Third Quarter 2017 Earnings Presentation 3 November 2017

2 Disclaimer This presentation contains certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbor provided for under these sections. These statements may include words such as “believe,” “estimate,” “project,” “intend,” “expect,” “plan,” “anticipate,” and similar expressions in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements reflect management’s current expectations and observations with respect to future events and financial performance. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected, or implied by those forward-looking statements. The forward-looking statements in this presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, examination of historical operating trends, data contained in our records and other data available from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. The principal factors that affect our financial position, results of operations and cash flows include, charter market rates, which have declined significantly from historic highs, periods of charter hire, vessel operating expenses and voyage costs, which are incurred primarily in U.S. dollars, depreciation expenses, which are a function of the cost of our vessels, significant vessel improvement costs and our vessels’ estimated useful lives, and financing costs related to our indebtedness. Our actual results may differ materially from those anticipated in these forward- looking statements as a result of certain factors which could include the following: (i) changes in demand in the dry bulk market, including, without limitation, changes in production of, or demand for, commodities and bulk cargoes, generally or in particular regions; (ii) greater than anticipated levels of dry bulk vessel new building orders or lower than anticipated rates of dry bulk vessel scrapping; (iii) changes in rules and regulations applicable to the dry bulk industry, including, without limitation, legislation adopted by international bodies or organizations such as the International Maritime Organization and the European Union or by individual countries; (iv) actions taken by regulatory authorities; (v) changes in trading patterns significantly impacting overall dry bulk tonnage requirements; (vi) changes in the typical seasonal variations in dry bulk charter rates; (vii) changes in the cost of other modes of bulk commodity transportation; (viii) changes in general domestic and international political conditions; (ix) changes in the condition of the Company’s vessels or applicable maintenance or regulatory standards (which may affect, among other things, our anticipated drydocking costs); (x) the outcome of legal proceedings in which we are involved; and (xi) and other factors listed from time to time in our filings with the SEC. We disclaim any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable security laws.

3 1 Highlights 2 Financial 3 Industry 4 Summary 5 Q&A Agenda

Highlights

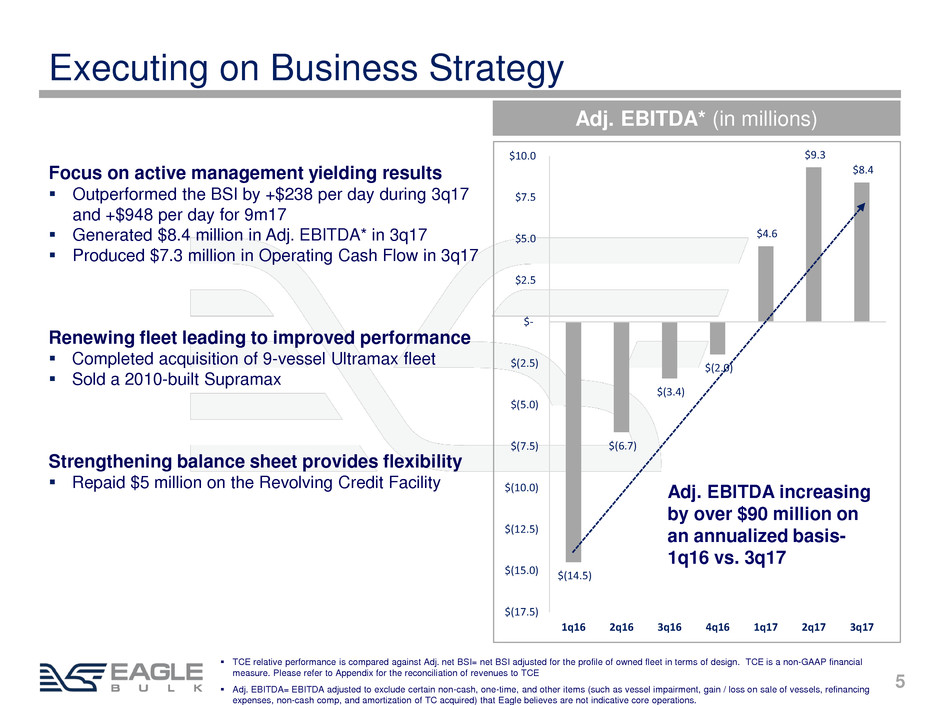

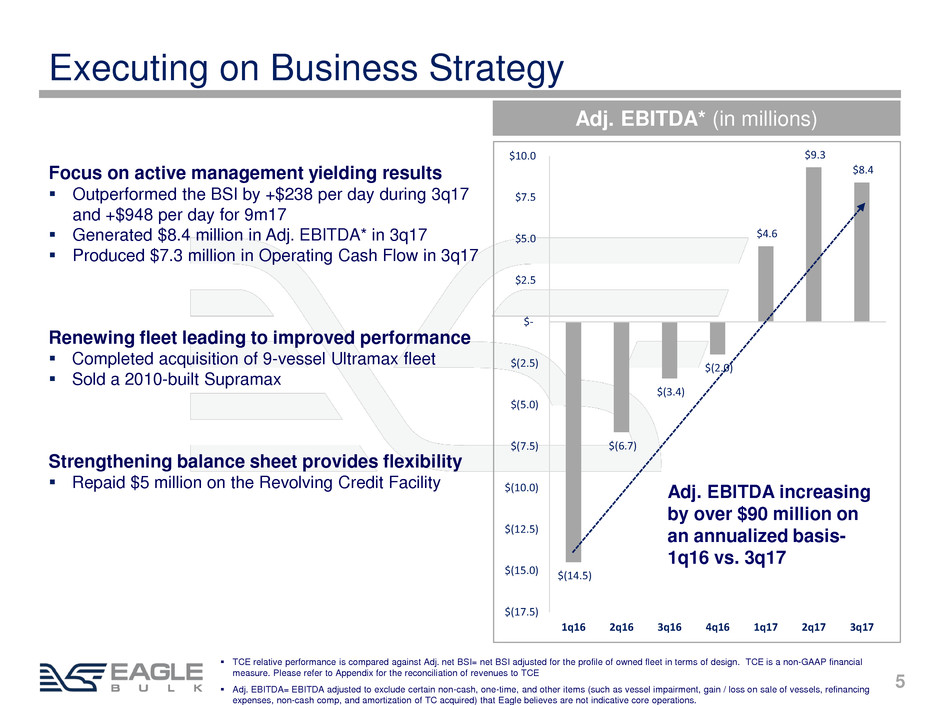

5 Executing on Business Strategy Focus on active management yielding results Outperformed the BSI by +$238 per day during 3q17 and +$948 per day for 9m17 Generated $8.4 million in Adj. EBITDA* in 3q17 Produced $7.3 million in Operating Cash Flow in 3q17 Renewing fleet leading to improved performance Completed acquisition of 9-vessel Ultramax fleet Sold a 2010-built Supramax Strengthening balance sheet provides flexibility Repaid $5 million on the Revolving Credit Facility TCE relative performance is compared against Adj. net BSI= net BSI adjusted for the profile of owned fleet in terms of design. TCE is a non-GAAP financial measure. Please refer to Appendix for the reconciliation of revenues to TCE Adj. EBITDA= EBITDA adjusted to exclude certain non-cash, one-time, and other items (such as vessel impairment, gain / loss on sale of vessels, refinancing expenses, non-cash comp, and amortization of TC acquired) that Eagle believes are not indicative core operations. $(14.5) $(6.7) $(3.4) $(2.0) $4.6 $9.3 $8.4 $(17.5) $(15.0) $(12.5) $(10.0) $(7.5) $(5.0) $(2.5) $- $2.5 $5.0 $7.5 $10.0 1q16 2q16 3q16 4q16 1q17 2q17 3q17 Adj. EBITDA* (in millions) Adj. EBITDA increasing by over $90 million on an annualized basis- 1q16 vs. 3q17

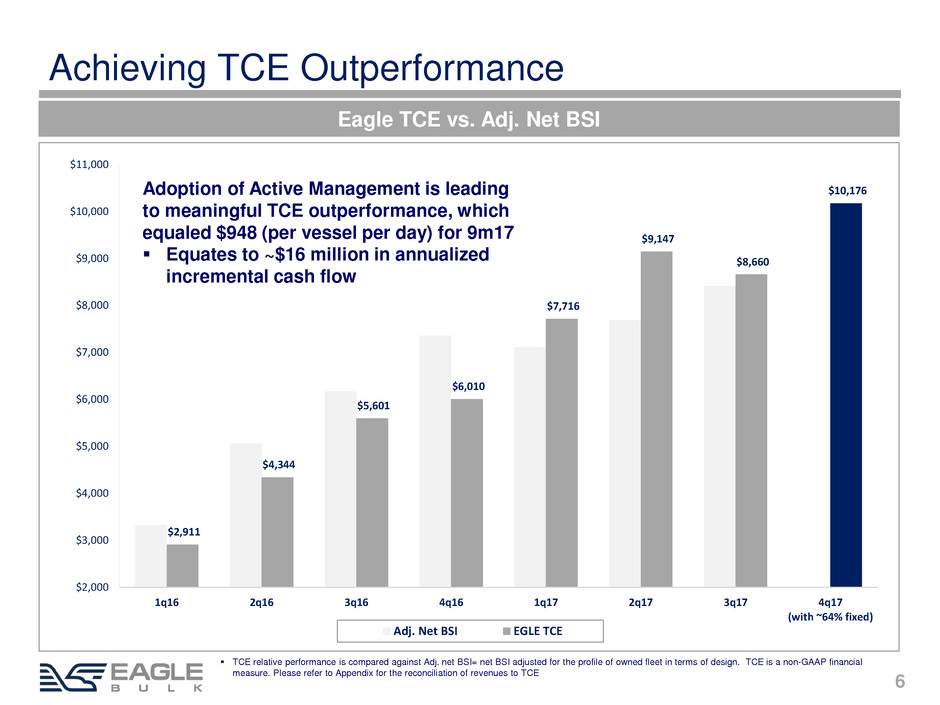

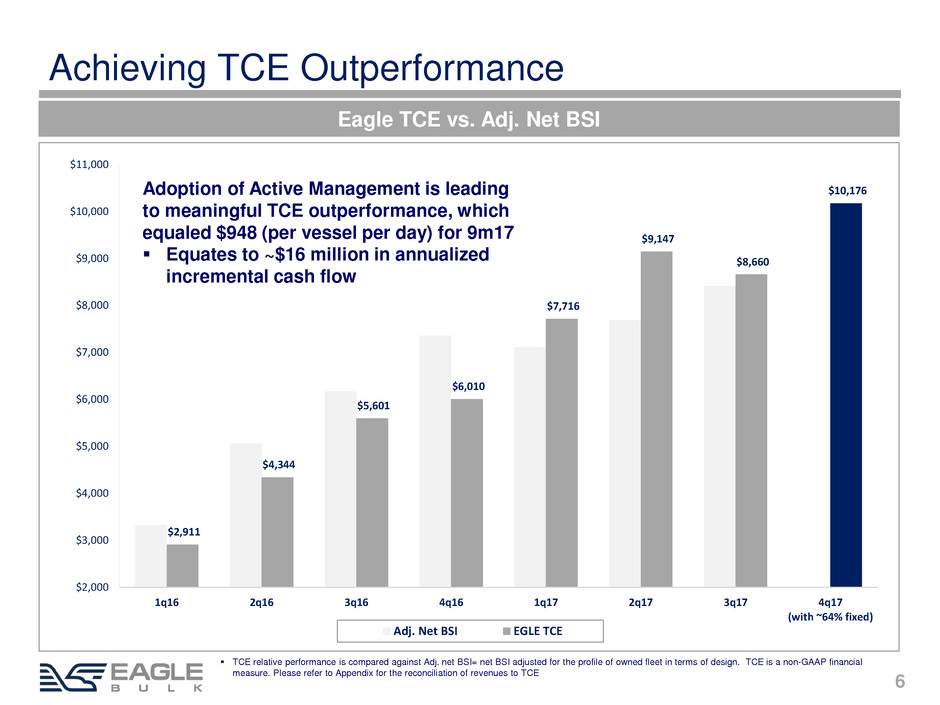

$2,911 $4,344 $5,601 $6,010 $7,716 $9,147 $8,660 $10,176 $2,000 $3,000 $4,000 $5,000 $6,000 $7,000 $8,000 $9,000 $10,000 $11,000 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 (with ~64% fixed) Adj. Net BSI EGLE TCE 6 Achieving TCE Outperformance Eagle TCE vs. Adj. Net BSI Adoption of Active Management is leading to meaningful TCE outperformance, which equaled $948 (per vessel per day) for 9m17 Equates to ~$16 million in annualized incremental cash flow TCE relative performance is compared against Adj. net BSI= net BSI adjusted for the profile of owned fleet in terms of design. TCE is a non-GAAP financial measure. Please refer to Appendix for the reconciliation of revenues to TCE

