |

| | | $ | 34,191,941 | | |

| Food Products — 2.0% | |

| Campbell Soup Co. | | | 17,968 | | | $ | 666,792 | | |

| ConAgra Foods, Inc. | | | 77,043 | | | | 1,703,421 | | |

| H.J. Heinz Co. | | | 14,987 | | | | 617,764 | | |

| Hershey Co. | | | 9,378 | | | | 516,446 | | |

| Kellogg Co. | | | 11,886 | | | | 575,639 | | |

| Meiji Seika Kaisha, Ltd. | | | 266,000 | | | | 1,357,235 | | |

| Morinaga & Co., Ltd. | | | 492,000 | | | | 1,355,928 | | |

| Nestle SA | | | 69,269 | | | | 21,673,132 | | |

| Nissin Food Products Co., Ltd. | | | 11,700 | | | | 413,684 | | |

| Sara Lee Corp. | | | 32,588 | | | | 522,060 | | |

| Unilever NV | | | 463,239 | | | | 10,487,607 | | |

| | | $ | 39,889,708 | | |

| Gas Utilities — 0.2% | |

| Gas Natural SDG SA | | | 45,614 | | | $ | 1,392,553 | | |

| Gaz de France | | | 26,064 | | | | 873,637 | | |

| Nicor, Inc. | | | 12,565 | | | | 521,448 | | |

| Peoples Energy Corp. | | | 13,340 | | | | 479,039 | | |

| Snam Rete Gas | | | 218,242 | | | | 958,660 | | |

| | | $ | 4,225,337 | | |

| Health Care Equipment & Supplies — 1.0% | |

| Becton, Dickinson and Co. | | | 9,970 | | | $ | 609,466 | | |

| Boston Scientific Corp.(1) | | | 31,355 | | | | 528,018 | | |

| C.R. Bard, Inc. | | | 7,942 | | | | 581,831 | | |

| Fisher Scientific International, Inc.(1) | | | 27,318 | | | | 1,995,580 | | |

| Hospira, Inc.(1) | | | 13,029 | | | | 559,465 | | |

| Immucor, Inc.(1) | | | 58,135 | | | | 1,117,936 | | |

| Intuitive Surgical, Inc.(1) | | | 37,629 | | | | 4,439,093 | | |

See notes to financial statements

6

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Health Care Equipment & Supplies (continued) | |

| Medtronic, Inc. | | | 134,465 | | | $ | 6,309,098 | | |

| Olympus Corp. | | | 64,000 | | | | 1,713,355 | | |

| St. Jude Medical, Inc.(1) | | | 13,530 | | | | 438,643 | | |

| Terumo Corp. | | | 48,700 | | | | 1,628,361 | | |

| | | $ | 19,920,846 | | |

| Health Care Providers & Services — 1.2% | |

| Caremark Rx, Inc. | | | 39,458 | | | $ | 1,967,770 | | |

| Coventry Health Care, Inc.(1) | | | 42,975 | | | | 2,361,047 | | |

| Genesis HealthCare Corp.(1) | | | 19,809 | | | | 938,352 | | |

| HCA, Inc. | | | 94,003 | | | | 4,056,229 | | |

| Health Management Associates, Inc., Class A | | | 24,182 | | | | 476,627 | | |

| Humana, Inc.(1) | | | 35,364 | | | | 1,899,047 | | |

| Laboratory Corporation of America Holdings(1) | | | 58,414 | | | | 3,635,103 | | |

