- ALBO Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

SC TO-C Filing

Albireo Pharma (ALBO) SC TO-CInformation about tender offer

Filed: 10 Jan 23, 6:06am

Exhibit 99.2 Bring The full potential of our innovative medicines to patients The acquisition of Albireo Build A high-value sustainable pipeline 9 January 2023 Deliver Efficiencies to enable targeted investment & growth Boost Focus. Together. A culture of collaboration For patients & society & excellence 1

Disclaimer & safe harbor − This presentation includes only summary information and does not purport to be comprehensive. Forward-looking statements, targets and estimates contained herein are for illustrative purposes only and are based on management’s current views and assumptions. Such statements involve known and unknown risks and uncertainties that may cause actual results, performance or events to differ materially from those anticipated in the summary information. Actual results may depart significantly from these targets given the occurrence of certain risks and uncertainties, notably given that a new medicine can appear to be promising at a preparatory stage of development or after clinical trials but never be launched on the market or be launched on the market but fail to sell notably for regulatory or competitive reasons. Ipsen must deal with or may have to deal with competition from generic medicines that may result in market-share losses, which could affect its level of growth in sales or profitability. The Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statements, targets or estimates contained in this presentation to reflect any change in events, conditions, assumptions or circumstances on which any such statements are based, unless so required by applicable law. − All medicine names listed in this document are either licensed to Ipsen or are registered trademarks of Ipsen or its partners. − The implementation of the strategy has to be submitted to the relevant staff representation authorities in each country concerned, in compliance with the specific procedures, terms and conditions set forth by each national legislation. − In those countries in which public or private-health cover is provided, Ipsen is dependent on prices set for medicines, pricing and reimbursement-regime reforms and is vulnerable to the potential withdrawal of certain medicines from the list of reimbursable medicines by governments, and the relevant regulatory authorities in its locations. In light of recent economic conditions, there could be increased pressure on the pharmaceutical industry to lower medicine prices. − Ipsen operates in certain geographical regions whose governmental finances, local currencies or inflation rates could erode the local competitiveness of Ipsen’s medicines relative to competitors operating in local currency, and/or could be detrimental to Ipsen’s margins in those regions where Ipsen’s sales are billed in local currencies. − In a number of countries, Ipsen markets its medicines via distributors or agents; some of these partners’ financial strengths could be impacted by changing economic or market conditions, potentially subjecting Ipsen to difficulties in recovering its receivables. Furthermore, in certain countries whose financial equilibrium is threatened by changing economic or market conditions, and where Ipsen sells its medicines directly to hospitals, Ipsen could be forced to lengthen its payment terms or could experience difficulties in recovering its receivables in full. − Ipsen also faces various risks and uncertainties inherent to its activities identified under the caption ‘Risk Factors’ in the Company’s Universal Registration Document. − All of the above risks could affect Ipsen’s future ability to achieve its financial targets, which were set assuming reasonable macroeconomic conditions based on the information available at the time. 2

Speakers David Loew Howard Mayer Aymeric Le Chief Executive Officer Head of Chatelier Research & Development Chief Financial Officer 3

Agenda 1 3 5 6 2 4 Conclusion Commercial Strategic opportunities rationale Questions Financials The science 4

STRATEGIC RATIONALE 5

The focus on three therapy areas To be a leading global, mid-sized biopharmaceutical company with a focus on transformative medicines Our vision in Oncology, Rare Disease & Neuroscience O N C O L O G Y R A R E D I S E A S E N E U R O S C I E N C E Strengthening Expanding Excelling & the position the scope accelerating 6

Albireo: expanding Ipsen’s scope in Rare Disease Perfectly aligned to the external-innovation strategy 1 Global rights Multiple opportunities • Bylvay: a potentially best-in-class • Bylvay: progressive familial rare liver-disease medicine intrahepatic cholestasis, Alagille approved in the U.S. & E.U. syndrome, biliary atresia • Early-stage pipeline: adult cholestatic liver diseases Strategic fit Financial impact • Expanding the pipeline • Sizeable peak sales ~$800m & portfolio in rare liver diseases • Accretive to core operating income from 2025 1. Except Japan. 7

