providing optimized global transportation of drybulk commodities Earnings Presentation First Quarter 2020 8 May 2020

Disclaimer This presentation contains certain statements that may be deemed to be “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, and are intended to be covered by the safe harbor provided for under these sections. These statements may include words such as “believe,” “estimate,” “project,” “intend,” “expect,” “plan,” “anticipate,” and similar expressions in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements reflect management’s current expectations and observations with respect to future events and financial performance. Where we express an expectation or belief as to future events or results, such expectation or belief is expressed in good faith and believed to have a reasonable basis. However, our forward-looking statements are subject to risks, uncertainties, and other factors, which could cause actual results to differ materially from future results expressed, projected, or implied by those forward-looking statements. The forward-looking statements in this presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, examination of historical operating trends, data contained in our records and other data available from third parties. Although Eagle Bulk Shipping Inc. believes that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond our control, Eagle Bulk Shipping Inc. cannot assure you that it will achieve or accomplish these expectations, beliefs or projections. The principal factors that affect our financial position, results of operations and cash flows include, charter market rates, which have declined significantly from historic highs, periods of charter hire, vessel operating expenses and voyage costs, which are incurred primarily in U.S. dollars, depreciation expenses, which are a function of the cost of our vessels, significant vessel improvement costs and our vessels’ estimated useful lives, and financing costs related to our indebtedness. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of certain factors which could include the following: (i) changes in demand in the drybulk market, including, without limitation, changes in production of, or demand for, commodities and bulk cargoes, generally or in particular regions; (ii) greater than anticipated levels of drybulk vessel newbuilding orders or lower than anticipated rates of drybulk vessel scrapping; (iii) changes in rules and regulations applicable to the drybulk industry, including, without limitation, legislation adopted by international bodies or organizations such as the International Maritime Organization and the European Union or by individual countries; (iv) actions taken by regulatory authorities including without limitation the U.S. Treasury Department’s Office of Foreign Assets Control (“OFAC”); (v) changes in trading patterns significantly impacting overall drybulk tonnage requirements; (vi) changes in the typical seasonal variations in drybulk charter rates; (vii) changes in the cost of other modes of bulk commodity transportation; (viii) changes in general domestic and international political conditions; (ix) changes in the condition of the Company’s vessels or applicable maintenance or regulatory standards (which may affect, among other things, our anticipated drydocking costs); (x) significant deterioration in charter hire rates from current levels or the inability of the Company to achieve its cost-cutting measures; (xi) the duration and impact of the novel coronavirus ("COVID-19") pandemic; (xii) the relative cost and availability of low and high sulfur fuel oil; (xiii) our ability to realize the economic benefits or recover the cost of the scrubbers we have installed; (xiv) any legal proceedings which we may be involved from time to time; and other factors listed from time to time in our filings with the Securities and Exchange Commission. This discussion also includes statistical data regarding world drybulk fleet and order book and fleet age. We generated some of this data internally, and some were obtained from independent industry publications and reports that we believe to be reliable sources. We have not independently verified this data nor sought the consent of any organizations to refer to their reports in this presentation. We disclaim any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. 2

Agenda 1 Highlights 2 Financial Summary 3 Industry Review * Appendix 3

Highlights

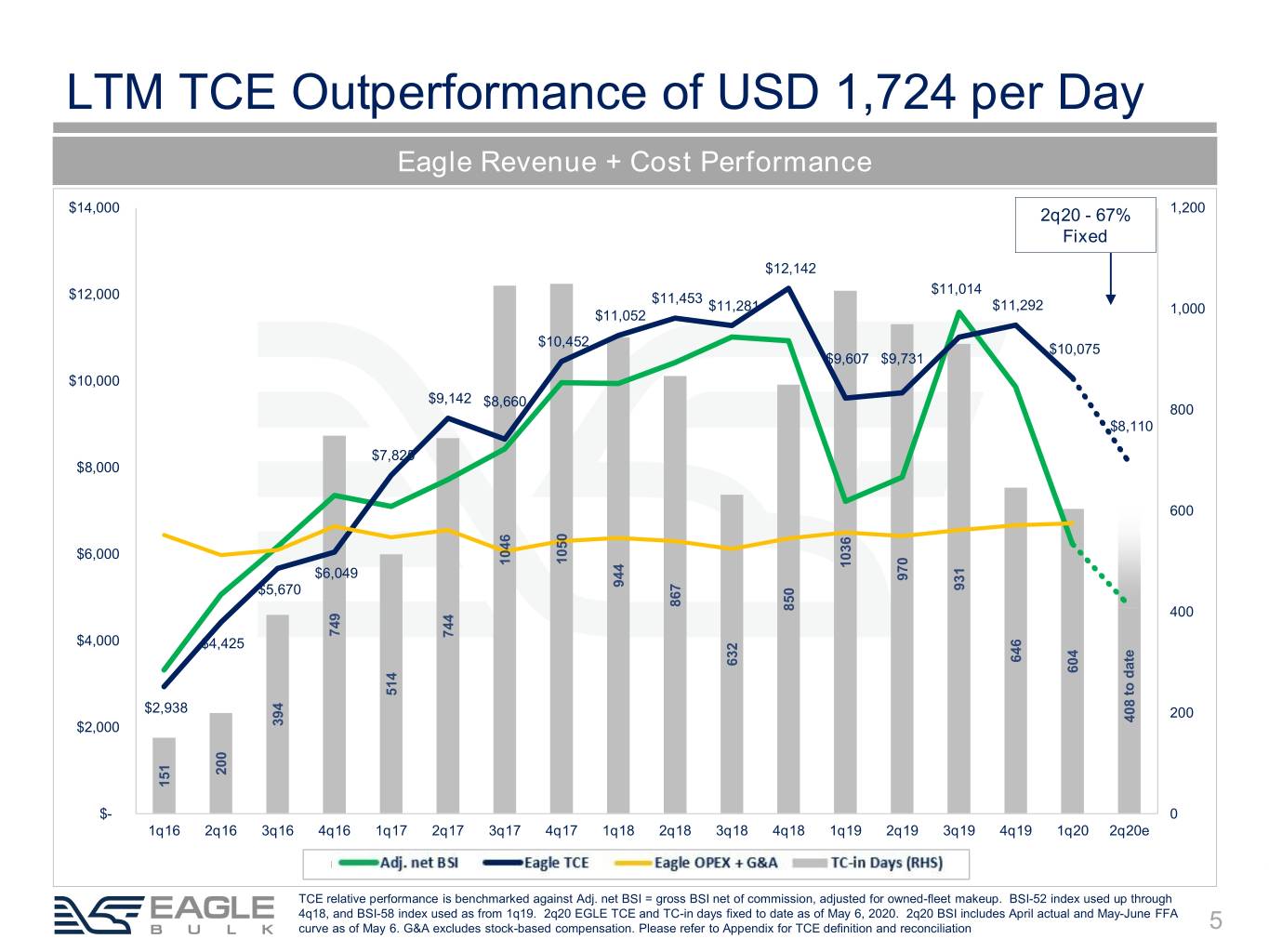

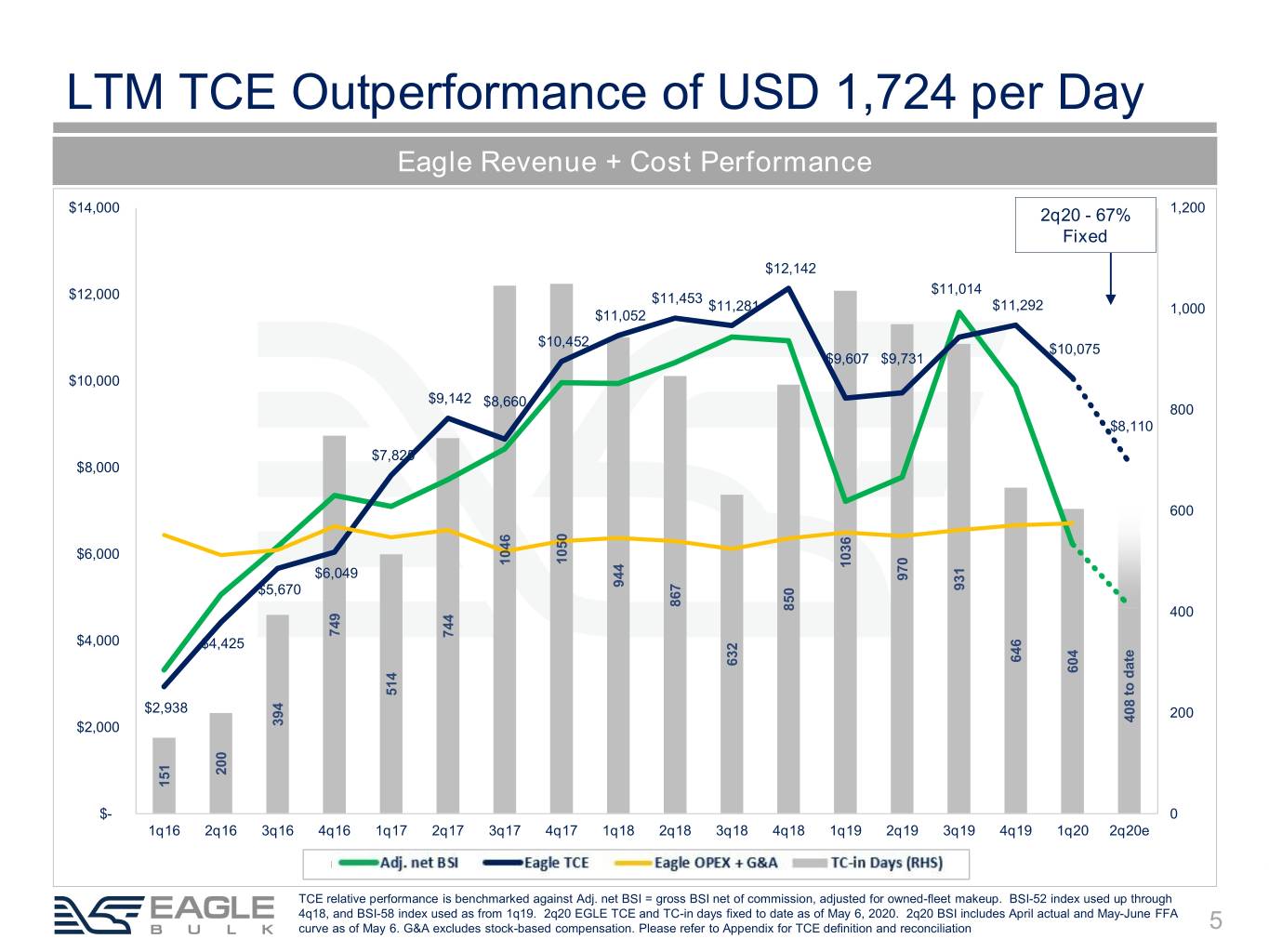

LTM TCE Outperformance of USD 1,724 per Day Eagle Revenue + Cost Performance $14,000 2q20 - 67% 1,200 Fixed $12,142 $11,014 $12,000 $11,453 $11,281 $11,292 $11,052 1,000 $10,452 $10,075 $9,607 $9,731 $10,000 $9,142 $8,660 800 $8,110 $7,825 $8,000 600 $6,000 $6,049 $5,670 400 $4,000 $4,425 $2,938 200 $2,000 $- 0 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 1q18 2q18 3q18 4q18 1q19 2q19 3q19 4q19 1q20 2q20e TC-in Days (RHS) Adj. net BSI Eagle TCE Eagle OPEX+G&A TCE relative performance is benchmarked against Adj. net BSI = gross BSI net of commission, adjusted for owned-fleet makeup. BSI-52 index used up through 4q18, and BSI-58 index used as from 1q19. 2q20 EGLE TCE and TC-in days fixed to date as of May 6, 2020. 2q20 BSI includes April actual and May-June FFA curve as of May 6. G&A excludes stock-based compensation. Please refer to Appendix for TCE definition and reconciliation 5

