|

|

Lazard World Dividend & Income Fund, Inc. |

Other Information |

(unaudited) |

|

Tax Information

Year Ended December 31, 2008

The following tax information represents year end disclosures of the tax benefits passed through to stockholders for 2008:

Of the dividends paid by the Fund, 59.01% of each dividend will be subject to a maximum tax rate of 15%, as provided by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The same information will be reported in conjunction with your 2008 1099-DIV.

Of the dividends paid by the Fund, 19.05% of the dividends qualify for the dividends received deduction available to corporate shareholders.

Pursuant to Section 871 of the Code, the Fund has no designated qualified short-term gains for purposes of exempting withholding of tax on such distributions to U.S. nonresident shareholders.

Certifications

The Fund’s chief executive officer has certified to the NYSE, pursuant to the requirements of Section 303A.12(a) of the NYSE Listed Company Manual, that as of May 20, 2008 he was not aware of any violation by the Fund of applicable NYSE corporate governance listing standards. The Fund’s reports to the Securities and Exchange Commission (the “SEC”) on Forms N-CSR and N-Q contain certifications by the Fund’s chief executive officer and chief financial officer as required by Rule 30a-2(a) under the Act, including certifications regarding the quality of the Fund’s disclosure in such reports and certifications regarding the Fund’s disclosure controls and procedures and internal control over financial reporting.

Proxy Voting

A description of the policies and procedures used to determine how proxies relating to Fund portfolio securities are voted is available (1) without charge, upon request, by calling (800) 823-6300 or (2) on the SEC’s website at http://www.sec.gov.

The Fund’s proxy voting record for the most recent 12-month period ended June 30 is available (1) without charge, upon request, by calling (800) 823-6300 or (2) on the SEC’s website at http://www.sec.gov. Information as of June 30 each year will generally be available by the following August 31.

Form N-Q

The Fund files a complete schedule of its portfolio holdings for the first and third quarters of its fiscal year with the SEC on Form N-Q. The Fund’s Forms N-Q are available on the SEC’s website at http://www.sec.gov and may be reviewed and copied at the SEC’s Public Reference Room in Washington, D.C. Information on the operation of the SEC’s Public Reference Room may be obtained by calling 1-800-SEC-0330.

Board Consideration of Management Agreement

At the meeting of the Fund’s Board of Directors held on November 3, 2008, the Board considered the approval, for an additional annual period, of the Management Agreement. The Directors who are not interested persons (as defined in the Act) of the Fund (the “Independent Directors”) were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of the Investment Manager.

Services Provided

Representatives of the Investment Manager gave a presentation to the Board about the nature, extent and quality of services that the Investment Manager provides the Fund, including a discussion of the Investment Manager and its clients (of which the Lazard Funds complex of 20 portfolios comprises approximately $8 billion of the approximately $100 billion of total assets under the management of the Investment Manager and its global affiliates). The representatives of the Investment Manager noted that the Investment Manager provides significant benefits to the Fund through substantial investment in the Investment Manager’s global investment advisory business, including technology and operational support and significant marketing infrastructure. The Directors also considered information provided by the Investment Manager regarding its personnel, resources, business reputation, financial condition and experience. The Directors were provided with the Fund’s market price performance and market discount to net asset value and distributions.

30

|

|

Lazard World Dividend & Income Fund, Inc. |

Other Information (continued) |

(unaudited) |

|

The Directors considered the various services provided by the Investment Manager to the Fund and considered the Investment Manager’s research and portfolio management capabilities and that the Investment Manager also provides oversight of day-to-day operations of the Fund, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Directors also considered the Investment Manager’s administrative, accounting and compliance infrastructure and agreed that the Fund benefits from the extensive services of the Investment Manager’s global platforms, and accepted management’s assertion that such services are greater than those typically provided to an $8 billion fund complex.

