SILVER WHEATON CORP.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2008

March 24, 2009

Suite 3150, 666 Burrard Street

Vancouver, B.C. V6C 2X8 |

SILVER WHEATON CORP.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED DECEMBER 31, 2008

TABLE OF CONTENTS

DESCRIPTION | PAGE NO. |

INTRODUCTORY NOTES | 1 |

CORPORATE STRUCTURE | 3 |

GENERAL DEVELOPMENT OF THE BUSINESS | 3 |

DESCRIPTION OF THE BUSINESS | 7 |

Principal Product | 7 |

Competitive Conditions | 7 |

Operations | 7 |

Risk Factors | 8 |

CIM Standards Definitions | 15 |

Summary of Mineral Reserves and Mineral Resources | 17 |

San Dimas Mines, Mexico | 26 |

Yauliyacu Mine, Perú | 36 |

Peñasquito Mine, Mexico | 44 |

DIVIDENDS | 52 |

DESCRIPTION OF CAPITAL STRUCTURE | 52 |

TRADING PRICE AND VOLUME | 53 |

DIRECTORS AND OFFICERS | 56 |

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 59 |

TRANSFER AGENT AND REGISTRAR | 60 |

MATERIAL CONTRACTS | 60 |

INTERESTS OF EXPERTS | 61 |

AUDIT COMMITTEE | 62 |

ADDITIONAL INFORMATION | 64 |

SCHEDULE “A” – AUDIT COMMITTEE CHARTER

INTRODUCTORY NOTES

Cautionary Note Regarding Forward-Looking Statements

This annual information form contains “forward-looking statements” within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information” within the meaning of applicable Canadian securities legislation. Forward-looking statements, which are all statements other than statements of historical fact, include, but are not limited to, statements with respect to the future price of silver, the estimation of mineral reserves and mineral resources, the realization of mineral reserve estimates, the timing and amount of estimated future production, costs of production, reserve determination and reserve conversion rates. Generally, these forward-looking statements can be identified by the use of forward-looking terminology such as “plans”, “expects” or “does not expect”, “is expected”, “budget”, “scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases or state that certain actions, events or results “may”, “could”, “would”, “might” or “will be taken”, “occur” or “be achieved”. All forward-looking statements and forward-looking information is based on reasonable assumptions that have been made by the Corporation as at the date such statements are made. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Silver Wheaton to be materially different from those expressed or implied by such forward-looking statements, including but not limited to: the impact of general business and economic conditions, global liquidity and credit availability on the timing of cash flows and the values of assets and liabilities based on projected future conditions, the absence of control over mining operations from which Silver Wheaton purchases silver and risks related to these mining operations, including risks related to international operations, actual results of current exploration activities, actual results of current reclamation activities, conclusions of economic evaluations, changes in project parameters as plans continue to be refined, as well as those factors discussed in the section entitled “Risk Factors” in this annual information form. Although Silver Wheaton has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate. Accordingly, readers should not place undue reliance on forward-looking statements. The forward-looking statements and forward-looking information contained or incorporated by reference in this annual information form are included for the purpose of providing investors with information to assist them in understanding the Offering as well as the Corporation’s expected financial and operational performance and may not be appropriate for other purposes. Silver Wheaton does not undertake to update any forward-looking statements that are included or incorporated by reference herein, except in accordance with applicable securities laws.

Currency Presentation and Exchange Rate Information

This annual information form contains references to United States dollars and Canadian dollars. All dollar amounts referenced, unless otherwise indicated, are expressed in United States dollars. Canadian dollars are referred to as “Canadian dollars” or “C$”. The high, low and closing noon spot rates for the United States dollar in terms of Canadian dollars for each of the three years in the period ended December 31, 2008, as quoted by the Bank of Canada, were as follows:

| Year ended December 31 |

| 2008 | | 2007 | | 2006 |

High | C$1.2969 | | C$1.1853 | | C$1.1726 |

Low | 0.9719 | | 0.9170 | | 1.0990 |

Closing | 1.2112 | | 0.9801 | | 1.1599 |

On March 24, 2009, the noon spot rate for the United States dollar in terms of Canadian dollars, as quoted by the Bank of Canada, was US$1.00 = C$1.2262.

- 1 -

Silver Prices

The high, low, average and closing fixing silver prices in United States dollars per troy ounce for each of the three years in the period ended December 31, 2008, as quoted on the London Bullion Market Association, were as follows:

| Year ended December 31 |

| 2008 | 2007 | 2006 |

High | 20.92 | $15.82 | $14.94 |

Low | 8.88 | 11.67 | 8.83 |

Average | 14.99 | 13.38 | 11.55 |

Closing | 10.79 | 14.76 | 12.90 |

On March 24, 2009, the closing fixing silver price in United States dollars per troy ounce, as quoted on the London Bullion Market Association, was $13.51.

CORPORATE STRUCTURE

Pursuant to Articles of Continuance dated December 17, 2004, Silver Wheaton Corp. (“Silver Wheaton” or the “Corporation”) was continued under the Business Corporations Act (Ontario).

The Corporation’s head office is located at Suite 3150, Park Place, 666 Burrard Street, Vancouver, British Columbia, V6C 2X8 and its registered office is located at Suite 2100, 40 King Street West, Toronto, Ontario, M5H 3C2.

The Corporation’s active subsidiaries are Silver Wheaton (Caymans) Ltd. (“Silver Wheaton Caymans”) which is wholly-owned and is governed by the laws of the Cayman Islands, and Silver Wheaton Luxembourg S.a.r.l. which is wholly-owned by Silver Wheaton Caymans and is governed by the laws of Luxembourg. As used in this annual information form, except as otherwise required by the context, reference to “Silver Wheaton” or the “Corporation” means Silver Wheaton Corp., Silver Wheaton (Caymans) Ltd. and Silver Wheaton Luxembourg S.a.r.l.