| Manor Care, Inc. | | | 42,178 | | | | 1,978,992 | | |

| McKesson Corp. | | | 125,474 | | | | 5,932,411 | | |

| Quest Diagnostics, Inc. | | | 22,456 | | | | 1,345,564 | | |

| | | $ | 24,591,142 | | |

| Health Care Technology — 0.1% | |

| Emdeon Corp.(1) | | | 104,294 | | | $ | 1,294,289 | | |

| IMS Health, Inc. | | | 20,213 | | | | 542,719 | | |

| | | $ | 1,837,008 | | |

| Hotels, Restaurants & Leisure — 1.6% | |

| Accor SA | | | 26,214 | | | $ | 1,594,245 | | |

| Carnival Corp. | | | 128,046 | | | | 5,344,640 | | |

| Harrah's Entertainment, Inc. | | | 90,811 | | | | 6,463,927 | | |

| International Game Technology | | | 19,378 | | | | 735,201 | | |

| Six Flags, Inc.(1) | | | 43,632 | | | | 245,212 | | |

| Skylark Co., Ltd. | | | 17,400 | | | | 381,198 | | |

| Starbucks Corp.(1) | | | 230,561 | | | | 8,705,983 | | |

| Starwood Hotels & Resorts Worldwide, Inc. | | | 54,114 | | | | 3,265,239 | | |

| Wendy's International, Inc. | | | 23,698 | | | | 1,381,356 | | |

| Yum! Brands, Inc. | | | 78,857 | | | | 3,964,141 | | |

| | | $ | 32,081,142 | | |

| Household Durables — 1.0% | |

| D.R. Horton, Inc. | | | 65,363 | | | $ | 1,556,947 | | |

| Daito Trust Construction Co., Ltd. | | | 9,200 | | | | 510,929 | | |

| Electrolux AB | | | 47,576 | | | | 685,641 | | |

| Fortune Brands, Inc. | | | 36,182 | | | | 2,569,284 | | |

| Security | | Shares | | Value | |

| Household Durables (continued) | |

| Husqvarna AB, Class B(1) | | | 47,576 | | | $ | 572,950 | | |

| Makita Corp. | | | 21,000 | | | | 662,978 | | |

| Pioneer Corp. | | | 89,500 | | | | 1,443,364 | | |

| Sekisui House, Ltd. | | | 174,000 | | | | 2,390,337 | | |

| Sharp Corp. | | | 86,000 | | | | 1,361,045 | | |

| Snap-On, Inc. | | | 15,120 | | | | 611,150 | | |

| Sony Corp. | | | 63,300 | | | | 2,793,950 | | |

| Stanley Works | | | 48,688 | | | | 2,299,047 | | |

| Thomson(1) | | | 53,754 | | | | 887,982 | | |

| Whirlpool Corp. | | | 7,584 | | | | 626,818 | | |

| | | $ | 18,972,422 | | |

| Household Products — 0.8% | |

| Henkel KGaA | | | 10,271 | | | $ | 1,171,865 | | |

| Kao Corp. | | | 124,000 | | | | 3,249,316 | | |

| Procter & Gamble Co. | | | 196,035 | | | | 10,899,546 | | |

| | | $ | 15,320,727 | | |

Independent Power Producers & Energy

Traders — 0.4% | |

| TXU Corp. | | | 129,585 | | | $ | 7,747,887 | | |

| | | $ | 7,747,887 | | |

| Industrial Conglomerates — 2.4% | |

| 3M Co. | | | 81,121 | | | $ | 6,552,143 | | |

| General Electric Co. | | | 673,171 | | | | 22,187,716 | | |

| Siemens AG | | | 171,864 | | | | 14,924,810 | | |

| Tyco International, Ltd. | | | 150,105 | | | | 4,127,888 | | |

| | | $ | 47,792,557 | | |

| Insurance — 4.0% | |

| ACE, Ltd. | | | 78,172 | | | $ | 3,954,721 | | |

| AFLAC, Inc. | | | 68,355 | | | | 3,168,254 | | |

| Alleanza Asicurazioni SPA | | | 106,954 | | | | 1,212,250 | | |

| Allstate Corp. | | | 134,987 | | | | 7,387,839 | | |

| American International Group, Inc. | | | 169,786 | | | | 10,025,863 | | |

| AON Corp. | | | 16,722 | | | | 582,260 | | |

| AXA SA | | | 431,704 | | | | 13,968,848 | | |

| Cincinnati Financial Corp. | | | 12,917 | | | | 607,228 | | |

| CNP Assurances | | | 12,081 | | | | 1,146,354 | | |

| Corp Mapfre SA | | | 49,878 | | | | 920,742 | | |

| Friends Provident PLC | | | 329,449 | | | | 1,089,572 | | |

See notes to financial statements

7

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Insurance (continued) | |

| Lincoln National Corp. | | | 19,628 | | | $ | 1,107,804 | | |

| Marsh & McLennan Cos., Inc. | | | 83,242 | | | | 2,238,377 | | |

| Muenchener Rueckversicherungs-Gesellschaft AG | | | 64,144 | | | | 8,744,354 | | |

| Old Mutual PLC | | | 330,882 | | | | 999,301 | | |

| Prudential Financial, Inc. | | | 55,210 | | | | 4,289,817 | | |

| Prudential PLC | | | 800,151 | | | | 9,049,712 | | |

| Resolution PLC | | | 86,351 | | | | 1,070,249 | | |

| Sompo Japan Insurance, Inc. | | | 91,000 | | | | 1,271,307 | | |

| T & D Holdings, Inc. | | | 17,500 | | | | 1,412,355 | | |

| XL Capital Ltd., Class A | | | 59,414 | | | | 3,642,078 | | |

| | | $ | 77,889,285 | | |

| Internet & Catalog Retail — 0.4% | |

| GUS PLC | | | 69,063 | | | $ | 1,233,002 | | |

| IAC/InterActiveCorp(1) | | | 273,397 | | | | 7,242,287 | | |

| | | $ | 8,475,289 | | |

| Internet Software & Services — 2.5% | |

| eAccess, Ltd. | | | 365 | | | $ | 239,444 | | |

| eBay, Inc.(1) | | | 417,326 | | | | 12,223,479 | | |

| Google, Inc., Class A(1) | | | 55,480 | | | | 23,264,428 | | |

| Yahoo!, Inc.(1) | | | 390,180 | | | | 12,875,940 | | |

| | | $ | 48,603,291 | | |

| IT Services — 0.7% | |

| Alliance Data Systems Corp.(1) | | | 12,680 | | | $ | 745,838 | | |

| CheckFree Corp.(1) | | | 66,718 | | | | 3,306,544 | | |

| CSK Holdings Corp. | | | 52,000 | | | | 2,376,533 | | |

| Electronic Data Systems Corp. | | | 26,776 | | | | 644,231 | | |

| Kanbay International, Inc.(1) | | | 27,846 | | | | 404,881 | | |

| MoneyGram International, Inc. | | | 25,276 | | | | 858,120 | | |

| Nomura Research Institute, Ltd. | | | 2,800 | | | | 346,773 | | |

| NTT Data Corp. | | | 706 | | | | 3,066,558 | | |

| Satyam Computer Services, Ltd. ADR | | | 56,732 | | | | 1,880,098 | | |

| | | $ | 13,629,576 | | |

| Leisure Equipment & Products — 0.3% | |

| Eastman Kodak Co. | | | 20,370 | | | $ | 484,399 | | |

| Fuji Photo Film Co., Ltd. | | | 46,800 | | | | 1,572,845 | | |

| Hasbro, Inc. | | | 26,234 | | | | 475,098 | | |

| Mattel, Inc. | | | 31,709 | | | | 523,516 | | |

| Namco Bandai Holdings, Inc. | | | 22,900 | | | | 349,227 | | |

| Security | | Shares | | Value | |

| Leisure Equipment & Products (continued) | |

| Nikon Corp. | | | 86,000 | | | $ | 1,506,175 | | |

| Sankyo Co., Ltd. | | | 4,500 | | | | 285,944 | | |

| Sega Sammy Holdings, Inc. | | | 10,700 | | | | 397,168 | | |

| | | $ | 5,594,372 | | |

| Life Sciences Tools & Services — 0.1% | |

| Applera Corp.-Applied Biosystems Group | | | 50,825 | | | $ | 1,644,189 | | |

| PerkinElmer, Inc. | | | 27,425 | | | | 573,183 | | |

| | | $ | 2,217,372 | | |

| Machinery — 1.6% | |

| Amada Co., Ltd. | | | 38,000 | | | $ | 399,431 | | |

| Amano Corp. | | | 26,000 | | | | 387,196 | | |

| Danaher Corp. | | | 34,126 | | | | 2,194,984 | | |

| Deere & Co. | | | 93,444 | | | | 7,801,640 | | |

| Dover Corp. | | | 13,219 | | | | 653,415 | | |

| Eaton Corp. | | | 46,216 | | | | 3,484,686 | | |

| Ebara Corp. | | | 337,000 | | | | 1,441,673 | | |

| Fanuc, Ltd. | | | 71,900 | | | | 6,465,401 | | |

| Illinois Tool Works, Inc. | | | 13,282 | | | | 630,895 | | |

| Kawasaki Heavy Industries, Ltd. | | | 209,000 | | | | 704,996 | | |

| Komatsu, Ltd. | | | 93,000 | | | | 1,852,629 | | |

| Kurita Water Industries, Ltd. | | | 14,700 | | | | 302,336 | | |

| MAN AG | | | 17,561 | | | | 1,269,266 | | |

| Minebea Co., Ltd. | | | 226,000 | | | | 1,233,773 | | |

| Mitsui Engineering and Shipbuilding Co., Ltd. | | | 154,000 | | | | 472,446 | | |

