As filed with the Securities and Exchange Commission on December , 2005

| | Registration No. 333-124930 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

TO

FORM S-4

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

CICERO, INC.(Exact name of registrant as specified in its charter)

Delaware | 7372 | 20-2199504 |

(State of other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

1433 State Highway 34, Building C

Farmingdale, New Jersey 07727

(732) 919-3150

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

John P. BroderickChief Executive Officer and Chief Financial Officer

Cicero, Inc.

1433 State Highway 34, Building C

Farmingdale, New Jersey 07727

(732) 919-3150

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:Lawrence M. Bell, Esq.

Golenbock Eiseman Assor Bell & Peskoe LLP

437 Madison Avenue

New York, New York 10022

(212) 907-7300

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement is declared effective and all conditions to the proposed transaction have been satisfied or waived.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering: o

| CALCULATION OF REGISTRATION FEE(1) | |

| Title of Each Class of Securities to be registered | | Amount to be Registered in Respect of Level 8 Common Stock (2) | | Amount of Common Stock to be Registered Issuable upon Conversion of the Cicero Series A-1 Preferred Stock (3) | | Amount to be Registered in Respect of Warrants and Convertible Bridge Notes (4) | | Amount to be Registered in Respect of Other Securities (5) | |

| | | | | | | | | | |

| Cicero, Inc. common stock, par value $0.001 per share | | | 2,775,042 | | | 8,866,129 | | | 70,702,415 | | | 527,258 | |

| Title of Each Class of Securities to be registered | | Total Amount of Shares to be Registered (1)(6) | | Proposed Maximum Offering Price per Share (6) | | Proposed Maximum Aggregate Offering Price (6) | | Amount of Registration Fee (1)(6) | |

| | | | | | | | | | |

| Cicero, Inc. common stock, par value $0.001 per share | | | 82,870,844 | | | | | $ | 66,296,674.80 | | $ | 7,803.12 | |

| Cicero, Inc. preferred stock, par value $0.001 per share | | | 8,866 | | | | | | | | | | |

(1) This Registration Statement carries forward the registration of 37,560,402 shares of common stock, $0.001 par value, that were registered on the Cicero, Inc. (“Cicero”) Registration Statement on Form S-4, filed May 13, 2005, Registration Number 333-124930. A registration fee in the amount of $6,631.29 was previously paid to register such securities. This table is intended to illustrate the source of all shares to be registered.

(2) The number of shares of Cicero common stock resulting from the conversion of each of 47,410,835 outstanding shares of Level 8 Systems, Inc. (“Level 8”) common stock into 0.05 shares of Cicero common stock, including 404,500 shares of Cicero common stock issued or issuable to various parties as fees pursuant to certain agreements of Level 8 Systems earned prior to or incurred and directly attributable to the recapitalization merger.

(3) Includes: (i) 22,443 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 1,571 outstanding shares of Level 8 Series A-3 preferred stock into 22.4 shares of Cicero Series A-1 preferred stock; (ii) 375,000 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 30,000 outstanding shares of Level 8 Series B-3 preferred stock into 375 shares of Cicero Series A-1 preferred stock; (iii) 228,200 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 1,141 outstanding shares of Level 8 Series C preferred stock into 228.2 shares of Cicero Series A-1 preferred stock; (iv) 283,880 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 1,136 outstanding shares of Level 8 Series D preferred stock into 283.88 shares of Cicero Series A-1 preferred stock.; and (v) 7,956,606 shares of Cicero common stock issuable upon conversion of $992,320 principal amount of Level 8 convertible promissory notes into 7,957 shares of Cicero Series A-1 preferred stock based on conversion prices ranging from $0.002 to $0.006.

(4) Includes: (i) 582,010 shares of Cicero common stock to be issued upon the automatic exercise of existing warrants held by those who have recently lent funds to Level 8 and received senior reorganization notes; (ii) 19,360,959 shares of Cicero common stock to be issued upon the automatic exercise of additional warrants held by senior reorganization noteholders upon approval of the recapitalization merger; (iii) 1,005,562 shares of Cicero common stock issuable upon exercise of early adopter warrants to be issued to certain senior reorganization noteholders; and (iv) 49,753,884 shares of Cicero common stock to be issued upon the automatic conversion of $1,562,272 principal amount of convertible bridge notes into shares of Cicero common stock at a conversion price of $0.0314 per share.

(5) Shares of Cicero common stock issuable upon exercise of each warrant for which the exercise price of such warrants has not been advanced to Level 8 in exchange for senior reorganization notes, with the number of shares of Cicero common stock issuable upon exercise of such security equal to one-twentieth (0.05) of the number of shares such security was exercisable for prior to the recapitalization merger.

(6) Estimated solely for calculating the registration fee pursuant to Rule 457(f) of the Securities Act of 1933, as amended. The proposed maximum offering price and the amount of the registration fee are based on the estimate of the average of the high and low price of the common stock as reported on the Over-the-Counter Bulletin Board on December 8, 2005.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

THIS PROXY STATEMENT/PROSPECTUS MAY INCORPORATE IMPORTANT BUSINESS AND FINANCIAL INFORMATION ABOUT LEVEL 8 THAT IS NOT INCLUDED OR DELIVERED WITH THE DOCUMENT. THIS INFORMATION IS AVAILABLE WITHOUT CHARGE TO SECURITY HOLDERS UPON WRITTEN OR ORAL REQUEST TO THE FOLLOWING PERSON:

John P. Broderick, Chief Executive Officer and Chief Financial Officer

Attn: Ms. Sharon Cothren

Level 8 Systems, Inc.

8000 Regency Pkwy, Suite 542

Cary, North Carolina 27511

If you would like to request documents from us, please do so by _______________, 2005 in order to receive them prior to the special meeting.

YOU SHOULD RELY ONLY ON THE INFORMATION CONTAINED IN THIS PROXY STATEMENT/PROSPECTUS OR TO WHICH THIS DOCUMENT HAS REFERRED YOU. LEVEL 8 AND CICERO HAVE NOT AUTHORIZED ANYONE TO PROVIDE YOU WITH INFORMATION THAT IS DIFFERENT. YOU SHOULD NOT ASSUME THAT THE INFORMATION IN THIS DOCUMENT IS ACCURATE AS OF ANY DATE OTHER THAN THE DATE ON THE FRONT OF THE DOCUMENT.

Preliminary Proxy Statement/Prospectus

Subject To Completion, Dated _________, 2005

1433 State Highway 34, Building C

Farmingdale, New Jersey 07727

On November 23, 2004, our board of directors unanimously approved a plan to merge Level 8 Systems, Inc. (“Level 8”) with and into Cicero, Inc. (“Cicero”), a wholly owned subsidiary of Level 8. Such plan was amended by our board of directors on September 13, 2005. If approved by our stockholders, Level 8 will become merged into Cicero, a Delaware corporation recently formed by Level 8, and Cicero will be the surviving corporation. Under the terms of the merger agreement, each outstanding share of Level 8 common stock would be converted into one-twentieth share of common stock of Cicero, all of Level 8’s outstanding shares of preferred stock would be convertible into Cicero Series A-1 preferred stock at certain reduced conversion prices, the convertible promissory notes would convert (subject to the election of the convertible promissory noteholders, of which the holders of 95% have agreed to convert), into Series A-1 preferred stock of Cicero, and the convertible bridge notes would be converted into shares of Cicero common stock at a conversion price of $0.0314. Immediately following the recapitalization merger, Cicero’s capital stock would consist only of common stock and Series A-1 preferred stock, and other investor debt would be canceled, assuming all of Level 8’s convertible promissory noteholders elect to convert. Management believes that the recapitalization merger will have a positive impact on the future operations of Level 8 and its ability to raise additional capital needed to continue operations.