SILVER WHEATON AND ITS PRINCIPAL SUBSIDIARIES

GENERAL DEVELOPMENT OF THE BUSINESS

Luismin Transaction

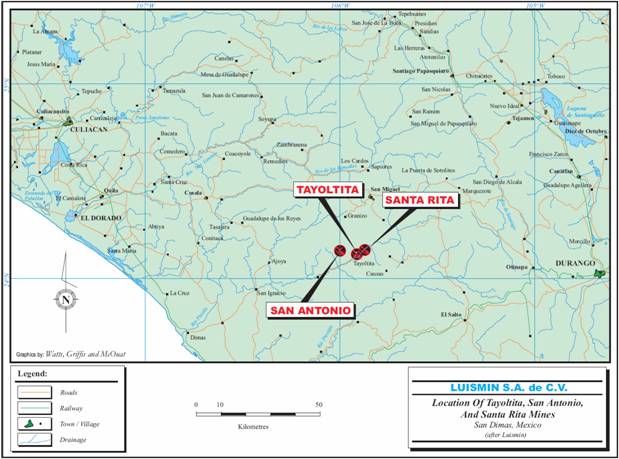

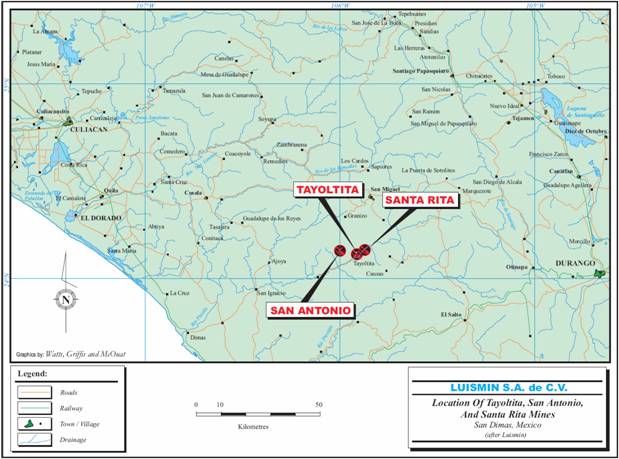

On October 15, 2004, Silver Wheaton Caymons entered into a silver purchase contract (the “Luismin Silver Purchase Contract”) with Goldcorp Inc. (“Goldcorp”) (formerly Wheaton River Minerals Ltd.), and Goldcorp Trading (Barbados) Limited (“Goldcorp Trading”) (formerly Wheaton Trading (Caymans) Ltd.), a wholly-owned subsidiary of Goldcorp, pursuant to which Silver Wheaton Caymans agreed to purchase 100% of the payable silver, for a period of 25 years, produced by Luismin, S.A. de C.V. (“Luismin”), a wholly-owned subsidiary of Goldcorp, from its Mexican mining operations which include the Tayoltita, Santa Rita and Central Block mines in the San Dimas district (collectively, the “San Dimas Mines”), the San Martin mine (recently sold by Goldcorp; however, silver is still required to be delivered to the Corporation by Goldcorp in an amount equal to the silver sales from such mine), the Nukay mine and the Los Filos mine (the “Los Filos Mine”, and with the San Dimas Mines, the San Martin mine and the Nukay mine collectively referred to herein as the “Luismin

- 3 -

Mines”) for an upfront payment of C$46 million in cash and 108 million common shares of the Corporation (generally referred to herein as the “Common Shares”), plus a payment equal to the lesser of (a) $3.90 per ounce of delivered silver (subject to an inflationary price adjustment after October 15, 2007; the inflationary price adjustment is equal to one-half of the US Consumer Price Index up to a maximum of 1.65% and a minimum of 0.4% to be compounded annually after October 15, 2007); and (b) the then prevailing market price per ounce of silver (the “Luismin Transaction”).

On March 30, 2006, the Corporation and Goldcorp amended the Luismin Silver Purchase Contract, eliminating any capital expenditure contributions previously required to be paid by Silver Wheaton. In consideration for these amendments, the Corporation issued to Goldcorp 18 million Common Shares, representing approximately 9.8% of the then outstanding Common Shares, and a $20 million one year non-interest bearing promissory note, which was paid in full on March 29, 2007.

See “Description of the Business – Luismin Mines, Mexico” for details regarding the Luismin Mines.

Zinkgruvan Transaction

On December 8, 2004, Silver Wheaton Caymans entered into a silver purchase contract (the “Zinkgruvan Silver Purchase Contract”) with Lundin Mining Corporation (“Lundin”) and Zinkgruvan Mining AB (“Zinkgruvan”), a wholly-owned subsidiary of Lundin, pursuant to which Silver Wheaton Caymans agreed to purchase 100% of the payable silver produced by Zinkgruvan from its mine in Sweden (the “Zinkgruvan Mine”) over its entire mine life for an upfront cash payment of $50 million in cash, 6 million Common Shares and 30 million Silver Wheaton common share purchase warrants (TSX: SLW.WT), plus a payment equal to the lesser of (a) $3.90 per ounce of delivered silver (subject to an inflationary price adjustment after December 8, 2007; the inflationary adjustment is equal to one-half of the US Consumer Price Index up to a maximum of 1.65% and a minimum of 0.4% to be compounded annually after December 8, 2007); and (b) the then prevailing market price per ounce of silver.

Yauliyacu Transaction

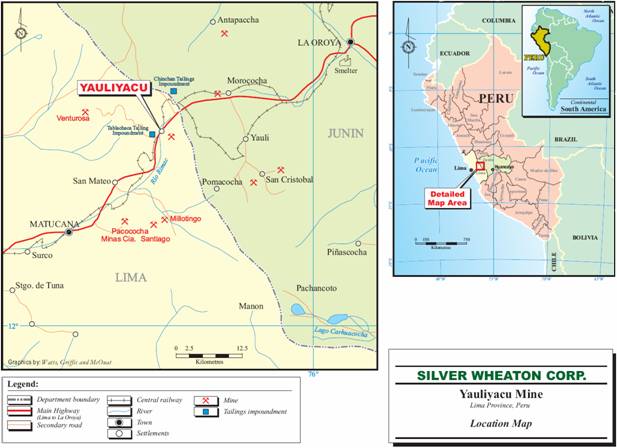

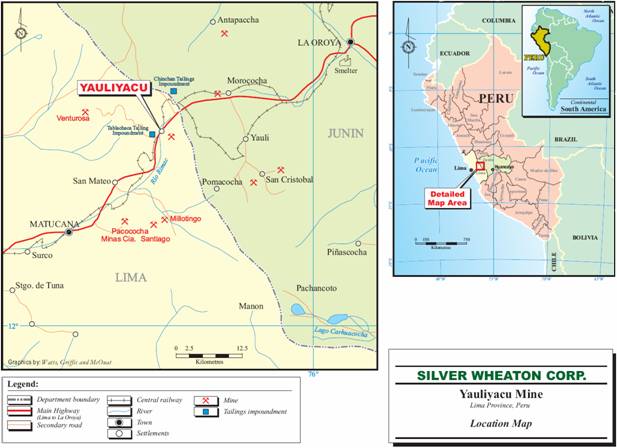

On March 23, 2006, Silver Wheaton Caymans entered into a silver purchase contract (the “Yauliyacu Silver Purchase Contract”) with Glencore International AG (“Glencore”) and Anani Investments Ltd., a wholly-owned subsidiary of Glencore, pursuant to which Silver Wheaton Caymans agreed to purchase up to 4.75 million ounces of silver produced per year (with the provision for exceeding this amount in the event that less is delivered in any year under the Yauliyacu Silver Purchase Contract), for a period of 20 years, based on production from Glencore’s Yauliyacu mining operations in Perú (the “Yauliyacu Mine”), for an upfront cash payment of $285 million, plus a payment equal to $3.90 per ounce of silver delivered under the contract (subject to an inflationary price adjustment after March 23, 2009; the inflationary adjustment is equal to one-half of the US Consumer Price Index up to a maximum of 1.65% and a minimum of 1.0% to be compounded annually after March 23, 2009). In the event that silver produced at the Yauliyacu Mine in any year totals less than 4.75 million ounces, the amount sold to Silver Wheaton Caymans in subsequent years will be increased to make up for the shortfall, so long as production allows.

During the term of the contract, Silver Wheaton has a right of first refusal on any future sales of silver streams from the Yauliyacu Mine and a right of first offer on future sales of silver streams from any other mine owned by Glencore at the time of the initial transaction. In addition, Silver Wheaton also has an option to extend the 20 year term of the Yauliyacu Silver Purchase Contract in five year increments, on substantially the same terms as the existing contract, subject primarily to an adjustment related to silver price expectations at the time.

See “Description of the Business – Yauliyacu Mine, Perú” for details regarding the Yauliyacu Mine.

Stratoni Transaction

On April 23, 2007, Silver Wheaton Caymans entered into a silver purchase contract (the “Stratoni Silver Purchase Contract”) with European Goldfields Limited (“European Goldfields”) and Hellas Gold S.A. (“Hellas Gold”), a 95%-owned subsidiary of European Goldfields, pursuant to which the Corporation agreed to purchase 100% of the payable silver produced by Hellas Gold from the Stratoni mine (the “Stratoni Mine”) located in

Greece over its entire mine life, for an upfront cash payment of $57.5 million, plus a payment equal to the lesser of (a) $3.90 per ounce of delivered silver (subject to an annual inflationary adjustment of 1% per annum after April 23, 2010); and (b) the then prevailing market price per ounce of silver. During the term of the contract, Silver Wheaton has a right of first refusal on any future sales of silver streams from any other mine owned by Hellas Gold or European Goldfields.

