Exhibit 99.1

TECHNICAL REPORT

ON THE

TAYOLTITA, SANTA RITA AND SAN ANTONIO MINES

DURANGO, MEXICO

FOR

GOLDCORP INC.,

MALA NOCHE RESOURCES CORP.,

AND

SILVER WHEATON CORP.

Velasquez Spring, P.Eng.

Senior Geologist

and

Gordon Watts, P.Eng.

Senior Associate Mineral Economist

| |

May 26, 2010

Toronto, Canada |  |

TABLE OF CONTENTS

| | | |

| | | | Page |

| |

| 1. SUMMARY | 1 |

| |

| 2. INTRODUCTION AND TERMS OF REFERENCE | 12 |

| 2.1 | GENERAL | 12 |

| | 2.2 | TERMS OF REFERENCE | 13 |

| | 2.3 | UNITS AND CURRENCY | 16 |

| | 2.4 | DEFINITIONS | 17 |

| | 2.5 | LUISMIN APPROACH TO MINERAL RESERVE ESTIMATION | 18 |

| |

| 3. RELIANCE ON OTHER EXPERTS | 20 |

| |

| 4. PROPERTY DESCRIPTION AND LOCATION | 21 |

| | 4.1 | LOCATION | 21 |

| | 4.2 | PROPERTY DESCRIPTION | 21 |

| |

| 5. ACCESS, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 25 |

| | 5.1 | ACCESS | 25 |

| | 5.2 | CLIMATE | 25 |

| | 5.3 | LOCAL RESOURCES | 25 |

| 5.4 | INFRASTRUCTURE | 26 |

| 5.5 | PHYSIOGRAPHY | 28 |

| |

| 6. HISTORY | 29 |

| |

| 7. GEOLOGICAL SETTING | 31 |

| |

| 8. DEPOSIT TYPES | 37 |

| |

| 9. MINERALIZATION | 38 |

| |

| 10. EXPLORATION | 42 |

| |

| 11. DRILLING | 47 |

| |

| 12. SAMPLING METHOD AND APPROACH | 48 |

| |

| 13. SAMPLE PREPARATION, ANALYSES AND SECURITY | 49 |

- ii -

TABLE OF CONTENTS

(continued)

| | | |

| | | | Page |

| |

| 14. DATA VERIFICATION | 50 |

| |

| 15. ADJACENT PROPERTIES | 51 |

| |

| 16. MINING OPERATIONS | 52 |

| | 16.1 | GENERAL | 52 |

| | 16.2 | GROUND SUPPORT FOR MINING | 52 |

| | 16.3 | GRADE CONTROL | 53 |

| | 16.4 | OPERATIONS WORKFORCE | 53 |

| | 16.5 | DISCUSSION | 54 |

| |

| 17. MILLING OPERATIONS | 55 |

| | 17.1 | GENERAL | 55 |

| | 17.2 | TAYOLTITA MILL | 55 |

| |

| 18. MINERAL RESOURCE AND MINERAL RESERVE ESTIMATES | 58 |

| | 18.1 | GENERAL | 58 |

| | 18.2 | LUISMIN APPROACH | 58 |

| | 18.3 | PAH AUDIT | 59 |

| | 18.4 | VOLUME ESTIMATE | 59 |

| 18.5 | TREATMENT OF HIGH GRADE ASSAYS | 60 |

| | 18.6 | TONNAGE FACTOR | 60 |

| | 18.7 | DILUTION | 60 |

| | 18.8 | CUTOFF GRADE | 61 |

| | 18.9 | CLASSIFICATION OF RESERVES | 61 |

| 18.10 | RECONCILIATION BETWEEN RESERVES AND PRODUCTION | 64 |

| 18.11 | DISCUSSION | 64 |

| |

| 19. SAN DIMAS TAILINGS MANAGEMENT | 80 |

| | 19.1 | GENERAL | 80 |

| | 19.2 | TAYOLTITA TAILINGS | 81 |

| 19.3 | SAN ANTONIO TAILINGS | 82 |

| 19.4 | EXPLORATION PROPERTIES | 83 |

| |

| 20. ECONOMIC ANALYSIS | 87 |

| | 20.1 | GENERAL | 87 |

| | 20.2 | CAPITAL COSTS | 87 |

- iii -

TABLE OF CONTENTS (continued)

| | | |

| | | | Page |

| | 20.3 | OPERATING COSTS | 90 |

| | 20.4 | TAXES | 91 |

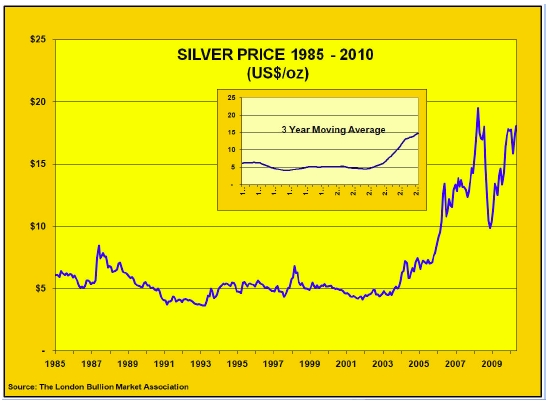

| | 20.5 | PRECIOUS METAL PRICES | 91 |

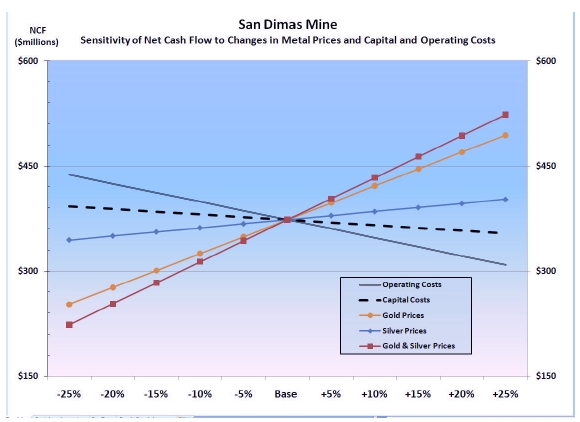

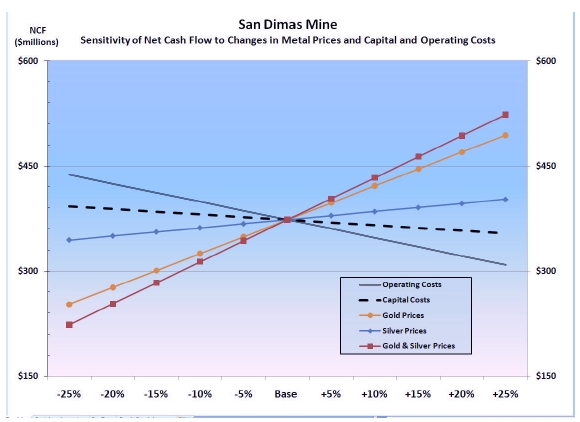

| | 20.6 | NET CASH FLOW SENSITIVITY TO COSTS AND METAL PRICES | 93 |

| | 20.7 | ECONOMIC ANALYSIS | 94 |

| |

| 21. MARKETS AND CONTRACTS | 95 |

| |

| 22. OBSERVATIONS, CONCLUSIONS AND RECOMMENDATIONS | 97 |

| |

| 23. SIGNATURE PAGE | 99 |

| |

| CERTIFICATES | 100 |

| |

| REFERENCES | 104 |

| |

| APPENDIX 1: SAN DIMAS MINE, PRETAX NET CASH FLOW CALCULATION | 105 |

| |

| |

| LIST OF TABLES |

| | |

| 1. | Reconciliation between Reserves predicted grade and production Luismin operations (1978-2009) | 19 |

| 2. | Goldcorp Mexico mineral concessions in the San Dimas mining district (at January 1, 2010) | 24 |

| 3. | Luismin mine production | 30 |

| 4. | Sinaloa Graben Block, Mineral Resources (January to February 2010) | 44 |

| 5. | Reconciliation between predicted Reserves and actual production – Tayoltita-Santa Rita (1978-2009) | 65 |

| 6. | Reconciliation between predicted Reserves and actual production – San Antonio (1987-2002) | 66 |

| 7. | Luismin, S.A. de C.V. operating mines Inferred Mineral Resources transformed into Mineral Reserves (1979-1998) | 66 |

| 8. | Inferred Mineral Resources of San Dimas District geology department (as of December 31, 2009) | 67 |

| 9. | Luismin S.A. de C.V., Tayoltita Mine Inferred Resources | 67 |

| 10. | Luismin S.A. de C.V. Santa Rita Mine Inferred Resources | 68 |

| 11. | Minas Luismin, S.A. de C.V. San Antonio area Inferred Resources | 69 |

| 12. | Mineral reserves of San Dimas District - Luismin geology department (as of December 31, 2009) | 76 |

- iv -

TABLE OF CONTENTS

(continued)

| | |

| | | Page |

| |

| 13. | Tayoltita Mineral Reserves | 77 |

| 14. | Santa Rita Mineral Reserves (December 31, 2009) | 78 |

| 15. | Block Central Mineral Reserves | 79 |

| 16. | Goldcorp Mexico exploration projects description, (as of January 2009) | 85 |

