UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-21751

Lazard World Dividend & Income Fund, Inc.

(Exact name of registrant as specified in charter)

30 Rockefeller Plaza

New York, New York 10112

(Address of principal executive offices) (Zip code)

Nathan A. Paul, Esq.

Lazard Asset Management LLC

30 Rockefeller Plaza

New York, New York 10112

(Name and address of agent for service)

Registrant’s telephone number, including area code: (212) 632-6000

Date of fiscal year end: 12/31

Date of reporting period: 6/30/13

ITEM 1. REPORTS TO STOCKHOLDERS.

Lazard World

Dividend & Income

Fund, Inc.

Semi-Annual Report

J U N E 3 0 , 2 0 1 3

Lazard World Dividend & Income Fund, Inc.

Lazard World Dividend & Income Fund, Inc.

Investment Overview

Dear Stockholders,

We are pleased to present this semi-annual report for Lazard World Dividend & Income Fund, Inc. (“LOR” or the “Fund”), for the period ended June 30, 2013. LOR is a diversified, closed-end management investment company that began trading on the New York Stock Exchange (“NYSE”) on June 28, 2005. Its ticker symbol is “LOR.”

For the second quarter and year-to-date periods ended June 30, 2013, the Fund’s net asset value (“NAV”) performance was behind its benchmark, the Morgan Stanley Capital International (MSCI®) All Country World Index (ACWI®) (the “Index”). However, we are pleased with LOR’s favorable NAV performance over the one-, three-, and five-year periods, as well as since inception. We believe that the Fund has provided investors with an attractive yield and diversification, backed by the extensive experience, commitment, and professional management of Lazard Asset Management LLC (the “Investment Manager” or “Lazard”).

Portfolio Update (as of June 30, 2013)

For the second quarter of 2013, the Fund’s NAV returned -3.0%, underperforming the Index return of -0.4%. For the year-to-date period, the Fund’s NAV returned 0.5%, below the 6.1% return of the Index. However, the Fund’s NAV performance outpaced the Index over the 12 months ended June 30, 2013, gaining 17.6% versus 16.6% for the Index, as well as for the three- and five-year periods then ended. In addition, on an annualized basis since inception, the Fund’s NAV return of 6.5% is ahead of the 5.2% return for the Index. Shares of LOR ended the second quarter of 2013 with a market price of $13.12, representing a 6.7% discount to the Fund’s NAV of $14.06.

The Fund’s net assets were $96.7 million as of June 30, 2013, with total leveraged assets of $133.0 million, representing a 27.3% leverage rate. This leverage rate is lower than that at the end of the first quarter of 2013 (29.2%), and below the maximum permitted leverage rate of 33⅓%.

Within the world equity portfolio, stock selection in the information technology sector, as well as within France and the United Kingdom, helped performance during the second quarter. However, stock selection in the financials and materials sectors hurt performance.

Performance for the smaller, short-duration1 emerging-market currency and debt portion of the Fund was

weak in the second quarter, and has been negative year to date. It has contributed positively to performance since inception.

As of June 30, 2013, 73.4% of the Fund’s total leveraged assets consisted of world equities, 25.7% consisted of emerging market currency and debt instruments, and 0.9% consisted of cash and other net assets.

Declaration of Distributions

Pursuant to LOR’s Level Distribution Policy, the Fund declares, monthly, a distribution equal to 6.5% (on an annualized basis) of the Fund’s NAV on the last business day of the previous year. The current monthly distribution rate per share of $0.07822 represents a distribution yield of 7.2% based on the Fund’s $13.12 market price as of the close of trading on the NYSE on June 30, 2013. It is currently estimated that $0.1524 of the $0.4693 distributed per share year-to-date through June 30, 2013 may represent a return of capital.

Additional Information

Please note that, available on www.LazardNet.com, are frequent updates on the Fund’s performance, press releases, distribution information, and a monthly fact sheet that provides information about the Fund’s major holdings, sector weightings, regional exposures, and other characteristics, including the notices required by Section 19(a) of the Investment Company Act of 1940, as amended. You may also reach Lazard by phone at 1-800-823-6300.

On behalf of Lazard, we thank you for your investment in Lazard World Dividend & Income Fund, Inc. and look forward to continuing to serve your investment needs in the future.

Message from the Portfolio Managers

World Equity Portfolio

(73.4% of total leveraged assets)

The Fund’s world equity portfolio is typically invested in 60 to 90 securities broadly diversified in both developed and emerging-market countries and across the capitalization spectrum. Examples include Pfizer, a research-based, global pharmaceutical company that is based in the United States; Zurich Insurance Group, a Swiss insurance-based financial services provider active in North America, Europe, Asia-Pacific, Latin America, and other markets; and Kumba Iron Ore, an iron ore mining company based in South Africa.

2

Lazard World Dividend & Income Fund, Inc.

Investment Overview (continued)

As of June 30, 2013, 31.2% of these stocks were based in North America, 31.1% were based in continental Europe (not including the United Kingdom), 14.5% were from Asia (not including Japan), 9.1% were from the United Kingdom, 7.6% were based in Africa and the Middle East, 4.8% were based in Latin America, and 1.7% were from Japan. The world equity portfolio is similarly well diversified across a number of industry sectors. The top two sectors, by weight, at June 30, 2013, were: financials (29.5%), which includes banks, insurance companies, and financial services companies; and consumer discretionary (15.9%), which includes automobile and components, consumer durables and apparel, consumer services, media, and retailing companies. Other sectors in the portfolio include consumer staples, energy, health care, industrials, information technology, materials, telecom services, and utilities. The average dividend yield on the securities held in the world equity portfolio was approximately 4.8% as of June 30, 2013.

World Equity Markets Review

The rally in global stocks persisted through most of May before US Federal Reserve (the Fed) Chairman Ben Bernanke’s reference to potentially slowing the pace of quantitative easing (QE)—at some point late this year or early in 2014—led to a sharp increase in volatility and a sell-off in global stocks. However, following a rebound late in June, the global market ended the second quarter broadly flat, and remains in positive territory year-to-date. While central bankers reiterated that any potential slowing in QE would be dependent on continued strength of US economic indicators, particularly those related to employment, investors would not be reassured, and aggressively sold risk assets. This was particularly the case for investments perceived to have been boosted by QE, such as large-cap, developed-market, high-yield equities, as well as emerging-market equities and bonds. While we understand the recent underperformance of large-cap, developed-market income stocks and emerging markets bonds, which have both been strong-performing asset classes with current yields well below longer-term norms, we were surprised by the weakness in emerging markets equities. These have been underperforming developed markets for nearly three years, and look attractively valued both in absolute and relative terms to developed markets, in our opinion. We feel that the Fed is discussing a reduction in QE due to the emergence of clear signs of a more robust recovery in the United States over the past 12 to 18 months, driven by a pronounced rebound

in housing. We also feel that this recovery will ultimately prove to be positive for equity markets, as earnings driven by a truly recovering global economy should warrant a higher valuation multiple than earnings driven by QE. However, the sharp upward move in government bond yields around the world reinforces our concern about the outlook for large-cap, developed-market, defensive income stocks (e.g., bond proxies). These have historically struggled amid rising rates, as they ultimately compete with bonds for income-seeking capital, and currently face the additional hurdle of valuations well above historic averages.

What Helped and What Hurt LOR

The portfolio’s position in auto parts maker Valeo contributed to performance, as shares rose after the company released quarterly sales figures. Although sales were expected to decline amid a weaker European outlook, figures exceeded expectations and displayed sales growth. In addition, despite the company’s domicile in France, Valeo has a global automotive presence with growing sales in Asia and North America. The portfolio was also helped by its position in French insurer AXA, which rose after the company reported quarterly results which exceeded expectations, led by better-than-expected margins and inflows in its asset management business. Investors were also heartened by the rise in rates during the second quarter, which is beneficial to AXA’s variable annuity business. Another contributor to the portfolio was its position in UK insurer Direct Line Insurance Group, which rose after the company announced that its cost-cutting initiative was expected to save twice the amount originally expected. It is anticipated that the initiative will lead to earnings growth and a potential increase in the company’s dividend.

In contrast, the portfolio’s position in Banco do Brasil detracted from returns, as regulatory and Latin American macroeconomic risks continued to weigh on investors. However, we expect Banco do Brasil to capitalize on continued loan growth in Brazil, and we believe the company’s valuation and dividend yield are attractive at current levels. The portfolio was also hurt by its position in US copper miner Southern Copper, as declining global copper prices caused concern. While near-term commodity prices may be volatile, we believe Southern Copper’s plan to increase production while maintaining cash costs will allow the company to remain profitable, and that it will be able to continue to return capital to shareholders through a

3

Lazard World Dividend & Income Fund, Inc.

Investment Overview (continued)

dividend. Another detractor was the portfolio’s position in ICL-Israel Chemicals. The security declined as global macroeconomic uncertainty has pressured potash demand, and regulatory risk in Israel has escalated. We have sold our position in favor of companies with more attractive risk-reward profiles.

Emerging Market Currency and Debt Portfolio

(25.7% of total leveraged assets)

The Fund also seeks enhanced income through investing primarily in high-yielding, short-duration emerging-market forward currency contracts and local currency debt instruments. As of June 30, 2013, this portfolio consisted of forward currency contracts (73.6%) and sovereign debt obligations (26.4%). The average duration of the emerging-market currency and debt portfolio increased from approximately 4 months to approximately 12 months during the second quarter, while the average yield rose from 5.6%2 on March 31, 2013 to 7.1% on June 30, 2013.

Emerging Market Currency and Debt Market Review

Nearly all emerging-market currencies (with the exception of the Chinese renminbi and those in some frontier markets) weakened during the second quarter as expectations for the Fed’s policy were sharply re-priced amid concerns that slowing the pace of QE would remove relative support for emerging-market currencies and perceived risk assets. Disappointing data from China, and its seeming reluctance to provide stimulus, also provided a headwind to some emerging-market currencies (particularly commodity-sensitive ones).

Despite the recent volatility, we believe emerging local market fundamentals have not markedly changed over the last two months. Rather, the market is in the midst of re-assessing the US interest rate environment and assessing its impact on emerging-market prospects. The emerging markets represent a diverse mix of fiscal, monetary and exchange-rate policies, which are likely to become a basis for differentiation once volatility and correlations wane. The Fed’s confidence in US growth, employment, and inflation objectives are pre-conditions for “tapering” stimulus, while actual tightening remains at least two years away, according to the Fed’s current guidance. If the US economy is doing well enough for tapering to occur, it likely means that consumption is solid, which bodes well for several emerging-market countries.

