Exhibit 99.1

Transaction Update US January 19, 2023 CONFIDENTIAL – FOR INTERNAL USE ONLY ©2023 Albireo Pharma, Inc. All rights reserved

2 Agenda • Transaction Updates • Integration Team • Timeline of Events • Employee Matters CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

3 Integration Team • Integration Team is in the process of being established • Albireo Program Leader will be Stefan Bluemmers, Head of Portfolio Management • Additional details on the scope and key deliverables will be provided soon • Unless and until closing occurs, we remain separate companies and will continue to operate in the ordinary course of business CONFIDENTIAL – FOR INTERNAL USE ONLY ©2023 Albireo Pharma, Inc. All rights reserved

4 Timeline of Events Pre - Close January Pre - Close February Close TBD Post Close CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

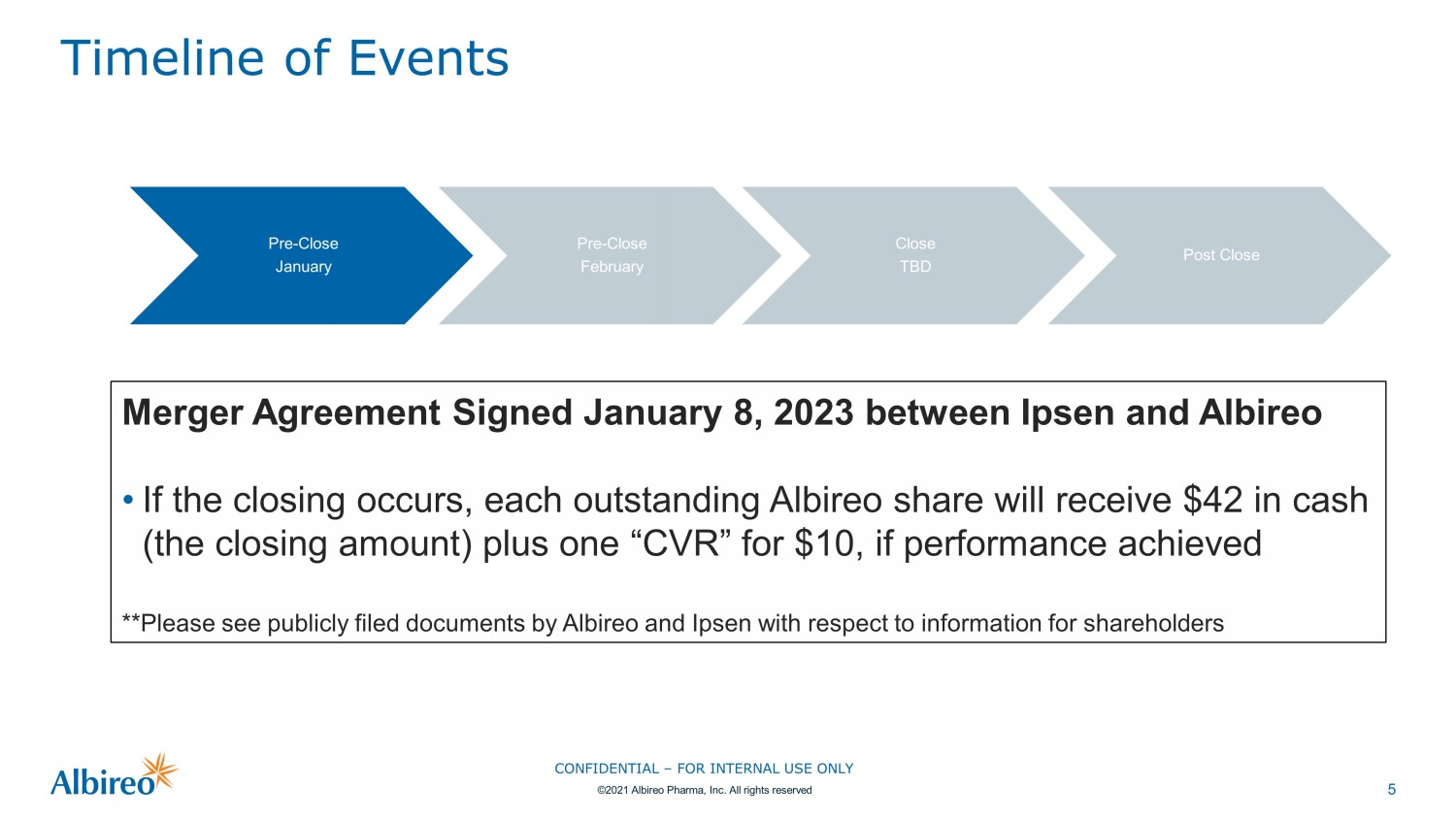

5 Timeline of Events Pre - Close January Pre - Close February Close TBD Post Close Merger Agreement Signed January 8, 2023 between Ipsen and Albireo • If the closing occurs, each outstanding Albireo share will receive $42 in cash (the closing amount) plus one “CVR” for $10, if performance achieved **Please see publicly filed documents by Albireo and Ipsen with respect to information for shareholders CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

6 What is a CVR? • CVR = Contingent Value Right • Transaction provides a contingent payment to stockholders of $10 per share dependent on the U.S. FDA approval of Bylvay in biliary atresia by December 31, 2027 • CVR will convert to cash ($10 X number of shares you held) if objective achieved by the deadline • If objective is not achieved by the deadline, CVR expires and does not have any value • Payment will be made less applicable taxes via payroll or by check or through paying agent CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

7 Timeline of Events Pre - Close January Pre - Close February Close TBD Post Close February • Compensation Statements Shared (if eligible) • Annual Merit • 2022 Bonus Payout • 2023 Equity Award in RSUs CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