THE SCIENCE 8

Pediatric cholestatic liver diseases Bile acids Chemicals made by the liver from cholesterol Transported from the liver to the intestines Help to absorb fats, fat soluble vitamins & nutrients for growth and development 95% recycled back to the liver & reused Failure of draining bile from liver to intestine Caused by defects in the intrahepatic production of bile, transmembrane transport of bile, or mechanical obstruction to bile flow 9

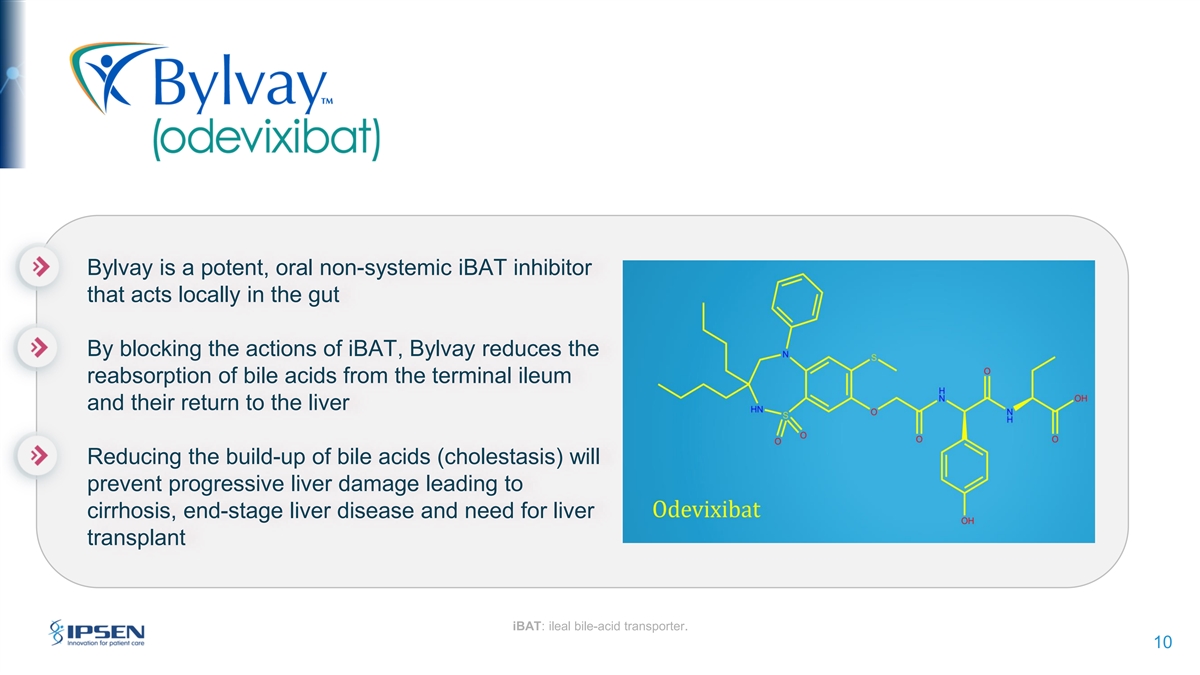

Bylvay is a potent, oral non-systemic iBAT inhibitor that acts locally in the gut By blocking the actions of iBAT, Bylvay reduces the reabsorption of bile acids from the terminal ileum and their return to the liver Reducing the build-up of bile acids (cholestasis) will prevent progressive liver damage leading to cirrhosis, end-stage liver disease and need for liver transplant iBAT: ileal bile-acid transporter. 10

