Eagle Bulk Shipping Inc.

1Q 2007 Results Presentation

8 May 2007

Forward Looking Statements

This presentation contains certain statements that may be deemed to be “forward-looking statements” within

the meaning of the Securities Acts. Forward-looking statements reflect management’s current views with

respect to future events and financial performance and may include statements concerning plans, objectives,

goals, strategies, future events or performance, and underlying assumptions and other statements, which are

other than statements of historical facts. The forward-looking statements in this presentation are based upon

various assumptions, many of which are based, in turn, upon further assumptions, including without

limitation, management's examination of historical operating trends, data contained in our records and other

data available from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were

reasonable when made, because these assumptions are inherently subject to significant uncertainties and

contingencies which are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc.

cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. Important

factors that, in our view, could cause actual results to differ materially from those discussed in the forward-

looking statements include the strength of world economies and currencies, general market conditions,

including changes in charterhire rates and vessel values, changes in demand that may affect attitudes of time

charterers to scheduled and unscheduled drydocking, changes in our vessel operating expenses, including

dry-docking and insurance costs, or actions taken by regulatory authorities, ability of our counterparties to

perform their obligations under sales agreements and charter contracts on a timely basis, potential liability

from future litigation, domestic and international political conditions, potential disruption of shipping routes

due to accidents and political events or acts by terrorists. Risks and uncertainties are further described in

reports filed by Eagle Bulk Shipping Inc. with the US Securities and Exchange Commission.

1

Agenda

First Quarter 2007 Highlights

The Fleet

Industry View

Financial Overview

Conclusion

2

1Q 2007 Highlights

1Q 2007 Highlights

1Q Gross Time Charter Revenues of $29.5 million

Net Income of $8.5 million includes non-dilutive, non-cash

compensation charge of $3.2 million

Excluding the non-cash compensation charge, Adjusted

Net Income was $11.7 million or $0.31 per share

EBITDA1 of $21.8 million

Declared and paid 1Q Cash Earnings Dividend of $0.50 per

share

Acquired three Supramax vessels for $138.7 million

Sold our oldest and smallest vessel for gain of $0.9 million

Expanded newbuilding program to four Supramax vessels

Raised $110 million in equity

1 EBITDA, as defined by our credit agreement, is Net Income plus Interest Expense, Depreciation and

Amortization, and Exceptional Items.

4

Purchased three modern Supramaxes for $138.7 million:

On April 24, 2007, Shrike, a 53,343 dwt Supramax vessel built in 2003,

delivered and commenced a two-year charter at a daily rate of $24,600.

Skua, a 53,350 dwt Supramax vessel built in 2003, expected to be

delivered in June 2007 and enter into a two-year charter at a daily rate of

$24,200.

Kittiwake, a 53,146 dwt Supramax vessel built in 2002, expected to be

delivered in June 2007 and enter into a one-year charter at a daily rate of

$30,400*.

Accretive transactions funded with a combination of common shares and

drawings from our credit facility, maintaining conservative debt structure.

New incremental commitment of $250 million increases liquidity to

approximately $460 million to help fund future growth.

New Acquisitions – Executing Our Growth Strategy

Young Supramax Fleet Maintains Quarterly Dividends

* The charter rate may reset at the beginning of each month based on the average time charter rate for the Baltic Supramax Index, but

in no case be less than $24,400 per day.

5

In 1Q-07 executed two additional contracts to construct 56,000 dwt

Supramax vessels at IHI Marine United, a pre-eminent Japanese shipyard, at

contract price of $33.2 million each

Company now has signed contracts for construction of four 56,000 dwt

Supramax vessels and placed an aggregate of $51 million in deposits

CROWNED EAGLE to be delivered in November 2008

CRESTED EAGLE to be delivered in February 2009

GOLDEN EAGLE to be delivered in January 2010

IMPERIAL EAGLE to be delivered in February 2010

Subsequent to 1Q-07, signed letter of intent for construction of fifth Japanese

56,000 dwt Supramax at a contract price of $33.6 million. Vessel expected to

be delivered in April 2009.

