QuickLinks -- Click here to rapidly navigate through this documentAs filed with the Securities and Exchange Commission on May 23, 2007

Registration No. 333-141655

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 2

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NovaCardia, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | | 2834 | | 33-0989994 |

| (State or Other Jurisdiction of Incorporation or Organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification Number) |

12750 High Bluff Drive, Suite 300

San Diego, CA 92130

(858) 509-0455

(Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant's Principal Executive Offices)

Randall E. Woods

President and Chief Executive Officer

NovaCardia, Inc.

12750 High Bluff Drive, Suite 300

San Diego, CA 92130

(858) 509-0455

(Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent for Service)

Copies to:

Barbara L. Borden, Esq.

J. Patrick Loofbourrow, Esq.

Cooley Godward Kronish LLP

4401 Eastgate Mall

San Diego, CA 92121

(858) 550-6000 | | Charles K. Ruck, Esq.

Cheston J. Larson, Esq.

Latham & Watkins LLP

12636 High Bluff Drive, Suite 400

San Diego, CA 92130

(858) 523-5400

|

Approximate date of commencement of proposed sale to the public:

As soon as practicable after the effective date of this registration statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, as amended (the "Securities Act"), check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

The Registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell or accept an offer to buy the securities under this preliminary prospectus until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities, and we are not soliciting an offer to buy these securities in any state where such offer or sale is not permitted.

Subject to completion, dated May 23, 2007

Prospectus

shares

Common stock

This is an initial public offering of shares of common stock by NovaCardia, Inc. NovaCardia is selling shares of common stock. The estimated initial public offering price is between $ and $ per share.

We have applied for listing of our common stock on the NASDAQ Global Market under the symbol NCAR.

|

| | Per share

| | Total

|

|---|

|

| Initial public offering price | | $ | | | $ | |

Underwriting discounts and commissions |

|

$ |

|

|

$ |

|

Proceeds to NovaCardia, before expenses |

|

$ |

|

|

$ |

|

|

|

|

|

|

|

|

|

NovaCardia has granted to the underwriters an option for a period of 30 days to purchase up to additional shares of common stock.

Investing in the common stock involves a high degree of risk. See "Risk factors" beginning on page 8.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| JPMorgan | | Credit Suisse |

Pacific Growth Equities, LLC |

|

First Albany Capital

|

, 2007

Table of contents

| | Page

|

|---|

| Prospectus summary | | 1 |

| Risk factors | | 8 |

| Forward-looking statements | | 40 |

| Use of proceeds | | 42 |

| Dividend policy | | 43 |

| Capitalization | | 44 |

| Dilution | | 47 |

| Selected financial data | | 50 |

| Management's discussion and analysis of financial condition and results of operations | | 52 |

| Business | | 67 |

| Management | | 91 |

| Executive compensation | | 99 |

| Transactions with related persons | | 119 |

| Principal stockholders | | 126 |

| Description of capital stock | | 129 |

| Shares eligible for future sale | | 135 |

| Material U.S. federal income tax consequences to non-U.S. holders | | 138 |

| Underwriting | | 141 |

| Legal matters | | 145 |

| Experts | | 145 |

| Where you can find more information | | 145 |

| Index to financial statements | | F-1 |

You should rely only on information contained or incorporated by reference in this prospectus. We have not authorized anyone to provide you with information different from or in addition to that contained in this prospectus. We are offering to sell, and seeking offers to buy, common stock only in jurisdictions where offers and sales are permitted. The information contained in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or of any sale of shares of our common stock.

No action is being taken in any jurisdiction outside the United States to permit a public offering of the shares of our common stock or possession or distribution of this prospectus in that jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of this prospectus applicable to that jurisdiction.

Prospectus summary

This summary highlights information contained in other parts of this prospectus. Because it is only a summary, it does not contain all of the information that you should consider before investing in shares of our common stock and it is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. You should read the entire prospectus carefully, especially "Risk factors" and our financial statements and notes to these financial statements, before deciding to invest in shares of our common stock.

NovaCardia, Inc.

We are a clinical-stage pharmaceutical company focused on developing drugs to treat major cardiovascular diseases that are underserved by existing therapies. We have two compounds in clinical development, KW-3902 for congestive heart failure, or CHF, and K201 (JTV-519) for atrial fibrillation, or A-Fib, an irregular heartbeat. We believe each compound has potential for use in both acute and chronic settings.

We are currently testing the intravenous, or IV, formulation of KW-3902 in Phase 3 clinical trials for the treatment of the acute form of CHF in patients with renal impairment and fluid overload. We expect to have the results from our pivotal Phase 3 trials in mid-2008. We also plan to initiate a Phase 2 clinical trial of the oral formulation of KW-3902 for the treatment of chronic CHF in the second half of 2007. In addition, we intend to initiate a Phase 2 trial of the IV formulation of K201 (JTV-519) for the acute treatment of A-Fib in the second half of 2007.

We hold commercial rights to our product candidates in major markets, including the United States and Europe, but excluding Asia, and plan to establish a hospital-based sales force to market the IV formulations of our product candidates in the United States. We plan to partner with third parties for the commercialization of our IV product candidates outside the United States and for the further development and commercialization of our oral product candidates in all regions where we have commercial rights. To expand our product pipeline, we intend to in-license additional product candidates with the potential to treat cardiovascular diseases.

KW-3902

There are nearly five million people in the United States with CHF, according to the American Heart Association, or AHA. Many CHF patients experience acute CHF, a rapid deterioration of their condition, requiring urgent treatment in the hospital. Renal function is an important determinant of the management and outcome of both acute and chronic CHF, and we estimate that more than half of CHF patients have some degree of renal impairment, based on a study published inCirculation in 2004. Worsening renal function during hospital stay is a strong predictor of negative outcomes, including length of hospital stay and mortality. Fluid overload is one of the major causes of hospitalization for CHF patients, and approximately 80% of CHF patients are on chronic diuretic therapy to manage their fluid overload at the time of their hospitalization, according to the ADHERE Registry, a registry of acute heart failure patient cases in the United States. However, the use of diuretic therapy, such as Lasix, to manage fluid overload in CHF patients may lead to further deterioration of renal function. As a result, we believe there is a significant need for a new therapy that protects renal function while further reducing fluid overload in both acute and chronic CHF patients.

1

KW-3902 is an adenosine A1 receptor antagonist that selectively blocks the effect of adenosine on the adenosine A1 receptor. In the kidneys, adenosine acts through the adenosine A1 receptor to restrict blood flow to the kidneys, which may result in worsening renal function and may also increase reabsorption of salt and water, thereby contributing to fluid overload. By blocking the adenosine A1 receptor, KW-3902 increases blood flow to the kidneys and reduces reabsorption of salt and water. We believe that these effects have the potential to improve the treatment of CHF patients by preserving renal function, improving the symptoms of fluid overload and enabling the more effective use of other CHF therapies. Therefore, KW-3902 may improve short- and long-term outcomes in CHF patients. We are developing IV and oral formulations of KW-3902 to be co-administered with diuretics for the treatment of acute and chronic CHF, respectively.

