UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

(Mark One)

| þ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2012

or

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-33337

COLEMAN CABLE, INC.

(Exact name of registrant as specified in its charter)

| | |

| Delaware | | 36-4410887 |

(State or other jurisdiction of incorporation or organization) | | (I.R.S. Employer Identification No.) |

1530 Shields Drive

Waukegan, Illinois 60085

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code:

(847) 672-2300

Securities registered pursuant to Section 12(b) of the Act:

| | |

Title of Each Class | | Name of Exchange on Which Registered |

| Common Stock, par value $0.001 per share | | NASDAQ Global Market |

Securities registered pursuant to Section 12(g) of the Act:

None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ¨ No þ

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ¨ No þ

Indicate by check mark whether the registrant: (1) has filed all reports to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirement for the past 90 days. Yes þ No ¨

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data file required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes þ No ¨

Indicate by check mark if disclosure of delinquent filers pursuant to Item 405 of Regulation S-K is not contained herein, and will not be contained, to the best of registrant’s knowledge, in definitive proxy or information statements incorporated by reference in Part III of this Form 10-K or any amendment to this Form 10-K. þ

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | þ |

| | | |

| Non-accelerated filer | | ¨ (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ¨ No þ

The aggregate market value of the voting stock held by non-affiliates of the registrant as of June 30, 2012 was $98,922,563.

As of March 1, 2013, we had 17,660,523 shares of common stock outstanding

DOCUMENTS INCORPORATED BY REFERENCE

Part III of this Annual Report on Form 10-K incorporates by reference portions of the registrant’s Proxy Statement on Schedule 14A for its 2013 Annual Meeting of Stockholders. If such proxy is not filed with the Securities and Exchange Commission within 120 days after the end of the fiscal year covered by this Annual Report on Form 10-K, an amendment to this Annual Report on Form 10-K will be filed not later than the end of such 120-day period.

TABLE OF CONTENTS

TRADEMARKS

Our trademarks, service marks and trade names referred to in this report include American Contractor®, BaronTM, Booster-in-a-Bag®, CCI®, Clear SignalTM, Copperfield®, Corra/Clad®, Maximum Energy®, Moonrays®, Plencote®, Polar-FlexTM, Polar-Rig 125(R), Polar Solar®, Power Station®, Push-LockTM, Road Power®, Royal®, Seoprene®, Continental®, Triangle®,Signal®, Woods®, The Designers Edge® ,TRC®, Shock Shield®, Electra Shield®, Fire Shield®, Yellow Jacket®, X-Treme BoxTM, and WatteredgeTM, among others.

2

PART I

Cautionary Note Regarding Forward-Looking Statements

Various statements contained in this report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These statements may be identified by the use of forward-looking terminology such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “predict,” “should,” or the negative thereof or other variations thereon or comparable terminology. In particular, statements about our expectations, beliefs, plans, objectives, assumptions or future events or performance contained in this report, including certain statements contained in “Business,” “Risk Factors,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” are forward-looking statements.

We have based these forward-looking statements on our current expectations, assumptions, estimates and projections. While we believe these expectations, assumptions, estimates and projections are reasonable, such forward-looking statements are only predictions and involve known and unknown risks and uncertainties, many of which are beyond our control. These and other important factors, including those discussed under “Risk Factors,” and elsewhere in this report may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by these forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include:

| | • | | fluctuations in the supply or price of copper and other raw materials including PVC and fuel; |

| | • | | increased competition from other wire and cable manufacturers, including foreign manufacturers; |

| | • | | pricing pressures causing margins to decrease; |

| | • | | our dependence on indebtedness and our ability to satisfy our debt obligations; |

| | • | | changes in the cost of labor; |

| | • | | failure to identify, finance or integrate acquisitions; |

| | • | | product liability claims and litigation resulting from the design or manufacture of our products; |

| | • | | advancements in wireless technology; |

| | • | | impairment charges related to our goodwill and long-lived assets; |

| | • | | disruption in the importation of raw materials and products from foreign-based suppliers; |

| | • | | our ability to maintain substantial levels of inventory; |

| | • | | increase in exposure to political and economic development, crises, instability, terrorism, civil strife, expropriation, and other risks of doing business in foreign markets; |

| | • | | other risks and uncertainties, including those described under “Risk Factors.” |

Given these risks and uncertainties, we caution you not to place undue reliance on these forward-looking statements. In addition, any forward-looking statements represent our views only as of today and should not be relied upon as representing our views as of any subsequent date. We do not undertake and specifically decline any obligation to update any of these statements or to publicly announce the result of any revisions to any of these statements to reflect future events or developments, therefore, you should not rely on these forward-looking statements as representing our views as on any date subsequent to today.

3

General

Coleman Cable, Inc. (the “Company,” “Coleman,” “we,” “us” or “our”) is a leading designer, developer, manufacturer and supplier of electrical wire and cable products for consumer, commercial and industrial applications, with operations primarily in the United States (“U.S.”) and, to a lesser degree, in Honduras and Canada. Our broad line of wire and cable products enables us to offer our customers a single source for many of their wire and cable product requirements. We manufacture our products in nine domestic manufacturing locations and supplement our domestic production with both international and domestic sourcing. We sell our products to more than 8,000 active customers in diverse end markets, including a wide range of specialty distributors, retailers and original equipment manufacturers (“OEMs”). Virtually all of our products are sold to customers located in either the U.S. or Canada.

Company History

We were incorporated in Delaware in 1999. The majority of our operations came from Coleman Cable Systems, Inc., our predecessor company, which was formed in 1970 and which we acquired in 2000. In March 2007, we registered 16.8 million shares of our common stock pursuant to a registration rights agreement with our principal shareholders in connection with a private placement of our common stock in 2006. Upon completion of such registration in March 2007, our common stock became listed on the NASDAQ Global Market under the symbol “CCIX.”

Business Overview

We produce products across four primary product lines: (1) industrial wire and cable, including portable cord, machine tool wiring, welding, instrumentation, tray and mining cable and other power cord products; (2) electronic wire, including telephone, data, security and coaxial cable, thermostat wire and irrigation cable; (3) assembled products, including extension cords, booster and battery cable, lighting products and surge and strip products; and (4) fabricated bare wire, including stranded, bunched, and single-end copper, copper clad steel and various copper alloy wire.

The core component of most of our products is copper wire which we draw from copper rod into a variety of gauges of both solid and stranded copper wires. We use a significant amount of the copper wire that we produce as an input into the production of our finished wire and cable products, while the remainder of our copper wire production is sold in the form of bare copper wire (in a variety of gauges) to external OEMs and wire and cable producers. In the majority of our wire and cable products, a thermoplastic or thermosetting insulation is extruded over the bare wire (in a wide array of compounds, quantities, colors and gauges) and then cabled (twisted) together with other insulated wires. An outer jacket is then extruded over the cabled product. This product is then coiled or spooled and packaged for sale or processed further into a cable assembly. We have further expanded our product offerings in recent years through acquisitions to include power management and electrical safety solutions and secondary power connectors.

Our business is organized into three reportable segments: (1) Distribution, (2) OEM, and (3) Engineered Solutions. Within these three reportable segments, we sell our products into multiple channels, including electrical distribution, wire and cable distribution, OEM/government, heating, ventilation, air conditioning and refrigeration (“HVAC/R”), irrigation, industrial/contractor, security/home automation, recreation/transportation, copper fabrication, U.S. military, retail and automotive.

More detailed information regarding our primary product lines and segments is set forth below within the “Product Overview” and “Segment Overview” sections, as well as within Note 18 of Notes to Consolidated Financial Statements contained in Part II, Item 8 of this document.

