Section 16(a) of the Securities Exchange Act of 1934, as amended, requires our directors and executive officers, and persons who own more than 10% of a registered class of our equity securities, to report their stock holdings and transactions to the Securities and Exchange Commission.

To our knowledge, based on a review of the copies of such reports furnished to us and written representations that no other reports were required, during the fiscal year ended December 31, 2005, our directors, officers and greater than 10% beneficial owners were in compliance with all of their Section 16(a) filing requirements, except that Mr. Foster inadvertently filed a late Form 3 in 2005 with respect to shares of stock of CSI that he had purchased in 2004 that were exchanged for shares of our common stock at the applicable exchange rate in the Merger.

We have employment agreements, which were entered into effective September 20, 2006, with each of our named executive officers on the terms and conditions summarized below, other than Peter Foster, whose employment with us terminated effective May 4, 2006. These employment agreements amended and restated the previously existing employment agreements with each of John Hinson, Michael Matysik, Kurt Lemvigh and Darryl Lustig.

Mr. Hinson. Pursuant to his employment agreement, Mr. Hinson serves as President and Chief Executive Officer. In 2005, under the terms of his prior employment agreement, Mr. Hinson received an annual base salary of $272,500 effective February 28, 2005. Effective May 1, 2006, Mr. Hinson’s annual base salary increased to $350,000. Mr. Hinson’s salary will be reviewed at least annually and may be changed at the discretion of the board or the compensation committee of the board. He is entitled to participate in the executive bonus plans adopted and modified by the board of directors and in other benefit programs, including basic health, dental and vision insurance, provided with the approval of the board, subject to applicable eligibility requirements. Mr. Hinson is also entitled to an annual automobile allowance of $6,000.

Mr. Matysik. Pursuant to his employment agreement, Mr. Matysik serves as Senior Vice President, Chief Financial Officer and Secretary. In 2005, under the terms of his prior employment agreement, Mr. Matysik received an annual base salary of $202,195 effective February 28, 2005. Effective May 1, 2006, Mr. Matysik’s annual base salary increased to $240,000. Mr. Matysik’s salary will be reviewed at least annually and may be changed at the discretion of the board or the compensation committee of the board. He is entitled to participate in the executive bonus plans adopted and modified by the board of directors and in other benefit programs, including basic health, dental and vision insurance, provided with the approval of the board, subject to applicable eligibility requirements.

Mr. Lemvigh. Pursuant to his employment agreement, Mr. Lemvigh serves as Vice President, International. Under his employment agreement, Mr. Lemvigh receives, and in 2005 under the terms of his prior employment agreement, Mr. Lemvigh received, an annual base salary of 1,673,640 DKr, or approximately $273,761. Mr. Lemvigh’s salary will be reviewed at least annually and may be changed at the discretion of the board or the compensation committee of the board. He is entitled to participate in the executive bonus plans and/or commission plans adopted and modified by the board of directors and in other benefit programs, including basic health, dental and vision insurance, provided with the approval of the board, subject to applicable eligibility requirements.

Mr. Lustig. Pursuant to his employment agreement, Mr. Lustig serves as Vice President, Primary Care. In 2005, under the terms of his prior employment agreement, Mr. Lustig received an annual base salary of $173,896 effective February 28, 2005. Effective May 1, 2006, Mr. Lustig’s annual base salary increased to $200,000. Mr. Lustig’s salary will be reviewed at least annually and may be changed at the discretion of the board or the compensation committee of the board. He is entitled to participate in the executive bonus plans and/or commission plans adopted and modified by the board of directors and in other benefit programs, including basic health, dental and vision insurance, provided with the approval of the board, subject to applicable eligibility requirements. Mr. Lustig is also entitled to an annual automobile allowance of $7,200.

Each of the agreements with Mr. Hinson, Mr. Matysik, Mr. Lemvigh and Mr. Lustig may be terminated (i) upon the death or total disability (as the term “total disability” is defined in the agreement) of such executed officer or (ii) by us or by such executive officer at any time for any reason; provided that with respect to Mr. Lemvigh, he is provided 2 months’ notice for termination by us for cause (as the term “cause” is defined in Mr. Lemvigh’s agreement) and 6 months’ notice for termination by us for any other reason, and Mr. Lemvigh provides 1 month’s notice for termination by him for any reason. If such executive officer’s employment is terminated due to death or total disability, he will be entitled to receive any base salary due to him and vacation time that has accrued through the date of his termination. If such executive officer’s employment is terminated for any reason, other than in connection with or within twenty-four months of a change of control, as described further below, he will be entitled to receive only base salary due to him and vacation time that has accrued through the date of his termination.

If a change of control occurs during the term of Mr. Hinson’s, Mr. Matysik’s, Mr. Lemvigh’s or Mr. Lustig’s employment with us and we terminate such executive officer’s employment without cause (as the term “cause” is defined in each agreement) in connection with the change of control, the successor employer terminates such executive officer’s employment without cause within twenty-four months of the consummation of the change of control, or the named executive officer terminates his employment for good reason (as the term “good reason” is defined in each agreement) in connection with the change of control or within twenty-four months of the consummation of the change of control (each such event a “Change in Control Trigger Event”), such executive officer will be entitled to receive a severance benefit equal to the percentage of his then current annual base salary to be paid out in accordance with regularly scheduled payroll and continuation of health and other benefits substantially equal to those benefits in place on the date of termination for a period of months, as specified below:

-14-

| | | | | | Continuation of Health |

| Name | | | Severance Benefit | | and Other Benefits (in months) |

| John R. Hinson | | 150 | % | | 18 | |

| Michael K. Matysik | | 100 | % | | 12 | |

| Kurt B. Lemvigh | | 50 | % | | 6 | |

| Darryl R. Lustig | | 50 | % | | 6 | |

In addition, each of Mr. Hinson, Mr. Matysik, Mr. Lemvigh and Mr. Lustig will also be entitled to payment of any unpaid annual salary and unpaid vacation that has accrued through the date of termination, a bonus payment equal to the target or budgeted amount for the year in which the termination occurs, pro-rated through the date of termination, and acceleration of vesting of all of unvested options to purchase shares of our common stock or shares of common stock of the successor employer held by such executive officer as of the date of termination. If we terminate Mr. Hinson’s, Mr. Matysik’s, Mr. Lemvigh’s or Mr. Lustig’s employment for cause in connection with the change of control, the successor employer terminates such executive officer’s employment with cause within twenty-four months of the consummation of the change of control, or such executive officer terminates his employment without good reason in connection with the change of control or within twenty-four months of the change of control, he will be entitled to receive only base salary due to him and vacation time that has accrued through the date of his termination. In all termination of employment events in connection with a change of control as described above, Mr. Lemvigh is entitled to 6 months’ notice during which he is entitled to receive base salary and benefits in effect as of the date of such notice.