| 17. | Summary, 5 year mine plan | 88 |

LIST OF FIGURES

| | |

| 1. | Luismin Organization Chart | 14 |

| 2. | Location map, Luismin's operating mines, Mexico | 15 |

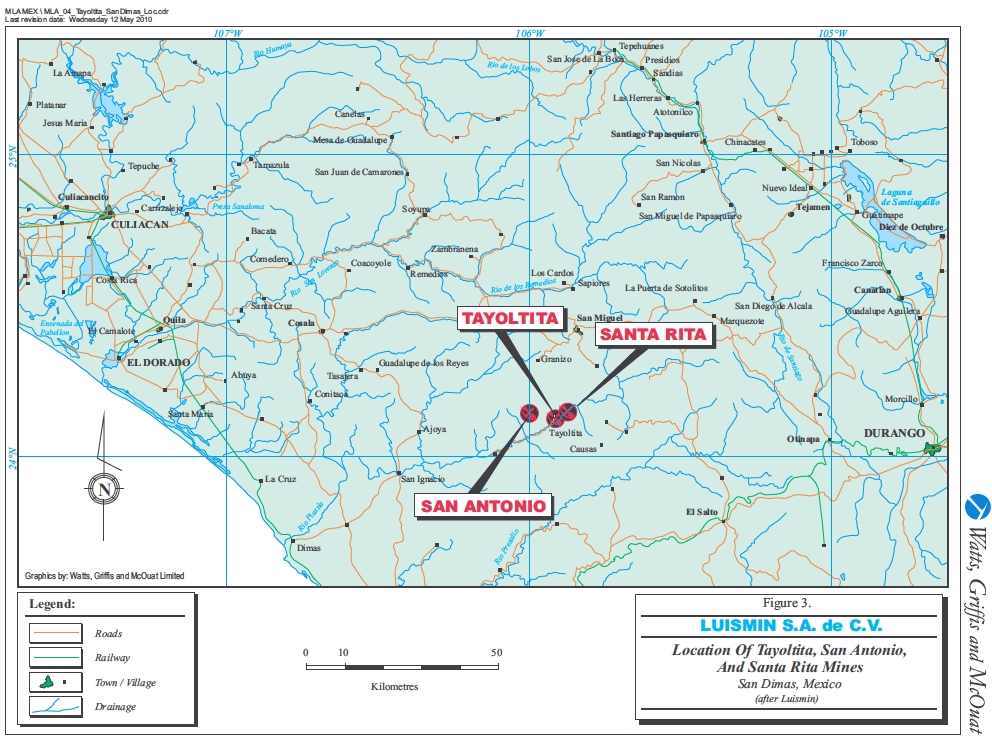

| 3. | Location of Tayoltita, San Antonio and Santa Rita mines | 22 |

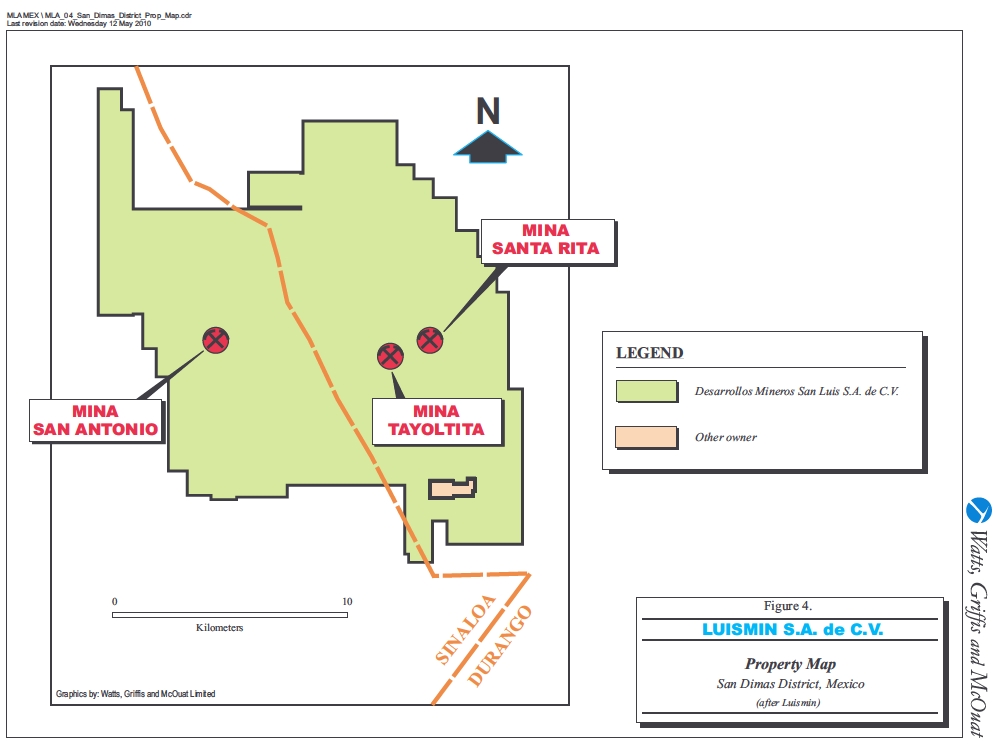

| 4. | Property map, San Dimas district | 23 |

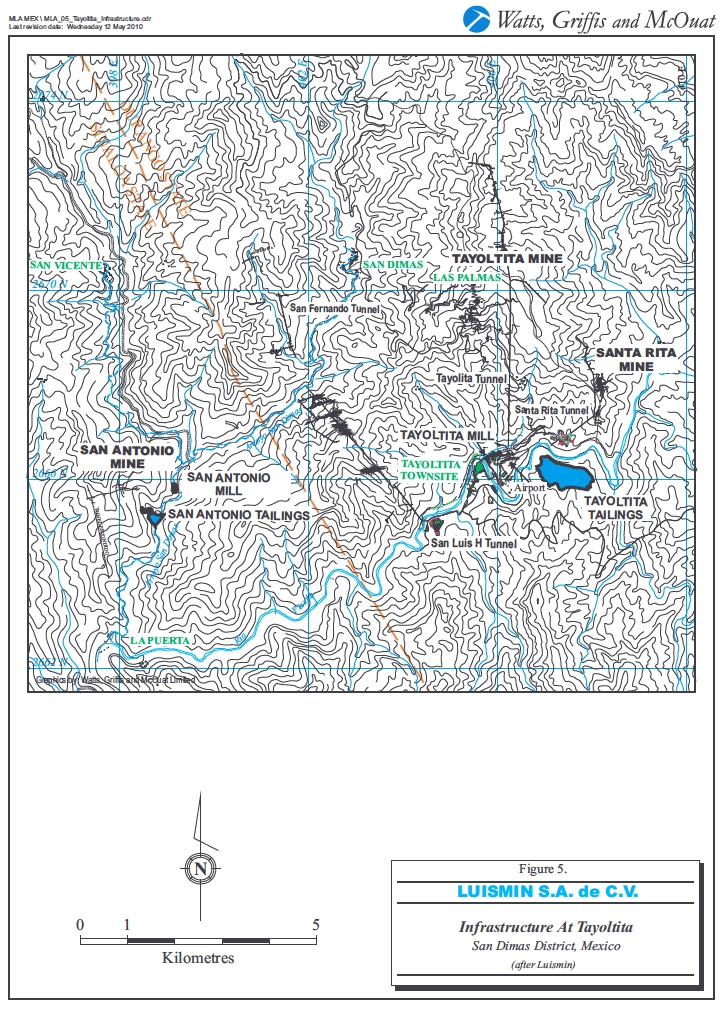

| 5. | Infrastructure at Tayoltita | 27 |

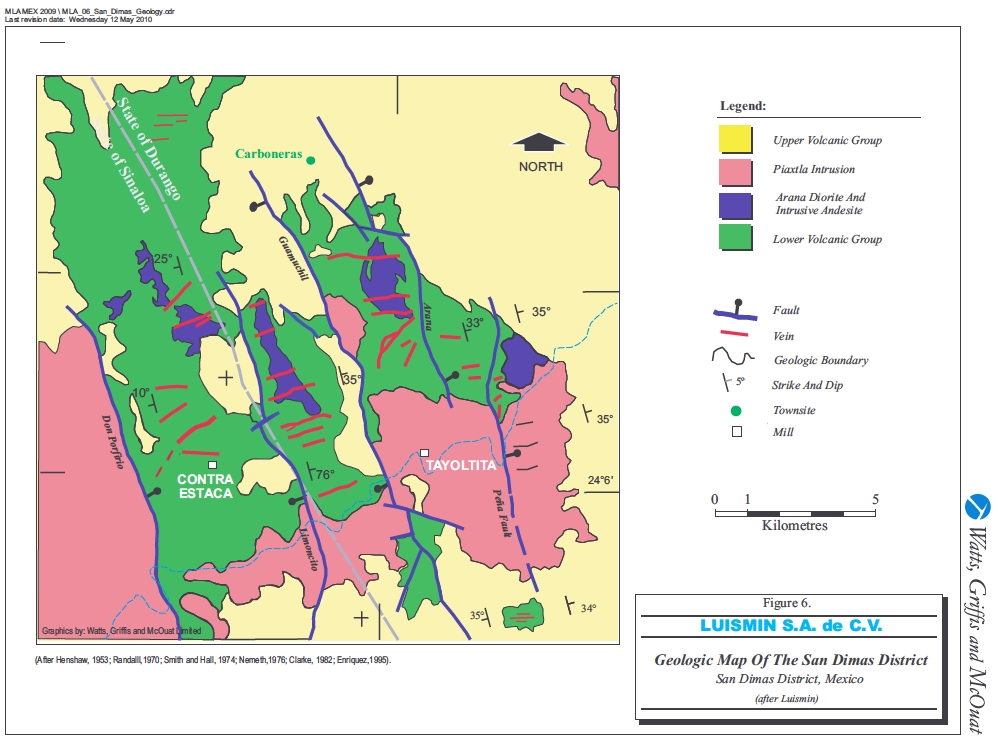

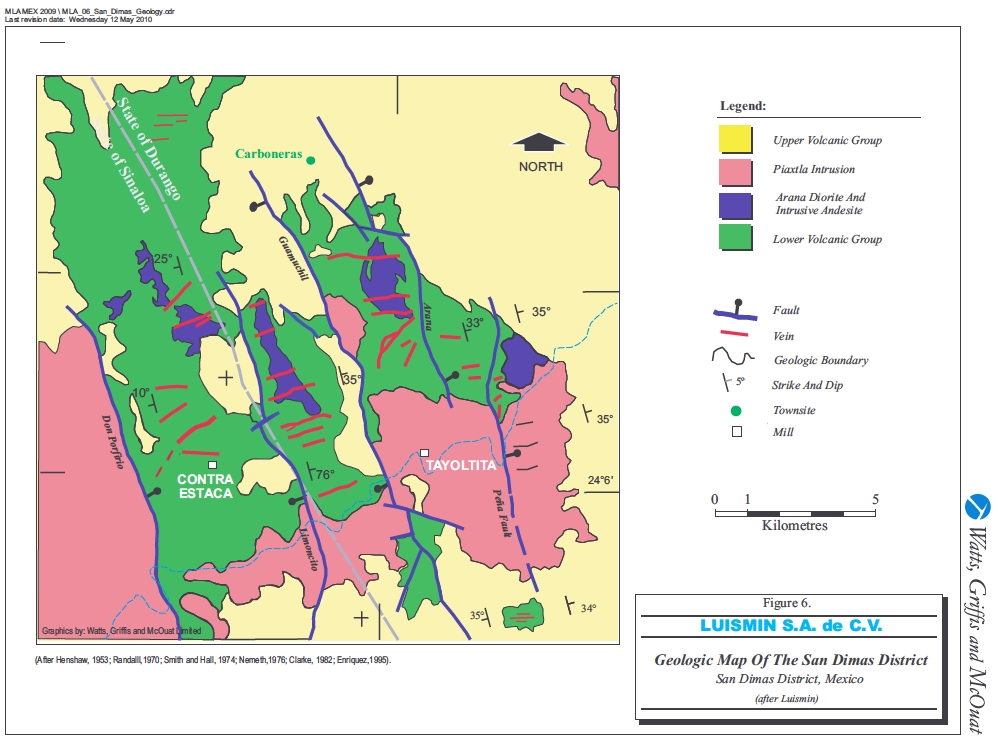

| 6. | Geologic Map of the San Dimas District | 32 |

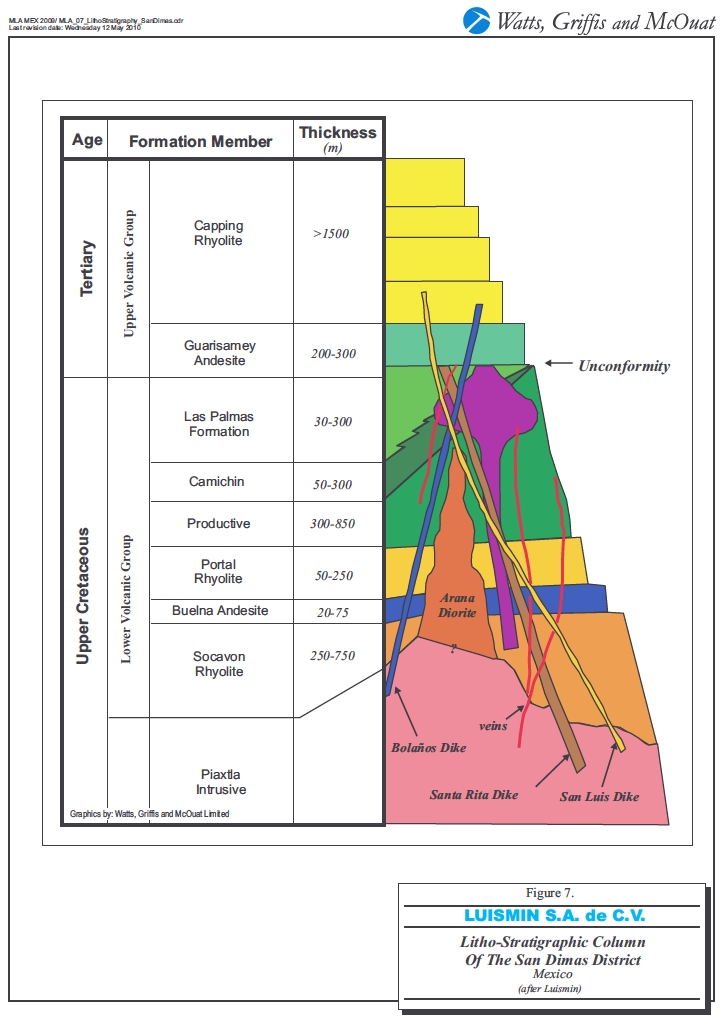

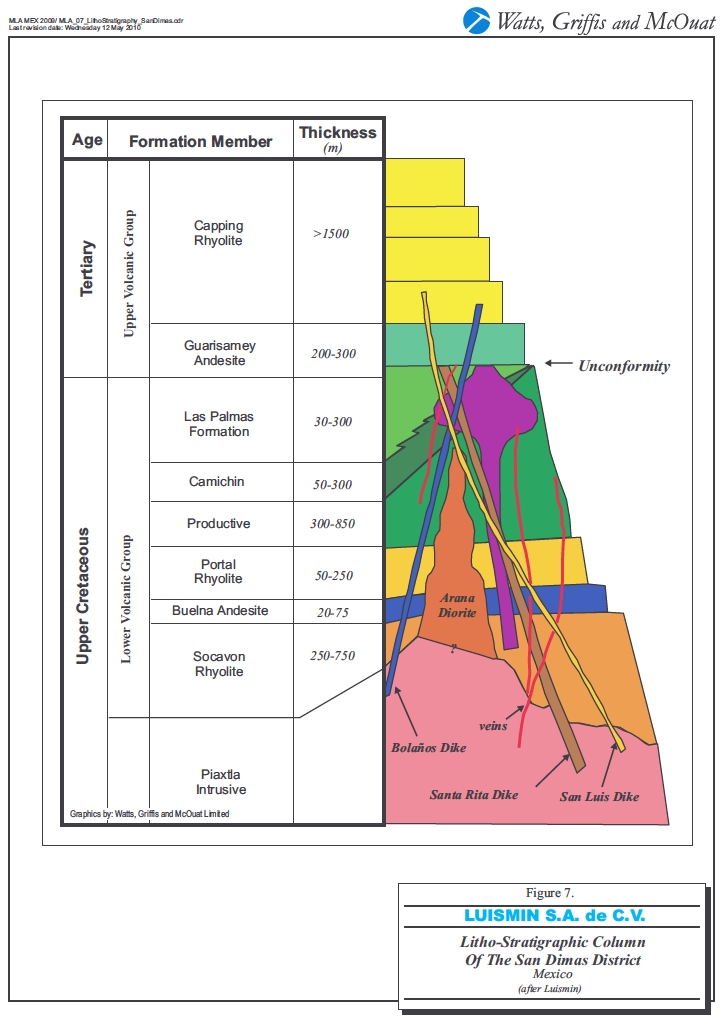

| 7. | Litho-stratigraphic column of the San Dimas District | 33 |

| 8. | Structural map of the San Dimas District | 35 |

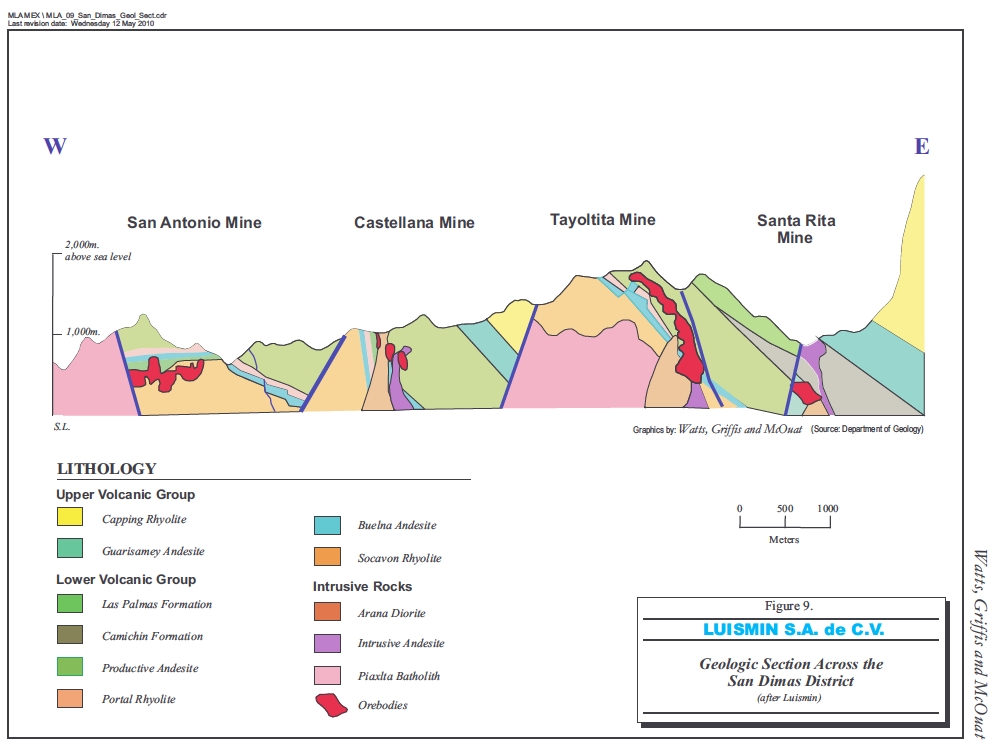

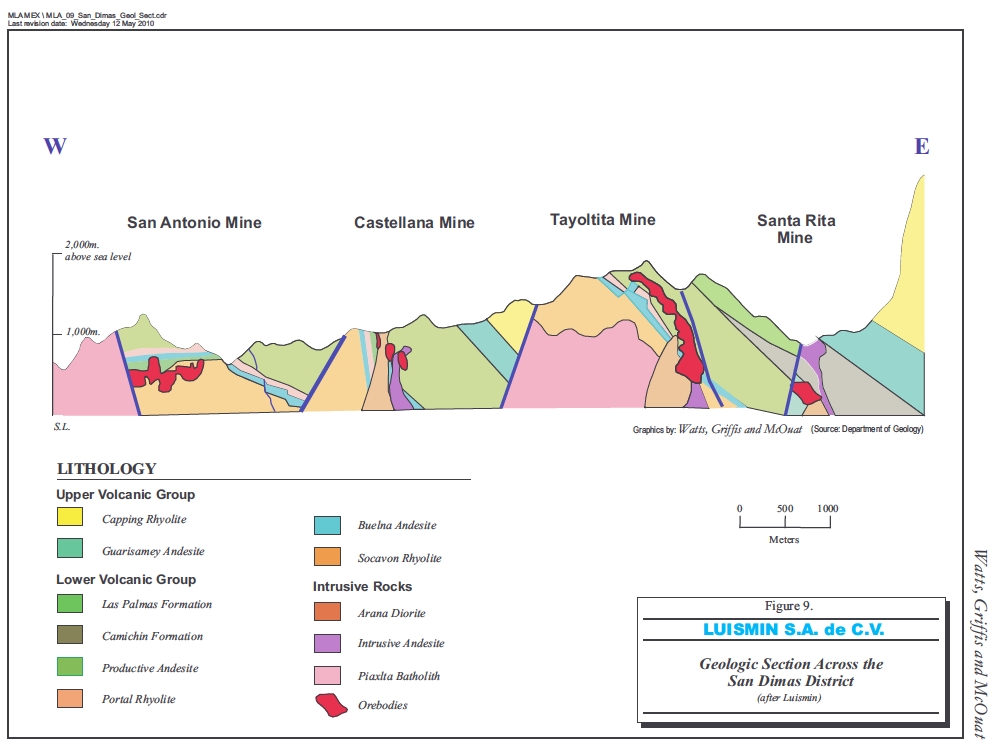

| 9. | Geologic sections across the San Dimas District | 36 |

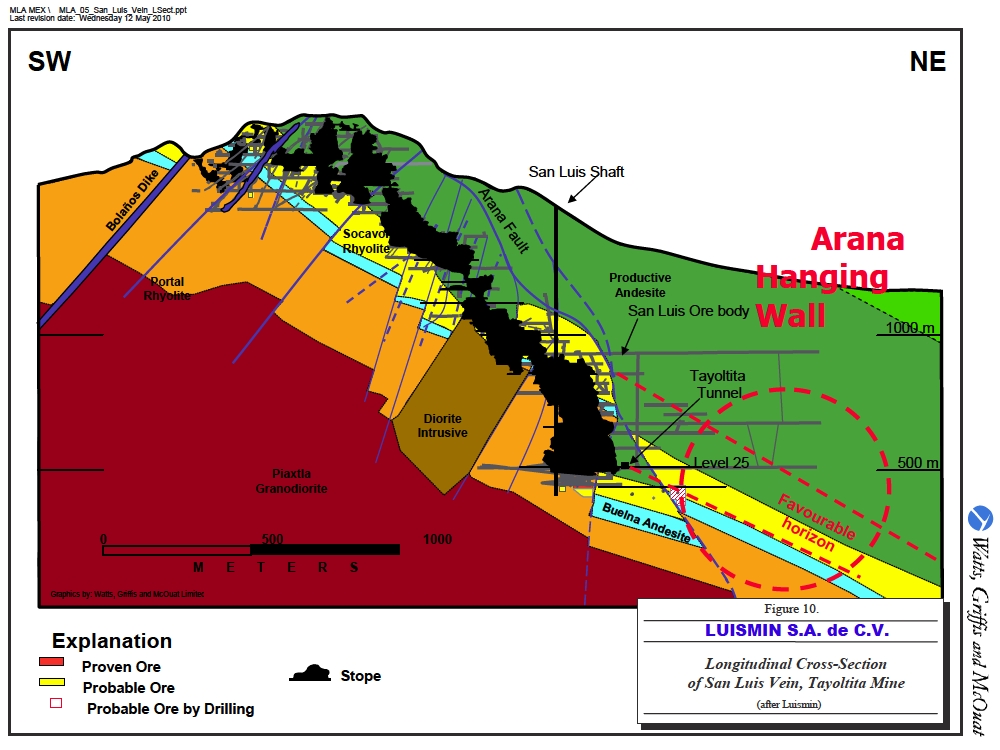

| 10. | Longitudinal cross-section of San Luis Vein, Tayoltita Mine | 39 |

| 11. | Longitudinal cross-section of Guadalupe Vein | 40 |

| 12. | Longitudinal cross-section of San Antonio Vein | 41 |

| 13. | Schematic section of the Favourable Zone | 43 |

| 14. | Plan map of San Dimas mine showing the trend of high grade Au-Ag | 45 |

| 15. | Plan and cross section of Sinaloa Graben | 46 |

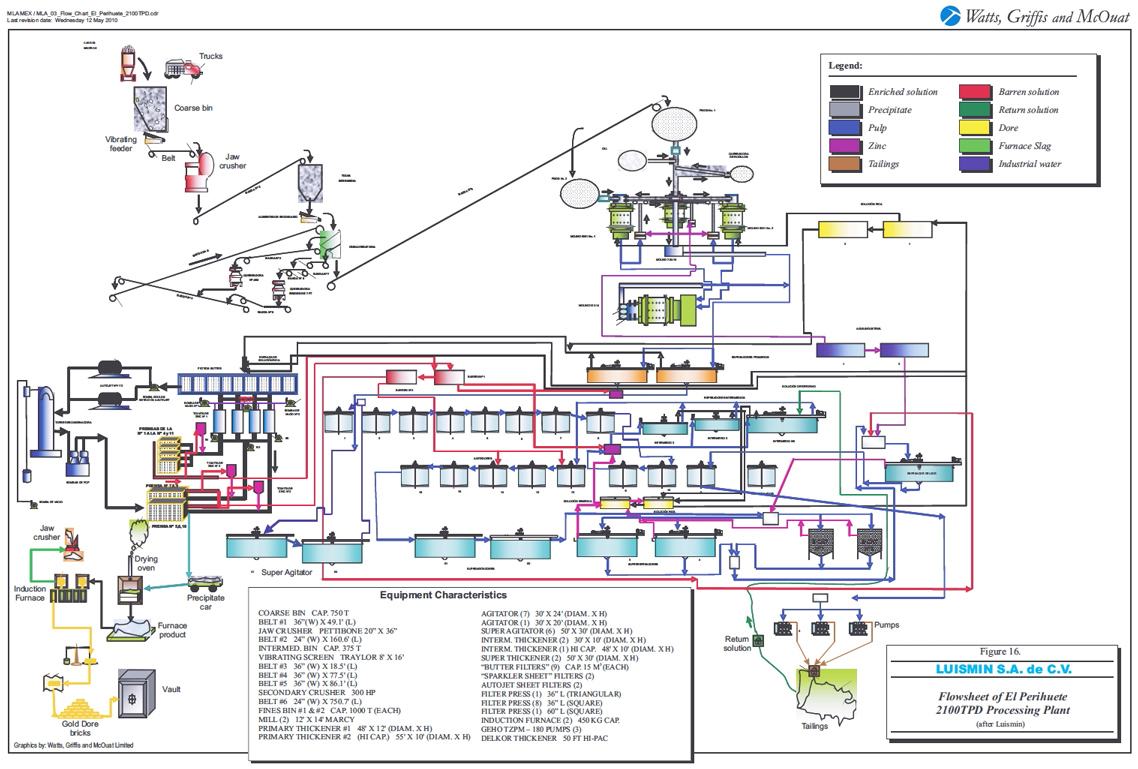

| 16. | Flowsheet of El Perihuete 2,100 tpd processing plant | 57 |

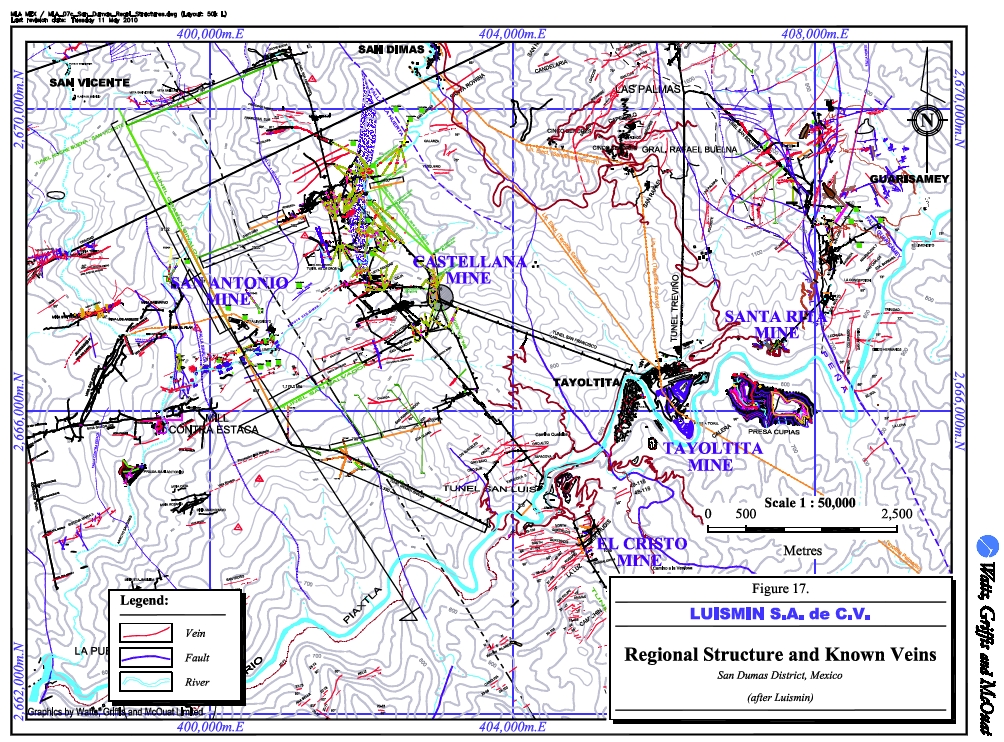

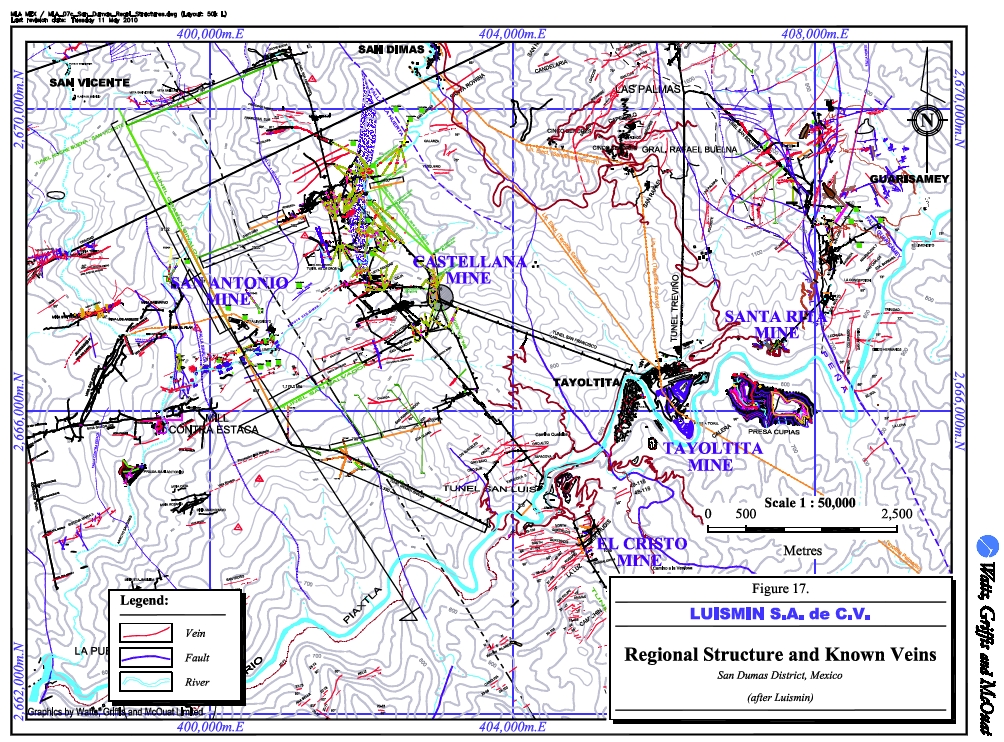

| 17. | Regional structure and known veins | 63 |

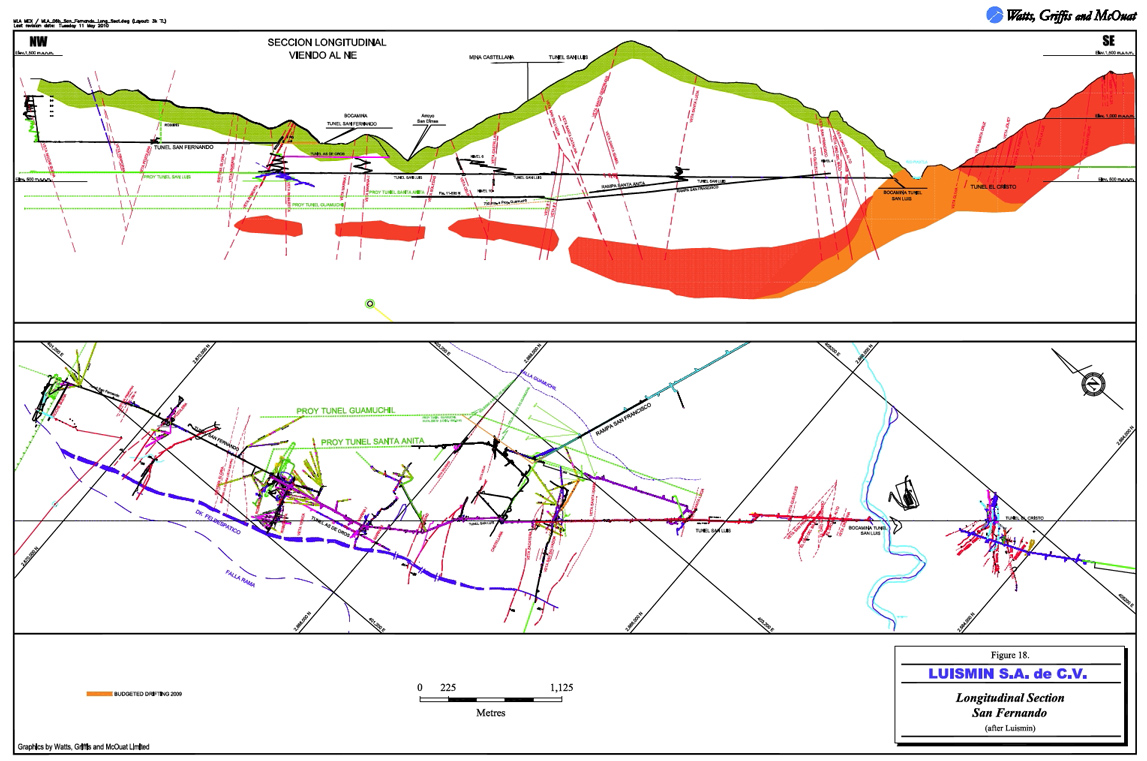

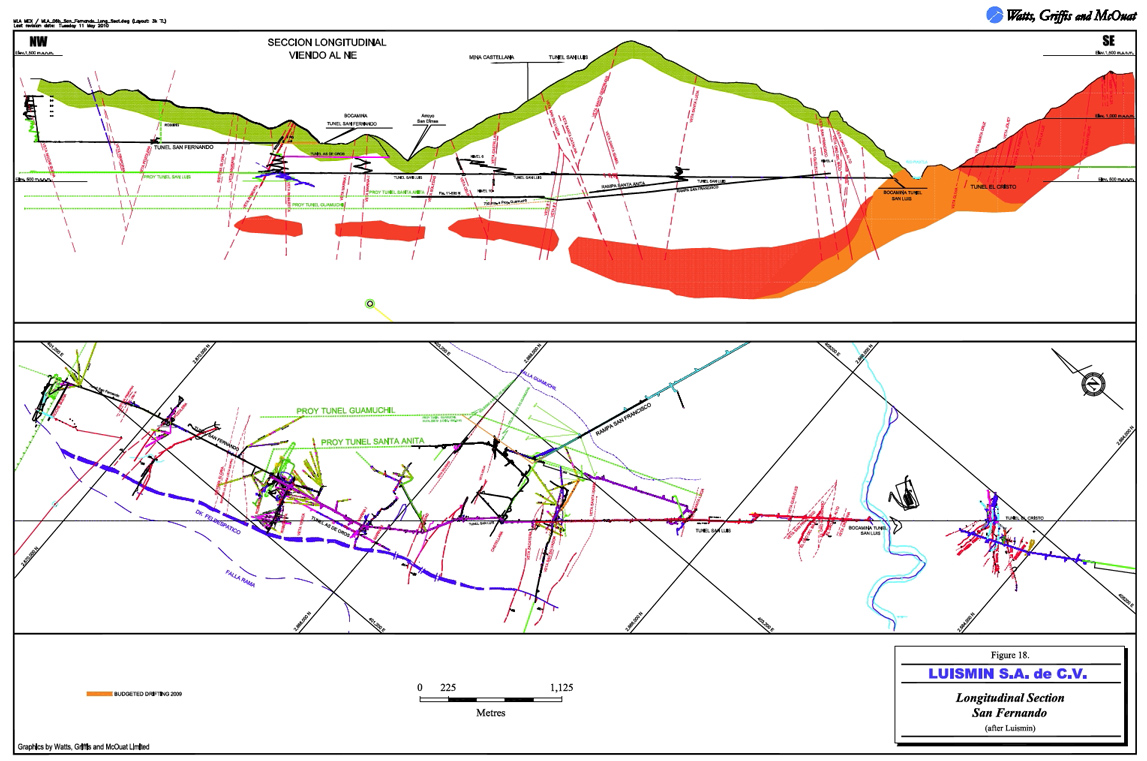

| 18. | Longitudinal section San Fernando | 70 |

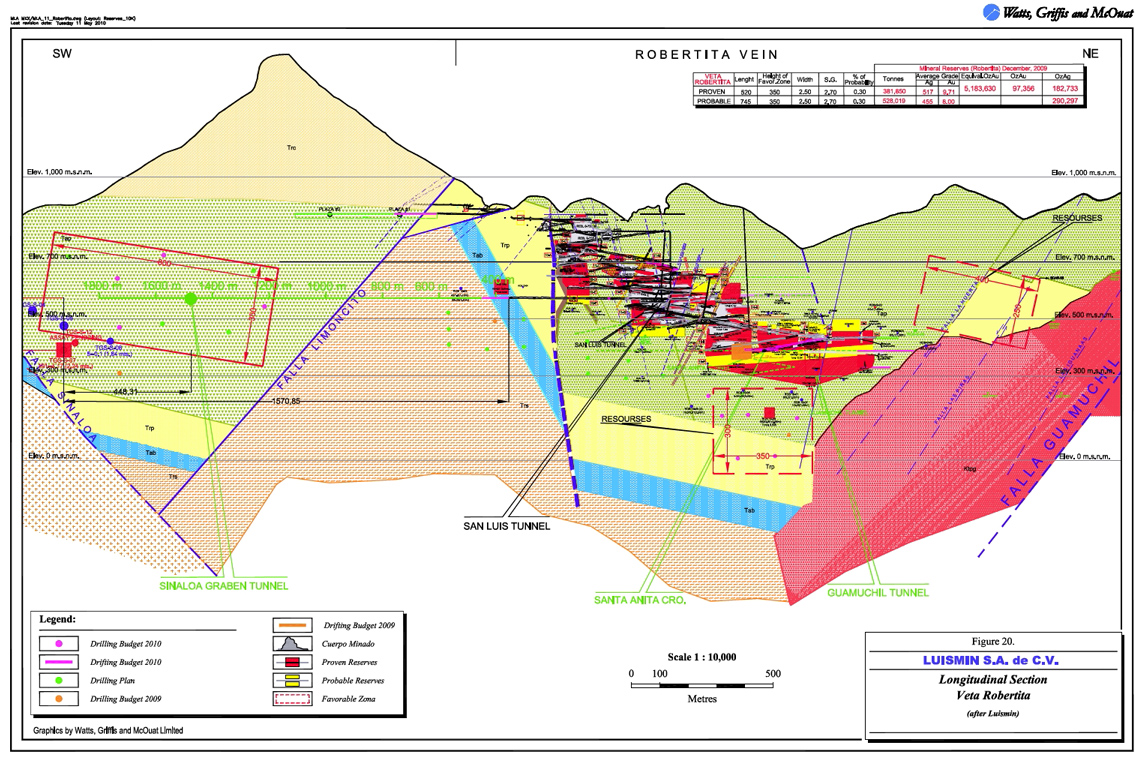

| 19. | Longitudinal section Veta Roberta | 71 |

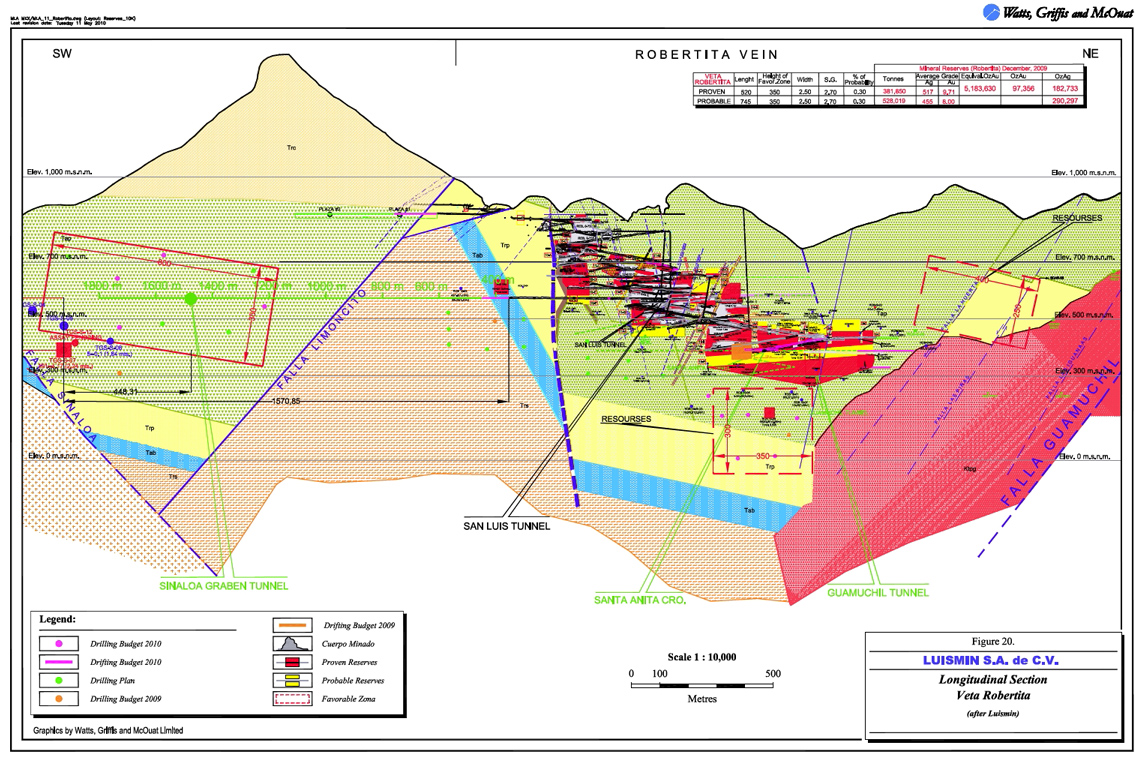

| 20. | Longitudinal section Veta Robertita | 72 |

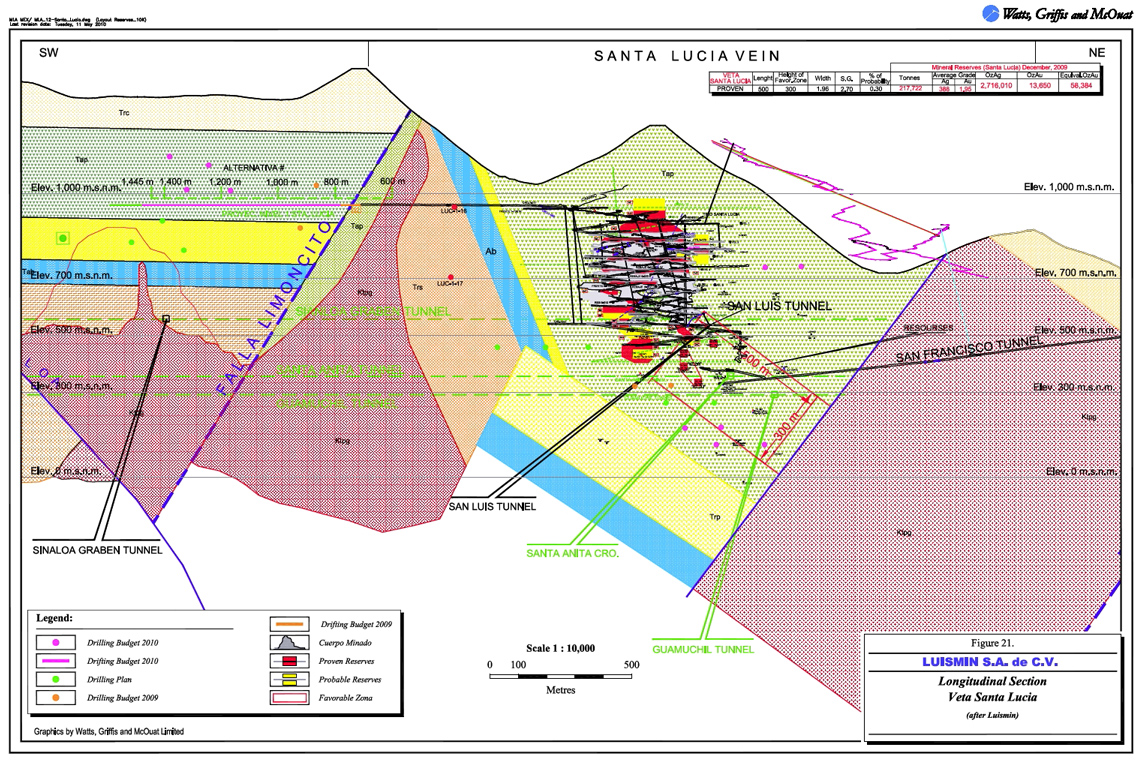

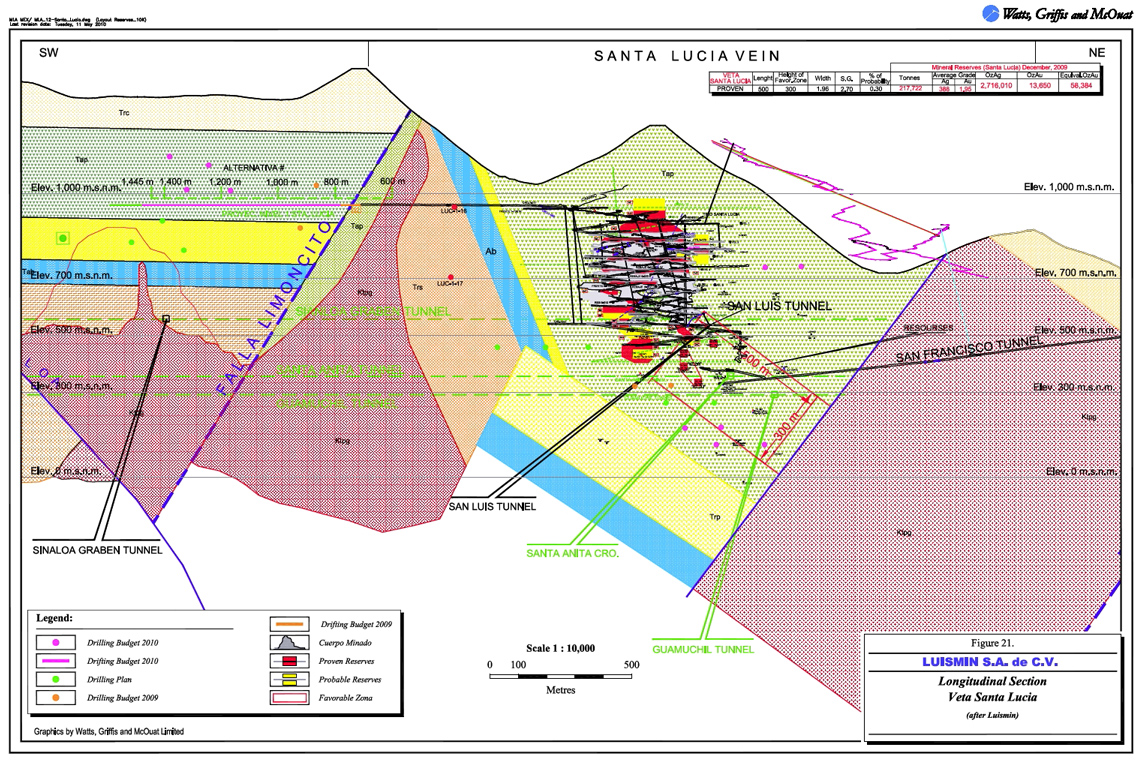

| 21. | Longitudinal section Veta Santa Lucia | 73 |

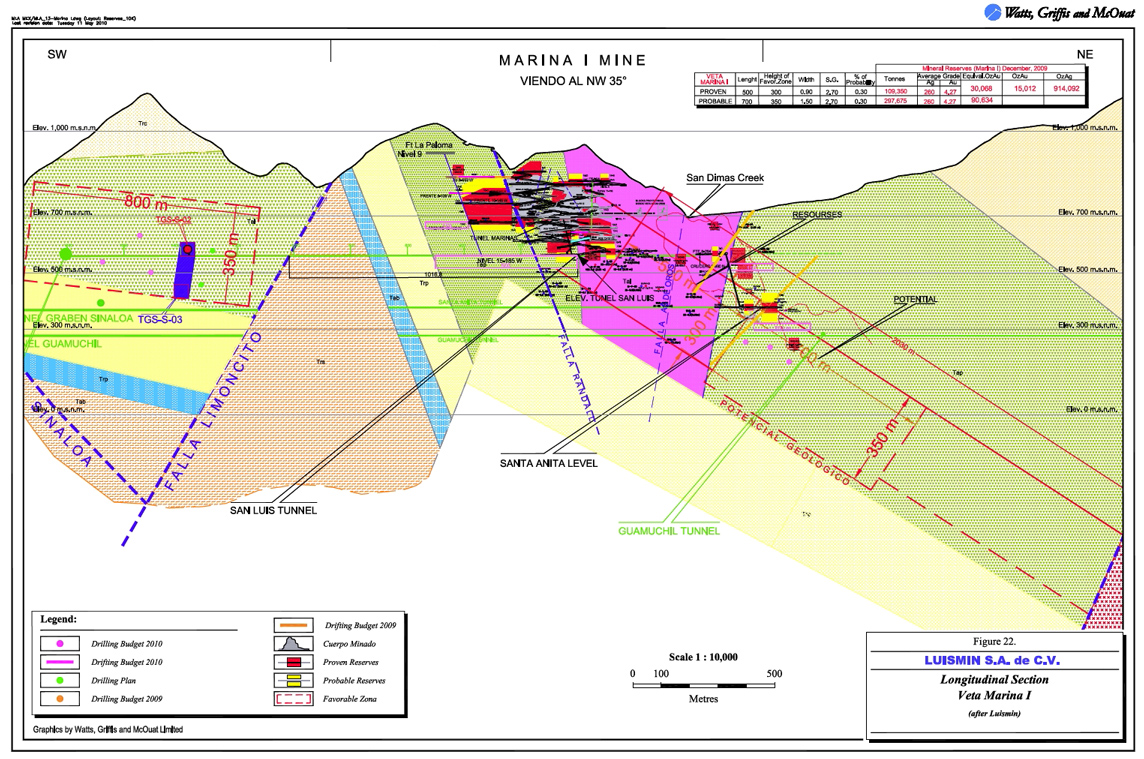

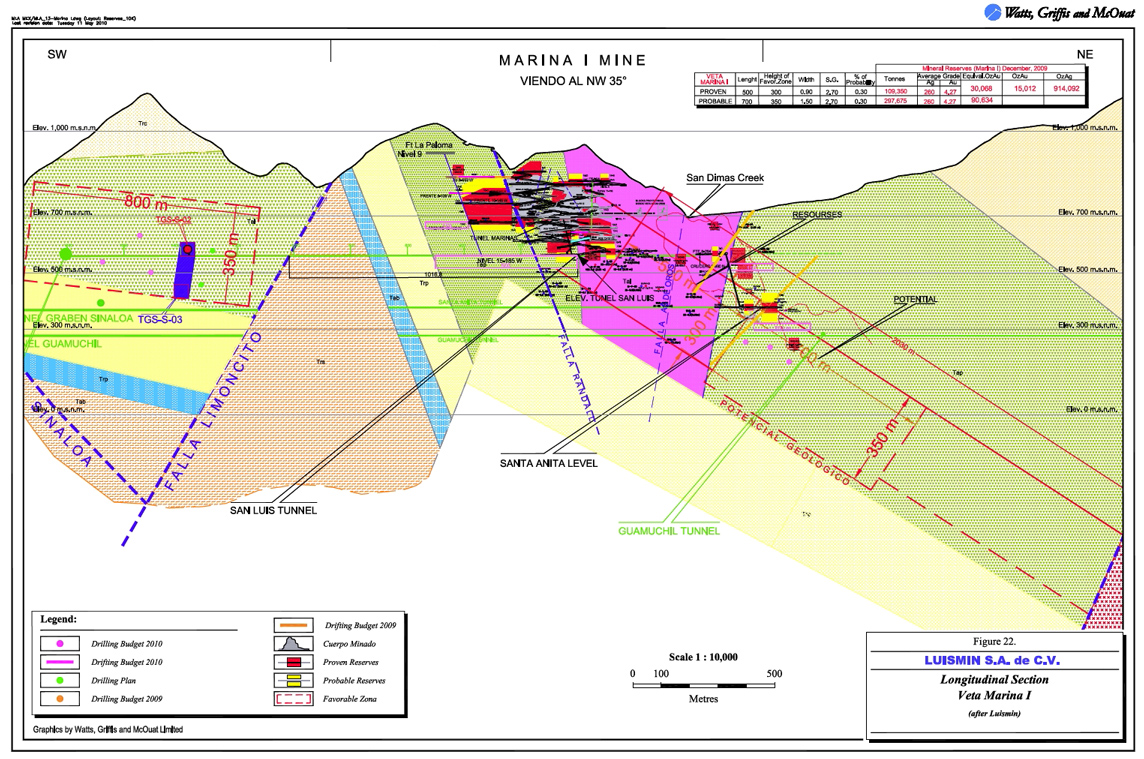

| 22. | Longitudinal section Veta Marina I | 74 |

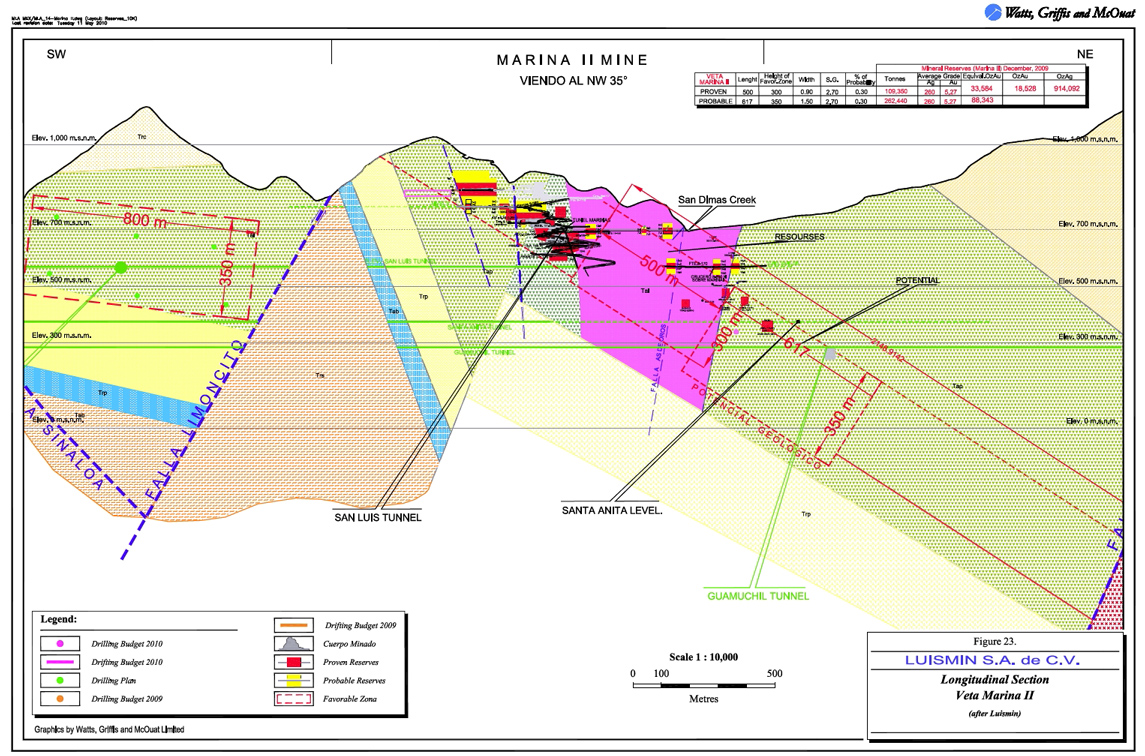

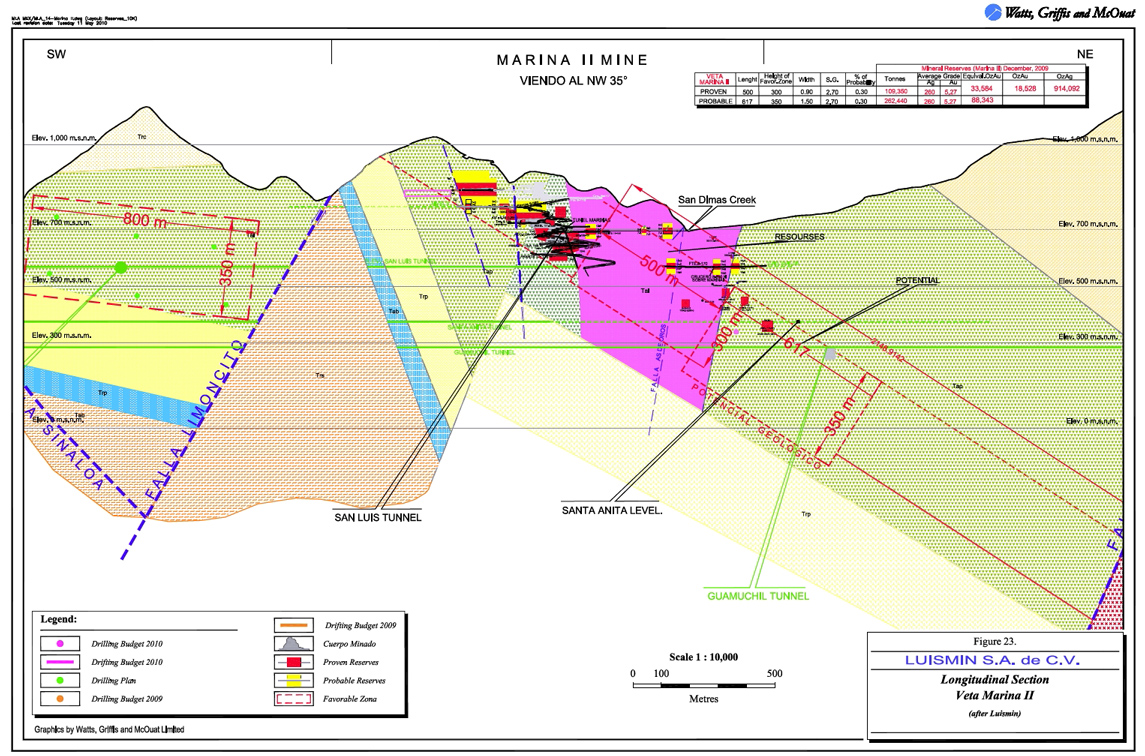

| 23. | Longitudinal section Veta Marina II | 75 |

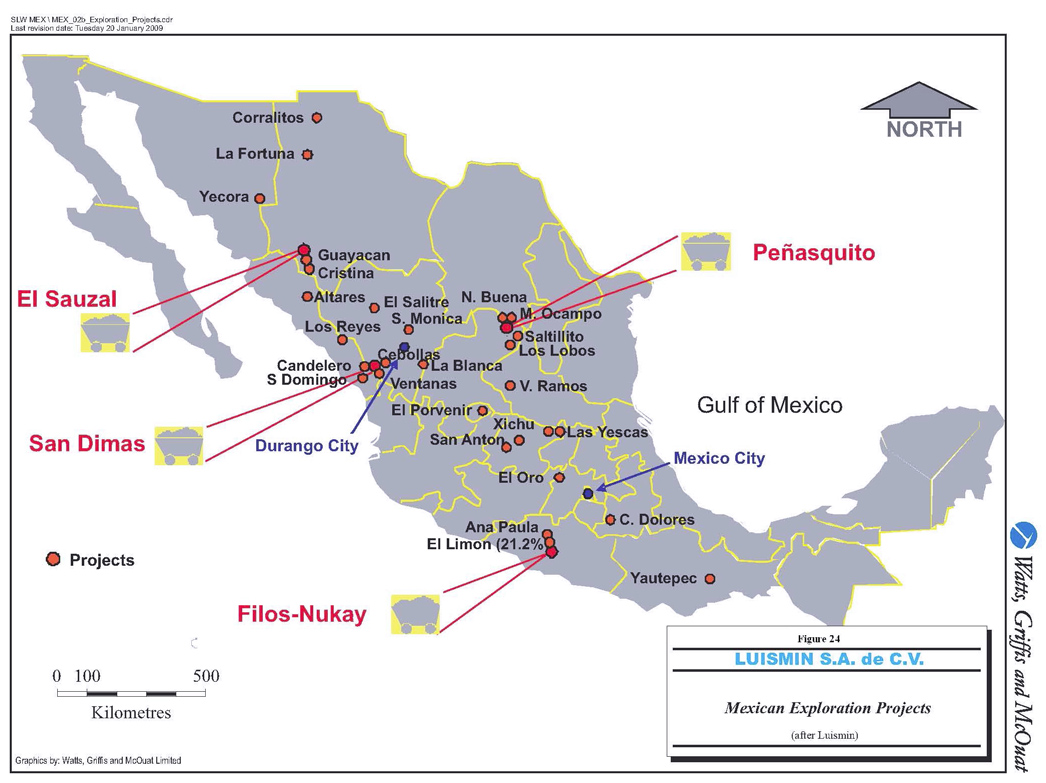

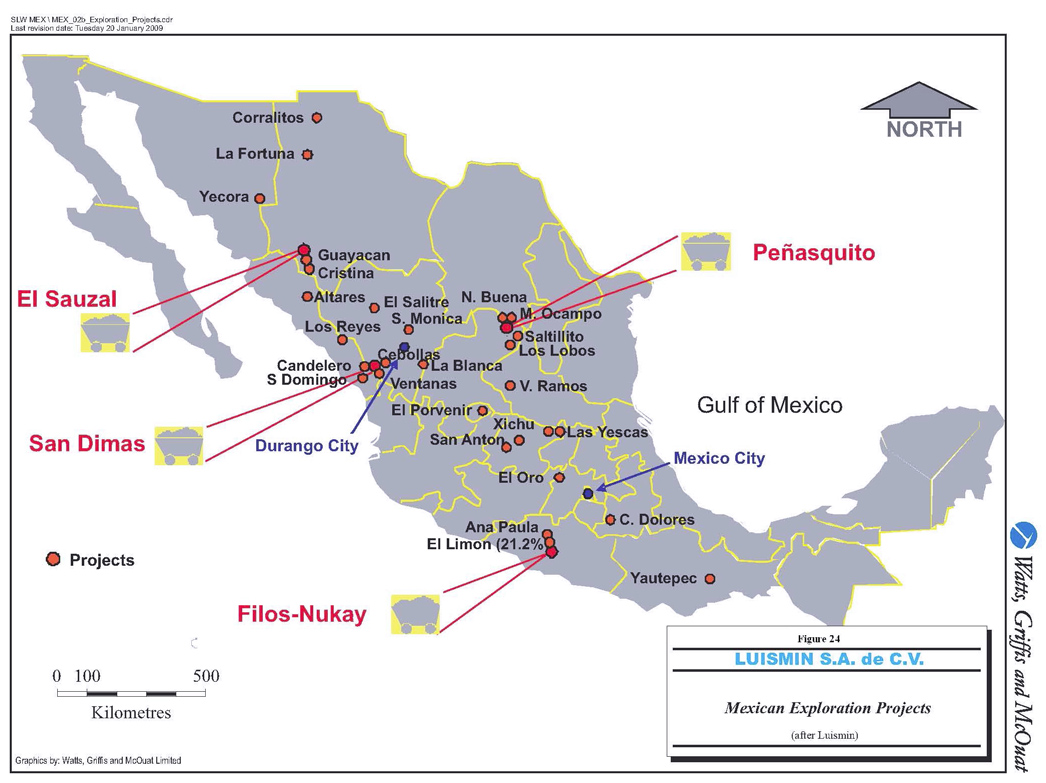

| 24. | Mexican exploration projects | 84 |

| 25. | Gold price 1985-2010 | 92 |

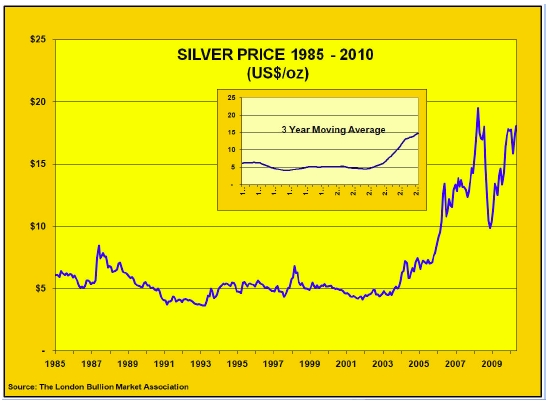

| 26. | Silver price 1985-2010 | 92 |

| 27. | Sensitivity of Net Cash Flow to changes in gold prices and capital and operating cost | 93 |

- v -

1. SUMMARY

Desarollos Mineros San Luis S.A. ("DMSL"), a subsidiary of Luismin S.A. de C.V. (“Luismin”), which is a subsidiary of Goldcorp Inc. ("Goldcorp") has recently entered into an Agreement with Mala Noche Resources Corp. ("Mala Noche") for the sale of their mining operations at San Dimas, Durango, Mexico. The sale would include the mines and mill at San Dimas and all attached facilities and equipment including the Twin Otter and helicopter aircrafts that are used in support of the San Dimas operations; the newly finished Las Truchas hydroelectric generation project, the nearby, small, former underground Ventanas Project; and the rights to the name "Luismin". Together these assets are referred to as the "San Dimas Assets".