As a result of the transaction, the current common stockholders of Level 8 would suffer substantial dilution. On a fully diluted basis, the current common stockholders, who own 52.7% of Level 8, will own only 2.8% of Cicero upon completion of the recapitalization merger. This dilution will occur in large part due to the automatic conversion of convertible bridge notes into shares of Cicero common stock, the conversion of convertible promissory notes into shares of Cicero Series A-1 preferred stock, the automatic exercise of existing warrants of Level 8 and the issuance by Level 8 and automatic exercise of additional warrants to investors who have recently lent funds to Level 8 and, to a lesser extent, the reduction to be effected pursuant to the recapitalization merger to the conversion rates of the convertible promissory notes and existing preferred stock of Level 8. The substantial dilution would result in a change of control of Level 8 to the extent that the current common stockholders of Level 8 will no longer own more than fifty percent of the voting stock of Cicero. The substantial dilution of the current common stockholders would be accompanied by a substantial increase in the holdings of the security holders who hold warrants, convertible bridge notes or both and who consist largely of the preferred stockholders who received warrants in connection with their shares of preferred stock and private placement participants, as well as the convertible promissory noteholders of Level 8, to the extent they elect to convert their notes into preferred stock. Following the recapitalization merger, current preferred stockholders and convertible promissory noteholders of Level 8 would hold 1.1% and 9.5% of Cicero, compared with 10.2% and 6.9%, respectively, prior to the recapitalization merger. As a result, the economic consequences to Level 8’s common stockholders will be significant.

As directed by our board of directors, senior management of Level 8 who are unaffiliated with holders of preferred stock or convertible or other notes of Level 8, along with certain preferred stockholders, evaluated and negotiated the merger agreement. Based in part on the recommendation of management, the board of directors of Level 8 has determined that the recapitalization merger is advisable and in the best interests of Level 8 and the holders of its common and preferred stock. The board of directors has approved the merger agreement, the recapitalization merger and other transactions contemplated by the merger agreement and recommends that the common stockholders of Level 8 and each of the holders of Series A-3, B-3, C and D preferred stock vote “FOR” adoption of the recapitalization merger agreement. For a detailed description of the reasons for and risks related to the recapitalization merger, please carefully review the enclosed proxy statement/prospectus.

At the special meeting, stockholders entitled to vote will also be asked to elect as the eight directors of Cicero the current eight directors of Level 8, and ratify Margolis & Company P.C.’s appointment as our independent registered public accounting firm for 2005. We hope you will take time to carefully consider each of these important matters.

We strongly recommend that all stockholders vote “FOR” the approval and adoption of the merger agreement, “FOR” the election of the board of director nominees and “FOR” ratification of Margolis & Company P.C.’s appointment as our independent registered public accounting firm for 2005.

This document constitutes a prospectus of Cicero filed as a part of a registration statement filed with the Securities and Exchange Commission relating to 82,870,844 shares of Cicero common stock, par value $0.001 per share, and 8,866 shares of Cicero Series A-1 preferred stock, par value $0.001 per share, that may be issued to Level 8’s stockholders in connection with the recapitalization merger. This document also constitutes a proxy statement for the special meeting of stockholders of Level 8 and describes matters to be considered and voted upon at the meeting. We urge all stockholders to read this proxy statement/prospectus, including the section describing Risk Factors that begins on page 48.

More specifically, the number of shares of Cicero common stock to be registered pursuant to the Registration Statement filed relating to the recapitalization merger consists of:

| | · | 2,370,542 shares of Cicero common stock resulting from the conversion of each of 47,410,835 shares of Level 8 common stock, including 404,500 shares of Cicero common stock issued or issuable to various parties as fees pursuant to certain agreements by Level 8 earned prior to or incurred and directly attributable to the recapitalization merger; |

| | · | 22,443 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 1,571 outstanding shares of Level 8 Series A-3 preferred stock into 22.43 shares of Cicero Series A-1 preferred stock; |

| | · | 375,000 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 30,000 outstanding shares of Level 8 Series B-3 preferred stock into 375 shares of Cicero Series A-1 preferred stock; |

| | · | 228,200 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 1,141 outstanding shares of Level 8 Series C preferred stock into 228.2 shares of Cicero Series A-1 preferred stock; |

| | · | 283,880 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of each of 1,136 outstanding shares of Level 8 Series D preferred stock into 283.88 shares of Cicero Series A-1 preferred stock; |

| | · | 7,956,606 shares of Cicero common stock issuable upon conversion of Cicero Series A-1 preferred stock issuable upon the conversion of $992,320 principal amount of convertible promissory notes of Level 8 convertible into 7,957 shares of Cicero Series A-1 preferred stock; |

| | · | 582,010 shares of Cicero common stock to be issued upon the automatic exercise of existing warrants of those who have recently lent funds to Level 8 and received senior reorganization notes, 19,360,959 shares of Cicero common stock to be issued upon the automatic exercise of additional warrants held by senior reorganization noteholders upon approval of the recapitalization merger, and 1,005,562 shares of Cicero common stock issuable upon exercise of early adopter warrants to be issued to senior reorganization noteholders upon the approval of the recapitalization merger; |

| | · | 49,753,884 shares of Cicero common stock to be issued upon the automatic conversion of $1,562,272 principal amount of convertible bridge notes at a conversion price of $0.0314 per share (or the equivalent of $0.00157 Level 8 shares); and |

| | · | 527,258 shares of Cicero common stock issuable upon exercise of each warrant for which the exercise price of such warrants has not been advanced to Level 8 in exchange for senior reorganization notes, with the number of shares of Cicero common stock issuable upon exercise of such security equal to |

| | | one-twentieth (0.05) of the number of shares such security was exercisable for prior to the recapitalization merger. |

The Registration Statement will also cover 8,866 shares of Cicero Series A-1 preferred stock issuable as described above upon conversion of shares and conversion of convertible promissory notes of Level 8.

We intend to make application to have the shares of Cicero common stock to be issued in the recapitalization merger listed on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “CCRO”.

The information in this proxy statement/prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary proxy statement/prospectus is not an offer to sell and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| | Sincerely, |

| | |

| | Mark Landis |

| | Chairman of the Board |

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this document is ______________, 2006. This document was first sent to stockholders on or about _____________, 2006.

LEVEL 8 SYSTEMS, INC.

1433 State Highway 34, Building C

Farmingdale, New Jersey 07727

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD _____________, 2006

To Our Stockholders:

You are cordially invited to attend the special meeting of the stockholders of Level 8 Systems, Inc. (“Level 8”), which will be held on ______________, 2006 at 10:00 a.m., local time, at the offices of Level 8, located at 1433 State Highway 34, Building C, Farmingdale, New Jersey. At the special meeting, Level 8 stockholders will be asked to consider and vote on the following proposals:

| | 1. | To approve and adopt the Agreement and Plan of Merger, dated December 30, 2004, as amended on September 13, 2005, between Level 8 and Cicero, Inc. (“Cicero”) which provides, among other things, (i) for the merger of Level 8 with and into Cicero, (ii) the conversion of each share of common stock of Level 8 outstanding immediately prior to the merger into 0.05 shares of Cicero common stock, plus cash in lieu of any fractional share interest, (iii) the conversion of each outstanding share of the various series of preferred stock of Level 8 into shares of Cicero Series A-1 preferred stock at various reduced conversion rates, (iv) the conversion of $992,320 principal amount of convertible promissory notes into 7,956,606 shares of Cicero common stock at reduced conversion prices, assuming the noteholders elects to convert their notes, and (v) the conversion of each option, warrant, purchase right, unit or other security of Level 8 into the identical security of Cicero with the number of shares of Cicero common stock underlying such security equal to one-twentieth (0.05) of the number of shares such security was exercisable for prior to the merger. Upon approval of the merger agreement, existing warrants of Level 8 held by investors who recently lent funds to Level 8 will be deemed exercised and additional warrants issued to such holders in connection with the loans made by them, evidenced by senior reorganization notes, will automatically be deemed exercised and those holders who lent Level 8 the first $1,000,000 will receive early adoptor warrants for shares of Level 8. Further, upon consummation of the recapitalization merger, convertible bridge notes will automatically convert into shares of Cicero common stock at a conversion price of $0.0314 per share (or the equivalent of $0.00157 shares of Level 8). |

A vote to approve the merger agreement by the holders of the Level 8 Series A-3, B-3, C and D preferred stock, with the holders of each series of preferred stock voting as a single class, will be deemed to be a vote “FOR” an amendment to the certificate of incorporation to amend the conversion rate for that series of preferred stock. A vote to approve the merger agreement by the holders of the Level 8 Series D preferred stock will also be deemed to be a waiver of the right of each holder, under the Level 8 Series D preferred stock Certificate of Designations, to require that the Company redeem any or all of the Level 8 Series D preferred stock outstanding in the event of the recapitalization merger.

| | 2. | To elect eight (8) directors to the board of directors to serve for the ensuing year and until their successors are duly elected and qualified. |

| | 3. | To ratify the appointment of Margolis & Company P.C. as Level 8's independent registered public accounting firm for the fiscal year ending December 31, 2005. |

All of the above matters are more fully described in the accompanying proxy statement/prospectus.