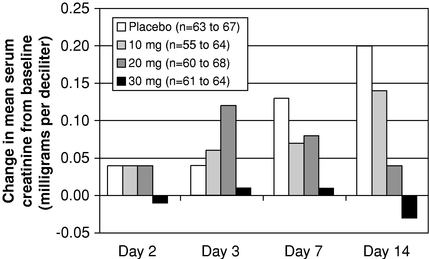

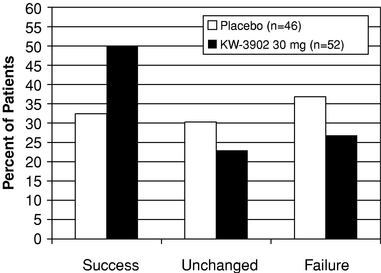

We have completed three multi-center, placebo-controlled Phase 2 clinical trials of the IV formulation of KW-3902 in which we demonstrated that KW-3902 preserves renal function and improves diuresis in acute CHF patients. In addition, in March 2007, we completed a preliminary analysis of data obtained from 276 patients in our 304-patient pilot Phase 3 clinical trial of KW-3902. In this analysis, we observed an improvement in patients' shortness of breath, a symptom for which CHF patients are frequently hospitalized, and a persistent maintenance of renal function. In addition, we confirmed the optimal dosing regimen for our Phase 3 trials and we did not observe an adverse safety profile for KW-3902.

We initiated two pivotal Phase 3 clinical trials of the IV formulation of KW-3902 in May 2007 and expect to have results from these trials in mid-2008. We have designed these pivotal trials to examine the effect of KW-3902 on dyspnea, or shortness of breath, renal function and worsening heart failure. We plan to initiate two additional Phase 3 trials of the IV formulation of KW-3902 and expect to commence one of these trials in mid-2007 and the other trial in the third quarter of 2007. We plan to commence a Phase 2 clinical trial of an oral formulation of KW-3902 in outpatients with chronic CHF in the second half of 2007.

K201 (JTV-519)

We are developing K201 (JTV-519) to treat A-Fib, a condition that afflicts over 2.2 million people in the United States and leads to over 440,000 hospitalizations per year, according to the most recent data from the AHA. A-Fib is an independent risk factor for stroke and increases the severity of symptoms experienced by CHF patients.

We are developing IV and oral formulations of K201 (JTV-519) to address acute and chronic A-Fib, respectively. We believe K201 (JTV-519) has the potential to treat A-Fib without the side effects, such as life-threatening ventricular arrhythmias, associated with current therapies. We plan to commence a Phase 2 clinical trial of the IV formulation of K201 (JTV-519) for the acute treatment of A-Fib in the second half of 2007.

2

Strategy

Our strategy is to in-license, develop and commercialize drugs to treat major cardiovascular diseases that are underserved by existing therapies. We intend to:

- •

- rapidly develop and commercialize our product candidates;

- •

- partner with third parties for the commercialization of our IV product candidates outside the United States and for the further development and commercialization of our oral product candidates in all regions where we hold commercial rights;

- •

- establish a hospital-based sales force to sell our products in the acute care setting in the United States; and

- •

- in-license additional cardiovascular product candidates.

Risks relating to our business

Our business and our ability to execute on our business strategy are subject to a number of risks of which you should be aware before you decide to buy our common stock. In particular, you should consider the following risks, which are discussed more fully in "Risk factors" beginning on page 8:

- •

- We are highly dependent on the success of our two product candidates, KW-3902 and K201 (JTV-519), and we cannot give any assurance that either product candidate will receive regulatory approval or be successfully commercialized.

- •

- KW-3902 and K201 (JTV-519) may not demonstrate adequate efficacy, may cause undesirable side effects or may have other properties that could delay or prevent their regulatory approval or commercialization or limit their commercial potential.

- •

- The timing of clinical development activities is hard to predict, and delays in the clinical trials for either of our product candidates could result in increased costs and delay or limit our ability to obtain regulatory approval.

- •

- We rely on third parties to conduct our clinical trials and manufacture our product candidates, and we cannot be sure that they will successfully carry out their contractual duties or meet expected deadlines.

- •

- If we fail to enter into collaborations with respect to the oral formulations of our product candidates, we may not be able to execute this portion of our business strategy.

- •

- Even if our product candidates are approved by regulatory authorities, they may still face regulatory and commercialization difficulties and will face intense competition.

- •

- Our two product candidates, KW-3902 and K201 (JTV-519), are both in-licensed from third parties, and any dispute with these parties may adversely affect our ability to develop and commercialize these product candidates.

- •

- We have had a history of losses since our inception, and we expect that losses will increase in future periods. Our net loss was $17.9 million in 2006 and $8.5 million during the first quarter of 2007 and, as of March 31, 2007, we had an accumulated deficit of $51.5 million.

- •

- We may not have adequate intellectual property protection for our product candidates.

3

Corporate information

We were incorporated in Delaware in November 2001. Our principal executive offices are located at 12750 High Bluff Drive, Suite 300, San Diego, California 92130 and our telephone number is (858) 509-0455. Our corporate website address iswww.novacardia.com. We do not incorporate the information contained on, or accessible through, our website into this prospectus, and you should not consider it part of this prospectus. Unless the context indicates otherwise, as used in this prospectus, the terms "NovaCardia," "we," "us" and "our" refer to NovaCardia, Inc., a Delaware corporation.

We have applied for registration of the trademark "NovaCardia" and our NovaCardia logo with the United States Patent and Trademark Office. This prospectus also contains trademarks and tradenames of other companies, including Lasix® and ADENTRI™, and those trademarks and tradenames are the property of their respective owners.

4

The offering

| Common stock offered by NovaCardia | | shares |

| Common stock to be outstanding after this offering | | shares |

| Over-allotment option | | We have granted the underwriters an option for a period of 30 days to purchase up to additional shares of common stock. |

| Use of proceeds | | We intend to use the net proceeds from this offering to fund clinical development of KW-3902 and K201 (JTV-519) and for working capital and general corporate purposes. See "Use of proceeds" beginning on page 42. |

| Proposed NASDAQ Global Market symbol | | NCAR |

The number of shares of common stock that will be outstanding after this offering is based on 88,543,718 shares outstanding as of March 31, 2007, after giving pro forma effect to the assumed cash exercise of warrants to purchase 548,800 shares of our Series B preferred stock outstanding as of March 31, 2007 that will terminate if not exercised prior to the effectiveness of this offering, and excludes:

- •

- 7,609,832 shares of common stock subject to outstanding options under our 2003 equity incentive plan, with a weighted average exercise price of $0.21 per share;

- •

- 1,233,949 shares of common stock reserved for future issuance under our 2003 equity incentive plan;

- •

- 18,000,000 shares of common stock reserved for future issuance under our 2007 equity incentive plan, 2007 non-employee directors' stock option plan and 2007 employee stock purchase plan, each of which will become effective upon the completion of this offering;

- •

- 663,809 shares of common stock subject to outstanding warrants, with a weighted average exercise price of $0.97 per share; and

- •

- up to 933,333 shares of common stock subject to an outstanding warrant issued in April 2007, with an exercise price of $1.125 per share, 666,666 shares of which are immediately exercisable and the remaining 266,667 shares of which will become exercisable if we borrow additional amounts under our credit facility (with the actual number of shares becoming exercisable equaling 3.0% of the amount actually drawn down under the credit facility, divided by the exercise price).

Unless otherwise stated, all information contained in this prospectus assumes:

- •

- a 1-for- reverse stock split of our common stock to be effected immediately prior to the completion of this offering;

- •

- the conversion of all outstanding shares of our preferred stock, including 548,800 shares of Series B preferred stock issued upon the assumed cash exercise of warrants that will terminate if not exercised prior to the effectiveness of this offering, into an aggregate of 85,817,499 shares of common stock upon the completion of this offering;

- •

- the filing of our amended and restated certificate of incorporation and adoption of our amended and restated bylaws, which will occur upon the completion of this offering; and

- •

- no exercise of the underwriters' over-allotment option.