What Helped and What Hurt LOR

Latin America was the worst-performing region during the second quarter, as the greatly reduced risk appetite pressured currencies, causing sharply weaker performance (particularly for countries with balance-of-payment deficits and exposure to China and commodities) despite aggressive central bank intervention in some countries. Among detractors for the second quarter, Brazil was most notable, despite such heavy central bank intervention throughout the month and the elimination of financial transaction taxes (IOF tax) on fixed-income inflows and foreign-exchange derivatives. Disappointing growth, balance-of-payment deterioration, and increased fiscal expenditures created by President Dilma Rousseff’s pledge to increase spending on health services and transportation in the wake of street protests weighed on the real. India also detracted from returns, as the rupee’s loss was aggravated by resurgent concerns over financing the current-account deficit in an environment of tighter global liquidity, slow growth, and high (though moderating) inflation. The Russian ruble hurt performance as capital outflows, negative seasonality for the current account, and an expected easing cycle to support the economy pressured the currency. Other detractors included the Turkish lira, due to the combination of rising inflation and widening current account, and the South African rand, due to a wide current-account deficit, slow growth, rising inflation, and a non-interventionist central bank.

Conversely, the Hungarian forint appreciated during the second quarter due to the country’s current account surplus and recovery from first-quarter weakness despite continued easing. Sizable exposure to the Serbian dinar helped performance, as foreign exchange and local debt rallied on high carry, yield curve compression, improving exports, and current account financing. The Chinese renminbi also added to returns due to its managed currency regime. The Romanian leu helped performance amid compelling yield, a risk-adjusted currency, and local debt prospects. Finally, frontier-market currencies (particularly, the Ugandan shilling, Dominican peso, and Nigerian naira) added to returns for the second quarter, as low foreign-exchange volatility and high yield buoyed relative results and provided uncorrelated alpha.

4

Lazard World Dividend & Income Fund, Inc.

Investment Overview (continued)

Notes to Investment Overview:

| 1 | A measure of the average cash weighted term-to-maturity of the investment holdings. Duration is a measure of the price sensitivity of a bond to interest rate movements. Duration for a forward currency contract is equal to its term-to-maturity. |

| | |

| 2 | The quoted yield does not account for the implicit cost of borrowing on the forward currency contracts, which would reduce the yield shown. |

All returns reflect reinvestment of all dividends and distributions. Past performance is not indicative, or a guarantee, of future results.

The performance data of the Index and other market data have been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to their accuracy. The Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of global developed and emerging markets. The Index is unmanaged, has no fees or costs and is not available for investment.

The views of the Fund’s Investment Manager and the securities described in this report are as of June 30, 2013; these views and portfolio holdings may have changed subsequent to this date. Nothing herein should be construed as a recommendation to buy, sell, or hold a particular security. There is no assurance that the securities discussed herein will remain in the Fund at the time you receive this report, or that securities sold will not have been repurchased. The specific securities discussed may, in aggregate, represent only a small percentage of the Fund’s holdings. It should not be assumed that securities identified and discussed were, or will be, profitable, or that the investment decisions made in the future will be profitable, or equal the investment performance of the securities discussed herein.

The views and opinions expressed are provided for general information only, and do not constitute specific tax, legal, or investment advice to, or recommendations for, any person. There can be no guarantee as to the accuracy of the outlooks for markets, sectors and securities as discussed herein.

5

Lazard World Dividend & Income Fund, Inc.

Investment Overview (continued)

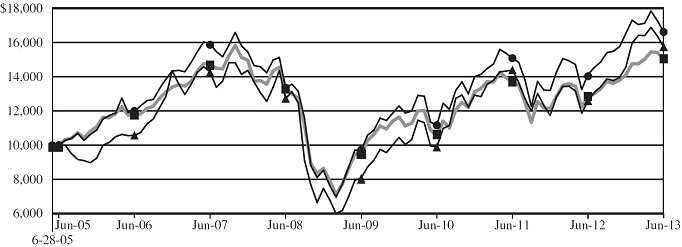

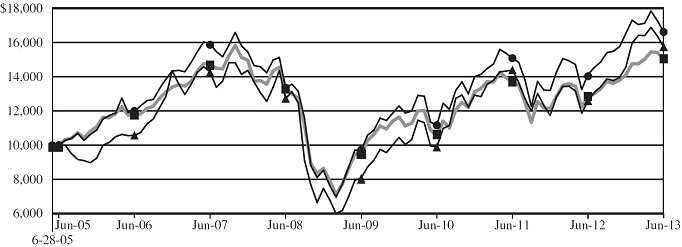

Comparison of Changes in Value of $10,000 Investment in

LOR and MSCI ACWI Index* (unaudited)

| | | | Value at

6/30/13 | |

| LOR at Market Price | | | $ | 15,741 | | |

| LOR at Net Asset Value | | | | 16,612 | | |

| MSCI ACWI Index | | | | 15,051 | | |

Average Annual Total Returns*

Periods Ended June 30, 2013 (unaudited) | | | | | | | | | | |

| | | One

Year | | Five

Years | | Since

Inception** | |

| Market Price | | | 25.10 | % | | | 4.34 | % | | | 5.83 | % | |

| Net Asset Value | | | 17.64 | % | | | 4.50 | % | | | 6.54 | % | |

| MSCI ACWI Index | | | 16.57 | % | | | 2.30 | % | | | 5.23 | % | |

| * | All returns reflect reinvestment of all dividends and distributions. The performance quoted represents past performance. Current performance may be lower or higher than the performance quoted. Past performance is not indicative, or a guarantee, of future results; the investment return, market price and net asset value of the Fund will fluctuate, so that an investor’s shares in the Fund, when sold, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a stockholder would pay on the Fund’s distributions or on the sale of Fund shares. |

| | |

| | The performance data of the Index has been prepared from sources and data that the Investment Manager believes to be reliable, but no representation is made as to its accuracy. The Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of global developed and emerging markets. The Index is unmanaged, has no fees or costs and is not available for investment. |

| | |

| ** | The Fund’s inception date was June 28, 2005. |

6

Lazard World Dividend & Income Fund, Inc.

Investment Overview (concluded)

| | Ten Largest Equity Holdings

June 30, 2013 (unaudited) | | | | | | | |

| | Security | | Value | | | Percentage of

Net Assets | |

| | CenturyLink, Inc. | | $ | 3,379,460 | | | | 3.5 | % | |

| | Royal Dutch Shell PLC, A Shares | | | 2,851,383 | | | | 2.9 | | |

| | Eni SpA | | | 2,796,648 | | | | 2.9 | | |

| | Atlantia SpA | | | 2,719,572 | | | | 2.8 | | |

| | Vodafone Group PLC | | | 2,361,502 | | | | 2.4 | | |

| | Red Electrica Corporacion SA | | | 2,306,642 | | | | 2.4 | | |

| | Mobile TeleSystems OJSC Sponsored ADR | | | 2,285,679 | | | | 2.4 | | |

| | Banco do Brasil SA | | | 1,969,047 | | | | 2.0 | | |

| | Agricultural Bank of China, Ltd., Class H | | | 1,914,376 | | | | 2.0 | | |

| | Intel Corp. | | | 1,911,685 | | | | 2.0 | | |

| | Portfolio Holdings Presented by Sector

June 30, 2013 (unaudited) | | | | |

| | Sector | | Percentage of

Total

Investments | |

| | Consumer Discretionary | | | 14.1 | % | | |

| | Consumer Staples | | | 1.7 | | | |

| | Energy | | | 9.7 | | | |

| | Financials | | | 26.2 | | | |

| | Health Care | | | 4.8 | | | |

| | Industrials | | | 7.6 | | | |

| | Information Technology | | | 8.0 | | | |

| | Materials | | | 3.0 | | | |

| | Telecommunications Services | | | 10.8 | | | |

| | Utilities | | | 2.9 | | | |

| | Emerging Markets Debt Obligations | | | 10.0 | | | |

| | Short-Term Investment | | | 1.2 | | | |

| | Total Investments | | | 100.0 | % | | |

| | | | | | | |

7

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments

June 30, 2013 (unaudited)

