Use these links to rapidly review the document

TABLE OF CONTENTS

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

| | |

| Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material Pursuant to §240.14a-12 |

| | | | |

| Kodiak Oil & Gas Corp. |

(Name of Registrant as Specified In Its Charter) |

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | (1) | | Title of each class of securities to which transaction applies:

|

| | | (2) | | Aggregate number of securities to which transaction applies:

|

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | | (4) | | Proposed maximum aggregate value of transaction:

|

| | | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | | (2) | | Form, Schedule or Registration Statement No.:

|

| | | (3) | | Filing Party:

|

| | | (4) | | Date Filed:

|

Table of Contents

KODIAK OIL & GAS CORP.

1625 Broadway, Suite 250, Denver, Colorado 80202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD WEDNESDAY, JUNE 15, 2011

To all Shareholders of Kodiak Oil & Gas Corp.:

NOTICE IS HEREBY GIVEN that the 2011 Annual Meeting of Shareholders of Kodiak Oil & Gas Corp. (the "Company") will be held at The Denver Athletic Club, Centennial Room, 1325 Glenarm Place, Denver, CO 80204, on Wednesday, June 15, 2011, beginning at 9:00 a.m. MDT, for the following purposes:

- 1.

- to elect the Nominees to the Company's Board to serve until the Company's 2012 Annual Meeting of Shareholders or until successors are duly elected and qualified;

- 2.

- to conduct an advisory vote on executive compensation;

- 3.

- to conduct an advisory vote on the frequency of conducting an advisory vote on executive compensation

- 4.

- to ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2011;

- 5.

- to approve Amendment No. 2 to the Company's 2007 Stock Incentive Plan;

- 6.

- any other business that may properly come before the Annual Meeting.

The Board has fixed Tuesday, April 26, 2011 as the record date for the 2011 Annual Meeting. Only shareholders of the Company of record at the close of business on that date will be entitled to notice of, and to vote at, the Annual Meeting. A list of registered shareholders as of April 26, 2011 will be available at the Annual Meeting for inspection by any shareholder.

Shareholders will need to register at the Annual Meeting to attend. If your shares are not registered in your name, you will need to bring proof of your ownership of those shares to the Annual Meeting in order to register. You should ask the broker, bank or other institution that holds your shares to provide you with either a copy of an account statement or a letter that shows your ownership of the Company's stock as of April 26, 2011. Please bring that documentation to the Annual Meeting to register.

IMPORTANT

If you are a registered holder, whether or not you expect to attend the Annual Meeting, please sign and promptly return the enclosed proxy card. If you are a non-registered/beneficial holder, whether or not you expect to attend the Annual Meeting, please vote in accordance with the instructions on your voting instruction form, which may allow voting by telephone or via the Internet. Should you decide to attend, you may revoke your proxy in accordance with the revocation procedures discussed in the enclosed Proxy Statement and vote your shares in person.

By Order of the Board of Directors,

/s/ JAMES P. HENDERSON

James P. Henderson,Secretary

Denver, Colorado

April 27, 2011

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON JUNE 15, 2011

The Company's Proxy Statement and Annual Report on Form 10-K for the year ended

December 31, 2010 are available at http://www.kodiakog.com

Table of Contents

| | |

Dear Shareholder: | | April 27, 2011

|

I am pleased to invite you to attend the 2011 Annual Meeting of Shareholders of Kodiak Oil & Gas Corp. (the "Company"), which will be held on Friday, June 15, 2011, at 9:00 a.m. MDT, in Denver, Colorado. We will meet at The Denver Athletic Club, Centennial Room, 1325 Glenarm Place, Denver, CO 80204.

The matters to be acted upon are described in the accompanying Notice of Annual General Meeting and Proxy Statement. At the meeting, we will also report on the Company's operations and respond to any questions you may have.

Whether or not you are personally able to attend the Annual Meeting, please promptly vote your shares in accordance with the enclosed proxy card or voting instruction form as soon as possible. Submitting your vote by such means in advance of the Annual Meeting will not limit your right to attend and vote in person. Your vote is very important.

Table of Contents

KODIAK OIL & GAS CORP.

PROXY STATEMENT

TABLE OF CONTENTS

| | | |

| | Page |

|---|

QUESTIONS AND ANSWERS ABOUT THE MEETING, PROXY MATERIALS AND VOTING | | 1 |

| | Why am I receiving this Proxy Statement and proxy card? | | 1 |

| | Why does my name not appear as a shareholder of record? | | 1 |

| | Who is making this solicitation and who will pay the related costs? | | 1 |

| | When is the record date? | | 2 |

| | How many shares are outstanding and how many votes can be cast by all shareholders? | | 2 |

| | On what am I voting? | | 2 |

| | How do I vote? | | 2 |

| | Can shareholders vote in person at the Annual Meeting? | | 2 |

| | What does it mean if I receive more than one proxy card? | | 3 |

| | What if I share an address with another shareholder and we received only one copy of the proxy materials? | | 3 |

| | May I revoke my proxy? | | 3 |

| | How many votes do you need to hold the Annual Meeting? | | 3 |

| | How are abstentions and broker non-votes counted? | | 3 |

| | How many votes are needed to elect directors? | | 4 |

| | How many votes are needed to approve the advisory vote on executive compensation and the advisory vote on the frequency of the vote on executive compensation? | | 4 |

| | How many votes are needed to ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm? | | 4 |

| | How many votes are needed to approve the amendments to the 2007 Stock Incentive Plan? | | 4 |

| | Will my shares be voted if I do not sign and return my Proxy Card? | | 5 |

| | How are votes counted? | | 5 |

| | Where can I find the voting results of the Annual Meeting? | | 5 |

| | How can I obtain a copy of the Proxy Statement and the 2010 Annual Report on Form 10-K? | | 5 |

| | What materials accompany this Proxy Statement? | | 5 |

PROPOSAL 1: ELECTION OF DIRECTORS | | 6 |

| | What is the current composition of the Board? | | 6 |

| | Is the Board divided into classes? How long is the term? | | 6 |

| | Who is standing for election this year? | | 6 |

| | What if a nominee is unable or unwilling to serve? | | 6 |

| | How are nominees elected? | | 6 |

| | May additional directors be appointed by the Board? | | 6 |

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS | | 7 |

| | Family and Certain Other Relationships | | 9 |

| | Interests of Insiders and Material Transactions | | 9 |

CORPORATE GOVERNANCE | | 9 |

| | Structure of the Board of Directors | | 9 |

| | Meetings of the Board and Board Member Attendance of Annual Meeting | | 9 |

| | Shareholder Communications to the Board | | 9 |

| | Board Committees | | 9 |

| | Board Leadership Structure | | 11 |

| | Board's Role in Risk Oversight | | 11 |

| | Risk Assessment Regarding Compensation Policies and Practices | | 12 |

DIRECTOR COMPENSATION | | 12 |

OTHER GOVERNANCE MATTERS | | 14 |

Table of Contents

| | | |

| | Page |

|---|

| | Code of Business Conduct and Ethics | | 14 |

| | Compensation Committee Interlocks and Insider Participation | | 14 |

| | Legal Proceedings | | 14 |

| | Mandate of the Board | | 14 |

| | Section 16(a) Beneficial Ownership Reporting Compliance | | 14 |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | | 14 |

COMPENSATION DISCUSSION AND ANALYSIS | | 16 |

EXECUTIVE COMPENSATION | | 25 |

| | Summary Compensation Table | | 25 |

| | Fiscal 2010 Grants Of Plan-Based Awards | | 26 |

| | Outstanding Equity Awards At 2010 Fiscal Year-End | | 27 |

| | 2010 Option Exercises And Stock Vested | | 27 |

| | Equity Compensation Plan Information as of December 31, 2010 | | 28 |

| | Potential Payments Upon Termination/Change of Control | | 29 |

| | Report On Repricing Of Options | | 34 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED SHAREHOLDER MATTERS | | 35 |

PROPOSAL TWO: ADVISORY VOTE ON EXECUTIVE COMPENSATION | | 37 |

PROPOSAL THREE: FREQUENCY OF SHAREHOLDER VOTES ON EXECUTIVE COMPENSATION | | 38 |

PROPOSAL 4: RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP | | 39 |

| | Fees Billed by Independent Auditors | | 40 |

| | Pre-Approval Policies and Procedures | | 40 |

| | Report on Audited Financial Statements | | 40 |

PROPOSAL FIVE: APPROVAL OF AMENDMENT NO. 2 TO THE 2007 STOCK INCENTIVE PLAN | | 41 |

SHAREHOLDER PROPOSALS | | 47 |

OTHER MATTERS | | 47 |

Appendix A | | 48 |

Table of Contents

KODIAK OIL & GAS CORP.

