Filed Pursuant to Rule 424(b)(3)

Registration No. 333-138030

Prospectus

9,937,568 SHARES OF COMMON STOCK OFFERED BY THE SELLING SHAREHOLDERS

This prospectus relates to the public offer and sale by some of the shareholders of Kodiak Oil & Gas Corp., a Yukon corporation (“KOG”) of 9,937,568 common shares. The selling shareholders may, from time to time, sell any or all of their common shares on any stock exchange, market or trading facility on which the shares are traded or in privately negotiated transactions at fixed prices that may be changed, at market prices prevailing at the time of sale or at negotiated prices.

We will not receive any proceeds from the sale of these shares.

Our common shares are quoted on the AMEX under the symbol “KOG”. On December 4, 2006, the last reported closing price for our common shares as reported by the AMEX was $4.40 per share.

An investment in the common shares offered for sale under this prospectus involves a high degree of risk. See “Risk Factors” beginning on page 7 of this prospectus.

Neither the United States Securities and Exchange Commission or the securities administrator

or similar regulatory authority of any other national, state, provincial or other jurisdiction,

has approved or disapproved of the common shares offered for sale under this prospectus

or the merits of that offering, or has determined that this prospectus is truthful or complete.

Any representation to the contrary is a criminal offense.

The date of this prospectus is December 8, 2006

Kodiak Oil and Gas Corp.

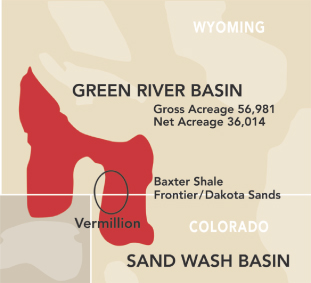

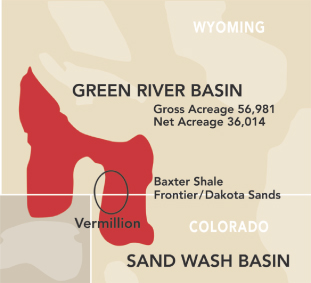

Green River Basin and Williston Basin

| | |

Green River Basin | |  |

| | | | | | | | | |

| Prospect Location | | 2006 Budgeted Costs | | September 30, 2006

Expenditures | | 2007 Budgeted Costs |

| Green River Basin | | | | | | | | | |

Vermillion Basin Shallow | | | 2,500,000 | | | 2,200,000 | | | – |

Vermillion Basin Deep | | | 10,500,000 | | | – | | | 33,750,000 |

Other Projects | | | 500,000 | | | – | | | 2,500,000 |

Acreage | | | 8,500,000 | | | 7,600,000 | | | 5,000,000 |

| Total Green River Basin | | $ | 22,000,000 | | $ | 9,800,000 | | $ | 41,250,000 |

| | |

Williston Basin | |  |

| | | | | | | | | |

| Prospect Location | | 2006 Budgeted Costs | | September 30, 2006

Expenditures | | 2007 Budgeted Costs |

| Williston Basin | | | | | | | | | |

Mission Canyon/Red River | | | 500,000 | | | 2,800,000 | | | 6,000,000 |

Bakken | | | 9,800,000 | | | 7,300,000 | | | 9,750,000 |

Acreage | | | 700,000 | | | 700,000 | | | 3,000,000 |

| Total Williston Basin | | $ | 11,000,000 | | $ | 10,800,000 | | $ | 18,750,000 |

TABLE OF CONTENTS

You should rely only on the information contained in this prospectus. We have not, and the underwriters have not, authorized anyone to provide you with information different from that contained in this prospectus. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is accurate only as of the date of this prospectus.

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. Because this is only a summary, it does not contain all of the information that may be important to you. You should read the entire prospectus, including our historical consolidated financial statements and the notes to those financial statements included in this prospectus. You should also carefully consider the matters discussed under “Risk Factors.”

In this prospectus, unless the context otherwise requires, the terms “Kodiak Oil & Gas,” “Kodiak,” “we,” “us” and “our” refer to Kodiak Oil & Gas Corp. and its consolidated subsidiary. We have included definitions of technical terms and abbreviations important to an understanding of our business under “Glossary of Terms” beginning on page 69.

Our functional currency is the United States dollar. All references to “dollars” or “$” in this prospectus refer to United States or U.S. dollars unless specific reference is made to Canadian or CDN dollars. The rate of exchange of Canadian dollars to United States dollars as of November 30, 2006 was CDN $1 to U.S. $0.8762.

Unless we specifically state otherwise, the information in this prospectus does not take into account the sale of up to 1,500,000 shares of common stock by us, which the underwriters have the option to purchase to cover over-allotments.

Our Business

We are an independent energy company focused on the exploration, exploitation, acquisition and production of crude oil and natural gas in the United States. Our oil and natural gas reserves and operations are concentrated in two Rocky Mountain basins. Our corporate strategy is to internally identify prospects, acquire lands encompassing those prospects and evaluate those prospects using subsurface geology and geophysical data and exploratory drilling. Using this strategy, we have developed an oil and natural gas portfolio of proved reserves as well as other conventional and unconventional prospects that we have the opportunity to explore, develop and drill.

We derived natural gas production revenues of $558,768 for the nine months ended September 30, 2006 from six wells in the Green River Basin, three of which we operate and in three of which we have a non-operating economic interest. We derived oil production revenues of $2,252,499 for the same period from seven wells that we operate in the Williston Basin. As of September 30, 2006, we owned natural gas and oil leasehold interests covering approximately 108,326 gross acres and 68,789 net acres, of which 102,726 gross acres and 65,563 net acres are undeveloped.

Our Properties

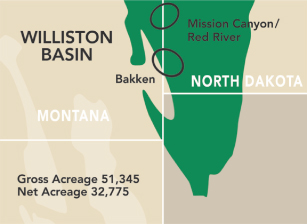

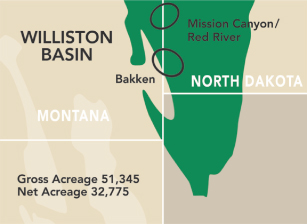

We have focused our exploration on two geographic areas in the Rocky Mountain Region of the United States. We explore for conventional and unconventional gas plays in the Green River Basin in Wyoming and Colorado, and for oil in the Williston Basin in Montana and North Dakota. Existing oil and natural gas pipeline infrastructure is of critical importance to us in identifying our prospects. In most cases, our natural gas prospects are within a reasonable distance of natural gas pipelines, therefore limiting the construction of gathering systems necessary to tie into existing lines. Our oil is transported mostly by trucks and, if available, pipelines.

Green River Basin

Our primary leaseholdings in the Green River Basin are located in an area referred to as the Vermillion Basin. In this geologic region, we believe there is natural gas trapped in various sands, coals and shales at depths ranging from 2,000 feet to nearly 15,000 feet. The primary targets of our exploration efforts are the Almond

1

sands at an approximate depth of 5,000 feet, the Baxter shale at approximately 10,000 feet, the Frontier sandstones at 13,000 feet and the Dakota sandstones at 14,000 feet. During the past two years, another exploration and production company has drilled fourteen wells in the Vermillion Basin to evaluate the deeper natural gas potential of this area. We believe that all of these wells are producing hydrocarbons, and that the prospective natural gas bearing zones may be present over a very large geologic area, including most of the area where we have our leaseholds. Based upon the results of this drilling and other wells previously drilled to deeper horizons, we believe that the Baxter shale and the Frontier and Dakota sands are subject to high pressure, which has allowed gas to be produced in rocks with low permeability. While the total productive area and applicable production drainage are unknown, based on the exploration work of other producers in the Green River basin, we believe that 40-acre spacing may be appropriate for optimum drainage on this prospect. Based on the 41,197 gross acres (25,973 net acres) that we control, we may have the potential for several hundred locations, based upon a 40-acre spacing pattern. We are currently drilling and operating our initial well in the prospect area and intend to drill at least one other well with the rig we secured for our initial well.