7 Optimizing Revenue Through Active Management 92 109 151 200 394 749 514 744 1046 0 100 200 300 400 500 600 700 800 900 1000 1100 3q15 4q15 1q16 2q16 3q16 4q16 1q17 2q17 3q17 Chartered-in Fleet - Days Third-party Timecharter-in Business Eagle charters-in third party vessels in order to cover cargo commitments, profit from vessel-positioning arbitrage opportunities, and increase overall coverage to the market

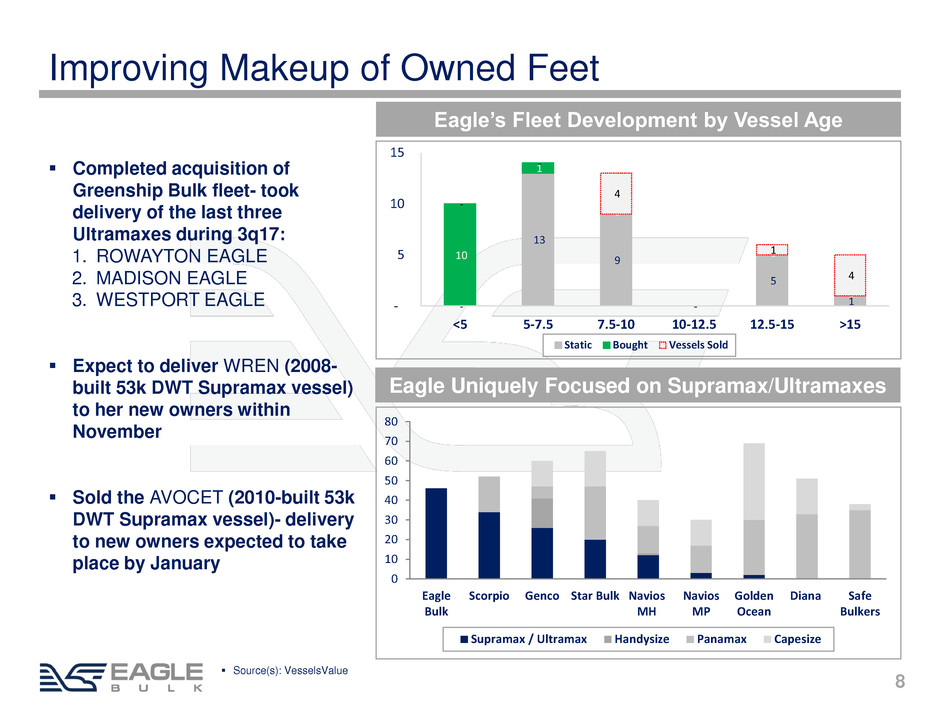

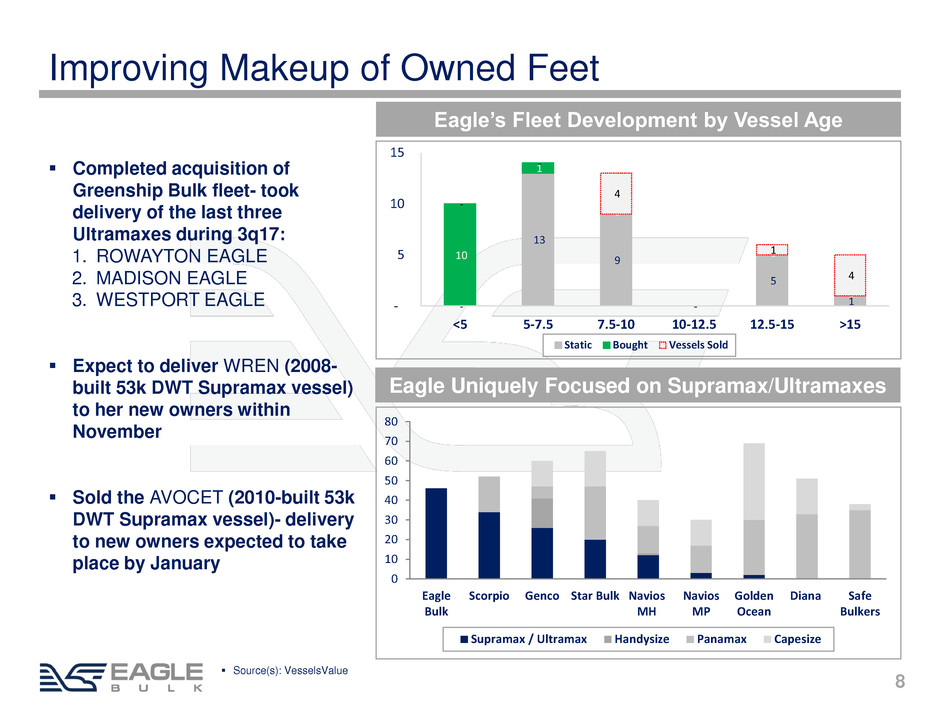

8 Eagle’s Fleet Development by Vessel Age Improving Makeup of Owned Feet Completed acquisition of Greenship Bulk fleet- took delivery of the last three Ultramaxes during 3q17: 1. ROWAYTON EAGLE 2. MADISON EAGLE 3. WESTPORT EAGLE Expect to deliver WREN (2008- built 53k DWT Supramax vessel) to her new owners within November Sold the AVOCET (2010-built 53k DWT Supramax vessel)- delivery to new owners expected to take place by January Eagle Uniquely Focused on Supramax/Ultramaxes Source(s): VesselsValue - 13 9 - 5 1 10 1 - - - - - 4 1 4 - 5 10 15 <5 5-7.5 7.5-10 10-12.5 12.5-15 >15 Static Bought Vessels Sold 0 10 20 30 40 50 60 70 80 Eagle Bulk Scorpio Genco Star Bulk Navios MH Navios MP Golden Ocean Diana Safe Bulkers Supramax / Ultramax Handysize Panamax Capesize

