UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act File Number: 811-21735

Eaton Vance Tax-Managed Buy-Write Opportunities Fund

(Exact Name of Registrant as Specified in Charter)

Two International Place, Boston, Massachusetts 02110

(Address of Principal Executive Offices)

Maureen A. Gemma

Two International Place, Boston, Massachusetts 02110

(Name and Address of Agent for Services)

(617) 482-8260

(Registrant’s Telephone Number)

December 31

Date of Fiscal Year End

December 31, 2013

Date of Reporting Period

Item 1. Reports to Stockholders

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund (ETV)

Annual Report

December 31, 2013

Commodity Futures Trading Commission Registration. Effective December 31, 2012, the Commodity Futures Trading Commission (“CFTC”) adopted certain regulatory changes that subject registered investment companies and advisers to regulation by the CFTC if a fund invests more than a prescribed level of its assets in certain CFTC-regulated instruments (including futures, certain options and swap agreements) or markets itself as providing investment exposure to such instruments. The Fund has claimed an exclusion from the definition of the term “commodity pool operator” under the Commodity Exchange Act and is not subject to the CFTC regulation. Because of its management of other strategies, the Fund’s adviser is registered with the CFTC as a commodity pool operator and a commodity trading advisor.

Managed Distribution Plan. Pursuant to an exemptive order issued by the Securities and Exchange Commission (Order), the Fund is authorized to distribute long-term capital gains to shareholders more frequently than once per year. Pursuant to the Order, the Fund’s Board of Trustees approved a Managed Distribution Plan (MDP) pursuant to which the Fund makes monthly cash distributions to common shareholders, stated in terms of a fixed amount per common share.

The Fund currently distributes monthly cash distributions equal to $0.1108 per share in accordance with the MDP. The Fund’s distribution frequency changed from quarterly to monthly beginning in January 2013. You should not draw any conclusions about the Fund’s investment performance from the amount of these distributions or from the terms of the MDP. The MDP will be subject to regular periodic review by the Fund’s Board of Trustees and the Board may amend or terminate the MDP at any time without prior notice to Fund shareholders. However, at this time there are no reasonably foreseeable circumstances that might cause the termination of the MDP.

The Fund may distribute more than its net investment income and net realized capital gains and, therefore, a distribution may include a return of capital. A return of capital distribution does not necessarily reflect the Fund’s investment performance and should not be confused with “yield” or “income.” With each distribution, the Fund will issue a notice to shareholders and a press release containing information about the amount and sources of the distribution and other related information. The amounts and sources of distributions contained in the notice and press release are only estimates and are not provided for tax purposes. The amounts and sources of the Fund’s distributions for tax purposes will be reported to shareholders on Form 1099-DIV for each calendar year.

Fund shares are not insured by the FDIC and are not deposits or other obligations of, or guaranteed by, any depository institution. Shares are subject to investment risks, including possible loss of principal invested.

Annual Report December 31, 2013

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

Table of Contents

Management’s Discussion of Fund Performance | 2 | |||

Performance | 3 | |||

Fund Profile | 3 | |||

Fund Snapshot | 4 | |||

Endnotes and Additional Disclosures | 5 | |||

Financial Statements | 6 | |||

Report of Independent Registered Public Accounting Firm | 20 | |||

Federal Tax Information | 21 | |||

Dividend Reinvestment Plan | 22 | |||

Management and Organization | 24 | |||

Important Notices | 27 | |||

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Management’s Discussion of Fund Performance1

Economic and Market Conditions

As the 12-month period started on January 1, 2013, U.S. stocks were just beginning a rally that would continue well into May. The rally was driven largely by strengthening U.S. economic data, as employment slowly improved and the housing market appeared to have finally turned the corner after its 2008 collapse.

In late May 2013, U.S. Federal Reserve (the Fed) Chairman Ben Bernanke surprised the markets by indicating that the Fed’s $85 billion in monthly asset purchases, known collectively as quantitative easing (QE), could begin to taper off sooner than most investors had expected. The negative effect on the markets was swift and dramatic. Bond investors rushed to sell assets in anticipation of rising interest rates. The prospect of reduced Fed stimulus weighed on equities as well.

By late June 2013, however, U.S. equities resumed their upward trajectory. The S&P 500 Index2, a broad measure of the U.S. stock market, closed at a new all-time high on August 2, 2013. Factors contributing to the rally included some backtracking by the Fed on its earlier statements regarding QE, ongoing improvements in housing and other U.S. economic data, and news from Europe that the eurozone had officially come out of its recession.

In late August 2013, U.S. equities faltered again, as investors worried that a U.S. strike on Syria could lead to a spike in oil prices. As those concerns faded, equities once more trended upward. In mid-September, the Fed again surprised investors by announcing that it was postponing any tapering of QE for the time being. Stocks initially surged in response, only to drift downward in late September and early October amid a Congressional impasse that led to a partial government shutdown on October 1, 2013.

In mid-October, U.S. stocks reversed direction again and began a rally that more or less lasted through the end of the 12-month period, with the S&P 500 Index and the Dow Jones Industrial Average both closing at all-time highs on December 31, 2013. Drivers of this latest rally included moderate growth in corporate earnings and a widespread belief that Janet Yellen — set to succeed Mr. Bernanke as Fed chairperson in early 2014 — would take a measured approach to winding down QE. Even the Fed’s mid-December announcement that tapering of QE would actually begin in January 2014 did not derail the rally, as investors appeared relieved that the tapering would be gradual and that the Fed still intended to keep the Fed funds rate near zero for an extended period.

The S&P 500 Index delivered a return of 32.39% for the 12-month period, while the Dow Jones Industrial Average returned 29.65%.

Fund Performance

For the 12-month period ended December 31, 2013, Eaton Vance Tax-Managed Buy-Write Opportunities Fund (the Fund) had a total return of 19.08% at net asset value

(NAV), underperforming the 32.39% return of the S&P 500 Index (the Index) and the 34.22% return of a blended index (comprised 60% of the S&P 500 Index and 40% of the NASDAQ-100 Index), and outperforming the 13.26% return of the CBOE S&P 500 BuyWrite Index and the 16.54% return of the CBOE NASDAQ-100 BuyWrite Index. The Fund’s underlying common stock portfolio outperformed the Index for the period, while the Fund’s options overlay strategy detracted from the Fund’s performance relative to the Index.

Within the Fund’s underlying common stock portfolio, stock selection in the health care sector, stock selection and underweights in the materials and energy sectors, and an underweight in the utilities sector all contributed to the Fund’s performance relative to the Index. Within the health care sector, stock selection and an overweight in the strong-performing biotechnology industry aided Fund performance versus the Index. An underweight in metals & mining and stock selection in chemicals both helped performance versus the Index in the materials sector. In the energy sector, Fund performance relative to the Index benefited from an underweight in oil, gas & consumable fuels and stock selection in energy equipment & services. An underweight in electric utilities contributed to Fund performance versus the Index in the utilities sector.

In contrast, stock selection and an overweight in the information technology (IT) sector, as well as an underweight and stock selection in the industrials sector, detracted from the Fund’s performance relative to the Index. Within the IT sector, Fund performance versus the Index was hurt by stock selection and an overweight in computers & peripherals, an overweight in communications equipment, and stock selection in software and in semiconductors & semiconductor equipment. In the industrials sector, detractors from Fund performance relative to the Index included stock selection and an overweight in trading companies & distributors, stock selection and an underweight in aerospace & defense, and an underweight in industrial conglomerates.

The Fund employs an options strategy of writing (selling) stock index call options on a portion of its underlying common stock portfolio. The options strategy, which is designed to help limit the Fund’s exposure to market volatility and enhance current income, can be beneficial during periods of market weakness, but may detract from the Fund’s performance versus the Index during periods of market strength. When the market was trending upward, as it was for most of the 12-month period, the Fund’s writing of index call options held back performance versus the Index.