Comparative Performance and Advisory Fees and Expense Ratios

The Directors reviewed the relative performance and advisory fees and expense ratio for the Fund, including comparative information through September 30, 2008 prepared by Lipper Inc. (“Lipper”), an independent provider of investment company data. Lipper’s materials stated that Lipper’s reports are specifically designed to provide boards of directors the necessary fee, expense and investment performance information to help fulfill their advisory contract renewal responsibilities under Section 15(c) of the Act.

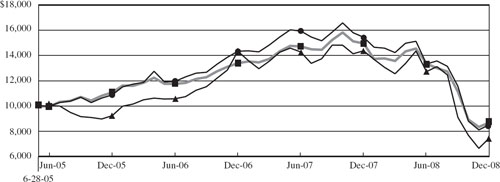

The Directors noted that the Fund’s total return performance (based on net asset value) generally ranked at or below the median range of its Lipper comparison group (“Group”) and Lipper category (“Category”). The Directors also discussed the advisory fees and current expense ratio for the Fund, and it was noted that they ranked below the median range of the Group and Category. The Directors, however, noted that no funds in the Group or Category pursued a strategy similar to that of the Fund’s strategy of investing in world equity securities and in forward currency contracts. They also were advised that the Investment Manager did not manage any other accounts using the Fund’s investment strategy.

Fee Calculation

The Board considered that the method of calculating management fees is based on the Fund’s Total Leveraged Assets1, pursuant to which the management fee borne by stockholders will increase to the extent the Investment Manager makes Currency Investments by incurring Financial Leverage rather than reducing the percentage of Net Assets invested in World Equity Investments for the purposes of making Currency Investments, and considered the advantages of increased investment exposure through Financial Leverage. The Board considered the economic equivalence, and the similarities, from an investment management perspective, of Currency Investments (1) made with Currency Commitments and (2) made with the proceeds of Borrowings.

The Board considered that (1) this method of calculating management fees is different than the way closed-end investment companies typically calculate management fees, (2) traditionally closed-end funds calculate management fees based on Net Assets plus Borrowings (excluding Financial Leverage obtained through Currency Commitments) and (3) the Investment Manager’s fee would be lower if its fee were calculated only on Net Assets plus Borrowings, because the Investment Manager would not earn fees on Currency Investments made with Currency Commitments (forward currency contracts or other derivative instruments whose value is derived from the performance of an underlying emerging market currency). The Board considered that the Investment Manager’s fee is different because the Fund’s leverage strategy is different than the strategy employed by many other leveraged closed-end investment companies—that although the Fund may employ Borrowings in making Currency Investments, the Fund’s leverage strategy relies primarily on Currency Commitments rather than relying exclusively on borrowing money and/or issuing preferred stock. The Board considered the Fund’s use of Currency Commitments for leverage (rather than relying exclusively on borrowing money and/or issuing preferred stock) and the Investment Manager’s belief that forward currency contracts, or other derivative instruments whose value is derived from the performance of an underlying emerging market currency, often offer a more attractive way to gain exposure to emerging market interest rate opportunities and currencies than investments in debt obligations and the fact that there might not be a viable debt market in certain emerging market countries. The Board also considered the Investment Manager’s view that foreign currency contracts present less counterparty and custody risks and the Investment Manager’s extensive expertise with these instruments, as discussed in detail in previous Board meetings.

Procedures adopted by the Investment Manager to evaluate possible conflicts of interest that may arise from the fee calculation methodology, included the following: (1) no less frequently than monthly, decisions regarding the amount of the

| |

|

1 | Capitalized terms used in the section without definition have the respective meanings ascribed to them in the Fund’s prospectus and shareholder reports. |

31

|

|

Lazard World Dividend & Income Fund, Inc. |

Other Information (concluded) |

(unaudited) |

|

Fund’s allocation to Currency Investments must be reviewed by a Managing Director of the Investment Manager not involved in the decision-making process and the Fund’s Chief Compliance Officer, and that such review be documented to include the basis therefor, documentation to be retained for six years, the first two years in an easily accessible place, (2) the Investment Manager must provide the Board with a quarterly report regarding these decisions and the reasons therefor and (3) the Investment Manager must deliver a quarterly certification to the Board, signed by a Managing Director of the Investment Manager and the Fund’s or the Investment Manager’s Chief Compliance Officer (as applicable), that the procedures had been complied with during the previous quarter. The Investment Manager representatives stated that such procedures had been followed and that the Investment Manager would continue to follow those procedures.