Financial

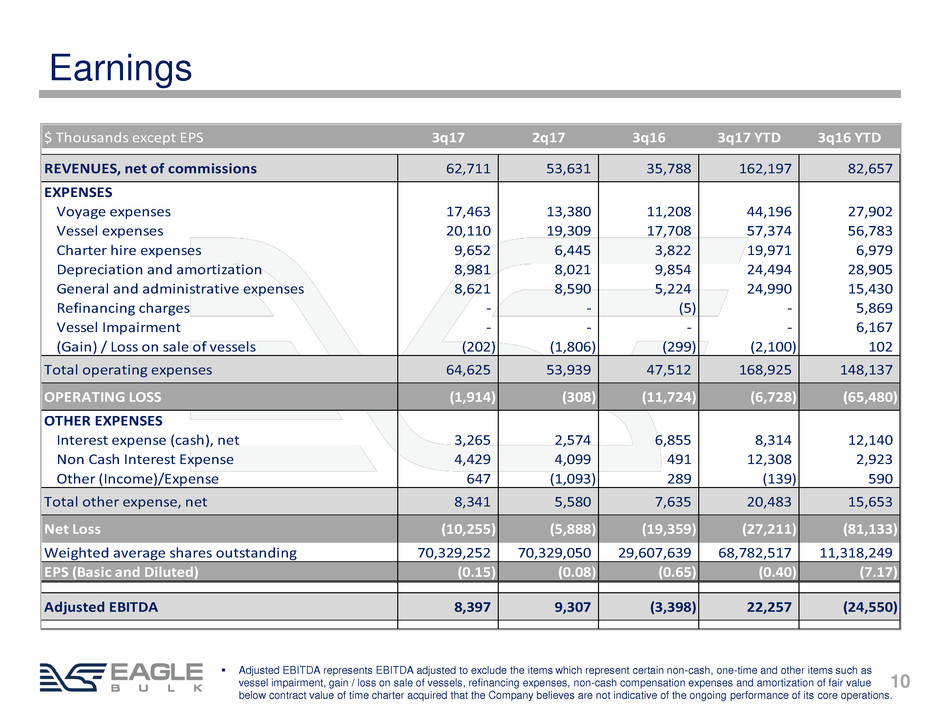

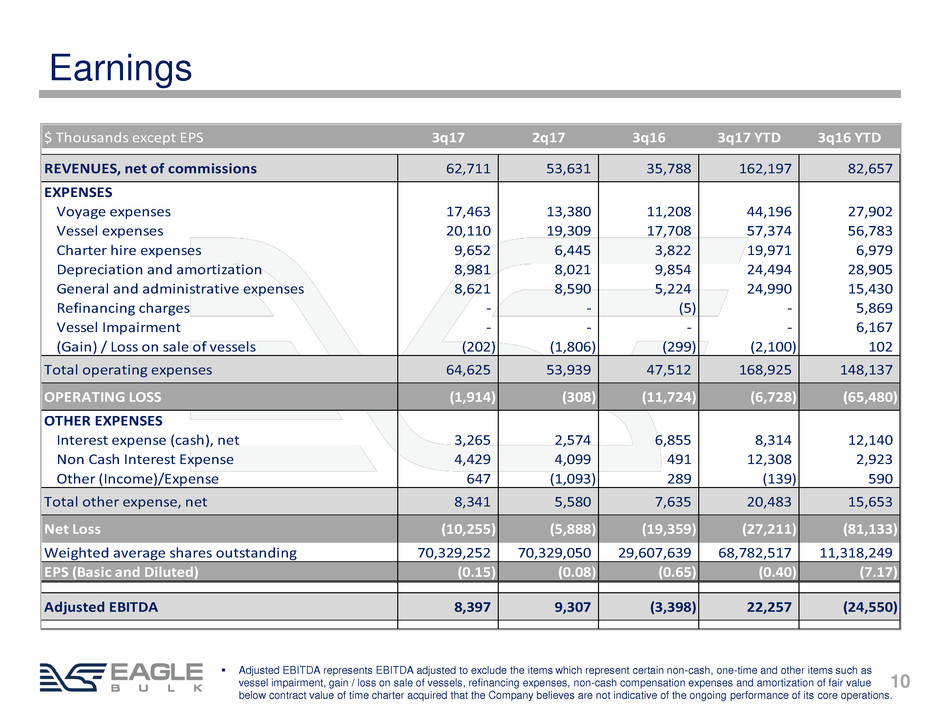

10 Earnings $ Thousands except EPS 3q17 2q17 3q16 3q17 YTD 3q16 YTD REVENUES, net of commissions 62,711 53,631 35,788 162,197 82,657 EXPENSES Voyage expenses 17,463 13,380 11,208 44,196 27,902 Vessel expenses 20,110 19,309 17,708 57,374 56,783 Charter hire expenses 9,652 6,445 3,822 19,971 6,979 Depreciation and amortization 8,981 8,021 9,854 24,494 28,905 General and administrative expenses 8,621 8,590 5,224 24,990 15,430 Refinancing charges - - (5) - 5,869 Vessel Impairment - - - - 6,167 (Gain) / Loss on sale of vessels (202) (1,806) (299) (2,100) 102 Total operating expenses 64,625 53,939 47,512 168,925 148,137 OPERATING LOSS (1,914) (308) (11,724) (6,728) (65,480) OTHER EXPENSES Interest expense (cash), net 3,265 2,574 6,855 8,314 12,140 Non Cash Interest Expense 4,429 4,099 491 12,308 2,923 Other (Income)/Expense 647 (1,093) 289 (139) 590 Total other expense, net 8,341 5,580 7,635 20,483 15,653 Net Loss (10,255) (5,888) (19,359) (27,211) (81,133) Weighted average shares outstanding 70,329,252 70,329,050 29,607,639 68,782,517 11,318,249 EPS (Basic and Diluted) (0.15) (0.08) (0.65) (0.40) (7.17) Adjusted EBITDA 8,397 9,307 (3,398) 22,257 (24,550) Adjusted EBITDA represents EBITDA adjusted to exclude the items which represent certain non-cash, one-time and other items such as vessel impairment, gain / loss on sale of vessels, refinancing expenses, non-cash compensation expenses and amortization of fair value below contract value of time charter acquired that the Company believes are not indicative of the ongoing performance of its core operations.

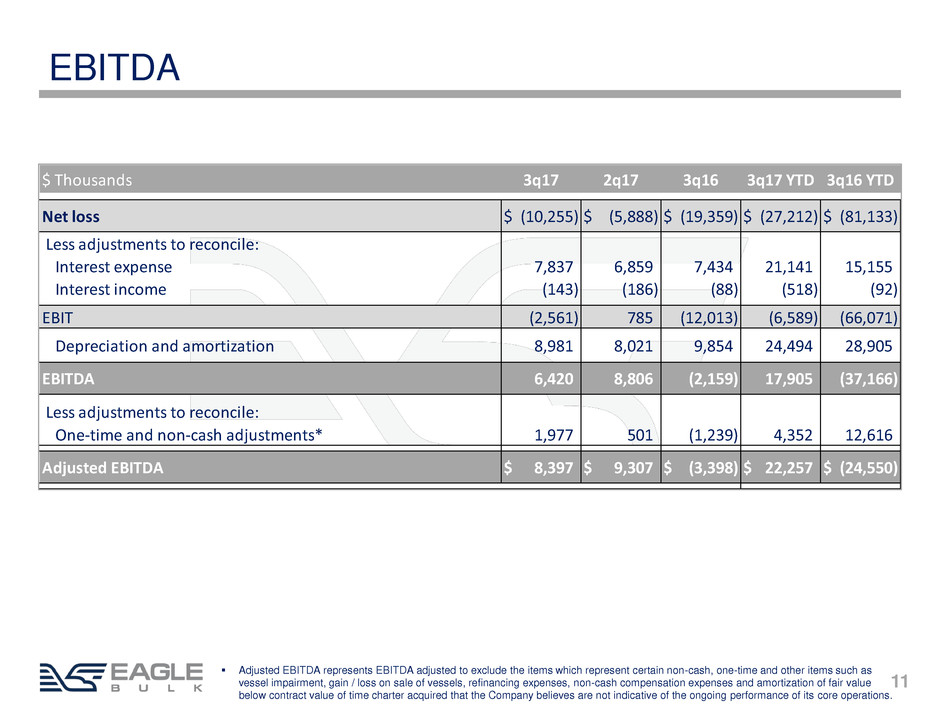

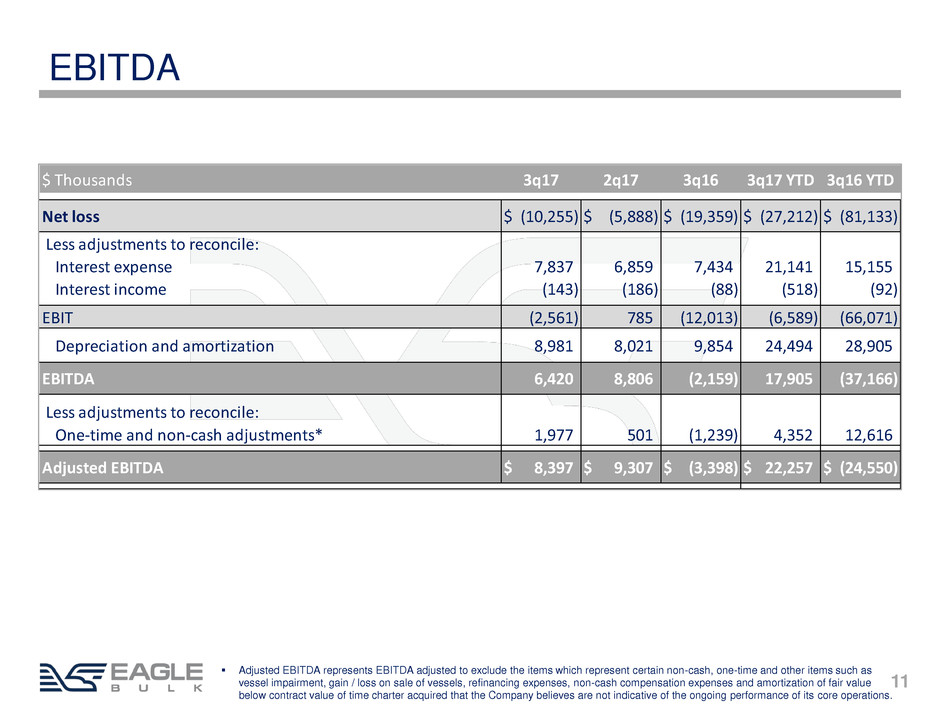

11 EBITDA $ Thousands 3q17 2q17 3q16 3q17 YTD 3q16 YTD Net loss (10,255)$ (5,888)$ (19,359)$ (27,212)$ (81,133)$ Less adjustments to reconcile: Interest expense 7,837 6,859 7,434 21,141 15,155 Interest income (143) (186) (88) (518) (92) EBIT (2,561) 785 (12,013) (6,589) (66,071) Depreciation and amortization 8,981 8,021 9,854 24,494 28,905 EBITDA 6,420 8,806 (2,159) 17,905 (37,166) Less adjustments to reconcile: One-time and non-cash adjustments* 1,977 501 (1,239) 4,352 12,616 Adjusted EBITDA 8,397$ 9,307$ (3,398)$ 22,257$ (24,550)$ Adjusted EBITDA represents EBITDA adjusted to exclude the items which represent certain non-cash, one-time and other items such as vessel impairment, gain / loss on sale of vessels, refinancing expenses, non-cash compensation expenses and amortization of fair value below contract value of time charter acquired that the Company believes are not indicative of the ongoing performance of its core operations.

12 Cash Flow Cash Flow from Operations ($ millions) 3Q17 Cash Flow Change ($ millions) -19.5 -13.2 -7.5 -5.3 -2.0 -3.8 7.3 -23.9 -10.1 -7.5 -4.5 2.1 4.9 2.7 1q16 2q16 3q16 4q16 1q17 2q17 3q17 Cash flow from operations ex Changes in operating assets and liabilities