Only stockholders who hold shares of Level 8’s common stock, Series A-3, B-3, C and D preferred stock at the close of business on November 30, 2005 will be entitled to vote at the meeting. The recapitalization merger will require the affirmative vote of (i) the holders of a majority of voting power of the issued and outstanding shares of Level 8 common stock, Series A-3, B-3, C and D preferred stock (each voting on an as-converted basis), entitled to

vote thereon, voting together as a single class, (ii) the holders of at least two-thirds of the issued and outstanding shares of Series D preferred stock entitled to vote thereon voting as a single class with respect to the reduction of conversion rates and as a single class with respect to the merger agreement, and (iii) each of the holders of at least 85% of the issued and outstanding shares of Series A-3, B-3 and C preferred stock entitled to vote thereon, each voting as a single class with respect to the reduction of conversion rates and together as a single class with respect to the merger agreement. As of November 30, 2005, there were 47,410,835 shares of Level 8 common stock outstanding on an as-converted basis, 5,585,223 shares of Series A-3, B-3 and C preferred stock outstanding and 3,548,500 shares of Series D preferred stock outstanding, on an as-converted basis. Each share of Level 8 common stock is entitled to one vote, and the holders of Level 8 preferred stock are entitled to vote for each share of common stock held by such holder on an as-converted basis, on each matter properly brought before the special meeting.

Holders of our Series A-3, B-3, C and D preferred stock who do not vote in favor of the adoption of the merger agreement who submit a written demand to us for appraisal of their shares in accordance with the General Corporation Law of the State of Delaware prior to the taking of the vote thereon and who comply with the other requirements of the General Corporation Law of the State of Delaware will be entitled to appraisal rights if such merger is consummated. Holders of common stock do not have appraisal rights.

Whether or not you expect to be present at the meeting, please complete, date, sign and mail the enclosed proxy in the envelope provided. Returning the proxy does NOT deprive you of your right to attend the meeting and vote your shares in person. You may revoke your proxy at any time, or you may attend the special meeting in person and cast your vote in person on all matters submitted at the special meeting, in which case your proxy would be ignored.

| | Page |

| 1 |

| | |

| 2 |

| | |

| 3 |

| | |

| 8 |

| | |

| 31 |

| | |

| 32 |

| | |

| 33 |

| | |

| 36 |

| | |

| 43 |

| | |

| 48 |

| | |

| 55 |

| | |

| 67 |

| | |

| 72 |

| | |

| 76 |

| | |

| 77 |

| | |

| 80 |

| | |

| 82 |

| | |

| 86 |

| | |

| 88 |

| | |

| 104 |

| | |

| 121 |

| | |

| 121 |

| | |

| 122 |

| | |

| 122 |

| | |

| 123 |

| | |

| 123 |

| | |

| F-1 |

| | |

| F-2 & F-3 |

ANNEXES

WHERE YOU CAN FIND ADDITIONAL INFORMATION

Level 8 files annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission. Copies of these materials may be examined without charge at the public reference room at 100, F Street N.E., Washington, D.C. 20549. Please call the Securities and Exchange Commission at 1-800-SEC-0330 for further information on the public reference room. Any person, including any beneficial owners, to whom this proxy statement is delivered may also obtain these materials from us at no cost by directing a written or oral request to us at Level 8 Systems, Inc., 8000 Regency Pkwy, Suite 542, Cary, North Carolina 27511, Attention: John P. Broderick, Chief Executive Officer and Chief Financial Officer, or by telephone, (919) 380-5000, or at our website www.Level8.com. In addition, the Securities and Exchange Commission maintains a web site, http://www.sec.gov, which contains reports, proxy and information statements and other information regarding registrants, including Level 8, that file electronically with the Securities and Exchange Commission.

We have filed a registration statement on Form S-4 to register with the Securities and Exchange Commission the common stock and preferred stock that Level 8 stockholders will receive in connection with the recapitalization merger. This proxy statement/prospectus is part of the registration statement on Form S-4 and is a prospectus of Cicero and a proxy statement for the Level 8 special meeting.

No persons have been authorized to give any information or to make any representations other than those contained in this proxy statement/prospectus and, if given or made, such information or representation must not be relied upon as having been authorized by Level 8, Cicero or any other person. You should rely only on the information contained in this proxy statement/prospectus or any supplement. You should disregard anything we stated in an earlier document that is inconsistent with what is in or incorporated by reference in this proxy statement/prospectus.

You should assume that the information in this proxy statement/prospectus or any supplement is accurate only as of the date on the front page of this proxy statement/prospectus. Our business financial condition, results of operation and prospects may have changed since that date and may change again.

FORWARD-LOOKING STATEMENTS

Certain statements in this proxy statement/prospectus constitute “forward-looking statements” as that term is defined under Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. We have based these forward-looking statements on our current expectations and projections about future events. Statements that are predictive in nature, that depend upon or refer to future results or conditions, or that include words such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “estimates,” “thinks” and similar expressions, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other factors that may cause our actual results and performance to be materially different from any future results or performance expressed or implied by these forward-looking statements. These factors include, among other things, those matters discussed under the caption “Risk Factors,” as well as the following:

| | · | our ability to raise sufficient funds to support our expectations or execute our strategic plan; |

| | · | risks related to not having sufficient liquidity and capital resources to meet changing business conditions; |

| | · | market acceptance of the Cicero product and successful execution of the new strategic direction; |

| | · | general economic or business conditions may be less favorable than expected, resulting in, among other things, lower than expected revenues; |

| | · | trends in sales of our products and general economic conditions may affect investors' expectations regarding our financial performance and may adversely affect our stock price; |

| | · | we may lose competitive presence and be required to reduce prices as a result of competition from our existing competitors, other vendors and information systems departments of customers; |

| | · | our future results may depend upon the continued growth and business use of the Internet; |

| | · | we may not have the ability to recruit, train and retain qualified personnel; |

| | · | rapid technological change could render our products obsolete; |

| | · | loss of any one of our major customers could adversely affect our business; |

| | · | our products may contain undetected software errors, which could adversely affect our business; |

| | · | because our technology is complex, we may be exposed to liability claims; |

| | · | we may be unable to enforce or defend our ownership and use of proprietary technology; and |

| | · | because we are a technology company, our common stock may be subject to erratic price fluctuations. |

Although we believe that these forward-looking statements are based upon reasonable assumptions, we can give no assurance that our goals will be achieved. Given these uncertainties, prospective investors are cautioned not to place undue reliance on these forward-looking statements. These forward-looking statements are made as of the date of this proxy statement/prospectus. We assume no obligation to update or revise them or provide reasons why actual results may differ.

QUESTIONS AND ANSWERS ABOUT THE RECAPITALIZATION MERGER AND OTHER MATTERS

The following questions and answers are provided for your convenience, and briefly address some commonly asked questions about the matters to be considered at the meeting. You should carefully read this entire proxy statement/prospectus, including each of the annexes.

