Notice of Annual Meeting of Shareholders

and

Management Information Circular

March 23, 2011

SILVER WHEATON CORP.

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVENthat the Annual Meeting of shareholders (the “Meeting”) of Silver Wheaton Corp. (the “Company”) will be held in the West Meeting Room of the Vancouver Convention Centre, 1055 Canada Place, Vancouver, British Columbia on May 20, 2011 at 11:00 a.m. (Vancouver time), for the following purposes:

| (a) | To receive and consider the audited consolidated financial statements of the Company for the year ended December 31, 2010 and the report of the auditors thereon; |

| | |

| (b) | To elect the directors of the Company for the ensuing year; |

| | |

| (c) | To appoint Deloitte & Touche LLP, Independent Registered Chartered Accountants, as auditors of the Company for the ensuing year and to authorize the directors to fix the auditors’ remuneration; and |

| | |

| (d) | To transact such other business as may properly come before the Meeting or any adjournment thereof. |

This notice is accompanied by a management information circular, either a form of proxy for registered shareholders or a voting instruction form for beneficial shareholders, and, for those registered shareholders who so requested, a copy of the audited consolidated financial statements and MD&A of the Company for the financial year ended December 31, 2010. Shareholders are able to request to receive copies of the Company’s annual and/or interim financial statements and MD&A on the form of proxy or voting instruction form, as applicable. The audited consolidated financial statements and MD&A of the Company for the financial year ended December 31, 2010 will be sent to those shareholders who have previously requested to receive them. Otherwise, they are available upon request to the Company or they can be found on SEDAR at www.sedar.com,on the United States Securities and Exchange Commission website at www.sec.gov, or on the Company’s website at www.silverwheaton.com.

Registered shareholders who are unable to attend the Meeting are requested to complete, date, sign and return the enclosed form of proxy and deposit it with the Company’s transfer agent by 11:00 a.m. (Vancouver time) on May 18, 2011, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned Meeting so that as large a representation as possible may be had at the Meeting.

Non-registered shareholders of the Company who have received this Notice of Meeting and accompanying materials through a broker, a financial institution, a participant, a trustee or administrator of a self-administered retirement savings plan, retirement income fund, education savings plan or other similar self-administered savings or investment plan registered under theIncome Tax Act(Canada), or a nominee of any of the foregoing that holds your security on your behalf (the “Intermediary”), are required to complete and return the materials in accordance with the instructions provided by the Intermediary.

The board of directors of the Company has by resolution fixed the close of business on March 31, 2011 as the record date, being the date for the determination of the registered holders of common shares entitled to receive notice of, and to vote at, the Meeting and any adjournment thereof.

If you have any questions, please contactKingsdale Shareholder Services Inc.by telephone at1-866-581-1477toll free in North America or(416) 867-2272outside of North America or by email atcontactus@kingsdaleshareholder.com.

DATEDat Vancouver, British Columbia this 23rd day of March, 2011.

| |

| By Order of the Board of Directors |

| |

| “Peter D. Barnes” |

| Peter D. Barnes |

| Chief Executive Officer |

- 1 -

COMMONLY ASKED QUESTIONS AND ANSWERS – VOTING AND PROXIES

| Q. | Who is soliciting my proxy? |

| |

| A. | The management of Silver Wheaton Corp. (“Silver Wheaton” or the “Company”) is soliciting your proxy. It is expected that the solicitation will be primarily by mail, however, proxies may also be solicited personally by regular employees of the Company and Kingsdale Shareholder Services Inc., the Company’s outside proxy solicitation agency. The cost of solicitation will be borne by the Company. |

| |

| Q. | Who is Kingsdale? |

| |

| A. | The Company has retained the services of Kingsdale Shareholder Services Inc. for the solicitation of proxies in Canada and the United States. |

| | |

| | |

| Kingsdale may be contacted | |

| | |

| by mail at: | The Exchange Tower |

| | 130 King Street West, Suite 2950 |

| | Toronto, Ontario M5X 1E2 |

| | |

| by email at: | contactus@kingsdaleshareholder.com |

| | |

| by toll free telephone at: | 1-866-581-1477 |

| | |

| by toll free facsimile at: | 1-866-545-5580 |

| | |

| Outside North America: | 416-867-2272 |

| Q. | Who is entitled to vote? |

| |

| A. | You are entitled to vote if you were a holder of common shares of Silver Wheaton as of the close of business on March 31, 2011. Each common share is entitled to one vote. |

| |

| Q. | When are proxies due? |

| |

| | Duly completed and executed proxies must be received by the Company’s transfer agent at the address indicated on the enclosed envelope no later than 11:00 a.m. (Vancouver time) on May 18, 2011, or no later than 48 hours before the time of any adjourned Meeting (excluding Saturdays, Sundays and holidays). |

| |

| Q. | How many votes are required to pass a matter on the agenda? |

| |

| A. | A simple majority of the votes cast, in person or represented by proxy, is required for each of the matters specified in this management information circular. |

| |

| Q. | How do I vote? |

| |

| A. | If you are eligible to vote and your shares are registered in your name, you can vote your shares in person at the Meeting or by signing and returning your form of proxy by mail in the prepaid envelope provided or by fax to the number indicated on the form. If your shares are not registered in your name but are held by a nominee (usually a bank, trust company, securities broker or other financial institution), please see the question and answer below. |

| |

| Q. | If my shares are not registered in my name but are held in the name of a nominee (a bank, trust company, securities broker or other financial institution), how do I vote my shares? |

- 2 -

| A. | If your shares are not registered in your name, but are held in the name of a nominee (usually a bank, trust company, securities broker or other financial institution), you are a “non-registered” shareholder and your nominee is required to seek instructions from you as to how to vote your shares. Your nominee will have provided you with a package of information including these meeting materials and either a form of proxy or a voting instruction form. Carefully follow the instructions accompanying the proxy or voting instruction form. |

| |

| Q. | What if I am a non-registered shareholder and do not give voting instructions to my nominee? |

| |

| A. | As a non-registered shareholder, in order to ensure your shares are voted in the way you would like, youmustprovide voting instructions to your bank, broker or other nominee by the deadline provided in the materials you receive from your bank, broker or other nominee. If you do not provide voting instructions to your bank, broker or other nominee, your shares will not be voted. |

| |

| Q. | What happens if I want to attend the Meeting and vote in person? |

| |

| A. | If you are a registered shareholder and wish to vote in person, you may present yourself to a representative of the scrutineer of the Meeting, CIBC Mellon Trust Company. Your vote will be taken and counted at the Meeting. If you wish to vote in person at the Meeting, do not complete or return the form of proxy. The Companydoes not have the names of its non-registered shareholders. Therefore, if you attend the Meeting, the Company will have no record of your shareholdings or of your entitlement to vote unless your nominee has appointed you as a proxyholder. If you wish to vote in person at the Meeting, insert your own name in the space provided (appointee section) on the form of proxy or voting instruction form sent to you by your nominee. In doing so, you are instructing your nominee to appoint you as a proxyholder. Complete the form by following the return instructions provided by your nominee. Do not otherwise complete the form as you will be voting in person at the Meeting. You should present yourself to a representative of CIBC Mellon upon arrival at the Meeting. |

| |

| Q. | Should I sign the form of proxy enclosed with this management information circular? |

| |

| A. | If you are a registered shareholder you must sign the enclosed form of proxy for it to be valid. If you are a non-registered shareholder please read the instructions provided by your nominee. |

| |

| Q. | What if my shares are registered in more than one name or in the name of a company? |

| |

| A. | If the shares are registered in more than one name, all those persons in whose name the shares are registered must sign the form of proxy. If the shares are registered in the name of a company or any name other than your own, you should provide documentation that proves you are authorized to sign the form of proxy. If you have any questions as to what documentation is required, contact CIBC Mellon prior to submitting your form or proxy. |

| |

| Q. | Can I appoint someone other than the individuals named in the enclosed form of proxy to votemyshares? |

| |

| A. | Yes, you have the right to appoint some other person of your choice who need not be a shareholder of the Company to attend and act on your behalf at the Meeting. If you wish to appoint a person other than those named in the enclosed form of proxy, then strike out those printed names appearing on the form of proxy and insert the name of your chosen proxyholder in the space provided. NOTE: It is important to ensure that any other person you appoint is attending the Meeting and is aware that his or her appointment has been made to vote your shares. Proxyholders should, on arrival at the Meeting, present themselves to a representative of CIBC Mellon. |