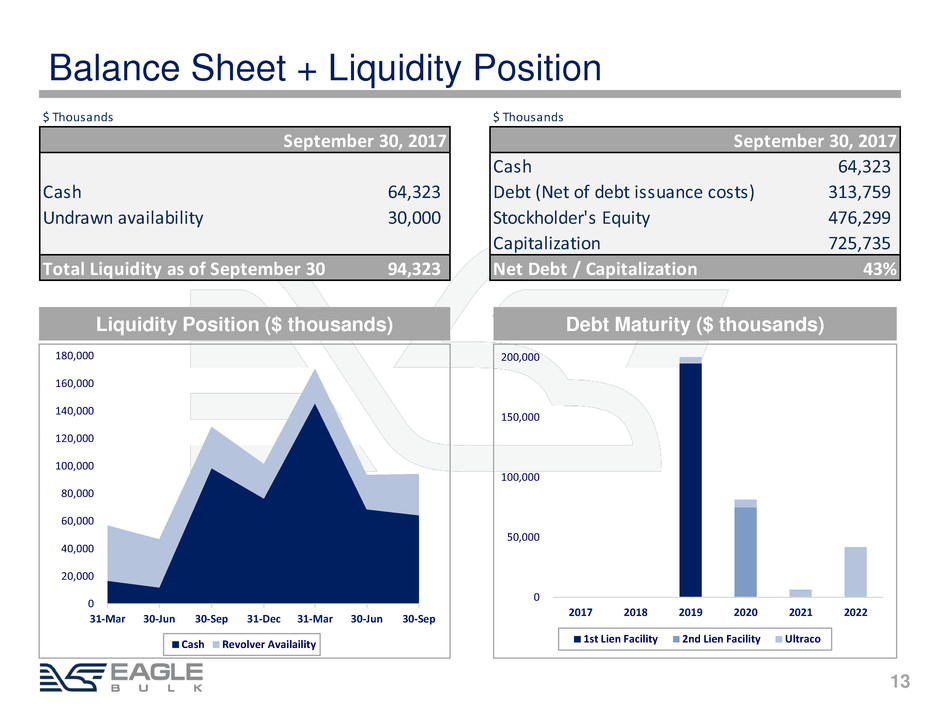

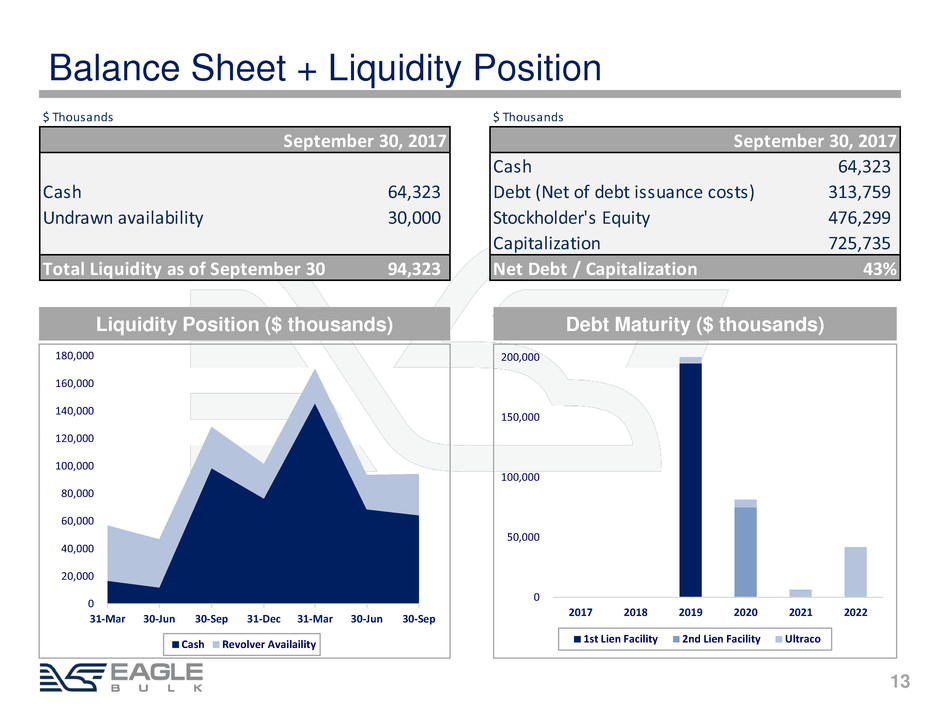

13 Balance Sheet + Liquidity Position Liquidity Position ($ thousands) Debt Maturity ($ thousands) 0 20,000 40,000 60,000 80,000 100,000 120,000 140,000 160,000 180,000 31-Mar 30-Jun 30-Sep 31-Dec 31-Mar 30-Jun 30-Sep Cash Revolver Availaility 0 50,000 100,000 150,000 200,000 2017 2018 2019 2020 2021 2022 1st Lien Facility 2nd Lien Facility Ultraco $ Thousands $ Thousands Cash 64,323 Cash 64,323 Debt (Net of debt issuance costs) 313,759 Undrawn availability 30,000 Stockholder's Equity 476,299 Capitalization 725,735 Total Liquidity as of September 30, 2017 94,323 Net Debt / Capitalization 43% September 30, 2017September 30, 2017

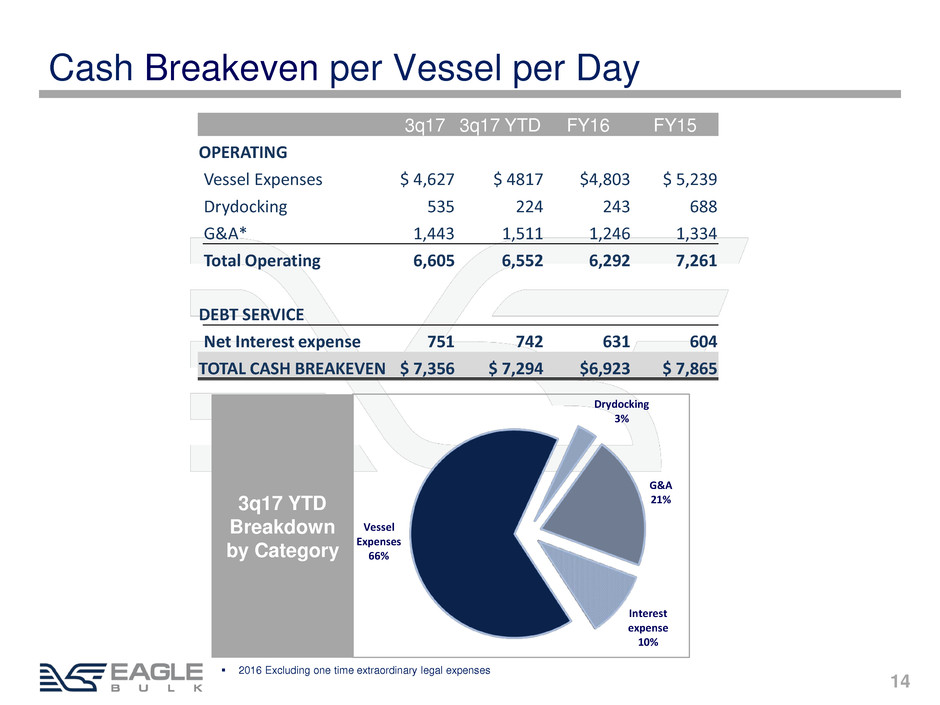

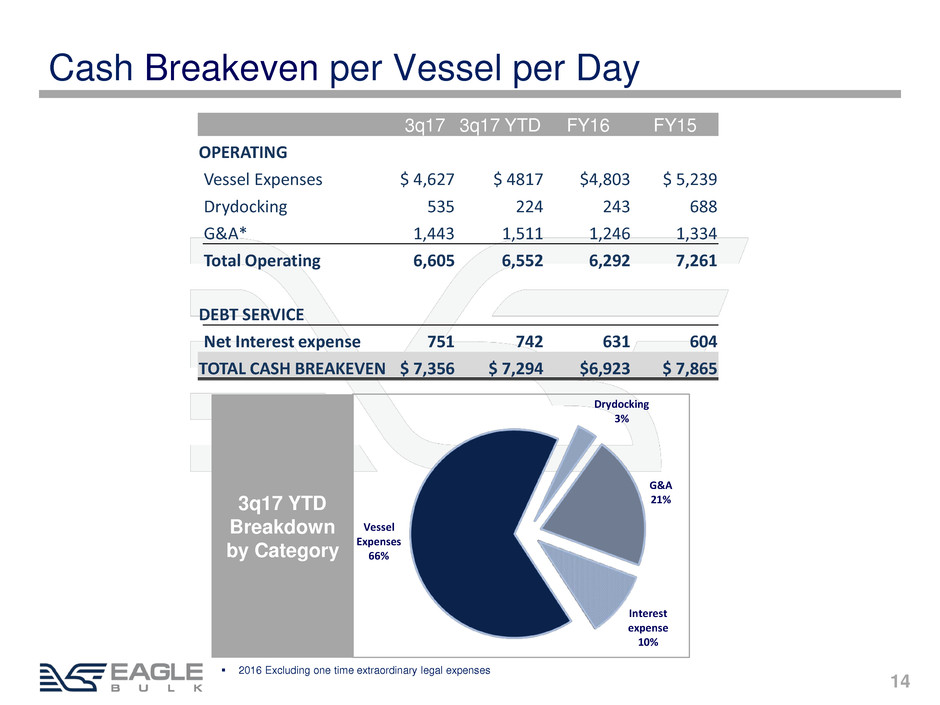

14 Cash Breakeven per Vessel per Day Vessel Expenses 66% Drydocking 3% G&A 21% Interest expense 10% 3q17 YTD Breakdown by Category 3q17 3q17 YTD FY16 FY15 OPERATING Vessel Expenses $ 4,627 $ 4817 $4,803 $ 5,239 Drydocking 535 224 243 688 G&A* 1,443 1,511 1,246 1,334 Total Operating 6,605 6,552 6,292 7,261 DEBT SERVICE Net Interest expense 751 742 631 604 TOTAL CASH BREAKEVEN $ 7,356 $ 7,294 $6,923 $ 7,865 2016 Excluding one time extraordinary legal expenses

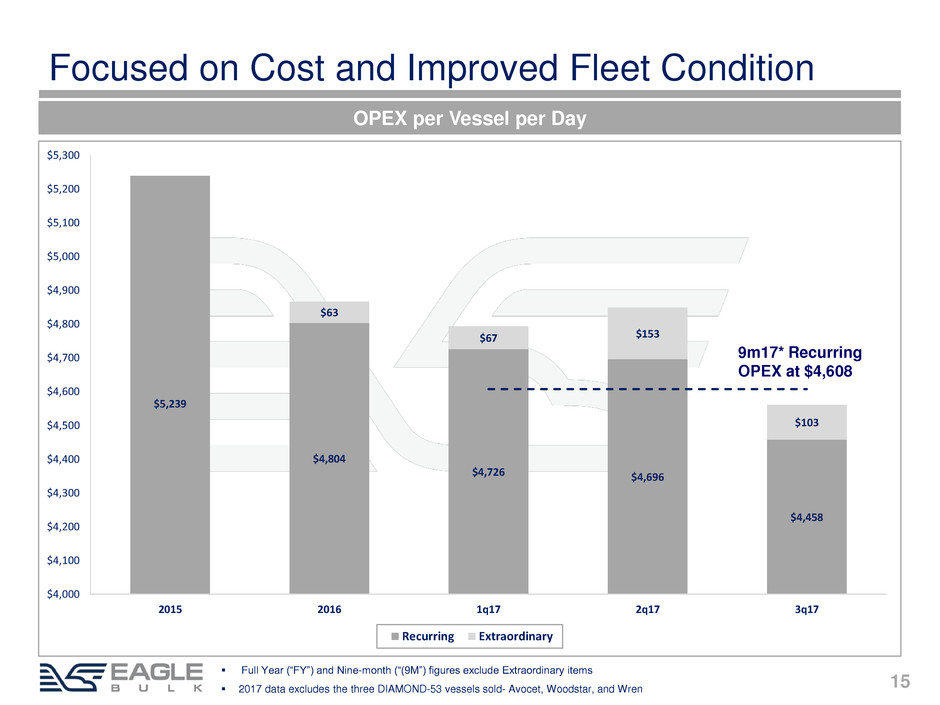

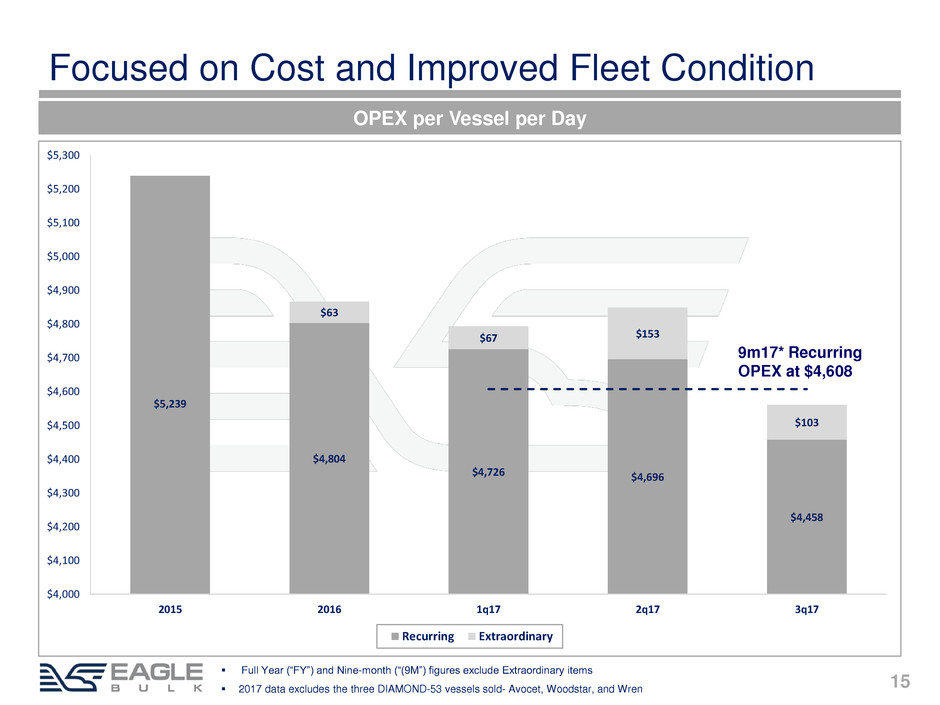

15 OPEX per Vessel per Day Full Year (“FY”) and Nine-month (“(9M”) figures exclude Extraordinary items 2017 data excludes the three DIAMOND-53 vessels sold- Avocet, Woodstar, and Wren Focused on Cost and Improved Fleet Condition $5,239 $4,804 $4,726 $4,696 $4,458 $63 $67 $153 $103 $4,000 $4,100 $4,200 $4,300 $4,400 $4,500 $4,600 $4,700 $4,800 $4,900 $5,000 $5,100 $5,200 $5,300 2015 2016 1q17 2q17 3q17 Recurring Extraordinary 9m17* Recurring OPEX at $4,608