Under the Agreement Mala Noche's Mexican subsidiary Mala Noche Resources S.A. de C.V. will acquire the San Dimas assets and all of the employees employed exclusively in connection with the San Dimas assets. Mala Noche Resources Corp. and Mala Noche Resources S.A. de C.V. together or individually are referred to as “Mala Noche”.

In consideration for the sale of the San Dimas Assets to Mala Noche will pay to Goldcorp and to DMSL, or its designated subsidiary, the sum of US$500 million and will assume all liabilities (contingent or otherwise) including but not limited to the liability with respect to environment and labour matters, arising from, or related to, all past, present and future operations of the San Dimas Assets.

Watts, Griffis and McOuat Limited ("WGM") was retained on April 14, 2010, as authorized by Mr. David Blaiklock, CFO of Mala Noche, and Mr. Samuel Mah, Director of Engineering of Silver Wheaton Corp. ("Silver Wheaton") to complete a review of the San Dimas mining operation and to document the results in an independent technical report. The report has been prepared in compliance with the Canadian National Instrument 43-101 ("NI 43-101") standards and guidelines. WGM understands that the purpose of this NI 43-101 report is for filing requirements by Silver Wheaton on the US Securities and Exchange Commission ("SEC") and on SEDAR in Canada.

WGM has visited the three mines on several occasions during the past ten years and produced independent Mineral Resource/Reserve audits of Luismin's operations as of: December 31, 2001; December 31, 2002; August 31, 2004, December 31, 2004, December 31, 2006, December 31, 2007, December 31, 2008, and December 31, 2009 that forms the basis of this present Technical Report. The most recent WGM visit was in April 2010. Previously Pincock, Allen and Holt ("PAH") had conducted independent audits as of: June 30, 1998; December 31, 1999; and, October 31, 2000.

- 1 -

The three mining properties are each operated by wholly owned subsidiaries of Luismin and include: Tayoltita, Santa Rita and San Antonio mines in the San Dimas district, on the border of Durango and Sinaloa states. Exploration and exploitation concessions covering the three mines have a total area of 22,721.57 ha. This extensive land ownership covers the mines, as well as the most prospective surrounding areas, and forms an important asset for Mala Noche's future exploration programs.

All mines are underground operations using primarily mechanized cut-and-fill mining methods. After milling, cyanidation, precipitation and smelting, doré bars are poured and then transported for refining to Salt Lake City, Utah.

Production of gold and silver from the San Dimas Assets: during 2007 was 132,898 oz Au and 6,911,482 oz Ag; during 2008 was 86,682 oz Au and 5,113,466 oz Ag; and during 2009 was 113,018 oz Au and 5,093,385 oz Ag.

The geological and engineering work done by Luismin is of high quality and follows accepted engineering practices, and record keeping is very good.

The three mines that comprise the San Dimas District (Tayoltita, Santa Rita and San Antonio) are located some 125 km northeast from Mazatlan, Sinaloa or approximately 150 km west of the city of Durango, Durango. The district is accessed by aircraft in a half hour flight from either Mazatlan or Durango, or by driving some 10 hours from Durango.