Williston Basin

Our exploration efforts in the Williston Basin are concentrated on exploiting the oil and natural gas potential of the Mission Canyon Formation at an approximate depth of 8,000 feet, the Bakken Formation at 10,500 feet and the Red River Formation at 11,000 feet. We have acquired an interest in 51,345 gross acres and 32,775 net acres in the Basin. We have been operating one rig in the Williston Basin continuously during the last 18 months.

Our Reserves

Sproule Associates Inc., a petroleum engineering consulting firm, evaluated and reviewed our reserve estimates as of December 31, 2005. All of our reserves are located within the continental United States. Reserve estimates are inherently imprecise and remain subject to revisions based on production history, results of additional exploration and development, prices of oil and natural gas, and other factors. You should read the notes following the table below and the information contained in note 9 to our audited financial statements for the year ended December 31, 2005 included elsewhere in this prospectus in conjunction with the following reserve estimates:

| | | |

| | | As of December 31, 2005 |

Proved Developed Oil Reserves (Thousands of Barrels, or MBbls) | | | 309.4 |

Proved Undeveloped Oil Reserves (MBbls) | | | 212.3 |

Total Proved Oil Reserves (MBbls) | | | 521.7 |

Proved Developed Gas Reserves (Million Cubic Feet, or MMcf) | | | 1,828.6 |

Proved Undeveloped Gas Reserves (MMcf) | | | 1,006.6 |

Total Proved Gas Reserves (MMcf) | | | 2,835.2 |

Total Proved Gas Equivalents (Million Cubic Feet Equivalent, or MMcfe)(1) | | | 5,965.4 |

| | | |

Present Value of Estimated Future Net Revenues Before Income Taxes, Discounted at 10%(2) | | $ | 18,157,000 |

| | | |

Present Value of Estimated Future Net Revenues After Income Taxes, Discounted at 10%(3) | | $ | 14,202,800 |

| (1) | We converted oil to Mcf of gas equivalent at a ratio of one barrel to six Mcf. |

| (2) | We calculated the present value of estimated future net revenues as of December 31, 2005 using oil and natural gas prices that were received by each respective property as of that date. The average prices that we utilized for December 31, 2005 were $8.11 per Mcf and $57.57 per barrel of oil. |

| (3) | The Present Value of Estimated Future Net Revenues After Income Taxes, Discounted at 10%, is referred to as the “Standardized Measure.” See Note 9 to our audited financial statements for the year ended December 31, 2005 included elsewhere in this prospectus. |

2

Capital Expenditures

We made capital expenditures of about $15 million in 2005. The following table sets forth our planned capital expenditures for our principal properties in 2006, together with current-year expenditures through September 30, 2006:

| | | | | | | | | | | | | |

Prospect Location | | Working

Interest

(WI) | | | Gross Wells | | Net Wells | | Estimated 2006

Expenditures | | Expenditures

through

September 30,

2006 |

Green River Basin | | | | | | | | | | | | | |

Vermillion Basin Shallow | | 50.0 | % | | 3 | | 1.50 | | | 2,500,000 | | | 2,200,000 |

Vermillion Basin Deep | | 100 | % | | 2 | | 2.00 | | | 10,500,000 | | | — |

Other Projects | | 50.0 | % | | 1 | | 0.25 | | | 500,000 | | | — |

Acreage | | | | | | | | | | 8,500,000 | | | 7,600,000 |

| | | | | | | | | | | | | |

Total Green River Basin | | | | | 6 | | 3.75 | | $ | 22,000,000 | | $ | 9,800,000 |

Williston Basin | | | | | | | | | | | | | |

Mission Canyon/Red River | | 50.0 | % | | 1 | | .50 | | | 500,000 | | | 2,800,000 |

Bakken | | 62.5 | % | | 3 | | 1.88 | | | 9,800,000 | | | 7,300,000 |

Acreage | | | | | | | | | | 700,000 | | | 700,000 |

| | | | | | | | | | | | | |

Total Williston Basin | | | | | 4 | | 2.38 | | | 11,000,000 | | | 10,800,000 |

| | | | | | | | | | | | | |

Total Kodiak Oil & Gas | | | | | 10 | | 6.13 | | $ | 33,000,000 | | $ | 20,600,000 |

Our preliminary 2007 capital expenditures budget is approximately $60 million. The following table sets forth our planned capital expenditures for our principal properties in 2007:

| | | | | | | | | | |

Prospect Location | | WI | | | Gross Wells | | Net Wells | | Estimated

2007 Expenditures |

Green River Basin | | | | | | | | | | |

Vermillion Deep Operated | | 100.0 | % | | 7 | | 7.00 | | | 31,500,000 |

Vermillion Deep Non-Op | | 25.0 | % | | 2 | | 0.50 | | | 2,250,000 |

Other Projects | | 50.0 | % | | 2 | | 1.00 | | | 2,500,000 |

Acreage/Seismic | | | | | | | | | | 5,000,000 |

| | | | | | | | | | |

Total Green River Basin | | | | | 11 | | 8.50 | | | 41,250,000 |

| | | | |

Williston Basin | | | | | | | | | | |

Mission Canyon / Red River | | 50.0 | % | | 6 | | 3.00 | | | 6,000,000 |

Bakken | | 62.5 | % | | 3 | | 1.88 | | | 9,750,000 |

Acreage/Seismic | | | | | | | | | | 3,000,000 |

| | | | | | | | | | |

Total Williston Basin | | | | | 9 | | 4.88 | | | 18,750,000 |

| | | | | | | | | | |

Total Kodiak Oil & Gas | | | | | 20 | | 13.38 | | $ | 60,000,000 |

Our Business Strategy

We aim to increase shareholder value by finding and developing oil and natural gas reserves at costs that provide an attractive rate of return on our investments. The principal elements of our business strategy are:

| | • | | Develop Our Existing Properties. We believe that our Green River and Williston Basin properties have the potential to provide us with near-term reserve and production growth from numerous drilling locations. We intend to focus our drilling and exploration programs in 2007 in these areas. |

3

| | • | | Pursue Selective Acquisitions and Joint Ventures. We expect to lease additional natural gas and oil properties in our areas of operation. We believe that our asset base and technical expertise position us well to attract industry joint venture partners and pursue strategic acquisitions. |

| | • | | Operate Our Properties and Maintain a High Working Interest in Our Wells. We plan to seek to operate our properties where possible and to maintain a high level of participation in our wells by investing our own capital in drilling operations in our high-growth areas. We believe this will position us to accelerate our growth in production, reserves and cash flows. |

| | • | | Reduce Unit Costs Through Economies of Scale and Efficient Operations. As we continue to increase our oil and natural gas production and develop our existing properties, we believe that our unit cost structure will benefit from our experience and economies of scale. We anticipate that we will be able to reduce unit costs through better utilization of our existing infrastructure over a larger number of wells. |

Our Competitive Strengths

We believe that our key competitive strengths include:

| | • | | Significant Production Growth Opportunities. We have acquired a large acreage position in an area where drilling and production activity by other exploration and production companies continues to increase. Based on the drilling results of other producers within our acreage position and our own drilling results on our acreage, we believe we are well-positioned to increase our reserves, production and cash flow. |

| | • | | Experienced Management Team with Strong Technical Capability. Our senior management team has extensive industry experience and technical expertise in engineering, geoscience, field operations and land acquisition, with an average of more than 25 years of experience in the oil and natural gas industry. |

| | • | | Financial Flexibility. We plan to maintain a conservative financial position and believe that our operating cash flow and proceeds from this offering will provide us with the financial flexibility to pursue our planned growth through exploration and development activities through 2007. |

| | • | | Incentivized Management Ownership. Our directors and executive officers are closely aligned with our stockholders. As of September 30, 2006, our directors and executive officers beneficially owned approximately 12% of our outstanding common stock. In addition, we believe that the compensation arrangements for our directors and executive officers are heavily weighted toward future performance-based equity payments rather than cash. |

Recent Events

Operational Update

Vermillion Basin

While we have operated gas wells in the Green River Basin since November 2005, we only recently completed drilling our first gas well in the Vermillion Basin area, the North Trail State #4-36 well located in Sweetwater County, Wyoming. We began drilling in October 2006 and completed drilling operations early in December 2006 at a total depth of 14,625 feet. We have set production casing for the well. We have obtained pipeline right-of-way and will install approximately three-quarters of a mile of pipeline prior to fracture stimulating the well. We operate and have a 100% working and 80% net revenue interest in the well.