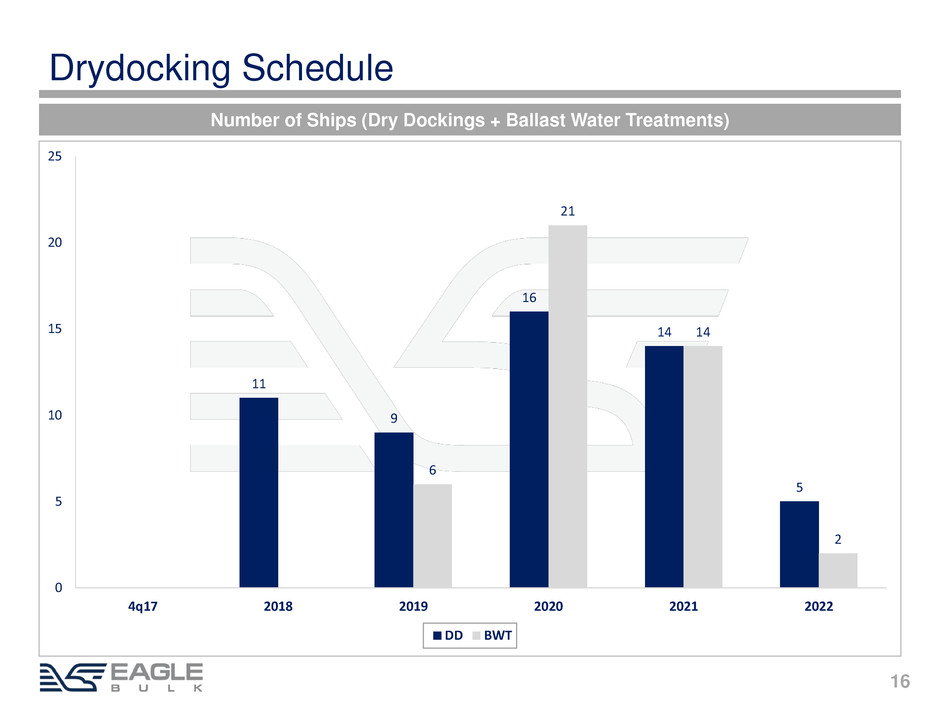

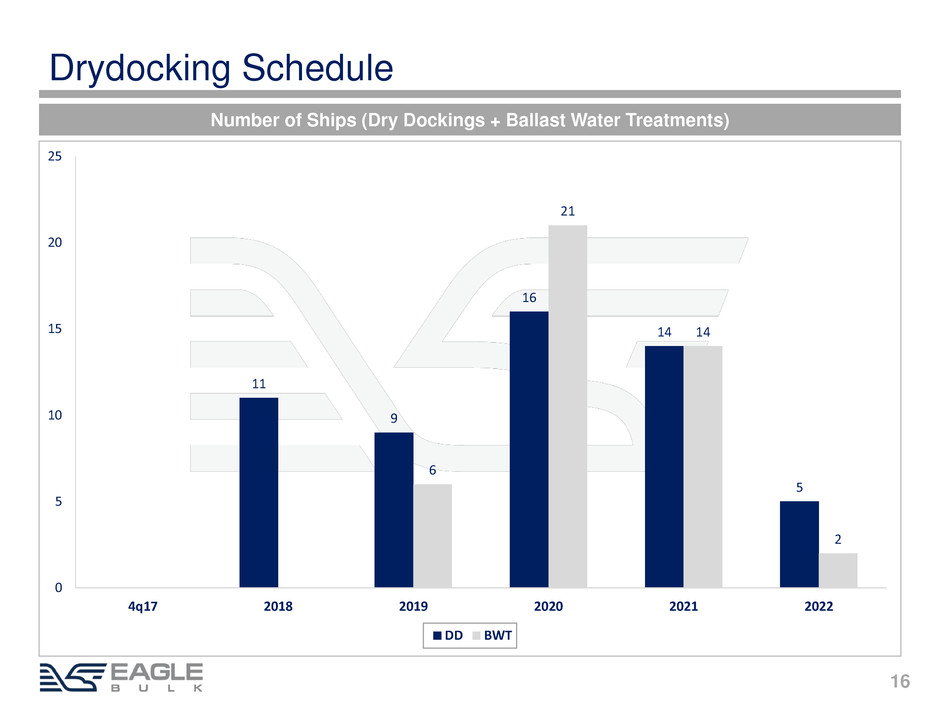

16 Drydocking Schedule 11 9 16 14 5 6 21 14 2 0 5 10 15 20 25 4q17 2018 2019 2020 2021 2022 DD BWT Number of Ships (Dry Dockings + Ballast Water Treatments)

Industry

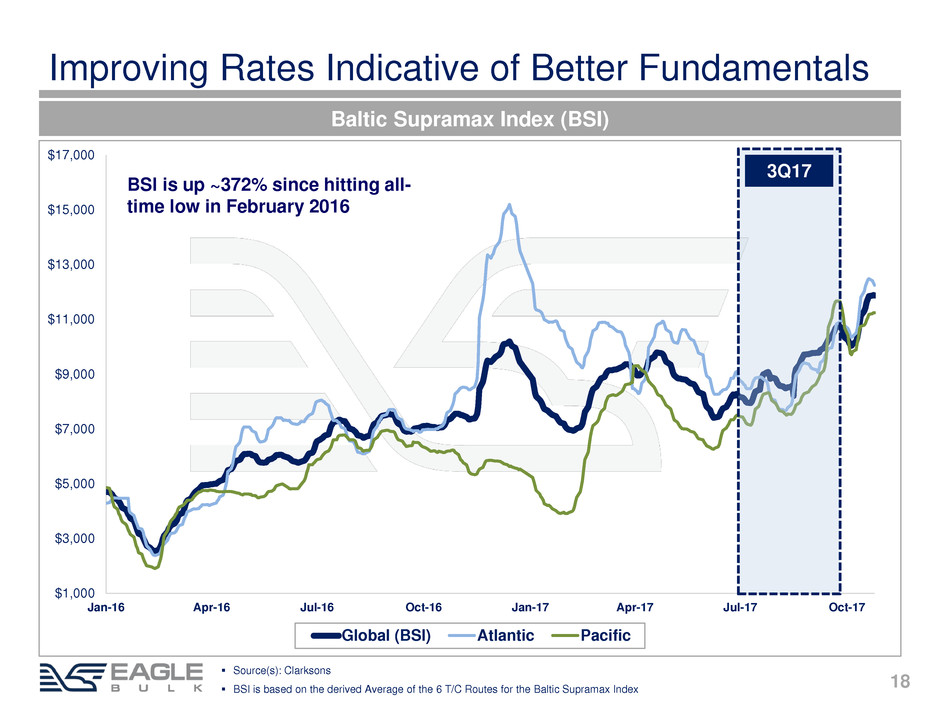

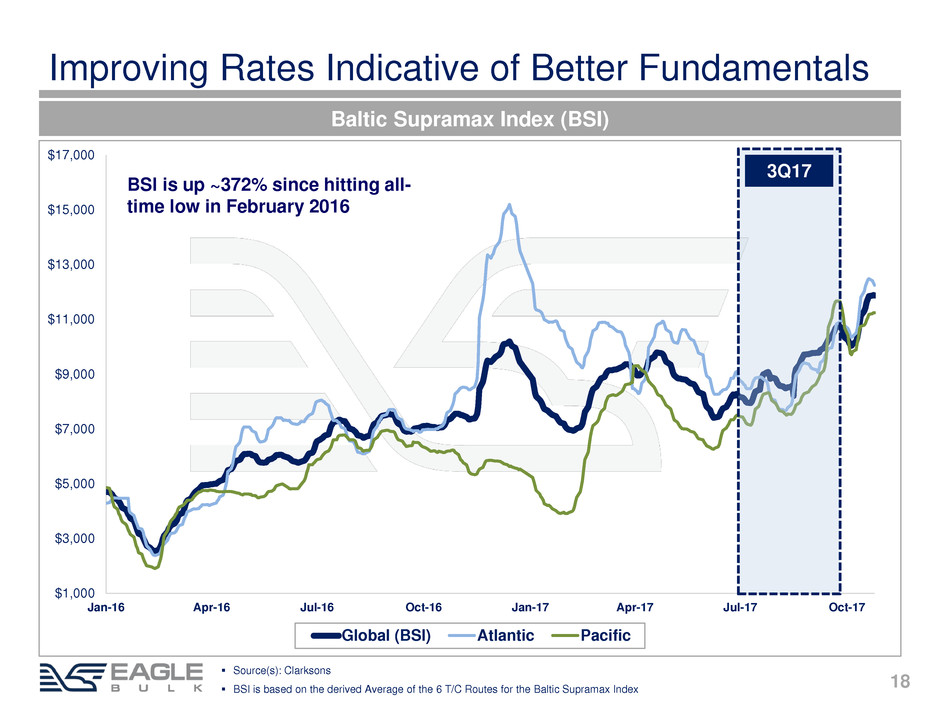

$1,000 $3,000 $5,000 $7,000 $9,000 $11,000 $13,000 $15,000 $17,000 Jan-16 Apr-16 Jul-16 Oct-16 Jan-17 Apr-17 Jul-17 Oct-17 Global (BSI) Atlantic Pacific Improving Rates Indicative of Better Fundamentals 18 Baltic Supramax Index (BSI) Source(s): Clarksons BSI is based on the derived Average of the 6 T/C Routes for the Baltic Supramax Index 3Q17 BSI is up ~372% since hitting all- time low in February 2016

-40 -20 0 20 40 60 80 100 120 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018f 2019f Deliveries Scrapping Net Supply 19 Source(s): Clarksons 2018f and 2019f Scrapping rate is inline with 2017e and long-term historical average Net Supply Growth at Lowest Level in 13 Years Deliveries + Scrapping (DWT) Orderbook (as a % of the on-the-water fleet) stands at just 8%, a 15yr low