The Santa Rita mine is located approximately 3 km upstream from the Tayoltita mine while the San Antonio mine is 7 km west of Tayoltita. Production from the three mines is processed in the central milling facility at Tayoltita. The San Antonio mill, that formerly processed production from the San Antonio mine, was put in care and maintenance in November 2003. The San Antonio mill is accessed from the Tayoltita mine by road, to the portal of the San Luis tunnel then through the tunnel and finally along a river bed or access road to the mill, about an hour and a half drive in total.

The San Dimas District has experienced a long recorded history of mining since precious metal production was first reported in 1757. Historical production through 2009 is estimated at 581.8 million ounces of silver and 10.79 million ounces of gold making the San Dimas District third in Mexico for precious metal production.

The geological setting at San Dimas shows two major volcanic successions, totalling 3,500 m in thickness, separated by an erosional and depositional unconformity. The Lower Volcanic Unit ("LVG") is predominantly composed of andesitic and rhyolitic flows and tuffs, while the Upper Volcanic Unit ("UVG") is composed of a lower andesitic horizon capped by rhyolitic ash flows and tuffs. The LVG is the host of the mineralized veins.

- 2 -

The district lies within an area of complex normal faulting. Five major, post-ore north-northwest trending faults have divided the district into five tilted blocks.

The deposits are high grade, silver-gold epithermal vein deposits formed from the final stages of igneous and hydrothermal activity in two different vein systems. The first formed set of veins strikes east-west while the second strikes north-northeast. Both sets of veins pinch, swell, bifurcate and exhibit horse-tailing and sigmoidal structures. The veins vary in width from a fraction of a centimetre to fifteen metres, but average 1.5 m. The ore shoots in the veins have variable strike lengths, and average 150 m. They can have up to 200 m down-dip extensions but the down-dip extensions are normally less than the strike length. The ore forming minerals are light coloured, medium to coarse grained quartz with intergrowths of base metal sulphides, pyrite, argentite, polybasite, native silver and electrum.

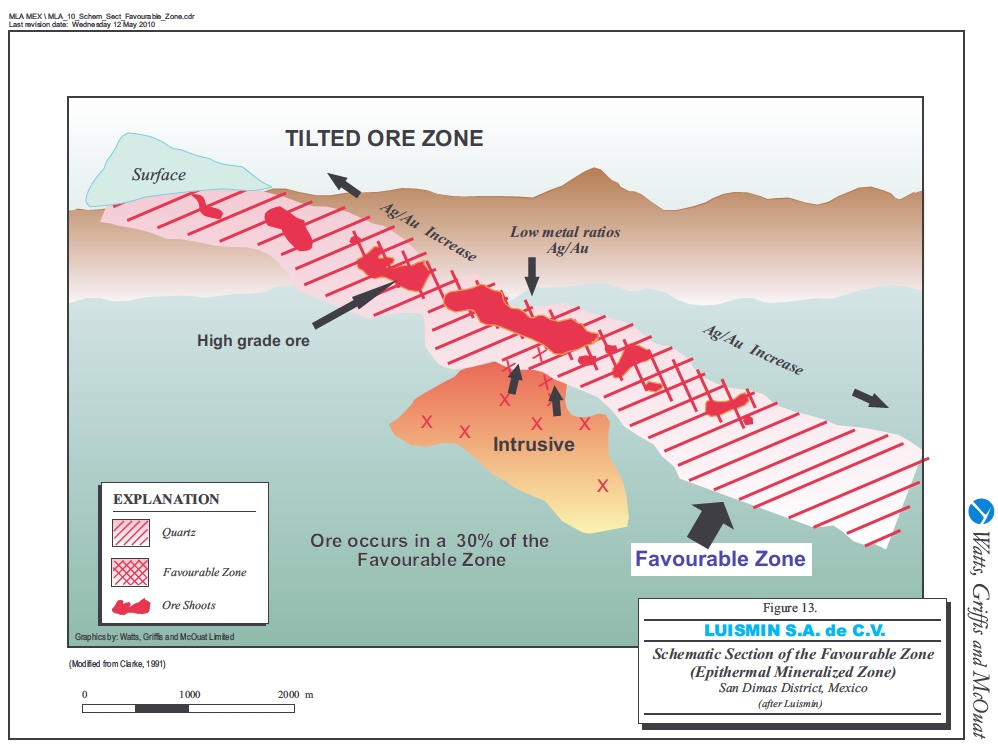

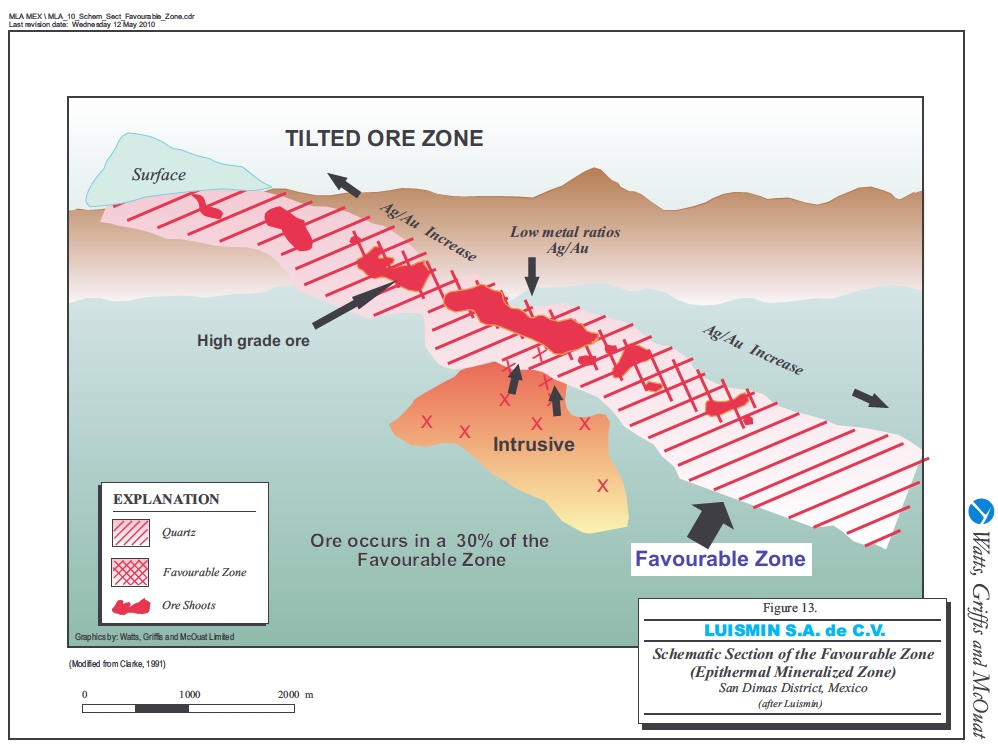

Typical of epithermal systems, the San Dimas District exhibits a vertical zonation with a distinct top and bottom that Luismin has termed the Favourable Zone. At the time of deposition, the Favourable Zone was in a horizontal position, paralleling the erosional surface of the LVG. Luismin has successfully located the Favourable Zone in fault tilted blocks from the position of the unconformity between the lower and upper volcanic units. At San Dimas, the Favourable Zone has a vertical extent of some 300 to 600 m. Past mining experience has shown that 30% of the volume/tonnage of structures in the Favourable Zone, when later developed, becomes ore. At the current mining rate, Inferred Mineral Resources are being successfully developed on a yearly basis into Mineral Reserves to replace mined out ore.

Exploration is done both by diamond drilling and by underground development work. The drilling is mainly done from underground stations.