The Merger Agreement

Q: | Why are we proposing the recapitalization merger? |

| A: | Our board of directors believes that the recapitalization merger would greatly simplify our capital and governance structures which would benefit all of our stockholders. The board believes that the simplified capital structure should make Cicero more understandable and hence more attractive to potential investors and highly skilled employees. The simplified capital structure of Cicero following the recapitalization merger should also improve Cicero’s ability to access the capital markets to pursue possible future equity and debt financings and acquisitions, and would provide a more transparent capital structure in which to value Cicero. Finally, we believe that the recapitalization will be helpful in retaining our attractiveness to our preferred stockholders and convertible promissory noteholders. See “Proposal I: Approval and Adoption of the Merger Agreement—Reasons for the Recapitalization Merger.” |

Q: | How does Level 8’s board of directors recommend that I vote on the proposal to adopt the merger agreement? |

| A: | Our board of directors recommends that you vote “FOR” the proposal to adopt the merger agreement. You should read “Proposal I: Approval and Adoption of the Merger Agreement—Reasons for the Recapitalization Merger” for a discussion of the factors that our board of directors considered in deciding to recommend the adoption of the merger agreement. |

Q: | How would the recapitalization merger be effected? |

| A: | The recapitalization merger would be accomplished by merging Level 8 with and into our newly formed wholly-owned subsidiary, Cicero, Inc., with Cicero continuing as the surviving corporation. |

Q: | What would happen to the shares of common stock in the recapitalization merger? |

| A: | Each share of common stock outstanding at the effective time of the merger would automatically be converted into 0.05 share of common stock of Cicero, entitled to one vote per share. |

Q: | What would happen to the shares of various series of preferred stock in the merger? |

| A: | If the recapitalization merger is completed, each share of Level 8 preferred stock, other than shares as to which appraisal rights are properly exercised, will be converted into the following number of shares of Cicero Series A-1 preferred stock: |

| Level 8 Preferred Stock | | Number of Shares of Cicero Series A-1 Preferred Stock |

| | Series A-3 | | | 0.0142857 |

| | Series B-3 | | | 0.125 |

| | Series C | | | 0.20 |

| | Series D | | | 0.25 |

No fractional shares of common stock would be issued to any holder. Holders would receive cash in lieu of fractional shares.

Q: | What would happen to the convertible promissory notes in the merger? |

| A: | If the recapitalization merger is completed, the outstanding convertible promissory notes may, at the option of the holder thereof, be converted into shares of Cicero Series A-1 preferred stock at conversion prices ranging from $0.002 to $0.026. |

Q: | What would happen to the senior reorganization notes in the recapitalization merger? |

| A: | Upon approval of the recapitalization merger (i) holders of senior reorganization notes will receive and have automatically exercised additional warrants exerciseable into shares of common stock, by applying the accrued interest on their senior reorganization notes and by cashless exercise to the extent of the balance of the exercise price, (ii) holders of existing warrants who advanced the exercise price of their warrants to Level 8 will have their existing warrants automatically exercised and (iii) those senior reorganization noteholders who loaned Level 8 the first $1,000,000 in respect of the exercise price of their warrants would receive early adopter warrants of Level 8 at a ratio of 2:1 for shares issuable upon exercise of each existing warrant exercised at the special exercise price of $0.10 per share, as part of the merger plan. |

Q: | What would happen to the convertible bridge notes in the recapitalization merger? |

| A: | Upon consummation of the recapitalization merger, holders of convertible bridge notes will have their notes automatically converted into shares of Cicero common stock at a conversion price of $0.0314 (the equivalent of $0.00157 for Level 8 stock). |

Q: | If the recapitalization merger is completed, would our shares continue to be publicly traded? |

| A: | If the recapitalization merger is completed, we expect that the shares of Cicero common stock into which Level 8 common stock would be converted pursuant to the recapitalization merger would trade on the Over-the-Counter Bulletin Board. We intend to make application to trade under the symbol “CCRO”. |

Q: | If the recapitalization merger is completed, would I still have the same voting rights as I do now? |

| A: | As a result of the recapitalization merger, holders of Cicero common stock will have the same voting rights they had when they held shares of Level 8 common stock. Each share of Cicero common stock will be entitled to one vote. Holders of Cicero Series A-1 preferred stock will be entitled to a number of votes equal to the number of shares of Cicero common stock into which the preferred stock is convertible. Holders of Cicero Series A-1 preferred stock will not be entitled to the same voting rights on some matters as holders of Series A-3, B-3, C or D preferred stock of Level 8. For an explanation of these differences, please see “Proposal I: Approval and Adoption of the Merger Agreement—Comparison of Preferred Stockholder Rights Before and After the Recapitalization.” Further, as a result of the transaction, the current common stockholders of Level 8 would suffer substantial dilution. On a fully diluted basis, the current common stockholders, who own 52.7% of Level 8, will own only 2.8% of Cicero upon completion of the recapitalization merger. The substantial dilution would result in a change of control to the extent that the current common stockholders of Level 8 will no longer own more than fifty percent of the common stock of Cicero. |

Q: | What protections for the minority stockholders of Cicero would be in place if the recapitalization merger is completed? |

| A: | Other than those provided by law, the minority stockholders of Cicero would receive no minority protections if the recapitalization merger is completed. |

Q: | What are the federal income tax consequences to me of the recapitalization merger? |

| A: | If the recapitalization merger is completed, you as the holder of shares of the common stock of Level 8 or as the holder of shares of preferred stock of Level 8 (or both) would not recognize any gain or loss for U.S. federal income tax purposes as the result of the recapitalization merger, except for any gain or loss that may result from your receipt of cash instead of a fractional share of Cicero common stock. Your tax basis in the shares of Cicero common stock received in the recapitalization merger would equal the basis of the Level 8 common shares that you owned immediately prior to and exchanged in the recapitalization merger. Your tax basis in the shares of Cicero Series A-1 preferred stock received in the recapitalization merger would equal the basis of the Level 8 preferred shares that you owned immediately prior to and exchanged in the recapitalization merger |

| | The holding period for each share of Cicero common stock or Cicero Series A-1 preferred stock that you own immediately following the recapitalization merger would include your holding period for the Level 8 common or preferred shares you exchanged in the recapitalization merger for such Cicero share, provided that the Level 8 share exchanged was held as a capital asset. |

If you receive cash instead of a fractional share of Cicero common stock, you will be considered as having received the fractional share pursuant to the recapitalization merger and then having exchanged the fractional share for cash in a redemption by Cicero. As a result, you will generally recognize gain or loss equal to the difference between the amount of cash received and the basis in your fractional share as set forth above. Provided such fractional share was held as a capital asset, the gain or loss will be capital gain or loss and will be long term capital gain or loss if, as of the effective date of the recapitalization merger, your holding period for such fractional share is greater than one year. The deductibility of capital losses is subject to limitations.

If you are a non-corporate U.S. holder of Level 8 common stock, you may be subject to information reporting and backup withholding at a 28% rate on any cash payments received in lieu of a fractional Cicero share. You will not be subject to backup withholding, however, if you (a) furnish a correct taxpayer identification number and certify that you are not subject to backup withholding on the Form W-9 or successor form included in the letter of transmittal to be delivered to the holders following the completion of the recapitalization merger; or (b) are otherwise exempt from backup withholding.

Tax matters are complicated, and the tax consequences of the recapitalization merger to you will depend on your particular tax situation. You should consult your tax advisor on the tax consequences of the recapitalization merger to you. You should also read “Proposal I—Approval and Adoption of the Merger Agreement Pursuant to Which the Merger Will be Effected—Federal Income Tax Consequences of the Recapitalization Merger.”