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested and includes management fees and other expenses. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to eatonvance.com.

| 2 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Performance2

Portfolio Managers Walter A. Row III, CFA, CMT, David Stein, Ph.D. and Thomas Seto

| % Average Annual Total Returns | Inception Date | One Year | Five Years | Since Inception | ||||||||||||

Fund at NAV | 06/30/2005 | 19.08 | % | 16.80 | % | 8.65 | % | |||||||||

Fund at Market Price | — | 23.84 | 19.38 | 7.92 | ||||||||||||

S&P 500 Index | — | 32.39 | % | 17.93 | % | 7.55 | % | |||||||||

NASDAQ–100 Index | — | 36.92 | 25.75 | 11.75 | ||||||||||||

CBOE S&P 500 BuyWrite Index | — | 13.26 | 10.91 | 4.85 | ||||||||||||

CBOE NASDAQ–100 BuyWrite Index | — | 16.54 | 13.60 | 4.02 | ||||||||||||

Blend of 60% S&P 500 Index and | — | 34.22 | 21.09 | 9.31 | ||||||||||||

40% NASDAQ-100 Index | ||||||||||||||||

| % Premium/Discount to NAV3 | ||||||||||||||||

| –5.59 | % | |||||||||||||||

| Distributions4 | ||||||||||||||||

Total Distributions per share for the period | $ | 1.330 | ||||||||||||||

Distribution Rate at NAV | 8.96 | % | ||||||||||||||

Distribution Rate at Market Price | 9.49 | % | ||||||||||||||

Fund Profile

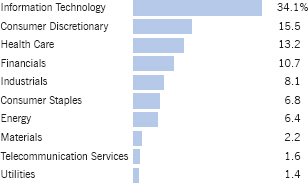

Sector Allocation (% of total investments)5

| Top 10 Holdings (% of total investments)5 | ||||

Apple, Inc. | 7.7 | % | ||

Google, Inc., Class A | 5.0 | |||

Microsoft Corp. | 4.7 | |||

Amazon.com, Inc. | 3.0 | |||

QUALCOMM, Inc. | 2.5 | |||

Comcast Corp., Class A | 2.5 | |||

Gilead Sciences, Inc. | 2.4 | |||

Cisco Systems, Inc. | 2.1 | |||

Intel Corp. | 2.1 | |||

Celgene Corp. | 1.7 | |||

Total | 33.7 | % | ||

See Endnotes and Additional Disclosures in this report.

Past performance is no guarantee of future results. Returns are historical and are calculated by determining the percentage change in net asset value (NAV) or market price (as applicable) with all distributions reinvested and includes management fees and other expenses. Fund performance at market price will differ from its results at NAV due to factors such as changing perceptions about the Fund, market conditions, fluctuations in supply and demand for Fund shares, or changes in Fund distributions. Investment return and principal value will fluctuate so that shares, when sold, may be worth more or less than their original cost. Performance less than one year is cumulative. Performance is for the stated time period only; due to market volatility, current Fund performance may be lower or higher than the quoted return. For performance as of the most recent month end, please refer to eatonvance.com.

| 3 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Fund Snapshot

| Objective | The primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation. | |

| Strategy | The Fund invests in a diversified portfolio of common stocks and writes call options on one or more U.S. indices on a substantial portion of the value of its common stock portfolio to generate current earnings from the option premium. The Fund evaluates returns on an after tax basis and seeks to minimize and defer federal income taxes incurred by shareholders in connection with their investment in the Fund. | |

Options Strategy | Write Index Covered Calls | |

Equity Benchmark2 | 60% S&P 500 Index 40% NASDAQ-100 Index | |

Morningstar Category | Large Growth | |

Distribution Frequency | Monthly | |

Common Stock Portfolio | ||

Positions Held | 204 | |

% US / Non-US | 99.3/0.7 | |

Average Market Cap | $150.0 Billion | |

Call Options Written | ||

% of Stock Portfolio | 94% | |

Average Days to Expiration | 13 days | |

% In the Money | –1.5% | |

The following terms as used in the Fund snapshot:

Average Market Cap: An indicator of the size of the companies in which the Fund invests and is the sum of each security’s weight in the portfolio multiplied by its market cap. Market Cap is determined by multiplying the price of a share of a company’s common stock by the number of shares outstanding.

Call Option: For an index call option, the buyer has the right to receive from the seller (or writer) a cash payment at the option expiration date equal to any positive difference between the value of the index at contract expiration and the exercise price. The buyer of a call option makes a cash payment (premium) to the seller (writer) of the option upon entering into the option contract.

Covered Call Strategy: A strategy of owning a portfolio of common stocks and writing call options on all or a portion of such stocks to generate current earnings from option premium.

In the Money: For a call option on an index, the extent to which the current price of the value of the index exceeds the exercise price of the option.

See Endnotes and Additional Disclosures in this report.

| 4 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Endnotes and Additional Disclosures

| 1 | The views expressed in this report are those of the portfolio manager(s) and are current only through the date stated at the top of this page. These views are subject to change at any time based upon market or other conditions, and Eaton Vance and the Fund(s) disclaim any responsibility to update such views. These views may not be relied upon as investment advice and, because investment decisions are based on many factors, may not be relied upon as an indication of trading intent on behalf of any Eaton Vance fund. This commentary may contain statements that are not historical facts, referred to as “forward looking statements”. The Fund’s actual future results may differ significantly from those stated in any forward looking statement, depending on factors such as changes in securities or financial markets or general economic conditions, the volume of sales and purchases of Fund shares, the continuation of investment advisory, administrative and service contracts, and other risks discussed from time to time in the Fund’s filings with the Securities and Exchange Commission. |

| 2 | S&P 500 Index is an unmanaged index of large-cap stocks commonly used as a measure of U.S. stock market performance. Dow Jones Industrial Average is a price-weighted average of 30 blue-chip stocks that are generally the leaders in their industry. NASDAQ-100 Index includes 100 of the largest domestic and international securities (by market cap), excluding financials, listed on NASDAQ. CBOE S&P 500 BuyWrite Index measures the performance of a hypothetical buy-write strategy on the S&P 500 Index. CBOE NASDAQ-100 BuyWrite Index measures the performance of a theoretical portfolio that owns stocks included in the NASDAQ-100 Index and writes (sells) NASDAQ-100 Index covered call options. Unless otherwise stated, index returns do not reflect the effect of any applicable sales charges, commissions, expenses, taxes or leverage, as applicable. It is not possible to invest directly in an index. Performance since inception for an index, if presented, is the performance since the Fund’s or oldest share class’ inception, as applicable. |

| 3 | The shares of the Fund often trade at a discount or premium from their net asset value. The discount or premium of the Fund may vary over time and may be higher or lower than what is quoted in this report. For up-to-date premium/discount information, please refer to http://eatonvance.com/closedend. |

| 4 | The Distribution Rate is based on the Fund’s last regular distribution per share in the period (annualized) divided by the Fund’s NAV or market price at the end of the period. The Fund’s distributions may be comprised of amounts characterized for federal income tax purposes as qualified and non-qualified ordinary dividends, capital gains and nondividend distributions, also known as return of capital. For additional information about nondividend distributions, please refer to Eaton Vance Closed-End Fund Distribution Notices (19a) posted on our website, eatonvance. com. The Fund will determine the federal income tax character of distributions paid to a shareholder after the end of the calendar year. This is reported on the IRS form 1099-DIV and provided to the shareholder shortly after each year-end. For information about the tax character of distributions made in prior calendar years, please refer to Performance-Tax Character of Distributions on the Fund’s webpage available at www.eatonvance.com. In recent years, a significant portion of the Fund’s distributions has been characterized as a return of capital. The Fund’s distributions are determined by the investment adviser based on its current assessment of the Fund’s long-term return potential. As portfolio and market conditions change, the rate of distributions paid by the Fund could change. |

| 5 | Depictions do not reflect the Fund’s option positions. Excludes cash and cash equivalents. |

| Fund snapshot and profile subject to change due to active management. |

Information About Share Repurchase Program

On September 30, 2013, the Fund’s Board of Trustees approved the continuation of the Fund’s share repurchase program. The Board authorized the Fund to repurchase up to 10% of its common shares outstanding as of September 30, 2013 in open market transactions at a discount to net asset value (NAV). Under the previous authorization, the Fund could repurchase up to 10% of its common shares outstanding as of August 8, 2012 at a discount to NAV in the open market. The terms of the reauthorization increased the number of shares available for repurchase. From the date it began repurchasing shares until December 31, 2013, the Fund has purchased the number and percentage of its outstanding shares and seen the changes in its market price and discount to NAV as set forth in the table below. For more information on the Fund’s share repurchase program, please see Note 5 in the Fund’s Notes to Financial Statements.

| No. of Shares Repurchased | % Shares Repurchased1 | Beginning Market Price2 | 12/31/13 Market Price | % Market Return3 | Beginning NAV Discount2 | 12/31/13 NAV Discount | Discount Change | |||||||||||||||||||||