Investment Manager Profitability and Economies of Scale

The Directors reviewed information prepared by the Investment Manager for the Fund concerning the expenses incurred, and profits realized, by the Investment Manager and its affiliates resulting from the Management Agreement, including the projected dollar amount of expenses allocated and profit received by the Investment Manager for the calendar year ending December 31, 2008 and the method used to determine such expenses and profits. The representatives of the Investment Manager stated that neither the Investment Manager nor its affiliates receive any significant indirect benefits from managing the Fund. The Investment Manager’s representatives stated that the Investment Manager’s broker-dealer affiliate is not currently used for brokerage purposes and that the Investment Manager did not benefit from money flow (float) in connection with transactions in the Fund’s shares. The Investment Manager’s representatives noted that the Investment Manager does obtain soft dollar research, as reviewed by the Board each quarter.

It was noted that the profitability percentage for the Fund was within ranges determined by relevant court cases not to be so disproportionately large that it bore no reasonable relationship to the services rendered and, given the overall service levels, was thought not to be excessive, and the Board concurred with this analysis.

The Directors considered the Investment Manager’s profitability (projected for the 2008 calendar year) with respect to the Fund as part of their evaluation of whether the Fund’s fee under the Management Agreement bears a reasonable relationship to the mix of services provided by the Investment Manager, including the nature, extent and quality of such services. The Investment Manager representatives noted that profitability levels had been relatively stable in recent years. The Directors evaluated the costs of the services provided and profits realized by the Investment Manager and its affiliates from the relationship with the Fund in light of the relevant circumstances. It was noted that a discussion of economies of scale should be predicated on increasing assets and that because the Fund is a closed-end fund without daily inflows and outflows of capital there were not at this time significant economies of scale to be realized by the Investment Manager in managing the Fund’s assets. The Directors also considered potential benefits to the Investment Manager and its affiliates from the Investment Manager acting as investment adviser to the Fund.

At the conclusion of these discussions, each of the Directors expressed the opinion that he or she had been furnished with sufficient information to make an informed business decision with respect to renewal of the Management Agreement. Based on its discussions and considerations as described above, the Board made the following conclusions and determinations.

| |

• | The Board concluded that the nature, extent and quality of the services provided by the Investment Manager are adequate and appropriate, noting the benefits of advisory and research services associated with a $100 billion global asset management business. |

| |

• | The Board was generally satisfied with the Fund’s performance. |

| |

• | The Board concluded that the Fund’s fee paid to the Investment Manager was reasonable in light of the services provided, comparative advisory fee and expense ratio information, costs of the services provided and profits realized and other benefits derived by the Investment Manager from the relationship with the Fund. |

| |

• | The Board determined that because the Fund is a closed-end fund without daily inflows and outflows of capital, the Fund’s fee schedule is reasonable in light of current economies of scale considerations and that there were not at this time significant economies of scale to be realized by the Investment Manager. |

The Board considered these conclusions and determinations in their totality and, without any one factor being dispositive, determined that approval of the Management Agreement was in the best interests of the Fund and its stockholders.

32

Lazard World Dividend & Income Fund, Inc.

30 Rockefeller Plaza

New York, New York 10112-6300

Telephone: 800-823-6300

http://www.LazardNet.com

Investment Manager

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112-6300

Telephone: 800-823-6300

Custodian

State Street Bank and Trust Company

One Lincoln Street

Boston, Massachusetts 02111

Transfer Agent and Registrar

Computershare Trust Company, N.A.

P.O. Box 43010

Providence, Rhode Island 02940-3010

Dividend Disbursing Agent

Computershare, Inc.