Investing for the Future – Capturing Growth

Sister Ships enhance operating efficiencies

6

The Fleet

Modern, High Quality Geared Fleet of Supramax Vessels

8

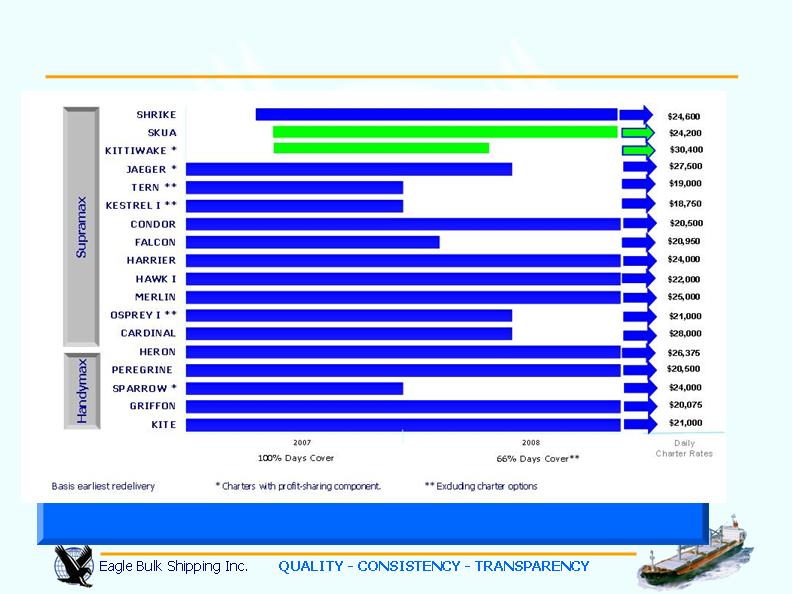

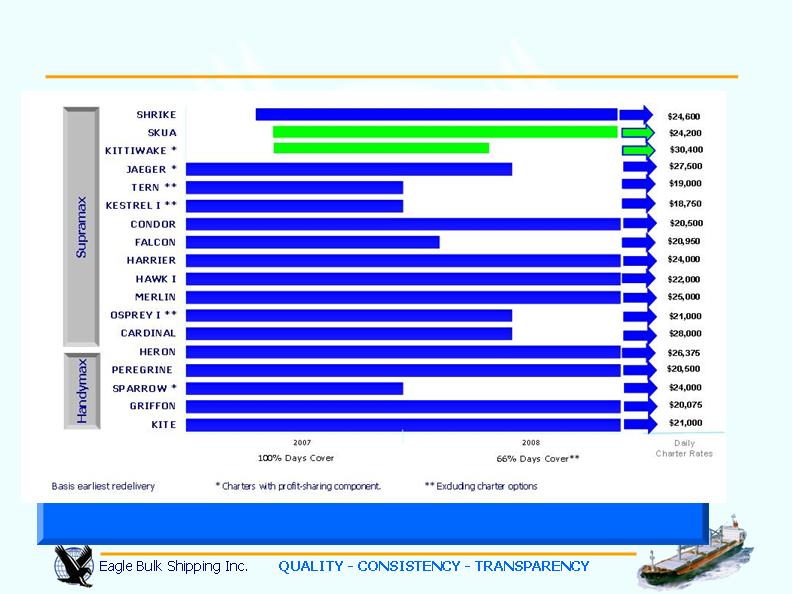

Eagle Captures Today’s Drybulk Values for Extended Periods

Charter renewals at today’s healthy rates extends high cashflow generation

Period cover extends revenue visibility and predictability and limits spot volatility

Secure Cash Flows Provide Stable Dividends

1 The MERLIN charter rate is $27,000 per day for first year, $25,000 per day for the second year, and $23,000 for the third year.