- 3 -

| Q. | Where do I send my completed proxy? |

| |

| A. | You should send your completed proxy to: |

| |

| | CIBC Mellon Trust Company

Attention: Proxy Department

P.O. Box 721

Agincourt, Ontario M1S 0A1

or by fax to: 416-368-2502 |

| |

| Q. | Can I change my mind once I send my proxy? |

| |

| A. | If you are a registered shareholder and have returned a form of proxy, you may revoke it by: |

| 1. | completing and signing another form of proxy bearing a later date, and delivering it to CIBC Mellon or; |

| | | |

| 2. | delivering a written statement, signed by you or your authorized attorney to: |

| | | |

| | (a) | the registered office of Silver Wheaton c/o Cassels Brock & Blackwell LLP, 40 King Street West, Suite 2100, Toronto, ON M5H 3C2; Attention: Mark T. Bennett , at any time up to and including May 19, 2011 or, if the Meeting is adjourned, the business day preceding the day to which the Meeting is adjourned; or |

| | | |

| | (b) | the Chair of the Meeting prior to the commencement of the Meeting on the day of the Meeting or, if the Meeting is adjourned, the day to which the Meeting is adjourned. |

| |

| If you are a non-registered shareholder, contact your nominee. |

| Q. | How will the shares be voted if I send my proxy? |

| |

| A. | The shares represented by your proxy must be voted as you instruct in the form of proxy. If you properly complete and return your proxy but do not specify how you wish to vote, your shares will be voted as your proxyholder sees fit. Unless contrary instructions are provided, shares represented by proxies received by management will be voted as follows: |

| | |

| | (a) | FOR the election of directors of the Company as set out in this management information circular; and |

| | |

| | (b) | FOR the appointment of Deloitte & Touche LLP, Chartered Accountants, as auditors of the Company for the ensuing year and to authorize the directors to fix their remuneration. |

| | |

| Q. | What if amendments are made to these matters or if other matters are brought before theMeeting? |

| |

| A. | If you attend the Meeting in person and are eligible to vote, you may vote on such matters as you choose. If you have completed and returned the form or proxy, the person named in the form of proxy will have discretionary authority with respect to amendments or variations to matters identified in the Notice of Annual Meeting of Shareholders of Silver Wheaton, and to other matters which may properly come before the Meeting. As of the date of this management information circular, the management of the Company knows of no such amendment, variation or other matter expected to come before the Meeting. If any other matters properly come before the Meeting, the persons named in the form of proxy will vote on them in accordance with their best judgment. |

- 4 -

| Q. | What if I am a registered shareholder and do not submit a proxy? |

| |

| A. | As a registered shareholder, if you do not submit a proxy prior to 48 hours before the Meeting or you do not attend and vote at the Meeting, your shares will not be voted on any matter that comes before the Meeting. |

| |

| Q. | Who counts the votes? |

| |

| A. | A scrutineer, employed by the Company’s registrar and transfer agent, CIBC Mellon, will count the votes and report the results to the Company. |

| |

| Q. | If I need to contact CIBC Mellon Trust Company, the Company’s registrar and transfer agent, how do I reach them? |

| |

| A. | You can contact the Company’s registrar and transfer agent: |

| | |

| | |

| by mail at: | CIBC Mellon Trust Company |

| | P.O. Box 7010, Adelaide Street Postal Station |

| | Toronto, Ontario M5C 2W9 |

| | |

| by toll free telephone | |

| in North America at: | 1-800-387-0825 |

| | |

| by telephone | |

| outside North America at: | 416-643-5500 |

| | |

| by fax at: | 416-643-5501 |

SILVER WHEATON CORP.

MANAGEMENT INFORMATION CIRCULAR

GENERAL PROXY INFORMATION

Solicitation of Proxies

This management information circular is furnished to the holders of common shares (the “shareholders”) in connection with the solicitation of proxies by the management of Silver Wheaton Corp. (the “Company”) for use at the annual meeting of shareholders (the “Meeting”) of the Company to be held at the time and place and for the purposes set forth in the accompanying Notice of Meeting. References in this management information circular to the Meeting include any adjournment or adjournments thereof. It is expected that the solicitation will be primarily by mail, however, proxies may also be solicited personally by regular employees of the Company and the Company may use the services of an outside proxy solicitation agency to solicit proxies. The costs of solicitation will be borne by the Company.

In addition, the Company has retained Kingsdale Shareholder Services Inc., The Exchange Tower, 130 King Street West, Suite 2950, Toronto, Ontario M5X 1E2 to assist in soliciting proxies from shareholders. You may contactKingsdale Shareholder Services Inc.in North America toll free at1-866-581-1477.

The board of directors of the Company (the “Board”) has fixed the close of business on March 31, 2011 as the record date, being the date for the determination of the registered holders of securities entitled to receive notice of, and to vote at, the Meeting. Duly completed and executed proxies must be received by the Company’s transfer agent at the address indicated on the enclosed envelope no later than 11:00 a.m. (Vancouver time) on May 18, 2011, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned Meeting. Late proxies may be accepted or rejected by the Chair of the Meeting in his sole discretion, and the Chair is under no obligation to accept or reject any late proxy.

Unless otherwise stated, the information contained in this management information circular is as of March 23, 2011. All dollar amounts referenced herein, unless otherwise indicated, are expressed in United States dollars and Canadian dollars are referred to as “C$”. Unless otherwise stated, any United States dollar amounts which have been converted from Canadian dollars have been converted at an exchange rate of C$1.00 = US$1.0054, the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2010.

Appointment and Revocation of Proxies

The persons named in the enclosed form of proxy are officers or directors of the Company.A shareholder desiring to appoint some other person, who need not be a shareholder, to represent such shareholder at the Meeting, may do so by inserting such person’s name in the blank space provided in the enclosed form of proxy or by completing another proper form of proxy and, in either case, depositing the completed and executed proxy at the office of the Company’s transfer agent indicated on the enclosed envelope no later than 11:00 a.m. (Vancouver time) on May 18, 2011, or no later than 48 hours (excluding Saturdays, Sundays and holidays) before the time of any adjourned Meeting.Late proxies may be accepted or rejected by the Chair of the Meeting in his sole discretion, and the Chair is under no obligation to accept or reject any late proxy.

A shareholder forwarding the enclosed proxy may indicate the manner in which the appointee is to vote with respect to any specific item by checking the appropriate space. If the shareholder giving the proxy wishes to confer a discretionary authority with respect to any item of business, then the space opposite the item is to be left blank. The shares represented by the proxy submitted by a shareholder will be voted in accordance with the directions, if any, given in the proxy.

- 2 -

A proxy given pursuant to this solicitation may be revoked by an instrument in writing executed by a shareholder or by a shareholder’s attorney authorized in writing (or, if the shareholder is a corporation, by a duly authorized officer or attorney) and deposited either at the registered office of the Company (Silver Wheaton Corp. c/o Cassels Brock & Blackwell LLP, 40 King Street West, Suite 2100, Toronto, ON M5H 3C2; Attention: Mark T. Bennett) at any time up to and including the last business day preceding the day of the Meeting or with the Chair of the Meeting on the day of the Meeting prior to the commencement of the Meeting or in any other manner permitted by law.

Exercise of Discretion by Proxies

The persons named in the enclosed form of proxy will vote the shares in respect of which they are appointed in accordance with the direction of the shareholders appointing them.In the absence of such direction, such shares will be voted in the discretion of the person named in the proxy. However, under New York Stock Exchange ("NYSE") rules, a broker who has not received specific voting instructions from the beneficial owner may not vote the shares in its discretion on behalf of such beneficial owner on "non-routine" proposals, including the election of directors.Thus, such shares will be included in determining the presence of a quorum at the Meeting and will be votes "cast" for purposes of other proposals but will not be considered votes "cast" for purposes of voting on the election of directors.

The enclosed form of proxy confers discretionary authority upon the persons named therein with respect to amendments or variations to matters identified in the Notice of Meeting and with respect to other matters which may properly come before the Meeting.At the time of printing of this management information circular, management knows of no such amendments, variations or other matters to come before the Meeting. However, if any other matters which are not now known to management should properly come before the Meeting, the proxy will be voted on such matters in accordance with the best judgment of the named proxies.