| NSK, Ltd. | | | 173,000 | | | | 1,437,788 | | |

| Pall Corp. | | | 19,443 | | | | 544,404 | | |

| Parker Hannifin Corp. | | | 8,874 | | | | 688,622 | | |

| | | $ | 31,965,581 | | |

| Marine — 0.2% | |

| AP Moller-Maersk A/S | | | 307 | | | $ | 2,394,126 | | |

| Nippon Yusen KK | | | 175,000 | | | | 1,140,156 | | |

| | | $ | 3,534,282 | | |

| Media — 2.4% | |

| CBS Corp., Class B | | | 87,263 | | | $ | 2,360,464 | | |

| Comcast Corp., Class A(1) | | | 350,863 | | | | 11,487,255 | | |

| Dow Jones & Co., Inc. | | | 55,771 | | | | 1,952,543 | | |

| EchoStar Communications Corp., Class A(1) | | | 32,305 | | | | 995,317 | | |

| Fuji Television Network, Inc. | | | 216 | | | | 480,198 | | |

See notes to financial statements

8

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Media (continued) | |

| Gannett Co., Inc. | | | 54,966 | | | $ | 3,074,248 | | |

| Getty Images, Inc.(1) | | | 5,657 | | | | 359,276 | | |

| Lagardere S.C.A. | | | 13,101 | | | | 965,395 | | |

| McGraw-Hill Cos., Inc., | | | 48,277 | | | | 2,424,954 | | |

| Mediaset SPA | | | 100,838 | | | | 1,187,671 | | |

| Meredith Corp. | | | 10,553 | | | | 522,796 | | |

| NTL, Inc. | | | 89,244 | | | | 2,222,176 | | |

| Omnicom Group, Inc. | | | 41,321 | | | | 3,681,288 | | |

| Telefonica Publicidad E Informacion SA | | | 118,091 | | | | 1,277,177 | | |

| TiVo, Inc.(1) | | | 196,331 | | | | 1,403,767 | | |

| Univision Communications, Inc., Class A(1) | | | 42,797 | | | | 1,433,700 | | |

| Viacom, Inc., Class B(1) | | | 87,263 | | | | 3,127,506 | | |

| Walt Disney Co. | | | 224,507 | | | | 6,735,210 | | |

| XM Satellite Radio Holdings, Inc., Class A(1) | | | 169,572 | | | | 2,484,230 | | |

| | | $ | 48,175,171 | | |

| Metals & Mining — 2.0% | |

| Alcan, Inc. | | | 41,646 | | | $ | 1,954,863 | | |

| Alcoa, Inc. | | | 49,548 | | | | 1,603,373 | | |

| Anglo American PLC | | | 195,022 | | | | 7,957,923 | | |

| Arcelor | | | 58,395 | | | | 2,825,259 | | |

| Dowa Mining Co., Ltd. | | | 146,000 | | | | 1,299,161 | | |

| Freeport-McMoRan Copper & Gold, Inc., Class B | | | 72,782 | | | | 4,032,851 | | |