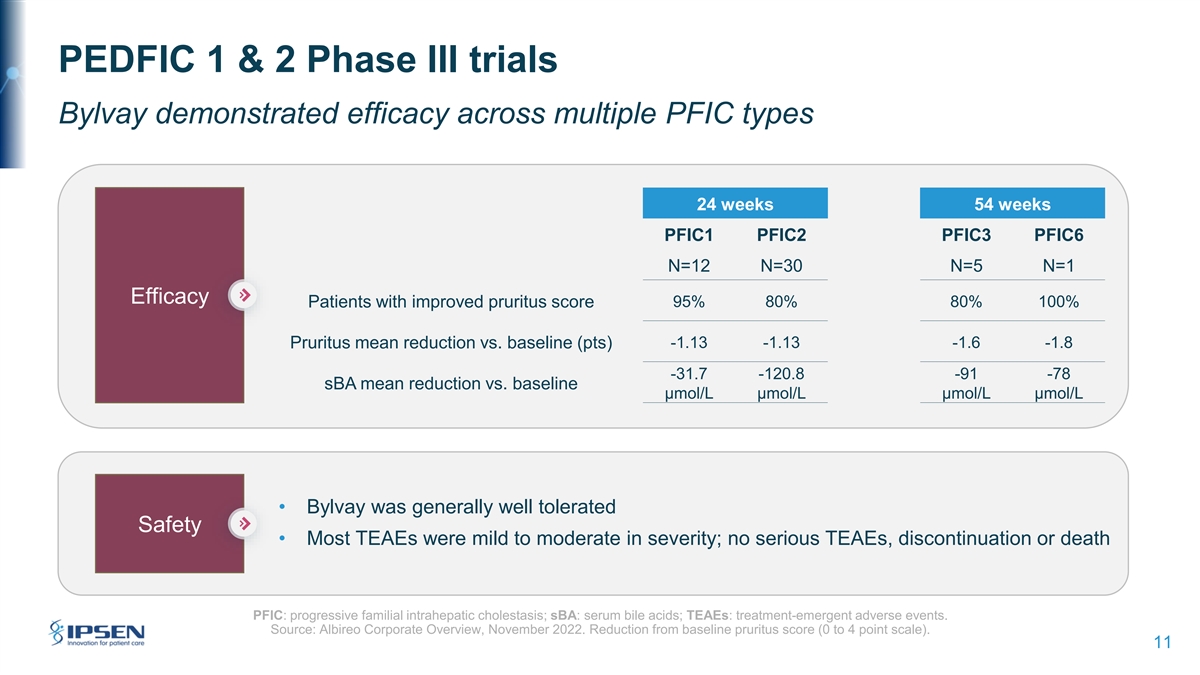

PEDFIC 1 & 2 Phase III trials Bylvay demonstrated efficacy across multiple PFIC types 24 weeks 54 weeks PFIC1 PFIC2 PFIC3 PFIC6 N=12 N=30 N=5 N=1 Efficacy Patients with improved pruritus score 95% 80% 80% 100% Pruritus mean reduction vs. baseline (pts) -1.13 -1.13 -1.6 -1.8 -31.7 -120.8 -91 -78 sBA mean reduction vs. baseline µmol/L µmol/L µmol/L µmol/L • Bylvay was generally well tolerated Safety • Most TEAEs were mild to moderate in severity; no serious TEAEs, discontinuation or death PFIC: progressive familial intrahepatic cholestasis; sBA: serum bile acids; TEAEs: treatment-emergent adverse events. Source: Albireo Corporate Overview, November 2022. Reduction from baseline pruritus score (0 to 4 point scale). 11