Voting by Non-Registered Shareholders

Only registered shareholders of the Company or the persons they appoint as their proxies are permitted to vote at the Meeting. Most shareholders of the Company are “non-registered” shareholders (“Non-Registered Shareholders”) because the shares they own are not registered in their names but are instead registered in the name of the brokerage firm, bank or trust company through which they purchased the shares. Shares beneficially owned by a Non-Registered Shareholder are registered either: (i) in the name of an intermediary (an “Intermediary”) that the Non-Registered Shareholder deals with in respect of the shares of the Company (Intermediaries include, among others, banks, trust companies, securities dealers or brokers and trustees or administrators of self-administered RRSPs, RRIFs, RESPs and similar plans); or (ii) in the name of a clearing agency (such as CDS Clearing and Depository Services Inc. or The Depository Trust & Clearing Corporation) of which the Intermediary is a participant. In accordance with applicable securities law requirements, the Company will have distributed copies of the notice of meeting, this management information circular and the form of proxy (which includes a place to request copies of the Company’s annual and/or interim financial statements and MD&A or to waive the receipt of the annual and/or interim financial statements and MD&A) (collectively, the “Meeting Materials”) to the clearing agencies and Intermediaries for distribution to Non-Registered Shareholders.

Intermediaries are required to forward the Meeting Materials to Non-Registered Shareholders unless a Non-Registered Shareholder has waived the right to receive them. Intermediaries often use service companies to forward the Meeting Materials to Non-Registered Shareholders. Generally, Non-Registered Shareholders who have not waived the right to receive Meeting Materials will either:

| (i) | be given a voting instruction formwhich is not signed by the Intermediaryand which, when properly completed and signed by the Non-Registered Shareholder andreturned to the Intermediary or its service company, will constitute voting instructions (often called a “voting instruction form”) which the Intermediary must follow. Typically, the voting instruction form will consist of a one page pre-printed form. Sometimes, instead of the one page pre-printed form, the voting instruction form will consist of a regular printed proxy form accompanied by a page of instructions which contains a removable label with a bar-code and other information. In order for the form of proxy to validly constitute a voting instruction form, the Non-Registered Shareholder must remove the label from the instructions and affix it to the form of proxy, properly complete and sign the form of proxy and submit it to the Intermediary or its service company in accordance with the instructions of the Intermediary or its service company. See above “Exercise of Discretion by Proxies” for broker discretion in the absence of non-registered shareholder direction; or |

- 3 -

| (ii) | be given a form of proxywhich has already been signed by the Intermediary(typically by a facsimile, stamped signature), which is restricted as to the number of shares beneficially owned by the Non-Registered Shareholder but which is otherwise not completed by the Intermediary. Because the Intermediary has already signed the form of proxy, this form of proxy is not required to be signed by the Non-Registered Shareholder when submitting the proxy. In this case, the Non-Registered Shareholder who wishes to submit a proxy should properly complete the form of proxy anddeposit it with the Company, c/o CIBC Mellon Trust Company, Attention: Proxy Department, P.O. Box 721, Agincourt, Ontario, M1S 0A1 or by facsimile at (416) 368-2502. |

In either case, the purpose of these procedures is to permit Non-Registered Shareholders to direct the voting of the shares of the Company they beneficially own. Should a Non-Registered Shareholder who receives one of the above forms wish to vote at the Meeting in person (or have another person attend and vote on behalf of the Non-Registered Shareholder), the Non-Registered Shareholder should strike out the persons named in the form of proxy and insert the Non-Registered Shareholder or such other person’s name in the blank space provided.In either case, Non-Registered Shareholders should carefully follow the instructions of their Intermediary, including those regarding when and where the proxy or voting instruction form is to be delivered.

A Non-Registered Shareholder may revoke a voting instruction form or a waiver of the right to receive Meeting Materials and to vote which has been given to an Intermediary at any time by written notice to the Intermediary provided that an Intermediary is not required to act on a revocation of a voting instruction form or of a waiver of the right to receive Meeting Materials and to vote which is not received by the Intermediary at least seven days prior to the Meeting.

Voting Securities and Principal Holders Thereof

As of March 23, 2011, 353,202,255 common shares (the “Common Shares”) in the capital of the Company were issued and outstanding. Each Common Share entitles the holder thereof to one vote on all matters to be acted upon at the Meeting. The record date for the determination of shareholders entitled to receive notice of, and to vote at, the Meeting has been fixed at March 31, 2011. In accordance with the provisions of theBusiness Corporations Act(Ontario), the Company will prepare a list of holders of Common Shares as of such record date. Each holder of Common Shares named in the list will be entitled to vote the shares shown opposite his or her name on the list at the Meeting. All such holders of record of Common Shares are entitled either to attend and vote thereat in person the Common Shares held by them or, provided a completed and executed proxy shall have been delivered to the Company’s transfer agent within the time specified in the attached Notice of Meeting, to attend and vote thereat by proxy the Common Shares held by them.

To the knowledge of the directors and executive officers of the Company, as of the date hereof, no person or company beneficially owns, directly or indirectly, or exercises control or direction over, voting securities of the Company carrying more than 10% of the voting rights attached to any class of voting securities of the Company.

- 4 -

STATEMENT OF EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Objectives of Compensation Program

The objectives of the Company’s compensation program are to attract, hold and inspire performance by members of senior management of a quality and nature that will enhance the sustainable profitability and growth of the Company.

Overview of the Compensation Philosophy

The following principles guide the Company’s overall compensation philosophy:

| (a) | compensation is determined on an individual basis by the need to attract and retain talented, high-achievers; |

| | |

| (b) | calculating total compensation is set with reference to the market for similar jobs in similar locations; |

| | |

| (c) | an appropriate portion of total compensation is variable and linked to achievements, both individual and corporate; |

| | |

| (d) | internal equity is maintained such that individuals in similar jobs and locations are treated fairly; and |

| | |

| (e) | the Company supports reasonable expenses in order that employees continuously maintain and enhance their skills. |

Role of the Human Resources Committee

The Human Resources Committee (formerly called the Compensation Committee) is established by the Board to assist in fulfilling the Board’s responsibilities relating to human resources and compensation issues and to establish a plan of continuity for executive officers. The Human Resources Committee ensures that the Company has an executive compensation plan that is both motivational and competitive so that it will attract, hold and inspire performance by executive officers of a quality and nature that will enhance the sustainable profitability and growth of the Company.

The Human Resources Committee reviews and recommends the compensation philosophy and guidelines for the Company which include reviewing compensation for executive officers for recommendation to the Board.

The Human Resources Committee reviews on an annual basis the cash compensation, performance and overall compensation package for each executive officer. It then submits to the Board recommendations with respect to the basic salary, bonus and participation in share compensation arrangements for each executive officer. During the first quarter of 2011, the Human Resources Committee received various reports from Mercer (Canada) Limited (“Mercer”) reviewing Silver Wheaton’s past and current compensation levels for executives, in comparison to a peer group of companies and practices in the current market. After reviewing the matters discussed in Mercer’s reports, discussing various factors with management and comparing to peers in the industry, and receiving recommendations from the Chief Executive Officer on 2010 bonuses, 2011 salaries and 2011 stock option grants for executive officers, the Human Resources Committee made its recommendations to the Board for approval in March 2011. In making its recommendations, the Human Resources Committee was satisfied that all recommendations complied with the Human Resources Committee’s philosophy and guidelines set forth above.

- 5 -

Role of the Chief Executive Officer

For the remainder of this Compensation Discussion and Analysis, the individuals included in the “Summary Compensation Table” on page 12 are referred to as the “Named Executive Officers” or “NEOs”; namely Peter D. Barnes, Randy V.J. Smallwood, Gary D. Brown, Curt D. Bernardi and Frazer W. Bourchier. As Mr. Bourchier joined the Company on January 1, 2010, some of the analysis undertaken with respect to the other Named Executive Officers was not undertaken for Mr. Bourchier, including with respect to base salary review for 2010 and stock option awards granted in 2010.

The Chief Executive Officer completes a review of the Named Executive Officers’ performance in accordance with the evaluation criteria listed below in the “Annual Performance-Based Cash Incentives” section. Based on the foregoing evaluation, as well as a subjective assessment, the Chief Executive Officer makes a recommendation to the Human Resources Committee on cash bonuses, base salaries and stock option grants for each Named Executive Officer, which is taken into consideration by the Human Resources Committee in completing its review and ultimate recommendations to the Board.