| Description | | Shares | | | Value | |

| | | | | | | |

| Common Stocks—100.0% | | | | | | | | |

| | | | | | | | | |

| Australia—2.3% | | | | | | | | |

| DUET Group | | | 456,124 | | | $ | 838,468 | |

| Transurban Group | | | 153,743 | | | | 950,494 | |

| Westfield Group REIT | | | 45,600 | | | | 477,088 | |

| | | | | | | | 2,266,050 | |

| | | | | | | | | |

| Belgium—0.8% | | | | | | | | |

| bpost SA | | | 41,150 | | | | 764,878 | |

| | | | | | | | | |

| Brazil—4.8% | | | | | | | | |

| Banco do Brasil SA | | | 198,717 | | | | 1,969,047 | |

| BB Seguridade Participacoes SA | | | 158,400 | | | | 1,246,557 | |

| Cia Hering | | | 46,400 | | | | 655,237 | |

| Direcional Engenharia SA | | | 125,300 | | | | 746,853 | |

| | | | | | | | 4,617,694 | |

| | | | | | | | | |

| Cambodia—0.7% | | | | | | | | |

| NagaCorp, Ltd. | | | 886,000 | | | | 692,254 | |

| | | | | | | | | |

| China—4.1% | | | | | | | | |

Agricultural Bank of China, Ltd.,

Class H | | | 4,640,000 | | | | 1,914,376 | |

China Construction Bank Corp.,

Class H | | | 1,963,180 | | | | 1,389,607 | |

Industrial and Commercial Bank of

China, Ltd., Class H | | | 1,036,440 | | | | 653,450 | |

| | | | | | | | 3,957,433 | |

| | | | | | | | | |

| Finland—1.6% | | | | | | | | |

| Sampo Oyj, A Shares | | | 38,534 | | | | 1,501,723 | |

| | | | | | | | | |

| France—6.9% | | | | | | | | |

| AXA SA | | | 73,034 | | | | 1,435,001 | |

| Rexel SA | | | 42,161 | | | | 948,307 | |

| Sanofi SA | | | 10,758 | | | | 1,114,930 | |

| Total SA | | | 27,541 | | | | 1,344,507 | |

| Valeo SA | | | 28,667 | | | | 1,801,725 | |

| | | | | | | | 6,644,470 | |

| | | | | | | | | |

| Germany—2.2% | | | | | | | | |

| Allianz SE | | | 7,412 | | | | 1,082,968 | |

| Bayerische Motoren Werke AG | | | 11,382 | | | | 995,297 | |

| | | | | | | | 2,078,265 | |

| | | | | | | | | |

| Guernsey—1.1% | | | | | | | | |

| Resolution, Ltd. | | | 239,710 | | | | 1,039,073 | |

| | | | | | | | | |

| Indonesia—0.5% | | | | | | | | |

PT Bank Pembangunan Daerah Jawa

Barat dan Banten Tbk | | | 4,280,500 | | | | 508,916 | |

| | | | | | | | | |

| Israel—1.6% | | | | | | | | |

Bezeq The Israeli Telecommunication

Corp., Ltd. | | | 1,137,912 | | | | 1,520,323 | |

| Description | | Shares | | | Value | |

| | | | | | | |

| Italy—5.7% | | | | | | | | |

| Atlantia SpA | | | 166,746 | | | $ | 2,719,572 | |

| Eni SpA | | | 136,156 | | | | 2,796,648 | |

| | | | | | | | 5,516,220 | |

| | | | | | | | | |

| Japan—1.7% | | | | | | | | |

| Mizuho Financial Group, Inc. | | | 797,300 | | | | 1,656,017 | |

| | | | | | | | | |

| Luxembourg—1.2% | | | | | | | | |

| RTL Group | | | 14,400 | | | | 1,184,230 | |

| | | | | | | | | |

| Macau—3.2% | | | | | | | | |

| Sands China, Ltd. | | | 272,000 | | | | 1,288,800 | |

| Wynn Macau, Ltd. | | | 678,000 | | | | 1,840,099 | |

| | | | | | | | 3,128,899 | |

| | | | | | | | | |

| Mexico—0.5% | | | | | | | | |

Fibra Uno Administracion SA de

CV REIT | | | 154,100 | | | | 517,455 | |

| | | | | | | | | |

| Norway—1.6% | | | | | | | | |

| Orkla ASA | | | 83,828 | | | | 686,704 | |

| Seadrill, Ltd. | | | 21,700 | | | | 884,058 | |

| | | | | | | | 1,570,762 | |

| | | | | | | | | |

| Russia—4.9% | | | | | | | | |

Globaltrans Investment PLC

Sponsored GDR | | | 95,851 | | | | 1,316,993 | |

Mobile TeleSystems OJSC

Sponsored ADR | | | 120,680 | | | | 2,285,679 | |

| Sberbank of Russia GDR (a), (b) | | | 96,808 | | | | 1,102,643 | |

| | | | | | | | 4,705,315 | |

| | | | | | | | | |

| South Africa—4.8% | | | | | | | | |

| AVI, Ltd. | | | 69,309 | | | | 416,834 | |

| Kumba Iron Ore, Ltd. | | | 13,647 | | | | 635,890 | |

| Life Healthcare Group Holdings Pte, Ltd. | | | 333,986 | | | | 1,267,012 | |

| MTN Group, Ltd. | | | 33,660 | | | | 626,546 | |

| Vodacom Group, Ltd. | | | 158,533 | | | | 1,684,274 | |

| | | | | | | | 4,630,556 | |

| | | | | | | | | |

| Spain—2.4% | | | | | | | | |

| Red Electrica Corporacion SA | | | 41,943 | | | | 2,306,642 | |

| | | | | | | | | |

| Sweden—1.8% | | | | | | | | |

| Electrolux AB, Series B | | | 36,909 | | | | 932,343 | |

| Swedbank AB, A Shares | | | 34,245 | | | | 785,387 | |

| | | | | | | | 1,717,730 | |

| | | | | | | | | |

| Switzerland—1.7% | | | | | | | | |

| Swiss Re AG | | | 12,945 | | | | 963,457 | |

| Zurich Insurance Group AG | | | 2,691 | | | | 697,999 | |

| | | | | | | | 1,661,456 | |

The accompanying notes are an integral part of these financial statements.

8

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments (continued)

June 30, 2013 (unaudited)

| Description | | Shares | | | Value | |

| | | | | | | |

| Taiwan—2.5% | | | | | | | | |

| Radiant Opto-Electronics Corp. | | | 322,000 | | | $ | 1,056,108 | |

| Siliconware Precision Industries Co. | | | 1,108,000 | | | | 1,393,734 | |

| | | | | | | | 2,449,842 | |

| | | | | | | | | |

| Thailand—1.2% | | | | | | | | |

| Dynasty Ceramic Public Co. Ltd. (b) | | | 269,600 | | | | 554,151 | |

| Krung Thai Bank Public Co. Ltd. (b) | | | 548,800 | | | | 359,202 | |

Tisco Financial Group Public Co.

Ltd. (b) | | | 217,800 | | | | 287,919 | |

| | | | | | | | 1,201,272 | |

| | | | | | | | | |

| Turkey—2.1% | | | | | | | | |

| Tofas Turk Otomobil Fabrikasi AS | | | 164,674 | | | | 1,028,839 | |

| Tupras-Turkiye Petrol Rafinerileri AS | | | 41,169 | | | | 1,005,371 | |

| | | | | | | | 2,034,210 | |

| | | | | | | | | |

| United Kingdom—8.1% | | | | | | | | |

| Direct Line Insurance Group PLC | | | 415,484 | | | | 1,472,397 | |

| Ladbrokes PLC | | | 167,471 | | | | 509,175 | |

| Rexam PLC | | | 84,204 | | | | 611,535 | |

| Royal Dutch Shell PLC, A Shares | | | 89,248 | | | | 2,851,383 | |

| Vodafone Group PLC | | | 826,537 | | | | 2,361,502 | |

| | | | | | | | 7,805,992 | |

| | | | | | | | | |

| United States—30.0% | | | | | | | | |

| Apple, Inc. | | | 1,779 | | | | 704,626 | |

| Aviv REIT, Inc. | | | 23,432 | | | | 592,595 | |

Blackstone Mortgage Trust, Inc.,

Class A | | | 48,800 | | | | 1,205,360 | |

| CenturyLink, Inc. | | | 95,600 | | | | 3,379,460 | |

| Cisco Systems, Inc. | | | 72,900 | | | | 1,772,199 | |

| ConocoPhillips | | | 16,560 | | | | 1,001,880 | |

| EPR Properties REIT | | | 17,800 | | | | 894,806 | |

| Harsco Corp. | | | 20,730 | | | | 480,729 | |

| Hasbro, Inc. | | | 40,285 | | | | 1,805,976 | |

| Intel Corp. | | | 78,930 | | | | 1,911,685 | |

| Johnson & Johnson | | | 12,100 | | | | 1,038,906 | |

| Lexington Realty Trust REIT | | | 150,500 | | | | 1,757,840 | |

| Medical Properties Trust, Inc. REIT | | | 44,300 | | | | 634,376 | |

| Microsoft Corp. | | | 46,100 | | | | 1,591,833 | |

| National CineMedia, Inc. | | | 36,600 | | | | 618,174 | |

| Nutrisystem, Inc. | | | 61,300 | | | | 722,114 | |

| People’s United Financial, Inc. | | | 55,700 | | | | 829,930 | |

| Pfizer, Inc. | | | 67,100 | | | | 1,879,471 | |

| Qualcomm, Inc. | | | 7,800 | | | | 476,424 | |

| Republic Services, Inc. | | | 21,500 | | | | 729,710 | |

| Southern Copper Corp. | | | 55,180 | | | | 1,524,072 | |

| STAG Industrial, Inc. REIT | | | 45,600 | | | | 909,720 | |

| Sysco Corp. | | | 54,610 | | | | 1,865,478 | |

| Wynn Resorts, Ltd. | | | 5,400 | | | | 691,200 | |

| | | | | | | | 29,018,564 | |

| Description | | Shares | | | Value | |

| | | | | | | |

Total Common Stocks

(Identified cost $94,044,233) | | | | | | $ | 96,696,241 | |

| | | | | | | | | |

| Preferred Stock—0.9% | | | | | | | | |

| | | | | | | | | |

| United States—0.9% | | | | | | | | |

Capital One Financial Corp.,

Series B

(Identified cost $928,277) | | | 37,205 | | | | 916,731 | |

| Description | | Principal

Amount

(000) (c) | | | Value | |

| | | | | | | |

Foreign Government

Obligations—11.3% | | | | | | | | |

| | | | | | | | | |

| Brazil—2.8% | | | | | | | | |

| Brazil NTN-B: | | | | | | | | |

| 6.00%, 05/15/15 | | | 915 | | | $ | 980,505 | |

| 6.00%, 08/15/16 | | | 273 | | | | 296,992 | |

| 6.00%, 08/15/18 | | | 460 | | | | 504,639 | |

Brazil NTN-F,

10.00%, 01/01/23 | | | 2,044 | | | | 910,487 | |

| | | | | | | | 2,692,623 | |

| | | | | | | | | |

| Colombia—0.1% | | | | | | | | |

Republic of Colombia,

12.00%, 10/22/15 | | | 188,000 | | | | 112,359 | |

| | | | | | | | | |

| Mexico—2.2% | | | | | | | | |

| Mexican Bonos: | | | | | | | | |

| 7.00%, 06/19/14 | | | 13,170 | | | | 1,044,723 | |

| 9.50%, 12/18/14 | | | 9,000 | | | | 746,403 | |

Mexican Udibonos,

5.00%, 06/16/16 | | | 4,308 | | | | 368,777 | |

| | | | | | | | 2,159,903 | |

| | | | | | | | | |

| Romania—1.9% | | | | | | | | |

| Romania Government Bonds: | | | | | | | | |

| 5.85%, 07/28/14 | | | 2,600 | | | | 764,889 | |

| 5.80%, 10/26/15 | | | 1,670 | | | | 492,419 | |

| 5.75%, 01/27/16 | | | 1,050 | | | | 309,605 | |

| 5.90%, 07/26/17 | | | 1,100 | | | | 322,045 | |

| | | | | | | | 1,888,958 | |

| | | | | | | | | |

| Russia—1.9% | | | | | | | | |

| Russia Government Bonds - OFZ: | | | | | | | | |

| 6.90%, 08/03/16 | | | 7,438 | | | | 228,644 | |

| 7.50%, 02/27/19 | | | 6,590 | | | | 203,579 | |

| 7.60%, 04/14/21 | | | 15,289 | | | | 473,719 | |

| 7.60%, 07/20/22 | | | 8,548 | | | | 262,115 | |

| 7.00%, 01/25/23 | | | 11,700 | | | | 343,822 | |

| 8.15%, 02/03/27 | | | 10,700 | | | | 334,454 | |

| | | | | | | | 1,846,333 | |

The accompanying notes are an integral part of these financial statements.