P.O. Box 43010

Providence, Rhode Island 02940-3010

Independent Registered Public Accounting Firm

Deloitte & Touche LLP

Two World Financial Center

New York, New York 10281-1414

Legal Counsel

Stroock & Stroock & Lavan LLP

180 Maiden Lane

New York, New York 10038-4982

http://www.stroock.com

This report is intended only for the information of stockholders of Common Stock of Lazard World Dividend & Income Fund, Inc.

| | |

| Lazard Asset Management LLC | 30 Rockefeller Plaza | www.LazardNet.com |

| | New York, NY 10112-6300 | |

ITEM 2. CODE OF ETHICS.

The Registrant has adopted a code of ethics that applies to the Registrant's principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions.

ITEM 3. AUDIT COMMITTEE FINANCIAL EXPERT.

The Registrant's Board of Directors (the “Board”) has determined that Lester Z. Lieberman, Robert M. Solmson and Nancy A. Eckl, members of the Audit Committee of the Board, are audit committee financial experts as defined by the Securities and Exchange Commission (the "SEC"). Mr. Lieberman, Mr. Solmson and Ms. Eckl are "independent" as defined by the SEC for purposes of audit committee financial expert determinations.

ITEM 4. PRINCIPAL ACCOUNTANT FEES AND SERVICES.

(a) Audit Fees. The aggregate fees billed for each of the last two fiscal years (the "Reporting Periods") for professional services rendered by the Registrant's principal accountant (the "Auditor") for the audit of the Registrant's annual financial statements, or services that are normally provided by the Auditor in connection with the statutory and regulatory filings or engagements for the Reporting Periods, were $50,000 in 2007 and $60,000 in 2008.

(b) Audit-Related Fees. There were no fees billed in the Reporting Periods by the Auditor to the Registrant for assurance and related services that are reasonably related to the performance of the audit of the Registrant's financial statements and are not reported under paragraph (a) of this Item 4.

The aggregate fees billed in the Reporting Periods for non-audit assurance and related services by the Auditor to Lazard Asset Management LLC, the Registrant’s investment manager (“Lazard”), and any entity controlling, controlled by or under common control with Lazard that provides ongoing services to the Registrant (“Service Affiliates”) that were reasonably related to the performance of the annual audit of the Service Affiliates which required pre-approval of the Audit Committee were $0.

(c) Tax Fees. The aggregate fees billed in the Reporting Periods to the Registrant for professional services rendered by the Auditor for tax compliance, tax advice and tax planning ("Tax Services") were $6,195 in 2007 and $6,375 in 2008. These services consisted of (i) review or preparation of U.S. federal, state, local and excise tax returns; and (ii) U.S. federal, state and local tax planning, advice and assistance regarding statutory, regulatory or administrative developments.

The aggregate fees billed for the Reporting Periods for Tax Services by the Auditor to Service Affiliates which required pre-approval by the Audit Committee were $0.

(d) All Other Fees. The aggregate fees billed for the Reporting Periods for products and services provided by the Auditor, other than the services reported above, were $0.

The aggregate fees billed for the Reporting Periods for non-audit services by the Auditor to Service Affiliates, other than the services reported above, which required pre-approval by the Audit Committee were $0.

(e) Audit Committee Pre-Approval Policies and Procedures. The Registrant's Audit Committee pre-approves the Auditor's engagements for audit and non-audit services to the Registrant and, as required, non-audit services to Service Affiliates on a case-by-case basis. Pre-approval considerations include whether the proposed services are compatible with maintaining the Auditor's independence. There were no services provided by the Auditor that were approved pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X.

(f) None.

(g) Non-Audit Fees. The aggregate non-audit fees billed by the Auditor for services rendered to the Registrant and rendered to Service Affiliates for the Reporting Periods were $885,500 in 2007 and $945,875 in 2008.

(h) Auditor Independence. The Audit Committee considered whether provision of non-audit services to Service Affiliates that were not required to be pre-approved is compatible with maintaining the Auditor’s independence.

ITEM 5. AUDIT COMMITTEE OF LISTED REGISTRANTS.