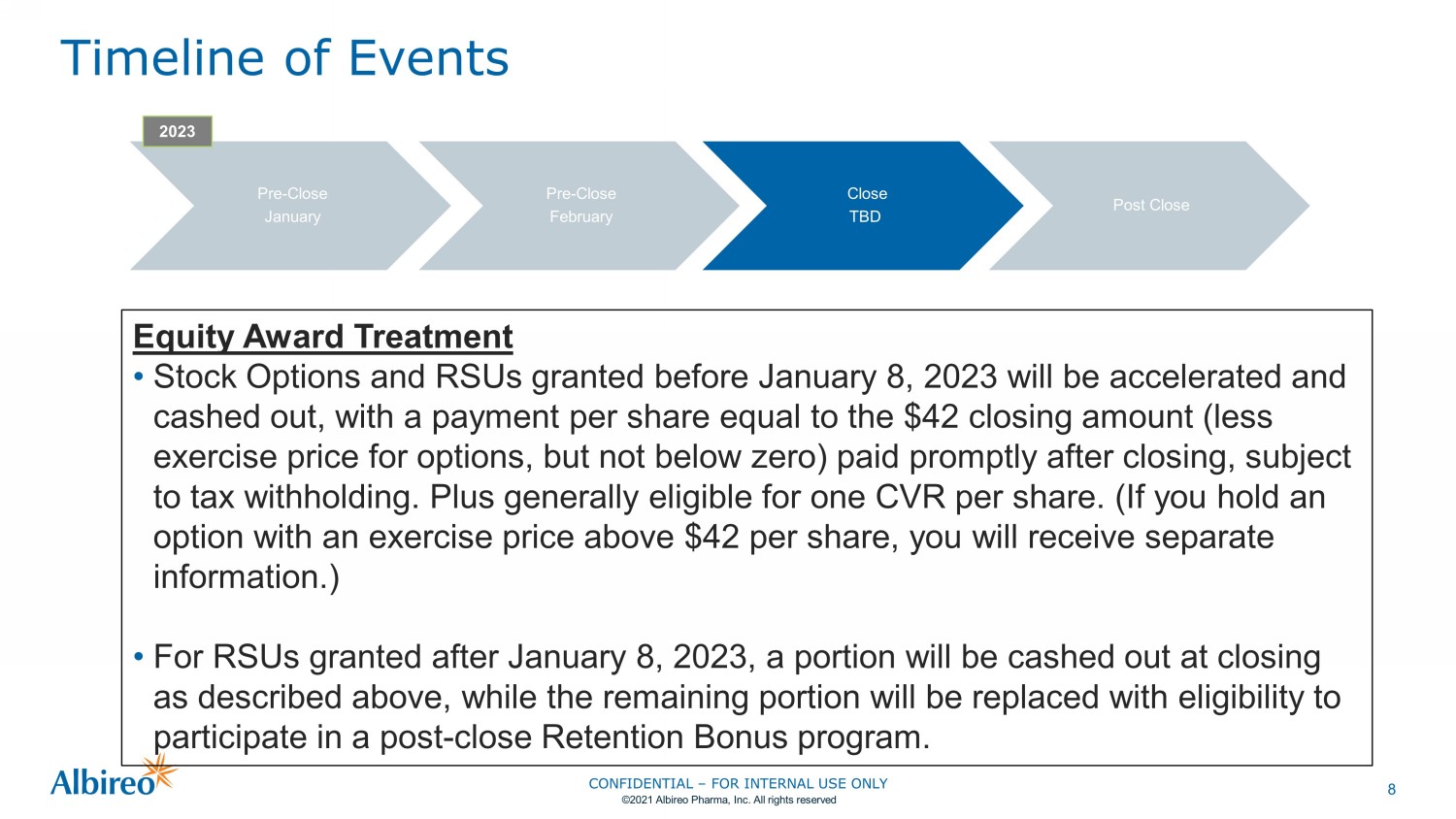

8 Timeline of Events Pre - Close January Pre - Close February Close TBD Post Close 2023 Equity Award Treatment • Stock Options and RSUs granted before January 8, 2023 will be accelerated and cashed out, with a payment per share equal to the $42 closing amount (less exercise price for options, but not below zero) paid promptly after closing, subject to tax withholding. Plus generally eligible for one CVR per share. (If you hold an option with an exercise price above $42 per share, you will receive separate information.) • For RSUs granted after January 8, 2023, a portion will be cashed out at closing as described above, while the remaining portion will be replaced with eligibility to participate in a post - close Retention Bonus program. CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

9 What Can You Do Now? • Consult with your tax and personal finance professionals • See your E*Trade account for further details about your holdings • 2023 Equity Awards will be posted in February CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