9

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments (continued)

June 30, 2013 (unaudited)

| Description | | Principal

Amount

(000) (c) | | | Value | |

| | | | | | | |

| South Africa—0.7% | | | | | | | | |

Republic of South Africa,

10.50%, 12/21/26 | | | 5,700 | | | $ | 698,977 | |

| | | | | | | | | |

| Turkey—0.9% | | | | | | | | |

| Turkey Government Bonds: | | | | | | | | |

| 8.00%, 10/09/13 | | | 465 | | | | 242,276 | |

| 10.00%, 12/04/13 | | | 310 | | | | 162,595 | |

| 4.00%, 04/29/15 | | | 808 | | | | 430,742 | |

| | | | | | | | 835,613 | |

| | | | | | | | | |

| Uruguay—0.8% | | | | | | | | |

| Uruguay Monetary Regulation Bills: | | | | | | | | |

| 0.00%, 07/05/13 | | | 11,150 | | | | 545,360 | |

| 0.00%, 07/16/13 | | | 450 | | | | 21,951 | |

| 0.00%, 08/15/13 | | | 3,000 | | | | 145,164 | |

| 0.00%, 01/31/14 | | | 900 | | | | 41,775 | |

| | | | | | | | 754,250 | |

| | | | | | | | | |

Total Foreign Government

Obligations

(Identified cost $11,333,591) | | | | | | | 10,989,016 | |

| | | | | | | |

| | | | | | | |

| Description | | Shares | | | Value | |

| | | | | | | |

| Short-Term Investment—1.4% | | | | | | | | |

State Street Institutional Treasury

Money Market Fund

(Identified cost $1,312,025) | | | 1,312,025 | | | $ | 1,312,025 | |

| | | | | | | | | |

Total Investments—113.6%

(Identified cost $107,618,126) (d), (e) | | | | | | $ | 109,914,013 | |

Liabilities in Excess of Cash and

Other Assets—(13.6)% | | | | | | | (13,189,923 | ) |

| Net Assets—100.0% | | | | | | $ | 96,724,090 | |

The accompanying notes are an integral part of these financial statements.

10

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments (continued)

June 30, 2013 (unaudited)

Forward Currency Purchase Contracts open at June 30, 2013:

| Currency | | Counterparty | | Expiration

Date | | Foreign

Currency

Amount | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| BRL | | BRC | | 07/02/13 | | 693,030 | | $ | 318,049 | | $ | 310,587 | | $ | — | | $ | 7,462 | |

| BRL | | RBC | | 07/02/13 | | 124,137 | | | 58,000 | | | 55,633 | | | — | | | 2,367 | |

| BRL | | RBC | | 07/02/13 | | 343,537 | | | 166,000 | | | 153,959 | | | — | | | 12,041 | |

| CLP | | RBC | | 07/24/13 | | 278,712,000 | | | 553,000 | | | 546,462 | | | — | | | 6,538 | |

| CLP | | UBS | | 07/10/13 | | 251,727,600 | | | 497,240 | | | 494,777 | | | — | | | 2,463 | |

| CLP | | UBS | | 07/15/13 | | 252,899,100 | | | 528,381 | | | 496,640 | | | — | | | 31,741 | |

| CNY | | BRC | | 07/31/13 | | 4,353,804 | | | 702,000 | | | 707,479 | | | 5,479 | | | — | |

| CNY | | HSB | | 07/19/13 | | 4,169,787 | | | 675,181 | | | 678,323 | | | 3,142 | | | — | |

| COP | | CIT | | 08/02/13 | | 885,339,000 | | | 459,737 | | | 459,351 | | | — | | | 386 | |

| COP | | RBC | | 07/24/13 | | 506,800,000 | | | 265,549 | | | 263,182 | | | — | | | 2,367 | |

| COP | | RBC | | 08/08/13 | | 765,107,200 | | | 401,315 | | | 396,736 | | | — | | | 4,579 | |

| COP | | UBS | | 07/03/13 | | 885,339,000 | | | 470,000 | | | 460,710 | | | — | | | 9,290 | |

| COP | | UBS | | 07/15/13 | | 1,124,789,900 | | | 611,000 | | | 584,623 | | | — | | | 26,377 | |

| CZK | | BNP | | 07/08/13 | | 9,650,295 | | | 489,138 | | | 482,871 | | | — | | | 6,267 | |

| CZK | | BNP | | 08/06/13 | | 716,450 | | | 37,424 | | | 35,853 | | | — | | | 1,571 | |

| CZK | | JPM | | 08/06/13 | | 9,936,612 | | | 506,784 | | | 497,264 | | | — | | | 9,520 | |

| CZK | | JPM | | 08/06/13 | | 11,013,724 | | | 560,516 | | | 551,166 | | | — | | | 9,350 | |

| DOP | | CIT | | 07/11/13 | | 5,443,000 | | | 130,465 | | | 130,416 | | | — | | | 49 | |

| DOP | | CIT | | 08/12/13 | | 7,474,950 | | | 178,060 | | | 178,230 | | | 170 | | | — | |

| EUR | | BRC | | 09/23/13 | | 355,273 | | | 468,217 | | | 462,609 | | | — | | | 5,608 | |

| EUR | | BRC | | 09/23/13 | | 803,000 | | | 1,058,286 | | | 1,045,605 | | | — | | | 12,681 | |

| EUR | | CIT | | 09/10/13 | | 400,035 | | | 526,719 | | | 520,862 | | | — | | | 5,857 | |

| EUR | | JPM | | 08/06/13 | | 67,000 | | | 85,885 | | | 87,223 | | | 1,338 | | | — | |

| EUR | | JPM | | 08/06/13 | | 843,000 | | | 1,126,290 | | | 1,097,445 | | | — | | | 28,845 | |

| GHS | | CIT | | 07/24/13 | | 337,000 | | | 165,830 | | | 164,277 | | | — | | | 1,553 | |

| GHS | | SCB | | 08/19/13 | | 86,000 | | | 41,667 | | | 41,381 | | | — | | | 286 | |

| GHS | | SCB | | 08/19/13 | | 1,638,500 | | | 790,324 | | | 788,402 | | | — | | | 1,922 | |

| HUF | | BNP | | 08/26/13 | | 31,134,900 | | | 136,671 | | | 136,654 | | | — | | | 17 | |

| HUF | | JPM | | 07/24/13 | | 192,397,220 | | | 847,640 | | | 847,177 | | | — | | | 463 | |

| HUF | | UBS | | 07/22/13 | | 16,331,040 | | | 72,000 | | | 71,925 | | | — | | | 75 | |

| IDR | | JPM | | 07/30/13 | | 3,697,549,000 | | | 373,000 | | | 371,501 | | | — | | | 1,499 | |

| IDR | | SCB | | 07/03/13 | | 5,915,840,000 | | | 591,584 | | | 595,994 | | | 4,410 | | | — | |

| IDR | | SCB | | 07/17/13 | | 3,085,425,000 | | | 305,488 | | | 310,405 | | | 4,917 | | | — | |

| IDR | | SCB | | 08/02/13 | | 5,366,441,000 | | | 527,000 | | | 539,016 | | | 12,016 | | | — | |

| INR | | JPM | | 07/15/13 | | 31,866,680 | | | 586,000 | | | 535,004 | | | — | | | 50,996 | |

| INR | | JPM | | 02/10/14 | | 54,104,300 | | | 961,000 | | | 879,096 | | | — | | | 81,904 | |

| INR | | SCB | | 07/31/13 | | 25,658,430 | | | 427,000 | | | 429,547 | | | 2,547 | | | — | |

| INR | | UBS | | 07/15/13 | | 428,745 | | | 7,373 | | | 7,198 | | | — | | | 175 | |

| JPY | | HSB | | 07/26/13 | | 7,995,403 | | | 83,630 | | | 80,622 | | | — | | | 3,008 | |

| KRW | | CIT | | 07/22/13 | | 606,558,380 | | | 541,000 | | | 530,559 | | | — | | | 10,441 | |

| KRW | | JPM | | 07/10/13 | | 32,900,030 | | | 28,516 | | | 28,796 | | | 280 | | | — | |

| KRW | | UBS | | 07/10/13 | | 756,452,000 | | | 673,000 | | | 662,087 | | | — | | | 10,913 | |

| KRW | | UBS | | 09/23/13 | | 277,952,500 | | | 245,000 | | | 242,479 | | | — | | | 2,521 | |

| KZT | | CIT | | 09/26/13 | | 51,424,800 | | | 336,000 | | | 334,774 | | | — | | | 1,226 | |

| KZT | | CIT | | 01/06/14 | | 43,187,880 | | | 280,114 | | | 277,357 | | | — | | | 2,757 | |

| KZT | | CIT | | 03/17/14 | | 63,292,260 | | | 404,941 | | | 402,706 | | | — | | | 2,235 | |

| KZT | | HSB | | 07/09/13 | | 20,776,050 | | | 135,419 | | | 136,741 | | | 1,322 | | | — | |

| KZT | | HSB | | 07/09/13 | | 41,900,000 | | | 272,964 | | | 275,772 | | | 2,808 | | | — | |

| KZT | | HSB | | 07/24/13 | | 38,200,000 | | | 251,266 | | | 250,916 | | | — | | | 350 | |

The accompanying notes are an integral part of these financial statements.