5

Summary financial data

The following tables present our summary financial data and should be read together with our financial statements and notes and "Management's discussion and analysis of financial condition and results of operations" appearing elsewhere in this prospectus. The summary statement of operations data for the years ended December 31, 2004, 2005 and 2006, and the summary balance sheet data as of December 31, 2006, are derived from our audited financial statements, which are included elsewhere in this prospectus. The summary statement of operations data for the period from November 30, 2001 (inception) through March 31, 2007 and for the three months ended March 31, 2006 and 2007, and the summary balance sheet data as of March 31, 2007, are derived from our unaudited financial statements, which are included elsewhere in this prospectus. Our historical results are not necessarily indicative of our future results.

| |

| | Years ended December 31,

| | Three months

ended March 31,

| |

| |

|---|

| | Period from

November 30, 2001

(inception) through

March 31, 2007

| |

|---|

(in thousands, except per share data)

| |

|---|

| | 2004

| | 2005

| | 2006

| | 2006

| | 2007

| |

|---|

| |

| Statement of operations data: | | | | | | | | | | | | | | | | | | | |

| Operating expenses: | | | | | | | | | | | | | | | | | | | |

| | Development | | $ | 6,343 | | $ | 9,023 | | $ | 14,184 | | $ | 1,776 | | $ | 7,576 | | $ | 41,699 | |

| | Selling, general and administrative | | | 1,782 | | | 1,973 | | | 2,124 | | | 402 | | | 1,219 | | | 8,573 | |

| | |

| |

| Total operating expenses | | | 8,125 | | | 10,996 | | | 16,308 | | | 2,178 | | | 8,795 | | | 50,272 | |

| | |

| |

| Loss from operations | | | (8,125 | ) | | (10,996 | ) | | (16,308 | ) | | (2,178 | ) | | (8,795 | ) | | (50,272 | ) |

| Other income (expense): | | | | | | | | | | | | | | | | | | | |

| | Interest income | | | 173 | | | 139 | | | 560 | | | 20 | | | 375 | | | 1,322 | |

| | Interest expense | | | — | | | (203 | ) | | (2,161 | ) | | (246 | ) | | (88 | ) | | (2,509 | ) |

| | |

| |

| Total other income (expense) | | | 173 | | | (64 | ) | | (1,601 | ) | | (226 | ) | | 287 | | | (1,187 | ) |

| | |

| |

| Net loss | | | (7,952 | ) | | (11,060 | ) | | (17,909 | ) | | (2,404 | ) | | (8,508 | ) | | (51,459 | ) |

| Deemed dividend related to beneficial conversion feature on Series B preferred stock | | | — | | | — | | | — | | | — | | | (8,080 | ) | | (8,080 | ) |

| | |

| |

| Net loss attributable to common stockholders | | $ | (7,952 | ) | $ | (11,060 | ) | $ | (17,909 | ) | $ | (2,404 | ) | $ | (16,588 | ) | $ | (59,539 | ) |

| | |

| |

| Basic and diluted net loss per share(1): | | | | | | | | | | | | | | | | | | | |

| | Historical | | $ | (6.09 | ) | $ | (5.96 | ) | $ | (8.37 | ) | $ | (1.21 | ) | $ | (7.13 | ) | | | |

| | |

| | | | |

| | Pro forma | | | | | | | | $ | (0.45 | ) | | | | $ | (0.23 | ) | | | |

| | | | | | | | |

| | | | |

| | | | |

| Shares used to compute basic and diluted net loss per share(1): | | | | | | | | | | | | | | | | | | | |

| | Historical | | | 1,305 | | | 1,855 | | | 2,139 | | | 1,984 | | | 2,326 | | | | |

| | |

| | | | |

| | Pro forma | | | | | | | | | 40,179 | | | | | | 73,148 | | | | |

| | | | | | | | |

| | | | |

| | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

- (1)

- Please see Note 1 to our financial statements for an explanation of the method used to calculate the historical and pro forma net loss per share and the number of shares used in the computation of the per share amounts.

6

|

March 31, 2007

(in thousands)

| | Actual

| | Pro forma(1)

| | Pro forma

as adjusted(2)

|

|---|

|

|---|

| |

| | (unaudited)

|

|---|

| Balance sheet data: | | | | | | | | | |

| Cash, cash equivalents and short-term investments | | $ | 42,509 | | $ | 47,509 | | $ | |

| Working capital | | | 34,301 | | | 40,423 | | | |

| Total assets | | | 48,640 | | | 53,640 | | | |

| Long-term debt (including current portion) | | | 2,631 | | | 7,631 | | | |

| Deficit accumulated during the development stage | | | (51,459 | ) | | (51,459 | ) | | |

| Total stockholders' equity | | | 38,850 | | | 38,850 | | | |

|

- (1)

- The pro forma balance sheet data give effect to $5.0 million borrowed in April 2007 and the restructuring of our outstanding indebtedness in April 2007 in connection with an amendment to our loan and security agreement with Lighthouse Capital Partners V, L.P.

- (2)

- The pro forma as adjusted balance sheet data also give effect to the assumed cash exercise of warrants to purchase 548,800 shares of our Series B preferred stock outstanding as of March 31, 2007 that will terminate if not exercised prior to the effectiveness of this offering at an exercise price of $1.125 per share, resulting in aggregate proceeds of $617,400, the sale of shares of our common stock in this offering at an assumed initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts and commissions and estimated offering costs payable by us and the automatic conversion of all preferred stock, including the 548,800 shares of Series B preferred stock issued upon the assumed cash exercise of warrants that will terminate if not exercised prior to the effectiveness of this offering. A $1.00 increase (decrease) in the assumed initial public offering price of $ per share, the mid-point of the price range set forth on the cover page of this prospectus, would increase (decrease) the net proceeds to us from this offering and our cash, cash equivalents and short-term investments, working capital, total assets and total stockholders' equity by $ million, assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting the estimated underwriting discounts and commissions and estimated offering costs payable by us. The pro forma as adjusted information is illustrative only and, following the completion of this offering, will be adjusted based on the actual initial public offering price and other terms of this offering determined at pricing.

7

Risk factors

An investment in shares of our common stock involves a high degree of risk. You should carefully consider the following information about these risks, together with the other information appearing elsewhere in this prospectus, before deciding to invest in our common stock. The occurrence of any of the following risks could have a material adverse effect on our business, financial condition, results of operations and future growth prospects. In these circumstances, the market price of our common stock could decline, and you may lose all or part of the money you paid to buy our common stock.

We are highly dependent on the success of our two product candidates, KW-3902 and K201 (JTV-519), and we cannot give any assurance that either product candidate will receive regulatory approval or be successfully commercialized.

We are a clinical-stage pharmaceutical company, and we do not currently have any commercial products that generate revenues or any other sources of revenue. We may never be able to successfully develop marketable products. We are dependent on the success of our two product candidates, KW-3902 and K201 (JTV-519). In particular, we are highly dependent on the success of our most advanced product candidate, the intravenous, or IV, formulation of KW-3902, which we in-licensed from Kyowa Hakko Kogyo Co., Ltd., or Kyowa Hakko, in August 2003. We initiated our pivotal Phase 3 clinical trials of the IV formulation of KW-3902 in May 2007 for the treatment of the acute form of congestive heart failure, or CHF, in patients with renal impairment and fluid overload. We plan to commence a Phase 2 clinical trial of an oral formulation of KW-3902 in outpatients with chronic CHF in the second half of 2007.