| Nucor Corp. | | | 85,478 | | | | 4,637,182 | | |

| Rio Tinto PLC | | | 236,332 | | | | 12,446,584 | | |

| Sumitomo Metal Industries, Ltd. | | | 302,000 | | | | 1,249,099 | | |

| Sumitomo Metal Mining Co., Ltd. | | | 15,000 | | | | 196,773 | | |

| Toho Zinc Co., Ltd. | | | 142,000 | | | | 1,013,039 | | |

| | | $ | 39,216,107 | | |

| Multiline Retail — 1.1% | |

| Dollar General Corp. | | | 151,116 | | | $ | 2,112,602 | | |

| Federated Department Stores, Inc. | | | 151,948 | | | | 5,561,297 | | |

| Hankyu Department Stores | | | 42,000 | | | | 326,200 | | |

| J.C. Penney Company, Inc. | | | 10,989 | | | | 741,867 | | |

| Nordstrom, Inc. | | | 42,995 | | | | 1,569,318 | | |

| PPR SA | | | 12,595 | | | | 1,604,280 | | |

| Ryohin Keikaku Co., Ltd. | | | 3,600 | | | | 296,333 | | |

| Sears Holdings Corp.(1) | | | 62,826 | | | | 9,727,978 | | |

| | | $ | 21,939,875 | | |

| Security | | Shares | | Value | |

| Multi-Utilities — 1.7% | |

| Ameren Corp. | | | 89,366 | | | $ | 4,512,983 | | |

| Centrica PLC | | | 281,371 | | | | 1,481,917 | | |

| Duke Energy Corp. | | | 104,432 | | | | 3,067,168 | | |

| KeySpan Corp. | | | 14,259 | | | | 576,064 | | |

| National Grid PLC | | | 115,397 | | | | 1,247,099 | | |

| NiSource, Inc. | | | 161,910 | | | | 3,536,114 | | |

| PG&E Corp. | | | 16,823 | | | | 660,807 | | |

| Public Service Enterprise Group, Inc. | | | 56,822 | | | | 3,757,071 | | |

| RWE AG | | | 22,826 | | | | 1,714,875 | | |

| Suez SA (Brussels Exchange) | | | 52,258 | | | | 2,152,823 | | |

| Suez SA (Paris Exchange) | | | 171,500 | | | | 7,119,821 | | |

| Suez SA STRIP VVPR(1) | | | 53,996 | | | | 691 | | |

| TECO Energy, Inc. | | | 30,971 | | | | 462,707 | | |

| United Utilities PLC | | | 97,162 | | | | 1,150,802 | | |

| Veolia Environnement | | | 31,200 | | | | 1,609,330 | | |

| Xcel Energy, Inc. | | | 15,922 | | | | 305,384 | | |

| | | $ | 33,355,656 | | |

| Office Electronics — 0.3% | |

| Canon, Inc. | | | 109,200 | | | $ | 5,357,668 | | |

| Xerox Corp.(1) | | | 38,686 | | | | 538,122 | | |

| | | $ | 5,895,790 | | |

| Oil, Gas & Consumable Fuels — 8.3% | |

| BP PLC | | | 3,286,131 | | | $ | 38,108,867 | | |

| Chevron Corp. | | | 90,016 | | | | 5,586,393 | | |

| ConocoPhillips | | | 144,488 | | | | 9,468,299 | | |

| El Paso Corp. | | | 56,715 | | | | 850,725 | | |

| EnCana Corp. | | | 13,766 | | | | 724,642 | | |

| ENI SPA | | | 515,272 | | | | 15,130,338 | | |

| Exxon Mobil Corp. | | | 386,451 | | | | 23,708,769 | | |

| Frontline, Ltd. | | | 27,509 | | | | 1,027,029 | | |

| Hugoton Royalty Trust | | | 717 | | | | 21,295 | | |

| Murphy Oil Corp. | | | 10,642 | | | | 594,462 | | |

| Nippon Mining Holdings, Inc. | | | 25,000 | | | | 211,253 | | |

| Parallel Petroleum Corp.(1) | | | 84,529 | | | | 2,088,712 | | |

| Royal Dutch Shell PLC, Class A | | | 507,453 | | | | 17,058,793 | | |

| Royal Dutch Shell PLC, Class B | | | 383,980 | | | | 13,414,680 | | |

| Ship Finance International, Ltd. | | | 1,812 | | | | 30,576 | | |

| Showa Shell Sekiyu KK | | | 119,900 | | | | 1,410,075 | | |

| Sunoco, Inc. | | | 15,302 | | | | 1,060,276 | | |

| TonenGeneral Sekiyu KK | | | 42,000 | | | | 432,435 | | |

See notes to financial statements

9

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Oil, Gas & Consumable Fuels (continued) | |

| Total SA | | | 424,404 | | | $ | 27,871,150 | | |

| Williams Cos., Inc. | | | 215,545 | | | | 5,035,131 | | |

| XTO Energy, Inc. | | | 12,033 | | | | 532,701 | | |

| | | $ | 164,366,601 | | |

| Paper and Forest Products — 0.2% | |

| International Paper Co. | | | 50,046 | | | $ | 1,616,486 | | |

| Nippon Paper Group, Inc. | | | 190 | | | | 777,844 | | |

| OJI Paper Co., Ltd. | | | 164,000 | | | | 934,062 | | |

| | | $ | 3,328,392 | | |

| Personal Products — 0.2% | |

| Alberto-Culver Co. | | | 11,849 | | | $ | 577,283 | | |

| Beiersdorf AG | | | 9,572 | | | | 1,441,157 | | |

| Oriflame Cosmetics SA | | | 36,069 | | | | 1,198,599 | | |

| | | $ | 3,217,039 | | |

| Pharmaceuticals — 7.7% | |

| Abbott Laboratories | | | 212,635 | | | $ | 9,273,012 | | |

| Allergan, Inc. | | | 20,957 | | | | 2,247,848 | | |

| Astellas Pharma, Inc. | | | 67,800 | | | | 2,495,038 | | |

| AstraZeneca PLC | | | 200,545 | | | | 12,061,229 | | |

| Bristol-Myers Squibb Co. | | | 330,336 | | | | 8,542,489 | | |

| Chugai Pharmaceuticals Co., Ltd. | | | 70,000 | | | | 1,430,893 | | |

| Cypress Bioscience, Inc.(1) | | | 25,169 | | | | 154,538 | | |

| Daiichi Sankyo Co., Ltd. | | | 11,800 | | | | 325,109 | | |

| Eisai Co., Ltd. | | | 85,900 | | | | 3,873,478 | | |

| GlaxoSmithKline PLC | | | 920,920 | | | | 25,704,965 | | |

| Johnson & Johnson Co. | | | 144,723 | | | | 8,671,802 | | |

| Merck & Co., Inc. | | | 269,420 | | | | 9,814,971 | | |

| Novartis AG | | | 206,358 | | | | 11,114,143 | | |

| Pfizer, Inc. | | | 599,790 | | | | 14,077,071 | | |

| Roche Holding AG | | | 118,891 | | | | 19,579,271 | | |

| Sanofi-Synthelabo SA | | | 167,961 | | | | 16,359,398 | | |

| Santen Pharmaceutical Co., Ltd. | | | 18,900 | | | | 449,852 | | |

| Takeda Pharmaceutical Co., Ltd. | | | 81,900 | | | | 5,103,655 | | |

| Tanabe Seiyaku Co., Ltd. | | | 28,000 | | | | 345,656 | | |

| Valeant Pharmaceuticals International | | | 43,284 | | | | 732,365 | | |

| | | $ | 152,356,783 | | |

| Real Estate Investment Trusts (REITs) — 0.4% | |

| Apartment Investment and Management Co., Class A | | | 42,450 | | | $ | 1,844,453 | | |