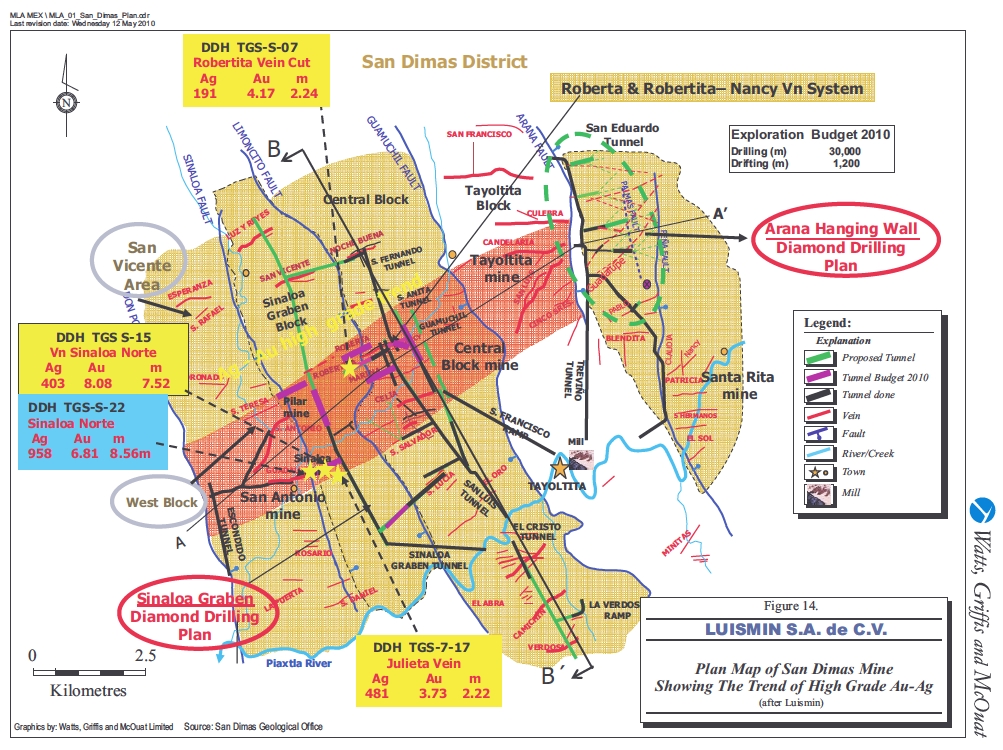

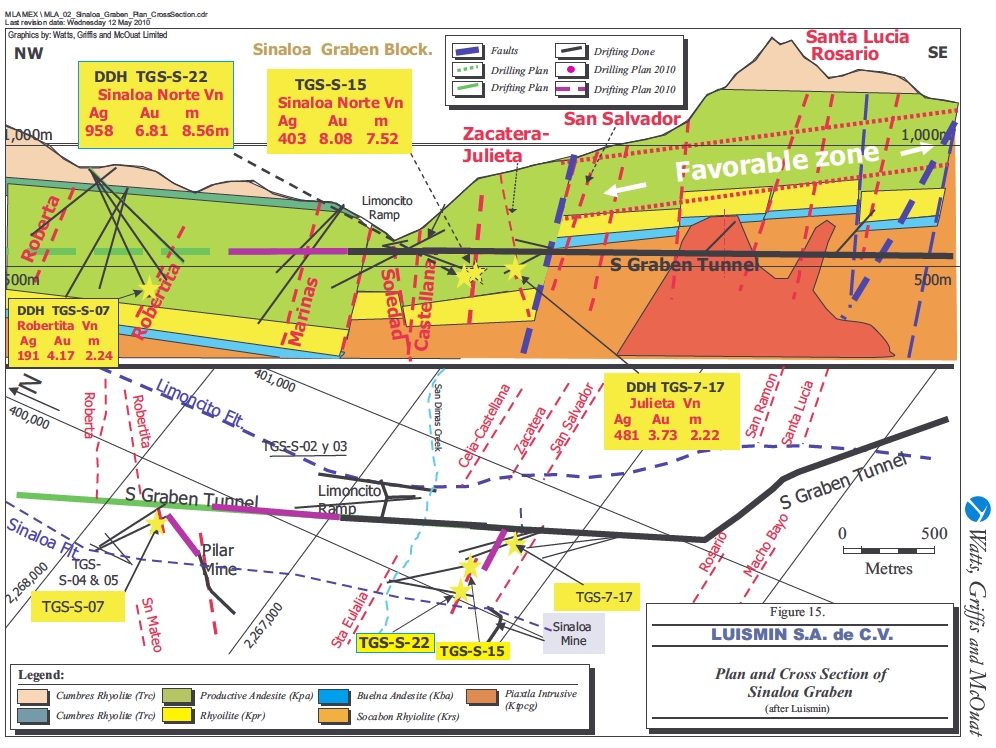

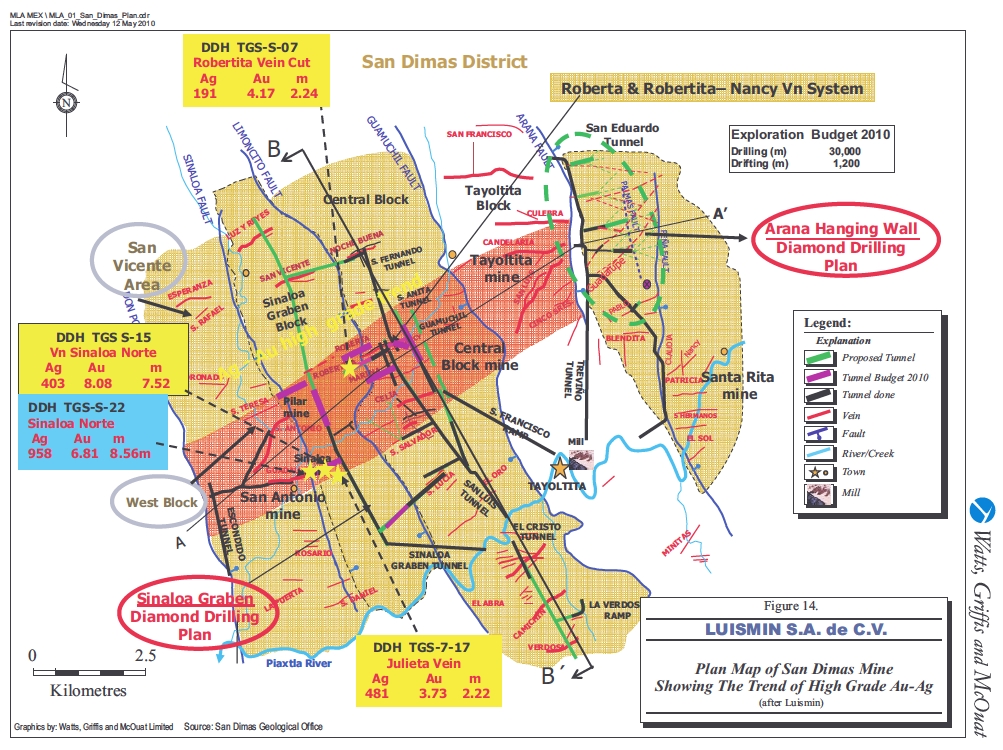

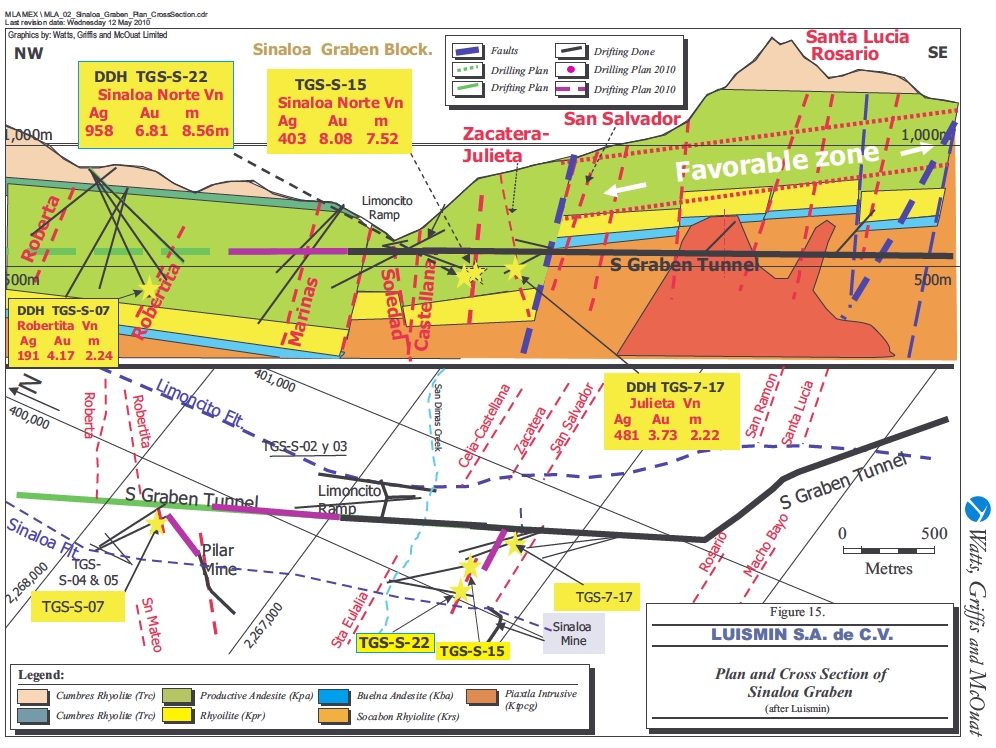

Exploration by diamond drilling and drifting during thefirst trimester of 2010at the San Dimas Mines has outlined Mineral Resources estimated to contain 2.9 million oz Ag and 31,209 oz Au. The greatest amount of these resources were found in the Sinaloa Graben, (a N-S, 7 km long by almost 2 km wide block) and were based on four diamond drill holes and a level development. A total Indicated Mineral Resource of 143,338 Mt at an average grade of 444 g Ag/t and 5.93 g Au/t is estimated within the Sinaloa Graben containing more than 27,000 oz Au and more than 2.0 million oz Ag. More than 10 veins are known in the Sinaloa Graben structure but only two have been mined and the others are unexplored.

- 3 -

Also during the first trimester of 2010 diamond drilling from inside the mine from the 22ndand 25thlevels has verified the presence of NE-SW and E-W striking narrow quartz filled structures (0.2 to 0.90 m wide) in the Arana block carrying mineralization in the order of 300 g Ag/t and 5 g Au/t. A diamond drilling program on a 400 x 400 m grid is planned to start in April 2010 on this potential high grade gold zone.

Based on Luismin’s knowledge of the Favourable Zone, and numerous years of developing Inferred Mineral Resources into Mineral Reserves, the newly outlined Mineral Resources of the Sinaloa Graben and the mineralization of the Arana Block indicate a long life to the mine and encourages further exploration and development of other areas in the mine.

The workings of the San Dimas District mines are sampled across the vein at 1.5 m intervals along the vein under the direction of the Geological Department. The splits are taken along the sample line to reflect geology but no sample is greater than 1.5 m. Once an ore block has been developed, the sample line spacing may be increased to 3.0 m. Sampling is by an approximately 10 cm wide chip-channel across the vein.

The samples are crushed, ground, split and homogenized at the mine assay laboratory to produce a representative 10 g sample for fire assaying. Routine quality control is carried out with check assays done at the mine assay laboratory, and between commercial assay mine laboratories.

The method used by Luismin to estimate tonnage/grade at the mines in an ore shoot is the conventional block estimation method where the average width is multiplied by the area measured in a vertical plane (corrected for dip) to determine the volume. This volume is multiplied by the Specific Gravity ("SG") of 2.7 to give the estimated tonnage.

Grade corrections of 0.85 by silver grade and 0.95 by gold grade, have been applied. To account for narrow veins at the San Dimas mines, a dilution factor of 10% (at zero grade) is also applied to blocks of less than 5,000 tonnes. These grade corrections and dilution, where appropriate, are applied to both the Proven and Probable Mineral Reserves and the Inferred Mineral Resources. Calculation of the minimum cutoff grade is based on market metal prices for gold and silver metal recovered in the mill and the average monthly production costs for mining/milling/overhead etc., to produce a minimum dollar per tonne cutoff grade.

The terminology used by Luismin to designate Measured and Indicated Mineral Resources and Proven and Probable Mineral Reserves is in general agreement with the CIM Standards as adopted in NI 43-101.

- 4 -

Luismin designates Proven Mineral Reserves only when mineralization above cutoff grade is exposed in a drift. The distance projected above and below the drift is a function of the exposed length of the above-cutoff grade mineralization in the drift. Luismin also estimates Probable Mineral Reserves by diamond drilling. A square is drawn on the vertical longitudinal section with the drillhole centered on the square. The shape and size of the block depends upon the geological interpretation and thickness of the vein ranging from 25 by 25 m for veins less than 1.0 m thick to 50 by 50 m for veins greater than 1.5 m thick.

Drillhole blocks, based on drillhole assays 50 m or less from underground workings, are classified as "Probable Mineral Reserves from Drilling".

Mining has been conducted in the San Dimas District for more than 200 years and knowledge of the geology i.e. character of the more than 100 veins/structures has been obtained. Detailed mapping and record keeping has assisted in developing a working model. The economic mineralization is known to be confined to an epithermal zone with a distinct top and bottom. Experience has shown that the mineralization within the vein/structure in the favourable zone is very irregular but statistically occupies 30% of the vein/structure. The extent of extrapolation of an individual vein/structure within the favourable zone is defined on structural and stratigraphic relationships supported by geochemical trace element studies and by fluid inclusion studies. These studies have been published as various papers in Economic Geology (see bibliography).

Extrapolation of a particular vein/structure (generally from 200 m to 500 m) is based on various criteria from: known underground workings, surface exposure, drillholes intercepts; continuity and width of the known part of the structure, etc.

WGM's audit of Luismin's Mineral Resource/Mineral Reserve estimates did not uncover any fatal flaws, and WGM believes that the methods used by Luismin to estimate the Mineral Resources/Mineral Reserves are reasonable.

Prior to 2004, the three Luismin mines in the San Dimas District were treated as separate mining units with production from the Tayoltita and Santa Rita mines processed at the Tayoltita mill and production from the San Antonio mine processed at the San Antonio mill. Late in 2003, the San Antonio mill was put on standby and closed, and with all mine production to be processed through the Tayoltita mill. A recent production reclassification has been made into seven new mining units: Tayoltita, El Cristo, Tayoltita (Alto Acana), Santa Rita, Central Block, San Vicente and Sinaloa Graben.

- 5 -

The Proven and Probable Mineral Reserves at the seven operating mining units of the three mines as of December 31, 2009 are5.589 million tonnes at 339 g Ag/t and 4.80 g Au/t, as follows:

| | | | | |

| Proven and Probable Mineral Reserves - San Dimas |

| | Metric | | | Total Contained |

| | Tonnes | g Ag/t | g Au/t | (oz Ag) | (oz Au) |

| Proven and Probable Reserves | | | | | |

| Tayoltita | 517,955 | 293 | 3.07 | 4,871,424 | 51,197 |

| El Cristo | 10,120 | 206 | 3.67 | 67,129 | 1,194 |

| Tayoltita (Alto Arana) | 20,140 | 286 | 2.27 | 185,051 | 1,467 |

| Santa Rita | 496,262 | 297 | 2.09 | 4,740,356 | 33,352 |

| Block Central | 2,499,594 | 386 | 6.35 | 31,055,710 | 510,226 |

| San Vicente | 39,932 | 218 | 4.60 | 279,935 | 5,902 |

| Sinaloa Graben | 4,714 | 189 | 3.13 | 28,596 | 474 |

| Total Proven and Probable Reserves | 3,588,716 | 357 | 5.23 | 41,288,200 | 603,813 |

| |

| Probable Reserves by Diamond Drilling | | | | | |

| Tayoltita | 759,483 | 287 | 2.84 | 7,000,160 | 69,302 |

| El Cristo | 103,737 | 268 | 3.98 | 894,383 | 13,282 |

| Tayoltita (Alto Arana) | 15,247 | 157 | 4.66 | 77,071 | 2,286 |

| Santa Rita | 344,537 | 333 | 2.84 | 3,692,127 | 31,435 |

| Block Central | 693,179 | 314 | 5.57 | 7,005,725 | 124,237 |

| San Vicente | 3,304 | 208 | 2.50 | 22,093 | 266 |

| Sinaloa Graben | 80,847 | 378 | 6.54 | 981,525 | 17,010 |

| Total Probable Reserves by Diamond Drilling | 2,000,334 | 306 | 4.01 | 19,673,082 | 257,817 |

| |

| GRAND TOTAL Proven and Probable Reserves | 5,589,050 | 339 | 4.80 | 60,901,283 | 861,630 |

| |

| Notes to Reserve Statement |

| 1. | Reserves were estimated by Luismin and audited by WGM as of December 31, 2009. |

| 2. | Cutoff grade based on total operating cost for Tayoltita, Santa Rita and Block Central (US$84.79/t). |

3. | All reserves are diluted, a mining recovery factor has not been applied, but WGM estimates that the mining recovery will be approximately 90%. |

4. | The tonnage factor is 2.7 tonnes per cubic metre. |

| 5. | Cutoff values are calculated at a silver price of US$13.00 per troy ounce and US$825.00 per troy ounce for gold. |

| 6. | Rounding of figures may alter the sum of individual column. |

| 7. | Exchange rate, pesos/US$12.50. |

The Inferred Mineral Resources at San Dimas, diluted, as of December 31, 2009 are about15.166 million tonnes at an approximate grade of 317 g Ag/t and 3.31 g Au/t, and are separately reported and not included in the above total Mineral Reserve as Inferred Mineral Resources are not known to the same degree of certainty as Mineral Reserves and do not have demonstrated economic viability.

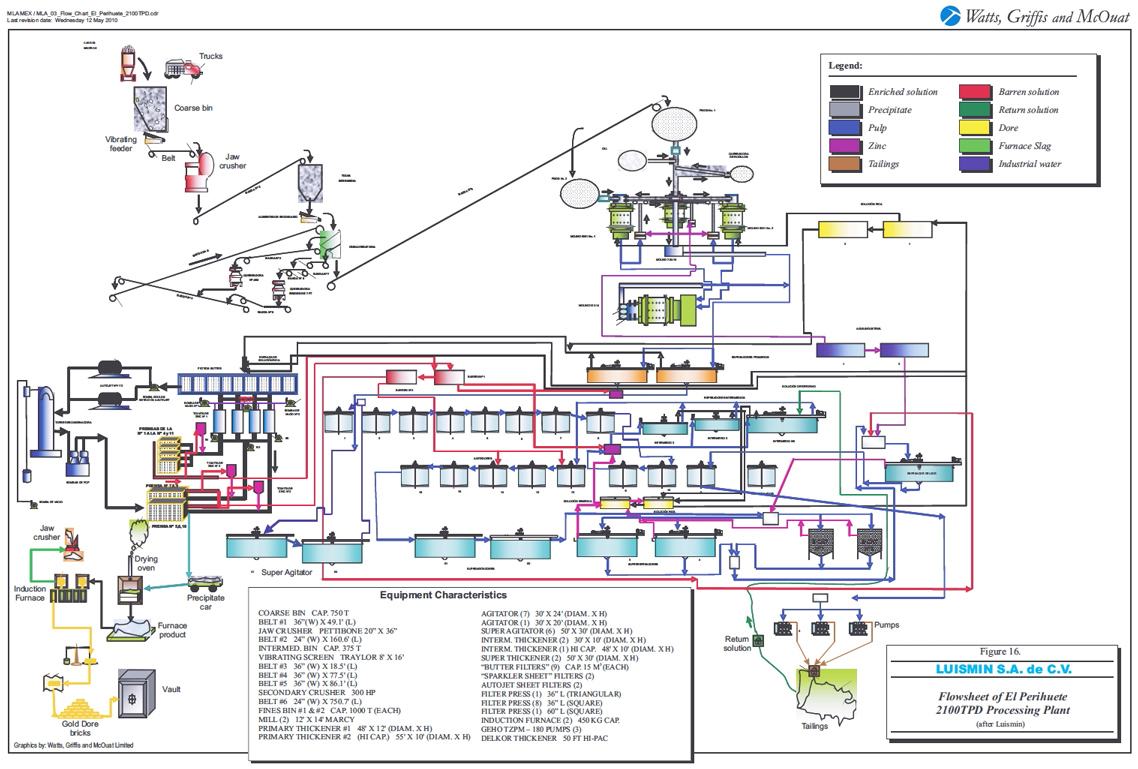

The seven silver and gold mining units of the three mines in the San Dimas district are underground operations employing cut-and-fill mining and using load, haul, and dump ("LHD") equipment. Primary access is provided by adits and internal ramps. Milling operations are carried out at Tayoltita which has a capacity of 2,100 tpd. The ore is processed by conventional cyanidation followed by zinc precipitation of the silver and gold and refining for the production of doré.

- 6 -

In 2007, the San Dimas District mined 685,162 tonnes at an average grade of 6.27 g Au/t and 341 g Ag/t for a production of 132,898 oz gold and 6,911,482 oz silver at recoveries of 94.7% and 91.1% respectively, in 2008, the production was 657,479 tonnes at an average grade of 4.25 g Au/t and 259 g Ag/t for a production of 86,682 oz gold and 5,113,466 oz silver at recoveries of 97.2% and 93.9% respectively. In 2009, the production was 673,311 tonnes at an average grade of 5.36 g Au/t and 249 g Ag/t for a production of 113,018 oz gold and 5,093,385 oz silver at recoveries of 97.4% and 94.6%, respectively.

When Wheaton River Minerals Ltd. acquired Luismin in 2002, Luismin’s practice in the design and operation of tailings containment sites complied with the requirements of Mexico and with the permits issued for the dams in use at San Dimas, however, improvements were necessary to bring the tailings dam designs and operations up to international guidelines. Various assessments and geotechnical testing have been carried out in the past eight years to investigate the safety of the dams and design improved operational procedures for the tailings deposits and Luismin has initiated various construction works to increase the dam safety and to better manage the tailings operations.

Tailings previously were discharged from milling operations into unlined structures designed to settle the solids and to collect and drain solutions for recycle to the milling operations. The containment structures were constructed from the more dense and coarse underflow from cyclones operating on the tailings lines. Solutions from the cyclone overflows drained to decant structures in the central dam area and the solutions were recycled to the mill.

In the San Dimas district, both tailings dams at San Antonio and at Tayoltita required extensive work to stabilize the structures against erosion and possible failure. The deficiencies were recognized and a total of US$20 million capital expenditures were carried out at both tailings dams to implement the recommendations of third party consultants and bring the tailings dams more in line with international guidelines.

At the San Antonio dam, the scope of work included seepage controls, geotechnical investigations to support the existing tailings and the installation of a rock filled berm and a Roller Compacted Concrete stepped spillway. The operation at the San Antonio mill had been shut down primarily due to the depletion of tailings storage capacity at the San Antonio tailings dam.