11

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments (continued)

June 30, 2013 (unaudited)

Forward Currency Purchase Contracts open at June 30, 2013 (continued):

| Currency | | Counterparty | | Expiration

Date | | Foreign

Currency

Amount | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| KZT | | HSB | | 07/29/13 | | 63,292,260 | | $ | 417,000 | | $ | 415,457 | | $ | — | | $ | 1,543 | |

| KZT | | HSB | | 10/30/13 | | 79,207,200 | | | 513,000 | | | 513,259 | | | 259 | | | — | |

| KZT | | HSB | | 06/16/14 | | 51,424,800 | | | 324,140 | | | 323,209 | | | — | | | 931 | |

| KZT | | HSB | | 06/16/14 | | 79,207,200 | | | 498,849 | | | 497,823 | | | — | | | 1,026 | |

| KZT | | UBS | | 02/28/14 | | 52,830,750 | | | 340,844 | | | 336,901 | | | — | | | 3,943 | |

| MYR | | JPM | | 07/10/13 | | 4,729,721 | | | 1,528,725 | | | 1,496,160 | | | — | | | 32,565 | |

| MYR | | JPM | | 09/18/13 | | 1,511,790 | | | 483,000 | | | 476,094 | | | — | | | 6,906 | |

| NGN | | BRC | | 09/10/13 | | 29,203,550 | | | 178,342 | | | 175,342 | | | — | | | 3,000 | |

| NGN | | BRC | | 06/18/14 | | 20,851,000 | | | 116,000 | | | 114,600 | | | — | | | 1,400 | |

| NGN | | CIT | | 07/23/13 | | 20,350,000 | | | 110,000 | | | 124,279 | | | 14,279 | | | — | |

| NGN | | CIT | | 08/12/13 | | 55,917,000 | | | 343,999 | | | 339,135 | | | — | | | 4,864 | |

| NGN | | CIT | | 09/19/13 | | 21,846,000 | | | 132,000 | | | 130,720 | | | — | | | 1,280 | |

| NGN | | JPM | | 06/17/14 | | 23,400,000 | | | 130,000 | | | 128,649 | | | — | | | 1,351 | |

| NGN | | SCB | | 09/24/13 | | 26,759,200 | | | 162,177 | | | 159,817 | | | — | | | 2,360 | |

| NGN | | SCB | | 10/31/13 | | 23,572,000 | | | 141,065 | | | 139,085 | | | — | | | 1,980 | |

| NGN | | SCB | | 10/31/13 | | 46,469,800 | | | 278,013 | | | 274,192 | | | — | | | 3,821 | |

| NGN | | SCB | | 12/18/13 | | 103,802,600 | | | 610,604 | | | 603,420 | | | — | | | 7,184 | |

| NGN | | SCB | | 03/20/14 | | 85,737,200 | | | 493,452 | | | 484,425 | | | — | | | 9,027 | |

| PEN | | BNP | | 07/24/13 | | 985,559 | | | 371,629 | | | 353,524 | | | — | | | 18,105 | |

| PEN | | BNP | | 08/23/13 | | 1,492,597 | | | 561,000 | | | 534,113 | | | — | | | 26,887 | |

| PEN | | HSB | | 07/18/13 | | 1,302,188 | | | 466,567 | | | 467,365 | | | 798 | | | — | |

| PEN | | JPM | | 08/21/13 | | 893,106 | | | 324,000 | | | 319,638 | | | — | | | 4,362 | |

| PEN | | UBS | | 08/01/13 | | 832,100 | | | 295,501 | | | 298,251 | | | 2,750 | | | — | |

| PHP | | BRC | | 07/18/13 | | 31,565,710 | | | 737,000 | | | 730,516 | | | — | | | 6,484 | |

| PHP | | JPM | | 07/08/13 | | 21,089,020 | | | 502,000 | | | 488,125 | | | — | | | 13,875 | |

| PLN | | BNP | | 07/24/13 | | 1,454,181 | | | 443,497 | | | 437,044 | | | — | | | 6,453 | |

| PLN | | BRC | | 07/22/13 | | 2,493,640 | | | 783,000 | | | 749,540 | | | — | | | 33,460 | |

| RON | | JPM | | 08/21/13 | | 933,553 | | | 276,756 | | | 270,671 | | | — | | | 6,085 | |

| RSD | | BRC | | 08/09/13 | | 77,822,550 | | | 927,011 | | | 882,781 | | | — | | | 44,230 | |

| RSD | | CIT | | 07/31/13 | | 33,269,680 | | | 383,866 | | | 378,177 | | | — | | | 5,689 | |

| RUB | | BNP | | 12/09/13 | | 16,735,950 | | | 506,000 | | | 495,381 | | | — | | | 10,619 | |

| RUB | | BRC | | 09/27/13 | | 24,745,896 | | | 777,000 | | | 741,813 | | | — | | | 35,187 | |

| RUB | | CIT | | 07/01/13 | | 48,284,805 | | | 1,472,995 | | | 1,469,577 | | | — | | | 3,418 | |

| RUB | | JPM | | 07/01/13 | | 1,245,855 | | | 39,000 | | | 37,918 | | | — | | | 1,082 | |

| RUB | | UBS | | 07/01/13 | | 13,767,255 | | | 384,668 | | | 419,015 | | | 34,347 | | | — | |

| RUB | | UBS | | 07/01/13 | | 21,619,770 | | | 660,398 | | | 658,011 | | | — | | | 2,387 | |

| RUB | | UBS | | 09/16/13 | | 15,951,180 | | | 489,000 | | | 479,044 | | | — | | | 9,956 | |

| RUB | | UBS | | 12/13/13 | | 16,238,600 | | | 490,000 | | | 480,327 | | | — | | | 9,673 | |

| SGD | | HSB | | 07/15/13 | | 1,157,864 | | | 924,000 | | | 913,527 | | | — | | | 10,473 | |

| SGD | | HSB | | 07/24/13 | | 728,265 | | | 580,000 | | | 574,594 | | | — | | | 5,406 | |

| THB | | BNP | | 07/18/13 | | 6,644,540 | | | 217,000 | | | 214,067 | | | — | | | 2,933 | |

| THB | | SCB | | 07/18/13 | | 14,760,155 | | | 477,907 | | | 475,527 | | | — | | | 2,380 | |

| THB | | SCB | | 07/23/13 | | 16,530,050 | | | 538,000 | | | 532,408 | | | — | | | 5,592 | |

| TRY | | HSB | | 09/20/13 | | 1,065,613 | | | 558,000 | | | 545,673 | | | — | | | 12,327 | |

| TRY | | JPM | | 07/05/13 | | 71,467 | | | 38,000 | | | 37,031 | | | — | | | 969 | |

| TRY | | JPM | | 07/05/13 | | 436,632 | | | 230,000 | | | 226,247 | | | — | | | 3,753 | |

| TRY | | JPM | | 07/05/13 | | 1,303,390 | | | 721,500 | | | 675,371 | | | — | | | 46,129 | |

| TRY | | JPM | | 07/05/13 | | 1,892,734 | | | 1,003,211 | | | 980,748 | | | — | | | 22,463 | |

| TWD | | HSB | | 07/15/13 | | 14,820,976 | | | 496,000 | | | 494,559 | | | — | | | 1,441 | |

The accompanying notes are an integral part of these financial statements.

12

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments (continued)

June 30, 2013 (unaudited)

Forward Currency Purchase Contracts open at June 30, 2013 (concluded):

| Currency | | Counterparty | | Expiration

Date | | Foreign

Currency

Amount | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| UGX | | BRC | | 08/07/13 | | 1,190,937,000 | | | $ | 453,000 | | | $ | 454,566 | | | $ | 1,566 | | | $ | — | |

| UGX | | CIT | | 07/05/13 | | 1,210,447,000 | | | | 457,118 | | | | 466,410 | | | | 9,292 | | | | — | |

| UYU | | CIT | | 07/29/13 | | 2,880,000 | | | | 137,602 | | | | 139,335 | | | | 1,733 | | | | — | |

| UYU | | CIT | | 07/31/13 | | 1,890,980 | | | | 97,928 | | | | 91,445 | | | | — | | | | 6,483 | |

| UYU | | CIT | | 08/05/13 | | 3,141,000 | | | | 162,830 | | | | 151,722 | | | | — | | | | 11,108 | |

| UYU | | CIT | | 09/09/13 | | 3,222,060 | | | | 166,000 | | | | 154,419 | | | | — | | | | 11,581 | |

| UYU | | HSB | | 07/25/13 | | 1,767,486 | | | | 84,166 | | | | 85,584 | | | | 1,418 | | | | — | |

| ZAR | | BRC | | 08/19/13 | | 1,533,908 | | | | 152,000 | | | | 154,107 | | | | 2,107 | | | | — | |

| ZAR | | BRC | | 08/19/13 | | 7,376,799 | | | | 782,825 | | | | 741,124 | | | | — | | | | 41,701 | |

| ZAR | | JPM | | 07/29/13 | | 2,483,660 | | | | 265,000 | | | | 250,270 | | | | — | | | | 14,730 | |

| ZMW | | BRC | | 07/15/13 | | 1,521,800 | | | | 280,000 | | | | 276,780 | | | | — | | | | 3,220 | |

| ZMW | | BRC | | 08/07/13 | | 2,757,570 | | | | 510,000 | | | | 498,787 | | | | — | | | | 11,213 | |

| ZMW | | SCB | | 08/28/13 | | 2,642,948 | | | | 493,087 | | | | 475,889 | | | | — | | | | 17,198 | |

| ZMW | | SCB | | 09/19/13 | | 1,184,619 | | | | 210,449 | | | | 211,906 | | | | 1,457 | | | | — | |

| ZMW | | SCB | | 12/19/13 | | 789,746 | | | | 137,228 | | | | 137,590 | | | | 362 | | | | — | |

| Total Forward Currency Purchase Contracts | | $ | 47,822,612 | | | $ | 47,021,476 | | | $ | 108,797 | | | $ | 909,933 | |