1625 BROADWAY, SUITE 250, DENVER, COLORADO 80202

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD JUNE 15, 2011

Unless the context requires otherwise, references in this statement to "we," "us," or "our" refer to Kodiak Oil & Gas Corp.

The Annual Meeting ("Annual Meeting") of Shareholders of Kodiak Oil & Gas Corp. (the "Company") will be held on Wednesday, June 15, 2011 at The Denver Athletic Club, Centennial Room, 1325 Glenarm Place, Denver, CO 80204, beginning at 9:00 a.m. MDT. We are providing the enclosed Proxy Statement, proxy materials and form of proxy in connection with the solicitation by the Company's Board of Directors (the "Board") of proxies for this Annual Meeting. The Company anticipates that this Proxy Statement, proxy materials and the form of proxy will be first mailed to holders of the Company's stock on or about May 5, 2011.

You are invited to attend the Annual Meeting at the above stated time and location. If you plan to attend and your shares are held in "street name"—in an account with a bank, broker, or other nominee—you must obtain a proxy issued in your name from such broker, bank or other nominee.

You can vote your shares by completing and returning the proxy card, or, if you are a non-registered/beneficial holder, by following the instructions set forth in the enclosed voting instruction form.A returned signed proxy card or voting instruction form without any indication of how shares should be voted will be voted FOR the election of directors and FOR the ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2011.

Our corporate by-laws define a quorum as two persons present in person, each being a shareholder entitled to vote or a duly appointed proxy for an absent shareholder so entitled and together holding or representing by proxy not less than 5% of the outstanding shares of the Company entitled to vote at the Annual Meeting. Our by-laws do not allow cumulative voting for directors. The nominees who receive the most votes will be elected. A simple majority of the votes cast is required to ratify the selection of Ernst & Young LLP as our independent registered public accounting firm.

Table of Contents

QUESTIONS AND ANSWERS ABOUT THE MEETING, PROXY MATERIALS AND VOTING

Why am I receiving this Proxy Statement and proxy card?

The Company is providing this Proxy Statement and proxy card directly to shareholders who are shareholders of record at the close of business on April 26, 2011 and are entitled to vote at the Annual Meeting. This Proxy Statement describes issues on which the Company would like you, as a shareholder, to vote. It provides information on these issues so that you can make an informed decision. You do not need to attend the Annual Meeting to vote your shares.

When you submit your executed proxy card, you appoint Lynn A. Peterson, President and Chief Executive Officer (or "CEO") of the Company and a member of the Board, and James P. Henderson, Secretary, Treasurer and Chief Financial Officer (or "CFO"), your representatives at the Annual Meeting. As your representatives, they will vote your shares at the Annual Meeting (or any adjournments or postponements) as you have instructed them on your proxy card. With proxy voting, your shares will be voted whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we recommend that you return your proxy card in advance of the Annual Meeting.

If an issue arises for voting at the Annual Meeting (or any adjournments or postponements) that is not described in this Proxy Statement, your representatives will vote your shares, under your proxy, at their discretion, subject to any limitations imposed by law.

Why does my name not appear as a shareholder of record?

Many, if not most, investors own their investment shares through a broker-dealer or other nominee. Broker-dealers frequently clear their transactions through other broker-dealers, and may hold the actual certificates for shares in the name of securities depositories, such as CEDE & Co. (operated by Depository Trust Company of New York City). In such a case, only the ultimate certificate holder appears on our records as a shareholder, even though that nominee may not have any economic interest in the shares that you actually own through your broker-dealer. You should contact your broker-dealer for more information about this process.

If your shares are held in an account with a brokerage firm, bank, dealer, or other similar organization, then you are the non-registered/beneficial owner of shares held in a "street name" and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares in your account by following the instructions on the enclosed voting instruction form. You are also invited to attend the Annual Meeting. However, since you are not the shareholder of record, you may not vote your shares in person at the Annual Meeting unless you request and obtain a valid proxy card from your broker, bank, or other nominee.

Who is making this solicitation and who will pay the related costs?

This solicitation is made on behalf of the management of the Company. No director has given management notice that he intends to oppose any action intended to be taken by management at the Annual Meeting. The Company will bear the cost of soliciting proxies. In an effort to have as large a representation at the Annual Meeting as possible, the Company's directors, officers and employees may solicit proxies by telephone or in person in certain circumstances. These individuals will receive no additional compensation for their services other than their regular salaries. Upon request, the Company will reimburse brokers, dealers, banks, voting trustees and their nominees who are holders of record of the Company's common stock on the record date for the reasonable expenses incurred for mailing copies of the proxy materials to the beneficial owners of such shares.

1

Table of Contents

When is the record date?

The Board has fixed Tuesday, April 26, 2011 as the record date for the Annual Meeting. Only holders of the Company's stock as of the close of business on that date will be entitled to vote at the Annual Meeting.

How many shares are outstanding and how many votes can be cast by all shareholders?

A total of 179,177,939 shares were outstanding as of April 26, 2011. Votes may be cast on each matter presented, consisting of one vote for each share of the Company's common stock outstanding as of the record date.

On what am I voting?

You are being asked to vote on the following:

- •

- the election of five directors for terms expiring in 2012;

- •

- an advisory vote on executive compensation;

- •

- an advisory vote on the frequency of conducting an advisory vote on executive compensation

- •

- the ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2011;

- •

- the approval of Amendment No. 2 to the Company's 2007 Stock Incentive Plan; and

- •

- any other business that may properly come before the Annual Meeting.

Each share of common stock is entitled to one vote. No cumulative rights are authorized, and dissenters' rights are not applicable to any of the matters being voted upon.

The Board recommends a voteFOR each of the nominees to the Board,FOR the advisory vote on executive compensation, for aTHREE YEAR frequency for conducting an advisory vote on executive compensation,FOR ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2011 andFOR the approval of amendment No. 2 to the Company's 2007 Stock Incentive Plan.

How do I vote?

If you are a registered holder, you may vote your shares by promptly completing, signing and returning the enclosed proxy card in the enclosed envelope or by attending the Annual Meeting in person and voting. Joint owners must each sign the proxy card. If you are a non-registered/beneficial holder, you will receive a voting instruction form from a broker-dealer or other nominee that you will use to instruct such persons how to vote your shares. If you receive a voting instruction form, you may vote those shares by mail, telephonically by calling the telephone number shown on the voting form or via the Internet at the web site shown on the voting instruction form. If you are a non-registered/beneficial holder, you are not considered to be a shareholder of record, and you will not be permitted to vote your shares in person at the Annual Meeting unless you have obtained a proxy for those shares from the person who holds your shares of record. Should you require additional information regarding the Annual Meeting, please contact James P. Henderson at (303) 592-8075.