Mr. Foster. In 2005, Mr. Foster received a base salary of $200,000, and was eligible to receive commissions of 0.001% on all worldwide sales to be paid monthly and for an incentive bonus of $20,000 (“Target Bonus”) based on the achievement of performance targets mutually agreed upon by Mr. Foster and our Chief Executive Officer. He was eligible to participate in stock option and other incentive programs available to our employees and the other employee benefit plans generally available to our employees.

Mr. Foster’s employment agreement provided certain compensation and other benefits in the event that Mr. Foster’s employment terminated under certain circumstances.

On April 26, 2006, we entered into a Severance and Release Agreement with Mr. Foster pursuant to which Mr. Foster’s employment was terminated effective April 30, 2006. Under the severance agreement, effective May 4, 2006, Mr. Foster received 5 times his regular base monthly salary paid in a lump sum, was entitled to receive his regular monthly base salary for 3 months following the termination date, a pro rata portion of bonus, if any, related to the achievement of sales targets, and a subsidy for medical insurance for up to 18 months following termination or until acceptance of new employment. In addition, Mr. Foster may receive up to $35,000 in moving expenses under this severance agreement. No bonus amount will be paid to Mr. Foster.

Change-in-Control Arrangements

Pursuant to both the 1998 Equity Incentive Plan (the “1998 Plan”) and the 2002 Plan, in the event of certain corporate transactions, such as the sale of all or substantially all of our securities or assets or a merger, the 1998 Plan and the 2002 Plan each provide that each outstanding award will be assumed or substituted with a comparable award by the surviving corporation or acquiring corporation. If the surviving corporation or acquiring corporation does not assume or substitute awards, outstanding awards will become 100% vested and exercisable immediately before the corporate transaction. To the extent that options accelerate due to a corporate transaction, the restrictions on stock awards also will lapse. In the event of our dissolution or liquidation, such awards terminate if not exercised prior to such event.

Pursuant to our 2002 Employee Stock Purchase Plan (the “ESPP”), in the event of certain corporate transactions, such as a merger, consolidation or sale of all or substantially all of our assets, each outstanding right to purchase shares under the ESPP will be assumed or an equivalent right substituted by the acquiring or surviving corporation. If such corporation does not assume or substitute for the right, the offering period during which a participant may purchase stock will be shortened to a specified date before the proposed transaction. Similarly, in the event of our proposed liquidation or dissolution, the offering period during which a participant may purchase stock will be shortened to a specified date before the date of the proposed liquidation or dissolution.

-15-

Pursuant to our 1997 Plan, in the event of certain corporate transactions, such as the sale of substantially all of our securities or assets or a merger, the shares subject to each option outstanding under the 1997 Plan at the time of such corporate transaction shall automatically become 100% vested and exercisable immediately prior to the effective date of the corporate transaction. In addition, all outstanding repurchase rights under the stock issuance program under the 1997 Plan shall also terminate automatically, and the shares subject to those terminated rights shall immediately vest in full, in the event of any corporate transaction. The plan administrator under the 1997 Plan also has the discretion, exercisable either at the time the option is granted or at any time while the option remains outstanding, to provide for the automatic acceleration (in whole or in part) of one or more outstanding options (and the immediate termination of our repurchase rights with respect to the shares).

Executive Compensation

Summary Compensation Table

The following table sets forth the compensation paid by us for services rendered to us in all capacities during the years ended December 31, 2005, 2004 and 2003, to our Chief Executive Officer and each of our other four most highly compensated executive officers whose total salary and bonus for such year exceeded $100,000. Mr. Hinson, Mr. Matysik and Mr. Lustig served as executive officers of Quinton prior to the Merger, and Mr. Foster and Mr. Lemvigh served as executive officers of CSI prior to the Merger. The compensation shown for fiscal year 2005 includes compensation for services to us following the consummation of the Merger on September 1, 2005, for the former Quinton executives includes compensation earned with respect to services to Quinton from January 1, 2005 through August 31, 2005, and for former CSI executives includes compensation earned with respect to services to CSI from January 1, 2005 through August 31, 2005. The compensation shown for the former Quinton executives for years prior to our 2005 fiscal year is for Quinton’s fiscal years ended December 31, 2004 and 2003. The compensation shown for the former CSI executives for years prior to our 2005 fiscal year is for CSI’s fiscal years ended December 31, 2004 and 2003. All information related to options granted prior to the consummation of the Merger reflects the number of the shares of Quinton or CSI common stock as adjusted to reflect the Merger.

| | | | | | | | | | | | Long Term | | | |

| | | | | | | | | | | | Compensation | | | |

| | | | | | | | | | | | Awards | | | |

| | | | | Annual Compensation | | Shares | | All Other |

| | | | | | | | | | Other Annual | | Underlying | | Compensation |

| Name & Principal Position | | | Year | | Salary ($) | | Bonus ($) | | Compensation | | Options (#) | | ($) |

| John R. Hinson | | 2005 | | 268,173 | | 70,000 | | | | (1) | | 50,000 | | | 3,390 | | (2) |

| President and CEO | | 2004 | | 250,000 | | 80,025 | | | | (1) | | 80,000 | | | 3,390 | |

| | | 2003 | | 232,692 | | 81,690 | | | | (1) | | 50,000 | | | 3,356 | |

| |

| Michael K. Matysik | | 2005 | | 198,985 | | 45,000 | | | | — | | 25,000 | | | 3,445 | | (3) |

| Senior Vice President and CFO | | 2004 | | 183,481 | | 54,539 | | | | — | | 50,000 | | | 3,406 | |

| | | 2003 | | 175,000 | | 49,183 | | | | — | | 25,000 | | | 3,256 | |

| |

| Peter Foster(4) | | 2005 | | 200,000 | | 66,322 | | (5) | | (7) | | 15,000 | | | 2,099 | | (8) |

| Vice President, Public Access Defibrillation | | 2004 | | 65,128 | | 17,090 | | (6) | | (7) | | 15,000 | | | 1,650 | |

| | | | | | | | | | | | | | | |

| Kurt B. Lemvigh | | 2005 | | 279,665 | | 30,127 | | (9) | | (12) | | 15,000 | | | 15,102 | | (13) |

| Vice President, International | | 2004 | | 240,613 | | 47,685 | | (10) | | (12) | | 7,500 | | | 12,993 | |

| | | 2003 | | 199,734 | | 28,377 | | (11) | | (12) | | 5,000 | | | 10,786 | |

| | | | | | | | | | | | | | | |

| Darryl R. Lustig | | 2005 | | 172,765 | | 65,212 | | (14) | | (17) | | 20,000 | | | 3,256 | | (18) |

| Vice President, Primary Care | | 2004 | | 166,477 | | 82,937 | | (15) | | (17) | | 20,000 | | | 3,256 | |

| | | 2003 | | 152,184 | | 81,831 | | (16) | | (17) | | 15,000 | | | 1,848 | |

____________________

| (1) | | Mr. Hinson received a car allowance in each of these years. |

| |

| (2) | | Consists of matching contributions of $3,000 made by us to his 401(k) savings and retirement plan account and life insurance premiums of $390 paid by us for term life insurance for his benefit. |

