Eagle Bulk Shipping Inc.

3Q 2006 Results Presentation

November 9, 2006

Forward Looking Statements

This presentation contains certain statements that may be deemed to be “forward-looking statements” within

the meaning of the Securities Acts. Forward-looking statements reflect management’s current views with

respect to future events and financial performance and may include statements concerning plans, objectives,

goals, strategies, future events or performance, and underlying assumptions and other statements, which are

other than statements of historical facts. The forward-looking statements in this presentation are based upon

various assumptions, many of which are based, in turn, upon further assumptions, including without

limitation, management's examination of historical operating trends, data contained in our records and other

data available from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were

reasonable when made, because these assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc.

cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Important

factors that, in our view, could cause actual results to differ materially from those discussed in the forward-

looking statements include the strength of world economies and currencies, general market conditions,

including changes in charterhire rates and vessel values, changes in demand that may affect attitudes of time

charterers to scheduled and unscheduled drydocking, changes in our vessel operating expenses, including

dry-docking and insurance costs, or actions taken by regulatory authorities, ability of our counterparties to

perform their obligations under sales agreements and charter contracts on a timely basis, potential liability

from future litigation, domestic and international political conditions, potential disruption of shipping routes

due to accidents and political events or acts by terrorists. Risks and uncertainties are further described in

reports filed by Eagle Bulk Shipping Inc. with the US Securities and Exchange Commission.

1

Agenda

Third Quarter 2006 Highlights

The Fleet

Industry View

Financial Overview

Conclusion

2

3Q 2006 Highlights

3Q 2006 Highlights

Gross Time Charter Revenues of $30.7 million

Net Income of $9.1 million includes non-dilutive, non-cash

compensation charge of $3.1 million

Excluding the non-cash compensation charge, Adjusted

Net Income was $12.2 million or $0.34 per share

EBITDA1 of $22.1 million

Paid 3Q Cash Earnings Dividend of $0.51 on Nov 2, 2006

Took Delivery of the 3 Supramax vessels acquired for $105

million

Combined take-over time of only 1.3 days before

entering charters

All 3 vessels delivered and on charter within 15 days of

signing purchase contracts

1 EBITDA, as defined by our credit agreement, is Net Income plus Interest Expense, Depreciation and

Amortization, and Exceptional Items.