Forward Currency Sale Contracts open at June 30, 2013:

| Currency | | Counterparty | | Expiration

Date | | Foreign

Currency

Amount | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| BRL | | BRC | | 08/02/13 | | 693,030 | | | $ | 315,962 | | | $ | 308,418 | | | $ | 7,544 | | | $ | — | |

| BRL | | RBC | | 07/02/13 | | 1,160,704 | | | | 512,000 | | | | 520,180 | | | | — | | | | 8,180 | |

| CLP | | BNP | | 07/10/13 | | 36,176,040 | | | | 69,764 | | | | 71,105 | | | | — | | | | 1,341 | |

| COP | | CIT | | 07/03/13 | | 885,339,000 | | | | 461,114 | | | | 460,710 | | | | 404 | | | | — | |

| CZK | | BNP | | 07/08/13 | | 680,176 | | | | 33,887 | | | | 34,034 | | | | — | | | | 147 | |

| CZK | | BNP | | 07/08/13 | | 8,970,119 | | | | 468,458 | | | | 448,837 | | | | 19,621 | | | | — | |

| CZK | | JPM | | 08/06/13 | | 21,666,786 | | | | 1,126,290 | | | | 1,084,283 | | | | 42,007 | | | | — | |

| EUR | | BNP | | 07/08/13 | | 377,000 | | | | 489,138 | | | | 490,734 | | | | — | | | | 1,596 | |

| EUR | | BNP | | 07/25/13 | | 356,000 | | | | 469,133 | | | | 463,429 | | | | 5,704 | | | | — | |

| EUR | | BRC | | 08/09/13 | | 689,000 | | | | 927,011 | | | | 896,976 | | | | 30,035 | | | | — | |

| EUR | | BRC | | 09/23/13 | | 616,000 | | | | 825,392 | | | | 802,108 | | | | 23,284 | | | | — | |

| EUR | | CIT | | 07/31/13 | | 289,000 | | | | 383,866 | | | | 376,220 | | | | 7,646 | | | | — | |

| EUR | | HSB | | 07/22/13 | | 105,293 | | | | 136,000 | | | | 137,066 | | | | — | | | | 1,066 | |

| EUR | | HSB | | 07/22/13 | | 116,084 | | | | 152,000 | | | | 151,112 | | | | 888 | | | | — | |

| EUR | | HSB | | 07/22/13 | | 815,399 | | | | 1,070,798 | | | | 1,061,448 | | | | 9,350 | | | | — | |

| EUR | | JPM | | 08/06/13 | | 86,443 | | | | 115,000 | | | | 112,534 | | | | 2,466 | | | | — | |

| EUR | | JPM | | 08/06/13 | | 1,852,173 | | | | 2,395,776 | | | | 2,411,220 | | | | — | | | | 15,444 | |

| EUR | | JPM | | 08/06/13 | | 386,315 | | | | 506,784 | | | | 502,918 | | | | 3,866 | | | | — | |

| EUR | | JPM | | 08/06/13 | | 428,000 | | | | 560,517 | | | | 557,185 | | | | 3,332 | | | | — | |

| EUR | | UBS | | 07/31/13 | | 55,597 | | | | 72,412 | | | | 72,377 | | | | 35 | | | | — | |

| EUR | | UBS | | 07/31/13 | | 181,682 | | | | 242,000 | | | | 236,513 | | | | 5,487 | | | | — | |

| EUR | | UBS | | 07/31/13 | | 183,753 | | | | 244,500 | | | | 239,210 | | | | 5,290 | | | | — | |

| HUF | | BRC | | 07/24/13 | | 234,655,280 | | | | 1,035,868 | | | | 1,033,249 | | | | 2,619 | | | | — | |

| IDR | | SCB | | 07/03/13 | | 5,915,840,000 | | | | 591,702 | | | | 595,994 | | | | — | | | | 4,292 | |

| JPY | | HSB | | 07/26/13 | | 51,898,868 | | | | 529,000 | | | | 523,326 | | | | 5,674 | | | | — | |

| JPY | | SCB | | 07/26/13 | | 88,021,442 | | | | 886,000 | | | | 887,571 | | | | — | | | | 1,571 | |

| JPY | | UBS | | 09/18/13 | | 23,104,235 | | | | 245,000 | | | | 233,036 | | | | 11,964 | | | | — | |

The accompanying notes are an integral part of these financial statements.

13

Lazard World Dividend & Income Fund, Inc.

Portfolio of Investments (concluded)

June 30, 2013 (unaudited)

Forward Currency Sale Contracts open at June 30, 2013 (concluded):

| Currency | | Counterparty | | Expiration

Date | | Foreign

Currency

Amount | | U.S. $ Cost

on Origination

Date | | U.S. $

Current

Value | | Unrealized

Appreciation | | Unrealized

Depreciation | |

| KZT | | CIT | | 07/29/13 | | 63,292,260 | | | $ | 415,849 | | | $ | 415,457 | | | $ | 392 | | | $ | — | |

| KZT | | HSB | | 09/26/13 | | 51,424,800 | | | | 335,015 | | | | 334,774 | | | | 241 | | | | — | |

| KZT | | HSB | | 10/30/13 | | 79,207,200 | | | | 513,499 | | | | 513,259 | | | | 240 | | | | — | |

| MXN | | CIT | | 08/19/13 | | 9,693,116 | | | | 752,454 | | | | 744,895 | | | | 7,559 | | | | — | |

| MYR | | BRC | | 07/08/13 | | 1,518,504 | | | | 471,000 | | | | 480,417 | | | | — | | | | 9,417 | |

| MYR | | BRC | | 07/10/13 | | 834,300 | | | | 270,000 | | | | 263,915 | | | | 6,085 | | | | — | |

| MYR | | JPM | | 07/10/13 | | 786,218 | | | | 249,000 | | | | 248,705 | | | | 295 | | | | — | |

| PHP | | CIT | | 07/18/13 | | 31,565,710 | | | | 716,100 | | | | 730,516 | | | | — | | | | 14,416 | |

| PHP | | JPM | | 07/08/13 | | 21,089,020 | | | | 490,785 | | | | 488,125 | | | | 2,660 | | | | — | |

| RUB | | CIT | | 07/01/13 | | 12,129,390 | | | | 384,950 | | | | 369,165 | | | | 15,785 | | | | — | |

| RUB | | CIT | | 07/01/13 | | 15,781,500 | | | | 501,000 | | | | 480,320 | | | | 20,680 | | | | — | |

| RUB | | CIT | | 09/16/13 | | 8,805,380 | | | | 265,206 | | | | 264,442 | | | | 764 | | | | — | |

| RUB | | CIT | | 09/16/13 | | 48,744,743 | | | | 1,467,000 | | | | 1,463,895 | | | | 3,105 | | | | — | |

| RUB | | JPM | | 07/01/13 | | 1,245,855 | | | | 38,056 | | | | 37,918 | | | | 138 | | | | — | |

| RUB | | UBS | | 07/01/13 | | 35,387,025 | | | | 1,083,000 | | | | 1,077,026 | | | | 5,974 | | | | — | |

| TRY | | BRC | | 07/10/13 | | 78,512 | | | | 40,381 | | | | 40,651 | | | | — | | | | 270 | |

| TRY | | CIT | | 07/10/13 | | 613,301 | | | | 315,322 | | | | 317,547 | | | | — | | | | 2,225 | |

| TRY | | JPM | | 07/05/13 | | 175,211 | | | | 92,000 | | | | 90,788 | | | | 1,212 | | | | — | |

| TRY | | JPM | | 07/05/13 | | 829,226 | | | | 428,098 | | | | 429,676 | | | | — | | | | 1,578 | |

| TRY | | JPM | | 07/05/13 | | 1,393,064 | | | | 728,000 | | | | 721,837 | | | | 6,163 | | | | — | |

| UGX | | CIT | | 07/05/13 | | 83,040,000 | | | | 32,000 | | | | 31,997 | | | | 3 | | | | — | |

| ZAR | | CIT | | 07/29/13 | | 2,401,134 | | | | 238,000 | | | | 241,954 | | | | — | | | | 3,954 | |

| ZAR | | JPM | | 07/29/13 | | 3,412,946 | | | | 348,615 | | | | 343,910 | | | | 4,705 | | | | — | |

| ZAR | | JPM | | 07/29/13 | | 5,332,866 | | | | 539,000 | | | | 537,374 | | | | 1,626 | | | | — | |

| Total Forward Currency Sale Contracts | | | $ | 25,579,702 | | | $ | 25,380,356 | | | $ | 264,843 | | | $ | 65,497 | |

Gross unrealized appreciation/depreciation on Forward Currency

Purchase and Sale Contracts | | | $ | 373,640 | | | $ | 975,430 | |

| BRL | — Brazilian Real | NGN | — Nigerian Naira |

| CLP | — Chilean Peso | PEN | — Peruvian New Sol |

| CNY | — Chinese Renminbi | PHP | — Philippine Peso |

| COP | — Colombian Peso | PLN | — Polish Zloty |

| CZK | — Czech Koruna | RON | — New Romanian Leu |

| DOP | — Dominican Republic Peso | RSD | — Serbian Dinar |

| EUR | — Euro | RUB | — Russian Ruble |

| GHS | — Ghanaian Cedi | SGD | — Singapore Dollar |

| HUF | — Hungarian Forint | THB | — Thai Baht |

| IDR | — Indonesian Rupiah | TRY | — New Turkish Lira |

| INR | — Indian Rupee | TWD | — New Taiwan Dollar |

| JPY | — Japanese Yen | UGX | — Ugandan Shilling |

| KRW | — South Korean Won | UYU | — Uruguayan Peso |

| KZT | — Kazakhstan Tenge | ZAR | — South African Rand |

| MXN | — Mexican New Peso | ZMW | — Zambian Kwacha |

| MYR | — Malaysian Ringgit | |

| Counterparty Abbreviations: | |

| BRC | — Barclays Bank PLC |

| BNP | — BNP Paribas SA |

| CIT | — Citibank NA |

| HSB | — HSBC Bank USA |

| JPM | — JPMorgan Chase Bank |

| RBC | — Royal Bank of Canada |

| SCB | — Standard Chartered Bank |

| UBS | — UBS AG |

The accompanying notes are an integral part of these financial statements.

14

Lazard World Dividend & Income Fund, Inc.