Historical EBITDA Adjusted EBITDA $30 TCE Outperformance contributed ~50% of Adjusted $14,000 EBITDA during the twelve months ending Mar 31, 2020 $25 $23.5 $21.1 $12,000 $20.2 $20 $18.8 $18.8 $17.2 $15.4 $10,000 $15 $13.2 $10.4 $9.3 $9.8 $10 $8.4 $8,000 $4.6 BSI $5 $6,000 $- Adjusted EBITDA millions) (in EBITDA Adjusted $(5) $(3.4) $4,000 $(2.0) $(6.7) $(10) $2,000 $(15) $(14.5) $(20) $- 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 1q18 2q18 3q18 4q18 1q19 2q19 3q19 4q19 1q20 Core Business TCE Outperformance TCE Underperformance Adj. Net BSI (RHS) ▪ Please refer to Appendix for definition of Adjusted EBITDA and reconciliation ▪ Please refer to Appendix for TCE definition and reconciliation 6 ▪ Core Business reflects EBITDA based on index commercial performance (i.e. no out/under-performance) less OPEX and cash G&A

Financial Summary

Earnings USD in Thousands except EPS 1q20 4q19 1q19 Revenues, net of commissions $ 74,378 $ 71,486 $ 77,390 Operating expenses Voyage expenses 26,564 21,442 25,906 Charter hire expenses 6,041 8,152 11,492 Vessel expenses 23,700 22,336 20,094 Depreciation and amortization 12,466 11,322 9,407 General and administrative expenses 7,962 10,140 8,409 Other operating expense - 1,125 - (Gain) / loss on sale of vessels - 66 (4,107) Total operating expenses 76,733 74,582 71,200 Operating income / (loss) (2,355) (3,096) 6,190 Other expenses Interest expense,net - cash 7,531 7,047 5,824 Interest expense - debt discount & deferred financing1 1,504 1,519 504 Gain on derivatives (7,862) (490) (2,438) Loss on debt extinguishment - - 2,268 Total other expenses, net 1,173 8,075 6,158 Net (loss) / income $ (3,528) $ (11,171) $ 29 Weighted average shares outstanding (Basic, in millions) 71,869 71,479 71,283 EPS (Basic) $ (0.05) $ (0.16) $ 0.00 Adjusted EBITDA2 $ 18,810 $ 9,780 $ 15,372 1 – Includes non-cash interest expense related to the amortization of the equity component of the convertible bond of $0.9 million for 4q19 and 1q20. 8 2 – Please refer to Appendix for Adjusted EBITDA definition and reconciliation

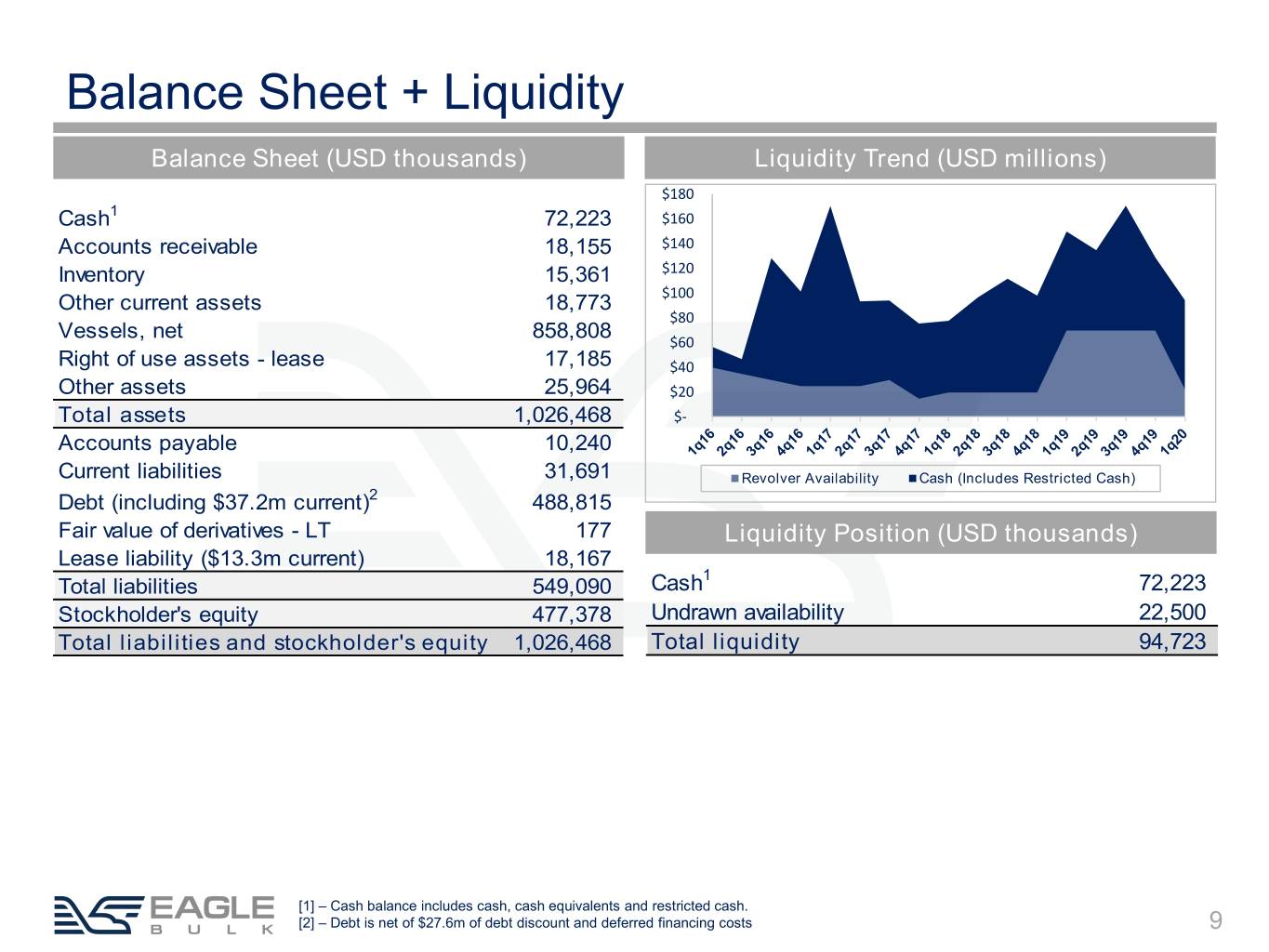

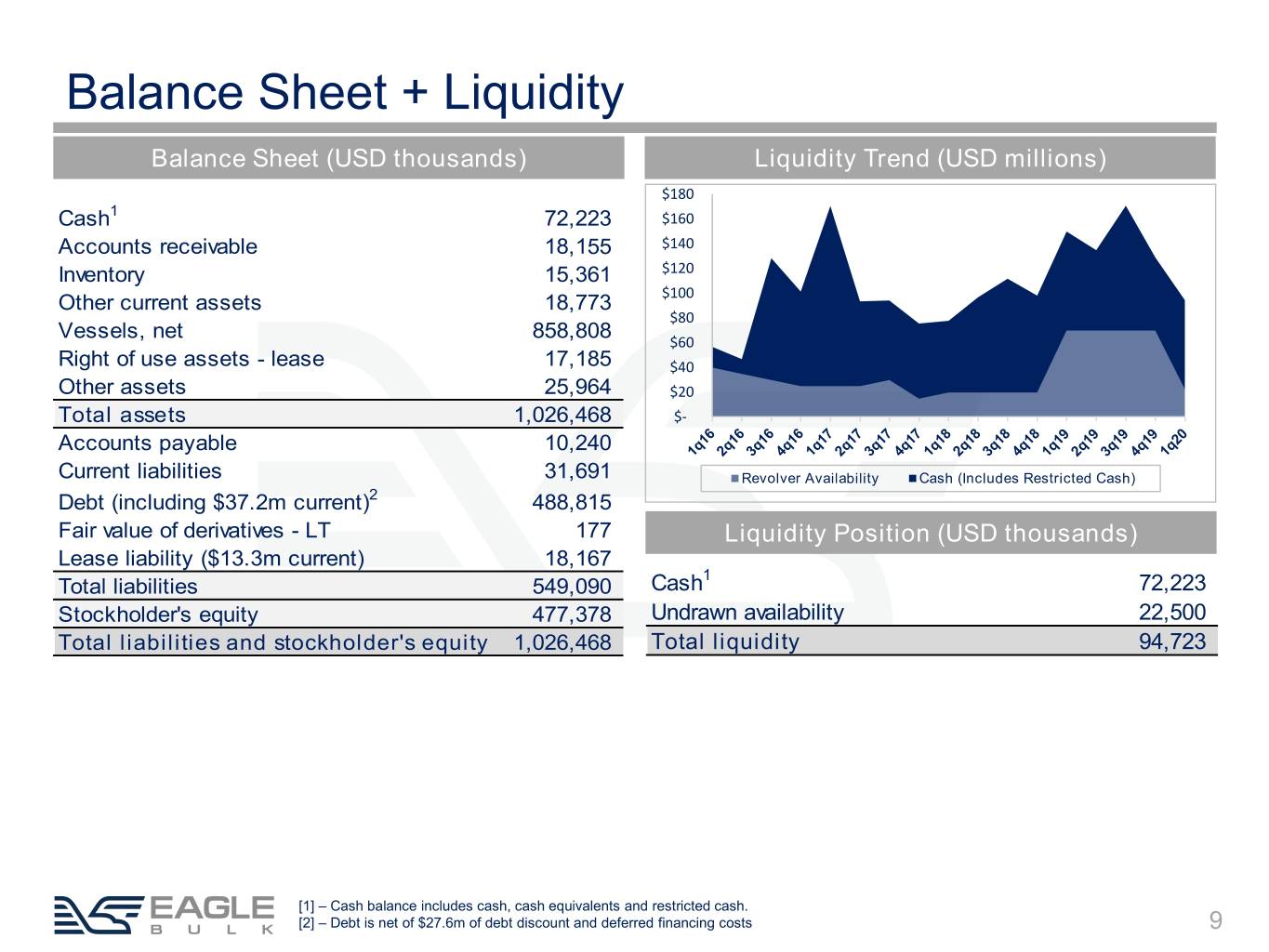

Balance Sheet + Liquidity Balance Sheet (USD thousands) Liquidity Trend (USD millions) $180 1 Cash 72,223 $160 Accounts receivable 18,155 $140 Inventory 15,361 $120 Other current assets 18,773 $100 $80 Vessels, net 858,808 $60 Right of use assets - lease 17,185 $40 Other assets 25,964 $20 Total assets 1,026,468 $- Accounts payable 10,240 Current liabilities 31,691 Revolver Availability Cash (Includes Restricted Cash) Debt (including $37.2m current)2 488,815 Fair value of derivatives - LT 177 Liquidity Position (USD thousands) Lease liability ($13.3m current) 18,167 1 Total liabilities 549,090 Cash 72,223 Stockholder's equity 477,378 Undrawn availability 22,500 Total liabilities and stockholder's equity 1,026,468 Total liquidity 94,723 [1] – Cash balance includes cash, cash equivalents and restricted cash. [2] – Debt is net of $27.6m of debt discount and deferred financing costs 9