4

Newbuild Vessels

Fleet Impact*

Contracted for 2 Japanese 56,000

dwt Supramax vessels with IHI

Marine United for an average

contract price of $33.5 million each

Delivery expected in January 2010

and February 2010

Increased credit facility to $500

million from $450 million

Balance sheet remains conservative

at 40% net debt/capitalization

Number of vessels increases from 16

to 18

Cargo carrying capacity expands by

14% to 910,000 dwt

Reduces fleet average age

Increases availability from $235

million to over $260 million

Newbuild Costs to be Capitalized

eliminating any impact on current

cashflows

Recent Events – Investing in Future Cashflow

Quarterly Dividend Cashflow Maintained

* Proforma

5

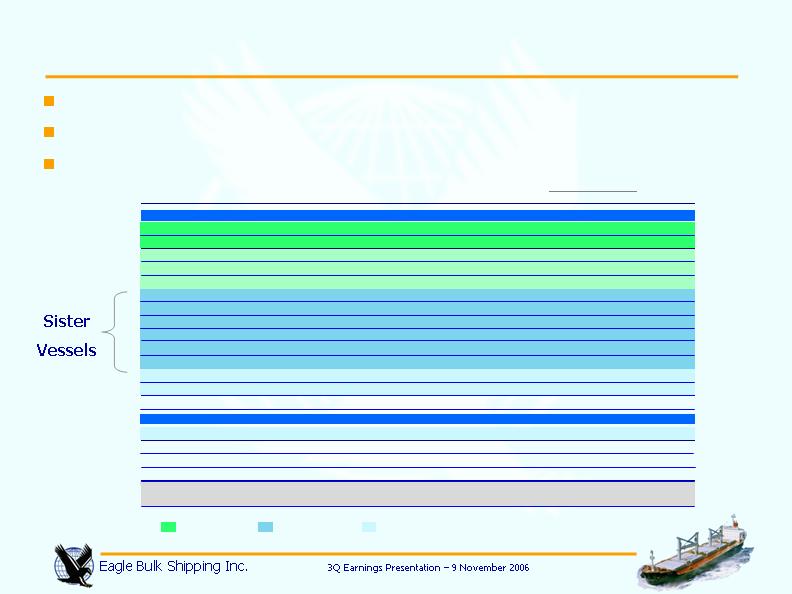

The Fleet

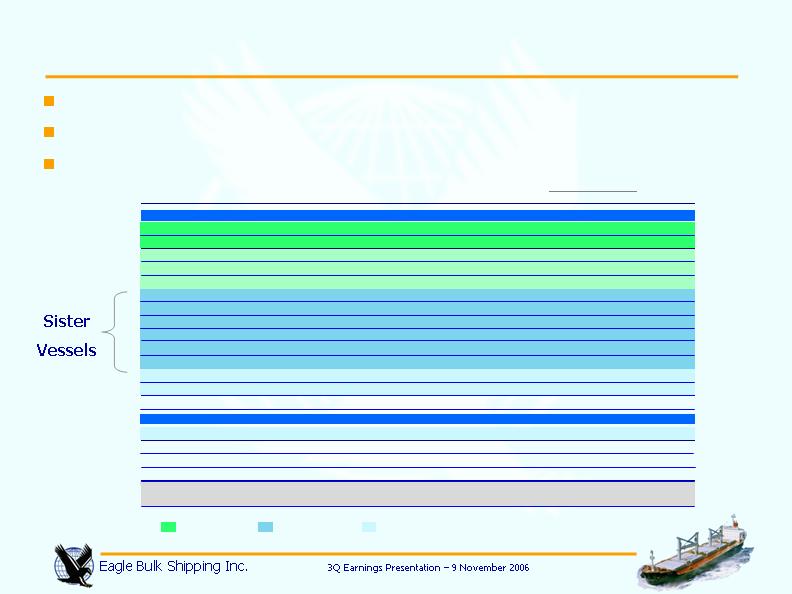

Average fleet age of under 6 years compared to industry average of over 15 years

Sistership strategy provides economies of scale

Cargo cranes and grabs on entire fleet maximizes utility of Eagle’s assets

Modern, High Quality Fleet of Handymax Vessels

7

Deadweight

Year

Length

Ship’s Cargo Gear

Vessel

(

Dwt)

Built

in meters

Cranes

Grabs

SUPRAMAX CLASS

Golden Eagle

56,000

2010

190 m

4 x 30 Tons

4 x 12 m3

Imperial Eagle

56,000

2010

190 m

4 x 30 Tons

Jaeger

52,248

2004

190 m

4 x 30 Tons

Kestrel I

50,326

2004

190 m

4 x 30 Tons

Tern

50,200

2003

190 m

4 x 30 Tons

Condor

50,296

2001

190 m

4 x 30 Tons

Falcon

50,296

2001

190 m

4 x 30 Tons

Harrier

50,296

2001

190 m

4 x 30 Tons

Hawk I

50,296

2001

190 m

4 x 30 Tons

Merlin

50,296

2001

190 m

4 x 30 Tons

Osprey I

50,206

2002

190 m

4 x 30 Tons

Cardinal

55,408

2004

190 m

4 x 30 Tons

Peregrine

50,913

2001

190 m

4 x 30 Tons

Heron

52,827

2001

190 m

4 x 30 Tons

HANDYMAX CLASS

Sparrow

48,225

2000

189 m

4 x 30 Tons

Kite

47,195

1997

190 m

4 x 30 Tons

Griffon

46,635

1995

190 m

4 x 30 Tons

Shikra

41,096

1984

185 m

4 x 25 Tons

Fleet Total Dwt

796,663

Fleet Average Age

5.7 years

(excluding Newbuild Vessels)