202,000 | 0.32 | % | $ | 12.98 | $ | 14.01 | 23.31 | % | -11.46 | % | -5.59 | % | -5.87 | % | ||||||||||||||

| 1 | % Shares Repurchased is based on the number of shares outstanding on August 8, 2012. 2 Beginning Market Price and Beginning NAV Discount are as of the close of the market on the business day preceding the Fund’s first share repurchase. 3 % Market Return reflects the change in the market price of the Fund shares plus any distributions paid during the period but not reflecting the reinvestment of distributions. |

| 5 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Portfolio of Investments

| Common Stocks — 101.7% | ||||||||

| Security | Shares | Value | ||||||

Aerospace & Defense — 2.1% |

| |||||||

Boeing Co. (The) | 26,140 | $ | 3,567,849 | |||||

Honeywell International, Inc. | 77,664 | 7,096,160 | ||||||

Northrop Grumman Corp. | 43,452 | 4,980,034 | ||||||

Rockwell Collins, Inc. | 49,396 | 3,651,352 | ||||||

Textron, Inc. | 15,478 | 568,971 | ||||||

| $ | 19,864,366 | |||||||

Airlines — 0.1% |

| |||||||

Southwest Airlines Co. | 60,023 | $ | 1,130,833 | |||||

| $ | 1,130,833 | |||||||

Auto Components — 0.5% |

| |||||||

Dana Holding Corp. | 77,289 | $ | 1,516,410 | |||||

Johnson Controls, Inc. | 71,926 | 3,689,804 | ||||||

| $ | 5,206,214 | |||||||

Automobiles — 0.2% |

| |||||||

Ford Motor Co. | 41,101 | $ | 634,188 | |||||

General Motors Co.(1) | 20,000 | 817,400 | ||||||

| $ | 1,451,588 | |||||||

Beverages — 1.7% |

| |||||||

Coca-Cola Co. (The) | 234,484 | $ | 9,686,534 | |||||

Coca-Cola Enterprises, Inc. | 21,105 | 931,364 | ||||||

PepsiCo, Inc. | 60,609 | 5,026,910 | ||||||

| $ | 15,644,808 | |||||||

Biotechnology — 6.3% |

| |||||||

Amgen, Inc. | 64,403 | $ | 7,352,246 | |||||

Biogen Idec, Inc.(1) | 40,574 | 11,350,577 | ||||||

BioMarin Pharmaceutical, Inc.(1) | 23,822 | 1,673,972 | ||||||

Celgene Corp.(1) | 95,610 | 16,154,266 | ||||||

Gilead Sciences, Inc.(1) | 310,289 | 23,318,218 | ||||||

| $ | 59,849,279 | |||||||

Building Products — 0.0%(2) |

| |||||||

Allegion PLC(1) | 10,516 | $ | 464,702 | |||||

| $ | 464,702 | |||||||

Capital Markets — 1.9% |

| |||||||

Franklin Resources, Inc. | 50,559 | $ | 2,918,771 | |||||

Goldman Sachs Group, Inc. (The) | 23,436 | 4,154,265 | ||||||

| Security | Shares | Value | ||||||

Capital Markets (continued) |

| |||||||

Invesco, Ltd. | 78,614 | $ | 2,861,550 | |||||

Morgan Stanley | 53,096 | 1,665,091 | ||||||

Northern Trust Corp. | 19,315 | 1,195,405 | ||||||

State Street Corp. | 43,478 | 3,190,851 | ||||||

T. Rowe Price Group, Inc. | 23,664 | 1,982,333 | ||||||

| $ | 17,968,266 | |||||||

Chemicals — 1.6% |

| |||||||

Air Products and Chemicals, Inc. | 26,339 | $ | 2,944,174 | |||||

Celanese Corp., Series A | 10,077 | 557,359 | ||||||

E.I. du Pont de Nemours & Co. | 63,024 | 4,094,669 | ||||||

PPG Industries, Inc. | 41,446 | 7,860,648 | ||||||

| $ | 15,456,850 | |||||||

Commercial Banks — 2.4% |

| |||||||

BankUnited, Inc. | 21,449 | $ | 706,101 | |||||

Fifth Third Bancorp | 100,126 | 2,105,650 | ||||||

First Republic Bank | 21,771 | 1,139,712 | ||||||

Huntington Bancshares, Inc. | 179,679 | 1,733,902 | ||||||

KeyCorp | 38,413 | 515,503 | ||||||

Regions Financial Corp. | 643,924 | 6,368,408 | ||||||

SunTrust Banks, Inc. | 49,905 | 1,837,003 | ||||||

U.S. Bancorp | 29,359 | 1,186,104 | ||||||

Wells Fargo & Co. | 163,476 | 7,421,810 | ||||||

| $ | 23,014,193 | |||||||

Commercial Services & Supplies — 0.3% |

| |||||||

Waste Management, Inc. | 53,872 | $ | 2,417,237 | |||||

| $ | 2,417,237 | |||||||

Communications Equipment — 5.0% |

| |||||||

Brocade Communications Systems, Inc.(1) | 321,783 | $ | 2,854,215 | |||||

Cisco Systems, Inc. | 879,620 | 19,747,469 | ||||||

Harris Corp. | 6,224 | 434,497 | ||||||

QUALCOMM, Inc. | 322,213 | 23,924,315 | ||||||

Riverbed Technology, Inc.(1) | 26,232 | 474,275 | ||||||

| $ | 47,434,771 | |||||||

Computers & Peripherals — 7.9% |

| |||||||

Apple, Inc. | 131,765 | $ | 73,934,659 | |||||

Hewlett-Packard Co. | 10,000 | 279,800 | ||||||

NetApp, Inc. | 20,000 | 822,800 | ||||||

| $ | 75,037,259 | |||||||

| 6 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Portfolio of Investments — continued