Williston Basin

In October 2006, we completed the Grizzly Federal #4-11H well located in McKenzie County, North Dakota. We began drilling in July 2006 and have drilled three lateral well bores totaling 14,000 feet in the

4

Bakken Formation. In October 2006, we tested the well at a calculated rate of 600 barrels of oil per day, or BOPD, and 300 thousand cubic feet of natural gas per day, or Mcfg/d. We operate and have a 62.5% working and 54.7% net revenue interest in the well.

We began drilling our initial test well, the Kodiak Grizzly #13-6H in May 2006. We have drilled to a depth of 10,500 feet with two lateral well bores totaling 9,000 feet. The well began producing oil in September 2006 and we fracture stimulated it in November. We currently are flow testing the well and expect to put it back on production in December 2006. We operate and have a 62.5% working and 51.3% net revenue interest in the well.

We began drilling a third well, the Grizzly Federal #1-27H well, in September 2006. The well has a single well bore and is located three miles north of our Grizzly Federal #4-11H well. We completed drilling operations on the #1-27H well in December 2006 with one lateral well bore totalling 7,000 feet. We operate and have a 62.5% working and 53.0% net revenue interest in the well.

Management Update

On October 2, 2006, Brian P. Ault joined us as our Manager of Operations. Mr. Ault brings 25 years of extensive Rocky Mountain oil and natural gas experience, most recently as Vice President and Operations Manager for Ultra Petroleum Corporation. While at Ultra from 1998 to 2006, Mr. Ault was responsible for operations in two natural gas fields—the Pinedale Anticline and the Jonah Field.

The Offering

This prospectus covers up to 9,937,568 common shares to be sold by the selling shareholder identified in this prospectus.

Shares offered by the selling shareholders | 9,937,568 common shares |

Offering price | Determined at the time of sale by the selling shareholder. |

Common shares outstanding as of December 8, 2006 | 75,473,426 shares |

Common stock owned by the selling shareholders following this offering if all shares are sold | None |

Use of proceeds | All proceeds of this offering will be received by the selling shareholders for their own account. |

American Stock Exchange and TSX Venture Exchange Symbols | KOG |

Risk factors | An investment in our common stock involves significant risks. You should carefully consider the matters discussed under “Risk Factors” immediately following this prospectus summary before making a decision to buy shares of our common stock. |

| (1) | Excludes common stock that may be issued upon the exercise of outstanding options. See “Shares Eligible for Future Sale.” |

5

History and Development of the Company

We were incorporated as a company on March 17, 1972 in the Province of British Columbia, Canada, under the name “Pacific Talc Ltd.” pursuant to the Company Act (British Columbia). On November 12, 1998, we changed our name to “Columbia Copper Company Ltd.” and consolidated our share capital on the basis of four old shares for one new share. On September 28, 2001, we were continued from British Columbia to the Yukon Territory and changed our name to “Kodiak Oil & Gas Corp.” On September 23, 2003, we incorporated a wholly-owned subsidiary, Kodiak Oil & Gas (USA) Inc., in Colorado to hold all of our U.S. oil and natural gas properties. Our common shares began trading on the TSX Venture Exchange on September 28, 2001 and on the American Stock Exchange on June 21, 2006.

Our Executive Offices

Our principal executive offices are located at 1625 Broadway, Suite 330, Denver, Colorado 80202, and our telephone number is (303) 592-8075. We maintain a website at http://www.kodiakog.com. The information contained on or accessible through our website is not part of this prospectus, and you should rely only on the information contained in this prospectus when making a decision as to whether or not to invest in our common stock.

6

RISK FACTORS

Investing in shares of our common stock is highly speculative and involves a high degree of risk. In addition to the other information included in this prospectus, you should carefully consider the risks described below before purchasing shares of our common stock. If any of the following risks actually occur, our business, financial condition and results of operations could materially suffer. As a result, the trading price of our common stock could decline, and you might lose all or part of your investment.

Risks Relating to the Company

We will require significant additional capital, which may not be available to us on favorable terms, or at all.

We will need to expend significant capital in order to explore and develop our properties. Our plan of operation for 2007 contemplates capital expenditures of $60 million for the development of existing properties and anticipated property acquisitions. If our available sources of liquidity are insufficient to fund our expected capital needs for 2007, or our needs are greater than anticipated, we will be required to raise additional funds in the future through private or public sales of equity securities or the incurrence of indebtedness. In addition, we will be required to raise additional funds in the future to fund our plan of operation beyond 2007.

There can be no assurance that we will obtain necessary additional financing on favorable terms or at all. If we borrow additional funds, we likely will be obligated to make periodic interest or other debt service payments and may be subject to additional restrictive covenants. Should we elect to raise additional capital through the issuance and sale of equity securities, the sales may be at prices below the market price of our stock, and our shareholders may suffer significant dilution. Our failure to obtain financing on a timely basis or on favorable terms could result in the loss or substantial dilution of our interests in our properties as disclosed in this prospectus. In addition, the failure of any of our joint venture partners to obtain any required financing could adversely affect our ability to complete the exploration or development of any of our joint venture projects on a timely basis.

We have historically incurred losses and expect to incur additional losses in the future. It is difficult for us to forecast when we will achieve profitability, if ever.

We have historically incurred losses from operations during our limited history in the oil and natural gas business. As at September 30, 2006, we had a cumulative deficit of $7,232,539. While we have developed some of our properties, most of our properties are in the exploration stage and to date we have established a limited volume of proved reserves on our properties. To become profitable, we would need to be successful in our acquisition, exploration, development and production activities, all of which are subject to many risks beyond our control. We cannot assure you that we will successfully implement our business plan or that we will achieve commercial profitability in the future. Even if we become profitable, we cannot assure you that our profitability will be sustainable or increase on a periodic basis. In addition, should we be unable to continue as a going concern, realization of assets and settlement of liabilities in other than the normal course of business may be at amounts significantly different from those in the financial statements included in this prospectus. Finally, due to our limited history in the oil and natural gas business, we have limited historical financial and operating information available to help you evaluate our performance or an investment in our common stock.

We may not be able to successfully drill wells that can produce oil or natural gas in commercially viable quantities.

We cannot assure you that we will be able to successfully drill wells that can produce commercial quantities of oil and natural gas in the future. The total cost of drilling, completing and operating a well is uncertain before drilling commences. Overruns in budgeted expenditures are common risks that can make a particular project uneconomical. The use of seismic data and other technologies and the study of producing fields in the same area

7

will not enable us to know conclusively prior to drilling whether oil or natural gas will be present or, if present, whether oil or natural gas will be present in commercial quantities. Further, many factors may curtail, delay or cancel drilling, including the following:

| | • | | our limited history of drilling wells; |

| | • | | delays and restrictions imposed by or resulting from compliance with regulatory requirements; |

| | • | | pressure or irregularities in geological formations; |

| | • | | shortages of or delays in obtaining equipment and qualified personnel; |

| | • | | equipment failures or accidents; |

| | • | | adverse weather conditions; |

| | • | | reductions in oil and natural gas prices; |

| | • | | land title problems; and |

| | • | | limitations in the market for oil and natural gas. |

The occurrence of any of these events could negatively affect our ability to successfully drill wells that can produce oil or natural gas in commercially viable quantities.