Newbuildings

Sister Ships

Similar Ships

**Represents Dwt weighted average age

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 12 m3

4 x 8 m3

4 x 12.5 m3

4 x 12 m3

4 x 12 m3

4 x 10 m3

4 x 10 m3

4 x 10 m3

4 x 8 m3

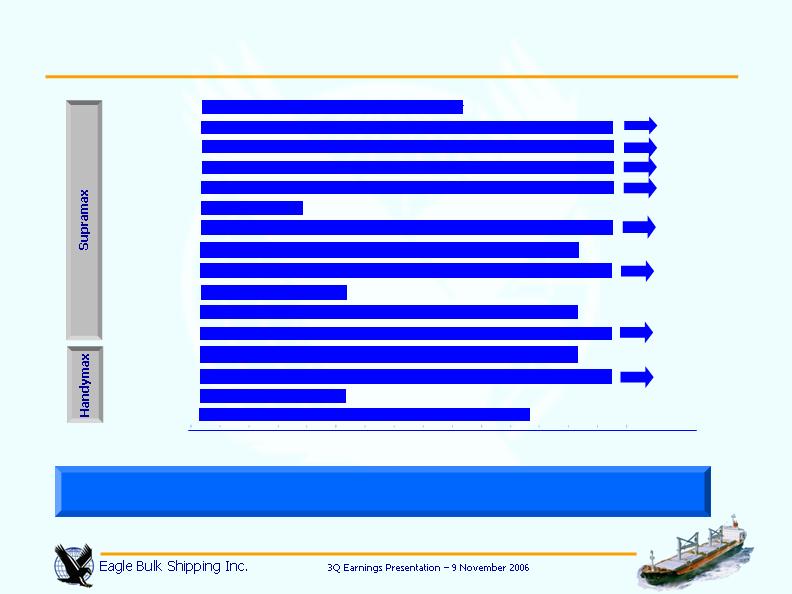

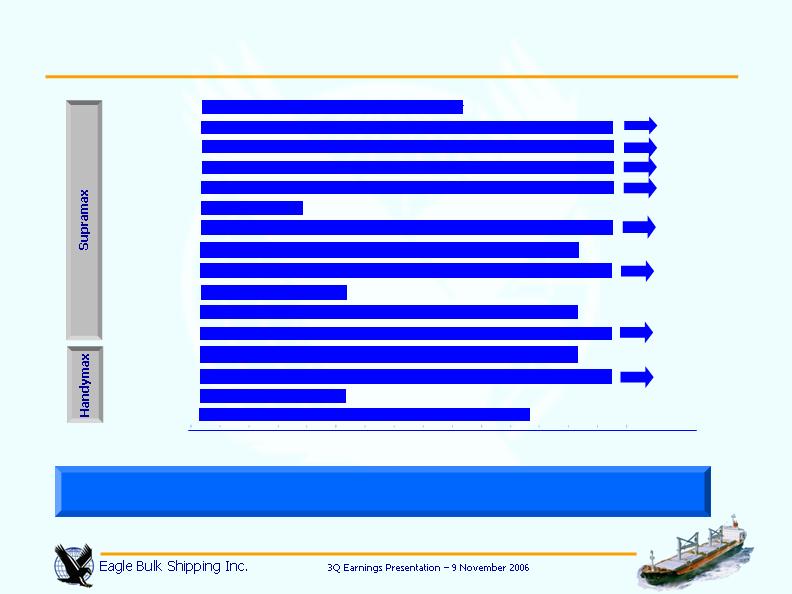

Eagle Captures Today’s Drybulk Values for Extended Periods

Charter renewals at today’s healthy rates extends high cashflow generation

Period cover extends revenue visibility and predictability and limits spot volatility