| Security | Shares | Value | ||||||

Consumer Finance — 1.3% |

| |||||||

American Express Co. | 52,940 | $ | 4,803,246 | |||||

Capital One Financial Corp. | 10,757 | 824,094 | ||||||

Discover Financial Services | 116,006 | 6,490,536 | ||||||

| $ | 12,117,876 | |||||||

Containers & Packaging — 0.4% |

| |||||||

Avery Dennison Corp. | 31,661 | $ | 1,589,066 | |||||

MeadWestvaco Corp. | 56,858 | 2,099,766 | ||||||

| $ | 3,688,832 | |||||||

Distributors — 0.2% |

| |||||||

Genuine Parts Co. | 19,047 | $ | 1,584,520 | |||||

| $ | 1,584,520 | |||||||

Diversified Financial Services — 2.5% |

| |||||||

Bank of America Corp. | 165,000 | $ | 2,569,050 | |||||

Berkshire Hathaway, Inc., Class B(1) | 19,434 | 2,304,095 | ||||||

Citigroup, Inc. | 15,000 | 781,650 | ||||||

CME Group, Inc. | 12,294 | 964,587 | ||||||

JPMorgan Chase & Co. | 151,347 | 8,850,773 | ||||||

McGraw Hill Financial, Inc. | 57,011 | 4,458,260 | ||||||

Moody’s Corp. | 45,252 | 3,550,925 | ||||||

| $ | 23,479,340 | |||||||

Diversified Telecommunication Services — 1.5% |

| |||||||

AT&T, Inc. | 166,227 | $ | 5,844,541 | |||||

Frontier Communications Corp. | 154,158 | 716,835 | ||||||

Verizon Communications, Inc. | 145,422 | 7,146,037 | ||||||

| $ | 13,707,413 | |||||||

Electric Utilities — 0.4% |

| |||||||

American Electric Power Co., Inc. | 16,075 | $ | 751,345 | |||||

Edison International | 62,309 | 2,884,907 | ||||||

| $ | 3,636,252 | |||||||

Electrical Equipment — 0.6% |

| |||||||

Emerson Electric Co. | 78,984 | $ | 5,543,097 | |||||

| $ | 5,543,097 | |||||||

Energy Equipment & Services — 1.2% |

| |||||||

Halliburton Co. | 104,167 | $ | 5,286,475 | |||||

Schlumberger, Ltd. | 62,574 | 5,638,543 | ||||||

| $ | 10,925,018 | |||||||

| Security | Shares | Value | ||||||

Food & Staples Retailing — 1.0% |

| |||||||

CVS Caremark Corp. | 102,959 | $ | 7,368,776 | |||||

Kroger Co. (The) | 37,587 | 1,485,814 | ||||||

Wal-Mart Stores, Inc. | 4,824 | 379,600 | ||||||

| $ | 9,234,190 | |||||||

Food Products — 1.6% |

| |||||||

ConAgra Foods, Inc. | 48,260 | $ | 1,626,362 | |||||

Hershey Co. (The) | 17,810 | 1,731,666 | ||||||

Hormel Foods Corp. | 10,580 | 477,899 | ||||||

Kraft Foods Group, Inc. | 49,708 | 2,680,255 | ||||||

Mondelez International, Inc., Class A | 250,000 | 8,825,000 | ||||||

| $ | 15,341,182 | |||||||

Health Care Equipment & Supplies — 1.8% |

| |||||||

Abbott Laboratories | 91,000 | $ | 3,488,030 | |||||

Baxter International, Inc. | 46,730 | 3,250,071 | ||||||

Covidien PLC | 25,801 | 1,757,048 | ||||||

Edwards Lifesciences Corp.(1) | 11,063 | 727,503 | ||||||

Intuitive Surgical, Inc.(1) | 12,611 | 4,843,633 | ||||||

Stryker Corp. | 33,820 | 2,541,235 | ||||||

| $ | 16,607,520 | |||||||

Health Care Providers & Services — 1.6% |

| |||||||

Cigna Corp. | 36,534 | $ | 3,195,994 | |||||

DaVita HealthCare Partners, Inc.(1) | 14,550 | 922,034 | ||||||

Express Scripts Holding Co.(1) | 30,000 | 2,107,200 | ||||||

LifePoint Hospitals, Inc.(1) | 43,020 | 2,273,177 | ||||||

McKesson Corp. | 7,813 | 1,261,018 | ||||||

UnitedHealth Group, Inc. | 70,143 | 5,281,768 | ||||||

| $ | 15,041,191 | |||||||

Hotels, Restaurants & Leisure — 2.3% |

| |||||||

International Game Technology | 56,626 | $ | 1,028,328 | |||||

Marriott International, Inc., Class A | 92,128 | 4,547,438 | ||||||

Marriott Vacations Worldwide Corp.(1) | 10,303 | 543,586 | ||||||

McDonald’s Corp. | 71,902 | 6,976,651 | ||||||

Starwood Hotels & Resorts Worldwide, Inc. | 39,775 | 3,160,124 | ||||||

Yum! Brands, Inc. | 72,349 | 5,470,308 | ||||||

| $ | 21,726,435 | |||||||

Household Durables — 0.5% |

| |||||||

Whirlpool Corp. | 29,270 | $ | 4,591,292 | |||||

| $ | 4,591,292 | |||||||

| 7 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Portfolio of Investments — continued

| Security | Shares | Value | ||||||

Household Products — 0.9% |

| |||||||

Clorox Co. (The) | 39,829 | $ | 3,694,538 | |||||

Colgate-Palmolive Co. | 31,592 | 2,060,115 | ||||||

Procter & Gamble Co. | 37,881 | 3,083,892 | ||||||

| $ | 8,838,545 | |||||||

Independent Power Producers & Energy Traders — 0.2% |

| |||||||

AES Corp. (The) | 103,235 | $ | 1,497,940 | |||||

| $ | 1,497,940 | |||||||

Industrial Conglomerates — 1.4% |

| |||||||

3M Co. | 28,082 | $ | 3,938,501 | |||||

General Electric Co. | 326,711 | 9,157,709 | ||||||

| $ | 13,096,210 | |||||||

Insurance — 1.6% |

| |||||||

ACE, Ltd. | 35,393 | $ | 3,664,237 | |||||

Aflac, Inc. | 17,703 | 1,182,560 | ||||||

Aon PLC | 4,957 | 415,843 | ||||||

Genworth Financial, Inc., Class A(1) | 74,552 | 1,157,793 | ||||||

Marsh & McLennan Cos., Inc. | 24,157 | 1,168,232 | ||||||

Travelers Companies, Inc. (The) | 52,815 | 4,781,870 | ||||||

Unum Group | 70,698 | 2,480,086 | ||||||

| $ | 14,850,621 | |||||||

Internet & Catalog Retail — 3.4% |

| |||||||

Amazon.com, Inc.(1) | 72,170 | $ | 28,780,674 | |||||

Netflix, Inc.(1) | 5,000 | 1,840,850 | ||||||

Shutterfly, Inc.(1) | 27,478 | 1,399,455 | ||||||

| $ | 32,020,979 | |||||||

Internet Software & Services — 7.8% | ||||||||

eBay, Inc.(1) | 206,613 | $ | 11,340,988 | |||||

Facebook, Inc., Class A(1) | 136,456 | 7,458,685 | ||||||

Google, Inc., Class A(1) | 43,234 | 48,452,776 | ||||||

LinkedIn Corp., Class A(1) | 4,433 | 961,207 | ||||||

VeriSign, Inc.(1) | 94,613 | 5,655,965 | ||||||

| $ | 73,869,621 | |||||||

IT Services — 3.1% | ||||||||

Alliance Data Systems Corp.(1) | 7,945 | $ | 2,088,979 | |||||

Cognizant Technology Solutions Corp., Class A(1) | 97,645 | 9,860,192 | ||||||

Fidelity National Information Services, Inc. | 79,262 | 4,254,784 | ||||||

International Business Machines Corp. | 35,984 | 6,749,519 | ||||||

MasterCard, Inc., Class A | 3,808 | 3,181,432 | ||||||

| Security | Shares | Value | ||||||

IT Services (continued) |

| |||||||

Visa, Inc., Class A | 15,924 | $ | 3,545,956 | |||||

| $ | 29,680,862 | |||||||

Life Sciences Tools & Services — 0.2% |

| |||||||

Bruker Corp.(1) | 57,399 | $ | 1,134,778 | |||||

PerkinElmer, Inc. | 23,065 | 950,970 | ||||||

| $ | 2,085,748 | |||||||

Machinery — 1.6% | ||||||||

Caterpillar, Inc. | 27,518 | $ | 2,498,910 | |||||

Dover Corp. | 40,339 | 3,894,327 | ||||||

Ingersoll-Rand PLC | 31,550 | 1,943,480 | ||||||

Parker Hannifin Corp. | 16,981 | 2,184,436 | ||||||

Stanley Black & Decker, Inc. | 51,390 | 4,146,659 | ||||||

| $ | 14,667,812 | |||||||

Marine — 0.2% | ||||||||

Kirby Corp.(1) | 17,666 | $ | 1,753,351 | |||||

| $ | 1,753,351 | |||||||

Media — 5.1% | ||||||||

CBS Corp., Class B | 100,317 | $ | 6,394,205 | |||||

Comcast Corp., Class A | 457,426 | 23,770,142 | ||||||

Omnicom Group, Inc. | 7,983 | 593,696 | ||||||

Sirius XM Holdings, Inc.(1) | 340,529 | 1,188,446 | ||||||

Time Warner, Inc. | 17,000 | 1,185,240 | ||||||

Twenty-First Century Fox, Inc., Class A | 80,000 | 2,814,400 | ||||||

Walt Disney Co. (The) | 162,337 | 12,402,547 | ||||||

| $ | 48,348,676 | |||||||

Metals & Mining — 0.2% | ||||||||

Freeport-McMoRan Copper & Gold, Inc. | 15,665 | $ | 591,197 | |||||

Nucor Corp. | 23,005 | 1,228,007 | ||||||

| $ | 1,819,204 | |||||||

Multi-Utilities — 0.8% | ||||||||

CMS Energy Corp. | 217,119 | $ | 5,812,276 | |||||

Public Service Enterprise Group, Inc. | 63,761 | 2,042,902 | ||||||

| $ | 7,855,178 | |||||||

Multiline Retail — 1.4% | ||||||||

Macy’s, Inc. | 106,841 | $ | 5,705,309 | |||||

Nordstrom, Inc. | 28,152 | 1,739,794 | ||||||

| 8 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Portfolio of Investments — continued