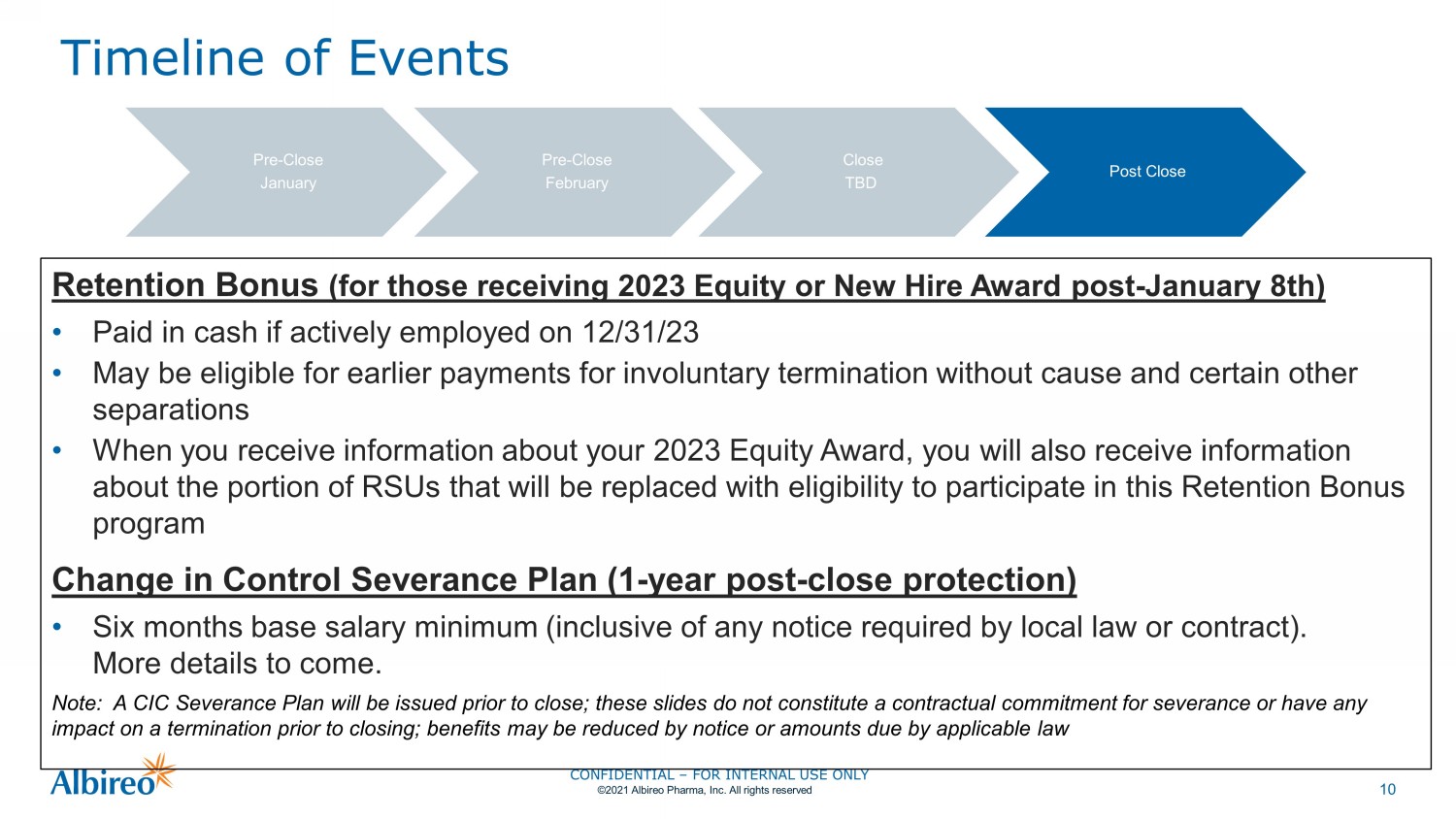

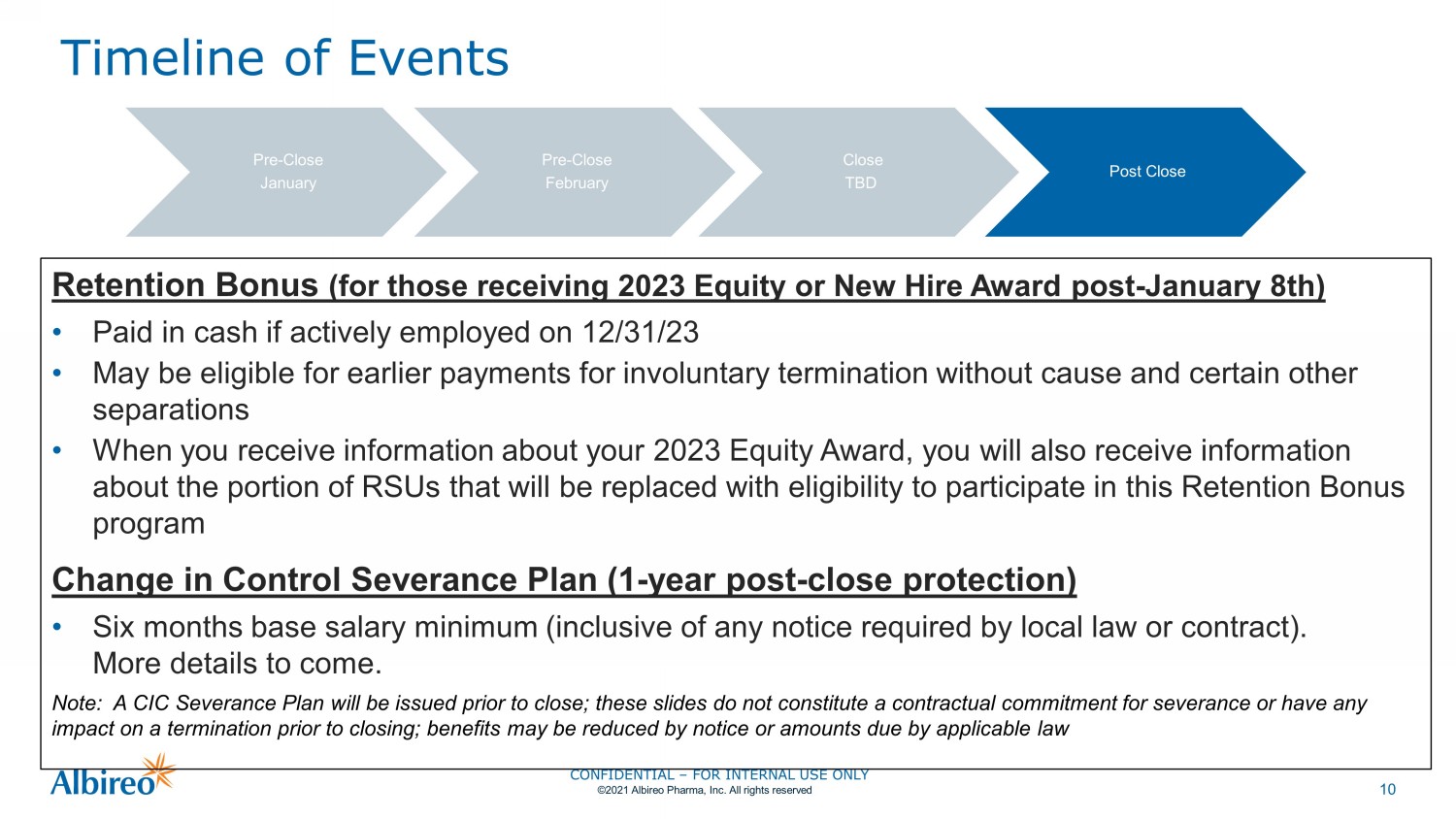

10 Timeline of Events Pre - Close January Pre - Close February Close TBD Post Close Retention Bonus (for those receiving 2023 Equity or New Hire Award post - January 8th) • Paid in cash if actively employed on 12/31/23 • May be eligible for earlier payments for involuntary termination without cause and certain other separations • When you receive information about your 2023 Equity Award, you will also receive information about the portion of RSUs that will be replaced with eligibility to participate in this Retention Bonus program Change in Control Severance Plan (1 - year post - close protection) • Six months base salary minimum (inclusive of any notice required by local law or contract). More details to come. Note: A CIC Severance Plan will be issued prior to close; these slides do not constitute a contractual commitment for severa nce or have any impact on a termination prior to closing; benefits may be reduced by notice or amounts due by applicable law CONFIDENTIAL – FOR INTERNAL USE ONLY ©2021 Albireo Pharma, Inc. All rights reserved

11 Ongoing Communication & Reminders • As a reminder, all media inquiries should be directed to Colleen Alabiso • Company & deal - related terms should not be discussed externally • FAQs will be updated as we have new information • Additional questions for FAQs – please send to Jennifer Moore • ET leaders will continue to have team meetings and extended department meetings • Townhalls and weekly will continue • Look for additional updates or new information • Updates on our business and success stories • Please work with your Manager or HR if you have additional questions CONFIDENTIAL – FOR INTERNAL USE ONLY ©2023 Albireo Pharma, Inc. All rights reserved

12 Staying Focused on Patients and Families as we transition from Albireo to Ipsen Current Close Future CONFIDENTIAL – FOR INTERNAL USE ONLY ©2023 Albireo Pharma, Inc. All rights reserved