Cash Flows Cash Flow from Operations - Quarterly ($ Millions) 15 14 16 13 12 12 12 12 3 10 10 10 8 2 5 7 3 7 7 6 - 6 (7) (7) (5) (4) (4) (10) (2) (3) (13) (12) (20) (24) 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 1q18 2q18 3q18 4q18 1q19 2q19 3q19 4q19 1q20 Cash flow from operations ex Changes in operating assets and liabilities 1q20 Cash Walk ($ Millions) ▪ Cash balances at beginning and end of period include 1) cash, 2) cash equivalents, and 3) restricted cash 10

Cash Breakeven per Vessel per Day 1q20 4q19 FY 2019 Operating Vessel expenses $ 5,209 $ 5,008 $ 4,859 Drydocking 1,138 1,310 702 G&A* 1,505 1,663 1,681 Total operating 7,852 7,981 7,243 Debt Service Interest Expense 1,655 1,580 1,471 Debt Principal Repayment 1,278 2,029 1,366 Total Cash Breakeven $ 10,784 $ 11,589 $ 10,080 1q20 Cash Breakeven by Category Drydocking G&A* 11% 14% Interest Expense 27% Vessel Expenses 48% ▪ G&A excludes stock-based compensation for all periods shown. G&A for 1q20, 4q19, and FY 2019 excludes certain non-recurring expenses. 11

Industry Review

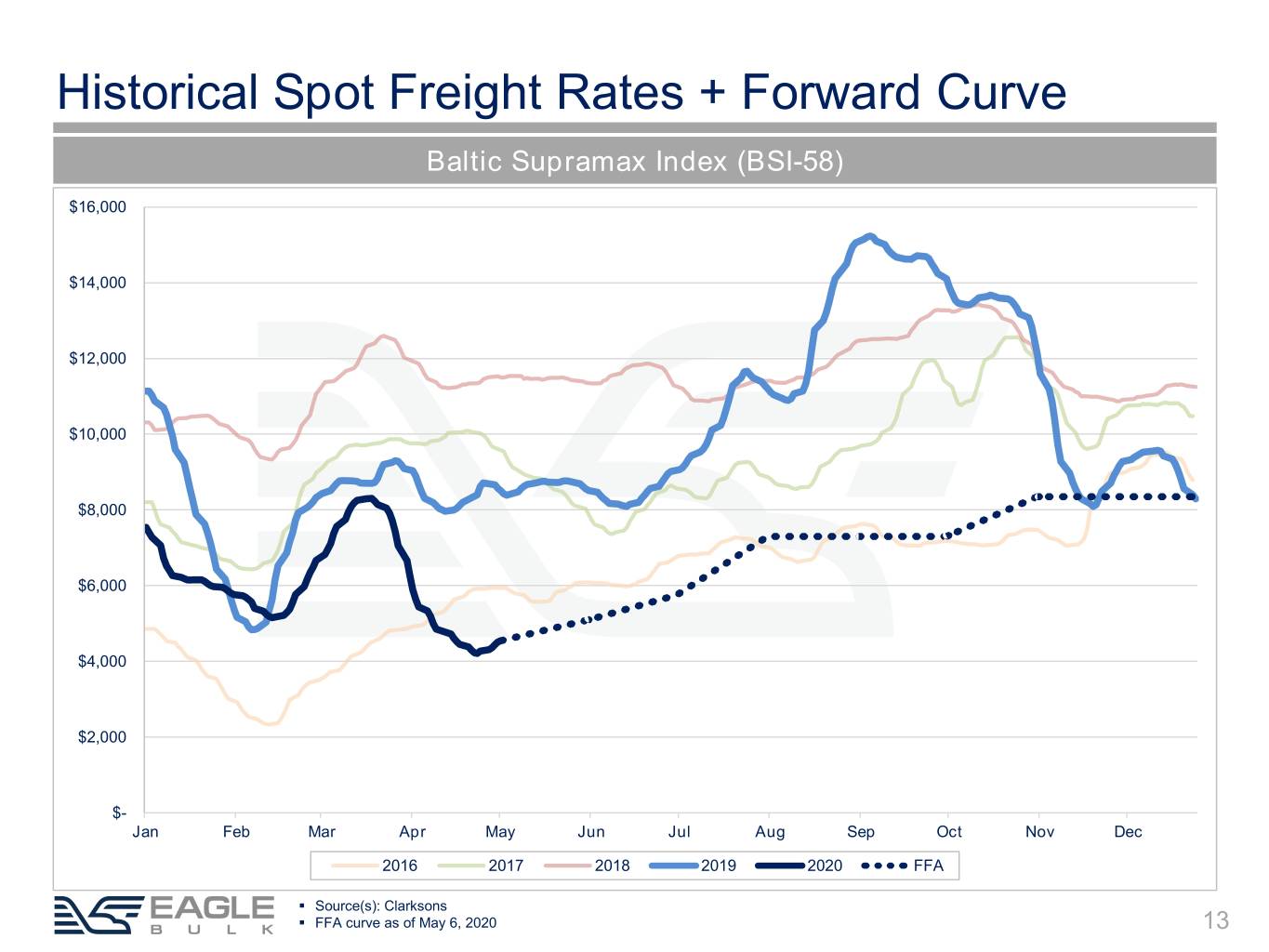

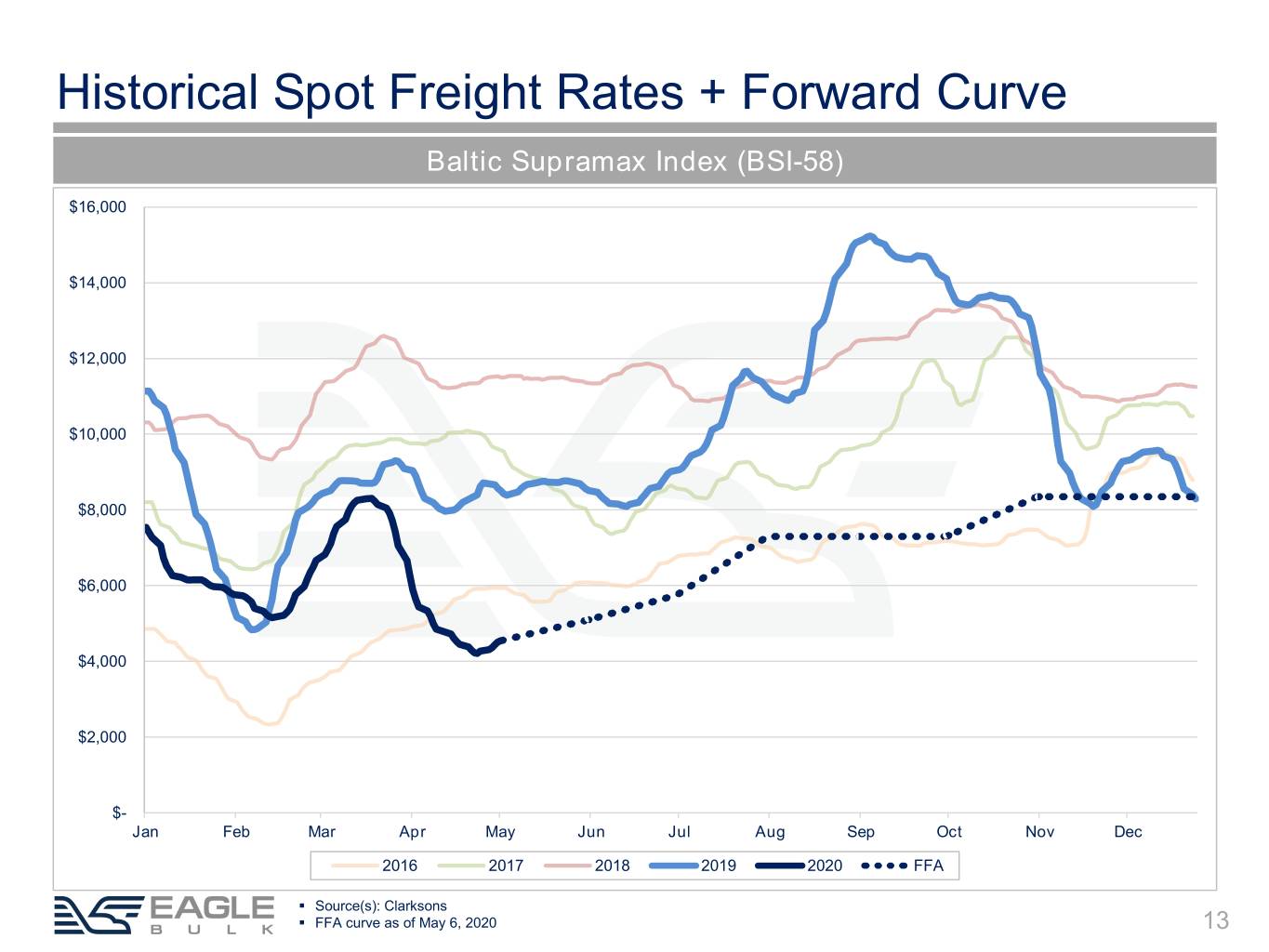

Historical Spot Freight Rates + Forward Curve Baltic Supramax Index (BSI-58) $16,000 $14,000 $12,000 $10,000 $8,000 $6,000 $4,000 $2,000 $- Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec 2016 2017 2018 2019 2020 FFA ▪ Source(s): Clarksons ▪ FFA curve as of May 6, 2020 13

Supramax/Ultramax 2020f Net Fleet Growth ~2.5% Drybulk Deliveries + Scrapping (DWT) 100 Net Fleet Growth Supramax Drybulk / Ultramax 80 2019e 3.9% 3.6% 2020f 2.5% 2.5% 60 2021f 1.9% 1.1% 40 20 0 -20 -40 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019e 2020f 2021f Total Deliveries Total Demolition Drybulk Net Supply Supramax/Ultramax Net Supply ▪ Figures are in million DWT ▪ Source(s): Clarksons (April 2020) 14