4

Industry and Competitive Overview

The industries which utilize our diversified products are mature and though they have experienced significant consolidation over the past few years, they remain fragmented and characterized by a large number of competitors. As such, the markets we serve are highly competitive. While no single company competes with us in all of our product lines as a result of the diversity of our offerings, various companies compete with us in one or more product lines. Many of these competitors are large, well-established companies with greater financial resources than us. In addition, many of our products are made to industry specifications and, therefore, may be interchangeable with our competitors’ products. In addition, in a number of product categories we face competition from products manufactured in foreign countries. Competition in the markets we serve is based on a number of factors, such as breadth of product offering, inventory availability, delivery time, price, quality, customer service and relationships, brand recognition and logistics capabilities. We believe we can compete effectively on the basis of each of these factors.

Product Overview

In 2012, 2011 and 2010, net sales across our four major product lines were as follows:

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

Net Sales by Product Lines | | 2012 | | | 2011 | | | 2010 | |

| | | (In thousands) | |

Industrial Wire and Cable | | $ | 455,870 | | | $ | 412,248 | | | $ | 328,405 | |

Assembled Products | | | 212,215 | | | | 237,716 | | | | 196,523 | |

Electronic Wire | | | 208,579 | | | | 177,817 | | | | 154,825 | |

Fabricated Bare Wire | | | 37,917 | | | | 39,575 | | | | 24,010 | |

| | | | | | | | | | | | |

Total | | $ | 914,581 | | | $ | 867,356 | | | $ | 703,763 | |

| | | | | | | | | | | | |

Industrial Wire and Cable

Our industrial wire and cable product line includes portable cord, machine tool wiring, building wire, welding, mining, pump, control, stage/lighting, diesel/locomotive, instrumentation, tray, thermocouple, high temperature, and metal clad cables and other power cord products. Our products are available in either polyvinyl chloride (“PVC”), crosslink, or thermoset constructions. Since 2008, we have invested resources to create 16 new industrial product lines to support the utility, energy, and infrastructure construction markets that are expected to grow over the next few years. These are medium power supply cables used for permanent or temporary connections between a power source (such as a power panel, receptacle or transformer) and a device (such as a motor, light, transformer or control panel). These products are used in construction, industrial material requisition order “MRO” and OEM applications, such as airline support systems, wind turbines, solar, utilities, cranes, marinas, offshore drilling, fountains, car washes, sports lighting, construction, food processing, forklifts, mining and military applications. In recent years, we have introduced several new industrial products. Our brands in this product line include Royal, Seoprene, Copperfield, Continental, Triangle and Corra/Clad.

Assembled Products

Our assembled products include multiple types of extension cords, as well as ground fault circuit interrupters, portable lighting (incandescent, fluorescent and halogen), retractable reels, holiday items, solar lighting, recreational vehicle (“RV”) cords and adapters, and surge and strip products. For the automotive aftermarket we offer booster cables, battery cables, battery accessories and secondary power connectors. This product type also includes the design and manufacture of power management and battery management tools for secondary or re-chargeable batteries. These battery product solutions support customers in military, commercial and industrial sectors. Our brands in this area of our business include Woods, Moonrays, Polar Solar, Yellow Jacket, American Contractor, Road Power, Power Station, Booster-in-a-Bag, TRC, Shock Shield, Electra Shield, Fire Shield, Designers Edge, Watteredge and privately-labeled brands.

5

Electronic Wire

Our electronic wire product line includes telephone, data, security, coaxial, industrial automation, instrumentation, twinaxial, fire alarm, plenum and home automation cables. These cables permanently connect devices, and they provide power, signal, voice, data or video transmissions from a device (such as a camera, alarm or terminal) to a source (such as a control panel, splice strip or video recorder). These products are used in applications such as telecommunication, security, fire detection, access control, video monitoring, data transmission, intercom and home automation systems. Our primary brands in this product line include Signal, Plencote, Soundsational and Clear Signal.

Our electronic wire product line also includes low voltage cable products comprised of thermostat wire and irrigation cables. These cables permanently connect devices, and they provide low levels of power between devices in a system (such as a thermostat and the switch on a furnace, or a timer and a switch, device or sensor). They are used in applications such as HVAC/R, energy management, home sprinkler systems and golf course irrigation. We sell many of our low voltage cables under the Baron, BaroStat and BaroPak brand names.

Fabricated Bare Wire Products

Our fabricated bare wire products conduct power or signals and include stranded, bunched and single-end copper, copper-clad steel and various copper alloy wire. In this area, we process copper rod into stranding for use in our electronic and electrical wire and cable products or for sale to others for use in their products. We use most of our copper wire production to produce our own finished products. Our primary brand in this product line is Copperfield.

Segment Overview

As noted above, we classify our business into three reportable segments: (1) Distribution, (2) OEM, and (3) Engineered Solutions. Our reportable segments are a function of how we are organized internally to market to our customer groups and measure our financial performance. The Distribution and OEM segments serve customers within the distribution, retail, and OEM businesses. Our Engineered Solutions segment was previously called “Other” and contained the majority of our TRC acquisition made in 2011. A portion of TRC’s legacy business was integrated into our Distribution segment during 2011 and remains unchanged. The “Other” segment was renamed “Engineered Solutions” as a result of having acquired Watteredge in May 2012 and also contains the remainder of TRC’s legacy business which has not been integrated into our other reportable segments. Financial data for our business segments is as follows:

| | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2012 | | | 2011 | | | 2010 | |

Net sales: | | | | | | | | | | | | |

Distribution | | $ | 646,007 | | | $ | 632,777 | | | $ | 525,274 | |

OEM | | | 225,282 | | | | 217,831 | | | | 178,489 | |

Engineered Solutions | | | 43,292 | | | | 16,748 | | | | — | |

| | | | | | | | | | | | |

Reporting Segment Total | | $ | 914,581 | | | $ | 867,356 | | | $ | 703,763 | |

| | | | | | | | | | | | |

Operating income: | | | | | | | | | | | | |

Distribution | | $ | 62,609 | | | $ | 60,885 | | | $ | 47,834 | |

OEM | | | 17,375 | | | | 15,526 | | | | 13,089 | |

Engineered Solutions | | | 4,772 | | | | (820 | ) | | | — | |

| | | | | | | | | | | | |

Reporting Segment Total | | | 84,756 | | | | 75,591 | | | | 60,923 | |

Corporate | | | (20,945 | ) | | | (22,907 | ) | | | (19,941 | ) |

| | | | | | | | | | | | |

Consolidated Operating Income | | $ | 63,811 | | | $ | 52,684 | | | $ | 40,982 | |

| | | | | | | | | | | | |

6

Segment operating income represents income from continuing operations before interest expense, other income or expense, and income taxes. Corporate consists of items not charged or allocated to the segments, including costs for employee relocation, discretionary bonuses, professional fees, restructuring expenses, asset impairments, share-based compensation expense, and intangible amortization. Our segments, excluding our Engineered Solutions segment, have largely common production processes, and share manufacturing and distribution capacity. Accordingly, we do not identify net assets to our Distribution and OEM segments.

Raw Materials

Copper is the primary raw material used in the manufacturing of our products. We currently obtain copper from multiple suppliers and there are many alternative sources of copper available to us. An unanticipated significant issue with any of our current suppliers of copper would require us to transition to alternative suppliers. While such a transition would cost us time and resources, alternative suppliers are readily available. Other significant raw materials used in the manufacturing of our products are plastics, such as polyethylene and PVC, aluminum, linerboard and wood reels. As with copper, these raw materials are sourced from multiple suppliers and there are many alternative suppliers available to us. We typically have supplier agreements with terms of one to two years under which we may make purchases at the prevailing market price at the time of purchase, with no minimum purchase requirements. Our centralized procurement department makes an ongoing effort to reduce and contain raw material costs. From time to time, we have employed, and may continue to employ, the use of derivatives, including copper commodity contracts, to manage our costs for such materials and to match our sales terms with certain customers.