Can shareholders vote in person at the Annual Meeting?

If you prefer, you may vote at the Annual Meeting. If you hold your shares through a brokerage account but do not have a physical share certificate, or the shares are registered in someone else's

2

Table of Contents

name, you must request a legal proxy from your stockbroker or the registered owner to vote at the Annual Meeting.

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, it likely means that you have multiple accounts with the transfer agent and/or with stockbrokers. Please vote all of the shares.

What if I share an address with another shareholder and we received only one copy of the proxy materials?

We have adopted a procedure that permits us and brokerage firms to send one copy of our 2010 Annual Report and this Proxy Statement and accompanying materials to multiple shareholders who share the same address, unless we receive contrary instructions from a shareholder.

In the event that a shareholder wishes to receive a separate copy of this proxy statement and accompanying materials for the Annual Meeting, the Company's 2010 Annual Report, or any future proxy materials or annual reports, the shareholder may promptly receive separate copies by written or oral request to James P. Henderson, Secretary of the Company, at (303) 592-8075, 1625 Broadway, Suite 250, Denver, Colorado 80202. Shareholders receiving multiple copies of these documents at the same address can request delivery of a single copy of these documents by contacting the Company in the same manner. Shareholders holding shares through a broker can request a single copy by contacting the broker. Please note that each shareholder should receive a separate proxy card to vote the shares they own.

May I revoke my proxy?

You may revoke your proxy and change your vote at any time up until the commencement of the Annual Meeting. You may do so by:

- •

- signing another proxy with a later date and delivering it to Computershare Investor Services, Inc., 100 University Avenue, Toronto, Ontario, Canada, M5J 2Y1 (according to the instructions on the proxy), not less than 48 hours (excluding Saturdays, Sundays and holidays) before the time for holding the Annual Meeting;

- •

- voting in person at the Annual Meeting;

- •

- signing and dating a written notice of revocation and delivering it to the head office of the Company, 1625 Broadway, Suite 250, Denver, Colorado, 80202, at any time up to and including the last business day preceding the day of the Annual Meeting or to the Chairman of the Annual Meeting on the day of the Annual Meeting; or

- •

- in any other manner provided by law.

How many votes do you need to hold the Annual Meeting?

To conduct the Annual Meeting, the Company must have a quorum, which means that two persons must be present in person, each being a shareholder entitled to vote or a duly appointed proxy for an absent shareholder so entitled and together holding or representing by proxy not less than 5% of the outstanding shares of the Company entitled to vote at the Annual Meeting.

How are abstentions and broker non-votes counted?

Abstentions with respect to a proposal are counted for purposes of establishing a quorum. If a quorum is present, abstentions will not be included in vote totals and will not affect the outcome of the vote of any proposal contained in this year's Proxy Statement. "Broker non-votes," which are shares

3

Table of Contents

held in "street name" by brokers or nominees, who indicate on their proxies that they do not have discretionary authority to vote such shares as to a particular matter, will be counted for purposes of establishing a quorum. If a quorum is present, broker non-votes will not be counted as votes in favor of such matter, and also will not be counted as shares voting on such matter. Accordingly, abstentions and broker non-votes will have no effect on the voting on a matter that requires the affirmative vote of a certain percentage of the shares voting on the matter.

A nominee is entitled to vote shares held for a beneficial owner on "routine" matters, such as the ratification of the selection of Ernst & Young LLP as our independent auditors, without instructions from the beneficial owner of those shares. However, absent instructions from the beneficial owner of such shares, a nominee is not entitled to vote shares held for a beneficial owner on certain "non-routine" matters. The election of our directors, the advisory vote on executive compensation, the advisory vote on the frequency of the vote on executive compensation and the approval of the Company's 2007 Stock Incentive Plan are treated as non-routine matters.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Annual Meeting. If you do not instruct your bank, broker, or other nominee how to vote in the election of directors, the advisory vote on executive compensation and the advisory vote on the frequency of the vote on executive compensation, then no votes will be cast on your behalf.

How many votes are needed to elect directors?

The nominees for election as directors at the 2011 Annual Meeting will be elected by a majority of the votes cast at the Annual Meeting. A properly executed proxy card or voting instruction form marked "Withheld" with respect to the election of directors will not be voted and will not count for or against any of the nominees.

How many votes are needed to approve the advisory vote on executive compensation and the advisory vote on the frequency of the vote on executive compensation?

Approval of the 2010 compensation of our Named Executive Officers requires the affirmative vote of a majority of the votes cast at the Annual Meeting.

Approval of a voting frequency requires the affirmative vote of a majority of the votes cast at the Annual Meeting. However, because this vote is advisory and non-binding, if none of the frequency options receive a majority of the votes, the option receiving the greatest number of votes will be considered the frequency recommended by the Company's shareholders.

While we intend to carefully consider the voting results of these proposals, the final votes are advisory in nature and therefore not binding on us, our Board of Directors or the Compensation Committee. Our Board of Directors and Compensation Committee value the opinions of all of our shareholders and will consider the outcome of this vote when making future decisions on executive compensation and the frequency with which we will hold an advisory vote on executive compensation.

How many votes are needed to ratify the selection of Ernst & Young LLP as the Company's independent registered public accounting firm?

The selection of Ernst & Young LLP as our independent registered public accounting firm will be ratified by a majority of the votes cast at the Annual Meeting.

How many votes are needed to approve the amendments to the 2007 Stock Incentive Plan?

Approval of the amendments to the 2007 Stock Incentive Plan requires affirmative vote of a majority of the votes cast at the Annual Meeting.

4

Table of Contents

Will my shares be voted if I do not sign and return my Proxy Card?

If your shares are registered in your name, and you do not sign and return your proxy card, your shares will not be voted at the Annual Meeting. If your shares are held through a brokerage account, your brokerage firm, under certain circumstances, may vote your shares.

How are votes counted?

Your shares will be voted as you indicate. If you simply submit your executed proxy card or voting instruction form with no further instructions, your shares will be voted:

- •

- FOR each director nominee for terms expiring in 2012;

- •

- FOR the advisory vote on executive compensation;

- •

- THREE YEAR frequency for conducting the advisory vote on executive compensation;

- •

- FOR ratification of the selection of Ernst & Young LLP as the Company's independent registered public accounting firm for the fiscal year ending December 31, 2011; and

- •

- FOR the approval of Amendment No. 2 to the 2007 Stock Incentive Plan.

Voting results will be tabulated and certified by a representative of Computershare Investor Services, Inc., scrutineer of the Annual Meeting.

Where can I find the voting results of the Annual Meeting?

The Company will publish the final results in a Current Report on Form 8-K, which will be filed with the Securities and Exchange Commission (the "SEC") and onhttp://www.sedar.com within four business days after the date of our Annual Meeting.

How can I obtain a copy of the Proxy Statement and the 2010 Annual Report on Form 10-K?

The Company's Proxy Statement and 2010 Annual Report on Form 10-K, including financial statements, are available through the SEC's website athttp://www.sec.gov, through the Company's website athttp://www.kodiakog.com and throughhttp://www.sedar.com.

At the written request of any shareholder who owns common stock on the record date, the Company will provide to such shareholder, without charge, a paper copy of the Company's 2010 Annual Report on Form 10-K, including the financial statements but not including exhibits. Upon your request and for a reasonable fee, the Company will provide copies of the exhibits. Requests for additional paper copies of the 2010 Annual Report on Form 10-K should be mailed to:

Kodiak Oil & Gas Corp.

1625 Broadway, Suite 250

Denver, Colorado 80202

Attention: James P. Henderson, Secretary

What materials accompany this Proxy Statement?

The following materials accompany this Proxy Statement:

- 1.