| Security | | Shares | | Value | |

| Real Estate Investment Trusts (REITs) (continued) | |

| Archstone-Smith Trust | | | 13,432 | | | $ | 683,286 | | |

| Host Hotels & Resorts, Inc. | | | 33,128 | | | | 724,509 | | |

| Japan Real Estate Investment Corp. | | | 50 | | | | 445,978 | | |

| Japan Retail Fund Investment Corp. | | | 50 | | | | 393,787 | | |

| Nippon Building Fund, Inc. | | | 56 | | | | 543,200 | | |

| Simon Property Group, Inc. | | | 35,779 | | | | 2,967,510 | | |

| | | $ | 7,602,723 | | |

| Real Estate Management & Development — 0.2% | |

| Heiwa Real Estate Co., Ltd. | | | 219,000 | | | $ | 1,274,903 | | |

| NTT Urban Development Corp. | | | 83 | | | | 650,520 | | |

| Sumitomo Realty & Development Co., Ltd. | | | 72,000 | | | | 1,778,557 | | |

| Tokyu Land Corp. | | | 29,000 | | | | 226,183 | | |

| | | $ | 3,930,163 | | |

| Road & Rail — 0.2% | |

| CSX Corp. | | | 11,897 | | | $ | 838,025 | | |

| East Japan Railway Co. | | | 50 | | | | 372,136 | | |

| Kinetsu Corp. | | | 91,000 | | | | 303,837 | | |

| Ryder System, Inc. | | | 15,960 | | | | 932,543 | | |

| Tobu Railway Co., Ltd. | | | 154,000 | | | | 735,322 | | |

| | | $ | 3,181,863 | | |

Semiconductors & Semiconductor

Equipment — 4.5% | |

| Advanced Micro Devices, Inc.(1) | | | 22,060 | | | $ | 538,705 | | |

| Advantest Corp. | | | 64,400 | | | | 6,593,033 | | |

| Analog Devices, Inc. | | | 33,409 | | | | 1,073,765 | | |

| Applied Materials, Inc. | | | 498,564 | | | | 8,116,622 | | |

| Atheros Communications, Inc.(1) | | | 55,283 | | | | 1,048,166 | | |

| Intel Corp. | | | 1,347,413 | | | | 25,533,476 | | |

| Intersil Corp., Class A | | | 40,863 | | | | 950,065 | | |

| KLA-Tencor Corp. | | | 154,838 | | | | 6,436,616 | | |

| LSI Logic Corp.(1) | | | 56,168 | | | | 502,704 | | |

| Marvell Technology Group, Ltd.(1) | | | 123,910 | | | | 5,492,930 | | |

| Maxim Integrated Products, Inc. | | | 301,951 | | | | 9,695,647 | | |

| Microchip Technology, Inc. | | | 191,324 | | | | 6,418,920 | | |

| Micron Technology, Inc.(1) | | | 80,894 | | | | 1,218,264 | | |

| NVIDIA Corp.(1) | | | 142,807 | | | | 3,040,361 | | |

| ROHM Co., Ltd. | | | 2,400 | | | | 215,019 | | |

| Silicon Image, Inc.(1) | | | 108,396 | | | | 1,168,509 | | |

| STMicroelectronics N.V. | | | 100,381 | | | | 1,613,123 | | |

See notes to financial statements

10

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Semiconductors & Semiconductor Equipment (continued) | |

| Teradyne, Inc.(1) | | | 33,940 | | | $ | 472,784 | | |

| Tessera Technologies, Inc.(1) | | | 26,615 | | | | 731,913 | | |

| Tokyo Electron, Ltd. | | | 67,300 | | | | 4,707,911 | | |

| Unaxis Holding AG(1) | | | 6,348 | | | | 1,758,799 | | |

| Veeco Instruments, Inc.(1) | | | 33,128 | | | | 789,772 | | |

| | | $ | 88,117,104 | | |

| Software — 4.5% | |

| Autodesk, Inc.(1) | | | 101,343 | | | $ | 3,492,280 | | |

| BMC Software, Inc.(1) | | | 26,642 | | | | 636,744 | | |

| CA, Inc. | | | 43,249 | | | | 888,767 | | |

| Compuware Corp.(1) | | | 58,560 | | | | 392,352 | | |

| Electronic Arts, Inc.(1) | | | 118,496 | | | | 5,100,068 | | |

| Konami Corp. | | | 85,700 | | | | 1,894,393 | | |

| Microsoft Corp. | | | 1,930,096 | | | | 44,971,237 | | |

| Nintendo Co., Ltd. | | | 4,100 | | | | 689,644 | | |

| Oracle Corp.(1) | | | 1,208,900 | | | | 17,516,961 | | |

| Oracle Corp. | | | 10,800 | | | | 506,285 | | |

| Symantec Corp.(1) | | | 598,288 | | | | 9,297,396 | | |

| Trend Micro, Inc. | | | 70,000 | | | | 2,365,780 | | |

| | | $ | 87,751,907 | | |

| Specialty Retail — 1.1% | |

| Abercrombie & Fitch Co., Class A | | | 46,375 | | | $ | 2,570,566 | | |

| Aoyama Trading Co., Ltd. | | | 9,600 | | | | 301,002 | | |

| Bed Bath and Beyond, Inc.(1) | | | 167,745 | | | | 5,564,102 | | |

| Best Buy Co., Inc. | | | 57,465 | | | | 3,151,381 | | |

| Big 5 Sporting Goods Corp. | | | 22,809 | | | | 444,776 | | |

| Fast Retailing Co., Ltd. | | | 65,600 | | | | 5,374,984 | | |

| Inditex SA | | | 44,192 | | | | 1,862,468 | | |

| Office Depot, Inc.(1) | | | 17,560 | | | | 667,280 | | |

| Shimamura Co., Ltd. | | | 1,900 | | | | 208,692 | | |

| Tiffany & Co. | | | 13,839 | | | | 456,964 | | |

| TJX Companies, Inc. | | | 25,596 | | | | 585,125 | | |

| | | $ | 21,187,340 | | |

| Textiles, Apparel & Luxury Goods — 0.6% | |

| Coach, Inc.(1) | | | 37,247 | | | $ | 1,113,685 | | |

| Compagnie Financiere Richemont AG, Class A | | | 33,833 | | | | 1,542,776 | | |