Role of Compensation Consultants

The Human Resources Committee’s mandate with Mercer was established in November 2006. The Human Resources Committee will agree annually, and on an as-needed basis, with input from management and Mercer, on the specific work to be undertaken by the consultant for the Human Resources Committee and the fees associated with such work. Mercer reports directly to the Chair of the Human Resources Committee and did not provide any other services to the Company in 2010.

During 2010 and the first quarter of 2011, Mercer was engaged by the Human Resources Committee to conduct a compensation review of the Named Executive Officers and present its findings based on a review of compensation levels of a peer group of companies. Although Mercer provides advice to the Human Resources Committee, the decisions of the Human Resources Committee may reflect factors and considerations other than the information and recommendations provided by Mercer.

During the financial year ended December 31, 2010, Mercer’s fees as the Human Resources Committee’s advisor totaled approximately C$102,000 (year ended December 31, 2009 – C$27,678) and Mercer’s fees in respect of all other services provided to the Company was nil (year ended December 31, 2009 – nil).

Elements of Executive Compensation

It is the compensation philosophy of the Company to provide a market-based blend of base salaries, bonuses and an equity incentive component in the form of stock options and restricted share rights. Base salaries have been at the lower to average end compared to industry peers with a greater emphasis placed on bonuses, stock options and restricted share rights. The Company believes that the bonus, stock option and restricted share right components serve to further align the interests of management with the interests of the Company’s shareholders.

For the financial year ended December 31, 2010, the Company’s executive compensation program consisted of the following elements:

base salary;

annual performance-based cash incentives;

performance-based restricted share rights;

medical and other benefits; and

equity compensation consisting of stock options.

- 6 -

The specific rationale and design of each of these elements are outlined in detail below.

| |

| Element of Compensation | Summary and Purpose of Element |

| |

| Base Salary | Salaries form an essential element of the Company’s compensation mix as they are the first base measure to compare and remain competitive relative to peer groups. Base salaries are fixed and therefore not subject to uncertainty and are used as the base to determine other elements of compensation and benefits.

The Human Resources Committee reviews NEO salaries at least annually as part of its overall competitive market assessment, as described above. Typically, the Human Resources Committee makes annual salary adjustments by March of each year for the 12 month period from January 1 to December 31 of that year. |

| |

| Annual Performance-Based Cash Incentives | Annual performance-based cash incentives are a variable component of compensation designed to reward the Company’s executive officers for maximizing annual operating performance.

The Human Resources Committee reviews annual performance-based awards of cash as part of its overall annual assessment of Company and individual performance, as more fully described under the heading “Annual Performance-Based Cash Incentives”. Typically, the Human Resources Committee makes awards by March of each year for the 12 month period from January 1 to December 31 of the prior year. |

|

| |

| Performance-Based Restricted Share Rights | Performance-based restricted share rights are a variable component of compensation designed to reward the Company’s executive officers for maximizing operating performance, while at the same time rewarding the Company’s executive officers for its success in achieving sustained, long-term profitability and increases in stock value.

The Human Resources Committee reviews performance-based awards of Restricted Share Rights as part of its overall assessment of Company and individual performance, as more fully described under the heading “Restricted Share Rights”. In special circumstances, the Human Resources Committee may make an award of Restricted Share Rights to the Named Executive Officers by March of each year for the 12 month period from January 1 to December 31 of the prior year. |

|

| |

| Stock Options | The granting of stock options is a variable component of compensation intended to reward the Company’s executive officers for their success in achieving sustained, long-term profitability and increases in stock value. Typically, the Human Resources Committee makes awards by March of each year for the 12 month period from January 1 to December 31 of that year |

| |

Other Compensation

(Perquisites) | The Company’s executive employee benefit program includes life, medical, dental and disability insurance, along with paid parking and a maximum contribution of C$11,000 to a registered retirement savings plan. Such benefits and perquisites are designed to be competitive overall with equivalent positions in comparable Canadian and United States organizations. |

| | |

|

|

- 7 -

Overview of How Compensation Program Fits with Compensation Goals

| |

| 1. | Attract, Hold and Inspire Key Talent |

The compensation package meets the goal of attracting, holding and motivating key talent in a highly competitive mining environment through the following elements:

A competitive cash compensation program, consisting of base salary and bonus, which is generally consistent with or superior to similar opportunities.

Providing an opportunity to participate in the Company’s growth through options and restricted share rights.

| |

| 2. | Alignment of Interest of Management with Interest of the Company’s Shareholders |

The compensation package meets the goal of aligning the interests of management with the interest of the Company’s shareholders through the following elements:

The grant of stock options and restricted share rights, where, if the price of the Company shares increases over time, both executives and shareholders will benefit;

A three-stage vesting on stock awards and restricted share rights, which drives management to create long-term shareholder value, rather than focusing on short-term increases; and

An executive share ownership policy (see page 14 for further details).

Base Salary

In determining the base salary of a Named Executive Officer, the Human Resources Committee’s practice in recent years has been to consider the recommendations made by the Chief Executive Officer and retain Mercer to review the remuneration paid to executives with similar titles at a comparator group of companies in the marketplace, based on sector, market capitalization and complexity. To date, the Human Resources Committee has recommended to the Board that the executive officers receive base salaries that are typically on the lower to average end of the comparator group and bonuses and equity compensation that are typically on the higher end of the comparator group, due to the Company’s unique business model and deal-driven nature. In arriving at an overall subjective assessment of base salary to be paid to a particular executive officer, the Human Resources Committee also considers the particular responsibilities of the position, the experience level of the executive officer, his or her past performance at the Company, the performance of the Company over the past year, and an overall assessment of market, industry and economic conditions.

Base salaries are reviewed at least annually, typically in March of each year for the 12 month period from January 1 to December 31 of that year.

The Human Resources Committee believes that it is appropriate to establish compensation levels based in large part on benchmarking against similar companies. In this way, the Company can gauge if its compensation is competitive and reasonable. The Company uses a comparator group of publicly-traded mining companies of similar size, as determined by market capitalization and complexity, to the Company, and that are based in either Canada or the United States. Given the rapid growth and success of the Company in becoming the market leader in the streaming and royalty markets, the Human Resources Committee re-considered the composition of the comparator group during the first quarter of 2010 to ensure that the comparator group continued to be comprised of publicly-traded mining companies of similar size, as determined by market capitalization and complexity, to the Company.

As a result of that review, the comparator group was updated to be the following for the purpose of determining 2010 annual base salaries (the “2010 Comparator Group”). This group remains unchanged from the comparator group used for purposes of determining bonus awards in respect of the 2009 year:

- 8 -

2010 Comparator Group of Companies

| |

| Agnico-Eagle Mines Limited | Eldorado Gold Corporation |

| First Quantum Minerals Ltd. | Franco-Nevada Corporation |

| Hudbay Minerals Inc. | IAMGold Corporation |

| Inmet Mining Corporation | Kinross Gold Corp. |

| Lundin Mining Corp. | Pan American Silver Corp. |

| Royal Gold, Inc. | Yamana Gold Inc. |

As at December 31, 2010, the market capitalization of the 2010 Comparator Group ranged from $2.7 billion to $21.5 billion (Silver Wheaton market capitalization was $13.6 billion) and the most recently reported annual net income as of December 31, 2010 (which in most cases would be for the year ended December 31, 2009) ranged from $21 million to $485 million (Silver Wheaton net income was $135 million for the year ended December 31, 2009).

The 2010 base salary of each of the Named Executive Officers was within the second quartile (between the 25th and 50th percentile) of the 2010 Comparator Group’s 2009 average base salary for comparable positions. The base salary of Mr. Bourchier was not considered in this review at this time as his employment with the Company only commenced in January 2010.

Annual Performance-Based Cash Incentives

In determining the annual cash bonus of a Named Executive Officer, the Human Resources Committee has implemented a performance based incentive plan that includes a target bonus for each Named Executive Officer, corporate and personal performance objectives and a payout depending on the achievement of those objectives. Importantly, however, the Human Resources Committee reviews the bonus that would be determined as a result of the application of the performance based incentive plan and compares it to the bonuses to be paid to executives with similar titles at the 2010 Comparator Group and makes adjustments as necessary to ensure that the bonuses reflect a targeted percentile range.

The Human Resources Committee also considers the recommendations made by the Chief Executive Officer in assessing the corporate and personal performance over the past year. All awards are at the discretion of the Human Resources Committee to determine for recommendation to the Board. Bonuses are considered annually, typically in March of each year for the 12 month period from January 1 to December 31 of the previous year.