The Registrant has a separately-designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Securities Exchange Act of 1934, as amended. It is composed of the following Directors, each of who is not an "interested person" (as defined in the Investment Company Act of 1940) of the Registrant ("Independent Directors"):

Lester Z. Lieberman, Audit Committee Chairman

Kenneth S. Davidson

Nancy A. Eckl

Leon M. Pollack

Richard Reiss, Jr.

Robert M. Solmson

ITEM 6. INVESTMENTS

Not applicable.

ITEM 7. DISCLOSURE OF PROXY VOTING POLICIES AND PROCEDURES FOR CLOSED END MANAGEMENT INVESTMENTCOMPANIES.

The Registrant has delegated voting of proxies in respect of portfolio holdings to Lazard, to vote the Registrant’s proxies in accordance with Lazard's proxy voting policy and guidelines (the "Voting Guidelines") that provide as follows:

| | • | Lazard votes proxies in the best interests of its clients. |

| |

| | • | Unless Lazard's Proxy Committee otherwise determines, Lazard votes proxies in a manner consistent with the Voting Guidelines. |

| | | |

| | • | To avoid conflicts of interest, Lazard votes proxies where a material conflict has been deemed to exist in accordance with specific proxy voting guidelines regarding various standard proxy proposals ("Approved Guidelines") or, if the Approved Guideline is to vote case-by-case, in accordance with the recommendation of an independent source. |

| |

| | • | Lazard also may determine not to vote proxies in respect of securities of any issuer if it determines that it would be in the client's overall best interests not to vote. |

The Voting Guidelines address how it will vote proxies on particular types of matters such as the election for directors, adoption of option plans and anti-takeover proposals. For example, Lazard generally will:

| | • | vote as recommended by management in routine election or re-election of directors; |

| |

| | • | favor programs intended to reward management and employees for positive, long-term performance, evaluating whether Lazard believes, under the circumstances, that the level of compensation is appropriate or excessive; and |

| |

| | • | vote against anti-takeover measures, such as adopting supermajority voting requirements, shareholder rights plans and fair price provisions. |

ITEM 8. PORTFOLIO MANAGERS OF CLOSED-END MANAGEMENT INVESTMENT COMPANIES.

Principal Portfolio Managers

As of the date of the filing of this Report on Form N-CSR, the following persons are responsible for the management of the Registrant's portfolio:

James Donald is responsible for allocation of the Registrant's assets between World Equity Investments and Currency Investments (each, as defined in the notes to the Registrant's annual report to shareholders contained in Item 1) and overall management of the Registrant's portfolio. World Equity Investments and Currency Investments are each managed on a team basis, with each member of the team involved at all levels of the investment process.

Mr. Donald, a Managing Director of Lazard, is a Portfolio Manager/Analyst and serves as head of the emerging markets group. Before joining Lazard in 1996, Mr. Donald worked at Mercury Asset Management ("Mercury"), which he joined in 1985. At Mercury, he was on the emerging markets team between 1992 and 1996 and worked on the international equity team between 1985 and 1992. At Mercury, between 1990 and 1996, Mr. Donald served as Vice President and Treasurer for The United Kingdom Fund and The Europe Fund. Mr. Donald is a Chartered Financial Analyst ("CFA") Charterholder and received an HBA from the University of Western Ontario.

World Equity Investments. Andrew Lacey and Patrick Ryan, with the assistance of Kyle Waldhauer, are jointly responsible for investment of the Registrant's assets allocated to World Equity Investments.

Mr. Lacey, a Deputy Chairman of Lazard, is a Portfolio Manager/Analyst on various U.S. equity and global equity portfolio management teams. He has been working in the investment field since 1995 when he joined Lazard as a member of Lazard's Global Research Platform. He has an MBA from Columbia University and a BA from Wesleyan University. Mr. Lacey is currently on the Board of Trustees of the Link Community School.