- the Company's Annual Report to Shareholders for the year ended December 31, 2010;

- 2.

- the Company's form of proxy card or voting instruction form;

- 3.

- a copy of the proposed amendments to the 2007 Stock Incentive Plan; and

- 4.

- a financial statement request form.

5

Table of Contents

PROPOSAL ONE:

ELECTION OF DIRECTORS

What is the current composition of the Board?

The Company's current bylaws require the Board to have at least three and no more than ten directors. The current Board is composed of five directors.

Is the Board divided into classes? How long is the term?

No, the Board is not divided into classes. All directors serve one-year terms until their successors are elected and qualified at the next Annual Meeting.

Who is standing for election this year?

The Compensation and Nominating Committee has nominated the following five current Board members for election at the 2011 Annual Meeting, to hold office until the 2012 Annual Meeting:

- •

- Lynn A. Peterson

- •

- James E. Catlin

- •

- Rodney D. Knutson

- •

- Herrick K. Lidstone, Jr.

- •

- William J. Krysiak

The following nominees qualify as independent under the applicable NYSE Amex LLC ("NYSE Amex") standards, SEC rules and the Multilateral Instrument 52-110 ("MI 52-110"): Rodney D. Knutson, Herrick K. Lidstone, Jr. and William J. Krysiak. Additional information concerning the above nominees, including their ages, positions and offices held with the Company, and terms of office as directors, is set forth below under the heading "Information Concerning the Board of Directors and Executive Officers."

What if a nominee is unable or unwilling to serve?

Should any one or more of the nominees become unable or unwilling to serve, which is not anticipated, the Board may designate substitute nominees, in which event only the following persons may vote: (1) registered shareholders present at the Annual Meeting and (2) proxyholders having a legal proxy and who are present at the Annual Meeting.

How are nominees elected?

Directors are elected by a majority of the votes present in person or represented by proxy and entitled to vote at the Annual Meeting.

May additional directors be appointed by the Board?

Between annual meetings, the directors possess authority under Yukon law to appoint additional directors of up to one-third of the current number of Board members, or two additional directors, subject to the overall limit of ten directors. The Board may also fill vacancies created during the year due to the death or resignation of a director.

The Board recommends a vote FOR each of the nominees.

6

Table of Contents

INFORMATION CONCERNING THE BOARD OF DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth certain information with respect to our current directors and executive officers. The term for each director expires at our next annual general meeting or at such time as his or her successor is appointed and qualified, upon ceasing to meet the qualifications for election as a director, upon death, upon removal by the shareholders or upon delivery or submission to the Company of the director's written resignation, unless the resignation specifies a later time of resignation. Each executive officer shall hold office until the earlier of the date his resignation becomes effective, the date his successor is appointed or he shall cease to be qualified for that office, or the date he is terminated by the Board. The ages of the directors and executive officers are shown as of December 31, 2010.

| | | | | | | | |

Name and Municipality of Residence | | Position and Office Held | | Director/Officer

Since | | Age | |

|---|

Executive Officers | | | | | | | | |

Lynn A. Peterson—Denver, Colorado | | Director, President & CEO | | November 2001 | | | 57 | |

James E. Catlin—Denver, Colorado | | Chairman, Executive V.P. & COO | | February 2001 | | | 64 | |

James P. Henderson—Denver, Colorado(1) | | CFO, Secretary & Treasurer | | March 2010 | | | 45 | |

Directors | | | | | | | | |

Rodney D. Knutson(2)(3)—Aspen, Colorado | | Director | | March 2001 | | | 69 | |

Herrick K. Lidstone, Jr.(2)(3)—Centennial, Colorado | | Director | | March 2006 | | | 61 | |

William J. Krysiak (2)(3)—Denver, Colorado | | Director | | September 2010 | | | 50 | |

- (1)

- Mr. Henderson rejoined the Company on April 1, 2010 after having formerly served as the Company's Chief Financial Officer from May 24, 2007 to May 10, 2008.

- (2)

- Member of the Compensation and Nominating Committee of the Board.

- (3)

- Member of the Audit Committee of the Board.

The following is a brief description of the employment background of the Company's current directors/director nominees and executive officers:

Lynn A. Peterson has served as a director of the Company since November 2001, and President and Chief Executive Officer since July 2002. Mr. Peterson has over 25 years of industry experience. Mr. Peterson was an owner of CP Resources, LLC, an independent oil and natural gas company from 1986 to 2001. Mr. Peterson served as Treasurer of Deca Energy from 1981 to 1986. Mr. Peterson was employed by Ernst and Whinney as a certified public accountant prior to this time. He received a Bachelor of Science in Accounting from the University of Northern Colorado in 1975. Mr. Peterson's business address is 1625 Broadway, Suite 250, Denver, Colorado 80202. The determination was made that Mr. Peterson should serve on our Board of Directors due to his extensive executive level experience working with oil and natural gas companies. In addition, we believe that it is of importance that the Board of Directors have the benefit of management's perspective, and in particular, that of the Chief Executive Officer.

James E. Catlin has served as a director of the Company since February 2001, Chairman since July 2002, Secretary from July 2002 to May 2008 and Chief Operating Officer since June 2006.Mr. Catlin has over 30 years of geologic experience, primarily in the Rocky Mountain Region. Mr. Catlin was an owner of CP Resources LLC, an independent oil and natural gas company from 1986 to 2001. Mr. Catlin was a founder and Vice-President of Deca Energy from 1980 to 1986 and worked as a district geologist for Petroleum Inc. and Fuelco prior to this time. He received a Bachelor of Arts and

7

Table of Contents

a Masters degree in Geology from the University of Northern Illinois in 1973. Mr. Catlin's business address is 1625 Broadway, Suite 250, Denver, Colorado 80202. The determination was made that Mr. Catlin should serve on our Board of Directors due to his extensive training and experience with respect to geology and executive level experience working with oil and natural gas companies.

James P. Henderson previously served as the Company's Chief Financial Officer from May 24, 2007 to May 10, 2008. He rejoined the Company on April 1, 2010 after two years as director of finance of Aspect Energy LLC, a Denver-based privately held energy company. Prior to May 2007, Mr. Henderson spent 17 years at Western Gas Resources and its successor, Anadarko Petroleum Corp., in its Denver office. During that time, he served as director, accounting services at Anadarko Petroleum Corp. and in various financial roles including director, financial planning and analysis at Western Gas Resources. Mr. Henderson holds a Bachelors degree in Accounting from Texas Tech University and a Master of Business Administration degree from Regis University in Denver. Mr. Henderson's business address is 1625 Broadway, Suite 250, Denver, Colorado 80202.

Rodney D. Knutson has served as a director of the Company since March 2001. Currently, he is a self-employed attorney in Aspen, Colorado. Prior to this, he had over thirty years of private law practice in Denver, Colorado working with oil, gas and mining companies. Mr. Knutson has a Bachelor of Electrical Engineering (1965) from the University of Minnesota and a Juris Doctor (1972) from the University of Denver. Mr. Knutson is a former president of the Rocky Mountain Mineral Law Foundation. Mr. Knutson's business address is 1625 Broadway, Suite 250, Denver, Colorado 80202. The determination was made that Mr. Knutson should serve on our Board of Directors due to his extensive experience working with oil, gas and mining companies.