As noted above, copper comprises one of the major components for wire and cable products. Copper prices can be volatile. Wire and cable manufacturers are generally able to pass through changes in the cost of copper to customers. The cost of our products typically comprises a relatively small component of the overall cost of end products produced by customers in each of our end markets. As a result, our customers are generally less sensitive to marginal fluctuations in the price of copper as our products make up a relatively small portion of their overall purchases. However, there can be timing delays of varying lengths for implementing price changes depending on the magnitude of the change, the type of product, competitive conditions, particular customer arrangements, and inventory management.

Foreign Sales and Assets

For 2012, 2011 and 2010, our consolidated net sales included a total of $65.8 million, $63.7 million and $47.7 million, respectively, of Canadian sales. In addition, we had a total of approximately $0.3 million and $0.2 million in tangible long-lived assets in Canada at December 31, 2012 and 2011, respectively. As a result of the Technology Research Corporation (“TRC”) acquisition, we had $1.5 million and $1.6 million in tangible long-lived assets in Honduras at December 31, 2012 and 2011, respectively. We did not have any significant sales outside of the U.S. and Canada in 2012, 2011 or 2010. In addition, there are no external sales from our location in Honduras. All sales transactions to and from Honduras are intercompany transactions with other owned entities.

Patents and Trademarks

We own a number of U.S. and foreign patents covering certain of our products. Our patents have varying durations currently ranging from less than a year to 15 years. We also own a number of registered trademarks. While we consider our patents and trademarks to be valuable assets, we do not consider any single patent or trademark to be of such material importance that its absence would cause a material disruption to our business.

Seasonality and Business Cycles

Our net sales follow general business cycles. We also have experienced, and expect to continue to experience, certain seasonal trends in net sales and cash flow. Net sales are generally higher in the third and fourth quarters

7

due to increased customer demand in anticipation of, and during, the winter months and holiday season. As a result of historically higher demand for our products during the late fall and early winter months, we typically increase our inventory levels during the third and early fourth quarters of the year. In addition, trade receivables arising from increased shipments made during the late fall and early winter months are typically collected during late fourth quarter and early first quarter of each year.

Backlog and Shipping

We have no significant order backlog because, in general, we follow the industry practice of stocking finished goods to meet customer demand on a just-in-time basis. We believe that the ability to fill orders in a timely fashion is a competitive factor in the markets in which we operate.

Employees

As of December 31, 2012, we had 1,726 employees, with 15.3% of our employees represented by one labor union. Our current collective bargaining agreement expired December 21, 2012 and was subsequently extended until April 30, 2013. We consider our labor relations to be good and we have not experienced any significant labor disputes.

Environmental, Health and Safety Regulation

Many of our products are subject to the requirements of federal, state and local or foreign regulatory authorities. We are subject to federal, state, local and foreign environmental, health and safety protection laws and regulations governing our operations and the use, handling, disposal and remediation of regulated materials currently or formerly used by us. A risk of environmental liability is inherent in our current and former manufacturing activities in the event of a release or discharge of regulated materials generated by us. We are party to one environmental claim, which is described below under the heading “Legal Proceedings.” At this time, the cost of compliance with environmental, health and safety laws and requirements is not material to us. There can be no assurance that the costs of complying with environmental, health and safety laws and requirements in our current operations, or that the potential liabilities arising from past releases of or exposure to regulated materials, will not result in future expenditures by us that could materially and adversely affect our financial position, results of operations or cash flows.

Disruptions in the supply of copper and other raw materials used in our products could cause us to be unable to meet customer demand, which could result in the loss of customers and net sales.

Copper is the primary raw material that we use to manufacture our products. Other significant raw materials that we use are plastics, such as polyethylene and PVC, aluminum, linerboard and wood reels. We typically have supplier agreements with terms of one to two years for our raw material needs that do not require us to purchase a minimum amount of these raw materials or involve long term fixed pricing arrangements. If we are unable to maintain good relations with our suppliers or if there are any business interruptions at our suppliers, we may not have access to a sufficient supply of raw materials. If we lose one or more key suppliers and are unable to locate an alternative supply, we may not be able to meet customer demand, which could result in the loss of customers and a decrease in net sales.

Fluctuations in the price of copper and other raw materials, as well as fuel and energy, and increases in freight costs could increase our cost of goods sold and affect our profitability.

The prices of copper and our other significant raw materials, as well as fuel and energy costs, are subject to considerable volatility. This volatility has affected our profitability and we expect that it will continue to do so in

8

the future. Our agreements with our suppliers generally require us to pay market price for raw materials at the time of purchase. As a result, volatility in these prices, particularly copper prices, can result in significant fluctuations in our cost of goods sold. If the cost of raw materials increase and we are unable to increase the prices of our products, or offset those cost increases with cost savings in other parts of our business, our profitability will be reduced. As a result, increases in the price of copper and other raw materials may affect our profitability if we cannot effectively pass these price increases on to our customers. In addition, we pay the freight costs on certain customer orders. In the event that freight costs increase substantially due to fuel surcharges or otherwise our profitability may decline.

The markets for our products are highly competitive, and our inability to compete with other manufacturers in the wire and cable industry could harm our net sales and profitability.

The markets for wire and cable products is fragmented and characterized by a large number of competitors. As such, these markets are highly competitive. We compete with at least one major competitor in each of our business lines. In addition, many of our products are made to industry specifications and may be considered fungible with our competitors’ products. Accordingly, we are subject to competition in many of our markets primarily on the basis of price. We must also be competitive in terms of quality both of product offering, inventory availability, delivery time, price, quality, customer service and relationships, brand recognition and logistics capabilities. We are facing increased competition from products manufactured in foreign countries that in many cases are comparable in terms of quality but are offered at lower prices. Unless we can produce our products at competitive prices or purchase comparable products from foreign sources on favorable terms, we may experience a decrease in our net sales and profitability. Many of these competitors have greater resources, financial and otherwise, than we do and may be better positioned to invest in manufacturing and supply chain efficiencies and product development. We may not be able to compete successfully with our existing competitors or with new competitors.

We face pricing pressure in each of our markets, and our inability to continue to achieve operating efficiency and productivity improvements in response to pricing pressure may result in lower margins.

We face pricing pressure in each of our markets as a result of significant competition and industry overcapacity, and price levels for many of our products (after excluding price adjustments related to the increased cost of copper) have declined over the past few years. We expect pricing pressure to continue for the foreseeable future. A component of our business strategy is to continue to achieve operating efficiencies and productivity improvements with a focus on lowering purchasing, manufacturing and distribution costs. We may not be successful in lowering our costs. In the event we are unable to lower these costs in response to pricing pressure, we may experience lower margins and decreased profitability.

We have significant indebtedness outstanding and may incur additional indebtedness that could negatively affect our business.

We have a significant amount of indebtedness. At December 31, 2012, we had approximately $323.8 million of total indebtedness, comprised of $272.7 million related to our 9% Senior Notes due in 2018 (“2018 Senior Notes”), including an unamortized debt discount of $2.3 million, $50.4 million from our revolving credit facility, and $0.7 million of capital leases.

Our high level of indebtedness and dependence on indebtedness could have important consequences to our shareholders, including the following:

| | • | | our ability to obtain additional financing for capital expenditures, potential acquisition opportunities or general corporate or other purposes may be impaired; |

| | • | | a substantial portion of our cash flow from operations must be dedicated to the payment of principal and interest on our indebtedness, reducing the funds available to us for other purposes; |

| | • | | it may place us at a competitive disadvantage compared to our competitors that have less debt or are less leveraged; and |

9

| | • | | we may be more vulnerable to economic downturns, may be limited in our ability to respond to competitive pressures and may have reduced flexibility in responding to changing business, regulatory and economic conditions. |

Our ability to satisfy our debt obligations will depend upon, among other things, our future operating performance and our ability to refinance indebtedness when necessary. Each of these factors is, to a large extent, is dependent on economic, financial, competitive and other factors beyond our control. If, in the future, we cannot generate sufficient cash from operations to make scheduled payments on our debt obligations, we will need to refinance our existing debt, issue additional equity securities or securities convertible into equity securities, obtain additional financing or sell assets. Our business may not be able to generate cash flow or we may not be able to obtain funding sufficient to satisfy our debt service requirements.