| Nike, Inc., Class B | | | 72,969 | | | | 5,910,489 | | |

| Onward Kashiyama Company, Ltd. | | | 24,000 | | | | 369,722 | | |

| Security | | Shares | | Value | |

| Textiles, Apparel & Luxury Goods (continued) | |

| Swatch Group AG, Class B | | | 6,996 | | | $ | 1,176,608 | | |

| Toyobo Co., Ltd. | | | 298,000 | | | | 845,609 | | |

| Unitika, Ltd. | | | 158,000 | | | | 258,416 | | |

| | | $ | 11,217,305 | | |

| Thrifts & Mortgage Finance — 0.4% | |

| Commercial Capital Bancorp | | | 30,478 | | | $ | 480,029 | | |

| Countrywide Financial Corp. | | | 19,114 | | | | 727,861 | | |

| Fannie Mae | | | 118,647 | | | | 5,706,921 | | |

| PFF Bancorp, Inc. | | | 52,597 | | | | 1,744,117 | | |

| | | $ | 8,658,928 | | |

| Tobacco — 1.1% | |

| Altadis SA | | | 29,497 | | | $ | 1,392,400 | | |

| Altria Group, Inc. | | | 127,887 | | | | 9,390,742 | | |

| Gallaher Group PLC | | | 84,360 | | | | 1,317,971 | | |

| Imperial Tobacco Group PLC | | | 46,553 | | | | 1,436,072 | | |

| Reynolds American, Inc. | | | 45,902 | | | | 5,292,501 | | |

| Swedish Match AB | | | 92,749 | | | | 1,492,573 | | |

| UST, Inc. | | | 28,896 | | | | 1,305,810 | | |

| | | $ | 21,628,069 | | |

| Trading Companies & Distributors — 0.3% | |

| ITOCHU Corp. | | | 24,000 | | | $ | 211,453 | | |

| Marubeni Corp. | | | 39,000 | | | | 208,633 | | |

| Mitsui and Co., Ltd. | | | 180,000 | | | | 2,547,777 | | |

| Toyota Tsusho Corp. | | | 56,591 | | | | 1,361,398 | | |

| WW Grainger, Inc. | | | 8,452 | | | | 635,844 | | |

| | | $ | 4,965,105 | | |

| Transportation Infrastructure — 0.1% | |

| Abertis Infraestructuras SA | | | 40,100 | | | $ | 938,915 | | |

| Autoroutes du Sud de la France | | | 20,604 | | | | 1,312,514 | | |

| | | $ | 2,251,429 | | |

| Water Utilities — 0.1% | |

| Kelda Group PLC | | | 79,871 | | | $ | 1,129,180 | | |

| Severn Trent PLC | | | 61,138 | | | | 1,322,126 | | |

| | | $ | 2,451,306 | | |

See notes to financial statements

11

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

PORTFOLIO OF INVESTMENTS (Unaudited) CONT'D

| Security | | Shares | | Value | |

| Wireless Telecommunication Services — 2.0% | |

| Bouygues SA | | | 28,071 | | | $ | 1,440,961 | | |

| KDDI Corp. | | | 630 | | | | 3,881,484 | | |

| NII Holdings, Inc., Class B(1) | | | 100,807 | | | | 5,683,499 | | |

| NTT DoCoMo, Inc. | | | 148 | | | | 216,766 | | |

| Softbank Corp. | | | 198,300 | | | | 4,451,271 | | |

| Sprint Nextel Corp. | | | 275,590 | | | | 5,509,044 | | |

| Vodafone Group PLC | | | 8,704,572 | | | | 18,529,783 | | |

| | | $ | 39,712,808 | | |

Total Common Stocks

(identified cost $1,893,391,646) | | | | | | $ | 2,001,950,024 | | |

Total Investments — 101.4%

(identified cost $1,893,391,646) | | | | | | $ | 2,001,950,024 | | |

| Covered Call Options Written — (2.1)% | |

| Type of Contract | | Number of

Contracts | | Premiums

Received | | Value | |

Eurotop 100 Index, Expires 7/18/06,

Strike 269.00 | | | 25,802 | | | $ | 11,309,017 | | | $ | (21,191,440 | ) | |

Nasdaq 100 Index, Expires 7/22/06,

Strike 1,560.00 | | | 572 | | | | 1,695,462 | | | | (2,259,400 | ) | |

Nasdaq 100 Index, Expires 7/22/06,

Strike 1,565.00 | | | 575 | | | | 1,959,887 | | | | (1,955,000 | ) | |

Nasdaq 100 Index, Expires 7/22/06,

Strike 1,575.00 | | | 1,656 | | | | 4,942,308 | | | | (4,471,200 | ) | |

Nikkei Index, Expires 7/22/06,

Strike 15,600.00 | | | 1,493 | | | | 4,254,977 | | | | (1,698,213 | ) | |

S & P 500 Index, Expires 7/22/06,

Strike 1,255.00 | | | 1,021 | | | | 1,692,818 | | | | (2,787,330 | ) | |

S & P 500 Index, Expires 7/22/06,

Strike 1,260.00 | | | 820 | | | | 1,277,560 | | | | (1,951,600 | ) | |

S & P 500 Index, Expires 7/22/06,

Strike 1,265.00 | | | 1,382 | | | | 2,249,896 | | | | (2,902,200 | ) | |

S & P 500 Index, Expires 7/22/06,

Strike 1,275.00 | | | 1,606 | | | | 2,564,736 | | | | (2,296,580 | ) | |

S & P 500 Index, Expires 7/22/06,

Strike 1,280.00 | | | 371 | | | | 596,568 | | | | (400,680 | ) | |

Total Call Options Written

(premiums received $32,543,229) | | | | | | | | | | $ | (41,913,643 | ) | |

| Other Assets, Less Liabilities — 0.7% | | | | | | | | | | $ | 13,324,711 | | |

| Net Assets — 100.0% | | | | | | | | | | $ | 1,973,361,092 | | |

ADR - American Depository Receipt

(1) Non-income producing security.

| Country Concentration of Portfolio | |

| Country | | Percentage of

Total Investments | | Value | |

| United States | | | 52.8 | % | | $ | 1,057,677,294 | | |

| United Kingdom | | | 11.6 | | | | 232,835,686 | | |

| Japan | | | 10.0 | | | | 199,419,852 | | |

| France | | | 5.4 | | | | 108,706,400 | | |

| Switzerland | | | 4.2 | | | | 84,623,914 | | |

| Germany | | | 3.9 | | | | 78,495,622 | | |

| Netherlands | | | 2.9 | | | | 58,602,246 | | |

| Italy | | | 2.2 | | | | 44,748,919 | | |

| Spain | | | 2.2 | | | | 44,228,361 | | |

| Cayman Islands | | | 0.8 | | | | 16,475,488 | | |

| Finland | | | 0.8 | | | | 15,201,625 | | |

| Bermuda | | | 0.7 | | | | 14,505,518 | | |

| Sweden | | | 0.7 | | | | 13,157,985 | | |

| Denmark | | | 0.5 | | | | 9,010,226 | | |

| Belgium | | | 0.4 | | | | 7,226,245 | | |

| Other Countries, less than 0.3% each | | | 0.9 | | | | 17,034,643 | | |

| | | | 100.0 | % | | $ | 2,001,950,024 | | |

See notes to financial statements

12

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

FINANCIAL STATEMENTS (Unaudited) CONT'D

Statement of Assets and Liabilities

As of June 30, 2006

| Assets | |

| Investments, at value (identified cost, $1,893,391,646) | | $ | 2,001,950,024 | | |