13 About the Offer The tender offer for the outstanding shares of Albireo common stock referenced in this presentation has not yet commenced . This presentation is for informational purposes only and is not a recommendation, an offer to purchase or a solicitation of an offer to sell securities, nor is it a substitute for the tender offer materials that Ipsen Biopharmaceuticals, Inc . (Parent) and its acquisition subsidiary will file with the SEC, upon the commencement of the tender offer . At the time the tender offer is commenced, Parent and its acquisition subsidiary will file with the SEC a tender offer statement on Schedule TO and thereafter Albireo Pharma, Inc . will file a Solicitation/Recommendation Statement on Schedule 14 D - 9 with the SEC with respect to the tender offer . Once filed, stockholders will be able to obtain a free copy of these materials and other documents filed by Parent and its acquisition subsidiary and Albireo with the SEC at the website maintained by the SEC at www . sec . gov . The tender offer materials (including an Offer to Purchase, a related Letter of Transmittal and certain other tender offer documents) may also be obtained (when available) for free by contacting the information agent for the tender offer . THE TENDER OFFER MATERIALS (INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION STATEMENT ON SCHEDULE 14 D - 9 WILL CONTAIN IMPORTANT INFORMATION . ALBIREO’S STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS CAREFULLY WHEN THEY BECOME AVAILABLE (AS EACH MAY BE AMENDED OR SUPPLEMENTED FROM TIME TO TIME) BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT HOLDERS OF ALBIREO’S SECURITIES SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SECURITIES . The tender offer materials and the Solicitation/Recommendation Statement (when available) may be obtained for free by contacting Parent or Albireo . Copies of the documents filed with the SEC by Albireo will be available free of charge on Albireo’s internet website at www . albireopharma . com or by contacting Albireo’s Investor Relations Department at 857 254 - 5555 . Additional Information In addition to the Offer to Purchase, the related Letter of Transmittal and certain other tender offer documents, as well as the Solicitation/Recommendation Statement, Albireo files annual, quarterly and current reports and other information with the SEC . Albireo’s filings with the SEC are available to the public from the website maintained by the SEC at www . sec . gov . CONFIDENTIAL – FOR INTERNAL USE ONLY ©2023 Albireo Pharma, Inc. All rights reserved