Mr. Ryan, a Director of Lazard, is a Portfolio Manager/Analyst on the global equity team. He began working in the investment industry in 1989. Before joining Lazard in 1994, he was an equity analyst with Hutson Management. He has a BS in Industrial Engineering from Columbia University School of Engineering and Applied Science, and is a CFA Charterholder. He is a member of the New York Society of Security Analysts and the CFA Institute.

Mr. Waldhauer is Vice President of Lazard and a Portfolio Manager/Analyst on the Global Equity Income team. He began working in the investment field in 1998. Prior to joining Lazard in 1998, Mr. Waldhauer was a financial representative at Fidelity Investments. He has a BS in Economics and Finance from Southern New Hampshire University.

Currency Investments. Ardra Belitz and Ganesh Ramachandran are jointly responsible for investment of the Registrant's assets allocated to Currency Investments.

Ms. Belitz is a Director of Lazard and a Portfolio Manager/Analyst specializing in emerging market currency and debt. She has been working in the investment field since 1994 and has been a member of the Emerging Income team since 1998. Before joining Lazard in 1996, she was a senior portfolio administrator with Bankers Trust Company. Ms. Belitz graduated Phi Beta Kappa from Brandeis University with a BA in Economics.

Mr. Ramachandran is a Director of Lazard and a Portfolio Manager/Analyst specializing in emerging market currency and debt. He has an MBA from the University of Rochester, Simon School of Business and a BS in Chemical Engineering from the Indian Institute of Technology at Madras. He joined Lazard in 1997.

Portfolio Management

Team Management. Portfolio managers at Lazard manage multiple accounts for a diverse client base, including private clients, institutions and investment funds. Lazard manages all portfolios on a team basis. The team is involved at all levels of the investment process. This team approach allows for every portfolio manager to benefit from his/her peers, and for clients to receive the firm's best thinking, not that of a single portfolio manager. Lazard manages all like investment mandates against a model portfolio. Specific client objectives, guidelines or limitations then are applied against the model, and any necessary adjustments are made.

Material Conflicts Related to Management of Similar Accounts. Although the potential for conflicts of interest exist when an investment adviser and portfolio managers manage other accounts that invest in securities in which the Registrant may invest or that may pursue a strategy similar to one of the Registrant's component strategies (collectively, "Similar Accounts"), Lazard has procedures in place that are designed to ensure that all accounts are treated fairly and that the Registrant is not disadvantaged, including procedures regarding trade allocations and "conflicting trades" (e.g., long and short positions in the same security, as described below). In addition, the Registrant, as a registered investment company, is subject to different regulations than certain of the Similar Accounts, and, consequently, may not be permitted to engage in all the investment techniques or transactions, or to engage in such techniques or transactions to the same degree, as the Similar Accounts.

Potential conflicts of interest may arise because of Lazard's management of the Registrant and Similar Accounts. For example, conflicts of interest may arise with both the aggregation and allocation of securities transactions and allocation of limited investment opportunities, as Lazard may be perceived as causing accounts it manages to participate in an offering to increase Lazard's overall allocation of securities in that offering, or to increase Lazard's ability to participate in future offerings by the same underwriter or issuer. Allocations of bunched trades, particularly trade orders that were only partially filled due to limited availability, and allocation of investment opportunities generally, could raise a potential conflict of interest, as Lazard may have an incentive to allocate securities that are expected to increase in value to preferred accounts. Initial public offerings, in particular, are frequently of very limited availability. Additionally, portfolio managers may be perceived to have a conflict of interest because of the large number of Similar Accounts, in addition to the Registrant, that they are managing on behalf of Lazard. In addition,

Lazard could be viewed as having a conflict of interest to the extent that Lazard and/or portfolio managers have a materially larger investment in a Similar Account than their investment in the Registrant. Although Lazard does not track each individual portfolio manager's time dedicated to each account, Lazard periodically reviews each portfolio manager's overall responsibilities to ensure that he or she is able to allocate the necessary time and resources to effectively manage the Registrant.