| Cash | | | 12,298,418 | | |

| Foreign currency, at value (cost, $415,224) | | | 418,613 | | |

| Receivable for investments sold | | | 1,509,030 | | |

| Dividends and interest receivable | | | 2,851,526 | | |

| Tax reclaims receivable | | | 588,234 | | |

| Total assets | | $ | 2,019,615,845 | | |

| Liabilities | |

| Written Options outstanding, at value (premiums received $32,543,229) | | $ | 41,913,643 | | |

| Payable for open forward foreign currency contracts | | | 2,485,035 | | |

| Payable to affiliate for investment advisory fee | | | 1,626,161 | | |

| Payable to affiliate for Trustees' fees | | | 6,339 | | |

| Accrued expenses | | | 223,575 | | |

| Total liabilities | | $ | 46,254,753 | | |

| Net assets applicable to common shares | | $ | 1,973,361,092 | | |

| Sources of Net Assets | |

Common Shares, $0.01 par value, unlimited number of shares authorized,

105,655,000 shares issued and outstanding | | $ | 1,056,550 | | |

| Additional paid-in capital | | | 1,986,943,183 | | |

| Accumulated net realized loss (computed on the basis of identified cost) | | | (32,378,674 | ) | |

| Distributions in excess of net investment income | | | (79,011,386 | ) | |

| Net unrealized appreciation (computed on the basis of identified cost) | | | 96,751,419 | | |

| Net assets applicable to common shares | | $ | 1,973,361,092 | | |

| Net Asset Value Per Common Share | |

($1,973,361,092 ÷ 105,655,000 common shares

issued and outstanding) | | $ | 18.68 | | |

Statement of Operations

For the Six Months Ended

June 30, 2006

| Investment Income | |

| Dividends (net of foreign taxes, $1,916,340) | | $ | 26,661,170 | | |

| Interest | | | 294,111 | | |

| Total investment income | | $ | 26,955,281 | | |

| Expenses | |

| Investment adviser fee | | $ | 10,046,391 | | |

| Trustees' fees and expenses | | | 12,163 | | |

| Custodian fee | | | 475,242 | | |

| Printing and postage | | | 123,154 | | |

| Transfer and dividend disbursing agent fees | | | 30,028 | | |

| Legal and accounting services | | | 25,981 | | |

| Miscellaneous | | | 118,946 | | |

| Total expenses | | $ | 10,831,905 | | |

| Net investment income | | $ | 16,123,376 | | |

| Realized and Unrealized Gain (Loss) | |

Net realized gain (loss) —

Investment transactions (identified cost basis) | | $ | 12,157,718 | | |

| Written options | | | 40,096,596 | | |

Foreign currency and forward foreign currency exchange contract

transactions | | | 3,243,224 | | |

| Net realized gain | | $ | 55,497,538 | | |

Change in unrealized appreciation (depreciation) —

Investments (identified cost basis) | | $ | 45,107,484 | | |

| Written options | | | (12,257,557 | ) | |

| Foreign currency and forward foreign currency exchange contracts | | | (2,426,637 | ) | |

| Net change in unrealized appreciation (depreciation) | | $ | 30,423,290 | | |

| Net realized and unrealized gain | | $ | 85,920,828 | | |

| Net increase in net assets from operations | | $ | 102,044,204 | | |

See notes to financial statements

13

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

FINANCIAL STATEMENTS CONT'D

Statements of Changes in Net Assets

Increase (Decrease)

in Net Assets | | Six Months Ended

June 30, 2006

(Unaudited) | | Period Ended

December 31, 2005(1) | |

From operations —

Net investment income | | $ | 16,123,376 | | | $ | 3,153,994 | | |

Net realizd gain (loss) from investment

transactions, written options and

foreign currency and forward

foreign currency exchange contract

transactions | | | 55,497,538 | | | | (72,483,303 | ) | |

Net change in unrealized apreciation

(depreciation) from investments,

written options and foreign

currency and forward foreign

currency exchange contracts | | | 30,423,290 | | | | 66,328,129 | | |

Net increase (decrease) in net assets from

operations | | $ | 102,044,204 | | | $ | (3,001,180 | ) | |

Distributions to common shareholders —

From net investment income | | $ | (95,089,500 | ) | | $ | (3,253,354 | ) | |

| From net realized gain | | | — | | | | (15,338,811 | ) | |

| Tax return of capital | | | — | | | | (28,952,585 | ) | |

| Total distributions to common shareholders | | $ | (95,089,500 | ) | | $ | (47,544,750 | ) | |

Capital share transactions —

Proceeds from sale of common shares | | $ | — | | | $ | 2,017,915,000 | (2) | |

| Offering costs | | | (213,482 | ) | | | (849,200 | ) | |

Net increase (decrease) in net assets from

capital share transactions | | $ | (213,482 | ) | | $ | 2,017,065,800 | | |

| Net increase in net assets | | $ | 6,741,222 | | | $ | 1,966,519,870 | | |

Net Assets Applicable to

Common Shares | |

| At beginning of period | | $ | 1,966,619,870 | | | $ | 100,000 | | |

| At end of period | | $ | 1,973,361,092 | | | $ | 1,966,619,870 | | |

Distributions in excess

of net investment

income included in net

assets applicable to

common shares | |

| At end of period | | $ | (79,011,386 | ) | | $ | (45,262 | ) | |

(1) For the period from the start of business, September 30, 2005, to December 31, 2005.

(2) Proceeds from sales of shares net of sales load paid of $95,085,000.