The following table summarizes the annual target bonus and the breakdown of the weighting of each of the corporate and personal performance objectives for each of the Named Executive Officers:

Target Bonus and Weightings

| | | | | |

| | | | | VP Legal | VP Business |

| | Chief | | Chief | and | Development |

| | Executive | | Financial | Corporate | & Technical |

| | Officer | President | Officer | Secretary | Services |

| | | | | | |

| Corporate Performance Weighting | | | | | |

| Value/Quality of Transactions completed | 40% | 40% | 25% | 30% | 40% |

| Capital Structure Management | 15% | 10% | 15% | 15% | 0% |

| Performance Against Budget: | | | | | |

Cash Flow Per Share | 15% | 5% | 10% | 10% | 15% |

Expense Control | 5% | 5% | 10% | 5% | 5% |

| Total Corporate Performance | 75% | 60% | 60% | 60% | 60% |

| | | | | | |

| Personal Performance Weighting | 25% | 40% | 40% | 40% | 40% |

| Combined Performance Total | 100% | 100% | 100% | 100% | 100% |

- 9 -

| | | | | |

| | | | | VP Legal | VP Business |

| | Chief | | Chief | and | Development |

| | Executive | | Financial | Corporate | & Technical |

| | Officer | President | Officer | Secretary | Services |

| Target Bonus (% of Base Salary) | 90% | 75% | 50% | 50% | 50% |

| Threshold Bonus (50% of Target Bonus) | 45% | 37.5% | 25% | 25% | 25% |

| Maximum Bonus (200% of Target Bonus) | 180% | 150% | 100% | 100% | 100% |

Each performance objective has a range of possible payouts depending on the assessment of that performance objective. The minimum percentage payout for each performance objective is 0%, threshold is 50% of the target bonus percentage and maximum bonus percentage is 200% of the target bonus percentage. The aggregate threshold and maximum potential bonus payouts are set out in the table above, expressed as a percentage of base salary of the applicable Named Executive Officer.

The following table details the targets for threshold, target and maximum achievement for each of the corporate performance objectives, as well as the actual performance for 2010 and the resulting performance factor to be applied in determining bonuses:

Target Corporate Performance and Actual Results

| | | | | | | |

| | | | Threshold | Target | Maximum | Actual | Performance |

| | | | (50%) | (100%) | (200%) | Performance | Factor |

| | | | | | |

| Value/Quality of TransactionsCompleted(1): | | | | | |

| (a) | Increase in Cash Flow Per Share | 5% | 10% | 20% | 5% | 48% |

| | - | Short term | 5% | 10% | 20% | 15% | 151% |

| | - | Long term | | | | | 99% |

| | Total Increase in Cash Flow Per Share(2) | | | | | |

| (b) | Increase in Production | 1m oz | 2m oz | 4m oz | 1.1m oz | 56% |

| | - | Short Term | 2m oz | 4m oz | 8m oz | 5.7m oz | 143% |

| | - | Long Term | | | | | 100% |

| | Total Increase in Production(2) | | | | | |

| (c) | Increase in R+R Per Share | 5% | 10% | 20% | 10% | 104% |

| | - | Increase in Reserves | 5% | 10% | 20% | 14% | 138% |

| | | Increase in Resources | | | | | 121% |

| | Total Increase in R+R Per Share(2) | | | | | +18% |

| (d) | Qualitative Assessment | | | | | |

| | | | | | | | 125% |

| Total Value/Quality of Transactions(3) | | | | | |

| | | | | | |

| | | |

| Capital Structure Management | Qualitative assessment | 200% |

| | | |

| | | | | | |

| Performance Against Budget: | | | | | |

| | Cash Flow Per Share | -10% | 0% | 20% | 17% | 186% |

| | Expense Control | 10% | 0% | -10% | -10.6% | 200% |

| | | | | | | |

| | |

| | |

| (1) | Short term refers to the year ended December 31, 2011 and long term refers to the year ended December 31, 2015. |

- 10 -

| | |

| (2) | The performance factor of each applicable sub-objective (Increase in Cash Flow Per Share; Increase in Production;Increase in Reserves and Resources Per Share) is the average of the further objectives within each such sub-objective. |

| (3) | The Total Value/Quality of Transactions performance factor is the average of the performance factors for each of the sub-objectives (Increase in Cash Flow Per Share; Increase in Production; Increase in Reserves and Resources Per Share),plus/minus the Qualitative Assessment Adjustment. |

The Corporate Performance objective is comprised of three sub-objectives as noted in the table above. The Value/Quality of Transactions Completed performance objective is determined on the basis of three sub-objectives, together with the potential for a qualitative adjustment. The three sub-objectives of the Value/Quality of Transaction Completed performance objective are Increase in Cash Flow Per Share, Increase in Production and Increase in Reserves and Resources Per Share. The evaluation of these sub-objectives is more fully described in the table above. The potential for a qualitative adjustment reflects the Human Resources Committee’s view that it retains discretion to adjust awards if necessary to ensure that they are fair and reasonable under the circumstances, rather than rigidly adhering to a formulaic approach that might not take into account developments during the year, intangibles in assessing the quality of an asset, comparisons of the resulting payout to the 2010 Comparator Group and other considerations not reflected within the Value/Quality of Transactions Completed performance objective.

Among other factors, the Human Resources Committee considered the following additional factors in recommending an adjustment of 18% to the Value/Quality of Transactions Completed performance objective:

the San Dimas transaction preserved the existing structure of the transaction, while providing greater aligned interest to increase silver production;

replacement of the San Martin mine with the Bermejal mine which extended the expected life of the underlying silver stream;

the buy back of the silver stream on the La Negra mine created significant value;

a number of business development opportunities were pursued and although not ultimately successful in 2010, positioned the Company well for future transactions;

long-term investment in Ventana Gold yielded value and included a right of first refusal in favour of the Company; and

implementation of a foreign currency election for Canadian tax purposes simplifying the accounting and administration of Canadian tax.

The assessment of the Capital Structure Management performance objective is based on a qualitative assessment of senior management’s ability to optimize the Company’s capital structure. Factors that are considered in making this assessment include:

the nature of capital raising activities during the year;

maintaining a conservative capital structure, including ensuring the Company is capable of servicing debt at silver prices that are significantly depressed from current levels;

delivering on market expectations regarding production guidance; and

the relative share price performance with an outperforming share price reducing the Company’s relative cost of capital.

In arriving at the performance factor of 200% for the Capital Structure Management performance objective for the 2010 year, the Human Resources Committee considered among other matters:

the renewal of the prospectus in the U.S. under which Common Shares are issued upon exercise of the Company’s $20.00 warrants;

the fact that the Company can comply with its debt covenants even with a significant decrease in silver prices or forecast silver volumes;

the accuracy of the 2010 production (within one percent of originally budgeted levels);

the Company share price significantly outperformed the 2010 Comparator Group and other mining sub-sectors during 2010; and

the improvement in the Company’s relative cost of capital, enhancing the ability of the Company to undertake accretive future transactions.

- 11 -

The Performance Against Budget performance objective is comprised of two sub-objectives: Cash Flow Per Share and Expense Control. The Cash Flow Per Share performance objective is the percentage by which the actual cash flow per share for 2010 exceeds (is less than) the budgeted cash flow per share for 2010. The Expense Control performance objective is the percentage by which the actual general and administration expense of the Company for 2010 is less than (exceeds) the budgeted general and administration expense for 2010.

The following table details the weighted result by Named Executive Officer of each of the corporate performance objectives for the 2010 year.

Actual Corporate Objectives Results Weighted By Named Executive Officer

| | | | | |

| | | | | VP Legal | VP Business |

| | Chief | | Chief | and | Development |

| | Executive | | Financial | Corporate | & Technical |

| | Officer | President | Officer | Secretary | Services |

| | | | | | |

| Total Corporate Performance -Target | 75% | 60% | 60% | 60% | 60% |

| | | | | |

Value/Quality of transactions completed | 50% | 50% | 31% | 38% | 50% |

Capital Structure Management | 30% | 20% | 30% | 30% | 0% |

Performance Against Budget: | | | | | |

Cash Flow per share | 28% | 9% | 19% | 19% | 28% |

Expense Control | 10% | 10% | 20% | 10% | 10% |

| Total Corporate Performance -Actual | 118% | 89% | 100% | 97% | 88% |

| Target Personal Performance | 25% | 40% | 40% | 40% | 40% |

The Personal Performance objective is based in part on a qualitative assessment by the Chief Executive Officer and Human Resources Committee on personal performance of the Named Executive Officers other than the Chief Executive Officer, and by the Human Resources Committee alone on personal performance of the Chief Executive Officer. Evaluation of personal performance factors is subjective and includes consideration of quality of work, effort undertaken and leadership abilities, among other factors.