A potential conflict of interest may be perceived to arise if transactions in one account closely follow related transactions in a different account, such as when a purchase increases the value of securities previously purchase by the other account, or when a sale in one account lowers the sale price received in a sale by a second account. Lazard and certain of the Registrant’s portfolio managers manage hedge funds that are subject to performance/incentive fees. Certain hedge funds managed by Lazard may also be permitted to sell securities short. However, Lazard currently does not have any portfolio managers that manage both hedge funds that engage in short sales and long-only accounts, including open-end and closed-end registered investment companies. When Lazard engages in short sales of securities of the type in which the Registrant invests, Lazard could be seen as harming the performance of the Registrant for the benefit of the account engaging in short sales if the short sales cause the market value of the securities to fall. As described above, Lazard has procedures in place to address these conflicts.

Other Accounts Managed by the Portfolio Managers. The chart below includes information regarding the members of the portfolio management team responsible for managing the Registrant. Specifically, it shows the number of other portfolios and assets managed by management teams of which each of the Registrant's portfolio managers is a member. Regardless of the number of accounts, the portfolio management team still manages each account based on a model portfolio as described above.

| | | | | Other Pooled | | |

| | | Registered Investment | | Investment Vehicles | | |

| Portfolio Manager | | Companies ($*)# | | ($*)# | | Other Accounts ($*)#, + |

| Ardra Belitz | | 2 (206.8 million) | | 5 (1.4 billion) | | 0 |

| James M. Donald | | 9 (5.1 billion) | | 52 (3.1 billion) | | 152 (3.6 billion) |

| Andrew D. Lacey | | 12 (9.0 billion) | | 34 (723.6 million) | | 280 (3.0 billion) |

| Ganesh Ramachandran | | 2 (206.8 million) | | 5 (1.4 billion) | | 0 |

| Patrick Ryan | | 2 (72.9 million) | | 14 (561.5 million) | | 12 (1.3 billion) |

| Kyle Waldhauer | | 2 (72.9 million) | | 3 (52.6 million) | | 5 (8.5 million) |

* Total assets in accounts as of December 31, 2008.

# The following portfolio managers manage accounts with respect to which the advisory fee is based on the performance of the account:

(1) Mr. Donald manages two other pooled investment vehicles and one other account with assets under management of approximately $341.5 million and $454.9 million, respectively.

(2) Mr. Lacey manages one registered investment company with assets under management of approximately $4.9 billion.

(3) Ms. Belitz and Mr. Ramachandran manage three other pooled investment vehicles with assets under management of approximately $1.3 billion.

+ Includes an aggregation of any Similar Accounts within managed account programs where the third party program sponsor is responsible for applying specific client objectives, guidelines and limitations against the model portfolio managed by the portfolio management team.

Compensation for Portfolio Managers

Lazard's portfolio managers are generally responsible for managing multiple types of accounts that may, or may not, invest in securities in which the Registrant may invest or pursue a strategy similar to one of the Registrant's component strategies. Portfolio managers responsible for

managing the Registrant may also manage sub-advised registered investment companies, collective investment trusts, unregistered funds and/or other pooled investment vehicles, separate accounts, separately managed account programs (often referred to as "wrap accounts") and model portfolios.

During the fiscal year covered by this Report on Form N-CSR, Lazard compensates portfolio managers by a competitive salary and bonus structure, which is determined both quantitatively and qualitatively. Salary and bonus are paid in cash and stock. Portfolio managers are compensated on the performance of the aggregate group of portfolios managed by the teams of which they are a member rather than for a specific fund or account. Various factors are considered in the determination of a portfolio manager's compensation. All of the portfolios managed by a portfolio manager are comprehensively evaluated to determine his or her positive and consistent performance contribution over time. Further factors include the amount of assets in the portfolios as well as qualitative aspects that reinforce Lazard's investment philosophy.

Total compensation is generally not fixed, but rather is based on the following factors: (i) leadership, teamwork and commitment, (ii) maintenance of current knowledge and opinions on companies owned in the portfolio; (iii) generation and development of new investment ideas, including the quality of security analysis and identification of appreciation catalysts; (iv) ability and willingness to develop and share ideas on a team basis; and (v) the performance results of the portfolios managed by the investment teams of which the portfolio manager is a member.