-16-

| (3) | | Consists of matching contributions of $3,000 made by us to his 401(k) savings and retirement plan account and life insurance premiums of $445 paid by us for term life insurance for his benefit. |

| |

| (4) | | Mr. Foster was hired by CSI in August 2004. |

| |

| (5) | | Includes $66,322 in sales commission. |

| |

| (6) | | Includes $17,090 in sales commission. |

| |

| (7) | | Mr. Foster received membership fees in a health club in each of these years. |

| |

| (8) | | Consists of matching contributions of $1,859 made by us to his 401(k) savings and retirement plan account and life insurance premiums of $240 paid by us for term life insurance for his benefit. |

| |

| (9) | | Includes $30,127 in sales bonuses. |

| |

| (10) | | Includes $47,685 in sales bonuses. |

| |

| (11) | | Includes $28,377 in sales bonuses. |

| |

| (12) | | We made lease payments on a car used by Mr. Lemvigh in each of these years. |

| |

| (13) | | Consists of matching contributions of $15,102 made by us to his pension plan. |

| |

| (14) | | Includes $45,212 in sales bonuses. |

| |

| (15) | | Includes $65,069 in sales bonuses. |

| |

| (16) | | Includes $47,294 in sales bonuses. |

| |

| (17) | | Mr. Lustig received a car allowance in each of these years. |

| |

| (18) | | Consists of matching contributions of $3,000 made by us to his 401(k) savings and retirement plan account and life insurance premiums of $256 paid by us for term life insurance for his benefit. |

Option Grants In Last Fiscal Year

The following table sets forth certain information regarding stock options we granted during the fiscal year ended December 31, 2005 to the executive officers named in the summary compensation table:

| | | Individual Grants | | | | | |

| | | Number of | | % of Total | | | | | | Potential Realizable Value at |

| | | Securities | | Options | | Exercise | | | | Assumed Annual Rates of |

| | | Underlying | | Granted to | | Price Per | | | | Share Price Appreciation for |

| | | Options | | Employees in | | Share | | | | Option Term (3) |

| Name | | | Granted (#)(1) | | Fiscal Year(2) | | ($/Share) | | Expiration Date | | 5% ($) | | 10% ($) |

| John R. Hinson | | 50,000 | | 10.3% | | | $ 9.05 | | 11/9/2015 | | $ | 284,500 | | $ 721,000 |

| |

| Michael K. Matysik | | 25,000 | | 5.2% | | | $ 9.05 | | 11/9/2015 | | $ | 142,250 | | $ 360,500 |

| |

| Peter Foster | | 15,000 | | 3.1% | | | $ 9.05 | | 11/9/2015 | | $ | 85,350 | | $ 218,300 |

| |

| Kurt B. Lemvigh | | 15,000 | | 3.1% | | | $ 9.05 | | 11/9/2015 | | $ | 85,350 | | $ 216,300 |

| |

| Darryl R. Lustig | | 20,000 | | 4.1% | | | $ 9.05 | | 11/9/2015 | | $ | 113,800 | | $ 288,400 |

____________________

| (1) | | The per share exercise price is the fair market value of our common stock on the date of grant. The options set forth above were vested 100% upon grant and are fully exercisable. |

| |

| (2) | | Based on options to purchase a total of 483,336 shares of our common stock granted to employees during fiscal year 2005. |

| |

| (3) | | The potential realizable value calculated based on the term of the option at the time of grant (10 years). Stock price appreciation of 5% and 10% is assumed pursuant to rules promulgated by the Securities and Exchange Commission and does not represent a prediction of our stock price performance. Actual gains, if any, are dependent on the actual future performance of our common stock and no gain to the optionee is possible unless the stock price increases over the option term, which will benefit all stockholders. |

-17-

Aggregated Option Exercises in Last Fiscal Year and Fiscal Year-End Option Values

None of the named executive officers exercised options during 2005. The following table sets forth information as of December 31, 2005 concerning exercisable and unexercisable stock options held by the executive officers named in the summary compensation table.

| | | Number of Securities | | | | | | |

| | | Underlying | | Value of Unexercised |

| | | Unexercised Options | | In-the-Money Options |

| | | at Fiscal Year-End (#) | | at Fiscal Year-End ($)(1) |

| Name | | | Exercisable | | Unexercisable | | Exercisable | | Unexercisable |

| John R. Hinson | | 292,720 | | 44,705 | | $ | 1,147,064 | | $ | 14,409 |

| Michael K. Matysik | | 172,131 | | 26,534 | | $ | 17,494 | | $ | 7,205 |

| Peter Foster | | 40,000 | | 0 | | $ | 0 | | $ | 0 |

| Kurt B. Lemvigh | | 30,000 | | 0 | | $ | 0 | | $ | 0 |

| Darryl R. Lustig | | 39,374 | | 19,218 | | $ | 10,496 | | $ | 4,324 |

____________________

| (1) | | Based on the difference between the fair market value on the December 31, 2005 ($9.05 per share) and the exercise price. |

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Concurrent with the closing of the Merger, and pursuant to the Senior Note and Warrant Conversion Agreement (the “Conversion Agreement”) by and among us, CSI and certain affiliates of Perseus, LLC (“Perseus”) dated February 28, 2005, Perseus exchanged senior notes having an aggregate principal amount and accrued interest of approximately $61 million, as well as warrants to purchase approximately 13.4 million shares of CSI common stock, for a combination of $20 million in cash and 2,843,915 shares of our common stock. We filed a registration statement on Form S-3 covering the resale of the securities issued pursuant to the Conversion Agreement on December 7, 2005. Ray E. Newton, III, one of our directors, is a managing director of Perseus, which through its affiliated funds beneficially owns approximately 14% of our outstanding common stock.

REPORT OF THE COMPENSATION COMMITTEE OF THE BOARD OF

DIRECTORS ON EXECUTIVE COMPENSATION

Compensation Committee Report

This is the report of the compensation committee that was established as of September 1, 2005, the effective date of the Merger.

Our executive compensation program is administered by the compensation committee, which is currently comprised of four non-employee directors.

Philosophy. Our executive compensation policy is designed to:

- assist us in attracting and retaining highly qualified executives critical to the company’s success;

- align the interests of the executives with the interests of our shareholders;

- link compensation to individual and company performance — both short-term and long-term; and

- motivate executives to achieve sustained superior performance.

Executive compensation consists of three major components that are reviewed annually by the compensation committee: base salary, bonuses and stock options.