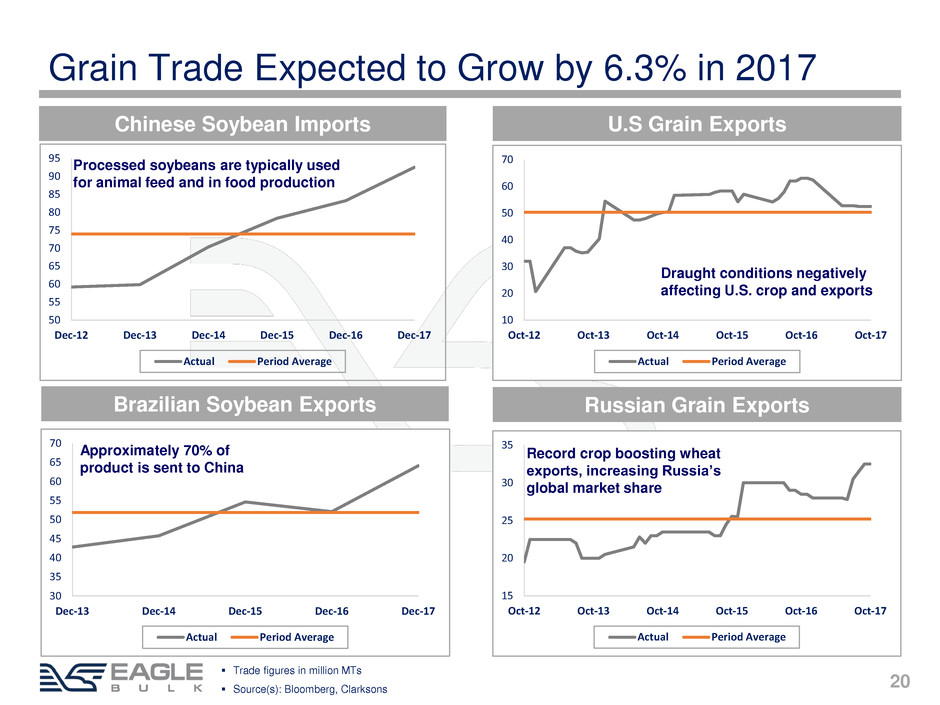

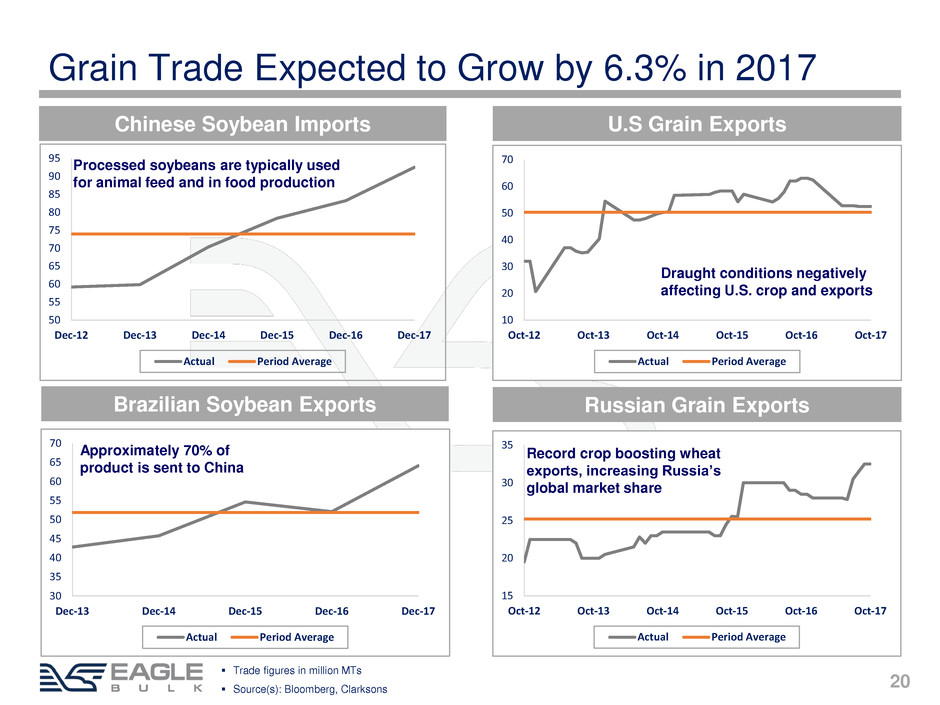

20 Trade figures in million MTs Source(s): Bloomberg, Clarksons Grain Trade Expected to Grow by 6.3% in 2017 U.S Grain Exports Chinese Soybean Imports 50 55 60 65 70 75 80 85 90 95 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Actual Period Average 10 20 30 40 50 60 70 Oct-12 Oct-13 Oct-14 Oct-15 Oct-16 Oct-17 Actual Period Average Russian Grain Exports 15 20 25 30 35 Oct-12 Oct-13 Oct-14 Oct-15 Oct-16 Oct-17 Actual Period Average Processed soybeans are typically used for animal feed and in food production Brazilian Soybean Exports 30 35 40 45 50 55 60 65 70 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Actual Period Average Approximately 70% of product is sent to China Record crop boosting wheat exports, increasing Russia’s global market share Draught conditions negatively affecting U.S. crop and exports

21 Trade figures in million MTs Source(s): Bloomberg, Clarksons Minor Bulks Represent 37% of Total Drybulk Trade Salt Trade Agribulks + Fertilizer Trade 20 30 40 50 60 70 80 90 100 110 Aug-12 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 China + India Period Average 40 42 44 46 48 50 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Actual Period Average Chile is a major exporter of salt Petcoke can be used as a substitute for coal in power generation 290 295 300 305 310 315 320 325 330 335 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Actual Period Average Fertilizer demand growth driven primarily by Brazil and India Bauxite Trade 70 75 80 85 90 95 100 105 110 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Actual Period Average Bauxite trade expected to increase by 18% Y/Y U.S. Petcoke Exports to China + India

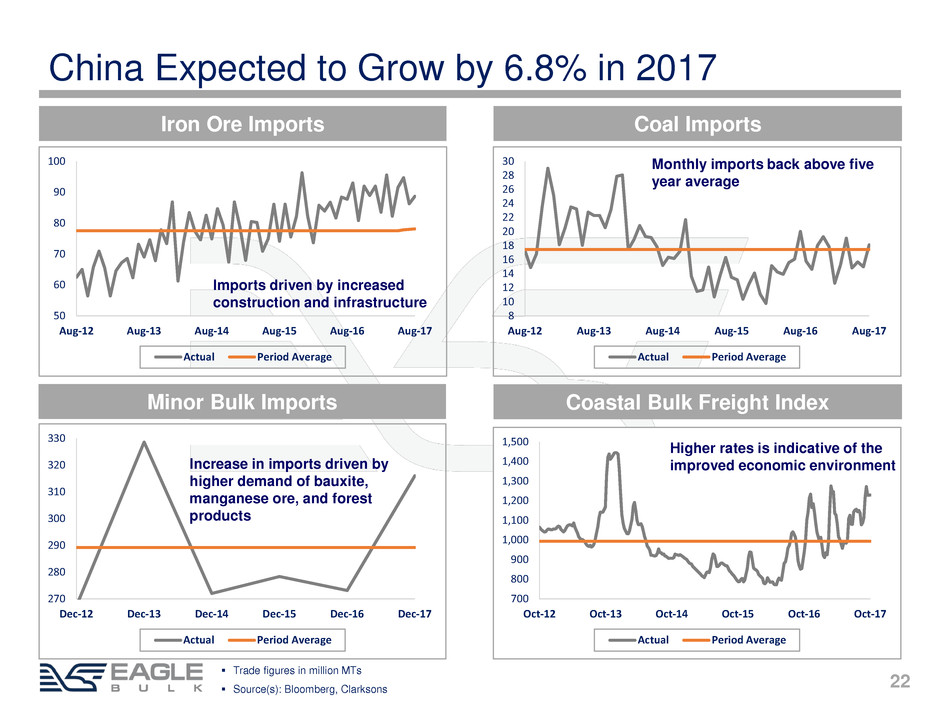

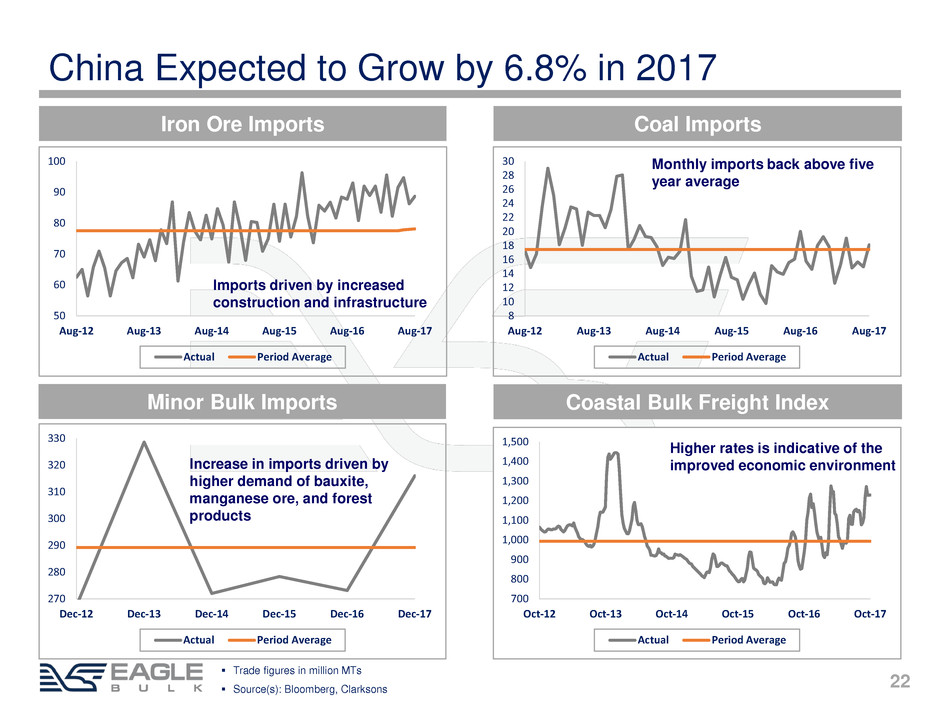

270 280 290 300 310 320 330 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Actual Period Average 22 Iron Ore Imports Coastal Bulk Freight Index Trade figures in million MTs Source(s): Bloomberg, Clarksons China Expected to Grow by 6.8% in 2017 Coal Imports 50 60 70 80 90 100 Aug-12 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 Actual Period Average 8 10 12 14 16 18 20 22 24 26 28 30 Aug-12 Aug-13 Aug-14 Aug-15 Aug-16 Aug-17 Actual Period Average 700 800 900 1,000 1,100 1,200 1,300 1,400 1,500 Oct-12 Oct-13 Oct-14 Oct-15 Oct-16 Oct-17 Actual Period Average Imports driven by increased construction and infrastructure Monthly imports back above five year average Higher rates is indicative of the improved economic environment Minor Bulk Imports Increase in imports driven by higher demand of bauxite, manganese ore, and forest products