Q: | When do we expect to complete the recapitalization merger? |

| A: | If the recapitalization merger is approved by Level 8’s stockholders, and assuming the satisfaction of the other conditions to the merger, it is anticipated that the recapitalization merger will become effective as soon as practicable. |

Q: | Who is entitled to vote on the merger agreement? |

| A: | Only holders of record of common stock and preferred stock of Level 8 at the close of business November 30, 2005 may vote on the merger agreement. |

Q: | What stockholder votes are required to adopt the merger agreement? |

| A: | The merger will require the affirmative vote of (i) the holders of a majority of voting power of the issued and outstanding shares of Level 8 common stock, Series A-3, B-3, C and D preferred stock (each voting on an as-converted basis) entitled to vote thereon, voting together as a single class, (ii) the holders of at least two-thirds of the issued and outstanding shares of Series D preferred stock entitled to vote thereon voting as a single class with respect to the reduction of conversion rates and as a single class with respect to the merger agreement, and (iii) each of the holders of at least 85% of the issued and outstanding shares of Series A-3, B-3 and C preferred stock entitled to vote thereon, each voting as a single class with respect to the reduction of conversion rates and together as a single class with respect to the merger agreement. |

Q: | What stockholders votes are required to amend the certificate of incorporation to reduce the conversion price for each series of Preferred Stock of Level 8? |

| A: | The amendment to certificate of incorporation will require the vote of (i) holders of at least two-thirds of the issued and outstanding shares of Series D preferred stock entitled to vote thereon voting as a single class; and (ii) each of the holders of at least 85% of the issued and outstanding shares of Series A-3, B-3 and C preferred stock entitled to vote thereon, each voting as a single class. A vote “FOR” the recapitalization merger of each such series will be deemed a vote “FOR” the reduction in the conversion price of each such series of preferred stock. |

Other Matters

Q: | What stockholder vote is required for the election of directors? |

| A: | The affirmative vote of a majority of the total votes represented by the shares of our common stock and our preferred stock (voting on an as-converted basis) present in person or represented by proxy and entitled to vote on such matter is required for the election of directors. Abstentions and broker non-votes (if any) will be disregarded and will have no effect on the outcome of the election of our directors. |

Q: | How long will the directors elected at the annual meeting serve? |

| A: | Directors will be elected to serve for the ensuing year and until their successors are duly elected and qualified. |

Q: | What stockholder vote is required for the ratification of our independent registered public accounting firm? |

| A: | The affirmative vote of a majority of the total votes represented by the shares of our common stock and our preferred stock (voting on an as-converted basis) present in person or represented by proxy and entitled to vote on such matter is required to ratify the appointment by our board of directors of Margolis & Company P.C. as our independent registered public accounting firm for the 2005 fiscal year. Consequently, an abstention will have the effect of a negative vote. |

Q: | How does Level 8’s board of directors recommend that I vote on the election of the proposed nominees and the appointment of Margolis & Company P.C. as independent registered public accounting firm for the year ending December 31, 2005? |

| A: | Our board of directors recommends that you vote “FOR” the election of the proposed nominees and the appointment of Margolis & Company P.C. as independent registered public accounting firm for the year ending December 31, 2005. You should read “Proposal II: Election of Directors,” and “Proposal III: Ratification of Margolis & Company P.C. Appointment As Our Independent Registered Public Accounting Firm” for a discussion of the factors that our board of directors considered in deciding to recommend the election of the proposed nominees and the appointment of Margolis & Company P.C. as independent public accounting firm. |

Q: | What do I need to do now? |

| A: | After you have carefully read this proxy statement/prospectus, indicate on your proxy card how you want your shares to be voted, then sign and mail it in the enclosed prepaid envelope as soon as possible, so that your shares may be represented and voted at the meeting to be held _____________, 2006. |

Q: | If my shares are held in “street name” by my broker, will my broker vote my shares for me? |

| A: | Maybe. Your broker will vote your shares only if you provide instructions on how to vote. You should follow the directions provided by your broker. Without instructions, your shares will not be voted on the merger agreement. |

Q: | If my shares are held in an IRA, who votes those shares? |

| A: | You vote shares held by you in an IRA as though you held those shares directly. |

Q: | Can I change my vote after I have mailed my signed proxy card? |

| A: | Yes. You can change your vote at any time before we vote your proxy at the meeting. There are three ways for you to revoke your proxy and change your vote. First, you may send a written notice to the person to whom you submitted your proxy stating that you would like to revoke your proxy. Second, you may complete and submit a new proxy card with a later date. Third, if you are a holder of record, you may vote in person at the special meeting. If you hold your shares through an account at a brokerage firm or bank, you should |

| | contact your brokerage firm or bank. |

Q: | Should I send in my stock certificate now? |

| A: | No. Shortly after the recapitalization merger is completed, Cicero will send you written instructions for exchanging your stock certificates. |

Q: | Am I entitled to appraisal rights? |

| A: | Under the General Corporation Law of the State of Delaware, holders of Series A-3, B-3, C and D preferred stock are entitled to appraisal rights if the recapitalization merger is completed. Any stockholder so entitled who wishes to exercise appraisal rights with respect to the merger must not consent to or vote in favor of adoption of the merger agreement, and must file written notice with us of an intention to demand appraisal of their shares prior to the taking of the vote thereon at the special meeting, and otherwise follow the procedures set forth in Section 262 of the General Corporation Law of the State of Delaware. Holders of common stock are not entitled to appraisal rights. See “Proposal I: Approval and Adoption of the Merger Agreement—Appraisal Rights”. |

Q: | Who should I call with questions or to obtain additional copies of this document? |

| A: | You should call: Mr. John P. Broderick, Chief Executive Officer and Chief Financial Officer, 8000 Regency Pkwy., Ste 542, Cary, NC 27511, (919) 380-5000. |

This summary highlights selected information from this proxy statement/prospectus. You should carefully read this entire proxy statement/prospectus and the other documents to which this proxy statement/prospectus refers in order to better understand the recapitalization merger. In particular, you should read the annexes attached to this proxy statement/prospectus, including the merger agreement, which is attached as Annex A. You should also read the forms of Cicero’s certificate of incorporation and bylaws, which are attached as Annex B and Annex C, respectively, because they will be the certificate of incorporation and bylaws governing your rights as a stockholder of Cicero following the completion of the recapitalization merger. See the section entitled “Where You Can Find Additional Information” at the beginning of this document. For a discussion of the risk factors that you should carefully consider, see the section entitled “Risk Factors” beginning on page 48.

The information contained in this proxy statement/prospectus, unless otherwise indicated, assumes the recapitalization merger and all transactions related to it, has occurred. When used in this proxy statement/prospectus, unless otherwise indicated or the context otherwise requires, the terms “Company,” “we,” “our” and “us” refer to Level 8 Systems, Inc. and its subsidiaries with respect to the period prior to the merger, and Cicero, Inc. and its subsidiaries with respect to the period after the merger. We also use “Level 8” to refer to Level 8 Systems, Inc. and “Cicero” to refer to Cicero, Inc.

The Companies

Level 8

Level 8 is a provider of business integration software, known as Cicero, which enables organizations to integrate new and existing information and processes at the desktop. Our Cicero business integration software addresses the emerging need for companies’ information systems to deliver enterprise-wide views of their business information processes.

In addition to software products, Level 8 also provides technical support, training and consulting services as part of its commitment to providing its customers with industry-leading integration solutions. Level 8’s consulting team has in-depth experience in developing successful enterprise-class solutions as well as valuable insight into the business information needs of customers in the Global 5000.

Our auditors are of the opinion that our continuation as a going concern is in doubt. The Company’s future revenues are largely dependent on acceptance of our newly developed and marketed product, Cicero, which has had only limited commercial success to date. Accordingly, there is substantial doubt that the Company can continue as a going concern if Cicero fails to gain acceptance in the market place. In order to address these issues and to obtain adequate financing for the Company’s operations for the next twelve months, the Company is actively promoting and expanding its Cicero related product line and continues to negotiate with customers that have expressed an interest in the Cicero technology. If we are unable to increase cash flow or obtain financing, we are not likely to be able to fund planned operations for the next twelve months.