-18-

Base Salary. The compensation committee sets the base salary of the Chief Executive Officer at an amount it believes is competitive with the salaries paid to executives of other companies in the industry. In determining salaries, the compensation committee relies on surveys and on knowledge of local pay practices, including total cash compensation paid to executives in base salary and bonus, as reported in financial periodicals or otherwise accessible to the committee. Additionally, the committee reviews the Chief Executive Officer’s performance and the company’s financial and stock price performance generally. Executive base salaries are targeted at mid-range for comparable positions in the industry, comparable scope of responsibility and comparable levels of experience. Taking into account the factors and the information described above, the compensation committee approved raises in base compensation for the company’s executive officers effective May 1, 2006. Increases ranged from 13.7% to 28.4%, with the exception of two executives recently hired by the Company who received no or nominal increases, an executive whose base salary remained unchanged due to it being higher than other executives in similar positions, and one executive who through a promotion received a slightly higher increase.

Bonus. The compensation committee believes that the company’s cash bonus plans are an important component of total cash compensation and have been implemented to provide executive officers and other employees the opportunity to earn incentive bonuses based on the company’s financial performance. The purpose of the bonus plans is to attract, retain, motivate and reward participants by directly linking the amount of a cash bonus under the bonus plans to specific financial goals.

The company assumed Quinton’s 2005 Management Incentive Plan in the Merger. All of the company’s executive officers, except Peter Foster and Kurt Lemvigh, were eligible to participate in the 2005 Management Incentive Plan. The 2005 Management Incentive Plan allows for cash distribution to all management employees, including executive officers. Goals of this plan include rewarding participants annually based on overall company performance and sharing in the company’s financial success. The amount of cash distribution under the plan is entirely discretionary, with 60% of the target payout subject to achievement of 80% of budgeted pretax income (based on the company’s audited financial results) and 40% of the target payout subject to achievement of individual performance goals set for each executive. No bonus is paid if the company does not achieve 80% of budgeted pretax income. Budgeted pretax income and individual performance goals are established early in the fiscal year. Target payouts are up to 10% of the executive’s base salary subject to availability of funds through an established accrual rate of 7.5% of consolidated pretax income. In addition, certain of the company’s senior executives, including the Chief Executive Officer, are eligible to participate in a senior management program administered under the 2005 Management Incentive Plan guidelines that sets target payouts at up to 50% of such executive’s base salary, including the 10% target payout under the general terms of the 2005 Management Incentive Plan. The 2005 Management Incentive Plan cash distributions were approved by the compensation committee in February 2006, and no executive received a payout in excess of his target payout. In May 2006, the compensation committee approved a 2006 Management Incentive Plan that is similar to the 2005 Management Incentive Plan.

The company also assumed Quinton’s 2005 sales bonus plans for key sales personnel in the Merger. Messrs. Criss and Lustig participated in 2005 sales bonus plans. Payments under the 2005 sales bonus plans were based on achievement of a pre-established sales target for each sales executive, which sales target was based on internally recorded annual revenues of specified products. No participant receives a bonus if he achieves less than 90% of his sales target. Each participant in a 2005 sales bonus plan receives 10% of his salary for achieving 90% of his sales target and could receive up to 30% of his base salary for 100% achievement of his sales target plus an additional 1% of base salary for each percentage point over 100% achievement of the sales target. In 2005, Mr. Lemvigh participated in a bonus program pursuant to which he eligible to receive a quarterly sales commission based on CSI’s international sales, and Peter Foster participated in a bonus program pursuant to which he was eligible to receive a bonus based on achievement of pre-established targets based on CSI’s total annual sales, both of which programs were assumed by the company in the Merger. The amount of bonus payments made in 2005 to Messrs. Foster, Lemvigh and Lustig is presented in the Summary Compensation Table under the heading “Bonus” and in the related footnotes. The compensation committee approved 2006 sales bonus plans for key sales personnel, including Messrs. Criss, Ford, and Lustig. The 2006 sales bonus plans are similar to the 2005 sales bonus plans, except sales targets are based on internally recorded annual revenues of a specified sales channel rather than for specified products. Mr. Lemvigh will continue to participate in the sales commission program described above.

-19-

Stock Option Grants. The objectives of substantial long-term incentives are to enhance long-term profitability and shareholder value. The compensation committee determines the number and terms of options granted to the company’s Chief Executive Officer, other executive officers and all other employees. Grant amounts are based on individual circumstances, in consideration of each executive’s experience, scope of responsibility and individual performance, both demonstrated and expected. In addition, the compensation committee evaluates information available to it about equity compensation paid to chief executive officers and chief financial officers at peer companies within the company’s industry. In general, the compensation committee approves annual grants to executive officers and employees once a year in March, a mid-year grant to employees who were hired by the company since the beginning of the year and to executives upon initial hire.

Chief Executive Officer Compensation.For his service as President and Chief Executive Officer of Quinton from January 1, 2005 to August 31, 2005 and as President and Chief Executive Officer of the Company from September 1, 2005 to December 31, 2005, Mr. Hinson received a base salary of $268,173. Mr. Hinson received a cash bonus of $70,000 under the 2005 Management Incentive Plan for his service to Quinton and the Company in 2005, which was based on the company’s achievement of 80% of pretax budgeted income, achievement of pre-established individual performance objectives and how Mr. Hinson’s performance contributed to the achievement of pre-established company financial objectives. In addition, he was granted options to purchase 50,000 shares of common stock during 2005. The compensation committee determined the salary, bonus and quantity of the stock options granted to Mr. Hinson based on his experience, scope of responsibility, and expected and demonstrated individual performance. In 2005, Mr. Hinson received $3,000 in matching contributions to the 401(k) plan along with $390 in life insurance premiums paid by the company for Mr. Hinson’s benefit and a car allowance.

Tax Deductibility Considerations. Section 162(m) of the Internal Revenue Code limits the tax deductibility by a corporation of compensation in excess of $1 million paid to the Chief Executive Officer and any other of its four most highly compensated executive officers. However, compensation that qualifies as “performance-based” is excluded from the $1 million limit. The committee does not presently expect total cash compensation payable for salaries to exceed the $1 million limit for any individual executive. At this time, equity awards under our equity incentive plans are not designed to qualify as performance-based compensation that is fully deductible by the company for income tax purposes. Therefore, some equity awards may result in some cases in the loss of tax deductibility of compensation. The committee intends to review periodically whether to continue this approach in light of the best interests of the company and shareholders.