Peñasquito Transaction

On July 24, 2007, Silver Wheaton Caymans entered into a silver purchase contract (the “Peñasquito Silver Purchase Contract”) with Goldcorp and Minera Peñasquito, S.A. de C.V. (“Minera Peñasquito”), a wholly-owned subsidiary of Goldcorp, pursuant to which Silver Wheaton Caymans agreed to purchase 25% of the payable silver produced by Minera Peñasquito from the Peñasquito Mine located in Mexico (the “Peñasquito Mine”) over its entire mine life, for an upfront cash payment of $485 million, plus a payment equal to the lesser of (a) $3.90 per ounce of delivered silver (subject to an annual inflationary adjustment equal to 50% of the percentage increase in the United States consumer price index, subject to a maximum adjustment of 1.65% and a minimum adjustment of 0.4% per annum three years after commercial production commences and every December 31st thereafter); and (b) the then prevailing market price per ounce of silver. Goldcorp has provided a completion guarantee to Silver Wheaton that the Peñasquito Mine will be constructed with certain minimum production criteria by certain dates.

See “Description of the Business – Peñasquito Mine, Mexico” for details regarding the Peñasquito Mine.

Mineral Park Transaction

On March 17, 2008, Silver Wheaton Caymans entered into a silver purchase contract (the “Mineral Park Silver Purchase Contract”) with Mercator Minerals Ltd. (“Mercator”) and Mercator Minerals (Barbados) Ltd., a wholly-owned subsidiary of Mercator, pursuant to which Silver Wheaton Caymans agreed to pay, subject to the completion of certain conditions, an upfront cash payment of $42 million in order to acquire 100% of the payable silver produced by the Mineral Park mine in the United States (the “Mineral Park Mine”), over its entire mine-life, for the lesser of $3.90 (subject to a 1% annual adjustment beginning three years after a minimum production level has been met) and the prevailing market price per ounce of delivered silver. Mercator has guaranteed that the Mineral Park Mine will attain a minimum production level by a certain date.

In addition to an SX/EW copper leach operation, the Mineral Park Mine consists of a milling operation that produces copper-silver and molybdenum concentrates.

Campo Morado Transaction

On May 13, 2008, Silver Wheaton Caymans entered into a silver purchase contract (the “Campo Morado Silver Purchase Contract”) with Farallon Resources Ltd. (“Farallon”) and Farallon Resources (Barbados) Ltd., a wholly-owned subsidiary of Farallon, pursuant to which Silver Wheaton Caymans agreed to pay, subject to the completion of certain conditions, an upfront cash payment of $80 million in order to acquire 75% of payable silver produced by the Campo Morado property in Mexico (the “Campo Morado Mine”), over its entire mine-life, for the lesser of $3.90 (subject to a 1% annual adjustment beginning in year four after production commences) and the prevailing market price per ounce of delivered silver. The upfront payment was made on a drawdown basis to fund ongoing capital expenditures at the Campo Morado Mine. Silver Wheaton Caymans received a right of first refusal over any future silver stream involving Farallon. Campo Morado is an underground high grade polymetallic mine with a mill throughput capacity of 1,500 tonnes per day.

La Negra Transaction

On June 2, 2008, Silver Wheaton Caymans entered into a silver purchase contract (the “La Negra Silver Purchase Contract”) with Aurcana Corporation (“Aurcana”) and Cane Silver Inc., a wholly-owned subsidiary of Aurcana, pursuant to which Silver Wheaton Caymans agreed to pay, subject to the completion of certain conditions, an upfront cash payment of $25 million in order to acquire 50% of the payable silver produced by the La Negra mine in Queretaro State, Mexico (the “La Negra Mine”), over its entire mine-life, for the lesser of $3.90 (subject to a 1% annual adjustment beginning in year four after production commences) and the prevailing market price per ounce of delivered silver. Aurcana has also granted to Silver Wheaton Caymans a right of first offer to purchase an amount of silver to be mutually agreed upon to be produced from its Shafter Silver Mine located in Texas, United States once Aurcana has delivered to Silver Wheaton Caymans a preliminary feasibility study pertaining to the Shafter Silver Mine. The La Negra Mine is a 1,000 tonne per day polymetallic mine originally discovered, developed and operated for thirty years by Pénoles S.A. de C.V.

Keno Hill Transaction

On October 2, 2008, the Corporation entered into a silver purchase contract (the “Keno Hill Silver Purchase Contract”) with Alexco Resources Corp. (“Alexco”) and Elsa Reclamation & Development Company Ltd. and Alexco Resource Canada Corp., each of which are wholly-owned subsidiaries of Alexco, pursuant to which the Corporation agreed to pay, subject to the completion of certain conditions, an upfront cash payment of $50 million in order to acquire 25% of all payable silver produced by the Keno Hill project in the Yukon Territory, Canada (the “Keno Hill Project”), over its entire mine-life, for the lesser of $3.90 (subject to a 1% annual adjustment beginning in year four after the achievement of specific operating targets) and the prevailing market price per ounce of delivered silver. The upfront payment will be made in several tranches, with a total payment of $15 million to fund ongoing underground development made upon the satisfaction of certain conditions, and the remaining $35 million payment to fund mill construction and mine development costs made on a drawdown basis, upon the satisfaction of certain additional requirements, including the receipt of operating permits. Silver Wheaton is not required to contribute to further capital or exploration expenditures and Alexco has provided a completion guarantee with certain minimum production criteria by specific dates. Keno Hill is historically one of the highest grade and most prolific silver producing districts in the world and Alexco is currently advancing the high grade silver-lead-zinc Bellekeno mine to production.

Acquisition of Silverstone Resources Corp.

On March 12, 2009, the Corporation announced that it had entered into a definitive agreement with Silverstone Resources Corp. pursuant to which Silver Wheaton will acquire by way of a plan of arrangement all of the outstanding common shares of Silverstone on the basis of each common share of Silverstone being exchanged for 0.185 of a Common Share resulting in the issuance of approximately 23 million Common Shares. The Silverstone transaction is subject to the approval of Silverstone shareholders and certain customary conditions, including receipt of all necessary court and regulatory approvals and third party consents. At the time of the announcement, the total value of the transaction was estimated to be approximately Cdn$190 million, on a fully diluted basis.

Long-Term Investments

At December 31, 2008, the Corporation held long-term investments with a market value of $21.8 million.

Bear Creek Mining Corporation

During 2008, Silver Wheaton acquired, by way of private placement, 770,000 common shares of Bear Creek Mining Corporation (TSXV: BCM) (“Bear Creek”) at a price of Cdn$5.10 per share, for total consideration of $3.9 million. As a result, at December 31, 2008, Silver Wheaton owned 8,916,505 common shares and warrants exercisable to acquire an additional 485,000 common shares, representing approximately 16% of the outstanding shares of Bear Creek on an undiluted basis. At December 31, 2008, the fair value of the Corporation’s investment in Bear Creek was $10.8 million.

Revett Minerals Inc.

At December 31, 2008, Silver Wheaton owned 12,382,900 common shares and warrants exercisable to acquire an additional 2,400,000 common shares, representing approximately 17% of the outstanding shares of Revett Minerals Inc. (TSX: RVM) (“Revett”) on an undiluted basis. At December 31, 2008, the fair value of the Corporation’s investment in Revett was $0.6 million.

Sabina Silver Corporation

At December 31, 2008, Silver Wheaton owned 7,800,000 common shares and warrants exercisable to acquire an additional 3,900,000 common shares, representing approximately 11% of the outstanding shares of Sabina Silver Corporation (TSXV: SBB) (“Sabina”) on an undiluted basis. At December 31, 2008, the fair value of the Corporation’s investment in Sabina was $3.6 million.

Mines Management, Inc.

At December 31, 2008, Silver Wheaton owned 2,500,000 common shares, representing approximately 11% of the outstanding shares of Mines Management, Inc. (AMEX: MGN, TSX: MGT) (“Mines Management”) on an undiluted basis. At December 31, 2008, the fair value of the Corporation’s investment in Mines Management was $3.2 million.