Improving the safety factor on the Tayoltita tailings dam has included the placement of a reinforcing berm downstream of the current dam and extension of the seepage collection system. The three phases of constructing the safety berm, to stabilize the dam, have been completed. The ten-stage tailings pumping system has been replaced with single stage positive displacement pumps as well as a new pipeline crossing of the river. The river crossing design includes spill protection in the event of a line failure. Belt filtering of the tailings that allows dry placement of the tailings, is currently in operation at the Tayoltita operation, one of three dry tailings operations in Mexico.

- 7 -

With the remediation and stabilization works underway and the work planned for the future, Luismin's operations have moved considerably forward in bringing the tailings operations to international guidelines since acquisition of the operations by Wheaton River/Goldcorp.

Capital expenditures are required to sustain the existing production facilities with equipment replacement and ongoing exploration and mine development.

Operating costs, in 2009, in the San Dimas District for the seven mining units of the three mines averaged US$84.79 per tonne. Detailed operating costs are separately accounted for all aspects of the mining operations to determine the cutoff grade to plan and control the mining operations.

The Luismin operations have achieved significant reductions in operating costs from increasing the scale of operations as well as improvements in the efficiencies of operating methods. All operations will incur some increase in operating costs associated with the future tailings operations and associated environmental monitoring and ongoing inflation within the mining industry.

Since February 2009, Luismin ships all of the doré bars to the Johnson Matthey refinery in Salt Lake City, where a refining charge of US$0.20 per troy oz of the doré received is paid to the refinery, and a charge of US$1.00/oz of the gold debited to the Luismin account.

On October 15, 2004 Silver Wheaton Caymans ("Silver Wheaton") entered into an agreement (amended on March 30, 2006) to acquire all of the silver produced by DMSL mining operations in Mexico (owned at the date of the transaction) for a period of 25 years. The purchase price of the silver was comprised of an upfront payment of C$46 million plus 540 million common shares of Silver Wheaton and an additional payment equal to the lesser of US$3.90 per ounce of silver delivered and the spot silver price. The US$3.90 per ounce payment is adjusted annually for inflation (currently at US$4.04 per ounce). On February 14, 2008 Goldcorp (Luismin’s parent company) sold its entire 48% interest in Silver Wheaton by way of a secondary offering. Under the Agreement, Silver Wheaton has consent rights in connection with any sale of DMSL of the San Dimas Assets. In return for Silver Wheaton providing its consent to the proposed transaction, the current Silver Wheaton purchase agreement will be changed as follows:

- 8 -

| 1. | The term of the Silver Wheaton purchase agreement is extended from the 25 years (19 years remaining) to the life of the mine. |

| | |

| 2. | During the first four years after Mala Noche acquires the San Dimas Assets, Silver Wheaton will receive each year the first 3.5 million troy ounces of the silver production. The yearly silver production, in excess of 3.5 million troy ounces, during each year of the four years, will be shared 50/50 between Silver Wheaton and Mala Noche. In return for this, Silver Wheaton will receive 1.5 million troy ounces of silver each year (for the four years) from another Goldcorp mine. |

| | |

| 3. | Starting in the fifth year after Mala Noche acquires the San Dimas Assets, Silver Wheaton will receive the first 6.0 million troy ounces of the yearly silver production. The yearly silver production in excess of 6.0 million troy ounces will be shared 50/50 between Silver Wheaton and Mala Noche. Other terms of Silver Wheaton purchase agreement will remain the same (ie. Mala Noche will be bound by the same terms and conditions to which Goldcorp is currently bound). |

Although Luismin has successfully used a hedging policy in the past for its sale prices, virtually all hedge positions were fulfilled by late 2002 and there are no hedges in place at the time of this report.

WGM believes that the Inferred Mineral Resources are an important part of the overall planning for this project because:

Production from the San Dimas deposits has been sustained for more than 200 years;

Luismin has been successfully conducting mine operations at San Dimas for more than 30 years;

Capital investment of approximately US$15.3 million is currently planned by Mala Noche in the first year. Over the next five years major capital expense will amount to US$7.3 million while sustaining capital amounts to US$12.4 million, exploration totals US$28.6 million and underground development totals US$29.1 million. Thus, over the next five years total capital expense is projected to average US$15.5 million per year;

A study in the main production area at San Dimas covering the period from 1979 to 1988 showed that Luismin was able to achieve a conversion rate of about 90% of the Inferred Mineral Resources into Mineral Reserves;

- 9 -

WGM believes that Luismin has successfully demonstrated that there is a high probability that Inferred Mineral Resources will be converted to Mineral Reserves;

Luismin operating practice has been to convert Mineral Resources into Mineral Reserves after drifting in the mineralization and completion of sampling and mining of the headings;

Due to the combination of ever expanding production requirements, better access to capital, the well understood geology and economic zone of the mineralization, and the historical success of the operations, Mala Noche will be better positioned to support mine development and Mineral Reserve definition with a normal level of diamond drilling prior to mining. This should provide for a higher level of Mineral Reserve definition prior to mining; and,

Mala Noche is targeting for the next five years, a production averaging approximately 686,000 tonnes of ore per year. The economics of the San Dimas Operations are extremely robust. For instance, assuming a spot silver price of $15.00/oz, the operations requires a gold price of US$204/oz to break even. Because Silver Wheaton purchases the first 3.5 million ounces of silver plus 50% of the production in excess of 3.5 million ounces in the first four years and the first 6 million ounces plus 50% of the production in excess of 6 million ounces thereafter at a price of approximately US$4.00/oz, the gold sold at $900/oz is sufficient to sustain a profitable operation. Lowering the spot metal prices by the same factor produces a breakeven net cash flow at a gold price of $340/oz and a silver price of $5.66/oz.

Luismin has estimated Proven and Probable Reserves as of December 31, 2009. WGM's audit of the reserves of the Luismin mines incorporated the following steps:

A review of all the steps in the estimation process to confirm that the procedures are appropriate for each of the deposits;

An analysis of the system used to classify the reserves to determine whether it meets current international standards of practice in the mining industry (NI 43-101);

A review of any changes in the estimation process since December 31, 2003;

A review of the reconciliation between predicted reserves and actual results of mining over the period 1975 through December 31, 2009; and,

An analysis of operating results for 2009 to confirm that the reserves are in fact being mined and processed at a profit.

- 10 -

WGM has concluded that:

Total Proven and Probable Mineral Reserves estimated as of December 31, 2009, for Luismin's seven mining units of the three operating mines (Tayoltita, Santa Rita, San Antonio/Block Central) are 5.589 million tonnes at a grade of 339 g Ag/t and 4.80 g Au/t;

The procedures used by Luismin to estimate the Mineral Reserves are reasonable and the reserves fairly represent the tonnage and grade that can be expected from an operation;

The total Inferred Mineral Resources, estimated as of December 31, 2009, for the same seven mining units, and not included in the Mineral Reserves stated above, are about 15.166 million tonnes at an approximate grade of 317 g Ag/t and 3.31 g Au/t;

Based on drilling and drifting in the first trimester of 2010, there are additional Inferred Mineral Resources of 6.8 million tonnes, with an estimated 1.1 million oz Au and 82.1 million oz Ag in the Sinaloa Graben area of the mine;

The procedures used by Luismin to estimate the Inferred Mineral Resources are reasonable and there is a reasonable expectation the Inferred Resource will be converted to Reserves;

The experience and capabilities of the Luismin management team are regarded as excellent and important elements in the success of current and future operations;

The potential for exploration, both on active mining properties as well as on exploration holdings, to expand the reserve base to both support and expand operations is excellent;

Future operations will incur additional capital and operating costs for management of tailings sites;

Opportunities for future reductions in operating costs will be possible with capital investment in mining and processing equipment as well as changes to operating practices; and,

The past history of the Luismin operations showed growth in small increments where capital expenditures were justified on short term planning and assessments. This resulted in "add on" style expansions and a variety of equipment sizes and types that reduced some efficiencies in operations and maintenance. The renewed support of capital and longer term planning should lead to better return on investments.

- 11 -

2. INTRODUCTION AND TERMS OF REFERENCE

At the request of Mala Noche Resources Corp. ("Mala Noche"), Silver Wheaton Corp. ("Silver Wheaton"), and Goldcorp Inc. ("Goldcorp"), Watts, Griffis and McOuat Limited ("WGM") revisited the three operating gold and silver mines in Mexico of the Mexican corporation Luismin S.A. de C.V. ("Luismin"). Desarollos Mineros San Luis S.A. ("DMSL"), a subsidiary of Luismin, which is a subsidiary of Goldcorp has recently entered into an Agreement with Mala Noche Resources Corp. for the sale of their mining operations at San Dimas, Durango, Mexico. The sale would include the mines and mill at San Dimas and all attached facilities and equipment including the Twin Otter and helicopter aircrafts that are used in support of the San Dimas operations; the newly finished Las Truchas hydroelectric generation project, the nearby, small, former underground Ventanas Project (which is the subject of a separate technical report); and the rights to the name "Lui smin". Together these assets are referred to as the "San Dimas Assets".

Under the Agreement, Mala Noche's Mexican subsidiary Mala Noche Resources S.A. de C.V. will acquire the San Dimas Assets and all of the employees employed exclusively in connection with the San Dimas Assets. Mala Noche Resources Corp. and Mala Noche Resources S.A. de C.V. together or individually are referred to as “Mala Noche”.

In consideration for the sale of San Dimas Assets to Mala Noche SAC, Mala Noche will pay to Goldcorp and to DMSL, the sum of US$500 million and will assume all liabilities (contingent or otherwise) including but not limited to the liability with respect to environment and labour matters, arising from, or related to, all past, present and future operations of the San Dimas Assets.

Watts, Griffis and McOuat Limited was retained on April 14, 2010, as authorized by Mr. David Blaiklock, CFO of Mala Noche, and Samuel Mah, Director of Engineering of Silver Wheaton to complete a review of the San Dimas mining operation and to document the results in an independent technical report. The report has been prepared in compliance with the Canadian National Instrument 43-101 ("NI 43-101") standards and guidelines.

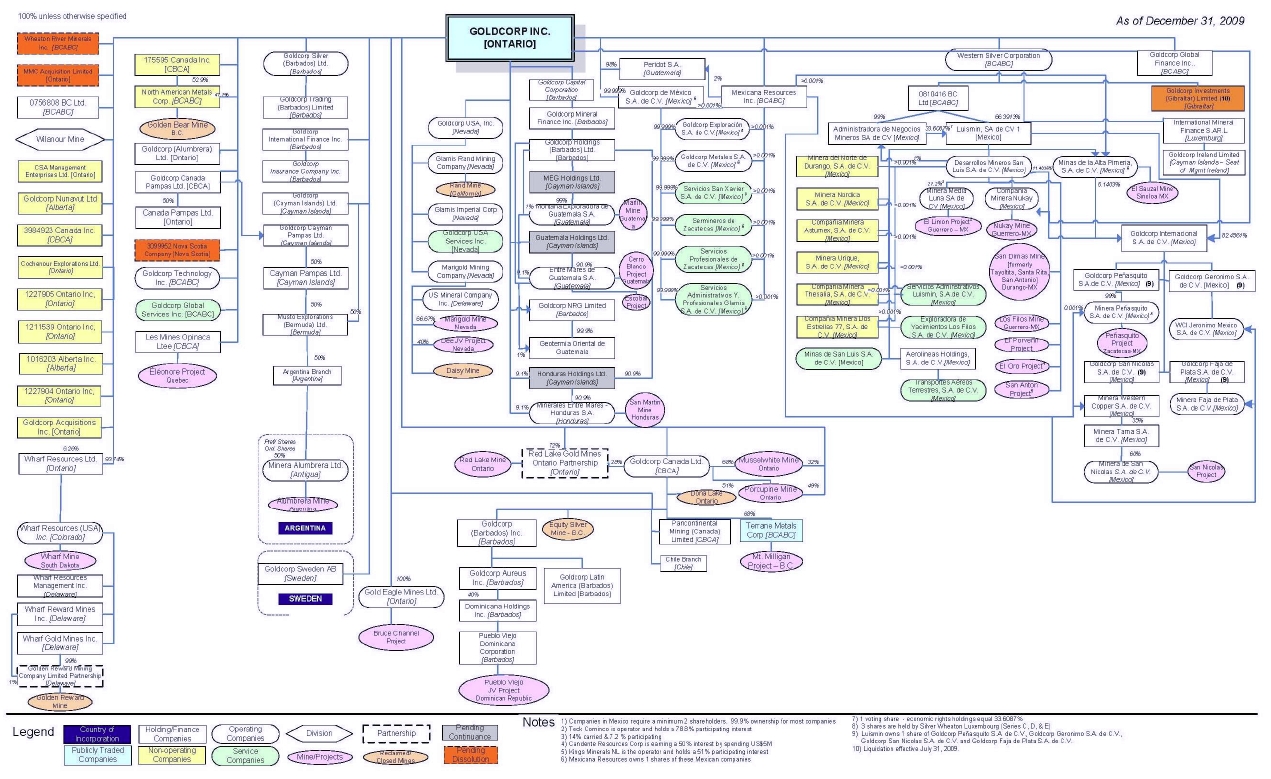

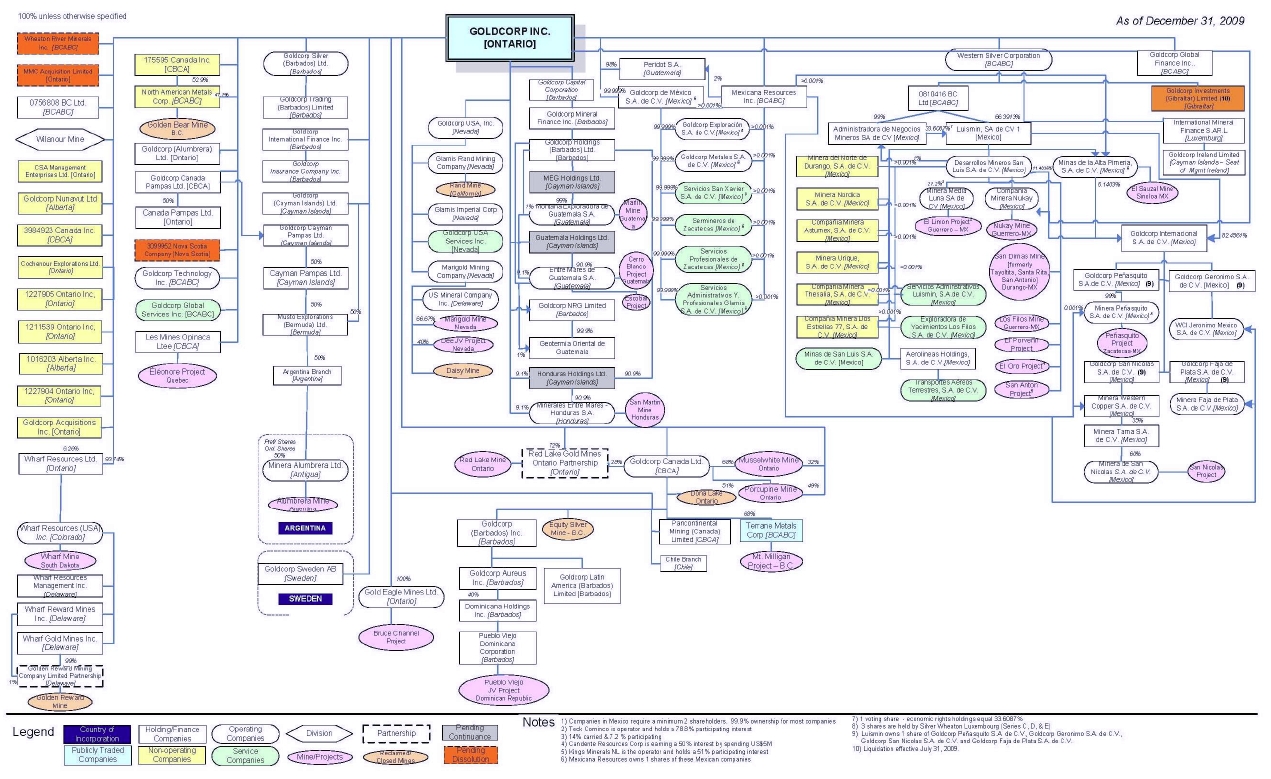

The three mining properties are each operated by wholly owned subsidiaries of Luismin and include: the Tayoltita, Santa Rita and San Antonio mines in the San Dimas district, on the border of Durango and Sinaloa states. The Goldcorp Inc. organization chart (Figure 1) illustrates the various wholly owned Luismin companies, which control the mining operations and exploration properties in Mexico. The three mines cover an area of approximately 22,721.57 ha in exploration and exploitation concessions. This extensive land ownership covers the mines as well as the most prospective surrounding areas, which forms an important asset for Luismin's future exploration programs.

- 12 -

All mines are underground operations using primarily mechanized cut-and-fill mining methods. After milling, cyanidation, precipitation and smelting, doré bars are poured and then transported for refining to Johnson Matthey in Salt Lake City, Utah. The locations of the mines are shown on Figure 2. WGM did not independently review the lease and land status information on the mines and the information as reported herein, was provided by Luismin.

Luismin also holds numerous exploration projects throughout Mexico, most of which are at the grassroots stage of development and some are being explored under option agreements.

Gold and silver production from Luismin’s three San Dimas mines: during 2006 was 162,669 oz gold and 8,695,955 oz silver, during 2007 was 132,898 oz gold and 6,911,482 oz silver, in 2008 was 86,682 oz gold and 5,113,466 oz silver, and in the past year (2009) was 113,018 oz gold and 5,093,385 oz silver.

WGM was retained on April 14, 2010 by Silver Wheaton to conduct an independent technical review and to prepare a report in compliance with National Instrument 43-101 following Form 43-101F1, on three operating silver-gold mines (Tayoltita, Santa Rita, San Antonio) in Mexico.

WGM has previously in 2002 been retained by Wheaton River Minerals Ltd. to conduct an independent technical review and to prepare a technical report in compliance with NI 43-101 on the same three mines and also in 2003 WGM was again retained by Wheaton to conduct an independent audit on the three mines as of: December 31, 2002; December 31, 2004; December 31, 2006; December 31, 2007; December 31, 2008; and December 31, 2009. WGM is very familiar with the operations at the three mines.

WGM understands that the purpose of this NI 43-101 report is for filing requirements by Silver Wheaton on the US Securities and Exchange Commission ("SEC") and on SEDAR in Canada.

- 13 -

Figure 1. Luismin Organization Chart

- 14 -

Figure 2. Location map, Luismin's operating mines, Mexico

- 15 -

Velasquez Spring, WGM's Senior Geologist revisited the three mining operations during January 12 and 13, 2010, and Gordon Watts, WGM's Senior Associate Mineral Economist, during April 15-16, 2010. Subsequent to the visits several telephone calls and discussions were held with Luismin engineers and geologists at each of the operating mines, as well as with senior personnel at Luismin’s head offices, regarding the mining/milling operations, exploration, and Mineral Resource/Reserve estimation procedures. During the site visit by G. Watts, a detailed review was made of the plans and capital budgets that were prepared by Mala Noche for the proposed underground expansions at each of the three Luismin mines. WGM checked the information provided during the visits to the mines and reviewed it for adequacy and completeness.

The geological and engineering work done by Luismin is of high quality and follows accepted engineering practices. The record keeping with regard to Mineral Resource/Mineral Reserve estimates, i.e. plans, sections and calculation sheets, is very good. From 1994 to 2000, Luismin retained the consulting firm of Pincock, Allen and Holt to conduct an independent audit on the Mineral Resource/Mineral Reserve estimates every two years.

The opinions and conclusions presented in this report are based on information received from Luismin. Specific references are included at the end of this report. WGM received the full cooperation and assistance of Luismin during the site visit and in preparation of this report.

This technical report is copyright protected. The copyright is vested in WGM and this report, or any part thereof, may not be reproduced in any form, or by any means whatsoever, without prior written permission of Watts, Griffis and McOuat Limited. Furthermore, WGM permits the report to be used as a basis for project financing and for filing on SEDAR. Part or all of the report may be reproduced by Silver Wheaton in any subsequent reports, with the prior written consent of WGM.

Throughout this report common measurements are in metric units. Tonnages are shown as tonnes (1,000 kg), linear measurements as metres ("m"), or kilometres ("km"), areas as hectares ("ha") and precious metal values as grams ("g"), grams of gold per tonne ("g Au/t"), and grams of silver per tonne ("g Ag/t"), and troy ounces ("oz"). Cubic metres per second ("cu m/s") is used for ventilation air flow. Tonnes per day ("tpd") for mine and mill daily production. Grams are converted to troy ounces based upon 31.103 grams per troy ounce.

All economic data is quoted in US dollars ("US$"). When peso amounts required conversion into US dollars, the peso exchange rate used was 12.50 pesos equivalent to US$1.00.

- 16 -

The classification of Mineral Resources and Mineral Reserves used in this report conforms with the definitions provided in the final version of National Instrument 43-101, which came into effect on February 1, 2001. We further confirm that, in arriving at our classification, we have followed the guidelines adopted by the Council of the Canadian Institute of Mining Metallurgy and Petroleum (the "CIM") standards. The relevant definitions for the CIM Standards/NI 43-101 are as follows:

AMineral Resourceis a concentration or occurrence of natural, solid, inorganic or fossilized organic material in or on the Earth's crust in such form and quantity and of such a grade or quality that it has reasonable prospects for economic extraction. The location, quantity, grade, geological characteristics and continuity of a Mineral Resource are known, estimated or interpreted from specific geological evidence and knowledge.

AnInferred Mineral Resourceis that part of a Mineral Resource for which quantity and grade or quality can be estimated on the basis of geological evidence and limited sampling and reasonably assumed, but not verified, geological and grade continuity. The estimate is based on limited information and sampling gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes.

AnIndicated Mineral Resourceis that part of a Mineral Resource for which quantity, grade or quality, densities, shape and physical characteristics, can be estimated with a level of confidence sufficient to allow the appropriate application of technical and economic parameters, to support mine planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes that are spaced closely enough for geological and grade continuity to be reasonably assumed.