Variable bonus is based on the portfolio manager's quantitative performance as measured by his or her ability to make investment decisions that contribute to the pre-tax absolute and relative returns of the accounts managed by the teams of which the portfolio manager is a member, by comparison of each account to a predetermined benchmark (as set forth in the prospectus or other governing document) over the current fiscal year and the longer-term performance (3-, 5- or 10-year, if applicable) of such account, as well as performance of the account relative to peers. The variable bonus for the Registrant's portfolio management team in respect of its management of the Registrant is determined by reference to the Morgan Stanley Capital International (MSCI®) All Country World Index. The portfolio manager's bonus also can be influenced by subjective measurement of the manager's ability to help others make investment decisions. Portfolio managers managing accounts that pay performance fees may receive a portion of the performance fee as part of their compensation.

Ownership of Registrant Securities

As of December 31, 2008, the portfolio managers of the Registrant owned the following shares of Common Stock of the Registrant.

| Portfolio Manager | | Market Value of Shares |

| |

| Ardra Belitz | | None |

| James M. Donald | | $100,001-$500,000 |

| Andrew D. Lacey | | $50,001-$100,000 |

| Ganesh Ramachandran | | $1-$10,000 |

| Patrick Ryan | | $10,001-$50,000 |

| Kyle Waldhauer | | $10,001-$50,000 |

ITEM 9. PURCHASES OF EQUITY SECURITIES BY CLOSED-END MANAGEMENT INVESTMENT COMPANY AND AFFILIATED PURCHASERS.

Not applicable.

ITEM 10. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS.

The Registrant has a Nominating Committee (the "Committee") of the Board, which is currently comprised of all of the Independent Directors. The Committee's function is to select and nominate candidates for election to the Board. The Committee will consider recommendations for nominees from stockholders sent to the Secretary of the Registrant, 30 Rockefeller Plaza, New York, New York 10112. Nominations may be submitted only by a stockholder or group of stockholders that, individually or as a group, has beneficially owned the lesser of (a) 1% of the Registrant's outstanding shares or (b) $500,000 of the Registrant's shares (calculated at market value) for at least one year prior to the date such stockholder or group submits a candidate for nomination. Not more than one nominee for Director may be submitted by such a stockholder or group each calendar year.

In evaluating potential nominees, including any nominees recommended by stockholders, the Committee takes into consideration the factors listed in the Nominating Committee Charter and Procedures, including character and integrity, business and professional experience, and whether the Committee believes that the person has the ability to apply sound and independent business judgment and would act in the interests of the Registrant and its stockholders. A nomination submission must include all information relating to the recommended nominee that is required to be disclosed in solicitations or proxy statements for the election of Directors, as well as information sufficient to evaluate the factors listed above. Nomination submissions must be accompanied by a written consent of the individual to stand for election if nominated by the Board and to serve if elected by the stockholders, and such additional information must be provided regarding the recommended nominee as reasonably requested by the Committee. A nomination submission must be received not less than 120 calendar days before the date of the Registrant’s proxy statement released to stockholders in connection with the previous year’s annual meeting. There were no material changes to these procedures during the period covered by this report.

ITEM 11. CONTROLS AND PROCEDURES.

(a) The Registrant's principal executive and principal financial officers have concluded, based on their evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes to the Registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this

report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

ITEM 12. EXHIBITS.

(a)(1) Code of Ethics referred to in Item 2.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certifications of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Lazard World Dividend & Income Fund, Inc.

| By | /s/ Charles Carroll | |

| | Charles Carroll |

| | Chief Executive Officer |

| |

| Date | March 11, 2009 |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated.

| By | /s/ Charles Carroll | |

| | Charles Carroll |

| | Chief Executive Officer |

| |

| Date | March 11, 2009 |

| |

| By | /s/ Stephen St. Clair | |

| | Stephen St. Clair |

| | Chief Financial Officer |

| |

| Date | March 11, 2009 |