14 Forward - Looking Statements Statements contained in this presentation regarding management’s future expectations, beliefs, intentions, goals, strategies, plans or prospects, the tender offer, the merger and related transactions are forward - looking statements . Forward - looking statements are statements that are not historical facts and may include projections and estimates and their underlying assumptions, statements regarding plans, objectives, intentions and expectations with respect to future financial results, events, operations, services, product development and potential, and statements regarding future performance . Forward - looking statements are generally identified by words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “planned,” “continue,” “guidance,” or the negative of these terms or other similar expressions . Forward - looking statements may include statements, other than statements of historical fact, regarding, among other things : Albireo’s commercialization plans ; the plans for, or progress, scope, cost, initiation, duration, enrollment, results or timing for availability of results of, development of Bylvay , A 3907 , A 2342 or any other Albireo product candidate or program ; the target indication(s) for development or approval ; potential regulatory approval and plans for potential commercialization of Bylvay in biliary atresia or ALGS or in additional countries, or Albireo’s other product candidates ; the timing for initiation or completion of or availability or reporting of results from any clinical trial ; the potential benefits or competitive position of Albireo or any other Albireo product candidate or program or the commercial opportunity in any target indication ; Albireo’s plans, expectations or future operations, financial position, revenues, costs or expenses ; statements regarding the expected timing of the completion of the transactions contemplated by the merger agreement ; statements regarding the ability to complete the transactions contemplated by the merger agreement considering the various closing conditions ; the projected financial information ; and any statements regarding assumptions underlying any of the foregoing . Although Albireo’s management believes that the expectations reflected in such forward - looking statements are reasonable, investors are cautioned that forward - looking information and statements are subject to various risks and uncertainties, many of which are difficult to predict and generally beyond the control of Albireo, that could cause actual results and developments to differ materially from those expressed in, or implied or projected by, the forward - looking information and statements . These risks and uncertainties include among other things, (i) uncertainties as to the timing of the transactions contemplated by the merger agreement; (ii) the risk that the transactions contemplated by the merger agreement may not be completed in a timely manner or at all; (iii) uncertainties as to the percentage of Albireo’s stockholders tendering their Shares in the Offer; (iv) the possibility that competing offers for Albireo may be made; (v) the possibility that any or all of the various conditions to the consummation of the transactions contemplated by the merger agreement may not be satisfied or waived, including the failure to receive any required regulatory approvals (or any conditions, limitations or restrictions placed on such approvals); (vi) the occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement, including in circumstances which would require Albireo to pay a termination fee; (vii) the risk that the milestone specified in the Contingent Value Rights agreement is not achieved; (viii) the effect of the announcement or pendency of the transactions contemplated by the merger agreement on Albireo’s ability to retain and hire key