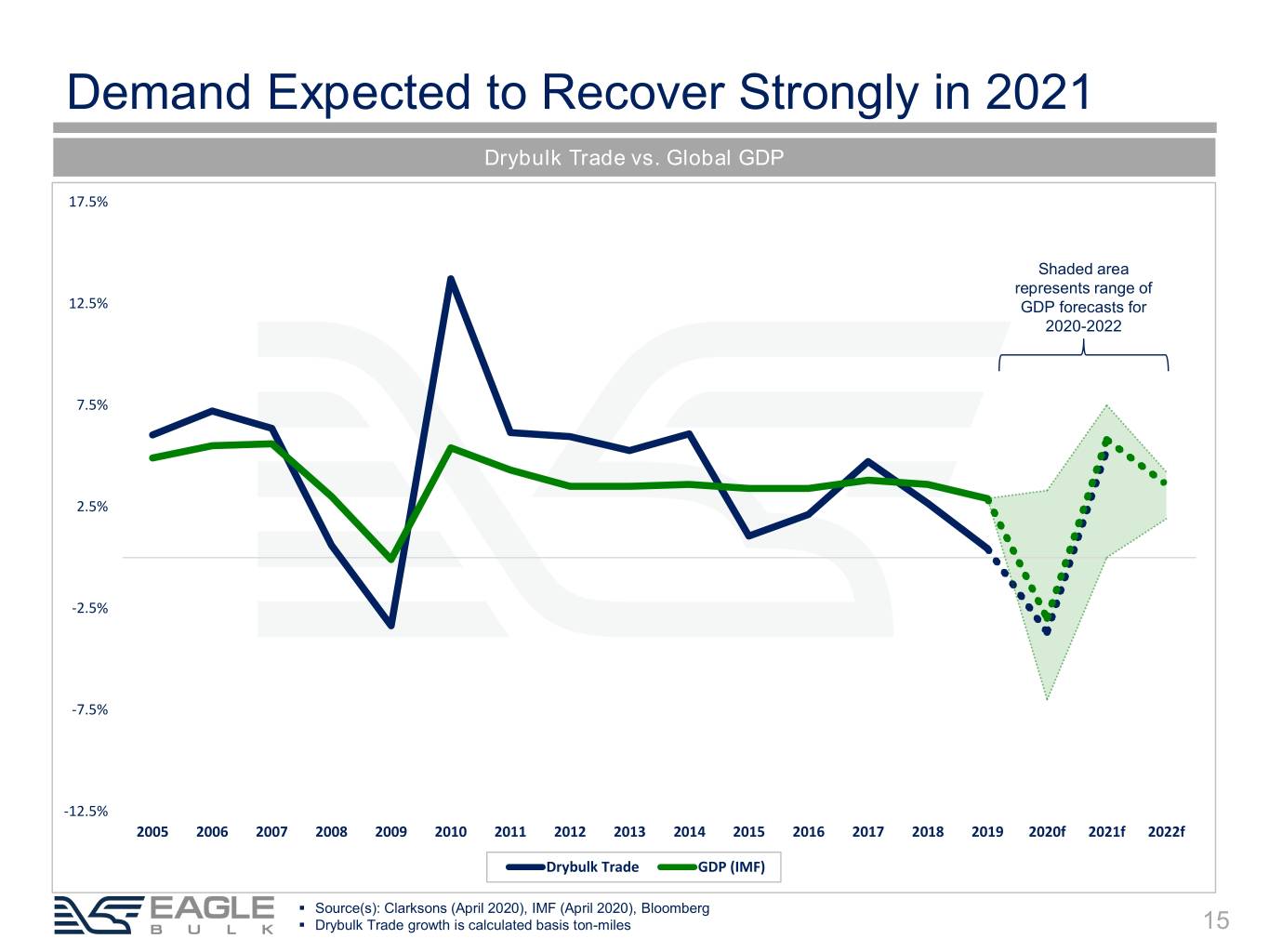

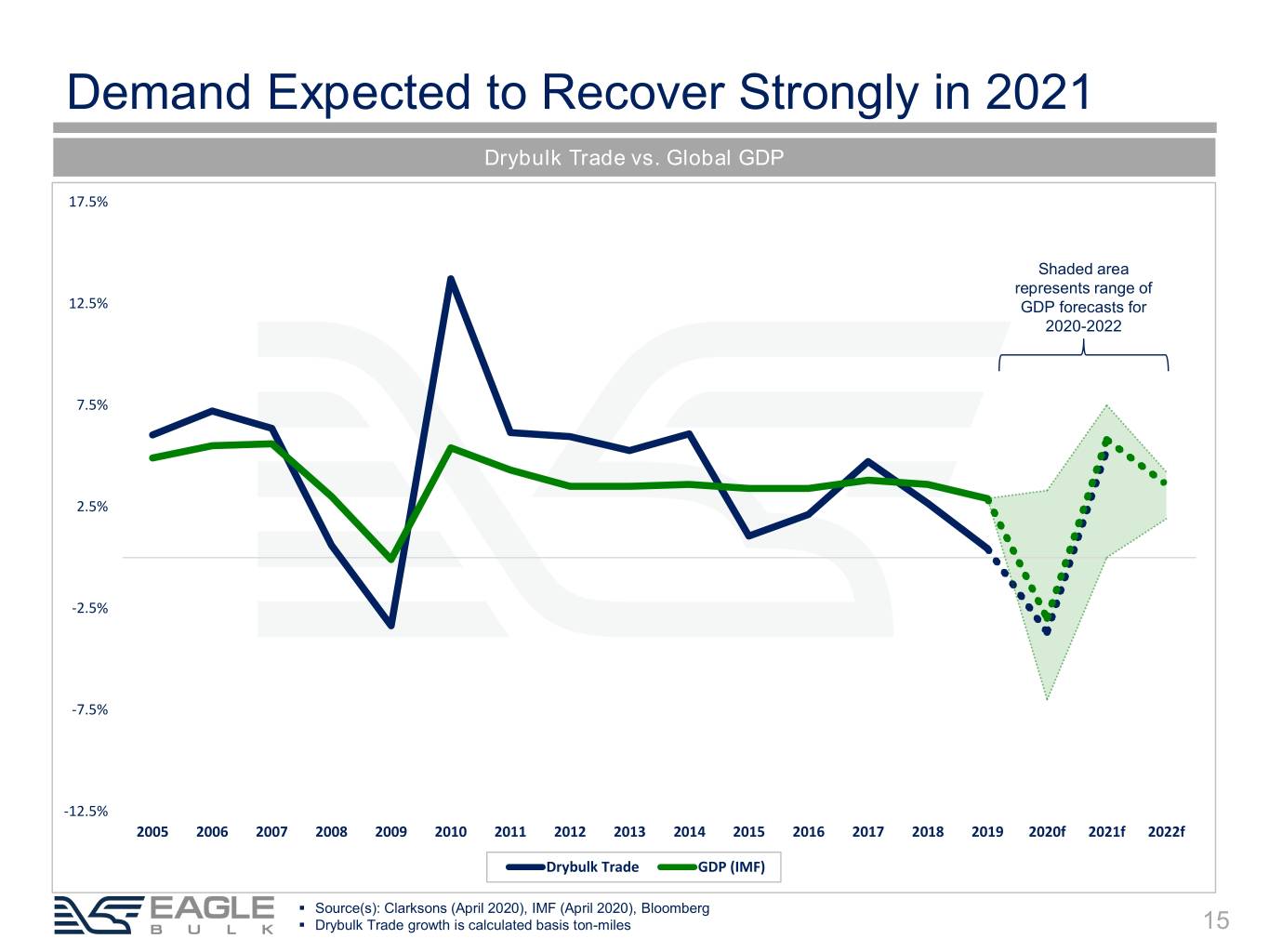

Demand Expected to Recover Strongly in 2021 Drybulk Trade vs. Global GDP 17.5% Shaded area represents range of 12.5% GDP forecasts for 2020-2022 7.5% 2.5% -2.5% -7.5% -12.5% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020f 2021f 2022f Drybulk Trade GDP (IMF) ▪ Source(s): Clarksons (April 2020), IMF (April 2020), Bloomberg ▪ Drybulk Trade growth is calculated basis ton-miles 15

APPENDIX

Corporate Structure Eagle Bulk Shipping Inc. (Parent | NASDAQ: EGLE) Convertible Bond: USD 114m Eagle Bulk Mgmt. LLC 100% 100% 100% 100% Eagle Bulk Shipco LLC Eagle Bulk Ultraco LLC Eagle Bulk Holdco LLC 24 vessels 24 vessels 2 vessels Bond: USD 188m TL: USD 167m Un-encumbered RCF: USD 12.5m available RCF: USD 10m available EBSC debt is non- recourse to the parent All management services (strategic / commercial / operational / technical / administrative) are performed in house by Eagle Bulk Management LLC, a wholly-owned subsidiary of the Parent ▪ All figures as of March 31, 2020 17