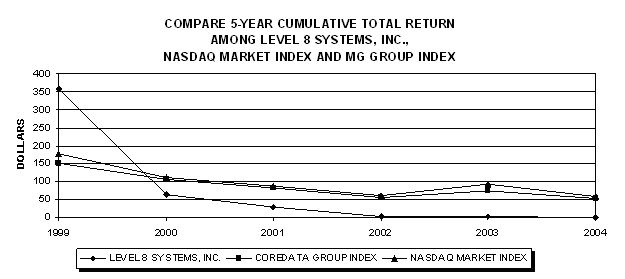

Level 8’s common stock currently trades on the Over-the-Counter Bulletin Board (“OTCBB”) under the symbol “LVEL”. We had previously been listed on The Nasdaq National Market and then subsequently the Nasdaq SmallCap Market until our failure to meet minimum listing requirements with respect to total stockholders equity resulted in our delisting in January of 2003.

Level 8’s principal offices are located at 1433 State Highway 34, Building C, Farmingdale, New Jersey 07727.

Cicero

Cicero, a wholly owned subsidiary of Level 8, was incorporated under the General Corporation Law of the State of Delaware on December 17, 2004 under the name "Cicero, Inc." exclusively for the purpose of merging with Level 8. The address and phone number of Cicero's principal office are the same as those of Level 8. Prior to the

recapitalization merger, Cicero will have no material assets or liabilities and will not have carried on any business other than those in connection with its formation and the execution of the merger agreement.

The Recapitalization Merger

Agreement and Plan of Merger

On December 30, 2004, Level 8 and Cicero entered into an Agreement and Plan of Merger pursuant to which Level 8 would merge with and into Cicero, with Cicero being the surviving corporation. Under the merger agreement, Cicero will assume all assets and liabilities of Level 8, including obligations under Level 8’s existing indebtedness and contracts. The board of directors and officers of Level 8 will become the board of directors and officers of Cicero for identical terms of office. The existing subsidiaries of Level 8 will become the existing subsidiaries of Cicero.

Structure of Recapitalization Merger

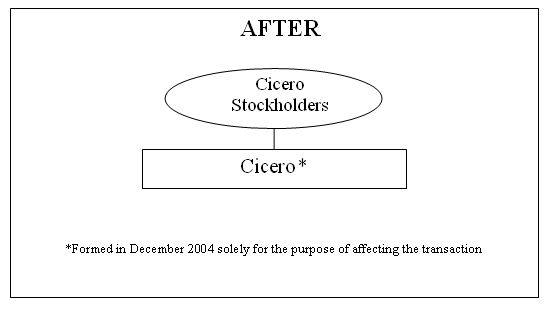

In order to help you better understand the merger and how it will affect Level 8 and Cicero, the charts below illustrate, in simplified form, the following:

| | · | Before: the organizational structure of Level 8 and Cicero (excluding Level 8’s operating subsidiaries), immediately before the recapitalization merger; |

| | · | Merger: the steps involved in and the effects of the recapitalization merger of Level 8 and Cicero and the exchange of shares of Cicero stock for shares of Level 8 stock; and |

| | · | After: the organization structure of Cicero (excluding its operating subsidiaries) immediately after the completion of the transactions. |

We subsequently amended the merger agreement on September 13, 2005 to include, upon consummation of the merger agreement, the automatic exercise of existing warrants held by Senior Reorganization Noteholders (as defined below), the exercise of Additional Warrants (as defined below) by applying the accrued interest on their Senior Reorganization Notes and by cashless exercise to the extent of the balance of the exercise price and the issuance of Early Adopter Warrants (as defined below). Further, the amended and restated merger agreement provides for the automatic conversion of Convertible Bridge Notes (as defined below) into shares of common stock of Cicero at a conversion price of $0.0314 upon the consummation of the merger recapitalization. In addition, holders of preferred stock waived provisions granting such holders control of the board of directors upon our failure to achieve a certain revenue threshhold. References to the merger agreement refer to such agreement, as amended.

Effect of Recapitalization Merger on Capital Stock

If the merger agreement is approved by the stockholders, the recapitalization merger will result in a significant change in our capital structure. As a result of the recapitalization merger:

| | · | Each share of Level 8 common stock will be converted into one-twentieth (0.05) share of Cicero common stock. This includes 404,500 shares of common stock issued or issuable as payment for certain fees earned prior to or incurred and directly attributable to the recapitalization merger. |

| | · | Each share of Level 8 Series A-3 preferred stock (other than shares to which appraisal rights are duly exercised) will be converted into 0.0142857 shares of Cicero Series A-1 preferred stock. |

| | · | Each share of Level 8 Series B-3 preferred stock (other than shares to which appraisal rights are duly exercised) will be converted into 0.0125 shares of Cicero Series A-1 preferred stock. |

| | · | Each share of Level 8 Series C preferred stock (other than shares to which appraisal rights are duly exercised) will be converted into 0.20 shares of Cicero Series A-1 preferred stock. |

| | · | Each share of Level 8 Series D preferred stock (other than shares to which appraisal rights are duly exercised) will be converted into 0.25 shares of Cicero Series A-1 preferred stock. |

| | · | Convertible promissory notes may, at the option of the holder thereof (of which holders of 95% have agreed to convert), be converted into shares of Cicero Series A-1 preferred stock at conversion prices ranging from $0.002 to $0.026. |

| | · | The senior secured notes of Level 8 (“Senior Reorganization Notes”) issued in the aggregate principal amount of $2,559,000 to holders of warrants of Level 8 who loaned to Level 8 the exercise price of their warrants and other investors who lent funds to Level 8 (“Senior Reorganization Noteholders”) in exchange for Senior Reorganization Notes and additional warrants, pursuant to note and warrant offerings in December 2004 ($1,615,000) and March 2005 ($944,000) (the “Note and Warrant Offerings”), will be cancelled and the existing warrants in respect of which the exercise price was loaned to Level 8, as evidenced by the Senior Reorganization Notes, will be exercised. Such warrant holders were offered a special one-time exercise price of the lesser of $0.10 per share and the original exercise price as part of the merger agreement. The exercise price of the warrants at that time ranged from $0.07 to $0.60. |

| | · | The warrants of Level 8 (“Additional Warrants”) issued to Senior Reorganization Noteholders in connection with their loans to Level 8, exercisable at $0.002 per share in the event of the consummation of the merger agreement, to acquire shares of Level 8 common stock, will automatically be deemed exercised, by applying the accrued interest on their Senior Reorganization Notes and by cashless exercise to the extent of the balance of the exercise price, upon the consummation of the recapitalization merger in accordance with their terms. The shares issuable upon exercise of the Additional Warrants will convert into an aggregate of 19,360,959 shares of Cicero common stock in the recapitalization merger (less the number of shares to be applied to the cashless exercise). |

| | · | Senior Reorganization Noteholders who loaned Level 8 the first $1,000,000 in respect of the exercise price of their warrants, pursuant to the Note and Warrant Offering in December 2004, will receive warrants of Level 8 (“Early Adopter Warrants”) at a ratio of 2:1 for shares issuable upon exercise of each existing warrant exercised at the special exercise price (before adjustment by the merger exchange ratio) of $0.10 per share, as part of the recapitalization merger. In the recapitalization merger, Early Adopter Warrants will convert into warrants of Cicero for an aggregate of 1,005,562 shares of Cicero, and the exercise price increased to $2.00 per share. |

| | · | The convertible bridge notes (the “Convertible Bridge Notes”) held by convertible bridge noteholders (the “Convertible Bridge Noteholders”) who had loaned money to Level 8 as part of the September 2005 |

| | | consortium note offering (the “Consortium Note Offering”) will be automatically converted into shares of Cicero common stock at a conversion price of $0.0314 (the equivalent of $0.00157 for Level 8 stock). |

| | · | Each option, warrant, purchase right, unit or other security of Level 8, including the Early Adopter Warrants, will be converted into the identical security of Cicero with the number of shares of Cicero common stock issuable upon exercise of such security equal to one-twentieth (0.05) of the number of shares such security was exercisable for prior to the recapitalization merger, and the exercise price increased to twenty times the exercise price prior to the recapitalization merger. |

The rights and interests of Cicero common stock will be the same as the rights and interest of Level 8 common stock.