- 7 -

DESCRIPTION OF THE BUSINESS

Silver Wheaton is the largest silver streaming company in the world. The Corporation is actively pursuing further growth opportunities, primarily by way of entering into long-term silver purchase contracts. There is no assurance that any such investigations or negotiations will result in the acquisition of additional silver production.

Principal Product

The Corporation’s principal product is silver that it has agreed to purchase pursuant to the Luismin Silver Purchase Contract, the Zinkgruvan Silver Purchase Contract, the Yauliyacu Silver Purchase Contract, the Stratoni Silver Purchase Contract, the Peñasquito Silver Purchase Contract, the Mineral Park Silver Purchase Contract, the Campo Morado Silver Purchase Contract, the La Negra Silver Purchase Contract and the Keno Hill Silver Purchase Contract. There is a worldwide silver market into which the Corporation can sell the silver purchased under the silver purchase contracts and, as a result, the Corporation will not be dependent on a particular purchaser with regard to the sale of the silver that it acquires from the Luismin, Yauliyacu, Peñasquito, La Negra and Campo Morado mines and, in the future, the Mineral Park and Keno Hill projects. The silver in concentrate from the Zinkgruvan Mine and the Stratoni Mine is purchased from Silver Wheaton by various smelters and offtakers at the worldwide market price for silver.

Competitive Conditions

The Corporation is the largest silver streaming company in the world. The ability of the Corporation to acquire additional silver in the future will depend on its ability to select suitable properties and enter into similar silver purchase contracts.

Operations

Raw Materials

The Corporation purchases silver from the Luismin Mines in Mexico, the Zinkgruvan Mine in Sweden, the Yauliyacu Mine in Peru and the Peñasquito Mine in Mexico for the lesser of $3.90 per ounce of delivered silver (subject to an annual inflationary adjustment equal to 50% of the percentage increase in the United States consumer price index, subject to a maximum adjustment of 1.65% and a minimum adjustment of 0.4% per annum after October 15, 2007 with respect to the Luismin Mines, after December 8, 2007 with respect to the Zinkgruvan Mine, after March 23, 2009 with respect to the Yauliyacu Mine and three years after commercial production commences and every December 31st thereafter with respect to the Peñasquito Mine) and the then prevailing market price per ounce of silver. The Corporation also purchases silver from the Stratoni Mine in Greece, the La Negra Mine in Mexico and will purchase silver from the Mineral Park Mine in Arizona and the Campo Morado Mine in Mexico, in each case for the lesser of $3.90 per ounce of delivered silver (subject to an annual inflationary adjustment of 1% per annum after April 23, 2010 with respect to the Stratoni Mine, after October 1, 2011 with respect to the La Negra Mine, three years after a minimum target rate of 35,000 tons of ore per day has been achieved for a 30-day consecutive period in the case of the Mineral Park Mine and after April 1, 2012 with respect to the Campo Morado Mine) and the then prevailing market price per ounce of silver. The Corporation also purchases silver from the Yauliyacu Mine in Perú for $3.90 per ounce of silver (subject to an annual inflationary adjustment equal to 50% of the percentage increase in the United States consumer price index, subject to a miximum adjustment of 1.65% and a minimum adjustment of 1% per annum after March 23, 2009).

Employees

Currently, the Corporation has 22 employees. Certain administrative services were provided to the Corporation pursuant to an administration services agreement (the “Services Agreement”) entered into with Goldcorp on October 15, 2004 pursuant to which the Corporation had agreed to reimburse Goldcorp for such services. Under the Services Agreement, the Corporation paid a monthly fee to Goldcorp based on actual costs incurred by Goldcorp on behalf of Silver Wheaton, including employee compensation costs and other miscellaneous expenses. The Services Agreement expired on October 20, 2008. Effective October 20, 2008, Silver Wheaton is independently managing its administrative processes and has eliminated any reliance on Goldcorp.

Foreign Interests

The Corporation currently purchases or expects to be purchasing all of the payable silver from the Luismin Mines, the Campo Morado Mine and the La Negra Mine in Mexico, the Stratoni Mine in Greece and the Mineral Park Mine in the United States, all of the payable silver contained in lead concentrate from the Zinkgruvan Mine in Sweden, 25% of all of the payable silver from the Peñasquito Mine in Mexico, and up to 4.75 million ounces of silver per year based on production from the Yauliyacu Mine in Perú. Any changes in regulations or shifts in political attitudes in such foreign countries are beyond the control of the Corporation and may adversely affect its business. The Corporation may be affected in varying degrees by such factors as government regulations (or changes thereto) with respect to the restrictions on production, export controls, income taxes, expropriation of property, repatriation of profits, environmental legislation, land use, water use, land claims of local people and mine safety. The effect of these factors cannot be accurately predicted. See “Description of the Business — Risk Factors — Risks relating to the Mining Operations — International Interests”.

Risk Factors

The operations of the Corporation are speculative due to the nature of its business which is the purchase of silver production from producing mining companies. These risk factors could materially affect the Corporation’s future operating results and could cause actual events to differ materially from those described in forward-looking statements relating to the Corporation. The risks described herein are not the only risks facing the Corporation. Additional risks and uncertainties not currently known to the Corporation, or that the Corporation currently deems immaterial, may also materially and adversely affect its business.

Risks Relating to the Corporation

Subject to Same Risk Factors as the Luismin, Yauliyacu, Peñasquito, Zinkgruvan, Stratoni, Mineral Park, La Negra Mines and Camp Morado Mines and the Keno Hill Projects

To the extent that they relate to the production of silver from, or the continued operation of, the Luismin Mines, the Yauliyacu Mine, the Peñasquito Mine, the Zinkgruvan Mine, the Stratoni Mine, the Mineral Park Mine, the La Negra Mine, the Campo Morado Mine or the Keno Hill Project (collectively, the “Mining Operations”), the Corporation will be subject to the risk factors applicable to the operators of such mines or projects, as set forth below under “Risks relating to the Mining Operations”.

Commodity Prices

The price of the Common Shares and the Corporation’s financial results may be significantly adversely affected by a decline in the price of silver. The price of silver fluctuates widely, especially in recent years, and is affected by numerous factors beyond the Corporation’s control, including but not limited to, the sale or purchase of silver by various central banks and financial institutions, interest rates, exchange rates, inflation or deflation, fluctuation in the value of the United States dollar and foreign currencies, global and regional supply and demand, and the political and economic conditions of major silver-producing countries throughout the world.

In the event that the prevailing market price of silver is $3.90 per ounce or less (subject to certain inflationary price adjustments), the price at which the Corporation can purchase silver from the Luismin Mines, the Zinkgruvan Mine, the Stratoni Mine, the Mineral Park Mine, the La Negra Mine, the Peñasquito Mine, the Campo Morado Mine and the Keno Hill Project will be the then prevailing market price per ounce of silver while the price at which the Corporation can purchase silver from the Yauliyacu Mine will be $3.90, in which case the Corporation will not generate positive cash flow or earnings.

No Control Over Mining Operations

The Corporation has agreed to purchase 100% of all of the payable silver produced by the Luismin Mines and the Mineral Park Mine, 100% of all of the payable silver contained in concentrate produced by the Zinkgruvan Mine and the Stratoni Mine, 100% of the payable silver, up to 4.75 million ounces of silver per year, based on production from the Yauliyacu Mine, 75% of the payable silver produced from the Campo Morado

Mine, 50% of the payable silver produced from the La Negra Mine and 25% of the payable silver produced from the Peñasquito Mine and the Keno Hill Project. The Corporation has no contractual rights relating to the operations of the Mining Operations. The Corporation will not be entitled to any material compensation if the Mining Operations do not meet their forecasted silver production targets in any specified period or if the Mining Operations shut down or discontinue their operations on a temporary or permanent basis. In the case of the Peñasquito Mine, the Mineral Park Mine, the Campo Morado Mine and the Keno Hill Project, they may not commence commercial production within the time frames anticipated, if at all, and there can be no assurance that the silver production from such properties will ultimately meet forecasts or targets. At any time, any of the operators of the Mining Operations or their successors may decide to suspend or discontinue operations.