Herrick K. Lidstone, Jr. has served as a director of the Company since March 2006. Mr. Lidstone is an attorney at law in Greenwood Village, Colorado, and is currently with Burns, Figa & Will, P.C., where he practices in corporate and securities law, dealing frequently with mergers and acquisitions, finance transactions, and private and public securities offerings. Mr. Lidstone serves on the Securities Board for the Department of Regulatory Agencies in Colorado. He has been Adjunct Professor of Law at the University of Colorado and the University of Denver and has taught continuing education courses for the National Business Institute, CLE in Colorado, Inc., and other CLE providers. He has numerous legal publications and presentations to his credit. Mr. Lidstone received a Bachelor of Arts from Cornell University in 1971 and a Juris Doctor from the University of Colorado School of Law in 1978. Mr. Lidstone's business address is Suite 1000, 6400 South Fiddler's Green Circle, Greenwood Village, Colorado 80111. The determination was made that Mr. Lidstone should serve on our Board of Directors due to his extensive business and securities law experience and his experience in representing companies involved in natural resource exploration, development and production.

Mr. Krysiak has served as a director of the Company since September 2010. He is currently the CFO of Southwest Generation Operating Company, LLC, an independent power producer. Prior to his current position, from September 2007 to July 2009, he was the CFO of Aspect Holdings LLC, a Denver-based energy company. Prior to Aspect, he served in various financial-oriented management and officer positions at Western Gas Resources, Inc. from 1985 to 2006, including Chief Financial Officer. Subsequent to the sale of Western Gas Resources to Anadarko, Mr. Krysiak assisted Anadarko in a transition period from August 2006 through June 2007 as the Director of Financial Projects. He earned his BS in business administration with a major in accounting from Colorado State University in 1982 and is a Certified Public Accountant. Mr. Krysiak's business address is 1625 Broadway, Suite 250, Denver, Colorado 80202. The determination was made that Mr. Krysiak should serve on our Board of Directors due to his substantial financial reporting, compliance, capital markets and oil and gas transactional experience gained by way of his 17 years of experience as a corporate officer responsible for accounting and financial matters and his strong public company experience in the oil and gas industry.

8

Table of Contents

Family and Certain Other Relationships

There are no family relationships among the members of the Board or the members of senior management of our company. There are no arrangements or understanding with major shareholders, customers, suppliers or others, pursuant to which any member of the Board or member of senior management was selected.

Interests of Insiders and Material Transactions

During the 2010 fiscal year, none of the directors or officers were indebted to the Company or were a party to a material transaction with the Company.

CORPORATE GOVERNANCE

Structure of the Board of Directors

The Company's current by-laws require the Board to have at least three and no more than ten directors. The current Board is comprised of the following five directors:

- •

- Lynn A. Peterson

- •

- James E. Catlin

- •

- Rodney D. Knutson

- •

- Herrick K. Lidstone, Jr.

- •

- William J. Krysiak

Meetings of the Board and Board Member Attendance of Annual Meeting

During the fiscal year ended December 31, 2010, the Board held 12 meetings. None of the incumbent directors attended fewer than 75% of the aggregate of the total number of Board meetings and meetings of the committees on which he serves.

Board members are not required to attend the annual general meeting. All of the board members serving as such at the time attended the 2010 Annual Meeting of Shareholders.

Shareholder Communications to the Board

Shareholders who are interested in communicating directly with members of the Board, or the Board as a group, may do so by writing directly to the individual Board member c/o Secretary, James P. Henderson, Kodiak Oil & Gas Corp., 1625 Broadway, Suite 250, Denver, Colorado 80202. The Company's Secretary will forward communications directly to the appropriate Board member. If the correspondence is not addressed to the particular member, the communication will be forwarded to a Board member to bring to the attention of the Board. The Company's Secretary will review all communications before forwarding them to the appropriate Board member. The Board has requested that items unrelated to the duties and responsibilities of the Board, such as junk mail and mass mailings, business solicitations, advertisements and other commercial communications, surveys and questionnaires, and resumes or other job inquiries, not be forwarded.

Board Committees

Audit Committee and Audit Committee Financial Expert

The Audit Committee was established by the Board in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), to oversee the Company's corporate accounting and financial reporting processes and audits of its financial statements. The

9

Table of Contents

members of our Audit Committee are Messrs. Krysiak, Lidstone and Knutson. Mr. Krysiak is chairman of the Audit Committee. All committee members qualify as independent directors under the applicable NYSE Amex standards, SEC rules and MI 52-110. The Board has determined that all current members of the Audit Committee are "financially literate" as interpreted by the Board in its business judgment. Mr. Krysiak further qualifies as an audit committee financial expert, as defined in the applicable rules of the SEC. The Audit Committee held five meetings during fiscal year 2010.

The Audit Committee meets periodically with our independent accountants and management to review the scope and results of the annual audit and to review our financial statements and related reporting matters prior to the submission of the financial statements to the Board. In addition, the committee meets with the independent auditors at least on a quarterly basis to review and discuss the annual audit or quarterly review of our financial statements.

We have established an Audit Committee Charter that deals with the establishment of the Audit Committee and sets out its duties and responsibilities. The Audit Committee reviews and reassesses the adequacy of the Audit Committee Charter on an annual basis. The Audit Committee Charter is available on our Company website athttp://www.kodiakog.com. Further information on our Audit Committee and related matters, including the Report of our Board on Audited Financial Statements, is located below under the section "Proposal Four—Ratification of the Appointment of Ernst & Young LLP."

Compensation and Nominating Committee

Our Board has established a Compensation and Nominating Committee, the current members of which are Messrs. Knutson, Lidstone and Krysiak. Mr. Lidstone is chairman of the Committee. All current committee members qualify as independent directors under the applicable NYSE Amex standards, SEC rules and MI 52-110. The Committee held four meetings during the fiscal year 2010. The Committee's Charter is available on our website athttp://www.kodiakog.com. The Committee, acting pursuant to its written charter, serves the following purposes: (i) to assist the Board in fulfilling its oversight responsibilities relating to officer and director compensation, succession planning for senior management, development and retention of senior management, and such other duties as directed by the Board, (ii) to advise the Board with respect to Board composition, procedures and committees, (iii) to lead the Board in its annual review of the Board's performance and (iv) to identify and recommend to the Board individuals qualified to be nominated for election to the Board and to be members and Chairpersons of the Board committees.

Director Nomination Policies

The Committee is responsible for reviewing any shareholder proposals to nominate Board candidates. Shareholders may submit names of persons to be considered for nomination, and the Committee will consider such persons in the same way it evaluates other individuals for nomination as a new director. For the Company's policies regarding shareholder requests for nominations, see the section entitled "Shareholder Proposals" in this Proxy Statement. None of the 2011 Committee nominees were nominated by a shareholder.

Annually, the Committee follows a process designed to consider the re-election of existing directors and to seek individuals qualified to become new board members for recommendation to the Board to fill any vacancies. In assessing the qualification of a candidate, the Committee generally adheres to the following guidelines:

- •

- the Committee observes any SEC or applicable stock exchange rules on independence;

- •

- no director shall be a director, consultant or employee of or to any competitor of the Company;

10

Table of Contents

- •

- the Committee shall consider the candidates' various other obligations and time commitments and their ability to attend meetings in person; and

- •

- to avoid potential conflicts of interest, interlocking directorships will not be allowed.

The Committee believes that having directors with relevant experience in business and industry, finance and other areas, and, in particular, experience with regard to exploration and production of natural gas and oil, financial reporting, risk management and business strategy, is beneficial to the Board as a whole. Directors with such backgrounds can provide a useful perspective on significant risks and competitive advantages and an understanding of the challenges the Company faces. The Committee monitors the mix of skills and experience of directors and Committee members to assess whether the Board has the appropriate tools to perform its oversight function effectively. With respect to nominating existing directors, the Committee reviews relevant information available to it and assesses their continued ability and willingness to serve as a director. The Committee also assesses each person's contribution in light of the mix of skills and experience the Committee deems appropriate for the Board.