The actual quantities and present value of our proved reserves may be lower than we have estimated.

This prospectus contains estimates of our proved oil and natural gas reserves and the estimated future net revenues from these reserves. The process of estimating oil and natural gas reserves is complex and requires significant decisions and assumptions in the evaluation of available geological, geophysical, engineering and economic data for each reservoir. Accordingly, these estimates are inherently imprecise. Actual future production, oil and natural gas prices, revenues, taxes, development and operating expenses, and quantities of recoverable oil and natural gas reserves most likely will vary from these estimates and vary over time. Such variations may be significant and could materially affect the estimated quantities and present value of our proved reserves. In addition, we may adjust estimates of proved reserves to reflect production history, results of exploration and development drilling, results of secondary and tertiary recovery applications, prevailing oil and natural gas prices and other factors, many of which are beyond our control.

You should not assume that the present value of future net revenues referred to in this prospectus is the current market value of our estimated oil and natural gas reserves. In accordance with SEC requirements, the estimated discounted future net cash flows from proved reserves are generally based on prices and costs as of the date of the estimate. Actual future prices and costs may be materially higher or lower than the prices and costs as of the date of the estimate. Any change in consumption by oil or natural gas purchasers or in governmental regulations or taxation will also affect actual future net cash flows. The timing of both the production and the expenses from the development and production of our oil and natural gas properties will affect the timing of actual future net cash flows from proved reserves and their present value. In addition, the 10% discount factor, which is required by the SEC to be used in calculating discounted future net cash flows for reporting purposes, is not necessarily the most appropriate discount factor nor does it reflect discount factors used in the market place for the purchase and sale of oil and natural gas.

Our interests are held in the form of leases that we may be unable to retain.

Our properties are held under leases, and working interests in leases. Generally, the leases we are a party to are for a fixed term, but contain a provision that allows us to extend the term of the lease so long as we are producing oil or natural gas in quantities to meet the required payments under the lease. If we or the holder of a lease fails to meet the specific requirements of the lease regarding delay rental payments, continuous production or development, or similar terms, portions of the lease may terminate or expire. There can be no assurance that

8

any of the obligations required to maintain each lease will be met. The termination or expiration of our leases or the working interests relating to leases may reduce our opportunity to exploit a given prospect for oil and natural gas production and thus have a material adverse effect on our business, results of operation and financial condition.

We have limited control over activities in properties we do not operate, which could reduce our production and revenues.

We do not operate all of the properties in which we have an interest. As of September 30, 2006, we owned a non-operating interest in three wells in the Vermillion Basin and may acquire non-operating interests in additional wells in the future. As a result, we may have a limited ability to exercise influence over normal operating procedures, expenditures or future development of underlying properties and their associated costs. For all of the properties that are operated by others, we are dependent on their decision-making with respect to day-to-day operations over which we have little control. The failure of an operator of wells in which we have an interest to adequately perform operations, or an operator’s breach of applicable agreements, could reduce production and revenues we receive from that well. The success and timing of our drilling and development activities on properties operated by others depend upon a number of factors outside of our control, including:

| | • | | timing and amount of capital expenditures; |

| | • | | expertise and financial resources; and |

| | • | | inclusion of other participants. |

We have a limited experience as an operator of wells.

We are an independent energy company with a limited operating history and limited experience in drilling and operating wells in the Green River Basin and the Williston Basin. We currently conduct some of our oil and natural gas exploration, development and production activities in joint ventures with others. As part of our corporate strategy, we plan to seek to operate our wells where possible and to maintain a high level of participation in our wells by investing our own capital in drilling operations. While our management team has considerable industry experience, to date our company has drilled only one well in the Green River Basin and ten wells in the Williston Basin. Currently, we operate only three wells in the Green River Basin and seven wells in the Williston Basin. If we fail to successfully manage our drilling and exploration programs or fail to successfully operate our wells, we may never become profitable.

The title to our properties may be defective.

It is our practice in acquiring oil and natural gas leases or interests in oil and natural gas leases not to undergo the expense of retaining lawyers to fully examine the title to the interest to be placed under lease or already placed under lease. Rather, we rely upon the judgment of oil and natural gas lease brokers or landmen who actually do the field work in examining records in the appropriate governmental office before attempting to place under lease a specific interest. We believe that this practice is widely followed in the oil and natural gas industry.

Prior to drilling a well for oil and natural gas, it is the normal practice in the oil and natural gas industry for the person or company acting as the operator of the well to hire a lawyer to examine the title to the unit within which the proposed oil and natural gas well is to be drilled. Frequently, as a result of such examination, curative work must be done to correct deficiencies in the marketability of the title. The work entails expense and might include obtaining an affidavit of heirship or causing an estate to be administered. The examination made by the title lawyers may reveal that the oil and natural gas lease or leases are worthless, having been purchased in error from a person who is not the owner of the mineral interest desired. In such instances, the amount paid for such oil and natural gas lease or leases may be lost.

9

Our officers and directors may become subject to conflicts of interest.

Some of our directors and officers may also become directors, officers, contractors, shareholders or employees of other companies engaged in oil and natural gas exploration and development. To the extent that such other companies may participate in ventures in which we may participate, our directors may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In the event that such a conflict of interest arises at a meeting of our directors, a director who has such a conflict will declare his interest and abstain from voting for or against the approval of such participation or such terms. In appropriate cases, we will establish a special committee of independent directors to review a matter in which several directors, or management, may have a conflict. From time to time, several companies may participate in the acquisition, exploration and development of oil and natural gas properties thereby allowing for their participation in larger programs, permitting involvement in a greater number of programs and reducing financial exposure in respect of any one program. A particular company may assign all or a portion of its interest in a particular program to another of these companies due to the financial position of the company making the assignment.

In accordance with the laws of the Yukon Territory, our directors are required to act honestly, in good faith and in the best interests of our company. In determining whether or not we will participate or acquire an interest in a particular program, our officers will primarily consider the potential benefits to our company, the degree of risk to which we may be exposed and our financial position at the time. See “Related Party Transactions.”

We depend on our current management team, the loss of any member of which could delay the further implementation of our business plan or cause business failure.

We are heavily dependent upon the expertise of our management team, especially our executive officers, Lynn Peterson and James Catlin. The loss of Mr. Peterson or Mr. Catlin would have a material adverse effect on us. Neither Mr. Peterson nor Mr. Catlin have entered into an employment agreement with us. In addition, the loss of the services of either of our executive officers, or any other member of our management team, through incapacity or otherwise, would be costly to us and would require us to seek and retain other qualified personnel. We cannot assure you that we could find a suitable replacement for any member of our management team. See “Management.”

Oil and natural gas reserves decline once a property becomes productive, and we may need to find new reserves to sustain revenue growth.

Even if we add oil and natural gas reserves through our exploration activities, our reserves will decline as they are produced. We will be constantly challenged to add new reserves through further exploration and development of our existing properties. We cannot assure you that our exploration and development activities will be successful in adding new reserves. If we fail to replace reserves, our business, results of operations and financial condition will be adversely impacted.

We will need to make substantial financial and man-power investments in order to assess our internal controls over financial reporting and our internal controls over financial reporting may be found to be deficient.

Section 404 of the Sarbanes-Oxley Act of 2002 requires management to assess our internal controls over financial reporting and requires auditors to attest to that assessment. Current regulations of the Securities and Exchange Commission, or SEC, will require us to include this assessment and attestation in our annual report commencing with the annual report we file with the SEC for our fiscal year ended December 31, 2007.