Conclusion. The committee believes that our compensation policies have been successful in attracting and retaining qualified employees and in linking compensation directly to corporate performance relative to our goals. The committee will continue to monitor the compensation levels potentially payable under our other compensation programs, but intends to retain the flexibility necessary to provide total compensation in line with competitive practice, our compensation philosophy and the company’s best interests.

| THE COMPENSATION COMMITTEE: |

| |

| Bruce J. Barclay |

| W. Robert Berg |

| Jue-Hsien Chern |

| Jeffrey F. O’Donnell, Sr. |

-20-

PERFORMANCE MEASUREMENT COMPARISON

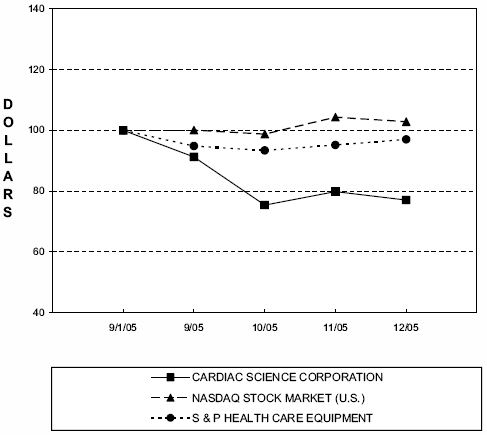

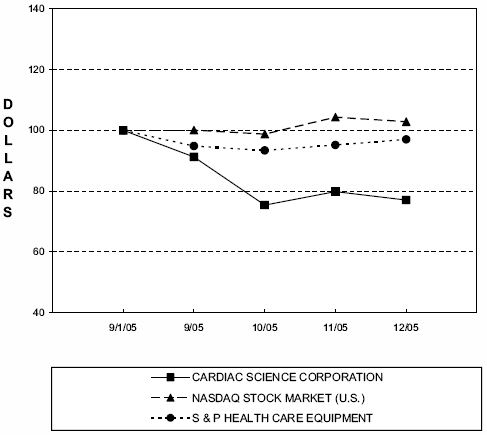

The following graph shows the cumulative total stockholder return of an investment of $100 in cash on September 1, 2005 (the date on which our common stock was first traded on the Nasdaq National Market) for (i) our common stock, (ii) the Nasdaq Stock Market (U.S.) Index, and (iii) the S&P Health Care Equipment Index. The cumulative total return on our common stock and each index assumes the value of each investment was $100 on September 1, 2005 and that all dividends were reinvested. All values are calculated as of the dates set forth in the graph below.

-21-

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information known to us with respect to the beneficial ownership of our common stock as of August 1, 2006, by:

- each person known to the board of directors to own beneficially 5% or more of our common stock;

- each of our directors;

- each of the executive officers named in the summary compensation table; and

- all of our current directors and executive officers as a group.

| Percent of Shares Beneficially Owned |

| |

| | | Number of Shares | | Percent of |

| Name of Beneficial Owner | | | Beneficially Owned (1) | | Outstanding Shares |

| Entities affiliated with Perseus L.L.C. (2) | | 3,151,773 | | | 13.9 | % |

| 2099 Pennsylvania Avenue, Suite 900 | | | | | | |

| Washington, D.C. 20006-7813 | | | | | | |

| J. Carlo Cannell (3) | | 1,729,224 | | | 7.7 | % |

| 150 California Street, 5thFloor | | | | | | |

| San Francisco, CA 94111 | | | | | | |

| Goldman Sachs Asset Management, L.P. (4) | | 1,270,824 | | | 5.6 | % |

| 32 Old Slip | | | | | | |

| New York, NY 10005 | | | | | | |

| Wells Fargo & Company (5) | | 1,204,605 | | | 5.4 | % |

| 420 Montgomery Street | | | | | | |

| San Francisco, CA 94104 | | | | | | |

| Raymond W. Cohen (6) | | 277,825 | | | 1.2 | % |

| Ruediger Naumann-Etienne (7) | | 481,869 | | | 2.1 | % |

| John R. Hinson (8) | | 488,577 | | | 2.1 | % |

| Michael K. Matysik (9) | | 205,244 | | | | * |

| Peter Foster (10) | | 32,436 | | | | * |

| Kurt Lemvigh (11) | | 40,000 | | | | * |

| Darryl R. Lustig (12) | | 51,905 | | | | * |

| Bruce J. Barclay (13) | | 27,500 | | | | * |

| W. Robert Berg (14) | | 34,698 | | | | * |

| Jue-Hsien Chern (15) | | 28,936 | | | | * |

| Ray E. Newton, III (16) | | — | | | | * |

| Jeffrey F. O’Donnell, Sr. (17) | | 27,500 | | | | * |

| All directors and executive officers (17 persons) (18) | | 2,167,204 | | | 9.0 | % |

____________________

| * | | Less than one percent. |

| | | |

| (1) | | Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act. In computing the number of shares beneficially owned by a person or a group and the percentage ownership of that person or group, shares of our common stock subject to options currently exercisable or exercisable within 60 days after August 1, 2006 are deemed outstanding, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. As of August 1, 2006, we had 22,516,569 shares of common stock outstanding. Except as otherwise indicated in the footnotes to this table and subject to applicable community property laws, each shareholder named in the table has sole voting and investment power with respect to the number of shares listed opposite the shareholder’s name. Unless otherwise indicated, the address of each of the individuals and entities named below is: c/o Cardiac Science Corporation, 3303 Monte Villa Parkway, Bothell, Washington 98021. |

-22-

| (2) | Consists of 96,888 shares issuable upon exercise of outstanding warrants and 3,054,885 shares owned by Perseus Acquisition/Recapitalization Fund, LLC, Perseus Market Opportunity Fund, LP and Cardiac Science Co-Investment, LP. Frank H. Pearl, an executive officer of Perseus, LLC, may be deemed a beneficial owner of the shares. |

| |

| | Ray E. Newton, III, is a member of our board of directors and a Managing Director of Perseus, LLC. Perseus Acquisition/Recapitalization Management, LLC is a Managing Member of Perseus Acquisition/Recapitalization Fund, LLC. Perseuspur, LLC is a Managing Member of Perseus Acquisition/Recapitalization Management, L.L.C. By reason of such relationships, each of (i) Perseus Acquisition/ Recapitalization Management, LLC and (ii) Perseuspur, LLC may be deemed to have the power to direct the voting and disposition of the shares beneficially owned by Perseus Acquisition/Recapitalization Fund, LLC. Mr. Frank H. Pearl may also be deemed to have the power to direct the voting and disposition of the shares beneficially owned by Perseus Acquisition/Recapitalization Fund, LLC. |

| |

| | Perseus Market Opportunity Partners, L.P. is a General Partner of Perseus Market Opportunity Fund, L.P. Perseus Market Opportunity Partners GP, L.L.C. is a General Partner of Perseus Market Opportunity Partners, L.P. Perseus, LLC is a Managing Member of Perseus Market Opportunity Partners, G.P., L.L.C. Perseuspur, LLC is a Managing Member of Perseus, LLC. By reason of such relationships, each of (i) Perseus Market Opportunity Partners, L.P., (ii) Perseus Market Opportunity Partners GP, L.L.C., (iii) Perseus, LLC and (iv) Perseuspur, LLC may be deemed to have the power to direct the voting and disposition of the shares beneficially owned by Perseus Market Opportunity Fund, L.P. Mr. Frank H. Pearl, a Managing Director of Perseus, LLC, may also be deemed to have the power to direct the voting and disposition of the shares beneficially owned by Perseus Market Opportunity Fund, L.P. |