100% of 2006 fleet covered by contracts

79% of 2007 fleet covered by contracts

Vessel

Charter

Commences

Charter

Period

Charter Rate

Sparrow

Oct 2006 -

Jan 2007

11 - 13 months

$24,000 per day

(floor rate) plus

profit share

Hawk I

Apr 2007

24 - 26 months

$22,000 per day

Condor

Oct 2006 -

Mar 2007

26 - 29 months

$20,500 per day

Griffon

Jan - Apr

2007

24 - 26 months

$20,075 per day

8

Time Charter Contracts Provide Stable and Visible Cashflows

Fleet contracted revenues in excess of $175 million at attractive rates

9

SHIKRA

KITE

GRIFFON

SPARROW

PEREGRINE

HERON

CARDINAL

OSPREY I

MERLIN

HAWK I

HARRIER

FALCON

CONDOR

KESTREL I

TERN

JAEGER

3Q 2007

4Q 2007

4Q 2006

2Q 2006

$18,550

Daily

Charter Rates

$14,800

$20,075

$24,000

$21,000

$22,000

$24,000

$23,750

$20,500

$24,000

$20,500

$26,500

$20,950

$18,750

$19,000

1Q 2007

$14,750

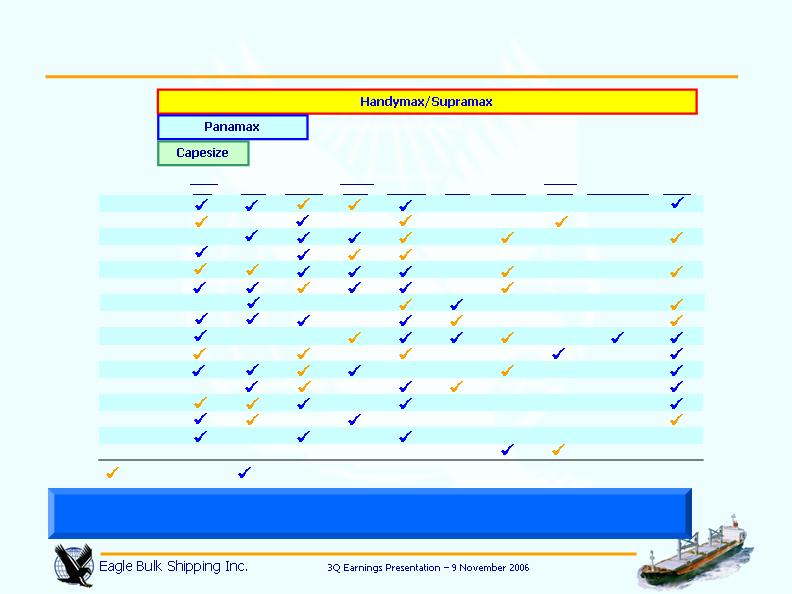

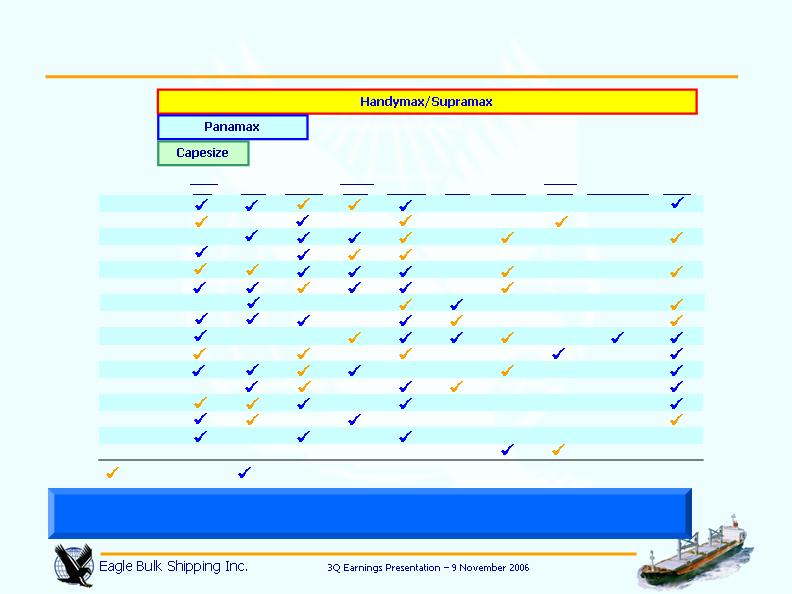

Charterers Attracted by Versatility of Handymax Vessels

MISC. cargoes include Phosrock, Sugar, HBI, and Concentrates

Eagle’s Cargo Carriage Span the Drybulk Sector

3Q 2006 YTD 2006

10

IRON

ORE

COAL

GRAINS

OTHER

ORES

CEMENT

COKE

STEELS

SCRAP

IRON

AGGREGATES

MISC.