With respect to considering nominations of new directors, including nominations by shareholders, the Committee conducts a thorough search to identify candidates based upon criteria the Committee deems appropriate and considers the mix of skills and experience necessary to complement existing Board members. The Committee reviews selected candidates and makes a recommendation to the Board. The Committee may also seek input from other Board members or senior management when identifying candidates. The Committee has not adopted a formal policy with regard to the consideration of diversity in identifying director nominees.

Compensation Policies

The Compensation and Nominating Committee, acting pursuant to its written charter, a copy of which is available on our website athttp://www.kodiakog.com, is responsible for setting executive compensation levels and executive and overall compensation policies. It is also responsible for reviewing and approving any executive benefit plans, making awards under the Company's equity plans and performing such other duties delegated to it by the Board. The Compensation Committee does not have express authority to delegate its authority to any subcommittee or other group. See "Compensation Discussion and Analysis" for additional discussion regarding the process and procedures of the Committee with respect to compensation.

Board Leadership Structure

The Board does not have a policy regarding the separation of the roles of Chief Executive Officer and Chairman of the Board, as the Board believes it is in the best interests of the Company to make that determination based on the position and direction of the Company and the membership of the Board. Currently, the position of Chief Executive Officer and Chairman are separate, with James Catlin, the Company's Executive Vice President and Chief Operating Officer, serving as the Chairman of the Board and Lynn Peterson serving at the Chief Executive Officer.

The Board believes that separating these roles allows the Chief Executive Office the opportunity to focus on running the Company's business and managing the day-to-day challenges, while providing the Board the opportunity to benefit from the Chairman's ability to support the other members of the Board and work closely with the other members of the executive team.

Board's Role in Risk Oversight

While Company management is charged with the day-to-day management of risks the Company faces, the Audit Committee, pursuant to its charter, is responsible for oversight of risk management.

11

Table of Contents

Specifically, the Audit Committee reviews and assesses the adequacy of the Company's risk management policies and procedures with regard to identification of the Company's principal risks, both financial and non-financial, and reviews updates on these risks from the Chief Executive Officer. The Audit Committee also reviews and assesses the adequacy of the implementation of appropriate systems to mitigate and manage the principal risks. In addition, the Audit Committee is charged with the responsibility of evaluating related party transactions and conflicts of interest. The Audit Committee reports to the Board of Directors regarding the foregoing matters, and the Board of Directors ultimately approves any changes in corporate policies, including those pertaining to risk management.

The Board leadership structure promotes effective oversight of the company's risk management for the same reasons that the structure is most effective for the Company in general, that is, by providing the Chief Executive Officer and other members of senior management with the responsibility to assess and manage the Company's day-to-day risk exposure and providing the Board, and specifically the Audit Committee of the Board, with the responsibility to oversee these efforts of management.

Risk Assessment Regarding Compensation Policies and Practices

The Compensation Committee recently conducted an assessment of the Company's compensation policies and practices, including its executive compensation programs, to evaluate the potential risks associated with these policies and practices. The Compensation Committee concluded that the Company's compensation programs are designed with an appropriate balance of risk and reward and do not encourage excessive or unnecessary risk-taking behavior. As a result, the Company does not believe that risks relating to its compensation policies and practices for its employees are reasonably likely to have a material adverse effect on the Company.

In conducting its review, the Compensation Committee noted the following risk-limiting characteristics of the Company's compensation policies and practices:

- •

- the Company's senior executive officers receive a fixed salary each year;

- •

- awards are made based on a review of a variety of indicators of performance, thus diversifying the risk associated with any single indicator of performance; and

- •

- members of the Compensation Committee, in their discretion, approve all final decisions concerning management compensation after reviewing executive and corporate performance and competitive benchmarking data.

DIRECTOR COMPENSATION

Our Compensation and Nominating Committee charter provides that the Compensation and Nominating Committee is to recommend to the Board of Directors matters related to director compensation. The director compensation package for non-employee directors consists of annual cash compensation and an award of stock options exercisable to purchase shares of common stock of the Company. Directors who also chair a committee will receive additional cash compensation for their service as a chairperson. No employee of the Company is entitled to compensation for service as a director. For the 2010 fiscal year, Herrick Lidstone, Jr. received additional cash compensation for his service as chairperson of the Compensation and Nominating Committee, and Don McDonald and William Krysiak each received additional cash compensation for their service as chairperson of the Audit Committee for the respective period each served in such role. No additional compensation was paid to any director for serving on any committee of the Board of Directors or for attending meetings.

12

Table of Contents

The following table provides information related to the compensation of our non-employee directors during fiscal year 2010.

| | | | | | | | | | |

Name | | Fees Earned

or Paid in

Cash

($)(1) | | Option

Awards

($)(2)(3) | | Total

$ | |

|---|

Rodney D. Knutson | | | 30,000 | | | 157,355 | | | 187,355 | |

William J. Krysiak(4) | | | 9,000 | | | 190,946 | | | 199,946 | |

Herrick K. Lidstone | | | 36,000 | | | 157,355 | | | 193,355 | |

Don A. McDonald(5) | | | 21,913 | | | 39,339 | | | 61,252 | |

- (1)

- For 2010, each director received an aggregate of $30,000 in cash compensation, and the chairman of each committee received an additional aggregate amount of $6,000. The cash compensation paid to Messrs. Krysiak and McDonald was prorated based on each of their respect service periods.

- (2)

- The amounts shown in this column represent stock options subject to our 2007 Stock Incentive Plan and reflect the aggregate grant date fair value of equity awards granted within the fiscal year in accordance with the Financial Accounting Standards Board ("FASB") Accounting Standards Codification Topic 718 for stock-based compensation. These amounts do not correspond to the actual cash value that will be recognized by the directors when received. Assumptions used in the calculation of this amount for fiscal years ended December 31, 2008, 2009 and 2010 are included in footnote 6 to the Company's audited financial statements for the fiscal year ended December 31, 2010, included in the Company's Annual Report on Form 10-K.

- (3)

- In 2010, the Company granted to each of Messrs. Knutson, Lidstone and McDonald (i) stock options to acquire 33,000 shares at an exercise price of $3.50, having a grant date of April 1, 2010, and (ii) stock options to acquire 42,000 at an exercise price of $3.48, having a grant date of June 3, 2010. On September 22, 2010, the Company granted to Mr. Krysiak 100,000 stock options at an exercise price of $3.13. As of December 31, 2010, each director had the following number of stock options outstanding: Mr. Knutson: 275,000; Mr. Lidstone 175,000; Mr. Krysiak: 100,000; and Mr. McDonald: 0.

- (4)

- Effective September 22, 2010, the Board appointed William J. Krysiak to the positions of director, member of the Compensation and Nominating Committee and the Audit Committee and Chairman of the Audit Committee.

- (5)

- Effective August 9, 2010, Don A. McDonald resigned from the Board. Upon his resignation, all of his unvested stock options terminated immediately and his vested but unexercised options remained exercisable for a period of three months after the date of resignation. As a result of the resignation, 56,250 of Mr. McDonald's unvested and unexercised options terminated.

13

Table of Contents

OTHER GOVERNANCE MATTERS

Code of Business Conduct and Ethics

The Board has adopted a Code of Business Conduct and Ethics, the full text of which can be found on our website athttp://www.kodiakog.com.

Compensation Committee Interlocks and Insider Participation

There were no compensation committee or board interlocks among the members of our Board.

Legal Proceedings

Neither we nor any of our property are currently subject to any material legal proceedings or other regulatory proceedings. We do not currently know of any legal proceedings against us involving our directors, executive officers, or shareholders of more than 5% of our voting stock.

Mandate of the Board

The Board believes that the principal objective of the Company is to generate economic returns with the goal of maximizing shareholder value. This will be accomplished by the effective discharge of the Board's responsibilities concerning strategic planning, appointment and oversight of management, succession planning, risk identification and management, environmental oversight and overseeing financial and corporate issues. The majority of the members of the Board are independent directors, and the primary responsibility for certain matters is delegated to committees composed entirely of independent directors.