The Human Resources Committee considered the 2010 Comparator Group three year average for comparable positions for each of the Named Executive Officers to be an important metric in retaining and incentivizing the Named Executive Officers. Therefore, the Human Resources Committee reviewed the actual bonuses that would have resulted from the application of the assessment of the Corporate and Personal Performance objectives, compared to the 2010 Comparator Group, for each of the Named Executive Officers other than Mr. Bourchier. Based on that review and taking into account the strong share price performance of the Company in relation to the 2010 Comparator Group, the relative size of the Company in relation to the 2010 Comparator Group, and the other factors set forth above, the Human Resources Committee determined that it was appropriate to increase the bonus awards with the intent that the base salary plus bonus awards would fall within the 60 to 65th percentile range of the 2010 Comparator Group three year average for comparable positions for each of the Named Executive Officers other than Mr. Bourchier. The Human Resources Committee believes this to be appropriate level of compensation. For Mr. Bourchier, the Human Resources Committee relied upon the bonus award recommended by the Chief Executive Officer, who made a recommendation based on the bonus awards for the other Named Executive Officers.

- 12 -

As a result of the foregoing, with respect to the financial year ended December 31, 2010, bonuses were awarded to the following Named Executive Officers in March 2011:

Non-equity Incentive Plan Actual Compensation

| | | | | | | | |

| | | | | Bonus | | | | |

| | | | | Amounts | | Actual | | Target |

| Name of Officer | | Title of Officer | | ($)(1) | | %(2) | | % |

| | | | | | | | |

| Peter D. Barnes | | Chief Executive Officer | | 1,005,400 | | 148% | | 90% |

| Randy V.J. Smallwood | | President | | 653,510 | | 163% | | 75% |

| Gary D. Brown | | Chief Financial Officer | | 402,160 | | 125% | | 50% |

| Curt D. Bernardi | | Vice President, Legal and Corporate Secretary | | 402,160 | | 125% | | 50% |

| Frazer W. Bourchier | | Vice President, Business Development & Technical Services | | 196,053 | | 76% | | 50% |

| | | | | 2,659,283 | | | | |

| | |

| | |

| (1) | Converted to United States dollars at the exchange rate of C$1.00 = US$1.0054, being the closing exchange rate forCanadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2010. |

| (2) | This column expresses the bonus amount awarded for 2010 as a percentage of 2010 base salary. |

Restricted Share Rights

Restricted Share Rights are awarded in special circumstances at the discretion of the Board, upon the recommendation of the Human Resources Committee. The Human Resources Committee recommended that no restricted share rights be awarded to the Named Executive Officers for performance in 2010, given the adjustment made to cash awards for 2010 as outlined above and given that the Human Resources Committee did not believe there to be any other special circumstances in respect of 2010 that warranted an award of Restricted Share Rights to the Named Executive Officers.

Stock Options

The Company’s share option plan (the “Share Option Plan”) is designed to advance the interests of the Company by encouraging eligible participants, being employees, officers and consultants, to have equity participation in the Company through the acquisition of Common Shares. For the purposes of the awards of options made to the Named Executive Officers: (i) the grant date is the third trading day following the release of the 2010 financial results of the Company; (ii) the exercise price for each option is equal to the closing price of the Common Shares on the TSX on the second trading day following the release of the 2010 financial results of the Company; (iii) the vesting schedule is 90 days following the grant date for one-third of the award, the first anniversary of the grant date for one-third of the award and the second anniversary of the grant date for the final one-third of the award; and (iv) the options are exercisable for a five year period following the grant date. For further details regarding the terms of the Share Option Plan, see “Share Option Plan” at page 27.

Annually, the Chief Executive Officer proposes stock option grants for executive officers in his presentation to the Human Resources Committee based on his evaluation of each executive’s performance. The Human Resources Committee considers the Chief Executive Officer’s recommendations in addition to the findings in Mercer’s report, in making its recommendation to the Board regarding any stock options to be granted.

The Human Resources Committee also considered the award of stock options for 2010 compared to the 2010 Comparator Group. For 2010, each of the awards to the Named Executive Officers falls within the third quartile (50th to 75th percentile range) of the 2010 Comparator Group three year average for long-term compensation awards for comparable positions based on information available at the time of the award in March of 2010. The stock award for Mr. Bourchier was not considered in this review at this time as his employment with the Company only commenced in January 2010 and stock option grants were made in March 2010. The Human Resources Committee determined that it was appropriate to target an award of stock options that would fall within the 50th to 75th percentile range of the 2010 Comparator Group three year average of long-term compensation awards for comparable positions based on the relative size of the Company in relation to the 2010 Comparator Group, the fact that a higher long-term compensation award percentage is necessary to offset the impact of the Company’s practice of targeting base salaries below the median of the 2010 Comparator Group, and based on the strong share price performance of the Company in 2010 in comparison to the 2010 Comparator Group.

- 13 -

In March 2010, on the recommendation of the Human Resources Committee, the Board granted stock options to the Named Executive Officers as follows. Mr. Bourchier’s stock options noted in the table below were awarded upon commencement of employment with the Company in January 2010 rather than in March 2010.

The number of stock options granted to the Named Executive Officers in 2010 represents approximately 0.24% of the Common Shares outstanding as of March 9, 2010, being the date of the grant.

Stock Option Awards

| | | | | | |

| Name of Officer | | Title of Officer | | Number of

Stock

Options | | Option

Awards

($)(1) |

| | | | | | |

| Peter D. Barnes | | Chief Executive Officer | | 290,700(2) | | 1,627,488 |

| Randy V.J. Smallwood | | President | | 225,000(2) | | 1,259,666 |

| Gary D. Brown | | Chief Financial Officer | | 100,000(2) | | 559,851 |

| Curt D. Bernardi | | Vice President, Legal and Corporate Secretary | | 100,000(2) | | 559,851 |

| Frazer W. Bourchier | | Vice President, Business Development & Technical Services | | 100,000(3) | | 559,499 |

| | | | | 815,700 | | 4,566,355 |

| | |

| | |

| (1) | The amounts in this column are calculated using the Black-Scholes-Merton model. Key assumptions and estimates used in the model include an expected option life of 2.5 years, a discount rate based on the average yields of 2 year and 3 year Government of Canada benchmark bonds and a volatility ranging from 50%-55% based on historical volatility of the stock price of the Company during the 2.5 year period immediately preceding the grant date. Converted to United States dollars at the exchange rate of C$1.00 = US$1.0054, being the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2010. |

| (2) | These stock options vested as to one-third on March 9, 2010 and as to one-third on March 9, 2011 and will vest as to one-third on March 9, 2012. The exercise price for these stock options is C$15.89. |

| (3) | These stock options vested as to one-third on January 1, 2010 and as to one-third on January 1, 2011 and will vest as to one-third on January 1, 2012. The exercise price for these stock options is C$15.88. |

Other Long-Term Incentive Plans

The Company does not have any other long-term incentive plans, including any supplemental executive retirement plans.

Other Compensation – Perquisites

During the financial year ended December 31, 2010, none of the Named Executive Officers received any perquisites which in the aggregate was greater than C$50,000 or 10% of the respective Named Executive Officer’s salary.

Future Year Compensation

Commencing in 2011, the Company’s executive compensation program includes an additional element consisting of performance share units (“PSUs”). Approximately 40% of the value of the long-term award that has historically been awarded in stock options of the Company was instead awarded in PSUs for 2011. The remaining 60% of the value of the long-term award continued to be awarded in stock options. PSUs are subject to performance criteria relating to the performance of the Common Shares compared to a comparator group, with a maximum potential payout of 200% of the original grant. The performance criteria will be evaluated at the end of a three year performance period. PSUs will be paid out in cash based on the value of Common Shares at the expiry of the performance period. This process will be more fully outlined in the management information circular of the Company for the year ended December 31, 2011.