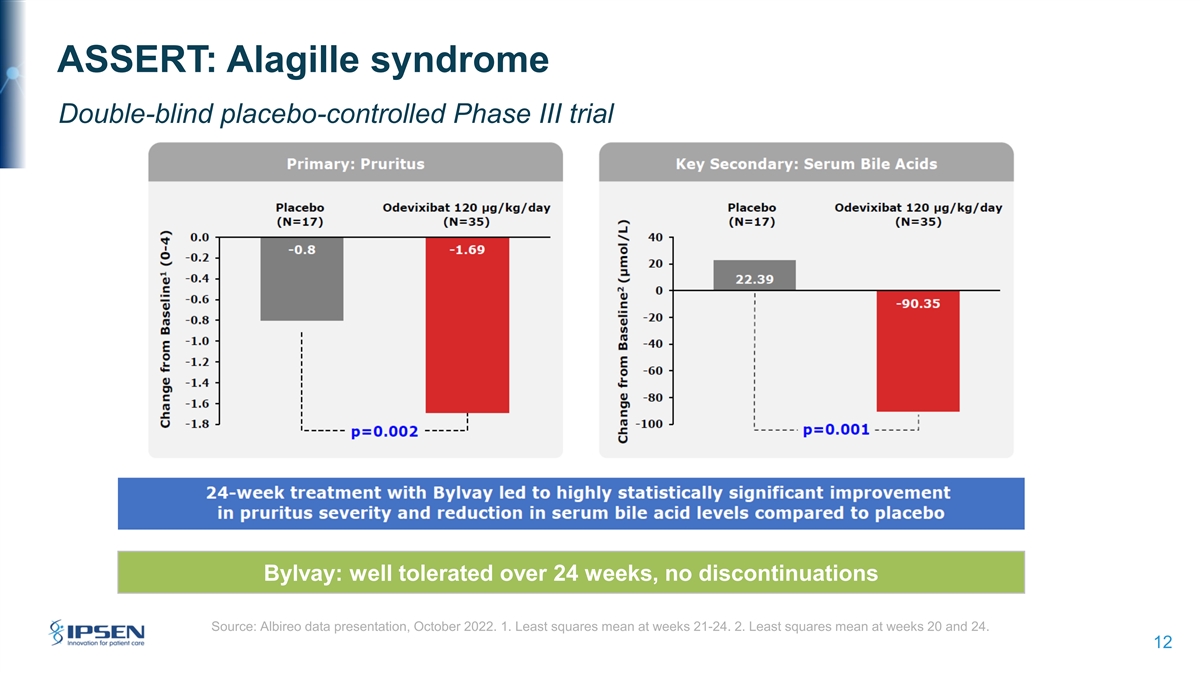

ASSERT: Alagille syndrome Double-blind placebo-controlled Phase III trial Significant Bylvay: well tolerated over 24 weeks, no discontinuations Source: Albireo data presentation, October 2022. 1. Least squares mean at weeks 21-24. 2. Least squares mean at weeks 20 and 24. 12