| |

| | Perseus Acquisition/Recapitalization Management, L.L.C. is a General Partner of Cardiac Science Co-Investment, L.P. Perseuspur, LLC is a Managing Member of Perseus Acquisition/Recapitalization Management L.L.C. By reason of such relationships, each of (i) Perseus Acquisition/Recapitalization Management, L.L.C. and (ii) Perseuspur, LLC may be deemed to have the power to direct the voting and disposition of the shares beneficially owned by Cardiac Science Co- Investment, L.P. Mr. Frank H. Pearl may also be deemed to have the power to direct the voting and disposition of the shares beneficially owned by Cardiac Science Co-Investment, L.P. |

| |

| (3) | Beneficial ownership of shares as reported on Schedule 13G/A filed with the Securities and Exchange Commission on February 15, 2006. According to such filing, J. Carlo Cannell has sole voting power and sole dispositive power with respect to all shares. Mr. Cannell is the controlling member of Cannell Capital, LLC, an investment adviser. |

| |

| (4) | Beneficial ownership of shares as reported on Schedule 13G/A filed with the Securities and Exchange Commission on February 6, 2006. According to such filing, Goldman Sachs Asset Management , L.P. has sole voting power with respect to 1,083,337 shares and sole dispositive power with respect to all shares. |

| |

| (5) | Beneficial ownership of shares as reported on Schedule 13G/A filed with the Securities and Exchange Commission on March 6, 2006. The Schedule 13G/A reports each of Wells Fargo & Company owns 1,204,605 shares and Wells Capital Management Incorporated owns 1,180,095 shares. The Schedule 13G/A also reports that Wells Fargo & Company is a parent holding company and that Wells Capital Management Incorporated is a registered investment advisor. As reported in the Schedule 13G/A, each of Wells Fargo & Company has sole voting power with respect to 1,092,865 shares and sole dispositive power with respect to all shares, and Wells Capital Management Incorporated has sole voting power with respect to 1,092,865 shares and sole dispositive power with respect to 1,180,095 shares. |

| |

| (6) | Includes 265,000 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (7) | Includes 386,121 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (8) | Includes 311,532 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (9) | Includes 182,987 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (10) | Includes 30,000 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (11) | Consists of 40,000 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (12) | Includes 46,372 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (13) | Consists of 27,500 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (14) | Includes 29,295 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

-23-

| (15) | Includes 25,436 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (16) | See Note 2. |

| |

| (17) | Consists of 27,500 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

| (18) | Includes 1,557,882 shares issuable upon exercise of options which are currently exercisable or exercisable within 60 days after August 1, 2006. |

| |

-24-

ADDITIONAL INFORMATION AND STOCKHOLDER PROPOSALS

Selection of Independent Registered Public Accounting Firm

The audit committee of our board of directors appointed KPMG LLP as our independent registered public accounting firm to audit our financial statements for the fiscal year ending December 31, 2006. We expect that representatives from KPMG LLP will be present at the 2006 annual meeting, will be given an opportunity to make a statement if they wish to do so and will be available to respond to appropriate questions.

Stockholder Proposals

Proposals of stockholders that are intended to be presented at our 2007 Annual Meeting of Stockholders must be received by us not later than May 26, 2007 in order to be included in the proxy statement and proxy relating to that annual meeting. A stockholder must have continuously held at least $2,000 in market value, or 1%, of our outstanding stock for at least one year by the date of submitting the proposal, and the stockholder must continue to own such stock through the date of the meeting. In addition, if we receive notice of a stockholder proposal earlier than June 26, 2007 or later than July 26, 2007, the persons named as proxies in the proxy statement for our 2007 Annual Meeting of Stockholders will have discretionary authority to vote on such proposal at the meeting.

Stockholders are also advised to review our bylaws that contain additional requirements with respect to advance notice of stockholder proposals and director nominations. These advance notice provisions apply regardless of whether a stockholder seeks to include such proposals in our proxy statement.

| By Order of the Board of Directors, |

|  |

| Michael K. Matysik |

| Senior Vice President, Chief Financial |

| Officer and Secretary |

September 22, 2006

A copy of our Annual Report to the Securities and Exchange Commission on Form 10-K for the fiscal year ended December 31, 2005 is available without charge upon written request to: Investor Relations, Cardiac Science Corporation, 3303 Monte Villa Parkway, Bothell, Washington 98021.

-25-

APPENDIX A

CARDIAC SCIENCE CORPORATION

AUDIT COMMITTEE CHARTER

I. GENERAL FUNCTIONS, AUTHORITY, AND ROLE

The Audit Committee (the “Audit Committee”) is a committee of the Board of Directors (the “Board”) of Cardiac Science Corporation (the “Company”). The Audit Committee’s primary function shall be to assist the Board in fulfilling its oversight responsibilities by reviewing the financial information to be provided to the stockholders and others, the systems of internal controls that management and the Board have established, and the Company’s audit process.

The Audit Committee shall have the power to conduct or authorize investigations into any matters within the Audit Committee’s scope of responsibilities. In connection with such investigations or otherwise in the course of fulfilling its responsibilities under this charter, the Audit Committee shall have the authority to engage and compensate special legal, accounting, or other consultants to advise it as it deems necessary, and may request any officer or employee of the Company, its outside legal counsel or outside auditor to attend a meeting of the Audit Committee or to meet with any members of, or consultants to, the Audit Committee. The Audit Committee may also meet with the Company’s investment bankers or financial analysts who follow the Company. The Audit Committee shall also have the authority to determine the funding by the Company of ordinary administrative expenses of the Audit Committee that are necessary and appropriate in carrying out its duties.

The Company’s outside auditor shall ultimately be accountable to the Board and to the Audit Committee, as representative of the stockholders, and the Audit Committee shall have direct responsibility to appoint, evaluate, compensate, retain, oversee (including resolving disagreements between management and the outside auditor regarding financial reporting) and, where appropriate, replace the outside auditor, or to nominate the outside auditor to be proposed for stockholder ratification. In the course of fulfilling its specific responsibilities hereunder, the Audit Committee shall strive to maintain an open avenue of communication between the Company’s outside auditor and the Board.

The responsibilities of a member of the Audit Committee shall be in addition to such member’s duties as a member of the Board.

II. MEMBERSHIP

The membership of the Audit Committee shall consist of at least three independent outside members of the Board who shall serve at the pleasure of the Board. The membership of the Audit Committee shall meet the independence and financial literacy, experience and sophistication requirements of The Nasdaq Stock Market, Inc.(“Nasdaq”) or similar requirements of such other securities exchange or quotation system as may from time to time apply to the Company (taking into account applicable exceptions therefrom) and any requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and the Securities and Exchange Commission (the “SEC”).

In addition, no member shall have participated in the preparation of the financial statements of the Company or any current subsidiary of the Company at any time during the past three years.

Members of the Audit Committee and the Audit Committee Chair shall be appointed, including when necessary to fill vacancies, by the Board upon the recommendation of the Nominating and Governance Committee.

A-1

III. RESPONSIBILITIES

The responsibilities of the Audit Committee shall be as follows:

General

1. Meet at least quarterly, or more frequently as circumstances or the obligations of the Audit Committee require, with the chief financial officer, the senior internal auditing executive and the outside auditor in separate executive sessions.