For purposes of revenue recognition, the charter is reflected on a straight-line basis at $25,000 per day for 36 to 39 months in

accordance with generally accepted accounting principles in the United States.

2 KITTIWAKE will deliver to the charterer at time charter rate of $30,400 per day for 11 to 13 months. The charter rate may reset

at the beginning of each month based on the average time charter rate for the Baltic Supramax Index, but in no case be less

than $24,400 per day.

9

Vessel

Charter

Commences

Charter Period

Charter Rate

Merlin

Oct - Dec

2007

36 - 39 months

$25,000 per day

1

Heron

Dec 2007 -

Feb 2008

36 - 39 months

$26,375 per day

Shrike

Apr 2007

24 - 27 months

$24,600 per day

Skua

Jun-07

23 - 25 months

$24,200 per day

Kittiwake

Jun-07

11 - 13 months

$30,400 per day

2

Time Charter Contracts Provide Stable and Visible Cashflows

Contracted gross revenues in excess of $300 million** at attractive rates

Renewal Rates

10

Industry View

Drybulk Demand Easily Absorbing Supply

China’s 1Q-07 GDP growth at 11%

India to invest $500 billion in infrastructure and

manufacturing over the next 3 years

Persian Gulf states investing $100 billion for

infrastructure

1Q-07 trade volume growth up 6.3%

1Q-07 ton-mile growth up

India diverts iron ore production to

internal needs – increasing long haul

supply from Brazil and Australia

Shift in trade patterns towards BRIC

countries (Brazil, Russia, India, China)