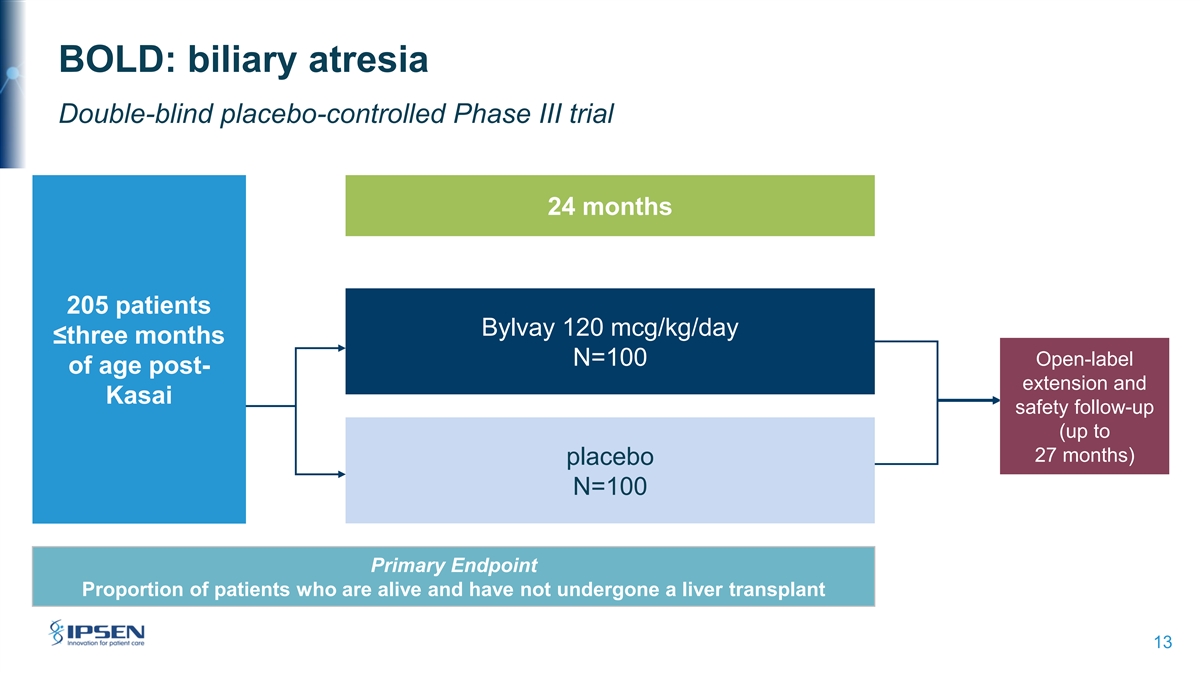

BOLD: biliary atresia Double-blind placebo-controlled Phase III trial 24 months 205 patients Bylvay 120 mcg/kg/day ≤three months N=100 Open-label of age post- extension and Kasai safety follow-up (up to 27 months) placebo N=100 Primary Endpoint Proportion of patients who are alive and have not undergone a liver transplant 13