See notes to financial statements

14

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

FINANCIAL STATEMENTS CONT'D

Financial Highlights

Selected data for a common share outstanding during the periods stated

| | | Six Months Ended

June 30, 2006

(Unaudited)(1) | | Period Ended

December 31,

2005(1)(2) | |

| Net asset value — Beginning of period | | $ | 18.610 | | | $ | 19.100 | (3) | |

| Income (loss) from operations | |

| Net investment income | | $ | 0.153 | | | $ | 0.031 | † | |

| Net realized and unrealized gain (loss) | | | 0.819 | | | | (0.063 | ) | |

| Total income (loss) from operations | | $ | 0.972 | | | $ | (0.032 | ) | |

| Less distributions to common shareholders | |

| From net investment income | | $ | (0.900 | ) | | $ | (0.031 | ) | |

| From net realized gain | | | — | | | | (0.145 | ) | |

| From tax return of capital | | | — | | | | (0.274 | ) | |

| Total distributions to common shareholders | | $ | (0.900 | ) | | $ | (0.450 | ) | |

| Common Shares offering costs charged to paid-in capital | | $ | (0.002 | ) | | $ | (0.008 | ) | |

| Net asset value — End of period | | $ | 18.680 | | | $ | 18.610 | | |

| Market value — End of period | | $ | 18.100 | | | $ | 17.200 | | |

| Total Investment Return on Net Asset Value(4) | | | 5.32 | % | | | (0.04 | )%(5) | |

| Total Investment Return on Market Value(4) | | | 10.41 | % | | | (7.62 | )%(5) | |

| Ratios/Supplemental Data | |

| Net assets, end of period (000's omitted) | | $ | 1,973,361 | | | $ | 1,966,620 | | |

| Ratios (As a percentage of average net assets): | |

| Net Expenses(6) | | | 1.08 | % | | | 1.07 | %† | |

| Net investment income(6) | | | 1.60 | % | | | 0.64 | %† | |

| Portfolio Turnover | | | 4 | % | | | 6 | % | |

† The operating expenses of the Fund reflect a reimbursement of organization expenses by the Adviser. Had such actions not been taken, the ratios and net investment income per share would have changed by less than 0.005% and $0.0005, respectively.

(1) Computed using average common shares outstanding.

(2) For the period from the start of business, September 30, 2005, to December 31, 2005.

(3) Net Asset Value at beginning of period reflects the deduction of the sales load of $0.90 per share paid by the shareholder from the $20.00 offering price.

(4) Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Total return is not computed on an annualized basis.

(5) Total investment return on net asset value is calculated assuming a purchase at the offering price of $20.00 less the sales load of $0.90 per share paid by the shareholder on the first day and a sale at the net asset value on the last day of the period reported. Total investment return on market value is calculated assuming a purchase at the offering price of $20.00 less the sales load of $0.90 per share paid by the shareholder on the first day and a sale at the current market price on the last day of the period reported. Total investment return on net asset value and total return on market value are not computed on an annualized basis.

(6) Annualized.

See notes to financial statements

15

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

NOTES TO FINANCIAL STATEMENTS (Unaudited)

1 Significant Accounting Policies

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund (the "Fund") is registered under the Investment Company Act of 1940, as amended, as a diversified, closed-end management investment company. The Fund was organized under the laws of the Commonwealth of Massachusetts by an Agreement and Declaration of Trust dated March 30, 2005. The Fund's primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation. In pursuing its investment objectives, the Fund will evaluate returns on an after-tax basis, seeking to minimize and defer shareholder federal income taxes. The Fund will seek to generate current earnings in part by employing an options strategy of writing index call options on at least 80% of the value of the Fund's total assets under normal market conditions. The following is a summary of significant accounting policies of the Fund. The policies are in conformity w ith accounting principles generally accepted in the United States of America.

A Investment Valuation — Securities listed on a U.S. securities exchange generally are valued at the last sale price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ National Market System generally are valued at the official NASDAQ closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices or, in the case of preferred equity securities that are not listed or traded in the over-the-counter market, by an independent pricing service. Exchange-traded options are valued at the last sale price for the day of valuation as quoted on the principal exchange or board of trade on which the options are traded or, in the absence of sales on such date, at the mean between the latest bid and asked prices therefore. Futures positions on securities and currencies generally are valued at closing settlement prices. Short-term debt securities with a remaining maturity of 60 days or less are valued at amortized cost. If short-term debt securities are acquired with a remaining maturity of more than 60 days, they will be valued by a pricing service. Other fixed income and debt securities, including listed securities and securities for which price quotations are available, will normally be valued on the basis of valuations furnished by a pricing service. Foreign securities and currencies are valued in U.S. dollars, based on foreign currency exchange rate quotations supplied by an independent quotation service. The daily valuation of exchange-traded foreign securities generally is determined as of the close of trading on the principal exchange on which such securities trade. Events occurring after the close of trading on foreign exchanges may result in adjustments to the valuation of foreign securities to more accurately reflect their fair value as of the close of regular trading on the New York Stock Exchange. When valuing foreign equity securities that meet certain criteria, the Trustees have approved the use of a fair value service that values such securities to reflect market trading that occurs after the close of the applicable foreign markets of comparable securities or other instruments that have a strong correlation to the fair-valued securities. Investments held by the Fund for which valuations or market quotations are unavailable and investments for which the price of the security is not believed to represent its fair market value, are valued at f air value using methods determined in good faith by or at the direction of the Trustees of the Fund considering relevant factors, data and information including the market value of freely tradable securities of the same class in the principal market on which such securities are normally traded.

B Income — Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Interest income is recorded on the basis of interest accrued, adjusted for amortization of premium or accretion of discount.

C Federal Taxes — The Fund's policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its taxable income, including any net realized capital gain on investments. Accordingly, no provision for federal income or excise tax is necessary.

At December 31, 2005, net capital losses of $79,429,648 attributable to security transactions incurred after October 31, 2005, are treated as arising on the first day of the Fund's taxable year ending December 31, 2006.

D Foreign Currency Translation — Investment valuations, other assets, and liabilities initially expressed in foreign currencies are converted each business day into U.S. dollars based upon current exchange rates. Purchases and sales of foreign investment securities and income and expenses are converted into U.S. dollars based upon currency exchange rates prevailing on the respective dates of such transactions. Recognized gains or losses on

16

Eaton Vance Tax-Managed Global Buy-Write Opportunities Fund as of June 30, 2006

NOTES TO FINANCIAL STATEMENTS (Unaudited) CONT'D

investment transactions attributable to changes in foreign currency exchange rates are recorded for financial statement purposes as net realized gains and losses on investments. That portion of unrealized gains and losses on investments that results from fluctuations in foreign currency exchange rates is not separately disclosed.