KW-3902 is an adenosine A1 receptor antagonist, and there are currently no adenosine A1 receptor antagonists that have received regulatory approval from the United States Food and Drug Administration, or FDA, for the treatment of CHF. Although we received favorable results in our Phase 2 clinical trials and pilot Phase 3 clinical trial of the IV formulation of KW-3902, we cannot give any assurance that our pivotal Phase 3 trials for the treatment of acute CHF in patients with renal impairment and fluid overload will achieve the clinical endpoints or serve as the basis for pursuing regulatory approval from the FDA. In particular, based on our discussions with the FDA, we believe that the FDA may require that we define treatment failure in our pivotal trials in a different manner from our pilot trial. This change could alter our ability to achieve favorable results. Although we plan to commence a Phase 2 clinical trial of an oral formulation of KW-3902, we are still optimizing the oral formulation of KW-3902. As such, we have not yet clinically tested any oral formulations. We may not be able to develop a suitable oral formulation of KW-3902.

Our second product candidate, K201 (JTV-519), was in-licensed from Aetas Pharma Co., Ltd., or Aetas, in September 2006. We expect to commence a Phase 2 clinical trial of the IV formulation of K201 (JTV-519) for the acute treatment of atrial fibrillation, or A-Fib, an irregular heartbeat, in the second half of 2007. We have not yet filed an Investigational New Drug Application, or IND, or its foreign equivalent for K201 (JTV-519), and there is no guarantee that we will be able to successfully file an IND or commence Phase 2 trials of K201 (JTV-519) for the treatment of A-Fib on our projected timeline, or at all.

If we are unable to develop, receive approval for or successfully commercialize KW-3902 or K201 (JTV-519), we will not be able to generate product revenues.

8

The clinical trial protocol and design for our planned Phase 3 clinical trials of KW-3902 may not be sufficient to allow us to submit a New Drug Application, or NDA, or demonstrate safety or efficacy at the level required by the FDA for product approval.

The clinical trial protocols and design of our Phase 3 clinical trials of the IV formulation of KW-3902 for the treatment of acute CHF in patients with renal impairment and fluid overload may prove to be insufficient for product approval. We are conducting our Phase 3 clinical trials of the IV formulation of KW-3902 to examine whether KW-3902, when co-administered with the IV diuretic furosemide, or Lasix, to patients with acute CHF will result in:

- •

- an improvement in patient-reported shortness of breath, also known as dyspnea; and

- •

- the absence of the occurrence of any of the following events within a certain time period after the first dosing with KW-3902 or placebo:

- •

- death or readmission to the hospital;

- •

- the worsening of heart failure requiring the use of rescue therapy; or

- •

- the worsening of renal function.

In particular, the measure of a patient's dyspnea and our other clinical endpoints have some subjective elements that are not as clear as other clinical endpoints that are based on specific objective measures. It is possible that the FDA could determine that there is inadequate evidence of dyspnea improvement.

Even if we achieve positive results on the endpoints for a trial, the results may not be sufficient to demonstrate efficacy at the level required by the FDA for product approval. It is possible that we may make modifications to the clinical trial protocols or designs of one or more of our Phase 3 clinical trials of the IV formulation of KW-3902 that delay the enrollment in, or the completion of, our clinical trials or delay our pursuit of regulatory approval of KW-3902.

In March 2006, we met with the FDA to discuss the clinical trial requirements for submission of an NDA for the IV formulation of KW-3902. We have not sought FDA agreement on our current primary endpoint or the statistical plans under which the results of our pivotal clinical trials will be analyzed. We have not submitted and do not plan to submit a Special Protocol Assessment, or SPA, which drug development companies sometimes use to obtain an agreement with the FDA concerning the design and size of a clinical trial intended to form the primary basis of an effectiveness claim. Without the concurrence of the FDA on an SPA or otherwise, we cannot be certain that the design, conduct and data analysis approach for our Phase 3 trials will be sufficient to allow us to submit or receive approval of an NDA for the IV formulation of KW-3902. If the FDA requires us, or we otherwise determine, to amend our protocols, change our clinical trial designs, increase enrollment targets or conduct additional clinical trials, our ability to obtain regulatory approval on our projected timeline would be jeopardized and we could be required to make significant additional expenditures related to clinical development. Any failure to obtain approval of KW-3902 on the timeline that we currently anticipate, or at all, would have a material and adverse impact on our business.

9

Because the results of early clinical trials are not necessarily predictive of future results, KW-3902, K201 (JTV-519) or any other product candidate we advance into clinical trials may not have favorable results in later clinical trials, if any, or receive regulatory approval.

Our product candidates are prone to the risks of failure inherent in drug development. We will be required to demonstrate through well-controlled clinical trials of KW-3902 and K201 (JTV-519) that our product candidates are safe and effective for use in a diverse population for their target indications before we can seek regulatory approvals for their commercial sale. Success in early clinical trials does not mean that later clinical trials will be successful because product candidates in later-stage clinical trials may fail to demonstrate sufficient safety or efficacy despite having progressed through initial clinical testing. All of our Phase 2 clinical trials, as well as our pilot Phase 3 clinical trial, involved relatively small patient populations. Because these patient populations were relatively small, our data from these trials may contain statistical anomalies and may not be predictive of later- stage trials. Moreover, based on our discussions with the FDA, we believe that the FDA may require that we change the definition of treatment failure to be used for the primary endpoint in our pivotal trials from the definition that we used in our pilot trial.

Companies frequently suffer significant setbacks in advanced clinical trials, even after earlier clinical trials have shown promising results. Any of our planned Phase 3 clinical trials of the IV formulation of KW-3902, Phase 2 clinical trial of the oral formulation of KW-3902 or Phase 2 trial of the IV formulation of K201 (JTV-519) may not be successful for a variety of reasons, including the clinical trial designs, the failure to enroll a sufficient number of patients, undesirable side effects and other safety concerns and the inability to demonstrate sufficient efficacy.

We modified the primary endpoint for our two PROTECT trials from that studied in the pilot Phase 3 clinical trial. This change may affect the results we observe in our pivotal Phase 3 trials as compared to the preliminary data from our pilot Phase 3 trial. Further, Phase 3 trials of the IV formulation of KW-3902 will enroll significantly more patients than we have enrolled in clinical trials of KW-3902 to date. The FDA has indicated that a minimum of 1,500 patients must have been administered the IV formulation of KW-3902 at doses that are equal to or above the dose for which we seek regulatory approval. We expect to enroll 2,359 patients in our Phase 3 trials. The data collected from clinical trials with larger patient populations may not demonstrate sufficient safety and efficacy to support regulatory approval of KW-3902 or any other product candidate we advance into clinical trials. If KW-3902, K201 (JTV-519) or any other product candidate we advance into clinical trials fails to demonstrate sufficient safety or efficacy, we would experience potentially significant delays in, or be required to abandon, development of that product candidate.

KW-3902, K201 (JTV-519) and any other product candidates we may advance into clinical development are subject to extensive regulation, which can be costly and time consuming, cause unanticipated delays or prevent the receipt of the required approvals to commercialize our product candidates.