We may not be able to successfully identify, finance or integrate acquisitions in order to grow our business.

We regularly evaluate possible acquisition candidates. We may not be successful in identifying, financing and closing acquisitions on favorable terms. Potential acquisitions may require us to obtain additional financing or issue additional equity securities or securities convertible into equity securities, and any such financing and issuance of equity may not be available on terms acceptable to us or at all. If we finance acquisitions by issuing equity securities or securities convertible into equity securities, our existing shareholders could be diluted, which, in turn, could adversely affect the market price of our stock. If we finance an acquisition with debt, it could result in higher leverage and interest costs. Further, we may not be successful in integrating any such acquisitions that are completed. Integration of any such acquisitions may require substantial management, financial and other resources and may pose risks with respect to production, customer service and market share of existing operations. In addition, we may acquire businesses that are subject to technological or competitive risks, and we may not be able to realize the benefits expected from such acquisitions.

Our products could be subject to product liability claims and litigation, which could adversely affect our financial condition and results of operations and harm our business reputation.

We manufacture products that create exposure to product liability claims, breach of contract claims and litigation. If our products are not properly manufactured or designed, personal injuries or property damage could result, which could subject us to claims for damages. The costs associated with defending product liability claims and payment of damages could be substantial. Our reputation could also be adversely affected by such claims, whether or not successful, and such claims could lead to decreased demand for our systems and products.

Advancing technologies, such as fiber optic and wireless technologies, may make some of our products less competitive and reduce our net sales.

Technological developments could cause our net sales to decline. For example, a significant decrease in the cost and complexity of installation of fiber optic systems or a significant increase in the cost of copper-based systems could make fiber optic systems superior on a price performance basis to copper systems and could have a material adverse effect on our business. Also, advancing wireless technologies, as they relate to network and communication systems, may reduce the demand for our products by reducing the need for on premises wiring. Wireless communications depend heavily on a fiber optic backbone and do not depend as much on copper-based systems. An increase in the acceptance and use of voice and wireless technology, or introduction of new wireless or fiber-optic based technologies, may have a material adverse effect on the marketability of our products and our profitability. If wireless technology were to significantly erode the markets for copper-based systems, our sales of copper premise cables could face downward pressure.

If our goodwill or other intangible assets become impaired, we may be required to recognize charges that would reduce our income.

Under accounting principles generally accepted in the U.S., goodwill assets are not amortized but must be reviewed for possible impairment annually, or more often in certain circumstances if events indicate that the

10

asset values are not recoverable. Deterioration in the macro-economic environment, changes in assumptions, or other factors could necessitate an earnings charge for the impairment of goodwill or other intangible assets in the future, which would reduce our income.

We have incurred restructuring charges in the past and may incur additional restructuring charges in the future.

We have incurred significant restructuring costs in the past and may incur additional restructuring charges in the future. We may not be able to achieve the planned cash flows and savings estimates associated with such restructuring activities if we are unable to accomplish them in a timely manner, are unable to achieve expected efficiencies or cost savings, or unforeseen developments or expenses arise. As we respond to changes in the market and fluctuations in demand levels, we may be required to realign plant production or otherwise restructure our operations, which may result in additional and potentially significant restructuring charges.

Some of our employees belong to a labor union and certain actions by such employees, such as strikes or work stoppages, could disrupt our operations or cause us to incur costs.

As of December 31, 2012, we employed 1,726 persons, 15.3% of whom are covered by a collective bargaining agreement, which expired on December 21, 2012. The Company subsequently extended the agreement until April 30, 2013. If unionized employees were to engage in a concerted strike or other work stoppage, if other employees were to become unionized, or if we are unable to negotiate a new collective bargaining agreement when the current one expires, we could experience a disruption of operations, higher labor costs or both. A strike or other disruption of operations or work stoppage could reduce our ability to manufacture quality products for our customers in a timely manner.

We may be unable to raise additional capital to meet working capital and capital expenditure needs if our operations do not generate sufficient funds to do so.

Our business is expected to have continuing capital expenditure needs. If our operations do not generate sufficient funds to meet our capital expenditure needs for the foreseeable future, we may not be able to gain access to additional capital, if needed, particularly in view of competitive factors and industry conditions. In addition, increases in the cost of copper increase our working capital requirements. If we are unable to obtain additional capital, or unable to obtain additional capital on favorable terms, our liquidity may be diminished and we may be unable to effectively operate our business.

We are subject to environmental, health and safety and other laws and regulations which could adversely affect our operations and business.

We are subject to the environmental laws and regulations of each jurisdiction where we do business. We are currently, and may in the future be, held responsible for remedial investigations and clean-up costs of certain sites damaged by the discharge of regulated materials, including sites that have never been owned or operated by us but at which we have been identified as a potentially responsible party under federal and state environmental laws. Certain of these laws, including the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. Section 9601et seq. (“CERCLA”), impose strict, and under certain circumstances, joint and several, liability for investigation and cleanup costs at contaminated sites on responsible parties, as well as liability for damages to natural resources. We have established reserves for such potential liability and believe those reserves to be adequate; however, there is no guarantee that such reserves will be adequate or that additional liabilities will not arise. See “Legal Proceedings.”

Failure to comply with environmental laws can result in substantial fines, orders to install pollution control equipment and/or claims for alleged personal injury and property damage. Changes in environmental requirements in both domestic and foreign jurisdictions and their enforcement could adversely affect our operations due to increased costs of compliance and potential liability for noncompliance.

11

Disruption in the importation of our raw materials and products and the risks associated with international operations could cause our operating results to decline.

We source certain raw materials and products from foreign-based suppliers. Foreign material purchases expose us to a number of risks, including unexpected changes in regulatory requirements and tariffs, possible difficulties in enforcing agreements, exchange rate fluctuations, and difficulties in obtaining import licenses, economic or political instability, embargoes, exchange controls or the adoption of other restrictions on foreign trade. Although we currently manufacture the vast majority of our products in the U.S., to the extent we decide to establish foreign manufacturing facilities, our foreign manufacturing sales would be subject to similar risks. Further, imports of raw materials and products are subject to unanticipated transportation delays that affect international commerce.

We have risks associated with inventory.

Our business requires us to maintain substantial levels of inventory. We must identify the right mix and quantity of products to keep in our inventory to meet customer orders. Failure to do so could adversely affect our sales and earnings. However, if our inventory levels are too high, we are at risk that an unexpected change in circumstances, such as a shift in market demands, drop in prices, or default or loss of a customer, could have a material adverse impact on the net realizable value of our inventory.

Changes in industry standards and regulatory requirements may adversely affect our business.

As a manufacturer and distributor of wire and cable products, we are subject to a number of industry standard setting authorities, such as Underwriters Laboratories. In addition, many of our products are subject to the requirements of federal, state, local or foreign regulatory authorities. Changes in the standards and requirements imposed by such authorities could have an adverse effect on us. In the event that we are unable to meet any such standards when adopted, our business could be adversely affected.

Our business is subject to the economic, political and other risks of operating and selling products in foreign countries.

Our foreign operations, including Canada, Honduras, and China, are subject to risks inherent in maintaining operations abroad, such as economic and political destabilization, international conflicts, restrictive actions by foreign governments, nationalizations or expropriations, changes in regulatory requirements, the difficulty of effectively managing diverse global operations, adverse foreign tax laws and the threat posed by potential pandemics in countries that do not have the resources necessary to deal with such outbreaks. Over time, we intend to continue expanding our foreign operations, which would serve to increase the level of these risks relative to our business operations and their potential effect on our financial position and results of operations.