We will incur significant increased costs in implementing and responding to these requirements. In particular, the rules governing the standards that must be met for management to assess its internal controls over financial reporting under Section 404 are complex, and require significant documentation, testing and possible

10

remediation. Our process of reviewing, documenting and testing our internal controls over financial reporting may cause a significant strain on our management, information systems and resources. We may have to invest in additional accounting and software systems. We may be required to hire additional personnel and to use outside legal, accounting and advisory services. In addition, we will incur additional fees from our auditors as they perform the additional services necessary for them to provide their attestation. If we are unable to favorably assess the effectiveness of our internal control over financial reporting when we are required to, or if our independent auditors are unable to provide an unqualified attestation report on such assessment, we may be required to change our internal control over financial reporting to remediate deficiencies. In addition, investors may lose confidence in the reliability of our financial statements causing our stock price to decline

We are subject to the risks associated with our prior business activities.

Additional risks may exist because of our prior business activities. Prior to current management’s acquisition of control of substantially all of our common stock, we engaged in a number of businesses, including mining operations and marketing of fire retardant operations. For a period of years prior to current management’s acquisition of control of us, we had no business operations. Although current management performed a due diligence review, we may still be exposed to undisclosed liabilities resulting from the prior operations of our company and we could incur losses, damages or other costs as a result.

Our focus on exploration activities exposes us to greater risks than are generally encountered in later-stage oil and natural gas property development businesses.

Much of our current activity involves drilling exploratory wells on properties with no proved oil and natural gas reserves. While all drilling, whether developmental or exploratory, involves risks, exploratory drilling involves greater risks of dry holes or failure to find commercial quantities of oil and natural gas. The economic success of any project will depend on numerous factors, including:

| | • | | our ability to drill, complete and operate wells; |

| | • | | our ability to estimate the volumes of recoverable reserves relating to individual projects; |

| | • | | rates of future production; |

| | • | | future commodity prices; and |

| | • | | investment and operating costs and possible environmental liabilities. |

All of these factors may impact whether a project will generate cash flows sufficient to provide a suitable return on investment. If we experience a series of failed drilling projects, our business, results of operations and financial condition could be materially adversely affected.

We rely on independent experts and technical or operational service providers over whom we may have limited control.

We use independent contractors to provide us with technical assistance and services. We rely upon the owners and operators of rigs and drilling equipment, and upon providers of field services, to drill and develop our prospects to production. In addition, we rely upon the services of other third parties to explore or analyze our prospects to determine a method in which the prospects may be developed in a cost-effective manner. Our limited control over the activities and business practices of these providers, any inability on our part to maintain satisfactory commercial relationships with them or their failure to provide quality services could materially and adversely affect our business, results of operations and financial condition.

11

We have not insured and cannot fully insure against all risks related to our operations, which could result in substantial claims for which we are underinsured or uninsured.

We have not insured and cannot fully insure against all risks and have not attempted to insure fully against risks where coverage is prohibitively expensive. We do not carry business interruption insurance coverage. Our exploration, drilling and other activities are subject to risks such as:

| | • | | environmental hazards, such as uncontrollable flows of natural gas, oil, brine, well fluids, toxic gas or other pollution into the environment, including groundwater and shoreline contamination; |

| | • | | abnormally pressured formations; |

| | • | | mechanical failures of drilling equipment; |

| | • | | personal injuries and death, including insufficient worker compensation coverage for third-party contractors who provide drilling services; and |

| | • | | natural disasters, such as adverse weather conditions. |

Losses and liabilities arising from uninsured and underinsured events, which could arise from even one catastrophic accident, could materially and adversely affect our business, results of operations and financial condition.

Our competitors include larger, better financed and more experienced companies.

The oil and natural gas industry is intensely competitive and, as an early-stage company, we must compete against larger companies that may have greater financial and technical resources than us and substantially more experience in our industry. Their competitive advantages may negatively impact our ability to acquire prospective properties, develop reserves, attract and retain quality personnel and raise capital. Their competitive advantages may also better enable our competitors to sustain the impact of higher exploration and production costs, oil and natural gas price volatility, productivity variances among properties, overall industry cycles and other factors related to our industry.

Properties that we acquire may not produce oil or natural gas as projected, and we may be unable to determine reserve potential, identify liabilities associated with the properties or obtain protection from sellers against them, which could cause us to incur losses.

One of our growth strategies is to pursue selective acquisitions of oil and natural gas reserves. If we choose to pursue an acquisition, we will perform a review of the target properties that we believe is consistent with industry practices. However, these reviews are inherently incomplete. Generally, it is not feasible to review in depth every individual property involved in each acquisition. Even a detailed review of records and properties may not necessarily reveal existing or potential problems, nor will it permit a buyer to become sufficiently familiar with the properties to assess fully their deficiencies and potential. We may not perform an inspection on every well, and environmental problems, such as groundwater contamination, are not necessarily observable even when an inspection is undertaken. Even when problems are identified, we may not be able to obtain effective contractual protection against all or part of those problems, and we may assume environmental and other risks and liabilities in connection with the acquired properties.

Our operations in North Dakota, Montana and Wyoming could be adversely affected by abnormally poor weather conditions.

Our operations in North Dakota, Montana and Wyoming are conducted in areas subject to extreme weather conditions and often in difficult terrain. Primarily in the winter and spring, our operations are often curtailed because of cold, snow and wet conditions. Unusually severe weather could further curtail these operations,

12

including drilling of new wells or production from existing wells, and depending on the severity of the weather, could have a material adverse effect on our business, financial condition and results of operations.

In addition, our federal leases generally include restrictions on drilling during the period of November 15 to April 30. These restrictions are intended to protect big game winter habitat and not to restrict operations or maintenance of production facilities. To the extent that our exploration and drilling program on our federal leases cannot be completed during the period of May 1 through November 14, our drilling program may be delayed.

Market conditions or operational impediments may hinder our access to oil and natural gas markets or delay our production.

We deliver oil and natural gas through gathering systems and pipelines that we do not own. These facilities may not be available to us in the future. Market conditions or the unavailability of satisfactory oil and natural gas transportation arrangements may hinder access to oil and natural gas markets or delay production, if any, at our wells. The availability of a ready market for our future oil and natural gas production will depend on a number of factors, including the demand for and supply of oil and natural gas and the proximity of reserves to pipelines and terminal facilities. Any significant change in our arrangements with gathering system or pipeline owners and operators or other market factors affecting the overall infrastructure facilities servicing our properties would adversely affect our ability to deliver the oil and natural gas we produce to markets in an efficient manner.

Risks Relating to Our Industry

The oil and natural gas industry is subject to significant competition, which may increase costs or otherwise adversely affect our ability to compete.

Oil and natural gas exploration is intensely competitive and involves a high degree of risk. In our efforts to acquire oil and natural gas producing properties, we compete with other companies that have greater resources. Many of these companies not only explore for and produce oil and natural gas, but also conduct refining and petroleum marketing operations on a worldwide basis. Our ability to compete for oil and natural gas producing properties will be affected by the amount of funds available to us, information available to us and any standards established by us for the minimum projected return on investment. Our products will also face competition from alternative fuel sources and technologies.

Oil and natural gas are commodities subject to price volatility based on many factors outside the control of producers, and low prices may make properties uneconomic for future production.

Oil and natural gas are commodities, and, therefore, their prices are subject to wide fluctuations in response to relatively minor changes in supply and demand. Historically, the markets for oil and natural gas have been volatile. These markets will likely continue to be volatile in the future. The prices a producer may expect and its level of production depend on numerous factors beyond its control, such as:

| | • | | changes in global supply and demand for oil and natural gas; |

| | • | | economic conditions in the United States and Canada; |

| | • | | the actions of the Organization of Petroleum Exporting Countries, or OPEC; |

| | • | | the price and quantity of imports of foreign oil and natural gas; |

| | • | | political conditions, including embargoes, in oil- and natural gas-producing regions; |

| | • | | the level of global oil and natural gas inventories; |

13

| | • | | technological advances affecting energy consumption; and |

| | • | | the price and availability of alternative fuels. |

Lower oil and natural gas prices may not only decrease revenues on a per unit basis, but also may reduce the amount of oil and natural gas that can be economically produced. Lower prices will also negatively affect the value of proved reserves.