| Security | Shares | Value | ||||||

Multiline Retail (continued) |

| |||||||

Target Corp. | 88,022 | $ | 5,569,152 | |||||

| $ | 13,014,255 | |||||||

Oil, Gas & Consumable Fuels — 5.4% | ||||||||

Chevron Corp. | 79,760 | $ | 9,962,822 | |||||

ConocoPhillips | 104,007 | 7,348,094 | ||||||

Denbury Resources, Inc.(1) | 25,661 | 421,610 | ||||||

EOG Resources, Inc. | 16,450 | 2,760,968 | ||||||

Exxon Mobil Corp. | 154,645 | 15,650,074 | ||||||

Hess Corp. | 28,844 | 2,394,052 | ||||||

Occidental Petroleum Corp. | 34,959 | 3,324,601 | ||||||

Phillips 66 | 57,101 | 4,404,200 | ||||||

Spectra Energy Corp. | 16,118 | 574,123 | ||||||

Suncor Energy, Inc. | 33,674 | 1,180,274 | ||||||

Williams Cos., Inc. | 48,359 | 1,865,207 | ||||||

WPX Energy, Inc.(1) | 41,343 | 842,570 | ||||||

| $ | 50,728,595 | |||||||

Personal Products — 0.6% | ||||||||

Estee Lauder Cos., Inc. (The), Class A | 77,774 | $ | 5,857,938 | |||||

| $ | 5,857,938 | |||||||

Pharmaceuticals — 3.5% | ||||||||

AbbVie, Inc. | 6,412 | $ | 338,618 | |||||

Bristol-Myers Squibb Co. | 134,845 | 7,167,012 | ||||||

Eli Lilly & Co. | 12,046 | 614,346 | ||||||

Johnson & Johnson | 51,777 | 4,742,255 | ||||||

Mallinckrodt PLC(1) | 3,225 | 168,539 | ||||||

Merck & Co., Inc. | 158,250 | 7,920,412 | ||||||

Pfizer, Inc. | 391,195 | 11,982,303 | ||||||

| $ | 32,933,485 | |||||||

Professional Services — 0.5% | ||||||||

Equifax, Inc. | 17,082 | $ | 1,180,195 | |||||

Nielsen Holdings NV | 16,843 | 772,925 | ||||||

Robert Half International, Inc. | 75,839 | 3,184,480 | ||||||

| $ | 5,137,600 | |||||||

Real Estate Investment Trusts (REITs) — 0.9% | ||||||||

American Tower Corp. | 17,730 | $ | 1,415,208 | |||||

Apartment Investment & Management Co., Class A | 35,696 | 924,883 | ||||||

Host Hotels & Resorts, Inc. | 28,981 | 563,391 | ||||||

Simon Property Group, Inc. | 38,580 | 5,870,333 | ||||||

| $ | 8,773,815 | |||||||

| Security | Shares | Value | ||||||

Real Estate Management & Development — 0.1% |

| |||||||

CB Richard Ellis Group, Inc., Class A(1) | 24,669 | $ | 648,795 | |||||

| $ | 648,795 | |||||||

Road & Rail — 0.9% | ||||||||

CSX Corp. | 34,587 | $ | 995,068 | |||||

Kansas City Southern | 15,641 | 1,936,825 | ||||||

Norfolk Southern Corp. | 10,785 | 1,001,171 | ||||||

Ryder System, Inc. | 12,392 | 914,282 | ||||||

Union Pacific Corp. | 20,249 | 3,401,832 | ||||||

| $ | 8,249,178 | |||||||

Semiconductors & Semiconductor Equipment — 4.4% |

| |||||||

Analog Devices, Inc. | 56,522 | $ | 2,878,665 | |||||

ASML Holding NV - NY Shares | 26,394 | 2,473,118 | ||||||

Cypress Semiconductor Corp.(1) | 245,589 | 2,578,685 | ||||||

Intel Corp. | 758,775 | 19,697,799 | ||||||

Microchip Technology, Inc. | 30,000 | 1,342,500 | ||||||

NXP Semiconductors NV(1) | 29,000 | 1,331,970 | ||||||

ON Semiconductor Corp.(1) | 149,333 | 1,230,504 | ||||||

Tessera Technologies, Inc. | 50,120 | 987,865 | ||||||

Texas Instruments, Inc. | 199,048 | 8,740,198 | ||||||

| $ | 41,261,304 | |||||||

Software — 6.4% | ||||||||

Compuware Corp. | 97,123 | $ | 1,088,749 | |||||

Microsoft Corp. | 1,207,317 | 45,189,875 | ||||||

Oracle Corp. | 308,110 | 11,788,289 | ||||||

Red Hat, Inc.(1) | 28,914 | 1,620,340 | ||||||

TiVo, Inc.(1) | 42,923 | 563,150 | ||||||

| $ | 60,250,403 | |||||||

Specialty Retail — 1.6% | ||||||||

Advance Auto Parts, Inc. | 40,120 | $ | 4,440,482 | |||||

Best Buy Co., Inc. | 28,506 | 1,136,819 | ||||||

Gap, Inc. (The) | 35,268 | 1,378,273 | ||||||

Home Depot, Inc. (The) | 58,008 | 4,776,379 | ||||||

Tiffany & Co. | 39,926 | 3,704,334 | ||||||

| $ | 15,436,287 | |||||||

Textiles, Apparel & Luxury Goods — 0.6% | ||||||||

NIKE, Inc., Class B | 73,632 | $ | 5,790,420 | |||||

| $ | 5,790,420 | |||||||

| 9 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Portfolio of Investments — continued

| Security | Shares | Value | ||||||

Thrifts & Mortgage Finance — 0.2% | ||||||||

Hudson City Bancorp, Inc. | 180,579 | $ | 1,702,860 | |||||

| $ | 1,702,860 | |||||||

Tobacco — 1.1% | ||||||||

Altria Group, Inc. | 27,194 | $ | 1,043,978 | |||||

Lorillard, Inc. | 17,939 | 909,148 | ||||||

Philip Morris International, Inc. | 101,144 | 8,812,677 | ||||||

| $ | 10,765,803 | |||||||

Trading Companies & Distributors — 0.6% | ||||||||

Fastenal Co. | 111,850 | $ | 5,313,994 | |||||

| $ | 5,313,994 | |||||||

Wireless Telecommunication Services — 0.1% | ||||||||

Rogers Communications, Inc., Class B | 26,731 | $ | 1,209,578 | |||||

| $ | 1,209,578 | |||||||

Total Common Stocks — 101.7% | $ | 959,623,581 | ||||||

| Call Options Written — (2.0)% | ||||||||||||||||

| Description | Number of Contracts | Strike Price | Expiration Date | Value | ||||||||||||

NASDAQ 100 Index | 260 | $ | 3,525 | 1/3/14 | $ | (1,825,200 | ) | |||||||||

NASDAQ 100 Index | 290 | 3,500 | 1/10/14 | (2,940,600 | ) | |||||||||||

NASDAQ 100 Index | 205 | 3,530 | 1/18/14 | (1,714,825 | ) | |||||||||||

NASDAQ 100 Index | 250 | 3,600 | 1/24/14 | (1,100,000 | ) | |||||||||||

S&P 500 Index | 720 | 1,810 | 1/3/14 | (2,880,000 | ) | |||||||||||

S&P 500 Index | 760 | 1,800 | 1/10/14 | (3,967,200 | ) | |||||||||||

S&P 500 Index | 705 | 1,825 | 1/18/14 | (2,439,300 | ) | |||||||||||

S&P 500 Index | 765 | 1,850 | 1/24/14 | (1,541,475 | ) | |||||||||||

Total Call Options Written |

| $ | (18,408,600 | ) | ||||||||||||

Other Assets, Less Liabilities — 0.3% |

| $ | 2,672,104 | |||||||||||||

Net Assets — 100.0% |

| $ | 943,887,085 | |||||||||||||

The percentage shown for each investment category in the Portfolio of Investments is based on net assets.

| (1) | Non-income producing security. |

| (2) | Amount is less than 0.05%. |

| 10 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Statement of Assets and Liabilities

| Assets | December 31, 2013 | |||

Investments, at value (identified cost, $420,960,989) | $ | 959,623,581 | ||

Cash | 598,387 | |||

Dividends receivable | 1,056,305 | |||

Receivable for written options | 2,042,348 | |||

Tax reclaims receivable | 4,231 | |||

Total assets | $ | 963,324,852 | ||

| Liabilities | ||||

Written options outstanding, at value (premiums received, $8,060,086) | $ | 18,408,600 | ||

Payable to affiliates: | ||||

Investment adviser fee | 795,178 | |||

Trustees’ fees | 9,003 | |||

Accrued expenses | 224,986 | |||

Total liabilities | $ | 19,437,767 | ||

Net Assets | $ | 943,887,085 | ||

| Sources of Net Assets | ||||

Common shares, $0.01 par value, unlimited number of shares authorized, 63,614,866 shares issued and outstanding | $ | 636,149 | ||

Additional paid-in capital | 439,805,118 | |||

Accumulated net realized loss | (24,965,470 | ) | ||

Accumulated undistributed net investment income | 97,220 | |||

Net unrealized appreciation | 528,314,068 | |||

Net Assets | $ | 943,887,085 | ||

| Net Asset Value | ||||

($943,887,085 ÷ 63,614,866 common shares issued and outstanding) | $ | 14.84 | ||

| 11 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Statement of Operations

| Investment Income | Year Ended December 31, 2013 | |||

Dividends (net of foreign taxes, $46,851) | $ | 18,097,107 | ||

Total investment income | $ | 18,097,107 | ||

| Expenses | ||||

Investment adviser fee | $ | 9,106,269 | ||

Trustees’ fees and expenses | 35,341 | |||

Custodian fee | 344,167 | |||

Transfer and dividend disbursing agent fees | 18,230 | |||

Legal and accounting services | 64,016 | |||

Printing and postage | 266,884 | |||

Miscellaneous | 109,348 | |||

Total expenses | $ | 9,944,255 | ||

Deduct — | ||||

Reduction of custodian fee | $ | 2,446 | ||

Total expense reductions | $ | 2,446 | ||

Net expenses | $ | 9,941,809 | ||

Net investment income | $ | 8,155,298 | ||

| Realized and Unrealized Gain (Loss) | ||||

Net realized gain (loss) — | ||||

Investment transactions | $ | 74,886,931 | ||

Written options | (92,812,620 | ) | ||

Foreign currency transactions | (1,007 | ) | ||

Net realized loss | $ | (17,926,696 | ) | |

Change in unrealized appreciation (depreciation) — | ||||

Investments | $ | 176,807,995 | ||

Written options | (14,719,115 | ) | ||

Foreign currency | 103 | |||

Net change in unrealized appreciation (depreciation) | $ | 162,088,983 | ||

Net realized and unrealized gain | $ | 144,162,287 | ||

Net increase in net assets from operations | $ | 152,317,585 | ||

| 12 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Statements of Changes in Net Assets

| Year Ended December 31, | ||||||||

| Increase (Decrease) in Net Assets | 2013 | 2012 | ||||||

From operations — | ||||||||

Net investment income | $ | 8,155,298 | $ | 8,342,791 | ||||

Net realized gain (loss) from investment transactions, written options and foreign currency transactions | (17,926,696 | ) | 165,880 | |||||