While the Board is responsible for management of the business of the Company by law, this is generally carried out by proxy through the Company's chief executive officer, who is appointed by the Board and charged with the day-to-day leadership and management of the Company. The Board approves the goals of the business, the objectives and policies within which it is managed, and then steps back and evaluates management's performance.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires the Company's officers and directors and persons who own more than 10% of a registered class of the Company's equity securities ("10% Shareholders"), to file reports of ownership and changes in ownership on Forms 3, 4 and 5 with the SEC. Officers, directors and 10% Shareholders are required to furnish the Company with copies of all Forms 3, 4 and 5 they file.

Based solely on a review of the reports received by the SEC, furnished to the Company, or written representations from reporting persons that all reportable transactions were reported, the Company believes that, during the fiscal year ended December 31, 2010, the Company's officers, directors and greater than ten percent owners timely filed all reports they were required to file under Section 16(a), except that four reports, covering a total of five transactions were filed late. Messrs. Knutson, Lidstone and McDonald each filed one late report, with each report consisting of one transaction relating to an exempt stock option grant, and Mr. Catlin filed one late report consisting of two transactions related to an exempt option exercise and related sale.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

In accordance with our Audit Committee Charter, our Audit Committee is responsible for reviewing, approving and overseeing all related party transactions. Our Code of Business Conduct and Ethics sets forth our written policy regarding related party transactions. Specifically, our Code of

14

Table of Contents

Business Conduct and Ethics provides that our directors, officers and employees should not be involved in any activity that creates or gives the appearance of a conflict of interest between their personal interests and the interests of the Company. In particular, our Code of Business Conduct states that, without the specific permission of our Board of Directors (including contracts approved by our Board of Directors), no director, officer or employee, or a member of his or her family shall:

- •

- be a consultant to, or a director, officer or employee of, or otherwise operate an outside business that:

- •

- is in competition with our current or potential business goals and objectives;

- •

- supplies products or services to the Company; or

- •

- has any financial interest, including significant stock ownership, in any entity with which we do business that might create or give the appearance of a conflict of interest;

- •

- seek or accept any personal loan or services from any entity with which we do business, except from financial institutions or service providers offering similar loans or services to third parties under similar terms in the ordinary course of their respective businesses;

- •

- be a consultant to, or a director, officer or employee of, or otherwise operate, an outside business if the demands of the outside business would interfere with the director's, officer's or employee's responsibilities to us;

- •

- accept any personal loan or guarantee of obligations from the Company, except to the extent such arrangements are legally permissible; or

- •

- conduct business on behalf of the Company with immediate family members, which include spouses, children, parents, siblings and persons sharing the same home whether or not legal relatives.

Directors, officers, and employees must immediately notify the Chair of our Audit Committee of the existence of any actual or potential conflict of interest. The circumstances will be reviewed for a decision on whether a conflict of interest is present, and if so, what course of action is to be taken. The Company had no reportable related party transactions during 2010.

Independence of Directors

The Board of Directors has determined that the following directors qualify as independent under the applicable NYSE Amex standards, SEC rules and the Multilateral Instrument 52-110 ("MI 52-110"): Rodney D. Knutson, Herrick K. Lidstone, Jr. and William J. Krysiak.

15

Table of Contents

COMPENSATION DISCUSSION AND ANALYSIS

The following contains a description of our 2010 compensation programs and objectives with respect to our Named Executive Officers identified in the Summary Compensation table (the "NEOs").

Executive Summary

The compensation package for our NEOs is composed of the following elements:

| | | | | | |

Component | | Short or

Long Term | | At Risk

or Not | | Summary |

|---|

Base Pay | | Short term | | Not at risk | | Fixed pay that is not subject to financial performance risk. |

Annual Bonus Incentive Program | | Short term | | At risk | | Annual award that is based on corporate performance. |

Performance Equity-Based Awards | | Long term | | At risk | | For 2010, the NEOs were awarded stock options, the vesting of which was tied to corporate performance objectives. For 2011, the NEOs were awarded a tandem grant of restricted stock units and performance awards, the vesting of which was tied to corporate performance objectives and additional time-based vesting requirements. |

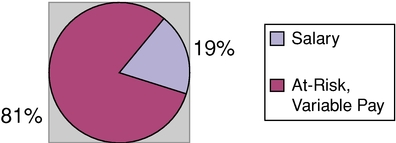

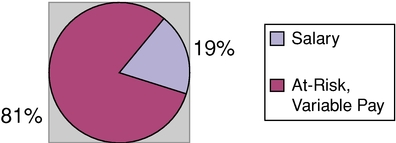

The Company's executive compensation program is designed to align the interests of the NEOs with shareholders by tying a significant portion of the NEOs' compensation to the Company's performance, as measured by a variety of factors during the applicable fiscal year. Under the program, the portion of compensation guaranteed to the NEOs at the beginning of any fiscal year represents only a fraction of the total potential compensation. On average, only 19% of the value of the NEOs' aggregate 2010 target annual compensation was assured in the form of salary, whereas 81% was linked directly to the Company's performance in the form of bonus and equity awards. The following illustrates the foregoing pay mix:

Pay Mix - NEOs

In making decisions on the payout and vesting of the performance-based compensation for 2010, the Compensation Committee considered the Company's financial and operational performance in the face of ongoing challenges of a recovering US and global economy. In the face of these conditions, the Compensation Committee noted that the Company nonetheless experienced an approximate 200% growth in its stock price per share, closed two significant equity offerings and a credit facility during 2010 and completed a significant property acquisition having a value of approximately $110 million. In

16

Table of Contents

addition, the Company achieved record financial results in the 2010 fiscal year. The chart below summarizes the key Company financial and operational results for fiscal 2010 compared to fiscal 2009.

| | | | | | | | | | |

| | Fiscal 2010 | | Fiscal 2009 | | Change | |

|---|

| | ($ in thousands, except

per share figure)

| | ($ in thousands, except

per share figure)

| |

| |

|---|

Net Worth | | $ | 299,047 | | | 69,928 | | | 327 | % |

Oil and Gas Sales | | $ | 30,212 | | | 10,652 | | | 183 | % |

Adjusted EBITDA(1) | | $ | 16,100 | | | 4,000 | | | 303 | % |

Sales Volume (BOE) | | | 460,000 | | | 219,000 | | | 110 | % |

Per Share Price as of Year-End | | $ | 6.60 | | $ | 2.22 | | | 197 | % |

- (1)

- "Adjusted EBITDA" is a non-GAAP financial measure. For further information regarding this measure, please see our earnings release furnished on a Form 8-K filed on March 3, 2011.

In light of these circumstances, and the fact that the Company far exceeded four of the five defined performance goals (discussed below), the Compensation Committee viewed the Company's fiscal 2010 results to be outstanding when considered against the backdrop of the challenging economic environment in which they were accomplished. Taking into account the foregoing factors, the following determinations were made with respect to the at-risk portion of the NEOs' 2010 compensation:

- •

- Annual Cash Incentive Program: Our CEO received a 131% payout under our annual incentive bonus program and our COO and CFO received 144% and 155% payouts respectively. Our CFO's salary used in this calculation was based on his partial year service. If his annualized 2010 salary was used instead, the payout is 116%.

- •

- Equity-Based Awards: 89.55% of the NEOs' target number of performance-based stock options vested that were subject to the 2010 performance criteria.