The clinical development, manufacturing, labeling, storage, record-keeping, advertising, promotion, import, export, marketing and distribution of KW-3902, K201 (JTV-519) or any future product candidates are subject to extensive regulation by the FDA in the United States and by comparable governmental authorities in foreign markets. In the United States, we are

10

not permitted to market our product candidates until we receive approval of an NDA from the FDA. The process of obtaining NDA approval is expensive, often takes many years and can vary substantially based upon the type, complexity and novelty of the products involved. Approval policies or regulations may change and the FDA has substantial discretion in the drug approval process, including the ability to delay, limit or deny approval of a product candidate for many reasons. Despite the time and expense invested in clinical development of product candidates, regulatory approval is never guaranteed. We intend to seek product approvals in countries outside the United States where we have commercial rights, including Europe. As a result, we will be subject to regulation by the European Medicines Agency, or EMEA, as well as the other regulatory agencies in many of these countries. The FDA, EMEA and any of the applicable European and other regulatory bodies can delay, limit or deny approval of a product candidate for many reasons, including:

- •

- a product candidate may not be safe and effective;

- •

- regulatory agencies may not find the data from preclinical testing and clinical trials to be sufficient;

- •

- the FDA may not accept clinical data from trials which are conducted in countries where the standard of care is potentially different from the United States;

- •

- the protocol, design or implementation of our clinical trials may not be consistent with the requirements of each applicable regulatory agency;

- •

- regulatory agencies may not approve of our third-party manufacturers' processes or facilities; or

- •

- regulatory agencies may change their approval policies or adopt new regulations.

In addition, recent events raising questions about the safety of certain marketed drugs may result in increased cautiousness by the FDA and other regulatory authorities in reviewing new drugs based on safety, efficacy or other regulatory considerations and may result in significant delays in obtaining regulatory approvals. Any delay in obtaining, or inability to obtain, applicable regulatory approvals would prevent us from commercializing our product candidates.

KW-3902, as an adenosine A1 receptor antagonist, increases the risk of seizure, which may delay or prevent its regulatory approval. We also expect that any approved label for KW-3902 will include a contra-indication for some patients with heightened seizure risk and will require other patients with heightened seizure risk to be co-administered one or more anti-seizure medications, which may limit the commercial potential of KW-3902.

KW-3902, like other adenosine A1 receptor antagonists, lowers patient seizure threshold and may contribute to seizures in CHF patients who are already at risk for seizure. In our Phase 2 clinical trials, two patients with risk factors for seizure had seizures that were determined to be drug-related. One of the patients subsequently died. As a result of the increased risk of seizure associated with the administration of KW-3902, we designed our Phase 3 clinical trials to exclude certain patients at risk for seizure, including patients with certain known medical histories, including, but not limited to, brain tumors, history of seizure, brain surgery within two years, alcohol withdrawal, stroke within two years, advanced multiple sclerosis, penetrating head trauma and late-stage Alzheimer's disease, from participating in the trials. In

11

addition, we require patients believed to have an elevated risk of seizure who are not excluded from our Phase 3 trials by the above criteria to take a prophylactic anti-seizure medication that raises the seizure threshold. We also extended the infusion time of KW-3902 to four hours. Although no seizures were observed in the 304 patients enrolled in our pilot Phase 3 clinical trial of the IV formulation of KW-3902, of which 225 received one or more doses of KW-3902, we believe that, given the baseline rate of seizures in heart failure patients and the size of the patient populations expected to be enrolled in these pivotal Phase 3 trials, some patients will likely experience seizures. KW-3902 could fail to receive regulatory approval for safety reasons if the FDA determines that the number of patients who experience seizures during our pivotal Phase 3 trials is unacceptable.

Even if we are able to obtain regulatory approval of the IV formulation of KW-3902 in acute CHF patients with renal impairment and fluid overload, we expect that the label will require that certain patients with heightened seizure risk will not be prescribed KW-3902 and that other patients with a heightened seizure risk be co-administered a benzodiazepine or another type of anti-seizure medication. Physicians may decide not to administer KW-3902 due to concerns over the potential side effects or other impact of administering an anti-seizure medication to an acute CHF patient. This or other concerns may diminish the usage of KW-3902 and limit its commercial success.

KW-3902, K201 (JTV-519) or any other product candidate we advance into clinical trials may cause undesirable side effects or have other properties that may delay or prevent their regulatory approval or commercialization or limit their commercial potential.

Undesirable side effects caused by KW-3902, K201 (JTV-519) or any other product candidate we advance into clinical trials could cause us or regulatory authorities to interrupt, delay or halt clinical trials and could result in the denial of regulatory approval by the FDA or other regulatory authorities for any or all targeted indications. This, in turn, could prevent us from commercializing the affected product candidate and generating revenues from its sale. In addition to seizure, other side effects were observed in our clinical trials of KW-3902 to date. The most common side effects observed in patients who received either KW-3902 or the IV placebo were worsening CHF, abnormal heart rhythms, kidney and urinary problems, hypokalemia (a low amount of potassium in the blood), aches and cramps, headaches, low blood pressure, nausea, constipation, hypoglycemia, insomnia, dizziness, anxiety and anemia.

We have not yet tested K201 (JTV-519) for the treatment of patients with A-Fib and we currently do not know what side effects, if any, will be observed in patients with A-Fib who receive K201 (JTV-519). Although K201 (JTV-519) has been administered to date in 141 people, including both healthy volunteers and patients with acute coronary syndrome, it has not been administered to treat A-Fib in humans.

In addition, if KW-3902, K201 (JTV-519) or any other product candidate we develop receives marketing approval and we or others later identify undesirable side effects caused by the product, a number of significant negative consequences could result, including:

- •

- regulatory authorities may withdraw their approval of the affected product;

- •

- regulatory authorities may require a larger clinical benefit for approval to offset the risk;

12

- •

- regulatory authorities may require the addition of labeling statements that could diminish the usage of the product or otherwise limit the commercial success of the affected product;

- •

- we may be required to change the way the affected product is administered, conduct additional clinical trials or change the labeling of the product;

- •

- we may choose to discontinue sale of the affected product;

- •

- we could be sued and held liable for harm caused to patients;

- •

- we may not be able to enter into collaboration agreements on acceptable terms and execute on our business model; and

- •

- our reputation may suffer.

Any one or a combination of these events could prevent us from achieving or maintaining market acceptance of the affected product or could substantially increase the costs and expenses of commercializing the affected product, which in turn could delay or prevent us from generating any revenues from the sale of the affected product.

We may experience delays in the commencement of our clinical trials, which could result in increased costs to us and delay our ability to pursue regulatory approval.

Delays in the commencement of clinical testing could significantly impact our product development costs. We do not know whether all of our planned Phase 3 clinical trials of the IV formulation of KW-3902, Phase 2 clinical trial of the oral formulation of KW-3902 or Phase 2 clinical trial of the IV formulation of K201 (JTV-519) will begin on time, or at all. The commencement of clinical trials can be delayed for a variety of reasons, including delays in:

- •

- obtaining regulatory clearance to commence a clinical trial;

- •

- identifying, recruiting and training suitable clinical investigators;

- •

- reaching agreement on acceptable terms with prospective contract research organizations, or CROs, and trial sites, the terms of which can be subject to extensive negotiation, may be subject to modification from time to time and may vary significantly among different CROs and trial sites;

- •

- obtaining sufficient quantities of a product candidate for use in clinical trials;

- •

- obtaining institutional review board, or IRB, approval to conduct a clinical trial at a prospective site;

- •

- identifying, recruiting and enrolling patients to participate in a clinical trial; and

- •

- retaining patients who have initiated a clinical trial but may withdraw due to adverse side effects from the therapy, insufficient efficacy, fatigue with the clinical trial process or personal issues.