Net change in unrealized appreciation (depreciation) from investments, written options and foreign currency | 162,088,983 | 83,783,789 | ||||||

Net increase in net assets from operations | $ | 152,317,585 | $ | 92,292,460 | ||||

Distributions to shareholders — | ||||||||

From net investment income | $ | (8,037,102 | ) | $ | (8,256,794 | ) | ||

Tax return of capital | (76,545,224 | ) | (76,485,243 | ) | ||||

Total distributions | $ | (84,582,326 | ) | $ | (84,742,037 | ) | ||

Capital share transactions — | ||||||||

Cost of shares repurchased (see Note 5) | $ | — | $ | (2,582,682 | ) | |||

Net decrease in net assets from capital share transactions | $ | — | $ | (2,582,682 | ) | |||

Net increase in net assets | $ | 67,735,259 | $ | 4,967,741 | ||||

| Net Assets | ||||||||

At beginning of year | $ | 876,151,826 | $ | 871,184,085 | ||||

At end of year | $ | 943,887,085 | $ | 876,151,826 | ||||

| Accumulated undistributed net investment income included in net assets | ||||||||

At end of year | $ | 97,220 | $ | 37,548 | ||||

| 13 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Financial Highlights

| Year Ended December 31, | ||||||||||||||||||||

| 2013 | 2012 | 2011 | 2010 | 2009 | ||||||||||||||||

Net asset value — Beginning of year | $ | 13.770 | $ | 13.650 | $ | 14.160 | $ | 14.510 | $ | 12.050 | ||||||||||

| Income (Loss) From Operations | ||||||||||||||||||||

Net investment income(1) | $ | 0.128 | $ | 0.131 | $ | 0.094 | $ | 0.087 | $ | 0.114 | ||||||||||

Net realized and unrealized gain | 2.272 | 1.313 | 0.725 | 1.095 | 4.246 | |||||||||||||||

Total income from operations | $ | 2.400 | $ | 1.444 | $ | 0.819 | $ | 1.182 | $ | 4.360 | ||||||||||

| Less Distributions | ||||||||||||||||||||

From net investment income | $ | (0.126 | ) | $ | (0.129 | ) | $ | (0.094 | ) | $ | (0.086 | ) | $ | (0.172 | ) | |||||

From net realized gain | — | — | (0.202 | ) | (0.033 | ) | — | |||||||||||||

Tax return of capital | (1.204 | ) | (1.200 | ) | (1.033 | ) | (1.413 | ) | (1.728 | ) | ||||||||||

Total distributions | $ | (1.330 | ) | $ | (1.329 | ) | $ | (1.329 | ) | $ | (1.532 | ) | $ | (1.900 | ) | |||||

Anti-dilutive effect of share repurchase program (see Note 5)(1) | $ | — | $ | 0.005 | $ | — | $ | — | $ | — | ||||||||||

Net asset value — End of year | $ | 14.840 | $ | 13.770 | $ | 13.650 | $ | 14.160 | $ | 14.510 | ||||||||||

Market value — End of year | $ | 14.010 | $ | 12.500 | $ | 11.720 | $ | 13.080 | $ | 15.050 | ||||||||||

Total Investment Return on Net Asset Value(2) | 19.08 | % | 11.77 | % | 7.48 | % | 9.22 | % | 39.22 | % | ||||||||||

Total Investment Return on Market Value(2) | 23.84 | % | 18.17 | % | (0.10 | )% | (2.73 | )% | 70.59 | % | ||||||||||

| Ratios/Supplemental Data | ||||||||||||||||||||

Net assets, end of year (000’s omitted) | $ | 943,887 | $ | 876,152 | $ | 871,184 | $ | 903,641 | $ | 921,312 | ||||||||||

Ratios (as a percentage of average daily net assets): | ||||||||||||||||||||

Expenses(3) | 1.09 | % | 1.09 | % | 1.09 | % | 1.07 | % | 1.08 | % | ||||||||||

Net investment income | 0.90 | % | 0.92 | % | 0.68 | % | 0.62 | % | 0.87 | % | ||||||||||

Portfolio Turnover | 2 | % | 5 | % | 20 | % | 11 | % | 16 | % | ||||||||||

| (1) | Computed using average shares outstanding. |

| (2) | Returns are historical and are calculated by determining the percentage change in net asset value or market value with all distributions reinvested. Distributions are assumed to be reinvested at prices obtained under the Fund’s dividend reinvestment plan. |

| (3) | Excludes the effect of custody fee credits, if any, of less than 0.005%. |

| 14 | See Notes to Financial Statements. |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Notes to Financial Statements

1 Significant Accounting Policies

Eaton Vance Tax-Managed Buy-Write Opportunities Fund (the Fund) is a Massachusetts business trust registered under the Investment Company Act of 1940, as amended (the 1940 Act), as a diversified, closed-end management investment company. The Fund’s primary investment objective is to provide current income and gains, with a secondary objective of capital appreciation.

The following is a summary of significant accounting policies of the Fund. The policies are in conformity with accounting principles generally accepted in the United States of America.

A Investment Valuation — The following methodologies are used to determine the market value or fair value of investments.

Equity Securities. Equity securities (including common shares of closed-end investment companies) listed on a U.S. securities exchange generally are valued at the last sale or closing price on the day of valuation or, if no sales took place on such date, at the mean between the closing bid and asked prices therefore on the exchange where such securities are principally traded. Equity securities listed on the NASDAQ Global or Global Select Market generally are valued at the NASDAQ official closing price. Unlisted or listed securities for which closing sales prices or closing quotations are not available are valued at the mean between the latest available bid and asked prices.

Derivatives. Exchange-traded options (other than FLexible EXchange traded options) are valued at the mean between the bid and asked prices at valuation time as reported by the Options Price Reporting Authority for U.S. listed options or by the relevant exchange or board of trade for non-U.S. listed options. Over-the-counter options and FLexible EXchange traded options traded at the Chicago Board Options Exchange are valued by a third party pricing service using techniques that consider factors including the value of the underlying instrument, the volatility of the underlying instrument and the period of time until option expiration.

Fair Valuation. Investments for which valuations or market quotations are not readily available or are deemed unreliable are valued at fair value using methods determined in good faith by or at the direction of the Trustees of the Fund in a manner that fairly reflects the security’s value, or the amount that the Fund might reasonably expect to receive for the security upon its current sale in the ordinary course. Each such determination is based on a consideration of relevant factors, which are likely to vary from one pricing context to another. These factors may include, but are not limited to, the type of security, the existence of any contractual restrictions on the security’s disposition, the price and extent of public trading in similar securities of the issuer or of comparable companies or entities, quotations or relevant information obtained from broker/dealers or other market participants, information obtained from the issuer, analysts, and/or the appropriate stock exchange (for exchange-traded securities), an analysis of the company’s or entity’s financial condition, and an evaluation of the forces that influence the issuer and the market(s) in which the security is purchased and sold.

B Investment Transactions — Investment transactions for financial statement purposes are accounted for on a trade date basis. Realized gains and losses on investments sold are determined on the basis of identified cost.

C Income — Dividend income is recorded on the ex-dividend date for dividends received in cash and/or securities. However, if the ex-dividend date has passed, certain dividends from foreign securities are recorded as the Fund is informed of the ex-dividend date. Withholding taxes on foreign dividends and capital gains have been provided for in accordance with the Fund’s understanding of the applicable countries’ tax rules and rates.

D Federal Taxes — The Fund’s policy is to comply with the provisions of the Internal Revenue Code applicable to regulated investment companies and to distribute to shareholders each year substantially all of its net investment income, and all or substantially all of its net realized capital gains. Accordingly, no provision for federal income or excise tax is necessary.