Exploration and drilling operations are subject to significant environmental regulation, which may increase costs or limit our ability to develop our properties.

We may encounter hazards incident to the exploration and development of oil and natural gas properties such as accidental spills or leakage of petroleum liquids and other unforeseen conditions. We may be subject to liability for pollution and other damages due to hazards that we cannot insure against due to prohibitive premium costs or for other reasons. Governmental regulations relating to environmental matters could also increase the cost of doing business or require alteration or cessation of operations in some areas.

Existing and possible future environmental legislation, regulations and actions could give rise to additional expense, capital expenditures, restrictions and delays in our activities, the extent of which we cannot predict. Regulatory requirements and environmental standards are subject to constant evaluation and may be significantly increased, which could materially and adversely affect our business or our ability to develop our properties on an economically feasible basis. Before development and production can commence on any properties, we must obtain regulatory and environmental approvals. We cannot assure you that we will obtain such approvals on a timely basis or at all. The cost of compliance with changes in governmental regulations has the potential to reduce the profitability of our operations and preclude entirely the economic development of a specific property.

A substantial or extended decline in oil and natural gas prices could reduce our future revenue and earnings.

As with most other companies involved in resource exploration and development, we may be adversely affected by future increases in the costs of conducting exploration, development and resource extraction that may not be fully offset by increases in the price received on sale of oil or natural gas.

Our revenues and growth, and the carrying value of our oil and natural gas properties are substantially dependent on prevailing prices of oil and natural gas. Our ability to obtain additional capital on attractive terms is also substantially dependent upon oil and natural gas prices. Prices for oil and natural gas are subject to large fluctuations in response to relatively minor changes in the supply of and demand for oil and natural gas, market uncertainty and a variety of additional factors beyond our control. These factors include changes in global supply and demand for oil and natural gas, economic conditions in the United States and Canada, the actions of OPEC, governmental regulation, the price and quantity of imports in foreign oil- and natural gas-producing regions, political conditions, including embargoes in oil- and natural gas-producing regions, the level of global oil and natural gas inventories, weather conditions, technological advances affecting energy consumption and the price and availability of alternate fuel sources. Any substantial and extended decline in the price of oil and natural gas would have an adverse effect on our business, financial condition and results of operations.

Volatile oil and natural gas prices make it difficult to estimate the value of producing properties for acquisition and often cause disruption in the market for oil and natural gas producing properties, as buyers and sellers have difficulty agreeing on such value. Price volatility also makes it difficult to budget for and project the return on acquisitions and development and exploitation projects.

Local, national and international economic conditions are beyond our control and may have a substantial adverse affect on our efforts. We cannot guard against the effects of these potential adverse conditions.

14

Our operations and demand for our products are affected by seasonal factors, which may lead to fluctuations in our operating results.

Our operating results are likely to vary due to seasonal factors. Demand for oil and natural gas products will generally increase during the winter because they are often used as heating fuels. The amount of such increased demand will depend to some extent upon the severity of winter. Because of the seasonality of our business and continuous fluctuations in the prices of our products, our operating results are likely to fluctuate from period to period.

Conducting operations in the oil and natural gas industry subjects us to complex laws and regulations that can have a material adverse affect on the cost, manner and feasibility of doing business.

Companies that explore for and develop, produce and sell oil and natural gas in the United States are subject to extensive federal, state and local laws and regulations, including complex tax and environmental laws and the corresponding regulations, and are required to obtain various permits and approvals from federal, state and local agencies. If these permits are not issued or unfavorable restrictions or conditions are imposed on our drilling activities, we may not be able to conduct our operations as planned. We may be required to make large expenditures to comply with governmental regulations. Matters subject to regulation include:

| | • | | water discharge and disposal permits for drilling operations; |

| | • | | reports concerning operations; |

| | • | | air quality, noise levels and related permits; |

| | • | | rights-of-way and easements; |

| | • | | unitization and pooling of properties; |

| | • | | gathering, transportation and marketing of oil and natural gas; |

| | • | | waste transport and disposal permits and requirements. |

Failure to comply with these laws may result in the suspension or termination of operations and subject us to liabilities under administrative, civil and criminal penalties. Compliance costs can be significant. Moreover, these laws could change in ways that substantially increase the costs of doing business. Any such liabilities, penalties, suspensions, terminations or regulatory changes could materially and adversely affect our business, financial condition and results of operations.

The unavailability or high cost of drilling rigs, equipment, supplies, personnel and oilfield services could adversely affect our cost of operations or our ability to execute our plans on a timely basis.

Due to domestic drilling activity increases, particularly in fields in which we operate, a general shortage of drilling rigs, equipment, supplies and personnel has developed. As a result, the costs and delivery times of rigs, equipment, supplies or personnel are substantially greater than in previous years. From time to time, these costs have sharply increased and could do so again. The demand for and wage rates of qualified drilling rig crews generally rise in response to the increasing number of active rigs in service and could increase sharply in the event of a shortage. Shortages of drilling rigs, equipment, supplies or personnel could delay or adversely affect our development operations, which could have a material adverse effect on our business, financial condition and results of operations.

15

Risks Relating to Our Common Stock and this Offering

Our common stock has a limited trading history and may experience price volatility.

Our common stock has been trading on the TSX Venture Exchange, or TSX-V, since September 28, 2001, and on the American Stock Exchange, or AMEX, since June 21, 2006. The volume of trading in our common stock varies greatly and may often be light, resulting in what is known as a “thinly-traded” stock. Until a larger secondary market for our common stock develops, the price of our common stock may fluctuate substantially. The price of our common stock may also be impacted by any of the following, some of which may have little or no relation to our company or industry:

| | • | | the breadth of our stockholder base and extent to which securities professionals follow our common stock; |

| | • | | investor perception of us and the oil and natural gas industry, including industry trends; |

| | • | | domestic and international economic and capital market conditions, including fluctuations in commodity prices; |

| | • | | responses to quarter-to-quarter variations in our results of operations; |

| | • | | announcements of significant acquisitions, strategic alliances, joint ventures or capital commitments by us or our competitors; |

| | • | | additions or departures of key personnel; |

| | • | | sales or purchases of our common stock by large stockholders or our insiders; |

| | • | | accounting pronouncements or changes in accounting rules that affect our financial reporting; and |

| | • | | changes in legal and regulatory compliance unrelated to our performance. |

We have not paid cash dividends on our common stock and do not anticipate paying any dividends on our common stock in the foreseeable future.

We do not anticipate paying cash dividends on our common stock in the foreseeable future. Payment of future cash dividends, if any, will be at the discretion of our board of directors and will depend on our financial condition, results of operations, contractual restrictions, capital requirements, business prospects and other factors that our board of directors considers relevant. Accordingly, investors may only see a return on their investment if the value of our securities appreciates.

Our constating documents permit us to issue an unlimited number of shares without shareholder approval.

Our Articles of Continuation permit us to issue an unlimited number of shares of our common stock. Subject to the requirements of any exchange on which we may be listed, we will not be required to obtain the approval of shareholders for the issuance of additional shares of our common stock. In 2005, we issued 20,671,875 shares of our common stock for gross proceeds of $17,935,173. In February 2006, we issued 19,514,268 shares of our common stock for net proceeds of $36,535,139. We anticipate that we will, from time to time, issue additional

16

shares of our common stock to provide working capital for future operations. Any further issuances of shares of our common stock from our treasury will result in immediate dilution to existing shareholders and may have an adverse effect on the value of their shareholdings.

17

FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements, other than statements of historical fact, contained in this prospectus, constitute forward-looking statements. In some cases you can identify forward-looking statements by terms such as “may,” “intend,” “might,” “will,” “should,” “could,” “would,” “expect,” “believe,” “estimate,” “anticipate,” “plans,” “predict,” “project,” “potential,” or the negative of these terms, and similar expressions intended to identify forward-looking statements.