increases ton-mile demand

Chinese coastal trade, an unreported shipping

statistic, now a major factor

Source: IMF, Financial Times

Lead Demand Indicator

1Q-07 Chinese steel output

up 22% year-on-year

1Q-07 Chinese iron ore

imports up 24%

Chinese grain stocks down

over 150m tons to 70m

tons since 2000 – more

long haul grain trades

Drybulk fleet cannot keep

pace with demand

12

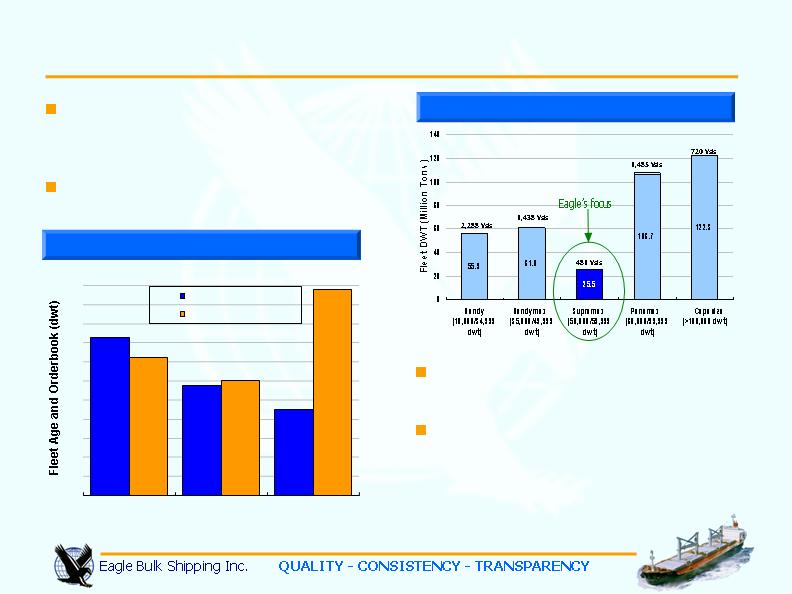

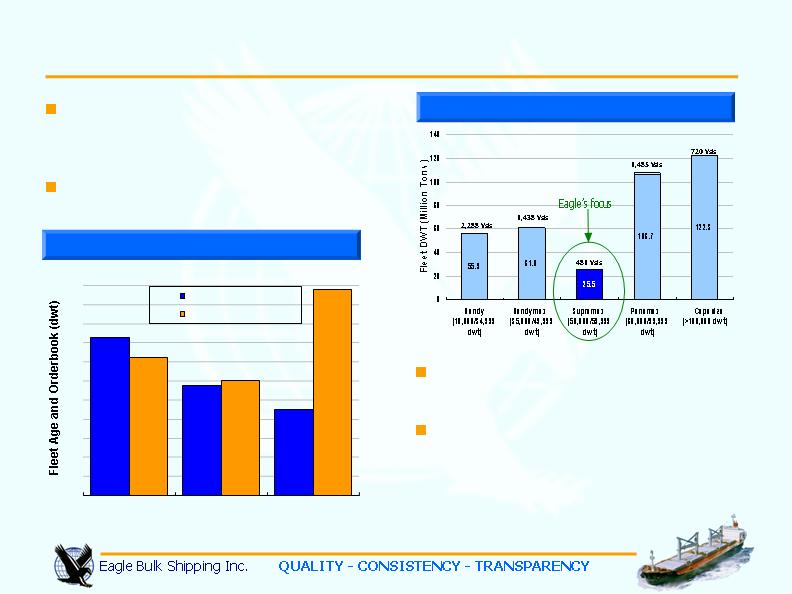

New Supramax Asset Class Services Growing Global Needs

Approximately 60% of Chinese berths cannot

handle Panamax or Capesize vessels*

Approximately 25% of Chinese berths require

vessels with cargo gear * – a constraint only

satisfied by sub-Panamax sector vessels

Vessel Gear increases flexibility and broadens customer base

Source: * J.E.Hyde

Exports of cement and steel out of China

expected to maintain healthy growth rates in

excess of 20%.

New mining capacities in Australia and Brazil

to increase iron ore output by 70-80 million

tons per annum.

Reduced Indian ore exports increases ton

miles as China increases imports from Brazil.

Protected Market

850m ton sub-Panamax market

13

Charterers Attracted by Versatility of Supramax Vessels

MISC. cargoes include Phosrock, Sugar, HBI, and Concentrates

28% of Eagle’s 1Q-07 Cargoes were “Capesize and Panamax cargoes”