AMeasured Mineral Resourceis that part of a Mineral Resource for which quantity, grade or quality, densities, shape, physical characteristics are so well established that they can be estimated with confidence sufficient to allow the appropriate application of technical and economic parameters, to support production planning and evaluation of the economic viability of the deposit. The estimate is based on detailed and reliable exploration, sampling and testing information gathered through appropriate techniques from locations such as outcrops, trenches, pits, workings and drillholes that are spaced closely enough to confirm both geological and grade continuity.

AMineral Reserveis the economically mineable part of a Measured or Indicated Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified. A Mineral Reserve includes diluting materials and allowances for losses that may occur when the material is mined.

- 17 -

AProbable Mineral Reserveis the economically mineable part of an Indicated, and in some circumstances a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at the time of reporting, that economic extraction can be justified.

AProven Mineral Reserveis the economically mineable part of a Measured Mineral Resource demonstrated by at least a Preliminary Feasibility Study. This Study must include adequate information on mining, processing, metallurgical, economic, and other relevant factors that demonstrate, at time of reporting, that economic extraction is justified.

The terminology used by Luismin to designate Measured and Indicated Mineral Resources and Proven and Probable Mineral Reserves is in general agreement with the CIM Standards as adopted in NI 43-101. Luismin’s Mineral Resource categories "potential resource" and "drill inferred resource" would, under the CIM Standards, be called Inferred Resources. We have used the term Inferred Mineral Resources for this material throughout the rest of this report.

| | |

| 2.5 | LUISMIN APPROACH TO MINERAL RESERVE ESTIMATION | |

Rather than calculating Mineral Resources/Mineral Reserves over a minimum mining width and then applying corrections for dilution and mine losses to determine Mineral Reserves, Luismin estimates the reserve in each of the underground mining blocks by using the conventional mining block estimation methods for underground mines and later applying a tonnage and grade correction to determine Mineral Reserves. The minimum mining width is 0.9 m. However, on occasion, where very high grade values are encountered over intervals less than 0.9 m, the minimum mining width is calculated to 0.9 m, using zero grade gold and silver values for the additional width required to meet 0.9 m.

Luismin’s success with predicting the tonnage and grade of the reserves over the period 1978-2009 for all operations is shown on Table 1. The table clearly shows that, although there are variances from year to year, the overall totals compare well.

- 18 -

| | | | | | | | | |

| TABLE 1. |

| RECONCILIATION BETWEEN RESERVES PREDICTED GRADE |

| AND PRODUCTION LUISMIN OPERATIONS (1978-2009) |

| YEAR | TONNES | SILVER GRADE | GOLD GRADE |

| | | | Variance | g Ag/t | Variance | g Au/t | Variance |

| | Predicted | Actual | % | Predicted | Actual | % | Predicted | Actual | % |

| 1978 | 156,000 | 159,628 | 2.30 | 400 | 404 | 1.00 | 7.00 | 7.10 | 1.40 |

| 1979 | 156,000 | 161,428 | 3.50 | 400 | 395 | -1.30 | 7.00 | 6.50 | -7.10 |

| 1980 | 162,000 | 162,290 | 0.2 | 390 | 381 | -2.3 | 6.40 | 6.40 | 0 |

| 1981 | 162,000 | 155,837 | -3.8 | 390 | 468 | 20 | 6.40 | 7.80 | 21.9 |

| 1982 | 162,000 | 158,163 | -2.4 | 390 | 483 | 23.8 | 6.40 | 7.70 | 20.3 |

| 1983 | 195,000 | 176,643 | -9.4 | 383 | 422 | 10.2 | 6.50 | 6.90 | 6.2 |

| 1984 | 216,000 | 200,256 | -7.3 | 396 | 424 | 7.1 | 6.30 | 6.60 | 4.8 |

| 1985 | 202,800 | 197,864 | -2.4 | 422 | 433 | 2.6 | 5.30 | 6.30 | 18.9 |

| 1986 | 236,300 | 222,295 | -5.9 | 396 | 423 | 6.8 | 5.77 | 6.20 | 8.8 |

| 1987 | 224,055 | 200,323 | -10.6 | 348 | 310 | -10.9 | 3.90 | 3.93 | -6.7 |

| 1988 | 222,520 | 256,756 | 1.9 | 346 | 319 | -7.8 | 3.67 | 4.38 | -10.3 |

| 1989 | 224,475 | 254,142 | -0.1 | 312 | 262 | -16 | 3.33 | 3.95 | -8.6 |

| 1990 | 229,607 | 214,025 | -6.8 | 287 | 248 | -13.6 | 2.50 | 3.58 | -2.9 |

| 1991 | 149,760 | 158,120 | 5.6 | 335 | 275 | -17.9 | 2.90 | 3.33 | -16.5 |

| 1992 | 234,685 | 237,580 | 1.2 | 341 | 311 | -8.8 | 2.26 | 3.49 | 5.8 |

| 1993 | 293,885 | 297,581 | 1.3 | 285 | 303 | 6.3 | 2.90 | 3.32 | -6.5 |

| 1994 | 300,150 | 300,711 | 0.2 | 307 | 286 | -6.8 | 2.30 | 2.95 | -10.5 |

| 1995 | 303,891 | 323,803 | 6.6 | 315 | 301 | -4.4 | 2.00 | 3.06 | -5.9 |

| 1996 | 334,225 | 339,704 | 1.6 | 311 | 312 | 0.3 | 1.90 | 3.30 | 4.1 |

| 1997 | 366,206 | 368,069 | 0.5 | 306 | 299 | -2.3 | 2.20 | 3.32 | -0.2 |

| 1998 | 388,163 | 401,743 | 3.5 | 274 | 264 | -3.6 | 1.85 | 3.06 | -5.1 |

| 1999 | 414,400 | 428,386 | 3.4 | 294 | 278 | -5.4 | 2.37 | 3.05 | 2.7 |

| 2000 | 432,690 | 439,590 | 1.6 | 288 | 274 | -4.9 | 2.50 | 3.12 | 1.4 |

| 2001 | 440,720 | 385,660 | -12.5 | 273 | 299 | 9.7 | 2.33 | 3.55 | 18.9 |

| 2002 | 330,225 | 313,145 | -5.2 | 350 | 363 | 3.1 | 3.94 | 3.80 | 9.5 |

| 2003 | 513,296 | 423,673 | -17.46 | 353 | 428 | 21.10 | 3.60 | 5.20 | 44.44 |

| 2004 | 530,913 | 397,647 | -25.10 | 385 | 525 | 36.47 | 4.32 | 6.90 | 59.72 |

| 2005 | 662,264 | 507,529 | -23.36 | 371 | 497 | 34.19 | 4.27 | 7.40 | 73.30 |

| 2006 | 709,800 | 688,942 | -2.94 | 450 | 438 | -2.62 | 6.00 | 7.76 | 29.35 |

| 2007 | 724,500 | 685,162 | -5.43 | 405 | 341 | -15.93 | 6.95 | 6.27 | -9.76 |

| 2008 | 720,353 | 657,479 | -8.73 | 335 | 259 | -22.63 | 6.30 | 4.25 | -32.54 |

| 2009 | 605,000 | 673,311 | 11.29 | 300 | 247 | -17.53 | 5.21 | 5.35 | 2.58 |

- 19 -

3. RELIANCE ON OTHER EXPERTS

WGM did not independently review the lease and land status information on the San Dimas Project and the information as reported herein, was provided by Luismin.

WGM prepared this study using the resource materials, reports and documents as noted in the text and "References" at the end of this report. WGM conducted an audit of the methods, parameters and documentation used and prepared by Luismin in the preparation of its Mineral Resource/Reserve estimates for the zones comprising the San Dimas Project.

WGM did not prepare independent Mineral Resource/Reserve estimates for the San Dimas Project, however, is satisfied that those persons who prepared the estimates were qualified to do so and that the estimates are reliable. WGM accepts the estimates as supplied by Luismin.

WGM has not verified title to the property, but has relied on information supplied by Luismin in this regard. WGM has no reason to doubt that the title situation is other than that which was reported to it by Luismin.

WGM did not carry out a formal due diligence review of environmental considerations as SRK Consulting ("SRK"), at the request of Wheaton, had conducted a due diligence environmental review of Luismin’s mining properties in January 2002. The SRK review was to identify if any serious liabilities exist that would materially affect the economic performance of the operations over the next 10 years. The report is titled "Environmental Due Diligence Review of Active Mining Units Owned and Operated by Minas Luismin, S.A. de C.V., February 20, 2002" and has been reviewed by WGM as part of the technical review of the Luismin operations.

The San Dimas mines are independently monitored annually by the Mexican authorities for its compliance to air pollution and water quality regulations.

- 20 -

4. PROPERTY DESCRIPTION AND LOCATION

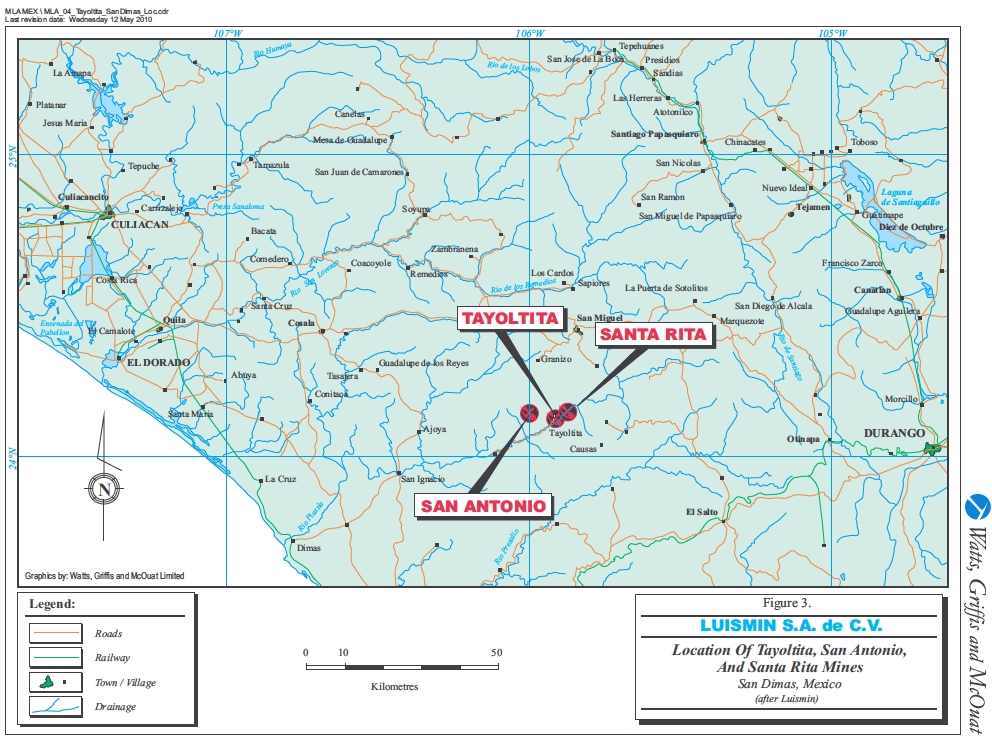

The San Dimas mining district is centered on latitude 24°06'N and longitude 105°56'W located about 125 km NE from Mazatlan, Sinaloa or approximately 150 km west of the city of Durango (Figure 3).

Luismin’s three operating mines in the San Dimas district, on the border of Durango and Sinaloa states include San Antonio, Tayoltita and Santa Rita.

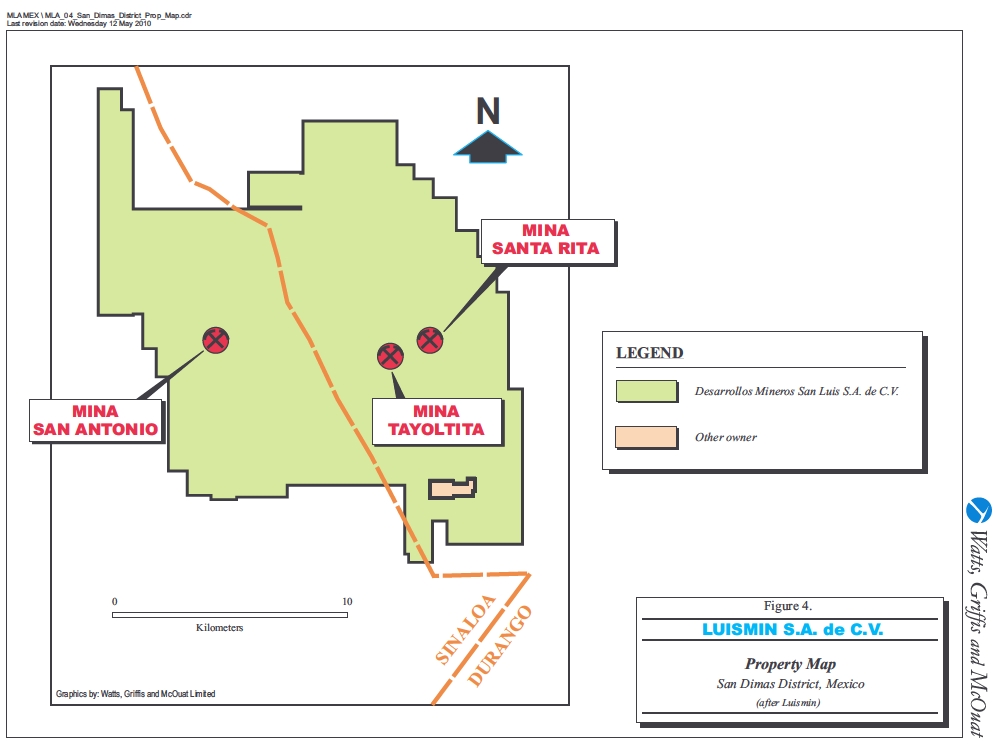

The San Dimas properties (mineral concessions) are surveyed and contained in a contiguous block and held in the name of Desarollos Mineros San Luis S.A. de C.V. and cover an area of 22,721.57 ha (Figure 4). Table 2 lists the various concessions.

- 21 -

Figure 3. Location of Tayoltita, San Antonio and Santa Rita mines

- 22 -

Figure 4. Property map, San Dimas district

- 23 -

| | | | | | | | |

| TABLE 2. |

| GOLDCORP MEXICO MINERAL CONCESSIONS IN THE SAN DIMAS MINING DISTRICT (at January 1, 2010) |

| No. | Lote | Title | Valid | Area | Mineral Tax – 2009 (Mexican peso) |

| | | | From | To | (Ha) | January | July | Total |

| 1 | San Manuel | 151174 | 24/03/1969 | 23/03/2019 | 103.8914 | 11,560 | 11,907 | 23,467 |

| 2 | Chela | 153116 | 14/07/1970 | 13/07/2020 | 253.7101 | 28,230 | 29,077 | 57,308 |

| 3 | Resurgimiento | 165046 | 23/08/1979 | 22/08/2029 | 93.0000 | 10,348 | 10,659 | 21,007 |

| 4 | Yolanda | 165489 | 30/10/1979 | 29/10/2029 | 10.0000 | 1,113 | 1,146 | 2,259 |

| 5 | San Luis I | 165682 | 28/11/1979 | 27/11/2029 | 391.0764 | 43,515 | 44,821 | 88,336 |

| 6 | San Luis 2 | 165683 | 28/11/1979 | 27/11/2029 | 474.4932 | 52,797 | 54,381 | 107,178 |

| 7 | San Luis 3 | 165981 | 04/02/1980 | 03/02/2030 | 307.1817 | 34,180 | 35,206 | 69,386 |

| 8 | El Reliz | 166004 | 20/02/1980 | 19/02/2030 | 8.0000 | 890 | 917 | 1,807 |

| 9 | Carrizo | 166615 | 27/06/1980 | 26/06/2030 | 2.0000 | 223 | 229 | 452 |

| 10 | San Daniel | 172411 | 15/12/1983 | 14/12/2033 | 322.0000 | 35,829 | 36,904 | 72,733 |

| 11 | Castellana Uno | 176291 | 26/08/1985 | 25/08/2035 | 107.7325 | 11,987 | 12,347 | 24,334 |

| 12 | Libia Estela | 177195 | 04/03/1986 | 03/03/2036 | 150.8840 | 16,789 | 17,293 | 34,081 |

| 13 | Promontorio | 177826 | 26/04/1986 | 25/04/2036 | 2.0000 | 223 | 229 | 452 |

| 14 | San Miguel | 178938 | 28/10/1986 | 27/10/2036 | 66.0000 | 7,344 | 7,564 | 14,908 |

| 15 | San Vicente Frac. Suroeste | 179299 | 08/12/1986 | 07/12/2036 | 300.0000 | 33,381 | 34,382 | 67,763 |

| 16 | Ampl. El Reliz | 179954 | 23/03/1987 | 22/03/2037 | 96.2687 | 10,712 | 11,033 | 21,745 |

| 17 | La Castellana | 180164 | 24/03/1987 | 23/03/2037 | 89.8893 | 10,002 | 10,302 | 20,304 |

| 18 | Hueco 2 | 180165 | 24/03/1987 | 23/03/2037 | 0.0917 | 10 | 11 | 21 |

| 19 | Juan Manuel | 180260 | 24/03/1987 | 23/03/2037 | 16.1399 | 1,796 | 1,850 | 3,646 |

| 20 | A. Noche Buena en Frapop. | 180679 | 14/07/1987 | 13/07/2037 | 233.5686 | 25,989 | 26,769 | 52,758 |

| 21 | San Vicente Frac. Norte | 180933 | 14/08/1987 | 13/08/2037 | 430.0000 | 47,846 | 49,281 | 97,128 |

| 22 | Noche Buena en Frapopan | 182516 | 15/07/1988 | 14/07/2038 | 400.0000 | 44,508 | 45,843 | 90,351 |

| 23 | Am. Nvo. Contaestaca F.B. | 183980 | 25/11/1988 | 24/11/2038 | 405.7190 | 45,144 | 46,499 | 91,643 |

| 24 | Guarisamey III | 184239 | 15/02/1989 | 14/02/2039 | 115.1343 | 12,811 | 13,195 | 26,006 |

| 25 | Am. Nvo. Contaestaca F.A. | 184991 | 13/12/1989 | 12/12/2039 | 318.8020 | 35,473 | 36,537 | 72,010 |

| 26 | El Favorable | 185109 | 14/12/1989 | 13/12/2039 | 451.9589 | 50,289 | 51,798 | 102,088 |

| 27 | Hueco 1 | 185138 | 14/12/1989 | 13/12/2039 | 0.3607 | 40 | 41 | 81 |

| 28 | Nvo. Contaestaca F.W. | 185479 | 14/12/1989 | 13/12/2039 | 324.0000 | 36,051 | 37,133 | 73,185 |

| 29 | Armida Sur | 185763 | 14/12/1989 | 13/12/2039 | 5.5441 | 617 | 635 | 1,252 |

| 30 | La Fe | 185842 | 14/12/1989 | 13/12/2039 | 38.9091 | 4,329 | 4,459 | 8,789 |

| 31 | Juan Manuel Dos | 185853 | 14/12/1989 | 13/12/2039 | 3.7207 | 414 | 426 | 840 |

| 32 | Guarisamey Frac. B | 185891 | 14/12/1989 | 13/12/2039 | 330.4353 | 36,768 | 37,871 | 74,638 |

| 33 | Guarisamey Frac. A | 185892 | 14/12/1989 | 13/12/2039 | 377.4990 | 42,004 | 43,264 | 85,269 |

| 34 | Armida Sur Frac. II | 186277 | 22/03/1990 | 21/03/2040 | 2.9381 | 327 | 337 | 664 |

| 35 | Am. Nvo. Contaestaca F.C. | 186378 | 29/03/1990 | 28/03/2040 | 474.4759 | 52,795 | 54,379 | 107,174 |

| 36 | San Miguel I | 186901 | 17/05/1990 | 16/05/2040 | 172.0582 | 19,145 | 19,719 | 38,864 |

| 37 | San Miguel 2 | 186902 | 17/05/1990 | 16/05/2040 | 452.0000 | 50,294 | 51,803 | 102,097 |

| 38 | Hueco Guarisamey | 186949 | 17/05/1990 | 16/05/2040 | 6.1651 | 686 | 707 | 1,393 |

| 39 | Armida Sur Frac. I | 189878 | 06/12/1990 | 05/12/2040 | 0.7607 | 85 | 87 | 172 |

| 40 | Hueco Tayoltita | 191055 | 29/04/1991 | 28/04/2041 | 27.8795 | 3,102 | 3,195 | 6,297 |

| 41 | La Soledad | 191661 | 19/12/1991 | 18/12/2041 | 20.5031 | 2,281 | 2,350 | 4,631 |

| 42 | Juan Manuel Tres | 194784 | 15/06/1992 | 14/06/2042 | 334.5201 | 37,222 | 38,339 | 75,561 |

| 43 | Guarisamey II | 195198 | 25/08/1992 | 24/08/2042 | 89.4634 | 9,955 | 10,253 | 20,208 |

| 44 | Armida | 195215 | 25/08/1992 | 24/08/2042 | 98.2417 | 10,931 | 11,259 | 22,191 |

| 45 | Nuevo Contraestaca F. Este | 196309 | 16/07/1993 | 15/07/2043 | 376.0000 | 41,838 | 43,093 | 84,930 |

| 46 | Guarisamey IV Frac. A | 196363 | 16/07/1993 | 15/07/2043 | 319.6344 | 35,566 | 36,633 | 72,198 |

| 47 | Tayoltita Norte | 196367 | 16/07/1993 | 15/07/2043 | 2,650.2912 | 294,898 | 303,745 | 598,643 |

| 48 | Amp. Silver Wheaton Contraestaca | 198339 | 19/11/1993 | 18/11/2043 | 662.8185 | 73,752 | 75,964 | 149,716 |

| 49 | Alicia II | 198408 | 26/11/1993 | 25/11/2043 | 204.4142 | 22,745 | 23,428 | 46,173 |

| 50 | Tayoltita | 198571 | 30/11/1993 | 29/11/2043 | 2,319.5200 | 258,093 | 265,836 | 523,929 |

| 51 | Tayoltita Oeste | 201555 | 11/10/1995 | 10/10/2045 | 1,395.0000 | 155,222 | 159,878 | 315,100 |

| 52 | Guarisamey V Frac. 1 | 203798 | 30/09/1996 | 29/09/2046 | 333.0000 | 37,053 | 38,164 | 75,217 |

| 53 | Guarisamey V Frac. NE | 203799 | 30/09/1996 | 29/09/2046 | 253.4236 | 28,198 | 29,044 | 57,243 |

| 54 | Guarisamey Sur | 208834 | 15/12/1998 | 14/12/2048 | 3,025.8239 | 336,683 | 346,784 | 683,467 |

| 55 | Guarisamey Norte | 209396 | 09/04/1999 | 08/04/2049 | 489.7110 | 54,490 | 56,125 | 110,615 |

| 56 | Contraestaca Norte | 209592 | 03/08/1999 | 02/08/2049 | 237.0914 | 14,989 | 15,439 | 30,428 |

| 57 | Guarisamey IV Frac. B | 209606 | 03/08/1999 | 02/08/2049 | 320.7168 | 20,276 | 20,884 | 41,160 |

| 58 | San Luis Norte 1 | 215251 | 14/02/2002 | 13/02/2052 | 174.8316 | 5,528 | 5,694 | 11,222 |

| 59 | San Luis Norte 2 | 215252 | 14/02/2002 | 13/02/2052 | 65.6208 | 2,075 | 2,137 | 4,212 |

| 60 | San Luis Norte 3 | 215253 | 14/02/2002 | 13/02/2052 | 838.8994 | 26,526 | 27,322 | 53,848 |

| 61 | Tayoltita Sur | 215615 | 12/12/1996 | 11/12/2046 | 783.7122 | 87,204 | 89,820 | 177,023 |

| 62 | San Miguel 3 | 223676 | 02/02/2005 | 01/02/2055 | 3.4720 | 55 | 56 | 111 |

| 63 | Guarisamey Suroeste | 223782 | 15/02/2005 | 14/02/2055 | 358.5774 | 5,637 | 5,806 | 11,443 |

| TOTAL | | | | | 22,721.5748 | 2,380,863 | 2,452,289 | 4,833,152 |

- 24 -

5. ACCESS, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE ANDPHYSIOGRAPHY

Access to the San Dimas area is by air or road from the city of Durango. By road the trip requires some 10 hours. A new highway (Highway 40) is under construction, connecting the city of Durango to the city of Mazatlan on the coast, which will significantly reduce the driving time to Dan Dimas. Luismin maintains a de Havilland Twin Otter aircraft and a helicopter; both are based at Tayoltita. An approximate one half hour flight in the Twin Otter is required from either Mazatlan or Durango to Tayoltita. Most of the personnel and light supplies for the San Dimas mines arrive on the company's regular flights from Mazatlan and Durango. Heavy equipment and supplies are brought in by road from Durango.