Silver Sales from the Luismin Mines Account for a Substantial Portion of the Corporation’s Net Earnings

The silver sales from the Luismin Mines currently account for a substantial portion of the Corporation’s net earnings. As a result, any significant disruptions at the Luismin Mines could have a material adverse effect on the Corporation’s net earnings.

Operating Model Risk

The Corporation is not directly involved in the ownership or operation of mines. The silver purchase agreements that the Corporation has entered into are subject to most of the significant risks and rewards of a mining company, with the primary exception that, under such agreements the Corporation acquires silver production at a fixed cost. As a result of the Corporation’s operating model, the cash flow of the Corporation is dependent upon the activities of third parties which creates the risk that at any time those third parties may (a) have business interests or targets that are inconsistent with those of the Corporation, (b) take action contrary to the Corporation’s policies or objectives, (c) be unable or unwilling to fulfill their obligations under their agreements with the Corporation, or (d) experience financial, operational or other difficulties, including insolvency, which could limit a third party’s ability to perform its obligations under the silver purchase agreements. In addition, the termination of one or more of the Corporation’s silver purchase agreements with such third parties could have a material adverse effect on the results of operations or financial condition of the Corporation.

Silver Produced as a By-Product

Silver is produced as a by-product metal at all operations with which the Corporation has silver purchase agreements, therefore, the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the mines.

Acquisition Strategy

As part of the Corporation’s business strategy, it has sought and will continue to seek new exploration, mining and development opportunities in the resource industry. In pursuit of such opportunities, the Corporation may fail to select appropriate acquisition candidates or negotiate acceptable arrangements, including arrangements to finance acquisitions or integrate the acquired businesses and their personnel into the Corporation. The Corporation cannot assure that it can complete any acquisition or business arrangement that it pursues, or is pursuing, on favourable terms, or that any acquisitions or business arrangements completed will ultimately benefit the Corporation.0

Market Price of the Common Shares and the Common Share Purchase Warrants

The Common Shares are listed and posted for trading on the TSX and on the NYSE and the Corporation’s four series of common share purchase warrants are listed and posted for trading on the TSX. An investment in the Corporation’s securities is highly speculative. Securities of companies involved in the resource industry have experienced substantial volatility in the past, often based on factors unrelated to the financial performance or prospects of the companies involved. The price of the Common Shares and the Corporation’s common share purchase warrants are also likely to be significantly affected by short-term changes in silver prices or in the Corporation’s financial condition or results of operations as reflected in its quarterly earnings reports.

Current Global Financial Condition

Current global financial conditions have been subject to increased volatility, with numerous financial institutions having either gone into bankruptcy or having to be rescued by government authorities. Access to financing has been negatively impacted by both sub-prime mortgages in the United States and elsewhere and the liquidity crisis affecting the asset-backed commercial paper market. As such, the Corporation is subject to counterparty risk and liquidity risk. The Corporation is exposed to various counterparty risks including, but not limited to: (i) through financial institutions that hold the Corporation’s cash; (ii) through companies that have payables to the Corporation, including concentrate customers; (iii) through the Corporation’s insurance providers; and (iv) through the Corporation’s lenders. The Corporation is also exposed to liquidity risks in meeting its operating expenditure requirements in instances where cash positions are unable to be maintained or appropriate financing is unavailable. These factors may impact the ability of the Corporation to obtain loans and other credit facilities in the future and, if obtained, on terms favourable to the Corporation. If these increased levels of volatility and market turmoil continue, the Corporation’s operations could be adversely impacted and the trading price of the Common Shares could be adversely affected.

Income Taxes

A substantial part of the Corporation’s profit is derived from its subsidiary, Silver Wheaton (Caymans) Ltd., which is incorporated and operated in the Cayman Islands, and such profit bears no income tax. The Corporation views the subsidiary’s profit as part of its permanent investment in the subsidiary, and it has determined that those profits will be reinvested in foreign jurisdictions for the foreseeable future, therefore, no current income taxes have been recorded.

Changes to taxation laws in either Canada, the Cayman Islands, Luxembourg or any of the countries in which the Mining Operations are located could result in some or all of the Corporation’s profits being subject to income tax. No assurance can be given that new taxation rules will not be enacted or that existing rules will not be applied in a manner which could result in the Corporation’s profits being subject to income tax.

Equity Price Risk

The Corporation is exposed to equity price risk as a result of holding long-term investments in other exploration and mining companies. Just as investing in the Corporation is inherent with risks such as those set out in this annual information form, by investing in these other companies, the Corporation is exposed to the risks associated with owning equity securities and those risks inherent in the investee companies. The Corporation does not actively trade these investments.

Dividend Policy

No dividends on the Common Shares have been paid by the Corporation to date. The Corporation anticipates that it will retain all earnings and other cash resources for the foreseeable future for the operation and development of its business. The Corporation does not intend to declare or pay any cash dividends in the foreseeable future. Payment of any future dividends will be at the discretion of the Corporation’s board of directors after taking into account many factors, including the Corporation’s operating results, financial condition and current and anticipated cash needs.

Conflicts of Interest

Certain of the directors and officers of the Corporation also serve as directors and/or officers of other companies involved in natural resource exploration, development and mining operations and consequently there exists the possibility for such directors and officers to be in a position of conflict. Any decision made by any of such directors and officers will be made in accordance with their duties and obligations to deal fairly and in good faith with a view to the best interests of the Corporation and its shareholders. In addition, each of the directors is required to declare and refrain from attending the portion of the meeting dedicated to discussing any matter in which such directors may have a conflict of interest or voting on such matter in accordance with the procedures set forth in the Business Corporations Act (Ontario) and other applicable laws.

Competition

The Corporation competes with other companies for silver purchase agreements and similar transactions, some of which may possess greater financial and technical resources than itself. Such competition may result in the Corporation being unable to enter into desirable silver purchase agreements or similar transactions, to recruit or retain qualified employees or to acquire the capital necessary to fund its silver purchase agreements. Existing or future competition in the mining industry could materially adversely affect the Corporation’s prospects for entering into additional silver purchase agreements in the future.

Dependence Upon Key Management Personnel

The Corporation is dependent upon a number of key management personnel. The Corporation’s ability to manage its activities will depend in large part on the efforts of these individuals. The Corporation faces intense competition for qualified personnel, and there can be no assurance that the Corporation will be able to attract and retain such personnel. The loss of the services of one or more of such key management personnel could have a material adverse effect on the Corporation.

The Corporation may fail to achieve and maintain the adequacy of internal control over financial reporting pursuant to the requirements of the Sarbanes-Oxley Act

The Corporation documented and tested during its most recent fiscal year, its internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”). SOX requires an annual assessment by management of the effectiveness of the Corporation’s internal control over financial reporting and an attestation report by the Corporation’s independent auditors addressing this assessment. The Corporation may fail to achieve and maintain the adequacy of its internal control over financial reporting as such standards are modified, supplemented, or amended from time to time, and the Corporation may not be able to ensure that it can conclude on an ongoing basis that it has effective internal controls over financial reporting in accordance with Section 404 of SOX. The Corporation’s failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of its financial statements, which in turn could harm the Corporation’s business and negatively impact the trading price of the Common Shares or market value of its other securities. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm the Corporation’s operating results or cause it to fail to meet its reporting obligations. There can be no assurance that the Corporation will be able to remediate material weaknesses, if any, identified in future periods, or maintain all of the control’s necessary for continued compliance, and there can be no assurance that the Corporation will be able to retain sufficient skilled finance and accounting personnel. Future acquisitions of companies, if any, may provide the Corporation with challenges in implementing the required processes, procedures and controls in its acquired operations. Future acquired companies, if any, may not have disclosure controls and procedures or internal control over financing reporting that are as thorough or effective as those required by securities laws currently applicable to the Corporation.