Each share of Cicero Series A-1 preferred stock will be convertible into 1,000 shares of Cicero common stock. The rights and interests of Cicero preferred stock will be substantially similar to the rights interests of each of the series of Level 8 preferred stock other than for (i) anti-dilution protections that have been permanently waived and (ii) certain voting, redemption and other rights that holders of Cicero Series A-1 preferred stock will not be entitled to. All shares of Cicero Series A-1 preferred stock will have a liquidation preference pari passu with all other Series A-1 preferred stock. For a comparison of these rights, see “Proposal I: Approval and Adoption of the Merger Agreement—Comparison of Preferred Stockholder Rights Before and After the Recapitalization”. The rights of holders of Cicero Series A-1 preferred stock are more fully described in the Cicero Series A-1 preferred stock certificate of designation, which is part of the certificate of incorporation of Cicero, attached hereto as Annex B.

The table below illustrates the current and amended conversion prices for the convertible promissory notes and the current and amended conversion rates for each series of preferred stock, as well as the common stock equivalents for each security. Each of such securities will be converted into the number of shares of Cicero Series A-1 preferred stock that corresponds to such number of shares of Cicero common stock issuable upon conversion of convertible promissory notes and preferred stock based on the amended conversion price and rates set forth below.

CURRENT AND AMENDED CONVERSION PRICES AND RATES FOR CONVERTIBLE PROMISSORY

NOTES AND PREFERRED STOCK

Security | Amount Invested | Current Conversion Price | Common Equivalents | Amended Conversion Price | Common Equivalents |

Convertible Promissory Notes | $150,000 | $0.37 | 405,405 | $0.026 | 3,323,077 |

| $185,000 | $0.32 | 578,125 | $0.023 | 8,093,750 |

| $125,000 | $0.28 | 446,429 | $0.02 | 6,250,006 |

| $112,000 | $0.20 | 560,000 | $0.014 | 7,840,000 |

| $15,320 | $0.17 | 90,118 | $0.012 | 1,261,647 |

| $125,000 | $0.16 | 781,250 | $0.011 | 11,363,636 |

| $100,000 | $0.10 | 1,000,000 | $0.0025 | 40,000,000 |

| $150,000 | $0.08 | 1,875,000 | $0.002 | 75,000,000 |

| $30,000 | $0.07 | 428,571 | $0.005 | 6,000,000 |

| Series A-3 Preferred Stock | $1,571,000 | $8.33 | 188,528 | $3.50 | 448,857 |

| Series B-3 Preferred Stock | $30,000,000 | $12.53 | 2,394,063 | $4.00 | 7,500,000 |

| Series C Preferred Stock | $1,141,000 | $0.38 | 3,002,632 | $0.25 | 4,564,000 |

| Series D Preferred Stock | $1,135,520 | $0.32 | 3,548,500 | $0.20 | 5,677,600 |

Current conversion prices reflect then-current market prices, with the exception of the Series A-3 and B-3 preferred stock, whose conversion rates were reduced in 2002 to then-current market prices in consideration of waiving anti-dilution protection in respect of certain capital raises. The current conversion prices for the convertible promissory notes were determined by the board of directors by reference to the fair market value on the date of

issue. The new conversion prices with respect to the Series A-3, B-3 and D preferred stock were negotiated with the holders of each series based upon such factors as the current conversion price in relation to the market, the dollar amount represented by such series and, waiver of anti-dilution, liquidation preferences, seniority and other senior rights. The conversion price for the Series C preferred stock was determined in relation to the conversion price for the Series D preferred stock. The board of directors determined the new conversion price of each series of Level 8 preferred stock after discussion and review of those rights, ranks and privileges that were being waived by the present holders of preferred stock. Among those rights being waived are anti-dilution protection, liquidation preferences and seniority. The conversion price for the convertible promissory notes was reduced, based on such negotiations, to approximately one-fourteenth of the current conversion prices. One of the goals of the negotiations was to encourage the holders of convertible promissory notes of Level 8 to convert in order to minimize liquidity issues after the recapitalization merger.

The conversion price for the Convertible Bridge Notes was determined by the board of directors based on a pre-money valuation of Level 8 of $1,500,000, an amount in excess of the then-current market capitalization of Level 8, and an offering size of $1,000,000 (later extended to $1,600,000). However, should the recapitalization merger not be declared effective by October 31, 2005 or December 31, 2005, Level 8 agreed that the pre-money valuation of $1,500,000 would be lowered to $1,250,000 and $1,000,000, respectively, reducing the conversion price of the Convertible Bridge Notes to $0.0314 and $0.025, respectively. See “Proposal I: Approval and Adoption of the Merger Agreement—Background of the Recapitalization Merger” and “—Changes in Conversion Prices and Rates”.

Amendments to the certificate of incorporation with respect to the conversion price for each series of preferred stock requires at least 85% of the issued and outstanding shares of Series A-3, B-3 and C preferred stock entitled to vote thereon, each voting as a single class, and at least 66% of the issued and outstanding shares of Series D preferred stock. Each vote of the holders of preferred stock of Level 8 with respect to the merger agreement will also be deemed the same vote with respect to the amendment of the conversion price of such series of preferred stock.

Impact of Changes in Capital Structure

As a result of the automatic conversion of Convertible Bridge Notes into shares of Cicero common stock, the automatic exercise of existing warrants of Level 8 and the issuance by Level 8 and exercise of Additional Warrants and, to a lesser extent, the conversion of Level 8 convertible promissory notes and preferred stock into Cicero Series A-1 preferred stock at the conversion rates set forth above, the holders of common stock will suffer substantial dilution in their holdings.

The table below illustrates (i) the number of shares of Level 8 common stock or common equivalents and the percentage of equity held by holders of each class of security of Level 8, and by each person known to Level 8 to be the beneficial owner of 5% or more on a common equivalent basis prior to the recapitalization merger (ii) the number of shares of Level 8 common stock or common equivalents and the percentage of equity held by holders of each class of security of Level 8, and by each person known to Level 8 to be the beneficial owner of 5% or more on a common equivalent basis if the recapitalization merger is approved as proposed, and (iii) the number of shares of Cicero common stock or common equivalents held by holders of each class of security of Cicero, and by each person known to Level 8 to be the beneficial owner of 5% or more of Level 8 on a common equivalent basis (anticipating that holders of more than 5% of the stock of Level 8 will hold more than 5% of the stock of Cicero) if the recapitalization merger is approved as proposed.

| | | Ownership of Each Class of Security of Level 8 Using Current Conversion Rates | | Ownership of Each Class of Security of Level 8 Using Amended Conversion Rates and Giving Effect to Merger and Related Issuances, Exercises and Conversions | | Ownership of Each Class of Security of Cicero Giving Effect to Merger | |

| | | % Held(1) | | Number of Shares Held | | % Held(1) | | Number of Shares Held | | % Held(1) | | Number of Shares Held | |

| Common Equivalents (1) | | | 100 | % | | 74,349,659 | | | 100 | % | | 1,629,950,694 | | | 100 | % | | 81,338,024 | |

| Common Stock | | | 63.8 | % | | 47,410,825 | | | 2.91 | % | | 47,410,835 | | | 89.1 | % | | 72,471,895 | |

| Series A-1Preferred Stock | | | | | | | | | | | | | | | 10.9 | % | | 8,866,129 | |

| Series A-3 Preferred Stock | | | 0.3 | % | | 188,528 | | | * | | | 448,857 | | | | | | | |

| Series B-3 Preferred Stock | | | 3.2 | % | | 2,394,063 | | | 0.5 | % | | 7,500,000 | | | | | | | |

| Series C Preferred Stock | | | 4.0 | % | | 3,002,632 | | | 0.3 | % | | 4,564,000 | | | | | | | |

| Series D Preferred Stock | | | 4.8 | % | | 3,548,500 | | | 0.3 | % | | 5,677,600 | | | | | | | |

| Senior Reorganization Notes (2) | | | 15.7 | % | | 11,640,203 | | | 24.9 | % | | 410,139,471 | | | | | | 1,005,562 | |

| Non-lenders Warrants (3) | | | | | | 7,735,872 | | | | | | 7,735,872 | | | | | | 527,258 | |

| Stock Options (4) | | | | | | 7,258,647 | | | | | | 7,258,647 | | | | | | 551,000 | |

| Convertible Bridge Notes (5) | | | | | | | | | 61.0 | % | | 995,077,815 | | | | | | | |

| Convertible PromissoryNotes | | | 6.9 | % | | 6,164,898 | | | 9.8 | % | | 159,132,116 | | | | | | | |