14

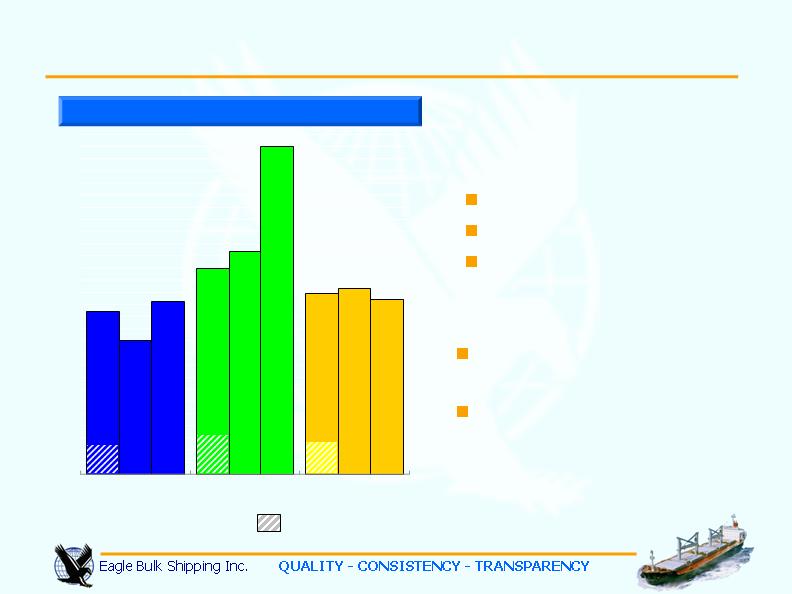

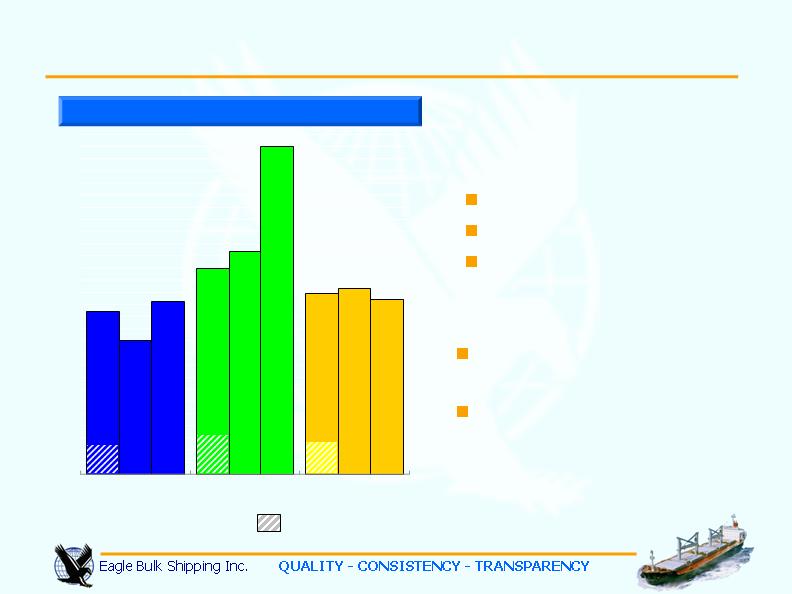

Drybulk supply position :

Lowest supply as a

percentage of existing fleet

Lowest orderbook supply in

million dwt

15

Supply as % of fleet :

as of 1 April 07

Drybulk : 30%

Tankers : 40%

Containers: 48%

World Vessel Supply 2007-2009

Source: Clarksons as of April 2007 Deliveries

Drybulk Sector – Best Market to be in the Next 3 Years

33.82

27.00

1.49

22.10

36.70

1.53

1.44

54.02

28.39

Drybulk

(m dwt)

Tankers

(m dwt)

Containers

(m teu)

2007 2008 2009

6.32

0.27

2007 2008 2009

2007 2008 2009

3.6

15 of the 18 vessels in the

Company’s on-the-water fleet are

Supramaxes

Smallest segment of the drybulk

market provides opportunities

Aging Handymax Fleet

Source: Clarksons as of April 2007

Aging Handymax fleet — 33% of

capacity > 20 years old

Negligible scrapping since 2003

could see surge of ships removed

from market in 2009-11

Orderbook and Fleet Age

16

World Dry Bulk Fleet

33%

23%

18%

29%

24%

43%

0%

4%

8%

12%

16%

20%

24%

28%

32%

36%

40%

44%

Handymax

Panamax

Capesize

% of Fleet > 20 years

Orderbook as % of Fleet

Financial Overview

High Utilization Rate = Maximum Revenue

Revenue Growth

18

99.1%

99.4%

Fleet Utilization

1,116

1,387

Operating Days

1,126

1,395

Available Days

44

12*

Less: Drydock Days

1,170

1,407

Ownership Days

1Q-06

1Q-07

* Includes time spent positioning the SHIKRA for sale.

2007(E) - Pro forms for acquisitions

Net revenues based on a pro forma 2007 fleet charter cover

of 100% and assuming earliest charter redelivery rates.

Net revenues include billed time charter revenues, deductions

for brokerage commissions and amortization of net prepaid

and deferred charter revenue. Please refer to our financial

statements for a definition of Ownership days, Available days,

Operating days, and Fleet Utilization.