No evaluation can provide complete assurance that the Corporation’s internal control over financial reporting will detect or uncover all failures of persons within the Corporation to disclose material information otherwise required to be reported. The effectiveness of the Corporation’s control and procedures could also be limited by simple errors or faulty judgments. In addition, as the Corporation continues to expand, the challenges involved in implementing appropriate internal controls over financial reporting will increase and will require that the Corporation continue to improve its internal controls over financial reporting. Although the Corporation intends to devote substantial time and incur costs, as necessary, to ensure ongoing compliance, the Corporation cannot be certain that it will be successful in complying with Section 404.

Risks Relating to the Mining Operations

Exploration, Development and Operating Risks

Mining operations generally involve a high degree of risk. The Mining Operations are subject to all the hazards and risks normally encountered in the exploration, development and production of silver, including unusual and unexpected geologic formations, seismic activity, rock bursts, cave-ins, flooding, environmental hazards and the discharge of toxic chemicals, explosions and other conditions involved in the drilling, blasting and removal of material, any of which could result in damage to, or destruction of mines and other producing facilities, damage to property, injury or loss of life, environmental damage, work stoppages, delays in production, increased production costs and possible legal liability. Milling operations are subject to hazards such as equipment failure or failure of retaining dams around tailings disposal areas which may result in environmental pollution and consequent liability for the owners or operators of the Mining Operations.

The exploration for and development of mineral deposits involves significant risks which even a combination of careful evaluation, experience and knowledge may not eliminate. Few properties which are explored are ultimately developed into producing mines. Major expenditures may be required to locate and establish mineral reserves, to develop metallurgical processes and to construct mining and processing facilities at a particular site. It is impossible to ensure that the exploration or development programs planned by the owners or operators of the Mining Operations will result in a profitable commercial mining operation. Whether a mineral deposit will be commercially viable depends on a number of factors, some of which are: the particular attributes of the deposit, such as size, grade and proximity to infrastructure; metal prices which are highly cyclical; government regulations, including regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting of minerals and environmental protection; and political stability. The exact effect of these factors cannot be accurately predicted.

Governmental Regulation

The Mining Operations are subject to extensive foreign laws and regulations governing exploration, development, production, exports, taxes, labour standards, waste disposal, protection and remediation of the environment, reclamation, historic and cultural resources preservation, mine safety and occupation health, handling, storage and transportation of hazardous substances and other matters. The costs of discovering, evaluating, planning, designing, developing, constructing, operating and closing the Mining Operations in compliance with such laws and regulations are significant. It is possible that the costs and delays associated with compliance with such laws and regulations could become such that the owners or operators of the Mining Operations would not proceed with the development of or continue to operate a mine. Moreover, it is possible that future regulatory developments, such as increasingly strict environmental protection laws, regulations and enforcement policies thereunder, and claims for damages to property and persons resulting from the Mining Operations could result in substantial costs and liabilities in the future.

Environmental Regulation

All phases of mining and exploration operations are subject to governmental regulation including environmental regulation. Environmental legislation is becoming more strict, with increased fines and penalties for non-compliance, more stringent environmental assessments of proposed projects and heightened responsibility for companies and their officers, directors and employees. There can be no assurance that possible future changes in environmental regulation will not adversely affect the Mining Operations. As well, environmental hazards may exist on a property in which the owners or operators of the Mining Operations hold an interest which were caused by previous or existing owners or operators of the properties and of which such owners or operators are not aware at present and which could impair the commercial success, levels of production and continued feasibility and project development and mining operations on these properties.

Permitting

The Mining Operations are subject to receiving and maintaining permits from appropriate governmental authorities. Although the Corporation believes that the owners and operators of the Mining Operations currently have all required permits for their respective operations as currently conducted, there is no assurance that delays will not occur in connection with obtaining all necessary renewals of such permits for the existing operations, additional permits for any possible future changes to operations or additional permits associated with new legislation. Prior to any development on any of these properties, permits from appropriate governmental authorities may be required. There can be no assurance that the owners or operators of the Mining Operations will continue to hold all permits necessary to develop or continue operating at any particular property.

Compliance with Laws

Failure to comply with applicable laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities causing operations to cease or be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage by reason of the mining activities and may be liable for civil or criminal fines or penalties imposed for violations of applicable laws or regulations. Amendments to current laws, regulations and permitting requirements, or more stringent application of existing laws, may have a material adverse impact on the owners or operators of the Mining Operations, resulting in increased capital expenditures or production costs, reduced levels of production at producing properties or abandonment or delays in development of properties.

Infrastructure

Mining, processing, development and exploration activities depend, to one degree or another, on adequate infrastructure. Reliable roads, bridges, power sources and water supply are important determinants, which affect capital and operating costs. Unusual or infrequent weather phenomena, sabotage, government or other interference in the maintenance or provision of such infrastructure could adversely affect the Mining Operations.

Mineral Reserve and Mineral Resource Estimates

The reported mineral reserves and mineral resources for the Mining Operations are only estimates. No assurance can be given that the estimated mineral reserves and mineral resources will be recovered or that they will be recovered at the rates estimated. Mineral reserve and mineral resource estimates are based on limited sampling, and, consequently, are uncertain because the samples may not be representative. Mineral reserve and mineral resource estimates may require revision (either up or down) based on actual production experience. Market fluctuations in the price of metals, as well as increased production costs or reduced recovery rates, may render certain mineral reserves and mineral resources uneconomic and may ultimately result in a restatement of estimated reserves and/or resources.

Need for Additional Mineral Reserves

Because mines have limited lives based primarily on proven and probable mineral reserves, the Mining Operations must continually replace and expand their mineral reserves as their mines produce metals. The life-of-mine estimates for the Mining Operations may not be correct. The ability of the owners or operators of the Mining Operations to maintain or increase their annual production of silver will be dependent in significant part on their ability to bring new mines into production and to expand mineral reserves at existing mines.

The Luismin Mines have an estimated mine life of 7 years based on proven and probable mineral reserves. Historically, the Luismin Mines have sustained operations through the conversion of a high percentage of inferred mineral resources to mineral reserves. Mineral resources that are not mineral reserves do

not have demonstrated economic viability. Due to the uncertainty of inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to proven and probable mineral reserves as a result of continued exploration.

Land Title

No assurances can be given that there are no title defects affecting the properties and mineral claims owned or used by the Mining Operations. Such properties and claims may be subject to prior unregistered liens, agreements, transfers or claims, including native land claims, and title may be affected by, among other things, undetected defects. In addition, the operators of such operations may be unable to operate them as permitted or to enforce their rights with respect to their properties and claims which may ultimately impair the ability of these operators to fulfill their obligations under the silver purchase agreements with the Corporation.

Commodity Price Fluctuations

The price of metals has fluctuated widely in recent years, and future serious price declines could cause continued development of and commercial production from the Mining Operations to be impracticable. Depending on the price of other metals produced from the mines which generate cash flow to the owners, gold in the case of the Luismin Mines, lead-zinc in the case of the Zinkgruvan Mine, the Yauliyacu Mine and the Stratoni Mine, copper-molybdenum in the case of the Mineral Park Mine, gold-lead-zinc in the case of the Peñasquito Mine, gold-silver-lead-zinc in the case of the Keno Hill Project and gold-silver-copper-lead-zinc in the case of the La Negra Mine and the Campo Morado Mine, cash flow from the Mining Operations may not be sufficient and such owners could be forced to discontinue production and may lose their interest in, or may be forced to sell, some of their properties. Future production from the Mining Operations is dependent on metal prices that are adequate to make these properties economic.