We are substantially dependent upon distributors and retailers for non-exclusive sales of our products and they could cease purchasing our products at any time.

Distributors and retailers account for a substantial portion of our sales. These distributors and retailers are not contractually obligated to carry our product lines exclusively or for any period of time. Therefore, these distributors and retailers may purchase products that compete with our products or cease purchasing our products at any time. The loss of one or more large distributors or retailers could have a material adverse effect on our ability to bring our products to end users and on our results of operations. Moreover, a downturn in the business of one or more large distributors or retailers could adversely affect our sales and could create significant credit exposure.

Changes in state and federal tax laws could have a significant impact on our business.

The Company is subject to federal, state, local and foreign taxes. Uncertainty exists surrounding whether certain income tax provisions will remain enacted or change in some manner through passage of new tax legislation. Our

12

effective tax rates could be adversely affected by changes in tax legislation. Additionally, the Company is subject to federal, state, and local tax audits, as well as audits by non-U.S. tax authorities. The audits could result in unfavorable tax adjustments, which could negatively impact the Company’s results.

Failure to retain and attract key employees could have a significant impact on our business.

Our success has been largely dependent on the skills, experience and efforts of our key employees and the loss of the services of any of our executive officers or other key employees, without a properly executed transition plan, could have an adverse affect on us. The loss of our key employees who have intimate knowledge of our manufacturing process could lead to increased competition to the extent that those employees are hired by a competitor and are able to recreate our manufacturing process. Our future success will also depend in part upon our continuing ability to attract and retain highly qualified personnel, who are in great demand.

| ITEM 1B. | Unresolved Staff Comments |

None.

As of December 31, 2012, we owned or leased the following primary facilities:

| | | | | | | | |

Operating Facilities | | Type of Facility | | Approximate

Square Feet | | | Leased or Owned |

Bremen, Indiana (Distribution Center) | | Warehouse | | | 48,000 | | | Leased |

Bremen, Indiana (East) | | Manufacturing | | | 309,200 | | | Owned |

Bremen, Indiana (Fabricating) | | Manufacturing | | | 124,160 | | | Owned |

Bremen, Indiana (Insulating) | | Manufacturing | | | 43,007 | | | Owned |

Clearwater, Florida | | Offices, Manufacturing, Warehouse | | | 59,800 | | | Building owned, land leased |

El Paso, Texas | | Manufacturing, Warehouse | | | 401,400 | | | Leased |

Hayesville, North Carolina | | Manufacturing | | | 104,000 | | | Owned |

Lafayette, Indiana | | Manufacturing, Warehouse | | | 397,188 | | | Owned |

Markham, Ontario, Canada | | Offices, Warehouse | | | 43,629 | | | Leased |

Pleasant Prairie, Wisconsin | | Warehouse | | | 503,000 | | | Leased |

San Pedro Sula, Honduras | | Offices, Manufacturing, Warehouse | | | 47,000 | | | Leased |

Titusville, Florida | | Offices, Warehouse | | | 10,000 | | | Leased* |

Waukegan, Illinois | | Manufacturing | | | 212,530 | | | Owned — 77,394 |

| | | | | | | | Leased — 135,136 |

Waukegan, Illinois | | Offices | | | 30,175 | | | Leased |

York, Pennsylvania | | Offices, Manufacturing, Warehouse | | | 65,000 | | | Leased |

| | | | | | | | |

Closed Facilities | | Closure Year | | Approximate

Square Feet | | | Leased or Owned |

Texarkana, Arkansas | | 2012 | | | 106,700 | | | Owned |

Nogales, Arizona | | 2008 | | | 84,000 | | | Leased |

Siler City, North Carolina | | 2006 | | | 86,000 | | | Owned |

| * | The associated lease expires in the first half of 2013 |

Our operating properties are used to support all of our reportable segments. We believe that our existing facilities are adequate for our operations. We do not believe that any single leased facility is material to our operations and, if necessary, we could readily obtain a replacement facility. Our real estate assets have been pledged as security for certain of our debt.

Our principal corporate offices are located at 1530 Shields Drive, Waukegan, Illinois 60085.

13

We are involved in legal proceedings and litigation arising in the ordinary course of our business, including product liability claims relating to the manufacture or design of our products. In those cases where we are the defendant, plaintiffs may seek to recover large and sometimes unspecified amounts or other types of relief and some matters may remain unresolved for several years. We believe that none of the routine litigation that we now face, individually or in the aggregate, will be material to our business. However, an adverse determination could be material to our financial position, results of operations or cash flows in any given period. We maintain insurance coverage for litigation that arises in the ordinary course of our business and believe such coverage is adequate.

We are party to one environmental claim. The Leonard Chemical Company Superfund site consists of approximately 7.1 acres of land in an industrial area located a half mile east of Catawba, York County, South Carolina. The Leonard Chemical Company operated this site until the early 1980s for recycling of waste solvents. These operations resulted in the contamination of soils and groundwater at the site with hazardous substances. In 1984, the U.S. Environmental Protection Agency listed this site on the National Priorities List. Riblet Products Corporation, with which we merged in 2000, was identified through documents as a company that sent solvents to the site for recycling and was one of the companies receiving a special notice letter from the Environmental Protection Agency (“EPA”) identifying it as a party potentially liable under the CERCLA.

In 2004, along with other “potentially responsible parties” (“PRPs”), we entered into a consent decree with the EPA requiring the performance of a remedial design and remedial action (“RD/RA”) for this site. We have entered into a site participation agreement with other PRPs for fulfillment of the requirements of the consent decree. Under the site participation agreement, we are responsible for a 9.19% share of the costs for the RD/RA. We had a $0.3 million accrual recorded for this liability as of December 31, 2012 and 2011.

We recently received a civil complaint for $2.3 million plus attorney’s fees and expenses related to a recent acquisition. We believe the civil complaint lacks merit and is not payable by us. We believe that we have substantial and meritorious defenses to all currently pending matters. As a result of these and other factors and although no assurances are possible, our currently pending matters are not expected to have a material adverse effect on our business, financial condition or results of operations.

Although no assurances are possible, we believe that our accruals related to environmental litigation and other claims are sufficient and that these items and our rights to available insurance and indemnity will be resolved without material adverse effect on our financial position, results of operations or cash flows.

| ITEM 4. | Mine Safety Disclosures |

Not applicable.

14

PART II

| ITEM 5. | Market for the Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities |

Common Stock

Our common stock is listed on the NASDAQ Global Market under the symbol “CCIX.” The table below sets forth, for the calendar quarters indicated, the reported high and low sales prices of our common stock:

| | | | | | | | | | | | |

| | | 2012 | | | | |

| | | Sales Price | | | | |

| | | High | | | Low | | | Cash

Dividends | |

First Quarter | | $ | 13.23 | | | $ | 8.73 | | | $ | — | |

Second Quarter | | $ | 10.06 | | | $ | 7.79 | | | $ | 0.02 | |

Third Quarter | | $ | 9.80 | | | $ | 8.20 | | | $ | 0.02 | |

Fourth Quarter | | $ | 9.90 | | | $ | 8.10 | | | $ | 0.02 | |

| | | | | | | | | | | | |

| | | 2011 | | | | |

| | | Sales Price | | | | |

| | | High | | | Low | | | Cash

Dividends | |

First Quarter | | $ | 9.00 | | | $ | 5.48 | | | $ | — | |

Second Quarter | | $ | 15.42 | | | $ | 8.25 | | | $ | — | |

Third Quarter | | $ | 17.21 | | | $ | 8.11 | | | $ | — | |

Fourth Quarter | | $ | 10.88 | | | $ | 7.30 | | | $ | — | |

As of March 1, 2013, there were 61 record holders of our common stock. The holders of our common stock are entitled to one vote per share.