Originally access to the Dimas district was from the town of San Ignacio, Sinaloa along a 55 km long narrow mule trail, carved in the steep valley wall above the high water level of the Piaxtla River. A rough road, paralleling the mule trail, now follows the river bed to San Ignacio but the road is only accessible for about six months of the year during the Spring dry season. San Ignacio is connected by 70 km of paved roads to Mazatlan.

Regionally, the climate is variable from the coast to the high plateau.

The climate of the San Dimas area is semi-tropical, characterized by relatively high temperatures and humidity, with hot summers (maximum about 35°C) and mild winters. At higher elevations in the Sierra, frosty nights occur in the winter (November to March). The majority of the precipitation occurs in the summer (June through September) however tropical rainstorms during October to January can result in considerable additional rainfall. The total average annual rainfall varies from about 66 to 108 cm.

Weather does not affect the operations and mining is carried out throughout the year.

Sufficient pine, juniper and scattered oak trees grow on the higher ridges, to support a timber industry while the lower slopes, and valleys are covered with thick brush, cactus and grasses. Subsistence farming, ranching, mining and timber cutting are the predominant activities of the region’s population. Tayoltita is the most important population centre in the area with approximately 8,000 inhabitants including mining company personnel. Population outside the mining and sawmill camps is sparse.

- 25 -

Water for the mining operations is obtained from wells and from the Piaxtla River. Water is also supplied by Luismin to the town of Tayoltita from an underground thermal spring at the Santa Rita mine.

Mining at both the Santa Rita and San Antonio mines is done by contract mining while at Tayoltita the mining is carried out by Luismin personnel.

Electrical power is provided by a combination of Luismin's own system and the Federal Power Commission supply system. Luismin operates hydroelectric and back-up diesel generators which are interconnected with the Federal Power Commission supply system. Luismin's hydroelectrical power was increased with additional turbines in a tunnel from Trout Lake and is now completed. Except for a few months of the year, during the dry season, Luismin hydroelectric generation from its Trout Reservoir provides all the electric requirements of the San Dimas mines. It is planned in the future to increase the capacity of the Trout Reservoir by raising the height of the face of the dam to be able to meet all of the mine's electric requirements year round.

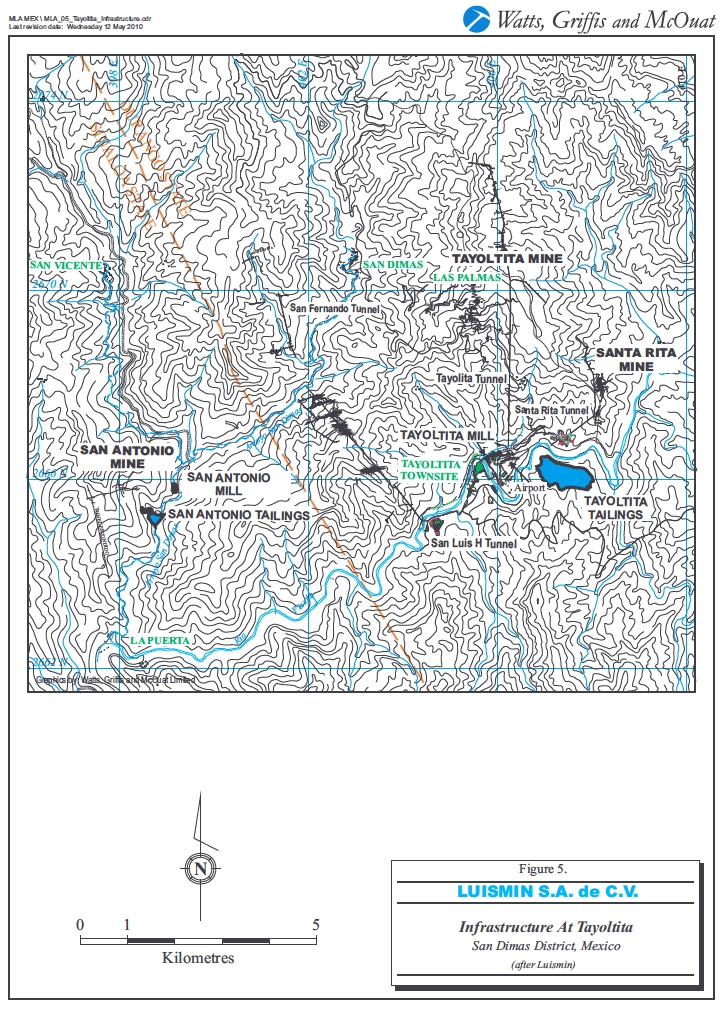

The infrastructure of the San Dimas district, roads, townsite, airport and mill tailings area for the operations of Tayoltita, San Antonio, and Santa Rita Mines is illustrated in Figure 5, around the town of Tayoltita.

The Santa Rita mine is located three kilometres upstream from Tayoltita. The ore from the Santa Rita mine is trucked along a winding road that follows the Rio Piaxtla to the Tayoltita mill.

The San Antonio mine is located 7 km west of the Tayoltita Mine in the State of Sinaloa. The mine is accessed, from Tayoltita, by road some 3 km paralleling the Piaxtla River opposite the town of Tayoltita to the portal of the San Luis Tunnel, through the tunnel and from the exit, by road, or along the San Antonio river bed to the San Antonio Mill, about an hour and a half drive in total.

- 26 -

Figure 5. Infrastructure at Tayoltita

- 27 -

Infrastructure at the San Antonio mine included a mill, small campsite, warehouse, analytical fire assay laboratory and maintenance shops, but the mine and mill are now shut-down.

The San Dimas district is located in the central part of the Sierra Madre Occidental, a mountain range characterized by very rugged topography with steep, often vertical walled valleys and narrow canyons. Elevations vary from 2,400 m above mean sea level ("amsl") on the high peaks to elevations of 400 m amsl in the valley floor of the Piaxtla River.

- 28 -

6. HISTORY

The San Dimas district has experienced a long mining history. Precious metal production was first reported in 1757 by a group of Spanish families living at Las Queleles (near the present town of Tayoltita). Government and religious authorities made several unsuccessful attempts to determine the location of the Queleles group of mines. By 1795, a town of 10,000 residents had been established upstream at Guarisamey where other gold and silver veins had been discovered. The Spanish continued working several of the mines until the start of the Mexican War of Independence (1810). Mining activity in the district then decreased and did not start up again until the 1880s when agents of William Randolph Hearst of San Francisco and American Colonel Daniel Burns arrived in the area. W.R. Hearst acquired the Tayoltita mine under the name of the San Luis Mining Company. In 1883, when Colonel Burns took control of the Candelaria mine, modern mining methods began. Later the Contraestaca (San Antonio) mine was discovered along with several large bonanza grade orebodies.

In 1904, the first cyanide mill in Mexico was built at Tayoltita. By 1940, the Candelaria Mine had been mined out and the properties of the Mexican Candelaria and Contraestaca mines were purchased by the San Luis Mining Company.

A mining law introduced in 1959 in Mexico required the majority of a Mexican mining company be held by Mexicans and forced the sale of 51% of the shares of the San Luis Mining Company to Mexicans. In 1961, the Minas de San Luis S.A. de C.V. was formed and assumed operations of the mine. In 1978, the remaining 49% interest was obtained by a group known as Luismin S.A. de C.V.

Historical production through 2009 from the San Dimas District is estimated at 582 million ounces of silver and 10.8 million ounces of gold, placing the district third in Mexico for precious metal production after Pachuca and Guanajuato. Production from the San Dimas District during 2009 was approximately 113,018 ounces of gold and 5.1 million ounces of silver respectively, while production in 2008 was approximately 86,700 ounces of gold and 5.1 million ounces of silver respectively.

- 29 -

| | | |

| TABLE 3. |

| LUISMIN MINE PRODUCTION |

| Area | Tonnes | Mill Head Grade |

| | | g Ag/t | g Au/t |

| Tayoltita | | | |

| 1996 | 259,807 | 275 | 1.3 |

| 1997 | 281,011 | 272 | 2.4 |

| 1998 | 294,979 | 242 | 2.3 |

| 1999 | 302,248 | 247 | 2.7 |

| 2000 | 279,164 | 254 | 2.8 |

| 2001 | 241,445 | 278 | 3.0 |

| 2002 | 178,334 | 262 | 3.5 |

| |

| Santa Rita | | | |

| 1996 | 79,898 | 432 | 2.6 |

| 1997 | 87,058 | 399 | 2.3 |

| 1998 | 106,764 | 341 | 2.3 |

| 1999 | 126,138 | 366 | 2.2 |

| 2000 | 160,428 | 308 | 2.1 |

| 2001 | 144,148 | 334 | 2.3 |

| 2002 | 134,810 | 493 | 4.2 |

| |

| San Antonio | | | |

| 1996 | 131,746 | 377 | 6.2 |

| 1997 | 148,302 | 356 | 5.3 |

| 1998 | 141,176 | 274 | 4.2 |

| 1999 | 136,025 | 267 | 3.8 |

| 2000 | 144,842 | 263 | 3.8 |

| 2001 | 146,470 | 319 | 5.1 |

| 2002 | 140,205 | 389 | 6.1 |

| |

| San Dimas District | | | |

| 2003 | 423,673 | 428 | 5.2 |

| 2004 | 397,646 | 665 | 7.2 |

| 2005 | 507,529 | 497 | 7.4 |

| 2006 | 668,942 | 438 | 7.8 |

| 2007 | 685,162 | 341 | 6.3 |

| 2008 | 619,554 | 259 | 4.3 |

| 2009 | 673,311 | 249 | 5.4 |

- 30 -

7. GEOLOGICAL SETTING

The general geological setting of the San Dimas District is illustrated in Figure 6. Two major volcanic successions totalling approximately 3,500 m in thickness have been described, the Lower Volcanic Group ("LVG") and the Upper Volcanic Group ("UVG") separated by an erosional and depositional unconformity.

The LVG is of Eocene age predominantly composed of andesites and rhyolitic flows and tuffs and has been locally divided into five units (Figure 7). The LVG outcrops along the canyons formed by major westward drainage systems and has been intruded by younger members of the batholith complex of granitic to granodioritic composition. The Socavón rhyolite is the oldest volcanic unit in the district, its lower contact destroyed by the intrusion of the Piaxtla granite.

More than 700 m thick, the Socavón rhyolite is host for several productive veins in the district. Overlying the Socavón rhyolite is the 20 to 75 m thick, well-bedded Buelna andesite that is remarkably present throughout the area. The Buelna andesite is overlain by the Portal rhyolite, a grey, cream to purple coloured rock containing potassic feldspar and quartz cementing small (5 to 10 mm) volcanic rock fragments. It ranges in thickness from 50 to 250 m and is also prevalent throughout the district.

The overlying Productive Andesite is more than 750 m in thickness and has been divided into two varieties based on grain size, but of identical mineralogy. One variety is fragmental (varying from a lapilli tuff to a coarse agglomerate), the other has a porphyritic texture (1 to 2 mm plagioclase phenocrysts).

The overlying Camichin unit, composed of purple to red interbedded rhyolitic and andesite tuffs and flows, is more than 300 m thick. It is the host rock of most of the productive ore shoots of Patricia, Patricia 2, Santa Rita and other lesser veins in the Santa Rita Mine.

The Las Palmas Formation, at the top of the LVG, consists of green conglomerates at the base and red arkoses and shales at the top, with a total thickness of approximately 300 m. This unit outcrops extensively in the Tayoltita area. The lower contact between the LVG and the underlying Productive Andesite is unconformable.

- 31 -

Figure 6. Geologic Map of the San Dimas District

- 32 -

Figure 7. Litho-stratigraphic column of the San Dimas District

- 33 -

The predominant plutonic events in the district resulted in intrusion of the LVG by granitic to granodioritic intrusives, part of the Sinaloa composite batholith.

Other intrusives cutting the LVG include the Intrusive Andesite, the Elena aplite and the Santa Rita dacitic dikes. The even younger Bolaños rhyolite dike, and the basic dykes intrude both the LVG and UVG. Intrusive activity in the western portion of the Sierra Madre Occidental has been dated continuously from 102 to 43 million years.

The UVG overlies the eroded surface of the LVG unconformably. In the San Dimas District, the UVG is divided into a subordinate lower unit composed mainly of lavas of intermediate composition called Guarisamey Andesite and an upper unit called the Capping Rhyolite. The Capping Rhyolite is mainly composed of rhyolitic ash flows and air-fall tuffs and is up to 1,500 m thick in the eastern part of the district however within most of the district is about 1,000 m thick.

The San Dimas district lies within an area of complex normal faulting along the western edge of the Sierra Madre Occidental. Compressive forces first formed predominantly east-west and east-northeast tension gashes, that were later cut by transgressive north-northwest striking slip faults. The strike-slip movements caused the development of secondary north-northeast faults, with right lateral displacement.

Five major north-northwest-trending normal faults divide the district into five tilted fault blocks generally dipping 35° to the east (Figures 8 and 9). In most cases, the faults are post ore in age and offset both the LVG and UVG.

All major faults display northeast-southwest extension and dip from near vertical (Peña fault) to less than 55° (Guamuchil fault). Offsets on the blocks range from a downthrow of 150 m on the Peña and Arana faults, to more than 1,500 m on the Guamuchil fault.

- 34 -

Figure 8. Structural map of the San Dimas District

- 35 -

Figure 9. Geologic sections across the San Dimas District

- 36 -

8. DEPOSIT TYPES

The deposits of the San Dimas district are high grade, silver-gold-epithermal vein deposits characterized by low sulphidation and adularia-sericitic alteration formed during the final stages of igneous and hydrothermal activity from quartz-monzonitic and andesitic intrusions.

As is common in epithermal deposits, the hydrothermal activity that produces the epithermal vein mineralization began a few million years after the intrusion of the closely associated plutonic rocks and several million years after the end of the volcanism that produced the rocks that host the hydrothermal systems. At San Dimas, based on age determinations, the average period between the end of late stage of plutonism and the hydrothermal activity is 2.1 million years, however hydrothermal activity continued for at least another 5.0 million years. Older veins appear more common in the eastern part of the district whereas younger veins are found in the western part.

- 37 -

9. MINERALIZATION

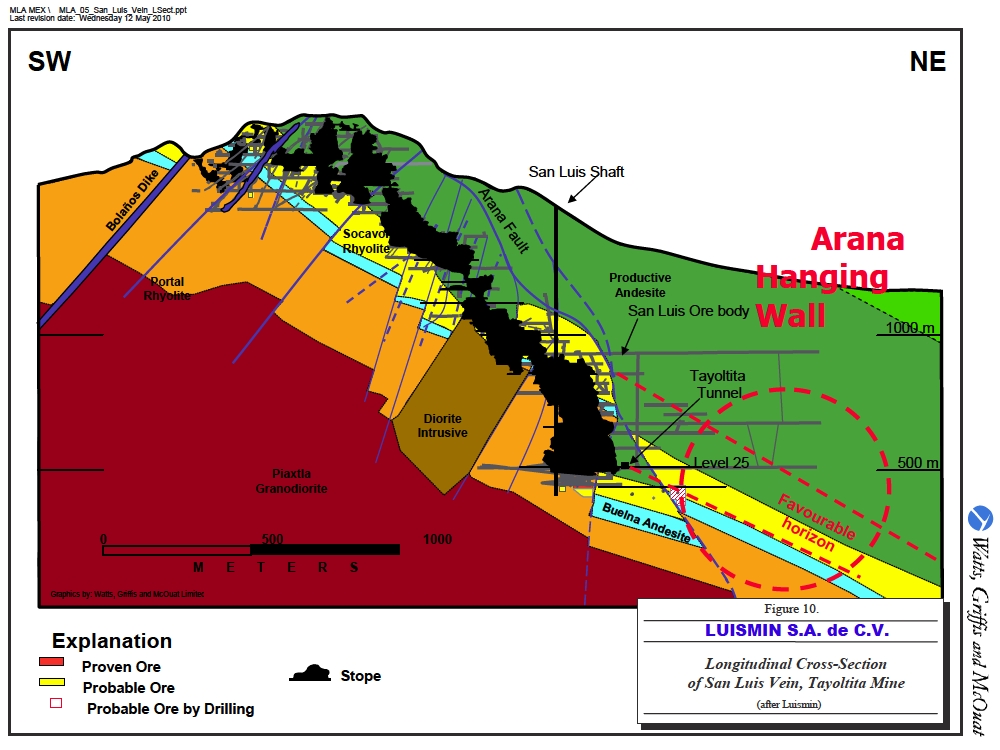

The mineralization is typical of epithermal vein structures with banded and drusy textures. Within the district, the veins occupy east-west trending fractures except in southern part of Tayoltita where they strike mainly northeast and in the Santa Rita mine where they strike north-northwest. The veins were formed in two different systems. The east-west striking veins were the first system developed, followed by a second system of north-northeast striking veins. Veins pinch and swell and commonly exhibit bifurcation, horse-tailing and cymoidal structures. The veins vary from a fraction of a centimetre in width to 15 m, but average 1.5 m. They have been followed underground from a few metres in strike-length to more than 1,500 m. Examples of veins with mineralization in the Favourable Zone extending over considerable distances are illustrated in the following three mined veins, each vein extending for more than 2,000 m, in the Tayoltita Mine, the San Luis Vein (Figure 10) and in the San Antonio Mine the Guadalupe Vein (Figure 11) and San Antonio Vein (Figure 12). Three major stages of mineralization have been recognized in the district:

| 1. | An early stage. |

| 2. | An ore forming stage. |

| 3. | A late stage quartz. |

Three distinct sub-stages of the ore forming stage also have been identified, each characterized by distinctive mineral assemblages with ore grade mineralization always occurring in the three sub-stages:

| a) | quartz-chlorite-adularia; |

| b) | quartz-rhodonite; and, |

| c) | quartz-calcite. |

The minerals characteristic of the ore forming stage are composed mainly of white, to light grey, medium to coarse grained crystalline quartz with intergrowths of base metal sulphides (sphalerite, chalcopyrite and galena) as well as pyrite, argentite, polybasite, stromeyerite, native silver and electrum.

The ore shoots within the veins have variable strike lengths (5 to 600 m); however, most average 150 m in strike-length. Down-dip extensions of ore shoots are up to 200 m but are generally less than the strike length.

- 38 -

Figure 10. Longitudinal cross-section of San Luis Vein, Tayoltita Mine

- 39 -

Figure 11. Longitudinal cross-section of Guadalupe Vein

- 40 -

Figure 12. Longitudinal cross-section of San Antonio Vein

- 41 -

10. EXPLORATION

Typical of epithermal systems, the silver and gold mineralization at the San Dimas District exhibits a vertical zone with a distinct top and bottom that Luismin has termed the Favourable Zone (Figure 13). At the time of deposition, this Favourable Zone was deposited in a horizontal position paralleling the erosional surface of the LVG on which the UVG was extruded.

This favourable, or productive, zone at San Dimas is some 300 to 600 m in vertical extent and can be correlated, based both on stratigraphic and geochronologic relationships, from vein system to vein system and from fault block to fault block. Using this concept of the dip of the unconformity at the base of the UVG, Luismin is able to infer the dip of the Favourable Zone and with considerable success explore and predict the Favourable Zone in untested areas.