In addition to adversely affecting the reserve estimates and financial conditions, declining commodity prices can impact operations by requiring a reassessment of the feasibility of a particular project. Such a reassessment may be the result of a management decision or may be required under financing arrangements related to a particular project. Even if the project is ultimately determined to be economically viable, the need to conduct such a reassessment may cause substantial delays or may interrupt operations until the reassessment can be completed.

Additional Capital

The mining, processing, development and exploration of the Mining Operations may require substantial additional financing. Failure to obtain sufficient financing may result in delaying or indefinite postponement of exploration, development or production on any or all of the Mining Operations and related properties or even a loss of property interest. There can be no assurance that additional capital or other types of financing will be available if needed or that, if available, will be on satisfactory terms.

International Interests

The operations at the Luismin Mines, the Peñasquito Mine, the La Negra Mine and the Campo Morado Mine are conducted in Mexico, the operations at the Zinkgruvan Mine are conducted in Sweden, the operations at the Yauliyacu Mine are conducted in Perú, the operations of the Stratoni Mine are conducted in Greece, the operations at the Mineral Park Mine are conducted in the United States and the operations of the Keno Hill Project are conducted in Canada, and as such the operations are all exposed to various levels of political, economic and other risks and uncertainties. These risks and uncertainties include, but are not limited to, terrorism, hostage taking, military repression, crime, political instability, currency controls, extreme fluctuations in currency exchange rates, high rates of inflation, labour unrest, the risks of war or civil unrest, expropriation and nationalization, renegotiation or nullification of existing concessions, licenses, permits, approvals and contracts, illegal mining, changes in taxation policies, restrictions on foreign exchange and repatriation, and changing political conditions and governmental regulations relating to foreign investment and the mining business.

The Yauliyacu Mine is located in central Perú and, accordingly, is subject to risks normally associated with the operation of mineral properties in Perú. Perú is a developing country that has experienced political, social and economic unrest in the past and protestors have from time to time targeted foreign mining firms.

Changes, if any, in mining or investment policies or shifts in political attitude in Mexico, Sweden, Perú, Greece, the United States or Canada may adversely affect the operations or profitability of the Mining Operations in these countries. Operations may be affected in varying degrees by government regulations with respect to, but not limited to, restrictions on production, price controls, export controls, currency remittance, income taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use, mine safety and the rewarding of contracts to local contractors or requiring foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction. Failure to comply strictly with applicable laws, regulations and local practices relating to mineral right applications and tenure, could result in loss, reduction or expropriation of entitlements, or the imposition of additional local or foreign parties as joint venture partners with carried or other interests.

The occurrence of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on the Mining Operations.

Construction and Development Risk

The Peñasquito Mine, the Mineral Park Mine, the Campo Morado Mine and the Keno Hill Project are currently in various stages of construction and development. Construction and development of such projects is subject to numerous risks, including, but not limited to, delays in obtaining equipment, material and services essential to completing construction of such projects in a timely manner; changes in environmental or other government regulations; currency exchange rates; labour shortages; and fluctuation in metal prices. There can be no assurance that the operators of such projects will have the financial, technical and operational resources to complete the construction and development of such projects in accordance with current expectations or at all.

CIM Standards Definitions

The estimated Mineral Reserves and Mineral Resources for the Luismin Mines, the Los Filos Mine, the Peñasquito Mine, the Stratoni Mine, the Mineral Park Mine, the Campo Morado Mine, the La Negra Mine and the Keno Hill Project and have been calculated in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) — Definitions Adopted by CIM Council on December 11, 2005 (the “CIM Standards”). The estimated Mineral Reserves and Mineral Resources for the Zinkgruvan Mine have been calculated in accordance with the current (1999) version of the Australasian Code for Reporting of Mineral Resources and Ore Reserves (the “JORC Code”), the Australian worldwide standards, and were restated by Zinkgruvan staff in accordance with the requirements of the Canadian Securities Administrators’ National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) to comply with the CIM Standards. The estimated Mineral Reserves and Mineral Resources for the Yauliyacu Mine have been calculated in accordance with the JORC Code and were audited by the Corporation in accordance with the requirements of NI 43-101 and restated to comply with the CIM Standards. The following definitions are reproduced from the CIM Standards (2005):

The term “Mineral Resource” is a concentration or occurrence of diamonds, natural, solid, inorganic or fossilized organic material including base and precious metals, coal, and industrial minerals in or on the Earth’s crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge. Mineral Resources are sub-divided, in order of increasing geological confidence, into Inferred, Indicated and Measured categories.

The term “Inferred Mineral Resource” is that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes.

The term “Indicated Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation

of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

The term “Measured Mineral Resource” is that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drill holes that are spaced closely enough to confirm both geological and grade continuity.

The term “Mineral Reserve” is the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

The term “Probable Mineral Reserve” is the economically mineable part of an Indicated Mineral Resource and, in some circumstances, a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

The term “Proven Mineral Reserve” is the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction is justified.

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources

This section and elsewhere in this annual information form use the terms “Measured”, “Indicated” and “Inferred” Mineral Resources. United States investors are advised that while such terms are recognized and required by Canadian regulations, the United States Securities and Exchange Commission does not recognize them. “Inferred Mineral Resources” have a great amount of uncertainty as to their existence, and as to their economic and legal feasibility. It cannot be assumed that all or any part of an Inferred Mineral Resource will ever be upgraded to a higher category. Under Canadian rules, estimates of Inferred Mineral Resources may not form the basis of feasibility or other economic studies. United States investors are cautioned not to assume that all or any part of Measured or Indicated Mineral Resources will ever be converted into Mineral Reserves. United States investors are also cautioned not to assume that all or any part of an Inferred Mineral Resource exists, or is economically or legally mineable.

Summary of Mineral Reserves and Mineral Resources

The Mineral Reserves and Mineral Resources contained in this Annual Information Form reflect the reserves and resources for the mines at which the Corporation has silver purchase agreements, adjusted where applicable to reflect the Corporation's percentage entitlement to silver produced from such mines.

Mineral Reserves

The following table sets forth the estimated Mineral Reserves (silver only) for the San Dimas Mines as of December 31, 2008:

Proven and Probable Mineral Reserves (1)(2),(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 1.69 | 381.3 | | 20.7 |

Probable | 3.40 | 362.2 | | 39.6 |

Proven + Probable | 5.09 | 368.5 | | 60.3 |

______________________

(1) | The Mineral Reserves for the San Dimas Mines set out in the table above have been prepared by mine staff under the direction of Reynaldo Rivera, MAusIMM, Vice President, Exploration at Luismin, who is a qualified person under NI 43-101. The Mineral Reserves for the San Dimas Mines set out in the table above have been audited by Velasquez Spring, P.Eng., Senior Geologist at Watts, Griffis and McOuat Limited (“WGM”), and Gordon Watts, P.Eng., Senior Associate Mineral Economist at WGM who are qualified persons under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. See “Description of the Business — San Dimas Mines, Mexico — Mineral Reserve and Mineral Resource Estimates” for further details. |

(2) | Numbers may not add up due to rounding. |

(3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The following table sets forth the estimated Mineral Reserves (silver only) for the Yauliyacu Mine as of December 31, 2008:

Proven and Probable Mineral Reserves(1)(2),(3)(4)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 0.77 | 138.7 | | 3.5 |