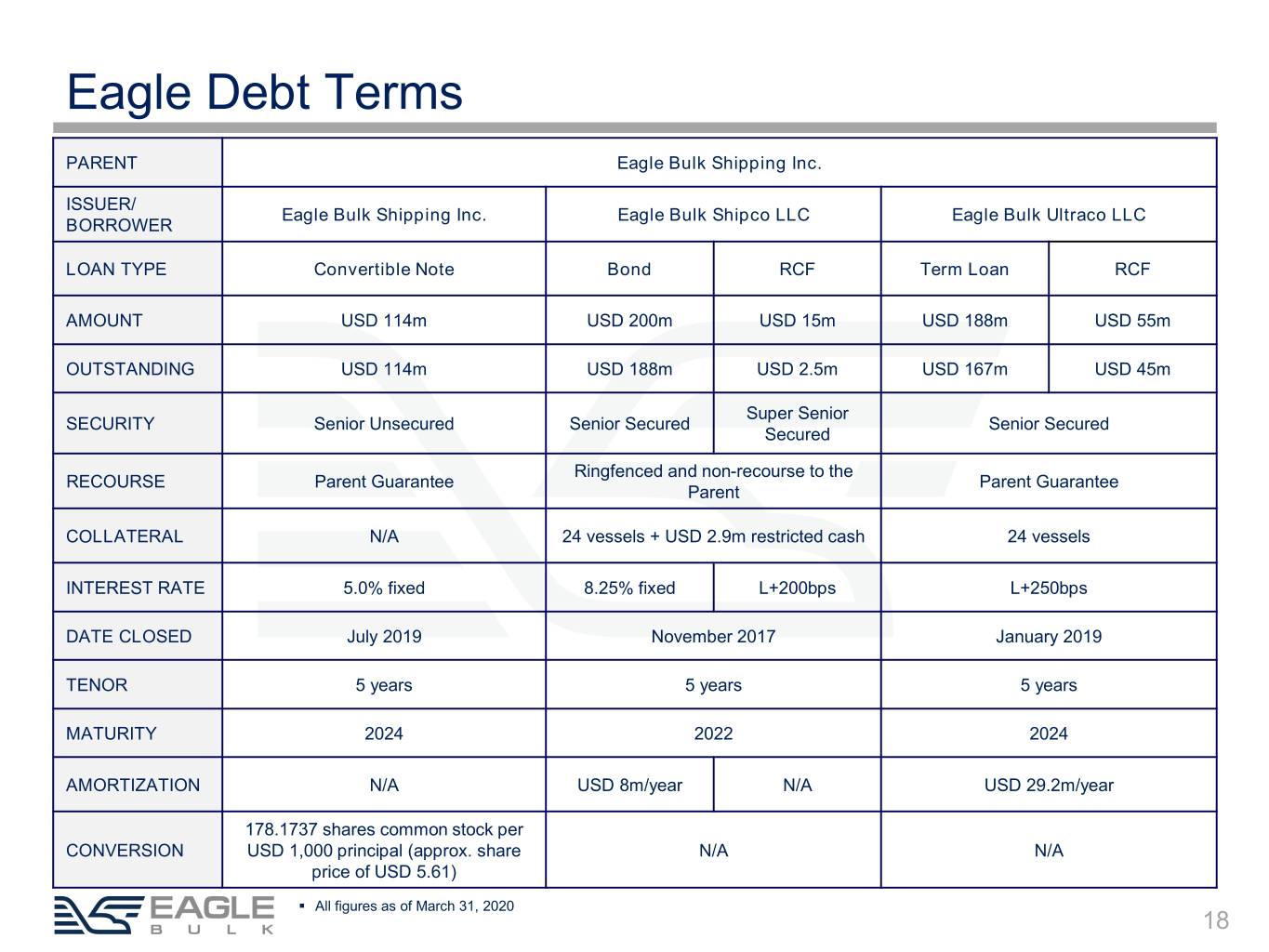

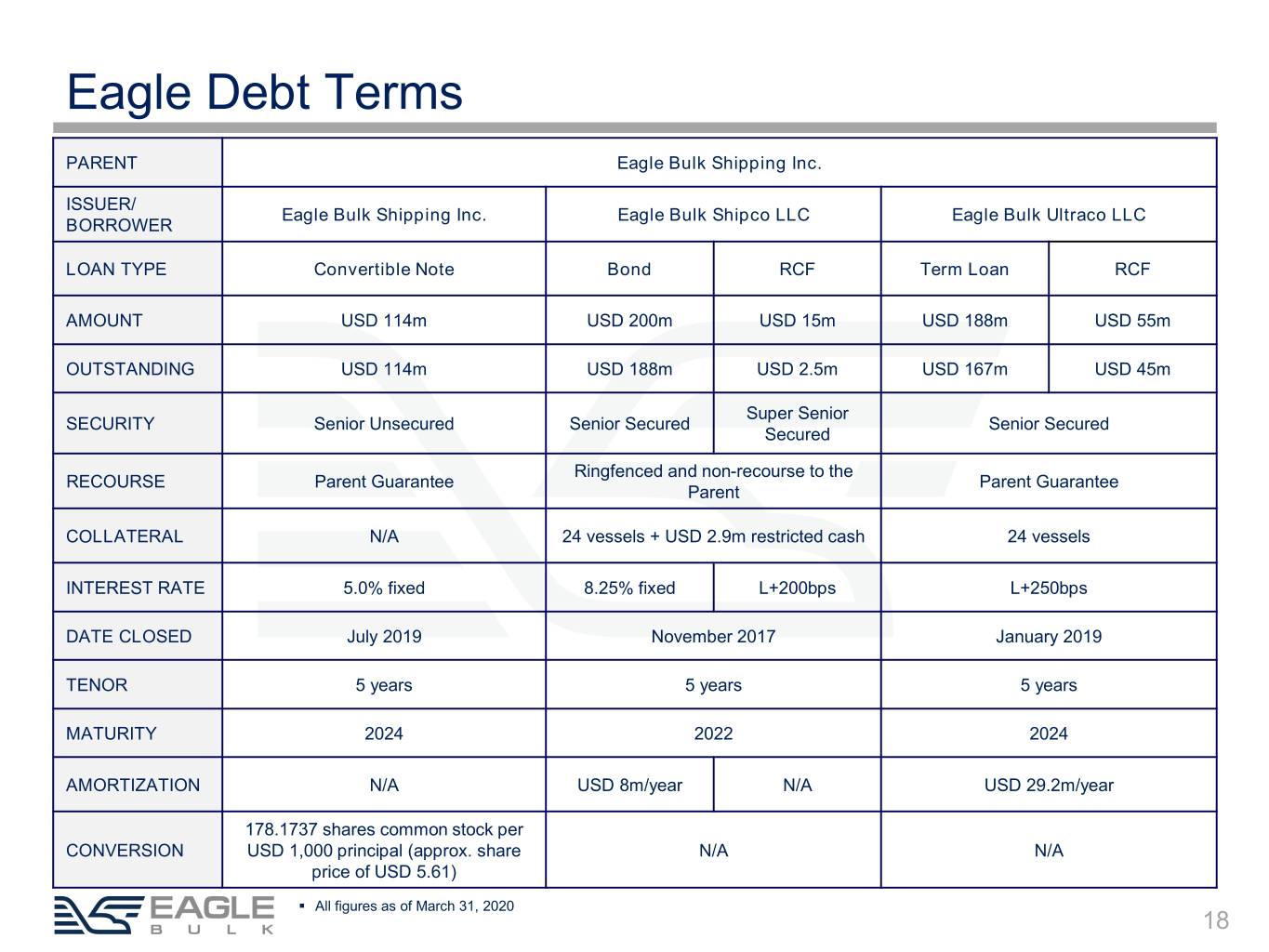

Eagle Debt Terms PARENT Eagle Bulk Shipping Inc. ISSUER/ Eagle Bulk Shipping Inc. Eagle Bulk Shipco LLC Eagle Bulk Ultraco LLC BORROWER LOAN TYPE Convertible Note Bond RCF Term Loan RCF AMOUNT USD 114m USD 200m USD 15m USD 188m USD 55m OUTSTANDING USD 114m USD 188m USD 2.5m USD 167m USD 45m Super Senior SECURITY Senior Unsecured Senior Secured Senior Secured Secured Ringfenced and non-recourse to the RECOURSE Parent Guarantee Parent Guarantee Parent COLLATERAL N/A 24 vessels + USD 2.9m restricted cash 24 vessels INTEREST RATE 5.0% fixed 8.25% fixed L+200bps L+250bps DATE CLOSED July 2019 November 2017 January 2019 TENOR 5 years 5 years 5 years MATURITY 2024 2022 2024 AMORTIZATION N/A USD 8m/year N/A USD 29.2m/year 178.1737 shares common stock per CONVERSION USD 1,000 principal (approx. share N/A N/A price of USD 5.61) ▪ All figures as of March 31, 2020 18

Owned Fleet Total Fleet: 50 Vessels 2946 DWT (MT, thousands) 8.9 Yrs Old Eagle Bulk Shipco LLC Eagle Bulk Ultraco LLC Eagle Bulk Holdco LLC Vessel Built DWT Vessel Built DWT Vessel Built DWT 1 Singapore Eagle 2017 63.4 1 Copenhagen Eagle 2015 63.5 1 Hong Kong Eagle 2016 63.5 2 Shanghai Eagle 2016 63.4 2 Sydney Eagle 2015 63.5 2 Santos Eagle 2015 63.5 3 Stamford Eagle 2016 61.5 3 Dublin Eagle 2015 63.5 4 Sandpiper Bulker 2011 57.8 4 New London Eagle 2015 63.1 5 Roadrunner Bulker 2011 57.8 5 Cape Town Eagle 2015 63.7 6 Puffin Bulker 2011 57.8 6 Westport Eagle 2015 63.3 7 Petrel Bulker 2011 57.8 7 Hamburg Eagle 2014 63.3 8 Owl 2011 57.8 8 Madison Eagle 2013 63.3 9 Oriole 2011 57.8 9 Greenwich Eagle 2013 63.3 10 Egret Bulker 2010 57.8 10 Groton Eagle 2013 63.3 11 Crane 2010 57.8 11 Fairfield Eagle 2013 63.3 12 Canary 2009 57.8 12 Southport Eagle 2013 63.3 13 Bittern 2009 57.8 13 Rowayton Eagle 2013 63.3 14 Stellar Eagle 2009 56.0 14 Mystic Eagle 2013 63.3 15 Crested Eagle 2009 56.0 15 Stonington Eagle 2012 63.3 16 Crowned Eagle 2008 55.9 16 Nighthawk 2011 57.8 17 Jaeger 2004 52.5 17 Martin 2010 57.8 18 Cardinal 2004 55.4 18 Kingfisher 2010 57.8 19 Skua 2003 53.4 19 Jay 2010 57.8 20 Shrike 2003 53.3 20 Ibis Bulker 2010 57.8 21 Tern 2003 50.2 21 Grebe Bulker 2010 57.8 22 Osprey I 2002 50.2 22 Gannet Bulker 2010 57.8 23 Goldeneye 2002 52.4 23 Imperial Eagle 2010 56.0 24 Hawk I 2001 50.3 24 Golden Eagle 2010 56.0 24 Vessels 1,352 24 Vessels 1,467 2 Vessels 127 ▪ Eagle fleet as of March 31, 2020 19

TCE Reconciliation $ Thousands except TCE and days 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 1q18 Revenues, net $ 21,278 $ 25,590 $ 35,788 $ 41,836 $ 45,855 $ 53,631 $ 62,711 $ 74,587 $ 79,371 Less: Voyage expenses (9,244) (7,450) (11,208) (14,192) (13,353) (13,380) (17,463) (18,155) (22,515) Charter hire expenses (1,489) (1,668) (3,822) (5,866) (3,873) (6,446) (9,652) (11,312) (10,268) Reversal of one legacy time charter 1,045 793 670 432 (302) 584 329 426 (86) Realized gain/(loss) - Derivatives - - (449) (113) - 83 248 (349) 117 TCE revenue $ 11,590 $ 17,265 $ 20,979 $ 22,097 $ 28,326 $ 34,473 $ 36,173 $ 45,197 $ 46,619 Owned available days * 3,945 3,902 3,700 3,653 3,620 3,771 4,177 4,324 4,218 TCE $ 2,938 $ 4,425 $ 5,670 $ 6,049 $ 7,825 $ 9,142 $ 8,660 $ 10,452 $ 11,052 $ Thousands except TCE and days 2q18 3q18 4q18 1q19 2q19 3q19 4q19 1q20 Revenues, net $ 74,939 $ 69,093 $ 86,692 $ 77,390 $ 69,391 $ 74,110 $ 71,486 $ 74,378 Less: Voyage expenses (17,205) (15,126) (24,721) (25,906) (20,907) (19,446) (21,442) (26,564) Charter hire expenses (10,108) (7,460) (10,209) (11,492) (11,179) (11,346) (8,152) (6,041) Reversal of one legacy time charter (404) 497 (226) (414) 767 (120) (270) 463 Realized gain/(loss) - Derivatives 345 284 (211) (475) 861 (806) 294 756 TCE revenue $ 47,567 $ 47,288 $ 51,326 $ 39,102 $ 38,933 $ 42,393 $ 41,917 $ 42,992 Owned available days * 4,153 4,192 4,227 4,070 4,001 3,849 3,712 4,267 TCE $ 11,453 $ 11,281 $ 12,142 $ 9,607 $ 9,731 $ 11,014 $ 11,292 $ 10,075 ▪ Please see the Definitions slide in the Appendix for an explanation of Owned Available Days 20