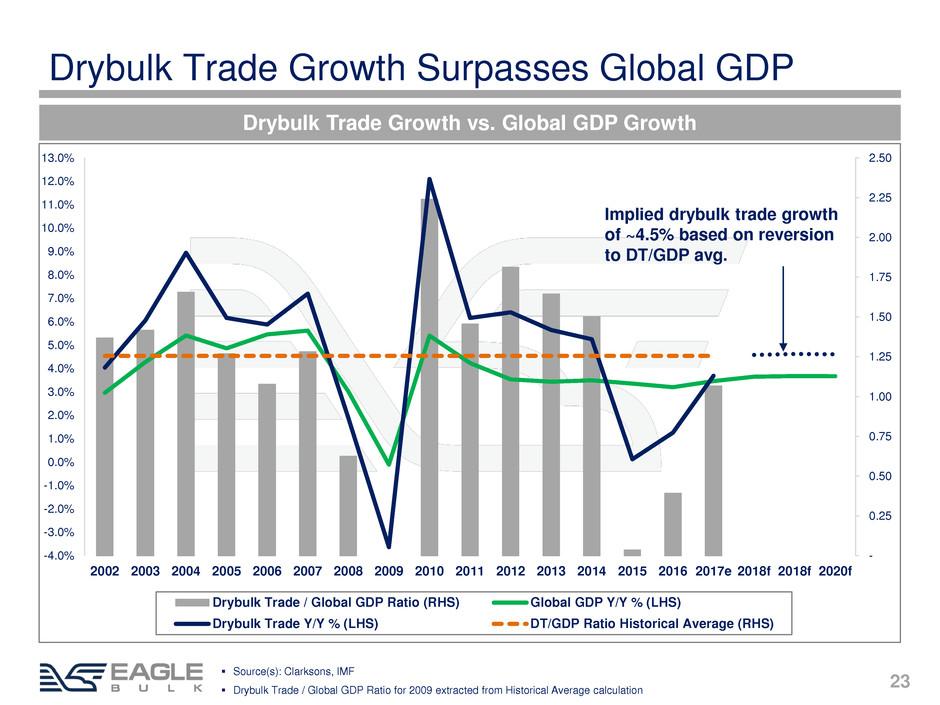

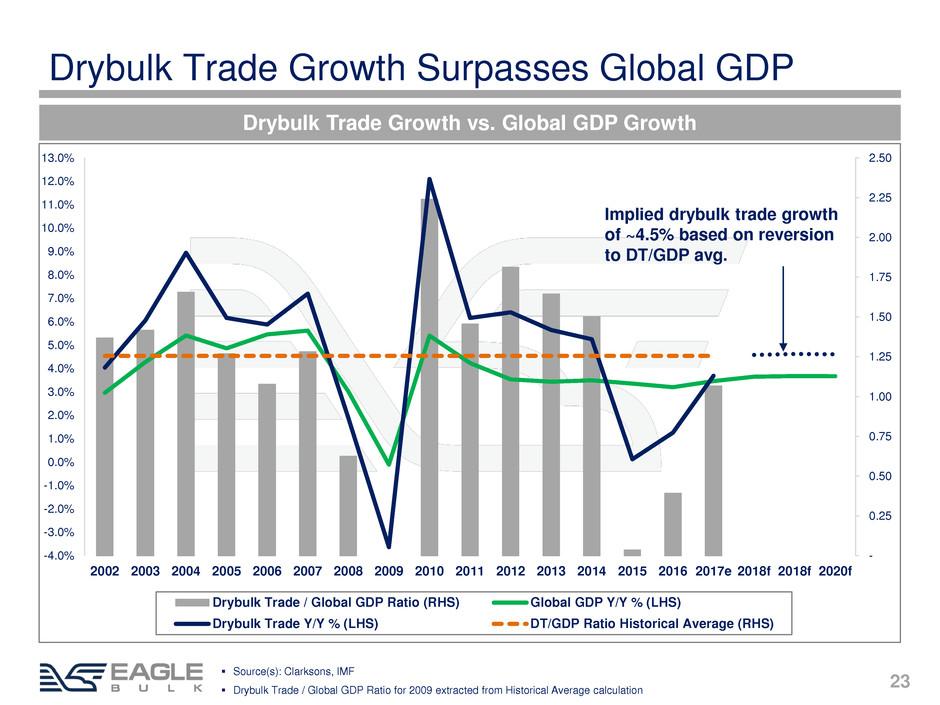

- 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 -4.0% -3.0% -2.0% -1.0% 0.0% 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017e 2018f 2018f 2020f Drybulk Trade / Global GDP Ratio (RHS) Global GDP Y/Y % (LHS) Drybulk Trade Y/Y % (LHS) DT/GDP Ratio Historical Average (RHS) 23 Source(s): Clarksons, IMF Drybulk Trade / Global GDP Ratio for 2009 extracted from Historical Average calculation Drybulk Trade Growth vs. Global GDP Growth Drybulk Trade Growth Surpasses Global GDP Implied drybulk trade growth of ~4.5% based on reversion to DT/GDP avg.

Summary

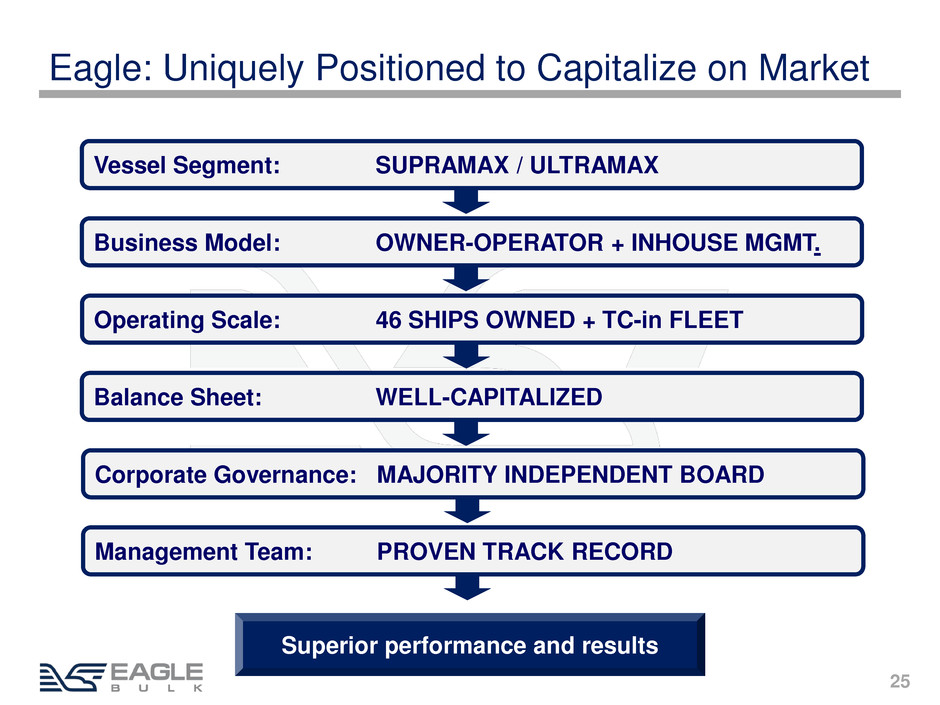

25 Eagle: Uniquely Positioned to Capitalize on Market Vessel Segment: SUPRAMAX / ULTRAMAX Superior performance and results Business Model: OWNER-OPERATOR + INHOUSE MGMT. Operating Scale: 46 SHIPS OWNED + TC-in FLEET Balance Sheet: WELL-CAPITALIZED Corporate Governance: MAJORITY INDEPENDENT BOARD Management Team: PROVEN TRACK RECORD