Issuer Purchases of Equity Securities

In August 2011, we announced a two-year stock repurchase plan approved by our board of directors pursuant to which up to 0.5 million shares of the Company’s common stock is authorized to be purchased in open market or privately negotiated transactions. We may repurchase our common shares in the future but whether we do so will depend on a number of factors and there can be no assurance that we will purchase any amounts of our common shares.

The following table provides information about purchases made during the quarter ended December 31, 2012 of equity securities that are registered by us pursuant to Section 12 of the Exchange Act:

| | | | | | | | | | | | | | | | |

| | | Total number of

shares purchased | | | Average price

paid per share | | | Total number of

shares purchased as part

of publically announced

Plans | | | Maximum number that may

yet be purchased

under the

Plan | |

October 1, 2012—October 31, 2012 | | | 11,592 | | | $ | 9.46 | | | | 11,592 | | | | | |

November 1, 2012—November 30, 2012 | | | 34,157 | | | $ | 8.64 | | | | 34,157 | | | | | |

December 1, 2012—December 31, 2012 | | | 6,614 | | | $ | 8.91 | | | | 6,614 | | | | | |

| | | | | | | | | | | | | | | | |

Total | | | 52,363 | | | $ | 8.94 | | | | 52,363 | | | | 74,395 | |

15

Recent Sales of Unregistered Securities

None.

Dividends and Distributions

The Company declared $0.02 dividends for shareholders of record in May, July and November during 2012. Payment of future dividends, if any, will be at the discretion of our board of directors and will depend on many factors, including general economic and business conditions, our strategic plans, our financial results and condition, legal requirements and other factors that our board of directors deems relevant. Our credit facility and the indenture governing our 2018 Senior Notes each contain restrictions on the payment of dividends to our shareholders. See Part II, Item 7, “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — Revolving Credit Facility,” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Liquidity and Capital Resources — 9% Senior Notes due 2018 (“Senior Notes”).”

Equity Compensation Plan Information

The following table presents securities authorized for issuance to employees and non-employees under equity compensation plans at December 31, 2012:

| | | | | | | | | | | | |

Plan Category | | Number of Securities to be

Issued Upon Exercise of

Outstanding Options,

Warrants and Rights(1) | | | Weighted-Average

Exercise Price of

Outstanding Options,

Warrants and Rights(2) | | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation

Plans (Excluding

Securities Reflected in

the First Column)(3) | |

Equity Compensation Plans Approved by Security Holders | | | 1,964,011 | | | $ | 11.09 | | | | 292,043 | |

Equity Compensation Plans Not Approved by Security Holders | | | — | | | | — | | | | — | |

Total | | | 1,964,011 | | | $ | 11.09 | | | | 292,043 | |

| (1) | Includes both grants of stock options and unvested share awards. |

| (2) | Includes weighted-average exercise price of outstanding stock options only. |

| (3) | Does not include shares which may become available due to forfeiture or expiration. |

16

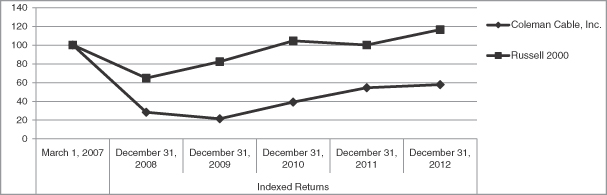

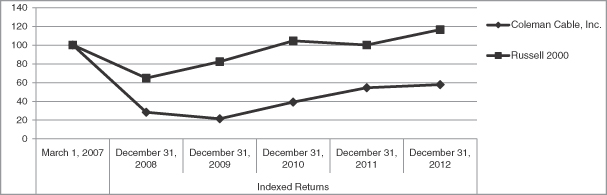

The graph below compares the change in cumulative shareholder return on our common stock as compared to that for the Russell 2000 Index for the period of March 1, 2007, the date Coleman Cable, Inc. (CCIX) began trading on the NASDAQ, through December 31, 2012.

This performance graph shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the Exchange Act), or incorporated by reference into any filing Coleman under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Comparison of Cumulative Return(1)

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Indexed Returns | |

| | | March 1,

2007 | | | December 31,

2008 | | | December 31,

2009 | | | December 31,

2010 | | | December 31,

2011 | | | December 31,

2012 | |

Coleman Cable, Inc. | | | 100 | | | | 28.31 | | | | 21.25 | | | | 39.25 | | | | 54.38 | | | | 57.94 | |

Russell 2000 | | | 100 | | | | 64.80 | | | | 82.41 | | | | 104.54 | | | | 100.17 | | | | 116.55 | |

17

| ITEM 6. | Selected Financial Data |

The following selected historical consolidated financial data should be read in conjunction with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere herein. The consolidated balance sheet data as of December 31, 2012 and 2011 and the consolidated statements of operations data for the years ended December 31, 2012, 2011 and 2010 are derived from our audited consolidated financial statements included elsewhere herein, which have been prepared in accordance with generally accepted accounting principles in the U.S. (“GAAP”). The consolidated balance sheet data as of December 31, 2010, 2009 and 2008 and the consolidated statements of operations data for the years ended December 31, 2009 and 2008 have been derived from our audited consolidated financial statements, which are not included in this report.

| | | | | | | | | | | | | | | | | | | | |

| | | As of and for the Year Ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| | | (In thousands except for per share data) | |

Statement of Operations Data: | | | | | | | | | | | | | | | | | | | | |

Net sales | | $ | 972,968 | | | $ | 504,152 | | | $ | 703,763 | | | $ | 867,356 | | | $ | 914,581 | |

Cost of goods sold | | | 879,367 | | | | 428,485 | | | | 606,734 | | | | 744,587 | | | | 775,999 | |

| | | | | | | | | | | | | | | | | | | | |

Gross profit | | | 93,601 | | | | 75,667 | | | | 97,029 | | | | 122,769 | | | | 138,582 | |

Selling, engineering, general and administrative expenses | | | 52,227 | | | | 40,821 | | | | 46,944 | | | | 61,107 | | | | 65,211 | |

Intangible asset amortization(1) | | | 12,006 | | | | 8,827 | | | | 6,826 | | | | 7,025 | | | | 7,945 | |

Asset impairments(2) | | | 29,276 | | | | 70,761 | | | | 324 | | | | — | | | | — | |

Restructuring charges(3) | | | 10,225 | | | | 5,468 | | | | 1,953 | | | | 1,953 | | | | 1,615 | |

| | | | | | | | | | | | | | | | | | | | |

Operating income (loss) | | | (10,133 | ) | | | (50,210 | ) | | | 40,982 | | | | 52,684 | | | | 63,811 | |

Interest expense | | | 29,656 | | | | 25,323 | | | | 27,436 | | | | 28,092 | | | | 27,984 | |

Gain on repurchase of 2012 Senior Notes(4) | | | — | | | | (3,285 | ) | | | — | | | | — | | | | — | |

Gain on available for sale securities | | | — | | | | — | | | | — | | | | (753 | ) | | | — | |

Loss on extinguishment of debt (5) | | | — | | | | — | | | | 8,566 | | | | — | | | | — | |

Other (income) loss, net(6) | | | 2,181 | | | | (1,195 | ) | | | (230 | ) | | | (78 | ) | | | 214 | |

| | | | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | (41,970 | ) | | | (71,053 | ) | | | 5,210 | | | | 25,423 | | | | 35,613 | |