COMMERCIAL OPPORTUNITIES PAGE 14

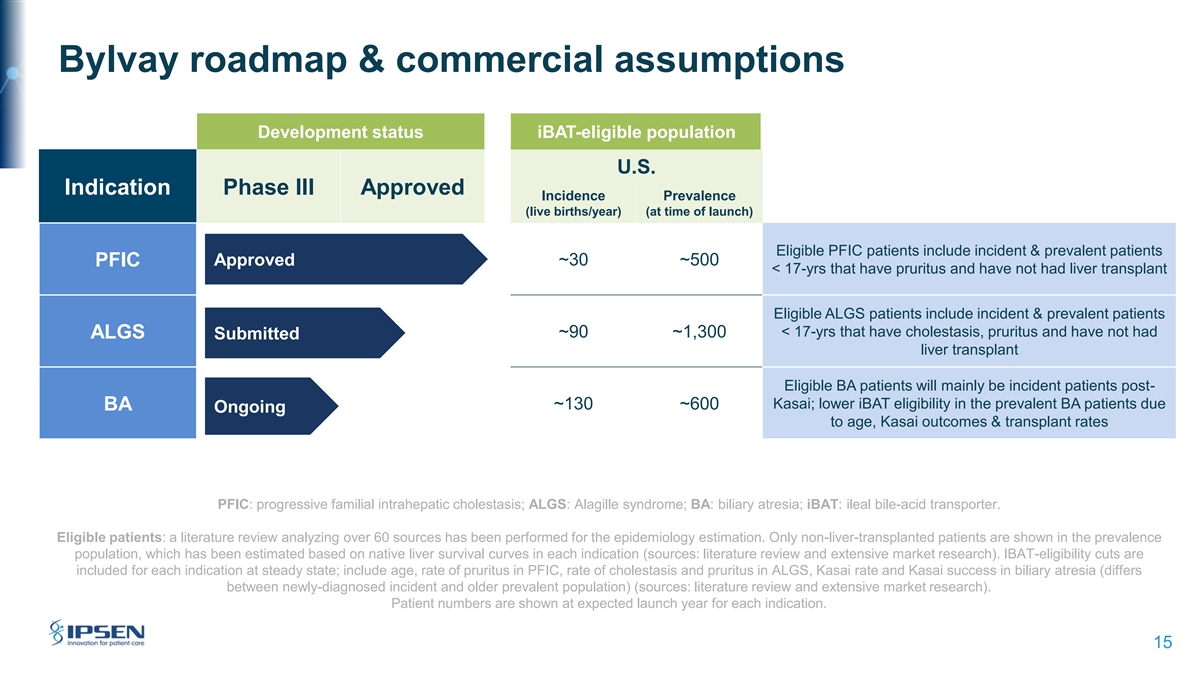

Bylvay roadmap & commercial assumptions Development status iBAT-eligible population U.S. Indication Phase III Approved Incidence Prevalence (live births/year) (at time of launch) Eligible PFIC patients include incident & prevalent patients PFIC Approved ~30 ~500 < 17-yrs that have pruritus and have not had liver transplant Eligible ALGS patients include incident & prevalent patients < 17-yrs that have cholestasis, pruritus and have not had ~90 ~1,300 ALGS Submitted liver transplant Eligible BA patients will mainly be incident patients post- Kasai; lower iBAT eligibility in the prevalent BA patients due ~130 ~600 BA Ongoing to age, Kasai outcomes & transplant rates PFIC: progressive familial intrahepatic cholestasis; ALGS: Alagille syndrome; BA: biliary atresia; iBAT: ileal bile-acid transporter. Eligible patients: a literature review analyzing over 60 sources has been performed for the epidemiology estimation. Only non-liver-transplanted patients are shown in the prevalence population, which has been estimated based on native liver survival curves in each indication (sources: literature review and extensive market research). IBAT-eligibility cuts are included for each indication at steady state; include age, rate of pruritus in PFIC, rate of cholestasis and pruritus in ALGS, Kasai rate and Kasai success in biliary atresia (differs between newly-diagnosed incident and older prevalent population) (sources: literature review and extensive market research). Patient numbers are shown at expected launch year for each indication. 15