At December 31, 2013, the Fund, for federal income tax purposes, had deferred capital losses of $35,313,980 which will reduce its taxable income arising from future net realized gains on investment transactions, if any, to the extent permitted by the Internal Revenue Code, and thus will reduce the amount of distributions to shareholders, which would otherwise be necessary to relieve the Fund of any liability for federal income or excise tax. The deferred capital losses are treated as arising on the first day of the Fund’s next taxable year.

Additionally, at December 31, 2013, the Fund had a late year ordinary loss of $22, related to certain specified losses realized after October 31, 2013, which it has elected to defer to the following taxable year pursuant to income tax regulations.

As of December 31, 2013, the Fund had no uncertain tax positions that would require financial statement recognition, de-recognition, or disclosure. The Fund files a U.S. federal income tax return annually after its fiscal year-end, which is subject to examination by the Internal Revenue Service for a period of three years from the date of filing.

E Expense Reduction — State Street Bank and Trust Company (SSBT) serves as custodian of the Fund. Pursuant to the custodian agreement, SSBT receives a fee reduced by credits, which are determined based on the average daily cash balance the Fund maintains with SSBT. All credit balances, if any, used to reduce the Fund’s custodian fees are reported as a reduction of expenses in the Statement of Operations.

F Foreign Currency Translation — Other assets and liabilities initially expressed in foreign currencies are translated each business day into U.S. dollars based upon current exchange rates. Income and expenses denominated in foreign currencies are translated into U.S. dollars based upon currency exchange rates in effect on the respective dates of such transactions.

| 15 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Notes to Financial Statements — continued

G Use of Estimates — The preparation of the financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the financial statements and the reported amounts of income and expense during the reporting period. Actual results could differ from those estimates.

H Indemnifications — Under the Fund’s organizational documents, its officers and Trustees may be indemnified against certain liabilities and expenses arising out of the performance of their duties to the Fund. Under Massachusetts law, if certain conditions prevail, shareholders of a Massachusetts business trust (such as the Fund) could be deemed to have personal liability for the obligations of the Fund. However, the Fund’s Declaration of Trust contains an express disclaimer of liability on the part of Fund shareholders and the By-laws provide that the Fund shall assume the defense on behalf of any Fund shareholders. Moreover, the By-laws also provide for indemnification out of Fund property of any shareholder held personally liable solely by reason of being or having been a shareholder for all loss or expense arising from such liability. Additionally, in the normal course of business, the Fund enters into agreements with service providers that may contain indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Fund that have not yet occurred.

I Written Options — Upon the writing of a call or a put option, the premium received by the Fund is included in the Statement of Assets and Liabilities as a liability. The amount of the liability is subsequently marked-to-market to reflect the current market value of the option written, in accordance with the Fund’s policies on investment valuations discussed above. Premiums received from writing options which expire are treated as realized gains. Premiums received from writing options which are exercised or are closed are added to or offset against the proceeds or amount paid on the transaction to determine the realized gain or loss. When an index option is exercised, the Fund is required to deliver an amount of cash determined by the excess of the strike price of the option over the value of the index (in the case of a put) or the excess of the value of the index over the strike price of the option (in the case of a call) at contract termination. If a put option on a security is exercised, the premium reduces the cost basis of the securities purchased by the Fund. The Fund, as a writer of an option, may have no control over whether the underlying securities or other assets may be sold (call) or purchased (put) and, as a result, bears the market risk of an unfavorable change in the price of the securities or other assets underlying the written option. The Fund may also bear the risk of not being able to enter into a closing transaction if a liquid secondary market does not exist.

2 Distributions to Shareholders

Subject to its Managed Distribution Plan, the Fund makes monthly distributions from its cash available for distribution, which consists of the Fund’s dividends and interest income after payment of Fund expenses, net option premiums and net realized and unrealized gains on stock investments. The Fund intends to distribute all or substantially all of its net realized capital gains. Distributions are recorded on the ex-dividend date. The Fund distinguishes between distributions on a tax basis and a financial reporting basis. Accounting principles generally accepted in the United States of America require that only distributions in excess of tax basis earnings and profits be reported in the financial statements as a return of capital. Permanent differences between book and tax accounting relating to distributions are reclassified to paid-in capital. For tax purposes, distributions from short-term capital gains are considered to be from ordinary income. Distributions in any year may include a substantial return of capital component.

The tax character of distributions declared for the years ended December 31, 2013 and December 31, 2012 was as follows:

| Year Ended December 31, | ||||||||

| 2013 | 2012 | |||||||

Distributions declared from: | ||||||||

Ordinary income | $ | 8,037,102 | $ | 8,256,794 | ||||

Tax return of capital | $ | 76,545,224 | $ | 76,485,243 | ||||

During the year ended December 31, 2013, accumulated net realized loss was decreased by $58,524 and accumulated undistributed net investment income was decreased by $58,524 due to differences between book and tax accounting, primarily for distributions from real estate investment trusts (REITs), return of capital distributions from securities and foreign currency gain (loss). These reclassifications had no effect on the net assets or net asset value per share of the Fund.

As of December 31, 2013, the components of distributable earnings (accumulated losses) and unrealized appreciation (depreciation) on a tax basis were as follows:

Deferred capital losses | $ | (35,313,980 | ) | |

Late year ordinary losses | $ | (22 | ) | |

Net unrealized appreciation | $ | 538,759,820 |

The differences between components of distributable earnings (accumulated losses) on a tax basis and the amounts reflected in the Statement of Assets and Liabilities are primarily due to distributions from REITs, return of capital distributions from securities, written options contracts and wash sales.

| 16 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Notes to Financial Statements — continued

3 Investment Adviser Fee and Other Transactions with Affiliates

The investment adviser fee is earned by Eaton Vance Management (EVM) as compensation for management and investment advisory services rendered to the Fund. The fee is computed at an annual rate of 1.00% of the Fund’s average daily gross assets and is payable monthly. Gross assets as referred to herein represent net assets plus obligations attributable to investment leverage, if any. For the year ended December 31, 2013, the Fund’s investment adviser fee amounted to $9,106,269. Pursuant to a sub-advisory agreement, EVM has delegated a portion of the investment management to Parametric Portfolio Associates LLC (Parametric), a majority-owned subsidiary of Eaton Vance Corp. EVM pays Parametric a portion of its advisory fee for sub-advisory services provided to the Fund. EVM also serves as administrator of the Fund, but receives no compensation.

Trustees and officers of the Fund who are members of EVM’s organization receive remuneration for their services to the Fund out of the investment adviser fee. Trustees of the Fund who are not affiliated with EVM may elect to defer receipt of all or a percentage of their annual fees in accordance with the terms of the Trustees Deferred Compensation Plan. For the year ended December 31, 2013, no significant amounts have been deferred. Certain officers and Trustees of the Fund are officers of EVM.

4 Purchases and Sales of Investments

Purchases and sales of investments, other than short-term obligations, aggregated $17,179,415 and $188,106,911, respectively, for the year ended December 31, 2013.

5 Common Shares of Beneficial Interest

The Fund may issue common shares pursuant to its dividend reinvestment plan. There were no common shares issued by the Fund for the years ended December 31, 2013 and December 31, 2012.

On August 6, 2012, the Board of Trustees of the Fund authorized the repurchase by the Fund of up to 10% of its then currently outstanding common shares in open-market transactions at a discount to net asset value (NAV). On September 30, 2013, the Board of Trustees of the Fund approved the continuation of the Fund’s share repurchase program. The Board authorized the repurchase by the Fund of up to 10% of its common shares outstanding as of September 30, 2013 in open market transactions at a discount to NAV. The terms of the reauthorization increased the number of shares available for repurchase. The repurchase program does not obligate the Fund to purchase a specific amount of shares. There were no repurchases of common shares by the Fund for the year ended December 31, 2013. During the year ended December 31, 2012, the Fund repurchased 202,000 of its common shares under the share repurchase program at a cost, including brokerage commissions, of $2,582,682 and an average price per share of $12.79. The weighted average discount per share to NAV on these repurchases amounted to 10.60% for the year ended December 31, 2012.

6 Federal Income Tax Basis of Investments

The cost and unrealized appreciation (depreciation) of investments of the Fund at December 31, 2013, as determined on a federal income tax basis, were as follows:

Aggregate cost | $ | 420,863,751 | ||

Gross unrealized appreciation | $ | 538,759,830 | ||

Gross unrealized depreciation | — | |||

Net unrealized appreciation | $ | 538,759,830 | ||

7 Financial Instruments

The Fund may trade in financial instruments with off-balance sheet risk in the normal course of its investing activities. These financial instruments may include written options and may involve, to a varying degree, elements of risk in excess of the amounts recognized for financial statement purposes. The notional or contractual amounts of these instruments represent the investment the Fund has in particular classes of financial instruments and do not necessarily represent the amounts potentially subject to risk. The measurement of the risks associated with these instruments is meaningful only when all related and offsetting transactions are considered. A summary of written options at December 31, 2013 is included in the Portfolio of Investments.

| 17 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Notes to Financial Statements — continued

Written options activity for the year ended December 31, 2013 was as follows:

| Number of Contracts | Premiums Received | |||||||

Outstanding, beginning of year | 4,785 | $ | 10,518,526 | |||||

Options written | 56,095 | 129,002,543 | ||||||

Options terminated in closing purchase transactions | (49,235 | ) | (115,458,401 | ) | ||||

Options expired | (7,690 | ) | (16,002,582 | ) | ||||

Outstanding, end of year | 3,955 | $ | 8,060,086 | |||||

All of the assets of the Fund are subject to segregation to satisfy the requirements of the escrow agent. At December 31, 2013, the Fund had sufficient cash and/or securities to cover commitments under these contracts.