Cardinal

Condor

Falcon

Griffon

Harrier

Hawk I

Heron

Kite

Merlin

Osprey I

Peregrine

Shikra

Sparrow

Kestrel I

Tern

Jaeger

Industry View

Drybulk Demand Easily Absorbing Supply

World output growth expected at 5.1% in 2006

and forecast 4.9% in 2007

Strongest 4-year period of global

expansion since early 1970s

China to sustain growth at an average 10% for

2006 and 2007

Emerging Markets growth at 7.3% in 2006 and

7.2% in 2007

India to sustain growth at 8% for 2006

and 2007

Persian Gulf states to invest $100 billion for

infrastructure

Gulf States 2006 GDP growth at 7.2%

24% of the world’s high-rise building

cranes are in Dubai

Shift in trade patterns towards BRIC countries

(Brazil, Russia, India, China) increases ton-mile

demand

Chinese coastal trade, an unreported shipping

statistic, now a major factor

Source: IMF, Financial Times

Construction Boom

Dubai

12

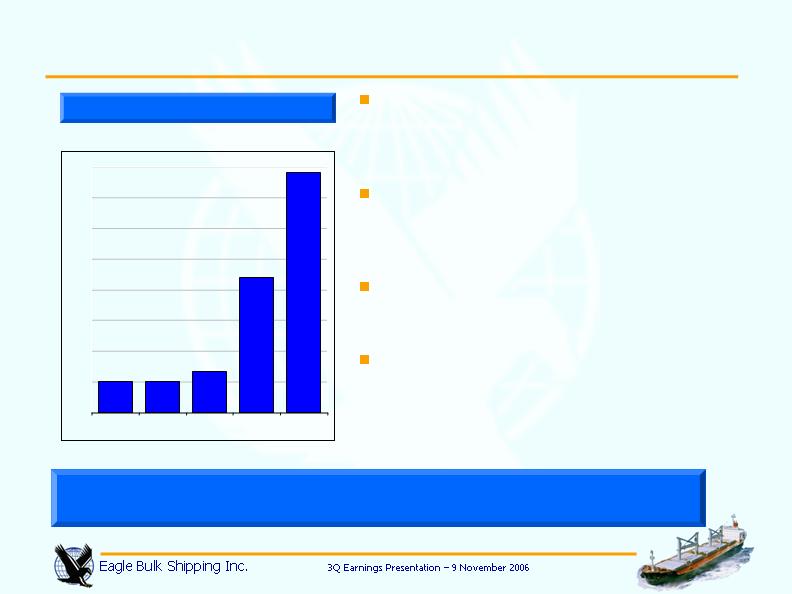

Eagle Fleet Well-Positioned for Changing Trade Patterns

Chinese 2006 iron ore imports jump by

16% to 320m tons while cement and steel

exports surge 126% and 58% respectively

– a major boost for Supramax owners

Grain demand into India forecast to

increase by 6m tons* – this equates to an

extra 150 cargoes on Handymax/Supramax

vessels

Approximately 60% of Chinese berths

cannot handle Panamax or Capesize

vessels**

Approximately 25% of Chinese berths

require vessels with cargo gear ** – a

constraint only satisfied by sub-Panamax

sector vessels

Vessel Gear increases flexibility and broadens customer base

Source: * Clarksons ; ** J.E.Hyde

13

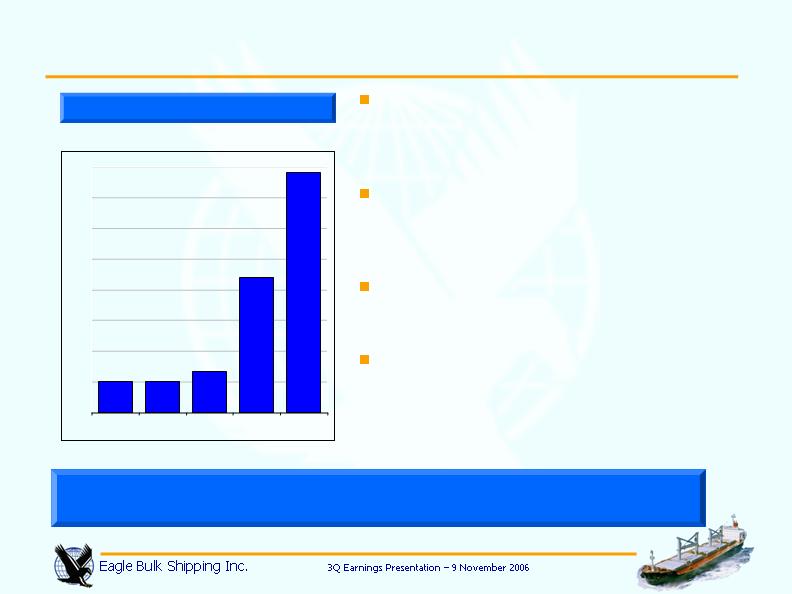

Source: HSBC – July 2006

Chinese Cement Exports

5.0

5.0

6.6

22.0

39.0

-

5

10

15

20

25

30

35

40

2002

2003

2004

2005

2006

(m tons)