Income tax expense (benefit) | | | (13,709 | ) | | | (4,034 | ) | | | 1,483 | | | | 7,982 | | | | 12,109 | |

| | | | | | | | | | | | | | | | | | | | |

Net income (loss) | | $ | (28,261 | ) | | $ | (67,019 | ) | | $ | 3,727 | | | $ | 17,441 | | | $ | 23,504 | |

| | | | | | | | | | | | | | | | | | | | |

Per Common Share Data: | | | | | | | | | | | | | | | | | | | | |

Net income (loss) per share | | | | | | | | | | | | | | | | | | | | |

Basic | | $ | (1.68 | ) | | $ | (3.99 | ) | | $ | 0.22 | | | $ | 1.00 | | | $ | 1.36 | |

Diluted | | $ | (1.68 | ) | | $ | (3.99 | ) | | $ | 0.21 | | | $ | 0.99 | | | $ | 1.34 | |

Weighted average shares outstanding | | | | | | | | | | | | | | | | | | | | |

Basic | | | 16,787 | | | | 16,809 | | | | 16,925 | | | | 17,090 | | | | 17,089 | |

Diluted | | | 16,787 | | | | 16,809 | | | | 16,991 | | | | 17,310 | | | | 17,323 | |

Other Financial Data: | | | | | | | | | | | | | | | | | | | | |

EBITDA(7) | | $ | 16,280 | | | $ | (23,847 | ) | | $ | 50,600 | | | $ | 72,618 | | | $ | 85,406 | |

Capital expenditures | | | 13,266 | | | | 4,087 | | | | 6,383 | | | | 15,033 | | | | 32,515 | |

Cash interest expense | | | 29,059 | | | | 24,380 | | | | 22,208 | | | | 26,461 | | | | 26,598 | |

Depreciation and amortization expense(8) | | | 28,594 | | | | 21,883 | | | | 17,954 | | | | 19,103 | | | | 21,809 | |

Net cash provided by operating activities | | | 116,198 | | | | 27,686 | | | | 7,084 | | | | 24,936 | | | | 46,523 | |

Net cash used in investing activities | | | (13,799 | ) | | | (3,964 | ) | | | (5,066 | ) | | | (74,245 | ) | | | (65,581 | ) |

Net cash provided by (used in) financing activities | | | (94,535 | ) | | | (32,798 | ) | | | 23,302 | | | | 26,291 | | | | 18,560 | |

Balance Sheet Data: | | | | | | | | | | | | | | | | | | | | |

Cash and cash equivalents | | $ | 16,328 | | | $ | 7,599 | | | $ | 33,454 | | | $ | 9,746 | | | $ | 9,562 | |

Working capital | | | 116,115 | | | | 131,239 | | | | 180,620 | | | | 188,182 | | | | 158,028 | |

Total assets | | | 411,966 | | | | 290,107 | | | | 341,111 | | | | 405,736 | | | | 449,340 | |

Total debt(9) | | | 270,462 | | | | 235,236 | | | | 275,012 | | | | 305,836 | | | | 326,125 | |

Total shareholders’ equity | | | 69,419 | | | | 5,260 | | | | 11,222 | | | | 28,095 | | | | 51,165 | |

18

| (1) | Intangible asset amortization was $12.0 million, $8.8 million, $6.8 million, $7.0 million and $7.9 million for 2008, 2009, 2010, 2011 and 2012, respectively, related to acquisitions made in 2007, 2011, and 2012. |

| (2) | Asset impairments included approximately: (1) $29.3 million recorded in 2008 primarily reflecting impairment of goodwill, other intangible assets and certain plant and equipment associated with our OEM segment; (2) $70.8 million of impairment charges consisting primarily of a goodwill impairment recorded during the first quarter of 2009 across three of four reporting units comprising our Distribution segment: Electrical distribution, Wire and Cable distribution, and Industrial distribution. This goodwill impairment resulted from a combination of factors which were in existence at that time, including a significant decline in our market capitalization, as well as the recessionary economic environment and its then estimated potential impact on our business; (3) $0.3 million recorded in 2010 for write-downs associated with properties held for sale. |

| (3) | Restructuring charges included: (1) $10.2 million recorded in 2008, primarily recorded in connection with the integration of our 2007 Acquisitions; (2) approximately $5.5 million recorded in 2009 related to the closure of our facilities in East Long Meadow, MA and Oswego, NY, both of which were closed in 2009, as well as holding costs associated with properties closed in 2008; (3) $2.0 million recorded in 2010 is related to our estimate of the remaining liability related to our closed facilities under lease in 2008 and 2009. The charge represented holding costs incurred related to those closed facilities; (4) $2.0 million recorded in 2011 primarily comprised of $0.9 million in severance costs related to an announced realignment of our Canadian operations and $0.4 million in connection with vacating and terminating a lease associated with such operations. The remaining charge also included lease termination and other holding costs for facilities closed in prior years; and (5) $1.6 million recorded in 2012, including most notably, $1.3 million related to equipment moving and other close-related costs, and severance incurred in connection with the closure of our manufacturing facility in Texarkana, Arkansas. The balance of the restructuring charges recorded for 2012 related to costs incurred at facilities closed in prior years currently consisting of one leased and one owned facility for which we continue to pay holding costs. |

| (4) | We recorded a gain of approximately $3.3 million in 2009 resulting from our repurchase of $15.0 million in par value of our 9.875% Senior Notes due 2012 (the “2012 Senior Note”). |

| (5) | We recorded a loss of $8.6 million in 2010 on the early extinguishment of our 2012 Senior Notes. The amount included the write-off of approximately $1.9 million of unamortized debt issuance costs and bond premium amounts related to the 2012 Senior Notes, as well as the impact of the call and tender premiums paid in connection with the refinancing. |

| (6) | Other (income) loss included approximately: (1) a loss of $2.2 million in 2008 primarily due to unfavorable exchange rate fluctuations related to our Canadian operations; (2) a gain of $1.2 million in 2009 primarily due to favorable exchange rate fluctuations related to our Canadian operations; (3) a gain of $0.2 million in 2010 primarily due to favorable exchange rate fluctuations; (4) a gain of $0.1 million which comprised of a $0.4 million gain recognized from the reversal of a contingent liability assumed from the acquisition of Technology Research Corporation that no longer became probable as well as a $0.3 million loss due to unfavorable exchange rate fluctuations; and (5) a loss of $0.2 million in 2012 related to unfavorable exchange rate fluctuations. |

| (7) | In addition to net income determined in accordance with GAAP, we use certain non-GAAP measures in assessing our operating performance. These non-GAAP measures used by management include: (1) EBITDA, which we define as net income before interest, income taxes, depreciation and amortization expense (“EBITDA”), (2) Adjusted EBITDA, which is our measure of EBITDA adjusted to exclude the impact of certain specifically identified items (“Adjusted EBITDA”), and (3) Adjusted earnings per share, which we calculate as diluted earnings per share adjusted to exclude the estimated per share impact of the same specifically identified items used to calculate Adjusted EBITDA (“Adjusted EPS”). For the periods presented in this report, the specifically identified items include asset impairments, restructuring charges, the gain on available for sale securities recorded in the second quarter of 2011 relative to our investment in TRC at the date of acquisition, acquisition-related costs, the favorable impact of an insurance settlement received in 2011 for a 2005 inventory-related theft, the loss recorded in connection with the extinguishment of our 2012 Senior Notes in 2010, and share-based compensation expense. |

19

We believe both EBITDA and Adjusted EBITDA serve as appropriate measures to be used in evaluating the performance of our business. We employ the use of these measures in the preparation of our annual operating budgets and in determining levels of operating and capital investments. We believe both EBITDA and Adjusted EBITDA allow us to readily view operating trends, perform analytical comparisons, determine key personnel bonuses, and identify strategies to improve operating performance. We also believe both EBITDA and Adjusted EBITDA are performance measures that provide investors, securities analysts and other interested parties a measure of operating results unaffected by differences in capital structures, business acquisitions, capital investment cycles and ages of related assets among otherwise comparable companies in our industry. However, the usefulness of both EBITDA and Adjusted EBITDA as performance measures is limited by the fact that they both exclude the impact of interest expense, depreciation and amortization expense, and taxes. We borrow money in order to finance our operations; therefore, interest expense is a necessary element of our costs and ability to generate revenue. Similarly, our use of capital assets makes depreciation and amortization expense a necessary element of our costs and ability to generate income. Since we are subject to state and federal income taxes, any measure that excludes tax expense has material limitations. Due to these limitations, we do not, and you should not, use either EBITDA or Adjusted EBITDA as the only measures of our performance. We also use, and recommend that you consider, net income in accordance with GAAP as a measure of our performance. Finally, other companies may define EBITDA and Adjusted EBITDA differently and, as a result, our measure of EBITDA and Adjusted EBITDA may not be directly comparable to EBITDA and Adjusted EBITDA measures of other companies.