-

20

40

60

80

100

120

140

2005

2006

2007 (E)

$ m

Net Revenues

1st Quarter Earnings

19

($000's)

REVENUES

Net Time Charter Revenues

27,989

24,727

Less : Amortization of Prepaid and Deferred Revenue

1,080

937

Net Revenues

26,909

23,790

EXPENSES

Vessel Expenses

6,246

4,705

Depreciation and Amortization

5,791

4,820

General & Administrative Expenses

1,644

985

Non-cash Compensation Expense

3,259

753

Gain on Sale of Vessel

(873)

-

Total Expenses

16,067

11,263

OPERATING INCOME

10,842

12,527

Interest Expense

3,152

2,066

Interest Income

(798)

(332)

NET INCOME

$8,488

$10,793

Basic and Diluted Income per Common Share

$0.23

$0.33

Weighted Average Shares Outstanding

37,450,578

33,150,000

Diluted Shares Outstanding

37,453,796

33,150,106

Adjusted Net Income

(non-GAAP measure)

:

Net Income

$8,488

$10,793

Add : Non-cash Compensation Expense

3,259

753

Adjusted Net Income :

$11,747

$11,546

Basic and Diluted Adjusted Net Income per Common Share

$0.31

$0.35

Mar. 31, 2007

Mar. 31, 2006

Three-months ended

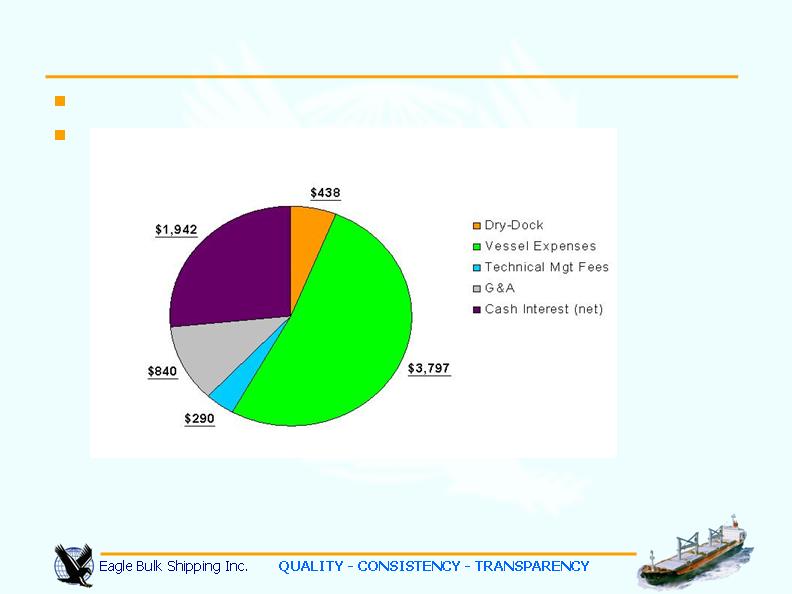

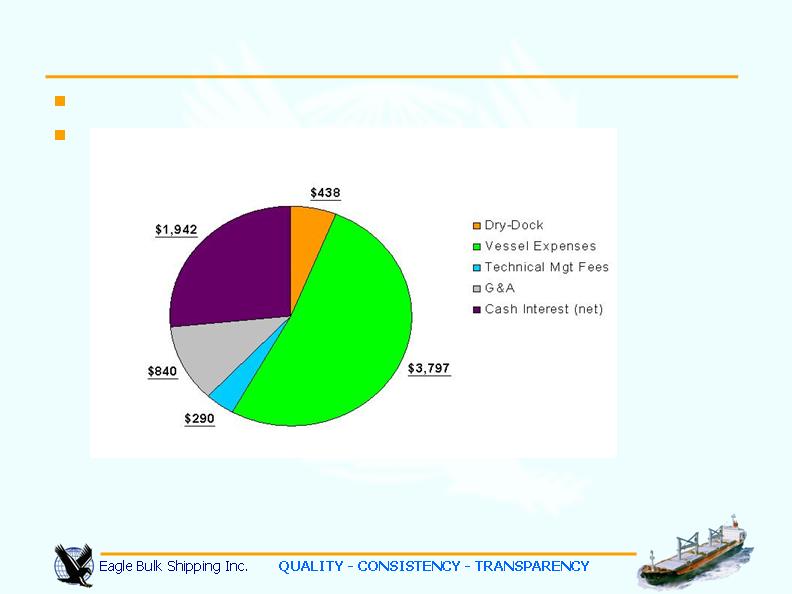

Daily cash breakeven cost of $7,307 per day per vessel (2007E)

No principal repayments until 2012

Low Breakeven Cost Strategy

The Company is anticipating higher crewing costs and higher costs for oil based supplies including lubes and paints. The

Company is also making allowance for constraints in yard drydocking capacity which has driven up drydocking costs.