Any delays in the commencement of our clinical trials will delay our ability to pursue regulatory approval for our product candidates. In addition, many of the factors that cause, or lead to, a delay in the commencement of clinical trials may also ultimately lead to the denial of regulatory approval of a product candidate.

13

Delays in the completion of clinical testing could result in increased costs to us and delay our ability to generate product revenues.

Once a clinical trial has begun, patient recruitment and enrollment may be slower than we anticipate. Our Phase 3 clinical trials of the IV formulation of KW-3902 will enroll significantly more patients than we have enrolled in clinical trials of KW-3902 to date. We expect to enroll 2,359 patients in our Phase 3 clinical trials. Because the patients we intend to enroll in our REACH UP Phase 3 trial are a smaller subset of the CHF patient population, we expect patient enrollment for this trial to take longer than the patient enrollment in our other Phase 3 trials.

In our pivotal Phase 3 clinical trials, we are enrolling patients who meet a higher BNP threshold than the patients we enrolled in our pilot Phase 3 trial. BNP is an indicator of heart failure and raising the BNP threshold will decrease the possibility of including patients without CHF in our Phase 3 trials. Approximately 75% of the patients enrolled in our pilot Phase 3 trial met the higher BNP threshold. As a result, we may experience slower enrollment in our pivotal Phase 3 trials than in our pilot Phase 3 trial.

We anticipate that some of our clinical trial sites may also be enrolling acute CHF patients in clinical trials for other sponsors, including potential competitors, and as a result we may face competition to enroll acute CHF patients in our Phase 3 clinical trials. Delays in enrollment in our Phase 3 trials of the IV formulation of KW-3902 would result in delays in our ability to pursue regulatory approval of KW-3902.

Clinical trials may also be delayed as a result of ambiguous or negative interim results. Further, a clinical trial may be suspended or terminated by us, the IRB or the Data Monitoring Committee overseeing the clinical trial, any of our clinical trial sites with respect to that site or the FDA or other regulatory authorities due to a number of factors, including:

- •

- failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols;

- •

- inspection of the clinical trial operations or clinical trial site by the FDA or other regulatory authorities resulting in the imposition of a clinical hold;

- •

- unforeseen safety issues or any determination that the clinical trial presents unacceptable health risks; and

- •

- lack of adequate funding to continue the clinical trial.

Changes in regulatory requirements and guidance also may occur and we may need to amend clinical trial protocols to reflect these changes. Amendments may require us to resubmit our clinical trial protocols to IRBs for re-examination, which may impact the costs, timing and successful completion of a clinical trial. If we experience delays in the completion of, or if we must terminate, any clinical trial of KW-3902, K201 (JTV-519) or any other product candidate we advance into clinical trials, our ability to obtain regulatory approval for that product candidate will be delayed and the commercial prospects, if any, for the product candidate may be harmed. In addition, many of these factors may also ultimately lead to the denial of regulatory approval of a product candidate. Even if we ultimately commercialize KW-3902 or K201 (JTV-519), other therapies for the same indications may have been introduced to the market during the period we have been delayed and such therapies may have established a competitive advantage over our product candidates.

14

We are relying on Hesperion Ltd., or Hesperion, to conduct and oversee our Phase 3 clinical trials of the IV formulation of KW-3902 and will rely upon third parties to conduct our other planned clinical trials. If Hesperion or other third parties do not meet our deadlines or otherwise conduct the trials as required, we may not be able to obtain regulatory approval for or commercialize our product candidates when expected or at all.

We have contracted with Hesperion to serve as our CRO for the Phase 3 clinical trials of the IV formulation of KW-3902. We have contracted with Duke Clinical Research Institute, or DCRI, to provide safety surveillance and conduct pharmacoeconomic sub-studies for these Phase 3 trials. We also rely upon medical institutions, clinical investigators and contract laboratories to conduct our trials in accordance with our clinical protocols. Our CROs, investigators and other third parties play a significant role in the conduct of these trials and the subsequent collection and analysis of data from the clinical trials.

There is no guarantee that Hesperion, DCRI, other CROs, investigators and other third parties will devote adequate time and resources to our clinical trials or perform as contractually required. If Hesperion, DCRI or any other third parties upon which we rely for administration and conduct of our clinical trials fail to meet expected deadlines, fail to adhere to our clinical protocols or otherwise perform in a substandard manner, our clinical trials may be extended, delayed or terminated, and we may not be able to commercialize our product candidates.

If any of our clinical trial sites terminate for any reason, we may experience the loss of follow-up information on patients enrolled in our ongoing clinical trials unless we are able to transfer the care of those patients to another qualified clinical trial site. In addition, principal investigators for our clinical trials may serve as scientific advisors or consultants to us from time to time and receive cash or equity compensation in connection with such services. If these relationships and any related compensation result in perceived or actual conflicts of interest, the integrity of the data generated at the applicable clinical trial site may be jeopardized.

If we fail to enter into a collaboration with respect to the advanced clinical development and commercialization of the oral formulations of our product candidates, we may not be able to execute this portion of our business strategy.

Currently, our strategy is to enter into collaborations with pharmaceutical and biotechnology companies for the commercialization of our oral product candidates in all regions where we hold commercial rights and for commercialization of our IV product candidates outside the United States. We may also pursue collaborations in which our partners provide funding for our future clinical development. It may be difficult for us to find suitable third parties that are willing to enter into collaborations on economic terms that are acceptable to us, or at all.

If we are not able to enter into collaborations for the oral formulations of our product candidates, we could be required to undertake and fund product development, clinical trials, manufacturing and marketing activities solely at our expense. Failure to enter into collaborations for the oral formulations of our product candidates would substantially increase our requirements for capital, which may not be available to us.

15

Even if KW-3902 or K201 (JTV-519) receives regulatory approval, our product candidates may still face future commercial and regulatory difficulties.

We may fail to commercialize successfully any of our product candidates that ultimately receive regulatory approval. For example, the availability of alternative treatments, cost effectiveness, the cost of manufacturing the product on a commercial scale, labeling restrictions and the effect of competition with other drugs may adversely impact the commercial success of a drug. If we fail to commercialize our product candidates as expected, we may be unable to generate sufficient revenue to attain or maintain profitability.

In addition, the FDA may impose significant restrictions on the indicated uses or marketing of a product or impose ongoing requirements for potentially costly post-approval clinical trials or studies. Our product candidates will also be subject to ongoing FDA requirements governing the labeling, packaging, storage, advertising, promotion, recordkeeping and submission of safety and other post-market information.

Even if our product candidates receive regulatory approval in the United States, we may never obtain regulatory approval or successfully commercialize our products outside of the United States.

In order to market any products outside of the United States, we must establish and comply with numerous and varying regulatory requirements of other countries regarding safety and efficacy. Approval procedures vary among countries and can involve additional product testing and additional administrative review periods. The time required to obtain approval in other countries might differ from that required to obtain FDA approval. The regulatory approval process in other countries may include all of the risks described above regarding FDA approval in the United States. Regulatory approval in one country does not ensure regulatory approval in another, but a failure or delay in obtaining regulatory approval in one country may negatively impact the regulatory process in others. To date, we have not initiated any discussions with the EMEA or other foreign regulatory authorities with respect to seeking regulatory approval of KW-3902 for any indication in Europe or in any other country outside the United States. As in the United States, the regulatory approval process in Europe and in other countries is a lengthy and challenging process. Failure to obtain regulatory approval in other countries or any delay or setback in obtaining such approval could have the same adverse effects detailed above regarding FDA approval in the United States. Such effects include the risk that our product candidates may not be approved for all indications requested, which could limit the uses of our product candidates and adversely impact potential product sales and/or collaboration opportunities, and that such approval may be subject to limitations on the indicated uses for which the product may be marketed or require costly, post-marketing follow-up studies.