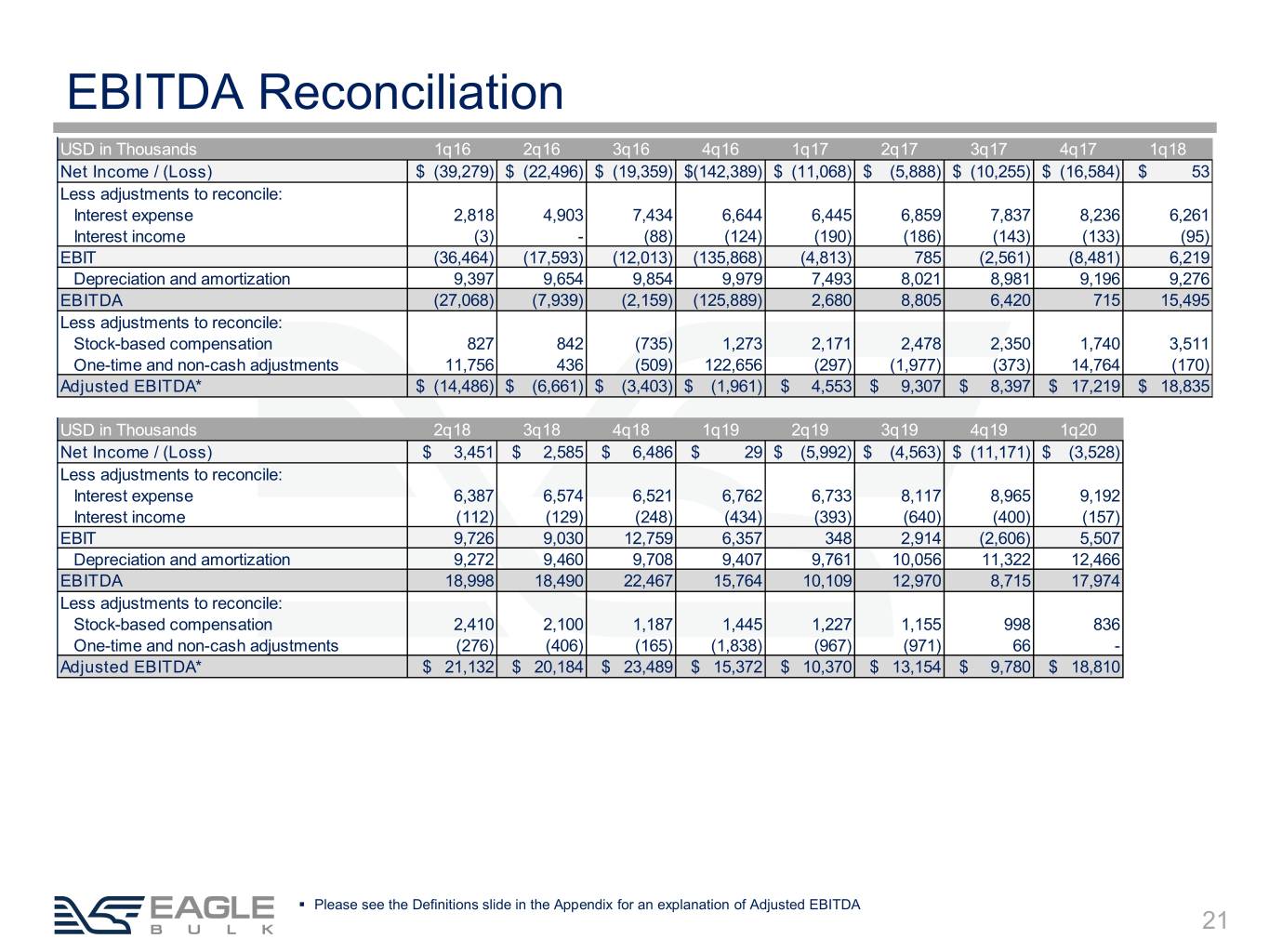

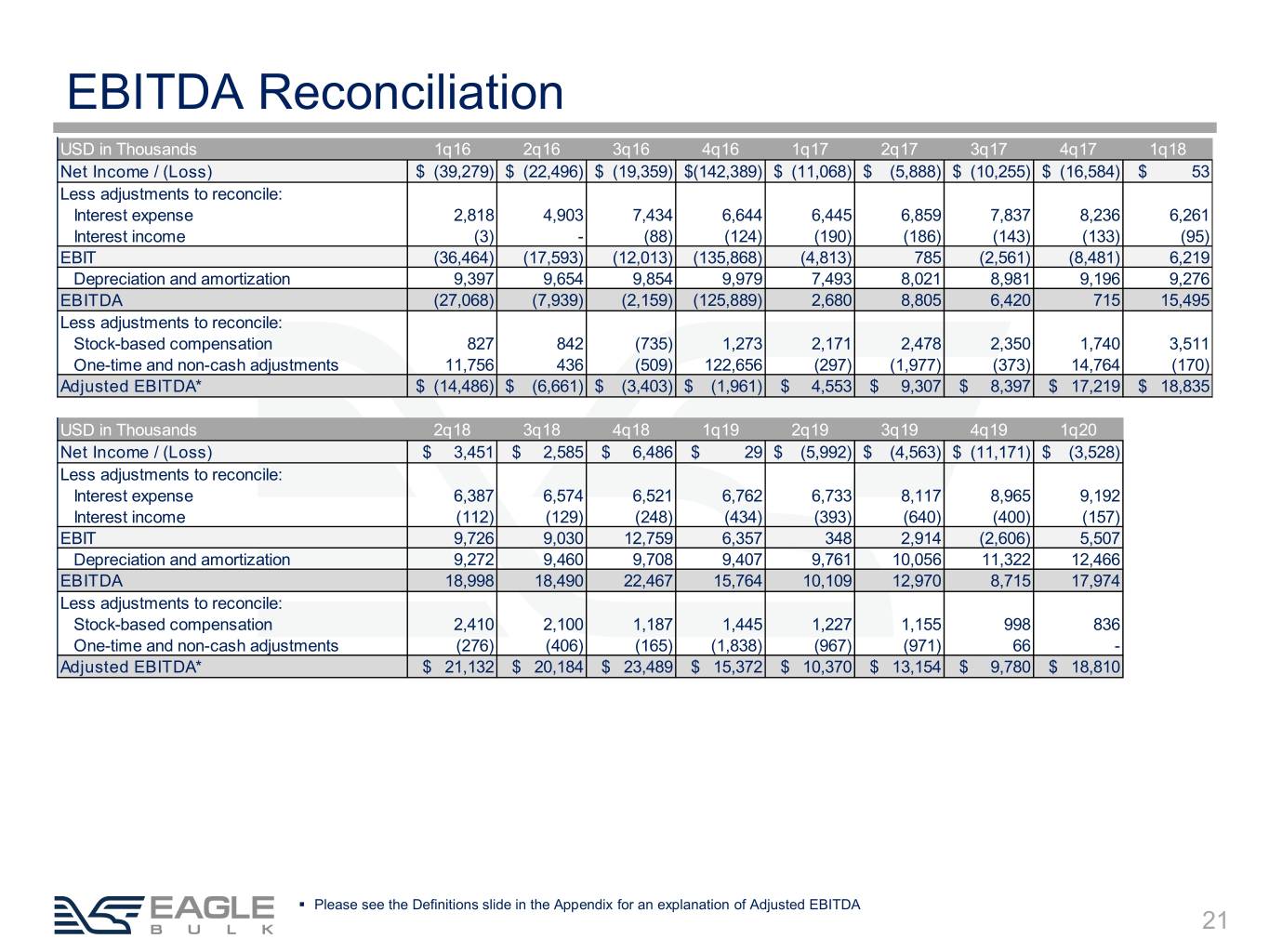

EBITDA Reconciliation USD in Thousands 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 1q18 Net Income / (Loss) $ (39,279) $ (22,496) $ (19,359) $(142,389) $ (11,068) $ (5,888) $ (10,255) $ (16,584) $ 53 Less adjustments to reconcile: Interest expense 2,818 4,903 7,434 6,644 6,445 6,859 7,837 8,236 6,261 Interest income (3) - (88) (124) (190) (186) (143) (133) (95) EBIT (36,464) (17,593) (12,013) (135,868) (4,813) 785 (2,561) (8,481) 6,219 Depreciation and amortization 9,397 9,654 9,854 9,979 7,493 8,021 8,981 9,196 9,276 EBITDA (27,068) (7,939) (2,159) (125,889) 2,680 8,805 6,420 715 15,495 Less adjustments to reconcile: Stock-based compensation 827 842 (735) 1,273 2,171 2,478 2,350 1,740 3,511 One-time and non-cash adjustments 11,756 436 (509) 122,656 (297) (1,977) (373) 14,764 (170) Adjusted EBITDA* $ (14,486) $ (6,661) $ (3,403) $ (1,961) $ 4,553 $ 9,307 $ 8,397 $ 17,219 $ 18,835 USD in Thousands 2q18 3q18 4q18 1q19 2q19 3q19 4q19 1q20 Net Income / (Loss) $ 3,451 $ 2,585 $ 6,486 $ 29 $ (5,992) $ (4,563) $ (11,171) $ (3,528) Less adjustments to reconcile: Interest expense 6,387 6,574 6,521 6,762 6,733 8,117 8,965 9,192 Interest income (112) (129) (248) (434) (393) (640) (400) (157) EBIT 9,726 9,030 12,759 6,357 348 2,914 (2,606) 5,507 Depreciation and amortization 9,272 9,460 9,708 9,407 9,761 10,056 11,322 12,466 EBITDA 18,998 18,490 22,467 15,764 10,109 12,970 8,715 17,974 Less adjustments to reconcile: Stock-based compensation 2,410 2,100 1,187 1,445 1,227 1,155 998 836 One-time and non-cash adjustments (276) (406) (165) (1,838) (967) (971) 66 - Adjusted EBITDA* $ 21,132 $ 20,184 $ 23,489 $ 15,372 $ 10,370 $ 13,154 $ 9,780 $ 18,810 ▪ Please see the Definitions slide in the Appendix for an explanation of Adjusted EBITDA 21