Notes to Portfolio of Investments

June 30, 2013 (unaudited)

| (a) | Pursuant to Rule 144A under the Securities Act of 1933, the security may only be traded among “qualified institutional buyers.” At June 30, 2013, this security amounted to 1.1% of net assets of the Fund, and is considered to be liquid. |

| | |

| (b) | Security valued using Level 2 inputs, based on reference to a similar security from the same issuer which was trading on an active market, under accounting principles generally accepted in the United States of America (“GAAP”) hierarchy – see Note 10. |

| | |

| (c) | Principal amount denominated in respective country’s currency. |

| | |

| (d) | For federal income tax purposes, the aggregate cost was $107,618,126, aggregate gross unrealized appreciation was $7,741,241, aggregate gross unrealized depreciation was $5,445,354, and the net unrealized appreciation was $2,295,887. |

| | |

| (e) | The Fund, at all times, maintains portfolio securities in sufficient amount to cover its obligations related to investments in forward currency contracts. |

| ADR | — American Depositary Receipt |

| GDR | — Global Depositary Receipt |

| NTN-B | — Brazil Sovereign “Nota do Tesouro Nacional” Series B |

| NTN-F | — Brazil Sovereign “Nota do Tesouro Nacional” Series F |

| REIT | — Real Estate Investment Trust |

| Portfolio holdings by industry (as a percentage of net assets): |

| Automotive | | | 4.0 | % |

| Banking | | | 9.3 | |

| Commercial Services | | | 2.4 | |

| Computer Software | | | 1.6 | |

| Consumer Products | | | 2.8 | |

| Electric | | | 3.3 | |

| Energy Integrated | | | 9.3 | |

| Energy Services | | | 0.9 | |

| Financial Services | | | 3.5 | |

| Food & Beverages | | | 1.9 | |

| Forest & Paper Products | | | 0.6 | |

| Health Services | | | 1.3 | |

| Housing | | | 1.3 | |

| Insurance | | | 9.8 | |

| Leisure & Entertainment | | | 7.2 | |

| Manufacturing | | | 1.6 | |

| Metals & Mining | | | 2.2 | |

| Pharmaceutical & Biotechnology | | | 4.2 | |

| Real Estate | | | 7.2 | |

| Retail | | | 0.7 | |

| Semiconductors & Components | | | 4.5 | |

| Technology Hardware | | | 3.1 | |

| Telecommunications | | | 12.3 | |

| Transportation | | | 5.9 | |

| Subtotal | | | 100.9 | |

| Foreign Government Obligations | | | 11.3 | |

| Short-Term Investment | | | 1.4 | |

| Total Investments | | | 113.6 | % |

The accompanying notes are an integral part of these financial statements.

15

Lazard World Dividend & Income Fund, Inc.

Statement of Assets and Liabilities

June 30, 2013 (unaudited)

| ASSETS | | | | |

| Investments in securities, at value (cost $107,618,126) | | $ | 109,914,013 | |

| Foreign currency, at value (cost $1,542,587) | | | 1,542,578 | |

| Dividends and interest receivable | | | 874,317 | |

| Gross unrealized appreciation on forward currency contracts | | | 373,640 | |

| Total assets | | | 112,704,548 | |

| | | | | |

| LIABILITIES | | | | |

| Payables for: | | | | |

| Management fees | | | 102,527 | |

| Investments purchased | | | 189,598 | |

| Line of credit outstanding | | | 14,634,000 | |

| Gross unrealized depreciation on forward currency contracts | | | 975,430 | |

| Other accrued expenses and payables | | | 78,903 | |

| Total liabilities | | | 15,980,458 | |

| Net assets | | $ | 96,724,090 | |

| | | | | |

| NET ASSETS | | | | |

| Paid in capital (Note 2(f)) | | $ | 125,879,889 | |

| Distributions in excess of net investment income (Note 2(f)) | | | (1,584,977 | ) |

| Accumulated net realized loss | | | (29,261,790 | ) |

| Net unrealized appreciation (depreciation) on: | | | | |

| Investments | | | 2,295,887 | |

| Foreign currency and forward currency contracts | | | (604,919 | ) |

| Net assets | | $ | 96,724,090 | |

| | | | | |

| Shares of common stock outstanding* | | | 6,880,183 | |

| Net asset value per share | | $ | 14.06 | |

| Market value per share | | $ | 13.12 | |

* $0.001 par value, 500,000,000 shares authorized for the Fund.

The accompanying notes are an integral part of these financial statements.

16

Lazard World Dividend & Income Fund, Inc.

Statement of Operations

For the Six Months Ended June 30, 2013 (unaudited)

INVESTMENT INCOME

| Income: | | | | |

| Dividends (net of foreign withholding taxes of $300,982) | | $ | 3,310,453 | |

| Interest (net of foreign withholding taxes of $9) | | | 309,899 | |

| Total investment income | | | 3,620,352 | |

| | | | | |

| Expenses: | | | | |

| Management fees (Note 3) | | | 639,771 | |

| Professional services | | | 71,171 | |

| Custodian fees | | | 51,894 | |

| Shareholders’ reports | | | 40,834 | |

| Administration fees | | | 31,168 | |

| Shareholders’ services | | | 21,403 | |

| Shareholders’ meeting | | | 10,321 | |

| Directors’ fees and expenses | | | 3,135 | |

| Other | | | 23,683 | |

| Total expenses before interest expense | | | 893,380 | |

| Interest expense | | | 59,507 | |

| Total expenses | | | 952,887 | |

| Net investment income | | | 2,667,465 | |

| | | | | |

NET REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS, FOREIGN CURRENCY

AND FORWARD CURRENCY CONTRACTS | | | | |

| Net realized gain on: | | | | |

| Investments | | | 2,380,841 | |

| Foreign currency and forward currency contracts | | | 505,100 | |

| Total net realized gain on investments, foreign currency and forward currency contracts | | | 2,885,941 | |

| Net change in unrealized depreciation on: | | | | |

| Investments | | | (3,839,508 | ) |

| Foreign currency and forward currency contracts | | | (1,129,330 | ) |

Total net change in unrealized depreciation on investments, foreign currency

and forward currency contracts | | | (4,968,838 | ) |

Net realized and unrealized loss on investments, foreign currency

and forward currency contracts | | | (2,082,897 | ) |

| Net increase in net assets resulting from operations | | $ | 584,568 | |

The accompanying notes are an integral part of these financial statements.

17

Lazard World Dividend & Income Fund, Inc.

Statements of Changes in Net Assets

| | | Six Months Ended | | Year Ended | |

| | | June 30, 2013 | | December 31, | |

| | | (unaudited) | | 2012 | |

| INCREASE (DECREASE) IN NET ASSETS | | | | | | | | | |

| | | | | | | | | | |

| Operations: | | | | | | | | | |

| Net investment income | | | $ | 2,667,465 | | | $ | 3,788,406 | |

Net realized gain on investments, foreign currency and forward

currency contracts | | | | 2,885,941 | | | | 4,585,064 | |

Net change in unrealized appreciation (depreciation) on investments,

foreign currency and forward currency contracts | | | | (4,968,838 | ) | | | 12,183,709 | |

| Net increase in net assets resulting from operations | | | | 584,568 | | | | 20,557,179 | |

| Distributions to Stockholders (Note 2(f)): | | | | | | | | | |

| From net investment income | | | | (3,229,008 | ) | | | (5,478,002 | ) |

| Net decrease in net assets resulting from distributions | | | | (3,229,008 | ) | | | (5,478,002 | ) |

| Total increase (decrease) in net assets | | | | (2,644,440 | ) | | | 15,079,177 | |

| Net assets at beginning of period | | | | 99,368,530 | | | | 84,289,353 | |

| Net assets at end of period* | | | $ | 96,724,090 | | | $ | 99,368,530 | |

| * Includes distributions in excess of net investment income of (Note 2(f)) | | | $ | (1,584,977 | ) | | $ | (1,023,434 | ) |

| | | | | | | | | | |

| Transactions in Capital Shares: | | | | | | | | | |

| Common shares outstanding at beginning of period | | | | 6,880,183 | | | | 6,880,183 | |

| Common shares outstanding at end of period | | | | 6,880,183 | | | | 6,880,183 | |

The accompanying notes are an integral part of these financial statements.

18

Lazard World Dividend & Income Fund, Inc.

Statement of Cash Flows

For the Six Months Ended June 30, 2013 (unaudited)

INCREASE (DECREASE) IN CASH AND FOREIGN CURRENCY

| Cash flows from operating activities: | | | | |

| Net increase in net assets resulting from operations | | $ | 584,568 | |

Adjustments to reconcile net increase in net assets resulting from operations

to net cash used in operating activities | | | | |

| Increase in dividends and interest receivable | | | (672,962 | ) |

| Accretion of bond discount and amortization of bond premium | | | (10,383 | ) |

| Inflation index adjustment | | | (36,032 | ) |

| Decrease in other accrued expenses and payables | | | (64,727 | ) |

| Net realized gain on investments, foreign currency and forward currency contracts | | | (2,885,941 | ) |

Net change in unrealized depreciation on investments, foreign currency

and forward currency contracts | | | 4,968,838 | |

| Purchase of long-term investments | | | (44,578,398 | ) |

| Proceeds from disposition of long-term investments | | | 43,114,223 | |

| Purchase of short-term investments, net | | | (1,238,247 | ) |

| Net cash used in operating activities | | | (819,061 | ) |

| Cash flows from financing activities: | | | | |

| Cash distribution paid (Note 2(f)) | | | (3,229,008 | ) |

| Gross drawdowns in line of credit balance | | | 6,470,000 | |

| Gross paydowns in line of credit balance | | | (3,000,000 | ) |

| Net cash provided by financing activities | | | 240,992 | |

| Effect of exchange rate changes on cash | | | 498,872 | |

| Net decrease in cash and foreign currency | | | (79,197 | ) |

| Cash and foreign currency: | | | | |

| Beginning balance | | | 1,621,775 | |

| Ending balance | | $ | 1,542,578 | |

| | | | | |

| Supplemental disclosure of cash flow information: | | | | |

| Cash paid during the period for interest | | $ | (62,279 | ) |

The accompanying notes are an integral part of these financial statements.

19

Lazard World Dividend & Income Fund, Inc.