Q&A

Appendix

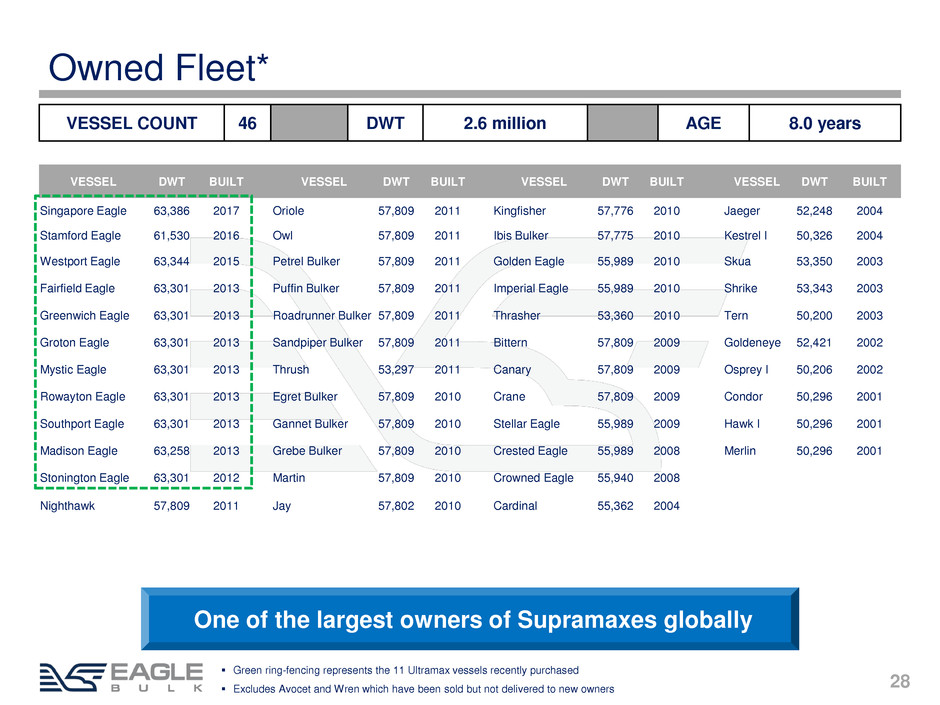

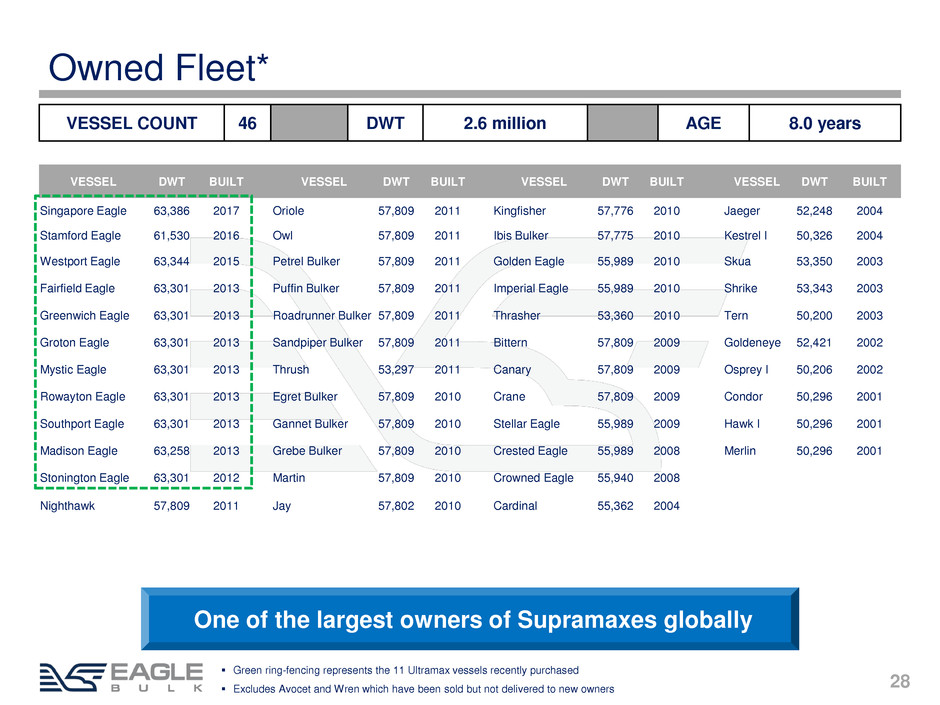

28 One of the largest owners of Supramaxes globally Owned Fleet* VESSEL DWT BUILT VESSEL DWT BUILT VESSEL DWT BUILT VESSEL DWT BUILT Singapore Eagle 63,386 2017 Oriole 57,809 2011 Kingfisher 57,776 2010 Jaeger 52,248 2004 Stamford Eagle 61,530 2016 Owl 57,809 2011 Ibis Bulker 57,775 2010 Kestrel I 50,326 2004 Westport Eagle 63,344 2015 Petrel Bulker 57,809 2011 Golden Eagle 55,989 2010 Skua 53,350 2003 Fairfield Eagle 63,301 2013 Puffin Bulker 57,809 2011 Imperial Eagle 55,989 2010 Shrike 53,343 2003 Greenwich Eagle 63,301 2013 Roadrunner Bulker 57,809 2011 Thrasher 53,360 2010 Tern 50,200 2003 Groton Eagle 63,301 2013 Sandpiper Bulker 57,809 2011 Bittern 57,809 2009 Goldeneye 52,421 2002 Mystic Eagle 63,301 2013 Thrush 53,297 2011 Canary 57,809 2009 Osprey I 50,206 2002 Rowayton Eagle 63,301 2013 Egret Bulker 57,809 2010 Crane 57,809 2009 Condor 50,296 2001 Southport Eagle 63,301 2013 Gannet Bulker 57,809 2010 Stellar Eagle 55,989 2009 Hawk I 50,296 2001 Madison Eagle 63,258 2013 Grebe Bulker 57,809 2010 Crested Eagle 55,989 2008 Merlin 50,296 2001 Stonington Eagle 63,301 2012 Martin 57,809 2010 Crowned Eagle 55,940 2008 Nighthawk 57,809 2011 Jay 57,802 2010 Cardinal 55,362 2004 VESSEL COUNT 46 DWT 2.6 million AGE 8.0 years Green ring-fencing represents the 11 Ultramax vessels recently purchased Excludes Avocet and Wren which have been sold but not delivered to new owners

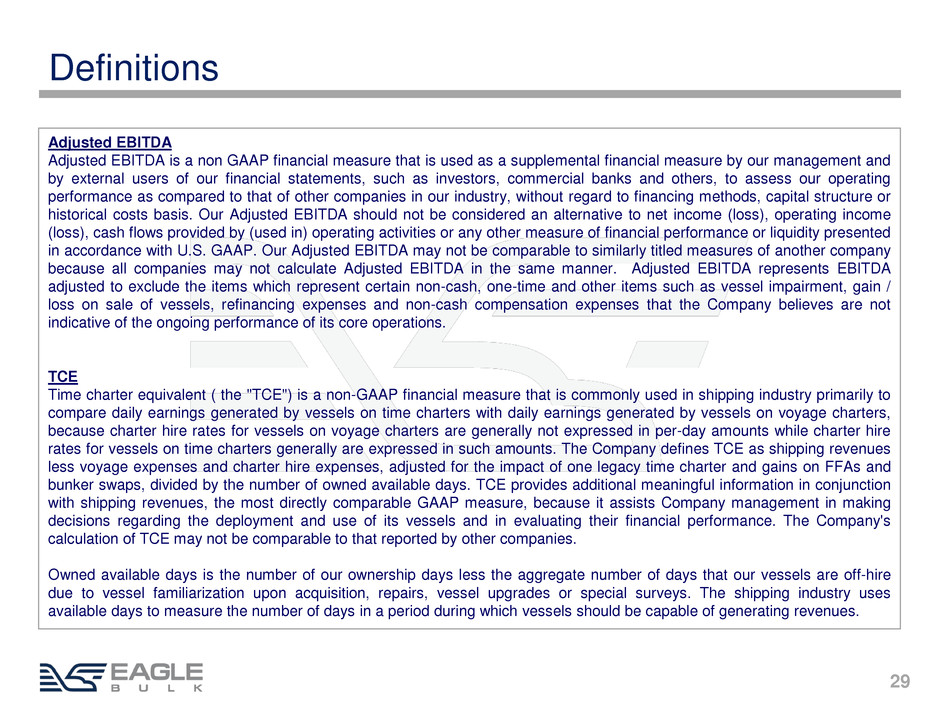

29 Definitions Adjusted EBITDA Adjusted EBITDA is a non GAAP financial measure that is used as a supplemental financial measure by our management and by external users of our financial statements, such as investors, commercial banks and others, to assess our operating performance as compared to that of other companies in our industry, without regard to financing methods, capital structure or historical costs basis. Our Adjusted EBITDA should not be considered an alternative to net income (loss), operating income (loss), cash flows provided by (used in) operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA in the same manner. Adjusted EBITDA represents EBITDA adjusted to exclude the items which represent certain non-cash, one-time and other items such as vessel impairment, gain / loss on sale of vessels, refinancing expenses and non-cash compensation expenses that the Company believes are not indicative of the ongoing performance of its core operations. TCE Time charter equivalent ( the "TCE") is a non-GAAP financial measure that is commonly used in shipping industry primarily to compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per-day amounts while charter hire rates for vessels on time charters generally are expressed in such amounts. The Company defines TCE as shipping revenues less voyage expenses and charter hire expenses, adjusted for the impact of one legacy time charter and gains on FFAs and bunker swaps, divided by the number of owned available days. TCE provides additional meaningful information in conjunction with shipping revenues, the most directly comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance. The Company's calculation of TCE may not be comparable to that reported by other companies. Owned available days is the number of our ownership days less the aggregate number of days that our vessels are off-hire due to vessel familiarization upon acquisition, repairs, vessel upgrades or special surveys. The shipping industry uses available days to measure the number of days in a period during which vessels should be capable of generating revenues.

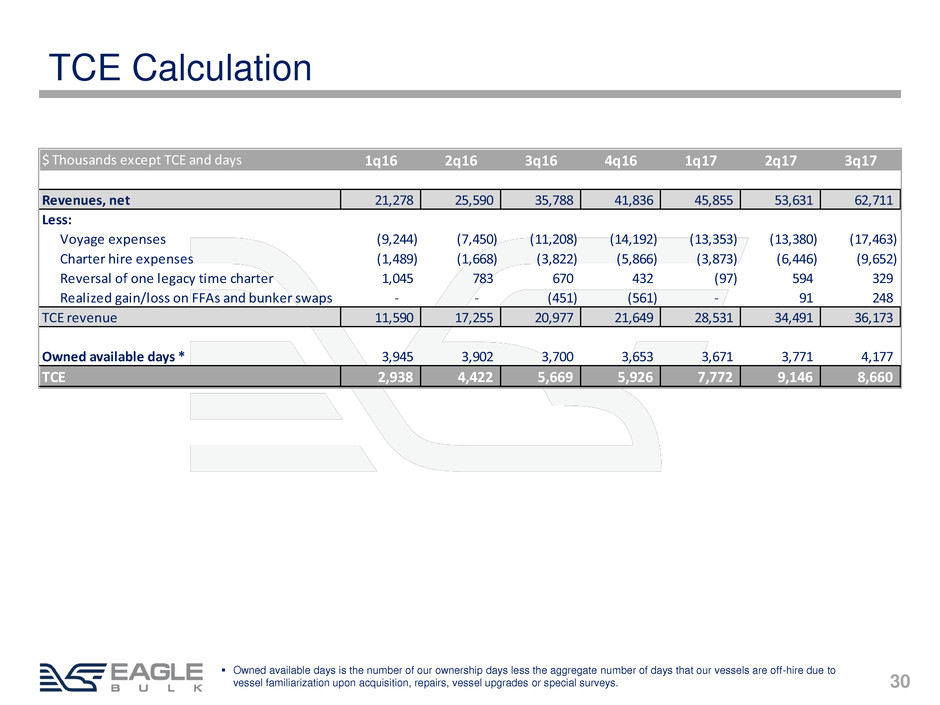

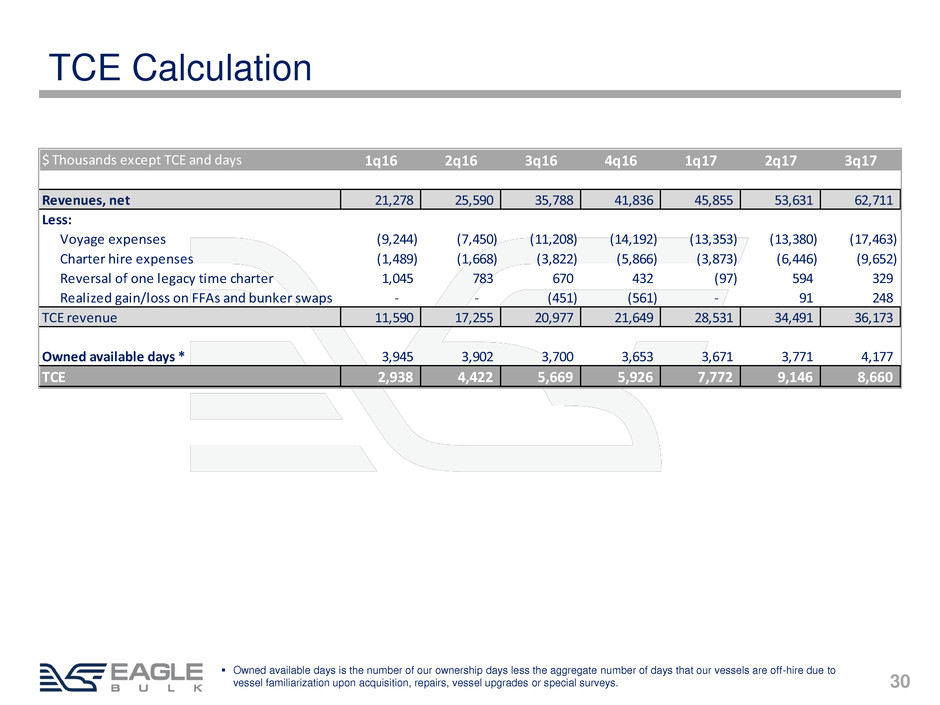

30 TCE Calculation Owned available days is the number of our ownership days less the aggregate number of days that our vessels are off-hire due to vessel familiarization upon acquisition, repairs, vessel upgrades or special surveys. $ Thousands except TCE and days 1q16 2q16 3q16 4q16 1q17 2q17 3q17 Revenues, net 21,278 25,590 35,788 41,836 45,855 53,631 62,711 Less: Voyage expenses (9,244) (7,450) (11,208) (14,192) (13,353) (13,380) (17,463) Charter hire expenses (1,489) (1,668) (3,822) (5,866) (3,873) (6,446) (9,652) Reversal of one legacy time charter 1,045 783 670 432 (97) 594 329 Realized gain/loss on FFAs and bunker swaps - - (451) (561) - 91 248 TCE revenue 11,590 17,255 20,977 21,649 28,531 34,491 36,173 Owned available days * 3,945 3,902 3,700 3,653 3,671 3,771 4,177 TCE 2,938 4,422 5,669 5,926 7,772 9,146 8,660

www.eagleships.com