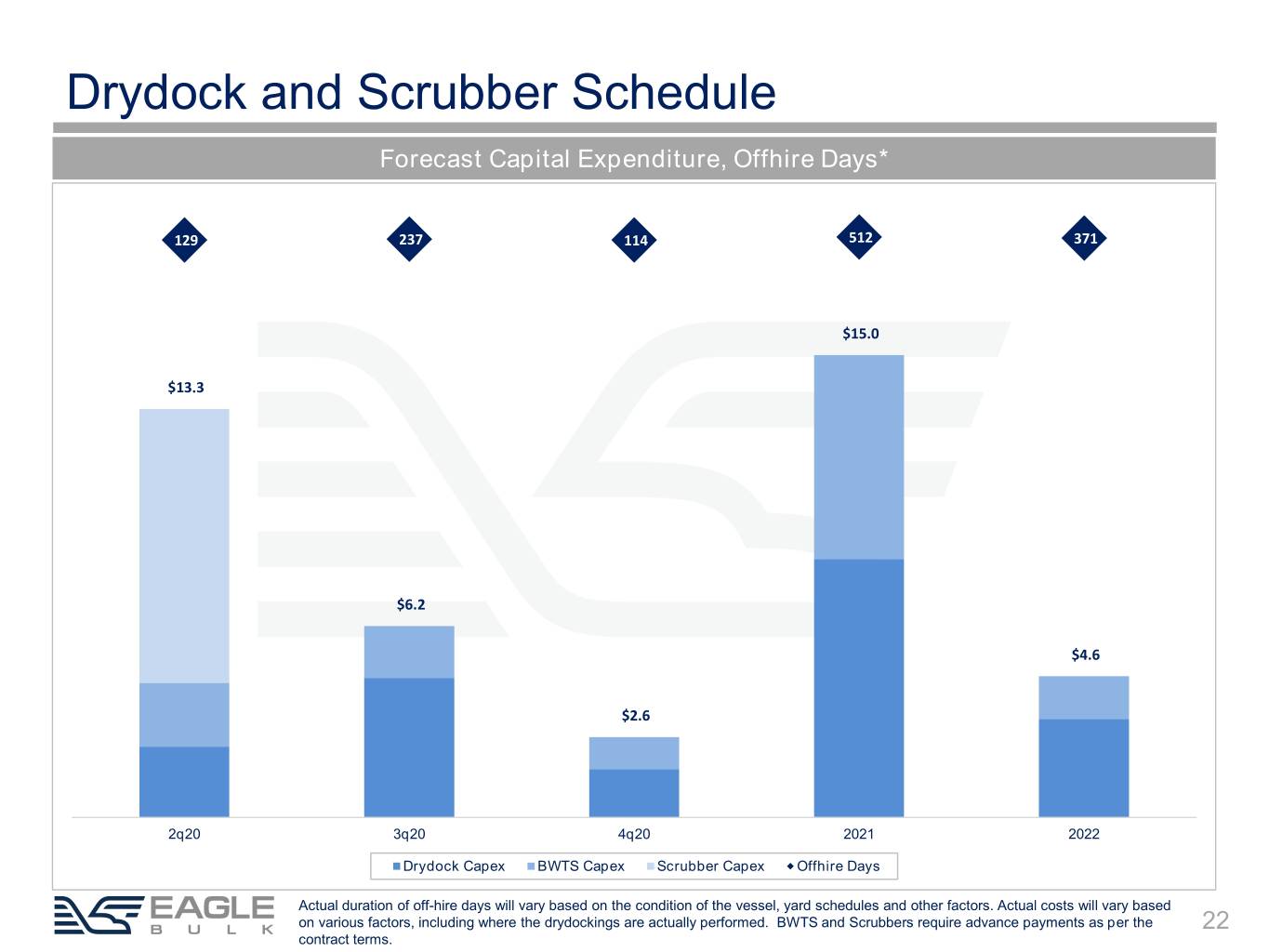

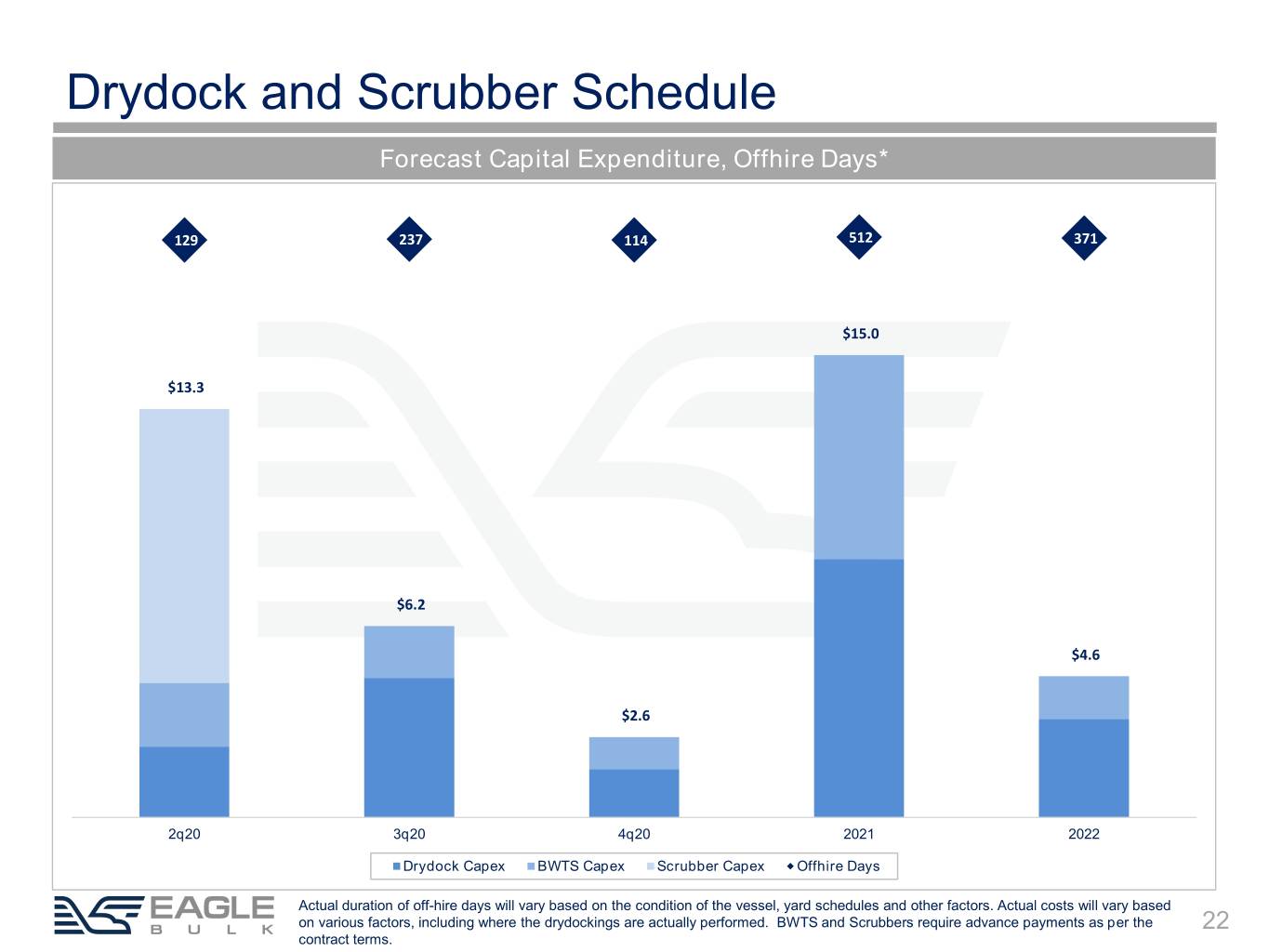

Drydock and Scrubber Schedule Forecast Capital Expenditure, Offhire Days* 129 237 114 512 371 $15.0 $13.3 $6.2 $4.6 $2.6 2q20 3q20 4q20 2021 2022 Drydock Capex BWTS Capex Scrubber Capex Offhire Days Actual duration of off-hire days will vary based on the condition of the vessel, yard schedules and other factors. Actual costs will vary based on various factors, including where the drydockings are actually performed. BWTS and Scrubbers require advance payments as per the 22 contract terms.

Evaluating TCE Relative Performance This page is meant to assist analysts/investors on how to potentially evaluate and forecast vessel/fleet TCE relative performance within the Supramax/Ultramax segment ▪ Since the Supramax/Ultramax segment is comprised of a number of different ship types / sizes / designs, TCE generation ability can differ significantly from the standard vessel used to calculate the BSI-58 benchmark ▪ For example, a 2013-built Chinese 60-65k DWT Ultramax should be expected to earn a significant premium to a 2013-built 55-60k Supramax, particularly given the incremental cost of the 60-65k DWT vessel ▪ Ultimately, it’s about yield – the expected earnings ability of a vessel versus its cost Supramax/Ultramax TCE Performance Matrix Matrix depicts the estimated TCE Earnings Performance range for a VESSEL TYPE INDEX FACTOR generic Supramax/Ultramax vessel type SIZE (DWT) (AS COMPARED TO THE BSI VESSEL) as compared to the BSI-58 ship SHIP TYPE JAPAN CHINA FROM TO FROM TO FROM TO The BSI-58 is based on the 58k DWT Japanese BSI-58 58,000 100.0% TESS-58 design Supramax and is gross of 1 50,000 55,000 86.0% 95.0% 81.0% 87.0% commissions 2 55,000 60,000 96.0% 106.0% 88.0% 97.0% A Chinese 60-65k DWT Ultramax should earn a 3 60,000 65,000 106.0% 118.0% 102.0% 113.0% premium of 2-13% to the net BSI-58, depending on its specific design characteristics, due to For Illustrative Purposes Only cargo carrying capacity, speed, and fuel consumption differences ▪ The Matrix is meant to capture general ship types but there are likely some vessels which fall outside the stated figures. The index factors shown were calculated using a TCE of USD 10,000 per day and fuel cost of USD 400 per ton. The specific index factors can change somewhat with movements in both fuel prices and (spot) rate environment, but the relative relationships will remain similar to 23 those shown.

Supramax Regional Relative Market Performance Atlantic (S4a/S4b) vs. Pacific (S2/S8/S10) Historical Difference 140.0% 120.0% 100.0% 80.0% 60.0% 40.0% Historical Average, 33.7% 20.0% 0.0% -20.0% 2q14 3q14 4q14 1q15 2q15 3q15 4q15 1q16 2q16 3q16 4q16 1q17 2q17 3q17 4q17 1q18 2q18 3q18 4q18 1q19 2q19 3q19 4q19 1q20 2q20 ATL Premium Historical Average ▪ Source(s): Clarksons SIN ▪ Calculated using BSI-52 until 2q15 and BSI-58 starting 3q15 through present. 2q20 estimated using rates through April 25, 2020 ▪ BSI-52: Atlantic market calculated based on BSI routes S4A and S4B. Pacific market calculated based on route S2. 24 ▪ BSI-58: Atlantic market calculated based on BSI routes S4A and S4B. Pacific market calculated based on routes S2, S8, and S10.