- 14 -

Executive Share Ownership Requirements

In November 2010, the Board implemented a policy which requires certain officers of the Company to hold a minimum of either two or three times their base salary in Common Shares, as more fully detailed in the table below. This requirement must be attained within three years of November 8, 2010 or becoming such an officer, whichever is later, and must be maintained throughout their tenure as such an officer. In calculating such holdings, the officer may include any Restricted Share Rights held, but may not include any options held. All of the Named Executive Officers to which the policy applies satisfied these requirements as at December 31, 2010, even though in some cases the Named Executive Officer was not required to satisfy these stock ownership requirements until November 8, 2013 as noted in the table below. The Human Resources Committee will periodically review and make recommendations to the Board as to what level of shareholding requirement is appropriate for the Company.

The following table provides information regarding the share ownership, actual and required, for each officer to which the share ownership requirement policy applies as of December 31, 2010.

Executive Share Ownership Requirements and Actual Share Ownership

| | | | | | |

| | Share Ownership Requirement | Actual Share Ownership(1) |

| | | Ownership | | Restricted | Total | Satisfied |

| | Multiple of | Requirement | Common | Share Rights | Ownership | Ownership |

| Name | Base Salary | ($) | Shares ($) | (2)($) | ($) | Requirement? |

| | | | 13,736,267 | 1,047,679 | | |

| Peter D. Barnes | Three times | 2,035,935 | (350,500 | (26,733 | 14,783,946 | Yes |

| | | | Shares) | Rights) | | |

| | | | | 1,007,196 | | |

| Randy V.J. Smallwood | Two times | 804,320 | 1,959,525 | (25,700 | 2,966,721 | N/A(3) |

| | | | (50,000 Shares) | Rights) | | |

| | | | | 462,448 | | |

| Gary D. Brown | Two times | 643,456 | 387,986 | (11,800 | 850,434 | N/A(3) |

| | | | (9,900 Shares) | Rights) | | |

| | | | | 693,672 | | |

| Curt D. Bernardi | Two times | 643,456 | Nil | (17,700 | 693,672 | N/A(3) |

| | | | (Nil Shares) | Rights) | | |

| Frazer W. Bourchier | Nil | Nil | Nil | Nil | Nil | N/A(4) |

| | | | (Nil Shares) | (Nil Rights) | | |

| | |

| | |

| (1) | Represents Common Shares and Restricted Share Rights beneficially owned by the respective officers, directly or indirectly, or over which control or direction is exercised. The number of securities held by officers is to the knowledge of the Company based on information provided by the officers. Calculated using the closing price of the Common Shares on the TSX on December 31, 2010 of C$38.98 and converted to United States dollars at the exchange rate of C$1.00 = US$1.0054, being the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2010. |

- 15 -

| |

| (2) | This column includes all Restricted Share Rights held, including Restricted Share Rights in respect of which the restricted period has expired but for which an officer has elected to defer receipt. |

| (3) | This requirement is not currently applicable as pursuant to the share ownership policy, the named executive officer has three years from the Board’s adoption of the stock ownership policy on November 8, 2010 to attain the required share ownership. |

| (4) | The share ownership policy does not apply to Mr. Bourchier. |

Succession Planning for Chief Executive Officer

The Board is responsible for succession planning for the role of the Chief Executive Officer of the Company, and the Human Resources Committee is responsible for providing recommendations to the Board on succession planning for the Chief Executive Officer.

The Human Resources Committee formally considers succession planning for the Chief Executive Officer at meetings held in March of each year.

The Board recognizes that succession planning at the Company is challenged by the limited number of employees the Company has. The Company has a total of 24 employees as of March 23, 2011, including six employees located in the Cayman Islands. Ultimately, an external hire may be necessary for the Chief Executive Officer role depending on the circumstances at the time of the vacancy. The Board seeks opportunities to interact with and develop potential eventual internal successors. The Board also encourages all employees to engage in professional development and training to improve their skills and abilities.

Depending on opportunities and identified candidates, further actions may be undertaken. In part as a result those discussions, as of January 1, 2010, Mr. Barnes ceased to the President of the Company but continued as the Chief Executive Officer of the Company, and Mr. Smallwood was appointed the President of the Company.

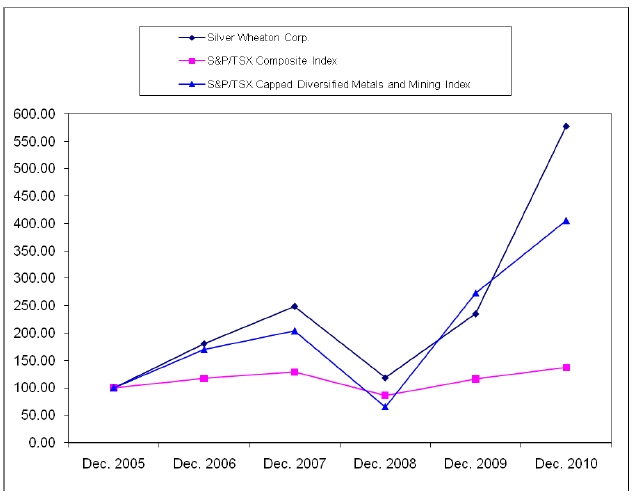

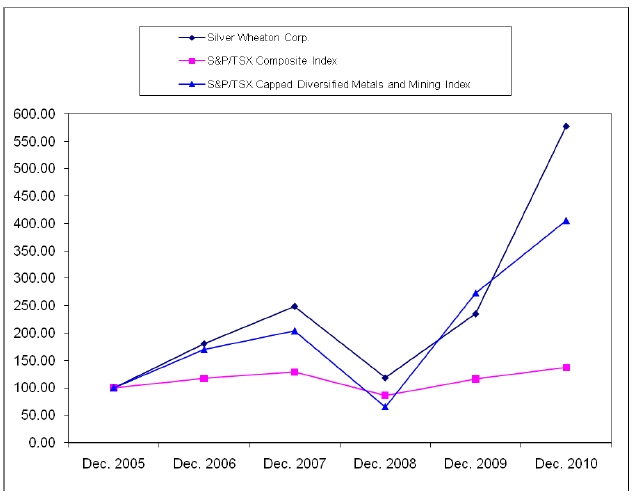

Performance Graph

The following graph compares the yearly percentage change in the cumulative total shareholder return for C$100 invested in Common Shares on December 31, 2005 against the cumulative total shareholder return of the S&P/TSX Composite Index and the S&P/TSX Capped Diversified Metals and Mining Index for the five most recently completed financial periods of the Company, assuming the reinvestment of all dividends.

- 16 -

| | | | | | |

| (in C$) | Dec/05 | Dec/06 | Dec/07 | Dec/08 | Dec/09 | Dec/10 |

| Silver Wheaton Corp. | 100.00 | 181.04 | 248.89 | 118.52 | 235.26 | 577.48 |

| S&P/TSX Composite Index | 100.00 | 117.26 | 128.79 | 86.28 | 116.53 | 137.05 |

| S&P/TSX Capped Diversified | | | | | | |

| Metals and Mining Index | 100.00 | 169.79 | 203.75 | 65.21 | 273.24 | 405.74 |

The performance graph illustrates that Silver Wheaton has outperformed both the S&P/TSX Composite Index and the S&P/TSX Capped Diversified Metals and Mining Index (“Metals and Mining Index”) over the five most recently completed financial periods of the Company. Generally, performance trends are more closely aligned with the Metals and Mining Index. NEO total compensation reported in 2005 is not necessarily reflective of Company performance in that period or easily comparable to compensation in subsequent years, as in 2005 the Company did not employ full-time executives as the business was in its start-up phase. NEO total compensation reported for financial periods ended in 2006 through 2010 is consistent with the Company’s trend in performance in that total compensation of the NEOs increased in 2006 and 2007, decreased in 2008, and again increased in 2009 and 2010.

The total shareholder return of the Company increased 145% from December 31, 2009 to December 31, 2010, compared to 18% for the S&P/TSX Composite Index and 48% for the Metals and Mining Index. NEO total compensation in respect of 2009 compared to the 2010 at the Company increased by 27% (excluding Mr. Bourchier who was not with the Company in 2009).