2. Make regular reports to the Board, including reports of any Audit Committee actions and such recommendations as the Audit Committee may deem appropriate.

3. Perform such functions as may be assigned by law, the Company’s Articles of Incorporation orBylaws, or the Board.

Outside Auditor

1. Review the experience and qualifications of the senior members of the outside auditor team and the quality control procedures of the outside auditor.

2. As necessary, consider with management and the outside auditor the rationale for employing audit firms other than the principal outside auditor. Evaluate together with the Board whether it is appropriate to adopt a policy of rotating outside auditors on a regular basis.

3. Appoint, evaluate, compensate, retain, oversee (including resolving disagreements between management and the outside auditor regarding financial reporting) and, where appropriate, replace the outside auditor, or nominate the outside auditor to be proposed for stockholder ratification.

4. Pre-approve the retention of the outside auditor for all audit, review and attestation engagements and such non-audit services as the outside auditor is permitted to provide the Company and approve the fees for such services pursuant to procedures that may be adopted by the Committee from time to time. Pre-approval of audit and non-audit services shall not be delegated to management, but may be delegated to one or more independent members of the Committee so long as that member or members report their decisions to the Committee at all regularly scheduled meetings. In considering whether to pre-approve any non-audit services, the Committee or its delegees shall consider whether the provision of such services is compatible with maintaining the independence of the outside auditor.

5. Approve the scope and fees to be paid to the outside auditor for audit services and approve the partner, manager and technical review partner on the audit engagement.

6. Take reasonable steps to confirm the independence of the outside auditor, which shall include(a) ensuring receipt from the outside auditor a formal written statement delineating all relationships between the outside auditor and the Company, consistent with Independence Standards Board Standard No. 1, (b) discussing with the outside auditor any disclosed relationships or services that may impact the objectivity and independence of the outside auditor, and (c) as necessary, taking, or recommending that the Board take, appropriate action to oversee the independence of the outside auditor. In performing this duty, the Audit Committee shall consider whether the outside auditor’s provision of financial systems design and implementation services and any other non-audit services is compatible with the independence of the outside auditor.

7. Recommend to the Board guidelines for the Company’s hiring of employees of the outside auditor who were engaged on the Company’s account, ensuring, at a minimum, the compliance with applicable legal and regulatory requirements.

A-2

Audit Process and Results

1. Consider, in consultation with the outside auditor and internal auditor prior to the audit, the audit’s scope, planning, and staffing.

2. Review with the outside auditor the coordination of the audit effort to assure completeness of coverage, reduction of redundant efforts, and the effective use of audit resources.

3. Consider and review with the outside auditor:

| | a. | The adequacy of the Company’s internal controls including computerized information system controls and security, ensuring compliance with applicable legal and regulatory requirements. |

| | | |

| | b. | Any related significant findings and recommendations of the outside auditor together with management’s responses thereto. |

| | |

| | c. | The matters required to be discussed by Statement on Auditing Standards No. 61, as the same may be modified and supplemented from time to time. |

| | |

| | d. | An analysis prepared by management and the outside auditor of significant financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements, including an analysis of the effect of alternative GAAP methods on the Company’s financial statements and a description of any transactions as to which management obtained Statement on Auditing Standards No. 50 letters. |

| | |

| | e. | Any report or attestation issued by the outside auditor regarding the Company’s internal controls. |

| | |

| | f. | All critical accounting policies and practices to be used. |

4. Review and discuss with management and with the outside auditor at the completion of the annual examination, or earlier, if circumstances require:

| | a. | The Company’s audited financial statements and related footnotes. |

| | | | |

| | b. | The outside auditor’s audit of the financial statements and their report thereon. |

| | | |

| | c. | Any significant changes required in the outside auditor’s audit plan. |

| | | |

| | d. | Any changes required in the planned scope of the internal audit. |

| | | |

| | e. Any major issues regarding accounting or auditing principles and practices as well as the adequacy of internal controls that could significantly affect the Company’s financial statements. |

| | |

| | f. Any difficulties encountered in the course of the audit work, including any restrictions on the scope of activities or access to required information, or disagreements with management encountered during the course of the audit. |

| | |

| | g. Any management letter provided by the outside auditor and management’s response to that letter or other material written communications between the outside auditor and management. |

| | |

| | h. | Significant findings during the year and management’s responses thereto. |

A-3

| | | i. Other matters related to the conduct of the audit which are to be communicated to the Audit Committee under generally accepted auditing standards. |

5. Meet periodically with management and the outside auditor to review the Company’s major financial risk exposures and the steps management has taken to monitor and control such exposures.

6. Review with management and the outside auditor the effect of regulatory and accounting initiatives as well as off-balance sheet structures on the Company’s financial statements.

7. Review major changes to the Company’s auditing and accounting principles and practices as suggested by the outside auditor, internal auditors or management.

8. Obtain from the outside auditor assurance that Section 10A of the Exchange Act has not been implicated.

9. Meet with the outside auditor and management in separate executive sessions to discuss any matters that the Audit Committee or these groups believe should be discussed privately with the Audit Committee.

10. Review with management and the outside auditor any correspondence with regulators or governmental agencies and any employee complaints or published reports which raise material issues regarding the Company’s financial statements or accounting policies.

11. Review with management and the outside auditor the findings of any examination by regulatory agencies regarding the Company’s financial statements or accounting policies.

12. Review management reports, providing assurance of compliance with regulatory requirements, including the effectiveness of, or any deficiencies in, the design or operation of internal controls, any material weaknesses in internal controls, and any fraud, whether or not material, that involves management or other employees who have a significant role in the Company’s internal controls.

Securities and Exchange Commission Filings

1. Review filings with the SEC and other published documents containing the Company’s financial statements.

2. Review with management and the outside auditor the draft of the quarterly earnings release, interim financial statements and results of the outside auditor’s reviews thereof before they are released to the public or filed with the SEC.

3. Discuss with the national office of the outside auditor issues on which it was consulted by the

Company’s audit team and matters of audit quality and consistency.

4. Prepare the report required by the rules of the SEC to be included in the Company’s annual proxy statement.

Internal Controls and Legal Matters

1. Review the Company’s policies and procedures with respect to officers’ expense accounts and perquisites, including their use of corporate assets, and consider the results of any review of these areas by the outside auditor.

2. Review with the Company’s general or outside counsel legal and regulatory matters that may have a material impact on the financial statements and review related Company compliance policies and any material reports or inquiries received from regulators or governmental agencies.

A-4

3. Receive corporate attorneys’ reports of evidence of material violations of securities laws or breaches of fiduciary duty.

4. Review the Company’s policies and procedures to assure that they preclude loans to officers and directors. Confirm periodically that no such loans have been made.

5. Review the Company’s policies and procedures to assure that any transactions with directors, officers or members of their immediate families are reviewed and approved in advance by the Audit Committee. Confirm periodically that no unapproved transactions have occurred.