If we fail to comply with applicable foreign regulatory requirements, we may be subject to fines, suspension or withdrawal of regulatory approvals, product recalls, seizure of products, operating restrictions and criminal prosecution.

16

Because we in-licensed KW-3902 from Kyowa Hakko and K201 (JTV-519) from Aetas, any dispute with these licensors may adversely affect our ability to develop and commercialize the applicable product candidates.

Both of our current product candidates were in-licensed from third parties. In August 2003, we licensed exclusive rights from Kyowa Hakko to the IV and oral formulations of our product candidate KW-3902 for the treatment of CHF and other indications in major markets, including the United States and Europe, but excluding Asia. Pursuant to the terms of our license agreement with Kyowa Hakko, Kyowa Hakko has the right to terminate the agreement in the event of an uncured material breach of the license agreement by us.

We entered into a license agreement with Aetas in September 2006 and supplemented this license agreement in January 2007 for the exclusive rights to the IV and oral formulations of our product candidate, K201 (JTV-519), for the treatment of cardiac arrhythmia and other cardiovascular indications in major markets, including the United States and Europe, but excluding Asia. Under the terms of our license agreement, Aetas has the right to terminate the agreement in the event of a material breach by us. Aetas also has the right to terminate the agreement in the event we fail to commence dosing, without reasonable reasons, in specified clinical trials of the IV formulation of K201 (JTV-519) by predetermined dates or otherwise fail to use commercially reasonable efforts to develop the product candidate, in each case as determined by Aetas in its sole discretion.

As a result, if there is any conflict, dispute or disagreement between us and Kyowa Hakko or Aetas regarding our rights or obligations under the license agreements, our ability to develop and commercialize the affected product candidate and our ability to enter into collaboration or marketing agreements for the affected product candidate may be adversely affected. Any loss of our rights under our license agreements could delay or completely terminate our product development efforts for the affected product candidate.

In addition, our agreements with Kyowa Hakko and Aetas permit our licensors to assign their rights under the respective license agreements to affiliates and to any third party, including our current or potential future competitors, in connection with the sale or transfer of the business or assets associated with the licensed product candidate. In addition, under the license agreement with Aetas, Aetas may assign its rights with our consent, which is not to be unreasonably withheld. If our licensors were to assign their rights to a third party, such parties may have interests that are adverse to us and may take actions that adversely affect our ability to commercialize our product candidates.

Any adverse developments that occur during any clinical trials conducted by Kyowa Hakko or Aetas, or their respective licensees, may affect our ability to obtain regulatory approval or commercialize our product candidates.

Kyowa Hakko retains the rights to develop and commercialize KW-3902 and Aetas retains the rights to develop and commercialize K201 (JTV-519) in Japan, China, India, Indonesia, Korea, Singapore, Taiwan, Thailand and other specified Asian countries. If either Kyowa Hakko or Aetas or any of their future licensees decides to conduct clinical trials with respect to these respective product candidates and serious adverse events occur during these trials, the FDA and other regulatory authorities may delay, limit or deny approval of our drug candidates or require us to conduct additional clinical trials as a condition to marketing approval, which would increase our costs. If we receive marketing approval for KW-3902 or K201 (JTV-519) and

17

a new and serious safety issue is identified in connection with clinical trials conducted by one of our licensors or their other licensees, the FDA and other regulatory authorities may withdraw their approval of the product or otherwise restrict our ability to market and sell our products. In addition, treating physicians may be less willing to administer our product candidates due to concerns over such adverse events which would limit our ability to commercialize the affected product candidate.

If our competitors develop treatments for CHF patients with renal impairment and fluid overload, treatments for chronic CHF patients or treatments for patients with A-Fib that are approved more quickly, marketed more effectively or demonstrated to be more effective than our product candidates, our commercial opportunity will be reduced or eliminated.

The biotechnology and pharmaceutical industries are characterized by rapidly advancing technologies, intense competition and a strong emphasis on proprietary products. We face competition from many different sources, including pharmaceutical and biotechnology enterprises, academic institutions, government agencies and private and public research institutions, many of which have significantly greater financial and other resources than we.

The cardiovascular indications for which we are developing products have a number of established therapies and products under development with which our product candidates will compete. Although there are currently no adenosine A1 receptor antagonists that have received regulatory approval from the FDA for the treatment of CHF, we believe that Biogen Idec Inc.'s product candidate, ADENTRI, and Solvay S.A.'s, or Solvay, product candidate, SLV-320, are both in Phase 2 clinical trials.

Several companies are engaged in the clinical development of vasopression antagonists for the treatment of CHF, including Otsuka Pharmaceuticals Group, which has tolvaptan in Phase 3 clinical trials, and Cardiokine Inc., which has Lixivaptan in Phase 2 clinical trials. PDL BioPharma, Inc. has the vasodilator, ularitide, a synthetic form of urodilatin, in Phase 2 development for acute CHF. Two other companies have inotropes, which are agents that increase or decrease the force or energy of muscular contractions, in clinical trials for the treatment of CHF, including Abbott Laboratories, which has levosimendan in Phase 3 trials, and Cytokinetics Inc., which has CK-1827452 in Phase 1 clinical trials. While these products will not compete directly with KW-3902, physicians may choose to use one therapy over another.

Current drugs in development for the acute treatment of A-Fib include vernakalant, which is being developed by Cardiome Pharma Corp., or Cardiome, in partnership with Astellas Pharma Inc., for which an NDA has been submitted. Currently in development for the long-term maintenance of A-Fib are Sanofi-Aventis S.A.'s dronedarone, which is in Phase 3 clinical trials, and the oral formulation of Cardiome's vernakalant, which is in Phase 2 clinical trials. Solvay's Tedisamil is also in clinical development for the treatment of arrthymias, including A-Fib.

New developments, including the development of other drug technologies and methods of preventing the incidence of disease, occur in the pharmaceutical and life sciences industries at a rapid pace. These developments may render our product candidates obsolete or noncompetitive. Compared to us, many of our potential competitors have substantially greater:

- •

- research and development resources, including personnel and technology;

- •

- regulatory experience;

18

- •

- drug development, clinical trial and drug commercialization experience;

- •

- experience and expertise in exploitation of intellectual property rights; and

- •

- capital resources.

As a result of these factors, our competitors may obtain regulatory approval of their products more rapidly than we or may obtain patent protection or other intellectual property rights that limit our ability to develop or commercialize our product candidates. Our competitors may also develop products for the treatment of CHF, A-Fib or other cardiovascular indications we pursue that are more effective, better tolerated, more useful and less costly than ours and may also be more successful in manufacturing and marketing their products. Our competitors may succeed in obtaining approvals from the FDA and foreign regulatory authorities for their product candidates sooner than we do for ours. In addition, if we receive regulatory approvals for our products, manufacturing efficiency is likely to be a significant competitive factor. We currently have no commercial manufacturing infrastructure. There can be no assurance that we can develop or contract for these capabilities on acceptable economic terms, or at all.

In addition, Kyowa Hakko retains the rights to develop and commercialize KW-3902 and Aetas retains the rights to develop and commercialize K201 (JTV-519) for fields of use outside the fields of use for which we have a license in the United States, Europe and other countries where we have commercial rights. In the event that our licensors, or their respective future licensees, successfully develop and commercialize these product candidates for use in fields outside of the fields of use licensed to us in countries where we hold commercial rights to these product candidates, we may face significant competition from our licensors or their future licensees as physicians and other healthcare providers may prescribe, and patients may use, the products of our licensors or their licensees for off-label use. We will receive no revenues from the sale of such products by our licensors or their future licensees.