How Executive Compensation is Determined and the Role of the Compensation Committee, Management and Consultants; Benchmarking

The compensation review process for the 2010 NEO compensation took place during the first quarter of the fiscal year with a presentation by the Chief Executive Officer to the Compensation Committee of current compensation philosophies and programs. The role of the Chief Executive Officer is to provide the Compensation Committee with perspectives on the business context to assist the Compensation Committee in making its decisions. The Chief Executive Officer also discusses with the Compensation Committee the compensation of the other NEOs. After such discussions, the Chief Executive Officer generally does not participate further in Compensation Committee deliberations or determinations regarding NEO compensation. The Compensation Committee makes all final decisions concerning NEO compensation. Compensation decisions are generally based upon an analysis of competitive benchmarking data and the performance of the Company overall and, at the sole discretion of the Compensation Committee, may also be based upon other considerations, such as the individual's performance and the individual's influence on the performance of the Company.

As part of its evaluation of 2010 NEO compensation, the Compensation Committee utilized a report developed by the compensation consultant Arlen L. Brammer, P.C. ("Brammer") in 2009. The Compensation Committee utilized the Brammer report to determine whether salary compensation previously established in the employment agreements for the NEOs was in line with compensation paid at other similar companies, and to determine the appropriate bonus and equity award potential. When developing the 2009 Brammer report, the Compensation Committee had instructed Brammer to conduct a review utilizing peer group data and to make recommendations with respect to compensation levels. The peer group utilized by Brammer based on input from the Compensation Committee

17

Table of Contents

consisted of oil and gas exploration and production companies with a total asset size of between $150 million and $250 million and was comprised of the following companies:

| | | | |

| | Abraxas Petroleum Corp.

Callon Petroleum Co.

Delta Petroleum Corporation

Double Eagle Petroleum Co.

Georesourses, Inc.

Gulfport Energy, Co.

Isramco Inc.

NGas Resources Inc.

PrimeEnergy Corporation

Vanguard Natural Resources, LLC

Venoco, Inc. | | |

Compensation Objectives

The compensation package for our NEOs is specifically designed to achieve three compensation objectives:

- •

- Attracting and retaining key talent;

- •

- Aligning the interests of our executive officers with the interests of the Company's shareholders; and

- •

- Providing our executives with reasonable security to motivate them to continue employment with the Company.

The compensation package achieves the goal of attracting and retaining key talent in a highly competitive oil and gas environment through a total compensation package that pays at market levels, as described in more detail below. The compensation package achieves the goal of aligning the interests of management and the Company's shareholders by linking the payout of executive officer bonus incentive awards, and the vesting of equity-based awards, to the successful performance of the Company, and in turn, to the creation of shareholder value. The compensation package achieves the goal of providing our executives with reasonable security through the provision of termination and change of control benefits, which promotes the executives' focus on the Company's business and enhancing shareholder value without undue concern about loss of their job.

2010 Compensation—The Year in Review

Following is a discussion of the 2010 compensation decisions with respect to Mr. Peterson, our CEO, Mr. Henderson, our CFO, and Mr. Catlin, our COO. Although Mr. Doss served as our CFO for a short time at the beginning of 2010, the Compensation Committee did not evaluate or re-determine his 2010 compensation, as he would cease to be an officer in early 2010. While Mr. Doss' salary remained the same in 2010 after his transition to the controller position, the CEO established Mr. Doss' other compensation elements based upon Mr. Doss' new position as controller, a non-officer position. The CEO determined Mr. Doss' other pay elements based upon internal equity considerations to ensure that employees at comparable rankings within the organization are comparably compensated.

Base Salary

With respect to the 2010 NEO base salaries, the Compensation Committee had concluded that the then-current salary levels of the CEO and COO were at or near the recommended mid-point of the peer group data. As a result, the Compensation Committee did not alter the base salary of the CEO or COO from the 2009 levels. However, a proportionate downward adjustment was made to Mr. Catlin's

18

Table of Contents

salary (from $350,000 in 2009 to $240,000 for 2010) to reflect Mr. Catlin's intention to reduce his time commitment to the Company from full-time to substantially full-time.

Upon hiring James Henderson as the Company's CFO, Mr. Henderson's compensation was increased relative to the salary of his predecessor, Mr. Doss, due to Mr. Henderson's greater experience in the role of CFO and the anticipated increase in the scope of responsibilities relative to that of Mr. Doss. Additionally, the increase was determined based on the Brammer information and the experience of the members of the Compensation Committee. As reflected in the Brammer report, even with the increased salary payable to Mr. Henderson as compared to Mr. Doss, the Compensation Committee observed that the base salary paid to the CFO was less than the mid-point salary in the Company's 2009 peer group. The Compensation Committee determined such initial compensation to be appropriate due to Mr. Henderson's new appointment to this role, but determined to reevaluate, and did reevaluate, his compensation subsequent to year-end.

Annual Incentive Bonuses

The Compensation Committee determined that the NEO annual incentive bonus eligibility would be 100% of the respective NEO's base salary, based upon the Brammer report's conclusion that such amounts were appropriate. The Compensation Committee did not establish any specific performance criteria in advance of the performance period for purposes of determining the payout of the 2010 annual incentive bonuses. Rather, after year-end, the Compensation Committee retrospectively evaluated the overall 2010 performance of the Company to determine whether and to what extent payout of annual incentive bonuses was warranted. Such review resulted in a determination that the officers would receive a bonus in an amount that exceeded the originally determined bonus eligibility of 100% of salary. Specifically, our CEO received a 131% payout under our annual incentive bonus program and our COO and CFO received 144% and 155% payouts, respectively, based upon the following performance factors and the exemplary performance of the Company overall:

- •

- the Company's net worth more than tripled from December 31, 2009 to December 31, 2010;

- •

- the Company achieved record annual oil and gas sales of over $30 million, reflecting an annual increase of over 175%;

- •

- the Company achieved record annual adjusted EBITDA (a non-GAAP measure) of $16.1 million, reflecting an annual increase of approximately 300%; and

- •

- each of the officers devoted a significant amount of time to the Company in achieving these successes.

Such bonuses were paid in part in shares of common stock and in part in cash.

Long-Term Equity-Based Incentive Awards

For 2010, the Compensation Committee awarded the annual NEO equity-based awards in the form of stock options. The specific number of stock options granted to each NEO in 2010 was determined based upon the historic option grants to the NEOs, the Brammer report and the Compensation Committee's determination that such amounts were appropriate in the circumstances. As in prior years, the stock options were granted during the first quarter of the performance period. The vesting of the stock options is linked to objective performance measures that were established by the Compensation Committee during the first quarter of the performance period.

19

Table of Contents

After the conclusion of the performance period, the Compensation Committee determined the extent to which the performance targets were satisfied. The vesting of such stock option grants was subject to the following corporate performance-based measurements:

| | | | | | | | | | |

| | Column A | | Column B | | Column C | |

|---|

Performance Category For Fiscal 2010 | | Goal(1)(2) | | Minimum(2) | | Percentage of

options to vest if goal

is achieved(3) | |

|---|

Net Worth | | $ | 83,914,058 | | $ | 69,928,382 | | | 7.0 | % |

Income (Loss) | | $ | 1,000,000 | | $ | (2,563,298 | ) | | 10.5 | % |

Adjusted EBITDA(4) | | $ | 4,815,230 | | $ | 4,012,692 | | | 10.5 | % |

Production—BOE (Bbl) | | | 263,161 | | | 219,300 | | | 21.0 | % |

Reserves—BOE proved developed and undeveloped (MBbl) | | | 5,349.8 | | | 4,458.2 | | | 21.0 | % |

Retained Compensation Committee Discretion | | | — | | | — | | | 30.0 | % |

- (1)

- If the Compensation Committee were to determine that the performance goal for the respective performance category was achieved, the percentage of stock options set forth in column C would vest for the respective performance category.

- (2)