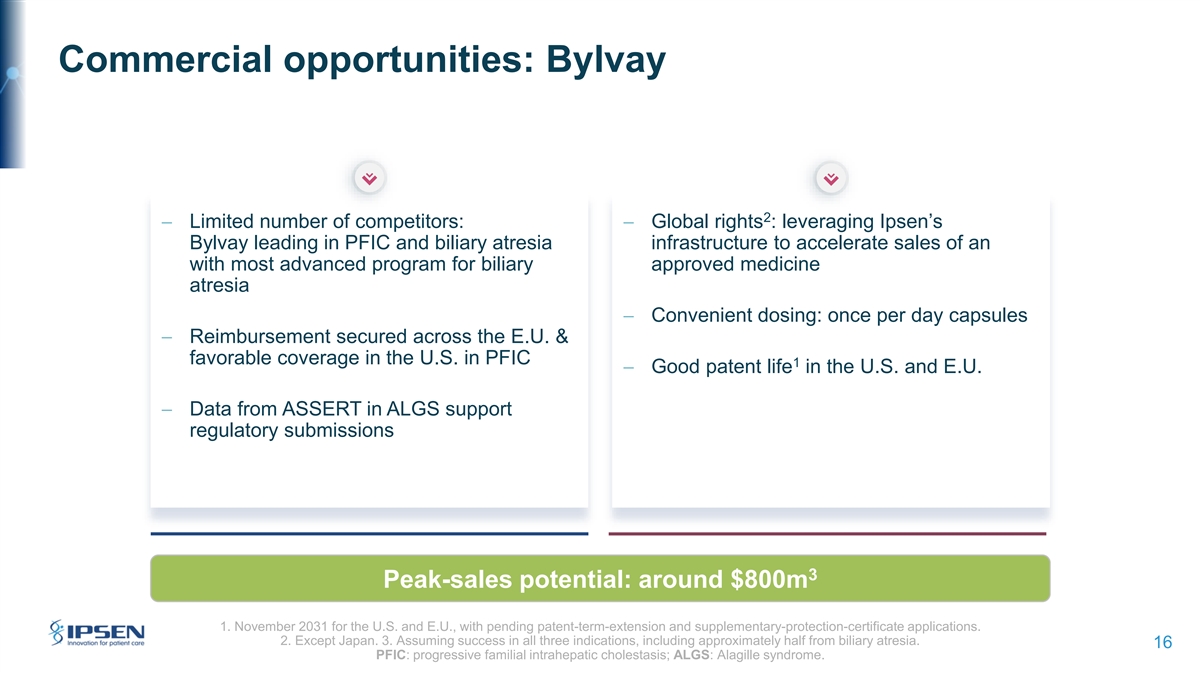

Commercial opportunities: Bylvay 2 − Limited number of competitors: − Global rights : leveraging Ipsen’s Bylvay leading in PFIC and biliary atresia infrastructure to accelerate sales of an with most advanced program for biliary approved medicine atresia − Convenient dosing: once per day capsules − Reimbursement secured across the E.U. & favorable coverage in the U.S. in PFIC 1 − Good patent life in the U.S. and E.U. − Data from ASSERT in ALGS support regulatory submissions 3 Peak-sales potential: around $800m 1. November 2031 for the U.S. and E.U., with pending patent-term-extension and supplementary-protection-certificate applications. 2. Except Japan. 3. Assuming success in all three indications, including approximately half from biliary atresia. 16 PFIC: progressive familial intrahepatic cholestasis; ALGS: Alagille syndrome.

FINANCIALS PAGE 17 M E N T I O N S H E R E

Financials 1 Ipsen to initiate a tender offer to acquire all outstanding shares of Albireo Offer price at $42.00 per share in cash at closing, equating to $952m Additional contingent-value payment of $10.00 per share, based on a potential U.S. regulatory approval of Bylvay in biliary atresia, equating to $244m Transaction expected to close by the end of Q1 2023, subject to the satisfaction of all closing conditions, including regulatory Accretive to core operating income from 2025 18

CONCLUSION PAGE 19

Conclusion Further execution of the external-innovation strategy − Expanding the scope in Rare Disease − Albireo: a leading innovator in bile-acid modulators for rare liver diseases − An on-market and potentially best-in-class medicine − Significant commercial opportunities − An excellent strategic fit 20

QUESTIONS 21

APPENDIX 22

Bylvay development in three Rare Disease indications Alagille syndrome PFIC Biliary atresia Age ~1-2 years, Age ~2 weeks - 3 months, Age ~4-12 months, Presentation cholestasis, pruritus, failure to strive, acholic multiple symptoms jaundice stools, jaundice Autosomal dominant genes, Absence of bile ducts, no Cause or genetic Multiple genes, bile-acid paucity of bile ducts, bile-acid bile-acid flow, fatal without build-up in the liver disorder build-up in the liver Kasai surgery Serum bile-acid elevation Serum bile-acid elevation Disease Serum bile-acid elevation, inflammation, fibrosis, post-Kasai correlates with progression multiple organ impact cirrhosis, death lower native liver survival Almost no patients survive Many patients may need Kasai life-saving surgery Treatment & beyond age 20 without surgical diversion or liver ~80% of patients have liver surgical diversion or transplant. Disease can survival transplant in first two years liver transplant stabilize PFIC: progressive familial intrahepatic cholestasis. 23

THANK YOU PAGE 24 M E N T I O N S H E R E

Investor Relations Craig MARKS Adrien DUPIN DE SAINT-CYR Vice President, Investor Relations Investor Relations Manager +44 7564 349 193 +33 6 64 26 17 49 craig.marks@ipsen.com adrien.dupin.de.saint.cyr@ipsen.com 25

Follow us www.ipsen.com PAGE 26 M E N T I O N S H E R E