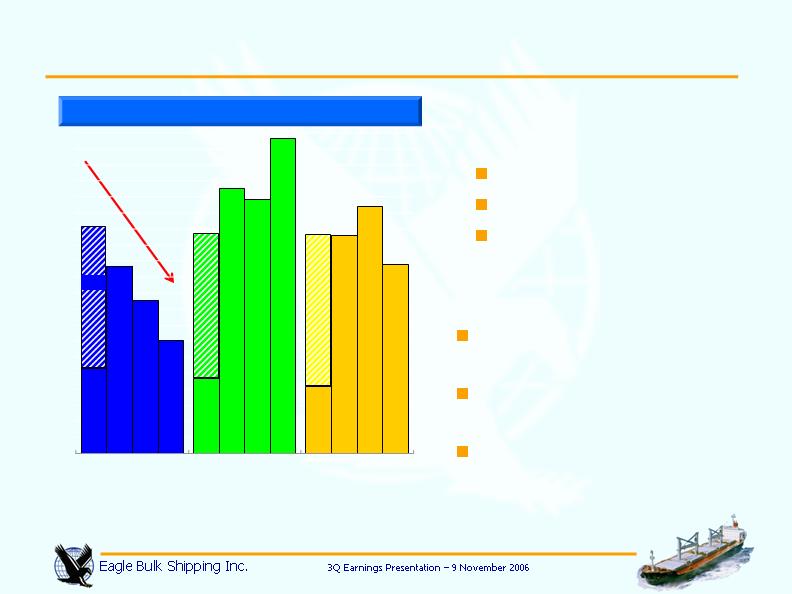

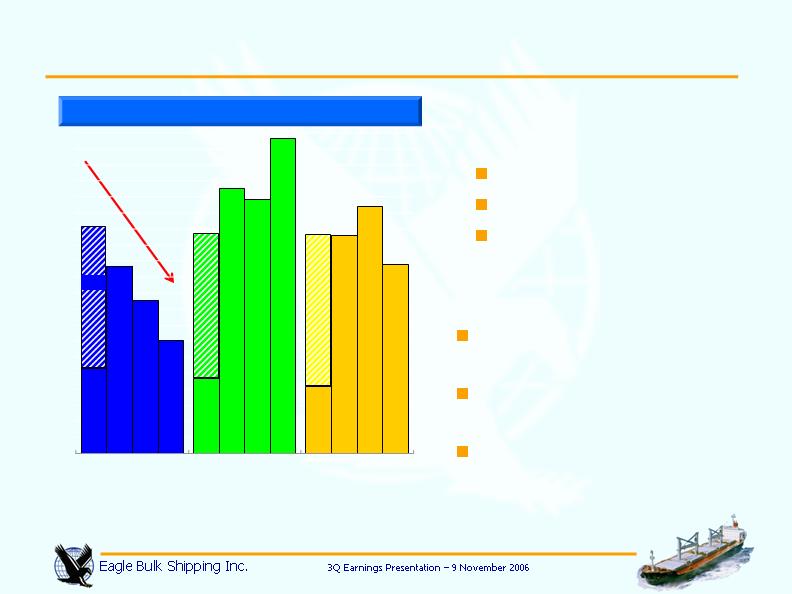

Drybulk supply position :

Lowest supply as a percentage

of existing fleet

Lowest orderbook supply in

million dwt

Only sector with consistently

declining orderbook through

2009

Striped Bars = Deliveries through September 2006

14

World Vessel Supply 2006-2009

Source: Clarksons as of October 2006

Drybulk Sector – Best Market to be in the Next 3 Years

9.40

0.42

11.72

1.36

23.30

33.01

1.54

31.62

19.07

14.11

39.22

1.18

Drybulk

(m dwt)

Tankers

(m dwt)

Containers

(m teu)

2006 2007 2008 2009

17.73

17.95

0.94

2006 2007 2008 2009

2006 2007 2008 2009

Supply as % of fleet :

as of

1 Jan 06

1 Oct 06

Drybulk :

19%

21%

Tankers :

25%

34%

Containers:

53%

53%

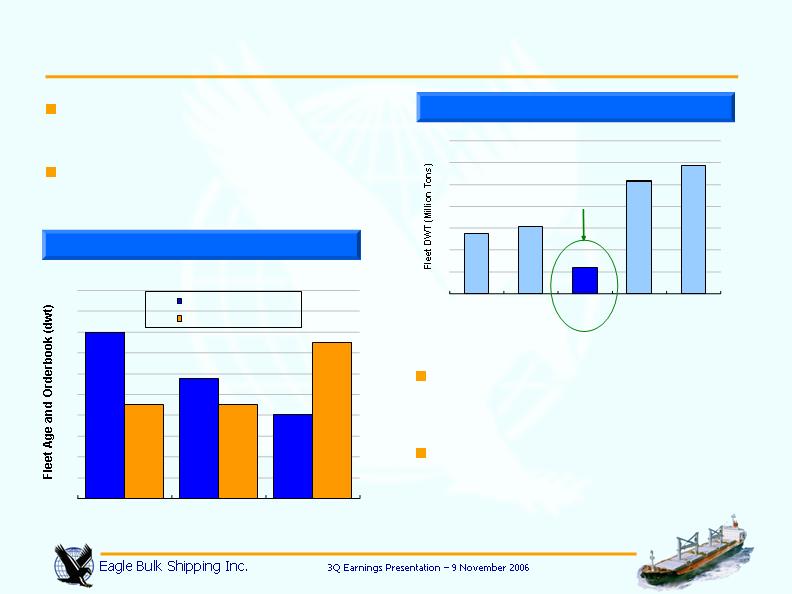

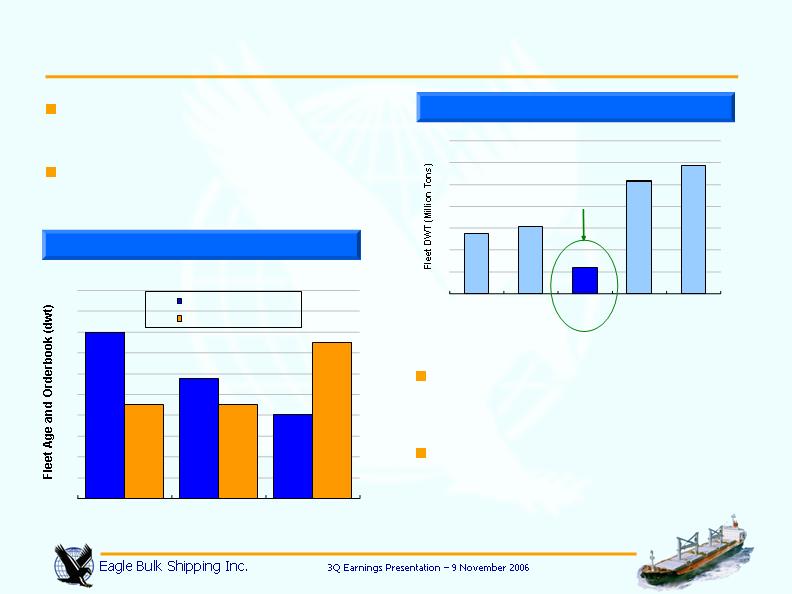

12 of the 16 vessels owned by the

Company are Supramaxes

Smallest segment of the drybulk

market provides opportunities

New Supramax Asset Class Services Growing Global Needs

Source: Clarksons as of October 2006

Aging Handymax fleet — 32% of

capacity > 20 years old

Number of Handymax vessels over

20 years old is 200% of the

orderbook

Orderbook and Fleet Age

102.8

23.6

61.0

117.2

55.6

0

20

40

60

80

100

120

140

Handy

(10,000/34,999

dwt)

Handymax

(35,000/49,999

dwt)

Supramax

(50,000/59,999

dwt)

Panamax

(60,000/99,999

dwt)

Capesize

(>100,000 dwt)

2,276 Vsls

445 Vsls

692 Vsls

1,434 Vsls

1,435 Vsls

Eagle’s focus

15

World Dry Bulk Fleet

32%

23%

16%

18%

18%

30%

0%

4%

8%

12%

16%

20%

24%

28%

32%

36%

40%

Handymax

Panamax

Capesize

% of Fleet > 20 years

Orderbook as % of Fleet

Financial Overview

Fleet Data

Ownership days: The Company defines ownership days as the aggregate number of days in a period during which each

vessel in its fleet has been owned.

Available days: The Company defines available days as the number of ownership days less the aggregate number of days

that its vessels are off-hire due to vessel familiarization upon acquisition, scheduled drydocks, repairs or repairs under

guarantee, vessel upgrades or special surveys and the aggregate amount of time that we spend positioning our vessels.

Operating days: The Company defines operating days as the number of its available days in a period less the aggregate

number of days that the vessels are off-hire due to any reason, including unforeseen circumstances.

Drydock days: The Company undertakes major capital expenditures which include a maintenance program of regularly

scheduled drydocking necessary to preserve the quality of our vessels as well as to comply with international shipping

standards and environmental laws and regulations. Although the Company has some flexibility regarding the timing of its

dry docking, management anticipates that vessels are to be drydocked every two and a half years. The Company

anticipates that this process of recertification will require it to reposition these vessels from a discharge port to shipyard

facilities, which will reduce available days and operating days during that period.

Net revenues include billed time charter revenues, deductions for brokerage commissions and amortization of net prepaid

and deferred charter revenue.

Fleet Operating Days

Q1 2006

Q2 2006

Q3 2006

Q4 2006 (E)

Ownership Days

1,170

1,183

1,463

1,472

Less : Drydock Days

44

-

20

-

Available Days

1,126

1,183

1,443

1,472

Operating Days

1,116

1,181

1,437

-

Fleet Utilization

99.1%

99.9%

99.6%

-

Three months ended

17

3rd Quarter 2006 Earnings

($000's)

REVENUES

Net Time Charter Revenues

29,084

78,690

Less : Amortization of Prepaid and Deferred Revenue

725

2,436

Net Revenues

28,359

76,254

EXPENSES

Vessel Expenses

6,118

15,742

Depreciation and Amortization

5,981

15,738

General & Administrative Expenses

1,267

3,365

Non-cash Compensation Expense

3,077

5,768

Total Expenses

16,442

40,614

OPERATING INCOME

11,916

35,639

Interest Expense

3,180

7,364

Interest Income

(365)

(1,010)

NET INCOME

$9,101

$29,285

Basic and Diluted Income per Common Share

$0.25

$0.86

Weighted Average Shares Outstanding

35,900,000

34,086,813

Diluted Shares Outstanding

35,900,678

34,086,848

Adjusted Net Income

(non-GAAP measure)

:

Net Income

$9,101

$29,285

Add : Non-cash Compensation Expense

3,077

5,768

Adjusted Net Income :

$12,177

$35,053

Basic and Diluted Adjusted Net Income per Common Share

$0.34

$1.03

Three-months ended

Sept. 30, 2006

Nine-months ended

Sept. 30, 2006

18

Daily cash breakeven cost of $6,947 per day per vessel (2006E)

Low cost basis enables cash operating margins of 75%

No principal repayments until 2012

Low Breakeven Cost Strategy

The Company is anticipating higher crewing costs and higher costs for oil based supplies including lubes and paints. The

Company is also making allowance for constraints in yard drydocking capacity which has driven up drydocking costs.