personnel, its ability to maintain relationships with its customers, suppliers and others with whom it does business, or its business generally; (ix) risks related to diverting management’s attention from Albireo’s ongoing business operations; (x) the risk that stockholder litigation in connection with the transactions contemplated by the merger agreement may result in significant costs of defense, indemnification and liability; as well as (xi) risks and uncertainties pertaining to Albireo’s business, including those detailed under “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in Albireo’s annual report on Form 10 - K for the year ended December 31 , 2021 , quarterly reports on Form 10 - Q and current reports on Form 8 - K filed with the U . S . Securities and Exchange Commission (SEC), such as the risk that the regulatory filings made for Bylvay in patients with ALGS will not be approved by the FDA and European Medicines Agency (“EMA”) and on the timelines Albireo anticipates ; the risk that the FDA and EMA will not complete their respective reviews within target timelines, once determined ; the risk that the FDA and EMA will require additional information, the risk that we will not be able to provide in a timely manner any additional information that the FDA and EMA request, and the risk that such additional information will not be satisfactory to the FDA and EMA ; the risk that Bylvay will not be commercially successful ; the risk that we may encounter issues, delays or other challenges in commercializing Bylvay ; the risk that Bylvay does not receive acceptance from patients and physicians for its approved indication ; the risk of challenges associated with execution of Albireo’s sales activities, which in each case could limit the potential of its product ; the risk of challenges associated with supply and distribution activities, which in each case could limit Albireo’s sales and the availability of its product ; the risk of potential negative impacts of the COVID - 19 pandemic, including on manufacturing, supply, conduct or initiation of clinical trials, or other aspects of our business ; the risk that favorable findings from clinical trials of Bylvay to date, including findings in PFIC, ALGS and other indications, will not be predictive of results from other clinical trials of Bylvay ; the risk that Bylvay will not be approved in jurisdictions or for indications beyond the jurisdictions in which or indications (such as biliary atresia or ALGS) for which Bylvay is currently approved ; the risk that Albireo’s other product candidates will not be approved ; the risk that estimates of the addressable patient population for target indications may prove to be incorrect ; the outcome and interpretation by regulatory authorities of the ongoing third - party study pooling and analyzing of long - term PFIC patient data ; the timing for initiation or completion of, or for availability of data from, clinical trials of Bylvay , including BOLD, and the Phase 2 clinical trial of A 3907 , and the outcomes of such trials ; Albireo’s ability to obtain coverage, pricing or reimbursement for approved products in the United States or Europe ; delays or other challenges in the recruitment of patients for, or the conduct of, Albireo’s clinical trials ; any repurchase by Albireo of Sagard’s interest in the royalty interest payments under our royalty monetization agreement with Sagard could materially impact our financial condition ; and Albireo’s critical accounting policies . The forward - looking statements speak only as of the date hereof and, other than as required by applicable law, none of Albireo , Ipsen or any of their respective affiliates undertakes any obligation to update or revise any forward - looking information or statements . CONFIDENTIAL – FOR INTERNAL USE ONLY ©2023 Albireo Pharma, Inc. All rights reserved