We will also face competition from these third parties in recruiting and retaining qualified personnel, establishing clinical trial sites and patient registration for clinical trials and in identifying and in-licensing new product candidates.

We do not have internal manufacturing capabilities, and if we fail to develop and maintain supply relationships with manufacturers, we may be unable to develop or commercialize our product candidates.

All of our manufacturing is outsourced to third parties with oversight by our internal managers, and we do not plan to build manufacturing capabilities. The production and manufacture of KW-3902 and K201 (JTV-519) employ small molecule organic chemistry procedures that require a high level of expertise. We currently rely on DSM Pharma Chemicals, Inc. for the production of the drug substance of KW-3902 and Patheon Italia S.p.A., or Patheon, for the production of finished IV and oral KW-3902 product candidates. Patheon is in the process of moving our KW-3902 production from a plant in Puerto Rico to a plant in Italy. Although we have sufficient inventory of finished KW-3902 for our clinical trials, we could experience temporary supply interruptions in connection with the facility move. In addition, although KW-3902 is manufactured from readily available raw materials using standard pharmaceutical methods and equipment and we can obtain the raw materials from multiple suppliers, the replacement of any one of our manufacturers would lead to significant delays

19

and increase our costs. We currently do not have long-term supply arrangements with any of these suppliers.

Our ability to develop and commercialize our product candidates depends, in part, on our ability to outsource the manufacturing at a competitive cost, in accordance with regulatory requirements and in sufficient quantities for clinical testing and eventual commercialization. Our manufacturers have not manufactured commercial batches of KW-3902 or clinical supplies of K201 (JTV-519). These manufacturers may encounter difficulties with the small- and large-scale formulation and manufacturing processes required to manufacture clinical and commercial quantities of our product candidates. Such difficulties could result in delays in our clinical trials and regulatory submissions, in the commercialization of KW-3902, K201 (JTV-519) or another product candidate or, if KW-3902, K201 (JTV-519) or any other product candidate is approved, in the recall or withdrawal of the product from the market. Further, development of large-scale manufacturing processes may require additional validation studies, which the FDA must review and approve. If our manufacturers fail to deliver the required commercial quantities on a timely basis and at commercially reasonable prices, we may be unable to meet demand for our products and could lose potential revenue.

Our manufacturers must comply with current good manufacturing practices, or cGMP, enforced by the FDA through its facilities inspection program and review of submitted technical information. We have little control over manufacturers' compliance with these regulations and standards and they may not comply. A failure to comply with these requirements may result in fines and civil penalties, suspension of production, suspension or delay in product approval, product seizure or recall, or withdrawal of product approval. If the safety of any quantities supplied by third parties is compromised due to their failure to adhere to applicable laws or for other reasons, we may not be able to obtain regulatory approval for or successfully commercialize the affected product candidate, and we may be held liable for any injuries sustained as a result. Any of these factors could cause a delay of clinical trials, regulatory submissions, approvals or commercialization of our product candidates, entail higher costs or result in our being unable to effectively commercialize our products.

If we are unable to establish sales and marketing capabilities or enter into agreements with third parties to market and sell any products we may develop, we may not be able to effectively market and sell our products and generate product revenue.

We do not currently have the infrastructure for the sales, marketing and distribution of our pharmaceutical products, and we must build this infrastructure or make arrangements with third parties to perform these functions in order to commercialize our products. We intend to establish (either internally or through a contract sales force) a hospital-based sales force to sell the IV formulations of KW-3902 and K201 (JTV-519), if approved, in the United States. We plan to partner with third parties to commercialize our IV product candidates outside the United States. We also plan to enter into collaborations to develop further, promote and sell the oral formulations of our product candidates within and outside of the United States.

The establishment and development of our own sales force in the United States or the establishment of a contract sales force to market any products we may develop will be expensive and time-consuming and could delay any product launch, and we cannot be certain that we would be able to successfully develop this capability. If we are unable to establish our sales and marketing capability or any other non-technical capabilities necessary to

20

commercialize any products we may develop, we will need to contract with third parties to market and sell such products in the United States. We currently possess limited resources and may not be successful in establishing our own internal sales force or in establishing arrangements with third-parties on acceptable terms, if at all.

If KW-3902, K201 (JTV-519) or any other product candidate that we may successfully develop does not achieve broad market acceptance among physicians, patients, healthcare payors and the medical community, the revenues that we generate from their sales will be limited.

Even if our product candidates receive regulatory approval, they may not gain market acceptance among physicians, patients, healthcare payors and the medical community. Coverage and reimbursement of our product candidates by third-party payors, including government payors, generally is also necessary for commercial success. The degree of market acceptance of any of our approved products will depend on a number of factors, including:

- •

- our ability to provide acceptable evidence of safety and efficacy;

- •

- the relative convenience and ease of administration;

- •

- the prevalence and severity of any adverse side effects;

- •

- warnings or limitations contained in a product's labeling;

- •

- the availability of alternative treatments;

- •

- pricing and cost effectiveness;

- •

- the effectiveness of our or any future collaborators' sales and marketing strategies;

- •

- our ability to obtain sufficient third-party coverage or reimbursement; and

- •

- the willingness of patients to pay out of pocket in the absence of third-party coverage.

Currently, acute CHF patients are prescribed primarily inexpensive generic drugs. Hospitals are generally reimbursed at a fixed dollar amount per hospital stay for acute CHF patients. The amount of reimbursement that hospitals receive is generally less than the average amount spent by the hospital on the treatment of acute CHF patients. Because reimbursement amounts generally do not increase to cover the cost of non-generic drugs in the event they are prescribed, physicians may resist prescribing KW-3902 or other non-generic drugs to acute CHF patients, even if there is valid pharmacoeconomic justification (such as a shorter hospital stay or reduced rate of hospital readmission) to offset the cost. Although we believe that we will be able to demonstrate adequate pharmacoeconomic justification, there is no guarantee that physicians will adopt the use of KW-3902 because of its cost or for other factors. If KW-3902, K201 (JTV-519) or any other product candidate we may develop is approved but does not achieve an adequate level of acceptance by physicians, hospitals, healthcare payors and patients, we may not generate sufficient revenue from these products and we may not become or remain profitable.

We may incur substantial liabilities from any product liability claims if our insurance coverage for those claims is inadequate.

We face an inherent risk of product liability exposure related to the testing of our product candidates in human clinical trials, and will face an even greater risk if we sell our product candidates commercially. An individual may bring a liability claim against us if one of our

21

product candidates causes, or merely appears to have caused, an injury. If we cannot successfully defend ourselves against product liability claims, we will incur substantial liabilities. Regardless of merit or eventual outcome, liability claims may result in:

- •

- decreased demand for our product candidates;

- •

- impairment to our business reputation;

- •

- withdrawal of clinical trial participants;

- •

- costs of related litigation;

- •

- distraction of management's attention from our primary business;

- •

- substantial monetary awards to patients or other claimants;

- •

- the inability to commercialize our product candidates; and

- •

- loss of revenues.

The estate of the patient who suffered a seizure in a Phase 2 clinical trial of the IV formulation of KW-3902 and subsequently died has filed a malpractice claim against the clinical investigator. Although we are not named as a defendant in the pending lawsuit, it is possible that the complaint may be amended or we may be joined as a defendant in the case.