19

$384

$3,750

$284

$806

$1,723

Dry-Dock

Vessel Expenses

Technical Mgt Fees

G&A

Cash Interest (net)

Strong Balance Sheet

* Net Debt is pro forma after taking into effect 3Q Dividend payment of $18.31 million.

** Liquidity includes undrawn amounts available under the enhanced credit facility

BALANCE SHEET DATA

Sept. 30, 2006

Newbuild

Acquisitions

Pro forma

Sept. 30, 2006

(in $ 000's)

(unaudited)

Cash

$23,214

-

$23,214

Other Current Assets

6,841

-

6,841

Advances for Vessels

-

25,048

25,048

Vessels, net

507,471

-

507,471

Restricted Cash

6,525

-

6,525

Other Assets

7,833

-

7,833

TOTAL ASSETS

551,884

576,932

Current Liabilities

7,759

-

7,759

Long-term Debt

214,800

25,048

239,848

Stockholders' Equity

329,326

-

329,326

Book Capitalization

569,174

Net Debt / Capitalization*

40.1%

Liquidity **

271,582

20

Revolving Credit Facility increased to $500 million

Interest only until 2012

* Thereafter semi-annual reduction in availability to Balloon

Ample Liquidity for Growth

Credit Facility Increased at Favorable Terms

Amount

$500 million

Maturity

July 2016

Interest Only until (at least)

July 2012

Interest Margin

Libor + 75/85

basis points

Commitment Fees on

undrawn amounts

25 basis points

Availabilty in full for next *

6 years

Balloon

$270 million

21

Conclusion

Poised for Growth

High Dividends

Operate a modern, homogenous

Supramax fleet

Stable and visible cashflows from

1 to 3 year time charters

79% of 2007 fleet days covered

by fixed contracts

Low cash breakeven of

$6,947/day

Strong balance sheet with Net

Debt to Capital of 40%

No debt amortization until 2012

Increased liquidity of $271m

Full cash payout dividend policy

Paid Dividends of $86.4 million or

$2.61 per share to shareholders

since September 2005

Demonstrates Strong Yield

Conclusion - Accretive Growth Strategy

Eagle Bulk – a solid, clear, focused investment story

Dividend Reinvestment Plan in effect

23

Appendix

Reconciliation of Net Income to EBITDA*

* EBITDA is as defined by the Company’s Credit Agreements. EBITDA represents operating earnings before extraordinary items, depreciation

and amortization, interest expense, and income taxes, if any. EBITDA is included because it is used by certain investors to measure a company's

financial performance. EBITDA is not an item recognized by GAAP and should not be considered a substitute for net income, cash flow from

operating activities and other operations or cash flow statement data prepared in accordance with accounting principles generally accepted in the

United States or as a measure of profitability or liquidity. EBITDA is presented to provide additional information with respect to the Company’s

ability to satisfy its obligations including debt service, capital expenditures, and working capital requirements. While EBITDA is frequently used as

a measure of operating results and the ability to meet debt service requirements, the definition of EBITDA used here may not be comparable to

that used by other companies due to differences in methods of calculation. The Company’s revolving credit facility permits it to pay dividends in

amounts up to its earnings before extraordinary or exceptional items, interest, taxes, depreciation and amortization (Credit Agreement EBITDA),

less the aggregate amount of interest incurred and net amounts payable under interest rate hedging agreements during the relevant period and

an agreed upon reserve for dry-docking, provided that there is not a default or breach of loan covenant under the credit facility and the payment of

the dividends would not result in a default or breach of a loan covenant. Therefore, the Company believes that this non-GAAP measure is

important for its investors as it reflects its ability to pay dividends.

Reconciliation of Net Income to Credit Agreement EBITDA

(in $ 000's, rounded)

Net Income

9,101

$

29,285

$

Interest Expense

3,180

7,364

Depreciation and Amortization

5,981

15,738

Amortization of Pre-paid Revenue

725

2,436

EBITDA

18,987

54,822

Adjustments for exceptional items

Non-cash Compensation Expense

3,077

5,768

Credit Agreement EBITDA

22,064

$

60,591

$

Three-months ended

Sept. 30, 2006

Nine-months ended

Sept. 30, 2006

25

Eagle Bulk Shipping Inc.