20

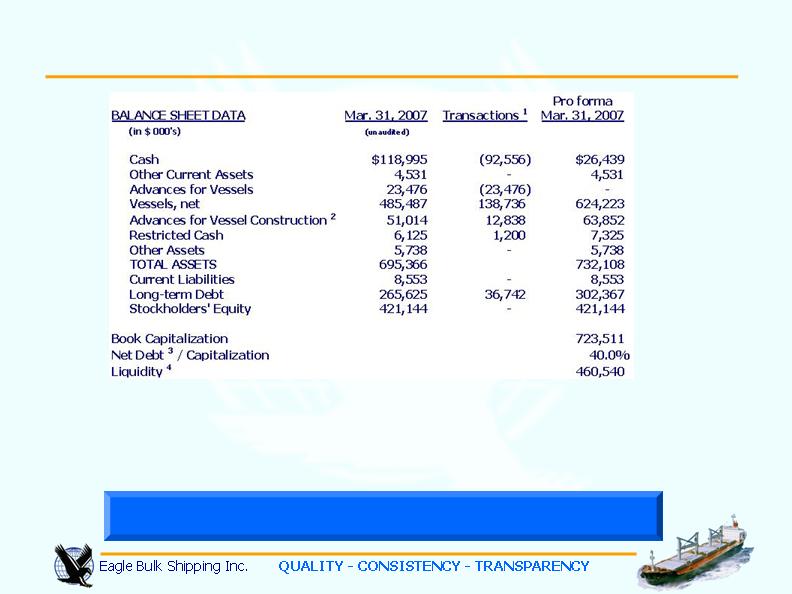

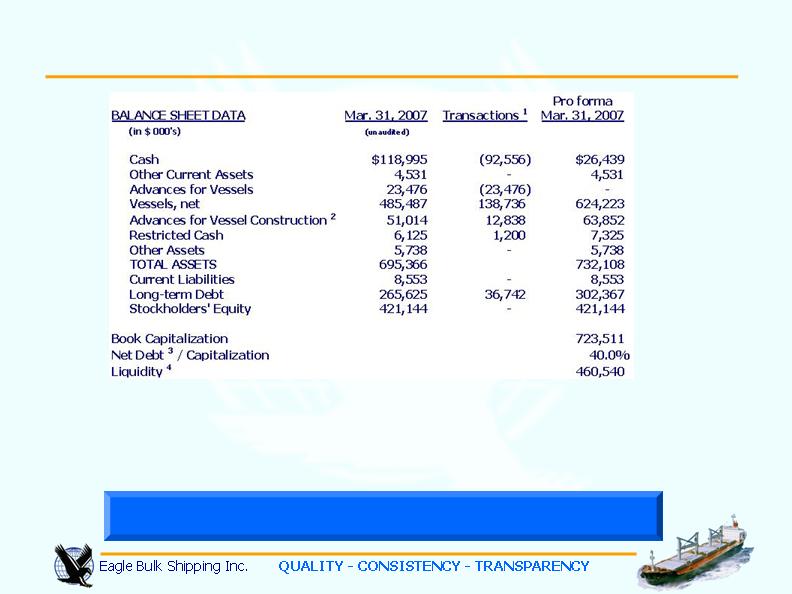

Strong Balance Sheet

1 Purchase of Shrike, Skua and Kittiwake, and deposit for the 5th Newbuild vessel.

2 Newbuild Costs to be Capitalized eliminating any impact on current cash flows.

3 Net Debt is pro forma after taking into effect 1Q-07 Dividend payment of $20.85 million.

4 Liquidity includes amounts available under the newly enhanced credit commitment

Quarterly Dividend Cash Flow Maintained

21

$500m existing Revolving Credit Facility

$250m Incremental Commitment

Interest only until 2012

* Thereafter semi-annual reduction in availability to Balloon

Ample Liquidity for Growth

22

$750 million Commitment at Favorable Terms

Commitment Amount

$750 million

Maturity

July 2016

Interest Only until (at least)

July 2012

Interest Margin

Libor + 75/85

basis points

Commitment Fees on

undrawn revolver

25 basis points

Availabilty in full until *

July 2012

Balloon (fully drawn)

$405 million

Conclusion

Poised for Growth

High Dividends

Operate a modern, homogeneous

Supramax fleet

Stable and visible cashflows from

1 to 3 year time charters

100% of 2007 fleet days1 covered

by fixed contracts

Low cash breakeven of $7,307

per day

Strong balance sheet with Net

Debt to Capital of 40%

No debt amortization until 2012

Accretive acquisition strategy

1 Pro forma for acquisition

Full cash payout dividend policy

Declared Dividends of $125.6 million or

$3.63 per share to shareholders

since September 2005

Demonstrates Strong Yield

Conclusion - Accretive Growth Strategy

Eagle Bulk – a solid, clear, focused investment story

Dividend Reinvestment Plan in effect

24

Appendix

Reconciliation of Net Income to EBITDA*

* EBITDA is as defined by the Company’s Credit Agreements. EBITDA represents operating earnings before extraordinary items, depreciation

and amortization, interest expense, and income taxes, if any. EBITDA is included because it is used by certain investors to measure a company's