The following is a reconciliation of net income (loss), as determined in accordance with GAAP, to EBITDA.

| | | | | | | | | | | | | | | | | | | | |

| | | Year Ended December 31, | |

| | | 2008 | | | 2009 | | | 2010 | | | 2011 | | | 2012 | |

| | | (In thousands) | |

Net income (loss) | | $ | (28,261 | ) | | $ | (67,019 | ) | | $ | 3,727 | | | $ | 17,441 | | | $ | 23,504 | |

Interest expense | | | 29,656 | | | | 25,323 | | | | 27,436 | | | | 28,092 | | | | 27,984 | |

Income tax expense (benefit) | | | (13,709 | ) | | | (4,034 | ) | | | 1,483 | | | | 7,982 | | | | 12,109 | |

Depreciation and amortization expense(8) | | | 28,594 | | | | 21,883 | | | | 17,954 | | | | 19,103 | | | | 21,809 | |

| | | | | | | | | | | | | | | | | | | | |

EBITDA | | $ | 16,280 | | | $ | (23,847 | ) | | $ | 50,600 | | | $ | 72,618 | | | $ | 85,406 | |

| | | | | | | | | | | | | | | | | | | | |

| (8) | Debt amortization costs are a component of interest expense per the income statement, but included within depreciation and amortization for operating cash flow presentation. Accordingly, for the above presentations only, depreciation and amortization expense does not include amortization of debt issuance costs, which is included in interest expense. |

| (9) | Total debt includes the current portion of long-term debt and excludes the unamortized premium of $2.4 million, and $1.6 million as of December 31, 2008, and 2009, respectively, related to the 2012 Senior Notes and the unamortized discount of $(3.2) million, $(2.7) million and $(2.3) million as of December 31, 2010, 2011, and 2012 respectively, related to the 2018 Senior Notes. |

20

| ITEM 7. | Management’s Discussion and Analysis of Financial Condition and Results of Operations |

You should read the following discussion in conjunction with our consolidated financial statements and the notes thereto included in this report. This discussion contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those anticipated in these forward-looking statements as a result of a variety of risks and uncertainties, including those described under “Item 1A, Risk Factors” and elsewhere in this report. We assume no obligation to update any of these forward-looking statements.

2012 Overview

Overall, our volumes, measured in total pounds shipped, increased 5.4% in 2012 as compared to 2011, with relatively stronger increases in our industrial-related product categories as well as our OEM business, as market demand in both areas was favorably impacted by increased industrial output in the U.S. from 2011 levels. The diversity of our platform within a variety of industries helped with our overall growth during the year. For example, the continued strengthening of the U.S. auto market favorably impacted demand for our products serving that end-market. Other areas remained challenging, particularly channels and product categories linked to construction end-markets. We also benefited from the continued expansion of new industrial products developed internally over the past few years, as increased sales of such products in 2012 helped offset declines in certain legacy wire and cable products.

The average price of copper in 2012 was $3.61 per pound compared to an average price of $4.00 in 2011. We experienced a sharp decline in copper prices in the fourth quarter of 2011 followed by a rebound in prices in the first quarter of 2012. Although there was some volatility in the price of copper during 2012, prices overall remained relatively stable when compared to the volatility we experienced in 2011. Such copper price fluctuations can significantly impact our sales and short-term profitability, as copper constitutes the primary component of our product input costs, accounting for approximately 65.4% of our total cost of goods sold, and sharp copper price changes can impact the spread between the cost of copper in our products and the prices we are able to charge for our products.

Our overall financial and operating performance in 2012 was strong:

| | • | | Earnings per diluted share of $1.34 for 2012, compared to $0.99 in 2011 and $0.21 in 2010. On an adjusted basis, we recorded adjusted earnings per share of $1.48 for 2012, as compared to $1.20 and $0.69 in 2011 and 2010, respectively. |

| | • | | EBITDA for 2012 reached $85.4 million, as compared to EBITDA of $72.6 million and $50.6 million in 2011 and 2010, respectively. On an adjusted basis, we recorded Adjusted EBITDA of $88.7 million in 2012, as compared to Adjusted EBITDA of $78.6 million and $64.0 million in 2011 and 2010, respectively. |

| | • | | Overall reported revenues increased 5.4% in 2012 to $914.6 million as compared to $867.4 million in 2011. The largest increase in both dollars and percentage came from our Engineered Solutions segment, approximately $26.5 million. |

| | • | | Our total volume, measured in pounds shipped, within our Distribution and OEM segments, increased 5.4%. |

| | • | | Operating profit increased 21.1% to $63.8 million in 2012 compared to $52.7 million in 2011. The largest increase in both dollars and percentage came from our Engineered Solutions segment which included the full year impact of the 2011 Acquisitions and seven months of results from our 2012 Watteredge acquisition. Both our Distribution and OEM segments also reported strong increases attributable to higher profitability on products sold. |

Both the above-noted GAAP results and Non-GAAP measures, including our definition of such Non-GAAP measures and their reconciliation to GAAP measures, are set forth in greater detail as part of the “Consolidated Results of Operations” section that follows.

21

2012 Acquisition – Watteredge (“WE”)

On May 31, 2012, we acquired most of the operating assets (and assumed certain liabilities) of WE, an Ohio corporation that designs, manufactures and sells secondary power connectors, including electric arc furnace cables, resistance welding cables, industrial high-performance copper bus and accessories, and other high performance power conduction devices and accessories. WE serves the steel, chemical, chlorine, power generation, fiberglass and automotive industries and sells its products and services worldwide. We believe the acquisition of WE strengthens and provides for greater diversification of our overall portfolio.

The acquisition of the assets of WE, was structured as an all-cash transaction valued at approximately $33.9 million (equal to a $35.0 million preliminary purchase price adjusted by a $1.1 million working capital adjustment). The transaction was funded with proceeds from Coleman’s existing credit facility. Coleman retained WE’s workforce and has continued all of WE’s production at its current manufacturing plant in Avon Lake, Ohio. WE has been included as a component of our Engineered Solutions segment reported herein.

2011 Acquisitions

During the second quarter of 2011, we utilized cash on hand, as well as borrowings under our credit facility to complete three business acquisitions (collectively, the “2011 Acquisitions”), as set forth below. Each of these 2011 Acquisitions was structured as a cash transaction, with aggregate consideration totaling $68.9 million. As further discussed below, we believe these acquisitions represent significant opportunities for us, including the strengthening and greater diversification of our overall portfolio.

Acquisition of the Assets of The Designers Edge (“DE”)

On April 1, 2011, we acquired certain assets of DE, a leading designer and distributor of specialty lighting products in the U.S. and Canada. The total purchase price for the assets acquired, primarily trade receivables and merchandise inventories, was $10.1 million. The acquisition of DE’s assets significantly expanded our product portfolio across a wide range of lighting product categories, including industrial, work and utility, as well as products for security and landscape applications. We fully integrated the acquired assets of DE into our Distribution segment during the second quarter of 2011.

Acquisition of the Assets of First Capitol Wire and Cable (“FCWC”) and Continental Wire and Cable (“CWC”)