Forward-looking statements are based on assumptions and estimates and are subject to risks and uncertainties. We have identified in this prospectus some of the factors that may cause actual results to differ materially from those expressed or assumed in any of our forward-looking statements. There may be other factors not so identified. Investors should not place undue reliance on our forward-looking statements. Further, any forward-looking statement speaks only as of the date on which it is made and, except as required by law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors emerge from time to time that may cause our business not to develop as we expect, and it is not possible for us to predict all of them. Factors that may cause actual results to differ materially from those expressed or implied by our forward-looking statements include, but are not limited to, those described under the heading “Risk Factors” and the following:

| | • | | our future financial and operating performance; |

| | • | | the risks of the oil and natural gas industry, such as operational risks in exploring for, developing and producing oil and natural gas; |

| | • | | risks and uncertainties involving geology of oil and natural gas deposits; |

| | • | | the uncertainty of reserves estimates and reserves life; |

| | • | | the uncertainty of estimates and projections relating to production, costs and expenses; |

| | • | | potential delays or changes in plans with respect to exploration or development projects or capital expenditures; |

| | • | | our dependence on key personnel; |

| | • | | fluctuations in oil and natural gas prices, foreign currency exchange rates and interest rates; |

| | • | | health, safety and environmental risks; |

| | • | | uncertainties as to the availability and cost of financing; |

| | • | | unforeseen liabilities arising from litigation; and |

| | • | | the possibility that government policies or laws may change or governmental approvals may be delayed or withheld. |

18

MARKET FOR COMMON STOCK

Shares of our common stock, no par value, are issued in registered form. The transfer agent for the shares is Computershare Trust Company Inc., 100 University Avenue, 9th Floor, Toronto, Ontario M5J 2Y1. No significant trading suspensions have occurred in our common stock in the last three years. Our common stock has been listed and posted for trading on the TSX-V under our current name since September 28, 2001, and on the AMEX since June 21, 2006.

The following tables set forth the reported high and low closing bid prices for shares of our common stock (i) in United States dollars on the AMEX for our two most recent fiscal quarters and the months of June, July, August, September and October 2006 (ii) in Canadian dollars on the TSX-V for each of our five most recently completed fiscal years, each of the fiscal quarters in our two most recently completed fiscal years and the current fiscal year, and each of the most recent six months.

High and Low Prices for the Five Most

Recent Fiscal Years Expressed in Cdn$

| | | | | | |

| | | TSX-V |

Fiscal Year ended December 31, | | High | | Low |

2005 | | $ | 2.40 | | $ | 0.70 |

2004 | | $ | 1.01 | | $ | 0.29 |

2003 | | $ | 0.40 | | $ | 0.05 |

2002 | | $ | 0.29 | | $ | 0.06 |

2001 | | $ | 0.25 | | $ | 0.05 |

High and Low Prices for Each Quarter in the Two Most Recent Fiscal Years

and any Subsequent Quarters Expressed in Cdn$ (TSX) and US$ (AMEX)

| | | | | | | | | | | | |

| | | TSX-V | | AMEX |

Three Months Ended | | High | | Low | | High | | Low |

September 30, 2006 | | $ | 4.90 | | $ | 3.65 | | $ | 4.46 | | $ | 3.25 |

June 30, 2006 | | $ | 4.95 | | $ | 2.75 | | $ | 4.03 | | $ | 3.38 |

March 31, 2006 | | $ | 3.40 | | $ | 2.15 | | | — | | | — |

December 31, 2005 | | $ | 2.40 | | $ | 0.91 | | | — | | | — |

September 30, 2005 | | $ | 1.05 | | $ | 0.79 | | | — | | | — |

June 30, 2005 | | $ | 1.12 | | $ | 0.70 | | | — | | | — |

March 31, 2005 | | $ | 1.24 | | $ | 0.76 | | | — | | | — |

December 31, 2004 | | $ | 0.94 | | $ | 0.69 | | | — | | | — |

September 30, 2004 | | $ | 1.01 | | $ | 0.77 | | | — | | | — |

June 30, 2004 | | $ | 0.83 | | $ | 0.46 | | | — | | | — |

March 31, 2004 | | $ | 0.65 | | $ | 0.29 | | | — | | | — |

High and Low Prices for the Six Most Recent

Months Expressed in Cdn$ (TSX) and US$ (AMEX)

| | | | | | | | | | | | |

| | | TSX-V | | AMEX |

Period | | High | | Low | | High | | Low |

November 2006 | | $ | 4.85 | | $ | 4.10 | | $ | 4.30 | | $ | 3.60 |

October 2006 | | $ | 4.25 | | $ | 3.53 | | $ | 3.81 | | $ | 3.12 |

September 2006 | | $ | 4.90 | | $ | 3.70 | | $ | 4.46 | | $ | 3.28 |

August 2006 | | $ | 4.94 | | $ | 4.39 | | $ | 4.40 | | $ | 3.93 |

July 2006 | | $ | 4.60 | | $ | 3.65 | | $ | 4.12 | | $ | 3.25 |

June 2006 | | $ | 4.95 | | $ | 3.35 | | $ | 4.03 | | $ | 3.38 |

19

DIVIDEND POLICY

We have never paid any cash dividends on our common stock and do not anticipate paying any dividends in the foreseeable future. Our current business plan is to retain any future earnings to finance the expansion and development of our business. Any future determination to pay cash dividends will be at the discretion of our board of directors, and will be dependent upon our financial condition, results of operations, capital requirements and other factors as our board may deem relevant at that time.

CAPITALIZATION AND INDEBTEDNESS

The following table shows our cash and cash equivalents and capitalization as of September 30, 2006. You should read this information in conjunction with “Selected Historical Financial Data” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our audited financial statements, including the related notes, included elsewhere in this prospectus.

| | | | |

| | | September 30,

2006 | |

Cash and cash equivalents | | $ | 21,432,860 | |

| | | | |

Total debt liabilities | | $ | 2,262,448 | |

Stockholders’ equity: | | | | |

Common stock, no par value; unlimited shares authorized; 74,969,426 shares issued and outstanding | | | 65,233,481 | |

Accumulated deficit | | $ | (7,232,539 | ) |

| | | | |

Total stockholders’ equity | | $ | 58,000,942 | |

| | | | |

Total capitalization | | $ | 60,263,390 | |

| | | | |

20

CURRENCY EXCHANGE RATES

The following tables set forth the high and low rates of exchange for the Canadian dollar, expressed as U.S. dollars per Canadian dollar, for each of the previous six months and the average of such exchange rates during each of the five most recent fiscal years. The average rates presented in the table below represent the average of the exchange rates on the last day of each month during the period. Exchange rates represent the noon buying rate in New York City for cable transfers payable in foreign currencies as certified for customs purposes by the Federal Reserve Bank of New York. The noon rate of exchange on December 31, 2005 and November 30, 2006 as reported by the United States Federal Reserve Bank of New York for the conversion of Canadian dollars into United States dollars was Cdn$1.00 = U.S.$0.8579 and U.S.$0.8762, respectively.