financial performance. EBITDA is not an item recognized by GAAP and should not be considered a substitute for net income, cash flow from

operating activities and other operations or cash flow statement data prepared in accordance with accounting principles generally accepted in

the United States or as a measure of profitability or liquidity. EBITDA is presented to provide additional information with respect to the

Company’s ability to satisfy its obligations including debt service, capital expenditures, and working capital requirements. While EBITDA is

frequently used as a measure of operating results and the ability to meet debt service requirements, the definition of EBITDA used here may not

be comparable to that used by other companies due to differences in methods of calculation. The Company’s revolving credit facility permits it to

pay dividends in amounts up to its earnings before extraordinary or exceptional items, interest, taxes, depreciation and amortization (Credit

Agreement EBITDA), less the aggregate amount of interest incurred and net amounts payable under interest rate hedging agreements during

the relevant period and an agreed upon reserve for dry-docking, provided that there is not a default or breach of loan covenant under the credit

facility and the payment of the dividends would not result in a default or breach of a loan covenant. Therefore, the Company believes that this

non-GAAP measure is important for its investors as it reflects its ability to pay dividends.

26

Reconciliation of Net Income to Credit Agreement EBITDA

(in $ 000's, rounded)

Net Income

8,488

$

10,793

$

Interest Expense

3,152

2,066

Depreciation and Amortization

5,791

4,820

Amortization of Pre-paid Revenue

1,080

937

EBITDA

18,511

18,615

Adjustments for exceptional items

Non-cash Compensation Expense

3,259

753

Credit Agreement EBITDA

21,770

$

19,368

$

Mar. 31, 2007

Mar. 31, 2006

Three-months ended

Eagle Bulk Shipping Inc.