The Fund is subject to equity price risk in the normal course of pursuing its investment objectives. The Fund writes index call options above the current value of the index to generate premium income. In writing index call options, the Fund in effect, sells potential appreciation in the value of the applicable index above the exercise price in exchange for the option premium received. The Fund retains the risk of loss, minus the premium received, should the price of the underlying index decline.

The fair value of open derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) and whose primary underlying risk exposure is equity price risk at December 31, 2013 was as follows:

| Fair Value | ||||||||

| Derivative | Asset Derivative | Liability Derivative | ||||||

Written options | $ | — | $ | (18,408,600 | )(1) | |||

| (1) | Statement of Assets and Liabilities location: Written options outstanding, at value. |

The effect of derivative instruments (not considered to be hedging instruments for accounting disclosure purposes) on the Statement of Operations and whose primary underlying risk exposure is equity price risk for the year ended December 31, 2013 was as follows:

| Derivative | Realized Gain (Loss) on Derivatives Recognized in Income | Change in Unrealized Appreciation (Depreciation) on Derivatives Recognized in Income | ||||||

Written options | $ | (92,812,620 | )(1) | $ | (14,719,115 | )(2) | ||

| (1) | Statement of Operations location: Net realized gain (loss) – Written options. |

| (2) | Statement of Operations location: Change in unrealized appreciation (depreciation) – Written options. |

8 Fair Value Measurements

Under generally accepted accounting principles for fair value measurements, a three-tier hierarchy to prioritize the assumptions, referred to as inputs, is used in valuation techniques to measure fair value. The three-tier hierarchy of inputs is summarized in the three broad levels listed below.

| Ÿ | Level 1 – quoted prices in active markets for identical investments |

| Ÿ | Level 2 – other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.) |

| Ÿ | Level 3 – significant unobservable inputs (including a fund’s own assumptions in determining the fair value of investments) |

In cases where the inputs used to measure fair value fall in different levels of the fair value hierarchy, the level disclosed is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

| 18 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Notes to Financial Statements — continued

At December 31, 2013, the hierarchy of inputs used in valuing the Fund’s investments and open derivative instruments, which are carried at value, were as follows:

| Asset Description | Level 1 | Level 2 | Level 3 | Total | ||||||||||||

Common Stocks | $ | 959,623,581 | * | $ | — | $ | — | $ | 959,623,581 | |||||||

Total Investments | $ | 959,623,581 | $ | — | $ | — | $ | 959,623,581 | ||||||||

Liability Description | ||||||||||||||||

Call Options Written | $ | (18,408,600 | ) | $ | — | $ | — | $ | (18,408,600 | ) | ||||||

Total | $ | (18,408,600 | ) | $ | — | $ | — | $ | (18,408,600 | ) | ||||||

| * | The level classification by major category of investments is the same as the category presentation in the Portfolio of Investments. |

The Fund held no investments or other financial instruments as of December 31, 2012 whose fair value was determined using Level 3 inputs. At December 31, 2013, there were no investments transferred between Level 1 and Level 2 during the year then ended.

| 19 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Report of Independent Registered Public Accounting Firm

To the Trustees and Shareholders of Eaton Vance Tax-Managed Buy-Write Opportunities Fund:

We have audited the accompanying statement of assets and liabilities of Eaton Vance Tax-Managed Buy-Write Opportunities Fund (the “Fund”), including the portfolio of investments, as of December 31, 2013, and the related statement of operations for the year then ended, the statements of changes in net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. The Fund is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements, assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and brokers; where replies were not received from brokers, we performed other auditing procedures. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, such financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of Eaton Vance Tax-Managed Buy-Write Opportunities Fund as of December 31, 2013, the results of its operations for the year then ended, the changes in its net assets for each of the two years in the period then ended, and the financial highlights for each of the five years in the period then ended, in conformity with accounting principles generally accepted in the United States of America.

DELOITTE & TOUCHE LLP

Boston, Massachusetts

February 17, 2014

| 20 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Federal Tax Information (Unaudited)

The Form 1099-DIV you received in January 2014 showed the tax status of all distributions paid to your account in calendar year 2013. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. The Fund designates approximately $17,884,361, or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for the reduced tax rate of 15%.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the Fund’s fiscal 2013 ordinary income dividends, 100% qualifies for the corporate dividends received deduction.

| 21 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Dividend Reinvestment Plan

The Fund offers a dividend reinvestment plan (Plan) pursuant to which shareholders may elect to have distributions automatically reinvested in common shares (Shares) of the Fund. You may elect to participate in the Plan by completing the Dividend Reinvestment Plan Application Form. If you do not participate, you will receive all distributions in cash paid by check mailed directly to you by American Stock Transfer & Trust Company, LLC (AST) as dividend paying agent. On the distribution payment date, if the NAV per Share is equal to or less than the market price per Share plus estimated brokerage commissions, then new Shares will be issued. The number of Shares shall be determined by the greater of the NAV per Share or 95% of the market price. Otherwise, Shares generally will be purchased on the open market by AST, the Plan agent (Agent). Distributions subject to income tax (if any) are taxable whether or not Shares are reinvested.

If your Shares are in the name of a brokerage firm, bank, or other nominee, you can ask the firm or nominee to participate in the Plan on your behalf. If the nominee does not offer the Plan, you will need to request that the Fund’s transfer agent re-register your Shares in your name or you will not be able to participate.

The Agent’s service fee for handling distributions will be paid by the Fund. Plan participants will be charged their pro rata share of brokerage commissions on all open-market purchases.

Plan participants may withdraw from the Plan at any time by writing to the Agent at the address noted on the following page. If you withdraw, you will receive Shares in your name for all Shares credited to your account under the Plan. If a participant elects by written notice to the Agent to sell part or all of his or her Shares and remit the proceeds, the Agent is authorized to deduct a $5.00 fee plus brokerage commissions from the proceeds.

If you wish to participate in the Plan and your Shares are held in your own name, you may complete the form on the following page and deliver it to the Agent. Any inquiries regarding the Plan can be directed to the Agent at 1-866-439-6787.

| 22 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Application For Participation In Dividend Reinvestment Plan

This form is for shareholders who hold their common shares in their own names. If your common shares are held in the name of a brokerage firm, bank, or other nominee, you should contact your nominee to see if it will participate in the Plan on your behalf. If you wish to participate in the Plan, but your brokerage firm, bank, or nominee is unable to participate on your behalf, you should request that your common shares be re-registered in your own name which will enable your participation in the Plan.

The following authorization and appointment is given with the understanding that I may terminate it at any time by terminating my participation in the Plan as provided in the terms and conditions of the Plan.

Please print exact name on account:

Shareholder signature Date

Shareholder signature Date

Please sign exactly as your common shares are registered. All persons whose names appear on the share certificate must sign.

YOU SHOULD NOT RETURN THIS FORM IF YOU WISH TO RECEIVE YOUR DISTRIBUTIONS IN CASH. THIS IS NOT A PROXY.

This authorization form, when signed, should be mailed to the following address:

Eaton Vance Tax-Managed Buy-Write Opportunities Fund

c/o American Stock Transfer & Trust Company, LLC

P.O. Box 922

Wall Street Station

New York, NY 10269-0560

Number of Employees

The Fund is organized as a Massachusetts business trust and is registered under the Investment Company Act of 1940, as amended, as a closed-end management investment company and has no employees.

Number of Shareholders

As of December 31, 2013, Fund records indicate that there are 27 registered shareholders and approximately 35,484 shareholders owning the Fund shares in street name, such as through brokers, banks, and financial intermediaries.

If you are a street name shareholder and wish to receive Fund reports directly, which contain important information about the Fund, please write or call:

Eaton Vance Distributors, Inc.

Two International Place

Boston, MA 02110

1-800-262-1122

New York Stock Exchange symbol

The New York Stock Exchange symbol is ETV.

| 23 |

Eaton Vance

Tax-Managed Buy-Write Opportunities Fund

December 31, 2013

Management and Organization