Financial Highlights

Selected data for a share of common stock outstanding throughout each period

| | | Six Months | | | | | | | | | | | |

| | | Ended | | Year Ended | |

| | | 6/30/13† | | 12/31/12 | | 12/31/11 | | 12/31/10 | | 12/31/09 | | 12/31/08 | |

| Net asset value, beginning of period | | $ | 14.44 | | $ | 12.25 | | $ | 13.90 | | $ | 13.04 | | $ | 9.78 | | $ | 20.21 | |

| Income (loss) from investment operations: | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | 0.39 | | | 0.55 | | | 0.63 | | | 0.62 | | | 0.78 | | | 1.05 | |

| Net realized and unrealized gain (loss) | | | (0.30 | ) | | 2.44 | | | (1.38 | ) | | 1.09 | | | 3.25 | | | (9.63 | ) |

| Total from investment operations | | | 0.09 | | | 2.99 | | | (0.75 | ) | | 1.71 | | | 4.03 | | | (8.58 | ) |

| Less distributions from (Note 2(f)): | | | | | | | | | | | | | | | | | | | |

| Net investment income | | | (0.47 | ) | | (0.80 | ) | | (0.90 | ) | | (0.85 | ) | | (0.55 | ) | | (1.41 | ) |

| Net realized gains | | | — | | | — | | | — | | | — | | | — | | | (0.44 | ) |

| Return of capital | | | — | | | — | | | — | | | — | | | (0.22 | ) | | — | |

| Total distributions | | | (0.47 | ) | | (0.80 | ) | | (0.90 | ) | | (0.85 | ) | | (0.77 | ) | | (1.85 | ) |

| Net asset value, end of period | | $ | 14.06 | | $ | 14.44 | | $ | 12.25 | | $ | 13.90 | | $ | 13.04 | | $ | 9.78 | |

| | | | | | | | | | | | | | | | | | | | |

| Market value, end of period | | $ | 13.12 | | $ | 12.55 | | $ | 10.83 | | $ | 12.82 | | $ | 11.15 | | $ | 8.74 | |

| | | | | | | | | | | | | | | | | | | | |

| Total Return based upon (a): | | | | | | | | | | | | | | | | | | | |

| Net asset value | | | 0.54% | | | 25.18% | | | –5.67% | | | 13.85% | | | 44.18% | | | –44.82% | |

| Market value | | | 8.18% | | | 23.99% | | | –9.17% | | | 23.70% | | | 39.81% | | | –48.02% | |

| | | | | | | | | | | | | | | | | | | | |

| Ratios and Supplemental Data: | | | | | | | | | | | | | | | | | | | |

| Net assets, end of period (in thousands) | | $ | 96,724 | | $ | 99,369 | | $ | 84,289 | | $ | 95,615 | | $ | 89,751 | | $ | 67,262 | |

| Ratios to average net assets (b): | | | | | | | | | | | | | | | | | | | |

| Net expenses | | | 1.89% | | | 1.93% | | | 2.06% | | | 2.11% | | | 2.13% | | | 2.30% | |

| Gross expenses | | | 1.89% | | | 1.93% | | | 2.06% | | | 2.11% | | | 2.13% | | | 2.30% | |

| Net investment income | | | 5.29% | | | 4.15% | | | 4.67% | | | 4.78% | | | 7.21% | | | 6.62% | |

| Portfolio turnover rate | | | 39% | | | 77% | | | 91% | | | 67% | | | 93% | | | 86% | |

| † | Unaudited. |

| (a) | Total return based on per share market price assumes the purchase of common shares at the closing market price on the business day immediately preceding the first day, and sales of common shares at the closing market price on the last day, of each period indicated; dividends and distributions are assumed to be reinvested in accordance with the Fund’s Dividend Reinvestment Plan. The total return based on net asset value, or NAV, assumes the purchase of common shares at the “net asset value, beginning of period” and sales of common shares at the “net asset value, end of period”, for each of the periods indicated; distributions are assumed to be reinvested at NAV. Past performance is not indicative, or a guarantee, of future results; the investment return, market price and net asset value of the Fund will fluctuate, so that an investor’s shares in the Fund, when sold, may be worth more or less than their original cost. The returns do not reflect the deduction of taxes that a stockholder would pay on the Fund’s distributions or on the sale of Fund shares. A period of less than one year is not annualized. |

| (b) | Annualized for a period of less than one year. |

The accompanying notes are an integral part of these financial statements.

20

Lazard World Dividend & Income Fund, Inc.

Notes to Financial Statements

June 30, 2013 (unaudited)

1. Organization

Lazard World Dividend & Income Fund, Inc. (the “Fund”) was incorporated in Maryland on April 6, 2005 and is registered under the Investment Company Act of 1940, as amended (the “Act”), as a diversified, closed-end management investment company. The Fund trades on the NYSE under the ticker symbol LOR and commenced operations on June 28, 2005. The Fund’s investment objective is total return through a combination of net income and capital appreciation.

2. Significant Accounting Policies

The accompanying financial statements are presented in conformity with GAAP. The following is a summary of significant accounting policies:

(a) Valuation of Investments—Market values for securities listed on the NYSE, NASDAQ national market or other US or foreign exchanges or markets are generally based on the last reported sales price on the exchange or market on which the security is principally traded, generally as of the close of regular trading on the NYSE (normally 4:00 p.m. Eastern time) on each valuation date; securities not traded on the valuation date are valued at the most recent quoted bid price. The Fund values NASDAQ-traded securities at the NASDAQ Official Closing Price, which may not be the last reported sales price in certain instances. Forward currency contracts are valued using quotations from an independent pricing service. Investments in money market funds are valued at the fund’s net asset value.

Bonds and other fixed-income securities that are not exchange-traded are valued on the basis of prices provided by independent pricing services which are based primarily on institutional trading in similar groups of securities, or by using brokers’ quotations or a matrix system which considers such factors as other security prices, yields and maturities. Debt securities maturing in 60 days or less are valued at amortized cost, except where to do so would not accurately reflect their fair value, in which case such securities are valued at fair value as determined by, or in accordance with procedures approved by, the Board of Directors (the “Board”).

The Valuation Committee of the Investment Manager, which meets periodically under the direction of the Board, may evaluate a variety of factors to determine the fair value of securities for which market quotations are determined not to be readily available or reliable. These factors include, but are not limited to, the type of security, the value of comparable securities, observations from financial institutions and relevant news events. Input from the Investment Manager’s analysts also will be considered.

If a significant event materially affecting the value of securities occurs between the close of the exchange or market on which the security is principally traded and the time when the Fund’s net asset value is calculated, or when current market quotations otherwise are determined not to be readily available or reliable (including restricted or other illiquid securities such as certain derivative instruments), such securities will be valued at their fair value as determined by, or in accordance with procedures approved by, the Board. The fair value of foreign securities may be determined with the assistance of an independent pricing service using correlations between the movement of prices of such securities and indices of domestic securities and other appropriate indicators, such as closing market prices of relevant ADRs or futures contracts. Foreign securities may trade on days when the Fund is not open for business, thus affecting the value of the Fund’s assets on days when Fund stockholders may not be able to buy or sell Fund shares.

The effect of using fair value pricing is that the net asset value of the Fund will reflect the affected securities’ values as determined in the judgment of the Board or its designee instead of being determined by the market. Using a fair value pricing methodology to price securities may result in a value that is different from the most recent closing price of a security and from the prices used by other investment companies to calculate their portfolios’ net asset values.

(b) Portfolio Securities Transactions and Investment Income—Portfolio securities transactions are accounted for on trade date. Realized gain (loss) on sales of investments are recorded on a specific identification basis. Dividend income is recorded on the ex-dividend date and interest income is accrued daily. The Fund amortizes premiums and accretes discounts on fixed-income securities using the effective yield method.

The Fund may be subject to taxes imposed by foreign countries in which it invests. Such taxes are generally based upon income earned or capital gains (realized or unrealized). The Fund accrues and applies such taxes to net investment income, net realized gains and net unrealized gains concurrent with the recognition of income or capital gains (realized and unrealized) from the applicable portfolio securities.

(c) Leveraging—The Fund uses leverage to invest Fund assets in currency investments, primarily using forward currency contracts and by borrowing under a credit facility with State Street Bank and Trust Company (“State Street”), up to a maximum of 33⅓% of the Fund’s total leveraged assets. If the assets of the Fund decline due to market con-

Lazard World Dividend & Income Fund, Inc.

Notes to Financial Statements (continued)

June 30, 2013 (unaudited)

ditions such that this 33⅓% threshold will be exceeded, leverage risk will increase.

If the Fund is able to realize a higher return on the leveraged portion of its investment portfolio than the cost of such leverage together with other related expenses, the effect of the leverage will be to cause the Fund to realize a higher net return than if the Fund were not so leveraged. There is no assurance that any leveraging strategy the Fund employs will be successful.

Using leverage is a speculative investment technique and involves certain risks. These include higher volatility of net asset value, the likelihood of more volatility in the market value of the Fund’s common stocks and, with respect to borrowings, the possibility either that the Fund’s return will fall if the interest rate on any borrowings rises, or that income will fluctuate because the interest rate of borrowings varies.

If the market value of the Fund’s leveraged currency investments declines, the leverage will result in a greater decrease in net asset value, or less of an increase in net asset value, than if the Fund were not leveraged. To the extent that the Fund is required or elects to prepay any borrowings, the Fund may need to liquidate investments to fund such prepayments. Liquidation at times of adverse economic conditions may result in capital losses and may reduce returns.

(d) Foreign Currency Translation and Forward Currency Contracts—The accounting records of the Fund are maintained in US dollars. Portfolio securities and other assets and liabilities denominated in a foreign currency are translated daily into US dollars at the prevailing rates of exchange. Purchases and sales of securities, income receipts and expense payments are translated into US dollars at the prevailing exchange rates on the respective transaction dates.

The Fund does not isolate the portion of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in their market prices. Such fluctuations are included in net realized and unrealized gain (loss) on investments. Net realized gain (loss) on foreign currency and forward currency contracts represents net foreign currency gain (loss) from forward currency contracts, disposition of foreign currencies, currency gain (loss) realized between the trade and settlement dates on securities transactions, and the difference between the amount of dividends, interest and foreign withholding taxes recorded on the Fund’s accounting records and the US dollar equivalent amounts actually received or paid. Net change in unrealized appreciation

(depreciation) on foreign currency reflects the impact of changes in exchange rates on the value of assets and liabilities, other than investments in securities, during the period.

A forward currency contract is an agreement between two parties to buy or sell currency at a set price on a future date. Upon entering into these contracts, risks may arise from the potential inability of counterparties to meet the terms of their contracts and from unanticipated movements in the value of the foreign currency relative to the US dollar.

The US dollar value of forward currency contracts is determined using quotations provided by an independent pricing service. Daily fluctuations in the value of such contracts are recorded as unrealized appreciation (depreciation) on forward currency contracts. When the contract is closed, the Fund records a realized gain (loss) equal to the difference between the value at the time it was opened and the value at the time it was closed.

(e) Federal Income Tax Policy—It is the Fund’s policy to comply with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and to distribute substantially all of its taxable income to its stockholders. Therefore, no provision for federal income taxes is required. The Fund files tax returns with the US Internal Revenue Service and various states.

At December 31, 2012, the Fund had $2,594,036 and $29,179,195 of unused realized capital loss carryforwards, expiring in 2016 and 2017, respectively.

Under current tax law, certain capital and net foreign currency losses realized after October 31 within the taxable year may be deferred and treated as occurring on the first day of the following tax year. For the tax year ended December 31, 2012, the Fund had no net capital and foreign currency losses arising between November 1, 2012 and December 31, 2012.