6. Review the Company’s policies and procedures to assure that all non-audit services provided by the Company’s auditors are reviewed and approved in advance by the Audit Committee. Confirm periodically that no unapproved transactions have occurred.

7. Obtain reports from management, the Company’s senior internal auditor and the outside auditor that the Company’s subsidiaries and foreign affiliated entities are in conformity with applicable legal requirements and the Company’s own policies, including disclosures of insider and affiliated party transactions.

8. Advise the Board with respect to the Company’s policies and procedures regarding compliance with applicable laws and regulations and compliance with the Company’s policies or code of conduct.

9. Review quarterly reports provided by management, relating to pending, threatened or likely litigation.

10. Review the appointment and replacement of the senior internal auditing executive, if applicable.

11. Review the internal audit department responsibilities, budget and staffing, if applicable.

12. Review significant reports to management prepared by the internal auditing department and management’s responses, if applicable.

13. Assure that the Company has adequate procedures in place for the receipt, retention and treatment of complaints received by the Company regarding allegations of suspected acts that are illegal or in violation of specific public regulations or policies, or regarding accounting, internal accounting controls or auditing matters, and the confidential, anonymous submission by employees of the Company of concerns regarding questionable accounting or auditing matters, as required under applicable SEC and Nasdaq rules.

14. Assure that the Company has adequate procedures in place for the confidential, anonymous submission by employees of the Company regarding questionable accounting or auditing matters.

15. Consult with the Nominating and Governance Committee regarding the development and monitoring of compliance with a code of ethics for the Chief Executive Officer and other senior financial officers pursuant to and to the extent required by regulations applicable to the Company from time to time.

16. Consult with the Nominating and Governance Committee regarding the development and monitoring of compliance with a code of conduct for all Company employees, officers and directors pursuant to and to the extent required by regulations applicable to the Company from time to time.

17. Review and approve all “related-party transactions” as required by Nasdaq rules, including transactions between the Company and its officers or directors or affiliates of officers or directors.

A-5

IV. NOTE ON RELATED MANAGEMENT AND OUTSIDE AUDITOR ROLES

While the Audit Committee has the responsibilities and powers set forth in this charter, it is not the duty of the Audit Committee to plan or conduct audits or to determine that the Company’s financial statements are complete, accurate, and in accordance with generally accepted accounting principles. These are the responsibilities of management and the outside auditor.

V. MEETINGS

In accordance with the applicable provisions of the Company’s Bylaws, as amended from time to time, the Audit Committee shall meet at such times and places as the members deem advisable.

VI. MINUTES

Minutes of each meeting of the Audit Committee shall be prepared by the Audit Committee Chairperson or by his/her designee and sent to Audit Committee members. Following an initial review by the Audit Committee members, the Audit Committee will provide the minutes to Board. The Secretary of the Company shall archive the approved minutes. The Audit Committee will also report to the Board on any significant matters arising from the Audit Committee’s work.

VII. EVALUATION

The Audit Committee shall review and reassess this Charter at least annually and, if appropriate, propose changes to the Board.

The Audit Committee shall obtain or perform a periodic evaluation of the Audit Committee’s performance and make applicable recommendations.

A-6

ATTN: LAURA PRINCE - PROXY

3303 MONTE VILLA PKWY

BOTHELL, WA 98021 | VOTE BY INTERNET -www.proxyvote.com |

| Use the Internet to transmit your voting instructions and for electronicdelivery of information up until 11:59 P.M. Eastern Time the day before thecut-off date or meeting date. Have your proxy card in hand when youaccess the web site and follow the instructions to obtain your records andto create an electronic voting instruction form. |

| |

| ELECTRONIC DELIVERY OF FUTURE SHAREHOLDERCOMMUNICATIONS |

| If you would like to reduce the costs incurred by Cardiac Science Corporationin mailing proxy materials, you can consent to receiving all future proxystatements, proxy cards and annual reports electronically via e-mail or theInternet. To sign up for electronic delivery, please follow the instructionsabove to vote using the Internet and, when prompted, indicate that youagree to receive or access shareholder communications electronically infuture years. |

| |

| VOTE BY PHONE - 1-800-690-6903 |

| Use any touch-tone telephone to transmit your voting instructions up until11:59 P.M. Eastern Time the day before the cut-off date or meeting date.Have your proxy card in hand when you call and then follow the instructions. |

| |

| VOTE BY MAIL |

| Mark, sign and date your proxy card and return it in the postage-paidenvelope we have provided or return it to Cardiac Science Corporation,c/o ADP, 51 Mercedes Way, Edgewood, NY 11717. |

TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: | CRDSC1 | KEEP THIS PORTION FOR YOUR RECORDS |

| | DETACH AND RETURN THIS PORTION ONLY |

THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. |

CARDIAC SCIENCE CORPORATION | | |

| | | | | | | |

| | | | | | | | | |

| | | | |

| THE DIRECTORS RECOMMEND A VOTE "FOR" ITEM 1. | | For

All | Withhold

All | | | |

| | Vote on Director | | | | |

| | | | | | |

| 1. | To elect as Director of Cardiac Science

Corporation the nominee listed below. | | o | o | |

| | | |

| | 01) Jeffrey F. O'Donnell, Sr. | |

| | | | | | | | |

| | | | | | | |

| | | | | | | |

| 2. | In their discretion upon such other matters that may properly come before the meeting or any adjournment oradjournments thereof. | | | | | |

| | | | | | | |

| | | | | | |

| The shares represented by this proxy when properly executed will be voted in the manner directed herein by the undersignedStockholder(s). If no direction is made, this proxy will be voted FOR item 1. If any other matters properly come before themeeting, the person named in the this proxy will vote in their discretion. | | | | |

| |

| | | | | |

| Please indicate if you plan to attend this meeting. | Yes

o | No

o | | | | | | |

| | | | | |

| | | | | | | |

| | | | | | |

| | | | | | |

| Signature [PLEASE SIGN WITHIN BOX] | Date | | Signature (Joint Owners) | Date | | |

| | | | | | | | | | | | | | | | | | | | | | | |

CARDIAC SCIENCE CORPORATION

THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

ANNUAL MEETING OF STOCKHOLDERS

October 27, 2006

The stockholder(s) hereby appoint(s) John R. Hinson and Michael K. Matysik, or either of them, as proxies, each with the power to appoint his substitute, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of Cardiac Science Corporation that the stockholder(s) is/are entitled to vote at the Annual Meeting of Stockholders to be held at 10:00 a.m., Pacific Time on October 27, 2006, at the offices of Cardiac Science Corporation located at 3303 Monte Villa Parkway, Bothell, Washington 98021, and any adjournment or postponement thereof.

THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE STOCKHOLDER(S). IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED FOR THE ELECTION OF THE NOMINEE LISTED ON THE REVERSE SIDE FOR THE BOARD OF DIRECTORS.

PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE

CONTINUED AND TO BE SIGNED ON REVERSE SIDE