Probable | 1.28 | 174.4 | | 7.2 |

Proven + Probable | 2.06 | 161.0 | | 10.7 |

_____________________________________

| (1) | The Mineral Reserves for the Yauliyacu Mine set out in the table above have been estimated by Yauliyacu staff and audited by Neil Burns, P.Geo., the Corporation's Director of Geology, and Samuel Mah, P.Eng., the Corporations's Director of Engineering, both qualified persons under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. See “Description of the Business — Yauliyacu Mine, Perú — Mineral Reserve and Mineral Resource Estimates” for further details. |

| (2) | Numbers may not add up due to rounding. |

| (3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

| (4) | The Yauliyacu Silver Purchase Agreement provides for the delivery of up to 4.75 million ounces of silver per year for 20 years so long as production allows. In the event that silver produced at Yauliyacu in any year totals less than 4.75 million ounces, the amount sold to Silver Wheaton in subsequent years will be increased to make up the shortfall. |

The following table sets forth the estimated Mineral Reserves (silver only) for 25% of the Peñasquito Mine as of December 31, 2008:

Proven and Probable Mineral Reserves (1)(2),(3)(4)(5)

| Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | | |

Mill | Proven | 140.30 | 33.9 | | 152.9 |

| Probable | 111.93 | 25.2 | | 90.5 |

| Proven + Probable | 252.23 | 30.0 | | 243.4 |

| | | | | |

Heap Leach | Proven | 14.45 | 18.4 | | 8.6 |

| Probable | 31.16 | 9.4 | | 9.4 |

| Proven + Probable | 45.61 | 12.3 | | 18.0 |

_______________________________

| (1) | The Mineral Reserves for the Peñasquito Mine set out in the table above represent the 25% attributable to the Corporation and have been prepared under the supervision of Robert H. Bryson, Vice President Engineering of Goldcorp Inc., who is a qualified person under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. See “Description of the Business – Peñasquito Mine, Mexico – Mineral Reserve and Mineral Resource Estimates” for further details. |

| (2) | The Mineral Reserves have been calculated using an assumed silver price of $12.00 per ounce. |

| (3) | The Proven and Probable Reserves have been calculated using NSR (Net Smelter Return) cut-off grades and assuming the Mineral Reserves metals prices set forth above. These cut-off grades are: $4.90 NSR for Peñasco-Azul sulphide feed and $5.40 NSR for Chile Colorado sulphide feed. A run-of-mine, heap leach process for gold and silver has been defined for the oxide materials at an NSR cut-off of $0.90 for Peñasco-Azul and at $0.95 for Chile Colorado. |

| (4) | Numbers may not add up due to rounding. |

| (5) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The following table sets forth the estimated Mineral Reserves (silver only) for the Los Filos Mine as of December 31, 2008:

Proven and Probable Mineral Reserves(1)(2),(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 28.10 | 4.4 | | 4.0 |

Probable | 42.16 | 3.3 | | 4.5 |

Proven + Probable | 70.26 | 3.7 | | 8.4 |

____________________________

| (1) | The Mineral Reserves for the Los Filos Mine set out in the table above have been estimated by Reynaldo Rivera, MAusIMM, Vice President, Exploration at Luismin, who is a qualified person under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. |

| (2) | Numbers may not add up due to rounding. |

| (3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The Los Filos Mine is not considered to be a material property to the Corporation.

The following table sets forth the estimated Mineral Reserves (silver only) for the Zinkgruvan Mine as of December 31, 2008:

Proven and Probable Mineral Reserves (1)(2),(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

Zinc Ore | | | | |

Proven | 8.76 | 112.0 | | 31.6 |

Probable | 2.00 | 56.0 | | 3.6 |

Proven + Probable | 10.76 | 101.6 | | 35.2 |

| | | | |

Copper Ore | | | | |

Proven | - | - | | - |

Probable | 2.90 | 28.0 | | 2.6 |

Proven + Probable | 2.90 | 28.0 | | 2.6 |

| | | | |

Total | | | | |

Proven | 8.76 | 112.0 | | 31.6 |

Probable | 4.90 | 39.4 | | 6.2 |

Proven + Probable | 13.66 | 86.0 | | 37.8 |

___________________________________

| (1) | The Mineral Reserves for the Zinkgruvan Mine set out in the table above have been estimated by Lars Malmström, Chief Geologist at Zinkgruvan, and Per Hedström, Senior Geologist at Zinkgruvan, who are qualified persons under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. |

| (2) | Numbers may not add up due to rounding. |

| (3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The Zinkgruvan Mine is not considered to be a material property to the Corporation.

The following table sets forth the estimated Mineral Reserves (silver only) for the Stratoni Mine as of December 31, 2007:

Proven and Probable Mineral Reserves (1)(2),(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 1.90 | 193.3 | | 11.8 |

Probable | 0.31 | 190.0 | | 1.9 |

Proven + Probable | 2.22 | 192.8 | | 13.7 |

__________________________

| (1) | The Mineral Reserves for the Stratoni Mine set out in the table above have been estimated by Patrick Forward, General Manager, Exploration of European Goldfields Limited, who is a qualified person under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. |

| (2) | Numbers may not add up due to rounding. |

| (3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The Stratoni Mine is not considered to be a material property to the Corporation.

The following table sets forth the estimated Mineral Reserves (silver only) for the San Martin Mine as of December 31, 2006:

Proven and Probable Mineral Reserves (1)(2),(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 0.32 | 32.7 | | 0.3 |

Probable | 0.71 | 47.8 | | 1.1 |

Proven + Probable | 1.03 | 43.2 | | 1.4 |

______________________

| (1) | The Mineral Reserves for the San Martin Mine set out in the table above have been audited by Velasquez Spring, P.Eng., Senior Geologist at WGM, who is a qualified person under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. |

| (2) | Numbers may not add up due to rounding. |

| (3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The San Martin Mine is not considered to be a material property to the Corporation.

The following table sets forth the estimated Mineral Reserves (silver only) for the Mineral Park Mine as of December 29, 2006:

Proven and Probable Mineral Reserves (1)(2),(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 315.88 | 2.9 | | 29.0 |

Probable | 81.33 | 2.4 | | 6.4 |

Proven + Probable | 397.21 | 2.8 | | 35.4 |

______________________

| (1) | Gary Simmerman, FAusIMM., Vice President, Engineering and Mine Manager of Mercator Minerals Inc., a qualified person as defined by NI 43-101, supervised the preparation of and verified the Mercator technical information contained in this annual information form. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. |

| (2) | The above Mineral Reserves do not include SX/EW leachable Mineral Reserves of 74.84 million tonnes, which only produces copper to the credit of Mercator. |

| (3) | Numbers may not add up due to rounding. |

| (4) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The Mineral Park Mine is not considered to be a material property to the Corporation.

The following table sets forth the estimated Mineral Reserves (silver only) for 50% of the La Negra Mine as of February 15, 2008:

Proven and Probable Mineral Reserves (1)(2)(3)

Category | Tonnes (millions) | Silver Grade (grams per tonne) | | Contained Silver (millions of ounces) |

| | | | |

Proven | 0.14 | 76.9 | | 0.3 |

Probable | 0.10 | 69.5 | | 0.2 |

Proven + Probable | 0.24 | 73.9 | | 0.6 |

______________________

| (1) | The Mineral Reserves for the La Negra Mine set out in the table above have been estimated by Thomas C. Stubens, M.A.Sc., P.Eng, Senior Geologist at Wardrop Engineering Inc., and Barnard Foo, P.Eng., M.Eng., Senior Mining Engineer at Wardrop Engineering Inc., who are qualified persons under NI 43-101. The Mineral Reserves are classified as Proven and Probable, and are based on the CIM Standards. |

| (2) | Numbers may not add up due to rounding. |

| (3) | Silver is produced as a by-product metal at all operations, therefore the economic cut-off applied to the reporting of silver reserves and resources will be influenced by changes in the commodity prices of other metals at the time. |

The La Negra Mine is not considered to be a material property to the Corporation.

Mineral Resources

Cautionary Note to United States Investors Concerning Estimates of Measured, Indicated and Inferred Mineral Resources