Total | | | | | | 89,344,178 | | | | | | 1,644,945,213 | | | | | | 83,421,844 | |

| Landis, Mark & Carolyn | | | 14.0 | % | | 10,404,575 | | | 20.2 | % | | 329,745,652 | | | 20.5 | % | | 16,642,045 | |

| Pizi, Anthony | | | 5.7 | % | | 4,207,497 | | | 7.7 | % | | 125,991,805 | | | 7.8 | % | | 6,323,340 | |

| Brown Simpson Partners I, Ltd. | | | 8.0 | % | | 5,936,921 | | | 6.3 | % | | 103,411,482 | | | 6.6 | % | | 5,328,076 | |

| Liraz Systems, Ltd. | | | 8.6 | % | | 6,426,869 | | | 0.7 | % | | 11,739,819 | | | 0.9 | % | | 715,789 | |

____________

*Represents less than 0.1%.

(1) Includes all issued and outstanding shares of common stock, shares issuable upon conversion of preferred stock, shares issuable upon the exercise of options and warrants, shares issuable upon automatic exercise of Additional Warrants, shares issuable upon conversion of convertible promissory notes and shares issuable upon conversion of Convertible Bridge Notes. Does not include shares issuable upon exercise of options and warrants having exercise prices in excess of the fair market value of Level 8 common stock as of November 30, 2005.

(2) Includes 1,005,562 Early Adopter Warrants. As the exercise price for the Early Adopter Warrants is in excess of market value, those warrants are not dilutive and are not included in the percentage column.

(3) Warrants held by those who did not advance the exercise price of their warrants in exchange for Senior Reorganization Notes. As the exercise prices for the warrants are in excess of market value, those warrants are not dilutive and are not included in the percentage column.

(4) Includes all options granted and reserved for grant under Level 8’s stock option plan. As the exercise price of all options granted are excess of market value, those options are not dilutive and neither non-dilutive options nor shares not subject to option grants are included in the percentage column.

(5) Assumes that the recapitalization merger will become effective prior to December 31, 2005.

For further information concerning the effects of the changes to conversion rates and the recapitalization merger with respect to affiliates, please see “Proposal I: Approval and Adoption of the Merger Agreement—Interests of Certain Parties in the Reorganization Merger.”

Recommendation of the Board of Directors

On November 23, 2004, the board of directors of Level 8 voted unanimously to approve the merger agreement and the recapitalization merger, and on September 13, 2005 voted unanimously to amend the merger agreement in certain respects. The board believes the effects of the merger agreement will have a positive impact on the future operations of the Company and its ability to raise additional capital that it will need to continue operations. Our board of directors unanimously recommends that you vote “FOR” the approval and adoption of the merger agreement and has determined that these actions are in the best interests of the Company and our stockholders. In addition, the board of directors unanimously recommends that you vote “FOR” the re-election of the board nominees and “FOR” ratification of the appointment of our independent registered public accounting firm.

Conditions to the Merger

The merger agreement was unanimously approved by the board of directors of Level 8 and the board of directors of Cicero (including the disinterested directors of each of the boards) and subsequently was adopted by Level 8 as the sole stockholder of Cicero.

Stockholder Approvals

The approval of the recapitalization merger requires the affirmative votes of (i) the holders of a majority of voting power of the issued and outstanding shares of Level 8 common stock and Series A-3, B-3, C and D preferred stock (each voting on an as-converted basis) entitled to vote thereon, voting together as a single class, (ii) the holders of at least two-thirds of the issued and outstanding shares of Series D preferred stock entitled to vote thereon, voting as a single class with respect to the reduction of conversion rates and as a single class with respect to the merger agreement and (iii) the holders of at least 85% of the issued and outstanding shares of Series A-3, B-3 and C preferred stock entitled to vote thereon, each voting as a single class with respect to the reduction of conversion rates and together as a single class with respect to the merger agreement.

As of November 30, 2005, the directors and executive officers of Level 8 and their affiliates together own about 3.4% of Level 8 voting stock, including 2.0% of common stock outstanding, 1.2% of Level 8 Series C preferred stock and 0.2% of Level 8 Series D preferred stock.

Regulatory Approvals

To the Company’s knowledge, the only required regulatory or governmental approval or filing necessary in connection with the consummation of the recapitalization merger will be the filing of the Certificate of Merger with the Secretary of State of the State of Delaware.

Our license agreement with Merrill Lynch with respect to the Cicero software, as more fully described under “Business-Strategic Alignment,” provides Merrill Lynch with the right to terminate such license in the event of a change in control of Level 8. It is a condition to consummation of the recapitalization merger that the license agreement be clarified so that the recapitalization merger would not give rise to a right of Merrill Lynch to terminate the license due to a change in control, as defined in the agreement.

Reasons for the Recapitalization Merger

The board of directors (including the five disinterested directors serving on the board at the time) has approved the recapitalization merger and we have proposed it to the stockholders of Level 8 for the following reasons:

Simplified capital and governance structure.

Both the simplified capital and governance structure resulting from the transaction should make Cicero more understandable and hence more attractive to potential investors.

Enhancement of our ability to access capital markets and engage in potential strategic alternative transactions.

The simplified capital structure of Cicero following the recapitalization merger should also improve Cicero’s ability to access the capital markets to pursue possible future equity and debt financings. In addition, the transaction may enhance our ability to enter into possible future transactions, including acquisitions on favorable terms.

Broaden the market for our common stock to be more attractive to potential investors and highly skilled employees.

We believe that the continued market price of Level 8’s common stock has and will continue to impair our acceptability to institutional investors, professional investors and other members of the investing public. Various brokerage house policies and practices tend to discourage individual brokers within those firms from dealing with low-priced stocks. In addition, the current price per share of our common stock may result in individual stockholders paying higher per-share transaction costs because fixed-price brokers’ commissions represent a higher percentage of the stock price on lower priced stock than fixed-price commissions on a higher priced stock.

We believe that one effect of the recapitalization merger is that our stock price may increase over time. We further believe that a higher stock price would help us to attract and retain employees and other service providers. We believe that some potential employees and service providers are less likely to work for a company with a low stock price, regardless of the size of a company’s market capitalization. If the merger agreement successfully increases the per share price of our common stock, we believe this increase will enhance our ability to attract and retain employees and service providers. However, while we believe that our common stock would trade at higher prices after the consummation of the recapitalization merger, there can be no assurance that the increase in the trading price will occur, or, if it does occur, that it will equal or exceed the price that is the quotient of the market price of the common stock prior to the recapitalization merger divided by the merger exchange ratio (i.e, 0.05). In some cases, the total market capitalization of a company following a recapitalization merger is lower, and may be substantially lower, than the total market capitalization before the recapitalization merger. This may occur in the recapitalization merger, since one aspect of the transaction is the automatic exercise of certain warrants, which will result in a significant dilution of our common stock. In addition, the fewer number of shares that will be available to trade will possibly cause the trading market of the common stock to become less liquid, which could have an adverse effect on the price of the common stock. In addition, there can be no assurance that the recapitalization merger will result in a per share price that will attract brokers and investors who do not trade in lower priced stock or that it will increase our ability to attract and retain employees and other service providers.

Retain our attractiveness to our most recent investors: Senior Reorganization Noteholders, convertible promissory noteholders, convertible bridge noteholders and preferred stockholders.