- 17 -

Summary Compensation Table

The following table provides information for the three most recently completed financial years ended December 31, 2010, 2009 and 2008 regarding compensation earned by each of the following executive officers of the Company: (a) the Chief Executive Officer, (b) the Chief Financial Officer, and (c) the other three most highly compensated “executive officers” during the financial year ended December 31, 2010 (the “Named Executive Officers” or “NEOs”).

| | | | | | | | |

| | | | | | Non-equity incentive plan | | |

| | | | | | compensation | | |

| | | | | | ($) | | |

| | | | Share-based | Option-based | Annual | Long-term | All other | Total |

| Name and principal | | Salary(1) | Awards(2) | awards | incentive | incentive | compensation | compensation |

| position | Year | ($) | ($) | ($)(3) | plans(4) | plans | ($)(5) | ($) |

Peter D. Barnes

Chief Executive Officer(6) | 2010 | 678,645 | Nil | 1,627,488 | 1,005,400 | Nil | 13,004(9) | 3,324,537 |

| 2009 | 594,688(7) | 606,285 | 827,921 | 713,625 | Nil | 11,647(9) | 2,754,166 |

| 2008 | 513,125 | Nil | 826,607 | 307,875(8) | Nil | 10,562(9) | 1,658,169 |

Randy V.J. Smallwood

President(6) | 2010 | 402,160 | Nil | 1,259,666 | 653,510 | Nil | Nil | 2,315,336 |

| 2009 | 285,450(7) | 388,567 | 620,941 | 570,900 | Nil | Nil | 1,865,858 |

| 2008 | 246,300 | Nil | 619,955 | 174,463(8) | Nil | Nil | 1,040,718 |

Gary D. Brown

Chief Financial Officer | 2010 | 321,728 | Nil | 559,851 | 402,160 | Nil | Nil | 1,283,739 |

| 2009 | 261,663(7) | 267,612 | 275,974 | 228,360 | Nil | Nil | 1,033,609 |

| 2008 | 121,427 | Nil | 525,386 | 53,365(8) | Nil | Nil | 700,178 |

Curt D. Bernardi

Vice President, Legal and

Corporate Secretary | 2010 | 321,728 | Nil | 559,851 | 402,160 | Nil | Nil | 1,283,739 |

| 2009 | 261,663(7) | 267,612 | 27,597 | 228,360 | Nil | Nil | 785,232 |

| 2008 | 14,617 | Nil | 157,124 | 4,105 | Nil | Nil | 175,846 |

Frazer W. Bourchier

Vice President, Business

Development & Technical

Services | | | | | | | | |

| 2010 | 256,377 | Nil | 559,499 | 196,053 | Nil | Nil | 1,011,929 |

| | | | | | | | |

| | | | | | | | |

| (1) | Salaries and bonuses for the Named Executive Officers are paid in Canadian dollars and converted to United States dollars for reporting purposes in the Summary Compensation Table for the financial year ended December 31, 2010 at the exchange rate of C$1.00 = US$1.0054, for the financial year ended December 31, 2009 at the exchange rate of C$1.00 = US$0.9515, and for the financial year ended December 31, 2008 at the exchange rate of C$1.00 = US$1.8210. |

| (2) | This column represents Restricted Share Rights granted in respect of the financial year noted. These awards are typically made by March 15 of the following financial year. The amounts in this column for 2009 are calculated by multiplying the grant date fair value of the Restricted Share Rights of C$15.89 (which was the closing price of the Common Shares on the TSX as of the day before the award was made) by the number of Restricted Share Rights awarded, and has been converted to United States dollars for reporting purposes in the Summary Compensation Table for the financial year ended December 31, 2009 at the exchange rate of C$1.00 = US$0.9515, being the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2009. |

| (3) | The amounts in this column are calculated using the Black-Scholes-Merton model. Key assumptions and estimates used in the model include an expected option life of 2.5 years, a discount rate based on the average yields of 2 year and 3 year Government of Canada benchmark bonds and a volatility ranging from 45%-50% for 2008, 50% for 2009 and 50% to 55% for 2010 based on historical volatility of the stock price of the Company during the 2.5 year period immediately preceding the grant date. |

| (4) | Amounts in this column are paid as annual cash bonuses in respect of the financial year noted. These payments are generally made by March 31 of the following financial year. |

| (5) | The value of perquisites for each Named Executive Officer did not exceed the lesser of C$50,000 and 10% of the total salary of such Named Executive Officer in 2010, and are therefore not included in “All other compensation” as permitted under Canadian securities laws. All perquisites have a direct cost to the Company and were valued on this basis. |

| (6) | As of January 1, 2010, Mr. Barnes ceased to be the President of the Company but continued as the Chief Executive Officer of the Company, and Mr. Smallwood was appointed the President of the Company. |

| (7) | The base salary for each Named Executive Officer remained unchanged from 2008 to 2009. Differences in this table between 2009 and 2008 base salaries result from the use of different exchange rates in 2009 and 2008 in converting to United States dollars, and in the case of Mr. Brown and Mr. Bernardi, from a full year salary applying in 2009 rather than being pro-rated based on the start date of employment in 2008. |

- 18 -

| (8) | These amounts have been restated to include the following bonuses awarded in July 2009 in respect of 2008 performance, which were not reflected in the management information circular of the Company dated March 27, 2009: C$150,000 for Mr. Barnes, C$100,000 for Mr. Smallwood and C$25,000 for Mr. Brown. |

| (9) | These amounts represent life and disability insurance premiums paid by the Company on behalf of Mr. Barnes. |

The aggregate total compensation paid to the Named Executive Officers represents approximately 3.2% of the 2010 net earnings of the Company and 2.2% of the 2010 total comprehensive income of the Company.

Incentive Plan Awards

The following table provides information regarding the incentive plan awards for each Named Executive Officer outstanding as of December 31, 2010.

Outstanding Share-Based Awards and Option-Based Awards

| | | | | | |

| | | Option-based Awards | | Share-based Awards |

| | | | | | | Market or |

| | Number of | | | | | payout value of |

| | securities | | | Value of | Number of shares | share-based |

| | underlying | Option | | unexercised | or units of shares | awards that |

| | unexercised | exercise | Option | in-the-money | that have not | have not |

| Name | options (#) | price (C$) | expiration date | options ($)(1)(2) | vested (#)(3) | vested ($)(2)(4) |

| Peter D. Barnes | 200,000 | 12.60 | February 21, 2012 | 5,304,490 | | |

| | 200,000 | 16.63 | February 27, 2013 | 4,494,138 | | |

| | 100,000 | 9.08 | February 23, 2014 | 3,006,146 | 26,733 | 1,047,679 |

| | 290,700 | 15.89 | March 9, 2015 | 6,748,509 | | |

| Randy V.J. Smallwood | 200,000 | 12.60 | February 21, 2012 | 5,304,490 | | |

| | 150,000 | 16.63 | February 27, 2013 | 3,370,604 | | |

| | 225,000 | 9.08 | February 23, 2014 | 6,763,829 | 25,700 | 1,007,196 |

| | 225,000 | 15.89 | March 9, 2015 | 5,223,304 | | |

| Gary D. Brown | 33,333 | 9.08 | February 23, 2014 | 1,002,039 | | |

| | 100,000 | 15.89 | March 9, 2015 | 2,321,469 | 11,800 | 462,448 |

| Curt D. Bernardi | 10,000 | 9.08 | February 23, 2014 | 300,615 | | |

| | 100,000 | 15.89 | March 9, 2015 | 2,321,469 | 17,700 | 693,672 |

| Frazer W. Bourchier | 66,667 | 15.88 | January 1, 2015 | 1,548,324 | Nil | Nil |

| (1) | Calculated using the closing price of the Common Shares on the TSX on December 31, 2010 of C$38.98 and subtracting the exercise price of in-the-money stock options. These stock options have not been, and may never be, exercised and actual gains, if any, on exercise will depend on the value of the Common Shares on the date of exercise. |

| (2) | Converted to United States dollars at the exchange rate of C$1.00 = US$1.0054, being the closing exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada on December 31, 2010. |

| (3) | This column reflects Restricted Share Rights for which the restricted period has not yet expired or for which the holder has irrevocably elected to defer receipt beyond December 31, 2010. |

| (4) | Calculated using the closing price of the Common Shares on the TSX on December 31, 2010 of C$38.98. |

- 19 -

The following table provides information regarding the value vested or earned of incentive plan awards for each Named Executive Officer for the financial year ended December 31, 2010.

Value Vested or Earned During the Financial Year Ended December 31, 2010

| | | |

| | Option-based awards – | Share-based awards – | Non-equity incentive plan |