Eagle Cargo Mix Cargoes Carried 2q19-1q20 Forest Products, 1% Agriculture Products, 3% Fertilizer, 4% Coke, 7% Coal, 22% Cement, 8% Steel Products, 7% Grain, 13% Metal & Ore, 11% Iron Ore, 5% Minerals, 19% Minor Bulks ~60% Major Bulks ~40% 25

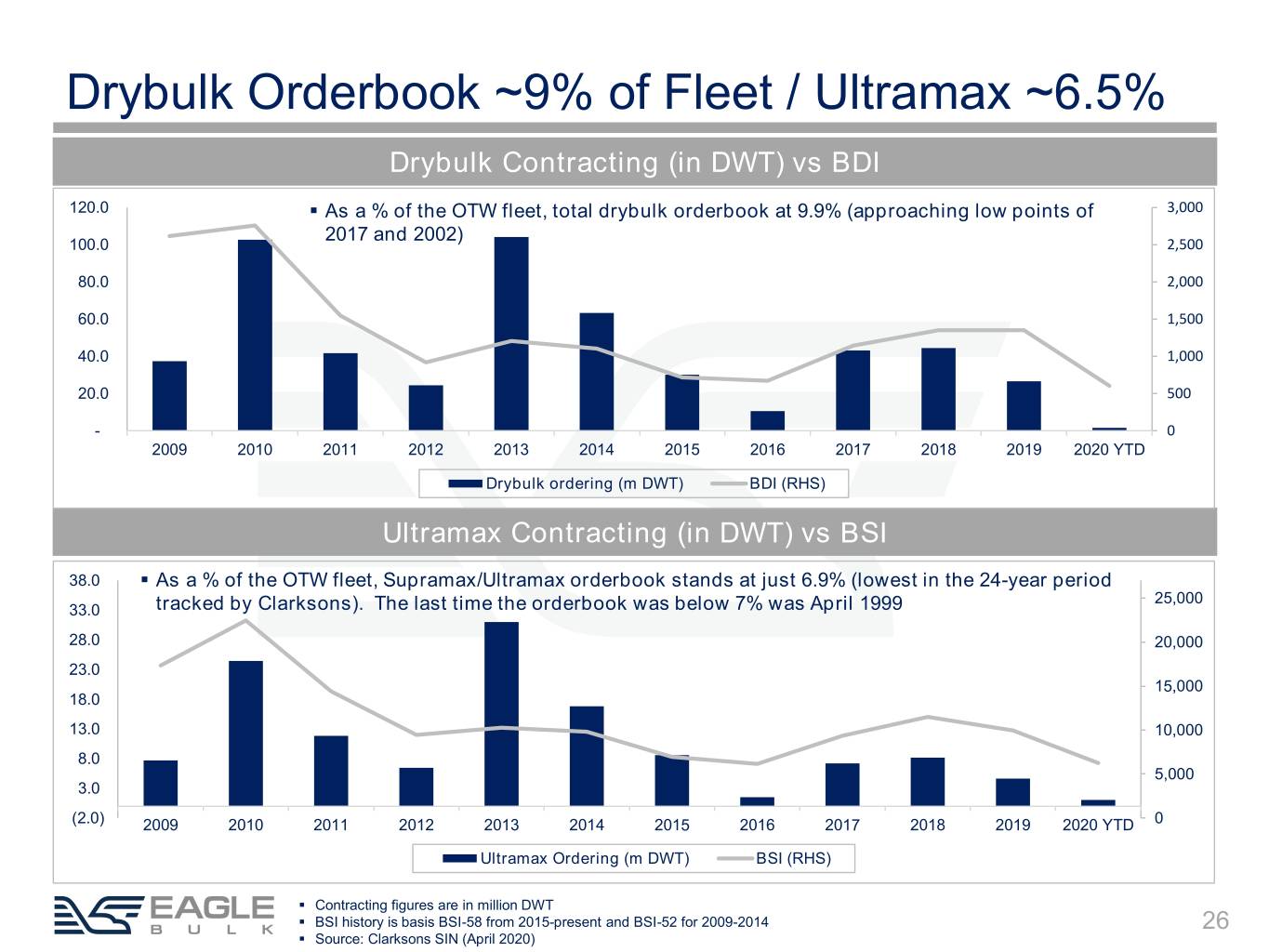

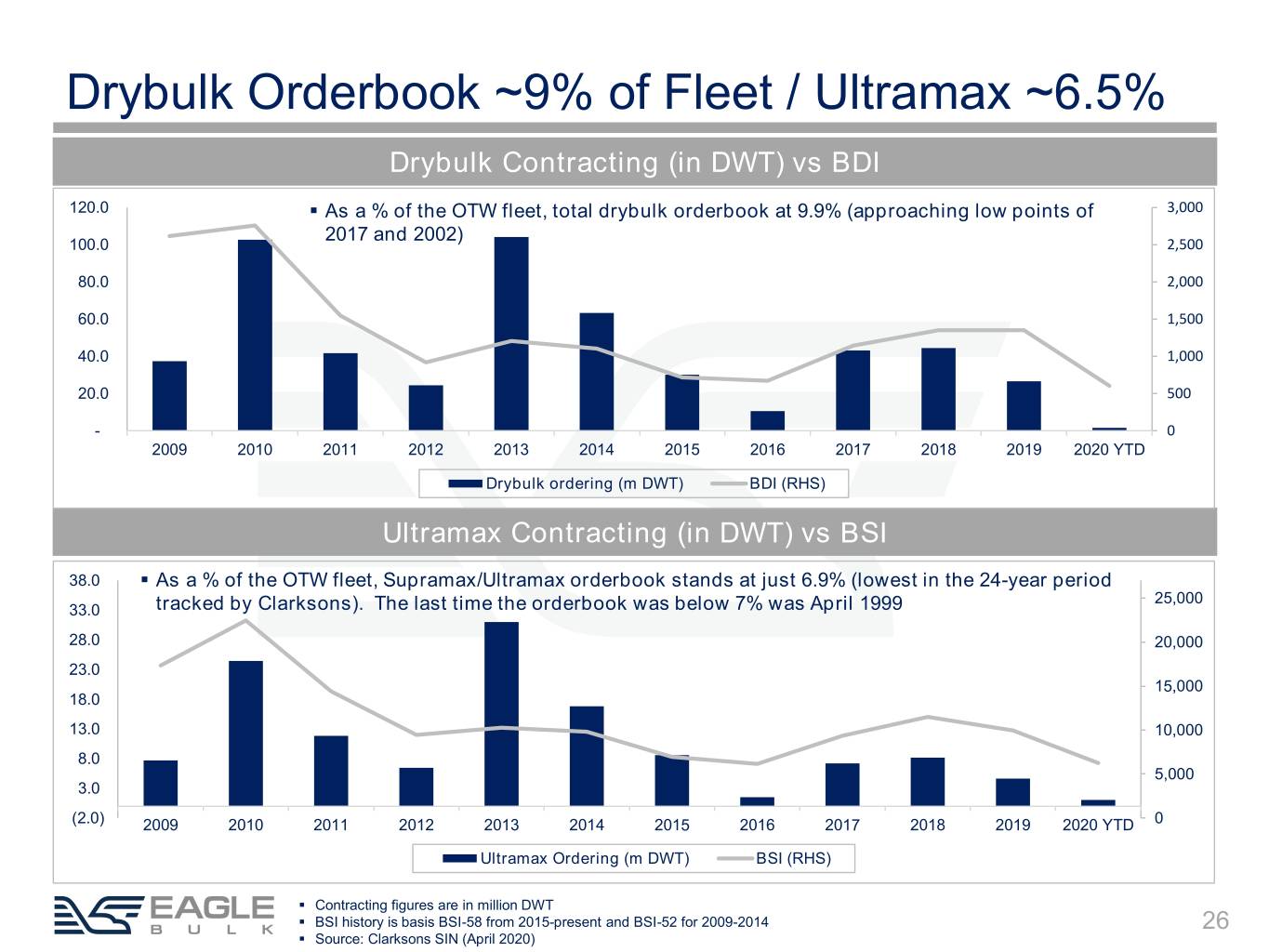

Drybulk Orderbook ~9% of Fleet / Ultramax ~6.5% Drybulk Contracting (in DWT) vs BDI 120.0 ▪ As a % of the OTW fleet, total drybulk orderbook at 9.9% (approaching low points of 3,000 2017 and 2002) 100.0 2,500 80.0 2,000 60.0 1,500 40.0 1,000 20.0 500 - 0 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD Drybulk ordering (m DWT) BDI (RHS) Ultramax Contracting (in DWT) vs BSI 38.0 ▪ As a % of the OTW fleet, Supramax/Ultramax orderbook stands at just 6.9% (lowest in the 24-year period 25,000 33.0 tracked by Clarksons). The last time the orderbook was below 7% was April 1999 28.0 20,000 23.0 15,000 18.0 13.0 10,000 8.0 5,000 3.0 (2.0) 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 YTD 0 Ultramax Ordering (m DWT) BSI (RHS) ▪ Contracting figures are in million DWT ▪ BSI history is basis BSI-58 from 2015-present and BSI-52 for 2009-2014 26 ▪ Source: Clarksons SIN (April 2020)

IMO 2020 Glossary Term Abbreviation Meaning Non-scrubber-fitted ships may not have HSFO onboard from Mar 1, 2020- Carriage Ban - this will assist with enforcement of the IMO 2020 regulations Protected areas with stricter sulfur emission rules that require ships to use Emission Control Area ECA MGO or scrubbers Exhaust Gas Cleaning Technical term for a scrubber, equipment used to remove SO from ship’s EGCS X System exhaust gas International Maritime IMO Specialized UN agency regulating shipping Organization Sulfur Oxides SOX Emission stream targeted by IMO 2020 regulation Fuel Type Abbreviation Characteristics and use Fuel with sulfur content above 0.50% that can only be used on scrubber- High Sulfur Fuel Oil HSFO fitted ships as of Jan 1 Fuel with sulfur content less than or equal to 0.50% that must be used by Very Low Sulfur Fuel VLSFO non-scrubber-fitted ships and can be used by scrubber-fitted ships in Oil locations where scrubbers cannot be operated Fuel with sulfur content less than or equal to 0.10% that must be used in Marine Gas Oil MGO ECA zones by non-scrubber-fitted ships and can be used by scrubber-fitted ships in locations where scrubbers cannot be operated 27

Definitions Item Description Adjusted EBITDA is a non-GAAP financial measure that is used as a supplemental financial measure by our management and Adjusted EBITDA by external users of our financial statements, such as investors, commercial banks and others, to assess our operating performance as compared to that of other companies in our industry, without regard to financing methods, capital structure or historical costs basis. Our Adjusted EBITDA should not be considered an alternative to net income/(loss), operating income/(loss), cash flows provided by/(used in) operating activities or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. Our Adjusted EBITDA may not be comparable to similarly titled measures of another company because all companies may not calculate Adjusted EBITDA in the same manner. Adjusted EBITDA represents EBITDA adjusted to exclude the items which represent certain non-cash, one-time and other items such as vessel impairment, gain/(loss) on sale of vessels, stock-based compensation, loss on debt extinguishment and restructuring expenses that the Company believes are not indicative of the ongoing performance of its core operations. Time charter equivalent ("TCE") is a non-GAAP financial measure that is commonly used in the shipping industry primarily to TCE compare daily earnings generated by vessels on time charters with daily earnings generated by vessels on voyage charters, because charter hire rates for vessels on voyage charters are generally not expressed in per-day amounts while charter hire rates for vessels on time charters generally are expressed in such amounts. The Company defines TCE as shipping revenues less voyage expenses and charter hire expenses, adjusted for the impact of one legacy time charter and realized gains on FFAs and bunker swaps, divided by the number of owned available days. TCE provides additional meaningful information in conjunction with shipping revenues, the most directly comparable GAAP measure, because it assists Company management in making decisions regarding the deployment and use of its vessels and in evaluating their financial performance. The Company's calculation of TCE may not be comparable to that reported by other companies. The Company calculates relative performance by comparing TCE against the Baltic Supramax Index ("BSI") adjusted for commissions and fleet makeup. The BSI was initiated in 2006 based on the Tess 52 design. The index for the Tess 58 design has been published commencing on April 3, 2017, and transition was completed as of December 2018, when the Baltic stopped publishing a dynamic Tess 52 daily rate. The Company has now switched to the Tess 58 index for valuation modeling as of January 1, 2019. The change in the BSI may affect comparability of our TCE against BSI in periods prior to Company switching to the Tess 58 index. Owned available days is the aggregate number of days in a period during which each vessel in our fleet has been owned by us less the aggregate number of days that our vessels are off-hire due to vessel familiarization upon acquisition, repairs, vessel upgrades or special surveys. The shipping industry uses available days to measure the number of days in a period during which vessels should be capable of generating revenues. 28

www.eagleships.com