Canadian Dollar/U.S. Dollar Exchange Rates for Five Most Recent Fiscal Years

| | | | | | | | | | |

| | | Year Ended December 31, | | Seven

Months

Ended December 31, 2001 |

| | | 2005 | | 2004 | | 2003 | | 2002 | |

End of period | | 0.8579 | | 0.8310 | | 0.7738 | | 0.6329 | | 0.6279 |

Average for the period | | 0.8282 | | 0.7719 | | 0.7205 | | 0.6370 | | 0.6406 |

High during the period | | 0.8690 | | 0.8493 | | 0.7738 | | 0.6619 | | 0.6622 |

Low during the period | | 0.7872 | | 0.7158 | | 0.6349 | | 0.6200 | | 0.6241 |

Canadian Dollar/U.S. Dollar Exchange Rates for Previous Six Months

| | | | | | | | | | | | |

| | | November

2006 | | October

2006 | | September

2006 | | August

2006 | | July

2006 | | June

2006 |

High | | 0.8869 | | 0.8965 | | 0.9048 | | 0.9037 | | 0.8999 | | 0.9098 |

Low | | 0.8715 | | 0.8784 | | 0.8872 | | 0.8840 | | 0.8760 | | 0.8896 |

21

BUSINESS

History and Development of the Company

We were incorporated as a company on March 17, 1972 in the Province of British Columbia, Canada, under the name “Pacific Talc Ltd.” pursuant to the Company Act (British Columbia). On November 12, 1998, we changed our name to “Columbia Copper Company Ltd.” and consolidated our share capital on the basis of four old shares for one new share. On September 28, 2001, we were continued from British Columbia to the Yukon Territory and changed our name to “Kodiak Oil & Gas Corp.” On September 23, 2003 we incorporated a wholly-owned subsidiary, Kodiak Oil & Gas (USA) Inc., in Colorado. We formed Kodiak Oil & Gas (USA) Inc. to hold all of our U.S. oil and natural gas properties.

We are an independent energy company focused on the exploration, exploitation, acquisition and production of natural gas and crude oil in the United States. Our oil and natural gas reserves and operations are concentrated in two Rocky Mountain Basins. Our corporate strategy is to internally identify prospects, acquire lands encompassing those prospects and evaluate those prospects using subsurface geology and geophysical data and exploratory drilling. Using this strategy, we have developed a portfolio of proved reserves, development and exploratory drilling opportunities on conventional and non-conventional oil and natural gas prospects.

Our current management acquired control of our company early in 2001. Initial operations focused on the acquisition of natural gas prospect lands in Wyoming. Our first project was a coalbed methane project in the Vermillion Basin of southwestern Wyoming, which we refer to as the Pacific Rim CBM Prospect. At the time, we did not have sufficient resources to fulfill our drilling commitments. Accordingly, we entered into an agreement with CP Resources LLC, a private company that was controlled by Messrs. Peterson and Catlin. Under the agreement, CP Resources paid the costs to drill two wells on the Pacific Rim CBM Prospect. Based on the drilling results, a third party entered into an agreement with CP Resources in June 2003 to jointly explore the Pacific Rim CBM Prospect. Under the agreement, the third party paid the first $2,500,000 of exploration expenditures. Subsequent expenditures were paid for in relationship to the parties’ respective working interests. CP Resources subsequently assigned its interest in the Pacific Rim CBM Prospect to our company in exchange for the issuance of 1,000,000 shares of our common stock and the delivery of a promissory note in the amount of $264,000, which represented 120% of the drilling costs incurred by CP Resources on the Pacific Rim CBM Prospect.

In September 2003, we raised net proceeds of $285,620 in a private placement of 3,857,500 units of equity securities. Each unit consisted of one share of common stock and one-half non-transferable share purchase warrant. One whole warrant entitled the holder to purchase one share of common stock at a price of Cdn$0.15 on or before six months from closing. In connection with the private placement, we also issued to the placement agent a warrant for 370,000 shares of common stock exercisable at Cdn$0.115 on or before September 17, 2004. All of the warrants issued to the investors and the placement agent were exercised. We used the net proceeds of the private placement and the exercise of the warrants to fund the Pacific Rim CBM Prospect and for general corporate purposes.

In February 2004, we raised net proceeds of $2,708,260 in a private placement of 11,428,572 units of equity securities. Each unit consisted of one share of common stock and one-half non-transferable share purchase warrant. One whole warrant entitled the holder to purchase one share of our common stock at a price of CDN$0.50 per share on or before twelve months from closing. We paid the placement agent a cash commission of 8% of the subscription proceeds and issued to the placement agent warrants equal to 8% of the number of units sold to purchase one share of our common stock at a price of Cdn$0.50 per share on or before twelve months from closing. In August 2004, we received net proceeds of $2,174,810 from the early exercise of 5,649,286 of the 5,714,286 purchase warrants issued to investors in the private placement. As an incentive to the warrant holders to exercise six months early, we issued an additional one-half non-transferable share purchase warrant, or a total of 2,824,643 bonus warrants, for each share purchase warrant exercised. Each bonus warrant entitled the

22

holder to purchase one share of our common stock at a price of Cdn$1.00 per share on or before twelve months from closing. In August 2005, we received net proceeds of $2,137,223 from the exercise of 2,561,618 bonus warrants. We used the proceeds from the issuance of the units and the exercise of the warrants in part to fund our exploration and development program and for working capital and general corporate purposes.

In March 2005, we raised net proceeds of $6,859,398 in a non-brokered private placement of 10 million shares of common stock. We used the net proceeds of this transaction to fund our exploration and development program.

In December 2005, we raised net proceeds of $8,492,475 in an unbrokered private placement of 7 million shares of common stock. We have used a portion of the net proceeds, and expect to use the remainder, to fund exploration and drilling programs and for working capital and general corporate purposes.

In March 2006, we raised net proceeds of $36,535,139 in a private placement of 19,514,268 shares of common stock to accredited investors. We have used a portion of the net proceeds, and expect to use the remainder, to fund exploration and drilling programs and for working capital and general corporate purposes.

Business Overview

We have focused our exploration on two geographic areas in the Rocky Mountain Region of the United States. We explore for conventional and unconventional natural gas plays in the Green River Basin in Wyoming and Colorado, and for oil in the Williston Basin in Montana and North Dakota. We are producing oil from our properties in the Williston Basin and natural gas from our properties in the Green River Basin. Existing oil and natural gas pipeline infrastructure is of critical importance to us in identifying our prospects. In most cases, our natural gas prospects are within a reasonable distance of natural gas pipelines, therefore limiting the construction of gathering systems necessary to tie into the existing lines. Our oil is transported mostly by trucks and, if available, pipelines. We sell our extracted oil to crude oil purchasers and our natural gas to natural gas pipeline operators at market prices.

We derived natural gas production revenues of $558,768 for the nine months ended September 30, 2006 from six wells in the Green River Basin, three of which we operate and in three of which we have a non-operating economic interest. We derived oil production revenues of $2,252,499 for the same period from seven wells that we operate in the Williston Basin.

Green River Basin

Our primary leaseholdings in the Green River Basin are located in an area referred to as the Vermillion Basin. In this geologic region, we believe there is natural gas trapped in various sands, coals, and shales at depths ranging from 2,000 feet to nearly 15,000 feet. The primary targets of our exploration efforts are the Almond sands at an approximate depth of 5,000 feet, the Baxter shale at approximately 10,000 feet, the Frontier sandstones at 13,000 feet and the Dakota sandstones at 14,000 feet. During the past two years, another exploration and production company has drilled fourteen wells in the Vermillion Basin to evaluate the deeper natural gas potential of this area. We believe that all of the wells are producing hydrocarbons, and that the prospective gas bearing zones may be present over a large geologic area, including most of the area where we have our leaseholds. Based upon the results of this drilling and other wells previously drilled to deeper horizons, the Baxter shale and the Frontier and Dakota sands have been found to be overpressured allowing gas to be produced in rocks with low permeability. While we do not know the total productive area and applicable production drainage, based on the exploration work of other producers in the Green River Basin, we believe that 40-acre spacing may be appropriate for optimum drainage on this prospect. Based on the 41,197 gross acres and 25,973 net acres that we control and a 40-acre spacing pattern, this prospect has the potential for hundreds of drilling locations.

23

Williston Basin

Our oil exploration efforts in the Williston Basin are concentrated on the oil and natural gas potential of the Mission Canyon Formation located at an approximate depth of 8,000 feet, the Bakken Formation at 10,500 feet and the Red River Formation at 11,000 feet. We have acquired an interest in 51,345 gross acres and 32,775 net acres in the Williston Basin.